UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-4984

AMERICAN BEACON FUNDS

(Exact name of registrant as specified in charter)

4151 Amon Carter Boulevard, MD 2450

Fort Worth, Texas 76155

(Address of principal executive offices)-(Zip code)

GENE L. NEEDLES, JR., PRESIDENT

4151 Amon Carter Boulevard, MD 2450

Fort Worth, Texas 76155

(Name and address of agent for service)

Registrant’s telephone number, including area code: (817) 391-6100

Date of fiscal year end: November 30, 2012

Date of reporting period: November 30, 2012

ITEM 1. REPORTS TO STOCKHOLDERS.

November 30, 2012

STEPHENS SMALL CAP GROWTH FUND

STEPHENS MID-CAP GROWTH FUND

Annual Report

About American Beacon Advisors

Since 1986, American Beacon Advisors has offered a variety of products and investment advisory services to numerous institutional and retail clients, including a variety of mutual funds, corporate cash management, and separate account management.

Our clients include defined benefit plans, defined contribution plans, foundations, endowments, corporations, financial planners, and other institutional investors. With American Beacon Advisors, you can put the experience of a multi-billion dollar asset management firm to work for your company.

The Funds may invest in futures contracts, which are a type of derivative investment. Investing in derivatives could result in losing more than the amount invested. Investing in foreign securities entails additional risk not associated with domestic securities, such as currency fluctuations, economic and political instability and differences in accounting standards. Investing in the securities of small and mid-capitalization companies involves greater risk and the possibility of greater price volatility than investing in larger capitalization and more established companies. Growth stocks typically are more volatile than value stocks; however, value stocks have a lower expected growth rate in earnings and sales. Please see the prospectus for a complete discussion of each Fund’s risks. There can be no assurances that the investment objectives of these Funds will be met.

Any opinions herein, including forecasts, reflect our judgment as of the end of the reporting period and are subject to change. Each advisor’s strategies and each Fund’s portfolio composition will change depending on economic and market conditions. This report is not a complete analysis of market conditions and therefore, should not be relied upon as investment advice. Although economic and market information has been compiled from reliable sources, American Beacon Advisors, Inc. makes no representation as to the completeness or accuracy of the statements contained herein.

| | |

| American Beacon Funds | | November 30, 2012 |

| | |

| | Dear Shareholders, After muddling through 2011, a year in which the S&P 500 finished almost exactly flat, the domestic stock markets have been much brighter of late. The first three months of 2012 were the best first quarter that the S&P 500 has experienced in more than a decade, and the markets have maintained most of those gains ever since. Certainly, the U.S. economy appears to be, if not in full recovery, growing at a steady pace. Corporations are sitting on mountains of cash and balance sheets have been largely cleansed since the recession. Although the economy is still operating below capacity, it retains the capability of moving quickly into a higher gear. And smaller companies should be able to take advantage of that growth as well as the large caps. |

For the 12-month period ended November 30, 2012:

| | • | | The American Beacon Stephens Small Cap Growth Fund (Institutional Class) returned 11.74%. |

| | • | | The American Beacon Stephens Mid-Cap Growth Fund (Institutional Class) returned 11.32%. |

There are still challenges to be met in the coming year, but no matter what happens to the macroeconomy, we will continue to serve as responsible stewards for your assets, and continue to treat your investments as if they were our own money.

Thank you for your continued investment in American Beacon Funds. For additional information about the Funds or to access your account information, please visit our website at www.americanbeaconfunds.com.

|

| Best Regards, |

|

|

| Gene L. Needles, Jr. |

| President |

| American Beacon Funds |

1

Domestic Equity Market Overview

November 30, 2012 (Unaudited)

U.S. stocks saw a resurgence for the one-year period ended November 30, 2012, with the Russell 2000 Growth, Russell Midcap Growth and S&P 500 Indexes returning 11.1%, 12.1% and 16.1%, respectively. The advance was impressive, as it was made in the face of a deteriorating global growth outlook and while individuals continued to withdraw billions of dollars from domestic equity mutual funds.

The bulk of these gains can be attributed to a rally at the end 2011 and beginning of 2012 that saw stock prices surge, as solid retail sales growth and upbeat gains in employment buoyed economic confidence. Through the middle part of spring, though, weak payroll employment reports and concerns over the eurozone debt crisis let the air out of the rally. There was a significant slowdown in economic activity in the U.S. and around the world in the second quarter, and Europe re-entered recession. Stocks responded to the weakening economic developments by dropping about 9% before rallying in June to cut the second quarter’s loss to 2.8% for the S&P 500 Index.

Improvement in the U.S. economy emerged late in the third quarter when reports for retail sales, automobile sales and consumer confidence were better than expected in September. Surprisingly strong housing activity also helped drive a summer rise in stocks that was wholly unexpected by many market observers.

Despite the strong gains during the year, it is still possible to find equities that remain inexpensive, but the broad market is no longer “cheap.” Stocks finished the period ended November 30, 2012, by losing some momentum in reaction to disappointing third-quarter earnings. Forward guidance still seems to be vulnerable to downward revisions, and economic growth remains sluggish.

Nevertheless, the U.S. economy also appears to be in better shape relative to most of the developed world. An energy boom is underway here that will radically reshape U.S. trade balances and competitiveness. U.S. oil and natural gas production is rising; imports of oil are falling. A manufacturing renaissance is underway, and here again, natural gas plays a part, as energy input costs here are far lower than the rest of the world. As labor costs soar in China, India, Brazil and other developing markets, the cost savings from moving overseas are disappearing. A June survey of 259 American manufacturers indicated 40% of them were returning production to the U.S. The U.S. is also an agricultural powerhouse and does not face food inflation, shortages or distribution problems like many other countries. And the U.S. remains far and away the leader in technology innovation; others may manufacture the products (for now) but the ideas come from U.S. shores more often than not.

From a longer-term perspective, stocks appear attractive. The economy is operating well below capacity while corporations are sitting on mountains of cash and balance sheets have been largely cleansed since the recession. U.S. Treasury securities, which offer negative real yields, look like an unattractive investment choice long-term. Individuals are underinvested in equities after moving billions of dollars out of domestic equity mutual funds. Corporate pension plans have made similar moves out of equities into very low-returning government bonds when bonds are the least attractive they have been in generations. Despite macroeconomic and geopolitical uncertainties, equities appear to continue to be a more compelling alternative.

2

American Beacon Stephens Small Cap Growth FundSM

Performance Overview

November 30, 2012 (Unaudited)

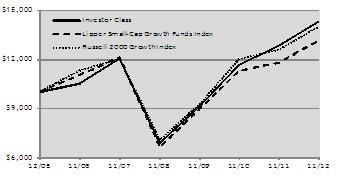

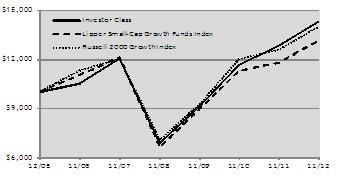

The Investor Class of the American Beacon Stephens Small Cap Growth Fund (the “Fund”) returned 11.44% for the twelve months ended November 30, 2012, outperforming the Russell 2000® Growth Index (the “Index”) return of 11.13% and the Lipper Small-Cap Growth Funds Index return of 11.19% for the same period.

Comparison of Change in Value of a $10,000 Investment

for the Period from 12/1/05 through 11/30/12

Annualized Total Returns

Periods Ended 11/30/12

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | Since

Incep.

(12/1/05) | | | Value of

$10,000

12/1/05-

11/30/12 | |

Institutional Class(1,2,7) | | | 11.74 | % | | | 3.76 | % | | | 6.52 | % | | $ | 14,841 | |

Y Class (1,3,7) | | | 11.71 | % | | | 3.55 | % | | | 5.27 | % | | | 14,323 | |

Investor Class(1,7) | | | 11.44 | % | | | 3.50 | % | | | 5.23 | % | | | 14,288 | |

A Class with sales

Charge (1,4,7) | | | 4.97 | % | | | 2.27 | % | | | 4.33 | % | | | 13,456 | |

A Class without sales

Charge (1,4,7) | | | 11.35 | % | | | 3.48 | % | | | 5.22 | % | | | 14,277 | |

C Class with sales

Charge (1,5,7) | | | 9.75 | % | | | 3.37 | % | | | 5.14 | % | | | 14,200 | |

C Class without sales

Charge (1,5,7) | | | 10.75 | % | | | 3.37 | % | | | 5.14 | % | | | 14,200 | |

S&P 500 Index (6) | | | 16.13 | % | | | 1.34 | % | | | 3.99 | % | | | 13,150 | |

Russell 2000 Growth Index(6) | | | 11.13 | % | | | 3.03 | % | | | 4.90 | % | | | 13,979 | |

Lipper Small-Cap Growth Funds Index(6) | | | 11.19 | % | | | 1.62 | % | | | 3.98 | % | | | 13,143 | |

| 1. | Performance shown is historical and is not indicative of future returns. Investment returns and principal value will vary, and shares may be worth more or less at redemption than at original purchase. Performance shown is as of date indicated, and current performance may be lower or higher than the performance data quoted. To obtain performance as of the most recent month end, please visit www.americanbeaconfunds.com or call 1-800-967-9009. Fund performance in the table above does not reflect the deduction of taxes a shareholder would pay on distributions or the redemption of shares. A portion of the fees charged to each Class was waived since 2012. Performance prior to waiving fees was lower than the actual returns shown since 2012. The Institutional Class and Investor Class of the Fund have adopted the performance history of the Class I and Class A shares, respectively, of the Fund’s predecessor. |

| 2. | Fund performance for the since inception period represents the returns achieved by the Institutional Class since its inception of 8/31/06. |

| 3. | Fund performance for the one-year, five-year, and since inception periods represent the returns achieved by the Investor Class from 12/1/05 up to 2/24/12, the inception date of the Y Class, and the returns of the Y Class since its inception. Expenses of the Y Class are lower than those of the Investor Class. Therefore, total returns shown may be lower than they would have been had the Y Class been in existence since 12/1/05. |

| 4. | Fund performance for the one-year, five-year, and since inception periods represent the returns achieved by the Investor Class from 12/1/05 up to 2/24/12, the inception date of the A Class, and the returns of the A Class since its inception. Expenses of the A Class are higher than those of the Investor Class. As a result total returns shown may be higher than they would have been had the A Class been in existence since 12/1/05. A Class has a maximum sales charge of 5.75%. |

| 5. | Fund performance for the one-year, five-year, and since inception periods represent the returns achieved by the Investor Class from 12/1/05 up to 2/24/12, the inception date of the C Class, and the returns of the C Class since its inception. Expenses of the C Class are higher than those of the Investor Class. As a result, total returns shown may be higher than they would have been had the C Class been in existence since 12/1/05. The maximum contingent deferred sales charge for C Class is 1.00% for shares redeemed within one year of the date of purchase. |

| 6. | The S&P 500 Index is a market capitalization weighted index of common stocks publicly traded in the United States. The Russell 2000 Growth Index is a registered trademark of Frank Russell Company. The Russell 2000 Growth Index is an unmanaged index of those stocks in the Russell 2000 Index with higher price-to-book ratios and higher forecasted growth values. The Russell 2000 Index is an unmanaged index of approximately 2000 smaller-capitalization stocks from various industrial sectors. The Lipper Small-Cap Growth Funds Index tracks the results of the 30 largest mutual funds in the Lipper Small-Cap Growth Funds category. Lipper is an independent mutual fund research and ranking service. One cannot directly invest in an index. |

| 7. | The total annual Fund operating expense ratio set forth in the most recent Fund prospectus for the Institutional, Y, Investor, A, and C Class shares was 1.15% 1.25%, 1.53%, 1.65%, and 2.40% respectively. The expense ratios above may vary from the expense ratios presented in other sections of this report that are based on expenses incurred during the period covered by this report. |

The Fund outperformed the Index primarily due to stock selection as sector allocation detracted minimal value relative to the Index.

From a stock selection standpoint, the Fund’s Information Technology companies added over 240 basis points (2.40%) to performance. Mellanox Technologies (up 108.2%), Stratasys (up 144.0%) and Cymer (up 96.1%) were the largest contributors in the Information Technology sector. Holdings in the Health Care sector also contributed to the Fund’s returns. In the Health Care sector, Zoll Medical (up 101.7%), Medidata Solutions (up 98.5%) and Catamaran (up 65.6%) added the most relative value. The aforementioned good performance was

3

American Beacon Stephens Small Cap Growth FundSM

Performance Overview

November 30, 2012 (Unaudited)

somewhat offset by poor stock selection in the Industrials sector where Acacia Research (down 36.1%), FTI Consulting (down 27.9%) and RPX (down 35.7%) were the largest detractors.

The Fund’s overweight in Energy, the worst performing sector in the Index, detracted approximately 40 basis points (0.40%) from performance through sector allocation. This was mostly offset by a slight overweight in Health Care, one of the better performing sectors in the Index.

Looking forward, the Fund’s sub-advisor will continue to maintain a disciplined, long-term approach to equity investing in smaller capitalization stocks with above-average growth potential.

Sector Allocation

| | | | |

| | | % of Equities | |

Information Technology | | | 23.9 | % |

Health Care | | | 20.9 | % |

Consumer Discretionary | | | 15.1 | % |

Industrials | | | 14.1 | % |

Financials | | | 10.5 | % |

Energy | | | 8.0 | % |

Consumer Staples | | | 6.2 | % |

Telecommunication Services | | | 0.8 | % |

Materials | | | 0.5 | % |

Top Ten Holdings

| | | | |

| | | % of

Net Assets | |

Lions Gate Entertainment Corp. | | | 1.8 | % |

CoStar Group, Inc. | | | 1.8 | % |

Advisory Board Co. | | | 1.6 | % |

First Cash Financial Services, Inc. | | | 1.6 | % |

Aspen Technology, Inc. | | | 1.5 | % |

OSI Systems, Inc. | | | 1.5 | % |

United Natural Foods, Inc. | | | 1.5 | % |

Encore Capital Group, Inc. | | | 1.5 | % |

Sourcefire, Inc. | | | 1.5 | % |

Neogen Corp. | | | 1.4 | % |

4

American Beacon Stephens Mid-Cap Growth FundSM

Performance Overview

November 30, 2012 (Unaudited)

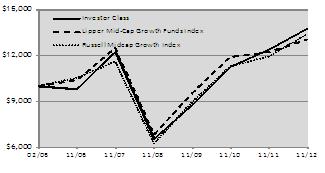

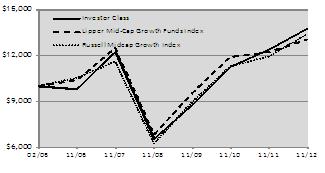

The Investor Class of the American Beacon Stephens Mid-Cap Growth Fund (the “Fund”) returned 11.00% for the twelve months ended November 30, 2012. The Fund trailed the Russell Midcap® Growth Index (the “Index”) return of 12.06%, but outperformed the Lipper Mid-Cap Growth Funds Index return of 9.60%.

Comparison of Change in Value of a $10,000 Investment

for the Period from 2/1/06 through 11/30/12

| | | | | | | | | | | | | | | | |

| | | Annualized Total

Returns

Periods Ended 11/30/12 | | | | |

| | | 1 Year | | | 5 Years | | | Since

Incep.

(2/1/06) | | | Value of

$10,000

2/1/06-

11/30/12 | |

Institutional Class(1,2,7) | | | 11.32 | % | | | 2.62 | % | | | 6.97 | % | | $ | 15,240 | |

Y Class (1,3,7) | | | 11.44 | % | | | 2.42 | % | | | 4.80 | % | | | 13,773 | |

Investor Class (1,7) | | | 11.00 | % | | | 2.34 | % | | | 4.74 | % | | | 13,720 | |

A Class with sales

charge (1,4,7) | | | 4.65 | % | | | 1.13 | % | | | 3.84 | % | | | 12,931 | |

A Class without sales

charge (1,4,7) | | | 11.00 | % | | | 2.34 | % | | | 4.74 | % | | | 13,720 | |

C Class with sales

charge (1,5,7) | | | 9.60 | % | | | 2.27 | % | | | 4.69 | % | | | 13,670 | |

C Class without sales

charge (1,5,7) | | | 10.60 | % | | | 2.27 | % | | | 4.69 | % | | | 13,670 | |

S&P 500 Index (6) | | | 16.13 | % | | | 1.34 | % | | | 3.69 | % | | | 12,807 | |

Russell Midcap Growth Index(6) | | | 12.06 | % | | | 2.92 | % | | | 4.38 | % | | | 13,398 | |

Lipper Mid-Cap Growth Funds Index(6) | | | 9.60 | % | | | 1.38 | % | | | 4.35 | % | | | 13,045 | |

| 1. | Performance shown is historical and is not indicative of future returns. Investment returns and principal value will vary, and shares may be worth more or less at redemption than at original purchase. Performance shown is as of date indicated, and current performance may be lower or higher than the performance data quoted. To obtain performance as of the most recent month end, please visit www.americanbeaconfunds.com or call 1-800-967-9009. Fund performance in the table above does not reflect the deduction of taxes a shareholder would pay on distributions or the redemption of shares. A portion of the fees charged to each Class was waived since 2012. Performance prior to waiving fees was lower than the actual returns shown since 2012. The Institutional Class and Investor Class of the Fund have adopted the performance history of the Class I and Class A shares, respectively, of the Fund’s predecessor. |

| 2. | Fund performance for the since inception period represents the returns achieved by the Institutional Class since its inception of 8/31/06. |

| 3. | Fund performance for the one-year, five-year, and since inception periods represent the returns achieved by the Investor Class from 2/1/06 up to 2/24/12, the inception date of the Y Class, and the returns of the Y Class since its inception. Expenses of the Y Class are lower than those of the Investor Class. Therefore, total returns shown may be lower than they would have been had the Y Class been in existence since 2/1/06. |

| 4. | Fund performance for the one-year, five-year, and since inception periods represent the returns achieved by the Investor Class from 2/1/06 up to 2/24/12, the inception date of the A Class, and the returns of the A Class since its inception. Expenses of the A Class are higher than those of the Investor Class. Therefore, total returns shown may be higher than they would have been had the A Class been in existence since 2/1/06. A Class has a maximum sales charge of 5.75%. |

| 5. | Fund performance for the one-year, five-year, and since inception periods represent the returns achieved by the Investor Class from 2/1/06 up to 2/24/12, the inception date of the C Class, and the returns of the C Class since its inception. Expenses of the C Class are higher than those of the Investor Class. Therefore, total returns shown may be higher than they would have been had the C Class been in existence since 2/1/06. The maximum contingent deferred sales charge for C Class is 1.00% for shares redeemed within one year of the date of purchase. |

| 6. | The S&P 500 Index is a market capitalization weighted index of common stocks publicly traded in the United States. The Russell Midcap Growth Index is an unmanaged index of those stocks in the Russell Midcap Index with higher price-to-book ratios and higher forecasted growth values. Russell Midcap Index measures the performance of the 800 smallest companies in the Russell 1000 Index. Russell Midcap Index, Russell Midcap Growth Index and Russell 1000 are registered trademarks of Frank Russell Company. The Lipper Mid-Cap Growth Funds Index tracks the results of the 30 largest mutual funds in the Lipper Mid-Cap Growth Funds category. Lipper is an independent mutual fund research and ranking service. One cannot directly invest in an index. |

| 7. | The total annual Fund operating expense ratio set forth in the most recent Fund prospectus for the Institutional, Y, Investor, A, and C Class shares was 1.12%, 1.22%, 1.50%, 1.62%, and 2.37%, respectively. The expense ratios above may vary from the expense ratios presented in other sections of this report that are based on expenses incurred during the period covered by this report. |

Prior to the deduction of expenses, the Fund outperformed the Index. The Fund’s excess performance was primarily generated through stock selection, as sector allocation detracted value relative to the Index.

From a stock selection standpoint, superior selections in the Consumer Discretionary, Industrials and Consumer Staples sectors contributed to the Fund’s performance. Discovery Communications (up 48.7%), TJX (up 45.3%) and Ulta Salon Cosmetics & Fragrance (up 45.6%) added

5

American Beacon Stephens Mid-Cap Growth FundSM

Performance Overview

November 30, 2012 (Unaudited)

the most relative value to performance in the Consumer Discretionary sector. In the Industrials sector, Valmont Industries (up 65.2%) and Verisk Analytics (up 26.9%) were the largest contributors, while not owning Joy Global, which was down 36.7% in the Index, also contributed to the Fund’s excess returns. In the Consumer Staples sector, being absent from Mead Johnson Nutrition, which was down 8.2% in the Index, added relative value. Investment in Whole Foods Market (up 38.0%) and Brown-Forman (up 34.1%) also contributed to the Fund’s performance.

Overweight positions in Information Technology and Energy, two of the poorer performing sectors in the Index, detracted value through sector allocation. An underweight in the Materials sector also detracted from the Fund’s returns.

Looking forward, the Fund’s sub-advisor will continue to maintain a disciplined, long-term approach to equity investing in medium capitalization stocks with above-average growth potential.

Sector Allocation

| | | | |

| | | % of Equities | |

Information Technology | | | 23.8 | % |

Consumer Discretionary | | | 20.9 | % |

Health Care | | | 18.5 | % |

Industrials | | | 14.4 | % |

Energy | | | 9.2 | % |

Financials | | | 6.0 | % |

Consumer Staples | | | 5.7 | % |

Materials | | | 1.5 | % |

Top Ten Holdings

| | | | |

| | | % of

Net Assets | |

Cerner Corp. | | | 1.8 | % |

Discovery Communications, Inc. | | | 1.7 | % |

Stericycle, Inc. | | | 1.7 | % |

Affiliated Managers Group, Inc. | | | 1.7 | % |

LKQ Corp. | | | 1.6 | % |

Whole Foods Market, Inc. | | | 1.6 | % |

Alliance Data Systems Corp. | | | 1.6 | % |

Catamaran Corp. | | | 1.5 | % |

Ulta Salon Cosmetics & Fragrance, Inc. | | | 1.5 | % |

Airgas, Inc. | | | 1.5 | % |

6

American Beacon FundsSM

Fund Expenses

November 30, 2012 (Unaudited)

Fund Expense Example

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption fees if applicable, and (2) ongoing costs, including management fees, administrative service fees, and other Fund expenses. The examples below are intended to help you understand the ongoing cost (in dollars) of investing in a particular Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested at the beginning of the period in each Class and held for the entire period from June 1, 2012 through November 30, 2012.

Actual Expenses

The following tables provide information about actual account values and actual expenses. You may use the information on this page, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the “Expenses Paid During Period” for the applicable Fund to estimate the expenses you paid on your account during this period. Shareholders of the Investor and Institutional Classes that invest in a Fund through an IRA may be subject to a custodial IRA fee of $15 that is typically deducted each December. If your account was subject to a custodial IRA fee during the period, your costs would have been $15 higher.

Hypothetical Example for Comparison Purposes

The following tables provide information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the Fund’s actual return). You may compare the ongoing costs of investing in a particular Fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. Shareholders of the Investor and Institutional Classes that invest in a Fund through an IRA may be subject to a custodial IRA fee of $15 that is typically deducted each December. If your account was subject to a custodial IRA fee during the period, your costs would have been $15 higher.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs charged by a Fund, such as sales charges (loads) or redemption fees as applicable. Similarly, the expense examples for other funds do not reflect any transaction costs charged by those funds, such as sales charges (loads), redemption fees or exchange fees. Therefore, the following tables are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. If you were subject to any transaction costs during the period, your costs would have been higher.

7

American Beacon FundsSM

Fund Expenses

November 30, 2012 (Unaudited)

Stephens Small Cap Growth Fund:

| | | | | | | | | | | | |

| | | Beginning

Account

Value

6/1/12 | | | Ending

Account

Value

11/30/12 | | | Expenses Paid

During Period*

6/1/12-11/30/12 | |

Institutional Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,040.74 | | | $ | 5.56 | |

Hypothetical ** | | $ | 1,000.00 | | | $ | 1,019.55 | | | $ | 5.50 | |

| | | |

Y Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,040.74 | | | $ | 6.07 | |

Hypothetical ** | | $ | 1,000.00 | | | $ | 1,019.05 | | | $ | 6.01 | |

| | | |

Investor Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,040.03 | | | $ | 6.89 | |

Hypothetical ** | | $ | 1,000.00 | | | $ | 1,018.25 | | | $ | 6.81 | |

| | | |

A Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,039.23 | | | $ | 8.11 | |

Hypothetical ** | | $ | 1,000.00 | | | $ | 1,017.05 | | | $ | 8.02 | |

| | | |

C Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,035.28 | | | $ | 11.70 | |

Hypothetical ** | | $ | 1,000.00 | | | $ | 1,013.50 | | | $ | 11.58 | |

| * | Expenses are equal to the Fund’s annualized expense ratios for the six-month period of 1.09%, 1.19%, 1.35%, 1.59%, and 2.30% for the Institutional, Y, Investor, A and C Classes respectively, multiplied by the average account value over the period, multiplied by the number derived by dividing the number of days in the most recent fiscal half-year (183) by days in the year (366) to reflect the half-year period. |

| ** | 5% return before expenses. |

Stephens Mid-Cap Growth Fund:

| | | | | | | | | | | | |

| | | Beginning

Account

Value

6/1/12 | | | Ending

Account

Value

11/30/12 | | | Expenses Paid

During Period*

6/1/12-11/30/12 | |

Institutional Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,062.76 | | | $ | 5.11 | |

Hypothetical ** | | $ | 1,000.00 | | | $ | 1,020.05 | | | $ | 5.00 | |

| | | |

Y Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,064.90 | | | $ | 5.63 | |

Hypothetical ** | | $ | 1,000.00 | | | $ | 1,019.55 | | | $ | 5.50 | |

| | | |

Investor Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,061.10 | | | $ | 7.01 | |

Hypothetical ** | | $ | 1,000.00 | | | $ | 1,018.20 | | | $ | 6.86 | |

| | | |

A Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,060.28 | | | $ | 7.67 | |

Hypothetical ** | | $ | 1,000.00 | | | $ | 1,017.55 | | | $ | 7.52 | |

| | | |

C Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,059.68 | | | $ | 11.53 | |

Hypothetical ** | | $ | 1,000.00 | | | $ | 1,013.80 | | | $ | 11.28 | |

| * | Expenses are equal to the Fund’s annualized expense ratios for the six-month period of 0.99%, 1.09%, 1.36%, 1.49%, and 2.24% for the Institutional, Y, Investor, A and C Classes respectively, multiplied by the average account value over the period, multiplied by the number derived by dividing the number of days in the most recent fiscal half-year (183) by days in the year (366) to reflect the half-year period. |

| ** | 5% return before expenses. |

8

American Beacon FundsSM

Report of Independent Registered Public Accounting Firm

To the Shareholders and the Board of Trustees of

American Beacon Stephens Small Cap Growth Fund and American Beacon Stephens Mid-Cap Growth Fund:

We have audited the accompanying statements of assets and liabilities, including the schedules of investments, of the American Beacon Stephens Small Cap Growth Fund and the American Beacon Stephens Mid-Cap Growth Fund (two of the funds constituting the American Beacon Funds) (collectively, the “Funds”), as of November 30, 2012, and the related statements of operations, statements of changes in net assets, and financial highlights for the year then ended. These financial statements and financial highlights are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. The statements of changes in net assets for the year ended November 30, 2011, and the financial highlights for each of the four years in the period then ended were audited by other auditors whose report dated January 26, 2012, expressed an unqualified opinion on those statements and financial highlights.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Funds’ internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of each Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of November 30, 2012, by correspondence with the custodian and brokers or by other appropriate auditing procedures where replies from brokers were not received. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the American Beacon Stephens Small Cap Growth Fund and the American Beacon Stephens Mid-Cap Growth Fund at November 30, 2012, and the results of their operations, the changes in their net assets, and the financial highlights for the year then ended, in conformity with U.S. generally accepted accounting principles.

Dallas, Texas

January 29, 2013

9

American Beacon Stephens Small Cap Growth FundSM

Schedule of Investments

November 30, 2012

| | | | | | | | |

| | | Shares | | | Fair Value | |

| | | | | | (000’s) | |

COMMON STOCK—98.22% | | | | | | | | |

CONSUMER DISCRETIONARY—14.87% | | | | | | | | |

Auto Components—0.54% | | | | | | | | |

LKQ Corp.A | | | 40,000 | | | $ | 877 | |

| | | | | | | | |

Distributors—0.75% | | | | | | | | |

Beacon Roofing Supply, Inc.A | | | 39,300 | | | | 1,212 | |

| | | | | | | | |

Hotels, Restaurants & Leisure—5.42% | | | | | | | | |

BJ’s Restaurants, Inc.A | | | 41,696 | | | | 1,430 | |

Buffalo Wild Wings, Inc.A | | | 21,500 | | | | 1,557 | |

Chuy’s Holdings, Inc.A B | | | 51,269 | | | | 1,207 | |

Ignite Restaurant Group, Inc.A | | | 73,999 | | | | 940 | |

Krispy Kreme Doughnuts, Inc.A | | | 168,100 | | | | 1,530 | |

National CineMedia, Inc. | | | 148,500 | | | | 2,123 | |

| | | | | | | | |

| | | | | | | 8,787 | |

| | | | | | | | |

Leisure Equipment & Products—0.76% | | | | | | | | |

Smith & Wesson Holding Corp.A | | | 116,700 | | | | 1,237 | |

| | | | | | | | |

Media—3.91% | | | | | | | | |

Acacia Research Corp.A | | | 65,819 | | | | 1,463 | |

IMAX Corp.A B | | | 90,256 | | | | 1,954 | |

Lions Gate Entertainment Corp.A B | | | 179,300 | | | | 2,937 | |

| | | | | | | | |

| | | | | | | 6,354 | |

| | | | | | | | |

Specialty Retail—3.49% | | | | | | | | |

Aaron’s, Inc. | | | 73,218 | | | | 2,102 | |

Cabela’s, Inc.A | | | 12,600 | | | | 602 | |

Titan Machinery, Inc.A B | | | 50,600 | | | | 1,120 | |

Ulta Salon Cosmetics & Fragrance, Inc. | | | 7,000 | | | | 702 | |

Zumiez, Inc.A B | | | 55,329 | | | | 1,144 | |

| | | | | | | | |

| | | | | | | 5,670 | |

| | | | | | | | |

Total Consumer Discretionary | | | | | | | 24,137 | |

| | | | | | | | |

CONSUMER STAPLES—6.09% | | | | | | | | |

Food & Drug Retailing—3.64% | | | | | | | | |

Andersons, Inc. | | | 16,500 | | | | 696 | |

Annie’s, Inc.A B | | | 33,862 | | | | 1,215 | |

Fresh Market, Inc.A | | | 30,400 | | | | 1,576 | |

United Natural Foods, Inc.A | | | 46,840 | | | | 2,424 | |

| | | | | | | | |

| | | | | | | 5,911 | |

| | | | | | | | |

Food Products—1.47% | | | | | | | | |

Darling International, Inc.A | | | 75,300 | | | | 1,270 | |

TreeHouse Foods, Inc.A | | | 21,200 | | | | 1,112 | |

| | | | | | | | |

| | | | | | | 2,382 | |

| | | | | | | | |

Personal Products—0.98% | | | | | | | | |

Steiner Leisure Ltd.A | | | 34,700 | | | | 1,596 | |

| | | | | | | | |

Total Consumer Staples | | | | | | | 9,889 | |

| | | | | | | | |

ENERGY—7.89% | | | | | | | | |

Energy Equipment & Services—4.42% | | | | | | | | |

Dril-Quip, Inc.A | | | 19,900 | | | | 1,400 | |

Forum Energy Technologies, Inc.A | | | 50,600 | | | | 1,277 | |

Hercules Offshore, Inc.A | | | 248,600 | | | | 1,283 | |

Hornbeck Offshore Services, Inc.A | | | 25,900 | | | | 932 | |

Oil States International, Inc.A | | | 19,900 | | | | 1,407 | |

Pacific Drilling S.A.A | | | 92,300 | | | | 877 | |

| | | | | | | | |

| | | | | | | 7,176 | |

| | | | | | | | |

Oil & Gas—3.47% | | | | | | | | |

Carrizo Oil & Gas, Inc.A | | | 57,200 | | | | 1,187 | |

Halcon Resources Corp.A | | | 178,389 | | | | 1,102 | |

| | | | | | | | |

| | | Shares | | | Fair Value | |

| | | | | | (000’s) | |

Kodiak Oil & Gas Corp.A | | | 118,200 | | | $ | 1,014 | |

Pioneer Energy Services Corp.A | | | 174,000 | | | | 1,259 | |

Rosetta Resources, Inc.A | | | 23,900 | | | | 1,074 | |

| | | | | | | | |

| | | | | | | 5,636 | |

| | | | | | | | |

Total Energy | | | | | | | 12,812 | |

| | | | | | | | |

FINANCIALS—10.33% | | | | | | | | |

Banks—1.43% | | | | | | | | |

East West Bancorp, Inc. | | | 49,300 | | | | 1,043 | |

SVB Financial GroupA | | | 23,000 | | | | 1,270 | |

| | | | | | | | |

| | | | | | | 2,313 | |

| | | | | | | | |

Diversified Financials—7.08% | | | | | | | | |

Cardtronics, Inc.A | | | 70,100 | | | | 1,608 | |

Encore Capital Group, Inc.A | | | 90,691 | | | | 2,411 | |

Euronet Worldwide, Inc.A | | | 74,900 | | | | 1,667 | |

First Cash Financial Services, Inc.A | | | 52,200 | | | | 2,521 | |

Portfolio Recovery Associates, Inc. | | | 22,100 | | | | 2,184 | |

Stifel Financial Corp.A | | | 36,550 | | | | 1,112 | |

| | | | | | | | |

| | | | | | | 11,503 | |

| | | | | | | | |

Insurance—1.82% | | | | | | | | |

Hilltop Holdings, Inc.A | | | 85,700 | | | | 1,225 | |

ProAssurance Corp. | | | 19,000 | | | | 1,723 | |

| | | | | | | | |

| | | | | | | 2,948 | |

| | | | | | | | |

Total Financials | | | | | | | 16,764 | |

| | | | | | | | |

HEALTH CARE—20.42% | | | | | | | | |

Biotechnology—5.90% | | | | | | | | |

Cepheid, Inc.A | | | 46,000 | | | | 1,491 | |

Cubist Pharmaceuticals, Inc.A | | | 23,000 | | | | 934 | |

MAP Pharmaceuticals, Inc.A | | | 52,200 | | | | 832 | |

Myriad Genetics, Inc.A | | | 66,729 | | | | 1,916 | |

Neogen Corp.A | | | 51,200 | | | | 2,333 | |

Polypore International, Inc.A B | | | 29,400 | | | | 1,207 | |

Techne Corp. | | | 12,200 | | | | 865 | |

| | | | | | | | |

| | | | | | | 9,578 | |

| | | | | | | | |

Health Care Equipment & Supplies—4.14% | | | | | | | | |

Medidata Solutions, Inc.A | | | 51,621 | | | | 2,066 | |

Merge Healthcare, Inc.B | | | 109,200 | | | | 357 | |

NuVasive, Inc.A | | | 78,380 | | | | 1,138 | |

Thoratec Corp.A | | | 40,900 | | | | 1,521 | |

Volcano Corp.A | | | 60,200 | | | | 1,641 | |

| | | | | | | | |

| | | | | | | 6,723 | |

| | | | | | | | |

Health Care Providers & Services—6.90% | | | | | | | | |

Acadia Healthcare Co. IncA | | | 22,500 | | | | 516 | |

Advisory Board Co.A | | | 56,998 | | | | 2,580 | |

ICON plc, ADRA C | | | 70,100 | | | | 1,823 | |

IPC The Hospitalist Co., Inc.A | | | 41,360 | | | | 1,561 | |

PAREXEL International Corp.A | | | 68,800 | | | | 2,222 | |

PSS World Medical, Inc.A | | | 45,479 | | | | 1,293 | |

VCA Antech, Inc.A | | | 58,055 | | | | 1,206 | |

| | | | | | | | |

| | | | | | | 11,201 | |

| | | | | | | | |

Pharmaceuticals—3.48% | | | | | | | | |

Akorn, Inc.A | | | 130,700 | | | | 1,763 | |

Pacira Pharmaceuticals, Inc.A | | | 57,500 | | | | 980 | |

Proto Labs, Inc.A | | | 54,640 | | | | 1,994 | |

Salix Pharmaceuticals Ltd.A | | | 21,200 | | | | 908 | |

| | | | | | | | |

| | | | | | | 5,645 | |

| | | | | | | | |

Total Health Care | | | | | | | 33,147 | |

| | | | | | | | |

American Beacon Stephens Small Cap Growth FundSM

Schedule of Investments

November 30, 2012

| | | | | | | | |

| | | Shares | | | Fair Value | |

| | | | | | (000’s) | |

INDUSTRIALS—13.90% | | | | | | | | |

Air Freight & Couriers—0.81% | | | | | | | | |

Echo Global Logistics, Inc.A | | | 74,900 | | | $ | 1,316 | |

| | | | | | | | |

Commercial Services & Supplies—8.09% | | | | | | | | |

Clean Harbors, Inc.A | | | 19,000 | | | | 1,088 | |

Corporate Executive Board Co. | | | 35,900 | | | | 1,537 | |

CoStar Group, Inc.A | | | 32,801 | | | | 2,848 | |

HMS Holdings Corp.A | | | 65,300 | | | | 1,513 | |

Insperity, Inc. | | | 43,300 | | | | 1,308 | |

Liquidity Services, Inc.A | | | 37,770 | | | | 1,551 | |

Marlin Business Services Corp. | | | 46,979 | | | | 813 | |

Tetra Tech, Inc.A | | | 44,200 | | | | 1,139 | |

WageWorks, Inc.A | | | 72,402 | | | | 1,337 | |

| | | | | | | | |

| | | | | | | 13,134 | |

| | | | | | | | |

Construction & Engineering—0.77% | | | | | | | | |

Mistras Group, Inc.A | | | 57,258 | | | | 1,242 | |

| | | | | | | | |

Industrial Conglomerates—0.31% | | | | | | | | |

RPX Corp.A | | | 55,900 | | | | 508 | |

| | | | | | | | |

Machinery—2.55% | | | | | | | | |

Chart Industries, Inc.A | | | 10,946 | | | | 662 | |

Flow International Corp.A | | | 239,100 | | | | 753 | |

Lindsay Corp. | | | 19,900 | | | | 1,574 | |

Valmont Industries, Inc. | | | 8,200 | | | | 1,145 | |

| | | | | | | | |

| | | | | | | 4,134 | |

| | | | | | | | |

Road & Rail—0.61% | | | | | | | | |

Knight Transportation, Inc. | | | 65,800 | | | | 989 | |

| | | | | | | | |

Trading Companies & Distributors—0.76% | | | | | | | | |

MSC Industrial Direct Co., Inc., Class A | | | 16,945 | | | | 1,231 | |

| | | | | | | | |

Total Industrials | | | | | | | 22,554 | |

| | | | | | | | |

INFORMATION TECHNOLOGY—23.38% | | | | | | | | |

Communications Equipment—1.65% | | | | | | | | |

Aruba Networks, Inc.A | | | 91,400 | | | | 1,780 | |

Procera Networks, Inc.A | | | 43,819 | | | | 905 | |

| | | | | | | | |

| | | | | | | 2,685 | |

| | | | | | | | |

Computers & Peripherals—1.09% | | | | | | | | |

Stratasys Ltd.A B | | | 23,700 | | | | 1,776 | |

| | | | | | | | |

Electronic Equipment & Instruments—2.43% | | | | | | | | |

Hittite Microwave Corp.A | | | 23,900 | | | | 1,450 | |

OSI Systems, Inc.A | | | 40,800 | | | | 2,500 | |

| | | | | | | | |

| | | | | | | 3,950 | |

| | | | | | | | |

Internet Software & Services—6.49% | | | | | | | | |

Athenahealth, Inc.A | | | 22,102 | | | | 1,408 | |

Fortinet, Inc.A | | | 42,000 | | | | 839 | |

MercadoLibre, Inc. | | | 19,900 | | | | 1,432 | |

RADWARE Ltd.A | | | 24,300 | | | | 777 | |

Shutterfly, Inc.A | | | 33,272 | | | | 897 | |

Sourcefire, Inc.A | | | 48,100 | | | | 2,367 | |

Vocera Communications, Inc.A | | | 25,094 | | | | 617 | |

Vocus, Inc.A | | | 86,970 | | | | 1,484 | |

Zix Corp. | | | 256,400 | | | | 703 | |

| | | | | | | | |

| | | | | | | 10,524 | |

| | | | | | | | |

Semiconductor Equipment & Products—4.81% | | | | | |

Cavium, Inc.A B | | | 37,300 | | | | 1,314 | |

Intermolecular, Inc.A | | | 102,600 | | | | 718 | |

| | | | | | | | |

| | | Shares | | | Fair Value | |

| | | | | | (000’s) | |

Mellanox Technologies Ltd.A B | | | 10,509 | | | $ | 766 | |

Microsemi Corp. A | | | 68,030 | | | | 1,302 | |

Power Integrations, Inc. | | | 47,600 | | | | 1,481 | |

Semtech Corp.A | | | 58,600 | | | | 1,603 | |

Volterra Semiconductor Corp.A | | | 35,100 | | | | 616 | |

| | | | | | | | |

| | | | | | | 7,800 | |

| | | | | | | | |

Software—6.91% | | | | | | | | |

Aspen Technology, Inc.A | | | 96,748 | | | | 2,515 | |

Bottomline Technologies, Inc.A | | | 21,700 | | | | 532 | |

Cognex Corp. | | | 32,900 | | | | 1,178 | |

Concur Technologies, Inc.A | | | 16,500 | | | | 1,084 | |

Ellie Mae, Inc.A | | | 5,245 | | | | 130 | |

Greenway Medical TechnologiesA B | | | 61,100 | | | | 1,188 | |

MICROS Systems, Inc.A | | | 26,000 | | | | 1,130 | |

National Instruments Corp. | | | 32,667 | | | | 794 | |

PROS Holdings, Inc.A | | | 72,400 | | | | 1,284 | |

Ultimate Software Group, Inc.A | | | 14,600 | | | | 1,381 | |

| | | | | | | | |

| | | | | | | 11,216 | |

| | | | | | | | |

Total Information Technology | | | | | | | 37,951 | |

| | | | | | | | |

MATERIALS—0.53% | | | | | | | | |

Balchem Corp. | | | 23,900 | | | | 854 | |

| | | | | | | | |

TELECOMMUNICATION SERVICES—0.80% | | | | | |

Allot Communications Ltd.A | | | 42,867 | | | | 937 | |

Ruckus Wireless, Inc.A B | | | 27,900 | | | | 369 | |

| | | | | | | | |

Total Telecommunication Services | | | | | | | 1,306 | |

| | | | | | | | |

Total Common Stock

(Cost $143,024) | | | | | | | 159,414 | |

| | | | | | | | |

SHORT-TERM INVESTMENTS—1.73%

(Cost $2,804) | | | | | | | | |

JPMorgan U.S. Government Money Market Fund, Capital Class | | | 2,803,684 | | | | 2,804 | |

| | | | | | | | |

SECURITIES LENDING COLLATERAL—9.06% | | | | | |

DWS Government and Agency Securities Portfolio, Institutional Class | | | 2,901,544 | | | | 2,902 | |

American Beacon U.S. Government Money Market Select Fund, Select ClassD | | | 11,803,516 | | | | 11,803 | |

| | | | | | | | |

Total Securities Lending Collateral

(Cost $14,705) | | | | | | | 14,705 | |

| | | | | | | | |

TOTAL INVESTMENTS —109.01%

(Cost $160,533) | | | | | | | 176,923 | |

LIABILITIES, NET OF OTHER ASSETS—(9.01%) | | | | (14,619 | ) |

| | | | | | | | |

TOTAL NET ASSETS—100.00% | | | | | | $ | 162,304 | |

| | | | | | | | |

Percentages are stated as a percent of net assets.

| A | Non-income producing security. |

| B | All or a portion of this security is on loan at November 30, 2012. |

| C | ADR—American Depositary Receipt. |

| D | The Fund is affiliated by having the same investment advisor. |

See accompanying notes

11

American Beacon Stephens Mid-Cap Growth FundSM

Schedule of Investments

November 30, 2012

| | | | | | | | |

| | | Shares | | | Fair Value | |

| | | | | | (000’s) | |

COMMON STOCK—97.02% | | | | | | | | |

CONSUMER DISCRETIONARY—20.25% | | | | | | | | |

Auto Components—1.60% | | | | | | | | |

LKQ Corp.A | | | 40,850 | | | $ | 895 | |

| | | | | | | | |

Automobiles—0.35% | | | | | | | | |

Tesla Motors, Inc.A | | | 5,750 | | | | 194 | |

| | | | | | | | |

Hotels, Restaurants & Leisure—1.71% | | | | | | | | |

Chipotle Mexican Grill, Inc.A | | | 1,200 | | | | 317 | |

Panera Bread Co., Class AA | | | 4,000 | | | | 642 | |

| | | | | | | | |

| | | | | | | 959 | |

| | | | | | | | |

Leisure Equipment & Products—0.51% | | | | | | | | |

Polaris Industries, Inc. | | | 3,350 | | | | 284 | |

| | | | | | | | |

Media—3.80% | | | | | | | | |

Cinemark Holdings, Inc. | | | 25,650 | | | | 698 | |

Discovery Communications, Inc., Class CA | | | 17,250 | | | | 970 | |

IMAX Corp.A | | | 21,227 | | | | 460 | |

| | | | | | | | |

| | | | | | | 2,128 | |

| | | | | | | | |

Multiline Retail—2.15% | | | | | | | | |

Family Dollar Stores, Inc. | | | 9,450 | | | | 673 | |

Nordstrom, Inc. | | | 9,850 | | | | 533 | |

| | | | | | | | |

| | | | | | | 1,206 | |

| | | | | | | | |

Specialty Retail—7.97% | | | | | | | | |

Cabela’s, Inc.A | | | 13,500 | | | | 645 | |

CarMax, Inc.A | | | 22,300 | | | | 809 | |

Ross Stores, Inc. | | | 13,550 | | | | 771 | |

Tractor Supply Co. | | | 7,050 | | | | 632 | |

Ulta Salon Cosmetics & Fragrance, Inc. | | | 8,550 | | | | 857 | |

Urban Outfitters, Inc.A | | | 20,050 | | | | 756 | |

| | | | | | | | |

| | | | | | | 4,470 | |

| | | | | | | | |

Textiles & Apparel—2.16% | | | | | | | | |

Lululemon Athletica, Inc.A | | | 8,900 | | | | 639 | |

Under Armour, Inc., Class AA | | | 11,000 | | | | 570 | |

| | | | | | | | |

| | | | | | | 1,209 | |

| | | | | | | | |

Total Consumer Discretionary | | | | | | | 11,345 | |

| | | | | | | | |

CONSUMER STAPLES—5.55% | | | | | | | | |

Beverages—2.16% | | | | | | | | |

Brown-Forman Corp., Class B | | | 10,380 | | | | 729 | |

Monster Beverage Corp.A | | | 9,250 | | | | 481 | |

| | | | | | | | |

| | | | | | | 1,210 | |

| | | | | | | | |

Food & Drug Retailing—2.89% | | | | | | | | |

Fresh Market, Inc.A | | | 5,600 | | | | 290 | |

United Natural Foods, Inc.A | | | 8,700 | | | | 450 | |

Whole Foods Market, Inc. | | | 9,400 | | | | 878 | |

| | | | | | | | |

| | | | | | | 1,618 | |

| | | | | | | | |

Food Products—0.50% | | | | | | | | |

Darling International, Inc.A | | | 16,700 | | | | 282 | |

| | | | | | | | |

Total Consumer Staples | | | | | | | 3,110 | |

| | | | | | | | |

ENERGY—8.95% | | | | | | | | |

Energy Equipment & Services—6.17% | | | | | | | | |

Core Laboratories N.V. | | | 6,300 | | | | 650 | |

Dril-Quip, Inc.A | | | 8,900 | | | | 626 | |

Ensco plc, Class A | | | 11,150 | | | | 649 | |

FMC Technologies, Inc.A | | | 8,830 | | | | 361 | |

Oceaneering International, Inc. | | | 13,750 | | | | 724 | |

| | | | | | | | |

| | | Shares | | | Fair Value | |

| | | | | | (000’s) | |

Oil States International, Inc.A | | | 6,300 | | | $ | 446 | |

| | | | | | | | |

| | | | | | | 3,456 | |

| | | | | | | | |

Oil & Gas—2.78% | | | | | | | | |

Pioneer Natural Resources Co. | | | 2,800 | | | | 300 | |

Range Resources Corp. | | | 7,250 | | | | 464 | |

Southwestern Energy Co.A | | | 9,110 | | | | 316 | |

Whiting Petroleum Corp.A | | | 11,350 | | | | 476 | |

| | | | | | | | |

| | | | | | | 1,556 | |

| | | | | | | | |

Total Energy | | | | | | | 5,012 | |

| | | | | | | | |

FINANCIALS—5.86% | | | | | | | | |

Banks—0.89% | | | | | | | | |

East West Bancorp, Inc. | | | 23,600 | | | | 499 | |

| | | | | | | | |

Diversified Financials—3.88% | | | | | | | | |

Affiliated Managers Group, Inc.A | | | 7,230 | | | | 931 | |

IntercontinentalExchange, Inc.A | | | 4,200 | | | | 555 | |

Portfolio Recovery Associates, Inc. | | | 7,000 | | | | 692 | |

| | | | | | | | |

| | | | | | | 2,178 | |

| | | | | | | | |

Insurance—1.09% | | | | | | | | |

ProAssurance Corp. | | | 6,700 | | | | 608 | |

| | | | | | | | |

Total Financials | | | | | | | 3,285 | |

| | | | | | | | |

HEALTH CARE—17.99% | | | | | | | | |

Biotechnology—3.58% | | | | | | | | |

Alexion Pharmaceuticals, Inc.A | | | 3,600 | | | | 346 | |

Cepheid, Inc.A | | | 12,900 | | | | 420 | |

Life Technologies Corp.A | | | 9,050 | | | | 446 | |

Polypore International, Inc.A | | | 7,250 | | | | 298 | |

QIAGEN N.V.A | | | 26,950 | | | | 498 | |

| | | | | | | | |

| | | | | | | 2,008 | |

| | | | | | | | |

Health Care Equipment & Supplies—7.26% | | | | | | | | |

Idexx Laboratories, Inc.A | | | 6,850 | | | | 640 | |

Illumina, Inc.A | | | 12,650 | | | | 679 | |

Intuitive Surgical, Inc.A | | | 1,505 | | | | 797 | |

ResMed, Inc. | | | 19,350 | | | | 795 | |

Sirona Dental Systems, Inc. | | | 6,150 | | | | 385 | |

Varian Medical Systems, Inc.A | | | 5,950 | | | | 412 | |

Waters Corp.A | | | 4,200 | | | | 355 | |

| | | | | | | | |

| | | | | | | 4,063 | |

| | | | | | | | |

Health Care Providers & Services—5.96% | | | | | | | | |

Catamaran Corp.A | | | 17,800 | | | | 867 | |

Cerner Corp.A | | | 12,990 | | | | 1,003 | |

Covance, Inc.A | | | 9,830 | | | | 560 | |

Henry Schein, Inc.A | | | 6,495 | | | | 525 | |

VCA Antech, Inc.A | | | 18,580 | | | | 386 | |

| | | | | | | | |

| | | | | | | 3,341 | |

| | | | | | | | |

Pharmaceuticals—1.19% | | | | | | | | |

Salix Pharmaceuticals Ltd.A | | | 7,200 | | | | 309 | |

Shire plc, ADRB | | | 4,105 | | | | 356 | |

| | | | | | | | |

| | | | | | | 665 | |

| | | | | | | | |

Total Health Care | | | | | | | 10,077 | |

| | | | | | | | |

INDUSTRIALS—14.00% | | | | | | | | |

Aerospace & Defense—2.65% | | | | | | | | |

B/E Aerospace, Inc.A | | | 12,800 | | | | 606 | |

Precision Castparts Corp. | | | 3,195 | | | | 586 | |

World Fuel Services Corp. | | | 7,450 | | | | 290 | |

| | | | | | | | |

| | | | | | | 1,482 | |

| | | | | | | | |

American Beacon Stephens Mid-Cap Growth FundSM

Schedule of Investments

November 30, 2012

| | | | | | | | |

| | | Shares | | | Fair Value | |

| | | | | | (000’s) | |

Commercial Services & Supplies—6.35% | | | | | | | | |

Clean Harbors, Inc.A | | | 4,850 | | | $ | 278 | |

Factset Research Systems, Inc. | | | 3,700 | | | | 342 | |

HMS Holdings Corp.A | | | 21,650 | | | | 502 | |

Iron Mountain, Inc. | | | 21,298 | | | | 673 | |

Stericycle, Inc.A | | | 10,200 | | | | 952 | |

Verisk Analytics, Inc., Class AA | | | 16,350 | | | | 815 | |

| | | | | | | | |

| | | | | | | 3,562 | |

| | | | | | | | |

Electrical Equipment—0.87% | | | | | | | | |

IPG Photonics Corp.A | | | 2,950 | | | | 174 | |

Roper Industries, Inc. | | | 2,800 | | | | 313 | |

| | | | | | | | |

| | | | | | | 487 | |

| | | | | | | | |

Machinery—2.12% | | | | | | | | |

Pall Corp. | | | 6,500 | | | | 387 | |

Valmont Industries, Inc. | | | 5,750 | | | | 803 | |

| | | | | | | | |

| | | | | | | 1,190 | |

| | | | | | | | |

Road & Rail—0.54% | | | | | | | | |

JB Hunt Transport Services, Inc. | | | 5,050 | | | | 300 | |

| | | | | | | | |

Trading Companies & Distributors—1.47% | | | | | | | | |

Fastenal Co. | | | 5,760 | | | | 241 | |

MSC Industrial Direct Co., Inc., Class A | | | 7,980 | | | | 580 | |

| | | | | | | | |

| | | | | | | 821 | |

| | | | | | | | |

Total Industrials | | | | | | | 7,842 | |

| | | | | | | | |

INFORMATION TECHNOLOGY—22.95% | | | | | | | | |

Communications Equipment—1.82% | | | | | | | | |

Aruba Networks, Inc.A | | | 23,300 | | | | 454 | |

F5 Networks, Inc.A | | | 5,450 | | | | 511 | |

Palo Alto Networks, Inc.A | | | 1,000 | | | | 54 | |

| | | | | | | | |

| | | | | | | 1,019 | |

| | | | | | | | |

Computers & Peripherals—1.59% | | | | | | | | |

NetApp, Inc.A | | | 7,800 | | | | 247 | |

SanDisk Corp.A | | | 8,550 | | | | 335 | |

Teradata Corp.A | | | 5,200 | | | | 309 | |

| | | | | | | | |

| | | | | | | 891 | |

| | | | | | | | |

Electronic Equipment & Instruments—0.94% | | | | | | | | |

Riverbed Technology, Inc.A | | | 7,600 | | | | 136 | |

Trimble Navigation Ltd.A | | | 7,010 | | | | 390 | |

| | | | | | | | |

| | | | | | | 526 | |

| | | | | | | | |

Internet Software & Services—4.20% | | | | | | | | |

Akamai Technologies, Inc.A | | | 13,750 | | | | 504 | |

Athenahealth, Inc.A | | | 4,400 | | | | 280 | |

Fortinet, Inc.A | | | 27,800 | | | | 555 | |

MercadoLibre, Inc. | | | 7,250 | | | | 522 | |

VeriSign, Inc. | | | 14,350 | | | | 490 | |

| | | | | | | | |

| | | | | | | 2,351 | |

| | | | | | | | |

IT Consulting & Services—2.72% | | | | | | | | |

Alliance Data Systems Corp.A | | | 6,150 | | | | 876 | |

IHS, Inc., Class AA | | | 7,050 | | | | 650 | |

| | | | | | | | |

| | | | | | | 1,526 | |

| | | | | | | | |

Semiconductor Equipment & Products—4.23% | | | | | | | | |

ARM Holdings plc, ADRB | | | 15,765 | | | | 589 | |

ASML Holding N.V. | | | 5,590 | | | | 350 | |

Cree, Inc.A | | | 9,850 | | | | 318 | |

Lam Research Corp.A | | | 10,218 | | | | 359 | |

Mellanox Technologies Ltd.A | | | 2,600 | | | | 189 | |

Microchip Technology, Inc. | | | 18,580 | | | | 565 | |

| | | | | | | | |

| | | | | | | 2,370 | |

| | | | | | | | |

| | | | | | | | |

| | | Shares | | | Fair Value | |

| | | | | | (000’s) | |

Software—7.45% | | | | | | | | |

Ansys, Inc.A | | | 5,200 | | | $ | 345 | |

Check Point Software Technologies Ltd.A | | | 9,850 | | | | 455 | |

MICROS Systems, Inc.A | | | 8,750 | | | | 380 | |

National Instruments Corp. | | | 16,905 | | | | 411 | |

Nuance Communications, Inc.A | | | 21,750 | | | | 484 | |

Red Hat, Inc.A | | | 15,790 | | | | 779 | |

Salesforce.com, Inc.A | | | 3,155 | | | | 497 | |

SolarWinds, Inc.A | | | 7,650 | | | | 429 | |

Ultimate Software Group, Inc.A | | | 4,200 | | | | 397 | |

| | | | | | | | |

| | | | | | | 4,177 | |

| | | | | | | | |

Total Information Technology | | | | | | | 12,860 | |

| | | | | | | | |

MATERIALS—1.47% | | | | | | | | |

Airgas, Inc. | | | 9,300 | | | | 824 | |

| | | | | | | | |

Total Common Stock

(Cost $46,105) | | | | | | | 54,355 | |

| | | | | | | | |

SHORT-TERM INVESTMENTS—3.79%

(Cost $2,125) | | | | | | | | |

JPMorgan U.S. Government Money Market Fund, Capital Class | | | 2,125,104 | | | | 2,125 | |

| | | | | | | | |

TOTAL INVESTMENTS —100.81%

(Cost $48,230) | | | | | | | 56,480 | |

LIABILITIES, NET OF OTHER ASSETS—(0.81%) | | | | (453 | ) |

| | | | | | | | |

TOTAL NET ASSETS—100.00% | | | | | | $ | 56,027 | |

| | | | | | | | |

Percentages are stated as a percent of net assets.

| A | Non-income producing security. |

| B | ADR—American Depositary Receipt. |

See accompanying notes

13

American Beacon FundsSM

Statements of Assets and Liabilities

November 30, 2012 (in thousands except share and per share amounts)

| | | | | | | | |

| | | Stephens

Small Cap

Growth Fund | | | Stephens

Mid-Cap

Growth Fund | |

Assets: | | | | | | | | |

Investments in unaffiliated securities, at fair value A C | | $ | 165,120 | | | $ | 56,480 | |

Investments in affiliated securities, at fair value B | | | 11,803 | | | | — | |

Receivable for investments sold | | | 530 | | | | 625 | |

Dividends and interest receivable | | | 19 | | | | 27 | |

Receivable for fund shares sold | | | 265 | | | | 14 | |

Receivable for tax reclaims | | | 1 | | | | — | |

Receivable for expense reimbursement (Note 2) | | | 40 | | | | 14 | |

Prepaid expenses | | | 23 | | | | 14 | |

| | | | | | | | |

Total assets | | | 177,801 | | | | 57,174 | |

| | | | | | | | |

Liabilities: | | | | | | | | |

Payable for investments purchased | | | 369 | | | | 1,042 | |

Payable upon return of securities loaned | | | 14,705 | | | | — | |

Payable for fund shares redeemed | | | 139 | | | | — | |

Management and investment advisory fees payable | | | 177 | | | | 50 | |

Administrative service and service fees payable | | | 71 | | | | 23 | |

Professional fees payable | | | 22 | | | | 22 | |

Trustee fees payable | | | 2 | | | | 2 | |

Prospectus and shareholder report expenses payable | | | 3 | | | | 5 | |

Other liabilities | | | 9 | | | | 3 | |

| | | | | | | | |

Total liabilities | | | 15,497 | | | | 1,147 | |

| | | | | | | | |

Net Assets | | $ | 162,304 | | | $ | 56,027 | |

| | | | | | | | |

Analysis of Net Assets: | | | | | | | | |

Paid-in-capital | | | 134,318 | | | | 47,209 | |

Undistributed net investment income | | | — | | | | — | |

Accumulated net realized gain | | | 11,596 | | | | 567 | |

Unrealized appreciation of investments | | | 16,390 | | | | 8,251 | |

| | | | | | | | |

Net assets | | $ | 162,304 | | | $ | 56,027 | |

| | | | | | | | |

Shares outstanding at no par value (Unlimited shares authorized): | | | | | | | | |

Institutional ClassD | | | 6,557,386 | | | | 2,001,824 | |

| | | | | | | | |

Y Class | | | 199,307 | | | | 14,597 | |

| | | | | | | | |

Investor ClassE | | | 5,194,765 | | | | 1,319,006 | |

| | | | | | | | |

A Class | | | 226,634 | | | | 514,907 | |

| | | | | | | | |

C Class | | | 26,610 | | | | 10,776 | |

| | | | | | | | |

Net asset value, offering and redemption price per share: | | | | | | | | |

Institutional ClassD | | $ | 13 .54 | | | $ | 15 .24 | |

| | | | | | | | |

Y Class | | $ | 13 .54 | | | $ | 15 .23 | |

| | | | | | | | |

Investor ClassE | | $ | 12 .99 | | | $ | 13 .72 | |

| | | | | | | | |

A Class (offering price $13.77 and $14.56, respectively) | | $ | 12 .98 | | | $ | 13 .72 | |

| | | | | | | | |

C Class | | $ | 12 .91 | | | $ | 13 .63 | |

| | | | | | | | |

Net assets (not in thousands): | | | | | | | | |

Institutional ClassD | | $ | 88,814,609 | | | $ | 30,503,408 | |

| | | | | | | | |

Y Class | | $ | 2,698,530 | | | $ | 222,277 | |

| | | | | | | | |

Investor ClassE | | $ | 67,505,875 | | | $ | 18,091,662 | |

| | | | | | | | |

A Class | | $ | 2,941,034 | | | $ | 7,062,772 | |

| | | | | | | | |

C Class | | $ | 343,410 | | | $ | 146,859 | |

| | | | | | | | |

| | |

A Cost of investments in unaffiliated securities | | $ | 148,730 | | | $ | 48,230 | |

B Cost of investments in affiliated securities | | $ | 11,803 | | | $ | — | |

C Fair value of securities on loan | | $ | 14,378 | | | $ | — | |

D Formerly known as Class I. | | | | | | | | |

E Formerly known as Class A. | | | | | | | | |

See accompanying notes

14

American Beacon FundsSM

Statements of Operations

For the year ended November 30, 2012 (in thousands)

| | | | | | | | |

| | | Stephens

Small Cap

Growth

Fund | | | Stephens

Mid-Cap

Growth

Fund | |

Investment Income: | | | | | | | | |

Dividend income from unaffiliated securities (net of foreign taxes)A | | $ | 326 | | | $ | 331 | |

Income derived from securities lending | | | 124 | | | | — | |

| | | | | | | | |

Total investment income | | | 450 | | | | 331 | |

| | | | | | | | |

Expenses: | | | | | | | | |

Management and investment advisory fees (Note 2) | | | 902 | | | | 294 | |

Administrative service fees (Note 2): | | | | | | | | |

Institutional ClassB | | | 195 | | | | 75 | |

Y Class | | | 1 | | | | — | |

Investor ClassC | | | 142 | | | | 52 | |

A Class | | | 5 | | | | 14 | |

Transfer agent fees: | | | | | | | | |

Institutional ClassB | | | 15 | | | | 12 | |

Y Class | | | 3 | | | | 4 | |

Investor ClassC | | | 22 | | | | 15 | |

A Class | | | 5 | | | | 5 | |

C Class | | | 3 | | | | 3 | |

Custody and fund accounting fees | | | 31 | | | | 19 | |

Professional fees | | | 50 | | | | 47 | |

Registration fees and expenses | | | 103 | | | | 98 | |

Service fees (Note 2): | | | | | | | | |

Y Class | | | 1 | | | | — | |

Investor ClassC | | | 158 | | | | 55 | |

A Class | | | 2 | | | | 5 | |

Distribution fees (Note 2): | | | | | | | | |

Investor ClassC (Note 1) | | | 27 | | | | 12 | |

A Class | | | 3 | | | | 9 | |

C Class | | | 1 | | | | — | |

Prospectus and shareholder report expenses | | | 22 | | | | 13 | |

Trustee fees | | | 8 | | | | 5 | |

Other expenses | | | 12 | | | | 9 | |

| | | | | | | | |

Total expenses | | | 1,711 | | | | 746 | |

| | | | | | | | |

Net (fees waived and expenses reimbursed) (Note 2) | | | (184 | ) | | | (141 | ) |

| | | | | | | | |

Net expenses | | | 1,527 | | | | 605 | |

| | | | | | | | |

Net investment income | | | (1,077 | ) | | | (274 | ) |

| | | | | | | | |

Realized and unrealized gain (loss) from investments: | | | | | | | | |

Net realized gain (loss) from: | | | | | | | | |

Investments | | | 13,236 | | | | 1,364 | |

Futures contracts | | | 419 | | | | (39 | ) |

Change in net unrealized appreciation or (depreciation) of: | | | | | | | | |

Investments | | | (1,894 | ) | | | 3,884 | |

| | | | | | | | |

Net gain from investments | | | 11,761 | | | | 5,209 | |

| | | | | | | | |

Net increase in net assets resulting from operations | | $ | 10,684 | | | $ | 4,935 | |

| | | | | | | | |

A Foreign taxes | | $ | 1 | | | $ | 2 | |

B Formerly known as Class I. | | | | | | | | |

C Formerly known as Class A. | | | | | | | | |

See accompanying notes

15

American Beacon FundsSM

Statements of Changes in Net Assets (in thousands)

| | | | | | | | | | | | | | | | |

| | | Stephens Small Cap Growth Fund | | | Stephens Mid-Cap Growth Fund | |

| | | Year Ended

November 30,

2012 | | | Year Ended

November 30,

2011 | | | Year Ended

November 30,

2012 | | | Year Ended

November 30,

2011 | |

Increase (Decrease) in Net Assets: | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | |

Net investment (loss) | | $ | (1,077 | ) | | $ | (954 | ) | | $ | (274 | ) | | $ | (264 | ) |

Net realized gain from investments and futures contracts | | | 13,655 | | | | 8,768 | | | | 1,325 | | | | 2,201 | |

Change in net unrealized appreciation or (depreciation) from investments | | | (1,894 | ) | | | 1,838 | | | | 3,884 | | | | 195 | |

| | | | | | | | | | | | | | | | |

Net increase in net assets resulting from operations | | | 10,684 | | | | 9,652 | | | | 4,935 | | | | 2,132 | |

| | | | | | | | | | | | | | | | |

Distributions to Shareholders: | | | | | | | | | | | | | | | | |

Net investment income: | | | | | | | | | | | | | | | | |

Institutional ClassA | | | — | | | | (502 | ) | | | — | | | | — | |

Investor ClassB | | | — | | | | (567 | ) | | | — | | | | — | |

Net realized gain from investments: | | | | | | | | | | | | | | | | |

Institutional ClassA | | | (4,196 | ) | | | — | | | | — | | | | — | |

Investor ClassB | | | (3,533 | ) | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Net distributions to shareholders | | | (7,729 | ) | | | (1,069 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Capital Share Transactions: | | | | | | | | | | | | | | | | |

Proceeds from sales of shares | | | 95,627 | | | | 41,877 | | | | 29,475 | | | | 13,720 | |

Reinvestment of dividends and distributions | | | 7,143 | | | | 910 | | | | — | | | | — | |

Cost of shares redeemed | | | (42,858 | ) | | | (37,013 | ) | | | (11,624 | ) | | | (4,811 | ) |

| | | | | | | | | | | | | | | | |

Net increase in net assets from capital share transactions | | | 59,912 | | | | 5,774 | | | | 17,851 | | | | 8,909 | |

| | | | | | | | | | | | | | | | |

Net increase in net assets | | | 62,867 | | | | 14,358 | | | | 22,786 | | | | 11,041 | |

| | | | | | | | | | | | | | | | |

Net Assets: | | | | | | | | | | | | | | | | |

Beginning of period | | | 99,437 | | | | 85,079 | | | | 33,241 | | | | 22,200 | |

| | | | | | | | | | | | | | | | |

End of Period * | | $ | 162,304 | | | $ | 99,437 | | | $ | 56,027 | | | $ | 33,241 | |

| | | | | | | | | | | | | | | | |

*Includes undistributed net investment income (loss) of | | $ | — | | | $ | — | | | $ | — | | | $ | 4 | |

| | | | | | | | | | | | | | | | |

A Formerly known as Class I.

B Formerly known as Class A.

See accompanying notes

16

American Beacon FundsSM

Notes to Financial Statements

November 30, 2012

1. Organization and Significant Accounting Policies

American Beacon Funds (the “Trust”), which is comprised of 24 Funds, is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended, (the “Act”) as a diversified, open-end management investment company. These financial statements and notes to the financial statements relate to the American Beacon Stephens Small Cap Growth Fund and the American Beacon Stephens Mid-Cap Growth Fund (each a “Fund” and collectively, the “Funds”), each a series of the Trust.

American Beacon Advisors, Inc. (the “Manager”), is a wholly-owned subsidiary of Lighthouse Holdings, Inc., and was organized in 1986 to provide business management, advisory, administrative and asset management consulting services to the Trust and other investors.

Reorganization

The American Beacon Stephens Small Cap Growth Fund and the American Beacon Mid-Cap Growth Fund are the legal successors to the Stephens Small Cap Growth Fund and the Stephens Mid-Cap Growth Fund, respectively (the “Predecessor Funds”). On February 24, 2012, the Funds (which had no prior activity or net assets) acquired all the net assets of the Predecessor Funds pursuant to a plan of reorganization. The exchange consisted of the Predecessor Funds’ Class I and Class A shares for the Funds’ Institutional and Investor class shares at the same aggregate value, respectively.

The acquisition was accounted for as a tax-free exchange after the close of business on February 24, 2012, as follows:

| | | | | | | | |

| | | Stephens Small Cap

Growth Fund | | | Stephens Mid-Cap

Growth Fund | |

Institutional Shares | | | 4,631,306 | | | | 1,732,001 | |

Investor Shares | | | 3,909,005 | | | | 1,680,312 | |

Net Assets | | $ | 114,025,583 | | | $ | 49,019,840 | |

Net Investment Income (loss) | | $ | (252,585 | ) | | $ | 92,807 | |

Unrealized Appreciation | | $ | 28,082,046 | | | $ | 8,639,632 | |

The accounting and performance history of the Class I and Class A Shares of the Predecessor Funds were re-designated as that of the Institutional and Investor Class shares of the Funds, respectively.

The reorganization shifted the management oversight responsibility from Stephens Investment Management Group, LLC (“Stephens”) to the Manager. The Manager engaged Stephens as the sub-advisor to the Funds, thus maintaining the continuity of the portfolio management.

For financial reporting purposes, assets received and shares issued by the Funds were recorded at fair value; however, the cost basis of the investments received from the Predecessor Funds was carried forward to align ongoing reporting of the Funds’ realized and unrealized gains and losses with amounts distributable to shareholders for tax purposes.

The Predecessor Funds had a distribution plan pursuant to Rule 12b-1 for the Class A Shares. Under this plan, the Funds collected 0.25% of the average daily net assets for distribution or service activities conducted on behalf of the Funds. Class A Shares were converted to Investor Class Shares on February 27, and this distribution plan was terminated. Prior to the reorganization, the distributor for the Predecessor Funds received $63 in sales commissions from the sale of A Class Shares (in thousands).

Class Disclosure

February 24, 2012 is the inception date of the Y, A, and C Classes.

17

American Beacon FundsSM

Notes to Financial Statements

November 30, 2012

Each Fund has multiple classes of shares designed to meet the needs of different groups of investors. The following table sets forth the differences amongst the classes:

| | |

Class: | | Offered to: |

Institutional Class | | Investors making an initial investment of $250,000 |

Y Class | | Investors making an initial investment of $100,000 |

Investor Class | | General public and investors investing through an intermediary |

A Class | | General public and investors investing through an intermediary with applicable sales charges |

C Class | | General public and investors investing through an intermediary with applicable sales charges |

Each class offered by the Trust has equal rights as to assets and voting privileges. Income and non-class specific expenses are allocated daily to each class on the basis of the relative net assets. Realized and unrealized capital gains and losses of each class are allocated daily based on the relative net assets of each class of the respective Fund. Class specific expenses, where applicable, currently include administrative service fees, service fees, and distribution fees and vary amongst the classes as described more fully in Note 2.

New Accounting Pronouncements

In May 2011, the Financial Accounting Standards Board (“FASB”) issued an Accounting Standards Update (“ASU”) ASU No. 2011-04 “Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. Generally Accepted Accounting Principles (“U.S. GAAP”) and the International Financial Reporting Standards (“IFRSs”)”. ASU No. 2011-04 amends FASB ASC Topic 820, Fair Value Measurements and Disclosures, to establish common requirements for measuring fair value and for disclosing information about fair value measurements in accordance with U.S. GAAP and IFRSs. ASU No. 2011-04 is effective for fiscal years beginning after December 15, 2011 and for the interim period June 1, 2012 to November 30, 2012.

Management has evaluated the implications of these changes and determined that the impact of the new guidance will only affect the disclosure requirements related to the financial statements. However, as the Funds did not hold any Level 3 investments as of November 30, 2012, the financial statements were not affected.

2. Transactions with Affiliates

Management Agreement

Prior to February 24, 2012, the manager of the Predecessor Funds received an annual rate of 0.75% of the average daily net assets of each Fund. Since February 24, the Trust and the Manager are parties to a Management Agreement that obligates the Manager to provide or oversee the provision of all investment advisory and portfolio management services. As compensation for performing the duties required under the Management Agreement, the Manager receives from the Funds an annualized fee equal to 0.05% of the average daily net assets plus amounts paid by the Manager to the unaffiliated investment advisor hired by the Manager to direct investment activities for the Funds. Management fees paid including amounts paid by the Predecessor Funds during the year ended November 30, 2012 were as follows (dollars in thousands):

| | | | | | | | | | | | | | | | |

| | | Management

Fee Rate | | | Management

Fee | | | Amounts paid

to Investment

Advisors* | | | Net Amounts

Retained by

Manager | |

Stephens Small Cap Growth | | | 0.72 | % | | $ | 902 | | | $ | 836 | | | $ | 66 | |

Stephens Mid-Cap Growth | | | 0.59 | % | | | 294 | | | | 274 | | | | 20 | |

| * | Includes amounts paid by the Predecessor Funds. |

As compensation for services provided by the Manager in connection with securities lending activities, the lending Fund pays to the Manager, with respect to cash collateral posted by borrowers, a fee up to 25% of the net monthly interest income (the gross income earned by the investment of cash collateral, less the amount paid to borrowers and related expenses) from such activities and, with respect to loan fees paid by

18

American Beacon FundsSM

Notes to Financial Statements

November 30, 2012

borrowers, a fee up to 25% of such loan fees. This fee is included in Income derived from securities lending and Management and investment advisory fees on the Statements of Operations. During the period ended November 30, 2012, securities lending fees paid to the Manager were $15,516.

Administrative Services Agreement

Prior to February 24, the Predecessor Funds contracted with U.S. Bancorp Fund Services, LLC to serve as the Funds’ Administrator and incurred $21,216 and $9,944 in administrative service fees for the Stephens Small Cap Growth and the Stephens Mid-Cap Growth Funds, respectively. Since February 24, the Manager and the Trust entered into an Administrative Services Agreement which obligates the Manager to provide or oversee administrative services to the Funds. As compensation for performing the duties required under the Administrative Services Agreement, the Manager receives an annualized fee of 0.30% of the average daily net assets of the Institutional, Y, and Investor Classes, and 0.40% of the average daily net assets of the A and C Classes of each of the Funds. For the period ended November 30, 2012, expenses for the C Class of the Stephens Small Cap Growth and Stephens Mid-Cap Growth Funds were less than $500.

Distribution Plans

The Funds, except for the A and C Classes of the Funds, have adopted a “defensive” Distribution Plan (the “Plan”) in accordance with Rule 12b-1 under the Act, pursuant to which no separate fees will be charged to the Funds for distribution purposes. However, the Plan authorizes the management and administrative service fees received by the Manager and the investment advisors hired by the Manager to be used for distribution purposes. Under this Plan, the Funds do not intend to compensate the Manager or any other party, either directly or indirectly, for the distribution of Fund shares.