| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| | FORM N-CSR |

| | CERTIFIED SHAREHOLDER REPORT |

| OF |

| REGISTERED MANAGEMENT INVESTMENT COMPANIES |

| | Investment Company Act File Number: 811-04875 |

| | Name of Registrant: Royce Value Trust, Inc. |

| | Address of Registrant: 745 Fifth Avenue |

| New York, NY 10151 |

| Name and address of agent for service: | | John E. Denneen, Esquire |

| | | 745 Fifth Avenue |

| | | New York, NY 10151 |

| Registrant’s telephone number, including area code: (212) 508-4500 |

| Date of fiscal year end: December 31 |

| Date of reporting period: January 1, 2016 – December 31, 2016 |

Item 1. Reports to Shareholders.

| | | DECEMBER 31, 2016 |

| | | |

| | | |

| | | |

| | | 2016 Annual |

| | | Review and Report to Stockholders |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | Royce Global Value Trust |

| | | | |

| | | Royce Micro-Cap Trust |

| | | | |

| | | Royce Value Trust |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | roycefunds.com |  |

| | | | |

| | | | |

| | | | |

A Few Words on Closed-End Funds

Royce & Associates, LP manages three closed-end funds: Royce Global Value Trust, which invests primarily in companies with headquarters outside of the United States, Royce Micro-Cap Trust, which invests primarily in micro-cap securities; and Royce Value Trust, which invests primarily in small-cap securities. A closed-end fund is an investment company whose shares are listed and traded on a stock exchange. Like all investment companies, including open-end mutual funds, the assets of a closed-end fund are professionally managed in accordance with the investment objectives and policies approved by the fund’s Board of Directors. A closed-end fund raises cash for investment by issuing a fixed number of shares through initial and other public offerings that may include shelf offerings and periodic rights offerings. Proceeds from the offerings are invested in an actively managed portfolio of securities. Investors wanting to buy or sell shares of a publicly traded closed-end fund after the offerings must do so on a stock exchange, as with any publicly traded stock. Shares of closed-end funds frequently trade at a discount to their net asset value. This is in contrast to open-end mutual funds, which sell and redeem their shares at net asset value on a continuous basis.

A Closed-End Fund Can Offer Several Distinct Advantages

| • | A closed-end fund does not issue redeemable securities or offer its securities on a continuous basis, so it does not need to liquidate securities or hold uninvested assets to meet investor demands for cash redemptions. |

| | |

| • | In a closed-end fund, not having to meet investor redemption requests or invest at inopportune times can be effective for value managers who attempt to buy stocks when prices are depressed and sell securities when prices are high. |

| | |

| • | A closed-end fund may invest in less liquid portfolio securities because it is not subject to potential stockholder redemption demands. This is potentially beneficial for Royce-managed closed-end funds, with significant investments in small- and micro-cap securities. |

| | |

| • | The fixed capital structure allows permanent leverage to be employed as a means to enhance capital appreciation potential. |

| | |

| • | Royce Micro-Cap Trust and Royce Value Trust distribute capital gains, if any, on a quarterly basis. Each of these Funds has adopted a quarterly distribution policy for its common stock. |

We believe that the closed-end fund structure can be an appropriate investment for a long-term investor who understands the benefits of a more stable pool of capital.

Why Dividend Reinvestment Is Important

A very important component of an investor’s total return comes from the reinvestment of distributions. By reinvesting distributions, our investors can maintain an undiluted investment in a Fund. To get a fair idea of the impact of reinvested distributions, please see the charts on pages 12 and 13. For additional information on the Funds’ Distribution Reinvestment and Cash Purchase Options and the benefits for stockholders, please see page 14 or visit our website at www.roycefunds.com.

Managed Distribution Policy

The Board of Directors of each of Royce Micro-Cap Trust and Royce Value Trust has authorized a managed distribution policy (“MDP”). Under the MDP, Royce Micro-Cap Trust and Royce Value Trust pay quarterly distributions at an annual rate of 7% of the average of the prior four quarter-end net asset values, with the fourth quarter being the greater of these annualized rates or the distribution required by IRS regulations. With each distribution, the Fund will issue a notice to its stockholders and an accompanying press release that provides detailed information regarding the amount and composition of the distribution (including whether any portion of the distribution represents a return of capital) and other information required by a Fund’s MDP. You should not draw any conclusions about a Fund’s investment performance from the amount of distributions or from the terms of a Fund’s MDP. A Fund’s Board of Directors may amend or terminate the MDP at any time without prior notice to stockholders; however, at this time there are no reasonably foreseeable circumstances that might cause the termination of any of the MDPs.

| This page is not part of the 2016 Annual Report to Stockholders |

| Table of Contents | | | |

| | | | |

| | | | |

| Annual Review | | | |

| | | | |

| Letter to Our Stockholders | | 2 | |

| | | | |

| Performance | | 5 | |

| | | | |

| | | | |

| Annual Report to Stockholders | | | |

| | | | |

| Managers’ Discussions of Fund Performance | | | |

| | | | |

Royce Global Value Trust | | 6 | |

| | | | |

Royce Micro-Cap Trust | | 8 | |

| | | | |

Royce Value Trust | | 10 | |

| | | | |

| History Since Inception | | 12 | |

| | | | |

| Distribution Reinvestment and Cash Purchase Options | | 14 | |

| | | | |

| Schedules of Investments and Other Financial Statements | | | |

| | | | |

Royce Global Value Trust | | 15 | |

| | | | |

Royce Micro-Cap Trust | | 29 | |

| | | | |

Royce Value Trust | | 44 | |

| | | | |

| Directors and Officers | | 60 | |

| | | | |

| Notes to Performance and Other Important Information | | 61 | |

| | | | |

| Results of Stockholders Meetings | | 62 | |

| This page is not part of the 2016 Annual Report to Stockholders |

Letter to Our Stockholders

A MOST WONDERFUL YEAR FOR SMALL-CAPS,

VALUE, AND CYCLICALS

By any measure, 2016 was a terrific year for domestic small-cap stocks, one that featured a double-digit positive return for the Russell 2000 Index, which advanced 21.3%, and a solid advantage over their large-cap counterparts. It was an even better year for small-cap value stocks and a highly rewarding one for cyclical sectors. These last two factors were critical in boosting results for certain active management approaches within the asset class, including a number of our own. Arguably even more important was what these developments may be telling us about the subsequent direction of small-cap equity returns. We flesh out the details later in this letter, but these three reversals—positive results for small-caps, leadership for value over growth, and outperformance for cyclicals—should be key in setting the tone for the direction of small-caps going forward. They coalesced around the central, normalizing force of rising interest rates.

The major impact of these reversals was both highly welcome and long overdue. We saw 2015—a year in which large-cap beat small-cap, the Russell 2000 had a negative return, and market leadership was extremely narrow—as a hinge year. It marked the transition out of the period that began in 2011, when an unprecedented amount of monetary intervention into the global economy had the unintended effect of stoking an intense appetite for yield and safety at one extreme of the U.S. equity markets and a hunger for high risk at the other. The bottom of a commodity super cycle, with the attendant slowdowns in the world’s largest developing markets, only exacerbated the challenges then faced by value stocks and active management approaches. |

As has usually been the case historically, the longer market trends last, the more regularly they are mistaken for permanent realignments. In this most recent instance, the consensus lined up around the perpetuation of near-zero rates, growth stock dominance, and the futility of active management. Whether in good times or bad for our own approaches, however, we have always stayed mindful of the fact that trends do not last forever—they persist, then, more often than not, they reverse. This investment truism should serve as a corrective for those who would take the example of a highly anomalous period for the markets and economy to validate an implacable bias against active management.

THE POWER OF RATES AND THE IMPACT

OF THE PARADIGM SHIFT

Even as small-cap specialists, we recognize that few forces act as powerfully on the value of investments as interest rates. The effects can be as obvious as they are subtle. We think three conditions matter most: the level of rates, the spread between short- and long-term rates, and the disparity in borrowing rates between better-run companies and worse ones. Capitalism tends to best foster economic growth when short rates hover a bit above inflation; when long rates are high enough to encourage lenders but not so high as to discourage borrowers; and when there is a premium for fiscal prudence and a commensurate penalty for profligate debtors. During the era of zero (or near-zero) rates—roughly 2011-2015—these historically “normal” conditions were largely absent. Yet we believe they began to manifest themselves again in 2016, marking a paradigm shift to a period of higher rates and a consequent reassessment of the relative values of financial assets. More normalized rates have historically been better for stocks than |

| 2 | This page is not part of the 2016 Annual Report to Stockholders |

LETTER TO OUR STOCKHOLDERS

bonds. More important for our purposes, they have also supported small-caps over large, value over growth stocks, and cyclicals over defensive areas. In many ways, 2016’s results exemplified exactly this shift—and we think it is just the beginning of what could be a steady, though not linear, multi-year run.

With 2016’s stellar results fresh in the mind, it may be difficult to recall just how poorly the year started and how fatalistic the expectations were for equities. Small-cap stocks plunged from the first peal of 2016’s opening bell. The downdraft exacerbated a trend that had begun the previous summer following the small-cap peak on June 23, 2015. By the time it was all over with the small-cap bottom on February 11, 2016, the Russell 2000 had fallen 25.7%. The last leg of the downdraft included many of the signs of a classic bottoming-out process—panic selling in a number of sectors (most notably within the biopharma complex), small-caps losing more than large-caps, and more resilience from value stocks—to us, the most significant development in the down phase. As unpleasant as any bear market is, we noted that the leadership shift, because it was nearly concomitant with the rate hike, was likely to last.

Moreover, these signs also gave us some assurance that this was a historically conventional decline, making us confident that the small-cap market was undergoing its own important and familiar shift. The depths plumbed by this bear market were comparable to previous downturns—and that encouraged our belief that the worst was over just before the Russell 2000 rebounded sharply from its February low through the end of the year. These small-cap bear and bull markets received so little comment beyond our own and that of fellow small-cap specialists that we refer to them as “stealth” markets. They also reinforced our contention that this small-cap rally has room to run. Despite its strong showing in 2016, the Russell 2000 finished the year only 7.2% above its June 2015 peak. For additional context, it is worth noting that small-cap upswings usually extend well beyond the |

| |

| Equity Indexes as of December 31, 2016 (%) | | | | | | | | | | |

| | | 1-YR | | 3-YR | | 5-YR | | 10-YR |

| |

| Russell 2000 | | | 21.31 | | | | 6.74 | | | | 14.46 | | | | 7.07 | |

| |

| Russell 2000 Value | | | 31.74 | | | | 8.31 | | | | 15.07 | | | | 6.26 | |

| |

| Russell 2000 Growth | | | 11.32 | | | | 5.05 | | | | 13.74 | | | | 7.76 | |

| |

| S&P 500 | | | 11.96 | | | | 8.87 | | | | 14.66 | | | | 6.95 | |

| |

| Russell 1000 | | | 12.05 | | | | 8.59 | | | | 14.69 | | | | 7.08 | |

| |

| Nasdaq Composite | | | 7.50 | | | | 8.83 | | | | 15.62 | | | | 8.34 | |

| |

| Russell Midcap | | | 13.80 | | | | 7.92 | | | | 14.72 | | | | 7.86 | |

| |

| Russell Microcap | | | 20.37 | | | | 5.77 | | | | 15.59 | | | | 5.47 | |

| |

| Russell Global ex-U.S. Small Cap | | | 5.04 | | | | 0.57 | | | | 7.22 | | | | 2.65 | |

| |

| Russell Global ex-U.S. Large Cap | | | 4.30 | | | | -1.51 | | | | 5.35 | | | | 1.24 | |

| |

| For details on The Royce Funds’ performance in the period, please turn to the Managers’ Discussions that begin on page 8. |

47.4% advance the small-cap index made from its February bottom through the end of 2016. There have been 12 declines of 15% or more for the Russell 2000 since its 1979 inception. The median return for the subsequent recovery period was 98.8%. So both history and the currently hospitable economic environment suggest to us that there may well be plenty of life left in the small-cap rally.

VALUE’S TURN?

The recent extended run of small-cap growth leadership makes it worth recalling that it is actually small-cap value stocks that own the pronounced long-term historical edge in relative performance. Of course, it makes sense that many investors were not conscious of this history at the beginning of the year. Prior to resuming leadership, the Russell 2000 Value Index trailed the Russell 2000 Growth Index in six out of seven years between 2009 and 2015. Based on their long-term performance and leadership history, this was an inordinately lengthy span. Is it now value’s turn, then? We think so. Prolonged periods of leadership for small-cap growth have historically been followed by long tenures at the helm for value. Multi-year trends typically do not have brief reversals before reappearing. Based on this pattern, we think the current leadership status of small-cap value is likely to last. Further, value stocks have historically outpaced growth issues when the economy is expanding—growth companies generally being most highly valued when growth is scarce in the economy. Rising interest rates have also historically provided a relative headwind for growth stocks because their valuations typically have a long-duration bond aspect to them that is highly sensitive to changes in rates.

We saw the post-election rally and the sudden shift in investor perspective that came with it as more symptom than cause of an overall improved environment for both the economy and stocks. After all, some had forecast the pickup in GDP growth prior to any votes being cast just as many investors realized that the era of “lower forever” interest rates had reached its conclusion before the Fed officially announced the hike in December. There were also encouraging pickups in employment and incremental growth in wages. Along with the added certainty that comes after nearly every election, especially a contentious one, all of this stoked bullishness. So while the election was undoubtedly an accelerant, it seemed to us that many investors—and management teams—simply needed the experience of a tangible event before they felt comfortable enough to embrace the good news that had been accumulating prior to November. |

| This page is not part of the 2016 Annual Report to Stockholders | 3 |

LETTER TO OUR STOCKHOLDERS

The aftermath of the election has set the stage for changes that could benefit small-cap companies, beginning with a lower corporate tax rate. With the bulk of their money coming from domestic sources, many small-cap businesses would receive a disproportionate benefit from any rate reduction. Also encouraging are the prospects for repatriation. It was not surprising, then, that the postelection period also witnessed a dramatic rotation away from safety—bonds and defensive stocks most notably. Investors are bullish on the potential for accelerated economic growth and the policy shift from monetary to fiscal—chiefly in the form of tax cuts and projected spending increases on infrastructure and defense. The critical question going forward is, how much of this has already been priced in?

TURN THE PAGE

All of this has convinced us that we have turned the page on that 2011-2015 period in which financial markets behaved in such odd and unprecedented ways. We firmly believe that we are back on the road to a more historically normal market environment. We expect a multi-year run for the current environment of increased return dispersion, declining correlation, and a steepening yield curve, such as we saw in 2016, and think this will also lead to more historically normal relative return patterns for equity asset classes.

Only time will tell, of course. However, we do not think a significant correction—that is, a decline of 15% or more—is in the offing. We see no signs of a recession or financial crisis. Still, a downdraft of anywhere from 8-10% would not be at all unexpected, and arguably healthy, given the strength of small-cap’s 2016 run. When one does occur, we are prepared to act opportunistically by trying to turn any volatility to our investors’ long-term advantage. In any event, we see ongoing leadership not only for small-cap value but for many cyclical sectors as well. Cyclicals lagged for so long that, as with value stocks (with which there is substantial overlap), we were anticipating a shift, which is precisely what we are seeing in the current cycle. Financials are benefiting from the steepening yield curve, which should help to lift bank profits, while the |

potential for accelerated economic growth is boosting Industrials and many Materials stocks. The latter are also benefiting from rebounding commodity prices that ignited energy stocks as well. In addition, the U.S. consumer continues to spend. We see all of these as potentially ongoing trends. And although the global outlook is admittedly less certain, any rebound in worldwide industrial activity would be an additional, and significant, positive.

A NEW DAY FOR ACTIVE MANAGEMENT

Ongoing leadership for value and the related strength of cyclicals could produce distinct advantages for small-cap active management. As rates continue to rise and access to capital begins to contract more consistently, the number of bankruptcies should escalate, restoring the healthy, Darwinian force that generally ensures survival for the best-run, most prudently managed enterprises while putting others at potentially greater risk. It creates challenges for more debt-dependent, long-duration growth while offering potential benefits for companies that are conservatively capitalized. If we are correct in our argument that a multi-year period of value leadership is just beginning, then we also expect it to be a strong period for thoughtful and disciplined small-cap active management.

To be sure, this was the case for domestic small-caps in 2016. Royce Micro-Cap Trust and Royce Value Trust increased more than 20% (and bested their respective benchmarks in the process). These performances were largely rooted in our dogged commitment to disciplined approaches to small-cap stock investing. They support the confidence we have going forward, which is also bolstered by the fact that our analysis of the dynamics in our asset class was sound. We felt validated not only by the high returns for our two domestically oriented portfolios but also that performance took place against the backdrop of a gradually growing economy. Historically, value-led periods have been good for many Royce Funds, and we remain committed to the effort of delivering strong results for our investors in the years to come.

You have our great thanks and deep appreciation for the commitment you have shown to us and our approaches over the years. |

| |  | |  |

| Charles M. Royce | | Christopher D. Clark | | Francis D. Gannon |

| Chairman, | | Chief Executive Officer and | | Co-Chief Investment Officer, |

| Royce & Associates, LP | | Co-Chief Investment Officer,

Royce & Associates, LP | | Royce & Associates, LP |

| | | | | |

| January 31, 2017 | | | | |

| 4 | This page is not part of the 2016 Annual Report to Stockholders |

Performance

| |

| |

NAV Average Annual Total Returns

As of December 31, 2016 (%) |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | 1-YR | | 3-YR | | 5-YR | | 10-YR | | 15-YR | | 20-YR | | 25-YR | | 30-YR | | SINCE

INCEPTION | | INCEPTION

DATE |

| |

| Royce Global Value Trust | | 11.12 | | 0.20 | | N/A | | N/A | | N/A | | N/A | | N/A | | N/A | | 1.05 | | 10/17/13 |

| |

| Royce Micro-Cap Trust | | 21.98 | | 3.70 | | 13.59 | | 6.07 | | 9.22 | | 10.26 | | N/A | | N/A | | 10.81 | | 12/14/93 |

| |

| Royce Value Trust | | 26.79 | | 5.50 | | 12.70 | | 5.81 | | 8.26 | | 9.81 | | 10.73 | | 10.58 | | 10.55 | | 11/26/86 |

| |

INDEX | | | | | | | | | | | | | | | | | | | | |

| |

| Russell 2000 Index | | 21.31 | | 6.74 | | 14.46 | | 7.07 | | 8.49 | | 8.25 | | 9.69 | | 9.62 | | N/A | | N/A |

| |

| Russell Microcap Index | | 20.37 | | 5.77 | | 15.59 | | 5.47 | | 8.16 | | N/A | | N/A | | N/A | | N/A | | N/A |

| |

| Russell Global Small Cap Index | | 11.50 | | 2.98 | | 9.92 | | 4.17 | | 8.87 | | 6.82 | | N/A | | N/A | | N/A | | N/A |

| |

1 Not Annualized

Important Performance and Risk Information

All performance information in this Review and Report reflects past performance, is presented on a total return basis, net of the Fund’s investment advisory fee, and reflects the reinvestment of distributions. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when sold. Current performance may be higher or lower than performance quoted. Current month-end performance may be obtained at www.roycefunds.com. The Funds are closed-end registered investment companies whose respective shares of common stock may trade at a discount to the net asset value. Shares of each Fund’s common stock are also subject to the market risk of investing in the underlying portfolio securities held by each Fund. Certain immaterial adjustments were made to the net assets of Royce Micro-Cap Trust at 12/31/12, as well as 12/31/14 and of Royce Value Trust at 12/31/16, for financial reporting purposes, and as a result the net asset value originally calculated on that date and the total return based on that net asset value differs from the adjusted net asset value and total return reported in the Financial Highlights. All indexes referenced are unmanaged and capitalization-weighted. Each index’s returns include net reinvested dividends and/or interest income. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Russell Investment Group. The Russell 2000 Index is an index of domestic small-cap stocks that measures the performance of the 2,000 smallest publicly traded U.S. companies in the Russell 3000 Index. The Russell Microcap Index includes 1,000 of the smallest securities in the small-cap Russell 2000 Index, along with the next smallest eligible securities as determined by Russell. The Russell Global Small Cap Index is an unmanaged, capitalization-weighted index of global small-cap stocks. The performance of an index does not represent exactly any particular investment, as you cannot invest directly in an index. Index returns include net reinvested dividends and/or interest income. Royce Value, Micro-Cap and Global Value Trust shares of common stock trade on the NYSE. Royce Fund Services, Inc (“RFS”) is a member of FINRA and files certain material with FINRA on behalf of each Fund. RFS is not an underwriter or distributor of any of the Funds.

This page is not part of the 2016 Annual Report to Stockholders | 5

| MANAGER’S DISCUSSION |

| Royce Global Value Trust (RGT) |

|

| Chuck Royce |

| |

FUND PERFORMANCE

Royce Global Value Trust advanced 11.1% on a net asset value (“NAV”) basis and 9.8% on a market price basis compared to a gain of 11.5% for its unleveraged benchmark, the Russell Global Small Cap Index, for the same period. This was a solid absolute result, though it disappointed on a relative basis. U.S. small-caps were very strong in 2016, in contrast to their international cousins. The Fund’s lower exposure to U.S. companies than the index, therefore, was a factor in its slight relative disadvantage for the calendar year. Investors in non-U.S. small-caps generally showed more favor to commodity-based international small-cap companies—oil & gas as well as metals & mining were among the top performers—than they did to the kind of businesses that we seek: small- and mid-cap stocks (those with market caps up to $10 billion) with high returns on invested capital or those with strong fundamentals and/or prospects trading at what Royce believes are attractive valuations.

During the first half of 2016, the Fund was up 3.9% on an NAV basis and 2.0% based on market price versus a 1.4% gain for the global small-cap index. Both the Fund and its benchmark showed even more life in the third quarter as many stocks bounced back or stabilized following Brexit-bred volatility. RGT was up 6.3% in the third quarter (while increasing 6.9% based on its market price) compared to a gain of 8.3% for the Russell Global Small Cap Index. During the fourth quarter, however, many international small-caps declined, which had a larger impact on RGT. The Fund increased 0.6% based on its NAV (and 0.7% based on market price) in the year’s final quarter compared to a 1.5% advance for the benchmark. A portion of RGT’s second-half lag can be traced to currency effects. The rising U.S. dollar was particularly strong against the British pound, which declined significantly in the wake of the Brexit vote, making things difficult for the Fund’s sizable investments in the U.K. |

| WHAT WORKED... AND WHAT DIDN’T |

Eight of the portfolio’s 10 equity sectors finished 2016 in the black. The most significant contributions came from Materials, Financials, Information Technology, and Industrials, which made a much larger impact than the remaining four contributing sectors. Health Care detracted—it was the only sector in the Russell Global Small Cap with a negative return in 2016—while Telecommunication Services was basically flat. Four industries had a substantial positive impact in 2016: metals & mining (Materials), electronic equipment, instruments & components (Information Technology), capital markets (Financials), and machinery (Industrials). The effect of detracting industries was comparatively modest. Pharmaceuticals (Health Care) detracted most by a sizable margin, followed by technology hardware, storage & peripherals (Information Technology), and oil, gas & consumable fuels (Energy).

The Fund’s top contributor at the position level was Genworth MI Canada, one of that country’s leading residential mortgage insurance providers. Its stock first began to rebound with consecutive quarters of improved operating results. The recovery of energy prices also helped as about 20% of Genworth’s policies are written in resource-rich Alberta. The company then announced solid results for its fiscal third quarter in November. We reduced our position in 2016. Pan American Silver was part of a group of both precious and industrial metals companies that came back strong in 2016 as commodity prices rose. |

| |

The portfolio’s top detractor at the position level was Virbac, a French firm that makes vaccines, antibiotics, and other veterinary medications. Its shares suffered mostly from the negative results of a 2014 FDA investigation of its U.S. plant in St. Louis that were released earlier this year. In December 2016, however, the FDA rescinded the warning letter, leaving the status of Virbac’s U.S. operations where they were at the beginning of the year, which allowed its shares to begin to recover. It was a top-40 holding in the Fund at the end of 2016. Value Partners Group is a Hong Kong-based asset manager that emphasizes value approaches. Subpar short-term performance, net outflows, and a CEO resignation all contributed to investors’ concerns. Because we remain confident in its long-term prospects, particularly in China, as well as in its Chairman, who has assumed CEO responsibilities, we were comfortable holding our stake.

Relative to the Russell Global Small Cap, the Fund was hurt most by ineffective stock picking in the Industrials sector, most meaningfully in the machinery and commercial services & supplies industries. Stock selection was also an issue in Financials. Conversely, both our overweight and savvy stock picking gave us a relative edge in Materials while stock selection also helped in Information Technology. |

| | | | | |

| | Top Contributors to Performance

For 2016 (%)1 | | | |

| | | | | |

| | Genworth MI Canada | | 0.65 | |

| | | |

| | Pan American Silver | | 0.63 | |

| | | |

| | CETIP - Mercados Organizados | | 0.50 | |

| | | |

| | Quaker Chemical | | 0.46 | |

| | | |

| | Nanometrics | | 0.44 | |

| | | |

| | 1 Includes dividends | | | |

| | | | | |

| | | | | |

| | Top Detractors from Performance

For 2016 (%)2 | | | |

| | | | | |

| | Virbac | | -0.54 | |

| | | |

| | Value Partners Group | | -0.46 | |

| | | |

| | Santen Pharmaceutical | | -0.40 | |

| | | |

| | Consort Medical | | -0.35 | |

| | | |

| | Clarkson | | -0.31 | |

| | | |

| | 2 Net of dividends | | | |

| | | | | |

| CURRENT POSITIONING AND OUTLOOK |

| At the end of 2016, the Fund’s largest country weights were the U.S., the U.K., Japan, and Canada. We think the global markets continue to offer terrific potential in a number of sectors and regions to find the kind of underappreciated, fundamentally solid companies that have long been our focus here at Royce. In our view cyclicals both in and outside the U.S. look well-positioned for ongoing leadership. In addition to our usual cyclical tilt, we are looking in some defensive areas such as healthcare. It is very much on a stock-by-stock basis, with a focus on individual companies that combine attractive valuations with strong fundamentals. |

| 6 | 2016 Annual Report to Stockholders |

| PERFORMANCE AND PORTFOLIO REVIEW | | SYMBOLS MARKET PRICE RGT NAV XRGTX |

| Performance |

| Average Annual Total Return (%) Through 12/31/16 |

| | | JUL-DEC 20161 | | 1-YR | | 3-YR | | SINCE INCEPTION (10/17/13) |

| |

| RGT (NAV) | | 6.99 | | 11.12 | | 0.20 | | 1.05 |

| |

| 1 Not Annualized | | | | | | | | |

Market Price Performance History Since Inception (10/17/13)Cumulative Performance of Investment1

| 1 | Reflects the cumulative performance experience of a continuous common stockholder who purchased one share at inception ($8.975 IPO) and

reinvested all distributions. |

| 2 | Reflects the actual month-end market price movement of one share as it has traded on NYSE and, prior to 12/1/03, on the Nasdaq. |

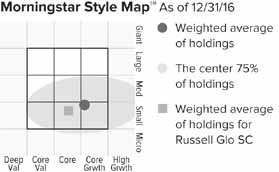

The Morningstar Style Map is the Morningstar Style Box™ with the center 75% of fund holdings plotted as the Morningstar Ownership Zone™. The Morningstar Style Box is designed to reveal a fund’s investment strategy. The Morningstar Ownership Zone provides detail about a portfolio’s investment style by showing the range of stock sizes and styles. The Ownership Zone is derived by plotting each stock in the portfolio within the proprietary Morningstar Style Box. Over time, the shape and location of a fund’s ownership zone may vary. See page 61 for additional information. |

|

| Top 10 Positions | | |

| % of Net Assets | | |

| | | |

|

| Kirby Corporation | | 2.2 |

| |

| SEI Investments | | 2.0 |

| |

| SEACOR Holdings | | 1.4 |

| |

| Meitec Corporation | | 1.4 |

| |

| Lazard Cl. A | | 1.3 |

| |

| VZ Holding | | 1.3 |

| |

| Raven Industries | | 1.3 |

| |

| KBR | | 1.2 |

| |

| Virtu Financial Cl. A | | 1.2 |

| |

| Nanometrics | | 1.1 |

| |

|

| Portfolio Sector Breakdown | | |

| % of Net Assets | | |

| | | |

| Industrials | | 28.8 |

| |

| Financials | | 18.1 |

| |

| Information Technology | | 17.3 |

| |

| Materials | | 11.4 |

| |

| Health Care | | 10.0 |

| |

| Consumer Discretionary | | 7.2 |

| |

| Energy | | 3.4 |

| |

| Consumer Staples | | 2.8 |

| |

| Real Estate | | 2.5 |

| |

| Telecommunication Services | | 0.2 |

| |

| Outstanding Line of Credit, Net of Cash and Cash Equivalents | | -1.7 |

| |

|

| Calendar Year Total Returns (%) | | |

| | | |

| YEAR | | RGT |

| |

| 2016 | | 11.1 |

| |

| 2015 | | -3.4 |

| |

| 2014 | | -6.2 |

| |

|

Portfolio Country Breakdown 1,2

% of Net Assets | | |

| | | |

| |

| United States | | 32.7 |

| |

| United Kingdom | | 13.0 |

| |

| Japan | | 9.7 |

| |

| Canada | | 8.4 |

| |

| Germany | | 4.6 |

| |

| France | | 4.3 |

| |

| Switzerland | | 4.3 |

| |

| 1 Represents countries that are 3% or more of net assets. |

| 2 Securities are categorized by the country of their headquarters. |

|

| Portfolio Diagnostics | | |

| | | |

| Fund Net Assets | | $100 million |

| |

| Number of Holdings | | 274 |

| |

| Turnover Rate | | 59% |

| |

| Net Asset Value | | $9.62 |

| |

| Market Price | | $8.04 |

| |

| Net Leverage1 | | 1.7% |

| |

| Average Market Capitalization2 | | $1,558 million |

| |

| Weighted Average P/E Ratio3, 4 | | 20.5x |

| |

| Weighted Average P/B Ratio3 | | 2.6x |

| |

| Active Share5 | | 97% |

| |

| 1 | Net leverage is the percentage, in excess of 100%, of the total value of equity type investments, divided by net assets. |

| 2 | Geometric Average. This weighted calculation uses each portfolio holding’s market cap in a way designed to not skew the effect of very large or small holdings; instead, it aims to better identify the portfolio’s center, which Royce believes offers a more accurate measure of average market cap than a simple mean or median. |

| 3 | Harmonic Average. This weighted calculation evaluates a portfolio as if it were a single stock and measures it overall. It compares the total market value of the portfolio to the portfolio’s share in the earnings or book value, as the case may be, of its underlying stocks. |

| 4 | The Fund’s P/E ratio calculation excludes companies with zero or negative earnings (10% of portfolio holdings as of 12/31/16). |

| 5 | Active Share is the sum of the absolute values of the different weightings of each holding in the Fund versus each holding in the benchmark, divided by two. |

| Important Performance and Risk Information

All performance information reflects past performance, is presented on a total return basis, net of the Fund’s investment advisory fee, and reflects the reinvestment of distributions. Past performance is no guarantee of future results. Current performance may be higher or lower than performance quoted. Returns as of the most recent month-end may be obtained at www.roycefunds.com. The market price of the Fund’s shares will fluctuate, so that shares may be worth more or less than their original cost when sold. The Fund invests primarily in securities of small- and mid-cap companies, which may involve considerably more risk than investments in securities of larger-cap companies. The Fund’s broadly diversified portfolio does not ensure a profit or guarantee against loss. From time to time, the Fund may invest a significant portion of its net assets in foreign securities, which may involve political, economic, currency and other risks not encountered in U.S. investments. Regarding the “Top Contributors” and “Top Detractors” tables shown on page 6, the sum of all contributors to, and all detractors from, performance for all securities in the portfolio would approximate the Fund’s year-to-date performance for 2016.

|

| 2016 Annual Report to Stockholders | 7 |

| | | MANAGER’S DISCUSSION |

| Royce Micro-Cap Trust (RMT) | | |

|

| Chuck Royce |

FUND PERFORMANCE

Royce Micro-Cap Trust (“RMT”) advanced 22.0% on a net asset value (“NAV”) basis and 22.3% on a market price basis in 2016, ahead of both of its unleveraged benchmarks: the small-cap Russell 2000 Index was up 21.3% while the Russell Microcap Index increased 20.4% for the same period. We were very pleased with the Fund’s results on both an absolute and relative basis, particularly in a year in which small-cap stocks held a slight edge over their micro-cap siblings. RMT’s multi-strategy core approach was well-positioned for a market that rewarded factors such as low valuation, liquidity, low volatility, and quality, all of which outperformed within the Russell 2000 and provided some validation for our approach.

The two halves of 2016 were mirror images of one another. The first was stronger on a relative basis while the second was better on an absolute scale. During the first half of 2016, the Fund was up 5.4% on an NAV basis (and 5.8% on a relative basis) versus a gain of 2.2% for the Russell 2000 and a decline of 1.7% for the Russell Microcap for the same period. In the second half, RMT increased 15.7% on an NAV basis and 15.6% based on market price basis. This compared to respective gains of 18.7% and 22.4% for the small-cap and micro-cap indexes. On an NAV basis, RMT outpaced the Russell Microcap for the one-, 10-, and 15-year periods ended December 31, 2016 while also beating the Russell 2000 for the one-, 15-, 20-year, and since inception (12/14/93) periods. (Returns for the Russell Microcap Index only go back to 2000.) RMT’s average annual NAV total return for the since inception period ended December 31, 2016 was 10.8%. |

| |

| WHAT WORKED... AND WHAT DIDN’T |

Each of the portfolio’s 11 equity sectors made a contribution to calendar-year results. The largest positive impact by far came from Information Technology and Industrials, RMT’s two largest sectors, followed by noteworthy net gains from Materials and Financials. Some of the smallest contributions came from those sectors with the smallest weightings: Real Estate, Consumer Staples, Telecommunication Services, and Utilities. At the industry level, the top-contributors by a sizable margin were electronic equipment, instruments & components (Information Technology), metals & mining (Materials), and machinery (Industrials). Detractors made a very modest negative impact, led by software (Information Technology), distributors (Consumer Discretionary), and IT services (Information Technology).

RMT’s top-contributing position was IES Holdings, which provides electrical contracting and maintenance services to the commercial, industrial, residential, and power line markets. The firm also engages in data communication services, including the installation of fiber optic telecommunications systems. Very healthy earnings and a strong outlook, both of which were boosted by five acquisitions the firm made between mid-2015 and the end of 2016, attracted investors. Top-five position Major Drilling Group International performs contract drilling for companies involved in mining and mineral exploration. In a challenging environment for miners early in 2016, the company was able to increase revenues and margins. Revenue growth continued throughout the year as business conditions, while remaining competitive, began to improve. Newport Corporation is a photonics technology specialist whose shares climbed in February after the company agreed to be acquired by MKS Instruments. |

| |

| As for those holdings that detracted from performance, we held the bulk of our position in ZAIS Group Holdings, an investment manager focused on specialized credit strategies—an asset management segment with what we think is ample long-term potential. Its shares fell with a quarterly loss reported in March and were mostly down through the end of June. A falling stock price in the first half and our confidence in its long-term prospects led us to add shares of Fenix Parts, which recycles and resells original equipment manufacturer automotive parts and products. Consecutive quarterly losses drove investors away before its shares rallied a bit only to fall again when accounting and regulatory issues surfaced. However, we like its core business and were hopeful that the company could resolve these issues in 2017. |

| |

| Relative to the Russell 2000, the Fund derived the bulk of its advantage from savvy stock selection in Health Care, the only sector in the Russell 2000 with a negative return in 2016. Stock picking offered a more modest advantage in Information Technology. Conversely, our underweight in banks and ineffective stock picks caused Financials to lag, as did poor stock selection in Consumer Discretionary. |

| | Top Contributors to Performance

For 2016 (%)1 | | | |

| | | |

| IES Holdings | | 0.88 |

| |

| Major Drilling Group International | | 0.68 |

| |

| Newport Corporation | | 0.57 |

| |

| Era Group | | 0.47 |

| |

| Surmodics | | 0.47 |

| |

| 1 Includes dividends | | |

| | Top Detractors from Performance

For 2016 (%)2 | | | |

| | | |

| ZAIS Group Holdings Cl. A | | -0.71 |

| |

| Fenix Parts | | -0.52 |

| |

| SeaChange International | | -0.43 |

| |

| Sangamo BioSciences | | -0.39 |

| |

| Zealand Pharma | | -0.37 |

| |

| 2 Net of dividends | | |

| CURRENT POSITIONING AND OUTLOOK |

| We are grateful to have been able to deliver such strong absolute and relative results for our investors and firmly believe that we have turned the page on the anomalous 2011-2015 period, in which extraordinary monetary accommodations caused financial markets to behave in odd and unprecedented ways. In our view, we are on the road back to a more historically normal market environment. We think this bodes well for micro-cap and small-cap stocks. In our view cyclicals look well-positioned for ongoing leadership. In addition to our usual cyclical tilt, we are looking in some defensive areas such as healthcare. It is very much on a stock-by-stock basis, with a focus on individual companies that combine attractive valuations with strong fundamentals. |

| 8 | 2016 Annual Report to Stockholders | |

| PERFORMANCE AND PORTFOLIO REVIEW | SYMBOLS MARKET PRICE RMT NAV XOTCX |

|

| Performance | | | | | | | | | | | | | | | | |

| Average Annual Total Return (%) Through 12/31/16 | | | | | | | | | | | | |

| | | JUL-DEC 20161 | | 1-YR | | 3-YR | | 5-YR | | 10-YR | | 15-YR | | 20-YR | | SINCE INCEPTION (12/14/93) |

|

| RMT (NAV) | | 15.74 | | 21.98 | | 3.70 | | 13.59 | | 6.07 | | 9.22 | | 10.26 | | 10.81 |

| |

| 1 Not Annualized | | | | | | | | | | | | | | | | |

|

| Market Price Performance History Since Inception (12/14/93) |

| Cumulative Performance of Investment1 | | | | | | | | |

| 1 | Reflects the cumulative performance experience of a continuous common stockholder who purchased one share at inception ($7.50 IPO), reinvested all distributions and fully participated in the primary subscription of the Fund’s 1994 rights offering. |

| 2 | Reflects the actual month-end market price movement of one share as it has traded on NYSE and, prior to 12/1/03, on the Nasdaq. |

| | |

| |

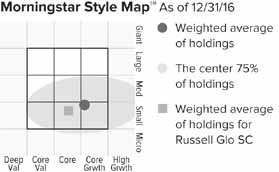

The Morningstar Style Map is the Morningstar Style Box™ with the center 75% of fund holdings plotted as the Morningstar Ownership Zone™. The Morningstar Style Box is designed to reveal a fund’s investment strategy. The Morningstar Ownership Zone provides detail about a portfolio’s investment style by showing the range of stock sizes and styles. The Ownership Zone is derived by plotting each stock in the portfolio within the proprietary Morningstar Style Box. Over time, the shape and location of a fund’s ownership zone may vary. See page 61 for additional information. |

|

| Top 10 Positions | | |

| % of Net Assets | | |

| | | |

| Era Group | | 1.4 |

| |

| IES Holdings | | 1.2 |

| |

| Seneca Foods | | 1.1 |

| |

| Heritage-Crystal Clean | | 1.0 |

| |

| Major Drilling Group International | | 1.0 |

| |

| Atrion Corporation | | 1.0 |

| |

| Sun Hydraulics | | 1.0 |

| |

| Orbotech | | 0.9 |

| |

| Kadant | | 0.9 |

| |

| Quaker Chemical | | 0.9 |

| |

|

| Portfolio Sector Breakdown | | |

| % of Net Assets | | |

| | | |

| Information Technology | | 19.0 |

| |

| Industrials | | 18.4 |

| |

| Consumer Discretionary | | 14.2 |

| |

| Health Care | | 13.4 |

| |

| Financials | | 11.9 |

| |

| Materials | | 6.2 |

| |

| Energy | | 5.7 |

| |

| Real Estate | | 3.7 |

| |

| Consumer Staples | | 2.7 |

| |

| Telecommunication Services | | 0.1 |

| |

| Utilities | | 0.1 |

| |

| Miscellaneous | | 4.7 |

| |

| Preferred Stock | | 0.3 |

| |

| Outstanding Line of Credit, Net of Cash and Cash Equivalents | | -0.4 |

| |

|

| Calendar Year Total Returns (%) | |

| | | |

| YEAR | | RMT |

| |

| 2016 | | 22.0 |

| |

| 2015 | | -11.7 |

| |

| 2014 | | 3.5 |

| |

| 2013 | | 44.5 |

| |

| 2012 | | 17.3 |

| |

| 2011 | | -7.7 |

| |

| 2010 | | 28.5 |

| |

| 2009 | | 46.5 |

| |

| 2008 | | -45.5 |

| |

| 2007 | | 0.6 |

| |

| 2006 | | 22.5 |

| |

| 2005 | | 6.8 |

| |

| 2004 | | 18.7 |

| |

| 2003 | | 55.5 |

| |

| 2002 | | -13.8 |

| |

|

| Portfolio Diagnostics | | |

| | | |

| Fund Net Assets | | $364 million |

| |

| Number of Holdings | | 338 |

| |

| Turnover Rate | | 26% |

| |

| Net Asset Value | | $9.63 |

| |

| Market Price | | $8.16 |

| |

| Net Leverage1 | | 0.4% |

| |

| Average Market Capitalization2 | | $384 million |

| |

| Weighted Average P/B Ratio3 | | 1.7x |

| |

| Active Share4 | | 95% |

| |

| U.S. Investments (% of Net Assets) | | 81.2% |

| |

| Non-U.S. Investments (% of Net Assets) | | 19.2% |

| |

| |

| 1 | Net leverage is the percentage, in excess of 100%, of the total value of equity type investments, divided by net assets. |

| 2 | Geometric Average. This weighted calculation uses each portfolio holding’s market cap in a way designed to not skew the effect of very large or small holdings; instead, it aims to better identify the portfolio’s center, which Royce believes offers a more accurate measure of average market cap than a simple mean or median. |

| 3 | Harmonic Average. This weighted calculation evaluates a portfolio as if it were a single stock and measures it overall. It compares the total market value of the portfolio to the portfolio’s share in the earnings or book value, as the case may be, of its underlying stocks. |

| 4 | Active Share is the sum of the absolute values of the different weightings of each holding in the Fund versus each holding in the benchmark, divided by two. |

Important Performance and Risk Information

All performance information reflects past performance, is presented on a total return basis, net of the Fund’s investment advisory fee, and reflects the reinvestment of distributions. Past performance is no guarantee of future results. Current performance may be higher or lower than performance quoted. Returns as of the most recent month-end may be obtained at www.roycefunds.com. Certain immaterial adjustments were made to the net assets of Royce Micro-Cap Trust at 12/31/12 and 12/31/14 for financial reporting purposes, and as a result the net asset value originally calculated on that date and the total return based on that net asset value differs from the adjusted net asset value and total return reported in the Financial Highlights. The market price of the Fund’s shares will fluctuate, so that shares may be worth more or less than their original cost when sold. The Fund normally invests in micro-cap companies, which may involve considerably more risk than investments in securities of larger-cap companies. The Fund’s broadly diversified portfolio does not ensure a profit or guarantee against loss. From time to time, the Fund may invest a significant portion of its net assets in foreign securities, which may involve political, economic, currency and other risks not encountered in U.S. investments. Regarding the “Top Contributors” and “Top Detractors” tables shown on page 8, the sum of all contributors to, and all detractors from, performance for all securities in the portfolio would approximate the Fund’s year-to-date performance for 2016. |

| | | 2016 Annual Report to Stockholders | 9 |

| | | MANAGER’S DISCUSSION |

| Royce Value Trust (RVT) | | |

|

| Chuck Royce |

FUND PERFORMANCE

Royce Value Trust Fund advanced 26.8% on a net asset value (“NAV”) basis and 23.5% on a market price basis in 2016, compared to respective increases of 21.3% and 26.5% for its unleveraged small-cap benchmarks, the Russell 2000 and S&P SmallCap 600 Indexes, for the same period. In such a strong year for small-cap stocks, we were pleased with the Fund’s terrific absolute and relative NAV showing. RVT’s multi-themed core approach served investors well during a year in which factors such as low valuation, liquidity, low volatility, and quality all outperformed within the Russell 2000. Calendar-year performance was even more gratifying in light of the questions both active management and value-oriented approaches were facing between 2011 and 2015, which made the year feel very much like a validation for our approach.

The Fund outperformed during the first half of 2016, gaining 8.2% on an NAV basis and 4.4% based on market price versus respective gains of 2.2% and 6.2% for the Russell 2000 and S&P SmallCap 600. The second half was stronger on an absolute basis but less so on a relative scale. During this period, RVT rose 17.3% based on NAV and 18.3% based on its market price compared to 18.7% for the Russell 2000 and 19.1% for the S&P SmallCap 600. Looking at longer-term periods, we were pleased that RVT outpaced the Russell 2000 for the one-, 20-, 25-, 30-year, and since inception (11/26/86) periods ended December 31, 2016. The Fund’s average annual NAV total return since inception was 10.6%, all under the management of Chuck Royce. |

| |

| WHAT WORKED... AND WHAT DIDN’T |

All of the portfolio’s 11 equity sectors finished 2016 with net gains. Industrials led by a considerable margin, followed by a strong contribution from Information Technology that was considerably higher than the meaningfully positive impact of Materials, the Fund’s third-highest contributor. Notable net gains also came from the Consumer Discretionary and Financials sectors. This widespread cyclical strength was consistent with trends in the overall small-cap market. Within Industrials, the best-performing industries were machinery (our largest industry weighting in the sector), commercial services & supplies, and construction & engineering. The portfolio’s top-performing industry, however, came from the Information Technology sector—electronic equipment, instruments & components. Coherent, which manufactures laser diodes and equipment, owned the top spot by position. Its shares skyrocketed in 2016, lifted by a combination of strong profits, a record backlog, and a robust order pipeline. Cognex Corporation is the market leader in machine vision technology that captures and analyzes visual information to automate tasks that previously relied on human eyesight. This technology is a major driver of industrial and process automation. Sales to the auto industry accelerated, its consumer electronics segment proved better than expected, and it gained share among logistics services providers. All of these factors produced an impressive performance for the stock.

Even in a good year there are a few disappointments. ZAIS Group Holdings is an investment manager focused primarily on structured credits. Recent credit market turmoil has caused investment performance to fall below various “high-water” marks, meaningfully dampening profitability and future growth opportunities. We chose to hold our shares in 2016 in light of its highly discounted valuation. We also chose to hold our position in The Advisory Board. Its shares fell most precipitously during the fall as this specialist in performance improvement software and solutions to the health care and higher education industries reported disappointing fiscal third-quarter revenues. We like its niche business and think its long-term prospects remain promising. We also held on to most of our shares of Zealand Pharma, a Danish firm whose share price decline was mostly driven by the sell-off in its industry. We remain optimistic about its long-term growth potential. |

| |

| Relative results in 2016 were driven by our underweight in the lagging Health Care sector, as well as positive stock selection in the sector. Also aiding relative performance was savvy stock selection in Information Technology. The two largest relative detractors had a similar theme—our underweight in banks caused the Fund to lag in Financials and our underweighting in REITs led to underperformance in the Real Estate sector. The Fund is typically underweight in these interest rate sensitive areas. |

| | Top Contributors to Performance

For 2016 (%)1 | | | |

| | | |

| Coherent | | 0.95 |

| |

| Cognex Corporation | | 0.60 |

| |

| Thor Industries | | 0.53 |

| |

| Quaker Chemical | | 0.53 |

| |

| Newport Corporation | | 0.50 |

| |

| 1 Includes dividends | | |

| | Top Detractors from Performance

For 2016 (%)2 | | | |

| | | |

| ZAIS Group Holdings Cl. A | | -0.42 |

| |

| Advisory Board (The) | | -0.32 |

| |

| Zealand Pharma | | -0.29 |

| |

| Value Partners Group | | -0.22 |

| |

| Citadel Capital | | -0.18 |

| |

| 2 Net of dividends | | |

| CURRENT POSITIONING AND OUTLOOK |

| We are grateful to have been able to deliver such strong absolute and relative NAV results for our investors and firmly believe that we have turned the page on the anomalous 2011-2015 period, in which extraordinary monetary accommodations caused financial markets to behave in odd and unprecedented ways. In our view, we are on the road back to a more historically normal market environment. We think this bodes well for small-cap stocks. In our view cyclicals look well-positioned for ongoing leadership. In addition to our usual cyclical tilt, we are looking in some defensive areas such as healthcare. It is very much on a stock-by-stock basis, with a focus on individual companies that combine attractive valuations with strong fundamentals. |

| 10 | 2016 Annual Report to Stockholders | |

| PERFORMANCE AND PORTFOLIO REVIEW | SYMBOLS MARKET PRICE RVT NAV XRVTX |

|

| Performance | | | | | | | | | | | | | | | | | |

| Average Annual Total Return (%) Through 12/31/16 | | | | | | | | | |

| | | JUL-DEC 20161 | | 1-YR | | 3-YR | | 5-YR | | 10-YR | | 15-YR | | 20-YR | | 25-YR | | 30-YR | | SINCE INCEPTION (11/26/86) |

|

| RVT (NAV) | | 17.21 | | 26.79 | | 5.50 | | 12.70 | | 5.81 | | 8.26 | | 9.81 | | 10.73 | | 10.58 | | 10.55 |

| |

| 1 Not Annualized | | | | | | | | | | | | | | | |

|

| Market Price Performance History Since Inception (11/26/86) |

| Cumulative Performance of Investment through 12/31/161 | | | | | | | | |

| 1 | Reflects the cumulative performance of an investment made by a stockholder who purchased one share at inception ($10.00 IPO), reinvested all distributions and fully participated in primary subscriptions of the Fund’s rights offerings. |

| 2 | Reflects the actual month-end market price movement of one share as it has traded on the NYSE. |

| | |

| |

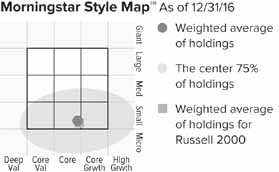

The Morningstar Style Map is the Morningstar Style Box™ with the center 75% of fund holdings plotted as the Morningstar Ownership Zone™. The Morningstar Style Box is designed to reveal a fund’s investment strategy. The Morningstar Ownership Zone provides detail about a portfolio’s investment style by showing the range of stock sizes and styles. The Ownership Zone is derived by plotting each stock in the portfolio within the proprietary Morningstar Style Box. Over time, the shape and location of a fund’s ownership zone may vary. See page 61 for additional information. |

|

| Top 10 Positions | | |

| % of Net Assets | | |

| | | |

| HEICO Corporation | | 1.3 |

| |

| Coherent | | 1.2 |

| |

| Quaker Chemical | | 1.1 |

| |

| Cognex Corporation | | 1.0 |

| |

| Ash Grove Cement Cl. B | | 1.0 |

| |

| Copart | | 0.9 |

| |

| E-L Financial | | 0.9 |

| |

| RBC Bearings | | 0.9 |

| |

| FLIR Systems | | 0.9 |

| |

| Sun Hydraulics | | 0.9 |

| |

|

| Portfolio Sector Breakdown | | |

| % of Net Assets | | |

| | | |

| Industrials | | 29.2 |

| |

| Information Technology | | 16.8 |

| |

| Financials | | 14.9 |

| |

| Consumer Discretionary | | 10.3 |

| |

| Materials | | 7.3 |

| |

| Energy | | 5.2 |

| |

| Health Care | | 4.2 |

| |

| Real Estate | | 2.8 |

| |

| Consumer Staples | | 2.2 |

| |

| Telecommunication Services | | 0.5 |

| |

| Utilities | | 0.1 |

| |

| Miscellaneous | | 4.3 |

| |

| Cash and Cash Equivalents, Net of Outstanding Line of Credit | | 2.2 |

| |

|

| Calendar Year Total Returns (%) | |

| | | |

| YEAR | | RVT |

| |

| 2016 | | 26.8 |

| |

| 2015 | | -8.1 |

| |

| 2014 | | 0.8 |

| |

| 2013 | | 34.1 |

| |

| 2012 | | 15.4 |

| |

| 2011 | | -10.1 |

| |

| 2010 | | 30.3 |

| |

| 2009 | | 44.6 |

| |

| 2008 | | -45.6 |

| |

| 2007 | | 5.0 |

| |

| 2006 | | 19.5 |

| |

| 2005 | | 8.4 |

| |

| 2004 | | 21.4 |

| |

| 2003 | | 40.8 |

| |

| 2002 | | -15.6 |

| |

|

| Portfolio Diagnostics | | |

| | | |

| Fund Net Assets | | $1,296 million |

| |

| Number of Holdings | | 424 |

| |

| Turnover Rate | | 28% |

| |

| Net Asset Value | | $15.84 |

| |

| Market Price | | $13.39 |

| |

| Average Market Capitalization1 | | $1,477 million |

| |

| Weighted Average P/E Ratio2,3 | | 20.3x |

| |

| Weighted Average P/B Ratio2 | | 2.1x |

| |

| Active Share4 | | 89% |

| |

| U.S. Investments (% of Net Assets) | | 82.6% |

| |

| Non-U.S. Investments (% of Net Assets) | | 15.2% |

| |

| |

| 1 | Geometric Average. This weighted calculation uses each portfolio holding’s market cap in a way designed to not skew the effect of very large or small holdings; instead, it aims to better identify the portfolio’s center, which Royce believes offers a more accurate measure of average market cap than a simple mean or median. |

| 2 | Harmonic Average. This weighted calculation evaluates a portfolio as if it were a single stock and measures it overall. It compares the total market value of the portfolio to the portfolio’s share in the earnings or book value, as the case may be, of its underlying stocks. |

| 3 | The Fund’s P/E ratio calculation excludes companies with zero or negative earnings (17% of portfolio holdings as of 12/31/16). |

| 4 | Active Share is the sum of the absolute values of the different weightings of each holding in the Fund versus each holding in the benchmark, divided by two. |

Important Performance and Risk Information

All performance information reflects past performance, is presented on a total return basis, net of the Fund’s investment advisory fee, and reflects the reinvestment of distributions. Past performance is no guarantee of future results. Current performance may be higher or lower than performance quoted. Returns as of the most recent month-end may be obtained at www.roycefunds.com. Certain immaterial adjustments were made to the net assets of Royce Value Trust at 12/31/16 for financial reporting purposes, and as a result the net asset value originally calculated on that date and the total return based on that net asset value differs from the adjusted net asset value and total return reported in the Financial Highlights. The market price of the Fund’s shares will fluctuate, so that shares may be worth more or less than their original cost when sold. The Fund invests primarily in securities of small- and micro-cap companies, which may involve considerably more risk than investing in larger-cap companies. The Fund’s broadly diversified portfolio does not ensure a profit or guarantee against loss. Regarding the “Top Contributors” and “Top Detractors” tables shown on page 10, the sum of all contributors to, and all detractors from, performance for all securities in the portfolio would approximate the Fund’s year-to date performance for 2015. |

| | | 2016 Annual Report to Stockholders | 11 |

History Since Inception

The following table details the share accumulations by an initial investor in the Funds who reinvested all distributions and participated fully in primary subscriptions for each of the rights offerings. Full participation in distribution reinvestments and rights offerings can maximize the returns available to a long-term investor. This table should be read in conjunction with the Performance and Portfolio Reviews of the Funds.

| HISTORY | | | | | AMOUNT INVESTED | | | PURCHASE PRICE1 | | | | SHARES | | | | NAV VALUE2 | | | | MARKET VALUE2 |

| |

| Royce Global Value Trust | | | | | | | | | | | | | | | | | | |

| 10/17/13 | | Initial Purchase | | $ | 8,975 | | $ | 8.975 | | | | 1,000 | | | $ | 9,780 | | | $ | 8,975 |

| |

| 12/11/14 | | Distribution $0.15 | | | | | | 7.970 | | | | 19 | | | | 9,426 | | | | 8,193 |

| |

| 12/10/15 | | Distribution $0.10 | | | | | | 7.230 | | | | 14 | | | | 9,101 | | | | 7,696 |

| |

| 12/9/16 | | Distribution $0.14 | | | | | | 7.940 | | | | 18 | | | | | | | | |

| |

| 12/31/16 | | | | $ | 8,975 | | | | | | | 1,051 | | | $ | 10,111 | | | $ | 8,446 |

| |

| | | | | | | | | | | | | | | | | | | | | |

| Royce Micro-Cap Trust | | | | | | | | | | | | | | | | | | |

| 12/14/93 | | Initial Purchase | | $ | 7,500 | | $ | 7.500 | | | | 1,000 | | | $ | 7,250 | | | $ | 7,500 |

| |

| 10/28/94 | | Rights Offering | | | 1,400 | | | 7.000 | | | | 200 | | | | | | | | |

| |

| 12/19/94 | | Distribution $0.05 | | | | | | 6.750 | | | | 9 | | | | 9,163 | | | | 8,462 |

| |

| 12/7/95 | | Distribution $0.36 | | | | | | 7.500 | | | | 58 | | | | 11,264 | | | | 10,136 |

| |

| 12/6/96 | | Distribution $0.80 | | | | | | 7.625 | | | | 133 | | | | 13,132 | | | | 11,550 |

| |

| 12/5/97 | | Distribution $1.00 | | | | | | 10.000 | | | | 140 | | | | 16,694 | | | | 15,593 |

| |

| 12/7/98 | | Distribution $0.29 | | | | | | 8.625 | | | | 52 | | | | 16,016 | | | | 14,129 |

| |

| 12/6/99 | | Distribution $0.27 | | | | | | 8.781 | | | | 49 | | | | 18,051 | | | | 14,769 |

| |

| 12/6/00 | | Distribution $1.72 | | | | | | 8.469 | | | | 333 | | | | 20,016 | | | | 17,026 |

| |

| 12/6/01 | | Distribution $0.57 | | | | | | 9.880 | | | | 114 | | | | 24,701 | | | | 21,924 |

| |

| 2002 | | Annual distribution total $0.80 | | | | | | 9.518 | | | | 180 | | | | 21,297 | | | | 19,142 |

| |

| 2003 | | Annual distribution total $0.92 | | | | | | 10.004 | | | | 217 | | | | 33,125 | | | | 31,311 |

| |

| 2004 | | Annual distribution total $1.33 | | | | | | 13.350 | | | | 257 | | | | 39,320 | | | | 41,788 |

| |

| 2005 | | Annual distribution total $1.85 | | | | | | 13.848 | | | | 383 | | | | 41,969 | | | | 45,500 |

| |

| 2006 | | Annual distribution total $1.55 | | | | | | 14.246 | | | | 354 | | | | 51,385 | | | | 57,647 |

| |

| 2007 | | Annual distribution total $1.35 | | | | | | 13.584 | | | | 357 | | | | 51,709 | | | | 45,802 |

| |

| 2008 | | Annual distribution total $1.193 | | | | | | 8.237 | | | | 578 | | | | 28,205 | | | | 24,807 |

| |

| 3/11/09 | | Distribution $0.223 | | | | | | 4.260 | | | | 228 | | | | 41,314 | | | | 34,212 |

| |

| 12/2/10 | | Distribution $0.08 | | | | | | 9.400 | | | | 40 | | | | 53,094 | | | | 45,884 |

| |

| 2011 | | Annual distribution total $0.533 | | | | | | 8.773 | | | | 289 | | | | 49,014 | | | | 43,596 |

| |

| 2012 | | Annual distribution total $0.51 | | | | | | 9.084 | | | | 285 | | | | 57,501 | | | | 49,669 |

| |

| 2013 | | Annual distribution total $1.38 | | | | | | 11.864 | | | | 630 | | | | 83,110 | | | | 74,222 |

| |

| 2014 | | Annual distribution total $2.90 | | | | | | 10.513 | | | | 1,704 | | | | 86,071 | | | | 76,507 |

| |

| 2015 | | Annual distribution total $1.26 | | | | | | 7.974 | | | | 1,256 | | | | 75,987 | | | | 64,222 |

| |

| 2016 | | Annual distribution total $0.64 | | | | | | 7.513 | | | | 779 | | | | | | | | |

| |

| 12/31/16 | | | | $ | 8,900 | | | | | | | 9,625 | | | $ | 92,689 | | | $ | 78,540 |

| |

| 1 The purchase price used for annual distribution totals is a weighted average of the distribution reinvestment prices for the year. |

| 2 Values are stated as of December 31 of the year indicated, after reinvestment of distributions, other than for initial purchase. |

| 3 Includes a return of capital. |

12 | 2016 Annual Report to Stockholders

| HISTORY | | | | | | AMOUNT INVESTED | | | | PURCHASE PRICE1 | | | | SHARES | | | | NAV VALUE2 | | | | MARKET VALUE2 |

| |

| Royce Value Trust | | | | | | | | | | | | | | | | | | | |

| 11/26/86 | | | Initial Purchase | | $ | 10,000 | | | $ | 10.000 | | | | 1,000 | | | $ | 9,280 | | | $ | 10,000 |

| |

| 10/15/87 | | | Distribution $0.30 | | | | | | | 7.000 | | | | 42 | | | | | | | | |

| |

| 12/31/87 | | | Distribution $0.22 | | | | | | | 7.125 | | | | 32 | | | | 8,578 | | | | 7,250 |

| |

| 12/27/88 | | | Distribution $0.51 | | | | | | | 8.625 | | | | 63 | | | | 10,529 | | | | 9,238 |

| |

| 9/22/89 | | | Rights Offering | | | 405 | | | | 9.000 | | | | 45 | | | | | | | | |

| |

| 12/29/89 | | | Distribution $0.52 | | | | | | | 9.125 | | | | 67 | | | | 12,942 | | | | 11,866 |

| |

| 9/24/90 | | | Rights Offering | | | 457 | | | | 7.375 | | | | 62 | | | | | | | | |

| |

| 12/31/90 | | | Distribution $0.32 | | | | | | | 8.000 | | | | 52 | | | | 11,713 | | | | 11,074 |

| |

| 9/23/91 | | | Rights Offering | | | 638 | | | | 9.375 | | | | 68 | | | | | | | | |

| |

| 12/31/91 | | | Distribution $0.61 | | | | | | | 10.625 | | | | 82 | | | | 17,919 | | | | 15,697 |

| |

| 9/25/92 | | | Rights Offering | | | 825 | | | | 11.000 | | | | 75 | | | | | | | | |

| |

| 12/31/92 | | | Distribution $0.90 | | | | | | | 12.500 | | | | 114 | | | | 21,999 | | | | 20,874 |

| |

| 9/27/93 | | | Rights Offering | | | 1,469 | | | | 13.000 | | | | 113 | | | | | | | | |

| |

| 12/31/93 | | | Distribution $1.15 | | | | | | | 13.000 | | | | 160 | | | | 26,603 | | | | 25,428 |

| |

| 10/28/94 | | | Rights Offering | | | 1,103 | | | | 11.250 | | | | 98 | | | | | | | | |

| |

| 12/19/94 | | | Distribution $1.05 | | | | | | | 11.375 | | | | 191 | | | | 27,939 | | | | 24,905 |

| |

| 11/3/95 | | | Rights Offering | | | 1,425 | | | | 12.500 | | | | 114 | | | | | | | | |

| |

| 12/7/95 | | | Distribution $1.29 | | | | | | | 12.125 | | | | 253 | | | | 35,676 | | | | 31,243 |

| |

| 12/6/96 | | | Distribution $1.15 | | | | | | | 12.250 | | | | 247 | | | | 41,213 | | | | 36,335 |

| |

| 1997 | | | Annual distribution total $1.21 | | | | | | | 15.374 | | | | 230 | | | | 52,556 | | | | 46,814 |

| |

| 1998 | | | Annual distribution total $1.54 | | | | | | | 14.311 | | | | 347 | | | �� | 54,313 | | | | 47,506 |

| |

| 1999 | | | Annual distribution total $1.37 | | | | | | | 12.616 | | | | 391 | | | | 60,653 | | | | 50,239 |

| |

| 2000 | | | Annual distribution total $1.48 | | | | | | | 13.972 | | | | 424 | | | | 70,711 | | | | 61,648 |

| |

| 2001 | | | Annual distribution total $1.49 | | | | | | | 15.072 | | | | 437 | | | | 81,478 | | | | 73,994 |

| |

| 2002 | | | Annual distribution total $1.51 | | | | | | | 14.903 | | | | 494 | | | | 68,770 | | | | 68,927 |

| |

| 1/28/03 | | | Rights Offering | | | 5,600 | | | | 10.770 | | | | 520 | | | | | | | | |

| |

| 2003 | | | Annual distribution total $1.30 | | | | | | | 14.582 | | | | 516 | | | | 106,216 | | | | 107,339 |

| |

| 2004 | | | Annual distribution total $1.55 | | | | | | | 17.604 | | | | 568 | | | | 128,955 | | | | 139,094 |

| |

| 2005 | | | Annual distribution total $1.61 | | | | | | | 18.739 | | | | 604 | | | | 139,808 | | | | 148,773 |

| |

| 2006 | | | Annual distribution total $1.78 | | | | | | | 19.696 | | | | 693 | | | | 167,063 | | | | 179,945 |

| |

| 2007 | | | Annual distribution total $1.85 | | | | | | | 19.687 | | | | 787 | | | | 175,469 | | | | 165,158 |

| |

| 2008 | | | Annual distribution total $1.723 | | | | | | | 12.307 | | | | 1,294 | | | | 95,415 | | | | 85,435 |

| |

| 3/11/09 | | | Distribution $0.323 | | | | | | | 6.071 | | | | 537 | | | | 137,966 | | | | 115,669 |

| |

| 12/2/10 | | | Distribution $0.03 | | | | | | | 13.850 | | | | 23 | | | | 179,730 | | | | 156,203 |

| |

| 2011 | | | Annual distribution total $0.783 | | | | | | | 13.043 | | | | 656 | | | | 161,638 | | | | 139,866 |

| |

| 2012 | | | Annual distribution total $0.80 | | | | | | | 13.063 | | | | 714 | | | | 186,540 | | | | 162,556 |

| |

| 2013 | | | Annual distribution total $2.194 | | | | | | | 16.647 | | | | 1,658 | | | | 250,219 | | | | 220,474 |

| |

| 2014 | | | Annual distribution total $1.82 | | | | | | | 14.840 | | | | 1,757 | | | | 252,175 | | | | 222,516 |

| |

| 2015 | | | Annual distribution total $1.24 | | | | | | | 12.725 | | | | 1,565 | | | | 231,781 | | | | 201,185 |

| |

| 2016 | | | Annual distribution total $1.02 | | | | | | | 12.334 | | | | 1,460 | | | | | | | | |

| |

| 12/31/16 | | | | | $ | 21,922 | | | | | | | | 18,533 | | | $ | 293,880 | | | $ | 248,425 |

| |

| 1 The purchase price used for annual distribution totals is a weighted average of the distribution reinvestment prices for the year. |

| 2 Values are stated as of December 31 of the year indicated, after reinvestment of distributions, other than for initial purchase. |

| 3 Includes a return of capital. |

| 4 Includes Royce Global Value Trust spin-off of $1.40 per share. |

2016 Annual Report to Stockholders | 13

| Distribution Reinvestment and Cash Purchase Options |

| Why should I reinvest my distributions? |

| By reinvesting distributions, a stockholder can maintain an undiluted investment in the Fund. The regular reinvestment of distributions has a significant impact on stockholder returns. In contrast, the stockholder who takes distributions in cash is penalized when shares are issued below net asset value to other stockholders. |

| |

| How does the reinvestment of distributions from the Royce closed-end funds work? |

| The Funds automatically issue shares in payment of distributions unless you indicate otherwise. The shares are generally issued at the lower of the market price or net asset value on the valuation date. |

| |

| How does this apply to registered stockholders? |

| If your shares are registered directly with a Fund, your distributions are automatically reinvested unless you have otherwise instructed the Funds’ transfer agent, Computershare, in writing, in which case you will receive your distribution in cash. A registered stockholder also may have the option to receive the distribution in the form of a stock certificate. |

| |

| What if my shares are held by a brokerage firm or a bank? |

| If your shares are held by a brokerage firm, bank, or other intermediary as the stockholder of record, you should contact your brokerage firm or bank to be certain that it is automatically reinvesting distributions on your behalf. If they are unable to reinvest distributions on your behalf, you should have your shares registered in your name in order to participate. |

| |

| What other features are available for registered stockholders? |

| The Distribution Reinvestment and Cash Purchase Plans also allow registered stockholders to make optional cash purchases of shares of a Fund’s common stock directly through Computershare on a monthly basis, and to deposit certificates representing your RVT and RMT shares with Computershare for safekeeping. (RGT does not issue shares in certificated form). Plan participants are subject to a $0.75 service fee for each voluntary cash purchase under the Plans. The Funds’ investment adviser absorbed all commissions on optional cash purchases under the Plans through December 31, 2016. |

| |

| How do the Plans work for registered stockholders? |

| Computershare maintains the accounts for registered stockholders in the Plans and sends written confirmation of all transactions in the account. Shares in the account of each participant will be held by Computershare in non-certificated form in the name of the participant, and each participant will be able to vote those shares at a stockholder meeting or by proxy. A participant may also send stock certificates for RVT and RMT held by them to Computershare to be held in non-certificated form. RGT does not issue shares in certificated form. There is no service fee charged to participants for reinvesting distributions. If a participant elects to sell shares from a Plan account, Computershare will deduct a $2.50 service fee from the sale transaction. The Funds’ investment adviser absorbed all commissions on optional sales under the Plans through December 31, 2016. If a nominee is the registered owner of your shares, the nominee will maintain the accounts on your behalf. |

| |

| How can I get more information on the Plans? |

You can call an Investor Services Representative at (800) 221-4268 or you can request a copy of the Plan for your Fund from Computershare. All correspondence (including notifications) should be directed to: [Name of Fund] Distribution Reinvestment and Cash Purchase Plan, c/o Computershare, PO Box 43078, Providence, RI 02940-3078, telephone (800) 426-5523 (from 9:00 A.M. to 5:00 P.M.). |

| 14 | 2016 Annual Report to Stockholders |

| Royce Global Value Trust | | December 31, 2016 |

| |

| Schedule of Investments |

| Common Stocks – 101.7% |

| | | | | | | |

| | | SHARES | | | | VALUE |

| |

| |

| AUSTRALIA – 2.2% | | | | | | |

ALS | | 88,176 | | | $ | 383,315 |

Austal | | 95,500 | | | | 119,804 |

†Cochlear | | 5,000 | | | | 441,394 |

Imdex 1 | | 130,600 | | | | 54,101 |

†IPH | | 140,000 | | | | 516,390 |

†NetComm Wireless 1 | | 26,700 | | | | 41,279 |

†Seeing Machines 1 | | 1,676,800 | | | | 87,782 |

†Spotless Group Holdings | | 500,000 | | | | 356,515 |

TFS Corporation | | 137,045 | | | | 164,100 |

| |

| Total (Cost $2,157,377) | | | | | | 2,164,680 |

| |

| |

| AUSTRIA – 0.9% | | | | | | |

Mayr-Melnhof Karton | | 8,000 | | | | 847,939 |

UBM Development | | 1,800 | | | | 58,731 |

| |

| Total (Cost $994,664) | | | | | | 906,670 |

| |

| |

| BELGIUM – 0.1% | | | | | | |

†Barco | | 1,100 | | | | 92,599 |

| |