0000809593americanbeacon:AMERICANBEACONINDEXBloombergUSAggregateBondIndex6767BroadBasedIndexMember2023-01-310000809593americanbeacon:AMERICANBEACONINDEXBloombergUSAggregateBondIndex6796BroadBasedIndexMember2020-09-300000809593americanbeacon:AMERICANBEACONINDEXBloombergUSAggregateBondIndex6793BroadBasedIndexMember2017-05-310000809593americanbeacon:C000114556Member2014-12-310000809593americanbeacon:C000114558Memberamericanbeacon:AssetCommonStocksCTIMember2024-08-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-4984

AMERICAN BEACON FUNDS

(Exact name of registrant as specified in charter)

220 East Las Colinas Boulevard, Suite 1200

Irving, Texas 75039

(Address of principal executive offices)-(Zip code)

GREGORY J. STUMM, PRESIDENT

220 East Las Colinas Boulevard, Suite 1200

Irving, Texas 75039

(Name and address of agent for service)

Registrant’s telephone number, including area code: (817) 391-6100

Date of fiscal year end: August 31, 2024

Date of reporting period: August 31, 2024

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Shareholders

FEAC Floating Rate Income Fund

Annual Shareholder Report - August 31, 2024

This annual shareholder report contains important information about American Beacon FEAC Floating Rate Income Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at www.americanbeaconfunds.com/literature. You can also request this information by contacting us at 800-658-5811. This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $112 | 1.07% |

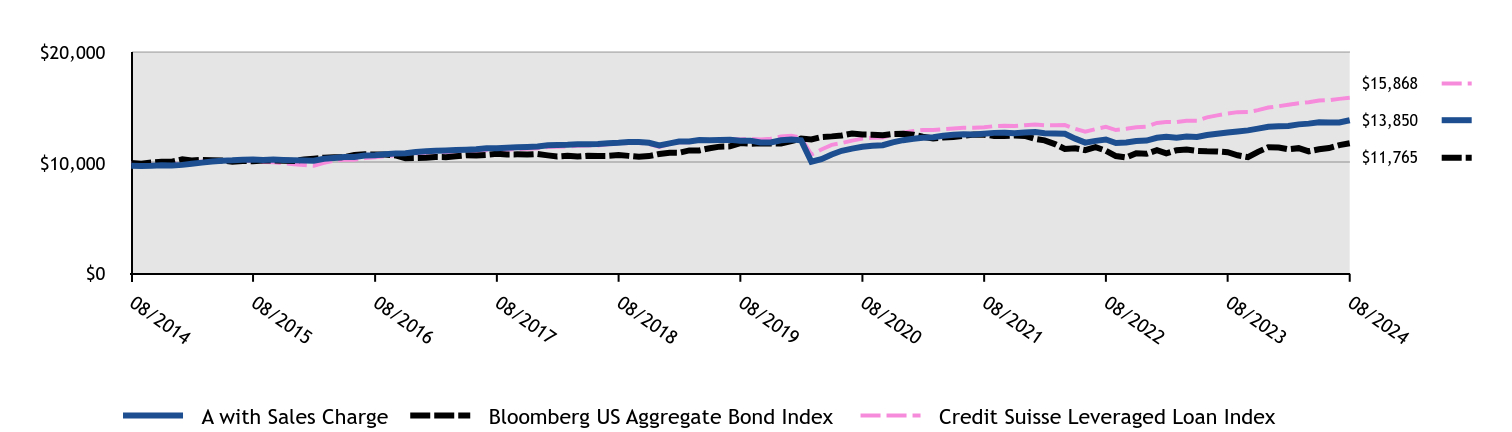

How did the Fund perform and what affected its performance?

The A Class of the Fund returned 5.92% (with sales charges) and 8.64% (without sales charges) for the twelve months ended August 31, 2024, compared to the Bloomberg U.S. Aggregate Bond Index return of 7.30% and the Credit Suisse Leveraged Loan Index return of 9.81%.

• The Fund provided a high level of current income and solid risk-adjusted returns against a backdrop of growing optimism of interest rate cuts from the Federal Reserve Bank, which caused market yields to decline.

• Services, Information Technology, and Diversified Media were the Fund’s largest industry exposures as the Fund sought defensive positions in a potentially weakening credit environment. However, the Fund’s positioning in Information Technology, Diversified Media and Health Care detracted from performance due primarily to security selection.

• The Fund’s overall credit quality allocation tended toward the upper range of non-investment grade ratings, which slightly detracted from performance.

• The Bloomberg US Aggregate Bond Index has been added since the last Shareholder Report to comply with a new regulatory requirement.

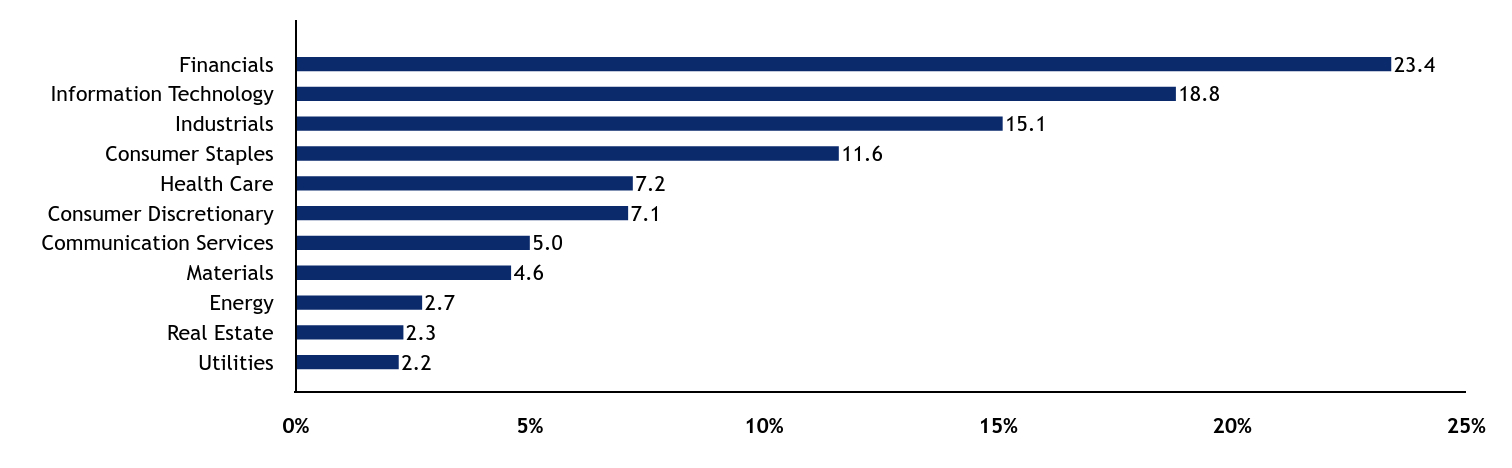

Cumulative Performance from August 31, 2014 through August 31, 2024

The initial investment, based on a $10,000 investment, is adjusted to reflect the maximum applicable sales charge, if any.

| A with Sales Charge | Bloomberg US Aggregate Bond Index | Credit Suisse Leveraged Loan Index |

|---|

| 08/2014 | $9,749 | $10,000 | $10,000 |

| 09/2014 | $9,730 | $9,932 | $9,948 |

| 10/2014 | $9,740 | $10,030 | $9,977 |

| 11/2014 | $9,786 | $10,101 | $10,022 |

| 12/2014 | $9,763 | $10,110 | $9,912 |

| 01/2015 | $9,821 | $10,322 | $9,937 |

| 02/2015 | $9,928 | $10,225 | $10,077 |

| 03/2015 | $10,025 | $10,273 | $10,117 |

| 04/2015 | $10,122 | $10,236 | $10,208 |

| 05/2015 | $10,200 | $10,211 | $10,228 |

| 06/2015 | $10,230 | $10,100 | $10,196 |

| 07/2015 | $10,290 | $10,170 | $10,205 |

| 08/2015 | $10,310 | $10,156 | $10,139 |

| 09/2015 | $10,270 | $10,224 | $10,071 |

| 10/2015 | $10,300 | $10,226 | $10,058 |

| 11/2015 | $10,260 | $10,199 | $9,968 |

| 12/2015 | $10,239 | $10,166 | $9,874 |

| 01/2016 | $10,207 | $10,306 | $9,802 |

| 02/2016 | $10,192 | $10,379 | $9,747 |

| 03/2016 | $10,372 | $10,474 | $10,005 |

| 04/2016 | $10,447 | $10,514 | $10,195 |

| 05/2016 | $10,533 | $10,517 | $10,288 |

| 06/2016 | $10,536 | $10,706 | $10,291 |

| 07/2016 | $10,658 | $10,774 | $10,436 |

| 08/2016 | $10,684 | $10,761 | $10,518 |

| 09/2016 | $10,783 | $10,755 | $10,610 |

| 10/2016 | $10,847 | $10,673 | $10,691 |

| 11/2016 | $10,870 | $10,420 | $10,726 |

| 12/2016 | $10,976 | $10,435 | $10,849 |

| 01/2017 | $11,041 | $10,456 | $10,907 |

| 02/2017 | $11,084 | $10,526 | $10,971 |

| 03/2017 | $11,116 | $10,520 | $10,979 |

| 04/2017 | $11,163 | $10,601 | $11,027 |

| 05/2017 | $11,194 | $10,683 | $11,069 |

| 06/2017 | $11,223 | $10,672 | $11,062 |

| 07/2017 | $11,311 | $10,718 | $11,149 |

| 08/2017 | $11,316 | $10,814 | $11,133 |

| 09/2017 | $11,366 | $10,763 | $11,179 |

| 10/2017 | $11,408 | $10,769 | $11,253 |

| 11/2017 | $11,439 | $10,755 | $11,266 |

| 12/2017 | $11,477 | $10,805 | $11,310 |

| 01/2018 | $11,589 | $10,680 | $11,432 |

| 02/2018 | $11,607 | $10,579 | $11,452 |

| 03/2018 | $11,630 | $10,647 | $11,489 |

| 04/2018 | $11,676 | $10,568 | $11,545 |

| 05/2018 | $11,684 | $10,643 | $11,567 |

| 06/2018 | $11,699 | $10,630 | $11,579 |

| 07/2018 | $11,774 | $10,633 | $11,675 |

| 08/2018 | $11,813 | $10,701 | $11,722 |

| 09/2018 | $11,883 | $10,632 | $11,802 |

| 10/2018 | $11,888 | $10,548 | $11,803 |

| 11/2018 | $11,813 | $10,611 | $11,707 |

| 12/2018 | $11,577 | $10,806 | $11,439 |

| 01/2019 | $11,765 | $10,921 | $11,702 |

| 02/2019 | $11,924 | $10,914 | $11,885 |

| 03/2019 | $11,926 | $11,124 | $11,871 |

| 04/2019 | $12,070 | $11,127 | $12,059 |

| 05/2019 | $12,034 | $11,324 | $12,032 |

| 06/2019 | $12,060 | $11,466 | $12,059 |

| 07/2019 | $12,088 | $11,492 | $12,153 |

| 08/2019 | $11,993 | $11,789 | $12,119 |

| 09/2019 | $12,004 | $11,727 | $12,170 |

| 10/2019 | $11,836 | $11,762 | $12,111 |

| 11/2019 | $11,836 | $11,756 | $12,177 |

| 12/2019 | $12,041 | $11,748 | $12,374 |

| 01/2020 | $12,118 | $11,974 | $12,440 |

| 02/2020 | $12,036 | $12,189 | $12,272 |

| 03/2020 | $10,104 | $12,118 | $10,742 |

| 04/2020 | $10,333 | $12,333 | $11,203 |

| 05/2020 | $10,758 | $12,391 | $11,629 |

| 06/2020 | $11,090 | $12,469 | $11,785 |

| 07/2020 | $11,291 | $12,655 | $12,007 |

| 08/2020 | $11,450 | $12,553 | $12,188 |

| 09/2020 | $11,548 | $12,546 | $12,271 |

| 10/2020 | $11,598 | $12,490 | $12,293 |

| 11/2020 | $11,848 | $12,612 | $12,555 |

| 12/2020 | $12,048 | $12,630 | $12,718 |

| 01/2021 | $12,169 | $12,539 | $12,879 |

| 02/2021 | $12,276 | $12,358 | $12,965 |

| 03/2021 | $12,319 | $12,204 | $12,973 |

| 04/2021 | $12,445 | $12,300 | $13,039 |

| 05/2021 | $12,529 | $12,340 | $13,107 |

| 06/2021 | $12,578 | $12,427 | $13,160 |

| 07/2021 | $12,565 | $12,566 | $13,160 |

| 08/2021 | $12,636 | $12,542 | $13,224 |

| 09/2021 | $12,707 | $12,433 | $13,310 |

| 10/2021 | $12,723 | $12,430 | $13,341 |

| 11/2021 | $12,679 | $12,467 | $13,321 |

| 12/2021 | $12,746 | $12,435 | $13,404 |

| 01/2022 | $12,787 | $12,167 | $13,452 |

| 02/2022 | $12,671 | $12,031 | $13,386 |

| 03/2022 | $12,648 | $11,697 | $13,391 |

| 04/2022 | $12,619 | $11,253 | $13,414 |

| 05/2022 | $12,186 | $11,326 | $13,077 |

| 06/2022 | $11,830 | $11,148 | $12,808 |

| 07/2022 | $11,985 | $11,420 | $13,047 |

| 08/2022 | $12,113 | $11,098 | $13,247 |

| 09/2022 | $11,793 | $10,618 | $12,960 |

| 10/2022 | $11,840 | $10,481 | $13,071 |

| 11/2022 | $11,973 | $10,866 | $13,216 |

| 12/2022 | $12,015 | $10,817 | $13,263 |

| 01/2023 | $12,264 | $11,150 | $13,603 |

| 02/2023 | $12,359 | $10,862 | $13,689 |

| 03/2023 | $12,279 | $11,138 | $13,675 |

| 04/2023 | $12,382 | $11,205 | $13,805 |

| 05/2023 | $12,342 | $11,083 | $13,793 |

| 06/2023 | $12,512 | $11,044 | $14,102 |

| 07/2023 | $12,632 | $11,036 | $14,285 |

| 08/2023 | $12,749 | $10,965 | $14,450 |

| 09/2023 | $12,834 | $10,687 | $14,577 |

| 10/2023 | $12,932 | $10,518 | $14,581 |

| 11/2023 | $13,090 | $10,994 | $14,756 |

| 12/2023 | $13,259 | $11,415 | $14,993 |

| 01/2024 | $13,299 | $11,384 | $15,110 |

| 02/2024 | $13,328 | $11,223 | $15,245 |

| 03/2024 | $13,474 | $11,327 | $15,371 |

| 04/2024 | $13,541 | $11,041 | $15,476 |

| 05/2024 | $13,663 | $11,228 | $15,616 |

| 06/2024 | $13,641 | $11,334 | $15,659 |

| 07/2024 | $13,640 | $11,599 | $15,774 |

| 08/2024 | $13,850 | $11,765 | $15,868 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

Class A without Sales ChargeFootnote Reference1 | 8.64% | 2.92% | 3.57% |

Class A with Maximum Sales Charge - 5.75%Footnote Reference1 | 5.92% | 2.40% | 3.31% |

| Bloomberg US Aggregate Bond Index | 7.30% | (0.04)% | 1.64% |

| Credit Suisse Leveraged Loan Index | 9.81% | 5.54% | 4.73% |

| Footnote | Description |

Footnote1 | Return may differ from actual shareholder return due to accounting adjustments for financial reporting purposes. |

Performance shown is historical and is not indicative of future returns. Investment returns and principal value will vary, and shares may be worth more or less at redemption than at original purchase. Performance shown is as of date indicated, and current performance may be lower or higher than the performance data quoted. To obtain performance as of the most recent month end, please visit americanbeaconfunds.com or call 800-967-9009. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance includes historical performance of another Class of the Fund. The Fund's performance benefited from fee waivers. For more information, visit americanbeaconfunds.com/Performance_Disclaimers.aspx.

| Total Net Assets | $133,778,638 |

| # of Portfolio Holdings | 198 |

| Portfolio Turnover Rate | 128% |

| Total Management Fees Paid | $904,490 |

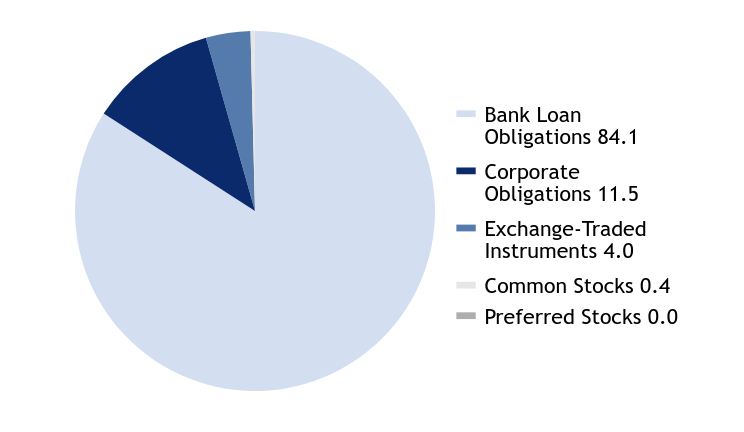

What did the Fund invest in?

Top Ten Holdings - % Net Assets

| Invesco Senior Loan ETF | 3.8 |

| Alvogen Pharma U.S., Inc., 12.985%, Due 6/30/2025 | 3.2 |

| Stats Intermediate Holdings LLC, 10.640%, Due 7/10/2026 | 3.2 |

| CMG Media Corp., 8.935%, Due 12/17/2026 | 3.2 |

| Banff Merger Sub, Inc., 9.005%, Due 7/30/2031 | 2.1 |

| United Airlines, Inc., 4.375%, Due 4/15/2026 | 1.8 |

| Pretium Packaging LLC, 9.848%, Due 10/2/2028 | 1.8 |

| ADT Security Corp., 4.125%, Due 8/1/2029 | 1.8 |

| Panther Escrow Issuer LLC, 7.125%, Due 6/1/2031 | 1.6 |

| AlixPartners LLP, 7.861%, Due 2/4/2028 | 1.5 |

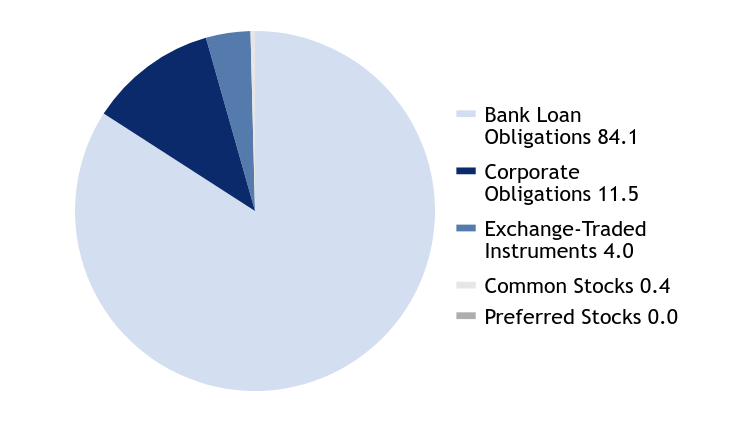

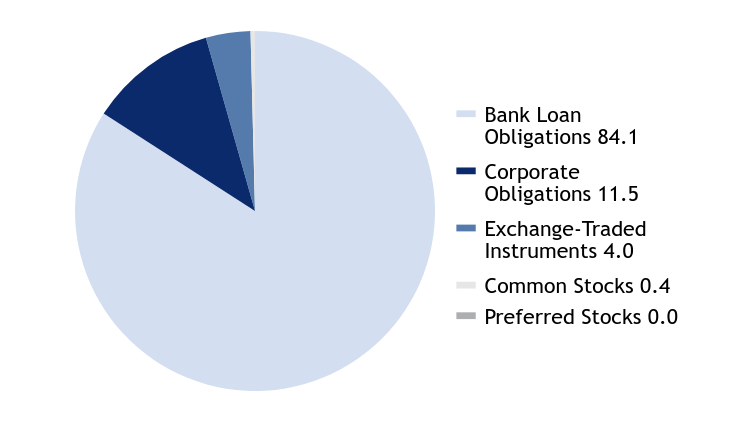

Asset Allocation - % Investments

| Value | Value |

|---|

| Bank Loan Obligations | 84.1 |

| Corporate Obligations | 11.5 |

| Exchange-Traded Instruments | 4.0 |

| Common Stocks | 0.4 |

| Preferred Stocks | 0.0 |

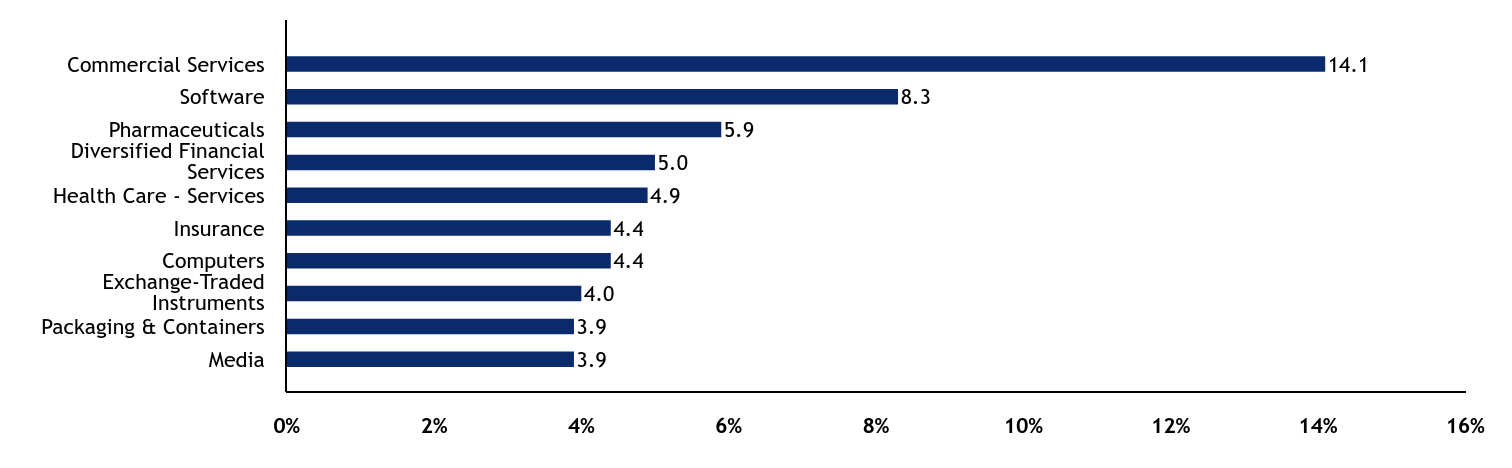

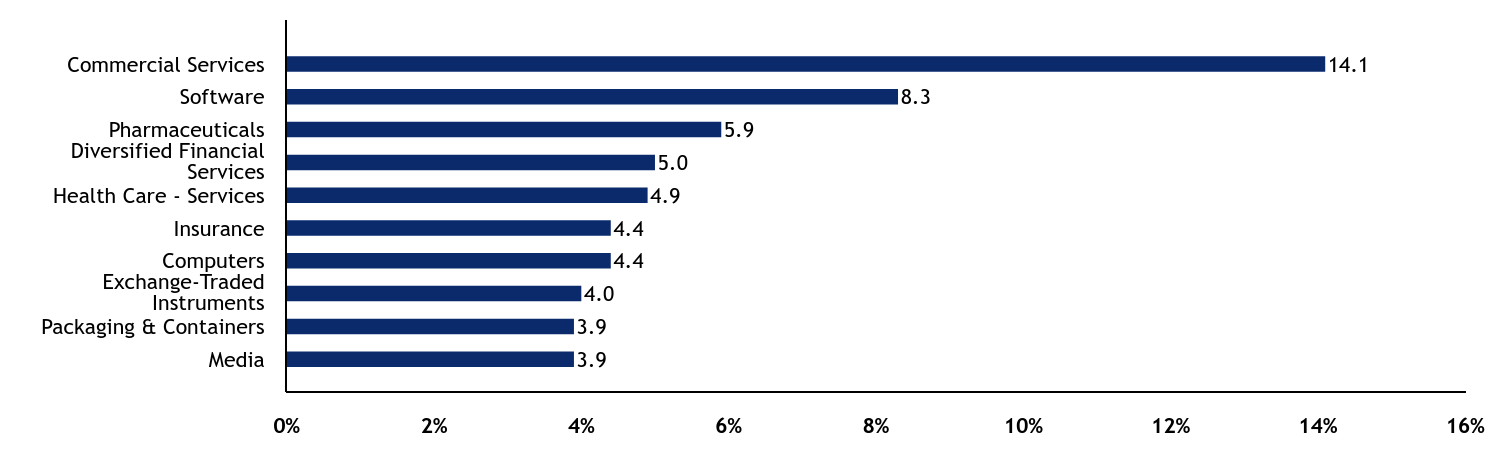

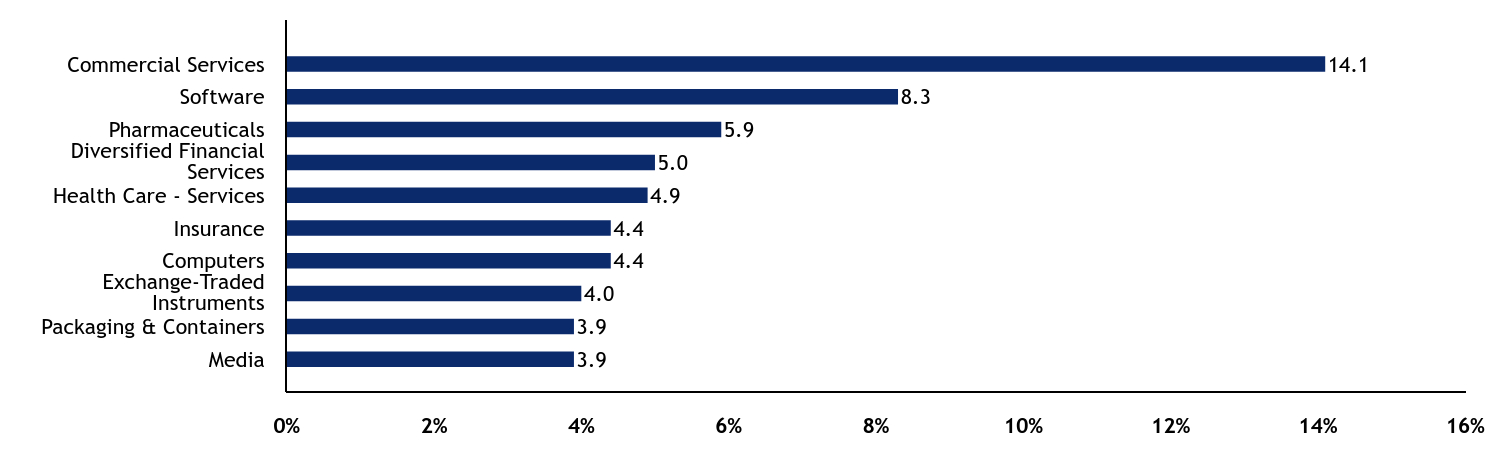

Top Ten Industry Allocations - % Investments

| Value | Value |

|---|

| Media | 3.9 |

| Packaging & Containers | 3.9 |

| Exchange-Traded Instruments | 4.0 |

| Computers | 4.4 |

| Insurance | 4.4 |

| Health Care - Services | 4.9 |

| Diversified Financial Services | 5.0 |

| Pharmaceuticals | 5.9 |

| Software | 8.3 |

| Commercial Services | 14.1 |

This is a summary of certain changes to the Fund since August 31, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by January 1, 2025 at www.americanbeaconfunds.com/literature or upon request at 800-658-5811.

Disclosed in a Supplement dated October 23, 2024 to the Prospectus and Summary Prospectus, each dated January 1, 2024, the Board of Trustees of the American Beacon Funds has approved a change to the non-fundamental policy of the American Beacon FEAC Floating Rate Income Fund (the “Fund”) with respect to the investment of at least 80% of its net assets (plus the amount of any borrowings for investment purposes), effective January 1, 2025.

For additional information about the Fund, including its prospectus, financial statements, holdings, and proxy voting information, please visit www.americanbeaconfunds.com/literature or call 1-800-658-5811.

If your financial institution mailed only one copy of this Report to an address shared by more than one account, you can request an individual copy by contacting your financial institution.

Distributed by Resolute Investment Distributors, Inc.

FEAC Floating Rate Income Fund

Annual Shareholder Report - August 31, 2024

FEAC Floating Rate Income Fund

Annual Shareholder Report - August 31, 2024

This annual shareholder report contains important information about American Beacon FEAC Floating Rate Income Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at www.americanbeaconfunds.com/literature. You can also request this information by contacting us at 800-658-5811. This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $194 | 1.87% |

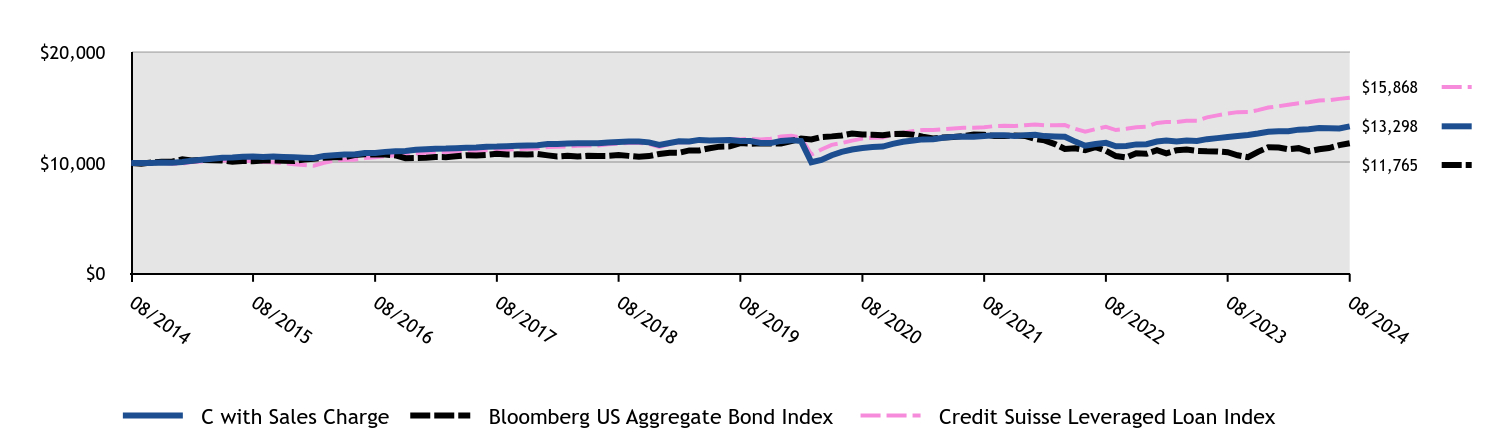

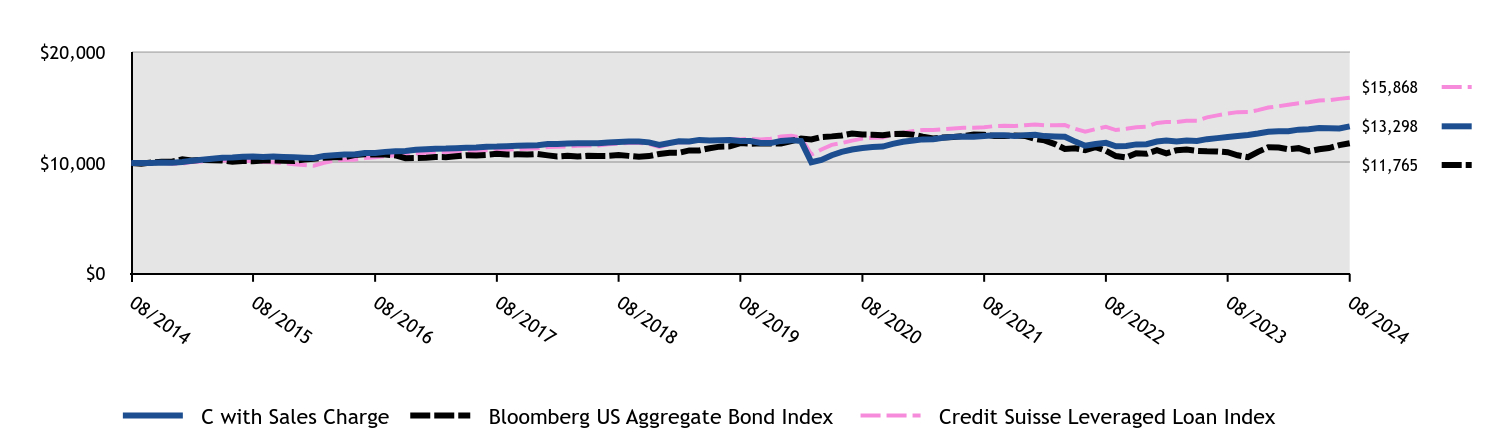

How did the Fund perform and what affected its performance?

The C Class of the Fund returned 6.77% (with sales charges) and 7.77% (without sales charges) for the twelve months ended August 31, 2024, compared to the Bloomberg U.S. Aggregate Bond Index return of 7.30% and the Credit Suisse Leveraged Loan Index return of 9.81%.

• The Fund provided a high level of current income and solid risk-adjusted returns against a backdrop of growing optimism of interest rate cuts from the Federal Reserve Bank, which caused market yields to decline.

• Services, Information Technology, and Diversified Media were the Fund’s largest industry exposures as the Fund sought defensive positions in a potentially weakening credit environment. However, the Fund’s positioning in Information Technology, Diversified Media and Health Care detracted from performance due primarily to security selection.

• The Fund’s overall credit quality allocation tended toward the upper range of non-investment grade ratings, which slightly detracted from performance.

• The Bloomberg US Aggregate Bond Index has been added since the last Shareholder Report to comply with a new regulatory requirement.

Cumulative Performance from August 31, 2014 through August 31, 2024

The initial investment, based on a $10,000 investment, is adjusted to reflect the maximum applicable sales charge, if any.

| C with Sales Charge | Bloomberg US Aggregate Bond Index | Credit Suisse Leveraged Loan Index |

|---|

| 08/2014 | $10,000 | $10,000 | $10,000 |

| 09/2014 | $9,981 | $9,932 | $9,948 |

| 10/2014 | $9,990 | $10,030 | $9,977 |

| 11/2014 | $10,038 | $10,101 | $10,022 |

| 12/2014 | $10,015 | $10,110 | $9,912 |

| 01/2015 | $10,074 | $10,322 | $9,937 |

| 02/2015 | $10,184 | $10,225 | $10,077 |

| 03/2015 | $10,283 | $10,273 | $10,117 |

| 04/2015 | $10,383 | $10,236 | $10,208 |

| 05/2015 | $10,462 | $10,211 | $10,228 |

| 06/2015 | $10,493 | $10,100 | $10,196 |

| 07/2015 | $10,555 | $10,170 | $10,205 |

| 08/2015 | $10,575 | $10,156 | $10,139 |

| 09/2015 | $10,534 | $10,224 | $10,071 |

| 10/2015 | $10,565 | $10,226 | $10,058 |

| 11/2015 | $10,524 | $10,199 | $9,968 |

| 12/2015 | $10,499 | $10,166 | $9,874 |

| 01/2016 | $10,459 | $10,306 | $9,802 |

| 02/2016 | $10,438 | $10,379 | $9,747 |

| 03/2016 | $10,615 | $10,474 | $10,005 |

| 04/2016 | $10,686 | $10,514 | $10,195 |

| 05/2016 | $10,766 | $10,517 | $10,288 |

| 06/2016 | $10,762 | $10,706 | $10,291 |

| 07/2016 | $10,891 | $10,774 | $10,436 |

| 08/2016 | $10,900 | $10,761 | $10,518 |

| 09/2016 | $10,994 | $10,755 | $10,610 |

| 10/2016 | $11,052 | $10,673 | $10,691 |

| 11/2016 | $11,079 | $10,420 | $10,726 |

| 12/2016 | $11,180 | $10,435 | $10,849 |

| 01/2017 | $11,229 | $10,456 | $10,907 |

| 02/2017 | $11,276 | $10,526 | $10,971 |

| 03/2017 | $11,291 | $10,520 | $10,979 |

| 04/2017 | $11,331 | $10,601 | $11,027 |

| 05/2017 | $11,367 | $10,683 | $11,069 |

| 06/2017 | $11,389 | $10,672 | $11,062 |

| 07/2017 | $11,460 | $10,718 | $11,149 |

| 08/2017 | $11,470 | $10,814 | $11,133 |

| 09/2017 | $11,503 | $10,763 | $11,179 |

| 10/2017 | $11,538 | $10,769 | $11,253 |

| 11/2017 | $11,562 | $10,755 | $11,266 |

| 12/2017 | $11,593 | $10,805 | $11,310 |

| 01/2018 | $11,700 | $10,680 | $11,432 |

| 02/2018 | $11,711 | $10,579 | $11,452 |

| 03/2018 | $11,738 | $10,647 | $11,489 |

| 04/2018 | $11,766 | $10,568 | $11,545 |

| 05/2018 | $11,767 | $10,643 | $11,567 |

| 06/2018 | $11,775 | $10,630 | $11,579 |

| 07/2018 | $11,843 | $10,633 | $11,675 |

| 08/2018 | $11,886 | $10,701 | $11,722 |

| 09/2018 | $11,937 | $10,632 | $11,802 |

| 10/2018 | $11,936 | $10,548 | $11,803 |

| 11/2018 | $11,852 | $10,611 | $11,707 |

| 12/2018 | $11,622 | $10,806 | $11,439 |

| 01/2019 | $11,790 | $10,921 | $11,702 |

| 02/2019 | $11,954 | $10,914 | $11,885 |

| 03/2019 | $11,936 | $11,124 | $11,871 |

| 04/2019 | $12,073 | $11,127 | $12,059 |

| 05/2019 | $12,030 | $11,324 | $12,032 |

| 06/2019 | $12,048 | $11,466 | $12,059 |

| 07/2019 | $12,067 | $11,492 | $12,153 |

| 08/2019 | $11,966 | $11,789 | $12,119 |

| 09/2019 | $11,969 | $11,727 | $12,170 |

| 10/2019 | $11,794 | $11,762 | $12,111 |

| 11/2019 | $11,787 | $11,756 | $12,177 |

| 12/2019 | $11,983 | $11,748 | $12,374 |

| 01/2020 | $12,052 | $11,974 | $12,440 |

| 02/2020 | $11,963 | $12,189 | $12,272 |

| 03/2020 | $10,054 | $12,118 | $10,742 |

| 04/2020 | $10,262 | $12,333 | $11,203 |

| 05/2020 | $10,688 | $12,391 | $11,629 |

| 06/2020 | $10,997 | $12,469 | $11,785 |

| 07/2020 | $11,201 | $12,655 | $12,007 |

| 08/2020 | $11,337 | $12,553 | $12,188 |

| 09/2020 | $11,440 | $12,546 | $12,271 |

| 10/2020 | $11,469 | $12,490 | $12,293 |

| 11/2020 | $11,721 | $12,612 | $12,555 |

| 12/2020 | $11,911 | $12,630 | $12,718 |

| 01/2021 | $12,023 | $12,539 | $12,879 |

| 02/2021 | $12,120 | $12,358 | $12,965 |

| 03/2021 | $12,141 | $12,204 | $12,973 |

| 04/2021 | $12,271 | $12,300 | $13,039 |

| 05/2021 | $12,346 | $12,340 | $13,107 |

| 06/2021 | $12,387 | $12,427 | $13,160 |

| 07/2021 | $12,365 | $12,566 | $13,160 |

| 08/2021 | $12,427 | $12,542 | $13,224 |

| 09/2021 | $12,488 | $12,433 | $13,310 |

| 10/2021 | $12,496 | $12,430 | $13,341 |

| 11/2021 | $12,433 | $12,467 | $13,321 |

| 12/2021 | $12,504 | $12,435 | $13,404 |

| 01/2022 | $12,536 | $12,167 | $13,452 |

| 02/2022 | $12,415 | $12,031 | $13,386 |

| 03/2022 | $12,384 | $11,697 | $13,391 |

| 04/2022 | $12,349 | $11,253 | $13,414 |

| 05/2022 | $11,920 | $11,326 | $13,077 |

| 06/2022 | $11,552 | $11,148 | $12,808 |

| 07/2022 | $11,709 | $11,420 | $13,047 |

| 08/2022 | $11,812 | $11,098 | $13,247 |

| 09/2022 | $11,494 | $10,618 | $12,960 |

| 10/2022 | $11,532 | $10,481 | $13,071 |

| 11/2022 | $11,669 | $10,866 | $13,216 |

| 12/2022 | $11,688 | $10,817 | $13,263 |

| 01/2023 | $11,922 | $11,150 | $13,603 |

| 02/2023 | $12,007 | $10,862 | $13,689 |

| 03/2023 | $11,922 | $11,138 | $13,675 |

| 04/2023 | $12,028 | $11,205 | $13,805 |

| 05/2023 | $11,968 | $11,083 | $13,793 |

| 06/2023 | $12,140 | $11,044 | $14,102 |

| 07/2023 | $12,233 | $11,036 | $14,285 |

| 08/2023 | $12,339 | $10,965 | $14,450 |

| 09/2023 | $12,428 | $10,687 | $14,577 |

| 10/2023 | $12,516 | $10,518 | $14,581 |

| 11/2023 | $12,644 | $10,994 | $14,756 |

| 12/2023 | $12,799 | $11,415 | $14,993 |

| 01/2024 | $12,845 | $11,384 | $15,110 |

| 02/2024 | $12,849 | $11,223 | $15,245 |

| 03/2024 | $12,998 | $11,327 | $15,371 |

| 04/2024 | $13,038 | $11,041 | $15,476 |

| 05/2024 | $13,148 | $11,228 | $15,616 |

| 06/2024 | $13,118 | $11,334 | $15,659 |

| 07/2024 | $13,105 | $11,599 | $15,774 |

| 08/2024 | $13,298 | $11,765 | $15,868 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

Class C without Deferred Sales ChargeFootnote Reference1 | 7.77% | 2.13% | 2.89% |

Class C with Maximum Deferred Sales Charge -1.00%Footnote Reference1 | 6.77% | 2.13% | 2.89% |

| Bloomberg US Aggregate Bond Index | 7.30% | (0.04)% | 1.64% |

| Credit Suisse Leveraged Loan Index | 9.81% | 5.54% | 4.73% |

| Footnote | Description |

Footnote1 | Return may differ from actual shareholder return due to accounting adjustments for financial reporting purposes. |

Performance shown is historical and is not indicative of future returns. Investment returns and principal value will vary, and shares may be worth more or less at redemption than at original purchase. Performance shown is as of date indicated, and current performance may be lower or higher than the performance data quoted. To obtain performance as of the most recent month end, please visit americanbeaconfunds.com or call 800-967-9009. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance includes historical performance of another Class of the Fund. The Fund's performance benefited from fee waivers. For more information, visit americanbeaconfunds.com/Performance_Disclaimers.aspx.

| Total Net Assets | $133,778,638 |

| # of Portfolio Holdings | 198 |

| Portfolio Turnover Rate | 128% |

| Total Management Fees Paid | $904,490 |

What did the Fund invest in?

Top Ten Holdings - % Net Assets

| Invesco Senior Loan ETF | 3.8 |

| Alvogen Pharma U.S., Inc., 12.985%, Due 6/30/2025 | 3.2 |

| Stats Intermediate Holdings LLC, 10.640%, Due 7/10/2026 | 3.2 |

| CMG Media Corp., 8.935%, Due 12/17/2026 | 3.2 |

| Banff Merger Sub, Inc., 9.005%, Due 7/30/2031 | 2.1 |

| United Airlines, Inc., 4.375%, Due 4/15/2026 | 1.8 |

| Pretium Packaging LLC, 9.848%, Due 10/2/2028 | 1.8 |

| ADT Security Corp., 4.125%, Due 8/1/2029 | 1.8 |

| Panther Escrow Issuer LLC, 7.125%, Due 6/1/2031 | 1.6 |

| AlixPartners LLP, 7.861%, Due 2/4/2028 | 1.5 |

Asset Allocation - % Investments

| Value | Value |

|---|

| Bank Loan Obligations | 84.1 |

| Corporate Obligations | 11.5 |

| Exchange-Traded Instruments | 4.0 |

| Common Stocks | 0.4 |

| Preferred Stocks | 0.0 |

Top Ten Industry Allocations - % Investments

| Value | Value |

|---|

| Media | 3.9 |

| Packaging & Containers | 3.9 |

| Exchange-Traded Instruments | 4.0 |

| Computers | 4.4 |

| Insurance | 4.4 |

| Health Care - Services | 4.9 |

| Diversified Financial Services | 5.0 |

| Pharmaceuticals | 5.9 |

| Software | 8.3 |

| Commercial Services | 14.1 |

This is a summary of certain changes to the Fund since August 31, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by January 1, 2025 at www.americanbeaconfunds.com/literature or upon request at 800-658-5811.

Disclosed in a Supplement dated October 23, 2024 to the Prospectus and Summary Prospectus, each dated January 1, 2024, the Board of Trustees of the American Beacon Funds has approved a change to the non-fundamental policy of the American Beacon FEAC Floating Rate Income Fund (the “Fund”) with respect to the investment of at least 80% of its net assets (plus the amount of any borrowings for investment purposes), effective January 1, 2025.

For additional information about the Fund, including its prospectus, financial statements, holdings, and proxy voting information, please visit www.americanbeaconfunds.com/literature or call 1-800-658-5811.

If your financial institution mailed only one copy of this Report to an address shared by more than one account, you can request an individual copy by contacting your financial institution.

Distributed by Resolute Investment Distributors, Inc.

FEAC Floating Rate Income Fund

Annual Shareholder Report - August 31, 2024

FEAC Floating Rate Income Fund

Annual Shareholder Report - August 31, 2024

This annual shareholder report contains important information about American Beacon FEAC Floating Rate Income Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at www.americanbeaconfunds.com/literature. You can also request this information by contacting us at 800-658-5811. This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor | $122 | 1.17% |

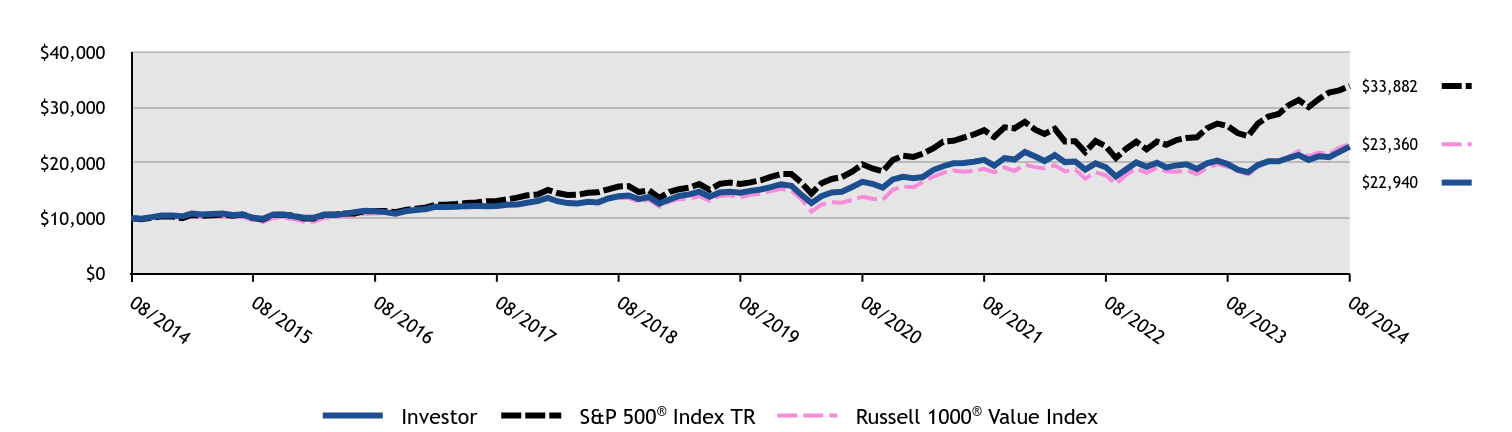

How did the Fund perform and what affected its performance?

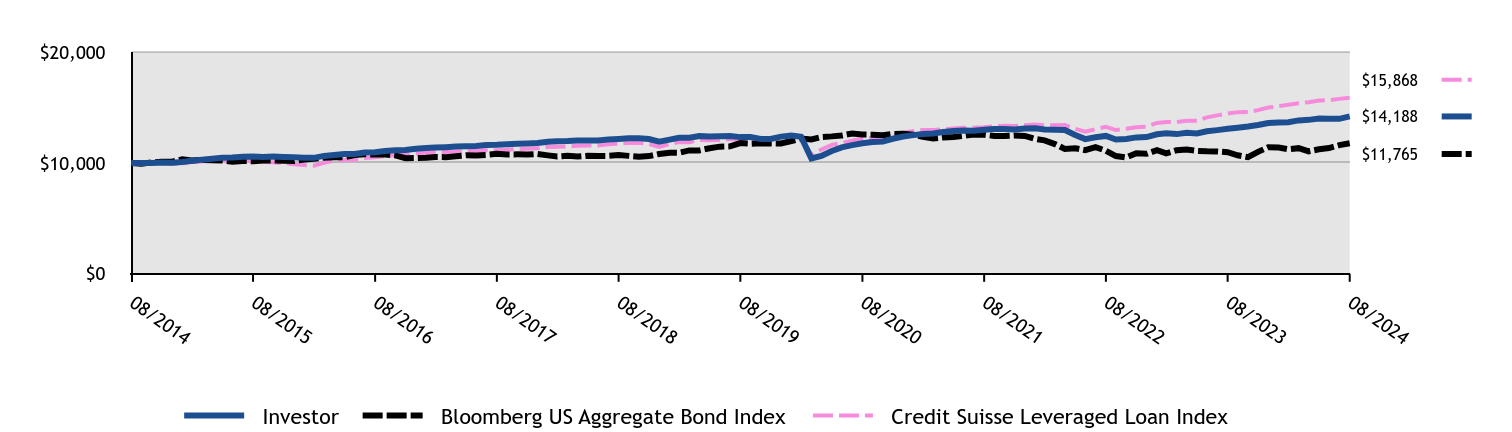

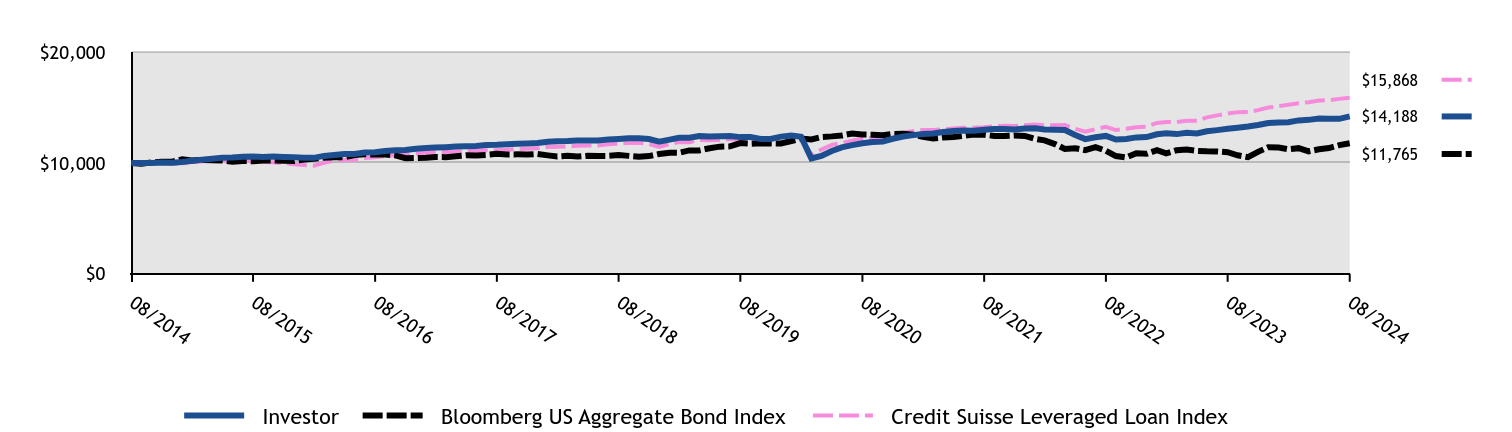

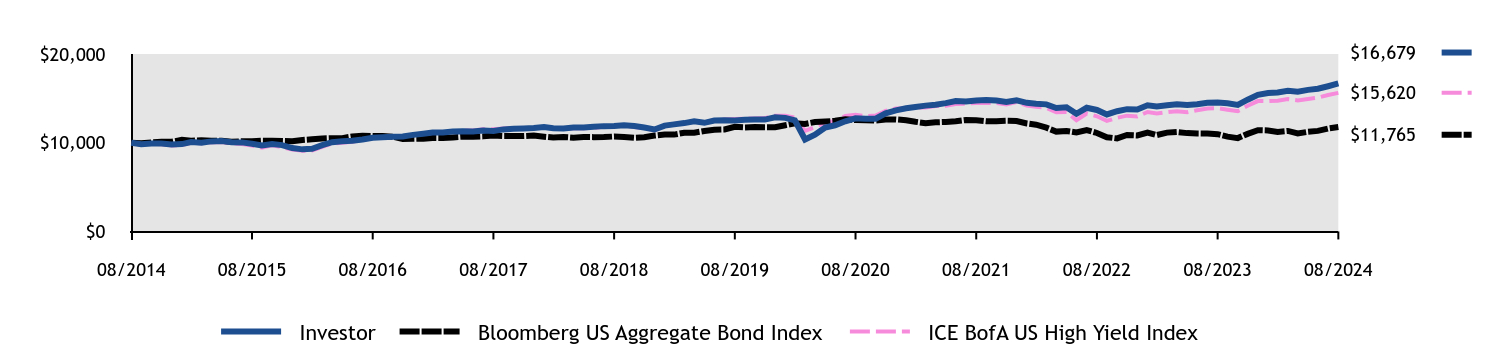

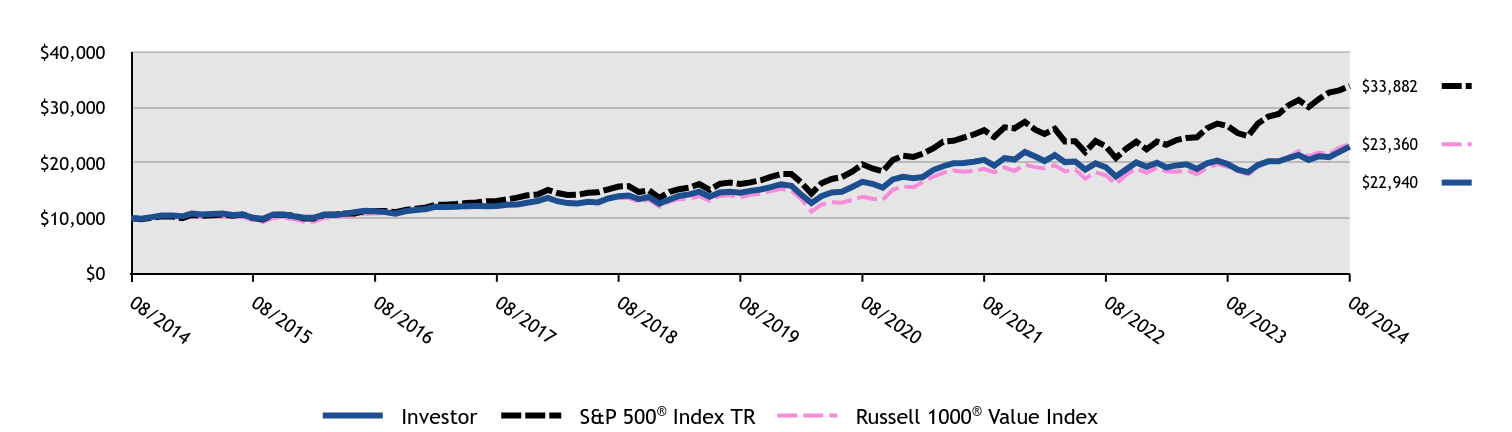

The Investor Class of the Fund returned 8.52% for the twelve months ended August 31, 2024, compared to the Bloomberg U.S. Aggregate Bond Index return of 7.30% and the Credit Suisse Leveraged Loan Index return of 9.81%.

• The Fund provided a high level of current income and solid risk-adjusted returns against a backdrop of growing optimism of interest rate cuts from the Federal Reserve Bank, which caused market yields to decline.

• Services, Information Technology, and Diversified Media were the Fund’s largest industry exposures as the Fund sought defensive positions in a potentially weakening credit environment. However, the Fund’s positioning in Information Technology, Diversified Media and Health Care detracted from performance due primarily to security selection.

• The Fund’s overall credit quality allocation tended toward the upper range of non-investment grade ratings, which slightly detracted from performance.

• The Bloomberg US Aggregate Bond Index has been added since the last Shareholder Report to comply with a new regulatory requirement.

Cumulative Performance from August 31, 2014 through August 31, 2024

The initial investment, based on a $10,000 investment, is adjusted to reflect the maximum applicable sales charge, if any.

| Investor | Bloomberg US Aggregate Bond Index | Credit Suisse Leveraged Loan Index |

|---|

| 08/2014 | $10,000 | $10,000 | $10,000 |

| 09/2014 | $9,981 | $9,932 | $9,948 |

| 10/2014 | $9,990 | $10,030 | $9,977 |

| 11/2014 | $10,038 | $10,101 | $10,022 |

| 12/2014 | $10,015 | $10,110 | $9,912 |

| 01/2015 | $10,074 | $10,322 | $9,937 |

| 02/2015 | $10,184 | $10,225 | $10,077 |

| 03/2015 | $10,283 | $10,273 | $10,117 |

| 04/2015 | $10,383 | $10,236 | $10,208 |

| 05/2015 | $10,462 | $10,211 | $10,228 |

| 06/2015 | $10,493 | $10,100 | $10,196 |

| 07/2015 | $10,555 | $10,170 | $10,205 |

| 08/2015 | $10,575 | $10,156 | $10,139 |

| 09/2015 | $10,534 | $10,224 | $10,071 |

| 10/2015 | $10,565 | $10,226 | $10,058 |

| 11/2015 | $10,524 | $10,199 | $9,968 |

| 12/2015 | $10,502 | $10,166 | $9,874 |

| 01/2016 | $10,469 | $10,306 | $9,802 |

| 02/2016 | $10,454 | $10,379 | $9,747 |

| 03/2016 | $10,629 | $10,474 | $10,005 |

| 04/2016 | $10,718 | $10,514 | $10,195 |

| 05/2016 | $10,805 | $10,517 | $10,288 |

| 06/2016 | $10,808 | $10,706 | $10,291 |

| 07/2016 | $10,934 | $10,774 | $10,436 |

| 08/2016 | $10,962 | $10,761 | $10,518 |

| 09/2016 | $11,063 | $10,755 | $10,610 |

| 10/2016 | $11,130 | $10,673 | $10,691 |

| 11/2016 | $11,160 | $10,420 | $10,726 |

| 12/2016 | $11,271 | $10,435 | $10,849 |

| 01/2017 | $11,339 | $10,456 | $10,907 |

| 02/2017 | $11,384 | $10,526 | $10,971 |

| 03/2017 | $11,419 | $10,520 | $10,979 |

| 04/2017 | $11,468 | $10,601 | $11,027 |

| 05/2017 | $11,502 | $10,683 | $11,069 |

| 06/2017 | $11,533 | $10,672 | $11,062 |

| 07/2017 | $11,614 | $10,718 | $11,149 |

| 08/2017 | $11,633 | $10,814 | $11,133 |

| 09/2017 | $11,675 | $10,763 | $11,179 |

| 10/2017 | $11,731 | $10,769 | $11,253 |

| 11/2017 | $11,753 | $10,755 | $11,266 |

| 12/2017 | $11,794 | $10,805 | $11,310 |

| 01/2018 | $11,911 | $10,680 | $11,432 |

| 02/2018 | $11,942 | $10,579 | $11,452 |

| 03/2018 | $11,967 | $10,647 | $11,489 |

| 04/2018 | $12,015 | $10,568 | $11,545 |

| 05/2018 | $12,022 | $10,643 | $11,567 |

| 06/2018 | $12,027 | $10,630 | $11,579 |

| 07/2018 | $12,104 | $10,633 | $11,675 |

| 08/2018 | $12,157 | $10,701 | $11,722 |

| 09/2018 | $12,218 | $10,632 | $11,802 |

| 10/2018 | $12,224 | $10,548 | $11,803 |

| 11/2018 | $12,147 | $10,611 | $11,707 |

| 12/2018 | $11,919 | $10,806 | $11,439 |

| 01/2019 | $12,100 | $10,921 | $11,702 |

| 02/2019 | $12,263 | $10,914 | $11,885 |

| 03/2019 | $12,265 | $11,124 | $11,871 |

| 04/2019 | $12,413 | $11,127 | $12,059 |

| 05/2019 | $12,376 | $11,324 | $12,032 |

| 06/2019 | $12,401 | $11,466 | $12,059 |

| 07/2019 | $12,423 | $11,492 | $12,153 |

| 08/2019 | $12,325 | $11,789 | $12,119 |

| 09/2019 | $12,336 | $11,727 | $12,170 |

| 10/2019 | $12,160 | $11,762 | $12,111 |

| 11/2019 | $12,159 | $11,756 | $12,177 |

| 12/2019 | $12,370 | $11,748 | $12,374 |

| 01/2020 | $12,462 | $11,974 | $12,440 |

| 02/2020 | $12,363 | $12,189 | $12,272 |

| 03/2020 | $10,396 | $12,118 | $10,742 |

| 04/2020 | $10,631 | $12,333 | $11,203 |

| 05/2020 | $11,068 | $12,391 | $11,629 |

| 06/2020 | $11,397 | $12,469 | $11,785 |

| 07/2020 | $11,603 | $12,655 | $12,007 |

| 08/2020 | $11,766 | $12,553 | $12,188 |

| 09/2020 | $11,880 | $12,546 | $12,271 |

| 10/2020 | $11,918 | $12,490 | $12,293 |

| 11/2020 | $12,175 | $12,612 | $12,555 |

| 12/2020 | $12,381 | $12,630 | $12,718 |

| 01/2021 | $12,505 | $12,539 | $12,879 |

| 02/2021 | $12,614 | $12,358 | $12,965 |

| 03/2021 | $12,657 | $12,204 | $12,973 |

| 04/2021 | $12,786 | $12,300 | $13,039 |

| 05/2021 | $12,872 | $12,340 | $13,107 |

| 06/2021 | $12,922 | $12,427 | $13,160 |

| 07/2021 | $12,907 | $12,566 | $13,160 |

| 08/2021 | $12,979 | $12,542 | $13,224 |

| 09/2021 | $13,052 | $12,433 | $13,310 |

| 10/2021 | $13,067 | $12,430 | $13,341 |

| 11/2021 | $13,022 | $12,467 | $13,321 |

| 12/2021 | $13,091 | $12,435 | $13,404 |

| 01/2022 | $13,132 | $12,167 | $13,452 |

| 02/2022 | $13,012 | $12,031 | $13,386 |

| 03/2022 | $12,987 | $11,697 | $13,391 |

| 04/2022 | $12,957 | $11,253 | $13,414 |

| 05/2022 | $12,525 | $11,326 | $13,077 |

| 06/2022 | $12,143 | $11,148 | $12,808 |

| 07/2022 | $12,316 | $11,420 | $13,047 |

| 08/2022 | $12,432 | $11,098 | $13,247 |

| 09/2022 | $12,101 | $10,618 | $12,960 |

| 10/2022 | $12,149 | $10,481 | $13,071 |

| 11/2022 | $12,300 | $10,866 | $13,216 |

| 12/2022 | $12,327 | $10,817 | $13,263 |

| 01/2023 | $12,582 | $11,150 | $13,603 |

| 02/2023 | $12,679 | $10,862 | $13,689 |

| 03/2023 | $12,596 | $11,138 | $13,675 |

| 04/2023 | $12,716 | $11,205 | $13,805 |

| 05/2023 | $12,659 | $11,083 | $13,793 |

| 06/2023 | $12,849 | $11,044 | $14,102 |

| 07/2023 | $12,955 | $11,036 | $14,285 |

| 08/2023 | $13,074 | $10,965 | $14,450 |

| 09/2023 | $13,176 | $10,687 | $14,577 |

| 10/2023 | $13,279 | $10,518 | $14,581 |

| 11/2023 | $13,424 | $10,994 | $14,756 |

| 12/2023 | $13,597 | $11,415 | $14,993 |

| 01/2024 | $13,637 | $11,384 | $15,110 |

| 02/2024 | $13,665 | $11,223 | $15,245 |

| 03/2024 | $13,831 | $11,327 | $15,371 |

| 04/2024 | $13,881 | $11,041 | $15,476 |

| 05/2024 | $14,006 | $11,228 | $15,616 |

| 06/2024 | $13,982 | $11,334 | $15,659 |

| 07/2024 | $13,974 | $11,599 | $15,774 |

| 08/2024 | $14,188 | $11,765 | $15,868 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

Investor ClassFootnote Reference1 | 8.52% | 2.86% | 3.56% |

| Bloomberg US Aggregate Bond Index | 7.30% | (0.04)% | 1.64% |

| Credit Suisse Leveraged Loan Index | 9.81% | 5.54% | 4.73% |

| Footnote | Description |

Footnote1 | Return may differ from actual shareholder return due to accounting adjustments for financial reporting purposes. |

Performance shown is historical and is not indicative of future returns. Investment returns and principal value will vary, and shares may be worth more or less at redemption than at original purchase. Performance shown is as of date indicated, and current performance may be lower or higher than the performance data quoted. To obtain performance as of the most recent month end, please visit americanbeaconfunds.com or call 800-967-9009. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance includes historical performance of another Class of the Fund. The Fund's performance benefited from fee waivers. For more information, visit americanbeaconfunds.com/Performance_Disclaimers.aspx.

| Total Net Assets | $133,778,638 |

| # of Portfolio Holdings | 198 |

| Portfolio Turnover Rate | 128% |

| Total Management Fees Paid | $904,490 |

What did the Fund invest in?

Top Ten Holdings - % Net Assets

| Invesco Senior Loan ETF | 3.8 |

| Alvogen Pharma U.S., Inc., 12.985%, Due 6/30/2025 | 3.2 |

| Stats Intermediate Holdings LLC, 10.640%, Due 7/10/2026 | 3.2 |

| CMG Media Corp., 8.935%, Due 12/17/2026 | 3.2 |

| Banff Merger Sub, Inc., 9.005%, Due 7/30/2031 | 2.1 |

| United Airlines, Inc., 4.375%, Due 4/15/2026 | 1.8 |

| Pretium Packaging LLC, 9.848%, Due 10/2/2028 | 1.8 |

| ADT Security Corp., 4.125%, Due 8/1/2029 | 1.8 |

| Panther Escrow Issuer LLC, 7.125%, Due 6/1/2031 | 1.6 |

| AlixPartners LLP, 7.861%, Due 2/4/2028 | 1.5 |

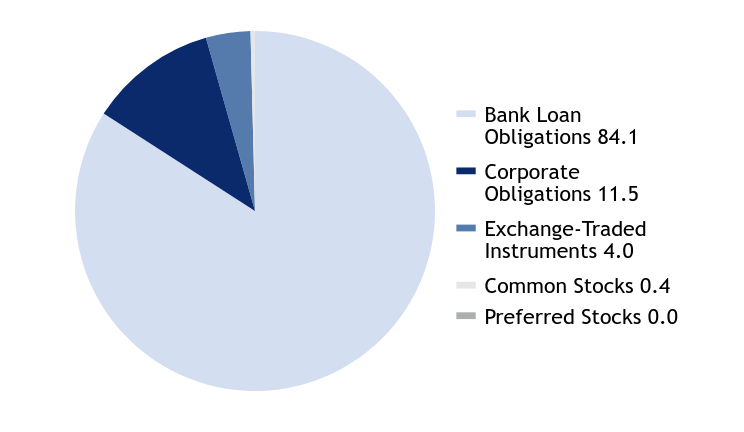

Asset Allocation - % Investments

| Value | Value |

|---|

| Bank Loan Obligations | 84.1 |

| Corporate Obligations | 11.5 |

| Exchange-Traded Instruments | 4.0 |

| Common Stocks | 0.4 |

| Preferred Stocks | 0.0 |

Top Ten Industry Allocations - % Investments

| Value | Value |

|---|

| Media | 3.9 |

| Packaging & Containers | 3.9 |

| Exchange-Traded Instruments | 4.0 |

| Computers | 4.4 |

| Insurance | 4.4 |

| Health Care - Services | 4.9 |

| Diversified Financial Services | 5.0 |

| Pharmaceuticals | 5.9 |

| Software | 8.3 |

| Commercial Services | 14.1 |

This is a summary of certain changes to the Fund since August 31, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by January 1, 2025 at www.americanbeaconfunds.com/literature or upon request at 800-658-5811.

Disclosed in a Supplement dated October 23, 2024 to the Prospectus and Summary Prospectus, each dated January 1, 2024, the Board of Trustees of the American Beacon Funds has approved a change to the non-fundamental policy of the American Beacon FEAC Floating Rate Income Fund (the “Fund”) with respect to the investment of at least 80% of its net assets (plus the amount of any borrowings for investment purposes), effective January 1, 2025.

For additional information about the Fund, including its prospectus, financial statements, holdings, and proxy voting information, please visit www.americanbeaconfunds.com/literature or call 1-800-658-5811.

If your financial institution mailed only one copy of this Report to an address shared by more than one account, you can request an individual copy by contacting your financial institution.

Distributed by Resolute Investment Distributors, Inc.

FEAC Floating Rate Income Fund

Annual Shareholder Report - August 31, 2024

FEAC Floating Rate Income Fund

Annual Shareholder Report - August 31, 2024

This annual shareholder report contains important information about American Beacon FEAC Floating Rate Income Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at www.americanbeaconfunds.com/literature. You can also request this information by contacting us at 800-658-5811. This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| R5 | $87 | 0.83% |

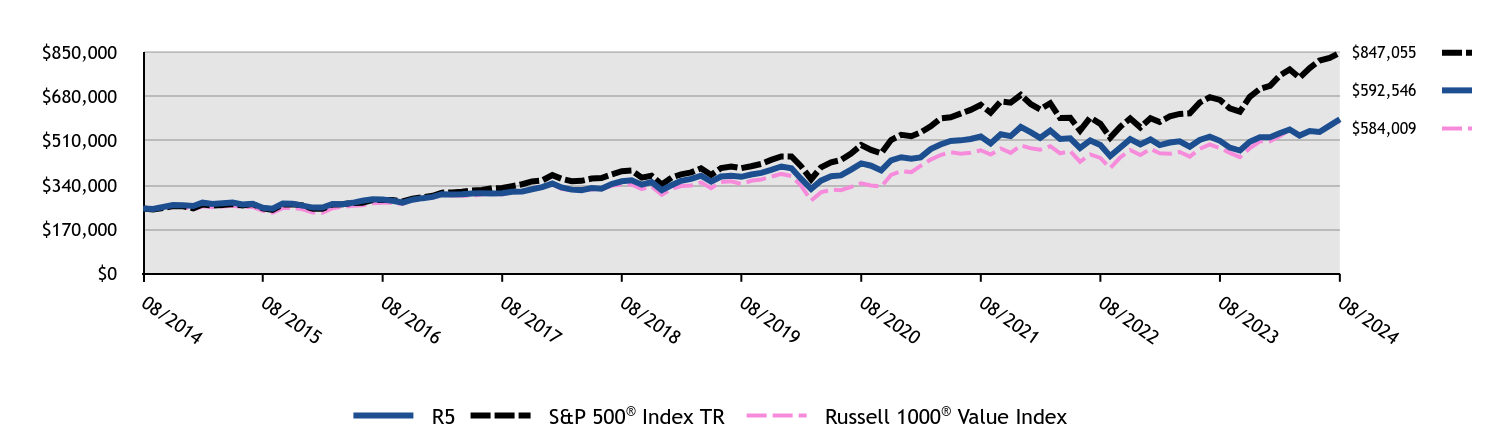

How did the Fund perform and what affected its performance?

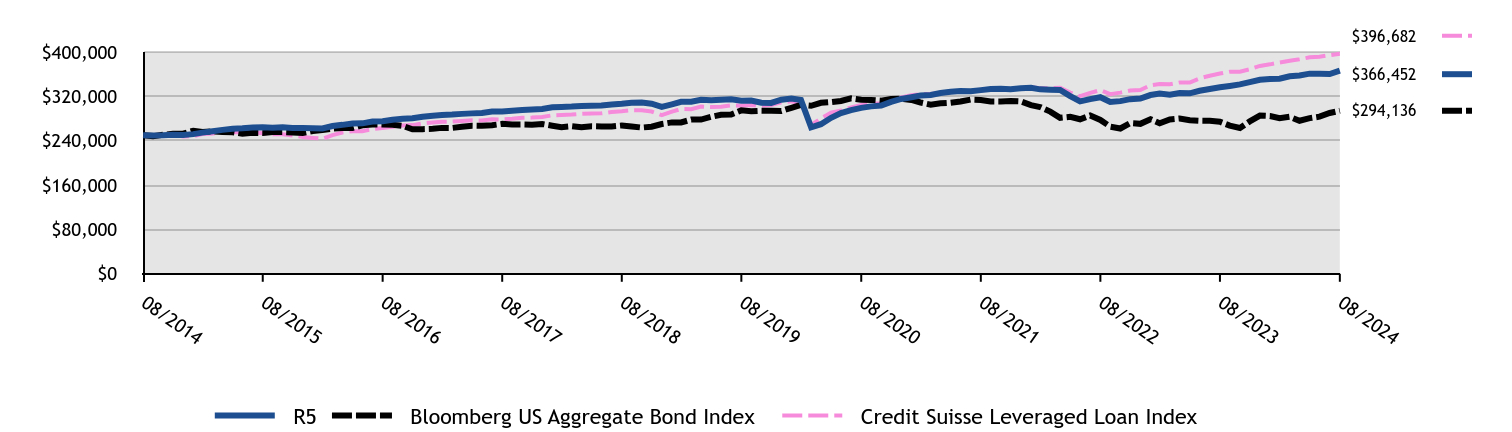

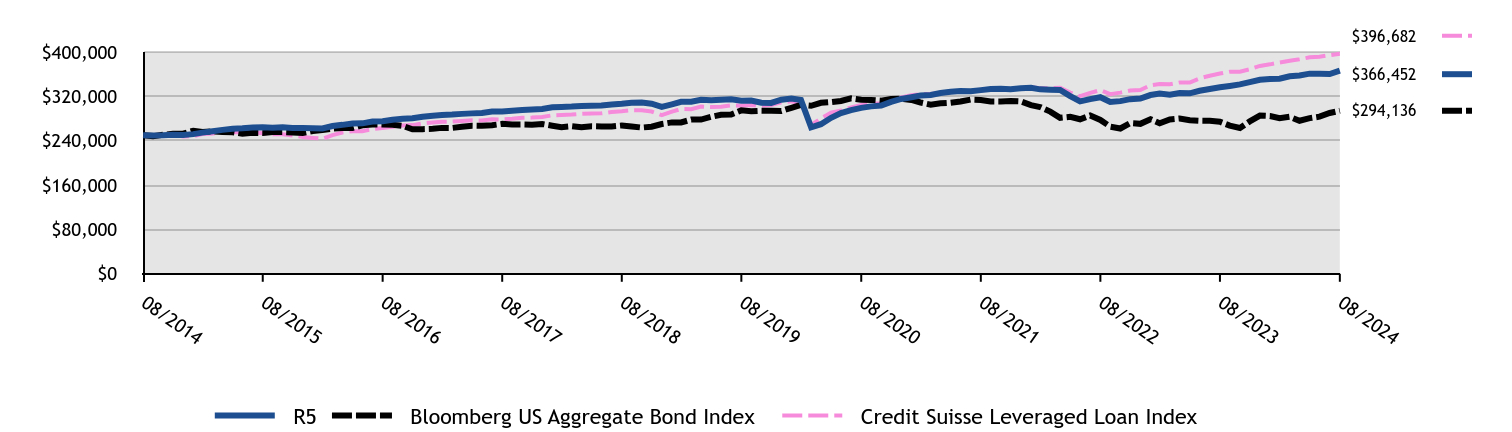

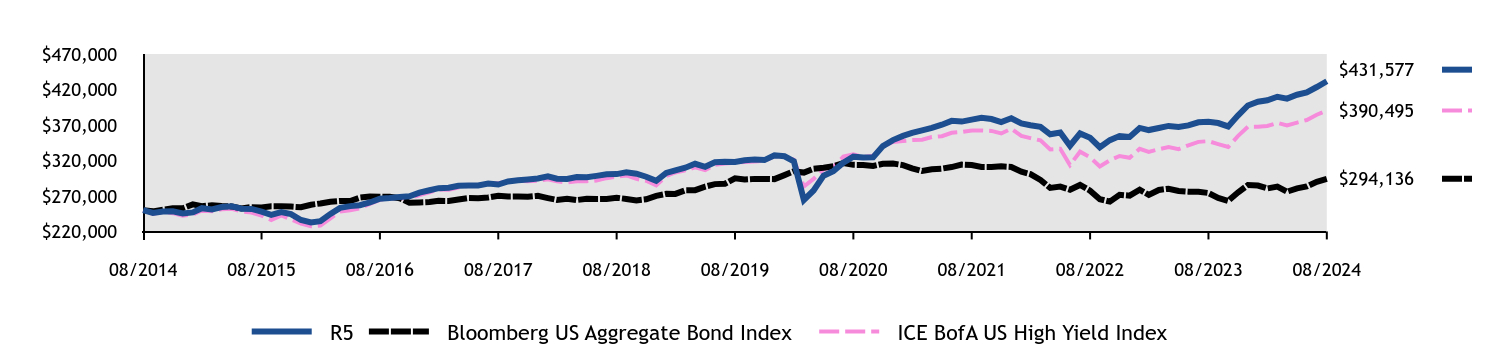

The R5 Class of the Fund returned 8.90% for the twelve months ended August 31, 2024, compared to the Bloomberg U.S. Aggregate Bond Index return of 7.30% and the Credit Suisse Leveraged Loan Index return of 9.81%.

• The Fund provided a high level of current income and solid risk-adjusted returns against a backdrop of growing optimism of interest rate cuts from the Federal Reserve Bank, which caused market yields to decline.

• Services, Information Technology, and Diversified Media were the Fund’s largest industry exposures as the Fund sought defensive positions in a potentially weakening credit environment. However, the Fund’s positioning in Information Technology, Diversified Media and Health Care detracted from performance due primarily to security selection.

• The Fund’s overall credit quality allocation tended toward the upper range of non-investment grade ratings, which slightly detracted from performance.

• The Bloomberg US Aggregate Bond Index has been added since the last Shareholder Report to comply with a new regulatory requirement.

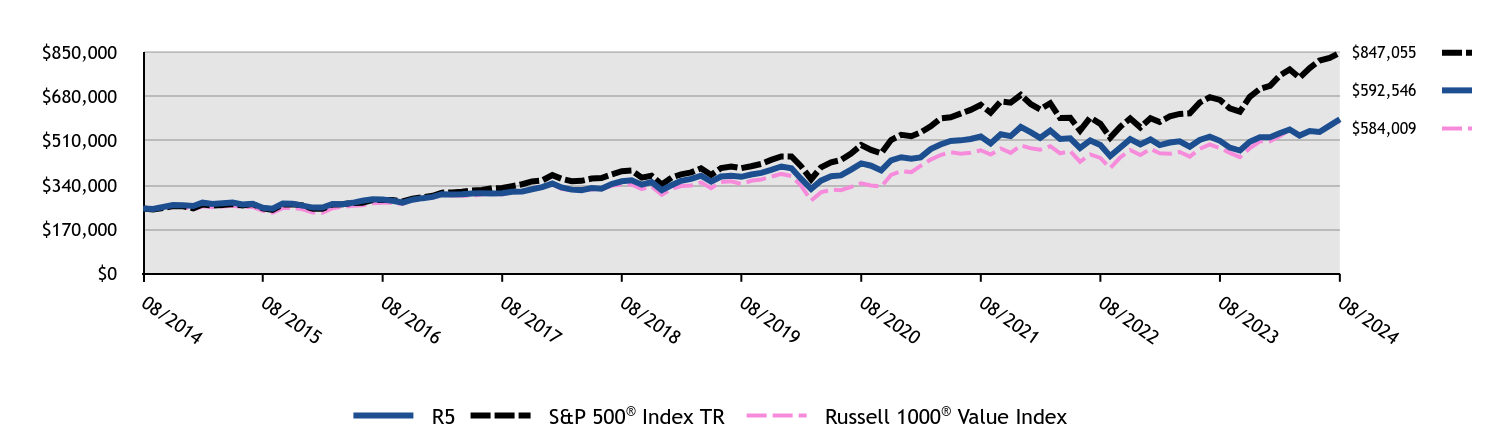

Cumulative Performance from August 31, 2014 through August 31, 2024

The initial investment, based on a $250,000 investment, is adjusted to reflect the maximum applicable sales charge, if any.

| R5 | Bloomberg US Aggregate Bond Index | Credit Suisse Leveraged Loan Index |

|---|

| 08/2014 | $250,000 | $250,000 | $250,000 |

| 09/2014 | $249,523 | $248,303 | $248,708 |

| 10/2014 | $249,762 | $250,744 | $249,418 |

| 11/2014 | $250,953 | $252,522 | $250,556 |

| 12/2014 | $250,364 | $252,758 | $247,790 |

| 01/2015 | $251,856 | $258,059 | $248,426 |

| 02/2015 | $254,591 | $255,632 | $251,922 |

| 03/2015 | $257,077 | $256,819 | $252,914 |

| 04/2015 | $259,564 | $255,898 | $255,191 |

| 05/2015 | $261,553 | $255,282 | $255,700 |

| 06/2015 | $262,334 | $252,498 | $254,903 |

| 07/2015 | $263,863 | $254,253 | $255,130 |

| 08/2015 | $264,372 | $253,888 | $253,469 |

| 09/2015 | $263,353 | $255,605 | $251,775 |

| 10/2015 | $264,117 | $255,648 | $251,440 |

| 11/2015 | $263,099 | $254,973 | $249,203 |

| 12/2015 | $262,871 | $254,149 | $246,836 |

| 01/2016 | $262,400 | $257,646 | $245,044 |

| 02/2016 | $262,105 | $259,474 | $243,678 |

| 03/2016 | $266,562 | $261,854 | $250,114 |

| 04/2016 | $268,609 | $262,859 | $254,862 |

| 05/2016 | $271,161 | $262,927 | $257,186 |

| 06/2016 | $271,334 | $267,651 | $257,274 |

| 07/2016 | $274,576 | $269,343 | $260,890 |

| 08/2016 | $275,268 | $269,035 | $262,946 |

| 09/2016 | $277,912 | $268,878 | $265,243 |

| 10/2016 | $279,668 | $266,821 | $267,279 |

| 11/2016 | $280,406 | $260,510 | $268,150 |

| 12/2016 | $283,249 | $260,877 | $271,218 |

| 01/2017 | $285,023 | $261,389 | $272,664 |

| 02/2017 | $286,201 | $263,146 | $274,265 |

| 03/2017 | $287,114 | $263,008 | $274,479 |

| 04/2017 | $288,408 | $265,037 | $275,671 |

| 05/2017 | $289,308 | $267,077 | $276,723 |

| 06/2017 | $290,146 | $266,809 | $276,544 |

| 07/2017 | $292,505 | $267,957 | $278,712 |

| 08/2017 | $292,802 | $270,360 | $278,330 |

| 09/2017 | $294,208 | $269,073 | $279,462 |

| 10/2017 | $295,370 | $269,228 | $281,311 |

| 11/2017 | $296,260 | $268,883 | $281,648 |

| 12/2017 | $297,325 | $270,117 | $282,737 |

| 01/2018 | $300,314 | $267,006 | $285,786 |

| 02/2018 | $300,853 | $264,475 | $286,298 |

| 03/2018 | $301,523 | $266,171 | $287,210 |

| 04/2018 | $302,797 | $264,191 | $288,610 |

| 05/2018 | $303,015 | $266,077 | $289,168 |

| 06/2018 | $303,482 | $265,750 | $289,460 |

| 07/2018 | $305,492 | $265,813 | $291,858 |

| 08/2018 | $306,606 | $267,523 | $293,057 |

| 09/2018 | $308,473 | $265,800 | $295,055 |

| 10/2018 | $308,692 | $263,700 | $295,073 |

| 11/2018 | $306,795 | $265,274 | $292,666 |

| 12/2018 | $300,930 | $270,148 | $285,965 |

| 01/2019 | $305,582 | $273,016 | $292,545 |

| 02/2019 | $310,091 | $272,858 | $297,131 |

| 03/2019 | $310,216 | $278,098 | $296,771 |

| 04/2019 | $313,729 | $278,169 | $301,478 |

| 05/2019 | $312,896 | $283,107 | $300,798 |

| 06/2019 | $313,935 | $286,662 | $301,460 |

| 07/2019 | $314,725 | $287,293 | $303,820 |

| 08/2019 | $312,026 | $294,737 | $302,963 |

| 09/2019 | $312,387 | $293,167 | $304,241 |

| 10/2019 | $308,418 | $294,050 | $302,764 |

| 11/2019 | $308,155 | $293,900 | $304,431 |

| 12/2019 | $313,952 | $293,696 | $309,342 |

| 01/2020 | $315,983 | $299,348 | $310,986 |

| 02/2020 | $313,578 | $304,735 | $306,784 |

| 03/2020 | $264,133 | $302,942 | $268,545 |

| 04/2020 | $269,844 | $308,327 | $280,064 |

| 05/2020 | $281,351 | $309,763 | $290,711 |

| 06/2020 | $289,757 | $311,714 | $294,627 |

| 07/2020 | $295,088 | $316,370 | $300,169 |

| 08/2020 | $299,301 | $313,816 | $304,684 |

| 09/2020 | $301,942 | $313,644 | $306,781 |

| 10/2020 | $303,331 | $312,244 | $307,315 |

| 11/2020 | $309,944 | $315,308 | $313,859 |

| 12/2020 | $315,266 | $315,742 | $317,937 |

| 01/2021 | $318,520 | $313,478 | $321,962 |

| 02/2021 | $321,366 | $308,952 | $324,129 |

| 03/2021 | $322,570 | $305,094 | $324,323 |

| 04/2021 | $325,955 | $307,504 | $325,972 |

| 05/2021 | $328,238 | $308,509 | $327,663 |

| 06/2021 | $329,601 | $310,676 | $329,003 |

| 07/2021 | $329,318 | $314,150 | $328,991 |

| 08/2021 | $331,259 | $313,552 | $330,591 |

| 09/2021 | $333,194 | $310,837 | $332,732 |

| 10/2021 | $333,695 | $310,751 | $333,517 |

| 11/2021 | $332,641 | $311,671 | $333,008 |

| 12/2021 | $334,490 | $310,873 | $335,104 |

| 01/2022 | $335,639 | $304,176 | $336,305 |

| 02/2022 | $332,657 | $300,782 | $334,637 |

| 03/2022 | $332,125 | $292,426 | $334,769 |

| 04/2022 | $331,458 | $281,329 | $335,343 |

| 05/2022 | $320,513 | $283,143 | $326,923 |

| 06/2022 | $310,846 | $278,701 | $320,198 |

| 07/2022 | $314,994 | $285,511 | $326,174 |

| 08/2022 | $318,418 | $277,443 | $331,178 |

| 09/2022 | $310,059 | $265,456 | $324,006 |

| 10/2022 | $311,378 | $262,018 | $326,759 |

| 11/2022 | $314,950 | $271,654 | $330,385 |

| 12/2022 | $316,120 | $270,428 | $331,563 |

| 01/2023 | $322,361 | $278,748 | $340,070 |

| 02/2023 | $324,971 | $271,541 | $342,211 |

| 03/2023 | $322,941 | $278,438 | $341,878 |

| 04/2023 | $326,106 | $280,126 | $345,117 |

| 05/2023 | $325,526 | $277,076 | $344,822 |

| 06/2023 | $330,096 | $276,088 | $352,539 |

| 07/2023 | $333,316 | $275,895 | $357,127 |

| 08/2023 | $336,489 | $274,133 | $361,250 |

| 09/2023 | $338,800 | $267,167 | $364,420 |

| 10/2023 | $341,519 | $262,950 | $364,531 |

| 11/2023 | $345,748 | $274,859 | $368,882 |

| 12/2023 | $349,888 | $285,380 | $374,810 |

| 01/2024 | $351,442 | $284,596 | $377,743 |

| 02/2024 | $351,843 | $280,575 | $381,109 |

| 03/2024 | $356,228 | $283,166 | $384,273 |

| 04/2024 | $357,628 | $276,014 | $386,882 |

| 05/2024 | $360,941 | $280,693 | $390,399 |

| 06/2024 | $360,878 | $283,350 | $391,459 |

| 07/2024 | $360,348 | $289,969 | $394,334 |

| 08/2024 | $366,452 | $294,136 | $396,682 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

Class R5Footnote Reference1 | 8.90% | 3.27% | 3.90% |

| Bloomberg US Aggregate Bond Index | 7.30% | (0.04)% | 1.64% |

| Credit Suisse Leveraged Loan Index | 9.81% | 5.54% | 4.73% |

| Footnote | Description |

Footnote1 | Return may differ from actual shareholder return due to accounting adjustments for financial reporting purposes. |

Performance shown is historical and is not indicative of future returns. Investment returns and principal value will vary, and shares may be worth more or less at redemption than at original purchase. Performance shown is as of date indicated, and current performance may be lower or higher than the performance data quoted. To obtain performance as of the most recent month end, please visit americanbeaconfunds.com or call 800-967-9009. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. The Fund's performance benefited from fee waivers. For more information, visit americanbeaconfunds.com/Performance_Disclaimers.aspx.

| Total Net Assets | $133,778,638 |

| # of Portfolio Holdings | 198 |

| Portfolio Turnover Rate | 128% |

| Total Management Fees Paid | $904,490 |

What did the Fund invest in?

Top Ten Holdings - % Net Assets

| Invesco Senior Loan ETF | 3.8 |

| Alvogen Pharma U.S., Inc., 12.985%, Due 6/30/2025 | 3.2 |

| Stats Intermediate Holdings LLC, 10.640%, Due 7/10/2026 | 3.2 |

| CMG Media Corp., 8.935%, Due 12/17/2026 | 3.2 |

| Banff Merger Sub, Inc., 9.005%, Due 7/30/2031 | 2.1 |

| United Airlines, Inc., 4.375%, Due 4/15/2026 | 1.8 |

| Pretium Packaging LLC, 9.848%, Due 10/2/2028 | 1.8 |

| ADT Security Corp., 4.125%, Due 8/1/2029 | 1.8 |

| Panther Escrow Issuer LLC, 7.125%, Due 6/1/2031 | 1.6 |

| AlixPartners LLP, 7.861%, Due 2/4/2028 | 1.5 |

Asset Allocation - % Investments

| Value | Value |

|---|

| Bank Loan Obligations | 84.1 |

| Corporate Obligations | 11.5 |

| Exchange-Traded Instruments | 4.0 |

| Common Stocks | 0.4 |

| Preferred Stocks | 0.0 |

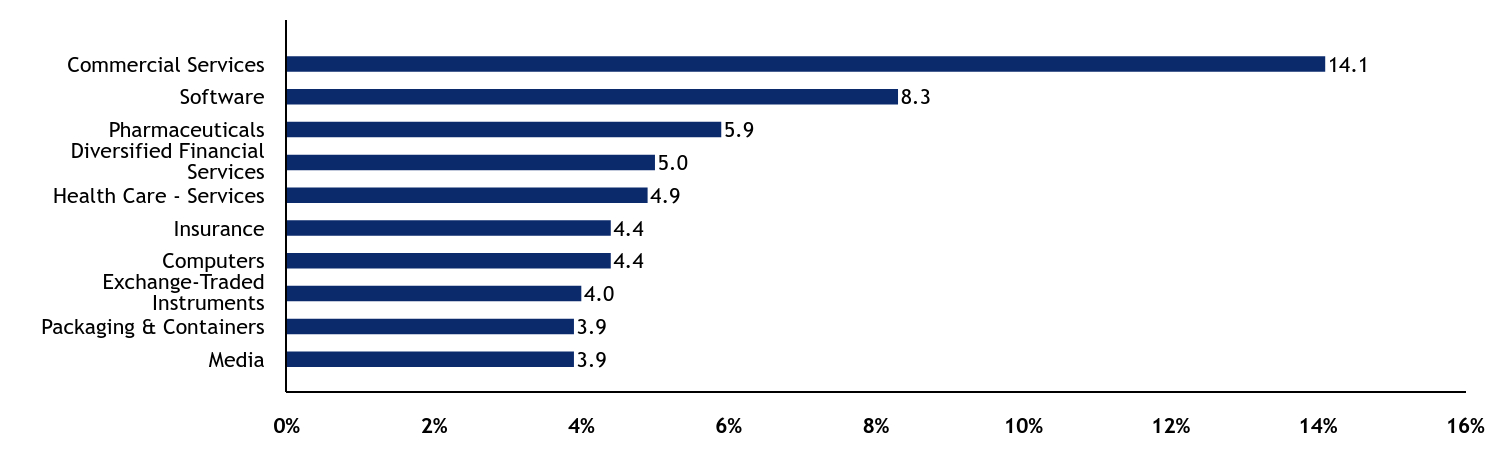

Top Ten Industry Allocations - % Investments

| Value | Value |

|---|

| Media | 3.9 |

| Packaging & Containers | 3.9 |

| Exchange-Traded Instruments | 4.0 |

| Computers | 4.4 |

| Insurance | 4.4 |

| Health Care - Services | 4.9 |

| Diversified Financial Services | 5.0 |

| Pharmaceuticals | 5.9 |

| Software | 8.3 |

| Commercial Services | 14.1 |

This is a summary of certain changes to the Fund since August 31, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by January 1, 2025 at www.americanbeaconfunds.com/literature or upon request at 800-658-5811.

Disclosed in a Supplement dated October 23, 2024 to the Prospectus and Summary Prospectus, each dated January 1, 2024, the Board of Trustees of the American Beacon Funds has approved a change to the non-fundamental policy of the American Beacon FEAC Floating Rate Income Fund (the “Fund”) with respect to the investment of at least 80% of its net assets (plus the amount of any borrowings for investment purposes), effective January 1, 2025.

For additional information about the Fund, including its prospectus, financial statements, holdings, and proxy voting information, please visit www.americanbeaconfunds.com/literature or call 1-800-658-5811.

If your financial institution mailed only one copy of this Report to an address shared by more than one account, you can request an individual copy by contacting your financial institution.

Distributed by Resolute Investment Distributors, Inc.

FEAC Floating Rate Income Fund

Annual Shareholder Report - August 31, 2024

FEAC Floating Rate Income Fund

Annual Shareholder Report - August 31, 2024

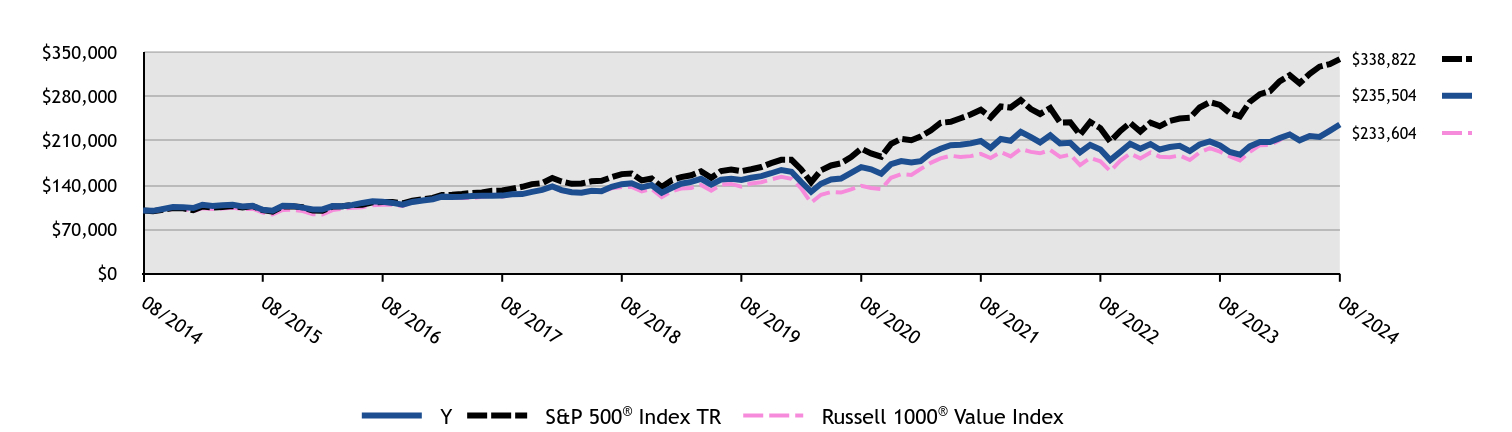

This annual shareholder report contains important information about American Beacon FEAC Floating Rate Income Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at www.americanbeaconfunds.com/literature. You can also request this information by contacting us at 800-658-5811. This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Y | $93 | 0.89% |

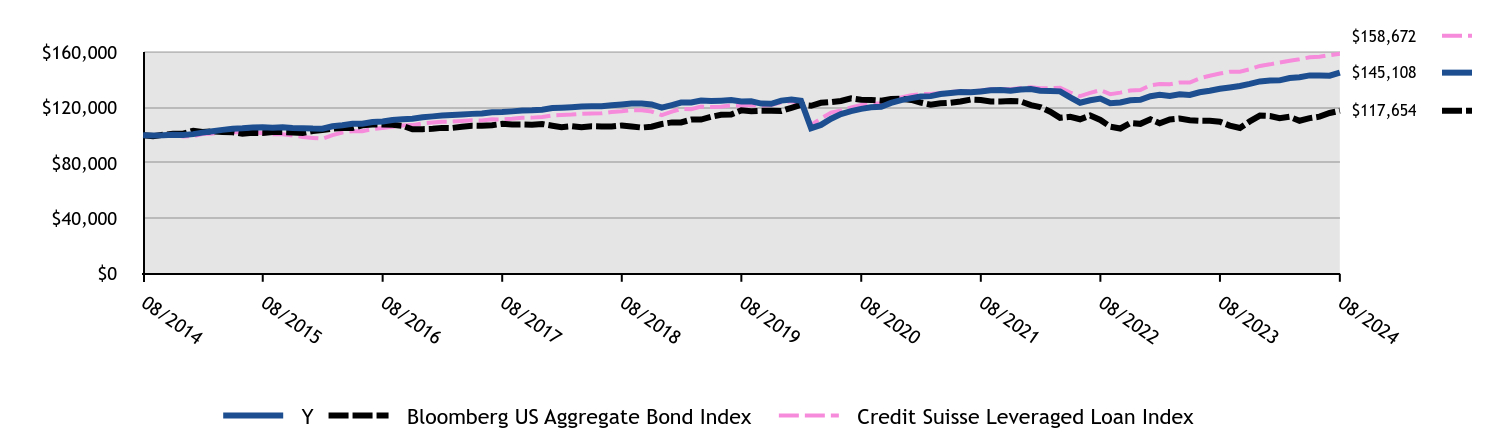

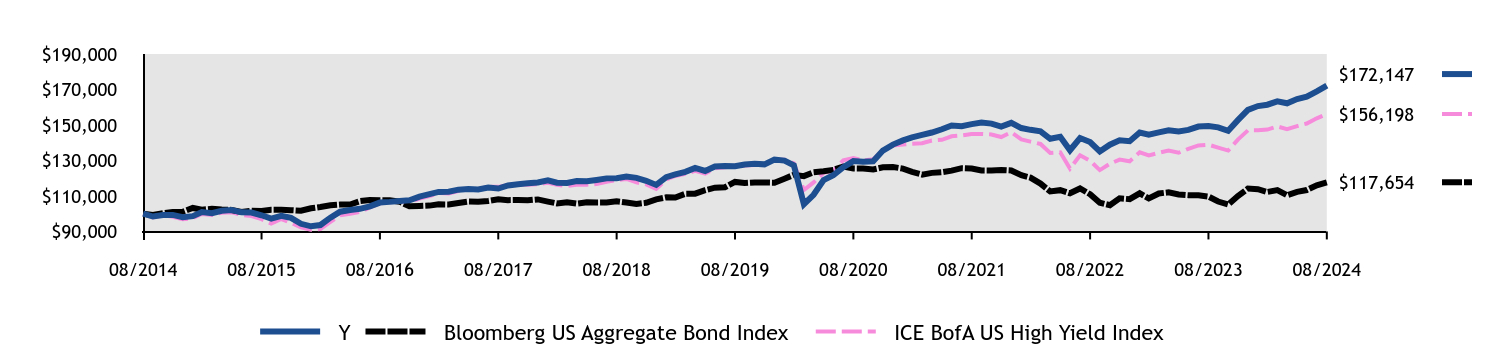

How did the Fund perform and what affected its performance?

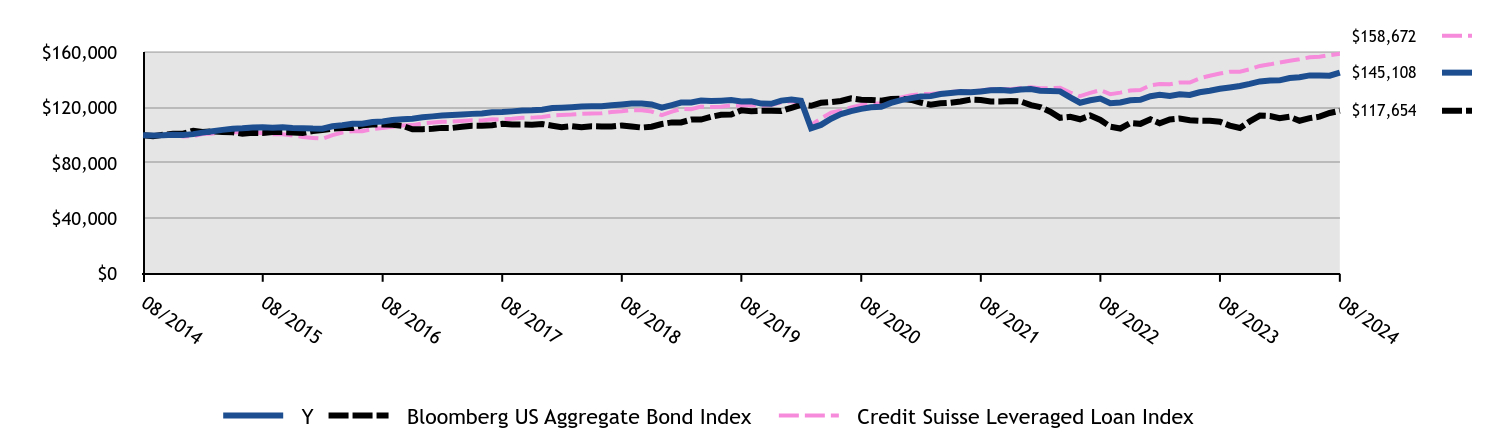

The Y Class of the Fund returned 8.70% for the twelve months ended August 31, 2024, compared to the Bloomberg U.S. Aggregate Bond Index return of 7.30% and the Credit Suisse Leveraged Loan Index return of 9.81%.

• The Fund provided a high level of current income and solid risk-adjusted returns against a backdrop of growing optimism of interest rate cuts from the Federal Reserve Bank, which caused market yields to decline.

• Services, Information Technology, and Diversified Media were the Fund’s largest industry exposures as the Fund sought defensive positions in a potentially weakening credit environment. However, the Fund’s positioning in Information Technology, Diversified Media and Health Care detracted from performance due primarily to security selection.

• The Fund’s overall credit quality allocation tended toward the upper range of non-investment grade ratings, which slightly detracted from performance.

• The Bloomberg US Aggregate Bond Index has been added since the last Shareholder Report to comply with a new regulatory requirement.

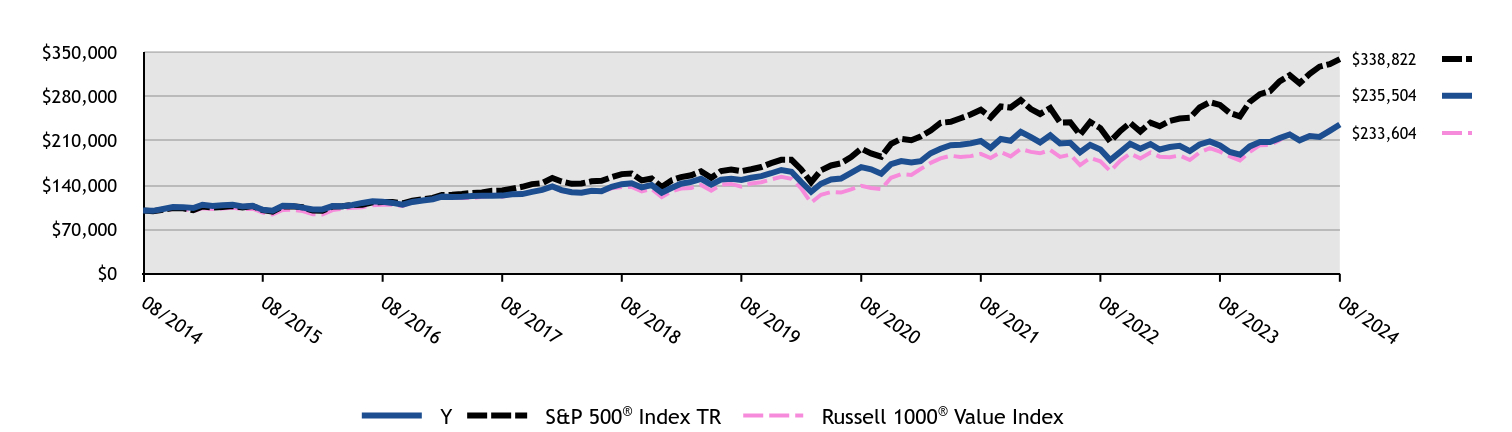

Cumulative Performance from August 31, 2014 through August 31, 2024

The initial investment, based on a $100,000 investment, is adjusted to reflect the maximum applicable sales charge, if any.

| Y | Bloomberg US Aggregate Bond Index | Credit Suisse Leveraged Loan Index |

|---|

| 08/2014 | $100,000 | $100,000 | $100,000 |

| 09/2014 | $99,809 | $99,321 | $99,483 |

| 10/2014 | $99,905 | $100,297 | $99,767 |

| 11/2014 | $100,381 | $101,009 | $100,222 |

| 12/2014 | $100,146 | $101,103 | $99,116 |

| 01/2015 | $100,742 | $103,223 | $99,370 |

| 02/2015 | $101,836 | $102,253 | $100,769 |

| 03/2015 | $102,831 | $102,728 | $101,165 |

| 04/2015 | $103,825 | $102,359 | $102,076 |

| 05/2015 | $104,621 | $102,113 | $102,280 |

| 06/2015 | $104,934 | $100,999 | $101,961 |

| 07/2015 | $105,545 | $101,701 | $102,052 |

| 08/2015 | $105,749 | $101,555 | $101,388 |

| 09/2015 | $105,341 | $102,242 | $100,710 |

| 10/2015 | $105,647 | $102,259 | $100,576 |

| 11/2015 | $105,239 | $101,989 | $99,681 |

| 12/2015 | $105,043 | $101,659 | $98,734 |

| 01/2016 | $104,742 | $103,058 | $98,017 |

| 02/2016 | $104,614 | $103,789 | $97,471 |

| 03/2016 | $106,384 | $104,742 | $100,045 |

| 04/2016 | $107,190 | $105,144 | $101,945 |

| 05/2016 | $108,199 | $105,171 | $102,874 |

| 06/2016 | $108,258 | $107,060 | $102,909 |

| 07/2016 | $109,544 | $107,737 | $104,356 |

| 08/2016 | $109,839 | $107,614 | $105,178 |

| 09/2016 | $110,884 | $107,551 | $106,097 |

| 10/2016 | $111,571 | $106,728 | $106,912 |

| 11/2016 | $111,851 | $104,204 | $107,260 |

| 12/2016 | $112,972 | $104,351 | $108,487 |

| 01/2017 | $113,564 | $104,556 | $109,065 |

| 02/2017 | $114,140 | $105,258 | $109,706 |

| 03/2017 | $114,502 | $105,203 | $109,791 |

| 04/2017 | $114,901 | $106,015 | $110,268 |

| 05/2017 | $115,364 | $106,831 | $110,689 |

| 06/2017 | $115,691 | $106,723 | $110,617 |

| 07/2017 | $116,513 | $107,183 | $111,485 |

| 08/2017 | $116,723 | $108,144 | $111,332 |

| 09/2017 | $117,163 | $107,629 | $111,785 |

| 10/2017 | $117,741 | $107,691 | $112,524 |

| 11/2017 | $117,984 | $107,553 | $112,659 |

| 12/2017 | $118,403 | $108,047 | $113,095 |

| 01/2018 | $119,591 | $106,802 | $114,314 |

| 02/2018 | $119,803 | $105,790 | $114,519 |

| 03/2018 | $120,183 | $106,468 | $114,884 |

| 04/2018 | $120,689 | $105,677 | $115,444 |

| 05/2018 | $120,775 | $106,431 | $115,667 |

| 06/2018 | $120,840 | $106,300 | $115,784 |

| 07/2018 | $121,636 | $106,325 | $116,743 |

| 08/2018 | $122,184 | $107,009 | $117,222 |

| 09/2018 | $122,808 | $106,320 | $118,022 |

| 10/2018 | $122,895 | $105,480 | $118,029 |

| 11/2018 | $122,134 | $106,110 | $117,066 |

| 12/2018 | $119,874 | $108,059 | $114,386 |

| 01/2019 | $121,719 | $109,207 | $117,018 |

| 02/2019 | $123,508 | $109,143 | $118,852 |

| 03/2019 | $123,553 | $111,239 | $118,708 |

| 04/2019 | $124,945 | $111,268 | $120,591 |

| 05/2019 | $124,600 | $113,243 | $120,319 |

| 06/2019 | $124,886 | $114,665 | $120,584 |

| 07/2019 | $125,321 | $114,917 | $121,528 |

| 08/2019 | $124,238 | $117,895 | $121,185 |

| 09/2019 | $124,376 | $117,267 | $121,696 |

| 10/2019 | $122,773 | $117,620 | $121,105 |

| 11/2019 | $122,663 | $117,560 | $121,772 |

| 12/2019 | $124,949 | $117,478 | $123,736 |

| 01/2020 | $125,770 | $119,739 | $124,394 |

| 02/2020 | $124,811 | $121,894 | $122,713 |

| 03/2020 | $105,016 | $121,177 | $107,418 |

| 04/2020 | $107,411 | $123,331 | $112,026 |

| 05/2020 | $111,849 | $123,905 | $116,284 |

| 06/2020 | $115,184 | $124,686 | $117,850 |

| 07/2020 | $117,295 | $126,548 | $120,067 |

| 08/2020 | $118,963 | $125,527 | $121,873 |

| 09/2020 | $120,141 | $125,458 | $122,712 |

| 10/2020 | $120,548 | $124,898 | $122,926 |

| 11/2020 | $123,306 | $126,123 | $125,543 |

| 12/2020 | $125,274 | $126,297 | $127,175 |

| 01/2021 | $126,699 | $125,391 | $128,785 |

| 02/2021 | $127,825 | $123,581 | $129,651 |

| 03/2021 | $128,158 | $122,038 | $129,729 |

| 04/2021 | $129,636 | $123,002 | $130,389 |

| 05/2021 | $130,397 | $123,403 | $131,065 |

| 06/2021 | $131,072 | $124,271 | $131,601 |

| 07/2021 | $130,953 | $125,660 | $131,596 |

| 08/2021 | $131,577 | $125,421 | $132,236 |

| 09/2021 | $132,339 | $124,335 | $133,093 |

| 10/2021 | $132,531 | $124,301 | $133,407 |

| 11/2021 | $132,103 | $124,668 | $133,203 |

| 12/2021 | $132,974 | $124,349 | $134,041 |

| 01/2022 | $133,279 | $121,670 | $134,522 |

| 02/2022 | $132,090 | $120,313 | $133,854 |

| 03/2022 | $131,872 | $116,970 | $133,907 |

| 04/2022 | $131,600 | $112,532 | $134,137 |

| 05/2022 | $127,249 | $113,257 | $130,769 |

| 06/2022 | $123,406 | $111,480 | $128,079 |

| 07/2022 | $125,198 | $114,204 | $130,469 |

| 08/2022 | $126,406 | $110,977 | $132,471 |

| 09/2022 | $123,081 | $106,182 | $129,602 |

| 10/2022 | $123,599 | $104,807 | $130,703 |

| 11/2022 | $125,161 | $108,661 | $132,154 |

| 12/2022 | $125,470 | $108,171 | $132,625 |

| 01/2023 | $128,094 | $111,499 | $136,028 |

| 02/2023 | $129,112 | $108,616 | $136,884 |

| 03/2023 | $128,301 | $111,375 | $136,751 |

| 04/2023 | $129,554 | $112,050 | $138,046 |

| 05/2023 | $129,003 | $110,830 | $137,929 |

| 06/2023 | $130,968 | $110,435 | $141,015 |

| 07/2023 | $132,079 | $110,358 | $142,851 |

| 08/2023 | $133,492 | $109,653 | $144,500 |

| 09/2023 | $134,402 | $106,867 | $145,768 |

| 10/2023 | $135,460 | $105,180 | $145,812 |

| 11/2023 | $136,964 | $109,943 | $147,552 |

| 12/2023 | $138,762 | $114,152 | $149,923 |

| 01/2024 | $139,373 | $113,838 | $151,097 |

| 02/2024 | $139,526 | $112,230 | $152,443 |

| 03/2024 | $141,259 | $113,266 | $153,709 |

| 04/2024 | $141,806 | $110,406 | $154,752 |

| 05/2024 | $143,113 | $112,277 | $156,159 |

| 06/2024 | $143,080 | $113,340 | $156,583 |

| 07/2024 | $142,880 | $115,987 | $157,733 |

| 08/2024 | $145,108 | $117,654 | $158,672 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

Class YFootnote Reference1 | 8.70% | 3.15% | 3.79% |

| Bloomberg US Aggregate Bond Index | 7.30% | (0.04)% | 1.64% |

| Credit Suisse Leveraged Loan Index | 9.81% | 5.54% | 4.73% |

| Footnote | Description |

Footnote1 | Return may differ from actual shareholder return due to accounting adjustments for financial reporting purposes. |

Performance shown is historical and is not indicative of future returns. Investment returns and principal value will vary, and shares may be worth more or less at redemption than at original purchase. Performance shown is as of date indicated, and current performance may be lower or higher than the performance data quoted. To obtain performance as of the most recent month end, please visit americanbeaconfunds.com or call 800-967-9009. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance includes historical performance of another Class of the Fund. The Fund's performance benefited from fee waivers. For more information, visit americanbeaconfunds.com/Performance_Disclaimers.aspx.

| Total Net Assets | $133,778,638 |

| # of Portfolio Holdings | 198 |

| Portfolio Turnover Rate | 128% |

| Total Management Fees Paid | $904,490 |

What did the Fund invest in?

Top Ten Holdings - % Net Assets

| Invesco Senior Loan ETF | 3.8 |

| Alvogen Pharma U.S., Inc., 12.985%, Due 6/30/2025 | 3.2 |

| Stats Intermediate Holdings LLC, 10.640%, Due 7/10/2026 | 3.2 |

| CMG Media Corp., 8.935%, Due 12/17/2026 | 3.2 |

| Banff Merger Sub, Inc., 9.005%, Due 7/30/2031 | 2.1 |

| United Airlines, Inc., 4.375%, Due 4/15/2026 | 1.8 |

| Pretium Packaging LLC, 9.848%, Due 10/2/2028 | 1.8 |

| ADT Security Corp., 4.125%, Due 8/1/2029 | 1.8 |

| Panther Escrow Issuer LLC, 7.125%, Due 6/1/2031 | 1.6 |

| AlixPartners LLP, 7.861%, Due 2/4/2028 | 1.5 |

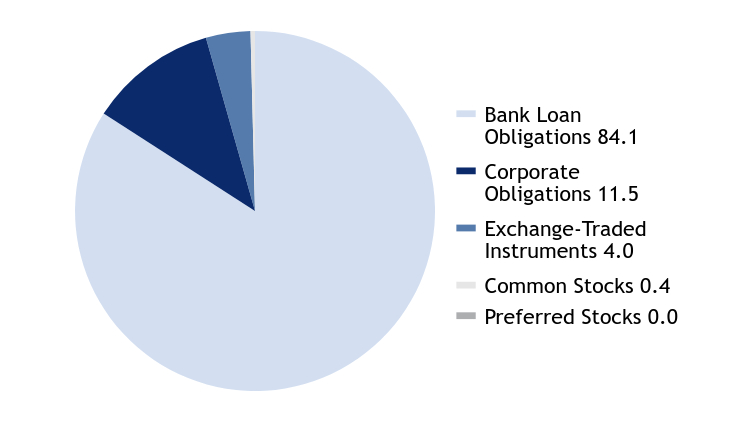

Asset Allocation - % Investments

| Value | Value |

|---|

| Bank Loan Obligations | 84.1 |

| Corporate Obligations | 11.5 |

| Exchange-Traded Instruments | 4.0 |

| Common Stocks | 0.4 |

| Preferred Stocks | 0.0 |

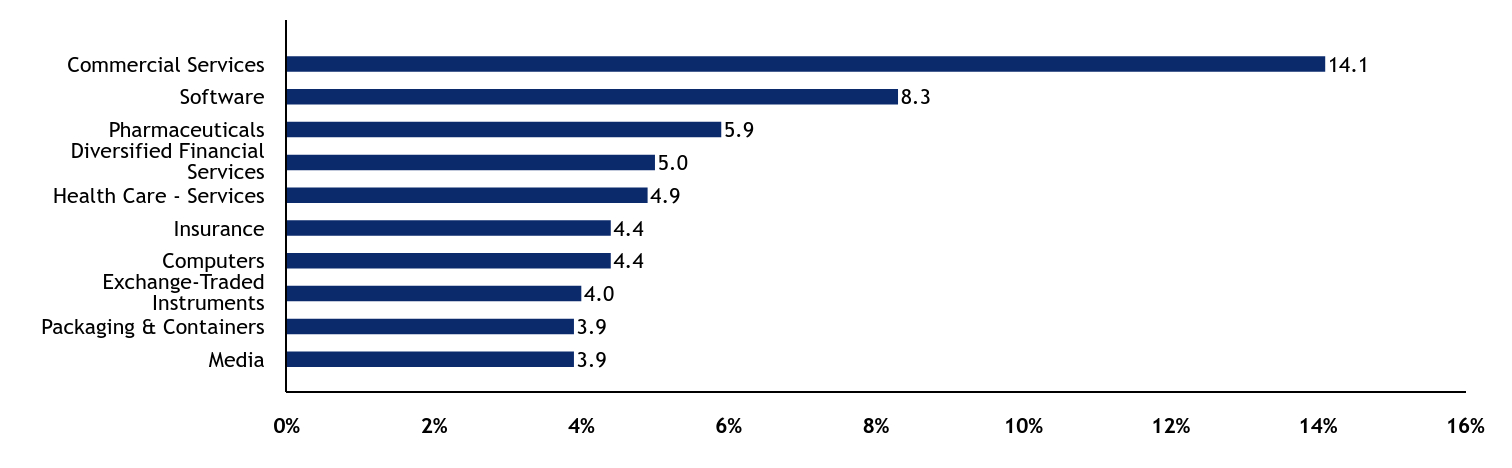

Top Ten Industry Allocations - % Investments

| Value | Value |

|---|

| Media | 3.9 |

| Packaging & Containers | 3.9 |

| Exchange-Traded Instruments | 4.0 |

| Computers | 4.4 |

| Insurance | 4.4 |

| Health Care - Services | 4.9 |

| Diversified Financial Services | 5.0 |

| Pharmaceuticals | 5.9 |

| Software | 8.3 |

| Commercial Services | 14.1 |

This is a summary of certain changes to the Fund since August 31, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by January 1, 2025 at www.americanbeaconfunds.com/literature or upon request at 800-658-5811.

Disclosed in a Supplement dated October 23, 2024 to the Prospectus and Summary Prospectus, each dated January 1, 2024, the Board of Trustees of the American Beacon Funds has approved a change to the non-fundamental policy of the American Beacon FEAC Floating Rate Income Fund (the “Fund”) with respect to the investment of at least 80% of its net assets (plus the amount of any borrowings for investment purposes), effective January 1, 2025.

For additional information about the Fund, including its prospectus, financial statements, holdings, and proxy voting information, please visit www.americanbeaconfunds.com/literature or call 1-800-658-5811.

If your financial institution mailed only one copy of this Report to an address shared by more than one account, you can request an individual copy by contacting your financial institution.

Distributed by Resolute Investment Distributors, Inc.

FEAC Floating Rate Income Fund

Annual Shareholder Report - August 31, 2024

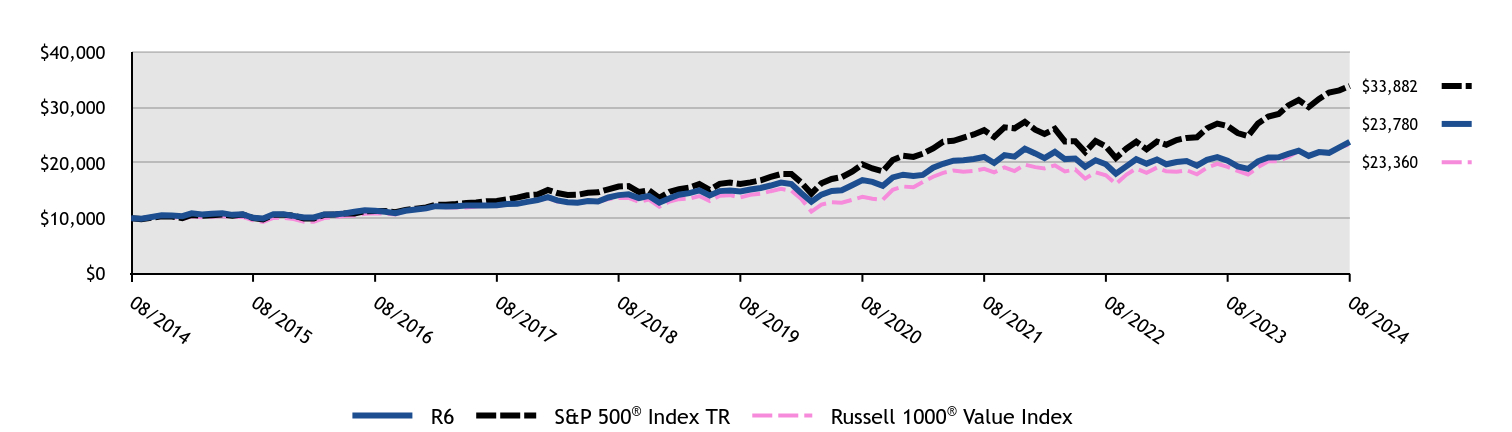

SiM High Yield Opportunities Fund

Annual Shareholder Report - August 31, 2024

This annual shareholder report contains important information about American Beacon SiM High Yield Opportunities Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at www.americanbeaconfunds.com/literature. You can also request this information by contacting us at 800-658-5811. This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $115 | 1.07% |

How did the Fund perform and what affected its performance?

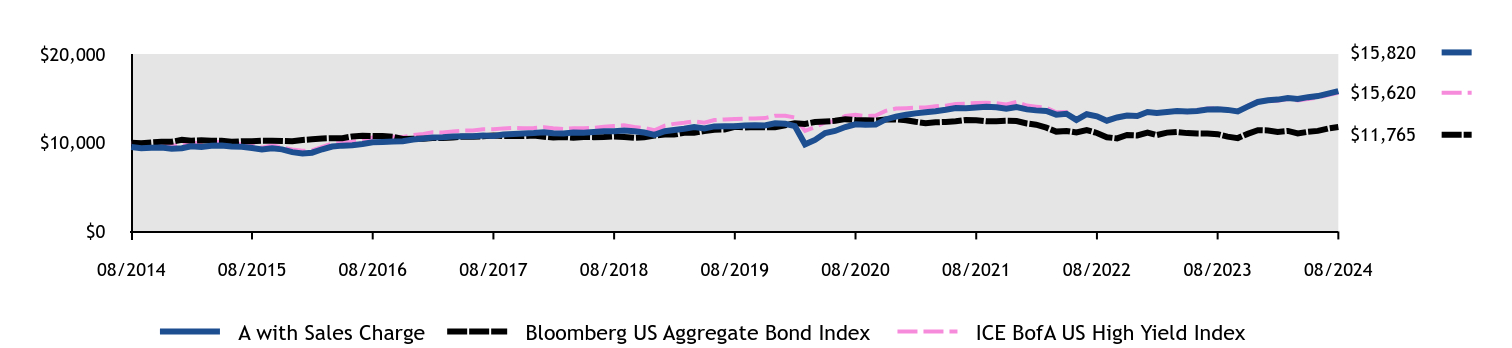

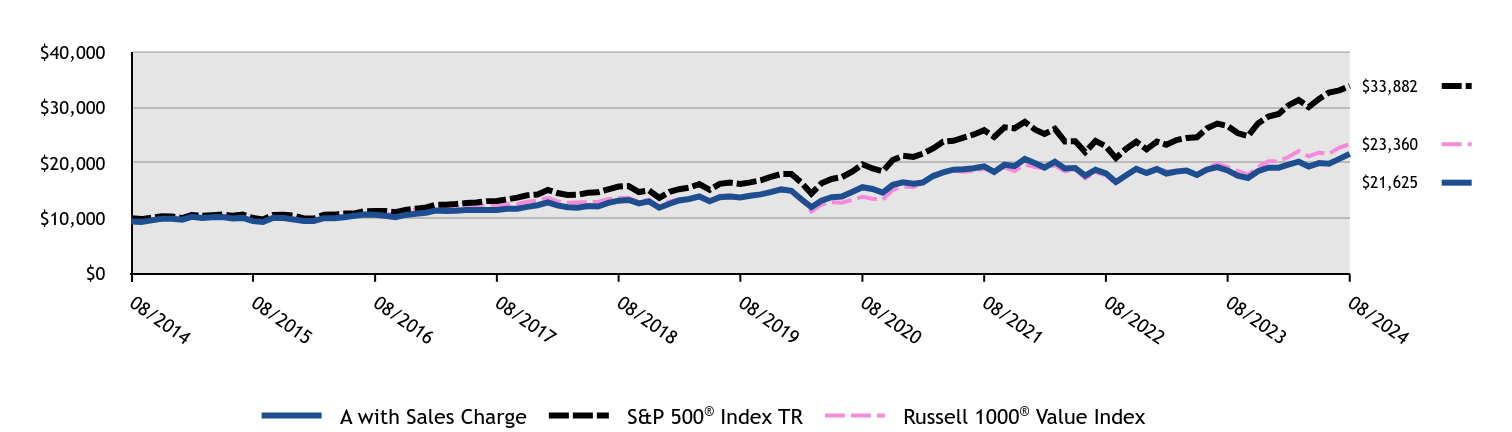

The A Class of the Fund returned 9.48% (with sales charges) and 14.91% (without sales charges) for the twelve months ended August 31, 2024, compared to the Bloomberg U.S. Aggregate Bond Index return of 7.30% and the ICE BofA U.S. High Yield Index return of 12.47%.

• As volatility of yields was high in the fixed income market during the last twelve months, the high yield market benefitted from ‘risk-on’ sentiment buoyed by the continued strength of the US economy.

• The Fund’s index agnostic and high conviction strategy within the high yield universe offered attractive yield and strong risk adjusted returns.

• The Fund’s holdings in Industrials, higher-rated securities, and short-term maturities contributed the most to performance.

• The Bloomberg US Aggregate Bond Index has been added since the last Shareholder Report to comply with a new regulatory requirement.

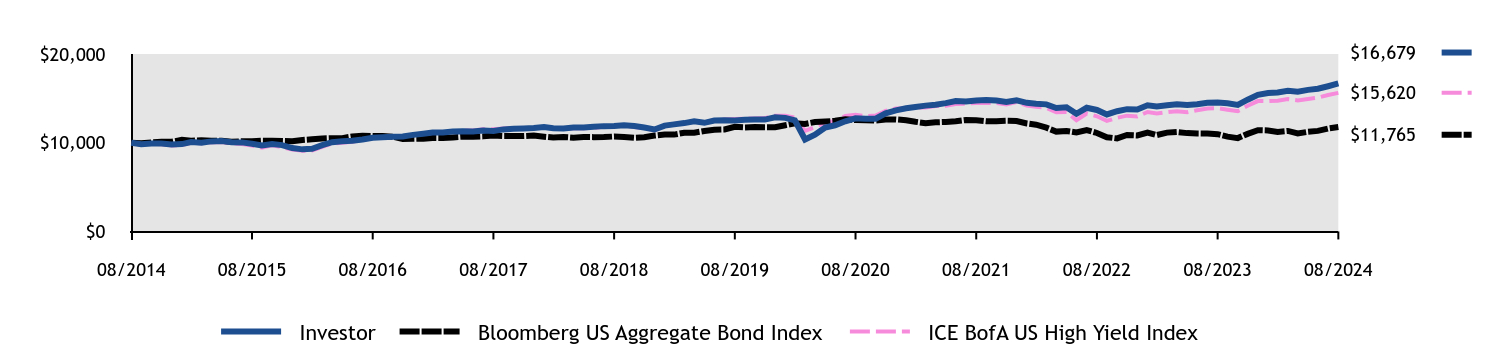

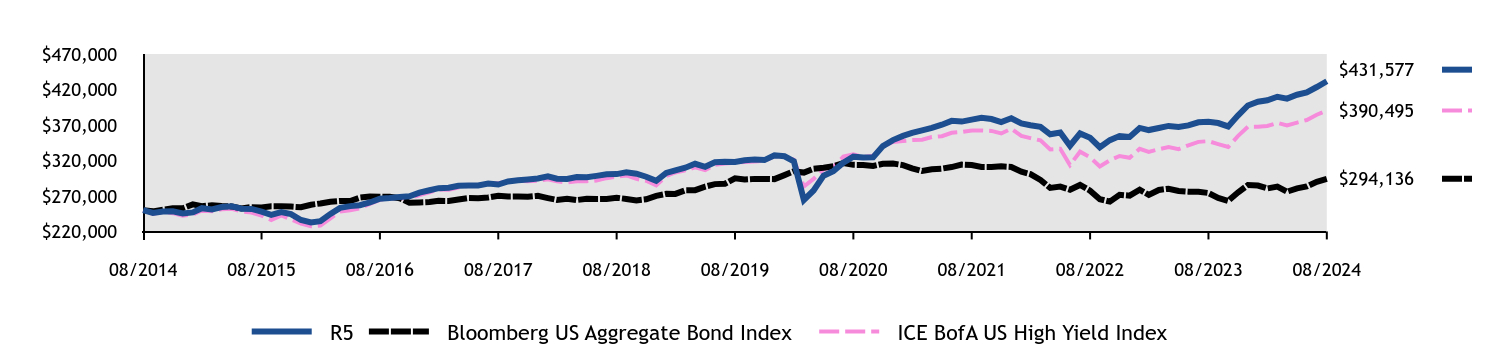

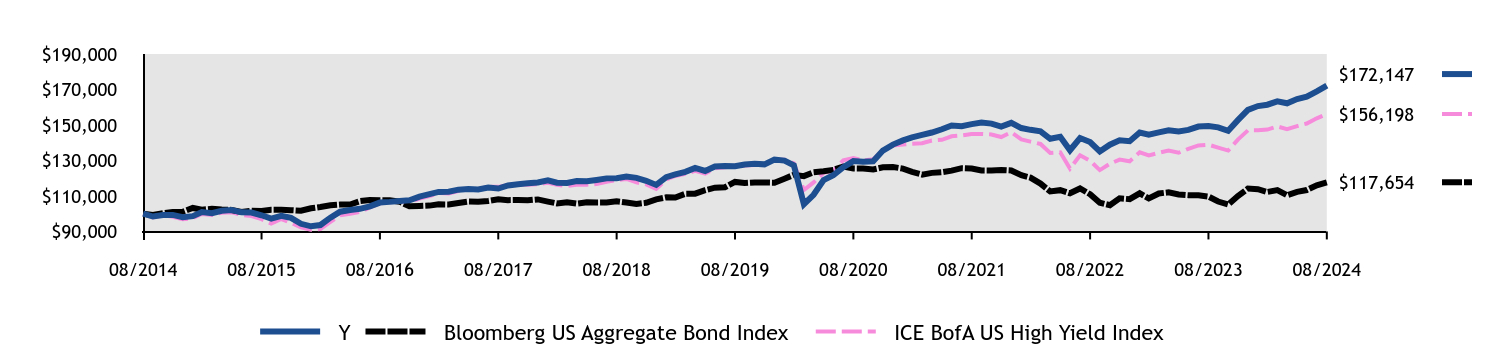

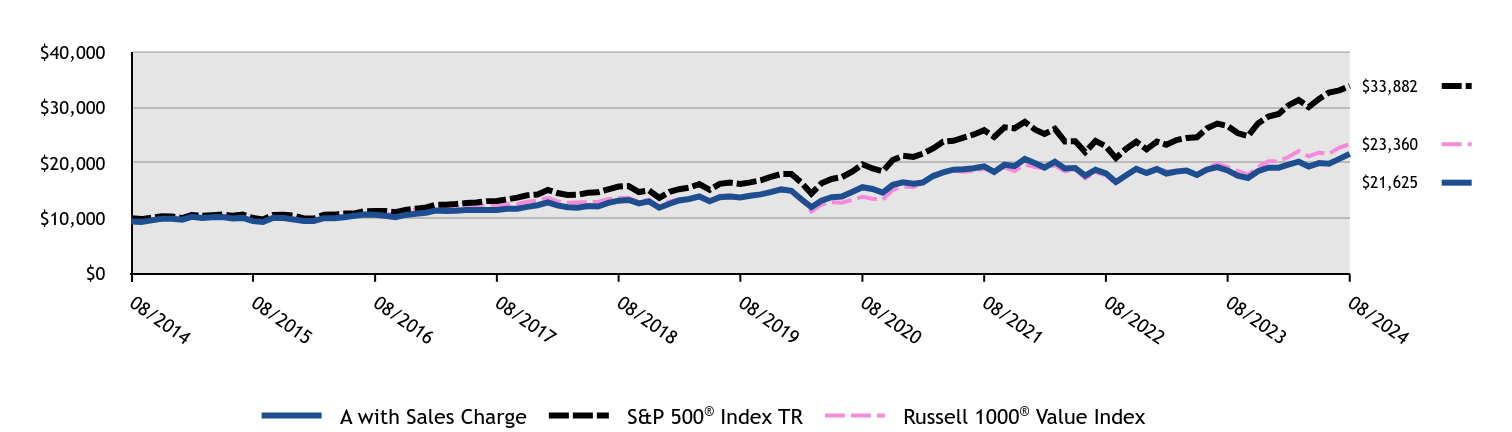

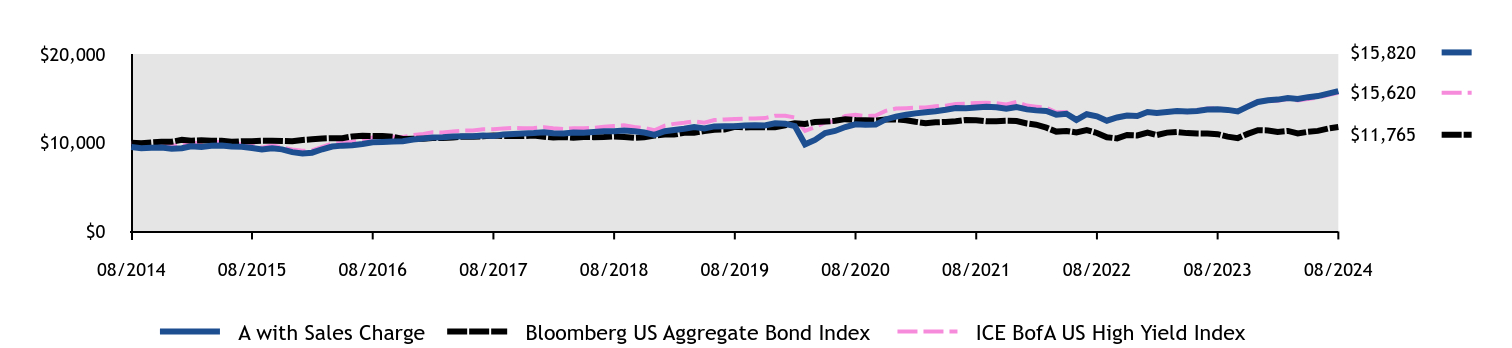

Cumulative Performance from August 31, 2014 through August 31, 2024

The initial investment, based on a $10,000 investment, is adjusted to reflect the maximum applicable sales charge, if any.

| A with Sales Charge | Bloomberg US Aggregate Bond Index | ICE BofA US High Yield Index |

|---|

| 08/2014 | $9,522 | $10,000 | $10,000 |

| 09/2014 | $9,368 | $9,932 | $9,790 |

| 10/2014 | $9,437 | $10,030 | $9,902 |

| 11/2014 | $9,449 | $10,101 | $9,831 |

| 12/2014 | $9,318 | $10,110 | $9,686 |

| 01/2015 | $9,378 | $10,322 | $9,753 |

| 02/2015 | $9,600 | $10,225 | $9,985 |

| 03/2015 | $9,525 | $10,273 | $9,932 |

| 04/2015 | $9,653 | $10,236 | $10,051 |

| 05/2015 | $9,697 | $10,211 | $10,081 |

| 06/2015 | $9,562 | $10,100 | $9,927 |

| 07/2015 | $9,555 | $10,170 | $9,866 |

| 08/2015 | $9,400 | $10,156 | $9,693 |

| 09/2015 | $9,232 | $10,224 | $9,441 |

| 10/2015 | $9,368 | $10,226 | $9,698 |

| 11/2015 | $9,251 | $10,199 | $9,481 |

| 12/2015 | $8,935 | $10,166 | $9,236 |

| 01/2016 | $8,799 | $10,306 | $9,090 |

| 02/2016 | $8,875 | $10,379 | $9,132 |

| 03/2016 | $9,263 | $10,474 | $9,536 |

| 04/2016 | $9,568 | $10,514 | $9,917 |

| 05/2016 | $9,671 | $10,517 | $9,989 |

| 06/2016 | $9,719 | $10,706 | $10,097 |

| 07/2016 | $9,860 | $10,774 | $10,352 |

| 08/2016 | $10,046 | $10,761 | $10,583 |

| 09/2016 | $10,092 | $10,755 | $10,651 |

| 10/2016 | $10,140 | $10,673 | $10,684 |

| 11/2016 | $10,164 | $10,420 | $10,642 |

| 12/2016 | $10,354 | $10,435 | $10,852 |

| 01/2017 | $10,479 | $10,456 | $10,997 |

| 02/2017 | $10,599 | $10,526 | $11,169 |

| 03/2017 | $10,608 | $10,520 | $11,145 |

| 04/2017 | $10,712 | $10,601 | $11,272 |

| 05/2017 | $10,738 | $10,683 | $11,372 |

| 06/2017 | $10,721 | $10,672 | $11,384 |

| 07/2017 | $10,825 | $10,718 | $11,516 |

| 08/2017 | $10,762 | $10,814 | $11,513 |

| 09/2017 | $10,934 | $10,763 | $11,616 |

| 10/2017 | $10,992 | $10,769 | $11,661 |

| 11/2017 | $11,033 | $10,755 | $11,630 |

| 12/2017 | $11,089 | $10,805 | $11,664 |

| 01/2018 | $11,185 | $10,680 | $11,738 |

| 02/2018 | $11,060 | $10,579 | $11,629 |

| 03/2018 | $11,045 | $10,647 | $11,557 |

| 04/2018 | $11,143 | $10,568 | $11,634 |

| 05/2018 | $11,134 | $10,643 | $11,632 |

| 06/2018 | $11,202 | $10,630 | $11,672 |

| 07/2018 | $11,293 | $10,633 | $11,803 |

| 08/2018 | $11,301 | $10,701 | $11,888 |

| 09/2018 | $11,390 | $10,632 | $11,957 |

| 10/2018 | $11,303 | $10,548 | $11,762 |

| 11/2018 | $11,143 | $10,611 | $11,655 |

| 12/2018 | $10,884 | $10,806 | $11,399 |

| 01/2019 | $11,294 | $10,921 | $11,923 |

| 02/2019 | $11,444 | $10,914 | $12,124 |

| 03/2019 | $11,566 | $11,124 | $12,243 |

| 04/2019 | $11,770 | $11,127 | $12,414 |

| 05/2019 | $11,609 | $11,324 | $12,257 |

| 06/2019 | $11,841 | $11,466 | $12,557 |

| 07/2019 | $11,866 | $11,492 | $12,621 |

| 08/2019 | $11,849 | $11,789 | $12,671 |

| 09/2019 | $11,944 | $11,727 | $12,711 |

| 10/2019 | $11,977 | $11,762 | $12,740 |

| 11/2019 | $11,944 | $11,756 | $12,775 |

| 12/2019 | $12,196 | $11,748 | $13,042 |

| 01/2020 | $12,139 | $11,974 | $13,043 |

| 02/2020 | $11,870 | $12,189 | $12,841 |

| 03/2020 | $9,818 | $12,118 | $11,331 |

| 04/2020 | $10,313 | $12,333 | $11,761 |

| 05/2020 | $11,091 | $12,391 | $12,299 |

| 06/2020 | $11,326 | $12,469 | $12,419 |

| 07/2020 | $11,765 | $12,655 | $13,012 |

| 08/2020 | $12,078 | $12,553 | $13,141 |

| 09/2020 | $12,031 | $12,546 | $13,004 |

| 10/2020 | $12,045 | $12,490 | $13,064 |

| 11/2020 | $12,624 | $12,612 | $13,587 |

| 12/2020 | $12,936 | $12,630 | $13,846 |

| 01/2021 | $13,153 | $12,539 | $13,897 |

| 02/2021 | $13,306 | $12,358 | $13,948 |

| 03/2021 | $13,439 | $12,204 | $13,972 |

| 04/2021 | $13,557 | $12,300 | $14,125 |

| 05/2021 | $13,723 | $12,340 | $14,166 |

| 06/2021 | $13,921 | $12,427 | $14,359 |

| 07/2021 | $13,880 | $12,566 | $14,410 |

| 08/2021 | $13,981 | $12,542 | $14,489 |

| 09/2021 | $14,053 | $12,433 | $14,494 |

| 10/2021 | $13,986 | $12,430 | $14,466 |

| 11/2021 | $13,826 | $12,467 | $14,320 |

| 12/2021 | $14,018 | $12,435 | $14,589 |

| 01/2022 | $13,757 | $12,167 | $14,188 |

| 02/2022 | $13,645 | $12,031 | $14,061 |

| 03/2022 | $13,576 | $11,697 | $13,931 |

| 04/2022 | $13,166 | $11,253 | $13,422 |

| 05/2022 | $13,269 | $11,326 | $13,457 |

| 06/2022 | $12,572 | $11,148 | $12,541 |

| 07/2022 | $13,212 | $11,420 | $13,294 |

| 08/2022 | $12,978 | $11,098 | $12,978 |

| 09/2022 | $12,483 | $10,618 | $12,456 |

| 10/2022 | $12,850 | $10,481 | $12,811 |

| 11/2022 | $13,065 | $10,866 | $13,051 |

| 12/2022 | $13,009 | $10,817 | $12,952 |

| 01/2023 | $13,460 | $11,150 | $13,459 |

| 02/2023 | $13,360 | $10,862 | $13,285 |

| 03/2023 | $13,462 | $11,138 | $13,434 |

| 04/2023 | $13,568 | $11,205 | $13,559 |

| 05/2023 | $13,510 | $11,083 | $13,435 |

| 06/2023 | $13,574 | $11,044 | $13,654 |

| 07/2023 | $13,746 | $11,036 | $13,848 |

| 08/2023 | $13,767 | $10,965 | $13,888 |

| 09/2023 | $13,698 | $10,687 | $13,724 |

| 10/2023 | $13,518 | $10,518 | $13,556 |

| 11/2023 | $14,064 | $10,994 | $14,173 |

| 12/2023 | $14,598 | $11,415 | $14,696 |

| 01/2024 | $14,791 | $11,384 | $14,698 |

| 02/2024 | $14,858 | $11,223 | $14,742 |

| 03/2024 | $15,040 | $11,327 | $14,918 |

| 04/2024 | $14,939 | $11,041 | $14,768 |

| 05/2024 | $15,136 | $11,228 | $14,936 |

| 06/2024 | $15,256 | $11,334 | $15,080 |

| 07/2024 | $15,526 | $11,599 | $15,376 |

| 08/2024 | $15,820 | $11,765 | $15,620 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

Class A without Sales ChargeFootnote Reference1 | 14.91% | 5.95% | 5.21% |

Class A with Maximum Sales Charge - 5.75%Footnote Reference1 | 9.48% | 4.92% | 4.69% |

| Bloomberg US Aggregate Bond Index | 7.30% | (0.04)% | 1.64% |

| ICE BofA US High Yield Index | 12.47% | 4.27% | 4.56% |

| Footnote | Description |

Footnote1 | Return may differ from actual shareholder return due to accounting adjustments for financial reporting purposes. |

Performance shown is historical and is not indicative of future returns. Investment returns and principal value will vary, and shares may be worth more or less at redemption than at original purchase. Performance shown is as of date indicated, and current performance may be lower or higher than the performance data quoted. To obtain performance as of the most recent month end, please visit americanbeaconfunds.com or call 800-967-9009. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. The Fund's performance benefited from fee waivers. For more information, visit americanbeaconfunds.com/Performance_Disclaimers.aspx.

| Total Net Assets | $1,639,510,166 |

| # of Portfolio Holdings | 109 |

| Portfolio Turnover Rate | 47% |

| Total Management Fees Paid | $8,176,445 |

What did the Fund invest in?

Top Ten Holdings - % Net Assets

| Samhallsbyggnadsbolaget i Norden AB, 2.250%, Due 8/12/2027 | 1.9 |

| SeaWorld Parks & Entertainment, Inc., 5.250%, Due 8/15/2029 | 1.7 |

| Paratus Energy Services Ltd., 9.500%, Due 6/27/2029 | 1.7 |

| GEO Group, Inc., 10.250%, Due 4/15/2031 | 1.7 |

| Borr IHC Ltd./Borr Finance LLC, 10.375%, Due 11/15/2030 | 1.7 |

| Boyd Gaming Corp., 4.750%, Due 6/15/2031 | 1.6 |

| Vector Group Ltd., 10.500%, Due 11/1/2026 | 1.6 |

| Euronav Luxembourg SA, 6.250%, Due 9/14/2026 | 1.6 |

| Churchill Downs, Inc., 6.750%, Due 5/1/2031 | 1.5 |

| Upstart Holdings, Inc., 0.250%, Due 8/15/2026 | 1.5 |

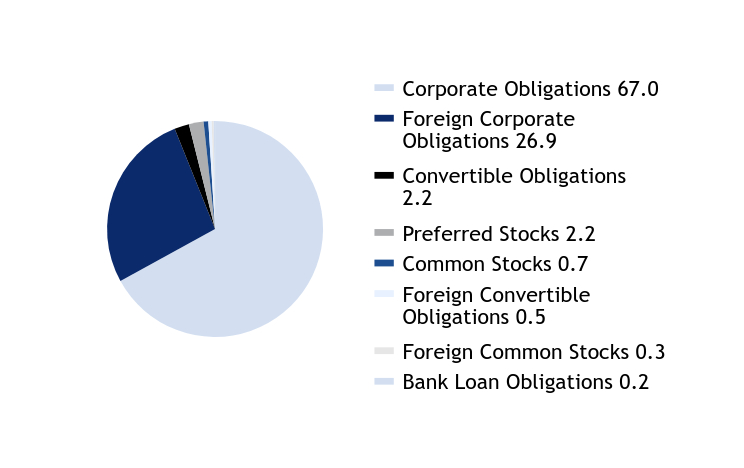

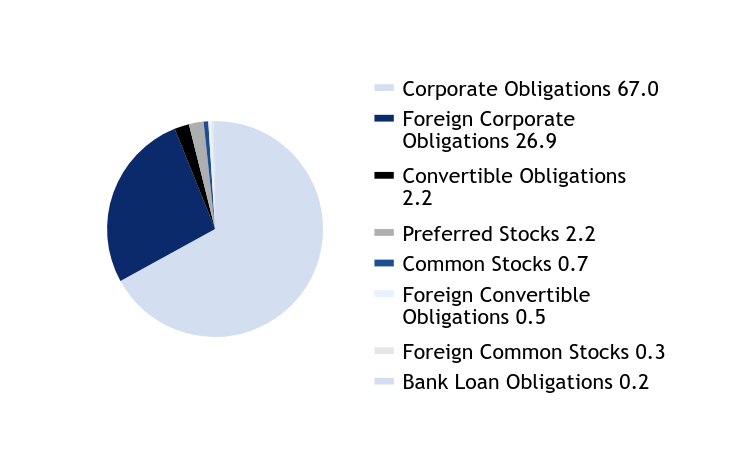

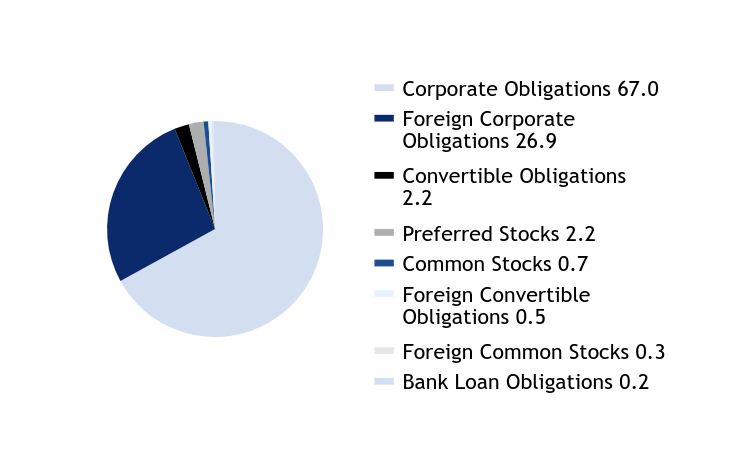

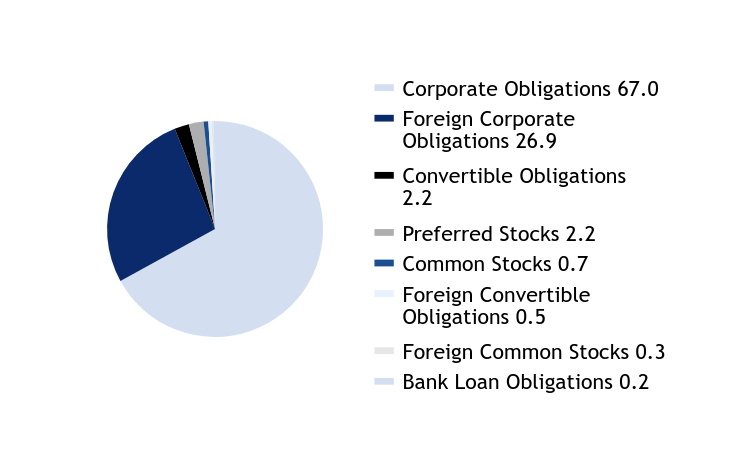

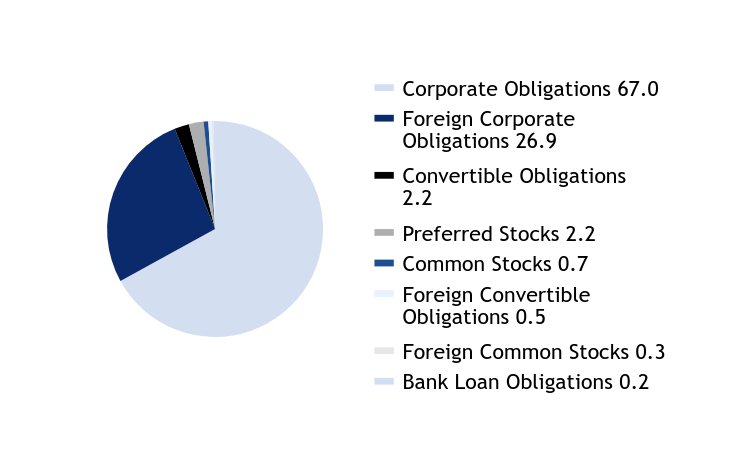

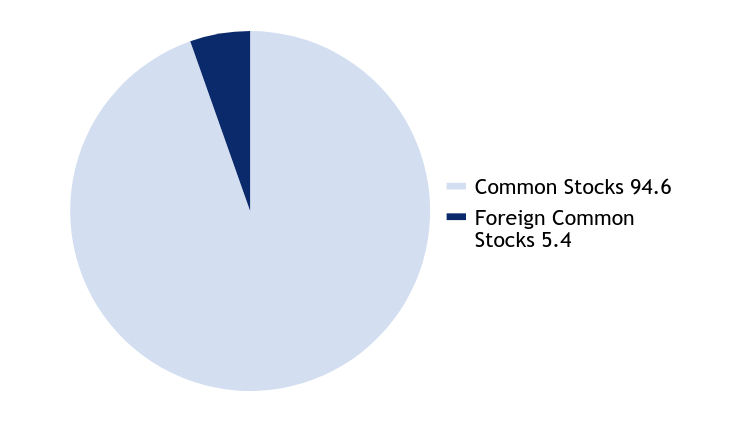

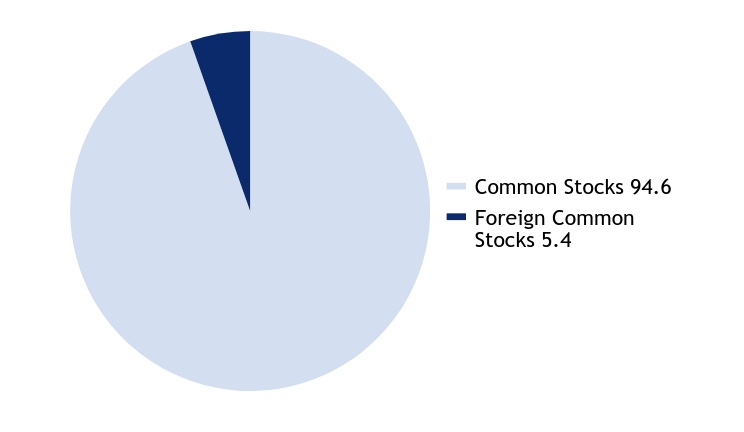

Asset Allocation - % Investments

| Value | Value |

|---|

| Corporate Obligations | 67.0 |

| Foreign Corporate Obligations | 26.9 |

| Convertible Obligations | 2.2 |

| Preferred Stocks | 2.2 |

| Common Stocks | 0.7 |

| Foreign Convertible Obligations | 0.5 |

| Foreign Common Stocks | 0.3 |

| Bank Loan Obligations | 0.2 |

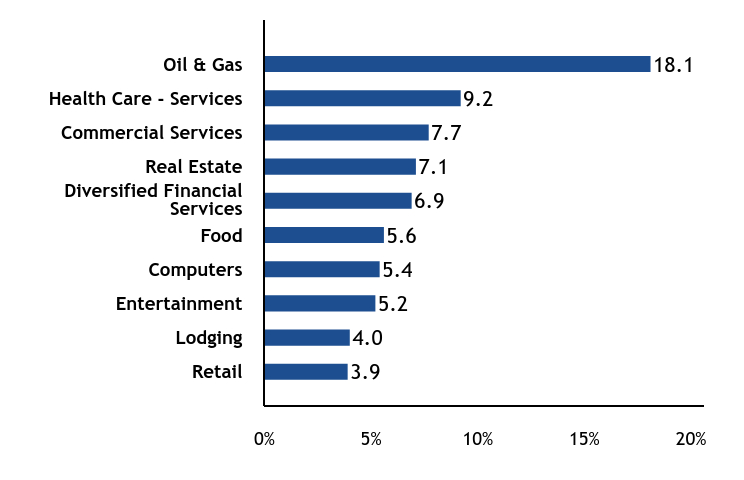

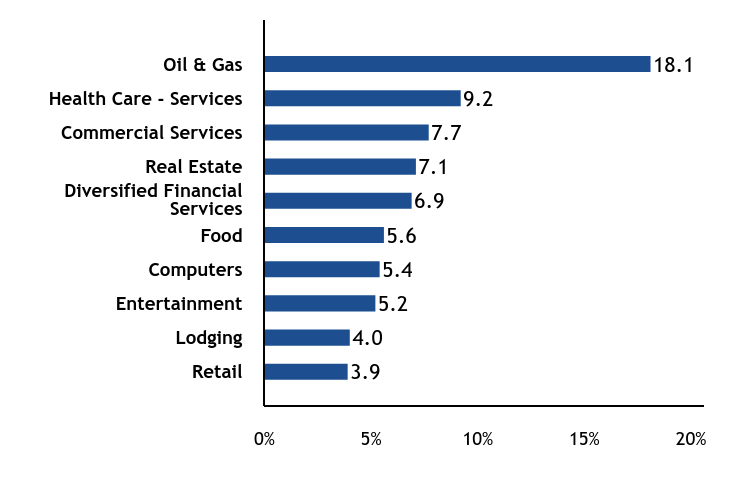

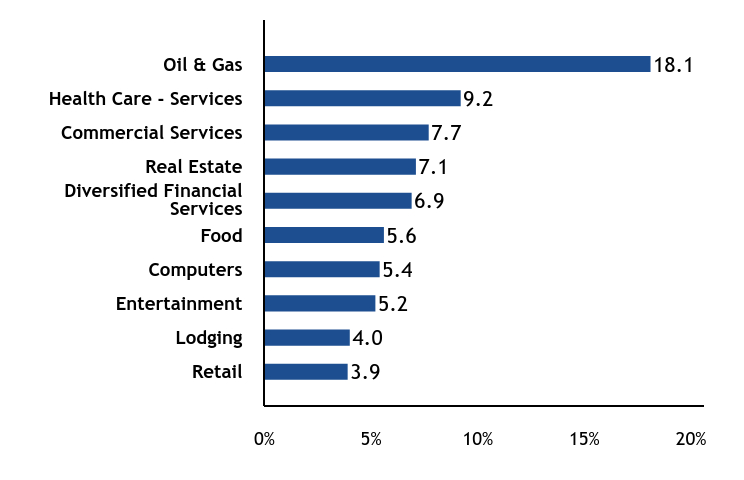

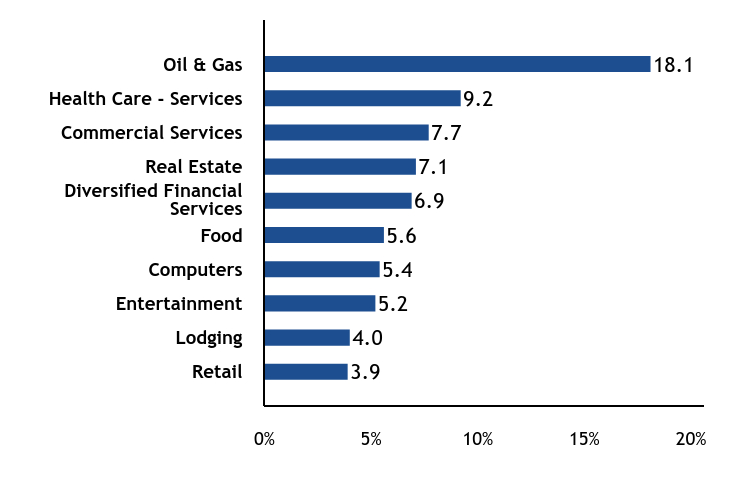

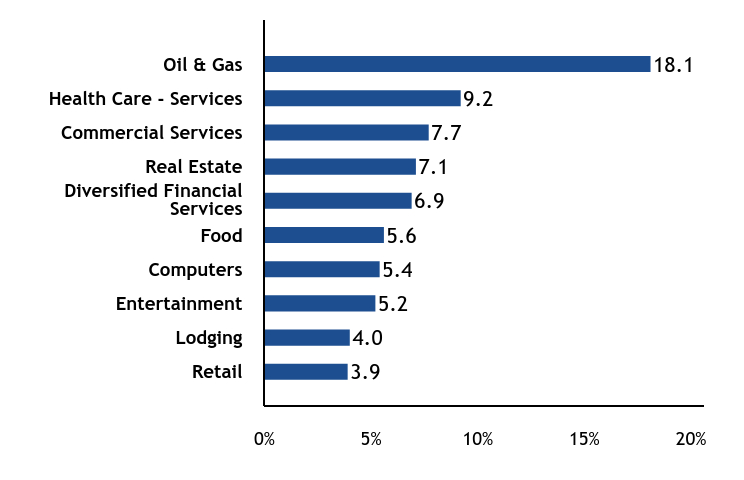

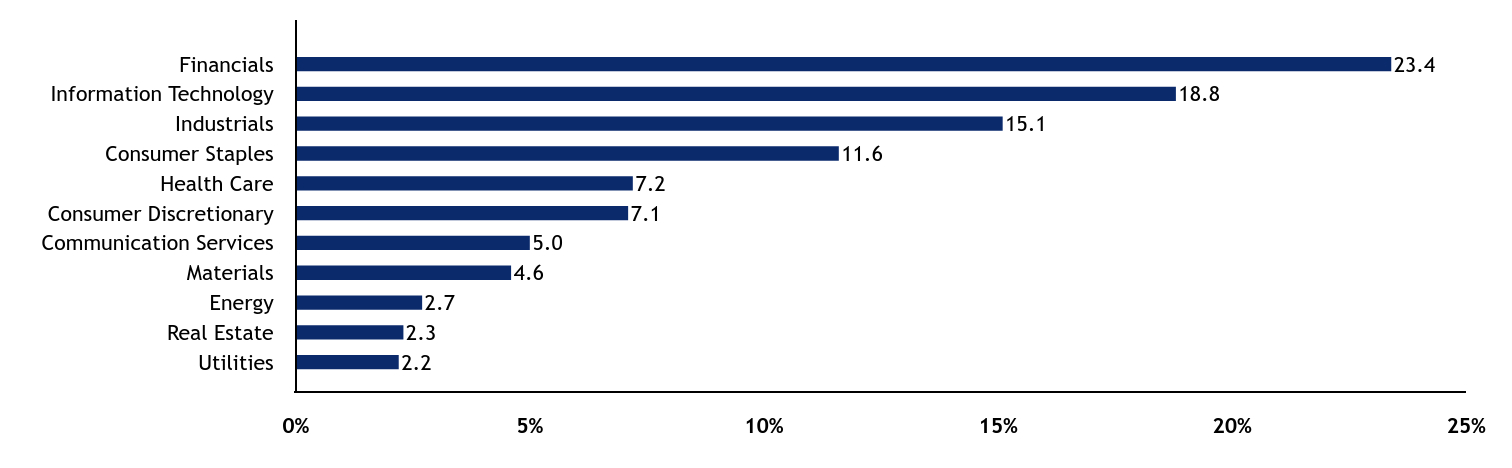

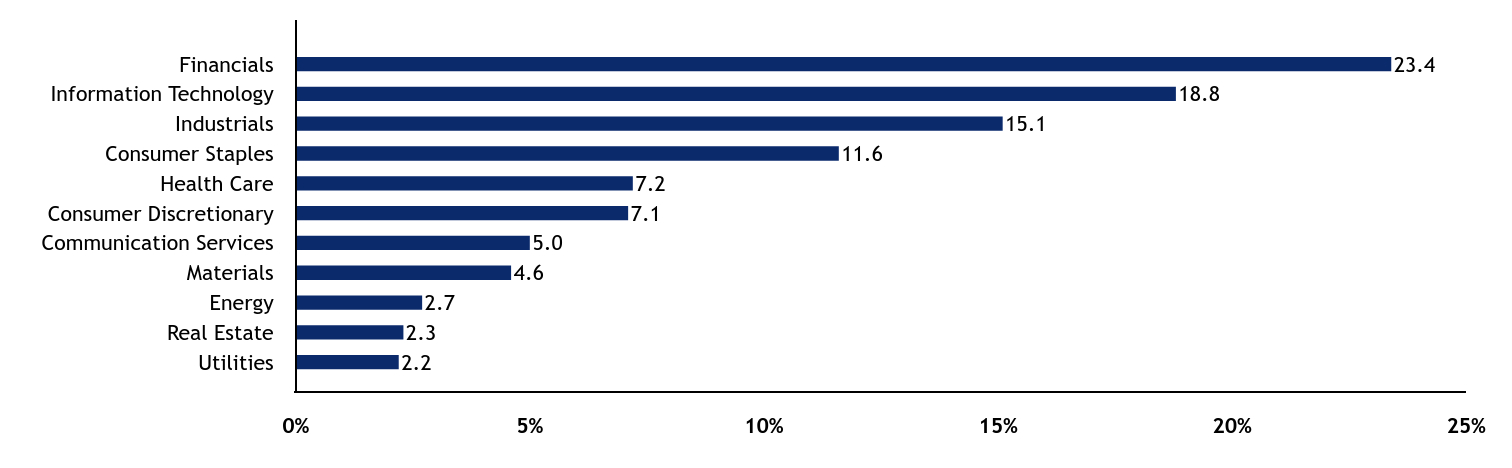

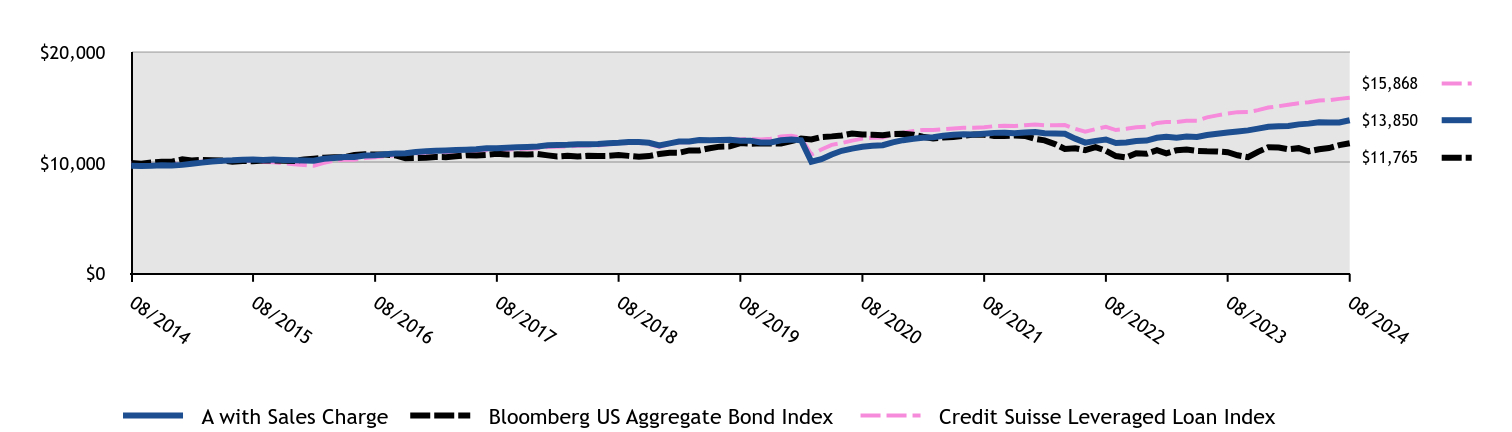

Top Ten Industry Allocations - % Fixed Income

| Value | Value |

|---|

| Retail | 3.9 |

| Lodging | 4.0 |

| Entertainment | 5.2 |

| Computers | 5.4 |

| Food | 5.6 |

| Diversified Financial Services | 6.9 |

| Real Estate | 7.1 |

| Commercial Services | 7.7 |

| Health Care - Services | 9.2 |

| Oil & Gas | 18.1 |

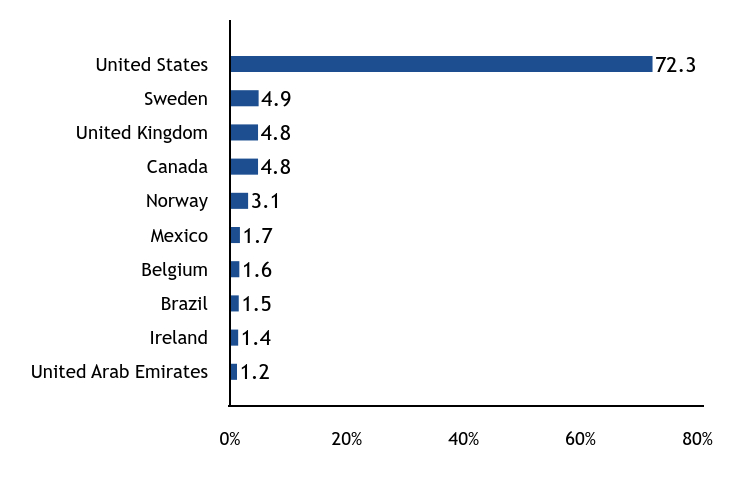

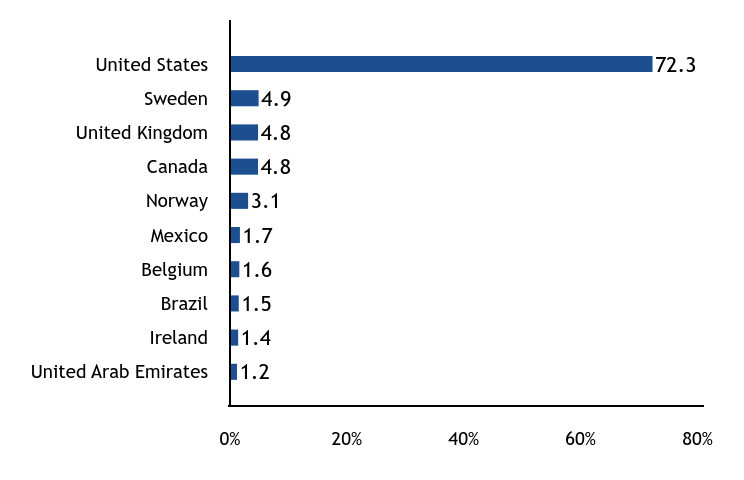

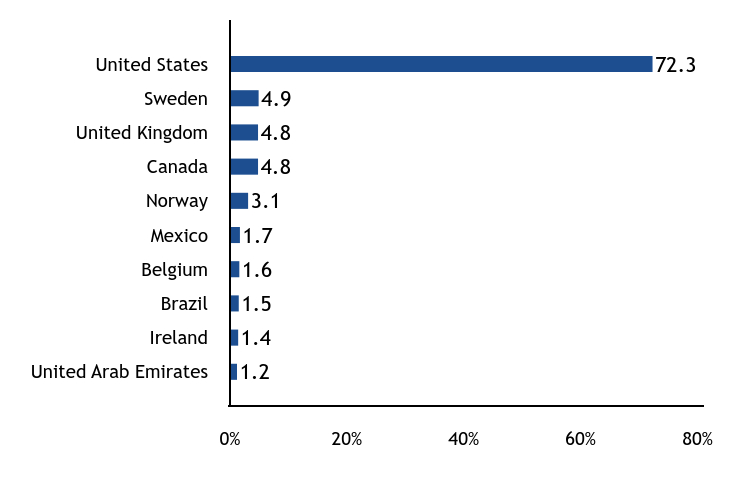

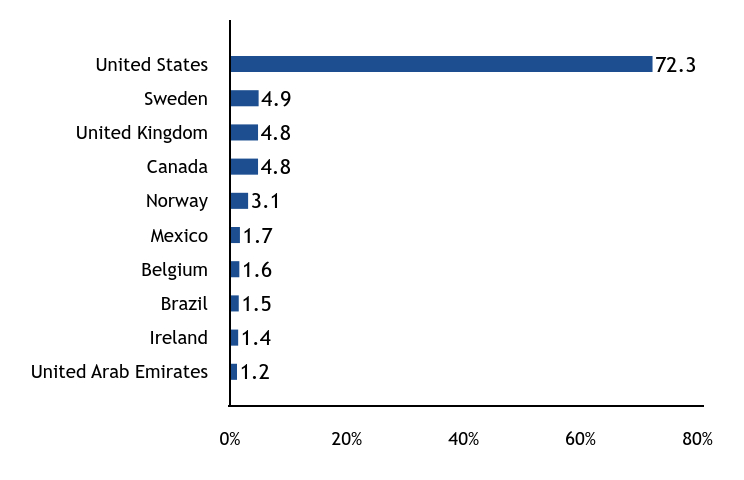

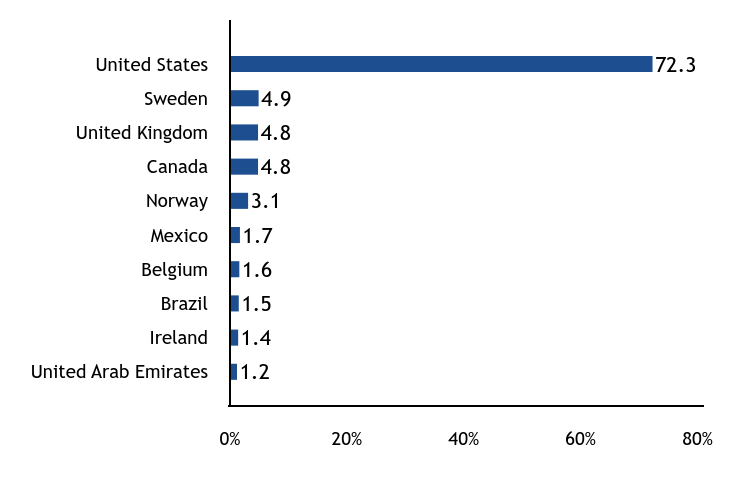

Top Ten Country Exposure - % Investments

| Value | Value |

|---|

| United Arab Emirates | 1.2 |

| Ireland | 1.4 |

| Brazil | 1.5 |

| Belgium | 1.6 |

| Mexico | 1.7 |

| Norway | 3.1 |

| Canada | 4.8 |

| United Kingdom | 4.8 |

| Sweden | 4.9 |

| United States | 72.3 |

Excludes foreign exchange holdings.

This is a summary of certain changes to the Fund since August 31, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by January 1, 2025 at www.americanbeaconfunds.com/literature or upon request at 800-658-5811.

Prior to July 1, 2024, the American Beacon SiM High Yield Opportunities Fund (the “Fund”) assessed a front-end sales load on purchases of A Class shares less than $1 million, and a contingent deferred sales charge (“CDSC”) of 0.50% on certain purchases of $1 million or more of A Class shares that are redeemed in whole or in part within 18 months of purchase. Beginning July 1, 2024, the Fund will no longer assess a front-end sales load on purchases of A Class shares of $500,000 or more, but will assess a CDSC of 1.00% on certain purchases of $500,000 or more of A Class shares that are redeemed in whole or in part within 18 months of purchase.

For additional information about the Fund, including its prospectus, financial statements, holdings, and proxy voting information, please visit www.americanbeaconfunds.com/literature or call 1-800-658-5811.

If your financial institution mailed only one copy of this Report to an address shared by more than one account, you can request an individual copy by contacting your financial institution.

Distributed by Resolute Investment Distributors, Inc.

SiM High Yield Opportunities Fund

Annual Shareholder Report - August 31, 2024

SiM High Yield Opportunities Fund

Annual Shareholder Report - August 31, 2024

This annual shareholder report contains important information about American Beacon SiM High Yield Opportunities Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at www.americanbeaconfunds.com/literature. You can also request this information by contacting us at 800-658-5811.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $194 | 1.81% |

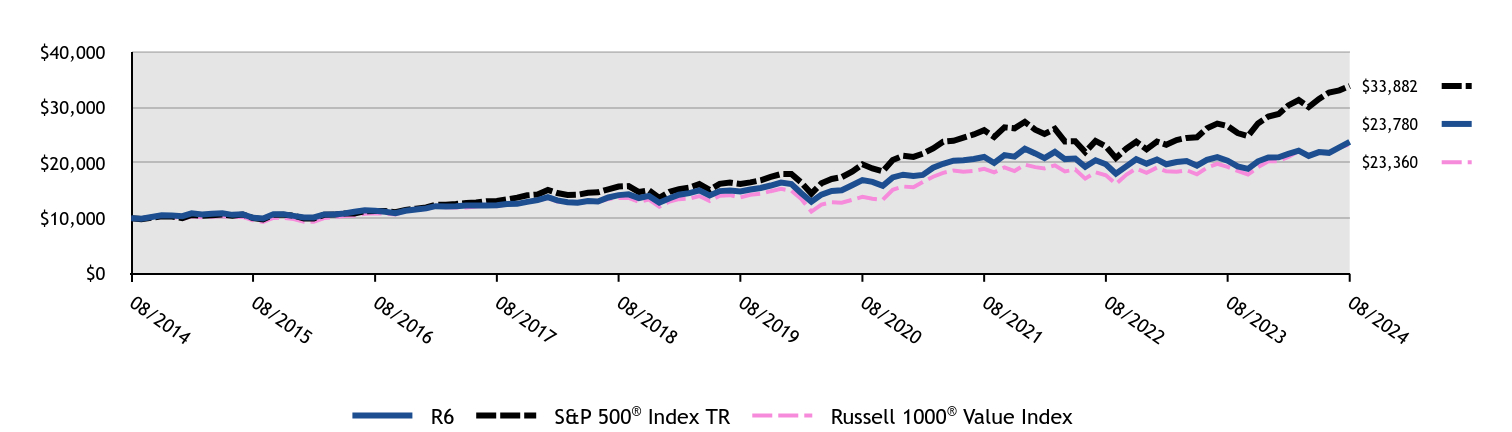

How did the Fund perform and what affected its performance?

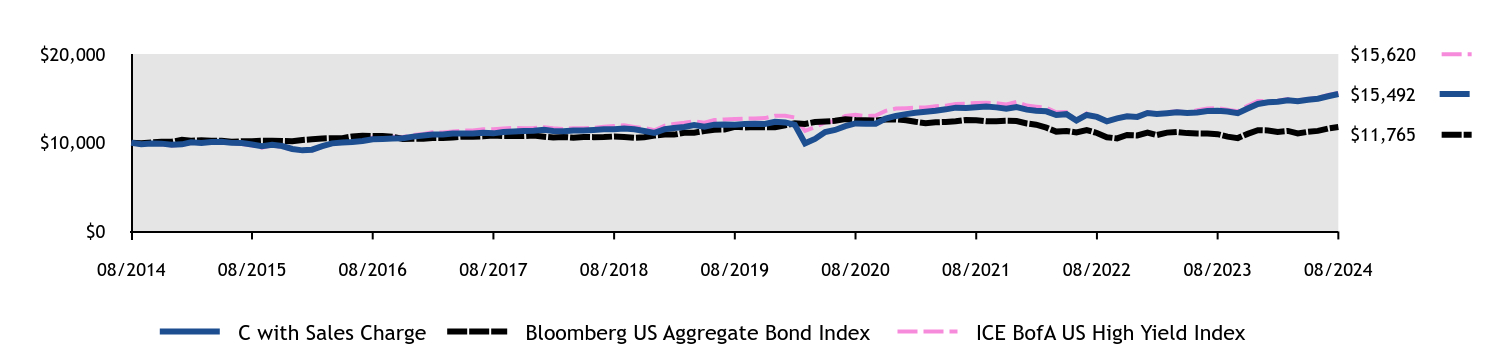

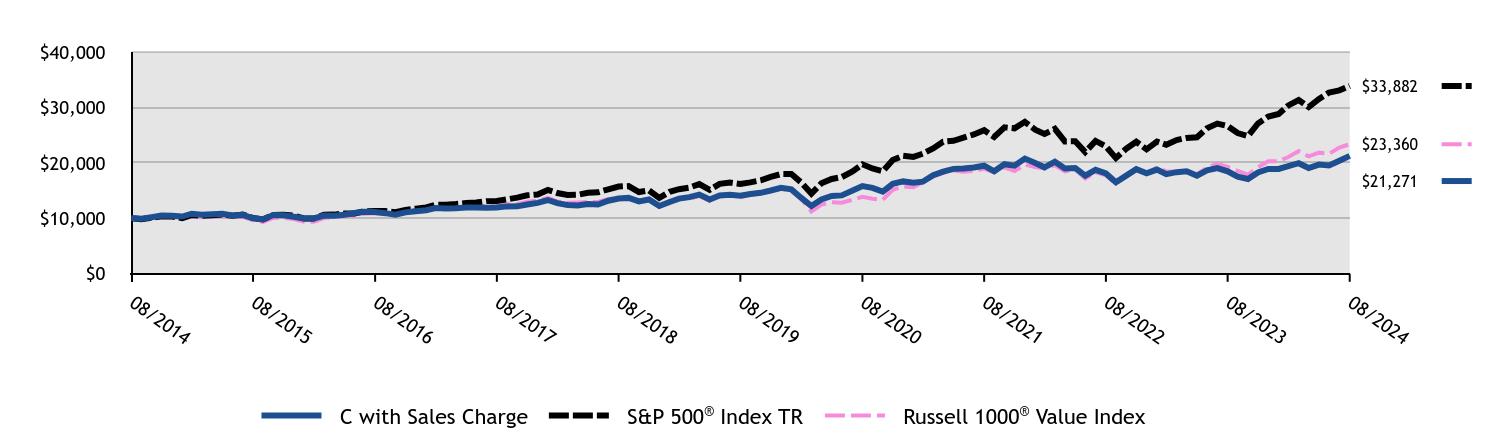

The C Class of the Fund returned 13.00% (with sales charges) and 14.00% (without sales charges) for the twelve months ended August 31, 2024, compared to the Bloomberg U.S. Aggregate Bond Index return of 7.30% and the ICE BofA U.S. High Yield Index return of 12.47%.

• As volatility of yields was high in the fixed income market during the last twelve months, the high yield market benefitted from ‘risk-on’ sentiment buoyed by the continued strength of the US economy.

• The Fund’s index agnostic and high conviction strategy within the high yield universe offered attractive yield and strong risk adjusted returns.

• The Fund’s holdings in Industrials, higher-rated securities, and short-term maturities contributed the most to performance.

• The Bloomberg US Aggregate Bond Index has been added since the last Shareholder Report to comply with a new regulatory requirement.

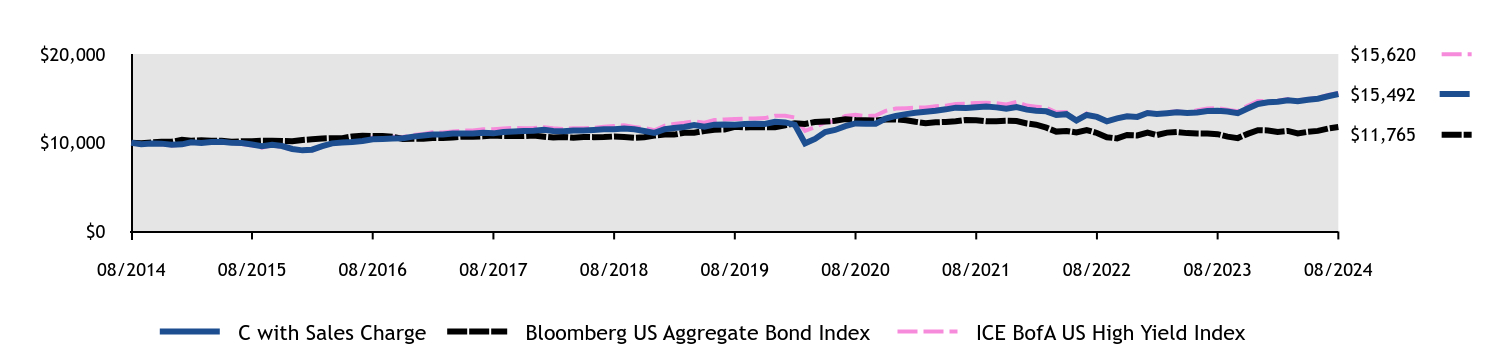

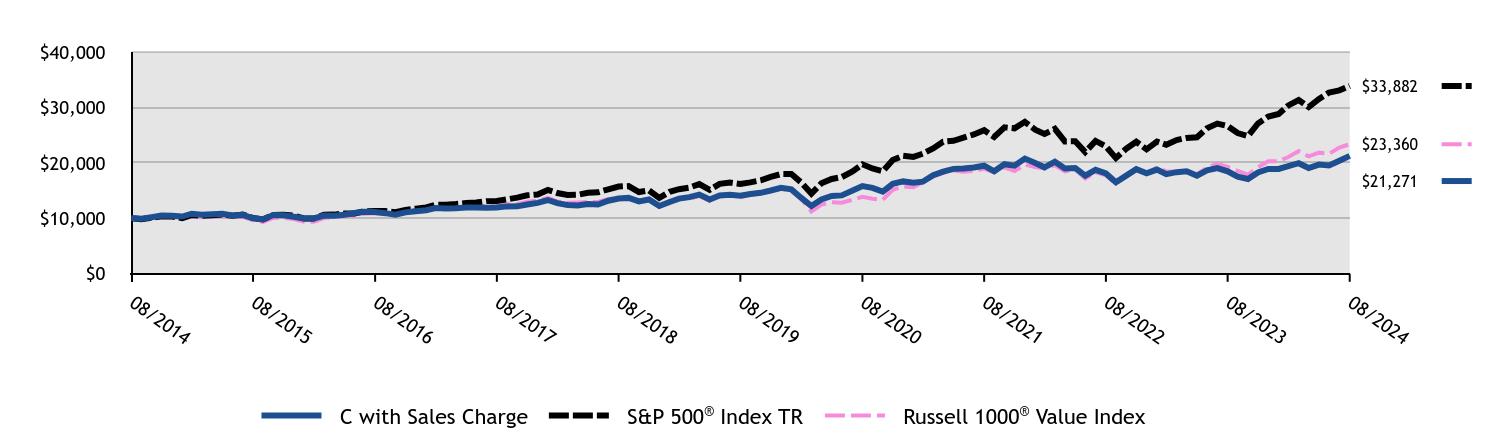

Cumulative Performance from August 31, 2014 through August 31, 2024

The initial investment, based on a $10,000 investment, is adjusted to reflect the maximum applicable sales charge, if any.

| C with Sales Charge | Bloomberg US Aggregate Bond Index | ICE BofA US High Yield Index |

|---|

| 08/2014 | $10,000 | $10,000 | $10,000 |

| 09/2014 | $9,823 | $9,932 | $9,790 |

| 10/2014 | $9,899 | $10,030 | $9,902 |

| 11/2014 | $9,896 | $10,101 | $9,831 |

| 12/2014 | $9,763 | $10,110 | $9,686 |

| 01/2015 | $9,820 | $10,322 | $9,753 |

| 02/2015 | $10,046 | $10,225 | $9,985 |

| 03/2015 | $9,961 | $10,273 | $9,932 |

| 04/2015 | $10,088 | $10,236 | $10,051 |

| 05/2015 | $10,118 | $10,211 | $10,081 |

| 06/2015 | $9,982 | $10,100 | $9,927 |

| 07/2015 | $9,958 | $10,170 | $9,866 |

| 08/2015 | $9,801 | $10,156 | $9,693 |

| 09/2015 | $9,611 | $10,224 | $9,441 |

| 10/2015 | $9,756 | $10,226 | $9,698 |

| 11/2015 | $9,629 | $10,199 | $9,481 |

| 12/2015 | $9,296 | $10,166 | $9,236 |

| 01/2016 | $9,139 | $10,306 | $9,090 |

| 02/2016 | $9,212 | $10,379 | $9,132 |

| 03/2016 | $9,608 | $10,474 | $9,536 |

| 04/2016 | $9,928 | $10,514 | $9,917 |

| 05/2016 | $10,017 | $10,517 | $9,989 |

| 06/2016 | $10,072 | $10,706 | $10,097 |

| 07/2016 | $10,201 | $10,774 | $10,352 |

| 08/2016 | $10,397 | $10,761 | $10,583 |

| 09/2016 | $10,427 | $10,755 | $10,651 |

| 10/2016 | $10,471 | $10,673 | $10,684 |

| 11/2016 | $10,500 | $10,420 | $10,642 |

| 12/2016 | $10,689 | $10,435 | $10,852 |

| 01/2017 | $10,811 | $10,456 | $10,997 |