UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4777

MFS SERIES TRUST I

(Exact name of registrant as specified in charter)

111 Huntington Avenue, Boston, Massachusetts 02199

(Address of principal executive offices) (Zip code)

Christopher R. Bohane

Massachusetts Financial Services Company

111 Huntington Avenue

Boston, Massachusetts 02199

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617) 954-5000

Date of fiscal year end: August 31

Date of reporting period: August 31, 2017

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

ANNUAL REPORT

August 31, 2017

MFS® CORE EQUITY FUND

RGI-ANN

MFS® CORE EQUITY FUND

CONTENTS

The report is prepared for the general information of shareholders.

It is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

LETTER FROM THE EXECUTIVE CHAIRMAN

Dear Shareholders:

Despite policy uncertainty accompanying a new presidential administration in the United States and unease over ongoing Brexit negotiations, most markets have proved

resilient. U.S. share prices have reached new highs in recent months although the U.S. Federal Reserve has continued to gradually hike interest rates. However, rates in most developed markets remain very low, with major non-U.S. central banks just beginning to contemplate curbing accommodative monetary policies.

Globally, we’ve experienced a year-long synchronized upturn in economic growth. Despite better growth, there are few immediate signs of worrisome inflation amid muted wage gains around the world. Europe has benefited from diminishing event risks as populist challengers fell short of upsetting establishment

candidates in both the Dutch and French elections. Emerging market economies have been boosted in part by a weaker U.S. dollar and are recovering despite lingering concerns over the potential for restrictive U.S. trade policies that could hamper global trade growth. Looking ahead, markets will have to contend with issues involving geopolitical hot spots on the Korean peninsula and in the Middle East.

At MFS®, we believe time is an asset. A patient, long-term approach to investing can have a powerful impact on decision making and outcomes. Time arbitrage, as we call it, comes down to having the conviction and discipline to allow enough time for good investment ideas to play out. In our view, such an approach, along with the professional guidance of a financial advisor, will help you reach your investment objectives.

Respectfully,

Robert J. Manning

Executive Chairman

MFS Investment Management

October 17, 2017

The opinions expressed in this letter are subject to change and may not be relied upon for investment advice. No forecasts can be guaranteed.

1

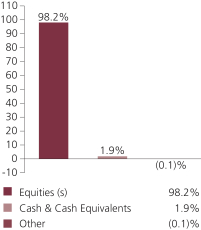

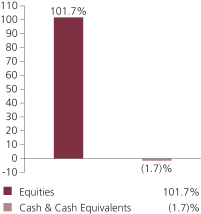

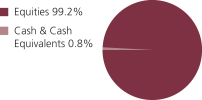

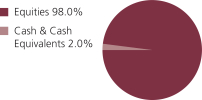

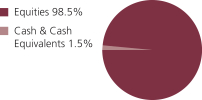

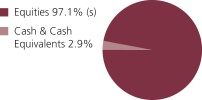

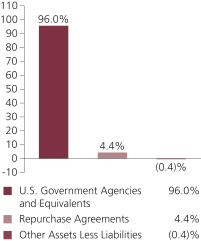

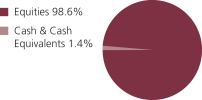

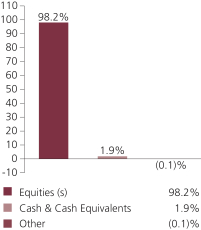

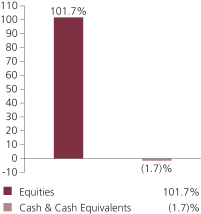

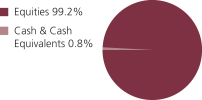

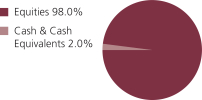

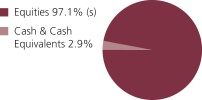

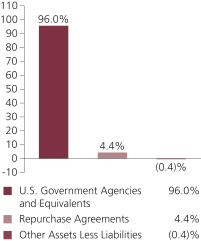

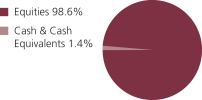

PORTFOLIO COMPOSITION

Portfolio structure

| | | | |

| Top ten holdings | | | | |

| Citigroup, Inc. | | | 2.7% | |

| Facebook, Inc., “A” | | | 2.6% | |

| Alphabet, Inc., “A” | | | 2.4% | |

| Chevron Corp. | | | 1.9% | |

| Aon PLC | | | 1.9% | |

| Pfizer, Inc. | | | 1.7% | |

| Texas Instruments, Inc. | | | 1.7% | |

| American Tower Corp., REIT | | | 1.6% | |

| Amazon.com, Inc. | | | 1.4% | |

| Honeywell International, Inc. | | | 1.4% | |

| | | | |

| Equity sectors | | | | |

| Financial Services | | | 18.8% | |

| Technology | | | 18.6% | |

| Health Care | | | 13.7% | |

| Industrial Goods & Services | | | 8.1% | |

| Consumer Staples | | | 6.5% | |

| Utilities & Communications (s) | | | 6.2% | |

| Retailing | | | 6.1% | |

| Leisure | | | 5.1% | |

| Energy | | | 4.6% | |

| Special Products & Services | | | 4.3% | |

| Basic Materials | | | 3.6% | |

| Transportation | | | 1.4% | |

| Autos & Housing | | | 1.2% | |

| (s) | Includes securities sold short. |

Cash & Cash Equivalents includes any cash, investments in money market funds, short-term securities, and other assets less liabilities. Please see the Statement of Assets and Liabilities for additional information related to the fund’s cash position and other assets and liabilities.

Other includes equivalent exposure from currency derivatives and/or any offsets to derivative positions and may be negative.

Percentages are based on net assets as of August 31, 2017.

The portfolio is actively managed and current holdings may be different.

2

MANAGEMENT REVIEW

Summary of Results

For the twelve months ended August 31, 2017, Class A shares of the MFS Core Equity Fund (“fund”) provided a total return of 18.11%, at net asset value. This compares with a return of 16.06% for the fund’s benchmark, the Russell 3000® Index.

Market Environment

For the first time in many years, the global economy is experiencing a period of synchronized economic growth. The rebound in emerging markets (“EM”) economies has been more pronounced (despite the deceleration in Chinese growth at the end of the period), helped by larger economies such as Brazil and Russia emerging from recessions. At the same time, developed markets (“DM”) economies continued to grow at or above potential. Market confidence increased in the US after the presidential elections in November in anticipation of lower taxes, a lighter regulatory burden and increased infrastructure spending, boosting US equities and corporate bond performance. Though hopes have largely faded for pro-growth US policies, market confidence persists. Globally, markets benefited from a reflation trade during the first half of the period as commodity prices strengthened, activity and growth prospects improved, and inflation moved higher, though within moderate bounds. While this bump in global inflation faded in the second half of the period as commodity prices, particularly oil, leveled off or declined, global growth remained relatively resilient. As a result, there have been more tightening signals and actions by DM central banks. The US Federal Reserve increased interest rates by 25 basis points during the second half of the period, bringing the total number of quarter-percent hikes in the federal funds rate to four since December 2015. The European Central Bank appears set to announce tapering of quantitative easing in the fall of 2017. The Bank of England may also begin reducing monetary accommodation. Markets have been comforted, along with central banks, by the decline in fears of a populist surge in Europe after establishment candidates won the Dutch and French elections. European growth has reflected the calmer political economic backdrop.

In recent months, the US dollar reversed the sharp rise seen early in the period, easing what had been a substantial headwind to earnings for multinationals. US consumer spending held up well during the second half of the period amid a modest increase in real wages and relatively low gasoline prices. Demand for autos reached near-record territory in the first half of the period before tapering off at the end of the period, while the housing market continued its recovery amid relatively low mortgage rates and tight inventories. Global trade, which was sluggish early in the period, showed signs of improvement in the period’s second half, a positive indicator of global economic activity and prospects. Early in the period, the US election resulted in a sell-off in EM assets due to fears that President Trump would follow through on various campaign threats and promises that were judged to be detrimental to EM. While President Trump withdrew the US from the Trans-Pacific Partnership and began the renegotiation of the North American Free Trade Agreement, significant additional policy action has so far been lacking on economic issues involving EM. As a result, emerging markets resumed their upward trajectory, powered by strong inflows throughout the first half of 2017.

3

Management Review – continued

Contributors to Performance

Strong security selection in the technology sector contributed to performance relative to the Russell 3000® Index. Within this sector, overweight positions in computer graphics processors maker NVIDIA, broadband communications and networking services provider Broadcom, software company Adobe Systems and social networking service provider Facebook supported relative returns. Shares of NVIDIA advanced during the period as increased demand in its Pascal and deep learning data center units, as well as stronger-than-anticipated performance in its automotive and gaming segments, led to positive results.

Security selection in both the utilities & communications and industrial goods & services sectors also bolstered relative performance. Within the utilities & communications sector, an overweight position in broadcast and communication tower management firm American Tower helped relative returns after the company reported solid international and domestic growth figures and a positive foreign exchange impact. Additionally, not owning shares of telecommunications company AT&T further supported relative results. Within the industrial goods & services sector, not owning shares of diversified industrial conglomerate General Electric benefited relative returns. Shares of General Electric came under pressure after the company reported disappointing results in its Power and Oil & Gas segments following weaker-than-expected order intakes.

Elsewhere, an overweight position in diversified financial services firm Citigroup aided relative results. Shares of Citigroup appreciated after the US presidential election, as banks outperformed the broader markets on prospects of higher interest rates, stronger growth and regulatory relief. Later in the reporting period, the company’s plan to return capital to shareholders, via share repurchases and dividends, was approved by the Federal Reserve, which further boosted the company’s share price. Additionally, not owning integrated oil and gas company Exxon Mobil, and the timing of the fund’s ownership in shares of financial services firm Goldman Sachs (h), also boosted relative returns.

Performance for the reporting period includes a 0.72% positive impact due to a litigation settlement to the fund by Household International, Inc.

Detractors from Performance

Stock selection in the retailing sector detracted from relative performance, led by overweight positions in apparel retailers Urban Outfitters and Express (h). Shares of Urban Outfitters declined due to weaker-than-expected sales.

Stocks in other sectors that detracted from relative performance included underweight positions in computer and personal electronics maker Apple and software giant Microsoft. Shares of Apple appreciated at the beginning of the calendar year after the company reported better-than-expected results, driven primarily by robust growth in iPhone sales which came in ahead of consensus estimates. The company’s Services segment also posted strong revenue growth during the reporting period, which further strengthened the stock. Additionally, overweight positions in real estate investment trusts Medical Properties Trust and Tanger Factory Outlet Centers (h) and global integrated energy company Hess, and not owning shares of aerospace company

4

Management Review – continued

Boeing and financial services firm JPMorgan Chase, also weakened relative returns. Shares of Medical Properties Trust weakened after the company lowered its full year outlook for its funds from operations.

The fund’s cash and/or cash equivalents position during the period was also a detractor from relative performance. Under normal market conditions, the fund strives to be fully invested and generally holds cash to buy new holdings and to provide liquidity. In a period when equity markets rose, as measured by the fund’s benchmark, holding cash hurt performance versus the benchmark, which has no cash position.

Respectfully,

Portfolio Manager(s)

Joseph MacDougall

| (h) | Security was not held in the fund at period end. |

The views expressed in this report are those of the portfolio manager(s) only through the end of the period of the report as stated on the cover and do not necessarily reflect the views of MFS or any other person in the MFS organization. These views are subject to change at any time based on market or other conditions, and MFS disclaims any responsibility to update such views. These views may not be relied upon as investment advice or an indication of trading intent on behalf of any MFS portfolio. References to specific securities are not recommendations of such securities, and may not be representative of any MFS portfolio’s current or future investments.

5

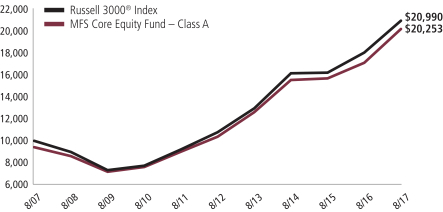

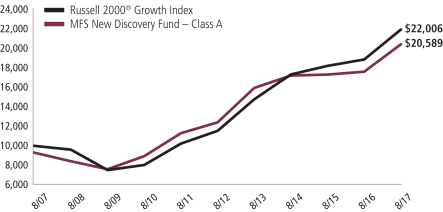

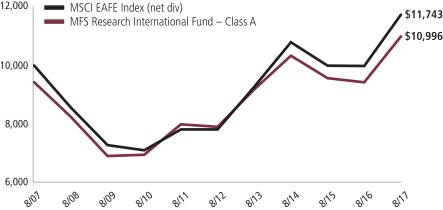

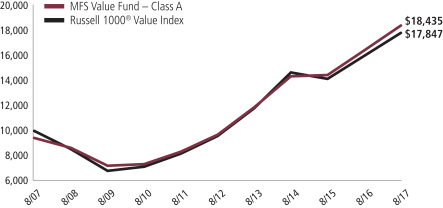

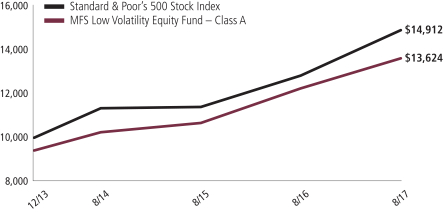

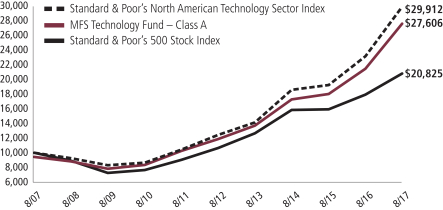

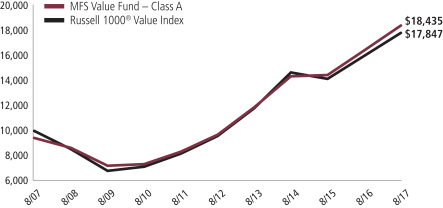

PERFORMANCE SUMMARY THROUGH 8/31/17

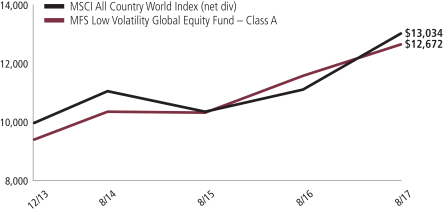

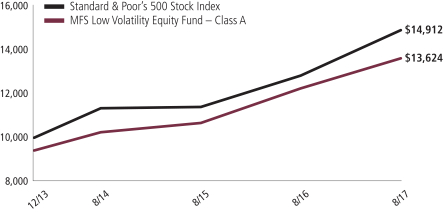

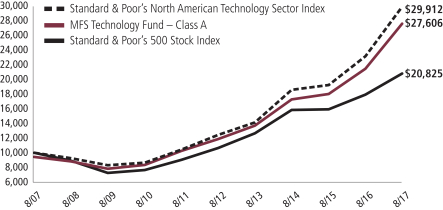

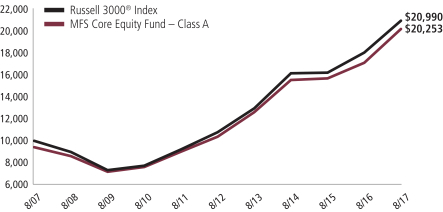

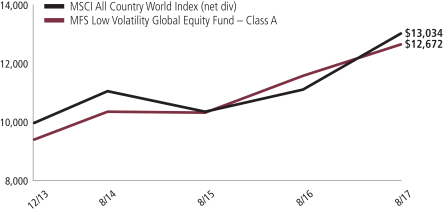

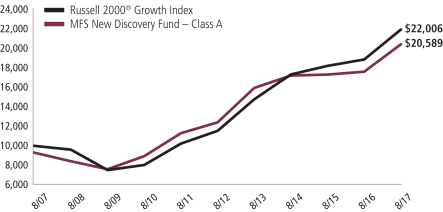

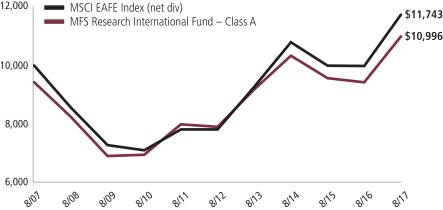

The following chart illustrates a representative class of the fund’s historical performance in comparison to its benchmark(s). Performance results include the deduction of the maximum applicable sales charge and reflect the percentage change in net asset value, including reinvestment of dividends and capital gains distributions. The performance of other share classes will be greater than or less than that of the class depicted below. Benchmarks are unmanaged and may not be invested in directly. Benchmark returns do not reflect sales charges, commissions or expenses. (See Notes to Performance Summary.)

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value fluctuate so your shares, when sold, may be worth more or less than the original cost; current performance may be lower or higher than quoted. The performance shown does not reflect the deduction of taxes, if any, that a shareholder would pay on fund distributions or the redemption of fund shares.

Growth of a Hypothetical $10,000 Investment

6

Performance Summary – continued

Total Returns through 8/31/17

Average annual without sales charge

| | | | | | | | | | | | | | |

| | | Share Class | | Class Inception Date | | 1-yr | | 5-yr | | 10-yr | | Life (t) | | |

| | | A | | 1/02/96 | | 18.11% | | 14.31% | | 7.95% | | N/A | | |

| | | B | | 1/02/97 | | 17.21% | | 13.46% | | 7.15% | | N/A | | |

| | | C | | 1/02/97 | | 17.22% | | 13.45% | | 7.16% | | N/A | | |

| | | I | | 1/02/97 | | 18.38% | | 14.59% | | 8.24% | | N/A | | |

| | | R1 | | 4/01/05 | | 17.19% | | 13.45% | | 7.15% | | N/A | | |

| | | R2 | | 10/31/03 | | 17.80% | | 14.03% | | 7.69% | | N/A | | |

| | | R3 | | 4/01/05 | | 18.10% | | 14.30% | | 7.96% | | N/A | | |

| | | R4 | | 4/01/05 | | 18.40% | | 14.59% | | 8.21% | | N/A | | |

| | | R6 | | 1/02/13 | | 18.49% | | N/A | | N/A | | 15.03% | | |

| Comparative benchmark(s) | | | | | | | | | | |

| | | Russell 3000® Index (f) | | 16.06% | | 14.27% | | 7.70% | | N/A | | |

| Average annual with sales charge | | | | | | | | | | |

| | | A

With Initial Sales Charge (5.75%) | | 11.32% | | 12.96% | | 7.31% | | N/A | | |

| | | B

With CDSC (Declining over six years from 4% to 0%) (v) | | 13.21% | | 13.21% | | 7.15% | | N/A | | |

| | | C

With CDSC (1% for 12 months) (v) | | 16.22% | | 13.45% | | 7.16% | | N/A | | |

CDSC – Contingent Deferred Sales Charge.

Class I, R1, R2, R3, R4, and R6 shares do not have a sales charge.

| (f) | Source: FactSet Research Systems Inc. |

| (t) | For the period from the class inception date through the stated period end (for those share classes with less than 10 years of performance history). No comparative benchmark performance information is provided for “life” periods. (See Notes to Performance Summary.) |

| (v) | Assuming redemption at the end of the applicable period. |

Included in all fund classes’ total returns for the month of May 31, 2017 are proceeds received from a non-recurring litigation settlement against Household International Inc. Had these proceeds not been included, all total returns within calendar year 2017 would have been lower by 0.72%.

Benchmark Definition(s)

Russell 3000® Index – constructed to provide a comprehensive barometer for the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market. The Russell 3000® Index is a trademark/service mark of the Frank Russell Company. Russell® is a trademark of the Frank Russell Company.

It is not possible to invest directly in an index.

7

Performance Summary – continued

Notes to Performance Summary

Average annual total return represents the average annual change in value for each share class for the periods presented. Life returns are presented where the share class has less than 10 years of performance history and represent the average annual total return from the class inception date to the stated period end date. As the fund’s share classes may have different inception dates, the life returns may represent different time periods and may not be comparable. As a result, no comparative benchmark performance information is provided for life periods.

Performance results reflect any applicable expense subsidies and waivers in effect during the periods shown. Without such subsidies and waivers the fund’s performance results would be less favorable. Please see the prospectus and financial statements for complete details.

Performance results do not include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles and may differ from amounts reported in the financial highlights.

From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower.

8

EXPENSE TABLE

Fund expenses borne by the shareholders during the period, March 1, 2017 through August 31, 2017

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on certain purchase or redemption payments, and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period March 1, 2017 through August 31, 2017.

Actual Expenses

The first line for each share class in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the following table provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

9

Expense Table – continued

| | | | | | | | | | | | | | | | | | |

Share

Class | | | | Annualized

Expense Ratio | | | Beginning

Account Value

3/01/17 | | | Ending Account Value

8/31/17 | | | Expenses

Paid During

Period (p)

3/01/17-8/31/17 | |

| A | | Actual | | | 1.02% | | | | $1,000.00 | | | | $1,078.23 | | | | $5.34 | |

| | Hypothetical (h) | | | 1.02% | | | | $1,000.00 | | | | $1,020.06 | | | | $5.19 | |

| B | | Actual | | | 1.77% | | | | $1,000.00 | | | | $1,074.34 | | | | $9.25 | |

| | Hypothetical (h) | | | 1.77% | | | | $1,000.00 | | | | $1,016.28 | | | | $9.00 | |

| C | | Actual | | | 1.77% | | | | $1,000.00 | | | | $1,074.34 | | | | $9.25 | |

| | Hypothetical (h) | | | 1.77% | | | | $1,000.00 | | | | $1,016.28 | | | | $9.00 | |

| I | | Actual | | | 0.77% | | | | $1,000.00 | | | | $1,079.80 | | | | $4.04 | |

| | Hypothetical (h) | | | 0.77% | | | | $1,000.00 | | | | $1,021.32 | | | | $3.92 | |

| R1 | | Actual | | | 1.77% | | | | $1,000.00 | | | | $1,074.40 | | | | $9.25 | |

| | Hypothetical (h) | | | 1.77% | | | | $1,000.00 | | | | $1,016.28 | | | | $9.00 | |

| R2 | | Actual | | | 1.27% | | | | $1,000.00 | | | | $1,077.12 | | | | $6.65 | |

| | Hypothetical (h) | | | 1.27% | | | | $1,000.00 | | | | $1,018.80 | | | | $6.46 | |

| R3 | | Actual | | | 1.02% | | | | $1,000.00 | | | | $1,078.21 | | | | $5.34 | |

| | Hypothetical (h) | | | 1.02% | | | | $1,000.00 | | | | $1,020.06 | | | | $5.19 | |

| R4 | | Actual | | | 0.77% | | | | $1,000.00 | | | | $1,079.82 | | | | $4.04 | |

| | Hypothetical (h) | | | 0.77% | | | | $1,000.00 | | | | $1,021.32 | | | | $3.92 | |

| R6 | | Actual | | | 0.69% | | | | $1,000.00 | | | | $1,080.03 | | | | $3.62 | |

| | Hypothetical (h) | | | 0.69% | | | | $1,000.00 | | | | $1,021.73 | | | | $3.52 | |

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. |

Notes to Expense Table

Expense ratios include 0.01% of investment related expenses from short sales (See Note 2 of the Notes to Financial Statements). Each class with a Rule 12b-1 service fee is subject to a rebate of a portion of such fee. Such rebates are included in the expense ratios above. For Class A, this rebate reduced the expense ratio above by 0.01%. See Note 3 in the Notes to Financial Statements for additional information.

10

PORTFOLIO OF INVESTMENTS

8/31/17

The Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by broad-based asset classes.

| | | | | | | | |

| Common Stocks - 98.4% | | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| Aerospace - 3.6% | | | | | | | | |

| Honeywell International, Inc. | | | 170,070 | | | $ | 23,515,579 | |

| L3 Technologies, Inc. | | | 33,173 | | | | 6,020,236 | |

| Leidos Holdings, Inc. | | | 81,599 | | | | 4,758,854 | |

| Northrop Grumman Corp. | | | 52,892 | | | | 14,397,731 | |

| Textron, Inc. | | | 88,560 | | | | 4,347,410 | |

| United Technologies Corp. | | | 62,194 | | | | 7,445,866 | |

| | | | | | | | |

| | | | | | | $ | 60,485,676 | |

| Alcoholic Beverages - 0.7% | | | | | | | | |

| Constellation Brands, Inc., “A” | | | 39,846 | | | $ | 7,973,185 | |

| Molson Coors Brewing Co. | | | 36,732 | | | | 3,296,697 | |

| | | | | | | | |

| | | | | | | $ | 11,269,882 | |

| Apparel Manufacturers - 1.3% | | | | | | | | |

| Hanesbrands, Inc. | | | 241,322 | | | $ | 5,854,472 | |

| NIKE, Inc., “B” | | | 310,242 | | | | 16,383,880 | |

| | | | | | | | |

| | | | | | | $ | 22,238,352 | |

| Automotive - 0.4% | | | | | | | | |

| Delphi Automotive PLC | | | 77,610 | | | $ | 7,481,604 | |

| | |

| Biotechnology - 1.6% | | | | | | | | |

| Biogen, Inc. (a) | | | 70,616 | | | $ | 22,354,201 | |

| Bruker BioSciences Corp. | | | 47,054 | | | | 1,368,801 | |

| Illumina, Inc. (a) | | | 17,797 | | | | 3,638,774 | |

| | | | | | | | |

| | | | | | | $ | 27,361,776 | |

| Brokerage & Asset Managers - 1.2% | | | | | | | | |

| Blackstone Group LP | | | 388,081 | | | $ | 12,701,891 | |

| TMX Group Ltd. | | | 134,487 | | | | 7,146,793 | |

| | | | | | | | |

| | | | | | | $ | 19,848,684 | |

| Business Services - 2.9% | | | | | | | | |

| Amdocs Ltd. | | | 58,936 | | | $ | 3,818,464 | |

| Cognizant Technology Solutions Corp., “A” | | | 118,300 | | | | 8,372,091 | |

| DXC Technology Co. | | | 86,015 | | | | 7,311,275 | |

| Fidelity National Information Services, Inc. | | | 107,203 | | | | 9,961,303 | |

| Global Payments, Inc. | | | 82,739 | | | | 7,900,747 | |

| Grand Canyon Education, Inc. (a) | | | 47,765 | | | | 3,919,118 | |

| Total System Services, Inc. | | | 44,719 | | | | 3,090,977 | |

11

Portfolio of Investments – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| Common Stocks - continued | | | | | | | | |

| Business Services - continued | | | | | | | | |

| Zendesk, Inc. (a) | | | 147,077 | | | $ | 4,029,910 | |

| | | | | | | | |

| | | | | | | $ | 48,403,885 | |

| Cable TV - 1.1% | | | | | | | | |

| Altice USA, Inc. (a) | | | 104,676 | | | $ | 3,193,665 | |

| Comcast Corp., “A” | | | 398,465 | | | | 16,181,663 | |

| | | | | | | | |

| | | | | | | $ | 19,375,328 | |

| Chemicals - 2.0% | | | | | | | | |

| Celanese Corp. | | | 50,190 | | | $ | 4,869,434 | |

| CF Industries Holdings, Inc. | | | 140,217 | | | | 4,064,891 | |

| E.I. du Pont de Nemours & Co. | | | 39,906 | | | | 3,349,311 | |

| FMC Corp. | | | 64,637 | | | | 5,573,002 | |

| Ingevity Corp. (a) | | | 67,326 | | | | 4,239,518 | |

| Monsanto Co. | | | 27,658 | | | | 3,241,518 | |

| PPG Industries, Inc. | | | 84,417 | | | | 8,806,381 | |

| | | | | | | | |

| | | | | | | $ | 34,144,055 | |

| Computer Software - 3.4% | | | | | | | | |

| Adobe Systems, Inc. (a) | | | 126,412 | | | $ | 19,614,086 | |

| Cloudera, Inc. (a)(l) | | | 6,573 | | | | 127,516 | |

| Microsoft Corp. | | | 210,450 | | | | 15,735,347 | |

| Salesforce.com, Inc. (a) | | | 224,123 | | | | 21,401,505 | |

| | | | | | | | |

| | | | | | | $ | 56,878,454 | |

| Computer Software - Systems - 2.2% | | | | | | | | |

| Apple, Inc. | | | 123,822 | | | $ | 20,306,808 | |

| NCR Corp. (a) | | | 97,216 | | | | 3,551,300 | |

| Presidio, Inc. (a) | | | 163,913 | | | | 2,280,030 | |

| Rapid7, Inc. (a) | | | 245,508 | | | | 4,139,265 | |

| SS&C Technologies Holdings, Inc. | | | 200,055 | | | | 7,744,129 | |

| | | | | | | | |

| | | | | | | $ | 38,021,532 | |

| Construction - 0.5% | | | | | | | | |

| Sherwin-Williams Co. | | | 23,306 | | | $ | 7,907,027 | |

| | |

| Consumer Products - 1.8% | | | | | | | | |

| Coty, Inc., “A” | | | 322,405 | | | $ | 5,345,475 | |

| Estee Lauder Cos., Inc., “A” | | | 70,910 | | | | 7,586,661 | |

| Newell Brands, Inc. | | | 97,687 | | | | 4,716,328 | |

| Procter & Gamble Co. | | | 143,749 | | | | 13,263,720 | |

| | | | | | | | |

| | | | | | | $ | 30,912,184 | |

12

Portfolio of Investments – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| Common Stocks - continued | | | | | | | | |

| Consumer Services - 1.4% | | | | | | | | |

| Bright Horizons Family Solutions, Inc. (a) | | | 69,840 | | | $ | 5,582,311 | |

| Priceline Group, Inc. (a) | | | 7,721 | | | | 14,299,910 | |

| ServiceMaster Global Holdings, Inc. (a) | | | 84,760 | | | | 3,993,891 | |

| | | | | | | | |

| | | | | | | $ | 23,876,112 | |

| Containers - 0.9% | | | | | | | | |

| Berry Global Group, Inc. (a) | | | 96,318 | | | $ | 5,416,924 | |

| CCL Industries, Inc. | | | 88,210 | | | | 4,092,096 | |

| Graphic Packaging Holding Co. | | | 237,981 | | | | 3,105,652 | |

| Sealed Air Corp. | | | 70,430 | | | | 3,125,684 | |

| | | | | | | | |

| | | | | | | $ | 15,740,356 | |

| Electrical Equipment - 2.0% | | | | | | | | |

| AMETEK, Inc. | | | 171,094 | | | $ | 10,821,695 | |

| HD Supply Holdings, Inc. (a) | | | 131,804 | | | | 4,389,073 | |

| Johnson Controls International PLC | | | 227,986 | | | | 9,025,966 | |

| Sensata Technologies Holding B.V. (a) | | | 166,292 | | | | 7,426,601 | |

| WESCO International, Inc. (a) | | | 48,457 | | | | 2,444,656 | |

| | | | | | | | |

| | | | | | | $ | 34,107,991 | |

| Electronics - 6.2% | | | | | | | | |

| Analog Devices, Inc. | | | 240,335 | | | $ | 20,108,829 | |

| Applied Materials, Inc. | | | 190,464 | | | | 8,593,736 | |

| Broadcom Corp. | | | 83,654 | | | | 21,086,664 | |

| Inphi Corp. (a) | | | 169,158 | | | | 6,477,060 | |

| Mellanox Technologies Ltd. (a) | | | 104,872 | | | | 4,923,740 | |

| NVIDIA Corp. | | | 88,630 | | | | 15,017,467 | |

| Texas Instruments, Inc. | | | 339,138 | | | | 28,087,409 | |

| | | | | | | | |

| | | | | | | $ | 104,294,905 | |

| Energy - Independent - 1.9% | | | | | | | | |

| Concho Resources, Inc. (a) | | | 30,635 | | | $ | 3,399,566 | |

| Energen Corp. (a) | | | 26,223 | | | | 1,344,716 | |

| EOG Resources, Inc. | | | 100,770 | | | | 8,564,442 | |

| EQT Corp. | | | 26,974 | | | | 1,681,559 | |

| Hess Corp. | | | 146,151 | | | | 5,685,274 | |

| Parsley Energy, Inc., “A” (a) | | | 76,742 | | | | 1,922,387 | |

| Phillips 66 | | | 80,745 | | | | 6,767,239 | |

| Pioneer Natural Resources Co. | | | 15,342 | | | | 1,989,090 | |

| | | | | | | | |

| | | | | | | $ | 31,354,273 | |

| Energy - Integrated - 1.9% | | | | | | | | |

| Chevron Corp. (s) | | | 306,770 | | | $ | 33,014,587 | |

13

Portfolio of Investments – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| Common Stocks - continued | | | | | | | | |

| Engineering - Construction - 0.2% | | | | | | | | |

| KBR, Inc. | | | 221,795 | | | $ | 3,608,605 | |

| | |

| Entertainment - 1.6% | | | | | | | | |

| Six Flags Entertainment Corp. | | | 71,573 | | | $ | 3,905,739 | |

| Time Warner, Inc. | | | 166,585 | | | | 16,841,743 | |

| Twenty-First Century Fox, Inc. | | | 236,096 | | | | 6,513,889 | |

| | | | | | | | |

| | | | | | | $ | 27,261,371 | |

| Food & Beverages - 3.0% | | | | | | | | |

| Blue Buffalo Pet Products, Inc. (a) | | | 92,556 | | | $ | 2,384,242 | |

| Cal-Maine Foods, Inc. (a)(l) | | | 132,798 | | | | 4,840,487 | |

| Mondelez International, Inc. | | | 251,527 | | | | 10,227,088 | |

| Monster Worldwide, Inc. (a) | | | 145,472 | | | | 8,120,247 | |

| PepsiCo, Inc. | | | 151,349 | | | | 17,515,620 | |

| Snyders-Lance, Inc. | | | 56,346 | | | | 2,001,410 | |

| TreeHouse Foods, Inc. (a) | | | 75,529 | | | | 5,059,688 | |

| | | | | | | | |

| | | | | | | $ | 50,148,782 | |

| Food & Drug Stores - 0.6% | | | | | | | | |

| CVS Health Corp. | | | 129,998 | | | $ | 10,054,045 | |

| | |

| Furniture & Appliances - 0.2% | | | | | | | | |

| Whirlpool Corp. | | | 24,482 | | | $ | 4,201,601 | |

| | |

| Gaming & Lodging - 0.4% | | | | | | | | |

| Marriott International, Inc., “A” | | | 67,142 | | | $ | 6,954,568 | |

| | |

| General Merchandise - 1.5% | | | | | | | | |

| Costco Wholesale Corp. | | | 88,574 | | | $ | 13,883,089 | |

| Dollar Tree, Inc. (a) | | | 100,076 | | | | 7,970,052 | |

| Five Below, Inc. (a) | | | 91,038 | | | | 4,330,678 | |

| | | | | | | | |

| | | | | | | $ | 26,183,819 | |

| Health Maintenance Organizations - 1.6% | | | | | | | | |

| Cigna Corp. | | | 42,156 | | | $ | 7,674,921 | |

| UnitedHealth Group, Inc. | | | 99,681 | | | | 19,826,551 | |

| | | | | | | | |

| | | | | | | $ | 27,501,472 | |

| Insurance - 3.1% | | | | | | | | |

| American International Group, Inc. | | | 103,970 | | | $ | 6,288,106 | |

| Aon PLC | | | 232,896 | | | | 32,409,807 | |

| Chubb Ltd. | | | 96,237 | | | | 13,609,836 | |

| | | | | | | | |

| | | | | | | $ | 52,307,749 | |

14

Portfolio of Investments – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| Common Stocks - continued | | | | | | | | |

| Internet - 6.0% | | | | | | | | |

| Alphabet, Inc., “A” (a)(s) | | | 41,951 | | | $ | 40,073,274 | |

| Alphabet, Inc., “C” (a) | | | 5,234 | | | | 4,916,453 | |

| Facebook, Inc., “A” (a) | | | 258,529 | | | | 44,459,232 | |

| LogMeIn, Inc. | | | 113,835 | | | | 13,022,724 | |

| | | | | | | | |

| | | | | | | $ | 102,471,683 | |

| Leisure & Toys - 0.4% | | | | | | | | |

| Electronic Arts, Inc. (a) | | | 61,106 | | | $ | 7,424,379 | |

| | |

| Machinery & Tools - 1.8% | | | | | | | | |

| Illinois Tool Works, Inc. | | | 42,469 | | | $ | 5,839,912 | |

| IPG Photonics Corp. (a) | | | 20,308 | | | | 3,569,943 | |

| ITT, Inc. | | | 98,430 | | | | 3,972,635 | |

| Roper Technologies, Inc. | | | 53,624 | | | | 12,368,912 | |

| SPX FLOW, Inc. (a) | | | 137,245 | | | | 4,593,590 | |

| | | | | | | | |

| | | | | | | $ | 30,344,992 | |

| Major Banks - 3.0% | | | | | | | | |

| Bank of America Corp. | | | 912,533 | | | $ | 21,800,413 | |

| Morgan Stanley | | | 313,194 | | | | 14,250,327 | |

| PNC Financial Services Group, Inc. | | | 117,158 | | | | 14,692,785 | |

| | | | | | | | |

| | | | | | | $ | 50,743,525 | |

| Medical & Health Technology & Services - 1.2% | | | | | | | | |

| Healthcare Services Group, Inc. | | | 52,343 | | | $ | 2,679,962 | |

| Henry Schein, Inc. (a) | | | 24,214 | | | | 4,205,487 | |

| ICON PLC (a) | | | 15,720 | | | | 1,782,491 | |

| LifePoint Hospitals, Inc. (a) | | | 50,344 | | | | 2,917,435 | |

| McKesson Corp. | | | 51,116 | | | | 7,632,130 | |

| MEDNAX, Inc. (a) | | | 23,277 | | | | 1,043,973 | |

| | | | | | | | |

| | | | | | | $ | 20,261,478 | |

| Medical Equipment - 4.3% | | | | | | | | |

| Danaher Corp. | | | 68,523 | | | $ | 5,716,189 | |

| DexCom, Inc. (a) | | | 32,948 | | | | 2,458,250 | |

| Edwards Lifesciences Corp. (a) | | | 101,468 | | | | 11,532,853 | |

| Medtronic PLC | | | 227,192 | | | | 18,316,219 | |

| NxStage Medical, Inc. (a) | | | 106,326 | | | | 2,977,128 | |

| Obalon Therapeutics, Inc. (a)(l) | | | 141,906 | | | | 1,275,735 | |

| PerkinElmer, Inc. | | | 78,501 | | | | 5,258,782 | |

| Steris PLC | | | 22,431 | | | | 1,955,086 | |

| Stryker Corp. | | | 81,729 | | | | 11,554,029 | |

| Zimmer Biomet Holdings, Inc. | | | 104,869 | | | | 11,983,380 | |

| | | | | | | | |

| | | | | | | $ | 73,027,651 | |

15

Portfolio of Investments – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| Common Stocks - continued | | | | | | | | |

| Metals & Mining - 0.3% | | | | | | | | |

| First Quantum Minerals Ltd. | | | 131,008 | | | $ | 1,578,915 | |

| Lundin Mining Corp. | | | 552,525 | | | | 4,176,846 | |

| | | | | | | | |

| | | | | | | $ | 5,755,761 | |

| Natural Gas - Distribution - 0.3% | | | | | | | | |

| New Jersey Resources Corp. | | | 92,273 | | | $ | 4,027,717 | |

| Sempra Energy | | | 7,753 | | | | 914,311 | |

| | | | | | | | |

| | | | | | | $ | 4,942,028 | |

| Natural Gas - Pipeline - 0.5% | | | | | | | | |

| Cheniere Energy, Inc. (a) | | | 147,851 | | | $ | 6,326,544 | |

| Enterprise Products Partners LP | | | 56,892 | | | | 1,483,175 | |

| | | | | | | | |

| | | | | | | $ | 7,809,719 | |

| Network & Telecom - 0.8% | | | | | | | | |

| Cisco Systems, Inc. | | | 154,358 | | | $ | 4,971,871 | |

| Motorola Solutions, Inc. | | | 104,281 | | | | 9,189,242 | |

| | | | | | | | |

| | | | | | | $ | 14,161,113 | |

| Oil Services - 0.8% | | | | | | | | |

| Keane Group, Inc. (a)(l) | | | 94,930 | | | $ | 1,229,344 | |

| Patterson-UTI Energy, Inc. | | | 119,799 | | | | 1,913,190 | |

| Schlumberger Ltd. | | | 95,712 | | | | 6,078,669 | |

| Solaris Oilfield Infrastructure, Inc., “A” (a)(l) | | | 198,176 | | | | 2,806,172 | |

| U.S. Silica Holdings, Inc. | | | 40,926 | | | | 1,113,596 | |

| | | | | | | | |

| | | | | | | $ | 13,140,971 | |

| Other Banks & Diversified Financials - 8.0% | | | | | | | | |

| Bank of the Ozarks, Inc. | | | 155,188 | | | $ | 6,666,876 | |

| Citigroup, Inc. (s) | | | 665,193 | | | | 45,253,080 | |

| Discover Financial Services | | | 205,248 | | | | 12,099,370 | |

| EuroDekania Ltd. (u) | | | 580,280 | | | | 67,353 | |

| First Republic Bank | | | 44,275 | | | | 4,296,889 | |

| Northern Trust Corp. | | | 71,801 | | | | 6,354,389 | |

| Signature Bank (a) | | | 28,813 | | | | 3,697,860 | |

| U.S. Bancorp | | | 405,174 | | | | 20,765,167 | |

| Visa, Inc., “A” | | | 217,262 | | | | 22,490,962 | |

| Wintrust Financial Corp. | | | 107,512 | | | | 7,827,949 | |

| Zions Bancorporation | | | 132,346 | | | | 5,778,226 | |

| | | | | | | | |

| | | | | | | $ | 135,298,121 | |

| Pharmaceuticals - 5.0% | | | | | | | | |

| Allergan PLC | | | 22,034 | | | $ | 5,056,362 | |

| Bristol-Myers Squibb Co. | | | 297,072 | | | | 17,966,915 | |

16

Portfolio of Investments – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| Common Stocks - continued | | | | | | | | |

| Pharmaceuticals - continued | | | | | | | | |

| Eli Lilly & Co. | | | 163,582 | | | $ | 13,297,581 | |

| Pfizer, Inc. | | | 869,638 | | | | 29,498,121 | |

| Zoetis, Inc. | | | 295,392 | | | | 18,521,078 | |

| | | | | | | | |

| | | | | | | $ | 84,340,057 | |

| Pollution Control - 0.5% | | | | | | | | |

| Clean Harbors, Inc. (a) | | | 61,381 | | | $ | 3,320,098 | |

| Waste Connections, Inc. | | | 72,646 | | | | 4,844,762 | |

| | | | | | | | |

| | | | | | | $ | 8,164,860 | |

| Railroad & Shipping - 1.2% | | | | | | | | |

| Canadian Pacific Railway Ltd. | | | 50,681 | | | $ | 7,885,964 | |

| Union Pacific Corp. | | | 113,308 | | | | 11,931,332 | |

| | | | | | | | |

| | | | | | | $ | 19,817,296 | |

| Real Estate - 3.5% | | | | | | | | |

| Gramercy Property Trust, REIT | | | 305,151 | | | $ | 9,294,900 | |

| Life Storage, Inc., REIT | | | 130,691 | | | | 9,617,551 | |

| Medical Properties Trust, Inc., REIT | | | 1,503,639 | | | | 19,787,889 | |

| Store Capital Corp., REIT | | | 475,130 | | | | 12,058,799 | |

| Sun Communities, Inc., REIT | | | 50,043 | | | | 4,519,383 | |

| Washington Prime Group, Inc., REIT | | | 573,877 | | | | 4,791,873 | |

| | | | | | | | |

| | | | | | | $ | 60,070,395 | |

| Restaurants - 1.5% | | | | | | | | |

| Aramark | | | 148,418 | | | $ | 6,039,129 | |

| Starbucks Corp. | | | 283,022 | | | | 15,526,587 | |

| U.S. Foods Holding Corp. (a) | | | 169,576 | | | | 4,654,861 | |

| | | | | | | | |

| | | | | | | $ | 26,220,577 | |

| Specialty Chemicals - 0.3% | | | | | | | | |

| Univar, Inc. (a) | | | 186,734 | | | $ | 5,267,766 | |

| | |

| Specialty Stores - 2.7% | | | | | | | | |

| Amazon.com, Inc. (a) | | | 24,500 | | | $ | 24,024,700 | |

| Lululemon Athletica, Inc. (a) | | | 67,167 | | | | 3,865,461 | |

| Michaels Co., Inc. (a) | | | 201,346 | | | | 4,520,218 | |

| Tractor Supply Co. | | | 110,456 | | | | 6,573,236 | |

| Urban Outfitters, Inc. (a) | | | 329,645 | | | | 6,737,944 | |

| | | | | | | | |

| | | | | | | $ | 45,721,559 | |

| Telecommunications - Wireless - 2.4% | | | | | | | | |

| American Tower Corp., REIT | | | 187,256 | | | $ | 27,723,251 | |

| SBA Communications Corp., REIT (a) | | | 78,870 | | | | 12,110,488 | |

| | | | | | | | |

| | | | | | | $ | 39,833,739 | |

17

Portfolio of Investments – continued

| | | | | | | | | | | | | | | | |

| Issuer | | | | | | | | | Shares/Par | | | Value ($) | |

| Common Stocks - continued | | | | | | | | | |

| Telephone Services - 0.6% | | | | | | | | | |

| Verizon Communications, Inc. | | | | 198,910 | | | $ | 9,541,713 | |

| | |

| Tobacco - 1.1% | | | | | | | | | |

| Philip Morris International, Inc. | | | | 155,732 | | | $ | 18,209,743 | |

| | |

| Trucking - 0.2% | | | | | | | | | |

| Schneider National, Inc. | | | | 143,829 | | | $ | 3,200,195 | |

| | |

| Utilities - Electric Power - 2.8% | | | | | | | | | |

| Alliant Energy Corp. | | | | 81,623 | | | $ | 3,488,567 | |

| American Electric Power Co., Inc. | | | | 77,175 | | | | 5,682,395 | |

| Avangrid, Inc. | | | | 86,179 | | | | 4,207,259 | |

| CMS Energy Corp. | | | | 109,726 | | | | 5,326,100 | |

| Exelon Corp. | | | | 146,109 | | | | 5,533,148 | |

| NextEra Energy, Inc. | | | | 60,866 | | | | 9,160,942 | |

| PG&E Corp. | | | | 81,675 | | | | 5,748,287 | |

| Xcel Energy, Inc. | | | | 165,101 | | | | 8,172,499 | |

| | | | | | | | | | | | | | | | |

| | | | $ | 47,319,197 | |

| Total Common Stocks (Identified Cost, $1,280,733,070) | | | $ | 1,668,027,193 | |

| | | | | |

Underlying/Expiration

Date/Exercise Price | | Put/Call | | Counterparty | | Notional

Amount | | | Number

of

Contracts | | | | |

| Purchased Options - 0.0% | | | | | | | | | | | | |

| Electrical Equipment - 0.0% | | | | | |

| General Electric Co. - January 2018 @ $28 (Premiums Paid, $701,966) | | Call | | Goldman Sachs International | | $ | 14,133,435 | | | | 5,757 | | | $ | 74,841 | |

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | | |

| Investment Companies (h) - 1.6% | | | | | | | | |

| Money Market Funds - 1.6% | | | | | | | | |

MFS Institutional Money Market Portfolio, 1.11% (v)

(Identified Cost, $26,817,468) | | | 26,819,115 | | | $ | 26,819,115 | |

| | |

| Collateral for Securities Loaned - 0.1% | | | | | | | | |

| State Street Navigator Securities Lending Government Money Market Portfolio, 1.01% (j) (Identified Cost, $2,131,661) | | | 2,131,661 | | | $ | 2,131,661 | |

18

Portfolio of Investments – continued

| | | | | | | | |

| Securities Sold Short - (0.3)% | | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| Telecommunications - Wireless - (0.3)% | | | | | | | | |

Crown Castle International Corp., REIT

(Proceeds Received, $3,678,192) | | | (44,300 | ) | | $ | (4,803,892 | ) |

| | |

| Other Assets, Less Liabilities - 0.2% | | | | | | | 2,958,451 | |

| Net Assets - 100.0% | | | | | | $ | 1,695,207,369 | |

| (a) | Non-income producing security. |

| (h) | An affiliated issuer may be considered one in which the fund owns 5% or more of the outstanding voting securities, or a company which is under common control. At period end, the aggregate values of the fund’s investments in affiliated issuers and in unaffiliated issuers were $26,819,115 and $1,670,233,695, respectively. |

| (j) | The rate quoted is the annualized seven-day yield of the fund at period end. |

| (l) | A portion of this security is on loan. |

| (s) | Security or a portion of the security was pledged to cover collateral requirements for securities sold short. |

| (u) | The security was valued using significant unobservable inputs and is considered level 3 under the fair value hierarchy. |

| (v) | Affiliated issuer that is available only to investment companies managed by MFS. The rate quoted for the MFS Institutional Money Market Portfolio is the annualized seven-day yield of the fund at period end. |

At August 31, 2017, the fund had cash collateral of $21,914 and other liquid securities with an aggregate value of $8,451,337 to cover collateral or margin obligations for securities sold short and certain derivative contracts. Cash collateral is comprised of deposits with brokers in the Statement of Assets and Liabilities.

The following abbreviations are used in this report and are defined:

| PLC | | Public Limited Company |

| REIT | | Real Estate Investment Trust |

See Notes to Financial Statements

19

Financial Statements

STATEMENT OF ASSETS AND LIABILITIES

At 8/31/17

This statement represents your fund’s balance sheet, which details the assets and liabilities comprising the total value of the fund.

| | | | |

| Assets | | | | |

Investments in unaffiliated issuers, at value, including $2,115,870 of securities on loan (identified cost, $1,283,566,697) | | | $1,670,233,695 | |

Investments in affiliated issuers, at value (identified cost, $26,817,468) | | | 26,819,115 | |

Cash | | | 13,991 | |

Foreign currency, at value (identified cost, $8) | | | 8 | |

Deposits with brokers for securities sold short | | | 21,914 | |

Receivables for | | | | |

Investments sold | | | 2,795,330 | |

Fund shares sold | | | 1,842,204 | |

Interest and dividends | | | 2,418,751 | |

Other assets | | | 1,703 | |

Total assets | | | $1,704,146,711 | |

| Liabilities | | | | |

Payables for | | | | |

Securities sold short, at value (proceeds received, $3,678,192) | | | $4,803,892 | |

Fund shares reacquired | | | 1,311,395 | |

Collateral for securities loaned, at value | | | 2,131,661 | |

Payable to affiliates | | | | |

Investment adviser | | | 54,114 | |

Shareholder servicing costs | | | 379,496 | |

Distribution and service fees | | | 15,259 | |

Payable for independent Trustees’ compensation | | | 64,002 | |

Accrued expenses and other liabilities | | | 179,523 | |

Total liabilities | | | $8,939,342 | |

Net assets | | | $1,695,207,369 | |

| Net assets consist of | | | | |

Paid-in capital | | | $1,198,271,005 | |

Unrealized appreciation (depreciation) | | | 385,543,225 | |

Accumulated net realized gain (loss) | | | 101,329,218 | |

Undistributed net investment income | | | 10,063,921 | |

Net assets | | | $1,695,207,369 | |

Shares of beneficial interest outstanding | | | 55,317,540 | |

20

Statement of Assets and Liabilities – continued

| | | | | | | | | | | | |

| | | Net assets | | | Shares

outstanding | | | Net asset value

per share (a) | |

Class A | | | $992,736,270 | | | | 32,595,826 | | | | $30.46 | |

Class B | | | 27,138,528 | | | | 998,853 | | | | 27.17 | |

Class C | | | 89,945,711 | | | | 3,346,635 | | | | 26.88 | |

Class I | | | 122,054,594 | | | | 3,806,086 | | | | 32.07 | |

Class R1 | | | 3,102,602 | | | | 115,517 | | | | 26.86 | |

Class R2 | | | 16,507,986 | | | | 554,974 | | | | 29.75 | |

Class R3 | | | 28,074,644 | | | | 925,755 | | | | 30.33 | |

Class R4 | | | 22,494,280 | | | | 732,575 | | | | 30.71 | |

Class R6 | | | 393,152,754 | | | | 12,241,319 | | | | 32.12 | |

| (a) | Maximum offering price per share was equal to the net asset value per share for all share classes, except for Class A, for which the maximum offering price per share was $32.32 [100 / 94.25 x $30.46]. On sales of $50,000 or more, the maximum offering price of Class A shares is reduced. A contingent deferred sales charge may be imposed on redemptions of Class A, Class B, and Class C shares. Redemption price per share was equal to the net asset value per share for Classes I, R1, R2, R3, R4, and R6. |

See Notes to Financial Statements

21

Financial Statements

STATEMENT OF OPERATIONS

Year ended 8/31/17

This statement describes how much your fund earned in investment income and accrued in expenses. It also describes any gains and/or losses generated by fund operations.

| | | | |

| Net investment income (loss) | | | | |

Income | | | | |

Dividends | | | $25,944,077 | |

Dividends from affiliated issuers | | | 113,205 | |

Income on securities loaned | | | 35,846 | |

Interest | | | 19,164 | |

Other | | | 14,900 | |

Foreign taxes withheld | | | (59,195 | ) |

Total investment income | | | $26,067,997 | |

Expenses | | | | |

Management fee | | | $9,214,952 | |

Distribution and service fees | | | 3,800,553 | |

Shareholder servicing costs | | | 1,829,102 | |

Administrative services fee | | | 259,950 | |

Independent Trustees’ compensation | | | 44,828 | |

Custodian fee | | | 86,138 | |

Reimbursement of custodian expenses | | | (96,938 | ) |

Shareholder communications | | | 173,254 | |

Audit and tax fees | | | 57,372 | |

Legal fees | | | 19,868 | |

Dividend and interest expense on securities sold short | | | 211,184 | |

Miscellaneous | | | 215,513 | |

Total expenses | | | $15,815,776 | |

Reduction of expenses by investment adviser and distributor | | | (176,691 | ) |

Net expenses | | | $15,639,085 | |

Net investment income (loss) | | | $10,428,912 | |

| Realized and unrealized gain (loss) | | | | |

Realized gain (loss) (identified cost basis) | | | | |

Unaffiliated issuers (s) | | | $121,535,866 | |

Affiliated issuers | | | 698 | |

Foreign currency | | | (1,959 | ) |

Net realized gain (loss) | | | $121,534,605 | |

Change in unrealized appreciation (depreciation) | | | | |

Unaffiliated issuers | | | $132,628,173 | |

Affiliated issuers | | | 1,647 | |

Securities sold short | | | (745,568 | ) |

Translation of assets and liabilities in foreign currencies | | | 286 | |

Net unrealized gain (loss) | | | $131,884,538 | |

Net realized and unrealized gain (loss) | | | $253,419,143 | |

Change in net assets from operations | | | $263,848,055 | |

| (s) | Realized gain (loss) on investment transactions includes proceeds received from a non-recurring cash settlement in the amount of $11,579,893 from a litigation settlement against Household International, Inc. Company. |

See Notes to Financial Statements

22

Financial Statements

STATEMENTS OF CHANGES IN NET ASSETS

These statements describe the increases and/or decreases in net assets resulting from operations, any distributions, and any shareholder transactions.

| | | | | | | | |

| | | Year ended | |

| | | 8/31/17 | | | 8/31/16 | |

| Change in net assets | | | | | | |

| From operations | | | | | | | | |

Net investment income (loss) | | | $10,428,912 | | | | $9,712,129 | |

Net realized gain (loss) | | | 121,534,605 | | | | 46,889,142 | |

Net unrealized gain (loss) | | | 131,884,538 | | | | 63,937,563 | |

Change in net assets from operations | | | $263,848,055 | | | | $120,538,834 | |

| Distributions declared to shareholders | | | | | | | | |

From net investment income | | | $(9,436,061 | ) | | | $(5,821,876 | ) |

From net realized gain on investments | | | (45,657,548 | ) | | | (119,401,189 | ) |

Total distributions declared to shareholders | | | $(55,093,609 | ) | | | $(125,223,065 | ) |

Change in net assets from fund share transactions | | | $(66,543,205 | ) | | | $309,510,191 | |

Total change in net assets | | | $142,211,241 | | | | $304,825,960 | |

| Net assets | | | | | | | | |

At beginning of period | | | 1,552,996,128 | | | | 1,248,170,168 | |

At end of period (including undistributed net investment

income of $10,063,921 and $9,358,570, respectively) | | | $1,695,207,369 | | | | $1,552,996,128 | |

See Notes to Financial Statements

23

Financial Statements

FINANCIAL HIGHLIGHTS

The financial highlights table is intended to help you understand the fund’s financial performance for the past 5 years (or life of a particular share class, if shorter). Certain information reflects financial results for a single fund share. The total returns in the table represent the rate that an investor would have earned (or lost) on an investment in the fund share class (assuming reinvestment of all distributions) held for the entire period.

| | | | | | | | | | | | | | | | | | | | |

| Class A | | Year ended | |

| | | 8/31/17 | | | 8/31/16 | | | 8/31/15 | | | 8/31/14 | | | 8/31/13 | |

Net asset value, beginning of period | | | $26.72 | | | | $27.19 | | | | $29.19 | | | | $23.82 | | | | $19.68 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $0.18 | (c) | | | $0.18 | | | | $0.15 | | | | $0.13 | | | | $0.18 | |

Net realized and unrealized gain (loss) | | | 4.53 | | | | 2.08 | | | | 0.13 | | | | 5.41 | | | | 4.07 | |

Total from investment operations | | | $4.71 | | | | $2.26 | | | | $0.28 | | | | $5.54 | | | | $4.25 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | | | |

From net investment income | | | $(0.16 | ) | | | $(0.14 | ) | | | $(0.13 | ) | | | $(0.17 | ) | | | $(0.11 | ) |

From net realized gain | | | (0.81 | ) | | | (2.59 | ) | | | (2.15 | ) | | | — | | | | — | |

Total distributions declared to shareholders | | | $(0.97 | ) | | | $(2.73 | ) | | | $(2.28 | ) | | | $(0.17 | ) | | | $(0.11 | ) |

Net asset value, end of period (x) | | | $30.46 | | | | $26.72 | | | | $27.19 | | | | $29.19 | | | | $23.82 | |

Total return (%) (r)(s)(t)(x) | | | 18.11 | (c) | | | 9.09 | | | | 0.98 | | | | 23.33 | | | | 21.69 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | | 1.03 | (c) | | | 1.07 | | | | 1.05 | | | | 1.05 | | | | 1.11 | |

Expenses after expense reductions (f) | | | 1.01 | (c) | | | 1.05 | | | | 1.04 | | | | 1.04 | | | | 1.11 | |

Net investment income (loss) | | | 0.63 | (c) | | | 0.70 | | | | 0.52 | | | | 0.49 | | | | 0.81 | |

Portfolio turnover | | | 46 | | | | 68 | | | | 53 | | | | 48 | | | | 58 | |

Net assets at end of period (000 omitted) | | | $992,736 | | | | $959,812 | | | | $963,167 | | | | $1,002,028 | | | | $873,139 | |

| Supplemental Ratios (%): | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets after

expense reductions excluding short sale

expenses and interest expense and fees (f) | | | 1.00 | (c) | | | 1.04 | | | | 1.03 | | | | 1.04 | | | | 1.10 | |

See Notes to Financial Statements

24

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | |

| Class B | | Year ended | |

| | | 8/31/17 | | | 8/31/16 | | | 8/31/15 | | | 8/31/14 | | | 8/31/13 | |

Net asset value, beginning of period | | | $23.96 | | | | $24.70 | | | | $26.78 | | | | $21.88 | | | | $18.11 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $(0.03 | )(c) | | | $(0.02 | ) | | | $(0.06 | ) | | | $(0.06 | ) | | | $0.01 | |

Net realized and unrealized gain (loss) | | | 4.05 | | | | 1.87 | | | | 0.13 | | | | 4.96 | | | | 3.76 | |

Total from investment operations | | | $4.02 | | | | $1.85 | | | | $0.07 | | | | $4.90 | | | | $3.77 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | | | |

From net realized gain | | | $(0.81 | ) | | | $(2.59 | ) | | | $(2.15 | ) | | | $— | | | | $— | |

Net asset value, end of period (x) | | | $27.17 | | | | $23.96 | | | | $24.70 | | | | $26.78 | | | | $21.88 | |

Total return (%) (r)(s)(t)(x) | | | 17.21 | (c) | | | 8.24 | | | | 0.25 | | | | 22.39 | | | | 20.82 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | | 1.78 | (c) | | | 1.82 | | | | 1.80 | | | | 1.80 | | | | 1.86 | |

Expenses after expense reductions (f) | | | 1.77 | (c) | | | 1.81 | | | | 1.80 | | | | 1.80 | | | | 1.86 | |

Net investment income (loss) | | | (0.12 | )(c) | | | (0.07 | ) | | | (0.23 | ) | | | (0.26 | ) | | | 0.07 | |

Portfolio turnover | | | 46 | | | | 68 | | | | 53 | | | | 48 | | | | 58 | |

Net assets at end of period (000 omitted) | | | $27,139 | | | | $30,324 | | | | $34,126 | | | | $40,536 | | | | $40,495 | |

| Supplemental Ratios (%): | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets after

expense reductions excluding short sale

expenses and interest expense and fees (f) | | | 1.75 | (c) | | | 1.79 | | | | 1.79 | | | | 1.80 | | | | 1.86 | |

See Notes to Financial Statements

25

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | |

| Class C | | Year ended | |

| | | 8/31/17 | | | 8/31/16 | | | 8/31/15 | | | 8/31/14 | | | 8/31/13 | |

Net asset value, beginning of period | | | $23.71 | | | | $24.47 | | | | $26.55 | | | | $21.72 | | | | $17.98 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $(0.03 | )(c) | | | $(0.01 | ) | | | $(0.06 | ) | | | $(0.06 | ) | | | $0.01 | |

Net realized and unrealized gain (loss) | | | 4.01 | | | | 1.84 | | | | 0.13 | | | | 4.92 | | | | 3.73 | |

Total from investment operations | | | $3.98 | | | | $1.83 | | | | $0.07 | | | | $4.86 | | | | $3.74 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | | | |

From net investment income | | | $— | | | | $— | | | | $— | | | | $(0.03 | ) | | | $— | |

From net realized gain | | | (0.81 | ) | | | (2.59 | ) | | | (2.15 | ) | | | — | | | | — | |

Total distributions declared to shareholders | | | $(0.81 | ) | | | $(2.59 | ) | | | $(2.15 | ) | | | $(0.03 | ) | | | $— | |

Net asset value, end of period (x) | | | $26.88 | | | | $23.71 | | | | $24.47 | | | | $26.55 | | | | $21.72 | |

Total return (%) (r)(s)(t)(x) | | | 17.22 | (c) | | | 8.24 | | | | 0.26 | | | | 22.38 | | | | 20.80 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | | 1.78 | (c) | | | 1.82 | | | | 1.80 | | | | 1.80 | | | | 1.86 | |

Expenses after expense reductions (f) | | | 1.77 | (c) | | | 1.81 | | | | 1.80 | | | | 1.80 | | | | 1.86 | |

Net investment income (loss) | | | (0.12 | )(c) | | | (0.05 | ) | | | (0.23 | ) | | | (0.26 | ) | | | 0.06 | |

Portfolio turnover | | | 46 | | | | 68 | | | | 53 | | | | 48 | | | | 58 | |

Net assets at end of period (000 omitted) | | | $89,946 | | | | $89,160 | | | | $88,020 | | | | $89,702 | | | | $78,777 | |

| Supplemental Ratios (%): | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets after

expense reductions excluding short sale

expenses and interest expense and fees (f) | | | 1.75 | (c) | | | 1.79 | | | | 1.79 | | | | 1.80 | | | | 1.86 | |

See Notes to Financial Statements

26

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | |

| Class I | | Year ended | |

| | | 8/31/17 | | | 8/31/16 | | | 8/31/15 | | | 8/31/14 | | | 8/31/13 | |

Net asset value, beginning of period | | | $28.10 | | | | $28.44 | | | | $30.43 | | | | $24.82 | | | | $20.49 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $0.26 | (c) | | | $0.29 | | | | $0.23 | | | | $0.21 | | | | $0.24 | |

Net realized and unrealized gain (loss) | | | 4.76 | | | | 2.15 | | | | 0.13 | | | | 5.62 | | | | 4.25 | |

Total from investment operations | | | $5.02 | | | | $2.44 | | | | $0.36 | | | | $5.83 | | | | $4.49 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | | | |

From net investment income | | | $(0.24 | ) | | | $(0.19 | ) | | | $(0.20 | ) | | | $(0.22 | ) | | | $(0.16 | ) |

From net realized gain | | | (0.81 | ) | | | (2.59 | ) | | | (2.15 | ) | | | — | | | | — | |

Total distributions declared to shareholders | | | $(1.05 | ) | | | $(2.78 | ) | | | $(2.35 | ) | | | $(0.22 | ) | | | $(0.16 | ) |

Net asset value, end of period (x) | | | $32.07 | | | | $28.10 | | | | $28.44 | | | | $30.43 | | | | $24.82 | |

Total return (%) (r)(s)(t)(x) | | | 18.38 | (c) | | | 9.36 | | | | 1.23 | | | | 23.61 | | | | 22.03 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | | 0.78 | (c) | | | 0.81 | | | | 0.80 | | | | 0.80 | | | | 0.86 | |

Expenses after expense reductions (f) | | | 0.77 | (c) | | | 0.80 | | | | 0.80 | | | | 0.80 | | | | 0.86 | |

Net investment income (loss) | | | 0.88 | (c) | | | 1.07 | | | | 0.77 | | | | 0.73 | | | | 1.05 | |

Portfolio turnover | | | 46 | | | | 68 | | | | 53 | | | | 48 | | | | 58 | |

Net assets at end of period (000 omitted) | | | $122,055 | | | | $61,739 | | | | $49,768 | | | | $45,089 | | | | $29,812 | |

| Supplemental Ratios (%): | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets after

expense reductions excluding short sale

expenses and interest expense and fees (f) | | | 0.75 | (c) | | | 0.79 | | | | 0.79 | | | | 0.80 | | | | 0.86 | |

See Notes to Financial Statements

27

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | |

| Class R1 | | Year ended | |

| | | 8/31/17 | | | 8/31/16 | | | 8/31/15 | | | 8/31/14 | | | 8/31/13 | |

Net asset value, beginning of period | | | $23.70 | | | | $24.45 | | | | $26.54 | | | | $21.69 | | | | $17.95 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $(0.03 | )(c) | | | $(0.02 | ) | | | $(0.06 | ) | | | $(0.06 | ) | | | $0.02 | |

Net realized and unrealized gain (loss) | | | 4.00 | | | | 1.86 | | | | 0.12 | | | | 4.91 | | | | 3.72 | |

Total from investment operations | | | $3.97 | | | | $1.84 | | | | $0.06 | | | | $4.85 | | | | $3.74 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | | | |

From net investment income | | | $— | | | | $— | | | | $— | | | | $(0.00 | )(w) | | | $— | |

From net realized gain | | | (0.81 | ) | | | (2.59 | ) | | | (2.15 | ) | | | — | | | | — | |

Total distributions declared to shareholders | | | $(0.81 | ) | | | $(2.59 | ) | | | $(2.15 | ) | | | $(0.00 | )(w) | | | $— | |

Net asset value, end of period (x) | | | $26.86 | | | | $23.70 | | | | $24.45 | | | | $26.54 | | | | $21.69 | |

Total return (%) (r)(s)(t)(x) | | | 17.19 | (c) | | | 8.29 | | | | 0.22 | | | | 22.38 | | | | 20.84 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | | 1.78 | (c) | | | 1.82 | | | | 1.80 | | | | 1.80 | | | | 1.86 | |

Expenses after expense reductions (f) | | | 1.77 | (c) | | | 1.81 | | | | 1.80 | | | | 1.80 | | | | 1.86 | |

Net investment income (loss) | | | (0.13 | )(c) | | | (0.09 | ) | | | (0.23 | ) | | | (0.26 | ) | | | 0.08 | |

Portfolio turnover | | | 46 | | | | 68 | | | | 53 | | | | 48 | | | | 58 | |

Net assets at end of period (000 omitted) | | | $3,103 | | | | $2,935 | | | | $3,625 | | | | $4,132 | | | | $3,839 | |

| Supplemental Ratios (%): | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets after

expense reductions excluding short sale

expenses and interest expense and fees (f) | | | 1.75 | (c) | | | 1.80 | | | | 1.79 | | | | 1.80 | | | | 1.85 | |

See Notes to Financial Statements

28

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | |

| Class R2 | | Year ended | |

| | | 8/31/17 | | | 8/31/16 | | | 8/31/15 | | | 8/31/14 | | | 8/31/13 | |

Net asset value, beginning of period | | | $26.12 | | | | $26.62 | | | | $28.59 | | | | $23.35 | | | | $19.28 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $0.10 | (c) | | | $0.11 | | | | $0.07 | | | | $0.06 | | | | $0.12 | |

Net realized and unrealized gain (loss) | | | 4.43 | | | | 2.04 | | | | 0.14 | | | | 5.29 | | | | 4.00 | |

Total from investment operations | | | $4.53 | | | | $2.15 | | | | $0.21 | | | | $5.35 | | | | $4.12 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | | | |

From net investment income | | | $(0.09 | ) | | | $(0.06 | ) | | | $(0.03 | ) | | | $(0.11 | ) | | | $(0.05 | ) |

From net realized gain | | | (0.81 | ) | | | (2.59 | ) | | | (2.15 | ) | | | — | | | | — | |

Total distributions declared to shareholders | | | $(0.90 | ) | | | $(2.65 | ) | | | $(2.18 | ) | | | $(0.11 | ) | | | $(0.05 | ) |

Net asset value, end of period (x) | | | $29.75 | | | | $26.12 | | | | $26.62 | | | | $28.59 | | | | $23.35 | |

Total return (%) (r)(s)(t)(x) | | | 17.80 | (c) | | | 8.82 | | | | 0.75 | | | | 22.96 | | | | 21.44 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | | 1.28 | (c) | | | 1.32 | | | | 1.30 | | | | 1.30 | | | | 1.36 | |

Expenses after expense reductions (f) | | | 1.27 | (c) | | | 1.31 | | | | 1.30 | | | | 1.30 | | | | 1.36 | |

Net investment income (loss) | | | 0.38 | (c) | | | 0.46 | | | | 0.27 | | | | 0.24 | | | | 0.56 | |

Portfolio turnover | | | 46 | | | | 68 | | | | 53 | | | | 48 | | | | 58 | |

Net assets at end of period (000 omitted) | | | $16,508 | | | | $15,932 | | | | $16,332 | | | | $19,434 | | | | $19,625 | |

| Supplemental Ratios (%): | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets after

expense reductions excluding short sale

expenses and interest expense and fees (f) | | | 1.25 | (c) | | | 1.29 | | | | 1.29 | | | | 1.30 | | | | 1.36 | |

See Notes to Financial Statements

29

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | |

| Class R3 | | Year ended | |

| | | 8/31/17 | | | 8/31/16 | | | 8/31/15 | | | 8/31/14 | | | 8/31/13 | |

Net asset value, beginning of period | | | $26.61 | | | | $27.10 | | | | $29.10 | | | | $23.75 | | | | $19.63 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $0.17 | (c) | | | $0.18 | | | | $0.15 | | | | $0.13 | | | | $0.18 | |

Net realized and unrealized gain (loss) | | | 4.52 | | | | 2.06 | | | | 0.13 | | | | 5.39 | | | | 4.05 | |

Total from investment operations | | | $4.69 | | | | $2.24 | | | | $0.28 | | | | $5.52 | | | | $4.23 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | | | |

From net investment income | | | $(0.16 | ) | | | $(0.14 | ) | | | $(0.13 | ) | | | $(0.17 | ) | | | $(0.11 | ) |

From net realized gain | | | (0.81 | ) | | | (2.59 | ) | | | (2.15 | ) | | | — | | | | — | |

Total distributions declared to shareholders | | | $(0.97 | ) | | | $(2.73 | ) | | | $(2.28 | ) | | | $(0.17 | ) | | | $(0.11 | ) |

Net asset value, end of period (x) | | | $30.33 | | | | $26.61 | | | | $27.10 | | | | $29.10 | | | | $23.75 | |

Total return (%) (r)(s)(t)(x) | | | 18.10 | (c) | | | 9.06 | | | | 0.99 | | | | 23.32 | | | | 21.68 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | | 1.02 | (c) | | | 1.07 | | | | 1.05 | | | | 1.05 | | | | 1.11 | |

Expenses after expense reductions (f) | | | 1.02 | (c) | | | 1.06 | | | | 1.05 | | | | 1.05 | | | | 1.11 | |

Net investment income (loss) | | | 0.62 | (c) | | | 0.71 | | | | 0.52 | | | | 0.49 | | | | 0.81 | |

Portfolio turnover | | | 46 | | | | 68 | | | | 53 | | | | 48 | | | | 58 | |

Net assets at end of period (000 omitted) | | | $28,075 | | | | $77,217 | | | | $65,775 | | | | $68,977 | | | | $58,381 | |

| Supplemental Ratios (%): | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets after

expense reductions excluding short sale

expenses and interest expense and fees (f) | | | 1.00 | (c) | | | 1.04 | | | | 1.04 | | | | 1.05 | | | | 1.10 | |

See Notes to Financial Statements

30

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | |

| Class R4 | | Year ended | |

| | | 8/31/17 | | | 8/31/16 | | | 8/31/15 | | | 8/31/14 | | | 8/31/13 | |

Net asset value, beginning of period | | | $26.93 | | | | $27.39 | | | | $29.40 | | | | $23.99 | | | | $19.81 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $0.25 | (c) | | | $0.23 | | | | $0.22 | | | | $0.20 | | | | $0.23 | |

Net realized and unrealized gain (loss) | | | 4.57 | | | | 2.11 | | | | 0.12 | | | | 5.44 | | | | 4.11 | |

Total from investment operations | | | $4.82 | | | | $2.34 | | | | $0.34 | | | | $5.64 | | | | $4.34 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | | | |

From net investment income | | | $(0.23 | ) | | | $(0.21 | ) | | | $(0.20 | ) | | | $(0.23 | ) | | | $(0.16 | ) |

From net realized gain | | | (0.81 | ) | | | (2.59 | ) | | | (2.15 | ) | | | — | | | | — | |

Total distributions declared to shareholders | | | $(1.04 | ) | | | $(2.80 | ) | | | $(2.35 | ) | | | $(0.23 | ) | | | $(0.16 | ) |

Net asset value, end of period (x) | | | $30.71 | | | | $26.93 | | | | $27.39 | | | | $29.40 | | | | $23.99 | |

Total return (%) (r)(s)(t)(x) | | | 18.40 | (c) | | | 9.36 | | | | 1.22 | | | | 23.62 | | | | 22.03 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | | 0.78 | (c) | | | 0.82 | | | | 0.80 | | | | 0.81 | | | | 0.86 | |

Expenses after expense reductions (f) | | | 0.77 | (c) | | | 0.81 | | | | 0.80 | | | | 0.80 | | | | 0.86 | |

Net investment income (loss) | | | 0.87 | (c) | | | 0.90 | | | | 0.76 | | | | 0.72 | | | | 1.04 | |

Portfolio turnover | | | 46 | | | | 68 | | | | 53 | | | | 48 | | | | 58 | |

Net assets at end of period (000 omitted) | | | $22,494 | | | | $15,799 | | | | $21,159 | | | | $19,706 | | | | $6,165 | |

| Supplemental Ratios (%): | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets after

expense reductions excluding short sale

expenses and interest expense and fees (f) | | | 0.76 | (c) | | | 0.79 | | | | 0.79 | | | | 0.80 | | | | 0.86 | |

See Notes to Financial Statements

31

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | |

| Class R6 | | Year ended | |

| | | 8/31/17 | | | 8/31/16 | | | 8/31/15 | | | 8/31/14 | | | 8/31/13 (i) | |

Net asset value, beginning of period | | | $28.13 | | | | $28.49 | | | | $30.47 | | | | $24.84 | | | | $21.02 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $0.29 | (c) | | | $0.58 | | | | $0.24 | | | | $0.23 | | | | $0.22 | |

Net realized and unrealized gain (loss) | | | 4.77 | | | | 1.89 | | | | 0.15 | | | | 5.64 | | | | 3.60 | |

Total from investment operations | | | $5.06 | | | | $2.47 | | | | $0.39 | | | | $5.87 | | | | $3.82 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | | | |

From net investment income | | | $(0.26 | ) | | | $(0.24 | ) | | | $(0.22 | ) | | | $(0.24 | ) | | | $— | |

From net realized gain | | | (0.81 | ) | | | (2.59 | ) | | | (2.15 | ) | | | — | | | | — | |

Total distributions declared to shareholders | | | $(1.07 | ) | | | $(2.83 | ) | | | $(2.37 | ) | | | $(0.24 | ) | | | $— | |

Net asset value, end of period (x) | | | $32.12 | | | | $28.13 | | | | $28.49 | | | | $30.47 | | | | $24.84 | |

Total return (%) (r)(s)(t)(x) | | | 18.49 | (c) | | | 9.46 | | | | 1.34 | | | | 23.73 | | | | 18.17 | (n) |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | | 0.69 | (c) | | | 0.70 | | | | 0.71 | | | | 0.71 | | | | 0.76 | (a) |

Expenses after expense reductions (f) | | | 0.68 | (c) | | | 0.69 | | | | 0.70 | | | | 0.71 | | | | 0.76 | (a) |

Net investment income (loss) | | | 0.97 | (c) | | | 2.10 | | | | 0.82 | | | | 0.80 | | | | 1.39 | (a) |

Portfolio turnover | | | 46 | | | | 68 | | | | 53 | | | | 48 | | | | 58 | |

Net assets at end of period (000 omitted) | | | $393,153 | | | | $300,078 | | | | $6,198 | | | | $2,492 | | | | $119 | |

| Supplemental Ratios (%): | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets after

expense reductions excluding short sale

expenses and interest expense and fees (f) | | | 0.66 | (c) | | | 0.68 | | | | 0.69 | | | | 0.71 | | | | 0.75 | (a) |

| (c) | Amount reflects a one-time reimbursement of expenses by the custodian (or former custodian) without which net investment income and performance would be lower and expenses would be higher. See Note 2 in the Notes to Financial Statements for additional information. |

| (d) | Per share data is based on average shares outstanding. |

| (f) | Ratios do not reflect reductions from fees paid indirectly, if applicable. |

| (i) | For the period from the class inception, January 2, 2013, through the stated period end. |

| (r) | Certain expenses have been reduced without which performance would have been lower. |

| (s) | From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower. Excluding the effect of the proceeds received from a non-recurring litigation settlement against Household International, Inc., the total return for the year ended August 31, 2017 would have been lower by approximately 0.72%. |

| (t) | Total returns do not include any applicable sales charges. |

| (w) | Per share amount was less than $0.01. |

| (x) | The net asset values and total returns have been calculated on net assets which include adjustments made in accordance with U.S. generally accepted accounting principles required at period end for financial reporting purposes. |

See Notes to Financial Statements

32

NOTES TO FINANCIAL STATEMENTS

(1) Business and Organization

MFS Core Equity Fund (the fund) is a diversified series of MFS Series Trust I (the trust). The trust is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company.

The fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services – Investment Companies.

(2) Significant Accounting Policies

General – The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. In the preparation of these financial statements, management has evaluated subsequent events occurring after the date of the fund’s Statement of Assets and Liabilities through the date that the financial statements were issued.

In October 2016, the Securities and Exchange Commission (SEC) released its Final Rule on Investment Company Reporting Modernization (the “Rule”). The Rule, which introduced two new regulatory reporting forms for investment companies – Form N-PORT and Form N-CEN – also contained amendments to Regulation S-X which impact financial statement presentation, particularly the presentation of derivative investments, for all reporting periods ending after August 1, 2017. The fund has adopted the Rule’s Regulation S-X amendments and believes that the fund’s financial statements are in compliance with those amendments.