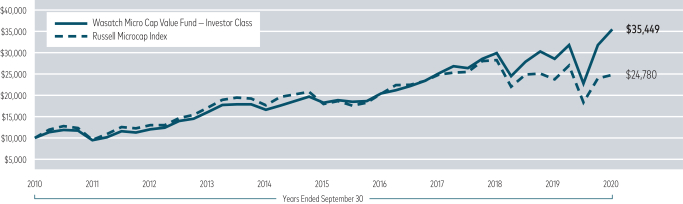

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04920

WASATCH FUNDS TRUST

(Exact name of registrant as specified in charter)

505 Wakara Way, 3rd Floor

Salt Lake City, UT 84108

(Address of principal executive offices)(Zip code)

| | |

| (Name and Address of Agent for Service) | | Copy to: |

| |

Eric S. Bergeson Wasatch Advisors, Inc. 505 Wakara Way, 3rd Floor Salt Lake City, UT 84108 | | Eric F. Fess, Esq. Chapman & Cutler LLP 111 West Monroe Street Chicago, IL 60603 |

Registrant’s telephone number, including area code: (801) 533-0777

Date of fiscal year end: September 30

Date of reporting period: September 30, 2020

Item 1. Report to Shareholders.

WASATCHGLOBAL.COM SEPTEMBER 30, 2020 2020 Annual Report Fund Investor Institutional Fund Investor Institutional Name Class Class Name Class Class Wasatch Core Growth Fund *52; ,*5; DVDWFK ,QWHUQDWLRQDO 2SSRUWXQLWLHV )XQG $,2; ,,2; DVDWFK (PHUJLQJ ,QGLD )XQG $,1; ,,1; DVDWFK ,QWHUQDWLRQDO 6HOHFW )XQG $,6; *,6; DVDWFK (PHUJLQJ 0DUNHWV 6HOHFW )XQG $(6; ,(6; Wasatch Micro Cap Fund 0,&; *,&; DVDWFK (PHUJLQJ 0DUNHWV 6PDOO &DS )XQG $(0; ,(0; Wasatch Micro Cap Value Fund $09; *09; Wasatch Frontier Emerging Small $)0; ,)0; Wasatch Small Cap Growth Fund $$(; ,$(; Countries Fund Wasatch Small Cap Value Fund 0&9; ,&9; DVDWFK *OREDO 2SSRUWXQLWLHV )XQG $*2; ,*2; Wasatch Ultra Growth Fund $0&; *0&; Wasatch Global Select Fund $*6; **6; DVDWFK +RLVLQJWRQ 8 6 7UHDVXU )XQG +26; Wasatch Global Value Fund )0,(; , &; DVDWFK ,QWHUQDWLRQDO *URZWK )XQG $,*; ,,*; Beginning January 31, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of DVDWFK )XQGV VKDUHKROGHU UHSRUWV ZLOO QR ORQJHU EH VHQW E PDLO XQOHVV RX VSHFL LFDOO UHTXHVW SDSHU FRSLHV RI WKH UHSRUWV IURP DVDWFK )XQGV RU IURP RXU LQDQFLDO LQWHUPHGLDU VXFK DV D EURNHU GHDOHU RU EDQN ,QVWHDG UHSRUWV ZLOO EH PDGH DYDLODEOH RQ DVDWFK )XQGVo ZHEVLWH ZDVDWFKJOREDO FRP DQG RX ZLOO EH QRWL LHG E PDLO HDFK WLPH D UHSRUW LV SRVWHG DQG SURYLGHG ZLWK D ZHEVLWH OLQN WR DFFHVV WKH UHSRUW ,I RX DOUHDG HOHFWHG WR UHFHLYH VKDUHKROGHU UHSRUWV HOHFWURQLFDOO RX ZLOO QRW EH D HFWHG E WKLV FKDQJH DQG RX QHHG QRW WDNH DQ DFWLRQ RX PD HOHFW WR UHFHLYH VKDUHKROGHU UHSRUWV DQG RWKHU FRPPXQLFDWLRQV IURP DVDWFK )XQGV HOHFWURQLFDOO E FRQWDFWLQJ RXU LQDQFLDO LQWHUPHGLDU VXFK DV D EURNHU GHDOHU RU EDQN RU IRU )XQG VKDUHV KHOG GLUHFWO ZLWK DVDWFK )XQGV E FDOOLQJ RU E HQUROOLQJ LQ H’HOLYHU E ORJJLQJ LQWR RXU DFFRXQW DW KWWSV ZDVDWFKIXQGV RODFFHVV FRP RX PD HOHFW WR UHFHLYH DOO IXWXUH UHSRUWV LQ SDSHU IUHH RI FKDUJH ,I RX LQYHVW WKURXJK D LQDQFLDO LQWHUPHGLDU RX FDQ FRQWDFW RXU LQDQFLDO LQWHUPHGLDU WR UHTXHVW WKDW RX FRQWLQXH UHFHLYLQJ SDSHU FRSLHV RI RXU VKDUHKROGHU UHSRUWV ,I RX LQYHVW GLUHFWO ZLWK DVDWFK )XQGV RX FDQ FDOO WR OHW WKH )XQGV NQRZ RX ZLVK WR FRQWLQXH UHFHLYLQJ SDSHU FRSLHV RI RXU VKDUHKROGHU UHSRUWV RXU HOHFWLRQ WR UHFHLYH UHSRUWV LQ SDSHU ZLOO DSSO WR DOO DVDWFK )XQGV KHOG LQ RXU DFFRXQW LI RX LQYHVW WKURXJK D LQDQFLDO LQWHUPHGLDU RU DOO DVDWFK )XQGV KHOG ZLWK WKH IXQG FRPSOH[ LI RX LQYHVW GLUHFWO ZLWK DVDWFK )XQGV

Wasatch Funds

Salt Lake City, Utah

wasatchglobal.com

800.551.1700

This material must be accompanied or preceded by a prospectus.

Please read the prospectus carefully before you invest.

Wasatch Funds are distributed by ALPS Distributors, Inc.

1

| | |

| Letter to Shareholders — Our Thoughts on Stock Valuations | | |

| | | | |

Ken Korngiebel, CFA Portfolio Manager | |

Jagjit Sahota Portfolio Manager | | DEAR FELLOW SHAREHOLDERS: Because stocks have rebounded so strongly despite the ongoing effects of the coronavirus, we’re frequently asked about the level of valuations in the market. In response, we acknowledge the higher prices but we emphasize that many of our companies — tech-related companies, in particular — have actually benefited from the pandemic because they facilitate activities like working remotely, seeing a doctor online, renovating household spaces and enjoying home-based recreation. Moreover, we think these activities will continue even after the pandemic ends because people have become accustomed to new routines. |

STOCK PRICES ARE FORWARD-LOOKING

Another consideration has to do with the forward-looking nature of stock prices. In this regard, think about the discussion from a recent CNBC interview with Wharton School professor Dr. Jeremy Siegel. The interviewer asked him to assess the effects of potentially lost earnings on stock valuations. Dr. Siegel responded that stocks represent claims on long-term company performance. He said that over 90% of a stock’s worth is generally based on earnings beyond one year into the future. In other words, if a company loses all of its earnings in the current year, the stock price should be down less than 10%. This is a very broad generalization, of course, and from our perspective it assumes the company can stay in business without impairment to its long-term competitive position, without dilution to its ownership structure and without a major increase in debt.

Because so much of a stock’s worth is forward-looking, it can be perfectly rational for a stock to experience a V-shaped recovery in the short term even if it takes the business and the broad economy much longer to get back on track. Additionally, for fast-growing small-cap companies such as those targeted by Wasatch, it’s likely that an even greater percentage of a stock’s worth is based on future earnings.

This is because especially fast growth puts extra emphasis on the future. For example, with the benefit of 20/20 hindsight, we all would have paid what would have seemed like very expensive share prices in the early years of Amazon.com and Netflix if we had known how fast the companies would grow and how long the duration of the growth would be.*

WASATCH’S PERSPECTIVE ON GROWTH-ORIENTED INVESTING

When considering the stock valuations of growth-oriented companies — especially in the current environment of generally elevated prices — we think there are two main points to keep in mind. But before we describe them, let’s start with a discussion of a standard valuation measure: the price/earnings (P/E) ratio.

While we generally prefer metrics like enterprise value to sales (EV/S), the more common expression of the perceived expensiveness of a company is the P/E ratio, which is the stock price divided by the earnings per share (EPS). The P/E ratio can be calculated in several ways — for example, based on trailing earnings or based on projected future earnings. We think most investors would agree that a high-quality company deserves to sell at a greater P/E ratio than a lower-quality company. The question is: How much greater?

At Wasatch Global Investors, we often invest in companies with significantly larger P/E ratios than the ratios for companies in the benchmark indexes. Our reason for this is we believe the high-quality characteristics we emphasize will allow our companies to grow sales and earnings much faster than the average index constituent. In other words, we’re not afraid to “pay up” for growth if, for example, we think a company can double in size within the next five years or so. Moreover, we believe high-quality companies are often better able to maintain operations during periodic downturns (like the current pandemic) and emerge stronger and well-positioned for the long term — even if their stocks are priced somewhat more richly in the short term.

This brings us to our first point. When we invest in a company with a high P/E ratio today, we don’t do so with the expectation the ratio will stay high indefinitely because that would require us to depend on the irrational behavior of other investors. Instead, we plan for P/E ratio contraction.

We try to estimate the company’s earnings about five years into the future. Then we calculate an expected future stock price based on the estimated earnings and based on a lower, less expensive P/E ratio. If the stock price at today’s higher P/E ratio is significantly below the expected future stock price at the less expensive P/E ratio, we think we can make an adequate return.

Our second point is we try to assess the likely duration of a company’s growth at various rates. For example, consider hypothetical investments in two different companies at the same valuation today. One company grows 25% annually for 10 years. The other company grows 25% annually for five years and then 10% annually for the next five years.

After the full 10 years, the company that maintained its 25% annual growth would be almost twice as large as the company that faltered in its growth. As you can see from this example, an investor who made good assessments of the differing growth rates and durations would have been well-rewarded for choosing the company with consistent 25% growth — even if the investor had been willing to pay a somewhat higher starting valuation.

2

FOCUS ON QUALITY FIRST, GROWTH SECOND

At Wasatch, we consider ourselves to be quality-oriented investors first and growth-oriented investors second. In contrast, we think some other growth investors that are less focused on quality get into trouble when there’s a bubble in stock prices for companies that don’t live up to their hype as total game-changers. A prime example was 2000’s peak in the dot-com mania — which, by the way, we at Wasatch largely avoided because we were grounded in our bottom-up research of company fundamentals.

Today, we don’t see a situation that’s analogous to the dot-com mania. Software-as-a-Service (SaaS) companies, for example, really are changing productivity, commerce and entertainment for the better. As mentioned earlier, many of these companies have actually benefited from the pandemic. Moreover, we continue to see headroom for ongoing growth based on new ways of living and conducting business.

An attractive feature of many higher-tech and other non-capital-intensive businesses is they can grow sales quickly without the risk of having to take on large amounts of debt or having to dilute their equity ownership excessively or repeatedly. Although these businesses may have stocks that seem to sell at relatively high P/E ratios, many of the businesses could reduce their sales growth and immediately become much more profitable if necessary. For example, Amazon and Netflix continue to operate with low earnings compared to their sales volumes because it still makes sense to plow cash back into expanding their businesses.

WASATCH OUTLOOK AND POSITIONING

Despite the lingering effects of the pandemic, stock markets around the world remained relatively strong during the third quarter of 2020, supported to a large extent by government-sponsored fiscal measures and accommodative central-bank monetary policies. In fact, the U.S. Federal Reserve recently announced its intention to keep interest rates extremely low for at least the next few years.

A close analysis of stock-price movements during September, however, showed the U.S. generally lagged many international developed markets and emerging markets. In addition, the information-technology sector trailed several other sectors. This underperformance wasn’t surprising to us because the U.S. and the information-technology sector were previously the leading areas of the markets, and it’s often the case that stocks take a breather after strong upward surges.

Going forward, we think that international developed markets and emerging markets — supported by strengthening currencies versus the dollar — may continue to outperform the U.S. as they did in September. After all, non-U.S. markets prior to their recent leadership had lagged the U.S. for several years. And they may still have some catching up to do. Moreover, our research indicates the combination of high-quality businesses and reasonable stock prices is especially prevalent beyond U.S. borders.

As for information technology, the sector holds an important place in our quality-oriented approach to investing because it is being propelled by key secular trends such as remote work, telemedicine and streaming entertainment that could continue to accelerate.

More generally, we believe sales and earnings growth drive stock prices over the long term. We favor industry-leading companies that are largely able to self-fund their growth without much debt and, if possible, without high fixed costs. We also look for sustainable competitive advantages, healthy balance sheets, high returns on capital and strong cash flows.

To sum up, we think well-chosen growth companies will benefit from the fact that today’s worth of a quickly developing business is especially dependent on future earnings. And this characteristic is likely to be reinforced by the Fed’s “lower for longer” interest-rate policy, which also places a premium on the future. So rather than attempting to navigate macro events like vaccine development and political election results, we prefer to stay squarely focused on assessing duration and quality for the long term.

With sincere thanks for your continuing investment and for your trust,

Ken Korngiebel and Jagjit Sahota

| * | As of September 30, 2020, none of the Wasatch Funds held Amazon.com, Inc. or Netflix, Inc. |

Information in this report regarding market or economic trends, or the factors influencing historical or future performance, reflects the opinions of management as of the date of this report. These statements should not be relied upon for any other purpose. Past performance is no guarantee of future results, and there is no guarantee that the market forecasts discussed will be realized.

The recent growth in the stock market has helped to produce short-term returns for some asset classes that are not typical and may not continue in the future.

CFA® is a trademark owned by the CFA Institute.

Wasatch Global Investors is the investment advisor to Wasatch Funds.

Wasatch Funds are distributed by ALPS Distributors, Inc. (ADI). ADI is not affiliated with Wasatch Global Investors.

Definitions of financial terms and index descriptions and disclosures begin on page 38.

3

| | |

| Wasatch Core Growth Fund (WGROX / WIGRX) | | SEPTEMBER 30, 2020 |

Management Discussion

The Wasatch Core Growth Fund is managed by a team of Wasatch portfolio managers led by JB Taylor, Paul Lambert and Mike Valentine.

| | | | |

JB Taylor Lead Portfolio Manager | |

Paul Lambert Portfolio Manager | |

Mike Valentine Portfolio Manager |

OVERVIEW

During the 12-month period ended September 30, 2020, stocks fluctuated wildly in large part due to the outbreak of the novel coronavirus and the ensuing responses. For the full period, the Wasatch Core Growth Fund — Investor Class gained 17.41% while the benchmark Russell 2000 Index increased 0.39% and the Russell 2000 Growth Index rose 15.71%.

Many stocks showed strong returns during the 12 months even though the pandemic remained unresolved. While companies were fairly resilient, no reasonable analyst would minimize the effects on stock prices from support by fiscal initiatives and monetary policies. For example, the U.S. Federal Reserve (Fed) recently announced its plans to keep interest rates extremely low for at least the next few years and to promote higher employment and inflation. In addition, the Fed stepped outside its monetary mandate by publicly encouraging Congress to do even more on the fiscal front to assist individuals and businesses facing hardship.

DETAILS OF THE YEAR

The information-technology and consumer-discretionary sectors were large sources of outperformance relative to the benchmark. In both sectors, a significant weighting and stock selection were key factors. In financials, the Fund benefited from being underweighted and having a few strong performers. Elsewhere, the Fund’s industrials did well and having no energy stocks was fortuitous. On the other hand, lagging returns in health care and an underweight in the sector were detrimental to the Fund’s relative performance.

The Fund’s top contributor was Five9, Inc., which provides contact-center software that is managed and hosted from the cloud. The company offers real-time and historical reporting, quality monitoring, and workforce and customer-relationship-management integrations. The stock benefited from the superiority of cloud-based software, which has become especially evident during the pandemic. On a longer-term basis, Five9 has competitive advantages that make it the dominant growth company in its industry. First, Five9 offers compelling products that address mission-critical customer needs, and the company has been leveraging these products with high research-and-development spending. Second, the company

has been enhancing its products for reliability, functionality and scalability at the enterprise level — thereby opening new revenue opportunities. Third, in our estimation, Five9’s leadership team has talent and depth at the home office and at the regional levels, and the company has created a culture that attracts and retains best-in-class personnel.

The largest detractor from Fund performance was Monro, Inc., a leading chain of automotive-repair shops with more than 1,280 locations spread across 32 states. The company has certainly been impacted in the short term by stay-at-home orders and decreased travel. Also, Monro’s CEO recently resigned to become the CEO of a larger company. Board Chairman Robert Mellor has been appointed interim CEO, and the search for a successor has been initiated. We spoke to Mr. Mellor recently and feel comfortable that a sound, long-term business plan remains in place for the company. Given an already-impressive footprint, we believe Monro still has significant headroom for growth over the next few years despite the company’s short-term challenges.

OUTLOOK

With the success of growth-oriented tech and tech-related stocks over the past several years, many investors are questioning whether there will be a market rotation away from growth stocks and toward value stocks — which are typically in more basic industries like oil drilling, mining and banking. For our part, we don’t think it’s possible to successfully navigate growth and value cycles. Instead, we prefer to stay invested in growth names that meet our strict quality standards.

More broadly, with the Fed committed to near-zero interest rates (and therefore a low cost of capital) for years on end, cash-generative growth companies should be particularly well-positioned to produce attractive returns on invested capital — especially if the companies’ total addressable markets are very large and expanding. Additionally, from a discounted-cash-flow perspective, low interest rates should favor companies that defer profits today in order to achieve large, recurring profits well into the future.

In closing, we’d like to emphasize that our expertise isn’t in trying to predict the intricacies of politics, vaccine development, the “reopening trade” or growth versus value cycles. We leave attempts at those predictions to others. For our part, we prefer to stay immersed in analyzing company fundamentals, activities we think actually give us an edge in the competitive field of investments.

Thank you for the opportunity to manage your assets.

Current and future holdings are subject to risk.

4

| | |

| Wasatch Core Growth Fund (WGROX / WIGRX) | | SEPTEMBER 30, 2020 |

Portfolio Summary

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | | | | | | | | |

| | | |

| | | 1 Year | | 5 Years | | 10 Years |

| | | |

Core Growth (WGROX) — Investor | | | | 17.41% | | | | | 14.43% | | | | | 14.69% | |

| | | |

Core Growth (WIGRX) — Institutional | | | | 17.58% | | | | | 14.59% | | | | | 14.80% | |

| | | |

Russell 2000® Index | | | | 0.39% | | | | | 8.00% | | | | | 9.85% | |

| | | |

Russell 2000® Growth Index | | | | 15.71% | | | | | 11.42% | | | | | 12.34% | |

Data show past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit wasatchglobal.com. The Advisor may absorb certain Fund expenses, without which total returns would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2020 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Core Growth Fund are Investor Class: 1.19% / Institutional Class — Gross: 1.09%, Net: 1.05%. The expense ratio shown elsewhere in this report may be different. Net expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch will deduct a 2.00% redemption fee on Fund shares held 60 days or less. Performance data do not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Performance for the Institutional Class prior to 1/31/2012 is based on the performance of the Investor Class. Performance of the Fund’s Institutional Class prior to 1/31/2012 uses the actual expenses of the Fund’s Investor Class without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses.

Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus.

TOP 10 EQUITY HOLDINGS*

| | | | |

| |

| Company | | % of Net Assets | |

| |

Pool Corp. | | | 3.8% | |

| |

ICON plc (Ireland) | | | 3.1% | |

| |

Trex Co., Inc. | | | 3.0% | |

| |

Paylocity Holding Corp. | | | 2.9% | |

| |

Floor & Decor Holdings, Inc., Class A | | | 2.8% | |

| | | | |

| |

| Company | | % of Net Assets | |

| |

Monolithic Power Systems, Inc. | | | 2.7% | |

| |

Five9, Inc. | | | 2.7% | |

| |

Medpace Holdings, Inc. | | | 2.6% | |

| |

Morningstar, Inc. | | | 2.6% | |

| |

Ensign Group, Inc. (The) | | | 2.4% | |

| * | As of September 30, 2020, there were 58 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

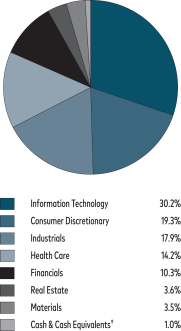

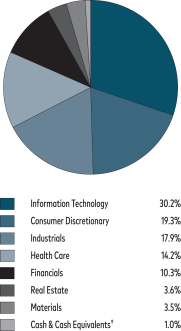

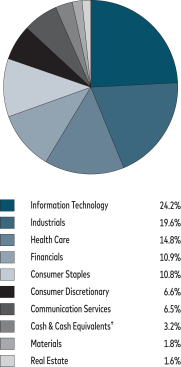

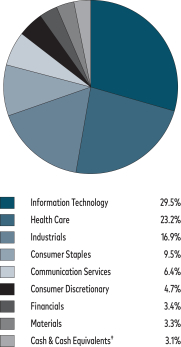

SECTOR BREAKDOWN**

| ** | Excludes securities sold short and options written, if any. |

| † | Also includes Other Assets & Liabilities. |

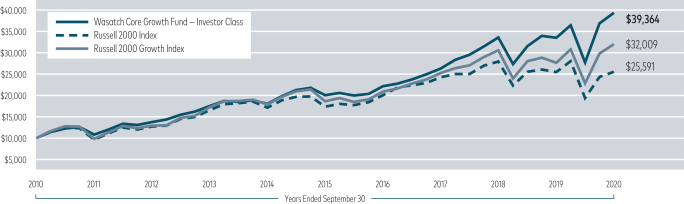

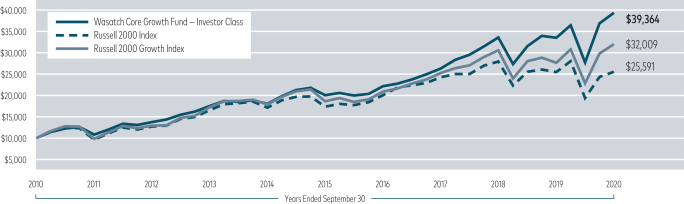

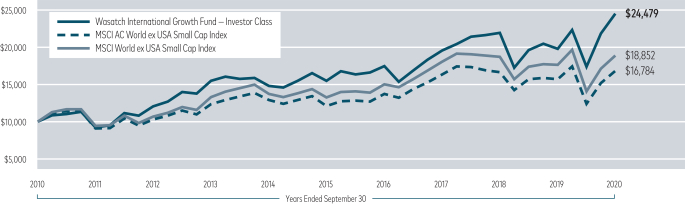

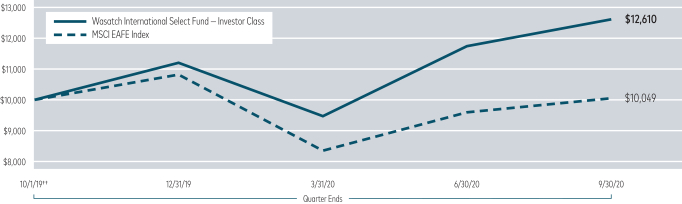

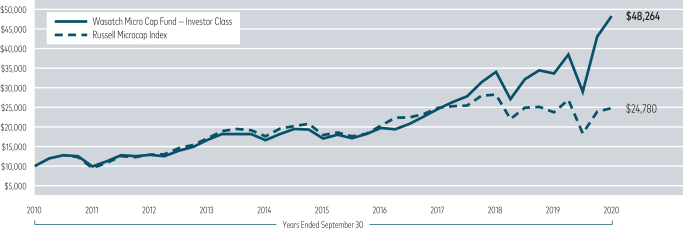

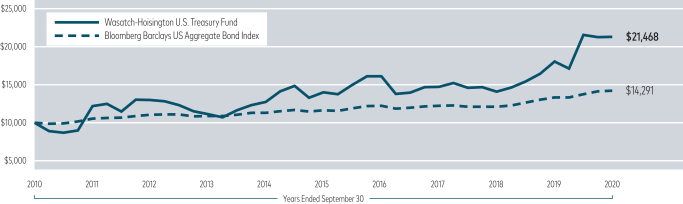

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees.

5

| | |

| Wasatch Emerging India Fund (WAINX / WIINX) | | SEPTEMBER 30, 2020 |

Management Discussion

The Wasatch Emerging India Fund is managed by a team of Wasatch portfolio managers led by Ajay Krishnan and Matthew Dreith.

| | | | |

Ajay Krishnan, CFA Lead Portfolio Manager | |

Matthew Dreith, CFA Portfolio Manager | | OVERVIEW Although the coronavirus pandemic roiled equity markets during the 12-month period ended September 30, 2020, the Wasatch Emerging India |

Fund — Investor Class declined only -0.38%. The Fund modestly underperformed the benchmark MSCI India Investable Market Index (IMI), which rose 1.10%.

During the second half of the period, Indian equities moved solidly higher amid better-than-expected corporate earnings and strong inflows of foreign capital. Restrictions on the activities of individuals and businesses eased as the government continued to unlock India’s economy in phases. Many investors are now optimistic regarding consumer sentiment heading into the annual festive season. The period from mid-October through December is typically the busiest time of the year in India for sales of big-ticket items such as gold jewelry, automobiles and apartments.

Additionally, manufacturing activity in September jumped to its highest level in more than eight years — which helped to reassure investors that India’s economy was on the mend following a sharp contraction in the April-to-June quarter. As for agriculture, India has reported the best monsoon rainfall in the past six years. This has improved crop yields and should also support gross domestic product (GDP) growth and rural consumption.

DETAILS OF THE YEAR

Although financials were down for the 12 months, the Fund benefited relative to the benchmark from favorable stock selection. Regarding communication services, the Fund saw excellent relative performance in a strong sector. Health care also proved advantageous, as the Fund was overweighted in this highflying sector. On the other hand, the Fund was disadvantaged by having no exposure to soaring energy stocks. Also on the negative side of the ledger, the Fund experienced poor stock performance among consumer-discretionary names.

Top contributors for the Fund included Divi’s Laboratories Ltd. and Info Edge India Ltd. Divi’s produces active pharmaceutical ingredients and intermediates. The company has benefited as international manufacturers of pharmaceuticals shift supply chains out of China or seek secondary sources of supply. Info Edge runs an online job-posting website and leading internet portals dedicated to matrimony, real estate and education. Following a sharp drop-off during India’s Covid-19 lockdown, traffic on the company’s flagship

recruitment-solutions platform has increased in recent months. Management noted significant acceleration in the real-estate segment as well. The matrimony segment of Info Edge also has benefited as Indians sheltering in place browsed the company’s portal, uploaded their profiles and availed themselves of industry-first video applications.

Financial companies accounted for several of the Fund’s greatest detractors. Among these were Bajaj Finance Ltd., AU Small Finance Bank Ltd. and Aavas Financiers Ltd. Bajaj is a non-bank financial company (NBFC) offering a broad spectrum of lending services. AU is a small finance bank that primarily targets unbanked and underbanked low- and middle-income individuals and small businesses. Aavas is an NBFC specializing in housing loans to low- and middle-income customers in semi-urban and rural areas. After contacting all three of these companies, we believe they have ample capital buffers and we expect them to emerge from the coronavirus crisis even stronger. We used the sharp declines in their share prices to add selectively to our positions. We think Bajaj is particularly well-situated because it focuses on India’s salaried class, whose loan payments are often made through automatic transfers.

OUTLOOK

In August, Federal Reserve Chairman Jerome Powell announced a new, more accommodative approach to U.S. monetary policy. As governments around the world struggle to revive their economies from virus-induced slowdowns, we think the Fed’s shift toward keeping U.S. interest rates lower for longer will prove especially beneficial for countries such as India.

India’s government and central bank sometimes find themselves hamstrung by rising energy prices. Because India imports about 80% of the oil it uses, higher-priced oil widens the country’s current-account deficit and stokes inflation. That, in turn, forces the Reserve Bank of India to keep interest rates high to defend the currency, and limits the government’s ability to run large deficits without scaring away the foreign capital needed to fund them. Although the risk of escalating crude-oil prices seems remote in the current environment, other factors can also create inflationary pressures that constrain efforts by India’s government and central bank to stimulate economic growth.

By making the U.S. dollar less attractive to international investors, the Fed’s new approach should give India’s policy makers some additional breathing room on both the fiscal and monetary sides. Moreover, we think the Fed’s updated monetary framework is likely to provide India and other emerging markets with a tailwind for at least the next few years.

Thank you for the opportunity to manage your assets.

Current and future holdings are subject to risk.

6

| | |

| Wasatch Emerging India Fund (WAINX / WIINX) | | SEPTEMBER 30, 2020 |

Portfolio Summary

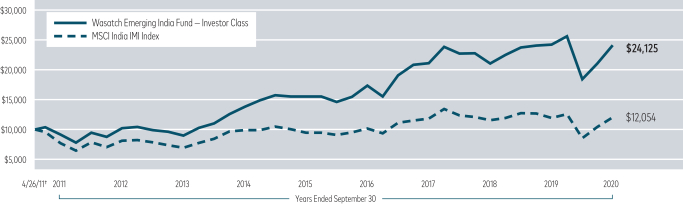

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | | | | | | | | |

| | | |

| | | 1 Year | | 5 Years | | Since Inception 4/26/2011 |

| | | |

Emerging India (WAINX) — Investor | | | | -0.38% | | | | | 9.25% | | | | | 9.79% | |

| | | |

Emerging India (WIINX) — Institutional | | | | -0.15% | | | | | 9.44% | | | | | 9.89% | |

| | | |

MSCI India IMI | | | | 1.10% | | | | | 5.01% | | | | | 2.00% | |

Data show past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit wasatchglobal.com. The Advisor may absorb certain Fund expenses, without which total returns would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2020 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Emerging India Fund are Investor Class: 1.68% / Institutional Class: 1.49%. The expense ratio shown elsewhere in this report may be different. Net expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch will deduct a 2.00% redemption fee on Fund shares held 60 days or less. Performance data do not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Performance for the Institutional Class prior to 2/1/2016 is based on the performance of the Investor Class. Performance of the Fund’s Institutional Class prior to 2/1/2016 uses the actual expenses of the Fund’s Investor Class without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses.

Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Investing in foreign securities, especially in emerging markets, entails special risks, such as unstable currencies, highly volatile securities markets and political and social instability, which are described in more detail in the prospectus. Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Being non-diversified, the Fund can invest a larger portion of its assets in the stocks of a limited number of companies than a diversified fund. Non-diversification increases the risk of loss to the Fund if the values of these securities decline.

TOP 10 EQUITY HOLDINGS*

| | | | |

| |

| Company | | % of Net Assets | |

| |

Bajaj Finance Ltd. (India) | | | 8.7% | |

| |

Divi’s Laboratories Ltd. (India) | | | 7.0% | |

| |

HDFC Bank Ltd. (India) | | | 6.0% | |

| |

Mindtree Ltd. (India) | | | 5.9% | |

| |

Larsen & Toubro Infotech Ltd. (India) | | | 5.8% | |

| | | | |

| |

| Company | | % of Net Assets | |

| |

Info Edge India Ltd. (India) | | | 5.3% | |

| |

Avenue Supermarts Ltd. (India) | | | 4.8% | |

| |

Dr. Lal PathLabs Ltd. (India) | | | 4.5% | |

| |

Trent Ltd. (India) | | | 4.5% | |

| |

Britannia Industries Ltd. (India) | | | 4.4% | |

| * | As of September 30, 2020, there were 27 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

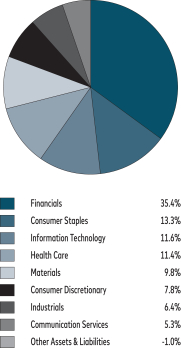

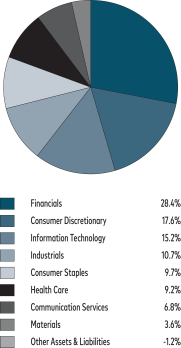

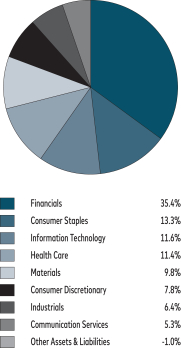

SECTOR BREAKDOWN**

| ** | Excludes securities sold short and options written, if any. |

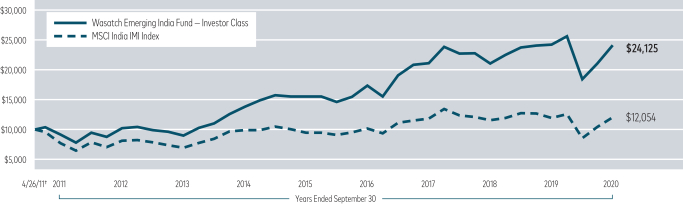

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

†Inception: April 26, 2011. Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees.

7

| | |

| Wasatch Emerging Markets Select Fund (WAESX / WIESX) | | SEPTEMBER 30, 2020 |

Management Discussion

The Wasatch Emerging Markets Select Fund is managed by a team of Wasatch portfolio managers led by Ajay Krishnan, Scott Thomas and Matthew Dreith.

| | | | |

Ajay Krishnan, CFA Lead Portfolio Manager | |

Scott Thomas, CFA Associate Portfolio

Manager | |

Matthew Dreith, CFA Associate Portfolio

Manager |

OVERVIEW

Despite the arrival of the coronavirus pandemic during the 12-month period ended September 30, 2020, the Wasatch Emerging Markets Select Fund — Investor Class rose 27.12%. The Fund significantly outperformed the benchmark MSCI Emerging Markets Index, which increased 10.54%.

Optimism for a rapid economic recovery drove solid gains in emerging-market equities during the second half of the period. A flagging U.S. dollar and progress toward vaccines and therapeutics also encouraged investors. Appreciation of emerging-market currencies against the dollar boosted performance of both the Fund and the Index. In addition to its direct effects on performance, a falling dollar supports riskier assets in emerging markets by increasing their appeal to international investors. A weaker greenback also makes it easier for developing nations to issue debt denominated in their own currencies. The dollar dropped to two-year lows against a basket of major rivals after the Federal Reserve unveiled a more accommodative approach to monetary policy.

DETAILS OF THE YEAR

From a country perspective, the Fund benefited relative to the benchmark from especially advantageous stock selection in Taiwan and Brazil. China, including Hong Kong, also contributed to the Fund’s return, but a larger weighting there would have been beneficial to relative performance. On the negative side of the ledger, the Fund was hurt by poor results in Korea and a sizable allocation and underperformance in India.

The Fund’s top contributor for the 12-month period was Silergy Corp., a Taiwanese manufacturer of high-performance mixed-signal and analog integrated circuits (ICs) used in a wide array of electronic devices. The company’s products include step-down regulators, step-up regulators, linear regulators, protection switches, power-management ICs and audio amplifiers. We think Silergy’s business model — which is based on analog design engineering — is difficult to replicate and is likely to provide the company with significant headroom for growth over the coming decade. On a shorter-term basis, strong revenues have recently helped alleviate concerns about potentially weak demand from China.

The Fund’s largest detractor was Bajaj Finance Ltd., a leading Indian non-bank financial company that offers a broad spectrum of lending services. The company’s shares languished earlier in the period as strict stay-at-home orders and a government-imposed moratorium on loan repayments battered Indian financials. Confident in the ability of Bajaj to ride out the pandemic and emerge stronger competitively, we continued to hold the Fund’s position. Our patience was rewarded with a rebound in the stock as the phased unlocking of India’s economy drove steady improvement in the company’s collection efficiency. Still, the stock hasn’t fully recovered its losses for the period.

OUTLOOK

We expect China to remain in the spotlight regarding issues such as the country’s response to the outbreak of Covid-19 in Wuhan, the Hong Kong national security law, human-rights concerns, and a host of issues related to trade and intellectual property. In a speech meant to demonstrate the failure of engagement efforts with China, U.S. Secretary of State Michael Pompeo added accusations of general nefariousness, lying, global hegemony, tyranny and communism.

For its part, China may already have concluded that — no matter what it does — the United States will never accept China’s rise and will instead seek to constrain it. If so, China’s leaders have little incentive to make concessions designed to appease U.S. antagonism. In the short term, this tension may create some volatility in emerging-market stocks. From a longer-term perspective, however, China appears to already have reached critical mass in terms of its own economy and sphere of influence. As a result, it’s doubtful that U.S.-led containment efforts will succeed to any significant degree. Put simply, we think China is too big to ignore, and we believe its relative contribution to world gross domestic product is only likely to increase from here.

Beyond China, we think Covid-19 has highlighted technological changes that are here to stay. In particular, the abrupt transformation of the workplace through videoconferencing and productivity platforms — initially adopted out of necessity — now appears likely to benefit both businesses and their employees going forward. In short, we expect what began as social-distancing requirements during the coronavirus pandemic to hasten a broad societal trend that had already been underway. We believe emerging markets with young populations are uniquely positioned to reap the benefits of these changes.

Thank you for the opportunity to manage your assets.

Current and future holdings are subject to risk.

8

| | |

| Wasatch Emerging Markets Select Fund (WAESX / WIESX) | | SEPTEMBER 30, 2020 |

Portfolio Summary

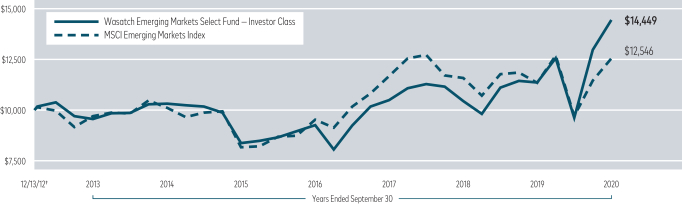

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | | | | | | | | |

| | | |

| | | 1 Year | | 5 Years | | Since Inception 12/13/2012 |

| | | |

Emerging Markets Select (WAESX) — Investor | | |

| 27.21%

|

| | |

| 11.50%

|

| | |

| 4.83%

|

|

| | | |

Emerging Markets Select (WIESX) — Institutional | | |

| 27.58%

|

| | |

| 11.80%

|

| | |

| 5.15%

|

|

| | | |

MSCI Emerging Markets Index | | |

| 10.54%

|

| | |

| 8.97%

|

| | |

| 2.95%

|

|

Data show past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit wasatchglobal.com. The Advisor may absorb certain Fund expenses, without which total returns would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2020 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Emerging Markets Select Fund are Investor Class — Gross: 1.97%, Net: 1.51% / Institutional Class — Gross: 1.43%, Net: 1.21%. The expense ratio shown elsewhere in this report may be different. Net expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch will deduct a 2.00% redemption fee on Fund shares held 60 days or less. Performance data do not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus. Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Being non-diversified, the Fund can invest a larger portion of its assets in the stocks of a limited number of companies than a diversified fund. Non-diversification increases the risk of loss to the Fund if the values of these securities decline.

TOP 10 EQUITY HOLDINGS*

| | | | |

| |

| Company | | % of Net Assets | |

| |

Bajaj Finance Ltd. (India) | | | 7.2% | |

| |

MercadoLibre, Inc. | | | 5.7% | |

| |

HDFC Bank Ltd. (India) | | | 5.1% | |

| |

Silergy Corp. (Taiwan) | | | 5.0% | |

| |

Sea Ltd. ADR (Singapore) | | | 4.7% | |

| | | | |

| |

| Company | | % of Net Assets | |

| |

Larsen & Toubro Infotech Ltd. (India) | | | 4.2% | |

| |

Globant S.A. (Argentina) | | | 4.1% | |

| |

Voltronic Power Technology Corp. (Taiwan) | | | 3.6% | |

| |

Raia Drogasil S.A. (Brazil) | | | 3.5% | |

| |

Wuxi Biologics Cayman, Inc. (China) | | | 3.2% | |

| * | As of September 30, 2020, there were 41 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

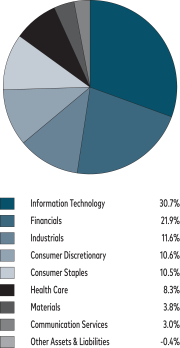

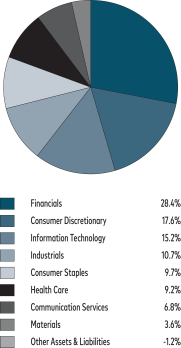

SECTOR BREAKDOWN**

| ** | Excludes securities sold short and options written, if any. |

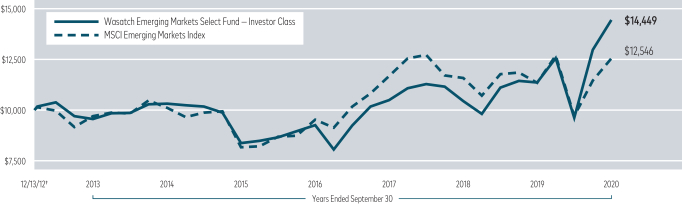

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

†Inception: December 13, 2012. Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees.

9

| | |

| Wasatch Emerging Markets Small Cap Fund (WAEMX / WIEMX) | | SEPTEMBER 30, 2020 |

Management Discussion

The Wasatch Emerging Markets Small Cap Fund is managed by a team of Wasatch portfolio managers led by Ajay Krishnan, Dan Chace, Scott Thomas and Kevin Unger.

| | | | |

Ajay Krishnan, CFA Lead Portfolio Manager

Scott Thomas, CFA Associate Portfolio Manager | |

Dan Chace, CFA Portfolio Manager

Kevin Unger, CFA Associate Portfolio Manager | | OVERVIEW Although the coronavirus pandemic took hold during the 12-month period ended September 30, 2020, the Wasatch Emerging Markets Small Cap Fund — Investor Class gained 21.12%. The Fund meaningfully outperformed the benchmark MSCI Emerging Markets Small Cap Index, which rose 6.89%. Following steep |

|

Covid-related losses, emerging-market equities rebounded during the second half of the period as economies battered by the virus began to reopen and hopes grew that vaccines and therapeutics would be developed. Stimulus measures enacted by governments and central banks also encouraged investors.

Moreover, our emphasis on what we consider high-quality companies with strong balance sheets and robust business models served the Fund well. Against a backdrop of heightened uncertainty, well-situated firms with the potential to survive and benefit from consolidation in their industries became more appealing to investors.

DETAILS OF THE YEAR

Although business conditions in many developing nations remained poor, not all companies were affected equally. The pandemic has been accelerating the adoption of e-commerce, social media and other technologies that replace person-to-person contact with digital content. We tend to focus our research on businesses we believe are aligned with broad societal trends. Companies that have been benefiting from increased use of digital forms of interaction were among the key contributors to Fund performance during the period.

In terms of countries, the Fund’s return relative to the benchmark was helped by favorable stock selection in Taiwan, Brazil, Argentina and Hong Kong. Conversely, Korea was a source of disappointment because our holdings lagged the benchmark’s Korean positions and the Fund was underweighted in a country that saw strong returns overall. Similarly, we were disappointed by the Fund’s performance in Mexico, where our overweight position was disadvantageous and where our holdings trailed the benchmark’s Mexican constituents.

One of the Fund’s largest contributors was Microport Scientific Corp., which is based in Shanghai, China. The company manufactures interventional and minimally invasive devices for keyhole surgery. While Microport’s current products are used in the treatment of vascular diseases, the company is developing additional devices to treat diabetes and orthopedic disorders. Reports that a well-respected, Asia-focused private-equity firm had acquired an ownership stake sent Microport’s stock price soaring.

Indian financial companies accounted for some of the Fund’s greatest detractors, including Bajaj Finance Ltd., AU Small Finance Bank Ltd. and Aavas Financiers Ltd. Bajaj is a non-bank financial company (NBFC) offering a broad spectrum of lending services. AU is a small finance bank that primarily targets unbanked and underbanked low- and middle-income individuals and small businesses. Aavas is an NBFC specializing in housing loans to low- and middle-income customers in semi-urban and rural areas. After contacting all three of these companies, we believe they have ample capital buffers and we expect them to emerge from the coronavirus crisis even stronger. We think Bajaj is particularly well-situated because it focuses on India’s salaried class, whose loan payments are often made through automatic transfers.

OUTLOOK

In September, Chinese manufacturing activity grew faster than expected. Driven by a pickup in export demand as global economies reopened, China’s economic recovery appears to be on relatively firm footing. Consumption also increased as the Chinese government continued to ease restrictions on travel and in-person entertainment. China’s success in battling the Covid-19 pandemic has cemented its substantial regional influence and growing economic status. These developments aren’t difficult to understand. As of this writing, China’s vast industrial sector has approached its pre-pandemic might — fueled by government-funded infrastructure expansion, rising exports and pent-up demand.

Of course, investing in China carries its own unique set of risks. Among these are the country’s deepening disputes with the U.S. over issues such as trade, technology and the situation in Hong Kong. When researching companies to own in the Fund, we seek firms whose fortunes are comparatively independent of geopolitics. We look for growing businesses that we think are well-positioned to benefit from secular trends in areas that include health care and technology.

We believe China will continue to develop and open up its economy. At the same time, we think ongoing improvements in China’s financial markets will deepen liquidity and attract increasing capital flows from around the world.

Thank you for the opportunity to manage your assets.

Current and future holdings are subject to risk.

10

| | |

| Wasatch Emerging Markets Small Cap Fund (WAEMX / WIEMX) | | SEPTEMBER 30, 2020 |

Portfolio Summary

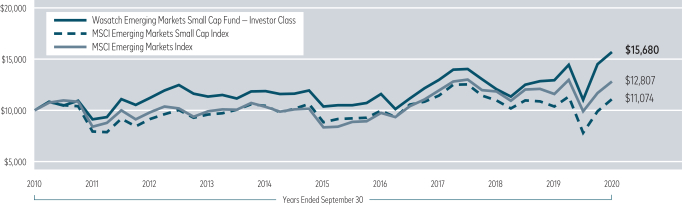

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | | | | | | | | |

| | | |

| | | 1 Year | | 5 Years | | 10 Years |

| | | |

Emerging Markets Small Cap (WAEMX) — Investor | | | | 21.12% | | | | | 8.62% | | | | | 4.60% | |

| | | |

Emerging Markets Small Cap (WIEMX) — Institutional | | | | 21.41% | | | | | 8.74% | | | | | 4.66% | |

| | | |

MSCI Emerging Markets Small Cap Index | | | | 6.89% | | | | | 4.60% | | | | | 1.03% | |

| | | |

MSCI Emerging Markets Index | | | | 10.54% | | | | | 8.97% | | | | | 2.50% | |

Data show past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit wasatchglobal.com. The Advisor may absorb certain Fund expenses, without which total returns would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2020 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Emerging Markets Small Cap Fund are Investor Class — Gross: 1.99%, Net: 1.97% / Institutional Class — Gross: 1.85%, Net: 1.82%. The expense ratio shown elsewhere in this report may be different. Net expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch will deduct a 2.00% redemption fee on Fund shares held 60 days or less. Performance data do not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Performance for the Institutional Class prior to 2/1/2016 is based on the performance of the Investor Class. Performance of the Fund’s Institutional Class prior to 2/1/2016 uses the actual expenses of the Fund’s Investor Class without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses.

Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus. Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Being non-diversified, the Fund can invest a larger portion of its assets in the stocks of a limited number of companies than a diversified fund. Non-diversification increases the risk of loss to the Fund if the values of these securities decline.

TOP 10 EQUITY HOLDINGS*

| | | | |

| |

| Company | | % of Net Assets | |

| |

Voltronic Power Technology Corp. (Taiwan) | | | 5.5% | |

| |

Silergy Corp. (Taiwan) | | | 5.0% | |

| |

Magazine Luiza S.A. (Brazil) | | | 4.6% | |

| |

Globant S.A. (Argentina) | | | 4.6% | |

| |

Bajaj Finance Ltd. (India) | | | 3.1% | |

| | | | |

| |

| Company | | % of Net Assets | |

| |

Raia Drogasil S.A. (Brazil) | | | 3.1% | |

| |

Larsen & Toubro Infotech Ltd. (India) | | | 3.1% | |

| |

Info Edge India Ltd. (India) | | | 3.0% | |

| |

Mindtree Ltd. (India) | | | 3.0% | |

| |

ICICI Lombard General Insurance Co. Ltd. (India) | | | 3.0% | |

| * | As of September 30, 2020, there were 53 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

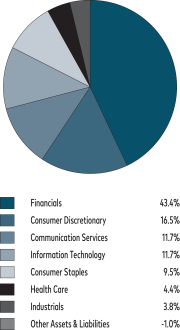

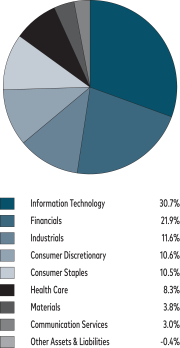

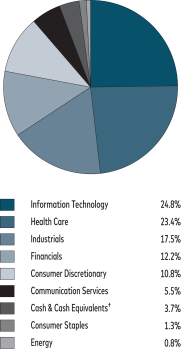

SECTOR BREAKDOWN**

| ** | Excludes securities sold short and options written, if any. |

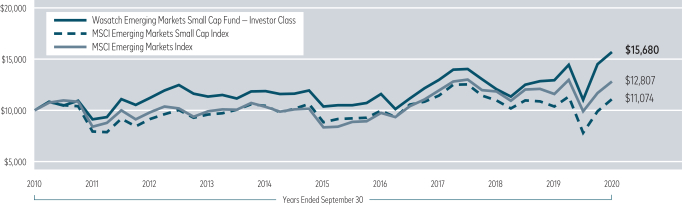

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees.

11

| | |

| Wasatch Frontier Emerging Small Countries Fund (WAFMX / WIFMX) | | SEPTEMBER 30, 2020 |

Management Discussion

The Wasatch Frontier Emerging Small Countries Fund is managed by a team of Wasatch portfolio managers led by Scott Thomas.

| | |

Scott Thomas, CFA Lead Portfolio Manager | | OVERVIEW The Wasatch Frontier Emerging Small Countries Fund — Investor Class finished the fiscal year ended September 30, 2020 with a gain of 9.85%, significantly outperforming its benchmark, the MSCI Frontier Emerging Markets Index, which declined -11.52% over the same period. |

Macroeconomic concerns, including upcoming elections in numerous countries, ongoing trade wars and the coronavirus pandemic, made the past 12-month period an unprecedented time. That said, we believe signs generally have been positive relative to worst-case projections earlier in 2020 following the onset of the pandemic. Certainly, given the unprecedented market environment, it was easy to envision a more muted outcome.

DETAILS OF THE YEAR

MercadoLibre, Inc., whose stock is traded in the U.S., was the largest individual contributor to the Fund’s return for the 12-month period. The company operates e-commerce platforms in Latin America. We believe MercadoLibre’s investments into payment and logistics opportunities has been paying off in the current environment, which has seemed to favor companies facilitating access to digital payment platforms.

As the demand for and adoption of online shopping has accelerated during the pandemic, we believe e-commerce is an industry in which companies may have valuations that appear high compared to their pre-pandemic levels, but that may in fact be justified by the industry’s growth. A Fund holding that highlights the dramatic rise of e-commerce across the world is Sea Ltd., a Singapore-based company and one of our top contributors for the fiscal year. The company’s offerings include digital gaming content, e-commerce and digital-payment platforms across Southeast Asia. We believe Sea’s market position is advantageous and we expect that will help the company to continue to grow over the long-term, in addition to being aided by rapid digitalization across the region in countries such as Indonesia, Vietnam, the Philippines and Thailand to name a few.

Globant S.A., a software-solutions company headquartered in Argentina, was also among the Fund’s top overall contributors. Globant provides engineering, design and innovation services for clients in North and South America, Europe and other regions. The large-scale migration of corporate clients to digital platforms has been benefiting IT service providers such as Globant. The company is considered a world-wide leader in digital-strategy consulting services.

AU Small Finance Bank Ltd. was the most-significant individual detractor from Fund performance for the period.

Based in India, AU primarily serves underbanked low- and middle-income individuals and small businesses. Indian financials have faced challenges in recent months. In addition to their stocks selling off early in the pandemic, financial institutions have also reckoned with stringent economic measures from the government in response to the crisis.

Philippine Seven Corp. was another of the Fund’s largest individual detractors. The company licenses the operation of 7-Eleven convenience stores in the Philippines, as well as leasing and constructing commercial real estate. The pandemic is likely to impact the company’s earnings over the short term, but we believe it should bounce back quickly and resume its earnings trajectory once the environment normalizes. However, we are monitoring Philippine Seven to make sure our investment thesis continues to hold true.

Cleopatra Hospital also detracted, but we continue to like the company’s long-term prospects. Cleopatra is the largest private hospital operator in Egypt and is at the forefront of consolidating a fragmented and underdeveloped hospital market. Egypt has a population of nearly 100 million people, a significant undersupply of hospital beds, and one of the lowest levels of health care spending per capita in the region. As a result, we believe demand for Cleopatra’s services is set to grow at a rapid pace.

OUTLOOK

The 12-month period was dominated by unique macroeconomic factors, not the least of which is the ongoing global pandemic. While we are cognizant of these factors and their potential impacts, we strive to be “macro aware” rather than “macro driven.” We have found that the news of the day rarely has much relevance to the fundamental investment thesis we develop for each of our holdings. Our investment thesis is grounded in research of company fundamentals — including whether a company has adequate cash reserves and a management team capable of guiding it through crises like the current one.

Indeed, in addition to highlighting the value of a bottom-up focus on fundamentals, we believe the current environment also highlights the value of thoughtful, active management with an eye toward the longer term. We believe our disciplined approach to investing in frontier markets and emerging small countries accounted for the strength of the Fund and was key to positive performance in an otherwise uncertain year for these markets.

Thank you for the opportunity to manage your assets.

Current and future holdings are subject to risk.

12

| | |

| Wasatch Frontier Emerging Small Countries Fund (WAFMX / WIFMX) | | SEPTEMBER 30, 2020 |

Portfolio Summary

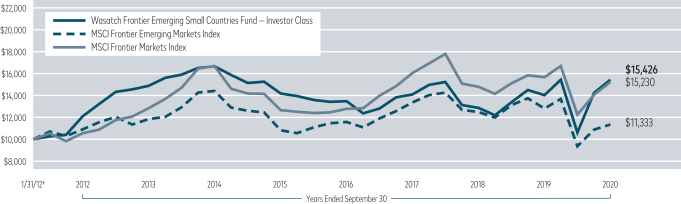

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | | | | | | | | |

| | | |

| | | 1 Year | | 5 Years | | Since Inception 1/31/2012 |

| | | |

Frontier Emerging Small Countries (WAFMX) — Investor | | | | 10.22% | | | | | 1.71% | | | | | 5.13% | |

| | | |

Frontier Emerging Small Countries (WIFMX) — Institutional | | | | 10.51% | | | | | 1.98% | | | | | 5.29% | |

| | | |

MSCI Frontier Emerging Markets Index | | | | -11.52% | | | | | 0.92% | | | | | 1.45% | |

| | | |

MSCI Frontier Markets Index | | | | -2.74% | | | | | 3.76% | | | | | 4.97% | |

Data show past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit wasatchglobal.com. The Advisor may absorb certain Fund expenses, without which total returns would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2020 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Frontier Emerging Small Countries Fund are Investor Class — Gross: 2.30%, Net: 2.20% / Institutional Class — Gross: 2.15%, Net: 2.00%. The expense ratio shown elsewhere in this report may be different. Net expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch will deduct a 2.00% redemption fee on Fund shares held 60 days or less. Performance data do not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Performance for the Institutional Class prior to 2/1/2016 is based on the performance of the Investor Class. Performance of the Fund’s Institutional Class prior to 2/1/2016 uses the actual expenses of the Fund’s Investor Class without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses.

Investing in foreign securities, especially in frontier and emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus. Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Being non-diversified, the Fund can invest a larger portion of its assets in the stocks of a limited number of companies than a diversified fund. Non-diversification increases the risk of loss to the Fund if the values of these securities decline.

TOP 10 EQUITY HOLDINGS*

| | | | |

| |

| Company | | % of Net Assets | |

| |

Sea Ltd. ADR (Singapore) | | | 9.0% | |

| |

MercadoLibre, Inc. | | | 7.0% | |

| |

Globant S.A. (Argentina) | | | 5.2% | |

| |

Qualitas Controladora S.A.B. de C.V. (Mexico) | | | 4.7% | |

| |

Bajaj Finance Ltd. (India) | | | 4.6% | |

| | | | |

| |

| Company | | % of Net Assets | |

| |

TCS Group Holding plc (Russia) | | | 4.5% | |

| |

Raia Drogasil S.A. (Brazil) | | | 4.5% | |

| |

TQM Corp. Public Co. Ltd. (Thailand) | | | 4.3% | |

| |

Naspers Ltd., Class N (South Africa) | | | 3.9% | |

| |

Bank for Foreign Trade of Vietnam JSC (Vietnam) | | | 3.8% | |

| * | As of September 30, 2020, there were 39 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

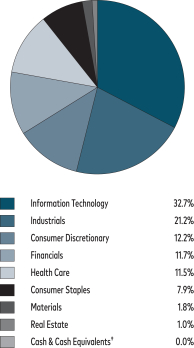

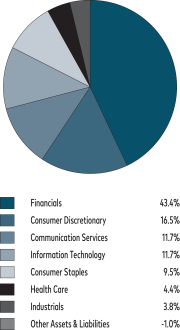

SECTOR BREAKDOWN**

| ** | Excludes securities sold short and options written, if any. |

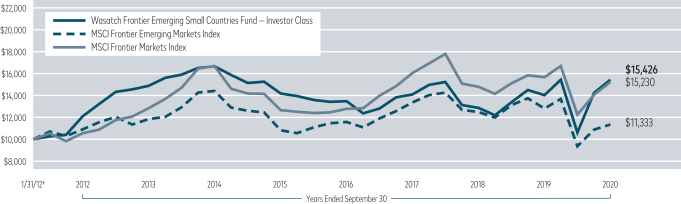

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

†Inception: January 31, 2012. Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees.

13

| | |

| Wasatch Global Opportunities Fund (WAGOX / WIGOX) | | SEPTEMBER 30, 2020 |

Management Discussion

The Wasatch Global Opportunities Fund is managed by a team of Wasatch portfolio managers led by JB Taylor, Ajay Krishnan, Ken Applegate and Paul Lambert.

| | | | |

JB Taylor Lead Portfolio Manager

Ken Applegate, CFA Portfolio Manager | |

Ajay Krishnan, CFA Lead Portfolio Manager

Paul Lambert Portfolio Manager | | OVERVIEW The Wasatch Global Opportunities Fund — Investor Class finished the fiscal year ended September 30, 2020 with a gain of 23.20%, significantly outperforming its benchmark, the MSCI AC (All Country) World Small Cap Index, which gained 3.22% over the same period. A large portion of the Fund’s outper- |

|

formance of the benchmark came from the information-technology (IT) sector. Going forward, it’s certainly possible that tech companies may have short-term trouble exceeding their recent success and that other sectors may outpace IT for a period of time. It’s also possible that value-oriented stocks may temporarily outshine growth-oriented stocks. But we don’t attempt to navigate such cycles in the market. Instead, we remain focused on the fundamentals of individual companies: management quality, business-model viability, scope for increased market share and market expansion, returns on capital and balance-sheet health.

DETAILS OF THE YEAR

Beyond the contribution from IT, the Fund’s outperformance of the benchmark was aided by stock selection, most notably in the U.S., Japan, the United Kingdom and Taiwan. India, Korea and Mexico were among the markets where the Fund had lagging performance for the 12-month period.

Taiwan-based Silergy Corp. was the top individual contributor to Fund performance for the year. The company manufactures high-performance mixed-signal and analog integrated circuits used in a wide variety of consumer and enterprise electronic devices.

Globant S.A., a software-solutions company headquartered in Argentina, was also among the Fund’s top overall contributors. Globant provides engineering, design and innovation services for clients in North and South America, Europe and other regions. The large-scale migration of corporate clients to digital platforms has been benefiting IT service providers such as Globant. The company is considered a world-wide leader in digital-strategy consulting services.

Another leading contributor was MercadoLibre, Inc. The company operates e-commerce platforms in Latin America.

We believe MercadoLibre’s investments into payment and logistics opportunities have been paying off in the current environment, which has seemed to favor companies facilitating access to digital payment platforms.

Indian financials have faced challenges in recent months. In addition to their stocks selling off early in the pandemic, financial institutions have also reckoned with stringent economic measures from the government in response to the crisis. India-based financial firms — AU Small Finance Bank Ltd. and Bajaj Finance Ltd. — were two of the Fund’s most-significant detractors for the 12-month period. AU is a bank that primarily serves underbanked low- and middle-income individuals and small businesses. Bajaj is a non-bank financial company. We are optimistic that positive trends in the most-recent quarter may continue over the long-term and believe both companies should benefit from pent-up demand as India slowly returns to normalcy.

Euronet Worldwide, Inc. was also a notable detractor. The company provides electronic-payment services, including automated teller machines, point-of-sale services and related financial services. Despite the anticipated drop-off in financial transactions due to the pandemic, we believe Euronet has the ability to generate double-digit annual sales growth over the long term, fueled by its meaningfully improved earnings and potential to generate significant free cash flows.

OUTLOOK

The 12-month period was dominated by unique macroeconomic factors, not the least of which is the ongoing global pandemic. While we are cognizant of these factors and their potential impacts, we strive to be “macro aware” rather than “macro driven.” We have found that the news of the day rarely has much relevance to the fundamental investment thesis we develop for each of our holdings. Our investment thesis is grounded in in-depth research of company fundamentals—including whether a company has adequate cash reserves and a management team capable of guiding it through crises like the current one.

As we navigate the current environment, we feel confident in the companies we hold. We also believe that irrational reactions to market volatility can lead to great buying opportunities for us as long-term investors. By applying our due-diligence process to companies that we see as having the strongest underlying fundamentals and management teams and by making thoughtful tactical decisions, we believe we can continue to make the Fund’s portfolio of companies even stronger over the five-year-plus time horizon toward which we prefer to invest.

Thank you for the opportunity to manage your assets.

Current and future holdings are subject to risk.

14

| | |

| Wasatch Global Opportunities Fund (WAGOX / WIGOX) | | SEPTEMBER 30, 2020 |

Portfolio Summary

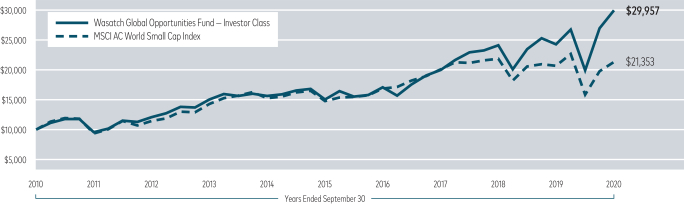

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | | | | | | | | |

| | | |

| | | 1 Year | | 5 Years | | 10 Years |

| | | |

Global Opportunities (WAGOX) — Investor | | | | 23.20% | | | | | 14.74% | | | | | 11.60% | |

| | | |

Global Opportunities (WIGOX) — Institutional | | | | 23.09% | | | | | 14.90% | | | | | 11.67% | |

| | | |

MSCI AC World Small Cap Index | | | | 3.22% | | | | | 7.63% | | | | | 7.88% | |

Data show past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit wasatchglobal.com. The Advisor may absorb certain Fund expenses, without which total returns would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2020 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Global Opportunities Fund are Investor Class: 1.56% / Institutional Class — Gross: 1.57%, Net: 1.36%. The expense ratio shown elsewhere in this report may be different. Net expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch will deduct a 2.00% redemption fee on Fund shares held 60 days or less. Performance data do not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Performance for the Institutional Class prior to 2/1/2016 is based on the performance of the Investor Class. Performance of the Fund’s Institutional Class prior to 2/1/2016 uses the actual expenses of the Fund’s Investor Class without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses.

Investing in small and micro cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus.

TOP 10 EQUITY HOLDINGS*

| | | | |

| |

| Company | | % of Net Assets | |

| |

MercadoLibre, Inc. | | | 3.1% | |

| |

Silergy Corp. (Taiwan) | | | 3.0% | |

| |

Globant S.A. (Argentina) | | | 3.0% | |

| |

Trex Co., Inc. | | | 2.9% | |

| |

Kornit Digital Ltd. (Israel) | | | 2.7% | |

| | | | |

| |

| Company | | % of Net Assets | |

| |

HubSpot, Inc. | | | 2.5% | |

| |

Monolithic Power Systems, Inc. | | | 2.5% | |

| |

Five9, Inc. | | | 2.4% | |

| |

Voltronic Power Technology Corp. (Taiwan) | | | 2.4% | |

| |

AU Small Finance Bank Ltd. (India) | | | 2.3% | |

| * | As of September 30, 2020, there were 77 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

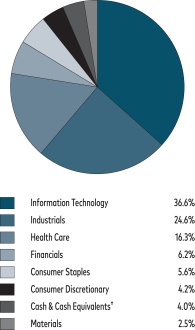

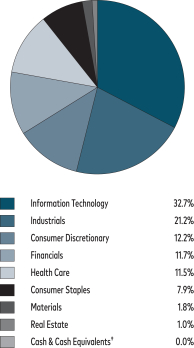

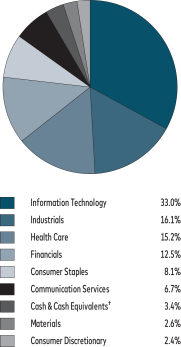

SECTOR BREAKDOWN**

| ** | Excludes securities sold short and options written, if any. |

| †Also | includes Other Assets & Liabilities. |

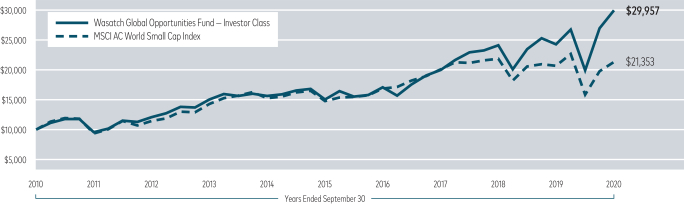

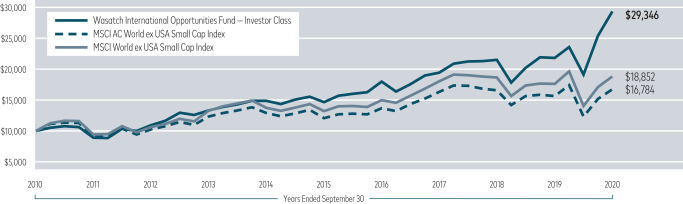

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees.

15

| | |

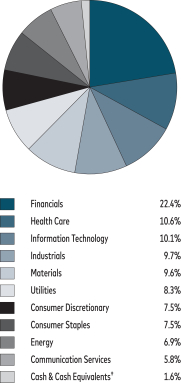

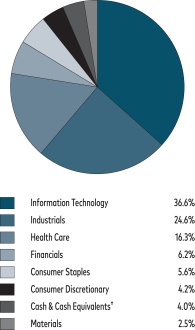

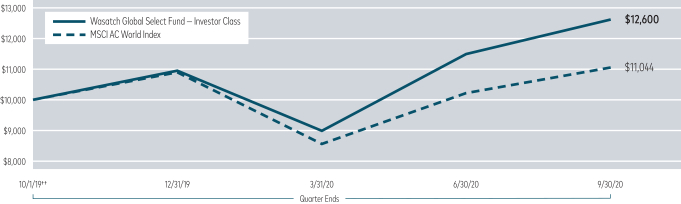

| Wasatch Global Select Fund (WAGSX / WGGSX) | | SEPTEMBER 30, 2020 |

Management Discussion

The Wasatch Global Select Fund is managed by a team of Wasatch portfolio managers led by Ken Applegate, Ken Korngiebel, Paul Lambert, Linda Lasater and Mike Valentine.

| | | | |

Ken Applegate, CFA Portfolio Manager

Linda Lasater, CFA Portfolio Manager | |

Ken Korngiebel, CFA Portfolio Manager

Mike Valentine Portfolio Manager | |

Paul Lambert Portfolio Manager |

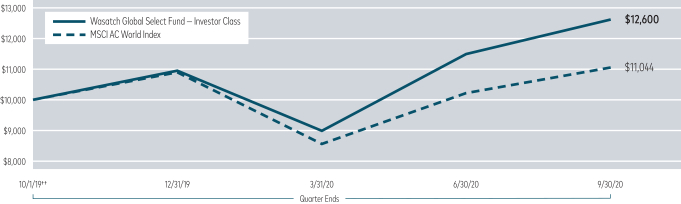

OVERVIEW

The Wasatch Global Select Fund — Investor Class gained 26.00% for the 12 months ended September 30, 2020. The Fund outperformed its benchmark, the MSCI AC (All Country) World Index, which gained 10.44% over the same period.

DETAILS OF THE YEAR

The largest individual contributor to Fund performance for the 12-month period was DocuSign, Inc. The San Francisco-based company offers e-signature software that enables businesses to digitally prepare and execute agreements. With the pandemic scattering corporate operations to home offices and curtailing business travel, DocuSign has been positioned to benefit as more companies sign contracts electronically over the internet.

Another strong contributor was Pool Corp., a wholesale distributor of swimming pools and related equipment and supplies. The company is headquartered in the U.S. and has sales centers in locations around the world including North America, Europe and Australia. Pool saw its stock price increase over the 12 months on rising demand from families increasingly favoring activities that can be enjoyed at home. The company also benefited from cost-saving measures put in place at the start of the pandemic. We believe Pool is on a promising long-term growth trajectory and also has the potential to see more business in the short term from greater use of swimming pools by housing communities and individual households.

Adyen NV was also one of the Fund’s leading contributors. Adyen is a Dutch company that provides payment solutions including an online payment processing platform, as well as mobile and point-of-sale systems. By enabling businesses to streamline payments coming from multiple channels, we

believe Adyen is timely in addressing a broad operational need of companies seeking to modernize.

Based in India, Bajaj Finance Ltd. is a non-bank financial company that finished the 12-month period as the Fund’s largest individual detractor. Indian financials have faced challenges in recent months. In addition to their stocks selling off early in the pandemic, financial institutions have also reckoned with stringent economic measures from the government in response to the crisis. We are optimistic that positive trends in the most-recent quarter may continue over the long-term and believe Bajaj and other Indian financial firms should benefit from pent-up demand as the country slowly returns to normalcy.

Euronet Worldwide, Inc. was also a notable detractor. The company provides electronic-payment services, including automated teller machines, point-of-sale services and related financial services. Despite the anticipated drop-off in financial transactions due to the pandemic, we believe Euronet has the ability to generate double-digit annual sales growth over the long term, fueled by its meaningfully improved earnings and potential to generate significant free cash flows.

Sonova Holding AG, a medical-device manufacturer based in Switzerland, was another detractor. A recall of one of Sonova’s devices caused us to question our long-term investment thesis for the company. As a result, we chose to exit our position in Sonova during the second quarter of 2020.

OUTLOOK

The 12-month period was dominated by unique macroeconomic factors, not the least of which is the ongoing global pandemic. While we are cognizant of these factors and their potential impacts, we strive to be “macro aware” rather than “macro driven.” We have found that the news of the day rarely has much relevance to the fundamental investment thesis we develop for each of our holdings. Our investment thesis is grounded in in-depth research of company fundamentals — including whether a company has adequate cash reserves and a management team capable of guiding it through crises like the current one.

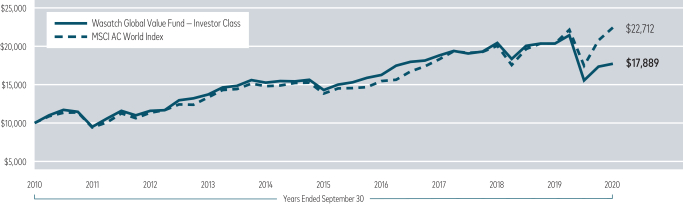

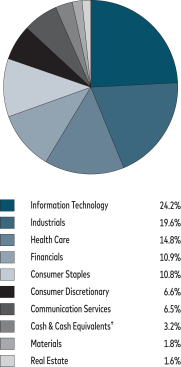

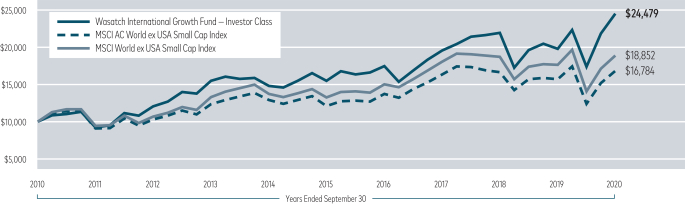

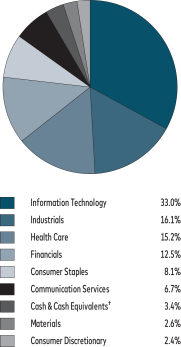

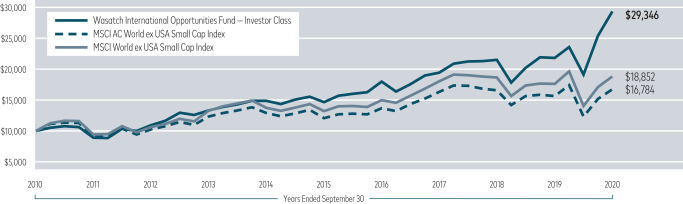

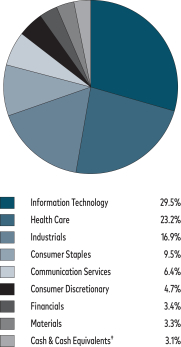

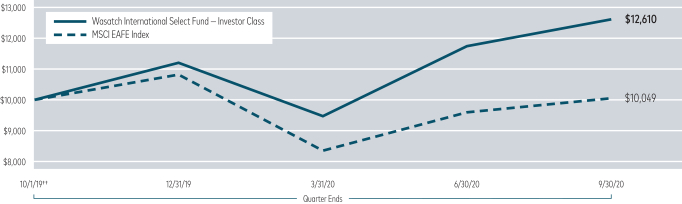

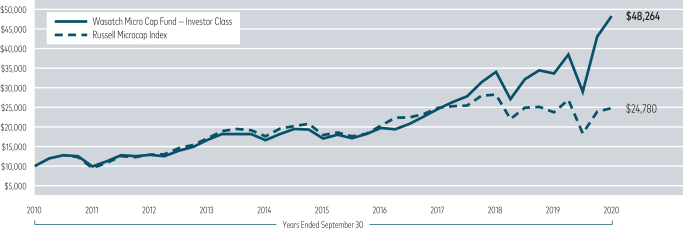

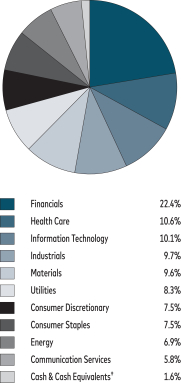

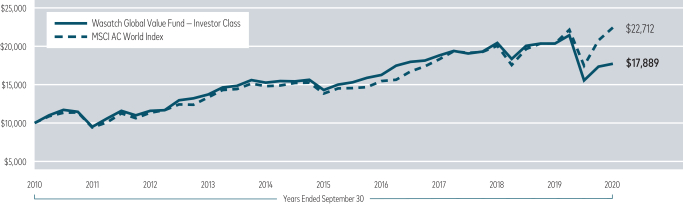

As we navigate the current environment, we feel confident in the companies we hold. We also believe that irrational reactions to market volatility can lead to great buying opportunities for us as long-term investors. By applying our due-diligence process to companies that we see as having the strongest underlying fundamentals and management teams and by making thoughtful tactical decisions, we believe we can continue to make the Fund’s portfolio of companies even stronger over the five-year-plus time horizon toward which we prefer to invest.