As filed with the Securities and Exchange Commission on May 24, 2022

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-4786

Ariel Investment Trust

(Exact name of registrant as specified in charter)

200 East Randolph Street

Suite 2900

Chicago, Illinois, 60601

(Address of principal executive offices) (Zip code)

Mareilé B. Cusack, Esq.

200 East Randolph Street

Suite 2900

Chicago, Illinois 60601

(Name and address of agent for service)

with a copy to:

Arthur Don, Esq.

Greenberg Traurig, LLP

77 West Wacker Drive

Suite 3100

Chicago, IL 60601

Registrant’s telephone number, including area code: (312) 726-0140

Date of fiscal year end: September 30

Date of reporting period: March 31, 2022

Item 1. Reports to Stockholders.

(a) The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “Act”) (17 CFR 270.30e-1):

The patient investor

SEMI-ANNUAL REPORT: 03/31/22

Ariel Fund

Ariel Appreciation Fund

Ariel Focus Fund

Ariel International Fund

Ariel Global Fund

Slow and steady wins the race.

Ariel Investment Trust

c/o U.S. Bank Global Fund Services

P.O. Box 701

Milwaukee, WI 53201-0701

800.292.7435

• arielinvestments.com

• linkedin.com/company/ariel-investments

• instagram.com/arielinvestments

• twitter.com/arielinvests

Table of contents

| | |

| |  |

| |

| John W. Rogers, Jr. | | Mellody Hobson |

| Chairman and | | Co-CEO and |

| Co-CEO | | President |

Average annual total returns as of 03/31/22

| | | | | | | | | | | | |

| | | 1Q22 | | 1-year | | 3-year | | 5-year | | 10-year | | Since

inception* |

| | | | | | |

Ariel Fund | | -5.11% | | 3.51% | | 13.00% | | 9.76% | | 12.23% | | 11.25% |

| | | | | | |

Russell 2500TM Value Index | | -1.50 | | 7.73 | | 12.97 | | 9.19 | | 11.04 | | 11.08 |

| | | | | | |

Russell 2500TM Index | | -5.82 | | 0.34 | | 13.79 | | 11.57 | | 12.09 | | 10.91 |

| | | | | | |

S&P 500® Index | | -4.60 | | 15.65 | | 18.92 | | 15.99 | | 14.64 | | 11.02 |

* The inception date for Ariel Fund is 11/06/86.

Average annual total returns as of 03/31/22

| | | | | | | | | | | | |

| | | 1Q22 | | 1-year | | 3-year | | 5-year | | 10-year | | Since

inception* |

| | | | | | |

| Ariel Appreciation Fund | | -4.57% | | 3.86% | | 11.60% | | 8.18% | | 10.56% | | 10.50% |

| | | | | | |

| Russell Midcap® Value Index | | -1.82 | | 11.45 | | 13.68 | | 10.00 | | 12.02 | | 11.39 |

| | | | | | |

| Russell Midcap® Index | | -5.68 | | 6.92 | | 14.89 | | 12.62 | | 12.86 | | 11.51 |

| | | | | | |

| S&P 500® Index | | -4.60 | | 15.65 | | 18.92 | | 15.99 | | 14.64 | | 10.52 |

* The inception date for Ariel Appreciation Fund is 12/01/89.

Performance data quoted represents past performance. Past performance does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains and represents returns of the Investor Class shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Any extraordinary performance shown for short-term periods may not be sustainable and is not representative of the performance over longer periods. Performance data current to the most recent month-end for Ariel Fund and Ariel Appreciation Fund may be obtained by visiting our website, arielinvestments.com.

ARIELINVESTMENTS.COM 3

DEAR FELLOW SHAREHOLDER:

After posting barnburner gains last year, the stock market has retreated in 2022—with negative index returns masking intensifying volatility. For the quarter, strength amongst our consumer names was not enough to overcome poorer performing economically and interest rate sensitive areas. Although Ariel Fund and Ariel Appreciation Fund trailed their primary value indices during the three-month period, both Funds managed to outpace their core benchmarks. Ariel Fund fell short of the S&P 500 during the quarter—as the lagging Financial and Industrial sectors took a bigger bite out of returns. Meanwhile, Ariel Appreciation Fund outperformed the broad market.

This year’s trading feels somewhat reminiscent of 2008, when the intra-day swings stunned and often defied logic. There are days when a plummeting market completely reverses itself before the close. Other times, an uneventful day goes bad at the bell. Since we are disciplined, patient investors (not day traders), we do not sit glued to a screen tracking minute-by-minute stock prices. And yet, we cannot help but acknowledge that these days, a few minutes at the “water cooler” can mean the difference between portfolio-wide gains or losses.

Against this jumpy backdrop, we seek to use the volatility to our advantage. Yes, there is no denying that the world is unstable as the pandemic lingers, inflation swells, war in Ukraine rages and China’s lockdown expands. The supply chain bottleneck that was expected to resolve itself remains entangled. US consumers are buying, but their confidence is falling. Many expect their willingness to absorb escalating prices to wane as well. With these challenging and well-telegraphed conditions increasingly priced in, our job is to focus on mining value from the uncertainty by looking past the near-term drama and instead, taking a long-term view.

FOR THE RECORD

As 2022 takes shape, we are clear-eyed and unemotional. Our views on some of the big issues of the day—including inflation and the future of growth stocks, as well as some of our highest conviction names, are playing out as we anticipated.

“With these challenging and well-telegraphed conditions increasingly priced in, our job is to focus on mining value from the uncertainty by looking past the near-term drama and instead, taking a long-term view.”

On inflation—Given the amount of stimulus that poured into global economies, inflation was to be expected. The looming questions were: “how much” and “how long?” As The New York Times noted, “While central bankers were hesitant to react to rapid inflation last year, hoping it would prove ‘transitory’ and fade quickly, those expectations have been dashed.”1 In our third quarter 2021 letter we wrote, “…some see growing inflation as ‘transitory,’ we do not completely agree. While we expect supply chain disruptions and shortages will soon pass, once large numbers of people receive wages to induce them to return to work, there is no cutting pay. We expect wage inflation to stick.”2

Now a “hawkish” Fed has declared its intentions to attempt to slow escalating inflation with a heavier hand. By rapidly raising interest rates and suspending its bond buying program, “Fed officials are making money more expensive to borrow and spend in a bid to slow shopping and business

| 1 | Smialek, Jeanna. “’Many’ at the Fed Supported Big Increase in Rates.” The New York Times. April 28, 2022. Pg. B1. |

| 2 | Ariel Fund and Ariel Appreciation Fund Portfolio Manager Letter. September 30, 2021. |

4 SLOW AND STEADY WINS THE RACE

investment, hoping that weaker demand will help tame prices, which are now climbing at the fastest pace in four decades.”3

While there is much market handwringing over the Fed’s intensifying policy efforts, we too remain skeptical that inflation can be so easily tamed. As we wrote in our December 31, 2021 letter, “…we are observant students of history and do not believe rising inflation is easily subdued with quick fixes. Nor do we think the Fed has practiced many ‘perfect landings’ when it comes to managing money supply. If the Fed sets rates too low, inflation can continue to run away. If rates are too high, it could trigger a recession. Like Goldilocks, ‘just right’ can be a temperamental temperature.” To this point, one economist recently quipped, “It’s like trying to land during an earthquake.”4 This difficulty has led a growing number of market watchers to begin considering recession scenarios.

While we are not ones to speculate on economic outcomes, we do recognize today’s US executives have little-to-no experience with 40-year inflation. And managing inflation is not a one quarter company fix. Much of the price escalations are completely out of a CEO’s control (i.e. chip shortages, COVID-induced labor shortages, product availability). Inflation can cause margin slippage as prices react slower than changing costs. Although we seek to dampen negative inflationary effects by investing in companies whose strong brands and franchises command pricing power, simply matching price to cost increases is exceedingly difficult in the short run. This is true of even the best run franchises with superior pricing power in the long run. Share price reactions have been brutal despite the widespread awareness of the challenge at hand. This unique environment requires sturdy patience.

On growth stocks—In that same year-end letter, we reminded our investors that, “…there are consequences to

Fed actions.”5 We doubled down on our view that, “When it comes to stocks—particularly growth stocks selling at high multiples—inflation acts as gravity. As interest rates are likely hiked to dampen inflation, a dollar earned today becomes more valuable than a dollar earned in the future. This is the exact opposite of the most recent low interest rate, growth stock heyday where the value of a dollar is not different than one earned in the future.”6 Our expectations of growth’s comeuppance and value’s resurrection are playing out in real-time. Look no further than the tech-laden Nasdaq—which is having its worst start to any year in its 51-year history.

We hold no ill will against growth stocks. In fact, our view has been that “some of today’s growth stocks are great businesses—but they are priced for near-perfection and an assumption that the current environment will last forever.”7 As the great Artist Formerly Known as Prince once sang, “Forever is a mighty long time.” All of a sudden, the road is becoming littered with wreckage. When the stock formerly known as Facebook and now called Meta Platforms, Inc. (FB) plummeted -26% in a single day in February, its market capitalization fell $251 billion in what has been called the “biggest wipeout in history.”8 Other high-flyers like PayPal Holdings Inc. (PYPL) nosedived -25% after announcing disappointing earnings—losing $50 billion in market value in hours. Then debt-laden Netflix Inc. (NFLX) fell -35% in one session and is now pondering the advertising-based business model it once shunned. Inevitably, stocks trade on fundamentals. The math is the math.

On orphaned value stocks—While losing money is never pleasant and we try to avoid it as best we can, we also know our weakest holdings and/or sectors are often the source of future gains. Last year, as large cap growth stocks continued to trounce value shares, we underscored our core belief that, “pessimism yields value and optimism

| 3 | Smialek, Jeanna. “’Many’ at the Fed Supported Big Increase in Rates.” The New York Times. April 7, 2022. Pg. B1. |

| 4 | Casselman, Ben. “Economy is Booming, but Some Worry a Bust is Coming.” The New York Times. April 7, 2022. Pg. B7. |

| 5 | Ariel Fund and Ariel Appreciation Fund Portfolio Manager Letter. December 31, 2021. |

| 6 | Ariel Fund and Ariel Appreciation Fund Portfolio Manager Letter. September 30, 2021. |

| 7 | Ariel Fund and Ariel Appreciation Fund Portfolio Manager Letter. December 31, 2021. |

| 8 | Adinarayan, Thyagaraju and Barnert, Jan-Patrick. “Meta Erases $251 Billion in Value, Biggest Wipeout in History.” Bloomberg Radio. February 3, 2022. |

ARIELINVESTMENTS.COM 5

is pricey.”9 Throughout the long run of recent growth stock domination, we have consistently spotlighted misunderstood values that we felt held great promise. Much like the recent pandemic shock, our sharpened focus on balance sheet strength following the 2008 financial crisis has largely taken financial stability and leverage concerns off the table—allowing us to focus on fundamental company developments without the added stress and volatility of weak balance sheets.

In September, we highlighted Nielsen Holdings plc (NLSN) after the stock shed -22% during the quarter. We laid out our investment thesis for the business and explained why “unrealized upside embedded in our portfolios was boosted as the stock was oversold.”10 While acknowledging the company’s checkered past, we stayed focused on the uniqueness of its franchise as the “only independent provider of unbiased comprehensive [television] viewership data.”11 We also expressed our enthusiasm for the new management team’s plan to “create the only true cross platform media measurement solution.”12 Jumping to the present, the stock was a top performer during the quarter as its shares climbed +40% on news of its takeover by a private equity consortium in an all-cash transaction valued at approximately $16 billion including debt—effectively demonstrating that value can be realized in public as well as private markets. As we write, another portfolio favorite, Mattel, Inc. (MAT), is making headlines as a potential private equity target. Last quarter, broadcast, digital media and marketing services company, TEGNA, Inc. (TGNA), was purchased by a strategic buyer. In all instances, we are pleased and not surprised.

On memes—Despite the fact that the high-flying meme stocks continue to defy gravity, we remain skeptical of their long-term prospects. Our view has been that “meme stocks are akin to a market virus—infectious, contagious and dangerous…lacking in fundamentals and inflated by whims.”13 Thus far, these issues continue to attract retail interest—crowdfunded by a pile-on effect that is likely to crumble under its own weight. Even as these names charge on, we continue to believe a day of reckoning will come.

PORTFOLIO COMINGS AND GOINGS

We did not add any new holdings to Ariel Fund during the quarter and successfully exited broadcast, digital media and marketing services company TEGNA, Inc. upon the announcement of its acquisition by Standard General.

We did not initiate or exit any holdings in Ariel Appreciation Fund during the period.

As always, we appreciate the opportunity to serve you and welcome any questions or comments you might have.

Sincerely,

| | |

| |  |

| John W. Rogers, Jr. | | Mellody Hobson |

| Chairman and Co-CEO | | Co-CEO and President |

| 9 | Ariel Fund and Ariel Appreciation Fund Portfolio Manager Letter. June 30, 2021. |

| 10 | Ariel Fund and Ariel Appreciation Fund Portfolio Manager Letter. September 30, 2021. |

| 11 | Ariel Fund and Ariel Appreciation Fund Portfolio Manager Letter. September 30, 2021. |

| 12 | Ariel Fund and Ariel Appreciation Fund Portfolio Manager Letter. September 30, 2021. |

| 13 | Ariel Fund and Ariel Appreciation Fund Portfolio Manager Letter. December 31, 2021. |

6 SLOW AND STEADY WINS THE RACE

| | |

| |

Ariel Fund performance summary | | INCEPTION: 11/06/86 |

|

| | |

| | | | |

| |  | |  |

| | |

| John W. Rogers, Jr. | | John P. Miller, CFA | | Kenneth E. Kuhrt, CPA |

| Lead portfolio | | Portfolio | | Portfolio |

| manager | | manager | | manager |

Composition of equity holdings (%)

| | | | | | | | |

| | | | |

| | | Ariel

Fund | | Russell

2500

Value

Index | | Russell

2500

Index | | S&P

500

Index |

| | | | |

Consumer Discretionary | | 35.78 | | 13.09 | | 14.20 | | 15.40 |

| | | | |

Industrials | | 20.72 | | 17.80 | | 18.27 | | 12.13 |

| | | | |

Financials | | 19.36 | | 20.11 | | 14.74 | | 10.66 |

| | | | |

Health Care | | 6.58 | | 7.45 | | 12.42 | | 12.95 |

| | | | |

Real Estate | | 5.28 | | 12.47 | | 8.90 | | 2.72 |

| | | | |

Consumer Staples | | 2.91 | | 3.12 | | 2.88 | | 5.33 |

| | | | |

Energy | | 2.91 | | 7.71 | | 6.64 | | 3.99 |

| | | | |

Utilities | | 2.80 | | 4.52 | | 3.15 | | 2.97 |

| | | | |

Technology | | 0.00 | | 6.33 | | 12.57 | | 29.12 |

| | | | |

Basic Materials | | 0.00 | | 6.05 | | 4.85 | | 1.91 |

| | | | |

Telecommunications | | 0.00 | | 1.34 | | 1.38 | | 2.80 |

Sector weightings for the Fund are calculated based on equity holdings as a percentage of total net assets.

Average annual total returns (%) as of 3/31/2022

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Quarter | | | 1-year | | | 3-year | | | 5-year | | | 10-year | | | 20-year | | | Since

inception | |

| | | | | | | |

Ariel Fund–Investor Class | | | -5.11 | | | | 3.51 | | | | 13.00 | | | | 9.76 | | | | 12.23 | | | | 8.56 | | | | 11.25 | |

| | | | | | | |

Ariel Fund–Institutional Class+ | | | -5.04 | | | | 3.83 | | | | 13.36 | | | | 10.09 | | | | 12.58 | | | | 8.73 | | | | 11.35 | |

| | | | | | | |

Russell 2500TM Value Index | | | -1.50 | | | | 7.73 | | | | 12.97 | | | | 9.19 | | | | 11.04 | | | | 9.23 | | | | 11.08 | |

| | | | | | | |

Russell 2500TM Index | | | -5.82 | | | | 0.34 | | | | 13.79 | | | | 11.57 | | | | 12.09 | | | | 9.76 | | | | 10.91 | |

| | | | | | | |

S&P 500® Index | | | -4.60 | | | | 15.65 | | | | 18.92 | | | | 15.99 | | | | 14.64 | | | | 9.25 | | | | 11.02 | |

Performance data quoted represents past performance and does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Any extraordinary performance shown for short-term periods may not be sustainable and is not representative of the performance over longer periods. To access performance data current to the most recent month-end, visit arielinvestments.com.

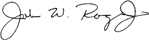

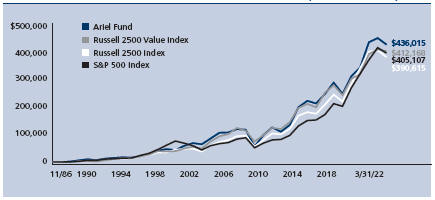

Growth of a $10,000 investment since inception (Investor Class)

The graph and performance table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Total return does not reflect a maximum 4.75% sales load charged prior to 7/15/94.

| | | | | | | | |

| Expense ratio (as of 9/30/21) | | | | | | |

Investor Class | | | 1.00 | % | | | | |

Institutional Class | | | 0.69 | % | | | | |

| | | | | | | | | | | | |

| Top ten equity holdings (% of net assets) |

| | | | | | |

| 1. | | Madison Square Garden Ent. Corp. | | 6.1 | | | | 6. | | JLL | | 3.4 |

| 2. | | Paramount Global | | 4.7 | | | | 7. | | Northern Trust Corp. | | 3.3 |

| 3. | | Lazard Ltd., Class A | | 3.8 | | | | 8. | | Mohawk Industries, Inc. | | 3.3 |

| 4. | | Adtalem Global Education, Inc. | | 3.8 | | | | 9. | | Gentex Corp. | | 3.0 |

| 5. | | Mattel, Inc. | | 3.7 | | | | 10. | | Envista Holdings Corp. | | 2.9 |

| + | The inception date for the Institutional Class shares is December 30, 2011. Performance information for the Institutional Class prior to that date reflects the actual performance of the Fund’s Investor Class (and uses the actual expenses of the Fund’s Investor Class, for such period of time), without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses, which are primarily differences in distribution and service fees. |

ARIELINVESTMENTS.COM 7

| | |

| |

Ariel Appreciation Fund performance summary | | INCEPTION: 12/01/89 |

|

| | |

| | | | |

| |  | | |

| |

| John W. Rogers, Jr. | | Timothy R. Fidler,CFA |

| Co-portfolio | | Co-portfolio | | |

| manager | | manager | | |

Composition of equity holdings (%)

| | | | | | | | |

| | | | |

| | | Ariel

Apprec-

iation

Fund | | Russell

Midcap

Value

Index | | Russell

Midcap

Index | | S&P

500

Index |

| | | | |

Financials | | 28.68 | | 16.25 | | 12.72 | | 10.66 |

| | | | |

Consumer Discretionary | | 27.10 | | 12.79 | | 14.85 | | 15.40 |

| | | | |

Industrials | | 15.46 | | 16.14 | | 16.94 | | 12.13 |

| | | | |

Health Care | | 11.05 | | 6.81 | | 9.67 | | 12.95 |

| | | | |

Consumer Staples | | 6.70 | | 6.14 | | 4.82 | | 5.33 |

| | | | |

Energy | | 2.83 | | 7.46 | | 6.21 | | ��3.99 |

| | | | |

Utilities | | 2.75 | | 8.37 | | 5.64 | | 2.97 |

| | | | |

Real Estate | | 1.78 | | 11.60 | | 8.74 | | 2.72 |

| | | | |

Technology | | 0.00 | | 7.73 | | 14.84 | | 29.12 |

| | | | |

Basic Materials | | 0.00 | | 5.03 | | 3.94 | | 1.91 |

| | | | |

Telecommunications | | 0.00 | | 1.69 | | 1.63 | | 2.80 |

Sector weightings for the Fund are calculated based on equity holdings as a percentage of total net assets.

Average annual total returns (%) as of 3/31/2022

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Quarter | | | 1-year | | | 3-year | | | 5-year | | | 10-year | | | 20-year | | | Since

inception | |

| | | | | | | |

Ariel Appreciation Fund–Investor Class | | | -4.57 | | | | 3.86 | | | | 11.60 | | | | 8.18 | | | | 10.56 | | | | 8.02 | | | | 10.50 | |

| | | | | | | |

Ariel Appreciation Fund–Institutional Class+ | | | -4.50 | | | | 4.18 | | | | 11.95 | | | | 8.52 | | | | 10.90 | | | | 8.19 | | | | 10.61 | |

| | | | | | | |

Russell Midcap® Value Index | | | -1.82 | | | | 11.45 | | | | 13.68 | | | | 10.00 | | | | 12.02 | | | | 10.00 | | | | 11.39 | |

| | | | | | | |

Russell Midcap® Index | | | -5.68 | | | | 6.92 | | | | 14.89 | | | | 12.62 | | | | 12.86 | | | | 10.33 | | | | 11.51 | |

| | | | | | | |

S&P 500® Index | | | -4.60 | | | | 15.65 | | | | 18.92 | | | | 15.99 | | | | 14.64 | | | | 9.25 | | | | 10.52 | |

Performance data quoted represents past performance and does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Any extraordinary performance shown for short-term periods may not be sustainable and is not representative of the performance over longer periods. To access performance data current to the most recent month-end, visit arielinvestments.com.

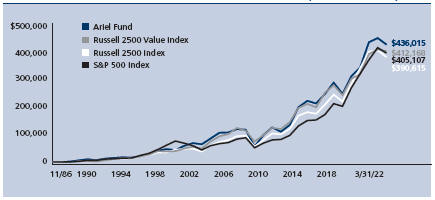

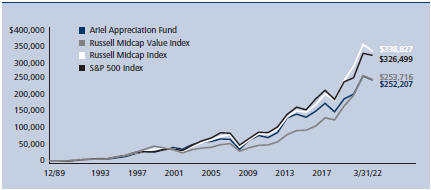

Growth of a $10,000 investment since inception (Investor Class)

The graph and performance table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Total return does not reflect a maximum 4.75% sales load charged prior to 7/15/94.

| | | | | | | | |

| Expense ratio (as of 9/30/21) | | | | | | |

Investor Class | | | 1.12 | % | | | | |

Institutional Class | | | 0.81 | % | | | | |

| | | | | | | | | | | | |

| Top ten equity holdings (% of net assets) |

| | | | | | |

| 1. | | Madison Square Garden Ent. Corp. | | 4.6 | | | | 6. | | Goldman Sachs Group, Inc. | | 3.6 |

| 2. | | BOK Financial Corp. | | 4.2 | | | | 7. | | The Charles Schwab Corp. | | 3.3 |

| 3. | | Northern Trust Corp. | | 4.1 | | | | 8. | | Laboratory Corp. of America Holdings | | 3.2 |

| 4. | | Mattel, Inc. | | 4.0 | | | | 9. | | Walgreens Boots Alliance, Inc. | | 3.1 |

| 5. | | Aflac, Inc. | | 3.8 | | | | 10. | | Lazard Ltd., Class A | | 2.9 |

| + | The inception date for the Institutional Class shares is December 30, 2011. Performance information for the Institutional Class prior to that date reflects the actual performance of the Fund’s Investor Class (and uses the actual expenses of the Fund’s Investor Class, for such period of time), without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses, which are primarily differences in distribution and service fees. |

8 SLOW AND STEADY WINS THE RACE

Charles K. Bobrinskoy

Vice Chairman

Portfolio Manager

Average annual total returns as of 03/31/22

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | 1Q22 | | | 1-year | | | 3-year | | | 5-year | | | 10-year | | | Since

inception* | |

Ariel Focus Fund | | | 3.97 | % | | | 8.14 | % | | | 14.22 | % | | | 9.53 | % | | | 9.95 | % | | | 6.97 | % |

Russell 1000® Value Index | | | -0.74 | | | | 11.67 | | | | 13.02 | | | | 10.29 | | | | 11.70 | | | | 8.26 | |

S&P 500® Index | | | -4.60 | | | | 15.65 | | | | 18.92 | | | | 15.99 | | | | 14.64 | | | | 10.52 | |

* The inception date for Ariel Focus Fund is 06/30/05.

DEAR FELLOW SHAREHOLDER:

Despite a tough environment, Ariel Focus Fund enjoyed strong first quarter 2022 performance gaining +3.97% compared to a loss of -0.74% for the Russell 1000 Value Index and a loss of -4.60% for the S&P 500. Last quarter, we outlined four themes for this year’s economy and equity markets that are playing out with positive implications for many of our largest holdings.

As a reminder, we believe equity markets will be dominated by 1) high and persistent inflation, 2) rising interest rates, 3) a strong reopening economy and 4) outperformance of value

over growth stocks. These factors are related and reinforcing. A strong economy will augment inflation. Higher inflation should drive higher interest rates. Higher rates should be relatively good for value versus growth.

INFLATION

Of all these themes, we have been the loudest and most consistent in forecasting higher inflation. Manufacturing supply-chain disruptions, dramatic increases in the money supply, trillion-dollar deficit spending (from both political parties), an accommodative Federal Reserve (still), and a historically tight labor market all push up prices.

Performance data quoted represents past performance. Past performance does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains and represents returns of the Investor Class shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Any extraordinary performance shown for short-term periods may not be sustainable and is not representative of the performance over longer periods. Performance data current to the most recent month-end for Ariel Focus Fund may be obtained by visiting our website, arielinvestments.com.

ARIELINVESTMENTS.COM 9

Economists from different “schools” of economic theory often disagree. Today, all can point to their own favorite cause to explain rising inflation. Monetarists (whom we currently find particularly persuasive) believe inflation comes from excessive increases in the money supply and point to a 40% increase in M2 (a measure of the money supply that includes cash, bank deposits and certain money market accounts). Meanwhile, Keynesian economists have taught generations of students that fiscal policy in the form of deficit spending will drive inflation as labor markets approach full employment. With trillion-dollar federal deficits and a 3.6% unemployment rate, they believe higher inflation is inevitable. Finally, Supply Side economists say constraints in manufacturing capacity from supply-chain disruptions overseas and labor shortages at home have “too much money chasing too few goods.” Remarkably, different schools of economic thought have come to the same conclusion today: prices are going up.

“Of all these themes, we have been the loudest and most consistent in forecasting higher inflation.”

INTEREST RATES

Higher inflation should lead to higher interest rates. Presumably, lenders will insist loans carry interest rates high enough to offset the loss of purchasing power. Normally fixed income markets would add a “time value of money” premium to the expected inflation rate to produce higher nominal rates. We say “should” because until recently, higher rates had not materialized. Interest rates remained stubbornly and surprisingly low, with the 10-Year Treasury ending 2021 at 1.52%, well below historical averages and below visible inflation. Lately, there has been a marked reversal as rates have moved substantively higher. As we go to print, the 10-year Treasury sits at 2.83%, which has driven the Barclays Fixed Income Aggregate Index down -7.88% this year. At long last, the Federal Reserve has acknowledged high and non-transitory inflation. While the increases in the federal funds rate are getting most of the attention, we would emphasize the end of its bond-buying program of $120 billion a month, which ballooned its balance sheet to $9 trillion. Ever since the Great Financial Crisis, bond

investors have been able to buy long-term bonds at surprisingly low interest rates, confident the Fed would keep prices high (and yields low) through aggressive open market purchases. “Don’t fight the Fed” meant don’t be a seller of bonds when the Fed was a buyer. Now the situation has flipped with bond investors seeking to exit through the same narrow door ahead of $9 trillion of “Quantitative Tightening.” In February, Barron’s ran an article with the subtitle: “Why Warren Buffett Hates Bonds.” We agree with Warren.

VALUE OVER GROWTH

Higher inflation and interest rates are directly impacting stock valuations. Until this year, low interest rates have fueled the outperformance of growth stocks over the value stocks we prefer. Our holdings earn a higher percentage of their current stock price in nearer term cash flows. Growth stocks, by definition, are priced to value earnings and cash flow often in the distant future. The weighted average years into the future of a company’s cash flows is called its expected “duration.” Just as rising interest rates hit long-term bonds harder than short-term bonds, increases in discount rates hit long-duration growth stocks harder than short-duration value stocks. Currently, our two largest holdings are APA Corporation (APA) and The Mosaic Company (MOS) trading at forward p/e multiples of 6.3x and 7.6x, respectively. In simple terms, both have the potential to earn more than half their current valuation in the next four years if earnings stay flat. As a result, increases in interest rates and discount rates should have comparatively little impact on their valuations, just as an increase in rates has little impact on a short-term bond.

By contrast, many growth stocks are popular technology companies trading at 30 to 45 times next year’s earnings. They are being valued on cash flows projected in the distant future. The Nasdaq Composite is trading at 27 times forward earnings. Rising interest rates disproportionately impact these companies whose earnings are far away, just as an increase in rates hits the price of long-term bonds harder than short-term bonds.

Now that rates are moving up, value is outperforming. The growth stock heavy Nasdaq Composite has fallen -9.10% this year. While the Russell 1000 Value is down -0.74%, the

10 SLOW AND STEADY WINS THE RACE

Russell 1000 Growth Index has dropped -9.04%. With our portfolio trading at only ten times forward earnings at the end of the first quarter, Ariel Focus Fund could be well positioned for a period of value outperformance.

CONSUMER DEMAND

Although we are increasingly confident higher inflation and higher rates will drive outperformance, recent events have made us more cautious around the final theme, a strong economy based on pent-up consumer demand. While predicting future recessions is notoriously difficult, we cannot deny a change in certain inputs that are likely to reduce growth. Dramatically higher energy and food prices negatively impact consumer confidence. Higher interest rates push mortgage rates up and tend to reduce demand for housing. Europe represents approximately 20% of the global economy and will feel the impact of the Russian invasion of Ukraine through higher energy prices. Renewed COVID lockdowns in parts of China will delay supply chain normalization, keeping US manufacturing levels below what we would otherwise have expected. Perhaps most important, US consumers have previously expressed confidence based on strong personal balance sheets, a robust job market and federal stimulus checks. With inflation outpacing wage increases, spending could slow. Although we remain optimistic about the long-term outlook for the US economy and are investing accordingly, the next 18 months could be bumpy.

CONTRIBUTORS AND DETRACTORS

It is a rare but happy occurrence when our largest holdings contribute most to positive performance. Such was the case in the first quarter. Our second largest position, Mosaic, surged +69.61% during the period. The company owns and operates fertilizer mines in Florida and Saskatchewan, Canada with obvious advantages in supplying the wheat fields of Kansas and the cornfields of Iowa. This geographic proximity was less important during the past decade as record low shipping rates (coming at least in part from record low energy costs) brought competition from Moroccan phosphates and Belarus potash. Since fertilizer increases crop yields on a cost-efficient basis, it is a critical farming ingredient in the long term as improved diets around

the world drive demand for food from finite arable land. We did not expect the dramatic acceleration in our thesis as the war simultaneously cut off major exports of grain from Russia and Ukraine while sanctions suppressed fertilizer shipments from Belarus. Mosaic was performing extremely well before the war. We expect concerns around reliance on Russian suppliers to accelerate growth trends for the foreseeable future.

APA Corporation, the parent company of Apache Inc., was our largest position at the start of the year and was the second biggest performance contributor, jumping +54.32% in the quarter. Like Mosaic, APA had already benefited from the rising commodity prices prior to the Ukraine invasion. Those inflationary pressures were exacerbated with the sanctions against Russian oil. Poor performance of oil and gas exploration and production companies over the last decade have simultaneously reduced capital expenditures in the industry as well as caused significant selling of US energy stocks. We believe an insufficient amount of capital has been invested to meet the global energy demand for petroleum products for at least the next five years. In our view, the current share price of APA represents less than the value of the company’s proven reserves with only an option value assigned to its exploratory wells off the coast of Suriname. If these Suriname properties prove productive, our investment in APA will be worth significantly more than today.

Meanwhile, our largest detractor was flooring manufacturer Mohawk Industries, Inc. (MHK) which declined -31.83% in the quarter. Mohawk faced the triple headwinds of higher petroleum input cost, concerns about declining housing activity and modest Russian operations. Additionally, Lazard Ltd. (LAZ) fell -19.97% during the period on expectations of lower M&A activity.

As always, we appreciate the opportunity to serve you and welcome any questions or comments you might have.

Sincerely,

Charles K. Bobrinskoy

Vice Chairman and Portfolio Manager

ARIELINVESTMENTS.COM 11

| | |

| |

Ariel Focus Fund performance summary | | INCEPTION: 06/30/05 |

|

| | |

|

|

|

| Charles K. Bobrinskoy |

| Portfolio manager |

Composition of equity holdings (%)

| | | | | | | | |

| | | |

| | | Ariel

Focus

Fund | | Russell

1000

Value

Index | | S&P

500

Index | |

| | | |

Financials | | 21.66 | | 20.23 | | | 10.66 | |

| | | |

Industrials | | 20.01 | | 12.75 | | | 12.13 | |

| | | |

Consumer Discretionary | | 15.83 | | 8.96 | | | 15.40 | |

| | | |

Health Care | | 14.37 | | 16.95 | | | 12.95 | |

| | | |

Basic Materials | | 10.82 | | 2.81 | | | 1.91 | |

| | | |

Energy | | 7.56 | | 7.18 | | | 3.99 | |

| | | |

Technology | | 3.50 | | 7.88 | | | 29.12 | |

| | | |

Consumer Staples | | 2.51 | | 7.43 | | | 5.33 | |

| | | |

Utilities | | 0.00 | | 5.90 | | | 2.97 | |

| | | |

Telecommunications | | 0.00 | | 4.96 | | | 2.80 | |

| | | |

Real Estate | | 0.00 | | 4.95 | | | 2.72 | |

Sector weightings for the Fund are calculated based on equity holdings as a percentage of total net assets.

Average annual total returns (%) as of 3/31/2022

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Quarter | | | 1-year | | | 3-year | | | 5-year | | | 10-year | | | Since

inception | |

| | | | | | |

Ariel Focus Fund–Investor Class | | | 3.97 | | | | 8.14 | | | | 14.22 | | | | 9.53 | | | | 9.95 | | | | 6.97 | |

| | | | | | |

Ariel Focus Fund–Institutional Class+ | | | 4.03 | | | | 8.40 | | | | 14.51 | | | | 9.81 | | | | 10.22 | | | | 7.14 | |

| | | | | | |

Russell 1000® Value Index | | | -0.74 | | | | 11.67 | | | | 13.02 | | | | 10.29 | | | | 11.70 | | | | 8.26 | |

| | | | | | |

S&P 500® Index | | | -4.60 | | | | 15.65 | | | | 18.92 | | | | 15.99 | | | | 14.64 | | | | 10.52 | |

Performance data quoted represents past performance and does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Any extraordinary performance shown for short-term periods may not be sustainable and is not representative of the performance over longer periods. To access performance data current to the most recent month-end, visit arielinvestments.com.

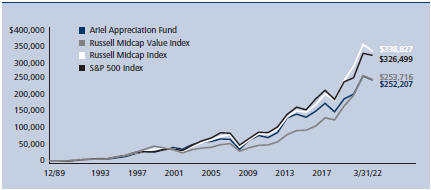

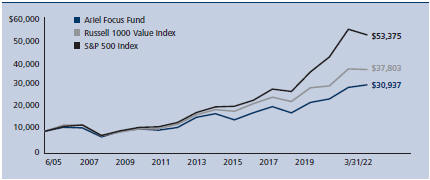

Growth of a $10,000 investment since inception (Investor Class)

The graph and performance table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | |

Expense ratio (as of 9/30/21) | | Net | | | Gross | |

Investor Class | | | 1.00 | % | | | 1.20% | |

Institutional Class | | | 0.75 | % | | | 0.86% | |

Currently, expense ratio caps of 1.00% for the Investor Class and 0.75% for the Institutional Class are in place to waive fees and reimburse certain expenses that exceed these caps. Ariel Investments, LLC (the Adviser) is contractually obligated to maintain these expense ratio caps through 9/30/23.

| | | | | | | | | | | | | | |

Top ten equity holdings (% of net assets) |

| | | | | | | |

| 1. | | APA Corp. | | 7.6 | | | | | 6. | | | Goldman Sachs Group, Inc. | | 4.2 |

| 2. | | Mosaic Co. | | 6.9 | | | | | 7. | | | Madison Square Garden Ent. Corp. | | 4.2 |

| 3. | | BorgWarner, Inc. | | 4.8 | | | | | 8. | | | Barrick Gold Corp. | | 4.0 |

| 4. | | BOK Financial Corp. | | 4.3 | | | | | 9. | | | Snap-on, Inc. | | 3.9 |

| 5. | | Lockheed Martin Corp. | | 4.2 | | | | | 10. | | | Resideo Technologies, Inc. | | 3.7 |

| + | The inception date for the Institutional Class shares is December 30, 2011. Performance information for the Institutional Class prior to that date reflects the actual performance of the Fund’s Investor Class (and uses the actual expenses of the Fund’s Investor Class, for such period of time), without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses, which are primarily differences in distribution and service fees. |

12 SLOW AND STEADY WINS THE RACE

Rupal J. Bhansali

Chief Investment Officer

International and Global Equities

Average annual total returns as of 03/31/22

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | 1Q22 | | | 1-year | | | 3-year | | | 5-year | | | 10-year | | | Since

inception* | |

Ariel International Fund | | | -2.02 | % | | | 2.01 | % | | | 4.76 | % | | | 3.78 | % | | | 5.01 | % | | | 5.40 | % |

MSCI EAFE Index | | | -5.91 | | | | 1.16 | | | | 7.78 | | | | 6.72 | | | | 6.27 | | | | 7.19 | |

MSCI ACWI ex-US Index | | | -5.44 | | | | -1.48 | | | | 7.51 | | | | 6.76 | | | | 5.55 | | | | 6.51 | |

MSCI EAFE Value Index | | | 0.33 | | | | 3.55 | | | | 5.23 | | | | 4.18 | | | | 4.87 | | | | 5.70 | |

MSCI ACWI ex-US Value Index | | | 0.13 | | | | 3.31 | | | | 5.44 | | | | 4.67 | | | | 4.24 | | | | 5.17 | |

* The inception date for Ariel International Fund is 12/30/11.

Average annual total returns as of 03/31/22

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | 1Q22 | | | 1-year | | | 3-year | | | 5-year | | | 10-year | | | Since

inception* | |

Ariel Global Fund | | | 0.11 | % | | | 7.87 | % | | | 8.53 | % | | | 7.45 | % | | | 8.00 | % | | | 8.33 | % |

MSCI ACWI Index | | | -5.36 | | | | 7.28 | | | | 13.75 | | | | 11.64 | | | | 10.00 | | | | 10.95 | |

MSCI ACWI Value Index | | | -0.95 | | | | 8.83 | | | | 9.02 | | | | 7.46 | | | | 7.64 | | | | 8.50 | |

* The inception date for the Ariel Global Fund is 12/30/11.

Performance data quoted represents past performance. Past performance does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains and represents returns of the Investor Class shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Any extraordinary performance shown for short-term periods may not be sustainable and is not representative of the performance over longer periods. Performance data current to the most recent month-end for Ariel International Fund and Ariel Global Fund may be obtained by visiting our website, arielinvestments.com.

ARIELINVESTMENTS.COM 13

DEAR FELLOW SHAREHOLDER:

The MSCI ACWI Index started 2022 in the red delivering its worst quarter of performance in two years. As the global economy seeks to place the pandemic in its rear-view mirror, Russia’s invasion of Ukraine introduced new shocks as markets were digesting the impacts of soaring inflation, a hawkish pivot by the Fed and concerns over the outlook for China. Ripple effects from higher energy prices have extended to other goods and services, increasing cost pressures and further disrupting already rattled supply chains. However, as conditions deteriorated, our Funds began to outperform their primary benchmarks. Although we lagged the dramatic rally in cyclicals that began in late 2020 and persisted throughout 2021, our risk-aware portfolio positioning better protected capital during the recent downturn. While our low portfolio turnover illustrates the merits of our patient approach, we credit our relative outperformance to our avoidance of the 4Ls: Lofty Valuations, Loss Making Companies, Leveraged Balance Sheets and Liquidity Risk.

LOFTY VALUATIONS

As we discussed in prior quarterly letters, the global economy’s rebound from the March 2020 low through last December was undeniable. With unprecedented fiscal support and interest rates at all-time lows, the MSCI ACWI and S&P 500 indexes surged to new highs in record time and corporate profits shined, propelling equity valuations past historic peaks. We discussed the high relative valuations of cyclicals versus defensives, the outperformance of growth relative to value, as well as how US stock returns versus the rest of the world have continued to widen over the last decade. By contrast, since our investment approach focuses on seeking a margin of safety1 as evaluated by discount to intrinsic worth, our global portfolios are currently overweight defensive sectors, such as Health Care and Communications relative to cyclicals, with greater international exposure. Our research also revealed favorable entry points within developing economies, where deeply discounted valuations in certain sectors, such as financials, continue to present compelling investment opportunities when weighing the risk and reward.

LOSS MAKING COMPANIES

At the core of every stock thesis is our differentiated process that considers the upside and downside potential for a name. As we scour the globe for high-quality companies with sustainable business models with stable or improving returns on invested capital, we discovered a growing percentage of unprofitable companies, particularly within the technology sector and amongst new issues (IPOs). Interestingly, money-losing tech stocks have been a positive contributor to overall returns across the Growth and Tech indices until this quarter.2 Meanwhile, in recent years roughly 80% of IPOs lacked profitability, a level not seen since the peak of the Dot Com Bubble two decades ago.3 Our concentrated portfolios avoid the risks associated with such businesses and instead are comprised of diversified holdings across profitable, well-established franchises with strong competitive positions and durable cost advantages.

LEVERAGED BALANCE SHEETS

Central banks in the world’s largest economies helped mitigate the economic fallout of both the coronavirus pandemic and the 2008 Financial Crisis through fiscal stimulus and monetary relief packages. The unconventional expansion in money supply, which began as quantitative easing, resulted in record low interest rates. These actions drove investment in riskier assets with higher yields, including stocks, junk bonds, real estate and commodities, as easy money policies distorted the hurdle rate companies and investors use to determine whether an investment is worth the risk/return. Lower capital costs also provided an incentive for corporations to access debt markets to fund acquisitions and/or repurchase shares already selling at inflated prices. Meanwhile, investment grade (IG) markets quadrupled in size since 2007, with approximately 50% of the Bloomberg US Corporate Bond Index consisting of BBB rated debt—the last rung of high-grade issues.4 Taking this one step further, today, the BBB segment of the corporate bond market stands at 5x the size of the BB tranche.5 This raises questions about the junk bond market’s ability to absorb additional supply without a collapse in pricing if there are large scale downgrades from BBB into high yield.

| 1 | Attempting to purchase with a margin of safety on price cannot protect investors from the volatility associated with stocks, incorrect assumptions or estimations on our part, declining fundamentals or external forces.” |

| 2 | “Tech stocks: Challenged, but not all created equal.” Principal Global. 14 Jan 2022. https://www.principalglobal.com/knowledge/insights/tech-stocks- challenged-not-all-created-equal |

| 3 | BofA Research Investment Committee [@Isabelnet_SA]. “More and more unprofitable companies are going public.” Twitter, 11 February 2021, 6:15 AM, https://twitter.com/isabelnet_sa/status/1359868723327344643?lang=es. |

14 SLOW AND STEADY WINS THE RACE

With inflation rising at its fastest pace in 40 years, corporate earnings growth has begun to face headwinds as pricing pressures climb across supply side factors, including production costs and operating expenditures. To prevent the economy from overheating, policymakers have begun to raise rates. This upward movement will further impact corporate profits, as greater debt servicing costs weigh on the bottom-line. Taken together, we believe these factors are an increasing source of vulnerability for market multiples within the context of various valuation methods. Consequently, our bottom-up fundamental research is laser-focused on the growth and return prospect of a business, as well as the fortitude and resilience of its balance sheet.

LIQUIDITY RISK

While analyzing whether a company has cash flow to fund its liabilities is one way we assess liquidity, evaluating how easily shares can be bought or sold in the market is another area we closely consider. Index funds have experienced massive inflows in recent years, highlighting a shift towards a growing number of price agnostic market participants. Passive strategies buy stocks in the same proportion as the indexes they track with no regard for stock price or fundamental security analysis. Research has shown “as bull markets run, cap weighted indexes tend to become more concentrated in a handful of sectors and stocks. These same sectors and stocks tend to account for a disproportionate amount of the markets gains.”6

However, during bear markets, flows tend to reverse, at least cyclically for risk assets. We saw a version of this play out in March 2020 when the stock market see-sawed from bull-to-bear status in just 20 days—“the fastest 20% drop in history.”7 Volatility reigned and liquidity for many of the large capitalization companies within the index dried up as markets went risk-off. Stock prices fell fast to bridge the large bid/ask spread between active fundamental investors on the buy-side and passive ones on the sell-side. As the correction unfolded, many passive strategies realized larger losses due to their greater concentration of equities held within the indexes.

This phenomenon could play out again, particularly since growth and cyclical valuations are trading at or near historic peaks. We believe the high active share of our portfolios helps side-step large bid/ask liquidity risk.

ACTIVELY AWARE

While markets may change from one period to the next, our investment process remains the same. Risk management is embedded in every step—regardless of the market backdrop. Although uncertainty is high and volatility is likely to remain elevated, we believe our global portfolios will drive strong longer-term performance, as they are heavily weighted towards undervalued, higher dividend yielding and better quality defensive holdings.

“While markets may change from one period to the next, our investment process remains the same.”

As Ben Graham once said, “in the short run, the market is a voting machine but in the long run, it is a weighing machine.”

As always, we appreciate the opportunity to serve you and welcome any questions or comments you might have.

Sincerely,

Rupal J. Bhansali

Chief Investment Officer

International and Global Equities

| 4 | 2022 Morgan Stanley Credit Strategy Chartbook. Morgan Stanley. 1 April 2022. |

| 5 | 2022 Deutsche Bank U.S. Credit Strategy. Deutsche Bank Research. 8 April 2022. |

| 6 | Johnson, Ben. “Is market-cap indexing a form of momentum investing.” TEBI. 24 February 2020. https://www.evidenceinvestor.com/is-market-cap-indexing-a-form-of-momentum-investing/ |

| 7 | Winck, Ben. “The Dow plunged into a bear market in just 20 days – the fastest 20% drop in history.” BusinessInsider. March 12, 2020. |

ARIELINVESTMENTS.COM 15

| | |

| |

Ariel International Fund performance summary | | INCEPTION: 12/30/11 |

|

| | |

Rupal J. Bhansali

Portfolio manager

Composition of equity holdings (%)

| | | | | | |

| | | | | | | MSCI |

| | | Ariel | | MSCI | | ACWI |

| | | International | | EAFE | | ex-US |

| | | Fund | | Index | | Index |

Health Care | | 17.82 | | 13.05 | | 9.37 |

Financials | | 17.51 | | 17.71 | | 20.56 |

Communication Services | | 15.15 | | 4.85 | | 6.16 |

Consumer Staples | | 12.36 | | 10.19 | | 8.43 |

Consumer Discretionary | | 11.99 | | 11.54 | | 11.08 |

Utilities | | 10.63 | | 3.39 | | 3.18 |

Information

Technology | | 3.40 | | 8.60 | | 12.21 |

Industrials | | 2.86 | | 15.40 | | 12.23 |

Energy | | 0.51 | | 4.14 | | 5.39 |

Real Estate | | 0.09 | | 2.89 | | 2.47 |

Materials | | 0.00 | | 8.23 | | 8.92 |

Sector weightings for the Fund are calculated based on equity holdings as a percentage of total net assets. The sectors above are the Global Industry Classification Standard (“GICS”) sector classifications.

Average annual total returns (%) as of 3/31/2022

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Quarter | | | 1-year | | | 3-year | | | 5-year | | | 10-year | | | Since

inception | |

| | | | | | |

Ariel International Fund–Investor Class | | | -2.02 | | | | 2.01 | | | | 4.76 | | | | 3.78 | | | | 5.01 | | | | 5.40 | |

| | | | | | |

Ariel International Fund–Institutional Class | | | -2.00 | | | | 2.24 | | | | 5.00 | | | | 4.05 | | | | 5.27 | | | | 5.65 | |

MSCI EAFE Index (net) | | | -5.91 | | | | 1.16 | | | | 7.78 | | | | 6.72 | | | | 6.27 | | | | 7.19 | |

MSCI ACWI ex-US Index (net) | | | -5.44 | | | | -1.48 | | | | 7.51 | | | | 6.76 | | | | 5.55 | | | | 6.51 | |

MSCI EAFE Value Index (net) | | | 0.33 | | | | 3.55 | | | | 5.23 | | | | 4.18 | | | | 4.87 | | | | 5.70 | |

MSCI ACWI ex-US Value Index (net) | | | 0.13 | | | | 3.31 | | | | 5.44 | | | | 4.67 | | | | 4.24 | | | | 5.17 | |

Performance data quoted represents past performance and does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Any extraordinary performance shown for short-term periods may not be sustainable and is not representative of the performance over longer periods. To access performance data current to the most recent month-end, visit arielinvestments.com.

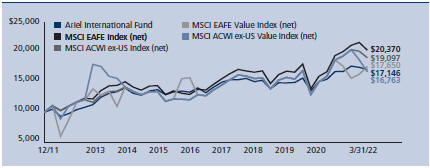

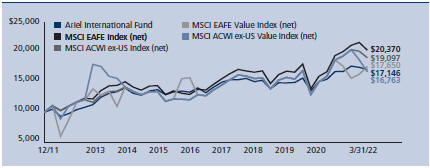

Growth of a $10,000 investment since inception (Investor Class)

The graph and performance table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | | | | | | | | | |

Expense ratio (as of 9/30/21) | | | Net | | | | | | | | Gross | | | | | |

Investor Class | | | 1.13 | % | | | | | | | 1.30% | | | | | |

Institutional Class | | | 0.88 | % | | | | | | | 0.93% | | | | | |

The net expense ratio reflects a contractual advisory fee waiver agreement effective through September 30, 2023. Prior to November 29, 2016, the fee waiver was 1.25% of net assets for the Investor Class and 1.00% for the Institutional Class, and, prior to February 1, 2014, the fee waiver was 1.40% for the Investor Class and 1.15% for the Institutional Class.

Top ten companies (% of net assets)

| | | | | | | | | | | | | | | | |

| 1. | | Deutsche Boerse AG | | 8.1 | | | 6. | | | Nintendo Co., Ltd. | | 5.3 | | | | |

| 2. | | Roche Holding AG | | 8.1 | | | 7. | | | Michelin (CGDE) | | 4.6 | | | | |

| 3. | | GlaxoSmithKline plc | | 6.2 | | | 8. | | | Endesa SA | | 4.4 | | | | |

| 4. | | Philip Morris Intl, Inc. | | 5.9 | | | 9. | | | Snam SpA | | 4.3 | | | | |

| 5. | | Koninklijke Ahold Delhaize NV | | 5.4 | | | 10. | | | Baidu, Inc. | | 3.7 | | | | |

For the purposes of determining the Fund’s top ten, securities of the same issuer are aggregated and, if held as depositary receipts, it is not so specified. This list excludes ETFs if held.

Top ten country weightings (% of net assets)

| | | | | | | | | | |

| | | |

Japan | | | 14.82 | | | United States | | | 6.80 | |

| | | |

Germany | | | 12.85 | | | Netherlands | | | 5.37 | |

| | | |

United Kingdom | | | 10.52 | | | Italy | | | 4.95 | |

| | | |

Switzerland | | | 9.44 | | | Spain | | | 4.93 | |

| | | |

France | | | 8.25 | | | China | | | 4.14 | |

16 SLOW AND STEADY WINS THE RACE

| | |

| |

Ariel Global Fund performance summary | | INCEPTION: 12/30/11 |

|

| | |

Rupal J. Bhansali

Portfolio manager

Composition of equity holdings (%)

| | | | |

| | | Ariel Global Fund | | MSCI

ACWI

Index |

Health Care | | 25.86 | | 11.86 |

Information Technology | | 17.04 | | 22.37 |

Financials | | 13.65 | | 14.59 |

Communication Services | | 12.46 | | 8.13 |

Consumer Staples | | 9.96 | | 6.89 |

Consumer Discretionary | | 8.18 | | 11.68 |

Utilities | | 4.89 | | 2.87 |

Real Estate | | 2.51 | | 2.72 |

Industrials | | 1.16 | | 9.52 |

Materials | | 0.00 | | �� 5.04 |

Energy | | 0.00 | | 4.33 |

Sector weightings for the Fund are calculated based on equity holdings as a percentage of total net assets. The sectors above are the Global Industry Classification Standard (“GICS”) sector classifications.

Average annual total returns (%) as of 3/31/2022

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Quarter | | | 1-year | | | 3-year | | | 5-year | | | 10-year | | | Since

inception | |

| | | | | | |

Ariel Global Fund–Investor Class | | | 0.11 | | | | 7.87 | | | | 8.53 | | | | 7.45 | | | | 8.00 | | | | 8.33 | |

| | | | | | |

Ariel Global Fund–Institutional Class | | | 0.11 | | | | 8.07 | | | | 8.79 | | | | 7.70 | | | | 8.27 | | | | 8.60 | |

MSCI ACWI Index (net) | | | -5.36 | | | | 7.28 | | | | 13.75 | | | | 11.64 | | | | 10.00 | | | | 10.95 | |

MSCI ACWI Value Index (net) | | | -0.95 | | | | 8.83 | | | | 9.02 | | | | 7.46 | | | | 7.64 | | | | 8.50 | |

Performance data quoted represents past performance and does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Any extraordinary performance shown for short-term periods may not be sustainable and is not representative of the performance over longer periods. To access performance data current to the most recent month-end, visit arielinvestments.com.

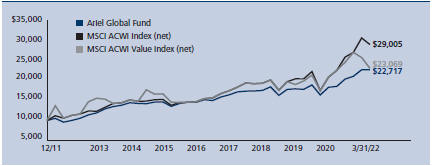

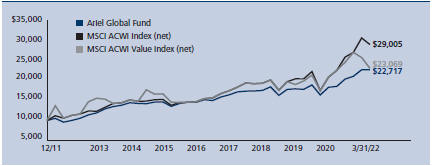

Growth of a $10,000 investment since inception (Investor Class)

The graph and performance table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | | | | | |

| Expense ratio (as of 9/30/21) | | Net | | | Gross | | | | |

Investor Class | | | 1.13 | % | | | 1.36% | | | | | |

Institutional Class | | | 0.88 | % | | | 0.95% | | | | | |

The net expense ratio reflects a contractual advisory fee waiver agreement effective through September 30, 2023. Prior to November 29, 2016, the fee waiver was 1.25% of net assets for the Investor Class and 1.00% for the Institutional Class, and, prior to February 1, 2014, the fee waiver was 1.40% for the Investor Class and 1.15% for the Institutional Class.

| | | | | | | | | | | | |

| Top ten companies (% of net assets) |

| | | | | | |

| 1. | | Microsoft Corp. | | 10.2 | | | | 6. | | Gilead Sciences, Inc. | | 5.0 |

| 2. | | Roche Holding AG | | 7.3 | | | | 7. | | Credicorp Ltd. | | 4.4 |

| 3. | | GlaxoSmithKline plc | | 6.1 | | | | 8. | | Johnson & Johnson | | 3.9 |

| 4. | | Philip Morris Intl, Inc. | | 5.6 | | | | 9. | | Endesa SA | | 3.3 |

| 5. | | Baidu, Inc. | | 5.3 | | | | 10. | | Deutsche Boerse AG | | 3.2 |

For the purposes of determining the Fund’s top ten, securities of the same issuer are aggregated and, if held as depositary receipts, it is not so specified. This list excludes ETFs if held.

| | | | | | | | | | |

Top ten country weightings (% of net assets) | | | | |

| | | |

United States | | | 36.29 | | | France | | | 5.12 | |

| | | |

Switzerland | | | 8.26 | | | Brazil | | | 4.51 | |

| | | |

United Kingdom | | | 7.94 | | | Peru | | | 4.35 | |

| | | |

China | | | 6.91 | | | Germany | | | 4.02 | |

| | | |

Japan | | | 6.73 | | | Spain | | | 3.33 | |

ARIELINVESTMENTS.COM 17

| | | | |

| |  | | John P. Miller, CFA® Senior Vice President Portfolio Manager |

One of the largest casino entertainment companies in the country, Boyd Gaming (NYSE: BYD) has served customers since 1975. Boyd owns and operates 28 gaming properties in 10 states across the U.S. In Nevada, the company is a market leader outside of the Las Vegas Strip, with 11 properties serving residents in the broader metropolitan area. Boyd prides itself on its proprietary approach to exceptional customer service and guest experience, which the company has coined: “Boyd Style.”

Ariel initiated a position in Boyd Gaming in December 2021. We believe the company is a solid operator with attractive fundamentals in a growing industry. It is rebounding from the pandemic with momentum, posting record operating results that have exceeded estimates. Additionally, Boyd’s successful expense-reduction initiatives have led to high margins, strong free cash flow and efficient debt reduction.

STRATEGIC FOOTPRINT

We view the Las Vegas Valley region as one of the most attractive global entertainment markets for investors. Boyd’s targeted marketing campaigns reach tourists from Hawaii, who account for more than half of the company’s reservations. Additionally, its Midwest and South properties include 17 land-based and dockside riverboat casinos across nine states. Despite high competition and regulatory uncertainty, these geographies continue to drive impressive results for Boyd.

ATTRACTIVE BALANCE SHEET

Ariel applauds the Boyd management team for its enhanced focus on: improving operating profitability; creating strong recurring cash flow; and implementing effective cost-reduction programs. The company’s financial leverage has declined significantly from pre-pandemic levels, following an effective effort to strengthen its balance sheet and capital structure. While its net debt surged during the

pandemic to 7.3x operating cash flow in 2020, Boyd ended 2021 with leverage at less than 2.2x. The company’s debt was recently upgraded by one of the major rating agencies. Boyd’s enhanced profit outlook, solid free cash flow and improved financial leverage metrics have enabled its leadership to aggressively repurchase shares under a new program and to reinstate its quarterly dividend to an amount more than double its pre-pandemic level.

SEASONED MANAGEMENT TEAM

The company’s leaders bring extensive industry experience and a long history of collaboration. Bill Boyd, Co-Executive Chair of the Board, co-founded Boyd Gaming with his father, the legendary casino developer, Sam Boyd. The Boyd family owns 26% of the company. Keith Smith, President and Chief Executive Officer, and Steve Thompson, Executive Vice President of Operations for the Nevada region, joined the business over three decades ago. Ted Bogich, Executive Vice President of Operations, will be celebrating his 30th anniversary in two years. Ariel’s investment team has built a relationship with Boyd’s Chief Financial Officer, Josh Hirsberg, since his previous role as Treasurer of Caesars Entertainment over 15 years ago. Hirsberg and his colleagues exhibit a passion for the business, and are transparent and aligned with Boyd shareholders.

At its current price, we see Boyd as a compelling investment. Gaming—especially from slot play at casinos—is a more consistent source of long-term profitability, compared to food, beverage and hotel rooms. We believe the gaming segment will continue to be a significant portion of Boyd’s future revenues. Additionally, we believe that Boyd’s strategic partnerships (e.g., a 5% equity ownership in sports betting and online casino company, FanDuel Group) will provide more upside to the company’s valuation.

As of March 31, 2022, shares traded at $65.78, a 24% discount to our private market value of $87.

18 SLOW AND STEADY WINS THE RACE

| | | | |

| |  | | Aaron Diaz Bianco, JD/CFA® Research Analyst |

Masco Corporation (NYSE: MAS) is a leading global designer, manufacturer and distributor of home improvement and building products. For nearly a century, Masco has offered a robust family of brands from its Livonia, Michigan headquarters. Despite rising interest rates and fears of a housing slowdown, Masco is well-positioned to leverage several tailwinds for long-term growth. These include: the company’s recent divestitures; strong brand recognition; and demographic trends driving increased consumer interest.

MARKET LEADERSHIP ACROSS MULTIPLE SALES CHANNELS

Masco’s portfolio of brands includes: Behr®, Delta®, Hansgrohe®, AXOR® and KILZ®. The company’s scale and product mix across design, manufacturing, and distribution make it the ideal provider for two segments. Masco’s global presence and variety of services meet the needs of large retailers. Its luxury brands serve customers in the specialty channel. This unique combination has fostered strong organic growth. For example, Masco’s strategic partnership with Home Depot has created significant income from the professional painter audience—starting with immaterial revenues in 2010 to over $700 million in 2021.

REFINED BRAND PORTFOLIO IS A COMPETITIVE ADVANTAGE

Rising interest rates have recently battered Masco’s shares, and the long shadow of the 2008-2009 financial crisis still challenges many companies with exposure to the housing market. However, Masco has made strategic changes to its portfolio, making it more resilient.

Masco recently sold its business lines that suffered most during the downturn. This enabled the company to focus on the brands that outperformed during the crisis. Its recently divested businesses—high-priced cabinetry, windows and specialty product lines—experienced a 68% peak-to-trough decline in sales in 2008-2009. This caused the businesses’ total operating margins to drop from the

mid-teens to -35%. Comparatively, Masco’s plumbing and decorative product brands—which comprise the current portfolio post-divestiture—saw a peak-to-trough revenue decline of -15% during the recession. While operating margins briefly fell from the low-teens to the high single-digits, they remained positive for these segments during this time period.

DEMOGRAPHIC SHIFTS FUEL GROWTH OPPORTUNITY

The pivotal demographic transition impending in the U.S. is a key growth driver. The Baby Boomer generation (born 1946-1964) can be expected to increase home improvement spending—whether they age-in-place, downsize or relocate. Generation X (born 1965-1980) are expected to upgrade their homes as their families grow. The “millennial” generation (born 1981-1996) is as large as the Baby Boomer population and can be expected to drive demand for new homes. On their heels is the largest cohort in U.S. history: Generation Z (born 1997-2012).

These shifts are occurring while housing is experiencing substantial wear-and-tear due to under-building during the 2010s. In the last decade, single-family home construction per million U.S. inhabitants slowed to half the rate of the prior five decades. This presents revenue opportunity for Masco’s brands.

Investor fears of a housing slowdown and under-appreciation for Masco’s recent business transformation have created a discount to our estimate of the company’s intrinsic value. In our view, shareholders who understand the company’s refined product portfolio will ultimately benefit from a category leader with scale, pricing power, relatively low capital requirements and a prudent capital allocation strategy. Masco should experience modest margin improvements through cost productivity and volume leverage. We believe Masco’s management team should have ample free cash flow to allocate in the future.

As of March 31, 2022, shares traded at $51.00, a 30% discount to our private market value of $72.87.

ARIELINVESTMENTS.COM 19

| | | | |

| |  | | Jamil Soriano Vice President, Research |

Founded in 1937 and based in Mayfield, Ohio, Progressive Corporation (NYSE: PGR) is one of the largest property and casualty automobile insurers in the United States. While Progressive is best known as a leader in personal car and truck coverage, the company also holds a strong position in the commercial auto market. Recently, Progressive acquired American Strategic Insurance Corporation, marking its first expansion into homeowners’ insurance. The company now offers a bundled home and automobile solution, distributing policies through digital direct-to-consumer channels and a vast network of over 30,000 independent agents. This updated model is difficult to replicate and strengthens Progressive’s competitive position.

BRAND MATTERS

Progressive stands out against peers due to its size, brand recognition, scale and underwriting expertise. Its sizable marketing budget keeps the company ahead of smaller players in a crowded direct-to-consumer market. Avid television watchers are likely familiar with “Flo,” Progressive’s comedic fictional saleswoman and advertising fixture for over a decade. The company also leverages superior data analytics to fuel sales and marketing innovation. For example, Progressive was the first insurer to use telematics – a method of monitoring automobiles using GPS technology to more accurately price policies and target customers. Since then, the company has developed industry-leading capabilities in collecting and analyzing this data. Progressive’s peers that lag in this area are more likely to experience underwriting losses. The company’s approach to data, combined with its strong brand identity provide distinct competitive advantages. For Progressive, these factors have yielded best-in-class results – both in losses to premiums earned and in return on equity.

POLICY RATE CHANGES TO OFFSET HEADWINDS

The company performed well in the early months of the COVID-19 pandemic. During widespread lockdowns, there were fewer drivers on the road. This meant less car accidents and insurance claims. These trends drove solid profitability and share price performance for Progressive. In the past year, drivers have returned to the roads, resulting in more accidents and claims. Strained global supply chains and inflation have made it more expensive to repair damaged vehicles, increasing payouts to customers. Progressive and other insurers have applied to state regulators for an increase to their policy rates to combat these margin headwinds. Although pricing changes may take time to materialize, the proposed increases should offset inflationary pressures on the industry and the company’s profitability should rebound in the long-term.

PRICING POWER REMAINS

Despite recent challenges, Ariel’s positive outlook on Progressive remains unchanged. The market agrees and the stock has outperformed, which is attributable to the company’s proactive pricing changes in a rising policy rate environment. Progressive’s larger scale and superior customer acquisition resources enable quicker pricing actions and ultimately faster shareholder returns than its peers. The company’s margins have already begun to stabilize over the last several months, indicating that its new rate strategy has succeeded. Progressive is prepared to navigate the moment. Insurance is a non-discretionary purchase for all vehicle and home owners, no matter what challenges the market may bring.

As of March 31, 2022, shares trade at $114, which is closing in on our estimated private market value of $116.23.

20 SLOW AND STEADY WINS THE RACE

| | |

Schedules of investments | | 03/31/22 (UNAUDITED) |

|

| | |

Ariel Fund | | |

| | | | | | | | |

| Number of Shares | | | | Common Stocks—96.34% | | Value |

| | | |

| | | | Consumer Discretionary—35.78% | | | | |

| | | |

2,311,606 | | | | Madison Square Garden Entertainment Corp.(a) | | | $192,579,896 | |

| | | |

3,952,668 | | | | Paramount Global | | | 149,450,377 | |

| | | |

4,063,521 | | | | Adtalem Global Education, Inc.(a)(b) | | | 120,727,209 | |

| | | |

5,233,168 | | | | Mattel, Inc.(a) | | | 116,228,661 | |

| | | |

3,309,681 | | | | Gentex Corp. | | | 96,543,395 | |

| | | |

511,197 | | | | Madison Square Garden Sports Corp.(a) | | | 91,688,294 | |

| | | |

1,385,115 | | | | Boyd Gaming Corp. | | | 91,112,865 | |

| | | |

2,519,813 | | | | Interpublic Group of Cos., Inc. | | | 89,327,371 | |

| | | |

5,839,506 | | | | Manchester United plc | | | 84,497,652 | |

| | | |

699,919 | | | | Royal Caribbean Cruises Ltd.(a) | | | 58,639,214 | |

| | | |

1,775,040 | | | | Nielsen Holdings plc | | | 48,352,090 | |

| | | | | | | | |

| | | | | | | 1,139,147,024 | |

| | | | | | | | |

| | | |

| | | | Consumer Staples—2.91% | | | | |

| | | |

684,955 | | | | J.M. Smucker Co. | | | 92,749,756 | |

| | | | | | | | |

| | | |

| | | | Energy—2.91% | | | | |

| | | |

2,926,476 | | | | Core Laboratories NV(b) | | | 92,564,436 | |

| | | | | | | | |

| | | |

| | | | Financials—19.36% | | | | |

| | | |

3,541,554 | | | | Lazard Ltd., Class A | | | 122,183,613 | |

| | | |

901,127 | | | | Northern Trust Corp. | | | 104,936,239 | |

| | | |

918,854 | | | | BOK Financial Corp. | | | 86,326,333 | |

| | | |

1,239,905 | | | | First American Financial Corp. | | | 80,370,642 | |

| | | |

568,624 | | | | Affiliated Managers Group, Inc. | | | 80,147,553 | |

| | | |

1,299,885 | | | | KKR & Co., Inc. | | | 76,004,276 | |

| | | |

1,903,797 | | | | Janus Henderson Group plc | | | 66,670,971 | |

| | | | | | | | |

| | | | | | | 616,639,627 | |

| | | | | | | | |

| | | |

| | | | Health Care—6.58% | | | | |

| | | |

1,910,485 | | | | Envista Holdings Corp.(a) | | | 93,059,724 | |

| | | |

285,500 | | | | Laboratory Corp. of America Holdings(a) | | | 75,274,930 | |

| | | |

75,945 | | | | Charles River Laboratories Intl, Inc.(a) | | | 21,566,102 | |

| | | |

34,781 | | | | Bio-Rad Laboratories, Inc.(a) | | | 19,589,703 | |

| | | | | | | | |

| | | | | | | 209,490,459 | |

| | | | | | | | |

| | | |

| | | | Industrials—20.72% | | | | |

| | | |

835,901 | | | | Mohawk Industries, Inc.(a) | | | 103,818,904 | |

| | | |

3,799,809 | | | | Resideo Technologies, Inc.(a) | | | 90,549,448 | |

| | | |

3,431,959 | | | | Axalta Coating Systems, Ltd.(a) | | | 84,357,552 | |

| | | |

10,325,388 | | | | ADT, Inc. | | | 78,369,695 | |

| | | |

2,738,532 | | | | Kennametal, Inc. | | | 78,349,400 | |

| | | |

365,463 | | | | Snap-on, Inc. | | | 75,095,337 | |

| | | |

1,322,197 | | | | Masco Corp. | | | 67,432,047 | |

| | | |

175,675 | | | | Keysight Technologies, Inc.(a) | | | 27,751,380 | |

| | | |

252,747 | | | | Simpson Manufacturing Co., Inc. | | | 27,559,533 | |

| | | |

63,674 | | | | Zebra Technologies Corp.(a) | | | 26,341,934 | |

| | | | | | | | |

| | | | | | | 659,625,230 | |

| | | | | | | | |

| | | |

| | | | Real Estate—5.28% | | | | |

| | | |

446,702 | | | | JLL(a) | | | 106,967,261 | |

| | | |

668,303 | | | | CBRE Group, Inc., Class A(a) | | | 61,163,091 | |

| | | | | | | | |

| | | | | | | 168,130,352 | |

| | | | | | | | |

| | | |

| | | | Utilities—2.80% | | | | |

| | | |

1,516,457 | | | | Stericycle, Inc.(a) | | | 89,349,646 | |

| | | | | | | | |

| | | | Total Common Stocks (Cost $2,147,018,608) | | | 3,067,696,530 | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

ARIELINVESTMENTS.COM 21

| | |

Schedules of investments | | 03/31/22 (UNAUDITED) |

|

Ariel Fund (continued) | | |

| | | | | | | | |

| Number of Shares | | | | Short-Term Investments—3.93% | | Value |

| | | |

124,988,177 | | | | Northern Institutional Treasury Portfolio, 0.12%(c) | | | $124,988,177 | |

| | | | | | | | |

| | | | Total Short-Term Investments (Cost $124,988,177) | | | 124,988,177 | |

| | | | | | | | |

| | | |

| | | | Total Investments—100.27% (Cost $2,272,006,785) | | | 3,192,684,707 | |

| | | |

| | | | Other Assets less Liabilities—(0.27)% | | | (8,616,922 | ) |

| | | | | | | | |

| | | |

| | | | Net Assets—100.00% | | | $3,184,067,785 | |

| | | | | | | | |

| | | | | | | | |

Ariel Appreciation Fund | | | | |

| | | | |

| Number of Shares | | | | Common Stocks—96.35% | | Value |

| | | |

| | | | Consumer Discretionary—27.10% | | | | |

| | | |

715,155 | | | | Madison Square Garden Entertainment Corp.(a) | | | $59,579,563 | |

| | | |

2,315,037 | | | | Mattel, Inc.(a) | | | 51,416,972 | |

| | | |

906,814 | | | | BorgWarner, Inc. | | | 35,275,065 | |

| | | |

343,584 | | | | Omnicom Group, Inc. | | | 29,163,410 | |

| | | |