UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant [X]

Filed by a Party other than the Registrant [_]

Check the appropriate box:

[_] Preliminary Proxy Statement

[_] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[X] Definitive Proxy Statement

[_] Definitive Additional Materials

[_] Soliciting Material Pursuant to §240.14a-12

JOY GLOBAL INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[_] Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

| (1) Title of each class of securities to which transaction applies: |

| (2) Aggregate number of securities to which transaction applies: |

| (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set

forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) Proposed maximum aggregate value of transaction: |

[_] Fee paid previously with preliminary materials:

| [_] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) Amount previously paid: |

| (2) Form, Schedule or Registration Statement No.: |

JOY GLOBAL INC.

| Notice of 2004

Annual Meeting of

Stockholders and

Proxy Statement |

CONTENTS

NOTICE OF ANNUAL MEETING

PROXY STATEMENT

JOY GLOBAL INC.

100 East Wisconsin Avenue, Suite 2780 Milwaukee,

WI 53202

NOTICE OF ANNUAL MEETING

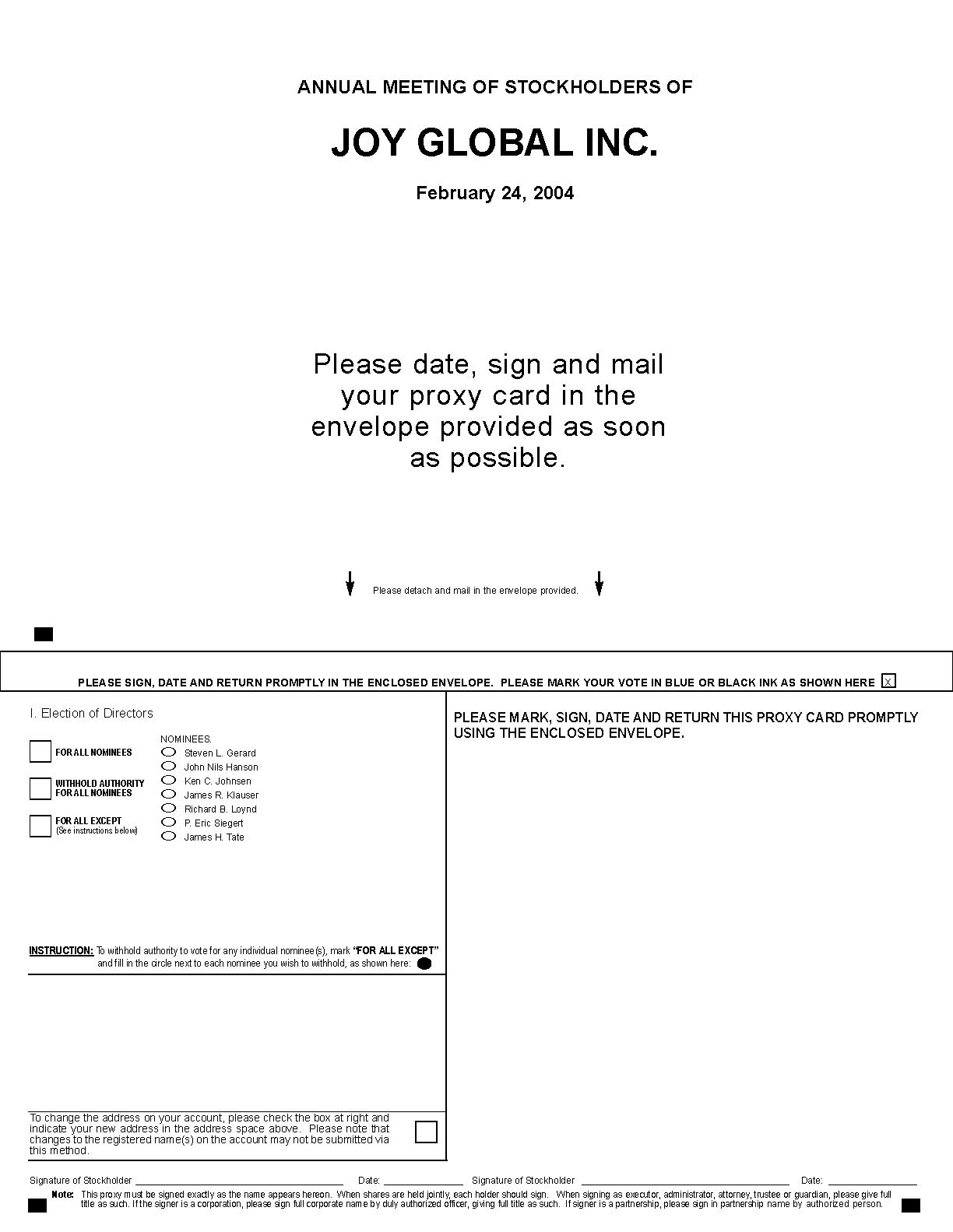

The annual meeting of stockholders of Joy Global Inc. will be held in the Tenant Conference Center, 100 East Wisconsin Avenue, Suite 1660, Milwaukee, Wisconsin, on Tuesday, February 24, 2004 at 8:00 a.m. for the following purposes:

| 1. | To elect seven persons to the corporation’s Board of Directors; and |

| 2. | To transact such other business as may properly come before the meeting or any adjournment or postponement of the meeting. |

Stockholders of record at the close of business on January 5, 2004 are entitled to receive notice of and to vote at the annual meeting and any adjournment or postponement of the meeting. A list of stockholders entitled to vote will be available at the corporation’s headquarters at least ten days prior to the meeting and may be inspected during business hours by any stockholder for any purpose germane to the meeting.

Whether or not you plan to attend the meeting, we urge you to mark, date and sign the enclosed proxy card and return it promptly so that your shares will be voted at the meeting in accordance with your instructions.

| |

|---|

| By order of the Board of Directors, |

|

ERIC B. FONSTAD

Secretary |

January 23, 2004

PLEASE PROMPTLY MARK, DATE, SIGN AND RETURN YOUR PROXY IN THE

ENCLOSED ENVELOPE.

PROXY STATEMENT

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors of Joy Global Inc., a Delaware corporation, for use at the 2004 annual meeting of stockholders to be held in the Tenant Conference Center, 100 East Wisconsin Avenue, Suite 1660, Milwaukee, Wisconsin, on Tuesday, February 24, 2004 at 8:00 a.m. and at any adjournment or postponement of the annual meeting. The proxy statement, proxy card and annual report are being mailed to stockholders on or about January 23, 2004.

Proxies

Properly signed and dated proxies received by the corporation’s Secretary prior to or at the annual meeting will be voted as instructed on the proxies or, in the absence of such instruction, FOR the election to the Board of Directors of the persons nominated by the Board and in accordance with the best judgment of the persons named in the proxy on any other matters which may properly come before the meeting.

Any proxy may be revoked by the person executing it for any reason at any time before the polls close by filing with the corporation’s Secretary a written revocation or duly executed form of proxy bearing a later date or by voting in person at the meeting. The Board of Directors has appointed an officer of American Stock Transfer & Trust Company, transfer agent for the corporation’s common stock, $1.00 par value per share (the “Common Stock”), to act as an independent inspector at the annual meeting.

Record Date, Shares Outstanding and Voting

Stockholders of record of Common Stock at the close of business on January 5, 2004 (the “Record Date”) are entitled to vote on all matters presented at the annual meeting. As of the Record Date, 50,008,160 shares of Common Stock were outstanding and entitled to vote at the annual meeting. Each share is entitled to one vote.

A majority of the shares entitled to vote, represented in person or by proxy, constitutes a quorum. Under the corporation’s bylaws, if a quorum is present, the election of directors is decided by plurality vote.

The independent inspector will count the votes. Abstentions are considered as shares represented and entitled to vote; therefore, abstentions are counted for purposes of the quorum determination but will have no effect on the election of directors.

Broker or nominee “non-votes” on a matter are not be considered as shares entitled to vote on that matter and therefore will not be counted by the inspector in calculating the number of shares represented and entitled to vote on that matter. Shares which are the subject of such non-votes are, however, counted toward the quorum requirement.

If less than a majority of the outstanding shares of Common Stock are represented at the meeting, a majority of the shares represented at the meeting may adjourn the meeting from time to time without further notice.

The following table lists the beneficial ownership of Common Stock as of January 15, 2004 by any person known to the corporation to own beneficially more than 5% of its Common Stock, each of the executive officers named in

the Summary Compensation Table, and the corporation’s executive officers and directors as a group. Beneficial ownership of these shares consists of sole voting power and sole investment power except as noted below.

|

|

|

|---|

Name and Address

of Beneficial Owner

| Shares

Owned (1)

| Percent

of Class

|

|---|

| Mac-Per-Wolf Company | | 4,473,590 | (2) | | 8.9% |

| 310 S. Michigan Ave., Suite 2600 | |

Chicago, Illinois 60604

| |

| Franklin Mutual Advisers, LLC | | 4,159,263 | (3) | | 8.3% |

| 51 John F. Kennedy Parkway | |

Short Hills, New Jersey 07078

| | | |

| Oaktree Capital Management, LLC | | 4,092,649 | (4) | | 8.2% |

| 333 South Grand Avenue | |

| 28th Floor | |

Los Angeles, California 90071

| | | |

| Berger Small Cap Value Fund | | 3,800,000 | (5) | | 7.6% |

| 210 University Blvd., Suite 900 | |

Denver, Colorado 80206

| | | |

| First Pacific Advisors, Inc. | | 2,605,557 | (6) | | 5.2% |

| 11400 W. Olympic Boulevard | |

| Suite 1200 | |

Los Angeles, California 90064

| | | |

| John Nils Hanson | | 300,002 | (7) | | less than 1% |

Donald C. Roof | | 112,668 | (7)(8) | | less than 1% |

Mark E. Readinger | | 9,484 | (7) | | less than 1% |

Michael W. Sutherlin | | 12,000 | | | less than 1% |

James A. Chokey | | 63,000 | (7) | | less than 1% |

All executive officers and directors | |

| as a group (12 persons) | | 651,154 | (7)(9) | | 1.3% |

|

|

|

Notes:

(1) The beneficial ownership information presented in this proxy statement is based on information furnished by the specified persons and is determined in accordance with Rule 13d-3 under the Securities Exchange Act of 1934, as required for purposes of this proxy statement. Accordingly, it includes shares of Common Stock that are issuable upon the exercise of stock options exercisable at or within 60 days after January 15, 2004. Such information is not necessarily to be construed as an admission of beneficial ownership for other purposes.

Notes (continued):

(2) Based on information contained in a Schedule 13G/A filed with the Securities and Exchange Commission on January 12, 2004 by Mac-Per-Wolf Company which indicates sole voting and investment power as to 4,473,590 shares.

(3) Based on information contained in a Schedule 13G/A filed with the Securities and Exchange Commission on January 30, 2003 by Franklin Mutual Advisers, LLC which indicates sole voting and investment power as to 4,159,263 shares.

(4) Based on information contained in a Schedule 13G/A filed with the Securities and Exchange Commission on January 7, 2004 by Oaktree Capital Management, LLC (“Oaktree”) in its capacities (i) as the general partner of OCM Opportunities Fund II, L.P., a Delaware limited partnership (the “Partnership”), and (ii) as the investment manager of a third party managed account (the “Oaktree Account”). The Schedule 13G states that the Partnership is the direct beneficial owner of 4,077,043 shares of Common Stock and the Oaktree Account is the direct beneficial owner of 15,606 shares of Common Stock.

(5) Based on information contained in a Schedule 13G/A filed with the Securities and Exchange Commission on March 17, 2003 by Berger Small Cap Value Fund, which is a portfolio series established under the Berger Omni Investment Trust, an open-ended management investment company registered under the Investment Company Act of 1940, as amended. The Schedule 13G/A indicates that Berger Small Cap Value Fund shares voting and investment power as to 3,800,000 shares with Perkins, Wolf, McDonnell & Company as the sub-investment advisor delegated with investment and voting authority.

(6) Based on information contained in a Schedule 13G filed with the Securities and Exchange Commission on February 13, 2003 by First Pacific Advisors, Inc. which indicates shared voting power as to 892,371 shares and shared investment power as to 2,605,557 shares.

(7) Includes the following number of shares the respective executive officer has a right to acquire upon exercise of currently exercisable options: Mr. Hanson, 265,002; Mr. Roof, 96,668; and Mr. Chokey, 60,000. Also includes the following number of shares the respective officer beneficially owns with his spouse: Mr. Hanson, 35,000; Mr. Readinger, 9,484; and Mr. Chokey, 3,000.

(8) Includes 5,000 shares held by Mr. Roof’s spouse.

(9) Includes 90,000 shares non-employee directors have a right to acquire upon exercise of currently exercisable stock options. Does not include 33,552 restricted stock units awarded to non-employee directors. See “Election of Directors” for information regarding beneficial ownership of Common Stock by each director. Includes 60,000 shares an executive officer not named in the Summary Compensation Table has a right to acquire upon exercise of currently exercisable options.

The following table shows certain information (including principal occupation, recent business experience and beneficial ownership of the corporation’s Common Stock as of January 15, 2004) for each of the individuals nominated by the Board of Directors for election at the 2004 annual meeting. Beneficial ownership of these shares consists of sole voting and investment power except as noted below. None of these individuals beneficially owns more than 1% of the outstanding Common Stock. All of the nominees are presently directors whose terms expire in 2004 and who are nominated to serve terms ending at the annual meeting in 2005. If for any unforeseen reason any of these nominees should not be available for election, the proxies will be voted for such person or persons as may be nominated by the Board of Directors.

|

|

|

|---|

|

| Director

Since

| Shares

Owned (1)

|

|---|

| Steven L. Gerard | Chairman and Chief Executive Officer of

Century Business Services, Inc., a leading provider of integrated business services and products headquartered in Cleveland, Ohio, since 2000. From 1997 to 2000 Mr. Gerard was Chairman and Chief Executive Officer of Great Point Capital, an operational and financial restructuring firm. Mr. Gerard is also a director of Lennar Corporation, Fairchild Corporation and Timco Aviation Services, Inc. He is 58.

| 2001 | 15,000 (2) |

| John Nils Hanson | Chairman, President and Chief Executive Officer of the corporation since August 2000. Vice Chairman, President and Chief Executive Officer from May 1999 to August 2000. Vice Chairman, President and Chief Operating Officer from 1998 to 1999. President and Chief Operating Officer from 1997 to 1998. Mr. Hanson is also a director of Arrow Electronics, Inc. He is 62.

| 1996 | 300,002 (3) |

| Ken C. Johnsen | Chief Restructuring Officer, Chief Executive Officer, President and a director of Geneva Steel Holdings Corp. Mr. Johnsen joined Geneva Steel in 1991. Geneva Steel filed a voluntary petition for reorganization under Chapter 11 in 2002. Mr. Johnsen has been retained, with the approval of Geneva Steel's secured lenders, to liquidate the assets of Geneva Steel. He is 45.

| 2001 | 15,000 (2) |

| James R. Klauser | Senior Vice President of Wisconsin Energy Corporation, a Milwaukee-based holding company with subsidiaries in utility and non-utility businesses. Prior to joining Wisconsin Energy in 1998, he was a senior partner with the law firm of Dewitt Ross and Stevens in Madison, Wisconsin. From 1986 to 1996 Mr. Klauser was Secretary of the Wisconsin Department of Administration. He is 64.

| 2001 | 15,000 (2) |

| Richard B. Loynd | Chairman of the Executive Committee and former Chairman of the Board and Chief Executive Officer of Furniture Brands International, Inc., the largest home furniture manufacturer in the United States. He is 76.

| 2001 | 17,000 (2) |

| P. Eric Siegert | Managing Director of Houlihan Lokey Howard & Zukin, an international investment banking firm. Houlihan Lokey acted as financial advisor to the Harnischfeger Creditors Committee during the corporation's reorganization. As Managing Director assigned to Houlihan Lokey's engagement with the Creditors Committee, Mr. Siegert advised the Committee on financial matters. Mr. Siegert is also a director of Alabama River Pulp, Inc. He is 38.

| 2001 | 15,000 (2)(4) |

| James H. Tate | Senior Vice President and Chief Financial Officer of Thermadyne Holdings Corporation, a global manufacturer of cutting and welding products headquartered in St. Louis, Missouri. Mr. Tate joined Thermadyne in 1993. Thermadyne voluntarily filed for reorganization under Chapter 11 in 2001 and emerged from bankruptcy in 2003. He is 56. | 2001 | 15,000 (2) |

|

|

|

Notes:

(1) The beneficial ownership information presented in this proxy statement is based on information furnished by the specified persons and is determined in accordance with Rule 13d-3 under the Securities Exchange Act of 1934, as required for purposes of this proxy statement. Accordingly, it includes shares of Common Stock that are issuable upon the exercise of stock options exercisable at or within 60 days after January 15, 2004, and restricted stock units. Such information is not necessarily to be construed as an admission of beneficial ownership for other purposes.

(2) Includes 15,000 shares the director has a right to acquire upon the exercise of currently exercisable options. Does not include 5,592 restricted stock units granted to each non-employee director.

(3) Includes 265,002 shares Mr. Hanson has a right to acquire upon exercise of currently exercisable stock options and 35,000 shares Mr. Hanson beneficially owns with his spouse.

(4) Pursuant to an order of the Bankruptcy Court, on February 6, 2002 the corporation issued 228,395 shares of Common Stock to Houlihan Lokey Howard & Zukin in payment of fees and expenses incurred by Houlihan Lokey Howard & Zukin in its role as financial advisor to the Harnischfeger Creditors Committee during the period the corporation operated under Chapter 11 bankruptcy protection (June 8, 1999 to July 12, 2001). The corporation did not incur fees to Houlihan Lokey Howard & Zukin during fiscal year 2003 and does not expect to incur any such fees in fiscal 2004.

The following graph shows the cumulative total stockholder return on the corporation’s Common Stock from August 1, 2001, the first trading day following the issuance of the corporation’s new Common Stock after its emergence from bankruptcy, until October 31, 2003, the last trading day before the end of fiscal 2003, as compared to the returns of the Standard & Poor’s 500 Stock Index and the Dow Jones U.S. Total Market Heavy Machinery Index. The companies in this index, listed below as the “Machinery Group,” are: AGCO Corporation, Astec Industries Inc., Caterpillar Inc., Deere & Co., Manitowoc Company, Terex Corporation, and, since March 24, 2003, Toro Company. The graph assumes $100 was invested on August 1, 2001 in (a) the corporation’s Common Stock, (b) the Standard & Poor’s 500 Stock Index and (c) the Machinery Group and assumes reinvestment of dividends.

Meetings

The Board of Directors held four meetings during fiscal 2003. Each of the directors attended over 90% of the total number of meetings of the Board and committees of which they were members. The Board of Directors has determined that all directors other than Mr. Hanson are independent under Nasdaq listing requirements.

Communications

Stockholder communications intended for the Board of Directors or for particular directors (other than stockholder proposals submitted pursuant to Exchange Act Rule 14a-8 and communications made in connection with such proposals) may be sent in care of the corporation’s Secretary at Joy Global Inc., 100 East Wisconsin Avenue Suite 2780, Milwaukee, Wisconsin 53202. The Secretary will forward all such communications to the Board of Directors or to particular directors as directed.

All directors are expected to attend the annual meeting and all directors attended the 2003 annual meeting either in person or by means of conference telephone. See the corporation’s website at www.joyglobal.com for further information about communications with directors and director attendance at annual meetings.

Compensation

Directors who are not officers or employees of the corporation receive an annual retainer fee of $30,000 and a fee of $1,250 for each Board and Board committee meeting attended. Committee chairs receive $1,500 for each committee meeting attended. In addition, as of the date of the annual meeting, each non-employee director receives a grant of restricted stock units under the terms of the 2003 Stock Incentive Plan. The number of restricted stock units granted annually to each non-employee director is equal to $60,000 divided by the then current market price of the corporation’s Common Stock. Restricted stock units become non-forfeitable one year after their grant and are paid out one year after the director terminates his duties on the board. Directors who are officers of the corporation earn no additional remuneration for their services as directors.

Committees

The Board has Audit, Human Resources and Executive committees.

Audit Committee and Audit Committee Financial Expert

The Audit Committee is a separately designated committee of the Board, established in accordance with Section 3(a)(58)(A) of the Exchange Act. Current members of the Audit Committee are James H. Tate (Chair), James R. Klauser and P. Eric Siegert. The Board of Directors has determined that Mr. Tate is an audit committee financial expert, and is independent, within the meaning of the Securities and Exchange Commission rules. The Board of Directors has also determined that all members of the Audit Committee are independent under Rule 4200(a)(15) of the Nasdaq’s listing standards.

The Board of Directors has adopted a written charter for the Audit Committee which is included as Annex A to this proxy statement. The charter is also available on the corporation’s website at www.joyglobal.com. The Audit Committee has the sole authority to appoint and replace the independent auditor and is directly responsible for the compensation and oversight of the independent auditor. The primary function of the Audit Committee is to monitor: (i) the integrity of the financial statements of the corporation; (ii) the independent auditor’s qualification and independence; (iii) the performance of the corporation’s internal audit function and the independent auditors; and (iv) the compliance by the corporation with legal and regulatory requirements. The Audit Committee met eight times during fiscal 2003.

Human Resources Committee

Current members of the Human Resources Committee are Richard B. Loynd (Chair), Steven L. Gerard and Ken C. Johnsen. The charter for the Human Resources Committee is available on the corporation’s website, www.joyglobal.com. The Board of Directors has determined that all members of the Human Resources Committee are independent under Rule 4200(a)(15) of the Nasdaq’s listing standards.

The primary functions of the Human Resources Committee are to: (i) periodically review and approve the compensation programs for the corporation’s key executives, including salary rates, incentive compensation plans, fringe benefits, non-cash perquisites and all other forms of compensation, (ii) administer the corporation’s stock option and stock-based compensation plans, (iii) periodically review the executive staffing of the corporation and make recommendations to the Board as appropriate, (iv) assess the performance of the Board and the performance of individual directors, (v) review and approve director compensation programs, and (vi) review and present to the Board for its consideration recommendations for nominations to fill expiring terms, vacancies or additions to the Board.

Stockholders who wish to recommend persons to become directors of the corporation should direct their recommendations to the Human Resources Committee in care of the corporation’s Secretary. The Human Resources Committee is developing specific, minimum qualifications for directors and a description of specific qualities or skills that it believes are necessary for one or more of the corporation’s directors to possess. Under the corporation’s bylaws, stockholder nominations of directors must be received by the corporation at the corporation’s principal executive offices, 100 East Wisconsin Avenue, Suite 2780, Milwaukee, Wisconsin 53202, directed to the attention of the Secretary, not less than 90 days before the 2005 meeting and any such nominations must contain the information specified in the corporation’s bylaws.

The current members of the board of directors were originally selected by the Creditors Committee in 2001 in connection with the corporation’s emergence from bankruptcy, were deemed approved by stockholders with the approval of the corporation’s plan of reorganization, and were reelected by stockholders at the 2002 and 2003 annual meetings. The Human Resources Committee is developing a process for identifying and evaluating nominees for directors. The Human Resources Committee met five times during fiscal 2003.

Executive Committee

Current members of the Executive Committee are Richard B. Loynd (Chair), John Nils Hanson, James R. Klauser and P. Eric Siegert. The primary functions of the Executive Committee are to consider proposals to (i) modify the corporation’s capital structure, (ii) acquire or divest businesses, (iii) make significant investments, or (iv) enter into strategic alliances. In addition, the Executive Committee may act upon a matter when it determines that prompt action is in the best interest of the corporation and it is not possible or necessary to call a meeting of the full Board. The Executive Committee did not meet during fiscal 2003.

The following table shows compensation awarded to, earned by or paid to the corporation’s Chief Executive Officer and each of the four most highly compensated executive officers other than the Chief Executive Officer who served as executive officers during fiscal 2003 for services rendered to the corporation and its subsidiaries during fiscal 2003, 2002 and 2001.

| Annual Compensation

| Long-Term

Compensation

| |

|---|

| Awards

| Payouts

| |

|---|

Name

And

Principal Position

| Year

| Salary

($)

| Bonus

($)

| Other

Annual

Compen-

sation

($)

(1)

| Restricted

Stock

Award(s)

($)

(2)

| Secu-

rities

Under-

lying

Options

/SARs

(#)

| LTIP

Payouts

| All

Other

Compen-

sation

($)

(3)

|

|---|

| John Nils Hanson | | 2003 | | 747,400 | | 681,087 | | 72,659 | | - | | 120,000 | | - | | 82,296 | |

| Chairman, President and | | 2002 | | 715,750 | | -- | | 38,202 | | - | | 397,500 | | - | | 136,717 | |

| Chief Executive | | 2001 | | 677,084 | | 963,078 | (4) | 23,191 | | - | | 132,500 | | - | | 4,902 | |

| Officer | |

|

| Donald C. Roof | | 2003 | | 384,000 | | 308,869 | | 12,526 | | - | | 50,000 | | - | | 131,709 | |

| Executive Vice | | 2002 | | 382,500 | | -- | | 12,022 | | - | | 217,500 | | - | | 86,883 | |

| President, Chief | | 2001 | | 210,350 | | 102,600 | | 4,690 | | - | | 72,500 | | - | | 23,176 | |

| Financial Officer and | |

| Treasurer | |

|

| Mark E. Readinger | | 2003 | | 316,250 | | 249,063 | | 72,691 | | - | | 100,000 | | - | | 66,128 | |

| Executive Vice | | 2002 | |

| President; President and | | 2001 | | 61,555 | | -- | | -- | | - | | -- | | - | | 789,601 | |

| Chief Operating Officer | |

| of P&H Mining | |

| Equipment (5) | |

|

| Michael W. Sutherlin | | 2003 | | 307,500 | | 273,405 | | 30,957 | | - | | 120,000 | | - | | 74,806 | |

| Executive Vice | |

| President; President and | |

| Chief Operating Officer, | |

| Joy Mining Machinery (6) | |

|

| James A. Chokey | | 2003 | | 301,200 | | 223,248 | | 21,375 | | - | | 30,000 | | - | | 9,401 | |

| Executive Vice | | 2002 | | 299,917 | | -- | | 23,340 | | - | | 90,000 | | - | | 4,882 | |

| President, Law and | | 2001 | | 291,583 | | 398,495 | (4) | 25,611 | | - | | 30,000 | | - | | 2,606 | |

| Government Affairs and | |

| General Counsel | |

|

Notes:

(1) None of the named executive officers received perquisites or other personal benefits in fiscal 2003 that in the aggregate exceeded the lesser of $50,000 or ten percent of total salary and bonus for the named executive officer. The amounts reported in this category represent amounts reimbursed during the fiscal year for the payment of taxes. Amounts reimbursed for the payment of taxes are not deemed to be perquisites or personal benefits.

(2) No restricted stock has been awarded to or is held by the named executive officers.

(3) Includes the following amounts for fiscal 2003: for Mr. Hanson, $67,500 for supplemental life insurance, $8,546 group term life insurance and $6,250 of 401(k) company matching contribution; for Mr. Roof, $125,000 paid pursuant to his offer of employment letter, $5,050 of 401(k) company matching contribution and $1,659 group term life insurance; for Mr. Readinger, $59,807 for relocation expenses, $5,406 of 401(k) company matching contribution and $915 group term life insurance; for Mr. Sutherlin, $74,806 for relocation expenses; and for Mr. Chokey, $6,199 of 401(k) company matching contribution and $3,202 group term life insurance. The amount listed for Mr. Readinger for fiscal 2001 includes $789,114 paid in connection with the liquidation of Beloit Corporation and as the result of the termination of the Employment, Consulting, Waiver and Release Agreement between Mr. Readinger and the corporation and $487 group term life insurance.

(4) Includes amounts paid under the corporation’s bonus compensation plans in effect for fiscal 2001 and the following emergence bonus payments paid in fiscal 2001 under the Bankruptcy Court approved Key Employee Retention Plan: Mr. Hanson, $544,003; and Mr. Chokey, $216,240. The entire amount of the emergence bonus payments received in fiscal 2001 is listed for fiscal 2001 although a portion of such bonus payments may be allocable to fiscal 2000 and 1999.

(5) Mr. Readinger became an executive officer during fiscal 2003. Mr. Readinger previously served as an executive officer of the corporation and President and Chief Operating Officer of Beloit Corporation until January 2001.

(6) Mr. Sutherlin became an executive officer during fiscal 2003.

The Human Resources Committee has presented the following report on executive compensation for inclusion in this proxy statement.

Compensation Philosophy

The members of the Human Resources Committee believe that the corporation’s senior executive officers, including the Chief Executive Officer, should be compensated on a basis competitive with other manufacturing companies of comparable size. The objective is to provide a total compensation program that establishes base salaries in a competitive range, bonus opportunities that reward above-average performance with above-average pay, and stock-based incentive programs designed to achieve long-term corporate financial goals and build executive stock ownership. The Committee has established long-term ownership objectives for the Chief Executive Officer and the other executive officers equal to five times annual salary in the case of the Chief Executive Officer and two and one-half times annual salary for the other executive officers. These objectives serve to align management and stockholder interests. This philosophy is based on the need to attract and retain experienced and talented executive officers.

Base Salaries For Fiscal 2003

Base salaries for fiscal 2003 for Mr. Hanson and the other executive officers named in the Summary Compensation Table were established by the Human Resources Committee early in the fiscal year using the compensation philosophy described above.

Bonus Plan for Fiscal 2003

The corporation has an annual bonus compensation plan that applies to senior executive officers and that was approved by stockholders at the 2002 annual meeting. The annual bonus compensation plan applies to Mr. Hanson and the other named executive officers who may be “covered employees” as defined in Section 162(m) of the Internal Revenue Code. The Committee has discretion under the annual bonus compensation plan to reduce or eliminate awards.

The bonus plan for fiscal 2003 for all other employees of the corporation was based on return on average working capital (ROAWC). As in fiscal 2002, management performed well under difficult market conditions in fiscal 2003. Unlike fiscal 2002 when performance goals were not met and no bonuses were paid to executives and other employees, performance goals for fiscal 2003 were met at both P&H Mining Equipment and Joy Mining Machinery. Employees at the business units and at the parent company earned above target bonuses in fiscal 2003.

Bonus targets for fiscal 2003 under the annual bonus compensation plan for senior executive officers were also met. The Committee exercised its discretion under the annual bonus compensation plan for senior executive officers and reduced bonus payments to Mr. Hanson and the other named executive officers for fiscal 2003 to the amounts those individuals would have earned had they participated in the ROAWC bonus plan for all other employees.

Stock Options

The Committee believes that stock options are an important component of a sound compensation program for executive officers. Stock options were granted on November 18, 2002, to approximately 250 employees, including executive officers. The Committee determined the number of stock options to grant to each executive officer after consultation with compensation advisors and based upon our philosophy of using stock-based incentive programs to build executive stock ownership and align management and stockholder interests.

Performance Unit Award Program

The Committee established a Performance Unit Award Program under the terms of the Stock Incentive Plan during fiscal 2001 in order to provide senior executive officers with long-term incentives to generate positive net cash flow. An initial grant of Performance Units under the program was made in fiscal 2001 and a second grant was made during fiscal 2003. The Committee believes that the Performance Unit Award Program serves as a powerful retention tool and motivates senior management of the corporation to generate the cash needed to meet debt obligations, fund operations, and provide an appropriate return for stockholders.

CEO Compensation For Fiscal 2003

Mr. Hanson’s compensation for fiscal 2003 as reported in the Summary Compensation Table includes base salary of $747,400 and a bonus of $681,087. In addition, during fiscal 2003 Mr. Hanson received a grant of 40,000 performance units and a grant of 120,000 stock options.

In November 2003 the Committee formally evaluated Mr. Hanson’s performance against goals established for Mr. Hanson by the Committee at the beginning of the year. The Committee also established performance goals for Mr. Hanson for fiscal 2004 and increased his base salary for 2004 to $782,400.

Tax Considerations

The Committee intends to take the necessary steps to satisfy the conditions of Section 162(m) of the Internal Revenue Code in order to preserve the deductibility of executive compensation to the fullest extent possible consistent with the Committee’s other compensation objectives and overall compensation philosophy.

| |

|---|

| Respectfully,

|

| Richard B. Loynd (Chair)

Steven L. Gerard

Ken C. Johnsen |

The Performance Unit Award Program provides long-term incentive compensation opportunities to the executives named in the Summary Compensation Table and to other executives of the corporation.

A number of shares of Common Stock may be earned by the named executives under awards granted in fiscal 2003 under the Performance Unit Award Program if, at the end of a 36-month award cycle, cumulative net cash flow exceeds a certain threshold amount. Each performance unit represents the right to earn one share of Common Stock. Awards can range from 0% to 150% of the target award opportunities. Awards are accelerated based on the greater of actual performance or target award in the event of a change in control, as defined in the Stock Incentive Plan.

The following table provides information regarding awards to the named executive officers during fiscal 2003 under the Performance Unit Award Program.

LONG-TERM INCENTIVE PLANS - AWARDS IN LAST FISCAL YEAR

| Estimated Future Payouts Under Non-Stock

Price-Based Plans

|

|---|

Name

| Number of

Shares,

Units or

Other Rights

(#)

| Performance or Other Period

Until Maturation Or Payout

| Threshold

(#)

| Target

(#)

| Maximum

(#)

|

|---|

| John Nils Hanson | | 40,000 | | October 29, 2005 | | 20,000 | | 40,000 | | 60,000 | |

|

| Donald C. Roof | | 16,500 | | October 29, 2005 | | 8,250 | | 16,500 | | 24,750 | |

|

| Mark E. Readinger | | 25,000 | | October 29, 2005 | | 12,500 | | 25,000 | | 37,500 | |

|

| Michael W. Sutherlin | | 30,000 | | October 29, 2005 | | 15,000 | | 30,000 | | 45,000 | |

|

| James A. Chokey | | 10,000 | | October 29, 2005 | | 5,000 | | 10,000 | | 15,000 | |

|

|

|

|

|

|

The following table summarizes information about the corporation’s equity compensation plans as of the end of fiscal 2003. All outstanding awards relate to Common Stock.

Plan category

| Number of securities to

be issued upon exercise

of outstanding options,

warrants and rights

(a)

| Weighted-average exercise

price of outstanding

options, warrants and

rights

(b)

| Number of securities

remaining available for

future issuance under

equity compensation

plans (excluding

securities reflected in

column (a))

(c)

|

|---|

Equity compensation plans

approved by security

holders (1)

|

5,096,894 (2) |

$14.88 |

2,813,934 |

Equity compensation plans

not approved by security

holders

|

-

|

-

|

-

|

| Total | 5,096,894

| $14.88

| 2,813,934

|

Notes:

(1) The corporation’s 2001 Stock Incentive Plan was deemed approved by stockholders in connection with the approval of the corporation’s plan of reorganization. The corporation’s 2003 Stock Inventive Plan was approved by stockholders at the 2003 annual meeting.

(2) Includes 734,566 shares of Common Stock which is the maximum number of shares that may be issued under awards granted in fiscal 2001 and fiscal 2003 under the Performance Unit Award Program and 33,492 shares of Common Stock that may be issued under restricted stock unit awards granted in fiscal 2003 to non-employee directors.

The following table shows information about stock option grants during the last fiscal year to the five executive officers named in the Summary Compensation Table.

OPTION/SAR GRANTS IN LAST FISCAL YEAR (1)

Individual Grants

|

|---|

Name

| Number of

Securities

Underlying

Options/SARs

Granted

(#)

| Percent of

Total

Options/SARs

Granted to

Employees

in Fiscal Year

| Exercise or

Base Price

($/sh)

| Expiration Date (2)

| Grant Date

Present

Value($)

(3)

|

|---|

| John Nils Hanson | | | | 120,000 | | | 10 | .98% | | 10 | .38 | November 18, 2012 | | | $ | 556,800 | |

|

| Donald C. Roof | | | | 50,000 | | | 4 | .58% | | 10 | .38 | November 18, 2012 | | | $ | 232,000 | |

|

| Mark E. Readinger | | | | 100,000 | | | 9 | .15% | | 10 | .87 | December 11, 2012 | | | $ | 477,000 | |

|

| Michael W. Sutherlin | | | | 120,000 | | | 10 | .98% | | 11 | .88 | January 10, 2013 | | | $ | 595,200 | |

|

| James A. Chokey | | | | 30,000 | | | 2 | .75% | | 10 | .38 | November 18, 2012 | | | $ | 139,200 | |

|

Notes:

(1) No Stock Appreciation Rights (SARs) were granted in the last fiscal year.

(2) Options become exercisable in one-third increments on the first, second and third anniversaries of November 18, 2002.

(3) Grant date present values were determined using the Black-Scholes option pricing model. The actual value, if any, an executive may realize will depend on the excess of the stock price over the exercise price on the date the option is exercised. There is no assurance the value realized by an executive will be at or near the value estimated by the Black-Scholes model. The estimated values are based on assumed volatility of 37%, risk-free rate of return of 4.5%, dividend yield of 0.0% and seven year option expiration. No adjustments have been made for non-transferability or risk of forfeiture.

The following table shows information with respect to the five executive officers named in the Summary Compensation Table concerning the value of options outstanding at the end of the last fiscal year. None of the five executive officers named in the Summary Compensation Table exercised options or stock appreciation rights during the last fiscal year. No Stock Appreciation Rights (SARs) are outstanding. The value of unexercised in-the-money options is determined by multiplying the number of unexercised options for each in-the-money grant by the difference between the option exercise price for that grant and the year-end closing price of $19.26 per share and then aggregating these amounts for all in-the-money grants for each executive officer.

AGGREGATED OPTION/SAR EXERCISES IN LAST FISCAL YEAR AND FY-END OPTION/SAR VALUES

| Shares

Acquired on

Exercise | Value

Realized | Number of Securities

Underlying Unexercised

Options/SARs at

Fiscal Year-End (#)

| Value of Unexercised

In-the-Money Options/

SARs at Fiscal Year-

End ($)

|

|---|

Name

| (#)

| ($)

| Exercisable

| Unexercisable

| Exercisable

| Unexercisable

|

|---|

| John Nils Hanson | | | - | | | - | | | | 353,336 | | | 296,664 | | $ | 1,078,558 | | $ | 1,604,867 | |

|

| Donald C. Roof | | | - | | | - | | | | 193,336 | | | 146,664 | | $ | 590,158 | | $ | 739,067 | |

|

| Mark E. Readinger | | | - | | | - | | | | -- | | | 100,000 | | | -- | | $ | 839,000 | |

|

| Michael W. Sutherlin | - | | | - | | | | -- | | | 120,000 | | | -- | | $ | 885,600 | |

|

| James A. Chokey | | | - | | | - | | | | 80,000 | | | 70,000 | | $ | 244,200 | | $ | 388,500 | |

|

The following table lists the estimated annual benefits payable upon retirement at normal retirement age for the years of service indicated under the corporation’s defined benefit pension plan (and excess benefit arrangements described below) at the indicated remuneration levels. Remuneration covered by the plan includes the salary and bonus amounts reported in the Summary Compensation Table.

The years of service credited for each of the executive officers named in the Summary Compensation Table are: John Nils Hanson, 22 years; Donald C. Roof, 2 years; Mark E. Readinger, 3 years; Michael W. Sutherlin, 0 years; and James A. Chokey, 21 years. Under an arrangement approved by the Human Resources Committee in 1999, Mr. Hanson is credited with three years of service for pension plan purposes for each year he is employed by the corporation after June 1999.

Benefits are based both upon credited years of service with the corporation or its subsidiaries and the highest average yearly salary and incentive compensation over a 60 consecutive calendar month period during the last 120 consecutive calendar months of service. The estimated benefits in the table do not reflect offsets under the plan of 1.25% per year of service (up to a maximum of 50%) of the Social Security benefit.

Estimated benefits under the retirement plan are subject to the provisions of the Internal Revenue Code which limit the annual benefits which may be paid from a tax qualified retirement plan. Amounts in excess of such limitations will be paid from the general funds of the corporation under the terms of the corporation’s Supplemental Retirement Plan.

| Years of Service

|

|---|

Remuneration

| 10

| 15

| 20

| 25

| 30

| 35

|

|---|

| $ | 400,000 | | $ | 60,000 | | $ | 90,000 | | $ | 120,000 | | $ | 150,000 | | $ | 180,000 | | $ | 210,000 | |

|

| | 600,000 | | | 90,000 | | | 135,000 | | | 180,000 | | | 225,000 | | | 270,000 | | | 315,000 | |

|

| | 800,000 | | | 120,000 | | | 180,000 | | | 240,000 | | | 300,000 | | | 360,000 | | | 420,000 | |

|

| | 1,000,000 | | | 150,000 | | | 225,000 | | | 300,000 | | | 375,000 | | | 450,000 | | | 525,000 | |

|

| | 1,200,000 | | | 180,000 | | | 270,000 | | | 360,000 | | | 450,000 | | | 540,000 | | | 630,000 | |

|

| | 1,400,000 | | | 210,000 | | | 315,000 | | | 420,000 | | | 525,000 | | | 630,000 | | | 735,000 | |

|

| | 1,600,000 | | | 240,000 | | | 360,000 | | | 480,000 | | | 600,000 | | | 720,000 | | | 840,000 | |

|

| | 1,800,000 | | | 270,000 | | | 405,000 | | | 540,000 | | | 675,000 | | | 810,000 | | | 945,000 | |

|

| | 2,000,000 | | | 300,000 | | | 450,000 | | | 600,000 | | | 750,000 | | | 900,000 | | | 1,050,000 | |

|

The corporation entered into change-in-control employment agreements dated as of May 20, 2003 with each of the executive officers named in the Compensation Table and certain other employees. The agreements replace change-in-control agreements that were put in place prior to the corporation’s reorganization and that expired on July 12, 2003.

The new agreements provide that, in the event of a “Change of Control” (as defined in the agreements), any outstanding and unvested stock options will be cashed out at a then current market price. The agreements provide further that in the event the executive’s employment is terminated during the three year period following a Change of Control, either by the executive for “Good Reason” or by the corporation without “Cause” (as such terms are defined in the agreements), the corporation will provide the executive with outplacement services and will provide medical, insurance and other welfare benefits to the executive for two years (three years in the case of the CEO), pay the executive accrued benefits including a pro rata target bonus, and pay the executive a lump sum equal to two times (three times in the case of the CEO) the sum of the executive’s base salary and target bonus.

The approximate dollar amounts that would have been payable to the named executive officers under the provisions of these agreements if a Change of Control had occurred and the respective executive’s employment was terminated as of the date of this proxy statement, either by the individual for “Good Reason” or by the corporation without “Cause”, are: Mr. Hanson, $7.5 million; Mr. Roof, $2.9 million; Mr. Readinger $2.2 million; Mr. Sutherlin $2.5 million; and Mr. Chokey, $1.8 million.

In the event of a “Change in Control” of the corporation as defined in the Stock Incentive Plan, Performance Unit Awards granted to each of the named executive officers contain provisions that provide for a lump sum cash payment of the greater of the value of the performance units earned as of the date of the Change in Control or the value of the pro rata target number of performance units through the date of the Change in Control. The approximate dollar amounts that would have been payable to the named executive officers under the provisions of the Performance Unit Awards had a Change in Control occurred as of the date of this proxy statement are: Mr. Hanson, $3.4 million; Mr. Roof, $1.6 million; Mr. Readinger $0.6 million; Mr. Sutherlin $0.7 million; and Mr. Chokey, $0.8 million.

Pursuant to the corporation’s bylaws, officers and directors of the corporation are indemnified by the corporation in the event claims are made against them arising out of their service as an officer or director. Other than these indemnification arrangements, there were no other relationships or related transactions during fiscal 2003 involving any director or executive officer (or any members of their immediate families) to which the corporation or any of its subsidiaries was a party which are required to be disclosed under the rules governing the preparation of proxy statements.

The Audit Committee has presented the following report for inclusion in this proxy statement.

The Audit Committee met with management and the independent auditor eight times during fiscal 2003.

Management represented to the Committee that the corporation’s financial statements were prepared in accordance with generally accepted accounting principles. The Committee has reviewed and discussed the financial statements with management and the independent auditor. The Committee discussed with the independent auditor matters required to be discussed by Statement on Auditing Standards No. 61 (Communications with Audit Committees).

The corporation’s independent auditor provided to the Committee the written disclosures required by Independence Standards

Board No. 1 (Independence Discussions with Audit Committees) and the Committee discussed with the independent auditor that firm’s independence.

Based upon the Committee’s discussions with management and the independent auditor and the Committee’s review of the representations of management and the report of the independent auditor to the Committee, the Committee recommended that the Board of Directors include the audited financial statements in the corporation’s Annual Report on Form 10-K for the fiscal year ended November 1, 2003 filed with the Securities and Exchange Commission.

| |

|---|

| Respectfully,

|

| James H. Tate (Chair)

James R. Klauser

P. Eric Siegert |

Ernst & Young LLP served as the corporation’s independent auditor for fiscal 2003. A representative of Ernst & Young is expected to be present at the 2004 annual meeting and will be given the opportunity to make a statement and answer questions that may be asked by stockholders. The Audit Committee expects to make its selection of independent auditor for fiscal 2004 during the first half of the year.

At a meeting held on July 22, 2002, the Board of Directors, upon recommendation of the Audit Committee, approved the engagement of Ernst & Young LLP as the corporation’s independent auditor and dismissed the firm of PricewaterhouseCoopers LLP. Except as described in the following sentence, PricewaterhouseCoopers’ reports on the corporation’s consolidated financial statements for the 2000 and 2001 fiscal years did not contain an adverse opinion or disclaimer of opinion, nor were such reports qualified or modified as to uncertainty, audit scope or accounting principle. PricewaterhouseCoopers’ report on the corporation’s consolidated financial statements for the 2000 fiscal year was qualified as to uncertainty about the ability of the corporation to continue as a going concern in light of the corporation’s bankruptcy filing in June 1999. The corporation emerged from bankruptcy in July 2001.

During the 2000 and 2001 fiscal years and through July 22, 2002, there were no disagreements between the corporation and PricewaterhouseCoopers on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure which, if not resolved to PricewaterhouseCoopers’ satisfaction, would have caused the firm to make reference to the subject matter thereof in connection with their report on the corporation’s consolidated financial statements and there were no reportable events as described in Item 304(a)(1)(v) of Regulation S-K.

During the 2000 and 2001 fiscal years and through July 22, 2002, the corporation did not consult with Ernst & Young with respect to the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the corporation’s consolidated financial statements, or any other matters or reportable events as set forth in Items 304(a)(2)(i) and (ii) of Regulation S-K.

Audit Fees

Ernst & Young LLP billed the corporation an aggregate of $1,189,133 in fees for professional services rendered for the audit of the corporation’s annual financial statements for fiscal 2003 and the reviews of the financial statements included in the corporation’s Forms 10-Q for fiscal 2003. These fees are for services that are normally provided by Ernst & Young in connection with statutory and regulatory filings or engagements including the annual consolidated audit, foreign statutory audits, consents and accounting consultation for matters that were addressed during the audit work. Fees billed in this category for fiscal 2002 aggregated $950,996.

Audit-Related Fees

Ernst & Young LLP billed the corporation an aggregate of $68,170 in fees for audit-related services. These fees are for assurance and related services provided by Ernst & Young that are reasonably related to the performance of the audit including employee benefit plan audits, accounting consultations not specifically linked to audit work and fees for access to electronic accounting research. Fees billed in this category for fiscal 2002 aggregated $20,174.

Tax Fees

Ernst & Young LLP billed the corporation an aggregate of $795,018 in tax fees. These fees are for tax consultation and tax planning provided by Ernst & Young that are related to various federal, state and international issues and entity restructuring. Fees billed in this category for fiscal 2002 aggregated $15,330.

All Other Fees

Ernst & Young LLP did not bill the corporation for fees in the “All Other Fees” category in either fiscal 2003 or fiscal 2002.

Audit Committee Pre-approval Policies and Procedures

The Audit Committee has established a policy to pre-approve the audit and non-audit services performed by the independent auditor in order to assure that the provision of such services does not impair the auditor’s independence. Based on information presented to the Audit Committee by Ernst & Young and the corporation’s management, the Audit Committee has pre-approved defined audit, audit-related, tax and other services for fiscal 2004 up to specified cost levels. Any proposed services exceeding pre-approved cost levels require specific pre-approval by the Audit Committee. The policy requires the independent auditor to provide detailed back-up documentation regarding the specific services to be provided. The policy also prohibits the independent auditor from providing services that are prohibited under the Sarbanes-Oxley Act of 2002.

None of the fees reported under the headings Audit-Related Fees, Tax Fees, and All Other Fees were approved by the Audit Committee pursuant to 17 CFR 210.2-01(c)(7)(i)(C) that permits the Audit Committee to waive its pre-approval requirement under certain circumstances.

Additional Matters

The Board of Directors is not aware of any other matters that will be presented for action at the 2004 annual meeting. Should any additional matters properly come before the meeting, the persons named in the enclosed proxy will vote on those matters in accordance with their best judgment.

Submission of Stockholder Proposals

Stockholder proposals for the 2005 annual meeting must be received no later than September 25, 2004 at the corporation’s principal executive offices, 100 East Wisconsin Avenue, Suite 2780, Milwaukee, Wisconsin 53202, directed to the attention of the Secretary, in order to be considered for inclusion in next year’s annual meeting proxy materials under Securities and Exchange Commission rules. Under the corporation’s bylaws, written notice of stockholder proposals for the 2005 annual meeting which are not intended to be considered for inclusion in next year’s annual meeting proxy materials (stockholder proposals submitted outside the processes of SEC Rule 14a-8) must be received by the corporation at such offices, directed to the attention of the Secretary, not less than 75 nor more than 105 days before the first anniversary of this year’s meeting and must contain the information specified in the corporation’s bylaws.

Cost of Proxy Solicitation

The corporation will pay the cost of preparing, printing and mailing proxy materials as well as the cost of soliciting proxies on behalf of the Board. In addition to using mail services, officers and other employees of the corporation, without additional remuneration, may solicit proxies in person and by telephone, e-mail or facsimile transmission. The corporation may retain a professional proxy solicitation firm, and pay such firm its customary fee, to solicit proxies from direct holders and from banks, brokers and other nominees having shares registered in their names which are beneficially owned by others.

Annual Report on Form 10-K

A copy (without exhibits) of the corporation’s Annual Report to the Securities and Exchange Commission on Form 10-K for the fiscal year ended November 1, 2003 is being provided with this proxy statement. The corporation will provide an additional copy of such Annual Report to any stockholder, without charge, upon written request of such stockholder. Such requests should be addressed to the attention of “Stockholder Relations” at Joy Global Inc., 100 East Wisconsin Avenue, Suite 2780, Milwaukee, Wisconsin 53202.

Section 16(a) Beneficial OwnershipReporting

Compliance

Based solely upon a review of Forms 3 and 4 and amendments thereto furnished to the corporation during the last fiscal year and Forms 5 and amendments thereto furnished to the corporation with respect to the last fiscal year or written representations that no reports were required, the corporation is not aware that any director, officer or beneficial owner of more than 10% of the corporation’s Common Stock failed to report on a timely basis transactions required to be reported during the last fiscal year by Section 16(a) of the Securities and Exchange Act of 1934.

| |

|---|

| By order of the Board of Directors

|

| ERIC B. FONSTAD

Secretary

|

| January 23, 2004 |

AUDIT COMMITTEE CHARTER

Purpose

The Audit Committee is appointed by the Board to assist the Board in monitoring (1) the integrity of the financial statements of the Corporation, (2) the independent auditor’s qualifications and independence, (3) the performance of the Corporation’s internal audit function and independent auditors, and (4) the compliance by the Corporation with legal and regulatory requirements.

The Audit Committee shall prepare the report required by the rules of the Securities and Exchange Commission (the “Commission”) to be included in the Corporation’s annual proxy statement.

Committee Membership

The Audit Committee shall consist of no fewer than three members. The members of the Audit Committee shall meet the independence and experience requirements of each stock exchange or market on which the Corporation’s securities are listed, Section 10A(m)(3) of the Securities Exchange Act of 1934 (the “Exchange Act”) and the rules and regulations of the Commission. All members of the Audit Committee shall have a working familiarity with basic finance and accounting practices and at least one member of the Audit Committee shall be a financial expert as defined by the Commission. Audit committee members shall not simultaneously serve on the audit committees of more than two other public companies.

The members of the Audit Committee shall be appointed by the Board on the recommendation of the Human Resources Committee. Audit Committee members may be replaced by the Board. Unless the Chair is designated by the Board, the members of the Audit Committee may designate a Chair by majority vote of the full Audit Committee membership.

Meetings

The Audit Committee shall meet as often as it determines, but not less frequently than quarterly. The Audit Committee shall meet periodically with management, the internal auditors and the independent auditor in separate executive sessions. The Audit Committee may request any officer or employee of the Corporation or the Corporation’s outside counsel or independent auditor to attend a meeting of the Committee or to meet with any members of, or consultants to, the Committee.

Committee Authority and Responsibilities

The Audit Committee shall have the sole authority to appoint or replace the independent auditor. The Audit Committee shall be directly responsible for the compensation and oversight of the work of the independent auditor (including resolution of disagreements between management and the independent auditor regarding financial reporting) for the purpose of preparing or issuing an audit report or related work. The independent auditor shall report directly to the Audit Committee.

The Audit Committee shall pre-approve all auditing services and permitted non-audit services (including the fees and terms thereof) to be performed for the Corporation by its independent auditor, subject to the de minimus exceptions for non-audit services described in Section 10A(i)(1)(B) of the Exchange Act which are approved by the Audit Committee prior to the completion of the audit. The Audit Committee may form and delegate authority to subcommittees consisting of one or more members when appropriate, including the authority to grant pre-approvals of audit and permitted non-audit services, provided that decisions of such subcommittee to grant pre-approvals shall be presented to the full Audit Committee at its next scheduled meeting.

The Audit Committee shall have the authority, to the extent it deems necessary or appropriate, to retain independent legal, accounting or other advisors. The Corporation shall provide for appropriate funding, as determined by the Audit Committee, for payment of compensation to the independent auditor for the purpose of rendering or issuing an audit report and to any advisors employed by the Audit Committee. The Audit Committee shall make regular reports to the Board. The Audit Committee shall review and reassess the adequacy of this Charter annually and recommend any proposed changes to the Board for approval. The Audit Committee shall annually review the Audit Committee’s own performance.

The Audit Committee, to the extent it deems necessary or appropriate, shall:

Financial Statement and Disclosure Matters

| 1. | Review and discuss with management and the independent auditor the annual audited financial statements, including disclosures made in management’s discussion and analysis, and recommend to the Board whether the audited financial statements should be included in the Corporation’s Form 10-K. |

| 2. | Review and discuss with management and the independent auditor the Corporation’s quarterly financial statements prior to the filing of its Form 10-Q, including the results of the independent auditor’s review of the quarterly financial statements. |

| 3. | Discuss with management and the independent auditor significant financial reporting issues and judgments made in connection with the preparation of the Corporation’s financial statements, including any significant changes in the Corporation’s selection or application of accounting principles, any major issues as to the adequacy of the Corporation’s internal controls and any special steps adopted in light of material control deficiencies. |

| 4. | Review and discuss reports from the independent auditors on: |

| a) | All critical accounting policies and practices to be used. |

| b) | All alternative treatments of financial information within generally accepted accounting principles that have been discussed with management, ramifications of the use of such alternative disclosures and treatments, and the treatment preferred by the independent auditor. |

| c) | Other material written communications between the independent auditor and management, such as any management letter or schedule of unadjusted differences. |

| 5. | Discuss with management the Corporation’s earnings press releases, as well as financial information and earnings guidance provided to investors, analysts and rating agencies. Such discussion may be done generally (consisting of discussing the types of information to be disclosed and the types of presentations to be made). |

| 6. | Discuss with management and the independent auditor the effect of regulatory and accounting initiatives as well as off-balance sheet structures on the Corporation’s financial statements. |

| 7. | Discuss with management the Corporation’s major financial risk exposures and the steps management has taken to monitor and control such exposures, including the Corporation’s risk assessment and risk management policies. |

| 8. | Discuss with the independent auditor the matters required to be discussed by Statement on Auditing Standards No. 61 relating to the conduct of the audit, including any difficulties encountered in the course of the audit work, any restrictions on the scope of activities or access to requested information, and any significant disagreements with management. |

| 9. | Review disclosures made to the Audit Committee by the Corporation’s CEO and CFO during their certification process for the Form 10-K and Form 10-Q about any significant deficiencies in the design or operation of internal controls or material weaknesses therein and any fraud involving management or other employees who have a significant role in the Corporation’s internal controls. |

Oversight of the Corporation’s Relationship with the Independent Auditor

| 10. | Review and evaluate the lead partner of the independent auditor team. |

| 11. | Obtain and review a report from the independent auditor at least annually regarding (a) the independent auditor’s internal quality-control procedures, (b) any material issues raised by the most recent internal quality-control review, or peer review, of the firm, or by any inquiry or investigation by governmental or professional authorities within the preceding five years respecting one or more independent audits carried out by the firm, (c) any steps taken to deal with any such issues, and (d) all relationships between the independent auditor and the Corporation. Evaluate the qualifications, performance and independence of the independent auditor, including considering whether the auditor’s quality controls are adequate and the provision of permitted non-audit services is compatible with maintaining the auditor’s independence, and taking into account the opinions of management and internal auditors. The Audit Committee shall present its conclusions with respect to the independent auditor to the Board. |

| 12. | Ensure the rotation of the lead (or coordinating) audit partner having primary responsibility for the audit and the audit partner responsible for reviewing the audit as required by law. Consider whether, in order to assure continuing auditor independence, it is appropriate to adopt a policy of rotating the independent auditing firm on a regular basis. |

| 13. | Recommend to the Board policies for the Corporation’s hiring of employees or former employees of the independent auditor who participated in any capacity in the audit of the Corporation. |

| 14. | Review with the independent auditor (i) matters of audit quality and consistency on which the Corporation’s audit team consulted with its national office and (ii) any other significant issues on which the Corporation’s audit team consulted with its national office. Consult with the national office of the independent auditor as the Committee determines to be appropriate. |

| 15. | Meet with the independent auditor prior to the audit to discuss the planning and staffing of the audit. |

Oversight of the Corporation’s Internal Audit Function

| 16. | Review the appointment and replacement of the senior internal auditing executive. |

| 17. | Review the significant reports to management prepared by the internal auditing department and management’s responses. |

| 18. | Discuss with the independent auditor and management the internal audit department responsibilities, budget and staffing and any recommended changes in the planned scope of the internal audit. |

Compliance Oversight Responsibilities

| 19. | Obtain from the independent auditor assurance that Section 10A(b) of the Exchange Act has not been implicated. |

| 20. | Obtain reports from management, the Corporation’s senior internal auditing executive and the independent auditor that the Corporation and its subsidiary/foreign affiliated entities are in conformity with applicable legal requirements, the Corporation’s Code of Ethics for the CEO and Senior Financial Officers, and the Corporation’s Worldwide Business Conduct Policy. Review reports and disclosures of insider and affiliated party transactions. Advise the Board with respect to the Corporation’s policies and procedures regarding compliance with applicable laws and regulations, with the Corporation’s Code of Ethics for the CEO and Senior Financial Officers, and with the Corporation’s Worldwide Business Conduct Policy. |

| 21. | Establish procedures for the receipt, retention and treatment of complaints received by the Corporation regarding accounting, internal accounting controls or auditing matters, and the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters. |

| 22. | Discuss with management and the independent auditor any correspondence with regulators or governmental agencies and any published reports which raise material issues regarding the Corporation’s financial statements or accounting policies. |

| 23. | Discuss with the Corporation’s General Counsel legal matters that may have a material impact on the financial statements or the Corporation’s compliance policies. |

Limitation of Audit Committee’s Role

While the Audit Committee has the responsibilities and powers set forth in this Charter, it is not the duty of the Audit Committee to plan or conduct audits or to determine that the Corporation’s financial statements and disclosures are complete and accurate and are in accordance with generally accepted accounting principles and applicable rules and regulations. These are the responsibilities of management and the independent auditor.