The information in this preliminary pricing supplement is not complete and may be changed. This preliminary pricing supplement and the accompanying prospectus supplement and prospectus are not an offer to sell these Notes and we are not soliciting an offer to buy these Notes in any jurisdiction where the offer or sale is not permitted.

Subject to Completion

Pricing Supplement dated February 14, 2008

| | |

Pricing Supplement To prospectus dated May 30, 2006 and MTN prospectus supplement dated May 30, 2006 | | Registration Statement no. 333-134553 Dated February , 2008 Rule 424(b)(2) |

$250,000,000

LEHMAN BROTHERS HOLDINGS INC.

Opta Exchange-Traded Notes due February 25, 2038

Linked to the Lehman Brothers Commodity Index Pure Beta Total Return

The Opta Exchange-Traded Notes due February 25, 2038 (the “Notes”) are linked to the Lehman Brothers Commodity Index Pure Beta Total Return, do not guarantee any return of principal at maturity and do not pay any interest during their term. Instead, you will receive a cash payment at maturity or upon early redemption based on the performance of the Lehman Brothers Commodity Index Pure Beta Total Return less an investor fee. The principal terms of the Notes are as follows:

| | |

Issuer: | | Lehman Brothers Holdings Inc. |

Issuer Ratings: | | A+/A1/AA-† |

Inception Date: | | February 20, 2008‡ |

Initial Settlement Date: | | February 25, 2008‡ |

Maturity Date: | | February 25, 2038ࠠ |

Term: | | 30 years |

Index: | | The Lehman Brothers Commodity Index Pure Beta Total Return (Bloomberg Symbol: “LBPBTR”) (the “Index” and, the Lehman Brothers Commodity Index Pure Beta generally, the “LBCI Pure Beta”) is a rules-based total return index that reflects the combined returns associated with changes in prices of exchange-traded futures contracts (collectively, the “Index Contracts” and each an “Index Contract”) on 20 underlying physical commodities, together with the “roll yields” on those Index Contracts (the price changes and roll yields together, the “excess return”) and the interest return on a hypothetical fully collateralized investment in those Index Contracts (the excess return and the interest return together, the “total return”). The 20 Index Contracts that comprise the Index are also included in the general Lehman Brothers Commodity Index Total Return (“LBCI Total Return”), and in many respects the Index is equivalent to the LBCI Total Return in characteristics and methodologies. However, the Index differs in part from the LBCI Total Return in that the Index applies a specific re-allocation methodology that may result in the Index investing in Index Contracts that are different than those in which the LBCI Total Return invests for the same physical commodities. The Index is sponsored by the Index Sponsor and calculated and published by the Index Calculation Agent. |

Payment at Maturity: | | If you hold your Notes to maturity, you will receive a cash payment at maturity equal to (1) the principal amount of your Notestimes (2) the index factor on the final valuation datetimes (3) the fee factor on the final valuation date. |

Secondary Market: | | We expect to list the Notes on the American Stock Exchange (“Amex”) under the ticker symbol “RAW”. If an active secondary market in the Notes exists, we expect that investors will purchase and sell the Notes primarily in this secondary market. You should be aware that the listing of the Notes on Amex, if accepted, will not necessarily ensure that a liquid trading market will be available for the Notes. |

Early Redemption: | | Subject to the notification requirements described below, you may require us to redeem your Notes prior to maturity. If you elect to require us to redeem your Notes, you will receive a cash payment in an amount equal to the applicable early redemption value, which will equal (1) the principal amount of your Notestimes (2) the index factor on the applicable valuation datetimes (3) the fee factor on the applicable valuation date. You must present for early redemption at least 50,000 Notes at one time in order to exercise your right to require us to redeem your Notes on any early redemption date. |

Early Redemption Mechanics: | | In order to effect an early redemption of your Notes, your broker or other person with whom you hold your Notes (each, a “broker/agent”) must deliver a duly completed notice of early redemption to us via email, which must be received by us no later than 11:00 a.m., New York City time, no later than the business day prior to the desired valuation date specified in the notice of early redemption (the “notice deadline date”) and follow the procedures set forth under “Description of Notes—Early Redemption Procedures”. If you fail to comply with these procedures, your notice will be deemed |

| | |

| | ineffective and we will not redeem your Notes on the early redemption date corresponding to the valuation date specified in your notice of early redemption. |

| Valuation Date: | | Valuation date means the trading day on which the Note calculation agent determines the amount payable on your Notes on the maturity date or an early redemption date, as the case may be. If you hold your Notes to maturity, the valuation date will be February 22, 2038‡††, which we refer to as the “final valuation date” (or if such day is not a trading day, the next succeeding trading day). If we redeem your Notes prior to maturity at your request, the valuation date will be the date specified in your notice of early redemption (or if such day is not a trading day, the next succeeding trading day). In each case, the valuation date is subject to postponement and adjustment due to a market disruption event, as described under “Description of Notes—Market Disruption Events”. |

| Early Redemption Date: | | The early redemption date is the third business day following the valuation date (for the early redemption of your Notes). |

| No Interest Payments: | | There will be no interest payments during the term of the Notes. |

| Initial Index Level: | | The closing level of the Index on the inception date. |

| Index Factor: | | The index factor on any given day will be equal to the closing level of the Index on that daydivided by the initial Index level, subject to postponement and adjustment due to a market disruption event as described under “Description of Notes—Market Disruption Events”. |

| Trading Day: | | A day, as determined in good faith by the Note calculation agent, on which the exchanges on which each of the Index Contracts is scheduled to be (or, but for the occurrence of a market disruption event, would have been) open for trading during its regular trading session (notwithstanding any such exchange closing prior to its scheduled closing time). |

| Index Sponsor: | | Lehman Brothers Inc. |

| Index Calculation Agent: | | International Data Corporation (“IDC”) |

| Note Calculation Agent: | | Lehman Brothers Inc. |

| Fee Factor: | | The fee factor, determined in accordance with the formula set forth below, is equal to (x) oneminus the annual investor fee,raised to the power of(y) the number of days elapsed from the inception date to and including the applicable valuation datedivided by 365. The annual investor fee is equal to 0.85%. Number of Days Since Inception |

| | Fee Factor = (1 – 0.0085) 365 |

| |

| | Because the fee factor reduces the amount of your return at maturity or upon early redemption, the level of the Index must increase significantly in order for you to receive at least the principal amount of your investment at maturity or upon early redemption. If the level of the Index decreases or does not increase sufficiently, you will receive less than the principal amount of your investment at maturity or upon early redemption. |

| Denominations: | | The Notes will be issued in denominations of $50. |

| CUSIP: | | 52522L731 |

| ISIN: | | US52522L7313 |

| ‡ | Expected. In the event that we make any change to the expected inception date and initial settlement date, the valuation dates and the maturity date will be changed so that the stated term of the Notes remains the same. |

† | Lehman Brothers Holdings Inc.’s long-term senior debt is rated A+ by Standard & Poor’s, A1 by Moody’s and AA- by Fitch. A credit rating reflects the creditworthiness of Lehman Brothers Holdings Inc. and is not a recommendation to buy, sell or hold securities, and it may be subject to revision or withdrawal at any time by the assigning rating organization. Each rating should be evaluated independently of any other rating. The creditworthiness of the Issuer does not affect or enhance the likely performance of the investment other than the ability of the issuer to meet its obligations. |

†† | Subject to postponement and adjustment in the event of a market disruption event or non-trading date, as described under “Description of Notes—Market Disruption Events” in this pricing supplement. |

Investing in the Opta Exchange-Traded Notes due February 25, 2038 involves a number of risks. See “Risk Factors” beginning on page PS-8 of this pricing supplement and “Risk Factors” in the MTN prospectus supplement.

The Notes do not guarantee any return of principal at maturity. YOU MAY LOSE THE ENTIRE PRINCIPAL AMOUNT OF YOUR INVESTMENT.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the Notes or passed upon the accuracy or the adequacy of this pricing supplement, the accompanying base prospectus and MTN prospectus supplement and any other related prospectus supplements, or any other relevant terms supplement. Any representation to the contrary is a criminal offense.

We intend to sell a portion of the Notes on the inception date at 100% of their stated principal amount. The remainder of the Notes will be offered and sold from time to time at market prices prevailing at the time of sale, at prices related to market prices or at negotiated prices. With respect to each Note sold, Lehman Brothers Inc. will be entitled to receive a fee, at the Note’s maturity or upon its early redemption, of up to 0.85% per annum on an amount equal to the product of (1) the principal amount of the Note and (2) the index factor on the applicable valuation date with respect to the early redemption or at maturity, as applicable (as described under “Description of Notes—Payment at Maturity” and “Description of Notes—Payment Upon Early Redemption”). Lehman Brothers Inc. may pay selling concessions to other dealers on an annual basis (the amount of which concessions may depend on the length of time investors have held the Notes) or on an annualized basis (reflecting payment of a concession amount determined at the time of sale). Lehman Brothers Inc. and/or an affiliate may earn additional income as a result of payments pursuant to the hedges. Please see “Supplemental Plan of Distribution” in this pricing supplement for more information.

We may use this pricing supplement in the sale of Notes. In addition, Lehman Brothers Inc. or another of our affiliates may use this pricing supplement in market-making transactions in any Notes after their initial sale.Unless we or our agent informs you otherwise in the confirmation of sale or in a notice delivered at the same time as the confirmation of sale, this pricing supplement together with the base prospectus, as supplemented by the MTN prospectus supplement relating to our Series I medium-term notes of which the Notes are a part, is being used in a market-making transaction.

LEHMAN BROTHERS

TABLE OF CONTENTS

PRICING SUPPLEMENT

ADDITIONAL TERMS SPECIFIC TO THE NOTES

Lehman Brothers Holdings Inc. has filed a registration statement (including a base prospectus) with the U.S. Securities and Exchange Commission, or SEC, for this offering. Before you invest, you should read this pricing supplement together with the accompanying base prospectus dated May 30, 2006, as supplemented by the MTN prospectus supplement dated May 30, 2006 relating to our Series I medium-term notes of which the Notes are a part. Buyers should rely upon the accompanying base prospectus and MTN prospectus supplement, this pricing supplement and any other relevant terms supplement for complete details. To the extent that there are any inconsistencies among the documents listed below, this pricing supplement shall supersede the base prospectus and the MTN prospectus supplement. We urge you to consult your investment, legal, tax, accounting and other advisors before you invest in the Notes. You may get these documents and other documents Lehman Brothers Holdings Inc. has filed for free by searching the SEC online database (EDGAR®) atwww.sec.gov, with “Lehman Brothers Holdings Inc.” as a search term or through the links below or by calling Lehman Brothers Inc. toll-free at 1-888-603-5847.

You may access these documents on the SEC website atwww.sec.govas follows (or if such address has changed, by reviewing our filings for the relevant date on the SEC website):

| | — | MTN prospectus supplement dated May 30, 2006: |

http://www.sec.gov/Archives/edgar/data/806085/000104746906007785/a2170815z424b2.htm

| | — | Base prospectus dated May 30, 2006: |

http://www.sec.gov/Archives/edgar/data/806085/000104746906007771/a2165526zs-3asr.htm

In making your investment decision, you should rely only on the information contained or incorporated by reference in this pricing supplement and the accompanying base prospectus and MTN prospectus supplement with respect to the Notes offered and with respect to Lehman Brothers Holdings Inc. We have not authorized anyone to give you any additional or different information. The information in this pricing supplement and the accompanying base prospectus and MTN prospectus supplement and in the documents incorporated by reference therein may be accurate only as of the respective dates of each of those documents.

The Notes described in this pricing supplement are not appropriate for all investors, and involve important legal and tax consequences and investment risks, which should be discussed with your professional advisors. You should be aware that the regulations of Financial Industry Regulatory Authority, Inc. (“FINRA”) and the laws of certain jurisdictions (including regulations and laws that require brokers to ensure that investments are suitable for their customers) may limit the availability of the Notes.

In this pricing supplement and the accompanying base prospectus and MTN prospectus supplement, “we,” “us” and “our” refer to Lehman Brothers Holdings Inc. and not to any of its subsidiaries, unless the context requires otherwise.

We are offering to sell, and are seeking offers to buy, the Notes only in jurisdictions where offers and sales are permitted. Neither this pricing supplement nor the accompanying base prospectus or MTN prospectus supplement constitutes an offer to sell, or a solicitation of an offer to buy, any Notes by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation. You must (1) comply with all applicable laws and regulations in force in any jurisdiction in connection with the possession or distribution of this pricing supplement and the accompanying base prospectus or MTN prospectus supplement, and the purchase, offer or sale of the Notes and (2) obtain any consent, approval or permission required to be obtained by you for the purchase, offer or sale by you of the Notes under the laws and regulations applicable to you in force in any jurisdiction to which you are subject or in which you make such purchases, offers or sales; neither we nor the agent shall have any responsibility therefor.

PS-1

SUMMARY INFORMATION – Q&A

The following is a summary of terms of the Opta Exchange-Traded Notes due February 25, 2038 (the “Notes”), as well as a discussion of considerations you should take into account when deciding whether to invest in the Notes. The information in this section is qualified in its entirety by the more detailed explanations set forth elsewhere in this pricing supplement and the accompanying base prospectus and MTN prospectus supplement.

What are the Notes?

The Notes are senior unsecured debt obligations that are linked to the performance of the Lehman Brothers Commodity Index Pure Beta Total Return (the “Index” and, the Lehman Brothers Commodity Index Pure Beta generally, the “LBCI Pure Beta”). The Notes will initially be issued in denominations of $50.

What does the Index measure?

The Index is a rules-based total return index that reflects the combined returns associated with changes in prices of exchange-traded futures contracts (collectively, the “Index Contracts” and each an “Index Contract”) on 20 underlying physical commodities, together with the “roll yields” on those Index Contracts (the price changes and roll yields together, the “excess return”) and the interest return on a hypothetical fully collateralized investment in those Index Contracts (the excess return and the interest return together, the “total return”). The 20 Index Contracts that comprise the Index are also included in the general Lehman Brothers Commodity Index Total Return (“LBCI Total Return”), and in many respects the Index is equivalent to the LBCI Total Return in characteristics and methodologies. However, the Index differs in part from the LBCI Total Return in that the Index applies a specific re-allocation methodology that may result in the Index investing in Index Contracts that are different than those in which the LBCI Total Return invests for the same physical commodities. The Index is sponsored by the Index Sponsor and calculated and published by the Index Calculation Agent.

How do the Notes work?

If you have not elected to require us to redeem your Notes prior to maturity, you will receive a cash payment at maturity equal to (1) the principal amount of your Notestimes(2) the index factor on the final valuation datetimes(3) the fee factor on the final valuation date. You may, subject to certain restrictions and procedures, elect to require us to redeem your Notes prior to maturity. You must present for early redemption at least 50,000 Notes at one time in order to exercise your right to require us to redeem your Notes on any early redemption date. Your broker or other financial intermediary (such as a bank or other financial institution not required to register as a broker-dealer to engage in securities transactions), but not you individually in combination with other investors, may bundle your Notes for early redemption with those of other investors to reach this minimum. If you choose to require us to redeem your Notes on an early redemption date prior to maturity, you will receive a cash payment on such date in an amount equal to the applicable early redemption value, which will equal (1) the principal amount of your Notestimes(2) the index factor on the applicable valuation datetimes(3) the fee factor on the applicable valuation date. For a description of the requirements you must observe in order to require us to redeem your Notes, see “How do I exercise my option to require Lehman Brothers Holdings Inc. to redeem my Notes?” below.

The initial Index level is the closing level of the Index on the inception date. The index factor on any given day will be equal to the closing level of the Index on that daydivided by the initial Index level, subject to postponement and adjustment due to a market disruption event as described under “Description of Notes—Market Disruption Events”.

The fee factor, determined in accordance with the formula set forth below, is equal to (x) oneminus the annual investor fee,raised to the power of(y) the number of days elapsed from the inception date to and including the applicable valuation datedivided by 365. The annual investor fee is equal to 0.85%.

| | | | | | |

| | | | Number of Days Since Inception | | |

| | Fee Factor = (1 – 0.0085) | | 365 | | |

As a result, if the Notes were held to maturity and purchased at 100% of their original principal amount, the Index would have to appreciate by approximately 29.2% or more in order for you to receive your principal at maturity.

The valuation date means the trading day on which the Note calculation agent determines the amount payable on your Notes on the maturity date or an early redemption date, as the case may be. If you hold your Notes to maturity, the valuation date will be

PS-2

February 22, 2038‡††, which we refer to as the “final valuation date” (or if such day is not a trading day, the next succeeding trading day). If we redeem your Notes prior to maturity at your request, the valuation date will be the date specified in your notice of early redemption (or if such day is not a trading day, the next succeeding trading day). In each case, the valuation date is subject to postponement and adjustment due to a market disruption event, as described under “Description of Notes—Market Disruption Events”. A trading day is a day, as determined in good faith by the Note calculation agent, on which the exchanges on which each of the Index Contracts is scheduled to be (or, but for the occurrence of a market disruption event, would have been) open for trading during its regular trading session (notwithstanding any such exchange closing prior to its scheduled closing time).

The early redemption date is the third business day following the valuation date for the early redemption of your Notes.

For a further description of how your payment at maturity or upon early redemption will be calculated, see “Description of Notes” in this pricing supplement.

Because the fee factor reduces the amount of your return at maturity or upon early redemption, the level of the Index must increase significantly in order for you to receive at least the principal amount of your investment at maturity or upon early redemption. If the level of the Index decreases or does not increase sufficiently, you will receive less than the principal amount of your investment at maturity or upon early redemption.

Will I receive interest payments on the Notes?

We will not pay you interest during the term of the Notes.

How do I exercise my option to require Lehman Brothers Holdings Inc. to redeem my Notes?

To exercise your option to require us to redeem your Notes, you must instruct your broker or other person through whom you hold your Notes (each, a “broker/agent”) to take the following steps on your behalf:

| | — | No later than the business day prior to the desired valuation date specified in your notice of early redemption (the “notice deadline date”), your broker/agent must deliver to us via email, and we must receive no later than 11:00 a.m., New York City time, on or prior to the notice deadline date, a duly completed notice of early redemption, which is attached as Annex B to this pricing supplement. If we receive your notice by the time specified in the preceding sentence, we will respond by sending your broker/agent a form of confirmation of early redemption, which is attached as Annex C to this pricing supplement; |

| | — | Upon receipt from us of the form of confirmation of early redemption, your broker/agent must deliver the signed confirmation of early redemption to us via facsimile in the specified form by 4:00 p.m., New York City time, on or prior to the notice deadline date. We or our affiliate must acknowledge receipt in order for your confirmation to be effective. If your notice and confirmation are received within the deadlines above on any business day on or prior to the notice deadline date, the valuation date for the early redemption of your Notes will be the date you have specified in your notice of early redemption (provided, however, that if such date is not a trading day, the valuation date will be the next succeeding trading day) and the early redemption date will be the third business day following that valuation date (in each case, subject to postponement and adjustment due to a market disruption event, as described under “Description of Notes—Market Disruption Events”); |

| | — | On the valuation date, your broker/agent must instruct your DTC custodian to book a delivery vs. payment trade with respect to your Notes at a price equal to the applicable early redemption value, facing Lehman Brothers DTC 074; and |

| | — | Your broker/agent must cause your DTC custodian to deliver the trade as booked for settlement via DTC at or prior to 10:00 a.m., New York City time, on the applicable early redemption date (the third business day following the valuation date). |

Different brokerage firms may have different deadlines for accepting instructions from their customers. Accordingly, you should consult the brokerage firm through which you own your interest in the Notes in respect of such deadlines. If we do not receive your notice of early redemption by 11:00 a.m., or your confirmation of early redemption by 4:00 p.m., on or prior to the notice deadline date, your notice will not be effective on the notice deadline date and we will not redeem your Notes on the early redemption date corresponding to the valuation date specified on the notice of early redemption (or any other early redemption date, unless a duly completed and timely notice and confirmation of early redemption is delivered with respect to such other early redemption date). Any

PS-3

early redemption instructions for which we (or our affiliate) receive a valid confirmation in accordance with the procedures described above will be irrevocable. You may only specify a trading day from February 21, 2008 to February 21, 2038, inclusive, as the desired valuation date on your notice of early redemption.

Will the Notes be listed on a stock exchange?

We expect to list the Notes on Amex under the ticker symbol “RAW”. If an active secondary market in the Notes exists, we expect that investors will purchase and sell the Notes primarily in this secondary market.

Are there any risks associated with my investment?

Yes, an investment in the Notes involves risks. We urge you to read the explanation of these risks in “Risk Factors” in this pricing supplement and “Risk Factors” in the MTN prospectus supplement.

What are the tax consequences of the Notes?

Investors should consider the tax consequences of investing in the Notes. No statutory, judicial or administrative authority directly addresses the characterization of the Notes or instruments similar to the Notes for United States federal income tax purposes. As a result, significant aspects of the United States federal income tax consequences of an investment in the Notes are not certain. Lehman Brothers Holdings Inc. is not requesting any ruling from the Internal Revenue Service with respect to the Notes and cannot assure you that the Internal Revenue Service will agree with the treatment described in this pricing supplement. The Internal Revenue Service could assert other characterizations that could affect the timing, amount and character of income or deductions. Lehman Brothers Holdings Inc. intends to treat, and by purchasing a Note, for all tax purposes, you agree to treat, a Note as a cash-settled financial contract, rather than as a debt instrument. You should consult your own tax advisor concerning the alternative characterizations. Neither Lehman Brothers Holdings Inc. nor any of its affiliates provide tax advice. See “Certain U.S. Federal Income Tax Consequences” in this pricing supplement.

How is the payment at maturity or upon early redemption determined?

Set forth below is an explanation of the steps necessary to calculate the payment on the Notes at maturity or upon early redemption.

Step 1: Calculate the fee factor

The fee factor, determined in accordance with the formula set forth below, is equal to (x) oneminus the annual investor fee,raised to the power of(y) the number of days elapsed from the inception date to and including the applicable valuation datedivided by 365.

| | | | | | |

| | | | Number of Days Since Inception | | |

| | Fee Factor = (1 – 0.0085) | | 365 | | |

Step 2: Calculate the index factor

The index factor on any given day will be equal to the closing level of the Index on that daydivided by the initial Index level, subject to postponement and adjustment due to a market disruption event as described under “Description of Notes—Market Disruption Events”.

Step 3: Calculate the payment

You will receive a cash payment at maturity or upon early redemption, as applicable, equal to (1) the principal amount of your Notestimes(2) the index factor on the applicable valuation datetimes (3) the fee factor on the applicable valuation date.

Because the fee factor reduces the amount of your return at maturity or upon early redemption, the level of the Index must increase significantly in order for you to receive at least the principal amount of your investment at maturity or upon early redemption of your Notes. If the level of the Index decreases or does not increase sufficiently, you will receive less than the principal amount of your investment at maturity or upon early redemption of your Notes.

PS-4

Hypothetical Payment at Maturity

The following table illustrates the hypothetical payment at maturity per $50 Note, for a hypothetical range of circumstances which assume 400% appreciation to 60% depreciation in the closing level of the Index on the final valuation date relative to the initial Index level. The payment at maturity amounts in the table below reflect the subtraction of the annual investor fee of 0.85% per year and assume an initial Index level of 121.90. The hypothetical payment at maturity examples set forth below are for illustrative purposes only, are based solely on the hypothetical examples cited and should not be taken as indicative of any actual payment at maturity on the Notes; the initial Index level, the closing level of the Index on the final valuation date and the index factors have been chosen arbitrarily for the purpose of these examples and should not be taken as indicative of the future performance of the Index. The numbers appearing in the table and examples below have been rounded for ease of analysis.

While the following examples relate to the calculation of the payment on a $50 Note if held to maturity, fundamentally similar calculations would be made to determine the early redemption amount that would be paid to you if you exercise your right to require us to redeem your Notes prior to the maturity date under the conditions described herein, except that in the case of any early redemption, the closing level of the Index and index factor indicated in the table below would instead be determined on, and the fee factor would be calculated to and including, the applicable valuation date.

| | | | | | | | | | | | | | | | |

Closing Level of the Index on the Final Valuation Date | | Index Factor 1 | | | | Fee Factor 2 | | | | Principal Amount | | | | Payment at Maturity | | |

609.50 | | 5.00 | | × | | 0.774 | | × | | $50 | | = | | $193.47 | | |

457.13 | | 3.75 | | × | | 0.774 | | × | | $50 | | = | | $145.10 | | |

335.23 | | 2.75 | | × | | 0.774 | | × | | $50 | | = | | $106.41 | | |

243.80 | | 2.00 | | × | | 0.774 | | × | | $50 | | = | | $77.39 | | |

182.85 | | 1.50 | | × | | 0.774 | | × | | $50 | | = | | $58.04 | | |

152.38 | | 1.25 | | × | | 0.774 | | × | | $50 | | = | | $48.37 | | |

121.90 | | 1.00 | | × | | 0.774 | | × | | $50 | | = | | $38.69 | | |

109.71 | | 0.90 | | × | | 0.774 | | × | | $50 | | = | | $34.83 | | |

97.52 | | 0.80 | | × | | 0.774 | | × | | $50 | | = | | $30.96 | | |

85.33 | | 0.70 | | × | | 0.774 | | × | | $50 | | = | | $27.09 | | |

73.14 | | 0.60 | | × | | 0.774 | | × | | $50 | | = | | $23.22 | | |

60.95 | | 0.50 | | × | | 0.774 | | × | | $50 | | = | | $19.35 | | |

48.76 | | 0.40 | | × | | 0.774 | | × | | $50 | | = | | $15.48 | | |

| | 1 | The index factor on any given day (which, for the purposes of the examples, is assumed to be the final valuation date) will be equal to the closing level of the Index on that daydivided by the initial Index level, subject to postponement and adjustment due to a market disruption event as described under “Description of Notes—Market Disruption Events”. |

| | 2 | The fee factor is equal to (x) oneminus the annual investor fee of 0.85%,raised to the power of(y) the number of days elapsed from the inception date to and including the applicable valuation datedivided by 365 and as of any date will be determined as follows: |

| | | | | | |

| | | | Number of Days Since Inception | | |

| | Fee Factor = (1 – 0.0085) | | 365 | | |

PS-5

The following examples illustrate how the Notes would perform in hypothetical circumstances. We have included one example in which the Index has increased by approximately 800% at maturity, as well as one example in which the Index has decreased by approximately 50% at maturity. These examples highlight the behavior of the indicative value in different circumstances. The figures in these examples have been rounded for convenience. Figures for year 30 are as of the final valuation date, and given the indicated assumptions, a holder will receive payment at maturity in the indicated amount, according to the indicated formula.

Assumptions:

| | | | | | |

| Annual Investor Fee | | Days | | Principal Amount | | Initial Index Level |

0.85% | | 365 | | $50.00 | | 121.90 |

N = the actual number of days elapsed from the inception date to and including the applicable valuation date. For purposes of the calculations in this table, each year is assumed to have 365 days.

Example 1:

| | | | | | | | | | | | | | |

A Year | | B Index Level | | C Hypothetical Index Factor | | D Hypothetical Fee Factor | | E Indicative Value | | F Investor Fee | | G Annualized Index Return | | H Annualized Note Return |

A | | B | | B / Initial Index Level | | (1-0.0085) N/365 | | 50 × C × D | | (50 × C) - E | | G | | H |

0 | | 121.90 | | 1.00 | | 1.000 | | $50.00 | | $0.00 | | | | |

1 | | 101.18 | | 0.83 | | 0.992 | | $41.15 | | $0.35 | | -17.00% | | -17.71% |

2 | | 70.70 | | 0.58 | | 0.983 | | $28.51 | | $0.49 | | -23.84% | | -24.49% |

3 | | 92.64 | | 0.76 | | 0.975 | | $37.04 | | $0.96 | | -8.74% | | -9.52% |

4 | | 90.21 | | 0.74 | | 0.966 | | $35.76 | | $1.24 | | -7.25% | | -8.04% |

5 | | 85.33 | | 0.70 | | 0.958 | | $33.54 | | $1.46 | | -6.89% | | -7.68% |

6 | | 74.36 | | 0.61 | | 0.950 | | $28.98 | | $1.52 | | -7.91% | | -8.69% |

7 | | 78.02 | | 0.64 | | 0.942 | | $30.14 | | $1.86 | | -6.18% | | -6.97% |

8 | | 90.21 | | 0.74 | | 0.934 | | $34.56 | | $2.44 | | -3.69% | | -4.51% |

9 | | 99.96 | | 0.82 | | 0.926 | | $37.97 | | $3.03 | | -2.18% | | -3.01% |

10 | | 119.46 | | 0.98 | | 0.918 | | $44.99 | | $4.01 | | -0.20% | | -1.05% |

11 | | 149.94 | | 1.23 | | 0.910 | | $55.99 | | $5.51 | | 1.90% | | 1.03% |

12 | | 180.41 | | 1.48 | | 0.903 | | $66.80 | | $7.20 | | 3.32% | | 2.44% |

13 | | 201.14 | | 1.65 | | 0.895 | | $73.83 | | $8.67 | | 3.93% | | 3.04% |

14 | | 199.92 | | 1.64 | | 0.887 | | $72.76 | | $9.24 | | 3.60% | | 2.72% |

15 | | 229.17 | | 1.88 | | 0.880 | | $82.70 | | $11.30 | | 4.30% | | 3.41% |

16 | | 249.90 | | 2.05 | | 0.872 | | $89.41 | | $13.09 | | 4.59% | | 3.70% |

17 | | 298.66 | | 2.45 | | 0.865 | | $105.95 | | $16.55 | | 5.41% | | 4.52% |

18 | | 305.97 | | 2.51 | | 0.858 | | $107.62 | | $17.88 | | 5.25% | | 4.35% |

19 | | 338.88 | | 2.78 | | 0.850 | | $118.19 | | $20.81 | | 5.53% | | 4.63% |

20 | | 390.08 | | 3.20 | | 0.843 | | $134.89 | | $25.11 | | 5.99% | | 5.09% |

21 | | 438.84 | | 3.60 | | 0.836 | | $150.46 | | $29.54 | | 6.29% | | 5.39% |

22 | | 476.63 | | 3.91 | | 0.829 | | $162.03 | | $33.47 | | 6.39% | | 5.49% |

23 | | 518.08 | | 4.25 | | 0.822 | | $174.62 | | $37.88 | | 6.49% | | 5.59% |

24 | | 599.75 | | 4.92 | | 0.815 | | $200.43 | | $45.57 | | 6.86% | | 5.96% |

25 | | 687.52 | | 5.64 | | 0.808 | | $227.81 | | $54.19 | | 7.16% | | 6.25% |

26 | | 747.25 | | 6.13 | | 0.801 | | $245.49 | | $61.01 | | 7.22% | | 6.31% |

27 | | 775.28 | | 6.36 | | 0.794 | | $252.54 | | $65.46 | | 7.09% | | 6.18% |

28 | | 847.21 | | 6.95 | | 0.787 | | $273.62 | | $73.88 | | 7.17% | | 6.26% |

29 | | 937.41 | | 7.69 | | 0.781 | | $300.18 | | $84.32 | | 7.29% | | 6.38% |

30 | | 1,097.10 | | 9.00 | | 0.774 | | $348.33 | | $101.67 | | 7.60% | | 6.68% |

PS-6

Example 2:

| | | | | | | | | | | | | | |

A Year | | B Index Level | | C Hypothetical Index Factor | | D Hypothetical Fee Factor | | E Indicative Value | | F Investor Fee | | G Annualized Index Return | | H Annualized Note Return |

A | | B | | B / Initial Index Level | | (1-0.0085) N/365 | | 50 × C × D | | (50 × C) - E | | G | | H |

0 | | 121.90 | | 1.00 | | 1.000 | | $50.00 | | $0.00 | | | | |

1 | | 112.15 | | 0.92 | | 0.992 | | $45.61 | | $0.39 | | -8.00% | | -8.78% |

2 | | 95.08 | | 0.78 | | 0.983 | | $38.34 | | $0.66 | | -11.68% | | -12.43% |

3 | | 113.37 | | 0.93 | | 0.975 | | $45.32 | | $1.18 | | -2.39% | | -3.22% |

4 | | 128.00 | | 1.05 | | 0.966 | | $50.74 | | $1.76 | | 1.23% | | 0.37% |

5 | | 140.19 | | 1.15 | | 0.958 | | $55.10 | | $2.40 | | 2.83% | | 1.96% |

6 | | 121.90 | | 1.00 | | 0.950 | | $47.50 | | $2.50 | | 0.00% | | -0.85% |

7 | | 124.34 | | 1.02 | | 0.942 | | $48.04 | | $2.96 | | 0.28% | | -0.57% |

8 | | 121.90 | | 1.00 | | 0.934 | | $46.70 | | $3.30 | | 0.00% | | -0.85% |

9 | | 119.46 | | 0.98 | | 0.926 | | $45.38 | | $3.62 | | -0.22% | | -1.07% |

10 | | 118.24 | | 0.97 | | 0.918 | | $44.53 | | $3.97 | | -0.30% | | -1.15% |

11 | | 114.59 | | 0.94 | | 0.910 | | $42.79 | | $4.21 | | -0.56% | | -1.41% |

12 | | 134.09 | | 1.10 | | 0.903 | | $49.64 | | $5.36 | | 0.80% | | -0.06% |

13 | | 118.24 | | 0.97 | | 0.895 | | $43.41 | | $5.09 | | -0.23% | | -1.08% |

14 | | 123.12 | | 1.01 | | 0.887 | | $44.81 | | $5.69 | | 0.07% | | -0.78% |

15 | | 114.59 | | 0.94 | | 0.880 | | $41.35 | | $5.65 | | -0.41% | | -1.26% |

16 | | 108.49 | | 0.89 | | 0.872 | | $38.82 | | $5.68 | | -0.73% | | -1.57% |

17 | | 109.71 | | 0.90 | | 0.865 | | $38.92 | | $6.08 | | -0.62% | | -1.46% |

18 | | 106.05 | | 0.87 | | 0.858 | | $37.30 | | $6.20 | | -0.77% | | -1.61% |

19 | | 145.06 | | 1.19 | | 0.850 | | $50.59 | | $8.91 | | 0.92% | | 0.06% |

20 | | 118.24 | | 0.97 | | 0.843 | | $40.89 | | $7.61 | | -0.15% | | -1.00% |

21 | | 108.49 | | 0.89 | | 0.836 | | $37.20 | | $7.30 | | -0.55% | | -1.40% |

22 | | 107.27 | | 0.88 | | 0.829 | | $36.47 | | $7.53 | | -0.58% | | -1.42% |

23 | | 99.96 | | 0.82 | | 0.822 | | $33.69 | | $7.31 | | -0.86% | | -1.70% |

24 | | 97.52 | | 0.80 | | 0.815 | | $32.59 | | $7.41 | | -0.93% | | -1.77% |

25 | | 91.43 | | 0.75 | | 0.808 | | $30.29 | | $7.21 | | -1.14% | | -1.98% |

26 | | 88.99 | | 0.73 | | 0.801 | | $29.24 | | $7.26 | | -1.20% | | -2.04% |

27 | | 84.11 | | 0.69 | | 0.794 | | $27.40 | | $7.10 | | -1.36% | | -2.20% |

28 | | 79.24 | | 0.65 | | 0.787 | | $25.59 | | $6.91 | | -1.53% | | -2.36% |

29 | | 82.89 | | 0.68 | | 0.781 | | $26.54 | | $7.46 | | -1.32% | | -2.16% |

30 | | 60.95 | | 0.50 | | 0.774 | | $19.35 | | $5.65 | | -2.28% | | -3.11% |

PS-7

RISK FACTORS

Your investment in the Notes will involve certain risks. The Notes do not pay interest or guarantee any return of principal at, or prior to, maturity. Investing in the Notes is not equivalent to investing directly in any of the futures contracts or commodities underlying the Index. In addition, your investment in the Notes entails other risks not associated with an investment in conventional debt securities.You should consider carefully the following discussion of risks as well as the other information contained in this pricing supplement, the accompanying MTN prospectus supplement and base prospectus or incorporated by reference before you decide that an investment in the Notes is suitable for you.You should reach an investment decision only after you have carefully considered with your advisors the suitability of an investment in the Notes in light of your particular circumstances.

RISKS RELATED TO THE NOTES

Your Investment in the Notes May Result in a Loss

You will not receive any periodic interest payments on the Notes, and the Notes are not principal protected and therefore do not guarantee a return of principal at maturity or upon an early redemption date, as the case may be. The return on the Notes is linked to the performance of the Index and will depend on (1) whether, and the extent to which, the closing level of the Index on the applicable valuation date (including the final valuation date) exceeds the initial Index level and (2) the fee factor on the applicable valuation date (including the final valuation date). As a result, if the Notes were held to maturity and purchased at 100% of their original principal amount, the Index would have to appreciate by approximately 29.2% or more in order for you to receive your principal at maturity. IF THE INDEX DECLINES, YOU MAY LOSE UP TO 100% OF YOUR INVESTMENT IN THE NOTES.

Even if the Level of the Index at Maturity or Upon Early Redemption Exceeds the Initial Index Level, You May Receive Less Than the Principal Amount of Your Notes

Because the fee factor reduces the amount of your return at maturity or upon early redemption, the level of the Index must increase significantly (by approximately 29.2% or more, assuming you purchased the Notes at 100% of their original principal amount and held the Notes to maturity) in order for you to receive at least the principal amount of your investment at maturity or upon an early redemption date, as the case may be. If the level of the Index decreases or does not increase sufficiently to offset the fee factor, you will receive less than the principal amount of your investment at maturity or upon an early redemption date, as the case may be. Furthermore, since the fee factor is accumulated on a daily basis, the longer your Notes have been outstanding, the greater the extent to which the fee factor will reduce the returns on your Notes.

There Are Restrictions on the Number of Notes We Will Redeem on any Early Redemption Date and There Are Procedures You Must Follow in Order to Exercise Your Early Redemption Option

You must present for early redemption at least 50,000 Notes at one time in order to exercise your right to require us to redeem your Notes on any early redemption date. We will only redeem your Notes on an early redemption date if we receive a notice of early redemption from you by no later than 11:00 a.m. and a confirmation of early redemption by no later than 4:00 p.m., in each case, no later than the business day prior to the desired valuation date specified in the notice of early redemption (the “notice deadline date”) and follow the procedures set forth under “Description of Notes—Early Redemption Procedures”. If you comply with these procedures, the valuation date for the early redemption of your Notes will be the date specified in your notice of early redemption (unless such date is not a trading day, in which case the valuation date will be the next succeeding trading day) and the early redemption date will be the third business day following that valuation date (in each case, subject to postponement and adjustment due to a market disruption event, as described under “Description of Notes—Market Disruption Events”). If we do not receive your notice of early redemption by 11:00 a.m., or your confirmation of early redemption by 4:00 p.m., on or prior to the notice deadline date, your notice will not be effective on the notice deadline date and we will not redeem your Notes on the early redemption date corresponding to the valuation date specified in your notice of early redemption (or any other early redemption date, unless a duly completed and timely notice and confirmation of early redemption is delivered with respect to such other early redemption date). Your notice of early redemption and confirmation of early redemption will not be effective until we confirm receipt. See “Description of Notes—Early Redemption Procedures” for more information. You will have no right to require us to redeem your Notes on the day on which the Notes mature.

PS-8

You Will Not Know the Early Redemption Value of the Notes at the Time You Elect to Require Us to Redeem Your Notes

Because an election to require us to redeem your Notes is irrevocable and a confirmation of early redemption must be received by us no later than 4:00 p.m. on the business day prior to the applicable valuation date, you will not know the early redemption value at the time that you must decide whether or not to exercise your early redemption rights on your Notes. As a result, you will be exposed to market risk in the event the market fluctuates after we confirm your notice of election to exercise your early redemption rights.

Many Economic and Market Factors Will Impact the Value of the Notes; these Factors Interrelate in Complex Ways and the Effect of any One Factor May Offset or Magnify the Effect of Another Factor

In addition to the level of the Index on any day, the value of the Notes will be affected by a number of economic and market factors that may either offset or magnify each other, including:

| | — | | supply and demand for the Notes, including inventory positions with any market maker; |

| | — | | the market price of the Index Contracts or the physical commodities underlying the Index Contracts; |

| | — | | interest rates in the market generally; |

| | — | | a variety of economic, financial, political, regulatory, geographical, agricultural, meteorological or judicial events; and |

| | — | | the credit ratings of Lehman Brothers Holdings Inc. |

These factors interrelate in complex ways, and the effect of one factor on the market value of your Notes may offset or enhance the effect of another.

The Return on Your Notes Will Only Reflect the Level of the Index on the Applicable Valuation Date

Because the payment at maturity or upon early redemption will be determined based on the index factor calculated using the Index closing level on the applicable valuation date, which is a single trading day prior to maturity or the early redemption date, as applicable, the level of the Index at other times during the term of the Notes will not impact the amount payable on the Notes upon early redemption or at maturity. Accordingly, the amount payable at maturity or upon early redemption will not increase as a result of any increase in the level of the Index on any date during the term of the Notes other than on the applicable valuation date. This difference could be particularly large if there is a significant decrease in the level of the Index prior to the relevant valuation date or if there is significant volatility in the Index closing level during the term of the Notes, especially on dates near the applicable valuation date.

There May Not Be an Active Trading Market in the Notes, and the Liquidity of any Market for the Notes May Vary Materially Over Time

Although we expect to list the Notes on Amex, there can be no assurance that a secondary market for the Notes will exist at any time. Certain affiliates of Lehman Brothers Holdings Inc. may engage in limited purchase and resale transactions in the Notes, although they are not required to do so. If they decide to engage in such transactions, they may stop at any time. We are not required to maintain any listing of the Notes on Amex or any other exchange.

As stated on the cover of this pricing supplement, we intend to sell a portion of the Notes on the issuance date, and the remainder of the Notes will be offered and sold from time to time through Lehman Brothers Inc., our affiliate, as agent. Also, the number of Notes outstanding or held by persons other than our affiliates could be reduced at any time due to early redemptions of the Notes. Accordingly, the liquidity of the market for the Notes, if any, could vary materially over the term of the Notes. While you may elect to require us to redeem your Notes prior to maturity, early redemption is subject to the conditions and procedures described elsewhere in this pricing supplement, including the condition that you must present for early redemption at least 50,000 Notes at one time in order to exercise your right to require us to redeem your Notes on any early redemption date.

PS-9

The Tax Consequences of an Investment in the Notes are Uncertain

Investors should consider the tax consequences of investing in the Notes. No statutory, judicial or administrative authority directly addresses the characterization of the Notes or instruments similar to the Notes for United States federal income tax purposes. As a result, significant aspects of the United States federal income tax consequences of an investment in the Notes are not certain. Lehman Brothers Holdings Inc. is not requesting any ruling from the Internal Revenue Service with respect to the Notes and cannot assure you that the Internal Revenue Service will agree with the treatment described in this pricing supplement. The Internal Revenue Service could assert other characterizations that could affect the timing, amount and character of income or deductions. Lehman Brothers Holdings Inc. intends to treat, and by purchasing a Note, for all tax purposes, you agree to treat, a Note as a cash-settled financial contract, rather than as a debt instrument. You should consult your own tax advisor concerning the alternative characterizations. Neither Lehman Brothers Holdings Inc. nor any of its affiliates provide tax advice. See “Certain U.S. Federal Income Tax Consequences” in this pricing supplement.

Potential Conflicts of Interest May Exist Between You and the Calculation Agent and Between You and Certain Third Parties

Lehman Brothers Inc., one of our affiliates, will act as a calculation agent with respect to the Notes. The Note calculation agent will determine, among other things, the initial Index level, the closing level of the Index on any valuation date, the index factor, the fee factor and the amount that we will pay you at maturity or upon early redemption. The Note calculation agent will also be responsible for determining whether a market disruption event has occurred, whether the Index has been discontinued and whether there has been a material change in the method of calculation of the Index. In performing these duties, Lehman Brothers Inc. may have interests adverse to the interests of the holders of the Notes, and such adverse interests may affect the return on your Notes, particularly where Lehman Brothers Inc., as the Note calculation agent, is entitled to exercise discretion.

Your dealer may receive a financial benefit for each additional year you retain your Notes if Lehman Brothers Inc. pays the dealer a selling concession that depends on the length of time you have held your Notes. Please see “Supplemental Plan of Distribution” in this pricing supplement.

Certain of Our, or Our Affiliates’, Activities May Adversely Affect the Value of Your Notes

We or one of our affiliates may serve as issuer, agent or underwriter for additional issuances of notes with returns linked or related to changes in the level of the Index or the Index Contracts that comprise the Index. By introducing competing products into the marketplace in this manner, we or one or more of our affiliates could adversely affect the value of the Notes.

We, through our affiliates or others, may hedge some or all of our anticipated exposure in connection with the Notes by taking positions in the Index or the Index Contracts underlying the Index, or instruments whose value is derived from the Index or the Index Contracts.

While we cannot predict an outcome, such hedging activity or other hedging or investment activity of ours could potentially increase the level of the Index, and therefore effectively establish a higher level that the Index must achieve for you to earn a positive return on your investment. From time to time, prior to maturity of the Notes, we may pursue a dynamic hedging strategy which may involve taking long or short positions in the Index or the Index Contracts underlying the Index, or instruments whose value is derived from the Index or the Index Contracts. We cannot assure you that any of these activities will not have a material impact on the level of the Index or the value of the Notes.

Lehman Brothers Holdings Inc. Employees Holding the Notes Must Comply With Policies That Limit Their Ability to Trade the Notes and May Affect the Value of Their Notes

If you are an employee of Lehman Brothers Holdings Inc. or one of its affiliates, you may acquire the Notes only in compliance with all of our internal policies and procedures. Because these policies and procedures limit the dates and times that you may transact in the Notes, you may not be able to purchase any Notes described in the relevant terms supplement from us and your ability to trade or sell any such Notes in the secondary market may be limited.

PS-10

RISKS RELATED TO THE INDEX

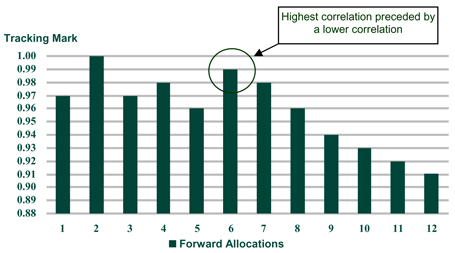

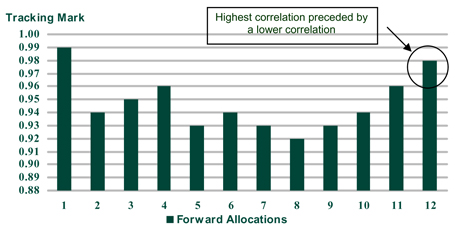

An Investment in the Notes Linked to the Index Carries the Risks Associated With the LBCI Pure Beta Re-Allocation Methodology

The Index is a total return index that re-allocates the underlying Index Contracts on a quarterly basis to a series of forward contracts in the standard LBCI Contract Calendar of successive one-month increments, or “Forward Allocations”, using the re-allocation methodology of the LBCI Pure Beta. This re-allocation methodology seeks both to mitigate distortions in the commodity markets associated with investment flows and supply disruptions, among others, and to underweight commodities that have been in contango and overweight commodities that have been in backwardation, offering the potential to minimize negative roll yield. If the re-allocation methodology does not achieve the expected objectives, the value of the Notes may be adversely affected. No assurance can be given that the strategy used to construct the Index will be successful or that the Index will outperform any alternative index or strategy that might be constructed from the underlying Index Contracts. In addition, the re-allocation methodology likely will result in different levels and returns for the Index relative to the general LBCI Total Return, and no assurance can be given that the Index will outperform the general LBCI Total Return.

Commodity Prices Change Unpredictably, Affecting the Index Level and the Value of Your Notes in Unforeseeable Ways

Trading in the Index Contracts and the commodities underlying such Index Contracts is speculative and can be extremely volatile. Market prices of the Index Contracts and the commodities underlying such Index Contracts may fluctuate rapidly based on numerous factors, including:

| | — | changes in supply and demand relationships; |

| | — | fiscal, monetary and exchange control programs; |

| | — | domestic and foreign political and economic events and policies; |

| | — | technological developments; |

| | — | changes in interest rates and growth rates in the global economy; and |

| | — | trading activities in commodities and related contracts, including the Index Contracts. |

These factors may affect the level of the Index and the value of your Notes in varying ways, and different factors may cause the value of different Index Contracts and the commodities underlying such Index Contracts, and the volatilities of their prices, to move in inconsistent directions at inconsistent rates.

Risks Associated with the Composition of the Index may Adversely Affect the Value of your Notes

Because the Notes are linked to the Index, which reflects the return on 20 different exchange-traded Index Contracts covering physical commodities, it will be less diversified than other funds or investment portfolios that are linked to a broader range of products and, therefore, could experience greater volatility. Additionally, the annual composition of the Index and the liquidity factors for each component Index Contract will be established based on the annual composition and liquidity factors determined for the general LBCI, which is in turn calculated in reliance upon historical commodity contract liquidity data that is subject to potential errors in data sources or other errors. Any discrepancies that require revision are not applied retroactively but will be reflected in the determinations for the Index for the following year. However, Lehman Brothers Inc., as Index Sponsor, may not discover every discrepancy. Furthermore, the Index Sponsor has no obligation to take the needs of any parties to transactions involving the Index or the general LBCI into consideration when making any changes to the Index or the general LBCI.

PS-11

Higher Future Prices of the Index Contracts Relative to their Current Prices may Decrease the Level of the Index, and Therefore the Amount Payable on the Notes

The Index is composed of the Index Contracts, which are futures contracts on physical commodities, and reflects the total combined returns associated with the changes in price of the Index Contracts and the “roll yields” for those Index Contracts (the price changes and roll yield taken together constitute the “excess return”), together with the interest return on a hypothetical fully collateralized position in the Index Contracts (the excess return together with this collateral return constitute the “total return”). Unlike equities, which typically entitle the holder to a continuing stake in a corporation, and unlike owning the commodity directly, a commodity futures contract normally specifies a certain date for delivery of the underlying physical commodity. A fundamental characteristic of the Index, like other commodity indices, is that as a result of being comprised of futures contracts, the Index must be managed to ensure it does not take delivery of the commodities in question. This is achieved through a process referred to as “rolling”, under which a given Index Contract during a month in which it approaches its settlement date is rolled forward to a new contract date (i.e., the Index Contract is effectively “sold” to “buy” a longer-dated Index Contract). For further information on the roll process for the Index and the LBCI generally, see “The Index—LBCI Pure Beta Return Calculations” and “The Lehman Brothers Commodity Index—LBCI Return Calculations” below.

Roll yield is generated during the roll process from the difference in price between the near-term and longer-dated futures contracts. When longer-dated contracts are priced lower than the nearer contract and spot prices, the market is in backwardation, and positive roll yield is generated when higher-priced near-term futures contracts are “sold” to “buy” lower priced longer-dated contracts. When the opposite is true and longer-dated contracts are priced higher, the market is in contango, and negative roll yields result from the “sale” of lower priced near-term futures contracts to “buy” higher priced longer-dated contracts. While many of the commodities underlying the Index Contracts have historically exhibited consistent periods of backwardation, backwardation will most likely not exist at all times. Accordingly, because the level of the Index includes the excess returns in the Index Contracts, negative “roll yields” resulting from contango markets could adversely affect the level of the Index.

Suspension or Disruptions of Market Trading in the Commodity and Related Futures Markets May Require an Adjustment to the Calculation of the Index and May Adversely Affect the Value of the Notes

The commodity markets are subject to temporary distortions or other disruptions due to various factors, including the lack of liquidity in the markets, the participation of speculators, and government regulation and intervention. In addition, U.S. futures exchanges and some foreign exchanges have regulations that limit the amount of fluctuation in futures contract prices that may occur during a single business day. These limits are generally referred to as “daily price fluctuation limits” and the maximum or minimum price of a contract on any given day as a result of these limits is referred to as a “limit price.” Once the limit price has been reached in a particular contract, no trades may be made at a different price. Limit prices have the effect of precluding trading in a particular contract or forcing the liquidation of contracts at disadvantageous times or prices. These circumstances could adversely affect the level of the Index and, therefore, the value of your Notes.

Certain of the events set forth above also constitute market disruption events under the terms of the Notes. To the extent any market disruption event occurs with respect to one or more Index Contracts and remains in effect on a scheduled valuation date for the Notes, the applicable valuation date for the affected Index Contracts will be postponed until the market disruption event ceases to be in effect or, if the market disruption event remains in effect for eight trading days after the valuation date, the Index level will be determined by the Note calculation agent in good faith as described below under “Description of Notes—Market Disruption Events”. In the event a valuation date is postponed, the Index level may be lower than you may have anticipated based on the last available closing level of the Index, and possibly less than the initial Index level, which may adversely affect the payment at maturity or upon early redemption or otherwise affect the value of your Notes. In addition, if a valuation date is postponed due to a market disruption event as described above (which, depending on the circumstances surrounding the market disruption event, could be a postponement of up to eight trading days), then (a) in the case of the maturity date, if the final valuation date is postponed so that it falls less than three business days prior to the maturity date, the maturity date, will be postponed to the third business day following the postponed final valuation date, or (b) in the case of any valuation date in respect of an early redemption prior to the maturity date, the early redemption date will be postponed to the third business day following the postponed valuation date. In either of such cases, settlement of the Notes will be delayed.

The Index May in the Future Include Contracts That are Not Traded on Regulated Futures Exchanges

The Index is based on the Index Contracts, which are all futures contracts traded on regulated futures exchanges (referred to in the United States as “designated contract markets”). However, it is possible that the Index could in the future include over-the-counter contracts (such as swaps and forward contracts) traded on trading facilities that are subject to lesser degrees of regulation or,

PS-12

in some cases, no substantive regulation. As a result, trading in such contracts, and the manner in which prices and volumes are reported by the relevant trading facilities, may not be subject to the provisions of, and the protections afforded by, the U.S. Commodity Exchange Act, or other applicable statutes and related regulations, that govern trading on regulated futures exchanges. In addition, many electronic trading facilities have only recently initiated trading and do not have significant trading histories. As a result, the trading of contracts on such facilities, and the inclusion of such contracts in the Index, could present certain risks not associated with most exchange traded futures contracts, including risks related to the liquidity and price histories of the relevant contracts.

The Notes are not Directly Linked to the Index Contracts or any other Exchange-Traded Futures Contracts

The Notes are not linked directly to the Index Contracts or any other exchange-traded futures contracts. The Notes are linked to the Index, which, as described above, reflects the excess returns that are potentially available through an investment in the Index Contracts (in addition to the interest return on a hypothetical fully collateralized position in these Index Contracts). Accordingly, the return on your Notes will reflect the excess returns associated with the Index Contracts, including any positive or negative “roll yield”, and therefore will not reflect the return you would realize if the Notes were linked directly to the Index Contracts or if you actually owned the Index Contracts or other exchange-traded futures contracts for a similar period.

As Sponsor of the Index, Lehman Brothers Inc., an Affiliate of Lehman Brothers Holdings Inc., Will Have the Authority to Make Determinations in Respect of the Index that Could Create Conflicts of Interest or Materially Affect your Notes in Various Ways

As further described under “The Index”, the Index was developed, and is owned, by Lehman Brothers Inc., an affiliate of Lehman Brothers Holdings Inc., and is calculated and disseminated by IDC. Lehman Brothers Inc. is responsible for, and has determinative influence over, the composition, methodologies and maintenance of the Index. The judgments that Lehman Brothers Inc., as Index Sponsor, makes in connection with the composition, methodologies and maintenance of the Index, or that IDC makes in connection with calculating the Index in accordance with the methodologies and other judgments made by the Index Sponsor, may affect the value of the Notes, the closing Index level on one or more dates and the payment at maturity or upon early redemption. See “The Index” for additional details on the role of Lehman Brothers Inc. as Index Sponsor and IDC as Index Calculation Agent. Neither Lehman Brothers Inc., in its capacity as Index Sponsor, or IDC, in its capacity as Index Calculation Agent, has any obligation to take your interests into consideration for any reason.

The role played by Lehman Brothers Inc., as Index Sponsor, and the exercise by it of the kinds of discretion described above could represent a conflict of interest. In addition, Lehman Brothers Inc. may decide to discontinue the Index, which would mean that, if Lehman Brothers Inc., an affiliate of Lehman Brothers Holdings Inc., as Note calculation agent, determines that no successor index exists on the date when the final Index level is required to be determined, then Lehman Brothers Inc. in its capacity as Note calculation agent would have the discretion to make determinations with respect to the level of the Index, which may adversely affect the value of the Notes, the Index level and the payment at maturity or upon early redemption. See “Description of Notes—Index Adjustment” below.

Trading and Other Transactions by Affiliates of Lehman Brothers Holdings Inc. and Others in the Index Contracts and the Commodities Underlying the Index Contracts May Affect the Level of the Index

Lehman Brothers Commodity Services Inc. and certain other affiliates of Lehman Brothers Holdings Inc. actively trade the Index Contracts and options on futures contracts on the commodities underlying the Index Contracts. Lehman Brothers Commodity Services Inc. and certain other affiliates of Lehman Brothers Holdings Inc. also actively enter into or trade and market securities, swaps, options, derivatives, and related instruments that are linked to the performance of the Index, the Index Contracts or the commodities underlying the Index Contracts. Certain affiliates of Lehman Brothers Holdings Inc. underwrite or issue other securities or financial instruments indexed to the Index and related indices. Lehman Brothers Inc. and certain of its affiliates license the Index for publication or for use by unaffiliated third parties. The markets in certain of the Index Contracts may not be traded in significant volumes and may be significantly affected by trading activities, including speculators.

Trading and underwriting activities by Lehman Brothers Holdings Inc. and its respective affiliates could adversely affect the value of the Index Contracts, the commodities underlying the Index Contracts and the level of the Index, and therefore could in turn affect the return on and the value of the Notes. For instance, a market maker in a financial instrument linked to the performance of the Index may expect to hedge some or all of its position in that financial instrument. Purchase (or selling) activity in the Index Contracts or the commodities underlying the Index Contracts in order to hedge the market maker’s position in the financial instrument may

PS-13

affect the market price of the Index Contracts, which in turn may affect the level of the Index. With respect to any of the activities described above, none of Lehman Brothers Holdings Inc. or its respective affiliates has any obligation to take the needs of any buyers, sellers or holders of the Notes into consideration at any time.

Lehman Brothers Inc. May be Required to Replace an Index Contract if that Contract is Terminated or Replaced

Each Index Contract is a “Designated Contract” that has been selected as the reference contract for each commodity represented in the Index and the LBCI generally, as described under “The Index—Index Composition and Index Contract Selection” and “The Lehman Brothers Commodity Index—Commodity Selection and Weights” below. Data concerning these Designated Contracts will be used to calculate the Index. If an Index Contract were to be terminated or replaced by an exchange, a comparable futures contract, if available, would be selected by Lehman Brothers Inc., as Index Sponsor, as a Designated Contract to replace that Index Contract. The termination or replacement of any Index Contract may have an adverse impact on the level of the Index.

Changes in the Treasury Bill Rate of Interest May Affect the Level of the Index and Your Notes

Because the level of the Index is determined, in part, by the rate of interest that could be earned on cash collateral invested in specified Treasury Bills, changes in the Treasury Bill rate of interest may affect the level of the Index and the amount payable on your Notes at maturity or upon early redemption, if any, and, therefore, the market value of your Notes. Assuming the trading prices of the Index Contracts remain constant, an increase in the Treasury Bill rate of interest will increase the level of the Index and, therefore, the value of your Notes. A decrease in the Treasury Bill rate of interest will adversely impact the level of the Index and, therefore, the value of your Notes.

Lack of Regulation by the CFTC

The Notes are debt securities that are direct obligations of Lehman Brothers Holdings Inc. The net proceeds to be received by Lehman Brothers Holdings Inc. from the sale of the Notes will not be used to purchase or sell Index Contracts, the commodities underlying the Index Contracts or other futures contracts on such commodities for the benefit of holders of the Notes. The Notes are not themselves commodity futures contracts, and an investment in the Notes does not constitute either an investment in the Index Contracts, the commodities underlying the Index Contracts or other futures contracts on such commodities, or in a collective investment vehicle that trades in the Index Contracts, the commodities underlying the Index Contracts or other futures contracts on such commodities.

Unlike an investment in the Notes, an investment in a collective investment vehicle that invests in commodities on behalf of its participants may be regulated as a commodity pool and its operator may be required to be registered with and regulated by the Commodity Futures Trading Commission (“CFTC”) as a “commodity pool operator” (“CPO”). Because the Notes are not interests in a commodity pool, the Notes will not be regulated by the CFTC as a commodity pool, Lehman Brothers Holdings Inc. will not be registered with the CFTC as a CPO, and you will not benefit from the CFTC’s or any non–U.S. regulatory authority’s regulatory protections afforded to persons who trade in commodity futures contracts or who invest in regulated commodity pools.

Because the Notes do not constitute investments by you in futures contracts traded on regulated futures exchanges, you will not benefit from the CFTC’s or any other regulatory authority’s regulatory protections afforded to persons who trade in futures contracts on a regulated futures exchange.

You Must Rely on Your Own Evaluation of the Merits of an Investment Linked to the Index and the Commodities Underlying the Index Contracts that Comprise the Index

In the ordinary course of their businesses, affiliates of Lehman Brothers Holdings Inc. may from time to time express views on expected movements in the level of the Index, the individual Index Contracts or the commodities underlying the Index Contracts. These views are sometimes communicated to clients who participate in markets in the Index Contracts or the commodities underlying the Index Contracts. However, these views, depending upon world-wide economic, political and other developments, may vary over differing time horizons and are subject to change. Moreover, other professionals who deal in markets for the Index Contracts or the commodities underlying the Index Contracts may at any time have significantly different views from those of Lehman Brothers Holdings Inc. or its affiliates. In connection with your purchase of the Notes, you should investigate the Index, the Index Contracts and the commodities underlying the Index Contracts and not rely on views which may be expressed by Lehman Brothers Holdings Inc. or its affiliates in the ordinary course of their businesses with respect to the Index or any such Index Contract or underlying

PS-14

commodity. With respect to any of these activities, neither Lehman Brothers Holdings Inc. nor any of its affiliates have any obligation to take into consideration the interests of holders of the Notes.

You should make such investigation as you deem appropriate as to the merits of an investment linked to the Index. Neither the offering of the Notes nor any views which may from time to time be expressed by Lehman Brothers Holdings Inc. or its affiliates in the ordinary course of their businesses with respect to the Index, individual Index Contracts or the commodities underlying the Index Contracts constitutes a recommendation as to the merits of an investment in the Notes.

PS-15

USE OF PROCEEDS; HEDGING

The net proceeds we receive from the sale of the Notes will be used, in whole or in part, by us or by one or more of our affiliates in connection with hedging our obligations under the Notes. The balance of the proceeds, if any, will be used for general corporate purposes.

On or prior to the date of this pricing supplement, we, through our affiliates or others, may hedge some or all of our anticipated exposure in connection with the Notes by taking positions in the Index Contracts, or instruments whose value is derived from the Index Contracts. While we cannot predict an outcome, such hedging activity could potentially increase the closing prices of the Index Contracts as well as the initial Index level, and, therefore, effectively establish higher closing prices that the Index Contracts must achieve as of the applicable valuation date, in order for you to receive at maturity or upon early redemption of the Notes more than the amount you originally invested in the Notes. From time to time, prior to maturity of the Notes, we may pursue a dynamic hedging strategy that may involve taking long or short positions in the Index Contracts or instruments whose value is derived from the Index Contracts. Although we have no reason to believe that any of these activities will have a material impact on the prices of the Index Contracts or the value of the Notes, we cannot assure you that these activities will not have such an effect.

We have no obligation to engage in any manner of hedging activity and will do so solely at our discretion and for our own account. No Note holder shall have any rights or interest in our hedging activity or any positions we may take in connection with our hedging activity.

PS-16

VALUATION OF THE NOTES

The market value of the Notes will be affected by several factors, many of which are beyond our control. We expect that generally the market value of the Notes will be affected by the level of the Index on any day more than by any other factor. Other factors that may influence the market value of the Notes include, but are not limited to, supply and demand for the Notes, the volatility of the Index, the market price of the Index Contracts, the Treasury Bill rate of interest, the volatility of commodities prices, economic, financial, political, regulatory, or judicial events that affect the level of the Index or the market price of the Index Contracts, the general interest rate environment, as well as the perceived creditworthiness of Lehman Brothers Holdings Inc. See “Risk Factors” in this pricing supplement for a discussion of the factors that may influence the market value of the Notes prior to maturity.

Indicative Value

An intraday “indicative value” meant to approximate the intrinsic economic value of the Notes will be calculated and published by International Data Corporation (“IDC”) or a successor via the facilities of the Consolidated Tape Association under the ticker symbol “RAW.IV”. We use the term “indicative value” to refer to the value of the Notes at a given time determined based on the following equation:

Indicative Value = [Principal Amount per Note × (Current Index Level/Initial Index Level)] × Current Fee Factor

where:

Principal Amount per Note = $50;

Current Index Level = The most recent published level of the Index;

Initial Index Level = The closing level of Index on the inception date; and

Current Fee Factor = The most recent daily calculation of the fee factor with respect to your Notes, determined as described above.

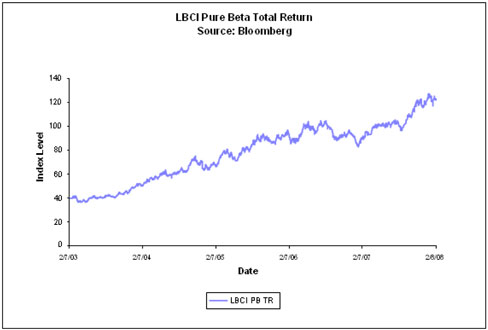

IDC is not affiliated with Lehman Brothers Holdings Inc. and does not approve, endorse, review or recommend Lehman Brothers Holdings Inc. or the Notes.