UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811- 4932

John Hancock World Fund

(Exact name of registrant as specified in charter)

601 Congress Street, Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Alfred P. Ouellette

Senior Counsel and Assistant Secretary

601 Congress Street

Boston, Massachusetts 02210

(Name and address of agent for service)

| Registrant's telephone number, including area code: | 617-663-4324 |

| Date of fiscal year end: | October 31 |

Date of reporting period: April 30, 2007

ITEM 1. REPORT TO SHAREHOLDERS.

| TABLE OF CONTENTS |

|

| Your fund at a glance |

| page 1 |

|

| Manager’s report |

| page 2 |

|

| A look at performance |

| page 6 |

|

| Your expenses |

| page 8 |

|

| Fund’s investments |

| page 10 |

|

| Financial statements |

| page 14 |

|

| Notes to financial |

| statements |

| page 20 |

|

| For more information |

| page 32 |

|

CEO corner

To Our Shareholders,

The U.S. financial markets produced solid results over the last six months. Positive economic news, stronger than expected corporate earnings and increased merger and acquisitions activity served to overcome concerns about inflation, energy costs and the troubled subprime mortgage market’s potential to put the brakes on the economy. This environment also led the Federal Reserve Board to hold short-term interest rates steady. Even with a sharp decline in late February, the broad stock market returned 8.60% for the six months ended April 30, 2007. The Dow Jones Industrial Average punched through the 13,000 mark for the first time in April and posted a string of new highs as the period ended.

After a remarkably long period of calm, the financial markets were rocked at the end of February by a dramatic sell-off in China’s stock market, which had ripple effects on financial markets worldwide. It also shook investors out of their seemingly casual attitude toward risk and remind them of the simple fact that stock markets move in two directions — down as well as up.

Although the downturn lasted for less than a month before positive news stopped the fall, it was also a good occasion to bring to mind several important investment principles that we believe are at the foundation of successful investing. First, keep a long-term approach to investing, avoiding emotional reactions to daily market moves. Second, maintain a well-diversified portfolio that is appropriate for your goals, risk profile and time horizons.

After the market’s recent moves, we encourage investors to sit back, take stock and set some realistic expectations. While history bodes well for the U.S. market in 2007 (since 1939, the S&P 500 Index has always produced positive results in the third year of a presidential term), there are no guarantees, and opinions are divided on the future of this more-than-four-year-old bull market.

The recent volatility could also be a wake-up call to contact your financial professional to determine whether changes are in order to your investment mix. Some asset groups have had long runs of outperformance. Others had truly outsized returns in 2006. These trends argue for a look to determine if these categories now represent a larger stake in your portfolios than prudent diversification would suggest they should. After all, we believe investors with a well-balanced portfolio and a marathon, not a sprint, approach to investing, stand a better chance of weathering the market’s short-term twists and turns, and reaching their long-term goals.

Sincerely,

Keith F. Hartstein,

President and Chief Executive Officer

This commentary reflects the CEO’s views as of April 30, 2007. They are subject to change at any time.

Your fund at a glance

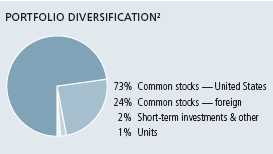

The Fund seeks long-term growth of capital by normally investing at least 80% of its assets in stocks of U.S. and foreign health sciences companies.

Over the last six months

► Health care stocks gained nicely, posting returns in line with the broader stock market.

► Positive investor sentiment, driven by low interest rates, strong economic growth and increased merger and acquisition activity, benefited the sector.

► Sharp declines in a few stocks caused the Fund to fall behind both the Russell 3000 Healthcare Index and the Morningstar specialty/health fund category average.

| Top 10 holdings | | | | |

| Shire Plc | 4.9% | | Inverness Medical Innovations, Inc. | 2.7% |

| |

|

| Bayer AG | 4.7% | | Aveta, Inc. | 2.7% |

| |

|

| Roche Holding AG | 3.8% | | Gilead Sciences, Inc. | 2.4% |

| |

|

| Novartis AG | 3.6% | | Amgen, Inc. | 2.1% |

| |

|

| Wyeth | 2.8% | | Medco Health Solutions, Inc. | 1.9% |

| |

|

As a percentage of net assets on April 30, 2007.

1

Manager’s report

John Hancock

Health Sciences Fund

Effective March 14, 2007, Jon D. Stephenson, CFA took over management responsibilities for the fund, replacing Robert C. Junkin, CPA, who left the firm to pursue other opportunities.

Health care stocks posted strong gains in line with the broader market during the six months ended April 30, 2007. The Federal Reserve’s decision to hold interest rates steady, the economy’s continued momentum and increased merger and acquisition activity helped fuel returns across the market.

Within the health care sector, many companies gained after reporting solid earnings growth, attracting investors to the sector. Heath care stocks temporarily lost their momentum in the first quarter as concerns related to subprime mortgage defaults temporarily unsettled the market. Subsectors with higher risk and return profiles, such as bio-technology, suffered more than more stable subsectors, such as health care services. Stocks across the market, however, got a second wind later in the period, helping the broader market to a strong finish. Health care companies overall reported solid earnings growth in the first quarter of 2007, leaving the Russell 3000 Healthcare Index with an 8.50% return for the six-month period.

Performance review

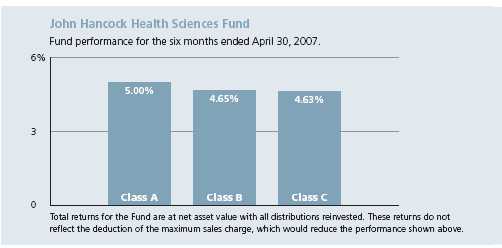

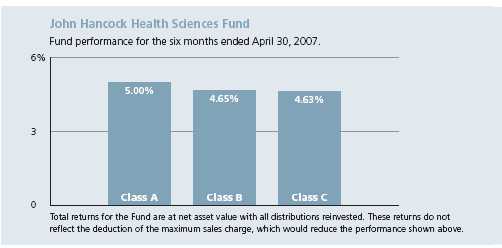

For the six months ended April 30, 2007, John Hancock Health Science Fund’s Class A, Class B and Class C shares posted total returns

SCORECARD

| INVESTMENT | | PERIOD’S PERFORMANCE ... AND WHAT’S BEHIND THE NUMBERS |

| | | |

| Aveta | ▼ | Disappointing fourth quarter earnings; debt concerns |

| | | |

| Accuray | ▼ | Worries over demand outlook following reduction in procedural |

| | | reimbursement rates |

| | | |

| Shire | ▲ | Strength in ADHD franchise, robust pipeline, new product approval |

2

Portfolio Manager, MFC Global Investment Management (U.S.), LLC Jon D. Stephenson, CFA

of 5.00%, 4.65% and 4.63%, respectively, at net asset value. During the same period, the average Morningstar, Inc. specialty/health fund returned 7.52% .1 Keep in mind that your net asset value return will be different from the Fund’s performance if you were not invested in the Fund for the entire period or did not reinvest all distributions.

“Health care stocks posted strong

gains in line with the broader

market during the six months

ended April 30, 2007.”

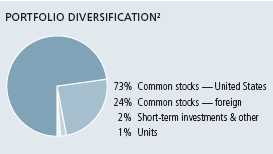

The Fund had a small- and mid-cap bias that stemmed from its focus on innovative biotechnology, pharmaceutical and medical device companies with strong growth prospects. At the same time, the Fund had a below-average investment in large-cap pharmaceutical companies, many of which have relatively weak new product pipelines and face competition from generic drug manufacturers. These strategies resulted in positive stock selection in both the biotechnology and pharmaceutical sub-sectors. However, sharp downturns in three stocks outside these subsectors caused the Fund to underperform the Russell index. Stock picks in the health care equipment group and certain subsector weighting decisions further eroded returns.

Positive contributions from biotechnology stocks

Biotechnology, which represented a larger weight in the Fund than the Russell index, made the biggest contribution to returns. Stock selection was very favorable, led by Theratechnologies, Inc.; Acorda Therapeutics, Inc.; and Gilead Sciences, Inc. Theratechnologies is a small Canadian biotech firm with an attractive product for treating HIV lipo-atrophy, a condition resulting in fat redistribution and sunken skin. The stock rose after the release of positive test data. Acorda climbed amid growing expectations for its new multiple sclerosis drug, Fampridine-SER, which has already shown in a phase III trial that it can improve walking function in patients.

Health Sciences Fund

3

Gilead Sciences, which focuses on HIV drug treatments, benefited from continued strong execution by management and growing demand for its products. In addition, the company’s outlook remained bright in light of positive secular trends, including increased screening for HIV and earlier intervention with drug therapies, both of which should boost demand for Gilead Sciences’ medications. The Fund also gained from downplaying large-cap biotechnology stocks, many of which were flat or declined during the period. We were concerned that many of these companies had weak pipelines and slowing earnings growth.

Added gains from pharmaceuticals

Within the pharmaceuticals industry, where the Fund had a sizable but much lower stake than the Russell index’s hefty 45% weighting, Shire Plc was a top performer. Shire, a specialty pharmaceutical company based in the United Kingdom, focuses heavily on treatments for Attention Deficit Hyperactivity Disorder (ADHD). Strong earnings growth, approval of the company’s next-generation ADHD medication and a promising new product pipeline propelled the stock higher. Elsewhere, Bayer AG, headquartered in Germany, continued to undergo a transformation from a chemicals conglomerate to a pharmaceutical-driven company with the purchase in 2006 of German drug giant Schering. This transition drove stock appreciation. Elsewhere, Medco Health Solutions, Inc., a leading provider of pharmacy benefit management services, rallied nicely, buoyed by overall prescription growth as well as the company’s increased penetration of higher-margin mail order services and generic drugs.

| INDUSTRY DISTRIBUTION2 |

| | |

| Pharmaceuticals | 34% |

| Biotechnology | 20% |

| Health care equipment | 15% |

| Health care services | 8% |

| Health care supplies | 6% |

| Diversified chemicals | 5% |

| Health care facilities | 3% |

| Health care distributors | 2% |

| All others | 5% |

Sharp losses from a few names

A few stocks accounted for most of the Fund’s underper-formance. Aveta, Inc. a privately held managed health care company with a strong market presence in Puerto Rico, took a nosedive after pre-announcing disappointing fourth quarter earnings numbers that raised concerns the company could default on its debt. Aveta’s downturn hurt even more because it was a large position in the Fund. We held on to our stake, believing the damage had been done and that new management was taking the right steps to restructure the company’s debt and re-price its managed care business starting in 2008.

Health Sciences Fund

4

For diversification purposes, the Fund also had a small investment in a non-health care company, Force Protection, Inc., which makes armored military vehicles that protect troops from landmines. Disappointing news about a key contract with the U.S. Marines caused the stock to slide early in the year. We cut our losses to focus on opportunities within health care, causing the Fund to miss the stock’s subsequent rebound. Accuray, Inc., a health care equipment stock, also hurt returns. The company, which makes large surgical equipment for excising tumors, declined due to concerns that procedural reimbursement rate cuts, which took effect in early 2007, would slow hospitals’ buying patterns. We also eliminated this position from the portfolio.

“Biotechnology, which

represented a larger weight in

the Fund than the Russell index,

made the biggest contribution

to returns.”

Optimistic outlook

We remain excited about investment opportunities in the health care sector, where positive secular trends, including an aging population, continue to drive growth in demand. Going forward, our focus will remain on pharmaceutical, biotech and medical device companies with innovative products as well as health care services companies that offer cost savings to payers. We plan to take advantage of market volatility, which can create attractive buying opportunities, allowing us to invest in these types of companies when their stocks are selling at a discount to their intrinsic value. In addition, we plan to look for potential catalysts — such as a new product or upcoming clinical data release — that could help unlock the stock’s true value. We believe these strategies will help us in our effort to generate sustainable returns for shareholders.

This commentary reflects the views of the manager through the end of the Fund’s period discussed in this report. The manager’s statements reflect his own opinions. As such, they are in no way guarantees of future events, and are not intended to be used as investment advice or a recommendation regarding any specific security. They are also subject to change at any time as market and other conditions warrant.

Sector investing is subject to greater risks than the market as a whole.

International investing involves special risks such as political, economic and currency risks and differences in accounting standards and financial reporting.

1 Figures from Morningstar, Inc. include reinvested dividends and do not take into account sales charges. Actual load-adjusted performance is lower.

2 As a percentage of net assets on April 30, 2007.

Health Sciences Fund

5

A look at performance

For the periods ended April 30, 2007

| | | Average annual returns | | | Cumulative total returns | | |

| | | with maximum sales charge (POP) | | with maximum sales charge (POP) | |

| | Inception | | | | Since | | | | | | Since |

| Class | date | 1-year | 5-year | 10-year | inception | | 6-month | 1-year | 5-year | 10-year | inception |

|

| A | 10-1-91 | 3.09% | 6.41% | 9.24% | — | | -0.26% | 3.09% | 36.43% | 141.89% | — |

|

| B | 3-7-94 | 3.57 | 6.47 | 9.19 | — | | 0.60 | 3.57 | 36.80 | 140.79 | — |

|

| C | 3-1-99 | 6.91 | 6.75 | — | 6.29% | | 3.82 | 6.91 | 38.64 | — | 64.53% |

|

Performance figures assume all distributions are reinvested. Public offering price (POP) figures reflect maximum sales charge on Class A shares of 5%, and the applicable contingent deferred sales charge (CDSC) on Class B and Class C shares. The returns for Class C shares have been adjusted to reflect the elimination of the front-end sales charge effective July 15, 2004. The Class B shares’ CDSC declines annually between years 1-6 according to the following schedule: 5, 4, 3, 3, 2, 1%. No sales charge will be assessed after the sixth year. Class C shares held for less than one year are subject to a 1% CDSC.

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the Fund’s current performance may be higher or lower than the performance shown. For performance data current to the most recent month-end, please call 1-800-225-5291 or visit the Fund’s Web site at www.jhfunds.com.

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Fund’s performance results reflect any applicable expense reductions, without which the expenses would increase and results would have been less favorable.

Health Sciences Fund

6

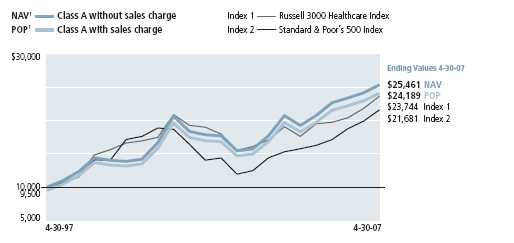

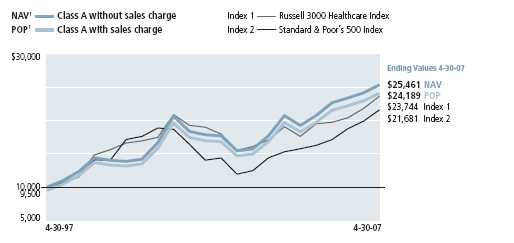

Growth of $10,000

This chart shows what happened to a hypothetical $10,000 investment in Health Sciences Fund Class A shares for the period indicated. For comparison, we’ve shown the same investment in two separate indexes.

| | | Without | With maximum | | |

| Class | Period beginning | sales charge | sales charge | Index 1 | Index 2 |

|

| B2 | 4-30-97 | $24,079 | $24,079 | $23,744 | $21,681 |

|

| C2,3 | 3-1-99 | 16,453 | 16,453 | 13,667 | 13,653 |

|

Assuming all distributions were reinvested for the period indicated, the table above shows the value of a $10,000 investment in the Fund’s Class B and Class C shares, respectively, as of April 30, 2007. The Class C shares investment with maximum sales charge has been adjusted to reflect the elimination of the front-end sales charge effective July 15, 2004. Performance of the classes will vary based on the difference in sales charges paid by shareholders investing in the different classes and the fee structure of those classes.

Russell 3000 Healthcare Index — Index 1 — is a capitalization-weighted index composed of companies involved in medical services or health care.

Standard & Poor’s 500 Index — Index 2 — is an unmanaged index that includes 500 widely traded common stocks.

It is not possible to invest directly in an index. Index figures do not reflect sales charges which would have resulted in lower values if they did.

1 NAV represents net asset value and POP represents public offering price.

2 No contingent deferred sales charge applicable.

3 Index 1 figure as of closest month end to inception date.

Health Sciences Fund

7

Your expenses

These examples are intended to help you understand your ongoing operating expenses.

Understanding fund expenses

As a shareholder of the Fund, you incur two types of costs:

■ Transaction costs which include sales charges (loads) on purchases or redemptions (varies by share class), minimum account fee charge, etc.

■ Ongoing operating expenses including management fees, distribution and service fees (if applicable) and other fund expenses.

We are going to present only your ongoing operating expenses here.

Actual expenses/actual returns

This example is intended to provide information about your fund’s actual ongoing operating expenses, and is based on your fund’s actual return. It assumes an account value of $1,000.00 on November 1, 2006, with the same investment held until April 30, 2007.

| | Account value | Ending value | Expenses paid during period |

| | on 11-1-06 | on 4-30-07 | ended 4-30-071 |

|

| Class A | $1,000.00 | $1,050.00 | $8.07 |

|

| Class B | 1,000.00 | 1,046.50 | 11.60 |

|

| Class C | 1,000.00 | 1,046.30 | 11.61 |

|

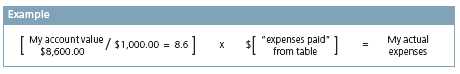

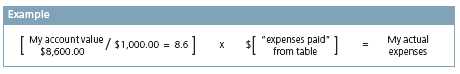

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at April 30, 2007 by $1,000.00, then multiply it by the “expenses paid” for your share class from the table above. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

Health Sciences Fund

8

Hypothetical example for comparison purposes

This table allows you to compare your fund’s ongoing operating expenses with those of any other fund. It provides an example of the Fund’s hypothetical account values and hypothetical expenses based on each class’s actual expense ratio and an assumed 5% annualized return before expenses (which is not your fund’s actual return). It assumes an account value of $1,000.00 on November 1, 2006, with the same investment held until April 30, 2007. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses.

| | Account value | Ending value | Expenses paid during period |

| | on 11-1-06 | on 4-30-07 | ended 4-30-071 |

|

| Class A | $1,000.00 | $1,016.92 | $7.94 |

|

| Class B | 1,000.00 | 1,013.46 | 11.41 |

|

| Class C | 1,000.00 | 1,013.45 | 11.42 |

|

Remember, these examples do not include any transaction costs, such as sales charges; therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the prospectus for details regarding transaction costs.

1 Expenses are equal to the Fund’s annualized expense ratio of 1.59%, 2.29% and 2.29% for Class A, Class B and Class C, respectively, multiplied by the average account value over the period, multiplied by number of days in most recent fiscal half-year/365 or 366 (to reflect the one-half year period).

Health Sciences Fund

9

F I N A N C I A L S T A T E M E N T S

Fund’s investments

Securities owned by the Fund on 4-30-07 (unaudited)

This schedule is divided into four main categories: common stocks, units, warrants and short-term investments. Common stocks, units and warrants are further broken down by industry group. Short-term investments, which represent the Fund’s cash position, are listed last.

| Issuer | Shares | Value |

| Common stocks 96.69% | | $218,130,825 |

|

| (Cost $178,246,369) | | |

| | | |

| Agricultural Products 1.39% | | 3,134,860 |

|

| Archer-Daniels-Midland Co. | 35,000 | 1,354,500 |

|

| Bunge Ltd. (Bermuda) | 23,500 | 1,780,360 |

| | | |

| Biotechnology 19.27% | | 43,466,428 |

|

| 3SBio, Inc., American Depositary Receipt (ADR) (Cayman Islands) (I) | 123,500 | 1,247,350 |

|

| Acorda Therapeutics, Inc. (I) | 122,942 | 3,046,503 |

|

| Advanced Magnetics, Inc. (I)(L) | 41,000 | 2,697,800 |

|

| Amgen, Inc. (I)(L) | 72,550 | 4,653,357 |

|

| BioMarin Pharmaceutical, Inc. (I) | 170,500 | 2,755,280 |

|

| BioSphere Medical, Inc. (I) | 178,600 | 1,212,694 |

|

| Celgene Corp. (I)(L) | 20,000 | 1,223,200 |

|

| CytRx Corp. (I)(L) | 370,000 | 1,528,100 |

|

| Exelixis, Inc. (I) | 123,200 | 1,323,168 |

|

| Gilead Sciences, Inc. (I)(L) | 67,000 | 5,475,240 |

|

| Iomai Corp. (I) | 135,000 | 677,700 |

|

| Isis Pharmaceuticals, Inc. (I)(L) | 175,000 | 1,790,250 |

|

| OSI Pharmaceuticals, Inc. (I) | 65,000 | 2,255,500 |

|

| Panacos Pharmaceuticals, Inc. (I)(L) | 490,750 | 2,335,970 |

|

| PDL BioPharma, Inc. (I) | 134,000 | 3,384,840 |

|

| Regeneration Technologies, Inc. (I) | 355,000 | 3,006,850 |

|

| Rosetta Genomics Ltd. (Israel) (I) | 95,000 | 684,000 |

|

| Theratechnologies, Inc. (Canada) (I) | 489,581 | 4,168,626 |

| Diversified Chemicals 4.70% | | 10,618,600 |

|

| Bayer AG (Germany) (C) | 154,500 | 10,618,600 |

| | | |

| Diversified Financial Services 0.53% | | 1,189,338 |

|

| Trans-India Acquisition Corp. (I) | 140,750 | 1,189,338 |

| | | |

| Health Care Distributors 2.02% | | 4,559,703 |

|

| Animal Health International, Inc. (I) | 37,620 | 502,603 |

|

| Cardinal Health, Inc. | 58,000 | 4,057,100 |

| | | |

| Health Care Equipment 14.45% | | 32,606,857 |

|

| ABIOMED, Inc. (I)(L) | 120,000 | 1,538,400 |

|

| ArthroCare Corp. (I)(L) | 50,000 | 2,063,000 |

See notes to financial statements

Health Sciences Fund

10

F I N A N C I A L S T A T E M E N T S

| Issuer | Shares | Value |

| | | |

| Health Care Equipment (continued) | | |

|

| Baxter International, Inc. | 71,000 | $4,020,730 |

|

| Cardica, Inc. (I)(L) | 125,000 | 778,750 |

|

| Electro-Optical Sciences, Inc. (I) | 250,000 | 1,120,000 |

|

| Electro-Optical Sciences, Inc. (I)(K) | 43,860 | 196,493 |

|

| Gen-Probe, Inc. (I) | 74,600 | 3,812,806 |

|

| Hospira, Inc. (I) | 100,000 | 4,055,000 |

|

| Micrus Endovascular Corp. (I) | 58,000 | 1,289,340 |

|

| NMT Medical, Inc. (I) | 130,000 | 2,025,400 |

|

| Northstar Neuroscience, Inc. (I) | 124,190 | 1,691,468 |

|

| SenoRx, Inc. (I) | 140,120 | 1,113,954 |

|

| SonoSite, Inc. (I)(L) | 85,000 | 2,463,300 |

|

| Stereotaxis, Inc. (I)(L) | 305,600 | 3,181,296 |

|

| Thoratec Corp. (I) | 166,000 | 3,256,920 |

| | | |

| Health Care Facilities 3.37% | | 7,595,577 |

|

| Assisted Living Concepts, Inc. (I) | 120,000 | 1,470,000 |

|

| Capital Senior Living Corp. (I) | 120,000 | 1,393,200 |

|

| DaVita, Inc. (I) | 34,000 | 1,856,740 |

|

| Sun Healthcare Group, Inc. (I) | 107,180 | 1,344,037 |

|

| Sunrise Senior Living, Inc. (I) | 40,000 | 1,531,600 |

| | | |

| Health Care Services 8.05% | | 18,166,815 |

|

| Aveta, Inc. (I)(S) | 752,790 | 6,022,320 |

|

| Medco Health Solutions, Inc. (I)(L) | 55,160 | 4,303,583 |

|

| Nektar Therapeutics (I)(L) | 170,000 | 2,102,900 |

|

| OXiGENE, Inc. (I) | 200,000 | 938,000 |

|

| Santarus, Inc. (I)(L) | 299,350 | 2,287,034 |

|

| Systems Xcellence, Inc. (Canada) (I) | 110,170 | 2,512,978 |

| | | |

| Health Care Supplies 5.74% | | 12,952,866 |

|

| Bioenvision, Inc. (I)(L) | 185,000 | 616,050 |

|

| Healthcare Acquisition Corp. (I) | 150,000 | 1,123,500 |

|

| Inverness Medical Innovations, Inc. (I) | 20,500 | 821,025 |

|

| Inverness Medical Innovations, Inc. (I)(K) | 152,000 | 6,087,600 |

|

| PolyMedica Corp. (L) | 75,000 | 3,033,000 |

|

| Xtent, Inc. (I)(L) | 94,060 | 1,271,691 |

| | | |

| Life Sciences Tools & Services 1.49% | | 3,362,000 |

|

| Enzo Biochem, Inc. (I)(L) | 200,000 | 3,362,000 |

| | | |

| Managed Health Care 1.27% | | 2,859,680 |

|

| Aetna, Inc. | 61,000 | 2,859,680 |

| | | |

| Pharmaceuticals 34.41% | | 77,618,101 |

|

| Altus Pharmaceuticals, Inc. (I) | 140,150 | 2,075,621 |

|

| Anesiva, Inc. (I) | 450,000 | 3,532,500 |

|

| Astellas Pharma, Inc. (Japan) | 60,150 | 2,630,799 |

|

| Auxilium Pharmaceuticals, Inc. (I) | 224,000 | 3,328,640 |

|

| Barr Pharmaceuticals, Inc. (I) | 55,000 | 2,659,800 |

See notes to financial statements

Health Sciences Fund

11

F I N A N C I A L S T A T E M E N T S

| Issuer | Shares | Value |

| | | |

| Pharmaceuticals (continued) | | |

|

| BioMimetic Therapeutics, Inc. (I) | 135,000 | $2,529,900 |

|

| Cubist Pharmaceuticals, Inc. (I)(L) | 75,000 | 1,608,750 |

|

| Endo Pharmaceuticals Holdings, Inc. (I) | 75,000 | 2,320,500 |

|

| Inspire Pharmaceuticals, Inc. (I) | 240,400 | 1,839,060 |

|

| Inyx, Inc. (I) | 647,500 | 1,651,125 |

|

| Labopharm, Inc. (Canada) (I)(L) | 200,000 | 1,408,000 |

|

| Medicis Pharmaceutical Corp. (Class A) | 90,000 | 2,736,000 |

|

| Merck & Co., Inc. | 82,000 | 4,218,080 |

|

| MGI Pharma, Inc. (I)(L) | 133,500 | 2,939,670 |

|

| Novartis AG (ADR) (Switzerland) | 139,000 | 8,074,510 |

|

| Paladin Labs, Inc. (Canada) (I) | 179,600 | 1,907,889 |

|

| Pharmion Corp. (I)(L) | 55,000 | 1,665,950 |

|

| Roche Holding AG (Switzerland) | 45,000 | 8,481,194 |

|

| Schering-Plough Corp. | 95,100 | 3,017,523 |

|

| Shire Plc (ADR) (United Kingdom) | 159,000 | 11,112,510 |

|

| Spectrum Pharmaceuticals, Inc. (I) | 248,000 | 1,664,080 |

|

| Wyeth | 112,000 | 6,216,000 |

| |

| Issuer | Shares | Value |

| Units 0.53% | | $1,184,040 |

|

| (Cost $1,104,000) | | |

| | | |

| Health Care Supplies 0.53% | | 1,184,040 |

|

| Oracle Healthcare Acquisition (I) | 138,000 | 1,184,040 |

| |

| Issuer | Shares | Value |

| Warrants 0.08% | | $168,000 |

|

| (Cost $142,500) | | |

| | | |

| Health Care Equipment 0.00% | | 0 |

|

| Electo-Optical Sciences, Inc. (B) | 6,579 | 0 |

| | | |

| Health Care Supplies 0.08% | | 168,000 |

|

| Healthcare Acquisition Corp. | 150,000 | 168,000 |

See notes to financial statements

Health Sciences Fund

12

F I N A N C I A L S T A T E M E N T S

| | Interest | Par value | |

| Issuer, description, maturity date | rate | (000) | Value |

| Short-term investments 23.30% | | | $52,567,403 |

|

| (Cost $52,567,403) | | | |

| | | | |

| Joint Repurchase Agreement 2.41% | | | 5,436,000 |

|

| Investment in a joint repurchase agreement transaction | | | |

| with Bank of America Corp. — Dated 4-30-07, due 5-1-07 | | | |

| (Secured by U.S. Treasury Inflation Indexed | | | |

| Notes 0.875%, due 4-15-10, 3.000%, due 7-15-12, | | | |

| 3.375%, due 1-15-12 and U.S. Treasury STRIPS, | | | |

| due 5-15-21). | | | |

| Maturity value: $5,436,773 | 5.120% | $5,436 | 5,436,000 |

| |

| | | Shares | |

| Cash Equivalents 20.89% | | | 47,131,403 |

|

| John Hancock Cash Investment Trust (T)(W) | | 47,131,403 | 47,131,403 |

|

| Total investments (Cost $232,060,272) 120.60% | | | $272,050,268 |

|

| |

| Other assets and liabilities, net (20.60%) | | | ($46,462,018) |

|

| |

| Total net assets 100.00% | | | $225,588,250 |

(B) This security is fair valued in good faith under procedures established by the Board of Trustees. These securities amounted to $0 or 0% of the Fund’s net assets as of April 30, 2007.

(C) Parenthetical disclosure of a country in the security description represents country of issuer; however, the security is euro-denominated.

(I) Non-income-producing security.

(K) Direct placement securities are restricted to resale. They have been fair valued in accordance with procedures approved by the Trustees after consideration of restrictions as to resale, financial condition and prospects of the issuer, general market conditions and pertinent information in accordance with the Fund’s bylaws and the Investment Company Act of 1940, as amended. The Fund has limited rights to registration under the Securities Act of 1933 with respect to these restricted securities.

Additional Information on these securities is as follows:

| | | | Value as a | |

| | | | percentage | |

| | Acquisition | Acquisition | of Fund's | Value as of |

| Issuer, description | date | cost | net assets | April 30, 2007 |

|

| Electro Optical Sciences, Inc. | 10-31-06 | $250,002 | 0.09% | $196,493 |

|

| Inverness Medical Innovations, Inc. | 8-17-06 | 4,598,000 | 2.70 | 6,087,600 |

(L) All or a portion of this security is on loan as of April 30, 2007.

(S) This security is exempt from registration under Rule 144A of the Securities Act of 1933. Such security may be resold, normally to qualified institutional buyers, in transactions exempt from registration. Rule 144A securities amounted to $6,022,320 or 2.67% of the Fund’s net assets as of April 30, 2007.

(T) Represents investment of securities lending collateral. (W) Issuer is an affiliate of John Hancock Advisers, LLC.

Parenthetical disclosure of a foreign country in the security description represents country of a foreign issuer.

The percentage shown for each investment category is the total value of that category as a percentage of the net assets of the Fund.

See notes to financial statements

Health Sciences Fund

13

F I N A N C I A L S T A T E M E N T S

Financial statements

Statement of assets and liabilities 4-30-07 (unaudited)

This Statement of Assets and Liabilities is the Fund’s balance sheet. It shows the value of what the Fund owns, is due and owes. You’ll also find the net asset value and the maximum offering price per share.

| Assets | |

|

| Investments at value (cost $232,060,272) including $45,445,628 | |

| of securities loaned | $272,050,268 |

| Cash | 10,698 |

| Foreign currency at value (cost $166,364) | 166,364 |

| Receivable for investments sold | 3,122,518 |

| Receivable for shares sold | 83,620 |

| Dividends and interest receivable | 91,280 |

| Other assets | 16,475 |

| | |

| Total assets | 275,541,223 |

| |

| Liabilities | |

|

| Payable for investments purchased | 1,008,277 |

| Payable for shares repurchased | 1,078,243 |

| Payable upon return of securities loaned | 47,131,403 |

| Payable to affiliates | |

| Management fees | 464,490 |

| Distribution and service fees | 16,619 |

| Other | 169,145 |

| Other payables and accrued expenses | 84,796 |

| | |

| Total liabilities | 49,952,973 |

| |

| Net assets | |

|

| Capital paid-in | 174,053,804 |

| Accumulated net realized gain on investments and foreign currency transactions | 12,616,281 |

| Net unrealized appreciation of investments and translation of assets and | |

| liabilities in foreign currencies | 39,991,264 |

| Accumulated net investment loss | (1,073,099) |

| | |

| Net assets | $225,588,250 |

| |

| Net asset value per share | |

|

| Based on net asset values and shares outstanding — the Fund has an | |

| unlimited number of shares authorized with no par value | |

| Class A ($151,569,212 ÷ 3,840,292 shares) | $39.47 |

| Class B ($61,434,300 ÷ 1,797,526 shares) | $34.18 |

| Class C ($12,584,738 ÷ 368,175 shares) | $34.18 |

| |

| Maximum offering price per share | |

|

| Class A1 ($39.47 ÷ 95.0%) | $41.55 |

1 On single retail sales of less than $50,000. On sales of $50,000 or more and on group sales the offering price is reduced.

See notes to financial statements

Health Sciences Fund

14

F I N A N C I A L S T A T E M E N T S

Statement of operations For the period ended 4-30-07 (unaudited)1

This Statement of Operations summarizes the Fund’s investment income earned and expenses incurred in operating the Fund. It also shows net gains (losses) for the period stated.

| Investment income | |

|

| Dividends (net of foreign withholding taxes of $65,669) | $722,059 |

| Interest | 200,736 |

| Securities lending | 167,308 |

| Total investment income | 1,090,103 |

| |

| Expenses | |

|

| Investment management fees (Note 2) | 922,102 |

| Distribution and service fees (Note 2) | 642,007 |

| Transfer agent fees (Note 2) | 431,641 |

| Accounting and legal services fees (Note 2) | 15,129 |

| Compliance fees | 4,163 |

| Printing fees | 30,227 |

| Blue sky fees | 27,693 |

| Custodian fees | 26,064 |

| Interest expense on securities sold short | 16,567 |

| Professional fees | 16,471 |

| Trustees’ fees | 7,240 |

| Securities lending fees | 6,713 |

| Interest | 848 |

| Miscellaneous | 8,687 |

| | |

| Total expenses | 2,155,552 |

| | |

| Net investment loss | (1,065,449) |

| |

| Realized and unrealized gain (loss) | |

|

| Net realized gain (loss) on | |

| Investments | 15,654,967 |

| Foreign currency transactions | (36,804) |

| | |

| Change in net unrealized appreciation (depreciation) of | |

| Investments | (3,817,823) |

| Investments sold short | 323,387 |

| Translation of assets and liabilities in foreign currencies | 2,317 |

| | |

| Net realized and unrealized gain | 12,126,044 |

| | |

| Increase in net assets from operations | $11,060,595 |

1 Semiannual period from 11-1-06 through 4-30-07.

See notes to financial statements

Health Sciences Fund

15

F I N A N C I A L S T A T E M E N T S

Statement of changes in net assets

These Statements of Changes in Net Assets show how the value of the Fund’s net assets has changed during the last two periods. The difference reflects earnings less expenses, any investment gains and losses, distributions, if any, paid to shareholders and the net of Fund share transactions.

| | Year | Period |

| | ended | ended |

| | 10-31-06 | 4-30-071 |

| Increase (decrease) in net assets | | |

|

| From operations | | |

| Net investment loss | $(2,953,448) | $(1,065,449) |

| Net realized gain | 67,227,102 | 15,618,163 |

| Change in net unrealized appreciation (depreciation) | (48,454,481) | (3,492,119) |

| | | |

| Increase in net assets resulting from operations | 15,819,173 | 11,060,595 |

| | | |

| Distributions to shareholders | | |

| From net realized gain | | |

| Class A | (15,429,832) | (32,669,792) |

| Class B | (13,896,965) | (17,818,136) |

| Class C | (1,898,067) | (3,156,263) |

| | (31,224,864) | (53,644,191) |

| From Fund share transactions | (22,073,968) | 15,758,660 |

| |

| Net assets | | |

|

| Beginning of period | 289,892,845 | 252,413,186 |

| | | |

| End of period2 | $252,413,186 | $225,588,250 |

1 Semiannual period from 11-1-06 through 4-30-07. Unaudited.

2 Includes accumulated net investment loss of $7,650 and $1,073,099, respectively.

See notes to financial statements

Health Sciences Fund

16

F I N A N C I A L S T A T E M E N T S

Financial highlights

The Financial Highlights show how the Fund’s net asset value for a share has changed since the end of the previous period.

CLASS A SHARES

| Period ended | 10-31-02 | 10-31-03 | 10-31-04 | 10-31-05 | 10-31-06 | 4-30-071 |

|

| Per share operating performance | | | | | | |

|

| Net asset value, beginning of period | $40.06 | $34.67 | $39.79 | $43.22 | $49.09 | $47.10 |

| Net investment loss2 | (0.41) | (0.38) | (0.47) | (0.49) | (0.13) | (0.13) |

| Net realized and unrealized | | | | | | |

| gain (loss) on investments | (4.98) | 5.50 | 3.90 | 7.93 | 3.22 | 2.19 |

| Total from investment operations | (5.39) | 5.12 | 3.43 | 7.44 | 3.09 | 2.06 |

| Less distributions | | | | | | |

| From net realized gain | — | — | — | (1.57) | (5.08) | (9.69) |

| Net asset value, end of period | $34.67 | $39.79 | $43.22 | $49.09 | $47.10 | $39.47 |

| Total return3 (%) | (13.45) | 14.77 | 8.62 | 17.774 | 6.614 | 5.007 |

| |

| Ratios and supplemental data | | | | | | |

|

| Net assets, end of period | | | | | | |

| (in millions) | $110 | $117 | $125 | $149 | $158 | $152 |

| Ratio of net expenses to average | | | | | | |

| net assets (%) | 1.59 | 1.67 | 1.57 | 1.56 | 1.59 | 1.598 |

| Ratio of gross expenses to average | | | | | | |

| net assets (%) | 1.59 | 1.67 | 1.57 | 1.585 | 1.595 | 1.598 |

| Ratio of net investment loss | | | | | | |

| to average net assets (%) | (1.06) | (1.04) | (1.08) | (1.06) | (0.69) | (0.66)8 |

| Portfolio turnover (%) | 85 | 95 | 54 | 506 | 93 | 437 |

See notes to financial statements

Health Sciences Fund

17

F I N A N C I A L S T A T E M E N T S

Financial highlights

| CLASS B SHARES | | | | | | |

| |

| Period ended | 10-31-02 | 10-31-03 | 10-31-04 | 10-31-05 | 10-31-06 | 4-30-071 |

|

| Per share operating performance | | | | | | |

|

| Net asset value, beginning of period | $37.68 | $32.39 | $36.91 | $39.81 | $44.76 | $42.18 |

| Net investment loss2 | (0.63) | (0.59) | (0.72) | (0.75) | (0.24) | (0.23) |

| Net realized and unrealized | | | | | | |

| gain (loss) on investments | (4.66) | 5.11 | 3.62 | 7.27 | 2.74 | 1.92 |

| Total from investment operations | (5.29) | 4.52 | 2.90 | 6.52 | 2.50 | 1.69 |

| Less distributions | | | | | | |

| From net realized gain | — | — | — | (1.57) | (5.08) | (9.69) |

| Net asset value, end of period | $32.39 | $36.91 | $39.81 | $44.76 | $42.18 | $34.18 |

| Total return3 (%) | (14.04) | 13.95 | 7.86 | 16.954 | 5.824 | 4.657 |

| |

| Ratios and supplemental data | | | | | | |

|

| Net assets, end of period | | | | | | |

| (in millions) | $162 | $154 | $134 | $124 | $80 | $61 |

| Ratio of net expenses to average | | | | | | |

| net assets (%) | 2.29 | 2.37 | 2.27 | 2.26 | 2.29 | 2.298 |

| Ratio of gross expenses to average | | | | | | |

| net assets (%) | 2.29 | 2.37 | 2.27 | 2.285 | 2.295 | 2.298 |

| Ratio of net investment loss | | | | | | |

| to average net assets (%) | (1.76) | (1.74) | (1.77) | (1.76) | (1.40) | (1.37)8 |

| Portfolio turnover (%) | 85 | 95 | 54 | 506 | 93 | 437 |

See notes to financial statements

Health Sciences Fund

18

F I N A N C I A L S T A T E M E N T S

Financial highlights

| CLASS C SHARES | | | | | | |

| |

| Period ended | 10-31-02 | 10-31-03 | 10-31-04 | 10-31-05 | 10-31-06 | 4-30-071 |

|

| Per share operating performance | | | | | | |

|

| Net asset value, beginning of period | $37.68 | $32.39 | $36.91 | $39.81 | $44.76 | $42.18 |

| Net investment loss2 | (0.63) | (0.59) | (0.72) | (0.75) | (0.23) | (0.23) |

| Net realized and unrealized | | | | | | |

| gain (loss) on investments | (4.66) | 5.11 | 3.62 | 7.27 | 2.73 | 1.92 |

| Total from investment operations | (5.29) | 4.52 | 2.90 | 6.52 | 2.50 | 1.69 |

| Less distributions | | | | | | |

| From net realized gain | — | — | — | (1.57) | (5.08) | (9.69) |

| Net asset value, end of period | $32.39 | $36.91 | $39.81 | $44.76 | $42.18 | $34.18 |

| Total return3 (%) | (14.04) | 13.95 | 7.86 | 16.954 | 5.854 | 4.637 |

| |

| Ratios and supplemental data | | | | | | |

|

| Net assets, end of period | | | | | | |

| (in millions) | $12 | $13 | $13 | $17 | $14 | $13 |

| Ratio of net expenses to average | | | | | | |

| net assets (%) | 2.29 | 2.37 | 2.27 | 2.26 | 2.29 | 2.298 |

| Ratio of gross expenses to average | | | | | | |

| net assets (%) | 2.29 | 2.37 | 2.27 | 2.285 | 2.295 | 2.298 |

| Ratio of net investment loss | | | | | | |

| to average net assets (%) | (1.76) | (1.73) | (1.78) | (1.76) | (1.49) | (1.36)8 |

| Portfolio turnover (%) | 85 | 95 | 54 | 506 | 93 | 437 |

1 Semiannual period from 11-1-06 through 4-30-07. Unaudited.

2 Based on the average of the shares outstanding.

3 Assumes dividend reinvestment and does not reflect the effect of sales charges.

4 Total returns would have been lower had certain expenses not been reduced during the period shown.

5 Does not take into consideration expense reductions during the period shown.

6 Excludes merger activity.

7 Not annualized.

8 Annualized.

See notes to financial statements

Health Sciences Fund

19

Notes to financial statements (unaudited)

Note 1 Accounting policies

John Hancock Health Sciences Fund (the Fund) is a non-diversified series of John Hancock World Fund (the Trust), an open-end management investment company registered under the Investment Company Act of 1940, as amended (the 1940 Act). The investment objective of the Fund is to achieve long-term growth of capital.

The Trustees have authorized the issuance of multiple classes of shares of the Fund, designated as Class A, Class B and Class C shares. The shares of each class represent an interest in the same portfolio of investments of the Fund and have equal rights as to voting, redemptions, dividends and liquidation, except that certain expenses, subject to the approval of the Trustees, may be applied differently to each class of shares in accordance with current regulations of the Securities and Exchange Commission (the SEC) and the Internal Revenue Service. Shareholders of a class that bears distribution and service expenses under the terms of a distribution plan have exclusive voting rights to that distribution plan. Class B shares will convert to Class A shares eight years after purchase.

Significant accounting policies of the Fund are as follows:

Valuation of investments

Securities in the Fund’s portfolio are valued on the basis of market quotations, valuations provided by independent pricing services or, if quotations are not readily available, or the value has been materially affected by events occurring after the close of a foreign market, at fair value as determined in good faith in accordance with procedures approved by the Trustees. Short-term debt investments which have a remaining maturity of 60 days or less may be valued at amortized cost, which approximates market value. Investments in John Hancock Cash Investment Trust, an affiliate of John Hancock Advisers, LLC (the Adviser), a wholly owned subsidiary of John Hancock Financial Services, Inc., a subsidiary of Manulife Financial Corporation (MFC), are valued at their net asset value each business day. All portfolio transactions initially expressed in terms of foreign currencies have been translated into U.S. dollars as described in “Foreign currency translation” below.

Joint repurchase agreement

Pursuant to an exemptive order issued by the SEC, the Fund, along with other registered investment companies having a management contract with the Adviser, may participate in a joint repurchase agreement transaction. Aggregate cash balances are invested in one or more large repurchase agreements, whose underlying securities are obligations of the U.S. government and/or its agencies. The Fund’s custodian bank receives delivery of the underlying securities for the joint account on the Fund’s behalf. The Adviser is responsible for ensuring that the agreement is fully collateralized at all times.

Foreign currency translation

All assets or liabilities initially expressed in terms of foreign currencies are translated into U.S. dollars based on London currency exchange quotations as of 4:00 p.m., London time, on the date of any determination of the net asset value of the Fund. Transactions affecting statement of operations accounts and net realized gain (loss) on investments are translated at the rates prevailing at the dates of the transactions.

The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss from investments.

Health Sciences Fund

20

Reported net realized foreign currency exchange gains or losses arise from sales of foreign currency, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign currency exchange gains and losses arise from changes in the value of assets and liabilities, other than investments in securities, resulting from changes in the exchange rates.

Investment transactions

Investment transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Net realized gains and losses on sales of investments are determined on the identified cost basis. Capital gains realized on some foreign securities are subject to foreign taxes, which are accrued as applicable.

Class allocations

Income, common expenses and realized and unrealized gains (losses) are determined at the fund level and allocated daily to each class of shares based on the appropriate net asset value of the respective classes. Distribution and service fees, if any, are calculated daily at the class level based on the appropriate net asset value of each class and the specific expense rate(s) applicable to each class.

Expenses

The majority of expenses are directly identifiable to an individual fund. Expenses that are not readily identifiable to a specific fund are allocated in such a manner as deemed equitable, taking into consideration, among other things, the nature and type of expense and the relative size of the funds.

Bank borrowings

The Fund is permitted to have bank borrowings for temporary or emergency purposes, including the meeting of redemption requests that otherwise might require the untimely disposition of securities. The Fund has entered into a line of credit agreement with The Bank of New York (BNY), the Swing Line Lender and Administrative Agent. This agreement enables the Fund to participate, with other funds managed by the Adviser, in an unsecured line of credit with BNY, which permits borrowings of up to $100 million, collectively. Interest is charged to each fund based on its borrowing. In addition, a commitment fee is charged to each fund based on the average daily unused portion of the line of credit, and is allocated among the participating funds. The Fund had no borrowing activity under the line of credit during the period ended April 30, 2007.

Securities lending

The Fund may lend securities to certain qualified brokers who pay the Fund negotiated lender fees. The loans are collateralized at all times with cash or securities with a market value at least equal to the market value of the securities on loan. The market value of the loaned securities is determined at the close of business of the Fund and any additional required collateral is delivered to the Fund on the next business day. As with other extensions of credit, the Fund may bear the risk of delay of the loaned securities in recovery or even loss of rights in the collateral, should the borrower of the securities fail financially. At April 30, 2007, the Fund loaned securities having a market value of $45,445,628 collateralized by securities in the amount of $47,131,403. The cash collateral was invested in John Hancock Cash Investment Trust. Securities lending expenses are paid by the Fund to the lending agent.

Short sales

The Fund, in “selling short,” sells borrowed securities, which must at some date be repurchased and returned to the lender. The risk associated with this practice is that, if the market value of securities sold short increases, the Fund may realize losses upon repurchase at prices which may exceed the prices used in determining the liability on the Fund’s Statement of Assets and Liabilities. Further, in unusual circumstances, the Fund may be unable to repurchase securities to close its short positions except at prices above those previously quoted in the market.

Health Sciences Fund

21

Forward foreign currency exchange contracts

The Fund may enter into forward foreign currency exchange contracts as a hedge against the effect of fluctuations in currency exchange rates. A forward foreign currency exchange contract involves an obligation to purchase or sell a specific currency at a future date at a set price. The aggregate principal amounts of the contracts are marked to market daily at the applicable foreign currency exchange rates. Any resulting unrealized gains and losses are included in the determination of the Fund’s daily net asset value. The Fund records realized gains and losses at the time the forward foreign currency exchange contracts are closed out. Risks may arise upon entering these contracts from the potential inability of counterparties to meet the terms of the contracts and from unanticipated movements in the value of a foreign currency relative to the U.S. dollar. These contracts involve market or credit risk in excess of the unrealized g ain or loss reflected in the Fund’s Statement of Assets and Liabilities.

The Fund may also purchase and sell forward contracts to facilitate the settlement of foreign currency denominated portfolio transactions, under which it intends to take delivery of the foreign currency. Such contracts normally involve no market risk if they are offset by the currency amount of the underlying transactions. The Fund had no open forward foreign currency exchange contracts on April 30, 2007.

Federal income taxes

The Fund qualifies as a “regulated investment company” by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required. For federal income tax purposes, the Fund has $2,745,340 of a capital loss carryforward available, to the extent provided by regulations, to offset future net realized capital gains. To the extent that such carryforward is used by the Fund, no capital gain distributions will be made. The loss carryforward expires as follows: October 31, 2009 — $1,622,916 and October 31, 2010 — $1,122,424.

New accounting pronouncements

In June 2006, Financial Accounting Standards Board (FASB) Interpretation No. 48, Accounting for Uncertainty in Income Taxes (the Interpretation), was issued and is effective for fiscal years beginning after December 15, 2006, and is to be applied to all open tax years as of the effective date. The Interpretation prescribes a minimum threshold for financial statement recognition of the benefit of a tax position taken or expected to be taken in a tax return, and requires certain expanded disclosures. Management is currently evaluating the application of the Interpretation to the Fund and has not at this time quantified the impact, if any, resulting from the adoption of this Interpretation on the Fund’s financial statements. The Fund will implement this pronouncement no later than Ap ril 30, 2008.

In September 2006, FASB Standard No. 157, Fair Value Measurements (FAS 157), was issued and is effective for fiscal years beginning after November 15, 2007. FAS 157 defines fair value, establishing a framework for measuring fair value and expands disclosure about fair value measurements. Management is currently evaluating the application of FAS 157 to the Fund and its impact, if any, resulting from the adoption of FAS 157 on the Fund’s financial statements.

Dividends, interest and distributions

Dividend income on investment securities is recorded on the ex-dividend date or, in the case of some foreign securities, on the date thereafter when the Fund identifies the dividend. Interest income on investment securities is recorded on the accrual basis. Foreign income may be subject to foreign withholding taxes, which are accrued as applicable.

The Fund records distributions to shareholders from net investment income and net realized gains, if any, on the ex-dividend date. During the year ended October 31, 2006, the tax character of distributions paid was as follows: long-term capital gain $31,224,864. Distributions paid by the Fund with respect to each class of shares are calculated in the same manner, at the same time and are in the

Health Sciences Fund

22

same amount, except for the effect of expenses that may be applied differently to each class.

Such distributions, on a tax basis, are determined in conformity with income tax regulations, which may differ from accounting principles generally accepted in the United States of America. Distributions in excess of tax basis earnings and profits, if any, are reported in the Fund’s financial statements as a return of capital.

Use of estimates

The preparation of these financial statements, in accordance with accounting principles generally accepted in the United States of America, incorporates estimates made by management in determining the reported amount of assets, liabilities, revenues and expenses of the Fund. Actual results could differ from these estimates.

Note 2

Management fee and transactions with

affiliates and others

The Fund has an investment management contract with the Adviser. Under the investment management contract, the Fund pays a quarterly management fee to the Adviser equivalent, on an annual basis, to the sum of: (a) 0.80% of the first $200,000,000 of the Fund’s average daily net asset value and (b) 0.70% of the Fund’s daily average net asset value in excess of $200,000,000.

The Fund has a Distribution Agreement with John Hancock Funds, LLC (JH Funds), a wholly owned subsidiary of the Adviser. The Fund has adopted Distribution Plans with respect to Class A, Class B and Class C, pursuant to Rule 12b-1 under the 1940 Act, to reimburse JH Funds for the services it provides as distributor of shares of the Fund. Accordingly, the Fund makes monthly payments to JH Funds at an annual rate not to exceed 0.30%, 1.00% and 1.00% of the average daily net asset value of Class A, Class B and Class C, respectively. A maximum of 0.25% of such payments may be service fees, as defined by the Conduct Rules of the National Association of Securities Dealers. Under the Conduct Rules, curtailment of a portion of the Fund’s 12b-1 payments could occur under certain circumstances.

Class A shares are assessed up-front sales charges. During the period ended April 30, 2007, JH Funds received net up-front sales charges of $73,190 with regard to sales of Class A shares. Of this amount, $9,444 was retained and used for printing prospectuses, advertising, sales literature and other purposes, $55,121 was paid as sales commissions to unrelated broker-dealers and $8,625 was paid as sales commissions to sales personnel of Signator Investors, Inc. (Signator Investors), a related broker-dealer. The Adviser’s indirect parent John Hancock Life Insurance Company (JHLICO), is the indirect sole shareholder of Signator Investors.

Class B shares that are redeemed within six years of purchase are subject to a contingent deferred sales charge (CDSC) at declining rates, beginning at 5.00% of the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed. Class C shares that are redeemed within one year of purchase are subject to a CDSC at a rate of 1.00% of the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed. Proceeds from the CDSCs are paid to JH Funds and are used, in whole or in part, to defray its expenses for providing distribution-related services to the Fund in connection with the sale of Class B and Class C shares. During the period ended April 30, 2007, CDSCs received by JH Funds amounted to $50,851 for Class B shares and $493 for Class C shares.

The Fund has a transfer agent agreement with John Hancock Signature Services, Inc. (Signature Services), an indirect subsidiary of JHLICO. The Fund pays a monthly transfer agent fee at an annual rate of 0.05% of each class’s average daily net asset value, plus a fee based on the number of shareholder accounts and reimbursement for certain out-of-pocket expenses, aggregated and allocated to each class on the basis of its relative net asset value.

Health Sciences Fund

23

The Fund has an agreement with the Adviser and affiliates to perform necessary tax, accounting and legal services for the Fund. The compensation for the period amounted to $15,129. The Fund also reimbursed JHLICO for certain compliance costs, included in the Fund’s Statement of Operations.

Expenses under the agreements described above for the period ended April 30, 2007, were as follows:

| | Distribution and |

| Share class | service fees |

|

| |

| Class A | $228,685 |

| Class B | 348,469 |

| Class C | 64,853 |

| Total | $642,007 |

The Fund has an independent advisory board composed of scientific and medical experts who provide the investment officers of the Fund with advice and consultation on health-care developments, for which the Fund pays the advisory board a fee.

Mr. James R. Boyle is Chairman of the Adviser, as well as affiliated Trustee of the Fund, and is compensated by the Adviser and/or its affiliates. The compensation of unaffiliated Trustees is borne by the Fund. The unaffiliated Trustees may elect to defer, for tax purposes, their receipt of this compensation under the John Hancock Group of Funds Deferred Compensation Plan. The Fund makes investments into other John Hancock funds, as applicable, to cover its liability for the deferred compensation. Investments to cover the Fund’s deferred compensation liability are recorded on the Fund’s books as an other asset. The deferred compensation liability and the related other asset are always equal and are marked to market on a periodic basis to reflect any income earned by the investments, as well as any unrealized gains or losses. The Deferred Compensation Plan investments had no impact on the operations of the Fund.

Note 3

Fund share transactions

This listing illustrates the number of Fund shares sold, reinvested and repurchased during the year ended October 31, 2006 and the period ended April 30, 2007, along with the corresponding dollar value.

| | Year ended 10-31-06 | Period ended 4-30-071 |

| | Shares | Amount | Shares | Amount |

|

| Class A shares | | | | |

|

| Sold | 905,024 | $40,986,398 | 391,581 | $15,724,998 |

| Distributions reinvested | 321,186 | 14,697,455 | 806,074 | 30,872,640 |

| Repurchased | (905,116) | (40,992,154) | (717,064) | (27,980,667) |

| Net increase | 321,094 | $14,691,699 | 480,591 | $18,616,971 |

| |

| Class B shares | | | | |

|

| Sold | 140,848 | $5,822,156 | 45,824 | $1,570,813 |

| Distributions reinvested | 318,638 | 13,147,022 | 508,697 | 16,924,355 |

| Repurchased | (1,332,425) | (54,233,794) | (656,750) | (22,453,778) |

| Net decrease | (872,939) | ($35,264,616) | (102,229) | ($3,958,610) |

| |

| Class C shares | | | | |

|

| Sold | 40,990 | $1,704,023 | 14,075 | $469,810 |

| Distributions reinvested | 42,275 | 1,744,277 | 90,600 | 3,014,274 |

| Repurchased | (121,336) | (4,949,351) | (69,882) | (2,383,785) |

| Net increase (decrease) | (38,071) | ($1,501,051) | 34,793 | $1,100,299 |

|

| |

| Net increase (decrease) | (589,916) | ($22,073,968) | 413,155 | $15,758,660 |

|

1 Semiannual period from 11-1-06 through 4-30-07. Unaudited.

Health Sciences Fund

24

Note 4

Investment transactions

Purchases and proceeds from sales or maturities of securities, other than short-term securities and obligations of the U.S. government, during the period ended April 30, 2007, aggregated $98,370,655 and $127,972,527, respectively.

The cost of investments owned on April 30, 2007, including short-term investments, for federal income tax purposes, was $232,060,272. Gross unrealized appreciation and depreciation of investments aggregated $50,546,518 and $10,556,522, respectively, resulting in net unrealized appreciation of $39,989,996.

Health Sciences Fund

25

Board Consideration of and

Continuation of Investment

Advisory Agreement and Subadvisory

Agreement: John Hancock Health

Sciences Fund

The Investment Company Act of 1940 (the 1940 Act) requires the Board of Trustees (the Board) of John Hancock World Fund (the Trust), including a majority of the Trustees who have no direct or indirect interest in the investment advisory agreement and are not “interested persons” of the Trust, as defined in the 1940 Act (the Independent Trustees), annually to review and consider the continuation of: (i) the investment advisory agreement (the Advisory Agreement) with John Hancock Advisers, LLC (the Adviser) and (ii) the investment subadvisory agreement (the Subadvisory Agreement) with MFC Global Investment Management (U.S.), LLC (the Subadviser) for the John Hancock Health Sciences Fund (the Fund). The Advisory Agreement and the Subadvisory Agreement are collectively referred to as the Advisory Agreements.

At meetings held on May 1–2 and June 5–6, 2006,1 the Board considered the factors and reached the conclusions described below relating to the selection of the Adviser and Subadviser and the continuation of the Advisory Agreements. During such meetings, the Board’s Contracts/Operations Committee and the Independent Trustees also met in executive sessions with their independent legal counsel.

In evaluating the Advisory Agreements, the Board, including the Contracts/Operations Committee and the Independent Trustees, reviewed a broad range of information requested for this purpose by the Independent Trustees, including: (i) the investment performance of the Fund relative to a category of relevant funds (the Category) and a peer group of comparable funds (the Peer Group) each selected by Morningstar Inc. (Morningstar), an independent provider of investment company data, for a range of periods ended December 31, 2005; (ii) advisory and other fees incurred by, and the expense ratios of, the Fund relative to a Category and a Peer Group; (iii) the advisory fees of comparable portfolios of other clients of the Adviser and the Subadviser; (iv) the Adviser’s financial results and condition, including its and certain of its affiliates’ profitability from services performed for the Fund; (v) breakpoints in the Fund’s and the Peer Group’s fees, and information about economies of scale; (vi) the Adviser’s and Subadviser’s record of compliance with applicable laws and regulations, with the Fund’s investment policies and restrictions and with the applicable Code of Ethics, and the structure and responsibilities of the Adviser’s and Subadviser’s compliance department; (vii) the background and experience of senior management and investment professionals and (viii) the nature, cost and character of advisory and non-investment management services provided by the Adviser and its affiliates and by the Subadviser.

The Board’s review and conclusions were based on a comprehensive consideration of all information presented to the Board and not the result of any single controlling factor. It was based on performance and other information as of December 31, 2005; facts may have changed between that date and the date of this shareholders report. The key factors considered by the Board and the conclusions reached are described below.

Nature, extent and quality of services

The Board considered the ability of the Adviser and the Subadviser, based on their resources, reputation and other attributes, to attract and retain qualified investment professionals, including research, advisory and supervisory personnel. The Board further considered the compliance programs and compliance records of the Adviser and Subadviser. In addition, the Board took into account the administrative services provided to the Fund by the Adviser and its affiliates.

Based on the above factors, together with those referenced below, the Board concluded that, within the context of its full deliberations, the nature, extent and quality of the investment advisory services provided to the Fund by the Adviser and Subadviser were sufficient to support renewal of the Advisory Agreements.

26

Fund performance

The Board considered the performance results for the Fund over various time periods ended December 31, 2005. The Board also considered these results in comparison to the performance of the Category, as well as the Fund’s Peer Group and benchmark index. Morningstar determined the Category and the Peer Group for the Fund. The Board reviewed, with a representative of Morningstar, the methodology used by Morningstar to select the funds in the Category and the Peer Group. The Board noted the imperfect comparability of the Peer Group.

The Board noted that the Fund’s performance during the 10-year period was equal to the performance of the Peer Group median and lower than the performance of the Category median, and its benchmark index — the Dow Jones Health Care Sector Index. The Board also noted that the performance of the Fund for the five-year period was higher than the median of its Category and Peer Group, and its benchmark index. The Board noted that, although the Fund’s performance was generally competitive with the performance of the Peer Group and Category medians during the more recent one- and three-year periods, the performance of the Fund was lower than the Peer Group and Category medians and higher than the performance of the benchmark index.

Investment advisory fee and subadvisory fee rates and expenses

The Board reviewed and considered the contractual investment advisory fee rate payable by the Fund to the Adviser for investment advisory services (the Advisory Agreement Rate). The Board received and considered information comparing the Advisory Agreement Rate with the advisory fees for the Peer Group and Category. The Board noted that the Advisory Agreement Rate was lower than the median rate of the Peer Group and Category.

The Board received and considered expense information regarding the Fund’s various components, including advisory fees, distribution and fees other than advisory and distribution fees, including transfer agent fees, custodian fees and other miscellaneous fees (e.g., fees for accounting and legal services). The Board also considered peer-adjusted comparisons for the transfer agent fees. The Board considered comparisons of these expenses to the Peer Group median. The Board also received and considered expense information regarding the Fund’s total operating expense ratio (Gross Expense Ratio) and total operating expense ratio after taking the fee waiver arrangement applicable to the Advisory Agreement Rate int o account (Net Expense Ratio). The Board received and considered information comparing the Gross Expense Ratio and Net Expense Ratio of the Fund to that of the Peer Group and Category medians. The Board noted that the Fund’s Gross and Net Expense Ratios were equal to the median of its Peer Group and not appreciably higher than median of the Category.

The Adviser also discussed the Morningstar data and rankings, and other relevant information, for the Fund. Based on the above-referenced considerations and other factors, the Board concluded that the Fund’s overall performance and expenses supported the re-approval of the Advisory Agreements.

The Board also received information about the investment subadvisory fee rate (the Subadvisory Agreement Rate) payable by the Adviser to the Subadviser for investment subadvisory services. The Board concluded that the Subadvisory Agreement Rate was fair and equitable, based on its consideration of the factors described here.

Profitability

The Board received and considered a detailed profitability analysis of the Adviser based on the Advisory Agreements, as well as on other relationships between the Fund and the Adviser and its affiliates, including the Subadviser. The Board concluded that, in light of the costs of providing investment management and other services to the Fund, the profits and other ancillary benefits reported by the Adviser were not unreasonable.

Economies of scale

The Board received and considered general information regarding economies of scale with respect to the management of the Fund, including the Fund’s ability to appropriately benefit from economies of scale under the

27

Fund’s fee structure. The Board recognized the inherent limitations of any analysis of economies of scale, stemming largely from the Board’s understanding that most of the Adviser’s costs are not specific to individual Funds, but rather are incurred across a variety of products and services.

To the extent the Board and the Adviser were able to identify actual or potential economies of scale from Fund-specific or allocated expenses, in order to ensure that any such economies continue to be reasonably shared with the Fund as its assets increase, the Adviser and the Board agreed to continue the existing breakpoints to the Advisory Agreement Rate.

Information about services to other clients

The Board also received information about the nature, extent and quality of services and fee rates offered by the Adviser and Subadviser to their other clients, including other registered investment companies, institutional investors and separate accounts. The Board concluded that the Advisory Agreement Rate and the Subadvisory Agreement Rate were not unreasonable, taking into account fee rates offered to others by the Adviser and Subadviser, respectively, after giving effect to differences in services.

Other benefits to the Adviser

The Board received information regarding potential “fall-out” or ancillary benefits received by the Adviser and its affiliates as a result of the Adviser’s relationship with the Fund. Such benefits could include, among others, benefits directly attributable to the relationship of the Adviser with the Fund and benefits potentially derived from an increase in the business of the Adviser as a result of its relationship with the Fund (such as the ability to market to shareholders other financial products offered by the Adviser and its affiliates).

The Board also considered the effectiveness of the Adviser’s, Subadviser’s and Fund’s policies and procedures for complying with the requirements of the federal securities laws, including those relating to best execution of portfolio transactions and brokerage allocation.

Other factors and broader review

As discussed above, the Board reviewed detailed materials received from the Adviser and Subadviser as part of the annual re-approval process. The Board also regularly reviews and assesses the quality of the services that the Fund receives throughout the year. In this regard, the Board reviews reports of the Adviser and Subadviser at least quarterly, which include, among other things, fund performance reports and compliance reports. In addition, the Board meets with portfolio managers and senior investment officers at various times throughout the year.

After considering the above-described factors and based on its deliberations and its evaluation of the information described above, the Board concluded that approval of the continuation of the Advisory Agreements for the Fund was in the best interest of the Fund and its shareholders. Accordingly, the Board unanimously approved the continuation of the Advisory Agreements.

1 The Board previously considered information about the Subadvisory Agreement at the September and December 2005 Board meetings in connection with the Adviser’s reorganization.

28

For more information

The Fund’s proxy voting policies, procedures and records are available without charge, upon request:

| By phone | On the Fund’s Web site | On the SEC’s Web site |

| 1-800-225-5291 | www.jhfunds.com/proxy | www.sec.gov |

|

| Trustees | Charles A. Rizzo | Custodian |

| Ronald R. Dion, Chairman | Chief Financial Officer | The Bank of New York |

| James R. Boyle† | | One Wall Street |

| James F. Carlin | Gordon M. Shone | New York, NY 10286 |

| William H. Cunningham | Treasurer | |

| Charles L. Ladner* | | Transfer agent |

| Dr. John A. Moore* | John G. Vrysen | John Hancock Signature |

| Patti McGill Peterson* | Chief Operations Officer | Services, Inc. |

| Steven R. Pruchansky | | One John Hancock Way, |

| *Members of the Audit Committee | Investment adviser | Suite 1000 |

| †Non-Independent Trustee | John Hancock Advisers, LLC | Boston, MA 02217-1000 |

| 601 Congress Street | |

| Officers | Boston, MA 02210-2805 | Legal counsel |

| Keith F. Hartstein | | Kirkpatrick & Lockhart |

| President and | Subadviser | Preston Gates Ellis LLP |

| Chief Executive Officer | MFC Global Investment | One Lincoln Street |

| Management (U.S.), LLC | Boston, MA 02111-2950 |

| Thomas Kinzler | 101 Huntington Avenue | |

| Secretary and Chief Legal Officer | Boston, MA 02199 | |

| | | |

| Francis V. Knox, Jr. | Principal distributor | |

| Chief Compliance Officer | John Hancock Funds, LLC | |

| 601 Congress Street | |

| Boston, MA 02210-2805 | |

| | |

| | |

| How to contact us | |

|

| Internet | www.jhfunds.com | |

|

| Mail | Regular mail: | Express mail: |

| | John Hancock | John Hancock |

| | Signature Services, Inc. | Signature Services, Inc. |

| | One John Hancock Way, Suite 1000 | Mutual Fund Image Operations |

| | Boston, MA 02217-1000 | 380 Stuart Street |

| | | Boston, MA 02116 |

|

| Phone | Customer service representatives | 1-800-225-5291 |

| | EASI-Line | 1-800-338-8080 |

| | TDD line | 1-800-554-6713 |

|

A listing of month-end portfolio holdings is available on our Web site, www.jhfunds.com. A more detailed portfolio holdings summary is available on a quarterly basis 60 days after the fiscal quarter on our Web site or upon request by calling 1-800-225-5291, or on the SEC’s Web site, www.sec.gov.

32

J O H N H A N C O C K F A M I L Y O F F U N D S

| EQUITY | INTERNATIONAL |

| Balanced Fund | Greater China Opportunities Fund |

| Classic Value Fund | International Allocation Portfolio |

| Classic Value Fund II | International Classic Value Fund |

| Classic Value Mega Cap Fund | International Core Fund |

| Core Equity Fund | International Growth Fund |

| Global Shareholder Yield Fund | |

| Growth Fund | INCOME |

| Growth Opportunities Fund | Bond Fund |

| Growth Trends Fund | Government Income Fund |

| Intrinsic Value Fund | High Yield Fund |

| Large Cap Equity Fund | Investment Grade Bond Fund |

| Large Cap Select Fund | Strategic Income Fund |

| Mid Cap Equity Fund | |

| Multi Cap Growth Fund | TAX-FREE INCOME |

| Small Cap Equity Fund | California Tax-Free Income Fund |