UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant [

X]

Filed by a party other than the registrant [_]

Check the appropriate box:

[_] Preliminary proxy statement.

[

X] Definitive proxy statement.

[_] Definitive additional materials.

[_] Soliciting material under Rule 14a-12.

[_] Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)).

___________________________________________________________

(Name of Registrant as Specified in Its Charter)

_____________________JOY GLOBAL INC._______________________

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of filing fee (check the appropriate box):

[

X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

____________________________________________________________________________

(2) Aggregate number of securities to which transaction applies:

____________________________________________________________________________

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11

(set forth the amount on which the filing fee is calculated and state how it was determined):

____________________________________________________________________________

(4) Proposed maximum aggregate value of transaction:

____________________________________________________________________________

(5) Total fee paid:

[_] Fee paid previously with preliminary materials:

____________________________________________________________________________

[_] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2)

and identify the filing for which the offsetting fee was paid previously. Identify the

previous filing by registration statement number, or the form or schedule and the date of

its filing.

(1) Amount Previously Paid:

____________________________________________________________________________

(2) Form, Schedule or Registration Statement No.:

____________________________________________________________________________

(3) Filing Party:

____________________________________________________________________________

(4) Date Filed:

____________________________________________________________________________

JOY GLOBAL INC.

Notice of 2002

Annual Meeting of

Stockholders and

Proxy Statement

CONTENTS

JOY GLOBAL INC.

100 East Wisconsin Avenue, Suite 2780

Milwaukee, WI 53202

NOTICE OF ANNUAL MEETING

The annual meeting of stockholders of Joy Global Inc. will be held in the Imperial Ballroom at the Pfister Hotel, 424 East Wisconsin Avenue, Milwaukee, Wisconsin, on Tuesday, February 26, 2002 at 10:00 a.m. for the following purposes:

- To elect seven persons to the corporation's Board of Directors;

- To consider and vote upon a proposal to approve certain provisions of the Joy Global Inc. 2001 Stock Incentive Plan, a copy of which is attached as Annex A to the accompanying proxy statement;

- To consider and vote upon a proposal to approve material terms of the Joy Global Inc. Annual Bonus Compensation Plan; and

- To transact such other business as may properly come before the meeting or any adjournment or postponement of the meeting.

Stockholders of record at the close of business on January 4, 2002 are entitled to receive notice of and to vote at the annual meeting and any adjournment or postponement of the meeting. A list of stockholders entitled to vote will be available at the corporation’s headquarters at least ten days prior to the meeting and may be inspected during usual business hours by any stockholder for any purpose germane to the meeting.

Whether or not you plan to attend the meeting, we urge you to mark, date and sign the enclosed proxy card and return it promptly so that your shares will be voted at the meeting in accordance with your instructions.

| | By order of the Board of Directors, |

| | |

| | |

| | |

| | ERIC B. FONSTAD |

| | Secretary |

January 25, 2002

PLEASE PROMPTLY MARK, DATE, SIGN AND RETURN YOUR

PROXY IN THE ENCLOSED ENVELOPE.

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors of Joy Global Inc., a Delaware corporation, for use at the 2002 annual meeting of stockholders to be held in the Imperial Ballroom at the Pfister Hotel, 424 East Wisconsin Avenue, Milwaukee, Wisconsin, on Tuesday, February 26, 2002 at 10:00 a.m. and at any adjournment or postponement of the annual meeting. The proxy statement, proxy card and annual report are being mailed to stockholders on or about January 25, 2002.

Proxies

Properly signed and dated proxies received by the corporation’s Secretary prior to or at the annual meeting will be voted as instructed on the proxies or, in the absence of such instruction, FOR the election to the Board of Directors of the persons nominated by the Board; FOR the proposals to approve certain provisions of the 2001 Stock Incentive Plan and the material terms of the Annual Bonus Compensation Plan; and in accordance with the best judgment of the persons named in the proxy on any other matters which may properly come before the meeting. Any proxy may be revoked by the person executing it for any reason at any time before the polls close at the meeting by filing with the corporation’s Secretary a written revocation or duly executed form of proxy bearing a later date or by voting in person at the meeting. The Board of Directors has appointed an officer of American Stock Transfer & Trust Company, transfer agent for the corporation, to act as an independent inspector at the annual meeting.

Record Date, Shares Outstanding and Voting

Stockholders of record of the corporation's common stock, $1.00 par value per share (the "Common Stock"), at the close of business on January 4, 2002 (the "Record Date") are entitled to vote on all matters presented at the annual meeting. As of the Record Date, 39,743,681 shares of Common Stock were outstanding and entitled to vote at the annual meeting. Each share is entitled to one vote.

A majority of the shares entitled to vote, represented in person or by proxy, constitutes a quorum. Under the corporation's bylaws, if a quorum is present, the election of directors is decided by plurality vote. The affirmative vote of a majority of the shares represented at the meeting and entitled to vote on the subject matter is required for the adoption of the proposals to approve certain provisions of the 2001 Stock Incentive Plan and the material terms of the Annual Bonus Compensation Plan.

The independent inspector will count the votes. Abstentions are considered as shares represented and entitled to vote; therefore, abstentions are counted for purposes of the quorum determination, will have no effect on the election of directors, but will have the same effect as a vote against the other proposals.

Broker or nominee “non-votes” on a matter will not be considered as shares entitled to vote on that matter and therefore will not be counted by the inspector in calculating the number of shares represented and entitled to vote on that matter. Shares which are the subject to such non-votes are, however, counted toward the quorum requirement.

If less than a majority of the outstanding shares of Common Stock are represented at the meeting, a majority of the shares represented at the meeting may adjourn the meeting from time to time without further notice.

The following table lists the beneficial ownership of Common Stock as of January 4, 2002 by any person known to the corporation to own beneficially more than 5% of its Common Stock, each of the executive officers named in the Summary Compensation Table, and the corporation’s executive officers and directors as a group. Beneficial ownership of these shares consists of sole voting power and sole investment power except as noted below. The beneficial ownership information presented in this proxy statement is not necessarily to be construed as an admission of beneficial ownership for other purposes.

| Name and Address | Shares | Percent |

|---|

| of Beneficial Owner | Owned | of Class |

|---|

| Perkins, Wolf, McDonnell & Company | 4,213,800 (1) | 10.6% |

| 53 W. Jackson Blvd., Suite 722 | | |

| Chicago, Illinois 60604 | | |

| | | |

| John Nils Hanson | 2,500 | less than 1% |

| | | |

| Robert W. Hale | 1,000 | less than 1% |

| | | |

| Wayne F. Hunnell | none | - |

| | | |

| James A. Chokey | 100 | less than 1% |

| | | |

| Dennis R. Winkleman | none | - |

| | | |

| All executive officers and directors | | |

| as a group (12 persons) | 67,600 (2) | less than 1% |

Notes:

(1) Based on information contained in a Schedule 13G filed with the Securities Exchange Commission on December 11, 2001 by Perkins, Wolf, McDonnell & Co. which indicates sole voting and investment power as to 60,700 shares and shared voting and investment power as to 4,153,100 shares.

(2) Includes 60,000 shares non-employee directors have a right to acquire upon exercise of currently exercisable stock options. See “Election of Directors” for information regarding beneficial ownership by each director and nominee for election as a director.

The following table shows certain information (including principal occupation, business experience and beneficial ownership of the corporation’s Common Stock as of January 4, 2002) for each of the individuals nominated by the Board of Directors for election at the 2002 annual meeting. Beneficial ownership of these shares consists of sole voting and investment power except as noted below. All of the current directors other than Mr. Hanson became directors upon the corporation’s reorganization effective July 12, 2001. All of the nominees are presently directors whose terms expire in 2002 and who are nominated to serve terms ending at the annual meeting in 2003. If for any unforeseen reason any of these nominees should not be available for election, the proxies will be voted for such person or persons as may be nominated by the Board of Directors.

| | | Director | Shares |

|---|

| | | Since | Owned |

|---|

| Steven L. Gerard | ..........Chief Executive Officer and a director of Century Business | 2001 | 10,000 (1) |

| Services, Inc., a leading provider of integrated business services and products headquartered in Cleveland, Ohio, since 2000. From 1997 to 2000 Mr. Gerard was Chairman and Chief Executive Officer of Great Point Capital, an operational and financial restructuring firm. From 1992 to 1997 he served as Chairman and Chief Executive Officer of Triangle Wire & Cable, Inc. Mr. Gerard is also a director of Lennar Corporation, Fairchild Corporation and Aviation Sales Company. He is 56. | | |

| | | | |

| John Nils Hanson | ..........Chairman, President and Chief Executive Officer of the | 1996 | 2,500 |

| | corporation since August 2000. Vice Chairman, President and Chief Executive Officer from May 1999 to August 2000. Vice Chairman, President and Chief Operating Officer from 1998 to 1999. President and Chief Operating Officer from 1997 to 1998. Executive Vice President and Chief Operating Officer from 1995 to 1997. President and Chief Executive Officer of Joy Mining Machinery from 1994 to 1995. Mr. Hanson is also a director of Arrow Electronics, Inc. He is 60. | | |

| | | | |

| Ken C. Johnsen | ............Chief Executive Officer, President and a director of Geneva | 2001 | 10,000 (1) |

| | Steel Holdings Corp. Geneva Steel, located 45 miles south of Salt Lake City, Utah, owns and operates the only integrated steel mill in the Western United States and emerged from chapter 11 bankruptcy on January 3, 2001. Prior to joining Geneva Steel in 1991, Mr. Johnsen was a partner with Parr Waddoups Brown Gee & Loveless in Salt Lake City, Utah. He is 43. | | |

| | | | |

| James R. Klauser | ..........Senior Vice President of Wisconsin Energy Corporation, a | 2001 | 10,000 (1) |

| | Milwaukee-based holding company with subsidiaries in utility and non-utility businesses. Prior to joining Wisconsin Energy in 1998, he was a senior partner with the law firm of Dewitt Ross and Stevens in Madison, Wisconsin. From 1986 to 1996 he served as Secretary of the Wisconsin Department of Administration. He was special counsel to the Governor of Wisconsin from 1994 to 1996. He is 62. | | |

| | | | |

| Richard B. Loynd | ..........Chairman of the Executive Committee and former Chairman of the | 2001 | 12,000 (1) |

| | Board and Chief Executive Officer of Furniture Brands International, Inc., the largest home furniture manufacturer in the United States. In 1982 Mr. Loynd and other investors purchased Converse, Inc., the largest U.S. manufacturer of athletic footwear. Converse was sold to INTERCO INCORPORATED in 1986. He became Chairman and Chief Executive Officer of INTERCO and guided it through a successful restructuring. In 1996, following the acquisition of Thomasville Furniture Industries, INTERCO changed its name to Furniture Brands International. Mr. Loynd is also a director of Emerson Electric Company. He is 74. | | |

| | | | |

| P. Eric Siegert (2) | ……Managing Director of Houlihan Lokey Howard & Zukin, | 2001 | 10,000 (1) |

| | an international investment banking firm. Houlihan Lokey acted as financial advisor to the Harnischfeger Creditors Committee during the corporation's reorganization. As Managing Director assigned to Houlihan Lokey's engagement with the Creditors Committee, Mr. Siegert advised the Committee on financial matters. Mr. Siegert is also a director of Alabama River Pulp, Inc. He is 36. | | |

| | | | |

| James H. Tate | .............Senior Vice President and Chief Financial Officer and a | 2001 | 10,000 (1) |

| | director of Thermadyne Holdings Corporation, a global manufacturer of cutting and welding products headquartered in St. Louis, Missouri. On November 19, 2001, Thermadyne announced that it voluntarily filed for reorganization under Chapter 11 in the U.S. Bankruptcy Court for the Eastern District of Missouri. Prior to joining Thermadyne in 1993, Mr. Tate was with Ernst & Young for eighteen years, the last six as an audit partner with Ernst & Young in Dallas. Mr. Tate is also a director of Rowe International, Inc. He is 54. | | |

Notes

(1) Includes 10,000 shares issuable upon the exercise of currently exercisable options.

(2) On December 13, 2001, the Bankruptcy Court approved the payment of fees and expenses totaling $6,214,364 incurred by Houlihan Lokey Howard & Zukin in its role as financial advisor to the Harnischfeger Creditors Committee during the period the corporation operated under Chapter 11 bankruptcy protection (June 8, 1999 to July 12, 2001). The corporation does not expect to incur fees to Houlihan Lokey Howard & Zukin during fiscal year 2002.

Stockholders are being asked to approve the addition of certain limitations to the Joy Global Inc. 2001 Stock Incentive Plan (the "Stock Incentive Plan") that were not included in the Stock Incentive Plan that was deemed approved by the stockholders of the corporation on the effective date of the corporation's reorganization. The new limitations are necessary to preserve the ability of the corporation to deduct compensation under the Stock Incentive Plan as a business expense under Section 162(m) of the Internal Revenue Code.

Specifically, stockholders are being asked to approve limitations that provide that: (i) no participant may be granted stock options or stock appreciation rights covering in excess of 1,000,000 shares of Common Stock in any fiscal year; and (ii) no more than 200,000 shares of Common Stock may be subject to Qualified Performance-Based Awards (as defined in the Stock Incentive Plan) granted to any participant in any fiscal year.

YOUR BOARD OF DIRECTORS RECOMMENDS A VOTE FOR ADOPTION OF PROPOSAL #2 TO APPROVE CERTAIN PROVISIONS OF THE STOCK INCENTIVE PLAN.

Certain features of the Stock Incentive Plan are summarized below. This summary is qualified by reference to the full text of the Stock Incentive Plan attached as Annex A to this proxy statement.

The Stock Incentive Plan is intended to promote the long-term growth and profitability of the corporation and its subsidiaries by providing directors, officers and employees of, or individuals who have accepted an offer of employment with, the corporation and its subsidiaries with incentives to maximize stockholder value and otherwise contribute to the success of the corporation. Grants of incentive or non-qualified stock options, stock appreciation rights, performance awards, or any combination of the foregoing, may be made under the Stock Incentive Plan at the discretion of the Human Resources Committee.

(1) Persons Eligible for Grants. Directors, officers and employees of the corporation and its subsidiaries and affiliates are eligible to participate in the Stock Incentive Plan. Of the approximately 7,200 persons eligible to participate in the Stock Incentive Plan, about 180 have been granted stock options as of the date of this proxy statement. The Stock Incentive Plan is designed to remain in effect for ten years.

(2) Administration. The Stock Incentive Plan is administered by the Human Resources Committee (the "Committee") of the Board of Directors.

(3) Authorized Shares. Subject to adjustments for stock splits, stock dividends, or other changes in corporate capitalization, the Stock Incentive Plan provides that the maximum number of shares of Common Stock that may be delivered to participants under the Stock Incentive Plan is 5,556,000, of which a maximum of 20% of such shares may be allocated to incentive stock options.

As noted above, stockholders are being asked to approve a limitation that provides that no participant may be granted stock options and/or stock appreciation rights covering in excess of 1,000,000 shares of Common Stock in a fiscal year. Shares subject to an award under the Stock Incentive Plan may be either authorized but unissued shares or treasury shares. If any award is forfeited, or if any stock option (and any related stock appreciation right) terminates, expires or lapses without being exercised, or if any stock appreciation right is exercised for cash, shares of Common Stock subject to such awards will again be available for distribution in connection with awards under the Stock Incentive Plan.

(4) Stock Options. Stock options, which may be "incentive stock options" (within the meaning of Section 422 of the Internal Revenue Code) or nonqualified stock options, as designated by the Committee and specified in the option agreement setting forth the terms and provisions of the options, may be granted alone or in addition to other awards granted under the Stock Incentive Plan.

(a) Option Term. The term of each stock option will be fixed by the Committee, but no incentive stock option shall be exercisable more than 10 years after the date it is granted.

(b) Option Price. The exercise price per share of Common Stock purchasable under a stock option will be determined by the Committee, and with respect to incentive stock options, shall not be less than the fair market value of the Common Stock on the date of grant. On January 18, 2002, the closing price of the Common Stock on the Nasdaq National Market was $17.00. Unless otherwise determined by the Committee, it is expected that options under the Stock Incentive Plan will have an exercise price equal to the fair market value of the Common Stock on the date of grant.

(c) Exercise. Except as otherwise provided in the Stock Incentive Plan, stock options will be exercisable at the time or times and subject to the terms and conditions determined by the Committee. With respect to any stock option subject to delayed vesting, the Committee may at any time waive any installment exercise provisions or otherwise accelerate the exercisability of the stock option. A participant exercising an option may pay the exercise price in cash or, if approved by the Committee, with previously acquired shares of Common Stock or a combination of cash and stock. The Committee, in its discretion, may allow the cashless exercise of options through the use of a broker-dealer or for payment of the exercise price by withholding from the shares issuable upon exercise a number of shares having a fair market value on the date of exercise equal to the aggregate exercise price, and may allow for the grant of reload options to optionees who exercise options and pay the exercise price by delivering previously owned shares of stock. Unless otherwise determined by the Committee, a reload option will have the same terms as the option being exercised, except that a reload option will always be a nonqualified stock option, will have an option price equal to the fair market value of the Common Stock on the date the reload option is granted, will expire the same date as the expiration date of the option to which the reload relates, and will vest and become exercisable six months following the date of grant of the reload option. The Committee may also provide for loans to be made by the corporation for the purpose of the exercise of stock options.

The Stock Incentive Plan contains provisions, which apply unless otherwise determined by the Committee, regarding the exercisability of options held by optionees whose employment with the corporation terminates by reason of death, disability, retirement, or otherwise.

The Plan provides that the Committee may elect to cash out all or part of the shares of Common Stock for which a stock option is being exercised by paying the optionee an amount, in cash or Common Stock, equal to the excess of the fair market value of such shares over their aggregate exercise price on the effective date of the cash-out. The Committee may also establish procedures permitting an optionee to elect to defer to a later time the receipt of shares issuable upon the exercise of a stock option and/or to receive cash at such later time in lieu of the deferred shares.

(5) Other Awards.

(a) Stock Appreciation Rights. Stock appreciation rights may be granted in conjunction with all or part of any stock option granted under the Stock Incentive Plan. A stock appreciation right will terminate and will no longer be exercisable upon the termination or exercise of the related stock option. A stock appreciation right may be exercised by an optionee, at the time or times and to the extent the related stock option is exercisable, by surrendering the applicable portion of the related stock option in accordance with procedures established by the Committee. Upon exercise, a stock appreciation right permits the optionee to receive cash, shares of Common Stock, or a combination of cash or stock, as determined by the Committee. The amount of cash or the value of the shares is equal to the excess of the fair market value of a share of Common Stock on the date of exercise over the per share exercise price of the related stock option, multiplied by the number of shares with respect to which the stock appreciation right is exercised.

(b) Performance Units. Performance units may be awarded either alone or in addition to other awards granted under the Stock Incentive Plan. The Committee will determine the eligible individuals to whom and the time or times at which performance units will be awarded, the number of performance units to be awarded to any eligible individual, the duration of the award cycle and any other terms and conditions of the award, in addition to those contained in the Stock Incentive Plan, and each award will be confirmed by and subject to the terms of a performance unit agreement. Performance units may be granted subject to the attainment of performance goals and/or the continued service of the participant. As noted above, stockholders are being asked to approve a limitation that provides that no more than 200,000 shares of Common Stock may be subject to "Qualified Performance-Based Awards" granted to any participant in any fiscal year of the corporation. A Qualified Performance-Based Award is an award of performance units designated as such by the Committee at the time of grant, based upon a determination that (1) the recipient is or may be a "covered employee" within the meaning of Section 162(m)(3) of the Internal Revenue Code in the year in which the corporation would expect to be able to claim a tax deduction in respect to such performance units and (2) the Committee wishes such award to qualify for the exemption from the limitation on deductibility of compensation with respect to any covered employee imposed by Section 162(m) of the Internal Revenue Code.

Except to the extent otherwise provided in the applicable performance unit agreement or the Stock Incentive Plan, all rights to receive cash or stock in settlement of performance units will be forfeited upon a participant's termination of employment for any reason during the award cycle or before any applicable performance goals are satisfied, unless the Committee, in its discretion, waives any or all remaining payment limitations (other than, in the case of performance units that are Qualified Performance-Based Awards, satisfaction of the applicable performance goals unless the participant's employment is terminated by reason of death or disability) with respect to such participant's performance units.

(c) Other Stock-Based Awards. Other awards of Common Stock and other awards that are valued by reference to, or otherwise based upon, Common Stock, including (without limitation) dividend equivalents and convertible debentures, may also be granted under the Stock Incentive Plan, either alone or in conjunction with other awards. The Committee may also grant to a participant receiving an award under the Stock Incentive Plan the right to receive a cash payment in an amount specified by the Committee, to be paid at such time or times (if ever) as the award results in compensation income to the participant, for the purpose of assisting the participant to pay the resulting taxes.

(6) Transferability of options and stock appreciation rights. Options and stock appreciation rights are nontransferable other than by will or the laws of descent and distribution or, at the discretion of the Committee, pursuant to a written beneficiary designation and, in the case of a nonqualified option, as otherwise expressly permitted by the Committee, including pursuant to a gift to members of the holder's immediate family. The gift may be made directly or indirectly or by means of a trust or partnership or otherwise. Stock options and stock appreciation rights may be exercised only by the optionee, any such permitted transferee or a guardian, legal representative or beneficiary.

(7) Change in Control. The Committee may provide in the terms of the grant that, in the event of a change in control (as defined in the Stock Incentive Plan), any option or stock appreciation right that is not then exercisable and vested will become fully exercisable and vested and performance units will be deemed earned and payable in full in cash.

(8) Amendments and Termination. The Stock Incentive Plan will terminate on May 18, 2011, the tenth anniversary of its effective date. The Board of Directors may at any time amend, alter, or discontinue the Stock Incentive Plan, but may not impair the rights of a holder of outstanding awards without the holder's consent, except for an amendment made to comply with applicable law, stock exchange rules or accounting rules. No amendment may be made without the approval of the corporation's stockholders to the extent such approval is required by applicable law or stock exchange rules. The Committee may amend the terms of any outstanding stock option or other award, but no such amendment may cause a Qualified Performance-Based Award to cease to qualify for the Section 162(m) exemption or impair the rights of any holder without the holder's consent, except an amendment made to cause the Stock Incentive Plan or award to comply with applicable law, stock exchange rules or accounting rules. The Committee's authority to modify, amend or adjust the terms and conditions of any award, including but not limited to performance goals, is subject to the condition that the Committee may not adjust upwards the amount payable with respect to a Qualified Performance-Based Award or waive or alter the performance goals associated with it. In the event an award is granted to an individual who is employed outside the United States and who is not compensated from a payroll maintained in the United States, the Committee may, in its sole discretion, modify the provisions of the Stock Incentive Plan as they pertain to such individual to comply with applicable foreign law.

(9) Director Stock Options. Each non-employee director of the corporation is automatically granted 10,000 nonqualified stock options on the first day after his or her first election as a director and 5,000 nonqualified stock options on the day after each annual meeting of stockholders. The option exercise price for such options is the fair market value of the stock on the date of grant.

(10) Federal Income Tax Consequences. The following is a brief summary of the federal income tax rules relevant to participants in the Stock Incentive Plan, based upon the Internal Revenue Code as currently in effect. These rules are highly technical and subject to change in the future. Because federal income tax consequences will vary as a result of individual circumstances, the optionee should consult the optionee's personal tax advisor with regards to the tax consequences of participating in the Stock Incentive Plan. Moreover, the following summary relates only to the optionee's federal income tax treatment, and the state, local and foreign tax consequences may be substantially different.

(a) Options. Stock options granted under the Stock Incentive Plan may be either nonqualified options or incentive options for federal income tax purposes.

(b) Nonqualified Options. Generally, the optionee does not recognize any taxable income at the time of grant of a nonqualified option. Upon the exercise of the nonqualified option, the optionee will recognize ordinary income, subject to wage and employment tax withholding, equal to the excess of the fair market value of the Common Stock acquired on the date of exercise over the exercise price. The corporation will be entitled to a deduction equal to the ordinary income.

The optionee will have a capital gain or loss upon the subsequent sale of the stock in an amount equal to the sale price less the fair market value of the Common Stock on the date of exercise. The capital gain or loss will be long- or short-term depending on whether the stock was held for more than one year after the exercise date. The corporation will not be entitled to a deduction for any capital gain realized. Capital losses on the sale of Common Stock acquired upon an option's exercise may be used to offset capital gains. If capital losses exceed capital gains, then up to $3,000 of the excess losses may be deducted from ordinary income. Remaining capital losses may be carried forward to future tax years.

(c) Incentive Stock Options. Generally, the optionee will not recognize any taxable income at the time of grant or exercise of an option that qualifies as an incentive option under Section 422 of the Internal Revenue Code. However, the excess of the stock's fair market value at the time of exercise over the exercise price will be included in the optionee's alternative minimum taxable income and thereby may cause the optionee to be subject to an alternative minimum tax. The optionee will recognize long-term capital gain or loss, measured by the difference between the stock sale price and the exercise price, when the shares are sold.

In order to qualify for the incentive option tax treatment described in the preceding paragraph, the optionee must be employed by the corporation continuously from the time of the option's grant until three months before the option's exercise, and the optionee must not sell the shares until at least one year after the option's exercise date and two years after its grant date. If the optionee does not satisfy these conditions, the optionee will recognize taxable ordinary income when the optionee sells the shares in an amount equal to the difference between the option exercise price and the lesser of (i) the fair market value of the stock on the exercise date and (ii) the sale price. If the sale price exceeds the fair market value on the exercise date, the excess will be taxable to the optionee as long-term or short-term capital gain, depending on whether the optionee held the stock for more than one year.

In any event, only up to $100,000 worth of shares, determined as of the date of grant, issuable upon exercise of options for the first time during any calendar year is eligible for incentive option tax treatment. Furthermore, different tax rules apply if the optionee holds more than 10% of the corporation's total voting power or if the optionee pays any part of the exercise price with shares of Common Stock acquired upon exercise of an incentive option and not held for the required holding period. The corporation will not be entitled to any deduction by reason of the grant or exercise of the incentive option or the sale of stock received upon exercise after the required holding periods have been satisfied. If the optionee does not satisfy the required holding periods before selling the shares and consequently recognizes ordinary income, the corporation will be allowed a deduction corresponding to the optionee's ordinary income.

(d) Transfer of Option to Family Member. The Stock Incentive Plan permits transfers of non-qualified options to participants' children and immediate family members, although incentive options are not allowed to be transferred to family members other than by will or the laws of descent and distribution. The optionee will not recognize taxable income if the optionee transfers a non-qualified option to a member of the optionee's family. However, when the transferee of the option exercises the option, the optionee will recognize ordinary income, subject to wage and employment tax withholding, equal to the excess of the fair market value of the Common Stock acquired by the transferee of the option on the date of exercise over the exercise price. The corporation will be entitled to a deduction equal to the ordinary income. The transferee of the option will have a capital gain or loss upon a subsequent sale of the stock in an amount equal to the sale price less the fair market value of the stock on the date the option was exercised. Any capital gain recognized by the transferee will be long-term capital gain if the transferee has held the stock for more than one year after the exercise date.

For gift tax purposes, the transfer of the option constitutes a completed gift on the date the optionee transfers the option if the transfer is irrevocable and the stock that would be received on exercise would not be subject to restrictions. Otherwise, the transfer of the option will not constitute a completed gift until the first date that both of these conditions are satisfied. For estate tax purposes, a transferred option is not included in the optionee's estate unless, on the date of the optionee's death, the transfer is not irrevocable or the stock that would be received on exercise would be subject to restrictions.

(e) Stock Appreciation Rights. The optionee will be subject to ordinary income tax, and wage and employment tax withholding, upon the exercise of a stock appreciation right, or SAR. Upon the exercise of an SAR, the optionee will recognize ordinary income equal to the excess of the fair market value of the Common Stock on the exercise date over the option exercise price. The corporation will be entitled to a corresponding deduction equal to the amount of ordinary income that the optionee recognizes. Upon the sale of Common Stock acquired upon exercise of an SAR, the optionee will recognize long- or short-term capital gain or loss, depending on whether the optionee has held the stock for more than one year from the date of exercise.

(f) Performance Awards. The optionee will not recognize taxable income at the time performance awards are granted, but the optionee will recognize ordinary income, and be subject to wage and employment tax withholding, upon the receipt of Common Stock or cash awards at the end of the applicable award cycle. The corporation will be entitled to claim a corresponding deduction.

(g) Withholding Taxes. Because the amount of ordinary income the optionee recognizes with respect to the receipt or exercise of an award may be treated as compensation that is subject to applicable withholding of federal, state and local income taxes and Social Security taxes, the corporation may require the optionee to pay the amount required to be withheld by the corporation before delivering to the optionee any shares purchased under the Stock Incentive Plan. Arrangements for payment may include deducting the amount of any withholding or other tax due from other compensation, including salary or bonus, otherwise payable to the optionee.

(11) Plan Benefits. The following table sets forth certain information with respect to stock options granted during fiscal 2001 under the Stock Incentive Plan.

| | Number of Securities |

|---|

| | Underlying Options |

|---|

| Name and Position | Granted |

|---|

| |

| John Nils Hanson | |

| Chairman, President and Chief Executive Officer | 132,500 |

| |

| Robert W. Hale | |

| Executive Vice President and President, P&H Mining Equipment | 53,750 |

| |

| Wayne F. Hunnell | |

| Executive Vice President and President, Joy Mining Machinery | 53,750 |

| |

| James A. Chokey | |

| Executive Vice President and General Counsel | 30,000 |

| |

| Dennis R. Winkleman | |

| Executive Vice President, Human Resources | 30,000 |

| |

| All current executive officers as a group (6 persons) | 372,500 |

| |

| All current directors who are not executive officers (6 persons) | 60,000 |

| |

| All employees, including all current officers | |

| who are not executive officers | 499,250 |

Stockholders are being asked to approve the material terms of the corporation's Annual Bonus Compensation Plan (the "Bonus Plan"). Stockholder approval of the material terms of the Bonus Plan is necessary to qualify payments under the Bonus Plan as "performance-based compensation" under Section 162(m) of the Internal Revenue Code and therefore be fully deductible by the corporation as a business expense in the year of payment. If such approval is not received, the Bonus Plan will not be adopted.

YOUR BOARD OF DIRECTORS RECOMMENDS A VOTE FOR ADOPTION OF PROPOSAL #3 TO APPROVE THE MATERIAL TERMS OF THE BONUS PLAN.

(1) Plan Objective. The Bonus Plan is intended to provide annual incentives that are "performance-based compensation" within the meaning of Section 162(m) of the Internal Revenue Code.

(2) Administration. The Human Resources Committee (the "Committee") will administer the Bonus Plan and have the authority to interpret the Bonus Plan and establish rules and procedures for its administration.

(3) Performance Period. The Performance Period for the Bonus Plan will be the corporation's fiscal year or such other period designated by the Committee.

(4) Participants. Participants include any "covered employee" as defined in Section 162(m) of the Internal Revenue Code who has been selected by the Committee to participate in the Bonus Plan during the Performance Period. For fiscal 2002, the participants are the five executive officers named in the Summary Compensation Table plus the Chief Financial Officer.

(5) Incentive Pool. The Incentive Pool under the Bonus Plan equals ten percent of Pre-Tax Income for the Performance Period. Pre-Tax Income is defined as pre-tax income adjusted to eliminate the effects of charges for restructurings, extraordinary items, discontinued operations, and cumulative effect of accounting changes, each as defined by generally accepted accounting principles. In addition, Pre-Tax Income shall exclude depreciation, amortization and other charges on the increase to fair value of inventory, intangible assets, and fixed assets with the implementation of fresh start accounting in connection with the corporation's reorganization.

(6) Incentive Pool Allocation. At the beginning of the Performance Period, each participant is assigned a percentage of the Incentive Pool. The total allocation may not exceed 100% and the allocation to any one individual may not exceed 40%.

(7) Size of Award. The maximum award for a participant is equal to the participant's Incentive Pool Allocation of the Incentive Pool. The Committee may use "negative discretion" to reduce or eliminate a participant's award. Under no circumstances may an Incentive Pool Allocation be increased.

(8) Payment of Awards. Awards may be paid immediately after the Committee certifies that the performance requirements have been met or may be deferred and may be paid in the form of cash, Common Stock or a combination of cash and Common Stock, as determined by the Committee.

The Board of Directors held five meetings during fiscal 2001, including three meetings after July 12, 2001, the date of the corporation's reorganization. All directors of the reorganized corporation attended at least 75% of the total number of meetings of the Board and committees of which they were members.

The Board has Audit, Human Resources and Executive committees. All committees consist entirely of outside directors except the Executive Committee of which Mr. Hanson is a member.

Audit Committee

Current members of the Audit Committee are James H. Tate (Chair), James R. Klauser and P. Eric Siegert. The members of the Audit Committee are independent (as independence is defined in Section 121(A) of the American Stock Exchange's listing standards and Rule 4200(a)(15) of the National Association of Securities Dealers' listing standards).

The primary function of the Audit Committee is to assist the Board of Directors in monitoring: (i) the integrity of the financial statements of the corporation; (ii) the compliance by the corporation with legal and regulatory requirements; (iii) the independence and performance of the corporation's internal and external auditors; (iv) the corporation's financial policies and processes and significant financial and business risks facing the corporation; and (v) the management of the corporation's employee benefit plans and trusts. The charter for the Audit Committee, which has been adopted by the Board, is attached as Annex B to this proxy statement. The Audit Committee met six times during fiscal 2001, including two meetings after the corporation's July 12, 2001 reorganization.

Human Resources Committee

Current members of the Human Resources Committee are Richard B. Loynd (Chair), Steven L. Gerard and Ken C. Johnsen. The primary functions of the Human Resources Committee are to: (i) periodically review and approve the compensation structure for the corporation's key executives, including salary rates, participation in any incentive bonus plan, fringe benefits, non-cash perquisites and all other forms of compensation, (ii) administer the corporation's stock option and stock-based compensation plans, (iii) periodically review the executive staffing of the corporation and make recommendations to the Board as appropriate, (iv) assess the performance of the Board and the performance of individual directors, (v) review and approve director compensation programs, and (vi) review and present to the Board for its consideration recommendations for nominations to fill expiring terms, vacancies or additions to the Board. Stockholders who wish to recommend persons to become directors of the corporation should direct their recommendations to the Human Resources Committee in care of the corporation. The Human Resources Committee met five times during fiscal 2001, including four meetings after the corporation's July 12, 2001 reorganization.

Executive Committee

Current members of the Executive Committee are Richard B. Loynd (Chair), John Nils Hanson, James R. Klauser and P. Eric Siegert. The primary functions of the Executive Committee are to consider proposals to (i) modify the corporation's capital structure, (ii) acquire or divest businesses, (iii) acquire a company, (iv) make significant investments in the corporation, or (v) enter into strategic alliances with the corporation. In addition, the Executive Committee may act upon a matter when it determines that prompt action is in the best interest of the corporation and it is not possible or necessary to call a meeting of the full Board. The Executive Committee did not meet during fiscal 2001.

EXECUTIVE COMPENSATION

The following table shows compensation awarded to, earned by or paid to the corporation's Chief Executive Officer and each of the four most highly compensated executive officers other than the Chief Executive Officer who were serving as executive officers at the end of fiscal 2001 for services rendered to the corporation and its subsidiaries during fiscal 2001, 2000 and 1999.

| | | | | | | | | |

|---|

| | | | | | Long-Term | |

|---|

| | | Annual Compensation | Compensation | |

|---|

| | |

|

| | |

|---|

| | | | | | Awards | Payouts |

|---|

| | | | | |

|

|

|---|

| | | | | | | Secu- | | |

|---|

| | | | | | | rities | | |

|---|

| | | | | Other | | Under- | | All |

|---|

| Name | | | | Annual | Restricted | lying | | Other |

|---|

| and | | | | Compen- | Stock | Options | LTIP | Compen- |

|---|

| Principal Position | Year | Salary | Bonus | sation | Award(s) | /SARs | Payouts | sation |

|---|

| | | ($) | ($) | ($) | ($) | (#) | ($) | ($) |

|---|

| | | | | (1) | (2) | | | (3) |

|---|

|

|

|

|

|

|

|

|

|

|---|

John Nils Hanson

Chairman, President and Chief

Executive Officer | 2001

2000

1999 | 677,084

650,004

545,186 | 963,078 (4)

640,590

- | 23,191

21,353

145,648 (5) | -

-

-

| 132,500

-

- | -

-

-

| 4,902

4,902

6,726 |

| | | | | | | | | |

|---|

Robert W. Hale

Executive Vice President

and President

P&H Mining Equipment | 2001

2000

1999 | 277,333

259,170

235,020 | 331,328 (4)

299,743

177,336 (6) | 15,427

-

- | -

-

- | 53,750

-

- | -

-

- | 2,768

1,582

3,846 |

| | | | | | | | | |

|---|

Wayne F. Hunnell

Executive Vice President

and President

Joy Mining Equipment | 2001

2000

1999 | 270,750

249,625

240,500 | 424,900 (4)

188,465

- | 5,061

1,496

1,496 | -

-

- | 53,750

-

- | -

-

- | 3,004

3,004

3,004 |

| | | | | | | | | |

|---|

James A. Chokey

Executive Vice President

and General Counsel | 2001

2000

1999 | 291,583

277,400

254,400 | 398,495 (4)

276,187

- | 25,611

23,507

19,931 | -

-

- | 30,000

-

- | -

-

- | 2,606

3,216

6,351 |

| | | | | | | | | |

|---|

Dennis R. Winkleman

Executive Vice President, Human

Resources (7) | 2001

2000 | 230,833

173,978 | 312,554 (4)

272,265 (8) | 22,196

3,713 | -

- | 30,000

- | -

- | 782

505 |

Notes

(1) Represents amounts reimbursed during the fiscal year for the payment of taxes. Also includes perquisites and other personal benefits unless the aggregate amount of such compensation is less than the lesser of $50,000 or ten percent of total salary and bonus for the named executive.

(2) No restricted stock has been awarded to or is held by the named executive officers.

(3) For fiscal 2001, represents life insurance premiums.

(4) Includes amounts paid under the corporation's bonus compensation plans in effect for fiscal 2001 and the following emergence bonus payments paid in fiscal 2001 under the Bankruptcy Court approved Key Employee Retention Plan: Mr. Hanson, $544,003; Mr. Hale, $199,767; Mr. Hunnell, $204,425; Mr. Chokey, $216,240; and Mr. Winkleman $191,250. The entire amount of the emergence bonus payments received in fiscal 2001 is listed for fiscal 2001 although a portion of such bonus payments may be allocable to fiscal 2000 and 1999.

(5) Includes $63,255 related to country club expenses and initial membership fees and $69,416 of tax reimbursement.

(6) Supplemental salary and profit sharing bonus earned by Mr. Hale in 1999, $77,530 of which was paid in fiscal 2000 and the remainder of which was paid in 2001.

(7) Mr. Winkleman became an executive officer in fiscal 2000.

(8) Includes bonus paid to Mr. Winkleman in 2000 in connection with the liquidation of Beloit Corporation under the Bankruptcy Court approved Key Employee Retention Plan.

The Human Resources Committee has presented the following report on executive compensation for inclusion in this proxy statement.

Compensation Philosophy

The members of the Human Resources Committee believe that the corporation’s executive officers should be compensated on a competitive basis with other manufacturing companies of comparable size, with the objective of providing a total compensation program that provides base salaries in a competitive range, bonus opportunities that reward above-average performance, and stock-based incentive programs designed to achieve long-term corporate financial goals and to align management and stockholder interests. This philosophy is grounded in the need to attract and retain experienced and talented executive officers.

Base Salaries for Calendar 2001

Base salaries for calendar 2001 for the executive officers were established by the former members of the Human Resources Committee prior to the corporation’s emergence from Chapter 11 bankruptcy protection in July of 2001. The current members of the Human Resources Committee have reviewed base salary levels for the executive officers, determined that the base salary levels were consistent with the Committee’s compensation philosophy, and established base salary levels for calendar 2002 which provide for increases ranging from 2.4% to 6.2%.

Bonus Plan for Fiscal 2001

The bonus compensation formula for the executive officers for the first half of fiscal 2001was set by the Bankruptcy Court and was tied to earnings before interest, taxes, depreciation and amortization (EBITDA) because the financial covenants in the corporation’s debtor-in-possession financing facility were based on EBITDA. Upon the corporation’s emergence from bankruptcy, the Human Resources Committee determined to extend the EBITDA based bonus plan to the second half of fiscal 2001.

Stock Options

The Committee believes that stock options are an important component of a sound compensation program for executive officers. Stock options are typically granted annually and, once vested, can be exercised for several years, with the result that in most companies executive officers hold several year’s worth of stock option grants. As a result of the corporation’s reorganization, none of the executive officers held options to buy the corporation’s Common Stock when the corporation emerged from bankruptcy. However, the corporation’s plan of reorganization provided for the grant of stock options for up to 5,556,000 shares of Common Stock under the 2001 Stock Incentive Plan.

In order to reestablish the “stock option component” of the corporation’s compensation program, the Committee adopted a program of granting options to the executive officers and other key employees in four phases. The first grant of approximately 900,000 stock options to approximately 175 individuals was made on July 16, 2001 at an exercise price of $13.76 per share, the estimated market value of the stock on that date based on the valuation of the corporation prepared in connection with the corporation’s plan of reorganization. The second grant of approximately 900,000 shares was made on November 1, 2001 at $17.49 per share, the market price on that date. The third and fourth grants are scheduled to take place on February 1 and May 1, 2002 at then current market prices. All stock options will become exercisable in one third increments on the first, second and third anniversaries of July 16, 2001.

Performance Unit Award Program

The Committee established a Performance Unit Award Program under the terms of the Stock Incentive Plan in order to provide senior executive officers with a long-term incentive to generate positive net cash flow. The Performance Unit Award Program is described in more detail under Long-Term Compensation elsewhere in this proxy statement. The Human Resources Committee believes that the Performance Unit Award Program serves as a powerful retention tool and motivates the senior executive management of the corporation to generate the cash needed to pay down the corporation’s debt.

CEO Compensation for Fiscal 2001

The elements of compensation for Mr. Hanson for fiscal 2001 as reported in the Summary Compensation Table include base salary of $677,084, annual bonus compensation tied to EBITDA of $419,075, and an emergence bonus under the Bankruptcy Court approved Key Employee Retention Plan of $544,003. As discussed above, during fiscal 2001 Mr. Hanson also received the first of four scheduled grants of 132,500 stock options. The Committee has increased Mr. Hanson's base salary for calendar 2002 to $722,400.

Tax Considerations

The Committee intends to take the necessary steps to satisfy the conditions of Section 162(m) of the Internal Revenue Code in order to preserve the deductibility of executive compensation to the fullest extent possible consistent with the Committee’s other compensation objectives and overall compensation philosophy. In furtherance of this policy, stockholders are being asked to approve Proposal #2 and #3 dealing with certain stock option and annual bonus compensation plan provisions. We strongly urge you to vote to approve these proposals.

Respectfully,

Richard B. Loynd (Chair)

Steven L. Gerard

Ken C. Johnsen

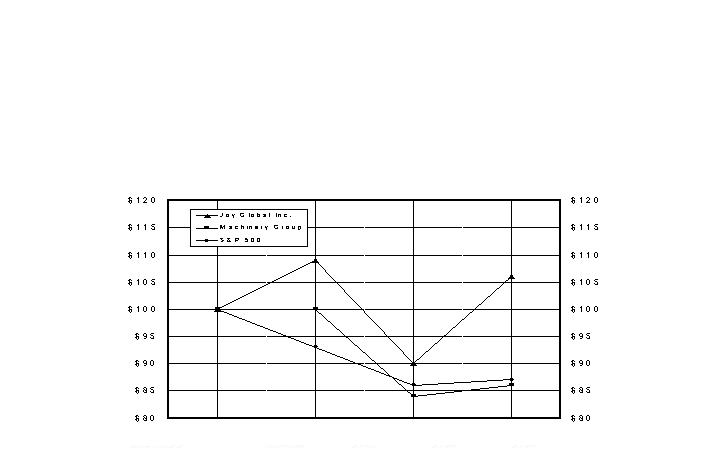

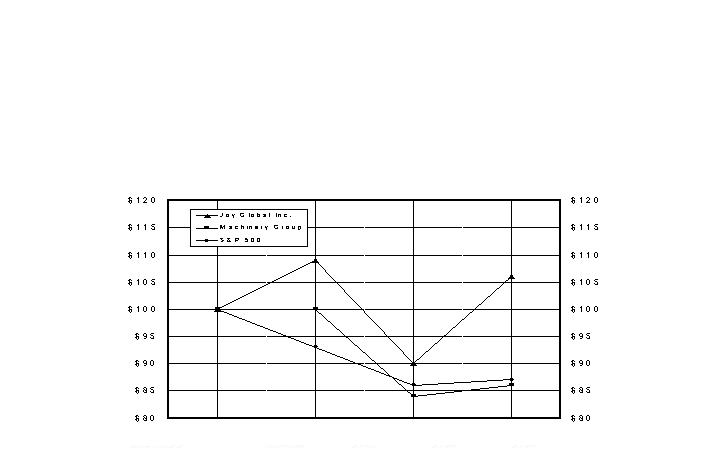

The following graph shows the cumulative total stockholder return on the corporation's Common Stock from August 1, 2001, the first trading day following the issuance of the corporation's new Common Stock after its reorganization, until the October 31, 2001 end of the corporation's fiscal year as compared to the returns of the Standard & Poor's 500 Stock Index and the Dow Jones Heavy Machinery Index. The Heavy Machinery subgroup consists of AGCO Corporation, Astec Industries Inc., Caterpillar Inc., Deere & Co., Manitowoc Company and Terex Corporation. The graph assumes $100 was invested on August 1, 2001 in (a) the corporation's Common Stock, (b) the Standard & Poor's 500 Stock Index, and (c) the Heavy Machinery Index, and assumes reinvestment of dividends.

| | 08/01/01 | 08/31/01 | 09/28/01 | 10/31/01 |

|---|

| Joy Global Inc. | $100 | $109 | $ 90 | $106 |

| Machinery Group | $100 | $100 | $ 84 | $ 86 |

| S&P 500 | $100 | $ 93 | $ 86 | $ 87 |

The following table shows information about stock option grants during the last fiscal year to the five executive officers named in the Summary Compensation Table.

| | | | | | |

|---|

| OPTION/SAR GRANTS IN LAST FISCAL YEAR (1) |

|---|

|

|---|

| Individual Grants |

|---|

|

|---|

Name | Number of

Securities

Underlying

Options/

SARs Granted

(#) | Percent

of Total

Options/

SARs Granted

to Employees

in Fiscal Year |

Exercise or

Base Price

($/sh) (2) |

Expiration

Date (3) |

Grant Date

Present

Value($) (4) |

|---|

|

|

|

|

|

|

|---|

| | | | | | |

|---|

| John Nils Hanson | 132,500 | 15.2% | $13.76 | July 16, 2011 | $653,225 |

| Robert W. Hale | 53,750 | 6.2% | $13.76 | July 16, 2011 | $264,988 |

| Wayne F. Hunnell | 53,750 | 6.2% | $13.76 | July 16, 2011 | $264,988 |

| James A. Chokey | 30,000 | 3.4% | $13.76 | July 16, 2011 | $147,900 |

| Dennis R. Winkleman | 30,000 | 3.4% | $13.76 | July 16, 2011 | $147,900 |

Notes

(1) No Stock Appreciation Rights (SARs) were granted in the last fiscal year.

(2) The exercise price is based on the estimated market value on the July 16, 2001 grant date consistent with the valuation of the corporation prepared in connection with the corporation’s plan of reorganization.

(3) Options become exercisable in one third increments on the first, second and third anniversaries of the grant date, expire ten years from the date of grant unless earlier terminated and become fully vested and exercisable in the event of a change in control, as defined in the Stock Incentive Plan.

(4) Grant date present values were determined using the Black-Scholes option pricing model. The actual value, if any, an executive may realize will depend on the excess of the stock price over the exercise price on the date the option is exercised. There is no assurance the value realized by an executive will be at or near the value estimated by the Black-Scholes model. The estimated values are based on assumed volatility of 30%, risk-free rate of return of 4.9%, dividend yield of 0.0% and five year option expiration. No adjustments have been made for non-transferability or risk of forfeiture.

The following table shows information with respect to the five executive officers named in the Summary Compensation Table concerning the value of options outstanding at the end of the last fiscal year. None of the five executive officers named in the Summary Compensation Table exercised options or stock appreciation rights during the last fiscal year.

| | | | | | | |

|---|

AGGREGATED OPTION/SAR EXERCISES IN LAST FISCAL YEAR

AND FY-END OPTION/SAR VALUES (1) |

|---|

|

|

|

|

|

|

|

|---|

| | | | | | | |

|---|

| | | | Number of Securities | Value of Unexercised |

|---|

| | | | Underlying Unexercised | In-the-Money Options/ |

|---|

| | | | Options/SARs at | SARs at Fiscal Year- |

|---|

| | Shares | | Fiscal Year-End (#) | End ($) (2) |

|---|

| | Acquired | |

|

|

|---|

| | on | Value |

|---|

| | Exercise | Realized |

|---|

| Name | (#) | ($) | Exercisable | Unexercisable | Exercisable | Unexercisable |

|---|

|

|

|

|

|

|

|

|---|

| | | | | | | |

|---|

| John Nils Hanson | - | - | - | 132,500 | - | $488,925 |

| Robert W. Hale | - | - | - | 53,750 | - | $198,338 |

| Wayne F. Hunnell | - | - | - | 53,750 | - | $198,338 |

| James A. Chokey | - | - | - | 30,000 | - | $110,700 |

| Dennis R. Winkelman | - | - | - | 30,000 | - | $110,700 |

Notes

(1) No Stock Appreciation Rights (SARs) are outstanding.

(2) Based on the closing price of the corporation's Common Stock as reported by Nasdaq at the end of the fiscal year of $17.45.

The Performance Unit Award Program provides long-term incentive compensation opportunities to the executives named in the Summary Compensation Table.

In general, a number of shares of Common Stock may be earned by the named executives under the Performance Unit Award Program if, at the end of a three and one quarter year award cycle, cumulative net cash flow exceeds a certain threshold amount. Each performance unit represents the right to earn one share of Common Stock. Awards can range from 0% to 150% of the target award opportunities. Awards are accelerated based on the greater of actual performance or target award in the event of a change in control, as defined in the Stock Incentive Plan.

The terms of the Performance Unit Award Program are summarized below.

(1) Eligibility. Senior executive officers of the corporation with responsibility for development and execution of the corporation’s business strategy, including the six members of the corporation’s management policy committee and three additional executives, are eligible for awards under the Performance Unit Award Program.

(2) Size of Awards. Target award opportunities for the members of the management policy committee as approved by the Human Resources Committee are as follows: Chief Executive Officer, 120,000; Chief Financial Officer and Presidents of Joy Mining Machinery and P&H Mining Equipment, 60,000; and General Counsel and Executive Vice President, Human Resources, 30,000. Target awards to the other three participants were smaller. The holder of a performance unit will be entitled to receive one share of Common Stock or an equivalent amount of cash for each performance unit the Human Resources Committee determines the holder has earned at the end of the Award Cycle.

(3) Award Cycle. Performance will be measured over a three year and one fiscal quarter period beginning August 1, 2001 and ending on the Saturday closest to October 31, 2004. Any participants added during the Award Cycle would participate on a pro-rata basis.

(4) Performance Goals. The Performance Goal for the Performance Unit Award Program is cash generation measured by cumulative net cash flow over the Award Cycle.

(5) Earn-Out Schedule. Awards can range from 0% to 150% of the target award opportunities.

(6) Vesting. Awards are fully vested upon completion of the Award Cycle, assuming continued employment. The Human Resources Committee may authorize pro-rata awards to participants who retire, become disabled, die or are involuntarily terminated without cause before the end of the Award Cycle.

(7) Change in Control. Upon a Change in Control (as defined in the Stock Incentive Plan), awards are accelerated based on the greater of actual performance or target award.

(8) Form of Payment. Payments will be made in cash or Common Stock or a combination of each, as determined by the Human Resources Committee at the time of payment.

(9) Time of Payment. Participants may elect to defer receipt of awards following the end of the Award Cycle.

The following table provides information regarding awards under the Performance Unit Award Program during fiscal 2001.

| | | | | | |

|---|

| LONG-TERM INCENTIVE PLANS - AWARDS IN LAST FISCAL YEAR |

|---|

| | | | | | |

|---|

| | Number of | | Estimated Future Payouts Under Non-Stock |

|---|

| | Shares, | | Price-Based Plans |

|---|

| | Units or | |

|

|---|

| | Other Rights | Performance or Other Period | | | |

|---|

| Name | (#) | Until Maturation Or Payout | Threshold (#) | Target (#) | Maximum (#) |

|---|

|

|

|

|

|

|

|---|

| | | | | | |

|---|

| John Nils Hanson | 180,000 | October 31, 2004 | 60,000 | 120,000 | 180,000 |

| Robert W. Hale | 90,000 | October 31, 2004 | 30,000 | 60,000 | 90,000 |

| Wayne F. Hunnell | 90,000 | October 31, 2004 | 30,000 | 60,000 | 90,000 |

| James A. Chokey | 45,000 | October 31, 2004 | 15,000 | 30,000 | 45,000 |

| Dennis R. Winkelman | 45,000 | October 31, 2004 | 15,000 | 30,000 | 45,000 |

The following table sets forth the estimated annual benefits payable upon retirement at normal retirement age for the years of service indicated under the corporation’s defined benefit pension plan (and excess benefit arrangements described below) at the indicated remuneration levels. Remuneration covered by the plan includes the salary and bonus amounts reported in the Summary Compensation Table.

The years of service credited for each of the executive officers named in the Summary Compensation Table are: John Nils Hanson, 16 years; Robert W. Hale, 13 years; Wayne F. Hunnell, 23 years; James A. Chokey, 19 years; and Dennis R. Winkleman, 4 years. Under an arrangement approved by the Human Resources Committee in 1999, for pension plan purposes Mr. Hanson is credited with three years of service for each year he is employed by the corporation after June 1999.

Benefits are based both upon credited years of service with the corporation or its subsidiaries and the highest consecutive five year average annual salary and incentive compensation during the last ten calendar years of service. The estimated benefits in the table do not reflect offsets under the plan of 1.25% per year of service (up to a maximum of 50%) of the Social Security benefit.

Estimated benefits under the retirement plan are subject to the provisions of the Internal Revenue Code which limit the annual benefits which may be paid from a tax qualified retirement plan. Amounts in excess of such limitations will be paid from the general funds of the corporation under the terms of the corporation’s Supplemental Retirement Plan.

| | | | | | | |

|---|

| | Years of Service |

|---|

| |

|

|---|

| Remuneration | 10 | 15 | 20 | 25 | 30 | 35 |

|---|

|

|

|

|

|

|

|

|---|

| | | | | | | |

|---|

| $ 400,000 | $60,000 | $ 90,000 | $120,000 | $150,000 | $180,000 | $210,000 |

| 600,000 | 90,000 | 135,000 | 180,000 | 225,000 | 270,000 | 315,000 |

| 800,000 | 120,000 | 180,000 | 240,000 | 300,000 | 360,000 | 420,000 |

| 1,000,000 | 150,000 | 225,000 | 300,000 | 375,000 | 450,000 | 525,000 |

| 1,200,000 | 180,000 | 270,000 | 360,000 | 450,000 | 540,000 | 630,000 |

| 1,400,000 | 210,000 | 315,000 | 420,000 | 525,000 | 630,000 | 735,000 |

| 1,600,000 | 240,000 | 360,000 | 480,000 | 600,000 | 720,000 | 840,000 |

| 1,800,000 | 270,000 | 405,000 | 540,000 | 675,000 | 810,000 | 945,000 |

| 2,000,000 | 300,000 | 450,000 | 600,000 | 750,000 | 900,000 | 1,050,000 |

Directors who are not officers or employees of the corporation receive an annual retainer fee of $30,000 and a fee of $1,250 for each Board and Board committee meeting attended. Committee chairs receive $1,500 for each committee meeting attended. Under the terms of the Joy Global Inc. 2001 Stock Incentive Plan, each non-employee director is granted 10,000 stock options upon becoming a director and annual grants of 5,000 stock options thereafter while serving as a director. Directors who are officers of the corporation earn no additional remuneration for their services as directors.

Certain Business Relationships

Pursuant to the corporation’s bylaws, officers and directors are indemnified by the corporation in the event claims are made against them arising out of their service as an officer or director of the corporation. Other than these indemnification arrangements, there were no other relationships or related transactions during fiscal 2001 involving any director or executive officer (or any members of their immediate families) to which the corporation or any of its subsidiaries was a party which are required to be disclosed under the rules governing the preparation of proxy statements.

Employment Contracts and Termination of Employment and Change-in-Control Arrangements

Change in control arrangements between the corporation and each of the executive officers named in the Summary Compensation Table were put in place prior to the corporation’s reorganization. The corporation’s emergence from bankruptcy qualified as a “change in control” under the terms of the change in control agreements with the result that the arrangements become employment contracts. The arrangements provide that, in the event that a named executive officer’s employment is terminated prior to July 12, 2003, the second anniversary of the corporation’s reorganization, either by the individual for “Good Reason” or by the corporation without “Cause” (as such terms are defined in the change in control agreements), the corporation will provide outplacement services and two years of medical insurance benefits and pay the individual a lump sum payment equal to three times the sum of the individual’s base salary and target bonus. The approximate dollar amounts that would be payable to the named executive officers under the provisions of these agreements if their employment were terminated as of the date of this proxy statement, either by the individual for “Good Reason” or by the corporation without “Cause”, are: Mr. Hanson, $3,792,600; Mr. Hale $1,388,160; Mr. Hunnell, $1,391,520; Mr. Chokey $1,445,760 and Mr. Winkleman $1,096,200.

Stock option grants and Performance Unit Awards to the named executive officers contain provisions that accelerate the vesting of stock options and performance unit awards in the event of a change in control of the corporation as defined in the Stock Incentive Plan.

The Audit Committee has presented the following report for inclusion in this proxy statement.

The Audit Committee met with management and PricewaterhouseCoopers LLP, the corporation’s independent accountants for fiscal 2001, twice following the corporation’s reorganization under Chapter 11 and before the end of fiscal 2001. To date, the Audit Committee has held three meetings during fiscal 2002 with management and the independent accountants.

Management represented to the Audit Committee that the corporation’s financial statements were prepared in accordance with generally accepted accounting principles. The Audit Committee has reviewed and discussed the financial statements with management and the independent accountants. The Audit Committee has discussed with the independent accountants the matters required to be discussed by Statement on Auditing Standards No. 61 (Communications with Audit Committees).

The corporation’s independent accountants also provided to the Audit Committee the written disclosures and the letter required by Independence Standards Board No. 1 (Independence Discussions with Audit Committees), and the Audit Committee discussed with the independent accountants that firm’s independence.

Based upon the Audit Committee’s discussions with management and the independent accountants and the Audit Committee’s review of the representations of management and the report of the independent accountants to the Audit Committee, the Audit Committee recommended that the Board of Directors include the audited financial statements in the corporation’s Annual Report on Form 10-K for the fiscal year ended October 31, 2001 filed with the Securities and Exchange Commission.

Respectfully,

James H. Tate (Chair)

James R. Klauser

P. Eric Siegert

PricewaterhouseCoopers LLP served as the corporation’s independent accountants for fiscal 2001. A representative of Pricewaterhouse-Coopers is expected to be present at the 2002 annual meeting and to have the opportunity to make a statement and answer questions that may be asked by stockholders. The Audit Committee expects to make its recommendation to the Board of Directors regarding the selection of independent accountants for fiscal 2002 during the first half of the year.

Audit Fees

PricewaterhouseCoopers LLP billed the corporation an aggregate of $1,103,500 in fees for professional services rendered for the audit of the corporation’s annual financial statements for fiscal 2001 and the reviews of the financial statements included in the corporation’s Forms 10-Q for fiscal 2001.

Financial Information Systems Design and Implementation Fees

No fees were billed by PricewaterhouseCoopers LLP for professional services related to information systems design and implementation for fiscal 2001.

All Other Fees

PricewaterhouseCoopers LLP billed the corporation an aggregate of $1,129,200 in fees in fiscal 2001 for all other professional services other than audit and financial information systems design and implementation fees. The all other fees amount represents services related to audits of certain employee benefit plans, statutory audit reporting of certain non-U.S. entities, and income tax planning, structuring and compliance activities.

Independence

The Audit Committee has reviewed the fees described under the headings “Financial Information Systems Design and Implementation Fees” and “All Other Fees” and determined that the provision of the services covered by such fees is compatible with maintaining the auditor’s independence.

Additional Matters

The Board of Directors is not aware of any other matters that will be presented for action at the 2002 annual meeting. Should any additional matters properly come before the meeting, the persons named in the enclosed proxy will vote on those matters in accordance with their best judgment.

Submission of Stockholder Proposals

Stockholder proposals for the 2003 annual meeting must be received no later than September 27, 2002 at the corporation’s principal executive offices, 100 East Wisconsin Avenue, Suite 2780, Milwaukee, Wisconsin 53202, directed to the attention of the Secretary, in order to be considered for inclusion in next year’s annual meeting proxy materials under Securities and Exchange Commission rules. Under the corporation’s bylaws, written notice of stockholder proposals for the 2003 annual meeting which are not intended to be considered for inclusion in next year’s annual meeting proxy materials (stockholder proposals submitted outside the processes of SEC Rule 14a-8) must be received by the corporation at such offices, directed to the attention of the Secretary, not less than 75 nor more than 105 days before the first anniversary of this year’s meeting, stockholder nominations of directors must be received not less than 90 days before the 2003 meeting and any such notice must contain the information specified in the corporation’s bylaws.

Cost of Proxy Solicitation

The corporation will pay the cost of preparing, printing and mailing proxy materials as well as the cost of soliciting proxies on behalf of the Board. In addition to using mail services, officers and other employees of the corporation, without additional remuneration, may solicit proxies in person and by telephone, e-mail or facsimile transmission. The corporation may retain a professional proxy solicitation firm, and pay such firm its customary fee, to solicit proxies from banks, brokers and other nominees having shares registered in their names which are beneficially owned by others.

Annual Report on Form 10-K

A copy (without exhibits) of the corporation’s Annual Report to the Securities and Exchange Commission on Form 10-K for the fiscal year ended October 31, 2001 has been provided with this proxy statement. The corporation will provide an additional copy of such Annual Report to any stockholder, without charge, upon written request of such stockholder. Such requests should be addressed to the attention of “Stockholder Relations” at Joy Global Inc., 100 East Wisconsin Avenue, Suite 2780, Milwaukee, Wisconsin 53202.

Section 16(a) Beneficial Ownership Reporting Compliance

Based solely upon a review of Forms 3 and 4 and amendments thereto furnished to the corporation during the last fiscal year and Forms 5 and amendments thereto furnished to the corporation with respect to the last fiscal year or written representations that no reports were required, the corporation is not aware that any director, officer or beneficial owner of more than 10% of the corporation’s Common Stock failed to report transactions required to be reported and file on a timely basis reports required by Section 16(a) of the Securities Exchange Act of 1934 during the last fiscal year.

By order of the Board of Directors

ERIC B. FONSTAD

Secretary

January 25, 2002

ANNEX A: JOY GLOBAL INC. 2001 STOCK INCENTIVE PLAN

SECTION 1. Purpose; Definitions

The purpose of the Plan is to give the Company a competitive advantage in attracting, retaining and motivating officers, employees, and/or directors and to provide the Company and its Subsidiaries and Affiliates with a stock plan providing incentives directly linked to the profitability of the Company's businesses and increases in Company shareholder value.

For purposes of the Plan, the following terms are defined as set forth below:

- "Affiliate" means a corporation or other entity controlled by, controlling or under common control with the Company.

- "Award" means a Stock Option, Stock Appreciation Right, Performance Unit, or other stock-based award.

- "Award Cycle" means a period of consecutive fiscal years or portions thereof designated by the Committee over which Performance Units are to be earned.

- "Board" means the Board of Directors of the Company.