As filed with the Securities and Exchange Commission on January 9, 2007

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4840

The Tocqueville Trust

(Exact name of registrant as specified in charter)

The Tocqueville Trust

40 W. 57th Street, 19th Floor

New York, NY 10019

(Address of principal executive offices) (Zip code)

Robert W. Kleinschmidt, President

The Tocqueville Trust

40 W. 57th Street, 19th Floor

New York, NY 10019

(Name and address of agent for service)

212-698-0800

Registrant’s telephone number, including area code

Date of fiscal year end: October 31

Date of reporting period: October 31, 2006

Item 1. Report to Stockholders.

Dear Fellow Shareholder,

By and large, the fiscal year ended October 31, 2006 has been more favorable for our Funds than I would have anticipated twelve months ago.

Periods like the present one, when liquidity and momentum drive markets, are not easy for our investment discipline. Typically, we make money, but less than benchmarks that are pushed ever higher by investors’ frantic search for short-term returns.

Values, across markets, were rare a year ago and are more so today; complacency seems to rule everywhere; and both good and bad news are seen as cause to continue enjoying the global bull market.

At a meeting shortly before our letters to shareholders were due, most of our managers found it difficult to offer any new pearls of wisdom: they would have been happy to reprint their comments of a year ago. The same pretty much applies to me.

Markets are driven in part by fundamentals and in part (perhaps a growing one) by crowd psychology. Though I am more concerned than most by the likelihood of economic or financial problems in the world’s two economic locomotives (the United States and China), I would be willing to rate the economic fundamentals as “neutral”.

The most myopic bulls see valuations that are down significantly from their recent bubble peaks. Historically, however, those remain fairly rich—especially if one takes into account today’s peak profit margins, which may not be sustainable through cycles.

Bear in mind that price/earnings ratios, which largely reflect investors’ expectations, historically have moved in long cycles of more than a decade’s duration. When they have been trending down, as has been the case since 2000, they seldom reversed until the investing public became totally disgusted with equities. This is hardly the case today and, if the start of a major new bull market for world equities is to be ruled out, one must wonder how much remains to be squeezed out of the current one.

Finally, many in the investing crowd expect the global stock market returns of recent years to be replicable ad infinitum. These, too have been above the historical norm and, for reasons that would be too long to document here, I am of the opinion that this expectation is unrealistic.

My only solace is that periods like the present one are not eternal: moods are cyclical and economic or financial parameters always wind up “reversing to the long-term mean”. When this inevitably happens, I believe a strong value-oriented, stock-picking discipline should both protect us on the downside and allow us to identify good contrarian opportunities for the longer term.

With my best wishes for a healthy, happy and financially secure New Year,

Respectfully,

François Sicart

Chairman

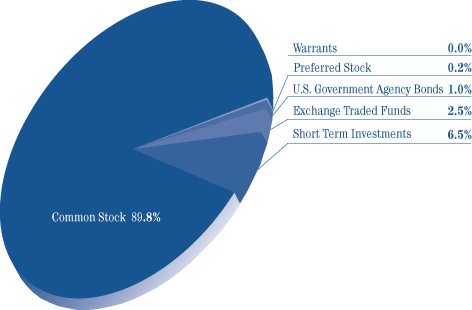

The Tocqueville Fund

Dear Fellow Shareholder,

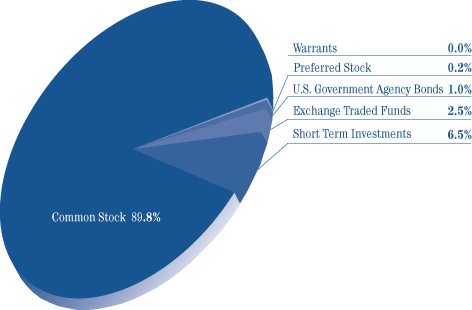

For the fiscal year ended October 31, 2006, the Tocqueville Fund generated a return of 20.50% compared with a 16.34% return for the S&P 500, the index against which we are most often compared.

This represents the seventh consecutive fiscal year in which the Fund has outperformed its benchmark. That record, though gratifying, could be an accident of the calendar. Far more important is the cumulative record over this period. Over the past seven years, the Fund has returned 85.11% while the overall market, as measured by the S&P 500 has gained 13.06%. Of course, in the two year period just before the new millennium, when our style was not in favor, the Fund substantially underperformed its benchmark, 12.42% versus 55.64% and underperformance could return should the market turn against us. Since October 31, 1996, which includes periods of both superior and inferior relative performance, our return is 168.68% compared with 129.03% for the S&P 500.

Outperforming a benchmark is not our primary investment objective. Capital appreciation is, and we try to accomplish this by limiting our exposure to disappointments in the stocks that we own. It is our belief that purchasing and holding the shares of good quality companies when we believe them to be out of favor and depressed in price can be a rewarding long term investment strategy and one that should minimize, to the extent possible, downside risk and nerve wracking volatility. This type of investing, which we call contrarian value requires not only patience, but a willingness to lean against the comfortable consensus.

Longtime shareholders will recognize the tendency of the Fund to be most heavily positioned in shares which defy the conventional wisdom and underrepresented, if invested at all, in companies where everyone knows the outlook is favorable. Thus, earlier this year we added to our underperforming technology and healthcare positions, while trimming or eliminating basic material shares which have driven our performance over the past several years and which have become media and Wall Street darlings.

Notwithstanding the rally in the markets over the past several months, we continue to expect a stock-picker’s market for the foreseeable future. We believe valuations are not low enough, nor are interest rates high enough and economic activity subdued enough to ignite a major bull market with their reversal. On the contrary, we would not be surprised to witness a sluggish market environment over the next couple of years. If so, we believe our approach will continue to add value to client portfolios. If we are wrong, however, and the market is off to the races, we will most likely underperform our benchmarks. Not making as much money as some others is a high class problem and a risk we are willing to take.

As a major investor in the Fund, as well as its manager, I thank you for your support and loyalty to the Tocqueville Fund.

Sincerely,

Robert W. Kleinschmidt

Portfolio Manager

The Tocqueville Fund

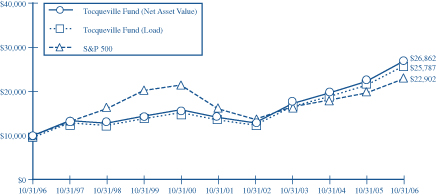

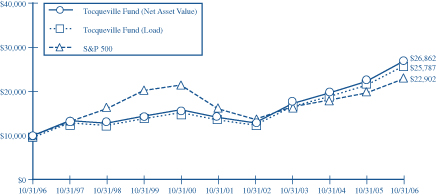

This chart assumes an initial gross investment of $10,000 made on 10/31/96. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than their original cost.

The Standard & Poor’s 500 Stock Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED OCTOBER 31, 2006

| | | | | | | | |

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year |

Tocqueville Fund—Net Asset Value | | 20.50% | | 15.81% | | 13.66% | | 10.39% |

Tocqueville Fund—Load* | | 20.50% | | 15.81% | | 13.66% | | 9.94% |

Standard & Poor’s 500 Stock Index | | 16.34% | | 11.44% | | 7.26% | | 8.64% |

| * | Effective February 1, 2000, the Fund eliminated its sales load. |

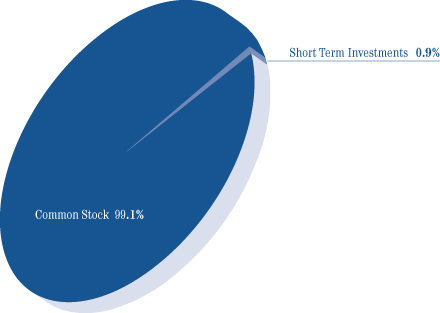

The Tocqueville Small Cap Value Fund

Dear Fellow Shareholder,

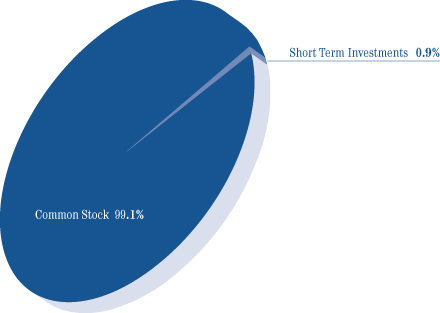

We are pleased to report that the Tocqueville Small Cap Value Fund finished its fiscal year, ended October 31, 2006 with an 8.81% increase in Net Asset Value to $18.04 per share. While this represents improvement over the 6.79% reported last year, our returns lagged the 19.98% return of our benchmark Russell 2000 Index. As indicated in the past, our goal is not to outperform any index over short-term periods, but rather it is to achieve long-term capital appreciation. Our average annual return since inception in 1994 is 13.29%, and the Fund closed the fiscal year near its all-time high.

Record Long-term Capital Gains Realized

As the year progressed we took advantage of what we believed to be overly optimistic valuations, and substantially reduced our portfolio exposure and concentration in some of our most appreciated energy related, computer software, and other technology investments. As a result of these and other changes, the Fund distributed long-term capital gains of $2.175 per share or 12%.

Cautious Optimism Maintained

In retrospect, the flat performance of the Fund during the first three quarters of the fiscal year mirrored the flat performance of most stocks. Lack of economic progress and fears of deterioration in sectors sensitive to rising energy costs and interest rates were at work. Fortunately, these negative perceptions lessened during the fourth quarter, and the general outlook appears to be improving as of this writing.

Two factors benefited our results last year. Foremost was the unprecedented price volatility of small stocks in general. In addition, we had ample opportunities to balance market risks with continually changing economic and geopolitical perceptions. These two factors enabled us to realize gains and make timely new investments in attractive new sectors.

We made no strategic changes as the year progressed, and concentrated instead on tactical issues. We increased our exposure to small out-of-favor healthcare and technology companies. These two sectors seemed to present us with the most attractive buying opportunities. While some of these investments still carry a level of business risk normally attached to small companies, overall long-term market risk seemed pretty much deflated by the recent poundings these stocks underwent before we bought them. We also diversified our risk exposure by adding what we believed to be promising new stocks to our list.

We eliminated eleven stocks from the Fund for valuation and other reasons, and we added fourteen new ones. Seven of these additions are technology/electronics related and five are small healthcare companies. As of October 31, 2006, we held 43 stocks, up from 40 stocks as of October 31, 2005. We reduced our concentration in our top ten holdings from 40% to 38% of assets. Eight of our top ten stocks are new to that list, and our three largest holdings are computer software companies with attractive long-term growth profiles.

We believe the fourteen additions to the Fund have a number of attractive common features. Most are small companies in emerging industries or market segments. Most are in the process of introducing costs-reducing new products or services which greatly enhance their solid long-term potential. Most fit well with our long practice of seeking to buy good businesses with decent finances that just happen to be undervalued. We believe most were suffering from deflated short-term expectations at their time of purchase, mitigated somewhat by likely prospects for improvement due to new products, pricing flexibility, increasing unit sales over the longer term, and solid relationships with their customers:

Datascope Corp. manufactures and sells catheter-based products used during cardiovascular and vascular surgery procedures; Dendrite Int’l designs and sells computer software that empowers drug industry reps in marketing products to doctors, and in clinical and regulatory compliance tracking; Keithley Instruments designs, manufactures and sells electrical test and measurement instruments used by scientists and engineers in the worldwide electronics industry; Mentor Graphics Corp. designs, sells and services Electronic Design Automation software to the worldwide electronics industry. International Rectifier, FEI Corp., Insight Enterprises designs, manufactures and sells devices and subsystems used to test electronic devices; Pharmion Corp. is a biotechnology company engaged in the licensing, development and commercialization of innovative hematology and oncology products.; Salix Pharmaceuticals develops and markets prescription pharmaceuticals for the treatment of gastrointestinal diseases; Synovis Life Technology Inc. designs, manufactures and markets implantable biomaterial products as well as conductor components used for cardiac rhythm management; Wright Medical Group., Inc. designs, manufactures and sells reconstructive joint devices and bio-orthopedic materials used in knee, hip and other joints replacement surgery. Following is a listing of our ten largest positions by sectors:

| | |

Agile Software (4.6%) | | PLM Software |

Dendrite Int. (4.2%) | | Healthcare Software |

Informatica Inc. (4.1%) | | Database software |

Hercules Inc. (4.0%) | | Chemicals |

Sensient Tech. (3.9%) | | Food ingredients |

3Com Corp. (3.7%) | | Routers |

Ceridian Corp. (3.4%) | | Financial Services |

Wright Medical (3.3%) | | Pharmaceuticals |

ABM Ind. (3.2%) | | Building maintenance |

Mentor Graphics (3.2%) | | Test instruments |

In closing, let me express my gratitude for your selection of the Tocqueville Small Cap Value Fund to achieve your long-term investment goals.

Sincerely,

Jean-Pierre Conreur

Portfolio Manager

The Tocqueville Small Cap Value Fund

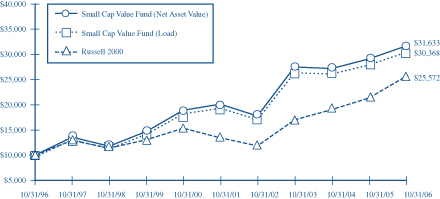

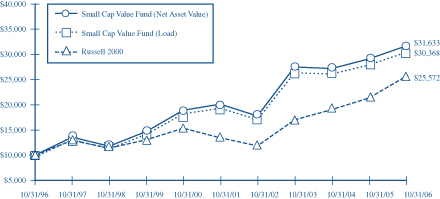

This chart assumes an initial gross investment of $10,000 made on 10/31/96. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than their original cost.

The Russell 2000 Index is an unmanaged index which measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED OCTOBER 31, 2006

| | | | | | | | |

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year |

Tocqueville Small Cap Value Fund—Net Asset Value | | 8.81% | | 4.79% | | 9.45% | | 12.20% |

Tocqueville Small Cap Value Fund—Load* | | 8.81% | | 4.79% | | 9.45% | | 11.74% |

Russell 2000 Index | | 19.98% | | 14.53% | | 13.76% | | 9.84% |

| * | Effective February 1, 2000, the Fund eliminated its sales load. |

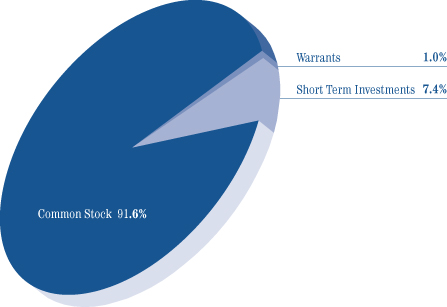

The Tocqueville International Value Fund

Dear Fellow Shareholder,

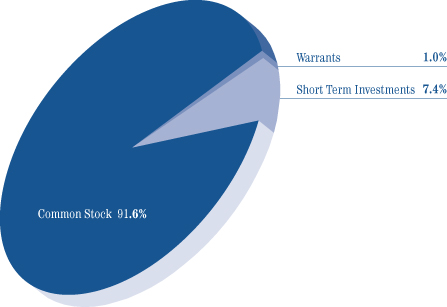

For the twelve months ended October 31, 2006, the Tocqueville International Value Fund’s total U.S. dollar return was 17.39%. In the same period, the Morgan Stanley EAFE Index had a total U.S. dollar return of 28.04%.

For the 5 year period ended October 31, 2006, the Tocqueville International Value Fund’s total U.S. dollar return was 163.08%. In the same period, the Morgan Stanley EAFE Index had a total U.S. dollar return of 101.16%. According to Bloomberg, our 5-year return positions the Fund in the top decile of funds that have a strategy of investing in non-U.S. equities.

Many of the currents of the last few years continued into 2006. Global economic growth continued at a healthy pace and commodity prices remained at lofty levels. In spite of this, inflation and interest rates remained stubbornly low, as low cost emerging markets production relieved cost pressures and burgeoning global liquidity chased bond yields down. Corporate earnings grew at a strong clip, abetted by corporate restructuring, particularly in Europe. Perceived risk, as measured by credit spreads on fixed income securities, remained low, and capital poured into risky assets, like emerging markets. Mergers and acquisitions activity accelerated and overcapitalized private equity firms searched the world for undervalued assets, propelling value realization among publicly traded equities. Risk appetite had a short-lived correction mid-year due to the conflict in Lebanon, rising oil prices, and concerns about a housing and consumer led economic slowdown in the U.S. But that quickly reversed as the Lebanon conflict eased in intensity, oil prices declined, and investor conviction grew that the U.S. Federal Reserve had finished its tightening for this cycle.

During the year, the European BE 500 index increased by 24.72% in local currency terms, the Japanese Nikkei 225 increased by 21.63% in local currency terms, the Morgan Stanley Far East increased by 20.97%. The Euro increased by 6.4% against the U.S. dollar as economic growth there accelerated and interested rates rose, while the Japanese Yen decreased by 0.5%, as markets overlooked Japan’s improving economic fundamentals and leveraged investors borrowed Yen to buy securities elsewhere in the world. Most other currencies increased in value against the U.S. dollar. Underscoring the extent of global risk appetite, yields on long term U.S. dollar-denominated bonds in the Brazil and the Philippines, for example, ended the year at around 6%, and among the best performing stock markets for the year were Vietnam, Venezuela, Botswana and Russia.

During the year, we had gains across geographies and industries, with notable contributions from Dutch animal feed producer Nutreco, Italian clothing maker Benetton, and Korean conglomerate Doosan, all restructuring stories, as well as Japanese game maker Nintendo and Finnish paper producer UPM, both cyclical recovery theses. We sold several positions that met our valuation targets, like Doosan, French aerial platform maker Pinguely-Haulotte, Japanese industrial chain maker Tsubakimoto Chain, Dutch chemical company Akzo Nobel, and French water company Veolia. In terms of geographic exposure, Europe increased from 38% to 40%, largely through price appreciation, Asia increased from 16% to 20% as we added new positions, and Japan was flat at 23%. We maintained small and decreasing exposures to Latin American and Canadian materials companies, and our overall exposure to emerging markets continued to be limited.

Thematically, new investments were concentrated in the areas of media and technology, which have been out of favor with the traditional growth investor constituency and offer compelling individual stock values. In media, we invested in French media conglomerate Vivendi Universal and Thai TV broadcaster BEC World, which are characterized by overcapitalized balance sheets, strong free cash flow, and improving business fundamentals. In technology, we took positions in Japanese software companies Capcom and Square Enix, which are characterized by low valuation multiples of down cycle cash flow, and stand to benefit from the new gaming console product cycle. Otherwise, our new investments have been focused on special situations, like UK nuclear company British Energy and French aerospace propulsion company Safran.

Our investment philosophy is long-term capital appreciation consistent with preservation of capital and our discipline is contrarian, value oriented stock picking. We are focused on positive absolute, rather than relative returns and we do not

pay heed to indices as part of our investment selection process. There are periods when our approach may achieve adequate absolute returns, and yet our returns may lag the benchmark against which we are typically compared. The last 12 months have been such a period. There are two principal reasons for this, both deriving from our investment discipline. First, before and during this fiscal year, we exited several positions, in areas like industrial metals and machinery, where we had made large gains over the last several years and which had become fully valued in our judgment. These same areas continued to produce strong returns during 2006, while the areas where we have been finding value and making new investments, like media and technology, did not. Second, we have had negligible exposure to financial, utility and telecom stocks in Europe, which do not meet our investment criteria for a mix of qualitative and quantitative reasons. These areas represent a large portion of the indices and produced strong returns during 2006. While our discipline led to some missed opportunities in 2006, we believe based on decades of experience that our approach is the best way to achieve the goal of capital appreciation consistent with preservation of capital.

Today, investors are pricing minimal risk into equity securities. To be sure, there are many reasons to be optimistic. Large emerging countries like India and China are fueling global growth, inflation is low for now, economic reform continues to occur in Europe, Japan and most other nations, and despite political posturing, international trade continues to expand. Rogue leaders like Venezuela’s Chavez and North Korea’s Kim have been marginalized or reengaged. Growth is improving living standards in the emerging world, and there has been progress in alleviating health and poverty problems and raising awareness regarding the environment. Corporate balance sheets are strong and equity valuations, while not cheap, are not exceedingly expensive. But when equities ignore risk, the balance tips in favor of negative surprises. And these could come in the form of rising oil prices, further economic slowdown in the U.S., instability in Pakistan or Iran, corporate profit margins deteriorating from current high levels, to name a few. With this potential reality in clear view, we continue to focus our efforts on uncovering individual stock ideas where we expect that internal fundamentals will drive value creation independent of the movements of equity markets.

We continue to hold a structurally bearish view regarding the U.S. dollar. And we expect the non-U.S. markets to benefit from improving corporate governance and management practices, the development of local equity cultures, and positive capital flows. Against this background, inefficient pricing of equities can provide exceptional opportunities. We continue to employ our investment discipline, seeking to discover fundamentally attractive companies that are out of favor and undervalued, and to provide our shareholders with above average returns with below average risk.

Sincerely,

| | |

| |  |

| James Hunt | | Francois Sicart |

| Portfolio Manager | | Portfolio Manager |

The Tocqueville International Value Fund

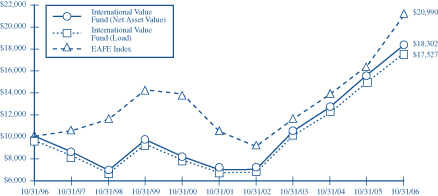

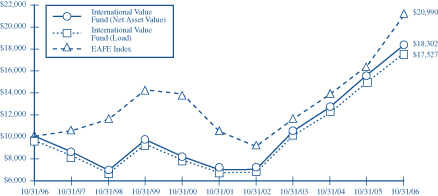

This chart assumes an initial gross investment of $10,000 made on 10/31/96. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than their original cost.

The Morgan Stanley EAFE Index is an unmanaged market-capitalization-weighted index composed of companies representative of the market structure of 20 Developed Market Countries in Europe, Australia, Asia and the Far East.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED OCTOBER 31, 2006

| | | | | | | | |

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year |

Tocqueville International Value Fund—Net Asset Value | | 17.39% | | 20.41% | | 21.34% | | 6.23% |

Tocqueville International Value Fund—Load* | | 17.39% | | 20.41% | | 21.34% | | 5.80% |

Morgan Stanley EAFE Index | | 28.04% | | 21.89% | | 15.00% | | 7.70% |

| * | Effective February 1, 2000, the Fund eliminated its sales load. |

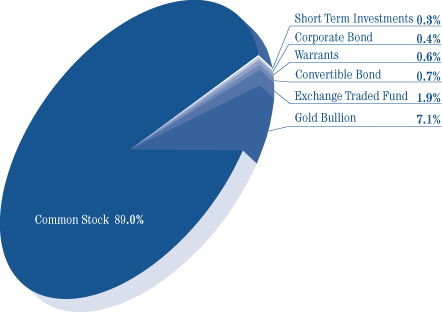

The Tocqueville Gold Fund

Dear Fellow Shareholder,

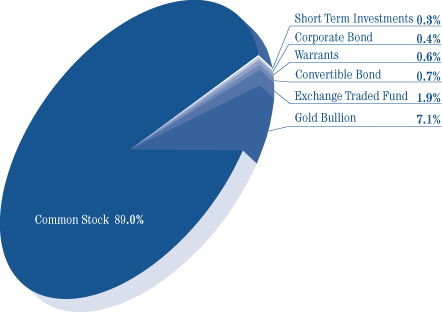

For the 2006 fiscal year ending October 31st, the Tocqueville Gold Fund produced a return of 52.54% vs. 30.53% for the XAU (Philadelphia Stock Exchange Gold and Silver Index) and 16.34% for the S&P 500. This marked a continuation of the upward trend in the gold price that has been in place since August of 1999. The prior bull market in gold lasted from 1968 to 1982, or 15 years. By that measure, we believe the current bull market has considerably more time to run.

The current dollar, based on official inflation statistics, is worth approximately half of what it was worth in 1980 when gold topped $800. Making the adjustment for the dollar’s loss of value since then, the current gold price is barely above $300. In other words, we see gold as having the potential to continue to climb and possibly reach its previous bull market high. Our belief is that the government’s official inflation numbers are overstating the effects of inflation and this, if correct, only reinforces our argument.

Despite these considerations, many question whether the best days for gold are behind it. A new investment commitment to gold after a seven year run might seem too late in the game. Capital market flows into the gold sector continue to be hesitant in nature and small in scale. Over the past year, gold has been seen by many as just another hard asset, a subset of tangible assets. The rise in price has mostly been attributed to the China story, i.e., the growing demand for hard assets in emerging market economies, while we believe little thought has been given to gold’s role as an alternative to monetary assets.

In our view, failure to comprehend gold’s monetary nature has resulted in a confusion with other commodities. Signs are encouraging that this is changing. The recently popular notion that the prices of gold and oil are inextricably linked is, in our opinion, all but dead. Since September 30, gold is up 5.47% and oil is down 3.78%, while the Reuters/Jefferies Commodity Research Bureau Index (“CRB”) is up 0.37%. Since the beginning of 2006, oil is down 0.82% and gold is up 22.48%, while the CRB is down 7.57%. In our recent web site article, Trivial Pursuit, we suggested that the next powerful leg of the gold market would be triggered by a separation of gold from other commodities. We appear to be in the early stages of that separation.

Gold may be a commodity, but it is the only significant one with monetary characteristics. A widening spread between gold and other commodities may signal trouble ahead for financial assets. For example, during the period June 1999 to December 2002, gold outperformed the CRB by 45% (+32% vs. +22%) and the S&P 500 declined 36%. The logic is that during periods of severe underperformance of financial assets, gold’s safe haven aspects become more highly valued than in more halcyon times. On a year to date basis, gold has outperformed the CRB by a significant percentage as already noted. However, the S&P 500 is also up so far this calendar year, by 12.06%. Is gold’s behavior relative to other commodities a danger signal, as it was seven years ago, or a false alarm?

Only time will tell, but today’s compressed credit spreads suggest that investors are reaching for yield. Reckless disregard for risk was, we believe, the precursor to the dot com bust. Is today’s environment any different? Italy borrows for 23 bps more than Germany. Sub prime borrowers get 30 year mortgages at a few basis points more than sovereign debt. Financial engineers repackage risk in collateralized debt obligations, instruments that are all but incomprehensible to external analysis. The next leg in the gold price will likely say more about the under pricing of risk than the traditional drivers of the metal such as inflation, deflation, or geopolitical events. We believe that gold rising against economically sensitive commodities will signify that a general reappraisal of risk is underway.

We believe the idea that all “hard” assets provide a safe haven from depreciating currencies is a dangerous one. It might seem valid for a while based upon the power of common belief to generate capital flows, but it will inevitably fall apart during periods of severe economic distortion caused by monetary imbalances. It appears to us that efforts to trivialize gold’s monetary significance are a key to the present day money illusion, that more paper equals more prosperity. It is far more palatable to the political and economic establishment to explain away the strength in the price of gold as a consequence of growing Asian prosperity or the reflection of an extreme fringe of investment thought (as suggested by Greenspan) than to read it as a reflection of flawed economic policies, archaic conventions, and corrupt institutions. A rise in the price of gold is equivalent to a fall in the value of financial assets. It is our view that the strength in the metal is a sign of distrust in the ability of present day financial instruments, including paper currencies, to preserve

capital over time. The global bid for physical gold is potentially immense. We believe it will be generated not by ephemeral and flaky speculative interests seeking instant gratification, but rather by the considered actions of capital interests with a long term perspective driven primarily by the desire to convey present day wealth to future generations.

In our view, we are still in the very early stages of a bull market in gold. When it has completed its course, we believe the duration and magnitude will exceed any historical precedent.

Sincerely,

John C. Hathaway

Portfolio Manager

The Tocqueville Gold Fund

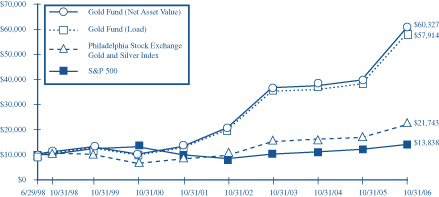

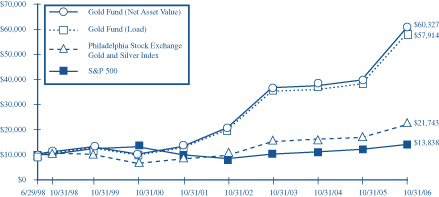

This chart assumes an initial gross investment of $10,000 made on 6/29/98 (commencement of operations). Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than their original cost.

In 2003 and 2006, the performance of The Tocqueville Gold Fund was achieved during a period of unusually favorable market conditions. Such performance may not be sustainable.

The Philadelphia Stock Exchange Gold and Silver Index is an unmanaged capitalization-weighted index which includes the leading companies involved in the mining of gold and silver.

The Standard & Poor’s 500 Stock Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED OCTOBER 31, 2006

| | | | | | | | |

| | | 1 Year | | 3 Year | | 5 Year | | Since inception 6/29/1998 |

Tocqueville Gold Fund—Net Asset Value | | 52.54% | | 18.24% | | 35.69% | | 24.05% |

Tocqueville Gold Fund—Load* | | 52.54% | | 18.24% | | 35.69% | | 23.42% |

Philadelphia Stock Exchange Gold and Silver Index | | 30.53% | | 13.15% | | 21.91% | | 9.76% |

Standard & Poor’s 500 Stock Index | | 16.34% | | 11.44% | | 7.26% | | 3.92% |

| * | Effective February 1, 2000, the Fund eliminated its sales load. |

Legend Related to Shareholder Letters

Past performance does not guarantee future results. The investment returns and principal value will fluctuate and the investor’s share, when redeemed, may be worth more or less than their original cost. You should consider the investment objectives, risks, charges and expenses of each Fund before investing. The Prospectus contains this and other information about The Tocqueville Trust and you should read it carefully before investing.

Each Fund’s holdings are also subject to change without notice. The mention of specific securities is not a recommendation or solicitation for any person to buy, sell or hold any mentioned security. The securities mentioned in the articles are not representative of each Fund’s entire portfolio.

There are special risks associated with investing in small cap and mid cap stocks, including: small and mid cap companies rely on limited product lines, financial resources and business activities that may make them more susceptible than larger companies to setbacks or downturns; and small and mid cap companies are less liquid and more thinly traded which make them more volatile than stocks of larger companies.

There are special risks associated with investing in foreign securities, including: the value of foreign currencies may decline relative to the US dollar; a foreign government may expropriate a Fund’s assets; and political, social or economic instability in a foreign country in which a Fund invests may cause the value of the Fund’s investments to decline.

The Tocqueville Gold Fund is subject to special risks associated with investing in gold and other precious metals, including: the price of gold/precious metals may be subject to wide fluctuations; the market for gold/precious metals is relatively limited; the sources of gold/precious metals are concentrated in countries that have the potential for instability; and the market for gold/precious metals is unregulated.

This commentary is not an advertisement or solicitation to subscribe to The Tocqueville Trust, which may only be made by Prospectus. This material must be preceded or accompanied by the Trust’s Prospectus.

The Tocqueville Trust Mutual Funds are distributed by Lepercq, de Neuflize/Tocqueville Securities L.P.

Expense Example—October 31, 2006

As a shareholder of The Tocqueville Trust (the “Funds”), you incur ongoing costs, including management fees; distribution fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held the entire period (May 1, 2006-October 31, 2006).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Expense Example Tables

The Tocqueville Fund

| | | | | | | | | |

| | | Beginning

Account Value

May 1, 2006 | | Ending Account Value

October 31, 2006 | | Expenses Paid During Period* May 1, 2006 -

October 31, 2006 |

Actual | | $ | 1,000.00 | | $ | 1,015.30 | | $ | 6.60 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,018.65 | | | 6.61 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.30%, mutiplied by the average account value over the period, muliplied by 184/365 to reflect the one-half year period. |

The Tocqueville Small Cap Value Fund

| | | | | | | | | |

| | | Beginning Account Value May 1, 2006 | | Ending Account Value

October 31, 2006 | | Expenses Paid

During Period* May 1, 2006 -

October 31, 2006 |

Actual | | $ | 1,000.00 | | $ | 968.30 | | $ | 6.65 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,018.45 | | | 6.82 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.34%, mutiplied by the average account value over the period, muliplied by 184/365 to reflect the one-half year period. |

The Tocqueville International Value Fund

| | | | | | | | | |

| | | Beginning Account Value

May 1, 2006 | | Ending Account Value

October 31, 2006 | | Expenses Paid

During Period* May 1, 2006 -

October 31, 2006 |

Actual | | $ | 1,000.00 | | $ | 969.80 | | $ | 7.99 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,017.09 | | | 8.19 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.61%, mutiplied by the average account value over the period, muliplied by 184/365 to reflect the one-half year period. |

The Tocqueville Gold Fund

| | | | | | | | | |

| | | Beginning Account Value

May 1, 2006 | | Ending Account Value

October 31, 2006 | | Expenses Paid

During Period* May 1, 2006 -

October 31, 2006 |

Actual | | $ | 1,000.00 | | $ | 913.80 | | $ | 7.24 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,017.64 | | | 7.63 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.50%, mutiplied by the average account value over the period, muliplied by 184/365 to reflect the one-half year period. |

The Tocqueville Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding throughout the year) | | Years Ended October 31, | |

| | 2006 | | | 2005 | | | 2004 | | | 2003 | | | 2002 | |

Net asset value, beginning of year | | $ | 22.17 | | | $ | 20.43 | | | $ | 17.99 | | | $ | 13.42 | | | $ | 14.99 | |

| | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | 0.14 | | | | 0.15 | | | | 0.05 | | | | 0.02 | | | | (0.01 | ) |

Net realized and unrealized gain (loss) | | | 4.33 | | | | 2.53 | | | | 2.41 | | | | 4.55 | | | | (1.28 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations (1) | | | 4.47 | | | | 2.68 | | | | 2.46 | | | | 4.57 | | | | (1.29 | ) |

| | | | | | | | | | | | | | | | | | | | |

Dividends and distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.22 | ) | | | (0.12 | ) | | | (0.02 | ) | | | — | | | | (0.01 | ) |

Distributions from net realized gains | | | (2.17 | ) | | | (0.82 | ) | | | — | | | | — | | | | (0.27 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total dividends and distributions | | | (2.39 | ) | | | (0.94 | ) | | | (0.02 | ) | | | — | | | | (0.28 | ) |

| | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the year | | | 2.08 | | | | 1.74 | | | | 2.44 | | | | 4.57 | | | | (1.57 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 24.25 | | | $ | 22.17 | | | $ | 20.43 | | | $ | 17.99 | | | $ | 13.42 | |

| | | | | | | | | | | | | | | | | | | | |

Total return | | | 20.5 | % | | | 13.4 | % | | | 13.7 | % | | | 34.1 | % | | | (8.9 | )% |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | $ | 392,495 | | | $ | 175,791 | | | $ | 145,435 | | | $ | 149,497 | | | $ | 70,134 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | |

Expenses (2) | | | 1.30 | % | | | 1.34 | % | | | 1.34 | % | | | 1.40 | % | | | 1.40 | % |

Net investment income (loss) (2) | | | 0.68 | % | | | 0.68 | % | | | 0.25 | % | | | 0.17 | % | | | (0.06 | %) |

Portfolio turnover rate | | | 32 | % | | | 45 | % | | | 40 | % | | | 32 | % | | | 62 | % |

| (1) | Total from investment operations per share includes redemption fees of $0.002, $0.003, $0.001 and $0.000 per share for the years ended October 31, 2006, 2005, 2004 and 2003, respectively. |

| (2) | Net of fees waived amounting to 0.07%, 0.01% and 0.06% of average net assets for the years ended October 31, 2003, 2002 and 2001, respectively. |

The accompanying notes are an integral part of these financial statements.

The Tocqueville Small Cap Value Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

Per share operating performance (For a share outstanding throughout the year) | | Years Ended October 31, | |

| | 2006 | | | 2005 | | | 2004 | | | 2003 | | | 2002 | |

Net asset value, beginning of year | | $ | 16.58 | | | $ | 16.11 | | | $ | 18.83 | | | $ | 12.18 | | | $ | 15.09 | |

| | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.07 | ) | | | (0.13 | ) | | | (0.11 | ) | | | (0.08 | ) | | | (0.08 | ) |

Net realized and unrealized gain (loss) | | | 1.53 | | | | 1.26 | | | | 0.21 | | | | 6.73 | | | | (1.45 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations (1) | | | 1.46 | | | | 1.13 | | | | 0.10 | | | | 6.65 | | | | (1.53 | ) |

| | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

Distributions from net realized gains | | | — | | | | (0.66 | ) | | | (2.82 | ) | | | — | | | | (1.38 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | — | | | | (0.66 | ) | | | (2.82 | ) | | | — | | | | (1.38 | ) |

| | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the year | | | 1.46 | | | | 0.47 | | | | (2.72 | ) | | | 6.65 | | | | (2.91 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 18.04 | | | $ | 16.58 | | | $ | 16.11 | | | $ | 18.83 | | | $ | 12.18 | |

| | | | | | | | | | | | | | | | | | | | |

Total return | | | 8.8 | % | | | 6.8 | % | | | (1.0 | )% | | | 54.6 | % | | | (11.7 | )% |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | $ | 52,701 | | | $ | 57,576 | | | $ | 75,005 | | | $ | 73,518 | | | $ | 50,879 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | |

Expenses | | | 1.34 | % | | | 1.39 | % | | | 1.41 | % | | | 1.36 | % | | | 1.44 | % |

Net investment loss | | | (0.38 | )% | | | (0.67 | )% | | | (0.61 | )% | | | (0.48 | )% | | | (0.62 | )% |

Portfolio turnover rate | | | 45 | % | | | 30 | % | | | 19 | % | | | 65 | % | | | 25 | % |

| (1) | Total from investment operations per share includes redemption fees of $0.015, $0.006, $0.02 and $0.03 per share for the years ended October 31, 2006, 2005, 2004 and 2003, respectively. |

The accompanying notes are an integral part of these financial statements.

The Tocqueville International Value Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

Per share operating performance (For a share outstanding throughout the year) | | Years Ended October 31, | |

| | 2006 | | | 2005 | | | 2004 | | | 2003 | | | 2002 | |

Net asset value, beginning of year | | $ | 16.06 | | | $ | 13.10 | | | $ | 10.90 | | | $ | 7.27 | | | $ | 7.24 | |

| | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.27 | | | | 0.04 | | | | 0.09 | | | | 0.06 | | | | 0.01 | |

Net realized and unrealized gain | | | 2.30 | | | | 3.00 | | | | 2.15 | | | | 3.58 | | | | 0.02 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations (1) | | | 2.57 | | | | 3.04 | | | | 2.24 | | | | 3.64 | | | | 0.03 | |

| | | | | | | | | | | | | | | | | | | | |

Dividends and distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.05 | ) | | | (0.08 | ) | | | (0.04 | ) | | | (0.01 | ) | | | — | |

Distributions from net realized gains | | | (1.86 | ) | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total dividends and distributions | | | (1.91 | ) | | | (0.08 | ) | | | (0.04 | ) | | | (0.01 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the year | | | 0.66 | | | | 2.96 | | | | 2.20 | | | | 3.63 | | | | 0.03 | |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 16.72 | | | $ | 16.06 | | | $ | 13.10 | | | $ | 10.90 | | | $ | 7.27 | |

| | | | | | | | | | | | | | | | | | | | |

Total return | | | 17.4 | % | | | 23.3 | % | | | 20.6 | % | | | 50.1 | % | | | 0.4 | % |

Ratios/supplemental data | | | | | | | | | | | | | �� | | | | | | | |

Net assets, end of year (000) | | $ | 225,234 | | | $ | 215,711 | | | $ | 196,424 | | | $ | 129,875 | | | $ | 78,951 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | |

Expenses | | | 1.61 | % | | | 1.66 | % | | | 1.71 | % | | | 1.77 | % | | | 1.73 | % |

Net investment income | | | 1.49 | % | | | 0.29 | % | | | 0.85 | % | | | 0.72 | % | | | 0.16 | % |

Portfolio turnover rate | | | 39 | % | | | 35 | % | | | 43 | % | | | 55 | % | | | 61 | % |

| (1) | Total from investment operations per share includes redemption fees of $0.011, $0.003, $0.01, $0.005 and $0.03 per share for the years ended October 31, 2006, 2005, 2004, 2003 and 2002, respectively. |

The accompanying notes are an integral part of these financial statements.

The Tocqueville Gold Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

Per share operating performance (For a share outstanding throughout the year) | | Years Ended October 31, | |

| | 2006 | | | 2005 | | | 2004 | | | 2003 | | | 2002 | |

Net asset value, beginning of year | | $ | 35.51 | | | $ | 34.84 | | | $ | 34.71 | | | $ | 20.49 | | | $ | 13.10 | |

| | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.22 | ) | | | (0.33 | ) | | | (0.33 | ) | | | (0.14 | ) | | | (0.08 | ) |

Net realized and unrealized gain (1) | | | 18.21 | | | | 2.36 | | | | 1.04 | | | | 15.41 | | | | 7.53 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations (2) | | | 17.99 | | | | 2.03 | | | | 0.71 | | | | 15.27 | | | | 7.45 | |

| | | | | | | | | | | | | | | | | | | | |

Dividends and distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | — | | | | (0.03 | ) | | | — | | | | — | |

Dividends from net realized gains | | | (2.09 | ) | | | (1.36 | ) | | | (0.55 | ) | | | (1.05 | ) | | | (0.06 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (2.09 | ) | | | (1.36 | ) | | | (0.58 | ) | | | (1.05 | ) | | | (0.06 | ) |

| | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the year | | | 15.90 | | | | 0.67 | | | | 0.13 | | | | 14.22 | | | | 7.39 | |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 51.41 | | | $ | 35.51 | | | $ | 34.84 | | | $ | 34.71 | | | $ | 20.49 | |

| | | | | | | | | | | | | | | | | | | | |

Total return | | | 52.5 | % | | | 6.2 | % | | | 2.0 | % | | | 77.3 | % | | | 57.2 | % |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | $ | 833,254 | | | $ | 538,492 | | | $ | 539,190 | | | $ | 433,554 | | | $ | 137,210 | |

Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

Expenses | | | 1.50 | % | | | 1.59 | % | | | 1.58 | % | | | 1.68 | % | | | 1.68 | % |

Net investment income (loss) | | | (0.51 | )% | | | (0.97 | )% | | | (1.11 | )% | | | (0.77 | )% | | | (0.61 | )% |

Portfolio turnover rate | | | 30 | % | | | 27 | % | | | 24 | % | | | 40 | % | | | 72 | % |

| (1) | As described in Note 4 to the financial statements , during the year ended October 31, 2004, the Fund incurred certain losses as a result of a pricing error. The Investment Adviser reimbursed the Fund for the amount of the loss which had a per share impact of $0.004. |

| (2) | Total from investment operations per share includes redemption fees of $0.06, $0.02, $0.09, $0.05 and $0.09 per share for the years ended October 31, 2006, 2005, 2004, 2003 and 2002, respectively. |

The accompanying notes are an integral part of these financial statements.

The Tocqueville Fund

Schedule of Investments as of October 31, 2006

| | | | | |

| Common Stocks—90.4% | | Shares | | Value |

Aerospace & Defense—1.1% | | | | | |

Boeing Co. | | 50,000 | | $ | 3,993,000 |

Ladish, Inc.(a) | | 9,000 | | | 280,980 |

| | | | | | 4,273,980 |

Airlines—0.8% | | | | | |

SkyWest, Inc. | | 112,000 | | | 2,985,920 |

Automobiles—0.8% | | | | | |

Tata Motors Ltd. ADR(b) | | 170,000 | | | 3,090,600 |

Beverages—2.7% | | | | | |

Anheuser-Busch Companies, Inc. | | 90,000 | | | 4,267,800 |

The Coca-Cola Co. | | 100,000 | | | 4,672,000 |

Koninklijke Grolsch N.V.(b) | | 41,500 | | | 1,483,070 |

| | | | | | 10,422,870 |

Biotechnology—1.2% | | | | | |

Kendle International, Inc.(a) | | 7,000 | | | 242,340 |

Pharmion Corp.(a) | | 190,000 | | | 4,645,500 |

| | | | | | 4,887,840 |

Building Products—0.2% | | | | | |

Masco Corp. | | 30,000 | | | 829,500 |

Capital Markets—0.9% | | | | | |

The Bank of New York Co., Inc. | | 100,000 | | | 3,437,000 |

Chemicals—2.6% | | | | | |

EI Du Pont de Nemours & Co. | | 150,000 | | | 6,870,000 |

W.R. Grace & Co.(a) | | 250,000 | | | 3,350,000 |

| | | | | | 10,220,000 |

Commercial Banks—4.3% | | | | | |

East West Bancorp, Inc. | | 50,000 | | | 1,825,500 |

First Midwest Bancorp Inc/IL | | 41,200 | | | 1,566,836 |

HSBC Holdings PLC ADR(b) | | 24,538 | | | 2,342,642 |

M&T Bank Corp. | | 10,000 | | | 1,218,100 |

Marshall & Ilsley Corp. | | 35,000 | | | 1,677,900 |

Mitsubishi Ufj Financial Group, Inc. ADR(b) | | 519,000 | | | 6,617,250 |

Wilmington Trust Corp. | | 40,000 | | | 1,663,200 |

| | | | | | 16,911,428 |

Commercial Physical And Biological Research—0.1% | | | |

Essex Corp.(a) | | 13,000 | | | 255,840 |

Commercial Services & Supplies—2.8% | | | |

Avery Dennison Corp. | | 70,000 | | | 4,419,800 |

DeVry, Inc.(a) | | 115,000 | | | 2,800,250 |

Pico Holdings, Inc.(a) | | 9,500 | | | 307,135 |

Steelcase, Inc. | | 214,000 | | | 3,545,980 |

| | | | | | 11,073,165 |

Communications Equipment—5.6% | | | |

Cisco Systems, Inc.(a) | | 475,000 | | | 11,461,750 |

Juniper Networks, Inc.(a) | | 200,000 | | | 3,444,000 |

| | | | | |

| Common Stocks (continued) | | Shares | | Value |

Nokia Oyj ADR(b) | | 250,000 | | $ | 4,970,000 |

Nortel Networks Corp.(a)(b) | | 1,000,000 | | | 2,230,000 |

| | | | | | 22,105,750 |

Computers & Peripherals—1.7% | | | | | |

Apple Computer, Inc.(a) | | 2,000 | | | 162,160 |

Dell, Inc.(a) | | 155,000 | | | 3,771,150 |

EMC Corp.(a) | | 200,000 | | | 2,450,000 |

Key Tronics Corp.(a) | | 50,562 | | | 291,237 |

| | | | | | 6,674,547 |

Construction & Engineering—0.6% | | | |

Chicago Bridge & Iron Co., N.V. ADR(b) | | 100,000 | | | 2,456,000 |

Construction Materials—0.9% | | | | | |

Cemex S.A. de C.V. ADR(a)(b) | | 112,832 | | | 3,468,456 |

Containers & Packaging—0.7% | | | | | |

Sonoco Products Co. | | 75,000 | | | 2,661,000 |

Discount—0.0% | | | | | |

Home Depot, Inc. | | 4,000 | | | 149,320 |

Diversified Financial Services—1.2% | | | |

Citigroup, Inc. | | 90,000 | | | 4,514,400 |

Diversified Telecommunication

Services—4.1% | | | |

Alaska Communications Systems Group, Inc. | | 421,000 | | | 6,058,190 |

Chunghwa Telecom Company Ltd. ADR(b) | | 250,000 | | | 4,572,500 |

Verizon Communications, Inc. | | 150,000 | | | 5,550,000 |

| | | | | | 16,180,690 |

Electric Utilities—2.6% | | | | | |

FPL Group, Inc. | | 150,000 | | | 7,650,000 |

Korea Electric Power Corp. ADR(b) | | 120,000 | | | 2,373,600 |

| | | | | | 10,023,600 |

Electrical Appliances, Television And Radio Sets—0.8% | | | |

Samsung Electronics Co., Ltd. GDR(b) | | 9,300 | | | 3,015,442 |

Electrical Equipment—0.1% | | | | | |

The Lamson & Sessions Co.(a) | | 3,000 | | | 65,640 |

Regal-Beloit Corp. | | 5,500 | | | 271,975 |

| | | | | | 337,615 |

Electronic Equipment & Instruments—0.5% | | | |

Itron, Inc.(a) | | 3,000 | | | 163,320 |

Molex, Inc. | | 50,000 | | | 1,745,000 |

| | | | | | 1,908,320 |

Energy Equipment & Services—2.1% | | | |

Schlumberger Ltd. | | 128,500 | | | 8,105,780 |

The accompanying notes are an integral part of these financial statements.

The Tocqueville Fund

Schedule of Investments as of October 31, 2006

| | | | | |

| Common Stocks (continued) | | Shares | | Value |

Food & Staples Retailing—1.7% | | | | | |

Sysco Corp. | | 50,000 | | $ | 1,749,000 |

Wal-Mart Stores, Inc. | | 100,000 | | | 4,928,000 |

| | | | | | 6,677,000 |

Food Products—1.8% | | | | | |

China Green Holdings Ltd.(b) | | 402,000 | | | 175,227 |

Sara Lee Corp. | | 200,000 | | | 3,420,000 |

Unilever NV ADR(b) | | 150,000 | | | 3,630,000 |

| | | | | | 7,225,227 |

Health Care Equipment & Supplies—2.2% | | | |

Boston Scientific Corp.(a) | | 100,000 | | | 1,591,000 |

Medtronic, Inc. | | 40,000 | | | 1,947,200 |

Stryker Corp. | | 32,500 | | | 1,699,425 |

Thoratec Corp.(a) | | 220,000 | | | 3,465,000 |

| | | | | | 8,702,625 |

Health Care Providers & Services—1.1% | | | |

Aetna, Inc. | | 75,000 | | | 3,091,500 |

UnitedHealth Group, Inc. | | 25,000 | | | 1,219,500 |

| | | | | | 4,311,000 |

Household Durables—0.2% | | | | | |

Leggett & Platt, Inc. | | 40,000 | | | 934,000 |

Household Products—0.4% | | | |

Colgate-Palmolive Co. | | 15,000 | | | 959,550 |

Kimberly-Clark Corp. | | 12,000 | | | 798,240 |

| | | | | | 1,757,790 |

Industrial Conglomerates—3.6% | | | | | |

3M Co. | | 55,000 | | | 4,336,200 |

General Electric Co. | | 175,000 | | | 6,144,250 |

Tyco International Ltd.(b) | | 125,000 | | | 3,678,750 |

| | | | | | 14,159,200 |

Insurance—5.2% | | | |

The Allstate Corp. | | 50,000 | | | 3,068,000 |

American International Group, Inc. | | 100,000 | | | 6,717,000 |

Conseco, Inc.(a) | | 250,000 | | | 5,085,000 |

Hannover Rueckverscherung AG(a)(b) | | 60,000 | | | 2,546,234 |

IPC Holdings Ltd.(b) | | 100,000 | | | 3,004,000 |

| | | | | | 20,420,234 |

Internet Software & Services—1.6% | | | |

webMethods, Inc.(a) | | 310,000 | | | 2,331,200 |

Yahoo!, Inc.(a) | | 150,000 | | | 3,951,000 |

| | | | | | 6,282,200 |

IT Services—0.4% | | | |

Automatic Data Processing, Inc. | | 35,000 | | | 1,730,400 |

Machinery—2.6% | | | |

Cummins, Inc. | | 2,500 | | | 317,450 |

Illinois Tool Works, Inc. | | 40,000 | | | 1,917,200 |

| | | | | |

| Common Stocks (continued) | | Shares | | Value |

The Manitowoc Co., Inc. | | 81,000 | | $ | 4,445,280 |

Parker Hannifin Corp. | | 40,000 | | | 3,345,200 |

| | | | | | 10,025,130 |

Media—3.0% | | | |

Clear Channel Communications, Inc. | | 115,000 | | | 4,007,750 |

Dow Jones & Co, Inc. | | 140,000 | | | 4,912,600 |

Getty Images, Inc.(a) | | 30,000 | | | 1,299,300 |

John Wiley & Sons, Inc. | | 44,000 | | | 1,553,200 |

| | | | | | 11,772,850 |

Metals & Mining—4.7% | | | |

Alcoa, Inc. | | 225,000 | | | 6,504,750 |

Allegheny Technologies, Inc. | | 3,500 | | | 275,555 |

AM Castle & Co. | | 6,000 | | | 200,640 |

Cleveland-Cliffs, Inc. | | 113,500 | | | 4,799,915 |

Newmont Mining Corp. | | 150,000 | | | 6,790,500 |

| | | | | | 18,571,360 |

Multiline Retail—0.0% | | | |

Conn’s, Inc.(a) | | 7,000 | | | 168,140 |

Multi-Utilities & Unregulated Power—0.4% | | | |

Suez SA(b) | | 31,500 | | | 1,409,542 |

National Commercial Banks—0.2% | | | |

Hang Seng Bank Ltd. ADR(b) | | 75,000 | | | 955,305 |

Oil & Gas—3.3% | | | |

Murphy Oil Corp. | | 230,000 | | | 10,846,800 |

Total SA ADR(b) | | 30,000 | | | 2,044,200 |

Valero Energy Corp. | | 3,500 | | | 183,155 |

| | | | | | 13,074,155 |

Oil Drilling, Equipment & Services—1.2% | | | |

Devon Energy Corp. | | 71,880 | | | 4,804,459 |

Paper & Forest Products—1.9% | | | |

Weyerhaeuser Co. | | 114,500 | | | 7,281,055 |

Personal Products—0.2% | | | |

Avon Products, Inc. | | 30,000 | | | 912,300 |

Pharmaceuticals—4.5% | | | |

Bristol-Myers Squibb Co. | | 200,000 | | | 4,950,000 |

Johnson & Johnson | | 40,000 | | | 2,696,000 |

King Pharmaceuticals, Inc.(a) | | 19,500 | | | 326,235 |

Novartis AG ADR(b) | | 30,000 | | | 1,821,900 |

Pfizer, Inc. | | 260,000 | | | 6,929,000 |

Sepracor, Inc.(a) | | 20,000 | | | 1,035,200 |

| | | | | | 17,758,335 |

Prepackaged Software—0.8% | | | |

Bio-key International, Inc.(a)(c)(e)(f) | | 47,090 | | | — |

Bio-key International, Inc.(a) | | 32,783 | | | 15,736 |

Indus International, Inc.(a) | | 785,000 | | | 2,928,050 |

| | | | | | 2,943,786 |

The accompanying notes are an integral part of these financial statements.

The Tocqueville Fund

Schedule of Investments as of October 31, 2006

| | | | | | |

| Common Stocks (continued) | | Shares | | Value |

Real Estate Investment Trust—0.8% | | | |

General Growth Properties, Inc. | | | 60,000 | | $ | 3,114,000 |

Semiconductor & Semiconductor Equipment—4.5% | | | |

Applied Materials, Inc. | | | 289,000 | | | 5,025,710 |

Intel Corp. | | | 417,250 | | | 8,904,115 |

Nvidia Corp.(a) | | | 7,000 | | | 244,090 |

Standard Microsystems Corp.(a) | | | 9,000 | | | 277,470 |

Ultratech, Inc.(a) | | | 220,000 | | | 3,143,800 |

| | | | | | | 17,595,185 |

Semiconductor Equipment & Products—0.0% | | | |

Vitesse Semiconductor Corp.(a) | | | 480 | | | 562 |

Software—5.0% | | | |

Activision, Inc.(a) | | | 185,000 | | | 2,852,700 |

Electronic Arts, Inc.(a) | | | 17,500 | | | 925,575 |

Mentor Graphics Corp.(a) | | | 150,000 | | | 2,530,500 |

Microsoft Corp. | | | 348,000 | | | 9,991,080 |

Oracle Corp.(a) | | | 175,000 | | | 3,232,250 |

| | | | | | | 19,532,105 |

Specialty Retail—0.4% | | | |

Borders Group, Inc. | | | 70,000 | | | 1,441,300 |

Water Supply—0.2% | | | |

Purecycle Corp.(a) | | | 100,000 | | | 807,500 |

Wireless Telecommunication Services—0.1% | | | |

America Movil S.A. de C.V. ADR(b) | | | 8,000 | | | 342,960 |

Total Common Stocks (Cost $282,549,955) | | | 354,698,768 |

Exchange Traded Funds—2.5% | | | |

SPDR Trust Series 1 | | | 200,000 | | | 6,660,000 |

StreetTRACKS Gold Trust(a) | | | 50,000 | | | 3,012,000 |

Total Exchange Traded Funds

(Cost $8,885,640) | | | 9,672,000 |

Preferred Stock—0.2% | | | |

Biotechnology—0.2% | | | |

Zymequest, Inc.(a)(c)(e)(f) | | | 400,000 | | | 960,000 |

Total Preferred Stock (Cost $960,000) | | | 960,000 |

Warrants—0.0% | | | |

Bio-key Warrants , $1.35 strike price, expires 4/14/09(a)(e) | | | 262,500 | | | — |

Raytheon Co. Warrants, $37.50 strike price, expires 6/16/11(a) | | | 1,581 | | | 24,854 |

Total Warrants (Cost $0) | | | | | | 24,854 |

| U.S. Government Agency Bonds—1.0% | |

| Principal

Amount | | | |

Freddie Mac, 3.70%, 8/25/09(d) | | $ | 2,000,000 | | $ | 1,977,576 |

Freddie Mac, 3.90%, 8/27/09(d) | | | 2,000,000 | | | 1,974,214 |

Total U.S. Government Agency Bonds

(Cost $4,045,571) | | | 3,951,790 |

| | | | | | | |

Short-Term Investments—6.6% | | Principal

Amount | | Value | |

Repurchase Agreement—2.6% | | | | |

Repurchase Agreement with U.S. Bank, N.A., 5.00%, dated 10/31/06, due 11/1/06, collateralized by a Freddie Mac 15-Year Fixed (Pool # 1491) valued at $10,250,607. Repurchase proceeds of $10,050,396

(Cost $10,049,000) | | $ | 10,049,000 | | $ | 10,049,000 | |

U.S. Treasury Bills—4.0% | | | | |

4.780%, due 11/02/06 | | | 1,000,000 | | | 999,867 | |

4.815%, due 12/07/06 | | | 1,000,000 | | | 995,050 | |

4.915%, due 12/14/06 | | | 1,000,000 | | | 994,063 | |

4.150%, due 12/28/06 | | | 3,000,000 | | | 2,976,084 | |

4.820%, due 1/18/07 | | | 3,000,000 | | | 2,968,020 | |

4.975%, due 2/01/07 | | | 1,000,000 | | | 987,388 | |

4.820%, due 2/15/07 | | | 3,000,000 | | | 2,956,521 | |

4.820%, due 3/15/07 | | | 3,000,000 | | | 2,945,082 | |

Total U.S. Treasury Bills (Cost $15,824,059) | | | 15,822,075 | |

Total Short-Term Investments

(Cost $25,873,059) | | | 25,871,075 | |

Total Investments

(Cost $322,314,225)—100.7% | | | 395,178,487 | |

Liabilities in Excess of Other Assets—(0.7)% | | | (2,683,538 | ) |

Total Net Assets—100.0% | | | | | $ | 392,494,949 | |

| | | | | | | |

Percentages are stated as a percent of net assets.

ADR—American Depository Receipt

GDR—Gobal Depository Receipt

| (a) | Non-income producing security. |

| (b) | Foreign issued security. Foreign concentration was as follows: Bermuda 1.7%; Canada 0.6%; Finland 1.3%; France 0.9%; Germany 0.6%; Hong Kong 0.3%; India 0.8%; Japan 1.7%; Mexico 1.0%; Netherlands 1.9%; South Korea 1.4%; Switzerland 0.5%; Taiwan 1.2%; United Kingdom 0.6%. |

| (c) | Denotes security is fully or partially restricted as to resale. The aggregate value of restricted securities at October 31, 2006 was $960,000 which represented 0.2% of net assets. |

| (d) | Security is a “step-up” bond where the coupon rate increases or steps up at a predetermined rate. Rate shown reflects the original rate. |

| (e) | Fair valued security. The aggregate value of fair valued securities at October 31, 2006 was $960,000 which represents 0.2% of net assets. |

| (f) | Security is considered illiquid and may be difficult to sell. |

The accompanying notes are an integral part of these financial statements.

The Tocqueville Small Cap Value Fund

Schedule of Investments as of October 31, 2006

| | | | | |

| Common Stocks—99.3% | | Shares | | Value |

Aerospace & Defense—1.2% | | | | | |

Cubic Corp. | | 30,000 | | $ | 627,300 |

Biotechnology—3.0% | | | | | |

Pharmion Corp.(a) | | 65,000 | | | 1,589,250 |

Chemicals—17.2% | | | | | |

A. Schulman, Inc. | | 65,000 | | | 1,573,650 |

Arch Chemicals, Inc. | | 39,000 | | | 1,304,940 |

Cambrex Corp. | | 35,000 | | | 819,000 |

Hercules, Inc.(a) | | 115,200 | | | 2,096,640 |

Olin Corp. | | 70,000 | | | 1,211,000 |

Sensient Technologies Corp. | | 90,000 | | | 2,074,500 |

| | | | | | 9,079,730 |

Commercial Services & Supplies—3.9% | | | |

ABM Industries, Inc. | | 85,000 | | | 1,688,100 |

Educate, Inc.(a) | | 50,000 | | | 382,500 |

| | | | | | 2,070,600 |

Communications Equipment—9.5% | | | |

3Com Corp.(a) | | 400,000 | | | 1,944,000 |

Plantronics, Inc. | | 40,800 | | | 861,288 |

Powerwave Technologies, Inc.(a) | | 180,000 | | | 1,171,800 |

Westell Technologies, Inc.(a) | | 420,000 | | | 1,008,000 |

| | | | | | 4,985,088 |

Computers & Peripherals—2.2% | | | |

Intermec, Inc.(a) | | 50,500 | | | 1,141,300 |

Electrical Equipment—7.1% | | | |

Baldor Electric Co. | | 50,000 | | | 1,604,000 |

Power-One, Inc.(a) | | 170,200 | | | 1,164,168 |

Vicor Corp. | | 82,200 | | | 978,180 |

| | | | | | 3,746,348 |

Electronic Equipment & Instruments—0.7% | | | |

Avnet, Inc.(a) | | 10,000 | | | 236,800 |

Keithley Instruments, Inc. | | 10,000 | | | 136,000 |

| | | | | | 372,800 |

Energy Equipment & Services—5.3% | | | |

Global Industries Ltd.(a) | | 80,000 | | | 1,328,000 |

Input/Output, Inc.(a) | | 130,000 | | | 1,457,300 |

| | | | | | 2,785,300 |

Food Products—2.0% | | | |

Del Monte Foods Co. | | 100,000 | | | 1,079,000 |

Health Care Equipment & Supplies—5.7% | | | |

Datascope Corp. | | 35,000 | | | 1,255,450 |

Wright Medical Group, Inc.(a) | | 70,000 | | | 1,729,700 |

| | | | | | 2,985,150 |

Health Care Providers & Services—4.3% | | | |

Bioscrip, Inc.(a) | | 40,000 | | | 97,600 |

Dendrite International, Inc.(a) | | 210,000 | | | 2,194,500 |

| | | | | | 2,292,100 |

| | | | | | | |

| Common Stocks (continued) | | Shares | | Value | |

Hotels Restaurants & Leisure—2.9% | | | | |

Bob Evans Farms, Inc. | | | 45,000 | | $ | 1,525,950 | |

Internet & Catalog Retail—1.9% | | | | |

Insight Enterprises, Inc.(a) | | | 46,000 | | | 988,540 | |

IT Services—8.6% | | | | |

Ceridian Corp.(a) | | | 75,000 | | | 1,767,750 | |

Computer Horizons Corp.(a) | | | 180,000 | | | 806,400 | |

Convergys Corp.(a) | | | 70,000 | | | 1,484,700 | |

Keane, Inc.(a) | | | 40,000 | | | 463,600 | |

| | | | | | | 4,522,450 | |

Leisure Equipment & Products—2.5% | | | | |

Leapfrog Enterprises, Inc.(a) | | | 135,000 | | | 1,301,400 | |

Machinery—1.9% | | | | |

Federal Signal Corp. | | | 65,000 | | | 991,900 | |

Orthopedic, Prosthetic, And Surgical Appliances And Supplies—0.6% | | | | |

Synovis Life Technologies, Inc.(a) | | | 42,000 | | | 309,960 | |

Pharmaceuticals—4.2% | | | | |

Perrigo Co. | | | 80,000 | | | 1,431,200 | |

Salix Pharmaceuticals, Ltd.(a) | | | 60,000 | | | 799,800 | |

| | | | | | | 2,231,000 | |

Semiconductor & Semiconductor Equipment—2.7% | | | | |

FEI Co.(a) | | | 30,000 | | | 685,800 | |

International Rectifier Corp.(a) | | | 20,000 | | | 719,400 | |

| | | | | | | 1,405,200 | |

Software—11.9% | | | | |

Agile Software Corp.(a) | | | 360,000 | | | 2,426,400 | |

Informatica Corp.(a) | | | 175,000 | | | 2,168,250 | |

Mentor Graphics Corp.(a) | | | 100,000 | | | 1,687,000 | |

| | | | | | | 6,281,650 | |

Total Common Stocks (Cost $44,609,466) | | | 52,312,016 | |

| Short-Term Investments—0.8% | |

| Principal

Amount | | | | |

Repurchase Agreement with U.S. Bank, N.A., 5.00%, dated 10/31/06, due 11/1/06, collateralized by a Fannie Mae 15-Year Fixed

(Pool # 5616) valued at $460,101. Repurchase proceeds of $451,063 (Cost $451,000) | | $ | 451,000 | | | 451,000 | |

Total Short-Term Investments

(Cost $451,000) | | | 451,000 | |

Total Investments

(Cost $45,060,466)—100.1% | | | 52,763,016 | |

Liabilities in Excess of Other Assets—(0.1)% | | | (61,973 | ) |

Total Net Assets—100.0% | | | | | $ | 52,701,043 | |

| | | | | | | |

Percentages are stated as a percent of net assets.

The accompanying notes are an integral part of these financial statements.

The Tocqueville International Value Fund

Schedule of Investments as of October 31, 2006

| | | | | |

| Common Stocks—87.0% | | Shares | | Value |

Belgium—1.0% | | | |

Umicore | | 14,000 | | $ | 2,172,787 |

Canada—2.0% | | | |

Alcan, Inc. | | 96,208 | | | 4,531,341 |

Finland—5.4% | | | |

Nokia Oyj ADR | | 290,000 | | | 5,765,200 |

UPM-Kymmene Oyj | | 256,700 | | | 6,516,526 |

| | | | | | 12,281,726 |

France—7.2% | | | |

M6 Metropole Television | | 190,000 | | | 5,883,013 |

Sanofi-Aventis | | 65,000 | | | 5,525,137 |

Vivendi SA | | 125,000 | | | 4,733,507 |

| | | | | | 16,141,657 |

Germany—0.6% | | | |

Siemens AG | | 14,000 | | | 1,254,534 |

Greece—1.2% | | | |

Titan Cement Co., SA | | 50,000 | | | 2,624,089 |

Hong Kong—0.4% | | | |

Gold Peak Industries Holding Ltd. | | 6,926,700 | | | 899,548 |

Indonesia—1.3% | | | |

PT Tempo Scan Pacific Tbk | | 34,380,000 | | | 2,980,543 |

Italy—5.9% | | | |

Ansaldo STS SpA(a) | | 40,575 | | | 424,647 |

Benetton Group SpA | | 288,064 | | | 5,456,050 |

Interpump SpA | | 508,300 | | | 4,499,062 |

Sogefi SpA | | 409,500 | | | 2,801,394 |

| | | | | | 13,181,153 |

Japan—23.6% | | | |

Aderans Company Ltd. | | 183,000 | | | 4,240,349 |

Amano Corp. | | 330,000 | | | 4,441,195 |

Capcom Co., Ltd. | | 130,000 | | | 2,384,250 |

Fuji Photo Film Co., Ltd. | | 160,000 | | | 5,937,326 |

Matsushita Electric Industrial Co., Ltd. ADR | | 200,000 | | | 4,160,000 |

Mitsubishi Tokyo Financial Group, Inc. ADR | | 356,000 | | | 4,539,000 |

Nintendo Co., Ltd. | | 20,000 | | | 4,090,462 |

Nippon Tv Network | | 25,000 | | | 3,219,187 |

Omron Corp. | | 220,000 | | | 5,680,818 |

Secom Co., Ltd. | | 77,000 | | | 3,851,481 |

Square Enix Co., Ltd. | | 150,000 | | | 3,757,856 |

Tecmo Ltd. | | 443,100 | | | 3,368,098 |

Tokyo Broadcasting System, Inc. | | 150,000 | | | 3,450,045 |

| | | | | | 53,120,067 |

Malaysia—1.3% | | | |

KLCC Property Holdings Berhad | | 4,700,000 | | | 3,011,088 |

| | | | | |

| Common Stocks (continued) | | Shares | | Value |

Mexico—2.2% | | | |

Cemex S.A. de C.V. ADR | | 161,032 | | $ | 4,950,124 |

Netherlands—6.2% | | | |

CSM NV | | 150,000 | | | 5,213,080 |

Nutreco Holding NV | | 50,601 | | | 3,015,355 |

Unilever NV ADR | | 240,000 | | | 5,808,000 |

| | | | | | 14,036,435 |

Singapore—1.4% | | | |

Gp Industries | | 9,775,949 | | | 3,265,348 |

South Korea—6.3% | | | |

Halla Climate Control | | 385,000 | | | 4,453,701 |

Kook Soon Dang Brewery Co., Ltd. | | 275,000 | | | 1,803,662 |

Pulmuone Co., Ltd. | | 60,190 | | | 2,008,995 |

Samsung Electronics Co., Ltd. | | 12,000 | | | 5,820,111 |

| | | | | | 14,086,469 |

Switzerland—4.9% | | | |

Ciba Specialty Chemicals AG | | 100,800 | | | 6,170,105 |

Kudelski SA | | 156,000 | | | 4,808,971 |

| | | | | | 10,979,076 |

Taiwan—6.5% | | | |

AU Optronics Corp. ADR ADR | | 314,768 | | | 4,274,549 |

Chunghwa Telecom Co., Ltd. ADR | | 326,400 | | | 5,969,856 |

Merrill Taiwan Secom Co., Ltd. | | 2,859,977 | | | 4,505,608 |

| | | | | | 14,750,013 |

Thailand—2.3% | | | |

BEC World Pcl | | 10,287,200 | | | 5,103,292 |

United Kingdom—5.3% | | | |

British Energy Group(a) | | 175,000 | | | 1,403,726 |

Bodycote International | | 1,041,250 | | | 4,881,201 |

GlaxoSmithKline Plc ADR | | 107,100 | | | 5,703,075 |

| | | | | | 11,988,002 |

United States—2.0% | | | |

Freeport-McMoRan Copper & Gold, Inc. | | 76,200 | | | 4,608,576 |

Total Common Stocks (Cost $151,001,481) | | | 195,965,868 |

Warrants—0.9% | | | |

Pihsiang Machinery Warrants, $0.00 strike price, expires 12/10/09(a) | | 975,000 | | | 2,078,700 |

Total Warrants (Cost $1,912,432) | | | 2,078,700 |

The accompanying notes are an integral part of these financial statements.

The Tocqueville International Value Fund

Schedule of Investments as of October 31, 2006

| | | | | |

| Short-Term Investments—7.1% | | Shares | | Value |

Variable Rate Demand Notes—7.1% | | | |

JP Morgan Chase Demand Deposits, 2.00% | | 15,866,825 | | $ | 15,866,825 |

Total Short-Term Investments

(Cost $15,866,825) | | | 15,866,825 |

Total Investments

(Cost $168,780,738)—95.0% | | | 213,911,393 |

Other Assets in Excess of Liabilities—5.0% | | | 11,322,513 |

Total Net Assets—100.0% | | | | $ | 225,233,906 |

| | | | | |

Percentages are stated as a percent of net assets.

ADR—American Depository Receipt

| (a) | Non-income producing security. |

The accompanying notes are an integral part of these financial statements.

The Tocqueville Gold Fund

Schedule of Investments as of October 31, 2006

| | | | | |

| Common Stocks—89.0% | | Shares | | Value |

Gold & Gold Related—76.5% | | | | | |

Agnico-Eagle Mines Ltd.(b) | | 502,000 | | $ | 18,558,940 |

Alamos Gold, Inc.(a)(b) | | 2,615,100 | | | 21,098,719 |

Almaden Minerals Ltd.(a)(b) | | 800,000 | | | 1,959,126 |

Anatolia Minerals Development(a)(b) | | 350,000 | | | 997,373 |

Apollo Gold Corp.(a)(b) | | 733,000 | | | 267,626 |

Aquiline Resources, Inc.(a)(b) | | 1,333,333 | | | 5,639,905 |

Aurelian Resources, Inc.(a)(b) | | 189,000 | | | 6,345,162 |

Aurizon Mines Ltd.(a)(b) | | 600,000 | | | 1,656,352 |

Banro Corp.(a)(b) | | 631,400 | | | 7,961,729 |

Barrick Gold Corp.(b) | | 51,562 | | | 1,595,600 |

Barrick Gold Corp. | | 592,053 | | | 18,353,643 |

Cambior, Inc.(a)(b) | | 1,000,000 | | | 3,550,000 |

Chesapeake Gold Corp.(a)(b) | | 339,000 | | | 1,766,018 |

Cia de Minas Buenaventura SA ADR(b) | | 613,800 | | | 15,866,730 |

Cluff Gold Ltd.(a)(b) | | 1,650,000 | | | 1,880,616 |

Crystallex International Corp.(a)(b) | | 2,555,600 | | | 7,104,568 |

Dominion Mining Ltd.(a)(b) | | 1,428,571 | | | 1,670,378 |

Eldorado Gold Corp.(a)(b) | | 1,000,000 | | | 4,247,740 |

FNX Mining Co, Inc.(a)(b) | | 300,000 | | | 4,140,879 |

Fury Explorations Ltd.(a)(b) | | 1,500,000 | | | 801,460 |

Gabriel Resources Ltd.(a)(b) | | 3,300,000 | | | 13,459,192 |

Gammon Lake Resources, Inc.(a)(b) | | 2,042,100 | | | 26,823,078 |

Gold Fields Ltd.(b) | | 166,249 | | | 2,753,420 |

Gold Fields Ltd. ADR(b) | | 2,111,500 | | | 35,388,740 |

Goldcorp, Inc.(b) | | 1,693,950 | | | 44,517,006 |

Golden Star Resources Ltd.(a) | | 4,059,000 | | | 11,405,790 |

Golden Star Resources Ltd.(a)(b) | | 1,080,000 | | | 2,991,050 |

Harmony Gold Mining Co., Ltd.(b) | | 106,667 | | | 1,617,327 |

Harmony Gold Mining Co., Ltd. ADR(b) | | 784,400 | | | 12,189,576 |

Iamgold Corp.(b) | | 1,485,700 | | | 12,529,123 |

Ivanhoe Mines Ltd.(a)(b) | | 3,892,000 | | | 40,550,692 |

Lihir Gold Ltd.(a)(b) | | 3,325,000 | | | 7,080,439 |

Meridian Gold, Inc.(a) | | 540,200 | | | 13,672,462 |

Meridian Gold, Inc.(a)(b) | | 110,331 | | | 2,777,557 |

Minefinders Corp.(a)(b) | | 663,000 | | | 4,983,054 |

Miramar Mining Corp.(a)(b) | | 4,331,306 | | | 21,006,834 |

New Gold, Inc.(a)(b) | | 516,500 | | | 4,173,320 |

Newcrest Mining Ltd.(b) | | 956,561 | | | 17,665,952 |

Newmont Mining Corp. | | 469,800 | | | 21,267,847 |

Orezone Resources, Inc.(a)(b) | | 6,063,700 | | | 8,693,670 |

Osisko Exploration Ltd.(a)(b) | | 1,155,000 | | | 5,955,252 |

Oxiana Ltd.(a)(b) | | 5,000,000 | | | 12,815,450 |

Pacific Rim Mining Corp.(a)(b) | | 35,000 | | | 29,750 |

Polyus Gold ADR(a)(b) | | 851,616 | | | 40,196,275 |

Premier Gold Mines Ltd.(a)(b) | | 927,500 | | | 726,836 |

Radius Gold, Inc.(a)(b) | | 1,329,544 | | | 438,071 |

| | | | | |

| Common Stocks (continued) | | Shares | | Value |

Randgold Resources Ltd. ADR(a)(b) | | 1,663,200 | | $ | 37,704,744 |

Royal Gold, Inc. | | 247,765 | | | 7,294,202 |

Semafo, Inc.(a)(b) | | 4,900,000 | | | 7,810,677 |

Sino Gold Ltd.(a)(b) | | 2,941,500 | | | 11,160,940 |

SouthernEra Diamonds, Inc.(a)(b) | | 375,000 | | | 130,237 |

Strongbow Exploration, Inc.(a)(b) | | 1,800,000 | | | 721,314 |

Sunridge Gold Corp.(a)(b) | | 500,000 | | | 1,202,191 |

SXR Uranium One, Inc.(a)(b) | | 1,852,500 | | | 20,868,360 |

Troy Resources NL(b) | | 1,463,000 | | | 3,002,106 |

U.S. Gold Corp.(a)(b) | | 223,000 | | | 1,090,227 |

Wesdome Gold Mines Ltd(a)(b) | | 627,250 | | | 916,060 |

Wolfden Resources, Inc.(a)(b) | | 1,325,000 | | | 1,994,078 |

Yamana Gold, Inc.(b) | | 3,541,532 | | | 35,227,670 |

Zijin Mining Group Co., Ltd.(b) | | 30,000,000 | | | 17,435,581 |

| | | | | | 637,728,714 |

Precious Metals & Related—12.5% | | | |

Aber Diamond Corp.(b) | | 100,000 | | | 3,706,000 |

African Platinum Plc(a)(b) | | 15,000,000 | | | 7,224,882 |

Apex Silver Mines Ltd.(a) | | 1,111,800 | | | 17,566,440 |

Brilliant Mining Corp.(a)(b) | | 1,875,000 | | | 1,302,373 |

Cameco Corp.(b) | | 261,000 | | | 9,168,930 |

Impala Platinum Holdings Ltd.(b) | | 80,000 | | | 14,064,144 |

Impala Platinum Holdings Ltd. ADR(b) | | 225,000 | | | 9,867,555 |

Ivanhoe Nickel & Platinum Ltd.(a)(b)(c)(d)(e) | | 83,333 | | | 249,999 |

Mvelaphanda Resources Ltd.(a)(b) | | 350,000 | | | 1,532,326 |

Peru Copper, Inc.(a)(b) | | 1,365,000 | | | 5,214,702 |

Sabina Silver Corp.(a)(b) | | 900,000 | | | 1,041,899 |

Silver Standard Resources, Inc.(a)(b) | | 557,000 | | | 13,702,200 |

Silver Wheaton Corp.(a)(b) | | 1,387,400 | | | 15,295,438 |

Stornoway Diamond Corp.(a)(b) | | 1,950,000 | | | 1,632,308 |

Trade Winds Ventures, Inc.(a)(b) | | 1,100,000 | | | 421,212 |