UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number | 811-04813 |

| | |

| | BNY Mellon Investment Funds I | |

| | (Exact name of Registrant as specified in charter) | |

| | | |

| | c/o BNY Mellon Investment Adviser, Inc. 240 Greenwich Street New York, New York 10286 | |

| | (Address of principal executive offices) (Zip code) | |

| | | |

| | Deirdre Cunnane, Esq. 240 Greenwich Street New York, New York 10286 | |

| | (Name and address of agent for service) | |

| |

| Registrant's telephone number, including area code: | (212) 922-6400 |

| | |

Date of fiscal year end: | 9/30 | |

| Date of reporting period: | 9/30/2023 | |

| | | | | | | |

The following N-CSR relates only to the Registrant's series listed below and does not relate to any series of the Registrant with a different fiscal year end and, therefore, different N-CSR reporting requirements. A separate N-CSR will be filed for any series with a different fiscal year end, as appropriate.

BNY Mellon International Equity Fund

BNY Mellon Small Cap Growth Fund

BNY Mellon Small Cap Value Fund

BNY Mellon Small/Mid Cap Growth Fund

FORM N-CSR

Item 1. Reports to Stockholders.

BNY Mellon International Equity Fund

| |

ANNUAL REPORT September 30, 2023 |

| |

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.im.bnymellon.com and sign up for eCommunications. It’s simple and only takes a few minutes. |

| |

The views expressed in this report reflect those of the portfolio manager(s) only through the end of the period covered and do not necessarily represent the views of BNY Mellon Investment Adviser, Inc. or any other person in the BNY Mellon Investment Adviser, Inc. organization. Any such views are subject to change at any time based upon market or other conditions and BNY Mellon Investment Adviser, Inc. disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund in the BNY Mellon Family of Funds are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund in the BNY Mellon Family of Funds. |

| |

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

Contents

THE FUND

FOR MORE INFORMATION

Back Cover

DISCUSSION OF FUND PERFORMANCE (Unaudited)

For the period from October 1, 2022, through September 30, 2023, as provided by Portfolio Managers, Thomas Wilson, Louise Kernohan and Georgina Cooper of Newton Investment Management Limited, sub-adviser.

Market and Fund Performance Overview

For the 12-month period ended September 30, 2023, BNY Mellon International Equity Fund (the “fund”) produced a total return of 20.33% for Class A shares, 19.43% for Class C shares, 20.63% for Class I shares and 20.61% for Class Y shares.1,2 In comparison, the fund’s benchmark, the MSCI EAFE® Index (the “Index”), produced a net return of 25.65% for the same period.3

International equity markets gained significant ground on broad economic growth and signs that inflation was coming under control. The fund underperformed the Index, primarily due to disappointing stock selections in the financials, consumer discretionary, consumer staples and materials sectors.

The Fund’s Investment Approach

The fund seeks long-term growth of capital. To pursue its goal, the fund normally invests at least 80% of its net assets, plus any borrowings for investment purposes, in common stocks or securities convertible into common stocks of foreign companies and depositary receipts evidencing ownership in such securities. At least 75% of the fund’s net assets will be invested in countries represented in the Index.

The core of the investment philosophy of Newton Investment Management Limited (“NIM”), the fund’s sub-investment adviser, is the belief that no company, market or economy can be considered in isolation; each must be understood within a global context. NIM believes that a global comparison of companies is the most effective method of stock analysis, and NIM’s global analysts research investment opportunities by global sector rather than by region.

The process begins by identifying a core list of investment themes that NIM believes will positively or negatively affect certain sectors or industries and cause stocks within these sectors or industries to outperform or underperform others. NIM then identifies specific companies, using these investment themes, to help focus on areas where thematic and strategic research indicates superior returns are likely to be achieved. Sell decisions for individual stocks will typically be a result of one or more of the following: a change in investment theme or strategy, profit taking, a significant change in the prospects of a company, price movement and market activity creating an extreme valuation, and the valuation of a company becoming expensive against its peers.

International Equities Rebound on Positive Macroeconomic Trends

International equities delivered positive returns in late 2022 as the outlook for inflation and the trajectory of monetary policy continued to dominate the narrative within financial markets. Despite some encouraging developments in the fight against inflation, central bankers steadfastly maintained a hawkish stance. Elsewhere, China eased its hitherto draconian COVID-19 policies.

2

Positive trends continued in early 2023, as investors maintained a risk-on mindset. However, as the year progressed, the U.S. Federal Reserve (the “Fed”) remained hawkish, putting pressure on risk assets. In addition, in early March, signs of stress emerged within the U.S. banking sector. Nevertheless, following rapid action by U.S. authorities to bolster banks, international equities soon regained their upward momentum, shrugging off the travails of U.S. regional banks, economic disappointment in China and persistently elevated geopolitical uncertainty. Investors’ enthusiasm regarding artificial intelligence (“AI”) proved particularly supportive of risk assets.

The interplay between growth, inflation and the direction of monetary policy remained central to the wider investment debate as international equity markets lost momentum over summer. The principal catalyst for this change in tone was the renewed rise in government bond yields. Factors contributing to this development included rising oil prices, technical market dynamics and the growing realization that U.S. interest rates would likely stay “higher for longer,” given the continuing resilience of the U.S. economy. In stark contrast to the United States, China announced a stream of piecemeal, and thus far ineffective, stimulus initiatives designed to stabilize its economy.

Stock Selection Undermines Relative Performance

Stock selection weighed on the fund’s performance relative to the Index in several sectors, including financials, consumer discretionary, consumer staples and materials. The fund’s cash allocation detracted as well. Among significant underperformers, Swiss pharmaceutical and diagnostics company Roche Holding AG stood out as the company failed to gain much traction with pandemic-related revenues falling away. A series of pipeline disappointments cast further doubts regarding the firm’s research and development capabilities, a source of strength historically. Another notable underperformer, UK alcoholic beverage producer Diageo PLC, came under pressure due to concerns regarding consumer demand and costs. Finally, lack of exposure to Danish pharmaceutical company Novo Nordisk A/S for much of the period weighted on relative returns, as the stock surged after a study found that the company’s obesity drug significantly reduced the likelihood of cardiovascular events.

On the positive side, stock selection and an underweight position contributed positively to relative returns in communication services, while a lack of exposure to real estate also proved beneficial in a rising rate environment. Among top holdings, shares in Japan-based semiconductor test equipment maker Advantest Corp. performed well despite some late-period weakness, gaining ground on AI-driven momentum in the semiconductor space. Advantest Corp. management also noted a wealth of business opportunities in the semiconductor testing market over the medium term. Despite a credit rating downgrade, shares in France-based global reinsurer SCOR SE rose in response to the company’s actions to increase its earnings resilience. Shares moved higher as reinsurance pricing continued its strong momentum, boding well for margin improvement. Indeed, first-quarter 2023 earnings easily surpassed consensus expectations. The stock finished the period strongly, with investors taking encouragement from the company’s new strategic plan. Shares in Japan-based automobile and heavy equipment maker Toyota Industries Corp. performed well against a backdrop of improving business momentum, amid hopes that profits in the company’s material handling business may be bottoming out. Long-term prospects for this segment continue to look attractive in our view, supported by strong demand for forklifts and warehouse solutions.

3

DISCUSSION OF FUND PERFORMANCE (Unaudited) (continued)

Maintaining a Balanced Focus on Resilient Earnings Profiles

Although economic data remains largely resilient, it remains unknown what the effect of recent monetary policy tightening may have on the wider economy from here. If inflation prompts central banks to keep rates elevated for a prolonged period, thereby increasing the cost of capital, valuations of all asset classes are likely to see negative impacts. On the other hand, positive structural demand trends remain in place. Sustainable competitive advantages and barriers to entry also represent important considerations as we continue to seek out thematic opportunities that are underappreciated by the market.

As of the end of the period, the fund holds its largest overweight sector position in information technology, where key technological megatrends and structural drivers remain in place, particularly in the areas of AI, the Internet of Things and smart devices. Health care is also an area for which we see ample thematic support, with a focus on companies offering best-in-class and innovative products, services and solutions that will serve the needs and tastes of an aging global population. Conversely, the fund continues to hold underweight exposure to utilities and real estate. We also remain somewhat cautious on the health of a consumer strained by higher interest rates, as reflected by underweight exposure in the consumer discretionary sector, with zero weighting in the automobiles & components subsector, given an uncertain outlook for big-ticket spending.

October 16, 2023

1 BNY Mellon Investment Adviser, Inc. serves as the investment adviser for the fund. Newton Investment Management Limited (NIM) is the fund’s sub-adviser. NIM’s comments are provided as a general market overview and should not be considered investment advice or predictive of any future market performance. NIM’s views are current as of the date of this communication and are subject to change rapidly as economic and market conditions dictate.

2 Total return includes reinvestment of dividends and any capital gains paid and does not take into consideration the maximum initial sales charge in the case of Class A shares, or the applicable contingent deferred sales charge imposed on redemptions in the case of Class C shares. Had these charges been reflected, returns would have been lower. Past performance is no guarantee of future results. Share price, yield and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost. The fund’s return reflects the absorption of certain fund expenses by BNY Mellon Investment Adviser, Inc. pursuant to an agreement in effect through February 1, 2024, at which time it may be extended, modified or terminated. Had these expenses not been absorbed, returns would have been lower.

3 Source: Lipper Inc. — The MSCI EAFE® Index (Europe, Australasia, Far East) is a free float-adjusted, market capitalization-weighted index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. It reflects reinvestment of net dividends and, where applicable, capital gain distributions. Investors cannot invest directly in any index.

Equities are subject generally to market, market sector, market liquidity, issuer and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus.

Investing internationally involves special risks, including changes in currency exchange rates, political, economic, and social instability, a lack of comprehensive company information, differing auditing and legal standards and less market liquidity.

The fund may, but is not required to, use derivative instruments. A small investment in derivatives could have a potentially large impact on the fund’s performance. The use of derivatives involves risks different from, or possibly greater than, the risks associated with investing directly in the underlying assets.

4

FUND PERFORMANCE (Unaudited)

Comparison of change in value of a $10,000 investment in Class A shares, Class C shares and Class I shares of BNY Mellon International Equity Fund with a hypothetical investment of $10,000 in the MSCI EAFE® Index (the “Index”).

† Source: Lipper Inc.

Past performance is not predictive of future performance.

The above graph compares a hypothetical $10,000 investment made in each of the Class A shares, Class C shares and Class I shares of BNY Mellon International Equity Fund on 9/30/13 to a hypothetical investment of $10,000 made in the Index on that date. All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph above takes into account the maximum initial sales charge on Class A shares and all other applicable fees and expenses on all classes. The Index (Europe, Australasia, Far East) is a free float‐adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

5

FUND PERFORMANCE (Unaudited) (continued)

Comparison of change in value of a $1,000,000 investment in Class Y shares of BNY Mellon International Equity Fund with a hypothetical investment of $1,000,000 in the MSCI EAFE® Index (the “Index”).

† Source: Lipper Inc.

Past performance is not predictive of future performance.

The above graph compares a hypothetical $1,000,000 investment made in Class Y shares of BNY Mellon International Equity Fund on 9/30/13 to a hypothetical investment of $1,000,000 made in the Index on that date. All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph above takes into account all other applicable fees and expenses of fund’s Class Y shares. The Index (Europe, Australasia, Far East) is a free float‐adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

6

| | | | | | | |

Average Annual Total Returns as of 9/30/2023 |

| | | | | |

| | 1 Year | 5 Years | 10 Years |

Class A shares | | | | |

with maximum sales charge (5.75%) | | 13.40% | -.44% | 1.50% |

without sales charge | | 20.33% | .74% | 2.10% |

Class C shares | | | | |

with applicable redemption charge† | | 18.43% | -.01% | 1.33% |

without redemption | | 19.43% | -.01% | 1.33% |

Class I shares | | 20.63% | .99% | 2.37% |

Class Y shares | | 20.61% | 1.00% | 2.40% |

MSCI EAFE® Index | | 25.65% | 3.24% | 3.82% |

† The maximum contingent deferred sales charge for Class C shares is 1% for shares redeemed within one year of the date of purchase.

The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate and an investor’s shares may be worth more or less than original cost upon redemption. Current performance may be lower or higher than the performance quoted. Go to www.im.bnymellon.com for the fund’s most recent month-end returns.

The fund's performance shown in the graphs and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In addition to the performance of Class A shares shown with and without a maximum sales charge, the fund's performance shown in the table takes into account all other applicable fees and expenses on all classes.

7

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in BNY Mellon International Equity Fund from April 1, 2023 to September 30, 2023. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | | |

Expenses and Value of a $1,000 Investment | |

Assume actual returns for the six months ended September 30, 2023 | |

| | | | | | |

| | Class A | Class C | Class I | Class Y | |

Expenses paid per $1,000† | $5.29 | $8.98 | $4.05 | $4.05 | |

Ending value (after expenses) | $970.70 | $967.30 | $971.90 | $971.70 | |

COMPARING YOUR FUND’S EXPENSES WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (“SEC”) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | | |

Expenses and Value of a $1,000 Investment | |

Assuming a hypothetical 5% annualized return for the six months ended September 30, 2023 | |

| | | | | | |

| | Class A | Class C | Class I | Class Y | |

Expenses paid per $1,000† | $5.42 | $9.20 | $4.15 | $4.15 | |

Ending value (after expenses) | $1,019.70 | $1,015.94 | $1,020.96 | $1,020.96 | |

† | Expenses are equal to the fund’s annualized expense ratio of 1.07% for Class A, 1.82% for Class C, .82% for Class I and .82% for Class Y, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). |

8

STATEMENT OF INVESTMENTS

September 30, 2023

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 98.8% | | | | | |

Bermuda - 1.7% | | | | | |

Hiscox Ltd. | | | | 481,167 | | 5,900,072 | |

Brazil - 2.5% | | | | | |

B3 SA - Brasil Bolsa Balcao | | | | 1,433,404 | | 3,498,994 | |

XP, Inc., Cl. A | | | | 229,407 | | 5,287,831 | |

| | | | | 8,786,825 | |

China - 2.2% | | | | | |

Alibaba Group Holding Ltd. | | | | 392,496 | a | 4,290,368 | |

Ping An Insurance Group Company of China Ltd., Cl. H | | | | 614,500 | | 3,519,410 | |

| | | | | 7,809,778 | |

Denmark - 3.8% | | | | | |

Chr. Hansen Holding A/S | | | | 36,915 | | 2,262,692 | |

Novo Nordisk A/S, Cl. B | | | | 102,567 | | 9,361,877 | |

Novozymes A/S, Cl. B | | | | 42,444 | | 1,712,934 | |

| | | | | 13,337,503 | |

France - 20.4% | | | | | |

Air Liquide SA | | | | 39,989 | | 6,757,775 | |

AXA SA | | | | 169,887 | | 5,061,495 | |

Capgemini SE | | | | 34,672 | | 6,077,726 | |

Compagnie de Saint-Gobain | | | | 69,932 | | 4,205,457 | |

Dassault Systemes SE | | | | 112,058 | | 4,181,516 | |

Edenred SE | | | | 62,771 | | 3,934,096 | |

L'Oreal SA | | | | 16,654 | | 6,923,246 | |

LVMH Moet Hennessy Louis Vuitton SE | | | | 11,152 | | 8,446,680 | |

Publicis Groupe SA | | | | 48,055 | | 3,645,849 | |

Sanofi | | | | 99,120 | | 10,634,558 | |

SCOR SE | | | | 263,660 | | 8,214,896 | |

Vinci SA | | | | 28,943 | | 3,213,611 | |

| | | | | 71,296,905 | |

Germany - 4.0% | | | | | |

Bayer AG | | | | 56,686 | | 2,723,876 | |

Deutsche Boerse AG | | | | 26,402 | | 4,569,442 | |

SAP SE | | | | 51,967 | | 6,747,990 | |

| | | | | 14,041,308 | |

Hong Kong - 3.0% | | | | | |

AIA Group Ltd. | | | | 781,312 | | 6,370,462 | |

Prudential PLC | | | | 382,816 | | 4,151,352 | |

| | | | | 10,521,814 | |

India - 1.6% | | | | | |

HDFC Bank Ltd. | | | | 310,479 | | 5,706,611 | |

9

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 98.8% (continued) | | | | | |

Ireland - 2.2% | | | | | |

Experian PLC | | | | 121,680 | | 3,995,106 | |

ICON PLC | | | | 14,835 | a | 3,653,119 | |

| | | | | 7,648,225 | |

Japan - 17.1% | | | | | |

Advantest Corp. | | | | 214,800 | | 6,009,628 | |

East Japan Railway Co. | | | | 100,800 | | 5,770,503 | |

Ebara Corp. | | | | 80,000 | | 3,752,141 | |

Pan Pacific International Holdings Corp. | | | | 229,400 | | 4,817,032 | |

Recruit Holdings Co. Ltd. | | | | 231,213 | | 7,131,027 | |

Sony Group Corp. | | | | 82,400 | | 6,749,036 | |

Sugi Holdings Co. Ltd. | | | | 122,700 | | 4,877,949 | |

TechnoPro Holdings, Inc. | | | | 367,100 | | 7,991,009 | |

Topcon Corp. | | | | 420,600 | | 4,642,530 | |

Toyota Industries Corp. | | | | 102,600 | | 8,084,281 | |

| | | | | 59,825,136 | |

Netherlands - 7.2% | | | | | |

ASML Holding NV | | | | 16,203 | | 9,577,731 | |

BE Semiconductor Industries NV | | | | 35,786 | | 3,518,632 | |

ING Groep NV | | | | 456,924 | | 6,062,690 | |

Universal Music Group NV | | | | 233,770 | | 6,112,102 | |

| | | | | 25,271,155 | |

South Korea - .8% | | | | | |

Samsung SDI Co. Ltd. | | | | 7,879 | | 2,989,512 | |

Spain - 1.4% | | | | | |

Amadeus IT Group SA | | | | 78,460 | | 4,751,481 | |

Switzerland - 12.9% | | | | | |

Alcon, Inc. | | | | 67,723 | | 5,248,560 | |

Lonza Group AG | | | | 11,379 | | 5,290,766 | |

Nestle SA | | | | 101,311 | | 11,481,950 | |

Novartis AG | | | | 68,304 | | 7,004,639 | |

Roche Holding AG | | | | 40,162 | | 10,988,773 | |

UBS Group AG | | | | 209,640 | | 5,196,626 | |

| | | | | 45,211,314 | |

Taiwan - 1.0% | | | | | |

Taiwan Semiconductor Manufacturing Co. Ltd., ADR | | | | 39,220 | | 3,408,218 | |

United Kingdom - 17.0% | | | | | |

Anglo American PLC | | | | 230,738 | | 6,377,913 | |

Ashtead Group PLC | | | | 88,717 | | 5,414,346 | |

AstraZeneca PLC | | | | 57,376 | | 7,771,895 | |

BAE Systems PLC | | | | 401,320 | | 4,885,733 | |

Barclays PLC | | | | 2,278,217 | | 4,417,980 | |

Croda International PLC | | | | 57,151 | | 3,427,226 | |

10

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 98.8% (continued) | | | | | |

United Kingdom - 17.0% (continued) | | | | | |

Diageo PLC | | | | 166,532 | | 6,164,654 | |

National Grid PLC | | | | 302,373 | | 3,615,468 | |

RELX PLC | | | | 217,232 | | 7,360,877 | |

Shell PLC | | | | 317,698 | | 10,101,464 | |

| | | | | 59,537,556 | |

Total Common Stocks (cost $293,714,539) | | | | 346,043,413 | |

| | | 1-Day

Yield (%) | | | | | |

Investment Companies - .0% | | | | | |

Registered Investment Companies - .0% | | | | | |

Dreyfus Institutional Preferred Government Plus Money Market Fund, Institutional Shares

(cost $15,044) | | 5.40 | | 15,044 | b | 15,044 | |

Total Investments (cost $293,729,583) | | 98.8% | | 346,058,457 | |

Cash and Receivables (Net) | | 1.2% | | 4,186,975 | |

Net Assets | | 100.0% | | 350,245,432 | |

ADR—American Depositary Receipt

a Non-income producing security.

b Investment in affiliated issuer. The investment objective of this investment company is publicly available and can be found within the investment company’s prospectus.

11

STATEMENT OF INVESTMENTS (continued)

| | |

Portfolio Summary (Unaudited) † | Value (%) |

Insurance | 9.5 |

Pharmaceuticals, Biotechnology & Life Sciences | 9.0 |

Capital Goods | 8.4 |

Commercial & Professional Services | 7.6 |

Pharmaceuticals Biotechnology & Life Sciences | 7.4 |

Semiconductors & Semiconductor Equipment | 6.4 |

Financial Services | 6.4 |

Materials | 5.9 |

Food, Beverage & Tobacco | 5.0 |

Software & Services | 4.9 |

Banks | 4.6 |

Consumer Durables & Apparel | 4.3 |

Energy | 2.9 |

Media & Entertainment | 2.8 |

Consumer Discretionary Distribution | 2.6 |

Technology Hardware & Equipment | 2.2 |

Household & Personal Products | 2.0 |

Transportation | 1.6 |

Health Care Equipment & Services | 1.5 |

Consumer Staples Distribution | 1.4 |

Consumer Services | 1.4 |

Utilities | 1.0 |

Investment Companies | .0 |

| | 98.8 |

† Based on net assets.

See notes to financial statements.

12

| | | | | | | |

Affiliated Issuers | | | |

Description | Value ($) 9/30/2022 | Purchases ($)† | Sales ($) | Value ($) 9/30/2023 | Dividends/

Distributions ($) | |

Registered Investment Companies - .0% | | |

Dreyfus Institutional Preferred Government Plus Money Market Fund, Institutional Shares - .0% | 196,010 | 154,845,008 | (155,025,974) | 15,044 | 178,863 | |

Investment of Cash Collateral for Securities Loaned - .0% | | |

Dreyfus Institutional Preferred Government Plus Money Market Fund, SL Shares - .0% | - | 12,265,886 | (12,265,886) | - | 2,570 | †† |

Total - .0% | 196,010 | 167,110,894 | (167,291,860) | 15,044 | 181,433 | |

† Includes reinvested dividends/distributions.

†† Represents securities lending income earned from the reinvestment of cash collateral from loaned securities, net of fees and collateral investment expenses, and other payments to and from borrowers of securities.

See notes to financial statements.

13

STATEMENT OF ASSETS AND LIABILITIES

September 30, 2023

| | | | | | | |

| | | | | | |

| | | Cost | | Value | |

Assets ($): | | | | |

Investments in securities—See Statement of Investments | | | |

Unaffiliated issuers | 293,714,539 | | 346,043,413 | |

Affiliated issuers | | 15,044 | | 15,044 | |

Cash denominated in foreign currency | | | 270,651 | | 270,657 | |

Receivable for investment securities sold | | 7,019,026 | |

Tax reclaim receivable—Note 1(b) | | 2,696,905 | |

Dividends and securities lending income receivable | | 444,325 | |

Receivable for shares of Beneficial Interest subscribed | | 274,808 | |

Prepaid expenses | | | | | 38,789 | |

| | | | | 356,802,967 | |

Liabilities ($): | | | | |

Due to BNY Mellon Investment Adviser, Inc. and affiliates—Note 3(c) | | 251,791 | |

Note payable—Note 2 | | 6,200,000 | |

Payable for shares of Beneficial Interest redeemed | | 53,846 | |

Trustees’ fees and expenses payable | | 5,585 | |

Interest payable—Note 2 | | 4,056 | |

Other accrued expenses | | | | | 42,257 | |

| | | | | 6,557,535 | |

Net Assets ($) | | | 350,245,432 | |

Composition of Net Assets ($): | | | | |

Paid-in capital | | | | | 281,044,144 | |

Total distributable earnings (loss) | | | | | 69,201,288 | |

Net Assets ($) | | | 350,245,432 | |

| | | | | | |

Net Asset Value Per Share | Class A | Class C | Class I | Class Y | |

Net Assets ($) | 8,973,526 | 477,745 | 95,256,564 | 245,537,597 | |

Shares Outstanding | 443,834 | 24,079 | 4,746,950 | 12,299,764 | |

Net Asset Value Per Share ($) | 20.22 | 19.84 | 20.07 | 19.96 | |

| | | | | |

See notes to financial statements. | | | | | |

14

STATEMENT OF OPERATIONS

Year Ended September 30, 2023

| | | | | | | |

| | | | | | |

| | | | | | |

Investment Income ($): | | | | |

Income: | | | | |

Cash dividends (net of $1,216,719 foreign taxes withheld at source): | |

Unaffiliated issuers | | | 11,027,575 | |

Affiliated issuers | | | 178,863 | |

Income from securities lending—Note 1(c) | | | 2,570 | |

Interest | | | 1,405 | |

Total Income | | | 11,210,413 | |

Expenses: | | | | |

Management fee—Note 3(a) | | | 3,104,407 | |

Professional fees | | | 117,517 | |

Shareholder servicing costs—Note 3(c) | | | 111,364 | |

Custodian fees—Note 3(c) | | | 80,176 | |

Registration fees | | | 68,851 | |

Trustees’ fees and expenses—Note 3(d) | | | 51,970 | |

Chief Compliance Officer fees—Note 3(c) | | | 20,026 | |

Prospectus and shareholders’ reports | | | 19,960 | |

Loan commitment fees—Note 2 | | | 9,799 | |

Interest expense—Note 2 | | | 9,599 | |

Distribution fees—Note 3(b) | | | 4,884 | |

Miscellaneous | | | 31,433 | |

Total Expenses | | | 3,629,986 | |

Less—reduction in expenses due to undertaking—Note 3(a) | | | (187,477) | |

Less—reduction in fees due to earnings credits—Note 3(c) | | | (2,036) | |

Net Expenses | | | 3,440,473 | |

Net Investment Income | | | 7,769,940 | |

Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | | |

Net realized gain (loss) on investments and foreign currency transactions | 21,403,560 | |

Net realized gain (loss) on forward foreign currency exchange contracts | (2,857,222) | |

Net Realized Gain (Loss) | | | 18,546,338 | |

Net change in unrealized appreciation (depreciation) on investments

and foreign currency transactions | 55,653,922 | |

Net change in unrealized appreciation (depreciation) on

forward foreign currency exchange contracts | 16,073 | |

Net Change in Unrealized Appreciation (Depreciation) | | | 55,669,995 | |

Net Realized and Unrealized Gain (Loss) on Investments | | | 74,216,333 | |

Net Increase in Net Assets Resulting from Operations | | 81,986,273 | |

| | | | | | |

See notes to financial statements. | | | | | |

15

STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | | | |

| | | | Year Ended September 30, |

| | | | 2023 | | 2022 | |

Operations ($): | | | | | | | | |

Net investment income | | | 7,769,940 | | | | 7,866,385 | |

Net realized gain (loss) on investments | | 18,546,338 | | | | 30,996,019 | |

Net change in unrealized appreciation

(depreciation) on investments | | 55,669,995 | | | | (223,790,630) | |

Net Increase (Decrease) in Net Assets

Resulting from Operations | 81,986,273 | | | | (184,928,226) | |

Distributions ($): | |

Distributions to shareholders: | | | | | | | | |

Class A | | | (323,257) | | | | (463,037) | |

Class C | | | (15,019) | | | | (28,314) | |

Class I | | | (3,690,294) | | | | (5,371,005) | |

Class Y | | | (11,286,552) | | | | (17,109,647) | |

Total Distributions | | | (15,315,122) | | | | (22,972,003) | |

Beneficial Interest Transactions ($): | |

Net proceeds from shares sold: | | | | | | | | |

Class A | | | 1,705,930 | | | | 10,417,534 | |

Class C | | | 35,262 | | | | 39,488 | |

Class I | | | 13,688,258 | | | | 29,403,414 | |

Class Y | | | 14,126,912 | | | | 44,837,236 | |

Distributions reinvested: | | | | | | | | |

Class A | | | 320,514 | | | | 457,203 | |

Class C | | | 15,019 | | | | 27,428 | |

Class I | | | 3,527,673 | | | | 5,130,777 | |

Class Y | | | 5,431,866 | | | | 6,511,272 | |

Cost of shares redeemed: | | | | | | | | |

Class A | | | (3,399,793) | | | | (6,911,544) | |

Class C | | | (357,840) | | | | (374,774) | |

Class I | | | (38,637,150) | | | | (52,531,717) | |

Class Y | | | (122,917,329) | | | | (134,157,947) | |

Increase (Decrease) in Net Assets

from Beneficial Interest Transactions | (126,460,678) | | | | (97,151,630) | |

Total Increase (Decrease) in Net Assets | (59,789,527) | | | | (305,051,859) | |

Net Assets ($): | |

Beginning of Period | | | 410,034,959 | | | | 715,086,818 | |

End of Period | | | 350,245,432 | | | | 410,034,959 | |

16

| | | | | | | | | | |

| | | | Year Ended September 30, |

| | | | 2023 | | 2022 | |

Capital Share Transactions (Shares): | |

Class A | | | | | | | | |

Shares sold | | | 81,676 | | | | 426,916 | |

Shares issued for distributions reinvested | | | 16,253 | | | | 18,570 | |

Shares redeemed | | | (168,477) | | | | (296,266) | |

Net Increase (Decrease) in Shares Outstanding | (70,548) | | | | 149,220 | |

Class C | | | | | | | | |

Shares sold | | | 1,957 | | | | 1,883 | |

Shares issued for distributions reinvesteda | | | 772 | | | | 1,132 | |

Shares redeemed | | | (17,582) | | | | (16,742) | |

Net Increase (Decrease) in Shares Outstanding | (14,853) | | | | (13,727) | |

Class I | | | | | | | | |

Shares sold | | | 671,583 | | | | 1,312,107 | |

Shares issued for distributions reinvesteda | | | 180,629 | | | | 210,192 | |

Shares redeemed | | | (1,933,946) | | | | (2,408,570) | |

Net Increase (Decrease) in Shares Outstanding | (1,081,734) | | | | (886,271) | |

Class Y | | | | | | | | |

Shares sold | | | 693,892 | | | | 2,118,295 | |

Shares issued for distributions reinvested | | | 279,561 | | | | 268,064 | |

Shares redeemed | | | (6,153,331) | | | | (6,274,899) | |

Net Increase (Decrease) in Shares Outstanding | (5,179,878) | | | | (3,888,540) | |

| | | | | | | | | |

a | During the period ended September 30, 2023, 196,806 Class Y shares representing $3,950,195 were exchanged for 195,809 Class I shares. During the period ended September 30, 2022, 466,158 Class Y shares representing $10,153,051 were exchanged for 463,844 Class I shares, and 1,394 Class Y shares representing $34,602 were exchanged for 1,375 Class A shares. | |

See notes to financial statements. | | | | | | | | |

17

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated. All information (except portfolio turnover rate) reflects financial results for a single fund share. Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, and redemption at net asset value on the last day of the period. Net asset value total return includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. These figures have been derived from the fund’s financial statements.

| | | | | | | |

| | | |

| | | Year Ended September 30, |

Class A Shares | | 2023 | 2022 | 2021 | 2020 | 2019 |

Per Share Data ($): | | | | | | |

Net asset value,

beginning of period | | 17.36 | 25.37 | 21.07 | 20.28 | 21.97 |

Investment Operations: | | | | | | |

Net investment incomea | | .33 | .25 | .23 | .16 | .33 |

Net realized and unrealized

gain (loss) on investments | | 3.19 | (7.46) | 4.39 | 1.13 | (1.66) |

Total from Investment Operations | | 3.52 | (7.21) | 4.62 | 1.29 | (1.33) |

Distributions: | | | | | | |

Dividends from

net investment income | | (.35) | (.80) | (.32) | (.50) | (.36) |

Dividends from net realized

gain on investments | | (.31) | - | - | - | - |

Total Distributions | | (.66) | (.80) | (.32) | (.50) | (.36) |

Net asset value, end of period | | 20.22 | 17.36 | 25.37 | 21.07 | 20.28 |

Total Return (%)b | | 20.33 | (29.34) | 22.00 | 6.31 | (5.89) |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses

to average net assets | | 1.20 | 1.16 | 1.17 | 1.19 | 1.18 |

Ratio of net expenses

to average net assets | | 1.07 | 1.07 | 1.07 | 1.07 | 1.07 |

Ratio of net investment income

to average net assets | | 1.62 | 1.08 | .93 | .78 | 1.66 |

Portfolio Turnover Rate | | 45.57 | 53.90 | 26.26 | 32.45 | 36.45 |

Net Assets,

end of period ($ x 1,000) | | 8,974 | 8,928 | 9,263 | 6,329 | 5,743 |

a Based on average shares outstanding.

b Exclusive of sales charge.

See notes to financial statements.

18

| | | | | | | |

| | | |

| | | Year Ended September 30, |

Class C Shares | | 2023 | 2022 | 2021 | 2020 | 2019 |

Per Share Data ($): | | | | | | |

Net asset value,

beginning of period | | 16.98 | 24.77 | 20.57 | 19.78 | 21.38 |

Investment Operations: | | | | | | |

Net investment incomea | | .18 | .06 | .03 | .00b | .17 |

Net realized and unrealized

gain (loss) on investments | | 3.12 | (7.29) | 4.29 | 1.10 | (1.59) |

Total from Investment Operations | | 3.30 | (7.23) | 4.32 | 1.10 | (1.42) |

Distributions: | | | | | | |

Dividends from

net investment income | | (.13) | (.56) | (.12) | (.31) | (.18) |

Dividends from net realized

gain on investments | | (.31) | - | - | - | - |

Total Distributions | | (.44) | (.56) | (.12) | (.31) | (.18) |

Net asset value, end of period | | 19.84 | 16.98 | 24.77 | 20.57 | 19.78 |

Total Return (%)c | | 19.43 | (29.88) | 21.11 | 5.47 | (6.55) |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses

to average net assets | | 2.07 | 1.98 | 1.95 | 1.96 | 1.93 |

Ratio of net expenses

to average net assets | | 1.82 | 1.82 | 1.82 | 1.82 | 1.82 |

Ratio of net investment income

to average net assets | | .89 | .26 | .14 | .00d | .89 |

Portfolio Turnover Rate | | 45.57 | 53.90 | 26.26 | 32.45 | 36.45 |

Net Assets,

end of period ($ x 1,000) | | 478 | 661 | 1,304 | 1,337 | 1,696 |

a Based on average shares outstanding.

b Amount represents less than $.01 per share.

c Exclusive of sales charge.

d Amount represents less than .01%.

See notes to financial statements.

19

FINANCIAL HIGHLIGHTS (continued)

| | | | | | | |

| | | |

| | | Year Ended September 30, |

Class I Shares | | 2023 | 2022 | 2021 | 2020 | 2019 |

Per Share Data ($): | | | | | | |

Net asset value,

beginning of period | | 17.24 | 25.18 | 20.90 | 20.12 | 21.79 |

Investment Operations: | | | | | | |

Net investment incomea | | .39 | .30 | .28 | .20 | .36 |

Net realized and unrealized

gain (loss) on investments | | 3.16 | (7.40) | 4.36 | 1.13 | (1.62) |

Total from Investment Operations | | 3.55 | (7.10) | 4.64 | 1.33 | (1.26) |

Distributions: | | | | | | |

Dividends from

net investment income | | (.41) | (.84) | (.36) | (.55) | (.41) |

Dividends from net realized

gain on investments | | (.31) | - | - | - | - |

Total Distributions | | (.72) | (.84) | (.36) | (.55) | (.41) |

Net asset value, end of period | | 20.07 | 17.24 | 25.18 | 20.90 | 20.12 |

Total Return (%) | | 20.63 | (29.19) | 22.32 | 6.53 | (5.62) |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses

to average net assets | | .92 | .89 | .88 | .88 | .86 |

Ratio of net expenses

to average net assets | | .82 | .82 | .82 | .82 | .82 |

Ratio of net investment income

to average net assets | | 1.90 | 1.34 | 1.14 | 1.02 | 1.84 |

Portfolio Turnover Rate | | 45.57 | 53.90 | 26.26 | 32.45 | 36.45 |

Net Assets,

end of period ($ x 1,000) | | 95,257 | 100,515 | 169,071 | 177,360 | 214,538 |

a Based on average shares outstanding.

See notes to financial statements.

20

| | | | | | | |

| | | |

| | | Year Ended September 30, |

Class Y Shares | | 2023 | 2022 | 2021 | 2020 | 2019 |

Per Share Data ($): | | | | | | |

Net asset value,

beginning of period | | 17.16 | 25.06 | 20.81 | 20.03 | 21.70 |

Investment Operations: | | | | | | |

Net investment incomea | | .38 | .29 | .28 | .20 | .37 |

Net realized and unrealized

gain (loss) on investments | | 3.14 | (7.35) | 4.33 | 1.13 | (1.63) |

Total from

Investment Operations | | 3.52 | (7.06) | 4.61 | 1.33 | (1.26) |

Distributions: | | | | | | |

Dividends from

net investment income | | (.41) | (.84) | (.36) | (.55) | (.41) |

Dividends from net realized

gain on investments | | (.31) | - | - | - | - |

Total Distributions | | (.72) | (.84) | (.36) | (.55) | (.41) |

Net asset value, end of period | | 19.96 | 17.16 | 25.06 | 20.81 | 20.03 |

Total Return (%) | | 20.61 | (29.17) | 22.29 | 6.58 | (5.63) |

Ratios/Supplemental Data (%): | | | | | |

Ratio of total expenses

to average net assets | | .85 | .82 | .82 | .82 | .80 |

Ratio of net expenses

to average net assets | | .82 | .82 | .82 | .82 | .80 |

Ratio of net investment income

to average net assets | | 1.88 | 1.32 | 1.15 | 1.00 | 1.88 |

Portfolio Turnover Rate | | 45.57 | 53.90 | 26.26 | 32.45 | 36.45 |

Net Assets,

end of period ($ x 1,000) | | 245,538 | 299,931 | 535,448 | 486,727 | 849,188 |

a Based on average shares outstanding.

See notes to financial statements.

21

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

BNY Mellon International Equity Fund (the “fund”) is a separate diversified series of BNY Mellon Investment Funds I (the “Trust”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company currently offering five series, including the fund. The fund’s investment objective is to seek long-term growth of capital. BNY Mellon Investment Adviser, Inc. (the “Adviser”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser. Newton Investment Management Limited (the “Sub-Adviser”), an indirect wholly-owned subsidiary of BNY Mellon and an affiliate of the Adviser, serves as the fund’s sub-adviser.

Effective March 31, 2023, the Sub-Adviser, entered into a sub-sub-investment advisory agreement with its affiliate, Newton Investment Management North America, LLC (“NIMNA”), to enable NIMNA to provide certain advisory services to the Sub-Adviser for the benefit of the fund, including, but not limited to, portfolio management services. NIMNA is subject to the supervision of the Sub-Adviser and the Adviser. NIMNA is also an affiliate of the Adviser. NIMNA’s principal office is located at BNY Mellon Center, 201 Washington Street, Boston, MA 02108. NIMNA is an indirect subsidiary of BNY Mellon.

BNY Mellon Securities Corporation (the “Distributor”), a wholly-owned subsidiary of the Adviser, is the distributor of the fund’s shares. The fund is authorized to issue an unlimited number of $.001 par value shares of Beneficial Interest in each of the following classes of shares: Class A, Class C, Class I and Class Y. Class A and Class C shares are sold primarily to retail investors through financial intermediaries and bear Distribution and/or Shareholder Services Plan fees. Class A shares generally are subject to a sales charge imposed at the time of purchase. Class A shares bought without an initial sales charge as part of an investment of $1 million or more may be charged a contingent deferred sales charge (“CDSC”) of 1.00% if redeemed within one year. Class C shares are subject to a CDSC imposed on Class C shares redeemed within one year of purchase. Class C shares automatically convert to Class A shares eight years after the date of purchase, without the imposition of a sales charge. Class I shares are sold primarily to bank trust departments and other financial service providers (including BNY Mellon and its affiliates), acting on behalf of customers having a qualified trust or an investment account or relationship at such

22

institution, and bear no Distribution or Shareholder Services Plan fees. Class Y shares are sold at net asset value per share generally to institutional investors, and bear no Distribution or Shareholder Services Plan fees. Class I and Class Y shares are offered without a front-end sales charge or CDSC. Other differences between the classes include the services offered to and the expenses borne by each class, the allocation of certain transfer agency costs and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

The Trust accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the SEC under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The fund is an investment company and applies the accounting and reporting guidance of the FASB ASC Topic 946 Financial Services-Investment Companies. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions. Actual results could differ from those estimates.

The Trust enters into contracts that contain a variety of indemnifications. The fund’s maximum exposure under these arrangements is unknown. The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value. This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly.

23

NOTES TO FINANCIAL STATEMENTS (continued)

GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements. These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for identical investments.

Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques used to value the fund’s investments are as follows:

The Trust’s Board of Trustees (the “Board���) has designated the Adviser as the fund’s valuation designee to make all fair value determinations with respect to the fund’s portfolio investments, subject to the Board’s oversight and pursuant to Rule 2a-5 under the Act.

Investments in equity securities are valued at the last sales price on the securities exchange or national securities market on which such securities are primarily traded. Securities listed on the National Market System for which market quotations are available are valued at the official closing price or, if there is no official closing price that day, at the last sales price. For open short positions, asked prices are used for valuation purposes. Bid price is used when no asked price is available. Registered investment companies that are not traded on an exchange are valued at their net asset value. All of the preceding securities are generally categorized within Level 1 of the fair value hierarchy.

Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices. These securities are generally categorized within Level 2 of the fair value hierarchy.

Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant ADRs and

24

futures. Utilizing these techniques may result in transfers between Level 1 and Level 2 of the fair value hierarchy.

When market quotations or official closing prices are not readily available, or are determined not to accurately reflect fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Board. Certain factors may be considered when fair valuing investments such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers. These securities are either categorized within Level 2 or 3 of the fair value hierarchy depending on the relevant inputs used.

For securities where observable inputs are limited, assumptions about market activity and risk are used and such securities are generally categorized within Level 3 of the fair value hierarchy.

Investments denominated in foreign currencies are translated to U.S. dollars at the prevailing rates of exchange.

The following is a summary of the inputs used as of September 30, 2023 in valuing the fund’s investments:

| | | | | | | |

| | Level 1-Unadjusted Quoted Prices | Level 2- Other Significant Observable Inputs | | Level 3-Significant Unobservable Inputs | Total | |

Assets ($) | | |

Investments in Securities:† | | |

Equity Securities - Common Stocks | 346,043,413 | - | | - | 346,043,413 | |

Investment Companies | 15,044 | - | | - | 15,044 | |

† See Statement of Investments for additional detailed categorizations, if any.

(b) Foreign currency transactions: The fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in the market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized on securities transactions

25

NOTES TO FINANCIAL STATEMENTS (continued)

between trade and settlement date, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments resulting from changes in exchange rates. Foreign currency gains and losses on foreign currency transactions are also included with net realized and unrealized gain or loss on investments.

Foreign taxes: The fund may be subject to foreign taxes (a portion of which may be reclaimable) on income, stock dividends, realized and unrealized capital gains on investments or certain foreign currency transactions. Foreign taxes are recorded in accordance with the applicable foreign tax regulations and rates that exist in the foreign jurisdictions in which the fund invests. These foreign taxes, if any, are paid by the fund and are reflected in the Statement of Operations, if applicable. Foreign taxes payable or deferred or those subject to reclaims as of September 30, 2023, if any, are disclosed in the fund’s Statement of Assets and Liabilities.

(c) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

Pursuant to a securities lending agreement with BNY Mellon, the fund may lend securities to qualified institutions. It is the fund’s policy that, at origination, all loans are secured by collateral of at least 102% of the value of U.S. securities loaned and 105% of the value of foreign securities loaned. Collateral equivalent to at least 100% of the market value of securities on loan is maintained at all times. Collateral is either in the form of cash, which can be invested in certain money market mutual funds managed by the Adviser, or U.S. Government and Agency securities. The fund is entitled to receive all dividends, interest and distributions on securities loaned, in addition to income earned as a result of the lending transaction. Should a borrower fail to return the securities in a timely manner, BNY Mellon is required to replace the securities for the benefit of the fund or credit the fund with the market value of the unreturned securities and is subrogated to the fund’s rights against the borrower and the collateral. Additionally, the contractual maturity of security lending transactions are on an overnight and continuous basis. During the period

26

ended September 30, 2023, BNY Mellon earned $350 from the lending of the fund’s portfolio securities, pursuant to the securities lending agreement.

(d) Affiliated issuers: Investments in other investment companies advised by the Adviser are considered “affiliated” under the Act.

(e) Market Risk: The value of the securities in which the fund invests may be affected by political, regulatory, economic and social developments, and developments that impact specific economic sectors, industries or segments of the market. The value of a security may also decline due to general market conditions that are not specifically related to a particular company or industry, such as real or perceived adverse economic conditions, changes in the general outlook for corporate earnings, changes in interest or currency rates, changes to inflation, adverse changes to credit markets or adverse investor sentiment generally. In addition, turbulence in financial markets and reduced liquidity in equity, credit and/or fixed-income markets may negatively affect many issuers, which could adversely affect the fund. Global economies and financial markets are becoming increasingly interconnected, and conditions and events in one country, region or financial market may adversely impact issuers in a different country, region or financial market. These risks may be magnified if certain events or developments adversely interrupt the global supply chain; in these and other circumstances, such risks might affect companies world-wide.

Foreign Investment Risk: To the extent the fund invests in foreign securities, the fund’s performance will be influenced by political, social and economic factors affecting investments in foreign issuers. Special risks associated with investments in foreign issuers include exposure to currency fluctuations, less liquidity, less developed or less efficient trading markets, lack of comprehensive company information, political and economic instability and differing auditing and legal standards.

(f) Dividends and distributions to shareholders: Dividends and distributions are recorded on the ex-dividend date. Dividends from net investment income and dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”). To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

27

NOTES TO FINANCIAL STATEMENTS (continued)

(g) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income and net realized capital gain sufficient to relieve it from substantially all federal income and excise taxes.

As of and during the period ended September 30, 2023, the fund did not have any liabilities for any uncertain tax positions. The fund recognizes interest and penalties, if any, related to uncertain tax positions as income tax expense in the Statement of Operations. During the period ended September 30, 2023, the fund did not incur any interest or penalties.

Each tax year in the four-year period ended September 30, 2023 remains subject to examination by the Internal Revenue Service and state taxing authorities.

At September 30, 2023, the components of accumulated earnings on a tax basis were as follows: undistributed ordinary income $7,759,934 undistributed capital gains $16,224,588 and unrealized appreciation $45,216,766.

The tax character of distributions paid to shareholders during the fiscal years ended September 30, 2023 and September 30, 2022 were as follows: ordinary income $8,760,104 and $22,972,003, and long-term capital gains $6,555,018 and $0, respectively.

NOTE 2—Bank Lines of Credit:

The fund participates with other long-term open-end funds managed by the Adviser in a $738 million unsecured credit facility led by Citibank, N.A. (the “Citibank Credit Facility”) and a $300 million unsecured credit facility provided by BNY Mellon (the “BNYM Credit Facility”), each to be utilized primarily for temporary or emergency purposes, including the financing of redemptions (each, a “Facility”). The Citibank Credit Facility is available in two tranches: (i) Tranche A is in an amount equal to $618 million and is available to all long-term open-ended funds, including the fund, and (ii) Tranche B is an amount equal to $120 million and is available only to BNY Mellon Floating Rate Income Fund, a series of BNY Mellon Investment Funds IV, Inc. Prior to September 27, 2023, the Citibank Credit Facility was $823.5 million with Tranche A available in an amount equal to $688.5 million and Tranche B available in an amount equal to $135 million. In connection therewith, the fund has agreed to pay its pro rata portion of commitment fees for Tranche A of the Citibank Credit Facility and the BNYM Credit Facility. Interest is charged to the fund

28

based on rates determined pursuant to the terms of the respective Facility at the time of borrowing.

During the period ended September 30, 2023, the fund was charged $9,599 for interest expense. These fees are included in Interest expense in the Statement of Operations. The average amount of borrowings outstanding under the Facilities during the period ended September 30, 2023 was approximately $171,233 with a related weighted average annualized interest rate of 5.61%.

NOTE 3—Management Fee, Sub-Advisory Fee and Other Transactions with Affiliates:

(a) Pursuant to a management agreement with the Adviser, the management fee was computed at the annual rate of .75% of the value of the fund’s average daily net assets and is payable monthly. The Adviser has contractually agreed, from October 1, 2022 through February 1, 2024, to waive receipt of its fees and/or assume the direct expenses of the fund so that the direct expenses of none of the fund’s share classes (excluding Rule 12b-1 Distribution Plan fees, Shareholder Services Plan fees, taxes, interest expense, brokerage commissions, commitment fees on borrowings and extraordinary expenses) exceed .82% of the value of the fund’s average daily net assets. On or after February 1, 2024, the Adviser may terminate this expense limitation at any time. The reduction in expenses, pursuant to the undertaking, amounted to $187,477 during the period ended September 30, 2023.

Pursuant to a sub-investment advisory agreement between the Adviser and the Sub-Adviser, the Adviser pays the Sub-Adviser a monthly fee at an annual rate of .36% of the value of the fund’s average daily net assets.

During the period ended September 30, 2023, the Distributor retained $29 from commissions earned on sales of the fund’s Class A shares.

(b) Under the Distribution Plan adopted pursuant to Rule 12b-1 under the Act, Class C shares pay the Distributor for distributing its shares at an annual rate of .75% of the value of its average daily net assets. The Distributor may pay one or more Service Agents in respect of advertising, marketing and other distribution services, and determines the amounts, if any, to be paid to Service Agents and the basis on which such payments are made. During the period ended September 30, 2023, Class C shares were charged $4,884 pursuant to the Distribution Plan.

(c) Under the Shareholder Services Plan, Class A and Class C shares pay the Distributor at an annual rate of .25% of the value of their average daily net assets for the provision of certain services. The services provided may

29

NOTES TO FINANCIAL STATEMENTS (continued)

include personal services relating to shareholder accounts, such as answering shareholder inquiries regarding the fund, and services related to the maintenance of shareholder accounts. The Distributor may make payments to Service Agents (securities dealers, financial institutions or other industry professionals) with respect to these services. The Distributor determines the amounts to be paid to Service Agents. During the period ended September 30, 2023, Class A and Class C shares were charged $23,829 and $1,628, respectively, pursuant to the Shareholder Services Plan.

Under its terms, the Distribution Plan and Shareholder Services Plan shall remain in effect from year to year, provided such continuance is approved annually by a vote of a majority of those Trustees who are not “interested persons” of the Trust and who have no direct or indirect financial interest in the operation of or in any agreement related to the Distribution Plan or Shareholder Services Plan.

The fund has an arrangement with BNY Mellon Transfer, Inc., (the “Transfer Agent”), a subsidiary of BNY Mellon and an affiliate of the Adviser, whereby the fund may receive earnings credits when positive cash balances are maintained, which are used to offset Transfer Agent fees. For financial reporting purposes, the fund includes transfer agent net earnings credits, if any, as an expense offset in the Statement of Operations.

The fund has an arrangement with The Bank of New York Mellon (the “Custodian”), a subsidiary of BNY Mellon and an affiliate of the Adviser, whereby the fund will receive interest income or be charged overdraft fees when cash balances are maintained. For financial reporting purposes, the fund includes this interest income and overdraft fees, if any, as interest income in the Statement of Operations.

The fund compensates the Transfer Agent, under a transfer agency agreement, for providing transfer agency and cash management services for the fund. The majority of Transfer Agent fees are comprised of amounts paid on a per account basis, while cash management fees are related to fund subscriptions and redemptions. During the period ended September 30, 2023, the fund was charged $6,021 for transfer agency services. These fees are included in Shareholder servicing costs in the Statement of Operations. These fees were partially offset by earnings credits of $2,036.

The fund compensates the Custodian, under a custody agreement, for providing custodial services for the fund. These fees are determined based on net assets, geographic region and transaction activity. During the period

30

ended September 30, 2023, the fund was charged $80,176 pursuant to the custody agreement.

During the period ended September 30, 2023, the fund was charged $20,026 for services performed by the fund’s Chief Compliance Officer and his staff. These fees are included in Chief Compliance Officer fees in the Statement of Operations.

The components of “Due to BNY Mellon Investment Adviser, Inc. and affiliates” in the Statement of Assets and Liabilities consist of: management fee of $229,736, Distribution Plan fees of $307, Shareholder Services Plan fees of $2,012, Custodian fee of $30,000, Chief Compliance Officer fees of $4,757 and Transfer Agent fees of $930, which are offset against an expense reimbursement currently in effect in the amount of $15,951.

(d) Each board member also serves as a board member of other funds in the BNY Mellon Family of Funds complex. Annual retainer fees and attendance fees are allocated to each fund based on net assets.

NOTE 4—Securities Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities and forward foreign currency exchange contracts (“forward contracts”), during the period ended September 30, 2023, amounted to $183,807,114 and $314,776,650, respectively.

Derivatives: A derivative is a financial instrument whose performance is derived from the performance of another asset. The fund enters into International Swaps and Derivatives Association, Inc. Master Agreements or similar agreements (collectively, “Master Agreements”) with its over-the-counter (“OTC”) derivative contract counterparties in order to, among other things, reduce its credit risk to counterparties. Master Agreements include provisions for general obligations, representations, collateral and events of default or termination. Under a Master Agreement, the fund may offset with the counterparty certain derivative financial instruments’ payables and/or receivables with collateral held and/or posted and create one single net payment in the event of default or termination. The SEC adopted Rule 18f-4 under the Act, which regulates the use of derivatives transactions for certain funds registered under the Act. The fund’s derivative transactions are subject to a value-at-risk leverage limit and certain reporting and other requirements pursuant to a derivatives risk management program adopted by the fund

Each type of derivative instrument that was held by the fund during the period ended September 30, 2023 is discussed below.

31

NOTES TO FINANCIAL STATEMENTS (continued)

Forward Foreign Currency Exchange Contracts: The fund enters into forward contracts in order to hedge its exposure to changes in foreign currency exchange rates on its foreign portfolio holdings, to settle foreign currency transactions or as a part of its investment strategy. When executing forward contracts, the fund is obligated to buy or sell a foreign currency at a specified rate on a certain date in the future. With respect to sales of forward contracts, the fund incurs a loss if the value of the contract increases between the date the forward contract is opened and the date the forward contract is closed. The fund realizes a gain if the value of the contract decreases between those dates. With respect to purchases of forward contracts, the fund incurs a loss if the value of the contract decreases between the date the forward contract is opened and the date the forward contract is closed. The fund realizes a gain if the value of the contract increases between those dates. Any realized or unrealized gains or losses which occurred during the period are reflected in the Statement of Operations. The fund is exposed to foreign currency risk as a result of changes in value of underlying financial instruments. The fund is also exposed to credit risk associated with counterparty non-performance on these forward contracts, which is generally limited to the unrealized gain on each open contract. This risk may be mitigated by Master Agreements, if any, between the fund and the counterparty and the posting of collateral, if any, by the counterparty to the fund to cover the fund’s exposure to the counterparty. At September 30, 2023, there were no forward contracts outstanding.

The following table summarizes the average market value of derivatives outstanding during the period ended September 30, 2023:

| | | |

| | Average Market Value ($) |

Forward contracts | | 28,919,212 |

At September 30, 2023, the cost of investments contracts for federal income tax purposes was $300,705,068; accordingly, accumulated net unrealized appreciation on investments was $45,353,389, consisting of $69,026,062 gross unrealized appreciation and $23,672,673 gross unrealized depreciation.

32

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders of the Fund and Board of Trustees of

BNY Mellon Investment Funds I:

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of BNY Mellon International Equity Fund (the Fund), a series of BNY Mellon Investment Funds, I including the statement of investments, as of September 30, 2023, the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, and the related notes (collectively, the financial statements) and the financial highlights for each of the years in the five-year period then ended. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Fund as of September 30, 2023, the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Such procedures also included confirmation of securities owned as of September 30, 2023, by correspondence with custodian. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more BNY Mellon Investment Adviser, Inc. investment companies since 1994.

New York, New York

November 22, 2023

33

IMPORTANT TAX INFORMATION (Unaudited)

For federal tax purposes, the fund elects to provide each shareholder with their portion of the fund’s income sourced from foreign countries and taxes paid from foreign countries. The fund reports the maximum amount allowable but not less than $12,244,294 as income sourced from foreign countries for the fiscal year ended September 30, 2023 in accordance with Section 853(c)(2) of the Internal Revenue Code and also the fund reports the maximum amount allowable but not less than $1,216,725 as taxes paid from foreign countries for the fiscal year ended September 30, 2023 in accordance with Section 853(a) of the Internal Revenue Code. Where required by federal tax rules, shareholders will receive notification of their proportionate share of foreign sourced income and foreign taxes paid for the 2023 calendar year with Form 1099-DIV which will be mailed in early 2024. Also the fund reports the maximum amount allowable, but not less than $9,976,829 as ordinary income dividends paid during the fiscal year ended September 30, 2023 as qualified dividend income in accordance with Section 854(b)(1)(B) Section 852(b)(3)(C) of the Internal Revenue Code. The fund also hereby reports $.306 per share as a long-term capital gain distribution paid on December 15, 2022.

34

LIQUIDITY RISK MANAGEMENT PROGRAM (Unaudited)

The fund adopted a liquidity risk management program (the “Liquidity Risk Management Program”) pursuant to the requirements of Rule 22e-4 under the Investment Company Act of 1940, as amended. Rule 22e-4 requires registered open-end funds, including mutual funds and exchange-traded funds but not money market funds, to establish liquidity risk management programs in order to effectively manage fund liquidity and shareholder redemptions. The rule is designed to mitigate the risk that a fund could not meet redemption requests without significantly diluting the interests of remaining investors.

The rule requires the fund to assess, manage and review their liquidity risk at least annually considering applicable factors such as investment strategy and liquidity during normal and foreseeable stressed conditions, including whether the strategy is appropriate for an open-end fund and whether the fund has a relatively concentrated portfolio or large positions in particular issuers. The fund must also assess its use of borrowings and derivatives, short-term and long-term cash flow projections in normal and stressed conditions, holdings of cash and cash equivalents, and borrowing arrangements and other funding sources.

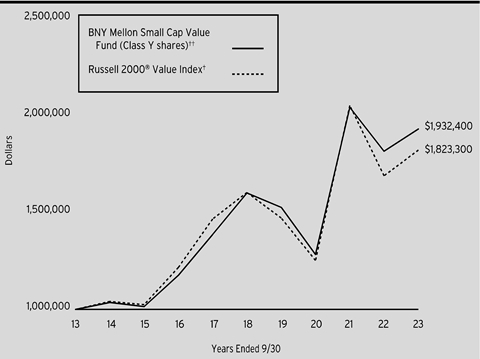

The rule also requires the fund to classify its investments as highly liquid, moderately liquid, less liquid or illiquid based on the number of days the fund expects it would take to liquidate the investment, and to review these classifications at least monthly or more often under certain conditions. The periods range from three or fewer business days for a highly liquid investment to greater than seven calendar days for settlement of a less liquid investment. Illiquid investments are those a fund does not expect to be able to sell or dispose of within seven calendar days without significantly changing the market value. The fund is prohibited from acquiring an investment if, after the acquisition, its holdings of illiquid assets will exceed 15% of its net assets. In addition, if a fund permits redemptions in-kind, the rule requires the fund to establish redemption in-kind policies and procedures governing how and when it will engage in such redemptions.