- PG Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

The Procter & Gamble Company (PG) 8-KRegulation FD Disclosure

Filed: 23 Feb 12, 12:00am

| 1. | Organic Sales Growth – pages 1 and 2 |

| 2. | Core EPS – pages 2 and 3 |

| 3. | Core Operating Profit Growth – page 3 |

| 4. | Core Selling, general and administrative expense (SG&A) – page 4 |

| 5. | Free Cash Flow – page 4 |

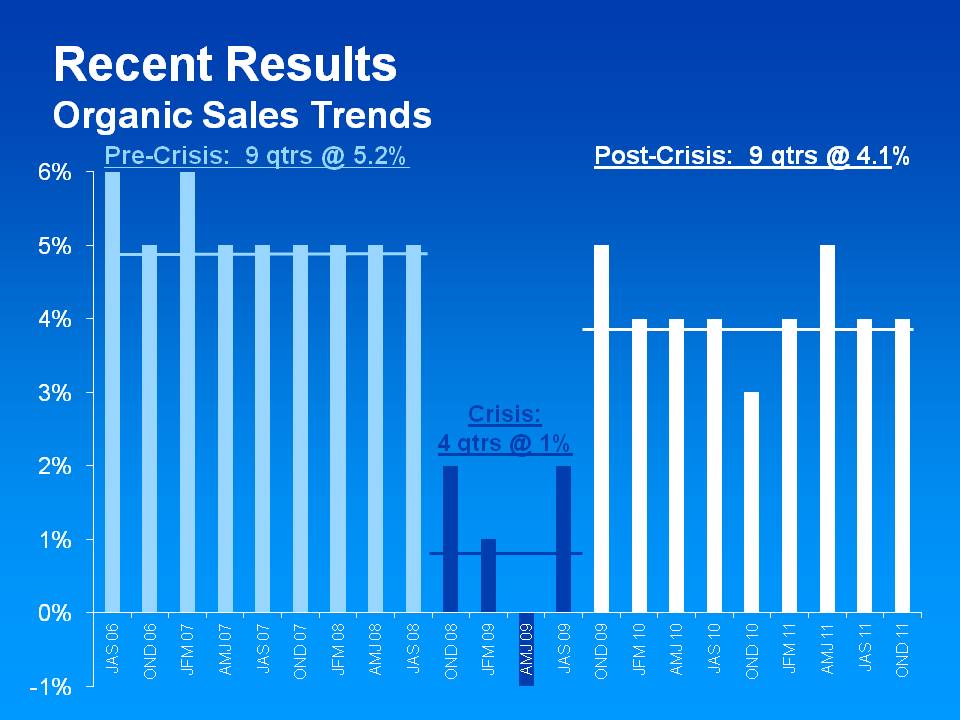

| Total P&G | Net Sales Growth | Foreign Exchange Impact | Acquisition/ Divestiture Impact* | Organic Sales Growth | ||||

| JAS 06 | 27% | -1% | -20% | 6% | ||||

| OND 06 | 8% | -3% | 0% | 5% | ||||

| JFM 07 | 8% | -2% | 0% | 6% | ||||

| AMJ 07 | 8% | -3% | 0% | 5% | ||||

| JAS 07 | 8% | -3% | 0% | 5% | ||||

| OND 07 | 9% | -5% | 1% | 5% | ||||

| JFM 08 | 9% | -5% | 1% | 5% | ||||

| AMJ 08 | 10% | -6% | 1% | 5% | ||||

| JAS 08 | 9% | -5% | 1% | 5% | ||||

| Average–JAS 06-JAS 08 | 11% | -4% | -2% | 5% | ||||

| OND 08 | -3% | 5% | 0% | 2% | ||||

| JFM 09 | -8% | 9% | 0% | 1% | ||||

| AMJ 09 | -11% | 9% | 1% | -1% | ||||

| JAS 09 | -6% | 7% | 1% | 2% | ||||

| Average–OND 08-JAS 09 | -7% | 8% | 0% | 1% | ||||

| OND 09 | 6% | -2% | 1% | 5% | ||||

| JFM 10 | 7% | -3% | 0% | 4% | ||||

| AMJ 10 | 5% | -1% | 0% | 4% | ||||

| JAS 10 | 2% | 3% | -1% | 4% | ||||

| OND 10 | 2% | 2% | -1% | 3% | ||||

| JFM 11 | 5% | -1% | 0% | 4% | ||||

| AMJ 11 | 10% | -5% | 0% | 5% | ||||

JAS 11 | 9% | -5% | 0% | 4% | ||||

| OND 11 | 4% | 0% | 0% | 4% | ||||

| Average–OND 09-OND 11 | 5% | -1% | 0% | 4% | ||||

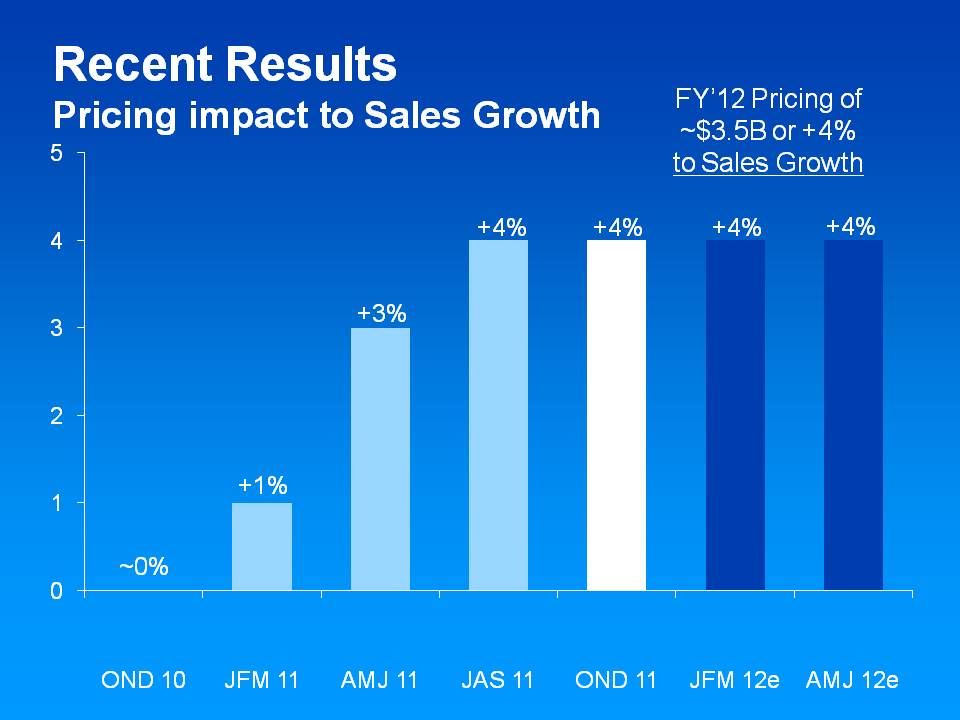

| JFM 12 (Estimate) | 0% to 2% | 3% | 0% | 3% to 5% | ||||

| AMJ 12 (Estimate) | -1% to 2% | 5% to 4% | 0% | 4% to 6% | ||||

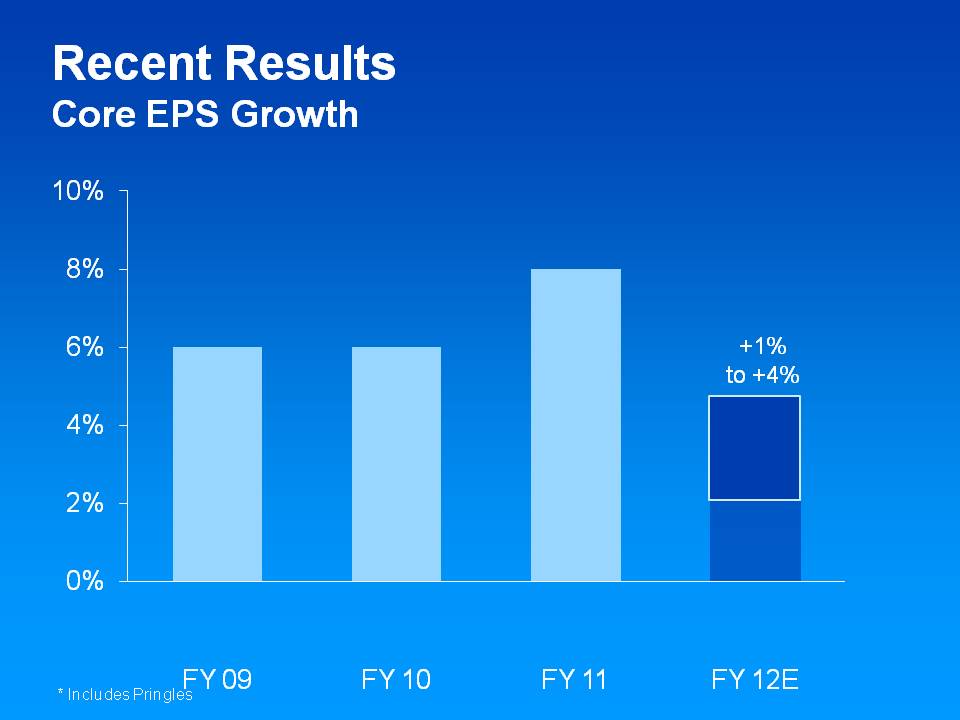

| Fiscal Year Data: | FY 2011 | FY 2010 | FY 2009 | FY 2008 | |||||||

| Diluted Net Earnings Per Share - Continuing Operations | $3.93 | $3.53 | $3.39 | $3.40 | |||||||

| Settlement from U.S. Tax Litigation | ($0.08) | - | - | - | |||||||

| Charges for European Legal Matters | $0.10 | $0.09 | - | - | |||||||

| Charge for Taxation of Retiree Healthcare Subsidy | - | $0.05 | - | - | |||||||

| Incremental Folgers-related Restructuring Charges | - | - | $0.09 | - | |||||||

| Significant Adjustments to Tax Reserves | - | - | - | ($0.14) | |||||||

| Rounding Impacts | ($0.01) | - | |||||||||

Core EPS | $3.95 | $3.67 | $3.47 | $3.26 | |||||||

| Core EPS Growth | 8% | 6% | 6% | ||||||||

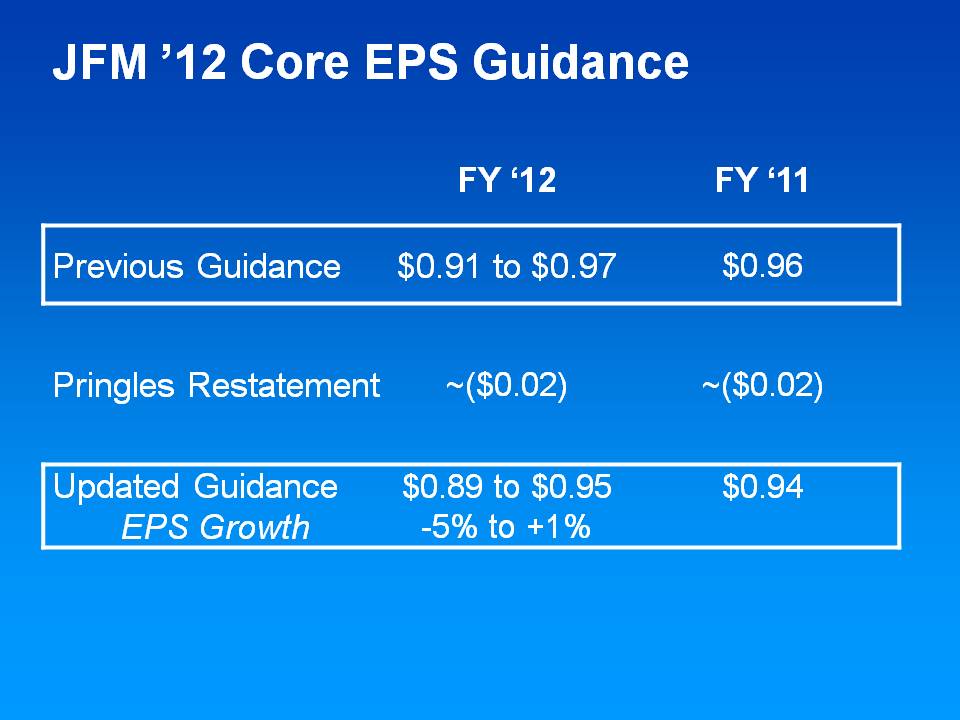

| JFM 12 (Est.) | JFM 11 | ||

| Diluted Net Earnings Per Share | $0.81 to $0.87 | $0.96 | |

| Snacks Dilution | ($0.02) | ($0.02) | |

| Incremental Restructuring | $0.10 | - | |

| Core EPS | $0.89 to $0.95 | $0.94 | |

| Core EPS Growth | -5% to 1% |

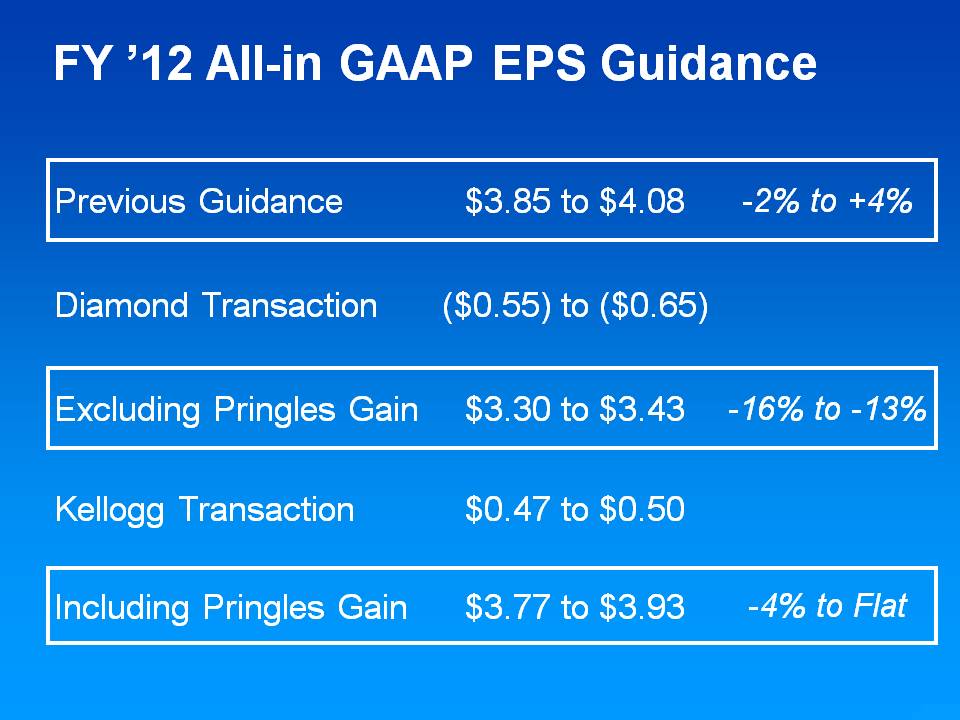

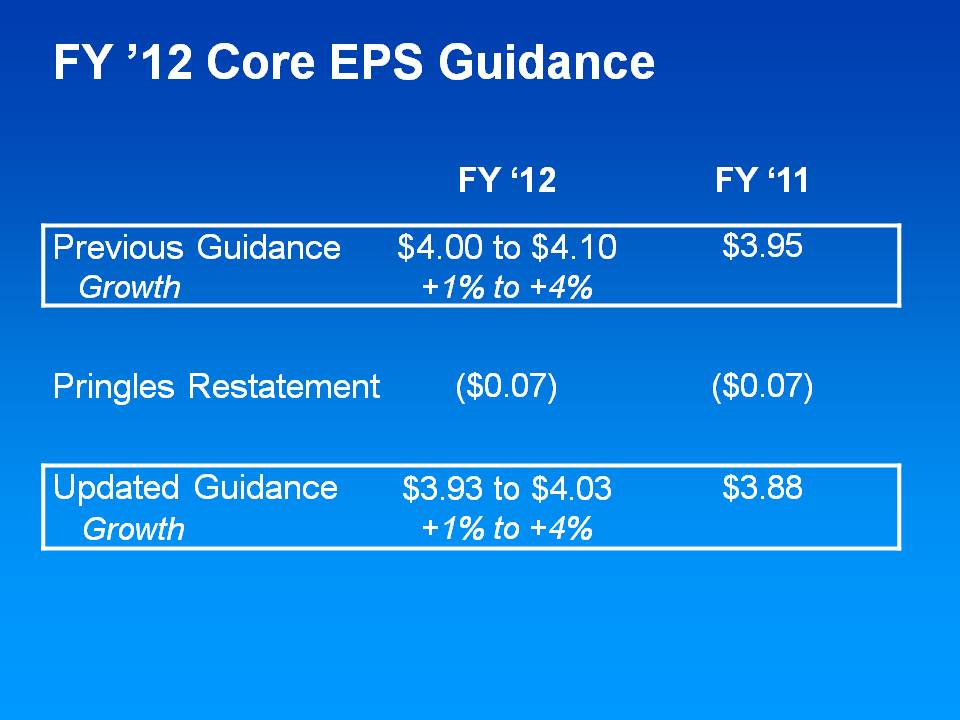

| FY 2012 (Est.) | FY 2011 | ||

| Diluted Net Earnings Per Share | $3.77 to $3.93 | $3.93 | |

| One-time gain from snacks divestiture | ($0.47) to ($0.50) | ||

| Impairment charges | $0.50 | - | |

| Charges for European legal matters | $0.02 | $0.10 | |

| Settlement from U.S. tax litigation | - | ($0.08) | |

| Snacks Dilution | ($0.07) | ($0.07) | |

| Incremental restructuring | $0.18 to $0.15 | - | |

| Core EPS | $3.93 to $4.03 | $3.88 | |

| Core EPS Growth | 1% to 4% |

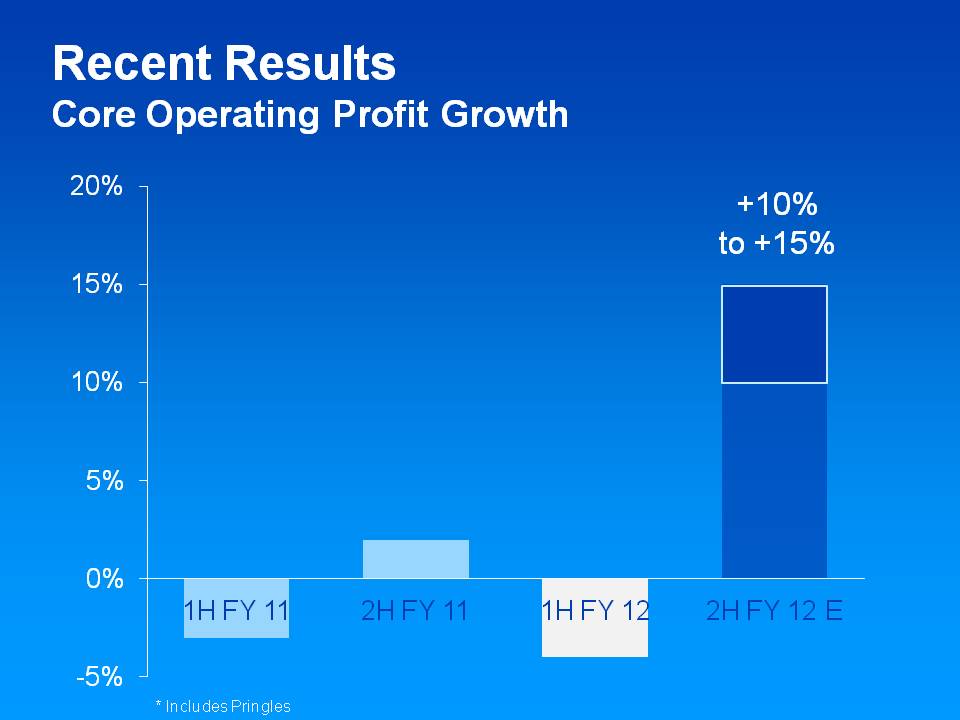

| 2H FY 2012 (Est.) | 1H FY 2012 | 2H FY 2011 | 1H FY 2011 | ||||

| Operating Profit Growth | 0% to 7% | -19% | 2% | -4% | |||

| Impairment charges | - | 18% | - | - | |||

| Charges for European legal matters | - | -3% | - | - | |||

| Incremental restructuring | 10% to 8% | - | - | - | |||

| Rounding | - | - | - | 1% | |||

| Core Operating Profit Growth | 10% to 15% | -4% | 2% | -3% |

| FY 2011 | |||

| Selling, general and administrative expense | $25,973 | ||

| Charges for European legal matters | ($303) | ||

| Core SG&A | $25,670 |

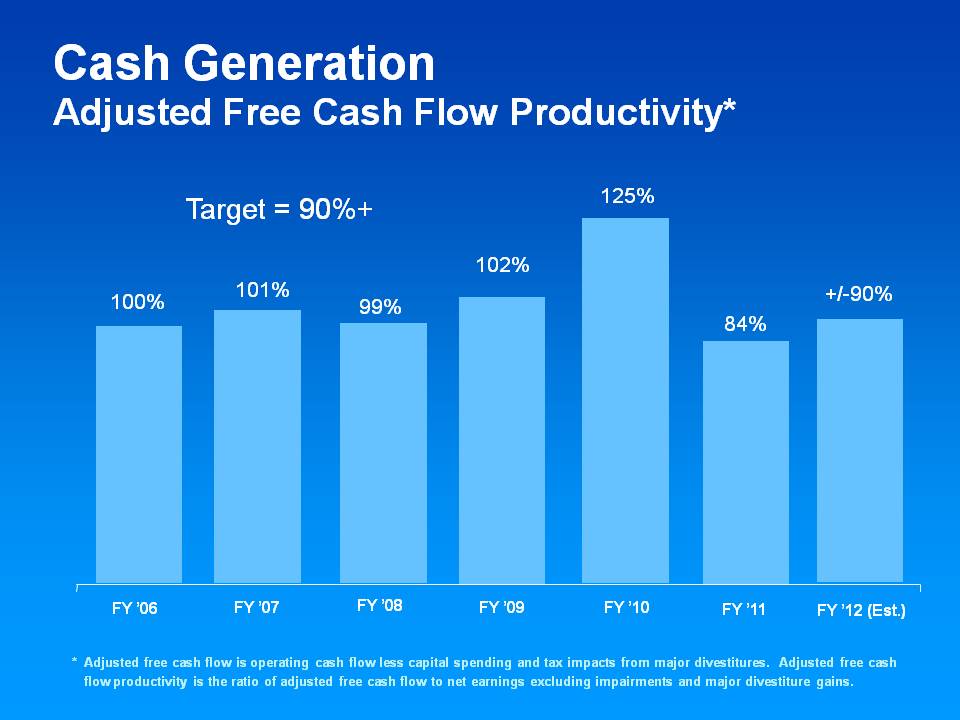

Operating Cash Flow | Capital Spending | Tax Payment on Divestitures | Adjusted Free Cash Flow | Net Earnings | Divestiture Gain | Net Earnings excluding Divestiture Gain | Free Cash Flow Productivity | |

| FY ‘06 | $11,372 | ($2,667) | $8,705 | $8,684 | $8,684 | 100% | ||

| FY ‘07 | $13,410 | ($2,945) | $10,465 | $10,340 | $10,340 | 101% | ||

| FY ‘08 | $15,008 | ($3,046) | $11,962 | $12,075 | $12,075 | 99% | ||

| FY ‘09 | $14,983 | ($3,238) | $11,745 | $13,522 | $2,011 | $11,511 | 102% | |

| FY ‘10 | $16,131 | ($3,067) | $980 | $14,044 | $12,846 | $1,585 | $11,261 | 125% |

| FY ‘11 | $13,330 | ($3,306) | $10,024 | $11,927 | $11,927 | 84% | ||