UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-4923

|

| Longleaf Partners Funds Trust |

(Exact name of registrant as specified in charter)

|

c/o Southeastern Asset Management, Inc. 6410 Poplar Avenue, Suite 900 Memphis, TN 38119 |

(Address of principal executive offices) (Zip code)

Andrew R. McCarroll, Esq.

|

Southeastern Asset Management, Inc. 6410 Poplar Ave., Suite 900 Memphis, TN 38119 |

(Name and address of agent for service)

Registrant’s telephone number, including area code: (901) 761-2474

Date of fiscal year end: December 31

Date of reporting period: December 31, 2022.

| Item 1(a). | Longleaf Partners Funds Annual Report at December 31, 2022. |

Annual Report

December 31, 2022

Partners Fund

Small-Cap Fund

International Fund

Global Fund

One of Southeastern's “Governing Principles” is that “we will communicate with our investment partners as candidly as possible,” because we believe Longleaf shareholders benefit from understanding our investment philosophy and approach. Our views and opinions regarding the investment prospects of our portfolio holdings and Funds are “forward looking statements” which may or may not be accurate over the long term. While we believe we have a reasonable basis for our appraisals, and we have confidence in our opinions, actual results may differ materially from those we anticipate. Information provided in this report should not be considered a recommendation to purchase or sell any particular security.

You can identify forward looking statements by words like “believe,” “expect,” “anticipate,” or similar expressions when discussing prospects for particular portfolio holdings and/or one of the Funds. We cannot assure future results and achievements. You should not place undue reliance on forward looking statements, which speak only as of the date of this report. We disclaim any obligation to update or alter any forward looking statements, whether as a result of new information, future events, or otherwise. Current performance may be lower or higher than the performance quoted herein. Past performance does not guarantee future results, fund prices fluctuate, and the value of an investment may be worth more or less than the purchase price. Call (800) 445-9469 or go to southeasternasset.com for current performance information and for the Prospectus and Summary Prospectus, both of which should be read carefully before investing to learn about fund investment objectives, risks and expenses. This material must be accompanied or preceded by a prospectus. Please read it carefully before investing.

The price-to-value ratio (“P/V”) is a calculation that compares the prices of the stocks in a portfolio to Southeastern's appraisals of their intrinsic values. P/V represents a single data point about a Fund, and should not be construed as something more. P/V does not guarantee future results, and we caution investors not to give this calculation undue weight. P/V alone tells nothing about:

| • | The quality of the businesses we own or the managements that run them; |

| • | The cash held in the portfolio and when that cash will be invested; |

| • | The range or distribution of individual P/V's that comprise the average; and |

| • | The sources of and changes in the P/V. |

When all of the above information is considered, the P/V is a useful tool to gauge the attractiveness of a Fund's potential opportunity. It does not, however, tell when that opportunity will be realized, nor does it guarantee that any particular company's price will ever reach its value. We remind our shareholders who want to find a single silver bullet of information that investments are rarely that simple. To the extent an investor considers P/V in assessing a Fund's return opportunity, the limits of this tool should be considered along with other factors relevant to each investor.

Unless otherwise noted, performance returns of Fund positions combine the underlying stock and bond securities including the effect of trading activity during the period.

Risks

The Longleaf Partners Funds are subject to stock market risk, meaning stocks in the Fund may fluctuate in response to developments at individual companies or due to general market and economic conditions. Also, because the Funds generally invest in 15 to 25 companies, share value could fluctuate more than if a greater number of securities were held. Mid-cap stocks held by the Funds may be more volatile than those of larger companies. With respect to the Small-Cap Fund, smaller company stocks may be more volatile with fewer financial resources than those of larger companies. With respect to the International and Global Funds, investing in non- U.S. securities may entail risk due to non-U.S. economic and political developments, exposure to non-U.S. currencies, and different accounting and financial standards. These risks may be higher when investing in emerging markets. Diversification does not eliminate the risk of experiencing investment losses.

Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management, and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested.

Indexes

The S&P 500 Index is an index of 500 stocks chosen for market size, liquidity and industry grouping, among other factors. The S&P is designed to be a leading indicator of U.S. equities and is meant to reflect the risk/return characteristics of the large cap universe.

The Russell 1000 Index measures the performance of the 1,000 largest companies in the Russell 3,000 Index. The Russell 1000 Value index is drawn from the constituents of the Russell 1000 based on book-to-price (B/P) ratio.

The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 10% of the total market capitalization of the Russell 3000 Index. The Russell 2000 Value index is drawn from the constituents of the Russell 2000 based on book-to-price (B/P) ratio.

The MSCI EAFE Index (Europe, Australia, Far East) is a broad based, unmanaged equity market index designed to measure the equity market performance of 22 developed markets, excluding the US & Canada. The MSCI EAFE Value Index captures large and mid-cap securities exhibiting overall value style characteristics across Developed Markets countries around the world, excluding the US and Canada.

The MSCI World Index is a broad-based, unmanaged equity market index designed to measure the equity market performance of 23 developed markets, including the United States. The MSCI World Value Index captures large and mid-cap securities exhibiting overall value style characteristics across 23 Developed Markets countries.

An index cannot be invested in directly.

Definitions

EBITDA is a company’s earnings before interest, taxes, depreciation and amortization.

A special purpose acquisition company (SPAC) is a company with no commercial operations that is formed strictly to raise capital for the purpose of acquiring an existing company.

Free Cash Flow (FCF) is a measure of a company’s ability to generate the cash flow necessary to maintain operations. Generally, it is calculated as operating cash flow minus capital expenditures.

Net Asset Value (NAV) is a statement of the value of a company's assets minus the value of its liabilities.

“Margin of Safety” is a reference to the difference between a stock’s market price and Southeastern’s calculated appraisal value. It is not a guarantee of investment performance or returns.

Price / Earnings (P/E) is the ratio of a company’s share price compared to its earnings per share.

Enterprise value (EV) is a company’s market capitalization plus debt,minority interest and preferred shares, and less total cash and cash equivalents.

Earnings per share (EPS) is the portion of a company's net income allocated to each share of common stock.

Private equity refers to investments in firms which are not listed on a public stock exchange.

A stock buyback is when a company uses cash to buy shares of its stock in the market.

Insider stock purchases are purchases of company stock by company officers and directors.

A spin-off is the creation of an independent company through the sale or distribution of new shares of an existing business.

Investing in securities that meet ESG criteria may result in a Fund forgoing otherwise attractive opportunities, which may result in underperformance when compared to funds that do not consider ESG factors.

The UN Sustainable Development Goals (SDGs) were adopted by the United Nations in 2015 as a universal call to action to end poverty, protect the planet, and ensure that by 2030 all people enjoy peace and prosperity. The 17 SDGs recognize that development must balance social, economic and environmental sustainability.

© 2023 Southeastern Asset Management, Inc. All Rights Reserved.

Longleaf, Longleaf Partners Funds and the pine cone logo are registered trademarks of Longleaf Partners Funds Trust.

Southeastern Asset Management, Inc. is a registered trademark.

Funds distributed by ALPS Distributors, Inc.

Performance Summary (Unaudited)

| Average Annual Returns for the Periods Ended December 31, 2022 |

| | 1 Year | 5 Year | 10 Year | 20 Year | Since

Inception |

Partners Fund

(Inception 4/8/87) | -23.25% | -0.26% | 4.48% | 5.36% | 9.00% |

| S&P 500 Index | -18.11 | 9.42 | 12.56 | 9.80 | 9.84 |

Small-Cap Fund

(Inception 2/21/89) | -19.27 | 0.89 | 6.59 | 8.98 | 9.46 |

| Russell 2000 Index | -20.44 | 4.13 | 9.01 | 9.36 | 8.94 |

International Fund

(Inception 10/26/98) | -18.69 | -2.36 | 2.21 | 4.51 | 5.68 |

| MSCI EAFE Index | -14.45 | 1.54 | 4.67 | 6.43 | 4.25 |

Global Fund

(Inception 12/27/12) | -24.15 | -3.02 | 3.11 | n/a | 3.11 |

| MSCI World Index | -18.14 | 6.14 | 8.85 | n/a | 8.86 |

The indices are unmanaged. During the inception year, the S&P 500 and the EAFE Index were available only at month-end; therefore the S&P 500 value at 3/31/87 and the EAFE value at 10/31/98 were used to calculate performance since inception. Returns reflect reinvested capital gains and dividends but not the deduction of taxes an investor would pay on distributions or share redemptions. Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of a Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting southeasternasset.com.

As reported in the Prospectus dated May 1, 2022, the total expense ratio for the Partners Fund is 1.00% (gross) and 0.79% (net). Through at least April 30, 2023, this expense ratio is subject to fee waiver to the extent the fund's normal annual operating expenses exceed 0.79% of average annual net assets. The total expense ratio of the Small-Cap Fund is 0.97% (gross) and 0.95% (net). Through at least April 30, 2023, this expense ratio is subject to fee waiver to the extent the fund's normal annual operating expenses exceed 0.95% of average annual net assets. The total expense ratio for the International Fund is 1.17% (gross) and 1.15% (net). This expense ratio is subject to a contractual fee waiver to the extent the fund's normal annual operating expenses exceed 1.15% of average annual net assets. The total expense ratio for the Global Fund is 1.31% (gross) and 1.15% (net). This expense ratio is subject to a contractual fee waiver to the extent the fund's normal annual operating expenses exceed 1.15% of average annual net assets. Please refer to the Financial Highlights within this report for the Funds' current expense ratio.

Management Discussion (Unaudited)

Partners Fund

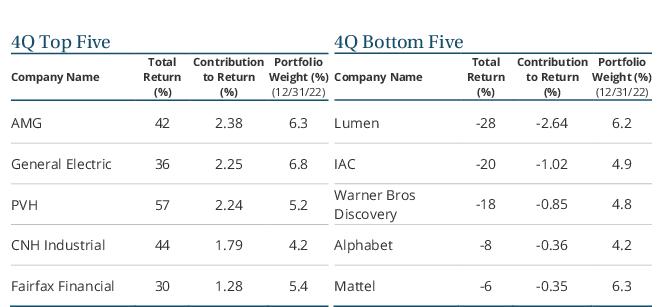

Longleaf Partners Fund added 8.63% in the fourth quarter, ending the year down 23.25%, while the S&P 500 returned 7.56% in the quarter and fell 18.11% in the year. Multiple companies rebounded in the fourth quarter, delivering strong double-digit returns that continued into the first part of 2023 as we are writing this letter. While we recognize that more near-term volatility may be in store, we believe this is only the beginning of better performance.

Our 2022 annual returns were subpar and lagged our expectations, driven primarily by declines at a handful of detractors – Lumen, IAC and Warner Bros Discovery – which more than accounted for the relative performance gap, as well as a large portion of the disappointing absolute performance over the last year. We discuss these positions and others in more detail below.

Last month we were talking with a long-time Southeastern observer. He said that with the two macro themes laid out in our 2021 annual letter – 1) no more free money / interest rates going up; 2) more market sanity after years of growth at all costs beating everything – he would have expected a better year for Southeastern in 2022. We agreed with him. In this talk and others like it, we spent the most time going stock-by- stock, detailing how we own high-quality companies that we believe will deliver more free cash flow (FCF) per share than current results and market expectations, leading to better future returns.

We have demonstrated long-term skill as bottom-up stock pickers, but partly because of this deep, micro research focus, it has taken us too long to learn some larger lessons. Our approach remains neither purely statistical value (which has done better this year after being out of favor for the last 15) nor compounders-at-any-cost (which has done much worse this year, after dominating for more than a decade). We believe seeking out the best of both served us well for our first three decades and will again serve us well from here.

Southeastern is at its best when we find temporarily unloved but high-quality companies with short-term earnings per share (EPS) below long-term free cash per share. We have picked many good stocks that fit this description. But we have held ourselves back by making certain portfolio management decisions and investing too early in certain types of stocks. We have done internal and external analysis to better quantify these mistakes, and the impact is large. While you should be wary if we were about to say that there is one magic thing or 10 minor tweaks that will take the next several years back up to our standards, we believe that the following three guidelines will make us much better. As Charlie Munger said: “All I want to know is where I’m going to die, so I won’t go there.” We have been wounded at these three places too often, so we will avoid them in the future.

1) Overweights: The numbers show that we are more often than not good stock pickers, but we have not done well with our overweighting decisions for a long time. After trying for years to qualitatively fix this problem, we are now limiting our discretion on this matter by not allowing stocks to get above 6.5% weightings in the portfolio for any extended period of time. Sometimes we will have companies temporarily pop over this level on good news, but the longer stocks have stayed at weightings like this, the worse they have done for us. While GE was above a 6.5% weight to end the quarter, this was because it was splitting into 2 parts in the first week of 2023.

2) Leverage: Southeastern has made good investments in companies that have net debt on the balance sheet, but some of our more disappointing investments have had excessive leverage. Previously, we have given ourselves too much leeway on these kinds of investments because we were too attracted by a low price-to-value ratio on equity value (P/V), when we should have focused more on the price to enterprise value ratio (P/EV) that better accounts for a company’s balance sheet. Going forward, once a prospective or existing investment crosses over 3x Net Debt to EBITDA (earnings before interest, taxes, depreciation and amortization), P/EV will become the key factor, not P/V or price to free cash flow (P/FCF). Often a P/V of 65% on a levered company can be closer to 80% on P/EV, leading to less margin of safety. It is also true that not all Net Debt to EBITDA ratios are created equal. 4x of long-term, non-recourse debt on a company with contracted, stable EBITDA that converts into free cash flow at a high rate can be better than 3.5x of short-term bank debt on a more volatile company (especially if it is not at the trough of a cycle) with less attractive free cash flow generation. The public markets start to differentiate on companies once they get over 3x and are harshest over 4x. Private equity, meanwhile, has benefitted from getting to mark their own prices on investments levered at well over 4x. We are now in the early stages of this coming home to roost, and we look forward to seeing private equity price marks catch up to public market peers. Back to what we can do about things, we will use a grid of P/EVs to pay ranging from the 70s for stable, high-quality companies levered closer to 3x to sub-60 (often equating to P/Vs in the 40s or below) for more volatile companies levered over 4x. If there are excessive financial liabilities that put the company’s future at significant risk, we won’t play at all.

3) Holding Companies: Value has been created at complex holding companies (holdcos) operating across multiple businesses. Berkshire Hathaway, Liberty Media and EXOR are prime examples that we have invested in at Southeastern. Companies like this can be dangerously seductive for value hounds like us. We get to dig into the footnotes and own multiple, high-quality assets when the market focuses too much on a consolidated EPS or book multiple. There have been, however, too many examples where our partners were not of the caliber of the above three and/or where we have been early before the market punishes anything complex, which often happens in a bear market. Going forward, we will do two things on these companies: 1) qualitatively, we must insist on higher quality partners who are manic about closing the price-to- value gap, since these structures magnify the plusses and minuses of the people involved; 2) quantitatively, when these companies have publicly traded parts, we need to use the lower of price or value of each sub-part when calculating the value of the entire holdco.

We understand that it might take time to earn your trust that we have changed on these fronts, and we are very grateful for our long-term and new clients who are with us today. The changes are in place, and the analysis supports our view that they can make a big difference. By the time this is obvious, the greatest opportunity to invest with us will be gone.

Contribution To Return

CNX Resources (CNX) - CNX was the top contributor for the year, but we were surprised it wasn’t an even larger one. Its value per share strongly outgrew its price performance for the year. While all energy companies saw a boost from higher prices, CNX had previously done more price hedging than peers. This decision held back near-term reported earnings, which remain the market’s focus. This helped relative returns at unhedged and more leveraged companies that were hoping for higher prices. CNX has been taking advantage of a widening price-to-value gap for itself as the year went on by continuing to be one of our largest share repurchasers. When you combine strong capital allocation like this with geopolitical conflict solidifying the long-term value of North American natural gas while hedges roll off with the passage of time, we remain excited about CNX’s future.

Affiliated Management Group (AMG) – Asset management holding company AMG was a top contributor in the quarter after reporting results and a positive outlook well ahead of expectations. CEO Jay Horgen is proving to be a great partner, and we believe it is still early days as AMG’s diversification of asset classes and management styles is becoming better appreciated.

General Electric (GE) – Formerly one of our most hated companies, industrial conglomerate GE is now on the verge of beginning its breakup into three separate businesses. It has been a solid relative contributor for the year with further potential upside in 2023 and beyond.

PVH – Apparel company PVH, which owns brands Tommy Hilfiger and Calvin Klein, is a new position that has quickly rebounded from 3Q lows after it was kicked out of the S&P 500 in September. The company reported solid revenue growth and increased guidance for the full year. PVH has repurchased shares at a 12% annualized pace, and both the CEO and CFO have bought shares personally in the second half, indicating their confidence in the company.

CNH Industrial – Agricultural machinery company CNH Industrial reported strong 3Q results, meaningfully beating expectations for both sales and margins, and increasing full year guidance. Management announced an additional $100 million buyback program on top of the $300 million program already in place. It is good to see new management delivering in a better environment, and the company still trades at too wide of a discount to other agricultural equipment companies.

Lumen – Global fiber company Lumen was the top absolute and relative detractor for both periods. This long-term position had a history of managing costs and producing steady free cash flow under the leadership of former CEO Jeff Storey, but its organic revenue growth has been disappointing for a few years and its cash flow began to disappoint recently. In September, the company announced a new CEO, Kate Johnson, would take over. Although her experience at Microsoft and proven track record of delivering organic growth make her a good fit for the role, the communication of her hire was mishandled. The stock price declined on the initial news and fell further as a previously feared dividend cut was announced in November. Lumen also announced in November the positive news of the planned sale of its Europe business for 11x EBITDA (when the whole company is now selling at 5x EBITDA) and a $1.5 billion share repurchase authorization, on top of closing on the previously announced sale of part of its consumer business to Apollo in October. The recent moves are creating a clearer

business mix and stronger balance sheet, and we believe we could see additional positive moves to finally separate the legacy Level 3/Qwest business from the remaining quality local market assets.

IAC – Digital holding company IAC saw its conglomerate discount grow wider over the course of the year as technology stocks declined precipitously. This time last year, we thought we were paying a low-double-digit multiple of FCF power for a growing collection of assets led by great people. We now think that is a mid-single-digit multiple and that the people remain aligned. While underlying holding company MGM is doing well, other parts of this holdco have not yet delivered. Angi reported another disappointing quarter and has undergone a necessary management change that is already producing better results. Dotdash Meredith is facing a tough online ad market, but the integration of the two businesses is on track. We remain confident in CEO Joey Levin and Chairman Barry Diller’s ability to close the wide price-to-value gap at IAC.

Warner Bros Discovery – Media conglomerate Warner Bros Discovery (WBD) was another top detractor in the quarter and for the year. As has been documented in almost every form of media over the last several months, while we and WBD’s board/management knew there were things wrong at Warner Brothers under AT&T, it turned out to be even worse than expected. The aforementioned advertising market is not helping WBD either. While the brand and library values remain intact, the realization of this value has been deferred. With leverage closer to 5x than the sub-4x we thought we would be looking at in 2023, the market’s judgment has been harsh. We remain confident in management and growing free cash flow from here, with eight different insiders buying shares personally this year. We encourage you to listen to Partners Fund PM Ross Glotzbach interviewing WBD CEO and President David Zaslav in the latest episode of the Price-to-Value Podcast at southeasternasset.com.

Liberty Broadband Corp – Cable and media holding company Liberty Broadband declined amid worsening sentiment for its underlying cable business Charter. We believe the Liberty management team will successfully close the valuation gap at both underlying holding Charter and holdco Liberty Broadband, as we have seen sentiment on cable stocks shift many times over our decades at Southeastern. This remains a good business run by great partners.

Douglas Emmett – Real estate investment trust company Douglas Emmett declined in a challenging year for office real estate. While DEI reported another strong gross leasing quarter in November, it has seen portfolio churn and new cash rents below old contracts. We have seen meaningful insider buying of the deeply discounted shares, including an impressive $6 million purchase by new independent director Shirley Wang. Additionally, the company approved a $300 million share repurchase program to take advantage of the steep price disconnect.

Portfolio Activity

We sold five companies and bought five new businesses this year as persistent market volatility threw out a number of compelling new opportunities. We had no new additions in the fourth quarter, and we sold our remaining position in CK Hutchison to make way for more compelling opportunities. We added opportunistically to heavily discounted businesses and trimmed several positions, including companies like AMG and Hyatt whose strong performance drove them over the 6.5% position limit.

Outlook

Some of our overall market views remain similar to previous years: the S&P 500 still looks elevated or fairly valued on potentially too-high earnings assumptions, but the median multiple is more attractive than the average multiple in this top-heavy index; the Russell 2000 looks better on its reported multiple, but this ignores many unprofitable companies; Non-US markets are statistically cheaper than US markets. The S&P 500 next twelve months’ EPS multiple is currently 17x, while the US 10-year treasury yield ended the year at 3.8% vs. one year ago at 1.5%. This is an interesting contrast to 10 years ago when the index was at 12x and the 10-year was at 1.8%, or 20 years ago when the numbers were 15x and 3.8%. The lesson is that there is a lot more that goes into valuation than just discount rates, but they are an important factor.

Our portfolio is at a NTM (next twelve months) P/E of 9x vs. these numbers. That remains an unusually wide gap. The portfolio reached a near-all-time low P/V ratio in the high-40s% in the second half and remains in the mid-50s% today, which has historically started a great time to invest with us:

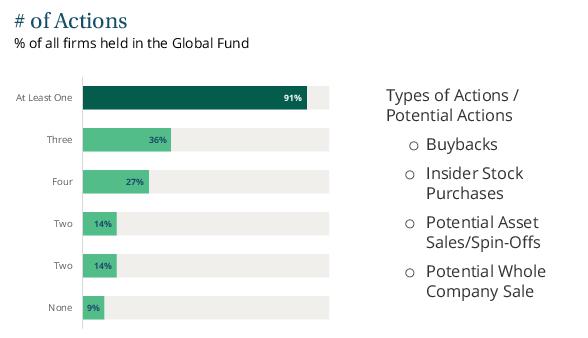

While most asset classes felt pain from higher interest rates this year, that is more priced in now, and some of the main free-money beneficiaries are significantly off their highs. The initial punch in the face has been felt by all, and now our partners are taking productive actions to differentiate themselves at an impressive rate:

We continue to believe that money costing something again is a healthy, long-term development for the capital markets in general and for Southeastern in particular. The change was abrupt, but our portfolios are positioned well for the future. The portfolio ended the year with nearly 5% cash, and our on-deck list remains healthy. We look forward to the changes we have discussed leading to better returns. Thank you for your long-term partnership.

Performance History (Unaudited)

Partners Fund

Comparison of Change in Value of $10,000 Investment

Since Inception April 8, 1987

| Average Annual Returns for the Periods Ended December 31, 2022 |

| | 1 Year | 5 Year | 10 Year | 20 Year | Since Inception

4/8/1987 |

| Partners Fund | -23.25% | -0.26% | 4.48% | 5.36% | 9.00% |

| S&P 500 Index | -18.11 | 9.42 | 12.56 | 9.80 | 9.84 |

The index is unmanaged. Because the S&P 500 Index was available only at month-end in 1987, we used the 3/31/87 value for performance since inception. Returns reflect reinvested capital gains and dividends but not the deduction of taxes an investor would pay on distributions or share redemptions. Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting southeasternasset.com. The Partners Fund is subject to stock market risk, meaning stocks in the Fund may fluctuate in response to developments at individual companies or due to general market and economic conditions. Also, because the Fund generally invests in 15 to 25 companies, share value could fluctuate more than if a greater number of securities were held. Mid-cap stocks held may be more volatile than those of larger companies.

As reported in the Prospectus dated May 1, 2022, the total expense ratio for the Partners Fund is 1.00% (gross) and 0.79% (net). Through at least April 30, 2023, this expense ratio is subject to fee waiver to the extent the fund's normal annual operating expenses exceed 0.79% of average annual net assets. Please refer to the Financial Highlights within this report for the Fund's current expense ratio.

Portfolio Summary (Unaudited)

Partners Fund

Top 10 Portfolio Holdings at December 31, 2022 |

|

| | Net Assets |

| General Electric Company | 6.8% |

| Mattel, Inc. | 6.3 |

| Affiliated Managers Group, Inc. | 6.3 |

| MGM Resorts International | 6.2 |

| Lumen Technologies, Inc. | 6.2 |

| FedEx Corporation | 5.9 |

| CNX Resources Corporation | 5.6 |

| Hyatt Hotels Corporation | 5.5 |

| Fairfax Financial Holdings Limited | 5.4 |

| Fiserv, Inc. | 5.3 |

| | 59.5% |

Portfolio Changes

January 1, 2022 through

December 31, 2022 | |

| New Holdings | Quarter |

| Alphabet Inc. | 2Q |

| Iveco Group N.V.(a) | 1Q |

| PVH Corp. | 2Q |

| Stanley Black & Decker, Inc. | 2Q |

| Warner Music Group Corp. | 3Q |

| Eliminations |

| Biogen Inc. | 2Q |

| CK Hutchison Holdings Limited | 4Q |

| Holcim Ltd | 3Q |

| Iveco Group N.V. | 2Q |

| The Williams Companies, Inc. | 2Q |

(a) Acquired through corporate action of CNH Industrial N.V.

| Sector Composition | |

| | Net Assets |

| Communication Services | 28.4% |

| Consumer Discretionary | 23.2 |

| Industrials | 19.0 |

| Financials | 11.7 |

| Energy | 5.6 |

| Information Technology | 5.3 |

| Real Estate | 2.0 |

| Cash & Other | 4.8 |

| | 100.0% |

Fund holdings are subject to change and holding discussions are not recommendations to buy or sell any security.

Portfolio of Investments

Partners Fund

| Common Stocks |

| | Shares | Value | % of Net Assets |

| Air Freight & Logistics |

| FedEx Corporation | 419,531 | $ 72,662,769 | 5.9% |

| Capital Markets |

| Affiliated Managers Group, Inc. | 492,252 | 77,987,484 | 6.3 |

| Diversified Telecommunication Services |

| Lumen Technologies, Inc. | 14,598,687 | 76,205,146 | 6.2 |

| Entertainment |

| Warner Bros., Discovery, Inc.* | 6,300,188 | 59,725,782 | 4.8 |

| Warner Music Group Corp. | 1,211,591 | 42,429,917 | 3.5 |

| | | 102,155,699 | 8.3 |

| Hotels, Restaurants & Leisure |

| Hyatt Hotels Corporation - Class A* | 747,434 | 67,605,405 | 5.5 |

| MGM Resorts International | 2,286,705 | 76,673,219 | 6.2 |

| | | 144,278,624 | 11.7 |

| Industrial Conglomerates |

| General Electric Company | 1,007,428 | 84,412,392 | 6.8 |

| Insurance |

| Fairfax Financial Holdings Limited (Canada) | 113,459 | 67,209,793 | 5.4 |

| Interactive Media & Services |

| Alphabet Inc. - Class C* | 589,746 | 52,328,162 | 4.2 |

| IAC, Inc.* | 1,358,794 | 60,330,454 | 4.9 |

| | | 112,658,616 | 9.1 |

| IT Services |

| Fiserv, Inc.* | 653,112 | 66,010,030 | 5.3 |

| Leisure Products |

| Mattel, Inc.* | 4,389,269 | 78,304,559 | 6.3 |

| Machinery |

| CNH Industrial N.V. (Italian Exhange) (Netherlands) | 2,430,335 | 38,932,227 | 3.2 |

| CNH Industrial N.V. (U.S. Exchange) (Netherlands) | 806,177 | 12,947,203 | 1.0 |

| Stanley Black & Decker, Inc. | 344,739 | 25,896,794 | 2.1 |

| | | 77,776,224 | 6.3 |

| Media |

| Liberty Broadband Corporation - Series C* | 773,919 | 59,026,802 | 4.8 |

| Oil, Gas & Consumable Fuels |

| CNX Resources Corporation* | 4,106,095 | 69,146,640 | 5.6 |

| Real Estate Investment Trusts (REITs) |

| Douglas Emmett, Inc. | 1,546,510 | 24,249,277 | 2.0 |

| Textiles, Apparel & Luxury Goods |

| PVH Corp. | 914,449 | 64,550,955 | 5.2 |

| Total Common Stocks (Cost $1,341,302,696) | | 1,176,635,010 | 95.2 |

See Notes to Financial Statements.

| Short-Term Obligations |

| | Principal Amount | Value | % of Net Assets |

| Repurchase agreement with State Street Bank, 3.55%, dated 12/30/22, due 01/03/23, Repurchase price $59,713,544 (Collateral: $60,883,887 U.S. Treasury Bond, 4.00% due 10/31/29, Par $60,647,000) (Cost $59,690,000) | 59,690,000 | $ 59,690,000 | 4.8% |

| Total Investments (Cost $1,400,992,696) | | 1,236,325,010 | 100.0 |

| Other Assets (Liabilities), Net | | (536,042) | (—) |

| Net Assets | | $1,235,788,968 | 100.0% |

| * | Non-income producing security. |

Note: Non-U.S. Companies represent 9.6% of net assets.

See Notes to Financial Statements.

Management Discussion (Unaudited)

Small-Cap Fund

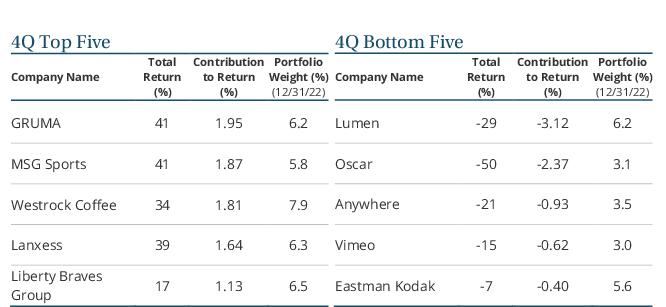

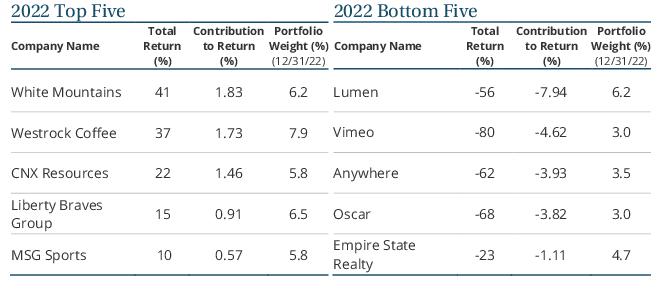

Longleaf Partners Small-Cap Fund added 4.74% in the fourth quarter and ended the year down 19.27%. The Fund’s year-to-date returns were narrowly ahead of the Russell 2000, which was down 20.44% for the year after adding 6.23% in the quarter. Multiple companies rebounded in the fourth quarter, delivering strong double-digit returns and positive relative performance across sectors. These solid results continued into the first part of 2023 as we are writing this letter. While we recognize that more near-term volatility may be in store, we believe this is only the beginning of better performance.

Our 2022 annual returns were subpar and lagged our expectations, driven primarily by declines at a handful of detractors – Lumen and Oscar Health – which were the top absolute and relative detractors in the quarter and among the top detractors for the year, along with Vimeo and Anywhere Real Estate. We discuss the specific positive and negative return drivers in more detail below.

Last month we were talking with a long-time Southeastern observer. He said that with the two macro themes laid out in our 2021 annual letter – 1) no more free money / interest rates going up; 2) more market sanity after years of growth at all costs beating everything – he would have expected a better year for Southeastern in 2022. We agreed with him. In this talk and others like it, we spent the most time going stock-by-stock, detailing how we own high-quality companies that we believe will deliver more free cash flow (FCF) per share than current results and market expectations, leading to better future returns.

We have demonstrated long-term skill as bottom-up stock pickers, but partly because of this deep, micro research focus, it has taken us too long to learn some larger lessons. Our approach remains neither purely statistical value (which has done better this year after being out of favor for the last 15) nor compounders-at-any-cost (which has done much worse this year, after dominating for more than a decade). We believe seeking out the best of both served us well for our first three decades and will again serve us well from here.

Southeastern is at its best when we find temporarily unloved but high-quality companies with short-term earnings per share below long-term free cash per share. We have picked many good stocks that fit this description. But we have held ourselves back by making certain portfolio management decisions and investing too early in certain types of stocks. We have done internal and external analysis to better quantify these mistakes, and the impact is large. While you should be wary if we were about to say that there is one magic thing or 10 minor tweaks that will take the next several years back up to our standards, we believe that the following three guidelines will make us much better. As Charlie Munger said: “All I want to know is where I’m going to die, so I won’t go there.” We have been wounded at these three places too often, so we will avoid them in the future.

1) Overweights: The numbers show that we are more often than not good stock pickers, but we have not done well with our overweighting decisions for a long time. After trying for years to qualitatively fix this problem, we are now limiting our discretion on this matter by not allowing stocks to get above 6.5% weightings in the portfolio for any extended period of time. Sometimes we will have companies temporarily pop over this level on good news, but the longer stocks have stayed at weightings like this, the worse they have done for us. As we have been putting this rule into practice recently, there remained one temporary outlier as of 12/31/2022.

2) Leverage: Southeastern has made good investments in companies that have net debt on the balance sheet, but some of our more disappointing investments have had excessive leverage. Previously, we have given ourselves too much leeway on these kinds of investments because we were too attracted by a low price-to-value ratio on equity value (P/V), when we should have focused more on the price to enterprise value ratio (P/EV) that better accounts for a company’s balance sheet. Going forward, once a prospective or existing investment crosses over 3x Net Debt to EBITDA (earnings before interest, taxes, depreciation and amortization), P/EV will become the key factor, not P/V or price to free cash flow (P/FCF). Often a P/V of 65% on a levered company can be closer to 80% on P/EV, leading to less margin of safety. It is also true that not all Net Debt to EBITDA ratios are created equal. 4x of long-term, non-recourse debt on a company with contracted, stable EBITDA that converts into free cash flow at a high rate can be better than 3.5x of short-term bank debt on a more volatile company (especially if it is not at the trough of a cycle) with less attractive free cash flow generation. The public markets start to differentiate on companies once they get over 3x and are harshest over 4x. Private equity, meanwhile, has benefitted from getting to mark their own prices on investments levered at well over 4x. We are now in the early stages of this coming home to roost, and we look forward to seeing private equity price marks catch up to public market peers. Back to what we can do about things, we will use a grid of P/EVs to pay ranging from the 70s for stable, high-quality companies levered closer to 3x to sub-60 (often equating to P/Vs in the 40s or below) for more volatile companies levered over 4x. If there are excessive financial liabilities that put the company’s future at significant risk, we won’t play at all.

3) Holding Companies: Value has been created at complex holding companies (holdcos) operating across multiple businesses. Berkshire Hathaway, Liberty Media and EXOR are prime examples that we have invested in at Southeastern. Companies like this can be dangerously seductive for value hounds like us. We get to dig into the footnotes and own multiple, high-quality assets when the market focuses too much on a consolidated EPS or book multiple. There have been, however, too many examples where our partners were not of the caliber of the above three and/or where we have been early before the market punishes anything complex, which often happens in a bear market. Going forward, we will do two things on these companies: 1) qualitatively, we must insist on higher quality partners who are manic about closing the price-to-value gap, since these structures magnify the plusses and minuses of the people involved; 2) quantitatively, when these companies have publicly traded parts, we need to use the lower of price or value of each sub-part when calculating the value of the entire holdco.

The Small-Cap portfolio has been most impacted by overweights and leverage, but we feel that these lessons will all be important for the future. We understand that it might take time to earn your trust that we have changed on these fronts, and we are very grateful for our long-term and new clients who are with us today. The changes are in place, and the analysis supports our view that they can make a big difference. By the time this is obvious, the greatest opportunity to invest with us will be gone.

Contribution To Return

White Mountains Insurance Group – Insurance conglomerate White Mountains was the top contributor for the year. We have great partners who have gone on offense this year with an intelligent asset sale of NSM Insurance Group to private equity and using their resulting strong net cash position to buy back discounted shares. We believe there is significant additional upside from here.

Westrock Coffee Company – Westrock Coffee, which is the “brand behind the brand” producing and distributing coffee, tea and extracts for larger entities, was another top performer this year. We first bought this company in the form of a SPAC called Riverview Acquisition Corp. Unlike the overall SPAC market, which was in full meltdown this year, the market properly differentiated profitable Westrock from unprofitable concept company insanity. We have successfully partnered at prior investments with both Chairman Brad Martin and Founder and CEO Scott Ford, and we expect both to continue their strong track records of value creation at Westrock.

Gruma – Corn flour and tortilla manufacturing company Gruma was the top performer in the fourth quarter and a solid performer for the year. This Mexican based consumer packaged goods company is a great, stable (read: boring) company that does not get the same valuation credit as inferior peers given it is headquartered in Mexico. Gruma issued its first comprehensive ESG (environmental, social and governance) report in October. The company made important ethical and environmental commitments, adopting scope 1 and 2 reporting, supported by a materiality analysis, measurable goals linked to the UN Sustainable Development Goals (SDGs) and actionable next steps to achieve them. We applaud the progress made at the company and look forward to seeing how they progress from here.

Madison Square Garden Sports Corp – MSG, the owner of the Knicks and the Rangers, contributed as the market for sports teams remained strong and if anything got better as the year went on. If the Phoenix Suns are worth anywhere near the $4 billion that they transacted at to end the year, then the Knicks are worth much more. Yet, with the Rangers at a Forbes or Sportico valuation, the Knicks are priced way below that $4 billion. The company also used its strong financial position to pay a dividend and repurchase shares.

Lumen – Global fiber company Lumen was the top absolute and relative detractor for both periods. This long-term position had a history of managing costs and producing steady free cash flow under the leadership of former CEO Jeff Storey, but its organic revenue growth has been disappointing for a few years and its cash flow began to disappoint recently. In September, the company announced a new CEO, Kate Johnson, would take over. Although her experience at Microsoft and proven track record of delivering organic growth make her a good fit for the role, the communication of her hire was mishandled. The stock price declined on the initial news and fell further as a previously feared dividend cut was announced in November. Lumen also announced in November the positive news of the planned sale of its Europe business for 11x EBITDA (when the whole company is now selling at 5x EBITDA) and a $1.5 billion share repurchase authorization, on top of closing on the previously announced sale of part of its consumer business to Apollo in October. The recent moves are creating a clearer business mix and stronger balance sheet, and we believe we could see additional positive moves to finally separate the legacy Level 3/Qwest business from the remaining quality local market assets.

Vimeo and Oscar – Digital software company Vimeo and US health insurance and software platform Oscar Health were both unduly punished this year alongside most tech-related businesses. We were too early at both companies, and our partners have not yet gone on offense to the degree we initially expected. Oscar grew too much, while Vimeo didn’t grow enough. Both still have key differentiating factors and the ability to control their own destiny, but we have been hesitant to take them back to full positions as our initial thesis has yet to play out. We are engaged with management teams at both companies to encourage proactive steps to close the value gap.

Anywhere Real Estate – Real Estate brokerage franchisor Anywhere declined this year in the face of broad concerns over the housing market and rising mortgage rates. We were wrong about the severity of the housing market downturn, further compounded at Anywhere by leverage. CEO Ryan Schneider has taken steps within his power to position the company to weather a tough environment. The company now trades at a single-digit multiple of 2023 extremely depressed FCF/share based on 4 million existing home sales and about 2.5x our estimate of long-term FCF/share based on a long-term average number of existing home sales of around 5.5 million units. Anywhere successfully navigated a much more challenging market during the GFC with even higher leverage, so we are confident the company will make it to the other side once again.

Portfolio Activity

We sold three companies and bought two new businesses this year as persistent market volatility threw out a number of compelling new opportunities. In the fourth quarter, we exited our small position in RenaissanceRe as it approached value. We added opportunistically to heavily discounted businesses and trimmed several positions, including companies like White Mountains, Gruma and Liberty Media Braves, whose strong performance drove them over the 6.5% position limit. We also trimmed our largest position, Lumen, to bring it below the 6.5% position limit.

Outlook

Some of our overall market views remain similar to previous years: the S&P 500 still looks elevated or fairly valued on potentially too-high earnings assumptions, but the median multiple is more attractive than the average multiple in this top-heavy index; the Russell 2000 looks better on its reported multiple, but this ignores many unprofitable companies; Non-US markets are statistically cheaper than US markets. The S&P 500 next twelve months’ EPS multiple is currently 17x, while the US 10-year treasury yield ended the year at 3.8% vs. one year ago at 1.5%. This is an interesting contrast to 10 years ago when the index was at 12x and the 10-year was at 1.8%, or 20 years ago when the numbers were 15x and 3.8%. The lesson is that there is a lot more that goes into valuation than just discount rates, but they are an important factor.

Our portfolio is at a NTM (next twelve months) P/E of 8x vs. these numbers. That remains an unusually wide gap. The portfolio reached a near all-time low P/V ratio of 50% in the second half and remains in the high-50s% today, which has historically started a great time to invest with us:

While most asset classes felt pain from higher interest rates this year, that is more priced in now, and some of the main free-money beneficiaries are significantly off their highs. The initial punch in the face has been taken by all, and now our partners are taking productive actions to differentiate themselves at an impressive rate:

We continue to believe that money costing something again is a healthy, long-term development for the capital markets in general and for Southeastern in particular. The change was abrupt, but our portfolios are positioned well for the future. Our on-deck list remains healthy. We look forward to the changes we have discussed leading to better returns. Thank you for your long-term partnership.

Performance History (Unaudited)

Small-Cap Fund

Comparison of Change in Value of $10,000 Investment

Since Inception February 21, 1989

| Average Annual Returns for the Periods Ended December 31, 2022 |

| | 1 Year | 5 Year | 10 Year | 20 Year | Since Inception

2/21/1989 |

| Small-Cap Fund | -19.27% | 0.89% | 6.59% | 8.98% | 9.46% |

| Russell 2000 Index | -20.44 | 4.13 | 9.01 | 9.36 | 8.94 |

The index is unmanaged. Returns reflect reinvested capital gains and dividends but not the deduction of taxes an investor would pay on distributions or share redemptions. Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting southeasternasset.com. The Small-Cap Fund is subject to stock market risk, meaning stocks in the Fund may fluctuate in response to developments at individual companies or due to general market and economic conditions. Also, because the Fund generally invests in 15 to 25 companies, share value could fluctuate more than if a greater number of securities were held. Smaller company stocks may be more volatile with fewer financial resources than those of larger companies.

As reported in the Prospectus dated May 1, 2022, the total expense ratio for the Small-Cap Fund is 0.97% (gross) and 0.95% (net). Through at least April 30, 2023, this expense ratio is subject to fee waiver to the extent the fund's normal annual operating expenses exceed 0.95% of average annual net assets. Please refer to the Financial Highlights within this report for the Fund's current expense ratio.

Performance Summary (Unaudited)

Small-Cap Fund

Top 10 Portfolio Holdings at December 31, 2022 |

|

| | Net Assets |

| Westrock Coffee Company | 7.9% |

| Mattel, Inc. | 6.5 |

| Liberty Braves Group | 6.5 |

| LANXESS AG | 6.3 |

| White Mountains Insurance Group, Ltd. | 6.2 |

| Gruma, S.A.B. DE C.V. | 6.2 |

| Lumen Technologies, Inc. | 6.2 |

| Madison Square Garden Sports Corp. | 5.8 |

| CNX Resources Corporation | 5.8 |

| Eastman Kodak Company | 5.6 |

| | 63.0% |

Portfolio Changes

January 1, 2022 through

December 31, 2022 | |

| New Holdings | Quarter |

| Masonite International Corporation | 3Q |

| Westrock Coffee Company | 2Q |

| Eliminations |

| Idorsia Ltd. | 3Q |

| Ingles Markets, Incorporated | 3Q |

| RenaissanceRe Holdings Ltd. | 4Q |

| Sector Composition | |

| | Net Assets |

| Communication Services | 21.5% |

| Consumer Discretionary | 15.9 |

| Consumer Staples | 14.1 |

| Financials | 13.9 |

| Real Estate | 8.2 |

| Materials | 6.3 |

| Energy | 5.8 |

| Information Technology | 5.6 |

| Industrials | 2.8 |

| Cash & Other | 5.9 |

| | 100.0% |

Fund holdings are subject to change and holding discussions are not recommendations to buy or sell any security.

Portfolio of Investments

Small-Cap Fund

| Common Stocks |

| | Shares | Value | % of Net Assets |

| Building Products |

| Masonite International Corporation* | 403,854 | $ 32,554,671 | 2.8% |

| Capital Markets |

| Lazard Ltd - Class A(a) | 1,576,008 | 54,640,197 | 4.6 |

| Chemicals |

| LANXESS AG (Germany) | 1,831,910 | 73,928,496 | 6.3 |

| Diversified Consumer Services |

| Graham Holdings Company - Class B | 91,627 | 55,361,950 | 4.7 |

| Diversified Telecommunication Services |

| Lumen Technologies, Inc. | 13,887,098 | 72,490,651 | 6.2 |

| Entertainment |

| Liberty Braves Group - Series C* | 2,372,960 | 76,480,501 | 6.5 |

| Madison Square Garden Sports Corp. - Class A | 373,927 | 68,552,037 | 5.8 |

| | | 145,032,538 | 12.3 |

| Food Products |

| Gruma, S.A.B. DE C.V. (Mexico) | 5,460,327 | 72,944,466 | 6.2 |

| Westrock Coffee Company - Class B*(b)(c) | 181,231 | 2,421,246 | 0.2 |

| Westrock Coffee Company - Class A*(b) | 6,796,159 | 90,796,684 | 7.7 |

| | | 166,162,396 | 14.1 |

| Hotels, Restaurants & Leisure |

| Hyatt Hotels Corporation - Class A* | 616,048 | 55,721,542 | 4.7 |

| Insurance |

| Oscar Health, Inc. - Class A*(b) | 14,568,462 | 35,838,417 | 3.1 |

| White Mountains Insurance Group, Ltd. | 51,937 | 73,456,057 | 6.2 |

| | | 109,294,474 | 9.3 |

| Interactive Media & Services |

| Vimeo, Inc.* | 10,264,046 | 35,205,678 | 3.0 |

| Leisure Products |

| Mattel, Inc.* | 4,321,003 | 77,086,693 | 6.5 |

| Oil, Gas & Consumable Fuels |

| CNX Resources Corporation* | 4,066,552 | 68,480,736 | 5.8 |

| Real Estate Investment Trusts (REITs) |

| Empire State Realty Trust, Inc.(b) | 8,264,248 | 55,701,031 | 4.7 |

| Real Estate Management & Development |

| Anywhere Real Estate Inc.*(b) | 6,507,042 | 41,579,998 | 3.5 |

| Total Common Stocks (Cost $1,129,833,226) | | 1,043,241,051 | 88.5 |

| Preferred Stock |

| | | | |

| Technology Hardware, Storage & Peripherals |

| Eastman Kodak Company Convertible Preferred Stock - Series B 4.00%(b)(d)(e) (Cost $95,452,160) | 932,150 | 66,369,080 | 5.6 |

See Notes to Financial Statements.

| Short-Term Obligations |

| | Principal Amount | Value | % of Net Assets |

| Repurchase agreement with State Street Bank, 3.55%, dated 12/30/22, due 01/03/23, Repurchase price $69,233,298 (Collateral: $70,590,153 U.S. Treasury Bond, 4.00% due 10/31/29, Par $70,315,500) (Cost $69,206,000) | 69,206,000 | $ 69,206,000 | 5.9% |

| Total Investments (Cost $1,294,491,386) | | 1,178,816,131 | 100.0 |

| Other Assets (Liabilities), Net | | 227,914 | — |

| Net Assets | | $1,179,044,045 | 100.0% |

| * | Non-income producing security. |

| (a) | Master Limited Partnership |

| (b) | Affiliated issuer during the period. See Note 6. |

| (c) | These shares were acquired on August 29, 2022, with a total cost at December 31, 2022 of $725. These shares are considered restricted securities under the Securities Act of 1933, and are restricted from resale until the earlier of (i) one year after the acquisition date (ii) the earlier to occur of (A) the first date on which the last reported sale price of the Westrock Coffee Company (“Westrock”) – Class A stock equals or exceeds $12.00 per share of stock (as adjusted for stock sub-divisions, stock dividends, reorganizations, recapitalizations and the like) for any 20 trading days within any 30-trading day period commencing at least 150 days after the acquisition date and (B) the date on which Westrock consummates a subsequent liquidation, merger, stock exchange or other similar transaction which results in all of Westrock’s stockholders having the right to exchange their Westrock common stock for cash, securities or other property. Due to the lack of an active trading market, all or a portion of this position may be illiquid. Judgment plays a greater role in valuing illiquid securities than those for which a more active market exists, and are valued by Southeastern Asset Management as designee under procedures adopted by the Board of Trustees (See Note 2). |

| (d) | Investment categorized as Level 3 in fair value hierarchy. See Note 7. |

| (e) | These shares were acquired directly from the issuer in a private placement on February 26, 2021 with a total cost at December 31, 2022 of $95,452,160. They are considered restricted securities under the Securities Act of 1933 (the "33 Act"). These shares may be sold only if registered under the 33 Act or an exemption is available. The issuer has filed with the SEC a registration statement on Form S-3 providing for the potential resale on an ongoing basis under 33 Act Rule 415 of Common Stock issuable upon conversion of the Series B Preferred Stock, subject to certain terms of a Registration Rights Agreement with the issuer. Due to the lack of an active trading market, all or a portion of this position may be illiquid. Judgment plays a greater role in valuing illiquid securities than those for which a more active market exists, and are valued by Southeastern Asset Management as designee under procedures adopted by the Board of Trustees (See Note 2). |

Note: Non-U.S. Companies represent 12.5% of net assets.

See Notes to Financial Statements.

Management Discussion (Unaudited)

International Fund

Longleaf Partners International Fund added 18.4% in the fourth quarter, outpacing the MSCI EAFE’s hefty 17.34% in the period. The Fund ended the year down 18.69%, while MSCI EAFE closed out the year down 14.45% in a particularly challenging year for most asset classes. Multiple companies rebounded in the fourth quarter, delivering strong double-digit returns that continued into the first part of 2023 as we are writing this letter. While we recognize that more near-term volatility may be in store, we believe this is only the beginning of better performance.

Asian and European markets began what we believe will be the initial stages of a rebound in the fourth quarter, after an extended period of persistent macro headwinds – ranging from the war in Ukraine, soaring energy costs, rising inflation and fears of a recession in Europe, currency weakness versus the US dollar, a slump in the Asia property sector driven by higher interest rates, Chinese consumer weakness and the ongoing pressure of China’s zero-COVID policy.

The Fund's strong fourth-quarter performance doesn't reflect the tremendous volatility experienced during the quarter. The quarter began amid extreme pessimism as Chinese leader Xi Jinping cemented a third term in office, continuing the draconian zero-Covid strategy. While we underestimated the duration of China's zero-Covid policy, China's exit from dynamic zero-Covid was faster than anyone expected. China and Hong Kong rebounded sharply as the Chinese policy environment turned more supportive for the battered property and tech sectors and in the wake of US President Joe Biden and Xi Jinping’s meeting in which they expressed a willingness to engage over issues constructively. European equity markets also saw gains as inflation appeared to peak in October, UK gilt yields and currency stabilized with the appointment of new Prime Minister Rishi Sunak and Chancellor Jeremy Hunt, the European Central Bank slowed its rate hikes and gas prices fell, helping to alleviate consumer price pressure.

While US dollar strength compounded local-denominated losses in 2022, the fourth quarter brought some relief. The US dollar peaked against European and Asian currencies, especially the Japanese yen, which appreciated about 10% during the fourth quarter against the US dollar. We believe the US dollar is expensive and could provide a multi-year tailwind to European and Asian currencies if conditions reverse.

The top contributors in the fourth quarter were among the top detractors in the prior nine months, and we believe we are still in the early stages of these businesses rebounding from overly discounted levels. In addition to the positive macro tailwinds that have persisted in early January, our management teams are taking action across the board, including spinning-off or selling assets, buying back heavily discounted shares and/or considering mergers and acquisitions for whole businesses. Even in the likely case that we see continued volatility in 2023, we believe the companies we own can close the price-to-value gap.

Contribution To Return

GRUMA – Corn flour and tortilla manufacturing company Gruma was the top performer in the fourth quarter and a solid performer for the year. This Mexican based consumer packaged goods company is a great, stable (read: boring) company that does not get the same valuation credit as inferior peers given it is headquartered in Mexico. Gruma issued its first comprehensive ESG report in October. The company made important ethical and environmental commitments, adopting scope 1 and 2 reporting, supported by a materiality analysis, measurable goals linked to the UN Sustainable Development Goals (SDGs) and actionable next steps to achieve them. We applaud the progress made at the company and look forward to seeing how they progress from here.

Richemont – Swiss luxury good company Richemont was a top contributor in a quarter in which our appraisal for the business grew 10%. The company announced its first set of results following the announced disposal of Yoox Net-a-Porter, and, as expected, removing this distraction focused the market on the best-in-class performance of the jewelry maisons. Richemont is benefitting from Chinese Covid lockdowns coming to an end, opening the prospect of the return of high-spending Chinese tourists. Branded jewelry benefits from several structural drivers, including the shift from unbranded to branded (only 25% of the market), the growth of the emerging market middle classes, growth in the underpenetrated US market and, increasingly, the rise of fine jewelry and watches as an investment asset class and store of wealth. With Richemont’s best-in-class brands they remain well-placed to outperform.

flatexDegiro– German-listed digital broker flatexDEGIRO was the single largest absolute and relative detractor for the year. In early December, the company announced disappointing results and lowered 2022 full year guidance. flatexDEGIRO ran into problems properly capitalizing its business in the wake of large growth over the last few years. We reduced our holding in the company in the third quarter and exited the remaining position in December. This was an especially frustrating outcome given it resulted in a permanent loss of capital, but we moved on quickly when events changed our outlook.

Domino’s Pizza Group – UK-listed Domino’s Pizza Group (DPG) was among the top contributors in the fourth quarter, but still ended the year as a top detractor for the full period. DPG announced in the first half that CEO Dominic Paul was stepping down, which resulted in a steep price decline, followed by further pressure in the third quarter as macro concerns over the UK consumer and a weak pound weighed on the stock price. To the good, DPG announced that Elias Diaz, whom we helped place on the board in 2019 and who brings extensive industry experience, capital allocation discipline and an ownership mindset to the business, was taking over as CEO. In November, the company rebounded on the back of reporting positive results, increased share buybacks and improved market share. It was nice to see a solid first quarter for new CEO Diaz and new CFO Edward Jamieson. We believe they will continue to execute from here.

Millicom - Latin American cable company Millicom was also a top detractor for the year after the company executed a poorly timed and steeply discounted rights offering to fund a strategic acquisition of the half of its Guatemala business that Millicom didn't already own. Additionally, Millicom faced competitive pressures in multiple markets. The company’s stock price rebounded in the fourth quarter after French telecom investor Xavier Niel took a 7% stake in Millicom, highlighting the large price-to-value gap. After quarter end, Millicom’s

share price rallied 15% in a day when rumors broke that Apollo Global Management and former SoftBank executive Marcelo Claure were exploring a potential acquisition of the company.

Lanxess – German-listed specialty chemical company Lanxess was among the top detractors in the year, led by steep declines in the first half given its perceived cyclical exposure to commodities, and specifically Russian gas. Lanxess stabilized mid-year on the back of reporting solid first quarter earnings ahead of expectations with consistent fiscal year 2022 guidance and an ability to pass through raw materials costs in the face of inflation. In May, the company announced a two-part deal to sell its DSM Engineering Materials business and enter into a joint venture with Advent/DSM in exchange for €1.1 billion in cash and a stake in the new entity. Lanxess was a top contributor in the fourth quarter on the back of solid results, increased margin targets and decreased capex and restructuring costs, all resulting in much stronger free cash flow power upside, even in a challenging environment.

Portfolio Activity

As market volatility expanded our universe of compelling opportunities, we bought seven new companies and sold five in the year. We initiated two new positions in the fourth quarter – a consumer staples business that we have successfully owned before and a life-sciences company we have long admired and finally had the opportunity to own at a discount. Both are currently undisclosed while we fill out the position sizes. As discussed above, we exited our position in German company flatexDEGIRO when our outlook for the business changed. We added to two heavily discounted holdings and trimmed several businesses that rebounded in the fourth quarter.

Outlook

The International Fund remains fully invested with approximately 3% cash, and our on-deck list has continued to grow longer and broader amid market volatility. Our management teams are taking productive actions to build and recognize value across the portfolio.

We still believe that the S&P 500 looks elevated – or at best fairly valued – on potentially too-high earnings assumptions, and Non-US markets remain statistically cheaper with potentially more attractive macro tailwinds to come than US markets. The portfolio reached a near all-time low P/V ratio of 51% in the second half and ended the year in the high-50s, which has historically been a great time to invest with us.

Performance History (Unaudited)

International Fund

Comparison of Change in Value of $10,000 Investment

Since Inception October 26, 1998

| Average Annual Returns for the Periods Ended December 31, 2022 |

| | 1 Year | 5 Year | 10 Year | 20 Year | Since Inception

10/26/1998 |

| International Fund | -18.69% | -2.36% | 2.21% | 4.51% | 5.68% |

| MSCI EAFE Index | -14.45 | 1.54 | 4.67 | 6.43 | 4.25 |

The index is unmanaged. Because the MSCI EAFE Index was available only at month-end in 1998, we used the 10/31/98 value for performance since inception. Returns reflect reinvested capital gains and dividends but not the deduction of taxes an investor would pay on distributions or share redemptions. Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting southeasternasset.com. The International Fund is subject to stock market risk, meaning stocks in the Fund may fluctuate in response to developments at individual companies or due to general market and economic conditions. Also, because the Fund generally invests in 15 to 25 companies, share value could fluctuate more than if a greater number of securities were held. Investing in non-U.S. securities may entail risk due to non-U.S. economic and political developments, exposure to non-U.S. currencies, and different accounting and financial standards. These risks may be higher when investing in emerging markets.

As reported in the Prospectus dated May 1, 2022, the total expense ratio for the International Fund is 1.17% (gross) and 1.15% (net). This expense ratio is subject to a contractual fee waiver to the extent the fund's normal annual operating expenses exceed 1.15% of average annual net assets. Please refer to the Financial Highlights within this report for the Fund's current expense ratio.

Portfolio Summary (Unaudited)

International Fund

Top 10 Portfolio Holdings at December 31, 2022 |

|

| | Net Assets |

| EXOR N.V. | 6.3% |

| Gruma, S.A.B. DE C.V. | 6.1 |

| Glanbia plc | 5.4 |

| Applus Services, S.A. | 5.0 |

| Prosus N.V. | 5.0 |

| Fairfax Financial Holdings Limited | 4.9 |

| Compagnie Financiere Richemont SA | 4.9 |

| LANXESS AG | 4.7 |

| Alibaba Group Holding Limited | 4.6 |

| CK Hutchison Holdings Limited | 4.5 |

| | 51.4% |

Portfolio Changes

January 1, 2022 through

December 31, 2022 | |

| New Holdings | Quarter |

| adidas AG | 2Q |

| Alibaba Group Holding Limited | 1Q |

| Becle, S.A.B. de C.V. | 4Q |

| Eurofins Scientific | 4Q |

| Housing Development Finance Corporation Ltd. | 2Q |

| Kering | 2Q |

| Seria Company Ltd. | 1Q |

| Eliminations |

| adidas AG | 3Q |

| flatexDegiro AG | 4Q |

| Great Eagle Holdings Limited | 1Q |

| Holcim Ltd | 2Q |

| Seria Company Ltd. | 2Q |

| Sector Composition | |

| | Net Assets |

| Consumer Discretionary | 36.3% |

| Consumer Staples | 22.0 |

| Financials | 18.0 |

| Industrials | 9.5 |

| Communication Services | 6.3 |

| Materials | 4.7 |

| Health Care | 0.2 |

| Cash & Other | 3.0 |

| | 100.0% |

| Regional Compostion | |

| | Net Assets |

| Europe Ex-United Kingdom | 45.2% |

| Asia Ex-Japan | 25.7 |

| North America | 17.4 |

| United Kingdom | 8.7 |

| Cash & Other | 3.0 |

| | 100.0% |

Fund holdings are subject to change and holding discussions are not recommendations to buy or sell any security.

Portfolio of Investments

International Fund

| Common Stocks |

| | Shares | Value | % of Net Assets |

| Beverages |

| Becle, S.A.B. de C.V. (Mexico) | 7,378,752 | $ 16,111,970 | 2.3% |

| Capital Markets |

| Lazard Ltd - Class A(a) (United States) | 811,826 | 28,146,007 | 4.1 |

| Chemicals |

| LANXESS AG (Germany) | 810,812 | 32,721,101 | 4.7 |

| Diversified Financial Services |

| EXOR N.V. (Netherlands) | 597,521 | 43,685,797 | 6.3 |

| Housing Development Finance Corporation Ltd. (India) | 587,667 | 18,736,014 | 2.7 |

| | | 62,421,811 | 9.0 |

| Entertainment |

| Juventus Football Club S.p.A.* (Italy) | 60,638,271 | 20,524,617 | 2.9 |

| Food Products |

| Glanbia plc (Ireland) | 2,967,092 | 37,859,394 | 5.4 |

| Gruma, S.A.B. DE C.V. (Mexico) | 3,153,015 | 42,121,102 | 6.1 |

| Premier Foods plc (United Kingdom) | 22,538,242 | 29,590,902 | 4.3 |

| WH Group Limited (Hong Kong) | 46,665,022 | 27,142,471 | 3.9 |

| | | 136,713,869 | 19.7 |

| Hotels, Restaurants & Leisure |

| Accor S.A.* (France) | 1,230,878 | 30,765,805 | 4.4 |

| Domino's Pizza Group PLC (United Kingdom) | 8,503,380 | 30,161,993 | 4.4 |

| Jollibee Foods Corporation (Philippines) | 6,818,370 | 28,194,344 | 4.1 |

| Melco International Development Limited* (Hong Kong) | 23,653,700 | 25,637,254 | 3.7 |

| | | 114,759,396 | 16.6 |

| Household Durables |

| Gree Electric Appliances, Inc. of Zhuhai (China) | 3,250,046 | 15,110,187 | 2.2 |

| Industrial Conglomerates |

| CK Hutchison Holdings Limited (Hong Kong) | 5,180,500 | 31,094,482 | 4.5 |

| Insurance |

| Fairfax Financial Holdings Limited (Canada) | 56,881 | 33,694,641 | 4.9 |

| Internet & Direct Marketing Retail |

| Alibaba Group Holding Limited* (China) | 2,878,600 | 31,808,448 | 4.6 |

| Prosus N.V. (Netherlands) | 500,858 | 34,554,445 | 5.0 |

| | | 66,362,893 | 9.6 |

| Life Sciences Tools & Services |

| Eurofins Scientific (France) | 21,900 | 1,572,078 | 0.2 |

| Professional Services |

| Applus Services, S.A. (Spain) | 5,090,281 | 34,954,638 | 5.0 |

| Textiles, Apparel & Luxury Goods |

| Compagnie Financiere Richemont SA (Switzerland) | 250,792 | 32,520,371 | 4.7 |

| Kering (France) | 40,484 | 20,606,314 | 3.0 |

| | | 53,126,685 | 7.7 |

| Wireless Telecommunication Services |

| Millicom International Cellular S.A.* (Sweden) | 1,849,634 | 23,424,307 | 3.4 |

| Total Common Stocks (Cost $642,882,412) | | 670,738,682 | 96.8 |

See Notes to Financial Statements.

| Warrants |

| | Shares | Value | % of Net Assets |

| Textiles, Apparel & Luxury Goods |

| Compagnie Financiere Richemont SA Warrants, exercise price $72.46, 11/22/23* (Switzerland) (Cost $0) | 1,311,288 | $ 1,091,972 | 0.2% |

| Short-Term Obligations |

| | Principal Amount | | |

| Repurchase agreement with State Street Bank, 3.55%, dated 12/30/22, due 01/03/23, Repurchase price $20,426,054 (Collateral: $20,826,431 U.S. Treasury Bond, 4.00% due 10/31/29, Par $20,745,400) (Cost $20,418,000) | 20,418,000 | 20,418,000 | 2.9 |

| Total Investments (Cost $663,300,412) | | 692,248,654 | 99.9 |

| Other Assets (Liabilities), Net | | 477,526 | 0.1 |

| Net Assets | | $ 692,726,180 | 100.0% |

| * | Non-income producing security. |

| (a) | Master Limited Partnership |

| Country Weightings | |

| | Net Assets |

| Hong Kong | 12.1% |

| Netherlands | 11.3 |

| United Kingdom | 8.7 |

| Mexico | 8.4 |

| France | 7.6 |

| China | 6.8 |

| Ireland | 5.4 |

| Spain | 5.0 |

| Canada | 4.9 |

| Switzerland | 4.9 |

| Germany | 4.7 |

| Philippines | 4.1 |

| United States | 4.1 |

| Sweden | 3.4 |

| Italy | 2.9 |

| India | 2.7 |

| Cash & Other | 3.0 |

| | 100.0% |

See Notes to Financial Statements.

Management Discussion (Unaudited)

Global Fund

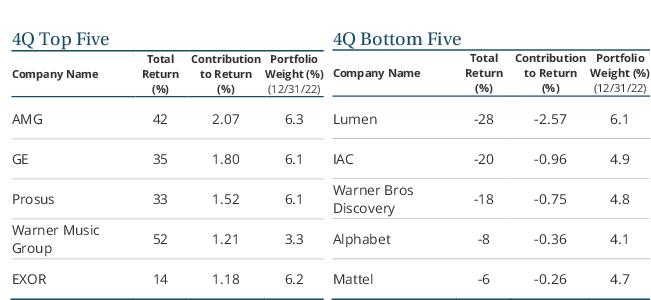

Longleaf Partners Global Fund added 10.19% in the fourth quarter, ending the year down 24.15%, while the MSCI World returned 9.77% in the quarter and fell 18.14% in the year. Multiple companies rebounded in the fourth quarter, delivering strong double-digit returns that continued into the first part of 2023 as we are writing this letter. While we recognize that more near-term volatility may be in store, we believe this is only the beginning of better performance.

Our 2022 annual returns were subpar and lagged our expectations, driven primarily by declines at a handful of detractors – Lumen, IAC and Warner Bros. Discovery – which more than accounted for the relative performance gap, as well as a large portion of the disappointing absolute performance over the last year. We discuss these positions and others in more detail below.

Last month we were talking with a long-time Southeastern observer. He said that with the two macro themes laid out in our 2021 annual letter – 1) no more free money / interest rates going up; 2) more market sanity after years of growth at all costs beating everything – he would have expected a better year for Southeastern in 2022. We agreed with him. In this talk and others like it, we spent the most time going stock-by-stock, detailing how we own high-quality companies that we believe will deliver more free cash flow (FCF) per share than current results and market expectations, leading to better future returns.

We have demonstrated long-term skill as bottom-up stock pickers, but partly because of this deep, micro research focus, it has taken us too long to learn some larger lessons. Our approach remains neither purely statistical value (which has done better this year after being out of favor for the last 15) nor compounders-at-any-cost (which has done much worse this year, after dominating for more than a decade). We believe seeking out the best of both served us well for our first three decades and will again serve us well from here.

Southeastern is at its best when we find temporarily unloved but high-quality companies with short-term earnings per share (EPS) below long-term free cash per share. We have picked many good stocks that fit this description. But we have held ourselves back by making certain portfolio management decisions and investing too early in certain types of stocks. We have done internal and external analysis to better quantify these mistakes, and the impact is large. While you should be wary if we were about to say that there is one magic thing or 10 minor tweaks that will take the next several years back up to our standards, we believe that the following three guidelines will make us much better. As Charlie Munger said: “All I want to know is where I’m going to die, so I won’t go there.” We have been wounded at these three places too often, so we will avoid them in the future.

1) Overweights: The numbers show that we are more often than not good stock pickers, but we have not done well with our overweighting decisions for a long time. After trying for years to qualitatively fix this problem, we are now limiting our discretion on this matter by not allowing stocks to get above 6.5% weightings in the portfolio for any extended period of time. Sometimes we will have companies temporarily pop over this level on good news, but the longer stocks have stayed at weightings like this, the worse they have done for us.