UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-4813

--------------------------------------------

DREYFUS INVESTMENT FUNDS

-------------------------------------------------------------

(Exact name of registrant as specified in charter)

c/o The Dreyfus Corporation

200 Park Avenue

New York, New York 10166

---------------------------------------------------------------

(Address of principal executive offices) (Zip code)

---------------------------------------------------------------

(Name and address of agent for service)

with a copy to:

Michael A. Rosenberg, Esq.

200 Park Avenue

New York, New York 10166

Registrant’s telephone number, including area code: (212) 922-6000

-----------------------------------------------------------

Date of fiscal year end: September 30

------------------------------------------

Date of reporting period: September 30, 2008

--------------------------------------

Item 1.

Reports to Stockholders.

Year Ended September 30, 2008

Emerging Markets Core Equity Fund

J. David Officer

President

The Boston Company Emerging Markets Core Equity Fund

The Boston Company Emerging Markets Core Equity Fund

| William S. Patzer, CFA Portfolio Manager The Boston Company Asset Management, LLC | Sylvia Han, CFA Portfolio Manager The Boston Company Asset Management, LLC | |||||

The Boston Company Emerging Markets Core Equity Fund

The Boston Company Emerging Markets Core Equity Fund and

the Morgan Stanley Capital International Emerging Markets Index (Unaudited)

| Average Annual Total Returns (for period ended 9/30/2008) | ||||||||

|---|---|---|---|---|---|---|---|---|

| 1 Year | Since Inception 7/10/2006 | |||||||

| (28.51)% | 8.52 % | |||||||

The Boston Company Emerging Markets Core Equity Fund

| | Beginning Account Value April 1, 2008 | | Ending Account Value September 30, 2008 | | Expenses Paid During Period† April 1, 2008 to September 30, 2008 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Actual | $ | 1,000.00 | $ | 764.80 | $ | 6.40 | ||||||||

| Hypothetical (5% return per year before expenses) | $ | 1,000.00 | $ | 1,017.75 | $ | 7.31 | ||||||||

† Expenses are equal to the Fund’s annualized expense ratio of 1.45%, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period).

The Boston Company Emerging Markets Core Equity Fund

| Top Ten Holdings* | | Country | | Sector | | Percentage of Investments | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Petroleo Brasileiro SA | Brazil | Energy | 4.2 | % | ||||||||||

| OAO Gazprom — ADR | Russia | Energy | 3.4 | |||||||||||

| Industrial and Commercial Bank of China | China | Financials | 2.9 | |||||||||||

| Companhia Vale do Rio Doce | Brazil | Materials | 2.6 | |||||||||||

| Taiwan Semiconductor Manufacturing Co., Ltd. ADR | Taiwan | Information Technology | 2.2 | |||||||||||

| CNOOC Ltd. | Hong Kong | Energy | 2.1 | |||||||||||

| Lukoil ADR | Russia | Energy | 2.1 | |||||||||||

| Teva Pharmaceutical Industries Ltd. ADR | Israel | Health Care | 2.0 | |||||||||||

| Samsung Electronics Co., Ltd. | South Korea | Information Technology | 2.0 | |||||||||||

| China Mobile Ltd. | Hong Kong | Telecommunications Services | 2.0 | |||||||||||

| 25.5 | % | |||||||||||||

| * | Excludes short-term securities and investment of cash collateral. |

| Geographic Region Allocation* | | Percentage of Investments | ||||

|---|---|---|---|---|---|---|

| Europe ex U.K. | 13.8 | % | ||||

| Pacific ex Japan | 52.4 | |||||

| Americas ex U.S. | 19.9 | |||||

| Middle East/Africa | 13.9 | |||||

| 100.0 | % | |||||

| * | Excludes short-term securities and investment of cash collateral. |

The Boston Company Emerging Markets Core Equity Fund

| Security | | Shares | | Value ($) (Note 1A) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

UNAFFILIATED INVESTMENTS—98.6% | ||||||||||

Common Equities—85.5% | ||||||||||

Brazil—2.3% | ||||||||||

| Redecard SA | 8,400 | 109,799 | ||||||||

| Uniao de Bancos Brasileiros SA | 13,300 | 135,907 | ||||||||

| Uniao de Bancos Brasileiros SA GDR | 1,020 | a | 102,938 | |||||||

| 348,644 | ||||||||||

China—7.9% | ||||||||||

| China Construction Bank Corp. | 291,000 | 193,166 | ||||||||

| China COSCO Holdings Co., Ltd. | 56,500 | 51,620 | ||||||||

| Dongfeng Motor Group Co., Ltd. | 306,000 | 113,114 | ||||||||

| Industrial and Commercial Bank of China | 741,000 | 441,425 | ||||||||

| Shanda Interactive Entertainment Ltd. ADR | 5,130 | a | 131,072 | |||||||

| Weichai Power Co., Ltd. | 31,000 | 116,666 | ||||||||

| Weiqiao Textile Co., Ltd. | 175,500 | 85,978 | ||||||||

| Yanzhou Coal Mining Co., Ltd. | 70,000 | 73,144 | ||||||||

| 1,206,185 | ||||||||||

Czech Republic—0.6% | ||||||||||

| CEZ | 1,383 | 84,588 | ||||||||

Egypt—.9% | ||||||||||

| Telecom Egypt | 53,355 | 145,109 | ||||||||

Hong Kong—7.7% | ||||||||||

| Bank of China Ltd. | 319,000 | 122,313 | ||||||||

| Chaoda Modern Agriculture Ltd. | 134,000 | 112,435 | ||||||||

| China Agri-Industries Holding Ltd. | 227,481 | a | 119,499 | |||||||

| China Mobile Ltd. | 30,000 | 300,399 | ||||||||

| China Pharmaceutical Group Ltd. | 254,000 | 82,227 | ||||||||

| CNOOC Ltd. | 279,000 | 320,188 | ||||||||

| Global Bio-Chem Technology Group Co., Ltd. | 378,000 | 122,095 | ||||||||

| 1,179,156 | ||||||||||

Hungary—0.7% | ||||||||||

| Magyar Telekom Telecommunications PLC | 23,150 | 109,139 | ||||||||

India—5.0% | ||||||||||

| Bank of India | 11,650 | 72,251 | ||||||||

| Bharat Petroleum Corp., Ltd. | 21,478 | 167,299 | ||||||||

| Hindalco Industries Ltd. | 40,980 | 86,768 | ||||||||

| Hindalco Industries Ltd. Rights | 17,014 | a | 236 | |||||||

| Infosys Technologies Ltd. | 5,810 | 176,157 | ||||||||

| Rolta India Ltd. | 15,355 | 78,735 | ||||||||

| State Bank of India Ltd. | 3,450 | 109,209 | ||||||||

| Tata Steel Ltd. | 7,501 | 69,614 | ||||||||

| 760,269 | ||||||||||

The Boston Company Emerging Markets Core Equity Fund

| Security | | Shares | | Value ($) (Note 1A) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

Indonesia—0.6% | ||||||||||

| PT Gudang Garam Tbk | 160,000 | 99,544 | ||||||||

Israel—4.0% | ||||||||||

| Bank Leumi Le-Israel | 46,830 | 176,609 | ||||||||

| Israel Chemicals Ltd. | 8,730 | 136,996 | ||||||||

| Teva Pharmaceutical Industries Ltd. ADR | 6,690 | b | 306,335 | |||||||

| 619,940 | ||||||||||

Malaysia—3.4% | ||||||||||

| Hong Leong Bank Bhd | 167,900 | 277,597 | ||||||||

| KLCC Property Holdings Bhd | 123,900 | 97,885 | ||||||||

| RHB Capital Bhd | 122,400 | 143,324 | ||||||||

| 518,806 | ||||||||||

Mexico—6.5% | ||||||||||

| Alfa SAB de CV | 56,000 | 252,065 | ||||||||

| America Movil SAB de CV ADR | 5,680 | 263,325 | ||||||||

| Cemex SAB de CV ADR | 6,780 | 116,752 | ||||||||

| Fomento Economico Mexicano de CV ADR | 5,480 | 209,007 | ||||||||

| Grupo Aeroportuario del Sureste | 12,400 | 60,965 | ||||||||

| Grupo Financiero Banorte SAB de CV | 27,200 | 86,847 | ||||||||

| 988,961 | ||||||||||

Poland—2.3% | ||||||||||

| BRE Bank SA | 1,035 | a | 136,490 | |||||||

| Telekomunikacja Polska SA | 22,070 | 211,268 | ||||||||

| 347,758 | ||||||||||

Russia—6.9% | ||||||||||

| Cherepovets MK-SPON 144A GDR | 4,100 | 42,640 | ||||||||

| JSC MMC Norilsk Nickel ADR | 4,310 | 58,918 | ||||||||

| Lukoil ADR | 5,360 | 315,168 | ||||||||

| Mobile TeleSystems ADR | 2,350 | 131,624 | ||||||||

| OAO Gazprom—ADR | 16,580 | 513,151 | ||||||||

| 1,061,501 | ||||||||||

South Africa—8.6% | ||||||||||

| ABSA Group Ltd. | 6,688 | 88,987 | ||||||||

| ArcelorMittal South Africa Ltd. | 9,296 | 187,372 | ||||||||

| Aveng Ltd. | 26,930 | 205,728 | ||||||||

| Metropolitan Holdings Ltd. | 62,658 | 84,397 | ||||||||

| MTN Group Ltd. | 17,384 | 246,639 | ||||||||

| Nedbank Group Ltd. | 7,020 | 89,169 | ||||||||

| Remgro Ltd. | 7,292 | 169,192 | ||||||||

| Sasol Ltd. | 5,710 | 243,008 | ||||||||

| 1,314,492 | ||||||||||

The Boston Company Emerging Markets Core Equity Fund

| Security | | Shares | | Value ($) (Note 1A) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

South Korea—15.5% | ||||||||||

| CJ Home Shopping | 1,985 | 114,023 | ||||||||

| Daehan Steel Co., Ltd. | 1,299 | 76,164 | ||||||||

| Dongbu Insurance Co., Ltd. | 4,810 | 111,549 | ||||||||

| Honam Petrochemical Corp. | 2,091 | 120,636 | ||||||||

| Hyundai Department Store Co., Ltd. | 1,507 | 117,321 | ||||||||

| Hyundai Marine & Fire Insurance Co., Ltd. | 7,620 | 123,104 | ||||||||

| Hyundai Motor Co. | 1,881 | 118,735 | ||||||||

| KT&G Corp. | 1,389 | 103,559 | ||||||||

| Kumho Industrial Co., Ltd. | 3,770 | 74,192 | ||||||||

| LG Chem Ltd. | 1,089 | 85,839 | ||||||||

| LG Corp. | 5,411 | 282,750 | ||||||||

| LG Fashion Corp. | 3,820 | 88,531 | ||||||||

| LG Telecom Ltd. | 10,180 | 85,151 | ||||||||

| POSCO | 746 | 275,896 | ||||||||

| Samsung Electronics Co., Ltd. | 660 | 304,077 | ||||||||

| Shinhan Financial Group Co., Ltd. | 8,090 | 291,839 | ||||||||

| 2,373,366 | ||||||||||

Taiwan—7.6% | ||||||||||

| Acer, Inc. | 69,000 | 117,548 | ||||||||

| Catcher Technology Co., Ltd. | 31,000 | 99,979 | ||||||||

| Compal Electronics, Inc. | 197,282 | 142,235 | ||||||||

| Giga-Byte Technology Co., Ltd. | 172,000 | 88,485 | ||||||||

| Polaris Securities Co., Ltd. | 200,560 | 79,439 | ||||||||

| Quanta Computer, Inc. | 78,680 | 99,158 | ||||||||

| Taiwan Mobile Co., Ltd. | 82,645 | 131,740 | ||||||||

| Taiwan Semiconductor Manufacturing Co., Ltd. ADR | 36,307 | 340,197 | ||||||||

| Tong Yang Industry Co., Ltd. | 127,936 | 64,963 | ||||||||

| 1,163,744 | ||||||||||

Thailand—2.0% | ||||||||||

| Electricity Generating Public Co., Ltd. | 48,900 | 90,373 | ||||||||

| PTT Public Co., Ltd. | 20,900 | 143,699 | ||||||||

| Total Access Communication Public Co., Ltd. | 66,500 | 78,232 | ||||||||

| 312,304 | ||||||||||

Turkey—3.0% | ||||||||||

| Haci Omer Sabanci Holding AS | 39,702 | 149,085 | ||||||||

| Selcuk Ecza Deposu Ticaret ve Sanayi AS | 91,548 | 91,592 | ||||||||

| Tupras-Turkiye Petrol Rafine AS | 7,783 | 142,582 | ||||||||

| Turkcell Iletisim Hizmetleri AS | 13,700 | 83,757 | ||||||||

| 467,016 | ||||||||||

| TOTAL COMMON EQUITIES (Cost $16,005,626) | 13,100,522 | |||||||||

The Boston Company Emerging Markets Core Equity Fund

| Security | | Shares | | Value ($) (Note 1A) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

Preferred Stocks—10.7% | ||||||||||

Brazil—10.7% | ||||||||||

| Companhia de Bebidas das Americas | 1,400 | 77,230 | ||||||||

| Companhia Energetica de Minas Gerais | 4,597 | 90,810 | ||||||||

| Companhia Paranaense de Energia-Copel | 13,200 | 183,083 | ||||||||

| Companhia Vale do Rio Doce | 23,500 | 403,848 | ||||||||

| Petroleo Brasileiro SA | 34,900 | 643,580 | ||||||||

| Tele Norte Leste Participacoes SA | 7,300 | 124,645 | ||||||||

| Usinas Siderurgicas de Minas Gerais SA | 5,175 | 110,139 | ||||||||

| TOTAL PREFERRED STOCKS (Cost $1,864,663) | 1,633,335 | |||||||||

EXCHANGE TRADED FUNDS—1.5% | ||||||||||

| Ishares MSCI Emerging Markets Index (Cost $224,767) | 6,790 | 232,014 | ||||||||

SHORT-TERM INVESTMENTS—2.1% | ||||||||||

INVESTMENT OF CASH COLLATERAL—0.9% | ||||||||||

| BlackRock Cash Strategies L.L.C. (Cost $144,388) | 144,388 | c,e | 144,388 | |||||||

| TOTAL UNAFFILIATED INVESTMENTS (Cost $18,239,444) | 15,110,259 | |||||||||

AFFILIATED INVESTMENTS —1.2% | ||||||||||

| Dreyfus Institutional Cash Advantage Fund | 58,562 | d,e | 58,562 | |||||||

| Dreyfus Institutional Preferred Plus Money Market Fund | 122,228 | d | 122,228 | |||||||

| TOTAL AFFILIATED INVESTMENTS (Cost $180,790) | 180,790 | |||||||||

TOTAL INVESTMENTS—99.8% (Cost $18,420,234) | 15,291,049 | |||||||||

OTHER ASSETS, LESS LIABILITIES—0.2% | 36,885 | |||||||||

NET ASSETS—100% | 15,327,934 | |||||||||

The Boston Company Emerging Markets Core Equity Fund

| Contracts to Deliver | | Local Principal Amount | | Contract Value Date | | Value at September 30, 2008 | | USD Amount to Receive | | Unrealized Appreciation | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Poland Zloty | 196,917 | 10/2/2008 | $81,661 | $82,375 | $714 | |||||||||||||||||

| Economic Sector Allocation | | Percentage of Net Assets | ||||

|---|---|---|---|---|---|---|

| Consumer Discretionary | 4.6 | % | ||||

| Consumer Staples | 5.5 | |||||

| Energy | 16.7 | |||||

| Financials | 21.4 | |||||

| Health Care | 3.2 | |||||

| Industrials | 6.8 | |||||

| Information Technology | 11.0 | |||||

| Materials | 11.6 | |||||

| Telecommunications Services | 12.5 | |||||

| Utilities | 2.9 | |||||

| Exchange Traded Funds | 1.5 | |||||

| Short-term and Other Assets | 2.3 | |||||

| 100.0 | % | |||||

The Boston Company Emerging Markets Core Equity Fund

September 30, 2008

Assets | ||||||||||

| Investment in securities, at value (Note 1A) (including securities on loan, valued at $206,513 (Note 7)): | ||||||||||

| Unaffiliated investments (cost $18,239,444) | $ | 15,110,259 | ||||||||

| Affiliated investments (Note 1H) (cost $180,790) | 180,790 | |||||||||

| Foreign currency, at value (cost $135,765) | 134,151 | |||||||||

| Receivable for investments sold | 552,916 | |||||||||

| Receivable from investment advisor | 106,982 | |||||||||

| Interest and dividends receivable | 35,001 | |||||||||

| Unrealized appreciation on forward currency exchange contracts (Note 6) | 714 | |||||||||

| Prepaid expenses | 500 | |||||||||

| Total assets | 16,121,313 | |||||||||

Liabilities | ||||||||||

| Payable for investments purchased | $ | 448,204 | ||||||||

| Collateral for securities on loan (Note 7) | 202,950 | |||||||||

| Accrued professional fees | 47,980 | |||||||||

| Accrued investment advisory fee (Note 2) | 46,965 | |||||||||

| Accrued accounting, custody, administration and transfer agent fees (Note 2) | 40,914 | |||||||||

| Accrued trustees’ fees (Note 2) | 1,452 | |||||||||

| Accrued shareholder reporting fees (Note 2) | 1,013 | |||||||||

| Accrued chief compliance officer fees (Note 2) | 429 | |||||||||

| Other accrued expenses and liabilities | 3,472 | |||||||||

| Total liabilities | 793,379 | |||||||||

Net Assets | $ | 15,327,934 | ||||||||

Net Assets consist of: | ||||||||||

| Paid-in capital | $ | 17,928,958 | ||||||||

| Accumulated net realized gain | 396,245 | |||||||||

| Undistributed net investment income | 142,210 | |||||||||

| Net unrealized depreciation | (3,139,479 | ) | ||||||||

Total Net Assets | $ | 15,327,934 | ||||||||

| Shares of beneficial interest outstanding | 718,710 | |||||||||

| Net Asset Value, offering and redemption price per share (Net Assets/Shares outstanding) | $ | 21.33 |

The Boston Company Emerging Markets Core Equity Fund

For the Year Ended September 30, 2008

Investment Income (Note 1B) | ||||||||||

| Dividend income from unaffiliated investments (net of foreign withholding taxes $52,555) | $ | 421,978 | ||||||||

| Dividend income from affiliated investments (Note 1 H) | 6,550 | |||||||||

| Securities lending income (Note 7) | 4,129 | |||||||||

| Total investment income | 432,657 | |||||||||

Expenses | ||||||||||

| Investment advisory fee (Note 2) | $ | 179,662 | ||||||||

| Accounting, custody, administration and transfer agent fees (Note 2) | 151,304 | |||||||||

| Professional fees | 62,078 | �� | ||||||||

| Registration fees | 23,250 | |||||||||

| Trustees’ fees and expenses (Note 2) | 5,868 | |||||||||

| Insurance expense | 363 | |||||||||

| Miscellaneous expenses | 23,558 | |||||||||

| Total expenses | 446,083 | |||||||||

Deduct: | ||||||||||

| Waiver of invesment advisory fee (Note 2) | (179,662 | ) | ||||||||

| Reimbursement of Fund operating expenses (Note 2) | (30,611 | ) | ||||||||

| Total expense deduction | (210,273 | ) | ||||||||

| Net Expenses | 235,810 | |||||||||

| Net investment income | 196,847 | |||||||||

Realized and Unrealized Gain (Loss) | ||||||||||

| Net realized gain (loss) on: | ||||||||||

| Investments | 886,548 | |||||||||

| Foreign currency transactions and forward foreign currency exchange transactions | 9,436 | |||||||||

| Net realized gain (loss) | 895,984 | |||||||||

| Change in unrealized appreciation (depreciation) on: | ||||||||||

| Investments | (6,836,314 | ) | ||||||||

| Foreign currency translations and forward foreign currency exchange transactions | (13,246 | ) | ||||||||

| Change in net unrealized appreciation (depreciation) | (6,849,560 | ) | ||||||||

| Net realized and unrealized gain (loss) on investments | (5,953,576 | ) | ||||||||

Net Increase (Decrease) in Net Assets from Operations | $ | (5,756,729 | ) |

The Boston Company Emerging Markets Core Equity Fund

| For the Year Ended September 30, 2008 | For the Year Ended September 30, 2007 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

Increase (Decrease) in Net Assets: | ||||||||||

From Operations | ||||||||||

| Net investment income (loss) | $ | 196,847 | $ | 104,925 | ||||||

| Net realized gain (loss) | 895,984 | 920,690 | ||||||||

| Change in net unrealized appreciation (depreciation) | (6,849,560 | ) | 3,541,091 | |||||||

| Net increase (decrease) in net assets from investment operations | (5,756,729 | ) | 4,566,706 | |||||||

Distributions to Shareholders (Note 1C) | ||||||||||

| From net investment income | (132,037 | ) | (78,456 | ) | ||||||

| From net realized gains on investments | (1,349,478 | ) | — | |||||||

| Total distributions to shareholders | (1,481,515 | ) | (78,456 | ) | ||||||

Fund Share Transactions (Note 4) | ||||||||||

| Net proceeds from sale of shares | 7,882,079 | 3,722,363 | ||||||||

| Value of shares issued to shareholders in reinvestment of distributions | 1,416,355 | 73,536 | ||||||||

| Cost of shares redeemed | (403,210 | ) | (306,321 | ) | ||||||

| Net increase (decrease) in net assets from Fund share transactions | 8,895,224 | 3,489,578 | ||||||||

Total Increase (Decrease) in Net Assets | 1,656,980 | 7,977,828 | ||||||||

Net Assets | ||||||||||

| At beginning of year | 13,670,954 | 5,693,126 | ||||||||

| At end of year [including undistributed net investment income of $142,210 and $67,966, respectively] | $ | 15,327,934 | $ | 13,670,954 | ||||||

The Boston Company Emerging Markets Core Equity Fund

| For the Year Ended September 30, 2008 | For the Year Ended September 30, 2007 | For the period July 10, 2006 (commencement of operations) to September 30, 2006 | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Net Asset Value, Beginning of Period | $ | 33.24 | $ | 20.55 | $ | 20.00 | |||||||||

From Operations: | |||||||||||||||

Net investment income * (a) | 0.35 | 0.31 | 0.06 | ||||||||||||

| Net realized and unrealized gains (loss) on investments | (8.86 | ) | 12.62 | 0.49 | |||||||||||

| Total from operations | (8.51 | ) | 12.93 | 0.55 | |||||||||||

Less Distributions to Shareholders: | |||||||||||||||

| From net investment income | (0.26 | ) | (0.24 | ) | — | ||||||||||

| From net realized gains | (3.14 | ) | — | — | |||||||||||

| Total distributions to shareholders | (3.40 | ) | (0.24 | ) | — | ||||||||||

Net Asset Value, End of Period | $ | 21.33 | $ | 33.24 | $ | 20.55 | |||||||||

Total Return (b) | (28.51 | %) | 63.25 | % | 2.75 | %(d) | |||||||||

Ratios/Supplemental Data: | |||||||||||||||

| Expenses (to average daily net assets)* | 1.45 | % | 1.45 | % | 1.45 | %(c) | |||||||||

| Net Investment Income (to average daily net assets)* | 1.21 | % | 1.15 | % | 1.31 | %(c) | |||||||||

| Portfolio Turnover | 128 | % | 76 | % | 31 | %(d) | |||||||||

| Net Assets, End of Period (000’s omitted) | $ | 15,328 | $ | 13,671 | $ | 5,693 | |||||||||

*For the periods indicated, the investment advisor voluntarily agreed not to impose a portion of its investment advisory fee and/or reimbursed the Fund for all or a portion of its operating expenses. If this voluntary action had not been taken, the investment income (loss) per share and the ratios, without waivers and reimbursement, would have been: | |||||||||||||||

Net investment income (loss) per share (a) | $ | (0.02 | ) | $ | (0.16 | ) | $ | (0.27 | ) | ||||||

| Ratios (to average daily net assets): | |||||||||||||||

| Expenses | 2.74 | % | 3.18 | % | 8.64 | %(c) | |||||||||

| Net investment income (loss) | (0.08 | %) | (0.59 | %) | (5.88 | %)(c) | |||||||||

| (a) | Calculated based on average shares outstanding. |

| (b) | Total return would have been lower in the absence of expense waivers. Returns for periods of less than one year have not been annualized. |

| (c) | Calculated on an annualized basis. |

| (d) | Not annualized. |

The Boston Company Emerging Markets Core Equity Fund

(1) | Organization and Significant Accounting Policies: |

The Boston Company Emerging Markets Core Equity Fund

The Boston Company Emerging Markets Core Equity Fund

(2) | Investment Advisory Fee and Other Transactions With Affiliates: |

The Boston Company Emerging Markets Core Equity Fund

(3) | Purchases and Sales of Investments: |

| Purchases | Sales | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Non-U.S. Government Securities | $ | 27,900,705 | $ | 20,373,768 | ||||||

(4) | Shares of Beneficial Interest: |

| For the Year Ended September 30, 2008 | For the Year Ended September 30, 2007 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Shares sold | 275,989 | 144,213 | ||||||||

| Shares issued to shareholders in reinvestment distributions | 47,368 | 2,828 | ||||||||

| Shares redeemed | (15,900 | ) | (12,790 | ) | ||||||

| Net increase (decrease) | 307,457 | 134,251 | ||||||||

(5) | Federal Taxes: |

The Boston Company Emerging Markets Core Equity Fund

| Cost for federal income tax purposes | $ | 18,642,981 | ||||

| Gross unrealized appreciation | $ | 148,264 | ||||

| Gross unrealized depreciation | (3,500,196 | ) | ||||

| Net unrealized appreciation (depreciation) | $ | (3,351,932 | ) | |||

| Undistributed ordinary income | $ | 152,590 | ||||

| Undistributed capital gains | 609,326 | |||||

| Total distributable earnings | $ | 761,916 |

| 2008 | 2007 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Ordinary income | $ | 1,125,936 | $ | 78,456 | ||||||

| Capital gains | 355,579 | — | ||||||||

| Total distributions | $ | 1,481,515 | $ | 78,456 | ||||||

(6) | Financial Instruments: |

The Boston Company Emerging Markets Core Equity Fund

(7) | Securities Lending: |

(8) | Line of Credit: |

(9) | Subsequent Event: |

The Boston Company Emerging Markets Core Equity Fund

New York, New York

November 28, 2008

The Boston Company Emerging Markets Core Equity Fund

The Boston Company Emerging Markets Core Equity Fund

The Boston Company Emerging Markets Core Equity Fund

The Boston Company Emerging Markets Core Equity Fund

| Name (Age) Address, and Date of Birth | | Position(s) Held with Trust | | Term of Office and Length of Time Served* | | Principal Occupation(s) During Past 5 Years | | Number of Portfolios in Fund Complex Overseen by Trustee | | Other Directorships Held by Trustee | | Trustee Remuneration (period ended September 30, 2008) | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Samuel C. Fleming (68) 61 Meadowbrook Road Weston, MA 02493 9/30/40 | Trustee | Trustee since 11/3/1986 | Chairman Emeritus, Decision Resources, Inc. (“DRI”) (healthcare research and consulting firm); formerly Chairman of the Board and Chief Executive Officer, DRI | 15 | None | Fund: $3,408 | |||||||||||||||||||||

| Benjamin M. Friedman (64) c/o Harvard University Littauer Center 127 Cambridge, MA 02138 8/5/44 | Trustee | Trustee since 9/13/1989 | William Joseph Maier Professor of Political Economy, Harvard University | 15 | Pioneer Funds | Fund: $3,408 | |||||||||||||||||||||

| John H. Hewitt (73) P.O. Box 2333 New London, NH 03257 4/11/35 | Trustee | Trustee since 11/3/1986 | Retired | 15 | None | Fund: $3,408 | |||||||||||||||||||||

| Caleb Loring III (64) c/o Essex Street Associates P.O. Box 5600 Beverly, MA 01915 11/14/43 | Trustee | Trustee since 11/3/1986 | Trustee, Essex Street Associates (family investment trust office) | 15 | None | Fund: $3,701 | |||||||||||||||||||||

Current Interested Trustee | |||||||||||||||||||||||||||

| J. David Officer (60) The Dreyfus Corporation 200 Park Ave., 55th Fl. New York, NY 10166 8/24/48 | Trustee (Chairman), President and Chief Executive Officer | Since 2008 | Director, Vice Chairman and Chief Operating Officer of The Dreyfus Corporation; Executive Vice President of The Bank of New York Mellon Corporation; and Director and President of MBSC Securities Corporation | 15 | None | Fund: $0 | |||||||||||||||||||||

| * | Each trustee serves for an indefinite term, until his successor is elected. Each officer is elected annually. |

| Name (Age) Address, and Date of Birth | | Position(s) Held with Trust | | Term of Office and Length of Time Served | | Principal Occupation(s) During Past 5 Years | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Steven M. Anderson (43) BNY Mellon Asset Management One Boston Place Boston, MA 02108 7/14/65 | Vice President, Treasurer and Chief Financial Officer | Vice President since 1999; Treasurer and CFO since 2002 | Vice President and Mutual Funds Controller, BNY Mellon Asset Management; formerly Assistant Vice President and Mutual Funds Controller, Standish Mellon Asset Management Company, LLC | |||||||||||

| Denise B. Kneeland (57) BNY Mellon Asset Management One Boston Place Boston, MA 02108 8/19/51 | Assistant Vice President and Secretary | Assistant Vice President since 1996; Secretary since 2007 | First Vice President and Manager, Mutual Funds Operations, BNY Mellon Asset Management; formerly Vice President and Manager, Mutual Fund Operations, Standish Mellon Asset Management Company, LLC | |||||||||||

| Janelle E. Belcher (50) Founders Asset Management, LLC 210 University Boulevard Suite 800 Denver, CO 80206 4/11/58 | Chief Compliance Officer | Since 2008 | Vice President — Compliance, Founders Asset Management, LLC (“Founders”), Chief Compliance Officer, Founders, Dreyfus Founders Funds, Inc., and Mellon Optima L/S Strategy Fund, LLC | |||||||||||

| Name (Age) | | Principal Occupation(s) During Past 5 Years | | Number of Portfolios in Fund Complex Overseen by Trustee | | Other Directorships Held by Trustee | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Joseph S. DiMartino (64) | Corporate Director and Trustee | 191 (including 14 Funds of the Trust) | Dreyfus Funds, Chairman of the Board CBIZ, Inc. (formerly, Century Business Services, Inc.), a provider of outsourcing functions for small and medium size companies, Director The Newark Group, Inc., a provider of a national market of paper recovery facilities, paperboard mills and paperboard converting plants, Director Sunair Services Corporation, a provider of certain outdoor-related services to homes and businesses, Director | |||||||||||

| James M. Fitzgibbons (74) | Corporate Director | 43 (including 14 Funds of the Trust) | Dreyfus Funds, Board Member Bill Barrett Company, an oil and gas exploration company, Director | |||||||||||

| Kenneth A. Himmel (62) | President and CEO, Related Urban Development, a real estate development company (1996-Present); President and CEO, Himmel & Company, a real estate development company (1980-Present); CEO, American Food Management, a restaurant company (1983-Present) | 43 (including 14 Funds of the Trust) | Dreyfus Funds, Board Member | |||||||||||

| Stephen J. Lockwood (61) | Chairman of the Board, Stephen J. Lockwood and Company LLC, an investment company (2000-Present) | 43 (including 14 Funds of the Trust) | Dreyfus Funds, Board Member | |||||||||||

| Name (Age) | | Principal Occupation(s) During Past 5 Years | | Number of Portfolios in Fund Complex Overseen by Trustee | | Other Directorships Held by Trustee | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Roslyn M. Watson (58) | Principal, Watson Ventures, Inc., a real estate investment company (1993-Present) | 43 (including 14 Funds of the Trust) | Dreyfus Funds, Board Member | |||||||||||

| Benaree Pratt Wiley (62) | Principal, The Wiley Group, a firm specializing in strategy and business development (2005-Present); President and CEO, The Partnership, an organization dedicated to increasing the representation of African Americans in positions of leadership, influence and decision-making in Boston, MA (1991-2005) | 53 (including 14 Funds of the Trust) | Dreyfus Funds, Board Member CBIZ, Inc. (formerly, Century Business Services, Inc.), a provider of outsourcing functions for small and medium size companies, Director | |||||||||||

Boston, MA 02108-4408

800.221.4795

www.melloninstitutionalfunds.com

Year Ended September 30, 2008

International Core Equity Fund

J. David Officer

President

The Boston Company International Core Equity Fund

The Boston Company International Core Equity Fund

Portfolio Manager

The Boston Company Asset Management, LLC

The Boston Company International Core Equity Fund

International Core Equity Fund and the MSCI EAFE Index (Unaudited)

| Average Annual Total Returns (for period ended 9/30/2008) | ||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

1 Year | 3 Years | 5 Years | 10 Years | Since Inception 12/8/1998 | ||||||||||||||||||||

Fund | (35.03)% | (1.83)% | 9.52% | 7.54% | 6.23% | |||||||||||||||||||

The Boston Company International Core Equity Fund

| | Beginning Account Value April 1, 2008 | | Ending Account Value September 30, 2008 | | Expenses Paid During Period† April 1, 2008 to September 30, 2008 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Actual | $ | 1,000.00 | $ | 761.90 | $ | 3.83 | ||||||||

| Hypothetical (5% return per year before expenses) | $ | 1,000.00 | $ | 1,020.65 | $ | 4.39 | ||||||||

† Expenses are equal to the Fund’s annualized expense ratio of 0.87%, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period).

The Boston Company International Core Equity Fund

| Top Ten Holdings* | | Country | | Sector | | Percentage of Investments | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| HSBC Holdings PLC | United Kingdom | Financials | 2.7 | % | ||||||||||

| Nestle SA | Switzerland | Consumer Staples | 2.6 | |||||||||||

| BHP Billiton Ltd. | Australia | Materials | 2.2 | |||||||||||

| Royal Dutch Shell PLC, Class B | United Kingdom | Energy | 2.1 | |||||||||||

| E. On AG | Germany | Utilities | 1.9 | |||||||||||

| Novartis AG | Switzerland | Health Care | 1.9 | |||||||||||

| Total SA | France | Energy | 1.8 | |||||||||||

| BNP Paribas | France | Financials | 1.6 | |||||||||||

| Vodafone Group PLC | United Kingdom | Telecommunication Services | 1.6 | |||||||||||

| WPP Group PLC | United Kingdom | Consumer Discretionary | 1.6 | |||||||||||

| 20.0 | % | |||||||||||||

| * | Excludes investment of cash collateral and short-term investments. |

| Geographic Region Allocation* | | Percentage of Investments | ||||

|---|---|---|---|---|---|---|

| Europe ex U.K. | 48.2 | % | ||||

| United Kingdom | 23.0 | |||||

| Pacific ex Japan | 8.8 | |||||

| Japan | 20.0 | |||||

| 100.0 | % | |||||

| * | Excludes investment of cash collateral and short-term investments. |

The Boston Company International Core Equity Fund

| Security | | Shares | | Value ($) (Note 1A) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

UNAFFILIATED INVESTMENTS — 96.8% | ||||||||||

Common Equities — 96.0% | ||||||||||

Australia — 5.6% | ||||||||||

| Bendigo and Adelaide Bank Ltd. | 134,790 | a | 1,287,395 | |||||||

| BHP Billiton Ltd. | 144,823 | 3,719,905 | ||||||||

| Computershare Ltd. | 103,629 | 779,035 | ||||||||

| Dexus Property Group REIT | 578,502 | 672,456 | ||||||||

| Incitec Pivot Ltd. | 94,800 | b | 391,461 | |||||||

| Sonic Healthcare Ltd. | 51,500 | 540,683 | ||||||||

| Telstra Corp. Ltd. | 302,690 | 1,014,880 | ||||||||

| Westpac Banking Corp. | 82,654 | 1,462,577 | ||||||||

| 9,868,392 | ||||||||||

Austria — 0.3% | ||||||||||

| Erste Group Bank AG | 11,310 | a | 569,987 | |||||||

| Belgium — 2.0% | ||||||||||

| Colruyt SA | 3,320 | 828,672 | ||||||||

| Delhaize Group | 31,070 | 1,810,443 | ||||||||

| Groupe Bruxelles Lambert SA | 9,750 | 841,856 | ||||||||

| 3,480,971 | ||||||||||

Finland — 1.5% | ||||||||||

| Nokia Oyj | 136,190 | 2,538,771 | ||||||||

France — 8.8% | ||||||||||

| AXA SA | 44,307 | 1,452,410 | ||||||||

| BNP Paribas SA | 28,020 | 2,693,465 | ||||||||

| Cap Gemini SA | 23,020 | 1,095,136 | ||||||||

| Casino Guichard-Perrachon SA | 23,456 | 2,102,813 | ||||||||

| CNP Assurances | 7,420 | 837,985 | ||||||||

| France Telecom SA | 26,764 | a | 749,445 | |||||||

| GDF Suez | 43,964 | 2,300,265 | ||||||||

| Total SA | 50,060 | 3,019,949 | ||||||||

| Unibail-Rodamco REIT | 5,652 | 1,151,332 | ||||||||

| 15,402,800 | ||||||||||

Germany — 8.7% | ||||||||||

| Adidas AG | 23,700 | 1,272,748 | ||||||||

| BASF SE | 30,860 | 1,478,884 | ||||||||

| Bayer AG | 26,720 | 1,950,231 | ||||||||

| Deutsche Bank AG | 13,920 | 990,304 | ||||||||

| Deutsche Telekom AG | 86,396 | 1,325,741 | ||||||||

| E. On AG | 63,640 | 3,222,708 | ||||||||

| Linde AG | 10,155 | 1,088,954 | ||||||||

| MAN AG | 8,180 | 549,437 | ||||||||

The Boston Company International Core Equity Fund

| Security | | Shares | | Value ($) (Note 1A) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

Germany (continued) | ||||||||||

| RWE AG | 7,065 | 679,253 | ||||||||

| Salzgitter AG | 4,270 | 431,316 | ||||||||

| SAP AG | 16,490 | 885,417 | ||||||||

| Siemens AG | 9,190 | 862,460 | ||||||||

| ThyssenKrupp AG | 18,060 | 543,608 | ||||||||

| 15,281,061 | ||||||||||

Hong Kong — 2.8% | ||||||||||

| CITIC International Financial Holdings Ltd. | 981,000 | b | 649,161 | |||||||

| Esprit Holdings Ltd. | 231,100 | 1,419,981 | ||||||||

| Hang Seng Bank Ltd. | 65,700 | 1,227,063 | ||||||||

| Hutchinson Whampoa Ltd. | 94,000 | 715,653 | ||||||||

| Hysan Development Co., Ltd. | 367,000 | 954,709 | ||||||||

| 4,966,567 | ||||||||||

Ireland — 0.6% | ||||||||||

| Kerry Group PLC, Class A | 33,025 | 967,555 | ||||||||

Italy — 5.2% | ||||||||||

| Banca Popolare di Milano Scarl (BPM) | 100,050 | 852,277 | ||||||||

| Buzzi Unicem SPA | 27,164 | 417,985 | ||||||||

| Enel SPA | 238,880 | 1,991,189 | ||||||||

| ENI SPA | 82,940 | 2,189,053 | ||||||||

| Intesa Sanpaolo SPA | 196,650 | 1,073,387 | ||||||||

| Prysmian SPA | 72,688 | b | 1,418,801 | |||||||

| Snam Rete Gas SPA | 201,410 | 1,212,318 | ||||||||

| 9,155,010 | ||||||||||

Japan — 19.3% | ||||||||||

| Canon, Inc. | 12,700 | 474,883 | ||||||||

| Daihatsu Motor Co., Ltd. | 234,000 | 2,547,761 | ||||||||

| Fujitsu Ltd. | 145,000 | 810,140 | ||||||||

| Hitachi Chemical Co., Ltd. | 46,100 | 612,392 | ||||||||

| INPEX Holdings, Inc. | 59 | 511,081 | ||||||||

| Isuzu Motors Ltd. | 832,000 | 2,298,760 | ||||||||

| JFE Holdings, Inc. | 18,400 | 572,443 | ||||||||

| KDDI Corp. | 362 | 2,027,859 | ||||||||

| Konica Minolta Holdings, Inc. | 65,000 | 749,320 | ||||||||

| Marubeni Corp. | 245,900 | 1,111,054 | ||||||||

| Mitsubishi Tanabe Pharma Corp. | 56,000 | 772,976 | ||||||||

| Mitsubishi UFJ Financial Group, Inc. | 276,800 | 2,399,817 | ||||||||

| Mitsubishi UFJ Lease & Finance Co., Ltd. | 22,400 | 740,502 | ||||||||

The Boston Company International Core Equity Fund

| Security | | Shares | | Value ($) (Note 1A) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

Japan (continued) | �� | |||||||||

| Mitsui & Co., Ltd. | 59,400 | 734,090 | ||||||||

| Mizuho Financial Group, Inc. | 321 | a | 1,408,538 | |||||||

| Nikon Corp. | 25,000 | 594,349 | ||||||||

| Nintendo Co., Ltd. | 1,420 | 591,208 | ||||||||

| Nippon Yusen Kabushiki Kaisha | 94,700 | 614,381 | ||||||||

| Nomura Holdings, Inc. | 59,800 | 771,861 | ||||||||

| Noruma Real Estate Holdings, Inc. | 36,900 | 881,293 | ||||||||

| NTT Corp. | 248 | 1,104,789 | ||||||||

| Panasonic Corp. | 108,000 | c | 1,874,614 | |||||||

| Seiko Epson Corp. | 36,800 | 848,979 | ||||||||

| Sony Corp. | 44,000 | 1,360,926 | ||||||||

| Sumitomo Electric Industries Ltd. | 92,800 | 1,009,305 | ||||||||

| Takeda Pharmaceutical Co., Ltd. | 20,200 | 1,017,476 | ||||||||

| Tokio Marine Holdings, Inc. | 46,200 | 1,676,760 | ||||||||

| Tosoh Corp. | 159,000 | 470,405 | ||||||||

| Toyo Engineering Corp. | 211,000 | 891,464 | ||||||||

| Tsumura & Co. | 28,000 | 709,508 | ||||||||

| Yamaguchi Financial Group, Inc. | 134,000 | 1,610,852 | ||||||||

| 33,799,786 | ||||||||||

Luxembourg — 0.2% | ||||||||||

| ArcelorMittal | 7,380 | 369,408 | ||||||||

Netherlands — 2.6% | ||||||||||

| Aalberts Industries NV | 36,730 | 470,594 | ||||||||

| European Aeronautic Defence and Space Co. | 59,758 | 1,033,889 | ||||||||

| ING Groep NV CVA | 69,422 | 1,510,042 | ||||||||

| Koninklijke BAM Groep NV | 59,059 | 766,071 | ||||||||

| Koninklijke DSM NV | 15,950 | 750,994 | ||||||||

| 4,531,590 | ||||||||||

Norway — 0.6% | ||||||||||

| StatoilHydro ASA | 44,450 | 1,060,000 | ||||||||

Spain — 4.3% | ||||||||||

| Banco Santander SA | 164,160 | 2,484,807 | ||||||||

| Corporacion Financiera Alba SA | 17,765 | 734,506 | ||||||||

| Mapfre SA | 189,170 | 827,421 | ||||||||

| Repsol YPF SA | 34,860 | 1,029,754 | ||||||||

| Telefonica SA | 100,320 | 2,398,018 | ||||||||

| 7,474,506 | ||||||||||

The Boston Company International Core Equity Fund

| Security | | Shares | | Value ($) (Note 1A) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

Sweden — 1.7% | ||||||||||

| Alfa Laval AB | 125,575 | 1,300,510 | ||||||||

| Nordea Bank AB | 137,700 | 1,653,035 | ||||||||

| 2,953,545 | ||||||||||

Switzerland — 8.9% | ||||||||||

| Adecco SA | 13,030 | 569,593 | ||||||||

| Credit Suisse Group AG | 51,100 | 2,434,025 | ||||||||

| Lonza Group AG | 7,804 | 971,002 | ||||||||

| Nestle SA | 103,250 | 4,467,762 | ||||||||

| Novartis AG | 61,286 | 3,207,014 | ||||||||

| Roche Holding AG | 14,734 | 2,297,860 | ||||||||

| Zurich Financial Services AG | 5,650 | 1,566,840 | ||||||||

| 15,514,096 | ||||||||||

United Kingdom — 22.9% | ||||||||||

| Anglo American PLC | 14,190 | 474,351 | ||||||||

| AstraZeneca PLC | 45,170 | 1,976,593 | ||||||||

| Barclays PLC | 282,080 | 1,713,427 | ||||||||

| BP PLC | 284,700 | 2,369,867 | ||||||||

| British American Tobacco PLC | 26,312 | 859,678 | ||||||||

| Charter PLC | 60,860 | 680,212 | ||||||||

| Cookson Group PLC | 147,021 | 1,239,795 | ||||||||

| Greene King PLC | 92,850 | 763,342 | ||||||||

| HSBC Holdings PLC | 281,200 | 4,553,605 | ||||||||

| Imperial Tobacco Group PLC | 74,190 | 2,383,462 | ||||||||

| Rexam PLC | 107,850 | 756,592 | ||||||||

| Royal Bank of Scotland Group PLC | 366,040 | 1,212,418 | ||||||||

| Royal Dutch Shell PLC, Class B | 126,490 | 3,588,151 | ||||||||

| RSA Insurance Group PLC | 533,516 | 1,438,580 | ||||||||

| Sage Group PLC | 190,710 | 663,852 | ||||||||

| Scottish and Southern Energy PLC | 43,930 | 1,116,661 | ||||||||

| Stagecoach Group PLC | 205,997 | 939,503 | ||||||||

| Standard Chartered PLC | 65,500 | 1,590,877 | ||||||||

| Standard Life PLC | 276,850 | 1,196,856 | ||||||||

| Tesco PLC | 295,700 | 2,056,258 | ||||||||

| Thomas Cook Group PLC | 432,800 | 1,709,727 | ||||||||

| Vedanta Resources PLC | 19,570 | 406,272 | ||||||||

| Vodafone Group PLC | 1,204,917 | 2,661,676 | ||||||||

| WPP Group PLC | 326,410 | 2,648,744 | ||||||||

| Xstrata PLC | 30,700 | 950,222 | ||||||||

| 39,950,721 | ||||||||||

| Total Common Equities (Cost $206,046,278) | 167,884,766 | |||||||||

The Boston Company International Core Equity Fund

| Security | | Shares | | Value ($) (Note 1A) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

PREFERRED STOCKS — 0.8% | ||||||||||

Germany — 0.8% | ||||||||||

| Fresenius AG (Cost $1,430,714) | 19,330 | 1,395,198 | ||||||||

SHORT-TERM INVESTMENTS — 0.4% | ||||||||||

INVESTMENT OF CASH COLLATERAL — 0.0% | ||||||||||

| BlackRock Cash Strategies L.L.C. (Cost $7,364) | 7,364 | d,f | 7,364 | |||||||

| TOTAL UNAFFILIATED INVESTMENTS (Cost $207,484,356) | 169,287,328 | |||||||||

AFFILIATED INVESTMENTS — 0.4% | ||||||||||

| Dreyfus Institutional Cash Advantage Fund | 112,476 | e,f | 112,476 | |||||||

| Dreyfus Institutional Prefered Plus Money Market Fund | 584,269 | e | 584,269 | |||||||

| TOTAL AFFILIATED INVESTMENTS (Cost $696,745) | 696,745 | |||||||||

TOTAL INVESTMENTS — 97.2% (Cost $208,181,101) | 169,984,073 | |||||||||

OTHER ASSETS, LESS LIABILITIES — 2.8% | 4,894,238 | |||||||||

NET ASSETS — 100% | 174,878,311 | |||||||||

The Boston Company International Core Equity Fund

| Contracts to Deliver | | Local Principal Amount | | Contract Value Date | | Value at September 30, 2008 | | USD Amount to Receive | | Unrealized Appreciation | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Australian Dollar | 259,124 | 10/1/2008 | $204,707 | $210,978 | $6,271 | |||||||||||||||||

| British Pound | 516,883 | 10/1/2008 | 918,863 | 932,974 | 14,111 | |||||||||||||||||

| Euro | 1,332,191 | 10/1/2008 | 1,875,326 | 1,915,824 | 40,498 | |||||||||||||||||

| Japanese Yen | 100,952,514 | 10/1/2008 | 949,337 | 956,533 | 7,196 | |||||||||||||||||

| Japanese Yen | 29,139,371 | 10/2/2008 | 274,021 | 276,203 | 2,182 | |||||||||||||||||

| Norwegian Krone | 122,591 | 10/1/2008 | 20,873 | 21,203 | 330 | |||||||||||||||||

| Swedish Krona | 402,222 | 10/1/2008 | 58,110 | 59,476 | 1,366 | |||||||||||||||||

| Swiss Franc | 339,214 | 10/1/2008 | 301,873 | 308,489 | 6,616 | |||||||||||||||||

| $78,570 | ||||||||||||||||||||||

| Contract | | Position | | Expiration Date | | Underlying Face Amount at Value | | Unrealized (Depreciation) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| MSCI Pan — Euro (53 Contracts) | Long | 12/19/2008 | $ | 1,305,940 | $ | (36,928 | ) | |||||||||||

| TOPIX (4 Contracts) | Long | 12/11/2008 | 408,501 | (16,969 | ) | |||||||||||||

| $ | (53,897 | ) | ||||||||||||||||

| Economic Sector Allocation | | Percentage of Net Assets | ||||

|---|---|---|---|---|---|---|

| Consumer Discretionary | 9.4 | % | ||||

| Consumer Staples | 8.9 | |||||

| Energy | 7.9 | |||||

| Financials | 28.1 | |||||

| Health Care | 8.5 | |||||

| Industrials | 8.5 | |||||

| Information Technology | 5.4 | |||||

| Materials | 7.7 | |||||

| Telecommunication Services | 6.4 | |||||

| Utilities | 6.0 | |||||

| Short-term and Net other Assets | 3.2 | |||||

| 100.0 | % | |||||

The Boston Company International Core Equity Fund

September 30, 2008

Assets | ||||||||||

| Investment in securities: (Note 1 A) (including securities on loan, valued at $117,151) (Note 7)): | ||||||||||

| Unaffiliated issuers, at value (Note 1 A) (cost $207,484,356) | $ | 169,287,328 | ||||||||

| Affiliated issuers, at value (Note 1 H) (cost $696,745) | 696,745 | |||||||||

| Cash | 1,725,558 | |||||||||

| Cash Collateral at broker for futures contracts | 729,000 | |||||||||

| Receivable for investments sold | 4,456,110 | |||||||||

| Interest and dividends receivable | 2,334,210 | |||||||||

| Foreign Currency, at value (cost $1,625,041) | 1,576,221 | |||||||||

| Receivable for Fund shares sold | 271,562 | |||||||||

| Unrealized appreciation on forward foreign currency exchange contracts (Note 6) | 78,570 | |||||||||

| Receivable for variation margin on open future contracts (Note 6) | 14,439 | |||||||||

| Prepaid expenses | 25,092 | |||||||||

| Total assets | 181,194,835 | |||||||||

Liabilities | ||||||||||

| Bank loan payable (Note 8) | $ | 3,463,000 | ||||||||

| Due to Custodian | 20,000 | |||||||||

| Payable for investments purchased | 1,905,188 | |||||||||

| Payable for Fund shares redeemed | 326,328 | |||||||||

| Payable to investment advisor (Note 2) | 189,534 | |||||||||

| Payable for securities lending collateral investment (Note 7) | 119,840 | |||||||||

| Accrued administrative service fees (Note 2) | 114,642 | |||||||||

| Accrued accounting, administration, custody and transfer agent fees (Note 2) | 92,413 | |||||||||

| Accrued professional fees | 57,953 | |||||||||

| Accrued trustees’ fees (Note 2) | 7,640 | |||||||||

| Accrued shareholder reporting fees (Note 2) | 1,182 | |||||||||

| Accrued chief compliance officer fees (Note 2) | 433 | |||||||||

| Other accrued expenses and liabilities | 18,371 | |||||||||

| Total liabilities | 6,316,524 | |||||||||

Net Assets | $ | 174,878,311 | ||||||||

Net Assets consist of: | ||||||||||

| Paid-in capital | $ | 249,245,253 | ||||||||

| Accumulated net realized loss | (36,055,160 | ) | ||||||||

| Distributions in excess of net investment income | (78,570 | ) | ||||||||

| Net unrealized depreciation | (38,233,212 | ) | ||||||||

Total Net Assets | $ | 174,878,311 | ||||||||

| Shares of beneficial interest outstanding | 10,120,852 | |||||||||

| Net Asset Value, offering and redemption price per share | ||||||||||

| (Net Assets/Shares outstanding) | $ | 17.28 |

The Boston Company International Core Equity Fund

For the Year Ended September 30, 2008

Investment Income (Note 1B) | ||||||||||

| Dividend income form unaffiliated investments (net of foreign witholding taxes $1,004,195) | $ | 10,902,833 | ||||||||

| Dividend income from affiliated investments (Note 1H) | 581,181 | |||||||||

| Interest income | 141,660 | |||||||||

| Security lending income (Note 7) | 621 | |||||||||

| Net investment income | 11,626,295 | |||||||||

Expenses | ||||||||||

| Investment advisory fee (Note 2) | $ | 3,585,968 | ||||||||

| Accounting, administration, custody and transfer agent fees (Note 2) | 344,708 | |||||||||

| Administrative service fees (Note 2) | 467,595 | |||||||||

| Registration fees | 31,451 | |||||||||

| Professional fees | 110,190 | |||||||||

| Trustees’ fees (Note 2) | 52,521 | |||||||||

| Insurance expense | 57,724 | |||||||||

| Miscellaneous expenses | 163,425 | |||||||||

| Total expenses | 4,813,582 | |||||||||

Deduct: | ||||||||||

| Waiver of investment advisory fee (Note 2) | (862,827 | ) | ||||||||

| Net expenses | 3,950,755 | |||||||||

| Net investment income | 7,675,540 | |||||||||

Realized and Unrealized Gain (Loss) | ||||||||||

| Net realized gain (loss) on: | ||||||||||

| Investments | 20,536,488 | |||||||||

| Financial futures transactions | (6,452,103 | ) | ||||||||

| Foreign currency transactions and forward currency exchange transactions | 1,077,463 | |||||||||

| Net realized gain (loss) | 15,161,848 | |||||||||

| Change in unrealized appreciation (depreciation) on: | ||||||||||

| Investments | (160,926,663 | ) | ||||||||

| Financial futures contracts | (1,297,484 | ) | ||||||||

| Foreign currency translations and forward foreign currency exchange contracts | (991,335 | ) | ||||||||

| Net change in net unrealized appreciation (depreciation) | (163,215,482 | ) | ||||||||

| Net realized and unrealized gain (loss) on investments | (148,053,634 | ) | ||||||||

Net Increase (Decrease) in Net Assets from Operations | $ | (140,378,094 | ) |

The Boston Company International Core Equity Fund

| For the Year Ended September 30, 2008 | For the Year Ended September 30, 2007 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

Increase (Decrease) in Net Assets: | ||||||||||

From Operations | ||||||||||

| Net investment income (loss) | $ | 7,675,540 | $ | 45,344,358 | ||||||

| Net realized gain (loss) | 15,161,848 | 403,675,988 | ||||||||

| Change in net unrealized appreciation (depreciation) | (163,215,482 | ) | (28,749,478 | ) | ||||||

| Net increase (decrease) in net assets from investment operations | (140,378,094 | ) | 420,270,868 | |||||||

Distributions to Shareholders (Note 1C) | ||||||||||

| From net investment income | (5,823,004 | ) | (37,760,225 | ) | ||||||

| From net realized gains on investments | (251,708,803 | ) | (55,518,833 | ) | ||||||

| Total distributions to shareholders | (257,531,807 | ) | (93,279,058 | ) | ||||||

Fund Share Transactions (Note 4) | ||||||||||

| Net proceeds from sale of shares | 70,954,970 | 777,178,564 | ||||||||

| Value of shares issued in reinvestment of distributions | 247,332,619 | 52,326,222 | ||||||||

| Cost of shares redeemed (net of redemption fees of $46,209 and $75,412, respectively) | (1,002,877,155 | ) | (1,914,206,731 | ) | ||||||

| Net increase (decrease) in net assets from Fund share transactions | (684,589,566 | ) | (1,084,701,945 | ) | ||||||

Total Increase (Decrease) in Net Assets | (1,082,499,467 | ) | (757,710,135 | ) | ||||||

Net Assets | ||||||||||

| At beginning of year | 1,257,377,778 | 2,015,087,913 | ||||||||

| At end of year [including undistributed (distributions in excess of) net investment income of $(78,570) and $500,969, respectively] | $ | 174,878,311 | $ | 1,257,377,778 | ||||||

The Boston Company International Core Equity Fund

| Year Ended September 30, | |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2008 | 2007 | 2006 | 2005 | 2004 | |||||||||||||||||||

Net Asset Value, Beginning of Year | $ | 46.03 | $ | 39.01 | $ | 34.34 | $ | 27.03 | $ | 21.62 | |||||||||||||

From Investment Operations: | |||||||||||||||||||||||

Net investment income (loss)* (a) | 0.49 | 0.78 | 0.71 | 0.50 | 0.31 | ||||||||||||||||||

| Net realized and unrealized gain (loss) on investments | (10.82 | ) | 7.82 | 5.59 | 7.73 | 5.49 | |||||||||||||||||

| Total from operations | (10.33 | ) | 8.60 | 6.30 | 8.23 | 5.80 | |||||||||||||||||

Less Distributions to Shareholders: | |||||||||||||||||||||||

| From net investment income | (0.44 | ) | (0.60 | ) | (0.40 | ) | (0.39 | ) | (0.39 | ) | |||||||||||||

| From net realized gains on investments | (17.98 | ) | (0.98 | ) | (1.23 | ) | (0.53 | ) | — | ||||||||||||||

| Total distributions to shareholders | (18.42 | ) | (1.58 | ) | (1.63 | ) | (0.92 | ) | (0.39 | ) | |||||||||||||

Net Asset Value, End of Year | $ | 17.28 | $ | 46.03 | $ | 39.01 | $ | 34.34 | $ | 27.03 | |||||||||||||

Total Return | (35.03 | )%(b) | 22.37 | %(b) | 19.01 | % | 31.06 | % | 27.04 | % | |||||||||||||

Ratios/Supplemental data: | |||||||||||||||||||||||

| Expenses (to average daily net assets)* | 0.87 | % | 0.77 | %(c) | 0.88 | %(c) | 1.01 | %(c) | 1.12 | %(c) | |||||||||||||

| Net Investment Income (to average daily net assets)* | 1.70 | % | 1.78 | % | 1.91 | % | 1.59 | % | 1.22 | % | |||||||||||||

| Portfolio Turnover | 98 | % | 83 | %(d) | 51 | %(d) | 58 | %(d) | 80%(d) | ||||||||||||||

| Net Assets, End of Year (000’s omitted) | $ | 174,878 | $ | 1,257,378 | $ | 2,015,088 | $ | 287,065 | $ | 124,675 | |||||||||||||

*The investment advisor voluntarily agreed not to impose a portion of its investment advisory fee and/or reimbursed the Fund for all or a portion of its operating expenses. If this voluntary action had not been taken, the investment income per share and the ratios without waivers and reimbursement would have been: | |||||||||||||||||||||||

Net investment income per share (a) | $ | 0.44 | $ | 0.78 | N/A | N/A | N/A | ||||||||||||||||

| Ratios (to average daily net assets): | |||||||||||||||||||||||

Expenses (c) | 1.07 | % | 0.78 | % | N/A | N/A | N/A | ||||||||||||||||

| Net investment income | 1.51 | % | 1.77 | % | N/A | N/A | N/A | ||||||||||||||||

| (a) | Calculated based on average shares outstanding. |

| (b) | Total return would have been lower in the absence of expense waivers. |

| (c) | For the period October 1, 2006 to September 19, 2007 and for the fiscal years ended September 30, 2003-2006, the ratio includes the Fund’s share of the The Boston Company International Core Equity Portfolio’s (the “Portfolio”) allocated expenses. |

| (d) | On September 19, 2007, the Fund, which had owned approximately 100% of the Portfolio on such date, withdrew entirely from the Portfolio and received the Portfolio’s securities and cash in exchange for its interests in the Portfolio. Effective September 20, 2007, the Fund began investing directly in the securities in which the Portfolio had invested. Portfolio turnover represents investment activity of both the Fund and the Portfolio for the year. The amounts shown for 2004-2006 are the ratios for the Portfolio. |

The Boston Company International Core Equity Fund

(1) | Organization and Significant Accounting Policies: |

The Boston Company International Core Equity Fund

The Boston Company International Core Equity Fund

(2) | Investment Advisory Fee and Other Transactions With Affiliates: |

The Boston Company International Core Equity Fund

(3) | Purchases and Sales of Investments: |

| Purchases | Sales | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Non-U.S. Government Securities | $ | 435,582,441 | $ | 1,260,480,432 | ||||||

(4) | Shares of Beneficial Interest: |

| For the Year Ended September 30, 2008 | For the Year Ended September 30, 2007 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Shares Sold | 2,724,470 | 18,088,840 | ||||||||

| Shares issued to shareholders in reinvested distributions | 9,696,307 | 1,212,198 | ||||||||

| Shares redeemed | (29,614,136 | ) | (43,638,985 | ) | ||||||

| Net increase (decrease) | (17,193,359 | ) | (24,337,947 | |||||||

(5) | Federal Taxes: |

The Boston Company International Core Equity Fund

| Cost for federal income tax purposes | $ | 212,530,542 | ||||

| Gross unrealized appreciation | $ | 1,701,453 | ||||

| Gross unrealized depreciation | (44,247,922 | ) | ||||

| Net unrealized appreciation (depreciation) | $ | (42,546,469 | ) |

| 2008 | 2007 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Ordinary income | $ | 11,931,652 | $ | 55,585,861 | ||||||

| Capital gains | 245,600,155 | 37,693,197 | ||||||||

| Total distributions | $ | 257,531,807 | $ | 93,279,058 | ||||||

(6) | Financial Instruments: |

The Boston Company International Core Equity Fund

any appreciation or depreciation are recorded for financial statement purposes as unrealized until the contract settlement date or upon the closing of the contract. Forward foreign currency exchange contracts are used by the Fund primarily to protect the value of the Fund’s foreign securities from adverse currency movements. Unrealized appreciation and depreciation of forward foreign currency exchange contracts is included in the Statement of Assets and Liabilities. The Fund is subject to off-balance sheet risk to the extent of the value of the contracts for purchases of foreign currency and in unlimited amount of sales of foreign currency.

(7) | Securities Lending: |

(8) | Line of Credit: |

(9) | Subsequent Event: |

The Boston Company International Core Equity Fund

New York, New York

November 28, 2008

The Boston Company International Core Equity Fund

The Boston Company International Core Equity Fund

The Boston Company International Core Equity Fund

presentation of profitability relative to that of several publicly traded investment advisers;

The Boston Company International Core Equity Fund

| Name (Age) Address, and Date of Birth | | Position(s) Held with Trust | | Term of Office and Length of Time Served* | | Principal Occupation(s) During Past 5 Years | | Number of Portfolios in Fund Complex Overseen by Trustee | | Other Directorships Held by Trustee | | Trustee Remuneration (period ended September 30, 2008) | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Samuel C. Fleming (68) 61 Meadowbrook Road Weston, MA 02493 9/30/40 | Trustee | Trustee since 11/3/1986 | Chairman Emeritus, Decision Resources, Inc. (“DRI”) (healthcare research and consulting firm); formerly Chairman of the Board and Chief Executive Officer, DRI | 15 | None | Fund: $3,408 | |||||||||||||||||||||

| Benjamin M. Friedman (64) c/o Harvard University Littauer Center 127 Cambridge, MA 02138 8/5/44 | Trustee | Trustee since 9/13/1989 | William Joseph Maier Professor of Political Economy, Harvard University | 15 | Pioneer Funds | Fund: $3,408 | |||||||||||||||||||||

| John H. Hewitt (73) P.O. Box 2333 New London, NH 03257 4/11/35 | Trustee | Trustee since 11/3/1986 | Retired | 15 | None | Fund: $3,408 | |||||||||||||||||||||

| Caleb Loring III (64) c/o Essex Street Associates P.O. Box 5600 Beverly, MA 01915 11/14/43 | Trustee | Trustee since 11/3/1986 | Trustee, Essex Street Associates (family investment trust office) | 15 | None | Fund: $3,701 | |||||||||||||||||||||

Current Interested Trustee | |||||||||||||||||||||||||||

| J. David Officer (60) The Dreyfus Corporation 200 Park Ave., 55th Fl. New York, NY 10166 8/24/48 | Trustee (Chairman), President and Chief Executive Officer | Since 2008 | Director, Vice Chairman and Chief Operating Officer of The Dreyfus Corporation; Executive Vice President of The Bank of New York Mellon Corporation; and Director and President of MBSC Securities Corporation | 15 | None | Fund: $0 | |||||||||||||||||||||

| * | Each trustee serves for an indefinite term, until his successor is elected. Each officer is elected annually. |

| Name (Age) Address, and Date of Birth | | Position(s) Held with Trust | | Term of Office and Length of Time Served | | Principal Occupation(s) During Past 5 Years | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Steven M. Anderson (43) BNY Mellon Asset Management One Boston Place Boston, MA 02108 7/14/65 | Vice President, Treasurer and Chief Financial Officer | Vice President since 1999; Treasurer and CFO since 2002 | Vice President and Mutual Funds Controller, BNY Mellon Asset Management; formerly Assistant Vice President and Mutual Funds Controller, Standish Mellon Asset Management Company, LLC | |||||||||||

| Denise B. Kneeland (57) BNY Mellon Asset Management One Boston Place Boston, MA 02108 8/19/51 | Assistant Vice President and Secretary | Assistant Vice President since 1996; Secretary since 2007 | First Vice President and Manager, Mutual Funds Operations, BNY Mellon Asset Management; formerly Vice President and Manager, Mutual Fund Operations, Standish Mellon Asset Management Company, LLC | |||||||||||

| Janelle E. Belcher (50) Founders Asset Management, LLC 210 University Boulevard Suite 800 Denver, CO 80206 4/11/58 | Chief Compliance Officer | Since 2008 | Vice President — Compliance, Founders Asset Management, LLC (“Founders”), Chief Compliance Officer, Founders, Dreyfus Founders Funds, Inc., and Mellon Optima L/S Strategy Fund, LLC | |||||||||||

| Name (Age) | | Principal Occupation(s) During Past 5 Years | | Number of Portfolios in Fund Complex Overseen by Trustee | | Other Directorships Held by Trustee | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Joseph S. DiMartino (64) | Corporate Director and Trustee | 191 (including 14 Funds of the Trust) | Dreyfus Funds, Chairman of the Board CBIZ, Inc. (formerly, Century Business Services, Inc.), a provider of outsourcing functions for small and medium size companies, Director The Newark Group, Inc., a provider of a national market of paper recovery facilities, paperboard mills and paperboard converting plants, Director Sunair Services Corporation, a provider of certain outdoor-related services to homes and businesses, Director | |||||||||||

| James M. Fitzgibbons (74) | Corporate Director | 43 (including 14 Funds of the Trust) | Dreyfus Funds, Board Member Bill Barrett Company, an oil and gas exploration company, Director | |||||||||||

| Kenneth A. Himmel (62) | President and CEO, Related Urban Development, a real estate development company (1996-Present); President and CEO, Himmel & Company, a real estate development company (1980-Present); CEO, American Food Management, a restaurant company (1983-Present) | 43 (including 14 Funds of the Trust) | Dreyfus Funds, Board Member | |||||||||||

| Stephen J. Lockwood (61) | Chairman of the Board, Stephen J. Lockwood and Company LLC, an investment company (2000-Present) | 43 (including 14 Funds of the Trust) | Dreyfus Funds, Board Member | |||||||||||

| Name (Age) | | Principal Occupation(s) During Past 5 Years | | Number of Portfolios in Fund Complex Overseen by Trustee | | Other Directorships Held by Trustee | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Roslyn M. Watson (58) | Principal, Watson Ventures, Inc., a real estate investment company (1993-Present) | 43 (including 14 Funds of the Trust) | Dreyfus Funds, Board Member | |||||||||||

| Benaree Pratt Wiley (62) | Principal, The Wiley Group, a firm specializing in strategy and business development (2005-Present); President and CEO, The Partnership, an organization dedicated to increasing the representation of African Americans in positions of leadership, influence and decision-making in Boston, MA (1991-2005) | 53 (including 14 Funds of the Trust) | Dreyfus Funds, Board Member CBIZ, Inc. (formerly, Century Business Services Inc.), a provider of outsourcing functions for small and medium size companies, Director | |||||||||||

Boston, MA 02108-4408

800.221.4795

www.melloninstitutionalfunds.com

Year Ended September 30, 2008

Small/Mid Cap Growth Fund

J. David Officer

President

The Boston Company Small/Mid Cap Growth Fund

| B. Randall Watts, Jr., CFA Portfolio Manager The Boston Company Asset Management, LLC | P. Hans von der Luft Portfolio Manager The Boston Company Asset Management, LLC | |||||

The Boston Company Small/Mid Cap Growth Fund

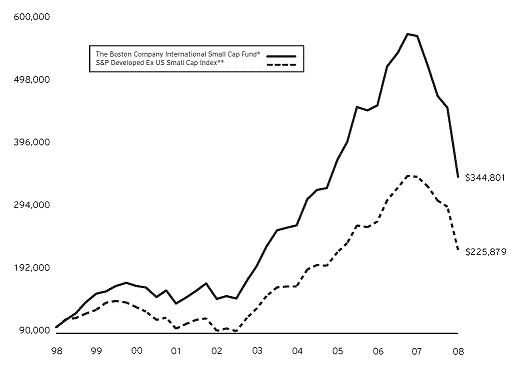

Growth Fund with the Russell 2500 Growth Index and the Russell 2000 Growth Index (Unaudited)

| Average Annual Total Returns (for period ended 9/30/2008) | ||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 Year | 3 Years | 5 Years | 10 Years | Since Inception 1/1/1988** | ||||||||||||||||||||

Fund | (14.32)% | 5.28% | 11.24% | 9.84% | 12.33% | |||||||||||||||||||

* | Source: Lipper Inc. |

** | Combines the performance of the Fund beginning September 1, 1990 and its predecessor, the Small Cap Equity Limited Partnership, from January 1, 1998 to that date. |

The Boston Company Small/Mid Cap Growth Fund

| | Beginning Account Value April 1, 2008 | | Ending Account Value September 30, 2008 | | Expenses Paid During Period† April 1, 2008 to September 30, 2008 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Actual | $ | 1,000.00 | $ | 930.10 | $ | 4.83 | ||||||||

| Hypothetical (5% return per year before expenses) | $ | 1,000.00 | $ | 1,020.00 | $ | 5.05 | ||||||||

† Expenses are equal to the Fund’s annualized expense ratio of 1.00%, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period).

The Boston Company Small/Mid Cap Growth Fund

| Top Ten Holdings* | | Sector | | Percentage of Investments | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Plum Creek Timber Co., Inc. REIT | Financials | 2.6 | % | |||||||

| NeuStar, Inc., Class A | Telecommunication Services | 2.3 | ||||||||

| Global Payments, Inc. | Technology | 2.3 | ||||||||

| CACI International, Inc., Class A | Technology | 2.2 | ||||||||

| Church & Dwight Co., Inc. | Consumer Staples | 2.1 | ||||||||

| Wright Medical Group, Inc. | Health Care | 2.1 | ||||||||

| ResMed, Inc. | Health Care | 2.1 | ||||||||

| Thermo Fisher Scientific, Inc. | Health Care | 1.9 | ||||||||

| Dun & Bradstreet Corp. | Industrials | 1.8 | ||||||||

| Bed Bath & Beyond, Inc. | Consumer Discetionary | 1.8 | ||||||||

| 21.2 | % | |||||||||

| * | Excludes short-term securities and investment of cash collateral. |

| Economic Sector Allocation | | Percentage of Net Assets | ||||

|---|---|---|---|---|---|---|

| Consumer Discretionary | 11.6 | % | ||||

| Consumer Staples | 6.2 | |||||

| Energy | 12.2 | |||||

| Financials | 5.8 | |||||

| Health Care | 22.4 | |||||

| Industrials | 11.3 | |||||

| Materials | 2.2 | |||||

| Technology | 22.6 | |||||

| Telecommunication Services | 2.3 | |||||

| Utilities | 0.4 | |||||

| Short-term and Other Liabilities | 3.0 | |||||

| 100.0 | % | |||||

The Boston Company Small/Mid Cap Growth Fund

| Security | | Shares | | Value ($) (Note 1A) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

UNAFFILIATED INVESTMENTS — 97.3% | ||||||||||

Equities — 97.0% | ||||||||||

Consumer Discretionary — 11.6% | ||||||||||

| Bed Bath & Beyond, Inc. | 51,130 | a | 1,605,993 | |||||||

| Gentex Corp. | 53,710 | 768,053 | ||||||||

| Interactive Data Corp. | 39,220 | 989,128 | ||||||||

| Lions Gate Entertainment Corp. | 171,518 | a | 1,560,814 | |||||||

| Panera Bread Co., Class A | 12,420 | a,b | 632,178 | |||||||

| PetSmart, Inc. | 47,500 | 1,173,725 | ||||||||

| Polaris Industries, Inc. | 13,090 | b | 595,464 | |||||||

| Tractor Supply Co. | 17,080 | a,b | 718,214 | |||||||

| Warnaco Group, Inc. | 21,300 | a | 964,677 | |||||||

| WMS Industries, Inc. | 47,490 | a,b | 1,451,769 | |||||||

| 10,460,015 | ||||||||||

Consumer Staples — 6.2% | ||||||||||

| Alberto-Culver Co. | 57,450 | 1,564,938 | ||||||||

| Church & Dwight Co., Inc. | 30,170 | 1,873,255 | ||||||||

| Estee Lauder Companies, Inc., Class A | 24,980 | b | 1,246,752 | |||||||

| NBTY, Inc. | 29,420 | a | 868,478 | |||||||

| 5,553,423 | ||||||||||

Energy — 12.2% | ||||||||||

| Arena Resources, Inc. | 22,690 | a | 881,507 | |||||||

| Berry Petroleum Co., Class A | 33,310 | b | 1,290,096 | |||||||

| CNX Gas Corp. | 44,190 | a | 989,414 | |||||||

| Denbury Resources, Inc. | 39,560 | a | 753,222 | |||||||

| Dril-Quip, Inc. | 36,080 | a,b | 1,565,511 | |||||||

| Energen Corp. | 13,580 | 614,902 | ||||||||

| FMC Technologies, Inc. | 16,920 | a | 787,626 | |||||||

| NATCO Group, Inc., Class A | 25,520 | a | 1,025,394 | |||||||

| Oil States International, Inc. | 11,540 | a | 407,939 | |||||||

| Penn Virginia Corp. | 20,810 | b | 1,112,086 | |||||||

| Superior Energy Services, Inc. | 18,900 | a | 588,546 | |||||||

| Tidewater, Inc. | 18,540 | b | 1,026,374 | |||||||

| 11,042,617 | ||||||||||

Financials — 5.8% | ||||||||||

| Arch Capital Group Ltd. | 21,160 | a | 1,545,315 | |||||||

| Plum Creek Timber Co., Inc. REIT | 45,980 | b | 2,292,563 | |||||||

| ProAssurance Corp. | 13,490 | a | 755,440 | |||||||

| RLI Corp. | 10,790 | 669,951 | ||||||||

| 5,263,269 | ||||||||||

Health Care — 22.4% | ||||||||||

| Alexion Pharmaceuticals, Inc. | 21,540 | a,b | 846,522 | |||||||

| Alnylam Pharmaceuticals, Inc. | 27,110 | a,b | 784,835 | |||||||

| Beckman Coulter, Inc. | 15,130 | 1,074,079 | ||||||||

| Bio-Rad Laboratories, Inc., Class A | 15,100 | a | 1,496,712 | |||||||

The Boston Company Small/Mid Cap Growth Fund

| Security | | Shares | | Value ($) (Note 1A) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

Health Care (continued) | ||||||||||

| Covance, Inc. | 15,410 | a | 1,362,398 | |||||||

| Henry Schein, Inc. | 18,630 | a,b | 1,003,039 | |||||||

| Integra LifeSciences Holdings Corp. | 26,020 | a,b | 1,145,661 | |||||||

| NuVasive, Inc. | 17,190 | a,b | 847,983 | |||||||

| PAREXEL International Corp. | 36,110 | a | 1,034,913 | |||||||

| PerkinElmer, Inc. | 25,890 | 646,473 | ||||||||

| PSS World Medical, Inc. | 31,700 | a,b | 618,150 | |||||||

| Regeneron Pharmaceuticals, Inc. | 15,630 | a | 341,203 | |||||||

| ResMed, Inc. | 41,970 | a,b | 1,804,710 | |||||||

| Thermo Fisher Scientific, Inc. | 31,010 | a | 1,705,550 | |||||||

| United Therapeutics Corp. | 6,480 | a | 681,502 | |||||||

| Varian, Inc. | 18,970 | a | 813,813 | |||||||

| Vertex Pharmaceuticals, Inc. | 19,920 | a | 662,141 | |||||||

| Waters Corp. | 18,850 | a | 1,096,693 | |||||||

| Wright Medical Group, Inc. | 59,620 | a,b | 1,814,833 | |||||||

| XenoPort, Inc. | 9,501 | a | 460,704 | |||||||

| 20,241,914 | ||||||||||

Industrials — 11.3% | ||||||||||

| Actuant Corp., Class A | 36,380 | 918,231 | ||||||||

| Bucyrus International, Inc. | 17,510 | 782,347 | ||||||||

| Clean Harbors, Inc. | 11,680 | a | 788,984 | |||||||

| Covanta Holding Corp. | 51,620 | a | 1,235,783 | |||||||

| Dun & Bradstreet Corp. | 17,050 | 1,608,838 | ||||||||

| Flowserve Corp. | 9,090 | 806,919 | ||||||||

| Landstar System, Inc. | 23,490 | 1,034,969 | ||||||||

| MSC Industrial Direct Co., Inc., Class A | 16,200 | b | 746,334 | |||||||

| Quanta Services, Inc. | 33,990 | a | 918,070 | |||||||

| UTI Worldwide, Inc. | 64,970 | 1,105,789 | ||||||||

| Werner Enterprises, Inc. | 12,980 | b | 281,796 | |||||||

| 10,228,060 | ||||||||||

Materials — 2.2% | ||||||||||

| Airgas, Inc. | 19,490 | 967,679 | ||||||||

| Packaging Corp. of America | 43,480 | 1,007,866 | ||||||||

| 1,975,545 | ||||||||||

Technology — 22.6% | �� | |||||||||

| Akamai Technologies, Inc. | 56,160 | a | 979,430 | |||||||

| Alliance Data Systems Corp. | 16,580 | a | 1,050,840 | |||||||

| Amdocs Ltd. | 49,810 | a | 1,363,798 | |||||||

| BMC Software, Inc. | 34,420 | a | 985,445 | |||||||

| Brocade Communications Systems, Inc. | 132,780 | a | 772,780 | |||||||

| CACI International, Inc., Class A | 37,910 | a | 1,899,291 | |||||||

| Cogent, Inc. | 60,210 | a | 615,346 | |||||||

| Cognizant Technology Solutions Corp., Class A | 62,480 | a | 1,426,418 | |||||||

| Concur Technologies, Inc. | 24,010 | a | 918,623 | |||||||

The Boston Company Small/Mid Cap Growth Fund

| Security | | Shares | | Value ($) (Note 1A) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

Technology (continued) | ||||||||||

| Global Payments, Inc. | 44,180 | 1,981,915 | ||||||||

| Harris Corp. | 23,320 | 1,077,384 | ||||||||

| Hewitt Associates, Inc., Class A | 24,280 | a | 884,763 | |||||||

| Iron Mountain, Inc. | 47,680 | a,b | 1,163,869 | |||||||

| j2 Global Communications, Inc. | 29,410 | a | 686,724 | |||||||

| ManTech International Corp., Class A | 13,680 | a | 811,087 | |||||||

| McAfee, Inc. | 12,410 | a | 421,444 | |||||||

| Metavante Technologies, Inc. | 42,390 | a | 816,431 | |||||||

| Microsemi Corp. | 24,030 | a,b | 612,284 | |||||||

| ON Semiconductor Corp. | 77,470 | a,b | 523,697 | |||||||

| Polycom, Inc. | 17,030 | a,b | 393,904 | |||||||

| SunPower Corp., Class A | 7,280 | a,b | 516,370 | |||||||

| Synopsys, Inc. | 24,480 | a | 488,376 | |||||||

| 20,390,219 | ||||||||||

Telecommunication Services — 2.3% | ||||||||||

| NeuStar, Inc., Class A | 102,110 | a | 2,030,968 | |||||||

Utilities — 0.4% | ||||||||||

| NRG Energy, Inc. | 15,680 | a,b | 388,080 | |||||||

| Total Equities (Cost $92,051,621) | 87,574,110 | |||||||||

SHORT-TERM INVESTMENTS — 25.0% | ||||||||||

INVESTMENT OF CASH COLLATERAL — 0.3% | ||||||||||

| BlackRock Cash Strategies L.L.C. (Cost $243,478) | 243,478 | c,e | 243,478 | |||||||

| TOTAL UNAFFILIATED INVESTMENTS (Cost $92,295,099) | 87,817,588 | |||||||||

AFFILIATED INVESTMENTS — 24.7% | ||||||||||

| Dreyfus Institutional Cash Advantage Fund | 19,433,305 | d,e | 19,433,305 | |||||||

| Dreyfus Institutional Preferred Plus Money Market Fund | 2,836,121 | d | 2,836,121 | |||||||

| TOTAL AFFILIATED INVESTMENTS (Cost $22,269,426) | 22,269,426 | |||||||||

TOTAL INVESTMENTS — 122.0% (Cost $114,564,525) | 110,087,014 | |||||||||

LIABILITIES IN EXCESS OF OTHER ASSETS — (22.0%) | (19,819,776 | ) | ||||||||

NET ASSETS — 100.0% | 90,267,238 | |||||||||

The Boston Company Small/Mid Cap Growth Fund

September 30, 2008

Assets | ||||||||||

| Investment in securities, at value (Note 1A) (including securities on loan, valued at $16,676,266 (Note 7)): | ||||||||||

| Unaffiliated investments (cost $92,295,099) | $ | 87,817,588 | ||||||||

| Affiliated investments (Note 1F) (cost $22,269,426) | 22,269,426 | |||||||||

| Receivable for investments sold | 8,807,564 | |||||||||

| Receivable for Fund shares sold | 506,888 | |||||||||

| Interest and dividends receivable | 61,068 | |||||||||

| Prepaid expenses | 16,993 | |||||||||

| Total assets | 119,479,527 | |||||||||

Liabilities | ||||||||||

| Collateral for securities on loan (Note 7) | $ | 19,676,783 | ||||||||

| Payable for investments purchased | 9,198,415 | |||||||||

| Payable for Fund shares redeemed | 113,519 | |||||||||

| Payable for investment advisory fee | 106,907 | |||||||||

| Accrued professional fees | 41,572 | |||||||||

| Accrued administrator service fees (Note 2) | 36,509 | |||||||||

| Accrued accounting, custody, administration and transfer agent fees (Note 2) | 28,309 | |||||||||

| Accrued shareholder reporting expense (Note 2) | 3,866 | |||||||||

| Accrued trustees’ fees (Note 2) | 3,272 | |||||||||

| Accrued chief compliance officer fee (Note 2) | 452 | |||||||||

| Other accrued expenses and liabilities | 2,685 | |||||||||

| Total liabilities | 29,212,289 | |||||||||

Net Assets | $ | 90,267,238 | ||||||||

Net Assets consist of: | ||||||||||

| Paid-in capital | $ | 100,279,508 | ||||||||

| Accumulated net realized loss | (5,534,759 | ) | ||||||||

| Net unrealized depreciation | (4,477,511 | ) | ||||||||

Total Net Assets | $ | 90,267,238 | ||||||||

| Shares of beneficial interest outstanding | 7,543,263 | |||||||||

| Net Asset Value, offering and redemption price per share | ||||||||||

| (Net Assets/Shares outstanding) | $ | 11.97 |

The Boston Company Small/Mid Cap Growth Fund

For the Year Ended September 30, 2008

Investment Income (Note 1B) | ||||||||||

| Dividend income (net foreign withholding taxes $120) (Note 1F) | $ | 233,274 | ||||||||

| Dividend income from affiliated investments | 136,603 | |||||||||

| Interest income | 1,792 | |||||||||

| Securities lending income (Note 7) | 77,993 | |||||||||

| Total investment income | 449,662 | |||||||||

Expenses | ||||||||||