UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04995

Sit U.S. Government Securities Fund, Inc.

(Exact name of registrant as specified in charter)

3300 IDS Center

80 South Eighth Street

Minneapolis, MN 55402

(Address of principal executive offices)

Paul E. Rasmussen, VP Treasurer

Sit Mutual Funds, Inc.

3300 IDS Center

80 South Eighth Street

Minneapolis, MN 55402

(Name and address of agent for service)

Registrant’s telephone number, including area code: (612) 332-3223

Date of fiscal year end: March 31, 2023

Date of reporting period: September 30, 2023

Item 1: Reports to Stockholders

Semi-Annual Report September 30, 2023 U.S. Government Securities Fund Quality Income Fund Tax-Free Income Fund Minnesota Tax-Free Income Fund Sit Mutual Funds

Sit Mutual Funds

BOND FUNDS SEMI-ANNUAL REPORT

TABLE OF CONTENTS

This document must be preceded or accompanied by a Prospectus.

CHAIRMAN’S LETTER

November 3, 2023

Dear fellow shareholders:

The Federal Reserve’s (the Fed) hawkish monetary policy and continued elevated inflation were the main focus for investors during the semi-annual period ended September 30th, 2023. The Fed twice raised its target for the Fed Funds rate during the period, while leaving it unchanged on two additional occasions. The decision to leave the target rate unchanged in June was the first Fed meeting where rates were not increased since March of 2022. The Fed’s stated intent to keep interest rates high until inflation drops near 2.0% resulted in a decline in bond prices during the period. The broad bond market, as measured by the Bloomberg Aggregate Bond Index, returned -4.1% for the period, as market yields rose for all maturities.

The Treasury yield curve shifted higher by more than 1.0% during the period and maintained its inverted shape, with the 2-year Treasury yielding 0.5% more than the 10-year Treasury. The rise in shorter-maturity Treasury yields reflects the market’s view that the Federal Reserve will maintain its restrictive policies for the foreseeable future as the 2-year Treasury yield anticipates future changes in the Fed Funds rate. Meanwhile, a pronounced shift in market sentiment during late summer to a ‘higher for longer’ rate policy expectation for the Fed sent the yield on the 30-year Treasury bond up to 5.0% for the first time since 2007. The downgrade by Fitch in August of the United States’ credit rating also pushed yields higher. In response to the protracted congressional negotiations over the government debt limit, Fitch downgraded the government’s credit rating from AAA to AA+. The debt rating is now below the AAA level by two of the three major rating agencies.

Monetary Policy

The Fed increased its target for the Fed Funds rate by 0.25% at both the May and July FOMC meetings, opting to leave rates unchanged at the June and September meetings as they slow the pace of monetary tightening. This tightening campaign is the most aggressive the economy has experienced since the early 1980s, with the Fed raising the Fed Funds rate from zero to 5.25% in under 17 months. Now, with the end of the tightening cycle likely nearing, the Fed is monitoring for lagged effects of how its policy is impacting economic data, particularly inflation, as it moves forward. The Fed has indicated that it intends to maintain a restrictive monetary policy until inflation stabilizes at 2.0%.

The Fed continues to shrink its bloated balance sheet by forgoing the reinvestment of the cash received from bond maturities and mortgage principal payments, subject to monthly caps. The Fed’s balance sheet ballooned to nearly $9.0 trillion as it absorbed the bond issuance required to finance the various pandemic-related fiscal stimulus packages. Total assets on the Fed’s balance sheet have now declined to under $8.0 trillion as $1.2 trillion of

principal payments were not reinvested. The Fed appears resolved to normalize the balance sheet and continue letting it shrink regardless of the level or direction of changes in the Fed Funds target rate. The Fed’s balance sheet expanded by $344 billion in March of 2023 as it provided emergency financing to the banking industry as rising interest rates pressured capital ratios for several banks. There was still $174 billion of emergency financing outstanding to these banks at the end of the period.

Inflation

Inflation moderated throughout 2023 as the year-over-year change in the Consumer Price Index (CPI) dropped from 6.4% as of December 2022 to 3.7% as of September 2023. Excluding food and energy prices, the core CPI also declined in 2023 from 5.7% to 4.1%. Furthermore, recent data suggests inflation has slowed even more, as the annualized 3-month change for core CPI as of September 2023 was just 3.1%. Core personal consumption expenditures (PCE), the Fed’s preferred inflation measure, has shown a similar trend with the year-over-year change as of August 2023 at 3.9% and the most recent 3-month annualized change nearing the Fed’s target at 2.2%.

The decline in inflation has been driven by the prices of goods. As of September 2023, the goods component of core CPI was unchanged from a year earlier, with eight of the last twelve months registering at or below 0.0%. Disinflation of goods prices has been driven by the easing of the pandemic-related supply chain disruptions that led to shortages and, consequently, higher prices. A shortage of labor was predominantly responsible for the empty shelves at retail stores as people were unwilling or unable to work due to government shutdowns, illness, or excessive pandemic-related fiscal stimulus. Millions left the labor force as three rounds of stimulus checks, a moratorium on student loan payments and evictions, and innumerable state initiatives bloated savings accounts. However, since the beginning of 2022, the personal savings rate has been running below long-term averages, depleting excess savings and pushing workers back into the labor force. The end of the student loan payment suspension in October 2023 should also result in an additional uptick in the labor force. As of September 2023, the Labor Force Participation Rate for workers aged 24 – 54 was 83.5%, higher than before the pandemic. The impact of so many people returning to work can be seen in recent ISM Manufacturing Surveys, which show declining prices for inputs since May 2023 and declining order backlogs since October 2022.

While the inflation rate for goods has returned to near-normal levels, the pace of price increases for services has remained elevated with the year-over-year change in the services component of core CPI at 5.7% through September 2023. Shelter prices, representing over 40% of core CPI, are the main driver of elevated services

| | |

| | |

| 2 | | SIT MUTUAL FUNDS SEMI-ANNUAL REPORT |

inflation, with a year-over-year change of 7.1% through September 2023. Despite mortgage interest rates over 7.5%, home prices continue to rise. Additionally, rents are now at an all-time high. However, the pace of rent increases is expected to slow as over 1 million new rental units are set to be completed through 2025. Due to the lag at which rent changes are reflected in the CPI data, the Fed has begun monitoring core services inflation, excluding housing. Like the core goods index, this new ‘supercore’ index points to moderating services inflation with a year-over-year change of 3.8% as of September 2023.

Outlook & Strategy

The Fed seems determined to keep monetary policy sufficiently restrictive until inflation is well on its way to stabilizing at 2.0% as it appears resolved to not declare victory over inflation too early. Economic growth will likely stall over the coming quarters as higher interest rates negatively impact the economy. To fight inflation, the Fed is focused on bringing aggregate demand in the economy down to the level of aggregate supply, where prices will find equilibrium. One key metric that the Fed monitors in this regard is the number of job openings per unemployed person. The ratio stood at 1.5 jobs-per-unemployed as of September 2023, after peaking at 2.0 jobs-per-unemployed in 2022. With demand for labor still surpassing supply by a wide margin, the Fed appears to believe it can keep rates high without inflicting too much harm on the economy. However, the effects of higher interest rates are being felt in several sectors of the economy. The Fed needed to bail out several banks earlier this year, higher mortgage rates have slowed housing activity, and manufacturing activity has been contracting for all of 2023. In fact, only 5% of respondents to a recent survey of small businesses think it is a good time to expand.

Inflation will likely continue to progress towards the Fed’s target as wage growth has stabilized at a moderate pace, while productivity gains and an expanding labor force keep shortages and order backlogs at bay. The Fed will likely begin lowering the target Fed Funds rate in the second half of 2024 as inflation nears the 2.0% target. The anticipation of an eventual cut in interest rates should result in a decline in short-maturity yields as the yield curve normalizes to an upward-sloping shape. For the Sit Quality Income Fund, we are emphasizing securities in the 3-5 year maturity part of the yield curve which we expect to disproportionally benefit from the normalization. The Sit U.S. Government Securities Fund continues to emphasize seasoned mortgages that we believe will provide an income advantage over the long term. In addition to the most attractive tax-exempt yields in a decade, our tax-free Funds also offer the potential for meaningful price appreciation when interest rates decline due to our longer than benchmark durations.

With yields at the highest levels since before the Great Financial Crisis, we expect that income will once again be a significant component of return.

In conclusion, investors should maintain a diversified portfolio of stocks and bonds underpinned by strong fundamentals to help manage risk in this challenging market. We appreciate your continued interest in the Sit family of funds. Please see our complete Outlook and Strategy research paper at www.sitfunds.com.

With best wishes,

Roger J. Sit

Chairman and President Sit Mutual Funds

Sit U.S. Government Securities Fund - Class S and Class Y

OBJECTIVE & STRATEGY

The objective of the Sit U.S. Government Securities Fund is to provide high current income and safety of principal, which it seeks to attain by investing solely in debt obligations issued, guaranteed or insured by the U.S. government or its agencies or its instrumentalities. Agency mortgage securities and U.S. Treasury securities are the principal holdings in the Fund. The mortgage securities that the Fund purchases consist of pass-through securities including those issued by Government National Mortgage Association (GNMA), Federal National Mortgage Association (FNMA) and Federal Home Loan Mortgage Corporation (FHLMC).

Fund Performance

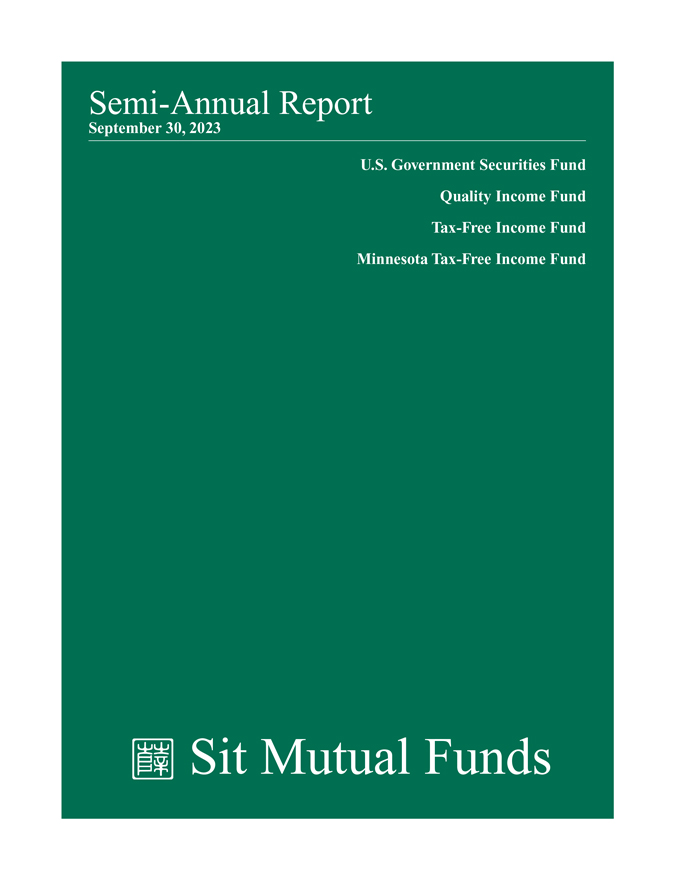

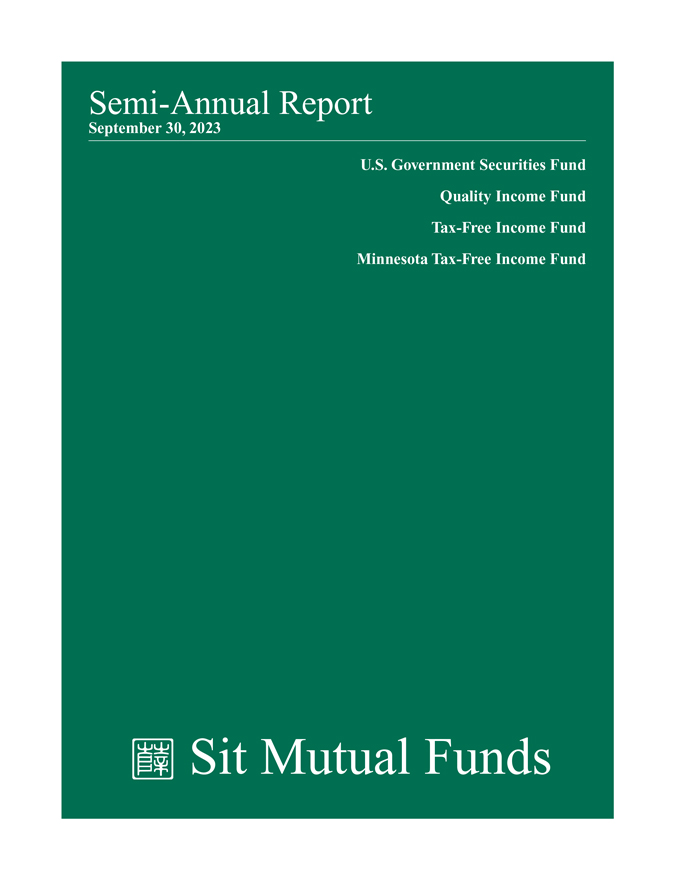

The Sit U.S. Government Securities Fund (Class S) provided a return of -2.46% during the 6-month period ended September 30, 2023, compared to the return of the Bloomberg Intermediate Government Bond Index of -1.90%. The Fund’s 30-day SEC yield was 3.98% and its 12-month distribution rate was 3.11%.

Factors that Influenced the Fund’s Performance

During the 6-month period, the Fund benefited from the consistent relatively high level of income provided by its holdings in higher coupon government agency mortgages. Yields on U.S. Treasury securities were higher across all maturities. The Fund seeks to reduce interest rate risk by using options on Treasury securities. The use of options was effective in providing stability to the Fund’s net asset value but detracted from overall performance. The Fund continued to experience relatively stable prepayment rates as the mortgage holdings are generally well seasoned and have been through many refinancing cycles. Mortgage pass-through holdings outperformed the benchmark due to the shorter duration while holdings in collateralized mortgage obligations underperformed due to longer durations. The Fund’s holdings in longer-dated U.S. Treasury securities detracted from performance as yields on those securities rose significantly.

Outlook and Positioning

The inflation rate has been the most scrutinized economic metric in the past six months while the Federal Reserve (Fed) continues to be ambiguous about the peak desired level of short-term interest rates. Investors have been whipsawed back and forth by economic indicators. Most believe that we have reached the maximum level of short-term interest rates in this cycle, but hawkish rhetoric from the Fed has investors weary. The Fed began the period with headwinds with respect to inflation such as the ongoing war between Ukraine and Russia, supply chain disruptions relating to Covid-19, and pent-up excess savings from loose fiscal policies. To combat inflation, the Fed embarked on one of the most aggressive interest rate hiking cycles ever which saw the Fed Funds rate upper bound target rate increase from 0.25% to 5.50% in only 18 months. The Fed’s policies achieved a disinflationary environment as year-over-year core PCE, the Fed’s preferred inflation metric, fell from 5.6% to 3.9%. Now the Fed has tailwinds with respect to lower inflation. Supply chains have normalized, and pent-up savings have been depleted. Any remaining pent-up savings will likely run out as student loan payments are set to resume this October. Talks of a recession have subsided, and

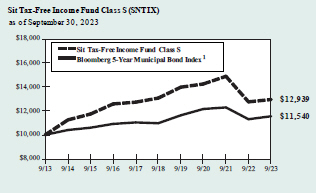

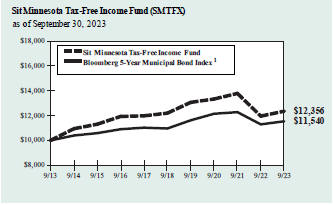

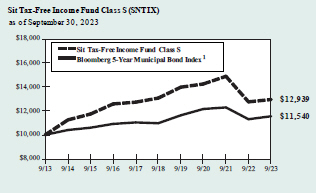

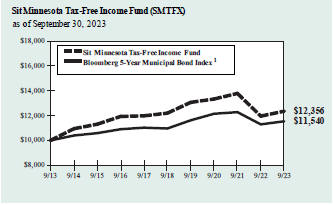

HYPOTHETICAL GROWTH OF $10,000

The chart above illustrates the total value of a hypothetical $10,000 investment in the Fund over the past 10 years (or for the life of the Fund if shorter) as compared to the performance of the Bloomberg Intermediate Government Bond Index. Past performance does not guarantee future results. Returns include the reinvestment of distributions. The chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| 1 | The Bloomberg Intermediate Government Bond Index is a sub-index of the Bloomberg Government Bond Index covering issues with remaining maturities of between three and five years. The Bloomberg Government Bond Index is an index that measures the performance of all public U.S. government obligations with remaining maturities of one year or more. The returns include the reinvestment of income and do not include any transaction costs, management fees or other costs. It is not possible to invest directly in an index. This is the Fund’s primary index. |

investors have accepted interest rates to remain higher well into next year. Mortgage rates, currently in the 7.5%-8.0% range, have significantly increased mortgage payments for people looking to buy a new home which will likely reduce the contribution to economic activity from the housing sector. Prepayments across all coupons have slowed and we expect decreased housing turnover and refinancing to grind to a halt.

We have positioned the portfolio for the eventual yield curve normalization when the Fed signals that it has reached its inflation goals. The Fund’s focus on seasoned, high coupon agency mortgage securities provide a high level of income which has been a fundamental focus of the Fund since its inception.

| | |

| Bryce A. Doty, CFA | | Mark H. Book, CFA |

| Senior Portfolio Manager | | Portfolio Manager |

| | |

| | |

| 4 | | SIT MUTUAL FUNDS SEMI-ANNUAL REPORT |

COMPARATIVE RATES OF RETURNS

as of September 30, 2023

| | | | | | | | | | | | | | | | |

| | | Sit U.S. Government | | | | | | | |

| | | Securities Fund | | | | | | | |

| | | Class S | | | Class Y | | | Bloomberg

Intermediate

Gov’t. Bond

Index1 | | | Lipper U.S.

Gov’t Fund

Index2 | |

Six Month | | | -2.46 | % | | | -2.43 | % | | | -1.90 | % | | | n/a | |

One Year | | | -0.93 | | | | -0.77 | | | | 1.33 | | | | -3.06 | % |

Five Year | | | 0.31 | | | | n/a | | | | 0.68 | | | | -0.78 | |

Ten Year | | | 0.76 | | | | n/a | | | | 0.81 | | | | 0.41 | |

Since Inception-Class S (6/2/87) | | | 4.51 | | | | n/a | | | | 4.67 | | | | 4.35 | |

Since Inception-Class Y (1/1/20) | | | n/a | | | | -0.59 | | | | -1.02 | | | | -3.27 | |

Performance figures are historical and do not guarantee future results. Investment returns and principal value will vary, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the performance data quoted. Contact the Fund for performance data current to the most recent month-end. Returns include changes in share price as well as reinvestment of all dividends and capital gains and all fee waivers. Without the fee waivers total return and yield figures would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Management fees and administrative expenses are included in the Fund’s performance. Returns for periods greater than one year are compounded average annual rates of return.

| 1 | The Bloomberg Intermediate Government Bond Index is a sub-index of the Bloomberg Government Bond Index covering issues with remaining maturities of between three and five years. The Bloomberg Government Bond Index is an index that measures the performance of all public U.S. government obligations with remaining maturities of one year or more. The returns include the reinvestment of income and do not include any transaction costs, management fees or other costs. It is not possible to invest directly in an index. |

| 2 | The Lipper returns are obtained from Lipper Analytical Services, Inc., a large independent evaluator of mutual funds. |

FUND DIVERSIFICATION

| | | | |

Collateralized Mortgage Obligations | | | 69.1 | % |

Government National Mortgage Association | | | 12.7 | |

Federal National Mortgage Association | | | 10.9 | |

Federal Home Loan Mortgage Corporation | | | 3.2 | |

Asset-Backed Securities | | | 1.0 | |

U.S. Treasury / Federal Agency Securities | | | 0.8 | |

Small Business Administration | | | 0.4 | |

Other Net Assets | | | 1.9 | |

Based on net assets as of September 30, 2023.

PORTFOLIO SUMMARY

| | | | | | | | |

Class S: | | | | | | | | |

Net Asset Value 9/30/23: | | $ | 9.94 | | | | Per Share | |

Net Asset Value 3/31/23: | | $ | 10.35 | | | | Per Share | |

Net Assets: | | $ | 213.4 | | | | Million | |

Class Y: | | | | | | | | |

Net Asset Value 9/30/23: | | $ | 9.93 | | | | Per Share | |

Net Asset Value 3/31/23: | | $ | 10.35 | | | | Per Share | |

Net Assets: | | $ | 79.4 | | | | Million | |

Average Maturity | | | 22.8 | | | | Years | |

Effective Duration:3 | | | 2.7 | | | | Years | |

| 3 | Duration is a measure of estimated price sensitivity relative to changes in interest rates. Portfolios with longer durations are typically more sensitive to changes in interest rates. For example, if interest rates rise by 1%, the fair value of a security with an effective duration of 5 years would decrease by 5%, with all other factors being constant. The correlation between duration and price sensitivity is greater for securities rated investment-grade than it is for securities rated below investment-grade. Duration estimates are based on assumptions by Sit Investment Associates, Inc. (the “Adviser”) and are subject to a number of limitations. Effective duration is calculated based on historical price changes of securities held by the Fund, and therefore is a more accurate estimate of price sensitivity provided interest rates remain within their historical range. |

ESTIMATED AVERAGE LIFE

| | | | |

0-1 Year | | | 1.9 | % |

1-5 Years | | | 90.8 | |

5-10 Years | | | 6.5 | |

10-20 Years | | | 0.8 | |

The table represents the Adviser’s estimates of the dollar weighted average life of the portfolio’s securities, which differ from their stated maturities. The Fund’s average stated maturity was 22.8 years as of September 30, 2023.

SCHEDULE OF INVESTMENTS (Unaudited)

September 30, 2023

Sit U.S. Government Securities Fund

| | | | | | | | | | | | | | |

Principal Amount ($) | | | Coupon Rate (%) | | | Maturity

Date | | | Fair

Value ($) | |

| | Mortgage Pass-Through Securities - 27.2% | | | | | |

| | Federal Home Loan Mortgage Corporation - 3.2% | |

| | 249,909 | | | | 2.00 | | | | 8/1/41 | | | | 200,243 | |

| | 14,394 | | | | 4.00 | | | | 7/1/25 | | | | 14,100 | |

| | 1,053,873 | | | | 4.50 | | | | 7/1/52 | | | | 968,875 | |

| | 312,136 | | | | 5.00 | | | | 5/1/42 | | | | 301,408 | |

| | 751,708 | | | | 5.50 | | | | 8/1/49 | | | | 741,336 | |

| | 45,223 | | | | 5.82 | | | | 10/1/37 | | | | 44,480 | |

| | 426,908 | | | | 6.00 | | | | 6/1/52 | | | | 422,079 | |

| | 233,989 | | | | 6.50 | | | | 12/1/34 | | | | 234,429 | |

| | 115,507 | | | | 6.88 | | | | 2/17/31 | | | | 116,133 | |

| | 13,670 | | | | 7.00 | | | | 8/1/27 | | | | 13,634 | |

| | 199,154 | | | | 7.00 | | | | 4/1/28 | | | | 197,972 | |

| | 1,569,579 | | | | 7.00 | | | | 12/1/31 | | | | 1,599,081 | |

| | 192,014 | | | | 7.00 | | | | 4/1/37 | | | | 198,325 | |

| | 2,455,190 | | | | 7.00 | | | | 10/1/37 | | | | 2,546,441 | |

| | 1,338,181 | | | | 7.00 | | | | 10/1/38 | | | | 1,402,663 | |

| | 2,165 | | | | 7.38 | | | | 12/17/24 | | | | 2,153 | |

| | 152,718 | | | | 7.50 | | | | 1/1/32 | | | | 156,804 | |

| | 121,515 | | | | 7.50 | | | | 8/1/32 | | | | 121,594 | |

| | 363 | | | | 7.95 | | | | 10/1/25 | | | | 363 | |

| | 54,246 | | | | 8.00 | | | | 1/1/37 | | | | 56,674 | |

| | 29,797 | | | | 8.50 | | | | 6/20/27 | | | | 30,166 | |

| | 5,194 | | | | 8.50 | | | | 12/1/29 | | | | 5,195 | |

| | 51,707 | | | | 8.50 | | | | 3/1/31 | | | | 53,154 | |

| | 2,734 | | | | 9.00 | | | | 3/20/27 | | | | 2,730 | |

| | 11,903 | | | | 9.00 | | | | 2/17/31 | | | | 11,804 | |

| | 3,722 | | | | 9.00 | | | | 5/1/31 | | | | 3,716 | |

| | 270 | | | | 10.00 | | | | 7/1/30 | | | | 269 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 9,445,821 | |

| | | | | | | | | | | | | | |

| | Federal National Mortgage Association - 10.9% | |

| | 3,100,000 | | | | 2.48 | | | | 2/1/35 | | | | 2,366,217 | |

| | 3,100,000 | | | | 2.68 | | | | 2/1/35 | | | | 2,414,528 | |

| | 216,248 | | | | 3.50 | | | | 10/1/34 | | | | 199,517 | |

| | 1,427,923 | | | | 4.50 | | | | 4/1/48 | | | | 1,341,627 | |

| | 4,972,555 | | | | 4.50 | | | | 7/1/52 | | | | 4,570,532 | |

| | 5,002,789 | | | | 4.50 | | | | 9/1/52 | | | | 4,597,987 | |

| | 942,809 | | | | 5.00 | | | | 9/1/43 | | | | 930,797 | |

| | 3,209,795 | | | | 5.00 | | | | 2/1/49 | | | | 3,108,793 | |

| | 356,721 | | | | 5.00 | | | | 6/1/51 | | | | 355,905 | |

| | 1,825,969 | | | | 5.00 | | | | 7/1/52 | | | | 1,697,336 | |

| | 253,280 | | | | 5.50 | | | | 6/1/33 | | | | 250,717 | |

| | 499,464 | | | | 5.50 | | | | 4/1/50 | | | | 490,598 | |

| | 761,581 | | | | 5.93 | | | | 5/1/35 | | | | 758,604 | |

| | 58,326 | | | | 6.00 | | | | 5/1/37 | | | | 57,665 | |

| | 44,035 | | | | 6.00 | | | | 9/1/37 | | | | 43,320 | |

| | 584,882 | | | | 6.50 | | | | 2/1/29 | | | | 587,950 | |

| | 76,982 | | | | 6.50 | | | | 3/1/29 | | | | 75,881 | |

| | 93,203 | | | | 6.50 | | | | 6/1/31 | | | | 93,630 | |

| | 27,879 | | | | 6.50 | | | | 8/1/34 | | | | 27,782 | |

| | 65,334 | | | | 6.50 | | | | 11/1/34 | | | | 64,727 | |

| | 127,067 | | | | 6.50 | | | | 1/1/39 | | | | 125,239 | |

| | 559,903 | | | | 6.75 | | | | 6/1/32 | | | | 578,339 | |

| | 4,590 | | | | 7.00 | | | | 2/1/26 | | | | 4,552 | |

| | 24,824 | | | | 7.00 | | | | 9/1/27 | | | | 24,619 | |

| | 12,143 | | | | 7.00 | | | | 10/1/27 | | | | 12,045 | |

| | 53,034 | | | | 7.00 | | | | 11/1/27 | | | | 52,931 | |

| | 14,549 | | | | 7.00 | | | | 1/1/28 | | | | 14,434 | |

| | 13,267 | | | | 7.00 | | | | 10/1/32 | | | | 13,224 | |

| | 1,846,876 | | | | 7.00 | | | | 12/1/32 | | | | 1,909,710 | |

| | | | | | | | | | | | | | |

Principal Amount ($) | | | Coupon Rate (%) | | | Maturity

Date | | | Fair

Value ($) | |

| | 63,308 | | | | 7.00 | | | | 7/1/33 | | | | 63,319 | |

| | 45,390 | | | | 7.00 | | | | 7/1/34 | | | | 45,805 | |

| | 9,952 | | | | 7.00 | | | | 12/1/37 | | | | 9,979 | |

| | 1,688,296 | | | | 7.00 | | | | 1/1/40 | | | | 1,721,939 | |

| | 432,067 | | | | 7.00 | | | | 9/1/47 | | | | 416,177 | |

| | 21,152 | | | | 7.50 | | | | 4/1/32 | | | | 21,045 | |

| | 93,563 | | | | 7.50 | | | | 1/1/34 | | | | 94,995 | |

| | 1,640,477 | | | | 7.50 | | | | 10/1/38 | | | | 1,684,539 | |

| | 671,908 | | | | 7.50 | | | | 11/1/38 | | | | 691,998 | |

| | 3,490 | | | | 7.99 | | | | 7/20/30 | | | | 3,485 | |

| | 1,523 | | | | 8.00 | | | | 8/20/25 | | | | 1,518 | |

| | 1,060 | | | | 8.00 | | | | 7/20/28 | | | | 1,058 | |

| | 74,447 | | | | 8.00 | | | | 1/1/32 | | | | 75,094 | |

| | 44,664 | | | | 8.00 | | | | 11/1/37 | | | | 46,539 | |

| | 30,113 | | | | 8.18 | | | | 11/15/31 | | | | 30,875 | |

| | 67,613 | | | | 8.50 | | | | 1/1/37 | | | | 67,389 | |

| | 642 | | | | 9.00 | | | | 6/15/25 | | | | 641 | |

| | 13,341 | | | | 9.00 | | | | 5/15/28 | | | | 13,303 | |

| | 16,092 | | | | 9.00 | | | | 7/1/31 | | | | 16,034 | |

| | 4,765 | | | | 9.50 | | | | 8/1/24 | | | | 4,750 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 31,779,688 | |

| | | | | | | | | | | | | | |

| | Government National Mortgage Association - 12.7% | |

| | 32,539 | | | | 4.00 | | | | 12/15/24 | | | | 32,107 | |

| | 269,178 | | | | 4.00 | | | | 10/20/30 | | | | 250,907 | |

| | 5,048,490 | | | | 4.00 | | | | 8/20/31 | | | | 4,748,878 | |

| | 553,258 | | | | 4.00 | | | | 12/20/31 | | | | 521,031 | |

| | 422,473 | | | | 4.25 | | | | 10/20/31 | | | | 398,478 | |

| | 292,150 | | | | 4.25 | | | | 3/20/37 | | | | 274,022 | |

| | 1,273,934 | | | | 4.75 | | | | 9/20/31 | | | | 1,224,944 | |

| | 403,725 | | | | 5.00 | | | | 7/20/49 | | | | 384,506 | |

| | 26,191 | | | | 5.50 | | | | 9/15/25 | | | | 25,701 | |

| | 584,097 | | | | 5.50 | | | | 5/15/29 | | | | 575,709 | |

| | 309,417 | | | | 5.50 | | | | 7/20/37 | | | | 310,284 | |

| | 395,821 | | | | 5.50 | | | | 5/20/40 | | | | 398,301 | |

| | 663,301 | | | | 5.50 | | | | 7/20/62 | | | | 639,316 | |

| | 10,021,348 | | | | 5.50 | | | | 8/20/62 | | | | 9,634,207 | |

| | 971,299 | | | | 5.75 | | | | 2/15/29 | | | | 952,531 | |

| | 470,506 | | | | 5.75 | | | | 10/20/31 | | | | 470,909 | |

| | 280,684 | | | | 6.00 | | | | 9/15/33 | | | | 279,160 | |

| | 142,272 | | | | 6.00 | | | | 2/20/47 | | | | 146,719 | |

| | 1,674,813 | | | | 6.00 | | | | 7/20/47 | | | | 1,726,650 | |

| | 7,607,412 | | | | 6.00 | | | | 8/20/62 | | | | 7,503,878 | |

| | 655 | | | | 6.25 | | | | 12/15/23 | | | | 638 | |

| | 273,674 | | | | 6.25 | | | | 4/15/29 | | | | 274,472 | |

| | 905 | | | | 6.50 | | | | 11/15/23 | | | | 903 | |

| | 5,329 | | | | 6.50 | | | | 4/15/24 | | | | 5,315 | |

| | 117,944 | | | | 6.50 | | | | 2/20/29 | | | | 117,596 | |

| | 15,186 | | | | 6.50 | | | | 12/20/38 | | | | 14,847 | |

| | 134,091 | | | | 6.50 | | | | 1/20/39 | | | | 134,964 | |

| | 79,661 | | | | 6.50 | | | | 2/20/39 | | | | 81,143 | |

| | 163,709 | | | | 6.50 | | | | 4/20/39 | | | | 168,298 | |

| | 172,933 | | | | 6.50 | | | | 6/20/39 | | | | 180,054 | |

| | 350,069 | | | | 6.50 | | | | 8/20/39 | | | | 364,183 | |

| | 179,107 | | | | 6.50 | | | | 4/20/43 | | | | 180,989 | |

| | 1,482,353 | | | | 7.00 | | | | 8/15/29 | | | | 1,513,444 | |

| | 1,699,963 | | | | 7.00 | | | | 10/15/29 | | | | 1,734,156 | |

| | 100,858 | | | | 7.00 | | | | 10/15/36 | | | | 99,935 | |

| | 1,635,734 | | | | 7.00 | | | | 12/20/52 | | | | 1,666,379 | |

| | 192,910 | | | | 7.50 | | | | 4/15/34 | | | | 194,583 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 37,230,137 | |

| | | | | | | | | | | | | | |

| | |

| |

| See accompanying notes to financial statements. | | |

| | |

| 6 | | SIT MUTUAL FUNDS SEMI-ANNUAL REPORT |

| | | | | | | | | | | | | | |

Principal Amount ($) | | | Coupon Rate (%) | | | Maturity

Date | | | Fair

Value ($) | |

| | Small Business Administration - 0.4% | |

| | 1,191,883 | | | | 5.33 | | | | 8/25/36 | | | | 1,105,178 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 1,105,178 | |

| | | | | | | | | | | | | | |

| Total Mortgage Pass-Through Securities

(cost: $86,945,499) |

| | | 79,560,824 | |

| | | | | | | | | | | | | | |

| | U.S. Treasury / Federal Agency Securities - 0.8% | |

| | U.S. Treasury Bonds: | |

| | 2,850,000 | | | | 3.63 | | | | 2/15/53 | | | | 2,354,367 | |

| | | | | | | | | | | | | | |

| Total U.S. Treasury / Federal Agency Securities

(cost: $2,710,468) |

| | | 2,354,367 | |

| | | | | | | | | | | | | | |

| | Collateralized Mortgage Obligations - 69.1% | |

| | Federal Home Loan Mortgage Corporation - 11.8% | |

| | 700,567 | | | | 4.66 | | | | 7/25/32 | 1 | | | 663,594 | |

| | 1,184,146 | | | | 5.00 | | | | 2/25/51 | | | | 1,126,274 | |

| | 5,312,298 | | | | 5.00 | | | | 11/25/50 | 1 | | | 4,932,602 | |

| | 175,803 | | | | 5.25 | | | | 5/15/38 | 1 | | | 171,130 | |

| | 4,807,928 | | | | 5.50 | | | | 6/25/51 | | | | 4,747,149 | |

| | 989,343 | | | | 6.00 | | | | 1/15/33 | | | | 992,220 | |

| | 1,120,581 | | | | 6.00 | | | | 5/15/36 | | | | 1,137,693 | |

| | 733,091 | | | | 6.00 | | | | 6/15/37 | | | | 731,110 | |

| | 1,005,076 | | | | 6.00 | | | | 9/15/42 | | | | 994,304 | |

| | 2,804,380 | | | | 6.00 | | | | 9/25/52 | | | | 2,822,547 | |

| | 5,814 | | | | 6.25 | | | | 5/15/29 | | | | 5,732 | |

| | 1,588 | | | | 6.50 | | | | 3/15/24 | | | | 1,586 | |

| | 157,386 | | | | 6.50 | | | | 7/15/27 | | | | 158,435 | |

| | 147,808 | | | | 6.50 | | | | 2/15/28 | | | | 147,823 | |

| | 6,506 | | | | 6.50 | | | | 2/15/30 | | | | 6,488 | |

| | 195,782 | | | | 6.50 | | | | 1/15/31 | | | | 196,896 | |

| | 115,340 | | | | 6.50 | | | | 8/15/31 | | | | 116,172 | |

| | 115,248 | | | | 6.50 | | | | 1/15/32 | | | | 115,720 | |

| | 37,999 | | | | 6.50 | | | | 3/15/32 | | | | 38,578 | |

| | 275,932 | | | | 6.50 | | | | 6/25/32 | | | | 272,011 | |

| | 107,473 | | | | 6.50 | | | | 7/15/32 | | | | 109,480 | |

| | 566,139 | | | | 6.50 | | | | 5/15/35 | | | | 579,618 | |

| | 257,533 | | | | 6.50 | | | | 8/15/39 | | | | 259,521 | |

| | 840,955 | | | | 6.50 | | | | 2/25/43 | | | | 838,991 | |

| | 325,420 | | | | 6.50 | | | | 3/25/43 | | | | 324,041 | |

| | 651,562 | | | | 6.50 | | | | 10/25/43 | | | | 647,739 | |

| | 1,618,602 | | | | 6.50 | | | | 8/15/45 | | | | 1,668,333 | |

| | 2,667 | | | | 7.00 | | | | 1/15/24 | | | | 2,661 | |

| | 1,208 | | | | 7.00 | | | | 3/15/24 | | | | 1,205 | |

| | 5,927 | | | | 7.00 | | | | 8/15/25 | | | | 5,895 | |

| | 15,315 | | | | 7.00 | | | | 9/15/26 | | | | 15,278 | |

| | 44,995 | | | | 7.00 | | | | 6/15/29 | | | | 45,758 | |

| | 122,936 | | | | 7.00 | | | | 8/15/29 | | | | 124,992 | |

| | 165,006 | | | | 7.00 | | | | 10/20/29 | | | | 168,812 | |

| | 30,889 | | | | 7.00 | | | | 1/15/30 | | | | 31,803 | |

| | 87,929 | | | | 7.00 | | | | 10/15/30 | | | | 90,640 | |

| | 82,445 | | | | 7.00 | | | | 7/15/31 | | | | 84,535 | |

| | 33,324 | | | | 7.00 | | | | 4/15/32 | | | | 33,758 | |

| | 600,000 | | | | 7.00 | | | | 12/15/40 | | | | 639,431 | |

| | 1,410,489 | | | | 7.00 | | | | 8/15/41 | | | | 1,395,484 | |

| | 1,761,477 | | | | 7.00 | | | | 3/25/43 | | | | 1,820,663 | |

| | 2,219,119 | | | | 7.00 | | | | 7/25/43 | | | | 2,274,793 | |

| | 949,368 | | | | 7.00 | | | | 3/15/49 | | | | 986,823 | |

| | 10,984 | | | | 7.50 | | | | 9/20/26 | | | | 11,038 | |

| | 73,588 | | | | 7.50 | | | | 3/15/28 | | | | 74,844 | |

| | 144,494 | | | | 7.50 | | | | 9/15/29 | | | | 149,087 | |

| | | | | | | | | | | | | | |

Principal Amount ($) | | | Coupon Rate (%) | | | Maturity

Date | | | Fair

Value ($) | |

| | 37,775 | | | | 7.50 | | | | 12/15/29 | | | | 38,432 | |

| | 86,311 | | | | 7.50 | | | | 6/15/30 | | | | 89,322 | |

| | 148,842 | | | | 7.50 | | | | 8/15/30 | | | | 153,351 | |

| | 51,909 | | | | 7.50 | | | | 9/15/30 | | | | 54,381 | |

| | 42,157 | | | | 7.50 | | | | 11/15/30 | | | | 43,571 | |

| | 1,567,557 | | | | 7.50 | | | | 6/15/34 | | | | 1,662,438 | |

| | 576,245 | | | | 7.50 | | | | 9/25/43 | | | | 574,936 | |

| | 1 | | | | 8.00 | | | | 4/25/24 | | | | 1 | |

| | 35,579 | | | | 8.00 | | | | 2/15/27 | | | | 36,334 | |

| | 65,168 | | | | 8.00 | | | | 11/20/29 | | | | 67,250 | |

| | 65,969 | | | | 8.00 | | | | 1/15/30 | | | | 68,624 | |

| | 18,014 | | | | 8.50 | | | | 3/15/25 | | | | 18,236 | |

| | 13,322 | | | | 8.50 | | | | 3/15/32 | | | | 13,973 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 34,584,136 | |

| | | | | | | | | | | | | | |

| | Federal National Mortgage Association - 18.9% | |

| | 211,038 | | | | 2.01 | | | | 7/25/37 | 1 | | | 178,637 | |

| | 103,332 | | | | 3.00 | | | | 7/25/40 | | | | 102,889 | |

| | 331,196 | | | | 3.58 | | | | 8/25/43 | 1 | | | 300,651 | |

| | 146,416 | | | | 4.55 | | | | 6/25/43 | | | | 138,758 | |

| | 1,583,579 | | | | 4.71 | | | | 2/25/42 | 1 | | | 1,515,723 | |

| | 1,041,016 | | | | 4.99 | | | | 10/25/42 | 1 | | | 1,029,655 | |

| | 1,822,627 | | | | 5.00 | | | | 7/25/33 | | | | 1,753,254 | |

| | 249,320 | | | | 5.00 | | | | 11/25/41 | | | | 243,582 | |

| | 413,862 | | | | 5.00 | | | | 6/25/43 | | | | 400,544 | |

| | 3,216,580 | | | | 5.00 | | | | 11/25/50 | | | | 3,051,109 | |

| | 3,821,993 | | | | 5.00 | | | | 12/25/50 | | | | 3,659,970 | |

| | 411,056 | | | | 5.00 | | | | 1/25/51 | | | | 392,268 | |

| | 1,949,602 | | | | 5.25 | | | | 12/25/42 | 1 | | | 1,842,323 | |

| | 440,314 | | | | 5.36 | | | | 6/25/42 | | | | 429,078 | |

| | 448,489 | | | | 5.50 | | | | 9/25/33 | | | | 441,065 | |

| | 317,556 | | | | 5.50 | | | | 6/25/40 | | | | 302,793 | |

| | 594,503 | | | | 5.66 | | | | 12/25/53 | 1 | | | 591,921 | |

| | 263,057 | | | | 5.75 | | | | 8/25/33 | | | | 259,314 | |

| | 504,973 | | | | 5.81 | | | | 8/25/43 | | | | 488,486 | |

| | 526,932 | | | | 6.00 | | | | 5/25/30 | | | | 525,822 | |

| | 107,502 | | | | 6.00 | | | | 11/25/32 | | | | 107,249 | |

| | 529,157 | | | | 6.00 | | | | 9/25/35 | | | | 531,014 | |

| | 1,268,394 | | | | 6.00 | | | | 5/25/36 | | | | 1,267,010 | |

| | 165,073 | | | | 6.00 | | | | 6/25/36 | | | | 166,206 | |

| | 615,560 | | | | 6.00 | | | | 10/25/36 | | | | 624,070 | |

| | 1,400,654 | | | | 6.00 | | | | 11/25/43 | | | | 1,384,738 | |

| | 1,690,953 | | | | 6.00 | | | | 6/25/44 | | | | 1,658,855 | |

| | 542,992 | | | | 6.00 | | | | 9/25/46 | | | | 524,409 | |

| | 711,140 | | | | 6.00 | | | | 2/25/48 | | | | 720,837 | |

| | 1,000,000 | | | | 6.00 | | | | 10/25/53 | | | | 986,250 | |

| | 658,360 | | | | 6.28 | | | | 8/25/47 | 1 | | | 640,858 | |

| | 801,968 | | | | 6.49 | | | | 9/25/37 | 1 | | | 770,841 | |

| | 99,257 | | | | 6.50 | | | | 8/20/28 | | | | 98,056 | |

| | 658,982 | | | | 6.50 | | | | 1/25/32 | | | | 664,032 | |

| | 111,786 | | | | 6.50 | | | | 3/25/32 | | | | 111,228 | |

| | 181,204 | | | | 6.50 | | | | 6/25/32 | | | | 183,273 | |

| | 31,553 | | | | 6.50 | | | | 9/25/36 | | | | 31,817 | |

| | 1,332,553 | | | | 6.50 | | | | 11/25/41 | | | | 1,332,909 | |

| | 133,998 | | | | 6.50 | | | | 3/25/42 | | | | 133,474 | |

| | 1,235,684 | | | | 6.50 | | | | 7/25/42 | | | | 1,226,509 | |

| | 2,156,193 | | | | 6.50 | | | | 12/25/43 | | | | 2,162,088 | |

| | 303,947 | | | | 6.66 | | | | 8/25/37 | 1 | | | 295,205 | |

| | 227,803 | | | | 6.71 | | | | 9/25/37 | 1 | | | 224,023 | |

| | 1,315,343 | | | | 6.75 | | | | 6/25/32 | | | | 1,350,866 | |

| | 299,468 | | | | 6.75 | | | | 4/25/37 | | | | 294,350 | |

| | 25,736 | | | | 6.85 | | | | 12/18/27 | | | | 25,437 | |

| | |

| |

| See accompanying notes to financial statements. | | |

| | |

| SEPTEMBER 30, 2023 | | 7 |

SCHEDULE OF INVESTMENTS (Unaudited)

September 30, 2023

Sit U.S. Government Securities Fund (Continued)

| | | | | | | | | | | | | | |

Principal Amount ($) | | | Coupon Rate (%) | | | Maturity

Date | | | Fair

Value ($) | |

| | 14,667 | | | | 7.00 | | | | 4/25/24 | | | | 14,588 | |

| | 53,226 | | | | 7.00 | | | | 9/18/27 | | | | 53,583 | |

| | 463,357 | | | | 7.00 | | | | 5/25/31 | | | | 458,703 | |

| | 898,435 | | | | 7.00 | | | | 12/25/33 | | | | 922,894 | |

| | 62,423 | | | | 7.00 | | | | 9/25/40 | | | | 62,624 | |

| | 703,657 | | | | 7.00 | | | | 6/19/41 | 1 | | | 716,713 | |

| | 315,699 | | | | 7.00 | | | | 10/25/41 | | | | 317,833 | |

| | 101,556 | | | | 7.00 | | | | 11/25/41 | | | | 104,274 | |

| | 210,835 | | | | 7.00 | | | | 12/25/41 | | | | 215,646 | |

| | 703,492 | | | | 7.00 | | | | 7/25/42 | | | | 719,686 | |

| | 1,339,939 | | | | 7.00 | | | | 2/25/44 | | | | 1,369,531 | |

| | 55,464 | | | | 7.00 | | | | 8/25/44 | | | | 56,985 | |

| | 735,725 | | | | 7.00 | | | | 4/25/49 | | | | 766,608 | |

| | 10,982 | | | | 7.50 | | | | 8/20/27 | | | | 11,069 | |

| | 283,026 | | | | 7.50 | | | | 10/25/40 | | | | 282,864 | |

| | 937,964 | | | | 7.50 | | | | 11/25/40 | | | | 920,976 | |

| | 946,046 | | | | 7.50 | | | | 7/25/41 | | | | 947,971 | |

| | 328,645 | | | | 7.50 | | | | 1/25/42 | | | | 338,739 | |

| | 2,465,819 | | | | 7.50 | | | | 5/25/42 | | | | 2,555,477 | |

| | 2,288,430 | | | | 7.50 | | | | 8/25/42 | 1 | | | 2,411,335 | |

| | 712,090 | | | | 7.50 | | | | 2/25/44 | | | | 730,569 | |

| | 285,463 | | | | 7.50 | | | | 3/25/44 | | | | 292,467 | |

| | 452,216 | | | | 7.50 | | | | 5/25/44 | | | | 472,407 | |

| | 28,334 | | | | 7.50 | | | | 10/25/44 | | | | 29,403 | |

| | 3,006,517 | | | | 7.50 | | | | 1/25/48 | | | | 3,132,033 | |

| | 246,949 | | | | 7.99 | | | | 11/25/37 | 1 | | | 257,561 | |

| | 10,340 | | | | 8.00 | | | | 7/18/27 | | | | 10,508 | |

| | 205,889 | | | | 8.00 | | | | 7/25/44 | | | | 207,624 | |

| | 118,259 | | | | 8.09 | | | | 11/25/37 | 1 | | | 123,250 | |

| | 28,125 | | | | 8.44 | | | | 10/25/42 | 1 | | | 29,535 | |

| | 1,025 | | | | 8.50 | | | | 1/25/25 | | | | 1,028 | |

| | 264,482 | | | | 8.50 | | | | 6/25/30 | | | | 280,453 | |

| | 22,817 | | | | 9.00 | | | | 11/25/28 | | | | 23,626 | |

| | 174,375 | | | | 9.00 | | | | 6/25/30 | | | | 187,241 | |

| | 36,274 | | | | 9.00 | | | | 10/25/30 | | | | 38,919 | |

| | 36,860 | | | | 9.47 | | | | 6/25/32 | 1 | | | 38,950 | |

| | 39,036 | | | | 9.50 | | | | 11/25/31 | | | | 41,943 | |

| | 161,402 | | | | 9.50 | | | | 12/25/41 | | | | 170,469 | |

| | 155,303 | | | | 9.67 | | | | 6/25/44 | 1 | | | 153,516 | |

| | 604,261 | | | | 11.37 | | | | 9/25/42 | 1 | | | 673,630 | |

| | 9,444 | | | | 20.85 | | | | 3/25/39 | 1 | | | 12,647 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 55,319,324 | |

| | | | | | | | | | | | | | |

| | Government National Mortgage Association - 37.5% | |

| | 2,224,438 | | | | 4.74 | | | | 5/20/51 | 1 | | | 2,113,325 | |

| | 2,275,406 | | | | 4.77 | | | | 5/20/51 | 1 | | | 2,164,910 | |

| | 4,874,115 | | | | 4.83 | | | | 8/20/51 | 1 | | | 4,609,914 | |

| | 2,823,053 | | | | 5.00 | | | | 12/20/50 | | | | 2,714,992 | |

| | 3,961,929 | | | | 5.00 | | | | 1/20/51 | | | | 3,819,494 | |

| | 7,086,948 | | | | 5.00 | | | | 2/20/51 | | | | 6,656,291 | |

| | 201,401 | | | | 5.47 | | | | 4/20/48 | 1 | | | 195,597 | |

| | 488,820 | | | | 5.50 | | | | 9/20/39 | | | | 477,316 | |

| | 8,072,717 | | | | 5.50 | | | | 10/20/50 | | | | 7,968,508 | |

| | 1,710,455 | | | | 5.50 | | | | 11/20/50 | | | | 1,713,392 | |

| | 3,684,570 | | | | 5.50 | | | | 12/20/50 | | | | 3,666,502 | |

| | 3,011,670 | | | | 5.50 | | | | 1/20/51 | | | | 3,048,666 | |

| | 1,799,870 | | | | 5.50 | | | | 4/20/51 | | | | 1,806,320 | |

| | 12,469,030 | | | | 5.50 | | | | 5/20/51 | | | | 12,347,599 | |

| | 12,816,053 | | | | 5.50 | | | | 6/20/51 | | | | 12,628,992 | |

| | 15,432,191 | | | | 5.50 | | | | 7/20/51 | | | | 15,235,499 | |

| | 485,926 | | | | 5.50 | | | | 10/20/51 | | | | 484,789 | |

| | 5,253,341 | | | | 5.50 | | | | 11/20/51 | | | | 5,169,996 | |

| | | | | | | | | | | | | | |

Principal Amount ($) | | | Coupon Rate (%) | | | Maturity

Date | | | Fair

Value ($) | |

| | 7,478,213 | | | | 5.84 | | | | 2/20/51 | 1 | | | 7,532,670 | |

| | 526,742 | | | | 5.91 | | | | 10/20/40 | 1 | | | 527,512 | |

| | 313,416 | | | | 5.99 | | | | 11/20/43 | 1 | | | 314,672 | |

| | 974,377 | | | | 6.00 | | | | 11/20/33 | | | | 968,658 | |

| | 321,405 | | | | 6.00 | | | | 12/20/35 | | | | 324,335 | |

| | 197,437 | | | | 6.00 | | | | 3/20/42 | | | | 198,389 | |

| | 269,968 | | | | 6.00 | | | | 3/20/48 | | | | 266,821 | |

| | 1,373,581 | | | | 6.00 | | | | 3/20/49 | | | | 1,348,792 | |

| | 400,128 | | | | 6.00 | | | | 5/20/49 | | | | 401,548 | |

| | 1,321,176 | | | | 6.13 | | | | 1/20/39 | 1 | | | 1,367,250 | |

| | 185,299 | | | | 6.46 | | | | 4/20/37 | 1 | | | 185,285 | |

| | 758,878 | | | | 6.50 | | | | 2/20/37 | | | | 760,704 | |

| | 143,945 | | | | 6.50 | | | | 9/16/38 | | | | 144,398 | |

| | 1,314,708 | | | | 6.50 | | | | 8/20/48 | | | | 1,316,141 | |

| | 935,209 | | | | 6.50 | | | | 10/20/48 | | | | 928,225 | |

| | 936,394 | | | | 6.50 | | | | 1/20/49 | | | | 918,311 | |

| | 867,637 | | | | 6.50 | | | | 7/20/39 | 1 | | | 881,388 | |

| | 479,798 | | | | 6.83 | | | | 8/20/40 | 1 | | | 492,607 | |

| | 204,186 | | | | 7.00 | | | | 6/20/45 | 1 | | | 209,426 | |

| | 77,280 | | | | 7.00 | | | | 9/16/33 | | | | 77,181 | |

| | 209,211 | | | | 7.00 | | | | 5/20/42 | | | | 215,751 | |

| | 548,740 | | | | 7.00 | | | | 10/20/48 | | | | 559,825 | |

| | 816,871 | | | | 7.00 | | | | 11/20/48 | | | | 831,809 | |

| | 323,846 | | | | 7.08 | | | | 2/20/45 | 1 | | | 335,803 | |

| | 767,310 | | | | 7.10 | | | | 12/20/38 | 1 | | | 785,912 | |

| | 792,054 | | | | 7.30 | | | | 8/20/38 | 1 | | | 821,294 | |

| | | | | | | | | | | | | | |

| | | | | 109,536,809 | |

| | | | | | | | | | | | | | |

| | Vendee Mortgage Trust - 0.9% | |

| | 138,992 | | | | 6.50 | | | | 2/15/24 | | | | 138,642 | |

| | 942,739 | | | | 6.50 | | | | 8/15/31 | | | | 922,808 | |

| | 525,988 | | | | 6.50 | | | | 10/15/31 | | | | 535,830 | |

| | 318,127 | | | | 6.53 | | | | 7/15/30 | 1 | | | 319,935 | |

| | 237,361 | | | | 6.75 | | | | 2/15/26 | | | | 238,998 | |

| | 316,023 | | | | 7.00 | | | | 3/15/28 | | | | 314,137 | |

| | 57,347 | | | | 7.25 | | | | 9/15/25 | | | | 57,762 | |

| | 39,172 | | | | 7.75 | | | | 9/15/24 | | | | 39,216 | |

| | 19,367 | | | | 8.00 | | | | 2/15/25 | | | | 19,321 | |

| | 32,536 | | | | 8.29 | | | | 12/15/26 | | | | 32,701 | |

| | | | | | | | | | | | | | |

| | | | | 2,619,350 | |

| | | | | | | | | | | | | | |

| Total Collateralized Mortgage Obligations

(cost: $225,702,900) |

| | | 202,059,619 | |

| | | | | | | | | | | | | | |

| | Asset-Backed Securities - 1.0% | |

| | Federal Home Loan Mortgage Corporation - 0.1% | |

| | 260 | | | | 6.09 | | | | 9/25/29 | 1 | | | 250 | |

| | 370,607 | | | | 7.16 | | | | 7/25/29 | | | | 371,289 | |

| | | | | | | | | | | | | | |

| | | | | 371,539 | |

| | | | | | | | | | | | | | |

| | Federal National Mortgage Association - 0.6% | | | | | |

| | 311,328 | | | | 4.40 | | | | 11/25/33 | 14 | | | 296,894 | |

| | 302,495 | | | | 4.45 | | | | 9/26/33 | 14 | | | 287,579 | |

| | 76,543 | | | | 4.87 | | | | 10/25/33 | 14 | | | 71,337 | |

| | 6,257 | | |

| 1 Mo. Libor

+ 0.17%, 5.60 |

| | | 11/25/32 | 1 | | | 6,156 | |

| | 1,145,499 | | | | 5.74 | | | | 2/25/33 | 14 | | | 1,071,912 | |

| | 1,014 | | | | 6.00 | | | | 5/25/32 | 14 | | | 983 | |

| | 34,655 | | | | 6.09 | | | | 10/25/31 | 14 | | | 34,513 | |

| | 927 | | | | 7.45 | | | | 6/25/26 | 1 | | | 924 | |

| | | | | | | | | | | | | | |

| | | | | 1,770,298 | |

| | | | | | | | | | | | | | |

| | |

| |

| See accompanying notes to financial statements. | | |

| | |

| 8 | | SIT MUTUAL FUNDS SEMI-ANNUAL REPORT |

| | | | | | | | | | | | | | |

Principal Amount ($) | | | Coupon Rate (%) | | | Maturity

Date | | | Fair

Value ($) | |

| | Small Business Administration - 0.3% | | | | | |

| | 95,353 | | | | 5.78 | | | | 8/1/27 | | | | 93,368 | |

| | 383,837 | | | | 5.87 | | | | 7/1/28 | | | | 374,722 | |

| | 380,672 | | | | 6.02 | | | | 8/1/28 | | | | 368,796 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 836,886 | |

| | | | | | | | | | | | | | |

| Total Asset-Backed Securities

(cost: $3,182,395) |

| | | 2,978,723 | |

| | | | | | | | | | | | | | |

| Put Options Purchased 19 - 0.2%

(cost: $567,606) |

| | | 562,500 | |

| | | | | | | | | | | | | | |

| | |

Quantity | | | Name of Issuer | | | Fair

Value ($) | |

| | Short-Term Securities - 1.2% | |

| | 3,612,232 | | |

| Fidelity Inst. Money Mkt.

Gvt. Fund, 5.27% |

| | | 3,612,232 | |

| | | | | | | | | | | | | | |

| | (cost: $3,612,232) | | | | | |

| Total Investments in Securities - 99.5%

(cost: $322,721,100) |

| | | 291,128,265 | |

| | | | | | | | | | | | | | |

| | Other Assets and Liabilities - 0.5% | | | | 1,586,530 | |

| | | | | | | | | | | | | | |

| | Net Assets - 100.0% | | | $ | 292,714,795 | |

| | | | | | | | | | | | | | |

| 1 | Variable rate security. Rate disclosed is as of September 30, 2023. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions, or, for mortgage-backed securities, are impacted by the individual mortgages which are paying off over time. These securities do not indicate a reference rate and spread in their descriptions. 14 Step Coupon: A bond that pays a coupon rate that increases on a specified date(s). Rate disclosed is as of September 30, 2023. |

Numeric footnotes not disclosed are not applicable to this Schedule of Investments.

| | |

| |

| See accompanying notes to financial statements. | | |

| | |

| SEPTEMBER 30, 2023 | | 9 |

SCHEDULE OF INVESTMENTS (Unaudited)

September 30, 2023

Sit U.S. Government Securities Fund (Continued)

| 19 | Options outstanding as of September 30, 2023 were as follows: |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Description | | Contracts | | | Exercise

Price ($) | | | Expiration Date | | | Counterparty | | | Notional

Amount ($) | | | Cost/

Premiums ($) | | | Value ($) | |

Put Options Purchased - U.S. Treasury Futures: | |

5-Year | | | 1,500 | | | | 104.25 | | | | November 2023 | | | | StoneX Financial, Inc. | | | | 156,375,000 | | | | 567,606 | | | | 562,500 | |

A summary of the levels for the Fund’s investments as of September 30, 2023 is as follows (see Note 2 - significant accounting policies in the notes to financial statements):

| | | | | | | | | | | | | | | | |

| | | Investment in Securities | |

| | | Level 1

Quoted

Prices ($) | | | Level 2

Other significant

observable inputs ($) | | | Level 3

Significant

unobservable inputs ($) | | | Total ($) | |

Mortgage Pass-Through Securities | | | — | | | | 79,560,824 | | | | — | | | | 79,560,824 | |

U.S. Treasury / Federal Agency Securities | | | — | | | | 2,354,367 | | | | — | | | | 2,354,367 | |

Collateralized Mortgage Obligations | | | — | | | | 202,059,619 | | | | — | | | | 202,059,619 | |

Asset-Backed Securities | | | — | | | | 2,978,723 | | | | — | | | | 2,978,723 | |

Put Options Purchased | | | 562,500 | | | | — | | | | — | | | | 562,500 | |

Short-Term Securities | | | 3,612,232 | | | | — | | | | — | | | | 3,612,232 | |

| | | | | | | | | | | | | | | | |

Total: | | | 4,174,732 | | | | 286,953,533 | | | | — | | | | 291,128,265 | |

| | | | | | | | | | | | | | | | |

There were no transfers into or out of level 3 during the reporting period.

| | |

| |

| See accompanying notes to financial statements. | | |

| | |

| 10 | | SIT MUTUAL FUNDS SEMI-ANNUAL REPORT |

[This page is intentionally left blank.]

Sit Quality Income Fund - Class S and Class Y

OBJECTIVE & STRATEGY

The objective of the Sit Quality Income Fund is to provide high current income and safety of principal, which it seeks to attain by investing under normal market conditions at least 80% of its assets in debt securities issued by the U.S. government and its agencies, debt securities issued by corporations, and mortgage and other asset-backed securities. The Fund invests at least 50% of its assets in U.S. government debt securities, which are securities issued, guaranteed or insured by the U.S. government, its agencies or instrumentalities.

Fund Performance

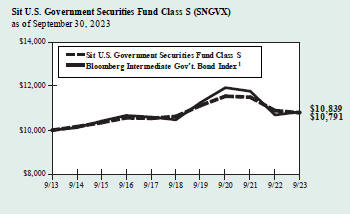

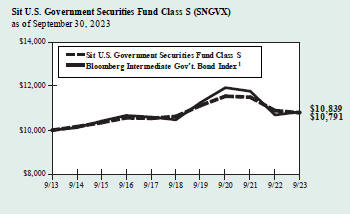

The Sit Quality Income Fund (Class S) provided a return of +0.24% during the 6-month period ended September 30, 2023, compared to the return of the Bloomberg 1-3 Year Government/Credit Bond Index of +0.35%. The Fund’s 30-day SEC yield was 4.35% and its 12-month distribution rate was 3.38%.

Factors that Influenced the Fund’s Performance

The primary goal of the Fund is to maintain a high credit quality portfolio with stable principal values, while generating a relatively high level of income. Yields of U.S. Treasury securities were higher across all maturities for the 6-month period causing large price declines across most sectors. The Fund’s strong income advantage was able to offset the price declines and provided a positive total return. The Fund seeks to reduce interest rate risk by using futures and options on Treasury securities. The use of futures and options was effective in providing stability to the Fund’s net asset value and provided a positive return. U.S. agency debentures outperformed as yield spreads narrowed and extended down the inverted yield curve. The Fund’s holdings in agency mortgage-backed securities and taxable municipal securities underperformed as those securities are longer in duration. The Fund’s corporate securities outperformed as yield spreads narrowed.

Outlook and Positioning

The inflation rate has been the most scrutinized economic metric in the past six months while the Federal Reserve (Fed) continues to be ambiguous about the peak desired level of short-term interest rates. Investors have been whipsawed back and forth by economic indicators. Most believe that we have reached the maximum level of short-term interest rates in this cycle, but hawkish rhetoric from the Fed has investors weary. The Fed began the period with headwinds with respect to inflation such as the ongoing war between Ukraine and Russia, supply chain disruptions relating to Covid-19, and pent-up excess savings from loose fiscal policies. To combat inflation, the Fed embarked on one of the most aggressive interest rate hiking cycles ever which saw the Fed Funds rate upper bound target rate increase from 0.25% to 5.50% in only 18 months. The Fed’s policies achieved a disinflationary environment as year-over-year core PCE, the Fed’s preferred inflation metric, fell from 5.6% to 3.9%. Now the Fed has tailwinds with respect to lower inflation. Supply chains have normalized, and pent-up savings have been depleted. Any

HYPOTHETICAL GROWTH OF $10,000

The chart above illustrates the total value of a hypothetical $10,000 investment in the Fund over the past 10 years as compared to the performance of the Bloomberg 1-3 Year Government/Credit Index. Past performance does not guarantee future results. Returns include the reinvestment of distributions. The chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| 1 | The Bloomberg 1-3 Year Government/Credit Index is an unmanaged index of Treasury or government agency securities and investment grade corporate debt securities with maturities of one to three years. The returns include the reinvestment of income and do not include any transaction costs, management fees or other costs. It is not possible to invest directly in an index. This is the Fund’s primary index. |

remaining pent-up savings will likely run out as student loan payments are set to resume this October. Talks of a recession have subsided, and investors have accepted interest rates to remain higher well into next year. Mortgage rates, currently in the 7.5%-8.0% range, may play a significant part in the upcoming months as housing affordability remains incredibly low. Prepayments across all coupons have slowed and we expect decreased housing turnover and refinancing to grind to a halt. We have positioned the Fund defensively in terms of credit quality while emphasizing securities that will benefit from a normalization of the yield curve. We focus on a mix of Treasury, agency and credit sectors that provide relatively high levels of income and stable prices.

| | |

| Bryce A. Doty, CFA | | Chris M. Rasmussen, CFA |

| Senior Portfolio Manager | | Mark H. Book, CFA |

| | Portfolio Managers |

| | |

| | |

| 12 | | SIT MUTUAL FUNDS SEMI-ANNUAL REPORT |

COMPARATIVE RATES OF RETURNS

as of September 30, 2023

| | | | | | | | | | | | | | | | |

| | | Sit Quality | | | | | | | |

| | | Income Fund | | | | | | | |

| | | Class S | | | Class Y | | | Bloomberg

1-3 Year

Government/

Credit Index1 | | | Lipper Short

Investment

Grade Bond

Index2 | |

Six Month | | | 0.24 | % | | | 0.36 | % | | | 0.35 | % | | | n/a | |

One Year | | | 1.85 | | | | 2.00 | | | | 2.77 | | | | 4.14 | % |

Five Year | | | 1.49 | | | | n/a | | | | 1.21 | | | | 1.64 | |

Ten Year | | | 1.07 | | | | n/a | | | | 1.02 | | | | 1.47 | |

Since Inception-Class S (12/31/12) | | | 1.03 | | | | n/a | | | | 0.99 | | | | 1.39 | |

Since Inception-Class Y (3/31/22) | | | n/a | | | | 0.17 | | | | 0.41 | | | | 0.97 | |

Performance figures are historical and do not guarantee future results. Investment returns and principal value will vary, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the performance data quoted. Contact the Fund for performance data current to the most recent month-end. Returns include changes in share price as well as reinvestment of all dividends and capital gains and all fee waivers. Without the fee waivers total return and yield figures would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Management fees and administrative expenses are included in the Fund’s performance. Returns for periods greater than one year are compounded average annual rates of return.

| 1 | The Bloomberg 1-3 Year Government/Credit Index is an unmanaged index of Treasury or government agency securities and investment grade corporate debt securities with maturities of one to three years. The returns include the reinvestment of income and do not include any transaction costs, management fees or other costs. It is not possible to invest directly in an index. |

| 2 | The Lipper returns are obtained from Lipper Analytical Services, Inc., a large independent evaluator of mutual funds. |

FUND DIVERSIFICATION

| | | | |

U.S. Treasury / Federal Agency Securities | | | 35.9 | % |

Taxable Municipal Bonds | | | 22.8 | |

Mortgage Pass-Through Securities | | | 17.6 | |

Corporate Bonds | | | 15.7 | |

Collateralized Mortgage Obligations - Non Agency | | | 4.8 | |

Asset-Backed Securities - Non Agency | | | 1.0 | |

Other Net Assets | | | 2.2 | |

Based on net assets as of September 30, 2023.

PORTFOLIO SUMMARY

| | | | | | | | |

Class S: | | | | | | | | |

Net Asset Value 9/30/23: | | $ | 9.30 | | | | Per Share | |

Net Asset Value 3/31/23: | | $ | 9.46 | | | | Per Share | |

Net Assets: | | $ | 32.7 | | | | Million | |

Class Y: | | | | | | | | |

Net Asset Value 9/30/23: | | $ | 9.32 | | | | Per Share | |

Net Asset Value 3/31/23: | | $ | 9.48 | | | | Per Share | |

Net Assets: | | $ | 101.3 | | | | Million | |

Average Maturity | | | 10.2 | | | | Years | |

Effective Duration:3 | | | 1.9 | | | | Years | |

| 3 | Duration is a measure of estimated price sensitivity relative to changes in interest rates. Portfolios with longer durations are typically more sensitive to changes in interest rates. For example, if interest rates rise by 1%, the fair value of a security with an effective duration of 5 years would decrease by 5%, with all other factors being constant. The correlation between duration and price sensitivity is greater for securities rated investment-grade than it is for securities rated below investment-grade. Duration estimates are based on assumptions by Sit Investment Associates, Inc. (the “Adviser”) and are subject to a number of limitations. Effective duration is calculated based on historical price changes of securities held by the Fund, and therefore is a more accurate estimate of price sensitivity provided interest rates remain within their historical range. |

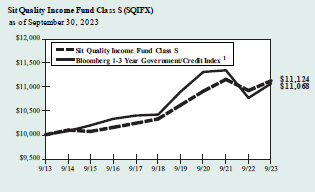

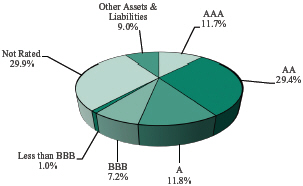

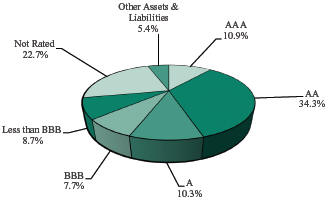

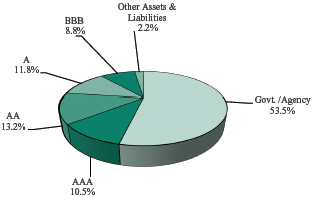

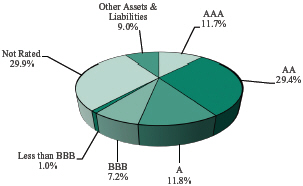

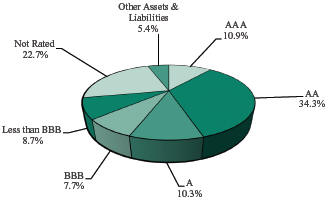

QUALITY RATING (% of Net Assets)

Lower of Moody’s, S&P, Fitch or Duff & Phelps ratings used.

SCHEDULE OF INVESTMENTS (Unaudited)

September 30, 2023

Sit Quality Income Fund

| | | | | | | | | | | | | | | | |

Name of Issuer | | Principal

Amount ($) | | | Coupon

Rate (%) | | | Maturity

Date | | | Fair

Value ($) | |

Asset-Backed Securities - 1.4% | | | | | | | | | | | | | | | | |

Agency - 0.4% | | | | | | | | | | | | | | | | |

FNMA Grantor Trust, Series 2004-T5, Class A11 1 | | | 376,975 | | | | 7.18 | | | | 5/28/35 | | | | 360,056 | |

Small Business Administration, Series 2006-20D, Class 1 | | | 57,640 | | | | 5.64 | | | | 4/1/26 | | | | 56,778 | |

Small Business Administration, Series 2007-20B, Class 1 | | | 44,621 | | | | 5.49 | | | | 2/1/27 | | | | 43,511 | |

Small Business Administration, Series 2007-20J, Class 1 | | | 98,517 | | | | 5.57 | | | | 10/1/27 | | | | 96,398 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 556,743 | |

| | | | | | | | | | | | | | | | |

Non-Agency - 1.0% | | | | | | | | | | | | | | | | |

Centex Home Equity Loan Trust, Series 2004-A, Class AF4 14 | | | 102,684 | | | | 5.01 | | | | 8/25/32 | | | | 99,351 | |

Home Equity Mortgage Loan Asset-Backed Trust, Series 2003-A, Class AV2, TSFR1M + 0.97% 1 | | | 73,513 | | | | 4.60 | | | | 10/25/33 | | | | 72,991 | |

Mill City Mortgage Loan Trust, Series 2017-3, Class A1 1, 4 | | | 48,135 | | | | 2.75 | | | | 1/25/61 | | | | 46,687 | |

Towd Point Mortgage Trust, Series 2019-MH1, Class A2 1, 4 | | | 800,000 | | | | 3.00 | | | | 11/25/58 | | | | 778,343 | |

Towd Point Mortgage Trust, Series 2020-MH1, Class A1A 1, 4 | | | 354,849 | | | | 2.18 | | | | 2/25/60 | | | | 332,847 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 1,330,219 | |

| | | | | | | | | | | | | | | | |

Total Asset-Backed Securities

(cost: $1,966,621) | | | | | | | | | | | | | | | 1,886,962 | |

| | | | | | | | | | | | | | | | |

Collateralized Mortgage Obligations - 20.6% | | | | | | | | | | | | | | | | |

Agency - 15.8% | | | | | | | | | | | | | | | | |

FHLMC REMICS, Series 3104, Class BY | | | 21,270 | | | | 5.50 | | | | 1/15/26 | | | | 21,011 | |

FHLMC REMICS, Series 3806, Class JA | | | 17,576 | | | | 3.50 | | | | 2/15/26 | | | | 17,376 | |

FHLMC REMICS, Series 3982, Class LA | | | 319,496 | | | | 2.50 | | | | 12/15/39 | | | | 313,712 | |

FHLMC REMICS, Series 4210, Class AD | | | 51,520 | | | | 4.00 | | | | 3/15/40 | | | | 51,371 | |

FHLMC REMICS, Series 4246, Class PT | | | 211,851 | | | | 6.50 | | | | 2/15/36 | | | | 215,404 | |

FHLMC REMICS, Series 4390, Class CA | | | 716,979 | | | | 3.50 | | | | 6/15/50 | | | | 695,728 | |

FHLMC REMICS, Series 4523, Class VB | | | 576,192 | | | | 3.50 | | | | 8/15/34 | | | | 573,689 | |

FHLMC REMICS, Series 4717, Class KV | | | 1,187,973 | | | | 3.50 | | | | 8/15/40 | | | | 1,159,494 | |

FHLMC REMICS, Series 4759, Class NA | | | 29,874 | | | | 3.00 | | | | 8/15/44 | | | | 29,377 | |

FHLMC REMICS, Series 5252, Class BT | | | 934,793 | | | | 6.00 | | | | 9/25/52 | | | | 940,849 | |

FHLMC Structured Pass-Through Certificates, Series T-60, Class 1A2 | | | 497,188 | | | | 7.00 | | | | 3/25/44 | | | | 475,448 | |

FNMA Grantor Trust, Series 2004-T1, Class 2A 1 | | | 237,936 | | | | 3.58 | | | | 8/25/43 | | | | 215,992 | |

FNMA REMICS, Series 2002-W1, Class 2A 1 | | | 844,892 | | | | 4.71 | | | | 2/25/42 | | | | 808,689 | |

FNMA REMICS, Series 2004-W5, Class A1 | | | 1,555,224 | | | | 6.00 | | | | 2/25/47 | | | | 1,516,371 | |

FNMA REMICS, Series 2011-146, Class LX | | | 1,067,657 | | | | 3.50 | | | | 10/25/40 | | | | 1,023,817 | |

FNMA REMICS, Series 2014-60, Class EA | | | 407,372 | | | | 3.00 | | | | 9/25/40 | | | | 404,938 | |

FNMA REMICS, Series 2017-97, Class DP | | | 13,630 | | | | 3.50 | | | | 10/25/46 | | | | 13,224 | |

FNMA REMICS, Series 2018-25, Class AG | | | 170,364 | | | | 3.50 | | | | 4/25/47 | | | | 159,030 | |

FNMA Trust, Series 2004-W9, Class 1A3 | | | 666,551 | | | | 6.05 | | | | 2/25/44 | | | | 649,607 | |

Freddie Mac Multifamily Structured Pass-Through Certificates, Series K036, Class A2 1 | | | 297,758 | | | | 3.53 | | | | 10/25/23 | | | | 296,632 | |

Freddie Mac Multifamily Structured Pass-Through Certificates, Series K037, Class A2 | | | 2,958,712 | | | | 3.49 | | | | 1/25/24 | | | | 2,937,950 | |

Freddie Mac Multifamily Structured Pass-Through Certificates, Series K724, Class A2 1 | | | 947,948 | | | | 3.06 | | | | 11/25/23 | | | | 943,592 | |

Freddie Mac Multifamily Structured Pass-Through Certificates, Series K728, Class A2 1 | | | 2,797,980 | | | | 3.06 | | | | 8/25/24 | | | | 2,738,446 | |

Freddie Mac Multifamily Structured Pass-Through Certificates, Series K730, Class A2 1 | | | 2,958,816 | | | | 3.59 | | | | 1/25/25 | | | | 2,884,346 | |

FRESB Mortgage Trust, Series 2018-SB45, Class A5H, SOFRRATE 30 Day Average + 0.81% 1 | | | 150,310 | | | | 6.13 | | | | 11/25/37 | | | | 149,319 | |

FRESB Mortgage Trust, Series 2018-SB46, Class A5H, SOFRRATE 30 Day Average + 0.81% 1 | | | 514,511 | | | | 6.13 | | | | 12/25/37 | | | | 505,373 | |

Seasoned Credit Risk Transfer Trust, Series 2019-4, Class M55D | | | 249,000 | | | | 4.00 | | | | 2/25/59 | | | | 230,203 | |

Seasoned Credit Risk Transfer Trust, Series 2022-2, Class M5TU | | | 1,389,237 | | | | 4.00 | | | | 4/25/62 | | | | 1,263,104 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 21,234,092 | |

| | | | | | | | | | | | | | | | |

Non-Agency - 4.8% | | | | | | | | | | | | | | | | |

JP Morgan Mortgage Trust, Series 2021-1, Class A4 1, 4 | | | 598,724 | | | | 2.50 | | | | 6/25/51 | | | | 518,471 | |

JP Morgan Mortgage Trust, Series 2021-14, Class A4 1, 4 | | | 807,350 | | | | 2.50 | | | | 5/25/52 | | | | 678,141 | |

JP Morgan Mortgage Trust, Series 2021-6, Class A4 1, 4 | | | 1,403,338 | | | | 2.50 | | | | 10/25/51 | | | | 1,189,499 | |

JP Morgan Mortgage Trust, Series 2021-7, Class A4 1, 4 | | | 488,171 | | | | 2.50 | | | | 11/25/51 | | | | 412,763 | |

JP Morgan Mortgage Trust, Series 2022-1, Class A11, SOFRRATE 30 Day Average + 0.85% 1, 4 | | | 2,592,052 | | | | 5.00 | | | | 7/25/52 | | | | 2,359,111 | |

New Residential Mortgage Loan Trust, Series 2017-2A, Class A4 1, 4 | | | 209,507 | | | | 4.00 | | | | 3/25/57 | | | | 191,471 | |

New Residential Mortgage Loan Trust, Series 2017-3A, Class A1 1, 4 | | | 221,784 | | | | 4.00 | | | | 4/25/57 | | | | 205,762 | |

| | |

| |

| See accompanying notes to financial statements. | | |

| | |

| 14 | | SIT MUTUAL FUNDS SEMI-ANNUAL REPORT |

| | | | | | | | | | | | | | | | |

Name of Issuer | | Principal

Amount ($) | | | Coupon

Rate (%) | | | Maturity

Date | | | Fair

Value ($) | |

New Residential Mortgage Loan Trust, Series 2017-5A, Class A1, TSFR1M + 1.61% 1, 4 | | | 71,651 | | | | 6.93 | | | | 6/25/57 | | | | 71,184 | |

New Residential Mortgage Loan Trust, Series 2018-1A, Class A1A 1, 4 | | | 161,406 | | | | 4.00 | | | | 12/25/57 | | | | 149,915 | |

New Residential Mortgage Loan Trust, Series 2018-4A, Class A1S, TSFR1M + 0.86% 1, 4 | | | 196,180 | | | | 6.18 | | | | 1/25/48 | | | | 190,240 | |

Sequoia Mortgage Trust, Series 2020-4, Class A5 1, 4 | | | 244,887 | | | | 2.50 | | | | 11/25/50 | | | | 214,562 | |

Wells Fargo Mortgaged Backed Securities Trust, Series 2020-5, Class A3 1, 4 | | | 220,225 | | | | 2.50 | | | | 9/25/50 | | | | 192,432 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 6,373,551 | |

| | | | | | | | | | | | | | | | |

Total Collateralized Mortgage Obligations

(cost: $28,872,313) | | | | | | | | | | | | | | | 27,607,643 | |

| | | | | | | | | | | | | | | | |

Corporate Bonds - 15.7% | | | | | | | | | | | | | | | | |

American Tower Trust 4 | | | 1,300,000 | | | | 5.49 | | | | 3/15/28 | | | | 1,279,659 | |

BGC Partners, Inc. | | | 900,000 | | | | 4.38 | | | | 12/15/25 | | | | 835,013 | |

Booz Allen Hamilton, Inc. 4 | | | 1,500,000 | | | | 3.88 | | | | 9/1/28 | | | | 1,343,850 | |

British Airways 2020-1 Class B Pass Through Trust 4 | | | 290,441 | | | | 8.38 | | | | 11/15/28 | | | | 295,357 | |

Cadence Bank (Subordinated), 3 Mo. Libor + 3.03% 1 | | | 1,200,000 | | | | 4.75 | | | | 6/30/29 | | | | 1,155,832 | |

CenterState Bank Corp. (Subordinated), TSFR3M + 5.62% 1 | | | 650,000 | | | | 5.75 | | | | 6/1/30 | | | | 607,879 | |

Comerica Bank | | | 500,000 | | | | 2.50 | | | | 7/23/24 | | | | 478,513 | |

Comerica Bank (Subordinated) | | | 750,000 | | | | 7.88 | | | | 9/15/26 | | | | 750,696 | |

CVS Pass-Through Trust Series 2009 4 | | | 799,590 | | | | 8.35 | | | | 7/10/31 | | | | 849,988 | |

Delta Air Lines 2015-1 Class AA Pass Through Trust | | | 325,730 | | | | 3.63 | | | | 7/30/27 | | | | 303,741 | |

F&G Global Funding 4 | | | 900,000 | | | | 0.90 | | | | 9/20/24 | | | | 849,721 | |

F&G Global Funding 4 | | | 1,600,000 | | | | 5.15 | | | | 7/7/25 | | | | 1,553,228 | |

Fairfax US, Inc. 4 | | | 600,000 | | | | 4.88 | | | | 8/13/24 | | | | 590,950 | |

First Midwest Bancorp, Inc. (Subordinated) | | | 1,000,000 | | | | 5.88 | | | | 9/29/26 | | | | 980,634 | |

First-Citizens Bank & Trust Co. (Subordinated), US Treasury + 2.37% 1 | | | 1,500,000 | | | | 4.13 | | | | 11/13/29 | | | | 1,430,108 | |

Metropolitan Life Insurance Co. (Subordinated) 4 | | | 900,000 | | | | 7.80 | | | | 11/1/25 | | | | 928,114 | |

Minnesota Life Insurance Co. (Subordinated) 4 | | | 1,020,000 | | | | 8.25 | | | | 9/15/25 | | | | 1,044,854 | |

Nationwide Mutual Insurance Co. (Subordinated), 3 Mo. Libor + 2.29% 1, 4 | | | 1,300,000 | | | | 7.96 | | | | 12/15/24 | | | | 1,299,954 | |

Prudential Insurance Co. of America (Subordinated) 4 | | | 325,000 | | | | 8.30 | | | | 7/1/25 | | | | 332,879 | |

Reliant Bancorp, Inc. (Subordinated), TSFR3M + 3.77% 1 | | | 1,250,000 | | | | 5.13 | | | | 12/15/29 | | | | 1,143,196 | |

SBA Tower Trust 4 | | | 1,300,000 | | | | 6.60 | | | | 1/15/28 | | | | 1,303,657 | |

Tennessee Gas Pipeline Co., LLC | | | 555,000 | | | | 7.00 | | | | 10/15/28 | | | | 575,790 | |

Tosco Corp. | | | 740,000 | | | | 7.80 | | | | 1/1/27 | | | | 782,354 | |

United Financial Bancorp, Inc. (Subordinated) | | | 300,000 | | | | 5.75 | | | | 10/1/24 | | | | 292,940 | |

| | | | | | | | | | | | | | | | |

Total Corporate Bonds

(cost: $22,136,024) | | | | | | | | | | | | | | | 21,008,907 | |

| | | | | | | | | | | | | | | | |

Mortgage Pass-Through Securities - 17.6% | | | | | | | | | | | | | | | | |

Federal Home Loan Mortgage Corporation - 4.7% | | | | | | | | | | | | | | | | |

Freddie Mac | | | 2,382,221 | | | | 2.50 | | | | 8/1/30 | | | | 2,173,306 | |

Freddie Mac | | | 32,765 | | | | 3.00 | | | | 9/1/27 | | | | 31,534 | |

Freddie Mac | | | 2,489,668 | | | | 3.00 | | | | 4/1/33 | | | | 2,243,073 | |

Freddie Mac | | | 5,764 | | | | 3.50 | | | | 7/1/26 | | | | 5,626 | |

Freddie Mac | | | 566,673 | | | | 3.50 | | | | 8/1/31 | | | | 533,667 | |

Freddie Mac | | | 225,855 | | | | 3.50 | | | | 9/1/32 | | | | 212,631 | |

Freddie Mac | | | 36,910 | | | | 4.00 | | | | 7/1/26 | | | | 35,635 | |

Freddie Mac | | | 39,979 | | | | 4.00 | | | | 1/1/27 | | | | 38,669 | |

Freddie Mac | | | 557,710 | | | | 4.00 | | | | 4/1/29 | | | | 533,604 | |

Freddie Mac | | | 117,455 | | | | 4.00 | | | | 10/1/31 | | | | 109,429 | |

Freddie Mac | | | 937 | | | | 4.50 | | | | 7/1/26 | | | | 909 | |

Freddie Mac | | | 244,586 | | | | 4.50 | | | | 10/1/34 | | | | 233,584 | |

Freddie Mac | | | 2,307 | | | | 5.00 | | | | 10/1/25 | | | | 2,220 | |

Freddie Mac | | | 191,847 | | | | 5.00 | | | | 5/1/28 | | | | 184,610 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 6,338,497 | |

| | | | | | | | | | | | | | | | |

Federal National Mortgage Association - 11.4% | | | | | | | | | | | | | | | | |

Fannie Mae | | | 421,387 | | | | 3.00 | | | | 10/1/27 | | | | 391,380 | |

Fannie Mae | | | 47,425 | | | | 3.00 | | | | 8/1/28 | | | | 45,600 | |

| | |

| |

| See accompanying notes to financial statements. | | |

| | |

| SEPTEMBER 30, 2023 | | 15 |

SCHEDULE OF INVESTMENTS (Unaudited)

September 30, 2023

Sit Quality Income Fund (Continued)

| | | | | | | | | | | | | | | | |

Name of Issuer | | Principal

Amount ($) | | | Coupon

Rate (%) | | | Maturity

Date | | | Fair

Value ($) | |

Fannie Mae | | | 604,726 | | | | 3.00 | | | | 5/1/30 | | | | 557,638 | |

Fannie Mae | | | 1,562,493 | | | | 3.00 | | | | 10/1/32 | | | | 1,405,832 | |

Fannie Mae | | | 81,312 | | | | 3.50 | | | | 1/1/26 | | | | 79,450 | |

Fannie Mae | | | 407,167 | | | | 3.50 | | | | 2/1/32 | | | | 375,786 | |

Fannie Mae | | | 1,778,825 | | | | 3.50 | | | | 4/1/32 | | | | 1,641,697 | |

Fannie Mae | | | 987,637 | | | | 3.50 | | | | 8/1/33 | | | | 911,233 | |

Fannie Mae | | | 404,143 | | | | 3.50 | | | | 11/1/38 | | | | 371,164 | |

Fannie Mae | | | 558 | | | | 4.00 | | | | 9/1/24 | | | | 550 | |

Fannie Mae | | | 15,708 | | | | 4.00 | | | | 6/1/25 | | | | 15,218 | |

Fannie Mae | | | 7,129 | | | | 4.00 | | | | 10/1/31 | | | | 6,626 | |

Fannie Mae | | | 424,365 | | | | 4.00 | | | | 10/1/34 | | | | 403,499 | |

Fannie Mae | | | 948,249 | | | | 4.00 | | | | 6/1/38 | | | | 881,245 | |

Fannie Mae | | | 8,375 | | | | 4.50 | | | | 4/1/25 | | | | 8,113 | |

Fannie Mae | | | 1,165,396 | | | | 4.50 | | | | 3/1/29 | | | | 1,128,322 | |

Fannie Mae | | | 99,757 | | | | 4.50 | | | | 7/1/31 | | | | 95,179 | |

Fannie Mae | | | 2,025,418 | | | | 4.50 | | | | 4/1/39 | | | | 1,951,939 | |

Fannie Mae | | | 2,691,745 | | | | 5.00 | | | | 3/1/43 | | | | 2,566,428 | |

Fannie Mae | | | 389,841 | | | | 5.50 | | | | 8/1/40 | | | | 398,970 | |

Fannie Mae | | | 608,778 | | | | 5.50 | | | | 2/1/42 | | | | 608,497 | |

Fannie Mae | | | 1,423,084 | | | | 6.00 | | | | 9/1/29 | | | | 1,405,936 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 15,250,302 | |

| | | | | | | | | | | | | | | | |

Government National Mortgage Association - 1.0% | | | | | | | | | | | | | | | | |

Ginnie Mae, US Treasury + 1.50% 1 | | | 15,124 | | | | 3.88 | | | | 4/20/33 | | | | 14,776 | |

Ginnie Mae, US Treasury + 1.50% 1 | | | 4,320 | | | | 3.88 | | | | 4/20/42 | | | | 4,243 | |

Ginnie Mae | | | 1,000,911 | | | | 4.00 | | | | 7/20/26 | | | | 945,718 | |

Ginnie Mae | | | 77 | | | | 5.00 | | | | 12/20/23 | | | | 76 | |

Ginnie Mae | | | 269 | | | | 5.00 | | | | 9/15/24 | | | | 264 | |

Ginnie Mae | | | 3,700 | | | | 5.00 | | | | 6/20/26 | | | | 3,600 | |

Ginnie Mae | | | 356,038 | | | | 6.00 | | | | 7/20/37 | | | | 367,192 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 1,335,869 | |

| | | | | | | | | | | | | | | | |

Other Federal Agency Securities - 0.5% | | | | | | | | | | | | | | | | |

Small Business Administration Pools, PRIME - 2.50% 1 | | | 151,953 | | | | 5.75 | | | | 5/25/43 | | | | 151,467 | |

Small Business Administration Pools, PRIME + 0.80% 1 | | | 338,231 | | | | 9.05 | | | | 2/25/28 | | | | 351,067 | |

Small Business Administration Pools, PRIME + 0.85% 1 | | | 146,489 | | | | 9.10 | | | | 3/25/30 | | | | 154,104 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 656,638 | |

| | | | | | | | | | | | | | | | |

Total Mortgage Pass-Through Securities

(cost: $25,072,097) | | | | | | | | | | | | | | | 23,581,306 | |

| | | | | | | | | | | | | | | | |

Taxable Municipal Bonds - 22.8% | | | | | | | | | | | | | | | | |

Arizona School Facilities Board 9 | | | 1,010,000 | | | | 6.00 | | | | 9/1/27 | | | | 1,024,746 | |

City of San Francisco CA | | | 155,000 | | | | 5.50 | | | | 11/1/25 | | | | 155,155 | |

Clark County School District | | | 240,000 | | | | 5.51 | | | | 6/15/24 | | | | 239,537 | |

Colorado Housing & Finance Authority | | | 745,000 | | | | 6.50 | | | | 5/1/48 | | | | 756,324 | |

Colorado Housing & Finance Authority | | | 5,000 | | | | 4.00 | | | | 11/1/31 | | | | 4,989 | |

County of Cook IL | | | 1,200,000 | | | | 5.79 | | | | 11/15/29 | | | | 1,208,628 | |

County of Yamhill OR | | | 415,000 | | | | 4.50 | | | | 10/1/30 | | | | 386,025 | |

Florida Capital Projects Finance Authority | | | 605,000 | | | | 4.00 | | | | 10/1/24 | | | | 598,841 | |

Idaho Housing & Finance Association | | | 1,000,000 | | | | 6.50 | | | | 7/1/53 | | | | 1,023,530 | |

Idaho Housing & Finance Association | | | 1,000,000 | | | | 6.00 | | | | 1/1/48 | | | | 1,000,380 | |

Illinois Housing Development Authority | | | 980,000 | | | | 5.63 | | | | 4/1/53 | | | | 963,546 | |

Illinois Housing Development Authority | | | 1,000,000 | | | | 5.75 | | | | 10/1/53 | | | | 988,840 | |

Kentucky Higher Education Student Loan Corp. 8 | | | 1,000,000 | | | | 2.52 | | | | 6/1/35 | | | | 823,130 | |

Kentucky Higher Education Student Loan Corp. | | | 1,000,000 | | | | 5.95 | | | | 6/1/37 | | | | 921,980 | |

Kindred Public School District No. 2 | | | 1,000,000 | | | | 6.00 | | | | 8/1/27 | | | | 1,012,620 | |

Louisiana Local Government Environmental Facilities & Community Development Authority | | | 1,191,407 | | | | 3.62 | | | | 2/1/29 | | | | 1,146,407 | |

Maine Municipal Bond Bank | | | 500,000 | | | | 6.12 | | | | 11/1/26 | | | | 506,485 | |

Maryland Community Development Administration | | | 315,000 | | | | 3.95 | | | | 3/1/27 | | | | 296,355 | |

Maryland Community Development Administration | | | 490,000 | | | | 4.40 | | | | 3/1/53 | | | | 462,075 | |

| | |

| |

| See accompanying notes to financial statements. | | |

| | |

| 16 | | SIT MUTUAL FUNDS SEMI-ANNUAL REPORT |

| | | | | | | | | | | | | | | | |

Name of Issuer | | Principal

Amount ($) | | | Coupon

Rate (%) | | | Maturity

Date | | | Fair

Value ($) | |

Maryland Community Development Administration | | | 1,000,000 | | | | 3.24 | | | | 9/1/48 | | | | 973,740 | |

Maryland Community Development Administration | | | 1,000,000 | | | | 6.00 | | | | 9/1/53 | | | | 997,770 | |

Massachusetts Educational Financing Authority | | | 90,000 | | | | 4.00 | | | | 1/1/32 | | | | 86,606 | |

Massachusetts Educational Financing Authority | | | 180,000 | | | | 4.41 | | | | 7/1/34 | | | | 169,171 | |

Massachusetts Educational Financing Authority | | | 1,000,000 | | | | 2.64 | | | | 7/1/37 | | | | 849,840 | |

Miami University of Ohio | | | 1,075,000 | | | | 6.67 | | | | 9/1/28 | | | | 1,117,645 | |

Michigan Municipal Bond Authority | | | 500,000 | | | | 6.70 | | | | 5/1/27 | | | | 501,485 | |

Minnesota Housing Finance Agency | | | 1,000,000 | | | | 6.25 | | | | 7/1/53 | | | | 1,011,760 | |

Minnesota Housing Finance Agency | | | 275,000 | | | | 4.17 | | | | 1/1/25 | | | | 269,090 | |

New Hampshire Housing Finance Authority | | | 10,000 | | | | 4.00 | | | | 7/1/35 | | | | 10,000 | |