UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811-5017

Ivy Variable Insurance Portfolios

(Exact name of registrant as specified in charter)

6300 Lamar Avenue, Overland Park, Kansas 66202

(Address of principal executive offices) (Zip code)

Jennifer K. Dulski

6300 Lamar Avenue

Overland Park, Kansas 66202

(Name and address of agent for service)

Registrant’s telephone number, including area code: (913)236-2000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2018

ITEM 1. REPORTS TO STOCKHOLDERS.

| | |

VARIABLE INSURANCE PORTFOLIOS | | Annual Report DECEMBER 31, 2018 |

| | | | | | | | |

| IVY Variable Insurance Portfolios | | | | | | | | |

| | |

| Asset Strategy | | | Class I | | | | Class II | |

| | |

| Balanced | | | | | | | Class II | |

| | |

| Energy | | | Class I | | | | Class II | |

| | |

| Growth | | | | | | | Class II | |

| | |

| High Income | | | Class I | | | | Class II | |

| | |

| International Core Equity | | | | | | | Class II | |

| | |

| Mid Cap Growth | | | Class I | | | | Class II | |

| | |

| Natural Resources | | | | | | | Class II | |

| | |

| Science and Technology | | | Class I | | | | Class II | |

| | |

| Small Cap Core | | | | | | | Class II | |

| | |

| Small Cap Growth | | | Class I | | | | Class II | |

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission (SEC), you may not be receiving paper copies of the Fund’s annual or semi-annual shareholder reports by mail, unless you specifically request paper copies of the reports from the insurance company that offers your variable annuity or variable life insurance contract or from your financial intermediary. Instead of delivering paper copies of the report, the insurance company may choose to make the reports available on a website, and will notify you by mail each time a shareholder report is posted and provide you with a website link to access the report. Instructions for requesting paper copies will be provided by your insurance company.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the insurance company or your financial intermediary electronically by following the instructions provided by the insurance company or by contacting your financial intermediary.

You may elect to receive all future Fund shareholder reports in paper free of charge from the insurance company. You can inform the insurance company or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by following the instructions provided by the insurance company or by contacting your financial intermediary. Your election to receive reports in paper will apply to all portfolio companies available under your contract with the insurance company.

| | |

| PRESIDENT’S LETTER | | IVY VIP |

| | |

| | DECEMBER 31, 2018 (UNAUDITED) |

| Philip J. Sanders, CFA | | |

Dear Shareholder,

While most of the fiscal year remained relatively calm, dramatic market volatility returned in the final quarter of 2018. The U.S. stock market, which had hit record highs during 2018, concluded the year with the worst quarter for U.S. equities since 2011 and the S&P 500 Index was down 6.24% over the12-month period. As the year progressed, trade disputes, geopolitical tensions and uncertain global growth rates provided a choppy ride for investors.

The U.S. economy is likely to finish 2018 with the strongest growth rate since the Great Recession that began 10 years ago. Our optimism is tempered somewhat for 2019 as we forecast U.S. gross domestic product (GDP) growth stabilizing around 2.5% with the possibility of further deceleration during the year.

The U.S. Federal Reserve (Fed) has indicated that short-term interest rates are close to what it believes to be neutral, meaning that policy is neither loose nor restrictive. We believe slower economic growth and lower oil prices will keep inflation well contained in early 2019, which is why the Fed decided to take a more dovish tone and ease its pace of quarterly rate hikes. Our base case belief is the Fed will raise rates once, possibly twice, in 2019.

The deterioration in eurozone economic data seems to be waning following an agreement between the U.S. and European Union (EU) to discuss a reduction in tariffs on industrial goods. Brexit negotiations between the U.K. and EU continue to be choppy, which has caused some delays in anticipated capital spending for the eurozone. While we believe the two parties will come to a resolution for the U.K.’s exit from the EU, the ongoing negotiations may cause lingering economic tumult until a deal can be reached.

Emerging markets faced multiple headwinds over the year, namely a strong dollar, China’s focus on deleveraging and regulations, trade wars, volatile energy prices and increased geopolitical risks. By comparison, U.S. equities benefitted from a more attractive growth rate, which was the result of tax reform, lower regulatory pressures and repatriation of overseas earnings.

The U.S.-China trade negotiations remain front and center for many emerging market economies. Any resolution to trade disputes would be critical not just for China, but also its Asian trading counterparts like South Korea and Taiwan. As such, we are cautiously optimistic for a status quo on the trade war without further escalations. We believe China has started loosening policy on the domestic front and we anticipate an easing of regulatory, monetary and fiscal policy as well, which should be supportive of the domestic economy. We believe emerging markets continue to offer a sound longer term fundamental outlook; however, market volatility is likely to persist until there is more clarity surrounding potential risks.

Overall, volatility was the name of the game across the fiscal year. Several forces conspired to create this environment, including macro events like the global trade slowdown and tightening monetary policy, as well as the staggering of the FAANG (Facebook, Apple, Amazon, Netflix and Google-parent Alphabet) stocks, which have been a major equities catalyst over the past couple of years.

Looking ahead, we believe the markets are likely to remain choppy for some time, although the landscape should present more selective opportunities, with greater emphasis on the fundamentals and quality of asset classes and sectors.

We believe it is important to stay focused on the fundamentals and merits of individual market sectors, industries and companies when making investment decisions. Those fundamentals historically have tended to outweigh external factors such as government policies and regulations. While those can affect every business and investor, we think the innovation and management skill within individual companies ultimately drive long-term stock prices.

Economic Snapshot

| | | | | | | | |

| | |

| | | 12/31/18 | | | 12/31/17 | |

S&P 500 Index | | | 2,506.85 | | | | 2,673.61 | |

MSCI EAFE Index | | | 1,719.88 | | | | 2,050.79 | |

10-Year Treasury Yield | | | 2.69 | % | | | 2.40 | % |

U.S. unemployment rate | | | 3.9 | % | | | 4.1 | % |

30-year fixed mortgage rate | | | 4.55 | % | | | 3.99 | % |

Oil price per barrel | | | $45.41 | | | | $60.42 | |

Sources: Bloomberg, U.S. Department of Labor, MBA, CME

All government statistics shown are subject to periodic revision. The S&P 500 Index is an unmanaged index that tracks the stocks of 500 primarilylarge-cap U.S. companies. MSCI EAFE Index is an unmanaged index comprised of securities that represent the securities markets in Europe, Australasia and the Far East. It is not possible to invest directly in any of these indexes. Mortgage rates are from BankRate and reflect the overnight national average rate on a conventional30-year fixed loan. Oil prices reflect the market price of West Texas intermediate grade crude.

Respectfully,

Philip J. Sanders, CFA

President

The opinions expressed in this letter are those of the President of the Ivy Variable Insurance Portfolios and are current only through the end of the period of the report, as stated on the cover. The President’s views are subject to change at any time, based on market and other conditions, and no forecasts can be guaranteed.

| | |

ILLUSTRATION OF PORTFOLIO EXPENSES | | IVY VIP |

(UNAUDITED)

Expense Example

As a shareholder of a Portfolio, you incur ongoing costs, including management fees, distribution and service fees, and other Portfolio expenses. The following table is intended to help you understand your ongoing costs (in dollars) of investing in a Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for thesix-month period ended December 31, 2018.

Actual Expenses

The first section in the following table provides information about actual investment values and actual expenses for each share class. You may use the information in this section, together with your initial investment in Portfolio shares, to estimate the expenses that you paid over the period. Simply divide the value of that investment by $1,000 (for example, a $7,500 initial investment divided by $1,000 = 7.5), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your investment during this period. In addition, there are fees and expenses imposed under the variable annuity or variable life insurance contract through which shares of the Portfolio are held. Additional fees have the effect of reducing investment returns.

Hypothetical Example for Comparison Purposes

The second section in the following table provides information about hypothetical investment values and hypothetical expenses for each share class based on the Portfolio’s actual expense ratio and an assumed rate of return of five percent per year before expenses, which is not the Portfolio’s actual return. The hypothetical investment values and expenses may not be used to estimate the actual investment value at the end of the period or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other funds. To do so, compare this five percent hypothetical example with the five percent hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs as a shareholder of the Portfolio and do not reflect any fees and expenses imposed under the variable annuity or variable life insurance contract through which shares of the Portfolio are held.

Expenses paid may be impacted by expense reduction arrangements. If those arrangements had not been in place, expenses paid would have been higher. See Note 6 to the Financial Statements for further information.

| | |

ILLUSTRATION OF PORTFOLIO EXPENSES | | IVY VIP |

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| | | Actual(1) | | | Hypothetical(2) | | | | |

| | | | | | | |

| Portfolio | | Beginning

Account

Value

6-30-18 | | | Ending

Account

Value

12-31-18 | | | Expenses

Paid During

Period* | | | Beginning

Account

Value

6-30-18 | | | Ending

Account

Value

12-31-18 | | | Expenses

Paid During

Period* | | | Annualized

Expense Ratio

Based on the

Six-Month

Period | |

Asset Strategy | |

Class I | | $ | 1,000 | | | $ | 930.80 | | | $ | 3.77 | | | $ | 1,000 | | | $ | 1,021.26 | | | $ | 3.94 | | | | 0.78% | |

Class II | | $ | 1,000 | | | $ | 929.60 | | | $ | 5.02 | | | $ | 1,000 | | | $ | 1,020.01 | | | $ | 5.25 | | | | 1.03% | |

Balanced | |

Class II | | $ | 1,000 | | | $ | 952.30 | | | $ | 4.98 | | | $ | 1,000 | | | $ | 1,020.15 | | | $ | 5.15 | | | | 1.00% | |

Energy | |

Class I | | $ | 1,000 | | | $ | 635.00 | | | $ | 3.76 | | | $ | 1,000 | | | $ | 1,020.63 | | | $ | 4.65 | | | | 0.94% | |

Class II | | $ | 1,000 | | | $ | 634.20 | | | $ | 4.90 | | | $ | 1,000 | | | $ | 1,019.19 | | | $ | 6.06 | | | | 1.19% | |

Growth | |

Class II | | $ | 1,000 | | | $ | 926.90 | | | $ | 4.82 | | | $ | 1,000 | | | $ | 1,020.19 | | | $ | 5.05 | | | | 1.00% | |

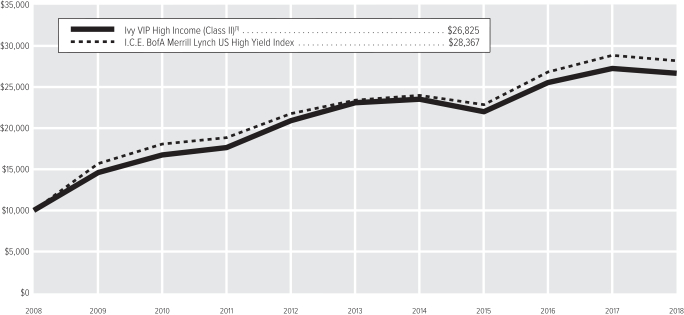

High Income | |

Class I | | $ | 1,000 | | | $ | 965.30 | | | $ | 3.24 | | | $ | 1,000 | | | $ | 1,021.90 | | | $ | 3.34 | | | | 0.66% | |

Class II | | $ | 1,000 | | | $ | 964.10 | | | $ | 4.52 | | | $ | 1,000 | | | $ | 1,020.64 | | | $ | 4.65 | | | | 0.91% | |

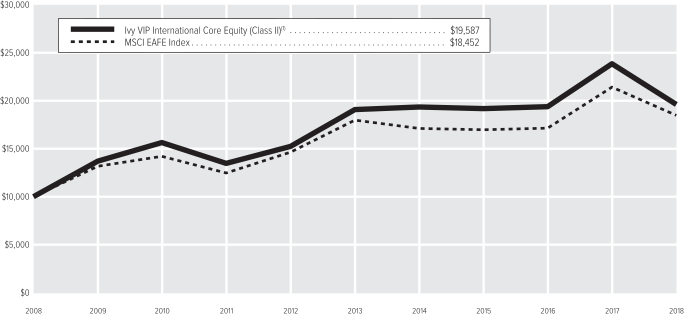

International Core Equity | |

Class II | | $ | 1,000 | | | $ | 845.00 | | | $ | 5.35 | | | $ | 1,000 | | | $ | 1,019.38 | | | $ | 5.86 | | | | 1.16% | |

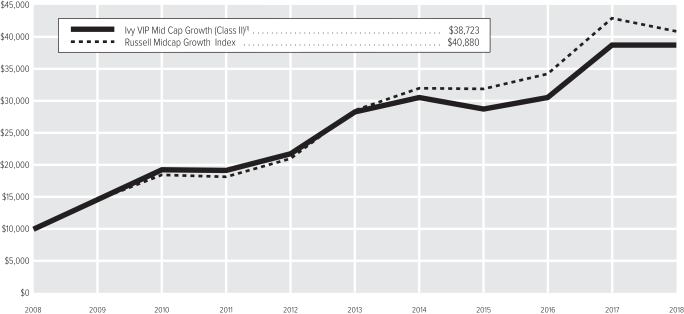

Mid Cap Growth | |

Class I | | $ | 1,000 | | | $ | 898.70 | | | $ | 4.08 | | | $ | 1,000 | | | $ | 1,020.90 | | | $ | 4.34 | | | | 0.85% | |

Class II | | $ | 1,000 | | | $ | 897.50 | | | $ | 5.31 | | | $ | 1,000 | | | $ | 1,019.65 | | | $ | 5.66 | | | | 1.10% | |

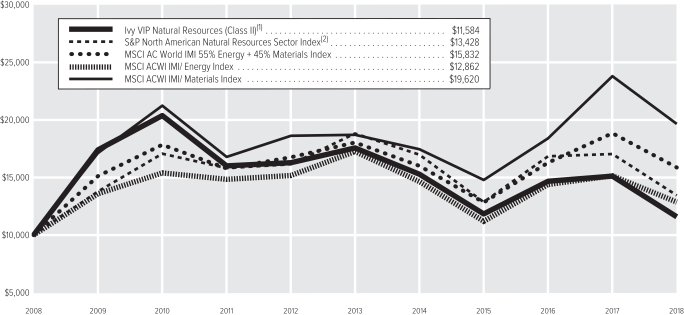

Natural Resources | |

Class II | | $ | 1,000 | | | $ | 784.40 | | | $ | 5.44 | | | $ | 1,000 | | | $ | 1,019.14 | | | $ | 6.16 | | | | 1.20% | |

Science and Technology | |

Class I | | $ | 1,000 | | | $ | 871.00 | | | $ | 4.21 | | | $ | 1,000 | | | $ | 1,020.68 | | | $ | 4.55 | | | | 0.90% | |

Class II | | $ | 1,000 | | | $ | 869.90 | | | $ | 5.42 | | | $ | 1,000 | | | $ | 1,019.41 | | | $ | 5.86 | | | | 1.15% | |

Small Cap Core | |

Class II | | $ | 1,000 | | | $ | 830.40 | | | $ | 5.40 | | | $ | 1,000 | | | $ | 1,019.34 | | | $ | 5.96 | | | | 1.16% | |

Small Cap Growth | |

Class��I** | | $ | 1,000 | | | $ | 877.60 | | | $ | 5.15 | | | $ | 1,000 | | | $ | 1,019.81 | | | $ | 5.54 | | | | 1.07% | (3) |

Class II | | $ | 1,000 | | | $ | 857.00 | | | $ | 5.20 | | | $ | 1,000 | | | $ | 1,019.62 | | | $ | 5.65 | | | | 1.11% | |

| * | Portfolio expenses are equal to the Portfolio’s annualized expense ratio (provided in the table), multiplied by the average account value over the period, multiplied by 184 days in thesix-month period ended December 31, 2018, and divided by 365. |

| ** | Actual inception date for this share class is11-5-18 (the date on which shares were first acquired by shareholders). The calculations are based on 57 days in the period ended December 31, 2018. |

| (1) | This section uses the Portfolio’s actual total return and actual Portfolio expenses. It is a guide to the actual expenses paid by the Portfolio in the period. The “Ending Account Value” shown is computed using the Portfolio’s actual return and the “Expenses Paid During Period” column shows the dollar amount that would have been paid by an investor who started with $1,000 in the Portfolio. A shareholder may use the information here, together with the dollar amount invested, to estimate the expenses that were paid over the period. For every thousand dollars a shareholder has invested, the expenses are listed in the last column of this section. |

| (2) | This section uses a hypothetical five percent annual return and actual Portfolio expenses. It helps to compare the Portfolio’s ongoing costs with other mutual funds. A shareholder can compare the Portfolio’s ongoing costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other Portfolios. |

| (3) | Annualized expense ratio based on the period excluding reorganization expense was 0.86%. |

The above illustrations are based on ongoing costs only.

| | |

| MANAGEMENT DISCUSSION | | ASSET STRATEGY |

(UNAUDITED)

|

F. Chace Brundige

W. Jeffery Surles |

Below, F. Chace Brundige, CFA, W. Jeffery Surles, CFA, portfolio managers of Ivy VIP Asset Strategy, discuss positioning, performance and results for the fiscal year ended December 31, 2018. Mr. Brundige has managed the Portfolio since 2014 and has 25 years of industry experience. Mr. Surles was named a co-portfolio manager on the Portfolio in February 2018. He has 17 years of industry experience. Cynthia Prince-Fox previously was a co-portfolio manager of the Portfolio. She retired effective April 30, 2018.

Fiscal Year Performance

| | | | |

For the 12 Months Ended December 31, 2018 | | | | |

Ivy VIP Asset Strategy(Class II shares at net asset value) | | | -5.44% | |

Benchmark(s) and/or Morningstar and Lipper Categories | | | | |

MSCI All Country World Index (ACWI) | | | -9.42% | |

(generally reflects the performance of stocks in 46 developed and emerging markets) | | | | |

S&P 500 Index | | | -4.38% | |

(generally reflects the performance of large-capitalization U.S. stocks) | | | | |

Bloomberg Barclays U.S. Aggregate Bond Index | | | 0.01% | |

(generally reflects the performance of most U.S.-traded investment grade bonds) | | | | |

Bloomberg Barclays U.S. Treasury Bills: 1-3 Month Index | | | 1.83% | |

(generally reflects the performance of investment-grade Treasury bills, representing cash) | | | | |

Morningstar World Allocation Universe Average | | | -8.01% | |

(generally reflects the performance of the universe of funds with similar investment objectives) | | | | |

Lipper Variable Annuity Alternative Other Universe Average | | | -5.15% | |

(generally reflects the performance of the universe of funds with similar investment objectives) | | | | |

Multiple indexes are shown because the Portfolio invests in multiple asset classes. The MSCI All Country World Index (ACWI) benchmark replaced the previous benchmarks shown above effective February 5, 2018, because the Portfolio’s adviser believes that this index is more representative of the types of securities that the Portfolio purchases.

Please note that the Portfolio returns include applicable investment fees and expense, whereas the index returns do not include any such fees. Also, the Portfolio’s performance data does not take into account any product expenses or charges associated with owning a variable life or annuity policy, which is invested in Ivy Variable Insurance Portfolios. Multiple indexes are shown because the Portfolio invests in multiple asset classes.

A year of significant change

2018 proved to be an eventful year both for both the Portfolio and financial markets. In February, the Portfolio’s investment process changed as we started operating with a defined risk budget; at the same time, the Portfolio’s benchmark changed to an all-equity index, the MSCI ACWI. We aim to generate MSCI ACWI-like returns over an investment cycle with 70-90% of that index’s expected risk.

Financial markets experienced the most challenging year for asset prices globally in 10 years. Negative returns persisted across all the major asset classes we track, including equities, fixed income and commodity markets. After 10 years of largely positive catalysts for riskier asset prices, a confluence of factors came to the surface during the fourth quarter of 2018 and led to a ferocious drawdown in asset prices. Fears that the U.S. Federal Reserve (Fed) would overtighten monetary policy, global trade wars, government shutdowns and the outcome of Brexit negotiations led to the largest repricing of risk assets since the global financial crisis.

While global economic growth largely held steady during the year, several leading indicators began to show cracks in the final quarter of the fiscal year. Purchasing manager index data globally started to slow, profit warnings began to appear from several bellwether companies, European consumer data weakened and commodity prices collapsed. The few remaining areas of positive returns were quickly wiped out as the year drew to a close, with U.S. equities falling and credit spreads widening aggressively.

Sharp reversal late in fiscal year

The Portfolio had a negative return for the fiscal year; however, it outperformed on a relative basis, exceeding the return of the MSCI ACWI and was competitive with the return of its Lipper Universe Average.

For the first eight months of the fiscal year, the Portfolio was positioned more aggressively and operated near the top end of its defined risk budget of 70-90% of the predicted risk of the benchmark index. The Portfolio was able to keep pace with and even exceed the benchmark while it was experiencing positive returns. The Portfolio reduced the risk level toward the end

of the third quarter to below the midpoint (<80% predicted total risk) of the risk target because of a growing number of macro headwinds. With hindsight, we believe it would have been appropriate to have taken risk down further ahead of the volatility experienced in the fourth quarter, but the risk reduction did help the Portfolio’s aggregate performance versus the MSCI ACWI.

Given the risk position early in the fiscal year, the Portfolio maintained heavy equity weightings though most of the first three quarters. The equity weighting was in the mid-70% area at the start of the year and remained near that level until we reduced risk near the end of the third quarter. For the rest of the year, the weighting was in the high-60% area. Fixed income comprised about 20% of assets early in the year but rose to just over 25% as we reduced risk. The gold allocation held fairly stable at 4.5-5% of assets.

The equity portfolio started off the year strong, held firm through the middle part of the year and, despite giving up some performance in the volatility of the fourth quarter, was the largest single contributor to the Portfolio’s relative outperformance against the benchmark. Our credit-heavy fixed income portfolio spent most of the year in positive territory despite major credit indices being firmly negative. It also gave up performance in the fourth quarter and finished the year in slightly negative territory.

During the fourth quarter we had the first real test of our new risk budget process during a drawdown in asset prices. For most of that quarter, we were operating at 77-78% of the total predicted risk versus the benchmark index. During the quarter, we actually experienced 81% of the downside to the benchmark. While not precise, it was well within our expected error range and a good test of our ability to deliver on our new process. While our diversifying sleeve will often hold diversifying assets that are risky on a standalone basis — such as high yield and emerging market debt — we are building the Portfolio on an asset-by-asset basis. These assets have certain diversifying traits that help control the risk profile on a Portfolio-wide basis while still providing potential for total return.

The equity portfolio in isolation outperformed the benchmark index for the year, despite lagging the index return during the final quarter of the year. That performance was driven largely by stock selection, as we would expect. Names in the technology sector led performance, as the Portfolio received strong contributions from long-held issues including Microsoft Corp., Adobe Systems, Inc., and Intuit, Inc., all of which were reduced from peak weightings during the summer and early fall.

Semiconductor and hardware-related stocks, such as Apple, Inc., detracted from performance somewhat for the year. Stock selection in the health care sector helped performance, across biotechnology, pharmaceuticals and hospitals. A shift into a higher consumer staples weighting midway through the year helped primarily via allocation effect, especially during the fourth quarter. We finally found relative value in certain areas of consumer staples at a time when they began to perform better — but of course relative value is often a driver of relative performance and we are always on the lookout.

On the negative front, our energy stocks underperformed the sector, with oilfield services the weakest. The majority of that weakness was experienced during the fourth quarter’s drawdown in crude oil prices. Our lack of an allocation to utilities also provided a bit of a headwind relative to the benchmark index, again most prominent in the fourth quarter.

Our fixed income portfolio, which comprised the bulk of our diversifying assets, held up well until the fourth quarter. The credit-heavy portfolio was not able to fully withstand the onslaught of negative macro data and lost about 3% during that quarter. Many of our fixed income positions contained optionality to higher interest rates either through floating interest rate structures or fixed-to-floating coupons. Those characteristics did not hold up as well as we would have liked during the fourth quarter as interest rates rallied aggressively and the market started pricing in a reduced probability of additional Fed rate hikes. Despite those headwinds, the fixed income portfolio generally served its purpose well throughout the year, dampening portfolio volatility while generating positive return against the benchmark in a down market.

On a security basis, the Portfolio’s high yield positions in telecommunications & oil services were particularly poor performers, as were our emerging market positions in Argentina. Positives were emerging market debt positions in Brazil, which in sharp contrast to Argentina were some of our best performing positions and showed the bifurcation that happened across emerging markets. Holdings in subordinated debt under European banks also performed well, along with select U.S. Treasury positions. Gold struggled early in the year as interest rates rose but it showed why we own it during the volatility in the fourth quarter, becoming the best-performing asset at up more than 7.5%.

Clouded outlook

Our outlook for the future is quite clouded. Negatives continue to stack up as a slew of additional profit warnings since the end of the calendar year have added to the already sour macro backdrop. But asset prices have corrected meaningfully and a number of potential positive catalysts exist through the potential for trade resolution, reopening of the U.S. government from its shutdown late in 2018, and additional stimulus which could positively impact asset prices. Most of these events are binary and very hard to predict.

In addition, we feel we have little edge in trying to determine if or when a trade deal gets struck with China. Our edge lies more in security selection and portfolio construction. Given that situation, we have been operating with a fairly cautious risk stance, limiting the size of our commitments and keeping our predicted total risk slightly below the midpoint of our target range.

The Portfolio’s focus has been on bottom-up security selections, with our sector weights showing less deviation from the benchmark than at any time in the past year. Our large technology overweight relative to the benchmark index has been reduced and more defensive sectors, such as consumer staples, have come into focus as we manage equity portfolio risk from a bottom-up perspective.

With the diversifying portfolio, we continue to seek individual securities that can provide risk diversification with an element of total return. We have taken a more neutral stance on interest rates, as we feel the Fed is in a bind with no good answers. Interest rate hikes have clearly slowed the economy and balance sheet runoff has tightened liquidity. Yet despite the rate hikes, employment remains strong and wage growth continues to build slowly. We expect this to cause the Fed to pause its rate increases as it reassesses the macro situation.

We expect to remain in this reduced risk mode until either the macro picture becomes clearer or valuation spreads compress to levels that provide more potential reward for the risk. While we have seen some compression in valuations, it still has not gotten near levels we feel will merit attention, given the starting points of relatively high equity valuations and corporate operating margins, as well as historically tight credit spreads. Until we get clarity on these issues, we expect to remain focused on bottom-up portfolio construction through security selection and on limiting the Portfolio’s risk profile.

Past performance is not a guarantee of future results. The value of the Portfolio’s shares will change, and you could lose money on your investment.

The Portfolio may allocate its assets among different asset classes of varying correlation around the globe.

International investing involves additional risks, including currency fluctuations, political or economic conditions affecting the foreign country, and differences in accounting standards and foreign regulations. These risks are magnified in emerging markets.

Fixed-income securities are subject to interest-rate risk and, as such, the net asset value of the Portfolio may fall as interest rates rise. Investing in high-income securities may carry a greater risk of nonpayment of interest or principal than higher-rated bonds.

The Portfolio may seek to hedge market risk via the use of derivative instruments. Such investments involve additional risks.

Investing in commodities is generally considered speculative because of the significant potential for investment loss. Markets for commodities are likely to be volatile and there may be sharp price fluctuations even during periods when prices overall are rising.

These and other risks are more fully described in the Portfolio’s prospectus.

The opinions expressed in this report are those of the portfolio managers and are current only through the end of the period of the report as stated on the cover. The managers’ views are subject to change at any time based on market and other conditions, and no forecasts can be guaranteed.

The indexes noted are unmanaged and include reinvested dividends. One cannot invest directly in an index, nor is an index representative of Ivy VIP Asset Strategy.

| | |

| PORTFOLIO HIGHLIGHTS | | ASSET STRATEGY |

ALL DATA IS AS OF DECEMBER 31, 2018 (UNAUDITED)

Asset Allocation

| | | | |

Stocks | | | 67.4% | |

Information Technology | | | 14.1% | |

Financials | | | 11.9% | |

Industrials | | | 9.5% | |

Consumer Staples | | | 8.8% | |

Health Care | | | 8.7% | |

Consumer Discretionary | | | 6.0% | |

Energy | | | 4.5% | |

Communication Services | | | 3.1% | |

Materials | | | 0.8% | |

Bullion (Gold) | | | 5.6% | |

Bonds | | | 24.5% | |

Corporate Debt Securities | | | 12.7% | |

Loans | | | 5.8% | |

United States Government and Government Agency Obligations | | | 4.1% | |

Other Government Securities | | | 1.9% | |

Cash and Other Assets (Net of Liabilities), and Cash Equivalents+ | | | 2.5% | |

Country Weightings

| | | | |

North America | | | 52.2% | |

United States | | | 51.3% | |

Other North America | | | 0.9% | |

Europe | | | 25.4% | |

France | | | 6.4% | |

United Kingdom | | | 4.8% | |

Switzerland | | | 4.3% | |

Netherlands | | | 3.5% | |

Other Europe | | | 6.4% | |

Pacific Basin | | | 12.9% | |

Japan | | | 3.5% | |

Other Pacific Basin | | | 9.4% | |

Bullion (Gold) | | | 5.6% | |

South America | | | 1.4% | |

Cash and Other Assets (Net of Liabilities), and Cash Equivalents+ | | | 2.5% | |

Top 10 Equity Holdings

| | | | | | |

| | | |

| Company | | Country | | Sector | | Industry |

Microsoft Corp. | | United States | | Information Technology | | Systems Software |

Pfizer, Inc. | | United States | | Health Care | | Pharmaceuticals |

Visa, Inc., Class A | | United States | | Information Technology | | Data Processing & Outsourced Services |

Coca-Cola Co. (The) | | United States | | Consumer Staples | | Soft Drinks |

Amazon.com, Inc. | | United States | | Consumer Discretionary | | Internet & Direct Marketing Retail |

AIA Group Ltd. | | Hong Kong | | Financials | | Life & Health Insurance |

Wal-Mart Stores, Inc. | | United States | | Consumer Staples | | Hypermarkets & Super Centers |

QUALCOMM, Inc. | | United States | | Information Technology | | Semiconductors |

Airbus SE | | France | | Industrials | | Aerospace & Defense |

Nestle S.A., Registered Shares | | Switzerland | | Consumer Staples | | Packaged Foods & Meats |

See your advisor or www.ivyinvestments.com for more information on the Portfolio’s most recently published Top 10 Equity Holdings.

+Cash equivalents are defined as highly liquid securities with maturities of less than three months. Cash equivalents may include U.S. Government Treasury bills, bank certificates of deposit, bankers’ acceptances, corporate commercial paper and other money market instruments.

| | |

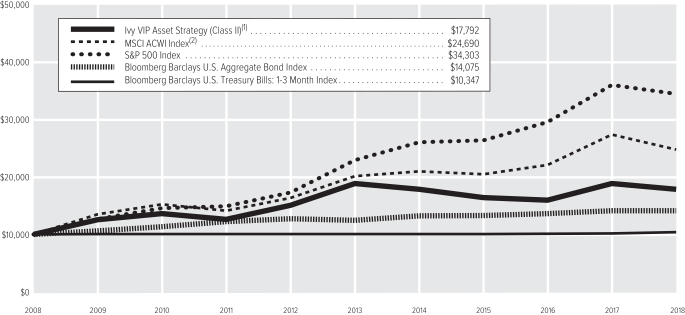

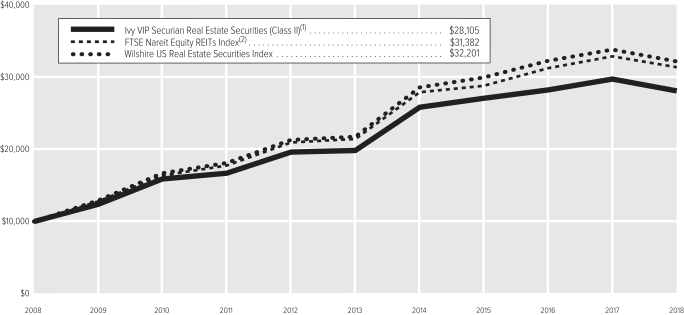

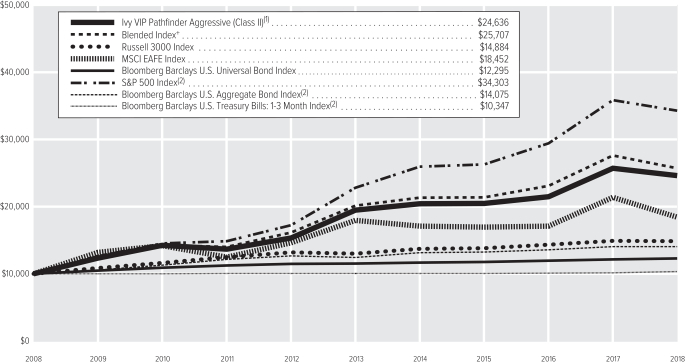

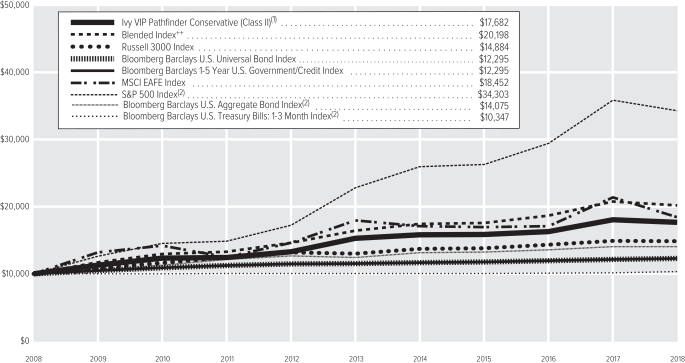

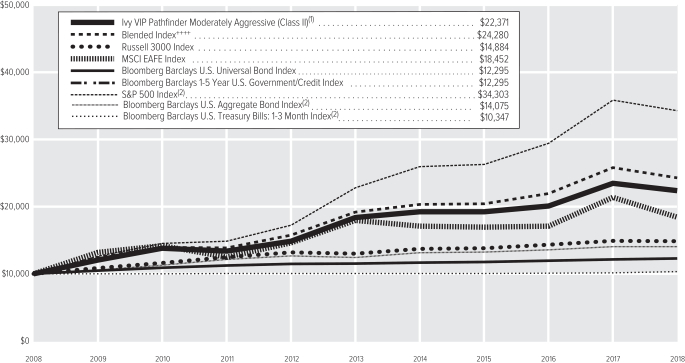

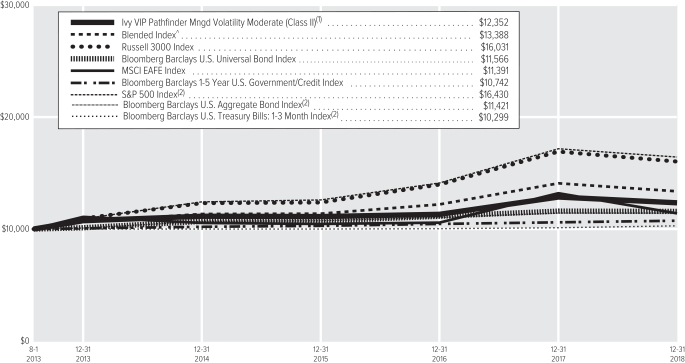

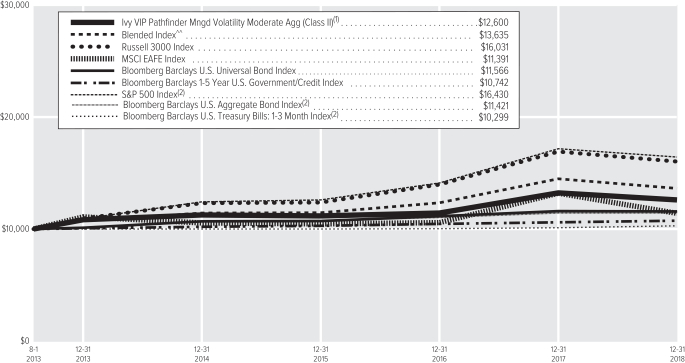

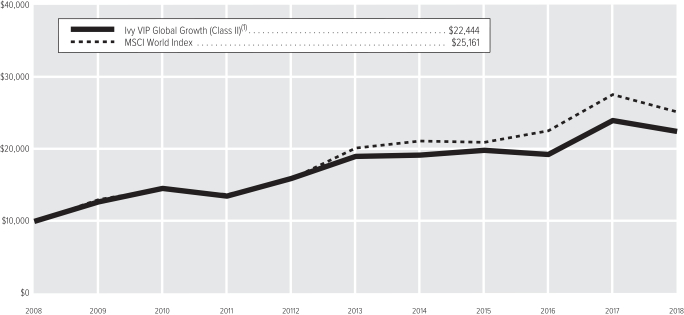

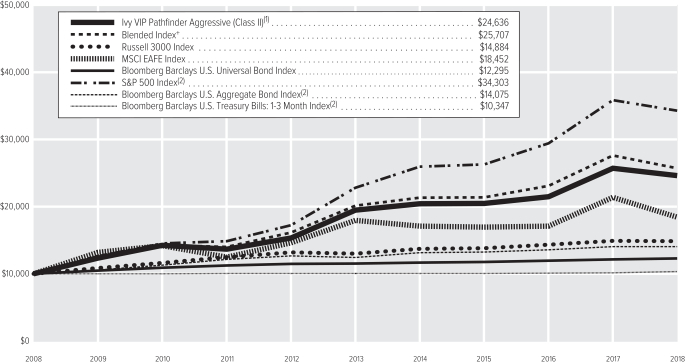

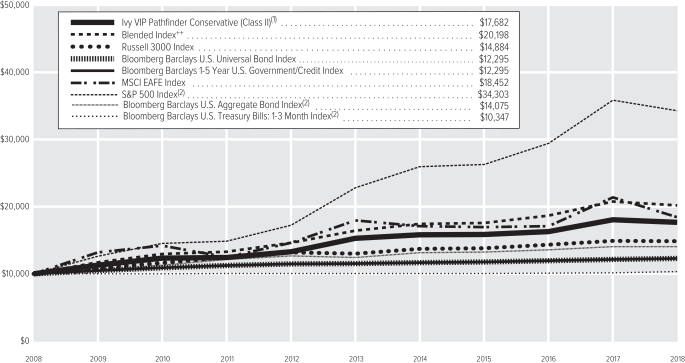

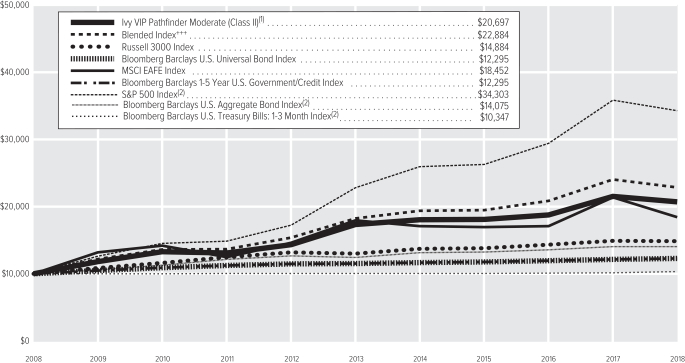

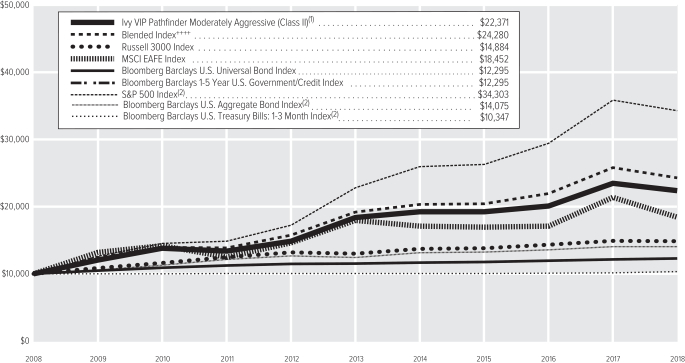

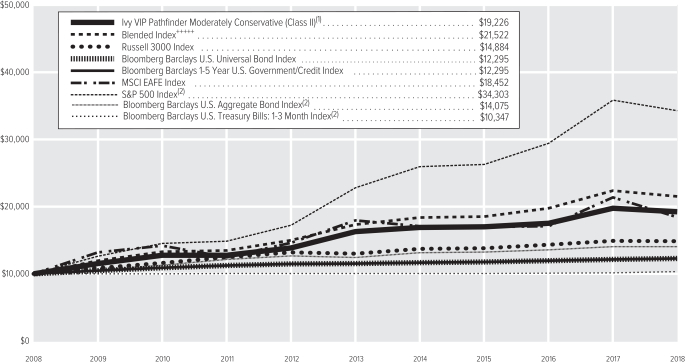

| COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT | | ASSET STRATEGY |

(UNAUDITED)

| (1) | The value of the investment in the Portfolio is impacted by the ongoing expenses of the Portfolio and assumes reinvestment of dividends and distributions. |

| (2) | Effective February 6, 2018, the MSCI ACWI Index is the Portfolio’s new benchmark index. IICO believes that this index is a more representative index for the types of securities that the Portfolio purchases than the three indexes listed. |

| | | | | | | | |

| | |

| Average Annual Total Return(3) | | Class I | | | Class II | |

1-year period ended12-31-18 | | | -5.20% | | | | -5.44% | |

5-year period ended12-31-18 | | | — | | | | -1.10% | |

10-year period ended12-31-18 | | | — | | | | 5.93% | |

Since Inception of Class through12-31-18(4) | | | 3.17% | | | | — | |

| (3) | Data quoted is past performance and current performance may be lower or higher. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost. Please visit www.ivyinvestments.com for the Portfolio’s most recentmonth-end performance. Performance data quoted does not reflect any expenses or charges associated with owning a variable life insurance policy or variable annuity contract that invests in the Portfolio’s shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower. |

| (4) | 4-28-17 (the date on which shares were first acquired by shareholders). |

Past performance is not necessarily indicative of future performance. Indexes are unmanaged. The performance graph and table do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or on the redemption of Portfolio shares. Performance results may include the effect of expense reduction arrangements for some or all of the periods shown. If those arrangements had not been in place, the performance results for those periods would have been lower.

| | |

| CONSOLIDATED SCHEDULE OF INVESTMENTS | | ASSET STRATEGY (in thousands) |

DECEMBER 31, 2018

| | | | | | | | |

| COMMON STOCKS | | Shares | | | Value | |

Communication Services | |

| |

Broadcasting – 1.0% | |

Discovery Holding Co., Class A (A)(B) | | | 314 | | | $ | 7,765 | |

| | | | | | | | |

| |

Integrated Telecommunication Services – 1.0% | |

China Unicom Ltd. (C) | | | 6,860 | | | | 7,309 | |

| | | | | | | | |

| |

Interactive Media & Services – 1.1% | |

Alphabet, Inc., Class A (A) | | | 8 | | | | 8,068 | |

| | | | | | | | |

| |

Total Communication Services – 3.1% | | | | 23,142 | |

Consumer Discretionary | |

| |

Auto Parts & Equipment – 0.9% | |

Magna International, Inc. (C) | | | 147 | | | | 6,663 | |

| | | | | | | | |

| |

Automobile Manufacturers – 1.3% | |

Suzuki Motor Corp. (C) | | | 203 | | | | 10,217 | |

| | | | | | | | |

| |

Home Improvement Retail – 1.0% | |

Home Depot, Inc. (The) | | | 43 | | | | 7,363 | |

| | | | | | | | |

| |

Internet & Direct Marketing Retail – 1.8% | |

Amazon.com, Inc. (A) | | | 9 | | | | 13,698 | |

| | | | | | | | |

| |

Leisure Facilities – 0.0% | |

COTA Racing & Entertainment LLC, Class B (A) | | | — | * | | | — | |

| | | | | | | | |

| |

Leisure Products – 0.0% | |

Media Group Holdings LLC,

Series H (A)(D)(E)(F) | | | 32 | | | | — | * |

Media Group Holdings LLC,

Series T (A)(D)(E)(F) | | | 4 | | | | 287 | |

| | | | | | | | |

| | | | | | | 287 | |

| | | | | | | | |

| |

Restaurants – 1.0% | |

Compass Group plc (C) | | | 346 | | | | 7,286 | |

| | | | | | | | |

| |

Total Consumer Discretionary – 6.0% | | | | 45,514 | |

Consumer Staples | |

| |

Household Products – 1.3% | |

Procter & Gamble Co. (The) | | | 104 | | | | 9,547 | |

| | | | | | | | |

| |

Hypermarkets & Super Centers – 1.6% | |

Wal-Mart Stores, Inc. | | | 130 | | | | 12,149 | |

| | | | | | | | |

| |

Packaged Foods & Meats – 2.5% | |

Danone S.A. (C) | | | 98 | | | | 6,907 | |

Nestle S.A., Registered Shares (C) | | | 144 | | | | 11,699 | |

| | | | | | | | |

| | | | | | | 18,606 | |

| | | | | | | | |

| |

Soft Drinks – 1.8% | |

Coca-Cola Co. (The) | | | 293 | | | | 13,859 | |

| | | | | | | | |

| |

Tobacco – 1.6% | |

ITC Ltd.(C) | | | 861 | | | | 3,473 | |

| | | | | | | | |

| COMMON STOCKS(Continued) | | Shares | | | Value | |

Tobacco(Continued) | |

Philip Morris International, Inc. | | | 130 | | | $ | 8,652 | |

| | | | | | | | |

| | | | | | | 12,125 | |

| | | | | | | | |

| |

Total Consumer Staples – 8.8% | | | | 66,286 | |

Energy | |

| |

Integrated Oil & Gas – 1.5% | |

Royal Dutch Shell plc, Class A (C) | | | 384 | | | | 11,328 | |

| | | | | | | | |

| |

Oil & Gas Equipment & Services – 1.2% | |

Halliburton Co. | | | 165 | | | | 4,383 | |

Schlumberger Ltd. | | | 121 | | | | 4,357 | |

| | | | | | | | |

| | | | | | | 8,740 | |

| | | | | | | | |

| |

Oil & Gas Exploration & Production – 1.8% | |

Cabot Oil & Gas Corp. | | | 185 | | | | 4,137 | |

EOG Resources, Inc. | | | 71 | | | | 6,213 | |

Noble Energy, Inc. | | | 184 | | | | 3,458 | |

| | | | | | | | |

| | | | | | | 13,808 | |

| | | | | | | | |

| |

Total Energy – 4.5% | | | | 33,876 | |

Financials | |

| |

Consumer Finance – 0.8% | |

ORIX Corp. (C) | | | 425 | | | | 6,205 | |

| | | | | | | | |

| |

Diversified Banks – 5.4% | |

Axis Bank Ltd. (C) | | | 1,019 | | | | 9,035 | |

BNP Paribas S.A. (C) | | | 141 | | | | 6,372 | |

China Construction Bank Corp. (C) | | | 8,937 | | | | 7,319 | |

Industrial and Commercial Bank of China Ltd., H Shares (C) | | | 10,458 | | | | 7,438 | |

Kabushiki Kaisha Mitsubishi Tokyo Financial Group (C) | | | 1,270 | | | | 6,231 | |

UniCredit S.p.A. (C) | | | 397 | | | | 4,502 | |

| | | | | | | | |

| | | | | | | 40,897 | |

| | | | | | | | |

| |

Life & Health Insurance – 1.7% | |

AIA Group Ltd. (C) | | | 1,572 | | | | 13,057 | |

| | | | | | | | |

| |

Multi-Line Insurance – 1.1% | |

Sampo plc, A Shares (C) | | | 179 | | | | 7,931 | |

| | | | | | | | |

| |

Multi-Sector Holdings – 1.2% | |

Berkshire Hathaway, Inc., Class B (A) | | | 43 | | | | 8,719 | |

| | | | | | | | |

| |

Regional Banks – 1.7% | |

KeyCorp | | | 420 | | | | 6,214 | |

PNC Financial Services Group, Inc. (The) | | | 57 | | | | 6,675 | |

| | | | | | | | |

| | | | | | | 12,889 | |

| | | | | | | | |

| |

Total Financials – 11.9% | | | | 89,698 | |

Health Care | |

| |

Biotechnology – 2.1% | |

BioMarin Pharmaceutical, Inc. (A) | | | 95 | | | | 8,105 | |

Sarepta Therapeutics, Inc. (A) | | | 69 | | | | 7,530 | |

| | | | | | | | |

| | | | | | | 15,635 | |

| | | | | | | | |

| | | | | | | | |

| COMMON STOCKS(Continued) | | Shares | | | Value | |

Health Care Equipment – 1.5% | |

Medtronic plc | | | 121 | | | $ | 11,001 | |

| | | | | | | | |

| |

Managed Health Care – 0.8% | |

UnitedHealth Group, Inc. | | | 24 | | | | 6,095 | |

| | | | | | | | |

| |

Pharmaceuticals – 4.3% | |

Merck KGaA (C) | | | 58 | | | | 5,974 | |

Pfizer, Inc. | | | 482 | | | | 21,043 | |

Zoetis, Inc. | | | 65 | | | | 5,564 | |

| | | | | | | | |

| | | | | | �� | 32,581 | |

| | | | | | | | |

| |

Total Health Care – 8.7% | | | | 65,312 | |

Industrials | |

| |

Aerospace & Defense – 3.2% | |

Airbus SE (C) | | | 123 | | | | 11,767 | |

Lockheed Martin Corp. | | | 21 | | | | 5,368 | |

Northrop Grumman Corp. | | | 28 | | | | 6,830 | |

| | | | | | | | |

| | | | | | | 23,965 | |

| | | | | | | | |

| |

Construction & Engineering – 2.3% | |

Larsen & Toubro Ltd. (C) | | | 502 | | | | 10,331 | |

Vinci (C) | | | 86 | | | | 7,033 | |

| | | | | | | | |

| | | | | | | 17,364 | |

| | | | | | | | |

| |

Construction Machinery & Heavy Trucks – 1.0% | |

Caterpillar, Inc. | | | 57 | | | | 7,239 | |

| | | | | | | | |

| |

Electrical Components & Equipment – 0.8% | |

Schneider Electric S.A. (C) | | | 91 | | | | 6,190 | |

| | | | | | | | |

| |

Railroads – 1.5% | |

Kansas City Southern | | | 58 | | | | 5,527 | |

Union Pacific Corp. | | | 44 | | | | 6,031 | |

| | | | | | | | |

| | | | | | | 11,558 | |

| | | | | | | | |

| |

Trading Companies & Distributors – 0.7% | |

Ferguson plc (C) | | | 78 | | | | 5,011 | |

| | | | | | | | |

| |

Total Industrials – 9.5% | | | | 71,327 | |

Information Technology | |

| |

Application Software – 2.5% | |

Adobe, Inc. (A) | | | 42 | | | | 9,440 | |

Intuit, Inc. | | | 49 | | | | 9,634 | |

| | | | | | | | |

| | | | | | | 19,074 | |

| | | | | | | | |

| |

Data Processing & Outsourced Services – 1.8% | |

Visa, Inc., Class A | | | 106 | | | | 13,935 | |

| | | | | | | | |

| |

Electronic Equipment & Instruments – 0.6% | |

Keyence Corp. (C) | | | 9 | | | | 4,498 | |

| | | | | | | | |

| |

Semiconductor Equipment – 1.7% | |

Applied Materials, Inc. | | | 199 | | | | 6,503 | |

ASML Holding N.V., Ordinary Shares (C) | | | 41 | | | | 6,366 | |

| | | | | | | | |

| | | | | | | 12,869 | |

| | | | | | | | |

| | |

| CONSOLIDATED SCHEDULE OF INVESTMENTS | | ASSET STRATEGY (in thousands) |

DECEMBER 31, 2018

| | | | | | | | |

| COMMON STOCKS(Continued) | | Shares | | | Value | |

Semiconductors – 2.7% | |

QUALCOMM, Inc. | | | 210 | | | $ | 11,953 | |

Taiwan Semiconductor Manufacturing Co. Ltd. (C) | | | 1,099 | | | | 7,981 | |

| | | | | | | | |

| | | | | | | 19,934 | |

| | | | | | | | |

| |

Systems Software – 3.1% | |

Microsoft Corp. | | | 228 | | | | 23,133 | |

| | | | | | | | |

| |

Technology Hardware, Storage & Peripherals – 1.7% | |

Apple, Inc. | | | 47 | | | | 7,383 | |

Samsung Electronics Co. Ltd. (C) | | | 154 | | | | 5,376 | |

| | | | | | | | |

| | | | | | | 12,759 | |

| | | | | | | | |

| |

Total Information Technology – 14.1% | | | | 106,202 | |

Materials | |

| |

Diversified Metals & Mining – 0.8% | |

Glencore International plc (C) | | | 1,713 | | | | 6,367 | |

| | | | | | | | |

| | |

Total Materials – 0.8% | | | | | | | 6,367 | |

| |

TOTAL COMMON STOCKS – 67.4% | | | $ | 507,724 | |

(Cost: $528,269) | | | | | | | | |

| | |

| CORPORATE DEBT SECURITIES | | Principal | | | | |

Communication Services | |

| |

Cable & Satellite – 1.7% | |

Altice France S.A.,8.125%, 2-1-27 (G) | | $ | 2,600 | | | | 2,450 | |

Altice S.A.: | | | | | | | | |

7.750%,5-15-22 (B)(G) | | | 6,448 | | | | 5,868 | |

7.625%,2-15-25 (G) | | | 4,656 | | | | 3,480 | |

Comcast Corp. (GTD by Comcast Cable Communications and NBCUniversal)(3-Month U.S. LIBOR plus 63 bps), 3.064%,4-15-24 (H) | | | 1,528 | | | | 1,493 | |

| | | | | | | | |

| | | | | | | 13,291 | |

| | | | | | | | |

| |

Integrated Telecommunication Services – 0.9% | |

Frontier Communications Corp.: | | | | | | | | |

7.625%,4-15-24 | | | 2,119 | | | | 1,091 | |

6.875%,1-15-25 | | | 4,337 | | | | 2,201 | |

11.000%,9-15-25 (B) | | | 3,180 | | | | 1,980 | |

9.000%,8-15-31 | | | 2,119 | | | | 1,134 | |

| | | | | | | | |

| | | | | | | 6,406 | |

| | | | | | | | |

| |

Total Communication Services – 2.6% | | | | 19,697 | |

Consumer Discretionary | |

| |

Leisure Facilities – 0.3% | |

Circuit of the Americas LLC,

Series D, 0.000%,12-31-20 (I) | | | 3,642 | | | | 2,023 | |

| | | | | | | | |

| |

Total Consumer Discretionary – 0.3% | | | | 2,023 | |

| | | | | | | | |

CORPORATE DEBT SECURITIES

(Continued) | | Principal | | | Value | |

Energy | |

| |

Integrated Oil & Gas – 0.5% | |

Petrobras Global Finance B.V. (GTD by Petroleo Brasileiro S.A.), 8.750%,5-23-26 | | $ | 3,219 | | | $ | 3,610 | |

| | | | | | | | |

| |

Oil & Gas Equipment & Services – 0.2% | |

SESI LLC, 7.125%,12-15-21 | | | 1,963 | | | | 1,669 | |

| | | | | | | | |

| |

Total Energy – 0.7% | | | | 5,279 | |

Financials | |

| |

Diversified Banks – 6.1% | |

Barclays plc,7.875%, 12-29-49 (B) | | | 10,192 | | | | 10,192 | |

BNP Paribas S.A., 7.625%,12-29-49 (G) | | | 2,810 | | | | 2,863 | |

HSBC Holdings plc, 6.875%,12-29-49 | | | 3,865 | | | | 3,972 | |

ING Groep N.V., Certicaaten Van Aandelen, 6.000%,10-16-66 | | | 4,280 | | | | 4,158 | |

Intesa Sanpaolo S.p.A., 5.710%,1-15-26 (G) | | | 2,830 | | | | 2,595 | |

Royal Bank of Scotland Group plc (The): | | | | | | | | |

7.500%,12-29-49 | | | 1,181 | | | | 1,169 | |

8.625%,12-29-49 (B) | | | 10,193 | | | | 10,550 | |

Societe Generale Group, 7.375%,12-29-49 (G) | | | 5,723 | | | | 5,573 | |

Standard Chartered plc, 7.500%,12-29-49 (G) | | | 2,481 | | | | 2,487 | |

UniCredit S.p.A., 5.861%,6-19-32 (G) | | | 2,700 | | | | 2,370 | |

| | | | | | | | |

| | | | | | | 45,929 | |

| | | | | | | | |

| |

Diversified Capital Markets – 1.2% | |

Credit Suisse Group AG: | | | | | | | | |

7.125%,7-29-66 (B) | | | 4,889 | | | | 4,828 | |

7.500%,6-11-67 (G) | | | 3,950 | | | | 4,015 | |

| | | | | | | | |

| | | | | | | 8,843 | |

| | | | | | | | |

| |

Investment Banking & Brokerage – 0.6% | |

Goldman Sachs Group, Inc. (The)(3-Month U.S. LIBOR plus 117 bps), 3.786%,5-15-26 (H) | | | 4,330 | | | | 4,156 | |

| | | | | | | | |

| |

Specialized Finance – 0.1% | |

Syngenta Finance N.V.: | | | | | | | | |

4.441%,4-24-23 (G) | | | 321 | | | | 309 | |

5.182%,4-24-28 (G) | | | 480 | | | | 446 | |

| | | | | | | | |

| | | | | | | 755 | |

| | | | | | | | |

| |

Total Financials – 8.0% | | | | 59,683 | |

Industrials | |

| |

Security & Alarm Services – 0.8% | |

Prime Security Services Borrower LLC, 9.250%,5-15-23 (G) | | | 5,762 | | | | 5,942 | |

| | | | | | | | |

| |

Total Industrials – 0.8% | | | | 5,942 | |

| | | | | | | | |

CORPORATE DEBT SECURITIES

(Continued) | | Principal | | | Value | |

Information Technology | |

| |

Data Processing & Outsourced Services – 0.3% | |

Alliance Data Systems Corp., 5.375%,8-1-22 (G) | | $ | 2,189 | | | $ | 2,134 | |

| | | | | | | | |

| |

Total Information Technology – 0.3% | | | | 2,134 | |

| |

TOTAL CORPORATE DEBT SECURITIES – 12.7% | | | $ | 94,758 | |

(Cost: $101,954) | | | | | | | | |

| | |

OTHER GOVERNMENT

SECURITIES(J) | | | | | | |

Argentina – 1.4% | |

Province of Mendoza, 8.375%,5-19-24 | | | 4,362 | | | | 3,533 | |

Republic of Argentina: | | | | | | | | |

4.625%,1-11-23 | | | 6,531 | | | | 5,160 | |

5.875%,1-11-28 | | | 2,100 | | | | 1,509 | |

| | | | | | | | |

| | | | | | | 10,202 | |

| | | | | | | | |

| |

Luxembourg – 0.5% | |

Rumo Luxembourg S.a.r.l., 7.375%,2-9-24 (G) | | | 3,651 | | | | 3,806 | |

| | | | | | | | |

| |

TOTAL OTHER GOVERNMENT SECURITIES – 1.9% | | | $ | 14,008 | |

(Cost: $16,284) | | | | | | | | |

| |

| LOANS(H) | | | | |

Communication Services | |

| |

Integrated Telecommunication Services – 0.7% | |

West Corp.(3-Month ICE LIBOR plus 400 bps), 6.527%,10-10-24 | | | 6,156 | | | | 5,636 | |

| | | | | | | | |

| |

Total Communication Services – 0.7% | | | | 5,636 | |

Consumer Staples | |

| |

Hypermarkets & Super Centers – 0.1% | |

GOBP Holdings, Inc. (ICE LIBOR plus 375 bps), 6.553%,10-22-25 | | | 680 | | | | 662 | |

| | | | | | | | |

| |

Total Consumer Staples – 0.1% | | | | 662 | |

Financials | |

| |

Financial Exchanges & Data – 0.4% | |

Financial & Risk U.S. Holdings, Inc. (ICE LIBOR plus 375 bps), 6.272%,10-1-25 | | | 3,276 | | | | 3,112 | |

| | | | | | | | |

| |

Investment Banking & Brokerage – 0.4% | |

Jane Street Group LLC (ICE LIBOR plus 375 bps), 5.527%,8-25-22 | | | 3,267 | | | | 3,171 | |

| | | | | | | | |

| | |

| CONSOLIDATED SCHEDULE OF INVESTMENTS | | ASSET STRATEGY (in thousands) |

DECEMBER 31, 2018

| | | | | | | | |

| LOANS(H)(Continued) | | Principal | | | Value | |

Property & Casualty Insurance – 1.4% | |

Hub International Ltd. (ICE LIBOR plus 300 bps), 5.240%,4-25-25 | | $ | 527 | | | $ | 497 | |

Mayfield Agency Borrower, Inc. (ICE LIBOR plus 450 bps), 6.522%,2-28-25 | | | 3,514 | | | | 3,417 | |

USI, Inc. (ICE LIBOR plus 300 bps), 5.803%,5-16-24 | | | 7,360 | | | | 6,927 | |

| | | | | | | | |

| | | | | | | 10,841 | |

| | | | | | | | |

| |

Total Financials – 2.2% | | | | 17,124 | |

Health Care | |

| |

Health Care Facilities – 0.7% | |

RegionalCare Hospital Partners Holdings, Inc. (ICE LIBOR plus 450 bps), 7.129%,11-16-25 | | | 2,943 | | | | 2,785 | |

Surgery Center Holdings, Inc. (ICE LIBOR plus 325 bps), 5.780%,8-31-24 | | | 2,848 | | | | 2,704 | |

| | | | | | | | |

| | | | | | | 5,489 | |

| | | | | | | | |

| |

Health Care Services – 0.3% | |

Heartland Dental LLC, 0.000%,4-30-25 (K) | | | 1,191 | | | | 1,139 | |

Heartland Dental LLC (ICE LIBOR plus 375 bps), 6.272%,4-30-25 | | | 1,453 | | | | 1,390 | |

| | | | | | | | |

| | | | | | | 2,529 | |

| | | | | | | | |

| |

Health Care Technology – 0.4% | |

Verscend Holding Corp. (ICE LIBOR plus 450 bps), 7.022%,8-27-25 | | | 2,990 | | | | 2,885 | |

| | | | | | | | |

| |

Total Health Care – 1.4% | | | | 10,903 | |

Industrials | |

| |

Construction & Engineering – 0.3% | |

McDermott Technology (Americas), Inc. (ICE LIBOR plus 500 bps), 7.522%,5-10-25 | | | 2,646 | | | | 2,463 | |

| | | | | | | | |

| |

Total Industrials – 0.3% | | | | 2,463 | |

Information Technology | |

| |

Application Software – 0.4% | |

Avaya, Inc. (ICE LIBOR plus 425 bps): | | | | | | | | |

6.694%,12-15-24 | | | 1,191 | | | | 1,148 | |

6.705%,12-15-24 | | | 1,957 | | | | 1,886 | |

| | | | | | | | |

| | | | | | | 3,034 | |

| | | | | | | | |

| |

Total Information Technology – 0.4% | | | | 3,034 | |

| | | | | | | | |

| LOANS(H)(Continued) | | Principal | | | Value | |

Materials | |

| |

Construction Materials – 0.7% | |

Hillman Group, Inc. (The) (ICE LIBOR plus 350 bps), 6.803%,5-31-25 | | $ | 5,358 | | | $ | 5,077 | |

| | | | | | | | |

| |

Total Materials – 0.7% | | | | 5,077 | |

| |

TOTAL LOANS – 5.8% | | | $ | 44,899 | |

(Cost: $47,207) | | | | | | | | |

| | |

UNITED STATES GOVERNMENT

OBLIGATIONS | | | | | | |

| |

Treasury Inflation Protected Obligations – 2.8% | |

U.S. Treasury Notes: | | | | | | | | |

0.125%,4-15-21 | | | 7,486 | | | | 7,279 | |

0.625%,1-15-26 | | | 8,345 | | | | 8,124 | |

0.125%,7-15-26 | | | 6,225 | | | | 5,844 | |

| | | | | | | | |

| | | | | | | 21,247 | |

| | | | | | | | |

| |

Treasury Obligations – 1.3% | |

U.S. Treasury Bonds, 2.750%,8-15-47 | | | 9,928 | | | | 9,419 | |

| | | | | | | | |

| |

TOTAL UNITED STATES GOVERNMENT OBLIGATIONS – 4.1% | | | $ | 30,666 | |

(Cost: $31,906) | | | | | | | | |

| | |

| BULLION – 5.6% | | Troy

Ounces | | | | |

Gold | | | 33 | | | | 42,280 | |

| | | | | | | | |

(Cost: $40,896) | | | | | | | | |

| | |

| SHORT-TERM SECURITIES | | Principal | | | | |

| |

Commercial Paper(L) – 0.9% | |

DTE Gas Co., 2.852%,1-3-19 | | $ | 3,000 | | | | 2,999 | |

J.M. Smucker Co. (The), 2.750%,1-2-19 | | | 3,468 | | | | 3,468 | |

| | | | | | | | |

| | | | | | | 6,467 | |

| | | | | | | | |

| |

Master Note – 0.5% | |

Toyota Motor Credit Corp.(1-Month U.S. LIBOR plus 15 bps), 2.720%,1-7-19 (M) | | | 3,719 | | | | 3,719 | |

| | | | | | | | |

| |

Money Market Funds – 0.7% | |

Dreyfus Institutional Preferred Government Money Market Fund – Institutional Shares, 2.400%, (N)(O) | | | 5,602 | | | | 5,602 | |

| | | | | | | | |

| | | | | | | | |

SHORT-TERM SECURITIES

(Continued) | | Principal | | | Value | |

United States Government Agency Obligations – 1.0% | |

Overseas Private Investment Corp. (GTD by U.S. Government)(3-Month U.S. TB Rate): | | | | | | | | |

2.470%,1-7-19 (M) | | $ | 7,500 | | | $ | 7,500 | |

| | | | | | | | |

| | | | | | | 7,500 | |

| | | | | | | | |

| |

TOTAL SHORT-TERM SECURITIES – 3.1% | | | $ | 23,288 | |

(Cost: $23,288) | | | | | | | | |

| |

TOTAL INVESTMENT SECURITIES – 100.6% | | | $ | 757,623 | |

(Cost: $789,804) | | | | | | | | |

| |

LIABILITIES, NET OF CASH AND OTHER ASSETS – (0.6)% | | | | (4,281 | ) |

| |

NET ASSETS – 100.0% | | | $ | 753,342 | |

| | |

| CONSOLIDATED SCHEDULE OF INVESTMENTS | | ASSET STRATEGY (in thousands) |

DECEMBER 31, 2018

Notes to Consolidated Schedule of Investments

| * | Not shown due to rounding. |

| (A) | No dividends were paid during the preceding 12 months. |

| (B) | All or a portion of securities with an aggregate value of $14,700 are on loan. |

| (C) | Listed on an exchange outside the United States. |

| (D) | Restricted securities. At December 31, 2018, the Portfolio owned the following restricted securities: |

| | | | | | | | | | | | | | | | | | | | |

| Security | | Acquisition Date(s) | | | Shares | | | Cost | | | Market Value | | | | |

Media Group Holdings LLC, Series H | | | 8-29-13 to 10-31-13 | | | | 32 | | | $ | 22,374 | | | $ | – | * | | | | |

Media Group Holdings LLC, Series T | | | 7-2-13 to 1-23-15 | | | | 4 | | | | 8,413 | | | | 287 | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | $ | 30,787 | | | $ | 287 | | | | | |

| | | | | | | | | | | | |

| | The total value of these securities represented 0.0% of net assets at December 31, 2018. |

| (E) | Investment is owned by an entity that is treated as a corporation for U.S. tax purposes and is owned by the Portfolio and consolidated as described in Note 5 of the Notes to Financial Statements. |

| (F) | Securities whose value was determined using significant unobservable inputs. |

| (G) | Securities were purchased pursuant to an exemption from registration available under Rule 144A under the Securities Act of 1933 and may only be resold in transactions exempt from registration, normally to qualified institutional buyers. At December 31, 2018 the total value of these securities amounted to $44,338 or 5.9% of net assets. |

| (H) | Variable rate security. Interest rate disclosed is that which is in effect at December 31, 2018. Description of the reference rate and spread, if applicable, are included in the security description. |

| (J) | Other Government Securities may include emerging markets sovereign, quasi-sovereign, corporate and supranational agency and organization debt securities. |

| (K) | All or a portion of this position has not settled. Full contract rates do not take effect until settlement date. |

| (L) | Rate shown is the yield to maturity at December 31, 2018. |

| (M) | Variable rate security. Interest rate disclosed is that which is in effect at December 31, 2018. Date shown represents the date that the variable rate resets. Description of the reference rate and spread, if applicable, are included in the security description. |

| (N) | Investment made with cash collateral received from securities on loan. |

| (O) | Rate shown is the annualized7-day yield at December 31, 2018. |

The following table is a summary of the valuation of the Portfolio’s investments by the fair value hierarchy levels as of December 31, 2018. See Note 3 to the Financial Statements for further information regarding fair value measurement.

| | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | |

Assets | | | | | | | | | | | | |

Investments in Securities | | | | | | | | | | | | |

Common Stocks | | | | | | | | | | | | |

Communication Services | | $ | 15,833 | | | $ | 7,309 | | | $ | — | |

Consumer Discretionary | | | 27,724 | | | | 17,503 | | | | 287 | |

Consumer Staples | | | 44,207 | | | | 22,079 | | | | — | |

Energy | | | 22,548 | | | | 11,328 | | | | — | |

Financials | | | 21,608 | | | | 68,090 | | | | — | |

Health Care | | | 59,338 | | | | 5,974 | | | | — | |

Industrials | | | 30,995 | | | | 40,332 | | | | — | |

Information Technology | | | 81,981 | | | | 24,221 | | | | — | |

Materials | | | — | | | | 6,367 | | | | — | |

Total Common Stocks | | $ | 304,234 | | | $ | 203,203 | | | $ | 287 | |

Corporate Debt Securities | | | — | | | | 94,758 | | | | — | |

Other Government Securities | | | — | | | | 14,008 | | | | — | |

Loans | | | — | | | | 44,899 | | | | — | |

United States Government Obligations | | | — | | | | 30,666 | | | | — | |

Bullion | | | 42,280 | | | | — | | | | — | |

Short-Term Securities | | | 5,602 | | | | 17,686 | | | | — | |

Total | | $ | 352,116 | | | $ | 405,220 | | | $ | 287 | |

During the year ended December 31, 2018, there were no transfers in or out of Level 3.

| | |

| CONSOLIDATED SCHEDULE OF INVESTMENTS | | ASSET STRATEGY (in thousands) |

DECEMBER 31, 2018

The following acronyms are used throughout this schedule:

GTD = Guaranteed

ICE = Intercontinental Exchange

LIBOR = London Interbank Offered Rate

TB = Treasury Bill

Country Diversification

| | | | |

(as a % of net assets) | | | | |

United States | | | 51.3% | |

France | | | 6.4% | |

United Kingdom | | | 4.8% | |

Switzerland | | | 4.3% | |

Japan | | | 3.5% | |

Netherlands | | | 3.5% | |

India | | | 3.1% | |

China | | | 3.0% | |

Country Diversification(Continued)

| | | | |

Luxembourg | | | 1.8% | |

Hong Kong | | | 1.7% | |

Ireland | | | 1.5% | |

Argentina | | | 1.4% | |

Italy | | | 1.2% | |

Finland | | | 1.1% | |

Taiwan | | | 1.0% | |

Other Countries | | | 2.3% | |

Other+ | | | 8.1% | |

+Includes gold bullion, cash and other assets (net of liabilities), and cash equivalents

See Accompanying Notes to Financial Statements.

| | |

| MANAGEMENT DISCUSSION | | BALANCED |

(UNAUDITED)

Matthew A. Hekman

Mark G. Beischel

Susan K. Regan

Below, Matthew A. Hekman, Susan K. Regan and Mark G. Beischel, CPA, the co-portfolio managers of Ivy VIP Balanced during the fiscal year ended December 31, 2018, discuss positioning, performance and results for the fiscal year. Mr. Hekman has managed the Portfolio since 2014, and has 20 years of industry experience. In April 2018, Rick Perry resigned his position as a portfolio manager. Mr. Beischel and Ms. Regan joined Mr. Hekman as co-portfolio managers of the Portfolio at that time. Mr. Beischel has 25 years of industry experience. Ms. Regan has 31 years of industry experience.

Fiscal year Performance

| | | | |

For the 12 Months Ended December 31, 2018 | | | | |

Ivy VIP Balanced(Class II shares at net asset value) | | | -3.24% | |

Benchmark(s) and/or Morningstar and Lipper Categories | | | | |

S&P 500 Index | | | -4.38% | |

(generally reflects the performance of large- and medium-sized U.S. stocks) | | | | |

Bloomberg Barclays U.S. Government/Credit Index | | | -0.42% | |

(generally reflects the performance of securities in the bond market) | | | | |

Morningstar Allocation 50% to 70% Equity Universe Average | | | -5.76% | |

(generally reflects the performance of the universe of funds with similar investment objectives) | | | | |

Lipper Variable Annuity Mixed-Asset Target Allocation Growth Universe Average | | | -6.64% | |

(generally reflects the performance of the universe of strategies with similar investment objectives) | | | | |

Please note that Portfolio returns include applicable fees and expenses, whereas the index returns do not include any such fees. Also, the Portfolio’s performance data does not take into account any product expenses or charges associated with owning a variable life or annuity policy, which is invested in Ivy Variable Insurance Portfolios. Multiple indexes are shown because the Portfolio invests in multiple asset classes.

Key Drivers

The year ended December 31, 2018 was disappointing for most investors as a volatile fourth quarter erased the gains experienced in the first three quarters, pushing most asset classes to a loss for the trailing year. Equity markets in particular exhibited elevated levels of volatility, culminating with the S&P 500 Index, the Portfolio’s equity benchmark, which declined 4.38% for the year.

The year was unusual in many respects, but quite notable was the divergence between earnings growth for the constituents of the S&P 500, which rose approximately 24%, juxtaposed against the index’s year-end performance. Also noteworthy was the benchmark’s particularly weak performance in December, with the benchmark’s 9.03% decline, representing the worst December since 1931.

It is important to note the context of 2018, which followed nine consecutive years of gains for the S&P 500 Index and occurred on the heels of a year which produced a 21.83% total return with just 6% realized volatility and twelve consecutive months of positive returns. In addition, markets are forward-looking, and the indications of decelerating economic growth are prevalent. However, even against that backdrop, the intensity of the decline to end 2018 was surprising. Within the equity market, the health care, utilities, consumer discretionary and information technology sectors produced positive returns for the year, while the traditionally pro-cyclical sectors of energy, materials, industrials and financials posted sharp declines.

Fixed income markets also experienced declines, though they were more modest in nature. The Portfolio’s fixed income benchmark, the Bloomberg Barclays U.S. Government /Credit Index, was down 0.42% for the period. Within the fixed income market, the U.S. Treasury yield curve flattened, benefiting longer duration positioning. While short-term Treasury yields rose as the U.S. Federal Reserve (Fed) increased the federal funds rate, longer-dated Treasury yields declined over the course of 2018, due to moderate growth expectations, modest inflation rates and global demand for the relatively attractive yield of U.S. Treasuries. Credit spreads widened over the course of the year as economic growth prospects moderated and leverage on corporate balance sheets increased.

Contributors and detractors

The Portfolio declined 2.26% for the fiscal year ended December 31, 2018. However, the Portfolio split its two asset class indexes, outperforming the equity benchmark and peer group, but trailing the fixed income benchmark. The Portfolio’s equity exposure averaged about 67% for the year, with 32% on average invested in fixed income securities and the balance in cash.

The equity component of the Portfolio declined 3.56% for the year, outperforming the S&P 500 Index. Relative performance versus that index was driven by strong security selection in the information technology and communication services sectors. The fixed income component of the Portfolio was down 0.84% for the year, underperforming the Bloomberg Barclays U.S. Government /Credit Index. Our longstanding short-duration position relative to that benchmark our underweight of Treasuries negatively impacted relative performance.

Top contributors to performance included Twenty-First Century Fox, Autodesk, Inc., O’Reilly Automotive, Mastercard, Inc. and Integrated Device Technology. Both Twenty-First Century Fox and Integrated Device Technology were acquired at significant premiums to their unaffected equity values in 2018 and are no longer held by the Portfolio. We believe the outlook for Autodesk, Inc. and Mastercard, Inc. continue to be promising for 2019. At Autodesk, Inc., a transition in revenue recognition from sale of product to recurring subscription fees coupled with strong demand for the company’s products have driven a re-rating for its stock, which we believe is durable. We believe that the secular shift to electronic payment and emerging opportunities in business-to-business payments at Mastercard, Inc. are compelling and meaningful drivers of growth well into the next decade. However, we are mindful of the company’s premium valuation and harvested some profits in the stock in 2018. Finally, at O’Reilly Automotive, strong management execution and a favorable outlook for its automotive parts business drove a re-rating of the company’s stock, which fully values the equity in our view and resulted in the position being closed.

Detractors to performance were Knight Transportation, Inc., Goldman Sachs Group, Inc., Philip Morris International, Inc., Apple, Inc., and Cimarex Energy Co. Knight Transportation, Inc. has been a frustrating investment as near-term earnings strength has been overcome by long-term cyclical worries, which resulted in a dramatic de-rating of the equity multiple. We believe the degree of cyclical concern and subsequent de-rating has been excessive. Goldman Sachs Group, Inc. weathered a difficult 2018 marked by poor management of its fixed income, currency and commodities trading businesses; growing concern over a legal liability along with management culpability related to a misguided financial transaction in a foreign country; and concerns over the company’s exposure to a decelerating global economy. We believe the stock has been unduly punished and represents good value for long-term investors. Philip Morris International, Inc. has struggled to transition its global tobacco business from combustible cigarettes to a non-combustible, reduced-risk product. While the transition has been bumpy, we believe the R&D and marketing investment currently expensed in the company’s financials will bear fruit as units and revenues of the new product ramp in future periods. Apple, Inc. had a difficult 2018 as its new iPhone products have been less popular than expected. However, the company’s services business continues to grow with attractive returns which we suspect will prove durable and supportive to valuation in the year ahead. Finally, the energy sector, and Cimarex Energy Co. in particular, declined in value in 2018 as budding enthusiasm for a recovery in the price of crude oil was stymied by a surprising political decision to exempt several countries from Iranian export sanctions and relentless gains in well productivity for U.S. shale formations drove supply growth in excess of demand. However, we think there are encouraging signs that a balanced crude oil market will occur later in 2019 and we are focused on companies with strong competitive positions that we believe can thrive in a modestly improved commodity price environment. The Portfolio held positions in these companies at the end of the fiscal year.

Outlook

As we look ahead, we think that global economic growth is very likely to decelerate over the next twelve months but we expect it to remain positive. As we have previously highlighted, individual and corporate tax reform was a meaningful positive for the domestic economy which, along with lighter regulation and a generally more business-friendly political climate is supportive of growth.

However, the uncertainties around political, monetary and trade policies have been stubbornly persistent and in our view are likely to linger for most of this year. While we believe domestic economic growth will continue, the lagged effects of tighter monetary policy and waning benefits from fiscal stimulus will be a headwind. As a result, we are closely watching inflation rates and inflation expectations which have been modest, and must remain so, in order to allow our central bank to respond to slower growth and adjust the pace of monetary policy normalization.

As the domestic economy grows, we expect the Fed to raise interest rates at a very modest pace and continue the process of winding down its balance sheet. While we continue to monitor macroeconomic forces and trends, we maintain an emphasis on finding high quality, growing companies whose securities are trading at a reasonable valuation with visible catalysts to drive relative outperformance over the next twelve months. This approach has served investors well over time, and our confidence in it has not waned.

Past performance is not a guarantee of future results. The value of the Portfolio’s shares will change, and you could lose money on your investment.

Fixed-income securities are subject to interest rate risk and, as such, the Portfolio’s net asset value may fall as interest rates rise. These and other risks are more fully described in the Portfolio’s prospectus.

The opinions expressed in this report are those of the Portfolio managers and are current only through the end of the period of the report as stated on the cover. The managers’ views are subject to change at any time based on market and other conditions, and no forecasts can be guaranteed.

The indexes noted are unmanaged, include reinvested dividends, and do not include fees. One cannot invest directly in an index, nor is an index representative of Ivy VIP Balanced.

| | |

| PORTFOLIO HIGHLIGHTS | | BALANCED |

ALL DATA IS AS OF DECEMBER 31, 2018 (UNAUDITED)

Asset Allocation

| | | | |

Stocks | | | 61.0% | |

Information Technology | | | 11.5% | |

Health Care | | | 10.4% | |

Financials | | | 9.9% | |

Industrials | | | 8.5% | |

Consumer Discretionary | | | 8.0% | |

Energy | | | 4.8% | |

Consumer Staples | | | 4.3% | |

Materials | | | 2.6% | |

Communication Services | | | 1.0% | |

Bonds | | | 37.3% | |

United States Government and Government Agency Obligations | | | 19.4% | |

Corporate Debt Securities | | | 17.6% | |

Loans | | | 0.3% | |

Cash and Other Assets (Net of Liabilities),

and Cash Equivalents+ | | | 1.7% | |

Top 10 Equity Holdings

| | | | |

| | |

| Company | | Sector | | Industry |

Broadcom Corp., Class A | | Information Technology | | Semiconductors |

Lowe’s Co., Inc. | | Consumer Discretionary | | Home Improvement Retail |

Microsoft Corp. | | Information Technology | | Systems Software |

Union Pacific Corp. | | Industrials | | Railroads |

PNC Financial Services Group, Inc. (The) | | Financials | | Regional Banks |

Autodesk, Inc. | | Information Technology | | Application Software |

UnitedHealth Group, Inc. | | Health Care | | Managed Health Care |

Chevron Corp. | | Energy | | Integrated Oil & Gas |

Las Vegas Sands, Inc. | | Consumer Discretionary | | Casinos & Gaming |

Northern Trust Corp. | | Financials | | Diversified Banks |

See your advisor or www.ivyinvestments.com for more information on the Portfolio’s most recently published Top 10 Equity Holdings.

+ Cash equivalents are defined as highly liquid securities with maturities of less than three months. Cash equivalents may include U.S. Government Treasury bills, bank certificates of deposit, bankers’ acceptances, corporate commercial paper and other money market instruments.

| | |

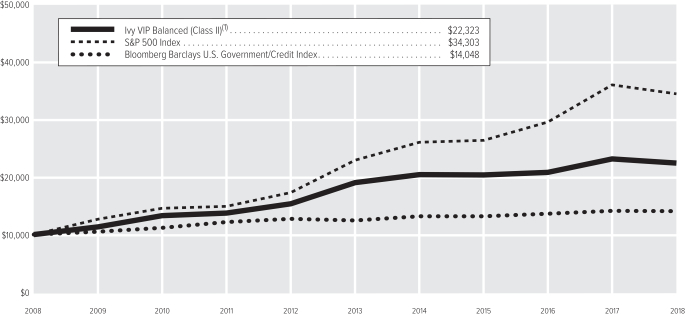

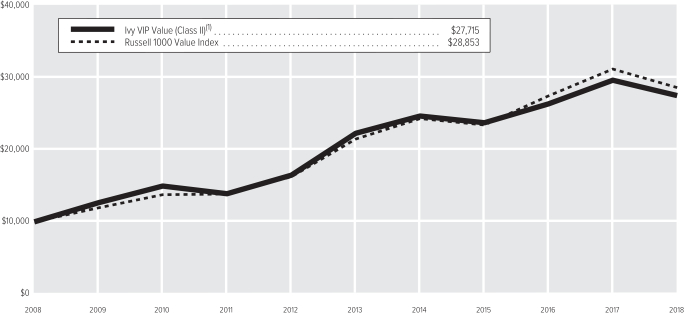

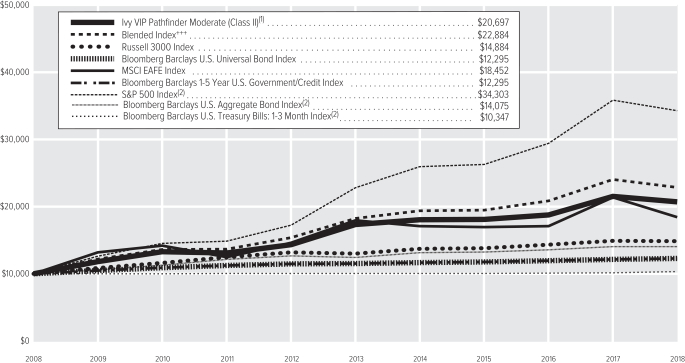

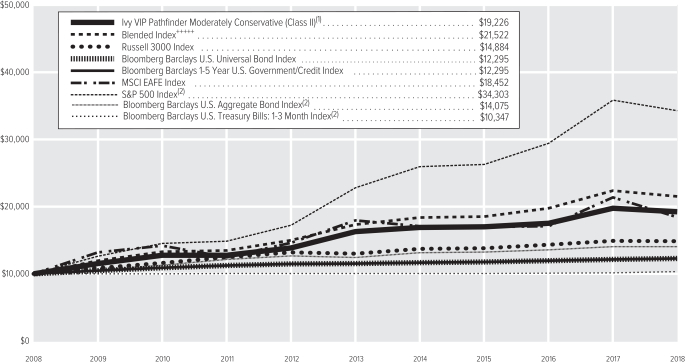

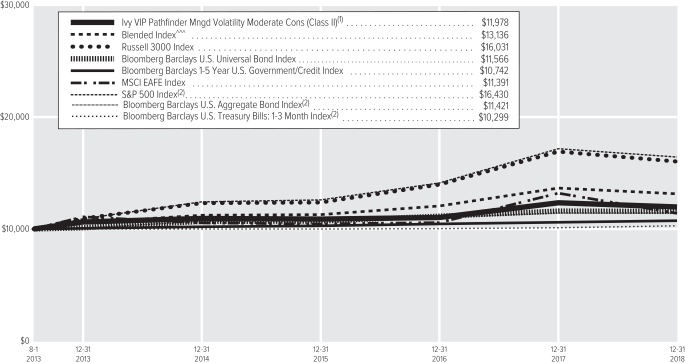

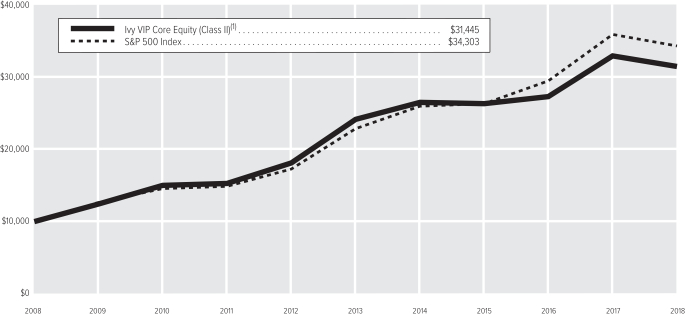

| COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT | | BALANCED |

(UNAUDITED)

| (1) | The value of the investment in the Portfolio is impacted by the ongoing expenses of the Portfolio and assumes reinvestment of dividends and distributions. |

| | | | |

| |

| Average Annual Total Return(2) | | Class II | |

1-year period ended12-31-18 | | | -3.24% | |

5-year period ended12-31-18 | | | 3.35% | |

10-year period ended12-31-18 | | | 8.36% | |

| (2) | Data quoted is past performance and current performance may be lower or higher. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost. Please visit www.ivyinvestments.com for the Portfolio’s most recentmonth-end performance. Performance data quoted does not reflect any expenses or charges associated with owning a variable life insurance policy or variable annuity contract that invests in the Portfolio’s shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower. |

Past performance is not necessarily indicative of future performance. Indexes are unmanaged. The performance graph and table do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or on the redemption of Portfolio shares. Performance results may include the effect of expense reduction arrangements for some or all of the periods shown. If those arrangements had not been in place, the performance results for those periods would have been lower.

| | |

| SCHEDULE OF INVESTMENTS | | BALANCED (in thousands) |

DECEMBER 31, 2018

| | | | | | | | |

| COMMON STOCKS | | Shares | | | Value | |

Communication Services | |

| |

Integrated Telecommunication Services – 1.0% | |

Verizon Communications, Inc. | | | 56 | | | $ | 3,134 | |

| | | | | | | | |

| |

Total Communication Services – 1.0% | | | | 3,134 | |

Consumer Discretionary | |

| |

Apparel, Accessories & Luxury Goods – 1.2% | |

Coach, Inc. | | | 113 | | | | 3,818 | |

| | | | | | | | |

| |

Casinos & Gaming – 1.8% | |

Las Vegas Sands, Inc. | | | 106 | | | | 5,527 | |

| | | | | | | | |

| |

General Merchandise Stores – 1.6% | |

Dollar General Corp. | | | 46 | | | | 5,014 | |

| | | | | | | | |

| |

Home Improvement Retail – 2.0% | |

Lowe’s Co., Inc. | | | 65 | | | | 5,997 | |

| | | | | | | | |

| |

Restaurants – 1.4% | |

YUM! Brands, Inc. | | | 47 | | | | 4,319 | |

| | | | | | | | |

| |

Total Consumer Discretionary – 8.0% | | | | 24,675 | |

Consumer Staples | |

| |

Brewers – 0.4% | |

Anheuser-Busch InBev S.A. ADR(A) | | | 17 | | | | 1,151 | |

| | | | | | | | |

| |

Household Products – 1.3% | |

Procter & Gamble Co. (The) | | | 45 | | | | 4,140 | |

| | | | | | | | |

| |

Packaged Foods & Meats – 1.4% | |

General Mills, Inc. | | | 114 | | | | 4,452 | |

| | | | | | | | |

| |

Tobacco – 1.2% | |

Philip Morris International, Inc. | | | 55 | | | | 3,694 | |

| | | | | | | | |

| |

Total Consumer Staples – 4.3% | | | | 13,437 | |

Energy | |

| |

Integrated Oil & Gas – 1.8% | |

Chevron Corp. | | | 51 | | | | 5,530 | |

| | | | | | | | |

| |

Oil & Gas Exploration & Production – 0.7% | |

Cimarex Energy Co. | | | 35 | | | | 2,132 | |

| | | | | | | | |

| |

Oil & Gas Storage & Transportation – 1.3% | |

Enterprise Products Partners L.P. | | | 161 | | | | 3,961 | |

| | | | | | | | |

| |

Total Energy – 3.8% | | | | 11,623 | |

Financials | |

| |

Asset Management & Custody Banks – 1.4% | |

Blackstone Group L.P. (The) | | | 140 | | | | 4,181 | |

| | | | | | | | |

| |

Diversified Banks – 2.8% | |

Northern Trust Corp. | | | 65 | | | | 5,415 | |

U.S. Bancorp | | | 69 | | | | 3,143 | |

| | | | | | | | |

| | | | | | | 8,558 | |

| | | | | | | | |

| | | | | | | | |

| COMMON STOCKS(Continued) | | Shares | | | Value | |

Financial Exchanges & Data – 1.3% | |

Intercontinental Exchange, Inc. | | | 55 | | | $ | 4,145 | |

| | | | | | | | |

| |