UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-5003

Blue Chip Value Fund, Inc.

(Exact name of registrant as specified in charter)

1225 17th Street, 26th Floor, Denver, Colorado 80202

(Address of principal executive offices) (Zip code)

Michael P. Malloy

Drinker Biddle & Reath LLP

One Logan Square

18th & Cherry Streets

Philadelphia, Pennsylvania 19103-6996

(Name and address of agent for service)

Registrant's Telephone Number, including Area Code: (800) 624-4190

Date of fiscal year end: December 31

Date of reporting period: December 31, 2006

Item 1 - Reports to Stockholders

The following is a copy of the report to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

|

Annual Report to Stockholders December 31, 2006 |

INVESTMENT ADVISER’S COMMENTARY

Dear Fellow Stockholders:

For the fourth quarter of 2006, Blue Chip Value Fund posted a strong return of 8.15% versus the S&P 500 Index at 6.70% and the Lipper Large-Cap Core peer group at 6.42%. The Fund returned 12.89% for the year, finishing behind the S&P 500 and the Lipper Large-Cap Core group, which posted returns of 15.80% and 13.39%, respectively.

For the year, the Fund underperformed in the technology, medical/healthcare and communications sectors. Our holdings of Dell and Intel hurt performance earlier in the year as we overestimated management’s ability to improve their earnings. We sold Dell, but not Intel because our conviction for Intel remains and its performance has improved. IBM was a strong contributor in the fourth quarter.

In the communications sector our investment in cell phone giant Nokia underperformed our expectations, because demand forecasts moved lower and licensing issues created short-term uncertainty. However, it appears to us that Nokia continues to gain market share and remains dominant in emerging markets where demand growth is the strongest.

In the medical/healthcare sector, Zimmer Holdings, a medical device company, was among the stronger performers in the portfolio. For the quarter and year, our investment in Teva Pharmaceutical Industries hurt performance because of concerns about competition in the generic drug industry. However, we believe that Teva has good prospects in the near future because several large branded drugs are coming off patent, and we expect the company will offer generic alternatives.

For the year, Fund holdings in the consumer cyclical, interest rate sensitive and consumer staples sectors outperformed the benchmark. In consumer cyclicals, Walt Disney did well because of improved profits at theme parks and movies, and JC Penney did well because better merchandising continued to improve sales and profits.

Our best performance for the fourth quarter came from the interest rate sensitive sector. Within this sector Merrill Lynch and Morgan Stanley continued to benefit from a very strong trading market, a good mergers and acquisitions market, and strong equity issuance in initial public offerings. We also benefited from MBIA, a financial guarantee company.

3

In consumer staples, the Fund’s strong relative performance was driven by our holding of Bunge Limited, one of the world’s largest processors of soybeans, with related fertilizer and food products businesses.

While our energy holdings did well for the year, they did not do well in the fourth quarter. This shortfall was primarily attributed to our holding of Transocean, an offshore contract drilling company, as the price of the stock was hurt by the decline in oil prices.

We remain optimistic about the prospects for the Blue Chip Value Fund. We believe that our research process can identify undervalued companies generating strong free cash flow and improving returns on capital. We believe this process has resulted in a portfolio of quality, large-cap stocks that have been purchased at attractive prices relative to their intrinsic value. As we look forward to 2007, we thank you for your continued support.

Sincerely,

Todger Anderson, CFA

President, Blue Chip Value Fund, Inc.

Chairman, Denver Investment Advisors LLC

The Investment Adviser’s Commentary included in this report contains certain forward-looking statements about the factors that may affect the performance of the Fund in the future. These statements are based on Fund management’s predictions and expectations concerning certain future events and their expected impact on the Fund, such as performance of the economy as a whole and of specific industry sectors, changes in the levels of interest rates, the impact of developing world events, and other factors that may influence the future performance of the Fund. Management believes these forward-looking statements to be reasonable, although they are inherently uncertain and difficult to predict. Actual events may cause adjustments in portfolio management strategies from those currently expected to be employed.

4

Sector Diversification in Comparison to

S&P 500 as of December 31, 2006* |

| | Fund | S&P 500 |

| Basic Materials | 0.0% | 2.7% |

| Capital Goods | 9.2% | 8.7% |

| Commercial Services | 4.4% | 2.4% |

| Communications | 3.8% | 7.2% |

| Consumer Cyclical | 10.3% | 12.7% |

| Consumer Staples | 7.8% | 8.8% |

| Energy | 7.9% | 9.4% |

| Financials | 25.5% | 20.1% |

| Medical/Healthcare | 16.4% | 11.5% |

| REITs | 0.0% | 1.1% |

| Technology | 11.9% | 10.1% |

| Transportation | 2.6% | 1.6% |

| Utilities | 0.0% | 3.7% |

| Short-Term Investments | 0.2% | 0.0% |

| *Sector diversification percentages are based on the Fund’s total investments at market value. Sector diversification is subject to change and may not be representative of future investments. |

Average Annual Total Returns

as of December 31, 2006 |

| Return | 1-Year | 3-Year | 5-Year | 10-Year |

Blue Chip

Value Fund –

Net Asset Value | 12.89% | 10.96% | 6.51% | 8.12% |

Blue Chip

Value Fund –

Market Price | 4.58% | 8.90% | 5.18% | 8.00% |

| S&P 500 Index | 15.79% | 10.44% | 6.19% | 8.42% |

Past performance is no guarantee of future results. Share prices will fluctuate, so that a share may be worth more or less than its original cost when sold. Total investment return is calculated assuming a purchase of common stock on the opening of the first day and a sale on the closing of the last day of each period reported. Dividends and distributions, if any, are assumed for purposes of this calculation to be reinvested at prices obtained under the Fund's dividend reinvestment plan. Rights offerings, if any, are assumed for purposes of this calculation to be fully subscribed under the terms of the rights offering. Please note that the Fund's total return shown above does not reflect the deduction of taxes that a stockholder would pay on Fund distributions or the sale of Fund shares. Current performance may be higher or lower than the total return shown above. Please visit our website at www.blu.com to obtain the most recent month end returns. Generally, total investment return based on net asset value will be higher than total investment return based on market value in periods where there is an increase in the discount or a decrease in the premium of the market value to the net asset value from the beginning to the end of such periods. Conversely, total investment return based on the net asset value will be lower than total investment return based on market value in periods where there is a decrease in the discount or an increase in the premium of the market value to the net asset value from the beginning to the end of such periods. |

5

MANAGED DISTRIBUTION POLICY

The Blue Chip Value Fund has a Managed Distribution Policy. This policy is to make quarterly distributions of at least 2.5% of the Fund’s net asset value to stockholders. This is the quarterly payment that most Fund investors elect to receive in cash. The Board of Directors believes this policy creates a predictable level of quarterly cash flow to Fund shareholders. You should not draw any conclusions about the Fund’s investment performance from the amount of this distribution. Please see the Fund’s performance information on Page 5 of this report. The Fund’s Managed Distribution Policy may be changed at the discretion of the Fund’s Board of Directors, however at this time, the Board has no intention of making any changes.

The Fund’s performance is measured by its total return. The source of the Fund’s total return is from income and net realized and unrealized gains and losses. The Fund realizes a capital gain or loss when it sells a security from its portfolio. If the Fund distributes more than its income and net realized capital gains, a portion of your distribution is a return of capital. When this happens, the Fund is giving you back money that you invested in the Fund. This portion of the distribution is not normally subject to income taxes. Please see the detail of the sources of the 2006 distributions presented on Page 11 of this report. It is important to note that the Fund’s investment adviser, Denver Investment Advisors LLC, seeks to minimize the amount of net realized capital gains, if consistent with the Fund’s investment objective, to reduce the amount of income taxes incurred by our stockholders. This strategy can lead to greater levels of return of capital being paid out under the Managed Distribution Policy.

6

Thus, the 2.5% quarterly distribution percentage does not reflect the Fund’s investment performance and should not be confused with “yield,” “income” or “return” of the Fund.

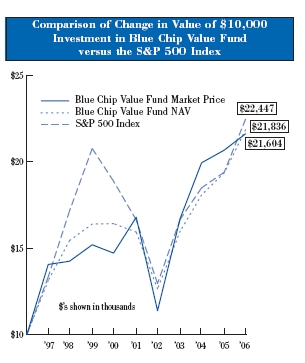

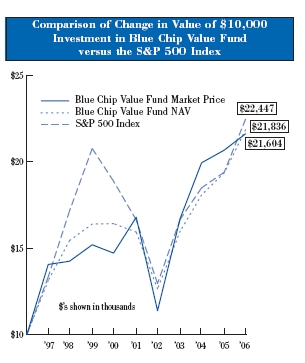

The first graph on Page 8 represents the cumulative value of a $10,000 investment in the Fund over the past ten years assuming reinvestment of all cash distributions through the Fund’s Dividend Reinvestment Plan and full participation in “rights offerings.” Stockholders who do not reinvest cash distributions in the Fund have a different rate of return on their investment than is shown in the first graph on Page 8. Also, these stockholders reduce their investment in the Fund by the amount of any return of capital. By contrast, stockholders who elect to reinvest their distributions receive additional Fund shares.

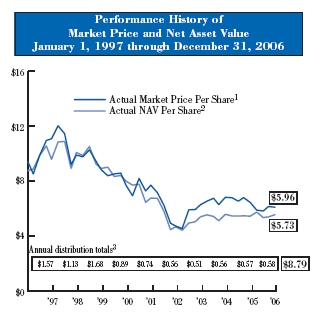

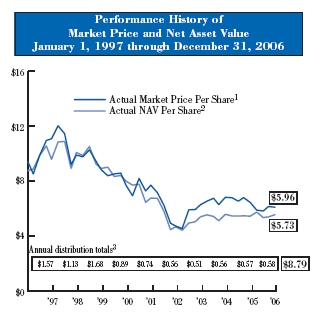

At the Fund level, the payment of return of capital can lead to the Fund having lower total assets if the total return earned by the Fund is less than the cash distribution. Similarly, the Fund’s net asset value per share will decline if the total return of the Fund’s net asset value is less than the cash distribution payout level over the same period. This scenario has occurred over the past ten years as depicted in the graph on Page 9.

7

Please Note: Performance calculations are as of the end of December each year. Past performance is not indicative of future results. This chart assumes an investment of $10,000 on 1/1/97. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. It is an unmanaged index.

Please see Average Annual Total Return information on page 5.

8

Please Note: line graph points are as of the end of each calendar quarter.

Past performance is no guarantee of future results. Share prices will fluctuate, so that a share may be worth more or less than its original cost when sold.

1Reflects the actual market price of one share as it has traded on the NYSE.

2Reflects the actual NAV of one share.

3The graph above includes the annual distribution totals over the past ten years, which equals $8.79 per share. The NAV Per Share is reduced by the amount of the distribution on the ex-dividend date . The sources of these distributions are as follows:

| | | | | | | | | Total |

| | | Net | | | | Return | | Amount |

| | | Investment | | Capital | | of | | of |

| Year | | Income | | Gains | | Capital | | Distribution |

| 1997 | | $ | 0.1000 | | $ | 1.4700 | | $ | 0.0000 | | $ | 1.57 |

| 1998 | | $ | 0.0541 | | $ | 1.0759 | | $ | 0.0000 | | $ | 1.13 |

| 1999 | | $ | 0.0335 | | $ | 1.6465 | | $ | 0.0000 | | $ | 1.68 |

| 2000 | | $ | 0.0530 | | $ | 0.8370 | | $ | 0.0000 | | $ | 0.89 |

| 2001 | | $ | 0.0412 | | $ | 0.3625 | | $ | 0.3363 | | $ | 0.74 |

| 2002 | | $ | 0.0351 | | $ | 0.0000 | | $ | 0.5249 | | $ | 0.56 |

| 2003 | | $ | 0.0136 | | $ | 0.0000 | | $ | 0.4964 | | $ | 0.51 |

| 2004 | | $ | 0.0283 | | $ | 0.5317 | | $ | 0.0000 | | $ | 0.56 |

| 2005 | | $ | 0.0150 | | $ | 0.1128 | | $ | 0.4422 | | $ | 0.57 |

| 2006 | | $ | 0.0182 | | $ | 0.1260 | | $ | 0.4358 | | $ | 0.58 |

| Totals | | $ | 0.3920 | | $ | 6.1624 | | $ | 2.2356 | | $ | 8.79 |

| % of Total | | | | | | | | | | | | |

| Distribution | | | 4.46% | | 70.11% | | 25.43% | | 100.00% |

9

DIVIDEND REINVESTMENT AND CASH PURCHASE PLAN

Blue Chip Value Fund, Inc.’s (the “Fund”) Dividend Reinvestment and Cash Purchase Plan offers stockholders the opportunity to reinvest dividends and capital gain distributions in additional shares of the Fund. A stockholder may also make additional cash investments under the Plan. There is no service charge for participation.

Participating stockholders will receive additional shares issued at a price equal to the net asset value per share as of the close of the New York Stock Exchange on the record date (“Net Asset Value”), unless at such time the Net Asset Value is higher than the market price of the Fund’s common stock, plus brokerage commission. In this case, the Fund will attempt, generally over the next 10 business days (the “Trading Period”), to acquire shares of the Fund’s common stock in the open market at a price plus brokerage commission which is less than the Net Asset Value. In the event that prior to the time such acquisition is completed, the market price of such common stock plus commission equals or exceeds the Net Asset Value, or in the event that such market purchases are unable to be completed by the end of the Trading Period, then the balance of the distribution shall be completed by issuing additional shares at Net Asset Value.

Participating stockholders may also make additional cash investments (minimum $50 and maximum $10,000 per month) by check or money order (or by wire for a $10 fee) to acquire additional shares of the Fund. Please note, however, that these additional shares will be purchased at market value plus brokerage commission (without regard to net asset value) per share.

A stockholder owning a minimum of 50 shares may join the Plan by sending an Enrollment Form to the Plan Agent at Mellon Investor Services, LLC, 480 Washington Blvd., Jersey City, NJ 07310.

The automatic reinvestment of dividends and distributions will not relieve participants of any income taxes that may be payable (or required to be withheld) on dividends or distributions, even though the stockholder does not receive the cash. Participants must own at least 50 shares at all times.

A stockholder may elect to withdraw from the Plan at any time on 15-days’ prior written notice, and receive future dividends and distributions in cash. There is no penalty for

10

withdrawal from the Plan and stockholders who have withdrawn from the Plan may rejoin in the future.

The Fund may amend the Plan at any time upon 30-days prior notice to participants.

Additional information about the Plan may be obtained from Blue Chip Value Fund, Inc. by writing to 1225 17th Street, 26th Floor, Denver, CO 80202, by telephone at (800) 624-4190 or by visiting us at www.blu.com.

If your shares are registered with a broker, you may still be able to participate in the Fund’s Dividend Reinvestment Plan. Please contact your broker about how to participate and to inquire if there are any fees which may be charged by the broker to your account.

STOCKHOLDER DISTRIBUTION INFORMATION

Certain tax information regarding Blue Chip Value Fund, Inc. is required to be provided to stockholders based upon the Fund’s income and distributions to the stockholders for the calendar year ended December 31, 2006.

The Board of Directors of Blue Chip Value Fund, Inc. voted to pay 2.5% of the Fund’s net asset value on a quarterly basis in accordance with the Fund’s distribution policy. The following table summarizes the final sources of such distributions:

| | Net | | Short-Term | | Long-Term | | Return | | |

| | Investment | | Capital | | Capital | | of | | |

| | Income | | Gain | | Gain | | Capital | | Total |

| 1st | | | | | | | | | | | | | | |

| Quarter | $ | 0.0047 | | $ | 0.0042 | | $ | 0.0284 | | $ | 0.1127 | | $ | 0.15 |

| 2nd | | | | | | | | | | | | | | |

| Quarter | $ | 0.0044 | | $ | 0.0039 | | $ | 0.0265 | | $ | 0.1052 | | $ | 0.14 |

| 3rd | | | | | | | | | | | | | | |

| Quarter | $ | 0.0044 | | $ | 0.0039 | | $ | 0.0265 | | $ | 0.1052 | | $ | 0.14 |

| 4th | | | | | | | | | | | | | | |

| Quarter | $ | 0.0047 | | $ | 0.0042 | | $ | 0.0284 | | $ | 0.1127 | | $ | 0.15 |

| Total | $ | 0.0182 | | $ | 0.0162 | | $ | 0.1098 | | $ | 0.4358 | | $ | 0.58 |

The Fund notified stockholders by the end of January 2007 of amounts for use in preparing 2006 income tax returns.

100% of the distributions paid from net investment income and short-term capital gain qualify for the corporate dividends received deduction and meet the requirements of the tax rules regarding qualified dividend income. In addition, none of the distributions from net investment income include income derived from U.S. Treasury obligations. There were no assets invested in direct U.S. Government Obligations as of December 31, 2006.

11

HOW TO OBTAIN A COPY OF THE FUND’S PROXY VOTING POLICIES AND RECORDS

A description of the policies and procedures that are used by the Fund’s investment adviser to vote proxies relating to the Fund’s portfolio securities is available (1) without charge, upon request, by calling (800) 624-4190; (2) on the Fund’s website at www.blu.com and (3) on the Fund’s Form N-CSR which is available on the U.S. Securities and Exchange Commission (“SEC”) website at www.sec.gov.

Information regarding how the Fund’s investment adviser voted proxies relating to the Fund’s portfolio securities during the most recent 12-month period ended June 30 is available, (1) without charge, upon request by calling (800) 624-4190; (2) on the Fund’s website at www.blu.com and (3) on the SEC website at www.sec.gov.

QUARTERLY PORTFOLIO HOLDINGS

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the SEC’s Public Reference Room may be obtained by calling 1-800-SEC-0330. In addition, the Fund’s complete schedule of portfolio holdings for the first and third quarters of each fiscal year is available on the Fund’s website at www.blu.com.

SEND US YOUR E-MAIL ADDRESS

If you would like to receive monthly portfolio composition and characteristic updates, press releases and financial reports electronically as soon as they are available, please send an e-mail to blu@denveria.com and include your name and e-mail address. You will still receive paper copies of any required communications and reports in the mail. This service is completely voluntary and you can cancel at any time by contacting us via e-mail at blu@denveria.com or toll-free at 1-800-624-4190.

12

INFORMATION ON THE DIRECTORS AND OFFICERS OF THE FUND

The list below provides certain information about the identity and business experience of the directors and officers of the Fund.

INTERESTED DIRECTORS*

TODGER ANDERSON, CFA1

Age: 62

Position(s) Held with the Fund:

President and Director

Term of Office2 and Length of Time Served:

President since 1987. Director from 1988 to 1995 and since 1998. Term as Director expires in 2007.

Principal Occupations During the Past Five Years:

Chairman, Denver Investment Advisors LLC (since 2004);

President, Westcore Funds (since 2005);

President, Denver Investment Advisors LLC and predecessor organizations (1983-2004);

Portfolio Manager, Westcore MIDCO Growth Fund (1986-2005);

Portfolio Co-Manager, Westcore Select Fund (2001-2005).

Number of Portfolios in Fund Complex3

Overseen by Director: One

Other Directorships4 Held by Director: Fischer Imaging Corporation

The Fund’s President has certified to the New York Stock Exchange that, as of June 5, 2006, he was not aware of any violation by the Fund of the applicable NYSE Corporate Governance listing standards. In addition, the Fund has filed certifications of its principal executive officer and principal financial officer as exhibits to its reports on Form N-CSR filed with the Securities and Exchange Commission relating to the quality of the disclosures contained in such reports.

13

KENNETH V. PENLAND, CFA1

Age: 64

Position(s) Held with the Fund:

Chairman of the Board and Director

Term of Office2 and Length of Time Served:

Chairman of the Board and Director since 1987. Term as Director expires in 2009.

Principal Occupations During the Past Five Years:

Chairman, Denver Investment Advisors LLC and predecessor organizations (1983-2001);

President, Westcore Funds (1995-2001)

Trustee, Westcore Funds (2001-2005).

Number of Portfolios in Fund Complex3

Overseen by Director: One

Other Directorships4 Held by Director: None

INDEPENDENT DIRECTORS

RICHARD C. SCHULTE1

Age: 62

Position(s) Held with the Fund:

Director

Term of Office2 and Length of Time Served:

Director since 1987. Term expires in 2008.

Principal Occupations During the Past Five Years:

Private Investor;

President, Transportation Service Systems, Inc., a subsidiary of Southern Pacific Lines, Denver, Colorado (1993-1996);

Employee, Rio Grande Industries, Denver, Colorado (holding company) (1991-1993).

Number of Portfolios in Fund Complex3

Overseen by Director: One

Other Directorships4 Held by Director: None

14

ROBERTA M. WILSON, CFA1

Age: 63

Position(s) Held with the Fund:

Director

Term of Office2 and Length of Time Served:

Director since 1987. Term expires in 2009.

Principal Occupations During the Past Five Years:

Management consultant and coach (since 1998);

Director of Finance, Denver Board of Water Commissioners (Retired), Denver, Colorado (1985-1998).

Number of Portfolios in Fund Complex3

Overseen by Director: One

Other Directorships4 Held by Director: None

LEE W. MATHER, JR.1

Age: 63

Position(s) Held with the Fund:

Director

Term of Office2 and Length of Time Served:

Director since 2001. Term expires in 2008.

Principal Occupations During the Past Five Years:

Director, American Rivers (conservation organization) (2000-2006);

Investment Banker, Merrill Lynch & Co. (1977-2000).

Number of Portfolios in Fund Complex3

Overseen by Director: One

Other Directorships4 Held by Director: None

GARY P. MCDANIEL1

Age: 61

Position(s) Held with the Fund:

Director

Term of Office2 and Length of Time Served:

Director since 2001. Term expires in 2007.

Principal Occupations During the Past Five Years:

Senior Managing Director, BaseCamp Capital LLC (private equity investing) (since 2003);

Chief Executive Officer, Chateau Communities, Inc. (REIT/manufactured housing) (1997-2002).

Number of Portfolios in Fund Complex3

Overseen by Director: One

Other Directorships4 Held by Director: None

15

OFFICERS

MARK M. ADELMANN, CFA, CPA

Age: 49

1225 Seventeenth St. 26th Floor

Denver, Colorado 80202

Position(s) Held with the Fund:

Vice President

Term of Office2 and Length of Time Served:

Vice President since 2002.

Principal Occupations During the Past Five Years:

Vice President, Denver Investment Advisors LLC (since 2000);

Research Analyst, Denver Investment Advisors LLC (since 1995).

JOAN OHLBAUM SWIRSKY

Age: 49

One Logan Square

18th and Cherry Sts.

Philadelphia, PA 19103

Position(s) Held with the Fund:

Secretary

Term of Office2 and Length of Time Served:

Secretary since 2004.

Principal Occupations During the Past Five Years:

Counsel to the law firm of Drinker Biddle & Reath LLP, Philadelphia, PA.

16

JASPER R. FRONTZ, CPA, CFA5

Age: 38

1225 Seventeenth St. 26th Floor

Denver, Colorado 80202

Position(s) Held with the Fund:

Treasurer, Chief Compliance Officer

Term of Office2 and Length of Time Served:

Treasurer since 1997, Chief Compliance Officer since 2004.

Principal Occupations During the Past Five Years:

Vice President, Denver Investment Advisors LLC (since 2000);

Director of Mutual Fund Administration, Denver Investment Advisors LLC (since 1997);

Fund Controller, ALPS Mutual Fund Services, Inc. (1995-1997);

Registered Representative, ALPS Distributors, Inc. (since 1995).

NOTES

* These directors each may be deemed to be an “interested director” of the Fund within the meaning of the Investment Company Act of 1940 by virtue of their affiliations with the Fund’s investment adviser and their positions as officers of the Fund.

1. Each director may be contacted by writing to the director, c/o Blue Chip Value Fund, Inc., 1225 Seventeenth Street, 26th Floor, Denver, Colorado 80202, Attn: Jasper Frontz.

2. The Fund’s By-Laws provide that the Board of Directors shall consist of three classes of members. Directors are chosen for a term of three years, and the term of one class of directors expires each year. The officers of the Fund are elected by the Board of Directors and, subject to earlier termination of office, each officer holds office for one year and until his or her successor is elected and qualified.

3. The Fund complex is comprised of thirteen portfolios, the Fund, eleven Westcore Funds and the Dunham Small-Cap Value Fund.

4. Includes only directorships of companies required to report to the Securities and Exchange Commission under the Securities Exchange Act of 1934 (i.e., “public companies”) or other investment companies registered under the Investment Company Act of 1940.

5. Mr. Frontz also serves as Treasurer and Chief Compliance Officer of Westcore Funds.

17

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Directors of Blue Chip Value Fund, Inc.:

We have audited the accompanying statement of assets and liabilities of Blue Chip Value Fund Inc., (the “Fund”), including the statement of investments, as of December 31, 2006, and the related statements of operations and cash flows for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2006, by correspondence with the custodian and brokers. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Blue Chip Value Fund, Inc. as of December 31, 2006, the results of its operations and its cash flows for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

| DELOITTE & TOUCHE LLP | |

| Denver, Colorado | February 21, 2007 |

18

BLUE CHIP VALUE FUND, INC.

STATEMENT OF INVESTMENTS

December 31, 2006

| | | | | | | |

| | | | | | Market |

| | Shares | | Cost | | Value |

| COMMON STOCKS – 107.57% | | | | | |

| CAPITAL GOODS – 9.95% | | | | | |

| Aerospace & Defense – 4.52% | | | | | |

| General Dynamics Corp. | 53,400 | $ | 2,817,927 | | $ | 3,970,290 |

| Raytheon Co. | 62,300 | | 2,320,567 | | | 3,289,440 |

| | | | 5,138,494 | | | 7,259,730 |

| Electrical Equipment – 2.08% | | | | | |

| General Electric Co. | 89,900 | | 3,221,255 | | | 3,345,179 |

| Industrial Products – 3.35% | | | | | |

| ITT Industries Inc. | 34,300 | | 1,744,525 | | | 1,948,926 |

| Parker Hannifin Corp. | 44,600 | | 3,140,511 | | | 3,428,848 |

| | | | 4,885,036 | | | 5,377,774 |

| TOTAL CAPITAL GOODS | | | 13,244,785 | | | 15,982,683 |

| | | | | | | |

| COMMERCIAL SERVICES – 4.76% | | | |

| IT Services – 2.04% | | | | | | |

| Computer | | | | | | |

| Sciences Corp.** | 61,450 | | 2,920,440 | | | 3,279,586 |

| Transaction Processing – 2.72% | | | | | |

| First Data Corp. | 91,200 | | 2,000,026 | | | 2,327,424 |

| The Western Union Co. | 91,200 | | 1,674,567 | | | 2,044,704 |

| | | | 3,674,593 | | | 4,372,128 |

| TOTAL COMMERCIAL SERVICES | | 6,595,033 | | | 7,651,714 |

| | | | | |

| COMMUNICATIONS – 4.12% | | | | | |

| Networking – 2.63% | | | | | | |

| Cisco Systems, Inc.** | 154,800 | | 3,864,637 | | | 4,230,684 |

| Telecomm Equipment & Solutions – 1.49% | | | |

| Nokia Corp. | 117,600 | | 1,871,784 | | | 2,389,632 |

| TOTAL COMMUNICATIONS | | 5,736,421 | | | 6,620,316 |

| | | | | | | |

| CONSUMER CYCLICAL – 11.07% | | | |

| Clothing & Accessories – 2.76% | | | | | |

| TJX Companies Inc. | 155,900 | | 3,681,804 | | | 4,440,032 |

| Hotels & Gaming – 2.17% | | | | | |

| Starwood Hotels & | | | | | | |

| Resorts Worldwide Inc. | 55,700 | | 2,165,453 | | | 3,481,250 |

| Publishing & Media – 2.97% | | | | | |

| Walt Disney Co. | 139,300 | | 3,518,260 | | | 4,773,811 |

| Restaurants – 1.86% | | | | | | |

| Darden Restaurants Inc. | 74,340 | | 1,931,625 | | | 2,986,238 |

| Retail – 1.31% | | | | | | |

| JC Penney Co. Inc. | 27,100 | | 1,544,216 | | | 2,096,456 |

| TOTAL CONSUMER CYCLICAL | | 12,841,358 | | | 17,777,787 |

19

| | | | | | Market |

| | Shares | | Cost | | Value |

| CONSUMER STAPLES – 8.43% | | | | | | |

| Food – 2.86% | | | | | | | |

| Campbell Soup Co. | 118,200 | | $ | 3,732,307 | | $ | 4,596,798 |

| Food & Agricultural Products – 2.70% | | | |

| Bunge Ltd. | 59,700 | | | 2,694,267 | | | 4,328,847 |

| Home Products – 2.87% | | | | | | |

| Colgate Palmolive Co. | 70,700 | | | 4,015,829 | | | 4,612,468 |

| TOTAL CONSUMER STAPLES | | | 10,442,403 | | | 13,538,113 |

| | | | | | | | |

| ENERGY – 8.53% | | | | | | | |

| Exploration & Production – 4.25% | | | |

| Occidental | | | | | | | |

| Petroleum Corp. | 77,200 | | | 2,268,139 | | | 3,769,676 |

| XTO Energy Inc. | 65,200 | | | 2,031,830 | | | 3,067,660 |

| | | | | 4,299,969 | | | 6,837,336 |

| Integrated Oils – 2.11% | | | | | | |

| Marathon Oil Corp. | 36,600 | | | 1,555,082 | | | 3,385,500 |

| Oil Services – 2.17% | | | | | | | |

| Transocean Inc.** | 43,100 | | | 1,599,884 | | | 3,486,359 |

| TOTAL ENERGY | | | | 7,454,935 | | | 13,709,195 |

| | | | | | | | |

| FINANCIALS – 27.49% | | | | | | | |

| Insurance – 4.39% | | | | | | | |

| ACE Ltd. | 69,700 | | | 3,855,884 | | | 4,221,729 |

| MBIA Inc. | 38,700 | | | 2,264,492 | | | 2,827,422 |

| | | | | 6,120,376 | | | 7,049,151 |

| Integrated Financial Services – 6.09% | | | |

| American | | | | | | | |

| International Group | 66,600 | | | 4,280,680 | | | 4,772,556 |

| Citigroup Inc. | 90,000 | | | 3,993,449 | | | 5,013,000 |

| | | | | 8,274,129 | | | 9,785,556 |

| Money Center Banks – 5.96% | | | | | | |

| Bank of America Corp. | 70,800 | | | 3,365,173 | | | 3,780,012 |

| The Bank of | | | | | | | |

| New York Co. Inc. | 93,100 | | | 3,289,567 | | | 3,665,347 |

| SunTrust Banks Inc. | 25,200 | | | 1,944,385 | | | 2,128,140 |

| | | | | 8,599,125 | | | 9,573,499 |

| Regional Banks – 2.32% | | | | | | |

| US Bancorp | 50,300 | | | 1,441,756 | | | 1,820,357 |

| Wachovia Corp. | 33,500 | | | 1,622,953 | | | 1,907,825 |

| | | | | 3,064,709 | | | 3,728,182 |

| Securities & Asset Management – 3.85% | | | |

| Merrill Lynch & | | | | | | | |

| Company Inc. | 32,800 | | | 1,797,762 | | | 3,053,680 |

| Morgan Stanley & Co. | 38,500 | | | 2,045,205 | | | 3,135,055 |

| | | | | 3,842,967 | | | 6,188,735 |

| Specialty Finance – 3.12% | | | | | | |

| Countrywide | | | | | | | |

| Financial Corp. | 54,400 | | | 1,873,608 | | | 2,309,280 |

20

| | | | | | Market |

| | Shares | | Cost | | Value |

| Freddie Mac | 39,800 | | $ | 2,536,727 | | $ | 2,702,420 |

| | | | | 4,410,335 | | | 5,011,700 |

| Thrifts – 1.76% | | | | | | | |

| Washington Mutual Inc. | 62,100 | | | 2,453,728 | | | 2,824,929 |

| TOTAL FINANCIALS | | | | 36,765,369 | | | 44,161,752 |

| | | | | | | |

| MEDICAL - HEALTHCARE – 17.67% | | | |

| Healthcare Services – 1.15% | | | | | | |

| Caremark Rx Inc. | 32,300 | | | 1,807,926 | | | 1,844,653 |

| Medical Technology – 3.10% | | | | | | |

| Medtronic Inc. | 93,100 | | | 4,567,216 | | | 4,981,781 |

| Pharmaceuticals – 13.42% | | | | | | |

| Abbott Laboratories | 124,100 | | | 5,265,894 | | | 6,044,911 |

| Amgen Inc.** | 66,300 | | | 3,898,633 | | | 4,528,953 |

| Barr Pharmaceuticals Inc.** | 32,800 | | | 1,518,135 | | | 1,643,936 |

| Teva Pharmaceutical | | | | | | | |

| Industries Ltd. | 160,100 | | | 4,249,764 | | | 4,975,908 |

| Zimmer Holdings Inc.** | 55,800 | | | 3,815,891 | | | 4,373,604 |

| | | | | 18,748,317 | | | 21,567,312 |

| TOTAL MEDICAL - HEALTHCARE | | | 25,123,459 | | | 28,393,746 |

| | | | | | | | |

| TECHNOLOGY – 12.79% | | | | | | |

| Computer Software – 8.73% | | | | | | |

| International Business | | | | | | | |

| Machines Corp. | 49,000 | | | 3,936,517 | | | 4,760,350 |

| Microsoft Corp. | 237,300 | | | 6,606,978 | | | 7,085,778 |

| Verisign Inc.** | 90,800 | | | 2,055,871 | | | 2,183,740 |

| | | | | 12,599,366 | | | 14,029,868 |

| Semiconductors – 4.06% | | | | | | |

| Altera Corp.** | 141,700 | | | 2,723,165 | | | 2,788,656 |

| Intel Corp. | 184,200 | | | 3,621,541 | | | 3,730,050 |

| | | | | 6,344,706 | | | 6,518,706 |

| TOTAL TECHNOLOGY | | | | 18,944,072 | | | 20,548,574 |

| | | | | | | |

| TRANSPORTATION – 2.76% | | | | | | |

| Railroads – 2.76% | | | | | | | |

| Norfolk Southern Corp. | 88,300 | | | 3,165,139 | | | 4,440,607 |

| TOTAL TRANSPORTATION | | | 3,165,139 | | | 4,440,607 |

| TOTAL COMMON STOCKS | | | | 140,312,974 | | | 172,824,487 |

| | | | | | | |

| SHORT TERM INVESTMENTS – 0.19% | | | |

| Goldman Sachs Financial | | | | | | | |

| Square Prime Obligations | | | | | | |

| Fund - FST Shares | 307,160 | | | 307,160 | | | 307,160 |

| TOTAL SHORT TERM | | | | | | | |

| INVESTMENTS | | | | 307,160 | | | 307,160 |

| | | | | | | | |

| TOTAL | | | | | | | |

| INVESTMENTS | 107.76% | | $ | 140,620,134 | | $ | 173,131,647 |

| Liabilities in Excess | | | | | | | |

| of Other Assets | (7.76%) | | | | | | (12,468,291) |

| NET ASSETS | 100.00% | | | | | $ | 160,663,356 |

**Denotes non-income producing security.

Please note that the Fund’s investments are primarily in U.S. based issuers.

See accompanying notes to financial statements.

21

BLUE CHIP VALUE FUND, INC.

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2006

| ASSETS | |

| Investments at market value | $ 173,131,647 |

| (identified cost $140,620,134) | |

| Dividends receivable | 216,292 |

| Interest receivable | 1,929 |

| Other assets | 10,815 |

| TOTAL ASSETS | 173,360,683 |

| | |

| | |

| LIABILITIES | |

| Loan payable to bank (Note 4) | 8,280,000 |

| Interest due on loan payable to bank | 48,906 |

| Distribution payable | 4,203,316 |

| Advisory fee payable | 84,130 |

| Administration fee payable | 10,112 |

| Accrued Compliance Officer fees | 5,250 |

| Accrued expenses and other liabilities | 65,613 |

| TOTAL LIABILITIES | 12,697,327 |

| NET ASSETS | $ 160,663,356 |

| | |

| | |

| COMPOSITION OF NET ASSETS | |

| Capital stock, at par | $ 280,221 |

| Paid-in-capital | 128,643,012 |

| Accumulated net realized loss | (771,390) |

| Net unrealized appreciation on investments | 32,511,513 |

| NET ASSETS | $ 160,663,356 |

| | |

| | |

| SHARES OF COMMON STOCK | |

| OUTSTANDING (100,000,000 shares | |

| authorized at $0.01 par value) | 28,022,104 |

| | |

| Net asset value per share | $ 5.73 |

| | |

| | |

| See accompanying notes to financial statements. | |

22

BLUE CHIP VALUE FUND, INC.

STATEMENT OF OPERATIONS

For the Year Ended December 31, 2006

| INCOME | | | | |

| Dividends (net of foreign | | | | |

| withholding taxes of $25,381) | $ 2,638,622 | | |

| Interest | | 22,158 | | |

| TOTAL INCOME | | | | $ 2,660,780 |

| | | | | |

| EXPENSES | | | | |

| Investment advisory fee | | | | |

| (Note 3) | | 940,922 | | |

| Administrative services fee | | | | |

| (Note 3) | | 102,318 | | |

| Interest on loan payable to bank | | 700,259 | | |

| Stockholder reporting | | 98,282 | | |

| Legal fees | | 76,010 | | |

| Directors’ fees | | 73,627 | | |

| Transfer agent fees | | 56,677 | | |

| NYSE listing fees | | 26,853 | | |

| Audit and tax preparation fees | | 24,310 | | |

| Chief Compliance Officer fees | | 19,000 | | |

| Insurance and fidelity bond | | 15,935 | | |

| Custodian fees | | 9,627 | | |

| Other | | 5,842 | | |

| TOTAL EXPENSES | | | | 2,149,662 |

| NET INVESTMENT INCOME | | | | 511,118 |

| REALIZED AND UNREALIZED | | | | |

| GAIN/(LOSS) ON INVESTMENTS | | | | |

| Net realized gain on investments | | | | 4,058,061 |

| Change in net unrealized appreciation/ | | |

| depreciation of investments | | | | 14,782,873 |

| NET GAIN ON INVESTMENTS | | | 18,840,934 |

| NET INCREASE IN NET ASSETS | | |

| RESULTING FROM OPERATIONS | | $ 19,352,052 |

| | | |

| |

| |

| See accompanying notes to financial statements. |

23

BLUE CHIP VALUE FUND, INC.

STATEMENTS OF CHANGES IN NET ASSETS

| | For the | | For the |

| | Year Ended | | Year Ended |

| | December 31, | | December 31, |

| | 2006 | | 2005 |

| | | | |

| Increase in net assets | | | | | |

| from operations: | | | | | |

| Net investment income | $ | 511,118 | | $ | 329,874 |

| Net realized gain from | | | | | |

| securities transactions | | 4,058,061 | | | 1,517,539 |

| Change in net unrealized | | | | | |

| appreciation or depreciation | | | | | |

| of investments | | 14,782,873 | | | 9,792,262 |

| | | 19,352,052 | | | 11,639,675 |

| | | | | | |

| | | | | | |

| Decrease in net assets | | | | | |

| from distributions to | | | | | |

| stockholders from: | | | | | |

| Net investment income | | (511,118) | | | (411,781) |

| Net realized gain on | | | | | |

| investments | | (3,514,240) | | | (3,102,020) |

| Return of capital | | (12,139,609) | | | (12,152,094) |

| | | (16,164,967) | | | (15,665,895) |

| | | | | | |

| | | | | | |

| Increase in net assets from | | | | | |

| common stock transactions: | | | | | |

| Net asset value of common | | | | | |

| stock issued to stockholders | | | | | |

| from reinvestment of | | | | | |

| dividends (398,849 and | | | | | |

| 379,616 shares issued, | | | | | |

| respectively) | | 2,267,911 | | | 2,331,343 |

| | | 2,267,911 | | | 2,331,343 |

| | | | | | |

| NET INCREASE/(DECREASE) | | | | | |

| IN NET ASSETS | | 5,454,996 | | | (1,694,877) |

| | | | | | |

| NET ASSETS | | | | | |

| Beginning of year | | 155,208,360 | | | 156,903,237 |

| End of year (including | | | | | |

| undistributed net | | | | | |

| investment income of | | | | | |

| $0 and $0, respectively) | $ | 160,663,356 | | $ | 155,208,360 |

| | | | | | |

| | | | | | |

| See accompanying notes to financial statements. | | | |

24

BLUE CHIP VALUE FUND, INC.

STATEMENT OF CASH FLOWS

For the Year Ended December 31, 2006

| Cash Flows from Operating Activities | | |

| Net increase in net assets from operations | $ 19,352,052 |

| Adjustments to reconcile net increase in net | | |

| assets from operations to net cash provided | | |

| by operating activities: | | |

| Purchase of investment securities | | (62,105,818) |

| Proceeds from disposition of | | |

| investment securities | | 79,805,903 |

| Net proceeds from disposition of | | |

| short-term investment securities | | 1,135,030 |

| Proceeds from class-action | | |

| litigation settlements | | 233,298 |

| Net realized gain from securities investments | | (4,058,061) |

| Net change in unrealized appreciation | | |

| on investments | | (14,782,873) |

| Increase in dividends and interest receivable | | (26,779) |

| Decrease in other assets | | 2,827 |

| Increase in advisory fee payable | | 5,968 |

| Increase in administrative fee payable | | 463 |

| Increase in accrued Compliance Officer fees | | 83 |

| Increase in other accrued expenses and payables | | 54,963 |

| Net cash provided by operating activities | | 19,617,056 |

| | | |

| Cash Flows from Financing Activities | | |

| Proceeds from bank borrowing | | 4,320,000 |

| Repayment of bank borrowing | | (10,040,000) |

| Cash distributions paid | | (13,897,056) |

| Net cash used in financing activities | | (19,617,056) |

| | | |

| Net increase in cash | | 0 |

| Cash, beginning balance | | 0 |

| Cash, ending balance | | 0 |

| | | |

| Supplemental disclosure of cash flow information: |

| Noncash financing activities not included herein consist of |

| reinvestment of dividends and distributions of $2,267,911. |

| | | |

| | | |

| See accompanying notes to financial statements. | | |

25

BLUE CHIP VALUE FUND, INC.

FINANCIAL HIGHLIGHTS

| | For the year ended December 31, |

| | | | | | | | | |

| | 2006 | | 2005 | | 2004 |

| Per Share Data | | | | | | | | |

| (for a share outstanding throughout each period) | | | | | | | | |

| Net asset value – beginning of period | $ | 5.62 | | $ | 5.76 | | $ | 5.58 |

| Investment operations(1) | | | | | | | | |

| Net investment income | | 0.02 | | | 0.01 | | | 0.03 |

| Net gain (loss) on investments | | 0.67 | | | 0.42 | | | 0.71 |

| Total from investment operations | | 0.69 | | | 0.43 | | | 0.74 |

| | | | | | | | | |

| Distributions | | | | | | | | |

| From net investment income | | (0.02) | | | (0.02) | | | (0.03) |

| From net realized gains on investments | | (0.13) | | | (0.11) | | | (0.53) |

| Return of capital | | (0.43) | | | (0.44) | | | — |

| Total distributions | | (0.58) | | | (0.57) | | | (0.56) |

| | | | | | | | | |

| Capital Share Transactions | | | | | | | | |

| Dilutive effects of rights offerings | | — | | | — | | | — |

| Offering costs charged to paid in capital | | — | | | — | | | — |

| Total capital share transactions | | — | | | — | | | — |

| Net asset value, end of period | $ | 5.73 | | $ | 5.62 | | $ | 5.76 |

| Per share market value, end of period | $ | 5.96 | | $ | 6.31 | | $ | 6.68 |

| | | | | | | | | |

| Total investment return(2) based on: | | | | | | | | |

| Market Value | | 4.6% | | | 3.7% | | | 19.2% |

| Net Asset Value | | 12.9% | | | 7.1% | | | 13.1% |

| Ratios/Supplemental data: | | | | | | | | |

| Ratio of total expenses to average net assets(3) | | 1.36% | | | 1.33% | | | 1.12% |

| Ratio of net investment income to average net assets | | 0.32% | | | 0.21% | | | 0.57% |

| Ratio of total distributions to average net assets | | 10.25% | | | 10.13% | | | 10.16% |

| Portfolio turnover rate(4) | | 36.54% | | | 40.96% | | | 115.39% |

| Net assets – end of period (in thousands) | $ | 160,663 | | $ | 155,208 | | $ | 156,903 |

See accompanying notes to financial statements.

(1) Per share amounts calculated based on average shares outstanding during the period.

(2) Total investment return is calculated assuming a purchase of common stock on the opening of the first day and a sale on the closing of the last day of each period reported. Dividends and distributions, if any, are assumed for purposes of this calculation to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. Rights offerings, if any, are assumed for purposes of this calculation to be fully subscribed under the terms of the rights offering. Please note that the Fund’s total investment return does not reflect the deduction of taxes that a stockholder would pay on Fund distributions or the sale of Fund shares. Generally, total investment return based on net asset value will be higher than total investment return based on market value in periods where there is an increase in the discount or a decrease in the premium of the market value to the net asset value from the beginning to the end of such periods. Conversely, total investment return based on the net asset value will be lower than total investment return based on market value in periods where there is a decrease in the discount or an increase in the premium of the market value to the net asset value from the beginning to the end of such periods.

(3) For the years ended December 31, 2006, 2005 and 2004, the ratio of total expenses to average net assets excluding interest expense was 0.92%, 0.97% and 0.99%, respectively. For all prior years presented, the interest expense, if any, was less than 0.01%.

(4) A portfolio turnover rate is the percentage computed by taking the lesser of purchases or sales of portfolio securities (excluding short-term investments) for a year and dividing it by the monthly average of the market value of the portfolio securities during the year. Purchases and sales of investment securities (excluding short-term securities) for the year ended December 31, 2006 were $62,105,818 and $79,805,903, respectively.

26

| | For the year ended December 31, |

| | | | | | |

| | 2003 | | 2002 |

| Per Share Data | | | | | |

| (for a share outstanding throughout each period) | | | | | |

| Net asset value – beginning of period | $ | 4.85 | | $ | 6.94 |

| Investment operations(1) | | | | | |

| Net investment income | | 0.01 | | | 0.04 |

| Net gain (loss) on investments | | 1.23 | | | (1.40) |

| Total from investment operations | | 1.24 | | | (1.36) |

| | | | | | |

| Distributions | | | | | |

| From net investment income | | (0.01) | | | (0.04) |

| From net realized gains on investments | | — | | | — |

| Return of capital | | (0.50) | | | (0.52) |

| Total distributions | | (0.51) | | | (0.56) |

| | | | | | |

| Capital Share Transactions | | | | | |

| Dilutive effects of rights offerings | | — | | | (0.16) |

| Offering costs charged to paid in capital | | — | | | (0.01) |

| Total capital share transactions | | — | | | (0.17) |

| Net asset value, end of period | $ | 5.58 | | $ | 4.85 |

| Per share market value, end of period | $ | 6.14 | | $ | 4.59 |

| | | | | | |

| Total investment return(2) based on: | | | | | |

| Market Value | | 46.9% | | | (32.2%) |

| Net Asset Value | | 26.4% | | | (20.6%) |

| Ratios/Supplemental data: | | | | | |

| Ratio of total expenses to average net assets(3) | | 1.13% | | | 0.93% |

| Ratio of net investment income to average net assets | | 0.27% | | | 0.64% |

| Ratio of total distributions to average net assets | | 10.07% | | | 10.15% |

| Portfolio turnover rate(4) | | 52.58% | | | 65.86% |

| Net assets – end of period (in thousands) | $ | 150,057 | | $ | 128,713 |

See accompanying notes to financial statements.

(1) Per share amounts calculated based on average shares outstanding during the period.

(2) Total investment return is calculated assuming a purchase of common stock on the opening of the first day and a sale on the closing of the last day of each period reported. Dividends and distributions, if any, are assumed for purposes of this calculation to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. Rights offerings, if any, are assumed for purposes of this calculation to be fully subscribed under the terms of the rights offering. Please note that the Fund’s total investment return does not reflect the deduction of taxes that a stockholder would pay on Fund distributions or the sale of Fund shares. Generally, total investment return based on net asset value will be higher than total investment return based on market value in periods where there is an increase in the discount or a decrease in the premium of the market value to the net asset value from the beginning to the end of such periods. Conversely, total investment return based on the net asset value will be lower than total investment return based on market value in periods where there is a decrease in the discount or an increase in the premium of the market value to the net asset value from the beginning to the end of such periods.

(3) For the years ended December 31, 2006, 2005 and 2004, the ratio of total expenses to average net assets excluding interest expense was 0.92%, 0.97% and 0.99%, respectively. For all prior years presented, the interest expense, if any, was less than 0.01%.

(4) A portfolio turnover rate is the percentage computed by taking the lesser of purchases or sales of portfolio securities (excluding short-term investments) for a year and dividing it by the monthly average of the market value of the portfolio securities during the year. Purchases and sales of investment securities (excluding short-term securities) for the year ended December 31, 2006 were $62,105,818 and $79,805,903, respectively.

27

BLUE CHIP VALUE FUND, INC.

NOTES TO FINANCIAL STATEMENTS

December 31, 2006

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Blue Chip Value Fund, Inc. (the “Fund”) is registered under the Investment Company Act of 1940, as amended, as a diversified, closed-end management investment company.

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.

Security Valuation – All securities of the Fund are valued as of the close of regular trading on the New York Stock Exchange (“NYSE”), currently 4:00 p.m. (Eastern Time), on each day that the NYSE is open. Listed securities are generally valued at the last sales price as of the close of regular trading on the NYSE. Securities traded on the National Association of Securities Dealers Automated Quotation (“NASDAQ”) are generally valued at the NASDAQ Official Closing Price (“NOCP”). In the absence of sales and NOCP, such securities are valued at the mean of the bid and asked prices.

Securities having a remaining maturity of 60 days or less are valued at amortized cost which approximates market value.

When market quotations are not readily available or when events occur that make established valuation methods unreliable, securities of the Fund may be valued at fair value determined in good faith by or under the direction of the Board of Directors. Factors which may be considered when determining the fair value of a security include (a) the fundamental data relating to the investment; (b) an evaluation of the forces which influence the market in which the security is sold, including the liquidity and depth of the market; (c) the market value at date of purchase; (d) information as to any transactions or offers with respect to the security or comparable securities; and (e) any other relevant matters.

Investment Transactions – Investment transactions are accounted for on the date the investments are purchased or sold (trade date). Realized gains and losses from investment transactions and unrealized appreciation and depreciation of investments are determined on the “specific identification” basis for both financial statement and federal income tax purposes. Dividend income is recorded on the ex-dividend date. Interest income, which includes interest earned on money market funds, is accrued and recorded daily.

28

Federal Income Taxes – The Fund intends to comply with the requirements of the Internal Revenue Code that are applicable to regulated investment companies and to distribute all of its taxable income to its stockholders. Therefore, no provision has been made for federal income taxes.

The tax character of the distributions paid was as follows:

| | Year Ended | | Year Ended |

| | December 31, | | December 31, |

| | 2006 | | 2005 |

| | | | |

| Distributions paid from: | | | | | |

| Ordinary income | $ | 960,443 | | $ | 1,073,408 |

| Long-term capital gain | | 3,064,915 | | | 2,440,387 |

| Return of capital | | 12,139,609 | | | 12,152,100 |

| Total | $ | 16,164,967 | | $ | 15,665,895 |

As of December 31, 2006 the components of distributable earnings on a tax basis were as follows:

| Accumulated net realized gain | $ | 0 |

| Net unrealized appreciation/(depreciation) | | 31,740,130 |

| Total | $ | 31,740,130 |

The difference between book basis and tax basis is attributable to the tax deferral of losses on wash sales and post-October losses.

Distributions to Stockholders – Distributions to stockholders are recorded on the ex-dividend date.

The Fund currently maintains a “managed distribution policy” which distributes at least 2.5% of its net asset value quarterly to its stockholders. These fixed distributions are not related to the amount of the Fund’s net investment income or net realized capital gains or losses and will be classified to conform to the tax reporting requirements of the Internal Revenue Code.

Denver Investment Advisors LLC (“DenverIA”) generally seeks to minimize realized capital gain distributions without generating capital loss carryforwards. As such, if the Fund’s total distributions required by the fixed quarterly payout policy for the year exceed the Fund’s “current and accumulated earnings and profits,” the excess will be treated as non-taxable return of capital, reducing the stockholder’s adjusted basis in his or her shares. Although capital loss carryforwards may offset any current year net realized capital gains, such amounts do not reduce the Fund’s “current earnings and profits.” Therefore, to the extent that current year net realized capital gains are offset by capital loss carryforwards, such excess

29

distributions would be classified as taxable ordinary income rather than non-taxable return of capital. In this situation, the Fund’s Board of Directors would consider that factor, among others, in determining whether to retain, alter or eliminate the “managed distribution policy.” The Fund’s distribution policy may be changed at the discretion of the Fund’s Board of Directors. At this time, the Board of Directors has no plans to change the current policy.

Use of Estimates – The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the amounts reported in the financial statements and disclosures made in the accompanying notes to the financial statements. Actual results could differ from those estimates.

2. UNREALIZED APPRECIATION AND DEPRECIATION OF INVESTMENTS (TAX BASIS)

| As of December 31, 2006: | | |

| Gross appreciation (excess of value over tax cost) | $ | 31,875,032 |

| Gross depreciation (excess of tax cost over value) | | (134,902) |

| Net unrealized appreciation/(depreciation) | $ | 31,740,130 |

| Cost of investments for income tax purposes | $ | 141,391,517 |

3. INVESTMENT ADVISORY AND ADMINISTRATION SERVICES

The Fund has an Investment Advisory Agreement with Denver Investment Advisors LLC (“DenverIA”), whereby a management fee is paid to DenverIA based on an annual rate of 0.65% of the Fund’s average weekly net assets up to $100,000,000 and 0.50% of the Fund’s average weekly net assets in excess of $100,000,000. The management fee is paid monthly based on the average of the net assets of the Fund computed as of the last business day the New York Stock Exchange is open each week. Certain officers and a director of the Fund are also officers of DenverIA.

ALPS Fund Services, Inc. (“ALPS”) and DenverIA serve as the Fund’s co-administrators. The Administrative Agreement includes the Fund’s administrative and fund accounting services. The administrative services fee is based on an annual rate for ALPS and DenverIA, respectively, of 0.0835% and

30

0.01% of the Fund’s average daily net assets up to $75,000,000, 0.04%, and 0.005% of the Fund’s average daily net assets between $75,000,000 and $125,000,000, and 0.02% and 0.005% of the Fund’s average daily net assets in excess of $125,000,000 plus certain out-of-pocket expenses. The administrative service fee is paid monthly.

Effective February 7, 2006, the administrative services fee for ALPS was increased to an annual rate of 0.0855% of the Fund’s average daily net assets up to $75,000,000. The remaining breakpoint fee schedule is unchanged.

The Directors have appointed a Chief Compliance Officer who is also Treasurer of the Fund and an employee of DenverIA. The Directors agreed that the Fund would reimburse DenverIA a portion of his compensation for his services as the Fund’s Chief Compliance Officer.

4. LINE OF CREDIT

The Fund has a line of credit with The Bank of New York (“BONY”) in which the Fund may borrow up to the lesser of $15,000,000 or the maximum amount the Fund is permitted to borrow under the Investment Company Act of 1940. The interest rate resets daily at overnight Federal Funds Rate plus 0.825%. The borrowings under the BONY loan are secured by a perfected security interest on all of the Fund’s assets.

Details of the line of credit are as follows:

| | | | Average for |

| | As of | | Year Ended |

| | December 31, | | December 31, |

| | 2006 | | 2006 |

| | | | |

| Loan outstanding | $ | 8,280,000 | | $ | 11,994,575 |

| Interest rate | | 6.08%* | | | 5.79% |

| % of Fund’s total assets | | 4.78% | | | 6.92% |

| Amount of debt per share | | | | | |

| outstanding | $ | 0.30 | | $ | 0.43 |

| Number of shares outstanding | | | | | |

| (in thousands) | | 28,022 | | | 27,858** |

| | | | | | |

| **Annualized | | | | | |

| **Weighted average | | | | | |

31

5. NEW ACCOUNTING PRONOUNCEMENTS

In June 2006, the Financial Accounting Standards Board (FASB) issued FASB Interpretation No. 48 – Accounting for Uncertainty in Income Taxes, that requires the tax effects of certain tax positions to be recognized. FASB Interpretation No. 48 is effective for fiscal periods beginning after December 15, 2006. Management of the Fund currently believes that FASB Interpretation No. 48 will have no impact on the Fund’s financial statements.

In September 2006, the Financial Accounting Standards Board (FASB) issued Statement of Financial Accounting Standards No. 157, “Fair Value Measurements” (SFAS No. 157). SFAS No. 157 defines fair value for securities in the Fund’s portfolio, establishes a framework for measuring fair value in accordance with generally accepted accounting principles and expands disclosure about fair value measurements. SFAS No. 157 is effective for fiscal years beginning after November 15, 2007. Management is currently evaluating the impact adoption of SFAS No. 157 will have on the Fund’s financial statement disclosures.

32

33

34

35

| BOARD OF DIRECTORS Kenneth V. Penland, Chairman Todger Anderson, Director Lee W. Mather, Jr, Director Gary P. McDaniel, Director Richard C. Schulte, Director Roberta M. Wilson, Director OFFICERS Kenneth V. Penland, Chairman Todger Anderson, President Mark M. Adelmann, Vice President Joan Ohlbaum Swirsky, Secretary Jasper R. Frontz, Treasurer, Chief Compliance Officer Investment Adviser/Co-Administrator Denver Investment Advisors LLC 1225 17th Street, 26th Floor Denver, CO 80202 Stockholder Relations Margaret R. Jurado (800) 624-4190 (option #2) e-mail: blu@denveria.com Custodian Bank of New York One Wall Street New York, NY 10286 Co-Administrator ALPS Fund Services, Inc. 1625 Broadway, Suite 2200 Denver, CO 80202 Transfer Agent Dividend Reinvestment Plan Agent (Questions regarding your Account) Mellon Investor Services, LLC 480 Washington Blvd. Jersey City, NJ 07310 (800) 624-4190 (option #1) www.melloninvestor.com NYSE Symbol—BLU

www.blu.com |

Item 2 - Code of Ethics

| (a) | The registrant, as of the end of the period covered by the report, has adopted a code of ethics that applies to the registrant's principal executive officer, principal financial officer, principal accounting officer or controller or any persons performing similar functions on behalf of the registrant. |

| | |

| (b) | Not applicable. |

| | |

| (c) | During the period covered by this report, no amendments were made to the provisions of the code of ethics adopted in 2(a) above. |

| | |

| (d) | During the period covered by this report, no implicit or explicit waivers to the provisions of the code of ethics adopted in 2(a) above were granted. |

| | |

| (e) | Not applicable. |

| | |

| (f) | The registrant's Code of Ethics is attached as an Exhibit hereto. |

Item 3 - Audit Committee Financial Expert

The Board of Directors of the registrant has determined that the registrant has at least one "audit committee financial expert" serving on its audit committee. The Board of Directors has designated Gary P. McDaniel and Roberta M. Wilson as the registrant's "audit committee financial experts." Mr. McDaniel and Ms. Wilson are "independent" as defined in paragraph (a)(2) of Item 3 to Form N-CSR.

Item 4. Principal Accountant Fees and Services

(a) Audit Fees: For the Registrant's fiscal years ended December 31, 2006 and December 31, 2005, the aggregate fees billed for professional services rendered by the principal accountant for the audit of the Registrant's annual financial statements were $22,000 and $19,000, respectively.

(b) Audit-Related Fees: In Registrant's fiscal years ended December 31, 2006 and December 31, 2005, no fees were billed for assurance and related services by the principal accountant that are reasonably related to the performance of the audit of the Registrant's financial statements and are not reported under paragraph (a) of this Item.

(c) Tax Fees: For the Registrant's fiscal years ended December 31, 2006 and December 31, 2005, aggregate fees of $2,310 and $2,150, respectively, were billed for professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning. The fiscal year 2004 tax fees were for tax return preparation services and assistance in preparing an application to change accounting method for the Registrant.

(d) All Other Fees: For the Registrant's fiscal year ended December 31, 2006 and December 31, 2005, no fees were billed to Registrant by the principal accountant for services other than the services reported in paragraph (a) through (c).

(e) (1) Audit Committee Pre-Approval Policies and Procedures: The Registrant's Audit Committee has not adopted pre-approval policies and procedures. Instead, the Audit Committee approves on a case-by-case basis each audit or non-audit service before the engagement.

(e) (2) No services described in paragraphs (b) through (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Not applicable.

(g) Aggregate non-audit fees of $2,310 were billed by the Registrant's principal accountant for services rendered to the Registrant and to Registrant's investment adviser for the Registrant's fiscal year ended December 31, 2006 and aggregate non-audit fees of $2,150 were billed by the Registrant's principal accountant for services rendered to the Registrant and to Registrant's investment adviser for the Registrant's fiscal year ended December 31, 2005.

(h) Not applicable.

Item 5 - Audit Committee of Listed Registrants

(a) The Registrant has a separately-designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Exchanges Act. The committee members are: Roberta M. Wilson, Richard C. Schulte, Lee W. Mather, Jr. and Gary P. McDaniel.

(b) Not applicable.

Item 6 - Schedule of Investments

Schedule of Investments is included as part of the Report to Stockholders filed under Item 1 of this form.

Item 7 - Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies

The Registrant's Board of Directors, at their February 2007 Board meeting, delegated to its investment adviser, Denver Investment Advisors, subject to the supervision of the Board, the authority to vote Registrant's proxies relating to portfolio securities and directed Denver Investment Advisors to follow and apply Denver Investment Advisors' proxy voting policies and procedures when voting such proxies. A copy of Denver Investment Advisors' Proxy Voting Policy which sets forth the guidelines to be utilized by Denver Investment Advisors in voting proxies for the Registrant follows.

Denver Investment Advisors LLC Proxy Voting Policy

Denver Investment Advisors LLC ("DenverIA"), unless otherwise directed by our clients, will make reasonable attempts to research, vote and record all proxy ballots for the security positions we maintain on our clients' behalf. To execute this responsibility to the highest standard, DenverIA relies heavily on its subscription to the ISS Proxy Voting system ("VoteX"). Institutional Shareholder Services ("ISS") provides proxy research and recommendations, as well as automated voting and record keeping, and is the world's leader in these services. Although ISS offers other consulting services to companies that it also makes proxy vote recommendations on, we review their policies a minimum of once per year and will only use ISS as long as we deem them independent.

1 We fully review annually ISS Proxy Voting Guidelines and follow their recommendations on most issues for shareholder vote. Subcategories within the guidelines include:

1) Operational Items

2) Board of Directors

3) Proxy Contests

4) Anti-takeover Defenses and Voting Related Issues

5) Mergers and Corporate Restructurings

6) State of Incorporation

7) Capital Structure

8) Executive and Director Compensation

9) Social and Environmental Issues

10) Mutual Fund Proxies

11) Global Proxy Voting Matters

In the rare instance where our portfolio research or security Analyst believes that any ISS recommendation would be to the detriment of our investment clients, we can and will override the ISS recommendation through a manual vote. The final authorization to override an ISS recommendation must be approved by the CCO, Executive Manager or Compliance Committee other than the Analyst. A written record supporting the decision to override the ISS recommendation will be maintained.

Special considerations are made for stocks traded on foreign exchanges. Specifically, if voting will hinder or impair the liquidity of these stocks, DenverIA will not exercise its voting rights.

For any matters subject to proxy vote for mutual funds in which DenverIA is an affiliated party, DenverIA will vote on behalf of clients invested in such mutual funds in accordance with ISS, with no exceptions.

Client information is automatically recorded in "VoteX" for record keeping. For accounts custodied at financial institutions that are not clients of ISS, physical proxy cards are received, marked and returned for voting. Those votes are then manually recorded in "VoteX". For client accounts held in an omnibus registration, ballots that are received will be voted, but no records for individual accounts held in omnibus registration are maintained.

DenverIA maintains proxy data showing the voting pattern on specific issues - either for an individual meeting or for all proxies voted within a specified time period, in addition to proxy voting on individual client accounts.

Upon request we have available ISS Proxy Voting Guidelines Summary documentation from the ISS Proxy Voting manual.

Last Amended: December 2006

ISS 2007 Proxy Voting Guidelines Summary

Effective for Meetings Feb 1, 2007

Updated December 15, 2006

The following is a condensed version of the proxy voting recommendations contained in the ISS Proxy Voting Manual.

| 1. Operational Items | 6 |

| Adjourn Meeting | 6 |

| Amend Quorum Requirements | 6 |

| Amend Minor Bylaws | 6 |

| Auditor Indemnification and Limitation of Liability | 6 |

| Auditor Ratification | 6 |

| Change Company Name | 7 |

| Change Date, Time, or Location of Annual Meeting | 7 |

| Transact Other Business | 7 |

| | |

| 2. Board of Directors: | 8 |

| Voting on Director Nominees in Uncontested Elections | 8 |

| 2007 Classification of Directors | 10 |

| Age Limits | 11 |

| Board Size | 11 |

| Classification/Declassification of the Board | 11 |

| Cumulative Voting | 11 |

| Director and Officer Indemnification and Liability Protection | 12 |

| Establish/Amend Nominee Qualifications | 12 |

| Filling Vacancies/Removal of Directors | 12 |

| Independent Chair (Separate Chair/CEO) | 13 |

| Majority of Independent Directors/Establishment of Committees | 13 |

| Majority Vote Shareholder Proposals | 13 |

| Office of the Board | 14 |

| Open Access | 14 |

| Performance Test for Directors | 14 |

| Stock Ownership Requirements | 15 |

| Term Limits | 15 |

| | |

| 3. Proxy Contests | 16 |

| Voting for Director Nominees in Contested Elections | 16 |

| Reimbursing Proxy Solicitation Expenses | 16 |

| Confidential Voting | 16 |

| | |

| 4. Antitakeover Defenses and Voting Related Issues | 17 |

| Advance Notice Requirements for Shareholder Proposals/Nominations | 17 |

| Amend Bylaws without Shareholder Consent | 17 |

| Poison Pills | 17 |

| Shareholder Ability to Act by Written Consent | 17 |

| Shareholder Ability to Call Special Meetings | 17 |

| Supermajority Vote Requirements | 17 |

| | |

| 5. Mergers and Corporate Restructurings | 18 |

| Overall Approach | 18 |

| Appraisal Rights | 18 |

| |

| | | 2 |

© 2006 Institutional Shareholder Services Inc. All Rights Reserved. |

| Asset Purchases | 18 |

| Asset Sales | 19 |

| Bundled Proposals | 19 |

| Conversion of Securities | 19 |

| Corporate Reorganization/Debt Restructuring/Prepackaged Bankruptcy Plans/Reverse | |

| Leveraged Buyouts/Wrap Plans | 19 |

| Formation of Holding Company | 19 |

| Going Private Transactions (LBOs, Minority Squeezeouts, and Going Dark) | 20 |

| Joint Ventures | 20 |

| Liquidations | 20 |

| Mergers and Acquisitions/ Issuance of Shares to Facilitate Merger or Acquisition | 20 |

| Private Placements/Warrants/Convertible Debentures | 20 |

| Spinoffs | 21 |

| Value Maximization Proposals | 21 |

| | |

| 6. State of Incorporation | 22 |

| Control Share Acquisition Provisions | 22 |

| Control Share Cash-out Provisions | 22 |

| Disgorgement Provisions | 22 |

| Fair Price Provisions | 22 |

| Freeze-out Provisions | 22 |

| Greenmail | 22 |

| Reincorporation Proposals | 23 |

| Stakeholder Provisions | 23 |

| State Antitakeover Statutes | 23 |

| | |

| 7. Capital Structure | 24 |

| Adjustments to Par Value of Common Stock | 24 |

| Common Stock Authorization | 24 |

| Dual-Class Stock | 24 |

| Issue Stock for Use with Rights Plan | 24 |

| Preemptive Rights | 24 |

| Preferred Stock | 24 |

| Recapitalization | 25 |

| Reverse Stock Splits | 25 |

| Share Repurchase Programs | 25 |

| Stock Distributions: Splits and Dividends | 25 |

| Tracking Stock | 25 |

| | |

| 8. Executive and Director Compensation | 26 |

| Equity Compensation Plans | 26 |

| Cost of Equity Plans | 26 |

| Repricing Provisions | 26 |

| Pay-for Performance Disconnect | 26 |

| Three-Year Burn Rate/Burn Rate Commitment | 28 |

| Poor Pay Practices | 29 |

| Specific Treatment of Certain Award Types in Equity Plan Evaluations: | 30 |

| Dividend Equivalent Rights | 30 |

| Liberal Share Recycling Provisions | 30 |

| Other Compensation Proposals and Policies | 30 |

| 401(k) Employee Benefit Plans | 30 |

| Director Compensation | 30 |

| Director Retirement Plans | 31 |

| Employee Stock Ownership Plans (ESOPs) | 31 |

| Employee Stock Purchase Plans-- Qualified Plans | 31 |

| |

| | | 3 |

© 2006 Institutional Shareholder Services Inc. All Rights Reserved. |

| Employee Stock Purchase Plans-- Non-Qualified Plans | 31 |

| Incentive Bonus Plans and Tax Deductibility Proposals (OBRA-Related | 32 |

| Compensation Proposals) | 32 |

| Options Backdating | 32 |

| Option Exchange Programs/Repricing Options | 32 |

| Stock Plans in Lieu of Cash | 33 |

| Transfer Programs of Stock Options | 33 |

| Shareholder Proposals on Compensation | 33 |

| Advisory Vote on Executive Compensation (Say-on-Pay) | 33 |

| Compensation Consultants- Disclosure of Board or Company’s Utilization | 33 |

| Disclosure/Setting Levels or Types of Compensation for Executives and Directors | 34 |

| Option Repricing | 34 |

| Pay for Superior Performance | 34 |

| Pension Plan Income Accounting | 34 |

| Performance-Based Awards | 35 |

| Severance Agreements for Executives/Golden Parachutes | 35 |

| Supplemental Executive Retirement Plans (SERPs) | 35 |

| | |

| 9. Corporate Responsibility | 36 |

| Consumer Issues and Public Safety | 36 |

| Animal Rights | 36 |

| Drug Pricing | 36 |

| Drug Reimportation | 36 |

| Genetically Modified Foods | 36 |

| Handguns | 37 |

| HIV/AIDS | 37 |

| Predatory Lending | 37 |

| Tobacco | 38 |

| Toxic Chemicals | 38 |

| Environment and Energy | 38 |

| Arctic National Wildlife Refuge | 38 |

| CERES Principles | 39 |

| Climate Change | 39 |

| Concentrated Area Feeding Operations (CAFOs) | 39 |

| Environmental-Economic Risk Report | 39 |

| Environmental Reports | 39 |

| Global Warming | 40 |

| Kyoto Protocol Compliance | 40 |

| Land Use | 40 |

| Nuclear Safety | 40 |

| Operations in Protected Areas | 40 |

| Recycling | 40 |

| Renewable Energy | 41 |

| Sustainability Report | 41 |

| General Corporate Issues | 41 |

| Charitable/Political Contributions | 41 |

| Disclosure of Lobbying Expenditures/Initiatives | 42 |

| Link Executive Compensation to Social Performance | 42 |

| Outsourcing/Offshoring | 42 |

| Labor Standards and Human Rights | 42 |

| China Principles | 42 |

| Country-specific Human Rights Reports | 42 |