UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811-4777

MFS SERIES TRUST I

(Exact name of registrant as specified in charter)

111 Huntington Avenue, Boston, Massachusetts 02199

(Address of principal executive offices) (Zip code)

Christopher R. Bohane

Massachusetts Financial Services Company

111 Huntington Avenue

Boston, Massachusetts 02199

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617)954-5000

Date of fiscal year end: August 31

Date of reporting period: August 31, 2019

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

Annual Report

August 31, 2019

MFS® Core Equity Fund

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the fund’s annual and semiannual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the complete reports will be made available on the fund’s Web site (funds.mfs.com), and you will be notified by mail each time a report is posted and provided with a Web site link to access the report.

If you are already signed up to receive shareholder reports by email, you will not be affected by this change and you need not take any action. You may sign up to receive shareholder reports and other communications from the fund by email by contacting your financial intermediary (such as a broker-dealer or bank) or, if you hold your shares directly with the fund, by calling 1-800-225-2606 or by logging on to MFS Access at mfs.com.

Beginning on January 1, 2019, you may elect to receive all future reports in paper free of charge. Contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the fund, you can call 1-800-225-2606 or send an email request to orderliterature@mfs.com to let the fund know that you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held with the MFS fund complex if you invest directly.

RGI-ANN

MFS® Core Equity Fund

CONTENTS

The report is prepared for the general information of shareholders.

It is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus.

NOT FDIC INSURED• MAY LOSE VALUE• NO BANK GUARANTEE

LETTER FROM THE EXECUTIVE CHAIRMAN

Dear Shareholders:

Slowing global growth, low inflation, and increasing trade friction between the United States and China have been hallmarks of the past 12 months. After experiencing an

uptick in market volatility in late 2018, markets steadied during the first half of 2019, thanks in large measure to the adoption of a dovish policy stance on the part of global central banks, focused on supporting economic growth. The U.S. and China have raised tariffs on each other, heightening tensions and uncertainty. Despite repeated declarations by British Prime Minister Boris Johnson that the United Kingdom will leave the European Union on October 31, 2019, with or without a deal, apprehension over the possibility of a no-deal Brexit has eased somewhat, with Parliament having taken steps to block such an outcome.

Markets expect that the longest economic expansion in U.S. history will continue for the time being, albeit at a slower pace. In an effort to prolong the expansion, the U.S. Federal Reserve lowered interest rates for the first time in more than a decade in July and again in September. Similarly, the European Central Bank loosened policy in September. While markets have grown more risk averse, the accommodative monetary environment has helped push global interest rates toward record-low levels and has been somewhat supportive of risk assets despite the unsettled economic and geopolitical backdrop.

Since launching the first U.S. open-end mutual fund in 1924, MFS® has been committed to a single purpose: to create value by allocating capital responsibly for clients. Through our powerful global investment platform, we combine collective expertise, thoughtful risk management, and long-term discipline to uncover what we believe are the best investment opportunities in the market.

Respectfully,

Robert J. Manning

Executive Chairman

MFS Investment Management

October 17, 2019

The opinions expressed in this letter are subject to change and may not be relied upon for investment advice. No forecasts can be guaranteed.

1

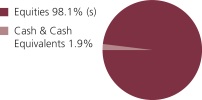

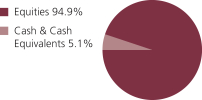

PORTFOLIO COMPOSITION

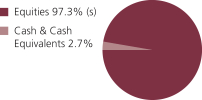

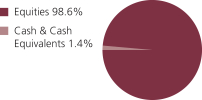

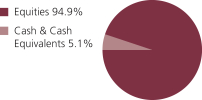

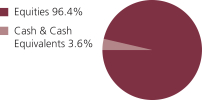

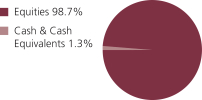

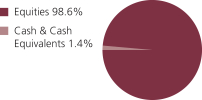

Portfolio structure

| | | | |

| Top ten holdings | |

| Apple, Inc. | | | 4.1% | |

| Microsoft Corp. | | | 3.1% | |

| Amazon.com, Inc. | | | 3.1% | |

| Alphabet, Inc., “A” | | | 2.9% | |

| American Tower Corp., REIT | | | 2.3% | |

| Mastercard, Inc., “A” | | | 2.1% | |

| Aon PLC | | | 2.0% | |

| Facebook, Inc., “A” | | | 1.9% | |

| Chevron Corp. | | | 1.7% | |

| Salesforce.com, Inc. | | | 1.5% | |

| | | | |

| Global equity sectors (k) | |

| Technology | | | 25.2% | |

| Financial Services | | | 17.1% | |

| Health Care (s) | | | 13.6% | |

| Consumer Cyclicals | | | 12.8% | |

| Capital Goods (s) | | | 12.8% | |

| Energy | | | 7.5% | |

| Consumer Staples | | | 5.3% | |

| Telecommunications/Cable Television (s) | | | 3.8% | |

| (k) | The sectors set forth above and the associated portfolio composition are based on MFS’ own custom sector classification methodology. |

| (s) | Includes securities sold short. |

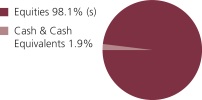

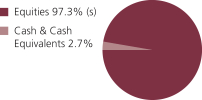

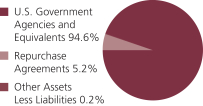

Cash & Cash Equivalents includes any cash, investments in money market funds, short-term securities, and other assets less liabilities. Please see the Statement of Assets and Liabilities for additional information related to the fund’s cash position and other assets and liabilities.

Percentages are based on net assets as of August 31, 2019.

The portfolio is actively managed and current holdings may be different.

2

MANAGEMENT REVIEW

Summary of Results

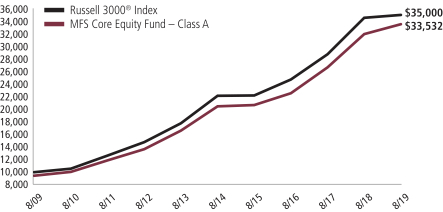

For the twelve months ended August 31, 2019, Class A shares of the MFS Core Equity Fund (fund) provided a total return of 4.94%, at net asset value. This compares with a return of 1.31% for the fund’s benchmark, the Russell 3000® Index.

Market Environment

Changes in market sentiment, driven largely by uncertainty over the outcome of trade negotiations between the United States and China, contributed to periodic bouts of volatility during the reporting period. The global economy decelerated, led by weakness in China and Europe.

The deteriorating global growth backdrop, along with declining inflationary pressures, prompted the US Federal Reserve to cut interest rates for the first time in over a decade at the end of July, which, combined with a more dovish posture beginning in early 2019, resulted in a sharp decline in long-term interest rates during the period’s second half, inverting portions of the US Treasury yield curve. Consequently, markets anticipate additional rate cuts in the coming quarters.

Globally, central banks have tilted more dovish as well, with China lowering reserve requirements, the Bank of Canada and Bank of England holding rates steady and the European Central Bank extending alow-interest-rate refinancing facility for eurozone banks to encourage the continued flow of credit. The ECB also indicated that it would likely lower rates further and possibly resume asset purchases this fall.

Emerging markets experienced considerable volatility earlier in the period (through the end of 2018) as tighter global financial conditions exposed structural weakness in some countries. Those conditions improved in 2019 as the Fed became more dovish, but diminished hopes for a trade deal between the US and China weighed on sentiment. Idiosyncratic factors negatively impacted some emerging economies, such as Argentina and Turkey.

From a geopolitical perspective, uncertainty over Brexit remains high. British Prime Minister Boris Johnson has shown a willingness to leave the European Union on October 31, 2019, without a withdrawal agreement, although Parliament has taken steps to prevent the United Kingdom from leaving the EU without a deal. The combination of Brexit uncertainty and the deteriorating outlook for global trade has damaged business confidence and hampered investment.

Contributors to Performance

Security selection in both thefinancial services andtelecommunications/cable television sectors contributed to performance relative to the Russell 3000® Index. Within thefinancial services sector, overweight positions in risk management and consulting services provider Aon, debit and credit transaction processing company Mastercard and real estate investment trusts Medical Properties Trust and W.P. Carey, as well as holding shares of global alternative asset manager Blackstone Group (b), aided relative performance. The share price of Aon rose as the company reported solid revenue growth, notably in both its reinsurance and commercial risk solutions divisions, and expense savings from its cost reduction program. Within thetelecommunications/cable television sector, the fund’s overweight positions in communications tower

3

Management Review – continued

management firm American Tower and telecommunications company Altice USA lifted relative returns. The share price of American Tower advanced on the back of strong organic growth, both domestically and internationally, as major wireless carriers ramped up investments in 5G technology.

Elsewhere, the fund’s underweight position in personal electronics maker Apple, and overweight positions in coffee and tea company Starbucks and animal health products manufacturer Zoetis, supported relative results. The share price of Starbucks appreciated over the reporting period as robust growth in global same-store sales and an improved corporate tax rate appeared to have lifted investor sentiment.

Detractors from Performance

From a sector perspective, there were no standout detractors that weakened the fund’s relative performance during the reporting period.

From an individual stock perspective, overweight positions in computer graphics processor maker NVIDIA (h), animal health services firm Elanco Animal Health, information technology company DXC Technology, electronic brokerage firm TD Ameritrade, independent petroleum products company Marathon Petroleum, information technology education company Pluralsight, energy exploration and production company EOG Resources and biotechnology company Biogen (h) weighed on relative returns. The share price of NVIDIA fell, notably early in the reporting period, as a decline in cryptocurrency prices translated into decreased demand for the company’s computer chips (used to mine cryptocurrencies) and led to a backlog of chip inventory. Not holding positions in global payments technology company Visa and pharmaceutical company Merck & Company also hurt relative results as both stocks delivered strong performance during the reporting period. The share price of Visa rose as strong processing and transaction fees, as well as cross-border transaction volumes, helped the company deliver better-than-expected earnings.

Respectfully,

Portfolio Manager(s)

Joseph MacDougall

| (b) | Security is not a benchmark constituent. |

| (h) | Security was not held in the portfolio at period end. |

The views expressed in this report are those of the portfolio manager(s) only through the end of the period of the report as stated on the cover and do not necessarily reflect the views of MFS or any other person in the MFS organization. These views are subject to change at any time based on market or other conditions, and MFS disclaims any responsibility to update such views. These views may not be relied upon as investment advice or an indication of trading intent on behalf of any MFS portfolio. References to specific securities are not recommendations of such securities, and may not be representative of any MFS portfolio’s current or future investments.

4

PERFORMANCE SUMMARYTHROUGH 8/31/19

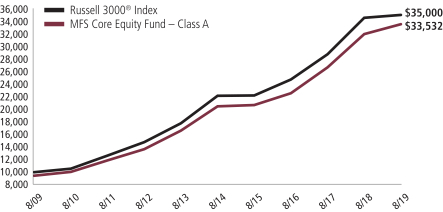

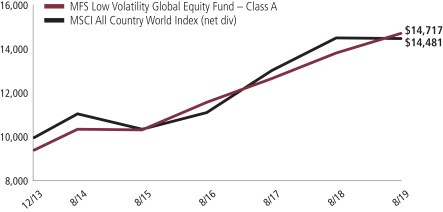

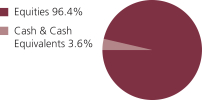

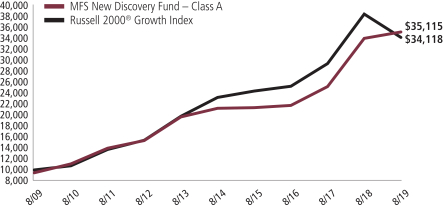

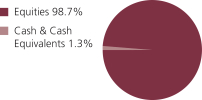

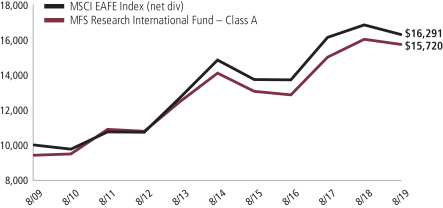

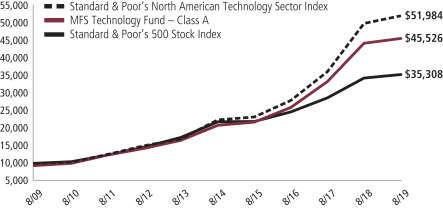

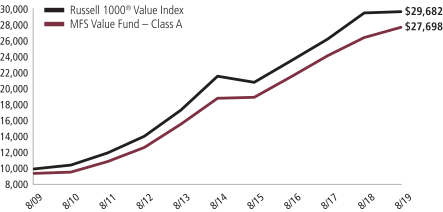

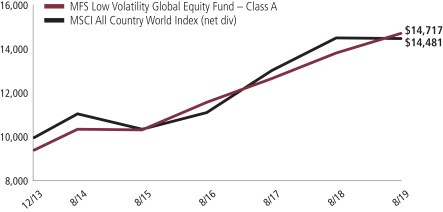

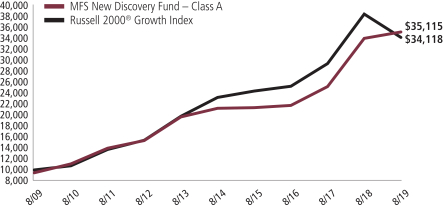

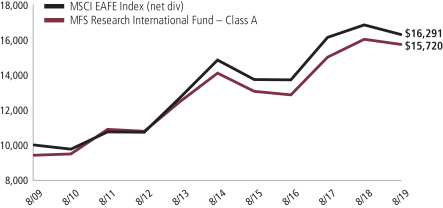

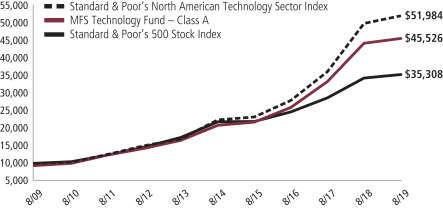

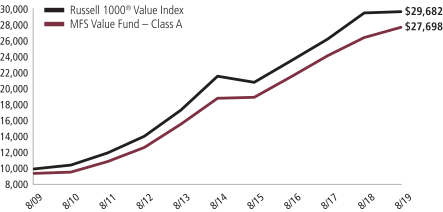

The following chart illustrates a representative class of the fund’s historical performance in comparison to its benchmark(s). Performance results include the deduction of the maximum applicable sales charge and reflect the percentage change in net asset value, including reinvestment of dividends and capital gains distributions. The performance of other share classes will be greater than or less than that of the class depicted below. Benchmarks are unmanaged and may not be invested in directly. Benchmark returns do not reflect sales charges, commissions or expenses. (See Notes to Performance Summary.)

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value fluctuate so your shares, when sold, may be worth more or less than the original cost; current performance may be lower or higher than quoted. The performance shown does not reflect the deduction of taxes, if any, that a shareholder would pay on fund distributions or the redemption of fund shares.

Growth of a Hypothetical $10,000 Investment

5

Performance Summary – continued

Total Returns through 8/31/19

Average annual without sales charge

| | | | | | | | | | | | | | |

| | | Share Class | | Class Inception Date | | 1-yr | | 5-yr | | 10-yr | | Life (t) | | |

| | | A | | 1/02/96 | | 4.94% | | 10.36% | | 13.53% | | N/A | | |

| | | B | | 1/02/97 | | 4.16% | | 9.53% | | 12.68% | | N/A | | |

| | | C | | 1/02/97 | | 4.14% | | 9.53% | | 12.67% | | N/A | | |

| | | I | | 1/02/97 | | 5.17% | | 10.63% | | 13.81% | | N/A | | |

| | | R1 | | 4/01/05 | | 4.14% | | 9.53% | | 12.68% | | N/A | | |

| | | R2 | | 10/31/03 | | 4.66% | | 10.09% | | 13.24% | | N/A | | |

| | | R3 | | 4/01/05 | | 4.91% | | 10.35% | | 13.52% | | N/A | | |

| | | R4 | | 4/01/05 | | 5.18% | | 10.63% | | 13.79% | | N/A | | |

| | | R6 | | 1/02/13 | | 5.28% | | 10.73% | | N/A | | 14.27% | | |

| | | | | |

| Comparative benchmark(s) | | | | | | | | | | |

| | | Russell 3000® Index (f) | | 1.31% | | 9.60% | | 13.35% | | N/A | | |

| | | | | |

| Average annual with sales charge | | | | | | | | | | |

| | | A

With Initial Sales Charge (5.75%) | | (1.09)% | | 9.06% | | 12.86% | | N/A | | |

| | | B

With CDSC (Declining over six years from 4% to 0%) (v) | | 0.42% | | 9.25% | | 12.68% | | N/A | | |

| | | C

With CDSC (1% for 12 months) (v) | | 3.21% | | 9.53% | | 12.67% | | N/A | | |

CDSC – Contingent Deferred Sales Charge.

Class I, R1, R2, R3, R4, and R6 shares do not have a sales charge.

| (f) | Source: FactSet Research Systems Inc. |

| (t) | For the period from the class inception date through the stated period end (for those share classes with less than 10 years of performance history). No comparative benchmark performance information is provided for “life” periods. (See Notes to Performance Summary.) |

| (v) | Assuming redemption at the end of the applicable period. |

Benchmark Definition(s)

Russell 3000® Index – constructed to provide a comprehensive barometer for the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market. The Russell 3000® Index is a trademark/service mark of the Frank Russell Company. Russell® is a trademark of the Frank Russell Company.

It is not possible to invest directly in an index.

Notes to Performance Summary

Average annual total return represents the average annual change in value for each share class for the periods presented. Life returns are presented where the share class has less than 10 years of performance history and represent the average annual total return from the class inception date to the stated period end date. As the fund’s share

6

Performance Summary – continued

classes may have different inception dates, the life returns may represent different time periods and may not be comparable. As a result, no comparative benchmark performance information is provided for life periods.

Performance results reflect any applicable expense subsidies and waivers in effect during the periods shown. Without such subsidies and waivers the fund’s performance results would be less favorable. Please see the prospectus and financial statements for complete details.

Performance results do not include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles and may differ from amounts reported in the financial highlights.

From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower.

7

EXPENSE TABLE

Fund expenses borne by the shareholders during the period, March 1, 2019 through August 31, 2019

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on certain purchase or redemption payments, and (2) ongoing costs, including management fees; distribution and service(12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period March 1, 2019 through August 31, 2019.

Actual Expenses

The first line for each share class in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the following table provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

8

Expense Table – continued

| | | | | | | | | | | | | | | | | | |

Share

Class | | | | Annualized

Expense Ratio | | | Beginning

Account Value

3/01/19 | | | Ending

Account Value

8/31/19 | | | Expenses Paid During

Period (p)

3/01/19-8/31/19 | |

| A | | Actual | | | 0.99% | | | | $1,000.00 | | | | $1,071.66 | | | | $5.17 | |

| | Hypothetical (h) | | | 0.99% | | | | $1,000.00 | | | | $1,020.21 | | | | $5.04 | |

| B | | Actual | | | 1.74% | | | | $1,000.00 | | | | $1,067.70 | | | | $9.07 | |

| | Hypothetical (h) | | | 1.74% | | | | $1,000.00 | | | | $1,016.43 | | | | $8.84 | |

| C | | Actual | | | 1.75% | | | | $1,000.00 | | | | $1,067.43 | | | | $9.12 | |

| | Hypothetical (h) | | | 1.75% | | | | $1,000.00 | | | | $1,016.38 | | | | $8.89 | |

| I | | Actual | | | 0.75% | | | | $1,000.00 | | | | $1,072.83 | | | | $3.92 | |

| | Hypothetical (h) | | | 0.75% | | | | $1,000.00 | | | | $1,021.42 | | | | $3.82 | |

| R1 | | Actual | | | 1.75% | | | | $1,000.00 | | | | $1,067.49 | | | | $9.12 | |

| | Hypothetical (h) | | | 1.75% | | | | $1,000.00 | | | | $1,016.38 | | | | $8.89 | |

| R2 | | Actual | | | 1.23% | | | | $1,000.00 | | | | $1,070.44 | | | | $6.42 | |

| | Hypothetical (h) | | | 1.23% | | | | $1,000.00 | | | | $1,019.00 | | | | $6.26 | |

| R3 | | Actual | | | 1.00% | | | | $1,000.00 | | | | $1,071.88 | | | | $5.22 | |

| | Hypothetical (h) | | | 1.00% | | | | $1,000.00 | | | | $1,020.16 | | | | $5.09 | |

| R4 | | Actual | | | 0.75% | | | | $1,000.00 | | | | $1,073.04 | | | | $3.92 | |

| | Hypothetical (h) | | | 0.75% | | | | $1,000.00 | | | | $1,021.42 | | | | $3.82 | |

| R6 | | Actual | | | 0.66% | | | | $1,000.00 | | | | $1,073.32 | | | | $3.45 | |

| | Hypothetical (h) | | | 0.66% | | | | $1,000.00 | | | | $1,021.88 | | | | $3.36 | |

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 184/365 (to reflect theone-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. |

Notes to Expense Table

Expense ratios include 0.03% of investment related expenses from short sales (See Note 2 of the Notes to Financial Statements). Each class with a Rule12b-1 service fee is subject to a rebate of a portion of such fee. Such rebates are included in the expense ratios above. For Class A and Class R2 shares, this rebate reduced the expense ratios above by 0.01%. See Note 3 in the Notes to Financial Statements for additional information.

9

PORTFOLIO OF INVESTMENTS

8/31/19

The Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by broad-based asset classes.

| | | | | | | | |

| Common Stocks - 98.5% | | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Aerospace - 3.6% | | | | | | | | |

| Boeing Co. | | | 61,420 | | | $ | 22,362,408 | |

| CACI International, Inc., “A” (a) | | | 35,545 | | | | 7,901,298 | |

| Curtiss-Wright Corp. | | | 39,565 | | | | 4,852,251 | |

| FLIR Systems, Inc. | | | 40,684 | | | | 2,004,501 | |

| Honeywell International, Inc. | | | 137,399 | | | | 22,618,623 | |

| Huntington Ingalls Industries, Inc. | | | 20,253 | | | | 4,232,877 | |

| Northrop Grumman Corp. | | | 60,409 | | | | 22,222,659 | |

| United Technologies Corp. | | | 119,682 | | | | 15,587,384 | |

| | | | | | | | |

| | | | | | | $ | 101,782,001 | |

| Alcoholic Beverages - 0.4% | | | | | | | | |

| Constellation Brands, Inc., “A” | | | 50,877 | | | $ | 10,396,715 | |

| | |

| Apparel Manufacturers - 0.4% | | | | | | | | |

| NIKE, Inc., “B” | | | 71,772 | | | $ | 6,064,734 | |

| Skechers USA, Inc., “A” (a) | | | 202,452 | | | | 6,409,630 | |

| | | | | | | | |

| | | | | | | $ | 12,474,364 | |

| Automotive - 0.7% | | | | | | | | |

| Copart, Inc. (a) | | | 85,423 | | | $ | 6,440,040 | |

| IAA, Inc. (a) | | | 69,606 | | | | 3,400,253 | |

| Lear Corp. | | | 47,412 | | | | 5,322,471 | |

| Stoneridge, Inc. (a) | | | 133,719 | | | | 4,106,511 | |

| | | | | | | | |

| | | | | | | $ | 19,269,275 | |

| Biotechnology - 0.3% | | | | | | | | |

| Adaptive Biotechnologies Corp. (a) | | | 28,762 | | | $ | 1,462,548 | |

| Illumina, Inc. (a) | | | 22,140 | | | | 6,228,867 | |

| | | | | | | | |

| | | | | | | $ | 7,691,415 | |

| Broadcasting - 0.5% | | | | | | | | |

| Netflix, Inc. (a) | | | 44,187 | | | $ | 12,979,931 | |

| | |

| Brokerage & Asset Managers - 2.1% | | | | | | | | |

| Blackstone Group, Inc. | | | 127,931 | | | $ | 6,365,846 | |

| Charles Schwab Corp. | | | 366,313 | | | | 14,018,798 | |

| CME Group, Inc. | | | 72,216 | | | | 15,691,815 | |

| TD Ameritrade Holding Corp. | | | 539,970 | | | | 23,980,068 | |

| | | | | | | | |

| | | | | | | $ | 60,056,527 | |

10

Portfolio of Investments – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Common Stocks - continued | | | | | | | | |

| Business Services - 4.1% | | | | | | | | |

| Amdocs Ltd. | | | 111,464 | | | $ | 7,216,179 | |

| Cognizant Technology Solutions Corp., “A” | | | 210,358 | | | | 12,913,878 | |

| DXC Technology Co. | | | 157,199 | | | | 5,222,151 | |

| Equinix, Inc., REIT | | | 18,971 | | | | 10,553,188 | |

| Fidelity National Information Services, Inc. | | | 110,548 | | | | 15,058,848 | |

| Fiserv, Inc. (a) | | | 103,112 | | | | 11,026,797 | |

| FleetCor Technologies, Inc. (a) | | | 65,817 | | | | 19,639,793 | |

| Global Payments, Inc. | | | 60,136 | | | | 9,981,373 | |

| Total System Services, Inc. | | | 64,927 | | | | 8,714,502 | |

| Verisk Analytics, Inc., “A” | | | 94,494 | | | | 15,264,561 | |

| | | | | | | | |

| | | | | | | $ | 115,591,270 | |

| Cable TV - 1.1% | | | | | | | | |

| Altice USA, Inc., “A” (a) | | | 676,597 | | | $ | 19,540,121 | |

| Comcast Corp., “A” | | | 285,688 | | | | 12,644,551 | |

| | | | | | | | |

| | | | | | | $ | 32,184,672 | |

| Chemicals - 0.4% | | | | | | | | |

| FMC Corp. | | | 93,795 | | | $ | 8,097,322 | |

| Ingevity Corp. (a) | | | 47,867 | | | | 3,646,030 | |

| | | | | | | | |

| | | | | | | $ | 11,743,352 | |

| Computer Software - 6.6% | | | | | | | | |

| Adobe Systems, Inc. (a) | | | 121,791 | | | $ | 34,650,758 | |

| Cadence Design Systems, Inc. (a) | | | 163,813 | | | | 11,217,914 | |

| DocuSign, Inc. (a) | | | 192,360 | | | | 8,981,289 | |

| Microsoft Corp. | | | 629,684 | | | | 86,808,236 | |

| Salesforce.com, Inc. (a) | | | 275,074 | | | | 42,930,799 | |

| | | | | | | | |

| | | | | | | $ | 184,588,996 | |

| Computer Software - Systems - 5.1% | | | | | | | | |

| Apple, Inc. (s) | | | 549,195 | | | $ | 114,638,964 | |

| Pluralsight, Inc., “A” (a) | | | 405,022 | | | | 6,520,854 | |

| Rapid7, Inc. (a) | | | 151,589 | | | | 8,138,814 | |

| ServiceNow, Inc. (a) | | | 45,299 | | | | 11,861,090 | |

| Square, Inc., “A” (a) | | | 31,045 | | | | 1,919,823 | |

| | | | | | | | |

| | | | | | | $ | 143,079,545 | |

| Construction - 1.6% | | | | | | | | |

| Masco Corp. | | | 409,797 | | | $ | 16,691,032 | |

| Toll Brothers, Inc. | | | 416,430 | | | | 15,070,601 | |

| Vulcan Materials Co. | | | 84,871 | | | | 11,988,029 | |

| | | | | | | | |

| | | | | | | $ | 43,749,662 | |

11

Portfolio of Investments – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Common Stocks - continued | | | | | | | | |

| Consumer Products - 1.6% | | | | | | | | |

| Colgate-Palmolive Co. | | | 194,800 | | | $ | 14,444,420 | |

| Energizer Holdings, Inc. | | | 40,763 | | | | 1,569,376 | |

| Kimberly-Clark Corp. | | | 90,975 | | | | 12,837,482 | |

| Procter & Gamble Co. | | | 129,679 | | | | 15,591,306 | |

| | | | | | | | |

| | | | | | | $ | 44,442,584 | |

| Consumer Services - 1.1% | | | | | | | | |

| Booking Holdings, Inc. (a) | | | 7,320 | | | $ | 14,394,121 | |

| Bright Horizons Family Solutions, Inc. (a) | | | 49,957 | | | | 8,245,403 | |

| Grand Canyon Education, Inc. (a) | | | 74,924 | | | | 9,410,455 | |

| | | | | | | | |

| | | | | | | $ | 32,049,979 | |

| Containers - 0.1% | | | | | | | | |

| Sealed Air Corp. | | | 108,331 | | | $ | 4,313,740 | |

| | |

| Electrical Equipment - 1.9% | | | | | | | | |

| AMETEK, Inc. | | | 238,340 | | | $ | 20,480,556 | |

| Fortive Corp. | | | 135,540 | | | | 9,609,786 | |

| HD Supply Holdings, Inc. (a) | | | 216,169 | | | | 8,411,136 | |

| Sensata Technologies Holding PLC (a) | | | 190,818 | | | | 8,697,484 | |

| TE Connectivity Ltd. | | | 58,085 | | | | 5,298,514 | |

| | | | | | | | |

| | | | | | | $ | 52,497,476 | |

| Electronics - 3.1% | | | | | | | | |

| Analog Devices, Inc. | | | 185,973 | | | $ | 20,425,415 | |

| Applied Materials, Inc. | | | 66,068 | | | | 3,172,585 | |

| Marvell Technology Group Ltd. | | | 426,131 | | | | 10,214,360 | |

| Mellanox Technologies Ltd. (a) | | | 33,149 | | | | 3,548,600 | |

| Monolithic Power Systems, Inc. | | | 23,737 | | | | 3,573,843 | |

| nLIGHT, Inc. (a) | | | 111,068 | | | | 1,434,999 | |

| NXP Semiconductors N.V. | | | 122,345 | | | | 12,496,318 | |

| Silicon Laboratories, Inc. (a) | | | 36,338 | | | | 3,960,842 | |

| Texas Instruments, Inc. | | | 222,924 | | | | 27,586,845 | |

| | | | | | | | |

| | | | | | | $ | 86,413,807 | |

| Energy - Independent - 1.5% | | | | | | | | |

| Diamondback Energy, Inc. | | | 68,786 | | | $ | 6,746,531 | |

| EOG Resources, Inc. | | | 172,192 | | | | 12,774,924 | |

| Hess Corp. | | | 75,794 | | | | 4,771,232 | |

| Marathon Petroleum Corp. | | | 244,422 | | | | 12,028,007 | |

| Pioneer Natural Resources Co. | | | 50,200 | | | | 6,195,684 | |

| | | | | | | | |

| | | | | | | $ | 42,516,378 | |

| Energy - Integrated - 1.7% | | | | | | | | |

| Chevron Corp. | | | 406,260 | | | $ | 47,824,927 | |

12

Portfolio of Investments – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Common Stocks - continued | | | | | | | | |

| Engineering - Construction - 0.2% | | | | | | | | |

| KBR, Inc. | | | 244,081 | | | $ | 6,228,947 | |

| | |

| Entertainment - 0.1% | | | | | | | | |

| World Wrestling Entertainment, Inc., “A” | | | 47,327 | | | $ | 3,380,568 | |

| | |

| Food & Beverages - 2.9% | | | | | | | | |

| Archer Daniels Midland Co. | | | 187,284 | | | $ | 7,126,156 | |

| Coca-Cola Co. | | | 219,818 | | | | 12,098,783 | |

| Hostess Brands, Inc. (a) | | | 365,487 | | | | 5,124,128 | |

| J.M. Smucker Co. | | | 46,751 | | | | 4,916,335 | |

| Mondelez International, Inc. | | | 371,877 | | | | 20,535,048 | |

| Nomad Foods Ltd. (a) | | | 138,210 | | | | 2,784,931 | |

| PepsiCo, Inc. | | | 211,908 | | | | 28,974,181 | |

| | | | | | | | |

| | | | | | | $ | 81,559,562 | |

| Food & Drug Stores - 0.1% | | | | | | | | |

| Grocery Outlet Holding Corp. (a) | | | 93,166 | | | $ | 3,768,565 | |

| | |

| Gaming & Lodging - 0.9% | | | | | | | | |

| Marriott International, Inc., “A” | | | 141,314 | | | $ | 17,814,043 | |

| Wyndham Hotels Group LLC | | | 151,490 | | | | 7,783,556 | |

| | | | | | | | |

| | | | | | | $ | 25,597,599 | |

| General Merchandise - 1.5% | | | | | | | | |

| Dollar General Corp. | | | 158,865 | | | $ | 24,797,238 | |

| Dollar Tree, Inc. (a) | | | 158,066 | | | | 16,048,441 | |

| | | | | | | | |

| | | | | | | $ | 40,845,679 | |

| Health Maintenance Organizations - 1.5% | | | | | | | | |

| Cigna Corp. | | | 143,285 | | | $ | 22,061,592 | |

| Humana, Inc. | | | 69,111 | | | | 19,572,926 | |

| | | | | | | | |

| | | | | | | $ | 41,634,518 | |

| Insurance - 4.3% | | | | | | | | |

| Aon PLC | | | 291,298 | | | $ | 56,759,415 | |

| Assurant, Inc. | | | 97,825 | | | | 12,032,475 | |

| Chubb Ltd. | | | 133,879 | | | | 20,922,610 | |

| Everest Re Group Ltd. | | | 21,104 | | | | 4,978,012 | |

| Hartford Financial Services Group, Inc. | | | 195,997 | | | | 11,422,705 | |

| MetLife, Inc. | | | 180,603 | | | | 8,000,713 | |

| Reinsurance Group of America, Inc. | | | 37,533 | | | | 5,778,956 | |

| | | | | | | | |

| | | | | | | $ | 119,894,886 | |

13

Portfolio of Investments – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Common Stocks - continued | | | | | | | | |

| Internet - 5.1% | | | | | | | | |

| Alphabet, Inc., “A” (a)(s) | | | 69,220 | | | $ | 82,408,486 | |

| CarGurus, Inc. (a) | | | 275,405 | | | | 8,983,711 | |

| Facebook, Inc., “A” (a) | | | 282,804 | | | | 52,508,219 | |

| | | | | | | | |

| | | | | | | $ | 143,900,416 | |

| Leisure & Toys - 0.8% | | | | | | | | |

| Brunswick Corp. | | | 109,169 | | | $ | 5,087,275 | |

| Electronic Arts, Inc. (a) | | | 171,833 | | | | 16,097,316 | |

| | | | | | | | |

| | | | | | | $ | 21,184,591 | |

| Machinery & Tools - 1.3% | | | | | | | | |

| Flowserve Corp. | | | 177,559 | | | $ | 7,578,218 | |

| IDEX Corp. | | | 37,720 | | | | 6,212,861 | |

| ITT, Inc. | | | 92,954 | | | | 5,290,942 | |

| Roper Technologies, Inc. | | | 47,394 | | | | 17,382,223 | |

| | | | | | | | |

| | | | | | | $ | 36,464,244 | |

| Major Banks - 2.3% | | | | | | | | |

| Goldman Sachs Group, Inc. | | | 159,211 | | | $ | 32,464,715 | |

| PNC Financial Services Group, Inc. | | | 130,213 | | | | 16,788,362 | |

| State Street Corp. | | | 122,663 | | | | 6,293,839 | |

| Wells Fargo & Co. | | | 182,869 | | | | 8,516,209 | |

| | | | | | | | |

| | | | | | | $ | 64,063,125 | |

| Medical & Health Technology & Services - 1.5% | | | | | | | | |

| Guardant Health, Inc. (a) | | | 12,509 | | | $ | 1,094,913 | |

| HCA Healthcare, Inc. | | | 95,684 | | | | 11,501,217 | |

| HealthEquity, Inc. (a) | | | 67,951 | | | | 4,033,571 | |

| ICON PLC (a) | | | 54,104 | | | | 8,342,296 | |

| IDEXX Laboratories, Inc. (a) | | | 13,691 | | | | 3,966,830 | |

| McKesson Corp. | | | 61,876 | | | | 8,555,594 | |

| Premier, Inc., “A” (a) | | | 105,899 | | | | 3,733,999 | |

| | | | | | | | |

| | | | | | | $ | 41,228,420 | |

| Medical Equipment - 4.4% | | | | | | | | |

| Becton, Dickinson and Co. | | | 72,858 | | | $ | 18,500,103 | |

| Boston Scientific Corp. (a) | | | 477,377 | | | | 20,398,319 | |

| Danaher Corp. | | | 72,937 | | | | 10,363,618 | |

| Masimo Corp. (a) | | | 57,107 | | | | 8,751,648 | |

| Medtronic PLC | | | 340,264 | | | | 36,711,083 | |

| PerkinElmer, Inc. | | | 151,335 | | | | 12,515,405 | |

| STERIS PLC | | | 52,078 | | | | 8,040,843 | |

| West Pharmaceutical Services, Inc. | | | 58,265 | | | | 8,475,227 | |

| | | | | | | | |

| | | | | | | $ | 123,756,246 | |

14

Portfolio of Investments – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Common Stocks - continued | | | | | | | | |

| Natural Gas - Pipeline - 0.5% | | | | | | | | |

| Enterprise Products Partners LP | | | 258,374 | | | $ | 7,366,243 | |

| Equitrans Midstream Corp. | | | 398,461 | | | | 5,375,239 | |

| | | | | | | | |

| | | | | | | $ | 12,741,482 | |

| Network & Telecom - 1.2% | | | | | | | | |

| Cisco Systems, Inc. | | | 585,747 | | | $ | 27,418,817 | |

| Interxion Holding N.V. (a) | | | 81,680 | | | | 6,611,179 | |

| | | | | | | | |

| | | | | | | $ | 34,029,996 | |

| Oil Services - 0.4% | | | | | | | | |

| Cactus, Inc., “A” (a) | | | 84,088 | | | $ | 2,141,721 | |

| Core Laboratories N.V. | | | 111,840 | | | | 4,427,746 | |

| Patterson-UTI Energy, Inc. | | | 624,219 | | | | 5,399,494 | |

| | | | | | | | |

| | | | | | | $ | 11,968,961 | |

| Other Banks & Diversified Financials - 6.1% | | | | | | | | |

| Bank OZK | | | 284,246 | | | $ | 7,333,547 | |

| BB&T Corp. | | | 633,559 | | | | 30,189,086 | |

| Citigroup, Inc. | | | 537,660 | | | | 34,598,421 | |

| Mastercard, Inc., “A” | | | 211,604 | | | | 59,539,018 | |

| Prosperity Bancshares, Inc. | | | 45,335 | | | | 2,943,148 | |

| SVB Financial Group (a) | | | 16,346 | | | | 3,181,259 | |

| U.S. Bancorp | | | 453,818 | | | | 23,911,670 | |

| Wintrust Financial Corp. | | | 172,489 | | | | 10,837,484 | |

| | | | | | | | |

| | | | | | | $ | 172,533,633 | |

| Pharmaceuticals - 6.2% | | | | | | | | |

| Elanco Animal Health, Inc. (a) | | | 879,952 | | | $ | 22,896,351 | |

| Eli Lilly & Co. | | | 280,581 | | | | 31,697,235 | |

| Johnson & Johnson | | | 312,324 | | | | 40,089,909 | |

| Pfizer, Inc. | | | 1,142,232 | | | | 40,606,348 | |

| Zoetis, Inc. | | | 311,842 | | | | 39,423,066 | |

| | | | | | | | |

| | | | | | | $ | 174,712,909 | |

| Pollution Control - 0.3% | | | | | | | | |

| Waste Connections, Inc. | | | 91,142 | | | $ | 8,375,950 | |

| | |

| Railroad & Shipping - 1.3% | | | | | | | | |

| Canadian Pacific Railway Ltd. | | | 80,236 | | | $ | 19,316,817 | |

| Kansas City Southern Co. | | | 132,271 | | | | 16,639,692 | |

| | | | | | | | |

| | | | | | | $ | 35,956,509 | |

| Real Estate - 2.2% | | | | | | | | |

| Industrial Logistics Properties Trust, REIT | | | 502,374 | | | $ | 10,745,780 | |

| Lexington Realty Trust, REIT | | | 262,146 | | | | 2,723,697 | |

15

Portfolio of Investments – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Common Stocks - continued | | | | | | | | |

| Real Estate - continued | | | | | | | | |

| Medical Properties Trust, Inc., REIT | | | 811,056 | | | $ | 15,077,531 | |

| STORE Capital Corp., REIT | | | 350,683 | | | | 13,241,790 | |

| Sun Communities, Inc., REIT | | | 29,138 | | | | 4,306,597 | |

| W.P. Carey, Inc., REIT | | | 183,859 | | | | 16,510,538 | |

| | | | | | | | |

| | | | | | | $ | 62,605,933 | |

| Restaurants - 1.4% | | | | | | | | |

| Starbucks Corp. | | | 302,681 | | | $ | 29,226,877 | |

| U.S. Foods Holding Corp. (a) | | | 260,342 | | | | 10,530,834 | |

| | | | | | | | |

| | | | | | | $ | 39,757,711 | |

| Specialty Chemicals - 1.0% | | | | | | | | |

| Corteva, Inc. | | | 342,504 | | | $ | 10,042,217 | |

| DuPont de Nemours, Inc. | | | 211,313 | | | | 14,354,492 | |

| Univar, Inc. (a) | | | 227,741 | | | | 4,406,789 | |

| | | | | | | | |

| | | | | | | $ | 28,803,498 | |

| Specialty Stores - 6.0% | | | | | | | | |

| Amazon.com, Inc. (a)(s) | | | 48,774 | | | $ | 86,636,769 | |

| Chewy, Inc., “A” (a) | | | 87,568 | | | | 2,889,744 | |

| Costco Wholesale Corp. | | | 67,691 | | | | 19,952,599 | |

| Floor & Decor Holdings, Inc. (a) | | | 281,096 | | | | 13,835,545 | |

| Ross Stores, Inc. | | | 202,240 | | | | 21,439,462 | |

| Target Corp. | | | 212,396 | | | | 22,734,868 | |

| | | | | | | | |

| | | | | | | $ | 167,488,987 | |

| Telecommunications - Wireless - 2.3% | | | | | | | | |

| American Tower Corp., REIT | | | 279,208 | | | $ | 64,270,890 | |

| | |

| Telephone Services - 0.6% | | | | | | | | |

| Verizon Communications, Inc. | | | 278,807 | | | $ | 16,215,415 | |

| | |

| Tobacco - 0.5% | | | | | | | | |

| Philip Morris International, Inc. | | | 194,882 | | | $ | 14,049,043 | |

| | |

| Trucking - 0.4% | | | | | | | | |

| Forward Air Corp. | | | 96,076 | | | $ | 5,985,535 | |

| Schneider National, Inc. | | | 263,190 | | | | 5,116,413 | |

| | | | | | | | |

| | | | | | | $ | 11,101,948 | |

| Utilities - Electric Power - 3.3% | | | | | | | | |

| American Electric Power Co., Inc. | | | 144,824 | | | $ | 13,200,708 | |

| Avangrid, Inc. | | | 44,644 | | | | 2,256,308 | |

| CenterPoint Energy, Inc. | | | 252,624 | | | | 6,995,158 | |

16

Portfolio of Investments – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Common Stocks - continued | | | | | | | | |

| Utilities - Electric Power - continued | | | | | | | | |

| CMS Energy Corp. | | | 176,300 | | | $ | 11,115,715 | |

| Evergy, Inc. | | | 168,643 | | | | 10,961,795 | |

| Exelon Corp. | | | 249,629 | | | | 11,797,466 | |

| NextEra Energy, Inc. | | | 84,491 | | | | 18,510,288 | |

| Southern Co. | | | 89,087 | | | | 5,190,209 | |

| Xcel Energy, Inc. | | | 190,621 | | | | 12,241,681 | |

| | | | | | | | |

| | | | | | | $ | 92,269,328 | |

| Total Common Stocks (Identified Cost, $2,173,375,659) | | | | | | $ | 2,766,036,175 | |

| | |

| Convertible Preferred Stocks - 0.1% | | | | | | | | |

| Natural Gas - Distribution - 0.1% | | | | | | | | |

| South Jersey Industries, Inc. | | | 37,587 | | | $ | 1,960,162 | |

| | |

| Utilities - Electric Power - 0.0% | | | | | | | | |

| American Electric Power Co., Inc. | | | 13,400 | | | $ | 755,492 | |

Total Convertible Preferred Stocks

(Identified Cost, $2,549,350) | | | | | | $ | 2,715,654 | |

| | |

| Investment Companies (h) - 1.3% | | | | | | | | |

| Money Market Funds - 1.3% | | | | | | | | |

MFS Institutional Money Market Portfolio, 2.17% (v)

(Identified Cost, $36,340,640) | | | 36,343,213 | | | $ | 36,346,848 | |

| | |

| Securities Sold Short - (0.5)% | | | | | | | | |

| Medical & Health Technology & Services - (0.2)% | | | | | | | | |

| Healthcare Services Group, Inc. | | | (242,368 | ) | | $ | (5,465,399 | ) |

| | |

| Telecommunications - Wireless - (0.2)% | | | | | | | | |

| Crown Castle International Corp., REIT | | | (44,300 | ) | | $ | (6,431,031 | ) |

| | |

| Trucking - (0.1)% | | | | | | | | |

| XPO Logistics, Inc. | | | (25,219 | ) | | $ | (1,787,018 | ) |

Total Securities Sold Short

(Proceeds Received, $13,924,288) | | | | | | $ | (13,683,448 | ) |

| | |

| Other Assets, Less Liabilities - 0.6% | | | | | | | 16,178,515 | |

| Net Assets - 100.0% | | | | | | $ | 2,807,593,744 | |

| (a) | Non-income producing security. |

| (h) | An affiliated issuer, which may be considered one in which the fund owns 5% or more of the outstanding voting securities, or a company which is under common control. At period end, the aggregate values of the fund’s investments in affiliated issuers and in unaffiliated issuers were $36,346,848 and $2,768,751,829, respectively. |

17

Portfolio of Investments – continued

| (s) | Security or a portion of the security was pledged to cover collateral requirements for securities sold short. |

| (v) | Affiliated issuer that is available only to investment companies managed by MFS. The rate quoted for the MFS Institutional Money Market Portfolio is the annualizedseven-day yield of the fund at period end. |

The following abbreviations are used in this report and are defined:

| REIT | | Real Estate Investment Trust |

At August 31, 2019, the fund had cash collateral of $1,694,212 and other liquid securities with an aggregate value of $20,982,492 to cover any collateral or margin obligations for securities sold short. Restricted cash and/or deposits with brokers in the Statement of Assets and Liabilities are comprised of cash collateral.

See Notes to Financial Statements

18

Financial Statements

STATEMENT OF ASSETS AND LIABILITIES

At 8/31/19

This statement represents your fund’s balance sheet, which details the assets and liabilities comprising the total value of the fund.

| | | | |

| Assets | | | | |

Investments in unaffiliated issuers, at value (identified cost, $2,175,925,009) | | | $2,768,751,829 | |

Investments in affiliated issuers, at value (identified cost, $36,340,640) | | | 36,346,848 | |

Cash | | | 29,691 | |

Deposits with brokers for | | | | |

Securities sold short | | | 1,694,212 | |

Receivables for | | | | |

Investments sold | | | 4,905,682 | |

Fund shares sold | | | 13,480,282 | |

Dividends | | | 4,271,990 | |

Other assets | | | 1,991 | |

Total assets | | | $2,829,482,525 | |

| |

| Liabilities | | | | |

Payables for | | | | |

Dividends on securities sold short | | | $48,171 | |

Securities sold short, at value (proceeds received, $13,924,288) | | | 13,683,448 | |

Investments purchased | | | 5,152,348 | |

Fund shares reacquired | | | 1,944,518 | |

Payable to affiliates | | | | |

Investment adviser | | | 126,676 | |

Administrative services fee | | | 3,135 | |

Shareholder servicing costs | | | 655,669 | |

Distribution and service fees | | | 30,249 | |

Payable for independent Trustees’ compensation | | | 9,075 | |

Accrued expenses and other liabilities | | | 235,492 | |

Total liabilities | | | $21,888,781 | |

Net assets | | | $2,807,593,744 | |

| |

| Net assets consist of | | | | |

Paid-in capital | | | $2,158,521,290 | |

Total distributable earnings (loss) | | | 649,072,454 | |

Net assets | | | $2,807,593,744 | |

Shares of beneficial interest outstanding | | | 84,705,776 | |

19

Statement of Assets and Liabilities – continued

| | | | | | | | | | | | |

| | | |

| | | Net assets | | | Shares

outstanding | | | Net asset value

per share (a) | |

| Class A | | | $1,373,524,274 | | | | 42,330,822 | | | | $32.45 | |

| Class B | | | 22,759,171 | | | | 806,265 | | | | 28.23 | |

| Class C | | | 72,092,796 | | | | 2,587,780 | | | | 27.86 | |

| Class I | | | 467,859,583 | | | | 13,572,510 | | | | 34.47 | |

| Class R1 | | | 3,185,757 | | | | 114,436 | | | | 27.84 | |

| Class R2 | | | 13,415,554 | | | | 424,452 | | | | 31.61 | |

| Class R3 | | | 42,198,588 | | | | 1,304,160 | | | | 32.36 | |

| Class R4 | | | 29,218,416 | | | | 891,877 | | | | 32.76 | |

| Class R6 | | | 783,339,605 | | | | 22,673,474 | | | | 34.55 | |

| (a) | Maximum offering price per share was equal to the net asset value per share for all share classes, except for Class A, for which the maximum offering price per share was $34.43 [100 / 94.25 x $32.45]. On sales of $50,000 or more, the maximum offering price of Class A shares is reduced. A contingent deferred sales charge may be imposed on redemptions of Class A, Class B, and Class C shares. Redemption price per share was equal to the net asset value per share for Classes I, R1, R2, R3, R4, and R6. |

See Notes to Financial Statements

20

Financial Statements

STATEMENT OF OPERATIONS

Year ended 8/31/19

This statement describes how much your fund earned in investment income and accrued in expenses. It also describes any gains and/or losses generated by fund operations.

| | | | |

| Net investment income (loss) | | | | |

Income | | | | |

Dividends | | | $37,233,606 | |

Dividends from affiliated issuers | | | 877,389 | |

Other | | | 359,485 | |

Income on securities loaned | | | 251,875 | |

Foreign taxes withheld | | | (78,372 | ) |

Total investment income | | | $38,643,983 | |

Expenses | | | | |

Management fee | | | $13,492,938 | |

Distribution and service fees | | | 4,111,600 | |

Shareholder servicing costs | | | 2,073,255 | |

Administrative services fee | | | 327,034 | |

Independent Trustees’ compensation | | | 36,609 | |

Custodian fee | | | 118,460 | |

Shareholder communications | | | 142,027 | |

Audit and tax fees | | | 61,062 | |

Legal fees | | | 49,594 | |

Dividend and interest expense on securities sold short | | | 581,911 | |

Interest expense and fees | | | 13,057 | |

Miscellaneous | | | 303,196 | |

Total expenses | | | $21,310,743 | |

Reduction of expenses by investment adviser and distributor | | | (308,054 | ) |

Net expenses | | | $21,002,689 | |

Net investment income (loss) | | | $17,641,294 | |

| |

| Realized and unrealized gain (loss) | | | | |

Realized gain (loss) (identified cost basis) | | | | |

Unaffiliated issuers | | | $45,661,773 | |

Affiliated issuers | | | (16,734 | ) |

Foreign currency | | | (3,717 | ) |

Net realized gain (loss) | | | $45,641,322 | |

Change in unrealized appreciation or depreciation | | | | |

Unaffiliated issuers | | | $72,947,809 | |

Affiliated issuers | | | 2,438 | |

Securities sold short | | | 1,614,177 | |

Translation of assets and liabilities in foreign currencies | | | 45 | |

Net unrealized gain (loss) | | | $74,564,469 | |

Net realized and unrealized gain (loss) | | | $120,205,791 | |

Change in net assets from operations | | | $137,847,085 | |

See Notes to Financial Statements

21

Financial Statements

STATEMENTS OF CHANGES IN NET ASSETS

These statements describe the increases and/or decreases in net assets resulting from operations, any distributions, and any shareholder transactions.

| | | | | | | | |

| | | Year ended | |

| | | 8/31/19 | | | 8/31/18 | |

| Change in net assets | | | | | | |

| | |

| From operations | | | | | | | | |

Net investment income (loss) | | | $17,641,294 | | | | $12,999,055 | |

Net realized gain (loss) | | | 45,641,322 | | | | 202,361,180 | |

Net unrealized gain (loss) | | | 74,564,469 | | | | 132,966,174 | |

Change in net assets from operations | | | $137,847,085 | | | | $348,326,409 | |

Total distributions to shareholders (a) | | | $(199,800,134 | ) | | | $(118,520,157 | ) |

Change in net assets from fund share transactions | | | $695,524,955 | | | | $249,008,217 | |

Total change in net assets | | | $633,571,906 | | | | $478,814,469 | |

| | |

| Net assets | | | | | | | | |

At beginning of period | | | 2,174,021,838 | | | | 1,695,207,369 | |

At end of period (b) | | | $2,807,593,744 | | | | $2,174,021,838 | |

| (a) | Distributions from net investment income and from net realized gain are no longer required to be separately disclosed. For the year ended August 31, 2018, distributions from net investment income and from net realized gain were $10,130,006 and $108,390,151, respectively. |

| (b) | Parenthetical disclosure of undistributed net investment income is no longer required. For the year ended August 31, 2018, end of period net assets included undistributed net investment income of $12,453,901. |

See Notes to Financial Statements

22

Financial Statements

FINANCIAL HIGHLIGHTS

The financial highlights table is intended to help you understand the fund’s financial performance for the past 5 years. Certain information reflects financial results for a single fund share. The total returns in the table represent the rate that an investor would have earned (or lost) on an investment in the fund share class (assuming reinvestment of all distributions) held for the entire period.

| | | | | | | | | | | | | | | | | | | | |

| Class A | | Year ended | |

| | | | | |

| | | 8/31/19 | | | 8/31/18 | | | 8/31/17 | | | 8/31/16 | | | 8/31/15 | |

Net asset value, beginning of period | | | $34.18 | | | | $30.46 | | | | $26.72 | | | | $27.19 | | | | $29.19 | |

| | | |

| Income (loss) from investment operations | | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $0.20 | | | | $0.20 | | | | $0.18 | (c) | | | $0.18 | | | | $0.15 | |

Net realized and unrealized gain (loss) | | | 1.05 | | | | 5.63 | | | | 4.53 | | | | 2.08 | | | | 0.13 | |

Total from investment operations | | | $1.25 | | | | $5.83 | | | | $4.71 | | | | $2.26 | | | | $0.28 | |

| | | |

| Less distributions declared to shareholders | | | | | | | | | | | | | |

From net investment income | | | $(0.16 | ) | | | $(0.17 | ) | | | $(0.16 | ) | | | $(0.14 | ) | | | $(0.13 | ) |

From net realized gain | | | (2.82 | ) | | | (1.94 | ) | | | (0.81 | ) | | | (2.59 | ) | | | (2.15 | ) |

Total distributions declared to shareholders | | | $(2.98 | ) | | | $(2.11 | ) | | | $(0.97 | ) | | | $(2.73 | ) | | | $(2.28 | ) |

Net asset value, end of period (x) | | | $32.45 | | | | $34.18 | | | | $30.46 | | | | $26.72 | | | | $27.19 | |

Total return (%) (r)(s)(t)(x) | | | 4.94 | | | | 19.89 | | | | 18.11 | (c) | | | 9.09 | | | | 0.98 | |

| | | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | | 1.00 | | | | 1.00 | | | | 1.03 | (c) | | | 1.07 | | | | 1.05 | |

Expenses after expense reductions (f) | | | 0.98 | | | | 0.99 | | | | 1.01 | (c) | | | 1.05 | | | | 1.04 | |

Net investment income (loss) | | | 0.65 | | | | 0.62 | | | | 0.63 | (c) | | | 0.70 | | | | 0.52 | |

Portfolio turnover | | | 39 | | | | 42 | | | | 46 | | | | 68 | | | | 53 | |

Net assets at end of period (000 omitted) | | | $1,373,524 | | | | $1,184,976 | | | | $992,736 | | | | $959,812 | | | | $963,167 | |

| | | | | |

| Supplemental Ratios (%): | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets after

expense reductions excluding short sale

expenses and interest expense and fees (f) | | | 0.96 | | | | 0.97 | | | | 1.00 | (c) | | | 1.04 | | | | 1.03 | |

See Notes to Financial Statements

23

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | |

| Class B | | Year ended | |

| | | | | |

| | | 8/31/19 | | | 8/31/18 | | | 8/31/17 | | | 8/31/16 | | | 8/31/15 | |

Net asset value, beginning of period | | | $30.19 | | | | $27.17 | | | | $23.96 | | | | $24.70 | | | | $26.78 | |

| | | | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $(0.03 | ) | | | $(0.04 | ) | | | $(0.03 | )(c) | | | $(0.02 | ) | | | $(0.06 | ) |

Net realized and unrealized gain (loss) | | | 0.89 | | | | 5.00 | | | | 4.05 | | | | 1.87 | | | | 0.13 | |

Total from investment operations | | | $0.86 | | | | $4.96 | | | | $4.02 | | | | $1.85 | | | | $0.07 | |

| | | | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | | | |

From net investment income | | | $— | | | | $— | | | | $— | | | | $— | | | | $— | |

From net realized gain | | | (2.82 | ) | | | (1.94 | ) | | | (0.81 | ) | | | (2.59 | ) | | | (2.15 | ) |

Total distributions declared to shareholders | | | $(2.82 | ) | | | $(1.94 | ) | | | $(0.81 | ) | | | $(2.59 | ) | | | $(2.15 | ) |

Net asset value, end of period (x) | | | $28.23 | | | | $30.19 | | | | $27.17 | | | | $23.96 | | | | $24.70 | |

Total return (%) (r)(s)(t)(x) | | | 4.16 | | | | 19.01 | | | | 17.21 | (c) | | | 8.24 | | | | 0.25 | |

| | | | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | | 1.75 | | | | 1.75 | | | | 1.78 | (c) | | | 1.82 | | | | 1.80 | |

Expenses after expense reductions (f) | | | 1.73 | | | | 1.74 | | | | 1.77 | (c) | | | 1.81 | | | | 1.80 | |

Net investment income (loss) | | | (0.11 | ) | | | (0.14 | ) | | | (0.12 | )(c) | | | (0.07 | ) | | | (0.23 | ) |

Portfolio turnover | | | 39 | | | | 42 | | | | 46 | | | | 68 | | | | 53 | |

Net assets at end of period (000 omitted) | | | $22,759 | | | | $26,993 | | | | $27,139 | | | | $30,324 | | | | $34,126 | |

| | | | |

| Supplemental Ratios (%): | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets after

expense reductions excluding short sale

expenses and interest expense and fees (f) | | | 1.71 | | | | 1.72 | | | | 1.75 | (c) | | | 1.79 | | | | 1.79 | |

See Notes to Financial Statements

24

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | |

| Class C | | Year ended | |

| | | | | |

| | | 8/31/19 | | | 8/31/18 | | | 8/31/17 | | | 8/31/16 | | | 8/31/15 | |

Net asset value, beginning of period | | | $29.84 | | | | $26.88 | | | | $23.71 | | | | $24.47 | | | | $26.55 | |

| | | | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $(0.03 | ) | | | $(0.05 | ) | | | $(0.03 | )(c) | | | $(0.01 | ) | | | $(0.06 | ) |

Net realized and unrealized gain (loss) | | | 0.87 | | | | 4.95 | | | | 4.01 | | | | 1.84 | | | | 0.13 | |

Total from investment operations | | | $0.84 | | | | $4.90 | | | | $3.98 | | | | $1.83 | | | | $0.07 | |

| | | | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | | | |

From net investment income | | | $— | | | | $— | | | | $— | | | | $— | | | | $— | |

From net realized gain | | | (2.82 | ) | | | (1.94 | ) | | | (0.81 | ) | | | (2.59 | ) | | | (2.15 | ) |

Total distributions declared to shareholders | | | $(2.82 | ) | | | $(1.94 | ) | | | $(0.81 | ) | | | $(2.59 | ) | | | $(2.15 | ) |

Net asset value, end of period (x) | | | $27.86 | | | | $29.84 | | | | $26.88 | | | | $23.71 | | | | $24.47 | |

Total return (%) (r)(s)(t)(x) | | | 4.14 | | | | 18.98 | | | | 17.22 | (c) | | | 8.24 | | | | 0.26 | |

| | | | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | | 1.75 | | | | 1.75 | | | | 1.78 | (c) | | | 1.82 | | | | 1.80 | |

Expenses after expense reductions (f) | | | 1.74 | | | | 1.74 | | | | 1.77 | (c) | | | 1.81 | | | | 1.80 | |

Net investment income (loss) | | | (0.10 | ) | | | (0.17 | ) | | | (0.12 | )(c) | | | (0.05 | ) | | | (0.23 | ) |

Portfolio turnover | | | 39 | | | | 42 | | | | 46 | | | | 68 | | | | 53 | |

Net assets at end of period (000 omitted) | | | $72,093 | | | | $56,413 | | | | $89,946 | | | | $89,160 | | | | $88,020 | |

| | | | |

| Supplemental Ratios (%): | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets after

expense reductions excluding short sale

expenses and interest expense and fees (f) | | | 1.71 | | | | 1.72 | | | | 1.75 | (c) | | | 1.79 | | | | 1.79 | |

See Notes to Financial Statements

25

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | |

| Class I | | Year ended | |

| | | | | |

| | | 8/31/19 | | | 8/31/18 | | | 8/31/17 | | | 8/31/16 | | | 8/31/15 | |

Net asset value, beginning of period | | | $36.12 | | | | $32.07 | | | | $28.10 | | | | $28.44 | | | | $30.43 | |

| | | | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $0.30 | | | | $0.30 | | | | $0.26 | (c) | | | $0.29 | | | | $0.23 | |

Net realized and unrealized gain (loss) | | | 1.11 | | | | 5.93 | | | | 4.76 | | | | 2.15 | | | | 0.13 | |

Total from investment operations | | | $1.41 | | | | $6.23 | | | | $5.02 | | | | $2.44 | | | | $0.36 | |

| | | | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | | | |

From net investment income | | | $(0.24 | ) | | | $(0.24 | ) | | | $(0.24 | ) | | | $(0.19 | ) | | | $(0.20 | ) |

From net realized gain | | | (2.82 | ) | | | (1.94 | ) | | | (0.81 | ) | | | (2.59 | ) | | | (2.15 | ) |

Total distributions declared to shareholders | | | $(3.06 | ) | | | $(2.18 | ) | | | $(1.05 | ) | | | $(2.78 | ) | | | $(2.35 | ) |

Net asset value, end of period (x) | | | $34.47 | | | | $36.12 | | | | $32.07 | | | | $28.10 | | | | $28.44 | |

Total return (%) (r)(s)(t)(x) | | | 5.17 | | | | 20.21 | | | | 18.38 | (c) | | | 9.36 | | | | 1.23 | |

| | | | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | | 0.75 | | | | 0.75 | | | | 0.78 | (c) | | | 0.81 | | | | 0.80 | |

Expenses after expense reductions (f) | | | 0.74 | | | | 0.74 | | | | 0.77 | (c) | | | 0.80 | | | | 0.80 | |

Net investment income (loss) | | | 0.90 | | | | 0.88 | | | | 0.88 | (c) | | | 1.07 | | | | 0.77 | |

Portfolio turnover | | | 39 | | | | 42 | | | | 46 | | | | 68 | | | | 53 | |

Net assets at end of period (000 omitted) | | | $467,860 | | | | $246,779 | | | | $122,055 | | | | $61,739 | | | | $49,768 | |

| | | | |

| Supplemental Ratios (%): | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets after

expense reductions excluding short sale

expenses and interest expense and fees (f) | | | 0.72 | | | | 0.73 | | | | 0.75 | (c) | | | 0.79 | | | | 0.79 | |

See Notes to Financial Statements

26

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | |

| Class R1 | | Year ended | |

| | | | | |

| | | 8/31/19 | | | 8/31/18 | | | 8/31/17 | | | 8/31/16 | | | 8/31/15 | |

Net asset value, beginning of period | | | $29.82 | | | | $26.86 | | | | $23.70 | | | | $24.45 | | | | $26.54 | |

| | | | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $(0.03 | ) | | | $(0.04 | ) | | | $(0.03 | )(c) | | | $(0.02 | ) | | | $(0.06 | ) |

Net realized and unrealized gain (loss) | | | 0.87 | | | | 4.94 | | | | 4.00 | | | | 1.86 | | | | 0.12 | |

Total from investment operations | | | $0.84 | | | | $4.90 | | | | $3.97 | | | | $1.84 | | | | $0.06 | |

| | | | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | | | |

From net investment income | | | $— | | | | $— | | | | $— | | | | $— | | | | $— | |

From net realized gain | | | (2.82 | ) | | | (1.94 | ) | | | (0.81 | ) | | | (2.59 | ) | | | (2.15 | ) |

Total distributions declared to shareholders | | | $(2.82 | ) | | | $(1.94 | ) | | | $(0.81 | ) | | | $(2.59 | ) | | | $(2.15 | ) |

Net asset value, end of period (x) | | | $27.84 | | | | $29.82 | | | | $26.86 | | | | $23.70 | | | | $24.45 | |

Total return (%) (r)(s)(t)(x) | | | 4.14 | | | | 19.00 | | | | 17.19 | (c) | | | 8.29 | | | | 0.22 | |

| | | | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | | 1.75 | | | | 1.75 | | | | 1.78 | (c) | | | 1.82 | | | | 1.80 | |

Expenses after expense reductions (f) | | | 1.74 | | | | 1.74 | | | | 1.77 | (c) | | | 1.81 | | | | 1.80 | |

Net investment income (loss) | | | (0.11 | ) | | | (0.14 | ) | | | (0.13 | )(c) | | | (0.09 | ) | | | (0.23 | ) |

Portfolio turnover | | | 39 | | | | 42 | | | | 46 | | | | 68 | | | | 53 | |

Net assets at end of period (000 omitted) | | | $3,186 | | | | $3,448 | | | | $3,103 | | | | $2,935 | | | | $3,625 | |

| | | | |

| Supplemental Ratios (%): | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets after

expense reductions excluding short sale

expenses and interest expense and fees (f) | | | 1.71 | | | | 1.73 | | | | 1.75 | (c) | | | 1.80 | | | | 1.79 | |

See Notes to Financial Statements

27

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | |

| Class R2 | | Year ended | |

| | | | | |

| | | 8/31/19 | | | 8/31/18 | | | 8/31/17 | | | 8/31/16 | | | 8/31/15 | |

Net asset value, beginning of period | | | $33.33 | | | | $29.75 | | | | $26.12 | | | | $26.62 | | | | $28.59 | |

| | | | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $0.12 | | | | $0.11 | | | | $0.10 | (c) | | | $0.11 | | | | $0.07 | |

Net realized and unrealized gain (loss) | | | 1.02 | | | | 5.50 | | | | 4.43 | | | | 2.04 | | | | 0.14 | |

Total from investment operations | | | $1.14 | | | | $5.61 | | | | $4.53 | | | | $2.15 | | | | $0.21 | |

| | | | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | | | |

From net investment income | | | $(0.04 | ) | | | $(0.09 | ) | | | $(0.09 | ) | | | $(0.06 | ) | | | $(0.03 | ) |

From net realized gain | | | (2.82 | ) | | | (1.94 | ) | | | (0.81 | ) | | | (2.59 | ) | | | (2.15 | ) |

Total distributions declared to shareholders | | | $(2.86 | ) | | | $(2.03 | ) | | | $(0.90 | ) | | | $(2.65 | ) | | | $(2.18 | ) |

Net asset value, end of period (x) | | | $31.61 | | | | $33.33 | | | | $29.75 | | | | $26.12 | | | | $26.62 | |

Total return (%) (r)(s)(t)(x) | | | 4.66 | | | | 19.61 | | | | 17.80 | (c) | | | 8.82 | | | | 0.75 | |

| | | | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | | 1.25 | | | | 1.25 | | | | 1.28 | (c) | | | 1.32 | | | | 1.30 | |

Expenses after expense reductions (f) | | | 1.23 | | | | 1.24 | | | | 1.27 | (c) | | | 1.31 | | | | 1.30 | |

Net investment income (loss) | | | 0.39 | | | | 0.35 | | | | 0.38 | (c) | | | 0.46 | | | | 0.27 | |

Portfolio turnover | | | 39 | | | | 42 | | | | 46 | | | | 68 | | | | 53 | |

Net assets at end of period (000 omitted) | | | $13,416 | | | | $15,202 | | | | $16,508 | | | | $15,932 | | | | $16,332 | |

| | | | |

| Supplemental Ratios (%): | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets after

expense reductions excluding short sale

expenses and interest expense and fees (f) | | | 1.20 | | | | 1.22 | | | | 1.25 | (c) | | | 1.29 | | | | 1.29 | |

See Notes to Financial Statements

28

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | |

| Class R3 | | Year ended | |

| | | | | |

| | | 8/31/19 | | | 8/31/18 | | | 8/31/17 | | | 8/31/16 | | | 8/31/15 | |

Net asset value, beginning of period | | | $34.11 | | | | $30.33 | | | | $26.61 | | | | $27.10 | | | | $29.10 | |

| | | | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $0.20 | | | | $0.20 | | | | $0.17 | (c) | | | $0.18 | | | | $0.15 | |

Net realized and unrealized gain (loss) | | | 1.04 | | | | 5.61 | | | | 4.52 | | | | 2.06 | | | | 0.13 | |

Total from investment operations | | | $1.24 | | | | $5.81 | | | | $4.69 | | | | $2.24 | | | | $0.28 | |

| | | | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | | | |

From net investment income | | | $(0.17 | ) | | | $(0.09 | ) | | | $(0.16 | ) | | | $(0.14 | ) | | | $(0.13 | ) |

From net realized gain | | | (2.82 | ) | | | (1.94 | ) | | | (0.81 | ) | | | (2.59 | ) | | | (2.15 | ) |

Total distributions declared to shareholders | | | $(2.99 | ) | | | $(2.03 | ) | | | $(0.97 | ) | | | $(2.73 | ) | | | $(2.28 | ) |

Net asset value, end of period (x) | | | $32.36 | | | | $34.11 | | | | $30.33 | | | | $26.61 | | | | $27.10 | |

Total return (%) (r)(s)(t)(x) | | | 4.91 | | | | 19.91 | | | | 18.10 | (c) | | | 9.06 | | | | 0.99 | |

| | | | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | | 1.00 | | | | 1.00 | | | | 1.02 | (c) | | | 1.07 | | | | 1.05 | |

Expenses after expense reductions (f) | | | 0.99 | | | | 0.99 | | | | 1.02 | (c) | | | 1.06 | | | | 1.05 | |

Net investment income (loss) | | | 0.64 | | | | 0.61 | | | | 0.62 | (c) | | | 0.71 | | | | 0.52 | |

Portfolio turnover | | | 39 | | | | 42 | | | | 46 | | | | 68 | | | | 53 | |

Net assets at end of period (000 omitted) | | | $42,199 | | | | $34,916 | | | | $28,075 | | | | $77,217 | | | | $65,775 | |

| | | | |

| Supplemental Ratios (%): | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets after

expense reductions excluding short sale

expenses and interest expense and fees (f) | | | 0.96 | | | | 0.98 | | | | 1.00 | (c) | | | 1.04 | | | | 1.04 | |

See Notes to Financial Statements

29

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | |

| Class R4 | | Year ended | |

| | | | | |

| | | 8/31/19 | | | 8/31/18 | | | 8/31/17 | | | 8/31/16 | | | 8/31/15 | |

Net asset value, beginning of period | | | $34.48 | | | | $30.71 | | | | $26.93 | | | | $27.39 | | | | $29.40 | |

| | | | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $0.28 | | | | $0.28 | | | | $0.25 | (c) | | | $0.23 | | | | $0.22 | |

Net realized and unrealized gain (loss) | | | 1.05 | | | | 5.67 | | | | 4.57 | | | | 2.11 | | | | 0.12 | |

Total from investment operations | | | $1.33 | | | | $5.95 | | | | $4.82 | | | | $2.34 | | | | $0.34 | |

| | | | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | | | |

From net investment income | | | $(0.23 | ) | | | $(0.24 | ) | | | $(0.23 | ) | | | $(0.21 | ) | | | $(0.20 | ) |

From net realized gain | | | (2.82 | ) | | | (1.94 | ) | | | (0.81 | ) | | | (2.59 | ) | | | (2.15 | ) |

Total distributions declared to shareholders | | | $(3.05 | ) | | | $(2.18 | ) | | | $(1.04 | ) | | | $(2.80 | ) | | | $(2.35 | ) |

Net asset value, end of period (x) | | | $32.76 | | | | $34.48 | | | | $30.71 | | | | $26.93 | | | | $27.39 | |

Total return (%) (r)(s)(t)(x) | | | 5.18 | | | | 20.18 | | | | 18.40 | (c) | | | 9.36 | | | | 1.22 | |

| | | | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | | 0.75 | | | | 0.75 | | | | 0.78 | (c) | | | 0.82 | | | | 0.80 | |

Expenses after expense reductions (f) | | | 0.74 | | | | 0.74 | | | | 0.77 | (c) | | | 0.81 | | | | 0.80 | |

Net investment income (loss) | | | 0.89 | | | | 0.86 | | | | 0.87 | (c) | | | 0.90 | | | | 0.76 | |

Portfolio turnover | | | 39 | | | | 42 | | | | 46 | | | | 68 | | | | 53 | |

Net assets at end of period (000 omitted) | | | $29,218 | | | | $27,707 | | | | $22,494 | | | | $15,799 | | | | $21,159 | |

| | | | |

| Supplemental Ratios (%): | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets after

expense reductions excluding short sale

expenses and interest expense and fees (f) | | | 0.71 | | | | 0.73 | | | | 0.76 | (c) | | | 0.79 | | | | 0.79 | |

See Notes to Financial Statements

30

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | |

| Class R6 | | Year ended | |

| | | | | |

| | | 8/31/19 | | | 8/31/18 | | | 8/31/17 | | | 8/31/16 | | | 8/31/15 | |

Net asset value, beginning of period | | | $36.18 | | | | $32.12 | | | | $28.13 | | | | $28.49 | | | | $30.47 | |

| | | | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $0.32 | | | | $0.32 | | | | $0.29 | (c) | | | $0.58 | | | | $0.24 | |

Net realized and unrealized gain (loss) | | | 1.13 | | | | 5.95 | | | | 4.77 | | | | 1.89 | | | | 0.15 | |

Total from investment operations | | | $1.45 | | | | $6.27 | | | | $5.06 | | | | $2.47 | | | | $0.39 | |

| | | | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | | | |

From net investment income | | | $(0.26 | ) | | | $(0.27 | ) | | | $(0.27 | ) | | | $(0.24 | ) | | | $(0.22 | ) |

From net realized gain | | | (2.82 | ) | | | (1.94 | ) | | | (0.81 | ) | | | (2.59 | ) | | | (2.15 | ) |

Total distributions declared to shareholders | | | $(3.08 | ) | | | $(2.21 | ) | | | $(1.07 | ) | | | $(2.83 | ) | | | $(2.37 | ) |

Net asset value, end of period (x) | | | $34.55 | | | | $36.18 | | | | $32.12 | | | | $28.13 | | | | $28.49 | |

Total return (%) (r)(s)(t)(x) | | | 5.28 | | | | 20.29 | | | | 18.49 | (c) | | | 9.46 | | | | 1.34 | |

| | | | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | | 0.67 | | | | 0.67 | | | | 0.69 | (c) | | | 0.70 | | | | 0.71 | |

Expenses after expense reductions (f) | | | 0.66 | | | | 0.66 | | | | 0.68 | (c) | | | 0.69 | | | | 0.70 | |

Net investment income (loss) | | | 0.98 | | | | 0.95 | | | | 0.97 | (c) | | | 2.10 | | | | 0.82 | |

Portfolio turnover | | | 39 | | | | 42 | | | | 46 | | | | 68 | | | | 53 | |

Net assets at end of period (000 omitted) | | | $783,340 | | | | $577,588 | | | | $393,153 | | | | $300,078 | | | | $6,198 | |

| | | | |

| Supplemental Ratios (%): | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets after

expense reductions excluding short sale

expenses and interest expense and fees (f) | | | 0.63 | | | | 0.65 | | | | 0.66 | (c) | | | 0.68 | | | | 0.69 | |

| (c) | Amount reflects aone-time reimbursement of expenses by the custodian (or former custodian) without which net investment income and performance would be lower and expenses would be higher. |

| (d) | Per share data is based on average shares outstanding. |

| (f) | Ratios do not reflect reductions from fees paid indirectly, if applicable. |

| (r) | Certain expenses have been reduced without which performance would have been lower. |

| (s) | From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower. Excluding the effect of the proceeds received from anon-recurring litigation settlement against Household International, Inc., the total return for the year ended August 31, 2017 would have been lower by approximately 0.85%. |

| (t) | Total returns do not include any applicable sales charges. |

| (x) | The net asset values and total returns have been calculated on net assets which include adjustments made in accordance with U.S. generally accepted accounting principles required at period end for financial reporting purposes. |

See Notes to Financial Statements

31

NOTES TO FINANCIAL STATEMENTS

(1) Business and Organization

MFS Core Equity Fund (the fund) is a diversified series of MFS Series Trust I (the trust). The trust is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended, as anopen-end management investment company.

The fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services – Investment Companies.

(2) Significant Accounting Policies

General– The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. In the preparation of these financial statements, management has evaluated subsequent events occurring after the date of the fund’s Statement of Assets and Liabilities through the date that the financial statements were issued.

Balance Sheet Offsetting– The fund’s accounting policy with respect to balance sheet offsetting is that, absent an event of default by the counterparty or a termination of the agreement, the International Swaps and Derivatives Association (ISDA) Master Agreement, or similar agreement, does not result in an offset of reported amounts of financial assets and financial liabilities in the Statement of Assets and Liabilities across transactions between the fund and the applicable counterparty. The fund’s right to setoff may be restricted or prohibited by the bankruptcy or insolvency laws of the particular jurisdiction to which a specific master netting agreement counterparty is subject. Balance sheet offsetting disclosures, to the extent applicable to the fund, have been included in the fund’s Significant Accounting Policies note under the captions for each of the fund’sin-scope financial instruments and transactions.

Investment Valuations– Equity securities, including restricted equity securities and equity securities sold short, are generally valued at the last sale or official closing price on their primary market or exchange as provided by a third-party pricing service. Equity securities, for which there were no sales reported that day, are generally valued at the last quoted daily bid quotation on their primary market or exchange as provided by a third-party pricing service. Equity securities sold short, for which there were no sales reported for that day, are generally valued at the last quoted daily ask quotation on their primary market or exchange as provided by a third-party pricing service.Short-term instruments with a maturity at issuance of 60 days or less may be valued at amortized cost, which approximates market value.Open-end investment companies are generally valued at net asset value per share. Securities and other assets generally valued on the basis of information from a third-party pricing service may also be valued at a broker/dealer bid quotation. In determining values, third-party pricing services can

32

Notes to Financial Statements – continued