UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-5017

Ivy Variable Insurance Portfolios

(Exact name of registrant as specified in charter)

6300 Lamar Avenue, Overland Park, Kansas 66202

(Address of principal executive offices) (Zip code)

Wendy J. Hills

6300 Lamar Avenue

Overland Park, Kansas 66202

(Name and address of agent for service)

Registrant’s telephone number, including area code: 913-236-2000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2016

ITEM 1. REPORTS TO STOCKHOLDERS.

| | |

| | Annual Report DECEMBER 31, 2016 |

|

| Ivy Variable Insurance Portfolios |

| Pathfinder Aggressive |

| Pathfinder Conservative |

| Pathfinder Moderate |

| Pathfinder Moderately Aggressive |

| Pathfinder Moderately Conservative |

| Pathfinder Moderate — Managed Volatility |

| Pathfinder Moderately Aggressive — Managed Volatility |

| Pathfinder Moderately Conservative — Managed Volatility |

| Asset Strategy |

| Balanced |

| Bond |

| Core Equity |

| Dividend Opportunities |

| Energy |

| Global Bond |

| Global Growth |

| Global Natural Resources |

| Government Money Market |

| Growth |

| High Income |

| International Core Equity |

| Limited — Term Bond |

| Micro Cap Growth |

| Mid Cap Growth |

| Real Estate Securities |

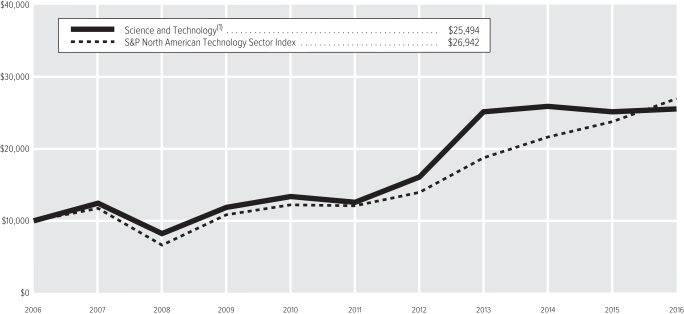

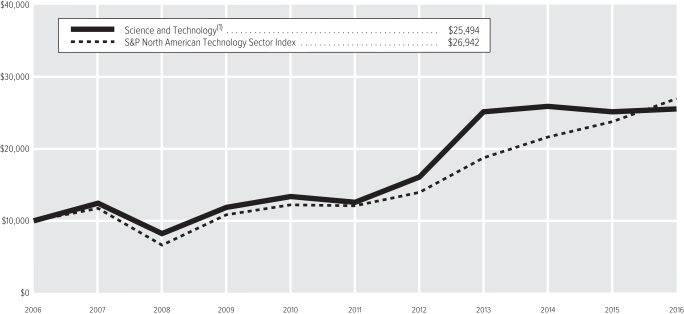

| Science and Technology |

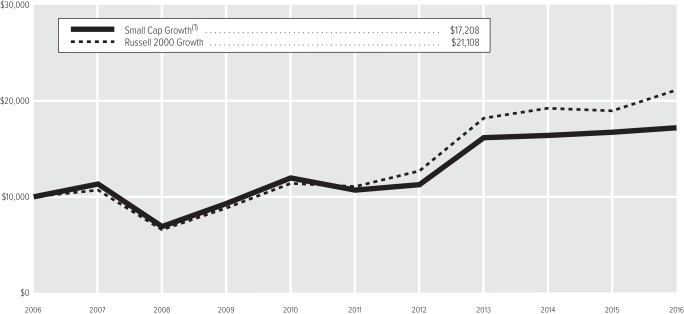

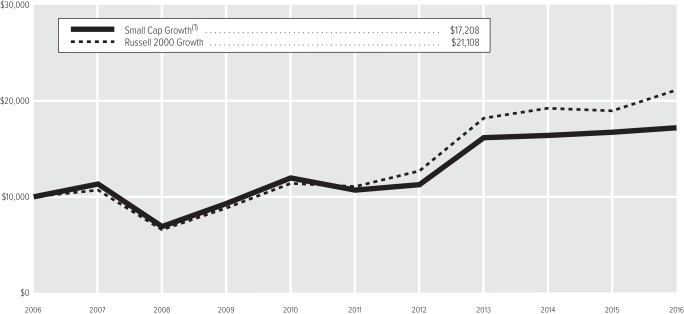

| Small Cap Growth |

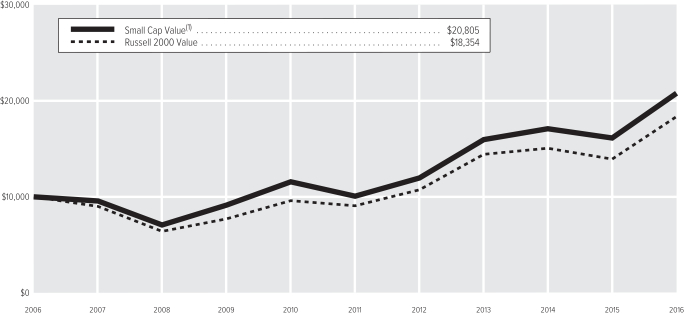

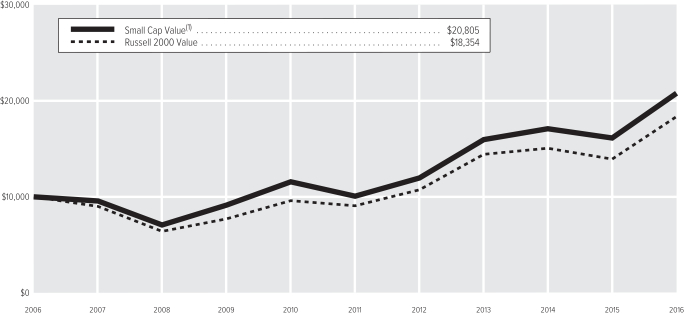

| Small Cap Value |

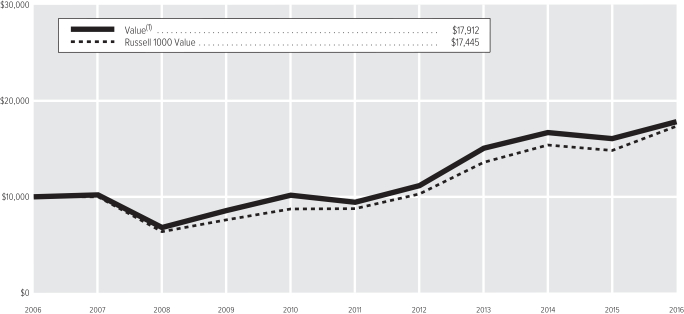

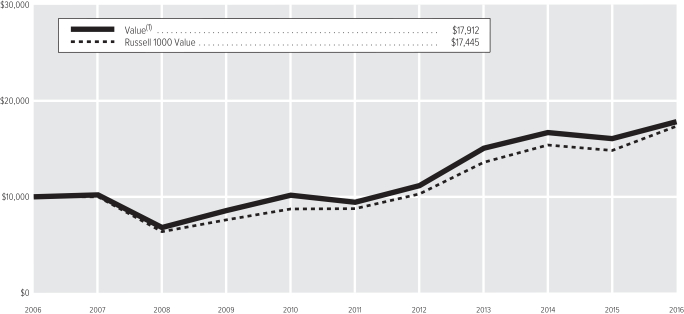

| Value |

| | |

| PRESIDENT’S LETTER | | IVY VIP |

| | |

| | DECEMBER 31, 2016 (UNAUDITED) |

| Philip J. Sanders, CFA | | |

Dear Shareholder,

The 12 months of 2016 were one of the most unusual in recent memory, bringing market volatility, political surprises and, by year-end, a strong upswing in the equity markets. Across the fiscal year, investors endured concerns about global economic growth, the level of interest rates, fluctuation in oil prices and the outcome of the U.S. presidential election. As 2016 closed, the domestic equity markets had risen by double digits and the bond market had seen a moderate rise. See the table for a year-over-year comparison in some common market metrics.

Many investors may be unsettled by the prospect that continued change — in leadership of key countries around the world, in government policy, in interest rate levels — will cause market volatility and general uncertainty. While that may be true in the short term, we believe it is important to stay focused on the fundamentals and merits of sectors, industries and companies when making investment decisions. Those fundamentals historically have tended to outweigh external factors such as government policies and regulations. While government policies can affect every business and investor, we think the innovation and skill of individual companies ultimately drives long-term success.

At year-end 2016, the U.S. economy remained fundamentally sound. The U.S. remains a relative bright spot in the world, supported primarily by the U.S. consumer, who is benefitting from lower energy prices, lower inflation in general and an improved labor market. Demand for cars, homes and furnishings has been healthy.

The Federal Reserve raised interest rates in December, with an indication that two to three more increases may be executed in 2017. We believe that job growth and inflation will be the most important determinants in the direction of long-term central bank policy. Overseas, the European Central Bank and Bank of Japan are actively engaged in aggressive easing. As yet, these steps are not leading to any notable strengthening of economic activity.

China, in the face of economic softening, has turned toward more aggressive stimulus. We believe economic growth in China is likely to hold steady, which should support broader global growth.

While challenges remain, we do see potential catalysts for growth in several areas and industries and our team continues to seek investment opportunities around the globe.

Economic Snapshot

| | | | | | | | |

| | | 12/31/16 | | | 12/31/15 | |

S&P 500 Index | | | 2,238.83 | | | | 2,043.94 | |

MSCI EAFE Index | | | 1,684.00 | | | | 1,716.28 | |

10-Year Treasury Yield | | | 2.45 | % | | | 2.27 | % |

U.S. unemployment rate | | | 4.7 | % | | | 5.0 | % |

30-year fixed mortgage rate | | | 4.32 | % | | | 4.01 | % |

Oil price per barrel | | | $53.72 | | | | $37.04 | |

Sources: Bloomberg, U.S. Department of Labor, MBA, CME

All government statistics shown are subject to periodic revision. The S&P 500 Index is an unmanaged index that tracks the stocks of 500 primarily large-cap U.S. companies. MSCI EAFE Index is an unmanaged index comprised of securities that represent the securities markets in Europe, Australasia and the Far East. It is not possible to invest directly in any of these indexes. Mortgage rates are from BankRate and reflect the overnight national average rate on a conventional 30-year fixed loan. Oil prices reflect the market price of West Texas intermediate grade crude.

Respectfully,

Philip J. Sanders, CFA

President

The opinions expressed in this letter are those of the President of the Ivy Variable Insurance Portfolios and are current only through the end of the period of the report, as stated on the cover. The President’s views are subject to change at any time, based on market and other conditions, and no forecasts can be guaranteed.

| | |

| ILLUSTRATION OF PORTFOLIO EXPENSES | | IVY VIP |

(UNAUDITED)

Expense Example

As a shareholder of a Portfolio, you incur ongoing costs, including management fees, distribution and service fees, and other Portfolio expenses. The following table is intended to help you understand your ongoing costs (in dollars) of investing in a Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds. As a shareholder in the underlying Ivy VIP Portfolios, the Pathfinder Aggressive, Pathfinder Conservative, Pathfinder Moderate, Pathfinder Moderately Aggressive and Pathfinder Moderately Conservative Portfolios (collectively, the “Pathfinder Portfolios”) and the Pathfinder Moderate — Managed Volatility, Pathfinder Moderately Aggressive — Managed Volatility and Pathfinder Moderately Conservative — Managed Volatility Portfolios (collectively, the “Managed Volatility Portfolios”) will indirectly bear their pro rata share of the expenses incurred by the underlying funds. These expenses are not included in the Pathfinder Portfolios or Managed Volatility Portfolios annualized expense ratios or the expenses paid during the period. These expenses are, however, included in the effective expenses paid during the period. The example is based on an investment of $1,000 invested at the beginning of the period and held for the six-month period ended December 31, 2016.

Actual Expenses

The first section in the following table provides information about actual investment values and actual expenses. You may use the information in this section, together with your initial investment in Portfolio shares, to estimate the expenses that you paid over the period. Simply divide the value of that investment by $1,000 (for example, a $7,500 initial investment divided by $1,000 = 7.5), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your investment during this period. In addition, there are fees and expenses imposed under the variable annuity or variable life insurance contract through which shares of the Portfolio are held. Additional fees have the effect of reducing investment returns.

Hypothetical Example for Comparison Purposes

The second section in the following table provides information about hypothetical investment values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of five percent per year before expenses, which is not the Portfolio’s actual return. The hypothetical investment values and expenses may not be used to estimate the actual investment value at the end of the period or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other funds. To do so, compare this five percent hypothetical example with the five percent hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs as a shareholder of the Portfolio and do not reflect any fees and expenses imposed under the variable annuity or variable life insurance contract through which shares of the Portfolio are held.

Expenses paid may be impacted by expense reduction arrangements. If those arrangements had not been in place, expenses paid would have been higher. See Note 7 to the Financial Statements for further information.

| | |

| ILLUSTRATION OF PORTFOLIO EXPENSES | | IVY VIP |

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual(1) | | | Hypothetical(2) | | | | |

| Portfolio | | Beginning

Account

Value

6-30-16 | | | Ending

Account

Value

12-31-16 | | | Expenses

Paid During

Period* | | | Beginning

Account

Value

6-30-16 | | | Ending

Account

Value

12-31-16 | | | Expenses

Paid During

Period* | | | Annualized

Expense Ratio

Based on the

Six-Month

Period | |

Pathfinder Aggressive | | $ | 1,000 | | | $ | 1,064.60 | | | $ | 0.31 | | | $ | 1,000 | | | $ | 1,024.87 | | | $ | 0.30 | | | | 0.07% | |

Pathfinder Conservative | | $ | 1,000 | | | $ | 1,030.00 | | | $ | 0.30 | | | $ | 1,000 | | | $ | 1,024.92 | | | $ | 0.30 | | | | 0.06% | |

Pathfinder Moderate | | $ | 1,000 | | | $ | 1,044.60 | | | $ | 0.20 | | | $ | 1,000 | | | $ | 1,025.04 | | | $ | 0.20 | | | | 0.03% | |

Pathfinder Moderately Aggressive | | $ | 1,000 | | | $ | 1,053.20 | | �� | $ | 0.21 | | | $ | 1,000 | | | $ | 1,025.03 | | | $ | 0.20 | | | | 0.03% | |

Pathfinder Moderately Conservative | | $ | 1,000 | | | $ | 1,037.00 | | | $ | 0.20 | | | $ | 1,000 | | | $ | 1,025.01 | | | $ | 0.20 | | | | 0.04% | |

Pathfinder Moderate — Managed Volatility | | $ | 1,000 | | | $ | 1,033.50 | | | $ | 1.22 | | | $ | 1,000 | | | $ | 1,024.01 | | | $ | 1.21 | | | | 0.24% | |

Pathfinder Moderately Aggressive — Managed Volatility | | $ | 1,000 | | | $ | 1,053.20 | | | $ | 1.54 | | | $ | 1,000 | | | $ | 1,023.68 | | | $ | 1.52 | | | | 0.30% | |

Pathfinder Moderately Conservative — Managed Volatility | | $ | 1,000 | | | $ | 1,025.50 | | | $ | 1.42 | | | $ | 1,000 | | | $ | 1,023.82 | | | $ | 1.42 | | | | 0.27% | |

Asset Strategy | | $ | 1,000 | | | $ | 1,001.20 | | | $ | 5.00 | | | $ | 1,000 | | | $ | 1,020.17 | | | $ | 5.05 | | | | 1.00% | |

Balanced | | $ | 1,000 | | | $ | 1,023.00 | | | $ | 5.16 | | | $ | 1,000 | | | $ | 1,020.15 | | | $ | 5.15 | | | | 1.00% | |

Bond | | $ | 1,000 | | | $ | 980.00 | | | $ | 3.86 | | | $ | 1,000 | | | $ | 1,021.29 | | | $ | 3.94 | | | | 0.78% | |

Core Equity | | $ | 1,000 | | | $ | 1,042.70 | | | $ | 4.90 | | | $ | 1,000 | | | $ | 1,020.39 | | | $ | 4.85 | | | | 0.96% | |

Dividend Opportunities | | $ | 1,000 | | | $ | 1,044.10 | | | $ | 5.21 | | | $ | 1,000 | | | $ | 1,020.15 | | | $ | 5.15 | | | | 1.00% | |

Energy | | $ | 1,000 | | | $ | 1,159.90 | | | $ | 6.37 | | | $ | 1,000 | | | $ | 1,019.29 | | | $ | 5.96 | | | | 1.17% | |

Global Bond | | $ | 1,000 | | | $ | 1,020.40 | | | $ | 2.12 | | | $ | 1,000 | | | $ | 1,023.15 | | | $ | 2.12 | | | | 0.41% | |

Global Growth | | $ | 1,000 | | | $ | 1,031.50 | | | $ | 5.79 | | | $ | 1,000 | | | $ | 1,019.48 | | | $ | 5.76 | | | | 1.14% | |

Global Natural Resources | | $ | 1,000 | | | $ | 1,113.00 | | | $ | 7.08 | | | $ | 1,000 | | | $ | 1,018.47 | | | $ | 6.76 | | | | 1.34% | |

Government Money Market | | $ | 1,000 | | | $ | 1,000.90 | | | $ | 2.30 | | | $ | 1,000 | | | $ | 1,022.87 | | | $ | 2.33 | | | | 0.46% | |

Growth | | $ | 1,000 | | | $ | 1,056.80 | | | $ | 5.04 | | | $ | 1,000 | | | $ | 1,020.27 | | | $ | 4.95 | | | | 0.98% | |

High Income | | $ | 1,000 | | | $ | 1,080.70 | | | $ | 4.68 | | | $ | 1,000 | | | $ | 1,020.70 | | | $ | 4.55 | | | | 0.89% | |

International Core Equity | | $ | 1,000 | | | $ | 1,069.10 | | | $ | 6.00 | | | $ | 1,000 | | | $ | 1,019.39 | | | $ | 5.86 | | | | 1.15% | |

Limited-Term Bond | | $ | 1,000 | | | $ | 991.80 | | | $ | 3.98 | | | $ | 1,000 | | | $ | 1,021.18 | | | $ | 4.04 | | | | 0.80% | |

Micro Cap Growth | | $ | 1,000 | | | $ | 1,172.50 | | | $ | 7.17 | | | $ | 1,000 | | | $ | 1,018.65 | | | $ | 6.66 | | | | 1.30% | |

Mid Cap Growth | | $ | 1,000 | | | $ | 1,040.50 | | | $ | 5.61 | | | $ | 1,000 | | | $ | 1,019.66 | | | $ | 5.55 | | | | 1.10% | |

Real Estate Securities | | $ | 1,000 | | | $ | 940.80 | | | $ | 5.73 | | | $ | 1,000 | | | $ | 1,019.29 | | | $ | 5.96 | | | | 1.17% | |

Science and Technology | | $ | 1,000 | | | $ | 1,116.90 | | | $ | 6.14 | | | $ | 1,000 | | | $ | 1,019.44 | | | $ | 5.86 | | | | 1.14% | |

Small Cap Growth | | $ | 1,000 | | | $ | 1,065.00 | | | $ | 5.89 | | | $ | 1,000 | | | $ | 1,019.47 | | | $ | 5.76 | | | | 1.14% | |

Small Cap Value | | $ | 1,000 | | | $ | 1,163.60 | | | $ | 6.27 | | | $ | 1,000 | | | $ | 1,019.40 | | | $ | 5.86 | | | | 1.15% | |

Value | | $ | 1,000 | | | $ | 1,131.30 | | | $ | 5.33 | | | $ | 1,000 | | | $ | 1,020.17 | | | $ | 5.05 | | | | 1.00% | |

| * | Portfolio expenses are equal to the Portfolio’s annualized expense ratio (provided in the table), multiplied by the average account value over the period, multiplied by 184 days in the six-month period ended December 31, 2016, and divided by 366. |

| (1) | This section uses the Portfolio’s actual total return and actual Portfolio expenses. It is a guide to the actual expenses paid by the Portfolio in the period. The “Ending Account Value” shown is computed using the Portfolio’s actual return and the “Expenses Paid During Period” column shows the dollar amount that would have been paid by an investor who started with $1,000 in the Portfolio. A shareholder may use the information here, together with the dollar amount invested, to estimate the expenses that were paid over the period. For every thousand dollars a shareholder has invested, the expenses are listed in the last column of this section. |

| (2) | This section uses a hypothetical five percent annual return and actual Portfolio expenses. It helps to compare the Portfolio’s ongoing costs with other mutual funds. A shareholder can compare the Portfolio’s ongoing costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other Portfolios. |

The above illustrations are based on ongoing costs only.

| | |

| MANAGEMENT DISCUSSION | | PATHFINDER PORTFOLIOS |

(UNAUDITED)

Chace Brundige

Cynthia P. Prince-Fox

Aaron Young

Below, Cynthia Prince-Fox, F. Chace Brundige, CFA, and Aaron Young, portfolio managers of each of the five Ivy VIP Pathfinder Portfolios and the three Ivy VIP Pathfinder Managed Volatility Portfolios, discuss positioning, performance and results for the fiscal year ended December 31, 2016. Ms. Prince-Fox, who has 33 years of industry experience, and Mr. Brundige, who has 23 years of industry experience, have managed each VIP Pathfinder Portfolio and VIP Pathfinder Managed Volatility Portfolio since June 2016. Mr. Young, who has 11 years of industry experience, joined the team as a co-portfolio manager on October 2016. The VIP Pathfinder Portfolios and VIP Pathfinder Managed Volatility Portfolios previously were managed by Michael Avery, who retired effective June 30, 2016. Since the Ivy VIP Pathfinder Managed Volatility Portfolios’ inception, Advantus Capital Management, Inc., has served as the subadvisor for the volatility management strategy of the Ivy VIP Pathfinder Managed Volatility Portfolios through portfolio managers David Kuplic, CFA, FRM and Craig Stapleton, CFA. Mr. Kuplic has 33 years of industry experience and Mr. Stapleton has 15 years of industry experience.

Fiscal Year Performance

| | | | |

For the 12 Months Ended December 31, 2016 | |

Ivy VIP Pathfinder Aggressive | | | 4.80% | |

Ivy VIP Pathfinder Conservative | | | 2.84% | |

Ivy VIP Pathfinder Moderate | | | 3.65% | |

Ivy VIP Pathfinder Moderately Aggressive | | | 4.52% | |

Ivy VIP Pathfinder Moderately Conservative | | | 3.10% | |

Ivy VIP Pathfinder Moderate — Managed Volatility | | | 1.81% | |

Ivy VIP Pathfinder Moderately Aggressive — Managed Volatility | | | 2.36% | |

Ivy VIP Pathfinder Moderately Conservative — Managed Volatility | | | 1.21% | |

Benchmarks For the 12 Months Ended December 31, 2016 | |

S&P 500 Index | | | 11.96% | |

(generally reflects the performance of large-capitalization U.S. stocks) | |

Barclays U.S. Aggregate Bond Index | | | 2.65% | |

(generally reflects the performance of most U.S.-traded investment grade bonds) | |

Barclays U.S. Treasury Bills: 1-3 Month Index | | | 0.26% | |

(generally reflects the performance of investment-grade Treasury bills, representing cash) | | | | |

Past performance is not a guarantee of future results. For additional performance information for each Portfolio, please see the Comparison of Change in Value of a $10,000 Investment and the Average Annual Total Return information for each Portfolio found in this report.

Please note that the Portfolio returns include applicable investment fees and expenses, whereas the index returns do not include any such fees. Also, each Portfolio’s performance data does not take into account any product expenses or charges associated with owning a variable life or annuity policy, which is invested in Ivy Variable Insurance Portfolios.

Macro events drive volatile year

“Risk-off” seemed to be the operative term in global fixed income, equity and currency markets during the first half of the fiscal year. China devalued its currency in January 2016 following the U.S. Federal Reserve’s (Fed) 0.25-percentage-point interest rate hike in December 2015, and voters in the U.K. on June 23 approved a proposal to leave the European Union — the so-called “Brexit.” By the fourth quarter, and especially after the surprise U.S. presidential election victory of Donald Trump, a general “risk-on” environment had taken hold in financial markets and both business and consumer sentiment improved.

U.S. Treasury 10-year yields began the year around 2.27% and then declined to a post-Brexit low of about 1.36% before rebounding steadily through the third quarter. In the days immediately following the U.S. elections, most global developed market yields moved higher and the U.S. Treasury 10-year securities closed the year around 2.44%.

The S&P 500 index declined almost 10% to start the year, moving from 2,012 on January 4 to 1,829 in mid-February. Except for some volatility around the Brexit vote and the U.S. elections, equities subsequently climbed higher and ended the year around 2,238.

The value of the broad, trade-weighted U.S. dollar began the year in a softer trend versus both developed and emerging market currencies. That continued through April before the U.S. dollar unevenly strengthened and accelerated after the U.S. elections. The Fed raised short-term rates by 0.25 percentage point in December 2016. With continued improvements in the labor market and wages finally turning higher, the Fed indicated that it anticipates three more interest rate hikes in 2017.

The Bank of Japan announced in September that its target for the 10-year Japanese government bond would be “around zero,” while it continued its asset purchase program. The European Central Bank (ECB) cut rates in March and expanded its quantitative easing facility. It also announced its Corporate Sector Purchase Program — moving beyond suppression of the “risk-free” rate in the euro and into compression of credit spreads. In December, the ECB announced a nine-month extension to the asset purchase program and, conversely, a reduction in the amount purchased each month.

We expect the final global gross domestic product growth rate to be about 3% for 2016. For 2017, we think there will be acceleration to 3.6% as economic growth prospects in the U.S., Japan and India are likely to improve.

We believe the U.S. labor market is likely to continue to improve, as initial jobless claims hover around the lows of the cycle and job openings are at record highs. U.S. consumers are getting support from wage growth at last. This situation is likely to support consumer spending, particularly in an environment in which inflation remains in check. Consumer sentiment, as measured by the University of Michigan index, reached 98.2 as of fiscal year end, the highest level since 2004.

Adjusting equity exposure during year

Each Portfolio completed the fiscal year with a positive return. The Portfolios overall trailed the performance of the all-equities benchmark index, but most outperformed the Barclays U.S. Aggregate Bond Index.

We made reallocations in the Pathfinder Portfolios at the end of the third quarter and again at the end of the fourth quarter. In general, the reallocations were done to add exposure to Europe and Japan, which we think will benefit from reacceleration of global growth and inflation, and add duration at year-end from cash.

The reallocations to all Pathfinder Portfolios in the third quarter were intended to make the allocations to the underlying Ivy VIP Global Growth and Ivy VIP International Core Equity consistent across all Portfolios.

The reallocations to all Pathfinder Portfolios in the fourth quarter added exposure to Ivy VIP Bond and reduced exposure to Ivy VIP Government Money Market (except in the Ivy VIP Pathfinder Aggressive Portfolio, which reduced exposure to Ivy VIP Limited Term Bond), given the sell-off in fixed income and duration positioning of the Pathfinder Portfolios overall. In addition, we made small reallocations from Ivy VIP Global Growth to Ivy VIP International Core Equity based on relative global equity valuations and the gains in the U.S. markets during the year, and on the allocation percentages to U.S. equities in the Pathfinder Portfolios overall.

The Pathfinder Managed Volatility Portfolios trailed the performance of the Pathfinder Portfolios during the fiscal year, largely because of the cost of applying the managed volatility strategy.

Assessing risks for 2017

We anticipate uncertainty around fiscal policy implementation and potential regulatory changes from President-elect Trump, including corporate and personal tax reform, border-adjusted taxation, infrastructure spending, renegotiating of trade agreements, and repeal/replacement of the Affordable Care Act, also known as “Obamacare.”

The housing market has been a contributor to economic growth in the U.S. as households worked to repair their balance sheets after the global financial crisis and inventories were cleared, supporting increases in home prices. Mortgage rates had already begun to rise in the fourth quarter, with the 30-year fixed rate exceeding 4% by year end — a level not seen in 18 months. This still is a relatively low interest rate, but if rates move higher — especially if they outpace wage gains — we think home sales and the wealth effect from them could be diminished.

As of the end of the fiscal year, we think commodity prices looked more stable at their higher levels. If the U.S. embarks upon a large infrastructure program or demand from China remains or accelerates on government policy, we believe those prices could move higher again. While that is likely to help commodity-producing companies and regions, a strong move higher could impinge on households and businesses as input costs rise.

Past performance is not a guarantee of future results. As with any mutual fund, the value of each Portfolio’s shares will change, and you could lose money on your investment.

The ability of each Portfolio to meet its investment objective depends both on the allocation of its assets among the Underlying Funds and the ability of those funds to meet their respective investment objectives. Each Portfolio’s

share price will likely change daily based on the performance of the Underlying Funds in which it invests. In general, each Portfolio is subject to the same risks as those of the Underlying Funds it holds. Because the Portfolios are weighted toward Underlying Funds that invest in stocks, both U.S. and foreign, including mid cap and small cap stocks, as well as bonds and short-term instruments, the Portfolios are more subject to the risks associated with those investments.

Advantus Capital may be unsuccessful in managing volatility, and there is a risk that the Ivy VIP Managed Volatility Portfolios may experience a high level of volatility in their returns. The Portfolios’ holdings are subject to price volatility, and the Portfolios may not be any less volatile than the market as a whole and could be more volatile. In addition, there can be no guarantee that the Portfolios will achieve their goal of managing the volatility of their equity returns. Furthermore, while the management of volatility seeks competitive returns with more consistent volatility, the management of volatility does not ensure that the Portfolios will deliver competitive returns. Additionally, even if successful, the Portfolios’ management of volatility may also generally result in the Portfolios’ NAV increasing to a lesser degree than the markets (for example, in a rising market with relatively high volatility) or decreasing to a greater degree than the market (for example, in a declining market with relatively low volatility). The Portfolios’ managed volatility strategy may expose the Portfolios to losses (some of which may be sudden) to which it would not have otherwise been exposed if invested only in Underlying Funds. Additionally, the derivatives used by Advantus Capital to hedge the value of the Portfolios are not identical to the Underlying Funds, and as a result, the Portfolios’ investment in derivatives may decline in value at the same time as the Portfolios’ investment in Underlying Funds. Advantus Capital does not intend to attempt to manage the volatility of the Portfolios’ fixed-income returns. It is possible that the fixed-income portion of the Portfolios, whose volatility would not be managed by the volatility management strategy, could become more volatile than the equity portion of the Portfolios.

The opinions expressed in this report are those of the portfolio managers and are current only through the end of the period of the report as stated on the cover. The managers’ views are subject to change at any time based on market and other conditions, and no forecasts can be guaranteed.

The indexes noted are unmanaged and include reinvested dividends. One cannot invest directly in an index, nor is an index representative of any Ivy VIP Pathfinder Portfolio or Ivy VIP Pathfinder Managed Volatility Portfolio.

| | |

| PORTFOLIO HIGHLIGHTS | | PATHFINDER PORTFOLIOS |

ALL DATA IS AS OF DECEMBER 31, 2016 (UNAUDITED)

Pathfinder Aggressive – Asset Allocation

| | |

Ivy VIP Growth | | 19.7% |

Ivy VIP International Core Equity | | 17.1% |

Ivy VIP Global Growth | | 12.2% |

Ivy VIP Mid Cap Growth | | 9.9% |

Ivy VIP Value | | 9.9% |

Ivy VIP Small Cap Growth | | 9.8% |

Ivy VIP Small Cap Value | | 9.8% |

Ivy VIP Limited-Term Bond | | 5.8% |

Ivy VIP Bond | | 5.0% |

Cash and Other Assets (Net of Liabilities), and Cash Equivalents+ | | 0.8% |

Pathfinder Conservative – Asset Allocation

| | |

Ivy VIP Government Money Market | | 30.0% |

Ivy VIP Limited-Term Bond | | 15.8% |

Ivy VIP Growth | | 12.8% |

Ivy VIP Dividend Opportunities | | 12.8% |

Ivy VIP International Core Equity | | 5.3% |

Ivy VIP Bond | | 5.0% |

Ivy VIP Small Cap Growth | | 4.9% |

Ivy VIP Global Growth | | 4.0% |

Ivy VIP Value | | 3.9% |

Ivy VIP Mid Cap Growth | | 3.0% |

Ivy VIP Small Cap Value | | 2.0% |

Cash and Other Assets (Net of Liabilities), and Cash Equivalents+ | | 0.5% |

Pathfinder Moderate – Asset Allocation

| | |

Ivy VIP Government Money Market | | 15.1% |

Ivy VIP Dividend Opportunities | | 14.9% |

Ivy VIP Growth | | 13.9% |

Ivy VIP International Core Equity | | 11.1% |

Ivy VIP Limited-Term Bond | | 10.8% |

Ivy VIP Global Growth | | 8.3% |

Ivy VIP Small Cap Growth | | 6.9% |

Ivy VIP Bond | | 5.1% |

Ivy VIP Value | | 5.0% |

Ivy VIP Small Cap Value | | 4.9% |

Ivy VIP Mid Cap Growth | | 4.0% |

Cash and Other Assets (Net of Liabilities), and Cash Equivalents+ | | 0.0% |

Pathfinder Moderately Aggressive – Asset Allocation

| | |

Ivy VIP Dividend Opportunities | | 14.9% |

Ivy VIP International Core Equity | | 13.9% |

Ivy VIP Growth | | 13.9% |

Ivy VIP Limited-Term Bond | | 10.8% |

Ivy VIP Global Growth | | 10.5% |

Ivy VIP Small Cap Growth | | 7.9% |

Ivy VIP Small Cap Value | | 7.9% |

Ivy VIP Bond | | 5.1% |

Ivy VIP Value | | 5.0% |

Ivy VIP Government Money Market | | 5.0% |

Ivy VIP Mid Cap Growth | | 5.0% |

Cash and Other Assets (Net of Liabilities), and Cash Equivalents+ | | 0.1% |

Pathfinder Moderately Conservative – Asset Allocation

| | |

Ivy VIP Government Money Market | | 20.0% |

Ivy VIP Limited-Term Bond | | 15.8% |

Ivy VIP Growth | | 13.8% |

Ivy VIP Dividend Opportunities | | 12.9% |

Ivy VIP International Core Equity | | 8.3% |

Ivy VIP Global Growth | | 6.0% |

Ivy VIP Small Cap Growth | | 5.9% |

Ivy VIP Bond | | 5.0% |

Ivy VIP Value | | 4.9% |

Ivy VIP Mid Cap Growth | | 4.0% |

Ivy VIP Small Cap Value | | 3.0% |

Cash and Other Assets (Net of Liabilities), and Cash Equivalents+ | | 0.4% |

Pathfinder Moderate – Managed Volatility – Asset Allocation

| | |

Ivy VIP Government Money Market | | 14.6% |

Ivy VIP Dividend Opportunities | | 14.5% |

Ivy VIP Growth | | 13.4% |

Ivy VIP International Core Equity | | 10.8% |

Ivy VIP Limited-Term Bond | | 10.5% |

Ivy VIP Global Growth | | 8.0% |

Ivy VIP Small Cap Growth | | 6.7% |

Ivy VIP Bond | | 4.9% |

Ivy VIP Small Cap Value | | 4.8% |

Ivy VIP Value | | 4.8% |

Ivy VIP Mid Cap Growth | | 3.9% |

Cash and Other Assets (Net of Liabilities), and Cash Equivalents+ | | 3.1% |

| | |

| PORTFOLIO HIGHLIGHTS | | PATHFINDER PORTFOLIOS |

ALL DATA IS AS OF DECEMBER 31, 2016 (UNAUDITED)

Pathfinder Moderately Aggressive – Managed Volatility – Asset Allocation

| | |

Ivy VIP Dividend Opportunities | | 14.6% |

Ivy VIP International Core Equity | | 13.5% |

Ivy VIP Growth | | 13.5% |

Ivy VIP Limited-Term Bond | | 10.6% |

Ivy VIP Global Growth | | 10.2% |

Ivy VIP Small Cap Growth | | 7.7% |

Ivy VIP Small Cap Value | | 7.7% |

Ivy VIP Government Money Market | | 4.9% |

Ivy VIP Bond | | 4.9% |

Ivy VIP Mid Cap Growth | | 4.9% |

Ivy VIP Value | | 4.8% |

Cash and Other Assets (Net of Liabilities), and Cash Equivalents+ | | 2.7% |

Pathfinder Moderately Conservative – Managed Volatility – Asset Allocation

| | |

Ivy VIP Government Money Market | | 19.8% |

Ivy VIP Limited-Term Bond | | 15.6% |

Ivy VIP Growth | | 13.7% |

Ivy VIP Dividend Opportunities | | 12.8% |

Ivy VIP International Core Equity | | 8.2% |

Ivy VIP Global Growth | | 5.9% |

Ivy VIP Small Cap Growth | | 5.9% |

Ivy VIP Bond | | 5.0% |

Ivy VIP Value | | 4.9% |

Ivy VIP Mid Cap Growth | | 3.9% |

Ivy VIP Small Cap Value | | 2.9% |

Cash and Other Assets (Net of Liabilities), and Cash Equivalents+ | | 1.4% |

The percentages of investments in the underlying funds may not currently be within the target allocation ranges disclosed in the Portfolios’ prospectus due to market movements; these percentages are expected to change over time, and deviation from the target allocation ranges due to market movements is permitted by the prospectus.

+Cash equivalents are defined as highly liquid securities with maturities of less than three months. Cash equivalents may include U.S. Government Treasury bills, bank certificates of deposit, bankers’ acceptances, corporate commercial paper and other money market instruments.

| | |

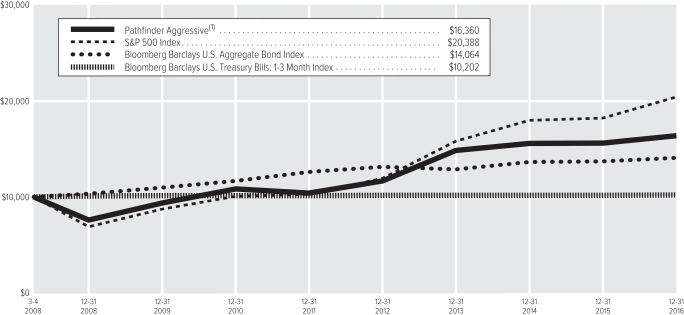

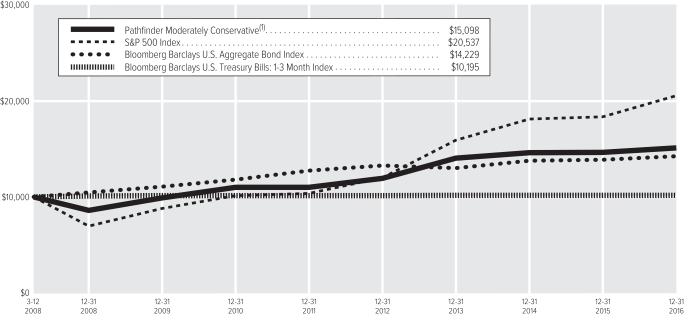

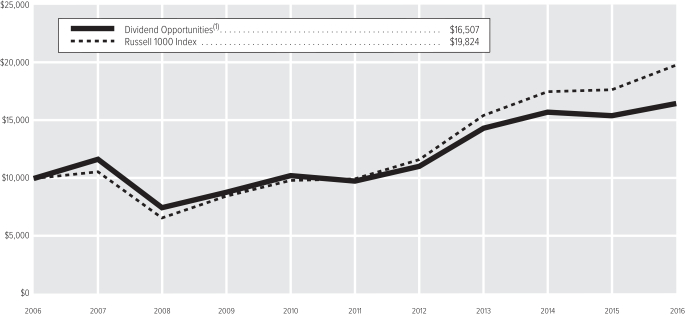

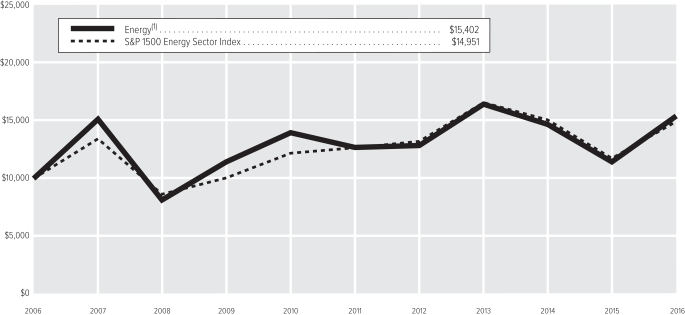

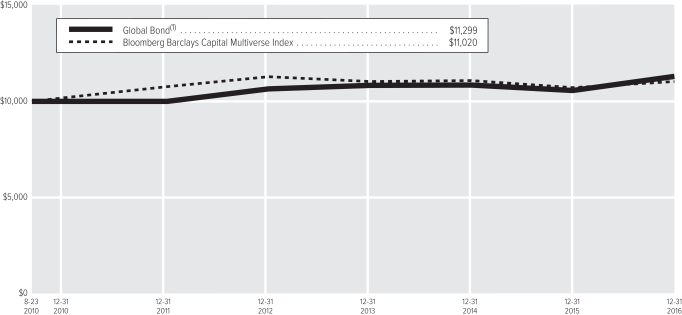

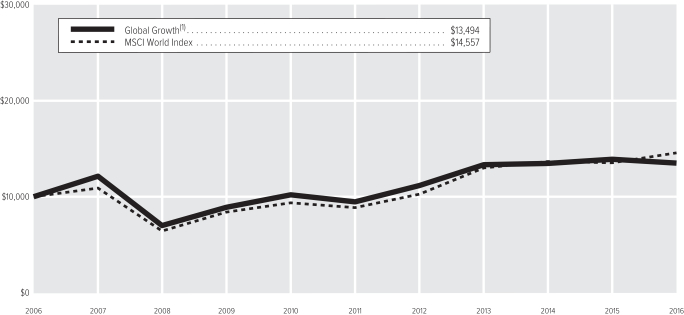

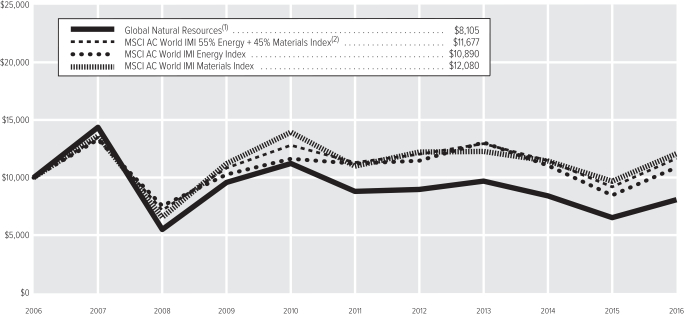

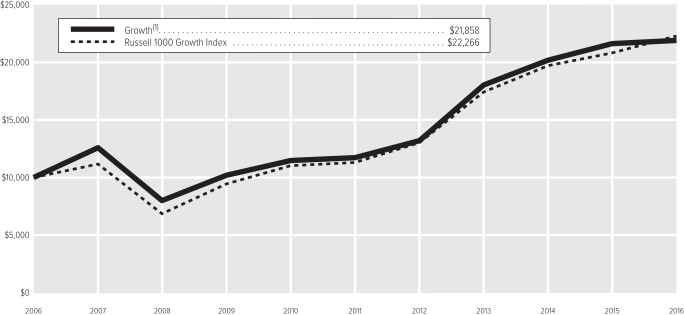

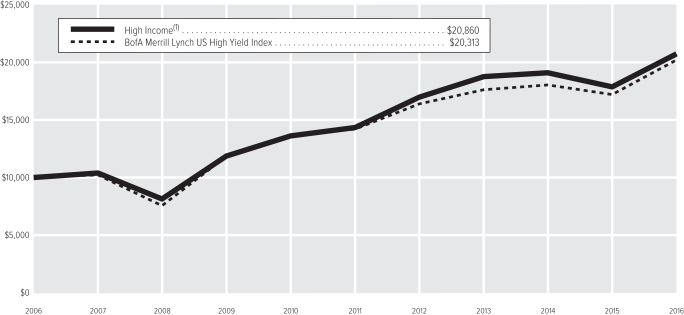

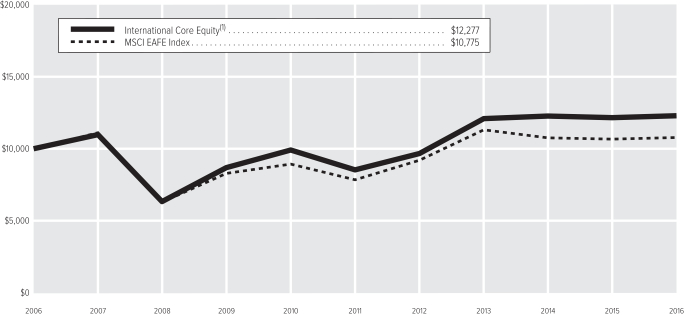

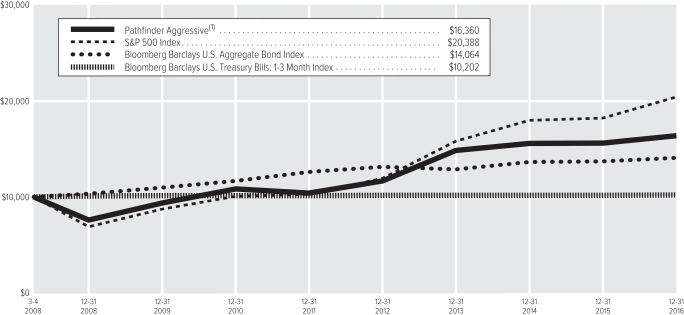

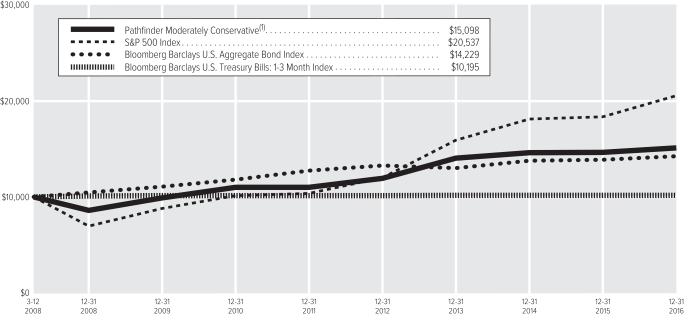

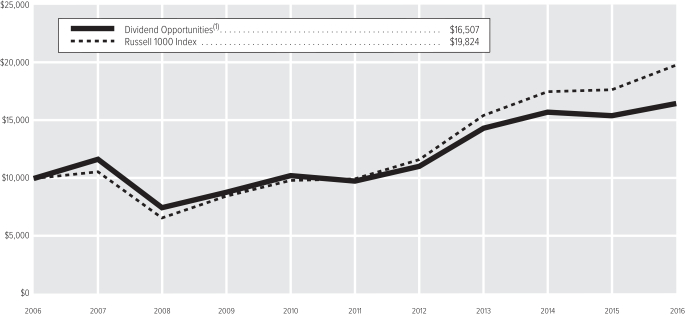

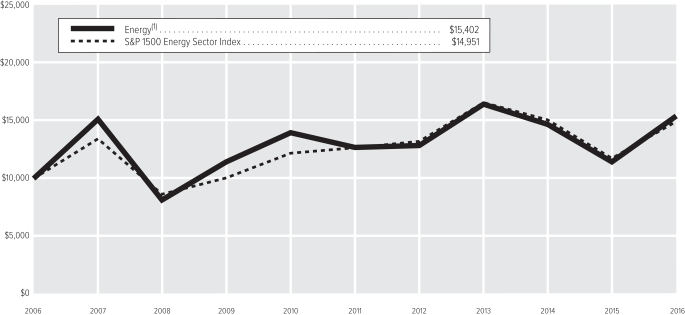

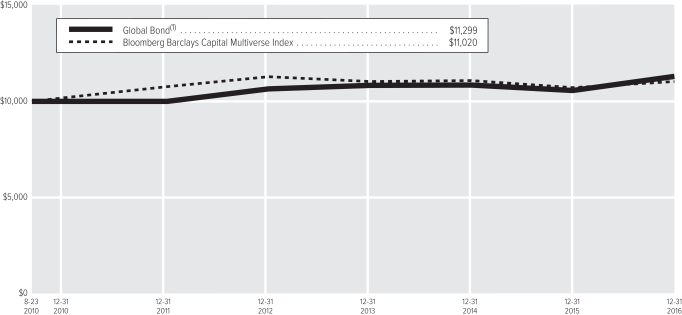

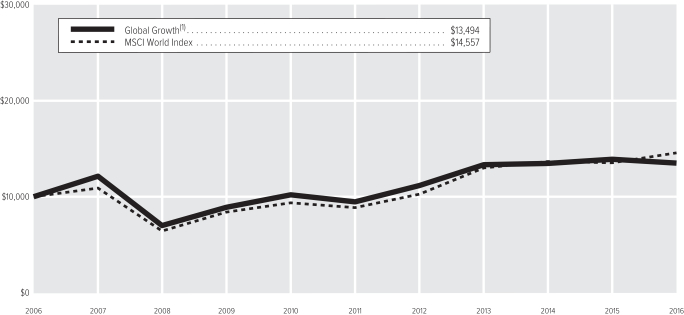

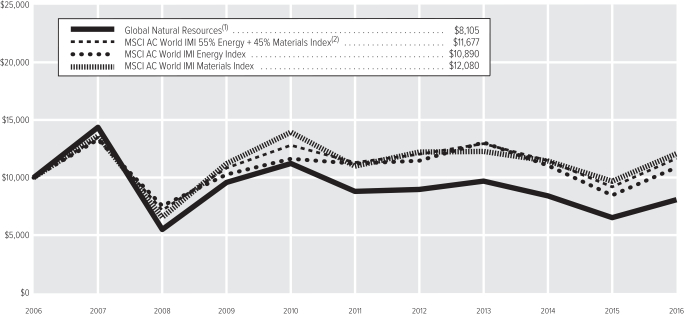

| COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT | | PATHFINDER PORTFOLIOS |

(UNAUDITED)

| (1) | The value of the investment in the Portfolio is impacted by the ongoing expenses of the Portfolio and assumes reinvestment of dividends and distributions. |

| | |

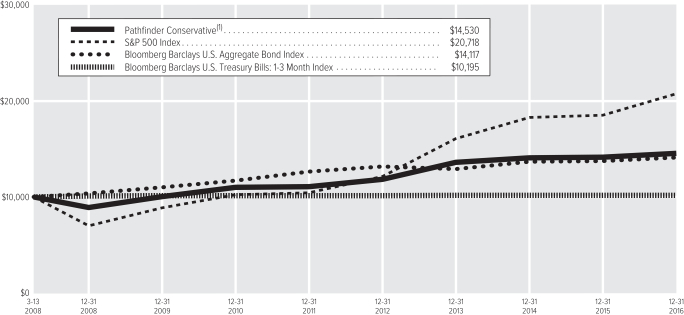

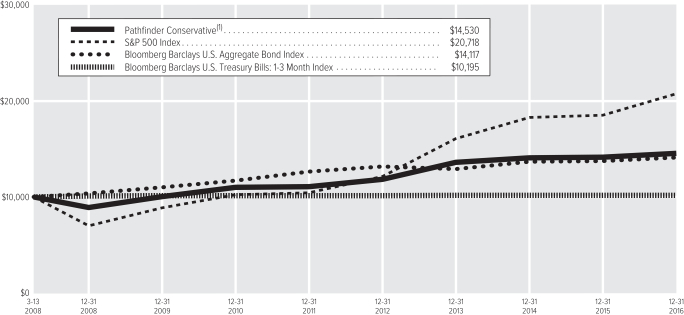

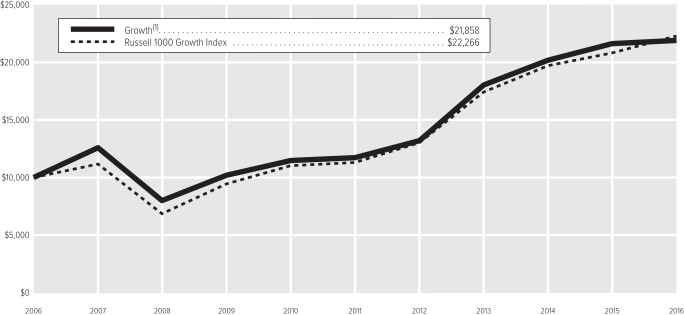

| COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT | | PATHFINDER PORTFOLIOS |

(UNAUDITED)

| (1) | The value of the investment in the Portfolio is impacted by the ongoing expenses of the Portfolio and assumes reinvestment of dividends and distributions. |

| | |

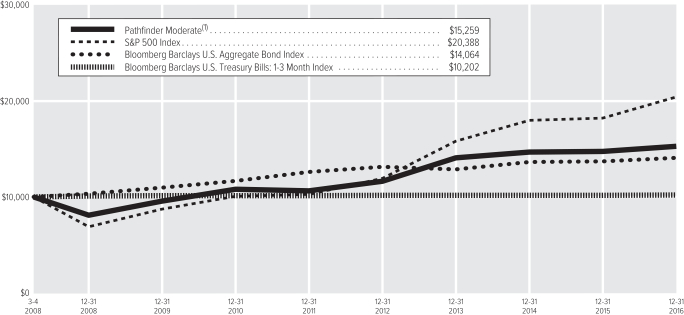

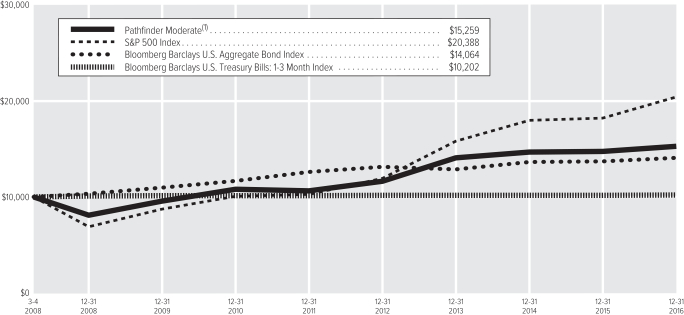

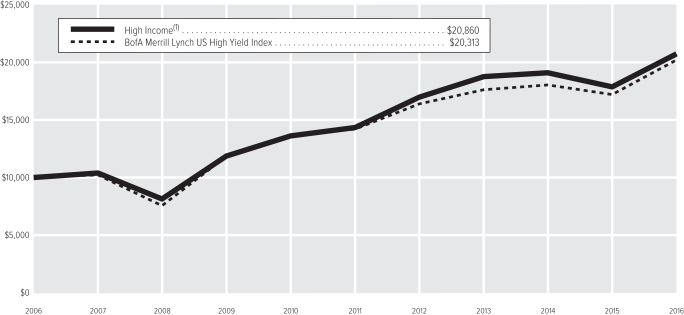

| COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT | | PATHFINDER PORTFOLIOS |

(UNAUDITED)

| (1) | The value of the investment in the Portfolio is impacted by the ongoing expenses of the Portfolio and assumes reinvestment of dividends and distributions. |

| | | | | | | | | | | | | | | | | | | | |

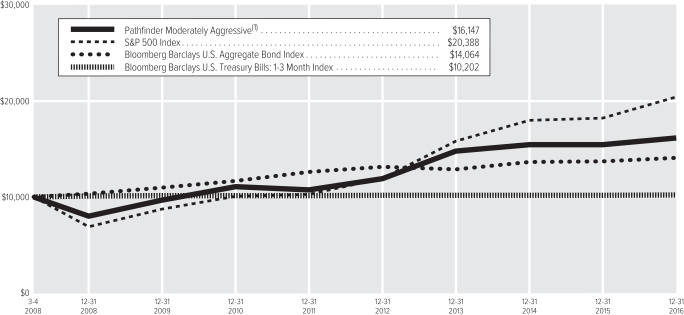

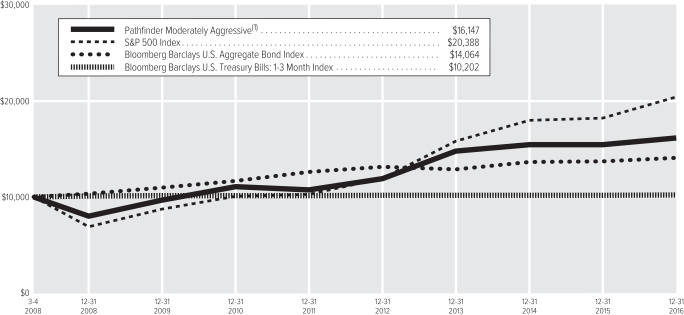

| Average Annual Total Return(2) | | Pathfinder

Aggressive | | | Pathfinder

Conservative | | | Pathfinder

Moderate | | | Pathfinder

Moderately

Aggressive | | | Pathfinder

Moderately

Conservative | |

1-year period ended 12-31-16 | | | 4.80% | | | | 2.84% | | | | 3.65% | | | | 4.52% | | | | 3.10% | |

5-year period ended 12-31-16 | | | 9.48% | | | | 5.56% | | | | 7.48% | | | | 8.46% | | | | 6.52% | |

10-year period ended 12-31-16 | | | — | | | | — | | | | — | | | | — | | | | — | |

Since inception of Portfolio(3) through 12-31-16 | | | 5.73% | | | | 4.34% | | | | 4.90% | | | | 5.58% | | | | 4.79% | |

| (2) | Data quoted is past performance and current performance may be lower or higher. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost. Please call 1.888.WADDELL for the Portfolio’s most recent month-end performance. Performance data quoted does not reflect any expenses or charges associated with owning a variable life insurance policy or variable annuity contract that invests in the Portfolio’s shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower. |

| (3) | 3-4-08 Pathfinder Aggressive, 3-4-08 Pathfinder Moderate, 3-4-08 Pathfinder Moderately Aggressive, 3-12-08 Pathfinder Moderately Conservative and 3-13-08 Pathfinder Conservative (the date on which shares were first acquired by shareholders). |

Past performance is not necessarily indicative of future performance. Indexes are unmanaged. The performance graph and table do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or on the redemption of Portfolio shares. Performance results may include the effect of expense reduction arrangements for some or all of the periods shown. If those arrangements had not been in place, the performance results for those periods would have been lower.

| | |

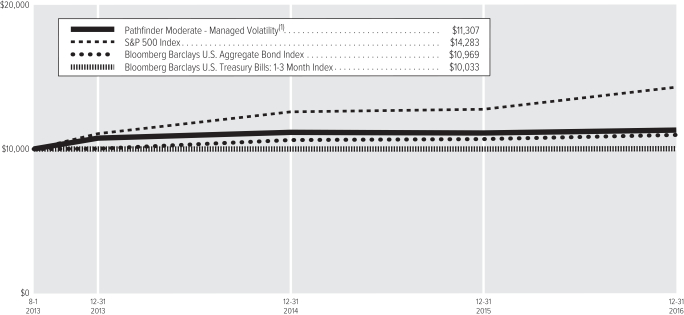

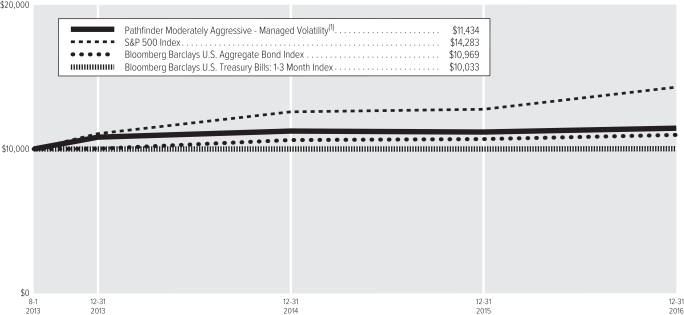

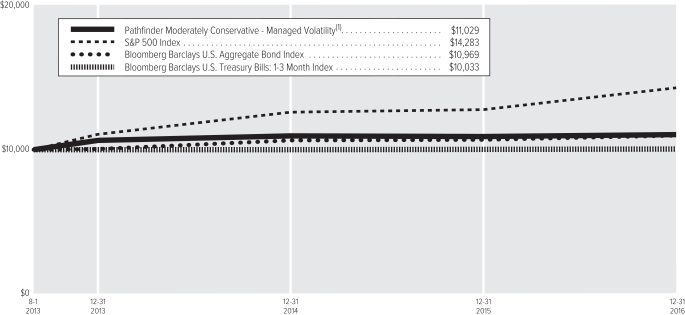

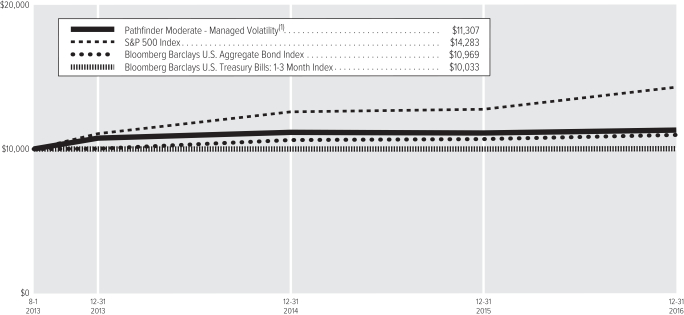

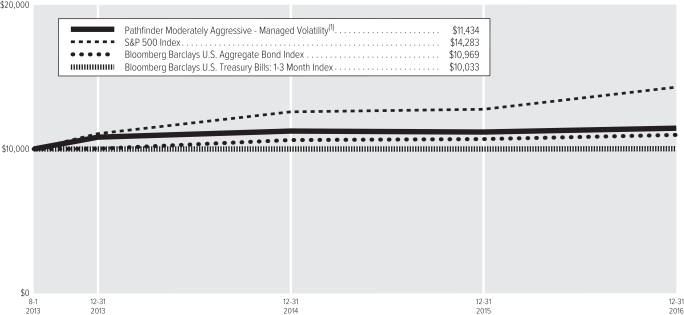

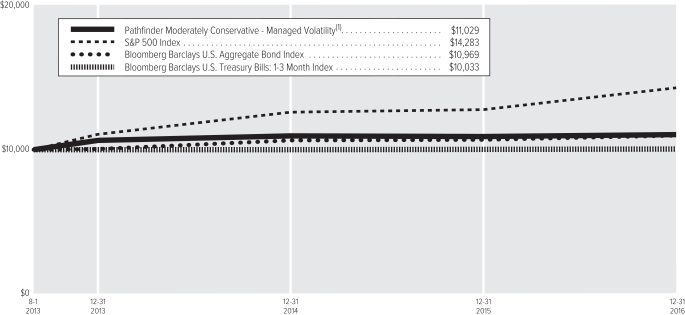

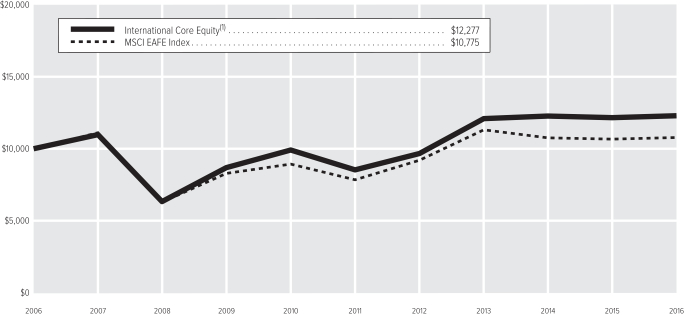

| COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT | | PATHFINDER PORTFOLIOS |

(UNAUDITED)

| (1) | The value of the investment in the Portfolio is impacted by the ongoing expenses of the Portfolio and assumes reinvestment of dividends and distributions. |

| | |

| COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT | | PATHFINDER PORTFOLIOS |

(UNAUDITED)

| (1) | The value of the investment in the Portfolio is impacted by the ongoing expenses of the Portfolio and assumes reinvestment of dividends and distributions. |

| | | | | | | | | | | | |

| Average Annual Total Return(2) | | Pathfinder Moderate – Managed Volatility | | | Pathfinder Moderately

Aggressive – Managed

Volatility | | | Pathfinder Moderately

Conservative – Managed

Volatility | |

1-year period ended 12-31-16 | | | 1.81% | | | | 2.36% | | | | 1.21% | |

5-year period ended 12-31-16 | | | — | | | | — | | | | — | |

10-year period ended 12-31-16 | | | — | | | | — | | | | — | |

Since inception of Portfolio(3) through 12-31-16 | | | 3.66% | | | | 4.00% | | | | 2.91% | |

| (2) | Data quoted is past performance and current performance may be lower or higher. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost. Please call 1.888.WADDELL for the Portfolio’s most recent month-end performance. Performance data quoted does not reflect any expenses or charges associated with owning a variable life insurance policy or variable annuity contract that invests in the Portfolio’s shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower. |

| (3) | 8-1-13 Pathfinder Moderate — Managed Volatility, 8-1-13 Pathfinder Moderately Aggressive — Managed Volatility and 8-1-13 Pathfinder Moderately Conservative — Managed Volatility (the date on which shares were first acquired by shareholders). |

Past performance is not necessarily indicative of future performance. Indexes are unmanaged. The performance graph and table do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or on the redemption of Portfolio shares. Performance results may include the effect of expense reduction arrangements for some or all of the periods shown. If those arrangements had not been in place, the performance results for those periods would have been lower.

| | |

| SCHEDULE OF INVESTMENTS | | PATHFINDER PORTFOLIOS (in thousands) |

DECEMBER 31, 2016

Pathfinder Aggressive

| | | | | | | | |

| AFFILIATED MUTUAL FUNDS | | Shares | | | Value | |

Ivy VIP Bond | | | 713 | | | $ | 3,753 | |

Ivy VIP Global Growth | | | 1,118 | | | | 9,109 | |

Ivy VIP Growth | | | 1,428 | | | | 14,710 | |

Ivy VIP International Core Equity | | | 833 | | | | 12,748 | |

Ivy VIP Limited-Term Bond | | | 881 | | | | 4,305 | |

Ivy VIP Mid Cap Growth | | | 784 | | | | 7,398 | |

Ivy VIP Small Cap Growth | | | 759 | | | | 7,349 | |

Ivy VIP Small Cap Value | | | 400 | | | | 7,343 | |

Ivy VIP Value | | | 1,241 | | | | 7,352 | |

| | | | | | | | |

| |

TOTAL AFFILIATED MUTUAL FUNDS – 99.2% | | | $ | 74,067 | |

(Cost: $81,183) | | | | | | | | |

| | |

| SHORT-TERM SECURITIES | | Principal | | | | |

| |

Master Note – 0.8% | |

Toyota Motor Credit Corp., | | | | | | | | |

0.860%, 1-4-17 (A) | | $ | 579 | | | | 579 | |

| | | | | | | | |

| |

TOTAL SHORT-TERM SECURITIES – 0.8% | | | $ | 579 | |

(Cost: $579) | | | | | | | | |

| |

TOTAL INVESTMENT SECURITIES – 100.0% | | | $ | 74,646 | |

(Cost: $81,762) | | | | | | | | |

| |

CASH AND OTHER ASSETS, NET OF LIABILITIES – 0.0% | | | | 10 | |

| |

NET ASSETS – 100.0% | | | $ | 74,656 | |

Notes to Schedule of Investments

| (A) | Variable rate security. Interest rate disclosed is that which is in effect at December 31, 2016. Date shown represents the date that the variable rate resets. |

The following table is a summary of the valuation of the Portfolio’s investments by the fair value hierarchy levels as of December 31, 2016. See Note 3 to the Financial Statements for further information regarding fair value measurement.

| | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | |

Assets | | | | | | | | | | | | |

Investments in Securities | | | | | | | | | | | | |

Affiliated Mutual Funds | | $ | 74,067 | | | $ | — | | | $ | — | |

Short-Term Securities | | | — | | | | 579 | | | | — | |

| | | | |

Total | | $ | 74,067 | | | $ | 579 | | | $ | — | |

| | | | |

During the year ended December 31, 2016, there were no transfers between Level 1 and 2.

Pathfinder Conservative

| | | | | | | | |

| AFFILIATED MUTUAL FUNDS | | Shares | | | Value | |

Ivy VIP Bond | | | 1,090 | | | $ | 5,739 | |

Ivy VIP Dividend Opportunities | | | 1,888 | | | | 14,697 | |

Ivy VIP Global Growth | | | 558 | | | | 4,549 | |

Ivy VIP Government Money Market | | | 34,266 | | | | 34,266 | |

Ivy VIP Growth | | | 1,419 | | | | 14,622 | |

Ivy VIP International Core Equity | | | 393 | | | | 6,020 | |

Ivy VIP Limited-Term Bond | | | 3,688 | | | | 18,033 | |

Ivy VIP Mid Cap Growth | | | 360 | | | | 3,394 | |

Ivy VIP Small Cap Growth | | | 580 | | | | 5,619 | |

Ivy VIP Small Cap Value | | | 122 | | | | 2,246 | |

Ivy VIP Value | | | 759 | | | | 4,497 | |

| | | | | | | | |

| |

TOTAL AFFILIATED MUTUAL FUNDS – 99.5% | | | $ | 113,682 | |

(Cost: $118,561) | | | | | | | | |

| | |

| SHORT-TERM SECURITIES | | Principal | | | | |

| |

Master Note – 0.5% | |

Toyota Motor Credit Corp., | | | | | | | | |

0.860%, 1-4-17 (A) | | $ | 575 | | | | 575 | |

| | | | | | | | |

| |

TOTAL SHORT-TERM SECURITIES – 0.5% | | | $ | 575 | |

(Cost: $575) | | | | | | | | |

| |

TOTAL INVESTMENT SECURITIES – 100.0% | | | $ | 114,257 | |

(Cost: $119,136) | | | | | | | | |

| |

CASH AND OTHER ASSETS, NET OF LIABILITIES – 0.0% | | | | 2 | |

| |

NET ASSETS – 100.0% | | | $ | 114,259 | |

Notes to Schedule of Investments

| (A) | Variable rate security. Interest rate disclosed is that which is in effect at December 31, 2016. Date shown represents the date that the variable rate resets. |

The following table is a summary of the valuation of the Portfolio’s investments by the fair value hierarchy levels as of December 31, 2016. See Note 3 to the Financial Statements for further information regarding fair value measurement.

| | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | |

Assets | | | | | | | | | | | | |

Investments in Securities | | | | | | | | | | | | |

Affiliated Mutual Funds | | $ | 113,682 | | | $ | — | | | $ | — | |

Short-Term Securities | | | — | | | | 575 | | | | — | |

| | | | |

Total | | $ | 113,682 | | | $ | 575 | | | $ | — | |

| | | | |

During the year ended December 31, 2016, there were no transfers between Level 1 and 2.

Pathfinder Moderate

| | | | | | | | |

| AFFILIATED MUTUAL FUNDS | | Shares | | | Value | |

Ivy VIP Bond | | | 8,256 | | | $ | 43,477 | |

Ivy VIP Dividend Opportunities | | | 16,500 | | | | 128,480 | |

Ivy VIP Global Growth | | | 8,726 | | | | 71,074 | |

Ivy VIP Government Money Market | | | 129,802 | | | | 129,802 | |

Ivy VIP Growth | | | 11,578 | | | | 119,295 | |

Ivy VIP International Core Equity | | | 6,246 | | | | 95,564 | |

Ivy VIP Limited-Term Bond | | | 19,071 | | | | 93,249 | |

Ivy VIP Mid Cap Growth | | | 3,633 | | | | 34,283 | |

Ivy VIP Small Cap Growth | | | 6,152 | | | | 59,602 | |

Ivy VIP Small Cap Value | | | 2,319 | | | | 42,537 | |

Ivy VIP Value | | | 7,186 | | | | 42,588 | |

| | | | | | | | |

| |

TOTAL AFFILIATED MUTUAL FUNDS – 100.0% | | | $ | 859,951 | |

(Cost: $892,598) | | | | | | | | |

| | |

| SHORT-TERM SECURITIES | | Principal | | | | |

| |

Master Note – 0.0% | |

Toyota Motor Credit Corp., | | | | | | | | |

0.860%, 1-4-17 (A) | | $ | 415 | | | | 415 | |

| | | | | | | | |

| |

TOTAL SHORT-TERM SECURITIES – 0.0% | | | $ | 415 | |

(Cost: $415) | | | | | | | | |

| |

TOTAL INVESTMENT SECURITIES – 100.0% | | | $ | 860,366 | |

(Cost: $893,013) | | | | | | | | |

| |

CASH AND OTHER ASSETS, NET OF LIABILITIES – 0.0% | | | | 105 | |

| |

NET ASSETS – 100.0% | | | $ | 860,471 | |

Notes to Schedule of Investments

| (A) | Variable rate security. Interest rate disclosed is that which is in effect at December 31, 2016. Date shown represents the date that the variable rate resets. |

The following table is a summary of the valuation of the Portfolio’s investments by the fair value hierarchy levels as of December 31, 2016. See Note 3 to the Financial Statements for further information regarding fair value measurement.

| | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | |

Assets | | | | | | | | | | | | |

Investments in Securities | | | | | | | | | | | | |

Affiliated Mutual Funds | | $ | 859,951 | | | $ | — | | | $ | — | |

Short-Term Securities | | | — | | | | 415 | | | | — | |

| | | | |

Total | | $ | 859,951 | | | $ | 415 | | | $ | — | |

| | | | |

During the year ended December 31, 2016, there were no transfers between Level 1 and 2.

| | |

| SCHEDULE OF INVESTMENTS | | PATHFINDER PORTFOLIOS (in thousands) |

DECEMBER 31, 2016

Pathfinder Moderately Aggressive

| | | | | | | | |

| AFFILIATED MUTUAL FUNDS | | Shares | | | Value | |

Ivy VIP Bond | | | 9,796 | | | $ | 51,586 | |

Ivy VIP Dividend Opportunities | | | 19,578 | | | | 152,443 | |

Ivy VIP Global Growth | | | 13,178 | | | | 107,329 | |

Ivy VIP Government Money Market | | | 51,342 | | | | 51,342 | |

Ivy VIP Growth | | | 13,738 | | | | 141,547 | |

Ivy VIP International Core Equity | | | 9,264 | | | | 141,736 | |

Ivy VIP Limited-Term Bond | | | 22,628 | | | | 110,642 | |

Ivy VIP Mid Cap Growth | | | 5,388 | | | | 50,847 | |

Ivy VIP Small Cap Growth | | | 8,343 | | | | 80,821 | |

Ivy VIP Small Cap Value | | | 4,402 | | | | 80,754 | |

Ivy VIP Value | | | 8,527 | | | | 50,531 | |

| | | | | | | | |

| |

TOTAL AFFILIATED MUTUAL FUNDS – 99.9% | | | $ | 1,019,578 | |

(Cost: $1,059,919) | | | | | | | | |

| | |

| SHORT-TERM SECURITIES | | Principal | | | | |

| |

Master Note – 0.1% | |

Toyota Motor Credit Corp., | | | | | | | | |

0.860%, 1-4-17 (A) | | $ | 555 | | | | 555 | |

| | | | | | | | |

| |

TOTAL SHORT-TERM SECURITIES – 0.1% | | | $ | 555 | |

(Cost: $555) | | | | | | | | |

| |

TOTAL INVESTMENT SECURITIES – 100.0% | | | $ | 1,020,133 | |

(Cost: $1,060,474) | | | | | | | | |

| |

LIABILITIES, NET OF CASH AND OTHER ASSETS – 0.0% | | | | (264 | ) |

| |

NET ASSETS – 100.0% | | | $ | 1,019,869 | |

Notes to Schedule of Investments

| (A) | Variable rate security. Interest rate disclosed is that which is in effect at December 31, 2016. Date shown represents the date that the variable rate resets. |

The following table is a summary of the valuation of the Portfolio’s investments by the fair value hierarchy levels as of December 31, 2016. See Note 3 to the Financial Statements for further information regarding fair value measurement.

| | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | |

Assets | | | | | | | | | | | | |

Investments in Securities | | | | | | | | | | | | |

Affiliated Mutual Funds | | $ | 1,019,578 | | | $ | — | | | $ | — | |

Short-Term Securities | | | — | | | | 555 | | | | — | |

| | | | |

Total | | $ | 1,019,578 | | | $ | 555 | | | $ | — | |

| | | | |

During the year ended December 31, 2016, there were no transfers between Level 1 and 2.

Pathfinder Moderately Conservative

| | | | | | | | |

| AFFILIATED MUTUAL FUNDS | | Shares | | | Value | |

Ivy VIP Bond | | | 2,495 | | | $ | 13,137 | |

Ivy VIP Dividend Opportunities | | | 4,321 | | | | 33,645 | |

Ivy VIP Global Growth | | | 1,918 | | | | 15,618 | |

Ivy VIP Government Money Market | | | 52,294 | | | | 52,294 | |

Ivy VIP Growth | | | 3,498 | | | | 36,046 | |

Ivy VIP International Core Equity | | | 1,415 | | | | 21,657 | |

Ivy VIP Limited-Term Bond | | | 8,443 | | | | 41,281 | |

Ivy VIP Mid Cap Growth | | | 1,098 | | | | 10,359 | |

Ivy VIP Small Cap Growth | | | 1,593 | | | | 15,436 | |

Ivy VIP Small Cap Value | | | 420 | | | | 7,712 | |

Ivy VIP Value | | | 2,171 | | | | 12,868 | |

| | | | | | | | |

| |

TOTAL AFFILIATED MUTUAL FUNDS – 99.6% | | | $ | 260,053 | |

(Cost: $271,457) | | | | | | | | |

| | |

| SHORT-TERM SECURITIES | | Principal | | | | |

| |

Master Note – 0.2% | |

Toyota Motor Credit Corp., | | | | | | | | |

0.860%, 1-4-17 (A) | | $ | 563 | | | | 563 | |

| | | | | | | | |

| |

TOTAL SHORT-TERM SECURITIES – 0.2% | | | $ | 563 | |

(Cost: $563) | | | | | | | | |

| |

TOTAL INVESTMENT SECURITIES – 99.8% | | | $ | 260,616 | |

(Cost: $272,020) | | | | | | | | |

| |

CASH AND OTHER ASSETS, NET OF LIABILITIES – 0.2% | | | | 434 | |

| |

NET ASSETS – 100.0% | | | $ | 261,050 | |

Notes to Schedule of Investments

| (A) | Variable rate security. Interest rate disclosed is that which is in effect at December 31, 2016. Date shown represents the date that the variable rate resets. |

The following table is a summary of the valuation of the Portfolio’s investments by the fair value hierarchy levels as of December 31, 2016. See Note 3 to the Financial Statements for further information regarding fair value measurement.

| | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | |

Assets | | | | | | | | | | | | |

Investments in Securities | | | | | | | | | | | | |

Affiliated Mutual Funds | | $ | 260,053 | | | $ | — | | | $ | — | |

Short-Term Securities | | | — | | | | 563 | | | | — | |

| | | | |

Total | | $ | 260,053 | | | $ | 563 | | | $ | — | |

| | | | |

During the year ended December 31, 2016, there were no transfers between Level 1 and 2.

Pathfinder Moderate – Managed Volatility

| | | | | | | | |

| AFFILIATED MUTUAL FUNDS | | Shares | | | Value | |

Ivy VIP Bond | | | 4,759 | | | $ | 25,061 | |

Ivy VIP Dividend Opportunities | | | 9,511 | | | | 74,061 | |

Ivy VIP Global Growth | | | 5,030 | | | | 40,969 | |

Ivy VIP Government Money Market | | | 74,822 | | | | 74,822 | |

Ivy VIP Growth | | | 6,674 | | | | 68,767 | |

Ivy VIP International Core Equity | | | 3,600 | | | | 55,086 | |

Ivy VIP Limited-Term Bond | | | 10,993 | | | | 53,751 | |

Ivy VIP Mid Cap Growth | | | 2,094 | | | | 19,762 | |

Ivy VIP Small Cap Growth | | | 3,547 | | | | 34,357 | |

Ivy VIP Small Cap Value | | | 1,337 | | | | 24,521 | |

Ivy VIP Value | | | 4,143 | | | | 24,550 | |

| | | | | | | | |

| |

TOTAL AFFILIATED MUTUAL FUNDS – 96.9% | | | $ | 495,707 | |

(Cost: $524,374) | | | | | | | | |

| | |

| SHORT-TERM SECURITIES | | Principal | | | | |

| |

Commercial Paper (A) – 1.6% | |

PacifiCorp, | | | | | | | | |

0.970%, 1-10-17 | | $ | 8,000 | | | | 7,998 | |

| | | | | | | | |

| |

Master Note – 1.4% | |

Toyota Motor Credit Corp., | | | | | | | | |

0.860%, 1-4-17 (B) | | | 7,184 | | | | 7,184 | |

| | | | | | | | |

| |

TOTAL SHORT-TERM SECURITIES – 3.0% | | | $ | 15,182 | |

(Cost: $15,182) | | | | | | | | |

| |

TOTAL INVESTMENT SECURITIES – 99.9% | | | $ | 510,889 | |

(Cost: $539,556) | | | | | | | | |

| |

CASH AND OTHER ASSETS, NET OF LIABILITIES (C) – 0.1% | | | | 468 | |

| |

NET ASSETS – 100.0% | | | $ | 511,357 | |

Notes to Schedule of Investments

| (A) | Rate shown is the yield to maturity at December 31, 2016. |

| (B) | Variable rate security. Interest rate disclosed is that which is in effect at December 31, 2016. Date shown represents the date that the variable rate resets. |

| (C) | Cash of $492 has been pledged as collateral on open futures contracts. |

The following futures contracts were outstanding at December 31, 2016 (contracts unrounded):

| | | | | | | | | | | | | | | | | | | | |

| Description | | Type | | Expiration

Date | | Number

of

Contracts | | | Value | | | Unrealized

Depreciation | | | | |

S&P 500 Index | | Short | | 3-16-17 | | | 16 | | | $ | (8,945 | ) | | $ | (150 | ) | | | | |

E-mini Russell 2000 Index | | Short | | 3-17-17 | | | 34 | | | | (2,307 | ) | | | (34 | ) | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | $ | (11,252 | ) | | $ | (184 | ) | | | | |

| | | | | | | | | | | | |

| | |

| SCHEDULE OF INVESTMENTS | | PATHFINDER PORTFOLIOS (in thousands) |

DECEMBER 31, 2016

The following table is a summary of the valuation of the Portfolio’s investments by the fair value hierarchy levels as of December 31, 2016. See Note 3 to the Financial Statements for further information regarding fair value measurement.

| | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | |

Assets | | | | | | | | | | | | |

Investments in Securities | | | | | | | | | | | | |

Affiliated Mutual Funds | | $ | 495,707 | | | $ | — | | | $ | — | |

Short-Term Securities | | | — | | | | 15,182 | | | | — | |

| | | | |

Total | | $ | 495,707 | | | $ | 15,182 | | | $ | — | |

| | | | |

Liabilities | | | | | | | | | | | | |

Futures Contracts | | $ | 184 | | | $ | — | | | $ | — | |

| | | | |

During the year ended December 31, 2016, there were no transfers between Level 1 and 2.

Pathfinder Moderately Aggressive – Managed Volatility

| | | | | | | | |

| AFFILIATED MUTUAL FUNDS | | Shares | | | Value | |

Ivy VIP Bond | | | 726 | | | $ | 3,821 | |

Ivy VIP Dividend Opportunities | | | 1,450 | | | | 11,292 | |

Ivy VIP Global Growth | | | 976 | | | | 7,950 | |

Ivy VIP Government Money Market | | | 3,803 | | | | 3,803 | |

Ivy VIP Growth | | | 1,018 | | | | 10,484 | |

Ivy VIP International Core Equity | | | 686 | | | | 10,498 | |

Ivy VIP Limited-Term Bond | | | 1,676 | | | | 8,195 | |

Ivy VIP Mid Cap Growth | | | 399 | | | | 3,766 | |

Ivy VIP Small Cap Growth | | | 618 | | | | 5,986 | |

Ivy VIP Small Cap Value | | | 326 | | | | 5,982 | |

Ivy VIP Value | | | 632 | | | | 3,743 | |

| | | | | | | | |

| |

TOTAL AFFILIATED MUTUAL FUNDS – 97.3% | | | $ | 75,520 | |

(Cost: $81,986) | | | | | | | | |

| | |

| SHORT-TERM SECURITIES | | Principal | | | | |

| |

Master Note – 2.8% | |

Toyota Motor Credit Corp., | | | | | | | | |

0.860%, 1-4-17 (A) | | $ | 2,138 | | | | 2,138 | |

| | | | | | | | |

| |

TOTAL SHORT-TERM SECURITIES – 2.8% | | | $ | 2,138 | |

(Cost: $2,138) | | | | | | | | |

| |

TOTAL INVESTMENT SECURITIES – 100.1% | | | $ | 77,658 | |

(Cost: $84,124) | | | | | | | | |

| |

LIABILITIES, NET OF CASH AND OTHER ASSETS (B) – (0.1)% | | | | (108 | ) |

| |

NET ASSETS – 100.0% | | | $ | 77,550 | |

Notes to Schedule of Investments

| (A) | Variable rate security. Interest rate disclosed is that which is in effect at December 31, 2016. Date shown represents the date that the variable rate resets. |

| (B) | Cash of $57 has been pledged as collateral on open futures contracts. |

The following futures contracts were outstanding at December 31, 2016 (contracts unrounded):

| | | | | | | | | | | | | | | | | | | | |

| Description | | Type | | Expiration

Date | | Number

of

Contracts | | | Value | | | Unrealized

Depreciation | | | | |

S&P 500 Index | | Short | | 3-16-17 | | | 2 | | | $ | (1,118 | ) | | $ | (19 | ) | | | | |

E-mini Russell 2000 Index | | Short | | 3-17-17 | | | 3 | | | | (204 | ) | | | (3 | ) | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | $ | (1,322 | ) | | $ | (22 | ) | | | | |

| | | | | | | | | | | | |

The following table is a summary of the valuation of the Portfolio’s investments by the fair value hierarchy levels as of December 31, 2016. See Note 3 to the Financial Statements for further information regarding fair value measurement.

| | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | |

Assets | | | | | | | | | | | | |

Investments in Securities | | | | | | | | | | | | |

Affiliated Mutual Funds | | $ | 75,520 | | | $ | — | | | $ | — | |

Short-Term Securities | | | — | | | | 2,138 | | | | — | |

| | | | |

Total | | $ | 75,520 | | | $ | 2,138 | | | $ | — | |

| | | | |

Liabilities | | | | | | | | | | | | |

Futures Contracts | | $ | 22 | | | $ | — | | | $ | — | |

| | | | |

During the year ended December 31, 2016, there were no transfers between Level 1 and 2.

| | |

| SCHEDULE OF INVESTMENTS | | PATHFINDER PORTFOLIOS (in thousands) |

DECEMBER 31, 2016

Pathfinder Moderately Conservative – Managed Volatility

| | | | | | | | |

| AFFILIATED MUTUAL FUNDS | | Shares | | | Value | |

Ivy VIP Bond | | | 634 | | | $ | 3,341 | |

Ivy VIP Dividend Opportunities | | | 1,099 | | | | 8,556 | |

Ivy VIP Global Growth | | | 488 | | | | 3,972 | |

Ivy VIP Government Money Market | | | 13,298 | | | | 13,298 | |

Ivy VIP Growth | | | 890 | | | | 9,167 | |

Ivy VIP International Core Equity | | | 360 | | | | 5,507 | |

Ivy VIP Limited-Term Bond | | | 2,147 | | | | 10,498 | |

Ivy VIP Mid Cap Growth | | | 279 | | | | 2,634 | |

Ivy VIP Small Cap Growth | | | 405 | | | | 3,926 | |

Ivy VIP Small Cap Value | | | 107 | | | | 1,961 | |

Ivy VIP Value | | | 552 | | | | 3,272 | |

| | | | | | | | |

| |

TOTAL AFFILIATED MUTUAL FUNDS – 98.6% | | | $ | 66,132 | |

(Cost: $69,688) | | | | | | | | |

| | |

| SHORT-TERM SECURITIES | | Principal | | | | |

| |

Master Note – 1.3% | |

Toyota Motor Credit Corp., | | | | | | | | |

0.860%, 1-4-17 (A) | | $ | 899 | | | | 899 | |

| | | | | | | | |

| |

TOTAL SHORT-TERM SECURITIES – 1.3% | | | $ | 899 | |

(Cost: $899) | | | | | | | | |

| |

TOTAL INVESTMENT SECURITIES – 99.9% | | | $ | 67,031 | |

(Cost: $70,587) | | | | | | | | |

| |

CASH AND OTHER ASSETS, NET OF LIABILITIES (B) – 0.1% | | | | 87 | |

| |

NET ASSETS – 100.0% | | | $ | 67,118 | |

Notes to Schedule of Investments

| (A) | Variable rate security. Interest rate disclosed is that which is in effect at December 31, 2016. Date shown represents the date that the variable rate resets. |

| (B) | Cash of $88 has been pledged as collateral on open futures contracts. |

The following futures contracts were outstanding at December 31, 2016 (contracts unrounded):

| | | | | | | | | | | | | | | | | | | | |

| Description | | Type | | Expiration

Date | | Number

of

Contracts | | | Value | | | Unrealized

Depreciation | | | | |

S&P 500 Index | | Short | | 3-16-17 | | | 3 | | | $ | (1,677 | ) | | $ | (28 | ) | | | | |

E-mini Russell 2000 Index | | Short | | 3-17-17 | | | 5 | | | | (339 | ) | | | (5 | ) | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | $ | (2,016 | ) | | $ | (33 | ) | | | | |

| | | | | | | | | | | | |

The following table is a summary of the valuation of the Portfolio’s investments by the fair value hierarchy levels as of December 31, 2016. See Note 3 to the Financial Statements for further information regarding fair value measurement.

| | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | |

Assets | | | | | | | | | | | | |

Investments in Securities | | | | | | | | | | | | |

Affiliated Mutual Funds | | $ | 66,132 | | | $ | — | | | $ | — | |

Short-Term Securities | | | — | | | | 899 | | | | — | |

| | | | |

Total | | $ | 66,132 | | | $ | 899 | | | $ | — | |

| | | | |

Liabilities | | | | | | | | | | | | |

Futures Contracts | | $ | 33 | | | $ | — | | | $ | — | |

| | | | |

During the year ended December 31, 2016, there were no transfers between Level 1 and 2.

See Accompanying Notes to Financial Statements.

| | |

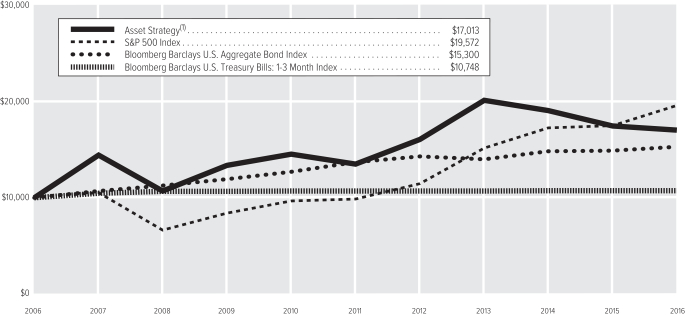

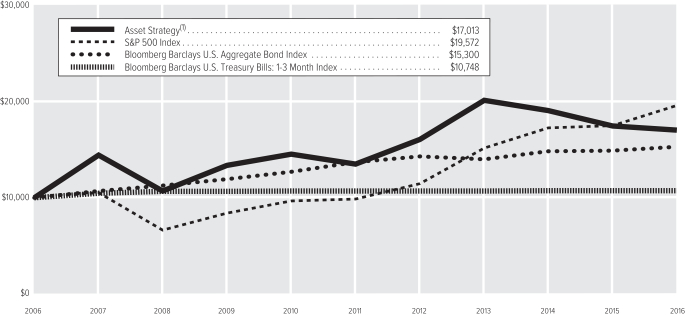

| MANAGEMENT DISCUSSION | | ASSET STRATEGY |

(UNAUDITED)

|

Chace Brundige

Cynthia P. Prince-Fox |

Below, Cynthia P. Prince-Fox and F. Chace Brundige, CFA, portfolio managers of Ivy VIP Asset Strategy, discuss positioning, performance and results for the fiscal year ended December 31, 2016. Ms. Prince-Fox has managed the Portfolio since 2014 and has 33 years of industry experience. Mr. Brundige has managed the Portfolio since 2014 and has 23 years of industry experience. Michael L. Avery previously was a co-portfolio manager on the Portfolio. He retired effective June 30, 2016.

Fiscal Year Performance

| | | | |

For the 12 Months Ended December 31, 2016 | | | | |

Ivy VIP Asset Strategy | | | -2.57% | |

Benchmark(s) and/or Lipper Category | | | | |

S&P 500 Index | | | 11.96% | |

(generally reflects the performance of large-capitalization U.S. stocks) | | | | |

Barclays U.S. Aggregate Bond Index | | | 2.65% | |

(generally reflects the performance of most U.S.-traded investment grade bonds) | | | | |

Barclays U.S. Treasury Bills: 1-3 Month Index | | | 0.26% | |

(generally reflects the performance of investment-grade Treasury bills, representing cash) | | | | |

Lipper Variable Annuity Alternative Other Universe Average | | | 6.29% | |

(generally reflects the performance of the universe of funds with similar investment objectives) | | | | |

Please note that the Portfolio returns include applicable investment fees and expense, whereas the index returns do not include any such fees. Also, the Portfolio’s performance data does not take into account any product expenses or charges associated with owning a variable life or annuity policy, which is invested in Ivy Variable Insurance Portfolios. Multiple indexes are shown because the Portfolio invests in multiple asset classes.

From risk-off to euphoria

“Risk-off” seemed to be the operative term in global fixed income, equity and currency markets during the first half of the fiscal year. China devalued its currency again in January 2016 following the U.S. Federal Reserve’s (Fed) 0.25-percentage-point interest rate hike and voters in the U.K. on June 23 approved a proposal to leave the European Union — the so-called “Brexit.” By the fourth quarter, and especially after the surprise U.S. presidential election victory of Donald Trump, a general “risk-on” environment had taken hold in financial markets and both business and consumer sentiment improved.

U.S. Treasury 10-year yields began the year around 2.27% and then declined to a post-Brexit low of about 1.36% before rebounding steadily through the third quarter. In the days immediately following the U.S. elections, most global developed market yields moved higher and the U.S. Treasury closed the year around 2.44%.

The S&P 500 index declined almost 10% to start the year, moving from 2,012 on January 4 to 1,829 in mid-February. Except for some volatility around the Brexit vote and the U.S. elections, equities subsequently climbed higher and ended the year around 2,238.

The value of the broad, trade-weighted U.S. dollar began the year in a softer trend versus both developed and emerging market currencies. That continued through April before the U.S. dollar unevenly strengthened and accelerated after the U.S. elections. The Fed did not raise interest rates at its September meeting, then raised short-term rates by 0.25 percentage point in December. With continued improvements in the labor market and wages finally turning higher, the Fed said it anticipates three more interest rate hikes in 2017.

The Japanese yen rallied during the first half of the year, even going below 100 briefly in August, before the “risk-on” trade sent it weaker through the fourth quarter. The Bank of Japan announced in September its target for the 10-year Japanese government bond would be “around zero” while it continued its asset purchase program. The euro traveled a fairly choppy path for most of the first half of the year before settling into a weaker trend during the final months of 2016. The European Central Bank (ECB) cut rates in March and expanded its quantitative easing facility. It also announced its Corporate Sector Purchase Program — moving beyond suppression of the “risk-free” rate in the euro and into compression of credit spreads. In December, the ECB announced a nine-month extension to the asset purchase program and a reduction in the amount purchased each month.

Commodity prices started the year lower along with the broader market volatility, but moved off those lows during the year and accelerated after the U.S. elections. West Texas Intermediate crude oil prices (the benchmark for oil prices in the U.S.) were below $30 per barrel in February, but moved higher on reduced supply expectations and continued growth in demand, closing the year around $53 per barrel.

We expect the final global gross domestic product growth rate to be about 3% for 2016. For 2017, we think there will be acceleration to 3.6% as economic growth prospects in the U.S., Japan and India are likely to significantly improve. We also think the coming fiscal year will be the first time developed and emerging economies accelerate together since 2010, as global trade continues to improve from its recent lull.

We believe the U.S. labor market will likely continue to improve, as initial jobless claims hover around the lows of the cycle and job openings are at record highs. U.S. consumers are getting support from wage growth at last. This situation is likely to support consumer spending, particularly in an environment in which inflation remains in check. Consumer sentiment, as measured by the University of Michigan index, reached 98.2 as of fiscal year end, the highest since 2004.

Business confidence and manufacturing struggled during the year’s early months, but showed signs of improvement after the U.S. elections. The ISM Manufacturing Index reached a two-year high in November. In our view, a combination of stronger confidence, inventory correction, higher oil prices and better global demand contributed to the increase.

Adjustments as year progressed

The Portfolio had a small negative return for the fiscal year, underperforming the positive returns of its benchmark indexes and Lipper Universe Average.

The Portfolio ended the fiscal year with about 64% of net assets allocated to equities, about 15% to fixed-income securities, roughly 6% to gold bullion and nearly 15% in cash and cash equivalents.

As the year began, we had maintained a somewhat cautious outlook on the markets. This was broadly based on the belief that we remained in a challenging environment of global overcapacity and low demand as well as uncertainty on how markets would react to the potential for higher rates. Areas of focus during the year included:

| • | | better-positioned U.S. consumers with cleaner personal balance sheets; |

| • | | the benefit to consumers of lower energy prices and an improving labor market; |

| • | | an improving housing market helped by marginally improved confidence among Millennials; |

| • | | growing numbers of emerging market consumers and where they would spend; |

| • | | technology that provided companies with improving efficiencies and productivity, as well as selected vendors with improved long-term returns because of the “Cloud” model. |

Relative to the S&P 500 Index benchmark, the top sector contributors within the Portfolio’s public equity holdings were energy, consumer staples and materials, as well as a lack of exposure to the real estate and utilities sectors.

The largest detractor to relative performance in the public equities was in the health care sector, followed by financials, consumer discretionary and information technology. Maintaining an allocation to pharmaceuticals and biotechnology during the fiscal year falls into the “lessons learned” category. We held on too long and did not adequately factor in the continuing negative effects of political headwinds combined with the overweight positioning of the active investor community. Several of the Portfolio’s private investments also were detractors from relative performance. In addition, we sold a small private credit in the first quarter.

Within fixed income, the Portfolio primarily held long-duration U.S. Treasury securities and Treasury Inflation Protected Securities (TIPS) during the first half of the year as part of our desire to own more liquid securities (in addition to cash and gold bullion) and assets that provided yield. By the third quarter, we began to sell some of the Treasuries and purchase more TIPS, as we could no longer ignore increasing inflation within wage indicators and other prices. We also began to invest in local currency debt within emerging markets, specifically Mexico and Brazil, as a way of benefitting from relatively high real yields when compared with developed markets, undervalued currencies and improving current account balances and/or economic growth prospects. Emerging market currencies were mostly weaker after the U.S. elections and the Mexican peso was one of the worst performers. Overall, our fixed income holdings detracted from relative performance for the year.

Gold bullion has been a long-term holding in the Portfolio and one we view as a currency with a stable “printing press,” especially relative to fiat currencies we may seek to hedge at times. We added to the gold position early in the year, but reduced the position in September and again in December. Gold rose during the first six months of the year, but turned lower in the fourth quarter. In the long run, we believe gold should reflect inflation expectations and asset prices, but in the final months of the year gold prices were lower as yields on fixed income securities rose and inflation remained relatively benign. Despite mounting leverage, the “fear” value faded as economic growth improved. The gold holdings were a detractor from relative performance for the year.

The Portfolio’s allocation weighting to cash and cash equivalents was higher during the first half of the year than the second half as we put it to work in more equities and emerging market sovereign debt. Holding cash with equity markets moving higher detracted from relative performance in the year.

Assessing risks for 2017

Looking ahead, we anticipate uncertainty around fiscal policy implementation and potential regulatory changes from President-elect Trump. There has been much discussion, and many tweets, about corporate and personal tax reform, border-adjusted taxation, infrastructure spending, renegotiating of trade agreements, and repeal and replacement of the Affordable Care Act, also known as “Obamacare.” As the politics play out, we expect continued sector volatility in the coming year.

The housing market has been a contributor to economic growth in the U.S. as households worked to repair their balance sheets after the global financial crisis and inventories were cleared, supporting increases in home prices. Mortgage rates had already begun to rise in the fourth quarter, with the 30-year fixed rate exceeding 4% by year end — a level not seen in 18 months. This still is a relatively low interest rate, but if rates move higher — especially if they outpace wage gains — we think home sales and the wealth effect from them could be diminished.

As of the end of the fiscal year, we think commodity prices looked more stable at their higher levels. If the U.S. embarks upon a large infrastructure program or demand from China remains or accelerates on government policy, we believe those prices could move higher again. While that is likely to help commodity-producing companies and regions, a strong move higher could impinge on households and businesses as input costs rise.

We remain focused on where we think growth will occur in the world. Many of our holdings from 2015 remained core holdings in 2016. Our highest conviction names fall into the secular growth category with strong balance sheets and attractive free cash flow generation that offer the optionality of share repurchases, dividends or acquisitions. We remain overweight the energy sector via oil service and exploration and production companies that we believe are well-positioned for renewed growth in U.S. onshore production.

We increased exposure to banks in the U.S. and Europe, as we believe this sector of the market remains attractively valued as interest rates begin to normalize. While industrial fundamentals have begun to improve, the shares have moved well ahead of the news, leaving less room for relative appreciation. Still, we have added exposure in certain sub-industries in which the market has not yet discounted the potential of the developing cycle.

Investments related to emerging market consumers had held a prominent role within the Portfolio since the financial crisis — particularly related to China — and we continue to believe in their long-term growth. We still think the rise in their discretionary income is likely to continue to eclipse that of developed market counterparts. However, we believe the growth rate for consumption will be slower and, from here, more dependent on structural reforms. In addition, multinationals are seeing increased competition from local companies as quality improves.

The Portfolio changes as the market environment in which we invest changes; it is the hallmark of its flexible mandate. What remains steadfast is the process we utilize to manage investor money.

Past performance is not a guarantee of future results. The value of the Portfolio’s shares will change, and you could lose money on your investment.

The Portfolio may allocate from 0-100% of its assets between stocks, bonds and short-term instruments of issuers around the globe and investments with exposure to various foreign securities. Subject to diversification limits, the Portfolio also may invest up to 25% of its total assets in precious metals.

International investing involves additional risks including currency fluctuations, political or economic conditions affecting the foreign country, and differences in accounting standards and foreign regulations. These risks are magnified in emerging markets.

Fixed-income securities are subject to interest-rate risk and, as such, the net asset value of the Portfolio may fall as interest rates rise. Investing in high-income securities may carry a greater risk of nonpayment of interest or principal than higher-rated bonds.

The Portfolio may focus its investments in certain regions or industries, thereby increasing its potential vulnerability to market volatility.

Investing in commodities is generally considered speculative because of the significant potential for investment loss due to cyclical economic conditions, sudden political events, and adverse international monetary policies. Markets for commodities are likely to be volatile and the Portfolio may pay more to store and accurately value its commodity holdings than it does with other holdings.

The Portfolio may seek to hedge market risk on various securities, manage and/or increase exposure to certain securities, companies, sectors, markets, foreign currencies and/or precious metals and seek to hedge certain event risks on positions held by the Portfolio via the use of derivative instruments. Such investments involve additional risks, as the fluctuations in the values of the derivatives may not correlate perfectly with the overall securities markets or with the underlying asset from which the derivative’s value is derived.

These and other risks are more fully described in the Portfolio’s prospectus.

The opinions expressed in this report are those of the portfolio managers and are current only through the end of the period of the report as stated on the cover. The managers’ views are subject to change at any time based on market and other conditions, and no forecasts can be guaranteed.

The indexes noted are unmanaged and include reinvested dividends. One cannot invest directly in an index, nor is an index representative of Ivy VIP Asset Strategy.

| | |

| PORTFOLIO HIGHLIGHTS | | ASSET STRATEGY |

ALL DATA IS AS OF DECEMBER 31, 2016 (UNAUDITED)

Asset Allocation

| | | | |

Stocks | | | 64.1% | |

Financials | | | 12.4% | |

Information Technology | | | 11.0% | |

Energy | | | 9.2% | |

Consumer Discretionary | | | 8.7% | |

Consumer Staples | | | 7.7% | |

Health Care | | | 6.5% | |

Industrials | | | 5.6% | |

Materials | | | 2.1% | |

Telecommunication Services | | | 0.9% | |

Bullion (Gold) | | | 6.0% | |

Bonds | | | 15.0% | |

Corporate Debt Securities | | | 6.5% | |

Other Government Securities | | | 5.4% | |

United States Government and Government Agency Obligations | | | 3.1% | |

Cash and Other Assets (Net of Liabilities), and Cash Equivalents+ | | | 14.9% | |

Country Weightings

| | | | |

North America | | | 55.2% | |

United States | | | 50.9% | |

Mexico | | | 4.3% | |

Europe | | | 15.2% | |

United Kingdom | | | 8.7% | |

Other Europe | | | 6.5% | |

Pacific Basin | | | 6.7% | |

Bullion (Gold) | | | 6.0% | |

South America | | | 2.0% | |

Cash and Other Assets (Net of Liabilities), and Cash Equivalents+ | | | 14.9% | |

Top 10 Equity Holdings

| | | | | | |

| Company | | Country | | Sector | | Industry |