UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-4984

AMERICAN BEACON FUNDS

(Exact name of registrant as specified in charter)

220 East Las Colinas Boulevard, Suite 1200

Irving, Texas 75039

(Address of principal executive offices)-(Zip code)

GENE L. NEEDLES, JR., PRESIDENT

220 East Las Colinas Boulevard, Suite 1200

Irving, Texas 75039

(Name and address of agent for service)

Registrant’s telephone number, including area code: (817) 391-6100

Date of fiscal year end: August 31, 2021

Date of reporting period: August 31, 2021

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

Reports go here

About American Beacon Advisors, Inc.

Since 1986, American Beacon Advisors, Inc. has offered a variety of products and investment advisory services to numerous institutional and retail clients, including a variety of mutual funds, corporate cash management, and separate account management.

Our clients include defined benefit plans, defined contribution plans, foundations, endowments, corporations, financial planners, and other institutional investors. With American Beacon Advisors, Inc., you can put the experience of a multi-billion dollar asset management firm to work for your company.

SIM HIGH YIELD OPPORTUNITIES FUND

Investing in high-yield securities (commonly referred to as “junk bonds”), including loans, restricted securities and floating rate securities, is subject to greater levels of credit, interest rate, market and liquidity risks than investment-grade securities. Investing in foreign and emerging market securities may involve heightened risk due to currency fluctuations and economic and political risks. Investing in derivative instruments involves liquidity, credit, interest rate and market risks. Geopolitical and other events have led to market disruptions causing adverse changes in the value of investments broadly. Changes in value may be temporary or may last for extended periods. Please see the prospectus for a complete discussion of the Fund’s risks. There can be no assurances that the investment objectives of this Fund will be met.

SOUND POINT FLOATING RATE INCOME FUND

Investing in high-yield securities (commonly referred to as “junk bonds”), including loans, CLOs, restricted securities and floating rate securities, is subject to greater levels of credit, interest rate, market and liquidity risks than investment-grade securities. In addition, loans are subject to the risk that the Fund may not be able to obtain the collateral securing the loan in a timely manner, and the value of the collateral may not cover the amount owed on the loan. Geopolitical and other events have led to market disruptions causing adverse changes in the value of investments broadly. Changes in value may be temporary or may last for extended periods. Please see the prospectus for a complete discussion of the Fund’s risks. There can be no assurances that the investment objectives of this Fund will be met.

Any opinions herein, including forecasts, reflect our judgment as of the end of the reporting period and are subject to change. Each advisor’s strategies and the Fund’s portfolio composition will change depending on economic and market conditions. This report is not a complete analysis of market conditions and therefore, should not be relied upon as investment advice. Although economic and market information has been compiled from reliable sources, American Beacon Advisors, Inc. makes no representation as to the completeness or accuracy of the statements contained herein.

American Beacon Advisors | August 31, 2021 |

| 1 | ||||

| 3 | ||||

| 9 | ||||

| 11 | ||||

| 12 | ||||

| 19 | ||||

| 33 | ||||

| 37 | ||||

| 70 | ||||

| 75 | ||||

| 81 | ||||

Disclosure Regarding Approvals of the Management and Investment Advisory Agreements | 82 | |||

| 87 | ||||

| 88 | ||||

| 95 | ||||

| Back Cover |

| Dear Shareholders,

The 24-hour news cycle has closely followed the COVID-19 pandemic and related events – including the spread of the delta variant and ongoing global vaccination efforts; U.S. stimulus and infrastructure spending; and the reopening of our nation’s airports, businesses, and schools – for more than a year now. Given the continued uncertainty, it appears we are still navigating turbulent waters and facing waves of virus variants that could dampen economic recovery.

However, during challenging times such as we’ve all experienced since March 2020, the fear of loss can be a powerful emotion. And it can cause many individuals to make short-term investment decisions that have the potential to sink their long-term financial objectives. We encourage you to |

remain focused on achieving your long-term investment goals by working with financial professionals to develop a personal savings plan, conduct annual plan reviews, and make thoughtful, purposeful plan adjustments to help manage your evolving financial needs and goals. By investing in different investment styles and asset classes, you may be able to help mitigate financial risks across your portfolio. By allocating your portfolio according to your risk-tolerance level, you may be better positioned to withstand crises. By staying the course, you will be better positioned to achieve enduring financial success.

Since 1986, American Beacon has endeavored to provide investors with a disciplined approach to realizing long-term financial goals. As a manager of managers, we strive to provide investment products that may enable investors to participate during market upswings while potentially insulating against market downswings. The investment teams behind our mutual funds seek to produce consistent, long-term results rather than focus only on short-term movements in the markets. In managing our investment products, we emphasize identifying opportunities that offer the potential for long-term financial rewards.

Thank you for continuing your financial journey with American Beacon. For additional information about our investment products or to access your account information, please visit our website at www.americanbeaconfunds.com.

Best Regards,

Gene L. Needles, Jr.

President

American Beacon Funds

1

Global Bond Market Overview

August 31, 2021 (Unaudited)

Within the U.S. fixed-income markets for the 12-month period ended August 31, 2021, the investment-grade Bloomberg U.S. Aggregate Bond Index fell slightly and returned -0.08%, while the ICE BofA U.S. High Yield Index returned 10.26% and the Credit Suisse Leveraged Loan Index returned 8.50%. Returns in the credit sectors were very strong during the period as spreads continued to narrow following the economic recovery.

Lower-quality bonds significantly outperformed with triple-C and lower-rated bonds returning 23.78%; in comparison, single-B bonds were up 8.74% and double-B bonds were up 8.41%, according to the ICE BofA U.S. High Yield Index. The highest-returning sectors within the ICE BofA U.S. High Yield Index included: Energy, 20.49%; Transportation, 18.94%; and Leisure 11.89%. The lowest-returning sectors included: Utility, 4.49%; Telecommunications, 5.23%; and Media 6.01%. Conversely, investment-grade credit returned 2.26% and U.S. Treasuries returned -2.11%, according to the Bloomberg U.S. Aggregate Bond Index.

Economic news throughout the 12-month period was mostly positive despite disruptions triggered by the ongoing COVID-19 pandemic. After a brief recession that lasted from February 2020 to April 2020, the economy started rebounding in the summer of 2020. By late 2020, the earlier-than-expected arrival of COVID-19 vaccines led to businesses reopening and expectations for even stronger economic growth. By period end, consumer spending was solid, driven by increased sales in housing and retail. The labor market steadily added new jobs, and generous unemployment benefits aided those temporarily out of work.

Inflation picked up steam during 2021, reflecting supply-chain disruptions and pent-up demand brought about by the pandemic. While inflationary issues remain, the Federal Reserve viewed the recent price increases as transitory and argued that slack in the labor market, low manufacturing capacity utilization rates and an economy that is still running below potential would help keep inflation muted. Additionally, the 10-year U.S. Treasury yield ended the period at 1.3% as of August 31, 2021, suggesting investors did not have long-term concerns about inflation.

With regard to monetary policy, the Federal Reserve maintained the federal funds rate at 0% to 0.25% during the 12-month period and continued purchasing at least $80 billion in Treasuries and $40 billion in mortgage-backed securities each month. Federal Open Market Committee members appeared to be feeling better about the economy, and there has been discussion of tapering quantitative easing as early as the fourth quarter of 2021. Any potential federal funds rate increases would be further down the road; there is little chance of any hikes occurring before late 2022 or early 2023.

2

American Beacon SiM High Yield Opportunities FundSM

August 31, 2021 (Unaudited)

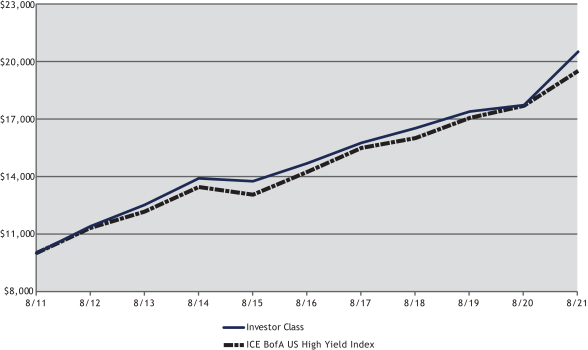

The Investor Class of the American Beacon SiM High Yield Opportunities Fund (the “Fund”) returned 15.73% for the twelve-month period ending August 31, 2021. The Fund outperformed the ICE BofA US High Yield Index (the “Index”) which returned 10.26% during the same period.

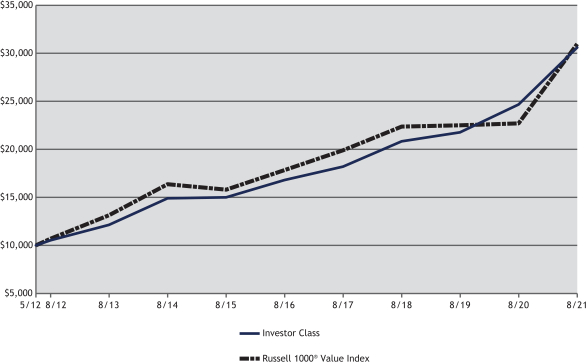

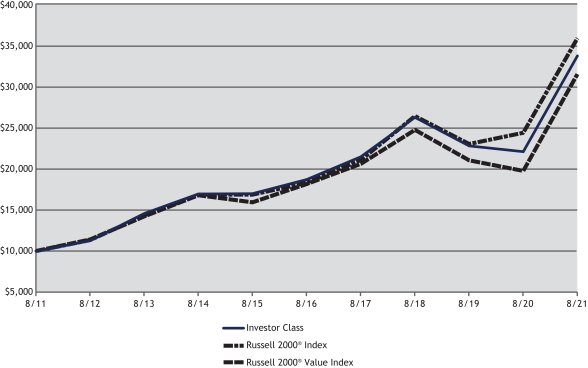

Comparison of Change in Value of a $10,000 Investment for the Period from 8/31/2011 through 8/31/2021

| Total Returns for the Period ended August 31, 2021 |

| |||||||||||||||||||||||||||||||

Ticker | 1 Year | 3 Years | 5 Years | 10 Years | Value of $10,000 8/31/2011- 8/31/2021 | |||||||||||||||||||||||||||

R5 Class (1,2,4) | SHOIX | 16.08 | % | 7.88 | % | 7.25 | % | 7.79 | % | $ | 21,179 | |||||||||||||||||||||

Y Class (1,2,4) | SHOYX | 16.06 | % | 7.83 | % | 7.20 | % | 7.72 | % | $ | 21,035 | |||||||||||||||||||||

Investor Class (1,2,4) | SHYPX | 15.73 | % | 7.49 | % | 6.91 | % | 7.44 | % | $ | 20,501 | |||||||||||||||||||||

A Class with sales Charge (1,2,4) | SHOAX | 10.25 | % | 5.61 | % | 5.81 | % | 6.81 | % | $ | 19,333 | |||||||||||||||||||||

A Class without sales charge (1,2,4) | SHOAX | 15.75 | % | 7.35 | % | 6.83 | % | 7.34 | % | $ | 20,299 | |||||||||||||||||||||

C Class with sales charge (1,2,4) | SHOCX | 13.94 | % | 6.74 | % | 6.12 | % | 6.59 | % | $ | 18,930 | |||||||||||||||||||||

C Class without sales charge (1,2,4) | SHOCX | 14.94 | % | 6.74 | % | 6.12 | % | 6.59 | % | $ | 18,930 | |||||||||||||||||||||

ICE BofA US High Yield Index (3) | 10.26 | % | 6.82 | % | 6.49 | % | 6.90 | % | $ | 19,487 | ||||||||||||||||||||||

| 1. | Performance shown is historical and is not indicative of future returns. Investment returns and principal value will vary, and shares may be worth more or less at redemption than at original purchase. Performance shown is calculated based on the published end of day net asset values as of date indicated, and current performance may be lower or higher than the performance data quoted. To obtain performance as of the most recent month end, please visit www.americanbeaconfunds.com or call 1-800-967-9009. Fund performance in the table above does not reflect the deduction of taxes a shareholder would pay on distributions or the redemption of shares. Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights. A Class shares have a maximum sales charge of 4.75%. The maximum contingent deferred sales charge for the C Class is 1.00% for shares redeemed within one year of the date of purchase. Please note that the recent performance of the securities market has helped produce short-term returns that are not typical and may not continue in the future. |

| 2. | A portion of fees charged to the R5 Class of the Fund was waived from Fund inception through 2018, partially recovered in 2019 and waived in 2020 and 2021. Performance prior to waiving fees was lower than actual returns shown for periods when waivers were in effect. A portion of fees charged to the Investor Class of the Fund was waived in 2011 and 2012, partially recovered in 2013, fully recovered in 2016 and waived in 2021. Performance prior to |

3

American Beacon SiM High Yield Opportunities FundSM

Performance Overview

August 31, 2021 (Unaudited)

| waiving fees was lower than actual returns shown for periods when waivers were in effect. A portion of fees charged to the Y Class of the Fund was waived from 2011 through 2013, fully recovered in 2015 and waived in 2016 and 2021. Performance prior to waiving fees was lower than actual returns shown for periods when waivers were in effect. A portion of fees charged to the A and C Classes of the Fund was waived from 2011 through 2014, partially recovered in 2015, fully recovered in 2016 and waived in 2021. Performance prior to waiving fees was lower than actual returns shown for periods when waivers were in effect. |

| 3. | The ICE BofA US High Yield Index tracks the performance of U.S. dollar denominated, below-investment-grade corporate debt publicly issued in the U.S. domestic market. Qualifying securities must have a below-investment-grade rating and an investment-grade rated country of risk. In addition, qualifying securities must have at least one-year remaining term to final maturity, a fixed coupon schedule and a minimum amount outstanding of $100 million. Defaulted securities and securities eligible for the dividends-received deduction are excluded from the Index. One cannot directly invest in an index. |

| 4. | The Total Annual Fund Operating Expense ratios set forth in the most recent Fund prospectus for the R5, Y, Investor, A, and C Class shares were 0.86%, 0.90%, 1.18%, 1.15%, 1.89%, respectively. The expense ratios above may vary from the expense ratios presented in other sections of this report that are based on expenses incurred during the period covered by this report. |

Issue selection within the Fund’s Energy, Finance and Transportation sectors contributed the most to relative returns. Conversely, the Fund’s issue selection within the Consumer and Manufacturing sectors detracted from relative performance.

From a sector allocation perspective, the Fund’s overweight to the Transportation sector and underweight to the Telecommunications sector contributed to relative performance. On the other hand, an overweight to the Services sector detracted slightly from the Fund’s relative returns.

From a credit quality issue selection standpoint, issue selection within the B-rated and Not-rated credit categories contributed positively to relative performance. Security selection within the BB-rated and BBB-rated credit category somewhat offset this performance by negatively impacting the Fund’s returns.

From a credit quality allocation perspective, the Fund’s underweight to the CCC-rated credit category and overweight to the Not-rated credit category detracted from the Fund’s relative performance. On the other hand, a significant underweight to the BB-rated credit category and an overweight to the BBB-rated credit category contributed positively to the Fund’s relative returns.

The sub-advisor’s investment process of identifying long-term secular themes and seeking out-of-favor sectors through bottom-up fundamental research remains in place.

| Top Ten Holdings (% Net Assets) |

| |||||||

| Athabasca Oil Corp., 9.875%, Due 2/24/2022 | 2.3 | |||||||

| Berry Petroleum Co. LLC, 7.000%, Due 2/15/2026 | 1.8 | |||||||

| CES Energy Solutions Corp., 6.375%, Due 10/21/2024 | 1.8 | |||||||

| Station Casinos LLC, 4.500%, Due 2/15/2028 | 1.7 | |||||||

| Baytex Energy Corp., 8.750%, Due 4/1/2027 | 1.6 | |||||||

| Boyd Gaming Corp., 4.750%, Due 6/15/2031 | 1.6 | |||||||

| Downstream Development Authority of the Quapaw Tribe of Oklahoma, 10.500%, Due 2/15/2023 | 1.6 | |||||||

| Scorpio Tankers, Inc., 3.000%, Due 5/15/2025 | 1.5 | |||||||

| Select Medical Corp., 6.250%, Due 8/15/2026 | 1.5 | |||||||

| TreeHouse Foods, Inc., 4.000%, Due 9/1/2028 | 1.5 | |||||||

| Total Fund Holdings | 92 | |||||||

| Sector Allocation (% Investments) |

| |||||||

| Consumer, Non-Cyclical | 34.0 | |||||||

| Industrial | 17.4 | |||||||

| Consumer, Cyclical | 17.2 | |||||||

| Energy | 14.0 | |||||||

| Technology | 10.7 | |||||||

| Communications | 3.7 | |||||||

| Financial | 3.0 | |||||||

4

American Beacon SiM High Yield Opportunities FundSM

Performance Overview

August 31, 2021 (Unaudited)

| Country Allocation (% Fixed Income) |

| |||||||

| United States | 80.7 | |||||||

| Canada | 10.6 | |||||||

| Norway | 2.1 | |||||||

| United Kingdom | 2.0 | |||||||

| Monaco | 1.6 | |||||||

| Chile | 1.3 | |||||||

| Netherlands | 1.3 | |||||||

| Ireland | 0.4 | |||||||

5

American Beacon Sound Point Floating Rate Income FundSM

Performance Overview

August 31, 2021 (Unaudited)

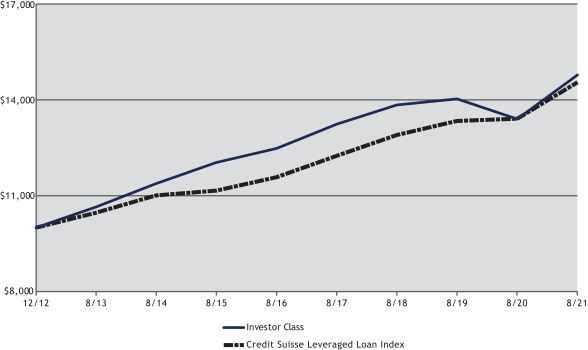

The Investor Class of the American Beacon Sound Point Floating Rate Income Fund (the “Fund”) returned 10.31% for the twelve months ended August 31, 2021. The Fund outperformed the Credit Suisse Leveraged Loan Index (the “Index”) return of 8.50% for the same period.

Comparison of Change in Value of a $10,000 Investment for the Period from 12/3/2012 through 8/31/2021

| Total Returns for the Period ended August 31, 2021 |

| |||||||||||||||||||||||||||||||

Ticker | 1 Year | 3 Years | 5 Years | Since Inception | Value of $10,000 12/3/2012- 8/31/2021 | |||||||||||||||||||||||||||

R5 Class (1,2,6) | SPFLX | 10.68 | % | 2.61 | % | 3.77 | % | 4.81 | % | $ | 15,081 | |||||||||||||||||||||

Y Class (1,2,3,6) | SPFYX | 10.60 | % | 2.50 | % | 3.68 | % | 4.73 | % | $ | 14,975 | |||||||||||||||||||||

Investor Class (1,2,3,6) | SPFPX | 10.31 | % | 2.21 | % | 3.44 | % | 4.56 | % | $ | 14,772 | |||||||||||||||||||||

A Class with sales Charge (1,2,3,6) | SOUAX | 7.56 | % | 1.42 | % | 2.89 | % | 4.24 | % | $ | 14,377 | |||||||||||||||||||||

A Class without sales charge (1,2,3,6) | SOUAX | 10.36 | % | 2.27 | % | 3.41 | % | 4.55 | % | $ | 14,751 | |||||||||||||||||||||

C Class with sales charge (1,2,3,6) | SOUCX | 8.61 | % | 1.49 | % | 2.66 | % | 4.04 | % | $ | 14,143 | |||||||||||||||||||||

C Class without sales charge (1,2,3,6) | SOUCX | 9.61 | % | 1.49 | % | 2.66 | % | 4.04 | % | $ | 14,143 | |||||||||||||||||||||

SP Class (1,2,4,6) | SPFRX | 13.27 | % | 3.13 | % | 4.00 | % | 4.86 | % | $ | 15,147 | |||||||||||||||||||||

Credit Suisse Leveraged Loan Index (5) | 8.50 | % | 4.10 | % | 4.69 | % | 4.38 | % | $ | 14,551 | ||||||||||||||||||||||

| 1. | Performance shown is historical and is not indicative of future returns. Investment returns and principal value will vary, and shares may be worth more or less at redemption than at original purchase. Performance shown is calculated based on the published end of day net asset values as of the date indicated, and current performance may be lower or higher than the performance data quoted. To obtain performance as of the most recent month end, please visit www.americanbeaconfunds.com or call 1-800-967-9009. Fund performance in the table above does not reflect the deduction of taxes a shareholder would pay on distributions or the redemption of shares. Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights. A Class shares have a maximum sales charge of 2.50%. The maximum contingent deferred sales charge for the C Class is 1.00% for shares redeemed within one year of the date of purchase. |

6

American Beacon Sound Point Floating Rate Income FundSM

Performance Overview

August 31, 2021 (Unaudited)

| 2. | A portion of the fees charged to the R5 Class of the Fund was waived from Fund inception through 2017, partially recovered in 2018 and 2019 and waived in 2021. Performance prior to waiving fees was lower than actual returns shown for periods when waivers were in effect. A portion of the fees charged to the Investor Class of the Fund was waived from Fund inception through 2016, fully recovered in 2017 and waived in 2021. Performance prior to waiving fees was lower than returns shown for periods when waivers were in effect. A portion of the fees charged to the Y Class of the Fund was waived from Fund inception through 2016, fully recovered in 2017 and waived in 2021. Performance prior to waiving fees was lower than actual returns shown for periods when waivers were in effect. A portion of the fees charged to A and C Classes was waived from Fund inception through 2016, partially recovered in 2017 and 2018 and waived in 2021. Performance prior to waiving fees was lower than actual returns shown for periods when waivers were in effect. A portion of fees charged to the SP Class of the Fund was waived from Fund inception through 2016, partially recovered from 2017 through 2019 and waived in 2021. Performance prior to waiving fees was lower than actual returns shown for periods when waivers were in effect. |

| 3. | Fund performance represents the returns achieved by the R5 Class from 12/3/12 up to 12/11/15, the inception date of the Y, Investor, A, and C Classes and the returns of each Class since its inception. Expenses of the R5 Class are lower than the other Classes. Therefore, total returns shown may be higher than they would have been had the Y, Investor, A, and C Classes been in existence since 12/3/12. |

| 4. | Fund performance represents the returns achieved by the R5 Class from 12/3/12 up to 5/30/14, the inception date of the SP Class, and the returns of the SP Class since its inception. Expenses of the R5 Class are lower than the SP Class. Therefore, total returns shown may be higher than they would have been had the SP Class been in existence since 12/3/12. |

| 5. | The Credit Suisse Leveraged Loan Index is an index designed to mirror the investable universe of the U.S. dollar-denominated leveraged loan market. One cannot directly invest in an index. |

| 6. | The Total Annual Fund Operating Expense ratios set forth in the most recent Fund prospectus for the R5, Y, Investor, A, C, and SP Class shares were 0.91%, 0.97%, 1.25%, 1.18%, 1.95%, and 1.17%, respectively. The expense ratios above may vary from the expense ratios presented in other sections of this report that are based on expenses incurred during the period covered by this report. |

The Fund benefitted primarily from its investments in medium-to-smaller sized companies with slightly lower average credit quality (and higher yields) as they outperformed during the period. Issuers rated near or below single-B outperformed, while issuers rated double-B and higher lagged. Likewise, smaller issuers in the Index, with under $1 billion outstanding, outperformed while larger issuers with over $1 billion outstanding lagged.

The low interest rate and narrow credit spread environment encouraged investors to seek higher yields in a variety of market segments, and record amounts of stimulus from the Federal Reserve Bank and Congress supported greater risk tolerance. Additionally, the secured and floating-rate nature of bank loan obligations was appealing to investors relative to traditional, unsecured fixed-rate high-yield bonds, and strong demand from the collateralized loan obligation (CLO) market provided a steady source of loan buyers.

Offsetting the benefits of the Fund’s issuer size and quality was slight underperformance from the Fund’s avoidance of certain highly leveraged and volatile sectors, such as Mining, Energy and certain consumer-oriented sectors, that posted strong returns as the economy recovered from the pandemic. By comparison, the Fund was overweight the more stable sectors, such as Media/Telecom and Technology, that lagged the Index. Likewise, residual cash balances in the Fund caused returns to lag given strong performance from the loan market.

The historic market disruption from the pandemic in early-2020 also allowed the Fund to benefit by identifying mini bull-market themes created from the stay-at-home environment, including home improvement, take-out dining, internet connectivity and aftermarket autos. Additionally, given historic-low interest rates, the Fund increased its allocation to loans with interest rate floors, which helped to maintain its yield advantage, relative to the Index, during the period.

Despite the unusual environment, the Fund sought to maintain a diversified portfolio of resilient issuers and avoided the more volatile sectors of the market. The Fund identified opportunity across the credit spectrum and concentrated on issuers with capacity to endure the pandemic. Over time, the strategy aims to generate higher yield and lower volatility than the Index over a full market cycle.

7

American Beacon Sound Point Floating Rate Income FundSM

Performance Overview

August 31, 2021 (Unaudited)

| Top Ten Holdings (% Net Assets) |

| |||||||

| Cengage Learning, Inc., 9.500%, Due 6/15/2024 | 1.0 | |||||||

| Cirque Du Soleil, Inc. | 0.9 | |||||||

| LogMeIn, Inc., 4.847%, Due 8/31/2027, Term Loan B, (1-mo. LIBOR + 4.750%) | 0.9 | |||||||

| Magenta Buyer LLC, 5.750%, Due 7/27/2028, 2021 USD 1st Lien Term Loan, (3-mo. LIBOR + 5.000%) | 0.9 | |||||||

| Metis Merger Sub LLC, 6.500%, Due 5/15/2029 | 0.9 | |||||||

| Mileage Plus Holdings LLC, 6.250%, Due 6/21/2027, 2020 Term Loan B, (3-mo. LIBOR + 5.250%) | 0.9 | |||||||

| United Airlines, Inc., 4.500%, Due 4/21/2028, 2021 Term Loan B, (3-mo. LIBOR + 3.750%) | 0.9 | |||||||

| Amynta Agency Borrower, Inc., 4.585%, Due 2/28/2025, 2018 1st Lien Term Loan, (1-mo. LIBOR + 4.500%) | 0.8 | |||||||

| Grab Holdings, Inc., 5.500%, Due 1/29/2026, Term Loan B, (6-mo. LIBOR + 4.500%) | 0.8 | |||||||

| Asurion LLC, 5.335%, Due 1/20/2029, 2021 Second Lien Term Loan B4, (1-mo. LIBOR + 5.250%) | 0.7 | |||||||

| Total Fund Holdings | 356 | |||||||

| Sector Weightings (% Investments) |

| |||||||

| Consumer, Cyclical | 21.7 | |||||||

| Consumer, Non-Cyclical | 19.4 | |||||||

| Technology | 16.2 | |||||||

| Communications | 14.4 | |||||||

| Industrial | 11.2 | |||||||

| Financial | 8.1 | |||||||

| Energy | 3.7 | |||||||

| Basic Materials | 3.5 | |||||||

| Consumer Discretionary | 1.0 | |||||||

| Diversified | 0.4 | |||||||

| Financials | 0.3 | |||||||

| Consumer Cyclical | 0.1 | |||||||

8

American Beacon FundsSM

August 31, 2021 (Unaudited)

Fund Expense Example

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption fees, if applicable, and (2) ongoing costs, including management fees, distribution (12b-1) fees, sub-transfer agent fees, and other Fund expenses. The Examples are intended to help you understand the ongoing cost (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Examples are based on an investment of $1,000 invested at the beginning of the period in each Class and held for the entire period from March 1, 2021 through August 31, 2021.

Actual Expenses

The “Actual” lines of the tables provide information about actual account values and actual expenses. You may use the information on this page, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = $8.60), then multiply the result by the “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. Shareholders of the Investor and R5 Classes that invest in the Fund through an IRA or Roth IRA may be subject to a custodial IRA fee of $15 that is typically deducted each December. If your account was subject to a custodial IRA fee during the period, your costs would have been $15 higher.

Hypothetical Example for Comparison Purposes

The “Hypothetical” lines of the tables provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the Fund’s actual return). You may compare the ongoing costs of investing in the Fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. Shareholders of the Investor and R5 Classes that invest in the Funds through an IRA or Roth IRA may be subject to a custodial IRA fee of $15 that is typically deducted each December. If your account was subject to a custodial IRA fee during the period, your costs would have been $15 higher.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs charged by the Fund, such as sales charges (loads) or redemption fees, as applicable. Similarly, the expense examples for other funds do not reflect any transaction costs charged by those funds, such as sales charges (loads), redemption fees or exchange fees. Therefore, the “Hypothetical” lines of the tables are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. If you were subject to any transaction costs during the period, your costs would have been higher.

9

American Beacon FundsSM

Expense Examples

August 31, 2021 (Unaudited)

| American Beacon SiM High Yield Opportunities Fund |

| ||||||||||||||

| Beginning Account Value 3/1/2021 | Ending Account Value 8/31/2021 | Expenses Paid During Period 3/1/2021-8/31/2021* | |||||||||||||

| R5 Class | |||||||||||||||

| Actual | $1,000.00 | $1,052.30 | $3.83 | ||||||||||||

| Hypothetical** | $1,000.00 | $1,021.48 | $3.77 | ||||||||||||

| Y Class | |||||||||||||||

| Actual | $1,000.00 | $1,052.30 | $3.88 | ||||||||||||

| Hypothetical** | $1,000.00 | $1,021.43 | $3.82 | ||||||||||||

| Investor Class | |||||||||||||||

| Actual | $1,000.00 | $1,051.70 | $5.69 | ||||||||||||

| Hypothetical** | $1,000.00 | $1,019.66 | $5.60 | ||||||||||||

| A Class | |||||||||||||||

| Actual | $1,000.00 | $1,050.70 | $5.53 | ||||||||||||

| Hypothetical** | $1,000.00 | $1,019.81 | $5.45 | ||||||||||||

| C Class | |||||||||||||||

| Actual | $1,000.00 | $1,046.60 | $9.34 | ||||||||||||

| Hypothetical** | $1,000.00 | $1,016.08 | $9.20 | ||||||||||||

| * | Expenses are equal to the Fund’s annualized expense ratios for the six-month period of 0.74%, 0.75%, 1.10%, 1.07%, and 1.81% for the R5, Y, Investor, A, and C Classes, respectively, multiplied by the average account value over the period, multiplied by the number derived by dividing the number of days in the most recent fiscal half-year (184) by days in the year (365) to reflect the half-year period. |

| ** | 5% return before expenses. |

| American Beacon Sound Point Floating Rate Income Fund |

| ||||||||||||||

| Beginning Account Value 3/1/2021 | Ending Account Value 8/31/2021 | Expenses Paid During Period 3/1/2021-8/31/2021* | |||||||||||||

| R5 Class | |||||||||||||||

| Actual | $1,000.00 | $1,030.80 | $4.15 | ||||||||||||

| Hypothetical** | $1,000.00 | $1,021.12 | $4.13 | ||||||||||||

| Y Class | |||||||||||||||

| Actual | $1,000.00 | $1,029.40 | $4.45 | ||||||||||||

| Hypothetical** | $1,000.00 | $1,020.82 | $4.43 | ||||||||||||

| Investor Class | |||||||||||||||

| Actual | $1,000.00 | $1,029.00 | $5.88 | ||||||||||||

| Hypothetical** | $1,000.00 | $1,019.41 | $5.85 | ||||||||||||

| A Class | |||||||||||||||

| Actual | $1,000.00 | $1,029.30 | $5.52 | ||||||||||||

| Hypothetical** | $1,000.00 | $1,019.76 | $5.50 | ||||||||||||

| C Class | |||||||||||||||

| Actual | $1,000.00 | $1,025.30 | $9.44 | ||||||||||||

| Hypothetical** | $1,000.00 | $1,015.88 | $9.40 | ||||||||||||

| SP Class | |||||||||||||||

| Actual | $1,000.00 | $1,056.70 | $5.60 | ||||||||||||

| Hypothetical** | $1,000.00 | $1,019.76 | $5.50 | ||||||||||||

| * | Expenses are equal to the Fund’s annualized expense ratios for the six-month period of 0.82%, 0.88%, 1.16%, 1.09%, and 1.86% for the R5, Y, Investor, A, C, and SP Classes, respectively, multiplied by the average account value over the period, multiplied by the number derived by dividing the number of days in the most recent fiscal half-year (184) by days in the year (365) to reflect the half-year period. |

| ** | 5% return before expenses. |

10

American Beacon FundsSM

Report of Independent Registered Public Accounting Firm

To the Shareholders of American Beacon SiM High Yield Opportunities Fund and American Beacon Sound Point Floating Rate Income Fund and the Board of Trustees of American Beacon Funds

Opinion on the Financial Statements

We have audited the accompanying statements of assets and liabilities of American Beacon SiM High Yield Opportunities Fund and American Beacon Sound Point Floating Rate Income Fund (collectively referred to as the “Funds”), (two of the funds constituting American Beacon Funds (the “Trust”)), including the schedules of investments, as of August 31, 2021, and the related statements of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of each of the Funds (two of the funds constituting American Beacon Funds) at August 31, 2021, the results of their operations for the year then ended, the changes in net assets for each of the two years in the period then ended and their financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Trust’s management. Our responsibility is to express an opinion on each of the Funds’ financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Trust in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Trust is not required to have, nor were we engaged to perform, an audit of the Trust’s internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Trust’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of August 31, 2021, by correspondence with the custodian, brokers and agent banks or by other appropriate auditing procedures where replies from brokers or agent banks were not received. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more American Beacon investment companies since 1987.

Dallas, Texas

October 29, 2021

11

American Beacon SiM High Yield Opportunities FundSM

August 31, 2021

| Shares | Fair Value | ||||||||||||||

| COMMON STOCKS - 0.09% (Cost $288,016) | |||||||||||||||

| Energy - 0.09% | |||||||||||||||

| Oil, Gas & Consumable Fuels - 0.09% | |||||||||||||||

| Pioneer Energy Services Corp.A B | 75,602 | $ | 1,257,261 | ||||||||||||

|

| ||||||||||||||

| PREFERRED STOCKS - 0.49% | |||||||||||||||

| Financials - 0.49% | |||||||||||||||

| Mortgage Real Estate Investment Trusts (REITs) - 0.49% | |||||||||||||||

| Annaly Capital Management, Inc., Series F, 6.950%, (3-mo. USD LIBOR + 4.993%)C D | 164,682 | 4,222,447 | |||||||||||||

| Annaly Capital Management, Inc., Series I, 6.750%, (3-mo. USD LIBOR + 4.989%)C D | 105,809 | 2,766,905 | |||||||||||||

|

| ||||||||||||||

| 6,989,352 | |||||||||||||||

|

| ||||||||||||||

Total Financials | 6,989,352 | ||||||||||||||

|

| ||||||||||||||

Total Preferred Stocks (Cost $7,050,324) | 6,989,352 | ||||||||||||||

|

| ||||||||||||||

| Principal Amount* | |||||||||||||||

| CORPORATE OBLIGATIONS - 75.52% | |||||||||||||||

| Communications - 3.57% | |||||||||||||||

| Advertising - 1.39% | |||||||||||||||

| Lamar Media Corp., 3.625%, Due 1/15/2031E | $ | 19,976,000 | 19,926,060 | ||||||||||||

|

| ||||||||||||||

| Internet - 1.31% | |||||||||||||||

| Go Daddy Operating Co. LLC / GD Finance Co., Inc., | |||||||||||||||

5.250%, Due 12/1/2027E | 10,895,000 | 11,485,509 | |||||||||||||

3.500%, Due 3/1/2029E | 7,425,000 | 7,332,187 | |||||||||||||

|

| ||||||||||||||

| 18,817,696 | |||||||||||||||

|

| ||||||||||||||

| Media - 0.87% | |||||||||||||||

| Townsquare Media, Inc., 6.875%, Due 2/1/2026E | 11,815,000 | 12,523,900 | |||||||||||||

|

| ||||||||||||||

Total Communications | 51,267,656 | ||||||||||||||

|

| ||||||||||||||

| Consumer, Cyclical - 14.79% | |||||||||||||||

| Entertainment - 6.48% | |||||||||||||||

| Caesars Resort Collection LLC / CRC Finco, Inc., 5.250%, Due 10/15/2025E | 17,120,000 | 17,363,104 | |||||||||||||

| Churchill Downs, Inc., 4.750%, Due 1/15/2028E | 19,792,000 | 20,698,474 | |||||||||||||

| Downstream Development Authority of the Quapaw Tribe of Oklahoma, 10.500%, Due 2/15/2023E | 22,075,000 | 23,040,781 | |||||||||||||

| SeaWorld Parks & Entertainment, Inc., 5.250%, Due 8/15/2029E | 14,170,000 | 14,148,036 | |||||||||||||

| Six Flags Entertainment Corp., 5.500%, Due 4/15/2027E | 17,340,000 | 17,946,900 | |||||||||||||

|

| ||||||||||||||

| 93,197,295 | |||||||||||||||

|

| ||||||||||||||

| Household Products/Wares - 1.00% | |||||||||||||||

| CD&R Smokey Buyer, Inc., 6.750%, Due 7/15/2025E | 13,575,000 | 14,449,773 | |||||||||||||

|

| ||||||||||||||

| Leisure Time - 0.99% | |||||||||||||||

| Carnival Corp., 6.650%, Due 1/15/2028 | 13,230,000 | 14,248,181 | |||||||||||||

|

| ||||||||||||||

| Lodging - 4.13% | |||||||||||||||

| Boyd Gaming Corp., 4.750%, Due 6/15/2031E | 22,145,000 | 22,850,872 | |||||||||||||

| Marriott Ownership Resorts, Inc., | |||||||||||||||

4.750%, Due 1/15/2028 | 6,945,000 | 7,049,175 | |||||||||||||

4.500%, Due 6/15/2029E | 4,390,000 | 4,433,461 | |||||||||||||

| Station Casinos LLC, 4.500%, Due 2/15/2028E | 24,720,000 | 24,967,200 | |||||||||||||

|

| ||||||||||||||

| 59,300,708 | |||||||||||||||

|

| ||||||||||||||

| Retail - 2.19% | |||||||||||||||

| Brinker International, Inc., | |||||||||||||||

3.875%, Due 5/15/2023 | 11,135,000 | 11,474,618 | |||||||||||||

5.000%, Due 10/1/2024E | 2,420,000 | 2,559,150 | |||||||||||||

See accompanying notes

12

American Beacon SiM High Yield Opportunities FundSM

Schedule of Investments

August 31, 2021

| Principal Amount* | Fair Value | ||||||||||||||

| CORPORATE OBLIGATIONS - 75.52% (continued) | |||||||||||||||

| Consumer, Cyclical - 14.79% (continued) | |||||||||||||||

| Retail - 2.19% (continued) | |||||||||||||||

| QVC, Inc., 5.950%, Due 3/15/2043 | $ | 16,711,000 | $ | 17,379,440 | |||||||||||

|

| ||||||||||||||

| 31,413,208 | |||||||||||||||

|

| ||||||||||||||

Total Consumer, Cyclical | 212,609,165 | ||||||||||||||

|

| ||||||||||||||

| Consumer, Non-Cyclical - 29.53% | |||||||||||||||

| Agriculture - 0.84% | |||||||||||||||

| Darling Ingredients, Inc., 5.250%, Due 4/15/2027E | 11,640,000 | 12,157,165 | |||||||||||||

|

| ||||||||||||||

| Biotechnology - 0.99% | |||||||||||||||

| HCRX Investments Holdco LP, 4.500%, Due 8/1/2029E | 14,000,000 | 14,180,425 | |||||||||||||

|

| ||||||||||||||

| Commercial Services - 4.16% | |||||||||||||||

| AMN Healthcare, Inc., 4.625%, Due 10/1/2027E | 19,673,000 | 20,509,103 | |||||||||||||

| Carriage Services, Inc. Co., 4.250%, Due 5/15/2029E | 20,595,000 | 20,627,128 | |||||||||||||

| TriNet Group, Inc., 3.500%, Due 3/1/2029E | 18,460,000 | 18,598,450 | |||||||||||||

|

| ||||||||||||||

| 59,734,681 | |||||||||||||||

|

| ||||||||||||||

| Food - 5.48% | |||||||||||||||

| JBS USA LUX SA / JBS USA Food Co. / JBS USA Finance, Inc., 5.500%, Due 1/15/2030E | 18,459,000 | 20,831,904 | |||||||||||||

| Pilgrim’s Pride Corp., 5.875%, Due 9/30/2027E | 17,731,000 | 18,923,764 | |||||||||||||

| Simmons Foods, Inc./Simmons Prepared Foods, Inc./Simmons Pet Food, Inc./Simmons Feed, 4.625%, Due 3/1/2029E | 16,760,000 | 17,055,814 | |||||||||||||

| TreeHouse Foods, Inc., 4.000%, Due 9/1/2028 | 22,710,000 | 21,889,034 | |||||||||||||

|

| ||||||||||||||

| 78,700,516 | |||||||||||||||

|

| ||||||||||||||

| Health Care - Products - 2.21% | |||||||||||||||

| Avantor Funding, Inc., 4.625%, Due 7/15/2028E | 17,585,000 | 18,594,379 | |||||||||||||

| Teleflex, Inc., 4.250%, Due 6/1/2028E | 12,715,000 | 13,239,494 | |||||||||||||

|

| ||||||||||||||

| 31,833,873 | |||||||||||||||

|

| ||||||||||||||

| Health Care - Services - 13.28% | |||||||||||||||

| Acadia Healthcare Co., Inc., 5.500%, Due 7/1/2028E | 19,158,000 | 20,211,690 | |||||||||||||

| Centene Corp., 3.000%, Due 10/15/2030 | 16,829,000 | 17,364,793 | |||||||||||||

| Charles River Laboratories International, Inc., 3.750%, Due 3/15/2029E | 20,500,000 | 21,132,220 | |||||||||||||

| Encompass Health Corp., 4.750%, Due 2/1/2030 | 16,515,000 | 17,608,954 | |||||||||||||

| HCA, Inc., 3.500%, Due 9/1/2030 | 19,700,000 | 21,138,888 | |||||||||||||

| IQVIA, Inc., 5.000%, Due 5/15/2027E | 13,710,000 | 14,325,990 | |||||||||||||

| MEDNAX, Inc., 6.250%, Due 1/15/2027E | 20,245,000 | 21,333,169 | |||||||||||||

| Select Medical Corp., 6.250%, Due 8/15/2026E | 20,401,000 | 21,574,057 | |||||||||||||

| Syneos Health, Inc., 3.625%, Due 1/15/2029E | 17,379,000 | 17,287,065 | |||||||||||||

| Tenet Healthcare Corp., 4.875%, Due 1/1/2026E | 18,190,000 | 18,868,487 | |||||||||||||

|

| ||||||||||||||

| 190,845,313 | |||||||||||||||

|

| ||||||||||||||

| Pharmaceuticals - 2.57% | |||||||||||||||

| Elanco Animal Health, Inc., 5.900%, Due 8/28/2028 | 16,965,000 | 19,859,399 | |||||||||||||

| Horizon Therapeutics USA, Inc., 5.500%, Due 8/1/2027E | 16,161,000 | 17,130,660 | |||||||||||||

|

| ||||||||||||||

| 36,990,059 | |||||||||||||||

|

| ||||||||||||||

Total Consumer, Non-Cyclical | 424,442,032 | ||||||||||||||

|

| ||||||||||||||

| Energy - 3.73% | |||||||||||||||

| Oil & Gas - 3.73% | |||||||||||||||

| Berry Petroleum Co. LLC, 7.000%, Due 2/15/2026E | 25,940,000 | 25,744,413 | |||||||||||||

| California Resources Corp., 7.125%, Due 2/1/2026E | 7,880,000 | 8,266,356 | |||||||||||||

See accompanying notes

13

American Beacon SiM High Yield Opportunities FundSM

Schedule of Investments

August 31, 2021

| Principal Amount* | Fair Value | ||||||||||||||

| CORPORATE OBLIGATIONS - 75.52% (continued) | |||||||||||||||

| Energy - 3.73% (continued) | |||||||||||||||

| Oil & Gas - 3.73% (continued) | |||||||||||||||

| Murphy Oil Corp., | |||||||||||||||

5.875%, Due 12/1/2027 | $ | 13,100,000 | $ | 13,624,000 | |||||||||||

6.375%, Due 12/1/2042 | 5,975,000 | 5,945,125 | |||||||||||||

|

| ||||||||||||||

| 53,579,894 | |||||||||||||||

|

| ||||||||||||||

Total Energy | 53,579,894 | ||||||||||||||

|

| ||||||||||||||

| Financial - 1.95% | |||||||||||||||

| Financial Services - 0.75% | |||||||||||||||

| Encore Capital Group, Inc., 4.250%, Due 6/1/2028E | GBP 7,775,000 | 10,689,460 | |||||||||||||

|

| ||||||||||||||

| REITS - 1.20% | |||||||||||||||

| MPT Operating Partnership LP / MPT Finance Corp., | |||||||||||||||

4.625%, Due 8/1/2029 | 8,175,000 | 8,740,444 | |||||||||||||

3.500%, Due 3/15/2031 | 8,295,000 | 8,528,090 | |||||||||||||

|

| ||||||||||||||

| 17,268,534 | |||||||||||||||

|

| ||||||||||||||

Total Financial | 27,957,994 | ||||||||||||||

|

| ||||||||||||||

| Industrial - 11.62% | |||||||||||||||

| Aerospace/Defense - 1.38% | |||||||||||||||

| Kratos Defense & Security Solutions, Inc., 6.500%, Due 11/30/2025E | 19,105,000 | 19,869,200 | |||||||||||||

|

| ||||||||||||||

| Engineering & Construction - 0.98% | |||||||||||||||

| AECOM, 5.125%, Due 3/15/2027 | 1,776,000 | 1,983,756 | |||||||||||||

| Dycom Industries, Inc., 4.500%, Due 4/15/2029E | 11,785,000 | 12,109,088 | |||||||||||||

|

| ||||||||||||||

| 14,092,844 | |||||||||||||||

|

| ||||||||||||||

| Environmental Control - 1.47% | |||||||||||||||

| Stericycle, Inc., 3.875%, Due 1/15/2029E | 20,781,000 | 21,149,032 | |||||||||||||

|

| ||||||||||||||

| Machinery - Construction & Mining - 1.20% | |||||||||||||||

| BWX Technologies, Inc., 4.125%, Due 4/15/2029E | 16,798,000 | 17,280,942 | |||||||||||||

|

| ||||||||||||||

| Machinery - Diversified - 2.40% | |||||||||||||||

| JPW Industries Holding Corp., 9.000%, Due 10/1/2024E | 19,595,000 | 20,555,155 | |||||||||||||

| Mueller Water Products, Inc., 4.000%, Due 6/15/2029E | 13,451,000 | 13,888,157 | |||||||||||||

|

| ||||||||||||||

| 34,443,312 | |||||||||||||||

|

| ||||||||||||||

| Packaging & Containers - 1.21% | |||||||||||||||

| TriMas Corp., 4.125%, Due 4/15/2029E | 17,006,000 | 17,322,992 | |||||||||||||

|

| ||||||||||||||

| Transportation - 2.98% | |||||||||||||||

| Eagle Bulk Shipco LLC, 8.250%, Due 11/28/2022 | 16,258,954 | 16,665,428 | |||||||||||||

| Navios Maritime Holdings, Inc. / Navios Maritime Finance II US, Inc., 11.250%, Due 8/15/2022E | 12,508,000 | 12,508,000 | |||||||||||||

| Navios South American Logistics, Inc. / Navios Logistics Finance US, Inc., 10.750%, Due 7/1/2025E | 12,510,000 | 13,635,900 | |||||||||||||

|

| ||||||||||||||

| 42,809,328 | |||||||||||||||

|

| ||||||||||||||

Total Industrial | 166,967,650 | ||||||||||||||

|

| ||||||||||||||

| Technology - 10.33% | |||||||||||||||

| Computers - 5.78% | |||||||||||||||

| Booz Allen Hamilton, Inc., 3.875%, Due 9/1/2028E | 20,506,000 | 21,136,765 | |||||||||||||

| KBR, Inc., 4.750%, Due 9/30/2028E | 20,296,000 | 20,600,440 | |||||||||||||

See accompanying notes

14

American Beacon SiM High Yield Opportunities FundSM

Schedule of Investments

August 31, 2021

| Principal Amount* | Fair Value | ||||||||||||||

| CORPORATE OBLIGATIONS - 75.52% (continued) | |||||||||||||||

| Technology - 10.33% (continued) | |||||||||||||||

| Computers - 5.78% (continued) | |||||||||||||||

| Leidos, Inc., | |||||||||||||||

7.125%, Due 7/1/2032 | $ | 9,520,000 | $ | 13,029,358 | |||||||||||

5.500%, Due 7/1/2033 | 8,771,000 | 10,843,149 | |||||||||||||

| Science Applications International Corp., 4.875%, Due 4/1/2028E | 16,668,000 | 17,407,892 | |||||||||||||

|

| ||||||||||||||

| 83,017,604 | |||||||||||||||

|

| ||||||||||||||

| Semiconductors - 3.82% | |||||||||||||||

| Entegris, Inc., 3.625%, Due 5/1/2029E | 20,580,000 | 21,225,800 | |||||||||||||

| Qorvo, Inc., 3.375%, Due 4/1/2031E | 15,277,000 | 16,246,937 | |||||||||||||

| Synaptics, Inc., 4.000%, Due 6/15/2029E | 17,100,000 | 17,420,625 | |||||||||||||

|

| ||||||||||||||

| 54,893,362 | |||||||||||||||

|

| ||||||||||||||

| Software - 0.73% | |||||||||||||||

| Clarivate Science Holdings Corp., 3.875%, Due 7/1/2028E | 10,380,000 | 10,552,619 | |||||||||||||

|

| ||||||||||||||

Total Technology | 148,463,585 | ||||||||||||||

|

| ||||||||||||||

Total Corporate Obligations (Cost $1,041,977,990) | 1,085,287,976 | ||||||||||||||

|

| ||||||||||||||

| CONVERTIBLE OBLIGATIONS - 2.32% | |||||||||||||||

| Consumer, Non-Cyclical - 0.40% | |||||||||||||||

| Food - 0.40% | |||||||||||||||

| Chefs’ Warehouse, Inc., 1.875%, Due 12/1/2024 | 5,665,000 | 5,792,463 | |||||||||||||

|

| ||||||||||||||

| Energy - 0.95% | |||||||||||||||

| Oil & Gas - 0.95% | |||||||||||||||

| Pioneer Energy Services Corp., Due 11/15/2025, PIK (in-kind rate 5.000%)A B E | 12,997,792 | 13,613,887 | |||||||||||||

|

| ||||||||||||||

| Financial - 0.49% | |||||||||||||||

| Financial Services - 0.49% | |||||||||||||||

| EZCORP, Inc., 2.375%, Due 05/1/2025 | 7,835,000 | 6,975,500 | |||||||||||||

|

| ||||||||||||||

| Industrial - 0.48% | |||||||||||||||

| Transportation - 0.48% | |||||||||||||||

| Eagle Bulk Shipping, Inc., 5.000%, Due 08/1/2024 | 4,835,000 | 6,956,707 | |||||||||||||

|

| ||||||||||||||

Total Convertible Obligations (Cost $28,957,063) | 33,338,557 | ||||||||||||||

|

| ||||||||||||||

| FOREIGN CONVERTIBLE OBLIGATIONS - 1.52% (Cost $22,802,141) | |||||||||||||||

| Industrial - 1.52% | |||||||||||||||

| Transportation - 1.52% | |||||||||||||||

| Scorpio Tankers, Inc., 3.000%, Due 05/15/2025E | 22,780,000 | 21,885,718 | |||||||||||||

|

| ||||||||||||||

| FOREIGN CORPORATE OBLIGATIONS - 17.03% | |||||||||||||||

| Consumer, Cyclical - 1.92% | |||||||||||||||

| Entertainment - 1.92% | |||||||||||||||

| Ladbrokes Group Finance PLC, 5.125%, Due 9/8/2023F | GBP 12,800,000 | 18,504,383 | |||||||||||||

| William Hill PLC, 4.750%, Due 5/1/2026F | 6,212,000 | 9,031,515 | |||||||||||||

|

| ||||||||||||||

| 27,535,898 | |||||||||||||||

|

| ||||||||||||||

Total Consumer, Cyclical | 27,535,898 | ||||||||||||||

|

| ||||||||||||||

| Consumer, Non-Cyclical - 2.98% | |||||||||||||||

| Agriculture - 1.34% | |||||||||||||||

| Cooke Omega Investments, Inc. / Alpha VesselCo Holdings, Inc., 8.500%, Due 12/15/2022E | $ | 18,847,000 | 19,247,499 | ||||||||||||

|

| ||||||||||||||

See accompanying notes

15

American Beacon SiM High Yield Opportunities FundSM

Schedule of Investments

August 31, 2021

| Principal Amount* | Fair Value | ||||||||||||||

| FOREIGN CORPORATE OBLIGATIONS - 17.03% (continued) | |||||||||||||||

| Consumer, Non-Cyclical - 2.98% (continued) | |||||||||||||||

| Food - 1.26% | |||||||||||||||

| Nova Austral SA, | |||||||||||||||

12.000%, Due 11/26/2026, PIK (in-kind rate 12.000%)E F | $ | 22,318,689 | $ | 14,283,961 | |||||||||||

12.000%, Due 11/26/2026, Cash (2.000%) or PIK (in-kind rate 10.000%)G | 12,989,236 | 3,831,824 | |||||||||||||

|

| ||||||||||||||

| 18,115,785 | |||||||||||||||

|

| ||||||||||||||

| Pharmaceuticals - 0.38% | |||||||||||||||

| Indigo Merger Sub, Inc., 2.875%, Due 7/15/2026E | 5,340,000 | 5,460,898 | |||||||||||||

|

| ||||||||||||||

Total Consumer, Non-Cyclical | 42,824,182 | ||||||||||||||

|

| ||||||||||||||

| Energy - 8.86% | |||||||||||||||

| Oil & Gas - 8.86% | |||||||||||||||

| Athabasca Oil Corp., 9.875%, Due 2/24/2022E | 34,996,000 | 33,246,200 | |||||||||||||

| Baytex Energy Corp., 8.750%, Due 4/1/2027E | 23,115,000 | 22,708,176 | |||||||||||||

| CES Energy Solutions Corp., 6.375%, Due 10/21/2024E | CAD 31,125,000 | 25,286,827 | |||||||||||||

| OKEA ASA, | |||||||||||||||

6.646%, Due 6/28/2023, (3-mo. USD LIBOR + 6.500%)C F | 16,600,000 | 17,056,500 | |||||||||||||

8.750%, Due 12/11/2024 | 11,100,000 | 11,373,397 | |||||||||||||

| Vermilion Energy, Inc., 5.625%, Due 3/15/2025E | 17,557,000 | 17,737,837 | |||||||||||||

|

| ||||||||||||||

| 127,408,937 | |||||||||||||||

|

| ||||||||||||||

Total Energy | 127,408,937 | ||||||||||||||

|

| ||||||||||||||

| Industrial - 3.27% | |||||||||||||||

| Environmental Control - 0.53% | |||||||||||||||

| Tervita Corp., 11.000%, Due 12/1/2025E | 6,576,000 | 7,564,307 | |||||||||||||

|

| ||||||||||||||

| Machinery - Diversified - 1.45% | |||||||||||||||

| ATS Automation Tooling Systems, Inc., 4.125%, Due 12/15/2028E | 20,235,000 | 20,851,358 | |||||||||||||

|

| ||||||||||||||

| Transportation - 1.29% | |||||||||||||||

| MPC Container Ships Invest BV, 4.885%, Due 3/22/2023, PIK (in-kind rate 4.885%), (3-mo. USD LIBOR + 4.750%)C F | 18,406,933 | 18,591,002 | |||||||||||||

|

| ||||||||||||||

Total Industrial | 47,006,667 | ||||||||||||||

|

| ||||||||||||||

Total Foreign Corporate Obligations (Cost $232,788,865) | 244,775,684 | ||||||||||||||

|

| ||||||||||||||

| Shares | |||||||||||||||

| SHORT-TERM INVESTMENTS - 0.86% (Cost $12,397,700) | |||||||||||||||

| Investment Companies - 0.86% | |||||||||||||||

| American Beacon U.S. Government Money Market Select Fund, 0.01%H I | 12,397,700 | 12,397,700 | |||||||||||||

|

| ||||||||||||||

TOTAL INVESTMENTS - 97.83% (Cost $1,346,262,099) | $ | 1,405,932,248 | |||||||||||||

OTHER ASSETS, NET OF LIABILITIES - 2.17% | 31,215,022 | ||||||||||||||

|

| ||||||||||||||

TOTAL NET ASSETS - 100.00% | $ | 1,437,147,270 | |||||||||||||

|

| ||||||||||||||

Percentages are stated as a percent of net assets. *In U.S. Dollars unless otherwise noted. | |||||||||||||||

A Fair valued pursuant to procedures approved by the Board of Trustees. At period end, the value of these securities amounted to $14,871,148 or 1.03% of net assets.

B Value was determined using significant unobservable inputs.

C Variable, floating, or adjustable rate securities with an interest rate that changes periodically. Rates are periodically reset with rates that are based on a predetermined benchmark such as a widely followed interest rate such as T-bills, LIBOR or PRIME plus a fixed spread. The interest rate disclosed reflects the rate in effect on August 31, 2021.

D A type of Preferred Stock that has no maturity date.

See accompanying notes

16

American Beacon SiM High Yield Opportunities FundSM

Schedule of Investments

August 31, 2021

E Security exempt from registration under the Securities Act of 1933. These securities may be resold to qualified institutional buyers pursuant to Rule 144A. At the period end, the value of these securities amounted to $1,059,802,812 or 73.74% of net assets. The Fund has no right to demand registration of these securities.

F Reg S - Security purchased under the Securities Act of 1933, which exempts from registration securities offered and sold outside of the United States. Such a security cannot be sold in the United States without either an effective registration statement filed pursuant to the Securities Act of 1933, or pursuant to an exemption from registration.

G Coupon rate may change based on changes of the underlying collateral or prepayments of principal. The coupon rate shown represents the rate at period end.

H The Fund is affiliated by having the same investment advisor.

I 7-day yield.

LIBOR - London Interbank Offered Rate.

LLC - Limited Liability Company.

LP - Limited Partnership.

PIK - Payment in Kind.

PLC - Public Limited Company.

PRIME - A rate, charged by banks, based on the U.S. Federal Funds rate.

REIT - Real Estate Investment Trust.

| Short Futures Contracts Open on August 31, 2021: | ||||||||||||||||

| Currency Futures Contracts | ||||||||||||||||

| Description | Number of Contracts | Expiration Date | Notional Amount | Contract Value | Unrealized Appreciation (Depreciation) | |||||||||||

| British Pound Currency | 454 | September 2021 | $ | (39,827,912 | ) | $ | (39,038,325 | ) | $ | 789,587 | ||||||

| Canadian Dollar Currency | 323 | September 2021 | (26,701,130 | ) | (25,620,360 | ) | 1,080,770 | |||||||||

|

|

|

|

|

| |||||||||||

| $ | (66,529,042 | ) | $ | (64,658,685 | ) | $ | 1,870,357 | |||||||||

|

|

|

|

|

| |||||||||||

| OTC Swap Agreements Outstanding on August 31, 2021: |

| |||||||||||||||||||||||||||||||

| Total Return Swap Agreements | ||||||||||||||||||||||||||||||||

| Pay/Receive Floating Rate | Description | Reference Entity | Counter- party | Floating Rate | Payment Frequency | Expiration Date | Reference Quantity | Notional Amount | Premiums Paid (Received) | Unrealized Appreciation (Depreciation) | ||||||||||||||||||||||

| Receive | 1-Month USD-FEDEF | BHP Group Ltd. | GST | 0.570% | Monthly | 7/19/2024 | 132,300 | 12,182,232 | $ | - | $ | 102,869 | ||||||||||||||||||||

|

|

|

| |||||||||||||||||||||||||||||

| $ | - | $ | 102,869 | |||||||||||||||||||||||||||||

|

|

|

| |||||||||||||||||||||||||||||

| Glossary: | ||

| Counterparty Abbreviations: | ||

| GST | Goldman Sachs International | |

| Exchange Abbreviations: | ||

| FEDEF | Effective Federal Funds Rate. | |

| Currency Abbreviations: | ||

| CAD | Canadian Dollar | |

| GBP | Pound Sterling | |

| USD | United States Dollar | |

| Other Abbreviations: | ||

| OTC | Over-the-Counter. | |

See accompanying notes

17

American Beacon SiM High Yield Opportunities FundSM

Schedule of Investments

August 31, 2021

The Fund’s investments are summarized by level based on the inputs used to determine their values. As of August 31, 2021, the investments were classified as described below:

SiM High Yield Opportunities Fund | Level 1 | Level 2 | Level 3 | Total | ||||||||||||||||||||||||

Assets |

| |||||||||||||||||||||||||||

Common Stocks | $ | - | $ | - | $ | 1,257,261 | $ | 1,257,261 | ||||||||||||||||||||

Preferred Stocks | 6,989,352 | - | - | 6,989,352 | ||||||||||||||||||||||||

Corporate Obligations | - | 1,085,287,976 | - | 1,085,287,976 | ||||||||||||||||||||||||

Convertible Obligations | - | 19,724,670 | 13,613,887 | 33,338,557 | ||||||||||||||||||||||||

Foreign Convertible Obligations | - | 21,885,718 | - | 21,885,718 | ||||||||||||||||||||||||

Foreign Corporate Obligations | - | 244,775,684 | - | 244,775,684 | ||||||||||||||||||||||||

Short-Term Investments | 12,397,700 | - | - | 12,397,700 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||||||

Total Investments in Securities - Assets | $ | 19,387,052 | $ | 1,371,674,048 | $ | 14,871,148 | $ | 1,405,932,248 | ||||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||||||

Financial Derivative Instruments - Assets |

| |||||||||||||||||||||||||||

Futures Contracts | $ | 1,870,357 | $ | - | $ | - | $ | 1,870,357 | ||||||||||||||||||||

Swap Contract Agreements | - | 102,869 | - | 102,869 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||||||

Total Financial Derivative Instruments - Assets | $ | 1,870,357 | $ | 102,869 | $ | - | $ | 1,973,226 | ||||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||||||

U.S. GAAP requires transfers between all levels to/from level 3 be disclosed. During the year ended August 31, 2021, there were no transfers into or out of Level 3.

The following table is a reconciliation of Level 3 assets within the Fund for which significant unobservable inputs were used to determine fair value. Transfers in or out of Level 3 represent the ending value of any security or instrument where a change in the level has occurred from the beginning to the end of the year:

| Security Type | Balance as of 8/31/2020 | Purchases | Sales | Accrued Discounts (Premiums) | Realized Gain (Loss) | Change in Unrealized Appreciation (Depreciation) | Transfer into Level 3 | Transfer out of Level 3 | Balance as of 8/31/2021 | Unrealized Appreciation (Depreciation) at Year End* | ||||||||||||||||||||||||||||||

| Common Stock | $ | 821,794 | $ | - | $ | - | $ | - | $ | - | $ | 435,467 | $ | - | $ | - | $ | 1,257,261 | $ | 474,786 | ||||||||||||||||||||

| Convertible Obligations | 12,412,725 | 602,793 | - | 147,265 | - | 451,104 | - | - | 13,613,887 | 1,351,227 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

| $ | 13,234,519 | $ | 602,793 | $ | - | $ | 147,265 | $ | - | $ | 886,571 | $ | - | $ | - | $ | 14,871,148 | $ | 1,826,013 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

| * | Change in unrealized appreciation (depreciation) attributable to Level 3 securities held at year end. This balance is included in the change in unrealized appreciation (depreciation) on the Statements of Operations. |

The following is a summary of significant unobservable inputs used in the fair valuation of the asset categorized within Level 3 of the fair value hierarchy:

| Security Type | Fair Value at 8/31/2021 | Valuation Technique | Input Description | Unobservable Input | Impact to Valuation From an Increase in Input** | |||||||||

Common Stock(1) | $ | 1,257,261 | Transaction Price | Patterson-UTI, Inc. Share Price | $7.76 | Increase | ||||||||

| Enterprise Valuation | TEV/EBITDA Multiples | 7.34x | Increase | |||||||||||

| EBITDA Estimate | $38 million | Increase | ||||||||||||

| Illiquidity discount | 20% | Decrease | ||||||||||||

Convertible Obligations(2) | $ | 13,613,887 | Transaction Price | Patterson-UTI, Inc. Share Price | $7.76 | Increase | ||||||||

Discounted Cash Flow | Implied Benchmark Yield | 7.495% | Decrease | |||||||||||

| Credit Spread | 10.98% | Decrease | ||||||||||||

| Black-Scholes Model | Common Stock Valuation Estimate | $15.20 | Increase | |||||||||||

| Equity Volatility | 65.00% | Increase | ||||||||||||

| ** | Represents the expected directional change in the fair value of the Level 3 investments that would result from an increase in the corresponding input. A decrease to the unobservable input would have the opposite effect. Significant changes in these inputs could result in significantly higher or lower fair value measurements. |

| (1) | During July 2021, Pioneer Energy agreed to be acquired by Patterson-UTI, Inc., (“PTEN”). The transaction was expected to be completed by the fourth quarter of 2021 and was completed on October 4, 2021. Due to transaction uncertainty, the value was determined using a probability weighted average of (83%) transaction price based on public stock value of PTEN, which is observable and (17%) enterprise valuation using guideline public companies. |

| (2) | The valuation for Pioneer Energy convertible notes was determined based on the probability weighted averages of the two scenarios described in Note (1). |

See accompanying notes

18

American Beacon Sound Point Floating Rate Income FundSM

Schedule of Investments

August 31, 2021

| Shares | Fair Value | ||||||||||||||

| COMMON STOCKS - 1.25% | |||||||||||||||

| Consumer Discretionary - 0.96% | |||||||||||||||

| Commercial Services & Supplies - 0.04% | |||||||||||||||

| Constellis Holdings LLCA | 69,609 | $ | 214,605 | ||||||||||||

|

| ||||||||||||||

| Diversified Consumer Services - 0.00% | |||||||||||||||

| Tweddle Group, Inc.A B C | 2,722 | - | |||||||||||||

|

| ||||||||||||||

| Entertainment - 0.92% | |||||||||||||||

| Cirque Du Soleil, Inc.A | 698,070 | 5,933,595 | |||||||||||||

| Deluxe EntertainmentA B C | 102,794 | - | |||||||||||||

|

| ||||||||||||||

| 5,933,595 | |||||||||||||||

|

| ||||||||||||||

Total Consumer Discretionary | 6,148,200 | ||||||||||||||

|

| ||||||||||||||

| Energy - 0.00% | |||||||||||||||

| Oil, Gas & Consumable Fuels - 0.00% | |||||||||||||||

| Southcross Energy Partners LPA | 336,500 | 2,692 | |||||||||||||

|

| ||||||||||||||

| Financials - 0.29% | |||||||||||||||

| Diversified Financial Services - 0.29% | |||||||||||||||

| Gee Acquisition Holdings Corp.A | 94,492 | 1,842,594 | |||||||||||||

| RCS 2L EscrowA B C | 667 | - | |||||||||||||

|

| ||||||||||||||

| 1,842,594 | |||||||||||||||

|

| ||||||||||||||

Total Financials | 1,842,594 | ||||||||||||||

|

| ||||||||||||||

| Information Technology - 0.00% | |||||||||||||||

| Communications Equipment - 0.00% | |||||||||||||||

| 4L Technologies, Inc.A | 140,935 | 14,093 | |||||||||||||

| Internap Corp.A | 87,247 | 13,087 | |||||||||||||

|

| ||||||||||||||

| 27,180 | |||||||||||||||

|

| ||||||||||||||

Total Information Technology | 27,180 | ||||||||||||||

|

| ||||||||||||||

Total Common Stocks (Cost $4,705,189) | 8,020,666 | ||||||||||||||

|

| ||||||||||||||

| WARRANTS - 0.12% (Cost $15,287) | |||||||||||||||

| Consumer Cyclical - 0.12% | |||||||||||||||

| CDS US Intermediate Holdings, Inc.A | 485,314 | 788,635 | |||||||||||||

|

| ||||||||||||||

| PREFERRED STOCKS - 0.34% (Cost $2,070,155) | |||||||||||||||

| Energy - 0.34% | |||||||||||||||

| Oil, Gas & Consumable Fuels - 0.34% | |||||||||||||||

| Southcross Energy Partners LPA D | 2,635,755 | 2,155,215 | |||||||||||||

|

| ||||||||||||||

| Principal Amount | |||||||||||||||

| BANK LOAN OBLIGATIONSE - 87.80% | |||||||||||||||

| Basic Materials - 3.33% | |||||||||||||||

| Chemicals - 2.55% | |||||||||||||||

| Archroma Finance SARL, 4.385% - 4.397%, Due 8/12/2024, USD 2017 Term Loan B2, (3-mo. LIBOR + 4.250%) | $ | 1,600,669 | 1,577,668 | ||||||||||||

| Ascend Performance Materials Operations LLC, 5.500%, Due 8/27/2026, 2021 Term Loan B, (3-mo. LIBOR + 4.750%) | 1,474,826 | 1,493,955 | |||||||||||||

| ASP Unifrax Holdings, Inc., 3.897%, Due 12/12/2025, Term Loan B, (3-mo. LIBOR + 3.750%) | 2,537,533 | 2,466,482 | |||||||||||||

| ASP Unifrax Holdings, Inc. (continued) 8.619%, Due 12/14/2026, 2nd Lien Term Loan, (3-mo. LIBOR + 8.500%) | 2,287,000 | 2,245,079 | |||||||||||||

| CPC Acquisition Corp., 4.500%, Due 12/29/2027, Term Loan, (3-mo. LIBOR + 3.750%) | 1,101,240 | 1,098,487 | |||||||||||||

See accompanying notes

19

American Beacon Sound Point Floating Rate Income FundSM

Schedule of Investments

August 31, 2021

| Principal Amount | Fair Value | ||||||||||||||

| BANK LOAN OBLIGATIONSE - 87.80% (continued) | |||||||||||||||

| Basic Materials - 3.33% (continued) | |||||||||||||||

| Chemicals - 2.55% (continued) | |||||||||||||||

| GEON Performance Solutions LLC, Due 8/9/2028, 2021 Term LoanF | $ | 278,000 | $ | 278,523 | |||||||||||

| Illuminate Buyer LLC, 3.585%, Due 6/30/2027, 2021 Term Loan, (1-mo. LIBOR + 3.500%) | 2,529,306 | 2,514,029 | |||||||||||||

| Lonza Group AG, 4.750%, Due 6/29/2028, USD Term Loan B, (3-mo. LIBOR + 4.000%) | 1,139,000 | 1,139,000 | |||||||||||||

| LSF11 Skyscraper Holdco SARL, 4.250%, Due 9/29/2027, 2021 USD Term Loan B, (3-mo. LIBOR + 3.500%) | 647,378 | 646,568 | |||||||||||||

| SCIH Salt Holdings, Inc., 4.750%, Due 3/16/2027, 2021 Incremental Term Loan B, (6-mo. LIBOR + 4.000%) | 2,085,748 | 2,087,980 | |||||||||||||

| Sparta US HoldCo LLC, 4.250%, Due 8/2/2028, 2021 Term Loan, (3-mo. LIBOR + 3.500%) | 620,000 | 619,615 | |||||||||||||

| W.R. Grace & Co., Due 8/12/2028, 2021 Term Loan BF | 245,000 | 245,409 | |||||||||||||

|

| ||||||||||||||

| 16,412,795 | |||||||||||||||

|

| ||||||||||||||

| Forest Products & Paper - 0.04% | |||||||||||||||

| Spa Holdings OY, Due 2/4/2028, USD Term Loan BF | 280,298 | 279,947 | |||||||||||||

|

| ||||||||||||||

| Iron/Steel - 0.74% | |||||||||||||||

| Phoenix Services International LLC, 4.750%, Due 3/1/2025, Term Loan, (1-mo. LIBOR + 3.750%) | 4,773,203 | 4,749,337 | |||||||||||||

|

| ||||||||||||||

Total Basic Materials | 21,442,079 | ||||||||||||||

|

| ||||||||||||||

| Communications - 11.32% | |||||||||||||||

| Advertising - 1.24% | |||||||||||||||

| ABG Intermediate Holdings LLC, 4.000%, Due 9/27/2024, 2021 Term Loan B, (3-mo. LIBOR + 3.250%) | 2,892,008 | 2,878,444 | |||||||||||||

| Clear Channel Outdoor Holdings, Inc., 3.607% - 3.629%, Due 8/21/2026, Term Loan B, (2-mo. LIBOR + 3.500%, 3-mo. LIBOR + 3.500%) | 2,187,760 | 2,134,619 | |||||||||||||

| Polyconcept Investments BV, 5.500%, Due 8/16/2023, USD 2016 Term Loan B, (6-mo. LIBOR + 4.500%) | 2,629,605 | 2,557,291 | |||||||||||||

| Red Ventures LLC, 4.250%, Due 11/8/2024, 2020 Term Loan B, (1-mo. LIBOR + 3.500%) | 396,010 | 395,020 | |||||||||||||

|

| ||||||||||||||

| 7,965,374 | |||||||||||||||

|

| ||||||||||||||

| Internet - 2.22% | |||||||||||||||

| Arches Buyer, Inc., 3.750%, Due 12/6/2027, 2021 Term Loan B, (1-mo. LIBOR + 3.250%) | 427,000 | 422,730 | |||||||||||||

| CNT Holdings Corp., 4.500%, Due 11/8/2027, 2020 Term Loan, (6-mo. LIBOR + 3.750%) | 1,015,455 | 1,014,328 | |||||||||||||

| 7.500%, Due 11/6/2028, 2020 2nd Lien Term Loan, (6-mo. LIBOR + 6.750%) | 1,168,000 | 1,185,520 | |||||||||||||

| Endure Digital, Inc., 4.250%, Due 2/10/2028, Term Loan, (3-mo. LIBOR + 3.500%) | 1,146,000 | 1,137,050 | |||||||||||||

| Hunter Holdco Ltd., 4.750%, Due 8/19/2028, USD Term Loan B, (3-mo. LIBOR + 4.250%) | 4,004,000 | 4,004,000 | |||||||||||||

| I-Logic Technologies Bidco Ltd., 4.500%, Due 2/16/2028, 2021 USD Term Loan B, (6-mo. LIBOR + 4.000%) | 469,219 | 468,928 | |||||||||||||

| Internap Corp., 5.500%, Due 5/8/2025, 2020 Second Out Term Loan, PIK (in-kind rate 3.500%) | 418,770 | 209,385 | |||||||||||||

| ION Trading Finance Ltd., 4.917%, Due 4/1/2028, 2021 USD Term Loan, (6-mo. LIBOR + 4.750%) | 2,643,000 | 2,642,339 | |||||||||||||

| Proofpoint, Inc., Due 8/31/2028, 1st Lien Term LoanF | 326,000 | 323,917 | |||||||||||||

| Shutterfly, Inc., | |||||||||||||||

Due 9/25/2026, 2021 Delayed Draw Term LoanF | 567,561 | 565,790 | |||||||||||||

Due 9/25/2026, 2021 Term LoanF | 2,349,439 | 2,342,109 | |||||||||||||

|

| ||||||||||||||

| 14,316,096 | |||||||||||||||

|

| ||||||||||||||

| Media - 3.78% | |||||||||||||||

| Cengage Learning, Inc., 5.750%, Due 6/29/2026, 2021 Term Loan B, (3-mo. LIBOR + 4.750%) | 3,992,894 | 4,001,758 | |||||||||||||

| Diamond Sports Group LLC, 3.340%, Due 8/24/2026, Term Loan, (1-mo. LIBOR + 3.250%) | 923,524 | 574,506 | |||||||||||||

| Gannett Holdings LLC, 7.750%, Due 1/29/2026, 2021 Term Loan B, (6-mo. LIBOR + 7.000%)F | 4,076,904 | 4,102,385 | |||||||||||||

| GEE Holdings LLC, | |||||||||||||||

9.000%, Due 3/24/2025, 2021 Exit Term Loan, (3-mo. LIBOR + 8.000%) | 2,192,511 | 2,190,691 | |||||||||||||

2.500%, Due 3/23/2026, 2021 2nd Lien Takeback Term Loan, PIK (in-kind rate 6.750%) | 1,634,070 | 1,495,174 | |||||||||||||

| McGraw-Hill Global Education Holdings LLC, 5.250%, Due 7/28/2028, 2021 Term Loan, (1-mo. LIBOR + 4.750%) | 2,791,000 | 2,770,068 | |||||||||||||

| NEP/NCP Holdco, Inc., 3.335%, Due 10/20/2025, 2018 1st Lien Term Loan, (1-mo. LIBOR + 3.250%)F | 4,821,409 | 4,581,689 | |||||||||||||

See accompanying notes

20

American Beacon Sound Point Floating Rate Income FundSM

Schedule of Investments

August 31, 2021

| Principal Amount | Fair Value | ||||||||||||||

| BANK LOAN OBLIGATIONSE - 87.80% (continued) | |||||||||||||||

| Communications - 11.32% (continued) | |||||||||||||||

| Media - 3.78% (continued) | |||||||||||||||

| Springer Nature Deutschland GmbH, 3.750%, Due 8/14/2026, 2021 USD Term Loan B18, (1-mo. LIBOR + 3.000%) | $ | 1,822,452 | $ | 1,818,880 | |||||||||||

| Univision Communications, Inc., | |||||||||||||||

4.250%, Due 3/15/2026, 2020 Replacement Term Loan, (1-mo. LIBOR + 3.250%) | 1,963,807 | 1,957,365 | |||||||||||||

Due 5/5/2028, 2021 Term Loan BF | 874,000 | 870,355 | |||||||||||||

|

| ||||||||||||||

| 24,362,871 | |||||||||||||||

|

| ||||||||||||||

| Telecommunications - 4.08% | |||||||||||||||

| CCI Buyer, Inc., 4.750%, Due 12/17/2027, Term Loan, (3-mo. LIBOR + 4.000%) | 693,263 | 694,566 | |||||||||||||

| Connect Finco SARL, 4.500%, Due 12/11/2026, 2021 Term Loan B, (1-mo. LIBOR + 3.500%) | 2,474,938 | 2,472,364 | |||||||||||||

| Crown Subsea Communications Holding, Inc., 5.750%, Due 4/20/2027, 2021 Term Loan, (1-mo. LIBOR + 5.000%)F | 1,190,664 | 1,197,118 | |||||||||||||

| Gigamon, Inc., 4.500%, Due 12/27/2024, 1st Lien Term Loan, (6-mo. LIBOR + 3.750%) | 1,484,892 | 1,484,892 | |||||||||||||

| Intelsat Jackson Holdings SA, | |||||||||||||||

6.500%, Due 7/13/2022, 2020 DIP Term Loan, (3-mo. LIBOR + 5.500%) | 193,218 | 194,003 | |||||||||||||

8.625%, Due 1/2/2024, 2017 Term Loan B5G | 514,000 | 522,111 | |||||||||||||

| Intrado Corp., 5.000%, Due 10/10/2024, 2017 Term Loan, (3-mo. LIBOR + 4.000%) | 3,000,476 | 2,897,169 | |||||||||||||

| Iridium Satellite LLC, 3.250%, Due 11/4/2026, 2021 Term Loan B, (1-mo. LIBOR + 2.500%) | 766,654 | 764,975 | |||||||||||||

| LogMeIn, Inc., 4.847%, Due 8/31/2027, Term Loan B, (1-mo. LIBOR + 4.750%) | 5,570,010 | 5,548,231 | |||||||||||||

| Maxar Technologies Ltd., 2.840%, Due 10/4/2024, Term Loan B, (1-mo. LIBOR + 2.750%) | 3,258,111 | 3,219,144 | |||||||||||||

| MLN US HoldCo LLC, | |||||||||||||||

4.583%, Due 11/30/2025, 2018 1st Lien Term Loan, (1-mo. LIBOR + 4.500%) | 1,628,042 | 1,475,413 | |||||||||||||

8.833%, Due 11/30/2026, 2018 2nd Lien Term Loan, (1-mo. LIBOR + 8.750%) | 3,985,000 | 2,505,569 | |||||||||||||

| US Telepacific Corp., 7.000%, Due 5/2/2023, 2017 Term Loan B, (6-mo. LIBOR + 6.000%) | 1,656,039 | 1,495,088 | |||||||||||||

| West Corp., 4.500%, Due 10/10/2024, 2018 Term Loan B1, (3-mo. LIBOR + 3.500%)F | 1,857,937 | 1,779,272 | |||||||||||||

|

| ||||||||||||||

| 26,249,915 | |||||||||||||||

|