UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04919

______________________________________________

UBS Series Trust

______________________________________________________________________________

(Exact name of registrant as specified in charter)

51 West 52nd Street, New York, New York 10019-6114

______________________________________________________________________________

(Address of principal executive offices) (Zip code)

Mark F. Kemper, Esq.

UBS Global Asset Management

51 West 52nd Street

New York, NY 10019-6114 |

| (Name and address of agent for service) |

| |

| Copy to: |

Jack W. Murphy, Esq.

Dechert LLP

1775 I Street, N.W.

Washington, DC 20006-2401 |

Registrant’s telephone number, including area code: 212-882 5000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2006

Item 1. Reports to Stockholders.

UBS Series Trust

U.S. Allocation Portfolio

Annual Report

December 31, 2006

UBS Series Trust—U.S. Allocation Portfolio

February 15, 2007

Dear contract owner,

We present you with the annual report for UBS Series Trust—U.S. Allocation Portfolio for the fiscal year ended December 31, 2006.

Performance

During the fiscal year ended December 31, 2006, the Portfolio’s Class H shares returned 11.29%. Since the Portfolio invests in both stocks and bonds, we feel it is appropriate to compare the Portfolio’s performance to the U.S. Allocation Fund Index* (the “Index”), which returned 11.98% over the same time period. By contrast, the S&P 500 Index, which tracks large cap US equities, returned 15.80% during the reporting period. (For Class H and Class I returns over various time periods, please refer to “Performance at a glance” on page 7.) | | | | UBS Series Trust— U.S.

Allocation Portfolio

Investment goal:

Total return, consisting of long-term capital appreciation and current income.

Portfolio managers:

Portfolio Management Team, including Brian D. Singer UBS Global Asset Management (Americas) Inc.

Commencement:

Class H—September 28, 1998

Class I—January 5, 1999

Dividend payments:

Annually | | |

| An interview with lead portfolio manager Brian D. Singer |

| Q. | Can you describe the economic environment during the reporting period? |

| A. | Gross domestic product (or GDP—the market value of all goods and services produced within a country in a given period of time) increased a sharp 5.6% in the first quarter of 2006, its largest gain in nearly three years. However, second quarter GDP growth was 2.6%, with third quarter growth at 2.0%. This period of more moderate growth was attributed to several factors, including the delayed impact of rising short-term interest rates, initially high oil prices and the cooling of the once red-hot housing market. Growth then picked up again in the fourth quarter, as the advance estimate for GDP growth came in at 3.5%. This upturn was driven largely by a sharp increase in consumer spending. |

| | |

| * | An unmanaged index compiled by the advisor, constructed as follows: from September 28, 1998 (Portfolio’s inception) until February 29, 2004: 100% S&P 500 Index; from March 1, 2004 until May 31, 2005: 65% Russell 3000 Index, 30% Lehman Brothers US Aggregate Bond Index, 5% Merrill Lynch US High Yield Cash Pay Index; from June 1, 2005 until present: 65% Russell 3000 Index, 30% Lehman Brothers US Aggregate Bond Index, 5% Merrill Lynch US High Yield Cash Pay Constrained Index. |

1

UBS Series Trust—U.S. Allocation Portfolio

| Q. | How did the Federal Reserve Board (the “Fed”) react in this economic environment? |

| A. | While the leadership at the Fed changed from Alan Greenspan to Ben Bernanke in early 2006, there was initially little deviation from its tightening campaign to ward off inflation. During its first four meetings in 2006, the Fed raised short-term interest rates on each occasion, bringing the federal funds target rate to 5.25%. (The federal funds rate, or “fed funds” rate, is the rate that banks charge one another for funds they borrow on an overnight basis.) After the June increase, the Fed then held rates steady at its meetings in August, September, October and December. The Fed indicated that future rate movements would be data dependent as it attempts to keep the economy growing at a reasonable pace and ward off inflation. |

| | |

| Q. | How did the stock market perform during the fiscal year? |

| A. | The US equity market generated strong returns in 2006. After treading water during the first half of the year, stock prices rallied sharply because of strong corporate earnings, a pause in Fed interest rate hikes, moderating oil prices, and a robust mergers and acquisition environment. During the one-year period ended December 31, 2006, large cap stocks, as represented by the Russell 1000 Index, returned 15.46%. In contrast, small cap stocks, as represented by the Russell 2000 Index, gained 18.37% over the same period. This marked the sixth year out of the last seven that small caps outperformed their large cap counterparts. However, excluding the month of January, large caps outperformed small caps in 2006, returning 12.31% versus 8.63%, respectively. This could be a signal that the long anticipated shift in market leadership to large caps may be beginning. |

| | |

| Q. | Did the bond market generate positive results as well during the reporting period? |

| A. | 2006 offered investors two distinct bond markets, the first marked by inflation fears and rising yields, the second by economic pessimism and falling yields. After weakening over the initial six months of the year in concert with four Fed rate hikes, the bond market then rallied. This was triggered by weakening economic data and the Fed’s pauses (pause is a term used when the Fed decides to leave rates unchanged) over the last six months of 2006. Yields fell in response, but ended the year higher than where they began. All told, the bond market, as measured by the Lehman Brothers US Aggregate Bond Index, returned 4.33% during the reporting period. |

2

UBS Series Trust—U.S. Allocation Portfolio

| Q. | How was the Portfolio allocated at the end of the fiscal year? |

| A. | As of December 31, 2006, the Portfolio’s assets were allocated as follows: approximately 66% was invested in US equities; 32% was invested in US bonds; and 2% was invested in cash equivalents and other assets. We continue to believe that the US equity market is currently priced within a range of fair value, largely in recognition of a relatively benign US economic outlook and in the strength of realized US earnings growth. Overall asset allocation follows our conclusion that many asset prices remain close to fair value. |

| | |

| Q. | Which portions of the Portfolio performed well during the year and which areas produced disappointing results? |

| A. | As always, during the year we relied on our bottom-up research process to guide sector allocation and security selection for the Portfolio. This type of approach focuses on specific companies, rather than on entire industries or on the economy as a whole. During the fiscal year, underweight positions in the energy reserves and forest and paper industries enhanced results. Overweights in the securities and asset management industry, as well as to electric utilities were also beneficial to performance. In contrast, from an industry perspective, overweights in medical services and banks detracted from results. Elsewhere, underweights in the tobacco and equity REIT industries were a drag on performance. |

| | |

| | In terms of the Portfolio’s fixed income exposure, we underweighted (versus the U.S. Allocation Fund Index) corporate bonds throughout the reporting period. We believed corporates insufficiently compensated investors for the market risk they would have contributed to the Portfolio versus other investment opportunities. Nonetheless, the Portfolio benefited from strong issue selection within corporates, especially in the auto industry. Issue selection was also strong within commercial mortgage-backed securities (CMBS) and asset-backed securities (ABS). The Portfolio’s largest overweight for the reporting period was in securitized sectors. Within this area, we favored hybrid adjustable rate mortgages (ARMs) and non-agency mortgages. This sector allocation contributed to relative performance, particularly in the first half of the year. Within US government issues, we continue to hold a small allocation to Treasury Inflation Protected securities (TIPS). Although we did not find TIPS undervalued in absolute terms, we felt they remained attractive relative to Treasuries. |

| | |

| Q. | What is your outlook for the markets and the Portfolio? |

| A. | Within equities, we find the utilities, financial and rail sectors attractive. Utilities, normally considered a defensive sector, has |

3

UBS Series Trust—U.S. Allocation Portfolio

| | outperformed the S&P 500 Index over the past three years—an unprecedented run during a period of overall market strength. In the financial sector, we continue to find what we believe are attractive opportunities, and we expect to remain overweighted to companies with exposure to the capital markets. Additionally, although the investment banking cycle in the US appears to be entering the mature phase, we continue to view this area as attractive. Rail companies also, in our view, remain compelling: excess capacity in existence for decades is mainly gone, and pricing power in the sector should remain strong, even with minimal volume growth. |

| | |

| | In terms of the fixed income market, while many investors are looking for and finding signs of economic weakness, we believe there are an equal number of positive signs. Taking note of tight credit spreads, a healthy equity market, and the continued strength of employment and manufacturing data, we expect to see continued, albeit slower, economic growth in 2007. As a result, we intend to maintain a meaningfully defensive strategy for our fixed income investments. We will continue to pursue sector and security specific opportunities to add value while monitoring risk exposure where we believe appropriate. |

4

UBS Series Trust—U.S. Allocation Portfolio

We thank you for your continued support and welcome any comments or questions you may have. For additional information on the UBS family of funds,* please contact your financial advisor or visit us at www.ubs.com/globalam-us.

Sincerely,

Kai R. Sotorp

President

UBS Series Trust — U.S. Allocation Portfolio

Head of the Americas

UBS Global Asset Management (Americas) Inc.

Brian D. Singer, CFA

Lead Portfolio Manager

UBS Series Trust—U.S. Allocation Portfolio

Regional Chief Investment Officer, Americas

UBS Global Asset Management (Americas) Inc.

This letter is intended to assist shareholders in understanding how the Portfolio performed during the fiscal year ended December 31, 2006. The views and opinions in the letter were current as of February 15, 2007. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and we reserve the right to change our views about individual securities, sectors and markets at any time. As a result, the views expressed should not be relied upon as a forecast of the fund’s future investment intent or results. We encourage you to consult your financial advisor regarding your personal investment program.

| * | Mutual funds are sold by prospectus only. You should read it carefully and consider a fund’s investment objectives, risks, charges, expenses and other important information contained in the prospectus before investing. Prospectuses for most of our funds can be obtained from your financial advisor, by calling UBS Funds at 800-647 1568 or by visiting our Web site at www.ubs.com/globalam-us. |

5

UBS Series Trust—U.S. Allocation Portfolio

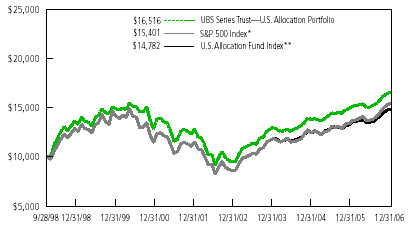

Comparison of the change in value of a $10,000 investment in UBS Series Trust—U.S. Allocation Portfolio (Class H), the S&P 500 Index* and the U.S. Allocation Fund Index**, from September 28, 1998 (inception of the Fund’s Class H shares) through December 31, 2006.

The performance of Class I shares will vary from the performance of Class H shares based on different fees paid by shareholders investing in the different share classes. Past performance does not predict future performance, and the performance provided does not reflect separate account charges applicable to variable annuity contracts. Performance results assume reinvestment of all dividend and capital gain distributions at net asset value on ex-dividend dates. It is important to note that the Portfolio is a professionally managed mutual fund, while the Indexes are not available for investment and are unmanaged. The comparison is shown for illustrative purposes only.

| * | The S&P 500 Index is an unmanaged weighted index composed of 500 widely held common stocks varying in composition, and is not available for direct investment. |

| | |

| ** | An unmanaged index (formerly known as the U.S. Tactical Allocation Fund Index) compiled by the advisor, constructed as follows: from September 28, 1998 (Portfolio’s inception) until February 29, 2004: 100% S&P 500 Index Fund; from March 1, 2004 until May 31, 2005: 65% Russell 3000 Index, 30% Lehman Brothers US Aggregate Bond Index, 5% Merrill Lynch U.S. High Yield Cash Pay Index; from June 1, 2005 until present: 65% Russell 3000 Index, 30% Lehman Brothers US Aggregate Bond Index, 5% Merrill Lynch U.S. High Yield Cash Pay Constrained Index. |

6

UBS Series Trust—U.S. Allocation Portfolio

Performance at a glance (unaudited)

Average annual total returns for periods ended 12/31/06

| | | | | | | | | | | | | | | | | | | Since |

| | | | 1 year | | | | | | | | 5 years | | | inception° |

|

| Class H* | | | 11.29 | % | | | | | | | | | 5.35 | % | | | | 6.27 | % | |

|

| Class I* | | | 10.99 | | | | | | | | | | 5.09 | | | | | 3.33 | | |

|

| S&P 500 Index** | | | 15.80 | | | | | | | | | | 6.19 | | | | | 5.37 | | |

|

| U.S. Allocation Fund Index*** | | | 11.98 | | | | | | | | | | 5.32 | | | | | 4.85 | | |

|

| ° | Since inception returns are calculated as of the commencement of issuance on September 28, 1998 for Class H shares and January 5, 1999 for Class I shares. Since inception returns for the S&P 500 Index and the U.S. Allocation Fund Index are calculated as of September 28, 1998, which is the inception date of the oldest share class (Class H). |

| | |

| * | Class H and Class I shares do not bear initial or contingent deferred sales charges. Class I shares bear ongoing distribution fees; Class H shares do not bear similar fees. |

| | |

| ** | The S&P 500 Index is an unmanaged weighted index composed of 500 widely held common stocks varying in composition, and is not available for direct investment. |

| | |

| *** | An unmanaged index (formerly known as the U.S. Tactical Allocation Fund Index) compiled by the advisor, constructed as follows: from September 28, 1998 (Portfolio’s inception) until February 29, 2004: 100% S&P 500 Index; from March 1, 2004 until May 31, 2005: 65% Russell 3000 Index, 30% Lehman Brothers US Aggregate Bond Index, 5% Merrill Lynch US High Yield Cash Pay Index; from June 1, 2005 until present: 65% Russell 3000 Index, 30% Lehman Brothers US Aggregate Bond Index, 5% Merrill Lynch US High Yield Cash Pay Constrained Index. |

Past performance does not predict future performance. The return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance results assume reinvestment of all dividends and capital gain distributions at net asset value on the ex-dividend dates and does not reflect separate account charges applicable to variable annuity contracts. Current performance may be higher or lower than the performance data quoted.

7

UBS Series Trust—U.S. Allocation Portfolio

Understanding your Portfolio’s expenses (unaudited)

As a shareholder of the Portfolio, you incur ongoing costs, including management fees, distribution fees (if applicable) and other Portfolio expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds.

The example below is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, July 1, 2006 to December 31, 2006.

Actual expenses

The first line for each class of shares in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over a period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line for each class of shares under the heading entitled “Expenses paid during period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second line for each class of shares in the table below provides information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratios for each class of shares and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return for each class of shares. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs (as applicable), such as contract level charges that may be applicable to variable annuity contracts. Therefore, the second line in the table for each class of shares is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

8

UBS Series Trust—U.S. Allocation Portfolio

Understanding your Portfolio’s expenses (unaudited) (concluded)

| | | | | Beginning | | Ending | | Expenses paid |

| | | | | account value | | account value | | during period* |

| | | | | July 1, 2006 | | December 31, 2006 | | 07/01/06 to 12/31/06 |

|

| Class H | | Actual | | $ | 1,000.00 | | | $ | 1,100.30 | | | $ | 4.39 | |

|

| | | Hypothetical (5% annual return before expenses) | | | 1,000.00 | | | | 1,021.02 | | | | 4.23 | |

|

| Class I | | Actual | | | 1,000.00 | | | | 1,099.60 | | | | 5.72 | |

|

| | | Hypothetical (5% annual return before expenses) | | | 1,000.00 | | | | 1,019.76 | | | | 5.50 | |

|

| * | Expenses are equal to the Portfolio’s annualized net expense ratios: Class H: 0.83%, Class I: 1.08%, multiplied by the average account value over the period, multiplied by 184 divided by 365 (to reflect the one-half year period). |

9

UBS Series Trust—U.S. Allocation Portfolio

Portfolio statistics (unaudited)

| Characteristics | | 12/31/06 | | | | | | 06/30/06 | | | | 12/31/05 |

|

| Net assets (mm) | | $46.6 | | | | | | | $48.2 | | | | | $52.9 | |

|

| Number of securities | | 171 | | | | | | | 157 | | | | | 145 | |

|

| |

| Portfolio composition* | | 12/31/06 | | | | | | 06/30/06 | | | | 12/31/05 |

|

| Common stocks and warrants** | | 66.2 | % | | | | | | 67.4 | % | | | | 66.3 | % |

|

| Bonds*** | | 32.1 | | | | | | | 30.4 | | | | | 29.0 | |

|

| Cash equivalents and other assets less liabilities | | 1.7 | | | | | | | 2.2 | | | | | 4.7 | |

|

| Total | | 100.0% | | | | | | 100.0% | | | | 100.0% |

|

| |

| Top five equity sectors* | | 12/31/06 | | | | | | 06/30/06 | | | | 12/31/05 |

|

| Financials | | 16.3 | % | | | | | | 15.6 | % | | | | 16.2 | % |

|

| Health care | | 9.8 | | | | | | | 11.4 | | | | | 11.7 | |

|

| Consumer discretionary | | 9.4 | | | | | | | 9.2 | | | | | 9.2 | |

|

| Information technology | | 8.2 | | | | | | | 8.6 | | | | | 7.6 | |

|

| Industrials | | 6.3 | | | | | | | 6.8 | | | | | 6.7 | |

|

| Total | | 50.0 | % | | | | | | 51.6 | % | | | | 51.4 | % |

|

| |

| Top ten equity securities* | | 12/31/06 | | | | | | 06/30/06 | | | | 12/31/05 |

|

| Citigroup | | 3.0 | % | | Citigroup | | | | 2.9 | % | | Citigroup | | 2.9 | % |

|

| Morgan Stanley | | 2.6 | | | Morgan Stanley | | | | 2.3 | | | Microsoft | | 2.4 | |

|

| Microsoft | | 2.3 | | | Microsoft | | | | 2.3 | | | Morgan Stanley | | 2.0 | |

|

| Wells Fargo | | 2.0 | | | Wells Fargo | | | | 2.1 | | | Wells Fargo | | 1.9 | |

|

| Exelon | | 1.7 | | | Wyeth | | | | 2.0 | | | Wyeth | | 1.9 | |

|

| American International Group | | 1.5 | | | Exelon | | | | 1.8 | | | Sprint Nextel | | 1.8 | |

|

| Allergan | | 1.5 | | | Sprint Nextel | | | | 1.6 | | | United Health Group | | 1.7 | |

|

| Wyeth | | 1.4 | | | Allergan | | | | 1.5 | | | American International Group | | 1.6 | |

|

| Mellon Financial | | 1.4 | | | Masco | | | | 1.5 | | | Exelon | | 1.6 | |

|

| Johnson Controls | | 1.3 | | | Omnicom Group | | | | 1.4 | | | J.P. Morgan | | 1.5 | |

|

| Total | | 18.7 | % | | Total | | | | 19.4 | % | | | | 19.3 | % |

|

| * | | Weightings represent percentages of the Portfolio’s net assets as of the dates indicated. The Portfolio is actively managed, and its composition will vary over time. |

| | | |

| ** | | Weightings include investment company holding of UBS U.S. Small Cap Equity Relationship Fund. |

| | | |

| *** | | Weightings include investment company holding of UBS High Yield Relationship Fund. |

10

UBS Series Trust—U.S. Allocation Portfolio

Portfolio statistics (unaudited) (continued)

| Fixed income sector allocation* | | 12/31/06 | | 06/30/06 | | 12/31/05 |

|

| Mortgage & agency debt securities | | 12.6 | % | | 11.1 | % | | 9.9 | % |

|

| US government obligations | | 7.4 | | | 8.1 | | | 7.4 | |

|

| Corporate bonds | | 5.7 | | | 5.3 | | | 4.7 | |

|

| Commercial mortgage-backed securities | | 2.8 | | | 2.9 | | | 3.6 | |

|

| Asset-backed securities | | 1.2 | | | 1.0 | | | 1.7 | |

|

| Collateralized debt obligation | | 0.3 | | | – | | | – | |

|

| International government obligations | | – | | | 0.1 | | | 0.1 | |

|

| Total | | 30.0 | % | | 28.5 | % | | 27.4 | % |

|

| * | Weightings represent percentages of the Portfolio’s net assets as of the dates indicated. The Portfolio is actively managed, and its composition will vary over time. |

11

UBS Series Trust—U.S. Allocation Portfolio

Portfolio statistics (unaudited) (concluded)

| Top ten fixed income securities* | | | 12/31/06 | | | | 06/30/06 | | | | 12/31/05 |

|

| US Treasury | | | | | | | US Treasury | | | | | | US Treasury | | | | |

| Notes, 4.875% | | | | | | | Notes, 4.750% | | | | | | Bonds, 8.750% | | | | |

| due 10/31/08 | | | | 1.5 | % | | due 03/31/11 | | | 1.7 | % | | due 05/15/17 | | | 1.6 | % |

|

| FNMA | | | | | | | FNMA | | | | | | US Treasury | | | | |

| Certificates, 6.500% | | | | | | | Certificates, 6.500% | | | | | | Notes, 3.625% | | | | |

| due 12/01/29 | | | | 1.3 | | | due 12/01/29 | | | 1.4 | | | due 06/15/10 | | | 1.5 | |

|

| US Treasury | | | | | | | US Treasury | | | | | | FNMA | | | | |

| Bonds, 6.250% | | | | | | | Notes, 4.875% | | | | | | Certificates, 6.500% | | | | |

| due 08/15/23 | | | | 1.2 | | | due 05/15/09 | | | 1.1 | | | due 12/01/29 | | | 1.4 | |

|

| | | | | | | | | | | | | | FNMA | | | | |

| US Treasury | | | | | | | GNMA | | | | | | Certificates, 5.000% | | | | |

| Notes, 4.875% | | | | | | | Certificates, 6.000% | | | | | | maturity to | | | | |

| due 05/15/09 | | | | 1.1 | | | due 07/15/29 | | | 1.0 | | | be assigned | | | 1.4 | |

|

| | | | | | | | FNMA | | | | | | | | | | |

| GNMA | | | | | | | Certificates, 5.000% | | | | | | US Treasury | | | | |

| Certificates, 6.000% | | | | | | | maturity to | | | | | | Bonds, 6.250% | | | | |

| due 07/15/29 | | | | 1.0 | | | be assigned | | | 0.9 | | | due 05/15/30 | | | 1.1 | |

|

| US Treasury | | | | | | | US Treasury | | | | | | GNMA | | | | |

| Notes, 4.875% | | | | | | | Bonds, 8.500% | | | | | | Certificates, 6.000% | | | | |

| due 08/31/08 | | | | 0.9 | | | due 02/15/20 | | | 0.9 | | | due 07/15/29 | | | 1.1 | |

|

| Asset Securitization | | | | | | | | | | | | | | | | | |

| Corp., Series | | | | | | | | | | | | | | | | | |

| 1995-MD4, | | | | | | | US Treasury | | | | | | US Treasury | | | | |

| Class A3, 7.384% | | | | | | | Notes, 4.500% | | | | | | Notes, 4.125% | | | | |

| due 08/13/29 | | | | 0.9 | | | due 11/15/15 | | | 0.8 | | | due 05/15/15 | | | 0.9 | |

|

| | | | | | | | Asset Securitization | | | | | | | | | | |

| | | | | | | | Corp., Series | | | | | | | | | | |

| US Treasury Inflation | | | | | | | 1995-MD4, | | | | | | US Treasury | | | | |

| Index Notes, 2.000% | | | | | | | Class A3, 7.384% | | | | | | Notes, 3.875% | | | | |

| due 01/15/16 | | | | 0.8 | | | due 08/13/29 | | | 0.8 | | | due 05/15/09 | | | 0.9 | |

|

| FHLMC REMIC, | | | | | | | | | | | | | | | | | |

| Series 3149, | | | | | | | US Treasury | | | | | | US Treasury | | | | |

| Class PC, 6.000% | | | | | | | Bonds, 8.875% | | | | | | Notes, 3.875% | | | | |

| due 10/15/31 | | | | 0.7 | | | due 02/15/19 | | | 0.8 | | | due 02/15/13 | | | 0.9 | |

|

| | | | | | | | | | | | | | Asset Securitization | | | | |

| | | | | | | | | | | | | | Corp., Series | | | | |

| FNMA | | | | | | | US Treasury | | | | | | 1995-MD4, | | | | |

| Certificates, 5.500% | | | | | | | Notes, 3.875% | | | | | | Class A3, 7.384% | | | | |

| due 07/01/33 | | | | 0.7 | | | due 02/15/13 | | | 0.8 | | | due 08/13/29 | | | 0.8 | |

|

| Total | | | | 10.1 | % | | Total | | | 10.2 | % | | | | | 11.6 | % |

|

| * | Weightings represent percentages of the Portfolio’s net assets as of the dates indicated. The Portfolio is actively managed, and its composition will vary over time. |

12

UBS Series Trust—U.S. Allocation Portfolio

Portfolio of investments—December 31, 2006

Common stocks—61.57%

| | | Number of | | | | | Number of | |

| Security description | | shares | | Value | | Security description | | shares | | Value |

| |

|

| Aerospace & defense—0.54% | | | | | | | Diversified financials—(concluded) | | | | | |

| Northrop Grumman Corp. | | 3,700 | | | $250,490 | | Federal Home Loan Mortgage Corp. | | 5,300 | | | $359,870 |

| |

|

| Air freight & couriers—1.07% | | | | | | | J.P. Morgan Chase & Co. | | 12,000 | | | 579,600 |

| FedEx Corp. | | 4,600 | | | 499,652 | |

|

| | Morgan Stanley | | 14,900 | | | 1,213,307 |

| Auto components—1.90% | | | | | | |

|

| BorgWarner, Inc. | | 4,700 | | | 277,394 | | | | | | | 3,528,567 |

| |

|

| Johnson Controls, Inc. | | 7,100 | | | 610,032 | | Diversified telecommunication | | | | | |

| | services—2.45% | | | | | |

| | | | | | 887,426 | | AT&T, Inc. | | 12,500 | | | 446,875 |

| |

|

| Banks—5.66% | | | | | | | Embarq Corp. | | 1,594 | | | 83,781 |

| City National Corp. | | 2,000 | | | 142,400 | |

|

| | Sprint Nextel Corp. | | 32,288 | | | 609,920 |

| Fifth Third Bancorp | | 12,500 | | | 511,625 | |

|

| | | | | | | 1,140,576 |

| Mellon Financial Corp. | | 15,800 | | | 665,970 | |

|

| | Electric utilities—2.75% | | | | | |

| PNC Financial Services Group | | 5,500 | | | 407,220 | | American Electric Power Co., Inc. | | 6,300 | | | 268,254 |

| |

|

| Wells Fargo & Co. | | 25,600 | | | 910,336 | | Exelon Corp.1 | | 12,800 | | | 792,192 |

| |

|

| | | | | | 2,637,551 | | Northeast Utilities | | 3,300 | | | 92,928 |

| |

|

| Beverages—0.94% | | | | | | | Pepco Holdings, Inc. | | 4,900 | | | 127,449 |

| Anheuser-Busch Cos., Inc. | | 4,400 | | | 216,480 | |

|

| | | | | | | 1,280,823 |

| Constellation Brands, Inc., Class A* | | 7,700 | | | 223,454 | |

|

| | Electronic equipment & | | | | | |

| | | | | | 439,934 | | instruments—0.47% | | | | | |

| | Waters Corp.* | | 4,500 | | | 220,365 |

| Biotechnology—1.15% | | | | | | |

|

| Genzyme Corp.* | | 6,600 | | | 406,428 | | Energy equipment & services—1.86% | | | | | |

| | ENSCO International, Inc. | | 5,600 | | | 280,336 |

| Millennium Pharmaceuticals, Inc.* | | 11,900 | | | 129,710 | |

|

| | GlobalSantaFe Corp.1 | | 5,400 | | | 317,412 |

| | | | | | 536,138 | |

|

| | Halliburton Co. | | 8,600 | | | 267,030 |

| Building products—1.31% | | | | | | |

|

| Masco Corp.1 | | 20,400 | | | 609,348 | | | | | | | 864,778 |

| |

|

| Commercial services & supplies—0.30% | | | | | | Food & drug retailing—0.92% | | | | | |

| H&R Block, Inc. | | 6,000 | | | 138,240 | | Sysco Corp. | | 11,700 | | | 430,092 |

| |

|

| Computers & peripherals—0.46% | | | | | | | Gas utilities—1.11% | | | | | |

| Dell, Inc.* | | 8,600 | | | 215,774 | | NiSource, Inc. | | 7,500 | | | 180,750 |

| |

|

| Diversified financials—7.57% | | | | | | | Sempra Energy | | 6,000 | | | 336,240 |

| Citigroup, Inc.1 | | 24,700 | | | 1,375,790 | |

|

| | | | | | | 516,990 |

| | | | | | | |

|

| | | | | | | | | | | | | |

13

UBS Series Trust—U.S. Allocation Portfolio

Portfolio of investments—December 31, 2006

Common stocks—(continued)

| | | Number of | | | | | Number of | |

| Security description | | shares | | Value | | Security description | | shares | | | Value |

| |

|

| Health care equipmentc & supplies—0.73% | | | Media—(concluded) | | | | | |

| Medtronic, Inc. | | 6,400 | | | $342,464 | | R.H.Donnelley Corp.* | | 4,120 | | | $258,448 |

| |

|

| Health care providers & services—1.23% | | | Univision Communications, Inc., Class A* | | 1,300 | | | 46,046 |

| UnitedHealth Group, Inc. | | 10,700 | | | 574,911 | |

|

| | Viacom, Inc., Class B* | | 1,000 | | | 41,030 |

| Hotels, restaurants & leisure—1.24% | | | | | | |

|

| Carnival Corp. | | 10,300 | | | 505,215 | | | | | | | 1,121,116 |

| |

|

| Wyndham Worldwide Corp.* | | 2,200 | | | 70,444 | | Multi-line retail—0.89% | | | | | |

| | Costco Wholesale Corp. | | 7,800 | | | 412,386 |

| | | | | | 575,659 | |

|

| | Oil & gas—1.58% | | | | | |

| Household durables—0.29% | | | | | | | Chevron Corp. | | 2,500 | | | 183,825 |

| Fortune Brands, Inc. | | 1,600 | | | 136,624 | |

|

| | EOG Resources, Inc.1 | | 3,800 | | | 237,310 |

| Insurance—2.89% | | | | | | |

|

| Allstate Corp. | | 4,900 | | | 319,039 | | Exxon Mobil Corp. | | 4,100 | | | 314,183 |

| |

|

| American International Group, Inc. | | 9,900 | | | 709,434 | | | | | | | 735,318 |

| |

|

| Hartford Financial Services Group, Inc. | | 3,400 | | | 317,254 | | Pharmaceuticals—6.71% | | | | | |

| | Allergan, Inc. | | 5,900 | | | 706,466 |

| | | | | | 1,345,727 | |

|

| | Bristol-Myers Squibb Co. | | 14,000 | | | 368,480 |

| Internet & catalog retail—0.42% | | | | | | |

|

| Amazon. Com, Inc.* | | 4,900 | | | 193,354 | | Cephalon, Inc.1* | | 2,100 | | | 147,861 |

| |

|

| Internet software & services—0.76% | | | | | | | Johnson & Johnson | | 7,700 | | | 508,354 |

| McAfee, Inc.1* | | 5,900 | | | 167,442 | |

|

| | Medco Health Solutions, Inc.* | | 6,100 | | | 325,984 |

| Yahoo!, Inc.* | | 7,400 | | | 188,996 | |

|

| | Merck & Co., Inc. | | 9,300 | | | 405,480 |

| | | | | | 356,438 | |

|

| | Wyeth | | 13,100 | | | 667,052 |

| IT consulting & services—0.57% | | | | | | |

|

| Accenture Ltd., Class A | | 7,200 | | | 265,896 | | | | | | | 3,129,677 |

| |

|

| Leisure equipment & products—0.50% | | | | | | | Real estate—0.17% | | | | | |

| Harley-Davidson, Inc. | | 3,300 | | | 232,551 | | Realogy Corp.* | | 2,650 | | | 80,348 |

| |

|

| Machinery—1.87% | | | | | | | Road & rail—1.17% | | | | | |

| Illinois Tool Works, Inc.1 | | 11,800 | | | 545,042 | | Burlington Northern Santa Fe Corp. | | 7,400 | | | 546,194 |

| |

|

| PACCAR, Inc. | | 5,000 | | | 324,500 | | Semiconductor equipment & products—2.48% | | | | | |

| | Analog Devices, Inc. | | 10,500 | | | 345,135 |

| | | | | | 869,542 | |

|

| | Intel Corp. | | 25,800 | | | 522,450 |

| Media—2.41% | | | | | | |

|

| News Corp., Class A | | 10,800 | | | 231,984 | | Xilinx, Inc. | | 12,100 | | | 288,101 |

| |

|

| Omnicom Group, Inc. | | 5,200 | | | 543,608 | | | | | | | 1,155,686 |

| |

|

14

UBS Series Trust—U.S. Allocation Portfolio

Portfolio of investments—December 31, 2006

Common stocks—(concluded)

| | | Number of | | | | | Number of | |

| Security description | | shares | | | Value | | Security description | | shares | | | Value |

| |

|

| Software—3.49% | | | | | | | Textiles & apparel—0.37% | | | | | |

| Microsoft Corp. | | 36,000 | | | $1,074,960 | | Coach, Inc.* | | 4,000 | | | $171,840 |

| |

|

| Red Hat, Inc.* | | 8,600 | | | 197,800 | | Total common stocks (cost—$23,953,506) | | 28,696,289 |

| |

|

| Symantec Corp.1* | | 17,063 | | | 355,763 | | | | | | | |

| | | | | | | |

| | | | | | 1,628,523 | | | | | | | |

| | | | | | | |

| Specialty retail—1.34% | | | | | | | | | | | | |

| Chico’s FAS, Inc.1* | | 7,900 | | | 163,451 | | | | | | | |

| | | | | | | |

| Home Depot, Inc. | | 11,500 | | | 461,840 | | | | | | | |

| | | | | | | |

| | | | | | 625,291 | | | | | | | |

| | | | | | | |

15

UBS Series Trust—U.S. Allocation Portfolio

Portfolio of investments—December 31, 2006

| Principal | | | | | | | | | | | | |

| amount | | | | | Maturity | | | Interest | | | |

| (000) | | | | | dates | | | rates | | Value | |

| |

| US government obligations—7.41% |

| $75 | | | US Treasury Bonds | | 08/15/21 | | | 8.125 | % | | $100,096 | |

| |

| 495 | | | US Treasury Bonds | | 08/15/23 | | | 6.250 | | | 569,753 | |

| |

| 200 | | | US Treasury Bonds | | 02/15/36 | | | 4.500 | | | 190,187 | |

| |

| 361 | | | US Treasury Inflation Index Notes | | 01/15/16 | | | 2.000 | | | 348,520 | |

| |

| 135 | | | US Treasury Notes | | 05/31/07 | | | 3.500 | | | 134,172 | |

| |

| 440 | | | US Treasury Notes | | 08/31/08 | | | 4.875 | | | 439,966 | |

| |

| 690 | | | US Treasury Notes | | 10/31/08 | | | 4.875 | | | 690,324 | |

| |

| 510 | | | US Treasury Notes | | 05/15/09 | | | 4.875 | | | 511,116 | |

| |

| 35 | | | US Treasury Notes | | 10/31/11 | | | 4.625 | | | 34,873 | |

| |

| 300 | | | US Treasury Notes | | 02/15/13 | | | 3.875 | | | 287,121 | |

| |

| 150 | | | US Treasury Notes | | 02/15/16 | | | 4.500 | | | 147,609 | |

| |

| Total US government obligations (cost—$3,456,197) | | | | | | | | 3,453,737 | |

| |

| Mortgage & agency debt securities—12.57% |

| 250 | | | Countrywide Home Loans, Series 2006-HYB1, Class 1A1 | | 03/20/36 | | | 5.385 | 2 | | 249,495 | |

| |

| 216 | | | CS First Boston Mortgage Securities Corp., Series 2005-11, Class 4A1 | | 12/25/35 | | | 7.000 | | | 220,519 | |

| |

| 100 | | | Federal Home Loan Mortgage Corporation Certificates | | 10/17/13 | | | 5.600 | | | 100,104 | |

| |

| 300 | | | Federal Home Loan Mortgage Corporation Certificates | | 06/15/31 | | | 5.000 | | | 292,260 | |

| |

| 222 | | | Federal Home Loan Mortgage Corporation Certificates | | 12/01/34 | | | 4.500 | | | 207,902 | |

| |

| 150 | | | Federal National Mortgage Association Certificates | | 05/15/10 | | | 4.125 | | | 146,286 | |

| |

| 145 | | | Federal National Mortgage Association Certificates | | 08/15/10 | | | 4.250 | | | 141,796 | |

| |

| 220 | | | Federal National Mortgage Association Certificates | | 03/15/13 | | | 4.375 | | | 212,957 | |

| |

| 105 | | | Federal National Mortgage Association Certificates | | 05/12/16 | | | 6.070 | | | 105,689 | |

| |

| 112 | | | Federal National Mortgage Association Certificates | | 10/01/17 | | | 5.500 | | | 112,351 | |

| |

| 218 | | | Federal National Mortgage Association Certificates | | 12/01/17 | | | 5.500 | | | 218,354 | |

| |

| 217 | | | Federal National Mortgage Association Certificates | | 07/01/18 | | | 5.500 | | | 217,285 | |

| |

16

UBS Series Trust—U.S. Allocation Portfolio

Portfolio of investments—December 31, 2006

| Principal | | | | | | | | | | | | |

| amount | | | | | Maturity | | | Interest | | | |

| (000) | | | | | dates | | | rates | | Value | |

| |

| Mortgage & agency debt securities—(concluded) |

| $587 | | | Federal National Mortgage Association Certificates | | 12/01/29 | | | 6.500 | % | | $602,560 | |

| |

| 295 | | | Federal National Mortgage Association Certificates | | 06/01/33 | | | 5.500 | | | 292,116 | |

| |

| 304 | | | Federal National Mortgage Association Certificates | | 07/01/33 | | | 5.500 | | | 300,752 | |

| |

| 215 | | | Federal National Mortgage Association Certificates | | 11/01/34 | | | 5.500 | | | 212,400 | |

| |

| 299 | | | Federal National Mortgage Association Certificates | | 12/01/36 | | | 6.000 | | | 299,095 | |

| |

| 241 | | | Federal National Mortgage Association Certificates ARM | | 05/01/35 | | | 4.877 | | | 238,959 | |

| |

| 300 | | | FHLMC REMIC, Series 3149, Class PC | | 10/15/31 | | | 6.000 | | | 304,258 | |

| |

| 55 | | | FNMA REMIC, Series 2001-69, Class PN | | 04/25/30 | | | 6.000 | | | 55,231 | |

| |

| 170 | | | FNMA REMIC, Series 2001-T4, Class A1 | | 07/25/41 | | | 7.500 | | | 176,169 | |

| |

| 211 | | | FNMA REMIC, Series 2002-T19, Class A1 | | 07/25/42 | | | 6.500 | | | 215,487 | |

| |

| 449 | | | Government National Mortgage Association Certificates | | 07/15/29 | | | 6.000 | | | 456,572 | |

| |

| 115 | | | Government National Mortgage Association Certificates | | 04/15/31 | | | 6.500 | | | 118,616 | |

| |

| 175 | | | J.P. Morgan Alternative Loan Trust, Series 2006-A4, Class A7 | | 09/25/36 | | | 6.300 | | | 177,777 | |

| |

| 183 | | | MLCC Mortgage Investors, Inc., Series 2006-2, Class 4A | | 05/25/36 | | | 5.800 | 2 | | 182,419 |

| |

| Total mortgage & agency debt securities (cost—$5,894,426) | | | | | | | | 5,857,409 | |

| |

| Commercial mortgage-backed securities—2.80% |

| 400 | | | Asset Securitization Corp., Series 1995-MD4, Class A3 | | 08/13/29 | | | 7.384 | | | 404,475 | |

| |

| 36 | | | First Union-Lehman Brothers Commercial Mortgage, Series 1997-C2, Class A3 | | 11/18/29 | | | 6.650 | | | 36,435 | |

| |

| 150 | | | GS Mortgage Securities Corp. II, Series 2006-RR2, Class A13 | | 06/23/46 | | | 5.689 | 2 | | 151,553 |

| |

| 253 | | | Hilton Hotel Pool Trust, Series 2000-HLTA, Class A13 | | 10/03/15 | | | 7.055 | | | 261,911 | |

| |

| 133 | | | Mach One Trust Commercial Mortgage, Series 2004-1A, Class A13 | | 05/28/40 | | | 3.890 | | | 131,726 | |

| |

| 148 | | | Morgan Stanley Mortgage Loan Trust, Series 2006-1AR, Class 2A | | 02/25/36 | | | 6.038 | 2 | | 149,374 | |

| |

17

UBS Series Trust—U.S. Allocation Portfolio

Portfolio of investments—December 31, 2006

| Principal | | | | | | | | | | | | |

| amount | | | | | Maturity | | | Interest | | | |

| (000) | | | | | dates | | | rates | | Value | |

| |

| Commercial mortgage-backed securities—(concluded) |

| $45 | | | Nomura Asset Securities Corp., Series 1996-MD5, Class A4 | | 04/13/39 | | | 8.201 | %2 | $45,803 | |

| |

| 124 | | | Washington Mutual, Series 2002-AR17, Class 1A | | 11/25/42 | | | 6.027 | 2 | | 124,364 | |

| |

| Total commercial mortgage-backed securities (cost—$1,312,685) | | | | | | | | 1,305,641 | |

| |

| Collateralized debt obligation4—0.32% |

| 150 | | | G-Force CDO Ltd., Series 2006-1A, Class A3 (cost—$147,895) | | 09/27/46 | | | 5.600 | | | 150,867 | |

| |

| Asset-backed securities—1.25% |

| 260 | | | Conseco Finance Securitizations Corp., Series 2000-5, Class A5 | | 02/01/32 | | | 7.700 | | | 260,073 | |

| |

| 24 | | | Greenpoint Home Equity Loan Trust, Series 2004-3, Class A | | 03/15/35 | | | 5.580 | 2 | | 24,272 | |

| |

| 100 | | | Paragon Mortgages PLC, Series 7A, Class B1A3 | | 05/15/43 | | | 6.124 | 2 | | 100,131 | |

| |

| 200 | | | Pinnacle Capital Asset Trust, Series 2006-A, Class B3 | | 09/25/09 | | | 5.510 | | | 199,766 | |

| |

| Total asset-backed securities (cost—$584,592) | | | | | | | | 584,242 | |

| |

| Corporate bonds—5.65% |

| |

| Aerospace & defense—0.10% |

| 45 | | | Boeing Capital Corp. | | 09/27/10 | | | 7.375 | | | 48,245 | |

| |

| Automobile OEM—1.01% |

| 115 | | | DaimlerChrysler N.A. Holding Corp. | | 06/04/08 | | | 4.050 | | | 112,543 | |

| |

| 295 | | | Ford Motor Credit Co. | | 01/12/09 | | | 5.800 | | | 289,644 | |

| |

| 65 | | | General Motors Acceptance Corp. | | 09/15/11 | | | 6.875 | | | 66,670 | |

| |

| | | | | | | | | | | | 468,857 | |

| |

| Banking-non-US—0.06% |

| 25 | | | Royal Bank of Scotland Group PLC, Series 1 | | 03/31/105 | | | 9.118 | | | 27,696 | |

| |

| Banking-US—1.38% |

| 100 | | | Bank of America Corp.3 | | 03/15/17 | | | 5.420 | | | 98,531 | |

| |

| 40 | | | Bank One Corp. | | 08/01/10 | | | 7.875 | | | 43,388 | |

| |

| 50 | | | Citigroup, Inc. | | 08/27/12 | | | 5.625 | | | 50,723 | |

| |

| 101 | | | Citigroup, Inc. | | 09/15/14 | | | 5.000 | | | 98,616 | |

| |

| 25 | | | Credit Suisse First Boston USA, Inc. | | 01/15/12 | | | 6.500 | | | 26,273 | |

| |

| 90 | | | HSBC Finance Corp. | | 05/15/11 | | | 6.750 | | | 95,251 | |

| |

18

UBS Series Trust—U.S. Allocation Portfolio

Portfolio of investments—December 31, 2006

| Principal | | | | | | | | | | | | |

| amount | | | | | Maturity | | | Interest | | | |

| (000) | | | | | dates | | | rates | | Value | |

| |

| Corporate bonds—(continued) |

| |

| Banking-US—(concluded) |

| $75 | | | J.P. Morgan Chase & Co. | | 02/01/11 | | | 6.750 | % | | $78,848 | |

| |

| 115 | | | Washington Mutual, Inc. | | 01/15/07 | | | 5.625 | | | 115,006 | |

| |

| 35 | | | Wells Fargo & Co. | | 08/01/11 | | | 6.375 | | | 36,653 | |

| |

| | | | | | | | | | | | 643,289 | |

| |

| Brokerage—0.48% |

| 90 | | | Goldman Sachs Group, Inc. | | 01/15/11 | | | 6.875 | | | 95,271 | |

| |

| 120 | | | Morgan Stanley | | 04/15/11 | | | 6.750 | | | 126,837 | |

| |

| | | | | | | | | | | | 222,108 | |

| |

| Cable—0.20% |

| 90 | | | Comcast Cable Communications, Inc. | | 01/30/11 | | | 6.750 | | | 94,301 | |

| |

| Chemicals—0.13% |

| 60 | | | ICI Wilmington, Inc. | | 12/01/08 | | | 4.375 | | | 58,871 | |

| |

| Consumer products-durables—0.09% |

| 45 | | | Fortune Brands, Inc. | | 01/15/16 | | | 5.375 | | | 42,669 | |

| |

| Consumer products-nondurables—0.10% |

| 45 | | | Avon Products, Inc. | | 11/15/09 | | | 7.150 | | | 47,109 | |

| |

| Electrical-integrated—0.14% |

| 30 | | | Dominion Resources, Inc. | | 06/15/35 | | | 5.950 | | | 29,494 | |

| |

| 35 | | | PSEG Power | | 06/01/12 | | | 6.950 | | | 37,002 | |

| |

| | | | | | | | | | | | 66,496 | |

| |

| Energy-refining & marketing—0.06% |

| 25 | | | Valero Energy Corp. | | 04/15/32 | | | 7.500 | | | 28,523 | |

| |

| Finance-noncaptive consumer—0.12% |

| 25 | | | Capital One Financial | | 06/01/15 | | | 5.500 | | | 24,983 | |

| |

| 30 | | | Residential Capital Corp. | | 11/21/08 | | | 6.125 | | | 30,148 | |

| |

| | | | | | | | | | | | 55,131 | |

| |

| Finance-noncaptive diversified—0.72% |

| 240 | | | General Electric Capital Corp. | | 06/15/12 | | | 6.000 | | | 248,441 | |

| |

| 35 | | | General Electric Capital Corp. | | 03/15/32 | | | 6.750 | | | 40,085 | |

| |

| 50 | | | International Lease Finance Corp. | | 04/01/09 | | | 3.500 | | | 48,096 | |

| |

| | | | | | | | | | | | 336,622 | |

| |

19

UBS Series Trust—U.S. Allocation Portfolio

Portfolio of investments—December 31, 2006

| Principal | | | | | | | | | | | | |

| amount | | | | | Maturity | | | Interest | | | |

| (000) | | | | | dates | | | rates | | Value | |

| |

| Corporate bonds—(concluded) |

| |

| Food—0.11% |

| $50 | | | Kraft Foods, Inc. | | 11/01/11 | | | 5.625 | % | | $50,532 | |

| |

| Food processors/beverage/bottling—0.08% |

| 35 | | | SABMiller PLC3 | | 07/01/16 | | | 6.500 | | | 36,509 | |

| |

| Gas pipelines—0.08% |

| 40 | | | Kinder Morgan Energy Partners | | 03/15/35 | | | 5.800 | | | 36,350 | |

| |

| Healthcare—0.08% |

| 40 | | | WellPoint, Inc. | | 01/15/36 | | | 5.850 | | | 38,858 | |

| |

| Pharmaceuticals—0.09% |

| 40 | | | Allergan, Inc. | | 04/01/16 | | | 5.750 | | | 40,453 | |

| |

| Real estate investment trusts—0.07% |

| 35 | | | Prologis | | 11/15/15 | | | 5.625 | | | 34,828 | |

| |

| Road & rail—0.05% |

| 25 | | | Norfolk Southern Corp. | | 09/17/14 | | | 5.257 | | | 24,774 | |

| |

| Technology-hardware—0.12% |

| 55 | | | Cisco Systems, Inc. | | 02/22/16 | | | 5.500 | | | 55,035 | |

| |

| Telecom-wirelines—0.05% |

| 25 | | | Telecom Italia Capital | | 11/15/33 | | | 6.375 | | | 23,621 | |

| |

| Wireless telecommunications services—0.33% |

| 80 | | | Sprint Capital Corp. | | 03/15/32 | | | 8.750 | | | 96,289 | |

| |

| 55 | | | Verizon New York, Inc., Series A | | 04/01/12 | | | 6.875 | | | 57,019 | |

| |

| | | | | | | | | | | | 153,308 | |

| |

| Total corporate bonds (cost—$2,644,515) | | | | | | | | 2,634,185 | |

| |

| | | | | | | | | | | | | |

| Number of | | | | | | | | | | | |

| shares | | | | | | | | | | | | |

| (000) | | | | | | | | | | | | |

| |

| Investment companies6*—6.67% |

| 46 | | | UBS High Yield Relationship Fund | | | | | | | | 966,361 | |

| |

| 46 | | | UBS U.S. Small Cap Equity Relationship Fund | | | | | | | | 2,144,129 | |

| |

| Total investment companies (cost—$2,328,049) | | | | | | | | 3,110,490 | |

| |

20

UBS Series Trust—U.S. Allocation Portfolio

Portfolio of investments—December 31, 2006

| Principal | | | | | | | | | | | | |

| amount | | | | | Maturity | | | Interest | | |

| (000) | | | | | dates | | | rates | Value | |

| |

| Repurchase agreement—2.29% |

| $1,066 | | | Repurchase agreement dated 12/29/06 with State Street Bank & Trust Co., collateralized by $648,117 US Treasury Bonds, 6.250% to 7.625% due 11/15/22 to 08/15/23 and $240,934 US Treasury Notes, 3.875% due 07/31/07; (value—$1,087,324); proceeds: $1,066,659 (cost—$1,066,000) | | 01/03/07 | | | 4.450 | % | | $1,066,000 | |

| |

| | | | | | | | | | | | | |

| Number of | | | | | | | | | | |

| shares | | | | | | | | | | | | |

| (000) | | | | | | | | | | | | |

| |

| Investments of cash collateral from securities loaned—5.60% |

| Money market funds7—3.46% |

| 3 | | | AIM Prime Portfolio | | | | | 5.212 | | | 3,273 | |

| |

| 1,608 | | | UBS Private Money Market Fund LLC6 | | | | | 5.213 | | | 1,608,147 | |

| |

| Total money market funds (cost—$1,611,420) | | | | | | | | 1,611,420 | |

| |

| | | | | | | | | | | | | |

| Principal | | | | | | | | | | | | |

| amount | | | | | | | | | | | | |

| (000) | | | | | | | | | | | | |

| |

| | | | | | | | | | | | | |

| Repurchase agreement—2.14% |

| $1,000 | | | Repurchase agreement dated 12/29/06 with Merrill Lynch & Co., collateralized by $2,670,000 Resolution Funding Strip Holding, zero coupon due 01/15/26; (value—$1,021,409); proceeds: $1,000,582 (cost—$1,000,000) | | 01/02/07 | | | 5.240 | | | 1,000,000 | |

| |

| Total investments of cash collateral from securities loaned (cost—$2,611,420) | | | | | | | | 2,611,420 | |

| |

| Total investments (cost—$43,999,285)—106.13% | | | | | | | | 49,470,280 | |

| |

| Liabilities in excess of other assets—(6.13)% | | | | | | | | (2,858,985 | ) |

| |

| Net assets—100.00% | | | | | | | | $46,611,295 | |

| |

| * | | Non-income producing security. |

| 1 | | Security, or portion thereof, was on loan at December 31, 2006. |

| 2 | | Floating rate security. The interest rate shown is the current rate as of December 31, 2006. |

| 3 | | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities, which represent 2.10% of net assets as of December 31, 2006, are considered liquid and may be resold in transactions exempt from registration, normally to qualified institutional buyers. |

21

UBS Series Trust—U.S. Allocation Portfolio

Portfolio of investments—December 31, 2006

| 4 | | The security detailed in the table below, which represents 0.32% of net assets, is considered illiquid and restricted as of December 31, 2006: |

| | | |

| | | | | | | | | | Acquisition | | | | | Value at | |

| Illiquid and | | | | | | | | | cost as a | | | | | 12/31/06 as | |

| restricted | | | Acquisition | | | Acquisition | | | percentage of | | | Value at | | a percentage | |

| Security | | | date | | | cost | | | net assets | | | 12/31/06 | | of net assets | |

|

| G-Force CDO Ltd., Series 2006-1A, Class A3, 5.600%, 09/27/46 | | | 08/03/06 | | | $147,895 | | | 0.32% | | | $150,867 | | 0.32% | |

|

| 5 | | Perpetual bond security. The maturity date reflects the next call date. |

| 6 | | The table below details the Portfolio’s transaction activity in affiliated issuers for the year ended December 31, 2006. |

| | | |

| | | | | | | | | | | | | | | Net |

| | | | | | | | | | | | | | | income |

| | | | | | | | | Net | | Net | | | | earned |

| | | | | | | | | realized | | unrealized | | | | from |

| | | | | Purchases | | Sales | | gains | | gains | | | | affiliate |

| | | | | during | | during | | for the | | for the | | | | for the |

| | | | | the year | | the year | | year | | year | | | | year |

| Security | | Value at | | ended | | ended | | ended | | ended | | Value at | | ended |

| description | | 12/31/05 | | 12/31/06 | | 12/31/06 | | 12/31/06 | | 12/31/06 | | 12/31/06 | | 12/31/06 |

|

| UBS High Yield Relationship Fund | | $871,205 | | – | | – | | – | | $95,156 | | $966,361 | | – |

|

| UBS Private Money Market Fund LLC | | 412,733 | | $11,805,068 | | $10,609,654 | | – | | – | | 1,608,147 | | $363 |

|

| UBS US Small Cap Equity Relationship Fund | | 2,563,749 | | – | | 750,000 | | $180,338 | | 150,042 | | 2,144,129 | | – |

|

| 7 | | Rates shown reflect yield at December 31, 2006. |

| ARM | | Adjustable Rate Mortgage. The interest rate shown is the current rate as of December 31, 2006. |

| CDO | | Collateralized Debt Obligation |

22

UBS Series Trust—U.S. Allocation Portfolio

Portfolio of investments—December 31, 2006

| FHLMC | | Federal Home Loan Mortgage Corporation |

| FNMA | | Federal National Mortgage Association |

| OEM | | Original Equipment Manufacturer |

| REMIC | | Real Estate Mortgage Investment Conduit |

| MLCC | | Merrill Lynch Credit Corporation |

| GS | | Goldman Sachs |

Issuer breakdown by country of origin (unaudited)

| Percentage of total investments |

|

| United States | | 97.1 | % |

|

| Panama | | 1.0 | |

|

| Cayman Islands | | 1.0 | |

|

| Bermuda | | 0.5 | |

|

| United Kingdom | | 0.3 | |

|

| Luxembourg | | 0.1 | |

|

| Total | | 100.0 | % |

|

See accompanying notes to financial statements

23

UBS Series Trust—U.S. Allocation Portfolio

Statement of assets and liabilities—December 31, 2006

| Assets: | | | | | | |

| Investments in unaffiliated securities, at value (cost–$40,063,089)* | | $44,751,643 | | | | |

| |

| Investments in affiliated securities, at value (cost–$3,936,196) | | 4,718,637 | | | | |

| |

| Total investments in securities, at value (cost–$43,999,285) | | | | | $49,470,280 | |

| |

| Cash | | | | | 449 | |

| |

| Receivable for investments sold | | | | | 290,110 | |

| |

| Receivable for dividends and interest | | | | | 175,415 | |

| |

| Receivable for shares of beneficial interest sold | | | | | 2,333 | |

| |

| Other assets | | | | | 509 | |

| |

| Total assets | | | | | 49,939,096 | |

| |

| | | | | | | |

| Liabilities: | | | | | | |

| Payable for cash collateral from securities loaned | | | | | 2,611,420 | |

| |

| Payable for investments purchased | | | | | 376,591 | |

| |

| Payable for shares of beneficial interest repurchased | | | | | 212,830 | |

| |

| Payable to affiliates | | | | | 40,647 | |

| |

| Accrued expenses and other liabilities | | | | | 86,313 | |

| |

| Total liabilities | | | | | 3,327,801 | |

| |

| | | | | | | |

| Net assets: | | | | | | |

| Beneficial interest–$0.001 par value per share (unlimited amount authorized) | | | | | 67,974,599 | |

| |

| Accumulated undistributed net investment income | | | | | 566,790 | |

| |

| Accumulated net realized loss from investment activities | | | | | (27,401,089 | ) |

| |

| Net unrealized appreciation of investments | | | | | 5,470,995 | |

| |

| Net assets | | | | | $46,611,295 | |

| |

| | | | | | | |

| Class H: | | | | | | |

| Net assets | | | | | $14,802,736 | |

| |

| Shares outstanding | | | | | 963,446 | |

| |

| Net asset value, offering price and redemption value per share | | | | | $15.36 | |

| |

| | | | | | | |

| Class I: | | | | | | |

| Net assets | | | | | $31,808,559 | |

| |

| Shares outstanding | | | | | 2,073,578 | |

| |

| Net asset value, offering price and redemption value per share | | | | | $15.34 | |

| |

| * | | Includes $3,127,393 of investments in securities on loan, at value. |

| | | |

| | | See accompanying notes to financial statements |

24

UBS Series Trust—U.S. Allocation Portfolio

Statement of operations

| | | For the |

| | | year ended |

| | | December 31, 2006 |

|

| Investment income: | | | |

| Interest | | $793,773 | |

|

| Dividends | | 531,893 | |

|

| Securities lending income (includes $363 earned from an affiliated entity) | | 663 | |

|

| | | 1,326,329 | |

|

| | | | |

| Expenses: | | | |

| Investment advisory and administration fees | | 245,242 | |

|

| Professional fees | | 102,341 | |

|

| Distribution fees—Class I | | 83,855 | |

|

| Custody and accounting fees | | 19,619 | |

|

| Reports and notices to shareholders | | 18,235 | |

|

| Trustees’ fees | | 14,881 | |

|

| Transfer agency fees—Class H | | 1,500 | |

|

| Transfer agency fees—Class I | | 1,500 | |

|

| Other expenses | | 8,239 | |

|

| | | 495,412 | |

|

| Net investment income | | 830,917 | |

|

| | | | |

| Realized and unrealized gains from investment activities: | | | |

| Net realized gains from investments (includes $180,338 of net realized gains from an affiliated entity) | | 3,063,639 | |

|

| Net change in unrealized appreciation of investments | | 1,208,077 | |

|

| Net realized and unrealized gain from investment activities | | 4,271,716 | |

|

| Net increase in net assets resulting from operations | | $5,102,633 | |

|

See accompanying notes to financial statements

25

UBS Series Trust—U.S. Allocation Portfolio

Statement of changes in net assets

| | | For the years ended December 31, |

| | |

|

| | | 2006 | | | | 2005 | |

|

| From operations: | | | | | | | |

| Net investment income | | $830,917 | | | | $942,231 | |

|

| |

| Net realized gains from: | | | | | | | |

|

| Investments | | 3,063,639 | | | | 2,419,589 | |

|

| Redemption-in-kind | | – | | | | 444,103 | |

|

| Net change in unrealized appreciation of investments | | 1,208,077 | | | | 107,631 | |

|

| Net increase in net assets resulting from operations | | 5,102,633 | | | | 3,913,554 | |

|

| | | | | | | | |

| Dividends to shareholders from: | | | | | | | |

| Net investment income-Class H | | (437,847 | ) | | | (285,578 | ) |

|

| Net investment income-Class I | | (832,466 | ) | | | (700,153 | ) |

|

| | | (1,270,313 | ) | | | (985,731 | ) |

|

| | | | | | | | |

| From beneficial interest transactions: | | | | | | | |

| Net proceeds from the sale of shares | | 925,691 | | | | 1,895,296 | |

|

| Cost of shares repurchased | | (12,285,040 | ) | | | (15,828,602 | ) |

|

| Cost of shares redeemed-in-kind | | – | | | | (12,832,521 | ) |

|

| Proceeds from dividends reinvested | | 1,270,313 | | | | 985,731 | |

|

| Net decrease in net assets from beneficial interest transactions | | (10,089,036 | ) | | | (25,780,096 | ) |

|

| Net decrease in net assets | | (6,256,716 | ) | | | (22,852,273 | ) |

|

| | | | | | | | |

| Net assets: | | | | | | | |

| Beginning of year | | 52,868,011 | | | | 75,720,284 | |

|

| End of year | | $46,611,295 | | | | $52,868,011 | |

|

| Accumulated undistributed net investment income | | $566,790 | | | | $991,877 | |

|

See accompanying notes to financial statements

26

UBS Series Trust—U.S. Allocation Portfolio

Notes to financial statements

Organization and significant accounting policies

UBS Series Trust—U.S. Allocation Portfolio (the “Portfolio”) is a diversified portfolio of UBS Series Trust (the “Trust”). The Trust is organized under Massachusetts law pursuant to an Amended and Restated Declaration of Trust dated February 11, 1998, as amended, and is registered with the Securities and Exchange Commission under the Investment Company Act of 1940, as amended, as an open-end management investment company. The Trust operates as a series company currently offering one portfolio. Shares of the Portfolio are offered to insurance company separate accounts which fund certain variable annuity and variable life contracts.

Currently the Portfolio offers Class H and Class I shares. Each class represents interests in the same assets of the Portfolio, and the classes are identical except for the Class I distribution charge. Both classes have equal voting privileges except that Class I has exclusive voting rights with respect to its distribution plan. Class H has no distribution plan.

In the normal course of business the Portfolio may enter into contracts that contain a variety of representations or that provide indemnification for certain liabilities. The Portfolio’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Portfolio that have not yet occurred. However, the Portfolio has not had prior claims or losses pursuant to these contracts and expects the risk of loss to be remote.

The preparation of financial statements in accordance with US generally accepted accounting principles requires the Trust’s management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates. The following is a summary of significant accounting policies:

Valuation of investments—The Portfolio calculates net asset values based on the current market value for its portfolio securities. The Portfolio normally obtains market values for its securities from independent pricing sources. Independent pricing sources may use last reported sale prices, current market quotations or valuations from computerized “matrix” systems that derive values based on comparable securities. Securities traded in the over-the-counter (“OTC”) market and listed on The Nasdaq Stock Market, Inc. (“NASDAQ”) normally are valued at the NASDAQ Official Closing Price. Other OTC securities are valued at the last bid price available

27

UBS Series Trust—U.S. Allocation Portfolio

Notes to financial statements

prior to valuation. Securities which are listed on US and foreign stock exchanges normally are valued at the last sale price on the day the securities are valued or, lacking any sales on such day, at the last available bid price. In cases where securities are traded on more than one exchange, the securities are valued on the exchange designated as the primary market by UBS Global Asset Management (Americas) Inc. If a market value is not available from an independent pricing source for a particular security, that security is valued at fair value as determined in good faith by or under the direction of the Trust’s Board of Trustees (the “Board”). Various factors may be reviewed in order to make a good faith determination of a security’s fair value. These factors may include, but are not limited to, the type and cost of the security; contractual or legal restrictions on resale of the security; relevant financial or business developments of the issuer; the value of actively traded similar or related securities; conversion or exchange rights on the security; related corporate actions; and changes in overall market conditions. If events occur that materially affect the value of securities (particularly non-US securities) between the close of trading in those securities and the close of regular trading on the New York Stock Exchange, these securities would be fair valued. The amortized cost method of valuation, which approximates market value, generally is used to value short-term debt-instruments with sixty days or less remaining to maturity, unless the Board determines that this does not represent fair value.

In September 2006, the Financial Accounting Standards Board (“FASB”) issued Statement on Financial Accounting Standards No. 157, “Fair Value Measurements” (“FAS 157”). This standard clarifies the definition of fair value for financial reporting, establishes a framework for measuring fair value and requires additional disclosures about the use of fair value measurements. FAS 157 is effective for financial statements issued for fiscal years beginning after November 15, 2007 and interim periods within those fiscal years. As of December 31, 2006, management does not believe the adoption of FAS 157 will impact the amounts reported in the financial statements, however, additional disclosures will be required about the inputs used to develop the measurements of fair value and the effect of certain of the measurements reported in the statement of operations for a fiscal period.

Repurchase agreements—The Portfolio may purchase securities or other obligations from a bank or securities dealer (or its affiliate), subject to the seller’s agreement to repurchase them at an agreed upon date (or upon demand) and price. The Portfolio maintains custody of the underlying

28

UBS Series Trust—U.S. Allocation Portfolio

Notes to financial statements

obligations prior to their repurchase, either through its regular custodian or through a special “tri-party” custodian or sub-custodian that maintains a separate account for both the Portfolio and its counterparty. The underlying collateral is valued daily to ensure that the value, including accrued interest, is at least equal to the repurchase price. In the event of default of the obligation to repurchase, the Portfolio generally has the right to liquidate the collateral and apply the proceeds in satisfaction of the obligation. Repurchase agreements involving obligations other than US government securities (such as commercial paper, corporate bonds and mortgage loans) may be subject to special risks and may not have the benefit of certain protections in the event of counterparty insolvency. If the seller (or seller’s guarantor, if any) becomes insolvent, the Portfolio may suffer delays, costs and possible losses in connection with the disposition or retention of the collateral. Under certain circumstances, in the event of default or bankruptcy by the other party to the agreement, realization and/or retention of the collateral may be subject to legal proceedings. The Portfolio may participate in joint repurchase agreement transactions with other funds managed, advised or sub-advised by UBS Global AM.

Investment transactions, investment income and expenses—Investment transactions are recorded on the trade date. Realized gains and losses from investment transactions are calculated using the identified cost method. Dividend income is recorded on the ex-dividend date (“ex-date”). Interest income is recorded on an accrual basis. Discounts are accreted and premiums are amortized as adjustments to interest income and the identified cost of investments.

Income, expenses (excluding class-specific expenses) and realized/unrealized gains/losses are allocated proportionately to each class of shares based upon the relative net asset value of outstanding shares (or the value of dividend-eligible shares, as appropriate) of each class at the beginning of the day (after adjusting for current capital share activity of the respective classes). Class-specific expenses are charged directly to the applicable class of shares.

Dividends and distributions—Dividends and distributions to shareholders are recorded on the ex-date. The amount of dividends and distributions is determined in accordance with federal income tax regulations, which may differ from US generally accepted accounting principles. These “book/tax” differences are either considered temporary or permanent in nature. To the extent these differences are permanent in

29

UBS Series Trust—U.S. Allocation Portfolio

Notes to financial statements

nature, such amounts are reclassified within the capital accounts based on their federal tax-basis treatment; temporary differences do not require reclassification.

Concentration of risk

The ability of the issuers of the debt securities held by the Portfolio to meet their obligations may be affected by economic developments; including those particular to a specific industry, country or region.

Investment advisor and administrator

UBS Global Asset Management (US) Inc. (“UBS Global AM—US”) served as the Portfolio’s investment advisor and administrator until April 1, 2006. On April 1, 2006, the Portfolio’s Investment Advisory and Administration Contract (“Advisory Contract”) was transferred from UBS Global AM—US to UBS Global Asset Management (Americas) Inc. (“UBS Global AM— Americas”).

The transfer of the Advisory Contract between sister companies occurred in connection with an internal reorganization involving UBS Global AM—US and UBS Global AM—Americas. The Portfolio’s Board of Trustees approved the transfer of the Advisory Contract effective April 1, 2006. All of the personnel of UBS Global AM—US who previously provided investment advisory services to the Portfolio continue to provide investment advisory services to the Portfolio as employees of UBS Global AM—Americas. UBS Global AM—Americas has the same contractual rights and responsibilities under the Advisory Contract as those previously held by UBS Global AM—US. UBS Global AM—US and UBS Global AM—Americas are both indirect wholly owned subsidiaries of UBS AG.

In accordance with the Advisory Contract, the Portfolio paid UBS Global AM—Americas (or UBS Global AM—US for periods prior to April 1, 2006) an investment advisory and administration fee, which was accrued daily and paid monthly, at an annual rate of 0.50% of the Portfolio’s average daily net assets. At December 31, 2006, the Portfolio owed UBS Global AM—Americas $19,993 for investment advisory and administration fees.

For the year ended December 31, 2006, the Portfolio paid $939 in brokerage commissions to UBS Financial Services Inc., an indirect wholly owned subsidiary of UBS AG for transactions executed on behalf of the Portfolio.

30

UBS Series Trust—U.S. Allocation Portfolio

Notes to financial statements

Additional information regarding compensation to affiliate of a board member

Effective March 1, 2005, Professor Meyer Feldberg accepted the position of senior advisor to Morgan Stanley, resulting in him becoming an interested trustee of the Portfolio. The Portfolio has been informed that Professor Feldberg’s role at Morgan Stanley does not involve matters directly affecting any UBS funds. Portfolio transactions are executed through Morgan Stanley based on that firm’s ability to provide best execution of the transactions. During the year ended December 31, 2006, the Portfolio paid brokerage commissions to Morgan Stanley in the amount of $1,064. During the year ended December 31, 2006, the Portfolio purchased and sold certain securities (e.g., fixed income securities) in principal trades with Morgan Stanley having an aggregate value of $9,387,690. Morgan Stanley received compensation in connection with these trades, which may have been in the form of a “mark-up” or “mark-down” of the price of the securities, a fee from the issuer for maintaining a commercial paper program, or some other form of compensation. Although the precise amount of this compensation is not generally known by UBS Global AM—Americas (or UBS Global AM—US for periods prior to April 1, 2006), UBS Global AM—Americas (or UBS Global AM—US for periods prior to April 1, 2006) believes that under normal circumstances it represents a small portion of the total value of the transactions.

Restricted securities

The Portfolio may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities is included at the end of the “Portfolio of investments.”

Distribution plan

Class I shares are offered to insurance company separate accounts where the related insurance companies receive payments for their services in connection with the distribution of the Portfolio’s Class I shares. Under the plan of distribution, the Portfolio pays to UBS Global AM—US for remittance to each participating insurance company or, at UBS Global AM—US’s direction, pays directly to a participating insurance company, a monthly distribution fee at the annual rate of 0.25% of the average daily net assets of the Class I shares held by the separate accounts of that participating

31

UBS Series Trust—U.S. Allocation Portfolio

Notes to financial statements

insurance company. At December 31, 2006, the Portfolio owed UBS Global AM—US $20,586 for distribution fees.

Securities lending

The Portfolio may lend securities up to 33 1/3% of its total assets to qualified broker-dealers or institutional investors. The loans are secured at all times by cash, US government securities or irrevocable letters of credit in an amount at least equal to the market value of the securities loaned, plus accrued interest and dividends, determined on a daily basis and adjusted accordingly. The Portfolio will regain ownership of loaned securities to exercise certain beneficial rights; however, the Portfolio may bear the risk of delay in recovery of, or even loss of rights in, the securities loaned should the borrower fail financially. The Portfolio receives compensation for lending its securities from interest or dividends earned on the cash, US government securities or irrevocable letters of credit held as collateral, net of fee rebates paid to the borrower plus reasonable administrative and custody fees. UBS Financial Services Inc. and other affiliated broker-dealers have been approved as borrowers under the Portfolio’s securities lending program. UBS Securities LLC is the Portfolio’s lending agent. For the year ended December 31, 2006, UBS Securities LLC earned $349 in compensation as the Portfolio’s lending agent. At December 31, 2006, the Portfolio owed UBS Securities LLC $68 in compensation as the Portfolio’s lending agent.

At December 31, 2006, the Portfolio had securities on loan having a market value of $3,127,393. The Portfolio’s custodian held cash equivalents as collateral for securities loaned of $2,611,420. In addition, the Portfolio’s custodian held a US government security having an aggregate value of $622,493 as collateral for portfolio securities loaned as follows:

| Principal | | | | | | | | | | | | |

| amount | | | | | Maturity | | | Interest | | | | |

| (000) | | | | | date | | | rate | | | | Value |

|

| $628 | | | US Treasury Inflation Index Note | | 01/15/16 | | | 2.000% | | | | $622,493 |

|

Bank line of credit

The Portfolio participates with other funds managed, advised or sub-advised by UBS Global AM in a $100 million committed credit facility with State Street Bank and Trust Company (“Committed Credit Facility”), to be utilized for temporary financing until the settlement of sales or purchases of portfolio securities, the repurchase or redemption of shares of the Portfolio at the request of shareholders and other temporary or emergency purposes.

32

UBS Series Trust—U.S. Allocation Portfolio

Notes to financial statements

Under the Committed Credit Facility arrangement, the Portfolio has agreed to pay commitment fees, pro rata, based on the relative asset size of the funds in the Committed Credit Facility. Interest is charged to the Portfolio at the overnight federal funds rate in effect at the time of borrowings, plus 0.50%. The Portfolio did not borrow under the Committed Credit Facility during the year ended December 31, 2006.

Purchases and sales of securities

For the year ended December 31, 2006, aggregate purchases and sales of portfolio securities, excluding short-term securities and US government and agency securities, were $12,235,960 and $20,038,582, respectively. For the year ended December 31, 2006, aggregate purchases and sales of US government and agency securities, excluding short-term securities were $21,955,610 and $22,898,159, respectively.

Federal tax status

The Portfolio intends to distribute substantially all of its income and to comply with the other requirements of the Internal Revenue Code applicable to regulated investment companies. Accordingly, no provision for federal income taxes is required. In addition, by distributing during each calendar year substantially all of its net investment income, net realized capital gains and certain other amounts, if any, the Portfolio intends not to be subject to a federal excise tax.

The tax character of distributions paid during the fiscal years ended December 31, 2006 and December 31, 2005 were as follows:

| Distributions paid from: | | | 2006 | | | 2005 |

|

| Ordinary income | | | $1,270,313 | | | $985,731 |

|

At December 31, 2006, the components of total accumulated earnings (deficit) on a tax basis were as follows:

| Undistributed ordinary income | | | $953,660 | |

| |

| Accumulated realized capital and other losses | | | (26,348,972 | ) |

| |

| Net unrealized appreciation of investments | | | 4,032,008 | |

| |

| Total accumulated deficit | | | $(21,363,304 | ) |

| |