UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-04875

Name of Registrant: Royce Value Trust, Inc.

Address of Registrant: 745 Fifth Avenue

New York, NY 10151

| Name and address of agent for service: | John E. Denneen, Esquire

745 Fifth Avenue

New York, NY 10151

|

Registrant’s telephone number, including area code: (212) 508-4500

Date of fiscal year end: December 31

Date of reporting period: January 1, 2014 – December 31, 2014

| Item 1. Reports to Shareholders. |

| | | DECEMBER 31, 2014 |

| | | |

| | | |

| | | |

| | | 2014 Annual |

| | | Review and Report to Stockholders |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | Royce Value Trust |

| | | | |

| | | Royce Micro-Cap Trust |

| | | | |

| | | Royce Global Value Trust | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | roycefunds.com |  |

| | | | |

| | | | |

| | | | |

| A Few Words on Closed-End Funds |

| |

Royce & Associates, LLC manages three closed-end funds: Royce Value Trust, which invests primarily in small-cap securities; Royce Micro-Cap Trust, which invests primarily in micro-cap securities; and Royce Global Value Trust, which invests in both U.S. and non-U.S. small-cap stocks. A closed-end fund is an investment company whose shares are listed and traded on a stock exchange. Like all investment companies, including open-end mutual funds, the assets of a closed-end fund are professionally managed in accordance with the investment objectives and policies approved by the fund’s Board of Directors. A closed-end fund raises cash for investment by issuing a fixed number of shares through initial and other public offerings that may include shelf offerings and periodic rights offerings. Proceeds from the offerings are invested in an actively managed portfolio of securities. Investors wanting to buy or sell shares of a publicly traded closed-end fund after the offerings must do so on a stock exchange, as with any publicly traded stock. Shares of closed-end funds frequently trade at a discount to their net asset value. This is in contrast to open-end mutual funds, which sell and redeem their shares at net asset value on a continuous basis. |

| A Closed-End Fund Can Offer Several Distinct Advantages |

| | | |

| • | | A closed-end fund does not issue redeemable securities or offer its securities on a continuous basis, so it does not need to liquidate securities or hold uninvested assets to meet investor demands for cash redemptions. |

| | | |

| • | | In a closed-end fund, not having to meet investor redemption requests or invest at inopportune times can be effective for value managers who attempt to buy stocks when prices are depressed and sell securities when prices are high. |

| | | |

| • | | A closed-end fund may invest in less liquid portfolio securities because it is not subject to potential stockholder redemption demands. This is potentially beneficial for Royce-managed closed-end funds, which invest primarily in small- and microcap securities. |

| | | |

| • | | The fixed capital structure allows permanent leverage to be employed as a means to enhance capital appreciation potential. |

| | | |

| • | | Royce Value Trust and Royce Micro-Cap Trust distribute capital gains on a quarterly basis. Each of these Funds has adopted a quarterly distribution policy for its common stock. |

| | | |

| We believe that the closed-end fund structure can be an appropriate investment for a long-term investor who understands the benefits of a more stable pool of capital. |

| Why Dividend Reinvestment Is Important |

| |

| A very important component of an investor’s total return comes from the reinvestment of distributions. By reinvesting distributions, our investors can maintain an undiluted investment in a Fund. To get a fair idea of the impact of reinvested distributions, please see the charts on pages 12 and 13. For additional information on the Funds’ Distribution Reinvestment and Cash Purchase Options and the benefits for stockholders, please see page 14 or visit our website at www.roycefunds.com. |

| |

| Managed Distribution Policy |

| |

| The Board of Directors of each of Royce Value Trust and Royce Micro-Cap Trust has authorized a managed distribution policy (“MDP”). Under the MDP, Royce Value Trust and Royce Micro-Cap Trust pay quarterly distributions at an annual rate of 7% of the average of the prior four quarter-end net asset values, with the fourth quarter being the greater of these annualized rates or the distribution required by IRS regulations. With each distribution, the Fund will issue a notice to its stockholders and an accompanying press release that provides detailed information regarding the amount and composition of the distribution (including whether any portion of the distribution represents a return of capital) and other information required by a Fund’s MDP. You should not draw any conclusions about a Fund’s investment performance from the amount of distributions or from the terms of a Fund’s MDP. A Fund’s Board of Directors may amend or terminate the MDP at any time without prior notice to stockholders; however, at this time there are no reasonably foreseeable circumstances that might cause the termination of any of the MDPs. |

| This page is not part of the 2014 Annual Report to Stockholders |

| Table of Contents | | | |

| | | | |

| | | | |

| Annual Review | | | |

| | | | |

| Letter to Our Stockholders | | 2 | |

| | | | |

| Performance | | 5 | |

| | | | |

| Annual Report to Stockholders | | | |

| | | | |

| Manager’s Discussions of Fund Performance | | | |

| | | | |

Royce Value Trust | | 6 | |

| | | | |

Royce Micro-Cap Trust | | 8 | |

| | | | |

Royce Global Value Trust | | 10 | |

| | | | |

| History Since Inception | | 12 | |

| | | |

| Distribution Reinvestment and Cash Purchase Options | | 14 | |

| | | |

| Schedules of Investments and Other Financial Statements | | | |

| | | |

Royce Value Trust | | 15 | |

| | | |

Royce Micro-Cap Trust | | 32 | |

| | | |

Royce Global Value Trust | | 47 | |

| | | | |

| Directors and Officers | | 59 | |

| | | | |

| Notes to Performance and Other Important Information | | 60 | |

| | | | |

| Results of Stockholders Meeting | Inside Back Cover | |

| This page is not part of the 2014 Annual Report to Stockholders | 1 |

Letter to Our Stockholders

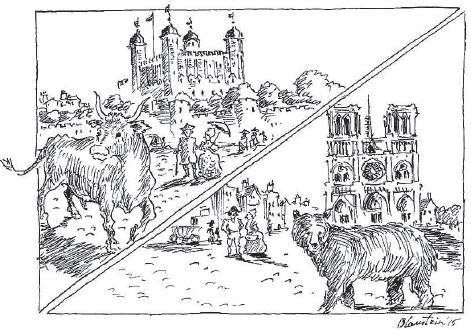

A TALE OF TWO MARKETS

It wasn’t the best of times; it wasn’t the worst of times. As 2014 began, it all seemed just right, with small-caps easing into the year on a more mutedly bullish note following their extraordinary run in 2013. So relaxed was the pace of returns, and in such stark contrast to the eventful years of 2008-2013, that in our June 30 Semiannual Review we remarked on how agreeably peaceful and undramatic it all was. During the year’s first six months, inflation was nearly non-existent, most commodity prices were stable, and volatility, as measured by the VIX, reached the end of June at its lowest level since 2007. These factors, along with a sprightly M&A market, looked to us like clear signs of ongoing growth. The case appeared even stronger as the Federal Reserve moved further and further into the background of the U.S. economy. We were not alone in thinking that the anticipated end of QE (“quantitative easing”) and what looked like an inevitable rise in interest rates would set the stage for a more dynamic pace of economic expansion. We also thought an extension of the bull market that began off the March 9, 2009 bottom seemed likely, though we were expecting both lower returns and increased volatility.

As it happens, this call was somewhat accurate: the economy did pick up speed in the second half while the bull market rolled on for large-cap stocks. More turbulent, small-caps (along with most Energy stocks) could not keep up. Of course, equity markets simply do not stay undisturbed for long, so the increased volatility in the second half of 2014 was not a surprise. Yet its highly selective reach was puzzling, even allowing for the historically higher volatility exhibited by smaller companies. Shortly after the |

Russell 2000 Index established a year-to-date high on July 3 (a high that would last into late December), small-cap prices began to fall. They slid most precipitously in July and September and rallied to varying degrees in August, October, November, and December. The downdrafts were sharper than the upswings, however—it took a furious rally in the final two weeks of the year’s closing month to shore up a modest positive return for the Russell 2000 in the second half. Meanwhile, the S&P 500 and Russell 1000 Indexes lost comparatively little in those two bearish months and posted solid gains during the other four. The upshot was such a strong year for large-cap companies that 2014 was the ninth-largest calendar-year spread between the Russell 2000 and the S&P 500 in the 36-year history of the small-cap index.

What, then, to make of a year in which the Russell 2000 posted a relatively undistinguished single-digit gain of 4.9%, ceded leadership to its larger siblings, and still bested most actively managed small-cap portfolios? A few developments in particular stood out. First, the rotation in leadership from small-cap to large in 2014 looked very much like a classic case of reversion to the mean to us. The former led the market decisively from the bottom in March of 2009 through the end of 2013, a prolonged period of small-cap leadership that made a shift all but inevitable. The second trend was more worrisome. Within small-cap, more economically cyclical sectors continued to lag in spite of the growing economy. The same held true for what we define as quality companies—those with strong balance sheets and high returns on invested capital. Even with the economy accelerating, investors tended to ignore profitable companies with solid fundamentals while they continued to be |

| 2 | This page is not part of the 2014 Annual Report to Stockholders |

| LETTER TO OUR STOCKHOLDERS |

| | | |

| drawn more to defensive and/or high-growth areas. This included utilities and REITs among the highly successful defensive areas of 2014, and social media, biotech, and pharmaceuticals among the speedy growth industries. In most instances, companies in these sectors and industries do not satisfy our purchase criteria because they lack the combination of balance-sheet strength and a long-term history of profitability that we find most attractive. | | volatility as an ally, agreeing with Warren Buffett’s statement: “Look at market fluctuations as your friend rather than your enemy; profit from folly rather than participate in it.” So while many investors think of volatility as being synonymous (or nearly so) with risk or even loss, we have never seen it that way. Instead, we try to take advantage of market movements—an essential skill for any successful active manager. Those times when the market cannot seem to make up its mind are exactly when securities tend to be most mispriced. And therein lies one of the keys to outperformance for active managers—the identification and purchase of mispriced securities. |

| | | |

| Even with the economy accelerating, investors tended to ignore profitable companies with solid fundamentals while they continued to be drawn more to defensive and/or high-growth areas. | | While many investors think of volatility as being synonymous (or nearly so) with risk or even loss, we have never seen it that way. |

| | | |

We were hopeful that the end of QE (along with rising rates) would help to reverse this trend. But the strengthening U.S. dollar and monetary stimulus efforts in Japan and Europe conspired to make the October conclusion of QE something of a non-event, while interest rates fell through most of the year. On the whole, then, 2014 was an often confounding period for us, especially its second half. Indeed, if there is a theme that best captures the year, it might be “A Tale of Two Markets.”And we should point out that Dickens’s rubric covers not just the very different halves of the year for small-cap stocks but also the disparity in results and volatility between small-caps and their bigger siblings. (More index returns can be found in the table below.) | | We conducted research that looked at some of the market forces that have helped to shape the current cycle, in particular the years from 2011-2014 when many active approaches struggled on a relative basis. (The full results of this research are available on our website at www.roycefunds.com/4qresearch.) As we have previously argued, the Fed’s easy-money policies of QE and ZIRP (“zero-interest rates”) have had the unintentional effect of stoking appetites for high yield and creating too few (if any) consequences for companies carrying a lot of debt. This led many investors to relatively neglect businesses with more pristine balance sheets and/or those with steady but smaller dividends. It also meant that from the beginning of 2011 through the end of 2014, the small-cap market was in a peculiar state, one characterized by a pile-up of anomalies—the combination of declining volatility with higher-than-average returns converging with contracting credit spreads. |

| | |

| VOLATILITY—OUR MUTUAL FRIEND | |

| Yet the level of conviction in our value-oriented approaches remains high. Although it may seem counterintuitive (or worse), the current extended period of relative underperformance for many Royce-managed portfolios actually helps to fuel our confidence in the years to come. Let us explain why. First, we have always viewed | |

Equity Indexes

As of December 31, 2014 (%) |

| | | |

| • | | The third quarter was the worst for the Russell 2000 since 9/30/11 and, relative to the S&P 500, was the index’s worst quarterly performance since 3/31/99. It also ended a streak of eight consecutive quarters of positive performance. |

| | | |

| • | | Small-caps rallied in October and December to outpace their large-cap counterparts in the fourth quarter. |

| | | |

| • | | 2014 marked just the fifth time since its inception in 1979 that the Russell 2000 had a gain in the single digits (+4.9%). Small-caps trailed large-caps by the widest margin since 1998. |

| | | |

| • | | Within the Russell 2000, Health Care, Utilities, and REITs were the best-performing areas in 2014 while Energy was by far the largest detractor. |

| |

| | | 3Q14 | 1 | 4Q14 | 1 | 1-YR | | 3-YR | | 5-YR | | 10-YR | |

| |

| Russell 2000 | | -7.36 | | 9.73 | | 4.89 | | 19.21 | | 15.55 | | 7.77 | |

| |

| S&P 500 | | 1.13 | | 4.93 | | 13.69 | | 20.41 | | 15.45 | | 7.67 | |

| |

| Russell 1000 | | 0.65 | | 4.88 | | 13.24 | | 20.62 | | 15.64 | | 7.96 | |

| |

| Nasdaq Composite | | 1.93 | | 5.40 | | 13.40 | | 22.05 | | 15.85 | | 8.09 | |

| |

| Russell Midcap | | -1.66 | | 5.94 | | 13.22 | | 21.40 | | 17.19 | | 9.56 | |

| |

| Russell Microcap | | -8.21 | | 11.19 | | 3.65 | | 21.81 | | 16.14 | | 5.96 | |

| |

| Russell Global ex-U.S. Small Cap | | -6.21 | | -4.45 | | -3.63 | | 10.31 | | 6.40 | | 6.65 | |

| |

| Russell Global ex-U.S. Large Cap | | -5.35 | | -3.72 | | -3.57 | | 9.41 | | 4.80 | | 5.36 | |

| |

| 1Not annualized |

| For details on The Royce Funds’ performance in the period, please turn to the Managers’ Discussions that begin on page 8. |

| This page is not part of the 2014 Annual Report to Stockholders | 3 |

| LETTER TO OUR STOCKHOLDERS |

| |

Needless to say, our risk-conscious, balance-sheet-centric approaches have been challenged in this setting, at least on a relative basis. Low volatility has arguably created the highest hurdle. We have always felt most comfortable in markets with higher levels of volatility, which usually create the differentiation that lies at the core of our active management styles. We analyze, assess, and evaluate multiple aspects of a company before determining whether or not the current stock price reflects the long-term prospects we see. Opportunities to purchase what we deem to be attractively undervalued companies tend to proliferate when stock prices are volatile rather than when markets are calm. Yet for most of the last four years, volatility has been falling, at least until the second half of 2014. This has made it far more difficult for our funds to outpace their respective benchmarks.

GREAT EXPECTATIONS

The questions are: How much longer is this going to last? More specifically, are interest rates going to remain at or near zero? Is the pace of economic growth likely to slacken? Are financial markets going to continue to behave atypically even as the economy continues to normalize? Will small-cap companies indefinitely gain an advantage by carrying more debt? Are three- and five-year average annual total returns for the Russell 2000 going to remain at levels higher than the index’s historical monthly rolling averages of 8.2% and 7.6%, respectively? For those who believe that most, or even some, of these things are likely to happen, then our approach would seem a bit at odds.

We confess that we have been anticipating some of these shifts for nearly two years. This has meant re-learning the hard lesson that change seldom occurs when we most want it to. Yet we are convinced that markets remain cyclical (recent events notwithstanding). In our view, reversion to the mean is as close to an iron law as the capital markets allow. Most trends reverse, though they may linger for longer than initially anticipated (or desired). Widening credit spreads, increasing volatility, and decreasing stock correlation should all help active management and allow stock pickers the chance to emerge as performance leaders. | | We also expect equity returns to remain attractive, though we see a decrease from the high levels we have seen over the last three to five years. Cyclical companies appear due for a round of revenue acceleration, particularly those in the Consumer Discretionary and Industrials sectors, as do some industries in the Information Technology sector. The best-managed companies within these areas could also see solid margin expansion. Among other cyclical sectors, we also see a number of profitable, conservatively capitalized businesses that have either been ignored or whose returns have lagged. We expect this to change.

On the valuation front, the picture looked admittedly tricky at the end of 2014. For example, an examination of trailing 12-month earnings for many companies suggests that small-cap share prices may be on the high side. But if you believe, as we do, that the economy is going to keep growing, that credit spreads will continue to expand, and that a more robust CAPEX cycle is in the offing, then valuations seem pretty reasonable, if not attractive in certain areas, Energy in particular. Many stocks look fairly valued though not fully valued to us. So while we do not shrink from the sobering truth of relative underperformance through much of this now-long bullish cycle, we continue to see good times ahead for our risk-conscious, fundamentally based approach.

While we do not shrink from the sobering truth of relative underperformance through much of this now-long bullish cycle, we continue to see good times ahead for our risk-conscious, fundamentally based approach.

The argument that we have been making for more than four decades remains the same. Small-cap is an inefficient area of the market in which we search for qualitative advantages and valuation discrepancies. Our belief that fundamentally strong companies trading at discounts to their private worth can outperform over the long term, often with lower volatility, will not change. It is our core investment principle, and it has served us very, very well over most of the last 40+ years. |

| |  | |  |

| Charles M. Royce | | Christopher D. Clark | | Francis D. Gannon |

| Chairman and Chief Executive Officer, | | President and Co-Chief Investment Officer, | | Co-Chief Investment Officer, |

| Royce & Associates, LLC | | Royce & Associates, LLC | | Royce & Associates, LLC |

| | | | | |

| January 26, 2015 | | | | |

| 4 | This page is not part of the 2014 Annual Report to Stockholders |

| | | LETTER TO OUR STOCKHOLDERS |

| | | |

| Performance | | |

| | | |

| NAV Average Annual Total Returns | | | | | | | | | | | | | | | | | |

| As of December 31, 2014 (%) | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| FUND | | 1-YR | | 3-YR | | 5-YR | | 10-YR | | 15-YR | | 20-YR | | 25-YR | | SINCE INCEPTION | | INCEPTION DATE |

| |

Royce Value Trust Royce Value Trust | | 0.78 | | 15.98 | | 12.82 | | 6.94 | | 9.29 | | 10.84 | | 10.84 | | 10.74 | | 11/26/86 |

| |

Royce Micro-Cap Trust Royce Micro-Cap Trust | | 3.55 | | 20.64 | | 15.81 | | 8.15 | | 10.97 | | 11.85 | | n.a. | | 11.50 | | 12/14/93 |

| |

Royce Global Value Trust Royce Global Value Trust | | -6.23 | | n.a. | | n.a. | | n.a. | | n.a. | | n.a. | | n.a. | | -3.03 | | 10/17/13 |

| |

| INDEX | | | | | | | | | | | | | | | | | | |

| |

| Russell 2000 | | 4.89 | | 19.21 | | 15.55 | | 7.77 | | 7.38 | | 9.63 | | 9.75 | | n.a. | | n.a. |

| |

| Russell Microcap | | 3.65 | | 21.81 | | 16.14 | | 5.96 | | n.a. | | n.a. | | n.a. | | n.a. | | n.a. |

| |

| Russell Global Small Cap | | -0.28 | | 13.57 | | 9.56 | | 6.87 | | 6.88 | | n.a. | | n.a. | | n.a. | | n.a. |

| |

| | | | | | | | | | | | | | | | | | | |

Important Performance and Risk Information

All performance information in this Review and Report reflects past performance, is presented on a total return basis, and reflects the reinvestment of distributions. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when sold. Current performance may be higher or lower than performance quoted. Current month-end performance may be obtained at www.roycefunds.com. The Funds are closed-end registered investment companies whose respective shares of common stock may trade at a discount to the net asset value. Shares of each Fund’s common stock are also subject to the market risk of investing in the underlying portfolio securities held by each Fund. Certain immaterial adjustments were made to the net assets of Royce Global Value Trust at 12/31/14 and Royce Micro-Cap Trust at 12/31/12, as well as 12/31/14, for financial reporting purposes, and as a result the net asset value originally calculated on that date and the total return based on that net asset value differs from the adjusted net asset value and total return reported in the Financial Highlights. All indexes referenced are unmanaged and capitalization-weighted. Each index’s returns include net reinvested dividends and/or interest income. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Russell Investment Group. The Russell 2000 Index is an index of domestic small-cap stocks that measures the performance of the 2,000 smallest publicly traded U.S. companies in the Russell 3000 Index. The Russell Microcap Index includes 1,000 of the smallest securities in the small-cap Russell 2000 Index, along with the next smallest eligible securities as determined by Russell. The Russell Global Small Cap Index is an unmanaged, capitalization-weighted index of global small-cap stocks. The performance of an index does not represent exactly any particular investment, as you cannot invest directly in an index. Index returns include net reinvested dividends and/or interest income. Royce Value, Micro-Cap and Global Value Trust shares of common stock trade on the NYSE. Royce Fund Services, Inc (“RFS”) is a member of FINRA and has filed this Review and Report with FINRA on behalf of each Fund. RFS is not an underwriter or distributor of any of the Funds. |

| This page is not part of the 2014 Annual Report to Stockholders | 5 |

| | | MANAGER’S DISCUSSION |

| | | |

Royce Value Trust Royce Value Trust | | |

| | | |

|

| Chuck Royce |

| FUND PERFORMANCE |

| In what was a solid year for small-caps overall, we were disappointed that Royce Value Trust (“RVT”) was unable to keep pace on a relative scale. The Fund was up 0.8% on an NAV (net asset value) basis and 0.9% on a market price basis in 2014 versus respective gains of 4.9% and 5.7% for its small-cap benchmarks, the Russell 2000 and the S&P 600 Indexes, for the same period. Equally frustrating was the fact that RVT was more competitive for the six-month period ended June 30, 2014, in which it outperformed both the Russell 2000 and S&P 600’s 3.2% advance on a market price basis (+3.9%) and narrowly lagged on a NAV basis (+3.0%). |

| |

| Unlike the first half of the year when equity returns were placid yet decidedly bullish, the last six months were a more volatile period for small-caps. Historically, the Fund has exhibited an ability to hold more value than its benchmarks during down markets. However, this was not the case in the third quarter of 2014, when RVT fell 7.5% on a NAV basis and 7.4% on a market price basis. (The Russell 2000 lost 7.4% and the S&P 600 lost 6.7%.) The Fund’s relative performance woes would continue into the fourth quarter, though its absolute results were respectable. During this period small-caps had a prominent upward bias, especially in the last few weeks of December when they rallied to finish the year well in the black. RVT gained 5.8% on an NAV basis and 4.9% on a market price basis while the Russell 2000 advanced 9.7% and the S&P 600 climbed 9.8%. Despite the Fund’s near- and intermediate-term struggles, we remain proud of RVT’s longer-term performance. On an NAV and market price basis, RVT outperformed the Russell 2000 for the 15-, 20-, 25-year, and since inception (11/26/86) periods ended December 30, 2014. The Fund’s average annual NAV total return since inception was 10.7%. |

| |

| WHAT WORKED... AND WHAT DIDN’T |

| Six of the Fund’s 10 equity sectors posted net gains in 2014, with Information Technology leading the list by a solid margin. Health Care also made a sizable contribution to performance at the sector level, followed by a modest net gain for Financials. The top contributor to first-half performance, Idenix Pharmaceuticals focuses on the development of drugs for the treatment of infections caused by HIV, hepatitis B, and hepatitis C. In early June, news of pharmaceutical giant Merck’s acquisition of the company helped the stock price to more than triple. By the middle of the month we had sold our stake. RVT also benefited from IT services company Sapient Corporation’s takeout by French advertising giant Publicis Groupe in early November. A long-time holding in the portfolio, Sapient provides integrated management consulting services, Internet commerce solutions, and systems implementation services. While the acquisition confirmed Sapient’s value and the increasing importance (and share gains) of digital marketing for more traditional advertising businesses, the company’s valuation exceeded our sell targets and we sold our shares shortly after the announcement. Miami-based technology consulting firm The Hackett Group provides executive advisory programs, best practice research, and benchmarking services. Its stock price was generally flat for much of 2014 until the company announced third-quarter earnings that topped Wall Street expectations in early November. We took some gains in early December and decided to hold our position. |

| |

| Conversely, net losses from Industrials, Energy, and Materials detracted from 2014 performance. Three of RVT’s top detractors came from the Industrials sector, including Houston-based engineering and construction firm KBR. Further execution delivery issues on several fixed-price projects, as well as a decline in bookings and cautious commentary regarding possible delays in oil and gas work in light of the oil price decline, continued to weigh on results. Later in the quarter, the company’s relatively new CEO unveiled a restructuring plan after strategic review of the business that includes streamlining operations and reducing overhead costs, refocusing on core E&C areas where it has had traditional strength, and exiting four non-core businesses. Bullish on the company’s prospects and an eventual turnaround in Energy, we last added to our position in mid-December. It was a top-40 holding at year end. Persistent weakness in the mining sector continued to stifle a sustained return to organic sales growth for cutting tools manufacturer Kennametal. Having some exposure to the oil and gas drilling market created some near-term headwinds for its business. Interested to hear what initial strategic priorities the company’s recently appointed CEO may implement, we held on to our remaining shares after trimming a bit in April, October, and November. |

| Top Contributors to Performance For 2014 (%)1 | | |

| | | |

| Idenix Pharmaceuticals | | 0.44 |

| |

| Sapient Corporation | | 0.31 |

| |

| Hackett Group (The) | | 0.29 |

| |

| Nautilus | | 0.29 |

| |

| Mechanics Bank | | 0.21 |

| |

| 1 Includes dividends | | |

| Top Detractors from Performance For 2014 (%)2 | | |

| | | |

| KBR | | -0.31 |

| |

| Kennametal | | -0.24 |

| |

| Steel Excel | | -0.23 |

| |

| Raven Industries | | -0.22 |

| |

| Qalaa Holdings | | -0.19 |

| |

| 2 Net of dividends | | |

| CURRENT POSITIONING AND OUTLOOK |

| We remain overweight in more economically sensitive areas such as Industrials and Information Technology. Despite recent headwinds in Energy, we believe the U.S. economy is still growing (albeit slowly), credit spreads will continue to expand, and that increasing volatility and decreasing stock correlation can help stock pickers to emerge as performance leaders. |

| 6 | 2014 Annual Report to Stockholders |

| PERFORMANCE AND PORTFOLIO REVIEW | | SYMBOLS MARKET PRICE RVT NAV XRVTX |

| |

| Performance | | | | | | | | | | | | | | | | | | |

| Average Annual Total Return (%) Through 12/31/14 |

| | | JUL-DEC 2014* | | 1-YR | | 3-YR | | 5-YR | | 10-YR | | 15-YR | | 20-YR | | 25-YR | | SINCE INCEPTION (11/26/86) |

| |

| RVT (NAV) | | -2.15 | | 0.78 | | 15.98 | | 12.82 | | 6.94 | | 9.29 | | 10.84 | | 10.84 | | 10.74 |

| |

| *Not Annualized | | | | | | | | | | | | | | | |

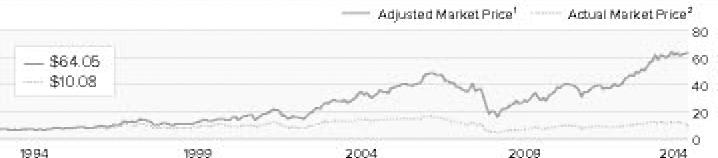

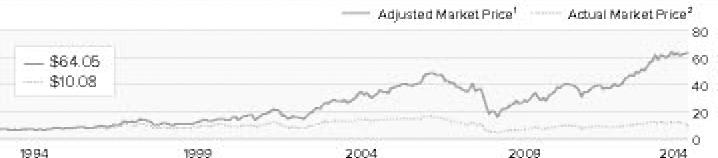

Market Price Performance History Since Inception (11/26/86)Cumulative Performance of Investment through 12/31/141 | | | 1-YR | | 5-YR | | 10-YR | | 15-YR | | 20-YR | | SINCE INCEPTION (11/26/86) |

| |

| RVT | | 0.9% | | 92.4% | | 60.0% | | 305.4% | | 679.2% | | 1361.9% |

| |

| 1 | Reflects the cumulative performance of an investment made by a stockholder who purchased one share at inception ($10.00 IPO), reinvested all distributions and fully participated in primary subscriptions of the Fund’s rights offerings. |

| 2 | Reflects the actual month-end market price movement of one share as it has traded on the NYSE. |

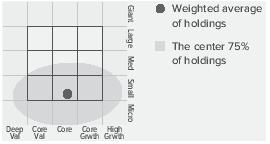

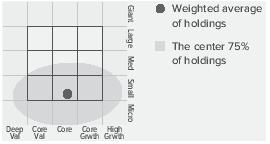

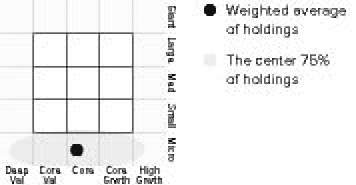

| Morningstar Style MapTM | As of 12/31/14 |

The Morningstar Style Map is the Morningstar Style BoxTM with the center 75% of fund holdings plotted as the Morningstar Ownership ZoneTM. The Morningstar Style Box is designed to reveal a fund’s investment strategy. The Morningstar Ownership Zone provides detail about a portfolio’s investment style by showing the range of stock sizes and styles. The Ownership Zone is derived by plotting each stock in the portfolio within the proprietary Morningstar Style Box. Over time, the shape and location of a fund’s ownership zone may vary. See page 60 for additional information. |

|

| Portfolio Diagnostics | | |

| | | |

| Fund Net Assets | | $1,232 million |

| |

| Number of Holdings | | 567 |

| |

| Turnover Rate | | 40% |

| |

| Net Asset Value | | $16.24 |

| |

| Market Price | | $14.33 |

| |

| Average Market Capitalization1 | | $1,289 million |

| |

| Weighted Average P/E Ratio2,3 | | 19.7x |

| |

| Weighted Average P/B Ratio2 | | 1.8x |

| |

| Holdings ≥ 75% of Total Investments | | 182 |

| |

| Active Share4 | | 88% |

| |

| U.S. Investments (% of Net Assets) | | 84.9% |

| |

| Non-U.S. Investments (% of Net Assets) | | 18.0% |

| |

| 1 | Geometric Average. This weighted calculation uses each portfolio holding’s market cap in a way designed to not skew the effect of very large or small holdings; instead, it aims to better identify the portfolio’s center, which Royce believes offers a more accurate measure of average market cap than a simple mean or median. | |

| 2 | Harmonic Average. This weighted calculation evaluates a portfolio as if it were a single stock and measures it overall. It compares the total market value of the portfolio to the portfolio’s share in the earnings or book value, as the case may be, of its underlying stocks. | |

| 3 | The Fund’s P/E ratio calculation excludes companies with zero or negative earnings (12% of portfolio holdings as of 12/31/14). | |

| 4 | Active Share is the sum of the absolute values of the different weightings of each holding in the Fund versus each holding in the benchmark, divided by two. | |

|

| Calendar Year Total Returns (%) | | |

| | | |

| YEAR | | RVT (NAV) |

| |

| 2014 | | 0.8 |

| |

| 2013 | | 34.1 |

| |

| 2012 | | 15.4 |

| |

| 2011 | | -10.1 |

| |

| 2010 | | 30.3 |

| |

| 2009 | | 44.6 |

| |

| 2008 | | -45.6 |

| |

| 2007 | | 5.0 |

| |

| 2006 | | 19.5 |

| |

| 2005 | | 8.4 |

| |

| 2004 | | 21.4 |

| |

| 2003 | | 40.8 |

| |

| 2002 | | -15.6 |

| |

| 2001 | | 15.2 |

| |

| 2000 | | 16.6 |

| |

|

| Top 10 Positions | | |

| % of Net Assets | | |

| | | |

| HEICO Corporation | | 1.5 |

| |

| Ritchie Bros. Auctioneers | | 1.0 |

| |

| Hackett Group (The) | | 0.9 |

| |

| On Assignment | | 0.9 |

| |

| Newport Corporation | | 0.9 |

| |

| Forward Air | | 0.9 |

| |

| SEACOR Holdings | | 0.8 |

| |

| Nautilus | | 0.8 |

| |

| Tejon Ranch | | 0.8 |

| |

| Woodward | | 0.8 |

| |

|

| Portfolio Sector Breakdown | | |

| % of Net Assets | | |

| | | |

| Industrials | | 29.9 |

| |

| Information Technology | | 20.6 |

| |

| Financials | | 15.7 |

| |

| Consumer Discretionary | | 11.8 |

| |

| Materials | | 7.5 |

| |

| Health Care | | 5.9 |

| |

| Energy | | 3.6 |

| |

| Consumer Staples | | 2.2 |

| |

| Telecommunication Services | | 0.7 |

| |

| Miscellaneous | | 4.9 |

| |

| Preferred Stock | | 0.1 |

| |

| Outstanding Line of Credit, Net of Cash and Cash Equivalents | | -2.9 |

| |

| Important Performance and Risk Information |

| All performance information reflects past performance, is presented on a total return basis, and reflects the reinvestment of distributions. Past performance is no guarantee of future results. Current performance may be higher or lower than performance quoted. Returns as of the most recent month-end may be obtained at www.roycefunds.com. The market price of the Fund’s shares will fluctuate, so that shares may be worth more or less than their original cost when sold. The Fund invests primarily in securities of small- and micro-cap companies, which may involve considerably more risk than investing in larger-cap companies. The Fund’s broadly diversified portfolio does not ensure a profit or guarantee against loss. Regarding the “Top Contributors” and “Top Detractors” tables shown on page 6, the sum of all contributors to, and all detractors from, performance for all securities in the portfolio would approximate the Fund’s performance for 2014. |

| 2014 Annual Report to Stockholders | 7 |

| | | MANAGER’S DISCUSSION |

| | | |

Royce Micro-Cap Trust Royce Micro-Cap Trust | | |

|

| Chuck Royce |

| FUND PERFORMANCE |

| Royce Micro-Cap Trust (“RMT”) gained 3.5% on an NAV (net asset value) basis and 3.1% on a market price basis in 2014, trailing its benchmarks, the Russell 2000 Index and Russell Microcap Index, which had respective returns of 4.9% and 3.6% for the same period. We were frustrated that RMT gave up its first-half advantage, a period in which RMT advanced 3.1% on an NAV basis and 3.9% on a market price basis compared to the small-cap index’s 3.2% advance and the Russell Microcap’s 1.6% advance. Following a small-cap high on July 3, small-caps entered a volatile phase that saw July and September in the red. RMT outperformed both benchmarks for the third quarter as a whole, losing 7.1% on an NAV basis and 4.8% on a market price basis against the Russell 2000’s 7.4% decline and the Russell Microcap’s 8.2% decrease. The Fund’s absolute performance in the fourth quarter was fine, though RMT was short of both indexes during this bullish swing. During the final quarter of the year, RMT was up 8.2% on an NAV basis and 4.2% on a market price basis, falling behind respective increases of 9.7% and 11.2% for the Russell 2000 and Russell Microcap. |

| |

| We were pleased with the Fund’s absolute and relative performance results over longer-term periods. On an NAV basis, RMT outperformed the Russell 2000 for the three-, five-, 10-, 15-, 20-year, and since inception (12/14/93) periods ended December 31, 2014. RMT also outperformed the Russell Microcap on an NAV basis during the 10-year period. (Data for the Russell Microcap only goes back to June 2000.) On a market price basis, the Fund bested the Russell 2000 for the three-, five-, 15-, 20-year, and since inception periods and beat the Russell Microcap for the five- and 10-year periods. RMT’s average annual NAV total return for the since inception period was 11.5%, a long-term performance record that gives us great pride. |

| |

| WHAT WORKED... AND WHAT DIDN’T |

| Seven of the Fund’s 10 equity sectors made a positive impact on 2014 performance. Health Care was RMT’s largest contributor by more than 160 basis points, followed by Consumer Discretionary and Information Technology. Energy and Industrials were the Fund’s largest detractors, with Materials posting modest net losses. A developer of drugs for the treatment of infections caused by HIV, hepatitis B, and hepatitis C, Idenix Pharmaceuticals was a take-out target by pharmaceutical giant Merck in early June. News of the acquisition helped triple the company’s stock price, and we gradually sold our stake by the middle of the month. We also sold our shares of Medical Action Industries in June. A Virginia-based manufacturer and distributor of disposable medical products, including operating room supplies, custom procedure trays, sterilizing products, and patient apparel, Medical Action Industries was acquired by Owens & Minor for a 95% premium. Outside of Health Care, long-time holding and a top contributor to first-half performance Rentrak Corporation is a digital media measurement and research company that serves the entertainment, television, and advertising industries. Its share price began to really take off in early September. Investors seemed to like the healthy revenue growth and optimistic outlook the company reported in June. The company cemented a deal to expand its alliance with ABC while also establishing new agreements with CBS and Fox. In October, the firm announced its purchase of Kantar Media, the U.S. television measurement arm of advertising conglomerate WPP. In addition, Rentrak acquired new patents that solidified its position as a leading viewership data provider. We started reducing our position in October. |

| |

| Computer Task Group is an IT services and staffing company. Its stock price began to decline steeply in early July after reporting lower-than-expected earnings largely due to higher costs and lower revenues from its healthcare business. While the company claimed these higher expenses were likely anomalous, it also boosted its projected medical costs for the rest of 2014, thus revising guidance downward. Heritage-Crystal Clean provides parts cleaning, used oil re-refining, and hazardous and non-hazardous waste services to small and mid-sized customers in the manufacturing and vehicle service industries. Its shares took a hit in December when the firm announced that it was issuing more stock to pay down debt incurred to make two recent acquisitions. We added shares in the hope of a rebound. Earnings misses hindered the performance of Sioux Falls-based Raven Industries. Softening demand for agricultural equipment put pressure on its shares. |

| Top Contributors to Performance For 2014 (%)1 | | |

| Rentrak Corporation | | 0.79 |

| |

| Idenix Pharmaceuticals | | 0.66 |

| |

| Medical Action Industries | | 0.56 |

| |

| Universal Electronics | | 0.49 |

| |

| Integrated Electrical Services | | 0.42 |

| |

| 1 Includes dividends | | |

| Top Detractors from Performance For 2014 (%)2 | | |

| Computer Task Group | | -0.36 |

| |

| Heritage-Crystal Clean | | -0.33 |

| |

| Raven Industries | | -0.31 |

| |

| Le Chateau Cl. A | | -0.28 |

| |

| Cache | | -0.26 |

| |

| 2 Net of dividends | | |

| CURRENT POSITIONING AND OUTLOOK |

| We remain overweight in economically sensitive cyclical sectors such as Industrials, Information Technology, and Consumer Discretionary—areas where we have seen a number of profitable, conservatively capitalized businesses trading at attractive valuations. As the U.S. economy continues to grow and normalize, we believe fundamentals will matter more to investors, especially in an inefficient asset class such as micro-cap. |

| 8 | 2014 Annual Report to Stockholders |

| PERFORMANCE AND PORTFOLIO REVIEW | | SYMBOLS MARKET PRICE RMT NAV XOTCX |

| |

| Performance | | | | | | | | | | | | | | | | |

| Average Annual Total Return (%) Through 12/31/14 | | | | | | | | |

| | | JUL-DEC 2014* | | 1-YR | | 3-YR | | 5-YR | | 10-YR | | 15-YR | | 20-YR | | SINCE INCEPTION (12/14/93) |

| |

| RMT (NAV) | | 0.47 | | 3.55 | | 20.64 | | 15.81 | | 8.15 | | 10.97 | | 11.85 | | 11.50 |

| |

| *Not Annualized | | | | | | | | | | | | | |

Market Price Performance History Since Inception (12/14/93)Cumulative Performance of Investment1 | | | 1-YR | | 5-YR | | 10-YR | | 15-YR | | 20-YR | | SINCE INCEPTION (12/14/93) |

| |

| RMT | | 3.1% | | 123.6% | | 83.1% | | 418.0% | | 803.9% | | 754.0% |

| |

|

| 1 | Reflects the cumulative performance experience of a continuous common stockholder who purchased one share at inception ($7.50 IPO), reinvested all distributions and fully participated in the primary subscription of the Fund’s 1994 rights offering. |

| 2 | Reflects the actual month-end market price movement of one share as it has traded on NYSE and, prior to 12/1/03, on the Nasdaq. |

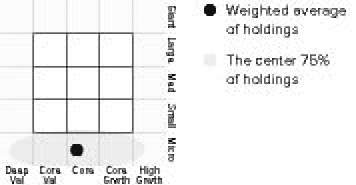

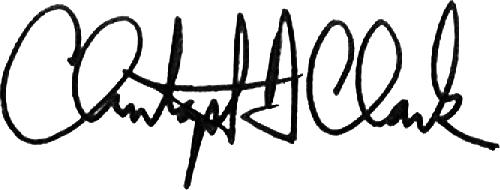

| Morningstar Style MapTM | | As of 12/31/14 |

| The Morningstar Style Map is the Morningstar Style BoxTM with the center 75% of fund holdings plotted as the Morningstar Ownership ZoneTM. The Morningstar Style Box is designed to reveal a fund’s investment strategy. The Morningstar Ownership Zone provides detail about a portfolio’s investment style by showing the range of stock sizes and styles. The Ownership Zone is derived by plotting each stock in the portfolio within the proprietary Morningstar Style Box. Over time, the shape and location of a fund’s ownership zone may vary. See page 60 for additional information. |

|

| Portfolio Diagnostics | | |

| | | |

| Fund Net Assets | | $387 million |

| |

| Number of Holdings | | 387 |

| |

| Turnover Rate | | 41% |

| |

| Net Asset Value | | $11.34 |

| |

| Market Price | | $10.08 |

| |

| Average Market Capitalization1 | | $348 million |

| |

| Weighted Average P/E Ratio2,3 | | 19.6x |

| |

| Weighted Average P/B Ratio2 | | 1.6x |

| |

| Holdings ≥ 75% of Total Investments | | 160 |

| |

| Active Share4 | | 94% |

| |

| U.S. Investments (% of Net Assets) | | 98.2% |

| |

| Non-U.S. Investments (% of Net Assets) | | 11.5% |

| |

| 1 | Geometric Average. This weighted calculation uses each portfolio holding’s market cap in a way designed to not skew the effect of very large or small holdings; instead, it aims to better identify the portfolio’s center, which Royce believes offers a more accurate measure of average market cap than a simple mean or median. | |

| 2 | Harmonic Average. This weighted calculation evaluates a portfolio as if it were a single stock and measures it overall. It compares the total market value of the portfolio to the portfolio’s share in the earnings or book value, as the case may be, of its underlying stocks. | |

| 3 | The Fund’s P/E ratio calculation excludes companies with zero or negative earnings (23% of portfolio holdings as of 12/31/14). | |

| 4 | Active Share is the sum of the absolute values of the different weightings of each holding in the Fund versus each holding in the benchmark, divided by two. | |

|

| Calendar Year Total Returns (%) | | |

| | | |

| YEAR | | RMT (NAV) |

| |

| 2014 | | 3.5 |

| |

| 2013 | | 44.5 |

| |

| 2012 | | 17.3 |

| |

| 2011 | | -7.7 |

| |

| 2010 | | 28.5 |

| |

| 2009 | | 46.5 |

| |

| 2008 | | -45.5 |

| |

| 2007 | | 0.6 |

| |

| 2006 | | 22.5 |

| |

| 2005 | | 6.8 |

| |

| 2004 | | 18.7 |

| |

| 2003 | | 55.5 |

| |

| 2002 | | -13.8 |

| |

| 2001 | | 23.4 |

| |

| 2000 | | 10.9 |

| |

|

| Top 10 Positions | | |

| % of Net Assets | | |

| | | |

| Newport Corporation | | 1.2 |

| |

| Integrated Electrical Services | | 1.1 |

| |

| FRP Holdings | | 1.1 |

| |

| Atrion Corporation | | 1.1 |

| |

| Seneca Foods | | 1.0 |

| |

| Permian Basin Royalty Trust | | 1.0 |

| |

| Diamond Hill Investment Group | | 1.0 |

| |

| Universal Truckload Services | | 1.0 |

| |

| MVC Capital | | 1.0 |

| |

| Silvercrest Asset Management Group Cl. A | | 0.9 |

| |

|

| Portfolio sector Breakdown | | |

| % of Net Assets | | |

| | | |

| Industrials | | 23.1 |

| |

| Information Technology | | 23.0 |

| |

| Consumer Discretionary | | 18.9 |

| |

| Financials | | 18.0 |

| |

| Health Care | | 10.4 |

| |

| Materials | | 6.9 |

| |

| Energy | | 2.4 |

| |

| Consumer Staples | | 1.8 |

| |

| Utilities | | 0.0 |

| |

| Miscellaneous | | 4.9 |

| |

| Preferred Stock | | 0.3 |

| |

| Outstanding Line of Credit, Net of Cash and Cash Equivalents | | -9.7 |

| |

| Important Performance and Risk Information |

| All performance information reflects past performance, is presented on a total return basis, and reflects the reinvestment of distributions. Past performance is no guarantee of future results. Current performance may be higher or lower than performance quoted. Returns as of the most recent month-end may be obtained at www.roycefunds.com. Certain immaterial adjustments were made to the net assets of Royce Micro-Cap Trust at 12/31/12 and 12/31/14 for financial reporting purposes, and as a result the net asset value originally calculated on that date and the total return based on that net asset value differs from the adjusted net asset value and total return reported in the Financial Highlights. The market price of the Fund’s shares will fluctuate, so that shares may be worth more or less than their original cost when sold. The Fund normally invests in micro-cap companies, which may involve considerably more risk than investing in larger-cap companies. The Fund’s broadly diversified portfolio does not ensure a profit or guarantee against loss. Regarding the “Top Contributors” and “Top Detractors” tables shown on page 8, the sum of all contributors to, and all detractors from, performance for all securities in the portfolio would approximate the Fund’s performance for 2014. |

| 2014 Annual Report to Stockholders | 9 |

| | | MANAGER’S DISCUSSION |

| | | |

Royce Global Value Trust Royce Global Value Trust | | |

| | | |

|

| Chuck Royce |

| FUND PERFORMANCE |

| Royce Global Value Trust (“RGT”) fell 6.2% on an NAV (net asset value) basis and 7.9% on a market price basis in 2014, results that considerably trailed its benchmark, the Russell Global Small Cap Index, which lost 0.3% for the same period. The Fund’s difficulties on both a relative and absolute basis were mostly attributable to a poor second half. The year began on a solidly bullish note. For the six-month period ended June 30, 2014 RGT climbed 5.6% on an NAV basis and 5.8% on a market price basis, essentially sandwiching its benchmark, which was up 5.7% for the same period. A strengthening Europe helped to compensate for a generally less robust Asia during the first few months of 2014. There were notable contributions from portfolio holdings in Canada, France, and Japan in the first half as well as trouble spots for positions headquartered in Hong Kong and the U.S. Stocks across the globe corrected (with the exception of U.S. large-caps) in the third quarter, with European shares among the most adversely affected. The Fund lost 7.1% on an NAV basis and 7.4% on a market price basis versus a decline of 6.7% for the Russell Global Small Cap Index. Portfolio holdings headquartered in the U.S., Canada, Hong Kong, and France were the largest detractors from quarterly results. Unfortunately, the Fund fell farther behind in the fourth quarter, a period in which U.S. small-caps rallied off a mid-October low while many non-U.S. companies saw additional losses or treaded water. For the fourth quarter, the Fund was down 4.4% on an NAV basis and 6.0% based on market price compared to a 1.1% increase for its global benchmark. In contrast to the third quarter, holdings headquartered in Japan, Brazil, and the U.K. had the most significant negative impact. While we were not pleased with the Fund’s thus-far brief since inception (10/17/13) results, we are confident that our disciplined, value-oriented approach can be successful. |

| |

| WHAT WORKED... AND WHAT DIDN’T |

| For the full year, those countries with the greatest positive impact were South Africa, Argentina, and the Philippines while holdings headquartered in Hong Kong, the U.S., the U.K., and Brazil detracted most from RGT’s calendar-year results. On a sector basis, only Information Technology and Consumer Staples finished 2014 in the black, though their respective net gains were modest. Industrials posted the largest net losses, nearly doubling the negative impact of the Fund’s next-biggest loser, Materials. The Consumer Discretionary sector also registered a decent-sized net loss for the year. BBVA Banco Frances is one of Argentina’s largest banks. Its strong revenue growth and terrific history of earnings per share growth helped to reassure investors otherwise anxious over the nation’s recent debt woes. We reduced our position as its stock price climbed. We chose to hold our position in food distribution business Universal Robina, one of the largest food companies in the Philippines. Improved domestic and international sales helped to move its shares higher. |

| |

LPS Brasil Consultoria de Imoveis provides integrated solutions in the real estate brokerage industry as well as consulting and financing promotion services in Brazil. A weak real estate market and depressed consumer sentiment contributed to the company’s fading share price, which was also hampered by Brazil’s overall sluggish economy. Not entirely sure of the timing for a turnaround, we began to reduce our stake in September. We were more confident in the long-term prospects for retailer New World Department Store China. We like how the company is positioned for a pick-up in the Chinese economy as well as its management and very generous dividend policy. LPKF Laser & Electronics develops specialized mechanical engineering products for electronics production, the automotive industry, and the manufacture of solar cells. A revised outlook for 2014 kept investors selling, but we believe the case for long-term growth remained intact. Its financing is solid and its profitability remains above-average, despite the recent revenue downturn. We think it can resume growth in 2015. Freund Corporation manufactures and sells granulation and coating equipment for the pharmaceutical, food, and chemical industries in Japan and internationally. Contracting demand for equipment shipments, surging prices in raw materials, and a rise in operating expenses all hurt its stock price. We added shares in the first half. The strength of the U.S. dollar was also a factor in the performance of non-U.S. holdings. |

| Top Contributors to Performance For 2014 (%)1 | | |

| BBVA Banco Frances ADR | | 0.49 |

| |

| Universal Robina | | 0.46 |

| |

| Relo Holdings | | 0.42 |

| |

| Shimano | | 0.38 |

| |

| Regent Manner International Holdings | | 0.31 |

| |

| 1 Includes dividends | | |

| Top Detractors from Performance For 2014 (%)2 | | |

| LPS Brasil Consultoria de Imoveis | | -0.58 |

| |

| New World Department Store China | | -0.57 |

| |

| LPKF Laser & Electronics | | -0.54 |

| |

| Freund Corporation | | -0.41 |

| |

| Pico Far East Holdings | | -0.39 |

| |

| 2 Net of dividends | | |

| CURRENT POSITIONING AND OUTLOOK |

| The Fund invests in a broadly diversified portfolio of both U.S. and non-U.S. small-cap stocks. At the end of 2014, RGT was overweight in cyclical sectors such as Consumer Discretionary and Industrials. We significantly added to our exposure in the latter during 2014. The portfolio also had reasonable exposure to Financials and Information Technology. The former group was underweight versus the benchmark, but was built up considerably in 2014. The Fund’s sector weightings reflect our belief in the recovery of global economic growth. |

| 10 | 2014 Annual Report to Stockholders |

| PERFORMANCE AND PORTFOLIO REVIEW | | SYMBOLS MARKET PRICE RGT NAV XRGTX |

| |

| Performance | | | | | | |

| Average Annual Total Return (%) Through 12/31/14 | | | | |

| | | JUL-DEC 2014* | | 1-YR | | SINCE INCEPTION (10/17/13) |

| |

| RGT (NAV) | | -11.18 | | -6.23 | | -3.03 |

| |

| *Not Annualized | | | | | | |

|

| Morningstar Style MapTM | | As of 12/31/14 |

| The Morningstar Style Map is the Morningstar Style BoxTM with the center 75% of fund holdings plotted as the Morningstar Ownership ZoneTM. The Morningstar Style Box is designed to reveal a fund’s investment strategy. The Morningstar Ownership Zone provides detail about a portfolio’s investment style by showing the range of stock sizes and styles. The Ownership Zone is derived by plotting each stock in the portfolio within the proprietary Morningstar Style Box. Over time, the shape and location of a fund’s ownership zone may vary. See page 60 for additional information. |

|

| Top 10 Positions | | |

| % of Net Assets | | |

| |

| Pico Far East Holdings | | 1.5 |

| |

| Ritchie Bros. Auctioneers | | 1.5 |

| |

| Lazard Cl. A | | 1.5 |

| |

| Relo Holdings | | 1.5 |

| |

| EPS Corporation | | 1.4 |

| |

| Clarkson | | 1.4 |

| |

| Silverlake Axis | | 1.4 |

| |

| Consort Medical | | 1.3 |

| |

| CETIP - Mercados Organizados | | 1.3 |

| |

| TGS-NOPEC Geophysical | | 1.2 |

| |

|

| Portfolio Sector Breakdown | | |

| % of Net Assets | | |

| |

| Industrials | | 22.3 |

| |

| Financials | | 19.6 |

| |

| Consumer Discretionary | | 17.5 |

| |

| Materials | | 14.2 |

| |

| Information Technology | | 13.5 |

| |

| Health Care | | 7.3 |

| |

| Energy | | 3.2 |

| |

| Consumer Staples | | 2.7 |

| |

| Other Net Liabilities | | -0.3 |

| |

|

| Calendar Year Total Returns (%) | | |

| | | |

| YEAR | | RGT (NAV) |

| |

| 2014 | | -6.2 |

| |

|

| Portfolio Country Breakdown1,2 | | |

| % of Net Assets | | |

| |

| United States | | 14.8 |

| |

| Japan | | 11.0 |

| |

| Hong Kong | | 10.0 |

| |

| United Kingdom | | 9.6 |

| |

| Canada | | 7.9 |

| |

| France | | 6.8 |

| |

| South Africa | | 5.1 |

| |

| Brazil | | 3.8 |

| |

| 1 | Represents countries that are 3% or more of net assets. |

| 2 | Securities are categorized by the country of their headquarters. |

|

| Portfolio Diagnostics | | |

| |

| Fund Net Assets | | $95 million |

| |

| Number of Holdings | | 229 |

| |

| Turnover Rate | | 43% |

| |

| Net Asset Value | | $9.25 |

| |

| Market Price | | $8.04 |

| |

| Average Market Capitalization1 | | $953 million |

| |

| Weighted Average P/E Ratio2,3 | | 16.3x |

| |

| Weighted Average P/B Ratio2 | | 1.7x |

| |

| Holdings ≥ 75% of Total Investments | | 91 |

| |

| Active Share4 | | 98% |

| |

| 1 | Geometric Average. This weighted calculation uses each portfolio holding’s market cap in a way designed to not skew the effect of very large or small holdings; instead, it aims to better identify the portfolio’s center, which Royce believes offers a more accurate measure of average market cap than a simple mean or median. |

| 2 | Harmonic Average. This weighted calculation evaluates a portfolio as if it were a single stock and measures it overall. It compares the total market value of the portfolio to the portfolio’s share in the earnings or book value, as the case may be, of its underlying stocks. |

| 3 | The Fund’s P/E ratio calculation excludes companies with zero or negative earnings (9% of portfolio holdings as of 12/31/14). |

| 4 | Active Share is the sum of the absolute values of the different weightings of each holding in the Fund versus each holding in the benchmark, divided by two. |

Important Performance and Risk Information

All performance information reflects past performance, is presented on a total return basis, and reflects the reinvestment of distributions. Past performance is no guarantee of future results. Current performance may be higher or lower than performance quoted. Returns as of the most recent month-end may be obtained at www.roycefunds.com. Certain immaterial adjustments were made to the net assets of Royce Global Value Trust at 12/31/14 for financial reporting purposes, and as a result the net asset value originally calculated on that date and the total return based on that net asset value differs from the adjusted net asset value and total return reported in the Financial Highlights. The market price of the Fund’s shares will fluctuate, so that shares may be worth more or less than their original cost when sold. The Fund invests primarily in securities of small- and micro-cap companies, which may involve considerably more risk than investments in securities of larger-cap companies. The Fund’s broadly diversified portfolio does not ensure a profit or guarantee against loss. From time to time, the Fund may invest a significant portion of its net assets in foreign securities, which may involve political, economic, currency and other risks not encountered in U.S. investments. Regarding the “Top Contributors” and “Top Detractors” tables shown on page 10, the sum of all contributors to, and all detractors from, performance for all securities in the portfolio would approximate the Fund’s performance for 2014. |

| 2014 Annual Report to Stockholders | 11 |

History Since Inception

The following table details the share accumulations by an initial investor in the Funds who reinvested all distributions and participated fully in primary subscriptions for each of the rights offerings. Full participation in distribution reinvestments and rights offerings can maximize the returns available to a long-term investor. This table should be read in conjunction with the Performance and Portfolio Reviews of the Funds.

| HISTORY | | | | AMOUNT INVESTED | | PURCHASE PRICE1 | | SHARES | | NAV VALUE2 | | MARKET VALUE3 | |

| |

| Royce Value Trust |

| 11/26/86 | | Initial Purchase | | $ | 10,000 | | $ | 10.000 | | | 1,000 | | $ | 9,280 | | $ | 10,000 | |

| |

| 10/15/87 | | Distribution $0.30 | | | | | | 7.000 | | | 42 | | | | | | | |

| |

| 12/31/87 | | Distribution $0.22 | | | | | | 7.125 | | | 32 | | | 8,578 | | | 7,250 | |

| |

| 12/27/88 | | Distribution $0.51 | | | | | | 8.625 | | | 63 | | | 10,529 | | | 9,238 | |

| |

| 9/22/89 | | Rights Offering | | | 405 | | | 9.000 | | | 45 | | | | | | | |

| |

| 12/29/89 | | Distribution $0.52 | | | | | | 9.125 | | | 67 | | | 12,942 | | | 11,866 | |

| |

| 9/24/90 | | Rights Offering | | | 457 | | | 7.375 | | | 62 | | | | | | | |

| |

| 12/31/90 | | Distribution $0.32 | | | | | | 8.000 | | | 52 | | | 11,713 | | | 11,074 | |

| |

| 9/23/91 | | Rights Offering | | | 638 | | | 9.375 | | | 68 | | | | | | | |

| |

| 12/31/91 | | Distribution $0.61 | | | | | | 10.625 | | | 82 | | | 17,919 | | | 15,697 | |

| |

| 9/25/92 | | Rights Offering | | | 825 | | | 11.000 | | | 75 | | | | | | | |

| |

| 12/31/92 | | Distribution $0.90 | | | | | | 12.500 | | | 114 | | | 21,999 | | | 20,874 | |

| |

| 9/27/93 | | Rights Offering | | | 1,469 | | | 13.000 | | | 113 | | | | | | | |

| |

| 12/31/93 | | Distribution $1.15 | | | | | | 13.000 | | | 160 | | | 26,603 | | | 25,428 | |

| |

| 10/28/94 | | Rights Offering | | | 1,103 | | | 11.250 | | | 98 | | | | | | | |

| |

| 12/19/94 | | Distribution $1.05 | | | | | | 11.375 | | | 191 | | | 27,939 | | | 24,905 | |

| |

| 11/3/95 | | Rights Offering | | | 1,425 | | | 12.500 | | | 114 | | | | | | | |

| |

| 12/7/95 | | Distribution $1.29 | | | | | | 12.125 | | | 253 | | | 35,676 | | | 31,243 | |

| |

| 12/6/96 | | Distribution $1.15 | | | | | | 12.250 | | | 247 | | | 41,213 | | | 36,335 | |

| |

| 1997 | | Annual distribution total $1.21 | | | | | | 15.374 | | | 230 | | | 52,556 | | | 46,814 | |

| |

| 1998 | | Annual distribution total $1.54 | | | | | | 14.311 | | | 347 | | | 54,313 | | | 47,506 | |

| |

| 1999 | | Annual distribution total $1.37 | | | | | | 12.616 | | | 391 | | | 60,653 | | | 50,239 | |

| |

| 2000 | | Annual distribution total $1.48 | | | | | | 13.972 | | | 424 | | | 70,711 | | | 61,648 | |

| |

| 2001 | | Annual distribution total $1.49 | | | | | | 15.072 | | | 437 | | | 81,478 | | | 73,994 | |

| |

| 2002 | | Annual distribution total $1.51 | | | | | | 14.903 | | | 494 | | | 68,770 | | | 68,927 | |

| |

| 1/28/03 | | Rights Offering | | | 5,600 | | | 10.770 | | | 520 | | | | | | | |

| |

| 2003 | | Annual distribution total $1.30 | | | | | | 14.582 | | | 516 | | | 106,216 | | | 107,339 | |

| |

| 2004 | | Annual distribution total $1.55 | | | | | | 17.604 | | | 568 | | | 128,955 | | | 139,094 | |

| |

| 2005 | | Annual distribution total $1.61 | | | | | | 18.739 | | | 604 | | | 139,808 | | | 148,773 | |

| |

| 2006 | | Annual distribution total $1.78 | | | | | | 19.696 | | | 693 | | | 167,063 | | | 179,945 | |

| |

| 2007 | | Annual distribution total $1.85 | | | | | | 19.687 | | | 787 | | | 175,469 | | | 165,158 | |

| |

| 2008 | | Annual distribution total $1.723 | | | | | | 12.307 | | | 1,294 | | | 95,415 | | | 85,435 | |

| |

| 3/11/09 | | Distribution $0.323 | | | | | | 6.071 | | | 537 | | | 137,966 | | | 115,669 | |

| |

| 12/2/10 | | Distribution $0.03 | | | | | | 13.850 | | | 23 | | | 179,730 | | | 156,203 | |

| |

| 2011 | | Annual distribution total $0.783 | | | | | | 13.043 | | | 656 | | | 161,638 | | | 139,866 | |

| |

| 2012 | | Annual distribution total $0.80 | | | | | | 13.063 | | | 714 | | | 186,540 | | | 162,556 | |

| |

| 2013 | | Annual distribution total $2.194 | | | | | | 16.647 | | | 1,658 | | | 250,219 | | | 220,474 | |

| |

| 2014 | | Annual distribution total $1.82 | | | | | | 14.840 | | | 1,757 | | | | | | | |

| |

| 12/31/14 | | | | $ | 21,922 | | | | | | 15,528 | | $ | 252,175 | | $ | 222,516 | |

| |

| 1 | The purchase price used for annual distribution totals is a weighted average of the distribution reinvestment prices for the year. |

| 2 | Values are stated as of December 31 of the year indicated, after reinvestment of distributions, other than for initial purchase. |

| 3 | Includes a return of capital. |

| 4 | Includes Royce Global Value Trust spin-off of $1.40 per share. |

| 12 | 2014 Annual Report to Stockholders |

| HISTORY | | | | AMOUNT INVESTED | | PURCHASE PRICE1 | | SHARES | | NAV VALUE2 | | MARKET VALUE2 | |

| |

| Royce Micro-Cap Trust |

| |

| 12/14/93 | | Initial Purchase | | $ | 7,500 | | $ | 7.500 | | | 1,000 | | $ | 7,250 | | $ | 7,500 | |

| |

| 10/28/94 | | Rights Offering | | | 1,400 | | | 7.000 | | | 200 | | | | | | | |

| |

| 12/19/94 | | Distribution $0.05 | | | | | | 6.750 | | | 9 | | | 9,163 | | | 8,462 | |

| |

| 12/7/95 | | Distribution $0.36 | | | | | | 7.500 | | | 58 | | | 11,264 | | | 10,136 | |

| |

| 12/6/96 | | Distribution $0.80 | | | | | | 7.625 | | | 133 | | | 13,132 | | | 11,550 | |

| |

| 12/5/97 | | Distribution $1.00 | | | | | | 10.000 | | | 140 | | | 16,694 | | | 15,593 | |

| |

| 12/7/98 | | Distribution $0.29 | | | | | | 8.625 | | | 52 | | | 16,016 | | | 14,129 | |

| |

| 12/6/99 | | Distribution $0.27 | | | | | | 8.781 | | | 49 | | | 18,051 | | | 14,769 | |

| |

| 12/6/00 | | Distribution $1.72 | | | | | | 8.469 | | | 333 | | | 20,016 | | | 17,026 | |

| |

| 12/6/01 | | Distribution $0.57 | | | | | | 9.880 | | | 114 | | | 24,701 | | | 21,924 | |

| |

| 2002 | | Annual distribution total $0.80 | | | | | | 9.518 | | | 180 | | | 21,297 | | | 19,142 | |

| |

| 2003 | | Annual distribution total $0.92 | | | | | | 10.004 | | | 217 | | | 33,125 | | | 31,311 | |

| |

| 2004 | | Annual distribution total $1.33 | | | | | | 13.350 | | | 257 | | | 39,320 | | | 41,788 | |

| |

| 2005 | | Annual distribution total $1.85 | | | | | | 13.848 | | | 383 | | | 41,969 | | | 45,500 | |

| |

| 2006 | | Annual distribution total $1.55 | | | | | | 14.246 | | | 354 | | | 51,385 | | | 57,647 | |

| |

| 2007 | | Annual distribution total $1.35 | | | | | | 13.584 | | | 357 | | | 51,709 | | | 45,802 | |

| |

| 2008 | | Annual distribution total $1.193 | | | | | | 8.237 | | | 578 | | | 28,205 | | | 24,807 | |

| |

| 3/11/09 | | Distribution $0.223 | | | | | | 4.260 | | | 228 | | | 41,314 | | | 34,212 | |

| |

| 12/2/10 | | Distribution $0.08 | | | | | | 9.400 | | | 40 | | | 53,094 | | | 45,884 | |

| |

| 2011 | | Annual distribution total $0.533 | | | | | | 8.773 | | | 289 | | | 49,014 | | | 43,596 | |

| |

| 2012 | | Annual distribution total $0.51 | | | | | | 9.084 | | | 285 | | | 57,501 | | | 49,669 | |

| |

| 2013 | | Annual distribution total $1.38 | | | | | | 11.864 | | | 630 | | | 83,110 | | | 74,222 | |

| |

| 2014 | | Annual distribution total $2.90 | | | | | | 10.513 | | | 1,704 | | | | | | | |

| |

| 12/31/14 | | | | $ | 8,900 | | | | | | 7,590 | | $ | 86,071 | | $ | 76,507 | |

| |

| Royce Global Value Trust |

| 10/17/13 | | Initial Purchase | | $ | 8,975 | | $ | 8.975 | | | 1,000 | | $ | 9,780 | | $ | 8,975 | |

| |

| 12/11/14 | | Distribution $0.15 | | | | | | 7.970 | | | 19 | | | | | | | |

| |

| 12/31/14 | | | | $ | 8,975 | | | | | | 1,019 | | $ | 9,426 | | $ | 8,193 | |

| |

| 1 | The purchase price used for annual distribution totals is a weighted average of the distribution reinvestment prices for the year. |

| 2 | Values are stated as of December 31 of the year indicated, after reinvestment of distributions, other than for initial purchase. |

| 3 | Includes a return of capital. |

| 2014 Annual Report to Stockholders | 13 |

Distribution Reinvestment and Cash Purchase Options

Why should I reinvest my distributions?

By reinvesting distributions, a stockholder can maintain an undiluted investment in the Fund. The regular reinvestment of distributions has a significant impact on stockholder returns. In contrast, the stockholder who takes distributions in cash is penalized when shares are issued below net asset value to other stockholders.

How does the reinvestment of distributions from the Royce closed-end funds work?

The Funds automatically issue shares in payment of distributions unless you indicate otherwise. The shares are generally issued at the lower of the market price or net asset value on the valuation date.

How does this apply to registered stockholders?

If your shares are registered directly with a Fund, your distributions are automatically reinvested unless you have otherwise instructed the Funds’ transfer agent, Computershare, in writing, in which case you will receive your distribution in cash. A registered stockholder also may have the option to receive the distribution in the form of a stock certificate.

What if my shares are held by a brokerage firm or a bank?

If your shares are held by a brokerage firm, bank, or other intermediary as the stockholder of record, you should contact your brokerage firm or bank to be certain that it is automatically reinvesting distributions on your behalf. If they are unable to reinvest distributions on behalf, you should have your shares registered in your name in order to participate.

What other features are available for registered stockholders?

The Distribution Reinvestment and Cash Purchase Plans also allow registered stockholders to make optional cash purchases of shares of a Fund’s common stock directly through Computershare on a monthly basis, and to deposit certificates representing your RVT and RMT shares with Computershare for safekeeping. (RGT does not issue shares in certificated form). Plan participants are subject to a $0.75 service fee for each voluntary cash purchase under the Plans. The Funds’ investment adviser absorbed all commissions on optional cash purchases under the Plans through December 31, 2014. |

How do the Plans work for registered stockholders?

Computershare maintains the accounts for registered stockholders in the Plans and sends written confirmation of all transactions in the account. Shares in the account of each participant will be held by Computershare in non-certificated form in the name of the participant, and each participant will be able to vote those shares at a stockholder meeting or by proxy. A participant may also send stock certificates for RVT and RMT held by them to Computershare to be held in non-certificated form. RGT does not issue shares in certificated form. There is no service fee charged to participants for reinvesting distributions. If a participant elects to sell shares from a Plan account, Computershare will deduct a $2.50 service fee from the sale transaction. The Funds’ investment adviser absorbed all commissions on optional sales under the Plans through December 31, 2014. If a nominee is the registered owner of your shares, the nominee will maintain the accounts on your behalf.

How can I get more information on the Plans?

You can call an Investor Services Representative at (800) 221-4268 or you can request a copy of the Plan for your Fund from Computershare. All correspondence (including notifications) should be directed to: [Name of Fund] Distribution Reinvestment and Cash Purchase Plan, c/o Computershare, PO Box 43078, Providence, RI 02940-3078, telephone (800) 426-5523 (from 9:00 A.M. to 5:00 P.M.). |

| 14 | 2014 Annual Report to Stockholders |

| Royce Value Trust | December 31, 2014 |

| |

Schedule of Investments

Common Stocks – 102.8% | | | | | | |

| | | SHARES | | | | VALUE |

| |

| | | | | | | |

| CONSUMER DISCRETIONARY – 11.8% | | | | | | |

| AUTO COMPONENTS - 0.9% | | | | | | |

| | 29,206 | | | $ | 1,491,551 |

| | 122,000 | | | | 1,334,680 |

| Gentex Corporation | | 122,740 | | | | 4,434,596 |

| | 35,500 | | | | 1,275,040 |

| Selamat Sempurna | | 6,867,400 | | | | 2,619,299 |

| Standard Motor Products | | 15,052 | | | | 573,782 |

| | | | | | |

| | | | | | | 11,728,948 |

| | | | | | |

| AUTOMOBILES - 0.9% | | | | | | |

| | 124,980 | | | | 6,982,633 |

| Winnebago Industries | | 211,400 | | | | 4,600,064 |

| | | | | | |

| | | | | | | 11,582,697 |

| | | | | | |

| DISTRIBUTORS - 0.2% | | | | | | |

| Weyco Group | | 97,992 | | | | 2,907,423 |

| | | | | | |

| DIVERSIFIED CONSUMER SERVICES - 1.5% | | | | | | |

American Public Education 1 | | 36,100 | | | | 1,331,007 |

| Benesse Holdings | | 35,000 | | | | 1,039,698 |

| | 20,000 | | | | 139,200 |

| Collectors Universe | | 72,300 | | | | 1,508,178 |

†Lincoln Educational Services | | 721,700 | | | | 2,035,194 |

| MegaStudy | | 15,000 | | | | 725,406 |

| | 233,800 | | | | 3,918,488 |

| Sotheby’s | | 138,200 | | | | 5,967,476 |

| Universal Technical Institute | | 130,432 | | | | 1,283,451 |

| | | | | | |

| | | | | | | 17,948,098 |

| | | | | | |

| HOTELS, RESTAURANTS & LEISURE - 0.0% | | | | | | |

| | 32,100 | | | | 80,250 |

Tropicana Entertainment 1,4 | | 8,000 | | | | 134,800 |

| | | | | | |

| | | | | | | 215,050 |

| | | | | | |

| HOUSEHOLD DURABLES - 2.4% | | | | | | |

| De’Longhi | | 20,000 | | | | 362,219 |

Ethan Allen Interiors | | 320,800 | | | | 9,935,176 |

| Flexsteel Industries | | 24,800 | | | | 799,800 |

| Harman International Industries | | 28,600 | | | | 3,051,906 |

| Lifetime Brands | | 54,426 | | | | 936,127 |

| | 28,000 | | | | 4,350,080 |

| | 2,096,300 | | | | 3,249,265 |

| | 2,600 | | | | 3,315,858 |

| | 1,012,235 | | | | 2,773,524 |

| | 184,782 | | | | 589,454 |

| | | | | | |

| | | | | | | 29,363,409 |

| | | | | | |

| INTERNET & CATALOG RETAIL - 0.2% | | | | | | |

| | 34,800 | | | | 1,253,148 |

| Manutan International | | 26,000 | | | | 1,289,144 |

| | | | | | |

| | | | | | | 2,542,292 |

| | | | | | |

| LEISURE PRODUCTS - 1.2% | | | | | | |

| Arctic Cat | | 15,800 | | | | 560,900 |

| | 55,000 | | | | 770,204 |

LeapFrog Enterprises Cl. A 1 | | 240,100 | | | | 1,133,272 |

| | 676,100 | | | | 10,263,198 |

| Shimano | | 11,000 | | | | 1,422,852 |

Smith & Wesson Holding Corporation 1 | | 39,300 | | | | 372,171 |

| | | | | | |

| | | | | | | 14,522,597 |

| | | | | | |

| MEDIA - 1.2% | | | | | | |

E.W. Scripps Company Cl. A 1 | | 53,300 | | | | 1,191,255 |

| Media Chinese International | | 7,650,000 | | | | 1,640,664 |

| Morningstar | | 84,600 | | | | 5,474,466 |

| Pico Far East Holdings | | 6,575,000 | | | | 1,506,650 |

RLJ Entertainment 1 | | 35,600 | | | | 71,200 |

SinoMedia Holding | | 500,000 | | | | 278,852 |

T4F Entretenimento 1 | | 141,800 | | | | 153,651 |

Television Broadcasts | | 308,400 | | | | 1,790,162 |

Wiley (John) & Sons Cl. A | | 48,200 | | | | 2,855,368 |

| | | | | | |

| | | | | | | 14,962,268 |

| | | | | | |

| MULTILINE RETAIL - 0.2% | | | | | | |

New World Department Store China | | 6,427,200 | | | | 2,054,707 |

| | | | | | |

| SPECIALTY RETAIL - 1.5% | | | | | | |

Aeropostale 1 | | 110,000 | | | | 255,200 |

Ascena Retail Group 1 | | 109,485 | | | | 1,375,132 |

Buckle (The) 2 | | 59,615 | | | | 3,130,980 |

Genesco 1 | | 42,785 | | | | 3,278,187 |

I.T | | 1,127,000 | | | | 324,855 |

Lewis Group | | 200,000 | | | | 1,279,730 |

Oriental Watch Holdings | | 543,000 | | | | 104,848 |

Sears Hometown and Outlet Stores 1 | | 10,400 | | | | 136,760 |

Signet Jewelers | | 8,000 | | | | 1,052,560 |

Stein Mart | | 167,800 | | | | 2,453,236 |

Systemax 1 | | 194,000 | | | | 2,619,000 |