UNITED STATES

SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04777

MFS SERIES TRUST I

(Exact name of registrant as specified in charter)

111 Huntington Avenue, Boston, Massachusetts 02199 (Address of principal executive offices) (Zip code)

Christopher R. Bohane

Massachusetts Financial Services Company

111Huntington Avenue Boston, Massachusetts 02199

(Name and address of agents for service)

Registrant's telephone number, including area code: (617) 954-5000

Date of fiscal year end: August 31

Date of reporting period: February 28, 2023

ITEM 1. REPORTS TO STOCKHOLDERS.

Item 1(a):

Semiannual Report

February 28, 2023

The report is prepared for the general information of shareholders. It is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

LETTER FROM THE CHAIR AND CEO

Dear Shareholders:

Markets — which rallied in late 2022 and early 2023 on signs of peaking inflation, hopes that monetary policy tightening cycles may be nearing an end and a rapid reopening of China’s economy — have hit turbulence after the sudden collapse of two US regional banks and the government-led merger of Switzerland’s two largest lenders. At the same time, US inflation data suggest that price pressures will prove more persistent than expected, making the US Federal Reserve’s job of trying to corral four-decade-high inflation without tipping the economy into recession that much more difficult. On a positive note, markets have largely adjusted to the challenges posed by Russia’s invasion of Ukraine, thanks in part to mild European winter weather that has alleviated concerns over potential near-term shortages of natural gas. Resilient labor markets in much of the developed world have further contributed to a brighter-than-expected economic backdrop. However, after the recent banking turmoil, investors are increasingly mindful that the lagged effects of ongoing monetary policy tightening have yet to fully work their way through the global economy.

One result of the banking crisis has been a rally in global government bond markets as investors sense that the global monetary tightening campaign is nearing its end, and the resulting lower yields have eased some of the pressure on interest rate–sensitive parts of the economy. Over the near term, amid tighter financial conditions, we feel companies will face a challenging earnings backdrop as they are forced to absorb higher input and labor costs while pricing power dwindles. As for fixed income, the rise in interest rates in recent months has made bonds more attractive than they have been in years, which may provide balance for investors’ portfolios.

During times of market transition, it is important to have a deep understanding of company fundamentals, and we have built our unique global research platform to do just that.

At MFS®, we put our clients’ assets to work responsibly by carefully navigating increasingly complex global capital markets. Our investment team is guided by a commitment to long-term fundamental investing. Our global investment platform — combining collective expertise, long-term discipline, and thoughtful risk management — seeks to uncover what we believe are the best, most durable investment ideas in markets around the world, enabling us to potentially create value for investors.

Respectfully,

Michael W. Roberge

Chair and Chief Executive Officer

MFS Investment Management

April 14, 2023

The opinions expressed in this letter are subject to change and may not be relied upon for investment advice. No forecasts can be guaranteed.

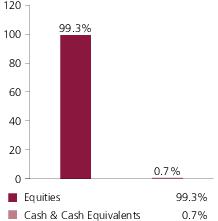

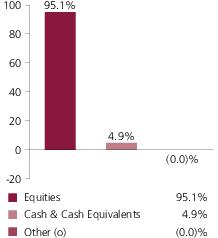

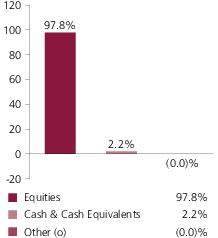

Portfolio structure

Top ten holdings

| Apple, Inc. | 6.2% |

| Microsoft Corp. | 5.7% |

| Alphabet, Inc., “A” | 3.1% |

| Amazon.com, Inc. | 2.6% |

| Exxon Mobil Corp. | 2.2% |

| Visa, Inc., “A” | 1.8% |

| JPMorgan Chase & Co. | 1.7% |

| Cigna Group | 1.4% |

| Johnson & Johnson | 1.3% |

| Home Depot, Inc. | 1.2% |

Global equity sectors (k)

| Technology | 28.1% |

| Financial Services | 15.2% |

| Health Care (s) | 14.8% |

| Capital Goods | 14.1% |

| Consumer Cyclicals | 11.5% |

| Energy | 8.1% |

| Consumer Staples | 5.1% |

| Telecommunications/Cable Television (s) | 2.0% |

| (k) | The sectors set forth above and the associated portfolio composition are based on MFS’ own custom sector classification methodology. |

| (s) | Includes securities sold short. |

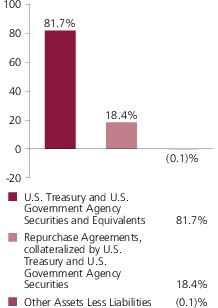

Cash & Cash Equivalents includes any cash, investments in money market funds, short-term securities, and other assets less liabilities. Please see the Statement of Assets and Liabilities for additional information related to the fund’s cash position and other assets and liabilities.

Percentages are based on net assets as of February 28, 2023.

The portfolio is actively managed and current holdings may be different.

Expense Table

Fund expenses borne by the shareholders during the period,

September 1, 2022 through February 28, 2023

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on certain purchase or redemption payments, and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period September 1, 2022 through February 28, 2023.

Actual Expenses

The first line for each share class in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the following table provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Expense Table - continued

Share

Class | | Annualized

Expense

Ratio | Beginning

Account Value

9/01/22 | Ending

Account Value

2/28/23 | Expenses

Paid During

Period (p)

9/01/22-2/28/23 |

| A | Actual | 0.91% | $1,000.00 | $1,012.41 | $4.54 |

| Hypothetical (h) | 0.91% | $1,000.00 | $1,020.28 | $4.56 |

| B | Actual | 1.66% | $1,000.00 | $1,009.01 | $8.27 |

| Hypothetical (h) | 1.66% | $1,000.00 | $1,016.56 | $8.30 |

| C | Actual | 1.66% | $1,000.00 | $1,008.85 | $8.27 |

| Hypothetical (h) | 1.66% | $1,000.00 | $1,016.56 | $8.30 |

| I | Actual | 0.66% | $1,000.00 | $1,013.99 | $3.30 |

| Hypothetical (h) | 0.66% | $1,000.00 | $1,021.52 | $3.31 |

| R1 | Actual | 1.66% | $1,000.00 | $1,008.71 | $8.27 |

| Hypothetical (h) | 1.66% | $1,000.00 | $1,016.56 | $8.30 |

| R2 | Actual | 1.14% | $1,000.00 | $1,011.35 | $5.69 |

| Hypothetical (h) | 1.14% | $1,000.00 | $1,019.14 | $5.71 |

| R3 | Actual | 0.91% | $1,000.00 | $1,012.52 | $4.54 |

| Hypothetical (h) | 0.91% | $1,000.00 | $1,020.28 | $4.56 |

| R4 | Actual | 0.66% | $1,000.00 | $1,013.83 | $3.30 |

| Hypothetical (h) | 0.66% | $1,000.00 | $1,021.52 | $3.31 |

| R6 | Actual | 0.57% | $1,000.00 | $1,014.19 | $2.85 |

| Hypothetical (h) | 0.57% | $1,000.00 | $1,021.97 | $2.86 |

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. |

Notes to Expense Table

Expense ratios include 0.01% of investment related expenses from short sales (See Note 2 of the Notes to Financial Statements).

Each class with a Rule 12b-1 service fee is subject to a rebate of a portion of such fee. Such rebates are included in the expense ratios above. For Class R2 shares, this rebate reduced the expense ratio above by 0.01%. See Note 3 in the Notes to Financial Statements for additional information.

Portfolio of Investments

2/28/23 (unaudited)

The Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by broad-based asset classes.

| Issuer | | | Shares/Par | Value ($) |

| Common Stocks – 99.1% |

| Aerospace & Defense – 2.4% | |

| Boeing Co. (a) | | 72,331 | $14,578,313 |

| Curtiss-Wright Corp. | | 55,702 | 9,736,153 |

| General Dynamics Corp. | | 84,682 | 19,299,875 |

| Honeywell International, Inc. | | 176,454 | 33,787,412 |

| Howmet Aerospace, Inc. | | 381,581 | 16,095,087 |

| Leidos Holdings, Inc. | | 106,903 | 10,377,074 |

| Raytheon Technologies Corp. | | 327,973 | 32,170,871 |

| | | | | $136,044,785 |

| Alcoholic Beverages – 0.5% | |

| Constellation Brands, Inc., “A” | | 120,920 | $27,049,804 |

| Apparel Manufacturers – 0.4% | |

| NIKE, Inc., “B” | | 66,701 | $7,923,412 |

| On Holding AG (a) | | 274,982 | 6,013,856 |

| Skechers USA, Inc., “A” (a) | | 136,600 | 6,080,066 |

| | | | | $20,017,334 |

| Automotive – 0.9% | |

| Aptiv PLC (a) | | 225,310 | $26,199,047 |

| LKQ Corp. | | 431,250 | 24,706,312 |

| | | | | $50,905,359 |

| Biotechnology – 0.1% | |

| Adaptive Biotechnologies Corp. (a) | | 318,825 | $2,725,954 |

| Oxford Nanopore Technologies PLC (a) | | 958,296 | 2,409,114 |

| | | | | $5,135,068 |

| Broadcasting – 1.1% | |

| Omnicom Group, Inc. | | 131,709 | $11,928,884 |

| Walt Disney Co. (a) | | 349,592 | 34,822,859 |

| Warner Bros. Discovery, Inc. (a) | | 852,078 | 13,309,459 |

| | | | | $60,061,202 |

| Brokerage & Asset Managers – 2.0% | |

| Charles Schwab Corp. | | 390,092 | $30,395,969 |

| CME Group, Inc. | | 149,199 | 27,655,527 |

| Invesco Ltd. | | 99,971 | 1,765,488 |

| KKR & Co., Inc. | | 203,210 | 11,450,883 |

| LPL Financial Holdings, Inc. | | 27,730 | 6,920,299 |

Portfolio of Investments (unaudited) – continued

| Issuer | | | Shares/Par | Value ($) |

| Common Stocks – continued |

| Brokerage & Asset Managers – continued | |

| Raymond James Financial, Inc. | | 309,172 | $33,532,795 |

| | | | | $111,720,961 |

| Business Services – 2.3% | |

| Accenture PLC, “A” | | 172,860 | $45,902,973 |

| Amdocs Ltd. | | 215,022 | 19,698,165 |

| Equifax, Inc. | | 23,022 | 4,662,646 |

| Fidelity National Information Services, Inc. | | 254,721 | 16,141,670 |

| Thoughtworks Holding, Inc. (a) | | 651,880 | 4,797,837 |

| TriNet Group, Inc. (a) | | 115,118 | 9,539,829 |

| WNS (Holdings) Ltd., ADR (a) | | 295,220 | 25,660,522 |

| | | | | $126,403,642 |

| Cable TV – 0.3% | |

| Cable One, Inc. | | 24,111 | $16,651,298 |

| Chemicals – 0.1% | |

| Element Solutions, Inc. | | 378,460 | $7,773,568 |

| Computer Software – 9.4% | |

| Adobe Systems, Inc. (a) | | 109,035 | $35,321,888 |

| Atlassian Corp. (a) | | 135,464 | 22,260,799 |

| Black Knight, Inc. (a) | | 288,382 | 17,187,567 |

| Cadence Design Systems, Inc. (a) | | 168,112 | 32,435,530 |

| Check Point Software Technologies Ltd. (a) | | 66,874 | 8,273,651 |

| Dun & Bradstreet Holdings, Inc. | | 899,687 | 10,805,241 |

| Elastic N.V. (a) | | 103,006 | 6,079,414 |

| Intuit, Inc. | | 56,412 | 22,969,838 |

| Microsoft Corp. (s) | | 1,283,839 | 320,215,124 |

| NICE Systems Ltd., ADR (a) | | 79,242 | 16,435,583 |

| Salesforce, Inc. (a) | | 229,065 | 37,477,325 |

| | | | | $529,461,960 |

| Computer Software - Systems – 7.7% | |

| Apple, Inc. (s) | | 2,372,326 | $349,704,575 |

| Block, Inc., “A” (a) | | 189,251 | 14,521,229 |

| Five9, Inc. (a) | | 81,056 | 5,349,696 |

| Rapid7, Inc. (a) | | 169,133 | 7,999,991 |

| ServiceNow, Inc. (a) | | 95,041 | 41,073,869 |

| Zebra Technologies Corp., “A” (a) | | 45,891 | 13,778,773 |

| | | | | $432,428,133 |

Portfolio of Investments (unaudited) – continued

| Issuer | | | Shares/Par | Value ($) |

| Common Stocks – continued |

| Construction – 1.4% | |

| AvalonBay Communities, Inc., REIT | | 109,818 | $18,945,802 |

| AZEK Co., Inc. (a) | | 401,070 | 9,661,776 |

| Masco Corp. | | 290,941 | 15,254,037 |

| Sherwin-Williams Co. | | 76,995 | 17,042,843 |

| Vulcan Materials Co. | | 88,186 | 15,953,729 |

| | | | | $76,858,187 |

| Consumer Products – 1.4% | |

| Colgate-Palmolive Co. | | 311,071 | $22,801,504 |

| International Flavors & Fragrances, Inc. | | 111,786 | 10,418,455 |

| Kimberly-Clark Corp. | | 146,714 | 18,346,586 |

| Procter & Gamble Co. | | 187,274 | 25,761,412 |

| | | | | $77,327,957 |

| Consumer Services – 0.8% | |

| Booking Holdings, Inc. (a) | | 8,654 | $21,842,696 |

| Bright Horizons Family Solutions, Inc. (a) | | 162,971 | 12,848,634 |

| Grand Canyon Education, Inc. (a) | | 72,366 | 8,198,344 |

| | | | | $42,889,674 |

| Containers – 0.2% | |

| Crown Holdings, Inc. | | 111,739 | $9,666,541 |

| Electrical Equipment – 2.0% | |

| AMETEK, Inc. | | 239,573 | $33,913,954 |

| Amphenol Corp., “A” | | 190,596 | 14,775,002 |

| Johnson Controls International PLC | | 493,596 | 30,958,341 |

| Sensata Technologies Holding PLC | | 504,982 | 25,541,990 |

| TE Connectivity Ltd. | | 50,936 | 6,485,171 |

| | | | | $111,674,458 |

| Electronics – 4.8% | |

| Advanced Micro Devices (a) | | 260,468 | $20,467,575 |

| Analog Devices, Inc. | | 210,120 | 38,550,716 |

| Applied Materials, Inc. | | 312,046 | 36,244,143 |

| Broadcom, Inc. | | 101,168 | 60,123,131 |

| Lam Research Corp. | | 56,549 | 27,483,380 |

| Marvell Technology, Inc. | | 386,392 | 17,445,599 |

| Monolithic Power Systems, Inc. | | 34,281 | 16,601,945 |

| NXP Semiconductors N.V. | | 164,731 | 29,401,189 |

| Texas Instruments, Inc. | | 149,280 | 25,594,056 |

| | | | | $271,911,734 |

Portfolio of Investments (unaudited) – continued

| Issuer | | | Shares/Par | Value ($) |

| Common Stocks – continued |

| Energy - Independent – 1.8% | |

| ConocoPhillips | | 312,664 | $32,313,824 |

| Diamondback Energy, Inc. | | 181,591 | 25,528,063 |

| Hess Corp. | | 126,657 | 17,060,698 |

| Valero Energy Corp. | | 191,931 | 25,283,071 |

| | | | | $100,185,656 |

| Energy - Integrated – 2.2% | |

| Exxon Mobil Corp. (s) | | 1,137,172 | $124,986,574 |

| Energy - Renewables – 0.2% | |

| Enphase Energy, Inc. (a) | | 47,205 | $9,938,068 |

| Generac Holdings, Inc. (a) | | 20,374 | 2,445,084 |

| | | | | $12,383,152 |

| Engineering - Construction – 0.3% | |

| APi Group, Inc. (a) | | 290,601 | $6,826,217 |

| Jacobs Solutions, Inc. | | 92,184 | 11,015,988 |

| | | | | $17,842,205 |

| Entertainment – 0.1% | |

| Vivid Seats, Inc., “A” (a)(l) | | 700,232 | $5,370,779 |

| Food & Beverages – 2.6% | |

| Archer Daniels Midland Co. | | 206,198 | $16,413,361 |

| Coca-Cola Co. | | 164,235 | 9,773,625 |

| Coca-Cola Europacific Partners PLC | | 221,371 | 12,175,405 |

| J.M. Smucker Co. | | 67,512 | 9,984,350 |

| Mondelez International, Inc. | | 579,436 | 37,767,638 |

| Oatly Group AB, ADR (a)(l) | | 2,373,645 | 5,222,019 |

| PepsiCo, Inc. | | 323,335 | 56,108,322 |

| | | | | $147,444,720 |

| Forest & Paper Products – 0.4% | |

| Rayonier, Inc., REIT | | 673,589 | $22,619,119 |

| Gaming & Lodging – 0.6% | |

| International Game Technology PLC | | 460,686 | $12,235,820 |

| Las Vegas Sands Corp. (a) | | 83,041 | 4,772,367 |

| Marriott International, Inc., “A” | | 97,680 | 16,531,363 |

| | | | | $33,539,550 |

| General Merchandise – 0.9% | |

| Dollar General Corp. | | 146,041 | $31,588,668 |

| Dollar Tree, Inc. (a) | | 146,817 | 21,329,574 |

| | | | | $52,918,242 |

Portfolio of Investments (unaudited) – continued

| Issuer | | | Shares/Par | Value ($) |

| Common Stocks – continued |

| Health Maintenance Organizations – 1.5% | |

| Cigna Group | | 259,999 | $75,945,708 |

| Humana, Inc. | | 18,779 | 9,295,980 |

| | | | | $85,241,688 |

| Insurance – 4.0% | |

| Aon PLC | | 179,710 | $54,640,825 |

| Arthur J. Gallagher & Co. | | 168,304 | 31,531,754 |

| Assurant, Inc. | | 68,737 | 8,756,406 |

| Chubb Ltd. | | 179,435 | 37,864,374 |

| Hartford Financial Services Group, Inc. | | 243,338 | 19,048,499 |

| MetLife, Inc. | | 250,247 | 17,950,217 |

| Reinsurance Group of America, Inc. | | 76,299 | 11,022,917 |

| Voya Financial, Inc. | | 273,928 | 20,404,897 |

| Willis Towers Watson PLC | | 91,205 | 21,374,804 |

| | | | | $222,594,693 |

| Internet – 3.2% | |

| Alphabet, Inc., “A” (a)(s) | | 1,922,081 | $173,102,615 |

| Gartner, Inc. (a) | | 26,890 | 8,814,811 |

| | | | | $181,917,426 |

| Leisure & Toys – 0.7% | |

| Electronic Arts, Inc. | | 207,007 | $22,965,356 |

| Funko, Inc., “A” (a) | | 674,226 | 7,288,383 |

| Take-Two Interactive Software, Inc. (a) | | 86,383 | 9,463,258 |

| | | | | $39,716,997 |

| Machinery & Tools – 2.8% | |

| Dover Corp. | | 129,367 | $19,392,113 |

| Eaton Corp. PLC | | 231,032 | 40,414,428 |

| Flowserve Corp. | | 333,644 | 11,574,110 |

| Ingersoll Rand, Inc. | | 385,905 | 22,409,503 |

| PACCAR, Inc. | | 260,992 | 18,843,623 |

| Regal Rexnord Corp. | | 133,377 | 21,025,550 |

| Wabtec Corp. | | 218,108 | 22,755,208 |

| | | | | $156,414,535 |

| Major Banks – 3.8% | |

| JPMorgan Chase & Co. | | 659,050 | $94,474,817 |

| Morgan Stanley | | 421,164 | 40,642,326 |

| PNC Financial Services Group, Inc. | | 115,105 | 18,177,382 |

| Regions Financial Corp. | | 952,808 | 22,219,483 |

| Wells Fargo & Co. | | 758,586 | 35,479,067 |

| | | | | $210,993,075 |

Portfolio of Investments (unaudited) – continued

| Issuer | | | Shares/Par | Value ($) |

| Common Stocks – continued |

| Medical & Health Technology & Services – 1.7% | |

| ICON PLC (a) | | 178,403 | $40,253,069 |

| IDEXX Laboratories, Inc. (a) | | 7,418 | 3,510,494 |

| McKesson Corp. | | 105,722 | 36,982,613 |

| Veeva Systems, Inc. (a) | | 103,433 | 17,134,711 |

| | | | | $97,880,887 |

| Medical Equipment – 5.1% | |

| Agilent Technologies, Inc. | | 162,360 | $23,050,249 |

| Align Technology, Inc. (a) | | 5,022 | 1,554,309 |

| Becton, Dickinson and Co. | | 195,495 | 45,853,352 |

| Boston Scientific Corp. (a) | | 1,248,952 | 58,351,037 |

| Envista Holdings Corp. (a) | | 329,975 | 12,756,834 |

| Maravai Lifesciences Holdings, Inc., “A” (a) | | 2,045,391 | 30,169,517 |

| Medtronic PLC | | 683,666 | 56,607,545 |

| Quidel Corp. (a) | | 297,792 | 25,890,036 |

| STERIS PLC | | 177,285 | 33,334,899 |

| | | | | $287,567,778 |

| Natural Gas - Pipeline – 0.2% | |

| Cheniere Energy, Inc. | | 86,755 | $13,650,032 |

| Network & Telecom – 0.7% | |

| Equinix, Inc., REIT | | 28,283 | $19,466,340 |

| Motorola Solutions, Inc. | | 65,658 | 17,255,579 |

| | | | | $36,721,919 |

| Oil Services – 0.7% | |

| Cactus, Inc., “A” | | 305,167 | $14,022,424 |

| Schlumberger Ltd. | | 462,028 | 24,584,510 |

| | | | | $38,606,934 |

| Other Banks & Diversified Financials – 3.9% | |

| American Express Co. | | 60,918 | $10,599,123 |

| First Interstate BancSystem, Inc. | | 260,289 | 9,250,671 |

| M&T Bank Corp. | | 221,597 | 34,411,798 |

| Moody's Corp. | | 82,698 | 23,994,825 |

| Northern Trust Corp. | | 101,521 | 9,671,906 |

| Signature Bank | | 53,846 | 6,194,982 |

| SLM Corp. | | 681,848 | 9,804,974 |

| SVB Financial Group (a) | | 20,072 | 5,782,944 |

| United Community Bank, Inc. | | 244,331 | 8,089,799 |

| Visa, Inc., “A” | | 452,072 | 99,428,716 |

| | | | | $217,229,738 |

Portfolio of Investments (unaudited) – continued

| Issuer | | | Shares/Par | Value ($) |

| Common Stocks – continued |

| Pharmaceuticals – 6.5% | |

| Eli Lilly & Co. | | 163,392 | $50,850,858 |

| Johnson & Johnson | | 482,219 | 73,904,884 |

| Merck & Co., Inc. | | 601,213 | 63,872,869 |

| Organon & Co. | | 674,380 | 16,515,566 |

| Pfizer, Inc. | | 1,409,838 | 57,197,128 |

| Vertex Pharmaceuticals, Inc. (a) | | 180,133 | 52,290,809 |

| Zoetis, Inc. | | 296,520 | 49,518,840 |

| | | | | $364,150,954 |

| Pollution Control – 0.5% | |

| GFL Environmental, Inc. | | 954,514 | $28,988,590 |

| Printing & Publishing – 0.1% | |

| Warner Music Group Corp. | | 153,411 | $4,841,651 |

| Railroad & Shipping – 1.0% | |

| Canadian Pacific Railway Ltd. | | 468,175 | $35,553,209 |

| CSX Corp. | | 704,612 | 21,483,620 |

| | | | | $57,036,829 |

| Real Estate – 1.6% | |

| Broadstone Net Lease, Inc., REIT | | 973,344 | $17,276,856 |

| Empire State Realty Trust, REIT, “A” | | 1,413,767 | 10,306,362 |

| Extra Space Storage, Inc., REIT | | 116,203 | 19,132,824 |

| Jones Lang LaSalle, Inc. (a) | | 48,148 | 8,399,900 |

| Prologis, Inc., REIT | | 53,098 | 6,552,293 |

| Spirit Realty Capital, Inc., REIT | | 376,592 | 15,508,059 |

| Sun Communities, Inc., REIT | | 98,810 | 14,143,663 |

| | | | | $91,319,957 |

| Restaurants – 1.4% | |

| Starbucks Corp. | | 557,678 | $56,933,347 |

| Wendy's Co. | | 1,045,226 | 22,953,163 |

| | | | | $79,886,510 |

| Specialty Chemicals – 1.7% | |

| Air Products & Chemicals, Inc. | | 69,663 | $19,922,225 |

| Axalta Coating Systems Ltd. (a) | | 350,152 | 10,434,530 |

| Chemours Co. | | 189,027 | 6,460,943 |

| Diversey Holdings Ltd. (a) | | 1,656,414 | 9,789,407 |

| DuPont de Nemours, Inc. | | 235,844 | 17,223,687 |

| Linde PLC | | 73,877 | 25,736,530 |

| Univar Solutions, Inc. (a) | | 168,404 | 5,852,039 |

| | | | | $95,419,361 |

Portfolio of Investments (unaudited) – continued

| Issuer | | | Shares/Par | Value ($) |

| Common Stocks – continued |

| Specialty Stores – 5.5% | |

| Amazon.com, Inc. (a)(s) | | 1,564,402 | $147,413,601 |

| Home Depot, Inc. | | 233,810 | 69,334,017 |

| Lululemon Athletica, Inc. (a) | | 53,812 | 16,638,670 |

| Ross Stores, Inc. | | 292,126 | 32,291,608 |

| Target Corp. | | 236,829 | 39,905,687 |

| | | | | $305,583,583 |

| Telecommunications - Wireless – 1.7% | |

| Liberty Broadband Corp. (a) | | 275,146 | $23,846,904 |

| SBA Communications Corp., REIT | | 121,071 | 31,399,764 |

| T-Mobile US, Inc. (a) | | 282,275 | 40,133,859 |

| | | | | $95,380,527 |

| Telephone Services – 0.1% | |

| Altice USA, Inc., “A” (a) | | 848,727 | $3,360,959 |

| Tobacco – 0.6% | |

| Philip Morris International, Inc. | | 357,481 | $34,782,901 |

| Trucking – 0.3% | |

| Saia, Inc. (a) | | 69,833 | $18,915,665 |

| Utilities - Electric Power – 2.9% | |

| CenterPoint Energy, Inc. | | 684,187 | $19,034,082 |

| Constellation Energy | | 100,354 | 7,515,511 |

| Dominion Energy, Inc. | | 110,451 | 6,143,285 |

| Duke Energy Corp. | | 170,350 | 16,057,191 |

| Evergy, Inc. | | 89,772 | 5,279,491 |

| Exelon Corp. | | 301,060 | 12,159,813 |

| NextEra Energy, Inc. | | 432,134 | 30,694,478 |

| PG&E Corp. (a) | | 1,970,840 | 30,784,521 |

| PPL Corp. | | 222,088 | 6,011,922 |

| Sempra Energy | | 67,637 | 10,142,845 |

| Xcel Energy, Inc. | | 292,788 | 18,905,321 |

| | | | | $162,728,460 |

| Total Common Stocks (Identified Cost, $4,380,913,083) | | $5,562,203,311 |

| Investment Companies (h) – 0.8% |

| Money Market Funds – 0.8% | |

| MFS Institutional Money Market Portfolio, 4.55% (v) (Identified Cost, $47,523,799) | | | 47,525,062 | $47,525,062 |

Portfolio of Investments (unaudited) – continued

| Issuer | | | Shares/Par | Value ($) |

| Collateral for Securities Loaned – 0.1% |

| State Street Navigator Securities Lending Government Money Market Portfolio, 4.59% (j) (Identified Cost, $3,647,311) | | | 3,647,311 | $3,647,311 |

| Securities Sold Short – (0.2)% |

| Medical & Health Technology & Services – (0.1)% |

| Healthcare Services Group, Inc. | | | (581,597) | $(7,717,792) |

| Telecommunications - Wireless – (0.1)% |

| Crown Castle, Inc., REIT | | | (44,300) | $(5,792,225) |

| Total Securities Sold Short (Proceeds Received, $21,409,922) | $(13,510,017) |

|

|

| Other Assets, Less Liabilities – 0.2% | | 11,669,156 |

| Net Assets – 100.0% | $5,611,534,823 |

| (a) | Non-income producing security. | | | |

| (h) | An affiliated issuer, which may be considered one in which the fund owns 5% or more of the outstanding voting securities, or a company which is under common control. At period end, the aggregate values of the fund's investments in affiliated issuers and in unaffiliated issuers were $47,525,062 and $5,565,850,622, respectively. | | | |

| (j) | The rate quoted is the annualized seven-day yield of the fund at period end. | | | |

| (l) | A portion of this security is on loan. See Note 2 for additional information. | | | |

| (s) | Security or a portion of the security was pledged to cover collateral requirements for securities sold short. | | | |

| (v) | Affiliated issuer that is available only to investment companies managed by MFS. The rate quoted for the MFS Institutional Money Market Portfolio is the annualized seven-day yield of the fund at period end. | | | |

| The following abbreviations are used in this report and are defined: |

| ADR | American Depositary Receipt |

| REIT | Real Estate Investment Trust |

At February 28, 2023, the fund had cash collateral of $53,345 and other liquid securities with an aggregate value of $38,495,694 to cover any collateral or margin obligations for securities sold short. Restricted cash and/or deposits with brokers in the Statement of Assets and Liabilities are comprised of cash collateral.

See Notes to Financial Statements

Financial Statements

Statement of Assets and Liabilities

At 2/28/23 (unaudited)

This statement represents your fund’s balance sheet, which details the assets and liabilities comprising the total value of the fund.

| Assets | |

| Investments in unaffiliated issuers, at value, including $3,263,204 of securities on loan (identified cost, $4,384,560,394) | $5,565,850,622 |

| Investments in affiliated issuers, at value (identified cost, $47,523,799) | 47,525,062 |

| Deposits with brokers for | |

| Securities sold short | 53,345 |

| Receivables for | |

| Investments sold | 19,796,287 |

| Fund shares sold | 7,108,038 |

| Interest and dividends | 7,766,918 |

| Other assets | 70,392 |

| Total assets | $5,648,170,664 |

| Liabilities | |

| Payable to custodian | $7,959,861 |

| Payables for | |

| Securities sold short, at value (proceeds received, $21,409,922) | 13,510,017 |

| Fund shares reacquired | 10,120,125 |

| Collateral for securities loaned, at value | 3,647,311 |

| Payable to affiliates | |

| Investment adviser | 158,659 |

| Administrative services fee | 3,537 |

| Shareholder servicing costs | 892,225 |

| Distribution and service fees | 36,966 |

| Payable for independent Trustees' compensation | 15,037 |

| Accrued expenses and other liabilities | 292,103 |

| Total liabilities | $36,635,841 |

| Net assets | $5,611,534,823 |

| Net assets consist of | |

| Paid-in capital | $4,441,196,627 |

| Total distributable earnings (loss) | 1,170,338,196 |

| Net assets | $5,611,534,823 |

| Shares of beneficial interest outstanding | 138,464,171 |

Statement of Assets and Liabilities (unaudited) – continued

| | Net assets | Shares

outstanding | Net asset value

per share (a) |

| Class A | $2,155,877,476 | 55,132,723 | $39.10 |

| Class B | 12,854,634 | 391,241 | 32.86 |

| Class C | 100,404,752 | 3,110,866 | 32.28 |

| Class I | 1,444,385,237 | 34,447,466 | 41.93 |

| Class R1 | 6,075,403 | 188,120 | 32.30 |

| Class R2 | 18,934,386 | 499,120 | 37.94 |

| Class R3 | 58,974,825 | 1,512,827 | 38.98 |

| Class R4 | 35,808,265 | 905,265 | 39.56 |

| Class R6 | 1,778,219,845 | 42,276,543 | 42.06 |

| (a) | Maximum offering price per share was equal to the net asset value per share for all share classes, except for Class A, for which the maximum offering price per share was $41.49 [100 / 94.25 x $39.10]. On sales of $50,000 or more, the maximum offering price of Class A shares is reduced. A contingent deferred sales charge may be imposed on redemptions of Class A, Class B, and Class C shares. Redemption price per share was equal to the net asset value per share for Classes I, R1, R2, R3, R4, and R6. |

See Notes to Financial Statements

Financial Statements

Statement of Operations

Six months ended 2/28/23 (unaudited)

This statement describes how much your fund earned in investment income and accrued in expenses. It also describes any gains and/or losses generated by fund operations.

| Net investment income (loss) | |

| Income | |

| Dividends | $40,431,442 |

| Dividends from affiliated issuers | 1,022,975 |

| Other | 110,981 |

| Income on securities loaned | 11,833 |

| Foreign taxes withheld | (65,354) |

| Total investment income | $41,511,877 |

| Expenses | |

| Management fee | $14,532,879 |

| Distribution and service fees | 3,387,228 |

| Shareholder servicing costs | 2,039,551 |

| Administrative services fee | 316,715 |

| Independent Trustees' compensation | 41,869 |

| Custodian fee | 69,897 |

| Shareholder communications | 146,315 |

| Audit and tax fees | 33,022 |

| Legal fees | 12,437 |

| Dividend and interest expense on securities sold short | 334,459 |

| Interest expense and fees | 14,162 |

| Miscellaneous | 168,786 |

| Total expenses | $21,097,320 |

| Reduction of expenses by investment adviser and distributor | (368,958) |

| Net expenses | $20,728,362 |

| Net investment income (loss) | $20,783,515 |

Statement of Operations (unaudited) – continued

| Realized and unrealized gain (loss) |

| Realized gain (loss) (identified cost basis) | |

| Unaffiliated issuers | $(35,449,096) |

| Affiliated issuers | (4,517) |

| Securities sold short | 4,054,986 |

| Foreign currency | (1,170) |

| Net realized gain (loss) | $(31,399,797) |

| Change in unrealized appreciation or depreciation | |

| Unaffiliated issuers | $86,332,967 |

| Affiliated issuers | (2,747) |

| Securities sold short | (1,107,757) |

| Net unrealized gain (loss) | $85,222,463 |

| Net realized and unrealized gain (loss) | $53,822,666 |

| Change in net assets from operations | $74,606,181 |

See Notes to Financial Statements

Financial Statements

Statements of Changes in Net Assets

These statements describe the increases and/or decreases in net assets resulting from operations, any distributions, and any shareholder transactions.

| | Six months ended | Year ended |

| | 2/28/23

(unaudited) | 8/31/22 |

| Change in net assets | | |

| From operations | | |

| Net investment income (loss) | $20,783,515 | $29,779,079 |

| Net realized gain (loss) | (31,399,797) | 204,862,215 |

| Net unrealized gain (loss) | 85,222,463 | (1,040,675,828) |

| Change in net assets from operations | $74,606,181 | $(806,034,534) |

| Total distributions to shareholders | $(203,307,193) | $(433,307,610) |

| Change in net assets from fund share transactions | $155,123,178 | $730,427,616 |

| Total change in net assets | $26,422,166 | $(508,914,528) |

| Net assets | | |

| At beginning of period | 5,585,112,657 | 6,094,027,185 |

| At end of period | $5,611,534,823 | $5,585,112,657 |

See Notes to Financial Statements

Financial Statements

Financial Highlights

The financial highlights table is intended to help you understand the fund's financial performance for the semiannual period and the past 5 fiscal years. Certain information reflects financial results for a single fund share. The total returns in the table represent the rate that an investor would have earned (or lost) on an investment in the fund share class (assuming reinvestment of all distributions) held for the entire period.

| Class A | Six months

ended | Year ended |

| | 2/28/23

(unaudited) | 8/31/22 | 8/31/21 | 8/31/20 | 8/31/19 | 8/31/18 |

| Net asset value, beginning of period | $40.07 | $49.38 | $38.41 | $32.45 | $34.18 | $30.46 |

| Income (loss) from investment operations |

| Net investment income (loss) (d) | $0.12 | $0.15 | $0.09 | $0.19 | $0.20 | $0.20 |

| Net realized and unrealized gain (loss) | 0.36 | (6.00) | 11.50 | 6.41 | 1.05 | 5.63 |

| Total from investment operations | $0.48 | $(5.85) | $11.59 | $6.60 | $1.25 | $5.83 |

| Less distributions declared to shareholders |

| From net investment income | $(0.15) | $(0.08) | $(0.15) | $(0.15) | $(0.16) | $(0.17) |

| From net realized gain | (1.30) | (3.39) | (0.47) | (0.49) | (2.82) | (1.94) |

| Total distributions declared to shareholders | $(1.45) | $(3.46) | $(0.62) | $(0.64) | $(2.98) | $(2.11) |

| Net asset value, end of period (x) | $39.10 | $40.07 | $49.38 | $38.41 | $32.45 | $34.18 |

| Total return (%) (r)(s)(t)(x) | 1.24(n) | (12.87) | 30.57 | 20.59 | 4.94 | 19.89 |

Ratios (%) (to average net assets)

and Supplemental data: |

| Expenses before expense reductions | 0.92(a) | 0.92 | 0.94 | 0.97 | 1.00 | 1.00 |

| Expenses after expense reductions | 0.91(a) | 0.91 | 0.92 | 0.96 | 0.98 | 0.99 |

| Net investment income (loss) | 0.60(a) | 0.35 | 0.22 | 0.56 | 0.65 | 0.62 |

| Portfolio turnover | 16(n) | 25 | 38 | 46 | 39 | 42 |

| Net assets at end of period (000 omitted) | $2,155,877 | $2,156,741 | $2,462,032 | $1,960,597 | $1,373,524 | $1,184,976 |

| Supplemental Ratios (%): |

| Ratios of expenses to average net assets after expense reductions excluding short sale expenses and interest expense and fees | 0.90(a) | 0.89 | 0.90 | 0.93 | 0.96 | 0.97 |

See Notes to Financial Statements

Financial Highlights – continued

| Class B | Six months

ended | Year ended |

| | 2/28/23

(unaudited) | 8/31/22 | 8/31/21 | 8/31/20 | 8/31/19 | 8/31/18 |

| Net asset value, beginning of period | $33.87 | $42.49 | $33.24 | $28.23 | $30.19 | $27.17 |

| Income (loss) from investment operations |

| Net investment income (loss) (d) | $(0.02) | $(0.16) | $(0.19) | $(0.05) | $(0.03) | $(0.04) |

| Net realized and unrealized gain (loss) | 0.31 | (5.07) | 9.91 | 5.55 | 0.89 | 5.00 |

| Total from investment operations | $0.29 | $(5.23) | $9.72 | $5.50 | $0.86 | $4.96 |

| Less distributions declared to shareholders |

| From net investment income | $— | $— | $— | $— | $— | $— |

| From net realized gain | (1.30) | (3.39) | (0.47) | (0.49) | (2.82) | (1.94) |

| Total distributions declared to shareholders | $(1.30) | $(3.39) | $(0.47) | $(0.49) | $(2.82) | $(1.94) |

| Net asset value, end of period (x) | $32.86 | $33.87 | $42.49 | $33.24 | $28.23 | $30.19 |

| Total return (%) (r)(s)(t)(x) | 0.90(n) | (13.52) | 29.58 | 19.69 | 4.16 | 19.01 |

Ratios (%) (to average net assets)

and Supplemental data: |

| Expenses before expense reductions | 1.67(a) | 1.67 | 1.69 | 1.72 | 1.75 | 1.75 |

| Expenses after expense reductions | 1.66(a) | 1.66 | 1.67 | 1.71 | 1.73 | 1.74 |

| Net investment income (loss) | (0.15)(a) | (0.42) | (0.53) | (0.18) | (0.11) | (0.14) |

| Portfolio turnover | 16(n) | 25 | 38 | 46 | 39 | 42 |

| Net assets at end of period (000 omitted) | $12,855 | $15,456 | $24,861 | $25,018 | $22,759 | $26,993 |

| Supplemental Ratios (%): |

| Ratios of expenses to average net assets after expense reductions excluding short sale expenses and interest expense and fees | 1.65(a) | 1.64 | 1.65 | 1.68 | 1.71 | 1.72 |

See Notes to Financial Statements

Financial Highlights – continued

| Class C | Six months

ended | Year ended |

| | 2/28/23

(unaudited) | 8/31/22 | 8/31/21 | 8/31/20 | 8/31/19 | 8/31/18 |

| Net asset value, beginning of period | $33.30 | $41.83 | $32.72 | $27.86 | $29.84 | $26.88 |

| Income (loss) from investment operations |

| Net investment income (loss) (d) | $(0.02) | $(0.15) | $(0.19) | $(0.05) | $(0.03) | $(0.05) |

| Net realized and unrealized gain (loss) | 0.30 | (4.99) | 9.77 | 5.46 | 0.87 | 4.95 |

| Total from investment operations | $0.28 | $(5.14) | $9.58 | $5.41 | $0.84 | $4.90 |

| Less distributions declared to shareholders |

| From net investment income | $— | $— | $— | $(0.06) | $— | $— |

| From net realized gain | (1.30) | (3.39) | (0.47) | (0.49) | (2.82) | (1.94) |

| Total distributions declared to shareholders | $(1.30) | $(3.39) | $(0.47) | $(0.55) | $(2.82) | $(1.94) |

| Net asset value, end of period (x) | $32.28 | $33.30 | $41.83 | $32.72 | $27.86 | $29.84 |

| Total return (%) (r)(s)(t)(x) | 0.89(n) | (13.51) | 29.62 | 19.66 | 4.14 | 18.98 |

Ratios (%) (to average net assets)

and Supplemental data: |

| Expenses before expense reductions | 1.67(a) | 1.67 | 1.69 | 1.72 | 1.75 | 1.75 |

| Expenses after expense reductions | 1.66(a) | 1.66 | 1.67 | 1.71 | 1.74 | 1.74 |

| Net investment income (loss) | (0.15)(a) | (0.41) | (0.53) | (0.18) | (0.10) | (0.17) |

| Portfolio turnover | 16(n) | 25 | 38 | 46 | 39 | 42 |

| Net assets at end of period (000 omitted) | $100,405 | $105,731 | $140,242 | $128,709 | $72,093 | $56,413 |

| Supplemental Ratios (%): |

| Ratios of expenses to average net assets after expense reductions excluding short sale expenses and interest expense and fees | 1.65(a) | 1.64 | 1.65 | 1.69 | 1.71 | 1.72 |

See Notes to Financial Statements

Financial Highlights – continued

| Class I | Six months

ended | Year ended |

| | 2/28/23

(unaudited) | 8/31/22 | 8/31/21 | 8/31/20 | 8/31/19 | 8/31/18 |

| Net asset value, beginning of period | $42.90 | $52.62 | $40.87 | $34.47 | $36.12 | $32.07 |

| Income (loss) from investment operations |

| Net investment income (loss) (d) | $0.18 | $0.29 | $0.22 | $0.29 | $0.30 | $0.30 |

| Net realized and unrealized gain (loss) | 0.40 | (6.44) | 12.24 | 6.82 | 1.11 | 5.93 |

| Total from investment operations | $0.58 | $(6.15) | $12.46 | $7.11 | $1.41 | $6.23 |

| Less distributions declared to shareholders |

| From net investment income | $(0.25) | $(0.18) | $(0.24) | $(0.22) | $(0.24) | $(0.24) |

| From net realized gain | (1.30) | (3.39) | (0.47) | (0.49) | (2.82) | (1.94) |

| Total distributions declared to shareholders | $(1.55) | $(3.57) | $(0.71) | $(0.71) | $(3.06) | $(2.18) |

| Net asset value, end of period (x) | $41.93 | $42.90 | $52.62 | $40.87 | $34.47 | $36.12 |

| Total return (%) (r)(s)(t)(x) | 1.40(n) | (12.67) | 30.91 | 20.89 | 5.17 | 20.21 |

Ratios (%) (to average net assets)

and Supplemental data: |

| Expenses before expense reductions | 0.67(a) | 0.68 | 0.68 | 0.72 | 0.75 | 0.75 |

| Expenses after expense reductions | 0.66(a) | 0.66 | 0.67 | 0.71 | 0.74 | 0.74 |

| Net investment income (loss) | 0.85(a) | 0.60 | 0.47 | 0.81 | 0.90 | 0.88 |

| Portfolio turnover | 16(n) | 25 | 38 | 46 | 39 | 42 |

| Net assets at end of period (000 omitted) | $1,444,385 | $1,405,183 | $1,416,134 | $841,296 | $467,860 | $246,779 |

| Supplemental Ratios (%): |

| Ratios of expenses to average net assets after expense reductions excluding short sale expenses and interest expense and fees | 0.65(a) | 0.64 | 0.65 | 0.69 | 0.72 | 0.73 |

See Notes to Financial Statements

Financial Highlights – continued

| Class R1 | Six months

ended | Year ended |

| | 2/28/23

(unaudited) | 8/31/22 | 8/31/21 | 8/31/20 | 8/31/19 | 8/31/18 |

| Net asset value, beginning of period | $33.35 | $41.89 | $32.77 | $27.84 | $29.82 | $26.86 |

| Income (loss) from investment operations |

| Net investment income (loss) (d) | $(0.02) | $(0.15) | $(0.19) | $(0.06) | $(0.03) | $(0.04) |

| Net realized and unrealized gain (loss) | 0.31 | (5.00) | 9.78 | 5.48 | 0.87 | 4.94 |

| Total from investment operations | $0.29 | $(5.15) | $9.59 | $5.42 | $0.84 | $4.90 |

| Less distributions declared to shareholders |

| From net investment income | $(0.04) | $— | $— | $— | $— | $— |

| From net realized gain | (1.30) | (3.39) | (0.47) | (0.49) | (2.82) | (1.94) |

| Total distributions declared to shareholders | $(1.34) | $(3.39) | $(0.47) | $(0.49) | $(2.82) | $(1.94) |

| Net asset value, end of period (x) | $32.30 | $33.35 | $41.89 | $32.77 | $27.84 | $29.82 |

| Total return (%) (r)(s)(t)(x) | 0.90(n) | (13.52) | 29.60 | 19.68 | 4.14 | 19.00 |

Ratios (%) (to average net assets)

and Supplemental data: |

| Expenses before expense reductions | 1.67(a) | 1.68 | 1.69 | 1.72 | 1.75 | 1.75 |

| Expenses after expense reductions | 1.66(a) | 1.66 | 1.67 | 1.71 | 1.74 | 1.74 |

| Net investment income (loss) | (0.15)(a) | (0.41) | (0.53) | (0.20) | (0.11) | (0.14) |

| Portfolio turnover | 16(n) | 25 | 38 | 46 | 39 | 42 |

| Net assets at end of period (000 omitted) | $6,075 | $2,974 | $3,791 | $3,816 | $3,186 | $3,448 |

| Supplemental Ratios (%): |

| Ratios of expenses to average net assets after expense reductions excluding short sale expenses and interest expense and fees | 1.65(a) | 1.64 | 1.65 | 1.69 | 1.71 | 1.73 |

See Notes to Financial Statements

Financial Highlights – continued

| Class R2 | Six months

ended | Year ended |

| | 2/28/23

(unaudited) | 8/31/22 | 8/31/21 | 8/31/20 | 8/31/19 | 8/31/18 |

| Net asset value, beginning of period | $38.87 | $48.04 | $37.40 | $31.61 | $33.33 | $29.75 |

| Income (loss) from investment operations |

| Net investment income (loss) (d) | $0.07 | $0.05 | $(0.01) | $0.10 | $0.12 | $0.11 |

| Net realized and unrealized gain (loss) | 0.36 | (5.83) | 11.20 | 6.24 | 1.02 | 5.50 |

| Total from investment operations | $0.43 | $(5.78) | $11.19 | $6.34 | $1.14 | $5.61 |

| Less distributions declared to shareholders |

| From net investment income | $(0.06) | $— | $(0.08) | $(0.06) | $(0.04) | $(0.09) |

| From net realized gain | (1.30) | (3.39) | (0.47) | (0.49) | (2.82) | (1.94) |

| Total distributions declared to shareholders | $(1.36) | $(3.39) | $(0.55) | $(0.55) | $(2.86) | $(2.03) |

| Net asset value, end of period (x) | $37.94 | $38.87 | $48.04 | $37.40 | $31.61 | $33.33 |

| Total return (%) (r)(s)(t)(x) | 1.16(n) | (13.08) | 30.27 | 20.28 | 4.66 | 19.61 |

Ratios (%) (to average net assets)

and Supplemental data: |

| Expenses before expense reductions | 1.17(a) | 1.18 | 1.19 | 1.22 | 1.25 | 1.25 |

| Expenses after expense reductions | 1.14(a) | 1.15 | 1.16 | 1.20 | 1.23 | 1.24 |

| Net investment income (loss) | 0.37(a) | 0.11 | (0.02) | 0.31 | 0.39 | 0.35 |

| Portfolio turnover | 16(n) | 25 | 38 | 46 | 39 | 42 |

| Net assets at end of period (000 omitted) | $18,934 | $18,825 | $21,214 | $17,335 | $13,416 | $15,202 |

| Supplemental Ratios (%): |

| Ratios of expenses to average net assets after expense reductions excluding short sale expenses and interest expense and fees | 1.13(a) | 1.13 | 1.14 | 1.17 | 1.20 | 1.22 |

See Notes to Financial Statements

Financial Highlights – continued

| Class R3 | Six months

ended | Year ended |

| | 2/28/23

(unaudited) | 8/31/22 | 8/31/21 | 8/31/20 | 8/31/19 | 8/31/18 |

| Net asset value, beginning of period | $39.94 | $49.22 | $38.29 | $32.36 | $34.11 | $30.33 |

| Income (loss) from investment operations |

| Net investment income (loss) (d) | $0.12 | $0.15 | $0.09 | $0.19 | $0.20 | $0.20 |

| Net realized and unrealized gain (loss) | 0.36 | (5.98) | 11.47 | 6.38 | 1.04 | 5.61 |

| Total from investment operations | $0.48 | $(5.83) | $11.56 | $6.57 | $1.24 | $5.81 |

| Less distributions declared to shareholders |

| From net investment income | $(0.14) | $(0.06) | $(0.16) | $(0.15) | $(0.17) | $(0.09) |

| From net realized gain | (1.30) | (3.39) | (0.47) | (0.49) | (2.82) | (1.94) |

| Total distributions declared to shareholders | $(1.44) | $(3.45) | $(0.63) | $(0.64) | $(2.99) | $(2.03) |

| Net asset value, end of period (x) | $38.98 | $39.94 | $49.22 | $38.29 | $32.36 | $34.11 |

| Total return (%) (r)(s)(t)(x) | 1.25(n) | (12.87) | 30.59 | 20.56 | 4.91 | 19.91 |

Ratios (%) (to average net assets)

and Supplemental data: |

| Expenses before expense reductions | 0.92(a) | 0.92 | 0.94 | 0.97 | 1.00 | 1.00 |

| Expenses after expense reductions | 0.91(a) | 0.91 | 0.92 | 0.96 | 0.99 | 0.99 |

| Net investment income (loss) | 0.60(a) | 0.34 | 0.22 | 0.56 | 0.64 | 0.61 |

| Portfolio turnover | 16(n) | 25 | 38 | 46 | 39 | 42 |

| Net assets at end of period (000 omitted) | $58,975 | $60,662 | $77,453 | $63,347 | $42,199 | $34,916 |

| Supplemental Ratios (%): |

| Ratios of expenses to average net assets after expense reductions excluding short sale expenses and interest expense and fees | 0.90(a) | 0.89 | 0.90 | 0.94 | 0.96 | 0.98 |

See Notes to Financial Statements

Financial Highlights – continued

| Class R4 | Six months

ended | Year ended |

| | 2/28/23

(unaudited) | 8/31/22 | 8/31/21 | 8/31/20 | 8/31/19 | 8/31/18 |

| Net asset value, beginning of period | $40.56 | $49.93 | $38.81 | $32.76 | $34.48 | $30.71 |

| Income (loss) from investment operations |

| Net investment income (loss) (d) | $0.17 | $0.27 | $0.20 | $0.27 | $0.28 | $0.28 |

| Net realized and unrealized gain (loss) | 0.38 | (6.08) | 11.63 | 6.48 | 1.05 | 5.67 |

| Total from investment operations | $0.55 | $(5.81) | $11.83 | $6.75 | $1.33 | $5.95 |

| Less distributions declared to shareholders |

| From net investment income | $(0.25) | $(0.17) | $(0.24) | $(0.21) | $(0.23) | $(0.24) |

| From net realized gain | (1.30) | (3.39) | (0.47) | (0.49) | (2.82) | (1.94) |

| Total distributions declared to shareholders | $(1.55) | $(3.56) | $(0.71) | $(0.70) | $(3.05) | $(2.18) |

| Net asset value, end of period (x) | $39.56 | $40.56 | $49.93 | $38.81 | $32.76 | $34.48 |

| Total return (%) (r)(s)(t)(x) | 1.41(n) | (12.67) | 30.92 | 20.88 | 5.18 | 20.18 |

Ratios (%) (to average net assets)

and Supplemental data: |

| Expenses before expense reductions | 0.67(a) | 0.67 | 0.69 | 0.72 | 0.75 | 0.75 |

| Expenses after expense reductions | 0.66(a) | 0.66 | 0.67 | 0.71 | 0.74 | 0.74 |

| Net investment income (loss) | 0.85(a) | 0.60 | 0.47 | 0.80 | 0.89 | 0.86 |

| Portfolio turnover | 16(n) | 25 | 38 | 46 | 39 | 42 |

| Net assets at end of period (000 omitted) | $35,808 | $36,425 | $42,883 | $35,770 | $29,218 | $27,707 |

| Supplemental Ratios (%): |

| Ratios of expenses to average net assets after expense reductions excluding short sale expenses and interest expense and fees | 0.65(a) | 0.64 | 0.65 | 0.69 | 0.71 | 0.73 |

See Notes to Financial Statements

Financial Highlights – continued

| Class R6 | Six months

ended | Year ended |

| | 2/28/23

(unaudited) | 8/31/22 | 8/31/21 | 8/31/20 | 8/31/19 | 8/31/18 |

| Net asset value, beginning of period | $43.06 | $52.78 | $40.98 | $34.55 | $36.18 | $32.12 |

| Income (loss) from investment operations |

| Net investment income (loss) (d) | $0.20 | $0.33 | $0.25 | $0.32 | $0.32 | $0.32 |

| Net realized and unrealized gain (loss) | 0.39 | (6.45) | 12.29 | 6.83 | 1.13 | 5.95 |

| Total from investment operations | $0.59 | $(6.12) | $12.54 | $7.15 | $1.45 | $6.27 |

| Less distributions declared to shareholders |

| From net investment income | $(0.29) | $(0.22) | $(0.27) | $(0.23) | $(0.26) | $(0.27) |

| From net realized gain | (1.30) | (3.39) | (0.47) | (0.49) | (2.82) | (1.94) |

| Total distributions declared to shareholders | $(1.59) | $(3.60) | $(0.74) | $(0.72) | $(3.08) | $(2.21) |

| Net asset value, end of period (x) | $42.06 | $43.06 | $52.78 | $40.98 | $34.55 | $36.18 |

| Total return (%) (r)(s)(t)(x) | 1.42(n) | (12.57) | 31.03 | 20.98 | 5.28 | 20.29 |

Ratios (%) (to average net assets)

and Supplemental data: |

| Expenses before expense reductions | 0.58(a) | 0.59 | 0.60 | 0.64 | 0.67 | 0.67 |

| Expenses after expense reductions | 0.57(a) | 0.57 | 0.59 | 0.63 | 0.66 | 0.66 |

| Net investment income (loss) | 0.94(a) | 0.69 | 0.56 | 0.89 | 0.98 | 0.95 |

| Portfolio turnover | 16(n) | 25 | 38 | 46 | 39 | 42 |

| Net assets at end of period (000 omitted) | $1,778,220 | $1,783,116 | $1,905,417 | $1,303,858 | $783,340 | $577,588 |

| Supplemental Ratios (%): |

| Ratios of expenses to average net assets after expense reductions excluding short sale expenses and interest expense and fees | 0.56(a) | 0.55 | 0.57 | 0.60 | 0.63 | 0.65 |

| (a) | Annualized. |

| (d) | Per share data is based on average shares outstanding. |

| (n) | Not annualized. |

| (r) | Certain expenses have been reduced without which performance would have been lower. |

| (s) | From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower. |

| (t) | Total returns do not include any applicable sales charges. |

| (x) | The net asset values and total returns have been calculated on net assets which include adjustments made in accordance with U.S. generally accepted accounting principles required at period end for financial reporting purposes. |

See Notes to Financial Statements

Notes to Financial Statements

(unaudited)

(1) Business and Organization

MFS Core Equity Fund (the fund) is a diversified series of MFS Series Trust I (the trust). The trust is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company.

The fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services - Investment Companies.

(2) Significant Accounting Policies

General — The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. In the preparation of these financial statements, management has evaluated subsequent events occurring after the date of the fund’s Statement of Assets and Liabilities through the date that the financial statements were issued.

Balance Sheet Offsetting — The fund's accounting policy with respect to balance sheet offsetting is that, absent an event of default by the counterparty or a termination of the agreement, the International Swaps and Derivatives Association (ISDA) Master Agreement, or similar agreement, does not result in an offset of reported amounts of financial assets and financial liabilities in the Statement of Assets and Liabilities across transactions between the fund and the applicable counterparty. The fund's right to setoff may be restricted or prohibited by the bankruptcy or insolvency laws of the particular jurisdiction to which a specific master netting agreement counterparty is subject. Balance sheet offsetting disclosures, to the extent applicable to the fund, have been included in the fund’s Significant Accounting Policies note under the captions for each of the fund’s in-scope financial instruments and transactions.

Investment Valuations — Subject to its oversight, the fund's Board of Trustees has delegated primary responsibility for determining or causing to be determined the value of the fund’s investments to MFS as the fund's adviser, pursuant to the fund’s valuation policy and procedures which have been adopted by the adviser and approved by the Board. Effective September 8, 2022, and in accordance with Rule 2a-5 under the Investment Company Act of 1940, the Board of Trustees designated the adviser as the “valuation designee” of the fund. If the adviser, as valuation designee, determines that reliable market quotations are not readily available for an investment, the investment is valued at fair value as determined in good faith by the adviser in accordance with the adviser’s fair valuation policy and procedures.

Under the fund's valuation policy and procedures, equity securities, including restricted equity securities and equity securities sold short, are generally valued at the last sale or official closing price on their primary market or exchange as provided by a third-party pricing service. Equity securities, for which there were no sales reported that day, are generally valued at the last quoted daily bid quotation on their primary market or

Notes to Financial Statements (unaudited) - continued

exchange as provided by a third-party pricing service. Equity securities sold short, for which there were no sales reported that day, are generally valued at the last quoted daily ask quotation on their primary market or exchange as provided by a third-party pricing service. Short-term instruments with a maturity at issuance of 60 days or less may be valued at amortized cost, which approximates market value. Open-end investment companies are generally valued at net asset value per share. The values of foreign securities and other assets and liabilities expressed in foreign currencies are converted to U.S. dollars using the mean of bid and asked prices for rates provided by a third-party pricing service.

Under the fund’s valuation policy and procedures, market quotations are not considered to be readily available for debt instruments, floating rate loans, and many types of derivatives. These investments are generally valued at fair value based on information from third-party pricing services or otherwise determined by the adviser in accordance with the adviser’s fair valuation policy and procedures. Securities and other assets generally valued on the basis of information from a third-party pricing service may also be valued at a broker/dealer bid quotation. In determining values, third-party pricing services can utilize both transaction data and market information such as yield, quality, coupon rate, maturity, type of issue, trading characteristics, spreads and other market data. An investment may also be valued at fair value if the adviser determines that the investment’s value has been materially affected by events occurring after the close of the exchange or market on which the investment is principally traded (such as foreign exchange or market) and prior to the determination of the fund’s net asset value, or after the halt of trading of a specific security where trading does not resume prior to the close of the exchange or market on which the security is principally traded. Events that occur after foreign markets close (such as developments in foreign markets and significant movements in the U.S. markets) and prior to the determination of the fund’s net asset value may be deemed to have a material effect on the value of securities traded in foreign markets. Accordingly, the fund’s foreign equity securities may often be valued at fair value. The adviser generally relies on third-party pricing services or other information (such as the correlation with price movements of similar securities in the same or other markets; the type, cost and investment characteristics of the security; the business and financial condition of the issuer; and trading and other market data) to assist in determining whether to fair value and at what value to fair value an investment. The value of an investment for purposes of calculating the fund’s net asset value can differ depending on the source and method used to determine value. When fair valuation is used, the value of an investment used to determine the fund’s net asset value may differ from quoted or published prices for the same investment. There can be no assurance that the fund could obtain the fair value assigned to an investment if it were to sell the investment at the same time at which the fund determines its net asset value per share.

Various inputs are used in determining the value of the fund's assets or liabilities. These inputs are categorized into three broad levels. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, an investment's level within the fair value hierarchy is based on the lowest level of input that is significant to the fair value measurement. The fund's assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment, and considers factors specific to the investment. Level 1 includes unadjusted quoted prices in active markets for identical assets or liabilities. Level 2 includes other significant observable market-based inputs (including quoted prices for similar

Notes to Financial Statements (unaudited) - continued

securities, interest rates, prepayment speed, and credit risk). Level 3 includes significant unobservable inputs, which may include the adviser's own assumptions in determining the fair value of investments. The following is a summary of the levels used as of February 28, 2023 in valuing the fund's assets and liabilities:

| Financial Instruments | Level 1 | Level 2 | Level 3 | Total |

| Equity Securities | $5,562,203,311 | $— | $— | $5,562,203,311 |

| Mutual Funds | 51,172,373 | — | — | 51,172,373 |

| Total | $5,613,375,684 | $— | $— | $5,613,375,684 |

| Securities Sold Short | $(13,510,017) | $— | $— | $(13,510,017) |

For further information regarding security characteristics, see the Portfolio of Investments.

Foreign Currency Translation — Purchases and sales of foreign investments, income, and expenses are converted into U.S. dollars based upon currency exchange rates prevailing on the respective dates of such transactions or on the reporting date for foreign denominated receivables and payables. Gains and losses attributable to foreign currency exchange rates on sales of securities are recorded for financial statement purposes as net realized gains and losses on investments. Gains and losses attributable to foreign exchange rate movements on receivables, payables, income and expenses are recorded for financial statement purposes as foreign currency transaction gains and losses. That portion of both realized and unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed.

Short Sales — The fund entered into short sales whereby it sells a security it does not own in anticipation of a decline in the value of that security. The fund will realize a gain if the security price decreases and a loss if the security price increases between the date of the short sale and the date on which the fund replaces the borrowed security. Losses from short sales can exceed the proceeds of the security sold; and they can also exceed the potential loss from an ordinary buy and sell transaction. The amount of any premium, dividends, or interest the fund may be required to pay in connection with a short sale will be recognized as a fund expense. During the six months ended February 28, 2023, this expense amounted to $334,459.

Security Loans — Under its Securities Lending Agency Agreement with the fund, State Street Bank and Trust Company, as lending agent, loans the securities of the fund to certain qualified institutions (the “Borrowers”) approved by the fund. Security loans can be terminated at the discretion of either the lending agent or the fund and the related securities must be returned within the earlier of the standard trade settlement period for such securities or within three business days. The loans are collateralized by cash and/or U.S. Treasury and federal agency obligations in an amount typically at least equal to the market value of the securities loaned. On loans collateralized by cash, the cash collateral is invested in a money market fund. The market value of the loaned securities is determined at the close of business of the fund and any additional required collateral is delivered to the fund on the next business day. The lending agent provides the fund with indemnification against Borrower default. In the event of Borrower default, the lending agent will, for the benefit of the fund, either purchase securities identical to those loaned or, when such purchase is commercially impracticable, pay the fund the market value of the loaned securities. In return, the lending agent assumes the fund's rights to the related collateral. If the collateral value is less than the cost to

Notes to Financial Statements (unaudited) - continued

purchase identical securities, the lending agent is responsible for the shortfall, but only to the extent that such shortfall is not due to a decline in collateral value resulting from collateral reinvestment for which the fund bears the risk of loss. At period end, the fund had investment securities on loan, all of which were classified as equity securities in the fund's Portfolio of Investments, with a fair value of $3,263,204. The fair value of the fund's investment securities on loan and a related liability of $3,647,311 for cash collateral received on securities loaned are both presented gross in the Statement of Assets and Liabilities. The collateral on securities loaned exceeded the value of securities on loan at period end. The liability for cash collateral for securities loaned is carried at fair value, which is categorized as level 2 within the fair value hierarchy. A portion of the income generated upon investment of the collateral is remitted to the Borrowers, and the remainder is allocated between the fund and the lending agent. On loans collateralized by U.S. Treasury and/or federal agency obligations, a fee is received from the Borrower, and is allocated between the fund and the lending agent. Income from securities lending is separately reported in the Statement of Operations. The dividend and interest income earned on the securities loaned is accounted for in the same manner as other dividend and interest income.

Indemnifications — Under the fund's organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the fund. Additionally, in the normal course of business, the fund enters into agreements with service providers that may contain indemnification clauses. The fund's maximum exposure under these agreements is unknown as this would involve future claims that may be made against the fund that have not yet occurred.

Investment Transactions and Income — Investment transactions are recorded on the trade date. Dividends received in cash are recorded on the ex-dividend date. Certain dividends from foreign securities will be recorded when the fund is informed of the dividend if such information is obtained subsequent to the ex-dividend date. Dividend payments received in additional securities are recorded on the ex-dividend date in an amount equal to the value of the security on such date. In determining the net gain or loss on securities sold, the cost of securities is determined on the identified cost basis.

The fund may receive proceeds from litigation settlements. Any proceeds received from litigation involving portfolio holdings are reflected in the Statement of Operations in realized gain/loss if the security has been disposed of by the fund or in unrealized gain/loss if the security is still held by the fund. Any other proceeds from litigation not related to portfolio holdings are reflected as other income in the Statement of Operations.

Tax Matters and Distributions — The fund intends to qualify as a regulated investment company, as defined under Subchapter M of the Internal Revenue Code, and to distribute all of its taxable income, including realized capital gains. As a result, no provision for federal income tax is required. The fund’s federal tax returns, when filed, will remain subject to examination by the Internal Revenue Service for a three year period. Management has analyzed the fund’s tax positions taken on federal and state tax returns for all open tax years and does not believe that there are any uncertain tax positions that require recognition of a tax liability. Foreign taxes, if any, have been accrued by the fund in the accompanying financial statements in accordance with the

Notes to Financial Statements (unaudited) - continued

applicable foreign tax law. Foreign income taxes may be withheld by certain countries in which the fund invests. Additionally, capital gains realized by the fund on securities issued in or by certain foreign countries may be subject to capital gains tax imposed by those countries.

Distributions to shareholders are recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. generally accepted accounting principles. Certain capital accounts in the financial statements are periodically adjusted for permanent differences in order to reflect their tax character. These adjustments have no impact on net assets or net asset value per share. Temporary differences which arise from recognizing certain items of income, expense, gain or loss in different periods for financial statement and tax purposes will reverse at some time in the future.

Book/tax differences primarily relate to wash sale loss deferrals, treating a portion of the proceeds from redemptions as a distribution for tax purposes, and partnership adjustments.

The tax character of distributions made during the current period will be determined at fiscal year end. The tax character of distributions declared to shareholders for the last fiscal year is as follows:

| | Year ended

8/31/22 |

| Ordinary income (including any short-term capital gains) | $183,307,105 |

| Long-term capital gains | 250,000,505 |

| Total distributions | $433,307,610 |

The federal tax cost and the tax basis components of distributable earnings were as follows:

| As of 2/28/23 | |

| Cost of investments | $4,445,174,232 |

| Gross appreciation | 1,410,102,697 |

| Gross depreciation | (241,901,245) |

| Net unrealized appreciation (depreciation) | $1,168,201,452 |

| As of 8/31/22 | |

| Undistributed ordinary income | 28,189,853 |

| Undistributed long-term capital gain | 174,804,849 |

| Other temporary differences | 4,480,256 |

| Net unrealized appreciation (depreciation) | 1,091,564,250 |

The aggregate cost above includes prior fiscal year end tax adjustments, if applicable.

Multiple Classes of Shares of Beneficial Interest — The fund offers multiple classes of shares, which differ in their respective distribution and service fees. The fund's income, realized and unrealized gain (loss), and common expenses are allocated to shareholders based on the daily net assets of each class. Dividends are declared separately for each class. Differences in per share dividend rates are generally due to differences in separate class expenses. Class B and Class C shares will convert to

Notes to Financial Statements (unaudited) - continued

Class A shares approximately eight years after purchase. The fund’s distributions declared to shareholders as reported in the Statements of Changes in Net Assets are presented by class as follows:

| | Six months

ended

2/28/23 | | Year

ended

8/31/22 |

| Class A | $78,167,508 | | $172,852,603 |

| Class B | 539,902 | | 1,835,488 |

| Class C | 4,075,665 | | 11,222,207 |

| Class I | 50,980,529 | | 102,395,888 |

| Class R1 | 241,291 | | 303,682 |

| Class R2 | 669,798 | | 1,478,984 |

| Class R3 | 2,119,841 | | 5,462,151 |

| Class R4 | 1,377,761 | | 2,852,391 |

| Class R6 | 65,134,898 | | 134,904,216 |

| Total | $203,307,193 | | $433,307,610 |

(3) Transactions with Affiliates

Investment Adviser — The fund has an investment advisory agreement with MFS to provide overall investment management and related administrative services and facilities to the fund. The management fee is computed daily and paid monthly at the following annual rates based on the fund's average daily net assets:

| Up to $500 million | 0.65% |

| In excess of $500 million and up to $2.5 billion | 0.55% |

| In excess of $2.5 billion and up to $5 billion | 0.50% |

| In excess of $5 billion and up to $10 billion | 0.47% |

| In excess of $10 billion | 0.45% |

MFS has agreed in writing to reduce its management fee by a specified amount if certain MFS mutual fund assets exceed thresholds agreed to by MFS and the fund's Board of Trustees. MFS has also agreed in writing to waive at least 0.01% of its management fee as part of this agreement. The agreement to waive at least 0.01% of the management fee will continue until modified by the fund's Board of Trustees, but such agreement will continue at least until December 31, 2023. For the six months ended February 28, 2023, this management fee reduction amounted to $367,106, which is included in the reduction of total expenses in the Statement of Operations.

The management fee incurred for the six months ended February 28, 2023 was equivalent to an annual effective rate of 0.51% of the fund's average daily net assets.

Distributor — MFS Fund Distributors, Inc. (MFD), a wholly-owned subsidiary of MFS, as distributor, received $142,177 for the six months ended February 28, 2023, as its portion of the initial sales charge on sales of Class A shares of the fund.

The Board of Trustees has adopted a distribution plan for certain share classes pursuant to Rule 12b-1 of the Investment Company Act of 1940.

Notes to Financial Statements (unaudited) - continued

The fund's distribution plan provides that the fund will pay MFD for services provided by MFD and financial intermediaries in connection with the distribution and servicing of certain share classes. One component of the plan is a distribution fee paid to MFD and another component of the plan is a service fee paid to MFD. MFD may subsequently pay all, or a portion, of the distribution and/or service fees to financial intermediaries.

Distribution Plan Fee Table:

| | Distribution

Fee Rate (d) | Service

Fee Rate (d) | Total

Distribution

Plan (d) | Annual

Effective

Rate (e) | Distribution

and Service

Fee |

| Class A | — | 0.25% | 0.25% | 0.25% | $ 2,655,688 |

| Class B | 0.75% | 0.25% | 1.00% | 1.00% | 69,442 |

| Class C | 0.75% | 0.25% | 1.00% | 1.00% | 513,267 |

| Class R1 | 0.75% | 0.25% | 1.00% | 1.00% | 29,058 |

| Class R2 | 0.25% | 0.25% | 0.50% | 0.49% | 47,084 |

| Class R3 | — | 0.25% | 0.25% | 0.25% | 72,689 |

| Total Distribution and Service Fees | | | | | $3,387,228 |

| (d) | In accordance with the distribution plan for certain classes, the fund pays distribution and/or service fees equal to these annual percentage rates of each class’s average daily net assets. The distribution and service fee rates disclosed by class represent the current rates in effect at the end of the reporting period. Any rate changes, if applicable, are detailed below. |

| (e) | The annual effective rates represent actual fees incurred under the distribution plan for the six months ended February 28, 2023 based on each class's average daily net assets. MFD has voluntarily agreed to rebate a portion of each class's 0.25% service fee attributable to accounts for which there is no financial intermediary specified on the account except for accounts attributable to MFS or its affiliates' seed money. For the six months ended February 28, 2023, this rebate amounted to $505, $10, $14, and $1,323 for Class A, Class B, Class C, and Class R2 shares, respectively, and is included in the reduction of total expenses in the Statement of Operations. |

Certain Class A shares are subject to a contingent deferred sales charge (CDSC) in the event of a shareholder redemption within 18 months of purchase. Class B shares are subject to a CDSC in the event of a shareholder redemption within six years of purchase. Class C shares are subject to a CDSC in the event of a shareholder redemption within 12 months of purchase. All contingent deferred sales charges are paid to MFD and during the six months ended February 28, 2023, were as follows:

| | Amount |

| Class A | $31,571 |

| Class B | 3,521 |

| Class C | 8,970 |

Shareholder Servicing Agent — MFS Service Center, Inc. (MFSC), a wholly-owned subsidiary of MFS, receives a fee from the fund for its services as shareholder servicing agent calculated as a percentage of the average daily net assets of the fund as determined periodically under the supervision of the fund's Board of Trustees. For the six months ended February 28, 2023, the fee was $237,613, which equated to 0.0086% annually of the fund's average daily net assets. MFSC also receives reimbursement from the fund for out-of-pocket expenses, sub-accounting and other shareholder servicing costs which may be paid to affiliated and unaffiliated service

Notes to Financial Statements (unaudited) - continued

providers. Class R6 shares do not incur sub-accounting fees. For the six months ended February 28, 2023, these out-of-pocket expenses, sub-accounting and other shareholder servicing costs amounted to $1,801,938.

Administrator — MFS provides certain financial, legal, shareholder communications, compliance, and other administrative services to the fund. Under an administrative services agreement, the fund reimburses MFS the costs incurred to provide these services. The fund is charged an annual fixed amount of $17,500 plus a fee based on average daily net assets. The administrative services fee incurred for the six months ended February 28, 2023 was equivalent to an annual effective rate of 0.0115% of the fund's average daily net assets.

Trustees’ and Officers’ Compensation — The fund pays compensation to independent Trustees in the form of a retainer, attendance fees, and additional compensation to Board and Committee chairpersons. The fund does not pay compensation directly to Trustees or officers of the fund who are also officers of the investment adviser, all of whom receive remuneration from MFS for their services to the fund. Certain officers and Trustees of the fund are officers or directors of MFS, MFD, and MFSC.