UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-4984

AMERICAN BEACON FUNDS

(Exact name of registrant as specified in charter)

220 East Las Colinas Boulevard, Suite 1200

Irving, Texas 75039

(Address of principal executive offices)-(Zip code)

JEFFREY K. RINGDAHL, PRESIDENT

220 East Las Colinas Boulevard, Suite 1200

Irving, Texas 75039

(Name and address of agent for service)

Registrant’s telephone number, including area code: (817) 391-6100

Date of fiscal year end: December 31, 2022

Date of reporting period: December 31, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

About American Beacon Advisors

Since 1986, American Beacon Advisors, Inc. has offered a variety of products and investment advisory services to numerous institutional and retail clients, including a variety of mutual funds, corporate cash management, and separate account management.

Our clients include defined benefit plans, defined contribution plans, foundations, endowments, corporations, financial planners, and other institutional investors. With American Beacon Advisors, you can put the experience of a multi-billion dollar asset management firm to work for your company.

AHL MANAGED FUTURES STRATEGY FUND

Investing in derivative instruments involves liquidity, credit, interest rate and market risks. Interest rate risk is the risk that debt securities will decrease in value with increases in market interest rates. Quantitative models may not perform as expected and may result in losses for the Fund. Investing in foreign and emerging market securities may involve heightened risk due to currency fluctuations and economic and political risks. Regulatory changes may impair the Fund’s ability to qualify for federal income tax treatment as a regulated investment company, which could result in the Fund and shareholders incurring significant income tax expense. The Fund may have high portfolio turnover risk, which could increase the Fund’s transaction costs and possibly have a negative impact on performance. Because the Fund may invest in fewer issuers than a more diversified portfolio, the fluctuating value of a single holding may have a greater effect on the value of the Fund.

AHL TARGETRISK FUND

Investing in derivative instruments involves liquidity, credit, interest rate and market risks. Interest rate risk is the risk that debt securities will decrease in value with increases in market interest rates. Quantitative models may not perform as expected and may result in losses for the Fund. Investments in high-yield securities (commonly referred to as “junk bonds”) are subject to greater levels of credit, interest rate, market and liquidity risks than investment-grade securities. In a period of sustained deflation, inflation index-linked securities may not pay any income and may suffer a loss. Investing in foreign and emerging market securities may involve heightened risk due to currency fluctuations and economic and political risks. Regulatory changes may impair the Fund’s ability to qualify for federal income tax treatment as a regulated investment company, which could result in the Fund and shareholders incurring significant income tax expense. The Fund may have high portfolio turnover risk, which could increase the Fund’s transaction costs and possibly have a negative impact on performance. Because the Fund may invest in fewer issuers than a more diversified portfolio, the fluctuating value of a single holding may have a greater effect on the value of the Fund.

AHL TARGETRISK CORE FUND

Investing in derivative instruments involves liquidity, credit, interest rate and market risks. Interest rate risk is the risk that debt securities will decrease in value with increases in market interest rates. Quantitative models may not perform as expected and may result in losses for the Fund. Investing in foreign and emerging market securities may involve heightened risk due to currency fluctuations and economic and political risks. The Fund may have high portfolio turnover risk, which could increase the Fund’s transaction costs and possibly have a negative impact on performance. Because the Fund may invest in fewer issuers than a more diversified portfolio, the fluctuating value of a single holding may have a greater effect on the value of the Fund.

Any opinions herein, including forecasts, reflect our judgment as of the end of the reporting period and are subject to change. Each advisor’s strategies and the Fund’s portfolio composition will change depending on economic and market conditions. This report is not a complete analysis of market conditions and therefore, should not be relied upon as investment advice. Although economic and market information has been compiled from reliable sources, American Beacon Advisors, Inc. makes no representation as to the completeness or accuracy of the statements contained herein.

American Beacon Funds | December 31, 2022 |

Contents

President’s Message

| | |

| | Dear Shareholders, Warren E. Buffett, the “Oracle of Omaha” and billionaire chairman and CEO of Berkshire Hathaway, once said, “Predicting rain doesn’t count. Building arks does.” Mr. Buffet’s plain-spoken words make a great deal of common sense. Figuring out when the next dangerous storm may occur could prove to be an effort in futility if we haven’t also devised a plan for preserving our physical well-being when the thunder rolls and the lightning strikes. The time to build a shelter is before the storm clouds appear on the horizon. The same can also be said about our investment portfolios. Careful planning and fine-tuning can be especially important as we seek to preserve and grow our |

investment portfolios during periods of economic uncertainty – particularly as we consider the effects of higher inflation, slower economic growth and geopolitical concerns such as Russia’s war with Ukraine.

None of us has the ability to foresee the future – not even the Oracle of Omaha. To help your investment portfolio weather storms over the long term, we encourage you to work with financial professionals to develop your personal savings plan, conduct annual plan reviews, and make thoughtful, purposeful plan adjustments to better manage your evolving financial needs and goals. By investing in different investment styles and asset classes, you may be able to help mitigate financial risks across your portfolio. By allocating your portfolio according to your risk-tolerance level, you may be better positioned to withstand short-term crises. Through careful planning, you will be better positioned to achieve enduring financial success.

Since 1986, American Beacon has endeavored to provide investors with a disciplined approach to realizing long-term financial goals. As a manager of managers, we strive to provide investment products that may enable investors to participate during market upswings while potentially insulating against market downswings. The investment teams behind our mutual funds seek to produce consistent, long-term results rather than focus only on short-term movements in the markets. In managing our investment products, we emphasize identifying opportunities that offer the potential for long-term financial rewards.

Thank you for entrusting your financial success with American Beacon. For additional information about our investment products or to access your account information, please visit our website at www.americanbeaconfunds.com.

Best Regards,

Jeffrey K. Ringdahl

President

American Beacon Funds

1

Alternative Investments Market Overview

December 31, 2022 (Unaudited)

During the 12-month period ended December 31, 2022, several themes were evident in the global markets, with inflation arguably a common thread: Russia’s war in Ukraine, central bank activity, supply chain disruption, de-globalization, and post-pandemic recovery. Inflation, as represented by the U.S. Consumer Price Index (“CPI”), hit levels not seen since the 1970s – and rarely seen in more than a century. Inflation has historically had a detrimental effect on global equities and bonds. What is worse, of course, is that the low (or negative) correlation between the two, often relied upon by classic “60-40” investors, failed.

Despite the clear negative performance of global equities in 2022, it was a volatile year characterized by several market reversals – in the immediate aftermath of the Russian invasion of Ukraine, in July and October when investor perception was that central banks may not have to hike rates as much as anticipated, and in November after a better-than-expected CPI print.

The downward price movement of bonds was accompanied by low, realized volatility relative to equities, although significantly higher than its own historical volatility. Bonds showed a clear downward trend, particularly in the first half of the year. The price of short-term rates trended down for most of the first three quarters as many central banks raised rates. Japanese bonds, in contrast, were much more range-bound as that country’s central bank elected not to join other central banks to the same degree.

The strength of the U.S. dollar was notable in 2022 as the Federal Reserve raised rates faster than most other central banks. This was observed most clearly with persistent weakness relative to the Japanese yen and British pound.

Commodity prices peaked mid-year. The price of U.S. natural gas was propelled higher as Europe tried to wean itself off Russian energy in the wake of Russia’s invasion of Ukraine, while the price of silver fell in the second quarter only to rally strongly in the fourth quarter.

This macroeconomic backdrop led to mixed performance over the period as traditional assets like stocks and bonds fell, while hard assets such as the broad commodity index rose. For context, the Morningstar Systematic Trend Category returned 16.14% for the 12-month period while the Morningstar Tactical Allocation Category returned -15.93% for the same period.

2

American Beacon AHL Managed Futures Strategy FundSM

Performance Overview

December 31, 2022 (Unaudited)

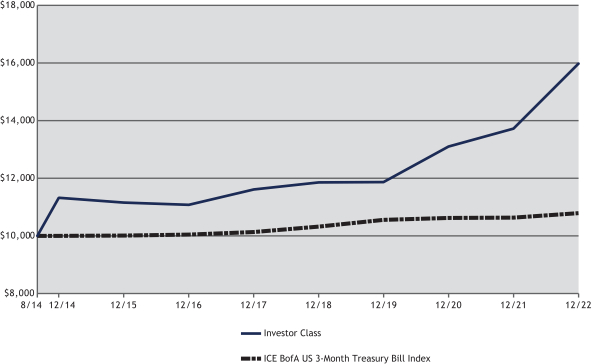

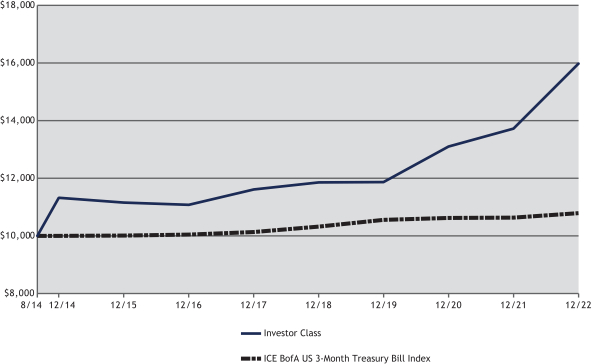

The Investor Class of the American Beacon AHL Managed Futures Strategy Fund (the “Fund”) returned 16.47% for the twelve months ended December 31, 2022.

Comparison of Change in Value of a $10,000 Investment for the period from 8/19/2014 through 12/31/2022

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Returns for the Period Ended December 31, 2022 | |

| | | | | | |

| | | Ticker | | 1 Year | | 3 Years | | 5 Years | | Since Inception

(8/19/2014) | | Value of $10,000

8/19/2014-

12/31/2022 |

R5 Class (1,4) | | AHLIX | | | | 16.93 | % | | | | 10.83 | % | | | | 6.99 | % | | | | 6.16 | % | | | $ | 16,490 | |

Y Class (1,4) | | AHLYX | | | | 16.84 | % | | | | 10.79 | % | | | | 6.93 | % | | | | 6.08 | % | | | $ | 16,390 | |

Investor Class (1,4) | | AHLPX | | | | 16.47 | % | | | | 10.43 | % | | | | 6.60 | % | | | | 5.76 | % | | | $ | 15,972 | |

A without Sales Charge (1,2,4) | | AHLAX | | | | 16.53 | % | | | | 10.51 | % | | | | 6.63 | % | | | | 5.76 | % | | | $ | 15,980 | |

A with Sales Charge (1,2,4) | | AHLAX | | | | 9.82 | % | | | | 8.36 | % | | | | 5.37 | % | | | | 5.02 | % | | | $ | 15,061 | |

C without Sales Charge (1,2,4) | | AHLCX | | | | 15.71 | % | | | | 9.68 | % | | | | 5.83 | % | | | | 5.02 | % | | | $ | 15,062 | |

C with Sales Charge (1,2,4) | | AHLCX | | | | 14.71 | % | | | | 9.68 | % | | | | 5.83 | % | | | | 5.02 | % | | | $ | 15,062 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

ICE BofA US 3-Month Treasury Bill Index (3) | | | | | | 1.45 | % | | | | 0.72 | % | | | | 1.26 | % | | | | 0.90 | % | | | $ | 10,780 | |

| 1. | Performance shown is historical and is not indicative of future returns. Investment returns and principal value will vary, and shares may be worth more or less at redemption than at original purchase. Performance shown is calculated based on the published end-of-day net asset values as of date indicated, and current performance may be lower or higher than the performance data quoted. To obtain performance as of the most recent month end, please visit www.americanbeaconfunds.com or call 1-800-967-9009. Fund performance in the table above does not reflect the deduction of taxes a shareholder would pay on distributions or the redemption of shares. Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only; and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights. A portion of the fees charged to the R5 and Investor Class of the Fund has been waived since Fund inception. A portion of the fees charged to the Y Class of the Fund was waived from Fund inception, partially recovered in 2019 and waived in 2020 through 2022. Performance prior to waiving fees was lower than actual returns shown for periods when fees were waived. |

| 2. | A Class shares have a maximum sales charge of 5.75%. The maximum contingent deferred sales charge for the C Class is 1.00% for shares redeemed within one year of the date of purchase. A portion of the fees charged to the A and C Class of the Fund was waived from Fund inception, partially recovered in 2019 and waived in 2020 through 2022. Performance prior to waiving fees was lower than actual returns shown for periods when fees were waived. |

3

American Beacon AHL Managed Futures Strategy FundSM

Performance Overview

December 31, 2022 (Unaudited)

| | C Class shares automatically convert to A Class shares 8 years after purchase, if the conversion is available through your financial intermediary. The performance for C Class shares reflects the conversion of C Class shares to A Class shares after 8 years. If the conversion was not reflected, the since inception return would have been 4.98% with and without Sales Charge. |

| 3. | ICE BofA US 3-Month Treasury Bill Index is an index of U.S. Treasury securities maturing in less than 3 months that assumes reinvestment of all income and is intended to track the daily performance of 3-month U.S. Treasury bills. One cannot directly invest in an index. |

| 4. | The Total Annual Fund Operating Expense ratios set forth in the most recent Fund prospectus for the R5, Y, Investor, A, and C Class shares were 1.55%, 1.54%, 1.93%, 1.82%, and 2.55%, respectively. The expense ratios above may vary from the expense ratios presented in other sections of this report that are based on expenses incurred during the period covered by this report. |

During the period, three asset classes contributed positively while one detracted. The top contributing asset class was Currencies as the Fund had a long position in the U.S. dollar which strengthened against the British pound and Japanese yen as the Federal Reserve raised rates faster than other central banks. Within Fixed Income, the top performers were the short positions in 3-month Sonia and Euribor rates that the Fund held for most of the period. Within Commodities, short positions in U.S. Natural Gas and Brent Crude Oil contributed positively to performance as Europe attempts to wean itself off Russian energy and the asset class added value overall.

The asset class that detracted from performance during the period was Stocks as global equity markets displayed very little trending behavior resulting in poor performance overall. There were several reversals during the year; in the immediate aftermath of the Russian invasion of Ukraine, in July and in October when investor perception was that central banks may not have to hike rates as much as anticipated. Equity short positions in these episodes were reduced, and performance was impacted negatively.

Looking forward, the Fund’s sub-advisor will continue to implement its trading strategy designed to capitalize on price trends (up or down) in a broad range of global equities, fixed income, currency, and commodity futures markets; seeking to achieve the Fund’s goal of capital growth.

4

American Beacon AHL Managed Futures Strategy FundSM

Performance Overview

December 31, 2022 (Unaudited)

| | | | | | | | |

| Top Active Exposures By Asset Class | |

| Commodities | | | | | | | % of VaR | * |

| Natural Gas | | | Short | | | | 4.41 | |

| Soybean | | | Long | | | | 2.37 | |

| Crude Oil | | | Short | | | | 2.03 | |

| Silver | | | Long | | | | 2.03 | |

| Corn | | | Long | | | | 1.69 | |

| | | | | | | | |

| Currencies | | | | | | | % of VaR | * |

| BRZ/USD | | | Long | | | | 4.41 | |

| AUD/USD | | | Short | | | | 3.05 | |

| CAD/USD | | | Short | | | | 3.05 | |

| CHP/USD | | | Long | | | | 2.71 | |

| MXN/USD | | | Long | | | | 2.71 | |

| | | | | | | | |

| Equities | | | | | | | % of VaR | * |

| Korean Kospi | | | Short | | | | 3.73 | |

| Australian SPI 200 Index | | | Long | | | | 2.71 | |

| NASDAQ 100 Index | | | Short | | | | 2.37 | |

| S&P 500 Index | | | Short | | | | 2.37 | |

| Euro-STOXX | | | Long | | | | 1.69 | |

| | | | | | | | |

| Fixed-Income | | | | | | | % of VaR | * |

| U.S. Treasuries | | | Short | | | | 5.08 | |

| Euribor | | | Short | | | | 3.73 | |

| Japanese Bonds | | | Short | | | | 2.71 | |

| 3M SOFR rates | | | Short | | | | 2.37 | |

| Euro-BUND | | | Short | | | | 2.37 | |

| | | | | | | | |

| Asset Class Exposure | | | | | | | % of VaR | * |

| Stocks | | | | | | | 30.9 | |

| Fixed Income | | | | | | | 25.4 | |

| Currencies | | | | | | | 23.1 | |

| Commodities | | | | | | | 20.7 | |

| | | | | | | | |

| Top 10 Exposures | | | | | | | % of VaR | * |

| U.S. Treasuries | | | Short | | | | 5.08 | |

| BRZ/USD | | | Long | | | | 4.41 | |

| Natural Gas | | | Short | | | | 4.41 | |

| Euribor | | | Short | | | | 3.73 | |

| Korean Kospi | | | Short | | | | 3.73 | |

| AUD/USD | | | Short | | | | 3.05 | |

| CAD/USD | | | Short | | | | 3.05 | |

| Australian SPI 200 Index | | | Long | | | | 2.71 | |

| CHP/USD | | | Long | | | | 2.71 | |

| Japanese Bonds | | | Short | | | | 2.71 | |

| * | Value at Risk (“VaR”) is a measure of the potential loss in value of a portfolio over a defined period for a given confidence interval. A one-day VaR at the 95% confidence level represents that there is a 5% probability that the mark-to-market loss on the portfolio over a one day horizon will exceed this value (assuming normal markets and no trading in the portfolio). |

5

American Beacon AHL TargetRisk FundSM

Performance Overview

December 31, 2022 (Unaudited)

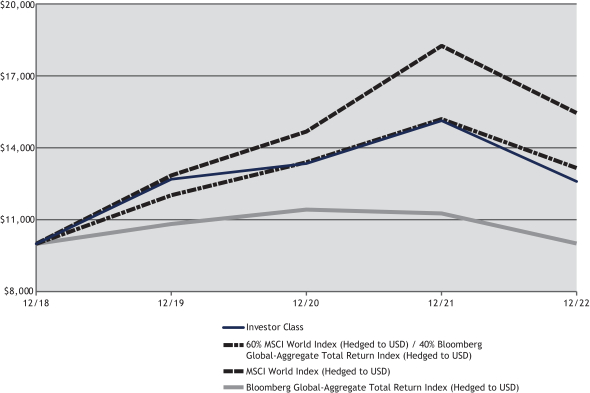

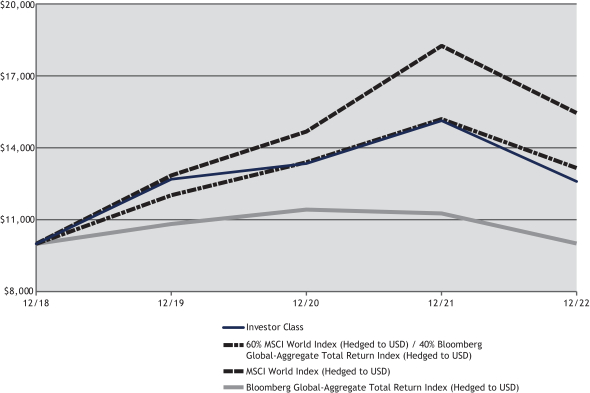

The Investor Class of the American Beacon AHL TargetRisk Fund (the “Fund”) returned -16.79% for the twelve months ended December 31, 2022.

Comparison of Change in Value of a $10,000 Investment for the period from 12/31/2018 through 12/31/2022

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Returns for the Period Ended December 31, 2022 | |

| | | | | |

| | | Ticker | | 1 Year | | 3 Years | | Since Inception (12/31/2018) | | Value of $10,000 12/31/2018- 12/31/2022 |

R5 Class (1,3) | | AHTIX | | | | (16.49 | )% | | | | 0.11 | % | | | | 6.28 | % | | | $ | 12,759 | |

Y Class (1,3) | | AHTYX | | | | (16.52 | )% | | | | 0.08 | % | | | | 6.23 | % | | | $ | 12,735 | |

Investor Class (1,3) | | AHTPX | | | | (16.79 | )% | | | | (0.24 | )% | | | | 5.93 | % | | | $ | 12,593 | |

A without Sales Charge (1,2,3) | | AHTAX | | | | (16.70 | )% | | | | (0.19 | )% | | | | 6.00 | % | | | $ | 12,626 | |

A with Sales Charge (1,2,3) | | AHTAX | | | | (21.50 | )% | | | | (2.14 | )% | | | | 4.45 | % | | | $ | 11,900 | |

C without Sales Charge (1,2,3) | | AHACX | | | | (17.33 | )% | | | | (0.93 | )% | | | | 5.28 | % | | | $ | 12,287 | |

C with Sales Charge (1,2,3) | | AHACX | | | | (18.33 | )% | | | | (0.93 | )% | | | | 5.28 | % | | | $ | 12,287 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

60% MSCI World Index (Hedged to USD) / 40% Bloomberg Global-Aggregate Total Return Index (Hedged to USD) (4) | | | | | | (13.50 | )% | | | | 3.04 | % | | | | 7.08 | % | | | $ | 13,150 | |

MSCI World Index (Hedged to USD) (4) | | | | | | (15.38 | )% | | | | 6.34 | % | | | | 11.47 | % | | | $ | 15,445 | |

Bloomberg Global-Aggregate Total Return Index (Hedged to USD) (4) | | | | | | (11.22 | )% | | | | (2.59 | )% | | | | 0.01 | % | | | $ | 10,003 | |

| 1. | Performance shown is historical and is not indicative of future returns. Investment returns and principal value will vary, and shares may be worth more or less at redemption than at original purchase. Performance shown is calculated based on the published end-of-day net asset values as of date indicated, and current performance may be lower or higher than the performance data quoted. To obtain performance as of the most recent month end, please visit www.americanbeaconfunds.com or call 1-800-967-9009. Fund performance in the table above does not reflect the deduction of taxes a shareholder would pay on distributions or the redemption of shares. Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights. A portion of the fees charged to the R5 Class of the Fund has been waived since Fund inception. A portion of the fees charged to the Investor Class of the Fund was waived from Fund inception through 2020. A portion of the fees charged to the A, C, and Y Class of the Fund was waived from Fund inception through 2020 and in 2022. Performance prior to waiving fees was lower than actual returns shown for periods when fees were waived. |

6

American Beacon AHL TargetRisk FundSM

Performance Overview

December 31, 2022 (Unaudited)

| 2. | A Class shares have a maximum sales charge of 5.75%. The maximum contingent deferred sales charge for the C Class is 1.00% for shares redeemed within one year of the date of purchase. Fund performance represents the returns achieved by the Investor Class from 12/31/2018 up to the 4/30/2019 inception date of the A and C Classes and returns of the A and C Classes since 4/30/2019. Expenses of the A and C Classes are higher than those of the Investor Class. Therefore, total returns shown may be higher than they would have been had the A and C Classes been in existence since 12/31/2018. |

| 3. | The Total Annual Fund Operating Expense ratios set forth in the most recent Fund prospectus for the R5, Y, Investor, A, and C Class shares were 1.05%, 1.07%, 1.42%, 1.30%, and 2.06%, respectively. The expense ratios above may vary from the expense ratios presented in other sections of this report that are based on expenses incurred during the period covered by this report. |

| 4. | The AHL TargetRisk Fund’s annual total return is compared to the TargetRisk Composite Index, which combines the returns of the MSCI World Index (Hedged to USD) and the Bloomberg Global-Aggregate Total Return Index (Hedged to USD) in a 60%/40% proportion. The MSCI World (Hedged to USD) represents a close estimation of the performance that can be achieved by hedging the currency exposures of its parent index, the MSCI World Index, to the USD, the “home” currency for the hedged index. The index is 100% hedged to the USD by selling each foreign currency forward at the one-month forward weight. The parent index is composed of large and mid-cap stocks across 23 Developed Markets (DM) countries and its local performance is calculated in 13 different currencies, including the Euro. The MSCI© information contained herein: (1) is provided “as is,” (2) is proprietary to MSCI and/or its content providers, (3) may not be used to create any financial instruments or products or any indexes and (4) may not be copied or distributed without MSCI’s express written consent. MSCI disclaims all warranties with respect to the information. Neither MSCI nor its content providers are responsible for any damages or losses arising from any use of this information. The Bloomberg Global-Aggregate Total Return Index (Hedged to USD) is a flagship measure of global investment grade debt from 24 local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively, “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg does not approve or endorse this material, or guarantee the accuracy or completeness of any information herein, or make any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, shall not have any liability or responsibility for injury or damages arising in connection therewith. One cannot directly invest in an index. |

During the period, three asset classes contributed negatively while only one contributed positively to performance. The top detracting asset class was Bonds within the Fund driven by U.S. 10-year Treasury and Ultra Bonds. The next top detractor asset class during the period was Stocks, in particular the S&P 500 and Nasdaq 100 positions were most impactful. Additionally, Credit within the Fund detracted during the period, specifically European and U.S. high yield positions. Commodities, within the Inflation sensitive bucket in the Fund generated gains, but not enough to offset the negative performance from other asset classes during the period. The risk management overlays were active throughout most of the year and helped mitigate the drawdowns during the sharpest selloffs. The exposure of the Fund adapted to the prevailing market conditions throughout. It remained low for most of the year, at an average of 135%, approximately half of its long-term average exposure level. The overlays deactivated in the fourth quarter and allowed the Fund to benefit from the market rally.

Looking forward, the Fund’s sub-advisor will continue to implement its trading strategy designed to maintain its targeted risk profile, by investing in a broad range of global equities, fixed income, credit, and commodity markets; seeking to achieve the Fund’s goal of capital growth.

7

American Beacon AHL TargetRisk FundSM

Performance Overview

December 31, 2022 (Unaudited)

| | | | | | | | |

| Top Ten Exposures | | | | | | | % of VaR | * |

| BBG Commodity ex-Agriculturals Index | | | | | | | 18.0 | |

| U.S. Treasuries | | | | | | | 13.2 | |

| U.K. Gilts | | | | | | | 5.6 | |

| S&P 500 Index | | | | | | | 5.6 | |

| Euro-BUND | | | | | | | 4.8 | |

| NASDAQ 100 Index | | | | | | | 3.6 | |

| French Bonds | | | | | | | 3.2 | |

| Tokyo Stock Exchange Index | | | | | | | 3.2 | |

| U.S. High Yield CDX Index | | | | | | | 3.2 | |

| S&P TSX 60 Index | | | | | | | 2.8 | |

| | | | | | | | |

| 3-Year Risk Summary | | | | | | | Fund | |

| Sharpe Ratio | | | | | | | (0.06 | ) |

| Standard Deviation | | | | | | | 10.12 | |

| | | | | | | | |

| Asset Class Exposure | | | Net | (%) | | | % of VaR | * |

| Bonds | | | 41.2 | | | | 0.7 | |

| Credits | | | 46.7 | | | | 0.2 | |

| Inflation | | | 26.3 | | | | 0.5 | |

| Stock Indices | | | 34.9 | | | | 0.8 | |

| * | Value at Risk (“VaR”) is a measure of the potential loss in value of a portfolio over a defined period for a given confidence interval. A one-day VaR at the 95% confidence level represents that there is a 5% probability that the mark-to-market loss on the portfolio over a one day horizon will exceed this value (assuming normal markets and no trading in the portfolio). |

8

American Beacon AHL TargetRisk Core FundSM

Performance Overview

December 31, 2022 (Unaudited)

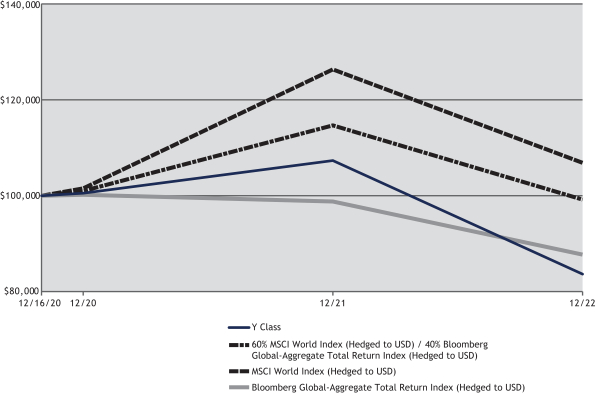

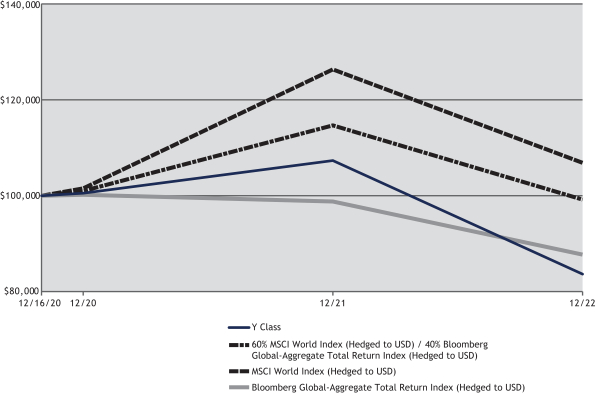

The Y Class of the American Beacon AHL TargetRisk Core Fund (the “Fund”) returned -22.01% for the twelve months ended December 31, 2022.

Comparison of Change in Value of a $100,000 Investment for the period from 12/16/2020 through 12/31/2022

| | | | | | | | | | | | | | | | | | | | |

| Total Returns for the Period Ended December 31, 2022 | |

| | | | |

| | | Ticker | | 1 Year | | Since Inception

(12/16/2020) | | Value of $100,000

12/16/2020-

12/31/2022 |

Y Class (1,3) | | AABYX | | | | (22.01 | )% | | | | (8.36 | )% | | | $ | 83,670 | |

A without Sales Charge (1,2,3) | | AAHAX | | | | (22.20 | )% | | | | (8.64 | )% | | | $ | 83,159 | |

A with Sales Charge (1,2,3) | | AAHAX | | | | (26.70 | )% | | | | (11.25 | )% | | | $ | 78,378 | |

C without Sales Charge (1,2,3) | | AAECX | | | | (22.77 | )% | | | | (9.31 | )% | | | $ | 81,925 | |

C with Sales Charge (1,2,3) | | AAECX | | | | (23.77 | )% | | | | (9.31 | )% | | | $ | 81,925 | |

R6 Class (1,3) | | AHTRX | | | | (21.89 | )% | | | | (8.25 | )% | | | $ | 83,877 | |

| | | | | | | | | | | | | | | | | | | |

60% MSCI World Index (Hedged to USD) / 40% Bloomberg Global-Aggregate Total Return Index (Hedged to USD) (4) | | | | | | (13.50 | )% | | | | (0.40 | )% | | | $ | 99,184 | |

MSCI World Index (Hedged to USD) (4) | | | | | | (15.38 | )% | | | | 3.31 | % | | | $ | 106,869 | |

Bloomberg Global-Aggregate Total Return Index (Hedged to USD) (4) | | | | | | (11.22 | )% | | | | (6.21 | )% | | | $ | 87,716 | |

| 1. | Performance shown is historical and is not indicative of future returns. Investment returns and principal value will vary, and shares may be worth more or less at redemption than at original purchase. Performance shown is calculated based on the published end-of-day net asset values as of date indicated, and current performance may be lower or higher than the performance data quoted. To obtain performance as of the most recent month end, please visit www.americanbeaconfunds.com or call 1-800-967-9009. Fund performance in the table above does not reflect the deduction of taxes a shareholder would pay on distributions or the redemption of shares. Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights. A portion of the fees charged to each Class of the Fund has been waived since Fund inception. Performance prior to waiving fees was lower than actual returns shown since inception. |

9

American Beacon AHL TargetRisk Core FundSM

Performance Overview

December 31, 2022 (Unaudited)

| 2. | A Class shares have a maximum sales charge of 5.75%. The maximum contingent deferred sales charge for the C Class is 1.00% for shares redeemed within one year of the date of purchase. |

| 3. | The Total Annual Fund Operating Expense ratios set forth in the most recent Fund prospectus for the Y, A, C, and R6 Class shares were 4.91%, 5.16%, 5.96%, and 3.60%, respectively. The expense ratios above may vary from the expense ratios presented in other sections of this report that are based on expenses incurred during the period covered by this report. |

| 4. | The AHL TargetRisk Core Fund’s annual total return is compared to the TargetRisk Composite Index, which combines the returns of the MSCI World Index (Hedged to USD) and the Bloomberg Global-Aggregate Total Return Index (Hedged to USD) in a 60%/40% proportion. The MSCI World Index (Hedged to USD) represents a close estimation of the performance that can be achieved by hedging the currency exposures of its parent index, the MSCI World Index, to the USD, the “home” currency for the hedged index. The index is 100% hedged to the USD by selling each foreign currency forward at the one-month forward weight. The parent index is composed of large and mid-cap stocks across 23 Developed Markets (DM) countries and its local performance is calculated in 13 different currencies, including the Euro. The MSCI© information contained herein: (1) is provided “as is,” (2) is proprietary to MSCI and/ or its content providers, (3) may not be used to create any financial instruments or products or any indexes and (4) may not be copied or distributed without MSCI’s express written consent. MSCI disclaims all warranties with respect to the information. Neither MSCI nor its content providers are responsible for any damages or losses arising from any use of this information. The Bloomberg Global-Aggregate Total Return Index (Hedged to USD) is a flagship measure of global investment grade debt from 24 local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively, “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg does not approve or endorse this material, or guarantee the accuracy or completeness of any information herein, or make any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, shall not have any liability or responsibility for injury or damages arising in connection therewith. One cannot directly invest in an index. |

Bonds and Stocks contributed negatively to performance during the period. The negative performance in Bonds was led by losses in the U.S. 10-year Treasury and Ultra bonds. The performance in Stocks was driven by losses in S&P 500 and Nasdaq 100 positions. The FTSE 100 and Nifty indices eked out small gains on the year within the equity asset class but not enough to balance out losses overall. The risk management overlays were active throughout most of the year and helped mitigate the drawdowns during the sharpest selloffs. The exposure of the Fund adapted to the prevailing market conditions. It began the year at 227% before hitting a low of 35% in October and expanding back up to 125% at year-end. The overlays largely deactivated in the fourth quarter and allowed the Fund to benefit from the market rally.

Looking forward, the Fund’s sub-advisor will continue to implement its trading strategy designed to maintain its targeted risk profile, by investing in a broad range of global equities and fixed income instruments while seeking to achieve the Fund’s goal of capital growth.

10

American Beacon AHL TargetRisk Core FundSM

Performance Overview

December 31, 2022 (Unaudited)

| | | | | | | | |

| Top Ten Exposures | | | | | | | % of VaR | * |

| U.S. Treasuries | | | | | | | 20.4 | |

| S&P 500 Index | | | | | | | 7.8 | |

| U.K. Gilts | | | | | | | 5.3 | |

| Italian Bonds | | | | | | | 5.3 | |

| Euro-BUND | | | | | | | 4.9 | |

| Tokyo Stock Exchange Index | | | | | | | 4.9 | |

| DAX Index | | | | | | | 4.5 | |

| NASDAQ Index | | | | | | | 3.7 | |

| Euro-STOXX | | | | | | | 3.3 | |

| U.S. Treasuries | | | | | | | | |

| | | | | | | | |

| Asset Class Exposure | | | Net | (%) | | | % of VaR | * |

| Bonds | | | 75.9 | | | | 1.0 | |

| Stock Indices | | | 48.8 | | | | 1.0 | |

| * | Value at Risk (“VaR”) is a measure of the potential loss in value of a portfolio over a defined period for a given confidence interval. A one-day VaR at the 95% confidence level represents that there is a 5% probability that the mark-to-market loss on the portfolio over a one day horizon will exceed this value (assuming normal markets and no trading in the portfolio). |

11

American Beacon FundsSM

Expense Examples

December 31, 2022 (Unaudited)

Fund Expense Example

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption fees, if applicable, and (2) ongoing costs, including management fees, distribution (12b-1) fees, sub-transfer agent fees, and other Fund expenses. The Examples are intended to help you understand the ongoing cost (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The Examples are based on an investment of $1,000 invested at the beginning of the period in each Class and held for the entire period from July 1, 2022 through December 31, 2022.

Actual Expenses

The “Actual” lines of the tables provide information about actual account values and actual expenses. You may use the information on this page, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = $8.60), then multiply the result by the “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. Shareholders of the Investor and R5 Classes that invest in the Funds through an IRA or Roth IRA may be subject to a custodial IRA fee of $15 that is typically deducted each December. If your account was subject to a custodial IRA fee during the period, your costs would have been $15 higher.

Hypothetical Example for Comparison Purposes

The “Hypothetical” lines of the tables provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the Fund’s actual return). You may compare the ongoing costs of investing in the Funds with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. Shareholders of the Investor and R5 Classes that invest in the Funds through an IRA or Roth IRA may be subject to a custodial IRA fee of $15 that is typically deducted each December. If your account was subject to a custodial IRA fee during the period, your costs would have been $15 higher.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs charged by the Funds, such as sales charges (loads) or redemption fees, as applicable. Similarly, the expense examples for other funds do not reflect any transaction costs charged by those funds, such as sales charges (loads), redemption fees or exchange fees. Therefore, the “Hypothetical” lines of the tables are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. If you were subject to any transaction costs during the period, your costs would have been higher.

12

American Beacon FundsSM

Expense Examples

December 31, 2022 (Unaudited)

| | | | | | | | | | | | | | | |

| American Beacon AHL Managed Futures Strategy Fund | |

| | | |

| | | Beginning Account Value

7/1/2022 | | Ending Account Value

12/31/2022 | | Expenses Paid During

Period

7/1/2022-12/31/2022* |

| R5 Class | | | | | | | | | | | | | | | |

| Actual | | | | $1,000.00 | | | | | $1,028.10 | | | | | $7.51 | |

| Hypothetical** | | | | $1,000.00 | | | | | $1,017.80 | | | | | $7.48 | |

| Y Class | | | | | | | | | | | | | | | |

| Actual | | | | $1,000.00 | | | | | $1,028.50 | | | | | $8.03 | |

| Hypothetical** | | | | $1,000.00 | | | | | $1,017.29 | | | | | $7.98 | |

| Investor Class | | | | | | | | | | | | | | | |

| Actual | | | | $1,000.00 | | | | | $1,026.50 | | | | | $9.35 | |

| Hypothetical** | | | | $1,000.00 | | | | | $1,015.98 | | | | | $9.30 | |

| A Class | | | | | | | | | | | | | | | |

| Actual | | | | $1,000.00 | | | | | $1,026.10 | | | | | $9.14 | |

| Hypothetical** | | | | $1,000.00 | | | | | $1,016.18 | | | | | $9.10 | |

| C Class | | | | | | | | | | | | | | | |

| Actual | | | | $1,000.00 | | | | | $1,022.20 | | | | | $12.90 | |

| Hypothetical** | | | | $1,000.00 | | | | | $1,012.45 | | | | | $12.83 | |

| * | Expenses are equal to the Fund’s annualized expense ratios for the six-month period of 1.47%, 1.57%, 1.83%, 1.79%, and 2.53% for the R5, Y, Investor, A, and C Classes, respectively, multiplied by the average account value over the period, multiplied by the number derived by dividing the number of days in the most recent fiscal half-year (184) by days in the year (365) to reflect the half-year period. |

| ** | 5% return before expenses. |

| | | | | | | | | | | | | | | |

| American Beacon AHL TargetRisk Fund | |

| | | |

| | | Beginning Account Value

7/1/2022 | | Ending Account Value

12/31/2022 | | Expenses Paid During

Period

7/1/2022-12/31/2022* |

| R5 Class | | | | | | | | | | | | | | | |

| Actual | | | | $1,000.00 | | | | | $976.10 | | | | | $5.23 | |

| Hypothetical** | | | | $1,000.00 | | | | | $1,019.91 | | | | | $5.35 | |

| Y Class | | | | | | | | | | | | | | | |

| Actual | | | | $1,000.00 | | | | | $976.00 | | | | | $5.73 | |

| Hypothetical** | | | | $1,000.00 | | | | | $1,019.41 | | | | | $5.85 | |

| Investor Class | | | | | | | | | | | | | | | |

| Actual | | | | $1,000.00 | | | | | $974.30 | | | | | $7.02 | |

| Hypothetical** | | | | $1,000.00 | | | | | $1,018.10 | | | | | $7.17 | |

| A Class | | | | | | | | | | | | | | | |

| Actual | | | | $1,000.00 | | | | | $974.80 | | | | | $6.77 | |

| Hypothetical** | | | | $1,000.00 | | | | | $1,018.35 | | | | | $6.92 | |

| C Class | | | | | | | | | | | | | | | |

| Actual | | | | $1,000.00 | | | | | $971.50 | | | | | $10.58 | |

| Hypothetical** | | | | $1,000.00 | | | | | $1,014.47 | | | | | $10.82 | |

| * | Expenses are equal to the Fund’s annualized expense ratios for the six-month period of 1.05%, 1.15%, 1.41%, 1.36%, and 2.13% for the R5, Y, Investor, A, and C Classes, respectively, multiplied by the average account value over the period, multiplied by the number derived by dividing the number of days in the most recent fiscal half-year (184) by days in the year (365) to reflect the half-year period. |

| ** | 5% return before expenses. |

13

American Beacon FundsSM

Expense Examples

December 31, 2022 (Unaudited)

| | | | | | | | | | | | | | | |

| American Beacon AHL TargetRisk Core Fund | |

| | | |

| | | Beginning Account Value

7/1/2022 | | Ending Account Value

12/31/2022 | | Expenses Paid During

Period

7/1/2022-12/31/2022* |

| Y Class | | | | | | | | | | | | | | | |

| Actual | | | | $1,000.00 | | | | | $952.80 | | | | | $5.37 | |

| Hypothetical** | | | | $1,000.00 | | | | | $1,019.71 | | | | | $5.55 | |

| A Class | | | | | | | | | | | | | | | |

| Actual | | | | $1,000.00 | | | | | $950.20 | | | | | $6.83 | |

| Hypothetical** | | | | $1,000.00 | | | | | $1,018.20 | | | | | $7.07 | |

| C Class | | | | | | | | | | | | | | | |

| Actual | | | | $1,000.00 | | | | | $947.10 | | | | | $10.50 | |

| Hypothetical** | | | | $1,000.00 | | | | | $1,014.42 | | | | | $10.87 | |

| R6 Class | | | | | | | | | | | | | | | |

| Actual | | | | $1,000.00 | | | | | $952.90 | | | | | $4.87 | |

| Hypothetical** | | | | $1,000.00 | | | | | $1,020.22 | | | | | $5.04 | |

| * | Expenses are equal to the Fund’s annualized expense ratios for the six-month period of 1.09%, 1.39%, 2.14%, and 0.99% for the Y, A, C, and R6 Classes, respectively, multiplied by the average account value over the period, multiplied by the number derived by dividing the number of days in the most recent fiscal half-year (184) by days in the year (365) to reflect the half-year period. |

| ** | 5% return before expenses. |

14

American Beacon FundsSM

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of American Beacon Funds and Shareholders of American Beacon AHL Managed Futures Strategy Fund, American Beacon AHL TargetRisk Fund, and American Beacon AHL TargetRisk Core Fund

Opinions on the Financial Statements

We have audited the accompanying statements of assets and liabilities, including the schedules of investments, of American Beacon American Beacon AHL Managed Futures Strategy Fund, American Beacon AHL TargetRisk Fund, and American Beacon AHL TargetRisk Core Fund (three of the funds constituting American Beacon Funds, hereafter collectively referred to as the “Funds”) as of December 31, 2022, the related statements of operations and of changes in net assets for the year ended December 31, 2022, including the related notes, and the financial highlights for the year ended December 31, 2022 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of each of the Funds as of December 31, 2022, the results of each of their operations, the changes in each of their net assets, and each of the financial highlights for the year ended December 31, 2022, in conformity with accounting principles generally accepted in the United States of America.

The financial statements of the Funds as of and for the year ended December 31, 2021 and the financial highlights for each of the periods ended on or prior to December 31, 2021 (not presented herein, other than the statement of changes in net assets and the financial highlights) were audited by other auditors whose report dated February 28, 2022 expressed an unqualified opinion on those financial statements and financial highlights.

Basis for Opinions

These financial statements are the responsibility of the Funds’ management. Our responsibility is to express an opinion on the Funds’ financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Funds in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of December 31, 2022 by correspondence with the custodians, and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinions.

/s/PricewaterhouseCoopers LLP

Boston, Massachusetts

March 1, 2023

We have served as the auditor of one or more investment companies in the American Beacon family of funds since 2016.

15

American Beacon AHL Managed Futures Strategy FundSM

Consolidated Schedule of Investments

December 31, 2022

| | | | | | | | | | | | | | | |

| | | |

| | | Principal Amount | | | | Fair Value |

| | | | | | | |

| | | |

| SHORT-TERM INVESTMENTS - 89.78% | | | | | | |

| | | |

| U.S. Treasury Obligations - 89.78% | | | | | | |

| U.S. Treasury Bills, | | | | | | | | | | | | | | | |

2.960%, Due 1/19/2023A | | | $ | 25,000,000 | | | | | | | | | $ | 24,959,778 | |

2.960%, Due 1/19/2023 | | | | 100,000,000 | | | | | | | | | | 99,839,111 | |

2.770%, Due 1/26/2023 | | | | 100,000,000 | | | | | | | | | | 99,752,079 | |

3.900%, Due 1/31/2023 | | | | 200,000,000 | | | | | | | | | | 199,403,400 | |

3.210%, Due 2/2/2023A | | | | 50,000,000 | | | | | | | | | | 49,841,361 | |

3.040%, Due 2/9/2023A | | | | 50,000,000 | | | | | | | | | | 49,800,525 | |

4.120%, Due 2/14/2023 | | | | 200,000,000 | | | | | | | | | | 199,059,822 | |

3.350%, Due 2/16/2023A | | | | 250,000,000 | | | | | | | | | | 248,756,770 | |

3.200%, Due 2/23/2023A | | | | 250,000,000 | | | | | | | | | | 248,495,455 | |

3.500%, Due 3/2/2023A | | | | 150,000,000 | | | | | | | | | | 148,975,605 | |

3.780%, Due 3/9/2023A | | | | 150,000,000 | | | | | | | | | | 148,850,787 | |

3.820%, Due 3/16/2023A | | | | 250,000,000 | | | | | | | | | | 247,926,750 | |

3.800%, Due 3/23/2023A | | | | 250,000,000 | | | | | | | | | | 247,673,135 | |

4.100%, Due 4/6/2023A | | | | 160,000,000 | | | | | | | | | | 158,264,000 | |

4.400%, Due 4/13/2023A | | | | 150,000,000 | | | | | | | | | | 148,306,250 | |

4.460%, Due 4/20/2023A | | | | 125,000,000 | | | | | | | | | | 123,370,294 | |

4.550%, Due 4/27/2023A | | | | 140,000,000 | | | | | | | | | | 138,027,277 | |

4.560%, Due 5/4/2023A | | | | 150,000,000 | | | | | | | | | | 147,735,871 | |

4.540%, Due 5/11/2023 | | | | 100,000,000 | | | | | | | | | | 98,385,541 | |

4.650%, Due 5/18/2023A | | | | 50,000,000 | | | | | | | | | | 49,153,554 | |

4.660%, Due 5/25/2023A | | | | 250,000,000 | | | | | | | | | | 245,551,160 | |

4.650%, Due 6/8/2023A | | | | 150,000,000 | | | | | | | | | | 147,068,501 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Total Short-Term Investments – 89.78% (Cost $3,270,459,160) | | | | | | | | | | | | | | 3,269,197,026 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

TOTAL INVESTMENTS - 89.78% (Cost $3,270,459,160) | | | | | | | | | | | | | | 3,269,197,026 | |

OTHER ASSETS, NET OF LIABILITIES - 10.22% | | | | | | | | | | | | | | 371,953,371 | |

| | | | | | | | | | | | | | | |

TOTAL NET ASSETS - 100.00% | | | | | | | | | | | | | $ | 3,641,150,397 | |

| | | | | | | | | | | | | | | |

| | | | | | | |

| Percentages are stated as a percent of net assets. | | | | | | | | | | | | | | | |

A All or a portion represents positions held by the American Beacon Cayman Managed Futures Strategy Fund, Ltd.

| | | | | | | | | | | | | | | | |

| Long Futures Contracts Open on December 31, 2022: | | | | | | | | | | | | |

| | | | | |

| Commodity Futures Contracts | | | | | | | | | | | | | |

| Description | | Number of

Contracts | | Expiration Date | | Notional Amount | | | Contract Value | | | Unrealized

Appreciation

(Depreciation) | |

| CBOT Corn FuturesA | | 1,622 | | March 2023 | | $ | 54,202,172 | | | $ | 55,026,350 | | | $ | 824,178 | |

| CBOT Soybean FuturesA | | 1,098 | | March 2023 | | | 81,450,356 | | | | 83,667,600 | | | | 2,217,244 | |

| COMEX Copper FuturesA | | 121 | | March 2023 | | | 11,408,094 | | | | 11,526,762 | | | | 118,668 | |

| COMEX Gold 100 Troy Ounces FuturesA | | 318 | | February 2023 | | | 56,841,614 | | | | 58,073,160 | | | | 1,231,546 | |

| COMEX Silver FuturesA | | 373 | | March 2023 | | | 42,754,768 | | | | 44,834,600 | | | | 2,079,832 | |

| ICE Gas Oil FuturesA | | 17 | | January 2023 | | | 1,577,396 | | | | 1,565,700 | | | | (11,696 | ) |

| ICE Gas Oil FuturesA | | 23 | | February 2023 | | | 2,119,953 | | | | 2,083,800 | | | | (36,153 | ) |

| LME Copper FuturesA | | 30 | | January 2023 | | | 6,052,923 | | | | 6,279,758 | | | | 226,835 | |

| LME Copper FuturesA | | 65 | | February 2023 | | | 13,275,974 | | | | 13,610,187 | | | | 334,213 | |

| LME Copper FuturesA | | 42 | | March 2023 | | | 8,890,327 | | | | 8,794,275 | | | | (96,052 | ) |

| LME Lead FuturesA | | 103 | | January 2023 | | | 5,635,492 | | | | 5,980,438 | | | | 344,946 | |

| LME Lead FuturesA | | 34 | | February 2023 | | | 1,825,041 | | | | 1,966,475 | | | | 141,434 | |

| LME Lead FuturesA | | 122 | | March 2023 | | | 6,764,488 | | | | 7,043,975 | | | | 279,487 | |

| LME Lead FuturesA | | 56 | | April 2023 | | | 3,166,125 | | | | 3,214,400 | | | | 48,275 | |

| LME Nickel FuturesA | | 45 | | January 2023 | | | 7,442,561 | | | | 8,073,270 | | | | 630,709 | |

| LME Nickel FuturesA | | 10 | | February 2023 | | | 1,591,848 | | | | 1,797,900 | | | | 206,052 | |

| LME Nickel FuturesA | | 30 | | March 2023 | | | 5,256,563 | | | | 5,408,100 | | | | 151,537 | |

| LME Primary Aluminum FuturesA | | 121 | | January 2023 | | | 7,354,004 | | | | 7,107,268 | | | | (246,736 | ) |

| LME Primary Aluminum FuturesA | | 165 | | March 2023 | | | 10,407,877 | | | | 9,784,541 | | | | (623,336 | ) |

| LME Zinc FuturesA | | 83 | | January 2023 | | | 6,518,556 | | | | 6,204,769 | | | | (313,787 | ) |

| LME Zinc FuturesA | | 123 | | February 2023 | | | 9,966,330 | | | | 9,173,494 | | | | (792,836 | ) |

| NYBOT CSC Cocoa FuturesA | | 824 | | March 2023 | | | 21,242,232 | | | | 21,424,000 | | | | 181,768 | |

| NYBOT CSC Number 11 World Sugar FuturesA | | 2,640 | | February 2023 | | | 56,741,802 | | | | 59,254,272 | | | | 2,512,470 | |

| | | | | | | | | | | | | | | | |

| | $ | 422,486,496 | | | $ | 431,895,094 | | | $ | 9,408,598 | |

| | | | | | | | | | | | | | | | |

See accompanying notes

16

American Beacon AHL Managed Futures Strategy FundSM

Consolidated Schedule of Investments

December 31, 2022

| | | | | | | | | | | | | | | | | | |

|

| Currency Futures Contracts | |

| Description | | Number of

Contracts | | Expiration Date | | | Notional Amount | | | Contract Value | | | Unrealized

Appreciation

(Depreciation) | |

| CME Mexican Peso Currency Futures | | 9,759 | | | March 2023 | | | $ | 243,853,909 | | | $ | 247,000,290 | | | $ | 3,146,381 | |

| CME New Zealand Dollar Currency Futures | | 1,028 | | | March 2023 | | | | 65,821,854 | | | | 65,216,320 | | | | (605,534 | ) |

| CME Swiss Franc Currency Futures | | 68 | | | March 2023 | | | | 9,203,924 | | | | 9,266,700 | | | | 62,776 | |

| NYBOT FINEX U.S. Dollar Index Futures | | 46 | | | March 2023 | | | | 4,805,479 | | | | 4,750,374 | | | | (55,105 | ) |

| | | | | | | | | | | | | | | | | | |

| | | $ | 323,685,166 | | | $ | 326,233,684 | | | $ | 2,548,518 | |

| | | | | | | | | | | | | | | | | | |

|

| Equity Futures Contracts | |

| Description | | Number of

Contracts | | Expiration Date | | | Notional Amount | | | Contract Value | | | Unrealized

Appreciation

(Depreciation) | |

| Eurex DAX Index Futures | | 127 | | | March 2023 | | | $ | 49,324,794 | | | $ | 47,540,696 | | | $ | (1,784,098 | ) |

| Eurex EURO STOXX 50 Futures | | 1,616 | | | March 2023 | | | | 68,518,724 | | | | 65,474,685 | | | | (3,044,039 | ) |

| Euronext Amsterdam Index Futures | | 153 | | | January 2023 | | | | 24,085,155 | | | | 22,590,006 | | | | (1,495,149 | ) |

| Euronext CAC 40 Index Futures | | 529 | | | January 2023 | | | | 37,904,927 | | | | 36,640,357 | | | | (1,264,570 | ) |

| FTSE 100 Index Futures | | 1,269 | | | March 2023 | | | | 114,666,907 | | | | 114,540,212 | | | | (126,695 | ) |

| FTSE/MIB Index Futures | | 424 | | | March 2023 | | | | 56,110,873 | | | | 53,801,819 | | | | (2,309,054 | ) |

| ICE U.S. mini MSCI EAFE Index Futures | | 186 | | | March 2023 | | | | 18,425,788 | | | | 18,129,420 | | | | (296,368 | ) |

| Montreal Exchange S&P/TSX 60 Index Futures | | 175 | | | March 2023 | | | | 31,370,238 | | | | 30,241,137 | | | | (1,129,101 | ) |

| OML Stockholm OMXS30 Index Futures | | 816 | | | January 2023 | | | | 16,630,294 | | | | 15,968,337 | | | | (661,957 | ) |

| SAFEX FTSE/JSE Top 40 Index Futures | | 1,623 | | | March 2023 | | | | 67,137,838 | | | | 64,685,977 | | | | (2,451,861 | ) |

| SFE S&P ASX Share Price Index 200 Futures | | 1,214 | | | March 2023 | | | | 147,990,540 | | | | 144,481,301 | | | | (3,509,239 | ) |

| SGX FTSE Taiwan Index Futures | | 613 | | | January 2023 | | | | 30,639,818 | | | | 30,447,710 | | | | (192,108 | ) |

| TSE TOPIX Futures | | 295 | | | March 2023 | | | | 43,793,323 | | | | 42,516,954 | | | | (1,276,369 | ) |

| | | | | | | | | | | | | | | | | | |

| | | $ | 706,599,219 | | | $ | 687,058,611 | | | $ | (19,540,608 | ) |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Short Futures Contracts Open on December 31, 2022: | |

|

| Commodity Futures Contracts | |

| Description | | Number of

Contracts | | Expiration Date | | | Notional Amount | | | Contract Value | | | Unrealized

Appreciation

(Depreciation) | |

| ICE Brent Crude Oil FuturesA | | 247 | | | January 2023 | | | $ | (20,257,063 | ) | | $ | (21,219,770 | ) | | $ | (962,707 | ) |

| ICE U.S. - Henry Ld1 Fixed Price FuturesA | | 64 | | | March 2023 | | | | (679,045 | ) | | | (626,720 | ) | | | 52,325 | |

| ICE U.S. - Henry Ld1 Fixed Price FuturesA | | 64 | | | April 2023 | | | | (679,045 | ) | | | (628,960 | ) | | | 50,085 | |

| ICE U.S. - Henry Ld1 Fixed Price FuturesA | | 64 | | | May 2023 | | | | (679,045 | ) | | | (647,520 | ) | | | 31,525 | |

| ICE U.S. - Henry Ld1 Fixed Price FuturesA | | 64 | | | June 2023 | | | | (679,045 | ) | | | (665,120 | ) | | | 13,925 | |

| ICE U.S. - Henry Ld1 Fixed Price FuturesA | | 64 | | | July 2023 | | | | (679,045 | ) | | | (666,080 | ) | | | 12,965 | |

| ICE U.S. - Henry Ld1 Fixed Price FuturesA | | 64 | | | August 2023 | | | | (679,045 | ) | | | (657,600 | ) | | | 21,445 | |

| ICE U.S. - Henry Ld1 Fixed Price FuturesA | | 64 | | | September 2023 | | | | (679,045 | ) | | | (667,840 | ) | | | 11,205 | |

| ICE U.S. - Henry Ld1 Fixed Price FuturesA | | 96 | | | October 2023 | | | | (1,161,490 | ) | | | (1,076,160 | ) | | | 85,330 | |

| ICE U.S. - Henry Ld1 Fixed Price FuturesA | | 96 | | | November 2023 | | | | (1,161,490 | ) | | | (1,170,480 | ) | | | (8,990 | ) |

| ICE U.S. - Henry Ld1 Fixed Price FuturesA | | 96 | | | December 2023 | | | | (1,161,490 | ) | | | (1,227,120 | ) | | | (65,630 | ) |

| ICE U.S. - Henry Ld1 Fixed Price FuturesA | | 96 | | | January 2024 | | | | (1,161,490 | ) | | | (1,186,080 | ) | | | (24,590 | ) |

| ICE U.S. - Henry Ld1 Fixed Price FuturesA | | 96 | | | February 2024 | | | | (1,161,490 | ) | | | (1,055,520 | ) | | | 105,970 | |

| KCBT Hard Red Winter Wheat FuturesA | | 305 | �� | | March 2023 | | | | (13,362,638 | ) | | | (13,542,000 | ) | | | (179,362 | ) |

| LME Copper FuturesA | | 30 | | | January 2023 | | | | (5,573,134 | ) | | | (6,279,757 | ) | | | (706,623 | ) |

| LME Copper FuturesA | | 8 | | | February 2023 | | | | (1,683,258 | ) | | | (1,675,100 | ) | | | 8,158 | |

| LME Lead FuturesA | | 103 | | | January 2023 | | | | (4,873,080 | ) | | | (5,980,437 | ) | | | (1,107,357 | ) |

| LME Lead FuturesA | | 12 | | | February 2023 | | | | (660,579 | ) | | | (694,050 | ) | | | (33,471 | ) |

| LME Nickel FuturesA | | 45 | | | January 2023 | | | | (5,887,997 | ) | | | (8,073,270 | ) | | | (2,185,273 | ) |

| LME Primary Aluminum FuturesA | | 121 | | | January 2023 | | | | (6,647,526 | ) | | | (7,107,268 | ) | | | (459,742 | ) |

| LME Primary Aluminum FuturesA | | 305 | | | March 2023 | | | | (18,186,458 | ) | | | (18,086,576 | ) | | | 99,882 | |

| LME Zinc FuturesA | | 83 | | | January 2023 | | | | (6,021,163 | ) | | | (6,204,769 | ) | | | (183,606 | ) |

| LME Zinc FuturesA | | 171 | | | February 2023 | | | | (12,387,778 | ) | | | (12,753,394 | ) | | | (365,616 | ) |

| LME Zinc FuturesA | | 111 | | | March 2023 | | | | (8,274,080 | ) | | | (8,259,788 | ) | | | 14,292 | |

| NYBOT CSC C Coffee FuturesA | | 386 | | | March 2023 | | | | (23,740,990 | ) | | | (24,216,675 | ) | | | (475,685 | ) |

| NYMEX Henry Hub Natural Gas FuturesA | | 626 | | | January 2023 | | | | (34,753,265 | ) | | | (28,013,500 | ) | | | 6,739,765 | |

| NYMEX Light Sweet Crude Oil FuturesA | | 282 | | | January 2023 | | | | (20,480,213 | ) | | | (22,633,320 | ) | | | (2,153,107 | ) |

| NYMEX NY Harbor ULSD FuturesA | | 5 | | | January 2023 | | | | (639,156 | ) | | | (691,950 | ) | | | (52,794 | ) |

| NYMEX Reformulated Gasoline Blendstock for Oxygen Blending RBOB FuturesA | | 68 | | | January 2023 | | | | (6,304,623 | ) | | | (7,078,025 | ) | | | (773,402 | ) |

| | | | | | | | | | | | | | | | | | |

| | | $ | (200,293,766 | ) | | $ | (202,784,849 | ) | | $ | (2,491,083 | ) |

| | | | | | | | | | | | | | | | | | |

See accompanying notes

17

American Beacon AHL Managed Futures Strategy FundSM

Consolidated Schedule of Investments

December 31, 2022

| | | | | | | | | | | | | | | | |

|

| Currency Futures Contracts | |

| Description | | Number of

Contracts | | Expiration

Date | | Notional

Amount | | | Contract Value | | | Unrealized

Appreciation

(Depreciation) | |

| CME Australian Dollar Currency Futures | | 2,596 | | March 2023 | | $ | (176,157,183 | ) | | $ | (177,267,860 | ) | | $ | (1,110,677 | ) |

| CME British Pound Currency Futures | | 764 | | March 2023 | | | (58,233,339 | ) | | | (57,701,100 | ) | | | 532,239 | |

| CME Canadian Dollar Currency Futures | | 3,992 | | March 2023 | | | (292,588,396 | ) | | | (295,088,640 | ) | | | (2,500,244 | ) |

| CME Euro Foreign Exchange Currency Futures | | 691 | | March 2023 | | | (91,678,867 | ) | | | (92,887,675 | ) | | | (1,208,808 | ) |

| CME Japanese Yen Currency Futures | | 317 | | March 2023 | | | (29,271,072 | ) | | | (30,538,987 | ) | | | (1,267,915 | ) |

| | | | | | | | | | | | | | | | |

| | $ | (647,928,857 | ) | | $ | (653,484,262 | ) | | $ | (5,555,405 | ) |

| | | | | | | | | | | | | | | | |

|

| Equity Futures Contracts | |

| Description | | Number of

Contracts | | Expiration

Date | | Notional

Amount | | | Contract Value | | | Unrealized

Appreciation

(Depreciation) | |

| CME E-Mini NASDAQ 100 Index Futures | | 280 | | March 2023 | | $ | (64,213,509 | ) | | $ | (61,724,600 | ) | | $ | 2,488,909 | |

| CME e-mini Russell Index Futures | | 414 | | March 2023 | | | (36,966,032 | ) | | | (36,657,630 | ) | | | 308,402 | |

| CME E-Mini Standard & Poor’s 500 Index Futures | | 392 | | March 2023 | | | (76,394,854 | ) | | | (75,675,600 | ) | | | 719,254 | |

| HKG Hang Seng China Enterprises Index Futures | | 725 | | January 2023 | | | (31,126,045 | ) | | | (31,394,731 | ) | | | (268,686 | ) |

| HKG Hang SHKG Hang Seng Index Futures | | 294 | | January 2023 | | | (37,190,489 | ) | | | (37,505,909 | ) | | | (315,420 | ) |

| ICE U.S. MSCI Emerging Markets EM Index Futures | | 863 | | March 2023 | | | (41,930,474 | ) | | | (41,398,110 | ) | | | 532,364 | |

| KFE KOSPI 200 Index Futures | | 2,545 | | March 2023 | | | (153,398,422 | ) | | | (147,351,374 | ) | | | 6,047,048 | |

| SGX Nikkei 225 Stock Index Futures | | 460 | | March 2023 | | | (46,028,583 | ) | | | (45,556,614 | ) | | | 471,969 | |

| | | | | | | | | | | | | | | | |

| | $ | (487,248,408 | ) | | $ | (477,264,568 | ) | | $ | 9,983,840 | |

| | | | | | | | | | | | | | | | |

|

| Interest Rate Futures Contracts | |

| Description | | Number of

Contracts | | Expiration

Date | | Notional

Amount | | | Contract Value | | | Unrealized

Appreciation

(Depreciation) | |

| 3 Month Euro Euribor Futures | | 2,763 | | December 2023 | | $ | (716,861,359 | ) | | $ | (712,757,149 | ) | | $ | 4,104,210 | |

| 3 Month Euro Euribor Futures | | 1,836 | | September 2024 | | | (476,873,827 | ) | | | (475,711,822 | ) | | | 1,162,005 | |

| 3 Month Euro Euribor Futures | | 1,229 | | June 2025 | | | (320,081,407 | ) | | | (319,028,738 | ) | | | 1,052,669 | |

| CBOT 10 Year U.S. Treasury Notes | | 1,560 | | March 2023 | | | (176,230,457 | ) | | | (175,183,125 | ) | | | 1,047,332 | |

| CBOT 2 Year U.S. Treasury Notes Futures | | 1,177 | | March 2023 | | | (241,412,942 | ) | | | (241,376,954 | ) | | | 35,988 | |

| CBOT 5 Year U.S. Treasury Notes | | 1,483 | | March 2023 | | | (160,264,807 | ) | | | (160,059,727 | ) | | | 205,080 | |

| CBOT U.S. Long Bond Futures | | 422 | | March 2023 | | | (53,234,136 | ) | | | (52,895,063 | ) | | | 339,073 | |

| CME 1 Year Mid-Curve 3 Month Eurodollar Option | | 1,418 | | March 2023 | | | (179,094,984 | ) | | | (175,696,622 | ) | | | 3,398,362 | |

| CME Ultra Long Term U.S. Treasury Bond Futures | | 270 | | March 2023 | | | (36,681,662 | ) | | | (36,264,375 | ) | | | 417,287 | |

| Eurex 10 Year Euro BUND Futures | | 996 | | March 2023 | | | (146,828,862 | ) | | | (141,725,672 | ) | | | 5,103,190 | |

| Eurex 2 Year Euro SCHATZ Futures | | 1,266 | | March 2023 | | | (143,374,736 | ) | | | (142,864,031 | ) | | | 510,705 | |

| Eurex 30 Year Euro BUXL Futures | | 262 | | March 2023 | | | (42,176,099 | ) | | | (37,929,108 | ) | | | 4,246,991 | |

| Long Gilt Futures | | 505 | | March 2023 | | | (63,132,624 | ) | | | (60,990,928 | ) | | | 2,141,696 | |

| SFE 10 Year Australian Bond Futures | | 770 | | March 2023 | | | (61,481,273 | ) | | | (60,646,533 | ) | | | 834,740 | |

| SFE 3 Year Australian Bond Futures | | 826 | | March 2023 | | | (60,034,114 | ) | | | (60,060,548 | ) | | | (26,434 | ) |

| Three Month SONIA Index Futures | | 1,198 | | March 2024 | | | (346,775,639 | ) | | | (345,334,329 | ) | | | 1,441,310 | |

| Three Month SONIA Index Futures | | 944 | | December 2024 | | | (274,645,984 | ) | | | (273,329,110 | ) | | | 1,316,874 | |

| Three-Month SOFR Futures | | 3,219 | | March 2024 | | | (772,187,204 | ) | | | (768,294,825 | ) | | | 3,892,379 | |

| Three-Month SOFR Futures | | 1,124 | | December 2024 | | | (271,812,916 | ) | | | (271,165,000 | ) | | | 647,916 | |

| Three-Month SOFR Futures | | 700 | | September 2025 | | | (169,485,119 | ) | | | (169,382,500 | ) | | | 102,619 | |

| TSE Japanese 10 Year Bond Futures | | 696 | | March 2023 | | | (774,238,186 | ) | | | (771,412,374 | ) | | | 2,825,812 | |

| | | | | | | | | | | | | | | | |

| | $ | (5,486,908,337 | ) | | $ | (5,452,108,533 | ) | | $ | 34,799,804 | |

| | | | | | | | | | | | | | | | |

A All or a portion represents positions held by the American Beacon Cayman Managed Futures Strategy Fund, Ltd.

See accompanying notes

18

American Beacon AHL Managed Futures Strategy FundSM

Consolidated Schedule of Investments

December 31, 2022

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Forward Foreign Currency Contracts Open on December 31, 2022: | |

| | | | | | |

| Currency Purchased* | | | Currency Sold* | | | Settlement

Date | | Counterparty | | Unrealized

Appreciation | | | Unrealized

(Depreciation) | | | Net Unrealized

Appreciation

(Depreciation) | |

| TWD | | | 81,379 | | | USD | | | 81,381 | | | 1/9/2023 | | CBK | | $ | - | | | $ | (2 | ) | | $ | (2 | ) |

| TWD | | | 81,379 | | | USD | | | 82,604 | | | 1/9/2023 | | CBK | | | - | | | | (1,225 | ) | | | (1,225 | ) |

| TWD | | | 81,379 | | | USD | | | 82,634 | | | 1/9/2023 | | CBK | | | - | | | | (1,255 | ) | | | (1,255 | ) |

| TWD | | | 81,379 | | | USD | | | 82,609 | | | 1/9/2023 | | CBK | | | - | | | | (1,230 | ) | | | (1,230 | ) |

| TWD | | | 81,379 | | | USD | | | 82,617 | | | 1/9/2023 | | CBK | | | - | | | | (1,238 | ) | | | (1,238 | ) |

| TWD | | | 162,758 | | | USD | | | 165,728 | | | 1/9/2023 | | CBK | | | - | | | | (2,970 | ) | | | (2,970 | ) |

| TWD | | | 162,758 | | | USD | | | 165,243 | | | 1/9/2023 | | CBK | | | - | | | | (2,485 | ) | | | (2,485 | ) |

| TWD | | | 244,137 | | | USD | | | 247,901 | | | 1/9/2023 | | CBK | | | - | | | | (3,764 | ) | | | (3,764 | ) |

| TWD | | | 325,516 | | | USD | | | 331,584 | | | 1/9/2023 | | CBK | | | - | | | | (6,068 | ) | | | (6,068 | ) |

| TWD | | | 325,516 | | | USD | | | 327,737 | | | 1/9/2023 | | CBK | | | - | | | | (2,221 | ) | | | (2,221 | ) |

| TWD | | | 67,951,368 | | | USD | | | 68,111,890 | | | 1/9/2023 | | CBK | | | - | | | | (160,522 | ) | | | (160,522 | ) |

| USD | | | 26,011,818 | | | TWD | | | 25,634,348 | | | 1/9/2023 | | CBK | | | 377,470 | | | | - | | | | 377,470 | |

| USD | | | 1,388,458 | | | TWD | | | 1,383,441 | | | 1/9/2023 | | CBK | | | 5,017 | | | | - | | | | 5,017 | |

| USD | | | 1,309,085 | | | TWD | | | 1,302,062 | | | 1/9/2023 | | CBK | | | 7,023 | | | | - | | | | 7,023 | |

| USD | | | 1,144,011 | | | TWD | | | 1,139,304 | | | 1/9/2023 | | CBK | | | 4,707 | | | | - | | | | 4,707 | |

| USD | | | 982,190 | | | TWD | | | 976,547 | | | 1/9/2023 | | CBK | | | 5,643 | | | | - | | | | 5,643 | |

| USD | | | 982,776 | | | TWD | | | 976,547 | | | 1/9/2023 | | CBK | | | 6,229 | | | | - | | | | 6,229 | |

| USD | | | 979,635 | | | TWD | | | 976,547 | | | 1/9/2023 | | CBK | | | 3,088 | | | | - | | | | 3,088 | |

| USD | | | 821,091 | | | TWD | | | 813,789 | | | 1/9/2023 | | CBK | | | 7,302 | | | | - | | | | 7,302 | |

| USD | | | 821,234 | | | TWD | | | 813,789 | | | 1/9/2023 | | CBK | | | 7,445 | | | | - | | | | 7,445 | |

| USD | | | 737,055 | | | TWD | | | 732,410 | | | 1/9/2023 | | CBK | | | 4,645 | | | | - | | | | 4,645 | |

| USD | | | 739,297 | | | TWD | | | 732,410 | | | 1/9/2023 | | CBK | | | 6,887 | | | | - | | | | 6,887 | |

| USD | | | 734,158 | | | TWD | | | 732,410 | | | 1/9/2023 | | CBK | | | 1,748 | | | | - | | | | 1,748 | |

| USD | | | 655,927 | | | TWD | | | 651,031 | | | 1/9/2023 | | CBK | | | 4,896 | | | | - | | | | 4,896 | |

| USD | | | 652,453 | | | TWD | | | 651,031 | | | 1/9/2023 | | CBK | | | 1,422 | | | | - | | | | 1,422 | |

| USD | | | 652,641 | | | TWD | | | 651,031 | | | 1/9/2023 | | CBK | | | 1,610 | | | | - | | | | 1,610 | |

| USD | | | 652,485 | | | TWD | | | 651,031 | | | 1/9/2023 | | CBK | | | 1,454 | | | | - | | | | 1,454 | |

| USD | | | 653,471 | | | TWD | | | 651,031 | | | 1/9/2023 | | CBK | | | 2,440 | | | | - | | | | 2,440 | |

| USD | | | 652,528 | | | TWD | | | 651,031 | | | 1/9/2023 | | CBK | | | 1,497 | | | | - | | | | 1,497 | |

| USD | | | 573,427 | | | TWD | | | 569,652 | | | 1/9/2023 | | CBK | | | 3,775 | | | | - | | | | 3,775 | |

| USD | | | 571,337 | | | TWD | | | 569,652 | | | 1/9/2023 | | CBK | | | 1,685 | | | | - | | | | 1,685 | |

| USD | | | 571,262 | | | TWD | | | 569,652 | | | 1/9/2023 | | CBK | | | 1,610 | | | | - | | | | 1,610 | |

| USD | | | 570,972 | | | TWD | | | 569,652 | | | 1/9/2023 | | CBK | | | 1,320 | | | | - | | | | 1,320 | |

| USD | | | 570,923 | | | TWD | | | 569,652 | | | 1/9/2023 | | CBK | | | 1,271 | | | | - | | | | 1,271 | |

| USD | | | 570,791 | | | TWD | | | 569,652 | | | 1/9/2023 | | CBK | | | 1,139 | | | | - | | | | 1,139 | |

| USD | | | 571,606 | | | TWD | | | 569,652 | | | 1/9/2023 | | CBK | | | 1,954 | | | | - | | | | 1,954 | |

| USD | | | 571,826 | | | TWD | | | 569,652 | | | 1/9/2023 | | CBK | | | 2,174 | | | | - | | | | 2,174 | |

| USD | | | 491,538 | | | TWD | | | 488,273 | | | 1/9/2023 | | CBK | | | 3,265 | | | | - | | | | 3,265 | |

| USD | | | 493,856 | | | TWD | | | 488,273 | | | 1/9/2023 | | CBK | | | 5,583 | | | | - | | | | 5,583 | |

| USD | | | 489,193 | | | TWD | | | 488,273 | | | 1/9/2023 | | CBK | | | 920 | | | | - | | | | 920 | |

| USD | | | 489,280 | | | TWD | | | 488,273 | | | 1/9/2023 | | CBK | | | 1,007 | | | | - | | | | 1,007 | |

| USD | | | 488,726 | | | TWD | | | 488,273 | | | 1/9/2023 | | CBK | | | 453 | | | | - | | | | 453 | |

| USD | | | 490,151 | | | TWD | | | 488,273 | | | 1/9/2023 | | CBK | | | 1,878 | | | | - | | | | 1,878 | |

| USD | | | 489,255 | | | TWD | | | 488,273 | | | 1/9/2023 | | CBK | | | 982 | | | | - | | | | 982 | |

| USD | | | 488,873 | | | TWD | | | 488,273 | | | 1/9/2023 | | CBK | | | 600 | | | | - | | | | 600 | |

| USD | | | 410,397 | | | TWD | | | 406,894 | | | 1/9/2023 | | CBK | | | 3,503 | | | | - | | | | 3,503 | |

| USD | | | 407,777 | | | TWD | | | 406,894 | | | 1/9/2023 | | CBK | | | 883 | | | | - | | | | 883 | |

| USD | | | 407,357 | | | TWD | | | 406,894 | | | 1/9/2023 | | CBK | | | 463 | | | | - | | | | 463 | |

| USD | | | 407,662 | | | TWD | | | 406,894 | | | 1/9/2023 | | CBK | | | 768 | | | | - | | | | 768 | |

| USD | | | 407,626 | | | TWD | | | 406,894 | | | 1/9/2023 | | CBK | | | 732 | | | | - | | | | 732 | |

| USD | | | 407,649 | | | TWD | | | 406,894 | | | 1/9/2023 | | CBK | | | 755 | | | | - | | | | 755 | |

| USD | | | 407,823 | | | TWD | | | 406,894 | | | 1/9/2023 | | CBK | | | 929 | | | | - | | | | 929 | |

| USD | | | 407,803 | | | TWD | | | 406,894 | | | 1/9/2023 | | CBK | | | 909 | | | | - | | | | 909 | |

| USD | | | 407,368 | | | TWD | | | 406,894 | | | 1/9/2023 | | CBK | | | 474 | | | | - | | | | 474 | |

| USD | | | 407,553 | | | TWD | | | 406,894 | | | 1/9/2023 | | CBK | | | 659 | | | | - | | | | 659 | |

| USD | | | 327,686 | | | TWD | | | 325,516 | | | 1/9/2023 | | CBK | | | 2,170 | | | | - | | | | 2,170 | |

| USD | | | 327,938 | | | TWD | | | 325,516 | | | 1/9/2023 | | CBK | | | 2,422 | | | | - | | | | 2,422 | |

| USD | | | 327,555 | | | TWD | | | 325,516 | | | 1/9/2023 | | CBK | | | 2,039 | | | | - | | | | 2,039 | |

See accompanying notes

19

American Beacon AHL Managed Futures Strategy FundSM

Consolidated Schedule of Investments

December 31, 2022

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Currency Purchased* | | | Currency Sold* | | | Settlement

Date | | Counterparty | | Unrealized

Appreciation | | | Unrealized

(Depreciation) | | | Net Unrealized

Appreciation

(Depreciation) | |

| USD | | | 327,960 | | | TWD | | | 325,516 | | | 1/9/2023 | | CBK | | $ | 2,444 | | | $ | - | | | $ | 2,444 | |

| USD | | | 326,180 | | | TWD | | | 325,516 | | | 1/9/2023 | | CBK | | | 664 | | | | - | | | | 664 | |

| USD | | | 326,330 | | | TWD | | | 325,516 | | | 1/9/2023 | | CBK | | | 814 | | | | - | | | | 814 | |

| USD | | | 325,585 | | | TWD | | | 325,516 | | | 1/9/2023 | | CBK | | | 69 | | | | - | | | | 69 | |

| USD | | | 327,056 | | | TWD | | | 325,516 | | | 1/9/2023 | | CBK | | | 1,540 | | | | - | | | | 1,540 | |

| USD | | | 325,773 | | | TWD | | | 325,516 | | | 1/9/2023 | | CBK | | | 257 | | | | - | | | | 257 | |

| USD | | | 325,914 | | | TWD | | | 325,516 | | | 1/9/2023 | | CBK | | | 398 | | | | - | | | | 398 | |

| USD | | | 325,890 | | | TWD | | | 325,516 | | | 1/9/2023 | | CBK | | | 374 | | | | - | | | | 374 | |

| USD | | | 326,054 | | | TWD | | | 325,516 | | | 1/9/2023 | | CBK | | | 538 | | | | - | | | | 538 | |

| USD | | | 326,201 | | | TWD | | | 325,516 | | | 1/9/2023 | | CBK | | | 685 | | | | - | | | | 685 | |

| USD | | | 325,876 | | | TWD | | | 325,516 | | | 1/9/2023 | | CBK | | | 360 | | | | - | | | | 360 | |

| USD | | | 325,966 | | | TWD | | | 325,516 | | | 1/9/2023 | | CBK | | | 450 | | | | - | | | | 450 | |

| USD | | | 326,300 | | | TWD | | | 325,516 | | | 1/9/2023 | | CBK | | | 784 | | | | - | | | | 784 | |

| USD | | | 326,241 | | | TWD | | | 325,516 | | | 1/9/2023 | | CBK | | | 725 | | | | - | | | | 725 | |

| USD | | | 325,948 | | | TWD | | | 325,516 | | | 1/9/2023 | | CBK | | | 432 | | | | - | | | | 432 | |

| USD | | | 326,117 | | | TWD | | | 325,516 | | | 1/9/2023 | | CBK | | | 601 | | | | - | | | | 601 | |

| USD | | | 246,541 | | | TWD | | | 244,137 | | | 1/9/2023 | | CBK | | | 2,404 | | | | - | | | | 2,404 | |

| USD | | | 244,650 | | | TWD | | | 244,137 | | | 1/9/2023 | | CBK | | | 513 | | | | - | | | | 513 | |

| USD | | | 244,621 | | | TWD | | | 244,137 | | | 1/9/2023 | | CBK | | | 484 | | | | - | | | | 484 | |

| USD | | | 244,251 | | | TWD | | | 244,137 | | | 1/9/2023 | | CBK | | | 114 | | | | - | | | | 114 | |

| USD | | | 244,192 | | | TWD | | | 244,137 | | | 1/9/2023 | | CBK | | | 55 | | | | - | | | | 55 | |

| USD | | | 245,348 | | | TWD | | | 244,137 | | | 1/9/2023 | | CBK | | | 1,211 | | | | - | | | | 1,211 | |

| USD | | | 245,259 | | | TWD | | | 244,137 | | | 1/9/2023 | | CBK | | | 1,122 | | | | - | | | | 1,122 | |

| USD | | | 245,125 | | | TWD | | | 244,137 | | | 1/9/2023 | | CBK | | | 988 | | | | - | | | | 988 | |