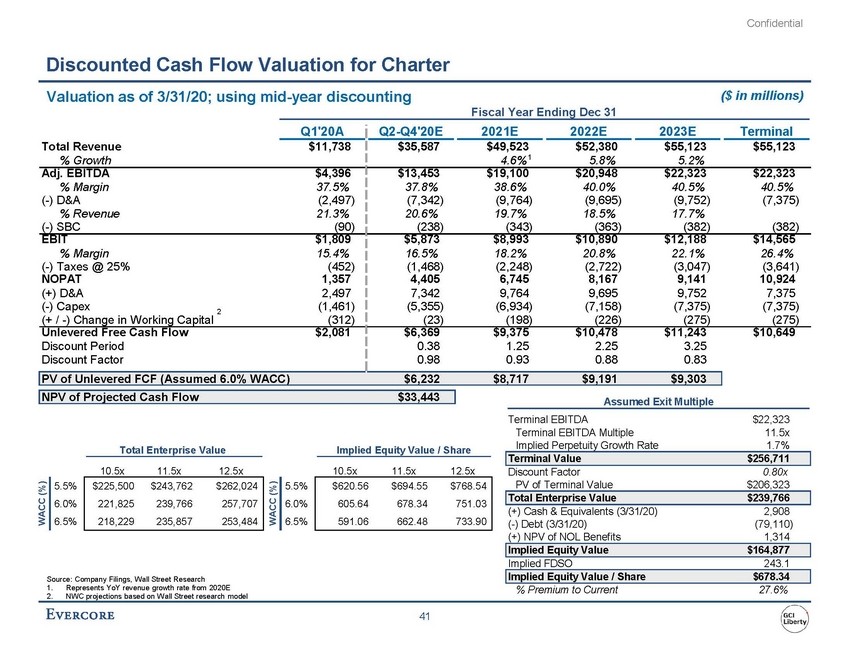

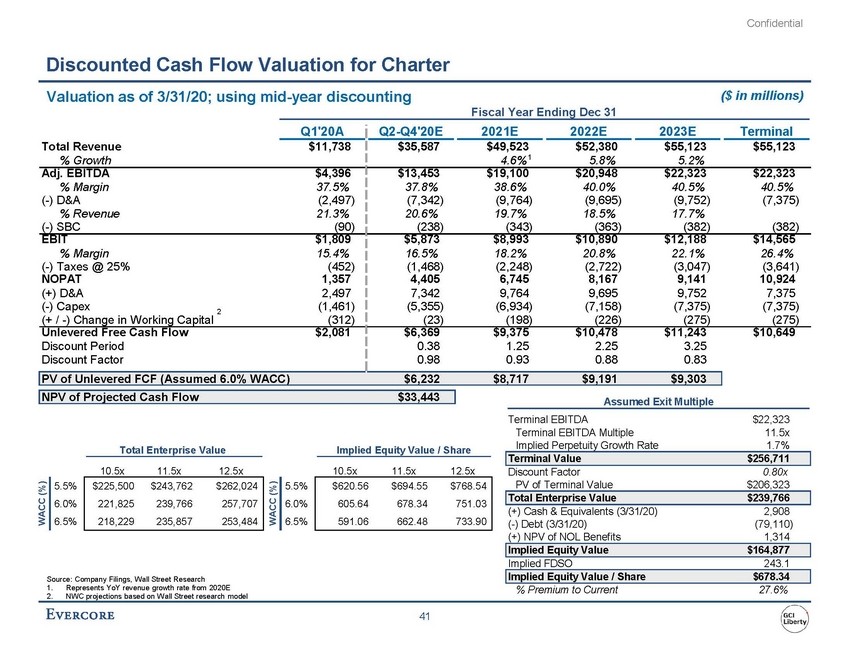

| Confidential Discounted Cash Flow Valuation for Charter Valuation as of 3/31/20; using mid-year discounting ($ in millions) Fiscal Year Ending Dec 31 (23) (198) (226) (275) (275) Terminal EBITDA Terminal EBITDA Multiple Implied Perpetuity Growth Rate $22,323 11.5x 1.7% Total Enterprise Value Implied Equity Value / Share 10.5x 11.5x 12.5x 10.5x 11.5x 12.5x Discount Factor PV of Terminal Value 0.80x $206,323 5.5% 6.0% 6.5% 5.5% 6.0% 6.5% (+) Cash & Equivalents (3/31/20) (-) Debt (3/31/20) (+) NPV of NOL Benefits 2,908 (79,110) 1,314 Implied FDSO 243.1 Source: Company Filings, Wall Street Research 1. 2. Represents YoY revenue growth rate from 2020E NWC projections based on Wall Street research model % Premium to Current 27.6% 41 WACC (%) WACC (%) Implied Equity Value / Share $678.34 Implied Equity Value $164,877 Total Enterprise Value $239,766 $620.56 $694.55 $768.54 605.64 678.34 751.03 591.06 662.48 733.90 $225,500 $243,762 $262,024 221,825 239,766 257,707 218,229 235,857 253,484 Terminal Value $256,711 Total Revenue % Growth Q1'20A Q2-Q4'20E 2021E 2022E 2023E Terminal $11,738 $35,587$49,523$52,380$55,123$55,123 4.6% 15.8%5.2% Adj. EBITDA$4,396 % Margin37.5% (-) D&A(2,497) % Revenue21.3% (-) SBC(90) $13,453$19,100$20,948$22,323$22,323 37.8%38.6%40.0%40.5%40.5% (7,342)(9,764)(9,695)(9,752)(7,375) 20.6%19.7%18.5%17.7% (238)(343)(363)(382)(382) EBIT$1,809 % Margin15.4% (-) Taxes @ 25%(452) NOPAT1,357 (+) D&A2,497 (-) Capex2(1,461) (+ / -) Change in Working Capital(312) $5,873$8,993$10,890$12,188$14,565 16.5%18.2%20.8%22.1%26.4% (1,468)(2,248)(2,722)(3,047)(3,641) 4,4056,7458,1679,14110,924 7,3429,7649,6959,7527,375 (5,355)(6,934)(7,158)(7,375)(7,375) Unlevered Free Cash Flow$2,081 Discount Period Discount Factor $6,369$9,375$10,478$11,243$10,649 0.381.252.253.25 0.980.930.880.83 PV of Unlevered FCF (Assumed 6.0% WACC)$6,232$8,717$9,191$9,303 NPV of Projected Cash Flow$33,443 Assumed Exit Multiple |