UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-5003

Blue Chip Value Fund, Inc.

(Exact name of registrant as specified in charter)

1225 17th Street, 26th Floor, Denver, Colorado 80202 |

(Address of principal executive offices) (Zip code) |

Michael P. Malloy

Drinker Biddle & Reath LLP

One Logan Square

18th & Cherry Streets

Philadelphia, Pennsylvania 19103-6996

(Name and address of agent for service)

Registrant’s Telephone Number, including Area Code: (800) 624-4190

Date of fiscal year end: December 31

Date of reporting period: January 1, 2008 - December 31, 2008

Item 1 - Reports to Stockholders

Annual Report to Stockholders December 31, 2008 |

MANAGED DISTRIBUTION POLICY

The Blue Chip Value Fund, Inc. (the “Fund”) has a Managed Distribution Policy. This policy is to make quarterly distributions of at least 2.5% of the Fund’s net asset value (“NAV”) to stockholders. This is the quarterly payment that Fund investors elect to receive in cash or reinvest in additional shares through the Fund’s Dividend Reinvestment Plan. The Board of Directors believes this policy creates a predictable level of quarterly cash flow to Fund shareholders.

The table on the next page sets forth the amounts of the most recent quarterly distribution and the cumulative distributions paid during the 2008 fiscal year from the following sources: net investment income; net realized short term capital gains; net realized long term capital gains; and return of capital.

You should not necessarily draw any conclusions about the Fund’s investment performance from the amount of the distributions, as summarized in the table on the next page, or from the terms of the Fund’s Managed Distribution Policy.

The Fund distributed more than its income and capital gains during 2008; therefore, a portion of the distributions, as summarized in the table on the next page, is a return of capital. A return of capital may occur, for example, when some or all of the money that you invested in the Fund is paid back to you. A return of capital distribution does not necessarily reflect the Fund’s investment performance and should not be confused with “yield” or “income.” It is important to note that the Fund’s investment adviser, Denver Investment Advisors LLC, seeks to minimize the amount of net realized capital gains, if consistent with the Fund’s investment objective, to reduce the amount of income taxes incurred by our stockholders. This strategy can lead to greater levels of return of capital being paid out under the Managed Distribution Policy.

The amounts and sources of distributions reported are not being provided for tax reporting purposes. The Fund will send you a Form 1099-DIV for the calendar year that will tell you how to report these distributions for federal income tax purposes.

The Fund’s Managed Distribution Policy may be changed or terminated at the discretion of the Fund’s Board of Directors without prior notice to stockholders. If, for example, the Fund’s total distributions for the year result in taxable return of capital, the Fund’s Board of Directors would consider that factor, among others, in determining whether to retain, alter or eliminate the Managed Distribution Policy. It is possible, that the Fund’s market price may decrease if the Managed Distribution Policy is terminated. At this time, the Board has no intention of making any changes or terminating the Managed Distribution Policy.

ESTIMATED SOURCES OF DISTRIBUTIONS |

| | | Current

Distribution ($)

4th Quarter 2008

(Book Basis) | | % Breakdown

of the

Current

Distribution

4th Quarter 2008

(Book Basis) | | Total Cumulative

Distributions

for the 2008 Fiscal

Year to Date ($)

(Book Basis) | | % Breakdown

of the Total Cumulative

Distributions

for the 2008 Fiscal

Year to Date

(Book Basis) | | % Breakdown

of the Total Cumulative

Distributions

for the 2008 Fiscal

Year to Date

(Tax Basis) | |

Net Investment | | | | | | | | | | | |

Income | | $0.0093 | | 13.29% | | $0.0180 | | 4.29% | | 3.67% | |

Net Realized Short Term | | | | | | | | | | | |

| Capital Gains | | $0.0083 | | 11.86% | | $0.0000 | | 0.00% | | 0.00% | |

Net Realized Long Term | | | | | | | | | | | |

| Capital Gains | | $0.0524 | | 74.85% | | $0.0087 | | 2.07% | | 1.49% | |

| Return of Capital | | $0.0000 | | 0.00% | | $0.3933 | | 93.64% | | 94.84% | |

Total (per common share) | | $0.0700 | | 100.00% | | $0.4200 | | 100.00% | | 100.00% | |

| | | | | | | | | | | | |

| Average annual total return (in relation to NAV) for the 5 years | | | | | |

| ended December 31, 2008 | | | | (3.03%) | |

| Annualized current distribution rate expressed as a percentage | | | | | |

| of NAV as of December 31, 2008 | | | | 9.69% | |

| Cumulative total return (in relation to NAV) for the fiscal year | | | | | |

| through December 31, 2008 | | | | (39.25%) | |

| Cumulative fiscal year distributions as a percentage | | | | | |

| of NAV as of December 31, 2008 | | | | 14.53% | |

| | | | | | |

1-800-624-4190 | • www.blu.com | 1 |

Send Us Your E-mail Address

If you would like to receive monthly portfolio composition and characteristic updates, press releases and financial reports electronically as soon as they are available, please send an e-mail to blu@denveria.com and include your name and e-mail address. You will still receive paper copies of any required communications and reports in the mail. This service is completely voluntary and you can cancel at any time by contacting us via e-mail at blu@denveria.com or toll-free at 1-800-624-4190.

| 2 | Annual Report December 31, 2008 |

1-800-624-4190 | • www.blu.com | 3 |

INVESTMENT ADVISER’S COMMENTARY

| Dear Fellow Stockholders: | February 12, 2009 |

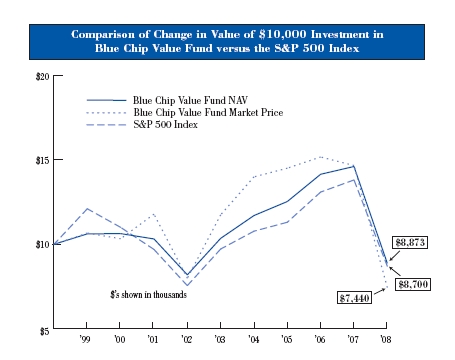

Market corrections, such as that experienced in 2008, most certainly test the resolve of investors. For the year ended December 31, 2008 the net asset value of the Blue Chip Value Fund, Inc. declined 39.25%. During this same period the S&P 500 Index, the Fund��s benchmark index, lost 37.00% and the Lipper Large Core peer group declined 37.07%. While the most likely reaction might be one of fear and retreat, in our opinion the historical ability of some American businesses to rise from the depths of recession to new heights of success suggests to us that this reaction is short-sighted. We believe that economic downturns and the associated market corrections provide investors with opportunities to invest in well-managed, fundamentally sound businesses.

Market weakness that had been centered on financials through much of the first three quarters became prevalent across most sectors by the fourth quarter. It appears to us that significant economic slowing became inevitable on the back of the financial crisis.

Turning to the portfolio, the relative outperformance of the Fund’s holdings in the basic materials sector for the year was driven by the Fund’s holding Ball Corporation (“Ball”). Ball is one of the world’s leading suppliers of rigid metal and plastic products and services, primarily to the food and beverage market. We believe that Ball’s exposure to the food and beverage can markets has made it more resilient to this economic slowdown. During 2008, the company initiated cost savings across its various businesses and recently announced plans to close two metal beverage container plants in North and South America. We believe these measures, as well as plant downtime, should help hold pricing at competitive levels and result in incremental cost savings for the company in the coming year.

Throughout 2008, we believe that investors increasingly began to give the Fund’s holding Amgen credit for its novel osteoporosis drug, Denosumab, helping to propel its stock price to a 24.4% return. We believe in the prospects for this drug not only for the treatment of osteoporosis, but also for the treatment of bone loss in oncology patients. Abbott Laboratories remains a top performer although it had a more difficult year with –2.5% return. In 2008, Abbott received FDA approval for its drug eluting stent, XIENCE V and Humira continues to receive FDA approval in other therapeutic areas. As a result of these holdings the Fund’s medical/healthcare holdings returned approximately –13.4% relative to the S&P 500’s sector return of –22.5%.

Fund holding, International Business Machines (“IBM”), continued to improve its free cash flow while maintaining profits through its increased focus on higher end mainframe computers. In the face of a weakening economy, IBM’s strong balance sheet provides some assurance, in our opinion, that it will be able to weather this economy and take advantage of opportunities that may arise. Technology stocks as a whole underperformed, however IBM’s performance meaningfully outperformed the market.

| 4 | Annual Report December 31, 2008 |

One of our best individual stocks for the year was Darden Restaurants, operator of Olive Garden and Red Lobster restaurants. Darden proved to be more resilient to the economic slowdown than other restaurants. It appears that its strong management team was able to manage labor and administrative costs effectively. Recently announced earnings for the fourth quarter were above expectations. We continue to believe that Darden’s value oriented restaurants are well positioned in this difficult environment.

Although interest rate-sensitive stocks in the portfolio were a disappointment during the first three quarters, they generated strong outperformance in the fourth quarter to finish the year modestly ahead. Early in 2008 we sold Citigroup, and became overweight in property casualty insurers, Travelers and ACE Ltd. Given difficult financial markets, we believe that insurers are becoming more cautious in their pricing which is resulting in increased profits. Additionally, it seems to us that Travelers and ACE Ltd. should gain customers as a result of AIG’s difficulties.

Just as energy appeared to overshoot expectations on the upside for much of the year, in the fourth quarter it seemed to be overshooting on the downside. The Fund’s underperformance in the energy sector during 2008 was mostly due to the weakness of Transocean’s stock price. We believe that this stock underperformed the market on the expectation that long-term contracts for state of the art offshore rigs will be cancelled. Uncertainty due to the recent and rapid fall in the price of oil is troubling for Transocean. However, we believe that its quality rigs will continue to be employed and produce strong free cash flow.

Another underperformer in the portfolio was Bunge Limited. Bunge’s stock price was pressured by the unexpected and significant reduction in demand for soybean-based products coupled with the dramatic decline in demand for fertilizer in South America. With its pending acquisition of Corn Products International and uncertainty in the demand for soybeans, we sold Bunge at the beginning of the fourth quarter.

The financial crisis has resulted in more damage than was expected as we entered the fourth quarter. At the same time, unprecedented intervention by governments around the globe to help stabilize financial markets has also taken place. Only time will tell whether government intervention will be effective and when we will begin to see stabilization and improvement in the financial markets. We continue to focus the portfolio on companies we believe have strong balance sheets and the ability to continue generating free cash flow while seeking to minimize the risks from the economic slowdown.

As we begin a new year, we want to thank our investors for their patience and confidence.

1-800-624-4190 | • www.blu.com | 5 |

Sector Diversification in Comparison to

S&P 500 as of December 31, 2008* |

| | | |

| | Fund | S&P 500 |

Basic Materials | 3.3% | 2.4% |

Capital Goods | 5.7% | 7.9% |

Commercial Services | 5.0% | 2.2% |

Communications | 8.8% | 7.6% |

Consumer Cyclical | 12.6% | 11.6% |

Consumer Staples | 8.0% | 11.7% |

Energy | 12.9% | 12.8% |

Interest Rate Sensitive | 12.6% | 11.6% |

Medical/Healthcare | 12.1% | 14.3% |

REITs | 0.0% | 0.9% |

Technology | 13.3% | 10.7% |

Transportation | 3.0% | 2.2% |

Utilities | 2.4% | 4.1% |

Short-Term Investments | 0.3% | 0.0% |

*Sector diversification percentages are based on the Fund’s total investments at market value.

Sector diversification is subject to change and may not be representative of future investments. |

Average Annual Total Returns

as of December 31, 2008 |

Return | 3 Mos. | 1-Year | 3-Year | 5-Year | 10-Year |

Blue Chip Value Fund – NAV | (25.48%) | (39.25%) | (10.87%) | (3.03%) | (1.19%) |

Blue Chip Value Fund – | | | | | |

Market Price | (27.67%) | (49.27%) | (19.96%) | (8.72%) | (2.92%) |

S&P 500 Index | (21.94%) | (37.00%) | (8.36%) | (2.19%) | (1.38%) |

| |

| Past performance is no guarantee of future results. Share prices will fluctuate, so that a share may be worth more or less than its original cost when sold. Total investment return is calculated assuming a purchase of common stock on the opening of the first day and a sale on the closing of the last day of each period reported. Dividends and distributions, if any, are assumed for purposes of this calculation to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. Rights offerings, if any, are assumed for purposes of this calculation to be fully subscribed under the terms of the rights offering. Please note that the Fund’s total return shown above does not reflect the deduction of taxes that a stockholder would pay on Fund distributions or the cost of sale of Fund shares. Current performance may be higher or lower than the total return shown above. Please visit our website at ww w.blu.com to obtain the most recent month end returns. Generally, total investment return based on net asset value will be higher than total investment return based on market value in periods where there is an increase in the discount or a decrease in the premium of the market value to the net asset value from the beginning to the end of such periods. Conversely, total investment return based on the net asset value will be lower than total investment return based on market value in periods where there is a decrease in the discount or an increase in the premium of the market value to the net asset value from the beginning to the end of such periods. The Fund’s gross expense ratio for the fiscal year ended December 31, 2008 was 1.38%. |

| 6 | Annual Report December 31, 2008 |

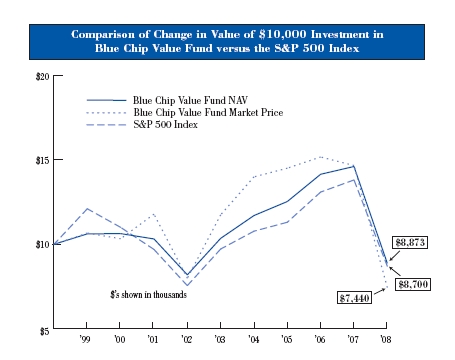

Please Note: Performance calculations are as of the end of December each year and the current period end. Past performance is not indicative of future results. This chart assumes an investment of $10,000 on 1/1/99. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. It is an unmanaged index.

Please see Average Annual Total Return information on page 6.

1-800-624-4190 | • www.blu.com | 7 |

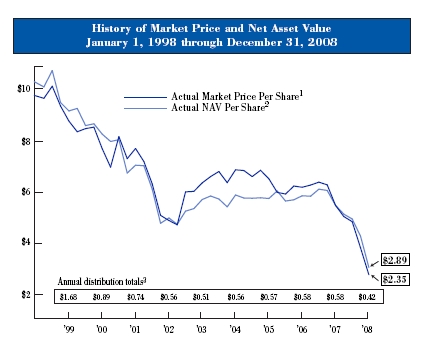

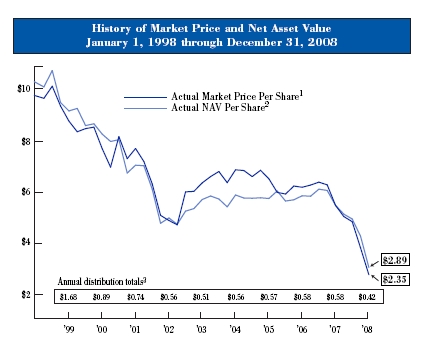

Please Note: line graph points are as of the end of each calendar quarter.

Past performance is no guarantee of future results. Share prices will fluctuate, so that a share may be worth more or less than its original cost when sold.

1Reflects the actual market price of one share as it has traded on the NYSE.

2Reflects the actual NAV of one share.

3The graph above includes the distribution totals on a book basis since January 1, 1999, which equals $7.09 per share. The NAV per share is reduced by the amount of the distribution on the ex-dividend date. The sources of these distributions are depicted in the chart on the next page.

| 8 | Annual Report December 31, 2008 |

STOCKHOLDER DISTRIBUTION INFORMATION

Certain tax information regarding Blue Chip Value Fund, Inc. is required to be provided to stockholders based upon the Fund’s income and distributions to the stockholders for the calendar year ended December 31, 2008.

The Board of Directors of Blue Chip Value Fund, Inc. voted to pay 2.5% of the Fund’s net asset value on a quarterly basis in accordance with the Fund’s distribution policy. The following table summarizes the final sources of the 2008 reportable distributions for tax purposes. Please note the taxability of the fourth quarter 2008 $0.07 distribution declared in December 2008 has been deferred until 2009 for tax purposes, pursuant to Section 852 of the Internal Revenue Code.

| Net

Investment

Income | Long-Term

Capital

Gain | Return

of

Capital | Total |

4th Quarter 2007 | $0.0051 | $0.0021 | $0.1328 | $ 0.14* |

1st Quarter 2008 | $0.0048 | $0.0019 | $0.1233 | $0.13 |

2nd Quarter 2008 | $0.0044 | $0.0018 | $0.1138 | $0.12 |

3rd Quarter 2008 | $0.0037 | $0.0015 | $0.0948 | $0.10 |

Total | $0.0180 | $0.0073 | $0.4647 | $0.49 |

| *Pursuant to Section 852 of the Internal Revenue Code, the taxability of this distribution had been deferred until 2008. Previously, it had been reported as “undesignated.” |

The Fund notified stockholders by the end of January 2009 of amounts for use in preparing 2008 income tax returns.

100% of the distributions paid from net investment income and short-term capital gain qualify for the corporate dividends received deduction and meet the requirements of the tax rules regarding qualified dividend income. In addition, none of the distributions from net investment income include income derived from U.S. Treasury obligations. There were no assets invested in direct U.S. Government Obligations as of December 31, 2008.

| HISTORICAL SOURCES OF DISTRIBUTIONS | |

| | | | | | | | | | Total | | Total | |

| | | Net | | | | | | Amount of | | Amount of | |

| | | Investment | | Capital | Return of | Distribution | | Distribution | |

| Year | | Income | | Gains | Capital | (Tax Basis) | | (BookBasis) | |

| 1999 | | | $0.0335 | | | $1.6465 | | $0.0000 | | $1.68 | | | $1.68 | |

| 2000 | | | $0.0530 | | | $0.8370 | | $0.0000 | | $0.89 | | | $0.89 | |

| 2001 | | | $0.0412 | | | $0.3625 | | $0.3363 | | $0.74 | | | $0.74 | |

| 2002 | | | $0.0351 | | | $0.0000 | | $0.5249 | | $0.56 | | | $0.56 | |

| 2003 | | | $0.0136 | | | $0.0000 | | $0.4964 | | $0.51 | | | $0.51 | |

| 2004 | | | $0.0283 | | | $0.5317 | | $0.0000 | | $0.56 | | | $0.56 | |

| 2005 | | | $0.0150 | | | $0.1128 | | $0.4422 | | $0.57 | | | $0.57 | |

| 2006 | | | $0.0182 | | | $0.1260 | | $0.4358 | | $0.58 | | | $0.58 | |

| 2007 | | | $0.0146 | | | $0.2118 | | $0.2136 | | $0.44 | | | $0.58 | |

| 2008 | | | $0.0180 | | | $0.0073 | | $0.4647 | | $0.49 | | | $0.42 | |

| Totals | | | $0.2705 | | | $3.8356 | | $2.9139 | | $7.02 | | | $7.09 | |

| % of Total | | | | | | | | | | | | | | |

| Distribution | | | 3.85% | | 54.64% | 41.51% | 100% | | | | |

Pursuant to Section 852 of the Internal Revenue Code, the taxability of the $ 0.07 per share distribution in the 4th quarter of 2008 has been deferred until 2009. | |

| |

1-800-624-4190 | • www.blu.com | 9 |

DIVIDEND REINVESTMENT AND CASH PURCHASE PLAN

The Blue Chip Value Fund Inc.’s (the “Fund”) Dividend Reinvestment and Cash Purchase Plan (the “Plan”) offers stockholders the opportunity to reinvest the Fund’s dividends and distributions in additional shares of the Fund. A stockholder may also make additional cash investments under the Plan.

Participating stockholders will receive additional shares issued at a price equal to the net asset value per share as of the close of the New York Stock Exchange on the record date (“Net Asset Value”), unless at such time the Net Asset Value is higher than the market price of the Fund’s common stock plus brokerage commission. In this case the Fund, through BNY Mellon Shareowner Services, (the “Plan Administrator”) will attempt, generally over the next 10 business days (the “Trading Period”), to acquire shares of the Fund’s common stock in the open market at a price plus brokerage commission which is less than the Net Asset Value. In the event that prior to the time such acquisition is completed, the market price of such common stock plus commission equals or exceeds the Net Asset Value, or in the event that such market purchases are unable to be completed by the end of the Trading Period, then the balance of the distribution shall be completed by issuing additional shares at Net Asset Value. The reinvestment price is then determined by the weighted average price per share, including trading fees, of the shares issued by the Fund and/or acquired by the Plan Administrator in connection with that transaction.

Participating stockholders may also make additional cash investments (minimum $50 and maximum $10,000 per month) to acquire additional shares of the Fund. Please note, however, that these additional shares will be purchased at market value plus brokerage commission (without regard to net asset value) per share. The transaction price of shares and fractional shares acquired on the open market for each participant’s account in connection with the Plan shall be determined by the weighted average price per share, including trading fees, of the shares acquired by the Plan Administrator in connection with that transaction.

A registered stockholder may join the Plan by completing an Enrollment Form from the Plan Administrator. The Plan Administrator will hold the shares acquired through the Plan in book-entry form, unless you request share certificates. If your shares are registered with a broker, you may still be able to participate in the Fund’s Dividend Reinvestment and Cash Purchase Plan. Please contact your broker about how to reregister your shares through the Direct Registration System (“DRS”) and to inquire if there are any fees which may be charged by the broker to your account.

The automatic reinvestment of dividends and distributions will not relieve participants of any income taxes that may be payable (or required to be withheld) on dividends or distributions, even though the stockholder does not receive the cash.

A stockholder may elect to withdraw from the Plan at any time on prior written notice, and receive future dividends and distributions in cash. There is no penalty for withdrawal from the Plan and stockholders who have withdrawn from the Plan may rejoin in the future. In addition, you may request the Plan Administrator to sell all or a portion of your shares. When your shares are sold, you will receive the proceeds less a service charge of $15.00 and trading fees of $0.02 per share. The Plan Administrator will generally sell your shares on the day your request is received in good order, however the Plan Administrator reserves the right to take up to 5 business days to sell your shares. Shares will be aggregated by the Plan Administrator with the shares of other participants selling their shares that day and sold on the open market. A participant will receive the weighted average price minus trading fees and service charges of all liquidated shares sold by the Plan Administrator on the transaction date.

| 10 | Annual Report December 31, 2008 |

The Fund may amend the Plan at any time upon 30-days prior notice to participants.

Additional information about the Plan may be obtained from the Plan Administrator by writing to BNY Mellon Shareowner Services, 480 Washington Blvd., Jersey City, NJ 07310, by telephone at (800) 624-4190 (option #1) or by visiting the Plan Administrator at www.bnymellon.com/shareowner.

OTHER IMPORTANT INFORMATION

Notice is hereby given in accordance with Section 23(c) of the Investment Company Act of 1940 that the Fund may purchase, from time to time, shares of its common stock in the open market.

How to Obtain a Copy of the Fund’s Proxy Voting Policies and Records

A description of the policies and procedures that are used by the Fund’s investment adviser to vote proxies relating to the Fund’s portfolio securities is available (1) without charge, upon request, by calling (800) 624-4190; (2) on the Fund’s website at www.blu.com and (3) on the Fund’s Form N-CSR which is available on the U.S. Securities and Exchange Commission (“SEC”) website at www.sec.gov.

Information regarding how the Fund’s investment adviser voted proxies relating to the Fund’s portfolio securities during the most recent 12-month period ended June 30 is available, (1) without charge, upon request by calling (800) 624-4190; (2) on the Fund’s website at www.blu.com and (3) on the SEC website at www.sec.gov.

Quarterly Portfolio Holdings

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the SEC’s Public Reference Room may be obtained by calling 1-800-SEC-0330. In addition, the Fund’s complete schedule of portfolio holdings for the first and third quarters of each fiscal year is available on the Fund’s website at www.blu.com.

1-800-624-4190 | • www.blu.com | 11 |

INFORMATION ON THE DIRECTORS AND OFFICERS OF THE FUND

The list below provides certain information about the identity and business experience of the directors and officers of the Fund.

INTERESTED DIRECTORS*

TODGER ANDERSON, CFA1

Age: 64

Position(s) Held with the Fund:

President and Director

Term of Office2 and Length of Time Served:

President since 1987. Director from 1988 to 1995 and since 1998. Term as Director expires in 2010.

Principal Occupations During the Past Five Years:

Chairman, Denver Investment Advisors LLC (since 2004);

President, Westcore Funds (since 2005);

President, Denver Investment Advisors LLC and predecessor organizations (1983-2004);

Portfolio Manager, Westcore MIDCO Growth Fund (1986-2005);

Portfolio Co-Manager, Westcore Select Fund (2001-2005).

Number of Portfolios in Fund Complex3 Overseen by Director: One

Other Directorships4 Held by Director: None

KENNETH V. PENLAND, CFA1

Age: 66

Position(s) Held with the Fund:

Chairman of the Board and Director

Term of Office2 and Length of Time Served:

Chairman of the Board and Director since 1987. Term as Director expires in 2009.

Principal Occupations During the Past Five Years:

Chairman, Denver Investment Advisors LLC and predecessor organizations (1983-2001);

President, Westcore Funds (1995-2001)

Trustee, Westcore Funds (2001-2005).

Number of Portfolios in Fund Complex3 Overseen by Director: One

Other Directorships4 Held by Director: None

| 12 | Annual Report December 31, 2008 |

INDEPENDENT DIRECTORS

RICHARD C. SCHULTE1

Age: 64

Position(s) Held with the Fund:

Director

Term of Office2 and Length of Time Served:

Director since 1987. Term expires in 2011.

Principal Occupations During the Past Five Years:

Private Investor;

President, Transportation Service Systems, Inc., a subsidiary of Southern Pacific Lines, Denver, Colorado (1993-1996);

Employee, Rio Grande Industries, Denver, Colorado (holding company) (1991-1993).

Number of Portfolios in Fund Complex3 Overseen by Director: One

Other Directorships4 Held by Director: None

ROBERTA M. WILSON, CFA1

Age: 65

Position(s) Held with the Fund:

Director

Term of Office2 and Length of Time Served:

Director since 1987. Term expires in 2009.

Principal Occupations During the Past Five Years:

Management consultant and coach (since 1998);

Director of Finance, Denver Board of Water Commissioners (Retired), Denver, Colorado (1985-1998).

Number of Portfolios in Fund Complex3 Overseen by Director: One

Other Directorships4 Held by Director: None

LEE W. MATHER, JR.1

Age: 65

Position(s) Held with the Fund:

Director

Term of Office2 and Length of Time Served:

Director since 2001. Term expires in 2011.

Principal Occupations During the Past Five Years:

Director, American Rivers (conservation organization) (2000-2006);

Investment Banker, Merrill Lynch & Co. (1977-2000).

Number of Portfolios in Fund Complex3 Overseen by Director: One

Other Directorships4 Held by Director: None

1-800-624-4190 | • www.blu.com | 13 |

OFFICERS

MARK M. ADELMANN, CFA, CPA

Age: 51

1225 Seventeenth St.

26th Floor

Denver, Colorado 80202

Position(s) Held with the Fund:

Vice President

Term of Office2 and Length of Time Served:

Vice President since 2002.

Principal Occupations During the Past Five Years:

Vice President (since 2000) and member (since 2001), Denver Investment Advisors LLC;

Research Analyst, Denver Investment Advisors LLC (since 1995);

Portfolio management team member, Westcore Funds (since 2002).

NANCY P. O’HARA

Age: 50

One Logan Square

18th and Cherry Sts.

Philadelphia, PA 19103

Position(s) Held with the Fund:

Secretary

Term of Office2 and Length of Time Served:

Secretary since 2007.

Principal Occupations During the Past Five Years:

Counsel (since 2009) and Associate (1999-2009) of the law firm of Drinker Biddle

& Reath LLP, Philadelphia, PA.

JASPER R. FRONTZ, CPA, CFA5

Age: 40

1225 Seventeenth St.

26th Floor

Denver, Colorado 80202

Position(s) Held with the Fund:

Treasurer, Chief Compliance Officer

Term of Office2 and Length of Time Served:

Treasurer since 1997, Chief Compliance Officer since 2004.

| 14 | Annual Report December 31, 2008 |

Principal Occupations During the Past Five Years:

Vice President, Denver Investment Advisors LLC (since 2000);

Director of Mutual Fund Administration, Denver Investment Advisors LLC

(since 1997);

Fund Controller, ALPS Mutual Fund Services, Inc. (1995-1997);

Registered Representative, ALPS Distributors, Inc. (since 1995).

| NOTES |

* | These directors each may be deemed to be an “interested director” of the Fund within the meaning of the Investment Company Act of 1940 by virtue of their affiliations with the Fund’s investment adviser and their positions as officers of the Fund. |

1. | Each director may be contacted by writing to the director, c/o Blue Chip Value Fund, Inc., 1225 Seventeenth Street, 26th Floor, Denver, Colorado 80202, Attn: Jasper Frontz. |

2. | The Fund’s By-Laws provide that the Board of Directors shall consist of three classes of members. Directors are chosen for a term of three years, and the term of one class of directors expires each year. The officers of the Fund are elected by the Board of Directors and, subject to earlier termination of office, each officer holds office for one year and until his or her successor is elected and qualified. |

3. | The Fund complex is comprised of fifteen portfolios, the Fund, twelve Westcore Funds, the Dunham Small-Cap Value Fund and the RiverSource Partners VP Small-Cap Value Fund. |

4. | Includes only directorships of companies required to report to the Securities and Exchange Commission under the Securities Exchange Act of 1934 (i.e., “public companies”) or other investment companies registered under the Investment Company Act of 1940. |

5. | Mr. Frontz also serves as Treasurer and Chief Compliance Officer of Westcore Funds. |

The Fund’s President has certified to the New York Stock Exchange that, as of May 29, 2008, he was not aware of any violation by the Fund of the applicable NYSE Corporate Governance listing standards. In addition, the Fund has filed certifications of its principal executive officer and principal financial officer as exhibits to its reports on Form N-CSR filed with the Securities and Exchange Commission relating to the quality of the disclosures contained in such reports.

1-800-624-4190 | • www.blu.com | 15 |

| BLUE CHIP VALUE FUND, INC. | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| STATEMENT OF INVESTMENTS |

| December 31, 2008 | | | | | | | |

| | | | | | | | Market |

| | Shares | | | Cost | | | Value |

| COMMON STOCKS – 116.87% | | | | | | | |

| BASIC MATERIALS – 3.87% | | | | | | | |

| Forestry & Paper – 0.35% | | | | | | | |

| International Paper Co. | 24,100 | | $ | 682,647 | | $ | 284,380 |

| Packaging & Containers – 3.52% | | | | | | | |

| Ball Corp. | 69,740 | | | 3,710,333 | | | 2,900,487 |

| | | | | | | | |

| TOTAL BASIC MATERIALS | | | | 4,392,980 | | | 3,184,867 |

| | | | | | | | |

| CAPITAL GOODS – 6.73% | | | | | | | |

| Aerospace & Defense – 4.10% | | | | | | | |

| General Dynamics Corp. | 18,700 | | | 957,891 | | | 1,076,933 |

| Raytheon Co. | 44,900 | | | 1,994,242 | | | 2,291,696 |

| | | | | 2,952,133 | | | 3,368,629 |

| Industrial Products – 2.63% | | | | | | | |

| ITT Corp. | 47,100 | | | 2,573,117 | | | 2,166,129 |

| | | | | | | | |

| TOTAL CAPITAL GOODS | | | | 5,525,250 | | | 5,534,758 |

| | | | | | | | |

| COMMERCIAL SERVICES – 5.91% | | | | | | | |

| Business Products & Services – 3.63% | | | | | | | |

| Quanta Services Inc.** | 150,600 | | | 4,720,354 | | | 2,981,880 |

| IT Services – 1.37% | | | | | | | |

| Computer Sciences Corp.** | 32,150 | | | 1,519,580 | | | 1,129,751 |

| Transaction Processing – 0.91% | | | | | | | |

| The Western Union Co. | 52,100 | | | 946,430 | | | 747,114 |

| | | | | | | | |

| TOTAL COMMERCIAL SERVICES | | | | 7,186,364 | | | 4,858,745 |

| | | | | | | | |

| COMMUNICATIONS – 10.33% | | | | | | | |

| Networking – 4.96% | | | | | | | |

| Cisco Systems Inc.** | 250,600 | | | 6,217,822 | | | 4,084,780 |

| Telecomm Equipment & Solutions – 5.37% | | | | | | | |

| Nokia Corp. - ADR (Finland) | 48,730 | | | 796,418 | | | 760,188 |

| QUALCOMM Inc. | 102,000 | | | 4,341,123 | | | 3,654,660 |

| | | | | 5,137,541 | | | 4,414,848 |

| | | | | | | | |

| TOTAL COMMUNICATIONS | | | | 11,355,363 | | | 8,499,628 |

| | | | | | | | |

| CONSUMER CYCLICAL – 14.79% | | | | | | | |

| Apparel & Footwear Manufacturers –3.24% | | | | | | | |

| Nike Inc. | 52,350 | | | 3,288,213 | | | 2,669,850 |

| Clothing & Accessories – 1.17% | | | | | | | |

| TJX Companies Inc. | 46,700 | | | 1,257,001 | | | 960,619 |

| Hotels & Gaming – 1.47% | | | | | | | |

| Starwood Hotels & Resorts Worldwide Inc. | 67,400 | | | 2,857,522 | | | 1,206,460 |

| 16 | Annual Report December 31, 2008 |

| STATEMENT OF INVESTMENTS (cont’d.) | | | |

| | | | | | | | Market | |

| | Shares | | | Cost | | | Value | |

| Internet – 0.91% | | | | | | | | |

| Expedia Inc.** | 90,800 | | $ | 2,569,349 | | $ | 748,192 | |

| Publishing & Media – 2.67% | | | | | | | | |

| Walt Disney Co. | 96,900 | | | 2,435,165 | | | 2,198,661 | |

| Restaurants – 3.69% | | | | | | | | |

| Darden Restaurants Inc. | 107,840 | | | 3,004,643 | | | 3,038,931 | |

| Specialty Retail – 1.64% | | | | | | | | |

| Best Buy Co. Inc | 48,000 | | | 2,067,944 | | | 1,349,280 | |

| TOTAL CONSUMER CYCLICAL | | | | 17,479,837 | | | 12,171,993 | |

| | | | | | | | | |

| CONSUMER STAPLES – 9.43% | | | | | | | | |

| Consumer Products – 4.00% | | | | | | | | |

| Colgate Palmolive Co. | 48,000 | | | 3,139,213 | | | 3,289,920 | |

| Food & Agricultural Products – 5.43% | | | | | | | | |

| Campbell Soup Co. | 70,400 | | | 2,567,984 | | | 2,112,704 | |

| Unilever N.V. (Netherlands) | 96,100 | | | 3,405,333 | | | 2,359,255 | |

| | | | | 5,973,317 | | | 4,471,959 | |

| TOTAL CONSUMER STAPLES | | | | 9,112,530 | | | 7,761,879 | |

| | | | | | | | | |

| ENERGY – 15.10% | | | | | | | | |

| Exploration & Production – 7.59% | | | | | | | | |

| Occidental Petroleum Corp. | 61,480 | | | 3,292,093 | | | 3,688,185 | |

| XTO Energy Inc. | 72,437 | | | 2,205,187 | | | 2,554,853 | |

| | | | | 5,497,280 | | | 6,243,038 | |

| Integrated Oils – 5.14% | | | | | | | | |

| ConocoPhillips | 9,600 | | | 463,583 | | | 497,280 | |

| Exxon Mobil Corp. | 18,300 | | | 1,387,784 | | | 1,460,889 | |

| Marathon Oil Corp. | 83,000 | | | 2,657,554 | | | 2,270,880 | |

| | | | | 4,508,921 | | | 4,229,049 | |

| Oil Services – 2.37% | | | | | | | | |

| Transocean Inc.** | 41,249 | | | 3,675,402 | | | 1,949,015 | |

| TOTAL ENERGY | | | | 13,681,603 | | | 12,421,102 | |

| | | | | | | | | |

| INTEREST RATE SENSITIVE – 14.72% | | | | | | | | |

| Integrated Financial Services – 2.57% | | | | | | | | |

| JPMorgan Chase & Co. | 66,900 | | | 2,853,541 | | | 2,109,357 | |

| | | | | | | | | |

| Money Center Banks – 1.38% | | | | | | | | |

| Bank of America Corp. | 80,800 | | | 3,030,439 | | | 1,137,664 | |

| | | | | | | | | |

| Property Casualty Insurance – 5.46% | | | | | | | | |

| ACE Ltd. (Cayman Islands) | 40,300 | | | 2,180,787 | | | 2,132,676 | |

| The Travelers Cos. Inc. | 52,200 | | | 2,519,527 | | | 2,359,440 | |

| | | | | 4,700,314 | | | 4,492,116 | |

1-800-624-4190 | • www.blu.com | 17 |

| STATEMENT OF INVESTMENTS (cont’d.) |

| | | | | | | | Market |

| | Shares | | | Cost | | | Value |

| Regional Banks – 1.37% | | | | | | | |

| The Bank of New York Mellon Corp. | 39,900 | | $ | 1,307,496 | | $ | 1,130,367 |

| | | | | | | | |

| Securities & Asset Management – 3.94% | | | | | | | |

| Invesco Ltd. | 111,000 | | | 2,711,688 | | | 1,602,840 |

| State Street Corp. | 41,700 | | | 2,611,240 | | | 1,640,061 |

| | | | | 5,322,928 | | | 3,242,901 |

| | | | | | | | |

| TOTAL INTEREST RATE SENSITIVE | | | | 17,214,718 | | | 12,112,405 |

| | | | | | | | |

| MEDICAL & HEALTHCARE – 14.13% | | | | | | | |

| Medical Technology – 3.15% | | | | | | | |

| Zimmer Holdings Inc.** | 64,200 | | | 4,505,569 | | | 2,594,964 |

| | | | | | | | |

| Pharmaceuticals – 10.98% | | | | | | | |

| Abbott Laboratories | 72,200 | | | 3,818,297 | | | 3,853,314 |

| Amgen Inc.** | 56,600 | | | 3,254,183 | | | 3,268,650 |

| Wyeth | 50,900 | | | 1,952,361 | | | 1,909,259 |

| | | | | 9,024,841 | | | 9,031,223 |

| | | | | | | | |

| TOTAL MEDICAL & HEALTHCARE | | | | 13,530,410 | | | 11,626,187 |

| | | | | | | | |

| TECHNOLOGY – 15.56% | | | | | | | |

| Computer Software – 4.48% | | | | | | | |

| Microsoft Corp. | 118,600 | | | 3,161,970 | | | 2,305,584 |

| Symantec Corp.** | 102,300 | | | 1,923,230 | | | 1,383,096 |

| | | | | 5,085,200 | | | 3,688,680 |

| PC’s & Servers – 4.68% | | | | | | | |

| Dell Inc.** | 120,000 | | | 1,886,506 | | | 1,228,800 |

| International Business Machines Corp. | 31,100 | | | 2,850,657 | | | 2,617,376 |

| | | | | 4,737,163 | | | 3,846,176 |

| Semiconductors – 6.40% | | | | | | | |

| Altera Corp. | 159,800 | | | 3,101,025 | | | 2,670,258 |

| Intel Corp. | 177,200 | | | 3,488,119 | | | 2,597,752 |

| | | | | 6,589,144 | | | 5,268,010 |

| | | | | | | | |

| TOTAL TECHNOLOGY | | | | 16,411,507 | | | 12,802,866 |

| | | | | | | | |

| TRANSPORTATION – 3.52% | | | | | | | |

| Railroads – 3.52% | | | | | | | |

| Norfolk Southern Corp. | 61,600 | | | 3,243,665 | | | 2,898,280 |

| TOTAL TRANSPORTATION | | | | 3,243,665 | | | 2,898,280 |

| | | | | | | | |

| UTILITIES – 2.78% | | | | | | | |

| Regulated Electric – 2.78% | | | | | | | |

| PPL Corp. | 74,450 | | | 3,496,290 | | | 2,284,871 |

| | | | | | | | |

| TOTAL UTILITIES | | | | 3,496,290 | | | 2,284,871 |

| TOTAL COMMON STOCKS | | | | 122,630,517 | | | 96,157,581 |

| 18 | Annual Report December 31, 2008 |

| STATEMENT OF INVESTMENTS (cont’d.) | |

| | | | | | | | Market |

| | | Shares | | | Cost | | Value |

| SHORT TERM INVESTMENTS –0.35% | | | | | |

| Fidelity Institutional Money Market | | | | | | |

| Government Portfolio - Class I | | | | | | |

| (7 Day Yield 1.05%) | 291,892 | | $ | 291,892 | $ | 291,892 |

| TOTAL SHORT TERM INVESTMENTS | | | | 291,892 | | 291,892 |

| | | | | | | | |

| TOTAL INVESTMENTS | 117.22% | | $ | 122,922,409 | $ | 96,449,473 |

| Liabilities in Excess of Other Assets | (17.22)% | | | | | (14,170,461) |

| NET ASSETS | | 100.00% | | | | $ | 82,279,012 |

| | | | | | | | |

| | | | | | | | |

| **Non-income producing security | | | | | | |

| ADR - American Depositary Receipt | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Sector and Industry classifications are unaudited. | | | | | |

| COUNTRY BREAKDOWN | | | |

| | | | |

| As of December 31, 2008 (unaudited) | | | | |

| | | Market | | |

| Country | | Value | | % |

| United States | $ | 91,197,354 | | 110.84% |

| Netherlands | | 2,359,255 | | 2.87% |

| Cayman Islands | | 2,132,676 | | 2.59% |

| Finland | | 760,188 | | 0.92% |

| Total Investments | $ | 96,449,473 | | 117.22% |

| Liabilities in Excess of Other Assets | | (14,170,461) | | (17.22%) |

| Net Assets | $ | 82,279,012 | | 100.00% |

| | | | | |

| | | | | |

| | | | | |

| Please note the country classification is based on the company headquarters. All of the Fund’s investments are traded on U.S. exchanges. |

| | | | | |

| See accompanying notes to financial statements. |

1-800-624-4190 | • www.blu.com | 19 |

| BLUE CHIP VALUE FUND, INC. | | | | |

| | | | | |

| | | | | |

| STATEMENT OF ASSETS AND LIABILITIES |

| December 31, 2008 | | | | |

| | | | | |

| ASSETS | | | | |

| Investments at market value (cost $122,922,409) | | $ | 96,449,473 |

| Dividends and interest receivable | | | | 226,127 |

| Other assets | | | | 18,684 |

| TOTAL ASSETS | | | | 96,694,284 |

| | | | | |

| LIABILITIES | | | | |

| Loan payable to bank (Note 5) | | | | 12,275,000 |

| Interest due on loan payable to bank | | | | 10,892 |

| Distribution payable | | | | 1,992,474 |

| Advisory fee payable | | | | 43,674 |

| Administration fee payable | | | | 6,898 |

| Accrued Compliance Officer fees | | | | 4,681 |

| Accrued expenses and other liabilities | | | | 81,653 |

| TOTAL LIABILITIES | | | | 14,415,272 |

| NET ASSETS | | | $ | 82,279,012 |

| | | | | |

| COMPOSITION OF NET ASSETS | | | | |

| Capital stock, at par | | | $ | 284,639 |

| Paid-in-capital | | | | 110,022,585 |

| Accumulated net realized loss | | | | (1,555,276) |

| Net unrealized depreciation on investments | | | | (26,472,936) |

| NET ASSETS | | | $ | 82,279,012 |

| | | | | |

| SHARES OF COMMON STOCK OUTSTANDING | | | | |

| (100,000,000 shares authorized at $0.01 par value) | | | | 28,463,912 |

| | | | | |

| Net asset value per share | | | $ | 2.89 |

| | | | | |

| | | | | |

| See accompanying notes to financial statements. | | | |

| 20 | Annual Report December 31, 2008 |

| BLUE CHIP VALUE FUND, INC. | | | |

| | | | | |

| | | | | |

| STATEMENT OF OPERATIONS | | | |

| For the Year Ended December 31, 2008 | | | | | |

| | | | | | | |

| INCOME | | | | | | |

| Dividends (net of foreign withholding taxes | | | | | |

| of $35,675) | $ | 2,231,224 | | | |

| Interest | | | 13,399 | | | |

| TOTAL INCOME | | | | $ | 2,244,623 |

| | | | | | | |

| EXPENSES | | | | | |

| Investment advisory fee (Note 4) | | 769,389 | | | |

| Administrative services fee (Note 4) | | 99,916 | | | |

| Interest on outstanding loan payable to bank | | 360,327 | | | |

| Stockholder reporting | | 148,820 | | | |

| Directors’ fees | | 87,000 | | | |

| Legal fees | | 81,780 | | | |

| Transfer agent fees | | 67,000 | | | |

| Audit and tax preparation fees | | 29,600 | | | |

| NYSE listing fees | | 27,966 | | | |

| Insurance and fidelity bond | | 21,549 | | | |

| Chief Compliance Officer fees | | 21,525 | | | |

| Custodian fees | | 9,581 | | | |

| Other | | | 9,211 | | | |

| TOTAL EXPENSES | | | | | 1,733,664 |

| NET INVESTMENT INCOME | | | | | 510,959 |

| REALIZED AND UNREALIZED | | | | | |

| GAIN/(LOSS) ON INVESTMENTS | | | | | |

| Net realized gain on investments | | | | | 248,725 |

| Change in net unrealized appreciation or | | | | | |

| (depreciation) of investments | | | | | (58,762,315) |

| NET REALIZED AND UNREALIZED LOSS | | | | | |

| ON INVESTMENTS | | | | | (58,513,590) |

| NET DECREASE IN NET ASSETS | | | | | |

| RESULTING FROM OPERATIONS | | | | $ | (58,002,631) |

| | | | | | | |

| | | | | | | |

| See accompanying notes to financial statements. | | | | | |

1-800-624-4190 | • www.blu.com | 21 |

| BLUE CHIP VALUE FUND, INC. | | | | |

| | | | | |

| | | | | |

| STATEMENTS OF CHANGES IN NET ASSETS | |

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| | | December 31, | | | December 31, | |

| | | 2008 | | | 2007 | |

| Increase/(decrease) in net assets | | | | | | |

| from operations: | | | | | | |

| Net investment income | $ | 510,959 | | $ | 411,499 | |

| Net realized gain on investments | | 248,725 | | | 5,229,902 | |

| Change in net unrealized appreciation | | | | | | |

| or depreciation of investments | | (58,762,315) | | | (222,134) | |

| | | (58,002,631) | | | 5,419,267 | |

| | | | | | | |

| Decrease in net assets from distributions | | | | | | |

| to stockholders from: | | | | | | |

| Net investment income | | (510,959) | | | (411,499) | |

| Net realized gain on investments | | (208,973) | | | (5,980,234) | |

| Tax Return of capital | | (11,232,334) | | | (10,012,387) | |

| | | (11,952,266) | | | (16,404,120) | |

| | | | | | | |

| Increase in net assets from common | | | | | | |

| stock transactions: | | | | | | |

| Net asset value of common stock issued to | | | | | | |

| stockholders from reinvestment of dividends | | | | | | |

| (29,014 and 412,794 shares issued, respectively) | | 142,459 | | | 2,412,947 | |

| | | 142,459 | | | 2,412,947 | |

| | | | | | | |

| NET DECREASE IN NET ASSETS | | (69,812,438) | | | (8,571,906) | |

| | | | | | | |

| NET ASSETS | | | | | | |

| Beginning of year | | 152,091,450 | | | 160,663,356 | |

| End of year (including undistributed net | | | | | | |

| investment income of $0 and $0, respectively) | $ | 82,279,012 | | $ | 152,091,450 | |

| | | | | | | |

| | | | | | | |

| See accompanying notes to financial statements. | | | | | | |

| 22 | Annual Report December 31, 2008 |

| BLUE CHIP VALUE FUND, INC. | | | | |

| | | | | |

| | | | | |

| STATEMENT OF CASH FLOWS | | | |

| | | | |

| For the Year Ended December 31, 2008 | | | | |

| | | | | |

| Cash Flows from Operating Activities | | | | |

| Net decrease in net assets from operations | | $ | (58,002,631) | |

| Adjustments to reconcile net decrease in net | | | | |

| assets from operations to net cash provided | | | | |

| by operating activities: | | | | |

| Purchase of investment securities | | | (71,875,735) | |

| Proceeds from disposition of investment securities | | | 82,838,774 | |

| Net purchase of short-term investment securities | | | (39,494) | |

| Proceeds from class-action litigation settlements | | | 47,013 | |

| Net realized gain from securities investments | | | (248,725) | |

| Net change in unrealized appreciation | | | | |

| on investments | | | 58,762,315 | |

| Decrease in receivable for securities sold | | | 2,434,479 | |

| Decrease in dividends and interest receivable | | | 41,419 | |

| Increase in other assets | | | (8,239) | |

| Decrease in advisory fee payable | | | (38,916) | |

| Decrease in administrative fee payable | | | (3,099) | |

| Increase in accrued Compliance Officer fees | | | 223 | |

| Decrease in other accrued expenses and payables | | | (29,165) | |

| Net cash provided by operating activities | | | 13,878,219 | |

| Cash Flows from Financing Activities | | | | |

| Proceeds from bank borrowing | | | 7,045,000 | |

| Repayment of bank borrowing | | | (7,125,000) | |

| Cash distributions paid | | | (13,798,219) | |

| Net cash used in financing activities | | | (13,878,219) | |

| Net increase in cash | | | 0 | |

| Cash, beginning balance | | | 0 | |

| Cash, ending balance | | | 0 | |

| Supplemental disclosure of cash flow information: | | | | |

| Cash paid during the period for interest from bank borrowing: $392,744. | | | |

| Noncash financing activities not included herein consist of reinvestment | | | |

| of dividends and distributions of $142,459. | | | | |

| | | | | |

| See accompanying notes to financial statements. | | | | |

1-800-624-4190 | • www.blu.com | 23 |

BLUE CHIP VALUE FUND, INC.

FINANCIAL HIGHLIGHTS

| | | For the year ended December 31, | |

| Per Share Data | | | | | | |

| (for a share outstanding throughout each period) | | 2008 | | | 2007 | |

| Net asset value – beginning of year | $ | 5.35 | | $ | 5.73 | |

| Investment operations(1) | | | | | | |

| Net investment income | | 0.02 | | | 0.01 | |

| Net gain/(loss) on investments | | (2.06) | | | 0.19 | |

| Total from investment operations | | (2.04) | | | 0.20 | |

| Distributions | | | | | | |

| From net investment income | | (0.02) | | | (0.02) | |

| From net realized gains on investments | | (0.01) | | | (0.21) | |

| Tax Return of capital | | (0.39) | | | (0.35) | |

| Total distributions | | (0.42) | | | (0.58) | |

| Net asset value, end of year | $ | 2.89 | | $ | 5.35 | |

| Per share market value, end of year | $ | 2.35 | | $ | 5.21 | |

| Total investment return(2) based on: | | | | | | |

| Market Value | | (49.27%) | | | (3.3%) | |

| Net Asset Value | | (39.25%) | | | 3.3% | |

| Ratios/Supplemental data: | | | | | | |

| Ratio of total expenses to average net assets(3) | | 1.38% | | | 1.34% | |

| Ratio of net investment income to average net assets | | 0.41% | | | 0.25% | |

| Ratio of total distributions to average net assets | | 9.51% | | | 10.04% | |

| Portfolio turnover rate(4) | | 51.40% | | | 40.03% | |

Net assets – end of period (in thousands) | $ | 82,279 | | $ | 152,091 | |

| | | | | | | |

| | | | | | | |

See accompanying notes to financial statements.

| (1) | Per share amounts calculated based on average shares outstanding during the period. |

| (2) | Total investment return is calculated assuming a purchase of common stock on the opening of the first day and a sale on the closing of the last day of each period reported. Dividends and distributions, if any, are assumed for purposes of this calculation to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. Rights offerings, if any, are assumed for purposes of this calculation to be fully subscribed under the terms of the rights offering. Please note that the Fund’s total investment return does not reflect the deduction of taxes that a stockholder would pay on Fund distributions or the sale of Fund shares. Generally, total investment return based on net asset value will be higher than total investment return based on market value in periods where there is an increase in the discount or a decrease in the premium of the market value to the net asset value from the beginning to the end of such periods. Conversely, total investment return based on the net asset value will be lower than total investment return based on market value in periods where there is a decrease in the discount or an increase in the premium of the market value to the net asset value from the beginning to the end of such periods. |

| (3) | For the years ended December 31, 2008, 2007, 2006, 2005 and 2004, the ratio of total expenses to average net assets excluding interest expense was 1.09%, 0.93%, 0.92%, 0.97% and 0.99%, respectively. |

| (4) | A portfolio turnover rate is the percentage computed by taking the lesser of purchases or sales of portfolio securities (excluding short-term investments) for the year and dividing it by the monthly average of the market value of the portfolio securities during the year. Purchases and sales of investment securities (excluding short-term securities) for the year ended December 31,2008 were $71,875,735 and $82,838,774, respectively. |

| 24 | Annual Report December 31, 2008 |

| | | | For the year ended December 31, |

| Per Share Data | | | | | | | | | |

| (for a share outstanding throughout each period) | | | 2006 | | | 2005 | | | 2004 |

| Net asset value – beginning of year | | $ | 5.62 | | $ | 5.76 | | $ | 5.58 |

| Investment operations(1) | | | | | | | | | |

| Net investment income | | | 0.02 | | | 0.01 | | | 0.03 |

| Net gain/(loss) on investments | | | 0.67 | | | 0.42 | | | 0.71 |

| Total from investment operations | | | 0.69 | | | 0.43 | | | 0.74 |

| Distributions | | | | | | | | | |

| From net investment income | | | (0.02) | | | (0.02) | | | (0.03) |

| From net realized gains on investments | | | (0.13) | | | (0.11) | | | (0.53) |

| Tax Return of capital | | | (0.43) | | | (0.44) | | | — |

| Total distributions | | | (0.58) | | | (0.57) | | | (0.56) |

| Net asset value, end of year | | $ | 5.73 | | $ | 5.62 | | $ | 5.76 |

| Per share market value, end of year | | $ | 5.96 | | $ | 6.31 | | $ | 6.68 |

| Total investment return(2) based on: | | | | | | | | | |

| Market Value | | | 4.6% | | | 3.7% | | | 19.2% |

| Net Asset Value | | | 12.9% | | | 7.1% | | | 13.1% |

| Ratios/Supplemental data: | | | | | | | | | |

| Ratio of total expenses to average net assets(3) | | | 1.36% | | | 1.33% | | | 1.12% |

| Ratio of net investment income to average net assets | | | 0.32% | | | 0.21% | | | 0.57% |

| Ratio of total distributions to average net assets | | | 10.25% | | | 10.13% | | | 10.16% |

| Portfolio turnover rate(4) | | | 36.54% | | | 40.96% | | | 115.39% |

Net assets – end of period (in thousands) | | $ | 160,663 | | $ | 155,208 | | $ | 156,903 |

| | | | | | | | | | |

| | | | | | | | | | |

See accompanying notes to financial statements.

| (1) | Per share amounts calculated based on average shares outstanding during the period. |

| (2) | Total investment return is calculated assuming a purchase of common stock on the opening of the first day and a sale on the closing of the last day of each period reported. Dividends and distributions, if any, are assumed for purposes of this calculation to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. Rights offerings, if any, are assumed for purposes of this calculation to be fully subscribed under the terms of the rights offering. Please note that the Fund’s total investment return does not reflect the deduction of taxes that a stockholder would pay on Fund distributions or the sale of Fund shares. Generally, total investment return based on net asset value will be higher than total investment return based on market value in periods where there is an increase in the discount or a decrease in the premium of the market value to the net asset value from the beginning to the end of such periods. Conversely, total investment return based on the net asset value will be lower than total investment return based on market value in periods where there is a decrease in the discount or an increase in the premium of the market value to the net asset value from the beginning to the end of such periods. |

| (3) | For the years ended December 31, 2008, 2007, 2006, 2005 and 2004, the ratio of total expenses to average net assets excluding interest expense was 1.09%, 0.93%, 0.92%, 0.97% and 0.99%, respectively. |

| (4) | A portfolio turnover rate is the percentage computed by taking the lesser of purchases or sales of portfolio securities (excluding short-term investments) for the year and dividing it by the monthly average of the market value of the portfolio securities during the year. Purchases and sales of investment securities (excluding short-term securities) for the year ended December 31,2008 were $71,875,735 and $82,838,774, respectively. |

1-800-624-4190 | • www.blu.com | 25 |

BLUE CHIP VALUE FUND, INC.

NOTES TO FINANCIAL STATEMENTS

December 31, 2008

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Blue Chip Value Fund, Inc. (the “Fund”) is registered under the Investment Company Act of 1940, as amended, as a diversified, closed-end management investment company.

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.

Security Valuation – All securities of the Fund are valued as of the close of regular trading on the New York Stock Exchange (“NYSE”), generally 4:00 p.m. (Eastern Time), on each day that the NYSE is open. Listed securities are generally valued at the last sales price as of the close of regular trading on the NYSE. Securities traded on the National Association of Securities Dealers Automated Quotation (“NASDAQ”) are generally valued at the NASDAQ Official Closing Price (“NOCP”). In the absence of sales and NOCP, such securities are valued at the mean of the bid and asked prices.

Securities having a remaining maturity of 60 days or less are valued at amortized cost which approximates market value.

When market quotations are not readily available or when events occur that make established valuation methods unreliable, securities of the Fund may be valued at fair value determined in good faith by or under the direction of the Board of Directors. Factors which may be considered when determining the fair value of a security include (a) the fundamental data relating to the investment; (b) an evaluation of the forces which influence the market in which the security is sold, including the liquidity and depth of the market; (c) the market value at date of purchase; (d) information as to any transactions or offers with respect to the security or comparable securities; and (e) any other relevant matters.

Investment Transactions – Investment transactions are accounted for on the date the investments are purchased or sold (trade date). Realized gains and losses from investment transactions and unrealized appreciation and depreciation of investments are determined on the “specific identification” basis for both financial statement and federal income tax purposes. Dividend income is recorded on the ex-dividend date. Interest income, which includes interest earned on money market funds, is accrued and recorded daily.

Federal Income Taxes – For federal income tax purposes, the Fund currently qualifies, and intends to remain qualified, as a regulated investment company under the provisions of the Internal Revenue Code by distributing substantially all of its investment company taxable net income including realized gain, not offset by capital loss carryforwards, if any, to its shareholders. Accordingly, no provision for federal income or excise taxes has been made.

| 26 | Annual Report December 31, 2008 |

The Fund intends to elect to defer to its fiscal year ending December 31, 2009 approximately $918,881 of losses recognized during the period from November 1, 2008 to December 31, 2008.

In accordance with FASB Interpretation No. 48 (“FIN 48”) “Accounting for Uncertainty in Income Taxes,” the financial statement effects of a tax position taken or expected to be taken in a tax return are to be recognized in the financial statements when it is more likely than not, based on the technical merits, that the position will be sustained upon examination. Management has concluded that the Fund has taken no uncertain tax positions that require adjustment to the financial statements to comply with the provisions of FIN 48. The Fund files income tax returns in the U.S. federal jurisdiction and Colorado. For the years ended December 31, 2005 through December 31, 2008 for the federal jurisdiction and for the years ended December 31, 2004 through December 31, 2008 for Colorado, the Fund’s returns are still open to examination by the appropriate taxing authority.

Classification of Distributions to Shareholders – Net investment income (loss) and net realized gain (loss) may differ for financial statement and tax purposes. The character of distributions made during the year from net investment income or net realized gains may differ from its ultimate characterization for federal income tax purposes. Also, due to the timing of dividend distributions, the fiscal year in which amounts are distributed may differ from the fiscal year in which the income or realized gain was recorded by the Fund.

The tax character of the distributions paid was as follows:

| | Year Ended | | Year Ended |

| | December 31, | | December 31, |

| | 2008 | | 2007 |

| Distributions paid from: | | | | | |

| Ordinary income | $ | 510,959 | | $ | 411,499 |

| Long-term capital gain | | 208,973 | | | 5,980,234 |

| Tax Return of capital | | 13,220,746 | | | 6,031,501 |

| Total | $ | 13,940,678 | | $ | 12,423,234 |

| | | | | | |

| As of December 31, 2008, the components of distributable earnings on a tax basis were as follows: |

| |

| Undistributed net investment income | | | | $ | — |

| Accumulated net realized loss | | | | | (918,881) |

| Net unrealized depreciation | | | | | (27,109,331) |

| Total | | | | $ | (28,028,212) |

1-800-624-4190 | • www.blu.com | 27 |

The difference between book basis and tax basis is typically attributable to the tax deferral of losses on wash sales and post October losses.

Distributions to Stockholders – Distributions to stockholders are recorded on the ex-dividend date.

The Fund currently maintains a “managed distribution policy” which distributes at least 2.5% of its net asset value quarterly to its stockholders. These fixed distributions are not related to the amount of the Fund’s net investment income or net realized capital gains or losses and will be classified to conform to the tax reporting requirements of the Internal Revenue Code.

Denver Investment Advisors LLC (“DenverIA”) generally seeks to minimize realized capital gain distributions without generating capital loss carryforwards. As such, if the Fund’s total distributions required by the fixed payout policy for the year exceed the Fund’s “current and accumulated earnings and profits,” the excess will be treated as non-taxable return of capital, reducing the stockholder’s adjusted basis in his or her shares. Although capital loss carryforwards may offset any current year net realized capital gains, such amounts do not reduce the Fund’s “current earnings and profits.” Therefore, to the extent that current year net realized capital gains are offset by capital loss carryforwards, such excess distributions would be classified as taxable ordinary income rather than non-taxable return of capital. In this situation, the Fund’s Board of Directors would consider that factor, among others, in determining whether to retain, alter or eliminate the “managed distribution policy.” The Fund’s distribution policy may be changed or terminated at the discretion of the Fund’s Board of Directors. At this time, the Board of Directors has no plans to change or terminate the current policy.

Use of Estimates – The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the amounts reported in the financial statements and disclosures made in the accompanying notes to the financial statements. Actual results could differ from those estimates.

2. FAS 157 MEASUREMENTS

The Fund adopted Financial Accounting Standards Board Statement of Financial Accounting Standards No. 157, Fair Value Measurements (“FAS 157”), effective January 1, 2008. FAS 157 defines fair value, establishes a three-tier hierarchy to measure fair value based on the extent of use of “observable inputs” as compared to “unobservable inputs” for disclosure purposes and requires additional disclosures about these valuations measurements. Inputs refer broadly to the assumptions that market participants would use in pricing a security. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the security developed based on market data obtained from sources independent of the reporting entity.

| 28 | Annual Report December 31, 2008 |

Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the security developed based on the best information available in the circumstances.

The three-tier hierarchy is summarized as follows:

Level 1 – quoted prices in active markets for identical investments.

Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments).

The following is a summary of the inputs used as of December 31, 2008 in valuing the Fund’s assets:

| | | | | Other |

| | | | | Financial |

| | | | | Instruments* – |

| | | Investments in | | Unrealized |

| | | Securities at | | Appreciation |

| Valuation Inputs | | Value | | (Depreciation) |

| Level 1 – Quoted Prices | $ | 96,449,473 | | $ | — |

| Level 2 – Other Significant Observable Inputs | $ | — | | $ | — |

| Level 3 – Significant Unobservable Inputs | $ | — | | $ | — |

| Total | $ | 96,449,473 | | $ | — |

| *Other financial instruments include futures, forwards and swap contracts. |

All securities of the Fund were valued using Level 1 inputs during the year ended December 31, 2008. Thus, a reconciliation of assets in which significant unobservable inputs (Level 3) were used in determining fair value is not applicable.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

3. UNREALIZED APPRECIATION AND DEPRECIATION OF INVESTMENTS (TAX BASIS)

| As of December 31, 2008: | | |

| Gross appreciation (excess of value over tax cost) | $ | 2,133,374 |

| Gross depreciation (excess of tax cost over value) | | (29,242,705) |

| Net unrealized depreciation | $ | (27,109,331) |

| Cost of investments for income tax purposes | $ | 123,558,804 |

1-800-624-4190 | • www.blu.com | 29 |

4. INVESTMENT ADVISORY AND ADMINISTRATION SERVICES

The Fund has an Investment Advisory Agreement with Denver Investment Advisors LLC, whereby an investment advisory fee is paid to DenverIA based on an annual rate of 0.65% of the Fund’s average weekly net assets up to $100,000,000 and 0.50% of the Fund’s average weekly net assets in excess of $100,000,000. The management fee is paid monthly based on the average of the net assets of the Fund computed as of the last business day the New York Stock Exchange is open each week. Certain officers and a director of the Fund are also officers of DenverIA.

ALPS Fund Services, Inc. (“ALPS”) and DenverIA serve as the Fund’s co-administrators. The Administrative Agreement includes the Fund’s administrative and fund accounting services. The administrative services fee is based on the current annual rate for ALPS and DenverIA, respectively, of 0.0955% and 0.01% of the Fund’s average daily net assets up to $75,000,000, 0.05%, and 0.005% of the Fund’s average daily net assets between $75,000,000 and $125,000,000, and 0.03% and 0.005% of the Fund’s average daily net assets in excess of $125,000,000 plus certain out-of-pocket expenses. The administrative service fee is paid monthly.

Prior to April 1, 2008, the administrative services fee for ALPS was an annual rate of 0.0855% of the Fund’s average daily net assets up to $75,000,000, 0.0400% of the Fund’s average daily net assets between $75,000,000 and $125,000,000 and 0.0200% of the Fund’s average daily net assets in excess of $125,000,000. DenverIA’s administrative services fee remains unchanged.

The Directors have appointed a Chief Compliance Officer who is also Treasurer of the Fund and an employee of DenverIA. The Directors agreed that the Fund would reimburse DenverIA a portion of his compensation for his services as the Fund’s Chief Compliance Officer.

5. LOAN OUTSTANDING

The Fund has a line of credit with The Bank of New York Mellon (“BONY”) in which the Fund may borrow up to the lesser of 15% of the Fund’s total assets, $15,000,000 or the maximum amount the Fund is permitted to borrow under the Investment Company Act of 1940. The loan is subject to annual renewal and the interest rate resets daily at overnight Federal Funds Rate plus 0.825%. Effective March 1, 2009, the interest rate will change to the overnight Federal Funds Rate plus 1.00% and the Fund will pay an annual loan facility fee of 0.03%. The borrowings under the BONY loan are secured by a perfected security interest on all of the Fund’s assets.

| 30 | Annual Report December 31, 2008 |

| Details of the loan outstanding are as follows: | | | | | | |

| | | | Average for the | |

| | As of | | Year Ended | |

| | December 31, | | December 31, | |

| | 2008 | | 2008 | |

| Loan outstanding | | $12,275,000 | | | $12,881,202 | |

| Interest rate | | 0.92%* | | | 2.76% | |

| % of Fund’s total assets | | 12.69% | | | 13.32% | |

| Amount of debt per share outstanding | | $0.43 | | | $0.45 | |

| Number of shares outstanding (in thousands) | | 28,464 | | | 28,455** | |

| | | | | | | |

| **Annualized | | | | | | |

| **Weighted average | | | | | | |

6. NEW ACCOUNTING PRONOUNCEMENTS

In March 2008, the FASB issued Statement of Financial Accounting Standards No. 161, “Disclosures about Derivative Instruments and Hedging Activities” (“SFAS 161”). SFAS 161 is effective for fiscal years and interim periods beginning after November 15, 2008. SFAS 161 requires enhanced disclosures about Funds’ derivative and hedging activities. Management of the Fund currently believes that SFAS 161 will have no impact on the Fund’s financial statements.

7. TAX DESIGNATIONS (Unaudited)

Certain tax information is provided to shareholders as required by the Internal Revenue Code or to meet a specific state’s requirement. The Fund designates the following amounts or, if subsequently determined to be different, the maximum amount allowable for its fiscal year ended December 31, 2008:

| Corporate Dividends Received Deduction | 100% | |

| Qualified Dividend Income | 100% | |

| Long-Term Capital Gain Dividends | $208,973 | |

1-800-624-4190 | �� www.blu.com | 31 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Directors of Blue Chip Value Fund, Inc.:

We have audited the accompanying statement of assets and liabilities of Blue Chip Value Fund, Inc. (the “Fund”), including the statement of investments, as of December 31, 2008, and the related statements of operations and cash flows for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2008, by correspondence with the custodian. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Blue Chip Value Fund, Inc. as of December 31, 2008, the results of its operations and its cash flows for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

DELOITTE & TOUCHE LLP

Denver, Colorado

February 17, 2009

| 32 | Annual Report December 31, 2008 |

BOARD OF DIRECTORS Kenneth V. Penland, Chairman

Todger Anderson, Director

Lee W. Mather, Jr, Director

Richard C. Schulte, Director

Roberta M. Wilson, Director OFFICERS Kenneth V. Penland, Chairman

Todger Anderson, President

Mark M. Adelmann, Vice President

Nancy P. O’Hara, Secretary

Jasper R. Frontz, Treasurer, Chief Compliance Officer Investment Adviser/Co-Administrator

Denver Investment Advisors LLC

1225 17th Street, 26th Floor

Denver, CO 80202 Stockholder Relations

(800) 624-4190 (option #2)

e-mail: blu@denveria.com Custodian

The Bank of New York Mellon

One Wall Street

New York, NY 10286 Co-Administrator

ALPS Fund Services, Inc.

1290 Broadway, Suite 1100

Denver, CO 80203 Transfer Agent Dividend Reinvestment Plan Agent

(Questions regarding your Account)

BNY Mellon Shareowner Services

480 Washington Blvd.

Jersey City, NJ 07310 (800) 624-4190 (option #1)

www.melloninvestor.com

|

Item 2. Code of Ethics.

(a) The registrant, as of the end of the period covered by the report, has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or any persons performing similar functions on behalf of the registrant.

(b) Not applicable.

(c) During the period covered by this report, no amendments were made to the provisions of the code of ethics adopted in 2(a) above.

(d) During the period covered by this report, no implicit or explicit waivers to the provisions of the code of ethics adopted in 2(a) above were granted.

(e) Not applicable.

(f) The registrant’s Code of Ethics is attached as an Exhibit hereto.

Item 3. Audit Committee Financial Expert.

The Board of Directors of the registrant has determined that the registrant has at least one “audit committee financial expert” serving on its audit committee. The Board of Directors has designated Roberta M. Wilson as the registrant’s “audit committee financial expert.” Ms. Wilson is “independent” as defined in paragraph (a)(2) of Item 3 to Form N-CSR.

Item 4. Principal Accountant Fees and Services.

(a) Audit Fees: For the registrant's fiscal years ended December 31, 2008 and December 31, 2007, the aggregate fees billed for professional services rendered by the principal accountant for the audit of the registrant's annual financial statements were $27,000 and $25,520, respectively.

(b) Audit-Related Fees: In registrant's fiscal years ended December 31, 2008 and December 31, 2007, no fees were billed for assurance and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant's financial statements and are not reported under paragraph (a) of this Item.

(c) Tax Fees: For the registrant's fiscal years ended December 31, 2008 and December 31, 2007, aggregate fees of $2,600 and $3,120, respectively, were billed for professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning.

(d) All Other Fees: For the registrant's fiscal year ended December 31, 2008 and December 31, 2007, no fees were billed to registrant by the principal accountant for services other than the services reported in paragraph (a) through (c) of this item.