Indexes

The S&P 500 Index is an index of 500 stocks chosen for market size, liquidity and industry grouping, among other factors. The S&P is designed to be a leading indicator of U.S. equities and is meant to reflect the risk/return characteristics of the large cap universe. The S&P 500 Value Index constituents are drawn from the S&P 500 and are based on three factors: the ratios of book value, earnings, and sales to price.

The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 10% of the total market capitalization of the Russell 3000 Index. The Russell 2000 Value index is drawn from the constituents of the Russell 2000 based on book-to-price (B/P) ratio.

The MSCI EAFE Index (Europe, Australia, Far East) is a broad based, unmanaged equity market index designed to measure the equity market performance of 21 developed markets, excluding the US & Canada.

The MSCI EAFE Value Index captures large and mid-cap securities exhibiting overall value style characteristics across Developed Markets countries around the world, excluding the US and Canada.

The MSCI World Index is a broad-based, unmanaged equity market index designed to measure the equity market performance of 23 developed markets, including the United States.

The MSCI World Value Index captures large and mid-cap securities exhibiting overall value style characteristics across 23 Developed Markets countries.

An index cannot be invested in directly.

Definitions

An ETF is an exchange traded fund.

EBITDA is a company’s earnings before interest, taxes, depreciation and amortization.

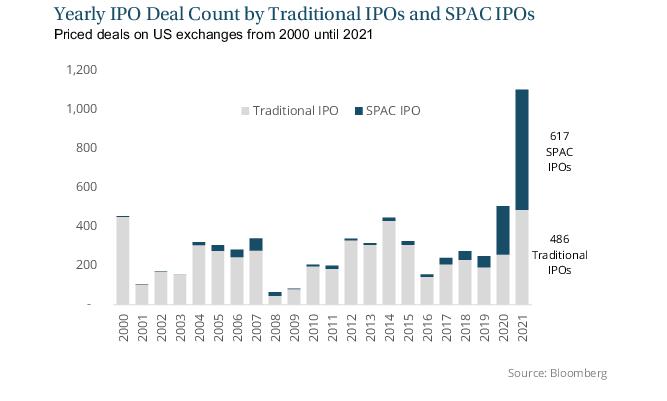

A special purpose acquisition company (SPAC) is a company with no commercial operations that is formed strictly to raise capital for the purpose of acquiring an existing company.

Discounted cash flow (DCF) is a valuation method used to estimate the attractiveness of an investment opportunity. DCF analysis uses future free cash flow projections and discounts them to arrive at a present value estimate, which is used to evaluate the potential for investment.

Free Cash Flow (FCF) is a measure of a company’s ability to generate the cash flow necessary to maintain operations. Generally, it is calculated as operating cash flow minus capital expenditures.

Internal rate of return (IRR) is the interest rate at which the net present value of all the cash flows from an investment equal zero.

Earnings per share (EPS) is the portion of a company's net income allocated to each share of common stock.

EV/EBITDA is a ratio comparing a company’s enterprise value and its earnings before interest, taxes, depreciation and amortization.

The Global Financial Crisis (GFC) is a reference to the financial crisis of 2007-2008.

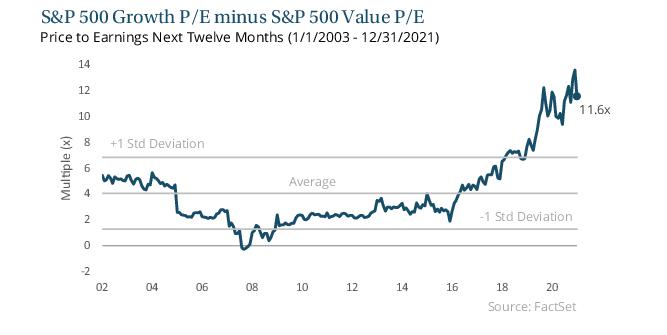

Price / Earnings (P/E) is the ratio of a company’s share price compared to its earnings per share.

A 13D filing is generally required for any beneficial owner of more than 5% of any class of registered equity securities, and who are not able to claim an exemption for more limited filings due to an intent to change or influence control of the issuer.

ESG stands for Environmental, Social and Governance, and refers to the three main factors when measuring the sustainability and ethical impact of an investment in a business or company.

© 2022 Southeastern Asset Management, Inc. All Rights Reserved.

Longleaf, Longleaf Partners Funds and the pine cone logo are registered trademarks of Longleaf Partners Funds Trust.

Southeastern Asset Management, Inc. is a registered trademark.

Funds distributed by ALPS Distributors, Inc.