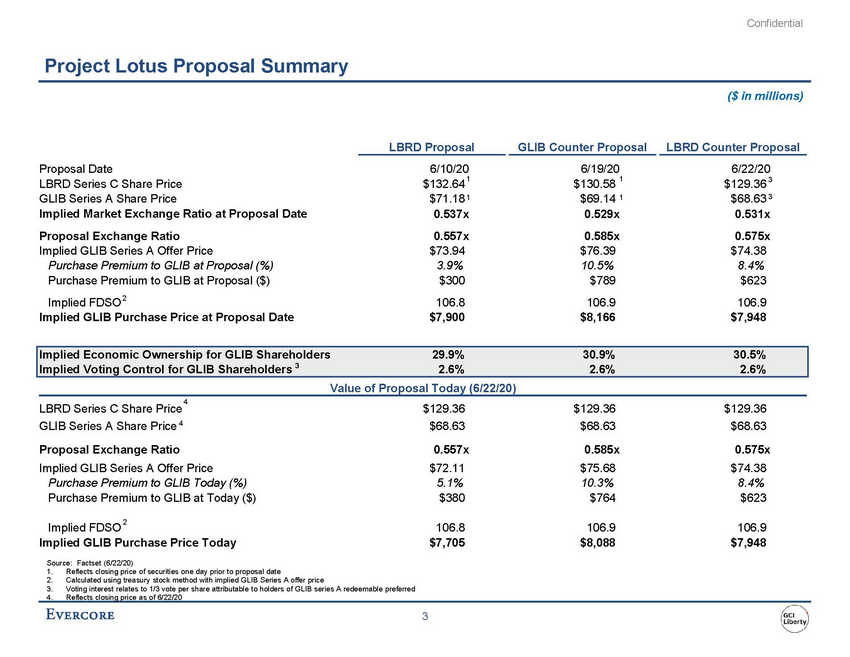

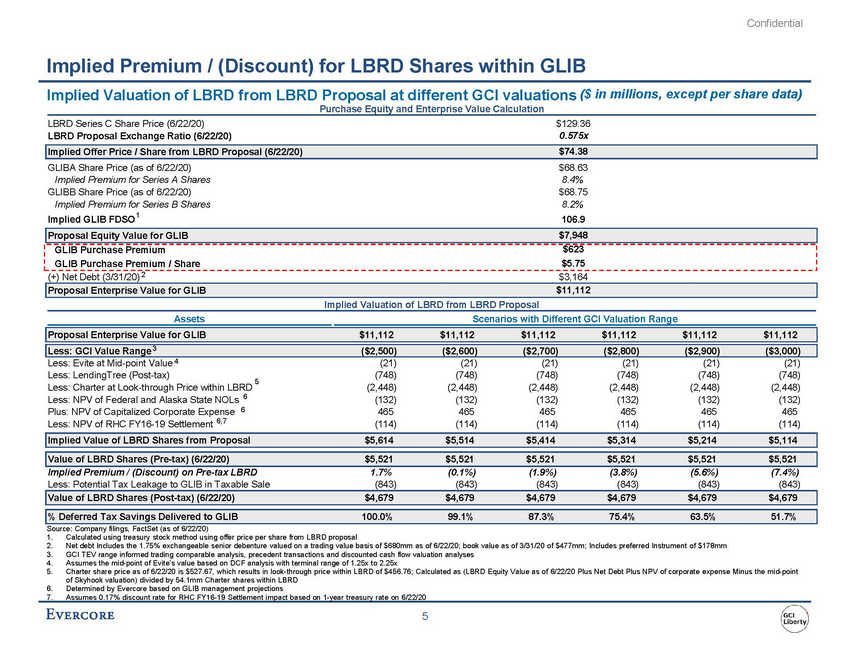

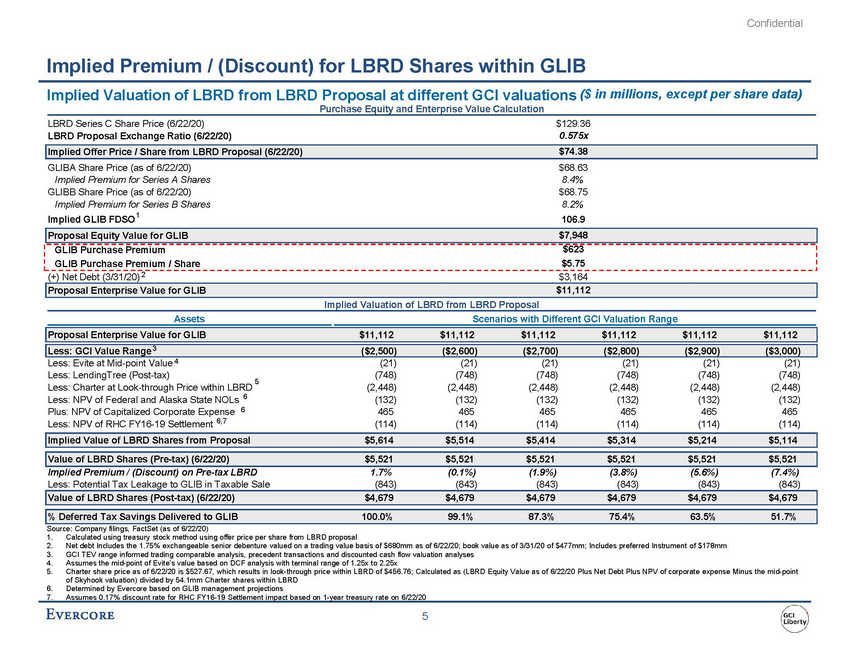

| Confidential Implied Premium / (Discount) for LBRD Shares within GLIB Implied Valuation of LBRD from LBRD Proposal at different GCI valuations ($ in millions, except per share data) Purchase Equity and Enterprise Value Calculation LBRD Series C Share Price (6/22/20) LBRD Proposal Exchange Ratio (6/22/20) $129.36 0.575x GLIBA Share Price (as of 6/22/20) Implied Premium for Series A Shares GLIBB Share Price (as of 6/22/20) Implied Premium for Series B Shares Implied GLIB FDSO 1 $68.63 8.4% $68.75 8.2% 106.9 (+) Net Debt (3/31/20) 2 $3,164 Implied Valuation of LBRD from LBRD Proposal Assets Scenarios with Different GCI Valuation Range Less: Evite at Mid-point Value 4 Less: LendingTree (Post-tax) Less: Charter at Look-through Price within LBRD Less: NPV of Federal and Alaska State NOLs 6 (21) (748) (2,448) (132) 465 (114) (21) (748) (2,448) (132) 465 (114) (21) (748) (2,448) (132) 465 (114) (21) (748) (2,448) (132) 465 (114) (21) (748) (2,448) (132) 465 (114) (21) (748) (2,448) (132) 465 (114) 5 6 Plus: NPV of Capitalized Corporate Expense Less: NPV of RHC FY16-19 Settlement 6,7 Implied Premium / (Discount) on Pre-tax LBRD Less: Potential Tax Leakage to GLIB in Taxable Sale 1.7% (843) (0.1%) (843) (1.9%) (843) (3.8%) (843) (5.6%) (843) (7.4%) (843) Source: Company filings, FactSet (as of 6/22/20) 1. 2. 3. 4. 5. Calculated using treasury stock method using offer price per share from LBRD proposal Net debt Includes the 1.75% exchangeable senior debenture valued on a trading value basis of $680mm as of 6/22/20; book value as of 3/31/20 of $477mm; Includes preferred Instrument of $178mm GCI TEV range informed trading comparable analysis, precedent transactions and discounted cash flow valuation analyses Assumes the mid-point of Evite’s value based on DCF analysis with terminal range of 1.25x to 2.25x Charter share price as of 6/22/20 is $527.67, which results in look-through price within LBRD of $456.76; Calculated as (LBRD Equity Value as of 6/22/20 Plus Net Debt Plus NPV of corporate expense Minus the mid-point of Skyhook valuation) divided by 54.1mm Charter shares within LBRD Determined by Evercore based on GLIB management projections 6. 7. Assumes 0.17% discount rate for RHC FY16-19 Settlement impact based on 1-year treasury rate on 6/22/20 5 Value of LBRD Shares (Post-tax) (6/22/20) $4,679 $4,679 $4,679 $4,679 $4,679 $4,679 % Deferred Tax Savings Delivered to GLIB 100.0% 99.1% 87.3% 75.4% 63.5% 51.7% Implied Value of LBRD Shares from Proposal $5,614 $5,514 $5,414 $5,314 $5,214 $5,114 Value of LBRD Shares (Pre-tax) (6/22/20) $5,521 $5,521 $5,521 $5,521 $5,521 $5,521 Proposal Enterprise Value for GLIB $11,112 $11,112 $11,112 $11,112 $11,112 $11,112 Less: GCI Value Range 3($2,500) ($2,600) ($2,700) ($2,800) ($2,900) ($3,000) Proposal Enterprise Value for GLIB $11,112 Proposal Equity Value for GLIB $7,948 GLIB Purchase Premium $623 GLIB Purchase Premium / Share $5.75 Implied Offer Price / Share from LBRD Proposal (6/22/20) $74.38 |