1933 Act Registration File No. 333-_______

[ ] Pre-Effective Amendment No. ___

[ ] Post-Effective Amendment No. ___

Gene L. Needles, Jr., President

Francine J. Rosenberger, Esq.

1601 K Street, N.W.

Washington, D.C. 20006

Approximate Date of Proposed Public Offering: As soon as practicable after the Registration Statement becomes effective under the Securities Act of 1933, as amended.

It is proposed that this filing will become effective on December 10, 2011 pursuant to Rule 488.

Title of Securities Being Registered: Investor Class shares and Institutional Class shares of American Beacon Stephens Small Cap Growth Fund and American Beacon Stephens Mid-Cap Growth Fund, each a series of the Registrant.

No filing fee is due because the Registrant is relying on Section 24(f) of the Investment Company Act of 1940, as amended, pursuant to which it has previously registered an indefinite number of securities.

We are pleased to announce that the Stephens Small Cap Growth Fund and the Stephens Mid Cap Growth Fund (each, a “Stephens Fund” and together, the “Stephens Funds”), each a series of Professionally Managed Portfolios (the “Trust”), are proposing to reorganize into the American Beacon Stephens Small Cap Growth Fund (the “AB Small Cap Fund”) and the American Beacon Stephens Mid-Cap Growth Fund (the “AB Mid-Cap Fund”), respectively. The AB Small Cap Fund and the AB Mid-Cap Fund are each a newly created series of the American Beacon Funds (the “AB Trust”). The AB Small Cap Fund and the AB Mid-Cap Fund (together, the “AB Funds”) are designed to be substantially similar from an investment perspective to the Stephens Small Cap Growth Fund and Stephens Mid Cap Growth Fund.

A Special Meeting of Shareholders of the Stephens Funds is to be held at ______ [a.m.][p.m.] Eastern time on Thursday, February 23, 2012, at _________________, where (1) shareholders of the Stephens Small Cap Growth Fund will be asked to vote on the proposal to reorganize the Stephens Small Cap Growth Fund into the AB Small Cap Fund, and (2) shareholders of the Stephens Mid Cap Growth Fund will be asked to vote on the proposal to reorganize the Stephens Mid Cap Growth Fund into the AB Mid-Cap Fund. A Combined Proxy Statement and Prospectus (the “Proxy Statement”) regarding the meeting, a proxy card for your vote at the meeting and a postage-prepaid envelope in which to return your proxy card are enclosed.

The primary purpose of the reorganization transactions (the “Reorganizations”) is to move the Stephens Funds to the American Beacon Family of Funds. The Reorganizations will shift management oversight responsibility for the Stephens Funds from Stephens Investment Management Group, LLC (“SIMG”) to American Beacon Advisors, Inc. (the “Manager”). The Manager is an experienced provider of investment advisory services to institutional and retail investors, with over $____ billion mutual fund and $____ billion overall assets under management. Since 1986, the Manager has offered a variety of services and products, including corporate cash management, separate account management, and mutual funds. SIMG believes that each Reorganization has the potential to expand the Stephen Fund’s presence in more distribution channels, increase its asset base and lower operating expenses as a percentage of assets.

By engaging SIMG as a sub-adviser (the “Sub-Adviser”) to the AB Funds, the Manager will provide continuity of the portfolio management team that has been responsible for the Stephens Funds’ performance records since the inception of each of the Stephens Funds. The portfolio managers of the Sub-Adviser who are primarily responsible for the day-to-day portfolio management of each of the Stephens Funds will remain the same.

The Reorganizations will not result in any increase in the advisory fees payable by the AB Funds as compared to the advisory fees that are currently paid by the Stephens Funds. A 2.00% redemption fee currently applies to Class A shares of the Stephens Funds redeemed within 30 days of purchase; the AB Funds will not charge a redemption fee in connection with the Reorganizations. The Reorganization will not result in any increase in the overall net expense ratio during the first two years as compared to the net expense ratio currently paid by the Stephens Funds. In addition, the Reorganization will not result in any

increase in the gross expense ratio for the AB Mid-Cap Fund’s Investor Class or Institutional Class or for the AB Small Cap Fund’s Institutional Class although there will be an increase in the gross expense ratio for the AB Small Cap Fund’s Investor Class.

If shareholders of the Stephens Funds approve the Reorganizations, the Reorganizations will take effect on or about February 24, 2012. At that time, the Class A and Class I shares of the Stephens Fund that you currently own would, in effect, be exchanged on a tax-free basis for, respectively, Investor Class shares and Institutional Class shares respectively, of the applicable AB Fund with the same aggregate value, as follows:

No sales loads, commissions or other transactional fees will be imposed on shareholders in connection with the tax-free exchange of their shares.

The Board of Trustees of the Trust, on behalf of Stephens Small Cap Growth Fund and Stephens Mid Cap Growth Fund, unanimously recommends that the shareholders of the Stephens Funds vote in favor of the proposed Reorganizations.

Detailed information about the proposals is contained in the enclosed materials. Whether or not you plan to attend the meeting in person, we need your vote. Once you have decided how you will vote, please promptly complete, sign, date and return the enclosed proxy card or vote by telephone or internet. If you have any questions regarding the proposal to be voted on, please do not hesitate to call Michael W. Nolte at 1-800-458-6589.

Your vote is very important to us. Thank you for your response and for your continued investment in the Stephens Funds.

J. Warren Simpson

TO BE HELD FEBRUARY 23, 2012.

To the Shareholders of the Stephens Small Cap Growth Fund and the Stephens Mid Cap Growth Fund:

NOTICE IS HEREBY GIVEN that a Special Meeting of Shareholders (the “Special Meeting”) of the Stephens Small Cap Growth Fund and the Stephens Mid Cap Growth Fund (together, the “Stephens Funds”), each a series of Professionally Managed Portfolios (the “Trust”), is to be held at _____ [a.m.][p.m.] Eastern time on Thursday, February 23, 2012, at ___________________ .

The Special Meeting is being held to consider an Agreement and Plan of Reorganization and Termination (the “Plan”) providing for the transfer of all of the assets of the Stephens Small Cap Growth Fund to the American Beacon Stephens Small Cap Growth Fund (the “AB Small Cap Fund”), and all of the assets of the Stephens Mid Cap Growth Fund to the American Beacon Stephens Mid-Cap Growth Fund (the “AB Mid-Cap Fund”). Both the AB Small Cap Fund and the AB Mid-Cap Fund are newly created series of American Beacon Funds (the “AB Trust”).

Those present and the appointed proxies also will transact such other business, if any, as may properly come before the Special Meeting or any adjournments or postponements thereof.

Holders of record of the shares of beneficial interest in each Stephens Fund as of the close of business on December 19, 2011 are entitled to vote at the Special Meeting or any adjournments or postponements thereof.

If the necessary quorum to transact business or the vote required to approve any proposal is not obtained at the Special Meeting or if quorum is obtained but sufficient votes required to approve the Plan are not obtained, the persons named as proxies on the enclosed proxy card may propose one or more adjournments of the Special Meeting to permit, in accordance with applicable law, further solicitation of proxies with respect to the proposal. Whether or not a quorum is present, any such adjournment as to a matter will require the affirmative vote of the holders of a majority of the shares represented at that meeting, either in person or by proxy. The meeting may be held as adjourned within a reasonable time after the date set for the original meeting without further notice unless a new record date is established for

the adjourned meeting and the adjourned meeting is held more than 60 days from the date set for the original meeting. The persons designated as proxies may use their discretionary authority to vote as instructed by management of the Stephens Funds on questions of adjournment and on any other proposals raised at the Special Meeting to the extent permitted by the proxy rules of the Securities and Exchange Commission (the “SEC”), including proposals for which timely notice was not received, as set forth in the SEC’s proxy rules.

Elaine E. Richards, Secretary

The Proxy Statement contains information that shareholders of the Stephens Funds should know before voting on the Reorganizations. The Proxy Statement should be retained for future reference.

shareholders of the Stephens Small Cap Growth Fund approve the Plan, the Stephens Small Cap Growth Fund will transfer all of its assets to the AB Small Cap Fund in return for shares of the AB Small Cap Fund and the AB Small Cap Fund’s assumption of the Stephens Small Cap Growth Fund’s liabilities, and if the shareholders of the Stephens Mid Cap Growth Fund approve the Plan, the Stephens Mid Cap Growth Fund will transfer all of its assets to the AB Mid-Cap Fund in return for shares of the AB Mid-Cap Fund and the AB Mid-Cap Fund’s assumption of the Stephens Mid Cap Growth Fund’s liabilities. The Stephens Small Cap Growth Fund and Stephens Mid Cap Growth Fund each will then distribute the shares it receives from the corresponding AB Fund to shareholders of the Stephens Small Cap Growth Fund and the Stephens Mid Cap Growth Fund, respectively.

Existing shareholders of Class A and Class I shares of the Stephens Small Cap Growth Fund and the Stephens Mid Cap Growth Fund will become shareholders of Investor Class and Institutional Class shares, respectively, of the AB Small Cap Fund or AB Mid-Cap Fund. Immediately after the Reorganization, each shareholder will hold the same number of Investor Class and Institutional Class shares of the AB Fund, with the same net asset value per share and total value, as the Class A and Class I shares of the Stephens Fund that he or she held immediately prior to the Reorganization. Subsequently, the Stephens Funds will be liquidated.

Please refer to the Proxy Statement for a detailed explanation of the proposal. If the Plan is approved by shareholders of the Stephens Funds at the Special Meeting of Shareholders (the “Special Meeting”), the Reorganizations presently are expected to be effective on or about February 24, 2012.

The Reorganizations will affect other services currently provided to the Stephens Funds. Foreside Fund Services, LLC will be the distributor and principal underwriter of the AB Funds’ shares; Quasar Distributions, LLC currently serves as the distributor and principal underwriter of the Stephens Funds’ shares. The AB Funds will engage State Street as their custodian and accounting agent; U.S.

Bank, National Association, currently serves as the custodian for the Stephens Funds and U.S. Bancorp currently serves as accounting agent for the Stephens Funds. The AB Funds will engage Boston Financial Data Services, a State Street affiliate, as their transfer agent. The Manager will provide administration services for the AB Funds; U.S. Bancorp Fund Services, LLC currently provides administration services and fund accounting for the Stephens Funds.

The Reorganizations will move the assets of the Stephens Funds from the Trust, which is a Massachusetts business trust, to the AB Funds, each a series of the AB Trust, which also is organized as a Massachusetts business trust. As a result of the Reorganizations, the AB Funds will operate under the supervision of a different Board of Trustees.

The Manager is an experienced provider of investment advisory services to institutional and retail investors, with over $____ billion mutual fund and $____ billion overall assets under management. Since 1986, the Manager has offered a variety of services and products, including corporate cash management, separate account management, and mutual funds. The Manager serves retail clients as well as defined benefit plans, defined contribution plans, foundations, endowments, corporations, and other institutional investors. There are currently 20 series of the AB Trust. The American Beacon Family of Funds advised by the Manager currently includes international and domestic equity portfolios spanning a variety of longer-range investment strategies through balanced portfolios, as well as short-term investment options such as bond funds and money market funds.

The Sub-Adviser was established in 2005 and is a subsidiary of Stephens Investments Holdings LLC, a privately held and family owned company. As of _________, 20__ the Sub-Adviser’s assets under management were approximately $____________.

The consummation of a Reorganization of a Stephens Fund is contingent on the consummation of the Reorganization of the other Stephens Fund. If shareholders of one or both of the Stephens Funds do not approve the Plan, neither of the Stephens Funds will be reorganized into its corresponding AB Fund. In such a case, the Board will meet to consider other alternatives.

Each of the Stephens Funds is a series of the Trust, which is an open-end management investment company registered with the SEC and organized as a Massachusetts business trust. Each of the AB Funds is a newly created series of the AB Trust, which is an open-end management investment company registered with the SEC and organized as a Massachusetts business trust.

This Proxy Statement sets forth the basic information you should know before voting on the proposals. You should read it and keep it for future reference. Additional information relating to the American Beacon Stephens Small Cap Growth Fund and the American Beacon Stephens Mid-Cap Growth Fund (each an “AB Fund”, and together, the “AB Funds”) and the Proxy Statement is set forth in

The following documents regarding the Stephens Funds have been filed with the SEC and are incorporated by this reference into this Proxy Statement, which means that these documents are considered legally to be part of the Proxy Statement:

The Stephens Funds’ Prospectuses dated March 31, 2011 and Annual Reports to Shareholders for the fiscal year ended November 30, 2010, containing audited financial statements, have been previously mailed to shareholders. Copies of these documents are available upon request and without charge by writing to the Trust, through the internet at www.stephensfunds.com or by calling (866) 735-7464.

Because the AB Funds have not yet commenced operations as of the date of this Proxy Statement, no annual or semi-annual reports are available for the AB Funds at this time.

THE SEC HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES NOR HAS IT PASSED ON THE ACCURACY OR ADEQUACY OF THIS PROXY STATEMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

In order to reorganize each Stephens Fund into a series of the AB Trust, substantially similar funds, referred to as the “AB Funds,” have been created as new series of the AB Trust. If the shareholders of the Stephens Funds approve the Plan, the Reorganizations will have three primary steps:

* First, each Stephens Fund will transfer all of its assets to the applicable AB Fund in exchange solely for Investor Class and Institutional Class shares of the AB Fund and the AB Fund’s assumption of all of the Stephens Fund’s liabilities;

* Third, the Stephens Funds will be liquidated.

Approval of the Plan by shareholders of a Stephens Fund will constitute approval of the transfer of that Stephens Fund’s assets, the assumption of its liabilities, the distribution of the corresponding AB Fund’s Investor Class and Institutional Class shares, and liquidation of that Stephens Fund. The Investor Class and Institutional Class shares issued in connection with each Reorganization will have an aggregate net asset value equal to the net value of the assets that the Stephens Fund transferred to the AB Fund, less the Stephens Fund’s liabilities that the AB Fund assumes. The value of a Stephens Fund shareholder’s account with the AB Fund immediately after a Reorganization will be the same as the value of such shareholder’s account with the Stephens Fund immediately prior to the Reorganization. No sales charge or fee of any kind will be charged to the shareholders of the Stephens Funds in connection with the Reorganizations.

The Trust believes that the Reorganizations will constitute a tax-free transaction for federal income tax purposes. The Trust and the AB Trust will receive an opinion from tax counsel to the AB Trust substantially to that effect. Therefore, shareholders should not recognize any gain or loss on their shares of the Stephens Funds for federal income tax purposes as a direct result of the Reorganizations.

The Board has fixed the close of business on December 19, 2011 as the record date for the determination of shareholders entitled to notice of and to vote at the Special Meeting and any adjournments thereof. In considering whether to approve a proposal relating to a Reorganization, you should review the proposal for each Stephens Fund of which you were a shareholder on December 19, 2011. In addition, you should review the information in this Proxy Statement that relates to both of the proposals and the Reorganizations generally.

Proposal One and Proposal Two (each, a “Proposal” and together the “Proposals”) request your approval of the Reorganization of the Stephens Funds into the corresponding AB Fund. In considering whether to approve a Proposal please review the following information.

Each Stephens Fund and the corresponding AB Fund have substantially similar investment objectives and strategies, which are presented in the table below. However, the AB Funds have great latitude with respect to investing cash balances in money market funds and the purchase and sale of futures contracts to gain market exposure on cash balances or to reduce market exposure in anticipation of liquidity needs. While the Stephens Funds seek to remain fully invested, they can invest in cash and cash equivalents and money market funds for temporary defensive purposes or in response to unusual circumstances such as large cash inflows or redemptions. The Stephens Funds are also more limited in their ability to use futures contracts.

Each AB Fund has been created as a shell series of the AB Trust solely for the purpose of acquiring its corresponding Stephens Fund’s assets and continuing its business investment strategy, and will not conduct any investment operations until after the closing of the Reorganization. The Manager has reviewed each of the Stephens Fund’s current portfolio holdings and determined that those holdings are compatible with the corresponding AB Fund’s investment objectives and policies. As a result, the Manager believes that, if the Reorganization is approved, all or substantially all of each Stephens Fund’s assets will be transferred to and held by the corresponding AB Fund.

The investment restrictions and limitations of the Stephens Funds and AB Funds (each sometimes referred to herein as a “Fund”) are substantially similar, except that the investment limitations of the AB Funds differ from those of the Stephens Funds to the extent necessary to harmonize them with the investment limitations of other American Beacon Funds. Unlike the Stephens Funds, each AB Fund is expressly permitted to operate as a feeder fund in a master-feeder investment structure. The AB Funds have no current intention to operate under such a structure.

Except as required by the 1940 Act or the Internal Revenue Code of 1986, as amended (“Code”), if any percentage restriction on investment or utilization of assets is adhered to at the time an investment is made, a later change in percentage resulting from a change in the market values of the Fund’s assets or purchases and redemptions of Fund shares will not be considered a violation of the limitation.

A fundamental limitation cannot be changed without the affirmative vote of the lesser of: (1) 50% of the outstanding shares of the Fund; or (2) 67% of the shares present or represented at a shareholders meeting at which the holders of more than 50% of the outstanding shares are present or represented. A non-fundamental limitation may be changed by the Board of Trustees without shareholder approval.

All of the investment policies noted in the table below are fundamental limitations, which cannot be changed by the Board of Trustees without affirmative shareholder approval as described above. The AB Funds, however, have sought to harmonize the fundamental investment limitations of the Stephens Funds with those of the other funds in the AB Fund complex. Although the wording appears different, the fundamental investment limitations of the Stephens Funds and the AB Funds are substantially similar. Notwithstanding any other limitation on investments in other investment companies, however, the AB Funds, unlike the Stephens Funds, are each expressly permitted to operate as a feeder fund in a master-feeder investment structure. The investment limitations for the Stephens Funds may be found in the Stephens Funds’ Statement of Additional Information (“SAI”), which is incorporated by reference into this Proxy Statement. The investment limitations for the AB Funds may be found in the SAI to this Proxy Statement, which is incorporated by reference into this Proxy Statement.

The Stephens Funds have each adopted the following investment limitations that may be changed by the Board without shareholder approval, but the change will only be effective after notice is given to the shareholders of the Stephens Fund. The AB Funds’ non-fundamental investment policies may be changed by the AB Board at any time.

The Manager has contractually agreed to cap Fund expenses through April 30, 2014, to the extent that total annual fund operating expenses of the Investor Class shares and Institutional Class shares exceed the annual rate of 1.35% and 1.09%, respectively, for the AB Small Cap Fund and 1.37% and 0.99%, respectively, for the AB Mid-Cap Fund excluding taxes, interest, portfolio transaction expenses and other extraordinary expenses.

the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

Each AB Fund’s Investor Class and Institutional Class shares will adopt, respectively, the performance history of the corresponding Stephens Fund’s Class A and Class I shares. The bar chart and the performance table below provide some indication of the risks of an investment in the AB Funds by showing each of the Stephens

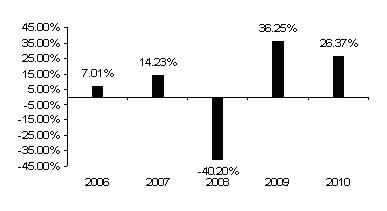

Stephens Small Cap Growth Fund – Class A

Stephens Small Cap Growth Fund Class A Shares*

Year-By-Year Total Return

| * | Calendar Year Total Returns in the bar chart do not reflect sales charges. If sales charges were included, returns would be lower. |

The Stephens Small Cap Growth Fund’s calendar year-to-date total return for Class A shares as of September 30, 2011 was ____%.

During the period shown in the bar chart, the highest quarterly return was 23.02% (for the quarter ended June 30, 2009) and the lowest quarterly return was -25.54% (for the quarter ended December 31, 2008). The Stephens Small Cap Growth Fund Class A Shares commenced investment operations on December 1, 2005.

AVERAGE ANNUAL TOTAL RETURN

For the periods Ended December 31, 2010 | One Year | Five Years | Since Inception (12/1/05) |

| Stephens Small Cap Growth Fund Class A Shares | | | |

| Return Before Taxes | 19.78% | 3.58% | 3.23% |

| Return After Taxes on Distributions | 19.56% | 3.54% | 3.19% |

| Return After Taxes on Distributions and Sale of Fund Shares | 13.14% | 3.07% | 2.77% |

S&P 500® Index(1) (Index reflects no deductions for fees, expenses or taxes) | 15.06% | 2.29% | 2.02% |

Russell 2000® Growth Index(2) (Index reflects no deductions for fees, expenses or taxes) | 29.09% | 5.30% | 4.78% |

| (1) | The S&P 500® Index is an unmanaged index generally representative of the market for the stocks of large-sized U.S. companies. |

| (2) | The Russell 2000® Growth Index measures the performance of those Russell 2000® Index companies with higher price-to-book ratios and higher forecasted growth values, which includes the 2,000 smallest companies by market capitalization within the Russell 3000® Index. |

Stephens Small Cap Growth Fund – Class I

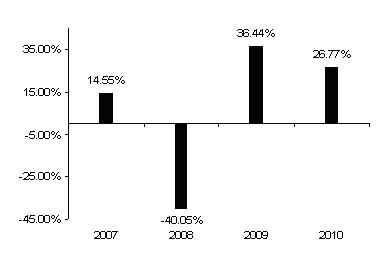

Stephens Small Cap Growth Fund Class I

Shares Year-By-Year Total Return

The Stephens Small Cap Growth Fund’s calendar year-to-date total return for Class I shares as of September 30, 2011, was _____%.

During the period shown in the bar chart, the highest quarterly return was 23.26% (for the quarter ended June 30, 2009) and the lowest quarterly return was -25.45% (for the quarter ended December 31, 2008). The Stephens Small Cap Growth Fund Class I Shares commenced investment operations on August 31, 2006.

For the periods Ended December 31, 2010 | One Year | Since Inception (8/31/06) |

| Stephens Small Cap Growth Fund Class I Shares | | |

| Return Before Taxes | 26.77% | 5.89% |

| Return After Taxes on Distributions | 26.56% | 5.85% |

| Return After Taxes on Distributions and Sale of Fund Shares | 17.70% | 5.08% |

S&P 500® Index(1) (Index reflects no deductions for fees, expenses or taxes) | 15.06% | 1.32% |

For the periods Ended December 31, 2010 | One Year | Since Inception (8/31/06) |

Russell 2000® Growth Index(2) (Index reflects no deductions for fees, expenses or taxes) | 29.09% | 5.29% |

| The S&P 500® Index is an unmanaged index generally representative of the market for the stocks of large-sized U.S. companies. |

| (2) | The Russell 2000® Growth Index measures the performance of those Russell 2000® Index companies with higher price-to-book ratios and higher forecasted growth values, which includes the 2,000 smallest companies by market capitalization within the Russell 3000® Index. |

Stephens Mid Cap Growth Fund – Class A

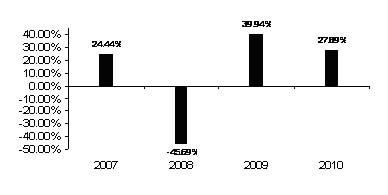

Stephens Mid Cap Growth Fund Class A Shares*

Year-By-Year Total Return

| * | Calendar Year Total Returns in the bar chart do not reflect sales charges. If sales charges were included, returns would be lower. |

The Stephens Mid Cap Growth Fund’s calendar year-to-date for Class A shares as of September 30, 2011, was ____%.

During the period shown in the bar chart, the highest quarterly return was 23.02% (for the quarter ended June 30, 2009) and the lowest quarterly return was -25.54% (for the quarter ended December 31, 2008). The Stephens Mid Cap Growth Fund Class A shares commenced investment operations on February 1, 2006.

AVERAGE ANNUAL TOTAL RETURN

For the periods Ended December 31, 2010 | One Year | Since Inception (2/1/06) |

| | Stephens Mid Cap Growth Fund Class A Shares | | |

| | Return Before Taxes | 21.21% | 2.36% |

| | Return After Taxes on Distributions | 21.21% | (2.69)% |

For the periods Ended December 31, 2010 | One Year | Since Inception (2/1/06) |

| | Return After Taxes on Distributions and Sale of Fund Shares | 13.79% | (2.28)% |

| | S&P 500® Index(1) (Index reflects no deductions for fees, expenses or taxes) | 15.06% | 1.75% |

| | Russell Midcap® Growth Index(2) (Index reflects no deductions for fees, expenses or taxes) | 26.38% | 3.71% |

| (1) | The S&P 500® Index is an unmanaged index generally representative of the market for the stocks of large-sized U.S. companies. |

| (2) | The Russell Midcap® Growth Index is an unmanaged index that measures the performance of the 800 smallest companies in the Russell 1000® Index, which represents approximately 30 percent of the total market capitalization of the Russell 1000® Index. |

Stephens Mid Cap Growth Fund – Class I

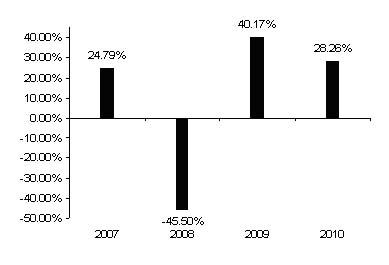

Stephens Mid Cap Growth Fund Class I Shares

Year-By-Year Total Return

The Stephens Mid Cap Growth Fund’s calendar year-to-date for Class I shares as of September 30, 2011, was ____%.

During the period shown in the bar chart, the highest quarterly return was 16.40% (for the quarter ended September 30, 2009) and the lowest quarterly return was -28.30% (for the quarter ended December 31, 2008). The Stephens Mid Cap Growth Fund Class I shares commenced investment operations on August 31, 2006.

For the periods Ended December 31, 2010 | One Year | Since Inception (8/31/06) |

| Stephens Mid Cap Growth Fund Class I Shares | | |

| Return Before Taxes | 28.26% | 6.37% |

| Return After Taxes on Distributions | 28.26% | 6.37% |

| Return After Taxes on Distributions and Sale of Fund Shares | 18.37% | 5.50% |

S&P 500® Index(1) (Index reflects no deductions for fees, expenses or taxes) | 15.06% | 1.32% |

Russell Midcap® Growth Index(2) (Index reflects no deductions for fees, expenses or taxes) | 26.38% | 5.37% |

| (1) | The S&P 500® Index is an unmanaged index generally representative of the market for the stocks of large-sized U.S. companies. |

| (2) | The Russell Midcap® Growth Index is an unmanaged index that measures the performance of the 800 smallest companies in the Russell 1000® Index, which represents approximately 30 percent of the total market capitalization of the Russell 1000® Index. |

After-Tax Returns

After-tax returns are calculated using the historical highest individual federal marginal income tax rate in effect at the time of each distribution and assumed sale, but do not reflect the impact of state and local taxes.

Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns reflect past tax effects and are not predictive of future tax effects. After-tax returns may not be relevant to investors who hold their Fund shares in a tax-deferred account (including a 401(k) or individual retirement account), or to investors that are tax-exempt.

Portfolio Turnover

Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in larger Fund distributions of net realized capital gains and, therefore, higher taxes for shareholders whose Fund shares are held in a taxable account. These costs, which are not reflected in Total Annual Fund Operating Expenses or in the Example, affect each Fund’s performance. For the fiscal year ended November 30, 2010, the Stephens Small Cap Growth Fund’s portfolio turnover rate was 66% of the average value of its portfolio, and the Stephens Mid Cap Growth Fund’s portfolio turnover rate was 20% of the average value of its portfolio.

The capitalization of the Stephens Funds as of May 31, 2011 and each of the AB Fund’s pro forma combined capitalization as of that date after giving effect to the Reorganization are as follows:

Stephens Small Cap Growth Fund

| (unaudited) | Stephens Small Cap Growth Fund Class A | Pro forma AB Small Cap Fund Investor Class | Stephens Small Cap Growth Fund Class I | Pro forma AB Small Cap Fund Institutional Class |

| Net Assets | $57,230,653 | $57,230,653 | $52,040,253 | $52,040,253 |

| | | | | |

| Shares Outstanding | 4,012,723 | | 3,524,706 | |

| | | | | |

| Net Asset Value per Share | $14.26 | $14.26 | $14.76 | $14.76 |

Stephens Mid Cap Growth Fund

| (unaudited) | Stephens Mid Cap Growth Fund Class A | Pro forma AB Mid-Cap Fund Investor Class | Stephens Mid Cap Growth Fund Class I | Pro forma AB Mid-Cap Fund Institutional Class |

| Net Assets | $20,310,076 | $20,310,076 | $15,046,212 | $15,046,212 |

| | | | | |

| Shares Outstanding | 1,550,656 | | 1,038,919 | |

| | | | | |

| Net Asset Value per Share | $13.10 | $13.10 | $14.48 | $14.48 |

Board’s Recommendation to Stephens Fund Shareholders

The Board recommends that you vote “FOR” Proposal One to approve the Reorganization with respect to the Stephens Small Cap Growth Fund, and “FOR” Proposal Two to approve the Reorganization with respect to the Stephens Mid Cap Growth Fund.

B. INFORMATION ABOUT THE REORGANIZATIONS

| | 1. | Reasons for the Reorganizations |

The primary purpose of the Reorganizations is to move the investment portfolio and shareholders of the Stephens Funds to the American Beacon Family of Funds. SIMG believes that reconstituting each Stephens Fund as a series of American Beacon has the potential to expand each Stephens Fund’s distribution network and increase the Stephens Funds’ assets.

The Reorganizations will shift management oversight responsibility for the Stephens Funds from SIMG to American Beacon Advisors, Inc. (the “Manager”). By engaging SIMG (the “Sub-Adviser”), the current adviser to the Stephens Funds, the Manager will provide continuity of the portfolio management team that has been responsible for the Stephens Funds’ performance record since the Stephens Small Cap Growth Fund’s inception on December 1, 2005 and the Stephens Mid Cap Growth Fund’s inception on February 1, 2006. The portfolio managers of the Sub-Adviser who are primarily responsible for the day-to-day portfolio management of the Stephens Funds will remain the same. The investment objective and strategies of the AB Funds will be substantially similar to those of the applicable Stephens Fund. The AB Funds’ fundamental and non-fundamental investment limitations are substantially similar to those of corresponding Stephens Fund; however, certain limitations and the language describing these limitations may be different for the AB Funds than their corresponding limitations in the Stephens Funds to conform them with current limitations of the other American Beacon Funds. SIMG recommends that the Stephens Funds be reorganized as series of the AB Trust.

The Reorganizations also will affect other services currently provided to the Stephens Funds. Foreside Fund Services, LLC (“Foreside”) will be the distributor and principal underwriter of the AB Funds’ shares; Quasar Distributions, LLC is the current distributor and principal underwriter of the Stephens Funds’ shares. The AB Funds will engage State Street as their custodian and accounting agent; U.S. Bank, National Association, currently serves as the custodian for the Stephens Funds. The AB Funds will engage Boston Financial Data Services as their transfer agent. The Manager will provide administration services for the AB Funds; U.S. Bancorp Fund Services, LLC currently provides administration services and fund accounting for the Stephens Funds. The AB Small Cap Fund will engage Brown Brothers Harriman & Co. as its securities lending agent; the AB Mid-Cap Fund will not currently engage in securities lending.

The Reorganizations will not result in any increase in the advisory fees payable by the AB Funds over those advisory fees currently incurred by the Stephens Funds. Although the Stephens Funds currently charge a 2.00% redemption fee on Class A shares redeemed within 30 days of purchase, the AB Funds will not change a redemption fee. The Reorganizations will not result in any increase in the overall net expense ratios during the first two years compared to the net expense ratios currently paid by the Stephens Funds. In addition, the Reorganization will not result in any increase in the gross expense ratio for the AB Mid-Cap Fund’s Investor Class or Institutional Class or for the AB Small Cap Fund’s Institutional Class although there will be an increase in the gross expense ratio for the AB Small Cap Fund’s Investor Class.

SIMG proposed, and the Board considered, the Reorganizations at in-person meetings of the Board held on August 9, 2011 and November 8, 2011. Based upon the recommendation of SIMG, its evaluation of the relevant information presented to it, and in light of its fiduciary duties under federal and

state law, the Board, including all trustees who are not “interested persons” of the Trust under the 1940 Act, determined that each Reorganization is in the best interests of the respective Stephens Fund and their shareholders and will not result in any dilution of the interests of the shareholders of the Stephens Fund.

In approving the proposed Reorganizations, the Board carefully considered that SIMG had come to the conclusion that it was unlikely, on its own, to be able to increase the distribution opportunities of the Stephens Funds and achieve substantial asset growth in the Stephens Funds which might then lead to a reduction in the Stephens Funds’ expense ratios to the benefit of shareholders. The Board considered that SIMG had concluded that it did not have the requisite resources to successfully improve the distribution of the Stephens Funds and that it could not continue indefinitely to support the Stephens Funds expenses by waiving its fees or capping the Stephens Funds’ expenses. The Board considered that SIMG had represented that it believed that the American Beacon Family of Funds provided the potential to grow the Stephens Funds’ assets meaningfully which would be potentially beneficial to the shareholders of the Stephens Funds.

In considering the Reorganization, the Board also took into account a number of additional factors. Some of the more prominent considerations are discussed below, in no particular order of priority:

The Terms and Conditions of the Reorganizations. The Board considered the terms of the Plan, including, (1) the requirement that the transfer of the assets of the Stephens Funds’ Class A and Class I shares be in exchange for Investor Class and Institutional Class shares, respectively, of the corresponding AB Fund, (2) the AB Funds’ assumption of all liabilities by the AB Funds of the corresponding Stephens Fund, and (3) the fact that Stephens Fund shareholders would receive AB Fund shares of equal number and value to their shares of their respective Stephens Fund at the time of the Reorganization. The Board also took note of the fact that no sales charges would be imposed in connection with the Reorganizations. The Board also noted that the Reorganizations would be submitted to shareholders of each of the Stephens Funds for approval.

Similarity of Investment Objectives, Policies and Restrictions and Continuity of Sub-Adviser. The Board considered that the AB Funds were newly created for the purpose of effecting the Reorganization and therefore were designed to largely replicate the Stephens Funds from an investment objective and strategy perspective. As a result, the Board considered that the investment objectives and strategies of the Stephens Funds and the corresponding AB Fund are substantially similar. The Board noted that while the investment limitations of AB Funds were in some cases worded differently from those of the Stephens Funds, those differences were not significant and were the result of the desire of the AB Funds to conform the limitations with the current limitations in the American Beacon Family of Funds complex.

The Board also considered that the existing day-to-day portfolio management arrangements for the Stephens Funds would not change as SIMG would be engaged as a sub-adviser to the AB Funds with responsibility for the day-to-day management of the AB Funds. The Board noted that in the event the Manager proposes termination of SIMG as the sub-advisor to an AB Fund, the Manager would provide reasonable support to SIMG to reorganize the AB Fund into a new fund upon approval of the AB Fund's Board and shareholders.

Expenses Relating to Reorganization. The Board considered that the Manager and SIMG will bear the direct costs associated with the Reorganization, Special Meeting, and solicitation of proxies, including the expenses associated with preparing and filing the registration statement that includes this Proxy Statement and the cost of copying, printing and mailing proxy materials.

Relative Expense Ratios and Continuation of Cap on Expenses. The Board reviewed information regarding comparative expense ratios (current and pro forma expense ratios are set forth in the “Comparison of Fees and Expenses” sections above). The Board considered that except for the Stephens Small Cap Growth Fund Class A shares, the Total Annual Operating Expenses for each class of shares of the Stephens Funds was expected to be reduced following the Reorganizations of the Stephens Funds into the AB Funds. The Board also considered that the Manager would contractually agree to cap expenses for each AB Fund through April 30, 2014, to the extent that total annual fund operating expenses of the Investor Class shares and Institutional Class shares exceed the annual rate of 1.35% and 1.09%, respectively, for the AB Small Cap Fund and 1.37% and 0.99%, respectively, for the AB Mid-Cap Fund. As a result of this expense cap, the Board considered that for at least two years following the Reorganizations, shareholders of each of the Stephens Funds, including Stephens Small Cap Growth Fund Class A shareholders, would be subject to a net total operating expense ratio for each AB Fund, which was at least equal to or less than the net total operating expense ratios of the corresponding Stephens Fund.

Potential Future Economies of Scale. The Board considered SIMG’s views as to the potential of each Stephens Fund to experience economies of scale following the Reorganization as a result of the potential for improved distribution and potential asset growth within the American Beacon Family of Funds. The Board noted that such asset growth, if it were to occur, would allow fixed costs, such as legal, accounting, shareholder services and trustee expenses, to be spread over a larger fund complex.

Distribution and Service Fees. The Board considered representations as to the fund distribution capabilities of the Manager and its affiliates and their commitment to distribute the AB Funds. The Board further considered that the 0.25% Rule 12b-1 distribution and service fees currently applicable to Class A shares of the Stephens Funds will not apply to the Investor Class shares of the AB Funds but that the Investor Class of the AB Funds will pay a 0.375% service fee. The Board also considered that Class I shares of the Stephens Funds currently do not pay a Rule 12b-1 distribution and service fee, and that Institutional Class shares of the AB Funds will not pay any Rule 12b-1 distribution and services fees or additional service fees.

Tax Consequences. The Board considered that the Reorganizations are expected to be free from adverse federal income tax consequences.

Other Alternatives. The Board considered alternatives to the Reorganizations, including the potential liquidation of the Stephens Funds. In considering these alternatives, the Board noted that current shareholders who did not wish to reorganize into the AB Funds could redeem their shares at any time prior to the Reorganization. In this regard, the Board approved suspension of the 2% redemption fee charged by the Stephens Funds on Class A shares for redemptions made within 30 days of purchase to allow shareholders not wishing to reorganize into the AB Funds to redeem their shares prior to closing without imposition of that fee. The Board also considered that the Reorganization would allow shareholders wishing to reorganize into the AB Funds to transfer their investment to a similar fund on a tax-free basis in the Reorganizations, whereas a liquidation would cause all shareholders to experience a taxable event.

Based on the foregoing and together with other factors and information considered to be relevant, the Board approved the Reorganizations, subject to approval by shareholders of each of the Stephens Funds and the solicitation of the shareholders of each of the Stephens Funds to vote “FOR” the approval of the Plan, the form of which is attached to this Proxy Statement in Appendix A.

| | 3. | Comparison of Principal Risks |

Risk is the chance that you will lose money on your investment or that it will not earn as much as you expect. In general, the greater the risk, the more money your investment can earn for you and the more you can lose. Like other investment companies, the value of each Fund’s shares may be affected by its investment objectives, principal investment strategies and particular risk factors. The principal risks of investing in the Funds are discussed below. However, other factors may also affect each Fund’s net asset value. There is no guarantee that a Fund will achieve its investment objectives or that it will not lose principal value.

The main risks of investing in each AB Fund are substantially similar to the risks of investing in the corresponding Stephens Fund, as the investment objectives and strategies of each of the Stephens Funds and its corresponding AB Fund are also substantially similar. The AB Funds have included certain additional risk disclosures, including futures contracts risk, and revised certain risk disclosures in its registration statement to clarify for shareholders the principal risks of investing in the AB Funds. In addition, the AB Small Cap Fund currently intends to engage in securities lending and therefore will have the additional risk of securities lending. Certain principal risks of the Stephens Funds will not be considered by the AB Funds to be principal risks, including portfolio turnover risk.

Management Risk

Management risk describes a Fund’s ability to meet its investment objective based on the adviser’s success or failure at implementing investment strategies for that Fund. The value of your investment in a Fund is subject to the effectiveness of the adviser’s research, analysis and asset allocation among portfolio securities. If the adviser’s investment strategies do not produce the expected results, your investment could be diminished or even lost.

General Market Risk

General market risk is the risk that the market value of a security may fluctuate, sometimes rapidly and unpredictably. These fluctuations may cause a security to be worth less than its cost when originally purchased or less than it was worth at an earlier time. General market risk may affect a single issuer, industry, sector of the economy or the market as a whole.

Equity Market Risk

Equity securities generally are subject to market risk. A Fund’s investments in equity securities may include common stocks, preferred stocks, securities convertible into or exchangeable for common stocks, real estate investment trusts (“REITs”), American Depositary Receipts (“ADRs”) and U.S. dollar-denominated foreign stocks trading on U.S. exchanges. Investing in such securities may expose the Fund to additional risks.

Common stock generally is subordinate to preferred stock upon the liquidation or bankruptcy of the issuing company. Preferred stocks and convertible securities are sensitive to movements in interest rates. In addition, convertible securities are subject to the risk that the credit standing of the issuer may have an effect on the convertible securities’ investment value. Investments in ADRs and U.S. dollar-denominated foreign stocks trading on U.S. exchanges are subject to certain of the risks associated with investing directly in foreign securities. Investments in REITs are subject to the risks associated with investing in the real estate industry such as adverse developments affecting the real estate industry and real property values.

Small- and Medium-Sized Company Risk

Investing in securities of small- and medium-sized companies, even indirectly, may involve greater volatility than investing in larger and more established companies because small and medium-sized companies can be subject to more abrupt or erratic share price changes than larger, more established companies. Smaller companies may have limited product lines, markets or financial resources and their management may be dependent on a limited number of key individuals. Securities of those companies may have limited market liquidity and their prices may be more volatile.

Foreign Securities Risk

To the extent that a Fund invests in securities of foreign companies, including ADRs and EDRs, your investment in that Fund is subject to foreign securities risk. These include risks relating to political, social and economic developments abroad and differences between U.S. and foreign regulatory requirements and market practices. Securities that are denominated in foreign currencies are subject to the further risk that the value of the foreign currency will fall in relation to the U.S. dollar and/or will be affected by volatile currency markets or actions of U.S. and foreign governments or central banks.

In addition to developed markets, a Fund may invest in companies located in emerging markets, which are markets of countries in the initial stages of industrialization and that generally have low per capita income. In addition to the risks of foreign securities in general, countries in emerging markets are generally more volatile and can have relatively unstable governments, social and legal systems that do not protect shareholders, economies based on only a few industries, and securities markets that trade a small number of issues, which could reduce liquidity.

Growth Style Investment Risk

Growth stocks can perform differently from the market as a whole and from other types of stocks. Growth stocks may be designated as such and purchased based on the premise that the market will eventually reward a given company’s long-term earnings growth with a higher stock price when that company’s earnings grow faster than both inflation and the economy in general. Thus a growth style investment strategy attempts to identify companies whose earnings may grow or are growing at a faster rate than inflation and the economy. While growth stocks may react differently to issuer, political, market and economic developments that the market as a whole and other types of stocks by rising in price in certain environments, growth stocks also tend to be sensitive to changes in the earnings of their underlying companies and more volatile than other types of stocks, particularly over the short term. During periods of adverse economic and market conditions, the stock prices of growth stocks may fall despite favorable earnings trends. Growth stocks also typically lack the dividend yield that can cushion stock prices in market downturns. Different investment styles tend to shift in and out of favor, depending on market conditions and investor sentiment. A Fund’s growth style could cause it to underperform funds that use a value or non-growth approach to investing or have a broader investment style.

Other Investment Companies Risk

A Fund may invest in shares of other registered investment companies, including open-end funds, closed-end funds, business development companies, ETFs and money market funds. To the extent that a Fund invests in shares of other registered investment companies, you will indirectly bear fees and expenses charged by the underlying funds in addition to a Fund’s direct fees and expenses and will be subject to the risks associated with investments in those funds.

Futures Contract Risk

There may be an imperfect correlation between the changes in market value of the securities held by a Fund and the prices of futures contracts. There may not be a liquid secondary market for the futures contract. When a Fund purchases or sells a futures contract, it is subject to daily variation margin calls that could be substantial in the event of adverse price movements. If a Fund has insufficient cash to meet daily variation margin requirements, it might need to sell securities at a time when such sales are disadvantageous.

Securities Lending Risk

To the extent the AB Small Cap Fund lends its securities, it may be subject to the following risk. Borrowers of the AB Small Cap Fund’s securities typically provide collateral in the form of cash that is reinvested in securities. The securities in which the collateral is invested may not perform sufficiently to cover the return collateral payments owed to borrowers. In addition, delays may occur in the recovery of securities from borrowers, which could interfere with the AB Small Cap Fund’s ability to vote proxies or to settle transactions.

| | 4. | Comparison of Distribution and Purchase, Redemption and Exchange Procedures |

Quasar Distributions, LLC (“Quasar”) is the distributor and principal underwriter for the Stephens Funds. Quasar is located at 615 East Michigan Street, Milwaukee, Wisconsin 53202. The Stephens Funds have adopted a distribution and shareholder servicing plan (“12b-1 Plan”) under Rule 12b-1 of the 1940 Act with respect to Class A shares of each Stephens Fund. Under the 12b-1 Plan, each Stephens Fund pays a fee to Quasar for distribution services (the “Distribution Fee”) at an annual rate of 0.25% of the Stephen Fund’s Class A Shares’ average daily net asset value. The 12b-1 Plan provides that Quasar may use all or any portion of the Distribution Fee to finance any activity that is principally intended to result in the sale of Stephens Fund shares, subject to the terms of the 12b-1 Plan, or to provide certain shareholder services. The Distribution Fee is payable to Quasar regardless of the distribution-related expenses actually incurred. Because the Distribution Fee is not directly tied to expenses, the amount of distribution fees paid by Class A shares of a Stephens Fund during any year may be more or less than actual expenses incurred pursuant to the 12b-1 Plan. Class I shares of the Stephens Funds do not pay any Rule 12b-1 fees. Investor Class and Institutional Class shares of the AB Funds will not pay any Rule 12b-1 fees. However, Investor Class shares of the AB Funds will pay a 0.375% service fee as described below.

Under a Distribution Agreement with the Trust, Quasar acts as the Stephens Funds’ principal underwriter and distributor of the Stephens Funds’ shares and will act as the agent of the Stephens Funds for the sale and distribution of shares of the Stephens Funds in jurisdictions wherein the shares may be legally offered for sale, on the terms and conditions set forth in the Distribution Agreement. Quasar is a registered broker-dealer and is a member of the Financial Industry Regulatory Authority (“FINRA”). Quasar agrees to sell Stephens Fund shares on a best efforts basis. Quasar has no obligation to sell any specific quantity of Stephens Fund shares. Quasar may, in its discretion, enter into agreements with such

qualified broker-dealers as it may select, in order that such broker-dealer also may sell shares of the Stephens Funds.

Foreside will be the distributor and principal underwriter of the AB Funds’ shares. Under a Distribution Agreement with the AB Trust, Foreside will act as the agent of the AB Trust in connection with the continuous offering of shares of the AB Funds. Foreside will continually distribute shares of the AB Funds on a best efforts basis. Foreside has no obligation to sell any specific quantity of AB Fund shares. In addition, pursuant to a Sub-Administration Agreement between Foreside and the Manager, Foreside will receive a separate fee from the Manager for providing administrative services in connection with the marketing and distribution of shares of the AB Funds.

The AB Funds have adopted a shareholder services plan (the “Service Plan”) for Investor Class shares that provides for the payment of certain non-distribution shareholder services provided by financial intermediaries. The Service Plan authorizes the annual payment of up to 0.375% per annum of the average daily net assets attributable to Investor Class shares. The AB Board has authorized the Investor Class shares to pay the maximum amount of fees permissible under the Service Plan. The fees, which are included as part of each AB Fund’s “Other Expenses” in the Table of Fees and Expenses in this Proxy Statement, will be payable monthly in arrears without regard to whether the amount of the fee is more or less than the actual expenses incurred in a particular month by the entity for the services provided pursuant to the Service Plan. Thus, the Manager may realize a profit or a loss based upon its actual servicing-related expenditures for the Investor Class shares. The primary expenses expected to be incurred under the Service Plan are transfer agency fees and servicing fees paid to financial intermediaries such as plan sponsors and broker-dealers.

Purchase, Redemption and Exchange Procedures.

Purchase Procedures. The purchase procedures for the Stephens Funds and the AB Funds are similar. Investors may invest by contacting the Funds through a broker or other financial institution who sells the Funds, or by mail, telephone or wire. Investors may also contact the AB Funds through the internet.

Class A shares of the Stephens Funds are subject to a 5.25% maximum front-end sales load. The AB Funds will not impose a front-end sales load on purchases of Investor Class shares. The Stephens Funds do not charge a front-end sales load on purchases of Class I shares and the AB Funds will not charge a front-end sales load on purchases of Institutional Class shares.

Each Stephens Fund pays 12b-1 fees at an annual rate of 0.25% of the Stephen Fund’s Class A Shares’ average daily net asset value. Class I shares of the Stephens Funds do not pay any Rule 12b-1 fees. Investor Class and Institutional Class shares of the AB Funds will not pay any Rule 12b-1 fees. However, Investor Class shares of the AB Funds will pay a 0.375% service fee as described above.

The minimum initial and minimum subsequent investment amounts for the Stephens Funds are different than the minimum initial and subsequent amounts for the AB Funds. The minimum initial investment for Class A shares of each Stephens Fund is $2,500 for retail accounts and $1,000 for individual retirement accounts (“IRAs”). There is no minimum initial investment amount for Class A shares of the Stephens Funds for asset or fee-based accounts managed by your financial advisor or for eligible employee benefit plans, SEP and SIMPLE IRA plans. The minimum initial investment amount for Investor Class shares of each AB Fund is $2,500. The minimum initial investment for Class I shares of each Stephens Fund is $1,000,000, which can be waived or changed by SIMG. The minimum initial investment for Institutional Class shares of the AB Fund is $250,000.

The minimum subsequent investment amount for Class A shares of each of the Stephens Funds is $100 for retail accounts and IRAs. There is no minimum subsequent investment amount for Class A shares of the Stephens Funds for asset or fee-based accounts managed by your financial advisor or for eligible employee benefit plans, SEP, and SIMPLE IRA plans. The minimum subsequent investment amount of Investor Class shares of each of the AB Funds is $500 if the investment is made by wire, and $50 if the investment is made by ACH, check or exchange. There is no stated minimum for subsequent investment amounts for Class I shares of the Stephens Funds. The minimum subsequent investment amount of Institutional Class shares of each of the AB Funds is $50 if made by ACH, check or exchange; there is no minimum subsequent investment amount for Institutional Class shares of the AB Funds made by wire.

Based on SIMG’s analysis of the size of the applicable market, market liquidity, portfolios holdings of the Stephens Small Cap Growth Fund and other accounts of SIMG as well as other issues, upon a 30-day written notice to Stephens Small Cap Growth Fund shareholders, the Stephens Small Cap Growth Fund may close to new investors when SIMG determines that the receipt of substantial additional assets would not be prudent from an investment perspective. In such event, it is expected that then-existing shareholders would be allowed to make additional purchases. If the Stephens Small Cap Growth Fund closes to new investors, the Board will review, on a periodic basis, market conditions and other factors presented by SIMG in order to determine whether to reopen the Stephens Small Cap Growth Fund to new investors. The AB Funds will evaluate from time to time the capacity of SIMG to manage substantial additional assets and make appropriate determinations at that time.

Redemption Procedures. The Stephens Funds permit, and the AB Funds will permit, redemptions by mail, wire, and telephone. Investors may also contact the AB Funds through the internet. The AB Funds will not charge a redemption fee; a 2.00% redemption fee generally applies to Class A shares of the Stephens Funds redeemed within 30 days of purchase, however, such fee is being suspended in light of the Reorganizations. If the Reorganizations do not occur, it is anticipated that the redemption fee will be reinstated.

Additionally, each Fund has also reserved the right to redeem shares “in kind.” Additional shareholder account information for the AB Funds is available in Appendix C to this Proxy Statement.

Exchange Procedures. The Stephens Funds and the AB Funds have similar exchange procedures. Shares of any class of the Stephens Funds or the AB Funds may be exchanged for shares of the same class of another Stephens Fund or American Beacon Fund, respectively, under certain limited circumstances. Since an exchange involves a concurrent purchase and redemption, please review the sections titled “Purchase Policies” and “Redemption Policies” in the AB Funds’ Prospectus for additional limitations that apply to purchases and redemptions.

There is no front-end sales charge on exchanges between Class A shares of a Stephens Fund. Class A shares of a Stephens Fund, which are subject to a CDSC, will not be charged a CDSC in an exchange. For the American Beacon Funds, if shares were purchased by check, to exchange out of one American Beacon Fund and into another, a shareholder must have owned shares of the redeeming American Beacon Fund for at least 10 days.

The minimum investment requirement must be met for the Stephens Fund or American Beacon Fund into which the shareholder is exchanging. Shares may be acquired through exchange only in states in which they can be legally sold. The American Beacon Funds reserve the right to charge a fee and to modify or terminate the exchange privilege at any time. To learn more about exchanges for the Stephens Funds, call (toll-free) at (866) 735-7464. For information on the American Beacon Funds’ policies

regarding frequent purchases, redemptions, and exchanges please refer to the section titled “Frequent Trading and Market Timing” in the AB Funds’ Prospectus.

C. KEY INFORMATION ABOUT THE PROPOSALS

The following is a summary of key information concerning the Reorganizations. Keep in mind that more detailed information appears in the Plan, the form of which is attached to this Proxy Statement as Appendix A.

| | 1. | Summary of the Proposed Reorganizations |

At the Special Meeting, the shareholders of the Stephens Small Cap Growth Fund will be asked to approve the Plan to reorganize the Stephens Small Cap Growth Fund into the AB Small Cap Fund, and the shareholders of the Stephens Mid Cap Growth Fund will be asked to approve the Plan to reorganize the Stephens Mid Cap Growth Fund into the AB Mid-Cap Fund. Each AB Fund is a newly organized series of the AB Trust that will commence operations upon consummation of the Reorganization. If the Plan is approved by the shareholders of the Stephens Funds and the Reorganizations are consummated, each Stephens Fund will transfer all of its assets to the corresponding AB Fund in exchange solely for (1) the number of full and fractional Investor Class and Institutional Class shares of the AB Fund equal to the number of full and fractional Class A and Class I shares, respectively, of the Stephens Fund as of the close of business on the closing date referred to below (the Closing) and (2) the AB Fund’s assumption of all of the corresponding Stephens Fund’s liabilities. Immediately thereafter, the Stephens Fund will distribute the AB Fund shares to its shareholders, by the AB Trust’s transfer agent establishing accounts on the AB Fund’s share records in the names of those shareholders and transferring those AB Fund shares to those accounts, by class, in complete liquidation of the Stephens Fund. As a result, each shareholder of the Stephens Fund will receive Investor Class and/or Institutional Class shares of the AB Fund, as the case may be, having an aggregate Net Asset Value (“NAV”) equal to the aggregate NAV of the shareholder’s Stephens Fund shares. The expenses associated with the Reorganizations will not be borne by the Stephens Funds’ shareholders; record of ownership will be held in book entry form only.

Until the Closing, shareholders of the Stephens Funds will continue to be able to redeem their shares at the NAV per share next determined after receipt by the Stephens Funds’ transfer agent of a redemption request in proper form. Redemption and purchase requests received by the transfer agent after the Closing will be treated as requests received for the redemption of shares of the AB Funds received by the shareholder in connection with the Reorganization or purchase of AB Fund shares. After the Reorganization, all of the issued and outstanding shares of the Stephens Funds will be canceled on the books of the Stephens Funds, and the share transfer books of the Stephens Funds will be permanently closed. If the Reorganizations are consummated, shareholders will be free to redeem the shares of the AB Fund that they receive in the transaction at their then-current NAV. Shareholders of the Stephens Funds may wish to consult their tax advisors as to any different consequences of redeeming their shares prior to the Reorganizations or exchanging such shares for shares of the AB Funds in the Reorganizations.

The Reorganizations are subject to a number of conditions, including the approval of the Plan by the shareholders of the Stephens Funds and the receipt of a legal opinion from counsel to the AB Trust with respect to certain tax matters (see Federal Income Tax Consequences, below). Assuming satisfaction of the conditions in the Plan, the closing date of the Reorganizations are expected to be February 24, 2012, or another date agreed to by the Trust and the AB Trust.

SIMG and the Manager have agreed to pay all direct costs relating to the Reorganization, including the costs relating to the Special Meeting and to preparing and filing the registration statement

that includes this Proxy Statement. They also will incur the direct costs associated with the solicitation of proxies, including the cost of copying, printing and mailing proxy materials.

The Plan may be amended by the mutual agreement of the Trust and the AB Trust, notwithstanding approval thereof by the Stephens Funds’ shareholders, provided that no such amendment after that approval may have a material adverse effect on those shareholders’ interests. In addition, the Plan may be terminated at or before the Closing by the mutual agreement of the Trust and the AB Trust or by either of them (1) in the event of the other’s material breach of any representation, warranty or covenant contained in the Plan to be performed at or before the Closing, (2) if a condition to its obligations has not been met and it reasonably appears that that condition will not or cannot be met, (3) if a governmental body issues an order, decree or ruling having the effect of permanently enjoining, restraining or otherwise prohibiting consummation of the Reorganization or (4) if the Closing has not occurred by August 31, 2012, or another date as to which they agree.

| | 2. | Description of the AB Funds’ Shares |

Investor Class and Institutional Class shares of the AB Funds issued to the shareholders of the Stephens Funds pursuant to the Reorganizations will be duly authorized, validly issued, fully paid and non-assessable when issued and will be transferable without restriction and will have no preemptive or conversion rights. Investor Class and Institutional Class shares will be sold and redeemed based upon their NAV next determined after receipt of the purchase or redemption request, as described in Appendix C to this Proxy Statement.

| | 3. | Federal Income Tax Consequences |

The Trust believes the Stephens Funds have qualified for treatment as a regulated investment companies under Part I of Subchapter M of Chapter 1 of Subtitle A of the Code (“Subchapter M”) since their inception. Accordingly, the Trust believes the Stephens Funds have been, and expects the Stephens Funds to continue through the Closing to be, relieved of any federal income tax liability on its taxable income and net gains it distributes to shareholders to the extent provided for in Subchapter M.

The Reorganizations are intended to qualify for federal income tax purposes as tax-free reorganizations under section 368(a) of the Code. As a condition to the Closing, the Trust and the AB Trust will receive an opinion of counsel to the AB Trust substantially to the effect that -- based on certain assumptions and conditioned on the representations set forth in the Plan (and, if such counsel requests, in separate letters from the Trust and the AB Trust) being true and complete at the time of the Closing and the Reorganizations being consummated in accordance with the Plan (without the waiver or modification of any terms or conditions thereof and without taking into account any amendment thereof that counsel has not approved) -- the Reorganizations will qualify as such reorganizations and that, accordingly, for federal income tax purposes:

| | ● | Each Fund will be “a party to a reorganization” (within the meaning of section 368(b) of the Code); |

| | ● | The Stephens Funds will recognize no gain or loss upon the transfer of its assets to the corresponding AB Fund in exchange solely for the AB Fund’s shares and the AB Funds’ assumption of the Stephens Fund’s liabilities or on the distribution of those shares to the Stephens Fund’s shareholders in exchange for their Stephens Fund shares; |

| | ● | A shareholder will recognize no gain or loss on the exchange of all of its Stephens Fund shares solely for AB Fund shares pursuant to the Reorganization; |

| | ● | A shareholder’s aggregate tax basis in the AB Fund shares it receives pursuant to the Reorganizations will be the same as the aggregate tax basis in its Stephens Fund shares it |

| | | actually or constructively surrenders in exchange for those AB Fund shares, and its holding period for those AB Fund shares will include, in each instance, its holding period for those Stephens Fund shares, provided the shareholder holds them as capital assets as of the time of the Closing; |

| | ● | The AB Funds will recognize no gain or loss on its receipt of the corresponding Stephens Fund’s assets in exchange solely for the AB Fund shares and the AB Fund’s assumption of the Stephens Fund’s liabilities; |

| | ● | Each AB Fund’s basis in each transferred asset will be the same as the corresponding Stephens Fund’s basis therein immediately before the Reorganization, and each AB Fund’s holding period for each such asset will include the corresponding Stephen Fund’s holding period therefor (except where the AB Fund’s investment activities have the effect of reducing or eliminating an asset’s holding period); and |

| | ● | For purposes of section 381 of the Code, each AB Fund will be treated just as each Stephens Fund would have been treated if there had been no Reorganizations. |

| | Accordingly, the Reorganizations will not result in the termination of the Stephens Funds’ taxable years, the Stephens Funds’ tax attributes enumerated in section 381(c) of the Code will be taken into account by the AB Funds as if there had been no Reorganizations, and the part of the Stephens Funds’ taxable years before the Reorganizations will be included in the AB Funds’ taxable years after the Reorganizations. |

Notwithstanding the above, the opinion of counsel may state that no opinion is expressed as to the effect of the Reorganization of the Funds or any shareholder with respect to any asset as to which any unrealized gain or loss is required to be recognized for federal income tax purposes at the end of a taxable year (or on the termination or transfer thereof) under a mark-to-market system of accounting.

Opinions of counsel are not binding upon the Internal Revenue Service (“IRS”) or the courts. If a Reorganization is consummated but does not qualify as a tax-free reorganization under the Code, the Stephens Fund would recognize gain or loss on the transfer of its assets to the corresponding AB Fund and each shareholder of the Stephens Fund would recognize a taxable gain or loss equal to the difference between its tax basis in the shares of the Stephens Fund and the fair market value of the shares of the AB Fund it receives.

Tracking Your Basis and Holding Period; State and Local Taxes. After the Reorganizations, you will continue to be responsible for tracking the adjusted tax basis and holding period of your AB Fund shares for federal income tax purposes. Pursuant to legislation passed by Congress in 2008, if you want to use the average cost method for determining basis with respect to any AB Fund shares you acquire after December 31, 2011 (“Covered Shares”), you will have to elect to do so in writing (which may be electronic). If you fail to affirmatively elect that method, the basis determination will be made in accordance with the AB Fund’s default method, which might be a method other than average cost. If, however, the AB Fund’s default method is average cost and you wish to use a different acceptable method for basis determination (e.g., a specific identification method), you will be able to elect to do so.

That legislation also requires the AB Fund (or administrative agent) to report to the IRS and furnish to its shareholders the cost basis information for Covered Shares. In addition to the current requirement to report the gross proceeds from the redemption of its shares, the AB Fund also will be required to report the cost basis information for Covered Shares and indicate whether they had a short-term or long-term holding period. You should consult with your tax adviser to determine the best IRS-accepted cost basis method for your tax situation and to obtain more information about how the cost basis reporting law will apply to you.

| | 4. | Comparison of Forms of Organization and Shareholder Rights |

Set forth below is a discussion of the material differences between the Funds and the rights of their shareholders.

Governing Law. The Stephens Funds are each a series of the Trust, which is organized as a Massachusetts business trust. Each AB Fund is a separate series of the AB Trust, which is organized as a Massachusetts business trust. Each Fund is authorized to issue an unlimited number of shares of beneficial interest. The Trust’s operations are governed by its Amended and Restated Agreement and Declaration of Trust, including any amendments thereto (collectively, “Stephens Declaration of Trust”) and By-Laws and applicable state law. The AB Trust’s operations are governed by its Amended and Restated Declaration of Trust (the “AB Declaration of Trust”) and By-Laws and applicable state law.

Shareholder Liability. Under the Stephens Declaration of Trust, any shareholder or former shareholder shall not be held personally liable for any obligation or liability of the Trust solely by reason of being or having been a shareholder and not because of such shareholder’s acts or omissions or for some other reason. The Stephens Funds are required to indemnify shareholders and former shareholders against losses and expenses arising from any personal liability for any obligation of the Stephens Funds solely by reason of being or having been a shareholder of the Stephens Funds and not because of his or her acts or omissions or for some other reason.

Under the AB Declaration of Trust, any shareholder or former shareholder of the AB Funds shall not be held to be personally liable for any obligation or liability of the AB Trust solely by reason of being or having been a shareholder. The AB Funds are required to indemnify shareholders and former shareholders against losses and expenses incurred in connection with proceedings relating to his or her being or having been a shareholder of the AB Funds and not because of his or her acts or omissions.

Board of Trustees. The Reorganizations will result in a change in the Board of Trustees because the trustees of the Trust are different from the trustees of the AB Trust. The Board has five trustees, four of whom are an “interested person,” as that term is defined under the 1940 Act, of the Trust. For more information, refer to the Statement of Additional Information dated March 31, 2011 for the Stephens Funds, which is incorporated by reference into this Proxy Statement.

The AB Board has eight trustees, one of whom is deemed an “interested person” of the AB Trust. For more information, refer to the Statement of Additional Information to this Proxy Statement, which is incorporated by reference into this Proxy Statement.

The Reorganizations also will result in a change in the officers because the officers of the Trust are different from the officers of the AB Trust.

Classes. Each Stephens Fund offers two classes of shares: Class A and Class I shares. Each AB Fund is a separate series of the AB Trust that is expected to offer Investor Class, Institutional Class, A Class, C Class and Y Class shares. It is anticipated that shareholders of each Stephens Fund will receive Investor Class and/or Institutional Class shares, as the case may be, of the corresponding AB Fund in the Reorganizations. Nothing contained herein shall be construed as an offer to purchase or otherwise acquire any other class of shares of the AB Funds. The AB Board has reserved the right to create and issue additional classes of the AB Funds following the Reorganization. Each share of a series or class represents an equal proportionate interest in that series or class with each other share of that series or class. Shares of each series or class generally vote together on fund- or trust-wide matters, except when required under federal securities laws to vote separately on matters that only affect a particular class, such as the approval of a distribution plan for a particular class. Structurally, there is no difference between