UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-4920

WASATCH FUNDS, INC.

(Exact name of registrant as specified in charter)

150 Social Hall Avenue

4th Floor

Salt Lake City, Utah 84111

(Address of principal executive offices) (Zip code)

| | |

| (Name and Address of Agent for Service) | | Copy to: |

| |

Samuel S. Stewart, Jr. Wasatch Funds, Inc. 150 Social Hall Avenue, 4th Floor Salt Lake City, Utah 84111 | | Eric F. Fess, Esq. Chapman & Cutler LLP 111 West Monroe Street Chicago, IL 60603 |

Registrant’s telephone number, including area code: (801) 533-0777

Date of fiscal year end: September 30

Date of reporting period: March 31, 2007

| Item 1: | Report to Shareholders. |

| | |

| | Semi-Annual Report |

| |

| MARCH 31, 2007 | | WASATCH CORE GROWTH FUND® |

| |

| | WASATCH GLOBAL SCIENCE & TECHNOLOGY FUND® |

| |

| | WASATCHHERITAGE GROWTH FUND® |

| |

| | WASATCH INTERNATIONAL GROWTH FUND® |

| |

| | WASATCH INTERNATIONAL OPPORTUNITIES FUND™ |

| |

| | WASATCH MICRO CAP FUND® |

| |

| | WASATCH MICRO CAP VALUE FUND® |

| |

| | WASATCH SMALL CAP GROWTH FUND® |

| |

| | WASATCH SMALL CAP VALUE FUND® |

| |

| | WASATCH STRATEGIC INCOME FUND™ |

| |

| | WASATCH ULTRA GROWTH FUND® |

| |

| | WASATCH-HOISINGTON U.S. TREASURY FUND® |

Wasatch Funds, Inc.

P.O. Box 2172

Milwaukee, WI 53201-2172

www.wasatchfunds.com

800.551.1700

This material must be accompanied or preceded by a prospectus.

Please read the prospectus carefully before you invest.

Wasatch Funds are distributed by ALPS Distributors, Inc.

1

| | |

Samuel S. Stewart, Jr., PhD, CFA President of

Wasatch Funds | | FELLOW SHAREHOLDERS: Back in the 1950s, there was a game show called The $64,000 Question. Each week, contestants would take the stage, step into the “isolation booth,” and try to win ever-larger prizes with ever-tougher questions. As time ticked away, the drama mounted. The contestants’ financial destiny was on the line with every right or wrong answer. Some investors today might feel a little like those contestants as they try to figure out where the economy is headed next. Overall, things look pretty good. Employment remains strong. Inflation is tame. Corporate earnings are solid. The markets are moving upward. On the other hand, the once-robust housing market has stagnated, the subprime mortgage sector has been hit hard, energy prices remain volatile, and we still see plenty of political instability around the world. That brings us to the $64,000 question: Will the equity markets and the economy be able to continue the growth of the past six months? Although we at Wasatch don’t focus on macroeconomic factors as the basis for our investment decisions, we do recognize that the overall health of the economy may have an impact on our funds over the short term. |

The recent troubles in the subprime mortgage sector are clearly a cause for concern. When housing prices were soaring, some lenders wrote mortgages for borrowers who couldn’t qualify for traditional financing. Both borrowers and lenders counted on continuing escalation of home values. Now that prices are flat or even slightly down, a lot of people are finding it hard to meet their payments, and an increasing number are facing foreclosure — a bad scenario for borrowers and lenders alike.

Whether this situation will turn out to be just a bump in the road, or one that reverberates more broadly through the economy, is not clear yet. There are ways the subprime issue could cause broader problems. One would be if it compounded the general slowdown in the housing market to cause a significant loss of jobs in the homebuilding industry and related areas like materials and consumer durables.

Another would be if it ultimately put the brakes on consumer spending. Over the past several years, homeowners have been able to use their homes, through refinancing and equity loans, as a ready source of extra cash. That’s helped to fuel all kinds of spending — from sensible home improvements to exotic travel and luxury automobiles. As many industries have benefited from this resource, the same would be hurt if it dried up in the wake of tighter borrowing guidelines.

We can’t ignore the potential impact from this tightening in the mortgage and housing sectors. What is important to remember, though, is that while the subprime meltdown could have broader implications, it doesn’t signal a crisis in our financial system. It’s clearly a situation we will continue to watch in the coming months, but at this point I view it as another cloud on the horizon — we should keep an eye on it, but I’m not ready to cancel the picnic.

PERFORMANCE

It was this very difficulty in trying to predict what the economy would do that led us in our early days to focus our efforts elsewhere — on fundamental due diligence to find strong companies. We saw that even the highest-paid, best-trained economists in this country struggled to figure out the macroeconomic landscape. It seemed pointless for us to get into that guessing game and then make our investment decisions based on such predictions. We felt much more comfortable identifying strong companies — those that can sail ahead even when the winds aren’t favorable — from the bottom up, and then owning them for the long-term.

O’Reilly Automotive is a great example of the type of company we want to own. O’Reilly is a U.S. automotive supplies retailer. It’s in a business that’s relatively immune to economic cycles. Automobiles constantly need maintenance and repair, and demand can actually accelerate when times are tough and people delay new car purchases. O’Reilly also has the tailwind of an aging U.S. auto fleet, the ability to expand geographically and a management team that has an excellent track record of growing the business. We first purchased O’Reilly in 1992 at around $3 per share and over the last 15 years have owned it in multiple funds. Of course its stock price hasn’t gone up every period, but with a great long-term business model O’Reilly has shown sustainable growth and its stock now trades at roughly $36.

A strong market like we’ve seen the past six months — the S&P 500® was up 7.38% — historically is not the kind of market in which tried-and-true companies such as O’Reilly lead, but I am encouraged by Wasatch’s overall performance during this recent period. Not all of our funds beat their respective benchmarks, but we began to feel traction again in most of our styles, delivered generally solid returns, and had some funds outperform their benchmarks by a wide margin, with particularly strong international returns.

As I’ve discussed before, international investing is an area of increasing interest and focus at Wasatch. We’ve broadened and deepened our international investment team, and committed more resources to global research. Why? There’s no place for an ‘isolation booth’ on today’s global investment stage. Our increased focus on international companies represents a long-term strategy, not a temporary shift. That’s why you’ll find international holdings not just in our global and international funds, but also at varying levels in every one of our domestic funds.

Our interest in international investing heightened several years ago. At that time, most foreign markets were depressed relative to the U.S., so valuations were attractive. Not only that, but better global communication was making it easier to conduct thorough research of international companies to determine which ones truly offered opportunity. And unlike our early days — when purchasing an international stock was a hard, if not infeasible, process — there is now an investment infrastructure that makes buying a foreign equity quite manageable. In short, it’s become easier to identify strong international prospects and to take action.

2

Researching international companies clearly helps us evaluate the prospects of U.S. based firms as they compete on a more global scale every day. Similarly, our domestic knowledge helps us evaluate companies elsewhere in the world. For example, Super Cheap Auto Group out of Australia looks surprisingly similar to how O’Reilly looked several years ago. Super Cheap’s primary business is a chain of roughly 200 auto parts stores in Australia and New Zealand. Our intimate knowledge of O’Reilly helped us get comfortable with the business model of this overseas peer much more quickly, thus allowing the funds that held Super Cheap to benefit from the dramatic 77% increase in its stock price over the last six months.

Obviously, we’re not the only people tuned into the investment potential of global markets. A lot of money is being directed at foreign countries. As a result, there are fewer inexpensive stocks — particularly in some smaller markets where even a modest influx of investor dollars can drive prices up quickly.

Three markets that particularly excite us are, not coincidentally, some of the world’s most populous: China, India, and Brazil. These countries have economies that are growing much faster than the United States.’ It’s not just that they have a lot of people — they have an expanding consumer class that demands more and better products and services. This has paved the way for a variety of companies, from consumer discretionary to financials, to grow rapidly by addressing these consumers’ appetites. As these companies grow, many are realizing that not only do they have huge local markets but that a global orientation creates numerous opportunities from which to choose.

With the U.S. and other established markets looking at only modest projections for growth, markets like these are drawing escalating interest from investors — including ourselves. That makes our expanded research capabilities all the more important in finding reasonably valued companies with the fundamental qualities to grow and thrive in the global economy. To learn as much as we can about each company, we travel extensively to see and hear about companies first hand and then compare notes with each other. Our Multiple Eyes™ research approach is about more than just sharing these investment ideas — it’s also about helping to identify possible pitfalls. In an increasingly competitive international investing landscape, there’s little room for guesswork.

OUTLOOK

Returning to the domestic front, it’s important to keep the market activity of recent months in context. There were certainly moments of high volatility and steep one-day declines. But they came as part of a remarkable run. From last June through the end of March, the U.S. equity markets experienced an almost uninterrupted nine-month upturn and finished by reaching all-time highs.

With such strength, the market almost inevitably will find a reason to correct. Recently, worries about the subprime mortgage situation and concern about a pullback in the Shanghai stock market were enough to provoke triple-digit single-day losses. But, in both instances the U.S. market quickly regained its footing and kept moving upward. Does that mean there’s nothing to worry about? Hardly. Investors ignore risk at their own peril. The market has shown real resilience and determination, but at the same time I don’t see enough overwhelmingly good news on the horizon for the market to keep up its recent pace.

Fortunately, the performance of Wasatch Funds doesn’t depend on the answer to the single question: Is the economy going to go up or down? Rather, we deal with dozens of questions every day. Is a company undervalued? Does it have unique advantages? Is it serving a market that can grow and expand even in a challenging environment? Does its management have the talent and vision to stay ahead of its competitors? The answers to these questions won’t help us win a one-time jackpot. But they provide something much more valuable. They help us build portfolios that can serve as a foundation for a long-term financial plan.

We appreciate the continued trust you have placed in us.

Sincerely,

Samuel S. Stewart, Jr.

President of Wasatch Funds

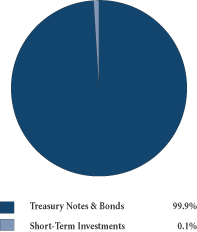

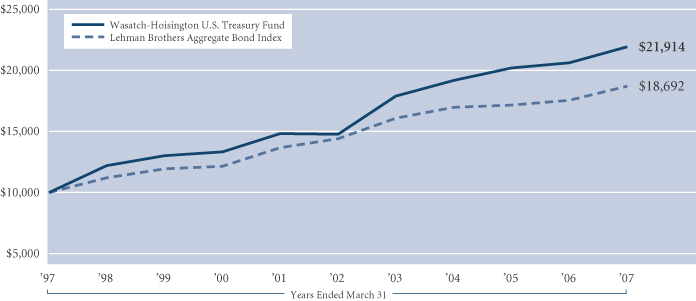

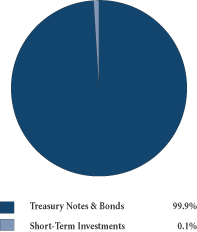

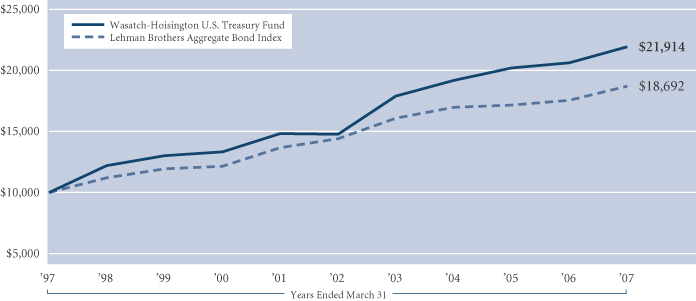

WASATCH-HOISINGTON U.S. TREASURY FUND

For information about the performance and outlook of the Fund, please see the management discussion and portfolio summary on pages 26 and 27. The views expressed in the management discussion are those of Hoisington Investment Management Company, sub-advisor to the Fund, and may differ from the views of Wasatch Advisors, investment advisor to Wasatch Funds.

Information in this shareholder report regarding market or economic trends or the factors influencing the Funds’ historical or future performance reflects the opinions of Fund management as of the date of this report. These statements should not be relied upon for any other purpose. Past performance is no guarantee of future results, and there is no guarantee that the market forecasts discussed will be realized.

3

| | |

| WASATCH CORE GROWTH FUND (WGROX) — Management Discussion | | MARCH 31, 2007 |

|

| |

| |

The Wasatch Core Growth Fund is managed by a team of Wasatch portfolio managers, led by JB Taylor and Paul Lambert.

| | | | |

JB Taylor

Portfolio Manager | |

Paul Lambert

Portfolio Manager | | OVERVIEW The Wasatch Core Growth Fund gained 10.77% in the six months ended March 31, 2007, while the Russell 2000 Index returned 11.02% over the same period. Although the Fund slightly |

underperformed the Index, it was able to post a strong return for this period. The six months began with generally stable conditions, but as the period progressed, the environment became increasingly choppy. The markets experienced some steep single-day declines in late February and early March. The volatility was seemingly triggered by concerns over the implications of a slowing U.S. economy, weakness in international equity markets, and worries about the potential impact of recent difficulties among subprime mortgage lenders.

Because we focus on individual company selection, not macroeconomic positioning or top-down sector allocation, our strategy typically has been to avoid companies that depend on effusive levels of consumer confidence and spending. Instead, our research tends to lead us to favor companies that can grow their earnings in both robust and weak economic environments.

That said, the top-contributing sectors for the Fund during the period were health care, financial services, and consumer discretionary. Virtually all sectors in which we were invested made positive contributions to performance over the six months.

DETAILSOFTHE PERIOD

The health care sector was home to two of the Fund’s strongest contributors for the six-month period, Sunrise Senior Living and Pediatrix Medical Group. Sunrise Senior Living, the largest operator of assisted-living facilities in the country, is capitalizing on the strong demand for high-quality, trusted senior care. The company is addressing these strong demographic trends by maintaining a premium position in the marketplace and by staying diversified geographically. A further boost to the stock came in the first quarter of 2007 when an affiliate REIT of the company was sold, giving investors greater insight into the parent company’s intrinsic value. Pediatrix was also particularly strong in the first quarter of 2007, as the provider of pediatric health services posted impressive fourth quarter top-line results.

Our focus on moving more assets into our highest quality names served us well, as we nicely increased our stake in both companies prior to the run up. This strategy had a positive impact on performance for the six months, and we believe it will continue to do so over the longer term.

UTI Bank, which is benefiting from the economic expansion and demand for more sophisticated financial services in the Indian market, was a top performer for the Fund and led our strong showing in the financials sector. This investment reflects our Multiple Eyes™ approach to investing, which includes working closely with our international investment team as we seek opportunities around the globe.

Several post-secondary education providers within the consumer discretionary sector produced solid performance during the period: Laureate Education, Strayer Education, and Universal Technical Institute. We believe these companies are positioned to thrive as both domestic and international workers seek to enhance their professional skill-sets and earn higher incomes. Laureate received a further boost from an announced buy-out led by a private equity firm and management.

Pool Corp., a provider of pool maintenance supplies and the Fund’s largest holding, was the biggest detractor in the consumer discretionary sector. Pool’s stock price languished primarily because many observers are associating its prospects with the slowdown in the housing market. However, because the company’s growth prospects over the next 10 years appear strong, we believe that sentiment is overdone. Pool’s valuation is now compelling, and we used the price declines to add to our position.

OUTLOOK

We remain pleased with the quality and value of the companies held in the Core Growth Fund. Over the past six months, we have focused on finding companies that have the potential to offer stable to accelerating earnings growth in a variety of economic climates, including an economy that may be softening. We expect the companies in the Fund to provide earnings growth rates in the mid- to high teens. We are taking special care to ensure that we are not being overly optimistic about their business models. We also believe that at 22x trailing earnings for our portfolio holdings, we are paying a reasonable price for earnings growth.

While we expect problems in the subprime mortgage market to have some ramifications for the broader economy, at this point the nature and dimensions of the potential disruption remain unclear. There are forecasts of record foreclosures, but we haven’t yet seen what the ultimate impact on the consumer will be. Further, it’s not yet clear what impact the slower housing market will have on employment levels. Rather than attempting to discern trends that are difficult to predict accurately, we are maintaining our focus on company-by-company research. In today’s somewhat uncertain environment, we are beginning to see the market turn toward higher-quality companies. These companies have strong management teams, generate higher returns on capital and have sustainable competitive advantages — exactly the types of companies we strive to own.

Thank you for the opportunity to manage your assets.

4

| | |

| WASATCH CORE GROWTH FUND (WGROX) — Portfolio Summary | | MARCH 31, 2007 |

|

| |

| |

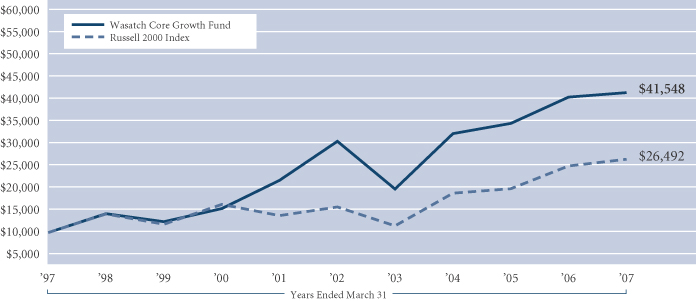

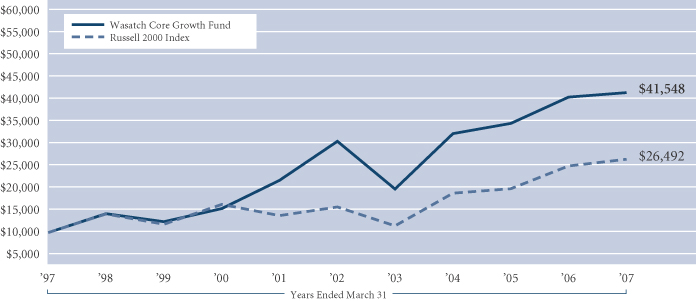

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | |

| | | SIX MONTHS* | | 1 YEAR | | 5 YEARS | | 10 YEARS |

Wasatch Core Growth Fund | | 10.77% | | 2.58% | | 6.33% | | 15.31% |

Russell 2000 Index | | 11.02% | | 5.91% | | 10.95% | | 10.23% |

Performance data quoted represents past performance. Past performance is not indicative of future performance and current performance may be lower or higher than the performance quoted. Wasatch Funds will deduct a fee of 2% from redemption proceeds on Fund shares held two months or less. Performance data does not reflect the deduction of this fee which, if charged, would reduce the performance quoted. The table above does not reflect the deduction of taxes that you would pay on fund distributions or the redemption of fund shares.

The total annual fund operating expenses for the Wasatch Core Growth Fund are 1.17% and are based on Fund expenses before any expense reimbursements by the Advisor. The net expenses for the Core Growth Fund are 1.17% and are based on Fund expenses, net of waivers and reimbursements. The Advisor has contractually agreed to reimburse the Fund for total annual fund operating expenses in excess of 1.50% until at least 1/31/08 (excluding interest, taxes, brokerage commissions, other investment related costs and extraordinary expenses in excess of such limitations). See the prospectus for additional information regarding Fund expenses.

To obtain the most recent month-end performance, please visit www.wasatchfunds.com or call 800.551.1700. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost. The Advisor has absorbed, in the past, certain Fund expenses, without which total returns would have been lower.

Investments in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds.

TOP 10 EQUITY HOLDINGS*

| | | | |

| Ticker | | Company | | % of Fund |

| POOL | | Pool Corp. Swimming pool supplies distributor. | | 5.11% |

| CPRT | | Copart, Inc. Vehicle salvage services. | | 4.81% |

| ORLY | | O’Reilly Automotive, Inc. Automotive parts retailer/distributor. | | 4.21% |

| PDX | | Pediatrix Medical Group, Inc. National network of neonatalogists. | | 4.04% |

| SRZ | | Sunrise Senior Living, Inc. Assisted living centers. | | 3.64% |

| | | | |

| Ticker | | Company | | % of Fund |

| STRA | | Strayer Education, Inc. Post-secondary education. | | 3.07% |

| MSM | | MSC Industrial Direct Co., Inc., Class A Industrial products distributor. | | 3.04% |

| GISX | | Global Imaging Systems, Inc. Office imaging equipment sales and service | | 3.00% |

| CBH | | Commerce Bancorp, Inc. Commercial banking, corporate trust and insurance brokerage services. | | 2.98% |

| GTRC | | Guitar Center, Inc. Music stores. | | 2.95% |

| * | | As of March 31, 2007, the Fund had 36.85% invested in the Top 10 equity holdings and there were 69 long-term holdings in the Fund. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. |

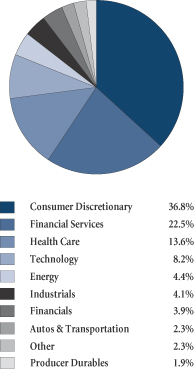

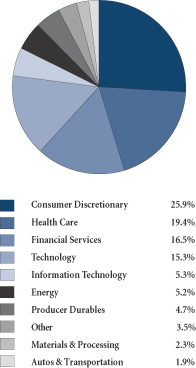

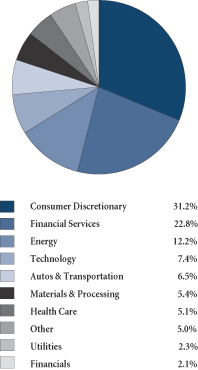

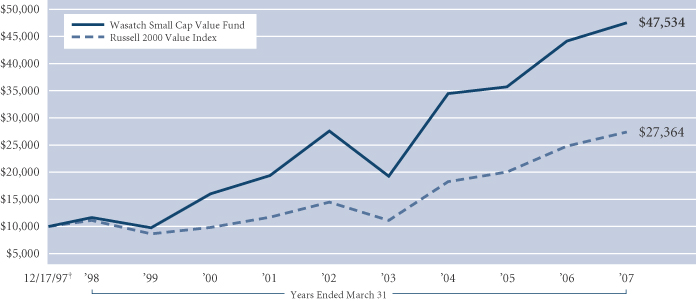

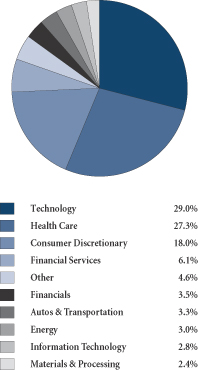

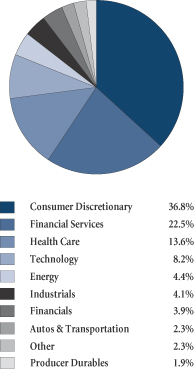

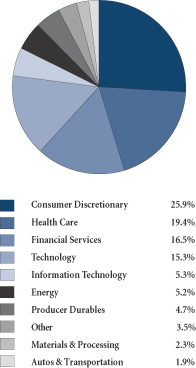

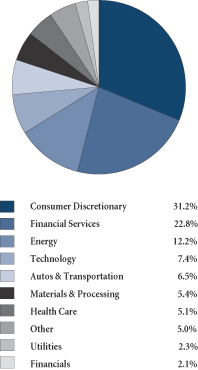

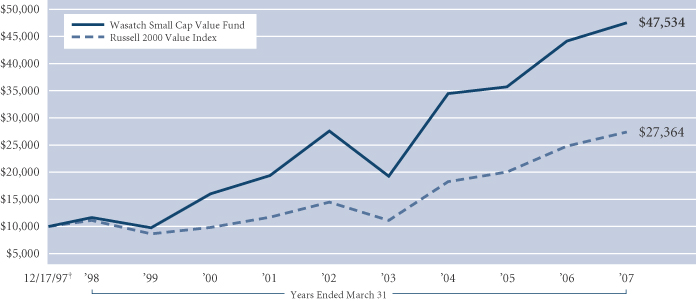

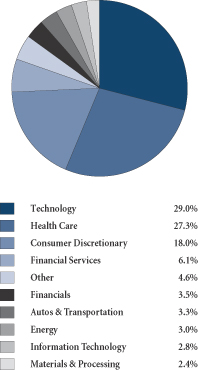

SECTOR BREAKDOWN**

| ** | | Excludes short-term investments, securities sold short and written options, if any. |

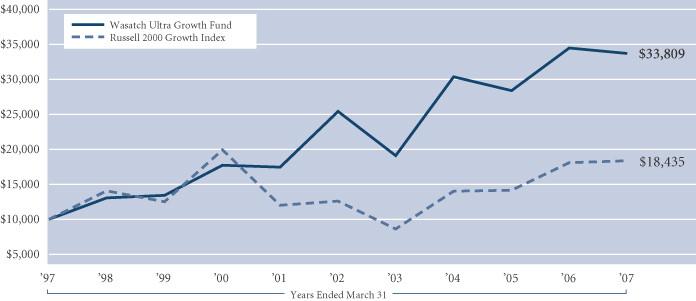

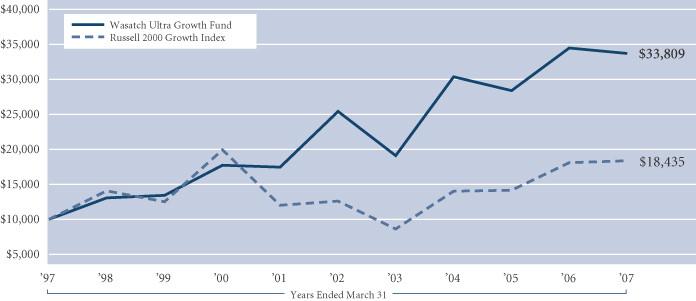

GROWTHOFA $10,000 INVESTMENT

The Russell 2000 Index is an unmanaged total return index of the smallest 2,000 companies in the Russell 3000 Index, as ranked by total market capitalization. The Russell 2000 Index is widely regarded in the industry as accurately capturing the universe of small company stocks. You cannot invest directly in the Index.

5

| | |

| WASATCH GLOBAL SCIENCE & TECHNOLOGY FUND (WAGTX) — Management Discussion | | MARCH 31, 2007 |

|

| |

| |

The Wasatch Global Science & Technology Fund is managed by a team of Wasatch portfolio managers, led by Noor Kamruddin and James S. Gulbrandsen.

| | | | |

Noor Kamruddin Portfolio Manager | |

James S. Gulbrandsen Portfolio Manager | | OVERVIEW The Wasatch Global Science & Technology Fund gained 12.96% in the six-month period ended March 31, 2007, easily outpacing the 7.48% return of the Lipper Science & Technology Index. In a |

volatile market, the Fund performed well in absolute and relative terms.

Fundamental bottom-up stock selection was the key to the Fund’s performance, although sector allocation helped as well. International holdings, particularly a handful of Brazilian companies, played a major role in propelling outperformance of the benchmark. Trips to Brazil yielded valuable insights, which helped as the Fund benefited from our companies located there, including Submarino, an online retailer, NII Holdings, a Latin American wireless service company, and Weg, a Brazilian manufacturer of customized, highly engineered motors and electronic control systems.

Our thorough approach to research, including in-person visits and our Multiple Eyes™ approach of sharing insights with fellow Wasatch managers helped us identify and gain insight on firms that fit what we look for — rationally valued, high-quality global science and technology companies with strong potential for increasing earnings momentum. Although it is becoming more challenging to outperform the global technology market because global markets are becoming more highly correlated, we believe that our research efforts are paying off.

DETAILSOFTHE PERIOD

By far, the Fund’s largest contributor was MMI Holdings, a Singapore-based manufacturer of electro-mechanical components and equipment. The company’s stock shot up when it announced that it was in talks with Kohlberg Kravis Roberts & Co. for a potential leveraged buyout at a substantial premium.

Among our Brazilian holdings, Submarino was the leading contributor to performance, and the second largest positive contributor overall. Both Submarino and MMI stock gained more than 70% during the period. Submarino, a major online retailer, is the Amazon.com* of Brazil. During the period, Submarino agreed to a merger with its primary online competitor, Americanas.com.* As a result, we believe Submarino solidified its position as the online commerce powerhouse of Brazil. The transaction was shareholder-friendly, and it appears Submarino’s management team will continue largely intact in the new company.

We believe Weg is another very strong company. A far cry from a typical manufacturing company, in our opinion this firm is a leading edge, high-end, custom design shop. We expect it to benefit from various economic trends, including

high global demand for capital goods, infrastructure build-out, energy efficiency, and the company’s potential to grow its market share in many areas. Weg’s vertical integration gives it additional flexibility and a more competitive cost structure. It also has an excellent and highly diversified book of business of customers in different regions and industries. This is a company that we hope and expect to profit from for a long time.

One of the more interesting Brazilian trips involved several days visiting the management of NII Holdings, a provider of digital wireless communication services primarily to business customers in Latin America. We believe NII has a best-in-breed wireless model in an under-penetrated market and its performance exceeded our expectations during the period. Although it’s a relatively new position, NII is already one of the Fund’s 10 largest holdings because of the confidence we gained from our in-depth research.

We like the business model of TGS-NOPEC, a Norwegian geophysical company that has a powerful and lucrative database of two-dimensional and three-dimensional seismic surveys for oil and gas exploration.

RaySearch Laboratories also added to performance. This Swedish medical technology company develops imaging software to help radiation treat cancer more effectively.

Among our disappointing holdings, Amgen and Advanced Micro Devices stood out. Amgen, a leading global biotechnology firm, faced a steady stream of bad news including safety concerns surrounding two of its bread-and-butter products, anemia-fighting drugs Epogen and Aranesp. The future of Amgen’s market share was threatened by a competitor’s drug. Further bad news about another drug in Amgen’s pipeline contributed to erosion in the company’s stock price. Despite this negative news, we remain enthusiastic about owning this company right now because of its current valuation and long history of successful growth.

AMD, which for years had been taking microprocessor market share from Intel,* its major competitor, woke the sleeping giant. AMD was hurt by Intel’s newly aggressive marketing approaches, which included substantially underpricing AMD in a number of markets. AMD is a small position in the Fund, and we’re holding onto it for now because of its current valuation and in the hope that it will begin to regain some market share from Intel soon.

OUTLOOK

Despite our concern that the capital markets are going through a trying time, we see opportunities to take advantage of attractive prices and we’re building positions in higher-conviction names. We are confident that recent research trips will yield some profitable results. We see plenty of promise, particularly in Brazil, and we think we’re uncovering a great deal of potential with our Multiple Eyes approach. The more we learn about our holdings in Brazil and elsewhere, the more assured we become that we’re following a smart strategy. More generally, we are increasingly focused on international tech opportunities.

Thank you for the opportunity to manage your assets.

| * | | As of March 31, 2007, none of the Wasatch Funds held Amazon.com, Americanas.com or Intel Corp. |

6

| | |

| WASATCH GLOBAL SCIENCE & TECHNOLOGY FUND (WAGTX) — Portfolio Summary | | MARCH 31, 2007 |

|

| |

| |

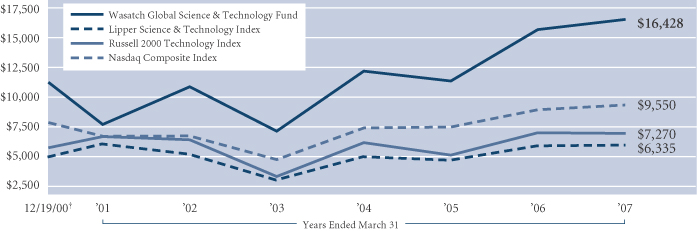

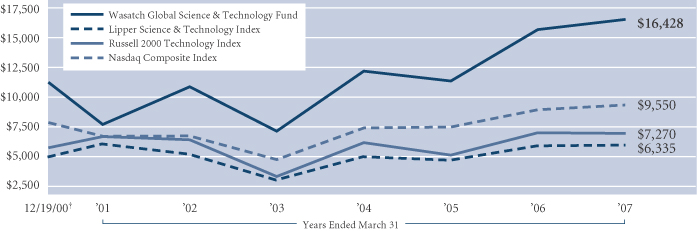

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | |

| | | SIX MONTHS* | | 1 YEAR | | 5 YEARS | | SINCE INCEPTION

12/19/00 |

Wasatch Global Science & Technology Fund | | 12.96% | | 5.13% | | 8.31% | | 8.22% |

Lipper Science & Technology Index | | 7.48% | | 1.16% | | 2.55% | | -7.01% |

Russell 2000 Technology Index | | 11.78% | | -0.69% | | 1.53% | | -4.95% |

Nasdaq Composite Index | | 7.62% | | 4.23% | | 6.23% | | -0.73% |

Performance data quoted represents past performance. Past performance is not indicative of future performance and current performance may be lower or higher than the performance quoted. Wasatch Funds will deduct a fee of 2% from redemption proceeds on Fund shares held two months or less. Performance data does not reflect the deduction of this fee which, if charged, would reduce the performance quoted. The table above does not reflect the deduction of taxes that you would pay on fund distributions or the redemption of fund shares.

The total annual fund operating expenses for the Wasatch Global Science & Technology Fund are 1.94% and are based on Fund expenses before any expense reimbursements by the Advisor. The net expenses for the Global Science & Technology Fund are 1.94% and are based on Fund expenses, net of waivers and reimbursements. The Advisor has contractually agreed to reimburse the Fund for total annual fund operating expenses in excess of 1.95% until at least 1/31/08 (excluding interest, taxes, brokerage commissions, other investment related costs and extraordinary expenses in excess of such limitations). See the prospectus for additional information regarding Fund expenses.

To obtain the most recent month-end performance, please visit www.wasatchfunds.com or call 800.551.1700. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost. The Advisor has absorbed, in the past, certain Fund expenses, without which total returns would have been lower.

Investments in concentrated funds will be more volatile and loss of principal could be greater than investing in more diversified funds. Investing in foreign securities entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus.

TOP 10 EQUITY HOLDINGS*

| | | | |

| Ticker | | Company | | % of Fund |

| NIHD | | NII Holdings, Inc. Wireless communications provider. | | 3.32% |

| AMXL MM | | America Movil S.A. de C.V., Series L (Mexico) Wireless telecommunication services. | | 2.93% |

| NSM | | National Semiconductor Corp. Semiconductors. | | 2.59% |

| INFO IN | | Infosys Technologies Ltd. (India) Business and information technology consulting. | | 2.52% |

| TGS NO | | TGS-NOPEC Geophysical Co. ASA (Norway) Geoscience data for energy exploration. | | 2.52% |

| | | | |

| Ticker | | Company | | % of Fund |

| MCHP | | Microchip Technology, Inc. Semiconductors. | | 2.45% |

| WEGE4 BZ | | Weg S.A. Pfd. (Brazil) Electric motors and components. | | 2.33% |

| TXN | | Texas Instruments, Inc. Semiconductors and electronic components. | | 2.25% |

| LMA SP | | LMA International N.V. (Singapore) Devices for airway support during surgery. | | 2.18% |

| MMI SP | | MMI Holdings Ltd. (Singapore) Electro-mechanical components and equipment. | | 2.08% |

| * | | As of March 31, 2007, the Fund had 25.17% invested in the Top 10 equity holdings and there were 111 long-term holdings in the Fund. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. |

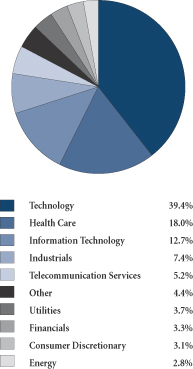

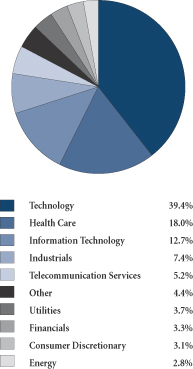

SECTOR BREAKDOWN**

| | ** | | Excludes short-term investments, securities sold short and written options, if any. |

GROWTHOFA $10,000 INVESTMENT

†Inception: December 19, 2000. The Lipper Science & Technology Index is a composite of mutual funds that invest in science and technology companies and have investment objectives similar to those of the Fund. The Russell 2000 Technology Index is a capitalization-weighted index of companies that serve the electronics and computer industries or that manufacture products based on the latest applied science. The Russell 2000 Index is an unmanaged total return index of the smallest 2,000 companies in the Russell 3000 Index, as ranked by total market capitalization. The Russell 2000 Index is widely regarded in the industry as accurately capturing the universe of small company stocks. The Nasdaq Composite Index is unmanaged and measures all Nasdaq domestic and non-U.S. based common stocks listed on The Nasdaq Stock Market. The Index is market-value weighted. This means each company’s security affects the Index in proportion to its market value. The market value, the last sale price multiplied by total shares outstanding, is calculated throughout the trading day, and is related to the total value of the Index. Due to their number and size, technology stocks tend to dominate the direction of the Index. You cannot invest directly in these indexes.

7

| | |

| WASATCH HERITAGE GROWTH FUND (WAHGX) — Management Discussion | | MARCH 31, 2007 |

|

| |

| |

The Wasatch Heritage Growth Fund is managed by a team of Wasatch portfolio managers, led by Chris Bowen and Ryan Snow.

| | | | |

Chris Bowen Portfolio Manager | |

Ryan Snow Portfolio Manager | | OVERVIEW The Wasatch Heritage Growth Fund returned 7.35% for the six-month period ended March 31, 2007. It was a mixed period for the Fund compared to its benchmarks. While we slightly |

outperformed the 7.19% return of the larger market capitalization Russell 1000 Index, we significantly underperformed the 11.18% return posted by the Fund’s primary benchmark, the Russell Midcap Growth Index (the “Index”).

From a sector perspective, the highlight of the period was the performance of the Fund’s technology holdings, which, in aggregate contributed just over 2% of the overall return and gained more than 1% on the Index.

Our underperformance was primarily driven by two sectors — energy, and materials and processing. As has been the case for the past several quarters, these sectors generally have been strong, while the Fund has had limited exposure to them. We have had some success finding companies in these sectors that meet our investment criteria, but we remain underweight versus the Index, especially in materials.

Overall, the Fund received a positive contribution from every sector in which it had a meaningful weight.

DETAILSOFTHE PERIOD

Although the market delivered strong performance during the period, the one constant was that volatility reigned. We witnessed the Dow’s largest one-day drop since 2001, but the Dow also experienced multiple sessions of 100-plus point gains. The market headlines were dominated by troubles in the subprime mortgage lending market, substantially lower homebuilding growth and speculation concerning the Fed’s next interest rate move.

While roller coaster markets can be unsettling, we believe volatility provides opportunity for long-term investors like Wasatch. Most stocks have a relatively wide spread between their high and low prices during any given year. Provided that nothing has fundamentally changed about a company’s earnings prospects, we view volatility on the downside as a chance to selectively purchase companies “on sale.”

Coach, Inc. is an ideal illustration. Coach sets the standard in the “affordable luxury” market for handbags, briefcases and other accessories. Last summer, the stock price dropped and we were able to add to our existing position at an attractive price. Subsequently, over the past six months, Coach was the Fund’s top contributor, returning over 45%. Although the stock carries an above-average price-to-earnings (P/E) ratio* compared to the market, our thesis remains that this is a well-run company that will continue to grow its earnings as worldwide consumer spending remains robust.

Unfortunately, the Fund’s biggest detractor also came from consumer discretionary, a sector that underperformed the Index for the period. Apollo Group, a for-profit provider of higher education programs, subtracted 0.65% from the Fund’s overall return. In October, the stock fell nearly 23% after Apollo Group posted disappointing earnings results and announced concerns about its then ongoing stock option review. Although we trimmed some of our exposure, we continue to be cautiously optimistic about the stock and felt that the market was too severe in its hastiness to sell it. By March 30, the stock had regained 17%.

The technology sector was led by the Fund’s largest holding, Infosys Technologies. This global information technology services firm based in India has been a steady performer that continues to execute its business plan. It has benefited the Fund due to our Multiple Eyes™ culture. Wasatch got to know Infosys when it was a much smaller company held in a variety of our small cap funds. As it grew, it became an attractive option for the Fund.

Zimmer Holdings, a provider of orthopedic implants, led our health care companies, which had an overall contribution in line with the Index. In contrast, our selection of financial services companies underperformed the Index.

In light of ongoing concerns for the homebuilding industry, it is perhaps surprising that NVR was our third best contributor, delivering a return of over 24% in the producer durables sector. Although NVR’s fundamentals are still somewhat weak, in our opinion, this was another case of a stock being oversold and then coming back to more reasonable levels.

OUTLOOK

Clearly, we prefer to outperform the Index by which we’re measured, but we believe the Fund’s potential to do well over the long term remains intact. We remain committed to Wasatch’s proven investment methodology, and we have solidified that belief by investing the majority of our personal investing assets in Heritage and other Funds in the Wasatch family.

We continue to look globally for reasonably priced companies that are growing their earnings at least 15% annually. We think we have several success-generating factors working in our favor. First, our Multiple Eyes culture essentially provides us with a company-wide research team that aides us in both uncovering new ideas and testing our investment rationale. Next, from a fundamental standpoint, we are pleased with our companies’ performance. On average, they’re growing earnings at our target rate, have solid returns on assets (ROA) and are priced attractively. Finally, we feel that our discipline is a key strength. We won’t arbitrarily forego our investing principles to chase the market’s hot sectors.

Although we can’t predict how the market will perform, we can and will continue striving to assemble a portfolio of quality companies that meet our investment criteria. In that light, we feel assured that the market will appreciate our holdings at some point.

Thank you for the opportunity to manage your assets.

| * | | Price-to-earnings multiple or P/E is the price of a company’s stock divided by its earnings per share (EPS). |

8

| | |

| WASATCH HERITAGE GROWTH FUND (WAHGX) — Portfolio Summary | | MARCH 31, 2007 |

|

| |

| |

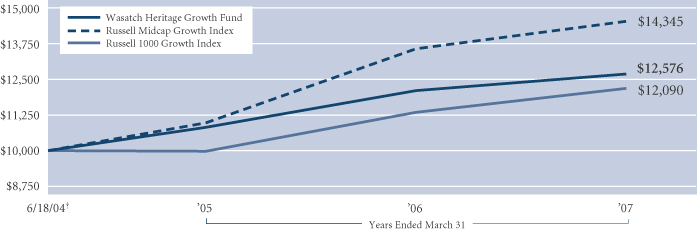

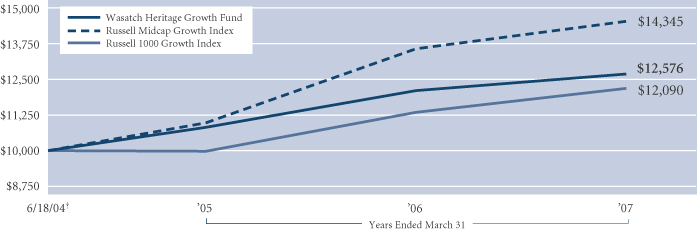

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | |

| | | SIX MONTHS* | | 1 YEAR | | 5 YEARS | | SINCE INCEPTION

6/18/04 |

Wasatch Heritage Growth Fund | | 7.35% | | 4.60% | | N/A | | 8.57% |

Russell Midcap Growth Index | | 11.18% | | 6.90% | | N/A | | 13.83% |

Russell 1000 Growth Index | | 7.19% | | 7.06% | | N/A | | 7.05% |

Performance data quoted represents past performance. Past performance is not indicative of future performance and current performance may be lower or higher than the performance quoted. Wasatch Funds will deduct a fee of 2% from redemption proceeds on Fund shares held two months or less. Performance data does not reflect the deduction of this fee which, if charged, would reduce the performance quoted. The table above does not reflect the deduction of taxes that you would pay on fund distributions or the redemption of fund shares.

The total annual fund operating expenses for the Wasatch Heritage Growth Fund are 0.95% and are based on Fund expenses before any expense reimbursements by the Advisor. The net expenses for the Heritage Growth Fund are 0.95% and are based on Fund expenses, net of waivers and reimbursements. The Advisor has contractually agreed to reimburse the Fund for total annual fund operating expenses in excess of 0.95% until at least 1/31/08 (excluding interest, taxes, brokerage commissions, other investment related costs and extraordinary expenses in excess of such limitations). See the prospectus for additional information regarding Fund expenses.

To obtain the most recent month-end performance, please visit www.wasatchfunds.com or call 800.551.1700. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost. The Advisor has absorbed, in the past, certain Fund expenses, without which total returns would have been lower.

Investing in mid cap funds will be more volatile and loss of principal could be greater than investing in large cap funds. Equity investing involves risks, including potential loss of the principal amount invested. Being non-diversified, the Fund can invest a larger portion of its assets in the stocks of a limited number of companies than a diversified fund. Non-diversification increases the risk of loss to the Fund if the values of these securities decline.

*Not annualized.

TOP 10 EQUITY HOLDINGS*

| | | | |

| Ticker | | Company | | % of Fund |

| INFO IN | | Infosys Technologies Ltd. Business and information technology consulting. | | 3.56% |

| WLP | | WellPoint, Inc. Health maintenance organization. | | 3.41% |

| ZMH | | Zimmer Holdings, Inc. Orthopedic implants. | | 2.84% |

| APH | | Amphenol Corp., Class A Interconnect products manufacturer. | | 2.83% |

| COH | | Coach, Inc. Handbags and accessories. | | 2.64% |

| | | | |

| Ticker | | Company | | % of Fund |

| NVR | | NVR, Inc. Homebuilder. | | 2.37% |

| APOL | | Apollo Group, Inc., Class A Higher education for working adults. | | 2.32% |

| DVA | | DaVita, Inc. Kidney dialysis centers. | | 2.21% |

| LLL | | L-3 Communications Holdings, Inc. Defense contractor. | | 2.19% |

| CVD | | Covance, Inc. Drug development services. | | 2.12% |

| * | | As of March 31, 2007, the Fund had 26.49% invested in the Top 10 equity holdings and there were 72 long-term holdings in the Fund. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. |

SECTOR BREAKDOWN**

| ** | | Excludes short-term investments, securities sold short and written options, if any. |

GROWTHOFA $10,000 INVESTMENT

| | † | | Inception: June 18, 2004. The Russell Midcap Growth Index measures the performance of those Russell Midcap Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell Midcap Index is an unmanaged total return index of the 800 smallest companies in the Russell 1000 Index, as ranked by total market capitalization. The stocks in the Russell Midcap Growth Index are also members of the Russell 1000 Growth Index. The Russell 1000 Growth Index measures the performance of those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values. You cannot invest directly in these indexes. |

9

| | |

| WASATCH INTERNATIONAL GROWTH FUND (WAIGX) — Management Discussion | | MARCH 31, 2007 |

|

| |

| |

The Wasatch International Growth Fund is managed by a team of Wasatch portfolio managers, led by Roger D. Edgley and Laura G. Hoffman.

| | | | |

Roger D. Edgley, CFA Portfolio Manager | |

Laura G. Hoffman, CFA Portfolio Manager | | OVERVIEW The Wasatch International Growth Fund gained 23.48% in the past six months and outperformed the MSCI World Ex-U.S.A. Small Cap Index, which gained 19.78%. In an environment |

of strong global growth fueled by emerging market infrastructure development, the Fund’s performance was broad based across countries and economic sectors. In Continental Europe, industrials companies were among the top contributors. In Asia, our retail holdings did especially well. We like the opportunities we are seeing in Brazil and adding to our weight in the period proved to be a good move. Stock exchanges and Scandinavian investment firms drove the return of the Fund’s financials sector, and a couple of our Scandinavian energy companies also posted strong results. In Japan, being underweight relative to the Index was a plus.

Although few areas in the Fund were weak, the impact of some bears mentioning. The United Kingdom was the largest contributor to the Index’s performance, but we had fewer holdings than the Index and they lagged in performance. The Fund had no exposure to utilities and was underweight in telecommunication services and materials, two sectors that were strong outperformers for the Index. We sold several holdings whose results were disappointing.

All in all, we are pleased with the way the Fund performed in the last six months and feel it remains well positioned for the future.

DETAILSOFTHE PERIOD

Strong economic growth in many emerging markets is helping fuel economic growth throughout the world. This trend led us to identify several interesting investment themes and some attractive opportunities.

Infrastructure spending in emerging markets has spurred the worldwide growth of the industrials and materials sectors. This has been beneficial for Europe where economies are largely based on industrials, and we have been rewarded for increasing our exposure to European industrials. We like companies that offer not only engineering or manufacturing expertise but also have a high service component to their revenues and a strong global presence. Services generally have higher margins and the revenue is typically steadier, which helps smooth out some of the cyclicality of the sector. An example is Demag Cranes based in Germany. Demag, a supplier of industrial cranes and port automation technology, has been able to improve margins by growing its maintenance and refurbishment services division.

One of our biggest missed opportunities over the past year was not adding enough to the materials sector. We are working hard to remedy this and initiated small positions in several companies late in 2006 and expect to continue increasing our exposure to the materials sector in 2007.

Retail companies throughout Asia have been benefiting from a powerful demographic trend — an emerging middle class with growing discretionary income. We look for companies that are building strong franchises and we want to invest in them when they are relatively undiscovered so we can buy them at reasonable valuations. One example is China Hongxing Sports, a shoe manufacturer that sells its products mainly in China. We own other shoe and apparel companies and discovered this company when it was trading at a discount to the rest of the sector. We have captured significant upside as management has continued to improve margins and expand the company’s retail network.

Stock exchanges — JSE Ltd. in South Africa and Osaka Securities Exchange in Japan were among the top performers in the financials sector. These companies are seeing increased volume and the scalability of their business models allows them to run that volume through their relatively fixed cost base, resulting in improvement in margins and profits.

In some European and Scandinavian countries, government and pension benefits for retirees are expected to decrease substantially in the years ahead. Companies like Acta Holdings in Norway are helping people begin saving for retirement and the Fund has benefited from investments in such companies.

Energy continues to command attention as the world struggles to find ways to meet the growing energy needs of its citizens. Energy exploration and oil and gas development has helped drive economic growth in Scandinavia where the Fund has invested in several energy companies that have done well. A notable example is TGS-NOPEC, a Norwegian company that provides seismic and geoscience data for energy exploration and was the Fund’s top contributor over the past six months.

While we continue to like Japanese real estate companies and see growth potential in some industrials companies, we are concerned by the downturn in consumer sentiment and feel that the current administration is not focusing enough on the economy. These concerns are behind our decision to remain substantially underweight versus the Index in Japan.

OUTLOOK

We see broad strength in economies around the world, although there is some concern that the U.S. economy could slow more than anticipated. European economies are expected to continue to benefit from emerging markets’ strong demand for industrials. Spending by the world’s emerging middle class should continue to support the results of our consumer-focused companies. We continue to monitor consumer sentiment in Japan, hoping that the administration will focus more on the economy and eventually provide a clear direction on interest rates.

Overall, we are pleased with the Fund’s results so far this year. We will continue to focus on investing in companies that we believe can deliver strong results, improve their core products and services, and maintain a global presence.

Thank you for the opportunity to manage your assets.

10

| | |

| WASATCH INTERNATIONAL GROWTH FUND (WAIGX) — Portfolio Summary | | MARCH 31, 2007 |

|

| |

| |

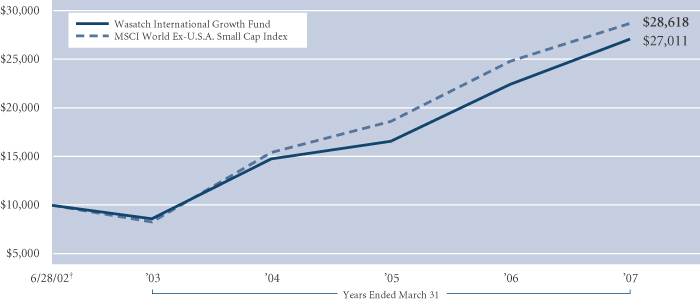

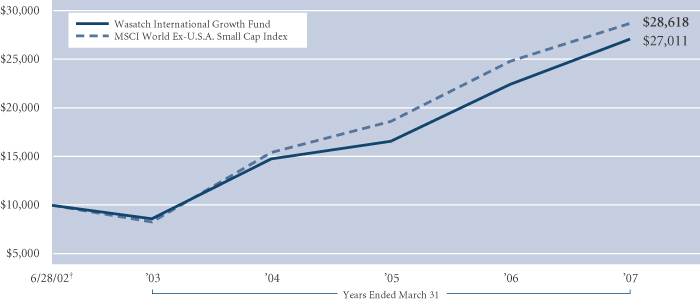

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | |

| | | SIX MONTHS* | | 1 YEAR | | 5 YEARS | | SINCE INCEPTION

6/28/02 |

Wasatch International Growth Fund | | 23.48% | | 20.72% | | N/A | | 23.22% |

MSCI World Ex-U.S.A. Small Cap Index | | 19.78% | | 15.70% | | N/A | | 24.71% |

Performance data quoted represents past performance. Past performance is not indicative of future performance and current performance may be lower or higher than the performance quoted. Wasatch Funds will deduct a fee of 2% from redemption proceeds on Fund shares held two months or less. Performance data does not reflect the deduction of this fee which, if charged, would reduce the performance quoted. The table above does not reflect the deduction of taxes that you would pay on fund distributions or the redemption of fund shares.

The total annual fund operating expenses for the Wasatch International Growth Fund are 1.78% and are based on Fund expenses before any expense reimbursements by the Advisor. The net expenses for the International Growth Fund are 1.78% and are based on Fund expenses, net of waivers and reimbursements. The Advisor has contractually agreed to reimburse the Fund for total annual fund operating expenses in excess of 1.95% until at least 1/31/08 (excluding interest, taxes, brokerage commissions, other investment related costs and extraordinary expenses in excess of such limitations). See the prospectus for additional information regarding Fund expenses.

To obtain the most recent month-end performance, please visit www.wasatchfunds.com or call 800.551.1700. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost. The Advisor has absorbed, in the past, certain Fund expenses, without which total returns would have been lower.

Investing in foreign securities entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus. Investments in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds.

*Not annualized.

TOP 10 EQUITY HOLDINGS*

| | | | |

| Ticker | | Company | | % of Fund |

| T3C GR | | Thielert AG (Germany) High performance engine and

component manufacturer. | | 2.19% |

| TGS NO | | TGS-NOPEC Geophysical Co. ASA (Norway) Geoscience data for energy exploration. | | 2.12% |

| CHHS SP | | China Hongxing Sports Ltd. (China) Athletic wear retailer. | | 2.02% |

| AWD GR | | AWD Holding AG (Germany) Financial services. | | 1.94% |

| NTB BH | | The Bank of N.T. Butterfield &

Son Ltd. (Bermuda) Wealth management and financial services. | | 1.77% |

| | | | |

| Ticker | | Company | | % of Fund |

| ACTA NO | | Acta Holdings ASA (Norway) Financial advisory services. | | 1.68% |

| 48 HK | | EganaGoldpfeil (Holdings) Ltd. (Hong Kong) Luxury fashion accessories brand manager. | | 1.67% |

| 8874 JP | | Joint Corp. (Japan) Residential condominium developer. | | 1.67% |

| JSE SJ | | JSE Ltd. (South Africa) Securities exchange. | | 1.62% |

| HEMX SS | | Hemtex AB (Sweden) Home furnishing products. | | 1.59% |

| * | | As of March 31, 2007, the Fund had 18.27% invested in the Top 10 equity holdings and there were 125 long-term holdings in the Fund. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. |

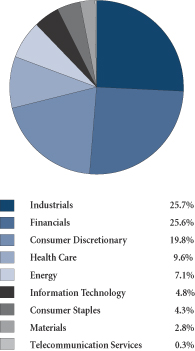

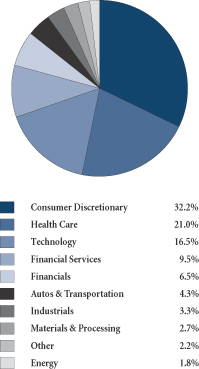

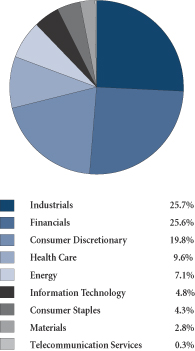

SECTOR BREAKDOWN**

| ** | | Excludes short-term investments, securities sold short and written options, if any. |

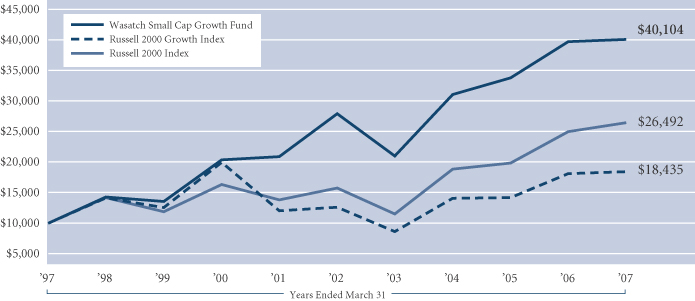

GROWTHOFA $10,000 INVESTMENT

| | † | Inception: June 28, 2002. The MSCI World Ex-U.S.A. Small Cap Index is an unmanaged index that measures the performance of stocks with market capitalizations between U.S. $200 million and $1.5 billion across 22 developed markets, excluding the United States. You cannot invest directly in the Index. |

11

| | |

| WASATCH INTERNATIONAL OPPORTUNITIES FUND (WAIOX) — Management Discussion | | MARCH 31, 2007 |

|

| |

| |

The Wasatch International Opportunities Fund is managed by a team of Wasatch portfolio managers, led by Roger D. Edgley and Blake H. Walker.

| | | | |

Roger D. Edgley, CFA Portfolio Manager | |

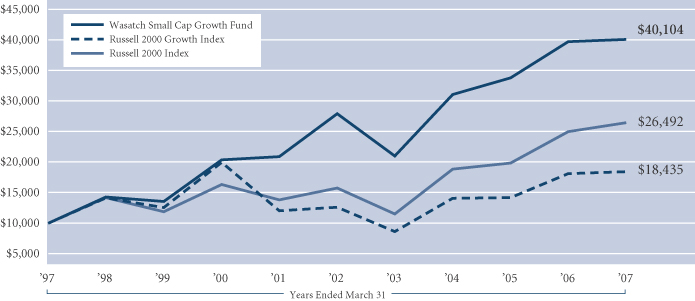

Blake H. Walker Portfolio Manager | | OVERVIEW The Wasatch International Opportunities Fund gained 30.96% in the six months ended March 31, 2007, outperforming the MSCI World Ex-U.S.A. Small Cap Index, which gained 19.78%. |

The Fund and the global markets were able to outperform their U.S. counterparts at a time when there were significant uncertainties on the macroeconomic front. Among the areas of concern were fears that a slowing housing market and difficulties among U.S. subprime mortgage lenders and borrowers would reverberate throughout global economies.

No single theme, trend, or industry was dominant during the period, though the growing power of the international consumer was felt throughout many sectors and companies. Holdings in the consumer discretionary and financials sectors were the driving forces in the Fund’s performance over the six months.

The consumer discretionary sector, which is substantially overweight in the Fund, made the greatest positive contribution to the Fund’s performance for the period. The rise of the global consumer remains an enormous force in international markets; stocks of companies that serve their needs and that benefit from their expanding buying power were among the strongest performers for the period. In many cases, strong performers even from non-consumer sectors have businesses that are driven in large part by these consumer forces.

In the financials sector, our performance benefited from holdings in a variety of international markets. Because the financial services and securities industries are still in relatively nascent stages in many international markets, they can offer far greater room for expansion than is available from their counterparts in the U.S.

Although economic concerns may be on the horizon in the U.S., at this point their ultimate impact there is unclear. More relevant for this Fund, thus far they haven’t had notable negative impact on international markets. This is a strong indication that global markets are becoming increasingly self-sustaining, and no longer take all of their cues from the U.S. In an uncertain domestic environment, this could be a positive trend for global investors.

DETAILSOFTHE PERIOD

The three strongest sectors for the Fund over the period were consumer discretionary, financials, and industrials. In the consumer discretionary sector, athletic shoe and apparel maker China Hongxing Sports produced a triple-digit return

and contributed just over 3% to performance. The company is benefiting from booming demand for its products in China, boosted in large part by excitement over the upcoming 2008 Olympics in Beijing. Given the size of that nation’s population and the rapid expansion of its consumer class, we have a firm conviction that the company is well-positioned for growth long after the games are over. Other holdings directly benefiting from Asian consumer spending included luxury-goods seller EganaGoldpfeil and fashion retailer Ports Design.

The rising sophistication and financial activity of international consumers — seeking not just material goods but also the opportunity to save and invest — played an important role in the performance of our holdings among financial stocks. Among our top performers in this sector were Acta Holdings, a Norwegian asset manager, Japan’s Osaka Securities Exchange, and South African securities exchange JSE Ltd. The exchanges also offer broad-based exposure to growth in their respective home markets.

An emerging area of interest for us in the financial sector is Japanese real estate. While we ultimately chose to trim most of our Japanese positions after a rebound failed to materialize, Japanese real estate is an area we believe offers a number of exciting opportunities. Among the strong factors underlying this segment of the market are a scarcity of real property and the availability of relatively cheap long-term debt. While our holdings in this area of the market, such as Babcock & Brown Japan Property Trust and Takara Leben did not contribute positively to returns over this period, we believe they have strong potential going forward.

Energy remained an important sector for the Fund. Over the six months, our holdings in this area (in which the Fund was overweight) underperformed their sector benchmark. Our Canadian holdings were hit hard by an unfavorable change in the taxation of energy trusts, compounded by lower commodity prices. There were some healthy performers among our holdings such as Singapore-traded Ezra Holdings, which provides offshore support and marine services to the oil and gas industry, and APL, a Norwegian company providing the industry with specialized technologies. We anticipate maintaining our overweight position in the sector going forward.

OUTLOOK

Many foreign markets no longer follow the lead of the U.S., having grown to the point that they set their own pace. Nonetheless, the level of uncertainty surrounding the U.S. is somewhat disquieting. Although many global markets may have developed their own capacity for broad and sustained growth, were a severe credit crunch to afflict the U.S., its impact could eventually be felt elsewhere in the world. Also, performance in Singapore, a market that is heavily represented in the portfolio, is still closely tied to that of the U.S.

We continue to have great confidence in the power of consumers in emerging markets. Encouraging factors include both the size of the markets involved in rising discretionary consumer spending — such as China, India, and Brazil — and the significant gap that remains between the standards of living for consumers in these markets and those in more mature economies.

Thank you for the opportunity to manage your assets.

12

| | |

| WASATCH INTERNATIONAL OPPORTUNITIES FUND (WAIOX) — Portfolio Summary | | MARCH 31, 2007 |

|

| |

| |

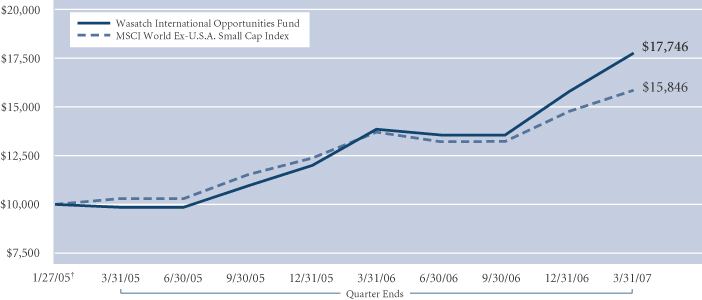

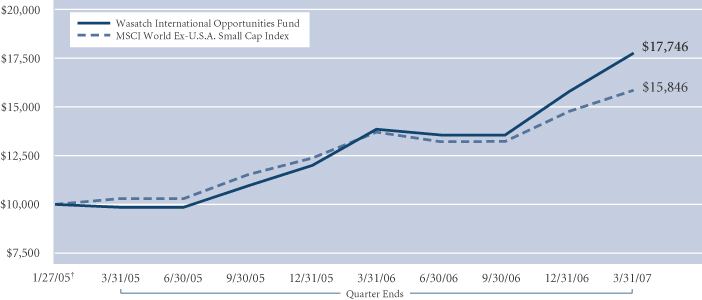

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | |

| | | SIX MONTHS* | | 1 YEAR | | 5 YEARS | | SINCE INCEPTION

1/27/05 |

Wasatch International Opportunities Fund | | 30.96% | | 28.13% | | N/A | | 30.17% |

MSCI World Ex-U.S.A. Small Cap Index | | 19.78% | | 15.70% | | N/A | | 23.57% |

Performance data quoted represents past performance. Past performance is not indicative of future performance and current performance may be lower or higher than the performance quoted. Wasatch Funds will deduct a fee of 2% from redemption proceeds on Fund shares held two months or less. Performance data does not reflect the deduction of this fee which, if charged, would reduce the performance quoted. The table above does not reflect the deduction of taxes that you would pay on fund distributions or the redemption of fund shares.

The total annual fund operating expenses for the Wasatch International Opportunities Fund are 2.63% and are based on Fund expenses before any expense reimbursements by the Advisor. The net expenses for the International Opportunities Fund are 2.26% and are based on Fund expenses, net of waivers and reimbursements. The Advisor has contractually agreed to reimburse the Fund for total annual fund operating expenses in excess of 2.25% until at least 1/31/08 (excluding interest, taxes, brokerage commissions, other investment related costs and extraordinary expenses in excess of such limitations). See the prospectus for additional information regarding Fund expenses.

To obtain the most recent month-end performance, please visit www.wasatchfunds.com or call 800.551.1700. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost. The Advisor has absorbed, currently or in the past, certain Fund expenses, without which total returns would have been lower.

Investing in foreign securities entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus. Investments in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds.

*Not annualized.

TOP 10 EQUITY HOLDINGS*

| | | | |

| Ticker | | Company | | % of Fund |

| ACTA NO | | Acta Holdings ASA (Norway) Financial advisory services. | | 3.58% |

| CHHS SP | | China Hongxing Sports Ltd. (China) Athletic wear retailer. | | 3.56% |

| 48 HK | | EganaGoldpfeil (Holdings) Ltd. (Hong Kong) Luxury fashion accessories brand manager. | | 2.62% |

| MMI SP | | MMI Holdings Ltd. (Singapore) Electro-mechanical components and equipment. | | 2.15% |

| EZRA SP | | Ezra Holdings Ltd. (Singapore) Marine services support. | | 2.14% |

| | | | |

| Ticker | | Company | | % of Fund |

| 072870 KS | | MegaStudy Co. Ltd. (Korea) Online education provider. | | 2.07% |

| JSE SJ | | JSE Ltd. (South Africa) Securities exchange. | | 2.04% |

| RAYB SS | | RaySearch Laboratories AB (Sweden) Dosage software for radiology. | | 2.01% |

| HEMX SS | | Hemtex AB (Sweden) Home furnishing products. | | 1.61% |

| AQR GR | | Arques Industries AG (Germany) Industrial turnaround specialist. | | 1.55% |

| * | | As of March 31, 2007, the Fund had 23.33% invested in the Top 10 equity holdings and there were 131 long-term holdings in the Fund. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. |

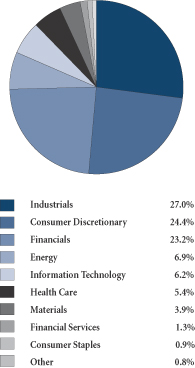

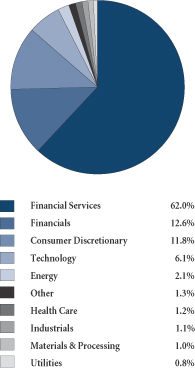

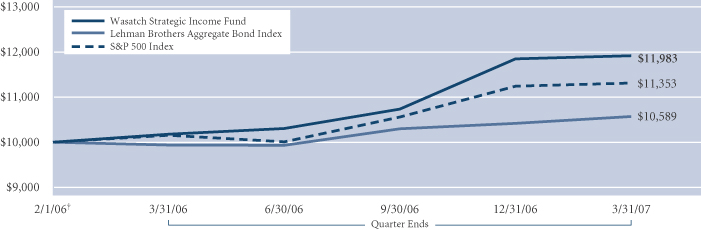

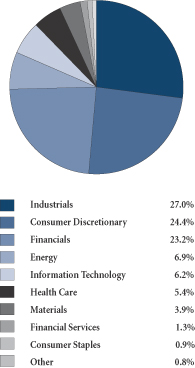

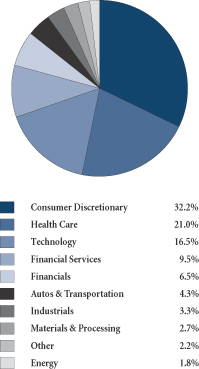

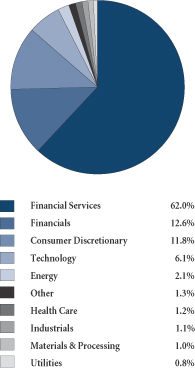

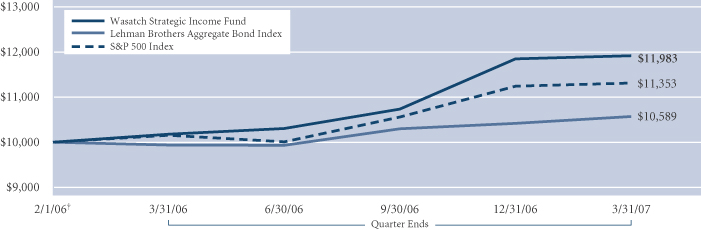

SECTOR BREAKDOWN**

| ** | | Excludes short-term investments, securities sold short and written options, if any. |

GROWTHOFA $10,000 INVESTMENT

| | † | | Inception: January 27, 2005. The MSCI World Ex-U.S.A. Small Cap Index is an unmanaged index that measures the performance of stocks with market capitalizations between U.S. $200 million and $1.5 billion across 22 developed markets, excluding the United States. You cannot invest directly in the Index. |

13

| | |

| WASATCH MICRO CAP FUND (WMICX) — Management Discussion | | MARCH 31, 2007 |

|

| |

| |

The Wasatch Micro Cap Fund is managed by a team of Wasatch portfolio managers, led by Daniel Chace.

| | |

Daniel Chace, CFA Portfolio Manager | | OVERVIEW The Wasatch Micro Cap Fund gained 12.94% during the six months ended March 31, 2007. The Russell 2000 Index (the “Index”) advanced 11.02% and the Russell Microcap Index rose 11.29% over the same time period. The Fund’s investments in international companies continued to do well, outpacing our domestic holdings and contributing to outperformance of the Index. Another key area of strength was the health care sector, which generated |

a significant increase and positively impacted relative returns. While the Fund’s performance was strong overall, a number of individual investments turned in disappointing results, including a business services company that missed earnings estimates.

Looking forward, there are some challenges facing small cap equities, including an apparent slowdown in corporate earnings growth and the potential for problems in the subprime mortgage market to spill over into other areas of the economy. Despite these big-picture risks, we believe that the Fund remains well-positioned for the long term given our focus on investing in companies exhibiting an attractive combination of quality, value and earnings growth.

DETAILSOFTHE PERIOD

Wasatch looks for opportunities around the world, and nearly 20% of the Fund’s total market value was invested in foreign-listed stocks* this period. Our international holdings generated a strong gain and added value relative to the Index, with companies domiciled in China and Singapore doing especially well. One of the Fund’s best-performing stocks was China Hongxing Sports (China), an athletic shoe and apparel retailer. The company is benefiting from several positive trends in China, including rising disposable incomes and the increasing popularity of sports, and reported significant earnings growth and margin expansion.

Raffles Education (Singapore), a provider of training and design courses, was another top-performing name in the Fund. Raffles Education is also experiencing good growth and margin improvement, driven by favorable enrollment trends and higher tuition fees, among other factors. Adhering to our valuation discipline, we have been trimming our position on price strength. We decided to maintain a small weight in the stock after a March meeting in Singapore with the company’s Chief Executive Officer, who made a compelling case for further margin expansion. The meeting was part of a trip made by several members of our research team representing different Wasatch funds, consistent with our belief that subjecting companies to the scrutiny of multiple sets of eyes leads to better investment decisions.

The Fund traditionally has been heavily weighted in health care stocks, because this is an area where our bottom-up, fundamental research typically finds many companies exhibiting strong growth prospects. Overall, our health care

investments produced a significant gain this period and favorably impacted results versus the Index. CorVel, a provider of medical cost containment services and a long-term holding, was one of the best-performing names in the portfolio. The stock had been weak for the better part of 2004 and 2005, mainly due to sluggish volumes of workers’ compensation insurance claims. We decided to stay the course, however, since our ongoing dialogue with management gave us confidence that CorVel’s business was poised to turn the corner. We were rewarded for our patience in 2006, when the company’s earnings growth started to accelerate, driven by cost controls and productivity enhancements that boosted margins. And although CorVel was a top 10 contributor to performance in the second, third and fourth quarters of 2006, we sold our position near the end of last year, because we felt the stock was becoming richly valued.

LECG Corp., a U.S.-based provider of expert services such as independent testimony, is an example of a stock that we ultimately did lose patience with after owning it in the Fund since late 2005. LECG Corp. was one of the biggest detractors this period, declining sharply after the company preannounced a substantial earnings shortfall. The earnings miss was just one in a series of disappointments and exacerbated our concerns that LECG Corp. would continue to struggle to grow its business and expand margins at the same time. As a result, we have lowered our weight in the stock.

OUTLOOK

2006 marked the fourth consecutive year of gains from U.S. small cap equities, and valuations aren’t as reasonable as they once were following such a strong run. In addition, earnings growth across the equity market appears to have peaked, and weakness in the housing and subprime mortgage sectors is clouding the outlook for the U.S. economy as a whole.

Despite these challenges facing the broad small cap market, we believe in the Fund’s ability to produce strong results over time. The aggregate earnings growth rate reported by our companies during the first quarter of 2007 was somewhat lower than we had anticipated, but our bottom-up earnings models suggest that portfolio earnings growth is likely to accelerate. We believe we have invested in a good selection of high-quality companies and continue to adhere to our valuation discipline, which should provide downside protection in a weaker environment. Lastly, the Fund had minimal direct exposure to the subprime mortgage market as of March 31, and we are closely monitoring the situation’s potential ripple effect on companies in other sectors of the economy.

Thank you for the opportunity to manage your assets.

| * | | These holdings excluded American Depositary Receipts (ADRs — receipts issued by domestic banks for shares of foreign-based corporations that trade on U.S. stock exchanges) and companies incorporated in other countries but whose shares trade on U.S. stock exchanges. |

14

| | |

| WASATCH MICRO CAP FUND (WMICX) — Portfolio Summary | | MARCH 31, 2007 |

|

| |

| |

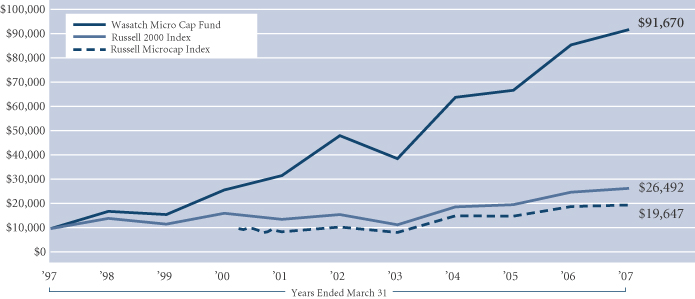

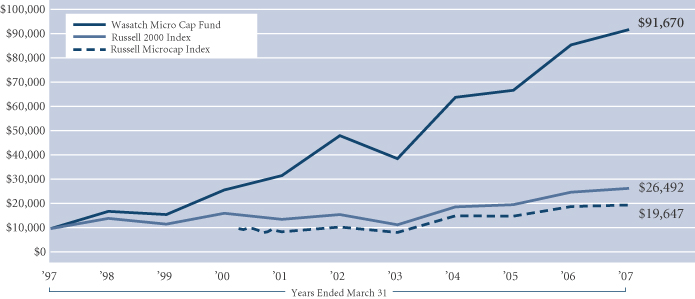

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | |

| | | SIX MONTHS* | | 1 YEAR | | 5 YEARS | | 10 YEARS |

Wasatch Micro Cap Fund | | 12.94% | | 7.25% | | 13.77% | | 24.80% |

Russell 2000 Index | | 11.02% | | 5.91% | | 10.95% | | 10.23% |

Russell Microcap Index | | 11.29% | | 3.05% | | 13.09% | | N/A |

Performance data quoted represents past performance. Past performance is not indicative of future performance and current performance may be lower or higher than the performance quoted. Wasatch Funds will deduct a fee of 2% from redemption proceeds on Fund shares held two months or less. Performance data does not reflect the deduction of this fee which, if charged, would reduce the performance quoted. The table above does not reflect the deduction of taxes that you would pay on fund distributions or the redemption of fund shares.

The total annual fund operating expenses for the Wasatch Micro Cap Fund are 2.15% and are based on Fund expenses before any expense reimbursements by the Advisor. The net expenses for the Micro Cap Fund are 2.15% and are based on Fund expenses, net of waivers and reimbursements. The Advisor has contractually agreed to reimburse the Fund for total annual fund operating expenses in excess of 2.50% until at least 1/31/08 (excluding interest, taxes, brokerage commissions, other investment related costs and extraordinary expenses in excess of such limitations). See the prospectus for additional information regarding Fund expenses.

To obtain the most recent month-end performance, please visit www.wasatchfunds.com or call 800.551.1700. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost. The Advisor has absorbed, in the past, certain Fund expenses, without which total returns would have been lower.

Investments in micro cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Investing in foreign securities entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus.

*Not annualized.

TOP 10 EQUITY HOLDINGS*

| | | | |

| Ticker | | Company | | % of Fund |

| BGFV | | Big 5 Sporting Goods Corp. Sporting goods retailer. | | 2.35% |

| CHHS SP | | China Hongxing Sports Ltd. (China) Athletic wear retailer. | | 2.22% |

| AMSG | | AmSurg Corp. Ambulatory surgery centers. | | 2.03% |

| OIIM | | O2Micro International Ltd. ADR (Cayman Islands) Semiconductors. | | 1.97% |

| POWI | | Power Integrations, Inc. Semiconductors. | | 1.86% |

| | | | |

| Ticker | | Company | | % of Fund |

| PRSC | | Providence Service Corp. (The) Management of U.S. government-sponsored social services. | | 1.86% |

| GTRC | | Guitar Center, Inc. Music stores. | | 1.80% |

| WINS | | SM&A Competition management services. | | 1.64% |

| MCRL | | Micrel, Inc. Semiconductors. | | 1.64% |

| ABAX | | Abaxis, Inc. Portable blood analysis systems. | | 1.60% |

| * | | As of March 31, 2007, the Fund had 18.97% invested in the Top 10 equity holdings and there were 144 long-term holdings in the Fund. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. |

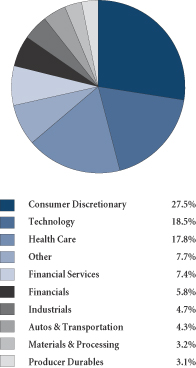

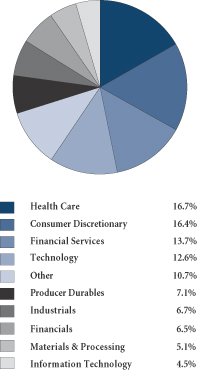

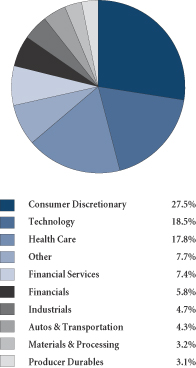

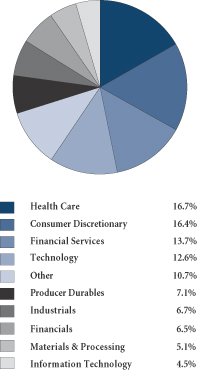

SECTOR BREAKDOWN**

| ** | | Excludes short-term investments, securities sold short and written options, if any. |

GROWTHOFA $10,000 INVESTMENT

The Russell 2000 Index is an unmanaged total return index of the smallest 2,000 companies in the Russell 3000 Index, as ranked by total market capitalization. The Russell 2000 Index is widely regarded in the industry as accurately capturing the universe of small company stocks. The Russell Microcap Index is an unmanaged total return index of the smallest 1,000 securities in the small cap Russell 2000 Index along with the next smallest 1,000 companies, based on a ranking of all U.S. equities by market capitalization. No data was available for the Index prior to 6/30/00. Data for the Index from 6/30/00 until its official start date of July 1, 2005 was from a paper portfolio. You cannot invest directly in these indexes.

15

| | |

| WASATCH MICRO CAP VALUE FUND (WAMVX) — Management Discussion | | MARCH 31, 2007 |

|

| |

| |

The Wasatch Micro Cap Value Fund is managed by a team of Wasatch portfolio managers, led by John Malooly and Brian Bythrow.

| | | | |

John Malooly, CFA Portfolio Manager | |

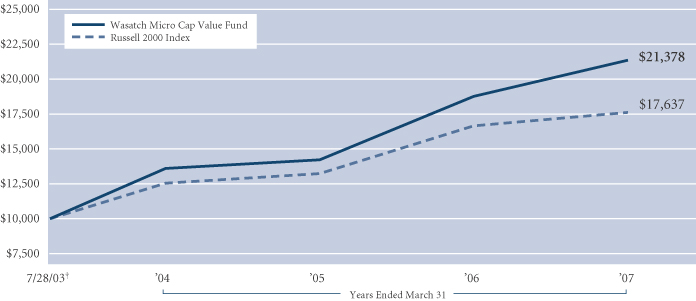

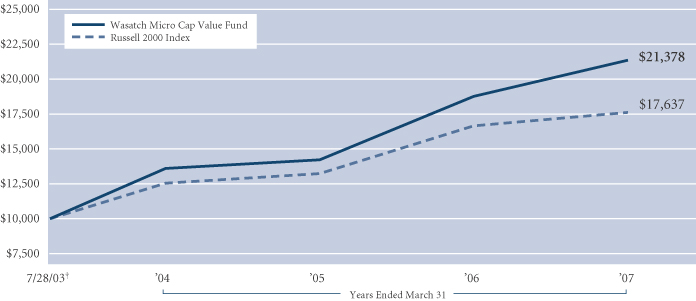

Brian Bythrow, CFA Portfolio Manager | | OVERVIEW The Wasatch Micro Cap Value Fund gained 16.65% for the six months ended March 31, 2007 and outperformed the Russell 2000 Index, which gained 11.02%. The market environment was |

generally positive in the last three months of 2006. In the first quarter of 2007, however, uncertainty began to permeate the market, with increased volatility due to concerns about the overall strength of the U.S. economy, weakness in the Chinese market, and the potential impact of difficulties among subprime mortgage lenders and borrowers.

Small cap stocks continued to outperform large caps — not the usual trend when concerns about the economy are rising. However, in the second half of the period, returns for micro cap stocks lagged small caps, offering some indication of investors’ diminishing appetite for risk. Such a trend is typical of the later stages of an economic cycle. We were pleased that our carefully selected portfolio was able to outperform the small cap index despite this headwind for micro caps.

The consumer discretionary sector, in which the Fund is underweight, made the greatest contribution to performance. Our strategy in this area has been to be underexposed to the U.S. consumer, and overexposed to the consumer from emerging economies. The health care and technology sectors also made substantial contributions to performance. Many companies in these areas offer defensive characteristics, which can be helpful in times of economic uncertainty.

We have been able to outperform during a challenging market in large part because we have identified what we believe are strong companies with above-average growth potential and more moderate levels of risk. We believe these companies have the potential to do well over the long term, even if economic growth slows.

DETAILSOFTHE PERIOD

After years of vigorous spending, it appears that the U.S. consumer may be tapped out. And while the ultimate impact of falling real estate values and the subprime mortgage crunch is not yet clear, it could prove to be another factor weighing on disposable income. We are sidestepping this issue by seeking out companies that play on the consumer in emerging markets, many of which are experiencing rapid growth and appear unfazed by problems in the U.S.

In line with this strategy, China Hongxing Sports was the single largest contributor to the Fund’s performance over the past six months, just as it was for all of 2006. The company, which produces and sells branded athletic shoes and