UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number | 811-04813 |

| |

| Dreyfus Investment Funds | |

| (Exact name of Registrant as specified in charter) | |

| | |

| c/o The Dreyfus Corporation 200 Park Avenue New York, New York 10166 | |

| (Address of principal executive offices) (Zip code) | |

| | |

| Janette E. Farragher, Esq. 200 Park Avenue New York, New York 10166 | |

| (Name and address of agent for service) | |

|

Registrant's telephone number, including area code: | (212) 922-6000 |

| |

Date of fiscal year end: | 9/30 | |

Date of reporting period: | 3/31/2012 | |

| | | | | | | |

The following N-CSR relates only to the Registrant’s series listed below and does not affect the other series of the Registrant, which have a different fiscal year end and, therefore, different N-CSR reporting requirements. Separate N-CSR Forms will be filed for those series, as appropriate.

-Dreyfus/The Boston Company Emerging Markets Core Equity Fund

-Dreyfus/The Boston Company Large Cap Core Fund

-Dreyfus/The Boston Company Small Cap Growth Fund

-Dreyfus/The Boston Company Small Cap Tax-Sensitive Equity Fund

-Dreyfus/The Boston Company Small Cap Value Fund

-Dreyfus/The Boston Company Small/Mid Growth Fund

-Dreyfus/Standish Intermediate Tax Exempt Bond Fund

-Dreyfus/Newton International Equity Fund

FORM N-CSR

Item 1. Reports to Stockholders.

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes.

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value

| | Contents |

| | THE FUND |

| 2 | A Letter from the Chairman and CEO |

| 3 | Discussion of Fund Performance |

| 6 | Understanding Your Fund’s Expenses |

| 6 | Comparing Your Fund’s Expenses With Those of Other Funds |

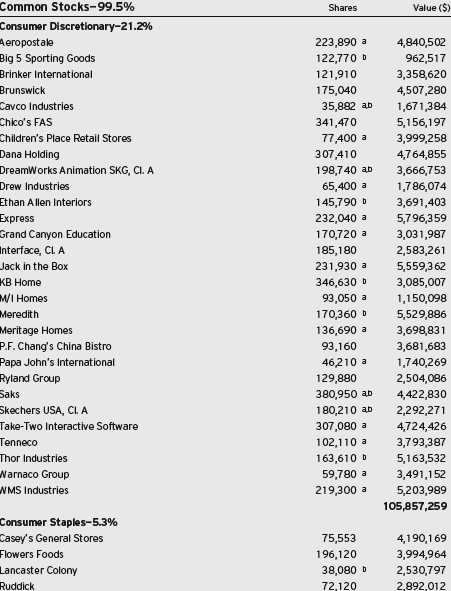

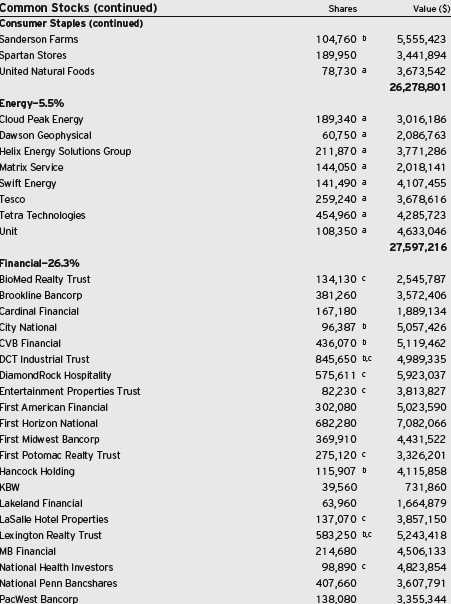

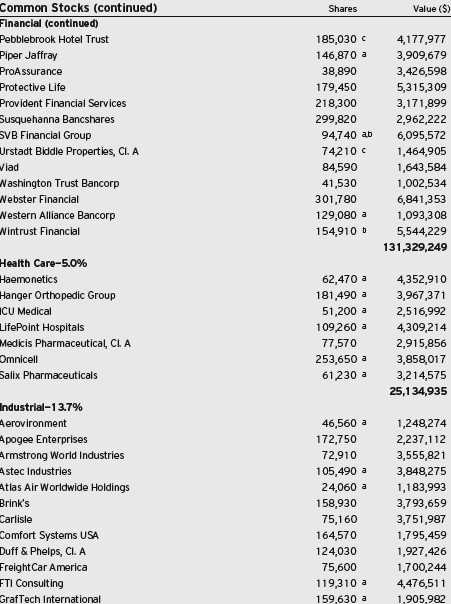

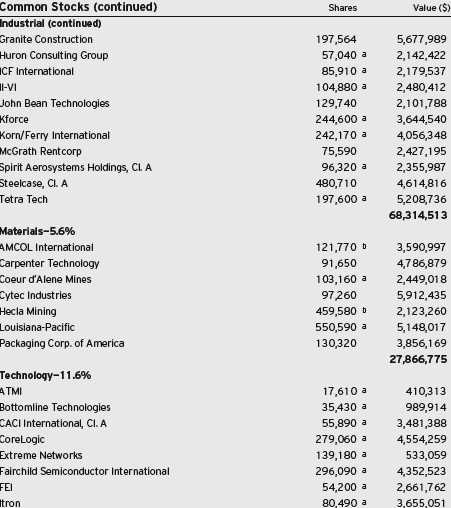

| 7 | Statement of Investments |

| 12 | Statement of Assets and Liabilities |

| 13 | Statement of Operations |

| 14 | Statement of Changes in Net Assets |

| 16 | Financial Highlights |

| 19 | Notes to Financial Statements |

| 34 | Information About the Renewal of the Fund’s Investment Advisory and Administration Agreements |

| | FOR MORE INFORMATION |

| | Back Cover |

Dreyfus/The Boston

Company Emerging

Markets Core Equity Fund

The Fund

A LETTER FROM THE CHAIRMAN AND CEO

Dear Shareholder:

This semiannual report for Dreyfus/The Boston Company Emerging Markets Core Equity Fund covers the six-month period from October 1, 2011, through March 31, 2012.

International stock markets had faltered just prior to the reporting period in the midst of heightened volatility stemming from adverse macroeconomic developments ranging from the resurgence of a sovereign debt crisis in Europe to fears of a slowdown in China. Fortunately, better economic news in October helped to reverse the trend, and improving economic fundamentals during the first quarter of 2012 sparked steep rallies in many global equity markets as China appeared headed for a soft landing and European policymakers made credible progress toward resolving the region’s debt problems.

Our economic forecast calls for sluggish growth for the global economy over the remainder of 2012, but with sharp differences among individual markets. Accommodative monetary policies throughout the world should help avoid a full-blown global recession, but risks remain with regard to financial stresses in Europe, the Chinese property market and oil supply vulnerabilities in the Middle East. As always, we encourage you to talk with your financial adviser about how these developments may affect your investments.

Thank you for your continued confidence and support.

Jonathan R. Baum

Chairman and Chief Executive Officer

The Dreyfus Corporation

April 16, 2012

2

DISCUSSION OF FUND PERFORMANCE

For the period of October 1, 2011, through March 31, 2012, as provided by Sean P. Fitzgibbon and Jay Malikowski, Portfolio Managers

Fund and Market Performance Overview

For the six-month period ended March 31, 2012, Dreyfus/The Boston Company Emerging Markets Core Equity Fund’s Class A shares produced a total return of 18.28%, Class C shares returned 17.80% and Class I shares returned 18.74%.1 In comparison, the fund’s benchmark, the Morgan Stanley Capital International Emerging Markets Index (the “MSCI EM Index”), produced a total return of 19.13% for the same period.2 Emerging market stocks rebounded sharply during the reporting period when fears of global financial instability eased and investors looked forward to better business conditions. The fund underperformed its benchmark, primarily due to our stock selections in India in the consumer staples and industrials sectors.

The Fund’s Investment Approach

The fund seeks long-term growth of capital. To pursue this goal, the fund normally invests at least 80% of its assets in equity securities of companies that are located in foreign countries represented in the MSCI EM Index. The fund may invest up to 20% of its net assets in fixed income securities and may invest in preferred stocks of any credit quality if common stocks of the relevant company are not available.The fund employs a “bottom-up” investment approach, which emphasizes individual stock selection.

Improving Fundamentals Buoyed Investor Sentiment

When the reporting period began, emerging markets were reeling from the impact of a sovereign debt crisis in Greece that threatened to spread to other members of the European Union, uncertainties regarding the strength and sustainability of the U.S. economy, and worries that inflation-fighting measures in China might dampen the region’s previously high growth rate. These concerns led investors to flock to traditional safe havens, often regardless of their underlying valuations. In addition, investors reduced their earnings expectations, and the stocks of many fundamentally sound companies were available at relatively attractive prices at the start of the reporting period.

DISCUSSION OF FUND PERFORMANCE (continued)

Fortunately, most of investors’ concerns at the time did not materialize. After a series of volatile swings during the fall of 2011, emerging equity markets advanced steadily from late December through the end of the reporting period. The market was bolstered by credible measures to address the debt crisis in Europe, encouraging U.S. economic news, and signs of lower inflation and continued growth in China and other emerging markets.

Stock Selections Returned Mixed Results

Success in certain areas were offset by disappointments in other market sectors, and specifically, in India. In the traditionally defensive consumer staples sector, Indian sugar producer Shree Renuka Sugars fell steeply when results from an expansion into Brazil did not meet expectations, and Indonesia’s Indofood Sukses Makmur consolidated its gains after rallying in the previous reporting period.Among industrial companies, Indian building materials producer Sintex Industries was hurt by concerns regarding cuts in government spending on low income housing. Indeed, India proved to be the fund’s greatest laggard on a country basis during the reporting period.

Our investment process proved effective in the information technology sector during the reporting period. Overweighted exposure to global technology leaders such as Samsung Electronics,Taiwan Semiconductor Manufacturing, electronic components maker Pegatron and contract manufacturer Hon Hai Precision Industry enabled the fund to participate fully in the sector’s gains.These and other technology winners enabled Taiwan to rank as the fund’s top performer on a country basis for the reporting period.

Returns from the consumer discretionary sector benefited from an emphasis on companies levered to the recovering automotive industry, such as China’s Great Wall Motor. In addition, Chinese advertising firm Focus Media Holding rebounded from depressed levels when previous corporate governance concerns proved unfounded. In the telecommunications services sector, we added to a position in Russia’s Mobile Telesystems, which had been punished during the downturn despite a generous dividend and easing competitive pressures. The stock moved higher when global investors returned their focus to underlying company fundamentals.

Finding Attractive Opportunities Throughout the World

As economic and market sentiment improved, we reduced the fund’s exposure to the energy and materials sectors, where we have grown

4

concerned about the impact of intensifying government regulation on corporate profits. Conversely, we have identified more opportunities among financial companies, which raised the fund’s exposure to the financials sector from an underweighted posture to a market-neutral position.

As of the end of the reporting period, we were encouraged by clear evidence that investors have been paying greater attention to the company fundamentals that lie at the heart of our stock selection process. Moreover, emerging-market stocks remain attractively valued compared to recent norms, and currently reasonable earnings expectations could support further equity market gains. In our judgment, our bottom-up approach is particularly well suited to a market environment in which investors focus on long-term company fundamentals rather than the headlines of the moment.

April 16, 2012

| |

| | Please note, the position in any security highlighted with italicized typeface was sold during the |

| | reporting period. |

| | Equity funds are subject generally to market, market sector, market liquidity, issuer and investment |

| | style risks, among other factors, to varying degrees, all of which are more fully described in the |

| | fund’s prospectus. |

| | The fund’s performance will be influenced by political, social and economic factors affecting |

| | investments in foreign companies.These special risks include exposure to currency fluctuations, less |

| | liquidity, less developed or less efficient trading markets, lack of comprehensive company |

| | information, political instability and differing auditing and legal standards. Investments in foreign |

| | currencies are subject to the risk that those currencies will decline in value relative to the U.S. |

| | dollar, or, in the case of hedged positions, that the U.S. dollar will decline relative to the currency |

| | being hedged. |

| | Emerging markets tend to be more volatile than the markets of more mature economies, and |

| | generally have less diverse and less mature economic structures and less stable political systems than |

| | those of developed countries. |

| 1 | Total return includes reinvestment of dividends and any capital gains paid, and does not take into |

| | consideration the maximum initial sales charge in the case of Class A shares, or the applicable |

| | contingent deferred sales charge imposed on redemptions in the case of Class C shares. Had these |

| | charges been reflected, returns would have been lower. Past performance is no guarantee of future |

| | results. Share price and investment return fluctuate such that upon redemption, fund shares may be |

| | worth more or less than their original cost.The fund’s returns reflect the absorption of certain fund |

| | expenses by The Dreyfus Corporation pursuant to an agreement in effect through February 1, |

| | 2013, at which time it may be extended, terminated or modified. Had these expenses not been |

| | absorbed, the fund’s returns would have been lower. |

| 2 | SOURCE: LIPPER INC. – Reflects reinvestment of net dividends and, where applicable, |

| | capital gain distributions.The Morgan Stanley Capital International Emerging Markets Index is |

| | a free float-adjusted market capitalization weighted index that is designed to measure the equity |

| | performance in global emerging markets.The index consists of select designated MSCI emerging |

| | market national indices. MSCI Indices reflect investable opportunities for global investors by taking |

| | into account local market restrictions on share ownership by foreigners. Investors cannot invest |

| | directly in any index. |

The Fund 5

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus/The Boston Company Emerging Markets Core Equity Fund from October 1, 2011 to March 31, 2012. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | |

| Expenses and Value of a $1,000 Investment | | | | |

| assuming actual returns for the six months ended March 31, 2012 | | |

| | | Class A | | Class C | | Class I |

| Expenses paid per $1,000† | $ | 12.28 | $ | 16.34 | $ | 8.20 |

| Ending value (after expenses) | $ | 1,182.80 | $ | 1,178.00 | $ | 1,187.40 |

|

| COMPARING YOUR FUND’S EXPENSES |

| WITH THOSE OF OTHER FUNDS (Unaudited) |

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds.All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | |

| Expenses and Value of a $1,000 Investment | | | | |

| assuming a hypothetical 5% annualized return for the six months ended March 31, 2012 |

| | | Class A | | Class C | | Class I |

| Expenses paid per $1,000† | $ | 11.33 | $ | 15.08 | $ | 7.57 |

| Ending value (after expenses) | $ | 1,013.75 | $ | 1,010.00 | $ | 1,017.50 |

Expenses are equal to the fund’s annualized expense ratio of 2.25% for Class A, 3.00% for Class C and 1.50% for Class I, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period).

6

|

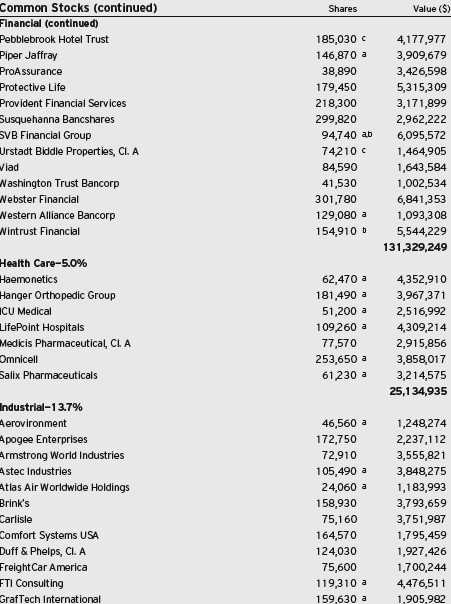

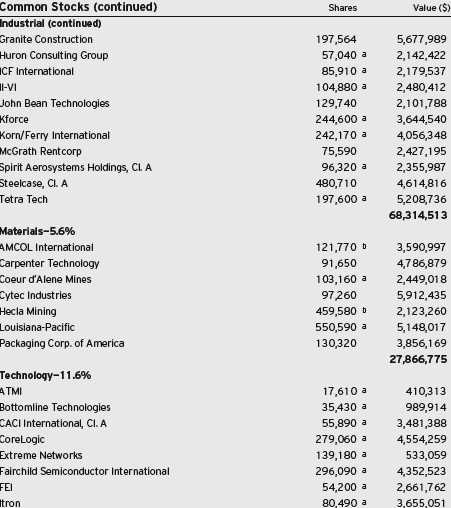

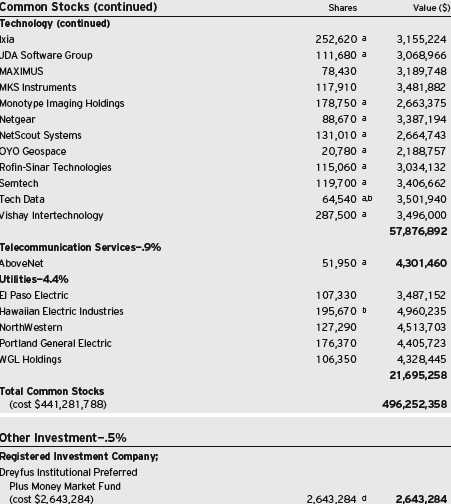

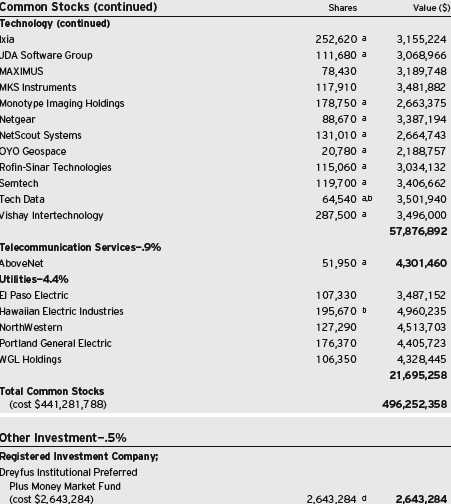

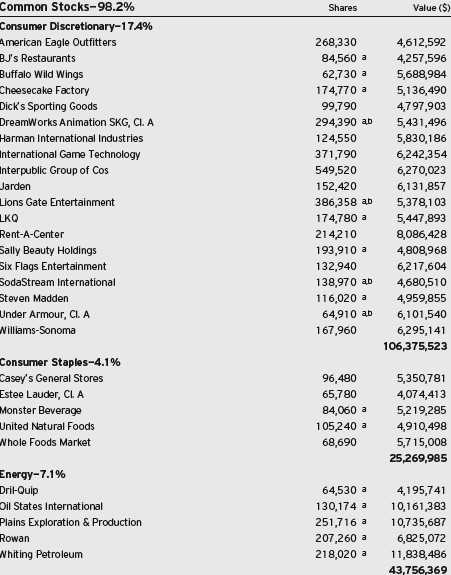

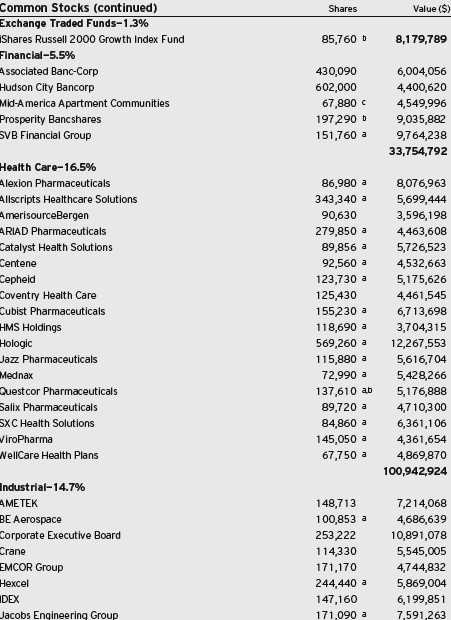

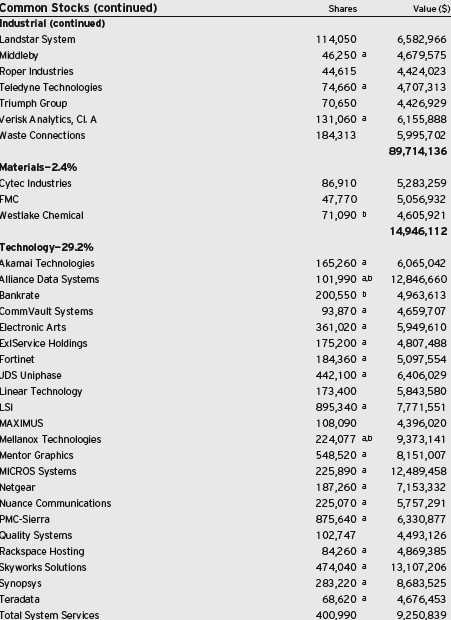

| STATEMENT OF INVESTMENTS |

| March 31, 2012 (Unaudited) |

| | | | |

| Common Stocks—89.8% | Shares | | | Value ($) |

| Brazil—9.9% | | | | |

| Cia de Bebidas das Americas, ADR | 880 | | | 36,362 |

| Cielo | 1,600 | | | 54,246 |

| Embraer, ADR | 1,290 | | | 41,254 |

| Fleury | 3,900 | | | 51,489 |

| Itau Unibanco Holding, ADR | 4,590 | | | 88,082 |

| Obrascon Huarte Lain Brasil | 1,400 | | | 59,046 |

| Rossi Residencial | 8,600 | | | 46,452 |

| Tim Participacoes | 9,061 | | | 57,827 |

| Vale, ADR | 1,780 | | | 41,527 |

| | | | | 476,285 |

| Chile—3.0% | | | | |

| Cencosud | 6,680 | | | 44,160 |

| Enersis, ADR | 1,900 | | | 38,361 |

| ENTEL | 3,210 | | | 64,903 |

| | | | | 147,424 |

| China—11.5% | | | | |

| Baidu, ADR | 350 a | | 51,020 |

| China BlueChemical, Cl. H | 36,000 | | | 27,259 |

| China Communications Construction, Cl. H | 70,000 | | | 70,220 |

| China Construction Bank, Cl. H | 105,000 | | | 81,128 |

| China Petroleum & Chemical, Cl. H | 82,000 | | | 89,333 |

| Focus Media Holding, ADR | 1,740 | | | 43,709 |

| Great Wall Motor, Cl. H | 35,250 | | | 68,543 |

| Industrial & Commercial Bank of China, Cl. H | 134,000 | | | 86,451 |

| WuXi PharmaTech, ADR | 2,700 a | | | 38,880 |

| | | | | 556,543 |

| Colombia—.5% | | | | |

| Bancolombia, ADR | 360 | | | 23,278 |

STATEMENT OF INVESTMENTS (Unaudited) (continued)

| | | |

| Common Stocks (continued) | Shares | | Value ($) |

| Hong Kong—6.3% | | | |

| China Agri-Industries Holdings | 105,481 | | 69,546 |

| China Mobile | 8,000 | | 88,030 |

| China Vanadium Titano-Magnetite Mining | 84,000 | | 19,471 |

| CNOOC | 14,000 | | 28,773 |

| Guangdong Investment | 34,000 | | 23,687 |

| Lenovo Group | 34,000 | | 30,604 |

| Yingde Gases | 39,500 | | 44,864 |

| | | | 304,975 |

| Hungary—.6% | | | |

| MOL Hungarian Oil and Gas | 350 a | | 29,167 |

| India—4.3% | | | |

| Apollo Tyres | 15,220 | | 23,796 |

| Hexaware Technologies | 14,960 | | 34,372 |

| Oil & Natural Gas | 5,740 | | 30,235 |

| Sintex Industries | 21,290 | | 36,044 |

| Sterlite Industries India | 16,760 | | 36,534 |

| Tata Motors | 8,710 | | 47,059 |

| | | | 208,040 |

| Indonesia—1.0% | | | |

| Indofood Sukses Makmur | 92,000 | | 48,797 |

| Malaysia—2.3% | | | |

| AMMB Holdings | 28,800 | | 59,320 |

| Genting | 14,200 | | 50,246 |

| | | | 109,566 |

| Mexico—2.6% | | | |

| Alfa, Cl. A | 400 | | 5,759 |

| America Movil, ADR, Ser. L | 1,580 | | 39,231 |

| Fomento Economico Mexicano, ADR | 980 | | 80,625 |

| | | | 125,615 |

8

| | |

| Common Stocks (continued) | Shares | Value ($) |

| Peru—1.4% | | |

| Credicorp | 520 | 68,546 |

| Russia—7.9% | | |

| Gazprom, ADR | 9,690 | 118,218 |

| Lukoil, ADR | 2,040 | 122,808 |

| MMC Norilsk Nickel, ADR | 582 | 10,651 |

| Mobile Telesystems, ADR | 3,090 | 56,671 |

| Sberbank of Russia, ADR | 4,060 | 52,080 |

| Sberbank-Sponsored, ADR | 1,480 | 19,817 |

| | | 380,245 |

| South Africa—9.0% | | |

| ABSA Group | 2,760 | 56,128 |

| AngloGold Ashanti | 1,020 | 37,550 |

| Aveng | 4,580 | 23,339 |

| Barloworld | 740 | 9,645 |

| Exxaro Resources | 1,930 | 49,849 |

| FirstRand | 16,800 | 51,905 |

| Growthpoint Properties | 21,992 | 57,338 |

| MTN Group | 2,174 | 38,265 |

| Nedbank Group | 2,920 | 62,427 |

| Sasol | 1,050 | 50,714 |

| | | 437,160 |

| South Korea—14.7% | | |

| BS Financial Group | 4,210 | 49,418 |

| Daelim Industrial | 615 | 66,491 |

| DGB Financial Group | 2,970 | 38,925 |

| Dongbu Insurance | 890 | 38,450 |

| Hana Financial Group | 1,290 | 48,615 |

| Hyundai Motor | 403 | 82,873 |

| KT&G | 622 | 44,136 |

STATEMENT OF INVESTMENTS (Unaudited) (continued)

| | |

| Common Stocks (continued) | Shares | Value ($) |

| South Korea (continued) | | |

| Kukdo Chemical | 400 | 17,863 |

| LG Display | 1,600 | 37,421 |

| Samsung Electronics | 215 | 241,935 |

| Youngone | 2,096 | 39,957 |

| | | 706,084 |

| Taiwan—9.5% | | |

| Asia Cement | 18,931 | 23,059 |

| CHIPBOND Technology | 26,000 | 33,695 |

| CTCI | 20,000 | 33,102 |

| Hon Hai Precision Industry | 32,000 | 124,142 |

| Pegatron | 30,000 | 46,757 |

| Taishin Financial Holdings | 87,395 | 34,941 |

| Taiwan Semiconductor | | |

| Manufacturing, ADR | 10,839 | 165,620 |

| | | 461,316 |

| Thailand—3.2% | | |

| Asian Property Development | 143,740 | 28,422 |

| Bangkok Bank | 6,500 | 40,875 |

| PTT | 1,900 | 21,802 |

| PTT Global Chemical | 28,643 | 65,921 |

| | | 157,020 |

| Turkey—.8% | | |

| Turk Telekomunikasyon | 8,930 | 38,780 |

| United States—1.3% | | |

| iShares MSCI Emerging Markets Index Fund | 1,470 | 63,122 |

| Total Common Stocks | | |

| (cost $3,711,058) | | 4,341,963 |

10

| | | | |

| Preferred Stocks—9.9% | | Shares | | Value ($) |

| Brazil | | | | |

| Banco Bradesco | | 3,375 | | 58,960 |

| Banco do Estado do Rio Grande do Sul, Cl. B | 5,100 | | 55,039 |

| Bradespar | | 2,000 | | 38,193 |

| Cia de Bebidas das Americas | | 900 | | 37,248 |

| Cia de Saneamento de Minas Gerais | | 800 | | 18,656 |

| Cia Paranaense de Energia, Cl. B | | 3,400 | | 79,624 |

| Petroleo Brasileiro | | 5,100 | | 65,236 |

| Randon Participacoes | | 3,600 | | 23,192 |

| Vale, Cl. A | | 4,400 | | 99,934 |

| Total Preferred Stocks | | | | |

| (cost $370,270) | | | | 476,082 |

| Total Investments (cost $4,081,328) | 99.7 | % | 4,818,045 |

| Cash and Receivables (Net) | | .3 | % | 15,589 |

| Net Assets | | 100.0 | % | 4,833,634 |

| |

| ADR—American Depository Receipts | | | | |

| a Non-income producing security. | | | | |

| |

| |

| Portfolio Summary (Unaudited)† | | | |

| | Value (%) | | | Value (%) |

| Financial | 22.8 | Industrial | | 7.6 |

| Information Technology | 17.0 | Consumer Staples | | 7.5 |

| Energy | 11.5 | Utilities | | 3.3 |

| Materials | 10.6 | Health Care | | 1.9 |

| Consumer Discretionary | 8.3 | Exchange Traded Funds | | 1.3 |

| Telecommunication Services | 7.9 | | | 99.7 |

| |

| † Based on net assets. | | | | |

| See notes to financial statements. | | | | |

|

| STATEMENT OF ASSETS AND LIABILITIES |

| March 31, 2012 (Unaudited) |

| | | | |

| | | Cost | Value |

| Assets ($): | | | |

| Investments in securities—See Statement of Investments | 4,081,328 | 4,818,045 |

| Cash denominated in foreign currencies | | 38,304 | 38,267 |

| Receivable for investment securities sold | | | 33,388 |

| Dividends receivable | | | 9,894 |

| Prepaid expenses | | | 29,444 |

| | | | 4,929,038 |

| Liabilities ($): | | | |

| Due to The Dreyfus Corporation and affiliates—Note 3(c) | | 28,443 |

| Cash overdraft due to Custodian | | | 12,614 |

| Payable for investment securities purchased | | | 23,491 |

| Unrealized depreciation on forward foreign | | | |

| currency exchange contracts—Note 4 | | | 61 |

| Accrued expenses | | | 30,795 |

| | | | 95,404 |

| Net Assets ($) | | | 4,833,634 |

| Composition of Net Assets ($): | | | |

| Paid-in capital | | | 5,213,916 |

| Accumulated distributions in excess of investment income—net | | (37,849) |

| Accumulated net realized gain (loss) on investments | | | (1,078,961) |

| Accumulated net unrealized appreciation (depreciation) | | | |

| on investments and foreign currency transactions | | | 736,528 |

| Net Assets ($) | | | 4,833,634 |

| |

| |

| Net Asset Value Per Share | | | |

| | Class A | Class C | Class I |

| Net Assets ($) | 149,482 | 83,737 | 4,600,415 |

| Shares Outstanding | 7,188 | 4,181 | 224,101 |

| Net Asset Value Per Share ($) | 20.80 | 20.03 | 20.53 |

| |

| See notes to financial statements. | | | |

12

|

| STATEMENT OF OPERATIONS |

| Six Months Ended March 31, 2012 (Unaudited) |

| | |

| Investment Income ($): | |

| Income: | |

| Cash dividends (net of $3,365 foreign taxes withheld at source): | |

| Unaffiliated issuers | 52,322 |

| Affiliated issuers | 8 |

| Total Income | 52,330 |

| Expenses: | |

| Investment advisory fee—Note 3(a) | 31,350 |

| Custodian fees—Note 3(c) | 25,154 |

| Auditing fees | 19,911 |

| Registration fees | 18,165 |

| Legal fees | 9,281 |

| Prospectus and shareholders’ reports | 6,073 |

| Administration fee—Note 3(a) | 2,850 |

| Shareholder servicing costs—Note 3(c) | 2,381 |

| Distribution fees—Note 3(b) | 519 |

| Trustees’ fees and expenses—Note 3(d) | 464 |

| Interest expense—Note 2 | 137 |

| Loan commitment fees—Note 2 | 55 |

| Miscellaneous | 8,411 |

| Total Expenses | 124,751 |

| Less—expense reimbursement from The Dreyfus | |

| Corporation due to undertaking—Note 3(a) | (80,343) |

| Less—reduction in fees due to earnings credits—Note 3(c) | (1) |

| Net Expenses | 44,407 |

| Investment Income—Net | 7,923 |

| Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | |

| Net realized gain (loss) on investments and foreign currency transactions | (586,414) |

| Net realized gain (loss) on forward foreign currency exchange contracts | (9,843) |

| Net Realized Gain (Loss) | (596,257) |

| Net unrealized appreciation (depreciation) on | |

| investments and foreign currency transactions | 1,803,973 |

| Net unrealized appreciation (depreciation) on | |

| forward foreign currency exchange contracts | (1,218) |

| Net Unrealized Appreciation (Depreciation) | 1,802,755 |

| Net Realized and Unrealized Gain (Loss) on Investments | 1,206,498 |

| Net Increase in Net Assets Resulting from Operations | 1,214,421 |

| |

| See notes to financial statements. | |

STATEMENT OF CHANGES IN NET ASSETS

| | | | |

| | Six Months Ended | |

| | March 31, 2012 | Year Ended |

| | (Unaudited) | September 30, 2011 |

| Operations ($): | | |

| Investment income—net | 7,923 | 129,678 |

| Net realized gain (loss) on investments | (596,257) | 3,308,227 |

| Net unrealized appreciation | | |

| (depreciation) on investments | 1,802,755 | (5,001,113) |

| Net Increase (Decrease) in Net Assets | | |

| Resulting from Operations | 1,214,421 | (1,563,208) |

| Dividends to Shareholders from ($): | | |

| Investment income—net: | | |

| Class A Shares | (517) | (603) |

| Class C Shares | (200) | — |

| Class I Shares | (64,392) | (62,615) |

| Net realized gain on investments: | | |

| Class A Shares | (27,294) | — |

| Class C Shares | (33,777) | — |

| Class I Shares | (808,941) | — |

| Total Dividends | (935,121) | (63,218) |

| Beneficial Interest Transactions ($): | | |

| Net proceeds from shares sold: | | |

| Class A Shares | 25,194 | 172,455 |

| Class C Shares | 55,738 | 11,090 |

| Class I Shares | 267,605 | 189,858 |

| Dividends reinvested: | | |

| Class A Shares | 27,812 | 512 |

| Class C Shares | 33,977 | — |

| Class I Shares | 442,938 | 4,708 |

| Cost of shares redeemed: | | |

| Class A Shares | (56,563) | (125,263) |

| Class C Shares | (151,101) | (73,795) |

| Class I Shares | (4,496,724) | (6,535,360) |

| Increase (Decrease) in Net Assets from | | |

| Beneficial Interest Transactions | (3,851,124) | (6,355,795) |

| Total Increase (Decrease) in Net Assets | (3,571,824) | (7,982,221) |

| Net Assets ($): | | |

| Beginning of Period | 8,405,458 | 16,387,679 |

| End of Period | 4,833,634 | 8,405,458 |

| Undistributed (distributions in excess of) | | |

| investment income—net | (37,849) | 19,337 |

14

| | | | |

| | Six Months Ended | |

| | March 31, 2012 | Year Ended |

| | (Unaudited) | September 30, 2011 |

| Capital Share Transactions: | | |

| Class A | | |

| Shares sold | 1,170 | 6,009 |

| Shares issued for dividends reinvested | 1,572 | 18 |

| Shares redeemed | (2,784) | (4,446) |

| Net Increase (Decrease) in Shares Outstanding | (42) | 1,581 |

| Class C | | |

| Shares sold | 2,581 | 394 |

| Shares issued for dividends reinvested | 1,989 | — |

| Shares redeemed | (7,794) | (2,766) |

| Net Increase (Decrease) in Shares Outstanding | (3,224) | (2,372) |

| Class I | | |

| Shares sold | 13,504 | 6,684 |

| Shares issued for dividends reinvested | 25,412 | 169 |

| Shares redeemed | (185,607) | (232,400) |

| Net Increase (Decrease) in Shares Outstanding | (146,691) | (225,547) |

| |

| See notes to financial statements. | | |

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated.All information (except portfolio turnover rate) reflects financial results for a single fund share.Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions.These figures have been derived from the fund’s financial statements.

| | | | | | | |

| Six Months Ended | | | |

| | March 31, 2012 | Year Ended September 30, |

| Class A Shares | (Unaudited) | 2011 | 2010 | 2009a |

| Per Share Data ($): | | | | |

| Net asset value, beginning of period | 21.86 | 26.99 | 22.70 | 13.55 |

| Investment Operations: | | | | |

| Investment income (loss)—netb | (.07) | .09 | .17 | .14 |

| Net realized and unrealized | | | | |

| gain (loss) on investments | 3.31 | (5.14) | 4.12 | 9.01 |

| Total from Investment Operations | 3.24 | (5.05) | 4.29 | 9.15 |

| Distributions: | | | | |

| Dividends from investment income—net | (.08) | (.08) | — | — |

| Dividends from net realized | | | | |

| gain on investments | (4.22) | — | — | — |

| Total Distributions | (4.30) | (.08) | — | — |

| Net asset value, end of period | 20.80 | 21.86 | 26.99 | 22.70 |

| Total Return (%)c | 18.28d | (18.77) | 18.85 | 67.60d |

| Ratios/Supplemental Data (%): | | | | |

| Ratio of total expenses to average net assets | 5.17e | 3.66 | 3.69 | 11.21e |

| Ratio of net expenses to average net assets | 2.25e | 2.25 | 2.25 | 2.00e |

| Ratio of net investment income | | | | |

| (loss) to average net assets | (.64)e | .30 | .71 | 1.56e |

| Portfolio Turnover Rate | 32.24d | 75.59 | 102.30 | 157.45 |

| Net Assets, end of period ($ x 1,000) | 149 | 158 | 152 | 25 |

| |

| a | From March 31, 2009 (commencement of initial offering) to September 30, 2009. |

| b | Based on average shares outstanding at each month end. |

| c | Exclusive of sales charge. |

| d | Not annualized. |

| e | Annualized. |

| See notes to financial statements. |

16

| | | | | | | | |

| Six Months Ended | | | |

| | March 31, 2012 | Year Ended September 30, |

| Class C Shares | (Unaudited) | 2011 | 2010 | 2009a |

| Per Share Data ($): | | | | |

| Net asset value, beginning of period | 21.23 | 26.36 | 22.62 | 13.55 |

| Investment Operations: | | | | |

| Investment (loss)—netb | (.16) | (.16) | (.13) | (.03) |

| Net realized and unrealized | | | | |

| gain (loss) on investments | 3.21 | (4.97) | 4.17 | 9.10 |

| Total from Investment Operations | 3.05 | (5.13) | 4.04 | 9.07 |

| Distributions: | | | | |

| Dividends from investment income—net | (.03) | — | (.30) | — |

| Dividends from net realized | | | | |

| gain on investments | (4.22) | — | — | — |

| Total Distributions | (4.25) | — | (.30) | — |

| Net asset value, end of period | 20.03 | 21.23 | 26.36 | 22.62 |

| Total Return (%)c | 17.80d | (19.43) | 17.95 | 66.94d |

| Ratios/Supplemental Data (%): | | | | |

| Ratio of total expenses to average net assets | 5.53e | 3.92 | 4.18 | 3.80e |

| Ratio of net expenses to average net assets | 3.00e | 3.00 | 3.00 | 2.75e |

| Ratio of net investment (loss) | | | | |

| to average net assets | (1.52)e | (.58) | (.57) | (.35)e |

| Portfolio Turnover Rate | 32.24d | 75.59 | 102.30 | 157.45 |

| Net Assets, end of period ($ x 1,000) | 84 | 157 | 258 | 178 |

| |

| a | From March 31, 2009 (commencement of initial offering) to September 30, 2009. |

| b | Based on average shares outstanding at each month end. |

| c | Exclusive of sales charge. |

| d | Not annualized. |

| e | Annualized. |

| See notes to financial statements. |

FINANCIAL HIGHLIGHTS (continued)

| | | | | | | | | | | | |

| Six Months Ended | | | | | |

| March 31, 2012 | | Year Ended September 30, | |

| Class I Shares | (Unaudited) | 2011 | 2010 | 2009a | 2008 | 2007 |

| Per Share Data ($): | | | | | | |

| Net asset value, | | | | | | |

| beginning of period | 21.82 | 26.79 | 22.67 | 21.33 | 33.24 | 20.55 |

| Investment Operations: | | | | | | |

| Investment income—netb | .04 | .25 | .18 | .24 | .35 | .31 |

| Net realized and unrealized | | | | | | |

| gain (loss) on investments | 3.23 | (5.11) | 4.26 | 2.21 | (8.86) | 12.62 |

| Total from Investment Operations | 3.27 | (4.86) | 4.44 | 2.45 | (8.51) | 12.93 |

| Distributions: | | | | | | |

| Dividends from | | | | | | |

| investment income—net | (.34) | (.11) | (.32) | (.26) | (.26) | (.24) |

| Dividends from net realized | | | | | | |

| gain on investments | (4.22) | — | — | (.85) | (3.14) | — |

| Total Distributions | (4.56) | (.11) | (.32) | (1.11) | (3.40) | (.24) |

| Net asset value, end of period | 20.53 | 21.82 | 26.79 | 22.67 | 21.33 | 33.24 |

| Total Return (%) | 18.74c | (18.27) | 19.73 | 14.90 | (28.51) | 63.25 |

| Ratios/Supplemental Data (%): | | | | | | |

| Ratio of total expenses | | | | | | |

| to average net assets | 4.33d | 2.83 | 3.07 | 3.50 | 2.74 | 3.18 |

| Ratio of net expenses | | | | | | |

| to average net assets | 1.50d | 1.50 | 1.50 | 1.43 | 1.45 | 1.45 |

| Ratio of net investment income | | | | | | |

| to average net assets | .35d | .90 | .75 | 1.43 | 1.21 | 1.15 |

| Portfolio Turnover Rate | 32.24c | 75.59 | 102.30 | 157.45 | 128 | 76 |

| Net Assets, end of period | | | | | | |

| ($ x 1,000) | 4,600 | 8,090 | 15,978 | 16,585 | 15,328 | 13,671 |

| |

| a | The fund commenced offering three classes of shares on March 31, 2009.The existing shares were redesignated as |

| | Class I shares. |

| b | Based on average shares outstanding at each month end. |

| c | Not annualized. |

| d | Annualized. |

| See notes to financial statements. |

18

NOTES TO FINANCIAL STATEMENTS (Unaudited)

NOTE 1—Significant Accounting Policies:

Dreyfus/The Boston Company Emerging Markets Core Equity Fund (the “fund”) is a separate diversified series of Dreyfus Investment Funds (the “Trust”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company currently offering eleven series, including the fund.The fund’s investment objective is to seek long-term growth of capital. The Dreyfus Corporation (the “Manager” or “Dreyfus”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser.

MBSC Securities Corporation (the “Distributor”), a wholly-owned subsidiary of the Manager, is the distributor of the fund’s shares. The fund is authorized to issue an unlimited number of $.001 par value shares of Beneficial Interest in each of the following classes of shares: Class A, Class C and Class I. Class A and Class C shares are sold primarily to retail investors through financial intermediaries and bear a distribution fee and/or shareholder services fee. Class A shares are subject to a sales charge imposed at the time of purchase. Class C shares are subject to a contingent deferred sales charge (“CDSC”) imposed on Class C shares redeemed within one year of purchase. Class I shares are sold primarily to bank trust departments and other financial service providers (including The Bank of NewYork Mellon, a subsidiary of BNY Mellon and an affiliate of Dreyfus), acting on behalf of customers having a qualified trust or an investment account or relationship at such institution, and bear no distribution or shareholder services fees. Class I shares are offered without a front-end sales charge or CDSC. Other differences between the classes include the services offered to and the expenses borne by each class, the allocation of certain transfer agency costs and certain voting rights. Income, expenses (other than expenses attributable

NOTES TO FINANCIAL STATEMENTS (Unaudited) (continued)

to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

The Trust accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange Commission (“SEC”) under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions.Actual results could differ from those estimates.

(a) Portfolio valuation: The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e. the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value.This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

20

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements.These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for identical investments.

Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques used to value the fund’s investments are as follows:

Investments in securities are valued at the last sales price on the securities exchange or national securities market on which such securities are primarily traded. Securities listed on the National Market System for which market quotations are available are valued at the official closing price or, if there is no official closing price that day, at the last sales price. Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices, except for open short positions, where the asked price is used for valuation purposes. Bid price is used when no asked price is available. Registered investment companies that are not traded on an exchange are valued at their net asset value. All of the preceding securities are categorized within Level 1 of the fair value hierarchy.

NOTES TO FINANCIAL STATEMENTS (Unaudited) (continued)

Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant ADRs and futures contracts. Utilizing these techniques may result in transfers between Level 1 and Level 2 of the fair value hierarchy.

When market quotations or official closing prices are not readily available, or are determined not to reflect accurately fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Board of Trustees. Certain factors may be considered when fair valuing investments such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers.These securities are either categorized as Level 2 or 3 depending on the relevant inputs used.

For restricted securities where observable inputs are limited, assumptions about market activity and risk are used and are categorized within Level 3 of the fair value hierarchy.

Investments denominated in foreign currencies are translated to U.S. dollars at the prevailing rates of exchange. Forward foreign currency exchange contracts (“forward contracts”) are valued at the forward rate. These securities are generally categorized within Level 2 of the fair value hierarchy.

22

The following is a summary of the inputs used as of March 31, 2012 in valuing the fund’s investments:

| | | | | | | |

| | | | Level 2—Other | | Level 3— | | |

| | | Level 1— | Significant | | Significant | | |

| | | Unadjusted | Observable | | Unobservable | | |

| | | Quoted Prices | Inputs | | Inputs | Total | |

| Assets ($) | | | | | | |

| Investments in Securities: | | | | | |

| Equity Securities— | | | | | | |

| | Foreign† | 4,754,923 | — | | — | 4,754,923 | |

| Exchange | | | | | | |

| | Traded Funds | 63,122 | — | | — | 63,122 | |

| Liabilities ($) | | | | | | |

| Other Financial | | | | | | |

| | Instruments: | | | | | | |

| Forward Foreign | | | | | | |

| | Currency Exchange | | | | | | |

| | Contracts†† | — | (61) | | — | (61 | ) |

| |

| † | See Statement of Investments for additional detailed categorizations. | | |

| †† | Amount shown represents unrealized depreciation at period end. | | |

In May 2011, FASB issued Accounting Standards Update (“ASU”) No. 2011-04 “Amendments to Achieve Common FairValue Measurement and Disclosure Requirements in GAAP and International Financial Reporting Standards (“IFRS”)” (“ASU 2011-04”). ASU 2011-04 includes common requirements for measurement of and disclosure about fair value between GAAP and IFRS. ASU 2011-04 will require reporting entities to disclose the following information for fair value measurements categorized within Level 3 of the fair value hierarchy: quantitative information about the unobservable inputs used in the fair value measurement, the valuation processes used by the reporting entity

NOTES TO FINANCIAL STATEMENTS (Unaudited) (continued)

and a narrative description of the sensitivity of the fair value measurement to changes in unobservable inputs and the interrelationships between those unobservable inputs. In addition, ASU 2011-04 will require reporting entities to make disclosures about amounts and reasons for all transfers in and out of Level 1 and Level 2 fair value measurements.The new and revised disclosures are effective for interim and annual reporting periods beginning after December 15, 2011. At this time, management is evaluating the implications of ASU 2011-04 and its impact on the financial statements.

(b) Foreign currency transactions: The fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized on securities transactions between trade and settlement date and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments resulting from changes in exchange rates. Foreign currency gains and losses on investments are included with net realized and unrealized gain or loss on investments.

(c) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

24

Investing in foreign markets may involve special risks and considerations not typically associated with investing in the U.S. These risks include revaluation of currencies, high rates of inflation, repatriation restrictions on income and capital, and adverse political and economic developments. Moreover, securities issued in these markets may be less liquid, subject to government ownership controls and delayed settlements, and their prices may be more volatile than those of comparable securities in the U.S.

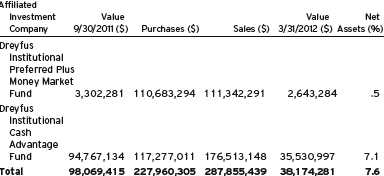

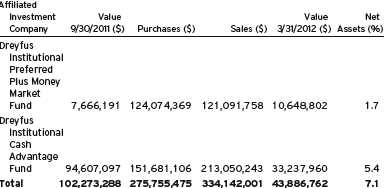

(d) Affiliated issuers: Other investment companies advised by Dreyfus are considered to be “affiliated” with the fund.

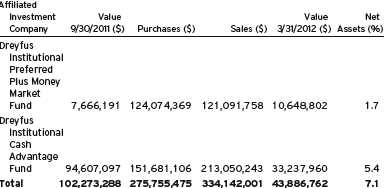

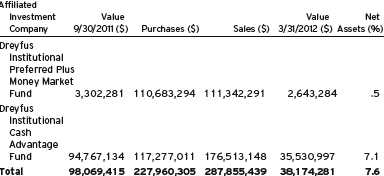

The fund may invest in shares of certain affiliated investment companies also advised or managed by Dreyfus. Investments in affiliated investment companies for the period ended March 31, 2012 were as follows:

| | | | | | | |

| Affiliated | | | | | | | |

| Investment | Value | | | | Value | | Net |

| Company | 9/30/2011 | ($) | Purchases ($) | Sales ($) | 3/31/2012 | ($) | Assets (%) |

| Dreyfus | | | | | | | |

| Institutional | | | | | | | |

| Preferred | | | | | | | |

| Plus Money | | | | | | | |

| Market Fund | 13,098 | | 1,092,421 | 1,105,519 | — | | — |

(e) Dividends to shareholders: Dividends are recorded on the ex-dividend date. Dividends from investment income-net and dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”).To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

NOTES TO FINANCIAL STATEMENTS (Unaudited) (continued)

(f) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income sufficient to relieve it from substantially all federal income and excise taxes.

As of and during the period ended March 31, 2012, the fund did not have any liabilities for any uncertain tax positions.The fund recognizes interest and penalties, if any, related to uncertain tax positions as income tax expense in the Statement of Operations. During the period, the fund did not incur any interest or penalties.

Each of the tax years in the three-year period ended September 30, 2011 remains subject to examination by the Internal Revenue Service and state taxing authorities.

The tax character of distributions paid to shareholders during the fiscal year ended September 30, 2011 was as follows: ordinary income $63,218.The tax character of current year distributions will be determined at the end of the current fiscal year.

NOTE 2—Bank Lines of Credit:

The fund participates with other Dreyfus-managed funds in a $225 million unsecured credit facility led by Citibank, N.A. and a $300 million unsecured credit facility provided by The Bank of New York Mellon (each, a “Facility”), each to be utilized primarily for temporary or emergency purposes, including the financing of redemptions. In connection therewith, the fund has agreed to pay its pro rata portion of commitment fees for each Facility. Interest is charged to the fund based on rates determined pursuant to the terms of the respective Facility at the time of borrowing.

The average amount of borrowings outstanding under the Facilities during the period ended March 31, 2012 was approximately $23,000, with a related weighted average annualized interest rate of 1.20%.

26

NOTE 3—Investment Advisory Fee and Other Transactions with Affiliates:

(a) Pursuant to an investment advisory agreement with the Manager, the investment advisory fee is computed at the annual rate of 1.10% of the value of the fund’s average daily net assets and is payable monthly. The Manager has agreed, until February 1, 2013, to waive receipt of its fees and/or assume the expenses of the fund, so that the direct expenses of Class A, Class C and Class I shares (excluding Rule 12b-1 fees, shareholder services fees, taxes, interest expense, brokerage commissions, commitment fees on borrowings, acquired fund fees and extraordinary expenses) do not exceed 2.00%, 2.00% and 1.50%, respectively, of the value of the respective class’ average daily net assets.The expense reimbursement, pursuant to the undertaking, amounted to $80,343 during the period ended March 31, 2012.

The Trust entered into a Fund Accounting and Administration Agreement (the “Administration Agreement”) with Dreyfus, whereby Dreyfus performs administrative, accounting and recordkeeping services for the fund.The fund has agreed to compensate Dreyfus for providing accounting services, administration, compliance monitoring, regulatory and shareholder reporting, as well as related facilities, equipment and clerical help.The fee is based on the fund’s average daily net assets and computed at the following annual rates: .10% of the first $500 million, .065% of the next $500 million and .02% in excess of $1 billion.

In addition, after applying any expense limitations or fee waivers that reduce the fees paid to Dreyfus for this service, Dreyfus has contractually agreed in writing to waive any remaining fees for this service to the extent that they exceed both Dreyfus’ costs in providing these services and a reasonable allocation of the costs incurred by Dreyfus and its affiliates related to the support and oversight of these services.The fund also reimburses Dreyfus for the out-of-pocket expenses Dreyfus incurs

NOTES TO FINANCIAL STATEMENTS (Unaudited) (continued)

in performing this service for the fund. Pursuant to the Administration Agreement, the fund was charged $2,850 during the period ended March 31, 2012.

(b) Under the Distribution Plan (the “Plan”) adopted pursuant to Rule 12b-1 under the Act, Class C shares pay the Distributor for distributing its shares at an annual rate of .75% of the value of the average daily net assets of Class C shares. During the period ended March 31, 2012, Class C shares were charged $519 pursuant to the Plan.

(c) Under the Shareholder Services Plan, Class A and Class C shares pay the Distributor at the annual rate of .25% of the value of their average daily net assets for the provision of certain services.The services provided may include personal services relating to shareholder accounts, such as answering shareholder inquiries regarding the fund and providing reports and other information, and services related to the maintenance of shareholder accounts.The Distributor may make payments to Service Agents (a securities dealer, financial institution or other industry professional) in respect of these services. The Distributor determines the amounts to be paid to Service Agents. During the period ended March 31, 2012, Class A and Class C shares were charged $183 and $173, respectively, pursuant to the Shareholder Services Plan.

Under its terms, the Plan and Shareholder Services Plan shall remain in effect from year to year, provided such continuance is approved annually by a vote of a majority of those Trustees who are not “interested persons” of theTrust and who have no direct or indirect financial interest in the operation of or in any agreement related to the Plan or Shareholder Services Plan.

The fund compensates Dreyfus Transfer, Inc., a wholly-owned subsidiary of the Manager, under a transfer agency agreement for providing personnel and facilities to perform transfer agency services for the fund. During the period ended March 31, 2012, the fund was charged $484 pursuant to the transfer agency agreement, which is included in Shareholder servicing costs in the Statement of Operations.

28

The fund has arrangements with the custodian and cash management bank whereby the fund may receive earnings credits when positive cash balances are maintained, which are used to offset custody and cash management fees. For financial reporting purposes, the fund includes net earnings credits as an expense offset in the Statement of Operations.

The fund compensates The Bank of New York Mellon under cash management agreements for performing cash management services related to fund subscriptions and redemptions. During the period ended March 31, 2012, the fund was charged $42 pursuant to the cash management agreements, which is included in Shareholder servicing costs in the Statement of Operations. These fees were partially offset by earnings credits of $1.

The fund also compensates The Bank of New York Mellon under a custody agreement for providing custodial services for the fund. During the period ended March 31, 2012, the fund was charged $25,154 pursuant to the custody agreement.

During the period ended March 31, 2012, the fund was charged $3,183 for services performed by the Chief Compliance Officer and his staff.

The components of “Due to The Dreyfus Corporation and affiliates” in the Statement of Assets and Liabilities consist of: investment advisory fees $6,621, administration fees $413, Rule 12b-1 distribution plan fees $54, shareholder services plan fees $50, custodian fees $19,045, chief compliance officer fees $1,591, Private Wealth sub-accounting fees $481 and transfer agency per account fees $188.

(d) Prior to January 1, 2012, each Trustee who is not an “interested person” of the Trust (as defined in the Act) received $60,000 per annum, plus $7,000 per joint Board meeting of the Trust, The Dreyfus/Laurel Funds, Inc., The Dreyfus/Laurel Funds Trust, The Dreyfus/Laurel Tax-Free Municipal Funds and Dreyfus Funds, Inc. (collectively, the “Board Group Open-End Funds”) attended, $2,500

NOTES TO FINANCIAL STATEMENTS (Unaudited) (continued)

for separate in-person committee meetings attended which were not held in conjunction with a regularly scheduled Board meeting and $2,000 for Board meetings and separate committee meetings attended that were conducted by telephone. The Board Group Open-End Funds also reimbursed each Trustee who is not an “interested person” of the Trust (as defined in the Act) for travel and out-of-pocket expenses. With respect to Board meetings, the Chair of the Board received an additional 25% of such compensation (with the exception of reimbursable amounts).The Chair of each of the Board’s committees, unless the Chair also served as Chair of the Board, received $1,350 per applicable committee meeting. In the event that there was an in-person joint committee meeting or a joint telephone meeting of the Board Group Open-End Funds and Dreyfus High Yield Strategies Fund (“DHF”), $2,500 was allocated between the Board Group Open-End Funds and DHF.

Effective January 1, 2012, the Board Group Open-End Funds and DHF (collectively, the “Board Group Funds”) pays each Trustee their respective allocated portions of an annual retainer of $85,000 and a fee of $10,000 for each regularly scheduled Board meeting attended ($75,000 and $8,000, respectively, in the aggregate, prior to January 1, 2012).With respect to the annual retainer and Board meetings of the Board Group Funds, the Chair of the Board receives an additional 25% of such compensation (with the exception of reimbursable amounts). Each Trustee receives $2,500 for any separate in-person committee meetings attended, which are not held in conjunction with a regularly scheduled Board meeting, such amount to be allocated among the Board Group Funds, as applicable. In the event that there is a joint telephone meeting of the Board Group Funds, a fee of $2,000 is allocated among the applicable Board Group Funds, accordingly (prior to January 1, 2012, the fee allocated was $2,500 if the meeting included DHF).The Chair of each of the Board’s committees, unless the Chair

30

also serves as Chair of the Board, receives $1,500 per applicable committee meeting. Each Emeritus Trustee is entitled to receive an annual retainer of one-half the amount paid as a retainer at the time the Trustee became Emeritus and a per meeting attended fee of one-half the amount paid to Trustees.The Board Group Funds also reimburse each Independent Trustee and Emeritus Trustees for travel and out-of-pocket expenses.These fees and expenses are charged and allocated to each series based on net assets.

(e) A 2% redemption fee is charged and retained by the fund on certain shares redeemed within sixty days following the date of issuance, subject to exceptions, including redemptions made through the use of the fund’s exchange privilege. During the period ended March 31, 2012, there were no redemption fees charged and retained by the fund.

NOTE 4—Securities Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities and forward contracts, during the period ended March 31, 2012, amounted to $1,887,291 and $6,654,856, respectively.

Forward Foreign Currency Exchange Contracts: The fund enters into forward contracts in order to hedge its exposure to changes in foreign currency exchange rates on its foreign portfolio holdings, to settle foreign currency transactions or as a part of its investment strategy. When executing forward contracts, the fund is obligated to buy or sell a foreign currency at a specified rate on a certain date in the future. With respect to sales of forward contracts, the fund incurs a loss if the value of the contract increases between the date the forward contract is opened and the date the forward contract is closed.The fund realizes a gain if the value of the contract decreases between those dates.With respect to purchases of forward contracts, the fund incurs a loss if the

NOTES TO FINANCIAL STATEMENTS (Unaudited) (continued)

value of the contract decreases between the date the forward contract is opened and the date the forward contract is closed.The fund realizes a gain if the value of the contract increases between those dates. Any realized gain or loss which occurred during the period is reflected in the Statement of Operations.The fund is exposed to foreign currency risk as a result of changes in value of underlying financial instruments. The fund is also exposed to credit risk associated with counterparty nonperformance on these forward contracts, which is typically limited to the unrealized gain on each open contract.The following summarizes open forward contracts at March 31, 2012:

| | | | | | | |

| Forward Foreign | | | | | | | |

| Currency | | Number | Foreign | | | | |

| Exchange | | of | Currency | | | Unrealized | |

| Contracts | | Contracts | Amounts | Cost ($) | Value ($) (Depreciation) ($) | |

| Purchases: | | | | | | | |

| Mexican | | | | | | | |

| New Peso, | | | | | | | |

| Expiring | | | | | | | |

| 4/3/2012 | a | 1 | 17,843 | 1,397 | 1,394 | (3 | ) |

| Thai Baht, | | | | | | | |

| Expiring | | | | | | | |

| 4/2/2012 | b | 1 | 251,796 | 8,170 | 8,162 | (8 | ) |

| Sales: | | | | Proceeds ($) | | | |

| Brazilian Real, | | | | | | | |

| Expiring: | | | | | | | |

| 4/3/2012 | a | 1 | 3,497 | 1,913 | 1,916 | (3 | ) |

| 4/4/2012 | a | 1 | 7,085 | 3,868 | 3,881 | (13 | ) |

| Hungarian Forint, | | | | | |

| Expiring: | | | | | | | |

| 4/2/2012 | a | 1 | 1,119,968 | 5,047 | 5,073 | (26 | ) |

| 4/3/2012 | c | 1 | 2,593,998 | 11,740 | 11,748 | (8 | ) |

| Gross Unrealized | | | | | |

| Depreciation | | | | | | (61 | ) |

| |

| Counterparties: | | | | | | | |

| a Citigroup | | | | | | | |

| b HSBC | | | | | | | |

| c Bank of America | | | | | |

32

The following summarizes the average market value of derivatives outstanding during the period ended March 31, 2012:

| |

| | Average Market Value ($) |

| Forward contracts | 17,428 |

At March 31, 2012, accumulated net unrealized appreciation on investments was $736,717, consisting of $908,392 gross unrealized appreciation and $171,675 gross unrealized depreciation.

At March 31, 2012, the cost of investments for federal income tax purposes was substantially the same as the cost for financial reporting purposes (see the Statement of Investments).

|

| INFORMATION ABOUT THE RENEWAL OF THE |

| FUND’S INVESTMENT ADVISORY AND |

| ADMINISTRATION AGREEMENTS (Unaudited) |

At a meeting of the fund’s Board of Trustees held on February 15-16, 2012, the Board considered the renewal of the fund’s Investment Advisory Agreement and Administration Agreement pursuant to which Dreyfus provides the fund with investment advisory services and administrative services (together, the “Agreement”).The Board members, none of whom are “interested persons” (as defined in the Investment Company Act of 1940, as amended) of the fund, were assisted in their review by independent legal counsel and met with counsel in executive session separate from representatives of Dreyfus. In considering the renewal of the Agreement, the Board considered all factors that it believed to be relevant, including those discussed below. The Board did not identify any one factor as dispositive, and each Board member may have attributed different weights to the factors considered.

Analysis of Nature, Extent, and Quality of Services Provided to the Fund.The Board considered information previously provided to them in presentations from Dreyfus representatives regarding the nature, extent, and quality of the services provided to funds in the Dreyfus fund complex, and Dreyfus representatives confirmed that there had been no material changes in this information. Dreyfus provided the number of open accounts in the fund, the fund’s asset size and the allocation of fund assets among distribution channels. Dreyfus also had previously provided information regarding the diverse intermediary relationships and distribution channels of funds in the Dreyfus fund complex and Dreyfus’ corresponding need for broad, deep, and diverse resources to be able to provide ongoing shareholder services to each distribution channel, including the distribution channel(s) for the fund.

The Board also considered research support available to, and portfolio management capabilities of, the fund’s portfolio management personnel and that Dreyfus also provides oversight of day-to-day fund operations, including fund accounting and administration and assistance in meeting legal and regulatory requirements.The Board also considered Dreyfus’ extensive administrative, accounting, and compliance infrastructures.

34

The Board also considered portfolio management’s brokerage policies and practices (including policies and practices regarding soft dollars) and the standards applied in seeking best execution.

Comparative Analysis of the Fund’s Performance and Management Fee and Expense Ratio.The Board reviewed reports prepared by Lipper, Inc. (“Lipper”), an independent provider of investment company data, which included information comparing (1) the fund’s performance with the performance of a group of comparable funds (the “Performance Group”) and with a broader group of funds (the “Performance Universe”), all for various periods ended December 31, 2011, and (2) the fund’s actual and contractual management fees and total expenses with those of a group of comparable funds (the “Expense Group”) and with a broader group of funds (the “Expense Universe”), the information for which was derived in part from fund financial statements available to Lipper as of the date of its analysis. Dreyfus previously had furnished the Board with a description of the methodology Lipper used to select the Performance Group and Performance Universe and the Expense Group and Expense Universe.

Dreyfus representatives stated that the usefulness of performance comparisons may be affected by a number of factors, including different investment limitations that may be applicable to the fund and comparison funds.They also noted that performance generally should be considered over longer periods of time, although it is possible that long-term performance can be adversely affected by even one period of significant underperformance so that a single investment decision or theme has the ability to affect disproportionately long-term performance. The Board discussed the results of the comparisons and noted that the fund’s total return performance was variously above and below the Performance Group and Performance Universe medians for the various periods. Dreyfus also provided a comparison of the fund’s calendar year total returns to the returns of the fund’s benchmark index.

|

| INFORMATION ABOUT THE RENEWAL OF THE FUND’S INVESTMENT |

| ADVISORY AND ADMINISTRATION AGREEMENTS (Unaudited) (continued) |

The Board also reviewed the range of actual and contractual management fees and total expenses of the Expense Group and Expense Universe funds and discussed the results of the comparisons.The Board noted that the fund’s contractual management fee was above the Expense Group median, the fund’s actual management fee was below the Expense Group and Expense Universe medians and the fund’s total expense ratio was slightly above the Expense Group and Expense Universe medians.

Dreyfus representatives noted that Dreyfus has contractually agreed to waive receipt of its fees and/or assume the expenses of the fund, until February 1, 2013, so that annual direct fund operating expenses of Class A, Class C and Class I shares (excluding Rule 12b-1 fees, shareholder services fees, taxes, interest expenses, brokerage commissions, acquired fund fees and extraordinary expenses) do not exceed 2.00%, 2.00% and 1.50%, respectively, of the fund’s average daily net assets. Dreyfus representatives also noted that, in connection with the Administration Agreement and its related fees, Dreyfus had contractually agreed to waive any fees to the extent that such fees exceed Dreyfus’ costs in providing the services contemplated under the Administration Agreement.

Dreyfus representatives reviewed with the Board the management or investment advisory fees (1) paid by funds advised or administered by Dreyfus that are in the same Lipper category as the fund and (2) paid to Dreyfus or the Dreyfus-affiliated primary employer of the fund’s primary portfolio manager(s) for advising any separate accounts and/or other types of client portfolios that are considered to have similar investment strategies and policies as the fund (the “Similar Clients”), and explained the nature of the Similar Clients.They discussed differences in fees paid and the relationship of the fees paid in light of any differences in the services provided and other relevant factors. The Board considered the relevance of the fee information provided for the Similar Clients to evaluate the appropriateness and reasonableness of the fund’s management fee.

36

Analysis of Profitability and Economies of Scale. Dreyfus representatives reviewed the expenses allocated and profit received by Dreyfus and the resulting profitability percentage for managing the fund, and the method used to determine the expenses and profit. The Board concluded that the profitability results were not unreasonable, given the services rendered and service levels provided by Dreyfus.The Board also noted the expense limitation arrangement and its effect on Dreyfus’ profitability.The Board previously had been provided with information prepared by an independent consulting firm regarding Dreyfus’ approach to allocating costs to, and determining the profitability of, individual funds and the entire Dreyfus fund complex.The consulting firm also had analyzed where any economies of scale might emerge in connection with the management of a fund.

The Board’s counsel stated that the Board should consider the profitability analysis (1) as part of their evaluation of whether the fees under the Agreement bear a reasonable relationship to the mix of services provided by Dreyfus, including the nature, extent and quality of such services, and (2) in light of the relevant circumstances for the fund and the extent to which economies of scale would be realized if the fund grows and whether fee levels reflect these economies of scale for the benefit of fund shareholders. Dreyfus representatives noted that a discussion of economies of scale is predicated on a fund having achieved a substantial size with increasing assets and that, if a fund’s assets had been stable or decreasing, the possibility that Dreyfus may have realized any economies of scale would be less. Dreyfus representatives also noted that, as a result of shared and allocated costs among funds in the Dreyfus fund complex, the extent of economies of scale could depend substantially on the level of assets in the complex as a whole, so that increases and decreases in complex-wide assets can affect potential economies of scale in a manner that is disproportionate to, or even in the opposite direction from,

|

| INFORMATION ABOUT THE RENEWAL OF THE FUND’S INVESTMENT |

| ADVISORY AND ADMINISTRATION AGREEMENTS (Unaudited) (continued) |

changes in the fund’s asset level. The Board also considered potential benefits to Dreyfus from acting as investment adviser and noted the soft dollar arrangements in effect for trading the fund’s investments.

At the conclusion of these discussions, the Board agreed that it had been furnished with sufficient information to make an informed business decision with respect to the renewal of the Agreement. Based on the discussions and considerations as described above, the Board concluded and determined as follows.

The Board concluded that the nature, extent and quality of the services provided by Dreyfus are adequate and appropriate.

The Board generally was satisfied with the fund’s overall performance.

The Board concluded that the fees payable to Dreyfus were reason- able in light of the considerations described above.

The Board determined that the economies of scale which may accrue to Dreyfus and its affiliates in connection with the management of the fund had been adequately considered by Dreyfus in connection with the fee rate charged to the fund pursuant to the Agreement and that, to the extent in the future it were determined that material economies of scale had not been shared with the fund, the Board would seek to have those economies of scale shared with the fund.

The Board considered these conclusions and determinations, along with information received on a routine and regular basis throughout the year. In addition, it should be noted that the Board’s consideration of the contractual fee arrangements for this fund had the benefit of a number of years of reviews of prior or similar agreements during which lengthy discussions took place between the Board and Dreyfus representatives. Certain aspects of the arrangements may receive greater scrutiny in some years than in others, and the Board’s conclusions may be based, in part, on their consideration of the same or similar arrangements in prior years.The Board determined that renewal of the Agreement was in the best interests of the fund and its shareholders.

38

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes.

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

| | Contents |

| | THE FUND |

| 2 | A Letter from the Chairman and CEO |

| 3 | Discussion of Fund Performance |

| 6 | Understanding Your Fund’s Expenses |

| 6 | Comparing Your Fund’s Expenses With Those of Other Funds |

| 7 | Statement of Investments |

| 11 | Statement of Assets and Liabilities |

| 12 | Statement of Operations |

| 13 | Statement of Changes in Net Assets |

| 15 | Financial Highlights |

| 18 | Notes to Financial Statements |

| 30 | Information About the Renewal of the Fund’s Investment Advisory and Administration Agreements |

| | FOR MORE INFORMATION |

| | Back Cover |

Dreyfus/The Boston

Company Large Cap

Core Fund

The Fund

A LETTER FROM THE CHAIRMAN AND CEO

Dear Shareholder:

This semiannual report for Dreyfus/The Boston Company Large Cap Core Fund covers the six-month period from October 1, 2011, through March 31, 2012. For information about how the fund performed during the reporting period, as well as general market perspectives, we provide a Discussion of Fund Performance on the pages that follow.

U.S. stock markets had faltered in the months prior to the reporting period, due primarily to the resurgence of a sovereign debt crisis in Europe and an unprecedented downgrade of long-term U.S. debt.These factors triggered a rally among traditional safe havens, while riskier assets such as stocks plunged. Fortunately, better economic news in the fall helped to reverse the downward trend, and improving economic fundamentals during the first quarter of 2012 sparked rallies in equity markets, enabling them to post significant gains for the reporting period overall.

Our economic forecast anticipates that the United States will continue to post better economic data than most of the rest of the developed world. An aggressively accommodative monetary policy, pent-up demand in several industry groups and gradual improvement in housing prices appear likely to offset risks stemming from the ongoing European debt crisis and volatile energy prices.As always, we encourage you to talk with your financial adviser about how these developments may affect your investments.

Thank you for your continued confidence and support.

Jonathan R. Baum

Chairman and Chief Executive Officer

The Dreyfus Corporation

April 16, 2012

2

DISCUSSION OF FUND PERFORMANCE

For the period of October 1, 2011, through March 31, 2012, as provided by Sean P. Fitzgibbon and Jeffrey D. McGrew, Portfolio Managers

Market and Fund Performance Overview

For the six-month period ended March 31, 2012, Dreyfus/The Boston Company Large Cap Core Fund’s Class A shares produced a total return of 25.41%, Class C shares returned 24.97% and Class I shares returned 25.60%.1 In comparison, the fund’s benchmark, the Standard & Poor’s 500 Composite Stock Price Index (“S&P 500 Index”), produced a total return of 25.86% for the same period.2

Improving economic fundamentals drove stocks broadly higher over the reporting period.The fund’s Class A and I shares produced returns that were roughly in line with the benchmark, as strong stock selections in the industrials, energy and consumer discretionary sectors were balanced by shortfalls in the consumer staples, materials and utilities sectors.

The Fund’s Investment Approach