Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

Filing exhibits

Related financial report

OXY similar filings

- 6 May 14 Submission of Matters to a Vote of Security Holders

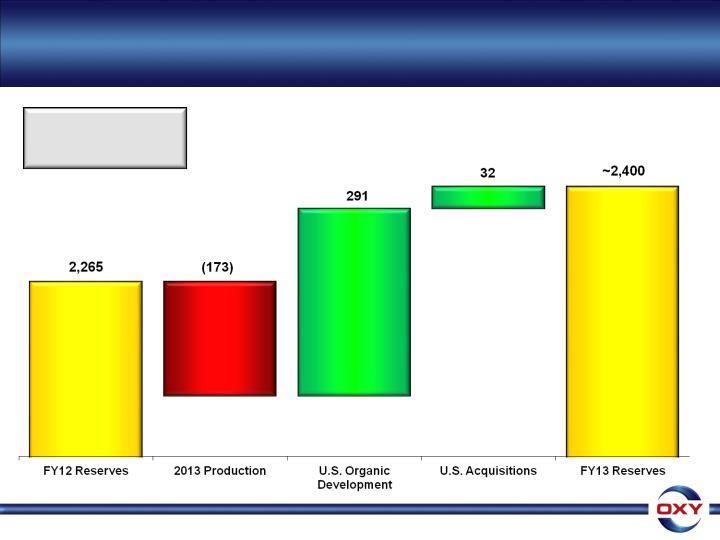

- 5 May 14 Occidental Petroleum Announces 1st Quarter of 2014 Net Income

- 14 Feb 14 Former SEC Chairman Elisse B. Walter Elected to Occidental Petroleum Board of Directors

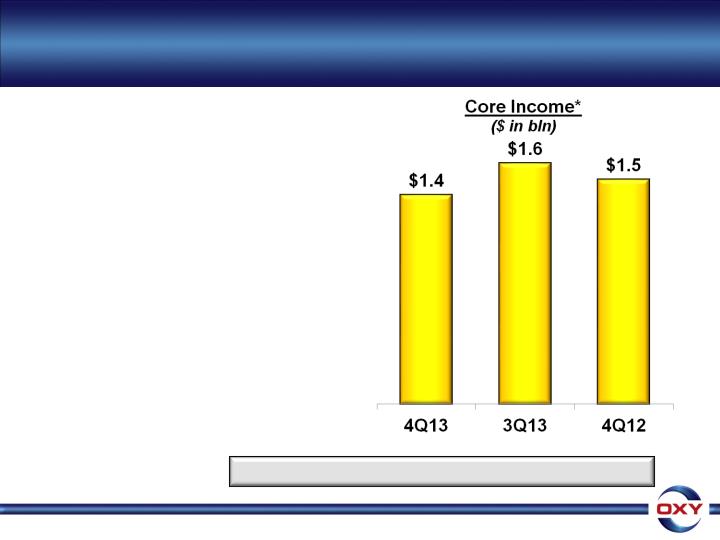

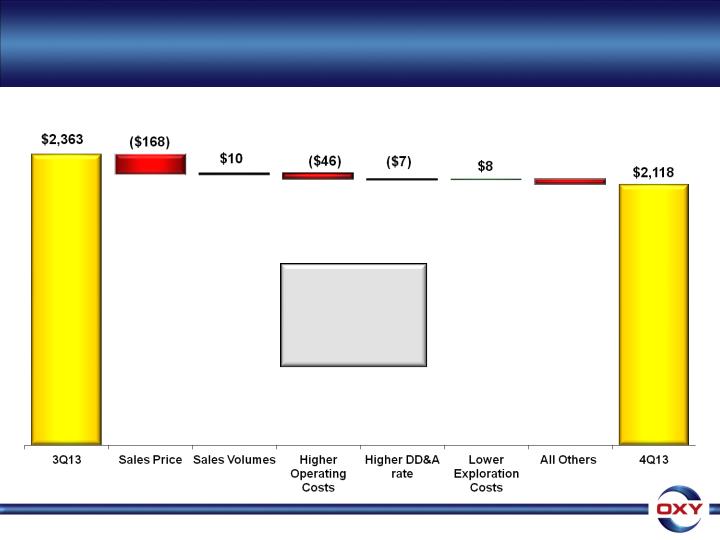

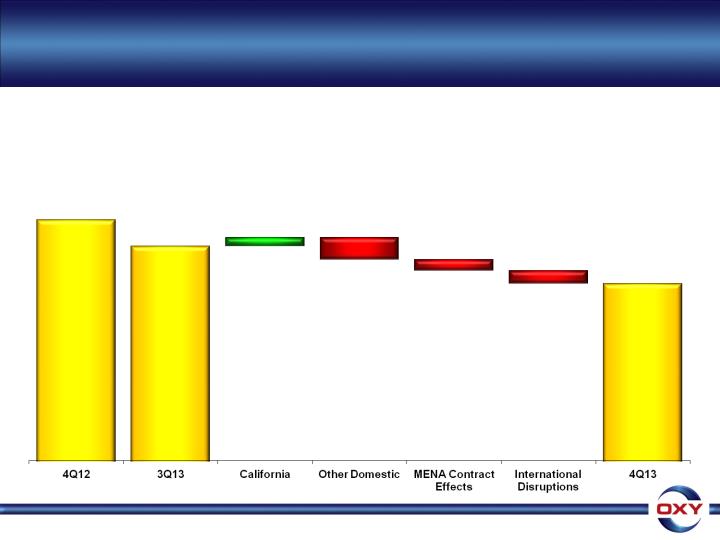

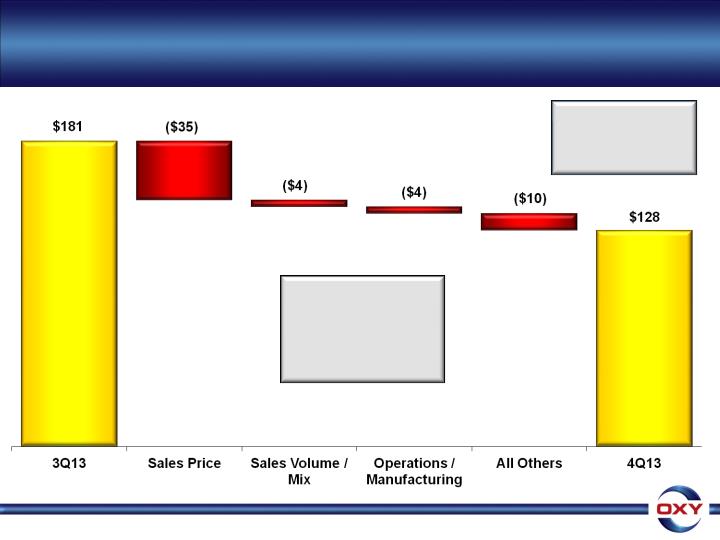

- 30 Jan 14 Occidental Petroleum Announces 4th Quarter and Twelve Months of 2013 Net Income

- 23 Dec 13 Settlement Agreement and General Release

- 29 Oct 13 Occidental Petroleum Announces 3rd Quarter and Nine Months of 2013 Net Income

- 18 Oct 13 Occidental Petroleum Announces Initial Phase of Strategic Review

Filing view

External links