As filed with the Securities and Exchange Commission on May 14, 2020

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number811-4786

Ariel Investment Trust

(Exact name of registrant as specified in charter)

200 East Randolph Street

Suite 2900

Chicago, Illinois, 60601

(Address of principal executive offices) (Zip code)

Mareilé B. Cusack, Esq.

200 East Randolph Street

Suite 2900

Chicago, Illinois 60601

(Name and address of agent for service)

with a copy to:

Arthur Don, Esq.

Greenberg Traurig, LLP

77 West Wacker Drive

Suite 3100

Chicago, IL 60601

Registrant’s telephone number, including area code: (312)726-0140

Date of fiscal year end:September 30

Date of reporting period:March 31, 2020

Item 1. Reports to Stockholders.

(a) The following is a copy of the report transmitted to shareholders pursuant to Rule30e-1 under the Investment Company Act of 1940 (the “Act”) (17 CFR270.30e-1):

The patient investor

SEMI-ANNUAL REPORT: 03/31/20

Ariel Fund

Ariel Appreciation Fund

Ariel Focus Fund

Ariel International Fund

Ariel Global Fund

|

Beginning March 31, 2021, we will be saving more trees by offering our quarterly reports electronically rather than printed and delivered via U.S. mail. Turn the page for more information and how to best receive The Patient Investor. |

IMPORTANT INFORMATION ON HOW TO RECEIVE YOUR SHAREHOLDER REPORTS IN THE FUTURE

Beginning on March 31, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, the Funds will no longer send paper copies of shareholder reports by mail, unless you specifically request paper copies from the Funds or from your financial intermediary, such as your broker-dealer or bank. The reports will be available on our website atarielinvestments.com/prospectus-and-reports and may also be available on the website hosted by your financial intermediary. You will receive a notification in the mail each time a report is posted, which will include a website address to access the report.

You may choose to receive all future reports in paper free of charge. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may choose to receive shareholder reports and other communications electronically from the Fund or your financial intermediary. Our direct shareholders simply need to follow three easy steps described on our website atarielinvestments.com/e-delivery.

Alternatively, you can inform the Funds or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by calling us at 800.292.7435 or, if applicable, by contacting your financial intermediary. Your election to receive reports in paper will apply to all Funds held within the Ariel Investment Trust fund complex or held through your financial intermediary.

Ariel Investment Trust

c/o U.S. Bank Global Fund Services

P.O. Box 701

Milwaukee, WI 53201-0701

800.292.7435

• arielinvestments.com

• linkedin.com/company/ariel-investments

• instagram.com/arielinvestments

• twitter.com/arielinvests

Table of contents

| | |

| |  |

| |

| John W. Rogers, Jr. | | Mellody Hobson |

Chairman and Co-CEO | | Co-CEO and President |

Average annual total returnsas of 03/31/20

| | | | | | | | | | | | |

| | | 1Q20 | | 1-year | | 3-year | | 5-year | | 10-year | | Since

inception* |

| | | | | | |

Ariel Fund | | – 35.14% | | – 31.23% | | – 8.78% | | – 3.42% | | 5.90% | | 9.51% |

| | | | | | |

Russell 2500TMValue Index | | – 34.64 | | – 28.60 | | – 8.40 | | – 2.14 | | 5.65 | | 9.45 |

| | | | | | |

Russell 2500TMIndex | | – 29.72 | | – 22.47 | | – 3.10 | | 0.49 | | 7.73 | | 9.47 |

| | | | | | |

S&P 500®Index | | – 19.60 | | – 6.98 | | 5.10 | | 6.73 | | 10.53 | | 9.76 |

* The inception date for Ariel Fund is 11/06/86.

Average annual total returnsas of 03/31/20

| | | | | | | | | | | | |

| | | 1Q20 | | 1-year | | 3-year | | 5-year | | 10-year | | Since

inception* |

| | | | | | |

Ariel Appreciation Fund | | – 31.43% | | – 26.09% | | – 7.64% | | – 3.05% | | 5.72% | | 8.94% |

| | | | | | |

Russell Midcap®Value Index | | – 31.71 | | – 24.13 | | – 5.97 | | – 0.76 | | 7.22 | | 9.76 |

| | | | | | |

Russell Midcap®Index | | – 27.07 | | – 18.31 | | – 0.81 | | 1.85 | | 8.77 | | 10.05 |

| | | | | | |

| S&P 500®Index | | – 19.60 | | – 6.98 | | 5.10 | | 6.73 | | 10.53 | | 9.10 |

* The inception date for Ariel Appreciation Fund is 12/01/89.

Performance data quoted represents past performance. Past performance does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains and represents returns of the Investor Class shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recentmonth-end for Ariel Fund and Ariel Appreciation Fund may be obtained by visiting our website, arielinvestments.com.

ARIELINVESTMENTS.COM 3

DEAR FELLOW SHAREHOLDER:

As our world confronts the most daunting challenge of this century, we want to start by expressing our deepest condolences to those who have lost family, friends and colleagues as a result of theCOVID-19 pandemic. We also want to offer our sincerest and heartfelt thanks to those on the frontlines who are risking their own health and well-being for our common good. No words can adequately convey our appreciation.

There is a surreal quality to life these days. Just a few weeks ago, the U.S. economy was literally humming: unemployment was at a50-year low; investors continued to benefit from the longest bull market in history; and with Chinese trade war tensions subsiding, the 2020 outlook was promising. All of this changed suddenly. AsBarron’s noted,“COVID-19 is a health crisis, an economic crisis, and a financial crisis rolled into one…”1 With the majority of our citizens sheltered in place andnon-essential businesses forcibly shut down, records were smashed when nearly 10 million people filed for unemployment insurance in the second half of March and the stock marketsee-sawed frombull-to-bear status in just 20 days—“the fastest 20% drop in history.”2

While there were degrees of bloodletting, nothing was spared. Large stocks lost less thanmid-sized issues, which did better than the small fries. Once again, growthier names continued to outperform their value counterparts. Here it is worth noting, theeye-popping performance gap between large cap growth and small cap value that has persisted in recent years was blown out even further. Although we hate to lose money, we take solace in the fact that we mostly kept up with our primary benchmarks. For the three months ending March 31, 2020, Ariel Fund fell-35.14% versus-34.64% for the Russell 2500 Value Index. The Russell 2500 Index dropped-29.72%. The slightly larger stocks in Ariel Appreciation Fund declined-31.43% compared to-31.71% for the Russell Midcap Value Index and-27.07% for the Russell Midcap Index. Under the circumstances, we were not surprised our Consumer Discretionary issues in both portfolios languished during

the period. By contrast, our stock picking in the Financial Services sector positively contributed to our results.

UNPRECEDENTED 4.0

One might think there are few times in life when the extraordinary plays out. Famed economist Nassim Taleb labeled such events “black swans” after birds that are real but exceedingly rare. We have been pondering this notion of late and in so doing, realize that we have lived through quite a few “unprecedented” moments in our firm’s37-year history. In hindsight, each circumstance appears to have added to our muscle memory and strengthened our collective ability to manage in a crisis.

“While a worldwide pandemic may be in a category all its own, we believe everything we have experienced up to this moment has helped prepare us for this new unknown.”

Early on, there was the Crash of 1987 when the Dow Jones Industrials plummeted-22%—the biggest one day drop in its history. Ariel was four years old as a firm and, like any small child, just learning our way in the world. When confronted with the falling wreckage on that fateful Monday, we did not run for cover. Instead, we called our clients to ask for more money to take advantage of what we thought to be “once in a lifetime bargains.” This contrarian lens served us well and drove our outperformance as the market recovered all losses by September 1989.

We all remember where we were on the morning of Tuesday, September 11, 2001 when New York’s Twin Towers fell in a terrorist attack. It was a senseless and unfathomable event that not only took thousands of precious lives, but initiated a new level of security protocol

| 1 | Levisohn, Ben. “Crisis Playbook.”Barron’s.March 16, 2020. Cover. |

| 2 | Winck, Ben. “The Dow plunged into a bear market in just 20 days—the fastest 20% drop in history.”BusinessInsider.March 12, 2020. |

4 SLOW AND STEADY WINS THE RACE

into our everyday existence. We waited out the following six days of a stock market shutdown by planning our “buys” in what many feared would be a very bad open. There was no way of knowing how big the losses would be, but our long-term, patient approach told us that the pain would not last forever. (While those six days seemed like an eternity, they pale in comparison to the4-month stock market closure that occurred at the start of World War I). Again, going against the grain paid off. “The market dropped 5% on reopen and sold off 12% at its lowest point shortly after September 11, which is less than many had feared just days before…One month after the attacks, the S&P 500 was back at its level from September 10.”3

Hands down, the19-month long Global Financial Crisis that started in 2008 represents the most challenging time in our firm’s history. We underperformed our benchmarks which led to significant client attrition. The period tested our mettle and led to a great deal of soul searching. Were-examined every aspect of our philosophy and processes. As a result, we implemented our own proprietary moat and debt ratings as well as formalized the role of the devil’s advocate. There is little question that we came away from this period with a profoundly heightened awareness of liquidity and risk of financial distress broadly. Realizing that contrarian buying in the face of weakened balance sheets ends in tears, we significantly improved our balance sheet work and added several more layers of rigor to our analysis. We also leaned on behavioral finance concepts to help us grow as effective and evolved contrarians. In the end, our strong returns coming out of the crisis underscored the merits of our learning culture and furthered our convictions.

CRISIS PLAYBOOK

While a worldwide pandemic may be in a category all its own, we believe everything we have experienced up to this moment has helped prepare us for this new unknown. We agree with JP Morgan Chase (JPM) CEO, Jamie Dimon, who recently wrote in his own annual letter, “Entering into a crisis is not the time to figure out what you want to be. You must

already be a well-functioning organization prepared to rapidly mobilize your resources, take your losses and survive another day for the good of all of your stakeholders.”4

We are battle-tested and battle-ready. Although sheltered in place, our investment team is formally meeting and in constant contact every day as if we were all only an office away. When there is indiscriminate selling—like we have seen recently—we must prioritize the opportunities at hand with a clear eye on avoiding any permanent loss of capital. The goal is to be quick, but not in a hurry. As Warren Buffett has said, “Widespread fear is your friend as an investor because it serves up bargain purchases.”5 To that end, we start byre-assessing every name in our existing portfolio. Here, we can act with speed because of our deep knowledge of the companies. Since we are in no way beholden to what we already own, were-examine our portfolios from a fresh perspective. The question becomes one of upside versus downside. To that point, there are instances when stocks that have held up relatively well are sold in favor ofwashed-out issues with higher return potential.

Next, we focus on our “watch list” which is comprised of names that we want to own but only at the right price. This list includes some past holdings that we would like to purchase again. In calmer times, we do a lot of work opportunistically evaluating companies since we know business quality changes at a much slower rate than market price. With this forward-thinking preparation, we can move fast when needed. Now, as we scrutinize these potential holdings, we mustre-price each company against the backdrop of a new environment. If valuations look compelling, we may initiate positions.

Lastly, we consider the brand new ideas. Here the goal is precision. How precisely can we assess the fallout and possible opportunity in the context of our existing knowledge and expertise? With new ideas in abundance, there is no need to stretch. Working within our “circle of competence” augments our conviction while also helping us avoid the proverbial “swings and misses.” Balance sheet

| 3 | Mackintosh, Phil. “Closing Markets is Not the Answer.” Nasdaq.com. March 26, 2020. |

| 4 | JP Morgan Chase & Co. (2020). 2019 annual report. Retrieved from https://www.jpmorganchase.com/corporate/investor-relations/document/ annualreport-2019.pdf |

| 5 | Constable, Simon. “Buy the Panic.”The Wall Street Journal.April 6, 2020, pg. R6. |

ARIELINVESTMENTS.COM 5

analysis dominates all of our discussions. Accordingly, we stress test a variety of extreme liquidity scenarios to first prove any potential new idea can survive this pandemic.

This crisis will end. The question is not “if,” but “when.” Although we consider “best-case” and “worst-case” outcomes, the “base case” serves as the foundation of our analysis.6 Currently, our base case scenarios assume a “U” shaped recovery marked by six months of severe economic pressure with underlying stresses equivalent to the worst of 2008-2009. With low expectations for the rest of this year, we believe 2021 will look more like the fundamentals we saw in 2019. If our view proves correct, today’s buys will be very profitable. If the recovery plays out over a longer period, picking up shares now still makes sense, albeit with less upside in the intermediate term. The good news is that given our long term approach, we can be wrong and still be right.

PORTFOLIO COMINGS AND GOINGS

As noted earlier, it has been a busy shopping period. In Ariel Fund, we initiated a position inEnvista Holdings Corporation (NVST), a dominant global dental supplier that was recently spun out of global science and technology conglomerate, Danaher Corporation (DHR); andVail Resorts Inc. (MTN), America’s largest ski resort operator. Meanwhile, we soldWestern Union Company (WU) when it began to approach our estimate of full value. We also eliminatedMTS Systems Corporation(MTSC)—a manufacturer of testing systems and sensor technologies—to pursue more compelling opportunities.

In addition to including Envista Holdings and Vail Resorts in Ariel Appreciation Fund, we added financial services powerhouse,Charles Schwab Corporation (SCHW), as well asThe Goldman Sachs Group (GS)—whose #1 position in the merger and acquisition space over the past five years produces one of the highest returns on equity in the business. We also bought shares ofbar-code manufacturer,Zebra Technologies Corporation(ZBRA)—a name that we have owned and know well. On the flip side, we eliminated famed jewelry retailer,

Tiffany & Co (TIF), after its successful acquisition by Moët Hennessy Louis Vuitton SE (LVMH).

As always, we appreciate the opportunity to serve you and welcome any questions or comments you might have. We also want to thank everyone at Ariel for making adjustments that allow us to continue operating at the highest level to serve you while staying safe.

Sincerely,

| | |

| |  |

| John W.Rogers, Jr. | | Mellody Hobson |

| Chairman andCo-CEO | | Co-CEO and President |

| 6 | Base case models assumptions deemed most likely to occur. The financial results for the base case sit between those of the best (upside) case and worst (downside) case. |

6 SLOW AND STEADY WINS THE RACE

| | |

| |

Ariel Fund performance summary | | INCEPTION: 11/06/86 |

|

| | | | |

| |  | |  |

| | |

| John W. Rogers, Jr. | | John P. Miller, CFA | | Kenneth E. Kuhrt, CPA |

| Lead portfolio | | Portfolio | | Portfolio |

| manager | | manager | | manager |

Composition of equity holdings(%)

| | | | | | | | |

| | | Ariel

Fund | | Russell

2500

Value

Index | | Russell

2500

Index | | S&P

500

Index |

| | | | |

Consumer discretionary | | 32.51 | | 11.30 | | 12.48 | | 14.31 |

| | | | |

Financial services | | 27.96 | | 37.95 | | 25.68 | | 17.85 |

| | | | |

Producer durables | | 18.14 | | 12.59 | | 13.44 | | 8.68 |

| | | | |

Health care | | 8.54 | | 7.42 | | 16.68 | | 14.79 |

| | | | |

Consumer staples | | 5.61 | | 3.72 | | 3.02 | | 6.82 |

| | | | |

Materials & processing | | 5.08 | | 8.15 | | 7.02 | | 2.60 |

| | | | |

Technology | | 1.01 | | 8.79 | | 15.44 | | 26.55 |

| | | | |

Energy | | 0.00 | | 2.44 | | 1.51 | | 2.65 |

| | | | |

Utilities | | 0.00 | | 7.58 | | 4.68 | | 5.77 |

Sector weightings for the Fund are calculated based on equity holdings as a percentage of total net assets.

Average annual total returns(%) as of 03/31/20

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Quarter | | | 1-year | | | 3-year | | | 5-year | | | 10-year | | | 20-year | | | Since

inception | |

| | | | | | | |

Ariel Fund–Investor Class | | | -35.14 | | | | -31.23 | | | | -8.78 | | | | -3.42 | | | | 5.90 | | | | 7.27 | | | | 9.51 | |

| | | | | | | |

Ariel Fund–Institutional Class+ | | | -35.10 | | | | -31.02 | | | | -8.50 | | | | -3.13 | | | | 6.17 | | | | 7.41 | | | | 9.59 | |

| | | | | | | |

Russell 2500TMValue Index | | | -34.64 | | | | -28.60 | | | | -8.40 | | | | -2.14 | | | | 5.65 | | | | 7.15 | | | | 9.45 | |

| | | | | | | |

Russell 2500TMIndex | | | -29.72 | | | | -22.47 | | | | -3.10 | | | | 0.49 | | | | 7.73 | | | | 6.27 | | | | 9.47 | |

| | | | | | | |

S&P 500®Index | | | -19.60 | | | | -6.98 | | | | 5.10 | | | | 6.73 | | | | 10.53 | | | | 4.79 | | | | 9.76 | |

Performance data quoted represents past performance and does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To access performance data current to the most recentmonth-end, visit arielinvestments.com. The minimum initial investment for Investor Class shares is $1,000; the minimum for Institutional Class shares is $1,000,000.

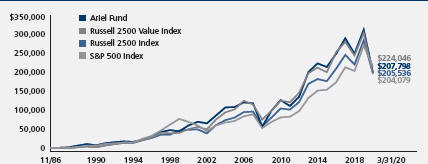

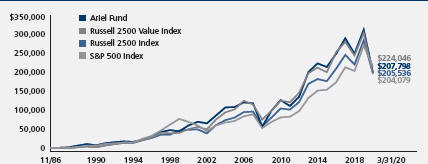

Growth of a $10,000 investment since inception (Investor Class)

The graph and performance table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Total return does not reflect a maximum 4.75% sales load charged prior to 7/15/94.

| | | | | | | | |

| Expense ratio(as of 9/30/19) | | | | | | |

Investor Class | | | 1.02 | % | | | | |

Institutional Class | | | 0.70 | % | | | | |

| | | | | | | | | | | | |

| Top ten equity holdings(% of net assets) |

| | | | | | |

| 1. | | KKR & Co., Inc. | | 5.2 | | | | 6. | | Stericycle, Inc. | | 4.1 |

| 2. | | Northern Trust Corp. | | 4.6 | | | | 7. | | Interpublic Group of Cos., Inc. | | 3.8 |

| 3. | | Mattel, Inc. | | 4.5 | | | | 8. | | Adtalem Global Education, Inc. | | 3.8 |

| 4. | | Zebra Technologies Corp. | | 4.4 | | | | 9. | | JLL | | 3.8 |

| 5. | | Lazard Ltd., Class A | | 4.1 | | | | 10. | | J.M. Smucker Co. | | 3.6 |

| + | The inception date for the Institutional Class shares is December 30, 2011. Performance information for the Institutional Class prior to that date reflects the actual performance of the Fund’s Investor Class (and uses the actual expenses of the Fund’s Investor Class, for such period of time), without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses, which are primarily differences in distribution and service fees. |

ARIELINVESTMENTS.COM 7

| | |

| |

Ariel Appreciation Fund performance summary | | INCEPTION: 12/01/89 |

|

| | |

| | | | |

| |  | | |

| |

| John W. Rogers, Jr. | | Timothy R. Fidler,CFA |

| Co-portfolio | | Co-portfolio | | |

| manager | | manager | | |

Composition of equity holdings(%)

| | | | | | | | |

| | | Ariel

Apprec-

iation

Fund | | Russell

Midcap

Value

Index | | Russell

Midcap

Index | | S&P

500

Index |

| | | | |

Financial services | | 34.36 | | 31.48 | | 24.32 | | 17.85 |

| | | | |

Consumer discretionary | | 25.84 | | 10.66 | | 13.28 | | 14.31 |

| | | | |

Producer durables | | 19.27 | | 9.98 | | 12.09 | | 8.68 |

| | | | |

Health care | | 11.14 | | 7.64 | | 11.13 | | 14.79 |

| | | | |

Consumer staples | | 5.37 | | 6.69 | | 5.38 | | 6.82 |

| | | | |

Technology | | 1.82 | | 8.36 | | 17.24 | | 26.55 |

| | | | |

Energy | | 1.21 | | 3.28 | | 2.16 | | 2.65 |

| | | | |

Materials & processing | | 0.32 | | 7.70 | | 6.39 | | 2.60 |

| | | | |

Utilities | | 0.00 | | 14.19 | | 7.99 | | 5.77 |

Sector weightings for the Fund are calculated based on equity holdings as a percentage of total net assets.

Average annual total returns(%) as of 03/31/20

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Quarter | | | 1-year | | | 3-year | | | 5-year | | | 10-year | | | 20-year | | | Since

inception | |

| | | | | | | |

Ariel Appreciation Fund–Investor Class | | | -31.43 | | | | -26.09 | | | | -7.64 | | | | -3.05 | | | | 5.72 | | | | 7.00 | | | | 8.94 | |

| | | | | | | |

Ariel Appreciation Fund–Institutional Class+ | | | -31.37 | | | | -25.85 | | | | -7.35 | | | | -2.74 | | | | 5.99 | | | | 7.14 | | | | 9.03 | |

| | | | | | | |

Russell Midcap®Value Index | | | -31.71 | | | | -24.13 | | | | -5.97 | | | | -0.76 | | | | 7.22 | | | | 7.84 | | | | 9.76 | |

| | | | | | | |

Russell Midcap®Index | | | -27.07 | | | | -18.31 | | | | -0.81 | | | | 1.85 | | | | 8.77 | | | | 6.79 | | | | 10.05 | |

| | | | | | | |

S&P 500®Index | | | -19.60 | | | | -6.98 | | | | 5.10 | | | | 6.73 | | | | 10.53 | | | | 4.79 | | | | 9.10 | |

Performance data quoted represents past performance and does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To access performance data current to the most recentmonth-end, visit arielinvestments.com. The minimum initial investment for Investor Class shares is $1,000; the minimum for Institutional Class shares is $1,000,000.

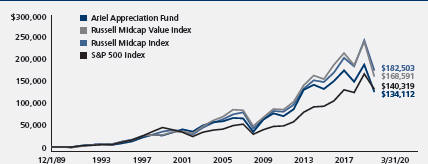

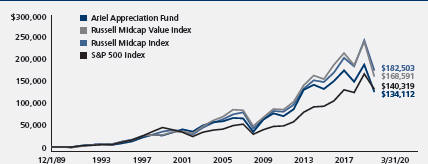

Growth of a $10,000 investment since inception (Investor Class)

The graph and performance table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Total return does not reflect a maximum 4.75% sales load charged prior to 7/15/94.

| | | | | | | | |

| Expense ratio(as of 9/30/19) | | | | | | |

Investor Class | | | 1.14 | % | | | | |

Institutional Class | | | 0.82 | % | | | | |

| | | | | | | | | | | | |

| Top ten equity holdings(% of net assets) |

| | | | | | |

| 1. | | Northern Trust Corp. | | 5.2 | | | | 6. | | J.M. Smucker Co. | | 3.9 |

| 2. | | Interpublic Group of Cos., Inc. | | 4.7 | | | | 7. | | Laboratory Corp. of America Holdings | | 3.7 |

| 3. | | Progressive Corp. | | 4.3 | | | | 8. | | Stanley Black & Decker, Inc. | | 3.7 |

| 4. | | Mattel, Inc. | | 4.0 | | | | 9. | | Stericycle, Inc. | | 3.5 |

| 5. | | Aflac, Inc. | | 3.9 | | | | 10. | | BorgWarner, Inc. | | 3.4 |

| + | The inception date for the Institutional Class shares is December 30, 2011. Performance information for the Institutional Class prior to that date reflects the actual performance of the Fund’s Investor Class (and uses the actual expenses of the Fund’s Investor Class, for such period of time), without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses, which are primarily differences in distribution and service fees. |

8 SLOW AND STEADY WINS THE RACE

Charles K. Bobrinskoy

Vice Chairman

Portfolio Manager

Average annual total returnsas of 03/31/20

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | 1Q20 | | | 1-year | | | 3-year | | | 5-year | | | 10-year | | | Since

inception* | |

Ariel Focus Fund | | | – 32.90 | % | | | – 25.74 | % | | | – 7.73 | % | | | – 2.51 | % | | | 3.92 | % | | | 2.98 | % |

Russell 1000®Value Index | | | – 26.73 | | | | – 17.17 | | | | – 2.18 | | | | 1.90 | | | | 7.67 | | | | 5.39 | |

S&P 500®Index | | | – 19.60 | | | | – 6.98 | | | | 5.10 | | | | 6.73 | | | | 10.53 | | | | 7.61 | |

* The inception date for Ariel Focus Fund is 06/30/05.

DEAR FELLOW SHAREHOLDER:

The first quarter of 2020 was one of the most difficult we have experienced in over thirty five years in the capital markets. We believe the U.S. economy will eventually rebound strongly from the impact ofCOVID-19 and many of our portfolio companies will produce excellent returns from current distressed levels. But equity markets are currently not focused on long-term prospects, instead discounting shares for the dramatic downturn that is likely to occur in the U.S. and global economy in the 2nd and 3rd quarters. We are seeking to position Ariel Focus Fund to take advantage of an economic recovery, a process we

believe will begin in the fourth quarter of this year.

Ariel Focus Fund underperformed its primary benchmark and the broad market in the first quarter of 2020 declining-32.90% versus a loss of-26.73% for the Russell 1000 Value Index and-19.60% for the S&P 500 Index. We entered 2020 believing the market was excessively concerned about a recession coming from a trade war with China, the negative impact of Brexit, or the election of a president unfriendly to business; concerns that seem almost trivial in hindsight. Our analysis suggested “safety stocks” (those companies such as consumer staples considered less sensitive to broad economic factors) were

Performance data quoted represents past performance. Past performance does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains and represents returns of the Investor Class shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recentmonth-end for Ariel Focus Fund may be obtained by visiting our website, arielinvestments.com.

ARIELINVESTMENTS.COM 9

overpriced. Likewise, extremely low interest rates had pushed investors to stretch for yield bidding up the price of bond substitute stocks such as high dividend paying utilities. Our analysis also suggested that technology companies including theso-called “FAANG” stocks were trading at excessive values. In the recent rapid downturn, all three of these groups have outperformed. Investors have increased their preference for consumer staples, bond substitutes and technology issues. Our lack of exposure to these sectors had a significant negative impact on performance in the quarter.

As we consider our portfolio today, we place companies into five categories. The first group consists of companies whose business we believe will actually improve in the short run because of the Coronavirus:J.M. SmuckerCompany (SJM), Progressive Corp. (PGR) andJohnson and Johnson (JNJ).SJM has seen sales of staples such as Jif peanut butter and Folgers coffee grow double digits as consumers stock up on basic food items. JNJ has benefitted from a dramatic increase in sales ofover-the-counter medicines such as Tylenol and has announced encouraging prospects for aCOVID-19 vaccine. A significant decrease in driving will reduce accident rates thereby reducing claim losses for PGR, at least in the short term. The market shares our positive assessment of the outlook for these companies and has rewarded their shares accordingly. Therefore, we are not finding attractive opportunities in this category, but are glad to own these names.

The second group are those companies whose business is generally unaffected either positively or negatively by the pandemic.Mosaic Co. (MOS), an agricultural fertilizer company andAdtalem Global Education (ATGE), a provider of health care educational services, fall into this group. Demand for grains and other farm products might actually grow in the current environment, offset perhaps by slower fertilizer sales to Asia and Europe, at least in the short term. The relative lack of population density in farming communities has reduced the spread of the virus among Mosaic’s customers. We believe we could actually see an increase in acres planted after last year’s Midwest

flood conditions. The market, however, has grouped MOS with other natural resource companies (particularly oil and gas) who have seen demand decline with the global slowdown.

DISSECTING OUR PORTFOLIO

Mosaic’s shares declined-49.85% in the first quarter and we have been adding to our position. Adtalem’s nursing and medical schools will continue to operate with an emphasis in online learning, a historic strength of the company. Demand for doctors and particularly nurses will increase in the short term, although it will take time for this to translate to increased enrollments. Its shares fell-26.60% in the quarter.

“Today our portfolio trades at a large discount to private market value and at low multiples of normalized earnings. Once we reach the other side of this pandemic crisis, we believe these issues will recover.”

The third group are those companies who we anticipate will experience a short-term decline in their business but, in our view, will enjoy pent up demand once we reach the other side of this crisis. Our favorite companies in this category areZimmer Biomet Holdings, Inc. (ZBH), Hanger, Inc. (HNGR) andKKR & Co. Inc. (KKR). ZBH makes orthopedic products such as replacement hips and knees. There is no doubtnon-emergency procedures such as hip replacements will decline as hospitals concentrate onCOVID-19 treatments. But, in our judgement, the total number of orthopedic procedures performed through 2022 will not be reduced, only consolidated into the later part of this year and next. Likewise, we believe demand for Hanger’s prosthetic products will come back sharply after

10 SLOW AND STEADY WINS THE RACE

orthotic clinics are reopened, a development we expect in the second quarter. There is no doubt KKR’s current investment portfolio will be negatively impacted by the downturn in capital markets and the global economy. But, the downturn will also provide KKR with exciting investment opportunities for the billions they have raised in committed capital. Likewise, institutional investors will appreciate the relative lack of volatility in KKR’s private funds, which are not marked to market on a daily basis.

The fourth category are companies which will suffer a permanent reduction in value from the current crisis, but may in some cases, see their stock prices decline by more than the loss in intrinsic value. Companies in the energy industry fall into this category. The total number of barrels of oil consumed worldwide through 2022 will be lower than previously estimated. The world’s proven reserves have not declined, resulting in a negative shift in supply demand curves. In January of this year,Apache Corporation (APA) announced a major oil discovery off the coast of Suriname in South America. French oil giant, Total S.A. agreed to provide much of the development capital for new wells sending APA shares up +79.50% on January 14, 2020 from their price on December 4, 2019. But since then, the price of West Texas Intermediate crude oil has collapsed from over $60 to $20 in late March. Despite continued positive developments on APA’s Suriname discovery, its stock price declined from $33 in January to $4 at quarter end, a painful-83.54% decline. APA was rated investment grade by both rating agencies before March when S&P downgraded the company to BB+, still the highest below investment grade rating. The credit default markets are more pessimistic, however pricing insurance against default at over 900 basis points per year as we go to print in early April. We believe APA will survive and its stock is trading well below its intrinsic value today. However, we acknowledge APA’s fate is dependent on factors outside of its control such as the global price of oil. We have added modestly to our position as a good risk reward opportunity but with our eyes wide open to the potential downside.

The fifth category contains companies who we believe have a high risk of not surviving the current crisis or suffering levels of equity dilution making shares uninvestable. Some of these companies are in industries we found unattractive before the pandemic. Others carried too much debt and will not generate sufficient free cash flow to service fixed income obligations. Unfortunately we would place many companies in the airline industry in this category. Other companies in this category include some restaurants, some ride sharing companies and perhaps even Airbnb, none of which we own.

We began this letter by noting the current environment is the most difficult we have experienced in our career. We entered this year believing investors were excessively pessimistic about risks such as Brexit and a trade war and were overvaluing safe stocks and growth stocks. Our analysis found good companies with some exposure to the economy were selling at attractive prices relative to our calculation of their intrinsic value. This positioning, both in terms of what we owned and what we did not, hurt our absolute and relative performance in the quarter. But today our portfolio trades at a large discount to private market value and at low multiples of normalized earnings. Once we reach the other side of this pandemic crisis, we believe these issues will recover. And, we WILL reach the other side.

As always, we appreciate the opportunity to serve you and welcome any questions or comments you might have.

Sincerely,

Charles K. Bobrinskoy

Vice Chairman and Portfolio Manager

ARIELINVESTMENTS.COM 11

| | |

| |

Ariel Focus Fund performance summary | | INCEPTION: 06/30/05 |

|

| | |

Charles K. Bobrinskoy

Portfolio manager

Composition of equity holdings(%)

| | | | | | |

| | | Ariel

Focus

Fund | | Russell

1000

Value

Index | | S&P

500

Index |

| | | |

Financial services | | 32.75 | | 26.87 | | 17.85 |

| | | |

Producer durables | | 17.89 | | 8.61 | | 8.68 |

| | | |

Health care | | 16.24 | | 14.59 | | 14.79 |

| | | |

Consumer discretionary | | 14.50 | | 10.56 | | 14.31 |

| | | |

Technology | | 5.98 | | 7.09 | | 26.55 |

| | | |

Energy | | 3.75 | | 5.50 | | 2.65 |

| | | |

Consumer staples | | 3.31 | | 10.15 | | 6.82 |

| | | |

Materials & processing | | 3.10 | | 4.37 | | 2.60 |

| | | |

Utilities | | 0.00 | | 12.25 | | 5.77 |

Sector weightings for the Fund are calculated based on equity holdings as a percentage of total net assets.

Average annual total returns(%) as of 03/31/20

| | | | | | | | | | | | |

| | | Quarter | | 1-year | | 3-year | | 5-year | | 10-year | | Since

inception |

| | | | | | |

Ariel Focus Fund–Investor Class | | -32.90 | | -25.74 | | -7.73 | | -2.51 | | 3.92 | | 2.98 |

| | | | | | |

Ariel Focus Fund–Institutional Class+ | | -32.87 | | -25.59 | | -7.51 | | -2.28 | | 4.13 | | 3.12 |

| | | | | | |

Russell 1000®Value Index | | -26.73 | | -17.17 | | -2.18 | | 1.90 | | 7.67 | | 5.39 |

| | | | | | |

S&P 500®Index | | -19.60 | | -6.98 | | 5.10 | | 6.73 | | 10.53 | | 7.61 |

Performance data quoted represents past performance and does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To access performance data current to the most recentmonth-end, visit arielinvestments.com. The minimum initial investment for Investor Class shares is $1,000; the minimum for Institutional Class shares is $1,000,000.

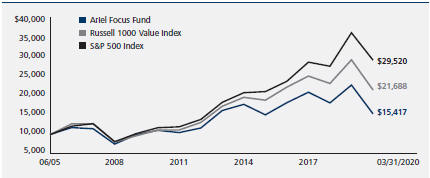

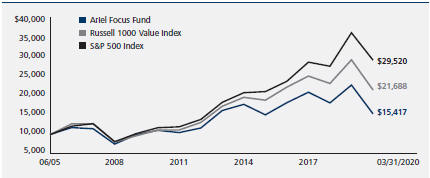

Growth of a $10,000 investment since inception (Investor Class)

The graph and performance table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | | | | | |

| Expense ratio(as of 9/30/19) | | Net | | | Gross | | | | |

Investor Class | | | 1.00 | % | | | 1.23% | | | | | |

Institutional Class | | | 0.75 | % | | | 0.89% | | | | | |

The net expense ratio reflects a contractual advisory fee waiver agreement effective through September 30, 2021. Prior to February 1, 2014, the fee waiver was 1.25% for the Investor Class and 1.00% for the Institutional Class.

| | | | | | | | | | | | |

| Top ten equity holdings(% of net assets) |

| | | | | | |

| 1. | | Oracle Corp. | | 6.0 | | | | 6. | | Zimmer Biomet Holdings, Inc. | | 5.1 |

| 2. | | Lockheed Martin Corp. | | 5.5 | | | | 7. | | Johnson & Johnson | | 4.4 |

| 3. | | KKR & Co., Inc. | | 5.5 | | | | 8. | | Lazard Ltd., Class A | | 4.4 |

| 4. | | Snap-on, Inc. | | 5.1 | | | | 9. | | Goldman Sachs Group, Inc. | | 4.3 |

| 5. | | Western Union Co. | | 5.1 | | | | 10. | | Zebra Technologies Corp. | | 4.2 |

| | | | | | | | | | | | |

| + | The inception date for the Institutional Class shares is December 30, 2011. Performance information for the Institutional Class prior to that date reflects the actual performance of the Fund’s Investor Class (and uses the actual expenses of the Fund’s Investor Class, for such period of time), without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses, which are primarily differences in distribution and service fees. |

12 SLOW AND STEADY WINS THE RACE

Rupal J. Bhansali

Chief Investment Officer

International and Global Equities

Average annual total returnsas of 03/31/20

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | 1Q20 | | | | | | 1-year | | | | | | 3-year | | | | | | 5-year | | | | | | Since inception* | |

Ariel International Fund | | | – 13.64 | % | | | | | | | – 9.04 | % | | | | | | | – 1.61 | % | | | | | | | 0.02 | % | | | | | | | 3.76 | % | | | | |

MSCI EAFE Net Index | | | – 22.83 | | | | | | | | – 14.38 | | | | | | | | – 1.82 | | | | | | | | – 0.62 | | | | | | | | 4.10 | | | | | |

MSCI ACWIex-US Net Index | | | – 23.36 | | | | | | | | – 15.57 | | | | | | | | – 1.96 | | | | | | | | – 0.64 | | | | | | | | 3.21 | | | | | |

* The inception date for Ariel International Fund is 12/30/11.

Average annual total returnsas of 03/31/20

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | 1Q20 | | | | | | 1-year | | | | | | 3-year | | | | | | 5-year | | | | | | Since inception* | |

Ariel Global Fund | | | – 13.28 | % | | | | | | | – 7.79 | % | | | | | | | 1.09 | % | | | | | | | 2.33 | % | | | | | | | 6.17 | % | | | | |

MSCI ACWI Net Index | | | – 21.37 | | | | | | | | –11.26 | | | | | | | | 1.50 | | | | | | | | 2.85 | | | | | | | | 7.01 | | | | | |

* The inception date for the Ariel Global Fund is 12/30/11.

DEAR FELLOW SHAREHOLDER:

Markets worldwide began 2020 on a high note, underscored by broad optimism around an improving global economic outlook and a phase 1 trade deal between the U.S. and China. However, in a swift and sudden

reversal, the coronavirus pandemic unleashed massive economic shocks as governments across the globe enacted strict containment policies, which shuttered businesses, halted commerce and imposed “social-distancing” measures confining regional populations to their homes. Uncertainty over the duration of the virus threat and

Performance data quoted represents past performance. Past performance does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains and represents returns of the Investor Class shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recentmonth-end for Ariel International Fund and Ariel Global Fund may be obtained by visiting our website, arielinvestments.com.

ARIELINVESTMENTS.COM 13

magnitude of its impact prompted policymakers and central banks in the world’s largest economies to deliver fiscal stimulus and monetary relief packages in hopes of easing the damage on Wall Street and Main Street. Amidst this extreme volatility, it is not surprising that our “risk-aware,” global and international portfolios outperformed on a relative basis as attention to fundamental factors such as quality, risk and valuation was rewarded.

IF WE SEE UNCHARTERED TERRITORY, IT IS ONLY BECAUSE WE DON’T YET RECOGNIZE THE PATTERN

Having covered 50 countries over several market cycles, the financial impact of this contagion seems akin to Japan’s Fukushima Daiichi nuclear disaster, which followed the magnitude 9.0 Great East Japan Earthquake and Tsunami in March 2011. While theCOVID-19 health crisis is global and far more intense in terms of its economic impact, we believe the playbook may prove similar. Japan lost considerable physical and human capital. The economy contracted-10% in the quarter following the nuclear accident but recovered by a similar amount in Q3 2011.1 The Bank of Japan provided market liquidity to ensure the stability of financial markets, and the central government and local policymakers in the region “launched a series of post-disaster economic and social rehabilitation projects.”2 “Most of the affected businesses, economic sectors and communities”3 recovered.

Flash forward 9 years—the unpredictability surrounding the human and economic toll ofCOVID-19 drove stocks to bear market territory, triggering unprecedented stimulus. Although markets have since recovered from their lows, we believe the trough of this new cycle remains on the horizon. The shock of the sudden freeze in the economy on corporate earnings and supply chains, as well as the second order effects on various countries, consumers and companies are not yet clear. And while the operating and financial environment will spare no one from adversity, we expect cyclicals to be harder hit than defensives and

companies with high fixed costs to suffer more than those with flexible cost structures. We also anticipate that companies carrying an excessive amount of financial leverage will experience larger challenges than those with cash rich balance sheets.

Furthermore, the “coronavirus extends liquidity and capital problems, [such as labor participation and productivity growth] to the real economy—and does so at unprecedented scale…while there is a policy playbook for dealing with financial crises, no such thing exists for a large-scale real economy freeze.”4 In our opinion, the 2020 recession and new economic cycle will be ‘mitigated but not fully offset’ by extensive monetary and fiscal stimulus. We expect the economic shock driven by social distancing will eventually recede as lockdowns are lifted and business, as well as consumer activity resumes. Although it will likely have a sobering impact on GDP through the third quarter, similar to Japan, our central scenario is that the world economy will begin its recovery process thereafter.

“While it may get worse before it gets better, decades of stock market history suggest it will eventually get better.”

OPPORTUNITY MEETS PREPARATION

While a worldwide pandemic is certainly unique to our lifetime, our performance record as patient, long-term intrinsic value investors during a bear market has proven its mettle. Stock volatility is likely to persist across all asset classes, but value in general has been particularly hard hit. On a technical basis, value is the worst performing factoryear-to-date, providing fertile opportunity for investment bargains. History highlights that value is the phoenix of asset classes rising out of a recession. As such, we are laser-focused on methodically and thoughtfully curating and availing of any opportunities to judiciously reposition the portfolio for years of future returns.

| 1 | 2020 Bloomberg Finance L.P. Accessed 19 March 2020. |

| 2 | Zhang, Hui, Chris Dolan, Si Meng Jing, Justine Uyimleshi and Peter Dodd. “Bounce Forward: Economic Recovery in Post-Disaster Fukushima.” MDPI. 27 November 2019, page 1, 2. www.mdpi.com/journal/sustainability |

| 3 | Zhang, Hui, Chris Dolan, Si Meng Jing, Justine Uyimleshi and Peter Dodd. “Bounce Forward: Economic Recovery in Post-Disaster Fukushima.” MDPI. 27 November 2019, page 1, 2. www.mdpi.com/journal/sustainability |

| 4 | Carlsson-Szlezak, Philipp, Martin Reeves and Paul Schwartz. “Understanding the Economic Shock of Coronavirus.” Harvard Business Review. 27 March 2020. |

14 SLOW AND STEADY WINS THE RACE

As you are aware, our investment philosophy is biased toward owning undervalued,out-of-favor, franchise-quality companies that are misunderstood and therefore mispriced by the market. We pay particular attention to the growth and return prospects of the companies, as well as the sustainability of the business modeland resilience of the balance sheet. Rest assured, this time is no different.

Given the economic backdrop, we are on the lookout for companies whose distinct fundamentals lends themselves to an inevitable recovery—wheredemand is delayed, not denied. Think consumer discretionary names, whose robust balance sheets and free cash flow allow operational flexibility in market downturns. Health Care is another area, where secular inventive franchises with strong research and development, as well as solid balance sheets offer defensive characteristics and have limited reliance on the cycle.

Our investment discipline is driven bybottom-up stock picking. We pay attention to risk management in addition to return management. This balanced approach has driven us to take profits in some of our more defensive holdings, such as telecoms where ournon-consensus thesis around the stability of these operators through a recession benefitted our portfolios in the quarter. We have also redeployed capital in existing names—where we have high conviction—that in our view, have unnecessarily underperformed in this environment. And although we are selectively accumulating cyclical and consumer discretionary issues, we are keeping a substantial amount of powder dry in anticipation of better opportunities emerging in the upcoming earnings season.

Lastly, while we expect a solid recovery for equities and earnings, we remain concerned with balance sheet risk. In response, we are paying close attention to debt multiples and leverage ratios, along with earnings metrics.

HISTORY REPEATS ITSELF

While it may get worse before it gets better, decades of stock market history suggest it will eventually get better.

Since 1928—through 14 recessions and 21 bear markets—U.S. equity markets have never failed to regain a prior peak. In addition, since 1972—through 4 worldwide recessions and 10 bear markets—Global equity markets have never failed to regain a prior peak. We strongly believe the patient investor that stays the course and consistently owns advantaged business models with resilient balance sheets whose stocks are mispriced and undervalued, are well-positioned to deliver superior risk-adjusted returns over thelong-run.

As always, we appreciate the opportunity to serve you and welcome any questions or comments you might have.

Sincerely,

Rupal J. Bhansali

Chief Investment Officer

International and Global Equities

ARIELINVESTMENTS.COM 15

| | |

| |

Ariel International Fund performance summary | | INCEPTION: 12/30/11 |

|

| | |

Rupal J. Bhansali

Portfolio manager

Composition of equity holdings(%)

| | | | | | |

| | | | | | | MSCI |

| | | Ariel | | MSCI | | ACWI |

| | | International | | EAFE | | ex-US |

| | | Fund | | Index | | Index |

Communication services | | 27.70 | | 5.52 | | 7.50 |

Health care | | 15.53 | | 14.33 | | 10.52 |

Consumer staples | | 14.38 | | 12.64 | | 10.50 |

Consumer discretionary | | 9.97 | | 11.08 | | 11.82 |

Financials | | 9.49 | | 16.45 | | 19.23 |

Utilities | | 6.81 | | 4.20 | | 3.73 |

Industrials | | 2.85 | | 14.23 | | 11.43 |

Information technology | | 2.43 | | 7.61 | | 10.05 |

Energy | | 2.00 | | 3.96 | | 5.21 |

Real estate | | 1.05 | | 3.30 | | 3.03 |

Materials | | 0.00 | | 6.69 | | 6.97 |

Sector weightings for the Fund are calculated based on equity holdings as a percentage of total net assets. The sectors above are the Global Industry Classification Standard (“GICS”) sector classifications.

Average annual total returns(%) as of 03/31/20

| | | | | | | | | | | | | | | | | | | | |

| | | Quarter | | | 1-year | | | 3-year | | | 5-year | | | Since

inception | |

| | | | | |

Ariel International Fund–Investor Class | | | -13.64 | | | | -9.04 | | | | -1.61 | | | | 0.02 | | | | 3.76 | |

| | | | | |

Ariel International Fund–Institutional Class | | | -13.65 | | | | -8.87 | | | | -1.36 | | | | 0.26 | | | | 4.01 | |

MSCI EAFE Index (net) | | | -22.83 | | | | -14.38 | | | | -1.82 | | | | -0.62 | | | | 4.10 | |

MSCI ACWIex-US Index (net) | | | -23.36 | | | | -15.57 | | | | -1.96 | | | | -0.64 | | | | 3.21 | |

Performance data quoted represents past performance and does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To access performance data current to the most recent month-end, visit arielinvestments.com. The minimum initial investment for Investor Class shares is $1,000; the minimum for Institutional Class shares is $1,000,000.

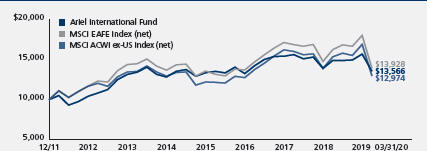

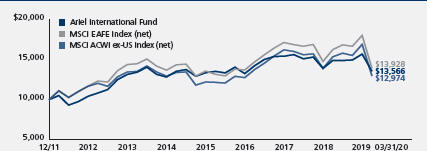

Growth of a $10,000 investment since inception (Investor Class)

The graph and performance table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | | | | | | | | | |

Expense ratio(as of 9/30/19) | | | Net | | | | | | | | Gross | | | | | |

Investor Class | | | 1.13 | % | | | | | | | 1.32% | | | | | |

Institutional Class | | | 0.88 | % | | | | | | | 0.93% | | | | | |

The net expense ratio reflects a contractual advisory fee waiver agreement effective through September 30, 2021. Prior to November 29, 2016, the fee waiver was 1.25% of net assets for the Investor Class and 1.00% for the Institutional Class, and, prior to February 1, 2014, the fee waiver was 1.40% for the Investor Class and 1.15% for the Institutional Class.

| | | | | | | | | | | | | | | | | | |

| Top ten companies(% of net assets) | | | | | | |

| 1. | | Roche Holding AG | | | 8.8 | | | | 6. | | | Philip Morris Intl, Inc. | | | 5.5 | | | |

| 2. | | Deutsche Boerse AG | | | 8.5 | | | | 7. | | | Koninklijke Ahold Delhaize N.V. | | | 5.0 | | | |

| 3. | | Nintendo Co., Ltd. | | | 7.4 | | | | 8. | | | Michelin (CGDE) | | | 4.0 | | | |

| 4. | | GlaxoSmithKline plc | | | 6.3 | | | | 9. | | | Nippon Telegraph & Telephone Corp. | | | 3.9 | | | |

| 5. | | China Mobile Ltd. | | | 5.8 | | | | 10. | | | Snam SpA | | | 3.1 | | | |

For the purposes of determining the Fund’s top ten, securities of the same issuer are aggregated.

| | | | | | | | | | |

Top ten country weightings(% of net assets) | | | | |

| | | |

Japan | | | 24.25 | | | United States | | | 6.01 | |

| | | |

Germany | | | 11.69 | | | France | | | 5.55 | |

| | | |

Switzerland | | | 11.36 | | | Netherlands | | | 5.02 | |

| | | |

China | | | 8.22 | | | Italy | | | 3.37 | |

| | | |

United Kingdom | | | 8.17 | | | Spain | | | 3.25 | |

16 SLOW AND STEADY WINS THE RACE

| | |

| |

Ariel Global Fund performance summary | | INCEPTION: 12/30/11 |

|

| | |

Rupal J. Bhansali

Portfolio manager

Composition of equity holdings(%)

| | | | |

| | | Ariel | | MSCI |

| | | Global | | ACWI |

| | | Fund | | Index |

Health care | | 26.46 | | 13.26 |

Communication services | | 20.73 | | 9.32 |

Information technology | | 14.16 | | 18.79 |

Consumer staples | | 9.17 | | 8.82 |

Financials | | 9.14 | | 14.45 |

Consumer discretionary | | 7.59 | | 10.84 |

Energy | | 2.16 | | 3.71 |

Utilities | | 1.39 | | 3.61 |

Industrials | | 1.11 | | 9.63 |

Real estate | | 0.87 | | 3.15 |

Materials | | 0.00 | | 4.40 |

Sector weightings for the Fund are calculated based on equity holdings as a percentage of total net assets. The sectors above are the Global Industry Classification Standard (“GICS”) sector classifications.

Average annual total returns(%) as of 03/31/20

| | | | | | | | | | | | | | | | | | | | |

| | | Quarter | | | 1-year | | | 3-year | | | 5-year | | | Since

inception | |

| | | | | |

Ariel Global Fund–Investor Class | | | -13.28 | | | | -7.79 | | | | 1.09 | | | | 2.33 | | | | 6.17 | |

| | | | | |

Ariel Global Fund–Institutional Class | | | -13.22 | | | | -7.56 | | | | 1.32 | | | | 2.57 | | | | 6.44 | |

MSCI ACWI Index (net) | | | -21.37 | | | | -11.26 | | | | 1.50 | | | | 2.85 | | | | 7.01 | |

Performance data quoted represents past performance and does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To access performance data current to the most recent month-end, visit arielinvestments.com. The minimum initial investment for Investor Class shares is $1,000; the minimum for Institutional Class shares is $1,000,000.

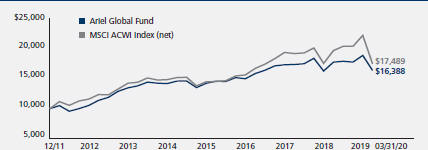

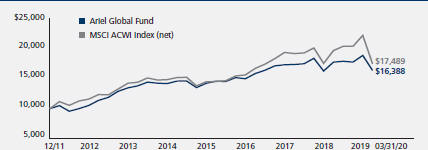

Growth of a $10,000 investment since inception (Investor Class)

The graph and performance table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | | | | | | | | | |

Expense ratio(as of 9/30/19) | | | Net | | | | | | | | Gross | | | | | |

Investor Class | | | 1.13 | % | | | | | | | 1.44% | | | | | |

Institutional Class | | | 0.88 | % | | | | | | | 0.99% | | | | | |

The net expense ratio reflects a contractual advisory fee waiver agreement effective through September 30, 2021. Prior to November 29, 2016, the fee waiver was 1.25% of net assets for the Investor Class and 1.00% for the Institutional Class, and, prior to February 1, 2014, the fee waiver was 1.40% for the Investor Class and 1.15% for the Institutional Class.

| | | | | | | | | | | | | | | | | | |

| Top ten companies(% of net assets) | | | | | | |

| 1. | | Microsoft Corp. | | | 9.8 | | | | 6. | | | China Mobile Ltd. | | | 5.6 | | | |

| 2. | | Roche Holding AG | | | 8.2 | | | | 7. | | | Nintendo Co., Ltd. | | | 3.9 | | | |

| 3. | | Gilead Sciences, Inc. | | | 7.0 | | | | 8. | | | Johnson & Johnson | | | 3.7 | | | |

| 4. | | GlaxoSmithKline plc | | | 5.8 | | | | 9. | | | Baidu, Inc. | | | 3.7 | | | |

| 5. | | Philip Morris Intl, Inc. | | | 5.6 | | | | 10. | | | Berkshire Hathaway, Inc., Class B | | | 3.5 | | | |

For the purposes of determining the Fund’s top ten, securities of the same issuer are aggregated.

| | | | | | | | | | |

Top ten country weightings(% of net assets) | | | | |

| | | |

United States | | | 42.15 | | | Germany | | | 4.01 | |

| | | |

Japan | | | 12.76 | | | France | | | 3.51 | |

| | | |

China | | | 9.33 | | | Finland | | | 1.73 | |

| | | |

Switzerland | | | 8.56 | | | South Korea | | | 1.08 | |

| | | |

United Kingdom | | | 6.10 | | | Thailand | | | 0.98 | |

ARIELINVESTMENTS.COM 17

| | | | |

| |

| | Aaron Diaz Bianco,JD/CFA® Research Analyst |

Kennametal, Inc. (KMT) is one of the world’s leading manufacturers of durable cutting tools. Customers rely on its products in general engineering, transportation, aerospace, agriculture, road construction, mining, and energy. Founded in 1938, Kennametal has helped customers improve manufacturing productivity for over 80 years. With so much attention given toCOVID-19, the marketplace appears to be overlooking that Kennametal is more profitable than it was a few years ago. Since the last downturn in 2015-2016, Kennametal has simplified and modernized its production. We expect the company’s improved cost structure will help lead to profitability for many years to come.

HIGH VALUE PROPOSITION FOR CUSTOMERS

The strong value proposition of Kennametal’s cutting tools and the high barriers to entry help preserve pricing power over economic cycles. The importance of avoiding malfunctions in heavy equipment such as commercial aircraft greatly outweighs the costs of these highly specialized cutting tools, such that customers are willing to spend what is necessary. Given this dynamic, one would expect many companies will rush to meet the demand. However, new entrants are not expected to flood the marketplace because of the substantial investment required. Serving cutting tools customers requires extensive materials science, engineering, sourcing, manufacturing and atechnically-proficient sales force.

RESILIENCE THROUGH CYCLES

Many of Kennametal’s end markets, most notably automotive and energy, were already experiencing production downturns in late 2019. Now with theCOVID-19 outbreak, end markets that were doing well, namely aerospace, are being affected. WhileCOVID-19 is unprecedented, in our view, investors should always, as a matter of discipline, look to the normalized earnings power of any business when calculating intrinsic

value. On this count, we believe Kennametal is being priced as if the extreme downward pressure on its end markets will persist indefinitely. However, this franchise will endure because it adds substantial value for its customers. Those customers will likely be ramping up production as soon as the pandemic subsides, and Kennametal will be well positioned to serve given its essential role in the production process.

LOOKING THROUGH THE WINDSHIELD VS. REAR VIEW MIRROR

In addition to maintaining our disciplined focus on the long term, which we think is being neglected by many market participants at this time, we also believe many are not fully appreciating Kennametal’s improved cost structure. In the past, Kennametal allocated resources to serving many small andmedium-sized clients, keeping the company’s cost base higher than it needed to be while also diverting resources from improvements that larger competitors made years before. Today, Kennametal has efficiently and strategically deemphasized smaller accounts where appropriate, resulting in decreased fixed costs. Accordingly, the company has used the excess capital to automate and modernize its factories.

A PATIENT APPROACH

Even during Kennametal’s period of elevated fixed costs, the company never sacrificed its scientific expertise and materials acumen. Improving its economies of scale by removing redundancies and automating production should enable it to remain the strongest player in the Western Hemisphere. Due to the deterioration of Kennametal’s end markets in the face of theCOVID-19 shock, the benefits of management’s actions may not immediately translate to profits. However, once we return to a normalized operating environment, Kennametal’s improvements will shine through for patient investors.

18 SLOW AND STEADY WINS THE RACE

| | | | |

| |

| | Sabrina Carollo,CFA® Senior Vice President Director of Research Operations |

Established as aspin-off of Danaher Corporation in September 2019,Envista Holdings Corp.(NVST) is a leading global dental manufacturing company. Under its Specialty Products & Technologies Division (49% of revenue), Envista offers dental implants, orthodontic traditional bracket and wire systems, dental lab products, and more innovative aligners. Additionally, the company offers digital imaging systems, impression materials, bonding agents, and infection prevention products under its Equipment and Consumables Division (51% of revenue).

SOLID COMPETITIVE ADVANTAGES

Though the global dental industry is highly fragmented, Envista’s reach includes more than 1 million dentists in over 150 countries. Furthermore, the company offers a broad product portfolio, covering approximately 90% of clinical needs for dental treatment. This strength and product breadth allow the company to boast a high-recurring revenue stream with approximately 70% derived from consumables, services and spare parts. A continued focus on innovation further enhances the company’s competitiveness, utilizing approximately 6% of revenue for research and development. Finally, Envista’s tenured management team of operating executives and leaders have a long history in the dental industry.

FAVORABLE GROWTH DRIVERS

Envista is positioned to capitalize on dental market trends to accelerate growth. First, the industry continues to experience favorable demographic shifts. The aging population is significant since older individuals have a higher dental expenditure per capita. Second, new studies continue to link dental health to overall health, which could help drive dental care to become part of a larger focus on preventative healthcare over time. Third, development outside the United States boasts higher growth dynamics, with the company generating 24% of revenue from

emerging markets in 2019. Fourth, cosmetic dentistry continues to experience increased demand and is particularly attractive since it focuses on more profitable product offerings. Finally, after a pause taken to focus on internal operations, Envista will completetuck-in acquisitions, thereby enhancing its growth trajectory.

SIGNIFICANT MARGIN UPSIDE POTENTIAL

Company operations are based on the Danaher operating culture, Envista Business System (EBS). Since 2015, Envista has invested heavily and rationalized product/brand lines, reducing manufacturing sites by 25% and other locations by 40%. Furthermore, imaging/treatment brands were rationalized from 11 to 6, and the company consolidatedback-office functions. We believe management is focused on further cost savings such as additional manufacturing site reduction and product streamlining. In our view, the company will rapidly expand margins at a higher rate versus Wall Street expectations.

ONCE-IN-A-LIFETIME OPPORTUNITY

While it may be a recently acquired portfolio company, Envista is certainly not a new name to Ariel. In 2006, Danaher Corporation acquired Sybron Dental, an Ariel portfolio company at that time. A large portion of the Envista product portfolio is represented by the former Sybron Dental. In this current, uncharteredCOVID-19 environment, the American Dental Association, along with other global regulatory bodies, have informed the dental community to see patients on an emergency-basis only. However, we know people will once again visit dentists for theirbi-annual dental cleanings and necessaryfollow-up procedures—the only uncertainty is when. As long-term investors, this temporary slowdown has provided us with aonce-in-a-lifetime opportunity to invest in a high-quality company trading at a significant discount to its private market valuation of $35.71.

ARIELINVESTMENTS.COM 19

| | | | |

| |

| | Jamil Soriano Vice President, Research |

Founded in 1937 and based in Mayfield, OH,Progressive Corp.(PGR) is one of the largest property and casualty automobile insurers in the U.S. With specialization in the personal auto segment, Progressive also maintains a solid position in the commercial auto market. As background, Progressive distributes its policies primarily through its digitaldirect-to-consumer (DTC) channel and network of over 30,000 independent agents. The company entered the homeowners’ insurance space in 2014 through the acquisition of American Strategic Insurance Corp., which strengthened its competitive positioning by facilitating a home/auto bundled solution. Additionally, it is gradually expanding beyond autos to other small commercial lines which it views as a long-term growth driver.

COMPETITIVE ADVANTAGE DRIVEN BY DATA, MARKETING AND INNOVATION

Brand strength, scale, and underwriting prowess differentiate the company from its peers in a highly competitive and relatively commoditized industry. Progressive maintains a sizeable marketing budget—illustrated by the public’s familiarity with “Flo” from its television commercials. This type of brand support gives the company an advantage, especially in the DTC channel and makes it difficult for smaller players to keep pace. Underwriting is supported by superior data analytics and innovation. Now an industry norm, telematics—the integrated use of communications and information technology to transmit, store and receive information—was first developed and employed by Progressive in an effort to inform pricing decisions. Progressive’s data superiority allows the company to better assess risk factors when determining competitive policy rates, which leaves the riskier driver pool and higher payouts for its competitors. This creates a virtuous cycle. Specifically,

industry participants increase rates in response to greater underwriting losses, which in turn promotes further Progressive market share gains. The company’s advantages are substantiated bybest-in-class loss ratios and return on equity.

A SHIFT IN THE GLOBAL OPERATING ENVIRONMENT

Prior to the pandemic, Progressive investors had been focused on the possibility of accelerated underwriting margin degradation as a result of increased competition and an uptick in accident frequency and severity. We believed loss trends would normalize at a more gradual pace given Progressive’s competitive positioning and pricing acumen. However, the emergence ofCOVID-19 dramatically altered the global operating environment and understandably shifted the focus to the public health and economic implications of the virus.

A PROMISING OUTLOOK IN THE FACE OF UNCERTAINTY

While the company’s shares have not been fully immune to market volatility, it has outperformed its peer set. Auto insurance is anon-discretionary expense and drivers need it regardless of how much they drive. Shelter in place designations across the country will likely translate into fewer miles driven and should lead to lower claims rates. While the low interest rate environment will remain a headwind for Progressive, it is important to remember the vast majority of its revenues are derived from earned premiums. Collectively, we like the company’s positioning regardless of the macroeconomic backdrop and expect its brand and data-driven culture to fuel growth and share gains in the long term.

20 SLOW AND STEADY WINS THE RACE

| | |

Schedules of investments | | 03/31/20 (UNAUDITED) |

|

| | |

Ariel Fund | | |

| | | | | | | | |

| Number of shares | | | | Common stocks—98.85% | | Value | |

| | | |

| | | | Consumer discretionary & services—32.51% | | | | |

| | | |

6,867,689 | | | | Mattel, Inc.(a) | | | $60,504,340 | |

| | | |

3,173,966 | | | | Interpublic Group of Cos., Inc. | | | 51,386,509 | |

| | | |

1,905,599 | | | | Adtalem Global Education, Inc.(a) | | | 51,050,997 | |

| | | |

4,376,984 | | | | MSG Networks, Inc.(a)(b) | | | 44,645,237 | |

| | | |

3,125,765 | | | | ViacomCBS, Inc. | | | 43,791,968 | |

| | | |

563,604 | | | | Mohawk Industries, Inc.(a) | | | 42,969,169 | |

| | | |

2,852,435 | | | | Nielsen Holdings plc | | | 35,769,535 | |

| | | |

3,205,077 | | | | TEGNA, Inc. | | | 34,807,136 | |

| | | |

2,220,256 | | | | Meredith Corp.(b) | | | 27,131,528 | |

| | | |

806,040 | | | | Royal Caribbean Cruises Ltd. | | | 25,930,307 | |

| | | |

130,969 | | | | Vail Resorts, Inc. | | | 19,345,431 | |

| | | | | | | | |

| | | | | | | 437,332,157 | |

| | | | | | | | |

| | | |

| | | | Consumer staples—5.61% | | | | |

| | | |

438,245 | | | | J.M. Smucker Co. | | | 48,645,195 | |

| | | |

688,000 | | | | Molson Coors Brewing Co. | | | 26,838,880 | |

| | | | | | | | |

| | | | | | | 75,484,075 | |

| | | | | | | | |

| | | |

| | | | Financial services—27.96% | | | | |

| | | |

2,975,439 | | | | KKR & Co., Inc. | | | 69,833,553 | |

| | | |

823,800 | | | | Northern Trust Corp. | | | 62,163,948 | |

| | | |

2,342,903 | | | | Lazard Ltd., Class A | | | 55,198,795 | |

| | | |

500,299 | | | | JLL | | | 50,520,193 | |

| | | |

1,195,953 | | | | CBRE Group, Inc., Class A(a) | | | 45,099,388 | |

| | | |

1,041,788 | | | | First American Financial Corp. | | | 44,182,229 | |

| | | |

528,600 | | | | Affiliated Managers Group, Inc. | | | 31,261,404 | |

| | | |

1,159,249 | | | | Janus Henderson Group plc | | | 17,759,695 | |

| | | | | | | | |

| | | | | | | 376,019,205 | |

| | | | | | | | |

| | | |

| | | | Health care—8.54% | | | | |

| | | |

323,100 | | | | Laboratory Corp. of America Holdings(a) | | | 40,836,609 | |

| | | |

1,919,315 | | | | Envista Holdings Corp.(a) | | | 28,674,566 | |

| | | |

186,506 | | | | Charles River Laboratories Intl, Inc.(a) | | | 23,538,922 | |

| | | |

62,281 | | | | Bio-Rad Laboratories, Inc.(a) | | | 21,833,227 | |

| | | | | | | | |

| | | | | | | 114,883,324 | |

| | | | | | | | |

| | | |

| | | | Materials & processing—5.08% | | | | |

| | | |

978,400 | | | | Masco Corp. | | | 33,823,288 | |

| | | |

398,197 | | | | Simpson Manufacturing Co., Inc. | | | 24,680,250 | |

| | | |

5,477,884 | | | | U.S. Silica Holdings, Inc.(b) | | | 9,860,191 | |

| | | | | | | | |

| | | | | | | 68,363,729 | |

| | | | | | | | |

| | | |

| | | | Producer durables—18.14% | | | | |

| | | |

325,100 | | | | Zebra Technologies Corp.(a) | | | 59,688,360 | |

| | | |

1,123,000 | | | | Stericycle, Inc.(a) | | | 54,555,340 | |

| | | |

543,585 | | | | Keysight Technologies, Inc.(a) | | | 45,487,193 | |

| | | |

2,266,141 | | | | Kennametal, Inc. | | | 42,195,545 | |

| | | |

387,163 | | | | Snap-on, Inc. | | | 42,131,078 | |

| | | | | | | | |

| | | | | | | 244,057,516 | |

| | | | | | | | |

| | | |

| | | | Technology—1.01% | | | | |

| | | |

1,012,665 | | | | Knowles Corp.(a) | | | 13,549,458 | |

| | | | | | | | |

| | | | Total common stocks (Cost $1,339,921,371) | | | 1,329,689,464 | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

ARIELINVESTMENTS.COM 21

| | |

Schedules of investments | | 03/31/20 (UNAUDITED) |

|

| | |

Ariel Fund(continued) | | |

| | | | | | | | |

| Number of shares | | | | Short-term investments—1.08% | | Value | |

| | | |

14,498,226 | | | | Northern Institutional Treasury Portfolio, 0.40%(c) | | | $14,498,226 | |

| | | | | | | | |

| | | | Total short-term investments (Cost $14,498,226) | | | 14,498,226 | |

| | | | | | | | |

| | | |

| | | | Total Investments—99.93% (Cost $1,354,419,597) | | | 1,344,187,690 | |

| | | |

| | | | Other Assets less Liabilities—0.07% | | | 955,143 | |

| | | | | | | | |

| | | |

| | | | Net Assets—100.00% | | | $1,345,142,833 | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

22 SLOW AND STEADY WINS THE RACE

| | |

Schedules of investments | | 03/31/20 (UNAUDITED) |

|

| | |

Ariel Appreciation Fund | | |

| | | | | | | | |

| Number of shares | | | | Common stocks—99.33% | | Value | |

| | | |

| | | | Consumer discretionary & services—25.84% | | | | |

| | | |

2,481,230 | | | | Interpublic Group of Cos., Inc. | | | $40,171,114 | |

| | | |

3,829,300 | | | | Mattel, Inc.(a) | | | 33,736,133 | |

| | | |

1,195,600 | | | | BorgWarner, Inc. | | | 29,136,772 | |

| | | |

336,900 | | | | Omnicom Group, Inc. | | | 18,495,810 | |

| | | |

1,314,898 | | | | ViacomCBS, Inc. | | | 18,421,721 | |

| | | |

333,000 | | | | CarMax, Inc.(a) | | | 17,925,390 | |

| | | |

1,745,437 | | | | MSG Networks, Inc.(a) | | | 17,803,457 | |

| | | |

1,265,624 | | | | Nielsen Holdings plc | | | 15,870,925 | |

| | | |

58,300 | | | | Vail Resorts, Inc. | | | 8,611,493 | |

| | | |

627,400 | | | | Carnival Corp. | | | 8,262,858 | |

| | | |

31,600 | | | | The Madison Square Garden Co., Class A(a) | | | 6,680,556 | |

| | | |

315,600 | | | | Nordstrom, Inc. | | | 4,841,304 | |

| | | | | | | | |

| | | | | | | 219,957,533 | |

| | | | | | | | |

| | | |

| | | | Consumer staples—5.37% | | | | |

| | | |

297,275 | | | | J.M. Smucker Co. | | | 32,997,525 | |

| | | |

325,400 | | | | Molson Coors Brewing Co. | | | 12,693,854 | |

| | | | | | | | |

| | | | | | | 45,691,379 | |

| | | | | | | | |

| | | |

| | | | Energy—1.21% | | | | |

| | | |

1,043,300 | | | | National Oilwell Varco | | | 10,255,639 | |

| | | | | | | | |

| | | |

| | | | Financial services—34.36% | | | | |

| | | |

585,800 | | | | Northern Trust Corp. | | | 44,204,468 | |

| | | |

500,100 | | | | Progressive Corp. | | | 36,927,384 | |

| | | |

973,200 | | | | Aflac, Inc. | | | 33,322,368 | |

| | | |

649,900 | | | | First American Financial Corp. | | | 27,562,259 | |

| | | |

585,189 | | | | BOK Financial Corp. | | | 24,905,644 | |

| | | |

1,041,720 | | | | Lazard Ltd., Class A | | | 24,542,923 | |

| | | |

420,789 | | | | Houlihan Lokey, Inc. | | | 21,931,523 | |

| | | |

119,454 | | | | Willis Towers Watson plc | | | 20,289,262 | |

| | | |

716,568 | | | | KKR & Co., Inc. | | | 16,817,851 | |

| | | |

451,700 | | | | The Charles Schwab Corp. | | | 15,186,154 | |

| | | |

224,450 | | | | CBRE Group, Inc., Class A(a) | | | 8,464,010 | |

| | | |

53,000 | | | | Goldman Sachs Group, Inc. | | | 8,193,270 | |

| | | |

146,950 | | | | Blackstone Group, Inc. | | | 6,696,511 | |

| | | |

33,980 | | | | JLL | | | 3,431,300 | |

| | | | | | | | |

| | | | | | | 292,474,927 | |

| | | | | | | | |

| | | |

| | | | Health care—11.14% | | | | |

| | | |

249,600 | | | | Laboratory Corp. of America Holdings(a) | | | 31,546,944 | |

| | | |