UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04875

Name of Registrant: Royce Value Trust, Inc.

Address of Registrant: 745 Fifth Avenue

New York, NY 10151

| Name and address of agent for service: | John E. Denneen, Esq.

745 Fifth Avenue

New York, NY 10151 |

Registrant’s telephone number, including area code: (212) 508-4500

Date of fiscal year end: December 31, 2018

Date of reporting period: January 1, 2018 – June 30, 2018

Item 1. Reports to Shareholders.

| | | JUNE 30, 2018 |

| | | |

| | | |

| | | |

| | | 2018 Semiannual |

| | | Review and Report to Stockholders |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | Royce Global Value Trust |

| | | | |

| | | Royce Micro-Cap Trust |

| | | | |

| | | Royce Value Trust |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | roycefunds.com |  |

| | | | |

| | | | |

| | | | |

A Few Words on Closed-End Funds

Royce & Associates, LP manages three closed-end funds: Royce Global Value Trust, which invests primarily in companies with headquarters outside of the United States, Royce Micro-Cap Trust, which invests primarily in micro-cap securities; and Royce Value Trust, which invests primarily in small-cap securities. A closed-end fund is an investment company whose shares are listed and traded on a stock exchange. Like all investment companies, including open-end mutual funds, the assets of a closed-end fund are professionally managed in accordance with the investment objectives and policies approved by the fund’s Board of Directors. A closed-end fund raises cash for investment by issuing a fixed number of shares through initial and other public offerings that may include shelf offerings and periodic rights offerings. Proceeds from the offerings are invested in an actively managed portfolio of securities. Investors wanting to buy or sell shares of a publicly traded closed-end fund after the offerings must do so on a stock exchange, as with any publicly traded stock. Shares of closed-end funds frequently trade at a discount to their net asset value. This is in contrast to open-end mutual funds, which sell and redeem their shares at net asset value on a continuous basis.

A Closed-End Fund Can Offer Several Distinct Advantages

| • | A closed-end fund does not issue redeemable securities or offer its securities on a continuous basis, so it does not need to liquidate securities or hold uninvested assets to meet investor demands for cash redemptions. |

| | |

| • | In a closed-end fund, not having to meet investor redemption requests or invest at inopportune times can be effective for value managers who attempt to buy stocks when prices are depressed and sell securities when prices are high. |

| | |

| • | A closed-end fund may invest in less liquid portfolio securities because it is not subject to potential stockholder redemption demands. This is potentially beneficial for Royce-managed closed-end funds, with significant investments in small- and micro-cap securities. |

| | |

| • | The fixed capital structure allows permanent leverage to be employed as a means to enhance capital appreciation potential. |

| | |

| • | Royce Micro-Cap Trust and Royce Value Trust distribute capital gains, if any, on a quarterly basis. Each of these Funds has adopted a quarterly distribution policy for its common stock. |

We believe that the closed-end fund structure can be an appropriate investment for a long-term investor who understands the benefits of a more stable pool of capital.

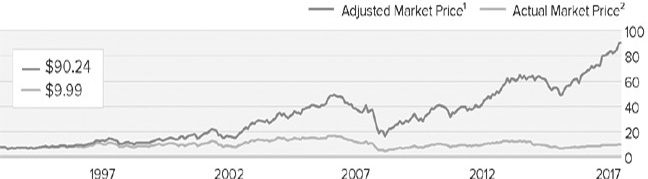

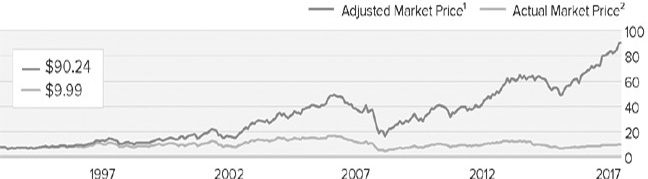

Why Dividend Reinvestment Is Important

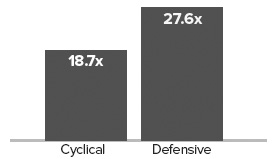

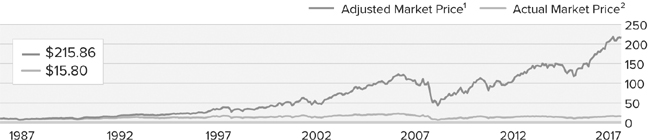

A very important component of an investor’s total return comes from the reinvestment of distributions. By reinvesting distributions, our investors can maintain an undiluted investment in a Fund. To get a fair idea of the impact of reinvested distributions, please see the charts on pages 54 and 55. For additional information on the Funds’ Distribution Reinvestment and Cash Purchase Options and the benefits for stockholders, please see page 56 or visit our website at www.roycefunds.com.

Managed Distribution Policy

The Board of Directors of each of Royce Micro-Cap Trust and Royce Value Trust has authorized a managed distribution policy (“MDP”). Under the MDP, Royce Micro-Cap Trust and Royce Value Trust pay quarterly distributions at an annual rate of 7% of the average of the prior four quarter-end net asset values, with the fourth quarter being the greater of these annualized rates or the distribution required by IRS regulations. With each distribution, the Fund will issue a notice to its stockholders and an accompanying press release that provides detailed information regarding the amount and composition of the distribution (including whether any portion of the distribution represents a return of capital) and other information required by a Fund’s MDP. You should not draw any conclusions about a Fund’s investment performance from the amount of distributions or from the terms of a Fund’s MDP. A Fund’s Board of Directors may amend or terminate the MDP at any time without prior notice to stockholders; however, at this time there are no reasonably foreseeable circumstances that might cause the termination of any of the MDPs.

| This page is not part of the 2018 Semiannual Report to Stockholders |

| Table of Contents | | | |

| | | | |

| | | | |

| Semiannual Review | | | |

| | | | |

| Letter to Our Stockholders | | 2 | |

| | | | |

| Performance | | 7 | |

| | | | |

| | | | |

| Semiannual Report to Stockholders | | | |

| | | | |

| Royce Global Value Trust | | | |

| | | | |

Manager’s Discussion of Fund Performance | | 8 | |

| | | | |

Schedule of Investments | | 10 | |

| | | | |

Other Financial Statements | | 14 | |

| | | | |

| Royce Micro-Cap Trust | | | |

| | | | |

Manager’s Discussion of Fund Performance | | 22 | |

| | | | |

Schedule of Investments | | 24 | |

| | | | |

Other Financial Statements | | 29 | |

| | | | |

| Royce Value Trust | | | |

| | | | |

Manager’s Discussion of Fund Performance | | 38 | |

| | | | |

Schedule of Investments | | 40 | |

| | | | |

Other Financial Statements | | 45 | |

| | | | |

| History Since Inception | | 54 | |

| | | | |

| Distribution Reinvestment and Cash Purchase Options | | 56 | |

| | | | |

| Directors and Officers | | 57 | |

| | | | |

| Notes to Performance and Other Important Information | | 58 | |

| | | | |

| Board Approval of Investment Advisory Agreements | | 59 | |

| This page is not part of the 2018 Semiannual Report to Stockholders |

Letter to Our Stockholders

SMALL-CAP’S FIRST HALF

Value Trails For Now

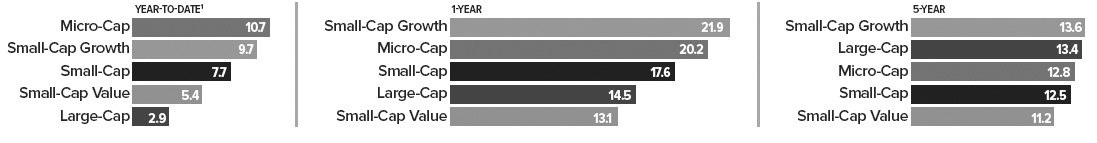

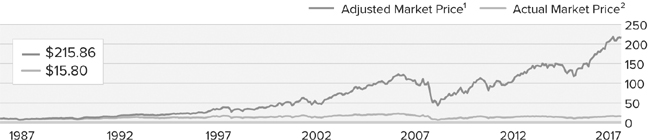

| During the first six months of 2018, small-cap stocks enjoyed the good times bred by a bull market that at this writing has not yet slowed down. Although the first half began with higher volatility and stalled equities prices—and ended with a series of wild days that made the bullish second quarter feel more tumultuous than it was—the overall direction of U.S. markets has remained positive, particularly for smaller stocks. For the year-to-date period ended June 30, 2018, the small-cap Russell 2000 Index gained 7.7%, well ahead of both the large-cap Russell 1000 (+2.9%) and S&P 500 (+2.6%) Indexes, while making a new historical high on June 20. Returns were even higher for micro-cap stocks—the Russell Microcap Index advanced 10.7% for the same period. |

| This mostly welcome absolute and relative performance took place against the backdrop of an accelerating U.S. economy, a strong job market, and, in many cases, sterling corporate profit growth while at the same time global economic progress slowed, most notably in China and other large emerging markets. The major non-U.S. indexes slipped deeper into negative territory during the first half, as the combination of slower international growth, rising emerging market instability, a stronger dollar, and heightened trade war worries led investors to prefer all things domestic. (In fact, 35 of the 45 non-U.S. small-cap markets that we follow had declines in the first half of 2018, though only 26 were negative when measured in local currencies.) Still, growth continued to skew positive outside the U.S., with the important economies of Japan and Germany continuing to look solid. |

| Equity Indexes Average Annual Total Return as of 6/30/18 (%) |

| |

|

Small-Cap is represented by Russell 2000; Small-Cap Value is represented by Russell 2000 Value, Small-Cap Growth is represented by Russell 2000 Growth, Large-Cap is represented by Russell 1000, Micro-Cap is represented by Russell Microcap. For details on The Royce Funds’ performance in the period, please turn to the Managers’ Discussions that begin on page 8. Past performance is no guarantee of future results. |

| 2 | This page is not part of the 2018 Semiannual Report to Stockholders |

LETTER TO OUR STOCKHOLDERS

We expect a leadership shift in the form of a reversion to the mean that would favor

small-cap value outperforming small-cap growth over the next five years.

| In this context, then, you would expect a small-cap specialist to be quite content, if not happy. This might especially be the case considering that small-caps—as well as micro-caps—have been true to their historical habit of outpacing larger companies through an economic expansion. Yet as much as we were pleased with first-half results, we find ourselves far from blissful. A closer look at small-cap performance in the first half reveals some genuine historical oddities in spite of all looking well on the surface. Our main concern is the disconnect between the confidence of the management teams we’ve been meeting with and the relatively underwhelming performance for many cyclical industries. We anticipated that stocks in these industries would do better owing to their recent earnings strength and ongoing prospects as well as to the healthy state of the U.S. economy (each, of course, being related to the other). |

| |

| OBSTACLE ON THE TRACK |

| The Troublesome 10-Year Treasury Yield |

| Another related concern is the way in which the ongoing weakness of the 10-year Treasury yield is at odds with the quickened pace of U.S. economic growth—when the 10-year has been sluggish in the past, it’s often been seen as a symptom of economic weakness, and not without some justification. The fact that the economy has arguably been some distance down the track to normal for at least a couple of years remains a source of concern to us. |

| |

| Road to Normalization: Economy vs Markets |

| |

|

| |

| 1 | Quarterly data. Source: Bloomberg |

We invite you to consider the following five points: through the end of June, the U.S. economy had grown for 109 consecutive months, GDP growth has converged with its long-term average, unemployment reached an 18-year low in June, personal consumption expenditure inflation hit the Fed’s 2% target in May, and short rates were rising. Additionally, we’re also seeing the early signs of inflation. Most are registering in increased commodity, raw material, and other input costs, which is historically familiar economic territory. History also shows, however, that these developments are also typically coincident with rising interest rates. So far, though, the 10-year Treasury yield has stubbornly refused to acquiesce to history—making the 10-year the major obstacle on the path back to normal in our view.

From our perspective as highly active, valuation-sensitive small-cap specialists, the most frustrating have been those periods when the 10-year yield has fallen back. It seems to us that nearly every time it has declined over the last 18 months, the market has witnessed a subsequent flight to high yield or growth stocks while value and economically sensitive issues struggled to keep pace. It almost seems as if investors became temporarily convinced that we had slipped back into the 2010-2015 era of quantitative easing and zero interest rates. We think it bears emphasizing that, for all its uncertainty, the current environment could not be more different. Yet the disconnect persisted into June.

The critical question, then, is, what happens next? More pertinently for our investors, the question can be phrased in a more specific way as, are we likely to see a shift in small-cap style and sector leadership? We believe that we will. The second quarter saw an admittedly short-term sign when the Russell 2000 Value Index shook off five straight quarters of underperformance to outpace its small-cap growth counterpart, up 8.3% versus 7.2%. But exactly when, and under what conditions, a longer-running shift materializes remains to be seen, of course. To be sure, the kind of leadership change that we expect—from growth to value and from defensives to cyclicals—seldom occurs without a fair bit of volatility. |

| This page is not part of the 2018 Semiannual Report to Stockholders | 3 |

SMALL-CAP HIGHS

Returns, Valuations–and Risks

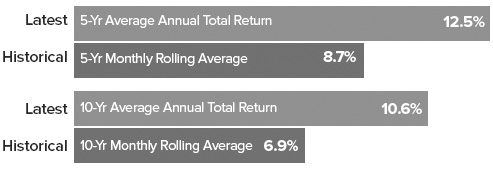

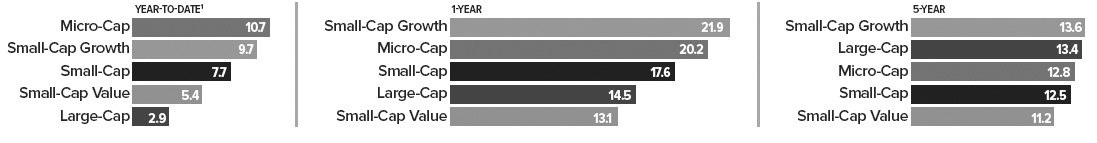

| Putting the issue of market turbulence aside for a moment, the timing does seem apt to us for a change. First, the two-year cumulative return at the end of June for the Russell 2000 was 46.5%—which is a wonderful, but sadly not a sustainable, pace. Second, the one-, five-, and 10-year average annual total returns for the small-cap index for the period ended June 30, 2018 were all comfortably ahead of their long-term monthly rolling averages. |

| |

Recent Small-Cap Returns Higher Than History

Russell 2000 through 6/30/18 |

| |

|

When we look at the same information for the Russell 2000 Growth Index, the contrast is even more stark, with its latest five-year return significantly in excess of its historical rolling average. This is one important reason why we expect a leadership shift in the form of a reversion to the mean that would favor small-cap value outperforming small-cap growth over the next five years.

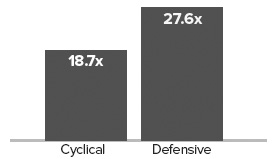

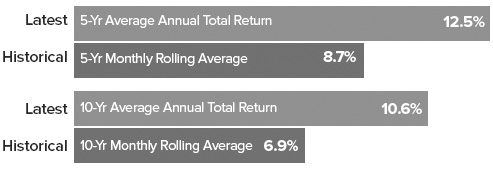

The state of small-cap valuations also looks unsustainably high to us, particularly if we see a continued, and more consistent, rise in the 10-year yield. While the P/E ratio for the Russell 2000 did not look especially rich at the end of June, another valuation metric, the last twelve months enterprise value to earnings before interest and taxes (EV/EBIT)—which we use most frequently when examining companies—tells a different story, one that reveals higher-than-average historical valuations. The currently elevated state of returns and valuations could mean that we are entering a longish period of multiple compression, which is one reason why we prefer select small-caps with strong earnings prospects and/or modest valuations. If we see increased volatility over the balance of the year, these types of stocks look better positioned to cope with it effectively. |

| Based on earnings and cash flow quality—as well as confident management teams—we are seeing superior fundamentals in selected cyclical areas that other investors are avoiding. For example, the supply/demand dynamics in a number of industries, such as semiconductors & semiconductor equipment, transportation, and chemicals, look favorable to us and do not appear to us to be fully reflected in their current valuations. Many cyclical companies appear much better positioned for intermediate-term growth than defensive and/or growth stocks. While most of these cyclical stocks have lagged the field over the last 18 months, they are also more reasonably priced than defensives based on EV to EBIT. We remain convinced that fundamentally strong small-cap companies, especially those with attractive-to-reasonable valuations, will become more appealing to investors as confidence in the U.S. economy continues to build. |

| |

| |

Cyclicals Cheaper than Defensives

Median LTM EV/EBIT1 Ex. Negative EBIT

for Russell 2000 as of 6/30/18 |

|

There’s a related point that may be equally important when considering valuations: The sheer size and diversity of the small-cap asset class means that there are almost always opportunities to find what we think are promising or quality businesses trading at attractive discounts. Based on EV/EBIT, the bottom three deciles of the Russell 2000 were trading at sizable discounts compared to the median for the index as a whole at the end of June. |

| |

Many Small-Caps Sell at a Significant Discount

Bottom Three Deciles in Russell 2000 Median LTM EV/EBIT1

Ex. Negative EBIT as of 6/30/18 |

|

| 1 Last Twelve Months Enterprise Value/Earnings Before Interest and Taxes |

| 4 | This page is not part of the 2018 Semiannual Report to Stockholders |

LETTER TO OUR STOCKHOLDERS

VOLATILITY AND INTEREST RATES

Both On the Rise

During the first quarter, the Russell 2000 moved 1% or more in 33% of its trading days compared to 18% in all of 2017. Another volatility measure, the CBOE Russell 2000 Volatility Index (“RVX”), measures market expectations of near-term volatility conveyed by Russell 2000 stock index option prices. The RVX has averaged 24.0% per year since its inception on 1/2/04. Its average in 2017 was 15.9%, and its year-to-date average through the end of June 2018 was 17.5%. Eighteen months of lower volatility suggests—strongly to us—that increased volatility is likely.

We also believe that the upward trend in rates is under way—and suspect that the 10-year yield will begin to move up more consistently over the next year. We see both rising rates and increased volatility as healthy. In fact, looking once more at history, we find that periods of rising rates have been favorable for small-cap stocks on both an absolute and relative basis. When the 10-Year Treasury yield was rising, the Russell 2000 outperformed the large-cap Russell 1000 in 70% of monthly rolling one-year periods for the 20-year period ended 6/30/18, with an average one-year return of 23.8% versus 19.2% for large-cap. Our expectations for absolute small-cap returns are more modest, though we do expect this historical relative return spread pattern to hold up. |

| |

How Have Small-Caps Performed When Rates Were Rising?

Russell 2000 vs Russell 1000 Trailing Monthly Rolling 1-Year Returns When

10-Year Treasury Yield was Rising From 6/30/98 through 6/30/18 |

| |

|

| 10-Year Treasury Yield rose in 92 of 229 periods |

| More specifically, we see rising rates as a phenomenon that should also be helpful to risk-conscious active managers in the small-cap space—primarily because it fosters an environment where better balance sheet companies are likely to be rewarded for their fiscal prudence. In other words, risk management matters. This is relevant today because of the increased leverage—specifically financial leverage—within the Russell 2000. And as rates continue to move up, the overall small-cap index looks increasingly risky. As active managers, we have the ability to screen and scrutinize small-cap businesses with better balance sheets and shy away from those that we see as having excess financial leverage. (It is worth mentioning that the market has largely ignored better balance sheet companies for much of the last 10 years.) Most of our strategies gravitate toward companies with low debt. We would rather focus on companies that have great operating leverage—but not financial leverage. With rising rates, inflation, and economic growth becoming established, the market seems to be transitioning into an environment that will favor similar qualities. |

| |

| REASONS TO BE CHEERFUL |

| We are therefore of two minds about the current cycle. On the one hand, we think that we could see some consolidation or a correction—the latter certainly seems more probable now than it did a year ago. Yet we remain optimistic about small-cap earnings growth and like the fundamentals of our holdings across our strategies in terms of balance sheets, cash flows, and earnings strength. It is in cyclical areas, including Industrials, the more cyclical precincts of technology, and Materials, and that we have most often uncovered what we judge to be the best combination of value, quality, and/or growth prospects. And this has always been a function of our bottom-up process rather than a top down view of the economy. |

| This page is not part of the 2018 Semiannual Report to Stockholders | 5 |

LETTER TO OUR STOCKHOLDERS

We see signs of progress that in our view place us squarely on the road to normalization, which was evident in the modest increases in bond yields and the reemergence of value’s leadership in 2018’s second quarter.

This is why many of our portfolios have had perennially higher weightings in those sectors (and while others we manage have had high weightings in Financials and Consumer Discretionary). We also long ago developed the practice of leaning into those areas of the asset class where we see excess pessimism. Investments in industries that the rest of the market is abandoning have often borne fruit, though we have learned through decades of small-cap asset management that it usually requires a great deal of patience—measured in years in many cases—before the arrival of a bountiful harvest.

We think it’s worth noting that the three changes in the market environment that we expect—lower returns, higher volatility, and |

| value/cyclical leadership—have all historically been coincident with leadership for active management. We see signs of progress that in our view place us squarely on the road to normalization, which was evident in the modest increases in bond yields and the reemergence of value’s leadership in 2018’s second quarter. There were other equally positive signs in July, including stabilizing macro indicators from outside the U.S., a welcome rebound in the performance of many industrial companies, and ongoing earnings strength for several cyclical areas. We expect to see more signs of normalizing markets to emerge as the year goes on. |

| |  | |  |

| Charles M. Royce | | Christopher D. Clark | | Francis D. Gannon |

| Chairman, | | Chief Executive Officer, and | | Co-Chief Investment Officer, |

| Royce & Associates, LP | | Co-Chief Investment Officer,

Royce & Associates, LP | | Royce & Associates, LP |

| | | | | |

| July 31, 2018 | | | | |

| 6 | This page is not part of the 2018 Semiannual Report to Stockholders |

Performance

| |

| |

NAV Average Annual Total Returns

As of June 30, 2018 (%) |

| | | YTD1 | | 1-YR | | 3-YR | | 5-YR | | 10-YR | | 15-YR | | 20-YR | | 25-YR | | 30-YR | | SINCE

INCEPTION | | INCEPTION

DATE |

| |

| Royce Global Value Trust | | -0.88 | | 11.89 | | 9.69 | | N/A | | N/A | | N/A | | N/A | | N/A | | N/A | | 6.48 | | 10/17/13 |

| |

| Royce Micro-Cap Trust | | 7.84 | | 19.79 | | 11.16 | | 12.51 | | 9.92 | | 10.76 | | 9.81 | | N/A | | N/A | | 11.19 | | 12/14/93 |

| |

| Royce Value Trust | | 2.78 | | 14.37 | | 12.03 | | 11.45 | | 8.81 | | 10.04 | | 9.15 | | 10.53 | | 10.97 | | 10.74 | | 11/26/86 |

| |

| |

| INDEX | | | | | | | | | | | | | | | | | | | | | | |

| |

| Russell Global Small Cap Index | | 0.67 | | 12.38 | | 8.52 | | 9.65 | | 6.87 | | 10.10 | | 7.65 | | N/A | | N/A | | N/A | | N/A |

| |

| Russell Microcap Index | | 10.71 | | 20.21 | | 10.49 | | 12.78 | | 10.63 | | 9.44 | | N/A | | N/A | | N/A | | N/A | | N/A |

| |

| Russell 2000 Index | | 7.66 | | 17.57 | | 10.96 | | 12.46 | | 10.60 | | 10.50 | | 8.03 | | 9.59 | | 9.85 | | N/A | | N/A |

| |

Important Performance and Risk Information

All performance information in this Review and Report reflects past performance, is presented on a total return basis, net of the Fund’s investment advisory fee, and reflects the reinvestment of distributions. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when sold. Current performance may be higher or lower than performance quoted. Current month-end performance may be obtained at www.roycefunds.com. The Funds are closed-end registered investment companies whose respective shares of common stock may trade at a discount to the net asset value. Shares of each Fund’s common stock are also subject to the market risk of investing in the underlying portfolio securities held by each Fund. Certain immaterial adjustments were made to the net assets of Royce Value Trust at 6/30/18, for financial reporting purposes, and as a result the total return based on that net asset value differs from the adjusted net asset value and total return reported in the Financial Highlights. All indexes referenced are unmanaged and capitalization-weighted. Each index’s returns include net reinvested dividends and/or interest income. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Russell Investment Group. The Russell 2000 Index is an index of domestic small-cap stocks that measures the performance of the 2,000 smallest publicly traded U.S. companies in the Russell 3000 Index. The Russell Microcap Index includes 1,000 of the smallest securities in the small-cap Russell 2000 Index, along with the next smallest eligible securities as determined by Russell. The Russell Global Small Cap Index is an unmanaged, capitalization-weighted index of global small-cap stocks. The performance of an index does not represent exactly any particular investment, as you cannot invest directly in an index. Index returns include net reinvested dividends and/or interest income. Royce Value, Micro-Cap and Global Value Trust shares of common stock trade on the NYSE. Royce Fund Services, LLC (“RFS”) is a member of FINRA and files certain material with FINRA on behalf of each Fund. RFS is not an underwriter or distributor of any of the Funds.

This page is not part of the 2018 Semiannual Report to Stockholders | 7

| MANAGERS’ DISCUSSION |

| Royce Global Value Trust (RGT) |

|

Chuck Royce

David Nadel

Chris Flynn |

| |

FUND PERFORMANCE

Royce Global Value Trust was down 0.9% on a net asset value (“NAV”) basis and 2.8% on a market price basis for the year-to-date period ended June 30, 2018, in both cases underperforming its unleveraged benchmark, the Russell Global Small Cap Index, which rose 0.7% for the same period. While U.S. stocks generally did well, most international indexes slipped into negative territory during 2018’s first six months, as the combination of a modest slowdown in international growth, rising emerging market instability, a stronger dollar, and heightened trade war concerns all affected results. |

| WHAT WORKED... AND WHAT DIDN’T |

Six of the Fund’s 11 equity sectors detracted from first-half results. Led by Consumer Discretionary and Industrials, their respective negative impacts were somewhat modest. Vakrangee, which detracted most at the position level, is an Indian company that operates a network of outlets providing everyday transactional services to mostly rural consumers, primarily in under-served areas. During the first quarter, the company faced questions about corporate governance and its internal investment policy, among other issues. Although Vakrangee refuted these allegations, the cloud overhanging the firm’s credibility gave us pause, and we exited our position in April. Burkhalter Holding is the leading provider of electrical engineering services in Switzerland. Its stock price was hurt by increasing talk that competition would pressure pricing. Seeing these issues as more temporal than structural, we chose to hold our shares during the first half.

The stock of California-based laser diode and equipment maker Coherent underwent a correction in the first half after the company’s announcement of slightly better-than-expected results came with a more muted profit outlook. Already reducing our position in 2017, we held our position in the first half in expectation of a recovery in its previously strong profitability. The U.K.’s Clarkson is the world’s largest ship broker. After a few difficult years, the company described an improving environment for its business in hiring ships to transport commodities in March. The firm then reversed course in April when it issued a profit warning, which sent its shares into a tailspin. Thinking about the long term, we added to our position in the first half.

Energy was the top-contributing sector in the first half, and the top contributor at the industry level was energy equipment & services, as the rebound for oil prices fed through to improved prospects for these businesses. Norway’s TGS-NOPEC Geophysical, which provides geoscience data to oil and gas companies worldwide, was the top contributor in this industry and in the portfolio as a whole. Its revenue and earnings were boosted by improving exploration and production spending, higher oil prices, and the longer-term need for energy companies to replenish reserves, which is driving increased spending on seismic data. Virtu Financial uses its technology to act as a market maker and liquidity provider to the global financial markets. Based in New York City, the firm announced impressive first-quarter results in profits and earnings thanks to increased market volatility and high trading volumes. From the Industrials sector, Kirby Corporation has the largest inland and coastal tank barge fleet in the U.S. and also draws revenue from servicing and distributing industrial engines, transmissions, parts, and oil field services equipment. The tank barge markets seem to be recovering well, thanks to retirements of older barges, limited new builds, and solid utilization rates. Kirby has also benefited from two recent acquisitions over the last 18 months that are allowing it to drive industry consolidation.

Relative to the Russell Global Small Cap, the major source of underperformance was ineffective stock selection in the Information Technology sector, most impactfully in the IT services and electronic equipment, instruments & components industries. Stock picking detracted in Health Care, particularly in the health care equipment & supplies group. Conversely, stock selection was a strength versus the benchmark in the Energy sector’s energy equipment & services industry, while a smaller advantage came from stock picks in Industrials, where the machinery group did best. |

| | Top Contributors to Performance

Year-to-Date Through 6/30/18 (%)1 | | | |

| | | | | |

| | TGS-NOPEC Geophysical | | 0.73 | |

| | | |

| | Virtu Financial Cl. A | | 0.47 | |

| | | |

| | Kirby Corporation | | 0.39 | |

| | | |

| | Bravura Solutions | | 0.33 | |

| | | |

| | Nanometrics | | 0.27 | |

| | | |

| | 1 Includes dividends | | | |

| | | | | |

| | | | | |

| | Top Detractors from Performance

Year-to-Date Through 6/30/18 (%)2 | | | |

| | | | | |

| | Vakrangee | | -0.31 | |

| | | |

| | Burkhalter Holding | | -0.28 | |

| | | |

| | Coherent | | -0.26 | |

| | | |

| | Clarkson | | -0.24 | |

| | | |

| | ManpowerGroup | | -0.23 | |

| | | |

| | 2 Net of dividends | | | |

| | | | | |

| CURRENT POSITIONING AND OUTLOOK |

| The market’s recent behavior looks curious to us. We hear optimism and solid progress from the management teams we meet with, see solid earnings reports, and observe consistently strong macroeconomic data. On the other hand, small-cap market leadership in the U.S. has stubbornly remained with defensive and yield-oriented stocks, while cyclicals have lagged. In addition, the rate of change in global growth has slowed, as measured by global PMIs (the Purchasing Managers’ Index, an indicator of economic health for manufacturing and service sectors), while the effects of tariffs are just now registering—and are only likely to intensify before a resolution is reached. All of this raises the degree of difficulty for U.S. equities to maintain their recent performance pace and for non-U.S. stocks to rebound. We do believe, however, that the portfolio holds companies that are well positioned to execute effectively in a more challenging environment. |

| 8 | 2018 Semiannual Report to Stockholders |

| PERFORMANCE AND PORTFOLIO REVIEW | | SYMBOLS MARKET PRICE RGT NAV XRGTX |

|

| Performance |

| Average Annual Total Return (%) Through 6/30/18 |

| | | JAN-JUN 20181 | | 1-YR | | 3-YR | | SINCE INCEPTION (10/17/13) |

| |

| RGT (NAV) | | -0.88 | | 11.89 | | 9.69 | | 6.48 |

| |

| 1 Not Annualized | | | | | | | | |

|

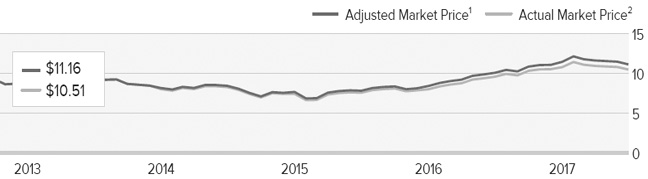

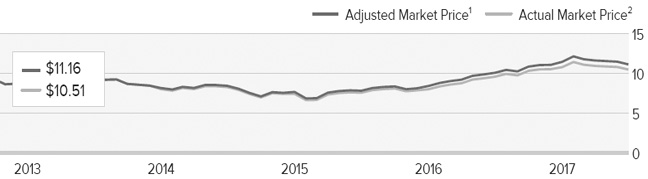

| Market Price Performance History Since Inception (10/17/13)Cumulative Performance of Investment1 |

| | | 1-YR | | 5-YR | | 10-YR | | 15-YR | | 20-YR | | SINCE INCEPTION (10/17/13) |

| |

| RGT | | 10.5% | | N/A | | N/A | | N/A | | N/A | | 24.4% |

| |

| 1 | Reflects the cumulative performance experience of a continuous common stockholder who purchased one share at inception ($8.975 IPO) and reinvested all distributions. |

| 2 | Reflects the actual month-end market price movement of one share as it has traded on NYSE and, prior to 12/1/03, on the Nasdaq. |

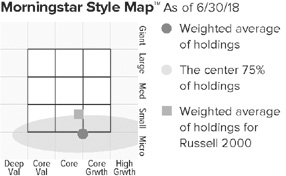

The Morningstar Style Map is the Morningstar Style Box™ with the center 75% of fund holdings plotted as the Morningstar Ownership Zone™. The Morningstar Style Box is designed to reveal a fund’s investment strategy. The Morningstar Ownership Zone provides detail about a portfolio’s investment style by showing the range of stock sizes and styles. The Ownership Zone is derived by plotting each stock in the portfolio within the proprietary Morningstar Style Box. Over time, the shape and location of a fund's ownership zone may vary. See page 66 for additional information. |

|

| Top 10 Positions | | |

| % of Net Assets | | |

| | | |

| Kirby Corporation | | 2.1 |

| |

| FLIR Systems | | 2.1 |

| |

| TGS-NOPEC Geophysical | | 1.6 |

| |

| Virtu Financial Cl. A | | 1.5 |

| |

| Computer Modelling Group | | 1.4 |

| |

| VZ Holding | | 1.4 |

| |

| SEI Investments | | 1.3 |

| |

| Spirax-Sarco Engineering | | 1.3 |

| |

| Lazard Cl. A | | 1.2 |

| |

| Raven Industries | | 1.2 |

| |

|

| Portfolio Sector Breakdown | | |

| % of Net Assets | | |

| | | |

| Industrials | | 28.1 |

| |

| Information Technology | | 17.6 |

| |

| Financials | | 15.3 |

| |

| Health Care | | 8.8 |

| |

| Materials | | 8.8 |

| |

| Consumer Discretionary | | 6.7 |

| |

| Energy | | 5.3 |

| |

| Real Estate | | 2.6 |

| |

| Consumer Staples | | 2.4 |

| |

| Telecommunication Services | | 0.3 |

| |

| Utilities | | 0.1 |

| |

| Cash and Cash Equivalents, Net of Outstanding Line of Credit | | 4.0 |

| |

|

| Calendar Year Total Returns (%) | | |

| | | |

| YEAR | | RGT |

| |

| 2017 | | 31.1 |

| |

| 2016 | | 11.1 |

| |

| 2015 | | -3.4 |

| |

| 2014 | | -6.2 |

| |

|

Portfolio Country Breakdown1,2

% of Net Assets | | |

| | | |

| |

| United States | | 27.5 |

| |

| United Kingdom | | 10.1 |

| |

| Canada | | 9.8 |

| |

| Japan | | 7.3 |

| |

| Australia | | 4.9 |

| |

| Switzerland | | 4.2 |

| |

| France | | 3.7 |

| |

| 1 Represents countries that are 3% or more of net assets. |

| 2 Securities are categorized by the country of their headquarters. |

|

| Portfolio Diagnostics | | |

| | | |

| Fund Net Assets | | $129 million |

| |

| Number of Holdings | | 260 |

| |

| Turnover Rate | | 23% |

| |

| Net Asset Value | | $12.37 |

| |

| Market Price | | $10.51 |

| |

| Average Market Capitalization1 | | $1,855 million |

| |

| Weighted Average P/E Ratio2,3 | | 20.0x |

| |

| Weighted Average P/B Ratio2 | | 2.6x |

| |

| Active Share4 | | 97% |

| |

| 1 | Geometric Average. This weighted calculation uses each portfolio holding’s market cap in a way designed to not skew the effect of very large or small holdings; instead, it aims to better identify the portfolio’s center, which Royce believes offers a more accurate measure of average market cap than a simple mean or median. |

| 2 | Harmonic Average. This weighted calculation evaluates a portfolio as if it were a single stock and measures it overall. It compares the total market value of the portfolio to the portfolio’s share in the earnings or book value, as the case may be, of its underlying stocks. |

| 3 | The Fund’s P/E ratio calculation excludes companies with zero or negative earnings (7% of portfolio holdings as of 6/30/18). |

| 4 | Active Share is the sum of the absolute values of the different weightings of each holding in the Fund versus each holding in the benchmark, divided by two. |

Important Performance and Risk Information

All performance information reflects past performance, is presented on a total return basis, net of the Fund’s investment advisory fee, and reflects the reinvestment of distributions. Past performance is no guarantee of future results. Current performance may be higher or lower than performance quoted. Returns as of the most recent month-end may be obtained at www.roycefunds.com. The market price of the Fund’s shares will fluctuate, so that shares may be worth more or less than their original cost when sold. The Fund invests primarily in securities of small- and mid-cap companies, which may involve considerably more risk than investments in securities of larger-cap companies. The Fund’s broadly diversified portfolio does not ensure a profit or guarantee against loss. From time to time, the Fund may invest a significant portion of its net assets in foreign securities, which may involve political, economic, currency and other risks not encountered in U.S. investments. Regarding the “Top Contributors” and “Top Detractors” tables shown above, the sum of all contributors to, and all detractors from, performance for all securities in the portfolio would approximate the Fund’s year-to-date performance for 2018. |

| 2018 Semiannual Report to Stockholders | 9 |

| |

| Schedule of Investments | | | | | | | | |

| Common Stocks – 96.0% | | | | | | | | |

| | | | SHARES | | | | VALUE | |

| |

| | | | | | | | | |

| AUSTRALIA – 4.9% | | | | | | | | |

ALS | | | 140,000 | | | $ | 781,197 | |

†Ausdrill | | | 109,800 | | | | 149,108 | |

†Bingo Industries | | | 60,700 | | | | 120,388 | |

Bravura Solutions | | | 475,000 | | | | 1,128,391 | |

Cochlear | | | 5,500 | | | | 814,747 | |

Hansen Technologies | | | 335,000 | | | | 780,938 | |

HT&E | | | 53,400 | | | | 99,192 | |

Imdex 1 | | | 83,800 | | | | 76,590 | |

IPH | | | 365,000 | | | | 1,202,026 | |

NetComm Wireless 1 | | | 30,000 | | | | 24,533 | |

Seeing Machines 1 | | | 1,474,517 | | | | 243,249 | |

Tassal Group | | | 23,000 | | | | 70,297 | |

†Technology One | | | 285,000 | | | | 896,386 | |

| |

| Total (Cost $5,618,222) | | | | | | | 6,387,042 | |

| |

| | | | | | | | | |

| AUSTRIA – 0.8% | | | | | | | | |

Mayr-Melnhof Karton | | | 7,500 | | | | 1,012,483 | |

| |

| Total (Cost $893,160) | | | | | | | 1,012,483 | |

| |

| | | | | | | | | |

| BELGIUM – 0.4% | | | | | | | | |

†Radisson Hospitality 1 | | | 180,000 | | | | 577,777 | |

| |

| Total (Cost $505,978) | | | | | | | 577,777 | |

| |

| | | | | | | | | |

| BRAZIL – 2.2% | | | | | | | | |

B3 | | | 32,847 | | | | 173,314 | |

Construtora Tenda 1 | | | 20,000 | | | | 122,763 | |

†CVC Brasil Operadora e Agencia de Viagens | | | 17,400 | | | | 202,923 | |

Direcional Engenharia 1 | | | 40,900 | | | | 62,895 | |

Industrias Romi | | | 51,900 | | | | 73,516 | |

International Meal Company Alimentacao | | | 25,000 | | | | 51,152 | |

MRV Engenharia e Participacoes | | | 21,700 | | | | 67,411 | |

OdontoPrev | | | 225,000 | | | | 758,756 | |

T4F Entretenimento | | | 50,400 | | | | 102,731 | |

†Tegma Gestao Logistica | | | 24,300 | | | | 96,617 | |

TOTVS | | | 168,000 | | | | 1,179,024 | |

| |

| Total (Cost $3,265,772) | | | | | | | 2,891,102 | |

| |

| | | | | | | | | |

| CANADA – 9.8% | | | | | | | | |

Agnico Eagle Mines 2 | | | 10,000 | | | | 458,300 | |

Altus Group | | | 38,000 | | | | 847,207 | |

Calfrac Well Services 1 | | | 45,800 | | | | 194,397 | |

Canaccord Genuity Group | | | 92,000 | | | | 508,059 | |

†Canadian Western Bank | | | 4,600 | | | | 121,241 | |

Computer Modelling Group | | | 234,000 | | | | 1,797,741 | |

E-L Financial | | | 1,200 | | | | 748,479 | |

FirstService Corporation | | | 10,300 | | | | 783,212 | |

Franco-Nevada Corporation 2 | | | 12,800 | | | | 934,656 | |

Genworth MI Canada | | | 13,000 | | | | 423,033 | |

Gluskin Sheff + Associates | | | 23,000 | | | | 287,270 | |

Hudbay Minerals | | | 13,000 | | | | 72,800 | |

Leucrotta Exploration 1 | | | 41,900 | | | | 62,468 | |

Magellan Aerospace | | | 14,000 | | | | 171,027 | |

Major Drilling Group International 1 | | | 201,300 | | | | 1,062,657 | |

Morneau Shepell | | | 50,000 | | | | 1,033,735 | |

North American Construction Group | | | 31,000 | | | | 184,450 | |

Pan American Silver 2 | | | 31,800 | | | | 569,220 | |

†Parex Resources 1 | | | 18,700 | | | | 353,048 | |

Solium Capital 1 | | | 66,000 | | | | 577,842 | |

Sprott | | | 520,600 | | | | 1,203,837 | |

†TORC Oil & Gas | | | 22,400 | | | | 125,064 | |

Western Forest Products | | | 101,250 | | | | 206,405 | |

| |

| Total (Cost $12,322,145) | | | | | | | 12,726,148 | |

| |

| | | | | | | | | |

| CHILE – 0.1% | | | | | | | | |

SMU 1 | | | 318,400 | | | | 93,805 | |

| |

| Total (Cost $85,780) | | | | | | | 93,805 | |

| |

| | | | | | | | | |

| CHINA – 1.4% | | | | | | | | |

†A-Living Services 1 | | | 45,100 | | | | 82,433 | |

China Communications Services | | | 303,600 | | | | 192,323 | |

China Lesso Group Holdings | | | 150,100 | | | | 95,276 | |

Chinasoft International | | | 130,900 | | | | 102,109 | |

Fufeng Group | | | 275,100 | | | | 123,777 | |

Hua Hong Semiconductor | | | 51,600 | | | | 177,249 | |

TravelSky Technology | | | 300,000 | | | | 873,738 | |

Xtep International Holdings | | | 180,100 | | | | 123,271 | |

| |

| Total (Cost $1,209,115) | | | | | | | 1,770,176 | |

| |

| | | | | | | | | |

| CYPRUS – 0.1% | | | | | | | | |

†TCS Group Holding GDR | | | 5,500 | | | | 113,850 | |

| |

| Total (Cost $114,206) | | | | | | | 113,850 | |

| |

| | | | | | | | | |

| DENMARK – 1.2% | | | | | | | | |

Chr. Hansen Holding | | | 5,500 | | | | 508,108 | |

Coloplast Cl. B | | | 4,000 | | | | 399,878 | |

DFDS | | | 4,000 | | | | 255,425 | |

†Nilfisk Holding 1 | | | 7,100 | | | | 346,656 | |

| |

| Total (Cost $1,091,309) | �� | | | | | | 1,510,067 | |

| |

| | | | | | | | | |

| EGYPT – 0.4% | | | | | | | | |

†Commercial International Bank (Egypt) | | | 23,800 | | | | 112,548 | |

Egyptian Financial Group-Hermes | | | | | | | | |

Holding Company 1 | | | 235,100 | | | | 303,304 | |

Oriental Weavers | | | 82,300 | | | | 56,354 | |

| |

| Total (Cost $494,574) | | | | | | | 472,206 | |

| |

| | | | | | | | | |

| FINLAND – 0.0% | | | | | | | | |

Ferratum | | | 1,300 | | | | 24,594 | |

| |

| Total (Cost $37,828) | | | | | | | 24,594 | |

| |

| | | | | | | | | |

| FRANCE – 3.7% | | | | | | | | |

†Albioma | | | 3,100 | | | | 69,942 | |

Interparfums | | | 14,850 | | | | 625,173 | |

Neurones | | | 26,339 | | | | 738,208 | |

Rothschild & Co | | | 33,000 | | | | 1,115,658 | |

†Sartorius Stedim Biotech | | | 9,000 | | | | 940,663 | |

Synergie | | | 1,200 | | | | 59,137 | |

Thermador Groupe | | | 19,000 | | | | 1,273,603 | |

| |

| Total (Cost $3,335,183) | | | | | | | 4,822,384 | |

| |

| | | | | | | | | |

| GEORGIA – 0.1% | | | | | | | | |

Bank of Georgia Group | | | 3,400 | | | | 84,583 | |

†Georgia Capital 1 | | | 3,400 | | | | 46,217 | |

| |

| Total (Cost $120,258) | | | | | | | 130,800 | |

| |

| | | | | | | | | |

| GERMANY – 2.7% | | | | | | | | |

Amadeus Fire | | | 8,000 | | | | 864,172 | |

Carl Zeiss Meditec | | | 13,500 | | | | 921,482 | |

CompuGroup Medical | | | 8,000 | | | | 411,066 | |

FinTech Group 1 | | | 500 | | | | 15,736 | |

| 10 | 2018 Semiannual Report to Stockholders | | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS |

| June 30, 2018 (unaudited) |

| |

| Schedule of Investments (continued) |

| | | SHARES | | | VALUE | |

| |

| | | | | | | | |

| GERMANY (continued) | | | | | | | |

MorphoSys 1 | | 6,000 | | | $ | 735,714 | |

STRATEC Biomedical | | 5,051 | | | | 394,613 | |

VIB Vermoegen | | 4,700 | | | | 120,202 | |

| |

| Total (Cost $2,145,542) | | | | | | 3,462,985 | |

| |

| | | | | | | | |

| GREECE – 0.2% | | | | | | | |

JUMBO | | 4,700 | | | | 77,500 | |

Sarantis | | 5,800 | | | | 50,122 | |

†Star Bulk Carriers 1 | | 8,000 | | | | 102,880 | |

| |

| Total (Cost $219,753) | | | | | | 230,502 | |

| |

| | | | | | | | |

| HONG KONG – 1.3% | | | | | | | |

HKBN | | 150,000 | | | | 230,958 | |

I.T | | 378,400 | | | | 270,093 | |

Pico Far East Holdings | | 526,500 | | | | 213,402 | |

Texhong Textile Group | | 47,600 | | | | 71,834 | |

Value Partners Group | | 894,500 | | | | 706,880 | |

Xinyi Glass Holdings | | 159,800 | | | | 195,330 | |

| |

| Total (Cost $1,440,404) | | | | | | 1,688,497 | |

| |

| | | | | | | | |

| INDIA – 2.0% | | | | | | | |

†AIA Engineering | | 45,000 | | | | 985,186 | |

Borosil Glass Works | | 5,800 | | | | 78,092 | |

Dewan Housing Finance | | 21,500 | | | | 199,577 | |

†Jubilant Life Sciences | | 16,300 | | | | 166,890 | |

Manappuram Finance | | 27,550 | | | | 39,667 | |

Mphasis | | 2,400 | | | | 37,831 | |

†Phillips Carbon Black | | 27,000 | | | | 85,751 | |

Radico Khaitan | | 24,000 | | | | 144,669 | |

Redington India | | 30,000 | | | | 48,165 | |

SH Kelkar & Company | | 200,000 | | | | 656,790 | |

†Sterlite Technologies | | 35,000 | | | | 140,506 | |

| |

| Total (Cost $2,836,758) | | | | | | 2,583,124 | |

| |

| | | | | | | | |

| INDONESIA – 0.4% | | | | | | | |

Selamat Sempurna | | 5,500,000 | | | | 502,791 | |

| |

| Total (Cost $501,555) | | | | | | 502,791 | |

| |

| | | | | | | | |

| IRELAND – 0.6% | | | | | | | |

†C&C Group | | 32,300 | | | | 122,212 | |

Irish Residential Properties REIT | | 62,500 | | | | 100,723 | |

Keywords Studios | | 25,000 | | | | 588,609 | |

| |

| Total (Cost $272,181) | | | | | | 811,544 | |

| |

| | | | | | | | |

| ISRAEL – 0.1% | | | | | | | |

Nova Measuring Instruments 1,2 | | 6,700 | | | | 182,575 | |

| |

| Total (Cost $126,148) | | | | | | 182,575 | |

| |

| | | | | | | | |

| ITALY – 0.8% | | | | | | | |

Anima Holding | | 7,400 | | | | 39,804 | |

DiaSorin | | 7,500 | | | | 855,706 | |

Openjobmetis 1 | | 15,900 | | | | 178,624 | |

| |

| Total (Cost $583,764) | | | | | | 1,074,134 | |

| |

| | | | | | | | |

| JAPAN – 7.3% | | | | | | | |

Ai Holdings | | 20,000 | | | | 433,907 | |

As One | | 15,000 | | | | 1,041,864 | |

EPS Holdings | | 34,600 | | | | 742,534 | |

Financial Products Group | | 10,000 | | | | 129,070 | |

†Fujitec Company | | 46,000 | | | | 567,132 | |

Kyowa Exeo | | 7,000 | | | | 183,923 | |

Leopalace21 | | 11,500 | | | | 63,049 | |

Mandom Corporation | | 1,200 | | | | 37,393 | |

Meitec Corporation | | 25,750 | | | | 1,237,321 | |

Nitto Kohki | | 2,900 | | | | 67,946 | |

NS Solutions | | 7,000 | | | | 176,589 | |

NSD | | 32,600 | | | | 743,191 | |

Open House | | 2,050 | | | | 121,465 | |

Pressance | | 6,150 | | | | 95,098 | |

Relo Group | | 40,000 | | | | 1,056,406 | |

Sun Frontier Fudousan | | 3,650 | | | | 43,220 | |

TATERU | | 4,400 | | | | 72,688 | |

†TKC Corporation | | 23,000 | | | | 857,969 | |

Tokai Corporation | | 4,300 | | | | 92,707 | |

Trancom | | 1,400 | | | | 96,229 | |

USS | | 67,500 | | | | 1,285,192 | |

Yumeshin Holdings | | 6,950 | | | | 72,880 | |

Zenkoku Hosho | | 6,100 | | | | 277,135 | |

| |

| Total (Cost $7,684,846) | | | | | | 9,494,908 | |

| |

| | | | | | | | |

| MALAYSIA – 0.2% | | | | | | | |

Kossan Rubber Industries | | 98,100 | | | | 204,967 | |

| |

| Total (Cost $202,847) | | | | | | 204,967 | |

| |

| | | | | | | | |

| MEXICO – 0.5% | | | | | | | |

Becle | | 200,000 | | | | 288,214 | |

Bolsa Mexicana de Valores | | 250,000 | | | | 420,815 | |

| |

| Total (Cost $789,517) | | | | | | 709,029 | |

| |

| | | | | | | | |

| NETHERLANDS – 1.0% | | | | | | | |

AMG Advanced Metallurgical Group | | 3,500 | | | | 197,008 | |

DP Eurasia 1 | | 119,700 | | | | 250,231 | |

†Intertrust | | 50,000 | | | | 888,696 | |

| |

| Total (Cost $1,433,730) | | | | | | 1,335,935 | |

| |

| | | | | | | | |

| NEW ZEALAND – 1.5% | | | | | | | |

Fisher & Paykel Healthcare | | 102,875 | | | | 1,037,494 | |

Trade Me Group | | 300,000 | | | | 946,865 | |

| |

| Total (Cost $1,542,076) | | | | | | 1,984,359 | |

| |

| | | | | | | | |

| NORWAY – 1.8% | | | | | | | |

Kongsberg Automotive 1 | | 130,000 | | | | 149,404 | |

†Leroy Seafood Group | | 12,300 | | | | 82,883 | |

Protector Forsikring 1 | | 8,950 | | | | 72,968 | |

TGS-NOPEC Geophysical | | 55,000 | | | | 2,025,944 | |

| |

| Total (Cost $1,336,546) | | | | | | 2,331,199 | |

| |

| | | | | | | | |

| PERU – 0.1% | | | | | | | |

Ferreycorp | | 93,200 | | | | 66,693 | |

| |

| Total (Cost $56,092) | | | | | | 66,693 | |

| |

| | | | | | | | |

| PHILIPPINES – 0.1% | | | | | | | |

Pryce Corporation | | 489,100 | | | | 54,530 | |

Robinsons Retail Holdings | | 69,200 | | | | 103,085 | |

| |

| Total (Cost $184,559) | | | | | | 157,615 | |

| |

| | | | | | | | |

| POLAND – 0.2% | | | | | | | |

Warsaw Stock Exchange | | 33,000 | | | | 322,454 | |

| |

| Total (Cost $459,764) | | | | | | 322,454 | |

| |

| THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS | | 2018 Semiannual Report to Stockholders | 11 |

| |

| Schedule of Investments (continued) |

| | | | | | | | |

| | | SHARES | | | VALUE | |

| |

| |

| PORTUGAL – 0.3% | | | | | | | |

Sonae | | 313,400 | | | $ | 376,968 | |

| |

| Total (Cost $421,495) | | | | | | 376,968 | |

| |

| | | | | | | | |

| RUSSIA – 0.5% | | | | | | | |

Globaltrans Investment GDR | | 61,600 | | | | 628,320 | |

| |

| Total (Cost $408,649) | | | | | | 628,320 | |

| |

| | | | | | | | |

| SINGAPORE – 1.2% | | | | | | | |

CSE Global | | 591,850 | | | | 186,786 | |

†Midas Holdings 1,3 | | 400,000 | | | | 42,275 | |

Sheng Siong Group | | 141,800 | | | | 110,318 | |

XP Power | | 24,000 | | | | 1,118,093 | |

Yanlord Land Group | | 134,300 | | | | 156,724 | |

| |

| Total (Cost $1,071,962) | | | | | | 1,614,196 | |

| |

| | | | | | | | |

| SOUTH AFRICA – 0.7% | | | | | | | |

Coronation Fund Managers | | 59,000 | | | | 250,796 | |

JSE | | 15,000 | | | | 177,266 | |

Nampak 1 | | 35,800 | | | | 40,922 | |

PSG Group | | 25,000 | | | | 394,022 | |

| |

| Total (Cost $1,039,463) | | | | | | 863,006 | |

| |

| | | | | | | | |

| SOUTH KOREA – 1.1% | | | | | | | |

†Amorepacific Corporation | | 700 | | | | 202,557 | |

†Com2uS | | 600 | | | | 90,444 | |

Eugene Technology | | 6,600 | | | | 93,271 | |

†Innocean Worldwide | | 5,700 | | | | 303,795 | |

Interojo | | 2,800 | | | | 87,053 | |

KIWOOM Securities | | 700 | | | | 68,147 | |

Koh Young Technology | | 1,200 | | | | 109,825 | |

Modetour Network | | 7,400 | | | | 180,601 | |

†S-1 Corporation | | 2,600 | | | | 225,823 | |

| |

| Total (Cost $1,417,075) | | | | | | 1,361,516 | |

| |

| | | | | | | | |

| SPAIN – 0.3% | | | | | | | |

Atento 2 | | 65,400 | | | | 447,990 | |

| |

| Total (Cost $622,537) | | | | | | 447,990 | |

| |

| | | | | | | | |

| SRI LANKA – 0.2% | | | | | | | |

National Development Bank | | 187,179 | | | | 145,321 | |

†Sampath Bank 1 | | 28,368 | | | | 54,299 | |

Sunshine Holdings | | 154,025 | | | | 51,568 | |

| |

| Total (Cost $270,465) | | | | | | 251,188 | |

| |

| | | | | | | | |

| SWEDEN – 2.7% | | | | | | | |

Addtech Cl. B | | 18,960 | | | | 419,557 | |

Bravida Holding | | 120,000 | | | | 953,248 | |

Dustin Group | | 7,650 | | | | 68,926 | |

†Green Landscaping Holding 1 | | 40,000 | | | | 115,220 | |

Hexpol | | 110,000 | | | | 1,144,612 | |

Knowit | | 7,000 | | | | 134,736 | |

†Lagercrantz Group | | 60,000 | | | | 653,809 | |

| |

| Total (Cost $2,910,627) | | | | | | 3,490,108 | |

| |

| | | | | | | | |

| SWITZERLAND – 4.2% | | | | | | | |

Burkhalter Holding | | 10,000 | | | | 847,218 | |

Forbo Holding | | 110 | | | | 164,617 | |

†Kardex | | 4,300 | | | | 596,607 | |

LEM Holding | | 500 | | | | 747,248 | |

Partners Group Holding | | 1,800 | | | | 1,322,327 | |

VZ Holding | | 5,600 | | | | 1,764,314 | |

| |

| Total (Cost $4,333,284) | | | | | | 5,442,331 | |

| |

| | | | | | | | |

| TAIWAN – 0.3% | | | | | | | |

Gourmet Master | | 12,177 | | | | 117,822 | |

Sitronix Technology | | 46,200 | | | | 178,051 | |

TCI | | 6,185 | | | | 95,548 | |

| |

| Total (Cost $271,223) | | | | | | 391,421 | |

| |

| | | | | | | | |

| THAILAND – 0.2% | | | | | | | |

Beauty Community | | 205,600 | | | | 75,712 | |

Erawan Group (The) | | 377,300 | | | | 71,747 | |

Plan B Media | | 300,000 | | | | 55,237 | |

| |

| Total (Cost $246,746) | | | | | | 202,696 | |

| |

| | | | | | | | |

| TURKEY – 0.1% | | | | | | | |

Tat Gida Sanayi | | 72,350 | | | | 68,824 | |

| |

| Total (Cost $130,798) | | | | | | 68,824 | |

| |

| | | | | | | | |

| UKRAINE – 0.3% | | | | | | | |

†MHP GDR | | 30,000 | | | | 399,000 | |

| |

| Total (Cost $411,612) | | | | | | 399,000 | |

| |

| | | | | | | | |

| UNITED ARAB EMIRATES – 0.1% | | | | | | | |

ADES International Holding 1 | | 8,100 | | | | 103,275 | |

| |

| Total (Cost $107,934) | | | | | | 103,275 | |

| |

| | | | | | | | |

| UNITED KINGDOM – 10.1% | | | | | | | |

Abcam | | 28,000 | | | | 492,953 | |

Ashmore Group | | 279,000 | | | | 1,373,425 | |

Biffa | | 111,400 | | | | 366,080 | |

Clarkson | | 40,600 | | | | 1,232,383 | |

Consort Medical | | 57,500 | | | | 904,557 | |

Conviviality 1,3 | | 61,200 | | | | 0 | |

Diploma | | 28,500 | | | | 493,105 | |

dotdigital group | | 142,200 | | | | 140,751 | |

Elementis | | 200,000 | | | | 667,266 | |

Equiniti Group | | 331,000 | | | | 1,078,988 | |

Ferroglobe | | 41,100 | | | | 352,227 | |

Ferroglobe (Warranty Insurance Trust)1,3 | | 41,100 | | | | 0 | |

†Go-Ahead Group | | 4,200 | | | | 88,022 | |

Hilton Food Group | | 16,100 | | | | 211,205 | |

†Huntsworth | | 151,800 | | | | 241,407 | |

ITE Group | | 380,341 | | | | 401,564 | |

†ITE Group (Rights) 1 | | 665,596 | | | | 209,943 | |

Jupiter Fund Management | | 36,000 | | | | 211,899 | |

Polypipe Group | | 95,000 | | | | 482,699 | |

Restore | | 58,500 | | | | 398,380 | |

RPC Group | | 23,000 | | | | 227,111 | |

SIG | | 100,000 | | | | 184,369 | |

Spirax-Sarco Engineering | | 19,000 | | | | 1,634,907 | |

Staffline Group | | 8,400 | | | | 103,875 | |

Stallergenes Greer 1 | | 10,800 | | | | 387,196 | |

Victrex | | 22,500 | | | | 865,294 | |

†WANdisco 1 | | 8,000 | | | | 117,722 | |

Xaar | | 53,591 | | | | 169,391 | |

| |

| Total (Cost $12,593,083) | | | | | | 13,036,719 | |

| |

| | | | | | | | |

| UNITED STATES – 27.5% | | | | | | | |

Air Lease Cl. A | | 36,460 | | | | 1,530,226 | |

| 12 | 2018 Semiannual Report to Stockholders | | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS |

| June 30, 2018 (unaudited) |

| |

| Schedule of Investments (continued) |

| | | SHARES | | | VALUE | |

| |

| | | | | | | | |

| UNITED STATES (continued) | | | | | | | |

Brooks Automation 2 | | 18,100 | | | $ | 590,422 | |

CIRCOR International 1 | | 32,200 | | | | 1,190,112 | |

Cognex Corporation | | 10,748 | | | | 479,468 | |

Coherent 1 | | 3,000 | | | | 469,260 | |

†comScore 1 | | 24,000 | | | | 523,200 | |

Diebold Nixdorf 2 | | 28,800 | | | | 344,160 | |

Diodes 1 | | 20,500 | | | | 706,635 | |

Dorian LPG 1 | | 4,475 | | | | 34,189 | |

EnerSys 2 | | 11,000 | | | | 821,040 | |

Expeditors International of Washington 2 | | 13,300 | | | | 972,230 | |

FLIR Systems 2 | | 51,500 | | | | 2,676,455 | |

Innospec 2,4 | | 12,457 | | | | 953,583 | |

Kadant | | 7,800 | | | | 749,970 | |

KBR 2 | | 58,700 | | | | 1,051,904 | |

Kirby Corporation 1,2,4 | | 32,900 | | | | 2,750,440 | |

Lazard Cl. A | | 32,600 | | | | 1,594,466 | |

Lindsay Corporation | | 13,700 | | | | 1,328,763 | |

Littelfuse | | 4,000 | | | | 912,720 | |

ManpowerGroup | | 8,800 | | | | 757,328 | |

MBIA 1,2,4 | | 80,300 | | | | 725,912 | |

Nanometrics 1,2,4 | | 35,600 | | | | 1,260,596 | |

National Instruments 2,4 | | 15,200 | | | | 638,096 | |

Popular | | 13,100 | | | | 592,251 | |

Quaker Chemical 2 | | 6,069 | | | | 939,906 | |

Raven Industries | | 40,000 | | | | 1,538,000 | |

Rogers Corporation 1,2,4 | | 4,800 | | | | 535,008 | |

SEACOR Holdings 1 | | 20,200 | | | | 1,156,854 | |

SEACOR Marine Holdings 1 | | 20,309 | | | | 468,935 | |

SEI Investments 2 | | 27,600 | | | | 1,725,552 | |

Signet Jewelers | | 5,500 | | | | 306,625 | |

Standard Motor Products | | 11,200 | | | | 541,408 | |

Sun Hydraulics 2 | | 15,139 | | | | 729,549 | |

Tennant Company 2 | | 11,600 | | | | 916,400 | |

Valmont Industries | | 5,400 | | | | 814,050 | |

Virtu Financial Cl. A 2 | | 74,300 | | | | 1,972,665 | |

World Fuel Services | | 12,000 | | | | 244,920 | |

| |

| Total (Cost $26,504,302) | | | | | | 35,543,298 | |

| |

| | | | | | | | |

| URUGUAY – 0.3% | | | | | | | |

Arcos Dorados Holdings Cl. A | | 46,800 | | | | 325,260 | |

| |

| Total (Cost $351,426) | | | | | | 325,260 | |

| |

| TOTAL COMMON STOCKS | | | | | | | |

| |

| (Cost $104,022,293) | | | | | $ | 124,221,861 | |

| |

| | | | | | | | |

| REPURCHASE AGREEMENT– 10.2% | | | | | | | |

Fixed Income Clearing Corporation, 0.35% dated 6/29/18, due 7/2/18, maturity value

$13,162,384 (collateralized by obligations of various U.S. Government Agencies, 1.375%

due 10/07/21, valued at $13,428,459) |

| |

| (Cost $13,162,000) | | | | | | 13,162,000 | |

| |

| | | | | | | | |

| TOTAL INVESTMENTS – 106.2% | | | | | | | |

| |

| (Cost $117,184,293) | | | | | | 137,383,861 | |

| |

| | | | | | | | |

| LIABILITIES LESS CASH AND OTHER ASSETS – (6.2)% | | | | | | (7,996,878 | ) |

| | | | | | | |

| | | | | | | | |

| |

| NET ASSETS – 100.0% | | | | | $ | 129,386,983 | |

| |

| † | New additions in 2018. |

| 1 | Non-income producing. |

| 2 | All or a portion of these securities were pledged as collateral in connection with the Fund’s revolving credit agreement at June 30, 2018. Total market value of pledged securities at June 30, 2018, was $14,875,097. |

| 3 | Securities for which market quotations are not readily available represent 0.0% of net assets. These securities have been valued at their fair value under procedures approved by the Fund’s Board of Directors. These securities are defined as Level 3 securities due to the use of significant unobservable inputs in the determination of fair value. See Notes to Financial Statements. |

| 4 | At June 30, 2018, a portion of these securities were rehypothecated in connection with the Fund’s revolving credit agreement in the aggregate amount of $5,000,988. |

| | |

| | Securities of Global/International Funds are categorized by the country of their headquarters, with the exception of exchange-traded funds. |

| | |

| | Bold indicates the Fund’s 20 largest equity holdings in terms of June 30, 2018, market value. |

| | |

| | TAX INFORMATION: The cost of total investments for Federal income tax purposes was $117,231,433. At June 30, 2018, net unrealized appreciation for all securities was $ 20,152,428 consisting of aggregate gross unrealized appreciation of $27,931,533 and aggregate gross unrealized depreciation of $7,779,105. The primary cause of the difference between book and tax basis cost is the timing of the recognition of losses on securities sold. |

| THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS | | 2018 Semiannual Report to Stockholders | 13 |

| Royce Global Value Trust | | June 30, 2018 (unaudited) |

| |

| Statement of Assets and Liabilities | | | | |

| | | | | |

| ASSETS: | | | | |

| Investments at value | | $ | 124,221,861 | |

| |

| Repurchase agreements (at cost and value) | | | 13,162,000 | |

| |

| Cash and foreign currency | | | 27,900 | |

| |

| Receivable for investments sold | | | 2,202,571 | |

| |

| Receivable for dividends and interest | | | 294,102 | |

| |

| Prepaid expenses and other assets | | | 31,792 | |

| |

| Total Assets | | | 139,940,226 | |

| |

| LIABILITIES: | | | | |

| Revolving credit agreement | | | 8,000,000 | |

| |

| Payable for investments purchased | | | 2,377,338 | |

| |

| Payable for investment advisory fee | | | 136,299 | |

| |

| Payable for directors’ fees | | | 9,151 | |

| |

| Payable for interest expense | | | 2,192 | |

| |

| Accrued expenses | | | 28,054 | |

| |

| Deferred capital gains tax | | | 209 | |

| |

| Total Liabilities | | | 10,553,243 | |

| |

| Net Assets | | $ | 129,386,983 | |

| |

| ANALYSIS OF NET ASSETS: | | | | |

| Paid-in capital - $0.001 par value per share; 10,461,711 shares outstanding (150,000,000 shares authorized) | | $ | 117,980,744 | |

| |

| Undistributed net investment income (loss) | | | (787,401 | ) |

| |

| Accumulated net realized gain (loss) on investments and foreign currency | | | (7,999,866 | ) |

| |

| Net unrealized appreciation (depreciation) on investments and foreign currency | | | 20,193,506 | |

| |

| Net Assets (net asset value per share - $12.37) | | $ | 129,386,983 | |

| |

| Investments at identified cost | | $ | 104,022,293 | |

| |

| 14 | 2018 Semiannual Report to Stockholders | | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS |

| |

| Statement of Changes in Net Assets | | | | | | | | |

| | | | | | | | | |

| | | SIX MONTHS ENDED | | | | |

| | | 6/30/18 | | | | |

| | | (UNAUDITED) | | YEAR ENDED 12/31/17 |

| |

| | | | | | | | | |

| INVESTMENT OPERATIONS: | | | | | | | | |

| Net investment income (loss) | | $ | 411,907 | | | $ | 241,105 | |

| |

| Net realized gain (loss) on investments and foreign currency | | | 5,981,008 | | | | 6,555,345 | |

| |

| Net change in unrealized appreciation (depreciation) on investments and foreign currency | | | (7,532,114 | ) | | | 24,156,512 | |

| |

| Net increase (decrease) in net assets from investment operations | | | (1,139,199 | ) | | | 30,952,962 | |

| |

| DISTRIBUTIONS: | | | | | | | | |

| Net investment income | | | – | | | | (1,145,697 | ) |

| |

| Net realized gain on investments and foreign currency | | | – | | | | – | |

| |

| Total distributions | | | – | | | | (1,145,697 | ) |

| |

| CAPITAL STOCK TRANSACTIONS: | | | | | | | | |

| Reinvestment of distributions | | | – | | | | 491,130 | |

| |

| Total capital stock transactions | | | – | | | | 491,130 | |

| |

| Net Increase (Decrease) In Net Assets | | | (1,139,199 | ) | | | 30,298,395 | |

| |

| NET ASSETS: | | | | | | | | |

| |

| Beginning of period | | | 130,526,182 | | | | 100,227,787 | |

| |

| End of period (including undistributed net investment income (loss) of $(787,401) at 6/30/18 and $(1,199,309) at 12/31/17) | | $ | 129,386,983 | | | $ | 130,526,182 | |

| |

| THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS | | 2018 Semiannual Report to Stockholders | 15 |

| Royce Global Value Trust | | Six Months Ended June 30, 2018 (unaudited) |

| |

| Statement of Operations | | | | |

| | | | | |

| INVESTMENT INCOME: | | | | |

| INCOME: | | | | |

| Dividends | | $ | 1,627,362 | |

| |

| Foreign withholding tax | | | (125,280 | ) |

| |

| Interest | | | 14,440 | |

| |

| Rehypothecation income | | | 9,719 | |

| |

| Total income | | | 1,526,241 | |

| |

| EXPENSES: | | | | |

| |

| Investment advisory fees | | | 824,678 | |

| |

| Interest expense | | | 124,069 | |

| |

| Custody and transfer agent fees | | | 65,355 | |

| |

| Stockholder reports | | | 30,650 | |

| |

| Professional fees | | | 25,118 | |

| |

| Administrative and office facilities | | | 16,778 | |

| |

| Directors’ fees | | | 15,562 | |

| |

| Other expenses | | | 12,142 | |

| |

| Total expenses | | | 1,114,352 | |

| |

| Compensating balance credits | | | (18 | ) |

| |

| Net expenses | | | 1,114,334 | |

| |

| Net investment income (loss) | | | 411,907 | |

| |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY: | | | | |

| NET REALIZED GAIN (LOSS): | | | | |

| |

| Investments | | | 6,005,916 | |

| |

| Foreign currency transactions | | | (24,908 | ) |

| |

| NET CHANGE IN UNREALIZED APPRECIATION (DEPRECIATION): | | | | |

| |

| Investments and foreign currency translations | | | (7,682,352 | ) |

| |

| Other assets and liabilities denominated in foreign currency | | | 150,238 | |

| |

| Net realized and unrealized gain (loss) on investments and foreign currency | | | (1,551,106 | ) |

| |

| NET INCREASE (DECREASE) IN NET ASSETS FROM INVESTMENT OPERATIONS | | $ | (1,139,199 | ) |

| |

| 16 | 2018 Semiannual Report to Stockholders | | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS |

| Royce Global Value Trust | | Six Months Ended June 30, 2018 (unaudited) |

| |

| Statement of Cash Flows | | | | |

| | | | | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | | |

| Net increase (decrease) in net assets from investment operations | | $ | (1,139,199 | ) |

| |

| Adjustments to reconcile net increase (decrease) in net assets from investment operations to net cash provided by operating activities: | | | | |

| |

Purchases of long-term investments | | | (27,799,230 | ) |

| |

Proceeds from sales and maturities of long-term investments | | | 31,384,318 | |

| |

Net purchases, sales and maturities of short-term investments | | | (3,831,000 | ) |

| |

Net (increase) decrease in dividends and interest receivable and other assets | | | (81,103 | ) |

| |

Net increase (decrease) in interest expense payable, accrued expenses and other liabilities | | | (207,827 | ) |

| |

Net change in unrealized appreciation (depreciation) on investments | | | 7,682,352 | |

| |

Net realized gain (loss) on investments and foreign currency | | | (5,981,008 | ) |

| |

| Net cash provided by operating activities | | | 27,303 | |

| |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | |

| Distributions | | | – | |

| |

| Reinvestment of distributions | | | – | |

| |

| Net cash used for financing activities | | | – | |

| |

| INCREASE (DECREASE) IN CASH: | | | 27,303 | |

| |

| Cash and foreign currency at beginning of period | | | 597 | |

| |

| Cash and foreign currency at end of period | | $ | 27,900 | |

| |

| THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS | | 2018 Semiannual Report to Stockholders | 17 |

| |

| Financial Highlights |

| This table is presented to show selected data for a share outstanding throughout each year or other indicated period, and to assist stockholders in evaluating the Fund’s performance for the periods presented. |

| | | SIX MONTHS | | YEARS ENDED | | | | |

| | | | | | | | | | | |

| | | ENDED 6/30/18 | | | | | | | | | | | | | | | | | | PERIOD ENDED |

| | | (UNAUDITED) | | 12/31/17 | | 12/31/16 | | 12/31/15 | | 12/31/14 | | 12/31/13 1 |

| |

| Net Asset Value, Beginning of Period | | $ | 12.48 | | | $ | 9.62 | | | $ | 8.81 | | | $ | 9.25 | | | $ | 10.05 | | | $ | 9.78 | |

| |

| INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | 0.04 | | | | 0.02 | | | | 0.06 | | | | 0.10 | | | | 0.13 | | | | (0.00 | ) |

| |

| Net realized and unrealized gain (loss) on investments and foreign currency | | | (0.15 | ) | | | 2.96 | | | | 0.90 | | | | (0.43 | ) | | | (0.77 | ) | | | 0.27 | |

| |

| Net increase (decrease) in net assets from investment operations | | | (0.11 | ) | | | 2.98 | | | | 0.96 | | | | (0.33 | ) | | | (0.64 | ) | | | 0.27 | |

| |

| DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | – | | | | (0.11 | ) | | | (0.14 | ) | | | (0.10 | ) | | | (0.15 | ) | | | – | |

| |

| Net realized gain on investments and foreign currency | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | |

| |

| Total distributions | | | – | | | | (0.11 | ) | | | (0.14 | ) | | | (0.10 | ) | | | (0.15 | ) | | | – | |

| |

| CAPITAL STOCK TRANSACTIONS: | | | | | | | | | | | | | | | | | | | | | | | | |

| Effect of reinvestment of distributions by Common Stockholders | | | – | | | | (0.01 | ) | | | (0.01 | ) | | | (0.01 | ) | | | (0.01 | ) | | | – | |

| |

| Total capital stock transactions | | | – | | | | (0.01 | ) | | | (0.01 | ) | | | (0.01 | ) | | | (0.01 | ) | | | – | |

| |

| Net Asset Value, End of Period | | $ | 12.37 | | | $ | 12.48 | | | $ | 9.62 | | | $ | 8.81 | | | $ | 9.25 | | | $ | 10.05 | |

| |

| Market Value, End of Period | | $ | 10.51 | | | $ | 10.81 | | | $ | 8.04 | | | $ | 7.45 | | | $ | 8.04 | | | $ | 8.89 | |

| |

| TOTAL RETURN: 2 | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value | | | (0.88 | )%3 | | | 31.07 | % | | | 11.12 | % | | | (3.44 | )% | | | (6.23 | )% | | | 2.76 | %3 |

| |

| Market Value | | | (2.81 | )%3 | | | 35.96 | % | | | 9.77 | % | | | (6.06 | )% | | | (7.86 | )% | | | (0.95 | )%3 |

| |

| RATIOS BASED ON AVERAGE NET ASSETS: | | | | | | | | | | | | | | | | | | | | | | | | |

| Investment advisory fee expense | | | 1.25 | %4 | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % | | | 1.25 | %4 |

| |

| Other operating expenses | | | 0.44 | %4 | | | 0.42 | % | | | 0.46 | % | | | 0.43 | % | | | 0.24 | % | | | 0.37 | %4 |

| |

| Total expenses (net) | | | 1.69 | %4 | | | 1.67 | % | | | 1.71 | % | | | 1.68 | % | | | 1.49 | % | | | 1.62 | %4 |

| |

| Expenses excluding interest expense | | | 1.50 | %4 | | | 1.52 | % | | | 1.57 | % | | | 1.58 | % | | | 1.49 | % | | | 1.62 | %4 |

| |

| Expenses prior to balance credits | | | 1.69 | %4 | | | 1.67 | % | | | 1.71 | % | | | 1.68 | % | | | 1.49 | % | | | 1.62 | %4 |

| |

| Net investment income (loss) | | | 0.62 | %4 | | | 0.21 | % | | | 0.69 | % | | | 1.03 | % | | | 1.30 | % | | | (0.13 | )%4 |

| |

| SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Assets, End of Period (in thousands) | | $ | 129,387 | | | $ | 130,526 | | | $ | 100,228 | | | $ | 91,174 | | | $ | 95,285 | | | $ | 102,684 | |

| |

| Portfolio Turnover Rate | | | 23 | % | | | 34 | % | | | 59 | % | | | 65 | % | | | 43 | % | | | 7 | % |

| |

| REVOLVING CREDIT AGREEMENT: | | | | | | | | | | | | | | | | | | | | | | | | |

| Asset coverage | | | 1717 | % | | | 1732 | % | | | 1353 | % | | | 1240 | % | | | | | | | | |

| |

| Asset coverage per $1,000 | | | 17,173 | | | | 17,316 | | | | 13,528 | | | | 12,397 | | | | | | | | | |

| |

| 1 | The Fund commenced operations on October 18, 2013. |

| 2 | The Market Value Total Return is calculated assuming a purchase of Common Stock on the opening of the first business day and a sale on the closing of the last business day of each period. Dividends and distributions are assumed for the purposes of this calculation to be reinvested at prices obtained under the Fund’s Distribution Reinvestment and Cash Purchase Plan. Net Asset Value Total Return is calculated on the same basis, except that the Fund’s net asset value is used on the purchase and sale dates instead of market value. |

| 3 | Not annualized |

| 4 | Annualized |

| 18 | 2018 Semiannual Report to Stockholders | | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS |

| Royce Global Value Trust |

| |

| Notes to Financial Statements (unaudited) |

| Summary of Significant Accounting Policies |

Royce Global Value Trust, Inc. (the “Fund”), is a diversified closed-end investment company that was incorporated under the laws of the State of Maryland on February 14, 2011. The Fund commenced operations on October 18, 2013. |

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates. |

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standard Codification Topic 946 “Financial Services-Investment Companies”. |

| VALUATION OF INVESTMENTS: |