UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number: 811-04919 |

|

| |

| UBS Series Trust |

|

| (Exact name of registrant as specified in charter) |

| |

| 51 West 52nd Street, New York, New York 10019-6114 |

|

| (Address of principal executive offices) (Zip code) |

| |

Mark F. Kemper, Esq.

UBS Global Asset Management

51 West 52nd Street

New York, NY 10019-6114

(Name and address of agent for service)

Copy to:

Jack W. Murphy, Esq.

Dechert LLP

1775 I Street, N.W.

Washington, DC 20006-2401

| Registrant’s telephone number, including area code: 212-882 5000 |

| |

| Date of fiscal year end: December 31 |

| |

| Date of reporting period: December 31, 2007 |

Item 1. Reports to Stockholders.

| | UBS Series Trust |

| | U.S. Allocation Portfolio |

| | Annual Report |

| | December 31, 2007 |

UBS Series Trust—U.S. Allocation Portfolio

February 15, 2008

Dear contract owner,

This report provides an overview of the UBS Series Trust—U.S. Allocation Portfolio for the twelve months ended December 31, 2007.

Performance

During the twelve months ended December 31, 2007, the Portfolio’s Class H shares returned 2.19%. Since the Portfolio invests in both stocks and bonds, we feel it is appropriate to compare the Portfolio’s performance to the U.S. Allocation Fund Index** (the “Index”), which returned 5.68% over the same time period. By contrast, the S&P 500 Index, which tracks large cap US equities, returned 5.49% during the reporting period. (For Class H and Class I returns over various time periods, please refer to “Performance at a glance” on page 11.) | | | UBS Series Trust—U.S. | |

| | | Allocation Portfolio | |

| | | | |

| | | Investment goal: | |

| | | Total return, consisting of

long-term capital

appreciation and

current income | |

| | | | |

| | | Portfolio Managers: | |

| | | Portfolio Management Team,

including Edwin M. Denson*

UBS Global Asset

Management (Americas) Inc. | |

| | | | |

| | | Commencement: | |

| | | Class H—September 28, 1998 | |

| | | Class I—January 5, 1999 | |

| | | | |

| | | Dividend payments: | |

| | | Annually | |

| An interview with Lead Portfolio Manager Edwin M. Denson |

| Q. | | Can you describe the economic environment during the reporting period? |

| A. | | While it was fairly resilient during much of the reporting period, the US economy weakened toward the end of 2007. US gross domestic product (“GDP”) expanded only 0.6% during the first quarter of 2007. A variety of factors caused the economy to stumble, including the ongoing troubles in the housing market and tepid business spending. |

| | | |

| | | The economy then picked up steam in the second quarter, boosted by improving manufacturing activity. During this period, GDP growth was |

| | | |

| * | | A portfolio management change occurred at the end of the reporting period. Effective December 31, 2007, Edwin Denson assumed the duties of Lead Portfolio Manager, replacing Brian Singer. |

| | | |

| ** | | An unmanaged index compiled by the advisor, constructed as follows: from September 28, 1998 (Portfolio’s inception) until February 29, 2004:100% S&P 500 Index; from March 1, 2004 until May 31, 2005: 65% Russell 3000 Index, 30% Lehman Brothers US Aggregate Bond Index, 5% Merrill Lynch US High Yield Cash Pay Index; from June 1, 2005 until present: 65% Russell 3000 Index, 30% Lehman Brothers US Aggregate Bond Index, 5% Merrill Lynch US High Yield Cash Pay Constrained Index. |

1

UBS Series Trust—U.S. Allocation Portfolio

| | | a solid 3.8%. The Commerce Department then reported that third quarter GDP growth was 4.9%. This was due, in part, to strong consumer spending and increased exports. However, advance estimates for the GDP growth rate in the fourth quarter fell back to the first quarter level, just 0.6%. The combined effects of the weak housing market, issues related to subprime mortgages and tighter credit conditions negatively impacted the overall economy. |

| | | |

| Q. | | How did the Federal Reserve Board (the “Fed”) react in this economic environment? |

| A. | | Fed Chairman Ben Bernanke initially indicated that the issues related to the subprime mortgage market would probably not impact the overall economy. However, as the problems and fallout from subprime mortgages escalated, the Fed became more concerned about these issues. As credit concerns mounted, the Fed provided greater amounts of liquidity to the market in an effort to facilitate normal market operations. |

| | | |

| | | In mid-August, the Fed lowered the discount rate—the rate the Fed uses for loans it makes directly to banks. Then, in mid-September, the Fed continued to take action by reducing the federal funds rate from 5.25% to 4.75%. (The federal funds rate, or “fed funds” rate, is the rate that banks charge one another for funds they borrow on an overnight basis.) This was the first reduction in the federal funds rate since June 2003. |

| | | |

| | | The Fed again lowered the fed funds rate in October and December 2007, bringing it to 4.25% by the end of the year. In January 2008, after the reporting period had ended, the Fed cut the rate twice within nine days. On January 22nd, it reduced the rate by 0.75%. This was followed by another 0.50% cut on January 30th, bringing the fed funds rate to 3.00%, the lowest level since May 2005. |

| | | |

| | | In its statement released in conjunction with this rate cut, the Fed stated: “Financial markets remain under considerable stress, and credit has tightened further for some businesses and households. Moreover, recent information indicates a deepening of the housing contraction as well as some softening in labor markets.” |

| | | |

| Q. | | How did the stock market perform during the reporting period? |

| A. | | The US stock market was extremely volatile during the reporting period. Generally posting positive returns early in the year, US equity prices fell sharply in June and July 2007. This was largely due to troubles in the |

2

UBS Series Trust—U.S. Allocation Portfolio

| | | housing market. In addition, inflationary pressures led to concerns that the Fed would not cut interest rates in the near future. |

| | | |

| | | US stock prices then began to rise in late August 2007 and continued to do so through October. This rebound was triggered by the Fed’s lowering of interest rates in an attempt to alleviate the credit crunch and avert a recession. Hopes that the market’s rally would continue ended suddenly in November. Lackluster third quarter corporate profits, surging oil prices and the continued fallout from the subprime mortgage market caused the S&P 500 Index (the “Index”) to fall 10% from its peak in October. This 10% decline, often referred to as a “correction,” was the first such occurrence since 2003. Stocks finished the year with a modest decline in December. All told, the Index returned 5.49% over the 12-month reporting period. |

| | | |

| Q. | | Did the bond market generate positive results as well during the reporting period? |

| A. | | As was the case with the US stock market, bond prices also fluctuated during the reporting period. Bond prices gyrated early in the reporting period, given changing expectations regarding economic growth, inflation and future Fed monetary policies. Issues related to the bursting of the housing bubble and subprime mortgage meltdown triggered several “flights to quality” in 2007. During those times, investors flocked to high quality government bonds, which they perceived to be safer than lower quality fixed income securities. |

| | | |

| | | During the 12 months ended December 31, 2007, two-year Treasury yields fell from 4.82% to 3.05%. Over the same period, 10-year Treasury yields moved from 4.71% to 4.04%. The overall bond market, as measured by the Lehman Brothers US Aggregate Index, returned 6.97% in 2007. |

| | | |

| Q. | | How was the Portfolio allocated at the end of the reporting period? |

| A. | | When the 12-month reporting period began, the Portfolio’s assets were allocated as follows: 66% was invested in US equities; 32% was invested in US bonds; and 2% was invested in cash equivalents. As of the end of the reporting period, the Portfolio’s allocation was similar, with 65% invested in US equities, a 1% decrease; 33% invested in US bonds, a 1% increase; and 2% was invested in cash equivalents. |

3

UBS Series Trust—U.S. Allocation Portfolio

| | | In the second quarter of 2007, we took advantage of the selloff in the bond market by increasing the Portfolio’s exposure to bonds slightly and reducing our position in cash equivalents. This had a negative impact on performance later in the reporting period. However, in our opinion, the selloff in bonds increased the attractiveness of the fixed income asset classes relative to cash, warranting a change in strategy. |

| | | |

| | | In the third quarter of 2007, the lack of liquidity in the credit markets—and the spillover into the high yield market—reduced what we believed to be the longstanding overvaluation of this asset class significantly. At the same time, a flight to quality caused the US Treasury bond market to become slightly overvalued, in our opinion. |

| | | |

| | | This provided us with an opportunity to gain exposure to high yield debt, and we reduced the Portfolio’s exposure to investment grade debt in order to do so. The selloff in equities that occurred as the credit market tightened led us to increase our exposure slightly to US equities at that time. To fund this, we further reduced our exposure to US investment grade bonds. Ultimately, however, increasing the Fund’s exposure to equities hindered performance when the selected securities posted weak returns. |

| | | |

| Q. | | Which equity selections performed well during the year and which areas produced disappointing results? |

| A. | | During the 12 months ended December 31, 2007, we had positive contributions from outperformers, such as The Bank of New York Mellon Corp., oil giant Exxon Mobil Corp. and pharmaceutical benefit manager Medco Health Solutions, Inc. Our holding in Amazon.com also benefited performance as its shares moved sharply higher before being sold at the end of the reporting period. Elsewhere, our exposure to Costco Wholesale Corp. enhanced results as it outperformed the overall market in 2007. |

| | | |

| | | However, on the downside, industry factors and stock selection detracted from overall results. The primary culprits at the stock level were our exposure to weak performing Sprint Nextel Corp. and not owning strong performer Apple, Inc. Other stocks we owned that generated disappointing performance during the year included Symantec Corp., Sysco Corp. and FedEx Corp. From an industry perspective, aspects of our portfolio positioning that detracted from results included our overweight to financials and underweights to energy, materials and industries such as aerospace and defense. |

4

UBS Series Trust—U.S. Allocation Portfolio

| Q. | | How did you manage the Portfolio’s fixed income exposure during the reporting period? |

| A. | | We kept the Portfolio’s duration slightly shorter than the benchmark for most of the reporting period. (Duration measures a portfolio’s sensitivity to changes in interest rates.) In the first half of the reporting period, we maintained an underweight duration exposure to the five- to 10-year part of the yield curve, expecting the yield in this area to rise relative to the short end of the curve. |

| | | |

| | | In the middle of the reporting period, we extended the Portfolio’s duration to a neutral position. This reflected our belief that market sentiment and pricing had moved within our fair value estimates. We maintained this position until the end of November, when we moved to a slightly underweight duration. In total, our duration positioning had a neutral impact on performance. |

| | | |

| | | Given the flights to quality during the summer and in November 2007, the non-Treasury sectors performed poorly during the second half of the reporting period. In particular, the fallout from the subprime meltdown negatively impacted the performance of the Portfolio’s positions in mortgages, asset-backed securities and commercial mortgage-backed securities. Overall, our security selection in the fixed-income portion of the portfolio detracted from performance. |

| | | |

| | | In terms of the Portfolio’s high yield component, we took a conservative stance during the first half of the reporting period, as we felt the sector was overvalued. Our approach detracted from performance during that time, but benefited the Portfolio during the second half of the period as high yield prices declined sharply. As discussed, we viewed this selloff as an opportunity, and increased the Portfolio’s exposure to the high yield bond asset class during the fourth quarter. |

| | | |

| Q. | | What is your outlook for the markets and the Portfolio? |

| A. | | In our view, US equities are within fair value range at the time of this writing. We believe that the Portfolio’s equity performance in 2008 will be influenced by its overweight positioning within the financial sector, and its underweights to the energy and materials sectors. |

| | | |

| | | In the investment grade fixed income component of the Portfolio, we continue to seek attractive opportunities. The markets are priced for continuing uncertainty and a challenging economic environment in the US. Looking forward, we expect the bond markets to improve, as liquidity conditions ease and investors eventually price in a more balanced risk perspective. |

5

UBS Series Trust—U.S. Allocation Portfolio

| | | Finally, the high yield component of the Portfolio was positioned more conservatively during the fourth quarter, concentrating on issuer-specific situations offering what we believed to be superior relative value. These include meaningful holdings in short-dated (one year or less) commercial paper that, while having ratings that are in some cases investment grade, carry yields that are more in line with distressed high yield securities. Our thesis for owning these credits is based on our belief that these companies have ample liquidity, and are able to weather near-term market conditions. |

6

UBS Series Trust—U.S. Allocation Portfolio

We thank you for your continued support and welcome any comments or questions you may have. For additional information on the UBS family of funds,* please contact your financial advisor or visit us at www.ubs.com/globalam-us.

Sincerely,

Kai R. Sotorp

President

UBS Series Trust—U.S. Allocation Portfolio

Head of the Americas

UBS Global Asset Management (Americas) Inc.

Edwin M. Denson, PhD.

Lead Portfolio Manager

Senior Asset Allocation Analyst

UBS Series Trust—U.S. Allocation Portfolio

UBS Global Asset Management (Americas) Inc.

This letter is intended to assist shareholders in understanding how the Portfolio performed during the fiscal year ended December 31, 2007. The views and opinions in the letter were current as of February 15, 2008. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and we reserve the right to change our views about individual securities, sectors and markets at any time. As a result, the views expressed should not be relied upon as a forecast of the fund’s future investment intent or results. We encourage you to consult your financial advisor regarding your personal investment program.

| * | | Mutual funds are sold by prospectus only. You should read it carefully and consider a fund’s investment objectives, risks, charges, expenses and other important information contained in the prospectus before investing. Prospectuses for most of our funds can be obtained from your financial advisor, by calling UBS Funds at 800-647 1568 or by visiting our Web site at www.ubs.com/globalam-us. |

7

UBS Series Trust—U.S. Allocation Portfolio

Understanding your Portfolio’s expenses (unaudited)

As a shareholder of the Portfolio, you incur ongoing costs, including management fees, distribution fees (if applicable) and other Portfolio expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds.

The example below is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, July 1, 2007 to December 31, 2007.

Actual expenses

The first line for each class of shares in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over a period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line for each class of shares under the heading entitled “Expenses paid during period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second line for each class of shares in the table below provides information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratios for each class of shares and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return for each class of shares. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs (as applicable), such as contract level charges that may be applicable to variable annuity contracts. Therefore, the second line in the table for each class of shares is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

8

UBS Series Trust—U.S. Allocation Portfolio

Understanding your Portfolio’s expenses (unaudited) (concluded)

| | | | | Beginning | | Ending | | Expenses paid |

| | | | | account value | | account value | | during period(1) |

| | | | | July 1, 2007 | | December 31, 2007 | | 07/01/07 to 12/31/07 |

|

| Class H | | Actual | | $ | 1,000.00 | | $969.60 | | $ | 5.06 |

|

| | | Hypothetical | | | | | | | | |

| | | (5% annual return | | | | | | | | |

| | | before expenses) | | | 1,000.00 | | 1,020.06 | | | 5.19 |

|

| Class I | | Actual | | | 1,000.00 | | 968.40 | | | 6.30 |

|

| | | Hypothetical | | | | | | | | |

| | | (5% annual return | | | | | | | | |

| | | before expenses) | | | 1,000.00 | | 1,018.80 | | | 6.46 |

|

| (1) | | Expenses are equal to the Portfolio’s annualized expense ratios: Class H: 1.02%, Class I: 1.27%, multiplied by the average account value over the period, multiplied by 184 divided by 365 (to reflect the one-half year period). |

9

UBS Series Trust—U.S. Allocation Portfolio

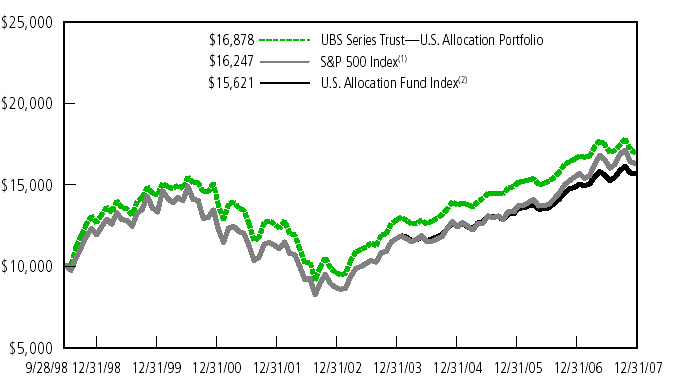

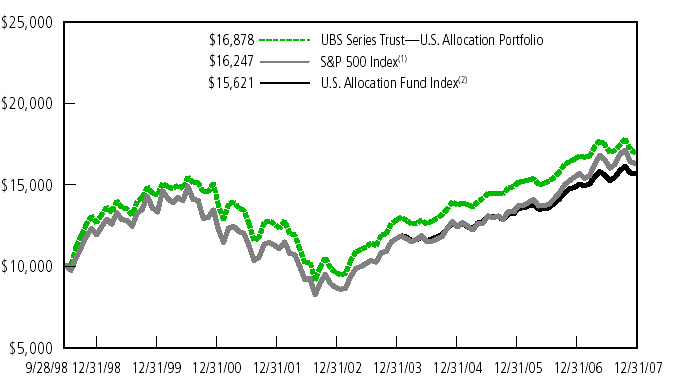

Comparison of the change in value of a $10,000 investment in UBS Series Trust—U.S. Allocation Portfolio (Class H), the S&P 500 Index(1) and the U.S. Allocation Fund Index(2), from September 28, 1998 (inception of the Fund’s Class H shares) through December 31, 2007.

| (1) | | The S&P 500 Index is an unmanaged weighted index composed of 500 widely held common stocks varying in composition, and is not available for direct investment. |

| | | |

| (2) | | An unmanaged index (formerly known as the U.S. Tactical Allocation Fund Index) compiled by the advisor, constructed as follows: from September 28, 1998 (Portfolio’s inception) until February 29, 2004: 100% S&P 500 Index; from March 1, 2004 until May 31, 2005: 65% Russell 3000 Index, 30% Lehman Brothers US Aggregate Bond Index, 5% Merrill Lynch US High Yield Cash Pay Index; from June 1, 2005 until present: 65% Russell 3000 Index, 30% Lehman Brothers US Aggregate Bond Index, 5% Merrill Lynch US High Yield Cash Pay Constrained Index. |

The performance of Class I shares will vary from the performance of Class H shares based on different fees paid by shareholders investing in the different share classes. Past performance does not predict future performance, and the performance information provided does not reflect the deduction of taxes that a shareholder could pay on Portfolio distributions or the redemption of Portfolio shares. The return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance results assume reinvestment of all dividends and capital gain distributions at net asset value on the ex-dividend dates and does not reflect separate account charges applicable to variable annuity contracts. Current performance may be higher or lower than the performance data quoted. It is important to note that the Portfolio is a professionally managed mutual fund, while the indexes are not available for investment and are unmanaged. The comparison is shown for illustration purposes only.

10

UBS Series Trust—U.S. Allocation Portfolio

Performance at a glance (unaudited)

| Average annual total returns for periods ended 12/31/07 |

| | | | | | | Since |

| | | 1 year | | 5 years | | inception(1) |

|

| Class H(2) | | 2.19% | | 11.40% | | 5.82% |

|

| Class I(2) | | 1.90 | | 11.13 | | 3.17 |

|

| S&P500 Index(3) | | 5.49 | | 12.83 | | 5.38 |

|

| U.S. Allocation Fund Index(4) | | 5.68 | | 11.95 | | 4.94 |

|

| (1) | | Since inception returns are calculated as of the commencement of issuance on September 28, 1998 for Class H shares and January 5, 1999 for Class I shares. Since inception returns for the S&P 500 Index and the U.S. Allocation Fund Index are calculated as of September 28, 1998, which is the inception date of the oldest share class (Class H). |

| | | |

| (2) | | Class H and Class I shares do not bear initial or contingent deferred sales charges. Class I shares bear ongoing distribution fees; Class H shares do not bear similar fees . |

| | | |

| (3) | | The S&P 500 Index is an unmanaged weighted index composed of 500 widely held common stocks varying in composition, and is not available for direct investment. |

| | | |

| (4) | | An unmanaged index (formerly known as the U.S. Tactical Allocation Fund Index) compiled by the advisor, constructed as follows: from September 28, 1998 (Portfolio’s inception) until February 29, 2004: 100% S&P 500 Index; from March 1, 2004 until May 31, 2005: 65% Russell 3000 Index, 30% Lehman Brothers US Aggregate Bond Index, 5% Merrill Lynch US High Yield Cash Pay Index; from June 1, 2005 until present: 65% Russell 3000 Index, 30% Lehman Brothers US Aggregate Bond Index, 5% Merrill Lynch US High Yield Cash Pay Constrained Index. |

Past performance does not predict future performance, and the performance information provided does not reflect the deduction of taxes that a shareholder could pay on Portfolio distributions or the redemption of Portfolio shares. The return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance results assume reinvestment of all dividends and capital gain distributions at net asset value on the ex-dividend dates and does not reflect separate account charges applicable to variable annuity contracts. Current performance may be higher or lower than the performance data quoted.

11

UBS Series Trust—U.S. Allocation Portfolio

Portfolio statistics (unaudited)

| Characteristics | | | 12/31/07 | | | 06/30/07 | | | | 12/31/06 |

|

| Net assets (mm) | | | $34.8 | | | | | $40.5 | | | | | $46.6 | |

|

| Number of securities | | | 196 | | | | | 165 | | | | | 171 | |

|

| Portfolio composition(1) | | | 12/31/07 | | | | 06/30/07 | | | | 12/31/06 |

|

| Common stocks(2) | | | 65.3 | % | | | | 68.9 | % | | | | 66.2 | % |

|

| Bonds(3) | | | 32.8 | | | | | 30.6 | | | | | 32.1 | |

|

| Cash equivalents and other | | | | | | | | | | | | | | |

| assets less liabilities | | | 1.9 | | | | | 0.5 | | | | | 1.7 | |

|

| Total | | | 100.0 | % | | | | 100.0 | % | | | | 100.0 | % |

|

| Top five equity sectors(1) | | | 12/31/07 | | | | 06/30/07 | | | | 12/31/06 |

|

| Financials | | | 11.6 | % | | | | 14.4 | % | | | | 16.3 | % |

|

| Health care | | | 10.6 | | | | | 9.7 | | | | | 9.8 | |

|

| Consumer discretionary | | | 9.3 | | | | | 11.3 | | | | | 9.4 | |

|

| Information technology | | | 8.2 | | | | | 9.8 | | | | | 8.2 | |

|

| Industrials | | | 7.7 | | | | | 7.3 | | | | | 6.3 | |

|

| Total | | | 47.4 | % | | | | 52.5 | % | | | | 50.0 | % |

|

| Top ten equity securities(1) | | | 12/31/07 | | | | 06/30/07 | | | | 12/31/06 |

|

| Exelon | | | 2.1 | % | | Citigroup | | 2.6 | % | | Citigroup | | 3.0 | % |

|

| General Electric | | | 2.0 | | | Morgan Stanley | | 2.4 | | | Morgan Stanley | | 2.6 | |

|

| Intel | | | 1.9 | | | Wells Fargo | | 2.1 | | | Microsoft | | 2.3 | |

|

| Wells Fargo | | | 1.8 | | | Microsoft | | 1.9 | | | Wells Fargo | | 2.0 | |

|

| Citigroup | | | 1.7 | | | Exelon | | 1.9 | | | Exelon | | 1.7 | |

|

| | | | | | | | | | | | American | | | |

| Morgan Stanley | | | 1.6 | | | Intel | | 1.7 | | | International Group | | 1.5 | |

|

| Wyeth | | | 1.5 | | | Wyeth | | 1.7 | | | Allergan | | 1.5 | |

|

| Microsoft | | | 1.5 | | | General Electric | | 1.7 | | | Wyeth | | 1.4 | |

|

| Allergan | | | 1.4 | | | Mellon Financial | | 1.4 | | | Mellon Financial | | 1.4 | |

|

| Merck | | | 1.3 | | | Johnson Controls | | 1.4 | | | Johnson Controls | | 1.3 | |

|

| Total | | | 16.8 | % | | | | 18.8 | % | | | | 18.7 | % |

|

| (1) | | Weightings represent percentages of the Portfolio’s net assets as of the dates indicated. The Portfolio is actively managed, and its composition will vary over time. |

| (2) | | Weightings include investment company holding of UBS U.S. Small Cap Equity Relationship Fund. |

| (3) | | Weightings include investment company holding of UBS High Yield Relationship Fund. |

12

UBS Series Trust—U.S. Allocation Portfolio

Portfolio statistics (unaudited) (continued)

| Fixed income | | | | | | | | | |

| sector allocation(1) | | 12/31/07 | | 06/30/07 | | 12/31/06 |

|

| Mortgage & agency debt securities | | 11.0 | % | | 12.1 | % | | 12.6 | % |

|

| Corporate bonds | | 5.4 | | | 5.8 | | | 5.7 | |

|

| US government obligations | | 5.2 | | | 4.9 | | | 7.4 | |

|

| Commercial mortgage-backed securities | | 3.8 | | | 3.2 | | | 2.8 | |

|

| Asset-backed securities | | 1.7 | | | 1.7 | | | 1.2 | |

|

| Collateralized debt obligation | | 0.4 | | | 0.4 | | | 0.3 | |

|

| Total | | 27.5 | % | | 28.1 | % | | 30.0 | % |

|

| (1) | | Weightings represent percentages of the Portfolio’s net assets as of the dates indicated. The Portfolio is actively managed, and its composition will vary over time. |

13

UBS Series Trust—U.S. Allocation Portfolio

Portfolio statistics (unaudited) (concluded)

| Top ten fixed | | | | | | | | | | | | | |

| income securities(1) | | 12/31/07 | | | | 06/30/07 | | | | 12/31/06 |

|

| FNMA | | | | | FNMA | | | | | US Treasury | | | |

| Certificates, 6.500% | | | | | Certificates, 6.500% | | | | | Notes, 4.875% | | | |

| due 01/01/36 | | 1.4 | % | | due 01/01/36 | | 1.3 | % | | due 10/31/08 | | 1.5 | % |

|

| US Treasury | | | | | US Treasury | | | | | FNMA | | | |

| Notes, 4.875% | | | | | Bonds, 6.250% | | | | | Certificates, 6.500% | | | |

| due 06/30/12 | | 1.4 | | | due 05/15/30 | | 1.3 | | | due 12/01/29 | | 1.3 | |

|

| US Treasury | | | | | US Treasury | | | | | US Treasury | | | |

| Bonds, 6.250% | | | | | Bonds, 6.250% | | | | | Bonds, 6.250% | | | |

| due 08/15/23 | | 1.0 | | | due 08/15/23 | | 1.2 | | | due 08/15/23 | | 1.2 | |

|

| US Treasury | | | | | US Treasury | | | | | US Treasury | | | |

| Notes, 4.875% | | | | | Bonds, 4.750% | | | | | Notes, 4.875% | | | |

| due 06/30/09 | | 0.9 | | | due 02/15/37 | | 1.2 | | | due 05/15/09 | | 1.1 | |

|

| | | | | | Federal Home | | | | | | | | |

| US Treasury | | | | | Loan Bank | | | | | GNMA | | | |

| Bonds, 4.750% | | | | | Certificates, 5.500% | | | | | Certificates, 6.000% | | | |

| due 02/15/37 | | 0.9 | | | due 08/13/14 | | 1.0 | | | due 07/15/29 | | 1.0 | |

|

| | | | | | Asset Securitization | | | | | | | | |

| | | | | | Corp., Series | | | | | | | | |

| Ford Motor | | | | | 1995-MD4, | | | | | US Treasury | | | |

| Credit Co, 5.800% | | | | | Class A3, 7.384% | | | | | Notes, 4.875% | | | |

| due 01/12/09 | | 0.7 | | | due 08/13/29 | | 1.0 | | | due 08/31/08 | | 0.9 | |

|

| JP Morgan Chase | | | | | | | | | | | | | |

| Commercial Mortgage | | | | | | | | | | Asset Securitization | | | |

| Securities Corp., | | | | | | | | | | Corp., Series | | | |

| Series 2005-LDP5, | | | | | FNMA | | | | | 1995-MD4, | | | |

| Class A4, 5.179% | | | | | Certificates, 5.500% | | | | | Class A3, 7.384% | | | |

| due 12/15/44 | | 0.7 | | | due 07/01/33 | | 0.7 | | | due 08/13/29 | | 0.9 | |

|

| | | | | | | | | | | US Treasury | | | |

| FHMLC | | | | | US Treasury | | | | | Inflation Index | | | |

| Certificates, 5.500% | | | | | Notes, 4.750% | | | | | Notes, 2.000% | | | |

| due 07/01/37 | | 0.6 | | | due 12/31/08 | | 0.7 | | | due 01/15/16 | | 0.8 | |

|

| | | | | | | | | | | FHLMC REMIC, | | | |

| FNMA | | | | | Ford Motor | | | | | Series 3149, | | | |

| Certificates, 5.500% | | | | | Credit Co., 5.800% | | | | | Class PC, 6.000% | | | |

| due 04/01/37 | | 0.6 | | | due 01/12/09 | | 0.6 | | | due 10/15/31 | | 0.7 | |

|

| Hilton Hotel Pool | | | | | | | | | | | | | |

| Trust, Series 2000-HLTA, | | | | | General Electric | | | | | FNMA | | | |

| Class A1, 7.055% | | | | | Capital Corp., 6.000% | | | | | Certificates, 5.500% | | | |

| due 10/03/15 | | 0.6 | | | due 06/15/12 | | 0.6 | | | due 07/01/33 | | 0.7 | |

|

| Total | | 8.8 | % | | | | 9.6 | % | | | | 10.1 | % |

|

| (1) | | Weightings represent percentages of the Portfolio’s net assets as of the dates indicated. The Portfolio is actively managed, and its composition will vary over time. |

14

UBS Series Trust—U.S. Allocation Portfolio

Portfolio of investments—December 31, 2007

Common stocks—60.47%

| | | Number of | |

| Security description | | shares | Value |

|

| Air freight & couriers—1.36% | | | | |

| FedEx Corp. | | 3,800 | | $338,846 |

|

| Ryder System, Inc. | | 2,900 | | 136,329 |

|

| | | | | 475,175 |

|

| Auto components—1.94% | | | | |

| BorgWarner, Inc. | | 6,700 | | 324,347 |

|

| Johnson Controls, Inc. | | 9,800 | | 353,192 |

|

| | | | | 677,539 |

|

| Banks—4.61% | | | | |

| City National Corp. | | 1,400 | | 83,370 |

|

| Fifth Third Bancorp | | 11,200 | | 281,456 |

|

| PNC Financial Services Group | | 2,500 | | 164,125 |

|

| The Bank of New York Mellon Corp. | | 9,400 | | 458,344 |

|

| Wells Fargo & Co. | | 20,500 | | 618,895 |

| | | | | 1,606,190 |

|

| Beverages—1.00% | | | | |

| Anheuser-Busch Cos., Inc. | | 3,200 | | 167,488 |

|

| Constellation Brands, Inc., Class A* | | 7,700 | | 182,028 |

|

| | | | | 349,516 |

|

| Biotechnology—1.43% | | | | |

| Amgen, Inc.* | | 1,400 | | 65,016 |

|

| Genzyme Corp.* | | 5,800 | | 431,752 |

|

| | | | | 496,768 |

|

| Building products—0.99% | | | | |

| Masco Corp. | | 16,000 | | 345,760 |

|

| Computers & peripherals—1.14% | | | | |

| Dell, Inc.* | | 8,300 | | 203,433 |

|

| Lexmark International, Inc., Class A* | | 2,100 | | 73,206 |

|

| Network Appliance, Inc.* | | 4,800 | | 119,808 |

|

| | | | | 396,447 |

|

| | | Number of | |

| Security description | | shares | Value |

|

| Diversified financials—5.58% | | | | |

| Citigroup, Inc. | | 19,700 | | $579,968 |

|

| Discover Financial Services | | 8,850 | | 133,458 |

|

| Federal Home Loan Mortgage Corp. | | 7,900 | | 269,153 |

|

| JP Morgan Chase & Co. | | 5,700 | | 248,805 |

|

| Morgan Stanley | | 10,800 | | 573,588 |

|

| Principal Financial Group, Inc. | | 1,200 | | 82,608 |

|

| The Blackstone Group LP | | 2,497 | | 55,259 |

|

| | | | | 1,942,839 |

|

| Diversified telecommunication services—1.96% | | | | |

| AT&T, Inc. | | 8,100 | | 336,636 |

|

| Sprint Nextel Corp. | | 26,488 | | 347,787 |

|

| | | | | 684,423 |

|

| Electric utilities—3.03% | | | | |

| American Electric Power Co., Inc. | | 4,500 | | 209,520 |

|

| Exelon Corp. | | 9,100 | | 742,924 |

|

| Pepco Holdings, Inc. | | 3,500 | | 102,655 |

|

| | | | | 1,055,099 |

|

| Energy equipment & services—1.81% | | | | |

| ENSCO International, Inc. | | 3,000 | | 178,860 |

|

| Halliburton Co. | | 11,900 | | 451,129 |

|

| | | | | 629,989 |

|

| Food & drug retailing—0.75% | | | | |

| Sysco Corp. | | 8,400 | | 262,164 |

|

| Gas utilities—1.06% | | | | |

| NiSource, Inc. | | 5,400 | | 102,006 |

|

| Sempra Energy | | 4,300 | | 266,084 |

|

| | | | | 368,090 |

|

15

| UBS Series Trust—U.S. Allocation Portfolio |

Portfolio of investments—December 31, 2007 |

| |

| Common stocks—(continued) |

| | | | Number of | | |

| Security description | | | shares | | Value |

|

| Health care equipment & supplies—1.08% | | | | | | |

| Medtronic, Inc. | | | 6,200 | | | $311,674 |

|

| Millipore Corp.* | | | 900 | | | 65,862 |

|

| | | | | | | 377,536 |

|

| Health care providers & services—0.97% | | | | | | |

| DaVita, Inc.* | | | 1,200 | | | 67,620 |

|

| Pharmaceutical Product Development, Inc. | | | 2,200 | | | 88,814 |

|

| UnitedHealth Group, Inc. | | | 3,100 | | | 180,420 |

|

| | | | | | | 336,854 |

|

| Hotels, restaurants & leisure—1.38% | | | | | | |

| Carnival Corp. | | | 7,400 | | | 329,226 |

|

| Royal Caribbean Cruises Ltd. | | | 3,600 | | | 152,784 |

|

| | | | | | | 482,010 |

|

| Household durables—0.52% | | | | | | |

| Fortune Brands, Inc. | | | 2,500 | | | 180,900 |

|

| Industrial conglomerates—2.03% | | | | | | |

| General Electric Co. | | | 19,100 | | | 708,037 |

|

| Insurance—1.55% | | | | | | |

| AFLAC, Inc. | | | 5,300 | | | 331,939 |

|

| Hartford Financial Services Group, Inc. | | | 2,400 | | | 209,256 |

|

| | | | | | | 541,195 |

|

| Leisure equipment & products—0.27% | | | | | | |

| Harley-Davidson, Inc. | | | 2,000 | | | 93,420 |

|

| Machinery—2.03% | | | | | | |

| Illinois Tool Works, Inc. | | | 8,400 | | | 449,736 |

|

| PACCAR, Inc. | | | 4,750 | | | 258,780 |

|

| | | | | | | 708,516 |

|

| Media—3.51% | | | | | | |

| Comcast Corp., Class A* | | | 10,000 | | | 182,600 |

|

| Interpublic Group of Cos., Inc.* | | | 16,500 | | | 133,815 |

|

| | | | Number of | | |

| Security description | | | shares | | Value |

|

| Media—(concluded) | | | | | | |

| McGraw-Hill Cos., Inc. | | | 2,200 | | | $96,382 |

|

| News Corp., Class A | | | 10,300 | | | 211,047 |

|

| Omnicom Group, Inc. | | | 5,100 | | | 242,403 |

|

| R.H. Donnelley Corp.* | | | 4,120 | | | 150,298 |

|

| Viacom, Inc., Class B* | | | 4,700 | | | 206,424 |

|

| | | | | | | 1,222,969 |

|

| Metals & mining—1.26% | | | | | | |

| Patriot Coal Corp.* | | | 330 | | | 13,774 |

|

| Peabody Energy Corp. | | | 6,900 | | | 425,316 |

|

| | | | | | | 439,090 |

|

| Multi-line retail—1.14% | | | | | | |

| Costco Wholesale Corp. | | | 3,100 | | | 216,256 |

|

| Target Corp. | | | 3,600 | | | 180,000 |

|

| | | | | | | 396,256 |

|

| Oil & gas—2.08% | | | | | | |

| Chevron Corp. | | | 1,800 | | | 167,994 |

|

| EOG Resources, Inc. | | | 3,700 | | | 330,225 |

|

| Exxon Mobil Corp. | | | 2,400 | | | 224,856 |

|

| | | | | | | 723,075 |

|

| Pharmaceuticals—7.16% | | | | | | |

| Allergan, Inc. | | | 7,600 | | | 488,224 |

|

| Bristol-Myers Squibb Co. | | | 4,700 | | | 124,644 |

|

| Cephalon, Inc.* | | | 1,300 | | | 93,288 |

|

| Johnson & Johnson | | | 6,100 | | | 406,870 |

|

| Medco Health Solutions, Inc.* | | | 2,600 | | | 263,640 |

|

| Merck & Co., Inc. | | | 8,000 | | | 464,880 |

|

| Schering-Plough Corp. | | | 4,500 | | | 119,880 |

|

| Wyeth | | | 12,100 | | | 534,699 |

|

| | | | | | | 2,496,125 |

|

| Road & rail—1.27% | | | | | | |

| Burlington Northern Santa Fe Corp. | | | 5,300 | | | 441,119 |

|

| UBS Series Trust—U.S. Allocation Portfolio |

Portfolio of investments—December 31, 2007 |

| |

| Common stocks—(concluded) |

| | | | Number of | | |

| Security description | | | shares | | Value |

|

| Semiconductor equipment & products—3.92% | | | | | | |

| Analog Devices, Inc. | | | 10,900 | | $ | 345,530 |

|

| Intel Corp. | | | 25,200 | | | 671,832 |

|

| Linear Technology Corp. | | | 5,000 | | | 159,150 |

|

| Xilinx, Inc. | | | 8,700 | | | 190,269 |

|

| | | | | | | 1,366,781 |

|

| Software—3.14% | | | | | | |

| Intuit, Inc.* | | | 5,300 | | | 167,533 |

|

| Microsoft Corp. | | | 14,900 | | | 530,440 |

|

| Red Hat, Inc.* | | | 2,900 | | | 60,436 |

|

| Symantec Corp.* | | | 20,863 | | | 336,729 |

|

| | | | | | | 1,095,138 |

|

| | | | Number of | | |

| Security description | | | shares | | Value |

|

| Specialty retail—0.17% | | | | | | |

| Chico’s FAS, Inc.* | | | 6,500 | | $ | 58,695 |

|

| Textiles & apparel—0.33% | | | | | | |

| Coach, Inc.* | | | 3,700 | | | 113,146 |

|

| Total common stocks | | | | | | |

| (cost—$19,420,589) | | | | | | 21,070,861 |

|

UBS Series Trust—U.S. Allocation Portfolio

Portfolio of investments—December 31, 2007

| | | | Face | | | |

| | | | amount | | | Value |

|

| US government obligations—5.20% | | | | | | |

|

| US Treasury Bonds, | | | | | | |

4.750%, due 02/15/37 | | | $285,000 | | | $298,270 |

|

6.250%, due 08/15/23 | | | 290,000 | | | 347,207 |

|

8.125%, due 08/15/19 | | | 10,000 | | | 13,480 |

|

| US Treasury Inflation Index Bonds (TIPS), | | | | | | |

2.375%, due 01/15/27 | | | 124,319 | | | 131,467 |

|

| US Treasury Notes, | | | | | | |

3.625%, due 10/31/09 | | | 95,000 | | | 95,935 |

|

4.625%, due 11/15/16 | | | 140,000 | | | 146,617 |

|

4.875%, due 06/30/09 | | | 295,000 | | | 302,560 |

|

4.875%, due 06/30/12 | | | 450,000 | | | 477,281 |

|

| Total US government obligations (cost—$1,780,461) | | | | | | 1,812,817 |

|

| Mortgage & agency debt securities—11.03% | | | | | | |

|

| Bear Stearns Adjustable Rate Mortgage Trust, | | | | | | |

Series 2005-1, Class 4A1, | | | | | | |

5.351%, due 03/25/35 | | | 53,577 | | | 53,058 |

|

Series 2007-3, Class 2A1, | | | | | | |

5.643%, due 05/25/47 | | | 98,419 | | | 97,815 |

|

| CS First Boston Mortgage Securities Corp., | | | | | | |

Series 2005-11, Class 4A1, | | | | | | |

7.000%, due 12/25/35 | | | 169,379 | | | 168,578 |

|

| Federal Home Loan Mortgage Corporation Certificates ARM, | | | | | | |

5.197%, due 05/01/37 | | | 95,119 | | | 95,769 |

|

| Federal Home Loan Mortgage Corporation Certificates, | | | | | | |

4.500%, due 06/01/21 | | | 102,292 | | | 100,522 |

|

4.500%, due 12/01/34 | | | 203,639 | | | 192,578 |

|

4.750%, due 03/05/12 | | | 135,000 | | | 139,368 |

|

5.500%, due 03/01/37 | | | 95,814 | | | 95,616 |

|

5.500%, due 07/01/37 | | | 219,831 | | | 219,377 |

|

5.600%, due 10/17/13 | | | 100,000 | | | 100,914 |

|

| Federal National Mortgage Association Certificates ARM, | | | | | | |

4.627%, due 09/01/35 | | | 112,828 | | | 111,540 |

|

| Federal National Mortgage Association Certificates, | | | | | | |

5.500%, due 10/01/17 | | | 91,014 | | | 92,390 |

|

5.500%, due 01/01/34 | | | 114,513 | | | 114,597 |

|

5.500%, due 11/01/34 | | | 194,062 | | | 194,195 |

|

5.500%, due 04/01/37 | | | 216,908 | | | 216,664 |

|

| | | | | | | |

|

| 18 | | | | | | |

UBS Series Trust—U.S. Allocation Portfolio

Portfolio of investments—December 31, 2007

| | | | Face | | | |

| | | | amount | | | Value |

|

| Mortgage & agency debt securities—(concluded) | | | | | | |

|

6.070%, due 05/12/16 | | | $105,000 | | | $105,427 |

|

6.500%, due 01/01/36 | | | 464,678 | | | 481,637 |

|

| FNMA REMIC, | | | | | | |

Series 2001-T4, Class A1, | | | | | | |

7.500%, due 07/25/41 | | | 142,160 | | | 150,924 |

|

Series 2002-T19, Class A1, | | | | | | |

6.500%, due 07/25/42 | | | 172,489 | | | 180,883 |

|

| Government National Mortgage Association Certificates, | | | | | | |

6.500%, due 04/15/31 | | | 94,443 | | | 98,011 |

|

| JP Morgan Alternative Loan Trust, | | | | | | |

Series 2006-A4, Class A7, | | | | | | |

6.300%, due 09/25/36 | | | 175,000 | | | 163,052 |

|

| Merrill Lynch/Countrywide Commercial Mortgage Trust, | | | | | | |

Series 2006-3, Class B, | | | | | | |

5.525%, due 07/12/46(1) | | | 25,000 | | | 22,620 |

|

Series 2007-8, Class C, | | | | | | |

6.156%, due 08/12/49(1) | | | 25,000 | | | 23,057 |

|

| MLCC Mortgage Investors, Inc., | | | | | | |

Series 2006-2, Class 4A, | | | | | | |

5.797%, due 05/25/36(1) | | | 155,836 | | | 155,350 |

|

| WAMU Mortgage Pass-Through Certificates, | | | | | | |

Series 2007-HY1, Class 3A3, | | | | | | |

5.883%, due 02/25/37(1) | | | 100,000 | | | 100,234 |

|

Series 2007-HY7, Class 2A2, | | | | | | |

5.880%, due 07/25/37(1) | | | 92,303 | | | 92,110 |

|

Series 2007-HY7, Class 3A1, | | | | | | |

5.914%, due 07/25/37(1) | | | 120,792 | | | 120,236 |

|

| Wells Fargo Mortgage Backed Securities Trust, | | | | | | |

Series 2007-11, Class B1, | | | | | | |

6.000%, due 08/25/37 | | | 124,697 | | | 108,463 |

|

Series 2007-AR4, Class A1, | | | | | | |

6.032%, due 08/25/37 | | | 46,528 | | | 46,563 |

|

| Total mortgage & agency debt securities (cost—$3,839,398) | | | | | | 3,841,548 |

|

| Commercial mortgage-backed securities—3.83% | | | | | | |

|

| Banc of America Commercial Mortgage, Inc., | | | | | | |

Series 2006-2, Class B, | | | | | | |

5.775%, due 05/10/45(1) | | | 25,000 | | | 23,674 |

|

Series 2006-5, Class B, | | | | | | |

5.463%, due 09/10/47 | | | 25,000 | | | 22,934 |

|

| | | | | | | |

|

| | | | | | | 19 |

UBS Series Trust—U.S. Allocation Portfolio

Portfolio of investments—December 31, 2007

| | | | Face | | | |

| | | | amount | | | Value |

|

| Commercial mortgage-backed securities—(continued) | | | | | | |

|

Series 2007-4, Class A4, | | | | | | |

5.936%, due 02/10/51(1) | | | $50,000 | | | $51,556 |

|

| Citigroup Commercial Mortgage Trust, | | | | | | |

Series 2006-C4, Class A3, | | | | | | |

5.723%, due 03/15/49(1) | | | 50,000 | | | 51,624 |

|

Series 2006-C5, Class A4, | | | | | | |

5.431%, due 10/15/49 | | | 50,000 | | | 50,286 |

|

Series 2007-C6, Class A4, | | | | | | |

5.700%, due 12/10/49(1) | | | 75,000 | | | 77,121 |

|

| Citigroup/Deutsche Bank Commercial Mortgage Trust, | | | | | | |

Series 2007-CD4, Class B, | | | | | | |

5.447%, due 12/11/49(1) | | | 25,000 | | | 22,474 |

|

| Credit Suisse Mortgage Capital Certificates, | | | | | | |

Series 2006-C3, Class B, | | | | | | |

6.021%, due 06/15/38 | | | 25,000 | | | 23,701 |

|

| GE Capital Commercial Mortgage Corp., | | | | | | |

Series 2006-C1, Class A4, | | | | | | |

5.339%, due 03/10/44(1) | | | 75,000 | | | 75,589 |

|

| GS Mortgage Securities Corp. II, | | | | | | |

Series 2006-RR2, Class A1, | | | | | | |

5.812%, due 06/23/46(1),(2) | | | 150,000 | | | 134,282 |

|

Series 2007-GG10, Class C, | | | | | | |

5.799%, due 08/10/45(1) | | | 25,000 | | | 22,766 |

|

| Hilton Hotel Pool Trust, | | | | | | |

Series 2000-HLTA, Class A1, | | | | | | |

7.055%, due 10/03/15(2) | | | 200,078 | | | 208,332 |

|

| JP Morgan Chase Commercial Mortgage Securities Corp., | | | | | | |

Series 2005-LDP5, Class A4, | | | | | | |

5.179%, due 12/15/44(1) | | | 230,000 | | | 229,041 |

|

Series 2006-LDP8, Class A4, | | | | | | |

5.399%, due 05/15/45 | | | 75,000 | | | 75,300 |

|

Series 2006-LDP8, Class B, | | | | | | |

5.520%, due 05/15/45 | | | 25,000 | | | 22,733 |

|

| Merrill Lynch Mortgage Trust, | | | | | | |

Series 2007-C1, Class B, | | | | | | |

6.022%, due 06/12/50 | | | 25,000 | | | 22,876 |

|

| Morgan Stanley Capital I, | | | | | | |

Series 2007-IQ16, Class A4, | | | | | | |

5.809%, due 12/12/49 | | | 45,000 | | | 46,312 |

|

| | | | | | | |

|

| 20 | | | | | | |

UBS Series Trust—U.S. Allocation Portfolio

Portfolio of investments—December 31, 2007

| | | Face | | |

| | | amount | | Value |

|

| Commercial mortgage-backed securities—(concluded) | | | | |

|

| Morgan Stanley Mortgage Loan Trust, | | | | |

Series 2006-1AR, Class 2A, | | | | |

5.665%, due 02/25/36(1) | | $122,978 | | $122,973 |

|

| Washington Mutual, | | | | |

Series 2002-AR17, Class 1A, | | | | |

6.063%, due 11/25/42(1) | | 53,559 | | 51,889 |

|

| Total commercial mortgage-backed securities (cost—$1,331,186) | | | | 1,335,463 |

|

| Collateralized debt obligation—0.39% | | | | |

|

| G-Force CDO Ltd., | | | | |

Series 2006-1A, Class A3, | | | | |

5.600%, due 09/27/46(3) (cost—$148,909) | | 150,000 | | 134,062 |

|

| Asset-backed securities—1.66% | | | | |

|

| American Home Mortgage Investment Trust, | | | | |

Series 2006-3, Class 4A, | | | | |

5.055%, due 11/25/35(1) | | 17,824 | | 13,183 |

|

| Capital One Auto Finance Trust, | | | | |

Series 2005-D, Class A4, | | | | |

5.068%, due 10/15/12(1) | | 50,000 | | 49,287 |

|

| Citibank Credit Card Issuance Trust, | | | | |

Series 2002-A8, Class A8, | | | | |

4.858%, due 11/07/11(1) | | 50,000 | | 49,943 |

|

Series 2003-A9, Class A9, | | | | |

5.029%, due 11/22/10(1) | | 50,000 | | 49,970 |

|

| Conseco Finance Securitizations Corp., | | | | |

Series 2000-5, Class A5, | | | | |

7.700%, due 02/01/32 | | 16,463 | | 16,461 |

|

| Daimler Chrysler Auto Trust, | | | | |

Series 2007-A, Class A2B, | | | | |

5.823%, due 03/08/11(1) | | 50,000 | | 50,012 |

|

| Fieldstone Mortgage Investment Corp., | | | | |

Series 2006-S1, Class A, | | | | |

5.085%, due 01/25/37(1),(2) | | 21,455 | | 13,946 |

|

| First Franklin Mortgage Loan Asset Backed Certificates, | | | | |

Series 2006-FFB, Class A2, | | | | |

4.995%, due 12/25/26(1) | | 19,087 | | 9,579 |

|

| Greenpoint Home Equity Loan Trust, | | | | |

Series 2004-3, Class A, | | | | |

5.258%, due 03/15/35(1) | | 17,294 | | 16,983 |

|

21

UBS Series Trust—U.S. Allocation Portfolio

Portfolio of investments—December 31, 2007

| | | Face | | |

| | | amount | | Value |

|

| Asset-backed securities—(concluded) | | | | |

|

| Home Equity Mortgage Trust, | | | | |

Series 2006-3, Class A1, | | | | |

5.594%, due 09/25/36(1),(4) | | $12,451 | | $8,905 |

|

Series 2006-5, Class A1, | | | | |

5.500%, due 01/25/37(4) | | 48,392 | | 31,348 |

|

Series 2006-6, Class 2A1, | | | | |

4.965%, due 03/25/37(1),(4) | | 17,213 | | 7,361 |

|

| Merrill Lynch First Franklin Mortgage Loan, | | | | |

Series 2007-A, Class A1, | | | | |

5.965%, due 10/25/27(1) | | 26,254 | | 23,345 |

|

| Merrill Lynch Mortgage Investors Trust, | | | | |

Series 2006-SL1, Class A, | | | | |

5.045%, due 09/25/36(1) | | 7,467 | | 5,894 |

|

| Morgan Stanley Mortgage Loan Trust, | | | | |

Series 2006-14SL, Class A1, | | | | |

5.025%, due 11/25/36(1) | | 18,189 | | 9,760 |

|

| Nomura Asset Acceptance Corp., | | | | |

Series 2006-S4, Class A1, | | | | |

5.035%, due 08/25/36(1) | | 16,134 | | 12,907 |

|

| Pinnacle Capital Asset Trust, | | | | |

Series 2006-A, Class B, | | | | |

5.510%, due 09/25/09(2) | | 200,000 | | 200,113 |

|

| SACO I Trust, | | | | |

Series 2006-5, Class 2A1, | | | | |

5.015%, due 05/25/36(1) | | 22,806 | | 10,391 |

|

| Total asset-backed securities (cost—$645,413) | | | | 579,388 |

|

| Corporate bonds—5.41% | | | | |

|

| Automobile OEM—0.84% | | | | |

| Ford Motor Credit Co. | | | | |

5.800%, due 01/12/09 | | 250,000 | | 237,299 |

|

| General Motors Acceptance Corp. | | | | |

6.875%, due 09/15/11 | | 65,000 | | 55,607 |

|

| | | | | 292,906 |

|

| Banking-non-US—0.08% | | | | |

| Royal Bank of Scotland Group PLC, | | | | |

Series 1 | | | | |

9.118%, due 03/31/10(5) | | 25,000 | | 26,726 |

|

22

UBS Series Trust—U.S. Allocation Portfolio

Portfolio of investments—December 31, 2007

| | | Face | | |

| | | amount | | Value |

|

| Corporate bonds—(continued) | | | | |

|

| Banking-US—1.23% | | | | |

| Bank of America Corp. | | | | |

5.420%, due 03/15/17 | | $100,000 | | $96,630 |

|

| Citigroup, Inc. | | | | |

5.625%, due 08/27/12 | | 50,000 | | 50,649 |

|

6.125%, due 11/21/17 | | 70,000 | | 71,904 |

|

| HSBC Finance Corp. | | | | |

6.750%, due 05/15/11 | | 90,000 | | 93,363 |

|

| JP Morgan Chase & Co. | | | | |

6.750%, due 02/01/11 | | 75,000 | | 78,749 |

|

| Wells Fargo & Co. | | | | |

6.375%, due 08/01/11 | | 35,000 | | 36,585 |

|

| | | | | 427,880 |

|

| Brokerage—0.60% | | | | |

| Bear Stearns Co., Inc. | | | | |

5.550%, due 01/22/17 | | 20,000 | | 17,924 |

|

| Goldman Sachs Group, Inc. | | | | |

6.875%, due 01/15/11 | | 30,000 | | 31,818 |

|

| Lehman Brothers Holdings Inc. | | | | |

5.750%, due 01/03/17 | | 35,000 | | 33,623 |

|

| Morgan Stanley | | | | |

6.750%, due 04/15/11 | | 120,000 | | 125,777 |

|

| | | | | 209,142 |

|

| Cable—0.27% | | | | |

| Comcast Cable Communications, Inc. | | | | |

6.750%, due 01/30/11 | | 90,000 | | 94,094 |

|

| Chemicals—0.17% | | | | |

| ICI Wilmington, Inc. | | | | |

4.375%, due 12/01/08 | | 60,000 | | 59,917 |

|

| Consumer products-durables—0.12% | | | | |

| Fortune Brands, Inc. | | | | |

5.375%, due 01/15/16 | | 45,000 | | 42,869 |

|

| Consumer products-nondurables—0.14% | | | | |

| Avon Products, Inc. | | | | |

7.150%, due 11/15/09 | | 45,000 | | 47,508 |

|

23

UBS Series Trust—U.S. Allocation Portfolio

Portfolio of investments—December 31, 2007

| | | Face | | |

| | | amount | | Value |

|

| Corporate bonds—(continued) | | | | |

|

| Electrical-integrated—0.19% | | | | |

| Dominion Resources, Inc. | | | | |

5.950%, due 06/15/35 | | $30,000 | | $28,036 |

|

| PSEG Power | | | | |

6.950%, due 06/01/12 | | 35,000 | | 37,314 |

|

| | | | | 65,350 |

|

| Entertainment—0.09% | | | | |

| Time Warner, Inc. | | | | |

6.875%, due 05/01/12 | | 30,000 | | 31,590 |

|

| Finance-noncaptive consumer—0.42% | | | | |

| Capital One Financial | | | | |

5.500%, due 06/01/15 | | 25,000 | | 23,059 |

|

| Countrywide Financial Corp. | | | | |

5.200%, due 02/27/08(1) | | 50,000 | | 47,671 |

|

| Residential Capital Corp. | | | | |

6.125%, due 11/21/08 | | 30,000 | | 23,850 |

|

| Residential Capital LLC | | | | |

5.646%, due 06/09/08(1) | | 25,000 | | 21,375 |

|

6.375%, due 06/30/10 | | 50,000 | | 32,000 |

|

| | | | | 147,955 |

|

| Finance-noncaptive diversified—0.14% | | | | |

| International Lease Finance Corp. | | | | |

3.500%, due 04/01/09 | | 50,000 | | 49,145 |

|

| Food processors/beverage/bottling—0.11% | | | | |

| SABMiller PLC | | | | |

6.500%, due 07/01/16(2) | | 35,000 | | 36,553 |

|

| Gas pipelines—0.10% | | | | |

| Kinder Morgan Energy Partners | | | | |

5.800%, due 03/15/35 | | 40,000 | | 36,209 |

|

| Pharmaceuticals—0.27% | | | | |

| Abbott Laboratories | | | | |

5.600%, due 11/30/17 | | 50,000 | | 51,371 |

|

| Allergan, Inc. | | | | |

5.750%, due 04/01/16 | | 40,000 | | 40,971 |

|

| | | | | 92,342 |

|

24

UBS Series Trust—U.S. Allocation Portfolio

Portfolio of investments—December 31, 2007

| | | Face | | |

| | | amount | | Value |

|

| Corporate bonds—(concluded) | | | | |

|

| Real estate investment trust—0.10% | | | | |

| ProLogis | | | | |

5.625%, due 11/15/15 | | $ 35,000 | | $33,480 |

|

| Specialty retail—0.07% | | | | |

| CVS Caremark Corp. | | | | |

5.750%, due 06/01/17 | | 25,000 | | 25,161 |

|

| Telecom-wirelines—0.17% | | | | |

| Telecom Italia Capital | | | | |

5.250%, due 11/15/13 | | 60,000 | | 59,300 |

|

| Wireless telecommunication services—0.30% | | | | |

| Sprint Capital Corp. | | | | |

6.875%, due 11/15/28 | | 50,000 | | 47,418 |

|

| Verizon New York, Inc., | | | | |

Series A | | | | |

6.875%, due 04/01/12 | | 55,000 | | 58,356 |

|

| | | | | 105,774 |

|

| Total corporate bonds (cost—$1,935,759) | | | | 1,883,901 |

|

| | | | | |

| | | Number of | | |

| | | shares | | |

|

| Investment companies(6),*—10.06% | | | | |

|

| UBS High Yield Relationship Fund | | 83,736 | | 1,820,470 |

|

| UBS U.S. Small Cap Equity Relationship Fund | | 35,984 | | 1,684,579 |

|

| Total investment companies (cost—$2,843,385) | | | | 3,505,049 |

|

| | | | | |

| | | Face | | |

| | | amount | | |

|

| Repurchase agreement—0.52% | | | | |

|

Repurchase agreement dated 12/31/07 with State Street Bank & Trust Co., 0.850%, due 01/02/08, collateralized by $109,336 US Treasury Bonds, 7.500% to 8.875% due 11/15/16 to 08/15/19 and $39,292 US Treasury Notes, 3.375% to 4.625% due 09/15/09 to 02/15/16; (value—$185,642); proceeds: $182,009(cost—$182,000) | | $ 182,000 | | 182,000 |

|

25

UBS Series Trust—U.S. Allocation Portfolio

Portfolio of investments—December 31, 2007

| | | Number of | | |

| | | shares | | Value |

|

| Investments of cash collateral from securities loaned—0.00% | | | | |

|

| Money market funds(7)—0.00% | | | | |

|

| DWS Money Market Series Institutional, 4.866% | | 88 | | $88 |

|

| UBS Private Money Market Fund LLC, 4.778%(6) | | 2 | | 2 |

|

| Total money market funds and investments of cash collateral | | | | |

from securities loaned (cost—$90) | | | | 90 |

|

| Total investments (cost—$32,127,190)—98.57% | | | | 34,345,179 |

|

| Other assets in excess of liabilities—1.43% | | | | 497,680 |

|

| Net assets—100.00% | | | | $34,842,859 |

|

| * | | Non-income producing security. |

| (1) | | Floating rate security. The interest rate shown is the current rate as of December 31, 2007. |

| (2) | | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities, which represent 1.70% of net assets as of December 31, 2007, are considered liquid and may be resold in transactions exempt from registration, normally to qualified institutional buyers. |

| (3) | | The security detailed in the table below, which represents 0.39% of net assets, is considered illiquid and restricted as of December 31, 2007: |

| | | | | | | Acquisition | | | | Value at |

| Illiquid and | | | | | | cost as a | | | | 12/31/07 as |

| restricted | | Acquisition | | Acquisition | | percentage | | Value at | | a percentage |

| security | | date | | cost | | of net assets | | 12/31/07 | | of net assets |

|

| G-Force CDO Ltd., Series 2006-1A, Class A3, 5.600%, due 09/27/46 | | 08/03/06 | | $147,859 | | 0.42% | | $134,062 | | 0.39% | |

|

| (4) | | Step-up bond that converts to the noted fixed rate at a designated future date. |

| (5) | | Perpetual bond security. The maturity date reflects the next call date. |

26

UBS Series Trust—U.S. Allocation Portfolio

Portfolio of investments—December 31, 2007

| (6) | | The table below details the Portfolio’s transaction activity in affiliated issuers for the year ended December 31, 2007. |

| | | | | | | | | | | | | | | Net |

| | | | | | | | | | | | | | | income |

| | | | | | | | | | | Net | | | | earned |

| | | | | | | | | Net | | unrealized | | | | from |

| | | | | Purchases | | Sales | | realized | | gain/(loss) | | | | affiliate |

| | | | | during | | during | | gains for | | for the | | | | for the |

| | | | | the year | | the year | | the year | | year | | | | year |

| Security | | Value at | | ended | | ended | | ended | | ended | | Value at | | ended |

| description | | 12/31/06 | | 12/31/07 | | 12/31/07 | | 12/31/07 | | 12/31/07 | | 12/31/07 | | 12/31/07 |

|

| UBS High Yield Relationship Fund | | $966,361 | | $1,000,000 | | $200,000 | | $43,872 | | $10,237 | | $1,820,470 | | — |

|

| UBS Private Money Market Fund LLC | | 1,608,147 | | 2,861,147 | | 4,469,292 | | — | | — | | 2 | | $162 |

|

| UBS U.S. Small Cap Equity Relationship Fund | | 2,144,129 | | — | | 500,000 | | 171,464 | | (131,014) | | 1,684,579 | | — |

|

| (7) | | Rates shown reflect yield at December 31, 2007. |

| ARM | | Adjustable Rate Mortgage. The interest rate shown is the current rate as of December 31, 2007. |

| CDO | | Collateralized Debt Obligation |

| FNMA | | Federal National Mortgage Association |

| GS | | Goldman Sachs |

| LP | | Limited Partnership |

| MLCC | | Merrill Lynch Credit Corporation |

| OEM | | Original Equipment Manufacturer |

| REMIC | | Real Estate Mortgage Investment Conduit |

| TIPS | | Treasury inflation protected securities (“TIPS”) are debt securities issued by the US Treasury whose principal and/or interest payments are adjusted for inflation, unlike debt securities that make fixed principal and interest payments. The interest rate paid by the TIPS is fixed, while the principal value rises or falls based on changes in a published Consumer Price Index (“CPI”). Thus, if inflation occurs, the principal and interest payments on the TIPS are adjusted accordingly to protect investors from inflationary loss. During a deflationary period, the principal and interest payments decrease, although the TIPS principal amounts will not drop below their face amounts at maturity. In exchange for the inflation protection, the TIPS generally pay lower interest rates than typical US Treasury securities. Only if inflation occurs would TIPS be expected to offer a higher real yield than a conventional Treasury bond of the same maturity. |

| WAMU | | Washington Mutual |

27

UBS Series Trust—U.S. Allocation Portfolio

Portfolio of investments—December 31, 2007

| Issuer breakdown by country of origin (unaudited) |

| | | | |

| | Percentage of total investments |

|

| United States | | 97.8 | % |

|

| Panama | | 1.0 | |

|

| Cayman Islands | | 0.4 | |

|

| Liberia | | 0.4 | |

|

| Italy | | 0.2 | |

|

| United Kingdom | | 0.2 | |

|

| Total | | 100.0 | % |

|

See accompanying notes to financial statements

28

UBS Series Trust—U.S. Allocation Portfolio

Statement of assets and liabilities—December 31, 2007

| Assets: | | | | | |

| Investments in unaffiliated securities, at value | | | | | |

(cost—$29,283,803) | | $30,840,128 | | | |

|

| Investments in affiliated securities, at value | | | | | |

(cost—$2,843,387) | | 3,505,051 | | | |

|

| Total investments in securities, at value (cost—$32,127,190) | | | | 34,345,179 | |

|

| Cash | | | | 927 | |

|

| Receivable for investments sold | | | | 814,232 | |

|

| Receivable for shares of beneficial interest sold | | | | 1,458 | |

|

| Receivable for dividends and interest | | | | 106,992 | |

|

| Other assets | | | | 3 | |

|

| Total assets | | | | 35,268,791 | |

|

| | | | | | |

| Liabilities: | | | | | |

| Payable for investments purchased | | | | 295,951 | |

|

| Payable to affiliates | | | | 30,755 | |

|

| Payable for shares of beneficial interest repurchased | | | | 18,746 | |

|

| Payable for cash collateral from securities loaned | | | | 90 | |

|

| Accrued expenses and other liabilities | | | | 80,390 | |

|

| Total liabilities | | | | 425,932 | |

|

| | | | | | |

| Net assets: | | | | | |

| Beneficial interest—$0.001 par value per share (unlimited amount authorized) | | | | 56,068,496 | |

|

| Accumulated undistributed net investment income | | | | 264,314 | |

|

| Accumulated net realized loss from investment activities | | | | (23,707,940 | ) |

|

| Net unrealized appreciation of investments | | | | 2,217,989 | |

|

| Net assets | | | | $34,842,859 | |

|

| | | | | | |

| Class H | | | | | |

| Net assets | | | | $11,435,398 | |

|

| Shares outstanding | | | | 746,203 | |

|

| Net asset value, offering price and redemption value per share | | | | $15.32 | |

|

| | | | | | |

| Class I | | | | | |

| Net assets | | | | $23,407,461 | |

|

| Shares outstanding | | | | 1,529,397 | |

|

| Net asset value, offering price and redemption value per share | | | | $15.31 | |

|

See accompanying notes to financial statements

29

UBS Series Trust—U.S. Allocation Portfolio

Statement of operations

| | | For the |

| | | year ended |

| | | December 31, 2007 |

|

| Investment income: | | | |

| Interest | | $646,613 | |

|

| Dividends | | 462,916 | |

|

| Securities lending income (includes $162 earned from an affiliated entity) | | 465 | |

|

| | | 1,109,994 | |

|

| | | | |

| Expenses: | | | |

| Investment advisory and administration fees | | 204,253 | |

|

| Professional fees | | 103,577 | |

|

| Distribution fees—Class I | | 68,385 | |

|

| Reports and notices to shareholders | | 39,165 | |

|

| Custody and accounting fees | | 16,340 | |

|

| Trustees’ fees | | 15,083 | |

|

| Transfer agency fees—Class H | | 1,500 | |

|

| Transfer agency fees—Class I | | 1,500 | |

|

| Other expenses | | 14,786 | |

|

| | | 464,589 | |

|

| Net investment income | | 645,405 | |

|

| | | | |

| Realized and unrealized gains/(losses) from investment activities: | | | |

| Net realized gains from investments (includes $215,336 of net realized gains from affiliated entities) | | 3,698,928 | |

|

| Net change in unrealized appreciation/depreciation of investments | | (3,253,006 | ) |

|

| Net realized and unrealized gain from investment activities | | 445,922 | |

|

| Net increase in net assets resulting from operations | | $1,091,327 | |

|

See accompanying notes to financial statements

30

UBS Series Trust—U.S. Allocation Portfolio

Statement of changes in net assets

| | | For the years ended December 31, | |

| | |

|

| | | 2007 | | | 2006 | |

|

| From operations: | | | | | | |

| Net investment income | | $645,405 | | | $830,917 | |

|

| Net realized gains from investments | | 3,698,928 | | | 3,063,639 | |

|

| Net change in unrealized appreciation/depreciation of investments | | (3,253,006 | ) | | 1,208,077 | |

|

| Net increase in net assets resulting from operations | | 1,091,327 | | | 5,102,633 | |

|

| | | | | | | |

| Dividends to shareholders from: | | | | | | |

| Net investment income—Class H | | (340,506 | ) | | (437,847 | ) |

|

| Net investment income—Class I | | (613,044 | ) | | (832,466 | ) |

|

| | | (953,550 | ) | | (1,270,313 | ) |

| | | | | | | |

| From beneficial interest transactions: | | | | | | |

| Net proceeds from the sale of shares | | 350,477 | | | 925,691 | |

|

| Cost of shares repurchased | | (13,210,240 | ) | | (12,285,040 | ) |

|

| Proceeds from dividends reinvested | | 953,550 | | | 1,270,313 | |

|

| Net decrease in net assets from beneficial transactions | | (11,906,213 | ) | | (10,089,036 | ) |

|

| Net decrease in net assets | | (11,768,436 | ) | | (6,256,716 | ) |

|

| | | | | | | |

| Net assets: | | | | | | |

| Beginning of year | | 46,611,295 | | | 52,868,011 | |

|

| End of year | | $34,842,859 | | | $46,611,295 | |

|

| Accumulated undistributed net investment income | | $264,314 | | | $566,790 | |

|

See accompanying notes to financial statements

31

UBS Series Trust—U.S. Allocation Portfolio

Financial highlights

Selected data for a share of beneficial interest outstanding throughout each year is presented below:

| | | Class H |

| | |

|

| | | For the years ended December 31, |

| | |

|

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

|

| Net asset value, | | | | | | | | | | | | | | | |

| beginning of year | | $15.36 | | | $14.19 | | | $13.50 | | | $12.31 | | | $9.77 | |

|

| Net investment income(1) | | 0.27 | | | 0.27 | | | 0.22 | | | 0.17 | | | 0.11 | |

|

| Net realized and unrealized gains from investment activities | | 0.07 | | | 1.30 | | | 0.68 | | | 1.14 | | | 2.55 | |

|

| Net increase from operations | | 0.34 | | | 1.57 | | | 0.90 | | | 1.31 | | | 2.66 | |

|

| Dividends from net investment income | | (0.38 | ) | | (0.40 | ) | | (0.21 | ) | | (0.12 | ) | | (0.12 | ) |

|

| Net asset value, end of year | | $15.32 | | | $15.36 | | | $14.19 | | | $13.50 | | | $12.31 | |

|

| Total investment return(2) | | 2.19 | % | | 11.29 | % | | 6.79 | % | | 10.68 | % | | 27.62 | % |

|

| Ratios/supplemental data: | | | | | | | | | | | | | | | |

| Net assets, end of year (000’s) | | $11,435 | | | $14,803 | | | $16,656 | | | $19,088 | | | $20,949 | |

|

| Expenses to average net assets | | 0.97 | % | | 0.84 | % | | 0.83 | % | | 0.80 | % | | 0.77 | % |

|

| Net investment income to average net assets | | 1.74 | % | | 1.86 | % | | 1.60 | % | | 1.39 | % | | 1.03 | % |

|

| Portfolio turnover | | 78 | % | | 72 | % | | 77 | % | | 136 | % | | 5 | % |

|

| (1) | | Calculated using the average shares method. |

| (2) | | Total investment return is calculated assuming a $10,000 investment on the first day of each year reported, reinvestment of all dividends and other distributions, if any, at net asset value on the ex-dividend dates, and a sale at net asset value on the last day of each year reported. The figures do not include additional contract level charges; results would be lower if they were included. |

See accompanying notes to financial statements

32

| Class I |

|

| For the years ended December 31, |

|

| 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

|

| | | | | | | | | | | | | | |

| $15.34 | | | $14.16 | | | $13.46 | | | $12.28 | | | $9.73 | |

|

| 0.23 | | | 0.23 | | | 0.18 | | | 0.14 | | | 0.08 | |

|

| | | | | | | | | | | | | | |

| 0.07 | | | 1.30 | | | 0.69 | | | 1.13 | | | 2.56 | |

|

| 0.30 | | | 1.53 | | | 0.87 | | | 1.27 | | | 2.64 | |

|

| | | | | | | | | | | | | | |

| (0.33 | ) | | (0.35 | ) | | (0.17 | ) | | (0.09 | ) | | (0.09 | ) |

|

| $15.31 | | | $15.34 | | | $14.16 | | | $13.46 | | | $12.28 | |

|

| 1.90 | % | | 10.99 | % | | 6.60 | % | | 10.38 | % | | 27.37 | % |

|

| | | | | | | | | | | | | | |

| $23,407 | | | $31,809 | | | $36,212 | | | $56,632 | | | $59,124 | |

|

| 1.22 | % | | 1.09 | % | | 1.07 | % | | 1.05 | % | | 1.02 | % |

|

| | | | | | | | | | | | | | |

| 1.50 | % | | 1.61 | % | | 1.35 | % | | 1.15 | % | | 0.78 | % |

|

| 78 | % | | 72 | % | | 77 | % | | 136 | % | | 5 | % |

|

See accompanying notes to financial statements

33

UBS Series Trust—U.S. Allocation Portfolio

Notes to financial statements

Organization and significant accounting policies

UBS Series Trust—U.S. Allocation Portfolio (the “Portfolio”) is a diversified portfolio of UBS Series Trust (the “Trust”). The Trust is organized under Massachusetts law pursuant to an Amended and Restated Declaration of Trust dated February 11, 1998, as amended, and is registered with the Securities and Exchange Commission under the Investment Company Act of 1940, as amended, as an open-end management investment company. The Trust operates as a series company currently offering one portfolio. Shares of the Portfolio are offered to insurance company separate accounts which fund certain variable annuity and variable life contracts.

Currently the Portfolio offers Class H and Class I shares. Each class represents interests in the same assets of the Portfolio, and the classes are identical except for the Class I distribution charge. Both classes have equal voting privileges except that Class I has exclusive voting rights with respect to its distribution plan. Class H has no distribution plan.

In the normal course of business the Portfolio may enter into contracts that contain a variety of representations or that provide indemnification for certain liabilities. The Portfolio’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Portfolio that have not yet occurred. However, the Portfolio has not had prior claims or losses pursuant to these contracts and expects the risk of loss to be remote.

The preparation of financial statements in accordance with US generally accepted accounting principles requires the Trust’s management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates. The following is a summary of significant accounting policies:

Valuation of investments—The Portfolio calculates net asset values based on the current market value for its portfolio securities. The Portfolio normally obtains market values for its securities from independent pricing sources. Independent pricing sources may use last reported sale prices, current market quotations or valuations from computerized “matrix” systems that derive values based on comparable securities. Securities traded in the over-the-counter (“OTC”) market and listed on The Nasdaq Stock Market, Inc. (“NASDAQ”) normally are valued at the NASDAQ Official Closing Price. Other OTC securities are valued at the last bid price available prior to valuation. Securities which are listed on US and foreign

34

UBS Series Trust—U.S. Allocation Portfolio

Notes to financial statements

stock exchanges normally are valued at the last sale price on the day the securities are valued or, lacking any sales on such day, at the last available bid price. In cases where securities are traded on more than one exchange, the securities are valued on the exchange designated as the primary market by UBS Global Asset Management (Americas) Inc. (“UBS Global AM”). If a market value is not available from an independent pricing source for a particular security, that security is valued at fair value as determined in good faith by or under the direction of the Trust’s Board of Trustees (the “Board”). Various factors may be reviewed in order to make a good faith determination of a security’s fair value. These factors may include, but are not limited to, the type and cost of the security; contractual or legal restrictions on resale of the security; relevant financial or business developments of the issuer; the value of actively traded similar or related securities; conversion or exchange rights on the security; related corporate actions; and changes in overall market conditions. If events occur that materially affect the value of securities (particularly non-US securities) between the close of trading in those securities and the close of regular trading on the New York Stock Exchange, these securities would be fair valued. The amortized cost method of valuation, which approximates market value, generally is used to value short-term debt-instruments with sixty days or less remaining to maturity, unless the Board determines that this does not represent fair value.

In September 2006, the Financial Accounting Standards Board (“FASB”) issued Statement on Financial Accounting Standards No. 157, “Fair Value Measurements” (“FAS 157”). This standard clarifies the definition of fair value for financial reporting, establishes a framework for measuring fair value and requires additional disclosures about the use of fair value measurements. FAS 157 is effective for financial statements issued for fiscal years beginning after November 15, 2007 and interim periods within those fiscal years. As of December 31, 2007, management does not believe the adoption of FAS 157 will impact the amounts reported in the financial statements, however, additional disclosures will be required about the inputs used to develop the measurements of fair value and the effect of certain measurements reported on the Statement of operations for a fiscal period.

Repurchase agreements—The Portfolio may purchase securities or other obligations from a bank or securities dealer (or its affiliate), subject to the seller’s agreement to repurchase them at an agreed upon date (or upon demand) and price. The Portfolio maintains custody of the underlying

35

UBS Series Trust—U.S. Allocation Portfolio

Notes to financial statements