UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

| | x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended January 30, 2010

OR

| | ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission file number 0-14970

COST PLUS, INC.

(Exact name of registrant as specified in its charter)

| | |

| California | | 94-1067973 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

200 4th Street Oakland, California | | 94607 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code (510) 893-7300

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | | Name of each exchange on which registered |

| Common Stock, $0.01 par value | | The NASDAQ Stock Market LLC |

| | (NASDAQ Global Select) |

Securities registered pursuant to Section 12(g) of the Act:

Preferred Share Purchase Rights

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a small reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “small reporting company” in Rule 12b-2 of the Exchange Act.

| | |

| Large accelerated filer ¨ | | Accelerated filer ¨ |

| Non-accelerated filer x(Do not check if a smaller reporting company) | | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of voting stock held by non-affiliates of the registrant based upon the closing sale price of the common stock on August 1, 2009, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $32.9 million as reported for such date on the Nasdaq Global Select Market. As of April 6, 2010, 22,087,113 shares of Common Stock, $.01 par value, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s proxy statement for the Annual Meeting of Shareholders to be held in 2010 (“Proxy Statement”) are incorporated by reference into Part III of this Annual Report on Form 10-K to the extent stated herein, which Proxy Statement will be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year covered by this Annual Report on Form 10-K. Except with respect to information specifically incorporated herein by reference, the Proxy Statement is not deemed to be filed as part hereof.

COST PLUS, INC.

TABLE OF CONTENTS

2009 FORM 10-K

Some of the statements under the sections entitled “Business,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Risk Factors,” and elsewhere in this Annual Report on Form 10-K are forward-looking statements, which reflect Cost Plus, Inc.’s current beliefs and estimates with respect to future events and the Company’s future financial performance, business, operations and competitive position. Forward looking statements may be identified by use of the words “may,” “should,” “expects,” “anticipates,” “estimates,” “believes,” “looking ahead,” “forecast,” “projects,” “continues,” “intends,” “likely,” “plans” and similar expressions. The forward-looking statements involve known and unknown risks and uncertainties which may cause the Company’s actual results or performance to differ materially from those expressed in such forward-looking statements due to a number of factors including those set forth in Risk Factors in this Annual Report on Form 10-K and in documents which are incorporated by reference herein. The Company may from time to time make additional written and oral forward-looking statements, including statements contained in the Company’s filings with the Securities and Exchange Commission (the “SEC”). You should not place undue reliance on our forward-looking statements, as they are not guarantees of future results, levels of activity or performance and represent the Company’s expectations only as of the date they are made. The Company does not undertake any obligation to update any forward-looking statement that may be made from time to time by or on behalf of the Company.

PART I

The Company

Cost Plus, Inc. and its subsidiaries (“Cost Plus World Market,” or “the Company”) is a leading specialty retailer of casual home furnishings and entertaining products in the United States. Cost Plus, Inc. was organized as a California corporation in November 1946 and opened its first retail store in 1958 in San Francisco, California. As of January 30, 2010, the Company operated 268 stores under the name “World Market,” “Cost Plus World Market,” “Cost Plus Imports” and “World Market Stores” in 30 states. Cost Plus World Market’s business strategy is to differentiate itself by offering a large and ever-changing selection of unique products, many of which are imported, at value prices in an exciting shopping environment. Many of Cost Plus World Market’s products are proprietary or private label, often incorporating the Company’s own designs, “World Market” brand name, quality standards and specifications and typically are not available at department stores or other specialty retailers.

The Company’s stores are located predominantly in high traffic metropolitan and suburban locales, often near major malls. During the fiscal year ended January 30, 2010, the Company opened a total of two new stores; both are in the existing markets of Tucson, AZ and Phoenix, AZ. In addition to opening two new stores in fiscal 2009, the Company also closed 30 stores. The Company did not open any stores in new states during fiscal 2009. In fiscal 2010, the Company intends to relocate one store.

The Company’s website address iswww.worldmarket.com. The Company has made available through its Internet website, free of charge, its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Definitive Proxy Statement and Section 16 filings and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (“Exchange Act”), as soon as reasonably practicable after such materials are electronically filed with, or furnished to, the SEC. This website address is intended to be an inactive, textual reference only. None of the material on this website is part of this Annual Report on Form 10-K.

Merchandising

Cost Plus World Market’s merchandising strategy is to offer customers a broad selection of distinctive items related to the theme of casual home furnishing and entertaining.

1

Products. The Company believes its distinctive and unique merchandise and shopping environment differentiates it from other retailers. Many of Cost Plus World Market’s products are proprietary or private label. The “World Market” brand name or other brand names exclusive to the Company often incorporate the Company’s own designs, and have quality standards and specifications typically not available at department stores or other specialty retailers. In addition to strengthening the stores’ product offering, proprietary and private label goods typically offer higher gross margins and stronger consumer values than branded goods. A significant portion of Cost Plus World Market’s products are made abroad in over 50 countries and many of these goods are handcrafted by local artisans. The Company’s product offering is designed to provide solutions to customers’ casual living and home entertaining needs. The offerings include home decorating items such as furniture, rugs, pillows, bath linens, lamps, window coverings, frames, and baskets. Cost Plus World Market’s furniture products include ready-to-assemble living and dining room pieces, unusual handcrafted case goods and occasional pieces, as well as outdoor furniture made from a variety of materials such as rattan, hardwood and wrought iron. The Company also sells a number of tabletop and kitchen items including glassware, ceramics, textiles and cooking utensils. Kitchen products include an assortment of products organized around a variety of themes such as baking, food preparation, barbecuing and international dining.

Cost Plus World Market offers a number of gift and decorative accessories, including collectibles, candles, framed art, and holiday and other seasonal items. The Company’s offering also includes a unique assortment of jewelry, fashion accessories and personal care items. Because many of the gift, jewelry and collectible items come from around the world, they contribute to the exotic atmosphere of the stores. The Company’s business is highly seasonal, reflecting the general pattern associated with the retail industry of peak sales and earnings during the fourth quarter holiday season (the “Holiday” season).

Cost Plus World Market also offers its customers a wide selection of gourmet foods and beverages, including wine, microbrewed and imported beer, coffee, tea and bottled water. The wine assortment offers a number of moderately priced premium wines, including a variety of well recognized labels, as well as wines not readily available at neighborhood wine or grocery stores that have been privately bottled and imported from around the world. State regulations may limit or restrict the Company’s ability to sell alcoholic beverages. Consumable products, particularly beverages, generally have lower margins compared to the Company’s average. Gourmet foods include packaged products from around the world and seasonal items that relate to “traditional” holidays and customs. Packaged snacks, candy and pasta are often displayed in open barrels and crates. Food items typically have a shelf life of six months or longer.

The Company accounts for its operations as one operating segment. The Company classifies its sales into the home furnishings and consumables product lines. Sales in each category as a percentage of total net sales for the prior three fiscal years were as follows:

| | | | | | | | | |

| | | Fiscal Year Ended | |

| | | January 30,

2010 | | | January 31,

2009 | | | February 2,

2008 | |

Home Furnishings | | 59 | % | | 61 | % | | 61 | % |

Consumables | | 41 | % | | 39 | % | | 39 | % |

The Company replaces or updates many of the items in its merchandise assortment on a regular basis in order to encourage repeat shopping and to promote a sense of discovery. The Company typically marks down retail prices of items that do not meet its turnover expectations.

Format and Presentation. The Company’s stores are designed to evoke the feeling of a “world marketplace” through colorful and creative visual displays and merchandise presentations, including goods in open barrels and crates, groupings of related products in distinct “shops” within the store and in-store activities such as food and coffee tastings and wine tasting in some states. The Company believes that its “world marketplace” effect provides customers with a fun shopping experience and encourages browsing throughout the store.

2

The average selling space of a Cost Plus World Market store is approximately 15,700 square feet, which allows flexibility for merchandise displays, product adjacencies and directed traffic patterns. Complementary products are positioned in proximity to one another and cross merchandising themes are used in merchandise displays to tie different product offerings together. The floor plan allows the customer to see virtually all of the different product areas in a Cost Plus World Market store from the store center where four zones, with bulk displays highlighting sharply priced items, lead the customer into different product areas. The Company has a seasonal shop, usually located in the heart of the store, which features seasonal products and themes, such as the holiday shop, harvest and outdoor. Store signage, including permanent as well as promotional signs, is developed by the Company’s in-house graphic design department. End caps, bulk stacks and free standing displays are changed frequently. Approximately 3,000 square feet of back office and stock space are included in the total square footage at a store, which averages about 18,700 square feet per store.

The Cost Plus World Market store format is also designed to reinforce the Company’s value image through exposed ceilings, concrete floors, simple wooden fixtures and open or bulk presentations of merchandise. The Company displays most of its inventory on the selling floor and makes effective use of vertical space, such as a display of chairs arranged on a wall and rugs hanging vertically from fixtures.

The Company believes that its customers usually visit a Cost Plus World Market store as a destination with a specific purchase in mind. The Company makes use of frequent receipts of products, seasonal themes and products, and consumable products to encourage frequent return visits by its customers. The Company also believes that once in the store, its customers often spend additional time shopping and browsing, which results in customers purchasing more items than they originally intended.

Pricing. Cost Plus World Market offers quality products at competitive prices. The Company complements its everyday low price strategy with selected product promotions and opportunistic buys, enabling the Company to pass on additional savings to the customer. The Company routinely shops a variety of retailers to ensure that its products are competitively priced.

Planning and Buying. Cost Plus World Market effectively manages a large number of products by utilizing centralized merchandise planning, tracking and replenishment systems. The Company regularly monitors merchandise activity at the item level through its management information systems to identify and respond to product trends. The Company maintains its own central buying staff that are responsible for establishing the assortment of inventory within its merchandise classifications each season, including integrating current trends or themes identified by the Company into its different product categories. The Company attempts to moderate the risk associated with merchandise purchasing by testing selected new products in a limited number of stores. The Company’s long-standing relationships with overseas suppliers, its international buying agency network and its knowledge of the import process facilitate the planning and buying process. The buyers work closely with suppliers to develop unique products that will meet customers’ expectations for quality and value.

Advertising

The Company’s marketing program is a multimedia strategy that has primarily utilized print and electronic media, including weekly newspaper circulars, radio and online search functionality. Each medium is used to highlight product offerings and communicate promotional activity. The Company continues to test new media vehicles to achieve greater customer reach and reduce reliance on print advertising. During fiscal 2009, the Company successfully expanded and augmented its direct mail capabilities with several targeted new customer acquisition campaigns. Additionally, the Company nearly doubled its proprietary customer email database in fiscal 2009.

In fiscal 2009, the Company also launched the World Market Explorer customer loyalty program that allows us to recognize and reward our best customers. Key program elements are designed to increase the shopping frequency, increase average ticket size and engage new customers with the brand. The program includes earned rewards based upon individual purchasing patterns, advance notice of new product offerings and in-store events, and special pricing on an ever-changing selection of items.

3

The Company offers selected products on its website atwww.worldmarket.com which provides customers with purchase options and product information for items sold in stores. The Company’s website is designed to leverage a multi-channel philosophy, giving customers an additional touch point with its merchandise and marketing and to increase traffic at its stores.

Product Sourcing and Distribution

The Company purchases most of its inventory centrally, which allows the Company to take advantage of volume purchase discounts and improve controls over inventory and product mix. The Company purchases its merchandise from approximately 2,000 suppliers; the largest of which represented approximately 4% of total purchases in the fiscal year ended January 30, 2010. A significant portion of Cost Plus World Market’s products are manufactured abroad in over 50 countries in Europe, North and South America, Asia, Africa and Australia. The Company has established a well developed overseas sourcing network and enjoys long standing relationships with many of its vendors. As is customary in the industry, the Company does not have long-term contracts with its suppliers. The Company’s buyers often work with suppliers to produce unique products exclusive to Cost Plus World Market. The Company believes that, although there could be delays in changing suppliers, alternate sources of merchandise for core product categories are available at comparable prices. Cost Plus World Market typically purchases overseas products on either a free-on-board or ex-works basis, and the Company’s insurance on such goods commences at the time it takes ownership. The Company also purchases a number of domestic products, especially in the gourmet food and beverage area. Due to state regulations, wine and beer are purchased from local distributors, with purchasing primarily directed by the corporate buying office.

The Company currently services its stores from its distribution centers located in Stockton, California (“California”) and Windsor, Virginia (“Virginia”). Domestically sourced merchandise is usually delivered to the distribution centers by common carrier or by Company trucks.

Information Systems

Each of the Company’s stores is linked to the Cost Plus World Market headquarters in Oakland, California through an IBM 4690 Point-of-Sale (POS) system and a Multiprotocol Label Switching (MPLS) data network that interfaces with an IBM AS/400 computer. The Company’s information systems keep records, which are updated daily, of every merchandise item sold in each store, as well as financial, sales and inventory information. The Point-of-Sale system also has scanning, price look-up and on-line credit/debit card approval capabilities, all of which improve transaction accuracy, speed checkout time and increase overall store efficiency. The Company continually upgrades its in-store information systems to improve information flow to store management and enhance other in-store administration capabilities. In fiscal 2009, a new customer loyalty system, World Market Explorer, was developed and implemented to drive shopping frequency and increase sales among customers who already shop with us.

Purchasing operations are facilitated by the use of merchandise information systems that allow the Company to analyze product sell-through and assist the buyers in making merchandise decisions. The Company’s Central Replenishment system includes stock keeping unit (SKU) and store-specific “model stock” logic that enables the Company to maintain adequate stock levels on basic goods in each location. A new Assortment Planning application was implemented in fiscal 2008 to improve SKU level planning and management.

The Company uses several other information systems to manage and control its operations and finances. These information systems are designed to ensure the integrity of the Company’s inventory, support pricing decisions, process payroll, pay bills, control cash, maintain fixed assets and track promotions throughout all of the Company’s stores. The Company’s Warehouse Management system enables our distribution centers to receive, locate, pick and ship inventory to stores. A new distribution center labor management system was implemented in fiscal 2008 to improve distribution center labor planning, tracking and reporting.

Additional systems enable the Company to produce the periodic financial reports necessary for developing budgets and monitoring individual store and consolidated Company performance.

4

Competition

The markets served by Cost Plus World Market are highly competitive. The Company competes against a diverse group of retailers ranging from specialty stores to department stores and discounters. The Company’s product offerings compete with such retailers as Bed Bath & Beyond, Target, Crate & Barrel, Pottery Barn, Michaels Stores, Pier 1 Imports, Trader Joe’s and Williams-Sonoma. Most specialty retailers tend to have higher prices and a narrower assortment of products and department stores typically have higher prices than Cost Plus World Market for similar merchandise. Discounters may have lower prices than Cost Plus World Market, but the product assortment is generally more limited. The Company competes with these and other retailers for customers principally on the basis of price, assortment of products, brand name recognition, suitable retail locations and qualified management personnel.

Employees

As of January 30, 2010, the Company had 2,010 full-time and 3,735 part-time employees. Of these, 5,137 were employed in the Company’s stores, and approximately 608 were employed in the distribution centers and corporate office. The Company regularly supplements its work force with temporary staff, especially in the fourth fiscal quarter of each year to service increased customer traffic during the peak Holiday season. Employees in 11 stores in Northern California are covered by a collective bargaining agreement that expires on May 31, 2012. The Company believes that it enjoys good relationships with its employees.

Trademarks

The Company regards its trademarks and service marks as having significant value and as being important to its marketing efforts. The Company has registered its “Asian Passage,” “Cab-u-lous,” “Castello Del Lago,” “Cost Plus,” “Cost Plus World Market,” “Crossroads,” “Electric Reindeer,” “Marche du Monde with logo,” “Marche du Monde,” “Market Classics,” “Mercado Del Mundo,” “One World. One Store,” “Soiree,” “The Big Sipper,” “There with logo,” “Villa Vitale,” “World Market” and “Zinfatuation” marks with the United States Patent and Trademark Office on the Principal register. The Company has pending applications to register its “World Grill,” “World Market Explorer,” “World Market Pairings” and “Pomona” marks with the United States Patent and Trademark Office. In Canada, the Company has registered its “Cost Plus,” “Cost Plus World Market” and “World Market” marks and has applied to register its “Cost Plus World Market” marks. In the European Union, the Company has registered its “World Market” and logo mark. The Company’s policy is to pursue prompt and broad registration of its marks and to vigorously oppose infringement of its marks.

Geographic Information

Substantially all of the Company’s revenues are generated in, and long-lived assets are located in, the United States.

The following information describes certain significant risks and uncertainties inherent in our business. You should carefully consider these risks and uncertainties, together with the other information contained in this Annual Report on Form 10-K and in the Company’s other public filings. If any of such risks and uncertainties materialize, the Company’s business, financial condition or operating results could differ materially from the plans, projections and other forward-looking statements included in the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in this report and in the Company’s other public filings. In addition, if any of the following risks and uncertainties, or if any other disclosed risks and uncertainties, actually occurs, the Company’s business, financial condition or operating results could be harmed substantially, which could cause the market price of our stock to decline, perhaps significantly.

5

We have a history of negative cash flows and losses in recent years.

Including fiscal 2009, we experienced net losses each annual period since fiscal 2006. As of January 30, 2010, we had an accumulated deficit of $97.5 million. For fiscal 2009 and fiscal 2008, we were unable to generate cash flows from operating activities. There can be no assurance that our business will be profitable or will generate sufficient cash to fund operations in the future or that additional losses and negative cash flows from operations will not be incurred, which could have a material adverse affect on our financial condition. We are dependent upon our asset-based credit facility to fund operating losses and seasonal inventory purchases. We do not plan on fully paying off our asset-based credit facility during fiscal 2010. Access to our asset-based credit facility is dependent upon meeting our debt covenants and not exceeding the borrowing limit of the asset-based credit facility. There can be no assurance that we will achieve or sustain positive cash flows from operations or profitability. If we are unable to maintain adequate liquidity, future operations may need to be scaled back or discontinued.

The recent deterioration of the global economic environment and its impact on consumer confidence and spending could adversely impact the Company’s results of operations.

The global economic environment has deteriorated substantially during the past two years. The declining values in real estate, reduced lending by banks, solvency concerns of major financial institutions, increases in unemployment levels and recent significant declines and volatility in the global financial markets have negatively impacted the level of consumer spending for discretionary items. The difficult economic situation faced in the United States and other countries is not expected to end in the near future and consumer confidence and spending could remain depressed and possibly deteriorate even further. During times of economic uncertainty, consumers tend to sacrifice purchases of discretionary items, including the Company’s products, which could continue to adversely impact the Company’s financial results and turnaround plan.

Possibility of delisting from Nasdaq.

Nasdaq marketplace rules require the maintenance of a number of continued listing standards. If we fail to comply with any of the continued listing standards and are unable to cure such defect within the allotted time following the receipt of any notice from Nasdaq regarding our failure to maintain such continued listing standard, Nasdaq might delist our common stock. Delisting would have an adverse effect on the liquidity of our common stock and, as a result, the market price for our common stock might become more volatile and we may have to trade on an alternate exchange.

We have significant indebtedness.

We have significant debt and may incur substantial additional debt in the future. A significant portion of our future cash flow from operating activities is likely to remain dedicated to the payment of interest and the repayment of principal on our indebtedness. There is no guarantee that we will be able to meet our debt service obligations. If we are unable to generate sufficient cash flow or obtain funds for required payments, or if we fail to comply with our debt covenants, we would be in default and the lenders would have the right to accelerate full payment of the loans. In such event, we might not have sufficient cash resources to repay the lenders and we might not be able to refinance our debt on terms acceptable to us, or at all. Our indebtedness could limit our ability to obtain additional financing for working capital, capital expenditures, debt service requirements, acquisitions or other purposes in the future, as needed; to plan for, or react to, changes in our business and competition; and to react in the event of an economic downturn.

Our lender has liens on substantially all of our assets and could foreclose in the event that we default under our credit facility.

Under the terms of our asset-based credit facility, our lender has a first priority lien on substantially all of our assets, including our cash and inventory balances. If we default under the asset-based credit facility, our lender would be entitled to, among other things, foreclose on our assets in order to satisfy our obligations under the credit facility.

6

If we are unable to positively differentiate ourselves from other retailers, our results of operations could be adversely affected.

The retail business is highly competitive. In the past we have been able to compete successfully by differentiating our shopping experience by creating an attractive value proposition through a careful combination of price, merchandise assortment, convenience, guest service and marketing efforts. We compete against a diverse group of retailers ranging from specialty stores to department stores and discounters. Our product offerings compete with such retailers as Bed Bath & Beyond, Target, Crate & Barrel, Pottery Barn, Michaels Stores, Pier 1 Imports, Trader Joe’s and Williams-Sonoma. We compete with these and other retailers for customers, suitable retail locations and qualified management personnel. Some of our competitors have greater resources, more customers, and greater brand recognition. They may secure better terms from vendors, adopt more aggressive pricing, and devote more resources to technology, distribution, and marketing. Competitive pressures or other factors could cause us to lose market share, which may require us to lower prices, increase marketing and advertising expenditures, or increase the use of discounting or promotional campaigns, each of which would adversely affect our margins and could result in a decrease in our operating results and profitability.

Our business is highly seasonal, and our operating results fluctuate significantly from quarter to quarter.

Our business is highly seasonal, reflecting the general pattern associated with the retail industry of peak sales and earnings during the Holiday season. Due to the importance of the Holiday selling season, the fourth quarter of each fiscal year has historically contributed, and we expect will continue to contribute, a large percentage of our net sales and much of our net income, if any, for the entire fiscal year. Any factors that have a negative effect on our business during the Holiday selling season in any year, including unfavorable economic conditions, would materially and adversely affect our financial condition and results of operations. We generally experience lower sales and earnings during the first three quarters and, as is typical in the retail industry, may incur losses in these quarters. The results of our operations for these interim periods are not necessarily indicative of the results for our full fiscal year.

We also must make decisions regarding merchandise well in advance of the season in which it will be sold. If the demand for our merchandise is significantly different than we have projected, it could harm our business and operating results, either as a result of lost sales due to insufficient inventory or lower gross margin due to the need to mark down excess inventory.

Our quarterly operating results may also fluctuate based on such factors as:

| | • | | delays in the flow of merchandise to our stores; |

| | • | | the amount of sales contributed by new and existing stores; |

| | • | | the mix of products sold; |

| | • | | the timing and level of markdowns; |

| | • | | store closings or relocations; |

| | • | | changes in fuel and other shipping costs; |

| | • | | general economic conditions; |

| | • | | foreign exchange rates; |

| | • | | labor market fluctuations; |

| | • | | the impact of terrorist activities; |

| | • | | our ability to acquire merchandise and manage inventory levels; |

| | • | | our ability to retain and increase sales to existing customers, attract new customers, and satisfy our customers’ demands; |

7

| | • | | changes in accounting rules and regulations; and |

| | • | | unseasonable weather conditions. |

These fluctuations may also cause a decline in the market price of our common stock.

Our success depends to a significant extent upon the overall level of consumer spending.

As a retail business our success depends to a significant extent upon the overall level of consumer spending. Among the factors that affect consumer spending are the general state of the economy, credit and financial markets, the level of consumer debt, prevailing interest rates and consumer confidence in future economic conditions. A substantial number of our stores are located in the western United States, especially in California. Lower levels of consumer spending in this region could have a material adverse affect on our financial condition and results of operations. Reduced consumer confidence and spending may result in reduced demand for our merchandise, may limit our ability to increase prices and may require us to incur higher selling and promotional expenses, which in turn would harm our business and operating results.

If we fail to protect the security of personal information about our customers, we could be subject to costly government and industry enforcement actions or private litigation and our reputation could suffer.

The nature of our business involves the receipt and storage of personal information about our customers. If we experience a data security breach, we could be exposed to government and industry enforcement actions and private litigation. In addition, our customers could lose confidence in our ability to protect their personal information, which could cause them to discontinue usage of our credit card products, or stop shopping at our stores altogether. Such events could lead to lost future sales and adversely affect our results of operations.

The occurrence or the threat of international conflicts or terrorist activities could harm our business and result in business interruptions.

A significant portion of the merchandise that we sell is purchased in other countries and must be shipped to the United States, transported from the port of entry to our distribution centers in California or Virginia and distributed to our stores from the distribution centers. The precise timing and coordination of these activities is crucial to our business. The occurrence or threat of international conflicts or terrorist activities and the responses to those developments, for example, the temporary shutdown of a port that we use, could have a significant impact upon our business, our personnel and facilities, our customers and suppliers, the retail and financial markets and general economic conditions.

Our business and operating results are sensitive to changes in energy and transportation costs.

We incur significant costs for the transportation of goods from foreign ports to our distribution centers and stores and for utility services in our stores, distribution centers and corporate offices. We continually negotiate pricing for certain transportation contracts and, in a period of volatile fuel costs such as we have recently experienced, we expect that our vendors for these services will increase their rates to compensate for any possible increases in energy costs. We may not be able to pass a portion of these increased costs on to our customers and remain competitively priced.

Our operating results will be harmed if we are unable to improve our gross margin and increase our comparable store sales.

Our results depend, in part, upon the success of numerous initiatives that were recently implemented to improve our gross margin and improve sales at our existing stores. Our comparable store sales, which are defined as sales by stores that have completed 14 full fiscal months of sales, fluctuate from year to year. Fiscal 2006 was 53 weeks; therefore, to ensure a meaningful comparison, comparable store sales for fiscal 2006 were measured on a

8

53-week basis. In all other years presented, comparable store sales were measured on a 52-week basis. In fiscal 2009, comparable store sales decreased by 7.1% from fiscal 2008 and fiscal 2008 sales decreased by 2.6% from fiscal 2007. Various factors affect both gross margin and comparable store sales, including:

| | • | | the general retail sales environment, |

| | • | | our ability to source and distribute products efficiently, |

| | • | | changes in our merchandise mix, |

| | • | | current economic conditions, |

| | • | | the timing of release of new merchandise and promotional events, |

| | • | | the success of marketing programs, and |

These factors and others may cause our gross margin and comparable store sales to differ significantly from prior periods and from expectations. If we fail to meet the gross margin and comparable store sales expectations of investors and security analysts in one or more future periods, the price of our common stock could decline.

The Company’s success depends, in part, on its ability to operate in desirable locations at reasonable rental rates and to close underperforming stores at or before the conclusion of their lease terms.

The profitability of the business is dependent on operating the current store base at a reasonable profit, opening and operating new stores at a reasonable profit, and identifying and closing underperforming stores. For a majority of the Company’s current store base, a large portion of a stores’ operating expense is the cost associated with leasing the location. Management actively monitors individual store performance and attempts to negotiate rent reductions to ensure stores can remain profitable or have the ability to rebound to a profitable state. Current locations may not continue to be desirable as demographics change, and the Company may choose to close an underperforming store before its lease expires and incur lease termination costs associated with that closing. The Company cannot give assurance that opening new stores or an increase in closings will result in greater profits.

We face a number of risks because we import much of our merchandise.

We import a significant amount of our merchandise from over 50 countries and numerous suppliers. We have no long-term contracts with our suppliers but instead rely on long-term relationships that we have established with many of these suppliers. Our future success will depend to a significant extent on our ability to maintain our relationships with our suppliers or to develop new ones. As an importer, our business is subject to the risks generally associated with doing business abroad such as the following:

| | • | | foreign governmental regulations, |

| | • | | freight cost increases, |

| | • | | changes in political or economic conditions in countries from which we purchase products, and |

| | • | | the effect of trade regulation by the United States, including quotas, duties and taxes and other charges or restrictions on imported merchandise. |

If these factors or others made the conduct of business in particular countries undesirable or impractical or if additional quotas, duties taxes or other charges or restrictions were imposed by the United States on the importation of our products, our business and operating results would be harmed.

9

Interruption of the supply chain and/or ability to obtain products from suppliers.

The products we sell are procured from a wide variety of domestic and foreign suppliers and are distributed to our stores through distribution facilities in Stockton, California and Windsor, Virginia, as well as direct store delivery. Any significant interruption in our ability to source the products and the efficiency of distributing such products to our stores would harm our business and operating results.

We may not be able to forecast customer preferences accurately in our merchandise selections.

Our success depends in part on our ability to anticipate the tastes of our customers and to provide merchandise that appeals to their preferences. Our strategy requires our merchandising staff to introduce products from around the world that meet current customer preferences and that are affordable, distinctive in quality and design and that are not widely available from other retailers. Many of our products require long order lead times. In addition, a large percentage of our merchandise changes regularly. Our failure to anticipate, identify or react appropriately to changes in consumer trends could cause excess inventories and higher markdowns or a shortage of products and could harm our business and operating results.

We rely on various key management personnel to ensure our success.

Our success will continue to depend on our key management personnel. The loss of the services of one or more of these executive officers or other key employees could harm our business and operating results. We do not maintain any key man life insurance policies.

Our common stock may be subject to substantial price and volume fluctuations.

The market price of our common stock is affected by factors such as fluctuations in our operating results, a downturn in the retail industry, changes in interest rates, changes in financial estimates by us or securities analysts and recommendations by securities analysts regarding our Company, other retail companies or the retail industry in general, and general market and economic conditions. In addition, the stock market can experience price and volume fluctuations that are unrelated to the operating performance of particular companies.

Impact of natural disasters.

The occurrence of one or more natural disasters, including earthquakes (particularly in California where our Stockton distribution center is located and approximately 28.6% of our sales were generated in fiscal 2009) could result in the disruption in the supply of our products and distribution of products to our stores, damage to and the temporary closure of one or more stores and interruption in our labor staffing. These, and other potential outcomes of a natural disaster, could materially and adversely affect our results of operations.

We may be subject to significant liability should the consumption of any of our products cause injury, illness or death.

Our business is subject to product recalls in the event of contamination, product tampering, mislabeling or damage to our products. We cannot assure you that product-liability claims will not be asserted against us or that we will not be obligated to recall our products in the future. A product-liability judgment against us or a product recall could have a material adverse effect on our business, financial condition or results of operations.

Our business is subject to risks associated with fluctuations in the values of foreign currencies against the United States dollar.

We have significant purchase obligations with suppliers outside of the United States. During fiscal 2009, approximately 3.8% of these purchases were settled in currencies other than the United States dollar, compared to approximately 3.4% of purchases in fiscal 2008. Fluctuations in the rates of exchange between the dollar and other currencies could harm our operating results. We have not hedged our currency risk in the past and do not currently anticipate doing so in the future.

10

Provisions in our charter documents as well as our shareholders’ rights plan could prevent or delay a change in control of our Company and may reduce the market price of our common stock.

Certain provisions of our articles of incorporation and bylaws may have the effect of making it more difficult for a third party to acquire, or may discourage a third party from attempting to acquire, control of the Company. Such provisions could limit the price that certain investors might be willing to pay in the future for shares of our common stock. Certain of these provisions allow us to issue preferred stock without any vote or further action by the shareholders. In addition, the right to cumulate votes in the election of directors has been eliminated. These provisions may make it more difficult for shareholders to take certain corporate actions and could have the effect of delaying or preventing a change in control of the Company. In addition, our board of directors has adopted a preferred share purchase rights agreement. Pursuant to the rights agreement, our board of directors declared a dividend of one right to purchase one one-thousandth share of our Series A Participating Preferred Stock for each outstanding share of our common stock. These rights could have the effect of delaying, deferring or preventing a change of control of our Company, discouraging a proxy contest or making more difficult the acquisition of a substantial block of our common stock. The rights agreement could also limit the price that investors might be willing to pay in the future for our common stock.

Lawsuits and other claims against our Company may adversely affect our operating results.

We are involved in litigation, claims and assessments incidental to our business, the disposition of which is not expected to have a material effect on our financial position or results of operations. It is possible, however, that future results of operations for any particular quarterly or annual period could be materially affected by changes in our assumptions related to these matters. We accrue our best estimate of the probable cost for the resolution of claims. When appropriate, such estimates are developed in consultation with outside counsel handling the matters and are based upon a combination of litigation and settlement strategies. To the extent additional information arises or our strategies change, it is possible that our best estimate of our probable liability may change.

Changes to estimates related to the Company’s property and equipment, or operating results that are lower than its current estimates at certain store locations, may cause the Company to incur impairment charges on certain long-lived assets.

The Company makes certain estimates and projections with regards to individual store operations in connection with its impairment analyses for long-lived assets in accordance with Accounting Standards Codification (“ASC”) 360, “Accounting for Impairment or Disposal of Long Lived Assets.” An impairment charge is required when the carrying value of the asset exceeds the estimated fair value or undiscounted future cash flows of the asset. The projection of future cash flows used in this analysis requires the use of judgment and a number of estimates and projections of future operating results. If actual results differ from the Company’s estimates, additional charges for asset impairments may be required in the future. If impairment charges are significant, the Company’s results of operations could be adversely affected.

If we fail to maintain an effective system of internal control, we may not be able to accurately report our financial results. As a result, current and potential shareholders could lose confidence in our financial reporting, which could harm our business and the market price of our stock.

Ensuring that we have adequate internal financial and accounting controls and procedures in place to produce accurate financial statements on a timely basis is a costly and time-consuming effort that needs to be re-evaluated frequently. Our management is responsible for establishing and maintaining adequate internal control over financial reporting to provide reasonable assurance regarding the reliability of our financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles in the United States. Our management does not expect that our internal control over financial reporting will prevent or detect all errors and all fraud. A control system, no matter how well designed and operated, can provide only reasonable, not absolute, assurance that the control system’s objectives will be

11

met. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that misstatements due to error or fraud will not occur or that all control issues and instances of fraud, if any, within our company will have been detected. Effective internal control is necessary for us to provide reliable financial reports. Failure on our part to have effective internal financial and accounting controls could cause our financial reporting to be unreliable, could have a material adverse effect on our business, operating results, and financial condition, and could adversely affect the trading price of our common stock.

Changes in our effective income tax rate could affect our results of operations.

Our effective income tax rate is influenced by a number of factors. Changes in the tax laws, the interpretation of existing laws, or our failure to sustain our reporting positions on examination could adversely affect our effective tax rate. Further, our effective tax rate in a given financial statement period may be materially impacted by changes in the mix and level of earnings or by changes to existing accounting rules or regulations and could have a material adverse effect on our results of operations.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

As of April 6, 2010, the Company operated 263 stores in 30 states. The average selling space of a Cost Plus World Market store was approximately 15,700 square feet. The total average square footage of a Cost Plus World Market store was approximately 18,700 square feet, including a back stock room and office space. The table below summarizes the distribution of stores by state:

| | | | | | | | | | | | | | | |

Alabama | | 5 | | | Idaho | | 2 | | Michigan | | 5 | | South Carolina | | 8 |

Arizona | | 15 | | | Illinois | | 12 | | Missouri | | 5 | | South Dakota | | 1 |

California | | 70 | | | Indiana | | 1 | | Montana | | 2 | | Tennessee | | 5 |

(Northern California | | 30 | ) | | Iowa | | 1 | | Nevada | | 5 | | Texas | | 31 |

(Southern California | | 40 | ) | | Kansas | | 2 | | New Mexico | | 3 | | Utah | | 2 |

Colorado | | 7 | | | Kentucky | | 1 | | North Carolina | | 11 | | Virginia | | 9 |

Florida | | 14 | | | Louisiana | | 6 | | Ohio | | 9 | | Washington | | 11 |

Georgia | | 6 | | | Maryland | | 2 | | Oregon | | 7 | | Wisconsin | | 5 |

The Company leases land and buildings for 258 stores (of which 10 are capital leases) and leases land and owns the buildings for five stores. The Company currently leases its executive headquarters in Oakland, CA pursuant to a lease that expires in October 2013.

The Company currently leases a distribution center of approximately 1,000,000 square feet in Stockton, CA on 55 acres of land. The distribution center has two separate but adjacent facilities under separate lease agreements, one of which is used primarily for furniture distribution and the other is primarily used for general merchandise distribution. The California distribution center is the Company’s primary distribution center for its stores in the western United States. The Company owned the property prior to leasing it. The initial term of the building lease expires April 30, 2026. The Company has two options to renew for five year terms each and one option to renew for a term of four years. Additionally, the Company has one time termination rights to terminate the leases on April 30, 2016 and July 31, 2017, respectively. The Company accounted for the sale and leaseback of the property as a financing whereby the net book value of the asset remains on the Company’s consolidated balance sheet.

The Company currently leases a distribution center of approximately 1,000,000 square feet in Windsor, VA on 82 acres of land. The Company owned the property prior to leasing it. The initial term of the lease expires December 21, 2026. The Company has the option to renew for four consecutive terms of five years each. Additionally, the Company has a one time termination right to terminate the lease on December 31, 2016. The Company accounted for the sale and leaseback of the property as a financing whereby the net book value of the asset remains on the Company’s consolidated balance sheet.

12

The Company believes its current distribution facilities are adequate to meet its needs and will be able to accommodate future store growth.

The Company is not a party to any pending legal proceeding other than claims and litigation that arise in the ordinary course of business. Based on currently available information, management does not believe that the ultimate outcome of any unresolved matters, individually or in the aggregate, is likely to have a material adverse effect on the Company’s financial position or results of operations. However, litigation is subject to inherent uncertainties, and management’s view of these matters may change in the future. Were an unfavorable outcome to occur, there exists the possibility of a material adverse impact on the Company’s financial position and results of operations for the period in which the unfavorable outcome occurs, which may extend into future periods.

| ITEM 4. | REMOVED AND RESERVED |

13

EXECUTIVE OFFICERS OF THE REGISTRANT

The executive officers of the Company and their respective ages as of April 6, 2010 are as follows:

| | | | |

Name | | Age | | Position |

Barry J. Feld | | 53 | | Chief Executive Officer, President and Director |

Jane L. Baughman | | 43 | | Executive Vice President, Chief Financial Officer and Secretary |

Joan S. Fujii | | 63 | | Executive Vice President, Human Resources |

Jeffrey A. Turner | | 47 | | Executive Vice President, Operations and Chief Information Officer |

Elizabeth J.A. Allen | | 43 | | Senior Vice President, Marketing |

Carrie F. Crooker | | 50 | | Senior Vice President, Store Operations |

Laura M. Sites-Reynolds | | 49 | | Senior Vice President, Inventory Management |

Mr. Feld was appointed Chief Executive Officer and President of Cost Plus, Inc. in October 2005. From August 1999 until October 2005, Mr. Feld was President, Chief Executive Officer and Chairman of the Board of Directors of PCA International, Inc., the largest North American operator of portrait studios focused on serving the discount retail market. From November 1998 to June 1999, Mr. Feld was President and Chief Operating Officer of Vista Eyecare, Inc., a specialty eyecare retailer. He joined Vista Eyecare as a result of its acquisition of New West Eyeworks, Inc., where he had been serving as President and a director since May 1991 and as Chief Executive Officer and a Director since February 1994. From 1987 to May 1991, Mr. Feld was with Frame-n-Lens Optical, Inc., where he served as its President prior to joining New West. Prior to that, he served in various senior management positions at Pearle Health Services for 10 years and, for a number of years, he served as an acquisition and turnaround specialist for optical retail groups acquired by Pearle. PCA International filed for protection under Chapter 11 of the federal Bankruptcy Code in August 2006.

Ms. Baughman is the Executive Vice President and Chief Financial Officer for Cost Plus, Inc. She is responsible for all of the Company’s financial activities including: Finance, Accounting, Treasury, Risk Management, Tax and Real Estate, and has more than 18 years of retail experience. Ms. Baughman joined Cost Plus in February 1996 as Manager of Merchandise Planning and has been promoted into positions of increasing responsibility including: Director of Financial Planning & Analysis, VP of Finance, Treasurer, and SVP Financial Operations prior to her appointment as EVP and Chief Financial Officer in September 2007. Ms. Baughman has also served as the Company’s Corporate Secretary since August 2001. Prior to joining the Company, Ms. Baughman served in various financial positions for The Nature Company and The Gap, Inc., and worked in investment banking as a financial analyst for Dillon Read & Co., Inc.

Ms. Fujii was named the Company’s Executive Vice President, Human Resources in July 2005. Ms. Fujii joined the Company in May 1991 and served as Senior Vice President, Human Resources from February 1998 to May 2005. From October 1994 to February 1998, Ms. Fujii served as Vice President, Human Resources. From May 1991 to October 1994, Ms. Fujii served as the Company’s Director of Human Resources. From September 1975 to May 1991, she was employed by Macy’s California in various operations and human resources management positions, ultimately serving as Vice President, Human Resources at Macy’s Union Square store in San Francisco.

Mr. Turner joined the Company in September 2007 as Senior Vice President and Chief Information Officer. Effective March 2010, Mr. Turner was promoted to the position of Executive Vice President of Operations and Chief Information Officer. As EVP of Operations and Chief Information Officer, Mr. Turner is responsible for information technology, store operations, logistics and the distribution centers. Mr. Turner has 26 years of information technology experience, as well as 18 years of retail systems experience. Prior to joining the Company, Mr. Turner served as Senior Vice President and Chief Information Officer for Restoration Hardware from June 2004 to September 2007. Mr. Turner also held senior level information technology positions at Levi Strauss & Co. and Gap Inc. from 1991 to 2004. He served as the Vice President, Global and North America Development at Levi Strauss & Co. from August 2001 to February 2004, and he served from September 1991 to

14

July 2001 in a variety of roles at Gap Inc. culminating in the position of Vice President, Global Store Technology. Mr. Turner began his career in management consulting with Arthur Andersen in July 1984.

Ms. Allen joined the Company in September 2008 as Senior Vice President of Marketing. She has 20 years of consumer marketing expertise developed while working with high-profile brands, including Apple, Gap, LucasArts, Boston Market and Sprint, where she managed a broad range of functions: brand management, marketing communications, advertising and consumer insights. Ms. Allen also held leadership positions developing and executing integrated marketing strategies on global, national and regional levels. She began her career in advertising and worked for Foote, Cone & Belding and J. Walter Thompson in both San Francisco and New York. Most recently, she served as Vice President of Marketing for Gap from 2004 to 2007.

Ms. Crooker joined the Company in March 2003 as the Regional Director for the Western Region. In January of 2005, she was promoted to Vice President of Store Operations and, ultimately, assumed responsibility for both the Eastern and Western Regions in the Company. In August of 2007, she was promoted to Senior Vice President of Store Operations. Prior to coming to Cost Plus World Market, Ms. Crooker worked for Target Corporation for 16 years in a variety of Store Operations roles. These roles included Target’s expansion into central and northern California in the late 1980’s. Ms. Crooker has been focused on field operations during her career and her roles at Target included, but were not exclusive to, Store Team Leader and District Team Leader.

Ms. Sites-Reynolds joined the Company in March 2006 as Vice President, Supply Chain and Inventory Management. Effective March 2010, Ms. Sites-Reynolds was promoted to the position of Senior Vice President, Inventory Management. Ms. Sites-Reynolds is responsible for all of the Company’s inventory investment activities including merchandise planning, store allocation, and business analytics. Prior to joining Cost Plus World Market, Ms. Sites-Reynolds served from May 2000 to March 2006 as Vice President, Supply Chain and Inventory Management, at Design Within Reach, Inc. Ms. Sites-Reynolds has also worked for Gymboree, Ross Stores, and has served in other senior management positions related to inventory management in retail start-up and turnaround situations.

There are no family relationships among any of our directors or executive officers.

15

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Information

The Company’s common stock is currently traded on the Nasdaq Global Select Market under the symbol “CPWM.” The following table sets forth the high and low closing sales prices, for the periods indicated, as reported by the Nasdaq Global Select Market.

Fiscal Year Ended January 30, 2010

| | | | | | |

| | | Price Range |

| | | High | | Low |

First Quarter | | $ | 2.03 | | $ | 0.55 |

Second Quarter | | | 2.03 | | | 1.29 |

Third Quarter | | | 2.95 | | | 1.61 |

Fourth Quarter | | | 2.10 | | | 0.98 |

Fiscal Year Ended January 31, 2009

| | | | | | |

| | | Price Range |

| | | High | | Low |

First Quarter | | $ | 4.07 | | $ | 2.76 |

Second Quarter | | | 3.52 | | | 2.26 |

Third Quarter | | | 2.50 | | | 1.05 |

Fourth Quarter | | | 1.66 | | | 0.80 |

As of March 25, 2010, the Company had 44 shareholders of record, excluding shareholders whose stock is held by brokers and other institutions on behalf of the shareholders. The Company estimated it had approximately 3,800 beneficial shareholders as of that date.

Dividend Policy

As of January 30, 2010, the Company has paid no cash dividends on its common stock, and the Company has no current intentions to do so. Certain provisions of the Company’s loan agreements restrict the ability of the Company to pay dividends.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

In March 2003, the Company announced a stock repurchase program that was approved by its Board of Directors to repurchase up to 500,000 shares of its common stock. The Company repurchased 425,500 shares in fiscal 2004 under the program. On November 18, 2004, the Company’s Board of Directors authorized the repurchase of an additional 1,000,000 shares resulting in a total of 1,074,500 shares available for repurchase under the program. No shares were repurchased under the program in fiscal 2009, 2008, 2007 and fiscal 2006. The program does not require the Company to repurchase any common stock and may be discontinued at any time.

Securities Authorized for Issuance Under Equity Compensation Plans

Information regarding the securities authorized for issuance under the Company’s equity compensation plans is incorporated by reference from our proxy statement to be filed for our 2010 Annual Meeting of Shareholders. See Item 12 of this Annual Report on Form 10-K.

16

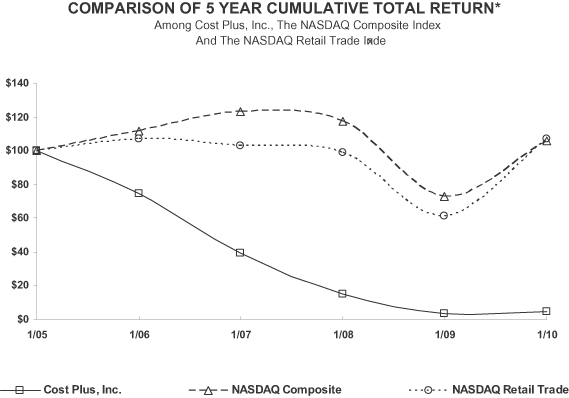

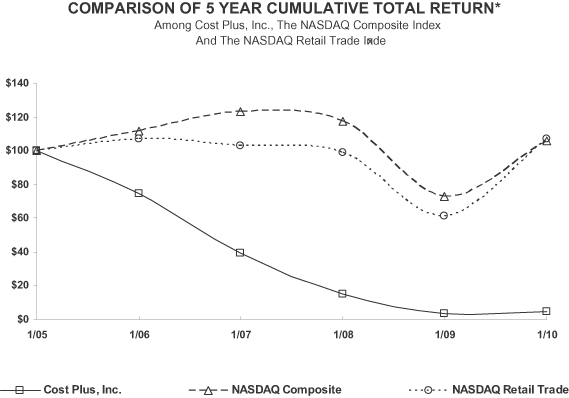

PERFORMANCE GRAPH

The following graph shows a comparison of cumulative total return for our common stock, the Nasdaq Composite Index and the Nasdaq Retail Trade Index from January 31, 2005 through the fiscal year ended January 30, 2010. In preparing the graph it was assumed that: (i) $100 was invested on January 31, 2005 in our common stock at $26.23 per share (adjusted for stock splits), the Nasdaq Composite Index and the Nasdaq Retail Trade Index; and (ii) all dividends were reinvested.

Notwithstanding anything to the contrary set forth in any of our previous filings under the Securities Act of 1933, as amended or the Exchange Act that might incorporate future filings, in whole or in part, the following performance graph shall neither be incorporated by reference into any such filings nor be incorporated by reference into any future filings, except to the extent we specifically incorporate this information by reference.

| | * | $100 invested on 1/31/05 in stock or index, including reinvestment of dividends. Fiscal year ending January 31. |

| | | | | | | | | | | | |

| | | 1/05 | | 1/06 | | 1/07 | | 1/08 | | 1/09 | | 1/10 |

Cost Plus, Inc. | | 100.00 | | 74.53 | | 39.27 | | 15.25 | | 3.66 | | 4.57 |

NASDAQ Composite | | 100.00 | | 111.69 | | 122.94 | | 117.70 | | 72.63 | | 105.78 |

NASDAQ Retail Trade | | 100.00 | | 106.90 | | 102.73 | | 99.06 | | 61.05 | | 107.14 |

17

| ITEM 6. | SELECTED FINANCIAL DATA |

Five Year Summary of Selected Financial Data1

| | | | | | | | | | | | | | | | | | | | |

(In thousands, except per share amounts and

selected operating data) | | Fiscal Year2 | |

| | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | |

Net sales | | $ | 869,459 | | | $ | 950,913 | | | $ | 949,838 | | | $ | 962,315 | | | $ | 902,551 | |

Cost of sales and occupancy | | | 639,846 | | | | 703,877 | | | | 678,972 | | | | 679,714 | | | | 599,778 | |

| | | | | | | | | | | | | | | | | | | | |

Gross profit | | | 229,613 | | | | 247,036 | | | | 270,866 | | | | 282,601 | | | | 302,773 | |

Selling, general and administrative expenses | | | 271,622 | | | | 314,467 | | | | 303,161 | | | | 293,333 | | | | 262,547 | |

Store closure costs | | | 5,799 | | | | — | | | | — | | | | — | | | | — | |

Store preopening expenses | | | 238 | | | | 3,228 | | | | 3,270 | | | | 5,303 | | | | 6,611 | |

Impairment of goodwill | | | — | | | | — | | | | — | | | | 4,178 | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Income (loss) from continuing operations, before interest and taxes | | | (48,046 | ) | | | (70,659 | ) | | | (35,565 | ) | | | (20,213 | ) | | | 33,615 | |

Net interest expense | | | 11,206 | | | | 12,840 | | | | 11,613 | | | | 7,126 | | | | 5,143 | |

| | | | | | | | | | | | | | | | | | | | |

Income (loss) from continuing operations before income taxes | | | (59,252 | ) | | | (83,499 | ) | | | (47,178 | ) | | | (27,339 | ) | | | 28,472 | |

Income tax (benefit) expense | | | (12,738 | ) | | | 758 | | | | 34 | | | | (10,687 | ) | | | 9,379 | |

| | | | | | | | | | | | | | | | | | | | |

Net income (loss) from continuing operations | | | (46,514 | ) | | | (84,257 | ) | | | (47,212 | ) | | | (16,652 | ) | | | 19,093 | |

| | | | | | | | | | | | | | | | | | | | |

Loss from discontinued operations, net of income tax | | | (16,805 | ) | | | (18,411 | ) | | | (8,288 | ) | | | (5,884 | ) | | | (2,504 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net income (loss) | | $ | (63,319 | ) | | $ | (102,668 | ) | | $ | (55,500 | ) | | $ | (22,536 | ) | | $ | 16,589 | |

| | | | | | | | | | | | | | | | | | | | |

Net income (loss) per share from continuing operations: | | | | | | | | | | | | | | | | | | | | |

Basic | | $ | (2.11 | ) | | $ | (3.82 | ) | | $ | (2.14 | ) | | $ | (0.75 | ) | | $ | 0.86 | |

Diluted | | $ | (2.11 | ) | | $ | (3.82 | ) | | $ | (2.14 | ) | | $ | (0.75 | ) | | $ | 0.86 | |

Net loss per share from discontinued operations: | | | | | | | | | | | | | | | | | | | | |

Basic | | $ | (0.76 | ) | | $ | (0.83 | ) | | $ | (0.37 | ) | | $ | (0.27 | ) | | $ | (0.11 | ) |

Diluted | | $ | (0.76 | ) | | $ | (0.83 | ) | | $ | (0.37 | ) | | $ | (0.27 | ) | | $ | (0.11 | ) |

Net income (loss) per share: | | | | | | | | | | | | | | | | | | | | |

Basic | | $ | (2.87 | ) | | $ | (4.65 | ) | | $ | (2.51 | ) | | $ | (1.02 | ) | | $ | 0.75 | |

Diluted | | $ | (2.87 | ) | | $ | (4.65 | ) | | $ | (2.51 | ) | | $ | (1.02 | ) | | $ | 0.75 | |

Weighted average shares outstanding—basic | | | 22,087 | | | | 22,087 | | | | 22,086 | | | | 22,068 | | | | 22,004 | |

Weighted average shares outstanding—diluted | | | 22,087 | | | | 22,087 | | | | 22,086 | | | | 22,068 | | | | 22,100 | |

| | | | | | | | | | | | | | | | | | | | |

Selected Operating Data: | | | | | | | | | | | | | | | | | | | | |

Percent of net sales: | | | | | | | | | | | | | | | | | | | | |

Gross profit | | | 26.4 | % | | | 26.0 | % | | | 28.5 | % | | | 29.4 | % | | | 33.5 | % |

Selling, general and administrative expenses | | | 31.2 | % | | | 33.1 | % | | | 31.9 | % | | | 30.5 | % | | | 29.1 | % |

Income (loss) from continuing operations, before interest and taxes | | | (5.5 | )% | | | (7.4 | )% | | | (3.7 | )% | | | (2.1 | )% | | | 3.7 | % |

Number of stores: | | | | | | | | | | | | | | | | | | | | |

Opened during period | | | 2 | | | | 15 | | | | 15 | | | | 24 | | | | 35 | |

Closed during period | | | 30 | | | | 17 | | | | 4 | | | | 4 | | | | 5 | |

Open at end of period | | | 268 | | | | 296 | | | | 298 | | | | 287 | | | | 267 | |

Average sales per selling square foot3 | | $ | 201 | | | $ | 222 | | | $ | 223 | | | $ | 237 | | | $ | 247 | |

Comparable store sales decrease4 | | | (7.1 | )% | | | (2.6 | )% | | | (5.4 | )% | | | (3.3 | )% | | | (2.6 | )% |

| | | | | | | | | | | | | | | | | | | | |

Balance Sheet Data (at period end): | | | | | | | | | | | | | | | | | | | | |

Working capital | | $ | 101,097 | | | $ | 128,773 | | | $ | 161,129 | | | $ | 198,749 | | | $ | 188,463 | |

Total assets | | | 380,432 | | | | 444,992 | | | | 553,747 | | | | 569,546 | | | | 529,571 | |

Long-term debt and capital lease obligations, less current portion | | | 119,665 | | | | 120,721 | | | | 122,769 | | | | 121,567 | | | | 62,319 | |

Total shareholders’ equity | | | 74,043 | | | | 136,209 | | | | 237,519 | | | | 291,459 | | | | 310,395 | |

Current ratio | | | 1.91 | | | | 2.11 | | | | 2.03 | | | | 2.73 | | | | 2.60 | |

Debt to equity ratio | | | 229.5 | % | | | 118.4 | % | | | 60.2 | % | | | 42.4 | % | | | 22.3 | % |

| | | | | | | | | | | | | | | | | | | | |

| | 1. | The consolidated statements of operations for the fiscal years ended 2008, 2007, 2006 and 2005 have been revised to present certain components as discontinued operations (see Note 3 of notes to consolidated financial statements). Unless otherwise indicated, information presented in the Notes to the Consolidated Financial Statements relates only to the Company’s continuing operations. |

| | 2. | The Company’s fiscal year end is the Saturday closest to the end of January. Fiscal 2006 was 53 weeks and ended on February 3, 2007. All other fiscal years presented consisted of 52 weeks. |

| | 3. | Calculated using net sales for stores open during the entire period divided by the selling square feet of such stores. |

| | 4. | A store is included in comparable store sales the first day of the fiscal month beginning with the fourteenth full fiscal month of sales. Comparable store sales for fiscal 2006 were measured on a 53-week basis. In all other years presented, comparable store sales were measured on a 52-week basis. |

18

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION |

The following discussion and analysis of results of operations, financial condition, liquidity and capital resources should be read in conjunction with the accompanying audited consolidated financial statements and notes thereto that are included elsewhere in this Annual Report on Form 10-K. The fiscal years ended January 30, 2010 (fiscal 2009), January 31, 2009 (fiscal 2008) and February 2, 2008 (fiscal 2007) all included 52 weeks. The consolidated statements of operations for periods ended fiscal 2008, fiscal 2007, fiscal 2006 and fiscal 2005 have been revised to present certain components as discontinued operations (see Note 3 of the notes to the consolidated financial statements). Unless otherwise indicated, information presented in the notes to the financial statements relates only to the Company’s continuing operations.

Overview

Cost Plus, Inc. is a leading specialty retailer of casual home furnishings and entertaining products. As of January 30, 2010, the Company operated 268 stores in 30 states. The stores feature an ever-changing selection of casual home furnishings, housewares, gifts, decorative accessories, gourmet foods and beverages offered at competitive prices and imported from more than 50 countries. Many items are unique and exclusive to Cost Plus World Market. The value, breadth and continual refreshment of products invites customers to come back throughout a lifetime of changing home furnishings and entertaining needs.

Net sales for fiscal 2009 decreased 8.6% to $869.5 million from $950.9 million for fiscal 2008, while comparable store sales for fiscal 2009 decreased 7.1% compared to a 2.6% decrease in fiscal 2008. The net loss in fiscal 2009 was $63.3 million, or $2.87 per diluted share, versus a net loss in fiscal 2008 of $102.7 million, or $4.65 per diluted share. Despite the 7.1% decrease in comparable store sales for fiscal 2009 the Company was able to decrease its net loss compared to last year by 38% during one of the toughest retail climates on record which was primarily achieved by tightly controlling expenses and inventory purchases.

The Company ended the year with $48.5 million in borrowings and $12.9 million in letters of credit outstanding under its asset-based credit facility compared to $38.5 million in borrowings and $13.5 million in letters of credit last year. The revolving credit facility is asset-based and expires in June 2012. At the end of fiscal 2009, inventory levels had declined 18.8% year-over-year. The reduction in inventory is the result of store closures, planned decreases in SKU (stock keeping unit) counts and lower weeks of supply.

While the Company has sufficient liquidity for the next 12 months we continue to explore alternate sources of capital for future expansion.

The Company opened two new stores and closed 30 stores during fiscal 2009 to end the year with 268 stores. The Company expects to close five stores and relocate one store in fiscal 2010.

Fiscal 2009 Compared to Fiscal 2008

Net SalesNet sales consist almost entirely of retail sales, but also include direct-to-consumer sales and shipping revenue. Net sales decreased $81.5 million, or 8.6%, to $869.5 million in fiscal 2009 from $950.9 million in fiscal 2008. The decrease in net sales was attributable to a decrease in comparable store sales and net sales related to the eight store closures in continuing operations. Comparable store sales decreased 7.1% compared to a decrease of 2.6% in 2008 due primarily to a lower average ticket and a relatively flat customer count. As of January 30, 2010, the calculation of comparable store sales included a base of 266 stores. A store is included as comparable at the beginning of the fourteenth full fiscal month of sales. As of January 30, 2010, the Company operated 268 stores compared to 296 stores as of January 31, 2009.

The Company classifies its sales into home furnishings and consumables product lines. Home furnishings were 59% of sales in fiscal 2009 compared to 61% in fiscal 2008 and consumables were 41% of sales in fiscal 2009 compared to 39% in fiscal 2008. The Company has grown its private label business, particularly in consumables, to compliment the branded gourmet food and wine products and to increase our customer’s

19

shopping frequency. During fiscal 2009, the Company continued to maximize its consumables business which helped to offset lower sales in some of the higher price home categories, primarily furniture, thereby affecting the overall sales mix between home and consumables. The Company expects the shift in sales mix experienced in fiscal 2009 to remain relatively constant for the next 12 months or until there is some level of economic recovery.

Cost of Sales and OccupancyCost of sales and occupancy, which consists of costs to acquire merchandise inventory, costs of freight and distribution, as well as certain facility costs, decreased $64.0 million, or 9.1%, to $639.8 million in fiscal 2009 compared to $703.9 million in fiscal 2008. As a percentage of net sales, total cost of sales and occupancy decreased 40 basis points to 73.6% in 2009 from 74.0% in 2008. Cost of sales for fiscal 2009 decreased 130 basis points largely due to the fact that fiscal 2008 included a $9.0 million charge to permanently write-down selected inventory to current retail value. Excluding the impact of this charge, cost of sales for fiscal 2009 decreased 40 basis points. Reductions in the cost of merchandise throughout the year were offset by promotional activity required to compete with aggressive discounting among other specialty retailers, particularly in the furniture category. Additionally, sales in consumables which have a lower margin rate continued to outperform home furnishings putting pressure on the overall margin rate. Occupancy as a percentage of net sales for the year increased 90 basis points as a result of the deleveraging of the costs on lower comparable store sales.