UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04875

Name of Registrant: Royce Value Trust, Inc.

Address of Registrant: 745 Fifth Avenue

New York, NY 10151

| Name and address of agent for service: | | John E. Denneen, Esq. |

| | | 745 Fifth Avenue |

| | | New York, NY 10151 |

Registrant’s telephone number, including area code: (212) 508-4500

Date of fiscal year end: December 31, 2015

Date of reporting period: January 1, 2015 – June 30, 2015

Item 1. Reports to Shareholders.

| | | JUNE 30, 2015 |

| | | |

| | | |

| | | |

| | | 2015 Semiannual |

| | | Review and Report to Stockholders |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | Royce Value Trust |

| | | | |

| | | Royce Micro-Cap Trust |

| | | | |

| | | Royce Global Value Trust | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | roycefunds.com |  |

| | | | |

| | | | |

| | | | |

| |

| |

| |

| A Few Words on Closed-End Funds |

| |

Royce & Associates, LLC manages three closed-end funds: Royce Value Trust, which invests primarily in small-cap securities; Royce Micro-Cap Trust, which invests primarily in micro-cap securities; and Royce Global Value Trust, which invests in both U.S. and non-U.S. small-cap stocks. A closed-end fund is an investment company whose shares are listed and traded on a stock exchange. Like all investment companies, including open-end mutual funds, the assets of a closed-end fund are professionally managed in accordance with the investment objectives and policies approved by the fund’s Board of Directors. A closed-end fund raises cash for investment by issuing a fixed number of shares through initial and other public offerings that may include shelf offerings and periodic rights offerings. Proceeds from the offerings are invested in an actively managed portfolio of securities. Investors wanting to buy or sell shares of a publicly traded closed-end fund after the offerings must do so on a stock exchange, as with any publicly traded stock. Shares of closed-end funds frequently trade at a discount to their net asset value. This is in contrast to open-end mutual funds, which sell and redeem their shares at net asset value on a continuous basis. |

| A Closed-End Fund Can Offer Several Distinct Advantages |

| | | |

| • | | A closed-end fund does not issue redeemable securities or offer its securities on a continuous basis, so it does not need to liquidate securities or hold uninvested assets to meet investor demands for cash redemptions. |

| | | |

| • | | In a closed-end fund, not having to meet investor redemption requests or invest at inopportune times can be effective for value managers who attempt to buy stocks when prices are depressed and sell securities when prices are high. |

| | | |

| • | | A closed-end fund may invest in less liquid portfolio securities because it is not subject to potential stockholder redemption demands. This is potentially beneficial for Royce-managed closed-end funds, which invest primarily in small- and micro-cap securities. |

| | | |

| • | | The fixed capital structure allows permanent leverage to be employed as a means to enhance capital appreciation potential. |

| | | |

| • | | Royce Value Trust and Royce Micro-Cap Trust distribute capital gains on a quarterly basis. Each of these Funds has adopted a quarterly distribution policy for its common stock. |

| | | |

| We believe that the closed-end fund structure can be an appropriate investment for a long-term investor who understands the benefits of a more stable pool of capital. |

| Why Dividend Reinvestment Is Important |

| |

| A very important component of an investor’s total return comes from the reinvestment of distributions. By reinvesting distributions, our investors can maintain an undiluted investment in a Fund. To get a fair idea of the impact of reinvested distributions, please see the charts on pages 12 and 13. For additional information on the Funds’ Distribution Reinvestment and Cash Purchase Options and the benefits for stockholders, please see page 14 or visit our website at www.roycefunds.com. |

| |

| Managed Distribution Policy |

| |

| The Board of Directors of each of Royce Value Trust and Royce Micro-Cap Trust has authorized a managed distribution policy (“MDP”). Under the MDP, Royce Value Trust and Royce Micro-Cap Trust pay quarterly distributions at an annual rate of 7% of the average of the prior four quarter-end net asset values, with the fourth quarter being the greater of these annualized rates or the distribution required by IRS regulations. With each distribution, the Fund will issue a notice to its stockholders and an accompanying press release that provides detailed information regarding the amount and composition of the distribution (including whether any portion of the distribution represents a return of capital) and other information required by a Fund’s MDP. You should not draw any conclusions about a Fund’s investment performance from the amount of distributions or from the terms of a Fund’s MDP. A Fund’s Board of Directors may amend or terminate the MDP at any time without prior notice to stockholders; however, at this time there are no reasonably foreseeable circumstances that might cause the termination of any of the MDPs. |

| This page is not part of the 2015 Semiannual Report to Stockholders |

| Table of Contents | | | |

| | | | |

| | | | |

| Semiannual Review | | | |

| | | | |

| Letter to Our Stockholders | | 2 | |

| | | | |

| Performance | | 5 | |

| | | | |

| | | | |

| Semiannual Report to Stockholders | | | |

| | | | |

| Managers’ Discussions of Fund Performance | | | |

| | | | |

Royce Value Trust | | 6 | |

| | | | |

Royce Micro-Cap Trust | | 8 | |

| | | | |

Royce Global Value Trust | | 10 | |

| | | | |

| History Since Inception | | 12 | |

| | | |

| Distribution Reinvestment and Cash Purchase Options | | 14 | |

| | | |

| Schedules of Investments and Other Financial Statements | | | |

| | | |

Royce Value Trust | | 15 | |

| | | |

Royce Micro-Cap Trust | | 30 | |

| | | |

Royce Global Value Trust | | 43 | |

| | | | |

| Directors and Officers | | 55 | |

| | | | |

| Board Approval of Investment Advisory Agreements | | 56 | |

| | | | |

| Notes to Performance and Other Important Information | 58 | |

| This page is not part of the 2015 Semiannual Report to Stockholders |

Letter to Our Stockholders

“THE TIME IS OUT OF JOINT”

Anyone reestablishing contact with the wider world at the end of June would no doubt be pleased by the numbers that guide the financial and economic parts of our lives. The economy, following a first-quarter stumble in which GDP is estimated to have grown by 0.6%, appears once again to be growing at a faster clip. One could argue that its pace could be livelier, but healthy employment numbers, improving wages, and robust housing and auto markets would seem to promise a quickening in the coming months. Inflation is, for now, not a matter of great concern. Interest rates remain low—and will remain that way on an absolute basis, even with an increase (or two) in short-term rates likely before the end of 2015. And a Fed-led increase in short rates may cause long-term rates to back up as well, which would be bad news for the bond markets, though perhaps not for stocks.

One could find positive developments in the equity markets through the first half of the year—or so it would seem. Returns for each of the major domestic indexes were in the black through the end of June, while a welcome recovery finally arrived for many non-U.S. stocks in the year’s first six months. Three- and five-year average annualized returns for the small-cap Russell 2000 Index, the Nasdaq Composite, and the large-cap Russell 1000 and S&P 500 Indexes all topped 17%, well above the rolling three- and five-year historical averages for each index. It would appear that we are living through good times for the economy and possibly great ones for equities. |

Why, then, have we purloined a line from Hamlet to introduce our own take on stocks in the first half, one in which the titular protagonist warns of a troubling dislocation in the world around him? Some of the reasons are clear enough: Positive results for the first half notwithstanding, global equities were rocked by the highly publicized Greek default late in June. On the second-to-last trading day of the first half, many stocks gave away most, if not all, of their second-quarter gains. Markets in China faced arguably even more significant problems, considering how much larger and more important that nation’s economy is to the world compared to that of Greece. Chinese stocks plummeted 30% in the three weeks leading up to our Independence Day, making what seemed like a typical correction in June far more worrisome. A cut in interest rates and more relaxed rules for margin trading—both hastily put in place late in June—did little to stem the tide of selling.

Closer to home, there is the matter of how thoroughly disjointed results were for domestic equities. Large-cap returns, for example, were paltry—as can be seen from the table on page 3—brought even lower by the Greek drama that ushered out the month of June. Performance for small-caps and the Nasdaq looked appreciably better, but in each case looks are almost assuredly deceiving. Health Care was by far the dominant sector in every market cap range, from micro to large, that Russell Investments tracks. Yet the rule in the first half seemed to be the smaller—and more growth-driven—the company, the loftier the results, especially if it was involved in biotech, the industry that has reigned supreme within the Russell 2000 over much of the last two years. This has had the |

| 2 | This page is not part of the 2015 Semiannual Report to Stockholders |

| LETTER TO OUR STOCKHOLDERS |

| | | |

effect of creating decidedly narrow market leadership within the small-cap space. Outside of biotech, strong first-half performances were mostly limited to a handful of other Health Care industries, software companies, and a few outliers such as construction materials and tobacco. The small-cap market has thus moved from the tightly correlated markets of 2011-2013 into a new phase of wide divergence and constricted leadership. From our perspective, then, the market is indeed out of joint.

“MORE THINGS IN HEAVEN AND EARTH…”

We have actually been arguing that the market has been disjointed for some time now. Fed policies designed to keep the economy and capital markets above water, which included multiple rounds of QE and keeping interest rates at or near zero, had other, unintended consequences that had an outsized effect on the small-cap market. For example, it became both easy and affordable for businesses to add debt, essentially eroding the risk differential between lower- and higher-quality businesses. Lower-quality and more highly levered companies then began a historically atypical period of outperformance in which our funds mostly did not participate. The Fed’s zero-interest-rate policy (“ZIRP”) also stoked an intense hunger for yield, which drove up values for bond-proxy equities such as REITs and Utilities, regardless of their underlying quality or profitability, that have only recently begun to correct. These actions also boosted stock correlations and reduced volatility, making it harder to find the kind of mispriced opportunities that have always been our stock in trade. | | Finally, there were significant runs for high-growth, non-earning, and more speculative businesses, many with negative EBIT. This continues into the present day with the recent contraction of small-cap leadership, which represents more of a bet on long-duration assets than current profitability. In each of these cases, our more qualitative, risk-conscious approaches have in general kept us away from these areas. While we are confident that this trend will fade and that speculative bubbles will burst, we also understand the frustrations that have built over the last few years as active managers such as ourselves have continued to lag our respective benchmarks. |

| | |

| | So do these challenges mean that something is rotten in the state of small-cap, if only in some of its actively managed precincts? That is the question, more or less, that we have been wrestling with of late. To be sure, we ran the gamut in the first half from disappointment to optimism to frustration as investor preferences moved around. They first showed favor to long-duration assets, then looked, if only briefly, toward consistently profitable and/or conservatively capitalized companies before shifting back again. However, we have seen enough signs, both economically and in the market, which suggest that stocks are slowly moving back to what we would call their historical norm—lower overall returns, higher volatility, and long-term advantages for companies with consistent profits and high returns on invested capital.

Most notably, there was a positive directional trend dating from the first-half low for the 10-year Treasury on January 30 |

Equity Indexes

As of June 30, 2015 (%) |

| | | |

| • | | Greek Drama Creates Underwhelming Results—The Greek default late in June eroded gains—giving equities second-quarter results that more closely hugged the flat line. The tech-oriented Nasdaq Composite was the leader, up 1.8%, followed by the small-cap Russell 2000 Index, which finished the quarter with a gain of 0.4%. The large-cap S&P 500 and Russell 1000 Indexes rose 0.3% and 0.1%, respectively. |

| | | |

| • | | Long-Term Returns in Excess—Both large-cap and small-cap indexes’ three- and five-year average annual total returns for the periods ended 6/30/15 were above 17%, well in excess of each index’s historical average. |

| | | |

| • | | Healthy and Informed—Health Care and Information Technology were the best performing sectors in the Russell 2000 year-to-date through 6/30/15—the former led by a wide margin—while Utilities and Materials were the worst performers in the year’s first half. |

| | | |

| |

| | | YTD1 | | 1-YR | | 3-YR | | 5-YR | | 10-YR | |

| |

| Russell 2000 | | 4.75 | | 6.49 | | 17.81 | | 17.08 | | 8.40 | |

| |

| S&P Small Cap 600 | | 4.15 | | 6.70 | | 18.81 | | 18.44 | | 9.28 | |

| |

| S&P 500 | | 1.23 | | 7.42 | | 17.31 | | 17.34 | | 7.89 | |

| |

| Russell 1000 | | 1.71 | | 7.37 | | 17.73 | | 17.58 | | 8.13 | |

| |

| Nasdaq Composite | | 5.30 | | 13.13 | | 19.33 | | 18.78 | | 9.26 | |

| |

| Russell Midcap | | 2.35 | | 6.63 | | 19.26 | | 18.23 | | 9.40 | |

| |

| Russell Microcap | | 6.03 | | 8.21 | | 19.25 | | 17.48 | | 7.07 | |

| |

| Russell Global ex-U.S. Small Cap | | 7.74 | | -3.46 | | 11.35 | | 8.99 | | 7.07 | |

| |

| Russell Global ex-U.S. Large Cap | | 4.23 | | -5.02 | | 9.96 | | 8.13 | | 5.80 | |

| |

| 1Not annualized |

| For details on The Royce Funds’ performance in the period, please turn to the Managers’ Discussions that begin on page 6. |

| This page is not part of the 2015 Semiannual Report to Stockholders | 3 |

| LETTER TO OUR STOCKHOLDERS |

| |

through the end of the first half. During this period, which included the bearish month of April, we were pleased with the way many of our portfolios either outperformed their benchmarks or began to narrow the gap. This was very clear during the growth scare engendered by (at the time) negative first-quarter GDP numbers, which led many companies to begin revising their earnings expectations downward. Of course, when it became clear that much of what put a drag on first-quarter numbers was temporary, including such factors as the awful winter weather, the West Coast port strike, and the plunge in oil prices, things began to pick up again fairly quickly, at least for the more speculative areas within Health Care and a few other narrow equity locales.

“THE READINESS IS ALL”

Yet this period also offered a potential preview of how the landscape for stocks will look when short-term interest rates begin to rise—which is likely to be later this year. We see higher rates breeding more uncertainty, be it about inflation, the cost of capital, or a number of other issues. This in turn typically leads to more mispricing in the short run, which creates precisely the opportunities that we crave as risk-conscious bargain hunters. To us, high rates are synonymous with higher risk. A higher-risk environment also tends to benefit quality companies (by which we mean conservatively capitalized, profitable businesses with high returns on invested capital and effective, shareholder-friendly management). So we have no worries about rising rates or greater volatility in the markets. In fact, we welcome both.

We see quality differentiating itself when risk premiums rise because quality businesses are better businesses—as profitable, financially sound enterprises, they are purpose-built and run to survive periods of higher risk and/or greater uncertainty, which helps to explain why the market of the last several years has seen many of these companies disadvantaged in the easy-money,

| | ZIRP environment. In a phase in which few if any of the traditional penalties were paid for larding leverage onto corporate balance sheets, there were also scant advantages that have historically accrued to higher-quality, more conservatively capitalized companies.

We feel confident that this era is over. Our expectation is for lower returns for stocks as a whole, but relatively better returns for both high-quality companies and more cyclical, less defensive sectors. We suspect that in a few years market observers will look back at 2015—and perhaps the longer span covering 2013-2015—as a hinge period in which the gradual sun-setting of interventionist Fed policies, coupled with the steady growth of the economy, restored the capital markets to something closer to more familiar historical patterns of performance and volatility. This is why we have been patiently holding so many companies in cyclical sectors, such as Industrials, Materials, and, more recently, Energy—they boast many attractive characteristics that the market has not yet fully recognized, a phenomenon we expect will change as the economy heats up. In our estimation their profitability, growth prospects, and reasonable to attractive valuations make them coiled springs. Until then, we wait.

To be sure, it has been a cycle of, at times, seemingly endless challenges for our active and risk-conscious approaches. Our collective patience has been sorely tested as we have waited (and waited) for many of our highest-confidence holdings to turn around. Of course, transitions are never easy, and the turn we have been anticipating has taken longer, after a few false starts, than any of us initially anticipated. Change, however, can take time—and we are often aware that a dramatic turn has occurred only in retrospect. We are content, then, to continue investing in the same way that we have for more than four decades—with a close eye on risk as we look for the intersection of attractive valuation and organic growth potential. |

| |  | |  |

| Charles M. Royce | | Christopher D. Clark | | Francis D. Gannon |

| Chief Executive Officer, | | President and Co-Chief Investment Officer, | | Co-Chief Investment Officer, |

| Royce & Associates, LLC | | Royce & Associates, LLC | | Royce & Associates, LLC |

| | | | | |

| July 31, 2015 | | | | |

| 4 | This page is not part of the 2015 Semiannual Report to Stockholders |

| NAV Average Annual Total Returns | | | | | | | | | | | | | | | | | |

| As of June 30, 2015 (%) | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | YTD1 | | 1-YR | | 3-YR | | 5-YR | | 10-YR | | 15-YR | | 20-YR | | 25-YR | | SINCE INCEPTION | | INCEPTION DATE |

| |

| Royce Value Trust | | 1.69 | | -0.49 | | 15.08 | | 13.90 | | 7.34 | | 8.87 | | 10.26 | | 10.77 | | 10.61 | | 11/26/86 |

| |

| Royce Micro-Cap Trust | | -0.52 | | -0.05 | | 17.94 | | 16.05 | | 8.25 | | 10.15 | | 11.16 | | n.a. | | 11.20 | | 12/14/93 |

| |

| Royce Global Value Trust | | 5.62 | | -6.18 | | n.a. | | n.a. | | n.a. | | n.a. | | n.a. | | n.a. | | 1.04 | | 10/17/13 |

| |

| INDEX | | | | | | | | | | | | | | | | | | | | |

| |

| Russell 2000 Index | | 4.75 | | 6.49 | | 17.81 | | 17.08 | | 8.40 | | 7.50 | | 9.15 | | 9.89 | | n.a. | | n.a. |

| |

| Russell Microcap Index | | 6.03 | | 8.21 | | 19.25 | | 17.48 | | 7.07 | | 7.79 | | n.a. | | n.a. | | n.a. | | n.a. |

| |

| Russell Global Small Cap Index | | 6.37 | | 0.34 | | 13.69 | | 11.77 | | 7.36 | | 7.30 | | n.a. | | n.a. | | n.a. | | n.a. |

| |

| 1 Not annualized | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Important Performance and Risk Information

All performance information in this Review and Report reflects past performance, is presented on a total return basis, and reflects the reinvestment of distributions. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when sold. Current performance may be higher or lower than performance quoted. Current month-end performance may be obtained at www.roycefunds.com. The Funds are closed-end registered investment companies whose respective shares of common stock may trade at a discount to the net asset value. Shares of each Fund’s common stock are also subject to the market risk of investing in the underlying portfolio securities held by each Fund. Certain immaterial adjustments were made to the net assets of Royce Micro-Cap Trust at 12/31/12, as well as 12/31/14, for financial reporting purposes, and as a result the net asset value originally calculated on that date and the total return based on that net asset value differs from the adjusted net asset value and total return reported in the Financial Highlights. All indexes referenced are unmanaged and capitalization-weighted. Each index’s returns include net reinvested dividends and/or interest income. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Russell Investment Group. The Russell 2000 Index is an index of domestic small-cap stocks that measures the performance of the 2,000 smallest publicly traded U.S. companies in the Russell 3000 Index. The Russell Microcap Index includes 1,000 of the smallest securities in the small-cap Russell 2000 Index, along with the next smallest eligible securities as determined by Russell. The Russell Global Small Cap Index is an unmanaged, capitalization-weighted index of global small-cap stocks. The performance of an index does not represent exactly any particular investment, as you cannot invest directly in an index. Index returns include net reinvested dividends and/or interest income. Royce Value, Micro-Cap and Global Value Trust shares of common stock trade on the NYSE. Royce Fund Services, Inc (“RFS”) is a member of FINRA and has filed this Review and Report with FINRA on behalf of each Fund. RFS is not an underwriter or distributor of any of the Funds. |

| This page is not part of the 2015 Semiannual Report to Stockholders | 5 |

| | | MANAGER’S DISCUSSION |

| | | |

| Royce Value Trust (RVT) | | |

| | | |

|

| Chuck Royce |

| FUND PERFORMANCE |

Royce Value Trust (NYSE: RVT) gained 1.7% on an NAV (net asset value) basis and 0.3% on a market price basis for the year-to-date period ended June 30, 2015, lagging each of its unleveraged small-cap benchmarks. For the same period, the Russell 2000 Index rose 4.8% while the S&P SmallCap 600 climbed 4.2%. Equities got off to a slow start in 2015 but soon righted themselves, with a bearish January giving way to solid first-quarter gains that were driven mostly by a strong rebound in February. RVT was up 1.0% on an NAV basis and 2.0% on a market price basis during the first quarter, trailing the Russell 2000, which gained 4.3%, and the S&P SmallCap 600, which advanced 4.0%.

A similar pattern could be seen in the second quarter, as small-cap share prices stumbled through a downturn in April (when RVT lost less than both small-cap indexes on an NAV and market price basis) before rallying in May. June wound up being a volatile month, though this was not fully felt until its second-to-last day when the Greek default sent global stock prices into a tailspin. On an NAV basis, the Fund felt the brunt less than its benchmarks, which helped to make the second quarter a relatively strong one. RVT was up 0.7% based on NAV but fell 1.7% based on market price, while the Russell 2000 was up 0.4% and the S&P Small Cap 600 rose 0.2%. This was not enough, however, to overcome the portfolio’s first-quarter disadvantage. On an NAV and market price basis, the Fund outperformed the Russell 2000 for the 15-, 20-, 25-year, and since inception (11/26/86) periods ended June 30, 2015 while trailing the S&P SmallCap 600. RVT’s average annual NAV total return for the since inception period was 10.6%.

WHAT WORKED… AND WHAT DIDN’T

On a relative basis versus the Russell 2000, two sectors made a significant negative impact for the semiannual period. Health Care was the clear leader within the small-cap market as a whole, driven by highly impressive results for biotech stocks. The Fund was significantly underweight this sector and had very limited exposure to biotech companies, which hurt relative performance. RVT was slightly overweight in Information Technology during the first half but was also meaningfully underweight in software companies, which dominated overall small-cap returns in a fashion similar to what biotech did in Health Care.

RVT’s first-half results were also affected by net losses in the Energy and Materials sectors. In the former, the energy equipment & services group had a sizable negative impact while the metals & mining group in Materials detracted most out of all the Fund’s industry groups. Net losses at the position level were relatively modest. ADTRAN manufactures telecommunications networking equipment and internetworking products. We began reducing our position in the first half, primarily due to our frustration with waiting several quarters for revenues from a telecom equipment deal with AT&T to produce revenue. ADTRAN then announced that this project had been effectively scrapped because AT&T was rethinking its capital spending plans. Absent this business, which we thought would be a key revenue driver going forward, ADTRAN’s outlook looked far less attractive relative to other opportunities. We chose to hold our shares of Anixter International as its stock slipped. The company provides security systems and solutions, makes enterprise cabling, and also distributes electrical and electronic wire. Its stock was hurt when the company reduced its organic growth outlook for the year in two of its core distribution businesses—the enterprise cabling and security solutions line and its electronic wire and cable segment. Still, we like its prospects for recovery. We also held shares of another detractor, Qalaa Holdings (formerly Citadel Capital), a leading investment company in Africa and the Middle East. Its stock suffered from fears that lower oil prices would result in a reduction in Egyptian investment by the oil-producing countries of the Persian Gulf. |

| |

| Turning to those areas that contributed to first-half returns, Industrials topped all of RVT’s 10 equity sectors and was positive relative to the Russell 2000. Top-contributing positions included The Hackett Group, which offers business consulting and technology implementation services. The firm’s shares moved higher in mid-May following the announcement of sterling results for its fiscal first quarter. Value Partners Group is a Hong Kong-based asset manager. Its stock rose sharply into May before correcting with the decline in Chinese stocks. We were pleased to see growth in its assets under management and improved performance and management fees, all of which helped its earnings. Nautilus, like The Hackett Group a top-10 holding at the end of June, makes branded health and fitness products such as Schwinn, Bowflex, and Nautilus itself. Its stock grew stronger after the firm reported double-digit earnings growth for its fiscal first quarter. |

| |

Top Contributors to Performance

Year-to-Date Through 6/30/15 (%)1 | | |

| | | |

| Hackett Group (The) | | 0.37 |

| |

| Value Partners Group | | 0.34 |

| |

| Nautilus | | 0.33 |

| |

| Insperity | | 0.18 |

| |

| On Assignment | | 0.17 |

| |

| 1 Includes dividends | | |

Top Detractors from Performance

Year-to-Date Through 6/30/15 (%)2 | | |

| | | |

| ADTRAN | | -0.14 |

| |

| Anixter International | | -0.13 |

| |

| Citadel Capital | | -0.13 |

| |

| Preformed Line Products | | -0.12 |

| |

| Ethan Allen Interiors | | -0.11 |

| |

| 2 Net of dividends | | |

| CURRENT POSITIONING AND OUTLOOK |

| At the end of June, RVT remained overweight in Industrials, Materials, and Information Technology—substantially so in the first two of the three sectors. Our focus remains on companies that look poised for profit margin expansion as their revenue growth normalizes in concert with a faster-moving U.S. economy. |

| 6 | 2015 Semiannual Report to Stockholders |

| PERFORMANCE AND PORTFOLIO REVIEW | | SYMBOLS MARKET PRICE RVT NAV XRVTX |

| |

| Performance | | | | | | | | | | | | | | | | | | |

| Average Annual Total Return (%) Through 6/30/15 |

| |

| | | JAN-JUN 2015** | | 1-YR | | 3-YR | | 5-YR | | 10-YR | | 15-YR | | 20-YR | | 25-YR | | SINCE INCEPTION (11/26/86) |

| |

| RVT (NAV) | | 1.69 | | -0.49 | | 15.08 | | 13.90 | | 7.34 | | 8.87 | | 10.26 | | 10.77 | | 10.61 |

| |

| *Not Annualized | | | | | | | | | | | | | | | |

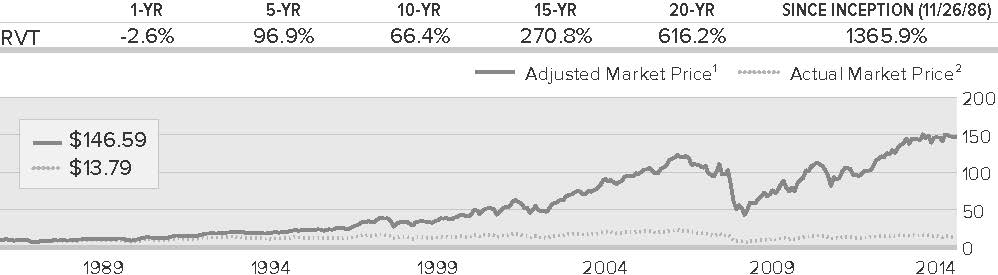

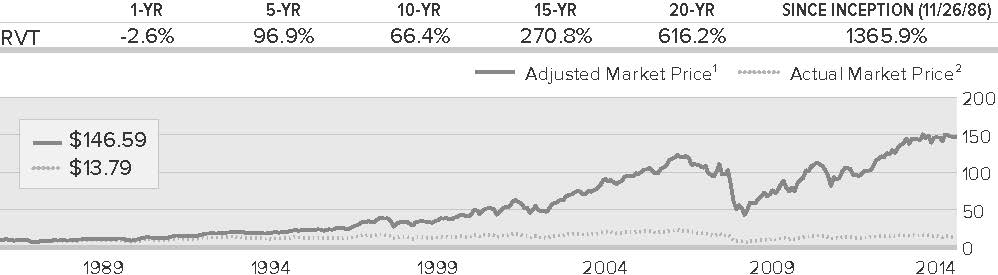

Market Price Performance History Since Inception (11/26/86)Cumulative Performance of Investment through 6/30/151

| 1 | Reflects the cumulative performance of an investment made by a stockholder who purchased one share at inception ($10.00 IPO), reinvested all distributions and fully participated in primary subscriptions of the Fund’s rights offerings. |

| 2 | Reflects the actual month-end market price movement of one share as it has traded on the NYSE. |

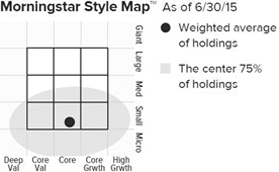

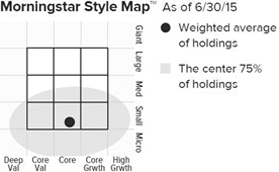

The Morningstar Style Map is the Morningstar Style BoxTM with the center 75% of fund holdings plotted as the Morningstar Ownership ZoneTM. The Morningstar Style Box is designed to reveal a fund’s investment strategy. The Morningstar Ownership Zone provides detail about a portfolio’s investment style by showing the range of stock sizes and styles. The Ownership Zone is derived by plotting each stock in the portfolio within the proprietary Morningstar Style Box. Over time, the shape and location of a fund’s ownership zone may vary. See page 58 for additional information. |

|

| Top 10 Positions | | |

| % of Net Assets | | |

| | | |

| Nautilus | | 1.2 |

| |

| Hackett Group (The) | | 1.1 |

| |

| Ritchie Bros. Auctioneers | | 1.1 |

| |

| HEICO Corporation | | 1.1 |

| |

| On Assignment | | 1.1 |

| |

| Woodward | | 0.9 |

| |

| SEI Investments | | 0.9 |

| |

| Forward Air | | 0.9 |

| |

| Newport Corporation | | 0.8 |

| |

| Reliance Steel & Aluminum | | 0.8 |

| |

|

| Portfolio Sector Breakdown | | |

| % of Net Assets | | |

| | | |

| Industrials | | 28.4 |

| |

| Information Technology | | 19.7 |

| |

| Financials | | 17.1 |

| |

| Consumer Discretionary | | 12.4 |

| |

| Materials | | 7.3 |

| |

| Health Care | | 5.0 |

| |

| Energy | | 2.8 |

| |

| Consumer Staples | | 2.5 |

| |

| Telecommunication Services | | 0.5 |

| |

| Utilities | | 0.1 |

| |

| Miscellaneous | | 3.0 |

| |

Cash and Cash Equivalents, Net of

Outstanding Line of Credit | | 1.2 |

| |

|

| Calendar Year Total Returns (%) | | |

| | | |

| YEAR | | RVT (NAV) |

| |

| 2014 | | 0.8 |

| |

| 2013 | | 34.1 |

| |

| 2012 | | 15.4 |

| |

| 2011 | | -10.1 |

| |

| 2010 | | 30.3 |

| |

| 2009 | | 44.6 |

| |

| 2008 | | -45.6 |

| |

| 2007 | | 5.0 |

| |

| 2006 | | 19.5 |

| |

| 2005 | | 8.4 |

| |

| 2004 | | 21.4 |

| |

| 2003 | | 40.8 |

| |

| 2002 | | -15.6 |

| |

| 2001 | | 15.2 |

| |

| 2000 | | 16.6 |

| |

|

| Portfolio Diagnostics | | |

| | | |

| Fund Net Assets | | $1,224 million |

| |

| Number of Holdings | | 503 |

| |

| Turnover Rate | | 17% |

| |

| Net Asset Value | | $15.85 |

| |

| Market Price | | $13.79 |

| |

| Average Market Capitalization1 | | $1,344 million |

| |

| Weighted Average P/E Ratio2,3 | | 20.4x |

| |

| Weighted Average P/B Ratio2 | | 2.6x |

| |

| Holdings ≥ 75% of Total Investments | | 159 |

| |

| Active Share4 | | 90% |

| |

| U.S. Investments (% of Net Assets) | | 81.8% |

| |

| Non-U.S. Investments (% of Net Assets) | | 17.0% |

| |

| 1 | Geometric Average. This weighted calculation uses each portfolio holding’s market cap in a way designed to not skew the effect of very large or small holdings; instead, it aims to better identify the portfolio’s center, which Royce believes offers a more accurate measure of average market cap than a simple mean or median. | |

| 2 | Harmonic Average. This weighted calculation evaluates a portfolio as if it were a single stock and measures it overall. It compares the total market value of the portfolio to the portfolio’s share in the earnings or book value, as the case may be, of its underlying stocks. | |

| 3 | The Fund’s P/E ratio calculation excludes companies with zero or negative earnings (12% of portfolio holdings as of 6/30/15). | |

| 4 | Active Share is the sum of the absolute values of the different weightings of each holding in the Fund versus each holding in the benchmark, divided by two. | |

| Important Performance and Risk Information |

| All performance information reflects past performance, is presented on a total return basis, and reflects the reinvestment of distributions. Past performance is no guarantee of future results. Current performance may be higher or lower than performance quoted. Returns as of the most recent month-end may be obtained at www.roycefunds.com. The market price of the Fund’s shares will fluctuate, so that shares may be worth more or less than their original cost when sold. The Fund invests primarily in securities of small- and micro-cap companies, which may involve considerably more risk than investing in larger-cap companies. The Fund’s broadly diversified portfolio does not ensure a profit or guarantee against loss. Regarding the “Top Contributors” and “Top Detractors” tables shown on page 6, the sum of all contributors to, and all detractors from, performance for all securities in the portfolio would approximate the Fund’s year-to date performance for 2015. |

| 2015 Semiannual Report to Stockholders | 7 |

| | | MANAGER’S DISCUSSION |

| | | |

| Royce Micro-Cap Trust (RMT) | | |

| | | |

|

| Chuck Royce |

| FUND PERFORMANCE |

| For the year-to-date period ended June 30, 2015, Royce Micro-Cap Trust (NYSE: RMT) was down 0.5% on an NAV (net asset value) basis and fell 4.2% on a market price basis, trailing both of its unleveraged benchmarks. The small-cap Russell 2000 Index gained 4.8% while the Russell Microcap Index increased 6.0% for the same period. The Fund got off to a difficult start, losing more than each benchmark during the bearish January and underperforming for the first quarter as a whole—RMT lost 0.8% on an NAV basis and was down 0.6% on a market price basis compared to a gain of 4.3% for the Russell 2000 and an increase of 3.1% for the Russell Microcap in the opening quarter of 2015. The second quarter was similarly underwhelming. RMT was up 0.3% on an NAV basis but slipped 3.6% based on market price versus respective second-quarter gains of 0.4% and 2.8% for the small-cap and micro-cap indexes. Long-term results offered more encouragement. The Fund outperformed the Russell 2000 on an NAV basis for the three-, 15-, 20-year, and since inception (12/14/93) periods ended June 30, 2015 while also beating the Russell Microcap for the 10- and 15-year periods ended June 30, 2015. (Returns for the Russell Microcap only go back to 2000.) RMT’s average annual NAV total return since inception was 11.2%. |

| |

| WHAT WORKED... AND WHAT DIDN’T |

| When comparing the Fund’s results for the semiannual period to those of its benchmarks, three sectors stand out as problem areas—Consumer Discretionary, Health Care, and Information Technology. Only the first of these sectors, however, posted a net loss in the portfolio, mostly due to dismal results for five industries: the diversified consumer services, media, specialty retail, household durables, and textile, apparel & luxury goods groups. Health Care cut both ways in the first half. It led all of the portfolio’s 10 equity sectors by a good-sized margin, yet its performance paled before that area’s results within the Russell 2000 and Microcap indexes. Much of this can be traced to the Fund being significantly underweight the sector as a whole as well as having very little exposure to biotech stocks, which dominated first-half results for both of RMT’s benchmarks. Most biotech companies, however, lack the fundamental attributes we seek in our holdings. While Information Technology showed a net gain in the Fund for the first half, it also came up short versus that same sector’s results in the small-cap and micro-cap indexes. Two industry groups—Internet software & services and software—fared poorly versus the indexes. As was the case with Consumer Discretionary, we were overweight Information Technology at the end of June and believed that many holdings in both sectors can continue to rebound in concert with a more robustly recovering economy. |

| |

The Industrials sector posted respectable net gains on both an absolute and relative basis, keyed by a terrific performance from the Fund’s top contributor, Frontier Services Group. The Hong Kong-based company provides logistical services in Africa and benefited from a large capital gain on a portfolio investment and investor perception that its enhanced liquidity position will help fund FSG’s plan to expand its logistics network. Two of RMT’s top-10 holdings also made solid contributions. Shares of Ohio-based investment management firm Diamond Hill Investment Group climbed over much of the last few years, boosted most recently by strong earnings and growing revenues. Nautilus offers branded health and fitness products such as Schwinn, Bowflex, and Nautilus itself. Its stock gained strength after the firm reported double-digit earnings growth for its fiscal first quarter, part of a multi-year turnaround that kicked off when new management came on board four years ago. New products and operational discipline helped to improve profitability.

As for those positions that detracted from results, we added shares of LeapFrog Enterprises early in the year when its stock was falling. The company makes technology-based educational platforms with curriculum interactive software content and standalone products. Around the same time the firm reported a fiscal third-quarter loss (caused primarily by poor sales and late product shipments), a class action suit was announced. We like its solid brand and think its business has value. EZCORP owns and operates pawn shops. Its stock fell sharply in the first quarter as the firm revised earnings downward before it declined further on news in April that it would delay its fiscal second-quarter earnings release because of an ongoing review of a loan portfolio. We reduced our position in March. Value Line produces investment-related periodical publications and also provides investment advisory services to mutual funds, institutions, and individuals. While the company remained solidly profitable and pays a dividend, its shares trended downward through much of the first half. We were happy to hold shares at the end of June. |

Top Contributors to Performance

Year-to-Date Through 6/30/15 (%)1 | | |

| |

| Frontier Services Group | | 0.97 |

| |

| Diamond Hill Investment Group | | 0.39 |

| |

| Nautilus | | 0.27 |

| |

| Smith & Wesson Holding Corporation | | 0.24 |

| |

| GTT Communications | | 0.22 |

| |

| 1 Includes dividends | | |

Top Detractors from Performance

Year-to-Date Through 6/30/15 (%)2 | | |

| |

| LeapFrog Enterprises Cl. A | | -0.32 |

| |

| EZCORP Cl. A | | -0.24 |

| |

| Value Line | | -0.22 |

| |

| Qumu Corporation | | -0.20 |

| |

| Graham Corporation | | -0.20 |

| |

| 2 Net of dividends | | |

| CURRENT POSITIONING AND OUTLOOK |

| The Fund had a significant overweight in Industrials and was also overweight in Consumer Discretionary, Information Technology, and Materials at the end of the semiannual period. We continue to believe that economic growth will accelerate, which should help portfolio holdings in these more cyclical sectors. |

| 8 | 2015 Semiannual Report to Stockholders |

| PERFORMANCE AND PORTFOLIO REVIEW | | SYMBOLS MARKET PRICE RMT NAV XOTCX |

| |

| Performance | | | | | | | | | | | | | | | | |

| Average Annual Total Return (%) Through 6/30/15 | | |

| |

| | | JAN-JUN 2015* | | 1-YR | | 3-YR | | 5-YR | | 10-YR | | 15-YR | | 20-YR | | SINCE INCEPTION (12/14/93) |

| |

| RMT (NAV) | | -0.52 | | -0.05 | | 17.94 | | 16.05 | | 8.25 | | 10.15 | | 11.16 | | 11.20 |

| |

| *Not Annualized | | | | | | | | | | | | | |

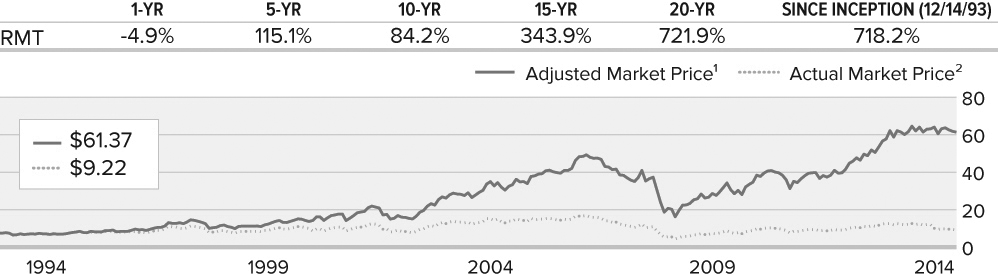

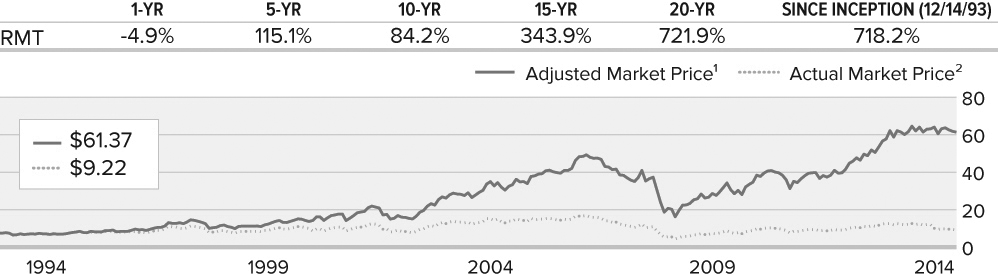

Market Price Performance History Since Inception (12/14/93)Cumulative Performance of Investment1

| 1 | Reflects the cumulative performance experience of a continuous common stockholder who purchased one share at inception ($7.50 IPO), reinvested all distributions and fully participated in the primary subscription of the Fund’s 1994 rights offering. |

| 2 | Reflects the actual month-end market price movement of one share as it has traded on NYSE and, prior to 12/1/03, on the Nasdaq. |

| The Morningstar Style Map is the Morningstar Style BoxTM with the center 75% of fund holdings plotted as the Morningstar Ownership ZoneTM. The Morningstar Style Box is designed to reveal a fund’s investment strategy. The Morningstar Ownership Zone provides detail about a portfolio’s investment style by showing the range of stock sizes and styles. The Ownership Zone is derived by plotting each stock in the portfolio within the proprietary Morningstar Style Box. Over time, the shape and location of a fund’s ownership zone may vary. See page 58 for additional information. |

|

| Top 10 Positions | | |

| % of Net Assets | | |

| | | |

| Diamond Hill Investment Group | | 1.2 |

| |

| Integrated Electrical Services | | 1.1 |

| |

| Atrion Corporation | | 1.1 |

| |

| MVC Capital | | 1.1 |

| |

| Seneca Foods | | 1.0 |

| |

| Nautilus | | 1.0 |

| |

| Newport Corporation | | 1.0 |

| |

| NN | | 1.0 |

| |

| Heritage-Crystal Clean | | 0.9 |

| |

| Mesa Laboratories | | 0.9 |

| |

|

| Portfolio Sector Breakdown | | |

| % of Net Assets | | |

| | | |

| Information Technology | | 22.6 |

| |

| Industrials | | 20.7 |

| |

| Financials | | 19.8 |

| |

| Consumer Discretionary | | 16.6 |

| |

| Health Care | | 10.7 |

| |

| Materials | | 6.4 |

| |

| Consumer Staples | | 2.8 |

| |

| Energy | | 1.7 |

| |

| Utilities | | 0.3 |

| |

| Telecommunication Services | | 0.1 |

| |

| Miscellaneous | | 4.2 |

| |

| Preferred Stock | | 0.3 |

| |

Outstanding Line of Credit, Net of Cash

and Cash Equivalents | | -6.2 |

| |

|

| Calendar Year Total Returns (%) | | |

| | | |

| YEAR | | RVT (NAV) |

| |

| 2014 | | 3.5 |

| |

| 2013 | | 44.5 |

| |

| 2012 | | 17.3 |

| |

| 2011 | | -7.7 |

| |

| 2010 | | 28.5 |

| |

| 2009 | | 46.5 |

| |

| 2008 | | -45.5 |

| |

| 2007 | | 0.6 |

| |

| 2006 | | 22.5 |

| |

| 2005 | | 6.8 |

| |

| 2004 | | 18.7 |

| |

| 2003 | | 55.5 |

| |

| 2002 | | -13.8 |

| |

| 2001 | | 23.4 |

| |

| 2000 | | 10.9 |

| |

|

| Portfolio Diagnostics | | |

| | | |

| Fund Net Assets | | $376 million |

| |

| Number of Holdings | | 358 |

| |

| Turnover Rate | | 17% |

| |

| Net Asset Value | | $10.77 |

| |

| Market Price | | $9.22 |

| |

| Net Leverage1 | | 6% |

| |

| Average Market Capitalization2 | | $349 million |

| |

| Weighted Average P/E Ratio3,4 | | 19.6x |

| |

| Weighted Average P/B Ratio3 | | 2.1x |

| |

| Holdings ≥ 75% of Total Investments | | 155 |

| |

| Active Share5 | | 95% |

| |

| U.S. Investments (% of Net Assets) | | 90.8% |

| |

| Non-U.S. Investments (% of Net Assets) | | 15.4% |

| |

| 1 | Net leverage is the percentage, in excess of 100%, of the total value of equity type investments, divided by net assets. |

| 2 | Geometric Average. This weighted calculation uses each portfolio holding’s market cap in a way designed to not skew the effect of very large or small holdings; instead, it aims to better identify the portfolio’s center, which Royce believes offers a more accurate measure of average market cap than a simple mean or median. |

| 3 | Harmonic Average. This weighted calculation evaluates a portfolio as if it were a single stock and measures it overall. It compares the total market value of the portfolio to the portfolio’s share in the earnings or book value, as the case may be, of its underlying stocks. |

| 4 | The Fund’s P/E ratio calculation excludes companies with zero or negative earnings (25% of portfolio holdings as of 6/30/15). |

| 5 | Active Share is the sum of the absolute values of the different weightings of each holding in the Fund versus each holding in the benchmark, divided by two. |

Important Performance and Risk Information

| All performance information reflects past performance, is presented on a total return basis, and reflects the reinvestment of distributions. Past performance is no guarantee of future results. Current performance may be higher or lower than performance quoted. Returns as of the most recent month-end may be obtained at www.roycefunds.com. Certain immaterial adjustments were made to the net assets of Royce Micro-Cap Trust at 12/31/12 and 12/31/14 for financial reporting purposes, and as a result the net asset value originally calculated on that date and the total return based on that net asset value differs from the adjusted net asset value and total return reported in the Financial Highlights. The market price of the Fund’s shares will fluctuate, so that shares may be worth more or less than their original cost when sold. The Fund normally invests in micro-cap companies, which may involve considerably more risk than investments in securities of larger-cap companies. The Fund’s broadly diversified portfolio does not ensure a profit or guarantee against loss. From time to time, the Fund may invest a significant portion of its net assets in foreign securities, which may involve political, economic, currency and other risks not encountered in U.S. investments. Regarding the “Top Contributors” and “Top Detractors” tables shown on page 8, the sum of all contributors to, and all detractors from, performance for all securities in the portfolio would approximate the Fund’s year-to-date performance for 2015. |

| 2015 Semiannual Report to Stockholders | 9 |

| | | MANAGER’S DISCUSSION |

| | | |

| Royce Global Value Trust (RGT) | | |

| | | |

|

| Chuck Royce |

| FUND PERFORMANCE |

| Royce Global Value Trust gained 5.6% on an NAV (net asset value) basis and 3.4% on a market price basis for the year-to-date period ended June 30, 2015, lagging its benchmark, the Russell Global Small Cap Index, which advanced 6.4% for the same period. For most U.S. stocks, 2015 started on a discouraging note while non-U.S. equities had more mixed results. We were disappointed to see the Fund shed more value than the benchmark in January, lag in the bullish February, in which results were driven largely by U.S. and European equities, and fall back into the red in March. In the first quarter, Global Value Trust was up 0.6% on an NAV basis and 0.1% on a market price basis versus 3.9% for the index. The Fund’s fortunes shifted in the opening month of the second quarter, when it held a generous lead over the global small-cap index on an NAV basis (+5.7% versus +2.3%). Unfortunately, this advantage did not last, and the Fund fell behind during May, when returns were lower though positive, and June, which turned decidedly bearish late in the month thanks to the Greek default and the quickening pace of decline for Chinese stocks. Global Value Trust, however, hung on to its relative edge thanks to its terrific April. For the second quarter, the Fund rose 4.9% on an NAV basis and 3.2% on a market price basis, outpacing the benchmark, which advanced 2.4% for the same period. While the Fund’s initial results have been underwhelming on both an absolute and relative basis, we remain confident that our disciplined, bottom-up approach can be successful. |

| |

| WHAT WORKED... AND WHAT DIDN’T |

| Of the Fund’s eight equity sectors, Financials and Industrials—followed by Consumer Discretionary—led performance in the semiannual period. We were pleased that the first of these groups also achieved better results than the sector did within the portfolio’s benchmark while the second had a modestly negative impact relative to the benchmark. Three other sectors—Information Technology, Materials, and Health Care—had a more pronounced adverse effect on relative results. The first two were the largest detractors on an absolute basis as well. The Fund’s two biggest net losses at the position level came from Information Technology and are based in Germany. Aixtron engineers and manufactures metal organic chemical vapor deposition (MOVD) systems used to produce compound semiconductor layer structures for use in LED, laser, solar cell, and other applications. Its stock has been mostly trending downward over the last couple of years and began to fall more steadily late in 2014 and into 2015 as growth in revenues and earnings remained poor. We sold our position in mid-March. LPKF Laser & Electronics develops specialized mechanical engineering products for electronics production, the automotive industry, and in the manufacture of solar cells. After a disappointing 2014, its shares rallied briefly in February only to begin falling again in March after a disappointing first-quarter report led to a wave of selling. We reduced our position in the first half. |

At the country level, holdings in the U.S. and Brazil had the largest negative impact on results in the first half. Net losses were somewhat mitigated, however, by holdings in Japan, the U.K., and Hong Kong. The advantage for the third of those nations was largely due to a position in the capital markets industry. Also a top-10 position at the end of June, Value Partners Group is a Hong Kong-based asset manager with a value orientation similar to our own. Its shares benefited from the meteoric rise in the Hong Kong and Shanghai markets in early May before cooling off with the bear market for Chinese stocks in June. We were pleased to see growth in its assets under management and improved performance and management fees, all of which helped its earnings. We trimmed our position before the correction. London-based Clarkson was the Fund’s biggest position at the end of June and second-largest contributor to performance in the first six months of 2015. An investment holding company whose subsidiaries provide integrated shipping services worldwide, its stock began to rise in February and did well through the remainder of 2015’s first half. Strong results for fiscal 2014, which were well ahead of market expectations, and a double-digit growth outlook helped drive performance. The company’s entrance into the FTSE 250 index on the London Stock Exchange in mid-April, a move which mandates that U.K. index funds invest in the stock, also played a part. |

Top Contributors to Performance

Year-to-Date Through 6/30/15 (%)1 | | |

| |

| Value Partners Group | | 0.80 |

| |

| Clarkson | | 0.64 |

| |

| Relo Holdings | | 0.49 |

| |

| Pico Far East Holdings | | 0.41 |

| |

| Trancom | | 0.31 |

| |

| 1 Includes dividends | | |

Top Detractors from Performance

Year-to-Date Through 6/30/15 (%)2 | | |

| |

| Aixtron ADR | | -0.22 |

| |

| LPKF Laser & Electronics | | -0.20 |

| |

| New World Department Store China | | -0.19 |

| |

| Daphne International Holdings | | -0.19 |

| |

| RHJ International | | -0.19 |

| |

| 2 Net of dividends | | |

| CURRENT POSITIONING AND OUTLOOK |

| As the global economy continues to recover, we continue to look for opportunities in several sectors and regions. At the end of the semiannual period Global Value Trust had substantial overweights in Industrials and Materials while also having greater exposure than its benchmark to Consumer Discretionary and Financials. At the country level the portfolio had far less exposure to the U.S. while having significantly greater exposure to the U.K., Canada, France, Hong Kong, Switzerland, Germany, and Brazil. |

| 10 | 2015 Semiannual Report to Stockholders |

| PERFORMANCE AND PORTFOLIO REVIEW | | SYMBOLS MARKET PRICE RGT NAV XRGTX |

| |

| Performance | | | | | | |

| Average Annual Total Return (%) Through 6/30/15 | | | | |

| |

| | | JAN-JUN 2015* | | 1-YR | | SINCE INCEPTION (10/17/13) |

| |

| RGT (NAV) | | 5.62 | | -6.18 | | 1.04 |

| |

| *Not Annualized | | | | | | |

| The Morningstar Style Map is the Morningstar Style BoxTM with the center 75% of fund holdings plotted as the Morningstar Ownership ZoneTM. The Morningstar Style Box is designed to reveal a fund’s investment strategy. The Morningstar Ownership Zone provides detail about a portfolio’s investment style by showing the range of stock sizes and styles. The Ownership Zone is derived by plotting each stock in the portfolio within the proprietary Morningstar Style Box. Over time, the shape and location of a fund’s ownership zone may vary. See page 58 for additional information. |

|

| Top 10 Positions | | |

| % of Net Assets | | |

| |

| Clarkson | | 2.0 |

| |

| Genworth MI Canada | | 2.0 |

| |

| Value Partners Group | | 1.6 |

| |

| CETIP - Mercados Organizados | | 1.5 |

| |

| Relo Holdings | | 1.4 |

| |

| Consort Medical | | 1.3 |

| |

| TGS-NOPEC Geophysical | | 1.3 |

| |

| New World Department Store China | | 1.2 |

| |

| Shimano | | 1.2 |

| |

| Ashmore Group | | 1.2 |

| |

|

| Portfolio Sector Breakdown | | |

| % of Net Assets | | |

| |

| Industrials | | 25.9 |

| |

| Financials | | 23.0 |

| |

| Consumer Discretionary | | 17.1 |

| |

| Information Technology | | 13.5 |

| |

| Materials | | 11.6 |

| |

| Health Care | | 9.3 |

| |

| Energy | | 3.5 |

| |

| Consumer Staples | | 1.9 |

| |

Outstanding Line of Credit, Net of Cash

and Cash Equivalents | | -5.8 |

| |

|

| Calendar Year Total Returns (%) | | |

| | | |

| YEAR | | RGT (NAV) |

| |

| 2014 | | -6.2 |

| |

|

| Portfolio Country Breakdown1,2 | | |

| % of Net Assets | | |

| |

| United States | | 14.8 |

| |

| United Kingdom | | 13.4 |

| |

| Japan | | 11.9 |

| |

| Canada | | 10.1 |

| |

| France | | 8.7 |

| |

| Hong Kong | | 7.4 |

| |

| Switzerland | | 5.3 |

| |

| Germany | | 4.1 |

| |

| Brazil | | 3.6 |

| |

| 1 | Represents countries that are 3% or more of net assets. |

| 2 | Securities are categorized by the country of their headquarters. |

|

| Portfolio Diagnostics | | |

| |

| Fund Net Assets | | $101 million |

| |

| Number of Holdings | | 269 |

| |

| Turnover Rate | | 34% |

| |

| Net Asset Value | | $9.77 |

| |

| Market Price | | $8.31 |

| |

| Net Leverage1 | | 6% |

| |

| Average Market Capitalization2 | | $1,330 million |

| |

| Weighted Average P/E Ratio3,4 | | 18.6x |

| |

| Weighted Average P/B Ratio3 | | 2.7x |

| |

| Holdings ≥ 75% of Total Investments | | 111 |

| |

| Active Share5 | | 98% |

| |

| 1 | Net leverage is the percentage, in excess of 100%, of the total value of equity type investments, divided by net assets. |

| 2 | Geometric Average. This weighted calculation uses each portfolio holding’s market cap in a way designed to not skew the effect of very large or small holdings; instead, it aims to better identify the portfolio’s center, which Royce believes offers a more accurate measure of average market cap than a simple mean or median. |

| 3 | Harmonic Average. This weighted calculation evaluates a portfolio as if it were a single stock and measures it overall. It compares the total market value of the portfolio to the portfolio’s share in the earnings or book value, as the case may be, of its underlying stocks. |

| 4 | The Fund’s P/E ratio calculation excludes companies with zero or negative earnings (6% of portfolio holdings as of 6/30/15). |

| 5 | Active Share is the sum of the absolute values of the different weightings of each holding in the Fund versus each holding in the benchmark, divided by two. |

Important Performance and Risk Information

All performance information reflects past performance, is presented on a total return basis, and reflects the reinvestment of distributions. Past performance is no guarantee of future results. Current performance may be higher or lower than performance quoted. Returns as of the most recent month-end may be obtained at www.roycefunds.com. The market price of the Fund’s shares will fluctuate, so that shares may be worth more or less than their original cost when sold. The Fund invests primarily in securities of small- and micro-cap companies, which may involve considerably more risk than investments in securities of larger-cap companies. The Fund’s broadly diversified portfolio does not ensure a profit or guarantee against loss. From time to time, the Fund may invest a significant portion of its net assets in foreign securities, which may involve political, economic, currency and other risks not encountered in U.S. investments. Regarding the “Top Contributors” and “Top Detractors” tables shown on page 10, the sum of all contributors to, and all detractors from, performance for all securities in the portfolio would approximate the Fund’s year-to-date performance for 2015. |

| 2015 Semiannual Report to Stockholders | 11 |

History Since Inception

The following table details the share accumulations by an initial investor in the Funds who reinvested all distributions and participated fully in primary subscriptions for each of the rights offerings. Full participation in distribution reinvestments and rights offerings can maximize the returns available to a long-term investor. This table should be read in conjunction with the Performance and Portfolio Reviews of the Funds.

| HISTORY | | AMOUNT INVESTED | | PURCHASE PRICE1 | | SHARES | | NAV VALUE2 | | MARKET VALUE2 | |

| |

| Royce Value Trust |

| 11/26/86 | | Initial Purchase | | $ | 10,000 | | $ | 10.000 | | | 1,000 | | $ | 9,280 | | $ | 10,000 | |

| |

| 10/15/87 | | Distribution $0.30 | | | | | | 7.000 | | | 42 | | | | | | | |

| |

| 12/31/87 | | Distribution $0.22 | | | | | | 7.125 | | | 32 | | | 8,578 | | | 7,250 | |

| |

| 12/27/88 | | Distribution $0.51 | | | | | | 8.625 | | | 63 | | | 10,529 | | | 9,238 | |

| |

| 9/22/89 | | Rights Offering | | | 405 | | | 9.000 | | | 45 | | | | | | | |

| |

| 12/29/89 | | Distribution $0.52 | | | | | | 9.125 | | | 67 | | | 12,942 | | | 11,866 | |

| |

| 9/24/90 | | Rights Offering | | | 457 | | | 7.375 | | | 62 | | | | | | | |

| |

| 12/31/90 | | Distribution $0.32 | | | | | | 8.000 | | | 52 | | | 11,713 | | | 11,074 | |

| |

| 9/23/91 | | Rights Offering | | | 638 | | | 9.375 | | | 68 | | | | | | | |

| |

| 12/31/91 | | Distribution $0.61 | | | | | | 10.625 | | | 82 | | | 17,919 | | | 15,697 | |

| |

| 9/25/92 | | Rights Offering | | | 825 | | | 11.000 | | | 75 | | | | | | | |

| |

| 12/31/92 | | Distribution $0.90 | | | | | | 12.500 | | | 114 | | | 21,999 | | | 20,874 | |

| |

| 9/27/93 | | Rights Offering | | | 1,469 | | | 13.000 | | | 113 | | | | | | | |

| |

| 12/31/93 | | Distribution $1.15 | | | | | | 13.000 | | | 160 | | | 26,603 | | | 25,428 | |

| |

| 10/28/94 | | Rights Offering | | | 1,103 | | | 11.250 | | | 98 | | | | | | | |

| |

| 12/19/94 | | Distribution $1.05 | | | | | | 11.375 | | | 191 | | | 27,939 | | | 24,905 | |

| |

| 11/3/95 | | Rights Offering | | | 1,425 | | | 12.500 | | | 114 | | | | | | | |

| |

| 12/7/95 | | Distribution $1.29 | | | | | | 12.125 | | | 253 | | | 35,676 | | | 31,243 | |

| |

| 12/6/96 | | Distribution $1.15 | | | | | | 12.250 | | | 247 | | | 41,213 | | | 36,335 | |

| |

| 1997 | | Annual distribution total $1.21 | | | | | | 15.374 | | | 230 | | | 52,556 | | | 46,814 | |

| |

| 1998 | | Annual distribution total $1.54 | | | | | | 14.311 | | | 347 | | | 54,313 | | | 47,506 | |

| |

| 1999 | | Annual distribution total $1.37 | | | | | | 12.616 | | | 391 | | | 60,653 | | | 50,239 | |

| |

| 2000 | | Annual distribution total $1.48 | | | | | | 13.972 | | | 424 | | | 70,711 | | | 61,648 | |

| |

| 2001 | | Annual distribution total $1.49 | | | | | | 15.072 | | | 437 | | | 81,478 | | | 73,994 | |

| |

| 2002 | | Annual distribution total $1.51 | | | | | | 14.903 | | | 494 | | | 68,770 | | | 68,927 | |

| |

| 1/28/03 | | Rights Offering | | | 5,600 | | | 10.770 | | | 520 | | | | | | | |

| |

| 2003 | | Annual distribution total $1.30 | | | | | | 14.582 | | | 516 | | | 106,216 | | | 107,339 | |

| |

| 2004 | | Annual distribution total $1.55 | | | | | | 17.604 | | | 568 | | | 128,955 | | | 139,094 | |

| |

| 2005 | | Annual distribution total $1.61 | | | | | | 18.739 | | | 604 | | | 139,808 | | | 148,773 | |

| |

| 2006 | | Annual distribution total $1.78 | | | | | | 19.696 | | | 693 | | | 167,063 | | | 179,945 | |

| |

| 2007 | | Annual distribution total $1.85 | | | | | | 19.687 | | | 787 | | | 175,469 | | | 165,158 | |

| |

| 2008 | | Annual distribution total $1.723 | | | | | | 12.307 | | | 1,294 | | | 95,415 | | | 85,435 | |

| |

| 3/11/09 | | Distribution $0.323 | | | | | | 6.071 | | | 537 | | | 137,966 | | | 115,669 | |

| |

| 12/2/10 | | Distribution $0.03 | | | | | | 13.850 | | | 23 | | | 179,730 | | | 156,203 | |

| |

| 2011 | | Annual distribution total $0.783 | | | | | | 13.043 | | | 656 | | | 161,638 | | | 139,866 | |

| |

| 2012 | | Annual distribution total $0.80 | | | | | | 13.063 | | | 714 | | | 186,540 | | | 162,556 | |

| |

| 2013 | | Annual distribution total $2.194 | | | | | | 16.647 | | | 1,658 | | | 250,219 | | | 220,474 | |

| |

| 2014 | | Annual distribution total $1.82 | | | | | | 14.840 | | | 1,757 | | | 252,175 | | | 222,516 | |

| |

| 2015 | | Year-to-Date distribution total $0.59 | | | | | | 14.196 | | | 652 | | | | | | | |

| |

| 6/30/15 | | | | $ | 21,922 | | | | | | 16,180 | | $ | 256,453 | | $ | 223,122 | |

| |

| | |

| 1 | The purchase price used for annual distribution totals is a weighted average of the distribution reinvestment prices for the year. |

| 2 | Values are stated as of December 31 of the year indicated, after reinvestment of distributions, other than for initial purchase. |

| 3 | Includes a return of capital. |

| 4 | Includes Royce Global Value Trust spin-off of $1.40 per share. |

| 12 | 2015 Semiannual Report to Stockholders |

| HISTORY | | | AMOUNT INVESTED | | | PURCHASE PRICE1 | | | SHARES | | | NAV VALUE2 | | | MARKET VALUE2 | |

| |

| Royce Micro-Cap Trust |

| 12/14/93 | | Initial Purchase | | $ | 7,500 | | $ | 7.500 | | | 1,000 | | $ | 7,250 | | $ | 7,500 | |

| |

| 10/28/94 | | Rights Offering | | | 1,400 | | | 7.000 | | | 200 | | | | | | | |

| |

| 12/19/94 | | Distribution $0.05 | | | | | | 6.750 | | | 9 | | | 9,163 | | | 8,462 | |

| |

| 12/7/95 | | Distribution $0.36 | | | | | | 7.500 | | | 58 | | | 11,264 | | | 10,136 | |

| |

| 12/6/96 | | Distribution $0.80 | | | | | | 7.625 | | | 133 | | | 13,132 | | | 11,550 | |

| |

| 12/5/97 | | Distribution $1.00 | | | | | | 10.000 | | | 140 | | | 16,694 | | | 15,593 | |

| |

| 12/7/98 | | Distribution $0.29 | | | | | | 8.625 | | | 52 | | | 16,016 | | | 14,129 | |

| |

| 12/6/99 | | Distribution $0.27 | | | | | | 8.781 | | | 49 | | | 18,051 | | | 14,769 | |

| |

| 12/6/00 | | Distribution $1.72 | | | | | | 8.469 | | | 333 | | | 20,016 | | | 17,026 | |

| |

| 12/6/01 | | Distribution $0.57 | | | | | | 9.880 | | | 114 | | | 24,701 | | | 21,924 | |

| |

| 2002 | | Annual distribution total $0.80 | | | | | | 9.518 | | | 180 | | | 21,297 | | | 19,142 | |

| |

| 2003 | | Annual distribution total $0.92 | | | | | | 10.004 | | | 217 | | | 33,125 | | | 31,311 | |

| |

| 2004 | | Annual distribution total $1.33 | | | | | | 13.350 | | | 257 | | | 39,320 | | | 41,788 | |

| |

| 2005 | | Annual distribution total $1.85 | | | | | | 13.848 | | | 383 | | | 41,969 | | | 45,500 | |

| |

| 2006 | | Annual distribution total $1.55 | | | | | | 14.246 | | | 354 | | | 51,385 | | | 57,647 | |

| |

| 2007 | | Annual distribution total $1.35 | | | | | | 13.584 | | | 357 | | | 51,709 | | | 45,802 | |

| |

| 2008 | | Annual distribution total $1.193 | | | | | | 8.237 | | | 578 | | | 28,205 | | | 24,807 | |

| |

| 3/11/09 | | Distribution $0.223 | | | | | | 4.260 | | | 228 | | | 41,314 | | | 34,212 | |

| |

| 12/2/10 | | Distribution $0.08 | | | | | | 9.400 | | | 40 | | | 53,094 | | | 45,884 | |

| |

| 2011 | | Annual distribution total $0.533 | | | | | | 8.773 | | | 289 | | | 49,014 | | | 43,596 | |

| |

| 2012 | | Annual distribution total $0.51 | | | | | | 9.084 | | | 285 | | | 57,501 | | | 49,669 | |

| |

| 2013 | | Annual distribution total $1.38 | | | | | | 11.864 | | | 630 | | | 83,110 | | | 74,222 | |

| |

| 2014 | | Annual distribution total $2.90 | | | | | | 10.513 | | | 1,704 | | | 86,071 | | | 76,507 | |

| |

| 2015 | | Year-to-Date distribution total $0.45 | | | | | | 9.597 | | | 360 | | | | | | | |

| |

| 6/30/15 | | | | $ | 8,900 | | | | | | 7,950 | | $ | 85,622 | | $ | 73,299 | |

| |

| Royce Global Value Trust |

| 10/17/13 | | Initial Purchase | | $ | 8,975 | | $ | 8.975 | | | 1,000 | | $ | 9,780 | | $ | 8,975 | |

| |

| 12/11/14 | | Distribution $0.15 | | | | | | 7.970 | | | 19 | | | 9,426 | | | 8,193 | |

| |

| 6/30/15 | | | | $ | 8,975 | | | | | | 1,019 | | $ | 9,956 | | $ | 8,468 | |

| |

| | | | | | | | | | | | | | | | | | | |

| 1 | The purchase price used for annual distribution totals is a weighted average of the distribution reinvestment prices for the year. |

| 2 | Values are stated as of December 31 of the year indicated, after reinvestment of distributions, other than for initial purchase. |

| 3 | Includes a return of capital. |

| 2015 Semiannual Report to Stockholders | 13 |

Distribution Reinvestment and Cash Purchase Options

Why should I reinvest my distributions?

By reinvesting distributions, a stockholder can maintain an undiluted investment in the Fund. The regular reinvestment of distributions has a significant impact on stockholder returns. In contrast, the stockholder who takes distributions in cash is penalized when shares are issued below net asset value to other stockholders.

How does the reinvestment of distributions from the Royce closed-end funds work?

The Funds automatically issue shares in payment of distributions unless you indicate otherwise. The shares are generally issued at the lower of the market price or net asset value on the valuation date.

How does this apply to registered stockholders?

If your shares are registered directly with a Fund, your distributions are automatically reinvested unless you have otherwise instructed the Funds’ transfer agent, Computershare, in writing, in which case you will receive your distribution in cash. A registered stockholder also may have the option to receive the distribution in the form of a stock certificate.

What if my shares are held by a brokerage firm or a bank?

If your shares are held by a brokerage firm, bank, or other intermediary as the stockholder of record, you should contact your brokerage firm or bank to be certain that it is automatically reinvesting distributions on your behalf. If they are unable to reinvest distributions on behalf, you should have your shares registered in your name in order to participate.

What other features are available for registered stockholders?

The Distribution Reinvestment and Cash Purchase Plans also allow registered stockholders to make optional cash purchases of shares of a Fund’s common stock directly through Computershare on a monthly basis, and to deposit certificates representing your RVT and RMT shares with Computershare for safekeeping. (RGT does not issue shares in certificated form). Plan participants are subject to a $0.75 service fee for each voluntary cash purchase under the Plans. The Funds’ investment adviser absorbed all commissions on optional cash purchases under the Plans through December 31, 2014. |

How do the Plans work for registered stockholders?

Computershare maintains the accounts for registered stockholders in the Plans and sends written confirmation of all transactions in the account. Shares in the account of each participant will be held by Computershare in non-certificated form in the name of the participant, and each participant will be able to vote those shares at a stockholder meeting or by proxy. A participant may also send stock certificates for RVT and RMT held by them to Computershare to be held in non-certificated form. RGT does not issue shares in certificated form. There is no service fee charged to participants for reinvesting distributions. If a participant elects to sell shares from a Plan account, Computershare will deduct a $2.50 service fee from the sale transaction. The Funds’ investment adviser absorbed all commissions on optional sales under the Plans through December 31, 2014. If a nominee is the registered owner of your shares, the nominee will maintain the accounts on your behalf.

How can I get more information on the Plans?

You can call an Investor Services Representative at (800) 221-4268 or you can request a copy of the Plan for your Fund from Computershare. All correspondence (including notifications) should be directed to: [Name of Fund] Distribution Reinvestment and Cash Purchase Plan, c/o Computershare, PO Box 43078, Providence, RI 02940-3078, telephone (800) 426-5523 (from 9:00 A.M. to 5:00 P.M.). |

| 14 | 2015 Semiannual Report to Stockholders |

| Royce Value Trust | June 30, 2015 (unaudited) |

| |

| Schedule of Investments |

| Common Stocks – 98.8% |

| | | SHARES | | VALUE |

| |

| CONSUMER DISCRETIONARY – 12.4% | | | |

| AUTO COMPONENTS - 1.2% | | | |

Drew Industries | | 93,736 | | $ | 5,438,563 |

Fuel Systems Solutions 1 | | 107,000 | | | 800,360 |

Gentex Corporation | | 223,050 | | | 3,662,481 |

Global & Yuasa Battery | | 28,500 | | | 977,296 |

Motorcar Parts of America 1 | | 7,990 | | | 240,419 |

MRF | | 800 | | | 429,585 |

Selamat Sempurna | | 1,816,700 | | | 628,845 |

Standard Motor Products | | 50,391 | | | 1,769,732 |

Superior Industries International | | 21,600 | | | 395,496 |

| | | | | |

| | | | | | 14,342,777 |

| | | | | |

| AUTOMOBILES - 1.1% | | | |

Thor Industries 2 | | 153,460 | | | 8,636,729 |

Winnebago Industries | | 211,400 | | | 4,986,926 |

| | | | | |

| | | | | | 13,623,655 |

| | | | | |

| DISTRIBUTORS - 0.8% | | | |

Core-Mark Holding Company | | 115,200 | | | 6,825,600 |

Weyco Group | | 97,992 | | | 2,922,121 |

| | | | | |

| | | | | | 9,747,721 |

| | | | | |

| DIVERSIFIED CONSUMER SERVICES - 1.2% | | | |

American Public Education 1 | | 36,100 | | | 928,492 |

Collectors Universe | | 50,400 | | | 1,004,976 |

Lincoln Educational Services 1 | | 712,300 | | | 1,438,846 |

Regis Corporation 1, 2, 3 | | 233,800 | | | 3,684,688 |

Sotheby’s | | 138,200 | | | 6,252,168 |

Universal Technical Institute | | 130,432 | | | 1,121,715 |

| | | | | |

| | | | | | 14,430,885 |

| | | | | |

| HOTELS, RESTAURANTS & LEISURE - 0.3% | | | |

Biglari Holdings 1 | | 700 | | | 289,625 |

Century Casinos 1 | | 209,600 | | | 1,320,480 |

Monarch Casino & Resort 1 | | 28,103 | | | 577,798 |

MTY Food Group | | 48,400 | | | 1,283,433 |

Thomas Cook (India) | | 100,000 | | | 350,581 |

Tropicana Entertainment 1, 4 | | 10,000 | | | 157,600 |

| | | | | |

| | | | | | 3,979,517 |

| | | | | |

| HOUSEHOLD DURABLES - 2.4% | | | |

Ethan Allen Interiors | | 320,800 | | | 8,449,872 |

Flexsteel Industries | | 23,700 | | | 1,021,233 |

Forbo Holding | | 110 | | | 130,831 |

Harman International Industries | | 28,600 | | | 3,401,684 |

Lifetime Brands | | 53,726 | | | 793,533 |

Mohawk Industries 1, 2 | | 28,000 | | | 5,345,200 |

Natuzzi ADR 1 | | 2,096,300 | | | 4,402,230 |

NVR 1 | | 2,340 | | | 3,135,600 |

Stanley Furniture 1, 5 | | 1,012,235 | | | 3,006,338 |

| | | | | |

| | | | | | 29,686,521 |

| | | | | |

| INTERNET & CATALOG RETAIL - 0.2% | | | |

Blue Nile 1 | | 67,100 | | | 2,039,169 |

Manutan International | | 4,200 | | | 199,609 |

| | | | | |

| | | | | | 2,238,778 |

| | | | | |

| LEISURE PRODUCTS - 1.3% | | | |

Beneteau | | 20,800 | | | 354,326 |

LeapFrog Enterprises Cl. A 1 | | 348,100 | | | 487,340 |

Nautilus 1 | | 667,100 | | | 14,349,321 |

Shimano | | 3,500 | | | 477,591 |

Smith & Wesson Holding Corporation 1 | | 30,600 | | | 507,654 |

| | | | | |

| | | | | | 16,176,232 |

| | | | | |

| MEDIA - 1.4% | | | |

E.W. Scripps Company Cl. A | | 76,640 | | | 1,751,224 |

Harte-Hanks | | 166,730 | | | 993,711 |

McClatchy Company (The) Cl. A 1 | | 334,200 | | | 360,936 |

Morningstar | | 84,600 | | | 6,729,930 |

Pico Far East Holdings | | 3,484,400 | | | 1,114,785 |

Rentrak Corporation 1 | | 17,400 | | | 1,214,520 |

RLJ Entertainment 1 | | 35,600 | | | 14,026 |

T4F Entretenimento 1 | | 143,800 | | | 168,817 |

Technicolor | | 30,000 | | | 195,656 |

Television Broadcasts | | 173,400 | | | 1,027,889 |

Wiley (John) & Sons Cl. A | | 62,440 | | | 3,394,863 |

| | | | | |

| | | | | | 16,966,357 |

| | | | | |

| MULTILINE RETAIL - 0.1% | | | |

New World Department Store China | | 2,947,500 | | | 790,913 |

Parkson Retail Asia | | 345,800 | | | 121,955 |

| | | | | |

| | | | | | 912,868 |

| | | | | |

| SPECIALTY RETAIL - 1.2% | | | |

Aeropostale 1 | | 110,000 | | | 178,200 |

Buckle (The) 2 | | 110,965 | | | 5,078,868 |

Destination Maternity | | 42,200 | | | 492,052 |

Genesco 1 | | 62,935 | | | 4,155,598 |