UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05010

THE HUNTINGTON FUNDS

(Exact name of registrant as specified in charter)

2960 North Meridian Street, Suite 300

Attn: Huntington Funds Officer

Indianapolis, IN 46208

(Address of principal executive offices) (Zip code)

Dave Carson

The Huntington National Bank

41 South High Street

Columbus, OH 43287

(Name and address of agent for service)

Copies to:

David C. Mahaffey, Esq.

Sullivan & Worcester

1666 K Street, N.W.

Washington, DC 20006

Registrant’s telephone number, including area code: 1-800-253-0412

Date of fiscal year end: October 31

Date of reporting period: October 31, 2012

Item 1. Reports to Stockholders.

Huntington World Income Fund

Huntington Income Generation Fund

OCTOBER 31, 2012

CLASS A SHARES

CLASS C SHARES

TRUST SHARES

Message from the Chief Investment Officer

Dear shareholders:

The markets during the fiscal year ending October 2012 continued their relatively volatile pattern, with the first quarter producing sufficiently positive results that, even with a tenuous market in the second quarter, most major market benchmarks remained in positive territory. The broad markets, as defined by the Standard & Poor’s 500 Index, rose 15.21%, while other market benchmarks such as the NASDAQ Composite Index increased 12.21% and the Dow Jones Industrial Average rose 12.56%. Likewise, the international markets improved, but not even half as robustly as the domestic marketplace. The strength of the dollar, a lack of attractive alternatives, a realization of the ‘value’ in the shares of corporate America and some positive news regarding the resolution of the European debt crisis, served as the catalyst for the market expansion.

Looking into 2013, we are anticipating a deadlock between the perceived ‘value’ of equities and the companies that they represent versus concerns over the economy. Our outlook for 2013 and beyond is based on our expectations of an unspectacular pace of real GDP growth at 2.1% for the upcoming year, as uncertainties in Europe and the U.S. fiscal outlook are forecasted to provide only modest tailwinds for the markets. Although U.S. policymakers will probably not allow the alleged fiscal cliff to push the economy into a recession, the debt, deficit and increased taxes will present an environment not necessarily favorable to investment markets.

Corporate balance sheets are generally strong, benefiting from record profits and cash flows. However, business caution with regard to the domestic policy environment and the ongoing euro-zone sovereign debt crisis will likely moderate gains in capital investment, exports and payroll growth. Consumers should benefit from historically low interest rates, the prospects of accelerated income recognition in the fourth calendar quarter and generally improving labor markets. However, rising inflation will likely reemerge next year. We expect the Federal Reserve to begin monetary policy tightening with gradual increases in the Fed Funds rate target in late 2013, followed by sustained increases in 2014.

Regarding Huntington Asset Advisor’s official equity strategy, we anticipate the combination of a slow growth economy and policy issues are likely to keep markets mired in a trading range (S&P 500 between 1300-1400). Present fundamentals are lackluster as evidenced by moderate but decelerating earnings growth and valuations that are now only fair. However, these conditions will not last forever and we caution against getting too negative. Getting past the U.S. fall elections and having some policy clarity will likely allow markets to move higher next year. For now, we favor larger-sized companies with quality balance sheets and moderate dividends as a good way to ride out the volatility. Also, adding or reducing equity exposure at the boundaries of our expected range should add value. Our sector weights are designed to balance cyclical and defensive areas of the market. There is a great possibility of increased merger and acquisition activity during 2013. Following the passage of the Sarbanes Oxley law in the early 2000’s, a number of companies either went private or chose to become acquired by a larger entity to help cover the costs of compliance, or went offshore.

We employ a significantly disciplined approach to the assessment of the markets and individual holdings. However, with respect to the investment environment, we remain both nimble and flexible in order to take advantage of improving conditions but mindful of areas of weaknesses.

The creation of the Huntington Income Generation Fund in 2012 was prompted by our clients’ need for income without a high level of exposure to the bond market. We are in the midst of a 30 year bull market for bonds and the Fed has conducted numerous purchase programs designed to keep interest rates low. The Income Generation Fund invests in several yield oriented Huntington Funds to provide diversification and the potential for a higher yield than typical income oriented funds. The manager generally will hold approximately 70% of the Fund’s portfolio in the Huntington World Income Fund with satellite strategies to provide hedging against market volatility.

Message from the Chief Investment Officer

Message from the Chief Investment Officer (Continued)

As always, we appreciate your confidence in Huntington Funds and hope that we have provided value to your investment needs and your financial well-being.

Sincerely,

B. Randolph Bateman, CFA

President

Huntington Asset Advisors, Inc.

Message from the Chief Investment Officer

| | |

Huntington World Income Fund | | |

Management’s Discussion of Fund Performance

Portfolio Manager:

Chip Hendon, MBA, Senior Portfolio Manager

Huntington Asset Advisors, Inc.

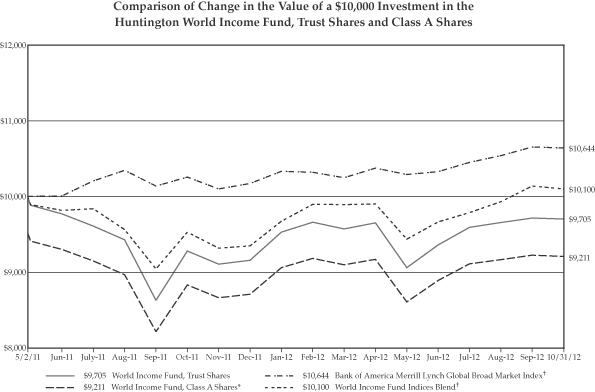

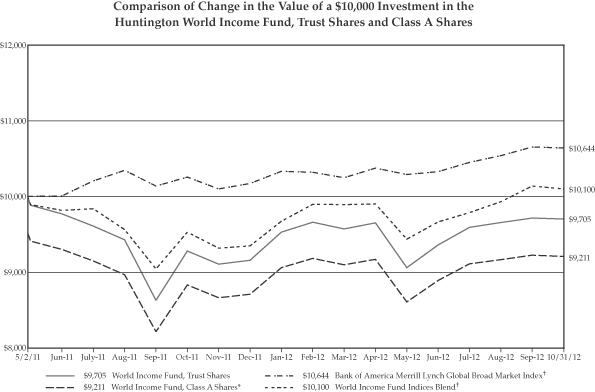

For the fiscal period ended October 31, 2012, the Huntington World Income Fund’s Trust Shares and Class A Shares produced total returns (not including the deduction of applicable sales charges) of 4.55% and 4.29%, respectively, based on net asset value. This performance was higher than the total return of 3.74% for the Fund’s primary benchmark, the Bank of America Merrill Lynch Global Broad Market Index1. However, since the World Income Fund has both equity and fixed income exposure in its portfolio and the primary benchmark does not reflect investments in equity securities, the Fund’s performance is also compared to the World Income Indices Blend1. This is a custom blended index reflecting the performance of two benchmarks, the MSCI AC World Index1 (“MSCI ACWI”), which focuses on international equities and the Bank of America Merrill Lynch Global Broad Market Index, which incorporates international bonds. This custom blended index produced a return of 6.15% for the same period.

The World Income fund outperformed its primary index due to its overweighting in equities versus the index. Although bonds continued to have positive return for the year, equities rallied significantly from the late 3rd quarter 2011 sell off.

The Fund is managed using our top-down style and portfolio construction techniques which are aimed at producing a high level of income and low volatility through the use of high dividend-paying domestic and foreign stocks, and preferred stocks. Foreign and domestic debt option hedges are also utilized to help mitigate the potential for loss and smooth out performance.

The Fund commenced operations in May 2011, and just concluded its first full fiscal year as of October 2012. Over the last year, the Fund participated with the beginning of the year rally in the broader markets, but was also subject to the sell off that occurred in May. Since that time, the Fund has rallied back to finish the year strong and deliver a positive return for investors. The Fund is focused on income and invests in Master Limited Partnerships, Canadian Royalty Trusts, preferred stocks and foreign and domestic bonds. The Fund also utilizes options and hedging techniques to try to mitigate the volatility and lower the risk. For the fiscal year, the options in the portfolio added 0.63% of incremental return. Going into 2013, the potential U.S. fiscal cliff and continued European financial crisis continue to be in the forefront of the Fund’s concerns. We will continue to focus on income as our first priority, but also intend to utilize options to a greater extent to help lower volatility.

| (1) | The Bank of America Merrill Lynch Global Broad Market Index tracks the performance of investment grade debt publicly issued in the major domestic and eurobond markets, including sovereign, quasi-government, corporate, securitized and collateralized securities. The World Income Fund Indices Blend is a custom blended index comprised of the following two indices with their noted respective weightings: MSCI ACWI (50%) and Bank of America Merrill Lynch Global Broad Market Index (50%). MSCI ACWI is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI ACWI consists of 45 country indices comprising 24 developed and 21 emerging market country indices. This custom blended index and its respective weightings are reflective of the Fund’s sector diversification. Indices are unmanaged and, unlike the Fund, are not affected by cash flows. It is not possible to invest directly in an index. |

Annual Shareholder Report

1

Huntington World Income Fund (Continued)

| | | | | | | | | | | | | | | | | | | | |

Total Returns For The Period Ended October 31, 2012 | |

| | | Trust

Shares | | | Class A

Shares | | | Class A

Shares,

with load | | | Bank of America

Merrill Lynch

Global Broad

Market Index+ | | | World Income

Indices Blend+ | |

One Year Return | | | 4.55 | % | | | 4.29 | % | | | -0.67 | % | | | 3.74 | % | | | 6.15 | % |

Since Inception (5/2/11)(1) | | | -1.97 | % | | | -2.20 | % | | | -5.33 | % | | | 4.24 | % | | | 0.54 | % |

| | | | |

Expense Ratios(2) | | | | | | | | | | | | | |

Total Annual Fund Operating Expenses | | | 1.86 | % | | | 2.11 | % | | | | | | | | | | | | |

The Fund’s past performance does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-253-0412. For after-tax returns call 1-800-253-0412. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund Shares. Mutual Funds are not obligations of or guaranteed by any bank and are not federally insured. Total returns, at load, include the maximum 4.75% sales charge for the Class A Shares.

The Fund is distributed by Unified Financial Securities, Inc., 2960 North Meridian Street, Suite 300, Indianapolis, IN 46208. (Member FINRA)

| * | Represents a hypothetical investment of $10,000 in the Fund after deducting the maximum sales load of 4.75% ($10,000 investment minus $475 sales load = $9,525) |

| + | The Bank of America Merrill Lynch Global Broad Market Index and World Income Fund Indices Blend are not adjusted to reflect sales charges, expenses, or other fees that the Securities and Exchange Commission requires to be reflected in the Fund’s performance. The indices are unmanaged and, unlike the Fund, are not affected by cash-flows. It is not possible to invest directly in an index. |

| (2) | The expense ratios are from the Fund’s prospectus dated February 28, 2012. Additional information pertaining to the Fund’s expense ratios as of October 31, 2012 can be found in the financial highlights. Effective November 30, 2012, the Advisor has contractually agreed to waive all or a portion of its management fee and/or reimburse certain operating expenses of the Fund to the extent necessary in order to limit the Fund’s total annual fund operating expenses (after the fee waivers and/or expense reimbursements, and exclusive of brokerage costs, interest, taxes and dividends, and extraordinary expenses) to not more than 1.10% and 1.35% of the Trust Shares and Class A Shares daily net assets, respectively, through February 27, 2015. While the Advisor does not anticipate terminating this arrangement prior to February 27, 2015, this arrangement may only be terminated prior to this date with the agreement of the Fund’s Board of Trustees. |

Annual Shareholder Report

2

| | |

Huntington Income Generation Fund | | |

Management’s Discussion of Fund Performance

Portfolio Manager:

Randy Bateman, CIO, Senior Portfolio Manager

Huntington Asset Advisors, Inc.

For the period of August 31, 2012 (Fund inception date) through October 31, 2012, the Huntington Income Generation Fund’s Trust Shares and Class C Shares produced since inception total returns (not including the deduction of applicable sales charges) of -0.07% and -0.20%, respectively, based on net asset value. This performance was less than the total return of 1.38% for the Fund’s primary benchmark, the Bank of America Merrill Lynch Global market Index1. However, since the Income Generation Fund has both equity and fixed income exposure in its portfolio and the primary benchmark does not reflect investments in equity securities, the Fund’s performance is also compared to the Income Generation Indices Blend1. This is a custom blended index reflecting the performance of two benchmarks, the MSCI AC World Index1 (“MSCI ACWI”), which focuses on international equities and the Bank of America Merrill Lynch Global Broad Market Index, which incorporates international bonds. This custom blended index produced a return of 2.20% for the same period.

The Fund noted its underperformance to the benchmark primarily due to the cash flow into the fund. As a newly created fund with little in the way of funded assets under management, any new additions would carry significant weight to the returns. In a rising market, there is inevitably a delay in the purchase of securities (funds) from cash inflows. In a smaller fund, these flows are more significant. In addition, the three funds that comprise the Income Generation Fund each underperformed the aggregate benchmark for the Fund, making it impossible to exceed the benchmark.

The Fund is managed using our top-down style and portfolio construction techniques which are aimed at producing a high level of income and low volatility through the use of high dividend-paying domestic and foreign stocks, Master Limited Partnerships (MLPs), Real Estate Investment Trusts (REITS) and preferred stocks. Foreign and domestic debt option hedges are also utilized to help mitigate the potential for loss and smooth out performance. These strategies are all incorporated within the Huntington World Income Fund, Huntington Dividend Capture Fund and Huntington Income Equity Fund, the underlying investments of the Fund that are tactically allocated to produce the Income Generation Fund.

The Fund commenced operations on August 31, 2012, during which time the Fund faced significant market volatility as investors assessed the pending U.S. election. From its outset, the Fund has focused on income and has been fully invested. The Fund will typically hold a predominance of its assets in the World Income Fund, to assist in the generation of income, in combination with other Funds to potentially add both income as well as a lack of correlation of market performance to the World Income Fund. Going forward, additional steps are being undertaken to hedge against market fluctuations.

| (1) | The Bank of America Merrill Lynch Global Broad Market Index tracks the performance of investment grade debt publicly issued in the major domestic and Eurobond markets, including sovereign, quasi-government, corporate, securitized and collateralized securities. The Income Generation Indices Blend is a custom blended index comprised of the following two indices with their noted respective weightings: MSCI ACWI (50%) and Bank of America Merrill Lynch Global Broad Market Index (50%). MSCI ACWI is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI ACWI consists of 45 country indices comprising 24 developed and 21 emerging market country indices. This custom blended index and its respective weightings are reflective of the Fund’s sector diversification. Indices are unmanaged and, unlike the Fund, are not affected by cash flows. It is not possible to invest directly in an index. |

Annual Shareholder Report

3

Huntington Income Generation Fund (Continued)

| | | | | | | | | | | | | | | | | | | | |

Total Returns For The Period Ended October 31, 2012 | |

| | | Trust

Shares | | | Class C

Shares | | | Class C

Shares,

with load | | | Bank of America

Merrill Lynch

Global Broad

Market Index+ | | | Income Generation

Indices Blend+ | |

Since Inception (8/31/12) | | | -0.07 | % | | | -0.20 | % | | | -1.19 | % | | | 1.38 | % | | | 2.20 | % |

| | | | |

Expense Ratios(1) | | | | | | | | | | | | | |

Total Annual Fund Operating Expenses | | | 1.24 | % | | | 1.99 | % | | | | | | | | | | | | |

The Fund’s past performance does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-253-0412. For after-tax returns call 1-800-253-0412. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund Shares. Mutual Funds are not obligations of or guaranteed by any bank and are not federally insured.

The Fund is distributed by Unified Financial Securities, Inc., 2960 North Meridian Street, Suite 300, Indianapolis, IN 46208. (Member FINRA)

| + | The Bank of America Merrill Lynch Global Broad Market Index and Income Generation Indices Blend are not adjusted to reflect sales charges, expenses, or other fees that the Securities and Exchange Commission requires to be reflected in the Fund’s performance. The indices are unmanaged and, unlike the Fund, are not affected by cash-flows. It is not possible to invest directly in an index. |

| (1) | The expense ratios are from the Fund’s prospectus dated August 31, 2012. Additional information pertaining to the Fund’s expense ratios as of October 31, 2012 can be found in the financial highlights. |

Annual Shareholder Report

4

| | |

| | |

| Huntington World Income Fund | | October 31, 2012 |

| | |

| Portfolio of Investments Summary Table | | (unaudited) |

| | | | |

| Asset Allocation | | Percentage of

Market Value | |

Common Stocks | | | 59.2% | |

Preferred Stocks | | | 10.3% | |

Corporate Bonds | | | 5.1% | |

Foreign Government Bonds | | | 4.9% | |

Closed-End Funds | | | 1.7% | |

Exchange-Traded Funds | | | 1.6% | |

Options Purchased | | | 0.4% | |

Cash1 | | | 2.8% | |

Short-Term Securities Held as Collateral for Securities Lending | | | 14.0% | |

Total | | | 100.0% | |

| 1 | Investments in an affiliated money market fund. |

Portfolio holdings and allocations are subject to change. As of October 31, 2012, percentages in the table above are based on total investments. Such total investments may differ from the percentages set forth below in the Portfolio of Investments which are computed using the Fund’s total net assets.

The Portfolio of Investments are broken down by sectors, and these sectors do not represent industry categories for purposes of identifying “industry concentration” as described in the Investment Company Act of 1940, as amended.

Portfolio of Investments

| | | | | | | | | | |

| Shares | | | | | Value | | | |

| | | | | | | | | | |

| Common Stocks — 69.6% | | | | | | |

| Australia — 0.7% | | | | | | |

| Financials — 0.7% | | | | | | |

| | 10,000 | | | National Australia Bank Ltd. | | $ | 267,712 | | | |

| Bermuda — 1.6% | | | | | | |

| Energy — 1.6% | | | | | | |

| | 27,500 | | | Nordic American Tankers Ltd. (a) | | | 231,000 | | | |

| | 10,000 | | | Seadrill Ltd. | | | 403,400 | | | |

| | | | | | | | 634,400 | | | |

| Brazil — 0.9% | | | | | | |

| Utilities — 0.9% | | | | | | |

| | 15,200 | | | CPFL Energia SA ADR (a) | | | 354,008 | | | |

| Canada — 11.5% | | | | | | |

| Energy — 7.3% | | | | | | |

| | 9,300 | | | Baytex Energy Corp. (a) | | | 423,708 | | | |

| | 11,000 | | | Crescent Point Energy Corp. | | | 457,044 | | | |

| | 20,000 | | | Freehold Royalties Ltd. | | | 406,083 | | | |

| | 17,212 | | | Pembina Pipeline Corp. (a) | | | 481,075 | | | |

| | 60,000 | | | Pengrowth Energy Corp. (a) | | | 359,400 | | | |

| | 25,000 | | | Penn West Petroleum Ltd. (a) | | | 324,750 | | | |

| | 8,000 | | | TransCanada Corp. | | | 361,840 | | | |

| | | | | | | | 2,813,900 | | | |

| Financials — 3.1% | | | | | | |

| | 7,200 | | | Bank of Montreal | | | 425,664 | | | |

| | 7,000 | | | Royal Bank of Canada (a) | | | 399,210 | | | |

| | 15,000 | | | Sun Life Financial, Inc. | | | 372,000 | | | |

| | | | | | | | 1,196,874 | | | |

| | | | | | | | | | |

| Shares | | | | | Value | | | |

| | | | | | | | | | |

| Common Stocks — (Continued) | | | | | | |

| Canada — (Continued) | | | | | | |

| Telecommunication Services — 1.1% | | | | | | |

| | 9,800 | | | BCE, Inc. ADR | | $ | 427,868 | | | |

| | | | | | | | 4,438,642 | | | |

| France — 2.7% | | | | | | |

| Energy — 1.0% | | | | | | |

| | 8,000 | | | Total SA ADR (a) | | | 403,200 | | | |

| Telecommunication Services — 0.7% | | | | | | |

| | 24,000 | | | France Telecom SA ADR | | | 269,280 | | | |

| Utilities — 1.0% | | | | | | |

| | 16,000 | | | GDF Suez SA ADR | | | 366,720 | | | |

| | | | | | | | 1,039,200 | | | |

| Greece — 1.1% | | | | | | |

| Industrials — 1.1% | | | | | | |

| | 26,000 | | | Navios Maritime Partners LP (a) | | | 404,300 | | | |

| Israel — 1.3% | | | | | | |

| Industrials — 1.3% | | | | | | |

| | 2,600 | | | Delek Group Ltd. | | | 494,323 | | | |

| New Zealand — 1.3% | | | | | | |

| Telecommunication Services — 1.3% | | | | | | |

| | 50,000 | | | Telecom Corp. of New Zealand Ltd. ADR | | | 487,500 | | | |

(See notes which are an integral part of the Financial Statements)

Annual Shareholder Report

5

| | |

| Huntington World Income Fund | | (Continued) |

| | | | | | | | | | |

| Shares | | | | | Value | | | |

| | | | | | | | | | |

| Common Stocks — (Continued) | | | | | | |

| Taiwan — 1.0% | | | | | | |

| Telecommunication Services — 1.0% | | | | | | |

| | 12,600 | | | Chunghwa Telecom Co. Ltd. ADR (a) | | $ | 391,608 | | | |

| United Kingdom — 4.1% | | | | | | |

| Financials — 0.8% | | | | | | |

| | 28,000 | | | Aviva PLC ADR (a) | | | 301,840 | | | |

| Health Care — 1.0% | | | | | | |

| | 9,000 | | | GlaxoSmithKline PLC ADR | | | 404,100 | | | |

| Utilities — 2.3% | | | | | | |

| | 6,000 | | | National Grid PLC ADR | | | 342,060 | | | |

| | 23,000 | | | SSE PLC | | | 537,465 | | | |

| | | | | | | | 879,525 | �� | | |

| | | | | | | | 1,585,465 | | | |

| United States — 43.4% | | | | | | |

| Consumer Staples — 1.1% | | | | | | |

| | 26,250 | | | Vector Group Ltd. | | | 432,075 | | | |

| Energy — 18.9% | | | | | | |

| | 3,500 | | | BP Prudhoe Bay Royalty Trust | | | 285,320 | | | |

| | 18,500 | | | Cheniere Energy Partners LP | | | 393,310 | | | |

| | 13,000 | | | Copano Energy LLC | | | 396,500 | | | |

| | 25,000 | | | Crosstex Energy LP | | | 387,250 | | | |

| | 5,700 | | | Diamond Offshore Drilling, Inc. | | | 394,668 | | | |

| | 9,300 | | | Energy Transfer Partners LP | | | 398,040 | | | |

| | 7,500 | | | Enterprise Products Partners LP | | | 395,325 | | | |

| | 12,000 | | | Genesis Energy LP | | | 386,760 | | | |

| | 4,600 | | | Kinder Morgan Energy Partners LP (a) | | | 384,836 | | | |

| | 15,000 | | | Legacy Reserves LP | | | 407,850 | | | |

| | 20,000 | | | LRR Energy LP (a) | | | 386,600 | | | |

| | 20,000 | | | Natural Resource Partners LP | | | 436,600 | | | |

| | 13,000 | | | North European Oil Royalty Trust | | | 367,120 | | | |

| | 19,000 | | | Permian Basin Royalty Trust | | | 267,330 | | | |

| | 10,800 | | | Plains All American Pipeline LP | | | 490,104 | | | |

| | 15,000 | | | PVR Partners LP | | | 379,200 | | | |

| | 15,000 | | | Regency Energy Partners LP | | | 345,900 | | | |

| | 15,000 | | | Vanguard Natural Resources LLC | | | 445,800 | | | |

| | 6,000 | | | Williams Partners LP | | | 317,880 | | | |

| | | | | | | | 7,266,393 | | | |

| Financials — 2.0% | | | | | | |

| | 40,000 | | | Fifth Street Finance Corp. | | | 436,400 | | | |

| | 15,000 | | | Solar Capital Ltd. | | | 342,000 | | | |

| | | | | | | | 778,400 | | | |

| Health Care — 3.4% | | | | | | |

| | 10,000 | | | Bristol-Myers Squibb Co. | | | 332,500 | | | |

| | 11,000 | | | Eli Lilly & Co. | | | 534,930 | | | |

| | 60,000 | | | PDL BioPharma, Inc. (a) | | | 447,000 | | | |

| | | | | | | | 1,314,430 | | | |

| | | | | | | | | | |

| Shares | | | | | Value | | | |

| | | | | | | | | | |

| Common Stocks — (Continued) | | | | | | |

| United States — (Continued) | | | | | | |

| Industrials — 3.0% | | | | | | |

| | 32,000 | | | R.R. Donnelley & Sons Co. (a) | | $ | 320,640 | | | |

| | 25,000 | | | SeaCube Container Leasing Ltd. | | | 463,000 | | | |

| | 11,000 | | | TAL International Group, Inc. | | | 375,540 | | | |

| | | | | | | | 1,159,180 | | | |

| Materials — 3.6% | | | | | | |

| | 8,200 | | | Cliffs Natural Resources, Inc. (b) | | | 297,414 | | | |

| | 12,200 | | | Dow Chemical Co./The (b) | | | 357,460 | | | |

| | 11,000 | | | Southern Copper Corp. | | | 419,100 | | | |

| | 1,500 | | | Terra Nitrogen Co. LP | | | 322,065 | | | |

| | | | | | | | 1,396,039 | | | |

| Real Estate Investment Trusts — 7.5% | | | | | | |

| | 22,000 | | | Annaly Capital Management, Inc. | | | 355,080 | | | |

| | 13,000 | | | Hatteras Financial Corp. | | | 354,510 | | | |

| | 16,000 | | | Hospitality Properties Trust | | | 369,920 | | | |

| | 36,000 | | | Inland Real Estate Corp. | | | 294,120 | | | |

| | 14,000 | | | Invesco Mortgage Capital, Inc. | | | 300,020 | | | |

| | 40,000 | | | Medical Properties Trust, Inc. | | | 459,200 | | | |

| | 17,000 | | | Omega Healthcare Investors, Inc. | | | 389,980 | | | |

| | 16,300 | | | Senior Housing Properties Trust | | | 358,274 | | | |

| | | | | | | | 2,881,104 | | | |

| Telecommunication Services — 2.9% | | | | | | |

| | 10,000 | | | CenturyLink, Inc. | | | 383,800 | | | |

| | 80,000 | | | Frontier Communications Corp. (a) | | | 377,600 | | | |

| | 37,000 | | | Windstream Corp. (a) | | | 352,980 | | | |

| | | | | | | | 1,114,380 | | | |

| Utilities — 1.0% | | | | | | |

| | 10,000 | | | Exelon Corp. | | | 357,800 | | | |

| | | | | | | | 16,699,801 | | | |

| Total Common Stocks (Cost $27,958,814) | | | 26,796,959 | | | |

| Preferred Stocks — 12.1% | | | | | | |

| Germany — 1.0% | | | | | | |

| Financials — 1.0% | | | | | | |

| | 15,000 | | | Allianz SE, 8.375% | | | 391,200 | | | |

| United States — 11.1% | | | | | | |

| Financials — 6.2% | | | | | | |

| | 13,000 | | | Ameriprise Financial, Inc., 7.750% | | | 372,450 | | | |

| | 14,000 | | | First Republic Bank, Series A, 6.700% | | | 380,520 | | | |

| | 17,800 | | | M&T Capital Trust IV, 8.500% | | | 459,774 | | | |

| | 15,000 | | | Merrill Lynch Preferred Capital Trust V, Series F, 7.280% | | | 378,150 | | | |

| | 12,000 | | | PNC Financial Services Group, Inc.,

Series P, 6.125% | | | 336,000 | | | |

| | 17,000 | | | Wells Fargo Capital Trust XII, 7.875% | | | 439,450 | | | |

| | | | | | | | 2,366,344 | | | |

| Materials — 0.6% | | | | | | |

| | 6,000 | | | Molycorp, Inc., Series A, 5.500% (a) | | | 240,360 | | | |

(See notes which are an integral part of the Financial Statements)

Annual Shareholder Report

6

| | |

| Huntington World Income Fund | | (Continued) |

| | | | | | | | | | |

Principal

Amount

or Shares | | | | | Value | | | |

| | | | | | | | | | |

| Preferred Stocks — (Continued) | | | | | | |

| United States — (Continued) | | | | | | |

| Real Estate Investment Trusts — 1.1% | | | | | | |

| | 14,500 | | | Vornado Realty LP, 7.875% | | $ | 404,405 | | | |

| Telecommunication Services — 1.2% | | | | | | |

| | 17,500 | | | Qwest Corp., 7.500% | | | 479,850 | | | |

| Utilities — 2.0% | | | | | | |

| | 15,000 | | | FPC Capital I, Series A, 7.100% | | | 388,500 | | | |

| | 13,000 | | | NextEra Energy Capital Holdings, Inc., Series F, 8.750% | | | 366,340 | | | |

| | | | | | | | 754,840 | | | |

| | | | | | | | 4,245,799 | | | |

| Total Preferred Stocks (Cost $4,689,590) | | | 4,636,999 | | | |

| Corporate Bonds — 5.9% | | | | | | |

| Australia — 1.5% | | | | | | |

| Financials — 1.5% | | | | | | |

| | 500,000 | | | Goldman Sachs Group, Inc./The, 7.750%, 11/23/16 (c) | | | 577,826 | | | |

| Multi-Nationals — 1.7% | | | | | | |

| Financials — 1.7% | | | | | | |

| | 625,000 | | | Asian Development Bank,

9.250%, 4/30/13 GMTN (d) | | | 313,900 | | | |

| | 860,000,000 | | | European Bank for Reconstruction & Development, 7.200%, 6/8/16 GMTN (e) | | | 94,915 | | | |

| | 2,500,000,000 | | | Inter-American Development Bank, 6.500%, 6/4/14 GMTN (e) | | | 262,602 | | | |

| | | | | | | | 671,417 | | | |

| United States — 2.7% | | | | | | |

| Financials — 2.1% | | | | | | |

| | 255,000 | | | General Electric Capital Corp.,

5.000%, 2/28/14 EMTN | | | 214,006 | | | |

| | 350,000 | | | General Electric Capital Corp.,

5.500%, 2/1/17 GMTN | | | 303,760 | | | |

| | 250,000 | | | Morgan Stanley, 7.625%, 3/3/16 GMTN | | | 277,734 | | | |

| | | | | | | | 795,500 | | | |

| Real Estate Investment Trusts — 0.6% | | | | | | |

| | 200,000 | | | Developers Diversified Realty Corp., 7.500%, 4/1/17 | | | 241,325 | | | |

| | | | | | | | 1,036,825 | | | |

| Total Corporate Bonds (Cost $2,259,322) | | | 2,286,068 | | | |

| Foreign Government Bonds — 5.7% | | | | | | |

| Canada — 1.0% | | | |

| | 665,000 | | | Export Development Canada,

7.500%, 3/22/13 EMTN (c) | | | 373,789 | | | |

| Indonesia — 0.5% | | | |

| | 1,700,000,000 | | | Indonesia Government Bond,

Series FR55, 7.375%, 9/15/16 (c) | | | 189,208 | | | |

| | | | | | | | | | |

Principal

Amount

or Shares | | | | | Value | | | |

| | | | | | | | | | |

| Foreign Government Bonds — (Continued) | | | | | | |

| Mexico — 1.9% | | | |

| | 33,500 | | | Mexican Bonos, Series MI10, 8.000%, 12/19/13 (c) | | $ | 264,792 | | | |

| | 23,500 | | | Mexican Bonos, Series M, 7.000%, 6/19/14 (c) | | | 185,264 | | | |

| | 38,000 | | | Mexican Bonos, Series M, 5.000%, 6/15/17 (c) | | | 288,204 | | | |

| | | | | | | | 738,260 | | | |

| Poland — 1.1% | | | | | | |

| | 530,000 | | | Poland Government Bond,

Series 414, 5.750%, 4/25/14 (c) | | | 170,353 | | | |

| | 279,000 | | | Poland Government Bond,

Series 415, 5.500%, 4/25/15 (c) | | | 90,638 | | | |

| | 560,000 | | | Poland Government Bond,

Series 416, 5.000%, 4/25/16 (c) | | | 181,013 | | | |

| | | | | | | | 442,004 | | | |

| South Africa — 0.2% | | | | | | |

| | 620,000 | | | South Africa Government Bond, Series R201, 8.750%, 12/21/14 (c) | | | 76,903 | | | |

| Turkey — 1.0% | | | | | | |

| | 300,000 | | | Turkey Government Bond,

0.000%, 11/7/12 (c) (f) | | | 167,172 | | | |

| | 394,000 | | | Turkey Government Bond,

8.000%, 1/29/14 (c) | | | 222,716 | | | |

| | | | | | | | 389,888 | | | |

| Total Foreign Government Bonds (Cost $2,374,407) | | | 2,210,052 | | | |

| Closed-End Funds — 2.0% | | | | | | |

| | 25,000 | | | GAMCO Global Gold, Natural Resources & Income Trust by Gabelli | | | 353,500 | | | |

| | 26,000 | | | Morgan Stanley Emerging Markets Domestic Debt Fund, Inc. | | | 428,220 | | | |

| Total Closed-End Funds (Cost $807,275) | | | 781,720 | | | |

| Exchange-Traded Funds — 1.9% | | | | | | |

| | 4,000 | | | iShares iBoxx $ High Yield Corporate Bond Fund | | | 370,520 | | | |

| | 4,300 | | | WisdomTree Emerging Markets Corporate Bond Fund | | | 344,645 | | | |

| Total Exchange-Traded Funds (Cost $688,315) | | | 715,165 | | | |

| Options Purchased — 0.5% | | | | | | |

| | 100 | | | CBOE Volatility Index, Call @ $10, Expiring November 2012 | | | 89,500 | | | |

| | 100 | | | CBOE Volatility Index, Call @ $13, Expiring December 2012 | | | 64,000 | | | |

| | 25 | | | S&P 500 Index, Put @ $1,400, Expiring November 2012 | | | 45,500 | | | |

| Total Options Purchased (Cost $232,425) | | | 199,000 | | | |

| Cash Equivalents — 3.3% | | | | | | |

| | 1,270,934 | | | Huntington Money Market Fund, Interfund Shares, 0.010% (g) (h) | | | 1,270,934 | | | |

| Total Cash Equivalents (Cost $1,270,934) | | | 1,270,934 | | | |

(See notes which are an integral part of the Financial Statements)

Annual Shareholder Report

7

| | |

| Huntington World Income Fund | | (Continued) |

| | | | | | | | | | |

| Shares | | | | | Value | | | |

| | | | | | | | | | |

| Short-Term Securities Held as Collateral for

Securities Lending — 16.5% | | | | | | |

| | 6,333,079 | | | Fidelity Institutional Money Market Portfolio, Institutional Class, 0.200% (h) | | $ | 6,333,079 | | | |

| Total Short-Term Securities Held as Collateral for

Securities Lending (Cost $6,333,079) | | | 6,333,079 | | | |

| Total Investments

(Cost $46,614,161) — 117.5% | | | 45,229,976 | | | |

| Liabilities in Excess of Other Assets — (17.5)% | | | (6,739,430) | | | |

| Net Assets — 100.0% | | $ | 38,490,546 | | | |

| (a) | All or a portion of the security was on loan as of October 31, 2012. The total value of securities on loan as of October 31, 2012 was $6,176,066. |

| (b) | All or a portion of the security is held as collateral for written call options. |

| (c) | Foreign-denominated security. Principal amount is reported in applicable country’s currency. |

| (d) | Foreign-denominated security. Principal amount is reported in Brazilian Real. |

| (e) | Foreign-denominated security. Principal amount is reported in Indonesian Rupiah. |

| (f) | Zero coupon capital appreciation bond. |

| (g) | Investment in affiliate. |

| (h) | Rate disclosed is the seven day yield as of October 31, 2012. |

ADR — American Depositary Receipt

EMTN — Euro Medium Term Note

GMTN — Global Medium Term Note

(See notes which are an integral part of the Financial Statements)

Annual Shareholder Report

8

| | |

| | |

| Huntington Income Generation Fund | | October 31, 2012 |

| | |

| Portfolio of Investments Summary Table | | (unaudited) |

| | | | |

| Asset Allocation | | Percentage of

Market Value | |

Fixed Income Mutual Funds1 | | | 61.6% | |

Equity Mutual Funds1 | | | 33.0% | |

Cash1 | | | 5.4% | |

Total | | | 100.0% | |

| 1 | Investments in an affiliated funds. |

Portfolio holdings and allocations are subject to change. As of October 31, 2012, percentages in the table above are based on total investments. Such total investments may differ from the percentages set forth below in the Portfolio of Investments which are computed using the Fund’s total net assets.

Portfolio of Investments

| | | | | | | | | | |

| Shares | | | | | Value | | | |

| Mutual Funds — 91.0% (a) | | | | | | |

| | 31,022 | | | Huntington Dividend Capture Fund, Trust Shares | | $ | 298,120 | | | |

| | 10,351 | | | Huntington Income Equity Fund, Trust Shares | | | 231,036 | | | |

| | 112,465 | | | Huntington World Income Fund, Trust Shares | | | 986,317 | | | |

| Total Mutual Funds (Cost $1,534,823) | | | 1,515,473 | | | |

| Cash Equivalents — 5.2% | | | | | | |

| | 86,588 | | | Huntington Money Market Fund, Interfund Shares, 0.010% (a) (b) | | | 86,588 | | | |

| Total Cash Equivalents (Cost $86,588) | | | 86,588 | | | |

| Total Investments

(Cost $1,621,411) — 96.2% | | | 1,602,061 | | | |

| Other Assets in Excess of Liabilities — 3.8% | | | 62,473 | | | |

| Net Assets — 100.0% | | $ | 1,664,534 | | | |

| (a) | Investment in affiliate. |

| (b) | Rate disclosed is the seven day yield as of October 31, 2012. |

(See notes which are an integral part of the Financial Statements)

Annual Shareholder Report

9

Statements of Assets and Liabilities

October 31, 2012

| | | | | | | | |

| | | Huntington

World Income

Fund | | | Huntington

Income

Generation

Fund | |

| Assets: | | | | | | | | |

Investments, at cost | | $ | 46,614,161 | | | $ | 1,621,411 | |

Investments, at value | | $ | 43,959,042 | | | $ | — | |

Investments in affiliated securities, at value | | | 1,270,934 | | | | 1,602,061 | |

Total investments | | | 45,229,976 | | | �� | 1,602,061 | |

Cash | | | 2,988 | | | | 6,346 | |

Foreign currencies, at value (Cost $4,386 and $-) | | | 4,396 | | | | — | |

Income receivable | | | 261,195 | | | | — | |

Receivable for shares sold | | | 44,019 | | | | 22,000 | |

Receivable from advisor | | | — | | | | 19,280 | |

Tax reclaims receivable | | | 5,724 | | | | — | |

Prepaid offering costs | | | — | | | | 6,969 | |

Prepaid expenses and other assets | | | 21,781 | | | | 36,510 | |

Total assets | | | 45,570,079 | | | | 1,693,166 | |

| Liabilities: | | | | | | | | |

Payable for return of collateral on loaned securities | | | 6,333,079 | | | | — | |

Options written, at value (premium received $17,755 and $-) | | | 4,964 | | | | — | |

Income distribution payable | | | 97,913 | | | | — | |

Payable for investments purchased | | | 581,594 | | | | — | |

Payable for shares redeemed | | | 1,816 | | | | 147 | |

Accrued expenses and other payables: | | | | | | | | |

Investment advisor fees | | | 8,110 | | | | — | |

Administration fees | | | 5,910 | | | | 228 | |

Custodian fees | | | 3,086 | | | | 262 | |

Financial administration fees | | | 3,723 | | | | 148 | |

Distribution service fee | | | 1,370 | | | | 873 | |

Shareholder services fee | | | 8,110 | | | | 312 | |

Transfer agent fees | | | 2,306 | | | | 2,147 | |

Professional fees | | | 22,089 | | | | 23,289 | |

Compliance service fees | | | 360 | | | | 65 | |

Line of credit fees | | | 52 | | | | — | |

Other | | | 5,051 | | | | 1,161 | |

Total liabilities | | | 7,079,533 | | | | 28,632 | |

Net Assets | | $ | 38,490,546 | | | $ | 1,664,534 | |

| | | | | | | | | |

| Net Assets Consist of: | | | | | | | | |

Paid in capital | | $ | 40,718,337 | | | $ | 1,681,189 | |

Net unrealized depreciation of investments, options and translations of assets and liabilities in foreign currency | | | (1,370,534 | ) | | | (19,350 | ) |

Accumulated net realized loss on investments, options and foreign currency transactions | | | (882,844 | ) | | | (113 | ) |

Accumulated net investment income | | | 25,587 | | | | 2,808 | |

Net Assets | | $ | 38,490,546 | | | $ | 1,664,534 | |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

Trust Shares | | $ | 31,934,996 | | | $ | 99,924 | |

Class A Shares | | $ | 6,555,550 | | | | — | |

Class C Shares | | | — | | | $ | 1,564,610 | |

| Shares Outstanding: (unlimited number of shares authorized, no par value): | | | | | | | | |

Trust Shares | | | 3,642,997 | | | | 10,033 | |

Class A Shares | | | 747,779 | | | | — | |

Class C Shares | | | — | | | | 157,274 | |

| Net Asset Value, Redemption Price and Offering Price Per Share: | | | | | | | | |

Trust Shares | | $ | 8.77 | | | $ | 9.96 | |

Class A Shares | | $ | 8.77 | | | | — | |

Class C Shares(a) | | | — | | | $ | 9.95 | |

| Offering Price Per Share (100%/(100%-maximum sales charge) of net asset value adjusted to the nearest cent) per share: | | | | | | | | |

Class A Shares | | $ | 9.21 | | | | — | |

| Maximum Sales Charge: | | | | | | | | |

Class A Shares | | | 4.75 | % | | | — | |

| | | | | | | | | |

| (a) | A contingent deferred sales charge (“CDSC”) of 1.00% may be charged on shares held less than 12 months. |

(See notes which are an integral part of the Financial Statements)

Annual Shareholder Report

10

Statements of Operations

Year Ended October 31, 2012

| | | | | | | | |

| | | Huntington

World Income

Fund | | | Huntington

Income

Generation

Fund(a) | |

| Investment Income: | | | | | | | | |

Dividend income | | $ | 2,428,188 | | | $ | — | |

Dividend income from affiliated securities | | | 89 | | | | 7,792 | |

Interest income | | | 277,215 | | | | — | |

Income from securities lending, net | | | 35,367 | | | | — | |

Foreign dividend taxes withheld | | | (89,977 | ) | | | — | |

Total investment income | | | 2,650,882 | | | | 7,792 | |

| Expenses: | | | | | | | | |

Investment advisor fees | | | 158,683 | | | | 184 | |

Administration fees | | | 57,824 | | | | 335 | |

Custodian fees | | | 7,240 | | | | 262 | |

Transfer and dividend disbursing agent fees and expenses | | | 27,221 | | | | 4,210 | |

Trustees’ fees | | | 1,981 | | | | 4 | |

Professional fees | | | 26,961 | | | | 23,289 | |

Financial administration fees | | | 21,382 | | | | 148 | |

Distribution services fee—Class A Shares | | | 12,436 | | | | — | |

Distribution services fee—Class C Shares | | | — | | | | 1,254 | |

Shareholder services fee—Trust Shares | | | 66,905 | | | | 42 | |

Shareholder services fee—Class A Shares | | | 12,436 | | | | — | |

Shareholder services fee—Class C Shares | | | — | | | | 418 | |

State registration costs | | | 48,545 | | | | 5,797 | |

Offering costs | | | 7,601 | | | | 2,049 | |

Printing and postage | | | 24,056 | | | | 1,063 | |

Insurance premiums | | | 3,268 | | | | 206 | |

Compliance service fees | | | 1,339 | | | | 65 | |

Line of credit fees | | | 548 | | | | 2 | |

Other | | | 3,309 | | | | 500 | |

Total expenses | | | 481,735 | | | | 39,828 | |

Investment advisory fees waived | | | (72,967 | ) | | | (184 | ) |

Reimbursement from advisor | | | — | | | | (38,282 | ) |

Net expenses | | | 408,768 | | | | 1,362 | |

Net investment income | | | 2,242,114 | | | | 6,430 | |

Net Realized/Unrealized Gain (Loss) on Investments, Options and

Foreign Currency Transactions: | | | | | | | | |

Net realized loss on investment transactions | | | (1,001,657 | ) | | | — | |

Net realized loss on investment transactions of affiliates | | | — | | | | (113 | ) |

Net realized gain on option transactions | | | 240,996 | | | | — | |

Net realized loss on foreign currency transactions | | | (16,771 | ) | | | — | |

Net realized loss on investments, options and translation of

assets and liabilities in foreign currency transactions | | | (777,432 | ) | | | (113 | ) |

Net change in unrealized depreciation of investments,

options and translation of assets and liabilities in foreign currency | | | (139,781 | ) | | | (19,350 | ) |

Net realized and unrealized loss on investments,

options and foreign currency transactions | | | (917,213 | ) | | | (19,463 | ) |

Change in net assets resulting from operations | | $ | 1,324,901 | | | $ | (13,033 | ) |

| | | | | | | | | |

| (a) | Reflects operations from the period August 31, 2012 (commencement of operations) to October 31, 2012. |

(See notes which are an integral part of the Financial Statements)

Annual Shareholder Report

11

Statements of Changes in Net Assets

| | | | | | | | | | | | |

| | | Huntington World

Income Fund | | | Huntington Income

Generation Fund | |

| | | Year Ended

October 31,

2012 | | | Period Ended

October 31,

2011(a) | | | Period Ended

October 31,

2012(b) | |

| Increase (Decrease) in Net Assets: | | | | | | | | | | | | |

| Operations— | | | | | | | | | | | | |

Net investment income | | $ | 2,242,114 | | | $ | 559,403 | | | $ | 6,430 | |

Net realized loss on investments, options and foreign currency transactions | | | (777,432 | ) | | | (551,486 | ) | | | (113 | ) |

Net change in unrealized depreciation of investments and foreign currency transactions | | | (139,781 | ) | | | (1,230,753 | ) | | | (19,350 | ) |

Net increase (decrease) in net assets resulting from operations | | | 1,324,901 | | | | (1,222,836 | ) | | | (13,033 | ) |

| Distributions to Shareholders— | | | | | | | | | | | | |

From and/or excess of net investment income: | | | | | | | | | | | | |

Trust Shares | | | (1,911,632 | ) | | | (462,906 | ) | | | (331 | ) |

Class A Shares | | | (345,108 | ) | | | (82,430 | ) | | | — | |

Class C Shares | | | — | | | | — | | | | (3,407 | ) |

Change in net assets resulting from distributions to shareholders | | | (2,256,740 | ) | | | (545,336 | ) | | | (3,738 | ) |

Change in net assets resulting from capital transactions | | | 16,962,889 | | | | 24,227,668 | | | | 1,681,305 | |

Change in net assets | | | 16,031,050 | | | | 22,459,496 | | | | 1,664,534 | |

| Net Assets | | | | | | | | | | | | |

Beginning of period | | | 22,459,496 | | | | — | | | | — | |

End of period | | $ | 38,490,546 | | | $ | 22,459,496 | | | $ | 1,664,534 | |

| | | | | | | | | | | | | |

Accumulated net investment income included in net assets at end of period | | $ | 25,587 | | | $ | 116,748 | | | $ | 2,808 | |

| Capital Transactions: | | | | | | | | | | | | |

Trust Shares | | | | | | | | | | | | |

Shares Sold | | $ | 17,455,125 | | | $ | 21,501,417 | | | $ | 100,180 | |

Dividends reinvested | | | 1,037,461 | | | | 308,992 | | | | 332 | |

Shares redeemed | | | (4,548,333 | ) | | | (1,513,802 | ) | | | — | |

Total Trust Shares | | | 13,944,253 | | | | 20,296,606 | | | | 100,512 | |

Class A Shares | | | | | | | | | | | | |

Shares Sold | | | 3,746,956 | | | | 4,341,716 | | | | — | |

Dividends reinvested | | | 199,468 | | | | 53,808 | | | | — | |

Shares redeemed | | | (927,788 | ) | | | (464,462 | ) | | | — | |

Total Class A Shares | | | 3,018,636 | | | | 3,931,062 | | | | — | |

Class C Shares | | | | | | | | | | | | |

Shares Sold | | | — | | | | — | | | | 1,579,996 | |

Dividends reinvested | | | — | | | | — | | | | 1,092 | |

Shares redeemed | | | — | | | | — | | | | (295 | ) |

Total Class C Shares | | | — | | | | — | | | | 1,580,793 | |

Net change resulting from capital transactions | | $ | 16,962,889 | | | $ | 24,227,668 | | | $ | 1,681,305 | |

| Share Transactions: | | | | | | | | | | | | |

Trust Shares | | | | | | | | | | | | |

Shares Sold | | | 1,953,446 | | | | 2,222,188 | | | | 10,000 | |

Dividends reinvested | | | 117,793 | | | | 33,447 | | | | 33 | |

Shares redeemed | | | (509,367 | ) | | | (174,510 | ) | | | — | |

Total Trust Shares | | | 1,561,872 | | | | 2,081,125 | | | | 10,033 | |

Class A Shares | | | | | | | | | | | | |

Shares Sold | | | 420,849 | | | | 458,068 | | | | — | |

Dividends reinvested | | | 22,654 | | | | 5,876 | | | | — | |

Shares redeemed | | | (106,163 | ) | | | (53,505 | ) | | | — | |

Total Class A Shares | | | 337,340 | | | | 410,439 | | | | — | |

Class C Shares | | | | | | | | | | | | |

Shares Sold | | | — | | | | — | | | | 157,194 | |

Dividends reinvested | | | — | | | | — | | | | 109 | |

Shares redeemed | | | — | | | | — | | | | (29 | ) |

Total Class C Shares | | | — | | | | — | | | | 157,274 | |

Net change resulting from share transactions | | | 1,899,212 | | | | 2,491,564 | | | | 167,307 | |

| | | | | | | | | | | | | |

| (a) | Reflects operations from the period May 2, 2011 (commencement of operations) to October 31, 2011. |

| (b) | Reflects operations from the period August 31, 2012 (commencement of operations) to October 31, 2012. |

(See notes which are an integral part of the Financial Statements)

Annual Shareholder Report

12

[THIS PAGE INTENTIONALLY LEFT BLANK]

Financial Highlights

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | |

Net Asset

Value,

beginning

of period | | | Net

investment

income (loss) | | | Net realized

and unrealized

gain (loss) on

investments | | | Total from

investment

operations | | | Distributions

from net

investment

income | | | Total

distributions | |

| HUNTINGTON WORLD INCOME FUND | | | | | | | | | | | | | | | | | | | | | |

| Trust Shares | | | | | | | | | | | | | | | | | | | | | | | | |

2011(4) | | $ | 10.00 | | | | 0.29 | | | | (1.00 | ) | | | (0.71 | ) | | | (0.28 | ) | | | (0.28 | ) |

2012 | | $ | 9.01 | | | | 0.61 | | | | (0.22 | ) | | | 0.39 | | | | (0.63 | ) | | | (0.63 | ) |

| Class A Shares | | | | | | | | | | | | | | | | | | | | | | | | |

2011(4) | | $ | 10.00 | | | | 0.26 | | | | (0.98 | ) | | | (0.72 | ) | | | (0.27 | ) | | | (0.27 | ) |

2012 | | $ | 9.01 | | | | 0.58 | | | | (0.21 | ) | | | 0.37 | | | | (0.61 | ) | | | (0.61 | ) |

| HUNTINGTON INCOME GENERATION FUND | | | | | | | | | | | | | | | | | |

| Trust Shares | | | | | | | | | | | | | | | | | | | | | | | | |

2012(7) | | $ | 10.00 | | | | 0.05 | | | | (0.06 | ) | | | (0.01 | ) | | | (0.03 | ) | | | (0.03 | ) |

| Class C Shares | | | | | | | | | | | | | | | | | | | | | | | | |

2012(7) | | $ | 10.00 | | | | 0.04 | | | | (0.06 | ) | | | (0.02 | ) | | | (0.03 | ) | | | (0.03 | ) |

| (1) | Based on net asset value, which does not reflect a sales charge or contingent deferred sales charge, if applicable. |

| (2) | If applicable, certain fees were waived and/or reimbursed. If such waivers/reimbursements had not occurred, the ratios would have been as indicated. |

| (3) | Portfolio Turnover is calculated on the basis of the Fund as a whole without distinguishing among the classes of shares. |

| (4) | For the period May 2, 2011 (commencement of operations) to October 31, 2011. |

| (6) | Computed on an annualized basis. |

| (7) | For the period August 31, 2012 (commencement of operations) to October 31, 2012. |

| (8) | Does not include the effect of expenses of underlying funds. |

(See notes which are an integral part of the Financial Statements)

Annual Shareholder Report

14

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Asset

Value, end

of period | | | Total

return(1) | | | Ratio of Net

Expenses to

Average Net

Assets | | | Ratio of Net

Investment

Income (Loss)

to Average

Net Assets | | | Ratio of Expenses

(Prior to

Reimbursements)

to Average

Net Assets(2) | | | Net Assets,

end of

period

(000 omitted) | | | Portfolio

turnover

rate(3) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| $ | 9.01 | | | | (7.17 | )%(5) | | | 1.79 | %(6) | | | 6.38 | %(6) | | | 1.79 | %(6) | | $ | 18,760 | | | | 60 | %(5) |

| $ | 8.77 | | | | 4.55 | % | | | 1.25 | % | | | 7.10 | % | | | 1.48 | % | | $ | 31,935 | | | | 76 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| $ | 9.01 | | | | (7.27 | )%(5) | | | 2.04 | %(6) | | | 6.13 | %(6) | | | 2.04 | %(6) | | $ | 3,699 | | | | 60 | %(5) |

| $ | 8.77 | | | | 4.29 | % | | | 1.50 | % | | | 6.83 | % | | | 1.73 | % | | $ | 6,556 | | | | 76 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| $ | 9.96 | | | | (0.07 | )%(5) | | | 0.04 | %(6)(8) | | | 2.83 | %(6) | | | 27.64 | %(6)(8) | | $ | 100 | | | | 2 | %(5) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| $ | 9.95 | | | | (0.20 | )%(5) | | | 0.79 | %(6)(8) | | | 3.47 | %(6) | | | 26.85 | %(6)(8) | | $ | 1,565 | | | | 2 | %(5) |

Annual Shareholder Report

15

Notes to Financial Statements

October 31, 2012

The Huntington Funds (the “Trust”) was originally two separate Massachusetts business trusts: The Huntington Funds, established on February 10, 1987, and Huntington VA Funds, established on June 30, 1999 (together, the “Original Trusts”). On June 23, 2006, the Original Trusts were reorganized into a single Delaware statutory trust retaining the name of The Huntington Funds. The Trust is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. As of October 31, 2012, the Trust operated 36 separate series, or mutual funds, each with its own investment objective and strategy. The prospectus provides a description of each fund’s investment objectives, policies and strategies along with information on the classes of shares currently being offered. This report contains financial statements and financial highlights of the Huntington World Income Fund (“World Income Fund”) and Huntington Income Generation Fund (“Income Generation Fund”) (individually referred to as a “Fund”, or collectively as the “Funds”). The World Income Fund commenced operations on May 2, 2011. The Income Generation Fund commenced operations on August 31, 2012. The World Income Fund offers Trust and Class A shares. The Income Generation Fund offers Trust and Class C shares. Each class of shares has identical rights and privileges except with respect to distribution (12b-1) and service fees, voting rights on matters affecting a single class of shares, exchange privileges of each class of shares and sales charges. The price at which the Fund will offer or redeem shares is the net asset value (“NAV”) per share next determined after the order is considered received, subject to any applicable front end or contingent deferred sales charges. Class A has a maximum sales charge on purchases of 4.75% as a percentage of the original purchase price. Class C has a contingent deferred sales charge of 1.00% on shares sold within one year of purchase.

Under the Trust’s organizational documents, its officers and Board of Trustees (“Trustees”) are indemnified against certain liabilities arising out of the performance of their duties to the Funds. In addition, in the normal course of business, the Trust may enter into contracts with vendors and others that provide for general indemnifications. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust. However, based on experience, the Trust expects that risk of loss to be remote.

| (2) | Significant Accounting Policies |

The following is a summary of significant accounting policies consistently followed by each Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”). The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts of assets, liabilities, and disclosure of contingent assets and liabilities at

the date of the financial statements and the reported amounts of income and expenses for the period. Actual results could differ from those estimates.

The Trust calculates the NAV for each of the Funds by valuing securities held based on fair value. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

The valuation techniques described below maximize the use of observable inputs and minimize the use of unobservable inputs in determining fair value. The inputs used for valuing the Funds’ investments are summarized in the three broad levels listed below:

| • | | Level 1—quoted prices in active markets for identical assets. |

| • | | Level 2—other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). |

| • | | Level 3—significant unobservable inputs (including the Funds’ own assumptions in determining the fair value of investments). |

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The Trust recognizes transfers between fair value hierarchy levels at the reporting period end. The inputs or methodology used for valuing investments is not necessarily an indication of the risk associated with investing in those investments.

In computing the NAV of the Funds, fair value is based on market valuations with respect to portfolio securities for which market quotations are readily available. Pursuant to Trustee-approved policies, the Trust relies on certain security pricing services to provide the current market value of securities. Those security pricing services value equity securities (including foreign equity securities, exchange-traded funds and closed-end funds) traded on a securities exchange at the last reported sales price on the principal exchange. Equity securities quoted by NASDAQ are valued at the NASDAQ official closing price. If there is no reported sale on the principal exchange, and in the case of over-the-counter securities, equity securities are valued at a bid price estimated by the security pricing service. In each of these situations, valuations are typically categorized as Level 1 in the fair value hierarchy. Investments in open-end investment companies are valued at their respective net asset value as reported by such companies and are typically categorized as Level 1 in the fair value hierarchy.

Option contracts are generally valued using the closing price based on quote data from the six major U.S. options exchanges on which such options are traded, and are typically categorized as Level 1 in the fair value hierarchy.

Debt securities traded on a national securities exchange or in the over-the-counter market are valued at the last reported

Annual Shareholder Report

16

sales price on the principal exchange. If there is no reported sale on the principal exchange, and for all other debt securities, debt securities are valued at a bid price estimated by the security pricing service. Foreign securities quoted in foreign currencies are translated in U.S. dollars at the foreign exchange rate in effect as of the close of the New York Stock Exchange (NYSE) (generally 4:00 p.m. Eastern Time), on the day the value of the foreign security is determined. Short-term investments with remaining maturities of 60 days or less at the time of purchase are valued at amortized cost. In each of these situations, valuations are typically categorized as Level 2 in the fair value hierarchy.

Under certain circumstances, a good faith determination of the fair value of a security may be used instead of its current market value, even if the security’s market price is readily available. In such circumstances, the Trust’s Sub-Administrator may request that the Trust’s Pricing Committee make its own fair value determination.

Securities for which market quotations are not readily available are valued at fair value under Trust procedures approved by the Trustees. In these cases, a Pricing Committee established and appointed by the Trustees determines in good faith, subject to Trust procedures, the fair value of portfolio securities held by a Fund (“good faith fair valuation”). When a good faith fair valuation of a security is required, consideration is generally given to a number of factors including, but not limited to the following: dealer quotes, published analyses by dealers or analysts regarding the security, transactions which provide implicit valuation of the security (such as a merger or tender offer transaction), the value of other securities or contracts which derive their value from the security at issue, and the implications of any other circumstances which have caused trading in the security to halt. With respect to certain narrow categories of securities, the procedures utilized by the Pricing Committee detail specific valuation methodologies to be applied in lieu of considering the aforementioned list of factors. Depending on the source and relative significance of valuation inputs, these instruments may be classified as Level 2 or Level 3 in the fair value hierarchy.

Fair valuation procedures are also used when a significant event affecting the value of a portfolio security is determined to have occurred between the time when the price of the portfolio security is determined and the close of trading on the NYSE, which is when each Fund’s NAV is computed. An event is considered significant if there is both an affirmative expectation that the security’s value will change in response to

the event and a reasonable basis for quantifying the resulting change in value. Significant events include significant securities market movements occurring between the time the price of the portfolio security is determined and the close of trading on the NYSE. For domestic fixed income securities, such events may occur where the cut-off time for the market information used by the independent pricing service is earlier than the end of regular trading on the NYSE. For securities normally priced at their last sale price in a foreign market, such events can occur between the close of trading in the foreign market and the close of trading on the NYSE.

In some cases, events affecting the issuer of a portfolio security may be considered significant events. Examples of potentially significant events include announcements concerning earnings, acquisitions, new products, management changes, litigation developments, a strike or natural disaster affecting the company’s operations or regulatory changes or market developments affecting the issuer’s industry occurring between the time when the price of the portfolio security is determined and the close of trading on the NYSE. For securities of foreign issuers, such events could also include political or other developments affecting the economy or markets in which the issuer conducts its operations or its securities are traded.

There can be no assurance that a Fund could purchase or sell a portfolio security at the price used to calculate the Fund’s NAV. In the case of good faith fair valued portfolio securities, lack of information and uncertainty as to the significance of information may lead to a conclusion that a prior valuation is the best indication of a portfolio security’s present value. Good faith fair valuations generally remain unchanged until new information becomes available. Consequently, changes in good faith fair valuation of portfolio securities may be less frequent and of greater magnitude than changes in the price of portfolio securities valued at their last sale price, by an independent pricing service, or based on market quotations.

The Funds’ Trustees have authorized the use of an independent fair valuation service to monitor changes in a designated U.S. market index after foreign markets close, and to implement a fair valuation methodology to adjust the closing prices of foreign securities if the movement in the index is significant. In the event of an increase or decrease greater than predetermined levels, the Funds may use a systematic valuation model provided by an independent third party to fair value its international equity securities, which are then typically categorized as Level 2 in the fair value hierarchy.

Annual Shareholder Report

17

Notes to Financial Statements (Continued)

The following is a summary of the inputs used to value the Funds’ investments as of October 31, 2012, based on the three levels defined above:

| | | | | | | | | | | | | | | | |

| | | LEVEL 1 | | | LEVEL 2 | | | LEVEL 3 | | | Total | |

World Income Fund | | | | | | | | | | | | | | | | |

Investment Securities: | | | | | | | | | | | | | | | | |

Common Stocks | | | | | | | | | | | | | | | | |

Consumer Staples | | $ | 432,075 | | | $ | — | | | $ | — | | | $ | 432,075 | |

Energy | | | 11,117,893 | | | | — | | | | — | | | | 11,117,893 | |

Financials | | | 2,544,826 | | | | — | | | | — | | | | 2,544,826 | |

Health Care | | | 1,718,530 | | | | — | | | | — | | | | 1,718,530 | |

Industrials | | | 2,057,803 | | | | — | | | | — | | | | 2,057,803 | |

Materials | | | 1,396,039 | | | | — | | | | — | | | | 1,396,039 | |

Real Estate Investment Trusts | | | 2,881,104 | | | | — | | | | — | | | | 2,881,104 | |

Telecommunication Services | | | 2,690,636 | | | | — | | | | — | | | | 2,690,636 | |

Utilities | | | 1,958,053 | | | | — | | | | — | | | | 1,958,053 | |

Preferred Stocks | | | | | | | | | | | | | | | | |

Financials | | | 2,366,344 | | | | 391,200 | | | | — | | | | 2,757,544 | |

Materials | | | 240,360 | | | | — | | | | — | | | | 240,360 | |

Real Estate Investment Trusts | | | 404,405 | | | | — | | | | — | | | | 404,405 | |

Telecommunication Services | | | 479,850 | | | | — | | | | — | | | | 479,850 | |

Utilities | | | 754,840 | | | | — | | | | — | | | | 754,840 | |

Corporate Bonds | | | | | | | | | | | | | | | | |

Financials | | | — | | | | 2,044,743 | | | | — | | | | 2,044,743 | |

Real Estate Investment Trusts | | | — | | | | 241,325 | | | | — | | | | 241,325 | |

Foreign Government Bonds | | | — | | | | 2,210,052 | | | | — | | | | 2,210,052 | |

Closed-End Funds | | | 781,720 | | | | — | | | | — | | | | 781,720 | |

Exchange-Traded Funds | | | 715,165 | | | | — | | | | — | | | | 715,165 | |

Options Purchased | | | 199,000 | | | | — | | | | — | | | | 199,000 | |

Cash Equivalents | | | 1,270,934 | | | | — | | | | — | | | | 1,270,934 | |

Short-Term Securities Held as Collateral for Securities | | | 6,333,079 | | | | — | | | | — | | | | 6,333,079 | |

| | | | | | | | | | | | | | | | |

Total Investment Securities | | | 40,342,656 | | | | 4,887,320 | | | | — | | | | 45,229,976 | |

| | | | | | | | | | | | | | | | |

Other Financial Instruments:* | | | | | | | | | | | | | | | | |

Written Options | | | (4,964 | ) | | | — | | | | — | | | | (4,964 | ) |

| | | | | | | | | | | | | | | | |

Total Investments | | | 40,337,692 | | | | 4,887,320 | | | | — | | | | 45,225,012 | |

| | | | | | | | | | | | | | | | |

Income Generation Fund | | | | | | | | | | | | | | | | |

Investment Securities: | | | | | | | | | | | | | | | | |

Mutual Funds | | | 1,515,473 | | | | — | | | | — | | | | 1,515,473 | |

Cash Equivalents | | | 86,588 | | | | — | | | | — | | | | 86,588 | |

| | | | | | | | | | | | | | | | |

Total Investment Securities | | | 1,602,061 | | | | — | | | | — | | | | 1,602,061 | |

| | | | | | | | | | | | | | | | |

| * | Other Financial Instruments are derivatives instruments not reflected on the Portfolio of Investments, such as written option contracts. |

For the period ended October 31, 2012, there were no Level 3 investments for which significant unobservable inputs were used to determine fair value. The Trust recognizes transfers between fair value hierarchy levels at the reporting period end. There were no transfers between all levels as of October 31, 2012.

| B. | When-Issued and Delayed Transactions |

The Funds may engage in when-issued or delayed delivery transactions. The Funds record when-issued securities on the trade date and maintain security positions such that sufficient liquid assets will be available to make payment for the securities purchased. Securities purchased on a when-issued or delayed delivery basis are marked to market daily and begin earning interest on the settlement date. Losses may occur on these transactions due to changes in market conditions or the failure of counterparties to perform under the contract.

| C. | Foreign Currency Translation |

The accounting records of the Funds are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars at the current rate of exchange each business day to determine the value of investments, and other assets and liabilities. Purchases and sales of foreign securities, and income and expenses, are translated at the prevailing rate of exchange on the respective date of these transactions. The Funds do not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from fluctuation arising from changes in market prices of securities held. These fluctuations are included with the net realized and unrealized gain or loss from investments and foreign currency transactions.

Annual Shareholder Report

18

The Funds may be subject to equity price risk and foreign currency exchange risk in the normal course of pursuing its investment objectives. The Funds may invest in various financial instruments including positions in foreign currency contracts and written option contracts to gain exposure to or hedge against changes in the value of equities or foreign currencies. The following is a description of the derivative instruments utilized by the Funds, including the primary underlying risk exposure related to each instrument type.

Foreign Exchange Contracts—The Funds may enter into forward foreign exchange contracts. A forward foreign exchange contract involves an obligation to purchase or sell a specific currency at a future date at a price set at the time of the contract. Such contracts are used to sell unwanted currency exposure that comes with holding securities in a market, or to buy currency exposure where the exposure from holding securities is insufficient to provide the desired currency exposure. The contracts are marked-to-market daily and the change in market value is recorded as unrealized

appreciation or depreciation. When a forward foreign currency contract is closed, the Fund records a realized gain or loss equal to the difference between the value at the time it was opened and the value at the time it was closed. The Funds could be exposed to risks if the counterparties to the contracts are unable to meet the terms of their contracts and from unanticipated movements in exchange rates. At October 31, 2012 the Funds did not have any forward foreign exchange contracts outstanding.

Written Options Contracts—The Funds may write options contracts for which premiums received are recorded as liabilities and are subsequently adjusted to the current value of the options written. Premiums received from writing options which expire are treated as realized gains. Premiums received from writing options which are either exercised or closed are offset against the proceeds received or the amount paid on the transaction to determine realized gains or losses. Investing in written options contracts exposes the Funds to equity price risk.

The following is a summary of World Income Fund’s written option activity for the fiscal year ended October 31, 2012:

| | | | | | | | |

| Contracts | | Number of

Contracts | | | Premium | |

Outstanding at 10/31/2011 | | | 597 | | | $ | 55,194 | |

Options written | | | 6,330 | | | | 592,053 | |

Options closed | | | (1,804 | ) | | | (304,513 | ) |

Options expired | | | (2,735 | ) | | | (158,665 | ) |

Options exercised | | | (2,184 | ) | | | (166,314 | ) |

Outstanding at 10/31/2012 | | | 204 | | | $ | 17,755 | |

As of October 31, 2012, World Income Fund had the following outstanding written option contracts:

| | | | | | | | | | | | | | | | | | | | | | | | |

| Contract | | Type | | | Expiration

Date | | | Exercise

Price | | | Number of

Contracts | | | Fair

Value | | | Unrealized

Appreciation | |

Cliff Natural Resources, Inc. | | | Call | | | | November 2012 | | | $ | 49 | | | | 82 | | | $ | 328 | | | $ | 7,790 | |

Dow Chemical Co./The | | | Call | | | | November 2012 | | | | 30 | | | | 122 | | | | 4,636 | | | | 5,001 | |

NET UNREALIZED APPRECIATION ON WRITTEN OPTION CONTRACTS | | | | | | | | | | | | | | | | | | | | | | $ | 12,791 | |

The following tables provide a summary of the fair value of derivative instruments, not accounted for as hedging instruments as of October 31, 2012, and the effect of derivative instruments on the Statements of Operations for the period ended October 31, 2012.

The Fair Value of Derivative Instruments as of October 31, 2012:

| | | | | | | | | | |

| | | Asset Derivatives | | Liability Derivatives | | | | | |

| Primary Risk Exposure | | Statements of Assets and

Liabilities Location | | Statements of Assets and

Liabilities Location | | Fund | | Fair Value | |

Option Contracts | | | | Options Written, at value | | World Income Fund | | $ | 4,964 | |

| | | | |

| | Investments, at value | | | | World Income Fund | | | 199,000 | |

Annual Shareholder Report

19

Notes to Financial Statements (Continued)

The effect of Derivative Instruments on the Statements of Operations for the fiscal year ended October 31, 2012:

| | | | | | | | | | | | |

| Primary Risk Exposure | | Location of Gain (Loss)

on Derivatives

Recognized in Income | | Fund | | Realized Gain on

Derivatives Recognized

in Income | | | Change in Unrealized

Appreciation/Depreciation

on Derivatives Recognized

in Income | |

Option Contracts | | Net realized gain on option transactions/net change in unrealized appreciation/(depreciation) of investments and options | | World Income Fund | | $ | 240,996 | | | $ | (34,503 | ) |

The notional value of the written options contracts outstanding as of October 31, 2012 and the month-end average notional amount for the fiscal year ended October 31, 2012 are detailed in the table below:

| | | | | | | | |

| Fund | | Average

Month-End

Notional Amount | | | October 31, 2012

Notional Amount | |

World Income Fund | | $ | 2,998,521 | | | $ | 767,800 | |

Derivative positions open during the period and at period end are reflected for each Fund in the tables above. The volume of these positions relative to each Fund’s net assets at the close of the reporting period is generally higher than the volume of such positions at the beginning of the reporting period. The Funds value derivative instruments at fair value and recognize changes in fair value currently in the results on operations.

Restricted securities are securities that may only be resold upon registration under federal securities laws or in transactions exempt from such registration. In some cases, the issuer of restricted securities has agreed to register such securities for resale, at the issuer’s expense, either upon demand by the Funds or in connection with another registered offering of the securities. Many restricted securities may be resold in the secondary market in transactions exempt from registration. Such restricted securities may be determined to be liquid. The Funds will not incur any registration costs upon such resale. The Fund’s restricted securities are valued at the price provided by dealers in the secondary market or, if no market prices are available, at the fair value price as determined by the Trust’s Pricing Committee. At October 31, 2012, the Funds did not hold restricted securities.

To generate additional income, the Funds may lend a certain percentage of their total assets, to the extent permitted by the 1940 Act or the rules or regulations thereunder, on a short-term basis to certain brokers, dealers or other financial institutions pursuant to a securities lending agreement with