| | |

| | A no-load mutual fund family of domestic funds |

| | |

| | |

| | PROSPECTUS |

| | October 31, 2011 |

| | |

| | |

| | www.bridgeway.com |

| | |

| | Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense. |

This prospectus presents concise information about the Large-Cap Value Fund, a series of the Bridgeway Funds, Inc., that you should know before investing. Please keep it for future reference. Text in shaded boxes is intended to help you understand or interpret other information presented nearby.

| | Fund Summary | [ ] |

| | Additional Fund Information | [ ] |

| | Management of the Fund | [ ] |

| | Shareholder Information | [ ] |

| | Financial Highlights | [ ] |

| | Privacy Policy | [ ] |

Investment Objective: The Large-Cap Value Fund (the “Fund”) seeks to provide long-term total return on capital, primarily through capital appreciation and some income.

Fees and Expenses of the Fund:

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

| | Shareholder Fees (paid directly from your investment) | |

| | Sales Charge (Load) Imposed on Purchases | None |

| | Sales Charge (Load) Imposed on Reinvested Dividends | None |

| | Redemption Fees | None |

| | Exchange Fees | None |

| | | |

| | Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |

| | Management Fees | 0.54% |

| | Distribution and/or Service (12b-1) Fees | None |

| | Acquired Fund Fees and Expenses | 0.00% |

| | Other Expenses | 0.63% |

| | Total Annual Fund Operating Expenses | 1.17% |

| | Fee Waiver and/or Expense Reimbursement1 | (0.33%) |

| | Total Annual Fund Operating Expenses (After Fee Waiver/Expense Reimbursement) | 0.84% |

1 Bridgeway Capital Management, Inc. (the “Adviser”), the investment adviser to the Fund, pursuant to its Management Agreement with Bridgeway Funds, Inc. (“Bridgeway Funds”), is contractually obligated to waive fees and/or pay Fund expenses, if necessary, to ensure that net expenses do not exceed 0.84%. Any material change to this Fund policy would require a vote by shareholders.

Example:

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years |

| $86 | $268 | $466 | $1,037 |

Portfolio Turnover:

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 43% of the average value of its portfolio.

Principal Investment Strategies:

The Fund invests in a diversified portfolio of large stocks that are listed on the New York Stock Exchange, the American Stock Exchange, and NASDAQ. Under normal circumstances, at least 80% of Fund net assets (plus borrowings for investment purposes) are invested in stocks from among those in the large-cap value category at the time of purchase. The Adviser selects stocks within the large-cap value category for the Fund using a proprietary statistically driven approach. Value stocks are those the Adviser believes are priced cheaply relative to some financial measures of worth, such as the ratio of price to earnings, price to sales, or price to cash flow.

While the Fund is actively managed for long-term total return, the Adviser seeks to minimize capital gains distributions as part of a tax management strategy. The successful application of this method is intended to result in a more tax-efficient fund than would otherwise be the case.

The Fund’s long-term investment outlook and its focus on lower turnover and lower operating and trading expenses may impact the speed and frequency in which investment ideas are acted upon compared to the most actively managed Bridgeway Funds.

Principal Risks:

Shareholders of the Fund are exposed to significant stock market risk (volatility) and could lose money.

While large-cap stocks have historically exhibited less volatility than small stocks over longer time horizons, the Fund is subject to the risk that large-cap value stocks will underperform other kinds of investments for a period of time.

In addition, large-cap stocks have tended to recover more slowly than small-cap stocks from a market downturn. Consequently, the Fund may expose shareholders to higher inflation risk (the risk that the Fund’s value will not keep up with inflation) than some other stock market segments.

Value investing carries the risk that the market will not recognize a security’s book value for a long time or that a stock judged to be undervalued may actually be appropriately priced. In addition, value stocks as a group may be out of favor at times and underperform the overall equity market for long periods while the market concentrates on other types of stocks, such as “growth” stocks.

If the Fund experiences extensive redemptions, the Adviser might need to sell some stocks, which could create capital gains. There can be no guarantee that the Fund may not someday distribute substantial capital gains, although the Adviser strongly intends to avoid them.

Performance:

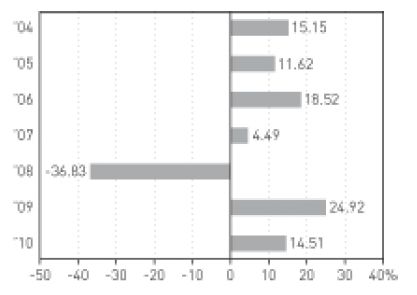

The bar chart and table below provide an indication of the risk of investing in the Fund. The bar chart shows how the Fund’s performance has varied on a calendar year basis. The table shows how the Fund’s average annual returns for various periods compare with those of a broad measure of market performance. In addition, the Fund’s performance is compared to the Lipper Large-Cap Value Index, an index of large-company, value-oriented funds. This information is based on past performance. Past performance (before and after taxes) does not guarantee future results. Updated performance information is available on the Fund’s website at www.bridgeway.com or by calling 800-661-3550.

Return from 1/1/11 through 9/30/11 was -9.16%.

| | Quarter | Total Return |

| Best Quarter: | Q3 09 | 17.15% |

| Worst Quarter: | Q4 08 | -18.26% |

Average Annual Total Returns

(For the periods ended 12/31/10)

| | 1 Year | 5 Years | Since Inception 10/31/03 |

| Return Before Taxes | 14.51% | 2.27% | 6.26% |

Return After Taxes on Distributions1 | 14.20% | 1.89% | 5.88% |

Return After Taxes on Distributions and Sale of Fund Shares1 | 9.79% | 1.89% | 5.35% |

Russell 1000® Value Index (reflects no deductions for fees, expenses or taxes) | 15.51% | 1.28% | 5.11% |

Lipper Large-Cap Value Index (reflects no deductions for fees, expenses or taxes) | 13.02% | 1.52% | 4.58% |

1 After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. Return After Taxes on Distributions and Sale of Fund Shares may be higher than other returns for the same period due to a tax benefit of realizing a capital loss upon the sale of Fund shares. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement plans.

Management of the Fund

Investment Adviser: Bridgeway Capital Management, Inc.

Portfolio Manager(s):

The Fund is team managed by the Adviser’s investment management team.

| Name | Title | Length of Service |

| John Montgomery | Investment management team leader | Since Fund inception |

| Elena Khoziaeva | Investment management team member | Since 2005 |

| Michael Whipple | Investment management team member | Since 2005 |

| Rasool Shaik | Investment management team member | Since 2007 |

Purchase and Sale of Fund Shares

| To open and maintain an account* | | $2,000 |

| Additional purchases* | | $50 by systematic purchase plan $100 by check, exchange, wire, or electronic bank transfer (other than systematic purchase plan) |

| *some retirement plans may have lower minimum initial investments. |

In general, you can buy or sell (redeem) shares of the Fund by mail, wire or telephone on any business day.

Tax Information

The Fund intends to make distributions that may be taxed to you as ordinary income, capital gains or some combination of both, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or individual retirement account. Withdrawals from such tax-deferred arrangements may be taxed at a later date.

Financial Intermediary Compensation

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for providing shareholder services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary to recommend the Fund over another investment. Ask your broker/dealer or other intermediary or visit your financial intermediary’s website for more information.

| Additional Fund Information | |

The Fund:

Bridgeway Funds, Inc. is a no-load diversified mutual fund family. Each Fund has its own investment objective, strategy, and risk profile. This prospectus applies only to one of the series of Bridgeway Funds, the Large-Cap Value Fund.

Suitability:

The Fund contained in this prospectus:

| | ● | is designed for investors with long-term goals in mind. |

| | | strongly discourages short-term trading of shares. |

| | | offers you the opportunity to participate in financial markets through funds professionally managed by the Adviser. |

| | | offers you the opportunity to diversify your investments. |

| | | carries certain risks, including the risk that you can lose money if fund shares, when redeemed, are worth less than the purchase price. |

| | | is not a bank deposit and is not guaranteed or insured. |

Investment Objective:

The Fund seeks to provide long-term total return on capital, primarily through capital appreciation and some income. The Fund’s investment objective may be changed by the Board of Directors of Bridgeway Funds, Inc. without shareholder approval. The Fund will notify shareholders at least 60 days prior to any change in its investment objective.

Principal Investment Strategies:

The Fund invests in a diversified portfolio of large stocks that are listed on the New York Stock Exchange, the American Stock Exchange, and NASDAQ. Under normal circumstances, at least 80% of Fund net assets (plus borrowings for investment purposes) are invested in stocks from among those in the large-cap value category at the time of purchase. For purposes of the Fund’s investments, “large-cap stocks” are those whose market capitalization (stock market worth) falls within the range of the Russell 1000® Index, an unmanaged, market value weighted index, which measures performance of approximately 1,000 of the largest companies in the market with dividends reinvested. The Russell 1000® Index is reconstituted from time to time. The market capitalization range for the Russell 1000® Index was $1.4 billion to $401 billion as of June 30, 2011. Value stocks are those the Adviser believes are priced cheaply relative to some financial measures of worth, such as the ratio of price to earnings, price to sales, or price to cash flow. Generally, these are stocks represented in the Russell 1000® Value Index, plus large stocks with similar “value” characteristics. The Russell 1000® Value Index includes those Russell 1000® companies with lower price-to-book ratios and lower forecasted growth values. The Adviser selects stocks within the large-cap value category for the Fund using a proprietary statistically driven approach. The Adviser will not necessarily sell a stock if it “migrates” to a different category after purchase. As a result, due to such “migration” or other market movements, the Fund may have less than 80% of its assets in large-cap stocks at any point in time.

While the Fund is actively managed for long-term total return, the Adviser seeks to minimize capital gains distributions as part of a tax management strategy. For example, the Adviser tracks tax lots and periodically harvests tax losses to offset capital gains from stock sales or mergers. (A capital gain occurs when the Fund sells a stock at a higher price than the purchase price; a capital loss occurs when the Fund sells a stock at a lower price than the purchase price.) The successful application of this method is intended to result in a more tax-efficient fund than would otherwise be the case.

Excluding turnover related to tax management, the Fund should normally have lower turnover and be more stable in composition than some of Bridgeway Funds’ most actively managed equity funds (Aggressive Investors 1 Fund, Aggressive Investors 2 Fund, Micro-Cap Limited Fund and Ultra-Small Company Fund). The Fund’s long-term investment outlook and its focus on lower turnover and lower operating and trading expenses may impact the speed and frequency in which investment ideas are acted upon compared to the most actively managed Bridgeway Funds.

The income objective of the Fund, which is a secondary objective, is achieved almost exclusively from dividends paid by Fund stocks. However, not all Fund stocks pay dividends.

The Fund will notify shareholders at least 60 days prior to any change in its policy of investing at least 80% of its assets in the types of securities described above.

Who Should Invest: The Adviser believes that the Fund is more appropriate as a long-term investment (at least 5 years, but ideally 10 years or more) for investors who want exposure to large, value-oriented stocks in an actively-managed fund while incurring low costs and minimizing taxable capital gains income. It is not an appropriate investment for short-

| Additional Fund Information | |

term investors, those trying to time the market, or those who would panic during a major market or Fund correction.

Principal Risks:

There is no guarantee that the Fund will meet its investment objectives. The following relates to the principal risks of investing in the Fund, as identified in the “Fund Summary” section of this prospectus. The Fund may invest in or use other types of investments or strategies not shown below that do not represent principal investment strategies or raise principal risks. More information about these non-principal investments, strategies and risks is available in the Fund’s Statement of Additional Information (“SAI”).

Capital Gains Risk: If the Fund experiences extensive redemptions, the Adviser might need to sell some stocks, which could create capital gains. There can be no guarantee that the Fund may not someday distribute substantial capital gains, although the Adviser strongly intends to avoid them.

Inflation Risk: Large-cap stocks have tended to recover more slowly than small-cap stocks from a market downturn. Consequently, the Fund may expose shareholders to higher inflation risk (the risk that the Fund value will not keep up with inflation) than some other stock market segments.

Market Risk: The Fund could lose value if the individual securities in which it has invested and/or the overall stock markets on which the stocks trade decline in price. Stocks and stock markets may experience short-term volatility (price fluctuation) as well as extended periods of price decline or little growth. Individual stocks are affected by many factors, including:

| | | market trends, including investor demand for a particular type of stock, such as growth or value stocks, small-or large-cap stocks, or stocks within a particular industry. |

Stock markets are affected by numerous factors, including interest rates, the outlook for corporate profits, the health of the national and world economies, national and world social and political events, and the fluctuation of other stock markets around the world.

Value Risk: Over time, a value investing style may go in and out of favor, causing the Fund to sometimes underperform other equity funds that use different investing styles. Value stocks can react differently to issuer, political, market and economic developments than the market overall and other types of stock. In addition, the Fund’s value approach carries the risk that the market will not recognize a security’s intrinsic or book value for a long time or that a stock judged to be undervalued may actually be appropriately priced. Based on historical data, such periods of underperformance may last three to five years or more.

Strategy Risk: The Fund utilizes its own distinct investment strategy. Investment strategies tend to shift in and out of favor depending upon market and economic conditions as well as investor sentiment. As such, there may be periods when the type of stocks that the Fund invests in are out of favor, and the Fund’s performance may suffer.

Temporary Investments:

The Fund generally will be fully invested in accordance with its objective and strategies. However, the Fund may invest without limit in cash or money market cash equivalents pending investment of cash balances or in anticipation of possible redemptions. The use of temporary investments therefore is not a principal strategy as it prevents the Fund from fully pursuing its investment objective, and the Fund may miss potential market upswings.

| Additional Fund Information | |

Commodity Exchange Act Exclusion:

The Fund has claimed an exclusion from the definition of the term “commodity pool operator” under the Commodity Exchange Act (“CEA”) and, therefore, is not subject to registration or regulation as a commodity pool operator under the CEA.

Selective Disclosure of Portfolio Holdings:

A description of the Bridgeway Funds’ policies and procedures regarding the release of portfolio holdings information is available in the SAI.

The Board of Directors of Bridgeway Funds oversees the Fund’s management, decides on matters of general policy and reviews the activities of the Fund’s Adviser. Bridgeway Capital Management, Inc., 20 Greenway Plaza, Suite 450, Houston, Texas 77046, acts as the investment adviser (the “Adviser”) to the Fund pursuant to a Management Agreement approved by the Board of Directors. A discussion regarding the basis for the Board of Directors approving the Management Agreement for the Fund is available in the Fund’s annual report to shareholders for the fiscal year ended June 30, 2011.

The Adviser is responsible for the investment and reinvestment of the Fund’s assets and provides personnel and certain administrative services for operation of the Fund’s daily business affairs. It formulates and implements a continuous investment program for the Fund consistent with its investment objective, policies and restrictions. The Fund has a management fee that is comprised of a base fee which is applied to average annual net assets, and a performance fee adjustment, which depends on performance relative to a market index over the last 5 years, and is applied to average net assets over this performance period. As a result, management fees expressed as a percentage of net assets are a function of both current and historic average net assets.

Performance-based management fees range from 0.45% to 0.55%. This range assumes current assets equal average assets over the performance period. However, the performance-based fee adjustments are calculated based on the Fund’s average daily net assets over the most recent five-year period ending on the last day of the quarter. If stated in terms of current year net assets (as in the financial highlights table) the effective performance fee rate can be less than or higher than this fee range. The Adviser seeks to protect shareholders from much higher than expected management fees that could result from this formula by contractually agreeing to expense limitations on the Fund.

For the fiscal year ended June 30, 2011, the Adviser received an investment management fee (as a percentage of the average daily net assets of the Fund), after taking into account any applicable management fee waivers and performance fee adjustments, of 0.21%.

The Adviser, pursuant to its Management Agreement with the Fund, is contractually obligated to waive fees and/or pay Fund expenses, if necessary, to ensure that net expenses do not exceed a fiscal year expense ratio of 0.84% for the Fund (the “Expense Cap”). Any material change to the Expense Cap would require a vote by shareholders of the Fund.

Please see the SAI for more detail on the management fee calculation.

Who Manages the Bridgeway Funds?

Bridgeway Capital Management is the Adviser for all Bridgeway Funds. The Adviser is responsible for all investment decisions subject to the investment strategies, objectives and restrictions applicable to each Fund. Some Funds are actively managed (such as the Fund) and some are more passively managed and seek to track distinct asset classes.

How Are the Actively Managed Funds Managed?

| The Adviser uses multiple statistical models to make investment decisions. For the actively managed Funds, these models were originally developed by the Adviser and are maintained by the Investment Management Team. Although the models are proprietary, some information may be shared for the investor’s understanding: |

The Adviser uses multiple, multi-factor models to manage the Funds. The Adviser looks at stocks from a variety of different perspectives using different models seeking to “dampen” some of the volatility inherent in each model and style. A confluence of favorable factors within a single model results in a stock being included as a model “buy.” |

The Adviser is extremely disciplined in following the models. The Adviser resists overriding the models with qualitative or subjective data. The Adviser relies heavily on statistics and the discipline of the process. |

The Adviser does not talk to company management or Wall Street analysts for investment ideas. Examples of model inputs include timely, publicly available financial and technical data from objective sources, thus avoiding the emotions or biases of third parties. |

The Adviser never times the market or incorporates macro-economic prognostication. |

The Adviser seeks to avoid bad data. The Adviser seeks to “tip the scales” in the Funds’ favor by seeking to verify, where possible and within time constraints, the quality of data input to the models. |

| Who is the Investment Management Team? |

Investment decisions for the Fund are based on statistical models run by the Investment Management Team. These models can apply to multiple funds. Therefore, the Investment Management Team is organized across two dimensions—

models and funds. First, each team member is trained on a set of statistical models, and each model has a primary and secondary “practitioner.” Second, each team member is assigned one or more funds for which he or she is responsible for such things as cash flow management, tax management, and risk management. Procedures are documented to the degree that, theoretically, any one of the team members could manage a given model or fund. Roles and responsibilities rotate across models and funds to build team depth and skills. Modeling research is designed, presented, and scrutinized at the team level.

Collectively, the following individuals are jointly and primarily responsible for the day-to-day management of the Fund’s portfolio:

John Montgomery is the investment management team leader and lead portfolio manager for the Fund and has held that position since the Fund’s inception. John founded the Adviser in 1993. He holds a BA in Engineering and Philosophy from Swarthmore College and graduate degrees from MIT and Harvard Business School.

Elena Khoziaeva, CFA, is an investment management team member and began working at the Adviser in 1998. Her responsibilities include portfolio management, investment research, and statistical modeling. Elena earned a Bachelor of Economic Sciences degree from Belarussian State Economic University in Minsk and graduated with highest honors from the University of Houston with an MBA in accounting.

Michael Whipple, CFA, is an investment management team member and began working at the Adviser in 2002. His responsibilities include portfolio management, investment research, and statistical modeling. He holds a BS in Accountancy and Finance from Miami University in Ohio. A Certified Public Accountant and Certified Internal Auditor, Michael worked in auditing from 1993 to 2000 before attending the University of Chicago Booth School of Business from 2000 to 2002, where he earned his MBA.

Rasool Shaik, CFA, is an investment management team member and began working for the Adviser in 2006 after earning an MBA with Honors from the University of Chicago Booth School of Business, which he attended from 2004 to 2006. His responsibilities include portfolio management, investment research, and statistical modeling. He holds a BS in Engineering from Indian Institute of Technology (IIT) Bombay, India and an MS in Engineering from Michigan Technological University, Houghton, Michigan. Prior to business school, from 1997 to 2004, Rasool developed software algorithms to manage complex supply chains.

Additional Information About Investment Management Team Members

The SAI provides information about the actual compensation of Mr. Montgomery. The SAI also provides information about the compensation structure of the Investment Management Team Members, ownership in each Bridgeway Fund and other accounts managed by the Investment Management Team Members.

| Who is Bridgeway Capital Management? |

Bridgeway Capital Management, Inc., a Texas corporation, was incorporated in 1993. The Adviser offers competitively priced, expertly designed investment building blocks to selected institutions and advisors. Statistically driven and grounded in academic theory, the Adviser’s disciplined investment process reflects our passion for logic, data and evidence. Putting investors’ interests first at all times is a hallmark of the firm’s unique culture and core business values of integrity, performance, cost efficiency, and service. Committed to community impact, the Adviser donates 50% of its investment advisory fee profits to non-profit organizations.

Both the Fund and the Adviser are committed to a mission statement that places integrity above every other business value. Due to actual or perceived conflicts of interest, neither the Fund nor the Adviser:

| | ● | takes part in directed brokerage arrangements, |

| | | participates in any soft dollar arrangements, or |

| | | has a brokerage relationship with any affiliated organization. |

Pursuant to Rule 17j-1 of the Investment Company Act of 1940, as amended (the “Investment Company Act”), Bridgeway Funds and the Adviser have adopted a Code of Ethics that applies to the personal trading activities of their staff members.

Fund managers are encouraged to invest in shares of the Bridgeway Funds and are not allowed to purchase shares of equity securities that the Fund might also potentially own. Other staff, Officers, and Directors of Bridgeway Funds and the Adviser are also encouraged to own shares of the Bridgeway Funds and may only trade shares of equity securities within stringent guidelines contained in the Code of Ethics.

Copies of the Code of Ethics may be obtained from our website under Forms & Literature. Any shareholder or potential shareholder who feels that a policy, action, or investment of the Fund or the Adviser either does compromise or may compromise the highest standards of integrity is encouraged to contact Bridgeway Funds.

What’s the Big Deal About the Code of Ethics?

The Adviser takes ethical issues very seriously. The Adviser seeks to minimize conflicts of interest (when possible) and may, in some cases, completely avoid them. The Adviser is willing to walk away from certain revenue generating activities to reduce conflicts of interest between Bridgeway Funds and the Adviser. The Adviser takes steps to more closely align the interests of the Adviser with those of the Fund’s shareholders.

The net asset value (“NAV”) per share of the Fund is the value of the Fund’s investments plus other assets, less its liabilities, divided by the number of Fund shares outstanding. In determining the NAV, the Fund’s assets are valued primarily on the basis of market quotations. In cases of trading halts or in other circumstances when quotations are not readily available for a particular security, the fair value of the security will be determined based on procedures established by the Board of Directors. Specifically, if a market value is not available for a security, the security will be valued at fair value as determined in good faith by or under the direction of the Board of Directors. The valuation assigned to a fair valued security for purposes of calculating the Fund’s NAV may differ from the security’s most recent closing market price and from the prices used by other mutual funds to calculate their NAVs.

Because the Fund charges no sales loads, the price you pay for shares is the Fund’s NAV. The Fund is open for business every day the NYSE is open. Every buy or sell order you place in the proper form will be processed at the next NAV calculated after your order has been received. The NAV is calculated for the Fund at the end of regular trading on the NYSE on business days, usually 4:00 p.m. Eastern time. If the NYSE begins an after-hours trading session, the Board of Directors will set closing price procedures. Mutual fund marketplaces and members of the National Securities Clearing Corporation (“NSCC”) may have an earlier cut-off time for pricing a transaction. Foreign markets may be open on days when U.S. markets are closed; therefore, the value of foreign securities owned by a Fund could change on days when you cannot buy or sell Fund shares. The NAV of the Fund, however, will only change when it is calculated at the NYSE daily close.

| Rule 12b-1 and Shareholder Services Fees |

On October 15, 1996, the Fund’s shareholders approved a 12b-1 Plan that permitted the Adviser to pay up to 0.25% of the Fund’s average daily assets for sales and distribution of Bridgeway Funds shares. In this plan, the Adviser agreed to pay directly all distribution costs associated with Class N shares, which is currently the only class of shares outstanding. This plan has been re-approved each year by the Board of Directors, including a majority of those Directors who are not “interested persons” as defined in Section 2(a)(19) of the Investment Company Act.

On October 1, 2003, the Bridgeway Funds’ shareholders approved modification of the 12b-1 Plan to permit selected Bridgeway Funds to add additional classes of Fund shares with a maximum 0.25% 12b-1 fee. This fee is payable by shareholders who purchase Fund shares through distribution channels that charge distribution and account servicing fees versus “no or low cost” alternatives. Currently, there are no classes of Fund shares subject to this 12b-1 fee.

| Policy Regarding Excessive or Short-Term Trading of Fund Shares |

The Board of Directors of the Fund has adopted and implemented policies and procedures to detect, discourage and prevent short-term or frequent trading (often described as “market timing”) in the Fund.

The Fund is not designed for professional market timing organizations, individuals, or entities using programmed or frequent exchanges or trades. Frequent exchanges or trades may be disruptive to the management of the Fund and can raise its expenses. The Fund reserves the right to reject or restrict any specific purchase and exchange request with respect to market timers and reserves the right to determine, in their sole discretion, that an individual, group or entity is or has acted as a market timer.

Although there is no generally applied standard in the marketplace as to what level of trading activity is excessive, the Fund may consider the following activities to be excessive trading:

| | ● | The sale or exchange of shares within a short period of time after the shares were purchased; |

| | | A series of transactions indicative of an excessive trading pattern or strategy; or |

| | | The Fund reasonably believes that a shareholder or person has engaged in such practices in connection with other Bridgeway Funds. |

The Fund may be more or less affected by short-term trading in Fund shares, depending on various factors such as the size of the Fund, the amount of assets the Fund typically maintains in cash or cash equivalents, the dollar amount, number, and frequency of trades in Fund shares and other factors. Short-term and excessive trading of Fund shares may present various risks to the Fund, including:

| | | potential dilution in the value of Fund shares, |

| | | interference with the efficient management of the Fund’s portfolio, and |

| | | increased brokerage and other transaction costs. |

The Fund currently monitors trade activity to reduce the risk of market timing.

When a pattern of short-term or excessive trading activity or other trading activity deemed harmful or disruptive to the Fund by an investor is detected, the Adviser may prohibit that investor from future purchases in the Fund or limit or terminate the investor’s exchange privilege. The detection of these patterns and the banning of further trading are inherently subjective and therefore involve some selectivity in their application. The Adviser seeks to make such determinations in a manner consistent with the interests of the Fund’s long-term shareholders.

There is no assurance that these policies and procedures will be effective in limiting short-term and excessive trading in all cases. For example, the Adviser may not be able to effectively monitor, detect or limit short-term or excessive trading by underlying shareholders that occurs through omnibus accounts maintained by broker-dealers or other financial intermediaries (see discussion below).

Market timing through financial intermediaries. Shareholders are subject to the Fund’s policy prohibiting frequent trading or market timing regardless of whether they invest directly with the Fund or indirectly through a financial intermediary such as a broker-dealer, a bank, an investment adviser or an administrator or trustee of a 401(k) retirement plan that maintains an omnibus account with the Fund for trading on behalf of its customers. To the extent required by applicable regulation, the Fund (or an agent of the Fund) enters into agreements with financial intermediaries under which the intermediaries agree to provide information about Fund share transactions effected through the financial intermediary. While the Fund (or an agent of the Fund) monitors accounts of financial intermediaries and will encourage financial intermediaries to apply the Fund’s policy prohibiting frequent trading or market timing to their customers who invest indirectly in the Fund, the Fund is limited in its ability to monitor the trading activity, enforce the Fund’s policy prohibiting frequent trading or enforce any applicable redemption fee with respect to customers of financial intermediaries. Certain financial intermediaries may be limited with respect to their monitoring systems and/or their ability to provide sufficient information from which to detect patterns of frequent trading potentially harmful to the Fund. For example, should it occur, the Fund may not be able to detect frequent trading or market timing that may be facilitated by financial intermediaries or it may be more difficult to identify in the omnibus accounts used by those intermediaries for aggregated purchases, exchanges and redemptions on behalf of all its customers. In certain circumstances, financial intermediaries such as 401(k) plan providers may not have the technical capability to apply the Fund’s policy prohibiting frequent trading to its customers. Reasonable efforts will be made to identify the financial intermediary customer engaging in frequent trading. Transactions placed through the same financial intermediary that violate the policy prohibiting frequent trading may be deemed part of a group for purposes of the Fund’s policy and may be rejected in whole or in part by the Fund. However, there can be no assurance that the Fund will be able to identify all those who trade excessively or employ a market timing strategy, and curtail their trading in every instance. Finally, it is important to note that shareholders who invest through

omnibus accounts also may be subject to the policies and procedures of their financial intermediaries with respect to short-term and excessive trading in the Fund.

The Adviser, from its own resources, may make payments to financial service agents as compensation for access to platforms or programs that facilitate the sale or distribution of mutual fund shares, and for related services provided in connection with such platforms and programs. These payments would be in addition to any other payments described in this prospectus. The amount of the payment may be different for different agents. These additional payments may include amounts that are sometimes referred to as “revenue sharing” payments. These payments may create an incentive for the recipient to recommend or sell shares of the Fund to you. The Board of Directors of the Fund will monitor these revenue sharing arrangements as well as the payment of management fees paid by the Fund to ensure that the levels of such management fees do not involve the indirect use of the Fund’s assets to pay for marketing, promotional or related services. Because revenue sharing payments are paid by the Adviser, and not from the Fund’s assets, the amount of any revenue sharing payments is determined by the Adviser.

Please contact your financial intermediary for details about additional payments it may receive and any potential conflicts of interest. Notwithstanding the payments described above, the Adviser is prohibited from considering a broker-dealer’s sale of Fund shares in selecting such broker-dealer for the execution of Fund portfolio transactions, except as may be specifically permitted by law. Also notwithstanding these arrangements, the Adviser routinely declines to participate in the most expensive “no-transaction fee” arrangements and is therefore excluded from participation in some of the highest profile “pay to play” distribution arrangements.

You may purchase shares using one of the options described below. Purchase orders will not be processed unless the account application and purchase payment are received in good order. In accordance with the USA PATRIOT Act, if you fail to provide all of the required information requested in the current account application, your purchase order will not be processed. Additionally, federal law requires that the Fund verifies and records your identifying information. The minimum initial investment in the Fund is $2,000, the subsequent investment minimum is $100 and the systematic purchase plan minimum is $50. However, some retirement plans may have lower minimum initial investments.

Buying Shares. You can purchase shares directly from the Fund by either completing an application online at www.bridgeway.com or by completing and submitting an application, which can be obtained on our website, or by calling 800-661-3550. All investments must be made by check, ACH or wire. All checks must be made payable in U.S. dollars and drawn on U.S. financial institutions. The Fund does not accept purchases made by cash or cash equivalents (for example, money order, traveler’s check, starter check or credit card check).

Checks. Checks must be made payable to “Bridgeway Funds.”

Automated Clearing House (ACH). You may purchase additional shares through an electronic transfer of money from a checking or savings account. The ACH service will automatically debit your pre-designated bank account for the desired amount. There is a limit of $25,000 on ACH purchases.

Wires. Call to notify us of your incoming wire and request wiring instructions. Instruct your U.S. financial institution with whom you have an account to make a Federal Funds wire payment to the Fund. Your financial institution may charge a fee for this service.

Shareholders may purchase and redeem Fund shares through selected mutual fund marketplaces. Check with your marketplace for availability. Many Fund investors prefer investing with marketplaces for the range of investment alternatives and statement consolidation. Account minimums and other terms and conditions may apply. Check with each marketplace for a more complete list of fees that you may incur.

From Financial Service Organizations. You may purchase shares of the Fund through participating brokers, dealers, and other financial professionals. Simply call your investment professional to make your purchase. If you are a client of a securities broker or other financial organization, you should note that such organizations may charge a separate fee for administrative services in connection with investments in Fund shares and may impose account minimums and other requirements. These fees and requirements are in addition to those imposed by the Fund. If you are investing through a securities broker or other financial organization, please refer to its program materials for any additional special provisions or conditions that may be different from those described in this prospectus (for example, some or all of the services and privileges described may not be available to you).

| | | |

| Type of Account | | Requirement |

Individual, Sole Proprietorship and Joint Accounts. Individual accounts are owned by one person, as are sole proprietorship accounts. Joint accounts have two or more owners (tenants). | | Instructions must be signed by all persons exactly as their names appear on the account. |

Gifts or Transfers to a Minor (UGMA, UTMA) These custodial accounts provide a way to give money to a child and obtain tax benefits. | | Depending on state laws, you can set up a custodial account under the UGMA or the UTMA. The custodian must sign instructions in a manner indicating custodial capacity. |

| Business Entities | | Submit a secretary’s (or similar) certificate covering incumbency and authority. |

| Trusts | | The trust must be established before an account can be opened. Provide the first and signature pages from the trust document identifying the trustees. |

| | | |

| How to Open an Account | | How to Add to Your Account |

| By check | | By check |

| ● | Obtain an application by mail, fax or from our website. | | ● | Complete an investment slip from a confirmation statement or write us a letter. |

| ● | Complete the application and any other required documentation. | | ● | Write your account number and Fund on your check. |

| ● | Mail your application and any other documents and your check. | | ● | Mail the slip or letter and your check. |

| By wire | | By wire |

| ● | Obtain an application by mail, fax or from our website. | | ● | Call to notify us of your incoming wire and request wiring instructions. |

| ● | Complete the application and any other required documentation. | | ● | Note your fund and account number in the memo portion of your wire request. |

| ● | Call us to fax the completed application and documentation. We will open the account and assign an account number. | | ● | Instruct your bank to wire your money to us. |

| ● | Instruct your bank to wire your money to us. | | | |

| ● | Mail us your original application and any other documentation. | | | |

Online | | Online |

| ● | Logon to our website www.bridgeway.com. | | ● | Logon to our website www.bridgeway.com. |

| ● | Click the link “How to Invest” then “Open an Account Online.” | | ● | Click the link “Shareholder Login.” |

| ● | Complete the online steps. | | ● | Login to your account. |

| ● | We will electronically debit your purchase from your selected financial institution account. | | ● | Follow the online steps. |

| | | | ● | We will electronically debit your purchase from your selected financial institution. |

| | | | | |

| | | | By automatic monthly ACH payment |

| | | | ● | Set-up can be done during the new account application process. |

| | | | ● | Online after logging on to your account under the link “Account Options.” |

| | | | ● | Write us to request an ACH providing us with your fund account number, dollar amount of the ACH, day of month you want the transaction to be processed on along with the bank name, address, ABA and account number, and type of banking account the funds will be drawn from. |

Canceled or Failed Payments. The Fund accepts checks and ACH transfers at full value subject to collections. If your payment for shares is not received or you pay with a check or ACH transfer that does not clear, your purchase will be canceled. You will be responsible for any losses or expenses incurred by the Fund or the transfer agent, and the Fund may redeem shares you own in the account as reimbursement. The Fund and its agents have the right to reject or cancel any purchase, exchange or redemption request due to nonpayment.

Rejection of Purchase Orders. The Fund reserves the right to refuse purchase orders for any reason. For example, the Fund may reject purchase orders for very small accounts (e.g., accounts comprised of only one share of the Fund) as well as for reasons that the Adviser feels will adversely affect its ability to manage the Fund effectively.

Selling Shares. The Fund processes redemption orders promptly, and you will generally receive redemption proceeds within a week. Delays of up to 7 days may occur in cases of very large redemptions, excessive trading or during unusual market conditions. If the Fund has not collected payment for the shares you are selling, however, it may delay sending redemption proceeds for up to 15 calendar days.

| How to Sell Shares from Your Account |

By Mail:

Prepare a written request including:

| | ● | Your name(s) and signature(s) |

| | | The dollar amount or number of shares you want to sell |

| | | How to send your proceeds (by check, wire* or ACH*) |

| | | Obtain a Medallion signature guarantee (See “Medallion Signature Guarantee Requirements”) |

| | | Obtain other documentation (See “Medallion Signature Guarantee Requirements”) |

| | | Mail your request and documentation |

By Telephone:

| | | Call us with your request (unless you declined telephone privileges on your account application) |

Provide the following information:

| | | Exact name(s) in which the account is registered |

| | | Additional form of identification |

| | | You may be responsible for any unauthorized telephone order, as long as the transfer agent takes reasonable measures to verify that the order is genuine. |

Online:

| | | Logon to our website www.bridgeway.com. |

| | | Click the link “Shareholder Login.” |

*Wire or ACH Redemptions. You may have your redemption proceeds sent by wire or ACH to you if you provided bank account information on your account application. Additional fees may apply for a Fedwire.

Medallion Signature Guarantee Requirements. To protect you and the Fund against fraud, certain redemption options will require a Medallion signature guarantee. A signature guarantee verifies the authenticity of your signature. You can obtain one from most banking institutions or securities brokers, but not from a notary public. The Fund and the transfer agent will need written instructions signed by all registered owners, with a Medallion signature guarantee for each owner, for any of the following:

| | | Redemptions greater than $100,000 or more. |

| | | Changes to a shareholder’s record name. |

| | | Check redemption from an account for which the address or account registration has changed within the last 30 days. |

| | | Sending redemption and distribution proceeds to any person, address or financial institution account not on record. |

| | | Sending redemption and distribution proceeds to an account with a different registration (name or ownership) from your account. |

| | | Adding or changing ACH or wire instructions, telephone redemption or exchange options. |

| | | The Fund and the transfer agent reserve the right to require a Medallion signature guarantee(s) on all redemptions. |

Redemption of Very Small Accounts. In order to reduce Fund expenses, the Board of Directors is authorized to cause the redemption of all of the shares of any shareholder whose account has declined to a value of less than $1,000 as a result of a transfer or redemption. For accounts that are valued at less than $1,000, the Fund or its representative may give shareholders 60 days prior written notice in which to purchase sufficient shares to avoid such redemption.

Redemption of Very Large Accounts. While a shareholder may redeem at any time without notice, it is important for Fund operations that you call Bridgeway Funds at least a week before you redeem an amount of $250,000 or more. We must consider the interests of all Fund shareholders and reserve the right to delay delivery of your redemption proceeds—up to seven days—if the amount will disrupt the Fund’s operation or performance. If your redemptions total more than $250,000 or 1% of the net assets of the Fund within any 90-day period, the Fund reserves the right to pay part or all of the redemption proceeds above $250,000 in kind (i.e., in securities, rather than in cash). Redemptions in kind may, at the Adviser’s option and where requested by a shareholder, be made for redemptions less than $250,000. If payment is made in kind, you may incur brokerage commissions if you elect to sell the securities for cash.

EXCHANGING SHARES

You may sell your Fund shares and buy shares of another Bridgeway Fund, also known as an exchange, by telephone or in writing, unless you declined telephone privileges on your account application. For a list of Bridgeway Funds available for exchange, please consult our website, www.bridgeway.com or call Bridgeway Funds at 800-661-3550. Exchange purchases are subject to the same minimum and subsequent investment levels as new accounts and to fund closing commitments. Because exchanges are treated as a sale and purchase, they may have tax consequences.

You may exchange only between identically registered accounts (name(s), address and taxpayer ID number). You may be responsible for any unauthorized telephone order as long as the transfer agent takes reasonable measures to verify that the order is genuine.

| How to Exchange Shares from Your Account |

By Mail:

Prepare a written request including:

| | ● | Your name(s) and signature(s) |

| | ● | The Fund names you are exchanging |

| | ● | The dollar amount or number of shares you want to sell (and exchange) |

| | ● | Mail your request and documentation |

By Telephone:

| | | Call us with your request (unless you declined telephone authorization privileges on your account application) |

Provide the following information:

| | | Exact name(s) in which the account is registered |

| | | Additional form of identification |

Online:

| | | Logon to our website www.bridgeway.com. |

| | | Click the link “Shareholder Login.” |

| MISCELLANEOUS INFORMATION |

Retirement Accounts. The Fund offers IRA accounts including traditional and Roth IRAs. Fund shares may also be an appropriate investment for other retirement plans. Before investing in any IRA or other retirement plan, you should consult your tax adviser. Whenever making an investment in an IRA, be sure to indicate the year for which the contribution is made.

Tax-Sheltered Retirement Plans. Shares of the Fund may be purchased for various types of retirement plans, including IRAs. For more complete information, contact Bridgeway Funds or the marketplaces previously described.

Lost Accounts. The transfer agent will consider your account lost if correspondence to your address of record is returned as undeliverable on more than two consecutive occasions, unless the transfer agent determines your new address. When an account is “lost,” all distributions on the account will be reinvested in additional Fund shares. In addition, the amount of any outstanding checks (unpaid for six months or more) or checks that have been returned to the transfer agent will be reinvested at the then-current NAV and the checks will be canceled. However, checks will not be reinvested into accounts with a zero balance.

Also, when your account is opened, if no activity occurs in the account within the time period specified by applicable state law, your property may be transferred to the appropriate state.

Householding. To reduce expenses, we may mail only one copy of the Fund’s prospectus, each annual and semi-annual report, and other shareholder communications to those addresses shared by two or more accounts. If you wish to receive additional copies of these documents, please call us at 800-661-3550 (or contact your financial institution). We will begin sending you individual copies thirty days after receiving your request.

| Dividends, Distributions and Taxes |

The Fund intends to qualify each year as a regulated investment company under the Internal Revenue Code. As a regulated investment company, it generally will pay no federal income tax on the income and gains it distributes to you. The Fund pays dividends from net investment income and distributes realized capital gains annually, usually in December. The Fund occasionally may be required to make supplemental distributions at some other time during the year. All dividends and distributions in full and fractional shares of the Fund will generally be reinvested in additional shares on the day that the dividend or distribution is paid at the next determined NAV. A direct shareholder may submit a written request to pay the dividend and/or the capital gains distribution to the shareholder in cash. Shareholders at fund marketplaces should contact the marketplace about their rules.

The amount of any distribution will vary, and there is no guarantee the Fund will pay either an income dividend or a capital gain distribution. At the time you purchase your Fund shares, the Fund’s net asset value may reflect undistributed income, undistributed capital gains, or net unrealized appreciation in value of portfolio securities held by the Fund. For taxable investors, a subsequent distribution to you of such amounts, although constituting a return of your investment, would be taxable. For example, if you buy 500 shares in the Fund on December 15th at the Fund’s current NAV of $10 per share, and the Fund makes a capital gain distribution on December 16th of $1 per share, your shares will then have an NAV of $9 per share (disregarding any change in the Fund’s market value), and you will have to pay a tax on what is essentially a return of your investment of $1 per share. This tax treatment is required even if you reinvest the $1 per share capital gain distribution in additional Fund shares. This is known as “buying a dividend.”

How Distributions Are Taxed. The tax information in this prospectus is provided as general information. You should contact your tax adviser about the federal and state tax consequences of an investment in the Fund.

In general, if you are a taxable investor in a taxable account, Fund distributions are taxable to you as ordinary income, capital gains or some combination of both. This is true whether you reinvest your distributions in additional Fund shares or receive them in cash. Distributions declared in December to shareholders of record in such month but paid in January are taxable as if they were paid in December. Each year, the Fund will send you an annual statement (Form 1099) of your account activity to assist you in completing your federal, state and local tax returns. Prior to issuing your statement, the Fund makes every effort to search for reclassified income to reduce the number of corrected forms mailed to shareholders. However, when necessary, the Fund will send you a corrected Form 1099 to reflect reclassified information.

For federal income tax purposes, Fund distributions of short-term capital gains are taxable to you as ordinary income. Fund distributions of long-term capital gains are taxable to you as long-term capital gains no matter how long you have owned your shares. With respect to taxable years of a fund beginning before January 1, 2013, unless such provision is extended or made permanent, a portion of income dividends designated by the Fund may be qualified dividend income eligible for taxation by individual shareholders at long-term capital gain rates, provided certain holding period requirements are met.

How Transactions Are Taxed. When you sell or redeem your Fund shares, you will generally realize a capital gain or loss. For tax purposes, an exchange of your Fund shares for shares of a different Bridgeway Fund is the same as a sale. Beginning with the 2012 calendar year, the Fund will be required to report to you and the IRS annually on Form 1099-B not only the gross proceeds of Fund shares you sell or redeem but also their cost basis for shares purchased or acquired

on or after January 1, 2012. Cost basis will be calculated using the Fund’s default method, unless you instruct the Fund to use a different calculation method. Shareholders should carefully review the cost basis information provided by the Fund and make any additional basis, holding period or other adjustments that are required when reporting these amounts on their federal income tax returns. If your account is held by your investment representative (financial advisor or other broker), please contact that representative with respect to reporting of cost basis and available elections for your account. Tax-advantaged retirement accounts will not be affected. Additional information and updates regarding cost basis reporting and available shareholder elections will be on Bridgeway’s website at www.bridgeway.com as the information becomes available.

Backup Withholding. By law, if you do not provide the Fund with your proper taxpayer identification number and certain required certifications, you may be subject to backup withholding on any distributions of income, capital gains or proceeds from the sale or redemption of your shares. The Fund also must withhold if the Internal Revenue Service instructs it to do so. When withholding is required, the amount will be 28% of any distributions or proceeds paid.

State and Local Taxes. Fund distributions and gains from the redemption or exchange of your Fund shares generally are subject to state and local taxes.

Non-U.S. Investors. Non-U.S. investors may be subject to U.S. withholding tax at a 30% or lower treaty rate and U.S. estate tax, and are subject to special U.S. tax certification requirements to avoid backup withholding and claim any treaty benefits. Exemptions from U.S. withholding tax are provided for capital gain dividends paid by the Fund from long-term capital gains, if any, and, with respect to taxable years of the Fund that begin before January 1, 2012 (unless such sunset date is extended or made permanent), interest-related dividends paid by the Fund from its qualified net interest income from U.S. sources and short-term capital gain dividends. However, notwithstanding such exemptions from U.S. withholding at the source, any such dividends and distributions of income and capital gains will be subject to backup withholding at a rate of 28% if you fail to properly certify that you are not a U.S. person.

This discussion of “Dividends, Distributions and Taxes” is not intended or written to be used as tax advice. Because everyone’s tax situation is unique, you should consult your tax professional about federal, state, local or foreign tax consequences before making an investment in the Fund.

The following discussion is not applicable to shareholders in tax-deferred accounts, such as IRAs.

An important aspect of fund ownership in a taxable account is the tax efficiency of the Fund. A fund may have great performance, but if a large percentage of that return is paid in taxes, the purpose of active management may be defeated. Tax efficiency is the ratio of after-tax total returns to before-tax total returns. The first column of the following table illustrates the tax efficiency of the Fund through December 31, 2010. It assumes that a shareholder was invested in the Fund for the full period since inception, had paid taxes at the maximum federal marginal rates and continues to hold the shares. Currently, these rates are 35% for income, 35% for short-term capital gains, and 15% for long-term capital gains (securities held for more than one year). These calculations exclude any state and local taxes. 100% tax efficiency means that the shareholder had no taxable distributions and paid no taxes. This measure of tax efficiency ignores potential future taxes represented by unrealized gains, stocks which have appreciated in value but have not been sold. It also ignores the taxes an individual would pay if they sold their shares. The second column is the same tax efficiency number, but considers taxes paid if a shareholder sold his or her shares at the end of the calendar year, December 31, 2010.

The Fund’s Tax Efficiency

% Tax Efficiency for Shares Held | % Tax Efficiency for Shares Sold |

94.01% | 85.51% |

The Fund has been on the relatively tax efficient end of the spectrum.

The financial highlights table is intended to help you understand the Fund’s financial performance for the past five years. The total returns in the table represent the rate that an investor would have earned (or lost) on an investment in the Fund (assuming reinvestment of all dividends and distributions). This information has been audited by BBD, LLP whose report, along with the Fund’s financial statements, is included in the annual report, which is available from Bridgeway Funds upon request.

| | | | | | |

| | For the Year Ended June 30, |

| | 2011 | 2010 | 2009 | 2008 | 2007 |

| Per Share Data | | | | | |

| Net asset value, beginning of year | $11.44 | $9.74 | $13.63 | $17.07 | $14.41 |

| Income from investment operations: | | | | | |

| Net investment income^ | 0.20 | 0.19 | 0.23 | 0.22 | 0.17 |

| Net realized and unrealized gain (loss) | 3.21 | 1.73 | (3.89) | (2.94) | 2.64 |

| | | | | | |

| Total from investment operations | 3.41 | 1.92 | (3.66) | (2.72) | 2.81 |

| Less distributions to shareholders from: | | | | | |

| Net realized gain | — | — | — | (0.51) | — |

| Net investment income | (0.23) | (0.22) | (0.23) | (0.21) | (0.15) |

| Total distributions | (0.23) | (0.22) | (0.23) | (0.72) | (0.15) |

| Net asset value, end of year | $14.62 | $11.44 | $9.74 | $13.63 | $17.07 |

| Total Return | 30.02%‡ | 19.65%‡ | (26.88%) ‡ | (16.46%)‡ | 19.57% |

| Ratios & Supplemental Data | | | | | |

| Net assets, end of year (‘000’s) | $29,647 | $25,534 | $27,996 | $54,144 | $86,095 |

| Ratios to average net assets: | | | | | |

| Expenses before waivers and reimbursements | 1.17% | 1.11% | 0.98% | 0.80% | 0.79% |

| Expenses after waivers and reimbursements | 0.84% | 0.84% | 0.84% | 0.79% | 0.79% |

| Net investment income after waivers and reimbursements | 1.50% | 1.58% | 2.20% | 1.38% | 1.08% |

| Portfolio turnover rate | 43% | 49% | 65% | 28% | 34% |

^ Per share amounts calculated based on the average daily shares outstanding during the period.

‡ Total return would have been lower had various fees not been waived during the period.

As the investment adviser and administrator for Bridgeway Funds, Inc. (the “Funds”), Bridgeway Capital Management, Inc. (the “Adviser”) invests the assets of the Funds and manages their day-to-day business. On behalf of the Funds and the Adviser, (collectively, “Bridgeway”), we make the following assurance of your privacy.

Bridgeway’s Commitment to You. We work hard to respect the privacy of your personal and financial data.

Not Using Your Personal Data for our Financial Gain. Bridgeway has never sold shareholder information to any other party, nor have we disclosed such data to any other organization, except as permitted by law. We have no plans to do so in the future. We will notify you prior to making any change in this policy. As a Fund shareholder, you compensate the Adviser through a management and administrative fee; this is how we earn our money for managing yours.

How We Do Use Your Personal and Financial Data. We use your information primarily to complete your investment transactions. We may also use it to communicate with you about other financial products that we offer.

The Information We Collect About You. You typically provide personal information when you complete a Bridgeway account application or when you request a transaction that involves Bridgeway, either directly or through a fund supermarket. This information may include your:

| | ● | Name, address and phone numbers |

| | | Social security or taxpayer identification number |

| | | Birth date and beneficiary information (for IRA applications) |

| | | Basic trust document information (for trusts only) |

How We Protect Your Personal Information. As emphasized above, we do not sell information about current or former shareholders or their accounts to third parties. We occasionally share such information to the extent permitted by law to complete transactions at your request, or to make you aware of related financial products that we offer. Here are the details:

| | | To complete certain transactions or account changes that you direct, it may be necessary to provide identifying information to companies, individuals, or groups that are not affiliated with Bridgeway. For example, if you ask to transfer assets from another financial institution to Bridgeway, we will need to provide certain information about you to that company to complete the transaction. |

| | | In certain instances, we may contract with non-affiliated companies to perform services for us, such as processing orders for share purchases and redemptions and distribution of shareholder letters. Where necessary, we will disclose information about you to these third parties. In all such cases, we provide the third party with only the information necessary to carry out its assigned responsibilities (in the case of shareholder letters, only your name and address) and only for that purpose. We require these third parties to treat your private information with the same high degree of confidentiality that we do. |

| | | Finally, we will release information about you if you direct us to do so, if we are compelled by law to do so, or in other legally limited circumstances (for example, to protect your account from fraud). |

How We Safeguard Your Personal Information. We restrict access to your information to those Bridgeway representatives who need to know the information to provide products or services to you. We maintain physical, electronic, and procedural safeguards to protect your personal information.

Fund Marketplaces or Other Brokerage Firms. Most Bridgeway shareholders purchase their shares through fund marketplaces. Please contact those firms for their own policies with respect to privacy issues.

What You Can Do. For your protection, we recommend that you do not provide your account information, user name, or password to anyone except a Bridgeway representative as appropriate for a transaction or to set up an account. If you become aware of any suspicious activity relating to your account, please contact us immediately.

We’ll Keep You Informed. As required by federal law, we will notify shareholders of our privacy policy annually. We reserve the right to modify this policy at any time, but rest assured that if we do change it, we will tell you promptly. You can access our privacy policy from our website.

The Fund’s Statement of Additional Information, contains more detail about policies and practices of the Fund and the Adviser, Bridgeway Capital Management, Inc. It is “the fine print,” and is incorporated here by reference and is legally part of the prospectus.

Shareholder Reports, such as the Fund’s annual and semi-annual reports, provide a closer look at the market conditions and investment strategies that have significantly affected Fund performance during the most recent period. They provide details of our performance vs. performance benchmarks, our top ten holdings (for our actively-managed funds), a detailed list of holdings twice annually, and more about the Adviser’s investment strategy. While these letters are usually a bit long (and sometimes lively), the first few sentences tell you how the Fund performed in the most recent period and the Portfolio Manager’s assessment of it. You won’t get a lot of mumbo jumbo about the economy, claims of brilliance when it’s going well, or whitewashing performance when it’s not going well.

Other documents, for example the Code of Ethics, are also available.

To contact Bridgeway Funds for a free electronic or printed copy of these documents or for your questions:

| | ● | Consult our website: www.bridgeway.com |

| | | E-mail us at: funds@bridgeway.com |

| | | Write to us: Bridgeway Funds, Inc. |

c/o BNY Mellon Investment Servicing (US) Inc.

P.O. Box 9860

Providence, RI 02940-8060

Call us at: 800-661-3550.

Information provided by the Securities and Exchange Commission (SEC)

You can review and copy information about the Fund (including the SAI) at the SEC’s Public Reference Room in Washington, D.C. To find out more about this public service, call the SEC at 202-551-8090. Reports and other information about the Fund is also available on the SEC’s website at www.sec.gov. You can receive copies of this information, for a fee, by writing the Public Reference Section, Securities and Exchange Commission, Washington, D.C. 20549-1520 or by sending an electronic request to the following email address: publicinfo@sec.gov.

Bridgeway Funds’ Investment Company Act file number is 811-08200.

| | |

BRIDGEWAY FUNDS, INC. c/o BNY Mellon Investment Servicing (US) Inc. P.O. Box 9860 Providence, RI 02940-8060 800-661-3550 | INDEPENDENT ACCOUNTANTS BBD, LLP 1835 Market Street, 26th Floor Philadelphia, PA 19103 |

| | |

DISTRIBUTOR Foreside Fund Services, LLC 3 Canal Plaza, Suite 100 Portland, ME 04101 | LEGAL COUNSEL Stradley Ronon Stevens & Young, LLP 1250 Connecticut Ave., N.W., Suite 500 Washington, DC 20036 |

21