| | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| MANAGEMENT INVESTMENT COMPANIES |

| |

| Investment Company Act file number 811- 4932 |

| |

| John Hancock World Fund |

| (Exact name of registrant as specified in charter) |

| |

| 601 Congress Street, Boston, Massachusetts 02210 |

| (Address of principal executive offices) (Zip code) |

| |

| Michael J. Leary |

| Treasurer |

| |

| 601 Congress Street |

| |

| Boston, Massachusetts 02210 |

| (Name and address of agent for service) |

| | |

| Registrant's telephone number, including area code: 617-663-4490 |

| | | |

| Date of fiscal year end: | October 31 |

| |

| |

| Date of reporting period: | April 30, 2009 |

| |

| |

| ITEM 1. REPORT TO SHAREHOLDERS. |

A look at performance

For the period ended April 30, 2009

| | | | | | | | | | | |

| | | | Average annual returns (%) | | | Cumulative total returns (%) | |

| | | | with maximum sales charge (POP) | | | with maximum sales charge (POP) | |

| | |

| | |

|

| | Inception | | | | | | | Six | | | |

| Class | date | | 1-year | 5-year | 10-year | | | months | 1-year | 5-year | 10-year |

|

| A | 10-1-91 | | –29.29 | –5.11 | 1.43 | | | –14.71 | –29.29 | –23.06 | 15.29 |

|

| B | 3-7-94 | | –29.75 | –5.02 | 1.38 | | | –14.92 | –29.75 | –22.72 | 14.68 |

|

| C | 3-1-99 | | –26.80 | –4.80 | 1.24 | | | –11.39 | –26.80 | –21.78 | 13.12 |

|

Performance figures assume all distributions are reinvested. Public offering price (POP) figures reflect maximum sales charge on Class A shares of 5%, and the applicable contingent deferred sales charge (CDSC) on Class B and Class C shares. The returns for Class C shares have been adjusted to reflect the elimination of the front-end sales charge effective July 15, 2004. The Class B shares’ CDSC declines annually between years 1 to 6 according to the following schedule: 5, 4, 3, 3, 2, 1%. No sales charge will be assessed after the sixth year. Class C shares held for less than one year are subject to a 1% CDSC.

The expense ratios of the Fund, both net (including any fee waivers or expense limitations) and gross (excluding any fee waivers or expense limitations), are set forth according to the most recent publicly available prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. The net expenses equal the gross expenses and are as follows: Class A — 1.67%, Class B — 2.37% and Class C — 2.37%. The Fund’s semiannual operating expenses will likely vary throughout the period and from year to year. Expenses for the current fiscal year may be higher than those shown above for one or more of the following reasons: (i) a significant decrease in average net assets may result in a higher advisory fee rate if advisory fee breakpoints are not achieved; (ii) a significant decrease in average net assets may result in an increase in the expense ratio because certain fund expenses do not decrease as asset levels decrease; or (iii) the termination of voluntary expense cap reimbursements and/or fee waivers, as applicable.

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the Fund’s current performance may be higher or lower than the performance shown. For performance data current to the most recent month end, please call 1–800–225–5291 or visit the Fund’s Web site at www.jhfunds.com.

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares.

The Fund’s performance results reflect any applicable fee waivers or expense reductions, without which the expenses would increase and results would have been less favorable.

| |

| 6 | Health Sciences Fund | Semiannual report |

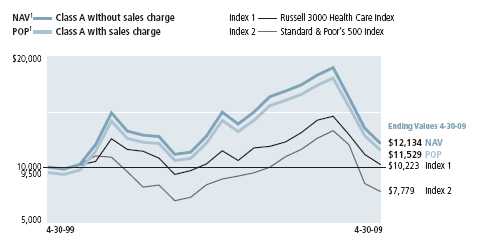

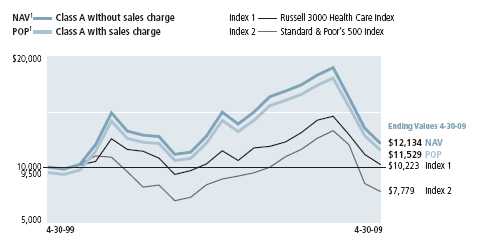

Growth of $10,000

This chart shows what happened to a hypothetical $10,000 investment in John Hancock Health Sciences Fund Class A shares for the period indicated. For comparison, we’ve shown the same investment in two separate indexes.

| | | | | |

| | | Without sales | With maximum | | |

| Class | Period beginning | charge | sales charge | Index 1 | Index 2 |

|

| B2 | 4-30-99 | $11,468 | $11,468 | $10,223 | $7,779 |

|

| C2 | 4-30-99 | 11,312 | 11,312 | 10,223 | 7,779 |

|

Assuming all distributions were reinvested for the period indicated, the table above shows the value of a $10,000 investment in the Fund’s Class B and Class C shares, respectively, as of April 30, 2009. The Class C shares investment with maximum sales charge has been adjusted to reflect the elimination of the front-end sales charge effective July 15, 2004. Performance of the classes will vary based on the difference in sales charges paid by shareholders investing in the different classes and the fee structure of those classes.

Russell 3000 Health Care Index — Index 1 — is an unmanaged index of healthcare sector stocks in the Russell 3000 Index, which represents the 3,000 largest U.S. companies based on total market capitalization.

Standard & Poor’s 500 Index — Index 2 — is an unmanaged index that includes 500 widely traded common stocks.

It is not possible to invest directly in an index. Index figures do not reflect sales charges or direct expenses, which would have resulted in lower values if they did.

1 NAV represents net asset value and POP represents public offering price.

2 No contingent deferred sales charge applicable.

| |

| Semiannual report | Health Sciences Fund | 7 |

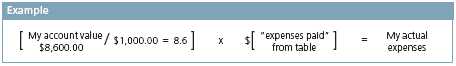

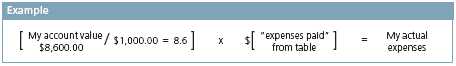

Your expenses

These examples are intended to help you understand your ongoing operating expenses.

Understanding fund expenses

As a shareholder of the Fund, you incur two types of costs:

■ Transaction costs which include sales charges (loads) on purchases or redemptions (varies by share class), minimum account fee charge, etc.

■ Ongoing operating expenses including management fees, distribution and service fees (if applicable), and other fund expenses.

We are going to present only your ongoing operating expenses here.

Actual expenses/actual returns

This example is intended to provide information about your fund’s actual ongoing operating expenses, and is based on your fund’s actual return. It assumes an account value of $1,000.00 on November 1, 2008 with the same investment held until April 30, 2009.

| | | |

| | Account value | Ending value | Expenses paid during |

| | on 11-1-08 | on 4-30-09 | period ended 4-30-091 |

|

| Class A | $1,000.00 | $897.80 | $11.67 |

|

| Class B | 1,000.00 | 894.90 | 14.71 |

|

| Class C | 1,000.00 | 894.90 | 14.94 |

|

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at April 30, 2009, by $1,000.00, then multiply it by the “expenses paid” for your share class from the table above. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

| |

| 8 | Health Sciences Fund | Semiannual report |

Hypothetical example for comparison purposes

This table allows you to compare your fund’s ongoing operating expenses with those of any other fund. It provides an example of the Fund’s hypothetical account values and hypothetical expenses based on each class’s actual expense ratio and an assumed 5% annualized return before expenses (which is not your fund’s actual return). It assumes an account value of $1,000.00 on November 1, 2008, with the same investment held until April 30, 2009. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses.

| | | |

| | Account value | Ending value | Expenses paid during |

| | on 11-1-08 | on 4-30-09 | period ended 4-30-091 |

|

| Class A | $1,000.00 | $1,012.50 | $12.37 |

|

| Class B | 1,000.00 | 1,009.30 | 15.59 |

|

| Class C | 1,000.00 | 1,009.00 | 15.84 |

|

Remember, these examples do not include any transaction costs, such as sales charges; therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the prospectus for details regarding transaction costs.

1 Expenses are equal to the Fund’s annualized expense ratio of 2.48%, 3.13% and 3.18% for Class A, Class B and Class C shares, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

| |

| Semiannual report | Health Sciences Fund | 9 |

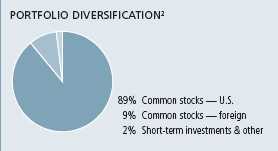

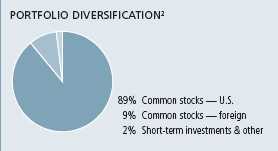

Portfolio summary

| | | | |

| Top 10 holdings1 | | | | |

|

| Medco Health Solutions, Inc. | 5.9% | | Roche Holdings AG | 5.1% |

| |

|

| Gilead Sciences, Inc. | 5.3% | | Abbott Laboratories | 5.1% |

| |

|

| Amgen, Inc. | 5.2% | | Express Scripts Inc. | 4.8% |

| |

|

| Johnson & Johnson | 5.2% | | Aetna, Inc. | 4.6% |

| |

|

| Cephalon, Inc. | 5.1% | | Pfizer, Inc. | 4.4% |

| |

|

| |

| Industry composition2,3 | | | | |

|

| Pharmaceuticals | 27% | | Managed Health Care | 8% |

| |

|

| Biotechnology | 20% | | Drug Retail | 7% |

| |

|

| Health Care Services | 13% | | Life Sciences Tools & Services | 3% |

| |

|

| Health Care Equipment | 10% | | Property & Casualty Insurance | 2% |

| |

|

| Health Care Distributors | 8% | | Short-term investments & other | 2% |

| |

|

1 As a percentage of net assets on April 30, 2009. Excludes cash and cash equivalents.

2 As a percentage of net assets on April 30, 2009.

3 Investments concentrated in one industry may fluctuate more widely than investments diversified across industries.

| |

| 10 | Health Sciences Fund | Semiannual report |

F I N A N C I A L S T A T E M E N T S

Fund’s investments

Securities owned by the Fund on 4-30-09 (unaudited)

| | |

| Issuer | Shares | Value |

|

| Common stocks 97.78% | | $91,125,188 |

|

| (Cost $104,392,352) | | |

| | | |

| Biotechnology 19.81% | | 18,465,265 |

|

| Amgen, Inc. (I) | 100,762 | 4,883,934 |

|

| Cephalon, Inc. (I) | 72,994 | 4,789,136 |

|

| Genzyme Corp. (I) | 33,968 | 1,811,514 |

|

| Gilead Sciences, Inc. (I) | 107,328 | 4,915,622 |

|

| OSI Pharmaceuticals, Inc. (I) | 61,515 | 2,065,059 |

| | | |

| Drug Retail 7.09% | | 6,603,522 |

|

| CVS Caremark Corp. | 110,769 | 3,520,239 |

|

| Walgreen Co. | 98,100 | 3,083,283 |

| | | |

| Health Care Distributors 8.04% | | 7,496,707 |

|

| AmerisourceBergen Corp. | 113,958 | 3,833,547 |

|

| Cardinal Health, Inc. | 36,028 | 1,217,386 |

|

| McKesson Corp. | 66,102 | 2,445,774 |

| | | |

| Health Care Equipment 9.91% | | 9,233,956 |

|

| Becton, Dickinson & Co. | 48,421 | 2,928,502 |

|

| Covidien, Ltd. | 41,585 | 1,371,473 |

|

| Medtronic, Inc. | 97,445 | 3,118,240 |

|

| Stryker Corp. | 23,752 | 919,440 |

|

| Syneron Medical, Ltd. (I) | 132,393 | 896,301 |

| | | |

| Health Care Facilities 0.04% | | 39,144 |

|

| TLC Vision Corp. (I) | 280,000 | 39,144 |

| | | |

| Health Care Services 12.86% | | 11,980,765 |

|

| Aveta, Inc. (B)(I)(S) | 762,790 | 1,405,326 |

|

| Express Scripts, Inc. (I) | 70,360 | 4,500,929 |

|

| Laboratory Corp. of America Holdings (I) | 9,745 | 625,142 |

|

| Medco Health Solutions, Inc. (I) | 125,129 | 5,449,368 |

| | | |

| Health Care Supplies 0.54% | | 500,309 |

|

| Cremer SA | 115,279 | 500,309 |

| | | |

| Insurance Brokers 1.19% | | 1,109,336 |

|

| eHealth, Inc. (I) | 57,808 | 1,109,336 |

| | | |

| Life Sciences Tools & Services 2.26% | | 2,109,029 |

|

| Waters Corp. (I) | 47,748 | 2,109,029 |

| | | |

| Managed Health Care 7.52% | | 7,009,600 |

|

| Aetna, Inc. | 194,387 | 4,278,458 |

|

| UnitedHealth Group, Inc. | 116,120 | 2,731,142 |

See notes to financial statements

| |

| Semiannual report | Health Sciences Fund | 11 |

F I N A N C I A L S T A T E M E N T S

| | |

| Issuer | Shares | Value |

| Pharmaceuticals 26.46% | | $24,662,695 |

|

| Abbott Laboratories | 114,009 | 4,771,277 |

|

| Bayer AG | 22,638 | 1,125,276 |

|

| Eli Lilly & Co. | 55,483 | 1,826,500 |

|

| Johnson & Johnson | 92,326 | 4,834,189 |

|

| Merck & Co., Inc. | 20,137 | 488,121 |

|

| Pfizer, Inc. | 307,321 | 4,105,808 |

|

| Roche Holdings AG — Genusschein | 37,928 | 4,782,877 |

|

| Teva Pharmaceutical Industries, Ltd., ADR | 21,719 | 953,247 |

|

| Tongjitang Chinese Medicines Co., ADR (I) | 131,038 | 488,772 |

|

| Wyeth | 30,345 | 1,286,628 |

| | | |

| Property & Casualty Insurance 2.06% | | 1,914,860 |

|

| American Physicians Capital, Inc. | 45,964 | 1,914,860 |

| | | | | | |

| | Interest | | Maturity | Credit | Par value | |

| Issuer, description | rate | | date | rating (A) | (000) | Value |

|

| Short-term investments 1.93% | | | | | | $1,800,000 |

|

| (Cost $1,800,000) | | | | | | |

| | | | | | | |

| U.S. Government Agency 1.93% | | | | | | 1,800,000 |

|

| Federal Home Loan Bank, | | | | | | |

| Discount Notes | Zero | | 05-01-09 | AAA | $1,800 | 1,800,000 |

|

| Total investments (Cost $106,192,352)† 99.71% | | | | | $92,925,188 |

|

| |

| Other assets and liabilities, net 0.29% | | | | | $271,904 |

|

| |

| Total net assets 100.00% | | | | | | $93,197,092 |

|

ADR American Depositary Receipts

(A) Credit ratings are unaudited and are rated by Moody’s Investors Service where Standard & Poor’s ratings are not available unless indicated otherwise.

(B) These securities are fair valued in good faith under procedures established by the Board of Trustees.

(I) Non-income producing security.

(S) This security is exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be resold, normally to qualified institutional buyers, in transactions exempt from registration.

† At April 30, 2009, the aggregate cost of investment securities for federal income tax purposes was $110,397,421. Net unrealized depreciation aggregated $17,472,233, of which $8,442,263 related to appreciated investment securities and $25,914,496 related to depreciated investment securities.

See notes to financial statements

| |

| 12 | Health Sciences Fund | Semiannual report |

F I N A N C I A L S T A T E M E N T S

Financial statements

Statement of assets and liabilities 4-30-09 (unaudited)

This Statement of Assets and Liabilities is the Fund’s balance sheet. It shows the value of what the Fund owns, is due and owes. You’ll also find the net asset value and the maximum offering price per share.

| |

| Assets | |

|

| Investments, at value (Cost $106,192,352) | $92,925,188 |

| Cash | 4,930 |

| Receivable for investments sold | 2,078,878 |

| Receivable for fund shares sold | 8,310 |

| Dividends and interest receivable | 95,377 |

| Receivable for security lending income | 692 |

| Other receivables and prepaid assets | 30,091 |

| Total assets | 95,143,466 |

| |

| Liabilities | |

|

| Payable for investments purchased | 802,468 |

| Payable for fund shares repurchased | 149,555 |

| Payable to affiliates | |

| Accounting and legal services fees | 5,024 |

| Transfer agent fees | 13,038 |

| Distribution and service fees | 32,969 |

| Trustees’ fees | 15,193 |

| Management fees | 211,063 |

| Other liabilities and accrued expenses | 717,064 |

| | |

| Total liabilities | 1,946,374 |

| |

| Net assets | |

|

| Capital paid-in | $127,669,157 |

| Accumulated net investment loss | (1,674,067) |

| Accumulated net realized loss on investments | (19,533,257) |

| Net unrealized depreciation on investments | (13,264,741) |

| | |

| Net assets | $93,197,092 |

| |

| Net asset value per share | |

|

| Based on net asset values and shares outstanding — the Fund has an | |

| unlimited number of shares authorized with no par value | |

| Class A ($72,749,601 ÷ 3,154,885 shares) | $23.06 |

| Class B ($14,948,887 ÷ 775,709 shares)1 | $19.27 |

| Class C ($5,498,604 ÷ 285,260 shares)1 | $19.28 |

| |

| Maximum public offering price per share | |

|

| Class A (net asset value per share ÷ 95%)2 | $24.27 |

1 Redemption price is equal to net asset value less any applicable contingent deferred sales charge.

2 On single retail sales of less than $50,000. On sales of $50,000 or more and on group sales the offering price is reduced.

See notes to financial statements

| |

| Semiannual report | Health Sciences Fund | 13 |

F I N A N C I A L S T A T E M E N T S

Statement of operations For the period ended 4-30-09 (unaudited)1

This Statement of Operations summarizes the Fund’s investment income earned and expenses incurred in operating the Fund. It also shows net gains (losses) for the period stated.

| |

| Investment income | |

|

| Dividends | $747,041 |

| Interest | 5,787 |

| Securities lending | 4,625 |

| Income from affiliated issuers | 1,626 |

| Less foreign taxes withheld | (30,964) |

| | |

| Total investment income | 728,115 |

| |

| Expenses | |

|

| Investment management fees (Note 5) | 407,071 |

| Distribution and service fees (Note 5) | 234,633 |

| Transfer agent fees (Note 5) | 254,028 |

| State registration fees | 3,941 |

| Printing and postage fees | 80 |

| Professional fees | 32,292 |

| Custodian fees | 12,954 |

| Registration and filing fees (Note 5) | 21,474 |

| Accounting and legal services fees (Note 5) | 10,429 |

| Trustees’ fees | 4,786 |

| Proxy fees | 33,984 |

| Tax expense | 652,402 |

| Miscellaneous | 1,301 |

| | |

| Total expenses | 1,669,375 |

| Less expense reductions (Note 5) | (66) |

| | |

| Net expenses | 1,669,309 |

| Net investment loss | (941,194) |

| |

| Realized and unrealized gain (loss) | |

|

| Net realized gain (loss) on | |

| Investments | (14,265,527) |

| Foreign currency transactions | 310,010 |

| | (13,955,517) |

| Change in net unrealized appreciation (depreciation) of | |

| Investments | 3,906,921 |

| Translation of assets and liabilities in foreign currencies | (712,376) |

| | 3,194,545 |

| Net realized and unrealized loss | (10,760,972) |

| | |

| Decrease in net assets from operations | ($11,702,166) |

1 Semiannual period from 11-1-08 to 4-30-09.

See notes to financial statements

| |

| 14 | Health Sciences Fund | Semiannual report |

F I N A N C I A L S T A T E M E N T S

Statements of changes in net assets

These Statements of Changes in Net Assets show how the value of the Fund’s net assets has changed during the last two periods. The difference reflects earnings less expenses, any investment gains and losses, distributions, if any, paid to shareholders and the net of Fund share transactions.

| | |

| | Period | Year |

| | ended | ended |

| | 4-30-091 | 10-31-08 |

|

| Increase (decrease) in net assets | | |

|

| From operations | | |

| Net investment loss | ($941,194) | ($746,957) |

| Net realized loss | (13,955,517) | (881,661) |

| Change in unrealized appreciation (depreciation) | 3,194,545 | (51,306,892) |

| Decrease in net assets resulting from operations | (11,702,166) | (52,935,510) |

| Distributions to shareholders | | |

| From net realized gain | | |

| Class A | (944,750) | (14,190,492) |

| Class B | (264,195) | (5,682,352) |

| Class C | (85,634) | (1,349,208) |

| | | |

| Total distributions | (1,294,579) | (21,222,052) |

| | | |

| From Fund share transactions (Note 6) | (15,144,070) | (6,338,920) |

| | | |

| Total decrease | (28,140,815) | (80,496,482) |

|

| Net assets | | |

|

| Beginning of period | 121,337,907 | 201,834,389 |

| | | |

| End of period | $93,197,092 | $121,337,907 |

| | | |

| Accumulated net investment loss | ($1,674,067) | ($732,873) |

1 Semiannual period from 11-1-08 to 4-30-09. Unaudited.

See notes to financial statements

| |

| Semiannual report | Health Sciences Fund | 15 |

F I N A N C I A L S T A T E M E N T S

Financial highlights

Financial highlights show how the Fund’s net asset value for a share has changed since the end of the previous period.

| | | | | | |

| CLASS A SHARES Period ended | 4-30-091 | 10-31-08 | 10-31-07 | 10-31-06 | 10-31-05 | 10-31-04 |

|

| Per share operating performance | | | | | | |

|

| Net asset value, beginning of period | $25.99 | $40.94 | $47.10 | $49.09 | $43.22 | $39.79 |

| | | |

| Net investment loss2 | (0.20) | (0.09) | (0.26) | (0.35) | (0.49) | (0.47) |

| Net realized and unrealized gain (loss) | | | | | | |

| on investments | (2.44) | (10.68) | 3.79 | 3.44 | 7.93 | 3.90 |

| | | |

| Total from investment operations | (2.64) | (10.77) | 3.53 | 3.09 | 7.44 | 3.43 |

| | | |

| Less distributions | | | | | | |

| | | |

| From net realized gain | (0.29) | (4.18) | (9.69) | (5.08) | (1.57) | — |

| | | |

| Net asset value, end of period | $23.06 | $25.99 | $40.94 | $47.10 | $49.09 | $43.22 |

| Total return (%)3 | (10.22)4,5 | (28.97)4 | 8.91 | 6.614 | 17.774 | 8.62 |

|

| Ratios and supplemental data | | | | | | |

|

| Net assets, end of period (in millions) | $73 | $94 | $140 | $158 | $149 | $125 |

| Ratios (as a percentage of average | | | | | | |

| net assets): | | | | | | |

| Expenses before reductions | 2.486 | 1.68 | 1.55 | 1.53 | 1.58 | 1.57 |

| Expenses net of all fee waivers | 2.486 | 1.687 | 1.55 | 1.52 | 1.56 | 1.57 |

| Expenses net of all fee waivers and credits | 2.486 | 1.677 | 1.55 | 1.52 | 1.56 | 1.57 |

| Net investment loss | (1.71)8 | (0.28) | (0.67) | (0.78) | (1.06) | (1.08) |

| Portfolio turnover (%) | 54 | 137 | 87 | 93 | 509 | 54 |

| |

1 Semiannual period from 11-1-08 to 4-30-09. Unaudited.

2 Based on the average of the shares outstanding.

3 Assumes dividend reinvestment and does not reflect the effect of sales charges.

4 Total returns would have been lower had certain expenses not been reduced during the periods shown.

5 Not annualized.

6 All expenses have been annualized except Tax Expense, which was 0.64% of average net assets. This expense increased the net investment loss by $0.16 and the net investment loss ratio by 0.59%.

7 Includes 0.01% related to interest expense.

8 Annualized.

9 Excludes merger activity.

See notes to financial statements

| |

| 16 | Health Sciences Fund | Semiannual report |

F I N A N C I A L S T A T E M E N T S

| | | | | | |

| CLASS B SHARES Period ended | 4-30-091 | 10-31-08 | 10-31-07 | 10-31-06 | 10-31-05 | 10-31-04 |

| |

| Per share operating performance | | | | | | |

|

| Net asset value, beginning of period | $21.84 | $35.32 | $42.18 | $44.76 | $39.81 | $36.91 |

| Net investment loss2 | (0.23) | (0.27) | (0.47) | (0.61) | (0.75) | (0.72) |

| Net realized and unrealized gain (loss) | | | | | | |

| on investments | (2.05) | (9.03) | 3.30 | 3.11 | 7.27 | 3.62 |

| Total from investment operations | (2.28) | (9.30) | 2.83 | 2.50 | 6.52 | 2.90 |

| Less distributions | | | | | | |

| From net realized gain | (0.29) | (4.18) | (9.69) | (5.08) | (1.57) | — |

| Net asset value, end of period | $19.27 | $21.84 | $35.32 | $42.18 | $44.76 | $39.81 |

| Total return (%)3 | (10.51)4,5 | (29.48)4 | 8.14 | 5.824 | 16.954 | 7.86 |

| | | | | | | |

| Ratios and supplemental data | | | | | | |

|

| Net assets, end of period (in millions) | $15 | $21 | $50 | $80 | $124 | $134 |

| Ratios (as a percentage of average | | | | | | |

| net assets): | | | | | | |

| Expenses before reductions | 3.136 | 2.38 | 2.25 | 2.23 | 2.28 | 2.27 |

| Expenses net of all fee waivers | 3.136 | 2.387 | 2.25 | 2.22 | 2.26 | 2.27 |

| Expenses net of all fee waivers | | | | | | |

| and credits | 3.136 | 2.377 | 2.25 | 2.22 | 2.26 | 2.27 |

| Net investment loss | (2.31)8 | (0.98) | (1.38) | (1.49) | (1.76) | (1.77) |

| Portfolio turnover (%) | 54 | 137 | 87 | 93 | 509 | 54 |

1 Semiannual period from 11-1-08 to 4-30-09. Unaudited.

2 Based on the average of the shares outstanding.

3 Assumes dividend reinvestment and does not reflect the effect of sales charges.

4 Total returns would have been lower had certain expenses not been reduced during the periods shown.

5 Not annualized.

6 All expenses have been annualized except Tax Expense which was 0.59% of average net assets. This expense increased the net investment loss by $0.12 and the net investment loss ratio by 0.59%.

7 Includes 0.01% related to interest expense.

8 Annualized.

9 Excludes merger activity.

| | | | | | |

| CLASS C SHARES Period ended | 4-30-091 | 10-31-08 | 10-31-07 | 10-31-06 | 10-31-05 | 10-31-04 |

| | | | | | | |

| Per share operating performance | | | | | | |

|

| Net asset value, beginning of period | $21.85 | $35.32 | $42.18 | $44.76 | $39.81 | $36.91 |

| Net investment loss2 | (0.24) | (0.27) | (0.46) | (0.61) | (0.75) | (0.72) |

| Net realized and unrealized gain (loss) | | | | | | |

| on investments | (2.04) | (9.02) | 3.29 | 3.11 | 7.27 | 3.62 |

| Total from investment operations | (2.28) | (9.29) | 2.83 | 2.50 | 6.52 | 2.90 |

| Less distributions | | | | | | |

| From net realized gain | (0.29) | (4.18) | (9.69) | (5.08) | (1.57) | — |

| Net asset value, end of period | $19.28 | $21.85 | $35.32 | $42.18 | $44.76 | $39.81 |

| Total return (%)3 | (10.51)4,5 | (29.45)4 | 8.12 | 5.854 | 16.954 | 7.86 |

| |

| Ratios and supplemental data | | | | | | |

|

| Net assets, end of period (in millions) | $5 | $7 | $11 | $14 | $17 | $13 |

| Ratios (as a percentage of average | | | | | | |

| net assets): | | | | | | |

| Expenses before reductions | 3.186 | 2.38 | 2.25 | 2.23 | 2.28 | 2.27 |

| Expenses net of all fee waivers | 3.186 | 2.387 | 2.25 | 2.22 | 2.26 | 2.27 |

| Expenses net of all fee waivers | | | | | | |

| and credits | 3.186 | 2.377 | 2.25 | 2.22 | 2.26 | 2.27 |

| Net investment loss | (2.40)8 | (0.98) | (1.37) | (1.49) | (1.76) | (1.78) |

| Portfolio turnover (%) | 54 | 137 | 87 | 93 | 509 | 54 |

1 Semiannual period from 11-1-08 to 4-30-09. Unaudited.

2 Based on the average of the shares outstanding.

3 Assumes dividend reinvestment and does not reflect the effect of sales charges.

4 Total returns would have been lower had certain expenses not been reduced during the periods shown.

5 Not annualized.

6 All expenses have been annualized except Tax Expense which was 0.64% of average net assets. This expense increased the net investment loss by $0.13 and the net investment loss ratio by 0.64%.

7 Includes 0.01% related to interest expense.

8 Annualized.

9 Excludes merger activity.

See notes to financial statements

| |

| Semiannual report | Health Sciences Fund | 17 |

Notes to financial statements (unaudited)

Note 1

Organization

John Hancock Health Sciences Fund (the Fund) is a non-diversified series of John Hancock World Fund (the Trust), an open-end management investment company registered under the Investment Company Act of 1940, as amended (the 1940 Act). The investment objective of the Fund is to seek long-term growth of capital.

The Board of Trustees has authorized the issuance of multiple classes of shares of the Fund, designated as Class A, Class B and Class C shares. The shares of each class represent an interest in the same portfolio of investments of the Fund and have equal rights as to voting, redemptions, dividends and liquidation, except that certain expenses, subject to the approval of the Trustees, may be applied differently to each class of shares in accordance with current regulations of the Securities and Exchange Commission and the Internal Revenue Service. Shareholders of a class that bears distribution and service expenses under the terms of a distribution plan have exclusive voting rights to that distribution plan. Class B shares will convert to Class A shares eight years aft er purchase.

Note 2

Significant accounting policies

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. The following summarizes the significant accounting policies of the Fund:

Security valuation

Investments are stated at value as of the close of the regular trading on the New York Stock Exchange (NYSE), normally at 4:00 P.M., Eastern Time. Equity securities held by the Fund are valued at the last sale price or official closing price (closing bid price or last evaluated price if no sale has occurred) as of the close of business on the principal securities exchange (domestic or foreign) on which they trade. Debt obligations are valued based on the evaluated prices provided by an independent pricing service, which utilizes both dealer-supplied and electronic data processing techniques, which take into account factors such as institutional-size tra ding in similar groups of securities, yield, quality, coupon rate, maturity, type of issue, trading characteristics and other market data. Foreign securities and currencies are valued in U.S. dollars, based on foreign currency exchange rates supplied by an independent pricing service. Securities traded only in the over-the-counter market are valued at the last bid price quoted by brokers making markets in the securities at the close of trading. Equity and debt obligations, for which there are no prices available from an independent pricing service, are valued based on broker quotes or fair valued as described below. Short-term debt investments that have a remaining matu rity of 60 days or less are valued at amortized cost, and thereafter assume a constant amortization to maturity of any discount or premium, which approximates market value.

Other portfolio securities and assets for which market quotations are not readily available are valued at fair value as determined in good faith by the Fund’s Pricing Committee in accordance with procedures adopted by the Board of Trustees. Generally, trading in non-U.S. securities is substantially completed each day at various times prior to the close of trading on the NYSE. The values of such securities used in computing the net asset value of the Fund’s shares are generally determined as of such times. Occasionally, significant events that affect the values of such securities may occur between the times at which such values are generally determined and the close of the NYSE. Upon such an occurrence, these securities will be valued at fair value as determined in good faith under consistently applied procedures established by

| |

| 18 | Health Sciences Fund | Semiannual report |

and under the general supervision of the Board of Trustees.

Valuations change in response to many factors including the historical and prospective earnings of the issuer, the value of the issuer’s assets, general economic and market conditions, interest rates, investor perceptions and market liquidity.

The Fund adopted Statement of Financial Accounting Standards No. 157 (FAS 157), Fair Value Measurements, effective with the beginning of the Fund’s fiscal year. FAS 157 established a three-tier hierarchy to prioritize the assumptions, referred to as inputs, used in valuation techniques to measure fair value. The three-tier hierarchy of inputs is summarized in the three broad levels listed below:

Level 1 – Quoted prices in active markets for identical securities.

Level 2 – Prices determined using other significant observable inputs. Observable inputs are inputs that other market participants would use in pricing a security. These may include quoted prices for similar securities, interest rates, prepayment speeds, credit risk and others.

Level 3 – Prices determined using significant unobservable inputs. In situations where quoted prices or observable inputs are unavailable, such as when there is little or no market activity for an investment, unobservable inputs may be used. Unobservable inputs reflect the Fund’s own assumptions about the factors that market participants would use in pricing an investment and would be based on the best information available.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used to value the Fund’s net assets as of April 30, 2009:

| | |

| | INVESTMENTS IN | OTHER FINANCIAL |

| VALUATION INPUTS | SECURITIES | INSTRUMENTS* |

|

| Level 1 — Quoted Prices | $83,811,709 | — |

| Level 2 — Other Significant Observable Inputs | 7,708,153 | — |

| Level 3 — Significant Unobservable Inputs | 1,405,326 | — |

| Total | $92,925,188 | — |

*Other financial instruments are derivative instruments not reflected in the Portfolio of Investments, such as futures, forwards, options and swap contracts, which are stated at value based upon futures’ settlement prices, foreign currency exchange forward rates, option prices and swap prices.

The following is a reconciliation of Level 3 assets for which significant unobservable inputs were used to determine fair value:

| | |

| | INVESTMENTS IN | OTHER FINANCIAL |

| | SECURITIES | INSTRUMENTS |

|

| Balance as of October 31, 2008 | — | — |

| Accrued discounts/premiums | — | — |

| Realized gain (loss) | — | — |

| Change in unrealized appreciation (depreciation) | ($3,131,614) | — |

| Net purchases (sales) | 20,200 | — |

| Transfers in and/or out of Level 3 | 4,516,740 | — |

| Balance as of April 30, 2009 | $1,405,326 | — |

| |

| Semiannual report | Health Sciences Fund | 19 |

Security transactions and related

investment income

Investment security transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is accrued as earned. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Foreign dividends are recorded on the ex-date or when the Fund becomes aware of the dividends from cash collections. Discounts/premiums are accreted/ amortized for financial reporting purposes. Non-cash dividends are recorded at the fair market value of the securities received. Debt obligations may be placed in a non-accrual status and related interest income may be reduced by ceasing current accruals and writing off interest receivables when the collection of all or a portion of interest has become doubtful. The Fund uses identified cost method for determining realized gain or loss on investments for both financial statement and federal income tax reporting purposes.

Line of credit

The Fund and other affiliated funds have entered into an agreement which enables them to participate in a $150 million unsecured committed line of credit with State Street Corporation (the Custodian). The Fund is permitted to have bank borrowings for temporary or emergency purposes, including the meeting of redemption requests that otherwise might require the untimely disposition of securities. Interest is charged to each participating fund based on its borrowings at a rate per annum equal to the Federal Funds rate plus 0.50%. In addition, a commitment fee of 0.08% per annum, payable at the end of each calendar quarter, based on the average daily-unused portion of the line of credit, is charged to each participating fund on a prorated basis based on average net assets. Prior to February 19, 2009, the commitment fee was 0.05% per annum. For the period ended April 30, 2009, there were no borrowings under the line of credit by the Fund.

Pursuant to the custodian agreement, the Custodian may, in its discretion, advance funds to the Fund to make properly authorized payments. When such payments result in an overdraft, the Fund is obligated to repay the Custodian for any overdraft, including any costs or expenses associated with the overdraft. The Custodian has a lien, security interest or security entitlement in any Fund property, that is not segregated, to the maximum extent permitted by law to the extent of any overdraft.

Expenses

The majority of expenses are directly identifiable to an individual fund. Trust expenses that are not readily identifiable to a specific fund are allocated in such a manner as deemed equitable, taking into consideration, among other things, the nature and type of expense and the relative size of the funds. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

During the period ended April 30, 2009, the Fund recorded a tax expense related to investments in passive foreign investment companies. This tax expense is currently reported in the Fund’s Statement of Operations.

Class allocations

Income, common expenses and realized and unrealized gains (losses) are determined at the fund level and allocated daily to each class of shares based on the appropriate net asset value of the respective classes. Distribution and service fees, if any, and transfer agent fees for all classes are calculated daily at the class level based on the appropriate net asset value of each class and the specific expense rate(s) applicable to each class.

Foreign currency translation

The books and records of the Fund are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in a foreign currency are translated into U.S. dollars at the prevailing exchange rates at period end. Purchases and sales of investment securities, income and expenses are translated into U.S. dollars at the prevailing exchange rates on the respective dates of the transactions.

Net realized and unrealized gains and losses on foreign currency transactions represent net gains

| |

| 20 | Health Sciences Fund | Semiannual report |

and losses between trade and settlement dates on securities transactions, the disposition of forward foreign currency exchange contracts and foreign currencies, and the difference between the amount of net investment income accrued and the U.S. dollar amount actually received. That portion of both realized and unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed but is included with net realized and unrealized gain/appreciation and loss/depreciation on investments.

The Fund may be subject to capital gains and repatriation taxes imposed by certain countries in which they invest. Such taxes are generally based upon income and/or capital gains earned or repatriated. Taxes are accrued based upon net investment income, net realized gains and net unrealized appreciation.

Federal income taxes

The Fund qualifies as a regulated investment company by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required.

For federal income tax purposes, the Fund has $1,372,670 of a capital loss carryforward available, to the extent provided by regulations, to offset future net realized capital gains. To the extent that such carryforward is used by the Fund, no capital gain distributions will be made. The loss carryforwards expire as follows: October 31, 2009 — $250,246 and October 31, 2010 — $1,122,424.

As of April 30, 2009. the Fund had no uncertain tax positions that would require financial statement recognition, de-recognition, or disclosure. Each of the Fund’s federal tax returns filed in the 3-year period ended October 31, 2008 remains subject to examination by the Internal Revenue Service.

Distribution of income and gains

The Fund records distributions to shareholders from net investment income and net realized gains, if any, on the ex-dividend date. The Fund generally declares and pays dividends and capital gains distributions, if any, annually.

During the year ended October 31, 2008, the tax character of distributions paid was as follows: ordinary income $10,245,062 and long-term capital gain $10,976,990. Distributions paid by the Fund with respect to each class of shares are calculated in the same manner, at the same time and are in the same amount, except for the effect of expenses that may be applied differently to each class.

Such distributions and distributable earnings, on a tax basis, are determined in conformity with income tax regulations, which may differ from accounting principles generally accepted in the United States of America. Distributions in excess of tax basis earnings and profits, if any, are reported in the Fund’s financial statements as a return of capital.

New accounting pronouncement

In March 2008, FASB No. 161 (FAS 161), Disclosures about Derivative Instruments and Hedging Activities, an amendment of FASB Statement No. 133 (FAS 133), was issued and is effective for fiscal years and interim periods beginning after November 15, 2008. FAS 161 amends and expands the disclosure requirements of FAS 133 in order to provide financial statement users an understanding of a company’s use of derivative instruments, how derivative instruments are accounted for under FAS 133 and related interpretations and how these instruments affect a company’s financial position, performance, and cash flows. FAS 161 requires com panies to disclose information detailing the objectives and strategies for using derivative instruments, the level of derivative activity entered into by the company, and any credit risk related contingent features of the agreements. As of April 30, 2009, management does not believe that the adoption of FAS 161 will have a material impact on the amounts reported in the financial statements.

Note 3

Risk and uncertainties

Industry risk – health sciences

The Fund may concentrate investments in a particular industry, sector of the economy or invest in a limited number of companies. The concentration is closely tied to a single sector or industry of the economy which may cause the Fund to underperform other sectors.

| |

| Semiannual report | Health Sciences Fund | 21 |

Specifically, health science companies are particularly susceptible to the impact of market, economic, regulatory and other factors affecting the industry. Accordingly, the concentration may make the Fund’s value more volatile and investment values may rise and fall rapidly.

Non-diversified risk

The Fund is allowed to invest in the securities of a relatively small number of issuers, which may result in greater susceptibility to associated risks. As a result, credit, market and other risks associated with a fund’s investment strategies or techniques may be more pronounced for Health Sciences Fund than for funds that are “diversified.”

Sector risk — pharmaceutical industry

Fund performance will be closely tied to a single sector of the economy, which may underperform other sectors over any given period of time. Pharmaceuticals companies can be hurt by economic declines and other factors. For instance, when economic conditions deteriorate, pharmaceutical stocks may decline.

Risks associated with foreign investments

Investing in securities issued by companies whose principal business activities are outside the United States may involve significant risks not present in domestic investments. For example, there is generally less publicly available information about foreign companies, particularly those not subject to the disclosure and reporting requirements of the U.S. securities laws. Foreign issuers are generally not bound by uniform accounting, auditing, and financial reporting requirements and standards of practice comparable to those applicable to domestic issuers. Investments in foreign securities also involve the risk of possible adverse changes in investment or exchange control regulations, expropriation o r confiscatory taxation, limitation on the removal of funds or other assets of the Fund, political or financial instability or diplomatic and other developments which could affect such investments. Foreign stock markets, while growing in volume and sophistication, are generally not as developed as those in the United States, and securities of some foreign issuers (particularly those located in developing countries) may be less liquid and more volatile than securities of comparable U.S. companies.

In general, there is less overall governmental supervision and regulation of foreign securities markets, broker-dealers and issuers than in the United States.

Note 4

Guarantees and indemnifications

Under the Fund’s organizational documents, its Officers and Trustees are indemnified against certain liability arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred.

Note 5

Management fee and transactions with

affiliates and others

The Fund has an investment management contract with John Hancock Advisers, LLC (the Adviser), a wholly owned subsidiary of John Hancock Financial Services, Inc., a subsidiary of Manulife Financial Corporation (MFC). Under the investment management contract, the Fund pays a monthly management fee to the Adviser equivalent, on an annual basis, to the sum of: (a) 0.80% of the first $200,000,000 of the Fund’s average daily net asset value, and (b) 0.70% of the Fund’s average daily net asset value in excess of $200,000,000. The Adviser has a subadvisory agreement with MFC Global Investment Management (U.S.), LLC, an indirectly owned subsidiary of MFC and an affiliate of the Adviser. The Fund is not responsible for payment of subadvisory fees.

The investment management fees incurred for the period ended April 30, 2009, were equivalent to an annual effective rate of 0.80% of the Fund’s average daily net assets.

The Fund has a Distribution Agreement with John Hancock Funds, LLC (JH Funds), a wholly owned subsidiary of the Adviser. The Fund has adopted Distribution Plans with respect to Class A, Class B and Class C shares, pursuant to Rule 12b-1 under the 1940 Act, to pay JH Funds for the services it provides as

| |

| 22 | Health Sciences Fund | Semiannual report |

distributor of shares of the Fund. Accordingly, the Fund makes monthly payments to JH Funds at an annual rate not to exceed 0.30%, 1.00% and 1.00% of average daily net asset value of Class A, Class B and Class C shares, respectively. A maximum of 0.25% of such payments may be service fees, as defined by the Conduct Rules of the Financial Industry Regulatory Authority (formerly the National Association of Securities Dealers). Under the Conduct Rules, curtailment of a portion of the Fund’s 12b-1 payments could occur under certain circumstances.

Pursuant to the Advisory Agreement, the Fund reimburses the Adviser for all expenses associated with providing the administrative, financial, legal, accounting and recordkeeping services of the Fund, including the preparation of all tax returns, annual, semiannual and periodic reports to shareholders and the preparation of all regulatory reports. These expenses are allocated based on the relative share of net assets of each class at the time the expense was incurred.

The accounting and legal services fees incurred for the period ended April 30, 2009, were equivalent to annual effective rate of less than 0.02% of the Fund’s average daily net assets.

Class A shares are assessed up-front sales charges. During the period ended April 30, 2009, JH Funds received net up-front sales charges of $23,437 with regard to sales of Class A shares. Of this amount, $3,402 was retained and used for printing prospectuses, advertising, sales literature and other purposes, $15,650 was paid as sales commissions to unrelated broker-dealers and $4,385 was paid as sales commissions to sales personnel of Signator Investors, Inc. (Signator Investors), a related broker-dealer. The Adviser’s indirect parent, John Hancock Life Insurance Company (JHLICO), is the indirect sole shareholder of Signator Investors.

Class B shares that are redeemed within six years of purchase are subject to a contingent deferred sales charge (CDSC) at declining rates, beginning at 5.00% of the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed. Class C shares that are redeemed within one year of purchase are subject to a CDSC at a rate of 1.00% of the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed. Proceeds from the CDSCs are paid to JH Funds and are used in whole or in part to defray its expenses for providing distribution-related services to the Fund in connection with the sale of Class B and Class C shares. During the peri od ended April 30, 2009, CDSCs received by JH Funds amounted to $11,009 for Class B shares and $376 for Class C shares.

The Fund has a transfer agent agreement with John Hancock Signature Services, Inc. (Signature Services), an indirect subsidiary of JHLICO. The transfer agent fees are made up of three components:

• The Fund pays a monthly transfer agent fee at an annual rate of 0.05% for all classes based on each class’s average daily net assets.

• The Fund pays a monthly fee which is based on an annual rate of $16.50 for each shareholder account.

• Inaddition, Signature Services is reimbursed for certain out-of-pocket expenses.

The Fund receives earnings credits from its transfer agent as a result of uninvested cash balances. These credits are used to reduce a portion of the Fund’s transfer agent fees and out-of-pocket expenses. During the period ended April 30, 2009, the Fund’s transfer agent fees and out-of-pocket expenses were reduced by $66 for transfer agent credits earned.

Class level expenses for the period ended April 30, 2009 were as follows:

| | |

| | Distribution and | Transfer |

| Share class | service fees | agent fees |

|

| Class A | $117,517 | $195,541 |

| Class B | 87,255 | 43,586 |

| Class C | 29,861 | 14,901 |

| Total | $234,633 | $254,028 |

Mr. James R. Boyle is Chairman of the Adviser, as well as affiliated Trustee of the Fund, and is compensated by the Adviser and/or its affiliates. Mr. John G. Vrysen is a Board member of the Adviser, as well as affiliated Trustee of

| |

| Semiannual report | Health Sciences Fund | 23 |

the Fund, and is compensated by the Adviser and/or its affiliates. The compensation of unaffiliated Trustees is borne by the Fund. The unaffiliated Trustees may elect to defer, for tax purposes, their receipt of this compensation under the John Hancock Group of Funds Deferred Compensation Plan. The Fund makes investments into other John Hancock funds, as applicable, to cover its liability for the deferred compensation. Investments to cover the Fund’s deferred compensation liability are recorded on the Fund’s books as an other asset. The deferred compensation liability and the related other asset are always equal and are marked to market on a periodic basis to reflect any income earned by the investments, as well as any unrealized gains or losses. The Deferred Compensation Plan investments had no impact on the operations of the Fund.

Note 6

Fund share transactions

This listing illustrates the number of Fund shares sold, reinvested and repurchased during the period ended April 30, 2009 and the year ended October 31, 2008, along with the corresponding dollar value.

| | | | |

| | Period ended 4-30-091 | Year ended 10-31-08 |

| | | |

| | Shares | Amount | Shares | Amount |

| Class A shares | | | | |

|

| Sold | 209,750 | $5,092,700 | 847,059 | $26,632,158 |

| Distributions reinvested | 35,659 | 864,029 | 386,628 | 13,597,709 |

| Repurchased | (695,842) | (16,996,666) | (1,052,330) | (33,913,234) |

| Net increase (decrease) | (450,433) | ($11,039,937) | 181,357 | $6,316,633 |

| |

| Class B shares | | | | |

|

| Sold | 42,493 | $853,609 | 75,001 | $2,019,742 |

| Distributions reinvested | 12,043 | 244,468 | 183,778 | 5,467,399 |

| Repurchased | (237,652) | (4,803,407) | (720,723) | (19,775,126) |

| Net decrease | (183,116) | ($3,705,330) | (461,944) | ($12,287,985) |

| |

| Class C shares | | | | |

|

| Sold | 25,058 | $523,631 | 41,423 | $1,118,033 |

| Distributions reinvested | 3,318 | 67,358 | 44,000 | 1,309,436 |

| Repurchased | (49,959) | (989,792) | (103,698) | (2,795,037) |

| Net decrease | (21,583) | ($398,803) | (18,275) | ($367,568) |

| |

| Net decrease | (655,132) | ($15,144,070) | (298,862) | ($6,338,920) |

|

1 Semiannual period from 11-1-08 to 4-30-09. Unaudited.

Note 7

Purchase and sale of securities

Purchases and proceeds from sales or maturities of securities, other than short-term securities and obligations of the U.S. government, during the period ended April 30, 2009, aggregated $51,821,064 and $56,036,155, respectively.

Note 8

Subsequent event

On June 9, 2009, the Board of Trustees of the Fund voted to approve a plan of reorganization providing for the transfer of substantially all the assets and liabilities of the Fund to the John Hancock Rainier Growth Fund for a representative amount of shares. The proposed merger is subject to a shareholder vote.

| |

| 24 | Health Sciences Fund | Semiannual report |

Board Consideration of and

Continuation of Investment Advisory

Agreement and Subadvisory

Agreement: John Hancock Health

Sciences Fund

The Investment Company Act of 1940 (the 1940 Act) requires the Board of Trustees (the Board) of John Hancock World Fund (the Trust), including a majority of the Trustees who have no direct or indirect interest in the investment advisory agreement and are not “interested persons” of the Trust, as defined in the 1940 Act (the Independent Trustees), annually to meet in person to review and consider the continuation of: (i) the investment advisory agreement (the Advisory Agreement) with John Hancock Advisers, LLC (the Adviser) and (ii) the investment subadvisory agreement (the Subadvisory Agreement) with MFC Global Investment Management (U.S.), LLC (the Subadviser) for the John Hancock Health Sciences Fund (the Fund). The Advisory Agreement and the Subadvisory Agreement are collectively referred to as the Advisory Agreements.

At meetings held on May 5–6 and June 9–10, 2008, the Board considered the factors and reached the conclusions described below relating to the selection of the Adviser and Subadviser and the continuation of the Advisory Agreements. During such meetings, the Board’s Contracts/Operations Committee and the Independent Trustees also met in executive sessions with their independent legal counsel.

In evaluating the Advisory Agreements, the Board, including the Contracts/Operations Committee and its Independent Trustees, reviewed a broad range of information requested for this purpose. This information included:

(i) the investment performance of the Fund relative to a category of relevant funds (the Category) and a peer group of comparable funds (the Peer Group). The funds within each Category and Peer Group were selected by Morningstar Inc. (Morningstar), an independent provider of investment company data.

Data covered a range of periods ended December 31, 2007,

(ii) advisory and other fees incurred by, and the expense ratios of, the Fund relative to a Category and a Peer Group,

(iii) the advisory fees of comparable portfolios of other clients of the Adviser and the Subadviser,

(iv) the Adviser’s financial results and condition, including its and certain of its affiliates’ profitability from services performed for the Fund,

(v) breakpoints in the Fund’s and the Peer Group’s fees, and information about economies of scale,

(vi) the Adviser’s and Subadviser’s record of compliance with applicable laws and regulations, with the Fund’s investment policies and restrictions, and with the applicable Code of Ethics, and the structure and responsibilities of the Adviser’s and Subadviser’s compliance department,

(vii) the background and experience of senior management and investment professionals, and

(viii) the nature, cost and character of advisory and non-investment management services provided by the Adviser and its affiliates and by the Subadviser.

The Independent Trustees considered the legal advice of independent legal counsel and relied on their own business judgment in determining the factors to be considered in evaluating the materials that were presented to them and the weight to be given to each such factor. The Board’s review and conclusions were based on a comprehensive consideration of all information presented to the Board and not the result of any single controlling factor. The Board principally considered data on performance and other information provided by Morningstar as of December 31, 2007. The Board also considered updated performance information provided to it by the Adviser or Subadviser at its May and June 2008 meetings. Performance and other information may be

| |

| Semiannual report | Health Sciences Fund | 25 |

quite different as of the date of this shareholders report. The key factors considered by the Board and the conclusions reached are described below.

Nature, extent and quality of services

The Board considered the ability of the Adviser and the Subadviser, based on their resources, reputation and other attributes, to attract and retain qualified investment professionals, including research, advisory, and supervisory personnel. The Board considered the investment philosophy, research and investment decision-making processes of the Adviser and Subadviser. The Board considered the Adviser’s execution of its oversight responsibilities. The Board further considered the culture of compliance, resources dedicated to compliance, compliance programs and compliance records of the Adviser and Subadviser. In addition, the Board took into account the administrative and other non-advisory services provided to the Fund by the Adviser and its affiliates.

Based on the above factors, together with those referenced below, the Board concluded that, within the context of its full deliberations, the nature, extent and quality of the investment advisory services provided to the Fund by the Adviser and Subadviser supported renewal of the Advisory Agreements.

Fund performance

The Board considered the performance results for the Fund over various time periods ended December 31, 2007. The Board also considered these results in comparison to the performance of the Category, as well as the Fund’s Peer Group and benchmark indices. The Board reviewed with representatives of Morningstar the methodology used by Morningstar to select the funds in the Category and Peer Group.

The Board noted that the Fund’s performance for all periods under review was lower than the performance of the Peer Group and Category medians. The Board also noted that the Fund’s performance for the 1- and 3-year periods was lower than both of its benchmark indices, the Russell 3000 Health Index and Standard & Poor’s 500 Index, but higher than the performance of its benchmark indices for the 10-year period. The Board noted that the Fund’s performance for the 5-year period was lower than the performance of Standard & Poor’s 500 Index but higher than the performance of the Russell 3000 Health Index. The Adviser discussed with the Board recent changes made in managing the Fund’s portfolio and new proposals designed to improve performance.

Investment advisory fee and subadvisory fee

rates and expenses

The Board reviewed and considered the contractual investment advisory fee rate payable by the Fund to the Adviser for investment advisory services (the Advisory Agreement Rate). The Board received and considered information comparing the Advisory Agreement Rate with the advisory fees for the Peer Group and Category. The Board noted that the Advisory Agreement Rate was lower than the Peer Group and Category median rates.

The Board received and considered expense information regarding the Fund’s various components, including advisory fees, distribution and fees other than advisory and distribution fees, including transfer agent fees, custodian fees, and other miscellaneous fees (e.g., fees for accounting and legal services). The Board considered comparisons of these expenses to the Peer Group median. The Board also received and considered expense information regarding the Fund’s total operating expense ratio (Gross Expense Ratio) and total operating expense ratio after taking the fee waiver arrangement applicable to the Advisory Agreement Rate into account (Net Expense Ratio). The Board received and considered information comparing the Gross Expense Ratio and Net Expense Ratio of the Fund to that of the Peer Group and Category medians. The Board noted that the Fund’s Gross and Net Expense Ratios were highe r than the median of the Category but lower than the median of its Peer Group.

The Adviser also discussed the Morningstar data and rankings, and other relevant information, for the Fund. Based on the above-referenced considerations and other factors, the Board concluded that the Fund’s overall expense results and plans to improve performance supported the re-approval of the Advisory Agreements.

| |

| 26 | Health Sciences Fund | Semiannual report |

The Board also received information about the investment subadvisory fee rate (the Subadvisory Agreement Rate) payable by the Adviser to the Subadviser for investment subadvisory services. The Board concluded that the Subadvisory Agreement Rate was fair and equitable, based on its consideration of the factors described here.

Profitability

The Board received and considered a detailed profitability analysis of the Adviser based on the Advisory Agreements, as well as on other relationships between the Fund and the Adviser and its affiliates, including the Subadviser. The Board also considered a comparison of the Adviser’s profitability to that of other similar investment advisers whose profitability information is publicly available. The Board concluded that, in light of the costs of providing investment management and other services to the Fund, the profits and other ancillary benefits reported by the Adviser were not unreasonable.

Economies of scale

The Board received and considered general information regarding economies of scale with respect to the management of the Fund, including the Fund’s ability to appropriately benefit from economies of scale under the Fund’s fee structure. The Board recognized the inherent limitations of any analysis of economies of scale, stemming largely from the Board’s understanding that most of the Adviser’s costs are not specific to individual Funds, but rather are incurred across a variety of products and services.

To the extent the Board and the Adviser were able to identify actual or potential economies of scale from Fund-specific or allocated expenses, in order to ensure that any such economies continue to be reasonably shared with the Fund as its assets increase, the Adviser and the Board agreed to continue the existing breakpoints to the Advisory Agreement Rate.

Information about services to other clients

The Board also received information about the nature, extent and quality of services and fee rates offered by the Adviser and Subadviser to their other clients, including other registered investment companies, institutional investors and separate accounts. The Board concluded that the Advisory Agreement Rate and the Subadvisory Agreement Rate were not unreasonable, taking into account fee rates offered to others by the Adviser and Subadviser, respectively, after giving effect to differences in services.

Other benefits to the Adviser

The Board received information regarding potential “fall-out” or ancillary benefits received by the Adviser and its affiliates, including the Subadviser, as a result of their relationship with the Fund. Such benefits could include, among others, benefits directly attributable to the relationship of the Adviser and Subadviser with the Fund and benefits potentially derived from an increase in business as a result of their relationship with the Fund (such as the ability to market to shareholders other financial products offered by the Adviser and its affiliates).

The Board also considered the effectiveness of the Adviser’s, Subadviser’s and Fund’s policies and procedures for complying with the requirements of the federal securities laws, including those relating to best execution of portfolio transactions and brokerage allocation.

Other factors and broader review

As discussed above, the Board reviewed detailed materials received from the Adviser and Subadviser as part of the annual re-approval process. The Board also regularly reviews and assesses the quality of the services that the Fund receives throughout the year. In this regard, the Board reviews reports of the Adviser at least quarterly, which include, among other things, fund performance reports and compliance reports. In addition, the Board meets with portfolio managers and senior investment officers at various times throughout the year.

After considering the above-described factors and based on its deliberations and its evaluation of the information described above, the Board concluded that approval of the continuation of the Advisory Agreements for the Fund was in the best interest of the Fund and its shareholders. Accordingly, the Board unanimously approved the continuation of the Advisory Agreements.

| |

| Semiannual report | Health Sciences Fund | 27 |

Board Consideration of Amendments to

Investment Advisory Agreement

In approving the proposed new form of Advisory Agreement at the December 8–9, 2008 meeting (which is subject to shareholder approval), the Board determined that it was appropriate to rely upon its recent consideration at its June 10, 2008 meeting of such factors as: fund performance; the realization of economies of scale; profitability of the Advisory Agreement to the Adviser; and comparative advisory fee rates (as well as its conclusions with respect to those factors). The Board noted that it had, at the June 10, 2008 meeting, concluded that these factors, taken as a whole, supported the continuation of the Advisory Agreement. The Board, at the December 8–9, 2008 meeting, revisited particular factors to the extent relevant to the proposed new form of Agreement. In particular, the Board noted the skill and competency of the Adviser in its past management of the Fund’s affairs and subadvisory relationships, the qualifications of the Adviser’s personnel who perform services for the Trust and the Fund, including those who served as officers of the Trust, and the high level and quality of services that the Adviser may reasonably be expected to continue to provide the Fund and concluded that the Adviser may reasonably be expected to perform its services ably under the proposed new form of Advisory Agreement. The Board also took into consideration the extensive analysis and effort undertaken by a working group comprised of a subset of the Board’s Independent Trustees, which met several times, both with management representatives and separately, prior to the Board’s December 8–9, 2008 meeting. The Board considered the differences between the current Advisory Agreement and proposed new form of Agreement, and agreed that the new Advisory Agreement structure would more clearly delineate the Adviser’s duties under the Agreement by separating the Adviser’s non-advisory functions from its advisory functions. The enhanced delineation is expect ed to facilitate oversight of the Adviser’s advisory and non-advisory activities without leading to any material increase in the Fund’s overall expense ratios.

| |

| 28 | Health Sciences Fund | Semiannual report |

Special Shareholder Meeting (unaudited)

On April 16, 2009, a Special Meeting of the Shareholders of John Hancock World Fund and its series, John Hancock Health Sciences Fund, was held at 601 Congress Street, Boston, Massachusetts, for the purpose of considering and voting on the proposals listed below:

Proposal 1: To elect eleven Trustees as members of the Board of Trustees of John Hancock World Fund.

PROPOSAL 1 PASSED FOR ALL TRUSTEES ON APRIL 16, 2009.

1. Election of eleven Trustees as members of the Board of Trustees of each of the Trusts (all Trusts):

| | | | | | |

| | | | | % of Outstanding | | % of Shares |

| | | No. of Shares | | Shares | | Present |

|

| |

| James R. Boyle | | | | | | |

| Affirmative | | 2,576,978.1483 | | 57.942% | | 93.494% |

| Withhold | | 179,314.9197 | | 4.032% | | 6.506% |

| | | | | | | |

| TOTAL | | 2,756,293.0680 | | 61.974% | | 100.000% |

| |

| John G. Vrysen | | | | | | |

| Affirmative | | 2,575,418.4213 | | 57.907% | | 93.438% |

| Withhold | | 180,874.6467 | | 4.067% | | 6.562% |

| | | | | | | |

| TOTAL | | 2,756,293.0680 | | 61.974% | | 100.000% |

| |

| James F. Carlin | | | | | | |

| Affirmative | | 2,560,443.2237 | | 57.570% | | 92.894% |

| Withhold | | 195,849.8443 | | 4.404% | | 7.106% |

| | | | | | | |

| TOTAL | | 2,756,293.0680 | | 61.974% | | 100.000% |

| |

| William H. Cunningham | | | | | | |

| Affirmative | | 2,574,373.2023 | | 57.884% | | 93.400% |

| Withhold | | 181,919.8657 | | 4.090% | | 6.600% |

| | | | | | | |

| TOTAL | | 2,756,293.0680 | | 61.974% | | 100.000% |

| |

| Deborah Jackson | | | | | | |

| Affirmative | | 2,573,279.2055 | | 57.859% | | 93.360% |

| Withhold | | 183,013.8625 | | 4.115% | | 6.640% |

| | | | | | | |

| TOTAL | | 2,756,293.0680 | | 61.974% | | 100.000% |

| |

| Charles L. Ladner | | | | | | |

| Affirmative | | 2,574,899.0153 | | 57.895% | | 93.419% |

| Withhold | | 181,394.0527 | | 4.079% | | 6.581% |

| | | | | | | |

| TOTAL | | 2,756,293.0680 | | 61.974% | | 100.000% |

| |

| Stanley Martin | | | | | | |

| Affirmative | | 2,572,611.6280 | | 57.844% | | 93.336% |

| Withhold | | 183,681.4400 | | 4.130% | | 6.664% |

| | | | | | |

| TOTAL | | 2,756,293.0680 | | 61.974% | | 100.000% |

| |

| Patti McGill Peterson | | | | | | |

| Affirmative | | 2,577,699.9145 | | 57.958% | | 93.521% |

| Withhold | | 178,593.1535 | | 4.016% | | 6.479% |

| | | | | | | |

| TOTAL | | 2,756,293.0680 | | 61.974% | | 100.000% |

| |

| Semiannual report | Health Sciences Fund | 29 |

| | | | | | |

| John A. Moore | | | | | | |

| Affirmative | | 2,566,416.9078 | | 57.705% | | 93.111% |

| Withhold | | 189,876.1602 | | 4.269% | | 6.889% |

| | | | | | | |

| TOTAL | | 2,756,293.0680 | | 61.974% | | 100.000% |

| |

| Steven R. Pruchansky | | | | | | |

| Affirmative | | 2,576,961.7493 | | 57.942% | | 93.494% |

| Withhold | | 179,331.3187 | | 4.032% | | 6.506% |

| | | | | | | |

| TOTAL | | 2,756,293.0680 | | 61.974% | | 100.000% |

| |

| Gregory A. Russo | | | | | | |

| Affirmative | | 2,571,287.7290 | | 57.814% | | 93.288% |

| Withhold | | 185,005.3390 | | 4.160% | | 6.712% |

| | | | | | | |

| TOTAL | | 2,756,293.0680 | | 61.974% | | 100.000% |

Proposal 6: To revise merger approval requirements for John Hancock World Fund

PROPOSAL 6 PASSED ON APRIL 16, 2009.

6. Revision to merger approval requirements (all Trusts).

| | | | | | |

| | | | | % of Outstanding | | % of Shares |

| | | No. of Shares | | Shares | | Present |

|

| |

| Affirmative | | 1,946,061.4581 | | 43.756% | | 70.605% |

| Against | | 156,586.9325 | | 3.521% | | 5.681% |

| Abstain | | 131,512.6774 | | 2.957% | | 4.771% |

| Broker Non-Votes | | 522,132.0000 | | 11.740% | | 18.943% |

| |

| TOTAL | | 2,756,293.0680 | | 61.974% | | 100.000% |

On May 5, 2009, an adjourned session of a Special Meeting of the Shareholders of John Hancock World Fund and its series, John Hancock Health Sciences Fund, was held at 601 Congress Street, Boston, Massachusetts, for the purpose of considering and voting on the proposals listed below:

Proposal 2: To approve a new form of Advisory Agreement between John Hancock World Fund and John Hancock Advisers, LLC.

PROPOSAL 2 PASSED ON MAY 5, 2009.

2. Approval of a new form of Advisory Agreement between each Trust and John Hancock Advisers, LLC (all Funds).

| | | | | | |

| | | | | % of Outstanding | | % of Shares |

| | | No. of Shares | | Shares | | Present |

|

| |

| Affirmative | | 830,574.7910 | | 18.674% | | 57.018% |

| Against | | 50,639.0420 | | 1.139% | | 3.476% |

| Abstain | | 53,348.1900 | | 1.200% | | 3.662% |

| Broker Non-Votes | | 522,129.0000 | | 11.740% | | 35.844% |

| | | | | | | |

| TOTAL | | 1,456,691.0230 | | 32.753% | | 100.000% |

Proposal 3: To approve the following changes to fundamental investment restrictions:

PROPOSALS 3A-3L PASSED ON MAY 5, 2009.

3. Approval of the following changes to fundamental investment restrictions (See Proxy Statement for Fund(s) voting on this Proposal):

| |

| 30 | Health Sciences Fund | Semiannual report |

| | | | | | |

| 3A. Revise: Concentration | | | | | | |

| |

| Affirmative | | 819,634.5570 | | 18.428% | | 56.266% |

| Against | | 53,526.0800 | | 1.204% | | 3.675% |

| Abstain | | 61,400.3860 | | 1.381% | | 4.215% |

| Broker Non-Votes | | 522,130.0000 | | 11.740% | | 35.844% |

| | | | | | | |

| TOTAL | | 1,456,691.0230 | | 32.753% | | 100.000% |

| |

| 3C. Revise: Underwriting | | | | | | |

| |

| Affirmative | | 816,693.3560 | | 18.363% | | 56.065% |

| Against | | 53,146.1090 | | 1.195% | | 3.648% |

| Abstain | | 64,722.5580 | | 1.455% | | 4.443% |

| Broker Non-Votes | | 522,129.0000 | | 11.740% | | 35.844% |

| | | | | | | |

| TOTAL | | 1,456,691.0230 | | 32.753% | | 100.000% |

| |

| 3D. Revise: Real Estate | | | | | | |

| |

| Affirmative | | 817,673.7550 | | 18.385% | | 56.132% |

| Against | | 55,687.5180 | | 1.252% | | 3.823% |

| Abstain | | 61,197.7500 | | 1.376% | | 4.201% |

| Broker Non-Votes | | 522,132.0000 | | 11.740% | | 35.844% |

| | | | | | | |

| TOTAL | | 1,456,691.0230 | | 32.753% | | 100.000% |

| |

| 3E. Revise: Loans | | | | | | |

| |

| Affirmative | | 814,788.1930 | | 18.320% | | 55.934% |

| Against | | 58,156.1860 | | 1.308% | | 3.992% |

| Abstain | | 61,616.6440 | | 1.385% | | 4.230% |

| Broker Non-Votes | | 522,130.0000 | | 11.740% | | 35.844% |

| | | | | | | |

| TOTAL | | 1,456,691.0230 | | 32.753% | | 100.000% |

| |

| 3F. Revise: Senior Securities | | | | | | |

| |

| Affirmative | | 815,988.0920 | | 18.347% | | 56.017% |

| Against | | 56,322.2230 | | 1.266% | | 3.866% |

| Abstain | | 62,249.7080 | | 1.400% | | 4.273% |

| Broker Non-Votes | | 522,131.0000 | | 11.740% | | 35.844% |

| | | | | | | |

| TOTAL | | 1,456,691.0230 | | 32.753% | | 100.000% |

| |

| 3L. Eliminate: Pledging Assets | | | | | | |

| |

| Affirmative | | 808,447.0750 | | 18.178% | | 55.499% |

| Against | | 61,753.3330 | | 1.388% | | 4.239% |

| Abstain | | 64,357.6150 | | 1.447% | | 4.418% |

| Broker Non-Votes | | 522,133.0000 | | 11.740% | | 35.844% |

| | | | | | | |

| TOTAL | | 1,456,691.0230 | | 32.753% | | 100.000% |

Proposal 4: To approve amendments changing Rule 12b-1 Plans for certain classes of the Fund from “reimbursement” to compensation plans.