As filed with the Securities and Exchange Commission on May 24, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-4786

Ariel Investment Trust

(Exact name of registrant as specified in charter)

200 East Randolph Street

Suite 2900

Chicago, Illinois, 60601

(Address of principal executive offices) (Zip code)

Emma Rodriguez-Ayala, Esq.

200 East Randolph Street

Suite 2900

Chicago, Illinois 60601

(Name and address of agent for service)

with a copy to:

Arthur Don, Esq.

Greenberg Traurig, LLP

77 West Wacker Drive

Suite 3100

Chicago, IL 60601

Registrant’s telephone number, including area code: (312) 726-0140

Date of fiscal year end: September 30

Date of reporting period: March 31, 2023

Item 1. Reports to Stockholders.

(a) The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “Act”) (17 CFR 270.30e-1):

SEMI-ANNUAL REPORT March 31 | 2023

Ariel Investment Trust c/o U.S. Bank Global Fund Services P.O. Box 701 Milwaukee, WI 53201-0701 800.292.7435 • arielinvestments.com • linkedin.com/company/ariel-investments • instagram.com/arielinvestments • twitter.com/arielinvests

| | | | | | |

| | |  | | | | Ariel Fund Ariel Appreciation Fund |

| | | | |

| | | | As of March 31, 2023 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Average Annual Total Returns (%) | |

| | | | | | |

| | | Quarter | | 1-Year | | 3-Year | | 5-Year | | 10-Year | | Since

Inception* |

| | | | | | |

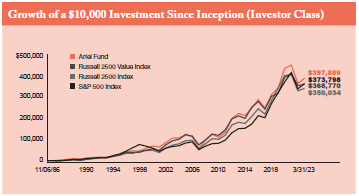

Ariel Fund | | | | 6.66 | | | | | -8.74 | | | | | 24.18 | | | | | 5.80 | | | | | 9.06 | | | | | 10.65 | |

| | | | | | |

Russell 2500 Value Index | | | | 1.40 | | | | | -10.53 | | | | | 21.82 | | | | | 5.61 | | | | | 7.72 | | | | | 10.42 | |

| | | | | | |

Russell 2500 Index | | | | 3.39 | | | | | -10.39 | | | | | 19.43 | | | | | 6.65 | | | | | 9.07 | | | | | 10.26 | |

| | | | | | |

S&P 500 Index | | | | 7.50 | | | | | -7.73 | | | | | 18.62 | | | | | 11.19 | | | | | 12.24 | | | | | 10.46 | |

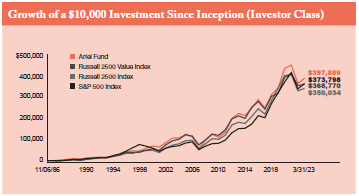

* The inception date for Ariel Fund is 11/06/86. | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Average Annual Total Returns (%) | |

| | | | | | |

| | | Quarter | | 1-Year | | 3-Year | | 5-Year | | 10-Year | | Since

Inception* |

| | | | | | |

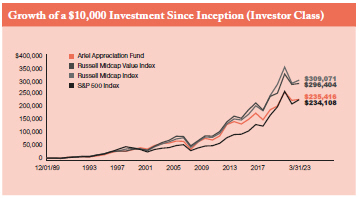

Ariel Appreciation Fund | | | | 1.72 | | | | | -6.66 | | | | | 20.63 | | | | | 5.32 | | | | | 7.94 | | | | | 9.94 | |

| | | | | | |

Russell Midcap Value Index | | | | 1.32 | | | | | -9.22 | | | | | 20.71 | | | | | 6.54 | | | | | 8.80 | | | | | 10.70 | |

| | | | | | |

Russell Midcap Index | | | | 4.06 | | | | | -8.78 | | | | | 19.21 | | | | | 8.06 | | | | | 10.05 | | | | | 10.84 | |

| | | | | | |

S&P 500 Index | | | | 7.50 | | | | | -7.73 | | | | | 18.62 | | | | | 11.19 | | | | | 12.24 | | | | | 9.92 | |

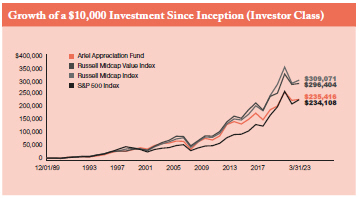

* The inception date for Ariel Appreciation Fund is 12/01/89.

Dear Fellow Shareholder: The positive quarter-end gains posted by U.S. stocks as of March 31, 2023, masked an increasingly volatile undercurrent fueled by the unintended consequences of rising interest rates which affected everything from regional banks to money market funds and tech shares. Despite the erratic backdrop, Ariel Fund performed well, meaningfully outperforming its primary and secondary benchmarks. This portfolio was buoyed by strong returns among our holdings in Consumer Discretionary, Financials and Industrials. These names easily overcame marginal weakness in the Real Estate, Basic Materials and Technology sectors where our weightings significantly trail those of our value benchmarks. Meanwhile, Ariel Appreciation Fund edged out the Russell Midcap Value Index but fell short of the secondary Russell Midcap Index. When compared to the value benchmark, strong stock

picking in the Consumer Discretionary sector was dampened by our Financials overweight, which was the worst-performing sector in the index.

Unintended Consequences—Regional Banks in Crisis

To tame stimulus-induced inflation, the Federal Reserve began the tedious effort of raising interest rates on March 2, 2022. They started slowly with a +0.25% move that immediately stepped up to +0.50% by May—with three consecutive +0.75% hikes in quick succession in July, September and November. By year-end, a +0.50% increase began to signal a shift, with two less aggressive +0.25% nudges this February and March. With the economy cooling and inflation decelerating, The Wall Street Journal noted,

Performance data quoted represents past performance. Past performance does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains and represents returns of the Investor Class shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Any extraordinary performance shown for short-term periods may not be sustainable and is not representative of the performance over longer periods. Performance data current to the most recent month-end for Ariel Fund and Ariel Appreciation Fund may be obtained by visiting our website, arielinvestments.com.

| | |

| SLOW AND STEADY WINS THE RACE | | 3 |

“…many bet that would lead the Federal Reserve to switch quickly from raising interest rates to cutting them.“1 All seemed well.

And then a banking crisis came out of nowhere. Silicon Valley Bank (SVB), the 16th largest bank in the country, suffered a bank run and became the second-largest bank failure in U.S. history. Given the tech industry concentration, the bank’s demise was as fast as any viral phenomenon on the internet. A run that started on a Thursday ended when the bank was taken into receivership and did not re-open on Monday. With investors and the market on edge, the U.S. Treasury, Federal Reserve and FDIC issued a late Sunday joint press release guaranteeing SVB’s $209 billion in deposits—even those with account values over the $250,000 insured limit. That tripartite move helped, but did not stop the domino effect. Just two days later, Signature Bank became the third-largest bank failure ever in the United States. With financial stocks getting hit hard and confidence quickly eroding, big banks took matters into their own hands— raising $30 billion in deposits amongst themselves to stabilize the next weakest link, First Republic Bank (FRC).

While many agree some structural misses contributed to the recent bank failures—including industry and customer concentrations as well as less robust regulation for regional players—the bigger culprit was the banks’ supposedly safe fixed income securities known as their hold to maturity portfolios (HTM). As interest rates rose, these bond issues were quickly devalued and would need to be marked to today’s sagging prices to fund an avalanche of deposit outflows. It is worth noting that were these bonds held to maturity as intended, they would be paid out at “par” or 100% of their paper value. In short, the Fed’s recent rate hikes drove the need for more capital as bond prices fell and account holders fled. In the absence of that capital, SVB and Signature are gone. In Europe, Credit Suisse was hastily absorbed by its country cousin, UBS Group AG, with special dispensation from the Swiss government. And, First Republic was just acquired by JPMorgan Chase (NYSE: JPM).

As these banks were teetering, the biggest banks in the U.S. were working around the clock to digest a rush of new customers. Unlike the 2008-09 crisis, the health of the overall banking industry is not in question. Large bank balance

sheets have been stress tested for the most extreme conditions and are in great shape. And yet, regional banks in need of more capital remain under a cloud despite being the “essential workers” when it comes to lending to local communities. Plus, that lending is likely to tighten given growing capital requirements. As a result of a stingier credit environment, some of the biggest losers are expected to be the commercial real estate developers who need regular financing and subsequent refinancing. Another unintended consequence.

It is worth noting that our sole regional bank, Tulsa-based BOK Financial (BOKF), traded down in the recent financial sell off. While we believe government actions were well constructed and have proven effective in staving off more contagion, we acknowledge BOKF may be impacted by reduced earnings in the near-to-medium term. That said, asset quality remains sturdy as the company continues to exhibit solid loan growth, healthy net interest margins, strong capital levels and balance sheet liquidity. We therefore continue to believe BOKF remains well positioned for long-term success given its high underwriting standards, proven credit discipline, diversified business model and experienced management team.

Unintended Consequences—Popularity at Opposite Ends of the Risk Spectrum

Just as rising interest rates are settling in, “…investors are wagering that a general slowdown and tighter lending conditions stemming from the turmoil in the banking sector will force the Federal Reserve to loosen monetary policy sooner than expected.”2 These contrasting factors—today’s higher rates and the prospect of lower future rates—are driving two disparate and increasingly crowded trades: one into money market funds and the other into large company tech shares. With yields now in excess of 4%, “Investors have added $336 billion to U.S. money market funds this year…a shift from last year when the funds suffered nearly $46 billion in outflows.”3 Meanwhile, in a falling interest rate environment, investors are more willing to pay up for future earnings. Growth stocks that trade at higher multiples of earnings suddenly look more attractive. As such, 2022’s downtrodden technology shares are now amongst some of 2023’s biggest winners—driving up the tech heavy Nasdaq composite which soared +17% in the first quarter.

1 Otani, Akane. “Stocks Cap Wild Quarter to Notch Big Gains.” The Wall Street Journal. April 1-2, 2023. Page A1.

2 Pitcher, Jack. “Stocks Mostly Fall on Slowdown Fears.” The Wall Street Journal. April 6, 2023. Page B11.

3 Ge Huang, Vicky. “Tech, Money-Market Funds are Havens.” The Wall Street Journal. April 3, 2023. Page B9.

| | |

| 4 | | SLOW AND STEADY WINS THE RACE |

Looking Forward

Should rates fall, our value bias and underweight to the tech sector could be a drag on our near-term results. Still, with technology stocks now “trading at 24.7 times projected earnings over the next 12 months, while the broader index has a multiple of 18.2,” these stocks remain pricey, which could dampen their future ascent.4 Meanwhile, “value stocks are ‘dirt cheap’ relative to growth, now more discounted than they have been four-fifths of the time in the U.S. stock market history, according to Rob Arnott, founder and chairman of Research Affiliates.“5 It is also worth acknowledging that when inflation is elevated, value tends to outperform growth since higher levels of near-term cash flow are worth more today than in the future.

While monetary policy is driving recent market volatility, we remain focused on bottom-up stock picking. As the market swings from one scenario to another, our sole consideration of recent events and macroeconomic developments is to consider their effect on the long-term intrinsic worth of our names over the next five-to-ten years. Given our “slow and steady” approach, we remain confident in our portfolio positioning, especially with our small and mid cap portfolios trading at a discount to their respective value indices. With Ariel Fund selling at a -34.2% discount to our estimate of private market value (PMV) and Ariel Appreciation Fund at a -29.8% discount—our portfolios are on sale and poised to benefit as their full potential is realized over time.6 Looking ahead, we firmly believe the actively patient investor that consistently owns differentiated businesses with robust balance sheets will likely achieve strong returns over the long run.

“While monetary policy is driving recent market volatility, we remain focused on bottom-up stock picking.”

Portfolio Comings and Goings

In Ariel Fund, we initiated a position in Leslie’s Inc. (LESL), the leading direct-to-consumer pool and spa care services company in the U.S. Shares recently sold off on near-term operational issues as well as concerns around

the sustainability of the company’s growth profile in a normalized, post-pandemic environment. Although new pool installments will likely slow down, the install base has materially increased and approximately 80% of Leslie’s business is tied to recurring maintenance. We did not exit any holdings in the period.

In Ariel Appreciation Fund, we initiated a position in long-time Ariel holding Jones Lang LaSalle, also known as JLL (JLL), which is a leading professional services firm that specializes in real estate and investment management. Although the first half of 2023 will likely be choppy given macro-uncertainty, the company’s leadership is highly confident about the medium- and longer-term revenue outlook for both transactional and recurring revenue streams. JLL is also making efforts to streamline operations and increase efficiencies to generate higher profit over time. We successfully sold personal auto insurer, Progressive Corporation (PGR) as it surpassed our estimate of private market value.

As always, we appreciate the opportunity to serve you and welcome any questions or comments you might have.

Sincerely,

| | |

| |  |

John W. Rogers, Jr. Chairman and Co-CEO | | Mellody Hobson Co-CEO and President |

| | 4 | Singh, Hardika. “S&P’s Resilience Amid Turmoil is Due to Tech.” The Wall Street Journal. April 4, 2023. Page B10. | |

| | 5 | Wallerstein, Eric. “Stocks Haven’t Looked This Ugly In Years.” The Wall Street Journal. April 4, 2023. Page A1. | |

| | 6 | Discount to Private Market Value is the percentage discount the portfolio’s holdings trade relative to Ariel Investments’ internal estimate of the portfolio’s holdings’ private market value (PMV). There is no guarantee that the companies we invest in will achieve our PMV. | |

| | |

| SLOW AND STEADY WINS THE RACE | | 5 |

| | | | | | |

| | | Performance Summary | | | | Ariel Fund |

| | | | |

| | | | As of March 31, 2023 |

Inception: November 6, 1986

| | | | | | | | | | | | | | | | |

|

Composition of Equity Holdings (%) | |

| | | | |

| | | Ariel

Fund | | | Russell

2500 Value

Index | | | Russell

2500

Index | | | S&P 500 Index |

| | | | |

Consumer Discretionary | | | 38.19 | | | | 15.48 | | | | 15.13 | | | | 13.93 | |

| | | | |

Industrials | | | 25.94 | | | | 19.10 | | | | 20.99 | | | | 12.55 | |

| | | | |

Financials | | | 18.63 | | | | 19.48 | | | | 14.35 | | | | 9.86 | |

| | | | |

Health Care | | | 5.45 | | | | 8.40 | | | | 12.26 | | | | 13.55 | |

| | | | |

Real Estate | | | 4.17 | | | | 11.24 | | | | 7.76 | | | | 2.64 | |

| | | | |

Energy | | | 2.87 | | | | 4.99 | | | | 5.44 | | | | 4.80 | |

| | | | |

Utilities | | | 2.33 | | | | 4.63 | | | | 3.45 | | | | 3.12 | |

| | | | |

Consumer Staples | | | 1.59 | | | | 2.86 | | | | 3.08 | | | | 6.00 | |

| | | | |

Basic Materials | | | 0.00 | | | | 5.21 | | | | 4.48 | | | | 1.95 | |

| | | | |

Technology | | | 0.00 | | | | 7.16 | | | | 11.64 | | | | 28.97 | |

| | | | |

Telecommunications | | | 0.00 | | | | 1.44 | | | | 1.42 | | | | 2.62 | |

| | | | |

Short-Term Investments | | | 0.58 | | | | 0.00 | | | | 0.00 | | | | 0.00 | |

Industry weightings are calculated based on equity holdings as a percentage of total net assets. Holdings are categorized according to the Russell Industry Classification Benchmark (ICB). Holdings not classified by ICB are categorized according to FactSet classification. Source: FactSet.

| | | | | | | | | | | | | | | | | | | | | | |

|

Average Annual Total Returns (%) |

| | | | | | |

| | | Quarter | | | 1-Year | | | 3-Year | | | 5-Year | | | 10-Year | | | Since Inception |

| | | | | | |

Ariel Fund-Investor Class | | | 6.66 | | | | -8.74 | | | | 24.18 | | | | 5.80 | | | | 9.06 | | | 10.65 |

| | | | | | |

Ariel Fund-Institutional Class* | | | 6.75 | | | | -8.45 | | | | 24.57 | | | | 6.14 | | | | 9.39 | | | 10.76 |

| | | | | | |

Russell 2500 Value Index | | | 1.40 | | | | -10.53 | | | | 21.82 | | | | 5.61 | | | | 7.72 | | | 10.42 |

| | | | | | |

Russell 2500 Index | | | 3.39 | | | | -10.39 | | | | 19.43 | | | | 6.65 | | | | 9.07 | | | 10.26 |

| | | | | | |

S&P 500 Index | | | 7.50 | | | | -7.73 | | | | 18.62 | | | | 11.19 | | | | 12.24 | | | 10.46 |

Performance data quoted represents past performance and does not guarantee future results. It includes the reinvestment of dividends and capital gains. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To access performance data as of the most recent month-end, visit arielinvestments.com. Any extraordinary short-term performance may not be sustainable and is not representative of the performance over longer periods. Annual Average Total Return does not reflect a maximum of 4.75% sales load charged prior to 7/15/94.

The graph and performance table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | |

|

Expense Ratio (as of September 30, 2022) | |

| | | | | |

| |

Investor Class | | | 0.98% | |

| |

Institutional Class | | | 0.67% | |

| | | | | | | | | | | | | | |

|

Top Ten Equity Holdings (% of net assets) | |

| | | | | |

| 1 | | Madison Square Garden Entertainment Corporation | | | 5.81 | | | 6 | | Mohawk Industries, Inc. | | | 3.63 | |

| | | | | |

| 2 | | Boyd Gaming Corporation | | | 4.24 | | | 7 | | Paramount Global | | | 3.61 | |

| | | | | |

| 3 | | Royal Caribbean Cruises, Ltd. | | | 4.23 | | | 8 | | Adtalem Global Education, Inc. | | | 3.51 | |

| | | | | |

| 4 | | Interpublic Group of Companies, Inc. | | | 3.93 | | | 9 | | Affiliated Managers Group, Inc. | | | 3.45 | |

| | | | | |

| 5 | | Zebra Technologies Corporation | | | 3.83 | | | 10 | | Mattel, Inc. | | | 3.43 | |

| | * | The inception date for the Institutional Class shares is December 30, 2011. Performance information for the Institutional Class prior to that date reflects the actual performance of the Fund’s Investor Class (and uses the actual expenses of the Fund’s Investor Class, for such period of time), without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses, which are primarily differences in distribution and service fees. | |

| | |

| 6 | | SLOW AND STEADY WINS THE RACE |

| | | | | | |

| | | Performance Summary | | | | Ariel Appreciation Fund |

| | | | |

| | | | As of March 31, 2023 |

Inception: December 1, 1989

| | | | | | | | | | | | | | | | |

|

Composition of Equity Holdings (%) | |

| | | | |

| | | Ariel

Appreciation

Fund | | | Russell

Midcap

Value

Index | | | Russell

Midcap

Index | | | S&P 500

Index | |

| | | | |

Consumer Discretionary | | | 27.37 | | | | 14.10 | | | | 16.46 | | | | 13.93 | |

| | | | |

Financials | | | 23.60 | | | | 16.26 | | | | 12.44 | | | | 9.86 | |

| | | | |

Industrials | | | 21.59 | | | | 18.32 | | | | 19.14 | | | | 12.55 | |

| | | | |

Health Care | | | 11.68 | | | | 7.41 | | | | 10.15 | | | | 13.55 | |

| | | | |

Consumer Staples | | | 4.99 | | | | 4.69 | | | | 4.28 | | | | 6.00 | |

| | | | |

Energy | | | 3.49 | | | | 5.42 | | | | 5.30 | | | | 4.80 | |

| | | | |

Real Estate | | | 2.94 | | | | 10.79 | | | | 7.55 | | | | 2.64 | |

| | | | |

Utilities | | | 2.05 | | | | 9.59 | | | | 6.17 | | | | 3.12 | |

| | | | |

Basic Materials | | | 0.00 | | | | 4.57 | | | | 3.79 | | | | 1.95 | |

| | | | |

Technology | | | 0.00 | | | | 7.25 | | | | 13.16 | | | | 28.97 | |

| | | | |

Telecommunications | | | 0.00 | | | | 1.60 | | | | 1.54 | | | | 2.62 | |

| | | | |

Short-Term Investments | | | 2.62 | | | | 0.00 | | | | 0.00 | | | | 0.00 | |

Industry weightings are calculated based on equity holdings as a percentage of total net assets. Holdings are categorized according to the Russell Industry Classification Benchmark (ICB). Holdings not classified by ICB are categorized according to FactSet classification. Source: FactSet.

| | | | | | | | | | | | | | | | | | | | | | |

|

Average Annual Total Returns (%) |

| | | | | | |

| | | Quarter | | | 1-Year | | | 3-Year | | | 5-Year | | | 10-Year | | | Since Inception |

| | | | | | |

Ariel Appreciation Fund-Investor Class | | | 1.72 | | | | -6.66 | | | | 20.63 | | | | 5.32 | | | | 7.94 | | | 9.94 |

| | | | | | |

Ariel Appreciation Fund-Institutional Class* | | | 1.79 | | | | -6.37 | | | | 21.00 | | | | 5.65 | | | | 8.28 | | | 10.06 |

| | | | | | |

Russell Midcap Value Index | | | 1.32 | | | | -9.22 | | | | 20.71 | | | | 6.54 | | | | 8.80 | | | 10.70 |

| | | | | | |

Russell Midcap Index | | | 4.06 | | | | -8.78 | | | | 19.21 | | | | 8.06 | | | | 10.05 | | | 10.84 |

| | | | | | |

S&P 500 Index | | | 7.50 | | | | -7.73 | | | | 18.62 | | | | 11.19 | | | | 12.24 | | | 9.92 |

Performance data quoted represents past performance and does not guarantee future results. It includes the reinvestment of dividends and capital gains. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To access performance data as of the most recent month-end, visit arielinvestments.com. Any extraordinary short-term performance may not be sustainable and is not representative of the performance over longer periods. Annual Average Total Return does not reflect a maximum 4.75% sales load charged prior to 7/15/94.

The graph and performance table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Total return does not reflect a maximum 4.75% sales load charged prior to 7/15/94.

| | | | |

| |

Expense Ratio (as of September 30, 2022) | | | | |

| | | | | |

| |

Investor Class | | | 1.10% | |

| |

Institutional Class | | | 0.79% | |

| | | | | | | | | | | | | | |

|

Top Ten Equity Holdings (% of net assets) | |

| | | | | |

1 | | Goldman Sachs Group, Inc. | | | 4.11 | | | 6 | | Mattel, Inc. | | | 3.24 | |

| | | | | |

2 | | Northern Trust Corporation | | | 4.00 | | | 7 | | Interpublic Group of Companies, Inc. | | | 3.24 | |

| | | | | |

3 | | Laboratory Corporation of America Holdings | | | 3.61 | | | 8 | | Kennametal, Inc. | | | 3.11 | |

| | | | | |

4 | | BorgWarner, Inc. | | | 3.60 | | | 9 | | Axalta Coating Systems, Ltd. | | | 3.05 | |

| | | | | |

5 | | Madison Square Garden Entertainment Corporation | | | 3.28 | | | 10 | | CarMax, Inc. | | | 2.97 | |

| | * | The inception date for the Institutional Class shares is December 30, 2011. Performance information for the Institutional Class prior to that date reflects the actual performance of the Fund’s Investor Class (and uses the actual expenses of the Fund’s Investor Class, for such period of time), without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses, which are primarily differences in distribution and service fees. | |

| | |

| SLOW AND STEADY WINS THE RACE | | 7 |

| | | | | | |

| | |  | | | | Ariel Focus Fund |

| | | | |

| | | | As of March 31, 2023 |

| | | | | | | | | | | | | | | | | | | | | | | | |

|

Average Annual Total Returns (%) | |

| | | | | | |

| | | Quarter | | | 1-Year | | | 3-Year | | | 5-Year | | | 10-Year | | | Since Inception* | |

| | | | | | |

Ariel Focus Fund | | | 0.35 | | | | -12.39 | | | | 20.69 | | | | 5.31 | | | | 7.36 | | | | 5.78 | |

| | | | | | |

Russell 1000 Value Index | | | 1.01 | | | | -5.91 | | | | 17.94 | | | | 7.50 | | | | 9.13 | | | | 7.41 | |

| | | | | | |

S&P 500 Index | | | 7.50 | | | | -7.73 | | | | 18.62 | | | | 11.19 | | | | 12.24 | | | | 9.40 | |

* The inception date for Ariel Focus Fund is 06/30/05.

Dear Fellow Shareholder: Ariel Focus Fund returned +0.35% in the first quarter, modestly trailing its primary benchmark, the Russell 1000 Value Index, which gained +1.01%. Meanwhile, the S&P 500 Index, with its heavy technology and growth stock weighting, grew +7.50% in the quarter. Last year, value stocks outperformed growth stocks by a wide margin. So far in 2023, growth has outperformed value, a headwind to our relative performance given the characteristics of our holdings. Of late, growth stock outperformance has been aided by falling interest rates, a decline we do not expect to continue.

Portfolio Recap

BorgWarner Inc. (BWA) and Madison Square Garden Entertainment Corp. (MSGE) were our top contributors in the quarter, while APA Corporation (APA) and BOK Financial Corp. (BOKF) were our biggest detractors. BorgWarner surged +22% on its growing leadership position in automotive propulsion and powertrains, particularly for electric vehicles. Last December, the company announced a spin-off of its fuel system and after-market parts businesses. Those businesses will focus on internal combustion engine

systems, while the remainder of BorgWarner will seek to expand its electric vehicle propulsion business. BorgWarner was Ariel Focus Fund’s largest holding at quarter end. We view the company as a leader in a growing industry with clear technical barriers to entry, trading at less than ten times our estimate of forward twelve months’ earnings.

After a difficult 2022, MSGE was our second largest contributor to performance this quarter jumping +31%. During the recent Super Bowl, the rock band U2 announced they would perform their first concert since 2019 at MSGE’s Sphere in Las Vegas this fall, which gave equity markets confidence that the Sphere would open on schedule. The company also announced a spinoff, creating a new separately traded company that will include Madison Square Garden, the Hulu Theater, Radio City Music Hall, The Beacon Theatre, and the Chicago Theatre.

Energy stocks were strong performers in 2022, including our portfolio holding APA Corporation, which leaped +76% for the year. By contrast, APA declined -22% in the most recent quarter. Fears of a global recession, the release of oil from America’s Strategic Petroleum Reserves, and a significant drop in U.S. natural gas prices all combined to pressure APA’s

Performance data quoted represents past performance. Past performance does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains and represents returns of the Investor Class shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Any extraordinary performance shown for short-term periods may not be sustainable and is not representative of the performance over longer periods. Performance data current to the most recent month-end for Ariel Focus Fund may be obtained by visiting our website, arielinvestments.com.

| | |

| 8 | | SLOW AND STEADY WINS THE RACE |

shares. A recent decision by OPEC to reduce oil production has sent West Texas Intermediate (“WTI”) prices back above $80 per barrel from the mid $60s earlier this year. APA trades for less than six times our estimate of the next twelve-month earnings.

BOKF was our second largest detractor, declining -18%. BOKF was pressured by the “double whammy” of falling oil prices and recent difficulties at regional banks. Based in Tulsa, Oklahoma, BOKF is rightly considered a leading lender to the U.S. oil petroleum industry.

However, BOKF’s exposure to oil and gas has been exaggerated by the market. Energy loans represent only 15% of the company’s lending portfolio. The bank’s fortunes are more tied to the health of the general economy in America’s southwest region than any industry. Texas, Oklahoma, Arizona, and Nevada will continue to show healthy economic growth with well-publicized increases in population and corporate headquarters. However, the threat of deposit withdrawals at regional banks after the failure of Silicon Valley Bank could be a more serious challenge. Customer deposits represent the least expensive source of funding for most regional banks. Were depositors to move a substantial portion of their deposits from regional banks to the large money center banks known as the Systemically Important Financial Institutions, bank earnings could be severely impacted, certainly in the short term.

We think the best explanation of the current woes of regional banks came from George Bailey during the bank run scene in It’s a Wonderful Life; “You’re thinking of this place all wrong. As if I had the money back in a safe. The money’s not here. Your money’s in Joe’s house…right next to yours. And in the Kennedy house, and Ms. Macklin’s house, and a hundred others. Why, you are lending them the money to build, and then, they are going to pay it back to you as best they can.” Just as the fictional Bailey Building & Loan depositors could have forced George to close his doors, a bank depositor run can cause a liquidity crisis for even a well-capitalized bank such as BOKF. So far, we do not see evidence of outsized deposit withdrawals at BOKF. However, we remain cautious and have not added to our position, even at today’s lower share price.

Reversal of Fortunes: The End of Declining Rates

The chart below is from St. Louis Federal Reserve Bank. It shows the market yield on 30-year Treasuries from April 1980 through February 2023. This graph explains why certain financial asset classes have outperformed over the last 40 years. The graph also explains why the last 40 years have been challenging for traditional value managers and why this might be about to change.

Market Yield on U.S. Treasury Securities at 30-Year Constant Maturity, Quoted on an Investment Basis

January 1, 1981 through March 7, 2023

| | |

| SLOW AND STEADY WINS THE RACE | | 9 |

First, the graph shows a dramatic decline in interest rates over the last 40 years. The 30-year Treasury declined from over 15% in 1981 to 0.99% in 2020. While the totality of this decline is well understood among market participants, what is less noted is how consistent this decline in rates has been. From 1981 to 2021, every rolling 10-year period ended with 30-year rates lower than when the period began. This four-decade winning streak for lower rates was only recently snapped when 30-year Treasuries ended 2022 at 3.97%, higher than their 2.9% yield at the end of 2012.

This consistent decline in rates is important as some asset classes benefit more from falling rates than others. Leveraged companies benefit more than companies without debt. Long-term bonds benefit more than short-term bonds. Notably, growth stocks and technology stocks benefit more than value stocks. On the last point, growth stocks are like long-term bonds in that they have a long duration, meaning their cash flows are farther in the future than value stocks. A growth stock investor may be counting on earnings 30 years from now, earnings whose present value increases with a lower time value of money.

A value stock will earn a much larger percentage of its stock price in the near term, cash flows whose present value will be less impacted by lower discount rates. Just as a drop in interest rates will have a more significant positive effect on a 30-year bond than a 6-month treasury, a drop in interest rates will have a greater positive impact on a portfolio of growth stocks than on a comparable portfolio of value stocks.

This is important because the consistent decline in interest rates over the last 40 years has been a continuous positive factor for growth stocks and a persistent negative factor for value stocks, at least on a relative basis. While growth stocks have had a steady wind at their backs, value stocks have faced a steady headwind. We believe this extraordinary period of consistently declining rates is ending. At a minimum, interest rates cannot fall over the next 40 years as they have over the past four decades. There is nowhere further for long-term rates to go. In a crisis, 30-year rates could drop temporarily back to the 0.99% they reached during the Covid crisis of 2020. But rates cannot steadily decline in the future as they have in the past.

When I attended business school in the 1980s, academicians agreed on the existence of a “Value Anomaly.” Value stocks beat growth stocks by much more than any valuation model would predict. This Value Anomaly has disappeared, particularly over the last 25 years. We believe value’s underperformance owes much to reduced interest rates. We also believe this period of steady declining rates is over.

Perhaps rates will not steadily increase, but they are not likely to steadily fall. With a more level interest rate playing field, value may return to its rightful place atop the asset class pyramid. We believe Ariel Focus Fund should be well positioned for the future with its emphasis on companies trading at low prices relative to their expected earnings.

“With a more level interest rate playing field, value may return to its rightful place atop the asset class pyramid.”

As always, we appreciate the opportunity to serve you and welcome any questions or comments you might have.

Sincerely,

Charles K. Bobrinskoy

Vice Chairman

| | |

| 10 | | SLOW AND STEADY WINS THE RACE |

| | | | | | |

| | | Performance Summary | | | | Ariel Focus Fund |

| | | | |

| | | | As of March 31, 2023 |

Inception: June 30, 2005

| | | | | | |

|

Composition of Equity Holdings (%) |

| | | |

| | | Ariel

Focus

Fund | | Russell

1000 Value

Index | | S&P 500 Index |

| | | |

Financials | | 27.55 | | 18.07 | | 9.86 |

| | | |

Industrials | | 24.06 | | 13.04 | | 12.55 |

| | | |

Consumer Discretionary | | 16.25 | | 10.38 | | 13.93 |

| | | |

Health Care | | 10.32 | | 15.62 | | 13.55 |

| | | |

Basic Materials | | 8.65 | | 3.39 | | 1.95 |

| | | |

Energy | | 5.39 | | 8.09 | | 4.80 |

| | | |

Technology | | 5.01 | | 9.17 | | 28.97 |

| | | |

Consumer Staples | | 0.00 | | 7.09 | | 6.00 |

| | | |

Real Estate | | 0.00 | | 4.62 | | 2.64 |

| | | |

Telecommunications | | 0.00 | | 4.66 | | 2.62 |

| | | |

Utilities | | 0.00 | | 5.85 | | 3.12 |

| | | |

Short-Term Investments | | 3.34 | | 0.00 | | 0.00 |

Industry weightings are calculated based on equity holdings as a percentage of total net assets. Holdings are categorized according to the Russell Industry Classification Benchmark (ICB). Holdings not classified by ICB are categorized according to FactSet classification. Source: FactSet.

| | | | | | | | | | | | | | | | | | | | | | |

|

Average Annual Total Returns (%) |

| | | | | | |

| | | Quarter | | | 1-Year | | | 3-Year | | | 5-Year | | | 10-Year | | | Since Inception |

| | | | | | |

Ariel Focus Fund-Investor Class | | | 0.35 | | | | -12.39 | | | | 20.69 | | | | 5.31 | | | | 7.36 | | | 5.78 |

| | | | | | |

Ariel Focus Fund-Institutional Class* | | | 0.35 | | | | -12.19 | | | | 21.01 | | | | 5.58 | | | | 7.63 | | | 5.95 |

| | | | | | |

Russell 1000 Value Index | | | 1.01 | | | | -5.91 | | | | 17.94 | | | | 7.50 | | | | 9.13 | | | 7.41 |

| | | | | | |

S&P 500 Index | | | 7.50 | | | | -7.73 | | | | 18.62 | | | | 11.19 | | | | 12.24 | | | 9.40 |

Performance data quoted represents past performance and does not guarantee future results. It includes the reinvestment of dividends and capital gains. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To access performance data as of the most recent month-end, visit arielinvestments.com. Any extraordinary short-term performance may not be sustainable and is not representative of the performance over longer periods. The total returns reflect that certain fees and expenses have been waived or reduced by the Adviser.

The graph and performance table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | |

|

Expense Ratio (as of September 30, 2022) | |

| | |

| | | Net | | Gross | |

| | |

Investor Class | | 1.00% | | | 1.13% | |

| | |

Institutional Class | | 0.75% | | | 0.85% | |

Expense ratio caps of 1.00% for the Investor Class and 0.75% for the Institutional Class are in place to waive fees and reimburse certain expenses that exceed these caps. Ariel Investments, LLC (the Adviser) is contractually obligated to maintain these expense ratio caps through 9/30/24.

| | | | | | | | | | | | | | |

|

Top Ten Equity Holdings (% of net assets) | |

| | | | | |

| 1 | | BorgWarner, Inc. | | | 6.69 | | | 6 | | Lockheed Martin Corporation | | | 5.07 | |

| | | | | |

| 2 | | Snap-on, Inc. | | | 5.79 | | | 7 | | Oracle Corporation | | | 5.01 | |

| | | | | |

| 3 | | Goldman Sachs Group, Inc. | | | 5.72 | | | 8 | | Mosaic Company | | | 4.96 | |

| | | | | |

| 4 | | APA Corporation | | | 5.39 | | | 9 | | Northern Trust Corporation | | | 3.88 | |

| | | | | |

| 5 | | BOK Financial Corporation | | | 5.35 | | | 10 | | Resideo Technologies, Inc. | | | 3.77 | |

| | * | The inception date for the Institutional Class shares is December 30, 2011. Performance information for the Institutional Class prior to that date reflects the actual performance of the Fund’s Investor Class (and uses the actual expenses of the Fund’s Investor Class, for such period of time), without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses, which are primarily differences in distribution and service fees. | |

| | |

| SLOW AND STEADY WINS THE RACE | | 11 |

| | | | | | |

| | |  | | | | Ariel International Fund Ariel Global Fund |

| | | | |

| | | | As of March 31, 2023 |

| | | | | | | | | | | | |

|

Average Annual Total Returns (%) |

| | | | | | |

| | | Quarter | | 1-Year | | 3-Year | | 5-Year | | 10-Year | | Since Inception* |

| | | | | | |

Ariel International Fund | | 5.40 | | -4.61 | | 6.43 | | 0.89 | | 4.20 | | 4.47 |

| | | | | | |

MSCI EAFE Net Index | | 8.47 | | -1.38 | | 12.99 | | 3.52 | | 5.00 | | 6.40 |

| | | | | | |

MSCI ACWI ex-US Net Index | | 6.87 | | -5.07 | | 11.81 | | 2.47 | | 4.17 | | 5.43 |

| | | | | | |

MSCI EAFE Value Net Index | | 5.93 | | -0.31 | | 14.59 | | 1.75 | | 3.75 | | 5.15 |

| | | | | | |

MSCI ACWI ex-US Value Net Index | | 5.16 | | -4.00 | | 13.83 | | 1.26 | | 3.06 | | 4.32 |

* The inception date for Ariel International Fund is 12/30/11.

| | | | | | | | | | | | |

| |

Average Annual Total Returns (%) | | |

| | | | | | |

| | | Quarter | | 1-Year | | 3-Year | | 5-Year | | 10-Year | | Since Inception* |

| | | | | | |

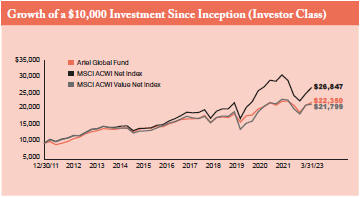

Ariel Global Fund | | 4.19 | | -1.61 | | 10.90 | | 5.15 | | 6.96 | | 7.41 |

| | | | | | |

MSCI ACWI Net Index | | 7.31 | | -7.44 | | 15.37 | | 6.93 | | 8.06 | | 9.18 |

| | | | | | |

MSCI ACWI Value Net Index | | 1.24 | | -5.50 | | 15.25 | | 4.27 | | 5.89 | | 7.17 |

* The inception date for Ariel Global Fund is 12/30/11.

Dear Fellow Shareholder: This quarter was a disruptive period for the U.S. banking sector. On March 10, 2023, the Federal Deposit Insurance Corporation (FDIC) took over Silicon Valley Bank (SVB) due to a bank run triggered by a sell-off of long-duration assets. SVB’s collapse was the second-largest failure of a financial institution in the nation’s history. As a result, bank stocks across all market caps slid to multi-year and all-time lows. While the industry has not experienced this level of distress since 2008-2009, we do not believe we are on the verge of another Great Financial Crisis. The U.S. government’s decision to increase regulation and guarantee regional bank deposits could have positive long-term effects. However, amid inflationary pressures, it could tighten financial conditions and induce a recession in the near term.

Our distinct focus on risk management aims to eliminate companies that assume outsized risks. We have avoided SVB, Signature Bank, and others with an asset-liability mismatch. In 2007, we witnessed a similar phenomenon called “the run on the Rock.” British bank Northern Rock was a darling stock in its heyday. Northern Rock’s meltdown was the first United Kingdom bank run in over 140 years, and, like SVB, investors were shocked when the company failed and requested the Bank of England’s support.

We rejected the company well before the debacle, believing the risks outweighed the rewards. Sixteen years later, we still apply the same approach. Unlike our peers, we do not screen on growth rates or multiples. We screen on risk—even if that means leaving money on the table. We target superior

Performance data quoted represents past performance. Past performance does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains and represents returns of the Investor Class shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Any extraordinary performance shown for short-term periods may not be sustainable and is not representative of the performance over longer periods. Performance data current to the most recent month-end for Ariel International Fund and Ariel Global Fund may be obtained by visiting our website, arielinvestments.com.

| | |

| 12 | | SLOW AND STEADY WINS THE RACE |

risk-adjusted returns, not high returns at any cost, and believe this distinction serves our clients well.

We are highly selective in our Financials exposure. We prefer to own BNP Paribas, KBC Group, and U.S. Bancorp, which we believe offer better profitability and higher capital ratios—albeit with lower growth than the SVBs of the world. In our view, large U.S. and European banks can weather the storm. When the European Union imposed strict capital requirements for all banks under a new regulatory construct called Basel III, they created a resilient system. Meanwhile, American financial institutions under $250 billion in assets have been exempt from Basel III, making them more vulnerable. While interest rate hikes have stressed Financials, our main concern for small- and mid-size lenders is not deposit flight per se. In our view, the most significant risk is excessive exposure to commercial real estate.

The Next Challenge for Regional Banks: Commercial Real Estate Loan Exposure

The pivot from in-person work to remote or hybrid has presented significant challenges for commercial real estate. While businesses have reopened at total capacity and the U.S. unemployment rate is at a five-decade low, commercial real estate investors are still grappling with the long-term consequences of virtual employment. The lessened demand for office space has led to vacancies in commercial buildings. In the fourth quarter of 2022, U.S. vacancy and total office availability rates reached 12.5% and 16%, respectively, which resemble the highs of the Great Financial Crisis. Twenty-four percent of the $11 trillion commercial real estate market represents office space. The industry will likely be pressured should a recession ensue.

“In our view, the most significant risk is excessive exposure to commercial real estate.”

U.S. regional banks account for 68% of all commercial real estate loans, putting them at severe risk as loans mature and defaults spike. Over $1.5 trillion in commercial real estate debt, financed when interest rates were near zero, will mature in the next three years. As property values fall and debt maturities unfold at higher rates, we expect a wave of defaults. Delinquency rates on office mortgages reached 2.4% in February 2023, an increase from 1.5% six months ago. In mid-February, multinational real estate giant Brookfield Corporation

defaulted on two of the firm’s most prominent skyscrapers in Los Angeles. As noted in Figure 1 below, large banks—with more robust liquidity and regulation—have less loan exposure to commercial real estate than their smaller peers. The market calamity surrounding SVB’s failure has subsided, yet the risks to the financial services industry still loom.

Figure 1: Commercial Real Estate Loans from Small U.S. Banks Exceed Large U.S. Banks

Source: Federal Reserve, Morgan Stanley Research

As small domestic banks experience more headwinds, we expect local businesses to face challenges. Following SVB’s crash, approximately $500 billion flowed out of small lenders and into money-market funds and big banks. Outflows and stricter regulatory guidelines could reduce their capacity to extend credit. Most small businesses rely on community banks or credit unions for financing, as these institutions often leverage soft knowledge of local market conditions to inform a loan decision. Large, highly regulated creditors have more barriers for borrowers than their smaller brethren. Nearly 94% of small firms use credit to cover their expenses, and 52% of that funding comes from community banks. These companies are the fuel of America’s economic engine. We believe more stress on regional banks might lead to a more difficult recession than the market expects.

A Bright Spot in Emerging Market Banks

Amidst the recent financial services turmoil, emerging markets held up better than their Western peers. EM banks do not face the same mark-to-market fears in securities portfolios, as they distribute loans to individuals and corporates. Likewise, these local institutions have a structural advantage as their clients hold liquid assets such as deposits. The sizeable unbanked population in EM countries can

| | |

| SLOW AND STEADY WINS THE RACE | | 13 |

create significant opportunities for growth. Deposits in developing nations tend to be sticky. Therefore, we do not anticipate similar balance sheet issues in these regions. Our EM Financial holdings declined due to macro rather than micro concerns. For instance, Peruvian bank Credicorp and Brazilian lender Itau Bank have conservative yet progressive management teams prioritizing technology to lower costs and increase revenues. Both companies have experienced a credit cycle but remain profitable and resilient despite high inflation and interest rates. Their stock price underperformance stands in contrast to their improving franchise position. We took advantage of recent market volatility and added to our positions.

Outlook and Positioning

While we cannot predict the severity of a recession, our stress testing shows that consensus estimates are too optimistic and could disappoint in the coming quarters. We are overweight in recession-resilient sectors, such as Healthcare, Utilities, and Consumer Staples, and underweight in cyclical sectors, including Energy, Materials, and Industrials. We believe low debt and large dividends will be critical in delivering total returns to equity shareholders. As a result, we have positioned our portfolios accordingly. Ariel International Fund and Ariel Global Fund have a lower debt/equity ratio and higher return on equity than their respective benchmarks. In our view, these fundamental characteristics should help reduce risk and preserve capital from adverse outcomes that may still lie ahead.

As always, we appreciate the opportunity to serve you and welcome any questions or comments you might have.

Sincerely,

Rupal J. Bhansali

Chief Investment Officer

Global Equities

| | |

| 14 | | SLOW AND STEADY WINS THE RACE |

| | | | | | |

| | | Performance Summary | | | | Ariel International Fund |

| | | | |

| | | | As of March 31, 2023 |

Inception: December 30, 2011

| | | | | | | | | | | | | | | |

|

Composition of Equity Holdings (%) | |

| | | |

| | | Ariel Institutional Fund | | MSCI EAFE Net Index | | MSCI ACWI ex-US Net Index |

| | | |

Financials | | | | 19.73 | | | | | 17.68 | | | | | 19.93 | |

| | | |

Health Care | | | | 16.13 | | | | | 13.17 | | | | | 9.57 | |

| | | |

Consumer Discretionary | | | | 13.81 | | | | | 12.02 | | | | | 11.93 | |

| | | |

Utilities | | | | 13.25 | | | | | 3.42 | | | | | 3.22 | |

| | | |

Consumer Staples | | | | 11.57 | | | | | 10.44 | | | | | 8.88 | |

| | | |

Communication Services | | | | 11.44 | | | | | 4.51 | | | | | 6.05 | |

| | | |

Information Technology | | | | 3.70 | | | | | 8.56 | | | | | 11.80 | |

| | | |

Industrials | | | | 2.54 | | | | | 15.62 | | | | | 12.70 | |

| | | |

Energy | | | | 0.57 | | | | | 4.48 | | | | | 5.54 | |

| | | |

Real Estate | | | | 0.09 | | | | | 2.38 | | | | | 2.12 | |

| | | |

Materials | | | | 0.00 | | | | | 7.71 | | | | | 8.26 | |

| | | |

Short-Term Investments | | | | 2.95 | | | | | 0.00 | | | | | 0.00 | |

Sector weightings for the Fund are calculated based on equity holdings as a percentage of total net assets. Source: Northern Trust. The sectors above are the MSCI Global Industry Classification Standard (“GICS”) sector classifications.

| | | | | | | | | | |

|

Top Ten Country Weightings (% of net assets) | |

| | | |

Germany | | | 14.09 | | | Spain | | | 6.20 | |

| | | |

Japan | | | 10.98 | | | United States | | | 6.19 | |

| | | |

France | | | 10.98 | | | Italy | | | 5.35 | |

| | | |

United Kingdom | | | 10.58 | | | China | | | 5.12 | |

| | | |

Switzerland | | | 7.21 | | | Netherlands | | | 5.06 | |

Holdings are categorized according to MSCI Country. Holdings not classified by MSCI are categorized according to Bloomberg Country of Risk. Source: Factset.

| | | | | | | | | | | | |

|

Average Annual Total Returns (%) |

| | | | | | |

| | | Quarter | | 1-Year | | 3-Year | | 5-Year | | 10-Year | | Since

Inception |

| | | | | | |

Ariel International Fund-Investor Class | | 5.40 | | -4.61 | | 6.43 | | 0.89 | | 4.20 | | 4.47 |

| | | | | | |

Ariel International Fund-Institutional Class | | 5.44 | | -4.37 | | 6.71 | | 1.14 | | 4.45 | | 4.72 |

| | | | | | |

MSCI EAFE Net Index | | 8.47 | | -1.38 | | 12.99 | | 3.52 | | 5.00 | | 6.40 |

| | | | | | |

MSCI ACWI ex-US Net Index | | 6.87 | | -5.07 | | 11.81 | | 2.47 | | 4.17 | | 5.43 |

| | | | | | |

MSCI EAFE Value Net Index | | 5.93 | | -0.31 | | 14.59 | | 1.75 | | 3.75 | | 5.15 |

| | | | | | |

MSCI ACWI ex-US Value Net Index | | 5.16 | | -4.00 | | 13.83 | | 1.26 | | 3.06 | | 4.32 |

Performance data quoted represents past performance and does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To access performance data as of the most recent month-end, visit arielinvestments.com. Any extraordinary short-term performance may not be sustainable and is not representative of the performance over longer periods. The total returns reflect that certain fees and expenses have been waived or reduced by the Adviser.

The graph and performance table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | | | | | |

|

Expense Ratio (as of September 30, 2022) | |

| | | |

| | | Net | | | Gross | | | | |

| | | | |

Investor Class | | | 1.13% | | | | 1.28% | | | | | |

| | | |

Institutional Class | | | 0.88% | | | | 0.93% | | | | | |

Expense ratio caps of 1.13% for the Investor Class and 0.88% for the Institutional Class are in place to waive fees and reimburse certain expenses that exceed these caps. Ariel Investments, LLC (the Adviser) is contractually obligated to maintain these expense ratio caps through 9/30/24.

| | | | | | | | | | | | | | |

|

Top Ten Companies (% of net assets) | |

| | | | | |

| 1 | | Deutsche Boerse AG | | | 9.11 | | | 6 | | Koninklijke Ahold Delhaize NV | | | 5.06 | |

| | | | | |

| 2 | | Roche Holding AG | | | 5.93 | | | 7 | | Philip Morris International, Inc. | | | 5.02 | |

| | | | | |

| 3 | | Michelin (CGDE) | | | 5.75 | | | 8 | | Baidu, Inc. | | | 4.81 | |

| | | | | |

| 4 | | Endesa SA | | | 5.63 | | | 9 | | Snam SpA | | | 4.31 | |

| | | | | |

| 5 | | GSK plc | | | 5.07 | | | 10 | | Subaru Corporation | | | 3.80 | |

Holdings of the same issuer are aggregated and if held as depositary receipts it is not so specified. This list excludes ETFs.

| | |

| SLOW AND STEADY WINS THE RACE | | 15 |

| | | | | | |

| | | Performance Summary | | | | Ariel Global Fund |

| | | | |

| | | | As of March 31, 2023 |

Inception: December 30, 2011

| | | | | | | | | | |

|

| Composition of Equity Holdings (%) |

| | | | | | | | | | |

| | |

| | | Ariel Global Fund | | MSCI ACWI Net

Index |

| | |

Health Care | | 20.62 | | 12.29 |

| | |

Information Technology | | 14.66 | | 22.47 |

| | |

Financials | | 14.28 | | 13.92 |

| | |

Communication Services | | 14.19 | | 7.34 |

| | |

Consumer Staples | | 9.47 | | 7.46 |

| | |

Consumer Discretionary | | 8.89 | | 11.15 |

| | |

Utilities | | 7.05 | | 2.93 |

| | |

Real Estate | | 4.41 | | 2.44 |

| | |

Industrials | | 0.88 | | 10.16 |

| | |

Energy | | 0.00 | | 4.95 |

| | |

Materials | | 0.00 | | 4.88 |

| | |

Short-Term Investments | | 4.73 | | 0.00 |

Sector weightings for the Fund are calculated based on equity holdings as a percentage of total net assets. Source: Northern Trust. The sectors above are the MSCI Global Industry Classification Standard (“GICS”) sector classifications.

| | | | | | | | | | |

|

Top Ten Country Weightings (% of net assets) | |

| | | |

United States | | | 34.75 | | | Brazil | | | 4.88 | |

| | | |

United Kingdom | | | 8.57 | | | Japan | | | 4.88 | |

| | | |

China | | | 7.21 | | | Germany | | | 4.52 | |

| | | |

France | | | 7.07 | | | Spain | | | 4.34 | |

| | | |

Switzerland | | | 5.79 | | | Peru | | | 3.22 | |

Holdings are categorized according to MSCI Country. Holdings not classified by MSCI are categorized according to Bloomberg Country of Risk. Source: Factset.

| | | | | | | | | | | | | | | | | | | | | | |

|

| Average Annual Total Returns (%) |

| | | | | | |

| | | Quarter | | | 1-Year | | | 3-Year | | | 5-Year | | | 10-Year | | | Since Inception |

| | | | | | |

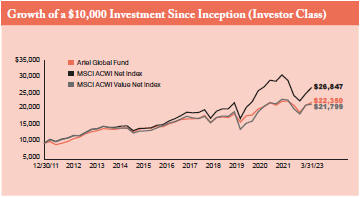

Ariel Global Fund-Investor Class | | | 4.19 | | | | -1.61 | | | | 10.90 | | | | 5.15 | | | | 6.96 | | | 7.41 |

| | | | | | |

Ariel Global Fund-Institutional Class | | | 4.27 | | | | -1.31 | | | | 11.19 | | | | 5.42 | | | | 7.24 | | | 7.68 |

| | | | | | |

MSCI ACWI Net Index | | | 7.31 | | | | -7.44 | | | | 15.37 | | | | 6.93 | | | | 8.06 | | | 9.18 |

| | | | | | |

MSCI ACWI Value Net Index | | | 1.24 | | | | -5.50 | | | | 15.25 | | | | 4.27 | | | | 5.89 | | | 7.17 |

Performance data quoted represents past performance and does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To access performance data as of the most recent month-end, visit arielinvestments.com. Any extraordinary short-term performance may not be sustainable and is not representative of the performance over longer periods. The total returns reflect that certain fees and expenses have been waived or reduced by the Adviser.

The graph and performance table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | | | | | |

|

Expense Ratio (as of September 30, 2022) | |

| | | |

| | | Net | | | Gross | | | | |

| | | | |

Investor Class | | | 1.13% | | | | 1.30% | | | | | |

| | | |

Institutional Class | | | 0.88% | | | | 0.94% | | | | | |

Expense ratio caps of 1.13% for the Investor Class and 0.88% for the Institutional Class are in place to waive fees and reimburse certain expenses that exceed those caps. Ariel Investments, LLC (the Adviser) is contractually obligated to maintain these expense ratio caps through 9/30/24.

| | | | | | | | | | | | | | |

|

Top Ten Companies (% of net assets) | |

| | | | | |

| 1 | | Microsoft Corporation | | | 8.19 | | | 6 | | Verizon Communications, Inc. | | | 4.50 | |

| | | | | |

| 2 | | Baidu, Inc. | | | 6.55 | | | 7 | | Equity Commonwealth | | | 4.41 | |

| | | | | |

| 3 | | Roche Holding AG | | | 5.03 | | | 8 | | Endesa SA | | | 4.34 | |

| | | | | |

| 4 | | GSK plc | | | 4.97 | | | 9 | | Michelin (CGDE) | | | 3.99 | |

| | | | | |

| 5 | | Philip Morris International, Inc. | | | 4.69 | | | 10 | | Deutsche Boerse AG | | | 3.34 | |

Holdings of the same issuer are aggregated and if held as depositary receipts it is not so specified. This list excludes ETFs.

| | |

| 16 | | SLOW AND STEADY WINS THE RACE |

| | | | | | |

| | | Company Spotlight | | | | Baidu, Inc. |

| | | | |

| | | | |

Founded in 2000, Baidu, Inc. is a leading artificial intelligence (AI) technology company that dominates internet search in China. As of 2022, its mobile platform reached 648 million monthly average users. Since 2016, Baidu has transitioned from an internet company into an AI technology company, offering a full AI stack, encompassing infrastructure that consists of AI chips, deep learning frameworks, The company also offers core AI capabilities, such as natural language processing, knowledge graphs, speech recognition, computer vision, augmented reality, as well as an open AI platform.

The Macro Recovery Play

Since the severe COVID-19 outbreak in March 2022, China’s COVID-Zero policy imposed strict measures and lockdowns to curb the spread of the virus, which disrupted outdoor activities and the overall macroeconomy. Companies like Baidu, which have substantial exposure to offline local services, travel and healthcare vertical industry advertisements, were particularly affected as the demand for these services dwindled. As the COVID-Zero policy eased last December and the country gradually reopened, Baidu was well-positioned to reap the rewards of the economic recovery. As industries like travel and local services continue to bounce back, the advertising demand from these sectors is anticipated to recover to 100% of pre-pandemic levels. We believe this will drive a resurgence in Baidu’s advertising revenue and overall business performance.

Internet Crackdown Fallout

Baidu’s stock was an indirect victim of the fallout resulting from China’s regulation of its internet sector, even though the company’s fundamentals were sound. Since the Ant Group and Didi IPO debacles in November 2020 and July 2021, respectively, the Chinese government has cracked down on the internet sector with a social agenda. Wide-ranging measures spanned protections for minors on video gaming, a ban on private education K-12 tutoring, anti-monopoly

steps for e-commerce, and strengthened data collection and data security on service platforms to protect national security and personal information. However, the regulatory impact on Baidu is limited given its low revenue exposure to video gaming and K-12 private tutoring. Its search engine also does not collect sensitive personal information. We believe Baidu’s multiple compression was excessive relative to the risk from the crackdown.

Driving Advancements in AI

Investors mischaracterize Baidu as merely an online marketing internet company. While 73% of the company’s core 2022 sales were generated by online marketing, Baidu has been an AI technology company since 2016, following a change in strategic focus by its visionary CEO Robin Li. Baidu proactively invested in AI research, integrating AI technologies into its existing products and services. Its initiatives span an open-source autonomous driving platform—Apollo (like Tesla’s full self-driving system) and an AI-powered voice assistant ecosystem—DuerOS (like Amazon’s Alexa). Most recently, the company launched Ernie Bot, an AI-based chatbot, which is the Chinese equivalent of ChatGPT. Drawing parallels with OpenAI, Baidu should be seen as China’s National Champion in AI, shaping the future of technology and driving AI advancements in the country.

Opportunity Awaits at a Deep Discount

On March 31, 2023, shares traded at $150.92, which was at a 30-40% discount to Tencent, Google and Meta. At current levels, investors have failed to capture both near-term economic recovery and long-term AI growth prospects in China.

| | |

| SLOW AND STEADY WINS THE RACE | | 17 |

| | | | | | |

| | | Company Spotlight | | | | Leslie’s, Inc. |

| | | | |

| | | | |

Founded in 1963, Leslie’s, Inc. (NYSE: LESL) is the largest direct-to-consumer brand in the U.S. pool and spa care industry, serving residential, professional and commercial consumers. As a market leader, its vertical integration, scale, and customer loyalty are differentiators in a highly fragmented industry positioned for consolidation. Eighty percent (80%) of Leslie’s revenue is considered recurring and non-discretionary. Demand continues to grow as homeowners invest in their properties. The addition of pools has increased the base of customers for the company’s specialty and maintenance products. As such, Leslie’s has experienced top-line growth in the worst economic cycles, such as the “dot com” bubble and the Great Financial Crisis. Resiliency through these periods has allowed Leslie’s to grow top-line revenue for 59 years.

After the closing of an attractive IPO aided by the pandemic, Leslie’s stock dipped as the market feared the company’s growth and new pool installations might be negatively impacted by a weakening housing market. However, we believe the market is undervaluing the industry’s resilience and Leslie’s ability to consolidate a niche and fragmented market. The company’s superior customer service and innovation have created a loyal customer base. Our belief is that this is an attractive opportunity to own a differentiated retailer in an industry poised to benefit from long lasting secular tailwinds uplifted by the pandemic.

It’s Not Just a Day at the Beach

Leslie’s has built a resilient business model in a consistent market. In-ground related pool installations have increased for 52 consecutive years. Pool maintenance is also much more complex and specialized than most realize, creating a unique opening between what specialty retailers and wholesalers can offer. Leslie’s is rare in that it is a one-stop shop for pool diagnostics. Not only does it provide a proprietary AccuBlu rapid testing option, but its tailored solutions are also designed to meet each customer’s needs. Other competitors

and wholesalers lack Leslie’s breadth of products, supplies and its high-quality pool equipment.

Swimming Around a Moat

The company manufactures and offers mostly proprietary formulas through physical and online channels. Leslie’s products are often the biggest sellers on e-commerce platforms such as Amazon. The company controls the entire process from manufacturing to the point of sales with visibility into the needs of pool owners. The company operates ~1,000 stores, a footprint 5x bigger than its 20 closest competitors combined and has more prominence on digital channels. Additionally, approximately 50% of the industry is composed of independent companies who lack Leslie’s bargaining acumen with suppliers to effectively compete. The company leverages its buying powers to boost margins on acquired stores. The geographical footprint puts 90% of all U.S. pools within 15 minutes of Leslie’s stores, allowing the company to remain top of mind for pool-related solutions or convenient purchases for pool professionals.

A Pool of Free Cash Flow

Leslie’s is the strongest player in a highly predictable industry with annuity-like revenue. For half a century, the number of pools in the U.S. has grown and Leslie’s revenue has expanded for nearly 60 years even through challenging economic times. Given the secular trends and its competitive advantages, Leslie’s is expected to continue driving top-line growth over the long run. As of March 31, 2023, shares traded at $11.01, a discount of 50% to our estimated private market value of $22.24.

| | |

| 18 | | SLOW AND STEADY WINS THE RACE |

| | | | | | |

| | | Company Spotlight | | | | Madison Square Garden Entertainment |

| | | | |

| | | | |

Madison Square Garden Entertainment (NYSE: MSGE) is a leader in live entertainment with assets such as Madison Square Garden, Hulu Theater, Radio City Music Hall, Beacon Theatre, The Chicago Theatre, and the Christmas Spectacular Starring the Radio City Rockettes. With much anticipation, the company will soon open MSG Sphere, an evolutionary venue for immersive concerts, shows and other events in Las Vegas. Madison Square Garden Entertainment also runs MSG Networks, home of the NY Knicks and NY Rangers who will soon be in the NBA and NHL playoffs, respectively.

Music to Our Ears

On April 20th, long-time holding Madison Square Garden Entertainment has the chance to transform itself again through a spinoff of its live entertainment business, which we believe should enhance shareholder value. During Ariel’s holding period, we have witnessed the 2015 separation of MSG Networks and MSG (Sports & Entertainment), the 2020 split of MSG into Madison Square Garden Entertainment and MSG Sports, which quickly resulted in Madison Square Garden Entertainment’s acquisition of MSG Networks in 2021.

In February of this year, board members approved the spin-off of the company’s live entertainment assets, including the iconic Madison Square Garden, to be named Madison Square Garden Entertainment Corp. (MSGE). The remaining entity, which includes the MSG Sphere, Tao Group Hospitality (dining and nightlife brands Tao and Hakkasan) and MSG Networks will be known as Sphere Entertainment Co. (SPHR).

Stronger Apart Than Together

Following disappointing stock performance, the board, led by Executive Chairman and CEO James Dolan, believes two separate publicly traded entities will offer investors better disclosure to properly value the businesses. We agree with this strategic corporate action and the market has responded favorably.

A Tale of Two Companies

Pre-market spinoff sentiment is positive on Madison Square Garden Entertainment given the expected cash flow from the iconic Madison Square Garden, Radio City Music Hall, and the Christmas Spectacular staring the Rockettes. The Garden has been the home of the NY Knicks and NY Rangers since 1968 and remains a ‘must-stop’ for many premier sporting events and performing acts, such as Elton John, Billy Joel, and Harry Styles. The fight of the century—Muhammad Ali versus Joe Frazier—and the matchup between Rocky Marciano versus Joe Lewis were also held at The Garden. The board’s recently announced $250 million share repurchase program should return value to shareholders.

By contrast, pre-market spinoff sentiment is soft on Sphere Entertainment. The substantial cost overruns in constructing the Sphere and the risks associated with filling such a unique, fully immersive entertainment experience are not trivial. That said, we remain optimistic that Madison Square Garden Entertainment will deliver operating results that will exceed expectations. Film makers and marquee events should produce higher than expected advertising revenue—U2 will be the venue’s first residency in the fall and the November 2023 Las Vegas Grand Prix will be winding through the MSG Sphere Zone with much enthusiasm. Given the estimated cash flow generation from the Sphere, a potential sale of its stake in Tao, significant cash flows from MSG Networks and a one-third interest in Madison Square Garden Entertainment, we are confident Sphere Entertainment Co. has more than adequate capital to address unforeseen circumstances.

Bargain Shopping for the Contrarian Investor

In our view, the market is being too pessimistic with its outlook for Madison Square Garden Entertainment and Sphere Entertainment. We believe spinoffs can create substantial shareholder value for investors over the long run. With an estimated private market value of $102.86, Madison Square Garden Entertainment is trading at a 43% discount to its March 31, 2023 price of $59.07.

| | |

| SLOW AND STEADY WINS THE RACE | | 19 |

| | | | | | |

| | | Company Spotlight | | | | Stericycle, Inc. |

| | | | |

| | | | |

Founded in 1989, Stericycle, Inc. (NYSE: SRCL) is a market leader for regulated waste and information destruction compliance-based solutions for industries and customers around the world. Regulated waste (needles, biohazard waste and expired pharmaceuticals) requires governmental-imposed handling, while regulated document disposal (confidential information) is discarded through a shredding or hard drive destruction process. The company’s more than one million customers range from healthcare facilities, veterinary and dental offices, cruise ships, government and military offices, banks, and many more businesses. The proper disposal of products in regulated industries is crucial to reputational preservation and the avoidance of high fines. With more than 440 facilities, Stericycle has the scale to service companies across the globe with a focus on large national and international customers. Given Stericycle’s history, reputation and reach, customers know they have a trusted solution to handle their waste and confidential information with the utmost care.

Focused and Innovating

In the past five years, Stericycle has revamped and upgraded its Board of Directors and managerial team with leaders Cindy Miller, President and Chief Executive Officer and Janet Zelenka, Chief Financial Officer. Cindy and Janet joined the company in 2018 and 2019, respectively and faced several challenges to refocus the business on its core strengths and value creation opportunities. This management team has executed on many initiatives, including small-customer pricing settlements, product and service rationalization, a secure information destruction Enterprise Resource Planning (ERP) software system implementation, and balance sheet improvements. We now sit on the precipice of the next greatest challenge—the implementation of the ERP system in the largest segment, Regulated Waste and Compliance Solutions. While this program is costly and disruptive in the short-term, we expect it to deliver meaningful operating efficiencies and margin upside over time.

Margin Expansion Creation

Stericycle, along with numerous other organizations, was negatively impacted in its Secure Information Destruction business by the pandemic due to office closures. In addition, the ERP implementation was delayed given the challenges in training employees as companies adapted to health recommendations on social distancing restrictions. Furthermore, the company has been adversely affected by the labor shortages and high inflationary environment. As these headwinds are stabilizing and with the long-anticipated roll-out of the ERP at hand this year, the company is positioned to exhibit significant margin expansion over the next several years. Unlocking the available data on a real-time basis will allow the company to increase service offering penetration, logistical efficiencies and productivity improvements. Given the years of work the team has already performed on the quality of revenue, Stericycle is expected to continue improving customer retention rates and cross-selling opportunities.

Fruits of Their Labors

Over the years, we have gained an appreciation for the significant amount of work the management team has undertaken and completed. These initiatives should improve the underlying business and provide a foundation for future growth and success. Our expectation is the hard work and dedication of Stericycle’s management and employees will deliver long-term results to patient investors. As of March 31, 2023, Stericycle traded at $43.61, a 46% discount to our valuation.

| | |

| 20 | | SLOW AND STEADY WINS THE RACE |

| | | | | | |

| | |  | | | | |

| | | | |

| | | | March 31, 2023 (Unaudited) |

| | | | |

| Number of Shares | | Common Stocks—99.17% | | Value ($) |

| | | Consumer Discretionary—38.19% | | |

| 2,692,235 | | Madison Square Garden Entertainment Corporation(a) | | 159,030,321 |

| 1,808,803 | | Boyd Gaming Corporation | | 115,980,448 |

| 1,771,242 | | Royal Caribbean Cruises, Ltd.(a) | | 115,662,103 |

| 2,884,183 | | Interpublic Group of Companies, Inc. | | 107,406,975 |

| 4,429,527 | | Paramount Global | | 98,822,747 |

| 2,483,699 | | Adtalem Global Education, Inc. (a)(b) | | 95,920,455 |

| 5,101,890 | | Mattel, lnc.(a) | | 93,925,795 |

| 3,027,551 | | Gentex Corporation | | 84,862,255 |

| 352,807 | | Madison Square Garden Sports Corporation | | 68,744,444 |

| 5,560,591 | | Leslie’s, lnc.(a) | | 61,222,107 |

| 1,954,771 | | Manchester United plc | | 43,298,178 |

| | | | | 1,044,875,828 |

| | | Consumer Staples—1.59% | | |

| 276,760 | | J.M. Smucker Company | | 43,553,721 |

| | | Energy—2.87% | | |

| 3,565,025 | | Core Laboratories NV(b) | | 78,608,801 |

| | | Financials—18.63% | | |

| 662,258 | | Affiliated Managers Group, Inc. | | 94,318,784 |

| 1,043,025 | | Northern Trust Corporation | | 91,921,793 |

| 2,589,887 | | Lazard, Ltd., Class A | | 85,751,159 |

| 1,178,222 | | First American Financial Corporation | | 65,579,837 |

| 1,705,585 | | Carlyle Group, Inc. | | 52,975,470 |

| 618,801 | | BOK Financial Corporation | | 52,232,992 |

| 1,903,797 | | Janus Henderson Group plc | | 50,717,152 |

| 2,070,647 | | GCM Grosvenor, Inc. | | 16,171,753 |

| | | | | 509,668,940 |

| | | Health Care—5.45% | | |

| 1,625,656 | | Envista Holdings Corporation(a) | | 66,456,817 |

| 226,536 | | Laboratory Corporation of America Holdings | | 51,971,889 |

| 152,341 | | Charles River Laboratories International, lnc.(a) | | 30,745,461 |

| | | | | 149,174,167 |

| | | Industrials—25.94% | | |

| 329,435 | | Zebra Technologies Corporation(a) | | 104,760,330 |

| 992,301 | | Mohawk Industries, Inc.(a) | | 99,448,406 |

| 4,892,079 | | Resideo Technologies, lnc.(a) | | 89,427,204 |

| 2,657,776 | | Axalta Coating Systems, Ltd.(a) | | 80,504,035 |

| 2,916,490 | | Kennametal, Inc. | | 80,436,794 |

| 9,347,528 | | ADT, Inc. | | 67,582,627 |

| 1,158,771 | | Masco Corporation | | 57,614,094 |

| 514,482 | | Generac Holdings, lnc.(a) | | 55,569,201 |

| 200,847 | | Snap-on, Inc. | | 49,587,116 |

| 225,232 | | Simpson Manufacturing Company, Inc. | | 24,694,437 |

| | | | | 709,624,244 |

| | | Real Estate—4.17% | | |

| 609,183 | | Jones Lang LaSalle, Inc.(a) | | 88,630,035 |

| 351,487 | | CBRE Group, Inc., Class A(a) | | 25,591,769 |

| | | | | 114,221,804 |