UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05010

(Exact name of registrant as specified in charter)

|

2960 North Meridian Street, Suite 300 Attn: Huntington Funds Officer Indianapolis, IN 46208 |

(Address of principal executive offices) (Zip code)

|

Ronald J. Corn, Esq. The Huntington National Bank 41 South High Street Columbus, OH 43287 |

(Name and address of agent for service)

Copies to:

David C. Mahaffey, Esq.

Sullivan & Worcester

1666 K Street, N.W.

Washington, DC 20006

Registrant’s telephone number, including area code: 1-800-253-0412

Date of fiscal year end: December 31

Date of reporting period: December 31, 2010

Item 1. Reports to Stockholders.

Money Market Funds

Huntington Tax-Free Money Market Fund

Huntington Money Market Fund

Huntington Ohio Municipal Money Market Fund

Huntington U.S. Treasury Money Market Fund

Equity Funds

Huntington Dividend Capture Fund

Huntington Global Select Markets Fund

Huntington Growth Fund

Huntington Income Equity Fund

Huntington International Equity Fund

Huntington Macro 100 Fund

Huntington Mid Corp America Fund

Huntington New Economy Fund

Huntington Real Strategies Fund

Huntington Rotating Markets Fund

Huntington Situs Fund

Huntington Technical Opportunities Fund

Income Funds

Huntington Fixed Income Securities Fund

Huntington Intermediate Government Income Fund

Huntington Mortgage Securities Fund

Huntington Ohio Tax-Free Fund

Huntington Short/Intermediate Fixed Income Securities Fund

Asset Allocation Funds

Huntington Balanced Allocation Fund

Huntington Conservative Allocation Fund

Huntington Growth Allocation Fund

DECEMBER 31, 2010

CLASS A SHARES

TRUST SHARES

| | |

Dividend Capture Fund | | As of 12/31/10 |

Management’s Discussion of Fund Performance

Portfolio Manager:

Kirk Mentzer, MBA, Director of Research

Huntington Asset Advisors, Inc.

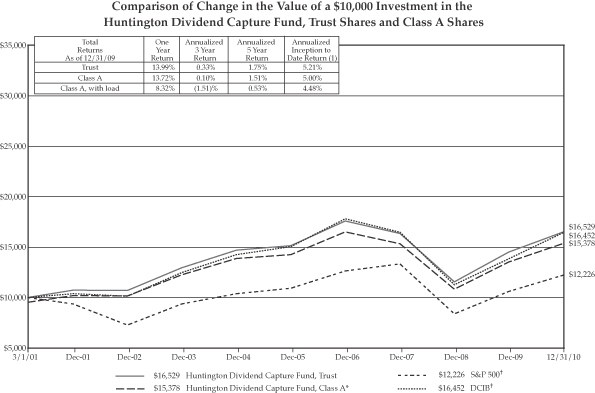

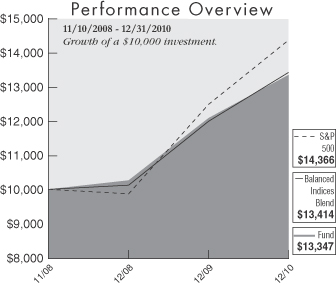

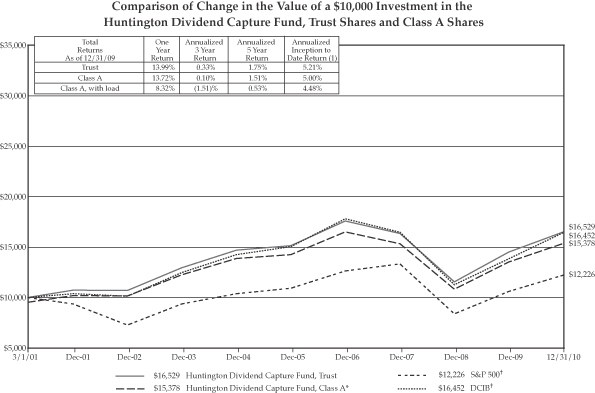

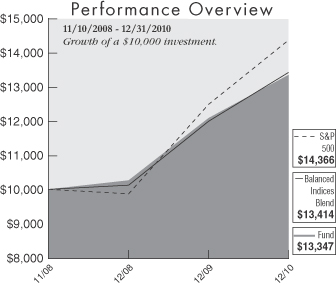

For the fiscal year ended December 31, 2010, the Huntington Dividend Capture Fund’s Trust Shares and Class A Shares produced total returns (not including the deduction of applicable sales charges) of 13.99% and 13.72%, respectively, based on net asset value. This performance was less than the total return of 15.06% for the Fund’s benchmark, the Standard & Poor’s 500 Index (S&P 500),1 and less than the 17.12% total return for the Dividend Capture Indices Blend (DCIB).2 The Huntington Dividend Capture A class shares underperformed the benchmark by -1.34%.

The Fund is managed using our top-down style and portfolio construction techniques, which are aimed at producing a high level of stable income and low volatility. In general terms, income-producing stocks and value-oriented investments lagged overall market performance during the fiscal year. Improving market sentiment, policy clarity and increased merger activity all converged late in the year to provide a strong finish for equity markets in 2010. However, the market had to wade through considerable uncertainty to get to its final destination. Sovereign debt issues in Europe at the beginning of summer threatened the durability of the financial system recovery. As a result, the Federal Reserve initiated further bond purchases in late summer to enhance market liquidity. Despite the US mid-term elections and China raising interest rates in the fall, the US equity market was able to power through all these barriers thanks to plentiful liquidity. For all of 2010, the S&P 500 posted a total return of 15.06%. Fourth quarter results were likewise strong at 10.76%. The Fund’s asset allocation efforts were successful in capturing much of the fourth quarter equity market move by selling REITs ( Real Estate Investment Trusts) and Preferred shares in favor of common stocks which were the best performing of the three classes.

Trading activity was responsible for -1.74% of the performance relative to the benchmark while portfolio structure had a positive impact of 0.62%. Portfolio structure can be explained by adding Security Characteristics: -0.01%, Sector Allocation: -1.09% and Security Selection: 1.72%. The three holdings that had the largest positive contribution to the Fund’s performance were Polaris Industries Inc. , Chevron Corp. and A.O. Smith Corp. These three holdings added 1.62% to the fund’s return. The three holdings that had the largest negative contribution to the Funds performance were Avon Products Inc., Pfizer Inc., and Archer Daniels Midland Co. These three holdings subtracted -0.86% from the Fund’s return.

| ¿ | | The composition of the Fund’s holdings is subject to change. |

| (1) | The S&P 500 is a capitalization-weighted index comprised of 500 stocks and is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an Index. |

| (2) | The DCIB is a custom, blended index comprised of the following three indices with their noted respective weightings: S&P 500 Value Index (40%), Merrill Lynch Fixed Rate Preferred Index (40%) and NAREIT Index (20%). This custom, blended index and its respective weightings are reflective of the Fund’s sector diversification. Indices are unmanaged and, unlike the Fund, are not affected by cashflows. It is not possible to invest directly in an Index. |

Annual Shareholder Report

1

Dividend Capture Fund (Continued)

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month end performance, visit www.huntingtonfunds.com or call 1-800-253-0412. For after-tax returns call 1-800-253-0412. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund Shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. Total returns, at load, include the maximum 4.75% sales charge for the Class A Shares.

| | | | |

| Class | | Expense Ratios | |

A | | | 1.66% | |

Trust | | | 1.41% | |

The above expense ratios are from the Funds’ prospectus dated May 1, 2010. Additional information pertaining to the Fund’s expense ratio as of December 31, 2010 can be found in the financial highlights.

The Fund’s performance assumes the reinvestment of all dividends and distributions on securities. The S&P 500 and DCIB have been adjusted to reflect reinvestment of dividends on securities in the indices.

| * | Represents a hypothetical investment of $10,000 in the Fund after deducting the maximum sales load of 4.75% ($10,000 investment minus $475 sales load = $9,525). |

| (1) | The Fund commenced operations for all Share classes on March 1, 2001. |

| † | The S&P 500 and DCIB are not adjusted to reflect sales charges, expenses, or other fees that the Securities and Exchange Commission requires to be reflected in the Fund’s performance. The indices are unmanaged and, unlike the Fund, are not affected by cashflows. It is not possible to invest directly in an index. |

Annual Shareholder Report

2

| | |

Global Select Markets Fund | | As of 12/31/10 |

Management’s Discussion of Fund Performance

Portfolio Manager: Paul W. Attwood, CFA

Vice President

Huntington Asset Advisors, Inc.

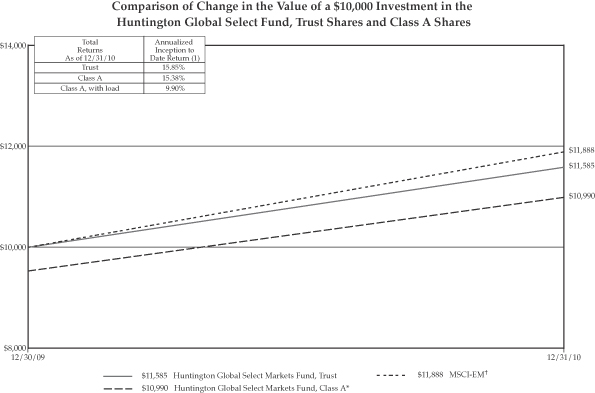

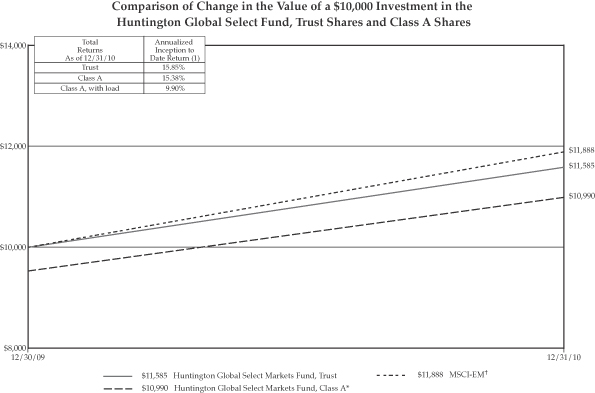

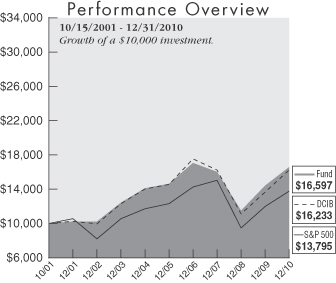

For the fiscal year ended December 31, 2010, the Huntington Global Select Markets Fund produced total returns (not including the deduction of applicable sales charges) of 15.85% and 15.38% for its Trust and Class A Shares respectively, based on net asset value. This underperformed the total return of 18.88% for the Morgan Stanley Capital International (MSCI) Emerging Market Index (MSCI-EM),1 the Fund’s benchmark index.

From a country perspective, Brazil and China were laggards which negatively affected the performance of the Fund. Some of the smaller emerging markets, such as the Indonesian Jakarta Composite, which appreciated 48.94%, bolstered overall total return. This turned out to be the major theme within the emerging markets for most of the year. A significant outperformance in 2009 along with concerns over overheating economies and inflation kept most of the larger markets in a trading range. The fund has a significant overweight in India which had a weak fourth quarter and played a major role in affecting relative performance.

The developing market currencies once again had positive performances versus the U.S dollar. Concerns over European sovereign debt negatively affected most Eastern European nations even though they are not European Community members. Another theme which is permeated these markets was concern over increasing capital flows and hence rising currencies. After Japan relented to global pressure in the 1990’s allowing the Yen to appreciate too rapidly, their competitiveness suffered dramatically and led to increases in unemployment and what is commonly referred to as the lost decade. Leaders within emerging market countries are committed to avoiding the same mistake. Brazil, for example, has imposed a “tariff” on international investors wanting to purchase Brazilian Real in order to gain exposure to equities or bonds. Other countries are expected to follow suit.

Consumer Discretionary and Staples were the top performing sectors for the year which was beneficial to the Fund’s performance. A major theme of the Fund is focused on the emergence of a middle-class consumer in select Asia and Latin America regions. Energy and Utilities were the weakest areas. Sector performance was highly differentiated on a regional basis. As an example, Brazil’s energy stocks were down over 16% as a group while China’s were up over 19%. Consumer names owned by the Fund produced some significant gains throughout the year, such as Taiwan-based President Chain Store which was up almost 100% and Brazil’s Ambev which was up over 50%. One of the weaker names was Petrobras which was down over 18% due to a large secondary offering during the year.

| ¿ | | The composition of the Fund’s holdings is subject to change. |

| ¿ | | International investing involves special risks including currency risk, political risk, increased volatility of foreign securities, and differences in auditing and other financial statements. |

| (1) | The MSCI-EM is a market-capitalization weighted equity index comprising 21 of the 48 countries in the MSCI universe. Each MSCI country index is created separately, then aggregated, without change, into MSCI indices. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an Index. |

Annual Shareholder Report

3

Global Select Markets Fund (Continued)

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month end performance, visit www.huntingtonfunds.com or call 1-800-253-0412. For after-tax returns call 1-800-253-0412. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund Shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. Total returns, at load, include the maximum 4.75% sales charge for the Class A Shares.

| | | | |

| Class | | Expense Ratios | |

A | | | 2.16% | |

Trust | | | 1.91% | |

The above expense ratios are from the Funds’ prospectus dated May 1, 2010. Additional information pertaining to the Fund’s expense ratio as of December 31, 2010 can be found in the financial highlights.

The Fund’s performance assumes the reinvestment of all dividends and distributions on securities. The MSCI-EM has been adjusted to reflect reinvestment of dividends on securities in the index.

| * | Represents a hypothetical investment of $10,000 in the Fund after deducting the maximum sales load of 4.75% ($10,000 investment minus $475 sales load = $9,525). |

| (1) | The Fund commenced operations for all Share classes on December 30, 2009. |

| † | The MSCI-EM is not adjusted to reflect sales charges, expenses, or other fees that the Securities and Exchange Commission requires to be reflected in the Fund’s performance. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an index. |

Annual Shareholder Report

4

| | |

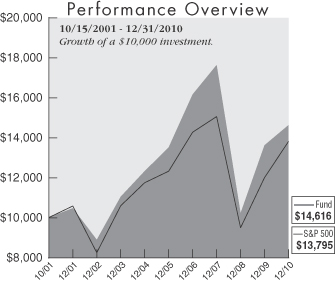

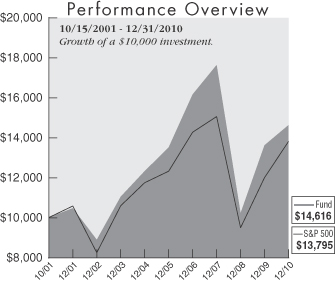

Growth Fund | | As of 12/31/10 |

Management’s Discussion of Fund Performance

Portfolio Manager:

Herb Chen, MBA

Senior Vice President

Huntington Asset Advisors, Inc.

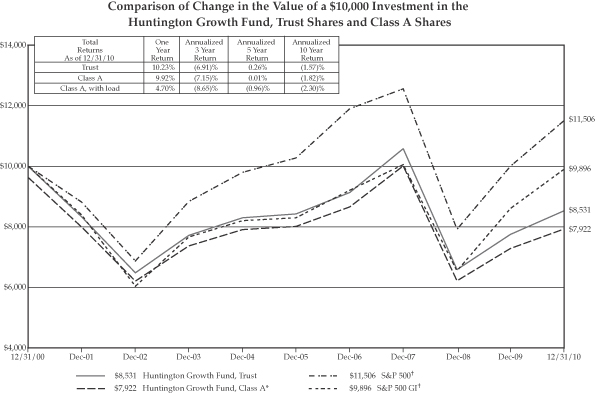

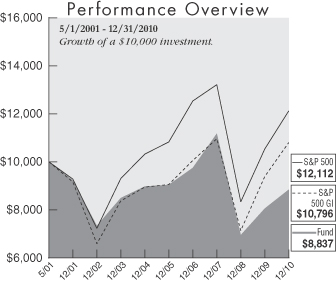

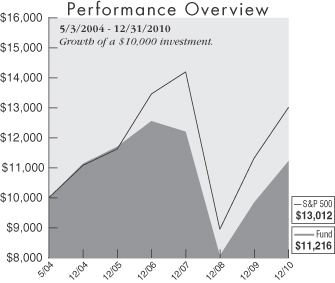

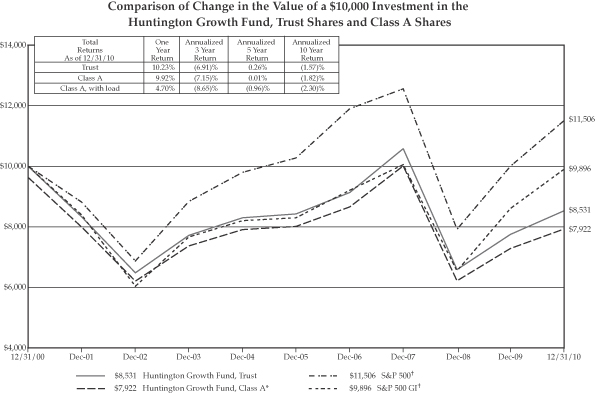

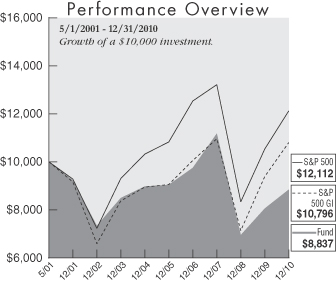

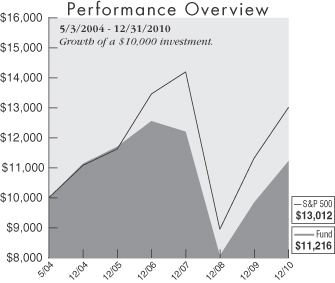

For the fiscal year ended December 31, 2010, the Huntington Growth Fund produced total returns (not including the deduction of applicable sales charges) of 10.23% and 9.92% for Trust Shares and Class A Shares, respectively, based on net asset value. This underperformed the total return of 15.05% for the Standard & Poor’s 500 Growth Index (S&P 500 GI), 1 the Fund’s benchmark and a total return of 15.06% for the Standard & Poor’s 500 Index (S&P 500)2 for the reporting period.

Under the management of the previous fund managers, the Growth Fund began the year with a relatively defensively structured portfolio. With the S& P 500 GI being up 3.71%, the Fund lagged by 1.74% at the end of the first quarter.

In April 2010, Herb Chen assumed management responsibility and three major changes were implemented to turn around Fund performance: the Fund was aligned with our forecast of an economic recovery, the number of positions was reduced from greater than 100 to 40, and the Beta of the Fund was increased above 1 to reflect a more aggressive growth portfolio.

In May 2010, the first month after the full rebalancing of the Fund, we began seeing positive relative returns. The Fund’s Trust Shares beat the benchmark by 1.83% in May 2010, and another 0.3% in June 2010. During these months, we were overweight in Consumer Discretionary, Energy, Industrials, and Materials, which typically outperform in an economic recovery.

In third quarter, profits were realized from Consumer Discretionary and re-invested into an overweight in Technology. The Fund delivered a 16.06% return, exceeding the benchmark by 3.43%. Security selection was the largest contributor at 4.57%, followed by security characteristics (-1.10%) and sector allocation (-1.07%). Baidu (2.40%),VMware (1.73%) and Salesforce.com (1.6%) were top stock contributors, representing 5.4%, 5.4% and 5.74% of the portfolio, respectively, at the end of the third quarter.

In the final quarter, Technology was returned to an underweight, with Consumer Discretionary moving back to an overweight. Security characteristics and sector allocation contributed 1.71%, to the Fund’s return, while stock selection reversed course with a -5.17% return. We believe this was more of an anomaly and will be carefully watched going forward. Companies that had appreciated significantly during the year disappointed during earnings release and sold off sharply. Several of these positions were sold to establish a fresh start in 2011.

| ¿ | | The composition of the Fund’s holdings is subject to change. |

| (1) | The S&P 500 GI is a capitalization-weighted index comprised of stocks in the S&P 500 having the highest price to book ratios. The index consists of approximately half of the S&P 500 on a market capitalization basis. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an Index. |

| (2) | The S&P 500 is a capitalization-weighted index comprised of 500 stocks and designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an Index. |

Annual Shareholder Report

5

Growth Fund (Continued)

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month end performance, visit www.huntingtonfunds.com or call 1-800-253-0412. For after-tax returns call 1-800-253-0412. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund Shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. Total returns, at load, include the maximum 4.75% sales charge for the Class A Shares.

| | | | |

| Class | | Expense Ratios | |

A | | | 1.47% | |

Trust | | | 1.22% | |

The above expense ratios are from the Funds’ prospectus dated May 1, 2010. Additional information pertaining to the Fund’s expense ratio as of December 31, 2010 can be found in the financial highlights.

The Fund’s performance assumes the reinvestment of all dividends and distributions on securities. The S&P 500 and S&P 500 GI have been adjusted to reflect reinvestment of dividends on securities in the indices.

| * | Represents a hypothetical investment of $10,000 in the Fund after deducting the maximum sales load of 4.75% ($10,000 investment minus $475 sales load = $9,525). |

| † | The S&P 500 and S&P 500 GI are not adjusted to reflect sales charges, expenses, or other fees that the Securities and Exchange Commission requires to be reflected in the Fund’s performance. The indices are unmanaged and, unlike the Fund, are not affected by cashflows. It is not possible to invest directly in an index. |

Annual Shareholder Report

6

| | |

Income Equity Fund | | As of 12/31/10 |

Management’s Discussion of Fund Performance

Portfolio Manager: Craig J. Hardy, CFA, MBA

Vice President

Huntington Asset Advisors, Inc.

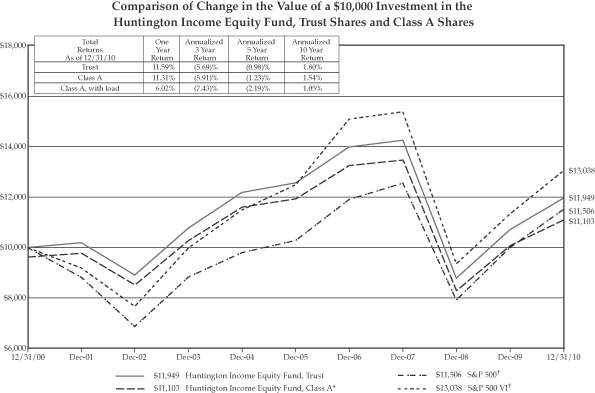

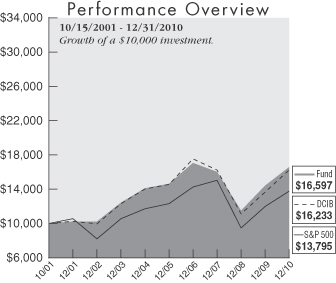

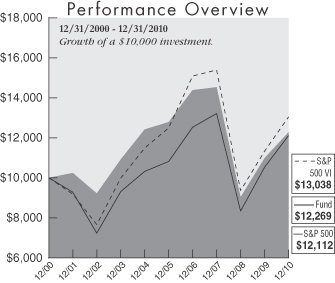

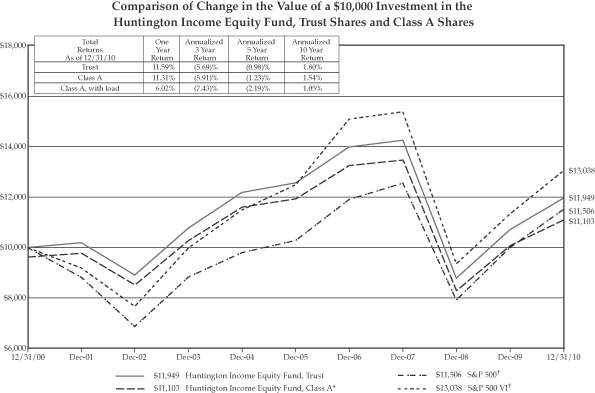

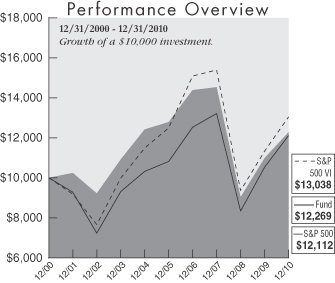

For the fiscal year ended December 31, 2010, the total returns (not including the deduction of applicable sales charges) for the Huntington Income Equity Fund were 11.59% and 11.31% for Trust Shares and Class A Shares, respectively, based on net asset value. These returns compare with a total return of 15.10% for the Standard & Poor’s 500 Value Index (S&P 500 VI),1 the Fund’s benchmark. The Standard & Poor’s 500 Index (S&P 500)2 returned 15.06% for the same period.

During the fiscal year, the Fund was positioned relatively conservatively, with an emphasis on stocks with above average dividend yields, reasonable dividend growth prospects and value orientation. Constructing the Fund with those characteristics meant that the Fund’s largest sector exposure during the fiscal year was in the Financial sector. This combination of characteristics produced returns for the Fund that were somewhat lower than the return of the S&P 500 VI and the S&P 500 for the reporting period.

The sectors that contributed most positively to the performance of the Fund during the year were Materials, Consumer Discretionary and Telecommunications. These sectors were positively affected by a growing economic environment and economic cyclicality. The sectors that most negatively impacted the Fund’s performance during the reporting period were Information Technology, Health Care and Energy. During a year of general stock market strength, these three sectors provided a degree of earnings stability and lesser economic sensitivity, but showed generally lower returns than some of the more cyclical sectors. The stocks that contributed most positively to the performance of the Fund during the year were Caterpillar Inc., Sara Lee Corp. and Limited Inc. The stocks that most negatively impacted Fund performance during the year were Banco Santander, BP and Sanofi-Aventis. In general, the sale of covered calls as a hedging technique added to the performance of the Fund.

| ¿ | | The composition of the Fund’s holdings is subject to change. |

| (1) | The S&P 500 VI is a capitalization-weighted index comprised of the stocks in the S&P 500 having the lowest price to book ratios and consists of approximately half of the S&P 500 on a market capitalization basis. The S&P multifactor methodology is used to score constituents, which are weighted according to market cap and classified as value. The index has a relatively low turnover. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an Index. |

| (2) | The S&P 500 is a capitalization-weighted index comprised of 500 stocks and designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an Index. |

Annual Shareholder Report

7

Income Equity Fund (Continued)

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month end performance, visit www.huntingtonfunds.com or call 1-800-253-0412. For after-tax returns call 1-800-253-0412. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund Shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. Total returns, at load, include the maximum 4.75% sales charge for the Class A Shares.

| | | | |

| Class | | Expense Ratios | |

A | | | 1.47% | |

Trust | | | 1.22% | |

The above expense ratios are from the Funds’ prospectus dated May 1, 2010. Additional information pertaining to the Fund’s expense ratio as of December 31, 2010 can be found in the financial highlights.

The Fund’s performance assumes the reinvestment of all dividends and distributions on securities. The S&P 500 and the S&P 500 CVI have been adjusted to reflect reinvestment of dividends on securities in the indices.

| * | Represents a hypothetical investment of $10,000 in the Fund after deducting the maximum sales load of 4.75% ($10,000 investment minus $475 sales load = $9,525). |

| † | The S&P 500 and the S&P 500 VI are not adjusted to reflect sales charges, expenses, or other fees that the Securities and Exchange Commission requires to be reflected in the Fund’s performance. The indices are unmanaged and, unlike the Fund, are not affected by cashflows. It is not possible to invest directly in an index. |

Annual Shareholder Report

8

| | |

International Equity Fund | | As of 12/31/10 |

Management’s Discussion of Fund Performance

Portfolio Manager: Madelynn M. Matlock, CFA, MBA

Director of International Investments

Senior Vice President

Huntington Asset Advisors, Inc.

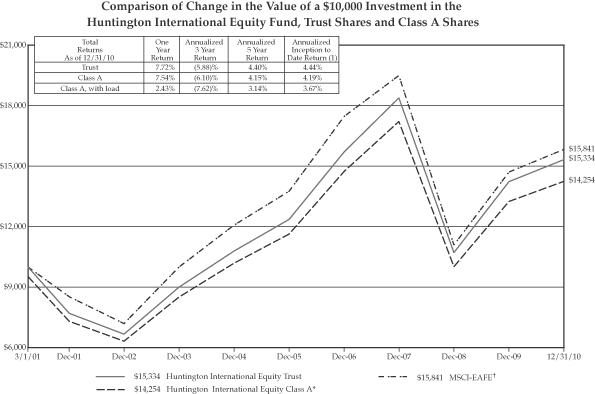

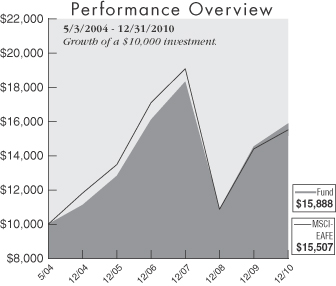

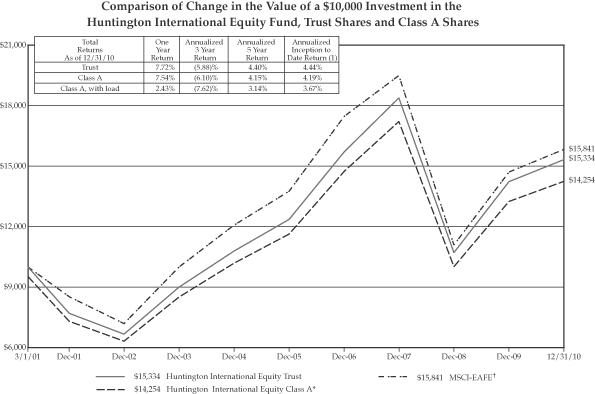

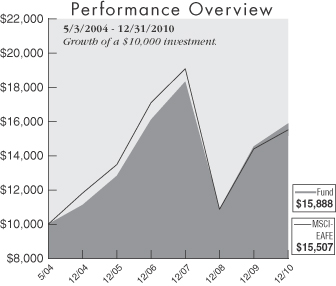

For the fiscal year ended December 31, 2010, the Huntington International Equity Fund produced total returns (not including the deduction of applicable sales charges) of 7.72%, and 7.54% for its Trust Shares and Class A Shares, respectively, based on net asset value. This slightly underperformed the total return of 7.75% for the Morgan Stanley Capital International (MSCI) Europe, Australasia and Far East Index (MSCI-EAFE),1 the Fund’s benchmark index.

The Fund’s small shortfall to the MSCI-EAFE was influenced by three main factors: its allocation to sectors, currency and regions, along with trading activity, which offset the beneficial impact from the selection of particular securities. Overall, sector weightings did not contribute to positive relative performance for the year. The portfolio had a less-than-benchmark weighting in materials and consumer discretionary stocks, which were strong contributors to index performance. This was partially offset by an above-index weighting in industrial and technology stocks, which did add value.

The best contributors to overall return were stocks in the industrial sector, including Fanuc and Komatsu in Japan, GEA Group in Germany, and Rolls Royce in the UK. Energy stocks also contributed to relative performance, including the Italian oil service stock Saipem and Canadian-based Cenovus. The currency exposure of the portfolio was slightly negative for performance, with a positive contribution due to an underweight in the euro offset by a lower than index exposure to the Australian dollar and the Swedish krona, which added to the MSCI-EAFE return. The Fund benefitted from a lighter weighting in financial stocks than the index, but one the weakest stocks in the portfolio was Banco Bilbao Vizcaya, which offset some of that positive effect.

The generally negative impact of trading in the portfolio was related to the positive impact of security selection. To control the risk of large position sizes, stock positions are trimmed when they become larger proportions of the portfolio, but in a year when good relative performance for particular stocks tended to persist, this meant reducing exposure to positions that were doing relatively well.

| ¿ | | The composition of the Fund’s holdings is subject to change. |

| ¿ | | International investing involves special risks including currency risk, political risk, increased volatility of foreign securities, and differences in auditing and other financial statements. |

| (1) | The MSCI-EAFE is a market-capitalization weighted equity index comprising 20 of the 48 countries in the MSCI universe and representing the developed world outside of North America. Each MSCI country index is created separately, then aggregated, without change, into MSCI indices. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an Index. |

Annual Shareholder Report

9

International Equity Fund (Continued)

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month end performance, visit www.huntingtonfunds.com or call 1-800-253-0412. For after-tax returns call 1-800-253-0412. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund Shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. Total returns, at load, include the maximum 4.75% sales charge for the Class A Shares.

| | | | |

| Class | | Expense Ratios | |

A | | | 1.89% | |

Trust | | | 1.64% | |

The above expense ratios are from the Funds’ prospectus dated May 1, 2010. Additional information pertaining to the Fund’s expense ratio as of December 31, 2010 can be found in the financial highlights.

The Fund’s performance assumes the reinvestment of all dividends and distributions. The MSCI-EAFE has been adjusted to reflect reinvestment of dividends on securities in the index.

| * | Represents a hypothetical investment of $10,000 in the Fund after deducting the maximum sales load of 4.75% ($10,000 investment minus $475 sales load = $9,525). |

| (1) | The Fund commenced operations for all share classes on March 1, 2001. |

| † | The MSCI-EAFE is not adjusted to reflect sales charges, expenses, or other fees that the Securities and Exchange Commission requires to be reflected in the Fund’s performance. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an index. |

Annual Shareholder Report

10

| | |

Macro 100 Fund | | As of 12/31/10 |

Management’s Discussion of Fund Performance

Portfolio Manager: Chadd Oviatt, Vice President and Senior Portfolio Manager

Huntington Asset Advisors, Inc.

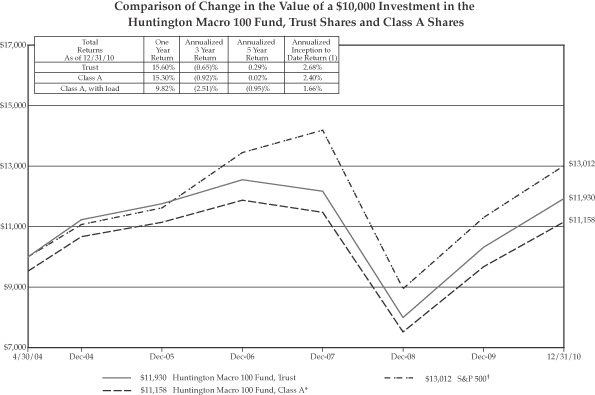

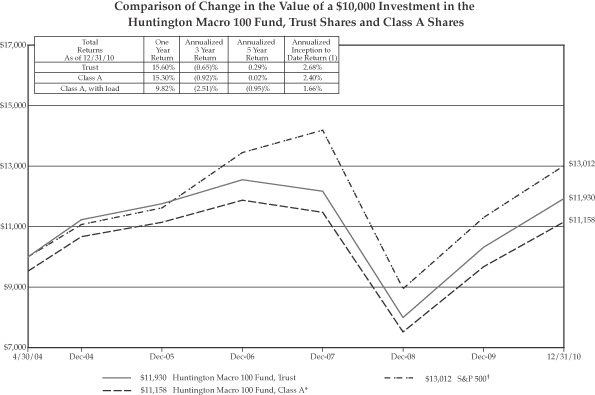

For the fiscal year ended December 31, 2010, the Huntington Macro 100 Fund produced total returns (not including the deduction of applicable sales charges) for the Fund’s Trust Shares and Class A Shares of 15.60% and 15.30%, respectively, based on net asset value. The Fund outperformed the total return of 15.06% for the Standard & Poor’s 500 Index (S&P 500),1 the Fund’s benchmark index.

The Fund’s outperformance relative to the S&P 500 was, in large part, due to the types of securities owned rather than the overall industry allocations. The Fund benefited from a slightly lower average market capitalization relative to its benchmark and was also positively impacted by other fundamental factors such as average earnings per share, average revenue per share and favorable debt to equity ratios. The major detractor from performance for the year was the Fund’s limited participation in the performance of the Consumer Discretionary sector. The combination of an underweight position in the Consumer Discretionary sector and individual security selection in this sector resulted in the underperformance relative the benchmark’s sector performance. The Financial Sector was also a detractor from performance due to its underweight position.

Despite a change in portfolio managers, which occurred in April of 2010, the Fund continued the process of integrating the quantitative macro-economic research provided by the consulting firm, Laffer Associates, Inc. (where the S & P 500 stocks are ranked according to the output of Laffer’s statistical models) with Huntington Asset Advisors’ recommended sector bias’. It was the combination of these two disciplines that resulted in added value within the investment selection process.

The Macro-economic environment, both domestically and globally, had a significant impact on the portfolio once again this year. The beginning of 2010 seemed to indicate that economic stability was taking hold, and a positive macroeconomic outlook helped to fuel the S&P 500 return of 5.39% in the first quarter. Unfortunately, the second quarter saw a global economy that was shaken by developments in Europe. The S&P 500 was not immune to the global disruption and posted a -11.43% return for the quarter. Of course, the third quarter was a much different story for the S&P 500 as global sentiment improved due in large part to the actions of various governments from around the world, as well as generally better than expected economic numbers. The S&P 500 returned 11.29% for the quarter. This positive momentum continued into the fourth quarter and paved the way for the S&P 500’s 15.06% total return for 2010. The Macro 100 Fund had a similar pattern throughout 2010, but was able to finish the year with a total return of 15.60% for the Trust Shares and 15.30% for the Class A Shares.

| ¿ | | The composition of the Fund’s holdings is subject to change. |

| (1) | The S&P 500 is a capitalization-weighted index comprised of 500 stocks and is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an Index. |

Annual Shareholder Report

11

Macro 100 Fund (Continued)

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month end performance, visit www.huntingtonfunds.com or call 1-800-253-0412. For after-tax returns call 1-800-253-0412. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund Shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. Total returns, at load, include the maximum 4.75% sales charge for the Class A Shares.

| | | | |

| Class | | Expense Ratios | |

A | | | 1.82% | |

Trust | | | 1.57% | |

The above expense ratios are from the Funds’ prospectus dated May 1, 2010. Additional information pertaining to the Fund’s expense ratio as of December 31, 2010 can be found in the financial highlights.

The Fund’s performance assumes the reinvestment of all dividends and distributions. The S&P 500 has been adjusted to reflect reinvestment of dividends on securities in the index.

| * | Represents a hypothetical investment of $10,000 in the Fund after deducting the maximum sales load of 4.75% ($10,000 investment minus $475 sales load = $9,525). |

| (1) | The Fund commenced operations for all share classes on April 30, 2004. |

| † | The S&P 500 is not adjusted to reflect sales charges, expenses, or other fees that the Securities and Exchange Commission requires to be reflected in the Fund’s performance. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an index. |

Annual Shareholder Report

12

| | |

Mid Corp America Fund | | As of 12/31/10 |

Management’s Discussion of Fund Performance

Portfolio Manager: Christopher M. Rowane, CFA, MBA

Senior Vice President

Huntington Asset Advisors, Inc.

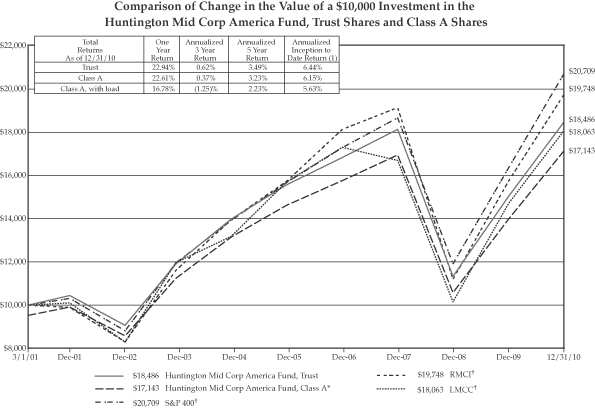

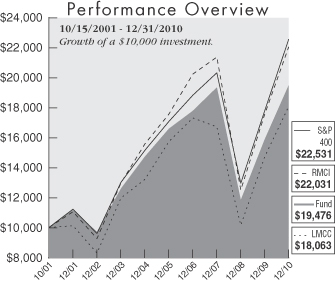

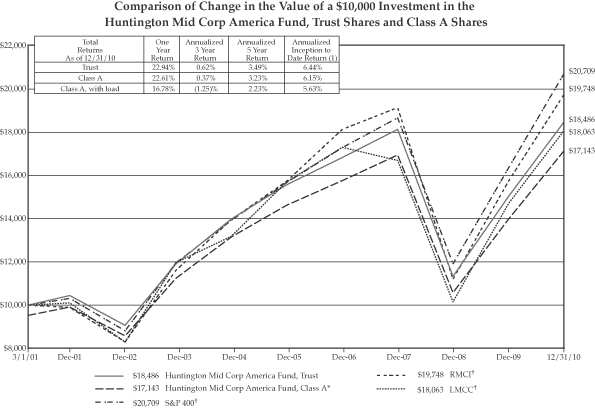

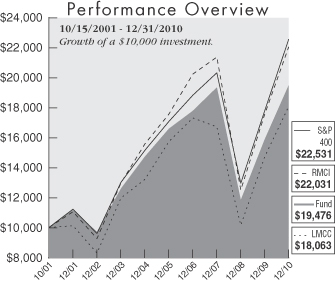

For the fiscal year ended December 31, 2010, the Huntington Mid Corp America Fund produced total returns (not including the deduction of applicable sales charges) of 22.94% and 22.61% for the Fund’s Trust Shares and Class A Shares, respectively, based on net asset value. In the same period the Fund’s benchmark, the Standard & Poor’s MidCap 400 Index (S&P 400),1 produced a total return of 26.64% and the Russell Midcap Index (RMCI) 2 produced a total return of 25.48%, while the Lipper Mid Cap Core Average (LMCC)3 returned 22.87%.

The Fund experienced volatility during 2010, subjected to the market lows in the summer months with a strong rebound toward year’s end. The highlight of the mid cap market was that it presented one of the greatest upsides in 2010 compared to other indices, outpacing large caps and slightly ahead of small caps, as represented by the Standard & Poor’s 500 Index (S&P 500)4 and the Standard & Poor’s Small Cap 600 Index (S&P 600)5 respectively.

The Fund underperformed the S&P 400 for 2010, mainly due to being defensive and maintaining higher quality securities. According to a Morningstar research report, only 22% of active mid cap managers have outpaced the S&P 400 index in the past decade, leading us to a strategy where managing risk might be as important as performance in these volatile markets.

The Fund was underweighted in the Consumer Discretionary and Financials sectors, while overweighted in the Energy and Technology sectors. The performance impact of being underweight in Consumer Discretionary lead to underperformance in the Fund, even with holdings like Royal Caribbean Cruises, which gained 85% for the year. The underweight in Financials proved to be a great benefit to performance, avoiding some of the weakest performers in the mid cap universe. Industrials proved to be another bright spot in sector weighting as well as security selection, but not without some volatile holdings, like Cummins Inc., which gained 142% and L-3 Communications Holdings, which fell 17% over the year. The greatest impact came with the under-exposure to Technology, with the index sector holdings registering a 32% return versus the portfolio’s return of 21% for this sector. The challenge was finding companies that met the quality earnings profile without the added incremental risk. The Fund focused on the long-term sector and stock selection attributes that have added to its performance over volatile cycles. The Fund maintained a higher number of holdings than some of its peers to provide greater diversification.6

| ¿ | | The composition of the Fund’s holdings is subject to change. |

| (1) | The S&P 400 is a capitalization weighted index comprised of common stocks representing all major industries in the mid-cap range of the U.S. stock market. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an Index. |

| (2) | The RMCI measures the performance of the 800 smallest companies in the Russell 1000 Index, which represent approximately 26% of the total market capitalization of the Russell 1000 Index. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an Index. |

| (3) | LMCC figures represent the average of the total returns reported by all of the mutual funds designated by the Lipper Inc. as falling in the category indicated. They do not reflect sales charges. |

| (4) | The S&P 500 is a capitalization-weighted index comprised of 500 stocks and designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an Index. |

| (5) | The S&P 600 is a capitalization-weighted index representing all major industries in the small-cap range of the U.S. stock market. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an Index. |

| (6) | Diversification does not assure a profit nor protect against loss. |

Annual Shareholder Report

13

Mid Corp America Fund (Continued)

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month end performance, visit www.huntingtonfunds.com or call 1-800-253-0412. For after-tax returns call 1-800-253-0412. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund Shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. Total returns, at load, include the maximum 4.75% sales charge for the Class A Shares.

| | | | |

| Class | | Expense Ratios | |

A | | | 1.64% | |

Trust | | | 1.39% | |

The above expense ratios are from the Funds’ prospectus dated May 1, 2010. Additional information pertaining to the Fund’s expense ratio as of December 31, 2010 can be found in the financial highlights.

The Fund’s performance assumes the reinvestment of all dividends and distributions. The S&P 400, RMCI and LMCC have been adjusted to reflect reinvestment of dividends on securities in the indices and average.

| * | Represents a hypothetical investment of $10,000 in the Fund after deducting the maximum sales load of 4.75% ($10,000 investment minus $475 sales load = $9,525). |

| (1) | The Fund commenced operations for all Share classes on March 1, 2001. |

| † | The S&P 400 and RMCI are not adjusted to reflect sales charges, expenses, or other fees that the Securities and Exchange Commission (SEC) requires to be reflected in the Fund’s performance. The indices are unmanaged and, unlike the Fund, are not affected by cashflows. It is not possible to invest directly in an index. The LMCC represents the average of the total returns reported by all of the mutual funds designated by Lipper, Inc. as falling in the category indicated, and is not adjusted to reflect any sales charges. However, these total returns are reported net of expenses or other fees that the SEC requires to be reflected in a Fund’s performance. |

Annual Shareholder Report

14

| | |

New Economy Fund | | As of 12/31/10 |

Management’s Discussion of Fund Performance

Portfolio Manager: Randy Hare

Vice President

Huntington Asset Advisors, Inc.

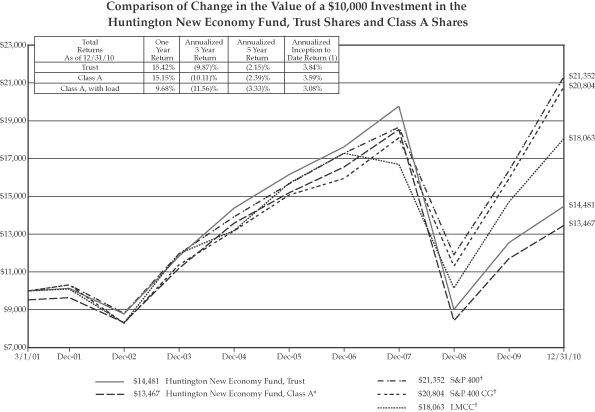

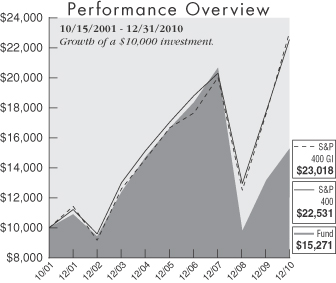

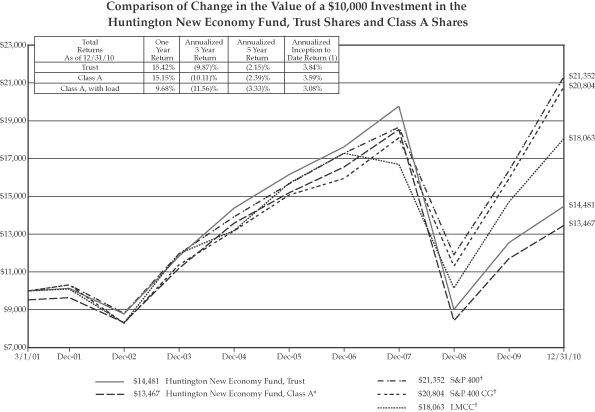

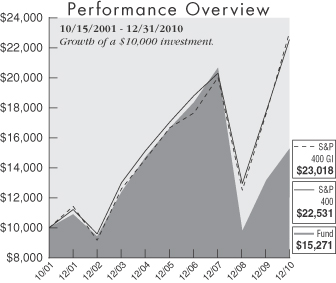

For the fiscal year ended December 31, 2010, the Huntington New Economy Fund produced total returns (not including the deduction of applicable sales charges) for the Fund’s Trust Shares and Class A Shares of 15.42% and 15.15% respectively, based on net asset value. The Fund’s benchmark, the Standard & Poor’s MidCap 400 Growth Index (S&P 400 GI)1 had a total return of 30.57%, and the Standard & Poor’s Mid Cap 400 Index (S&P 400)2 had a total return of 26.64%, while the Lipper Mid Cap Core Average (LMCC)3 returned 22.78%.

During the year, the Fund’s holdings remained invested in companies producing or benefiting from increased productivity trends. Trading activity was responsible for -6.69% of the performance relative to the benchmark, while portfolio structure had a negative impact of -8.46%. Portfolio structure can be explained by adding Security Characteristics: -0.34%, Sector Allocation: -0.16% and Security Selection: -7.95%.

The Fund’s performance relative to the benchmark was affected by both sector selection and individual stock selection. The Consumer Discretionary and Information Technology sectors provided the largest sources of returns above the benchmark. Consumer Discretionary was a focus in the beginning of the year and the Fund reduced exposure throughout the year. Information Technology remained an overweight sector for the year ending December 31, 2010. The source for the largest underperformance relative to the benchmark was the stock selection in the Financial sector. The Fund’s overweight position in the Energy sector also provided negative relative performance for the Fund during the year. The remaining relative sector weights provided minimal contribution versus the Fund’s benchmark. The Fund’s sector selection process during 2010 continued to be driven by the sector strategy of Huntington Asset Advisors, Inc.

The three holdings that had the largest positive contribution to the Fund’s performance were F5 Networks Inc., CF Industries Holdings Inc. and lululemon athletica inc. These three holdings added 4.95% to the Fund’s return. The three holdings that had the largest negative contribution to the Fund’s performance were iPath S&P 500 Vix Call JAN11 48, Intuitive Surgical Inc. and iPath S&P 500 VIX SH TM FT CALL (0.02%). These three holdings subtracted -1.74% from the Fund’s return.

| ¿ | | The composition of the Fund’s holdings is subject to change. |

| (1) | The S&P 400 GI is designed to provide a comprehensive measure of mid-cap U.S. equity “growth” performance. It is a float adjusted market capitalization weighted index comprised of stocks representing approximately half the market capitalization of the S&P MidCap 400 that have been identified as being on the growth end of the growth-value spectrum. Indices are unmanaged and, unlike the Fund, are not affected by cashflows. It is not possible to invest directly in an Index. |

| (2) | The S&P 400 is a capitalization-weighted index comprised of common stocks representing all major industries in the mid-range of the U.S. stock market. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an Index. |

| (3) | LMCC figures represent the average of the total returns reported by all of the mutual funds designated by the Lipper Inc. as falling in the category indicated. They do not reflect sales charges. |

Annual Shareholder Report

15

| | |

New Economy Fund (Continued) | | |

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month end performance, visit www.huntingtonfunds.com or call 1-800-253-0412. For after-tax returns call 1-800-253-0412. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund Shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. Total returns, at load, include the maximum 4.75% sales charge for the Class A Shares.

| | | | |

| Class | | Expense Ratios | |

A | | | 1.84% | |

Trust | | | 1.59% | |

The above expense ratios are from the Funds’ prospectus dated May 1, 2010. Additional information pertaining to the Fund’s expense ratio as of December 31, 2010 can be found in the financial highlights.

The Fund’s performance assumes the reinvestment of all dividends and distributions. The S&P 400, S&P 400 CG and LMCC have been adjusted to reflect reinvestment of dividends on securities in the indices.

| * | Represents a hypothetical investment of $10,000 in the Fund after deducting the maximum sales load of 4.75% a ($10,000 investment minus $475 sales load = $9,525). |

| (1) | The Fund commenced operations for all classes on March 1, 2001. |

| † | The S&P 400 and S&P 400 CG are not adjusted to reflect sales charges, expenses, or other fees that the Securities and Exchange Commission requires to be reflected in the Fund’s performance. The indices are unmanaged and, unlike the Fund, are not affected by cashflows. It is not possible to invest directly in an index. The LMCC represents the average of the total returns reported by all of the mutual funds designated by Lipper, Inc. as falling in the category indicated, and is not adjusted to reflect any sales charges. However, these total returns are reported net of expenses or other fees that the SEC requires to be reflected in a Fund’s performance. |

Annual Shareholder Report

16

| | |

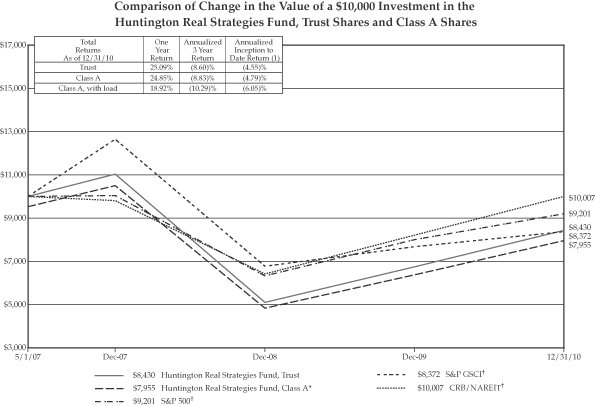

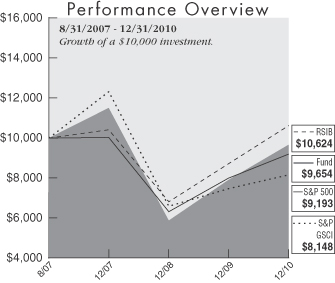

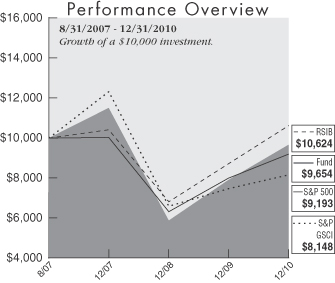

Real Strategies Fund | | As of 12/31/10 |

Management’s Discussion of Fund Performance

Portfolio Manager: Peter Sorrentino, CFA

Vice President

Huntington Asset Advisors, Inc.

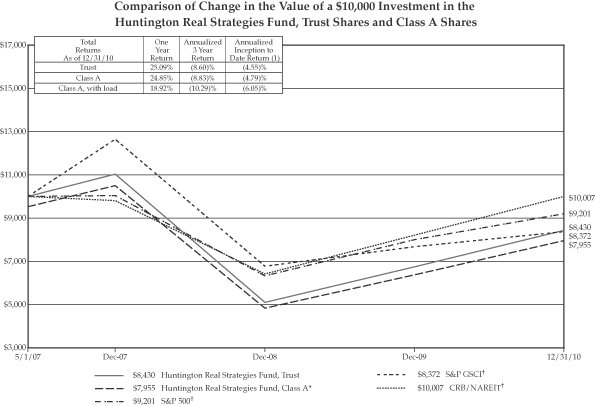

For the fiscal year ended December 31, 2010, the Huntington Real Strategies Fund produced total returns (not including the deduction of applicable sales charges) of 25.09% and 24.85% for Trust Shares and Class A Shares, respectively, based upon net asset value. The Fund outperformed its benchmark, the S&P GSCI® Index1, which had a total return of 9.03%. The Fund also outperformed the Standard & Poor’s 500 Index (S&P 500)2, which returned 15.06% and the Real Strategies Indices Blend3, which returned 21.90% for the same period.

The Fund’s performance during the year was bifurcated with performance during the opening months of the year driven by agriculture related themes and the closing months of the year driven by energy related themes. Overall, prices for precious metals increased throughout the year, but performance was also bifurcated with gold moving rapidly higher in the opening months only to be supplanted by silver during the second half of the year.

In the realm of agriculture, the Fund’s most successful investments were those in a number of fertilizer producers and machinery manufacturers. This area experienced considerable merger and acquisition activity throughout the year that propelled prices higher for companies around the globe. The Fund’s shares of Sociedad Quimeca y Minera de Chile advanced over 60%, followed by the 58% contribution from Bucyrus International and 56% for AGCO Corp. Not all agriculture related holdings worked however, as witnessed by the 34% decline in Monsanto.

Returns for the Fund’s energy holdings were strongest for coal and uranium, and the unifying theme for both was demand from China. China lacks the infrastructure to fully utilize its domestic coal supply and is increasingly relying upon seaborne supplies to meet its needs. The Chinese began an aggressive reactor construction program some years ago and now many of those stations are reaching the fueling stage. This demand, combined with refueling needs for existing stations around the world, sent the prices for uranium mining companies higher. The Fund’s shares of Uranium Energy Corp. advanced Fund’s coal holdings, Arch Coal enjoyed the largest advance, picking up 63%, while shares of Peabody Energy added 41%. Again, as with agriculture, not all coal stocks were positive for the year, as shares of James River Coal slipped 8%.

The Fund did benefit from the resurgence of merger and acquisition activity during the year where. While the attempt by BHP to acquire Potash failed, it served to sustain the run-up in price that swept the group during the Agrium CF Industries transaction. This was also evident in the equipment sector, as Caterpillar’s bid for the shares of Bucyrus International served to boost the price for shares of Deer & Co. and AGCO Corp.

| ¿ | | The composition of the Fund’s holdings is subject to change. |

| (1) | The S&P GSCI® Index measures general price movements and inflation in the world economy. The Index is calculated primarily on a world production-weighted basis and is comprised of the principal physical commodities that are the subject of active, liquid futures markets. The Fund’s investment adviser elected to change the benchmark index from the S&P 500 to the S&P GSCI® Index because the S&P GSCI® Index is more reflective of the securities in which the Fund invests. The indices are unmanaged and, unlike the Fund, are not affected by cashflows. It is not possible to invest directly in an index. |

| (2) | The S&P 500 is a capitalization-weighted Index comprised of 500 stocks and is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an Index. |

| (3) | The Real Strategies Indices Blend is a custom blended index comprised of the following two indices with their noted respective weightings; Reuters/Jefferies CRB Total Return Index (50%) and NAREIT Index (50%). The Reuters/Jefferies CRB Total Return Index is a commodity index, a basket of exchange-traded futures contracts representing long-only positions in underlying commodities. Indices typically include a variety of commodity sectors to provide investors broader exposure to commodities as an asset class and free the investor from the mechanics of future trading (e.g., contract rolling and physical delivery). The index return does not reflect the deduction of expenses, which have been deducted from the Fund’s returns. The Index return assumes reinvestment of all distributions and does not reflect the deduction of taxes and fees. Individuals cannot invest directly in the Index, however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of benchmark Index. The NAREIT represents returns for the National Association of Real Estate Investment Trust Equity Index. The indices are unmanaged and, unlike the Fund, are not affected by cashflows. |

Annual Shareholder Report

17

Real Strategies Fund (Continued)

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month end performance, visit www.huntingtonfunds.com or call 1-800-253-0412. For after-tax returns call 1-800-253-0412. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund Shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. Total returns, at load, include the maximum 4.75% sales charge for the Class A Shares.

| | | | |

| Class | | Expense Ratios | |

A | | | 1.77% | |

Trust | | | 1.52% | |

The above expense ratios are from the Funds’ prospectus dated May 1, 2010. Additional information pertaining to the Fund’s expense ratio as of December 31, 2010 can be found in the financial highlights.

The Fund’s performance assumes the reinvestment of all dividends and distributions. The S&P 500, S&P GSCI and CRB/NAREIT have been adjusted to reflect reinvestment of dividends on securities in the indices.

| * | Represents a hypothetical investment of $10,000 in the Fund after deducting the maximum sales load of 4.75% ($10,000 investment minus $475 sales load = $9,525). |

| (1) | The Fund commenced operations for all Share classes on May 1, 2007. |

| † | The S&P 500, S&P GSCI and CRB/NAREIT are not adjusted to reflect sales charges, expenses, or other fees that the Securities and Exchange Commission requires to be reflected in the Fund’s performance. The indices are unmanaged and, unlike the Fund, are not affected by cashflows. It is not possible to invest directly in an index. |

Annual Shareholder Report

18

| | |

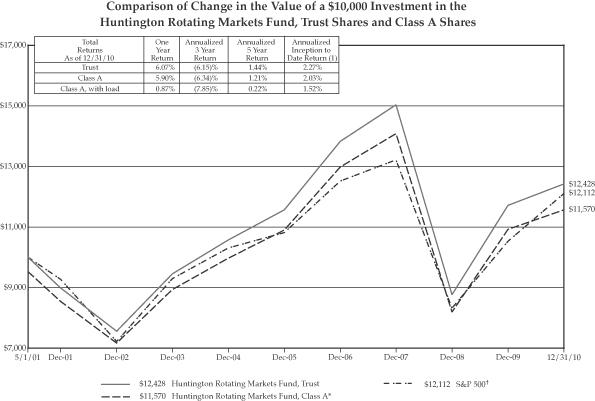

Rotating Markets Fund | | As of 12/31/10 |

Management’s Discussion of Fund Performance

Portfolio Manager: Paul Koscik, JD

Vice President

Huntington Asset Advisors, Inc.

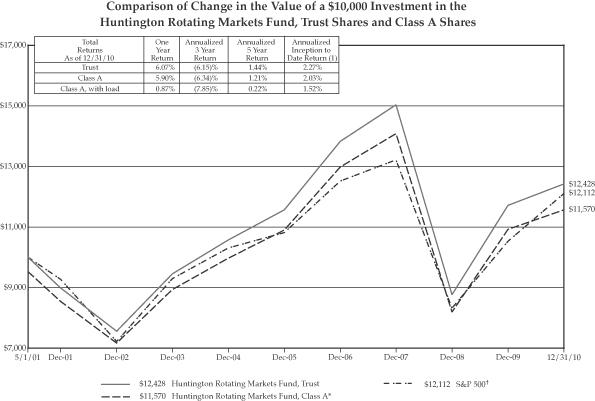

For the fiscal year ended December 31, 2010, the Huntington Rotating Markets Fund produced total returns (not including the deduction of applicable sales charges 6.07% and 5.90% for Trust Shares and Class A Shares, respectively, based on net asset value. This underperformed the total return of 15.06% for the Fund’s benchmark, the Standard & Poor’s 500 Index (S&P 500).1

The Rotating Markets Fund finished 2009 invested in the Global segment of the stock market having significantly outperformed its benchmark, the S&P 500, by more than 650 basis points. 2010 began with the Fund still invested in the global segment. As the year progressed, it became apparent that international stocks were becoming a drag on performance. Concerns about the fiscal stability of the European Union in general, and such countries as Greece and Ireland in particular, were causing investors to shift funds toward the US. In response to the shifting investment environment, the Fund elected to rotate to the Large Cap segment of the stock market. Because the equity markets had staged a massive rally from the March, 2009 bottom (the S&P 500 for example was up 60%) without any significant correction, it was decided to emulate the Dow Jones Industrial Average, which is a conservative equity index. This index is viewed as one of the best indices to own in the event of a sharp correction. Unfortunately, no correction occurred after the rotation on September 1, 2010. In fact, the rally continued the rest of the year with the more aggressive S&P 500 handily outperforming the more conservative Dow Jones Industrial Average. Although the Fund underperformed the S&P 500 Index because of its conservative stance regarding the equity market, it is well positioned in the event that a correction does occur.

| ¿ | | The composition of the Fund’s holdings is subject to change. |

| (1) | The S&P 500 is a capitalization-weighted index comprised of 500 stocks and is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an Index. |

Annual Shareholder Report

19

Rotating Markets Fund (Continued)

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month end performance, visit www.huntingtonfunds.com or call 1-800-253-0412. For after-tax returns call 1-800-253-0412. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund Shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. Total returns, at load, include the maximum 4.75% sales charge for the Class A Shares.

| | | | |

| Class | | Expense Ratios | |

A | | | 2.31% | |

Trust | | | 2.06% | |

The above expense ratios are from the Funds’ prospectus dated May 1, 2010. Additional information pertaining to the Fund’s expense ratio as of December 31, 2010 can be found in the financial highlights.

The Fund’s performance assumes the reinvestment of all dividends and distributions. The S&P 500 has been adjusted to reflect reinvestment of dividends on securities in the index.

| * | Represents a hypothetical investment of $10,000 in the Fund after deducting the maximum sales load of 4.75% ($10,000 investment minus $475 sales load = $9,525). |

| (1) | Trust Shares and Class A Shares commenced operations on May 1, 2001. |

| † | The S&P 500 is not adjusted to reflect sales charges, expenses, or other fees that the Securities and Exchange Commission requires to be reflected in the Fund’s performance. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an index. |

Annual Shareholder Report

20

| | |

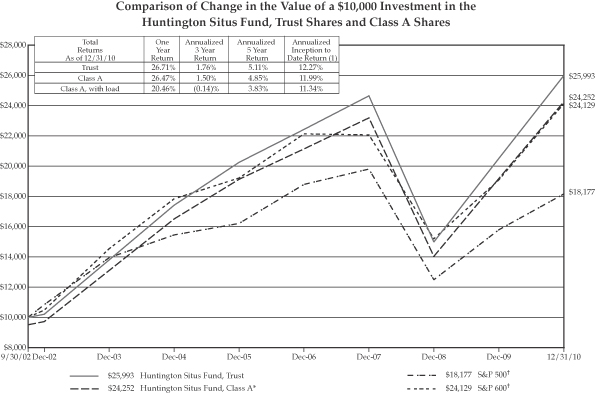

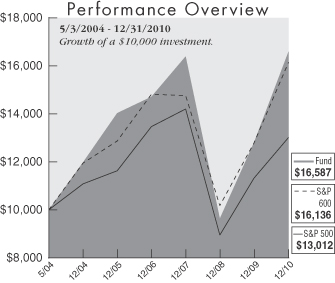

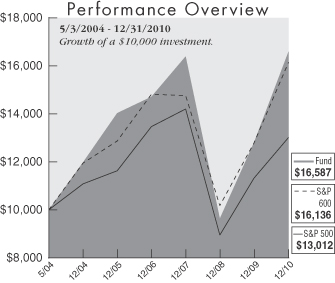

Situs Fund | | As of 12/31/10 |

Management’s Discussion of Fund Performance

Portfolio Manager: B. Randolph Bateman, CFA

Chief Investment Officer

Huntington Asset Advisors, Inc.

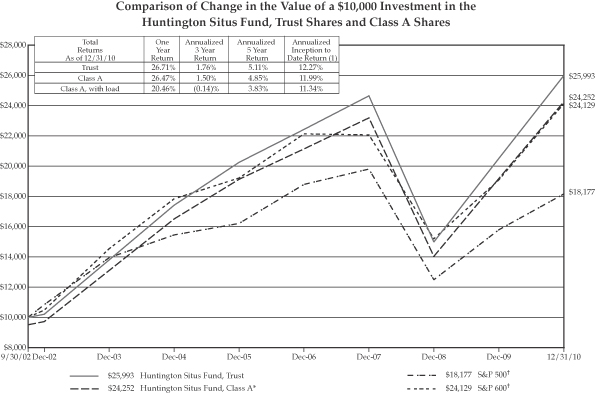

For the fiscal year ended December 31, 2010, the Huntington Situs Fund produced total returns (not including the deduction of applicable sales charges) of 26.71% and 26.47% for Trust Shares and Class A shares, respectively, based on net asset value. The Fund experienced a strongly positive relative performance versus its benchmark, the Standard & Poor’s Small Cap 600 Index (S&P 600),1 which had a total return of 26.31% for the same period. This represented a return for the Fund’s Trust Shares that was 40 basis points above the benchmark index. This was the second consecutive year that the fund exceeded the unmanaged benchmark.

The Fund also outperformed the Standard & Poor’s 500 Index (S&P 500),2 the broader stock market index, which had a return of 15.06% for the reporting period. The Fund continued to focus on its approach of utilizing, among other things, strict quantitative analysis, industry sector emphasis or de-emphasis according to the policy guidelines established by Huntington Asset Advisors, Inc.’s Investment Policy Committee and selecting stocks of companies with geographical location advantages. These factors contributed to the Fund outperforming its benchmark and market peers over the longer term and were significant in the over performance achieved in 2010.

During the reporting period, the economy moved from a rebound phase to an expansion and most markets reflected this positive movement in the economy. The small and mid cap stocks, however, seemed to fair the best in this environment and their performance significantly outperformed their larger counterparts. The sectors that outperformed in the Situs Fund were Energy and Materials, of which the Fund held an overweight position during much of the year. It was difficult to develop investment strategies in the market environment of 2010. There was a lack of sector leadership on any consistent basis and there were considerable swings in daily performance in individual names as well as industries. The Situs Fund wrote few options during the year as market conditions were not favorable, but with two years of strong back to back performance (+25% each), it is likely that the manager will employ more coverage strategies in 2011. In addition, we anticipate that the Energy and Material sectors will be lightened during the year as capital gains situations are considered. The Fund had taken a large amount of gains during the 2010 tax period and the manager was hesitant to incur greater taxes in order to balance the sector weights.

| ¿ | | The composition of the Fund’s holdings is subject to change. |

| (1) | The S&P 600 is a capitalization-weighted index representing all major industries in the small-cap range of the U.S. stock market. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an Index. |

| (2) | The S&P 500 is a capitalization-weighted index comprised of 500 stocks and designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an Index. |

Annual Shareholder Report

21

Situs Fund (Continued)

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month end performance, visit www.huntingtonfunds.com or call 1-800-253-0412. For after-tax returns call 1-800-253-0412. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund Shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. Total returns, at load, include the maximum 4.75% sales charge for the Class A Shares.

| | | | |

| Class | | Expense Ratios | |

A | | | 1.66% | |

Trust | | | 1.41% | |

The above expense ratios are from the Funds’ prospectus dated May 1, 2010. Additional information pertaining to the Fund’s expense ratio as of December 31, 2010 can be found in the financial highlights.

The Fund’s performance assumes the reinvestment of all dividends and distributions. The S&P 600 and S&P 500 have been adjusted to reflect reinvestment of dividends on securities in the indices.

| * | Represents a hypothetical investment of $10,000 in the Fund after deducting the maximum sales load of 4.75% ($10,000 investment minus $475 sales load = $9,525). |

| (1) | The Fund commenced operations for all classes on September 30, 2002. |

| † | The S&P 600 and S&P 500 are not adjusted to reflect sales charges, expenses, or other fees that the Securities and Exchange Commission requires to be reflected in the Fund’s performance. The indices are unmanaged and, unlike the Fund, are not affected by cashflows. It is not possible to invest directly in an index. |

Annual Shareholder Report

22

| | |

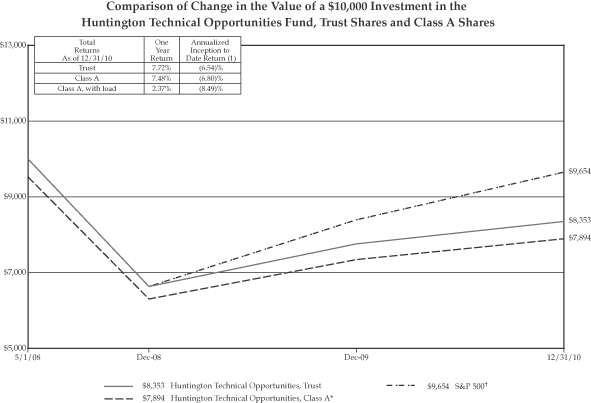

Technical Opportunities Fund | | As of 12/31/10 |

Management’s Discussion of Fund Performance

Co-Portfolio Managers:

Martina Cheung, CFA, CMT, MBA

Vice President

Portfolio Manager: Paul Koscik, JD

Vice President

Huntington Asset Advisors, Inc.

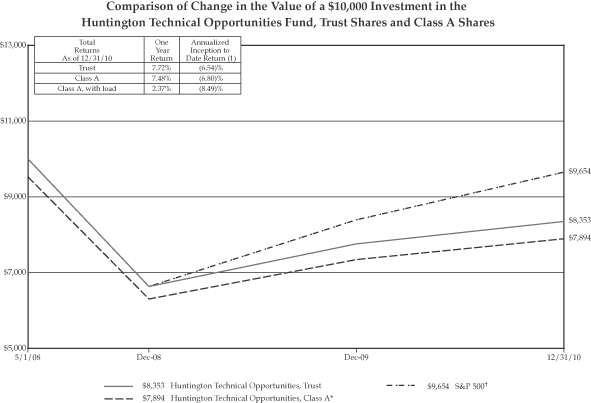

For the fiscal year ended December 31, 2010, the Huntington Technical Opportunities Fund produced total returns (not including the deduction of applicable sales charges) of 7.72% and 7.48% for Trust Shares and Class A Shares, respectively, based on net asset value. The Fund underperformed the total return of 15.06% for the Fund’s benchmark, the Standard & Poor’s 500 Index (S&P 500)1, for the same time period.

The Fund commenced operations in 2010 with 36% of its portfolio invested in international equities. Although this exposure was very helpful to performance in 2009, the holdings in the Exchange Traded Funds with exposure to certain Emerging Markets (South Korea, Brazil and Singapore) had a very negative impact on performance in the first quarter of the year. In fact, the Fund’s underperformance for all of 2010 was largely due its first quarter results.

The rest of the year was characterized by restructuring the portfolio to add more international exposure, with an emphasis on emerging markets, and gaining exposure to various commodities. This strategy was pursued because these areas would most likely be beneficiaries of any global recovery. The added exposure was accomplished by purchasing individual equities that looked promising using technical analysis. Purchases were made all over the world including companies located in Mexico, Australia, Israel, Russia, South Africa, and China. These purchases were complemented by adding exposure to various commodities through the purchase of companies with exposure to oil, platinum, copper, and gold. As a result of the portfolio changes, the Fund had comparable performance to the S&P 500 Index for the remainder of the year. As we look forward to the year 2011, the Fund is well positioned to benefit from a global recovery.

| ¿ | | The composition of the Fund’s holdings is subject to change. |

| (1) | The S&P 500 is a capitalization-weighted index comprised of 500 stocks and is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an Index. |

Annual Shareholder Report

23

Technical Opportunities Fund (Continued)

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month end performance, visit www.huntingtonfunds.com or call 1-800-253-0412. For after-tax returns call 1-800-253-0412. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund Shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. Total returns, at load, include the maximum 4.75% sales charge for the Class A Shares.

| | | | |

| Class | | Expense Ratios | |

A | | | 3.18% | |

Trust | | | 2.93% | |

The above expense ratios are from the Funds’ prospectus dated May 1, 2010. Additional information pertaining to the Fund’s expense ratio as of December 31, 2010 can be found in the financial highlights.

The Fund’s performance assumes the reinvestment of all dividends and distributions. The S&P 500 has been adjusted to reflect reinvestment of dividends on securities in the index.

| * | Represents a hypothetical investment of $10,000 in the Fund after deducting the maximum sales load of 4.75% ($10,000 investment minus $475 sales load = $9,525). |

| (1) | The Fund commenced operations for all Share classes on May 1, 2008. |

| † | The S&P 500 is not adjusted to reflect sales charges, expenses, or other fees that the Securities and Exchange Commission requires to be reflected in the Fund’s performance. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an index. |

Annual Shareholder Report

24

| | |

Fixed Income Securities Fund | | As of 12/31/10 |

Management’s Discussion of Fund Performance

Portfolio Manager: Kirk Mentzer, MBA

Senior Vice President and Director of Research

Huntington Asset Advisors, Inc.

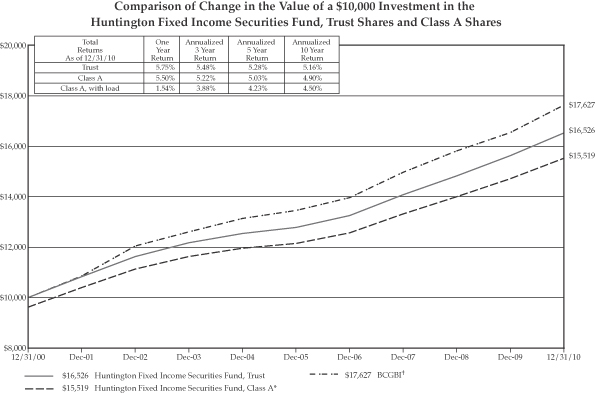

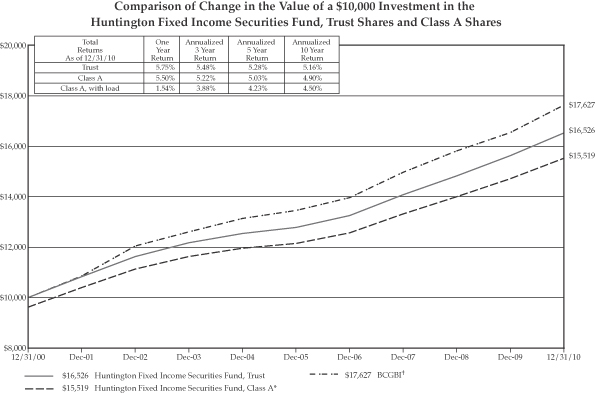

For the fiscal year ended December 31, 2010, the Huntington Fixed Income Securities Fund’s Trust Shares and Class A Shares produced total returns (not including the deduction of applicable sales charges) of 5.75% and 5.50%, respectively, based on net asset value. These returns compared to the Fund’s benchmark, the Barclays Government/Credit Bond Index (BGCBI),1 which had a total return of 6.59% for the same period. The Fund’s returns were below the 7.73% total return of the Lipper Intermediate Investment Grade Debt Funds Average,2 the Fund’s peer group.

In 2010, corporate bonds posted another positive year with excess returns beating Treasury securities by 2.8%. Agency and mortgage securities experienced a similar effect during the year as well, with gains exceeding +0.8% and 2.7% respectively above Treasury markets. Treasury yields rose substantially in the fourth quarter on improving economic growth, erasing most of the decline that occurred earlier in 2010, leaving Treasuries as one of the worst performing segments for both the year and final quarter of 2010. For the year, broad fixed income market indices produced a total return of 6.59%, as measured by the BGCBI.

The Fund’s Trust Share’s gross returns for the fiscal year exceeded the benchmark index by 0.24% when measured on a gross of fee basis. Net of fees, the Fund trailed both the index and peer groups. Positive contributors to Fund performance included tactical purchases of corporate bonds when yield premiums were attractive. Overall for the year, the Fund’s exposure to corporate bonds had a positive impact on performance. Detractors from Fund relative performance were predominantly related to the Fund upgrading its holdings to higher quality issuers. Purchases of Treasury and agency securities did not produce the total returns expected and relative performance was negatively impacted

| ¿ | | The composition of the Fund’s holdings is subject to change. |

| (1) | The BGCBI comprises bonds that are investment grade rated Baa or higher by Moody’s or BBB or higher by Standard & Poor’s, if unrated by Moody’s. Issues must have at least one year to maturity. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an Index. |

| (2) | Lipper figures represent the average of the total returns reported by all of the mutual funds designated by Lipper Inc. as falling into the category indicated. They do not reflect sales charges. |

Annual Shareholder Report

25

Fixed Income Securities Fund (Continued)

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month end performance, visit www.huntingtonfunds.com or call 1-800-253-0412. For after-tax returns call 1-800-253-0412. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund Shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. Total returns, at load, include the maximum 3.75% sales charge for the Class A Shares.

| | | | |

| Class | | Expense Ratios | |

A | | | 1.34% | |

Trust | | | 1.09% | |

The above expense ratios are from the Funds’ prospectus dated May 1, 2010. Additional information pertaining to the Fund’s expense ratio as of December 31, 2010 can be found in the financial highlights.

The Fund’s performance assumes the reinvestment of all dividends and distributions. The BGCBI has been adjusted to reflect reinvestment of dividends on securities in the index.

| * | Represents a hypothetical investment of $10,000 in the Fund after deducting the maximum sales load of 3.75% ($10,000 investment minus $375 sales load = $9,625). |

| † | The BGCBI is not adjusted to reflect sales charges, expenses, or other fees that the Securities and Exchange Commission requires to be reflected in the Fund’s performance. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an index. |

Annual Shareholder Report

26

| | |

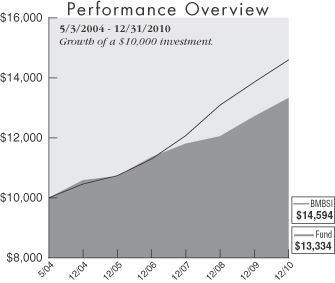

Intermediate Government Income Fund | | As of 12/31/10 |

Management’s Discussion of Fund Performance

Portfolio Manager: William G. Doughty; MBA

Vice President

Huntington Asset Advisors, Inc.

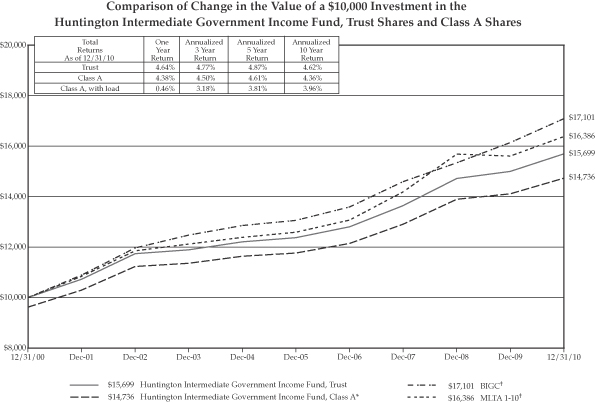

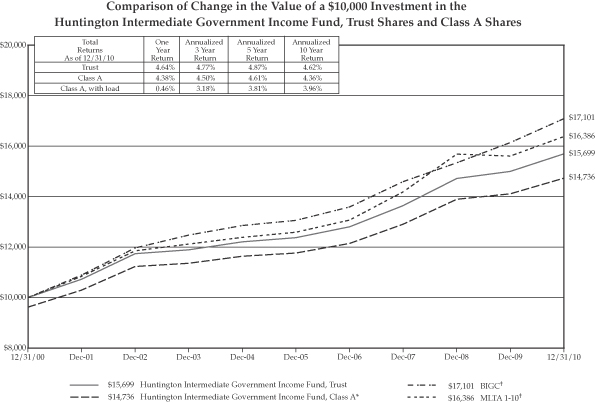

For the fiscal year ended December 31, 2010, the Huntington Intermediate Government Income Fund produced total returns (not including the deduction of applicable sales charges) of 4.64%, and 4.38% for Trust and Class A Shares, respectively, based on net asset value. This compared with the return of the Barclays Intermediate Government/Credit Index (BIGC),1 the Fund’s benchmark, return of 5.89%, the Merrill Lynch U.S. Treasuries/Agencies 1-10 Years Index’s (G5A0 1-10)2 return of 4.93% and the Lipper Short-Intermediate Government Funds Average3 of 3.54% for the same period.

During 2010, the Barclays U.S. Aggregate Bond Index 4, which represents a broad bond market index, showed a return of 6.15%. Sector performance favored the corporate bond market by a wide margin. This was the second year in a row where corporate bonds outperformed other asset classes. The Fund’s underperformance against its benchmark index, the BIGC, was due to the asset mix of the portfolio. The Fund had a heavy weighting in Treasuries and Agencies, which were the fixed income asset classes with the two worst returns in 2010. The mortgage portion of portfolio did benefit the Fund, as mortgage securities had good relative performance in 2010, despite the Treasury purchase program of mortgage securities ending in the first quarter of 2010.

| ¿ | | The composition of the Fund’s holdings is subject to change. |

| | Bond prices are sensitive to changes in interest rates and a rise in interest rates can cause a decline in their prices. |

| (1) | The BIGC is a market value weighted performance benchmark for government and corporate fixed-rate debt issues with maturities between one and ten years. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an Index. |

| (2) | The MLTA 1-10 tracks the current 10-year Treasury securities. This index is produced by Merrill Lynch, Pierce, Fenner & Smith, Inc. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an Index. |

| (3) | Lipper figures represent the average of the total returns reported by all of the mutual funds designated by Lipper Inc. as falling into the category indicated. They do not reflect sales charges. |

| (4) | The Barclay’s U.S. Aggregate Bond Index is composed of securities from the Barclay’s Government/Corporate Bond Index, Mortgage Securities Index and the Asset Based Securities Index. Total return comprises price appreciation/depreciation and income as a percentage of the original investment. Indices are rebalanced monthly by market capitalization. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an Index. |

Annual Shareholder Report

27

Intermediate Government Income Fund (Continued)

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month end performance, visit www.huntingtonfunds.com or call 1-800-253-0412. For after-tax returns call 1-800-253-0412. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund Shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. Total returns, at load, include the maximum 3.75% sales charge for the Class A Shares.

| | | | |

| Class | | Expense Ratios | |

A | | | 1.36% | |

Trust | | | 1.11% | |

The above expense ratios are from the Funds’ prospectus dated May 1, 2010. Additional information pertaining to the Fund’s expense ratio as of December 31, 2010 can be found in the financial highlights.

The Fund’s performance assumes the reinvestment of all dividends and distributions. The BIGC and MLTA 1-10 have been adjusted to reflect reinvestment of dividends on securities in the indices.

| * | Represents a hypothetical investment of $10,000 in the Fund after deducting the maximum sales load of 3.75% ($10,000 investment minus $375 sales load = $9,625). |

| † | The BIGC and MLTA 1-10 are not adjusted to reflect sales charges, expenses, or other fees that the Securities and Exchange Commission requires to be reflected in the Fund’s performance. The indices are unmanaged and, unlike the Fund, are not affected by cashflows. It is not possible to invest directly in an index. |

Annual Shareholder Report

28

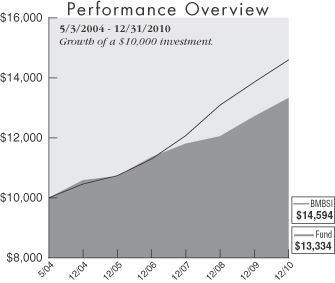

| | |

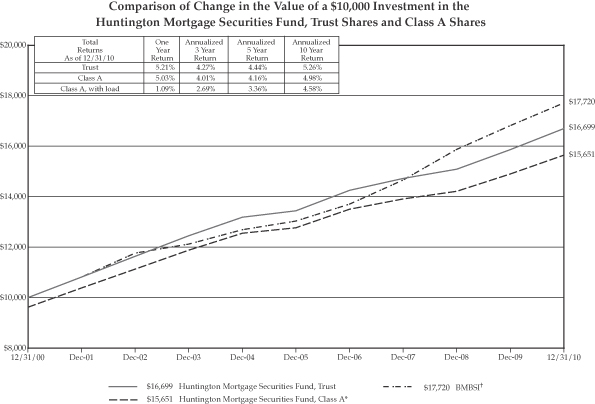

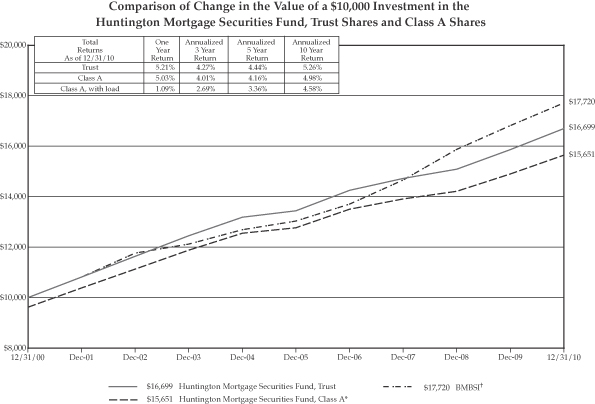

Mortgage Securities Fund | | As of 12/31/10 |

Management’s Discussion of Fund Performance

Co-Portfolio Managers:

William G. Doughty, MBA

Vice President

Gustave J. Seasongood

Vice President

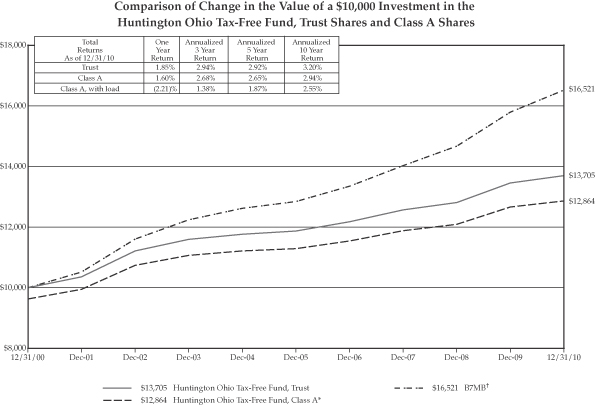

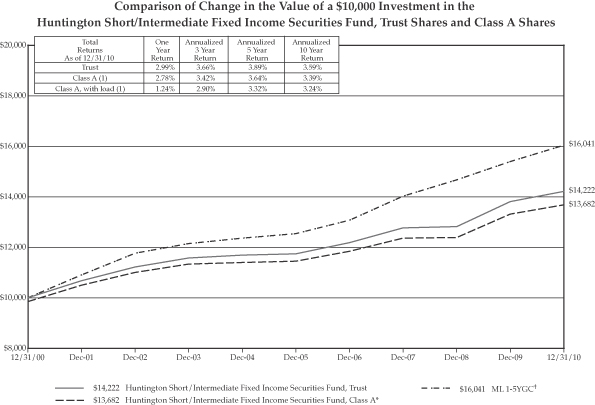

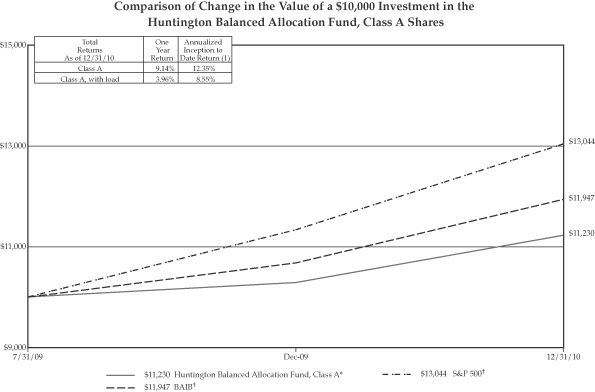

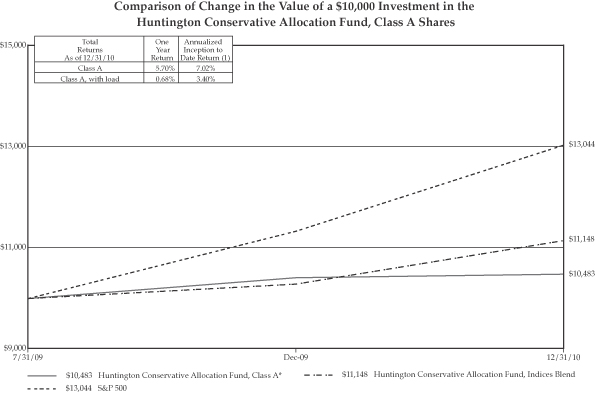

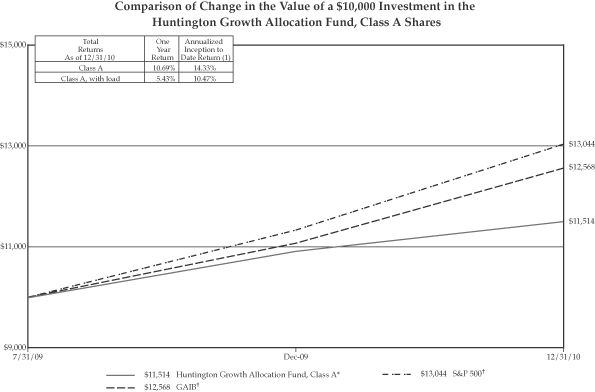

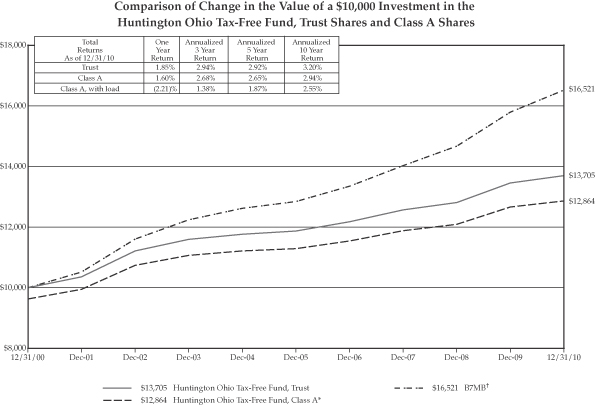

Huntington Asset Advisors, Inc.