UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File number: 811-04982

Heartland Group, Inc.

(Exact name of Registrant as specified in charter)

| 790 North Water Street, Suite 1200, Milwaukee, WI | | 53202 |

| (Address of principal executive offices) | | (Zip code) |

Nicole J. Best

Heartland Group, Inc., 790 North Water Street, Suite 1200, Milwaukee, WI 53202

(Name and address of agent for service)

Ellen Drought

Godfrey & Kahn, S.C., 833 East Michigan Street, Suite 1800, Milwaukee, WI 53202-5615

(With a copy to:)

Registrant’s telephone number, including area code: (414) 347-7777

Date of fiscal year end: December 31

Date of reporting period: June 30, 2020

Form N-CSR is to be used by management investment companies to file reports with the Commission, not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A Registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A Registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

SEMIANNUAL

REPORT

June 30, 2020

Select Value Fund

Mid Cap Value Fund

Value Plus Fund

Value Fund

TABLE OF CONTENTS

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Funds’ annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website at www.heartlandadvisors.com and you will be notified by mail each time a report is posted and provided with a website link to access the report.

You may, notwithstanding the availability of shareholder reports online, elect to receive all future shareholder reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Funds, you can call 1-800-432-7856 to let the Funds know you wish to continue receiving paper copies of your shareholder reports.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by enrolling at www.heartlandadvisors.com.

A MESSAGE FROM OUR PRESIDENT AND CEO (UNAUDITED)

“Price is What You Pay; Value is What You Get”

—Warren Buffett

Dear Fellow Shareholders,

The first half of 2020 has been anything but normal. In the course of just a few months, investors have gone from panic-based selling, to aggressively bidding up stocks in hopes of a V-shaped economic recovery.

While the recent move higher was a welcome relief for battered portfolios, a closer look painted a less optimistic picture. Breadth was weak with shares of many companies failing to recoup previous losses and large-cap names trumped small.

Adding to our concern was the seeming indifference investors had for fundamentals. As shown below, shares of companies with low returns on equity, as a whole, materially outperformed their higher quality counterparts. Weaker businesses often lead in rallies following selloffs, but the magnitude of the bounce back was noteworthy.

We’d be tempted to overlook these developments as a temporary blip if it weren’t for the picture painted by the data. Recent analysis shows that the mass herding into weak businesses and mega-caps has resulted in profitable small cap companies trading at historical discounts—the most in 30+ years—to the S&P 500 as reflected by earnings yield.

Maybe it’s the result of our long history of value investing, but we find it hard to find joy in overpaying for inferior businesses.

Instead of chasing the allure of a quick rush from buying shares of a questionable business in hopes there is a greater fool out there willing to pay a few cents more, we prefer a more diligent approach. Our satisfaction comes from digging into a business to determine its intrinsic value. We get to know the management team, identify catalysts for growth and look for mispriced opportunities.

We believe this fundamental approach is the best way to help our clients achieve their goal of capital appreciation. In our view, the valuations across each of our portfolios are compelling with solid sales and earnings growth, which could exceed that of many ridiculously priced market darlings.

Low Quality in the Limelight

Source: FactSet; FTSE Russell; Jefferies. This chart shows companies held in the Russell 2000 Index. The 2020 bear market is representing data gathered during 1/16/2020 to 3/18/2020. The average bear market data is calculated based on bear markets taking place during 12/31/1985 to 6/18/2020. Bottom was on 3/18/2020. The average 3-month after bear market data is calculated based on 3 months following each bear market taking place during 12/31/1985 to 6/18/2020. Return on equity (ROE) measures the net income after taxes a firm is able to earn as a percentage of shareholders’ equity. A bear market occurs when the price of a group of securities is falling or is expected to fall.

Past performance does not guarantee future results.

Sincerely,

Will Nasgovitz

President and Chief Executive Officer

HEARTLAND SELECT VALUE FUND

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (UNAUDITED)

| MANAGEMENT REPORT Despite a strong second quarter, U.S. equities failed to fully recoup losses stemming from the COVID-19 selloff of February and March and finished the first half of the year in negative territory. The Heartland Select Value Fund Investor Class lagged the Russell 3000® Value Index, returning -19.18% versus -16.74%. The Fund’s Information Technology holdings outperformed those in the benchmark, and the group contained a top contributor, Alphabet Inc. (GOOGL), the parent company of Google. Shares of Alphabet snapped back after selling off earlier in the year due to fears of a pandemic-driven slump in ad sales revenue. Wall Street analysts cut their outlook for Alphabet earnings for the next 12 months by roughly 15% during the first quarter, however, shares of the company fell by more than twice that amount during the height of the selloff. Near-term economic challenges have muddied the picture for predicting digital ad spending, however, we believe that Alphabet is an excellent business that should be able to grow at a rate in excess of GDP growth in the years ahead. Additionally, the company’s balance sheet is a standout among public companies, and management is investing more than $25 billion per year on research and development, which should provide a catalyst for sustained, above-market earnings expansion. As States started to ease stay-at-home restrictions in late spring, investors showed signs of increasing confidence that the economy would bounce back quickly. The bullish sentiment boosted economically sensitive areas and helped portfolio holdings such as Canadian National Railway Company (CNI), a rail transport company with routes throughout the U.S. Canadian National is an industry leader featuring a management team with a history of making innovative and forward-looking investments in the business. Under this approach, the company has built a rail network that spans coast to coast and from Canada south to the Gulf of Mexico. The efficiency and capacity gained through its rail network, in our view, provides the company with a competitive advantage that it will be able to leverage for the foreseeable future. When shares of Canadian National sold off late in the first quarter, we were quick to take a position at what we believed was a rare discount for an industry powerhouse. Our decision was rewarded this quarter as shares were up double digits from our purchase price. During the weakness that plagued the markets throughout March, we were able to add to some high-quality names as their valuations became more attractive. For example, we had been selling shares of Gorman-Rupp Company (GRC), a global-leading manufacturer of pumps used in municipal water, industrial, agricultural and petrochemical applications early in the year as it approached our estimates of fair value. But as the market began to sell off, valuations once again reached attractive levels and we began to add shares. While we believe the industrial economy will be challenged in the intermediate term, Gorman-Rupp should benefit from demand for water projects throughout the country. Water infrastructure is funded with tax receipts and, therefore, is less sensitive to the economic cycle. We have seen several large municipalities raise money to upgrade their water pump station infrastructure, which we believe will benefit Gorman-Rupp in the years to come. The fallout from COVID-19 is far from over and we have no doubt that unforeseen effects from this evolving pandemic will ripple through the economy and equity markets for quarters to come. We believe businesses with pricing power will have an advantage in an economy that is likely to see excess supply and weakened consumer demand in the near-term. CFA® is a registered trademark owned by the CFA Institute. |

HEARTLAND SELECT VALUE FUND

(UNAUDITED)

FUND SUMMARY

| Average Annual Total Returns | | Inception | | Year To | | One | | Three | | Five | | Ten | | Fifteen | | Twenty | | Since |

| as of June 30, 2020 | | Date | | Date* | | Year | | Years | | Years | | Years | | Years | | Years | | Inception |

| Investor Class (HRSVX) | | 10/11/96 | | -19.18% | | -16.07% | | 0.18% | | 2.85% | | 8.06% | | 6.51% | | 8.74% | | 8.86% |

| Institutional Class (HNSVX) | | 5/1/08 | | -19.06 | | -15.84 | | 0.43 | | 3.10 | | 8.36 | | 6.76 | | 8.93 | | 9.02 |

| Russell 3000® Value Index | | — | | -16.74 | | -9.42 | | 1.41 | | 4.41 | | 10.23 | | 6.15 | | 6.42 | | 7.84 |

Index Source: FactSet Research Systems, Inc. and Russell®.

* Not annualized.

In the prospectus dated 5/1/20, the Gross Fund Operating Expenses for the Investor and Institutional Class are 1.25% and 1.02%, respectively. Heartland Advisors (the “Advisor”) has voluntarily agreed to waive fees and/or reimburse expenses with respect to the Institutional Class, to the extent necessary to maintain the Institutional Class’ Net Annual Operating Expenses at a ratio not to exceed 0.99% of average daily net assets. This voluntary waiver/reimbursement may be discontinued at any time. Without such waivers and/or reimbursements, total returns may have been lower.

Past performance does not guarantee future results. Performance for the Institutional Class prior to its initial offering is based on the performance of the Investor Class. Performance represents past -performance; current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. All returns reflect reinvested dividends and capital gains distributions, but do not reflect the deduction of taxes that an investor would pay on distributions or redemptions. Subject to certain exceptions, shares of a Fund redeemed or exchanged within 10 days of purchase are subject to a 2% redemption fee.

Performance does not reflect this fee, which if deducted would reduce an -individual’s return. To obtain performance through the most recent month end, call 800-432-7856, or visit www.heartlandadvisors.com.

HYPOTHETICAL GROWTH OF $10,000 SINCE INCEPTION — 10/11/96 — INVESTOR CLASS SHARES

SECTOR ALLOCATION — % OF EQUITY INVESTMENTS

Sector and Industry classifications are sourced from GICS®. The Global Industry Classification Standard (GICS®) is the exclusive intellectual property of MSCI Inc. (“MSCI”) and S&P Global Market Intelligence (“S&P”). Neither MSCI, S&P, their affiliates, nor any of their third party providers (“GICS Parties”) makes any representations or warranties, express or implied, with respect to GICS or the results to be obtained by the use thereof, and expressly disclaims all warranties, including warranties of accuracy, completeness, merchantability, and fitness for a particular purpose. The GICS Parties shall not have any liability for any direct, indirect, special, punitive, consequential, or any other damages (including lost profits) even if notified of such damages.

VALUATION ANALYSIS (Equity Securities Only, Weighted Harmonic Average Unless Otherwise Noted)

Source: FactSet Research Systems, Inc., and Russell®.

INVESTMENT GOAL

The Fund seeks long-term capital appreciation.

INVESTMENT STRATEGY/DISTINGUISHING CHARACTERISTIC

The Fund seeks to capture long-term capital appreciation by investing in companies with market capitalizations greater than $500 million. The Fund’s flexible pursuit of value positions it as a core holding. The Fund utilizes Heartland’s disciplined and time–tested 10 Principles of Value Investing™, designed to capture upside potential while minimizing downside risk.

INVESTMENT CONSIDERATIONS

In addition to stocks of large companies, the Fund invests in small- and mid-sized companies- that are generally less liquid and more volatile than large -companies. The Fund also invests in a smaller number of stocks (generally 40 to 60) than the average mutual fund. The performance of these holdings generally will increase the volatility of the Fund’s returns. Value investments are subject to the risk that their intrinsic value may not be recognized by the broad market.

| PORTFOLIO STATISTICS | | |

| | | |

| Number of holdings (excludes cash equivalents) | | 50 |

| Net assets | | $140.1 mil. |

| NAV (Investor Class) | | $20.61 |

| NAV (Institutional Class) | | $20.55 |

| Median market cap | | $1.4 bil. |

| Weighted average market cap | | $107.2 bil. |

| TOP TEN HOLDINGS — % OF NET ASSETS (EXCLUDES CASH EQUIVALENTS) | | |

| | | |

| Berkshire Hathaway, Inc. (Class B) | | 4.46% |

| Johnson & Johnson | | 3.94 |

| Cisco Systems, Inc. | | 3.66 |

| Verizon Communications, Inc. | | 3.51 |

| Exelon Corp. | | 3.42 |

| Unilever NV | | 3.27 |

| The Charles Schwab Corp. | | 3.25 |

| Cal-Maine Foods, Inc. | | 3.11 |

| Alphabet, Inc. (Class A) | | 3.10 |

| Skyworks Solutions, Inc. | | 2.92 |

Portfolio holdings, statistics, and manager views are subject to change without notice, and discussions of portfolio holdings are intended as illustrations of investment strategy, not as recommendations. Index definitions and investment terms are found on the page titled “Definitions and Disclosures.” All indices are unmanaged. It is not possible to invest directly in an index. All information, unless otherwise indicated, is as of 6/30/2020.

HEARTLAND MID CAP VALUE FUND

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (UNAUDITED)

| MANAGEMENT REPORT A strong second quarter for U.S. equities helped recoup some of the losses stemming from the COVID-19 selloff of February and March, but the major indices ended the first half of the year in the red. The Heartland Mid Cap Value Fund Investor Class held up better than its Russell Midcap® Value Index benchmark, returning -17.32% versus -18.09%. Information Technology (IT) lagged but the group contained a top performer, Skyworks Solutions Inc. (SWKS), a manufacturer of semiconductors used in multiple end markets including aerospace and defense, medical, consumer electronics and wireless communication products. Advancements in technology are expected to lead to greater opportunities for Skyworks in the consumer smart phone market, as well as in higher margin commercial applications, which currently account for one-third of total revenue. Sales growth in the industrial, defense and medical lines should help diversify sources of income and improve margins, while advancements in smart phones are expected to drive the use of more Skyworks products in each handset sold. Skyworks has enjoyed a sharp move higher since our purchase late last year, but we still believe it has a long runway for sales growth. Global economic concerns drove a significant pullback in the Energy sector. The portfolio’s names performed in line with the average for the benchmark. In light of the weak pricing power for producers, we’ve sought to own companies with strong balance sheets and top-tier assets such as Pioneer Natural Resources Company (PXD). Pioneer is the largest independent producer operating in the Permian Basin. The company’s size, along with its resource-rich drillable acreage, low-cost structure, and financial strength provides the business with a competitive advantage and the ability to withstand temporary shocks to demand and pricing. Management has implemented a massive streamlining initiative at Pioneer that has already begun to boost free cash flow generation and has resulted in dividend increases and share buybacks. The company has also been selling non-core assets, which provides it more flexibility in the future and has further bolstered its financial position. The portfolio’s Consumer Discretionary names held up meaningfully better than the benchmark average and the group included a solid performer, Advance Auto Parts, Inc. (AAP). The company is a dominant player in the fragmented auto parts industry and differentiates itself from peers through its client mix. We took a stake in the business after it experienced what we viewed as a temporary lull in its self-help efforts. Despite the setback, we’ve been impressed with management’s ability to stabilize gross profit margin, improve free cash flow, and deleverage the balance sheet. We continue to see ample opportunity for achievable operating improvements and believe management is on the right path. As the U.S. economy has begun to reopen from the COVID-19 shutdown, Advance Auto Parts has enjoyed a surge in sales. The jump has caught the attention of investors and shares are up double-digits for the quarter. Investors have been heartened by recent data that shows a more resilient economy than initially expected at the beginning of the pandemic. However, the fallout from COVID-19 is far from over and we have no doubt that unforeseen effects from the coronavirus will ripple through the economy and equity markets for quarters to come. In the face of this ever-changing backdrop, we believe “less bad” news will no longer drive positive performance. Instead, companies will need to show bottom-line growth to differentiate themselves. Balance sheet strength and catalysts that can result in a change in perception by investors remain a priority. We also believe businesses with pricing power will have an advantage in an economy that is likely to see excess supply and weakened consumer demand in the near-term. CFA® is a registered trademark owned by the CFA Institute. |

heartland mid cap value fund

(UNAUDITED)

FUND SUMMARY

| Average Annual Total Returns | | Inception | | Year To | | One | | Three | | Five | | Since |

| as of June 30, 2020 | | Date | | Date* | | Year | | Years | | Years | | Inception |

| Investor Class (HRMDX) | | 10/31/14 | | -17.32% | | -11.16% | | 0.15% | | 4.19% | | 3.93% |

| Institutional Class (HNMDX) | | 10/31/14 | | -17.28 | | -10.98 | | 0.37 | | 4.44 | | 4.19 |

| Russell Midcap® Value Index | | — | | -18.09 | | -11.81 | | -0.54 | | 3.32 | | 3.46 |

Index Source: FactSet Research Systems, Inc., and Russell®.

* Not annualized.

In the prospectus dated 5/1/20, the Net Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement for the Investor and Institutional Class are 1.10% and 0.85%, respectively. The Advisor has contractually agreed to waive its management fees and/or reimburse expenses of the Fund to ensure that Net Annual Operating Expenses do not exceed 1.10% of the Fund’s average daily net assets for the Investor Class and 0.85% for the Institutional Class, through at least May 1, 2022, and subject thereafter to annual reapproval of the agreement by the Board of Directors. Without such waiver and/or reimbursements, the Gross Fund Operating Expenses would be 1.36% and 1.07% for the Investor and Institutional Class, respectively.

Past performance does not guarantee future results. Performance represents past performance; current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. All returns reflect reinvested dividends and capital gains distributions, but do not reflect the deduction of taxes that an investor would pay on distributions or redemptions. Subject to certain exceptions, shares of a Fund redeemed or exchanged within 10 days of purchase are subject to a 2% redemption fee. Performance does not reflect this fee, which if deducted would reduce an individual’s return. To obtain performance through the most recent month end, call 800-432-7856, or visit www.heartlandadvisors.com.

HYPOTHETICAL GROWTH OF $10,000 SINCE INCEPTION — 10/31/14 — INVESTOR CLASS SHARES

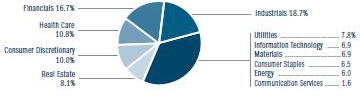

SECTOR ALLOCATION — % OF EQUITY INVESTMENTS

Sector and Industry classifications are sourced from GICS®. The Global Industry Classification Standard (GICS®) is the exclusive intellectual property of MSCI Inc. (“MSCI”) and S&P Global Market Intelligence (“S&P”). Neither MSCI, S&P, their affiliates, nor any of their third party providers (“GICS Parties”) makes any representations or warranties, express or implied, with respect to GICS or the results to be obtained by the use thereof, and expressly disclaims all warranties, including warranties of accuracy, completeness, merchantability, and fitness for a particular purpose. The GICS Parties shall not have any liability for any direct, indirect, special, punitive, consequential, or any other damages (including lost profits) even if notified of such damages.

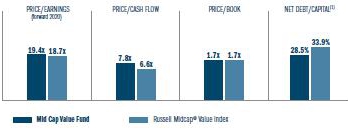

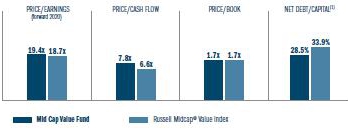

VALUATION ANALYSIS (Equity Securities Only, Weighted Harmonic Average Unless Otherwise Noted)

Source: FactSet Research Systems, Inc., and Russell®.

(1) Weighted average

INVESTMENT GOAL

The Fund seeks long-term capital appreciation and modest current income.

INVESTMENT STRATEGY/DISTINGUISHING CHARACTERISTIC

The Fund seeks long–term capital appreciation. It invests in mid-size, dividend paying companies with a market cap range defined by the Russell Midcap® Index. The Fund utilizes Heartland’s disciplined and time–tested 10 Principles of Value Investing™, designed to capture upside potential while minimizing downside risk.

INVESTMENT CONSIDERATIONS

The Fund invests in a smaller number of stocks (generally 30 to 60) than the average mutual fund. The performance of these holdings generally will increase the volatility of the Fund’s returns. The Fund also invests in mid-sized companies on a value basis. Mid-sized securities generally are more volatile and less liquid than those of larger companies. There can be no assurance that the Fund will grow to or maintain an economically viable size, in which case the Board of Directors may determine to liquidate the Fund. There is no assurance that dividend-paying stocks will mitigate volatility. Value investments are subject to the risk that their intrinsic value may not be recognized by the broad market.

| PORTFOLIO STATISTICS | | | | |

| | | | | |

| Number of holdings (excludes cash equivalents) | | | 47 | |

| Net assets | | | $56.3 mil. | |

| NAV (Investor Class) | | | $10.12 | |

| NAV (Institutional Class) | | | $10.15 | |

| Median market cap | | | $7.5 bil. | |

| Weighted average market cap | | | $11.7 bil. | |

| TOP TEN HOLDINGS — % OF NET ASSETS (EXCLUDES CASH EQUIVALENTS) | | | | |

| | | | | |

| Lincoln Electric Holdings, Inc. | | | 4.16 | % |

| Quest Diagnostics, Inc. | | | 3.96 | |

| Skyworks Solutions, Inc. | | | 3.55 | |

| Exelon Corp. | | | 3.33 | |

| Advance Auto Parts, Inc. | | | 3.08 | |

| Raymond James Financial, Inc. | | | 2.99 | |

| Mohawk Industries, Inc. | | | 2.98 | |

| The Charles Schwab Corp. | | | 2.80 | |

| UMB Financial Corp. | | | 2.60 | |

| International Paper Co | | | 2.49 | |

Portfolio holdings, statistics, and manager views are subject to change without notice, and discussions of portfolio holdings are intended as illustrations of investment strategy, not as recommendations. Index definitions and investment terms are found on the page titled “Definitions and Disclosures.” All indices are unmanaged. It is not possible to invest directly in an index. All information, unless otherwise indicated, is as of 6/30/2020.

HEARTLAND VALUE PLUS FUND

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (UNAUDITED)

| | |

| MANAGEMENT REPORT With the Federal Reserve jumping in to backstop the economy and prop up even the weakest businesses, investors flocked back to the equity markets to end the first half of the year. The stampede was a welcome relief for battered portfolios, but the major indices still finished the first half of the year in negative territory. The Heartland Value Plus Fund Investor Class meaningfully outpaced the Russell 2000® Value Index, returning -12.23% versus -23.50%. As part of our quest to find businesses with opportunities to improve sales and earnings, we have sought companies that are taking a differentiated path from competitors. We believe these disruptors will be well suited to compete in the aftermath of the global pandemic. Sonic Automotive Inc. (SAH), a top performer in the Consumer Discretionary sector, is an example of our thinking. Sonic is one of the country’s largest automotive retailers, with 95 franchises in 12 states. The business operates in two segments—traditional, franchised dealerships and its high-growth, EchoPark unit which offers a unique car buying experience in the 1- to 4-year-old used vehicle market. Shares of the company were up sharply during the quarter as auto sales surged after a dismal first quarter due to COVID-19. We welcomed the improvement but view Sonic as attractive for the long haul. Specifically, in our view, the company has one of the strongest balances sheets in the industry coupled with a unique high-growth engine in EchoPark. EchoPark focuses on newer, used vehicles, prices the vehicles below market and offers a simplified, no hassle car purchasing environment that we believe will continue to resonate well with consumers. InterDigital Inc. (IDCC), a winner in the Information Technology (IT) area epitomizes our focus on sound balance sheets and steady cashflows. The company pays a dividend and is financially strong with nearly $500 million of net cash on the balance sheet. The business develops and licenses numerous IP patents related to cellular/ wireless products, consumer electronics and video. Shares have rebounded from the lows during the COVID-19 selloff, but we believe investors aren’t fully appreciating InterDigital’s durable cash flow. Unlike many IT players, IDCC generates 90% of its revenues from fixed fee agreements that are not reliant upon customer sales volumes. Additionally, we believe IDCC should see a surge in revenue tied to the continued rollout of 5G technology in cellular service, an area where the company holds a strong portfolio of patents. The Fund’s Health Care names lagged the benchmark average. We have avoided biotech companies as they tend to be richly valued and speculative. We remain confident in the long-term prospect of our holdings including a key detractor, Cross Country Health Care Inc. (CCRN), a health care staffing company specializing in traveling nurses. Shares of Cross Country were under pressure as demand for health care workers was down due to “elective” procedures being halted during COVID-19. As restrictions have eased and procedures have ramped up, the company has begun to see a rebound in revenue. We expect top-line trends to continue to improve and have been encouraged by meaningful share purchases made by company executives this year. The far-reaching economic impact caused by COVID-19 is likely to play out for several years. The pandemic will change the way consumers shop, where they eat and how they work. Against this still evolving backdrop, we have sought to identify companies trading at attractive valuations that have avenues to succeed under multiple scenarios. Commoditized areas of the market, such as in Energy, could continue to face headwinds due to excess supply and diminished demand. As such, we have struggled to find compelling opportunities in the space, and it remains an underweight for the portfolio. CFA® is a registered trademark owned by the CFA Institute. |

| | |

HEARTLAND VALUE PLUS FUND

(UNAUDITED)

FUND SUMMARY

| Average Annual Total Returns | | Inception | | Year To | | One | | Three | | Five | | Ten | | Fifteen | | Twenty | | Twenty-Five | | Since |

| as of June 30, 2020 | | Date | | Date* | | Year | | Years | | Years | | Years | | Years | | Years | | Years | | Inception |

| Investor Class (HRVIX) | | 10/26/93 | | -12.23% | | -6.35% | | 2.66% | | 2.83% | | 6.75% | | 6.42% | | 8.47% | | 9.03% | | 9.11% |

| Institutional Class (HNVIX) | | 5/1/08 | | -12.13 | | -6.14 | | 2.89 | | 3.04 | | 7.01 | | 6.63 | | 8.63 | | 9.16 | | 9.23 |

| Russell 2000® Value Index | | — | | -23.50 | | -17.48 | | -4.35 | | 1.26 | | 7.82 | | 4.97 | | 7.65 | | 8.45 | | 8.40 |

Index Source: FactSet Research Systems, Inc., and Russell®.

* Not annualized.

In the prospectus dated 5/1/20, the Gross Fund Operating Expenses for the Investor and Institutional Class are 1.19% and 0.98%, respectively. The Advisor has voluntarily agreed to waive fees and/or reimburse expenses with respect to the Institutional Class, to the extent necessary to maintain the Institutional Class’ Net Annual Operating Expenses at a ratio not to exceed 0.99% of average daily net assets. This voluntary waiver/reimbursement may be discontinued at any time. Without such waivers and/or reimbursements, total returns may have been lower.

Past performance does not guarantee future results. Performance for the Institutional Class prior to its initial offering is based on the performance of the Investor Class. Performance represents past -performance; current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. All returns reflect reinvested dividends and capital gains distributions, but do not reflect the deduction of taxes that an investor would pay on distributions or redemptions. Subject to certain exceptions, shares of a Fund redeemed or exchanged within 10 days of purchase are subject to a 2% redemption fee. Performance does not reflect this fee, which if deducted would reduce an -individual’s return. To obtain performance through the most recent month end, call 800-432-7856, or visit www.heartlandadvisors.com.

HYPOTHETICAL GROWTH OF $10,000 SINCE INCEPTION —10/26/93 — INVESTOR CLASS SHARES

SECTOR ALLOCATION — % OF EQUITY INVESTMENTS

Sector and Industry classifications are sourced from GICS®. The Global Industry Classification Standard (GICS®) is the exclusive intellectual property of MSCI Inc. (“MSCI”) and S&P Global Market Intelligence (“S&P”). Neither MSCI, S&P, their affiliates, nor any of their third party providers (“GICS Parties”) makes any representations or warranties, express or implied, with respect to GICS or the results to be obtained by the use thereof, and expressly disclaims all warranties, including warranties of accuracy, completeness, merchantability, and fitness for a particular purpose. The GICS Parties shall not have any liability for any direct, indirect, special, punitive, consequential, or any other damages (including lost profits) even if notified of such damages.

VALUATION ANALYSIS (Equity Securities Only, Weighted Harmonic Average Unless Otherwise Noted)

Source: FactSet Research Systems, Inc., and Russell®.

(1) Weighted average

INVESTMENT GOAL

The Fund seeks long-term capital appreciation and modest current income.

INVESTMENT STRATEGY/DISTINGUISHING CHARACTERISTIC

The Fund seeks to capture the long-term capital appreciation of small-cap stocks, while potentially mitigating volatility by focusing on dividend-paying companies. The Fund utilizes Heartland’s disciplined and time-tested 10 Principles of Value Investing™, designed to capture upside potential while minimizing downside risk.

INVESTMENT CONSIDERATIONS

The Fund invests in small companies that are generally less liquid and more volatile than large companies. The Fund also invests in a smaller number of stocks (generally 40 to 70) than the average- mutual fund. The performance of these -holdings generally will increase the volatility of the Fund’s returns. Value investments are subject to the risk that their intrinsic value may not be recognized by the broad market.

| PORTFOLIO STATISTICS | | | | |

| | | | | |

| Number of holdings (excludes cash equivalents) | | | 44 | |

| Net assets | | | $302.7 mil. | |

| NAV (Investor Class) | | | $31.14 | |

| NAV (Institutional Class) | | | $1.00 | |

| Median market cap | | | $2.0 bil. | |

| Weighted average market cap | | | $2.1 bil. | |

| | | | | |

| TOP TEN HOLDINGS — % OF NET ASSETS (EXCLUDES CASH EQUIVALENTS) | | | | |

| | | | | |

| Hain Celestial Group, Inc. | | | 3.96 | % |

| PotlatchDeltic Corp. | | | 3.83 | |

| Portland General Electric Co | | | 3.80 | |

| Sonic Automotive, Inc. (Class A) | | | 3.69 | |

| ATN International, Inc. | | | 3.40 | |

| Kratos Defense & Security Solutions, Inc. | | | 3.33 | |

| TreeHouse Foods, Inc. | | | 3.19 | |

| Heartland Express, Inc. | | | 3.10 | |

| MicroStrategy, Inc. | | | 3.00 | |

| Phibro Animal Health Corp. (Class A) | | | 2.80 | |

Portfolio holdings, statistics, and manager views are subject to change without notice, and discussions of portfolio holdings are intended as illustrations of investment strategy, not as recommendations. Index definitions and investment terms are found on the page titled “Definitions and Disclosures.” All indices are unmanaged. It is not possible to invest directly in an index. All information, unless otherwise indicated, is as of 6/30/2020.

HEARTLAND VALUE FUND

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (UNAUDITED)

| MANAGEMENT REPORT “Stocks only go up, this is the easiest game I’ve been part of!”

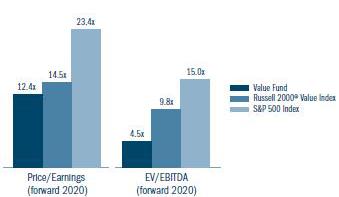

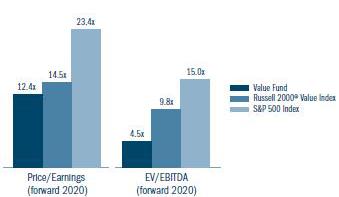

—David Portnoy, Internet Celebrity and Founder of website Barstool Sports Despite recent headwinds, the Value Fund outperformed the Russell 2000® Value Index through the first half of the year. The portfolio was up nearly 30% during the second quarter but was unable to undo the damage from the pandemic-fueled selloff of Spring, with the Investor Class finishing the first half down -15.75%, well ahead of the -23.50% for its benchmark. In a market driven by momentum and speculation, the fact that the Fund outpaced its benchmark is encouraging given the team’s commitment to fundamental research focusing on valuations. Information Technology (IT) was a source of strength for the portfolio during the period, and we believe holdings such as Photronics Inc. (PLAB) have further room to run. Photronics is a global manufacturer of photomasks used to transfer circuit patterns onto semiconductor wafers and flat panel displays during the fabrication process. The company operates nine manufacturing facilities throughout the world and is an established player in fast-growing markets. We took a stake in Photronics when shares were under pressure as it was investing in expanding its capacity. While other investors were fixated on the short-term effect capital spending put on profit margins, we saw a business that was positioning itself to meet the needs of the high-growth IT industry. Value Fund Valuations

Source: FactSet Research Systems Inc., Russell®, Standard & Poor’s, and Heartland Advisors, Inc., as of 6/30/2020 Price/Earnings and EV/EBITDA are calculated as weighted harmonic average. Certain security valuations and forward estimates are based on Heartland Advisors’ calculations. Certain outliers may be excluded. Any forecasts may not prove to be true. Economic predictions are based on estimates and are subject to change. All indices are unmanaged. It is not possible to invest directly in an index. Past performance does not guarantee future returns. Photronics is now set to reap the benefits of several years of growth investments. Along with an expected jump in sales, margins should expand as capital improvements wind down leaving the company well situated to generate robust cash flow going forward. We also view the business’ financial position, with $2.76/ share of cash on the balance sheet, as a competitive advantage. The sleepy Utilities sector is rarely seen as a place to look for businesses with strong growth prospects. However, for investors willing to do their homework, opportunities do exist. Recent portfolio National Fuel Gas Company (NFG) is a prime example Although NFG is lumped in with plain vanilla power companies, it is much more diverse. In addition to its utility operations, a pipeline and storage division generates almost a quarter of its profits and the company generates nearly 40% of its bottom line from natural gas exploration and production. Given the current state of the energy industry, we believe NFG’s gas unit could be an overlooked source of growth. As a result of decreased oil drilling, natural gas production has shrunk. The upshot is that the supply/demand dynamic may finally be shifting in favor of gas producers who have lacked pricing power for years. Sensing the improved outlook, NFG opportunistically expanded its gas producing footprint when it acquired assets from a subsidiary of Royal Dutch Shell in May. The deal is expected to immediately contribute to earnings and provide the company with additional fertile acreage and room to grow its 4% dividend yield. The first six months of 2020 have been anything but normal. In the course of just a few months, investors have gone from panic-based selling to clamoring to bid up shares of bankrupt businesses. For some, like Mr. Portnoy, the chaos has created a game like atmosphere where trading stocks is done for entertainment. Maybe it’s the result of our decades of experience as value investors, but we find it hard to find joy in overpaying for inferior companies. Our satisfaction comes from digging into a business to determine its intrinsic value. We get to know the management team, identify catalysts for growth and look for mispriced valuations. We believe this fundamental approach is the best way to help our clients achieve their goal of capital appreciation. The valuations of your portfolio, shown above, are compelling in our view with solid sales and earnings growth which could exceed that of many ridiculously priced market darlings. |

HEARTLAND VALUE FUND

(UNAUDITED)

FUND SUMMARY

| Average Annual Total Returns | | Inception | | Year To | | One | | Three | | Five | | Ten | | Fifteen | | Twenty | | Twenty-Five | | Since |

| as of June 30, 2020 | | Date | | Date* | | Year | | Years | | Years | | Years | | Years | | Years | | Years | | Inception |

| Investor Class (HRTVX) | | 12/28/84 | | -15.75% | | -12.65% | | -2.65% | | -0.15% | | 5.86% | | 4.52% | | 7.52% | | 8.18% | | 10.55% |

| Institutional Class (HNTVX) | | 5/1/08 | | -15.70 | | -12.56 | | -2.50 | | 0.01 | | 6.03 | | 4.68 | | 7.64 | | 8.27 | | 10.62 |

| Russell 2000® Value Index | | — | | -23.50 | | -17.48 | | -4.35 | | 1.26 | | 7.82 | | 4.97 | | 7.65 | | 8.45 | | 9.91 |

Index Source: FactSet Research Systems, Inc., and Russell®.

* Not annualized.

In the prospectus dated 5/1/20, the Gross Fund Operating Expenses for the Investor and Institutional Class are 1.10% and 0.92%, respectively. The Advisor has voluntarily agreed to waive fees and/or reimburse expenses with respect to the Institutional Class, to the extent necessary to maintain the Institutional Class’ Net Annual Operating Expenses at a ratio not to exceed 0.99% of average daily net assets. This voluntary waiver/reimbursement may be discontinued at any time. Without such waivers total returns may have been lower.

Past performance does not guarantee future results. Performance for the Institutional Class prior to its initial offering is based on the performance of the Investor Class. Performance represents past -performance; current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. All returns reflect reinvested dividends and capital gains distributions, but do not reflect the deduction of taxes that an investor would pay on distributions or redemptions. Subject to certain exceptions, shares of a Fund redeemed or exchanged within 10 days of purchase are subject to a 2% redemption fee. Performance does not reflect this fee, which if deducted would reduce an -individual’s return. To obtain performance through the most recent month end, call 800-432-7856, or visit www.heartlandadvisors.com.

HYPOTHETICAL GROWTH OF $10,000 SINCE INCEPTION — 12/28/84 — INVESTOR CLASS SHARES

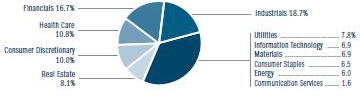

SECTOR ALLOCATION — % OF EQUITY INVESTMENTS

Sector and Industry classifications are sourced from GICS®. The Global Industry Classification Standard (GICS®) is the exclusive intellectual property of MSCI Inc. (“MSCI”) and S&P Global Market Intelligence (“S&P”). Neither MSCI, S&P, their affiliates, nor any of their third party providers (“GICS Parties”) makes any representations or warranties, express or implied, with respect to GICS or the results to be obtained by the use thereof, and expressly disclaims all warranties, including warranties of accuracy, completeness, merchantability, and fitness for a particular purpose. The GICS Parties shall not have any liability for any direct, indirect, special, punitive, consequential, or any other damages (including lost profits) even if notified of such damages.

VALUATION ANALYSIS (Equity Securities Only, Weighted Harmonic Average Unless Otherwise Noted)

Source: FactSet Research Systems, Inc., and Russell®.

INVESTMENT GOAL

The Fund seeks long-term capital appreciation through investing in small companies.

INVESTMENT STRATEGY/DISTINGUISHING CHARACTERISTIC

The Fund seeks to capture long-term capital appreciation by investing in micro- and small-cap companies. The micro- and small-cap segment of the stock market is robust with thousands of publicly traded issues, many of which lack traditional Wall Street research coverage. Thus, we believe this market is often inefficient, mispricing businesses and offering opportunities for fundamental research-minded investors such as Heartland. The Fund utilizes Heartland’s disciplined and time-tested 10 Principles of Value Investing™, designed to capture upside potential while minimizing downside risk.

INVESTMENT CONSIDERATIONS

The Fund invests primarily in small -companies selected on a value basis. Such securities generally are more volatile and less liquid than those of larger companies. Value investments are subject to the risk that their intrinsic value may not be recognized by the broad market.

| PORTFOLIO STATISTICS | | | |

| | | | |

| Number of holdings (excludes cash equivalents) | | | 109 | |

| Net assets | | | $521.9 mil. | |

| NAV (Investor Class) | | | $32.47 | |

| NAV (Institutional Class) | | | $33.18 | |

| Median market cap | | | $418 mil. | |

| Weighted average market cap | | | $1.5 bil. | |

| | | | | |

| TOP TEN HOLDINGS — % OF NET ASSETS (EXCLUDES CASH EQUIVALENTS) | | | | |

| | | | | |

| Centerra Gold, Inc. | | | 4.28 | % |

| Vistra Energy Corp. | | | 2.85 | |

| UMB Financial Corp. | | | 2.47 | |

| MGIC Investment Corp. | | | 2.35 | |

| Century Communities, Inc. | | | 2.35 | |

| Argan, Inc. | | | 2.27 | |

| Radian Group, Inc. | | | 2.23 | |

| TriCo Bancshares | | | 2.20 | |

| Kennedy-Wilson Holdings, Inc. | | | 2.29 | |

| Vonage Holdings Corp. | | | 2.12 | |

Portfolio holdings, statistics, and manager views are subject to change without notice, and discussions of portfolio holdings are intended as illustrations of investment strategy, not as recommendations. Index definitions and investment terms are found on the page titled “Definitions and Disclosures.” All indices are unmanaged. It is not possible to invest directly in an index. All information, unless otherwise indicated, is as of 6/30/2020.

the heartland family of equity funds

ADDITIONAL FUND CHARACTERISTICS (UNAUDITED)

SECTOR ALLOCATION — % OF TOTAL INVESTMENTS

The following table summarizes the sector classifications of each of the Heartland Funds as of June 30, 2020. These sectors represent groupings of industry classifications.

| | | SELECT | | | MID CAP | | | VALUE | | | VALUE | |

| | | VALUE FUND | | | VALUE FUND | | | PLUS FUND | | | FUND | |

| Communication Services | | | 6.7 | % | | | 1.6 | % | | | 3.4 | % | | | 2.8 | % |

| Consumer Discretionary | | | 8.0 | | | | 10.0 | | | | 8.2 | | | | 10.5 | |

| Consumer Staples | | | 8.5 | | | | 6.5 | | | | 9.3 | | | | 2.2 | |

| Energy | | | 4.7 | | | | 6.0 | | | | 0.9 | | | | 1.1 | |

| Financials | | | 21.5 | | | | 16.7 | | | | 20.6 | | | | 23.6 | |

| Health Care | | | 14.5 | | | | 10.8 | | | | 8.2 | | | | 9.6 | |

| Industrials | | | 13.8 | | | | 18.6 | | | | 15.1 | | | | 17.7 | |

| Information Technology | | | 10.0 | | | | 6.9 | | | | 12.7 | | | | 11.6 | |

| Materials | | | 3.3 | | | | 6.9 | | | | 10.4 | | | | 9.9 | |

| Real Estate | | | 3.5 | | | | 8.2 | | | | 6.3 | | | | 5.7 | |

| Utilities | | | 5.2 | | | | 7.7 | | | | 3.8 | | | | 5.0 | |

| Short-Term Investments | | | 0.3 | | | | 0.1 | | | | 1.1 | | | | 0.3 | |

| Total | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % |

Portfolio holdings, statistics, and manager views are subject to change without notice and discussions of portfolio holdings are intended as illustrations of investment strategy, not as recommendations.

financial statements

SELECT VALUE FUND — SCHEDULE OF INVESTMENTS

June 30, 2020 (Unaudited)

| | | SHARES | | | VALUE | |

| COMMON STOCKS (98.7%) | | | | | | | | |

| Aerospace & Defense (1.0%) | | | | | | | | |

| Huntington Ingalls Industries, Inc. | | | 8,435 | | | $ | 1,471,823 | |

| | | | | | | | | |

| Air Freight & Logistics (2.2%) | | | | | | | | |

| FedEx Corp. | | | 22,200 | | | | 3,112,884 | |

| | | | | | | | | |

| Automobiles (0.9%) | | | | | | | | |

| Thor Industries, Inc. | | | 12,200 | | | | 1,299,666 | |

| | | | | | | | | |

| Banks (8.2%) | | | | | | | | |

| Community Trust Bancorp, Inc. | | | 75,002 | | | | 2,457,066 | |

| PNC Financial Services Group, Inc. | | | 32,000 | | | | 3,366,720 | |

| Stock Yards Bancorp, Inc. | | | 95,000 | | | | 3,819,000 | |

| Truist Financial Corp. | | | 48,933 | | | | 1,837,434 | |

| | | | | | | | 11,480,220 | |

| | | | | | | | | |

| Capital Markets (5.3%) | | | | | | | | |

| Raymond James Financial, Inc. | | | 41,195 | | | | 2,835,452 | |

| The Charles Schwab Corp. | | | 135,000 | | | | 4,554,900 | |

| | | | | | | | 7,390,352 | |

| Chemicals (2.3%) | | | | | | | | |

| American Vanguard Corp. | | | 110,000 | | | | 1,513,600 | |

| Sensient Technologies Corp. | | | 32,000 | | | | 1,669,120 | |

| | | | | | | | 3,182,720 | |

| | | | | | | | | |

| Commercial Services & Supplies (1.0%) | | | | | | | | |

| Stericycle, Inc.(a) | | | 25,000 | | | | 1,399,500 | |

| | | | | | | | | |

| Communications Equipment (3.7%) | | | | | | | | |

| Cisco Systems, Inc. | | | 110,000 | | | | 5,130,400 | |

| | | | | | | | | |

| Consumer Finance (1.0%) | | | | | | | | |

| Capital One Financial Corp. | | | 22,000 | | | | 1,376,980 | |

| | | | | | | | | |

| Diversified Consumer Services (1.1%) | | | | | | | | |

| Grand Canyon Education, Inc.(a) | | | 16,800 | | | | 1,520,904 | |

| | | | | | | | | |

| Diversified Financial Services (4.4%) | | | | | | | | |

| Berkshire Hathaway, Inc. (Class B)(a) | | | 35,000 | | | | 6,247,850 | |

| | | | | | | | | |

| Diversified Telecommunication Services (3.5%) | | | | | | | | |

| Verizon Communications, Inc. | | | 89,057 | | | | 4,909,713 | |

| | | | | | | | | |

| Electric Utilities (3.4%) | | | | | | | | |

| Exelon Corp. | | | 132,000 | | | | 4,790,280 | |

| | | | | | | | | |

| Electrical Equipment (0.7%) | | | | | | | | |

| Regal Beloit Corp. | | | 10,995 | | | | 960,083 | |

| | | | | | | | | |

| Equity Real Estate Investment Trusts (REITs) (2.8%) | | | | | | | | |

| CyrusOne, Inc. | | | 23,508 | | | | 1,710,207 | |

| Public Storage | | | 11,800 | | | | 2,264,302 | |

| | | | | | | | 3,974,509 | |

| | | | | | | | | |

| Food Products (5.2%) | | | | | | | | |

| Bunge, Ltd. | | | 70,929 | | | | 2,917,310 | |

| Cal-Maine Foods, Inc.(a) | | | 97,824 | | | | 4,351,211 | |

| | | | | | | | 7,268,521 | |

| | | | | | | | | |

| Health Care Equipment & Supplies (2.4%) | | | | | | | | |

| AngioDynamics, Inc.(a) | | | 125,000 | | | | 1,271,250 | |

| Medtronic PLC | | | 22,213 | | | | 2,036,932 | |

| | | | | | | | 3,308,182 | |

| | | | | | | | | |

| Health Care Providers & Services (6.1%) | | | | | | | | |

| CVS Health Corp. | | | 45,000 | | | | 2,923,650 | |

| Quest Diagnostics, Inc. | | | 35,900 | | | | 4,091,164 | |

| Triple-S Management Corp. (Class B)(a) | | | 77,621 | | | | 1,476,352 | |

| | | | | | | | 8,491,166 | |

| Hotels, Restaurants & Leisure (0.5%) | | | | | | | | |

| Hilton Worldwide Holdings, Inc. | | | 9,212 | | | | 676,621 | |

| | | | | | | | | |

| Household Durables (1.8%) | | | | | | | | |

| Mohawk Industries, Inc.(a) | | | 25,000 | | | | 2,544,000 | |

| | | | | | | | | |

| Insurance (2.3%) | | | | | | | | |

| Old Republic International Corp. | | | 143,350 | | | | 2,338,039 | |

| Reinsurance Group of America, Inc. | | | 12,000 | | | | 941,280 | |

| | | | | | | | 3,279,319 | |

| | | | | | | | | |

| Interactive Media & Services (3.1%) | | | | | | | | |

| Alphabet, Inc. (Class A)(a) | | | 3,064 | | | | 4,344,905 | |

| | | | | | | | | |

| Machinery (4.3%) | | | | | | | | |

| Gorman-Rupp Co. | | | 72,142 | | | | 2,242,173 | |

| Lincoln Electric Holdings, Inc. | | | 45,331 | | | | 3,818,684 | |

| | | | | | | | 6,060,857 | |

| | | | | | | | | |

| Metals & Mining (1.0%) | | | | | | | | |

| Schnitzer Steel Industries, Inc. (Class A) | | | 80,000 | | | | 1,411,200 | |

| | | | | | | | | |

| Multi-Utilities (1.7%) | | | | | | | | |

| MDU Resources Group, Inc. | | | 110,000 | | | | 2,439,800 | |

| | | | | | | | | |

| Oil, Gas & Consumable Fuels (4.7%) | | | | | | | | |

| HollyFrontier Corp. | | | 91,100 | | | | 2,660,120 | |

| Suncor Energy, Inc. | | | 231,269 | | | | 3,899,195 | |

| | | | | | | | 6,559,315 | |

| | | | | | | | | |

| Personal Products (3.3%) | | | | | | | | |

| Unilever NV | | | 86,000 | | | | 4,581,220 | |

| | | | | | | | | |

| Pharmaceuticals (6.0%) | | | | | | | | |

| Johnson & Johnson | | | 39,200 | | | | 5,512,696 | |

| Sanofi (ADR) | | | 55,600 | | | | 2,838,380 | |

| | | | | | | | 8,351,076 | |

| | | | | | | | | |

| Professional Services (1.9%) | | | | | | | | |

| ManpowerGroup, Inc. | | | 38,550 | | | | 2,650,313 | |

| | | | | | | | | |

| Real Estate Management & Development (0.6%) | | | | | | | | |

| Forestar Group, Inc.(a) | | | 57,000 | | | | 859,560 | |

| | | | | | | | | |

| Road & Rail (2.5%) | | | | | | | | |

| Canadian National Railway Co. | | | 39,509 | | | | 3,499,312 | |

| | | | | | | | | |

| Semiconductors & Semiconductor Equipment (3.7%) | | | | | | | | |

| ON Semiconductor Corp.(a) | | | 52,298 | | | | 1,036,546 | |

| Skyworks Solutions, Inc. | | | 32,000 | | | | 4,091,520 | |

| | | | | | | | 5,128,066 | |

| Software (2.6%) | | | | | | | | |

| Oracle Corp. | | | 65,000 | | | | 3,592,550 | |

| | | | | | | | | |

| Specialty Retail (3.5%) | | | | | | | | |

| Aaron’s, Inc. | | | 40,735 | | | | 1,849,369 | |

| Advance Auto Parts, Inc. | | | 21,800 | | | | 3,105,410 | |

| | | | | | | | 4,954,779 | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $133,212,274) | | | | | | $ | 138,248,646 | |

| | | | | | | | | |

| | | | INTEREST | | | | PAR | | | | | |

| | | RATE | | | | AMOUNT | | | | VALUE | |

| SHORT-TERM INVESTMENTS (0.3%) | | | | | | | | | | | | |

| Time Deposits (0.3%) | | | | | | | | | | | | |

| JPM Chase (New York)(b) | | | 0.01 | % | | $ | 486,097 | | | $ | 486,097 | |

| | | | | | | | | | | | | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | | | | | |

| (Cost $486,097) | | | | | | | | | | $ | 486,097 | |

| | | | | | | | | | | | | |

| TOTAL INVESTMENTS - (99.0%) | | | | | | | | | | | | |

| (Cost $133,698,371) | | | | | | | | | | $ | 138,734,743 | |

| OTHER ASSETS AND LIABILITIES, NET - (1.0%) | | | | | | | | | | | 1,323,103 | |

| TOTAL NET ASSETS - (100.0%) | | | | | | | | | | $ | 140,057,846 | |

The accompanying Notes to Financial Statements are an integral part of these Statements.

MID CAP VALUE FUND — SCHEDULE OF INVESTMENTS

June 30, 2020 (Unaudited)

| | | SHARES | | | VALUE | |

| COMMON STOCKS (99.7%) | | | | | | | | |

| Aerospace & Defense (2.2%) | | | | | | | | |

| Huntington Ingalls Industries, Inc. | | | 7,073 | | | $ | 1,234,168 | |

| | | | | | | | | |

| Automobiles (1.9%) | | | | | | | | |

| Thor Industries, Inc. | | | 10,280 | | | | 1,095,128 | |

| | | | | | | | | |

| Banks (6.6%) | | | | | | | | |

| First Horizon National Corp. | | | 99,150 | | | | 987,534 | |

| Popular, Inc. | | | 33,468 | | | | 1,244,006 | |

| UMB Financial Corp. | | | 28,406 | | | | 1,464,329 | |

| | | | | | | | 3,695,869 | |

| | | | | | | | | |

| Building Products (1.8%) | | | | | | | | |

| A.O. Smith Corp. | | | 21,669 | | | | 1,021,043 | |

| | | | | | | | | |

| Capital Markets (5.8%) | | | | | | | | |

| Raymond James Financial, Inc. | | | 24,479 | | | | 1,684,890 | |

| The Charles Schwab Corp. | | | 46,814 | | | | 1,579,504 | |

| | | | | | | | 3,264,394 | |

| | | | | | | | | |

| Chemicals (2.3%) | | | | | | | | |

| Eastman Chemical Co. | | | 18,366 | | | | 1,279,008 | |

| | | | | | | | | |

| Commercial Services & Supplies (2.1%) | | | | | | | | |

| Stericycle, Inc.(a) | | | 21,314 | | | | 1,193,158 | |

| | | | | | | | | |

| Consumer Finance (1.4%) | | | | | | | | |

| Discover Financial Services | | | 15,397 | | | | 771,236 | |

| | | | | | | | | |

| Containers & Packaging (2.5%) | | | | | | | | |

| International Paper Co. | | | 39,843 | | | | 1,402,872 | |

| | | | | | | | | |

| Electric Utilities (5.3%) | | | | | | | | |

| Exelon Corp. | | | 51,718 | | | | 1,876,846 | |

| FirstEnergy Corp. | | | 27,922 | | | | 1,082,815 | |

| | | | | | | | 2,959,661 | |

| | | | | | | | | |

| Electrical Equipment (1.1%) | | | | | | | | |

| Regal Beloit Corp. | | | 7,320 | | | | 639,182 | |

| | | | | | | | | |

| Energy Equipment & Services (1.8%) | | | | | | | | |

| National Oilwell Varco, Inc. | | | 81,088 | | | | 993,328 | |

| | | | | | | | | |

| Equity Real Estate Investment Trusts (REITs) (8.1%) | | | | | | | | |

| American Homes 4 Rent (Class A) | | | 41,460 | | | | 1,115,274 | |

| PS Business Parks, Inc. | | | 8,508 | | | | 1,126,459 | |

| Public Storage | | | 6,706 | | | | 1,286,814 | |

| Ryman Hospitality Properties, Inc. | | | 30,096 | | | | 1,041,322 | |

| | | | | | | | 4,569,869 | |

| | | | | | | | | |

| Food Products (4.3%) | | | | | | | | |

| Bunge, Ltd. | | | 33,940 | | | | 1,395,952 | |

| Cal-Maine Foods, Inc.(a) | | | 22,721 | | | | 1,010,630 | |

| | | | | | | | 2,406,582 | |

| | | | | | | | | |

| Health Care Equipment & Supplies (2.4%) | | | | | | | | |

| DENTSPLY SIRONA, Inc. | | | 31,265 | | | | 1,377,536 | |

| | | | | | | | | |

| Health Care Providers & Services (6.3%) | | | | | | | | |

| Encompass Health Corp | | | 11,961 | | | | 740,745 | |

| Humana, Inc. | | | 1,528 | | | | 592,482 | |

| Quest Diagnostics, Inc. | | | 19,584 | | | | 2,231,792 | |

| | | | | | | | 3,565,019 | |

| | | | | | | | | |

| Hotels, Restaurants & Leisure (0.9%) | | | | | | | | |

| Hilton Worldwide Holdings, Inc. | | | 7,316 | | | | 537,360 | |

| | | | | | | | | |

| Household Durables (4.0%) | | | | | | | | |

| DR Horton, Inc. | | | 10,184 | | | | 564,703 | |

| Mohawk Industries, Inc.(a) | | | 16,500 | | | | 1,679,040 | |

| | | | | | | | 2,243,743 | |

| | | | | | | | | |

| Household Products (2.2%) | | | | | | | | |

| Spectrum Brands Holdings, Inc. | | | 27,430 | | | | 1,259,037 | |

| | | | | | | | | |

| Insurance (3.0%) | | | | | | | | |

| Old Republic International Corp. | | | 78,632 | | | | 1,282,488 | |

| Reinsurance Group of America, Inc. | | | 4,910 | | | | 385,140 | |

| | | | | | | | 1,667,628 | |

| | | | | | | | | |

| IT Services (1.5%) | | | | | | | | |

| The Western Union Co. | | | 40,268 | | | | 870,594 | |

| | | | | | | | | |

| Machinery (7.0%) | | | | | | | | |

| Flowserve Corp. | | | 25,400 | | | | 724,408 | |

| Lincoln Electric Holdings, Inc. | | | 27,822 | | | | 2,343,726 | |

| Parker-Hannifin Corp. | | | 4,660 | | | | 854,038 | |

| | | | | | | | 3,922,172 | |

| | | | | | | | | |

| Media (1.6%) | | | | | | | | |

| Omnicom Group, Inc. | | | 16,556 | | | | 903,958 | |

| | | | | | | | | |

| Metals & Mining (2.1%) | | | | | | | | |

| Freeport-McMoRan, Inc. | | | 104,708 | | | | 1,211,472 | |

| | | | | | | | | |

| Multi-Utilities (2.5%) | | | | | | | | |

| MDU Resources Group, Inc. | | | 62,499 | | | | 1,386,228 | |

| | | | | | | | | |

| Oil, Gas & Consumable Fuels (4.2%) | | | | | | | |

| Cabot Oil & Gas Corp. | | | 62,505 | | | | 1,073,836 | |

| Pioneer Natural Resources Co. | | | 13,224 | | | | 1,291,985 | |

| | | | | | | | 2,365,821 | |

| | | | | | | | | |

| Pharmaceuticals (2.0%) | | | | | | | | |

| Perrigo Co. PLC | | | 20,105 | | | | 1,111,203 | |

| | | | | | | | | |

| Professional Services (2.0%) | | | | | | | | |

| ManpowerGroup, Inc. | | | 16,363 | | | | 1,124,956 | |

| | | | | | | | | |

| Road & Rail (2.4%) | | | | | | | | |

| AMERCO | | | 4,434 | | | | 1,339,911 | |

| | | | | | | | | |

| Semiconductors & Semiconductor Equipment (5.3%) | | | | | | | | |

| ON Semiconductor Corp.(a) | | | 50,411 | | | | 999,146 | |

| Skyworks Solutions, Inc. | | | 15,651 | | | | 2,001,137 | |

| | | | | | | | 3,000,283 | |

| | | | | | | | | |

| Specialty Retail (3.1%) | | | | | | | | |

| Advance Auto Parts, Inc. | | | 12,185 | | | | 1,735,753 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $49,781,172) | | | | | | $ | 56,148,172 | |

| | | INTEREST | | | PAR | | | | |

| | | RATE | | | AMOUNT | | | VALUE | |

| SHORT-TERM INVESTMENTS (0.1%) | | | | | | | | | | | | |

| Time Deposits (0.1%) | | | | | | | | | | | | |

| Citibank (New York)(b) | | | 0.01 | % | | $ | 81,961 | | | $ | 81,961 | |

| | | | | | | | | | | | | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | | | | | |

| (Cost $81,961) | | | | | | | | | | $ | 81,961 | |

| | | | | | | | | | | | | |

| TOTAL INVESTMENTS - (99.8%) | | | | | | | | | | | | |

| (Cost $49,863,133) | | | | | | | | | | $ | 56,230,133 | |

| OTHER ASSETS AND LIABILITIES, NET - (0.2%) | | | | | | | | | | | 91,229 | |

| TOTAL NET ASSETS - (100.0%) | | | | | | | | | | $ | 56,321,362 | |

The accompanying Notes to Financial Statements are an integral part of these Statements.

VALUE PLUS FUND — SCHEDULE OF INVESTMENTS

June 30, 2020 (Unaudited)

| | | SHARES | | | VALUE | |

| COMMON STOCKS (98.7%) | | | | | | | | |

| Aerospace & Defense (3.3%) | | | | | | | | |

| Kratos Defense & Security Solutions, Inc.(a) | | | 645,000 | | | $ | 10,081,350 | |

| | | | | | | | | |

| Banks (10.8%) | | | | | | | | |

| Associated Banc-Corp | | | 559,000 | | | | 7,647,120 | |

| Glacier Bancorp, Inc. | | | 175,000 | | | | 6,175,750 | |

| Independent Bank Corp. | | | 125,000 | | | | 8,386,250 | |

| Old National Bancorp | | | 359,800 | | | | 4,950,848 | |

| Seacoast Banking Corp. of Florida(a) | | | 267,500 | | | | 5,457,000 | |

| | | | | | | | 32,616,968 | |

| Capital Markets (4.0%) | | | | | | | | |

| Artisan Partners Asset Management, Inc. (Class A) | | | 145,000 | | | | 4,712,500 | |

| B Riley Financial, Inc. | | | 335,000 | | | | 7,289,600 | |

| | | | | | | | 12,002,100 | |

| | | | | | | | | |

| Chemicals (5.3%) | | | | | | | | |

| American Vanguard Corp. | | | 600,000 | | | | 8,256,000 | |

| Sensient Technologies Corp. | | | 150,000 | | | | 7,824,000 | |

| | | | | | | | 16,080,000 | |

| | | | | | | | | |

| Commercial Services & Supplies (1.6%) | | | | | | | | |

| Brady Corp. (Class A) | | | 100,000 | | | | 4,682,000 | |

| | | | | | | | | |

| Communications Equipment (2.7%) | | | | | | | | |

| InterDigital, Inc. | | | 145,000 | | | | 8,211,350 | |

| | | | | | | | | |

| Consumer Finance (2.2%) | | | | | | | | |

| FirstCash, Inc. | | | 100,000 | | | | 6,748,000 | |

| | | | | | | | | |

| Diversified Telecommunication Services (3.4%) | | | | | | | | |

| ATN International, Inc. | | | 170,000 | | | | 10,296,900 | |

| | | | | | | | | |

| Electric Utilities (3.8%) | | | | | | | | |

| Portland General Electric Co. | | | 275,000 | | | | 11,497,750 | |

| | | | | | | | | |

| Electrical Equipment (1.7%) | | | | | | | | |

| Vicor Corp.(a) | | | 70,000 | | | | 5,036,500 | |

| | | | | | | | | |

| Electronic Equipment, Instruments & Components (2.7%) | | | | | | | | |

| Knowles Corp.(a) | | | 325,000 | | | | 4,959,500 | |

| Methode Electronics, Inc. | | | 100,000 | | | | 3,126,000 | |

| | | | | | | | 8,085,500 | |

| Equity Real Estate Investment Trusts (REITs) (6.3%) | | | | | | | | |

| Lamar Advertising Co. (Class A) | | | 110,000 | | | | 7,343,600 | |

| PotlatchDeltic Corp. | | | 305,000 | | | | 11,599,150 | |

| | | | | | | | 18,942,750 | |

| Food Products (7.1%) | | | | | | | | |

| Hain Celestial Group, Inc.(a) | | | 380,000 | | | | 11,973,800 | |

| TreeHouse Foods, Inc.(a) | | | 220,000 | | | | 9,636,000 | |

| | | | | | | | 21,609,800 | |

| Health Care Equipment & Supplies (3.7%) | | | | | | | | |

| AngioDynamics, Inc.(a) | | | 390,000 | | | | 3,966,300 | |

| Avanos Medical, Inc.(a) | | | 250,000 | | | | 7,347,500 | |

| | | | | | | | 11,313,800 | |

| Health Care Providers & Services (1.6%) | | | | | | | | |

| Cross Country Healthcare, Inc.(a) | | | 785,000 | | | | 4,835,600 | |

| | | | | | | | | |

| Household Durables (2.3%) | | | | | | | | |

| MDC Holdings, Inc. | | | 195,000 | | | | 6,961,500 | |

| | | | | | | | | |

| Household Products (2.1%) | | | | | | | | |

| Spectrum Brands Holdings, Inc. | | | 140,000 | | | | 6,426,000 | |

| | | | | | | | | |

| Insurance (3.6%) | | | | | | | | |

| Old Republic International Corp. | | | 200,000 | | | | 3,262,000 | |

| The Hanover Insurance Group, Inc. | | | 75,000 | | | | 7,599,750 | |

| | | | | | | | 10,861,750 | |

| Leisure Products (2.2%) | | | | | | | | |

| Acushnet Holdings Corp. | | | 195,000 | | | | 6,784,050 | |

| | | | | | | | | |

| Machinery (5.5%) | | | | | | | | |

| Astec Industries, Inc. | | | 115,000 | | | | 5,325,650 | |

| Donaldson Co., Inc. | | | 115,000 | | | | 5,349,800 | |

| Enerpac Tool Group Corp. (Class A) | | | 170,000 | | | | 2,992,000 | |

| Kennametal, Inc. | | | 100,000 | | | | 2,871,000 | |

| | | | | | | | 16,538,450 | |

| | | | | | | | | |

| Metals & Mining (2.3%) | | | | | | | | |

| Materion Corp. | | | 55,000 | | | | 3,381,950 | |

| Schnitzer Steel Industries, Inc. (Class A) | | | 200,000 | | | | 3,528,000 | |

| | | | | | | | 6,909,950 | |

| Oil, Gas & Consumable Fuels (0.9%) | | | | | | | | |

| Cabot Oil & Gas Corp. | | | 150,000 | | | | 2,577,000 | |

| | | | | | | | | |

| Paper & Forest Products (2.7%) | | | | | | | | |

| P.H. Glatfelter Co. | | | 515,000 | | | | 8,265,750 | |

| | | | | | | | | |

| Pharmaceuticals (2.8%) | | | | | | | | |

| Phibro Animal Health Corp. (Class A) | | | 325,000 | | | | 8,537,750 | |

| | | | | | | | | |

| Road & Rail (3.1%) | | | | | | | | |

| Heartland Express, Inc. | | | 450,000 | | | | 9,369,000 | |

| | | | | | | | | |

| Semiconductors & Semiconductor Equipment (4.3%) | | | | | | | | |

| DSP Group, Inc.(a) | | | 475,000 | | | | 7,543,000 | |

| Semtech Corp.(a) | | | 105,000 | | | | 5,483,100 | |

| | | | | | | | 13,026,100 | |

| | | | | | | | | |

| Software (3.0%) | | | | | | | | |

| MicroStrategy, Inc. (Class A)(a) | | | 76,750 | | | | 9,078,758 | |

| | | | | | | | | |

| Specialty Retail (3.7%) | | | | | | | | |

| Sonic Automotive, Inc. (Class A) | | | 350,000 | | | | 11,168,500 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $283,900,522) | | | | | | $ | 298,544,926 | |

| | | INTEREST

RATE | | | PAR

AMOUNT | | | VALUE | |

| SHORT-TERM INVESTMENTS (1.1%) | | | | | | |

| Time Deposits (1.1%) | | | | | | | | | | | | |

| Citibank (New York)(b) | | | 0.01 | % | | $ | 3,390,034 | | | $ | 3,390,034 | |

| | | | | | | | | | | | | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | | | | | |

| (Cost $3,390,034) | | | | | | | | | | $ | 3,390,034 | |

| | | | | | | | | | | | | |

| TOTAL INVESTMENTS - (99.8%) | | | | | | | | | | | | |

| (Cost $287,290,556) | | | | | | | | | | $ | 301,934,960 | |

| OTHER ASSETS AND LIABILITIES, NET - (0.2%) | | | | | | | | | | | 742,653 | |

| TOTAL NET ASSETS - (100.0%) | | | | | | | | | | $ | 302,677,613 | |

The accompanying Notes to Financial Statements are an integral part of these Statements.

VALUE FUND — SCHEDULE OF INVESTMENTS

June 30, 2020 (Unaudited)

| | | SHARES | | | VALUE | |

| COMMON STOCKS (99.4%) | | | | | | | | |

| Aerospace & Defense (1.2%) | | | | | | | | |

| CPI Aerostructures, Inc.(a) | | | 500,000 | | | $ | 1,645,000 | |

| Cubic Corp. | | | 100,000 | | | | 4,803,000 | |

| | | | | | | | 6,448,000 | |

| | | | | | | | | |

| Air Freight & Logistics (0.8%) | | | | | | | | |

| Atlas Air Worldwide Holdings, Inc.(a) | | | 100,000 | | | | 4,303,000 | |

| | | | | | | | | |

| Auto Components (1.4%) | | | | | | | | |

| Motorcar Parts of America, Inc.(a) | | | 400,200 | | | | 7,071,534 | |

| | | | | | | | | |

| Banks (14.8%) | | | | | | | | |

| Associated Banc-Corp | | | 600,000 | | | | 8,208,000 | |

| Bancorp, Inc.(a) | | | 750,000 | | | | 7,350,000 | |

| Capital City Bank Group, Inc. | | | 500,000 | | | | 10,475,000 | |

| Century Bancorp, Inc. (Class A) | | | 73,100 | | | | 5,681,332 | |

| First Internet Bancorp | | | 301,671 | | | | 5,013,772 | |

| Heritage Financial Corp. | | | 300,000 | | | | 6,000,000 | |

| Stock Yards Bancorp, Inc. | | | 100,000 | | | | 4,020,000 | |

| TriCo Bancshares | | | 377,320 | | | | 11,489,394 | |

| TriState Capital Holdings, Inc.(a) | | | 400,000 | | | | 6,284,000 | |

| UMB Financial Corp. | | | 250,000 | | | | 12,887,500 | |

| | | | | | | | 77,408,998 | |

| | | | | | | | | |

| Biotechnology (1.8%) | | | | | | | | |

| Albireo Pharma, Inc.(a) | | | 150,000 | | | | 3,973,500 | |

| Heron Therapeutics, Inc.(a) | | | 375,000 | | | | 5,516,250 | |

| | | | | | | | 9,489,750 | |

| | | | | | | | | |

| Capital Markets (3.4%) | | | | | | | | |

| Cowen, Inc. (Class A) | | | 525,000 | | | | 8,510,250 | |

| US Global Investors, Inc. (Class A) | | | 550,000 | | | | 1,045,000 | |

| Waddell & Reed Financial, Inc.(Class A) | | | 425,000 | | | | 6,591,750 | |

| WisdomTree Investments, Inc. | | | 500,000 | | | | 1,735,000 | |

| | | | | | | | 17,882,000 | |

| | | | | | | | | |

| Commercial Services & Supplies (1.9%) | | | | | | | | |

| CECO Environmental Corp.(a) | | | 550,000 | | | | 3,624,500 | |

| Perma-Fix Environmental Services, Inc.(a)(c) | | | 1,007,700 | | | | 6,439,203 | |

| | | | | | | | 10,063,703 | |

| | | | | | | | | |

| Communications Equipment (2.1%) | | | | | | | | |

| Calix, Inc.(a) | | | 300,000 | | | | 4,470,000 | |

| DASAN Zhone Solutions, Inc.(a) | | | 400,000 | | | | 3,572,000 | |

| Digi International, Inc.(a) | | | 150,000 | | | | 1,747,500 | |

| Franklin Wireless Corp.(a) | | | 200,000 | | | | 1,104,000 | |

| | | | | | | | 10,893,500 | |

| Construction & Engineering (4.5%) | | | | | | | | |

| Argan, Inc. | | | 250,000 | | | | 11,845,000 | |

| Northwest Pipe Co.(a) | | | 375,000 | | | | 9,401,250 | |

| Sterling Construction Co., Inc.(a) | | | 225,000 | | | | 2,355,750 | |

| | | | | | | | 23,602,000 | |

| | | | | | | | | |

| Construction Materials (0.4%) | | | | | | | | |

| Tecnoglass, Inc. | | | 350,000 | | | | 1,907,500 | |

| | | | | | | | | |

| Containers & Packaging (0.6%) | | | | | | | | |

| Westrock Co. | | | 100,000 | | | | 2,826,000 | |

| | | | | | | | | |

| Diversified Consumer Services (3.3%) | | | | | | | | |

| Carriage Services, Inc. (Class A) | | | 100,000 | | | | 1,812,000 | |

| Lincoln Educational Services Corp.(a)(c) | | | 2,395,000 | | | | 9,340,500 | |

| Zovio, Inc.(a)(c) | | | 2,025,000 | | | | 6,196,500 | |

| | | | | | | | 17,349,000 | |

| | | | | | | | | |

| Diversified Telecommunication Services (2.1%) | | | | | | | | |

| Vonage Holdings Corp.(a) | | | 1,100,000 | | | | 11,066,000 | |

| | | | | | | | | |

| Electric Utilities (0.6%) | | | | | | | | |

| Spark Energy, Inc. (Class A) | | | 450,000 | | | | 3,181,500 | |

| | | | | | | | | |

| Electrical Equipment (1.0%) | | | | | | | | |

| Orion Energy Systems, Inc.(a) | | | 750,000 | | | | 2,595,000 | |

| Powell Industries, Inc. | | | 87,155 | | | | 2,387,176 | |

| | | | | | | | 4,982,176 | |

| | | | | | | | | |

| Electronic Equipment, Instruments & Components (1.8%) | | | | | | | | |

| Identiv, Inc.(a) | | | 600,000 | | | | 3,060,000 | |

| Intellicheck, Inc.(a) | | | 500,000 | | | | 3,775,000 | |

| Orbital Energy Group, Inc.(a) | | | 1,415,000 | | | | 875,954 | |

| SMTC Corp.(a) | | | 600,000 | | | | 1,818,000 | |

| | | | | | | | 9,528,954 | |

| | | | | | | | | |

| Equity Real Estate Investment Trusts (REITs) (3.5%) | | | | | | | | |

| CareTrust REIT, Inc. | | | 300,000 | | | | 5,148,000 | |

| Equity Commonwealth | | | 50,000 | | | | 1,610,000 | |

| Investors Real Estate Trust | | | 40,000 | | | | 2,819,600 | |

| Monmouth Real Estate Investment Corp. | | | 350,000 | | | | 5,071,500 | |

| PotlatchDeltic Corp. | | | 90,000 | | | | 3,422,700 | |

| | | | | | | | 18,071,800 | |

| | | | | | | | | |

| Food Products (2.2%) | | | | | | | | |

| Hanover Foods Corp. (Class A)(d) | | | 48,633 | | | | 3,258,411 | |

| Landec Corp.(a) | | | 1,050,000 | | | | 8,358,000 | |

| | | | | | | | 11,616,411 | |

| Gas Utilities (0.8%) | | | | | | | | |

| National Fuel Gas Co. | | | 100,000 | | | | 4,193,000 | |

| | | | | | | | | |

| Health Care Equipment & Supplies (1.8%) | | | | | | | | |

| Accuray, Inc.(a) | | | 3,000,000 | | | | 6,090,000 | |

| Chembio Diagnostics, Inc.(a)(e) | | | 275,000 | | | | 893,750 | |

| Cutera, Inc.(a) | | | 50,000 | | | | 608,500 | |

| Trinity Biotech, PLC (ADR)(a)(e) | | | 850,000 | | | | 1,853,000 | |

| | | | | | | | 9,445,250 | |

| | | | | | | | | |

| Health Care Providers & Services (2.5%) | | | | | | | | |

| Patterson Cos., Inc. | | | 250,000 | | | | 5,500,000 | |

| Triple-S Management Corp.(Class B)(a) | | | 400,000 | | | | 7,608,000 | |

| | | | | | | | 13,108,000 | |

| | | | | | | | | |

| Household Durables (4.5%) | | | | | | | | |

| Century Communities, Inc.(a) | | | 400,000 | | | | 12,264,000 | |

| Hooker Furniture Corp. | | | 64,153 | | | | 1,247,776 | |

| MDC Holdings, Inc. | | | 250,000 | | | | 8,925,000 | |

| ZAGG, Inc.(a) | | | 400,000 | | | | 1,256,000 | |

| | | | | | | | 23,692,776 | |

| | | | | | | | | |

| Independent Power & Renewable Electricity Producers (2.9%) | | | | | | | | |

| Spark Power Group, Inc. (CAD)(a)(f) | | | 500,000 | | | | 423,542 | |

| Vistra Energy Corp. | | | 800,000 | | | | 14,896,000 | |

| | | | | | | | 15,319,542 | |

| | | | | | | | | |

| Insurance (0.7%) | | | | | | | | |

| FedNat Holding Co. | | | 325,000 | | | | 3,597,750 | |

| | | | | | | | | |

| Internet & Direct Marketing Retail (0.4%) | | | | | | | | |

| Trxade Group, Inc.(a) | | | 300,000 | | | | 1,800,000 | |

| | | | | | | | | |

| IT Services (3.0%) | | | | | | | | |

| EVERTEC, Inc. | | | 270,911 | | | | 7,612,599 | |

| Limelight Networks, Inc.(a)(e) | | | 600,000 | | | | 4,416,000 | |

| USA Technologies, Inc.(a) | | | 500,000 | | | | 3,505,000 | |

| | | | | | | | 15,533,599 | |

| | | | | | | | | |

| Leisure Products (0.2%) | | | | | | | | |

| Vista Outdoor, Inc.(a) | | | 75,000 | | | | 1,083,750 | |

| | | | | | | | | |

| Life Sciences Tools & Services (0.9%) | | | | | | | | |

| Harvard Bioscience, Inc.(a) | | | 1,000,000 | | | | 3,100,000 | |

| Pacific Biosciences of California, Inc.(a) | | | 500,000 | | | | 1,725,000 | |

| | | | | | | | 4,825,000 | |

The accompanying Notes to Financial Statements are an integral part of these Statements.

VALUE FUND — SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2020 (Unaudited)

| | | SHARES | | | VALUE | |

| Machinery (3.5%) | | | | | | |

| Energy Recovery, Inc.(a) | | | 168,943 | | | $ | 1,283,122 | |

| Gorman-Rupp Co. | | | 150,000 | | | | 4,662,000 | |

| Mayville Engineering Co., Inc.(a) | | | 6,048 | | | | 47,779 | |

| Pentair PLC | | | 100,000 | | | | 3,799,000 | |

| Shyft Group, Inc. | | | 500,000 | | | | 8,420,000 | |

| | | | | | | | 18,211,901 | |

| Media (0.7%) | | | | | | | | |

| A H Belo Corp. (Class A) | | | 900,000 | | | | 1,557,000 | |

| Marchex, Inc. (Class B)(a) | | | 1,400,000 | | | | 2,212,000 | |

| | | | | | | | 3,769,000 | |

| Metals & Mining (8.5%) | | | | | | | | |

| Centerra Gold, Inc. (CAD)(f) | | | 2,000,000 | | | | 22,318,798 | |

| IAMGOLD Corp.(a) | | | 1,000,000 | | | | 3,950,000 | |

| Major Drilling Group International, Inc. (CAD)(a)(f) | | | 600,000 | | | | 1,895,993 | |

| Pretium Resources, Inc.(a) | | | 1,000,000 | | | | 8,400,000 | |

| Roxgold, Inc. (CAD)(a)(f) | | | 5,000,000 | | | | 5,634,944 | |

| Standard Lithium, Ltd. (CAD)(a)(f) | | | 900,000 | | | | 662,934 | |

| Teranga Gold Corp. (CAD)(a)(f) | | | 150,000 | | | | 1,359,016 | |

| | | | | | | | 44,221,685 | |

| Multi-Utilities (0.6%) | | | | | | | | |

| MDU Resources Group, Inc. | | | 150,000 | | | | 3,327,000 | |

| | | | | | | | | |

| Oil, Gas & Consumable Fuels (1.1%) | | | | | | | | |

| Berry Corp. (Class A) | | | 1,000,000 | | | | 4,830,000 | |

| HollyFrontier Corp. | | | 25,000 | | | | 730,000 | |

| | | | | | | | 5,560,000 | |

| Paper & Forest Products (0.5%) | | | | | | | | |

| Western Forest Products, Inc. (CAD)(f) | | | 3,900,000 | | | | 2,671,626 | |

| | | | | | | | | |

| Pharmaceuticals (2.5%) | | | | | | | | |

| Evofem Biosciences, Inc.(a)(g) | | | 1,500,000 | | | | 4,245,000 | |

| Jazz Pharmaceuticals PLC(a) | | | 80,000 | | | | 8,827,200 | |

| | | | | | | | 13,072,200 | |

| Professional Services (4.2%) | | | | | | | | |

| Acacia Research Corp.(a) | | | 2,429,800 | | | | 9,937,882 | |