Stephens Funds®

Prospectus

March 31, 2011

Stephens Small Cap Growth Fund

Class A – STSGX

Stephens Mid Cap Growth Fund

Class A – STMGX

The Securities and Exchange Commission has not approved or disapproved of these securities or determined if this Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Stephens Funds®

Class A Shares

Stephens Small Cap Growth Fund

Stephens Mid Cap Growth Fund

Table of Contents

| SUMMARY SECTION | 1 |

| Stephens Small Cap Growth Fund | 1 |

| Stephens Mid Cap Growth Fund | 6 |

| INVESTMENT OBJECTIVE, STRATEGIES AND RISKS | 10 |

| Investment Objectives | 10 |

| Principal Investment Strategies | 10 |

| Principal Risks | 11 |

| Portfolio Holdings Information | 13 |

| MANAGEMENT OF THE FUNDS | 13 |

| The Advisor | 13 |

| Portfolio Managers | 14 |

| SHAREHOLDER INFORMATION | 14 |

| 12b-1 Plan | 14 |

| About Class A Shares | 15 |

| Share Price | 17 |

| How to Purchase Shares | 18 |

| How to Redeem Shares | 20 |

| Account and Transaction Policies | 22 |

| Exchanging Shares | 23 |

| Short-Term Trading and Redemption Fees | 23 |

| Tools to Combat Frequent Transactions | 24 |

| Service Fees and/or Other Third Party Fees | 25 |

| DISTRIBUTIONS AND TAXES | 25 |

| Dividends and Distributions | 25 |

| Tax Consequences | 25 |

| INDEX DESCRIPTIONS | 27 |

| FINANCIAL HIGHLIGHTS | 28 |

| PRIVACY NOTICE | 30 |

Class A Shares

Stephens Small Cap Growth Fund

Investment Objective

The Stephens Small Cap Growth Fund (the “Small Cap Growth Fund”) seeks long-term growth of capital.

Fees and Expenses of the Fund

The table below describes the fees and expenses that you may pay if you buy and hold shares of the Small Cap Growth Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $25,000 in the Small Cap Growth Fund. More information about these and other discounts is available from your financial professional, in the section entitled “Class A Sales Charge (Load)” of the Fund’s statutory Prospectus on page 15 and in the section entitled “Additional Purchase and Redemption Information” of the Fund’s Statement of Additional Information (“SAI”) on page B-39.

Shareholder Fees (fees paid directly from your investment) | Class A Shares |

Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | 5.25% |

Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, whichever is less) | None |

Redemption Fee (as a percentage of amount redeemed within 30 days of purchase) | 2.00% |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | Class A Shares |

| Management Fees | 0.75% |

| Distribution (12b-1) Fees | 0.25% |

| Other Expenses | 0.42% |

| Total Annual Fund Operating Expenses | 1.42% |

| Fee Waiver and/or Expense Reimbursement | -0.06% |

Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement(1)(2) | 1.36% |

| | |

| (1) | Stephens Investment Management Group, LLC (the “Advisor”) has contractually agreed to reduce its fees and/or pay Fund expenses (excluding the expenses associated with the Small Cap Growth Fund’s investment in other investment companies referred to as “Acquired Fund Fees and Expenses,” interest expense in connection with investment activities, taxes and extraordinary expenses) in order to limit Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement for the Small Cap Growth Fund to 1.35% of the Small Cap Growth Fund’s Class A Shares’ average net assets (the “Expense Cap”). The Expense Cap will remain in effect until at least March 31, 2012. The Advisor is permitted to be reimbursed for fee reductions and/or expense payments made in the prior three fiscal years. Any such reimbursement is subject to Board review and approval. A reimbursement may be requested by the Advisor if the aggregate amount actually paid by the Small Cap Growth Fund toward operating expenses for such fiscal year (taking into account any reimbursement) does not exceed the Expense Cap. The Agreement may be terminated at any time by the Board of Trustees upon 60 days’ notice to the Advisor, or by the Advisor with the consent of the Board. |

| (2) | The Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement for the Fund do not correlate to the Ratio of Expenses to Average Net Assets provided in the Financial Highlights section of the statutory prospectus, which reflects the operating expenses of the Fund and does not include Acquired Fund Fees and Expenses. |

Example

This example is intended to help you compare the cost of investing in the Small Cap Growth Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same (taking into account the contractual Expense Cap for one year). Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| One Year | Three Years | Five Years | Ten Years |

| $656 | $945 | $1,255 | $2,133 |

Portfolio Turnover

The Small Cap Growth Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Small Cap Growth Fund’s performance. During the most recent fiscal year, the Small Cap Growth Fund’s portfolio turnover rate was 66% of the average value of its portfolio.

Principal Investment Strategies

Under normal market conditions, the Small Cap Growth Fund invests at least 80% of its net assets (plus any borrowings for investment purposes) in stocks of small capitalization companies. The Small Cap Growth Fund considers a company to be a small-cap company if it has a market capitalization, at the time of purchase, of $2.5 billion or less. The Small Cap Growth Fund may invest up to 20% of its net assets in equity securities of issuers that have market capitalizations, at the time of purchase, greater than $2.5 billion.

Most of the assets of the Small Cap Growth Fund will be invested in U.S. common stocks the Advisor believes have clear indicators of future earnings growth, or that demonstrate other potential for growth of capital. The Fund may invest in other equity securities, including convertible debt securities and preferred stock, as well as exchange-traded funds (“ETFs”). Not all ETFs in which the Fund may invest will be invested exclusively in small-cap companies. The Fund may also invest in equity index futures, investment grade, non-convertible debt securities, U.S. government securities, high quality money market instruments and money market funds. In addition, the Fund may invest up to 25% of its net assets in the securities of foreign issuers, including American Depositary Receipts (“ADRs”) and European Depositary Receipts (“EDRs”), including in emerging markets. In selecting companies for the Fund, the Advisor employs quantitative analysis and fundamental research with a focus on earnings growth. The Advisor will sell a security when appropriate and consistent with the Small Cap Growth Fund’s investment objective and policies.

Principal Investment Risks

There is the risk that you could lose all or a portion of your investment in the Small Cap Growth Fund. The following risks could affect the value of your investment:

| ● | Management Risk: The risk that the Advisor may fail to implement the Fund’s investment strategies and meet its investment objective. |

| ● | General Market Risk: The risk that the market value of a security may fluctuate, sometimes rapidly and unpredictably. |

| ● | Equity Market Risk: Common stocks are susceptible to general stock market fluctuations and to volatile increases and decreases in value. |

| ● | Small-Sized Company Risk: Investing in securities of small-sized companies, even indirectly, may involve greater volatility than investing in larger and more established companies. |

| ● | Foreign Securities Risk: Foreign securities involve increased risks due to political, social and economic developments abroad, as well as due to differences between U.S. and foreign regulatory practices. Investments in emerging markets are generally more volatile than investments in developed foreign markets. |

| ● | Growth Style Investment Risk: Growth-oriented funds may underperform when value investing is in favor. |

| ● | Other Investment Companies Risk: To the extent the Fund invests in shares of other investment companies, you will indirectly bear fees and expenses charged by those investment companies and will be subject to the risks that those investment companies are subject to. |

| ● | Portfolio Turnover Risk: High portfolio turnover involves correspondingly greater expenses to the Fund, including brokerage commissions and dealer mark-ups and other transaction costs. This may also result in adverse tax consequences for Fund shareholders. |

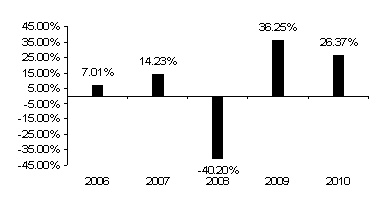

Performance

The following performance information provides some indication of the risks of investing in the Small Cap Growth Fund. The bar chart below illustrates how the Small Cap Growth Fund’s total returns have varied from year to year. The table below illustrates how the Small Cap Growth Fund’s average annual total returns over time compare with a domestic broad-based market index and secondary index provided to offer a broader market perspective. The Small Cap Growth Fund’s performance, before and after taxes is not necessarily an indication of how the Small Cap Growth Fund will perform in the future. Updated performance is available on the Small Cap Growth Fund’s website www.stephensfunds.com.

Stephens Small Cap Growth Fund - Class A Shares*

Calendar Year Total Return

| * | Calendar Year Total Returns in the bar chart do not reflect sales charges. If sales charges were included, returns would be lower. |

| Best Quarter | Q2 2009 | 23.02% |

| Worst Quarter | Q4 2008 | -25.54% |

| Average Annual Total Returns as of December 31, 2010 |

| | 1 Year | 5 Years | Since Inception (12/01/2005) |

| Stephens Small Cap Growth Fund | | | |

| Class A Shares | | | |

| Return Before Taxes | 19.78% | 3.58% | 3.23% |

| Return After Taxes on Distributions | 19.56% | 3.54% | 3.19% |

| Return After Taxes on Distributions and Sale of Fund Shares | 13.14% | 3.07% | 2.77% |

S&P 500® Index (reflects no deduction for fees, expenses or taxes) | 15.06% | 2.29% | 2.02% |

Russell 2000® Growth Index (reflects no deduction for fees, expenses or taxes) | 29.09% | 5.30% | 4.78%% |

After tax returns are calculated using the historical highest individual federal marginal income tax rates and does not reflect the impact of state and local taxes. Actual after-tax returns depend on your situation and may differ from those shown. Furthermore, the after-tax returns shown are not relevant to those who hold their shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts (“IRAs”).

Investment Advisor

Stephens Investment Management Group, LLC.

Portfolio Managers

Ryan Crane is the Chief Investment Officer of the Advisor, and has been the Senior Portfolio Manager for the Small Cap Growth Fund since its inception in 2005. John Thornton is the Co-Portfolio Manager of the Small Cap Growth Fund and has served as the Co-Portfolio Manager of the Fund since its inception in 2005. Kelly Ranucci and Sam Chase were named Co-Portfolio Managers of the Small Cap Growth Fund on March 31, 2011 and have served as Senior Equity Analysts since the Fund’s inception in 2005.

Purchase and Sale of Fund Shares

You may purchase, exchange or redeem Small Cap Growth Fund shares on any business day by written request via mail (Stephens Small Cap Growth Fund, c/o U.S. Bancorp Fund Services, LLC, P.O. Box 701, Milwaukee, WI 53201-0701), by wire transfer, by telephone at (866) 735-7464, or through a financial intermediary. Purchases and redemptions by telephone are only permitted if you previously established these options on your account. The minimum initial investment amounts are shown in the table below.

| Minimum Investment | To Open Your Account | To Add to Your Account |

| Regular Accounts | $2,500 | $100 |

| Individual Retirement Accounts (“IRAs”) | $1,000 | $100 |

| Asset or fee-based accounts managed by your financial advisor | None | None |

| Eligible employee benefit plans, SEP, and SIMPLE IRA plans | None | None |

Tax Information

The Small Cap Growth Fund’s distributions are taxed as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the Small Cap Growth Fund through a broker-dealer or other financial intermediary (such as a bank), the Small Cap Growth Fund and its related companies may pay the intermediary for the sale of Small Cap Growth Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Small Cap Growth Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

Stephens Mid Cap Growth Fund

Investment Objective

The Stephens Mid Cap Growth Fund (the “Mid Cap Growth Fund”) seeks long-term growth of capital.

Fees and Expenses of the Fund

The table below describes the fees and expenses that you may pay if you buy and hold shares of the Mid Cap Growth Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $25,000 in the Mid Cap Growth Fund. More information about these and other discounts is available from your financial professional, in the section entitled “Class A Sales Charge (Load)” of the Fund’s statutory Prospectus on page 15 and in the section entitled “Additional Purchase and Redemption Information” of the Fund’s Statement of Additional Information (“SAI”) on page B-39.

Shareholder Fees (fees paid directly from your investment) | Class A Shares |

Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | 5.25% |

Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, whichever is less) | None |

Redemption Fee (as a percentage of amount redeemed within 30 days of purchase) | 2.00% |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | Class A Shares |

| Management Fees | 0.75% |

| Distribution (12b-1) Fees | 0.25% |

| Other Expenses | 1.01% |

| Total Annual Fund Operating Expenses | 2.01% |

| Fee Waiver and/or Expense Reimbursement | -0.50% |

Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement(1)(2) | 1.51% |

| | |

| (1) | Stephens Investment Management Group, LLC (the “Advisor”) has contractually agreed to reduce its fees and/or pay Fund expenses (excluding the expenses associated with the Mid Cap Growth Fund’s investment in other investment companies referred to as “Acquired Fund Fees and Expenses,” interest expense in connection with investment activities, taxes and extraordinary expenses) in order to limit Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement for the Mid Cap Growth Fund to 1.50% of the Fund’s Class A Shares’ average net assets (the “Expense Cap”). The Expense Cap will remain in effect until at least March 31, 2012. The Advisor is permitted to be reimbursed for fee reductions and/or expense payments made in the prior three fiscal years. Any such reimbursement is subject to Board review and approval. A reimbursement may be requested by the Advisor if the aggregate amount actually paid by the Fund toward operating expenses for such fiscal year (taking into account any reimbursement) does not exceed the Expense Cap. The Agreement may be terminated at any time by the Board of Trustees upon 60 days’ notice to the Advisor, or by the Advisor with the consent of the Board. |

| (2) | The Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement for the Fund do not correlate to the Ratio of Expenses to Average Net Assets provided in the Financial Highlights section of the statutory prospectus, which reflects the operating expenses of the Fund and does not include Acquired Fund Fees and Expenses. |

Example

This example is intended to help you compare the cost of investing in the Mid Cap Growth Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same (taking into account the contractual Expense Cap for one year). Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| One Year | Three Years | Five Years | Ten Years |

| $671 | $1,077 | $1,507 | $2,702 |

Portfolio Turnover

The Mid Cap Growth Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Mid Cap Growth Fund’s performance. During the most recent fiscal year, the Mid Cap Growth Fund’s portfolio turnover rate was 20% of the average value of its portfolio.

Principal Investment Strategies

Under normal market conditions, the Mid Cap Growth Fund invests at least 80% of its net assets (plus any borrowings for investment purposes) in stocks of medium capitalization companies. The Mid Cap Growth Fund considers a company to be a mid-cap company if it has a market capitalization, at the time of purchase, of $1.5 billion to $12.5 billion. The Mid Cap Growth Fund may invest up to 20% of its net assets in equity securities of issuers that have market capitalizations, at the time of purchase, of less than $1.5 billion or greater than $12.5 billion.

Most of the assets of the Mid Cap Growth Fund will be invested in U.S. common stocks the Advisor believes have clear indicators of future earnings growth, or that demonstrate other potential for growth of capital. The Fund may invest in other equity securities, including convertible debt securities and preferred stock, as well as ETFs. Not all ETFs in which the Fund may invest will be invested exclusively in mid-cap companies. The Fund may also invest in equity index futures, investment grade, non-convertible debt securities, U.S. government securities, high quality money market instruments and money market funds. In addition, the Fund may invest up to 25% of its net assets in the securities of foreign issuers, including ADRs and EDRs, including in emerging markets. In selecting companies for the Fund, the Advisor employs quantitative analysis and fundamental research with a focus on earnings growth. The Advisor will sell a security when appropriate and consistent with the Fund’s investment objective and policies.

Principal Investment Risks

There is the risk that you could lose all or a portion of your investment in the Mid Cap Growth Fund. The following risks could affect the value of your investment:

| ● | Management Risk: The risk that the Advisor may fail to implement the Fund’s investment strategies and meet its investment objective. |

| ● | General Market Risk: The risk that the market value of a security may fluctuate, sometimes rapidly and unpredictably. |

| ● | Equity Market Risk: Common stocks are susceptible to general stock market fluctuations and to volatile increases and decreases in value. |

| ● | Medium-Sized Company Risk: Investing in securities of medium-sized companies, even indirectly, may involve greater volatility than investing in larger and more established companies. |

| ● | Foreign Securities Risk: Foreign securities involve increased risks due to political, social and economic developments abroad, as well as due to differences between U.S. and foreign regulatorypractices. Investments in emerging markets are generally more volatile than investments in developed foreign markets. |

| ● | Growth Style Investment Risk: Growth-oriented funds may underperform when value investing is in favor. |

| ● | Other Investment Companies Risk: To the extent the Fund invests in shares of other investment companies, you will indirectly bear fees and expenses charged by those investment companies and will be subject to the risks that those investment companies are subject to. |

| ● | Portfolio Turnover Risk: High portfolio turnover involves correspondingly greater expenses to the Fund, including brokerage commissions and dealer mark-ups and other transaction costs. This may also result in adverse tax consequences for Fund shareholders. |

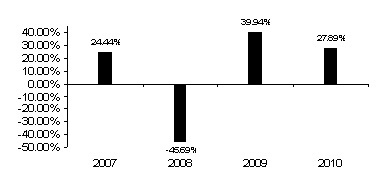

Performance

The following performance information provides some indication of the risks of investing in the Mid Cap Growth Fund. The bar chart below illustrates how the Mid Cap Growth Fund’s total returns have varied from year to year. The table below illustrates how the Mid Cap Growth Fund’s average annual total returns over time compare with a domestic broad-based market index and secondary index provided to offer a broader market perspective. The Mid Cap Growth Fund’s performance, before and after taxes is not necessarily an indication of how the Fund will perform in the future. Updated performance is available on the Fund’s website www.stephensfunds.com.

Stephens Mid Cap Growth Fund – Class A Shares*

Calendar Year Total Return

| * | Calendar Year Total Returns in the bar chart do not reflect sales charges. If sales charges were included, returns would be lower. |

| Best Quarter | Q3 2009 | 16.31% |

| Worst Quarter | Q4 2008 | -28.39% |

| Average Annual Total Returns as of December 31, 2010 |

| | 1 Year | Since Inception (2/01/2006) |

| Stephens Mid Cap Growth Fund | | |

| Class A Shares | | |

| Return Before Taxes | 21.21% | 2.36% |

| Return After Taxes on Distributions | 21.21% | -2.69% |

| Return After Taxes on Distributions and Sale of Fund Shares | 13.79% | -2.28% |

S&P 500® Index (reflects no deduction for fees, expenses or taxes) | 15.06% | 1.75% |

Russell Midcap® Growth Index (reflects no deduction for fees, expenses or taxes) | 26.38% | 3.71% |

After tax returns are calculated using the historical highest individual federal marginal income tax rates and does not reflect the impact of state and local taxes. Actual after-tax returns depend on your situation and may differ from those shown. Furthermore, the after-tax returns shown are not relevant to those who hold their shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts (“IRAs”). The “Return After Taxes on Distributions and Sale of Fund Shares” may be higher than other return figures because when a capital loss occurs upon the redemption of Fund shares, a tax deduction is provided that benefits the investor.

Investment Advisor

Stephens Investment Management Group, LLC.

Portfolio Managers

Ryan Crane is the Chief Investment Officer of the Advisor, and has been the Senior Portfolio Manager for the Mid Cap Growth Fund since its inception in 2006. John Thornton is the Co-Portfolio Manager of the Mid Cap Growth Fund and has served as the Co-Portfolio Manager of the Fund since its inception in 2006. Kelly Ranucci and Sam Chase were named Co-Portfolio Managers of the Mid Cap Growth Fund on March 31, 2011 and have served as Senior Equity Analysts since the Fund’s inception in 2006.

Purchase and Sale of Fund Shares

You may purchase, exchange or redeem Mid Cap Growth Fund shares on any business day by written request via mail (Stephens Mid Cap Growth Fund, c/o U.S. Bancorp Fund Services, LLC, P.O. Box 701, Milwaukee, WI 53201-0701), by wire transfer, by telephone at (866) 735-7464, or through a financial intermediary. Purchases and redemptions by telephone are only permitted if you previously established these options on your account. The minimum initial investment amounts are shown in the table below.

| Minimum Investment | To Open Your Account | To Add to Your Account |

| Regular Accounts | $2,500 | $100 |

| Individual Retirement Accounts (“IRAs”) | $1,000 | $100 |

| Asset or fee-based accounts managed by your financial advisor | None | None |

| Eligible employee benefit plans, SEP, and SIMPLE IRA plans | None | None |

Tax Information

The Mid Cap Growth Fund’s distributions are taxed as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the Mid Cap Growth Fund through a broker-dealer or other financial intermediary (such as a bank), the Mid Cap Growth Fund and its related companies may pay the intermediary for the sale of Mid Cap Growth Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Mid Cap Growth Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

| Investment Objective, Strategies and Risks |

Investment Objectives

The Stephens Small Cap Growth Fund’s and the Stephens Mid Cap Growth Fund’s (each a “Fund” and collectively “the Funds”) investment objective is long-term growth of capital. There is no assurance that the Funds will achieve their investment objective. Each Fund’s investment objective, strategies and policies described below may be changed without the approval of the Fund’s shareholders upon a 30-day written notice to shareholders. However, the Small Cap Growth Fund will not change its investment policy of investing at least 80% of its net assets in small-cap companies and the Mid Cap Growth Fund will not change its investment policy of investing at least 80% of its net assets in mid-cap companies without first changing the respective Fund’s name and providing shareholders with at least a 60-day prior written notice.

Principal Investment Strategies

The Small Cap Growth Fund seeks to achieve its objective by investing primarily in common stocks of U.S. companies with small market capitalizations (“small-cap” companies). The Advisor will seek to identify growth stocks using a disciplined, bottom-up approach, employing quantitative analysis and fundamental research with a focus on earnings growth. Under normal market conditions, the Small Cap Growth Fund invests at least 80% of its net assets (plus any borrowings for investment purposes) in the stocks of small-cap companies. The Small Cap Growth Fund considers a company to be a small-cap company if it has a market capitalization, at the time of purchase, of $2.5 billion or less. To achieve the 80% investment requirement, the Fund may invest in equity securities, including convertible debt securities and preferred stock, as well as ETFs. Not all ETFs in which the Fund may invest will be invested exclusively in small-cap companies. The Advisor will use, and monitor regularly, the dollar-weighted average market cap of the underlying securities held by the ETF to determine whether or not the ETF falls into the 80% investment requirement. The Small Cap Growth Fund may invest up to 20% of its net assets in equity securities of issuers that have market capitalizations, at the time of purchase, greater than $2.5 billion, as well as equity index futures.

The Mid Cap Growth Fund seeks to achieve its objective by investing primarily in common stock of U.S. companies with medium market capitalizations (“mid-cap companies”). The Advisor will seek to identify growth stocks using a disciplined, bottom-up approach, employing quantitative analysis and fundamental research with a focus on earnings growth. Under normal market conditions, the Mid Cap Growth Fund invests at least 80% of its net assets (plus any borrowings for investment purposes) in the stocks of mid-cap companies. The Mid Cap Growth Fund considers a company to be a mid-cap company if it has a market capitalization, at the time of purchase, of $1.5 billion to $12.5 billion. To achieve the 80% investment requirement, the Fund may invest in equity securities, including convertible debt securities and preferred stock, as well as ETFs. Not all ETFs in which the Fund may invest will be invested exclusively in mid-cap companies. The Advisor will use, and monitor regularly, the dollar-weighted average market cap of the underlying securities held by the ETF to determine whether or not the ETF falls into the 80% investment requirement. The Mid Cap Growth Fund may invest up to 20% of its net assets in equity securities of issuers that have market capitalizations, at the time of purchase, of less than $1.5 billion or greater than $12.5 billion, as well as equity index futures.

In selecting investments using a “bottom-up” approach, the Advisor selects companies that it believes have clear indicators of future earnings growth, or that demonstrate other potential for growth of capital. The Advisor adheres to the historical perspective that common stocks have dramatically outperformed other financial investments over longer periods of time. Each Fund’s investment strategy takes into consideration revenue and earnings growth rates, profit trends, earnings risk, and company valuation.

Additionally, each Fund may invest in investment-grade, non-convertible debt securities, U.S. government securities, high-quality money market instruments and money market funds. Each Fund may also invest

up to 25% of its net assets in foreign securities, including sponsored or un-sponsored ADRs and EDRs, including in emerging markets. ADRs and EDRs evidence ownership of foreign securities but are traded on domestic exchanges.

Each Fund is actively managed, which means that the Advisor may frequently buy and sell securities. The Advisor will sell a security when appropriate and consistent with a Fund’s investment objective and policies regardless of the effect on the Fund’s portfolio turnover rate. Please note that buying and selling securities generally involves some expense to a Fund, such as broker commissions and other transaction costs, and a high turnover rate in any year will result in payment by a Fund of above-average transaction costs and could result in the payment by shareholders of above-average amounts of taxes on realized investment gains. Each Fund cannot accurately predict its future annual portfolio turnover rate, which may vary substantially from year-to-year since portfolio adjustments are made when conditions affecting relevant markets, particular industries or individual issues warrant such action. In addition, portfolio turnover may also be affected by sales of portfolio securities necessary to meet cash requirements for redemptions of shares.

Small Cap Growth Fund’s Ability to Close. Based on the Advisor’s analysis of the size of the applicable market, market liquidity, portfolio holdings of the Small Cap Growth Fund and other accounts of the Advisor, as well as other issues, upon a 30-day written notice to Small Cap Growth Fund shareholders the Small Cap Growth Fund may close to new investors when the Advisor determines that the receipt of substantial additional assets would not be prudent from an investment perspective. In such event, it is expected that then-existing shareholders would be allowed to make additional purchases. If the Small Cap Growth Fund closes to new investors, the Board will review, on a periodic basis, market conditions and other factors presented by the Advisor in order to determine whether to reopen the Small Cap Growth Fund to new investors.

Temporary or Cash Investments. In anticipation of or in response to adverse market or other conditions or atypical circumstances such as unusually large cash inflows or redemptions, each Fund may temporarily hold all or a portion of its assets in cash, cash equivalents or high-quality debt instruments. As a result, each Fund may not achieve its investment objective.

To the extent a Fund invests in ETFs or uses a money market fund for its cash position, there will be some duplication of expenses because the Fund would bear its pro rata portion of such fund’s advisory fees and other operational expenses.

Principal Risks

Before investing in a Fund, you should carefully consider your own investment goals, the amount of time you are willing to leave your money invested and the amount of risk you are willing to take. Remember that in addition to possibly not achieving your investment goals, you could lose all or a portion of your investment by investing in a Fund. The value of your investment in a Fund will fluctuate with the prices of the securities in which the Fund invests. The principal risks of investing in the Funds are:

Management Risk. Management risk describes each Fund’s ability to meet its investment objective based on the Advisor’s success or failure at implementing investment strategies for each Fund. The value of your investment in a Fund is subject to the effectiveness of the Advisor’s research, analysis and asset allocation among portfolio securities. If the Advisor’s investment strategies do not produce the expected results, your investment could be diminished or even lost.

General Market Risk. General market risk is the risk that the market value of a security may fluctuate, sometimes rapidly and unpredictably. These fluctuations may cause a security to be worth less than its cost when originally purchased or less than it was worth at an earlier time. General market risk may affect a single issuer, industry, sector of the economy or the market as a whole.

Equity Market Risk. Common stocks are susceptible to general stock market fluctuations and to volatile increases and decreases in value. Investor perceptions may impact the markets and are based on various and unpredictable factors including expectations regarding government, economic, monetary and fiscal policies; inflation and interest rates; economic expansion or contraction; and global or regional political, economic and banking crises. If you hold common stocks of any given issuer, you would generally be exposed to greater risk than if you hold preferred stocks and debt obligations of the issuer because common stockholders generally have inferior rights to receive payments from issuers in comparison with the rights of preferred stockholders, bondholders and other creditors of such issuers.

Small- and Medium-Sized Company Risk. Investing in securities of small- and medium-sized companies, even indirectly, may involve greater volatility than investing in larger and more established companies because small and medium-sized companies can be subject to more abrupt or erratic share price changes than larger, more established companies. Smaller companies may have limited product lines, markets or financial resources and their management may be dependent on a limited number of key individuals. Securities of those companies may have limited market liquidity and their prices may be more volatile.

Foreign Securities Risk. To the extent that a Fund invests in securities of foreign companies, including ADRs and EDRs, your investment in a Fund is subject to foreign securities risk. These include risks relating to political, social and economic developments abroad and differences between U.S. and foreign regulatory requirements and market practices. Securities that are denominated in foreign currencies are subject to the further risk that the value of the foreign currency will fall in relation to the U.S. dollar and/or will be affected by volatile currency markets or actions of U.S. and foreign governments or central banks.

In addition to developed markets, each Fund may invest in companies located in emerging markets, which are markets of countries in the initial stages of industrialization and that generally have low per capita income. In addition to the risks of foreign securities in general, countries in emerging markets are generally more volatile and can have relatively unstable governments, social and legal systems that do not protect shareholders, economies based on only a few industries, and securities markets that trade a small number of issues, which could reduce liquidity.

Growth Style Investment Risk. Growth stocks can perform differently from the market as a whole and from other types of stocks. Growth stocks may be designated as such and purchased based on the premise that the market will eventually reward a given company’s long-term earnings growth with a higher stock price when that company’s earnings grow faster than both inflation and the economy in general. Thus a growth style investment strategy attempts to identify companies whose earnings may grow or are growing at a faster rate than inflation and the economy. While growth stocks may react differently to issuer, political, market and economic developments than the market as a whole and other types of stocks by rising in price in certain environments, growth stocks also tend to be sensitive to changes in the earnings of their underlying companies and more volatile than other types of stocks, particularly over the short term. During periods of adverse economic and market conditions, the stock prices of growth stocks may fall despite favorable earnings trends.

Other Investment Companies Risk. Each Fund may invest in shares of other registered investment companies, including ETFs and money market funds. To the extent that a Fund invests in shares of other registered investment companies, you will indirectly bear fees and expenses charged by the underlying funds (the “Underlying Funds”) in addition to a Fund’s direct fees and expenses and will be subject to the risks associated with investments in those funds.

Portfolio Turnover Risk. High portfolio turnover involves correspondingly greater expenses to a Fund, including brokerage commissions or dealer mark-ups and other transaction costs on the sale of securities and reinvestments in other securities. Such sales also may result in adverse tax consequences to a Fund’s shareholders. The trading costs and tax effects associated with portfolio turnover may adversely affect a Fund’s performance.

The Funds may be appropriate for investors who:

| ● | Are pursuing a long-term goal such as retirement; |

| ● | Want to add an equity investment with growth potential to their investment portfolio; and |

| ● | Understand and can bear the risks of investing in smaller size companies (Small Cap Growth Fund) or medium size companies (Mid Cap Growth Fund). |

Portfolio Holdings Information

A description of each Fund’s policies and procedures with respect to disclosure of its portfolio holdings is available in the Funds’ SAI and on the Funds’ website at www.stephensfunds.com.

The Advisor

Each Fund has entered into separate investment advisory agreements (the “Advisory Agreements”) with Stephens Investment Management Group, LLC, 111 Center Street, Little Rock, Arkansas 72201, under which the Advisor manages that Fund’s investments subject to the supervision of the Board. The Advisor was founded in 2005 and is a subsidiary of Stephens Investments Holdings LLC, a privately held and family owned company. Key employees also have a significant ownership stake in the Advisor. As of February 28, 2011, the Advisor’s assets under management were approximately $1 billion. Under the Advisory Agreements, the Funds compensate the Advisor for its investment advisory services at the annual rate of 0.75% of each Fund’s average daily net assets, payable on a monthly basis. For the fiscal year ended November 30, 2010, the Advisor received net management fees as a percentage of average daily net assets of 0.50% from the Small Cap Growth Fund. For the fiscal year ended November 30, 2010, the Advisor did not receive any net management fees from the Mid Cap Growth Fund because the Advisor agreed to waive all of its fees pursuant to the expense limitation agreement described below.

Subject to the general supervision of the Board, the Advisor is responsible for managing the Funds in accordance with their investment objective and policies, making decisions with respect to, and also orders for, all purchases and sales of portfolio securities. The Advisor also maintains related records for the Funds.

A discussion regarding the basis of the Board’s approval of the Advisory Agreement with the Advisor is available in the Funds’ Annual Report to shareholders for the fiscal year ended November 30, 2010.

Fund Expenses. The Advisor has contractually agreed to reduce its fees and/or pay Fund expenses (excluding Acquired Fund Fees and Expenses, interest expense in connection with investment activities, taxes and extraordinary expenses) in order to limit Total Annual Fund Operating Expenses for shares of each Fund to 1.35% of the Small Cap Growth Fund’s Class A Shares’ average net assets and 1.50% of the Mid Cap Growth Fund’s Class A Shares’ average net assets. Any reduction in advisory fees or payment of expenses made by the Advisor is subject to reimbursement by a Fund if requested by the Advisor, and the Board approves such reimbursement in subsequent fiscal years. This reimbursement may be requested by the Advisor if the aggregate amount actually paid by a Fund toward operating expenses for such fiscal year (taking into account any reimbursements) does not exceed the Expense Cap. The Advisor is permitted to be reimbursed for fee reductions and/or expense payments made in the prior three fiscal years. The Funds must pay its current ordinary operating expenses before the Advisor is entitled to any reimbursement of fees and/or expenses.

Portfolio Managers

Ryan Crane is the Senior Portfolio Manager for the Funds and Chief Investment Officer of the Advisor, and is primarily responsible for the day-to-day management of the Funds’ portfolios. Mr. Crane joined Stephens Inc., an affiliate of the Advisor, in September of 2004 as a Senior Portfolio Manager in charge of small and small/mid-cap growth accounts. Prior to joining Stephens Inc., Mr. Crane worked for AIM Management Group (“AIM”) since 1994. While at AIM, Mr. Crane was the lead manager of the AIM Small Cap Growth Fund and served as co-manager on various other AIM funds. Mr. Crane earned a B.A. with honors in Economics from the University of Houston. Mr. Crane is a CFA Charterholder and is FINRA Series 7, 9, 10 and 63 registered.

John Thornton is the Co-Portfolio Manager of the Funds and is jointly responsible for the day-to-day management of the Funds’ portfolios. Mr. Thornton joined Stephens Inc. in September of 2004 as a Co-Portfolio Manager in charge of small and small/mid-cap growth accounts. Prior to joining Stephens Inc., Mr. Thornton worked for AIM since 2000. While at AIM, Mr. Thornton was the senior analyst of the AIM Small Cap Growth Fund and various AIM technology funds. Mr. Thornton earned a B.A. in Engineering at Vanderbilt University and an M.B.A. from the University of Texas – Austin. Mr. Thornton is a CFA Charterholder and is FINRA Series 6, 7 and 63 registered.

Kelly Ranucci is the Co-Portfolio Manager of the Funds and is jointly responsible for the day-to-day management of the Funds’ portfolios. Ms. Ranucci joined Stephens Inc. in September of 2004 as a Senior Equity Analyst of small/mid-cap growth accounts. Prior to joining Stephens Inc., Ms. Ranucci worked for AIM since 1994. While at AIM, Ms. Ranucci was responsible for research and analysis of small and medium capitalization securities for AIM’s Small Cap Growth and Mid-Cap Growth Funds. Ms. Ranucci earned a B.B.A. from Texas A&M University and an M.B.A. with a concentration in Finance from the University of Houston. Ms. Ranucci is a CFA Charterholder and is FINRA Series 6, 7 and 63 registered.

Sam Chase is the Co-Portfolio Manager of the Funds and is jointly responsible for the day-to-day management of the Funds’ portfolios. Mr. Chase joined Stephens Inc. in September of 2004 as a Senior Equity Analyst of small/mid-cap growth accounts. Prior to joining Stephens Inc., Mr. Chase worked for AIM. While at AIM, Mr. Chase was responsible for research and analysis of small capitalization securities for AIM’s Small Cap Growth Fund. Mr. Chase earned his bachelor’s degree in History at Washington and Lee University and is M.B.A. from Southern Methodist University. Mr. Chase is a CFA Charterholder and is FINRA Series 7, 63 and 65 registered.

The Funds’ SAI provides additional information about the Portfolio Managers’ compensation, other accounts managed by the Portfolio Managers and the Portfolio Managers’ ownership of securities in the Funds.

12b-1 Plan

The Trust has adopted a Rule 12b-1 Distribution and Shareholder Servicing Plan (“Rule 12b-1 Plan”) on behalf of the Funds. Under the Rule 12b-1 Plan, each Fund pays a fee up to 0.25% of the average daily net asset value of the Fund’s Class A shares to Quasar Distributors, LLC (the “Distributor”). The Distributor uses this fee to finance activities that promote the sale of Fund shares, or to pay third parties, including, without limitation, Stephens Inc., for certain shareholder services. Such activities and services include, but are not necessarily limited to, shareholder servicing, advertising, printing and mailing prospectuses to persons other than current shareholders, printing and mailing sales literature, and compensating underwriters, dealers and sales personnel. The Rule 12b-1 Plan has the effect of increasing the expenses of the shares from what they would otherwise be.

About Class A Shares

Class A shares of the Funds are offered in this Prospectus. Class I shares of the Funds are offered in a separate Prospectus. Please note, sales charges and expense structures are class specific.

| | Class A |

| Initial Sales Charge | 5.25% |

| Contingent Deferred Sales Charge (“CDSC”) | None, (except a charge of 0.50% will be imposed on Class A shares redeemed within one year of purchase by investors who have taken advantage of the sales charge waiver allowed for investments of $1 million or more) |

| Distribution/Shareholder Servicing (12b-1) Fee | 0.25% |

| Maximum Purchase | None. |

| Conversion Feature | Not applicable. |

If you would like additional information about sales charge waivers, call your financial representative or contact the Funds at (866) 735-7464. Information about the Funds’ sales charges is available free of charge on the Funds’ website at www.stephensfunds.com.

Class A Sales Charge (Load) If you purchase Class A shares of the Funds you will pay an initial sales charge of 5.25% when you invest unless you qualify for a reduction or waiver of the sales charge. The sales charge for Class A shares of the Funds is calculated as follows:

| CLASS A SALES CHARGES |

| When you invest this amount | This sales charge makes up this % of the offering price(1) | Which equals this % of your net investment(1) | % of offering price retained by selling dealer |

| Under $25,000 | 5.25% | 5.54% | 5.00% |

| $25,000 but under $50,000 | 4.75% | 4.99% | 4.50% |

| $50,000 but under $100,000 | 4.00 | 4.17% | 3.75% |

| $100,000 but under $250,000 | 3.00% | 3.09% | 2.75% |

$250,000 but under $1 million | 2.00% | 2.04% | 1.80% |

$1 million and over(2),(3) | 0.00% | 0.00% | 0.00% |

| (1) | The dollar amount of the sales charge is the difference between the offering price of the shares purchased (which factors in the applicable sales charge in this table) and the net asset value of those shares. Since the offering price is calculated to two decimal places using standard rounding criteria, the number of shares purchased and the dollar amount of the sales charge as a percentage of the offering price and of your net investment may be higher or lower depending on whether there was a downward or upward rounding. |

| (2) | A contingent deferred sales charge of 0.50% will be imposed on Class A Shares redeemed within one year of purchase by investors who have taken advantage of the sales charge waiver afforded to investments of $1 million or above and received a finder’s fee. |

| (3) | The Advisor may directly or indirectly pay a one-time finder's fee to a dealer or other financial institution for investments of over $1 million in a Fund for which they are responsible as follows: 0.75% for investments over $1 million up to, and including, $3 million; 0.50% for investments over $3 million up to, and including, $20 million; and 0.25% for investments over $20 million. See the SAI for more information regarding finders’ fees. |

Class A Sales Charge Reductions

Rights of Accumulation. Rights of Accumulation allow you to combine Class A shares of any Stephens Fund you already own, in order to reach breakpoint levels and to qualify for sales load discounts on subsequent purchases of Class A shares. The purchase amount used in determining the sales charge on your purchase will be calculated by multiplying the maximum public offering price by the number of Class A shares of any Stephens Fund you already own and adding the dollar amount of your current purchase. These rights apply to shares currently owned by you and by your family members such as spouses, minor children or parents.

Letter of Intent. By signing a Letter of Intent (“LOI”) you can reduce your Class A sales charge. Your individual purchases will be made at the applicable sales charge based on the amount you intend to invest over a 13-month period. The LOI will apply to all purchases of Class A shares. Purchases resulting from the reinvestment of dividends and capital gains do not apply toward fulfillment of the LOI. Shares equal to 5.25% of the amount of the LOI will be held in escrow during the 13-month period. If, at the end of that time the total amount of purchases made is less than the amount intended, you will be required to pay the difference between the reduced sales charge and the sales charge applicable to the individual purchases had the LOI not been in effect. This amount will be obtained from redemption of the escrow shares. Any remaining escrow shares will be released to you.

Class A Sales Charge Waivers. Sales charges for Class A shares may be waived under certain circumstances for some investors or for certain payments. You will not have to pay a sales charge on purchases of Class A shares if you are any of the following persons:

| ● | any affiliate of the Advisor or any of its or the Funds’ officers, directors/trustees, employees or retirees; |

| ● | registered representatives of any broker-dealer authorized to sell Fund shares, subject to the internal policies and procedures of the broker-dealer; |

| ● | members of the immediate families of any of the foregoing (i.e., parent, child, spouse, domestic partner, sibling, step or adopted relationships, grandparent, grandchild and UTMA accounts naming qualifying persons); |

| ● | fee-based registered investment advisors, financial planners, bank trust departments or registered broker-dealers who are purchasing shares on behalf of their customers, certain wrap programs offered by financial institutions; |

| ● | retirement and deferred compensation plans and the trusts used to fund such plans (including, but not limited to, those defined in Sections 401(k), 403(b) and 457 of the Internal Revenue Code and “rabbi trusts”), for which an affiliate of the Advisor acts as trustee or administrator; or |

| ● | 401(k), 403(b) and 457 plans, and profit sharing and pension plans that have all plan transactions executed through a single or omnibus account |

To receive a reduction in your Class A sales charge, you must let your financial institution or shareholder services representative know at the time you purchase shares that you qualify for such a reduction. You may be asked by your financial adviser or shareholder services representative to provide account statements or other information regarding your related accounts or related accounts of your immediate family in order to verify your eligibility for a reduced sales charge. Your investment professional or financial institution must notify the Fund if your share purchase is eligible for the sales load waiver.

Additionally, you will not pay initial sales charges on shares purchased by reinvesting dividends and distributions.

Investments of $1 Million or More. If you invest $1 million or more as a lump sum or through the programs described above, you can purchase Class A shares of the Funds without an initial sales charge. Additionally, investors who currently own Class A shares of one Stephens Fund and make additional purchases that result in account balances of $1 million or more do not pay an initial sales charge on the additional purchases. However, if you have taken advantage of this waiver and received a finder’s fee, if you redeem your shares within one year of purchase, there is a CDSC of 0.50% imposed on such shares. The CDSC percentage you pay is based on the NAV of the shares at the time of redemption. However, the CDSC will not apply if you are otherwise entitled to a waiver of the initial sales charge as listed in “Sales Charge Waivers” above. Additionally, all redemptions of Class A shares made within 30 days of purchase are subject to a 2.00% redemption fee. Please refer to the “Short-Term Trading and Redemption Fees” for a further discussion of the redemption fee, and certain exclusions that may apply.

Share Price

A Fund’s share price is known as its NAV. The NAV is determined by dividing the value of a Fund’s securities, cash and other assets, minus all liabilities, by the number of shares outstanding (assets – liabilities / number of shares = NAV). The NAV takes into account the expenses and fees of a Fund, including management, administration and other fees, which are accrued daily. Each Fund’s share price is calculated as of the close of regular trading (generally 4:00 p.m., Eastern time) on each day the New York Stock Exchange (“NYSE”) is open for business.

All shareholder transaction orders received in good form (as described below under “How to Purchase Shares”) by U.S. Bancorp Fund Services, LLC, the Fund’s transfer agent (“Transfer Agent”), or a Financial Intermediary by 4:00 p.m., Eastern time will be processed at that day’s NAV plus any applicable sales charges. Transaction orders received after 4:00 p.m., Eastern time will receive the applicable price determined on the next business day. A Fund’s NAV, however, may be calculated earlier if trading on the NYSE is restricted or as permitted by the SEC. The Funds do not determine the NAV of their shares on any day when the NYSE is not open for trading, such as weekends and certain national holidays as disclosed in the SAI (even if there is sufficient trading in its portfolio securities on such days to materially affect the NAV per share). Fair value determinations may be made as described below under procedures as adopted by the Board.

Fair Value Pricing. Occasionally, reliable market quotations are not readily available or there may be events affecting the value of foreign securities or other securities held by the Funds that occur when regular trading on foreign or other exchanges is closed, but before trading on the NYSE is closed. Fair value determinations are then made in good faith in accordance with procedures adopted by the Board. Generally, the fair value of a portfolio security or other asset shall be the amount that the owner of the security or asset might reasonably expect to receive upon its current sale.

Attempts to determine the fair value of securities introduce an element of subjectivity to the pricing of securities. As a result, the price of a security determined through fair valuation techniques may differ from the price quoted or published by other sources and may not accurately reflect the market value of the security when trading resumes. If a reliable market quotation becomes available for a security formerly valued through fair valuation techniques, a Fund would compare the new market quotation to the fair value price to evaluate the effectiveness of its fair valuation determination. If any significant discrepancies are found, a Fund may adjust its fair valuation procedures.

How to Purchase Shares

You may open a Fund account with a minimum initial investment as listed in the table below.

| Minimum Investment | To Open Your Account | To Add to Your Account |

| Regular Accounts | $2,500 | $100 |

| Individual Retirement Accounts (“IRAs”) | $1,000 | $100 |

| Asset or fee-based accounts managed by your financial advisor | None | None |

| Eligible employee benefit plans, SEP, and SIMPLE IRA plans | None | None |

You may purchase shares of the Funds by completing an Account Application. Your order will not be accepted until the completed Account Application is received by the Funds or the Transfer Agent. Account Applications will not be accepted unless they are accompanied by payment in U.S. dollars, drawn on a U.S. financial institution. The Funds will not accept payment in cash, money orders or cashier’s checks unless the cashier’s checks are in excess of $10,000. In addition, to prevent check fraud, the Funds will not accept third party checks, Treasury checks, credit card checks, traveler’s checks or starter checks for the purchase of shares. The Funds are unable to accept post dated checks, post dated on-line bill pay checks or any conditional order or payment. If any payment is returned for any reason, a service fee of $25 will be deducted from a shareholder’s account. You will also be responsible for any losses suffered by the Funds as a result. The Funds do not issue share certificates. The Funds reserve the right to reject any purchase orders if, in their opinion, it is in a Fund’s best interest to do so. This minimum can be changed or waived by the Funds at any time. Shareholders will be given at least a 30-day notice of any increase in the minimum dollar amount of initial or subsequent investments.

If the Funds do not have a reasonable belief of the identity of a shareholder, the Account Application will be rejected or you will not be allowed to perform a transaction on the account until such information is received. The Funds may also reserve the right to close the account within five business days if clarifying information/documentation is not received.

Shares of the Funds have not been registered for sale outside of the U.S and its territories. The Funds generally do not sell shares to investors residing outside the U.S., even if they are U.S. citizens or lawful permanent residents, except to investors with U.S. military APO or FPO addresses.

PATRIOT Act. The USA PATRIOT Act of 2001 requires financial institutions, including the Funds, to adopt certain policies and programs to prevent money laundering activities, including procedures to verify the identity of customers opening new accounts. When completing a new Account Application, you will be required to supply your full name, date of birth, social security number and permanent street address to assist in verifying your identity. Mailing addresses containing only a P.O. Box will not be accepted. Until such verification is made, the Funds may temporarily limit transactions or close an account if it is unable to verify a shareholder’s identity. As required by law, the Funds may employ various procedures, such as comparing the information to fraud databases or requesting additional information or documentation from you, to ensure that the information supplied by you is correct.

Purchase by Mail. To purchase a Fund’s shares by mail, simply complete and sign the enclosed Account Application and mail it, along with a check made payable to “Stephens Funds,” to:

Regular Mail Stephens Funds c/o U.S. Bancorp Fund Services, LLC P.O. Box 701 Milwaukee, WI 53201-0701 | Overnight or Express Mail Stephens Funds c/o U.S. Bancorp Fund Services, LLC 615 East Michigan Street, 3rd Floor Milwaukee, WI 53202 |

The Funds do not consider the U.S. Postal Service or other independent delivery services to be their agents. Therefore, deposit in the mail or with such services, or receipt at the Transfer Agent’s post office box of purchase orders or redemption requests, does not constitute receipt by the Transfer Agent.

Investing by Telephone. If you have completed the “Telephone Purchase Authorization” section of the Account Application, you may purchase additional shares by telephoning the Funds toll free at (866) 735-7464. Telephone orders will be accepted via electronic funds transfer from your pre-designated bank account through the Automated Clearing House (“ACH”) network. You must have banking information established on your account prior to making a purchase by telephone. Only bank accounts held at domestic institutions that are ACH members may be used for telephone transactions. If your order is received prior to 4:00 p.m., Eastern time, shares will be purchased at the NAV plus applicable sales charge next calculated. For security reasons, requests by telephone may be recorded. During periods of high market activity, you may encounter higher than usual wait times. Please allow sufficient time to ensure that you will be able to complete your telephone transaction prior to market close. If you are unable to contact the Fund by telephone, you may make your purchase request in writing. Once a telephone transaction has been placed, it cannot be cancelled or modified.

Purchase by Wire. Initial Investment. If you are making your first investment in the Funds, before you wire funds, please contact the Funds by phone to make arrangements with a customer service representative to submit your completed Account Application via mail, overnight delivery, or facsimile. Upon receipt of your completed Account Application, your account will be established and a service representative will contact you within 24 hours to provide you with an account number and wiring instructions.

Once your account has been established, you may instruct your bank to send the wire using the instructions you were given. Prior to sending the wire, please call the Transfer Agent at (866) 735-7464 to advise them of the wire, and to ensure proper credit upon receipt. Your bank must include the name of the Fund, your name and account number so that monies can be correctly applied.

Subsequent Investments. If you are making a subsequent purchase, your bank should wire funds as indicated below. Before each wire purchase, please contact the Funds to advise of your intent to wire funds. This will ensure prompt and accurate credit upon receipt of your wire. It is essential that your bank include the name of the Fund and your account number in all wire instructions. If you have questions about how to invest by wire, you may call the Funds. Your bank may charge you a fee for sending a wire to a Fund.

Your bank should transmit immediately available funds by wire to:

| Wire to: | U.S. Bank, N.A. |

| ABA Number: | 075000022 |

| Credit: | U.S. Bancorp Fund Services, LLC |

| Account: | 112-952-137 |

| Further Credit: | Stephens Funds |

| | (Shareholder Name/Account Registration) |

| | (Shareholder Account Number) |

Wired funds must be received prior to 4:00 p.m., Eastern time, to be eligible for same day pricing. Neither the Funds nor U.S. Bank, N.A., the Funds’ custodian, are responsible for the consequences of delays resulting from the banking or Federal Reserve wire system or from incomplete wiring instructions. If you have questions about how to invest by wire, you may call the Fund.

Through a Financial Intermediary. You may buy and sell shares of the Funds through Financial Intermediaries. Your order will be priced at the Fund’s NAV plus any applicable sales charge, next computed after it is received by a Financial Intermediary. A Financial Intermediary may hold your shares in an omnibus account in the Financial Intermediary’s name and the Financial Intermediary may maintain your individual ownership records. The Funds may pay the Financial Intermediary for maintaining

individual ownership records as well as providing other shareholder services. Financial Intermediaries may charge fees for the services they provide to you in connection with processing your transaction order or maintaining your account with them. Financial Intermediaries are responsible for placing your order correctly and promptly with the Funds, forwarding payment promptly, as well as ensuring that you receive copies of the Funds’ Prospectus. If you transmit your order with a Financial Intermediary before the close of regular trading (generally 4:00 p.m., Eastern time) on a day that the NYSE is open for business, your order will be priced at the Fund’s NAV plus any applicable sales charge, next computed after it is received by the Financial Intermediary. Investors should check with their Financial Intermediary to determine if it is subject to these arrangements.

Automatic Investment Plan. For your convenience, the Funds offer an Automatic Investment Plan (“AIP”). Under the AIP, after you make your initial investment, you may authorize a Fund to withdraw automatically from your personal checking or savings account an amount that you wish to invest, which must be at least $100 on a monthly or quarterly basis. If you wish to enroll in the AIP, complete the “Automatic Investment Plan” section in the Account Application or call the Transfer Agent at (866) 735-7464. In order to participate in the AIP, your bank or financial institution must be a member of the ACH network. The Funds may terminate or modify this privilege at any time. You may terminate your participation in the AIP at any time by notifying the Transfer Agent at least five days prior to the effective date. A fee ($25) will be charged if your bank does not honor the AIP draft for any reason.

The AIP is a method of using dollar cost averaging as an investment strategy that involves investing a fixed amount of money at regular time intervals. However, a program of regular investment cannot ensure a profit or protect against a loss as a result of declining markets. By continually investing the same amount, you will be purchasing more shares when the price is low and fewer shares when the price is high. Please call (866) 735-7464 for additional information regarding the Funds’ AIP.

How to Redeem Shares

In general, orders to sell or “redeem” shares may be placed either directly with the Funds, the Transfer Agent or with your Financial Intermediary. You may redeem part or all of a Fund’s shares at the next determined NAV after a Fund receives your order. You should request your redemption prior to the close of the NYSE, generally 4:00 p.m., Eastern time, to obtain that day’s closing NAV. Redemption requests received after the close of the NYSE will be treated as though received on the next business day.

By Mail. You may redeem Fund shares by simply sending a written request to the Fund. Please provide the name of the Fund, account number and state the number of shares or dollar amount you would like redeemed. The letter should be signed by all shareholders whose names appear on the account registration. Redemption requests will not become effective until all documents have been received in good form by the Fund. Additional documents are required for certain types of shareholders, such as corporations, partnerships, executors, trustees, administrators, or guardians (i.e., corporate resolutions, or trust documents indicating proper authorization). Shareholders should contact the Fund for further information concerning documentation required for redemption of Fund shares.

Shareholders who have an IRA or other retirement plan must indicate on their redemption request whether or not to withhold federal income tax. Redemption requests failing to indicate an election not to have tax withheld will generally be subject to a 10% withholding tax.

Redemption requests in writing should be sent to:

Regular Mail Stephens Funds c/o U.S. Bancorp Fund Services, LLC P.O. Box 701 Milwaukee, WI 53201-0701 | Overnight or Express Mail Stephens Funds c/o U.S. Bancorp Fund Services, LLC 615 East Michigan Street, 3rd Floor Milwaukee, WI 53202 |

The Funds do not consider the U.S. Postal Service or other independent delivery services to be their agents. Therefore, deposit in the mail or with such services, or receipt at the Transfer Agent’s post office box of purchase orders or redemption requests, does not constitute receipt by the Transfer Agent.

Telephone or Wire Redemption. You may redeem Fund shares by telephone by completing the “Redemption by Telephone” portion of the Account Application. You may also request telephone redemption privileges after your account is opened by calling the Funds at (866) 735-7464. A signature guarantee, a signature verification from a Signature Validation Program member, or another acceptable form of authentication from a financial institution source may be required of shareholders in order to qualify for or to change telephone redemption privileges on an existing account. If you have a retirement account, you may not redeem shares by telephone. During periods of high market activity, you may encounter higher than usual wait times. Please allow sufficient time to ensure that you will be able to complete your telephone transaction prior to market close. If you are unable to contact the Funds by telephone, you may also mail the requests to the Funds at the address listed under “How to Purchase Shares.” Once a telephone transaction has been placed, it cannot be canceled or modified.

You may redeem up to $100,000 in shares by calling the Funds at (866) 735-7464 prior to the close of trading on the NYSE, generally 4:00 p.m., Eastern time. Redemption proceeds will be sent on the next business day to the mailing address that appears on the Fund’s records. Per your request, redemption proceeds may be wired or may be sent by electronic funds transfer via the ACH network to your pre-designated bank account. The minimum amount that may be wired is $2,500. You will not incur any charge when proceeds are sent via the ACH network; however, most ACH transfers require two days for the bank account to receive credit. Telephone redemptions cannot be made if you notify the Transfer Agent of a change of address within 15 days before the redemption request.

Prior to executing instructions received to redeem shares by telephone, the Funds will use reasonable procedures to confirm that the telephone instructions are genuine. The telephone call may be recorded and the caller may be asked to verify certain personal identification information. If the Funds or their agents follow these procedures, they cannot be held liable for any loss, expense, or cost arising out of any telephone redemption request that is reasonably believed to be genuine. This includes any fraudulent or unauthorized request. The Funds may change, modify or terminate these privileges at any time upon at least a 60-day notice to shareholders.

Through a Financial Intermediary. You may redeem Fund shares through your Financial Intermediary. Redemptions made through a Financial Intermediary may be subject to procedures established by that institution. Your Financial Intermediary is responsible for sending your order to the Fund and for crediting your account with the proceeds. For redemption through Financial Intermediaries, orders will be processed at the NAV per share next effective after receipt of the order by the Fund or Financial Intermediary. Please keep in mind that your Financial Intermediary may charge additional fees for its services. Investors should check with their Financial Intermediary to determine if it is subject to these arrangements.

Systematic Withdrawal Program. The Funds offer a Systematic Withdrawal Program (“SWP”) whereby shareholders or their representatives may request a redemption in a predetermined amount each month or calendar quarter. Proceeds can be sent via check to the address on the account or proceeds can be sent by electronic funds transfer via the ACH network to a designated bank account. To start this program, your account must have Fund shares with a value of at least $2,500, and the minimum amount that may be withdrawn each month or quarter is $50. This program may be terminated or modified by a shareholder or a Fund at any time without charge or penalty.

A withdrawal under the SWP involves a redemption of Fund shares, and may result in a gain or loss for federal income tax purposes. In addition, if the amount withdrawn exceeds the dividends credited to your account, the account ultimately may be depleted. To establish the SWP, complete the SWP section of the Account Application. Please call (866) 735-7464 for additional information regarding the SWP.

Account and Transaction Policies

Before selling recently purchased shares, please note that if the Transfer Agent has not yet collected payment for the shares you are selling, it may delay sending the proceeds until the payment is collected, which may take up to 15 days from the purchase date.

Low Balance Accounts. The Funds reserve the right to redeem the shares of any shareholder whose account balance is less than $1,000, other than as a result of market fluctuations. If you do not bring your total account balance up to $1,000 within 30 days, the Fund may sell your shares and send you the proceeds. The Funds will provide shareholders with written notice 30 days prior to redeeming the shareholder’s account.

Redemption In-Kind. The Funds generally pay sale (redemption) proceeds in cash. However, under unusual conditions that make the payment of cash unwise (and for the protection of the Fund’s remaining shareholders), a Fund might pay all or part of a shareholder’s redemption proceeds in liquid securities with a market value equal to the redemption price (redemption in-kind).

Specifically, if the amount you are redeeming is in excess of the lesser of $250,000 or 1% of the Fund’s NAV, the Fund has the right to redeem your shares by giving you the amount that exceeds $250,000 or 1% of the Fund’s NAV in securities instead of cash. If a Fund pays your redemption proceeds by a distribution of securities, you could incur brokerage or other charges in converting the securities to cash, and will bear any market risks associated with such securities until they are converted into cash.

Signature Guarantees. A signature guarantee may be required for certain redemption requests. A signature guarantee assures that your signature is genuine and protects you from unauthorized account redemptions.

A signature guarantee of each owner is required in the following situations:

| ● | If ownership is being changed on your account; |

| ● | When redemption proceeds are payable or sent to any person, address or bank account not on record; |

| ● | If a change of address request has been received by the Transfer Agent within the last 15 days; and |

| ● | For all redemptions of $100,000 or more from any shareholder account. |

Non financial transactions including establishing or modifying certain services on an account may require a signature verification from a Signature Validation Program member or other acceptable form of authentication from a financial institution source.

In addition to the situations described above, the Funds and/or the Transfer Agent reserves the right to require a signature guarantee in other instances based on the circumstances relative to the particular situation. Signature guarantees will generally be accepted from domestic banks, brokers, dealers, credit unions, national securities exchanges, registered securities associations, clearing agencies and savings associations, as well as from participants in the New York Stock Exchange Medallion Signature Program and the Securities Transfer Agents Medallion Program (“STAMP”). A notary public is not an acceptable signature guarantor.

Householding. In an effort to decrease costs, the Funds intend to reduce the number of duplicate prospectuses and Annual and Semi-Annual Reports you receive by sending only one copy of each to those addresses shared by two or more accounts and to shareholders the Transfer Agent reasonably believes are from the same family or household. Once implemented, if you would like to discontinue householding for your accounts, please call toll-free at (866) 735-7464 to request individual copies of these documents. Once the Transfer Agent receives notice to stop householding, the Transfer Agent will begin sending individual copies thirty days after receiving your request. This policy does not apply to account statements.

Unclaimed Property. Your mutual fund account may be transferred to your state of residence if no activity occurs within your account during the “inactivity period” specified in your State’s abandoned property laws.

Exchanging Shares