Free-Writing Prospectus

Filed pursuant to Rule 433

Registration Statement No. 333-134553

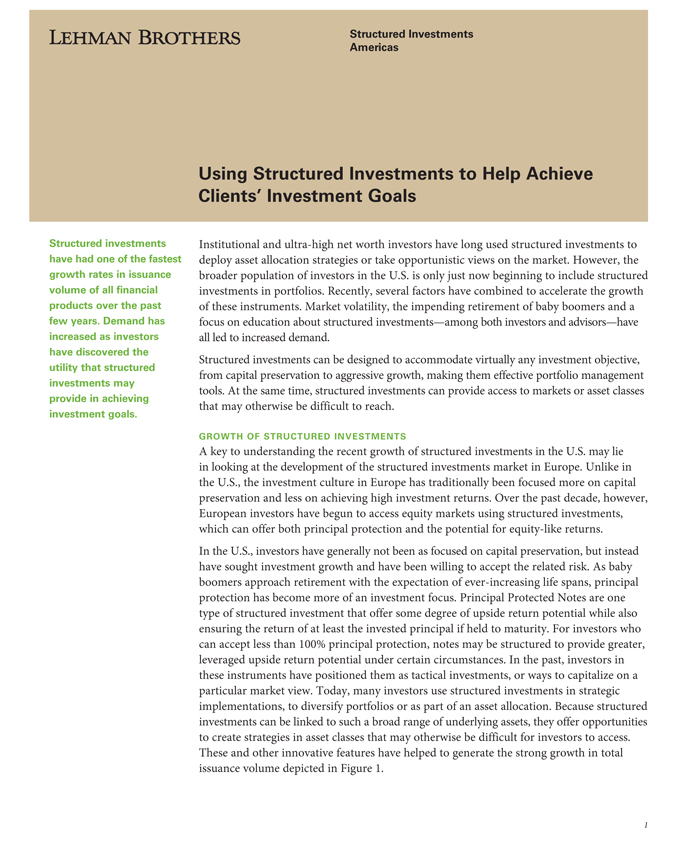

LEHMAN BROTHERS Structured Investments Americas Using Structured Investments to Help Achieve Clients’ Investment Goals Structured investments have had one of the fastest growth rates in issuance volume of all financial products over the past few years. demand has increased as investors have discovered the utility that structured investments may provide in achieving investment goals. Institutional and ultra-high net worth investors have long used structured investments to deploy asset allocation strategies or take opportunistic views on the market. However, the broader population of investors in the U.S. is only just now beginning to include structured investments in portfolios. Recently, several factors have combined to accelerate the growth of these instruments. Market volatility, the impending retirement of baby boomers and a focus on education about structured investments—among both investors and advisors—have all led to increased demand. Structured investments can be designed to accommodate virtually any investment objective, from capital preservation to aggressive growth, making them effective portfolio management tools. At the same time, structured investments can provide access to markets or asset classes that may otherwise be difficult to reach. Growth of Structured Investments A key to understanding the recent growth of structured investments in the U.S. may lie in looking at the development of the structured investments market in Europe. Unlike in the U.S., the investment culture in Europe has traditionally been focused more on capital preservation and less on achieving high investment returns. Over the past decade, however, European investors have begun to access equity markets using structured investments, which can offer both principal protection and the potential for equity-like returns. In the U.S., investors have generally not been as focused on capital preservation, but instead have sought investment growth and have been willing to accept the related risk. As baby boomers approach retirement with the expectation of ever-increasing life spans, principal protection has become more of an investment focus. Principal Protected Notes are one type of structured investment that offer some degree of upside return potential while also ensuring the return of at least the invested principal if held to maturity. For investors who can accept less than 100% principal protection, notes may be structured to provide greater, leveraged upside return potential under certain circumstances. In the past, investors in these instruments have positioned them as tactical investments, or ways to capitalize on a particular market view. Today, many investors use structured investments in strategic implementations, to diversify portfolios or as part of an asset allocation. Because structured investments can be linked to such a broad range of underlying assets, they offer opportunities to create strategies in asset classes that may otherwise be difficult for investors to access. These and other innovative features have helped to generate the strong growth in total issuance volume depicted in Figure 1.

figure 1: Registered structured investment issuance, u.s. Source: Structured Products Association, www.structuredproducts.org (Structured investments involve a tradeoff between risk and return, and any risk-adjusted total return will generally be no greater than the underlying asset’s risk-adjusted total return. For example, any decrease in downside risk achieved through principal protection will generally be balanced by diminished upside exposure. Investors may receive only a fraction of any positive returns on the linked asset, the investment may be subject to a cap on returns or the investor may not be entitled to participate in any dividends, interest payments or other periodic income from the underlying asset. Conversely, greater opportunity to participate in upside returns on the linked asset will generally be accompanied by increased downside risk exposure.) Creating A Structured Investment Issuers typically create structured investments by combining bonds with derivatives linked to an underlying asset. These bonds are usually zero-coupon bonds, which are issued at a discount and appreciate to par value at maturity, thereby providing principal protection to the investor at maturity. The zero-coupon bond may then be combined with options or other derivatives that link to the underlying asset to create a structured investment. This structured investment is typically issued as a bond or a bank certificate of deposit (CD) with a maturity date. The principal protection, if any, is based on holding the note until maturity. At its simplest, the benefit of a structured investment is that it allows the investor to alter the risk/return profile of an investment. Structured investments may allow for optimization around an investor’s financial goals, ranging from capital preservation to aggressive growth. They also allow for a tremendous range of investment options. The linked asset can be an individual stock, commodity, foreign currency exchange rate or interest rate, or a combination of these (i.e., a basket or index). This may make structured investments an immensely valuable portfolio diversifier and asset allocation tool. Structured Investments: Case Studies The most intuitive way to understand the use and benefits of a structured investment is to look at a particular investor situation and then examine a structured investment that may provide a solution. Tactical implementations, which usually have shorter-dated maturities (approximately two years or less), might be used to express a view on the market—for example, the trend in oil prices, a currency play involving the appreciation or depreciation of one currency versus another (i.e., dollar/yen or dollar/euro), or a view on the housing market. Strategic implementations are generally longer-dated, from two years to five-plus years, and can provide access to difficult-to-reach asset classes that an investor desires for long-term exposure in a portfolio, such as commodities or foreign currency exchange rates. They can also provide a means to include a particular asset class in a diversified portfolio that an investor would consider too risky without principal protection. Structured investments may allow for optimization around an investor’s financial goals, ranging from capital preservation to aggressive growth.

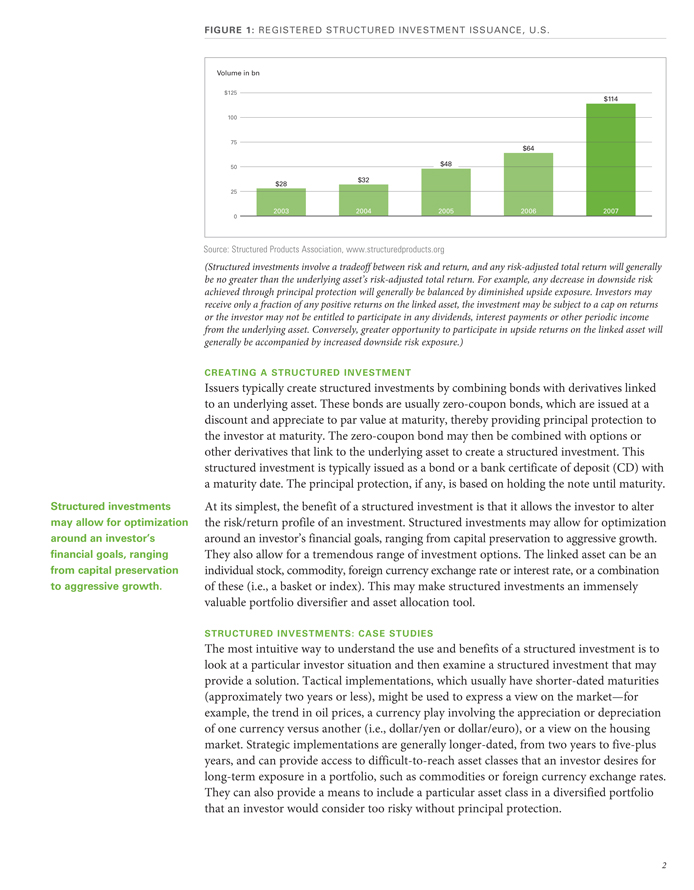

this note may provide international diversification, exposure to the growth potential of equities and principal protection that may be a surrogate for the security that some investors associate with bonds. CAS e Study 1: Principal Protected note Our first case study involves a couple approaching retirement. They have become more concerned with principal preservation as their ability to tolerate risk is diminishing. As a result, they consider a plan to overweight fixed income relative to equity. However, they are also aware that increased life expectancy gives rise to the possibility that they may outlive their savings. They want to be sure they have enough assets to live comfortably throughout an extended retirement, and they worry that fixed income will not provide enough growth on their investment to outpace inflation. One potential solution may be a Principal Protected Note linked to a basket of global equity indices. This note may provide international diversification, exposure to the growth potential of equities and principal protection that may be a surrogate for the security that some investors associate with bonds. Figures 2 and 3 outline the assumptions and the payout of this hypothetical Principal Protected Note, under both bull and bear market scenarios. figure 2 — Hypothetical principal protected note (Bull ma Rket scenario) Hypothetical note Features • The linked asset is an equally-weighted basket of global price return stock indices (e.g., S&P 500, EuroStoxx, and Nikkei, excluding any dividends). • The term of the note is four years. • The note provides 100% principal protection (if held to maturity) and 100% participation in any potential increase in the level of the linked asset over the life of the investment. • The note is held to maturity, at which point the payoff equals the amount invested plus the positive return of the basket of indices. If the return of the basket is negative, the note will pay only the original invested principal. scenario assumptions • The example below assumes an increase in the linked basket of indices of 40% over the life of the investment. In this scenario, the payout at maturity equals the initial investment of $1,000, plus $400 from the market return of the linked investment, for a total payout of $1,400 dollars.

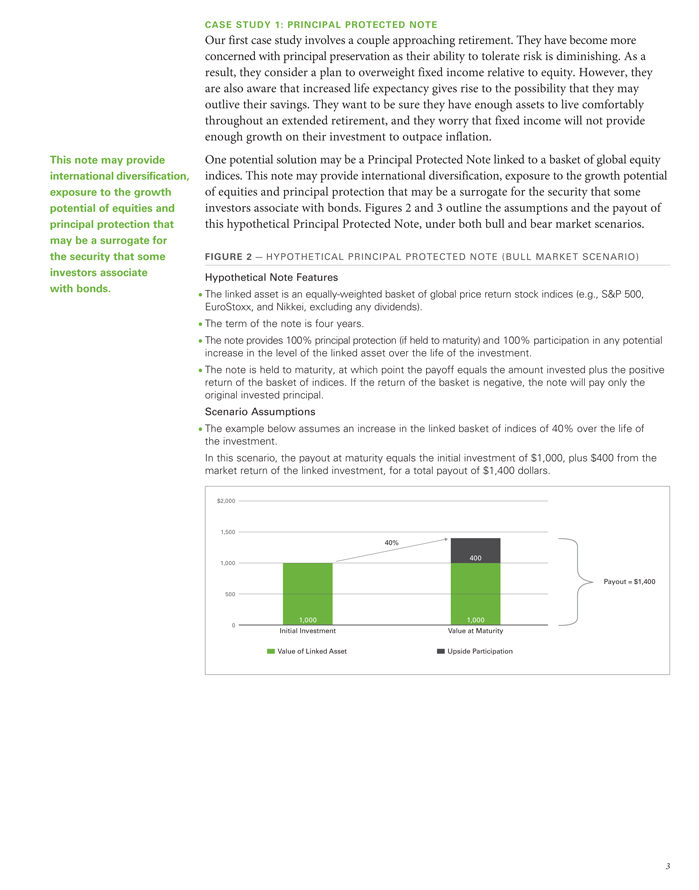

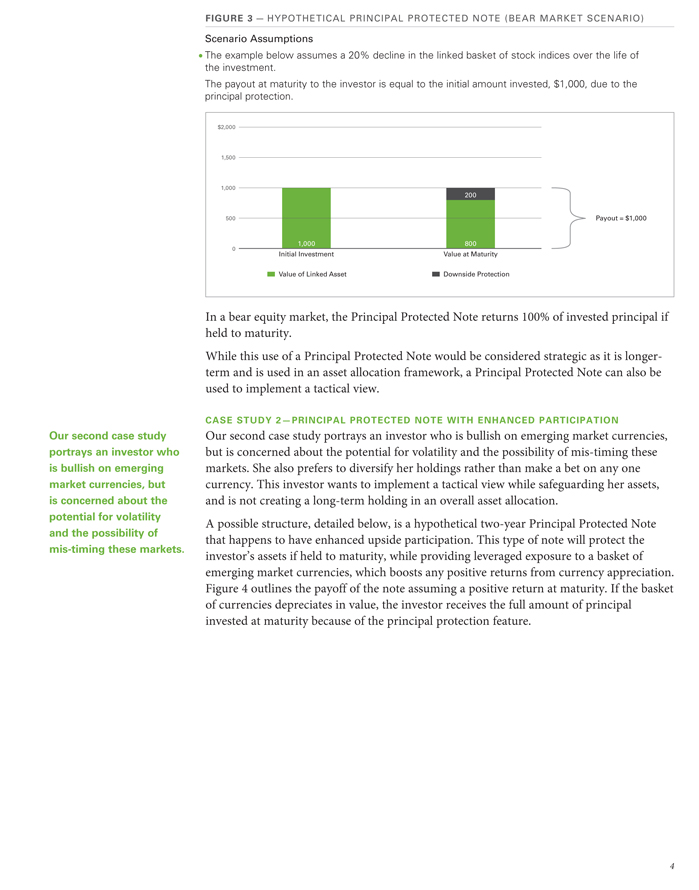

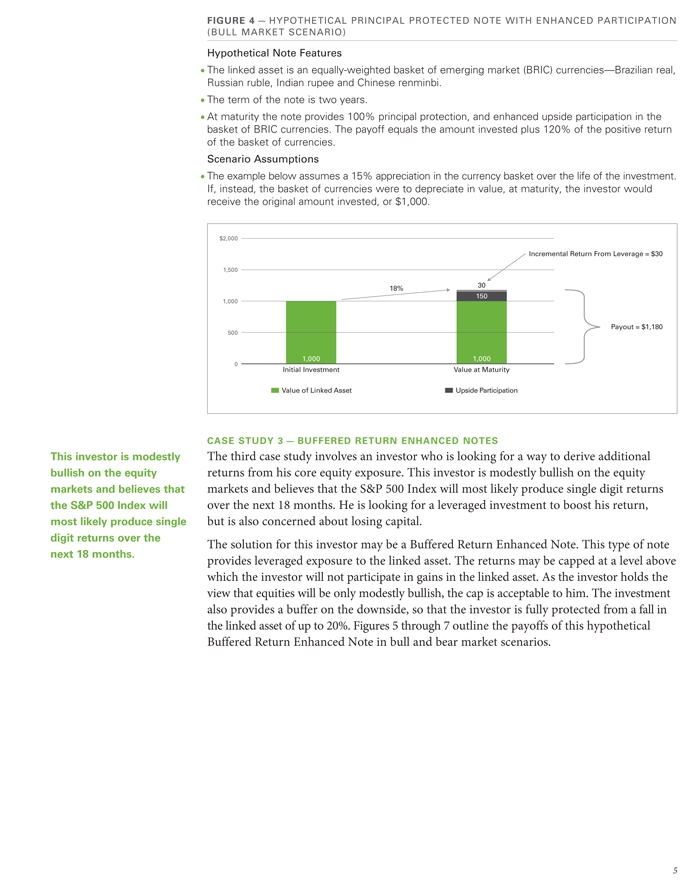

our second case study portrays an investor who is bullish on emerging market currencies, but is concerned about the potential for volatility and the possibility of mis-timing these markets. figure 3 — Hypothetical principal protected note (Bear ma Rket scenario) scenario assumptions • The example below assumes a 20% decline in the linked basket of stock indices over the life of the investment. The payout at maturity to the investor is equal to the initial amount invested, $1,000, due to the principal protection. $2,000 1,500 1,000 500 Payout = $1,000 1,000 800 0 Initial Investment Value at Maturity Value of Linked Asset Downside Protection In a bear equity market, the Principal Protected Note returns 100% of invested principal if held to maturity. While this use of a Principal Protected Note would be considered strategic as it is longer-term and is used in an asset allocation framework, a Principal Protected Note can also be used to implement a tactical view. CAS e Study 2—Principal Protected note wItH enhanced Participation Our second case study portrays an investor who is bullish on emerging market currencies, but is concerned about the potential for volatility and the possibility of mis-timing these markets. She also prefers to diversify her holdings rather than make a bet on any one currency. This investor wants to implement a tactical view while safeguarding her assets, and is not creating a long-term holding in an overall asset allocation. A possible structure, detailed below, is a hypothetical two-year Principal Protected Note that happens to have enhanced upside participation. This type of note will protect the investor’s assets if held to maturity, while providing leveraged exposure to a basket of emerging market currencies, which boosts any positive returns from currency appreciation. Figure 4 outlines the payoff of the note assuming a positive return at maturity. If the basket of currencies depreciates in value, the investor receives the full amount of principal invested at maturity because of the principal protection feature.

this investor is modestly bullish on the equity markets and believes that the S&P 500 Index will most likely produce single digit returns over the next 18 months. figure 4 — Hypothetical principal protected note with enhanced participation (Bull market scenario) Hypothetical note Features • The linked asset is an equally-weighted basket of emerging market (BRIC) currencies—Brazilian real, Russian ruble, Indian rupee and Chinese renminbi. • The term of the note is two years. • At maturity the note provides 100% principal protection, and enhanced upside participation in the basket of BRIC currencies. The payoff equals the amount invested plus 120% of the positive return of the basket of currencies. scenario assumptions • The example below assumes a 15% appreciation in the currency basket over the life of the investment. If, instead, the basket of currencies were to depreciate in value, at maturity, the investor would receive the original amount invested, or $1,000. CAS e Study 3 — buffered retUrn en HAnCed noteS The third case study involves an investor who is looking for a way to derive additional returns from his core equity exposure. This investor is modestly bullish on the equity markets and believes that the S&P 500 Index will most likely produce single digit returns over the next 18 months. He is looking for a leveraged investment to boost his return, but is also concerned about losing capital. The solution for this investor may be a Buffered Return Enhanced Note. This type of note provides leveraged exposure to the linked asset. The returns may be capped at a level above which the investor will not participate in gains in the linked asset. As the investor holds the view that equities will be only modestly bullish, the cap is acceptable to him. The investment also provides a buffer on the downside, so that the investor is fully protected from a fall in the linked asset of up to 20%. Figures 5 through 7 outline the payoffs of this hypothetical Buffered Return Enhanced Note in bull and bear market scenarios.

by investing in this note, the investor forgoes any appreciation in the linked asset beyond 10%, but enjoys enhanced participation in linked asset returns between 0% and 10%. figure 5 — Hypothetical Buffered Return enhanced note (modest Bull ma Rket scenario) Hypothetical note Features • The linked asset is the price return of the S&P 500. • The term of the note is 18 months. • There is a 20% buffer that protects the investor from a 20% decline in the linked asset. The investor will lose 1.25% for every 1% decrease in the linked asset below the 20% buffer. • At maturity, the note provides 150% participation in the positive returns of the S&P 500 up to a maximum return of 10% in the S&P 500. The note would then provide a return of 15%, which is the maximum, capped return of the note. scenario assumptions • The example below assumes a modest bull equity market return of 5% over the life of the investment. In this scenario, as the 10% maximum return cap of the S&P 500 was not breached, the investor receives the full 150% upside participation of the note. The payout to the investor at maturity is the initial amount invested, $1,000, plus 150% of the upside return of the linked asset, for a total of $1,075, or 7.5%. figure 6 — Hypothetical Buffered Return enH anced note (stRong Bull ma Rket scenaRio) scenario assumptions • The example below assumes a strong bull equity market over the life of the investment that results in an increase of the linked asset of 30% at maturity. Since the S&P 500 appreciated by more than 10%, the payoff to the investor at maturity in this scenario is the initial amount invested, $1,000, plus the note’s capped payoff of 15%, for a total payoff of $1,150. Note that if the investor had invested directly in the linked asset over this same time period, the investor would have realized a return of 30% or $300. By investing in this note, the investor forgoes any appreciation in the linked asset beyond 10%, but enjoys enhanced participation in linked asset returns between 0% and 10%.

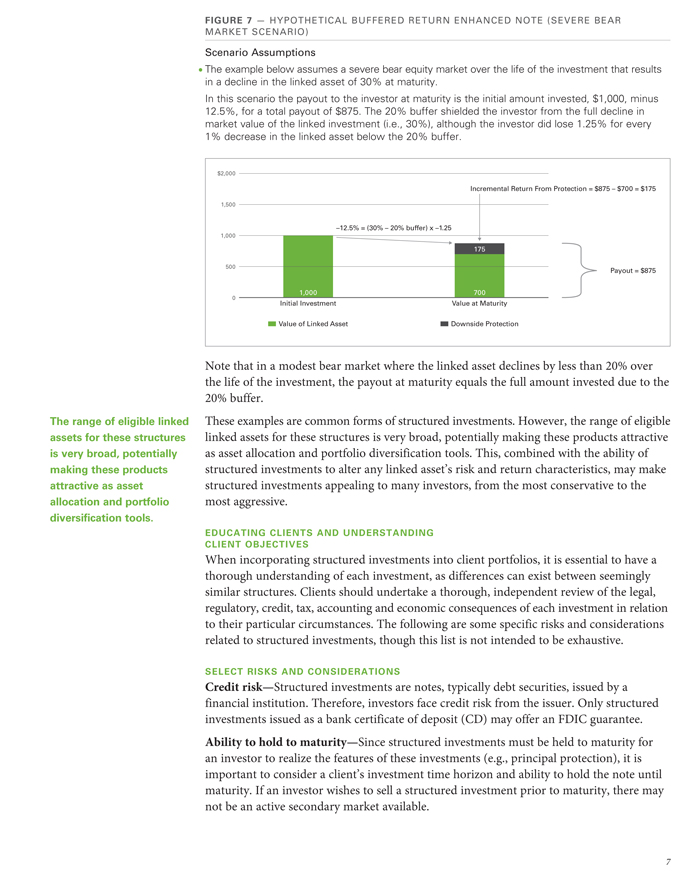

the range of eligible linked assets for these structures is very broad, potentially making these products attractive as asset allocation and portfolio diversification tools. figure 7 — Hypothetical Buffered Return enhanced note (seveRe BeaR ma Rket scenaRio) scenario assumptions • The example below assumes a severe bear equity market over the life of the investment that results in a decline in the linked asset of 30% at maturity. In this scenario the payout to the investor at maturity is the initial amount invested, $1,000, minus 12.5%, for a total payout of $875. The 20% buffer shielded the investor from the full decline in market value of the linked investment (i.e., 30%), although the investor did lose 1.25% for every 1% decrease in the linked asset below the 20% buffer. Note that in a modest bear market where the linked asset declines by less than 20% over the life of the investment, the payout at maturity equals the full amount invested due to the 20% buffer. These examples are common forms of structured investments. However, the range of eligible linked assets for these structures is very broad, potentially making these products attractive as asset allocation and portfolio diversification tools. This, combined with the ability of structured investments to alter any linked asset’s risk and return characteristics, may make structured investments appealing to many investors, from the most conservative to the most aggressive. edUCAtInG Clients And Understanding Client objectives When incorporating structured investments into client portfolios, it is essential to have a thorough understanding of each investment, as differences can exist between seemingly similar structures. Clients should undertake a thorough, independent review of the legal, regulatory, credit, tax, accounting and economic consequences of each investment in relation to their particular circumstances. The following are some specific risks and considerations related to structured investments, though this list is not intended to be exhaustive. Select risks And Considerations Credit risk Structured — investments are notes, typically debt securities, issued by a financial institution. Therefore, investors face credit risk from the issuer. Only structured investments issued as a bank certificate of deposit (CD) may offer an FDIC guarantee. Ability to hold to maturity Since structured — investments must be held to maturity for an investor to realize the features of these investments (e.g., principal protection), it is important to consider a client’s investment time horizon and ability to hold the note until maturity. If an investor wishes to sell a structured investment prior to maturity, there may not be an active secondary market available.

Pricing prior to maturity Determining — the value of structured investments prior to maturity depends on many variables including the volatility of the linked asset, interest rates and time to maturity. Pricing prior to maturity may be affected by these and other variables, some of which may be highly volatile. Price volatility at maturity The value — of a structured investment at maturity depends on the value of the linked asset, which may be highly volatile. In addition, structured investments may include leverage, which may cause their performance to have more volatility than the linked asset. Income prior to maturity Structured — investments typically do not pay dividends or coupons prior to maturity (even if the linked asset does). The client should not be dependent on receiving a regular income stream from the note. Conclusion The recent strong growth in structured investment issuance volume is the result of investors discovering the utility of these products in asset management. Structured investments may provide portfolio diversification that is otherwise unavailable to investors. They may offer the ability to alter the risk and return characteristics of linked assets and they may provide a means to express a short-term outlook on the market. While there are limitations on, and risks associated with, structured investments, such as having fixed maturities and issuer credit risk, for investors who are comfortable with and understand these products, they can offer an opportunity to further optimize a portfolio and help to achieve clients’ investment goals. We welcome your feedback. For any questions or comments please contact us. Lehman brothers Structured Investments Americas 212.526.0905 “Nikkei” and “Nikkei 225” are the service marks of Nikkei Inc. Nikkei Inc. reserves all the rights, including copyright, to the Nikkei 225SM Index. “Standard & Poor’s®”, “S&P®”, “S&P 500®” and “500®” are trademarks of the McGraw-Hill Companies, Inc. and have been licensed for use by Lehman Brothers. “Dow Jones EURO STOXX 50®” and “STOXX®” are trademarks of STOXX Limited and are licensed for use by Lehman Brothers. Lehman Brothers Holdings Inc. has filed a registration statement (including a prospectus) with the U.S. Securities and Exchange Commission (SEC) for this offering. Before you invest, you should read the prospectus dated May 30, 2006, the prospectus supplement dated May 30, 2006 for its Medium Term Notes, Series I, and other documents Lehman Brothers Holdings Inc. has filed with the SEC for more complete information about Lehman Brothers Holdings Inc. and this offering. Buyers should rely upon the prospectus, prospectus supplement and any relevant free writing prospectus for complete details. You may get these documents and other documents Lehman Brothers Holdings Inc. has filed for free by searching the SEC online database (EDGAR®) at www.sec.gov with “Lehman Brothers Holdings Inc.” as a search term. You may also access the prospectus and Series I MTN prospectus supplement on the SEC web site as follows: •Series I MTN prospectus supplement dated May 30, 2006: data/806085/000104746906007785/a2170815z424b2.htm •Prospectus dated May 30, 2006: http://www.sec. a2165526zs-3asr.htm Alternatively, Lehman Brothers Inc. will arrange to send you the prospectus, Series I MTN prospectus supplement and final pricing supplement (when completed) if you request it by calling your Lehman Brothers sales representative or 1-888-603-5847. I0142 03/08 LB18116 ©2008 Lehman Brothers Inc. Member SIPC. All rights reserved.