UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-4984

AMERICAN BEACON FUNDS

(Exact name of registrant as specified in charter)

4151 Amon Carter Boulevard, MD 2450

Fort Worth, Texas 76155

(Address of principal executive offices)-(Zip code)

Gene L. Needles, Jr., PRESIDENT

4151 Amon Carter Boulevard, MD 2450

Fort Worth, Texas 76155

(Name and address of agent for service)

Registrant’s telephone number, including area code: (817) 391-6100

Date of fiscal year end: August 31, 2013

Date of reporting period: August 31, 2013

| ITEM 1. | REPORT TO STOCKHOLDERS. |

About American Beacon Advisors

Since 1986, American Beacon Advisors has offered a variety of products and investment advisory services to numerous institutional and retail clients, including a variety of mutual funds, corporate cash management, and separate account management.

Our clients include defined benefit plans, defined contribution plans, foundations, endowments, corporations, financial planners, and other institutional investors. With American Beacon Advisors, you can put the experience of a multi-billion dollar asset management firm to work for your company.

| | | | |

Contents | |

President’s Message | | | 1 | |

| |

Market and Performance Overview | | | 2-4 | |

| |

Schedule of Investments | | | 7 | |

| |

Financial Statements | | | 33 | |

| |

Notes to the Financial Statements | | | 37 | |

| |

Financial Highlights | | | 62 | |

| |

Additional Information | | | Back Cover | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Important Information: Indexes are unmanaged and one cannot invest directly in an index. Because the Fund has a flexible approach to investing, the risks of the Fund are likewise varied. The primary risks fall into one of several broad categories including high yield securities risk, credit risk, foreign investment risk, derivatives risk, interest rate risk and non-diversification risk. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets. Mortgage and asset-backed securities may be sensitive to changes in interest rates, subject to early repayment risk and their value may fluctuate in response to the market’s perception of issuer creditworthiness; while generally supported by some form of government or private guarantee, there is no assurance that private guarantors will meet their obligations. Income from municipal bonds may be subject to state and local taxes and at times the alternative minimum tax. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when more advantageous. Investing in derivatives could result in losing more than the amount invested. Diversification does not ensure against loss. Investing in debt securities entails interest rate risk, which is the risk that debt securities will decrease in value with increases in market interest rates. Bonds and bond funds with longer durations tend to be more sensitive and more volatile than securities with shorter durations; bond prices generally fall as interest rates rise. Please see the prospectus for a complete discussion of the Fund’s risks. There can be no assurances that the investment objectives of this Fund will be met.

|

Any opinions herein, including forecasts, reflect our judgment as of the end of the reporting period and are subject to change. Each advisor’s strategies and the Fund’s portfolio composition will change depending on economic and market conditions. This report is not a complete analysis of market conditions and therefore, should not be relied upon as investment advice. Although economic and market information has been compiled from reliable sources, American Beacon Advisors, Inc. makes no representation as to the completeness or accuracy of the statements contained herein. |

| | |

| American Beacon Funds | | August 31, 2013 |

| | |

| | Dear Shareholders, The past 12 months have been challenging for global bond markets. Concern over a possible tapering of the U.S. Federal Reserve’s quantitative easing program caused a rise in interest rates with the yield on the benchmark 10-year U.S. Treasury note approaching three percent. The upshot was a very challenging 12 months for global fixed-income investors. The Barclays Capital U.S. Aggregate Index, the flagship index for the bond market, lost 2.47% of its value over the period under review. |

| | • | | For the 12-month period ended August 31, 2013, the American Beacon Flexible Bond Fund (Investor Class) returned 0.38%. |

We believe that the bond funds best positioned to succeed in this new environment are those that can adapt to different landscapes, with the flexibility to deal with changing interest rates. We’re encouraged by the way our American Beacon Flexible Bond Fund has been able to negotiate these challenges.

Thank you for your continued investment in the American Beacon Funds. For additional information about the Funds or to access your account information, please visit our website at www.americanbeaconfunds.com.

|

| Best Regards, |

|

| Gene L. Needles, Jr. |

| President |

| American Beacon Funds |

1

|

| Global Bond Market Overview |

| August 31, 2013 (Unaudited) |

The primary factor affecting the global bond market over the 12 months prior to August 31, 2013, was the scope of central bank interventions around the world, led by the Federal Reserve Bank in the U.S. The turning point for this period came in May, when Federal Reserve chairman Ben Bernanke indicated that the Fed’s asset-purchasing program would be coming to an end in the near future. With interest rates low in most parts of the global economy, it was a challenging landscape for fixed-income investors, one in which the Barclays Capital U.S. Aggregate Index lost 2.5% over the period.

The most important reflation initiatives affecting the world’s bond markets came from the world’s leading central banks. The European Central Bank (ECB) backed up its 2011-announced Longer-Term Refinancing Operations program in July 2012 with a pledge from ECB President Mario Draghi to do “whatever it takes to preserve the euro.” Mervyn King, the former governor of the Bank of England, admitted that simply targeting inflation was no longer enough to prevent another future economic calamity. In the same vein, current Governor Mark Carney said that nominal income level targets might serve economic interests better, especially in the current environment.

In Asia, the Bank of Japan faced political pressure to lift its inflation target and weaken the currency. Chinese authorities veered from fighting real estate speculation toward boosting growth in pursuit of an expansion less dependent on exports.

In the U.S., the Federal Open Market Committee pledged more quantitative easing with no specific endpoint. It also tied the end of its zero interest-rate policy to achieving a 7% unemployment rate as long as “inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee’s 2% longer-run goal, and longer-term inflation expectations continue to be well anchored.”

There was some positive news investors could take from the bond markets. The “risk-on/risk-off” dynamic from 2008 to 2011 started to change throughout 2012, and the breakdown in risk correlations was one of the clues that a more positive outcome was playing out. The divergence between stock and commodities prices was one

example. The simultaneous rise in Italian and Spanish yields along with the drop in Polish and Mexican yields earlier in the year was another. Investors were becoming more selective about where risk was concentrated.

The yield on 10-year U.S. Treasury notes was under 2% on May 21, the day before Chairman Bernanke’s testimony made tapering the dominant theme in the second quarter. By August 31, that yield had risen to 2.78%. Ten-year U.S. TIPS yields rose from negative 40 basis points (-0.40%) to over 60 basis points (0.60%) over the same period. U.S. investment-grade corporates and long-term mortgage yields rose as well. Meanwhile, there were huge dislocations in the emerging markets. During the same May 21 to August 31 period, Mexican long bond yields rose more than 160 basis points (1.60%), while the yield on Brazilian three-year debt surged more than 250 basis points (2.50%).

The period ended with the global markets in a tempest over the timeline for tapering the scale of asset purchases by the U.S. Federal Reserve. If the U.S. economy continues to improve and the unemployment rate stays on its current trajectory lower, then short-term interest rates could start to normalize sometime in 2015. It would be reasonable under those conditions to expect the quantitative easing program to end before that, sometime in 2014.

2

|

American Beacon Flexible Bond Fund SM Performance Overview |

| August 31, 2013 (Unaudited) |

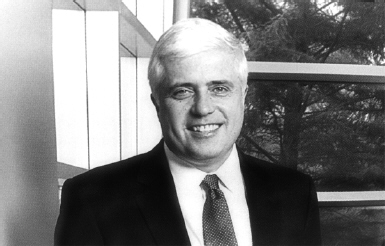

The Investor Class of the Flexible Bond Fund (the “Fund”) returned 0.38% for the twelve months ended August 31, 2013. The Fund outperformed the BofA Merrill Lynch 3-Month LIBOR Index (the “Index”) return of 0.34%. The performance objective of the Fund is to generate positive total returns over a full market cycle and it successfully achieved positive absolute returns during the twelve-month period.

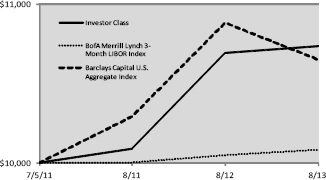

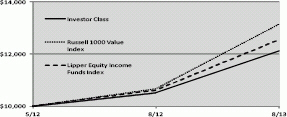

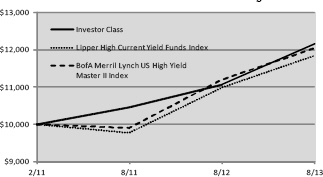

Comparison of Change in Value of a $10,000 Investment

For the period from 7/5/11 through 8/31/13

Total Returns for the Period ended 8/31/13

| | | | | | | | | | | | |

| | | 1 Year | | | Since Inception (7/5/2011) | | | Value of $10,000 7/5/11- 8/31/13 | |

Institutional Class (1,2,4) | | | 0.74 | % | | | 3.57 | % | | $ | 10,787 | |

Y Class (1,2,4) | | | 0.67 | % | | | 3.48 | % | | | 10,765 | |

Investor Class(1,2,4) | | | 0.38 | % | | | 3.34 | % | | | 10,734 | |

A Class with sales charge (1,2,4) | | | -4.48 | % | | | 0.80 | % | | | 10,173 | |

A Class without sales charge (1,2,4) | | | 0.25 | % | | | 3.10 | % | | | 10,681 | |

C Class with sales charge (1,2,4) | | | -1.44 | % | | | 2.67 | % | | | 10,585 | |

C Class without sales charge (1,2,4) | | | -0.44 | % | | | 2.67 | % | | | 10,585 | |

BofA Merrill Lynch

3-Month LIBOR Index(3) | | | 0.34 | % | | | 0.36 | % | | | 10,081 | |

Barclays Capital U.S. Aggregate Index(3) | | | -2.47 | % | | | 2.97 | % | | | 10,650 | |

| 1. | Performance shown is historical and is not indicative of future returns. Investment returns and principal value will vary, and shares may be worth more or less at redemption than at original purchase. Performance shown is as of date indicated, and current performance may be lower or higher than the performance data quoted. To obtain performance as of the most recent month end, please visit www.americanbeaconfunds.com or call 1-800-967-9009. Fund performance in the table above does not reflect the deduction of taxes a shareholder would pay on distributions or the redemption of shares. A Class shares have a maximum sales charge of 4.75%. The maximum contingent deferred sales charge for the C Class is 1.00% for shares redeemed within one year of the date of purchase. |

| 2. | A portion of the fees charged to each Class of the Fund was waived since inception. Performance prior to waiving fees was lower than the actual returns shown since inception. |

| 3. | The BofA Merrill Lynch U.S. Dollar 3-Month LIBOR Index represents the London interbank offered rate (LIBOR) with a constant 3-month average maturity. LIBOR is a composite of the rates of interest at which banks borrow from one another in the London market, and it is a widely used benchmark for short-term interest rates. The Barclays Capital U.S. Aggregate Index is a market weighted index of government, corporate, mortgage-backed and asset-backed fixed-rate debt securities of all maturities. |

| 4. | The total annual Fund operating expense ratio set forth in the most recent Fund prospectus for the Institutional, Y, Investor, A and C Class shares was 1.44%, 1.51%, 1.78%, 1.95% and 2.76%, respectively. The expense ratios above may vary from the expense ratios presented in other sections of this report that are based on expenses incurred during the period covered by this report. |

The Fund’s focus on investing in high quality fixed income securities proved beneficial in achieving its return objective. The majority of the assets are invested in investment grade securities, which generally were positive during the period. However, the Fund’s investments within the U.S. Treasury and U.S. TIPS sectors generated negative returns during the period (down 1.9% and 8.1%, respectively).

Despite the negative returns generated by U.S. Government related securities, Foreign Sovereign investments helped offset some of those losses and experienced gains (up 1.6%). A smaller portion of the Fund’s assets were invested in non-investment grade securities, and this positioning was rewarded as these securities typically outperformed the higher rated securities.

The Fund’s Corporate fixed income exposure provided a positive contribution to the return generated over the period. Among the Corporate holdings, positions in the Finance sector had the most significant impact. The Finance sector represented 15.4% of the Fund’s assets and experienced strong returns (up 4.1%).

Securities with a duration of less than three years had a positive impact during the period. The Treasury yield curve experienced increased yields from securities with a maturity of two years and greater, so the Fund’s emphasis on short duration investments helped.

3

|

American Beacon Flexible Bond Fund SM Performance Overview |

| August 31, 2013 (Unaudited) |

The Fund has the flexibility to utilize derivative instruments and will do so to enhance return, hedge risk, gain efficient exposure to an asset class or to manage liquidity. When considering the Fund’s use of derivatives, it is important to note that the Fund does not use derivatives for the purpose of creating financial leverage. During the period, the Fund experienced modest declines from the use of derivatives in swaps.

Looking forward, the Fund’s investment managers will continue to allocate investments across a wide range of global investment opportunities, seeking to achieve the Fund’s goal of positive total returns regardless of market conditions over a full market cycle.

Top Ten Holdings (% Net Assets)

| | | | | | | | |

U.S. Treasury Bill, 0.040%, Due 10/17/2013 | | | | | | | 5.6 | |

U.S. Treasury Bond, 2.00%, Due 2/15/2023 | | | | | | | 3.2 | |

Fannie Mae Pool, 3.00%, Due 12/1/2099 | | | | | | | 3.1 | |

U.S. Treasury Bill, 0.010%, Due 3/6/2014 | | | | | | | 2.4 | |

U.S. Treasury Bill, 0.01%, Due 11/14/2013 | | | | | | | 1.9 | |

Government National Mortgage Association, 1.013%, Due 7/20/2062 | | | | | | | 1.8 | |

U.S. Treasury, 1.750%, Due 5/15/2023 | | | | | | | 1.8 | |

Italy Government Bond, 5.000%, Due 8/1/2039 | | | | | | | 1.7 | |

U.S. Treasury, 0.625%, Due 2/15/2043 | | | | | | | 1.7 | |

U.S. Treasury, 2.875%, Due 5/15/2043 | | | | | | | 1.6 | |

| | |

Total Fund Holdings | | | 427 | | | | | |

Sector Allocation (% Investments)

| | | | | | |

Sovereign | | | | | 19.8 | |

U.S. Treasury | | | | | 19.7 | |

Finance | | | | | 16.0 | |

Short-Term Investments | | | | | 13.5 | |

Other Investment Companies | | | | | 10.6 | |

Mortgage Backed Obligations | | | | | 9.5 | |

Manufacturing | | | | | 4.3 | |

Service | | | | | 2.7 | |

Energy | | | | | 1.2 | |

Consumer | | | | | 1.0 | |

Asset-Backed Obligations | | | | | 0.6 | |

Telecommunications | | | | | 0.5 | |

Utilities | | | | | 0.4 | |

Agency | | | | | 0.2 | |

Transportation | | | | | 0.0 | |

4

|

American Beacon Flexible Bond Fund SM Fund Expenses |

| August 31, 2013 (Unaudited) |

Fund Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on shares purchased and (2) ongoing costs, including management fees, administrative service fees, distribution (12b-1) fees, and other Fund expenses. The examples below are intended to help you understand the ongoing cost (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 invested at the beginning of the period in each Class and held for the entire period from March 1, 2013 through August 31, 2013.

Actual Expenses

The “Actual” lines of the table provide information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. Shareholders of the Investor and Institutional Classes that invest in the Fund through an IRA or Roth IRA may be subject to a custodial IRA fee of $15 that is typically deducted each December. If your account was subject to a custodial IRA fee during the period, your costs would have been $15 higher.

Hypothetical Example for Comparison Purposes

The “Hypothetical” lines of the table provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the Fund’s actual return). You may compare the ongoing costs of investing in the Fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Shareholders of the Investor and Institutional Classes that invest in the Fund through an IRA or Roth IRA may be subject to a custodial IRA fee of $15 that is typically deducted each December. If your account was subject to a custodial IRA fee during the period, your costs would have been $15 higher.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs charged by the Fund, such as sales charges (loads). Similarly, the expense examples for other funds do not reflect any transaction costs charged by those funds, such as sales charges (loads), redemption fees or exchange fees. Therefore, the “Hypothetical” lines of the table are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. If you were subject to any transaction costs during the period, your costs would have been higher.

| | | | | | | | | | | | |

| | | Beginning

Account

Value

3/1/13 | | | Ending

Account

Value

8/31/13 | | | Expenses Paid

During Period*

3/1/13-8/31/13 | |

Institutional Class | |

Actual | | $ | 1,000.00 | | | $ | 971.05 | | | $ | 4.47 | |

Hypothetical ** | | $ | 1,000.00 | | | $ | 1,020.67 | | | $ | 4.58 | |

Y Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 970.65 | | | $ | 4.92 | |

Hypothetical ** | | $ | 1,000.00 | | | $ | 1,020.21 | | | $ | 5.04 | |

Investor Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 969.26 | | | $ | 6.30 | |

Hypothetical ** | | $ | 1,000.00 | | | $ | 1,018.80 | | | $ | 6.46 | |

A Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 968.68 | | | $ | 6.90 | |

Hypothetical ** | | $ | 1,000.00 | | | $ | 1,018.20 | | | $ | 7.07 | |

C Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 965.59 | | | $ | 10.60 | |

Hypothetical ** | | $ | 1,000.00 | | | $ | 1,014.42 | | | $ | 10.87 | |

| * | Expenses are equal to the Fund’s annualized expense ratios for the six-month period of 0.90%, 0.99%, 1.27%, 1.39% and 2.14% for the Institutional, Y, Investor, A and C Classes respectively, multiplied by the average account value over the period, multiplied by the number derived by dividing the number of days in the most recent fiscal half-year (184) by days in the year (365) to reflect the half-year period. |

| ** | 5% return before expenses. |

5

|

American Beacon Flexible Bond Fund SM Report of Independent Registered Public Accounting Firm |

To the Shareholders and the Board of Trustees of

American Beacon Flexible Bond Fund:

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of the American Beacon Flexible Bond Fund (one of the funds constituting the American Beacon Funds) (the “Fund”), as of August 31, 2013, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for the periods indicated therein. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Funds’ internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of August 31, 2013, by correspondence with the custodian and brokers or by other appropriate auditing procedures where replies from brokers were not received. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the American Beacon Flexible Bond Fund at August 31, 2013, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for the periods indicated therein, in conformity with U.S. generally accepted accounting principles.

Dallas, Texas

October 30, 2013

6

|

American Beacon Flexible Bond FundSM Schedule of Investments |

| August 31, 2013 |

| | | | | | | | |

| | | Shares | | | Fair Value | |

| | | | | | (000’s) | |

PREFERRED STOCK - 0.15% | | | | | | | | |

FINANCE - 0.14% | | | | | | | | |

Banks - 0.14% | | | | | | | | |

Lloyds Banking Group PLC, | | | | | | | | |

Due 12/31/2049A B | | | 300,000 | | | $ | 254 | |

Due 12/31/2049A B | | | 140,000 | | | | 127 | |

| | | | | | | | |

Total Finance | | | | | | | 381 | |

| | | | | | | | |

MANUFACTURING - 0.01% | | | | | | | | |

Metals/Mining - 0.01% | | | | | | | | |

ArcelorMittal | | | 1,900 | | | | 39 | |

| | | | | | | | |

Total Preferred Stock (Cost $430) | | | | | | | 420 | |

| | | | | | | | |

| | |

| | | Par Amount M | | | | |

| | | (000’s) | | | | |

DOMESTIC CONVERTIBLE OBLIGATIONS - 1.25% | | | | | | | | |

Consumer - 0.03% | | | | | | | | |

Olam International Ltd., 6.00%, Due 10/15/2016 | | $ | 100 | | | | 95 | |

| | | | | | | | |

Energy - 0.10% | | | | | | | | |

Lukoil International Finance BV, 2.625%, Due 6/16/2015 | | | 100 | | | | 109 | |

Seadrill Ltd., 3.375%, Due 10/27/2017 | | | 100 | | | | 162 | |

| | | | | | | | |

| | | | | | | 271 | |

| | | | | | | | |

Finance - 0.24% | | | | | | | | |

BES Finance Ltd., 3.50%, Due 12/6/2015 | | | 200 | | | | 200 | |

Hong Kong Exchanges, 0.50%, Due 10/23/2017 | | | 200 | | | | 210 | |

Noble Group Ltd., 0.01%, Due 6/13/2014 | | | 100 | | | | 147 | |

WellPoint, Inc., 2.75%, Due 10/15/2042B | | | 90 | | | | 115 | |

| | | | | | | | |

| | | | | | | 672 | |

| | | | | | | | |

Manufacturing - 0.64% | | | | | | | | |

DR Horton, Inc., 2.00%, Due 5/15/2014 | | | 250 | | | | 354 | |

Electronic Arts, Inc., 0.75%, Due 7/15/2016 | | | 81 | | | | 90 | |

EMC Corp., 1.75%, Due 12/1/2013 | | | 200 | | | | 321 | |

Ford Motor Co., 4.25%, Due 11/15/2016 | | | 40 | | | | 76 | |

Glencore Finance Europe S.A., 5.00%, Due 12/31/2014 | | | 100 | | | | 113 | |

Goldcorp, Inc., 2.00%, Due 8/1/2014 | | | 13 | | | | 13 | |

Intel Corp., 3.25%, Due 8/1/2039 | | | 200 | | | | 240 | |

Lam Research Corp., 0.50%, Due 5/15/2016 | | | 30 | | | | 33 | |

Siemens AG, 1.05%, Due 8/16/2017 | | | 500 | | | | 524 | |

| | | | | | | | |

| | | | | | | 1,764 | |

| | | | | | | | |

Service - 0.20% | | | | | | | | |

Hologic, Inc., 2.00%, Due 12/15/2037C | | | 57 | | | | 65 | |

Newford Capital Ltd., 0.01%, Due 5/12/2016 | | | 100 | | | | 101 | |

priceline.com, Inc., 1.00%, Due 3/15/2018 | | | 140 | | | | 173 | |

Shire PLC, 2.75%, Due 5/9/2014 | | | 200 | | | | 236 | |

| | | | | | | | |

| | | | | | | 575 | |

| | | | | | | | |

Telecommunications - 0.04% | | | | | | | | |

Billion Express Investment Ltd, 0.75%, Due 10/18/2015 | | | 100 | | | | 103 | |

| | | | | | | | |

Transportation - 0.00% | | | | | | | | |

Ship Finance International Ltd., 3.25%, Due 2/1/2018 | | | 8 | | | | 8 | |

| | | | | | | | |

Total Domestic Convertible Obligations (Cost $3,355) | | | | | | | 3,488 | |

| | | | | | | | |

DOMESTIC OBLIGATIONS - 22.22% | | | | | | | | |

Consumer - 0.64% | | | | | | | | |

BAT International Finance PLC, 1.125%, Due 3/29/2016 | | | 300 | | | | 299 | |

BRF - Brasil Foods S.A., 5.875%, Due 6/6/2022B | | | 200 | | | | 199 | |

Constellation Brands, Inc., 3.75%, Due 5/1/2021 | | | 240 | | | | 222 | |

Grupo Famsa SAB de CV, 7.25%, Due 6/1/2020B | | | 140 | | | | 137 | |

HJ Heinz Co., 1.00%, Due 6/5/2020O | | | 200 | | | | 201 | |

|

American Beacon Flexible Bond FundSM Schedule of Investments |

| August 31, 2013 |

| | | | | | | | |

| | | Par AmountM | | | Fair Value | |

| | | (000’s) | | | (000’s) | |

Land O’Lakes Capital Trust I, 7.45%, Due 3/15/2028B | | $ | 100 | | | $ | 98 | |

Marfrig Holding Europe BV, 9.875%, Due 7/24/2017 | | | 200 | | | | 199 | |

Reynolds Group Issuer Inc., | | | | | | | | |

7.125%, Due 4/15/2019 | | | 100 | | | | 106 | |

7.875%, Due 8/15/2019 | | | 100 | | | | 110 | |

SABMiller Holdings, Inc., 0.955%, Due 8/1/2018B C | | | 200 | | | | 200 | |

| | | | | | | | |

| | | | | | | 1,771 | |

| | | | | | | | |

Energy - 1.07% | | | | | | | | |

Continental Resources, Inc., 4.50%, Due 4/15/2023 | | | 300 | | | | 295 | |

Indian Oil Corp Ltd., 5.75%, Due 8/1/2023 | | | 500 | | | | 460 | |

ION Geophysical Corp., 8.125%, Due 5/15/2018B | | | 75 | | | | 71 | |

Millennium Offshore Services Superholdings LLC, 9.50%, Due 2/15/2018D | | | 200 | | | | 204 | |

Plains Exploration & Production Co., | | | | | | | | |

6.50%, Due 11/15/2020 | | | 80 | | | | 85 | |

6.875%, Due 2/15/2023 | | | 135 | | | | 144 | |

Reliance Holdings USA, Inc., 4.50%, Due 10/19/2020 | | | 250 | | | | 237 | |

Sinopec Group Overseas Development 2012 Ltd., | | | | | | | | |

2.75%, Due 5/17/2017 | | | 200 | | | | 202 | |

3.90%, Due 5/17/2022 | | | 200 | | | | 194 | |

SK Innovation Co. Ltd., 3.625%, Due 8/14/2018 | | | 200 | | | | 202 | |

Total Capital International S.A., 0.835%, Due 8/10/2018C | | | 600 | | | | 601 | |

Total Capital S.A., 2.125%, Due 8/10/2018 | | | 300 | | | | 299 | |

| | | | | | | | |

| | | | | | | 2,994 | |

| | | | | | | | |

Finance - 13.75% | | | | | | | | |

African Export Import BA, 5.75%, Due 7/27/2016 | | | 347 | | | | 362 | |

Agile Property Holdings Ltd., 8.875%, Due 4/28/2017 | | | 300 | | | | 314 | |

Alexandria Real Estate Equities, Inc., 4.60%, Due 4/1/2022E | | | 50 | | | | 50 | |

Ally Financial, Inc., | | | | | | | | |

4.50%, Due 2/11/2014 | | | 380 | | | | 383 | |

6.75%, Due 12/1/2014 | | | 100 | | | | 105 | |

4.625%, Due 6/26/2015 | | | 1,100 | | | | 1,138 | |

American Express Credit Corp., 0.774%, Due 7/29/2016 | | | 425 | | | | 426 | |

American International Group, Inc., 8.25%, Due 8/15/2018 | | | 235 | | | | 291 | |

Asian Development Bank, 2.75%, Due 5/21/2014 | | | 500 | | | | 509 | |

Banco do Brasil S.A. Cayman, 4.50%, Due 1/22/2015B | | | 250 | | | | 259 | |

Banco Santander Brasil SA/Brazil, 4.25%, Due 1/14/2016B | | | 400 | | | | 408 | |

Bank of America Corp., | | | | | | | | |

6.50%, Due 8/1/2016 | | | 285 | | | | 321 | |

0.594%, Due 8/15/2016 | | | 890 | | | | 859 | |

5.75%, Due 12/1/2017 | | | 60 | | | | 67 | |

5.65%, Due 5/1/2018 | | | 700 | | | | 780 | |

7.625%, Due 6/1/2019 | | | 100 | | | | 120 | |

Bank of America NA, 5.30%, Due 3/15/2017 | | | 250 | | | | 273 | |

Bank of India, 3.625%, Due 9/21/2018 | | | 200 | | | | 183 | |

Bank Rakyat Indonesia, 2.95%, Due 3/28/2018 | | | 200 | | | | 178 | |

Barclays Bank PLC, | | | | | | | | |

5.015%, Due 11/12/2013 | | | 625 | | | | 628 | |

5.20%, Due 7/10/2014 | | | 450 | | | | 467 | |

Bear Stearns Cos. LLC, 0.653%, Due 11/21/2016D | | | 800 | | | | 790 | |

Bestgain Real Estate Ltd., 2.625%, Due 3/13/2018 | | | 200 | | | | 184 | |

BNP Paribas S.A., | | | | | | | | |

1.169%, Due 1/10/2014C | | | 250 | | | | 251 | |

2.70%, Due 8/20/2018 | | | 500 | | | | 498 | |

Capital One Financial Corp., 7.375%, Due 5/23/2014 | | | 780 | | | | 817 | |

CBRE Services, Inc., 5.00%, Due 3/15/2023 | | | 155 | | | | 144 | |

Cie de Financement Foncier, 2.25%, Due 3/7/2014B | | | 200 | | | | 202 | |

CIT Group, Inc., | | | | | | | | |

5.25%, Due 4/1/2014B | | | 1,000 | | | | 1,019 | |

4.75%, Due 2/15/2015B | | | 100 | | | | 103 | |

5.00%, Due 5/15/2017 | | | 100 | | | | 104 | |

Citigroup, Inc., | | | | | | | | |

6.375%, Due 8/12/2014 | | | 560 | | | | 590 | |

5.00%, Due 9/15/2014 | | | 829 | | | | 861 | |

|

| American Beacon Flexible Bond FundSM |

| Schedule of Investments |

| August 31, 2013 |

| | | | | | | | |

| | | Par AmountM | | | Fair Value | |

| | | (000’s) | | | (000’s) | |

5.50%, Due 10/15/2014 | | $ | 925 | | | $ | 971 | |

1.25%, Due 1/15/2016 | | | 100 | | | | 99 | |

6.125%, Due 5/15/2018 | | | 760 | | | | 872 | |

Country Garden Holdings Co., 10.50%, Due 8/11/2015 | | | 100 | | | | 111 | |

Country Garden Holdings Co. Ltd, 11.25%, Due 4/22/2017 | | | 200 | | | | 218 | |

Danske Bank A/S, 1.318%, Due 4/14/2014B C | | | 200 | | | | 201 | |

Deutsche Bank AG, 4.296%, Due 5/24/2028 | | | 300 | | | | 269 | |

Development Bank of Kaza, 5.50%, Due 12/20/2015 | | | 200 | | | | 210 | |

Dexia Credit Local S.A., 2.75%, Due 4/29/2014 | | | 250 | | | | 253 | |

DuPont Fabros Technology LP, 8.50%, Due 12/15/2017F | | | 375 | | | | 395 | |

European Investment Bank, 1.25%, Due 9/17/2013 | | | 395 | | | | 395 | |

Export-Import Bank of Korea, 5.00%, Due 4/11/2022 | | | 200 | | | | 214 | |

Fifth Third Bancorp, 0.692%, Due 12/20/2016C | | | 435 | | | | 429 | |

General Electric Capital Corp., 2.15%, Due 1/9/2015 | | | 390 | | | | 398 | |

Goldman Sachs Capital II, 4.00%, Due 12/31/2049C | | | 155 | | | | 116 | |

Goldman Sachs Group, Inc., | | | | | | | | |

0.666%, Due 7/22/2015C | | | 440 | | | | 437 | |

7.50%, Due 2/15/2019 | | | 332 | | | | 396 | |

HBOS PLC, 0.983%, Due 9/6/2017 | | | 365 | | | | 342 | |

Hospitality Properties Trust, 5.00%, Due 8/15/2022E | | | 40 | | | | 40 | |

HSBC Bank PLC, | | | | | | | | |

0.904%, Due 5/15/2018 | | | 800 | | | | 802 | |

1.50%, Due 5/15/2018B | | | 200 | | | | 192 | |

ING Bank N.V., | | | | | | | | |

1.586%, Due 10/18/2013B G | | | 180 | | | | 180 | |

1.674%, Due 6/9/2014B G | | | 515 | | | | 519 | |

1.375%, Due 3/7/2016B | | | 1,000 | | | | 992 | |

0.973%, Due 7/3/2017G | | | 385 | | | | 370 | |

International Lease Finance Corp., | | | | | | | | |

5.65%, Due 6/1/2014 | | | 385 | | | | 395 | |

6.50%, Due 9/1/2014B | | | 100 | | | | 104 | |

4.875%, Due 4/1/2015 | | | 100 | | | | 103 | |

6.75%, Due 9/1/2016B | | | 600 | | | | 655 | |

Jones Lang LaSalle, Inc., 4.40%, Due 11/15/2022 | | | 30 | | | | 29 | |

JPMorgan Chase & Co., | | | | | | | | |

0.715%, Due 4/23/2015 | | | 440 | | | | 440 | |

4.40%, Due 7/22/2020 | | | 10 | | | | 10 | |

KazAgro National Management Holding JSC, 4.625%, Due 5/24/2023B | | | 200 | | | | 175 | |

Kookmin Bank, 7.25%, Due 5/14/2014 | | | 500 | | | | 521 | |

Korea Exchange Bank, 2.00%, Due 4/2/2018 | | | 200 | | | | 191 | |

Longfor Properties Co. Ltd, 9.50%, Due 4/7/2016 | | | 200 | | | | 215 | |

Merrill Lynch & Co., Inc., 5.45%, Due 7/15/2014 | | | 765 | | | | 796 | |

Mizuho Bank Ltd., 1.85%, Due 3/21/2018 | | | 200 | | | | 194 | |

Morgan Stanley, | | | | | | | | |

4.75%, Due 4/1/2014 | | | 1,448 | | | | 1,477 | |

1.512%, Due 2/25/2016C | | | 250 | | | | 251 | |

1.75%, Due 2/25/2016 | | | 250 | | | | 250 | |

0.716%, Due 10/18/2016C | | | 600 | | | | 586 | |

4.75%, Due 3/22/2017 | | | 130 | | | | 139 | |

7.30%, Due 5/13/2019 | | | 300 | | | | 355 | |

MPT Operating Partnership LP, 6.875%, Due 5/1/2021F | | | 200 | | | | 211 | |

National Australia Bank Ltd., | | | | | | | | |

1.60%, Due 8/7/2015 | | | 250 | | | | 254 | |

0.816%, Due 7/25/2016 | | | 625 | | | | 626 | |

Nationwide Building Society, 4.65%, Due 2/25/2015B | | | 500 | | | | 522 | |

RBS Capital Trust IV, 1.076%, Due 12/31/2049C | | | 70 | | | | 52 | |

Royal Bank of Scotland Group PLC, | | | | | | | | |

2.55%, Due 9/18/2015 | | | 850 | | | | 867 | |

7.648%, Due 12/31/2049 | | | 80 | | | | 78 | |

Royal Bank of Scotland PLC, 9.50%, Due 3/16/2022G | | | 300 | | | | 340 | |

Russian Standard Bank, 9.25%, Due 7/11/2017 | | | 200 | | | | 212 | |

Santander US Debt S.A. Unipersonal, 3.724%, Due 1/20/2015B | | | 700 | | | | 709 | |

Santander US Debt SAU, 2.991%, Due 10/7/2013 | | | 500 | | | | 501 | |

|

| American Beacon Flexible Bond FundSM |

| Schedule of Investments |

August 31, 2013 |

| | | | | | | | |

| | | Par AmountM | | | Fair Value | |

| | | (000’s) | | | (000’s) | |

Shimao Property Holdings Ltd., 9.65%, Due 8/3/2017 | | $ | 200 | | | $ | 216 | |

SLM Corp., | | | | | | | | |

5.00%, Due 10/1/2013 | | | 265 | | | | 266 | |

5.00%, Due 4/15/2015 | | | 600 | | | | 617 | |

6.25%, Due 1/25/2016 | | | 100 | | | | 107 | |

6.00%, Due 1/25/2017 | | | 200 | | | | 212 | |

Springleaf Finance Corp., 5.75%, Due 9/15/2016 | | | 100 | | | | 102 | |

Standard Bank PLC, 8.125%, Due 12/2/2019H | | | 100 | | | | 110 | |

Standard Chartered PLC, | | | | | | | | |

5.50%, Due 11/18/2014B | | | 300 | | | | 316 | |

3.85%, Due 4/27/2015B | | | 576 | | | | 600 | |

State Bank of India, 3.25%, Due 4/18/2018 | | | 200 | | | | 185 | |

Swire Properties MTN Financing Ltd., 4.375%, Due 6/18/2022 | | | 200 | | | | 199 | |

Temasek Financial I Ltd., 3.375%, Due 7/23/2042 | | | 250 | | | | 199 | |

Tenedora Nemak S.A. de CV, 5.50%, Due 2/28/2023 | | | 200 | | | | 187 | |

UBS AG, 5.875%, Due 12/20/2017 | | | 175 | | | | 201 | |

Wachovia Corp., 0.605%, Due 10/28/2015C | | | 425 | | | | 422 | |

Yuexiu Property Co. Ltd., 3.25%, Due 1/24/2018 | | | 200 | | | | 184 | |

| | | | | | | | |

| | | | | | | 38,486 | |

| | | | | | | | |

Manufacturing - 3.24% | | | | | | | | |

American Axle & Manufacturing Holdings, Inc., 9.25%, Due 1/15/2017B | | | 44 | | | | 47 | |

American Tower Corp., 3.40%, Due 2/15/2019 | | | 200 | | | | 201 | |

Apple, Inc., | | | | | | | | |

0.516%, Due 5/3/2018 | | | 320 | | | | 320 | |

2.40%, Due 5/3/2023 | | | 190 | | | | 172 | |

ArcelorMittal, | | | | | | | | |

9.50%, Due 2/15/2015 | | | 190 | | | | 209 | |

4.25%, Due 8/5/2015 | | | 210 | | | | 216 | |

Barminco Finance Property Ltd., 9.00%, Due 6/1/2018B | | | 100 | | | | 88 | |

Case New Holland, Inc., 7.75%, Due 9/1/2013 | | | 355 | | | | 355 | |

Citic Pacific Limited, 6.375%, Due 4/10/2020 | | | 200 | | | | 181 | |

Dell, Inc., | | | | | | | | |

1.00%, Due 2/28/2014 | | | 100 | | | | 100 | |

1.00%, Due 2/5/2021 | | | 100 | | | | 100 | |

Evraz Group S.A., 6.50%, Due 4/22/2020 | | | 200 | | | | 180 | |

Fidelity National Information Services, Inc., | | | | | | | | |

5.00%, Due 3/15/2022 | | | 150 | | | | 154 | |

3.50%, Due 4/15/2023 | | | 125 | | | | 113 | |

Ford Motor Credit Co. LLC, | | | | | | | | |

7.00%, Due 10/1/2013D | | | 965 | | | | 969 | |

8.00%, Due 6/1/2014D | | | 1,025 | | | | 1,074 | |

8.70%, Due 10/1/2014D | | | 730 | | | | 786 | |

2.75%, Due 5/15/2015D | | | 200 | | | | 203 | |

1.516%, Due 5/9/2016D | | | 425 | | | | 426 | |

5.00%, Due 5/15/2018D | | | 200 | | | | 215 | |

Freeport-McMoRan Copper & Gold, Inc., | | | | | | | | |

3.10%, Due 3/15/2020B | | | 85 | | | | 77 | |

3.875%, Due 3/15/2023B | | | 40 | | | | 36 | |

Georgia-Pacific LLC, 3.734%, Due 7/15/2023B D | | | 100 | | | | 97 | |

Glencore Funding, LLC, 1.422%, Due 5/27/2016D | | | 700 | | | | 684 | |

Heathrow Funding Ltd., 2.50%, Due 6/25/2017B | | | 200 | | | | 202 | |

Hewlett-Packard Co., 4.65%, Due 12/9/2021 | | | 80 | | | | 78 | |

Lear Corp., 4.75%, Due 1/15/2023B | | | 90 | | | | 84 | |

Metalsa S.A. de CV, 4.90%, Due 4/24/2023B | | | 150 | | | | 139 | |

Metinvest BV, 10.25%, Due 5/20/2015B | | | 100 | | | | 104 | |

Mohawk Industries, Inc., 3.85%, Due 2/1/2023 | | | 92 | | | | 87 | |

Montell Finance Co., 8.10%, Due 3/15/2027B | | | 150 | | | | 190 | |

Nitrogenmuvek Zrt, 7.875%, Due 5/21/2020B | | | 200 | | | | 184 | |

Oracle Corp., | | | | | | | | |

0.848%, Due 1/15/2019 | | | 100 | | | | 101 | |

3.625%, Due 7/15/2023 | | | 200 | | | | 198 | |

PTT Global Chemical PCL, 4.25%, Due 9/19/2022 | | | 200 | | | | 187 | |

Rio Tinto Finance USA PLC, 0.823%, Due 6/19/2015 | | | 200 | | | | 200 | |

|

| American Beacon Flexible Bond FundSM |

| Schedule of Investments |

August 31, 2013 |

| | | | | | | | |

| | | Par AmountM | | | Fair Value | |

| | | (000’s) | | | (000’s) | |

Rock Tenn Co., | | | | | | | | |

3.50%, Due 3/1/2020 | | $ | 20 | | | $ | 19 | |

4.00%, Due 3/1/2023 | | | 20 | | | | 19 | |

Schaeffler Finance BV, 4.75%, Due 5/15/2021B | | | 200 | | | | 188 | |

Vale S.A., 5.625%, Due 9/11/2042 | | | 100 | | | | 84 | |

| | | | | | | | |

| | | | | | | 9,067 | |

| | | | | | | | |

Service - 2.00% | | | | | | | | |

ADT Corp., 2.25%, Due 7/15/2017 | | | 1,005 | | | | 945 | |

Boston Scientific Corp., 2.65%, Due 10/1/2018 | | | 200 | | | | 198 | |

CBS Corp., 3.375%, Due 3/1/2022 | | | 330 | | | | 311 | |

DIRECTV Holdings LLC, 3.80%, Due 3/15/2022D | | | 115 | | | | 107 | |

DISH DBS Corp., 7.75%, Due 5/31/2015 | | | 800 | | | | 868 | |

Endo Health Solutions, Inc., 7.25%, Due 1/15/2022 | | | 100 | | | | 102 | |

FTI Consulting, Inc., | | | | | | | | |

6.75%, Due 10/1/2020 | | | 190 | | | | 201 | |

6.00%, Due 11/15/2022 | | | 30 | | | | 30 | |

HCA, Inc., | | | | | | | | |

8.50%, Due 4/15/2019 | | | 300 | | | | 324 | |

6.50%, Due 2/15/2020 | | | 800 | | | | 859 | |

Host Hotels & Resorts LP, 3.75%, Due 10/15/2023E F | | | 200 | | | | 183 | |

Lamar Media Corp., 9.75%, Due 4/1/2014 | | | 455 | | | | 474 | |

Marriott International, Inc., | | | | | | | | |

3.00%, Due 3/1/2019 | | | 75 | | | | 75 | |

3.25%, Due 9/15/2022 | | | 30 | | | | 28 | |

Sirius XM Radio, Inc., 4.25%, Due 5/15/2020B | | | 210 | | | | 192 | |

Stonemor Partners LP, 7.875%, Due 6/1/2021B F | | | 50 | | | | 50 | |

Tenet Healthcare Corp., | | | | | | | | |

4.50%, Due 4/1/2021B | | | 105 | | | | 97 | |

4.375%, Due 10/1/2021B | | | 105 | | | | 95 | |

Valeant Pharmaceuticals International, 7.00%, Due 10/1/2020B | | | 115 | | | | 121 | |

Wyndham Worldwide Corp., | | | | | | | | |

2.50%, Due 3/1/2018 | | | 100 | | | | 98 | |

4.25%, Due 3/1/2022 | | | 50 | | | | 49 | |

Wynn Las Vegas LLC, 4.25%, Due 5/30/2023B F | | | 210 | | | | 188 | |

| | | | | | | | |

| | | | | | | 5,595 | |

| | | | | | | | |

Sovereign - 0.80% | | | | | | | | |

Dubai DOF Sukuk Ltd., 4.90%, Due 5/2/2017 | | | 750 | | | | 784 | |

Eksportfinans ASA, | | | | | | | | |

3.00%, Due 11/17/2014 | | | 50 | | | | 50 | |

2.375%, Due 5/25/2016 | | | 100 | | | | 96 | |

5.50%, Due 5/25/2016 | | | 100 | | | | 104 | |

Financing of Infrastructural Project, 9.00%, Due 12/7/2017 | | | 200 | | | | 184 | |

Hungary Government International Bond, 5.375%, Due 2/21/2023 | | | 100 | | | | 94 | |

KommunalBanken AS, 1.375%, Due 6/8/2017 | | | 200 | | | | 200 | |

Korea Housing Finance Corp., 1.625%, Due 9/15/2018 | | | 350 | | | | 325 | |

Republic of Namibia, 5.50%, Due 11/3/2021 | | | 200 | | | | 201 | |

Republic of Portugal, 3.50%, Due 3/25/2015B | | | 200 | | | | 196 | |

| | | | | | | | |

| | | | | | | 2,234 | |

| | | | | | | | |

Telecommunications - 0.40% | | | | | | | | |

BellSouth Corp., 4.117%, Due 4/26/2021B | | | 520 | | | | 530 | |

British Telecommunications PLC, 1.397%, Due 12/20/2013G | | | 200 | | | | 201 | |

MetroPCS Wireless, Inc., 6.25%, Due 4/1/2021B | | | 140 | | | | 140 | |

Softbank Corp., 4.50%, Due 4/15/2020B | | | 200 | | | | 189 | |

Sprint Nextel Corp., 7.00%, Due 8/15/2020 | | | 61 | | | | 63 | |

| | | | | | | | |

| | | | | | | 1,123 | |

| | | | | | | | |

Utilities - 0.33% | | | | | | | | |

Dewa Sukuk 2013 Ltd., 3.00%, Due 3/5/2018 | | | 200 | | | | 196 | |

Meiya Power Co. Ltd., 4.00%, Due 8/19/2018 | | | 200 | | | | 197 | |

Saudi Electricity Global, 5.06%, Due 4/8/2043 | | | 200 | | | | 170 | |

SP PowerAssets Ltd., 2.70%, Due 9/14/2022 | | | 200 | | | | 183 | |

Star Energy Geothermal Wayang Windu Ltd., 6.125%, Due 3/27/2020 | | | 200 | | | | 180 | |

| | | | | | | | |

| | | | | | | 926 | |

| | | | | | | | |

Total Domestic Obligations (Cost $62,994) | | | | | | | 62,196 | |

| | | | | | | | |

|

| American Beacon Flexible Bond FundSM |

| Schedule of Investments |

August 31, 2013 |

| | | | | | | | | | |

| | | | | Par AmountM | | | Fair Value | |

| | | | | (000’s) | | | (000’s) | |

FOREIGN CONVERTIBLE OBLIGATIONS - 1.12% | | | | | | | | | | |

Energy - 0.10% | | | | | | | | | | |

Eni S.p.A., 0.25%, Due 11/30/2015 | | EUR | | $ | 200 | | | $ | 278 | |

| | | | | | | | | | |

Finance - 0.40% | | | | | | | | | | |

Aabar Investments PJSC, 4.00%, Due 5/27/2016 | | EUR | | | 200 | | | | 290 | |

Derwent Cap Jersey Ltd., 2.75%, Due 7/15/2016 | | GBP | | | 100 | | | | 183 | |

Deutsche Bank AG/London, 0.01%, Due 3/19/2014 | | JPY | | | 20,000 | | | | 227 | |

Standard Chartered Bank, 0.01%, Due 5/6/2015L | | KRW | | | 221,840 | | | | 214 | |

Temasek Financial III Private Ltd., 0.01%, Due 10/24/2014 | | SGD | | | 250 | | | | 203 | |

| | | | | | | | | | |

| | | | | | | | | 1,117 | |

| | | | | | | | | | |

Manufacturing - 0.48% | | | | | | | | | | |

Camfin SpA, 5.625%, Due 10/26/2017 | | EUR | | | 100 | | | | 151 | |

Cap Gemini Sogeti, 3.50%, Due 1/1/2014N | | EUR | | | 390 | | | | 216 | |

Faurecia, 3.25%, Due 1/1/2018N | | EUR | | | 800 | | | | 255 | |

Salzgitter Finance B.V., 2.00%, Due 11/8/2017 | | EUR | | | 100 | | | | 151 | |

Volkswagen International Finance NV, 5.50%, Due 11/9/2015 | | EUR | | | 400 | | | | 581 | |

| | | | | | | | | | |

| | | | | | | | | 1,354 | |

| | | | | | | | | | |

Service - 0.12% | | | | | | | | | | |

Aeon Co. Ltd., 0.30%, Due 11/22/2013 | | JPY | | | 1,000 | | | | 15 | |

China Water Affairs Group, 2.50%, Due 4/15/2015 | | HKD | | | 100 | | | | 15 | |

MNV ZRT, 4.40%, Due 9/25/2014 | | EUR | | | 100 | | | | 134 | |

UCB S.A., 4.50%, Due 10/22/2015 | | EUR | | | 100 | | | | 164 | |

| | | | | | | | | | |

| | | | | | | | | 328 | |

| | | | | | | | | | |

Transportation - 0.02% | | | | | | | | | | |

Air France KLM Company, 2.03%, Due 2/15/2023 | | EUR | | | 440 | | | | 55 | |

| | | | | | | | | | |

Total Foreign Convertible Obligations (Cost $3,279) | | | | | | | | | 3,132 | |

| | | | | | | | | | |

FOREIGN OBLIGATIONS - 22.44% | | | | | | | | | | |

Consumer - 0.34% | | | | | | | | | | |

Carlsberg Breweries A/S, 7.25%, Due 11/28/2016 | | GBP | | | 300 | | | | 542 | |

Heineken N.V., 7.25%, Due 3/10/2015 | | GBP | | | 250 | | | | 421 | |

| | | | | | | | | | |

| | | | | | | | | 963 | |

| | | | | | | | | | |

Energy - 0.01% | | | | | | | | | | |

Establis Maurel ET, 7.125%, Due 7/31/2014 | | EUR | | | 151 | | | | 34 | |

| | | | | | | | | | |

Finance - 1.77% | | | | | | | | | | |

AG Spring Finance II Ltd., 9.50%, Due 6/1/2019 | | EUR | | | 100 | | | | 131 | |

AIB Mortgage Bank, 2.625%, Due 7/28/2017 | | EUR | | | 100 | | | | 134 | |

Asian Development Bank, 2.00%, Due 8/29/2017 | | NOR | | | 400 | | | | 65 | |

Barclays Bank PLC, 4.875%, Due 12/31/2049 | | EUR | | | 190 | | | | 202 | |

Deutsche Bank Cap FD Trust, 5.33%, Due 12/31/2049 | | EUR | | | 175 | | | | 212 | |

European Investment Bank, 6.00%, Due 12/7/2028 | | GBP | | | 150 | | | | 292 | |

Goldman Sachs Group, Inc., 2.625%, Due 8/19/2020 | | EUR | | | 150 | | | | 197 | |

Henderson UK Finance PLC, 7.25%, Due 3/24/2016 | | GBP | | | 100 | | | | 164 | |

Hypo Aple Adria International AG, 2.375%, Due 12/13/2022 | | EUR | | | 100 | | | | 128 | |

JP Morgan Chase Bank NA, 0.888%, Due 5/31/2017G | | EUR | | | 800 | | | | 1,033 | |

Lloyds Banking Group PLC, 5.008%, Due 10/1/2014G | | AUS | | | 100 | | | | 90 | |

Morgan Stanley, 7.60%, Due 8/8/2017 | | NZD | | | 430 | | | | 352 | |

Nordic Investment Bank, 2.125%, Due 8/9/2017 | | NOR | | | 400 | | | | 65 | |

Realkredit Danmark, 2.00%, Due 4/1/2016 | | DKK | | | 500 | | | | 91 | |

Royal Bank of Scotland Group PLC, 5.50%, Due 12/31/2049 | | EUR | | | 145 | | | | 145 | |

Royal Bank of Scotland PLC, | | | | | | | | | | |

3.36%, Due 2/17/2017 | | AUS | | | 500 | | | | 382 | |

6.934%, Due 4/9/2018 | | EUR | | | 100 | | | | 141 | |

Santander International, 3.16%, Due 12/1/2015 | | GBP | | | 200 | | | | 310 | |

Societe Generale NA, Inc., 4.21%, Due 10/20/2014G | | AUS | | | 250 | | | | 224 | |

Tesco Property Finance 3 PLC, 5.744%, Due 4/13/2040 | | GBP | | | 50 | | | | 82 | |

Tesco Property Finance 4 PLC, 5.801%, Due 10/13/2040 | | GBP | | | 199 | | | | 329 | |

Tesco Property Finance 5 PLC, 5.661%, Due 10/13/2041 | | GBP | | | 99 | | | | 162 | |

| | | | | | | | | | |

| | | | | | | | | 4,931 | |

| | | | | | | | | | |

|

| American Beacon Flexible Bond FundSM |

| Schedule of Investments |

August 31, 2013 |

| | | | | | | | | | |

| | | | | Par AmountM | | | Fair Value | |

| | | | | (000’s) | | | (000’s) | |

Manufacturing - 0.10% | | | | | | | | | | |

Heathrow Finance PLC, 7.125%, Due 3/1/2017 | | GBP | | $ | 70 | | | $ | 117 | |

Jaguar Land Rover PLC, 8.125%, Due 5/15/2018 | | GBP | | | 100 | | | | 168 | |

| | | | | | | | | | |

| | | | | | | | | 285 | |

| | | | | | | | | | |

Service - 0.47% | | | | | | | | | | |

La Finac Atalian S.A., 7.25%, Due 1/15/2020 | | EUR | | | 100 | | | | 129 | |

Nara Cable Funding II Ltd., 8.50%, Due 3/1/2020 | | EUR | | | 100 | | | | 143 | |

Next PLC, 5.875%, Due 10/12/2016 | | GBP | | | 450 | | | | 778 | |

WPP PLC, 6.00%, Due 4/4/2017 | | GBP | | | 150 | | | | 263 | |

| | | | | | | | | | |

| | | | | | | | | 1,313 | |

| | | | | | | | | | |

Sovereign - 19.61% | | | | | | | | | | |

Brazil Government Bond, | | | | | | | | | | |

0.01%, Due 1/1/2017N | | BRL | | | 8,000 | | | | 2,308 | |

10.00%, Due 1/1/2017N | | BRL | | | 2,500 | | | | 1,016 | |

10.00%, Due 1/1/2021N | | BRL | | | 4,405 | | | | 1,707 | |

6.00%, Due 8/15/2022N | | BRL | | | 100 | | | | 996 | |

0.000%, Due 1/1/2023N | | BRL | | | 8,800 | | | | 3,353 | |

Chile Government Bond, | | | | | | | | | | |

3.00%, Due 1/1/2017J | | CLP | | | 218,868 | | | | 441 | |

3.00%, Due 7/1/2017J | | CLP | | | 184,310 | | | | 373 | |

Czechoslovakia Government Bond, 4.00%, Due 4/11/2017 | | CZK | | | 3,200 | | | | 181 | |

Hungary Government Bond, | | | | | | | | | | |

5.50%, Due 2/12/2016 | | HUF | | | 770,000 | | | | 3,425 | |

7.50%, Due 11/12/2020 | | HUF | | | 30,000 | | | | 140 | |

Italy Government Bond, | | | | | | | | | | |

2.35%, Due 9/15/2035 | | EUR | | | 949 | | | | 1,081 | |

5.00%, Due 8/1/2039 | | EUR | | | 3,600 | | | | 4,774 | |

Korea Treasury Bond, | | | | | | | | | | |

3.00%, Due 12/10/2013 | | KRW | | | 352,000 | | | | 317 | |

5.75%, Due 9/10/2018 | | KRW | | | 3,100,000 | | | | 3,117 | |

Mexico Government Bond, | | | | | | | | | | |

6.50%, Due 6/10/202N | | MXN | | | 5,000 | | | | 383 | |

8.00%, Due 12/7/2023N | | MXN | | | 2,500 | | | | 210 | |

10.00%, Due 12/5/2024N | | MXN | | | 4,500 | | | | 434 | |

8.50%, Due 5/31/2029N | | MXN | | | 49,000 | | | | 4,199 | |

8.50%, Due 11/18/2038N | | MXN | | | 45,700 | | | | 3,826 | |

7.75%, Due 11/13/2042N | | MXN | | | 52,800 | | | | 4,063 | |

New Zealand Government Bond, 6.00%, Due 5/15/2021 | | NZD | | | 3,100 | | | | 2,647 | |

Poland Government Bond, 5.25%, Due 10/25/2020 | | PLN | | | 11,105 | | | | 3,655 | |

Portugal Government Bond, | | | | | | | | | | |

4.375%, Due 6/16/2014 | | EUR | | | 100 | | | | 133 | |

3.85%, Due 4/15/2021 | | EUR | | | 260 | | | | 287 | |

4.95%, Due 10/25/2023 | | EUR | | | 1,675 | | | | 1,933 | |

Republic of Ireland Treasury, | | | | | | | | | | |

4.50%, Due 4/18/2020 | | EUR | | | 1,165 | | | | 1,597 | |

5.40%, Due 3/13/2025 | | EUR | | | 100 | | | | 142 | |

South Africa Government Bond, | | | | | | | | | | |

6.75%, Due 3/31/2021 | | ZAR | | | 16,133 | | | | 1,463 | |

6.50%, Due 2/28/2041 | | ZAR | | | 25,210 | | | | 1,775 | |

Turkey Government Bond, 9.00%, Due 3/5/2014 | | TRY | | | 4,330 | | | | 2,126 | |

UK Treasury Bond, 2.25%, Due 3/7/2014 | | GBP | | | 1,765 | | | | 2,762 | |

| | | | | | | | | | |

| | | | | | | | | 54,864 | |

| | | | | | | | | | |

Telecommunications - 0.10% | | | | | | | | | | |

Altice Financing S.A., 8.00%, Due 12/15/2019 | | EUR | | | 200 | | | | 280 | |

| | | | | | | | | | |

Utilities - 0.05% | | | | | | | | | | |

Tokyo Electric Power Co. Inc, 4.50%, Due 3/24/2014 | | EUR | | | 100 | | | | 132 | |

| | | | | | | | | | |

Total Foreign Obligations (Cost $66,463) | | | | | | | | | 62,802 | |

| | | | | | | | | | |

|

| American Beacon Flexible Bond FundSM |

| Schedule of Investments |

August 31, 2013 |

| | | | | | | | |

| | | Par AmountM | | | Fair Value | |

| | | (000’s) | | | (000’s) | |

ASSET-BACKED OBLIGATIONS - 0.64% | | | | | | | | |

2013-2 Aviation Loan Trust, 2.383%, Due 12/15/2022, B H | | $ | 97 | | | $ | 90 | |

Apidos CDO, 0.524%, Due 7/27/2017, 2005 1X A1 | | | 161 | | | | 159 | |

Argent Securities Trust 2006-W4, 0.454%, Due 5/25/2036, | | | 2,242 | | | | 840 | |

Continental Airlines 2012-2 Class A Pass Thru Certificates, 4.00%, Due 4/29/2026, | | | 100 | | | | 98 | |

KGS Alpha SBA, 0.745%, Due 8/25/2038, COOF 8/37 1H | | | 5,000 | | | | 221 | |

US Airways 2013-1 Class A Pass Through Trust, 3.95%, Due 5/15/2027, | | | 400 | | | | 372 | |

| | | | | | | | |

Total Asset-Backed Obligations (Cost $1,820) | | | | | | | 1,780 | |

| | | | | | | | |

NON-AGENCY MORTGAGE-BACKED OBLIGATIONS - 3.65% | | | | | | | | |

Adjustable Rate Mortgage Trust, 2.871%, Due 9/25/2035, 2005 5 2A1 | | | 93 | | | | 80 | |

American Home Mortgage Investment Trust, | | | | | | | | |

2.191%, Due 10/25/2034, 2004 3 5AC | | | 74 | | | | 72 | |

1.897%, Due 9/25/2045, 2005 2 4A1C | | | 10 | | | | 9 | |

Banc of America Alternative Loan Trust, 0.584%, Due 5/25/2035, 2005 4 CB6C | | | 84 | | | | 59 | |

Banc of America Large Loan Trust, 2.484%, Due 11/15/2015, 2010 HLTNB C | | | 798 | | | | 799 | |

Banc of America Mortgage Securities, Inc., 3.438%, Due 7/20/2032, 2002 G1A3C | | | 23 | | | | 22 | |

Bear Stearns Adjustable Rate Mortgage Trust, | | | | | | | | |

2.733%, Due 11/25/2030, 2000 2 A1 | | | 51 | | | | 50 | |

2.600%, Due 8/25/2033, 2003 5 2A1C | | | 119 | | | | 119 | |

2.856%, Due 8/25/2033, 2003 5 1A1C | | | 57 | | | | 55 | |

2.875%, Due 4/25/2034, 2004 1 22A1C | | | 54 | | | | 51 | |

3.514%, Due 11/25/2034, 2004 9 22A1C | | | 29 | | | | 29 | |

2.47%, Due 10/25/2035, 2005 9 A1C | | | 70 | | | | 67 | |

Bear Stearns Alt-A Trust, | | | | | | | | |

2.72%, Due 9/25/2034, 2004 9 2A1C | | | 200 | | | | 172 | |

2.841%, Due 11/25/2036, 2006 6 32A1 | | | 133 | | | | 87 | |

Carrington Mortgage Loan Trust, 0.444%, Due 2/25/2037, 2007 FRE1 AC3C | | | 500 | | | | 283 | |

Chase Mortgage Finance Corp., | | | | | | | | |

5.50%, Due 11/25/2035, 2005 S3 A10 | | | 200 | | | | 197 | |

2.701%, Due 2/25/2037, 2007 A1 7A1 | | | 433 | | | | 431 | |

2.875%, Due 2/25/2037, 2007 A1 1A5 | | | 56 | | | | 55 | |

4.623%, Due 3/25/2037, 2007 A1 12M3C | | | 353 | | | | 284 | |

Citigroup Mortgage Loan Trust, Inc., | | | | | | | | |

2.624%, Due 8/25/2035, 2005 3 2A2A | | | 60 | | | | 58 | |

1.94%, Due 9/25/2035, 2005 6 A3C | | | 55 | | | | 54 | |

0.554%, Due 1/25/2036, 2006 WFH1 M2 | | | 100 | | | | 81 | |

Countrywide Alternative Loan Trust, | | | | | | | | |

0.634%, Due 8/25/2033, 2003 15T2 A2C | | | 8 | | | | 8 | |

5.50%, Due 10/25/2033, 2003 20CB 1A4 | | | 172 | | | | 179 | |

6.00%, Due 10/25/2033, 2003 J2 A1 | | | 28 | | | | 29 | |

0.464%, Due 2/25/2037, 2005 81 A1C | | | 20 | | | | 14 | |

0.394%, Due 7/20/2046, 2006 OA9 2A1AC | | | 15 | | | | 8 | |

0.374%, Due 9/25/2046, 2006 OA11 A1BC | | | 21 | | | | 13 | |

Countrywide Asset-Backed Certificates Trust, | | | | | | | | |

0.364%, Due 6/25/2036, 2006 3 2A2 | | | 50 | | | | 47 | |

0.344%, Due 3/25/2037, 2006 18 2A2 | | | 464 | | | | 398 | |

Countrywide Home Loan Mortgage Pass Through Trust, | | | | | | | | |

2.760%, Due 6/25/2033, 2003 27 A1C | | | 59 | | | | 54 | |

0.944%, Due 9/25/2034, 2004 16 1A4AC | | | 55 | | | | 50 | |

0.474%, Due 4/25/2035, 2005 3 2A1C | | | 240 | | | | 184 | |

0.414%, Due 5/25/2035, 2005 9 1A3C | | | 166 | | | | 133 | |

Credit Suisse First Boston Mortgage Securities Corp., 2.622%, Due 9/25/2034, 2004 AR8 2A1 | | | 48 | | | | 48 | |

First Horizon Asset Securities, Inc., 2.545%, Due 2/25/2034, 2004 AR1 2A1C | | | 75 | | | | 74 | |

Fremont Home Loan Trust, 0.354%, Due 2/25/2036, 2006 2 2A3C | | | 395 | | | | 287 | |

GSAMP Trust 2007-FM1, 0.304%, Due 12/25/2036, | | | 1,798 | | | | 868 | |

GSR Mortgage Loan Trust, | | | | | | | | |

6.00%, Due 3/25/2032, 2003 2F 3A1 | | | 4 | | | | 4 | |

2.300%, Due 6/25/2034, 2004 7 3A1 | | | 50 | | | | 49 | |

5.070%, Due 11/25/2035, 2005 AR7 6A1C | | | 55 | | | | 53 | |

JP Morgan Alternative Loan Trust, 5.615%, Due 5/26/2037, 2008 R3 3A1B | | | 319 | | | | 253 | |

LB-UBS Commercial Mortgage Trust, 0.464%, Due 9/15/2045, 2007 C7 XW | | | 1,456 | | | | 15 | |

Morgan Stanley ABS Capital I Inc. Trust, | | | | | | | | |

|

| American Beacon Flexible Bond FundSM |

| Schedule of Investments |

August 31, 2013 |

| | | | | | | | |

| | | Par AmountM | | | Fair Value | |

| | | (000’s) | | | (000’s) | |

0.234%, Due 7/25/2036, 2006 A2FPC | | $ | 86 | | | $ | 29 | |

0.334%, Due 11/25/2036, 2007 HE1 A2CC | | | 595 | | | | 324 | |

Morgan Stanley Mortgage Loan Trust, 2.273%, Due 6/25/2036, 2006 8AR 5A4C | | | 32 | | | | 29 | |

New Century Alternative Mortgage Loan Trust, 5.909%, Due 7/25/2036, 2006 ALT1 AF2 | | | 12 | | | | 8 | |

Nomura Asset Acceptance Corp., 7.50%, Due 3/25/2034, 2004 R1 A2B | | | 132 | | | | 142 | |

Oakwood Mortgage Investors, Inc., 6.61%, Due 2/15/2021, 2001 C A3 | | | 333 | | | | 167 | |

Prime Mortgage Trust, 0.684%, Due 2/25/2035, 2006 CL1 A1C | | | 120 | | | | 109 | |

Residential Accredit Loans, Inc., 0.284%, Due 5/25/2037, 2007 QA3 A1C | | | 383 | | | | 267 | |

Residential Asset Securities Corp.Trust, | | | | | | | | |

0.764%, Due 7/25/2033, RASC 2003 KS5 AIIBC | | | 9 | | | | 7 | |

0.584%, Due 12/25/2035,CRASC Series 2005-KS11C | | | 900 | | | | 778 | |

0.624%, Due 1/25/2036, RASC 2005 KS12 M1C | | | 175 | | | | 151 | |

Residential Asset Securitization Trust, 2.659%, Due 12/25/2034, 2004 IP2 4A | | | 109 | | | | 106 | |

Structured Adjustable Rate Mortgage Loan Trust, | | | | | | | | |

2.550%, Due 5/25/2034, 2004 5 3A2 | | | 81 | | | | 79 | |

2.508%, Due 7/25/2034, 2004 8 3AC | | | 78 | | | | 76 | |

Structured Asset Mortgage Investments, Inc., 0.414%, Due 5/25/2045, 2005 AR2 2A1C | | | 113 | | | | 89 | |

Structured Asset Securities Corp., 5.50%, Due 5/25/2035, 2005 6 2A14 | | | 158 | | | | 162 | |

WaMu Mortgage Pass Through Certificates, | | | | | | | | |

2.090%, Due 2/25/2033, 2003 AR1 2AC | | | 4 | | | | 4 | |

2.497%, Due 3/25/2035, 2005 AR3 A1 | | | 56 | | | | 54 | |

5.50%, Due 11/25/2035, 2005 9 2A2 | | | 369 | | | | 322 | |

0.344%, Due 2/25/2037, 2007 HY1 A2AC | | | 374 | | | | 246 | |

2.551%, Due 3/25/2037, 2007 HY3 4A1C | | | 228 | | | | 209 | |

1.898%, Due 12/19/2039, 2001 AR5 1A | | | 112 | | | | 110 | |

0.414%, Due 4/25/2045, 2005 AR6 2A1AC | | | 167 | | | | 151 | |

0.504%, Due 7/25/2045, 2005 AR9 A1AC | | | 99 | | | | 91 | |

0.474%, Due 10/25/2045, 2005 AR13 A1A1 | | | 394 | | | | 354 | |

0.454%, Due 12/25/2045, 2005 AR17 A1A1C | | | 168 | | | | 150 | |

Wells Fargo Mortgage Backed Securities Trust, 2.646%, Due 3/25/2035, 2005 AR3 2A1C | | | 116 | | | | 116 | |

| | | | | | | | |

Total Non-Agency Mortgage-Backed Obligations (Cost $9,927) | | | | | | | 10,212 | |

| | | | | | | | |

U.S. AGENCY MORTGAGE-BACKED OBLIGATIONS - 6.16% | | | | | | | | |

Federal National Mortgage Association - 3.30% | | | | | | | | |

0.384%, Due 10/27/2037, 2007 114 A6 | | | 600 | | | | 600 | |

6.00%, Due 2/25/2044, 2004 T3 CL 1A1 | | | 17 | | | | 19 | |

3.00%, Due 12/1/2099, I | | | 9,000 | | | | 8,609 | |

| | | | | | | | |

| | | | | | | 9,228 | |

| | | | | | | | |

Government National Mortgage Association - 2.86% | | | | | | | | |

0.85%, Due 10/20/2061, 2011 H21 FTC | | | 1,951 | | | | 1,951 | |

0.895%, Due 10/20/2061, 2011 H23 FAC | | | 900 | | | | 903 | |

1.013%, Due 7/20/2062, 2012 H20 PT | | | 5,158 | | | | 5,156 | |

| | | | | | | | |

| | | | | | | 8,010 | |

| | | | | | | | |

Total U.S. Agency Mortgage-Backed Obligations (Cost $17,207) | | | | | | | 17,238 | |

| | | | | | | | |

U.S. AGENCY OBLIGATIONS - 0.21% | | | | | | | | |

Federal Home Loan Bank Discount Notes, | | | | | | | | |

0.085%, Due 9/13/2013 | | | 100 | | | | 100 | |

0.045%, Due 10/2/2013 | | | 300 | | | | 300 | |

Freddie Mac Discount Notes, 0.08%, Due 9/16/2013 | | | 200 | | | | 200 | |

| | | | | | | | |

Total U.S. Agency Obligations (Cost $600) | | | | | | | 600 | |

| | | | | | | | |

U.S. TREASURY OBLIGATIONS - 20.25% | | | | | | | | |

0.75%, Due 9/15/2013 | | | 2,100 | | | | 2,100 | |

0.125%, Due 9/30/2013 | | | 2,200 | | | | 2,200 | |

0.50%, Due 10/15/2013K | | | 1,700 | | | | 1,701 | |

2.75%, Due 10/31/2013K | | | 2,400 | | | | 2,410 | |

0.50%, Due 11/15/2013 | | | 2,200 | | | | 2,202 | |

0.25%, Due 11/30/2013 | | | 2,000 | | | | 2,001 | |

2.00%, Due 11/30/2013K | | | 3,000 | | | | 3,014 | |

1.50%, Due 12/31/2013 | | | 2,000 | | | | 2,009 | |

|

| American Beacon Flexible Bond FundSM |

| Schedule of Investments |

August 31, 2013 |

| | | | | | | | |

| | | Par AmountM | | | Fair Value | |

| | | (000’s) | | | (000’s) | |

0.25%, Due 1/31/2014 | | $ | 1,200 | | | $ | 1,201 | |

1.75%, Due 1/31/2014K | | | 2,400 | | | | 2,416 | |

1.25%, Due 2/15/2014 | | | 3,000 | | | | 3,016 | |

1.875%, Due 4/30/2014K | | | 2,400 | | | | 2,428 | |

2.00%, Due 7/15/2014 J | | | 372 | | | | 382 | |

1.625%, Due 1/15/2015 J | | | 122 | | | | 127 | |

2.00%, Due 11/15/2021 | | | 700 | | | | 674 | |

1.625%, Due 8/15/2022K | | | 200 | | | | 184 | |

1.625%, Due 11/15/2022K | | | 1,300 | | | | 1,187 | |

2.00%, Due 2/15/2023 | | | 9,550 | | | | 8,981 | |

1.75%, Due 5/15/2023 | | | 5,600 | | | | 5,121 | |

2.375%, Due 1/15/2025 J | | | 1,152 | | | | 1,350 | |

2.00%, Due 1/15/2026 J | | | 59 | | | | 67 | |

2.375%, Due 1/15/2027 J | | | 787 | | | | 930 | |

1.75%, Due 1/15/2028 J | | | 446 | | | | 490 | |

2.50%, Due 1/15/2029 J | | | 163 | | | | 197 | |

3.875%, Due 4/15/2029 J | | | 480 | | | | 676 | |

4.375%, Due 5/15/2041 | | | 325 | | | | 368 | |

0.625%, Due 2/15/2043 J | | | 5,789 | | | | 4,661 | |

2.875%, Due 5/15/2043 | | | 5,390 | | | | 4,588 | |

| | | | | | | | |

Total U.S. Treasury Obligations (Cost $58,783) | | | | | | | 56,681 | |

| | | | | | | | |

| | |

| | | Shares | | | | |

SHORT-TERM INVESTMENTS - 25.01% | | | | | | | | |

Other Investment Companies - 10.92% | | | | | | | | |

JPMorgan U.S. Government Money Market Fund, Capital Class | | | 30,573,320 | | | | 30,573 | |

| | | | | | | | |

| | |

| | | Par AmountM | | | | |

| | | (000’s) | | | | |

Certificates Of Deposit - 0.18% | | | | | | | | |

Banco do Brasil S.A. , 0.01%, Due 3/27/2014 | | $ | 500 | | | | 497 | |

| | | | | | | | |

Repurchase Agreements - 1.04% | | | | | | | | |

BNP Paribas Securities, Corp., 0.07%, acquired on 8/30/2013, Due 9/3/2013Kat $2,900, (held at BNY Mellon, collateralized by a Government Obligation valued at $2,989, 6.00%, Due 1/1/2039) K | | | 2,900 | | | | 2,900 | |

| | | | | | | | |

U.S. Treasury Bills - 12.87% | | | | | | | | |

0.12%, Due 11/14/2013 | | | 5,355 | | | | 5,355 | |

0.10%, Due 3/6/2014 | | | 6,665 | | | | 6,663 | |

0.04%, Due 10/17/2013K | | | 15,700 | | | | 15,699 | |

0.09%, Due 2/6/2014 | | | 2 | | | | 2 | |

0.04%, Due 10/10/2013 | | | 4,400 | | | | 4,400 | |

0.05%, Due 2/13/2014 | | | 3,600 | | | | 3,599 | |

0.07%, Due 2/27/2014 | | | 300 | | | | 300 | |

| | | | | | | | |

| | | | | | | 36,019 | |

| | | | | | | | |

Total Short-Term Investments (Cost 69,982) | | | | | | | 69,989 | |

| | | | | | | | |

TOTAL INVESTMENTS - 103.09% (Cost $294,840) | | | | | | | 288,538 | |

PURCHASED OPTIONS AND SWAPTIONS - 0.47% (Cost $1,276) | | | | | | | 1,315 | |

WRITTEN OPTIONS - (0.33%) (Premium $888) | | | | | | | (929 | ) |

LIABILITIES, NET OF OTHER ASSETS - (3.23%) | | | | | | | (9,021 | ) |

| | | | | | | | |

TOTAL NET ASSETS - 100.00% | | | | | | $ | 279,903 | |

| | | | | | | | |

Percentages are stated as a percent of net assets.

| A | Non-income producing security. |

| B | Security exempt from registration under the Securities Act of 1933. These securities may be resold to qualified institutional buyers pursuant to Rule 144A. At the period end, the value of these securities amounted to $12,875 or 4.60% of net assets (in thousands). The Fund has no right to demand registration of these securities. |

|

| American Beacon Flexible Bond FundSM |

| Schedule of Investments |

August 31, 2013 |

| C | The coupon rate shown on floating or adjustable rate securities represents the rate at period end. The due date on these types of securities reflects the final maturity date. |

| D | Limited Liability Company. |

| E | REIT - Real Estate Investment Trust. |

| H | Valued at fair value pursuant to procedures approved by the Board of Trustees. |

| J | Inflation-Indexed Note. |

| K | This security or a piece thereof is held as segregated collateral for interest rate and credit default swaps. |

| L | The security is an equity linked note with Samsung Electronics Company Ltd., as the single underlying asset. The movement in the price of Samsung Electronics Company Ltd., and the credit quality of Standard Chartered Bank will affect the market value of the bond. |

| M | In U.S. Dollars unless otherwise noted. |

| N | Par value represents units rather than shares. |

|

Futures Contracts Open on August 31, 2013: |

| | | | | | | | | | | | | | |

Description | | Type | | Number of

Contracts | | Expiration Date | | Contract

Value | | | Unrealized

Appreciation

(Depreciation) | |

10-Year Government of Canada Bond December Futures | | Short | | 2 | | December, 2013 | | $ | 244,565 | | | $ | (2,981 | ) |

3-Month Sterling September Futures | | Long | | 5 | | September, 2016 | | | 948,271 | | | | 630 | |

90 Day Australian Bank Bill June Futures | | Short | | 10 | | June, 2014 | | | 8,846,033 | | | | (1,409 | ) |

90 Day Eurodollar December Futures | | Long | | 82 | | December, 2015 | | | 20,166,875 | | | | (56,533 | ) |

90 Day Eurodollar March Futures | | Long | | 3 | | March, 2014 | | | 747,300 | | | | 969 | |

Euro Italian Government Bond December Futures | | Short | | 5 | | December, 2013 | | | 728,730 | | | | 396 | |

Euro OAT December Futures | | Short | | 11 | | December, 2013 | | | 1,899,483 | | | | (185 | ) |

Euro OAT September Futures | | Short | | 118 | | September, 2013 | | | 20,608,634 | | | | 378,067 | |

German Euro Bobl September Futures | | Short | | 18 | | September, 2013 | | | 2,975,265 | | | | 9,516 | |

German Euro Bund September Futures | | Short | | 5 | | September, 2013 | | | 929,481 | | | | 15,985 | |

Long GILT December Futures | | Short | | 20 | | December, 2013 | | | 3,390,744 | | | | (49,404 | ) |

U.S. 10-Year Deliverable IRS September Futures | | Short | | 2 | | September, 2013 | | | 187,125 | | | | 559 | |

U.S. 30-Year Deliverable IRS September Futures | | Long | | 3 | | September, 2013 | | | 259,219 | | | | 25,929 | |

U.S. 5-Year Deliverable IRS September Futures | | Short | | 32 | | September, 2013 | | | 3,116,000 | | | | 51,457 | |

U.S. Treasury 10-Year Note December Futures | | Long | | 4 | | December, 2013 | | | 497,125 | | | | 1,557 | |

U.S. Treasury 10-Year Note December Futures | | Short | | 57 | | December, 2013 | | | 7,084,031 | | | | (22,711 | ) |

U.S. Treasury 30-Year Note December Futures | | Short | | 9 | | December, 2013 | | | 1,187,156 | | | | (12,164 | ) |

U.S. Treasury 5-Year Note December Futures | | Short | | 52 | | December, 2013 | | | 6,223,344 | | | | 5,688 | |

U.S. Treasury 5-Year Note December Futures | | Short | | 102 | | December, 2013 | | | 12,207,328 | | | | (23,271 | ) |

U.S. Treasury Ultra Long December Futures | | Short | | 2 | | December, 2013 | | | 283,750 | | | | (4,250 | ) |

| | | | | | | | | | | | | | |

| | | | | | | | $ | 92,530,459 | | | $ | 317,845 | |

| | | | | | | | | | | | | | |

|

Centrally cleared swap agreements outstanding on August 31, 2013: |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest Rate Swaps | |

| | | | | | | | |

Pay/Receive Floating Rate | | Floating Rate Index | | Fixed

Rate | | | Expiration

Date | | Curr | | Notional

Amount(4) | | | Upfront

Premiums

Paid

(Received) | | | Unrealized

Appreciation

(Depreciation) | | | Fair Value | |

Pay | | 3-Month AUD-BBSW | | | 3.2500 | | | 9/11/2015 | | AUD | | | 900,000 | | | $ | 258 | | | $ | 1,619 | | | $ | 1,877 | |

Receive | | 6-Month EUR-LIBOR | | | 0.6970 | | | 12/12/2015 | | EUR | | | 800,500 | | | | — | | | | 1,086 | | | | 1,086 | |

Receive | | 6-Month JPY-LIBOR | | | 0.5000 | | | 1/15/2016 | | JPY | | | 1,680,000,000 | | | | (49,847 | ) | | | (24,382 | ) | | | (74,229 | ) |

Receive | | 6-Month GBP-LIBOR | | | 1.2500 | | | 7/10/2016 | | GBP | | | 1,703,000 | | | | — | | | | 7,928 | | | | 7,928 | |

Receive | | 6-Month GBP-LIBOR | | | 1.3000 | | | 7/10/2016 | | GBP | | | 1,139,500 | | | | — | | | | 4,438 | | | | 4,438 | |

Receive | | 6-Month GBP-LIBOR | | | 1.3960 | | | 8/7/2016 | | GBP | | | 3,287,000 | | | | — | | | | 10,835 | | | | 10,835 | |

Pay | | 6-Month JPY-LIBOR | | | 0.3470 | | | 8/21/2016 | | JPY | | | 152,959,000 | | | | — | | | | 189 | | | | 189 | |

Pay | | 6-Month JPY-LIBOR | | | 0.3475 | | | 8/21/2016 | | JPY | | | 166,070,500 | | | | — | | | | 222 | | | | 222 | |

|

American Beacon Flexible Bond FundSM Schedule of Investments |

August 31, 2013 |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Pay/Receive Floating Rate | | Floating Rate Index | | Fixed

Rate | | | Maturity

Date | | Curr | | Notional

Amount(4) | | | Upfront

Premiums

Paid

(Received) | | | Unrealized

Appreciation

(Depreciation) | | | Fair Value | |

Pay | | 6-Month JPY-LIBOR | | | 0.3325 | | | 8/22/2016 | | JPY | | | 166,138,500 | | | $ | — | | | $ | (291 | ) | | $ | (291 | ) |

Receive | | 6-Month GBP-LIBOR | | | 1.6365 | | | 8/27/2016 | | GBP | | | 1,686,500 | | | | — | | | | 487 | | | | 487 | |

Pay | | 6-Month GBP-LIBOR | | | 1.7300 | | | 7/6/2017 | | GBP | | | 559,000 | | | | — | | | | (3,237 | ) | | | (3,237 | ) |

Pay | | 6-Month GBP-LIBOR | | | 2.2370 | | | 8/8/2017 | | GBP | | | 6,704,500 | | | | — | | | | (13,189 | ) | | | (13,189 | ) |

Pay | | 6-Month GBP-LIBOR | | | 2.0500 | | | 8/20/2017 | | GBP | | | 823,500 | | | | — | | | | 932 | | | | 932 | |

Pay | | 6-Month GBP-LIBOR | | | 2.1600 | | | 8/23/2017 | | GBP | | | 822,500 | | | | — | | | | 3,505 | | | | 3,505 | |

Pay | | 6-Month GBP-LIBOR | | | 2.1600 | | | 8/24/2017 | | GBP | | | 828,500 | | | | — | | | | 3,512 | | | | 3,512 | |

Pay | | 6-Month GBP-LIBOR | | | 2.1900 | | | 8/24/2017 | | GBP | | | 797,000 | | | | — | | | | 4,095 | | | | 4,095 | |

Pay | | 6-Month GBP-LIBOR | | | 2.1375 | | | 8/24/2017 | | GBP | | | 826,000 | | | | — | | | | 2,945 | | | | 2,945 | |

Pay | | 3-Month USD-LIBOR | | | 2.2925 | | | 8/27/2017 | | USD | | | 1,651,000 | | | | — | | | | 3,419 | | | | 3,419 | |

Pay | | 3-Month USD-LIBOR | | | 2.3000 | | | 8/27/2017 | | USD | | | 2,479,500 | | | | — | | | | 5,495 | | | | 5,495 | |

Pay | | 3-Month USD-LIBOR | | | 2.2600 | | | 8/28/2017 | | USD | | | 1,651,000 | | | | — | | | | 2,352 | | | | 2,352 | |

Pay | | 3-Month USD-LIBOR | | | 2.3300 | | | 8/28/2017 | | USD | | | 1,656,000 | | | | — | | | | 4,600 | | | | 4,600 | |

Pay | | 6-Month GBP-LIBOR | | | 2.4300 | | | 8/30/2017 | | GBP | | | 3,479,500 | | | | — | | | | 1,062 | | | | 1,062 | |

Pay | | 6-Month EUR-LIBOR | | | 1.4150 | | | 12/14/2017 | | EUR | | | 2,044,500 | | | | — | | | | (18,983 | ) | | | (18,983 | ) |

Pay | | 6-Month EUR-LIBOR | | | 1.8700 | | | 6/24/2018 | | EUR | | | 1,063,000 | | | | — | | | | (5,073 | ) | | | (5,073 | ) |

Pay | | 6-Month EUR-LIBOR | | | 1.9400 | | | 6/25/2018 | | EUR | | | 1,063,000 | | | | — | | | | (3,222 | ) | | | (3,222 | ) |

Pay | | 6-Month EUR-LIBOR | | | 2.0700 | | | 6/27/2018 | | EUR | | | 531,500 | | | | — | | | | 138 | | | | 138 | |

Pay | | 6-Month GBP-LIBOR | | | 2.3338 | | | 7/11/2018 | | GBP | | | 1,761,000 | | | | — | | | | (14,160 | ) | | | (14,160 | ) |

Pay | | 6-Month GBP-LIBOR | | | 2.3650 | | | 7/11/2018 | | GBP | | | 1,175,500 | | | | — | | | | (8,374 | ) | | | (8,374 | ) |

Pay | | 6-Month GBP-LIBOR | | | 2.4611 | | | 8/8/2018 | | GBP | | | 1,434,500 | | | | — | | | | (8,101 | ) | | | (8,101 | ) |

Pay | | 6-Month GBP-LIBOR | | | 2.7325 | | | 8/15/2018 | | GBP | | | 718,500 | | | | — | | | | 1,419 | | | | 1,419 | |

Pay | | 6-Month GBP-LIBOR | | | 2.6660 | | | 8/15/2018 | | GBP | | | 718,500 | | | | — | | | | 19 | | | | 19 | |

Pay | | 3-Month ILS-TELBOR | | | 3.4950 | | | 8/19/2018 | | ILS | | | 2,356,000 | | | | — | | | | (6,002 | ) | | | (6,002 | ) |

Pay | | 3-Month ILS-TELBOR | | | 3.4600 | | | 8/19/2018 | | ILS | | | 2,248,000 | | | | — | | | | (6,112 | ) | | | (6,112 | ) |

Receive | | 6-Month JPY-LIBOR | | | 0.6510 | | | 8/21/2018 | | JPY | | | 309,104,500 | | | | — | | | | (2,961 | ) | | | (2,961 | ) |

Receive | | 6-Month JPY-LIBOR | | | 0.6475 | | | 8/21/2018 | | JPY | | | 335,544,500 | | | | — | | | | (2,972 | ) | | | (2,972 | ) |

Receive | | 6-Month JPY-LIBOR | | | 0.6200 | | | 8/22/2018 | | JPY | | | 335,681,000 | | | | — | | | | (1,053 | ) | | | (1,053 | ) |

Pay | | 6-Month AUD-BBSW | | | 3.5000 | | | 12/11/2018 | | AUD | | | 2,600,000 | | | | 8,410 | | | | (34,674 | ) | | | (26,264 | ) |

Pay | | 6-Month EUR-LIBOR | | | 1.2340 | | | 12/12/2018 | | EUR | | | 319,500 | | | | — | | | | (5,323 | ) | | | (5,323 | ) |

Pay | | 6-Month EUR-LIBOR | | | 1.4400 | | | 12/27/2018 | | EUR | | | 428,000 | | | | — | | | | (1,927 | ) | | | (1,927 | ) |

Pay | | 3-Month ILS-TELBOR | | | 2.8800 | | | 2/21/2019 | | ILS | | | 733,000 | | | | — | | | | (2,579 | ) | | | (2,579 | ) |

Pay | | 3-Month ILS-LIBOR | | | 2.8800 | | | 2/21/2019 | | ILS | | | 988,000 | | | | — | | | | (3,476 | ) | | | (3,476 | ) |

Pay | | 6-Month EUR-LIBOR | | | 2.2100 | | | 6/24/2019 | | EUR | | | 1,083,500 | | | | — | | | | (6,989 | ) | | | (6,989 | ) |

Pay | | 6-Month EUR-LIBOR | | | 2.2060 | | | 6/26/2019 | | EUR | | | 576,000 | | | | — | | | | (5,893 | ) | | | (5,893 | ) |

Pay | | 6-Month EUR-LIBOR | | | 2.2520 | | | 6/26/2019 | | EUR | | | 1,154,000 | | | | — | | | | (6,263 | ) | | | (6,263 | ) |

Pay | | 6-Month EUR-LIBOR | | | 2.4360 | | | 6/28/2019 | | EUR | | | 1,162,500 | | | | — | | | | 20,949 | | | | 20,949 | |

Pay | | 3-Month ZAR-JIBAR | | | 7.8700 | | | 7/2/2019 | | ZAR | | | 1,071,500 | | | | — | | | | (1,125 | ) | | | (1,125 | ) |

Pay | | 3-Month ZAR-JIBAR | | | 7.8600 | | | 7/2/2019 | | ZAR | | | 1,071,500 | | | | — | | | | (1,166 | ) | | | (1,166 | ) |

Receive | | 6-Month GBP-LIBOR | | | 3.0983 | | | 8/7/2019 | | GBP | | | 2,096,000 | | | | — | | | | (48,927 | ) | | | (48,927 | ) |

Receive | | 6-Month GBP-LIBOR | | | 3.2300 | | | 8/29/2019 | | GBP | | | 1,089,000 | | | | — | | | | (1,195 | ) | | | (1,195 | ) |

Receive | | 6-Month EUR-LIBOR | | | 2.1355 | | | 12/12/2019 | | EUR | | | 1,585,000 | | | | — | | | | 18,878 | | | | 18,878 | |

Pay | | 6-Month JPY-LIBOR | | | 1.2700 | | | 6/18/2020 | | JPY | | | 57,241,500 | | | | — | | | | 2,784 | | | | 2,784 | |

Pay | | 6-Month JPY-LIBOR | | | 1.2600 | | | 6/24/2020 | | JPY | | | 51,108,500 | | | | — | | | | 2,319 | | | | 2,319 | |

Receive | | 6-Month EUR-LIBOR | | | 2.4450 | | | 6/25/2020 | | EUR | | | 1,104,000 | | | | — | | | | 8,589 | | | | 8,589 | |

Receive | | 6-Month EUR-LIBOR | | | 2.5050 | | | 6/25/2020 | | EUR | | | 1,104,000 | | | | — | | | | 6,970 | | | | 6,970 | |

Pay | | 6-Month JPY-LIBOR | | | 1.2670 | | | 6/25/2020 | | JPY | | | 216,590,500 | | | | — | | | | 10,143 | | | | 10,143 | |

Receive | | 6-Month EUR-LIBOR | | | 2.6200 | | | 6/26/2020 | | EUR | | | 556,000 | | | | — | | | | 1,954 | | | | 1,954 | |

Receive | | 6-Month GBP-LIBOR | | | 3.3300 | | | 7/10/2020 | | GBP | | | 773,000 | | | | — | | | | 4,305 | | | | 4,305 | |

Receive | | 6-Month GBP-LIBOR | | | 3.3200 | | | 7/10/2020 | | GBP | | | 1,162,000 | | | | — | | | | 6,793 | | | | 6,793 | |

Pay | | 6-Month JPY-LIBOR | | | 1.1665 | | | 8/21/2020 | | JPY | | | 153,596,500 | | | | — | | | | 2,706 | | | | 2,706 | |