UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05010

THE HUNTINGTON FUNDS

(Exact name of registrant as specified in charter)

2960 North Meridian Street, Suite 300

Attn: Huntington Funds Officer

Indianapolis, IN 46208

(Address of principal executive offices) (Zip code)

Martin R. Dean

The Huntington National Bank

37 West Broad Street, 6th Floor

Columbus, OH 43215

(Name and address of agent for service)

Copies to:

David C. Mahaffey, Esq.

Sullivan & Worcester

1666 K Street, N.W.

Washington, DC 20006

Registrant’s telephone number, including area code: 1-800-253-0412

Date of fiscal year end: October 31

Date of reporting period: October 31, 2013

Item 1. Reports to Stockholders.

A Message from the

Chief Investment Officer and

Annual Shareholder Report

OCTOBER 31, 2013

CLASS A SHARES

CLASS C SHARES

TRUST SHARES

Message from the Chief Investment Officer

Dear Shareholder:

Despite a raft of economic, political, earnings, international and market concerns during 2012 and into 2013, many of the equity markets produced attractive returns for the year ended October 31, 2013. Buoyed by a continuation of Federal Reserve (Fed) bond buying programs and global central banks providing excess liquidity, investors were encouraged by the flood of capital provided to the economic system. Small and middle capitalized companies led the performance derby with returns of 39.08% and 33.48%, as measured by the Standard and Poor’s SmallCap 600 Index1 and Standard and Poor’s MidCap 400 Index2 respectively, for the year ended October 31, 2013. The large caps, as represented by the Dow Jones Industrial Average3 and the Standard & Poor’s 500 Index4, were also up 21.81% and 27.15%, respectively.

The most significant investment event during this past year was certainly the Presidential election in November 2012. Virtually all investment strategies were based upon who would win the White House. With diametrically opposed views on taxes and economic stimulus, the two candidates were deadlocked up until the day of the election. Huntington Asset Advisors, Inc. (the “Adviser”) developed two separate strategies based upon the eventual outcome. We believed that certain sectors would perform differently under the policies of the two candidates. Upon confirmation of the election, the Adviser moved quickly in all Huntington Funds to implement our predetermined strategy. This included reducing betas and emphasizing certain industries that would be favored under the Obama administration. Expectations regarding the changes in tax policies associated with capital gains and dividends that had been espoused by Obama ultimately were muted in the fiscal cliff negotiations. This carried positive momentum for investors into 2013.

One of the longer-term strategies that the Adviser employed during the year was to emphasize the agribusiness sector. With back-to-back strong years in farm income and dramatically growing international demand for food, our analysts looked into a variety of avenues to uncover opportunities. The traditional approach would be to invest in farm equipment, fertilizers and seed companies. We looked deeper into the periphery of agribusiness that included investments in rural retail establishments, irrigation and flow control devices, transportation equipment and catalog companies that cater to outdoor life. We firmly believe that this strategy has longer-term positive investment implications that can be implemented irrespective of Fed policy, economic issues and regulatory initiatives.

Interest rates remained at a very low range due to Fed monetary policy. While this policy was good for the nation to help stimulate exports and domestic consumption, it had extremely negative implications for investors that wanted income from their investment dollars. Within the Adviser’s top-down investment philosophy, there is a strong focus on the recognition of trends in the markets, demographics and economy. As we developed our investment strategies relative to this macro environment, we perceived a need for non-fixed income producers. Investors’ desire to replace their dwindling bond income with more robust equity-based strategies have favored the Huntington Income Generation Fund and the Huntington World Income Fund. Both Funds have helped shareholders to replace their traditional income sources with the potential for high current income and with hedged volatility.

Looking into 2014, there are two major pieces of legislation that will start to have significant implications for the economy and the financial markets. With the drafting of Dodd-Frank provisions and the institution of the new healthcare laws, there will be additional costs and regulations impacting critical aspects of the economy. Just as the passage of Sarbanes-Oxley created ripples in the markets ten years ago, the banking and healthcare bills will need to be sorted out by investors. We believe that one accompaniment of the Dodd-Frank legislation will be an increase in merger and acquisition activities as smaller financial firms seek to cover costs by adding economies of scale. This would be consistent with the experience of Sarbanes-Oxley as many firms merged, went private or sold out. The year following the passage of Sarbances-Oxley, there were fewer publically traded companies than the year before, as many firms merged with significant premiums to previous valuations. This could be an interesting opportunity for 2014 strategies, if past is prologue.

As the Adviser to the Huntington Funds, we are focused on increasing shareholder value, improving competitive advantages, and addressing changing industry trends. We conduct our efforts with the highest level of attention to the investment disciplines we have employed for several decades, with the goal of controlling risk. We believe there are four key investor needs that will be increasing in demand: strategic income, protection against impending inflation, managing volatility, and capital appreciation. Please take a moment to review the following October 31, 2013 Annual

Message from the Chief Investment Officer

Message from the Chief Investment Officer (Continued)

Report. We believe these two Huntington Funds—Huntington Income Generation Fund and Huntington World Income Fund—will continue to provide you with strategic income opportunities as we head into 2014.

Sincerely,

B. Randolph Bateman, CFA

President

Huntington Asset Advisors, Inc.

| (1) | The Standard & Poor’s SmallCap 600 Index is a capitalization-weighted index which generally represents all major industries in the small cap range of the U.S. stock market. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an index. |

| (2) | The Standard & Poor’s MidCap 400 Index is a capitalization-weighted index of common stocks representing the mid-range sector of the U.S. stock market. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an index. |

| (3) | The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and Nasdaq. |

| (4) | The Standard & Poor’s 500 Index is a capitalization-weighted index comprised of 500 stocks and is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an index. |

This commentary may include statements that constitute “forward-looking statements” under the U.S. securities laws. Forward-looking statements include, among other things, projections, estimates, and information about possible or future results related to the Funds, market or regulatory developments. The views expressed above are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein. The views expressed above are those of the Adviser as of October 31, 2013 and are subject to change at any time based upon economic, market, or other conditions and the Adviser undertakes no obligation to update the views expressed herein. Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. The views expressed above (including any forward-looking statement) may not be relied upon as investment advice or as an indication of the Funds’ trading intent. Information about the Funds’ holdings, asset allocation or country diversification is historical and is not an indication of future Funds’ composition, which may vary.

The performance of any index mentioned in this commentary has not been adjusted for ongoing management, distribution and operating expenses, and sales charges applicable to mutual fund investments. In addition, the returns do not reflect additional fees charged by separate accounts or variable insurance contracts that an investor in the Funds may pay. If these additional fees were reflected, performance would have been lower.

This material represents the manager’s assessment of the Funds and market environment at a specific point in time and should not be relied upon by the reader as research, tax or investment advice.

The Adviser does not provide tax advice. Please note that i) any discussion of U.S. tax matters contained in this communication cannot be used by you for the purpose of avoiding tax penalties; ii) this communication was written to support the promotion or marketing of the matters addressed herein; and iii) you should seek advice based on your particular circumstances from an independent tax advisor.

Message from the Chief Investment Officer

Annual Shareholder Report

Huntington World Income Fund

Huntington Income Generation Fund

| | |

Huntington World Income Fund | | As of 10/31/2013 |

Management’s Discussion of Fund Performance

Portfolio Manager:

Chip Hendon, MBA,

Senior Portfolio Manager

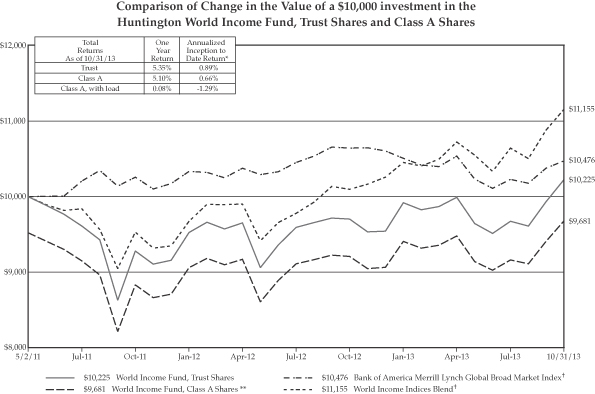

Huntington Asset Advisors, Inc.

For the fiscal year ended October 31, 2013, the Huntington World Income Fund’s (“Fund”) Trust Shares and Class A Shares produced total returns (not including the deduction of applicable sales charges) of 5.35% and 5.10%, respectively, based on net asset value. This performance was higher than the total return of -1.57% for the Fund’s primary benchmark, the Bank of America Merrill Lynch Global Broad Market Index1 for the same period. However, since the World Income Fund has both equity and fixed income exposure in its portfolio and the primary benchmark does not reflect investments in equity securities, the Fund’s performance is also compared to the World Income Indices Blend1. This is a custom blended index reflecting the performance of two benchmarks, the MSCI AC World Index1 (“MSCI ACWI”), which focuses on international equities, and the Bank of America Merrill Lynch Global Broad Market Index, which incorporates international bonds. This custom blended index produced a return of 10.86% for the same period.

The Fund is managed using our top-down style and portfolio construction techniques which are aimed at producing a high level of income and low volatility through the use of high dividend-paying domestic and foreign stocks, and preferred stocks. Foreign and domestic debt option hedges are also utilized to help mitigate the potential for loss and smooth out performance.

The Fund concluded its second full fiscal year on October 31, 2013. Over the last year, the Fund participated in both the up and down cycles of the markets. Following the November 2012 Presidential election, there were fears that the new tax laws on income-producing products would have an adverse effect on investors. As a result, we saw a selloff in the main components of the Fund. However, once the realization that income-oriented vehicles would not be as negatively impacted as originally thought, we saw a rally in the Fund that lasted through April. In April and May of 2013, interest rates rose unexpectedly as the Federal Reserve (Fed) hinted that quantitative easing would be coming to an end, again negatively impacting income-oriented stocks and bonds. Then, in June through the end of the fiscal year, interest rates stabilized and the equity markets continued to make new highs. Since that time, the Fund has rallied back to finish the year strong and delivered a positive return for investors.

The Fund is focused on income and invests in Master Limited Partnerships (“MLPs”)2, Canadian Royalty Trusts, preferred stocks and foreign and domestic bonds. The Fund also utilizes options and hedging techniques to try to mitigate the volatility and lower risk. For the fiscal year ended October 31, 2013, the options in the portfolio subtracted -4.79% of incremental return. Going into 2014, the focus will be on the Fed, under Janet Yellen’s leadership, ending quantitative easing and potentially raising interest rates sometime during the year. We will continue to focus on income as our first priority, but also intend to continue to utilize options to lower volatility as we did in 2013 when the volatility of the Fund decreased significantly.

| (1) | The Bank of America Merrill Lynch Global Broad Market Index tracks the performance of investment grade debt publicly issued in the major domestic and Eurobond markets, including sovereign, quasi-government, corporate, securitized and collateralized securities. The World Income Indices Blend is a custom blended index comprised of the following two indices with their noted respective weightings: MSCI ACWI (50%) and Bank of America Merrill Lynch Global Broad Market Index (50%). MSCI ACWI is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI ACWI consists of 45 country indices comprising 24 developed and 21 emerging market country indices. This custom blended index and its respective weightings are reflective of the Fund’s sector diversification. Indices are unmanaged and, unlike the Fund, are not affected by cash flows. It is not possible to invest directly in an index. |

| (2) | Funds that invest in MLPs may have additional expense, as some MLPs pay incentive distribution fees to their general partners. |

| | Investments in international markets present special risks including currency fluctuation, the potential for diplomatic and political instability, regulatory and liquidity risks, foreign taxation and differences in auditing and other financial standards. Risks of foreign investing are generally intensified for investments in emerging markets. |

| | Bonds are affected by a number of risks, including fluctuations in interest rates, credit risks, and prepayment risk. In general, as prevailing interest rates rise, fixed income securities prices will fall. Bonds face credit risk if a decline in an issuer’s credit rating or credit worthiness, causes a bond’s price to decline. High yield bonds are subject to additional risks such as increased risk of default and greater volatility because of lower credit quality of the issues. |

Annual Shareholder Report

1

Huntington World Income Fund (Continued)

The Fund’s past performance does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current ot the most recent month end or after-tax returns may be obtained by calling 1-800-253-0412. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. Total returns, at load, include the 4.75% maximum sales charge for the Class A shares.

| | | | |

| Class | | Expense Ratios | |

A | | | 1.35% | |

Trust | | | 1.10% | |

The above expense ratios are from the Fund’s prospectus dated February 28, 2013. Additional information pertaining to the Fund’s expense ratio as of October 31, 2013 can be found in the financial highlights.

The Fund and its benchmarks performance assumes the reinvestment of all dividends and distributions.

The Fund is distributed by Unified Financial Securities, Inc. (Member FINRA), a wholly-owned subsidiary of Huntington Bancshares, Inc. and an affiliate of Huntington Asset Advisors, Inc., the adviser of the Huntington Funds.

| * | The Fund commenced operations for all share classes on May 2, 2011. |

| ** | Represents a hypothetical investment of $10,000 in the Fund after deducting the maximum sales load of 4.75% ($10,000 investment minus $475 sales load = $9,525). |

| + | The Bank of America Merrill Lynch Global Broad Market Index and World Income Indices Blend are not adjusted to reflect sales charges, expenses, or other fees that the Securities and Exchange Commission requires to be reflected in the Fund’s performance. The indices are unmanaged and, unlike the Fund, are not affected by cash flows. It is not possible to invest directly in an index. |

Annual Shareholder Report

2

| | |

Huntington Income Generation Fund | | As of 10/31/2013 |

Management’s Discussion of Fund Performance

Portfolio Manager:

Randy Bateman, CIO,

Senior Portfolio Manager

Huntington Asset Advisors, Inc.

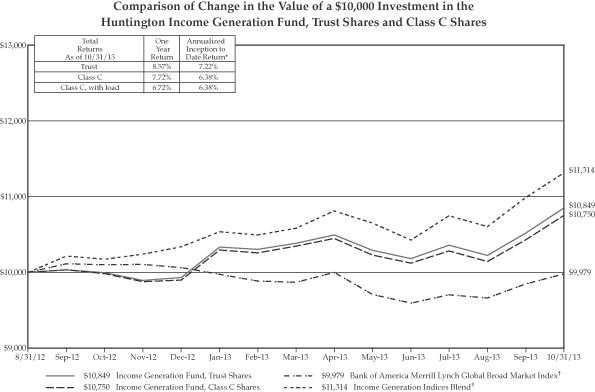

For the fiscal year ended October 31, 2013, the Huntington Income Generation Fund’s (“Fund”) Trust Shares and Class C Shares produced total returns (not including the deduction of applicable sales charges) of 8.57% and 7.72%, respectively, based on net asset value. This performance was significantly greater than the total return of -1.57% for the Fund’s primary benchmark, the Bank of America Merrill Lynch Global Broad Market Index1 for the same period. However, since the Fund has both equity and fixed income exposure in its portfolio and the primary benchmark does not reflect investments in equity securities, the Fund’s performance is also compared to the Income Generation Indices Blend1. This is a custom blended index reflecting the performance of two benchmarks, the MSCI AC World Index1 (“MSCI ACWI”), which focuses on international equities, and the Bank of America Merrill Lynch Global Broad Market Index1, which incorporates international bonds. This custom blended index produced a return of 10.86% for the same period due to the strong equity performance in the world’s stock markets.

The Fund is managed using our top-down style and portfolio construction techniques which are aimed at producing a high level of income and low volatility through the use of high dividend-paying domestic and foreign stocks, Master Limited Partnerships, Real Estate Investment Trusts (“REITs”)2 and preferred stocks. Foreign and domestic debt option hedges are also utilized to help mitigate the potential for loss and smooth out performance. These strategies are all incorporated within the Huntington World Income Fund, Huntington Dividend Capture Fund and Huntington Income Equity Fund, which are underlying investments of the Fund that are tactically allocated to produce the Income Generation Fund.

The Fund concluded its first fiscal year on October 31, 2013. Over the last year, the Fund faced significant market volatility as investors assessed the pending U.S. election. From its outset, the Fund has focused on income and has been fully invested. The Fund will typically hold a predominance of its assets in the World Income Fund, to assist in the generation of income, and in combination with other Funds, to potentially add both income as well as a hedge against the volatile markets in both stocks and fixed income investments. The Fund’s prospectus now allows for the inclusion of the Huntington Disciplined Equity Fund to add a level of incremental safety and lower volatility.

| (1) | The Bank of America Merrill Lynch Global Broad Market Index tracks the performance of investment grade debt publicly issued in the major domestic and Eurobond markets, including sovereign, quasi-government, corporate, securitized and collateralized securities. The Income Generation Indices Blend is a custom blended index comprised of the following two indices with their noted respective weightings: MSCI ACWI (50%) and Bank of America Merrill Lynch Global Broad Market Index (50%). MSCI ACWI is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI ACWI consists of 45 country indices comprising 24 developed and 21 emerging market country indices. This custom blended index and its respective weightings are reflective of the Fund’s sector diversification. Indices are unmanaged and, unlike the Fund, are not affected by cash flows. It is not possible to invest directly in an index. |

| (2) | Investments in REITs and real-estate related securities involve special risks associated with an investment in real estate, such as limited liquidity and interest rate risks and may be more volatile than other securities. In addition, the value of REITs and other real estate-related investments is sensitive to changes in real estate values, extended vacancies of properties and other environmental and economic factors. |

Annual Shareholder Report

3

Huntington Income Generation Fund (Continued)

The Fund’s past performance does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current ot the most recent month end and after-tax returns may be obtained by calling 1-800-253-0412. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. Total returns, at load, include the 1.00% maximum deferred sales charge for the Class C shares.

| | | | |

| Class | | Expense Ratios | |

C | | | 1.99% | |

Trust | | | 1.24% | |

The above expense ratios are from the Fund’s prospectus dated February 28, 2013. Additional information pertaining to the Fund’s expense ratio as of October 31, 2013 can be found in the financial highlights.

The Fund and its benchmarks performance assumes the reinvestment of all dividends and distributions.

The Fund is distributed by Unified Financial Securities, Inc. (Member FINRA), a wholly-owned subsidiary of Huntington Bancshares, Inc. and an affiliate of Huntington Asset Advisors, Inc., the adviser of the Huntington Funds.

| * | The Fund commenced operations for all share classes on August 31, 2012. |

| + | The Bank of America Merrill Lynch Global Broad Market Index and Income Generation Indices Blend are not adjusted to reflect sales charges, expenses, or other fees that the Securities and Exchange Commission requires to be reflected in the Fund’s performance. The indices are unmanaged and, unlike the Fund, are not affected by cash flows. It is not possible to invest directly in an index. |

Annual Shareholder Report

4

| | |

| | |

| Huntington World Income Fund | | October 31, 2013 |

| | |

| Portfolio of Investments Summary Table | | (unaudited) |

| | | | |

| Asset Allocation | | Percentage of Market Value | |

Common Stocks | | | 59.9% | |

Short-Term Securities Held as Collateral for Securities Lending | | | 16.4% | |

Preferred Stocks | | | 11.2% | |

Corporate Bonds | | | 4.3% | |

Foreign Government Bonds | | | 3.3% | |

Cash1 | | | 2.6% | |

Options Purchased | | | 1.5% | |

Closed-End Funds | | | 0.8% | |

Total | | | 100.0% | |

| 1 | Investments in an affliated money market fund. |

Portfolio holdings and allocations are subject to change. As of October 31, 2013, percentages in the table above are based on total investments. Such total investments may differ from the percentage set forth below in the Portfolio of Investments which are computed using the Fund’s net assets.

The Portfolio of Investments are broken down by sectors, and these sectors do no represent industry categories for purposes of identifying “industy concentration” as described in the Investment Company Act of 1940, as amended.

Portfolio of Investments

| | | | | | | | | | |

| Shares | | | | | Value | | | |

| | | | | | | | | | |

| Common Stocks — 71.4% | | | | | | |

| Australia — 1.0% | | | | | | |

| Financials — 1.0% | | | | | | |

| | 10,000 | | | National Australia Bank Ltd. | | $ | 333,727 | | | |

| Bermuda — 0.9% | | | | | | |

| Energy — 0.9% | | | | | | |

| | 9,500 | | | Golar LNG Partners LP | | | 293,930 | | | |

| Brazil — 1.1% | | | | | | |

| Telecommunication Services — 1.1% | | | | | | |

| | 16,000 | | | Telefonica Brasil SA ADR | | | 354,880 | | | |

| Canada — 10.3% | | | | | | |

| Energy — 4.5% | | | | | | |

| | 11,000 | | | Crescent Point Energy Corp. | | | 427,163 | | | |

| | 20,000 | | | Freehold Royalties Ltd. | | | 455,178 | | | |

| | 17,212 | | | Pembina Pipeline Corp. (a) | | | 564,554 | | | |

| | | | | | | | 1,446,895 | | | |

| Financials — 1.2% | | | | | | |

| | 4,700 | | | Canadian Imperial Bank of Commerce | | | 400,205 | | | |

| Industrials — 2.5% | | | | | | |

| | 13,000 | | | Norbord, Inc. | | | 370,370 | | | |

| | 70,000 | | | Student Transportation, Inc. (a) | | | 441,700 | | | |

| | | | | | | | 812,070 | | | |

| Real Estate Investment Trusts — 0.8% | | | | | | |

| | 9,400 | | | Dundee Real Estate Investment Trust, Class A | | | 260,633 | | | |

| Telecommunication Services — 1.3% | | | | | | |

| | 9,800 | | | BCE, Inc. ADR | | | 426,594 | | | |

| | | | | | | | 3,346,397 | | | |

| | | | | | | | | | |

| Shares | | | | | Value | | | |

| | | | | | | | | | |

| Common Stocks — (Continued) | | | | | | |

| France — 3.1% | | | | | | |

| Industrials — 1.5% | | | | | | |

| | 12,000 | | | Bouygues SA (a) | | $ | 469,052 | | | |

| Utilities — 1.6% | | | | | | |

| | 31,000 | | | Veolia Environnement SA ADR | | | 533,510 | | | |

| | | | | | | | 1,002,562 | | | |

| Germany — 1.0% | | | | | | |

| Telecommunication Services — 1.0% | | | | | | |

| | 42,700 | | | Telefonica Deutschland | | | 336,765 | | | |

| Italy — 0.3% | | | | | | |

| Energy — 0.3% | | | | | | |

| | 2,100 | | | Eni SpA ADR (a) | | | 106,680 | | | |

| Netherlands — 3.5% | | | | | | |

| Energy — 0.9% | | | | | | |

| | 4,400 | | | Royal Dutch Shell PLC ADR | | | 305,888 | | | |

| Real Estate Investment Trusts — 1.2% | | | | | | |

| | 4,900 | | | Wereldhave NV | | | 381,396 | | | |

| Telecommunication Services — 1.4% | | | | | | |

| | 32,700 | | | VimpelCom Ltd. ADR | | | 470,553 | | | |

| | | | | | | | 1,157,837 | | | |

| New Zealand — 1.5% | | | | | | |

| Telecommunication Services — 1.5% | | | | | | |

| | 50,000 | | | Telecom Corp. of New Zealand Ltd. ADR | | | 480,000 | | | |

| Norway — 1.1% | | | | | | |

| Energy — 1.1% | | | | | | |

| | 21,000 | | | Ship Finance International Ltd. (a) | | | 347,550 | | | |

(See notes which are an integral part of the Financial Statements)

Annual Shareholder Report

5

| | |

| Huntington World Income Fund | | (Continued) |

| | | | | | | | | | |

| Shares | | | | | Value | | | |

| | | | | | | | | | |

| Common Stocks — (Continued) | | | | | | |

| Russian Federation — 1.2% | | | | | | |

| Consumer Discretionary — 1.2% | | | | | | |

| | 30,000 | | | CTC Media, Inc. | | $ | 379,200 | | | |

| South Africa — 1.3% | | | | | | |

| Consumer Discretionary — 1.3% | | | | | | |

| | 141,000 | | | JD Group Ltd. | | | 433,993 | | | |

| Spain — 1.4% | | | | | | |

| Financials — 1.4% | | | | | | |

| | 50,907 | | | Banco Santander SA ADR (a) | | | 453,581 | | | |

| Switzerland — 1.1% | | | | | | |

| Financials — 1.1% | | | | | | |

| | 4,100 | | | Swiss Re AG | | | 360,125 | | | |

| United Kingdom — 3.4% | | | | | | |

| Financials — 1.8% | | | | | | |

| | 40,000 | | | Aviva PLC ADR (a) | | | 577,600 | | | |

| Health Care — 1.6% | | | | | | |

| | 10,000 | | | AstraZeneca PLC ADR | | | 528,600 | | | |

| | | | | | | | 1,106,200 | | | |

| United States — 39.2% | | | | | | |

| Consumer Staples — 1.0% | | | | | | |

| | 8,500 | | | Altria Group, Inc. | | | 316,455 | | | |

| Energy — 7.7% | | | | | | |

| | 11,200 | | | Calumet Specialty Products

Partners LP | | | 333,872 | | | |

| | 60,000 | | | Eagle Rock Energy Partners LP | | | 368,400 | | | |

| | 6,500 | | | Energy Transfer Partners LP | | | 344,305 | | | |

| | 9,663 | | | Kinder Morgan Energy

Partners LP (a) | | | 779,804 | | | |

| | 17,500 | | | Natural Resource Partners LP | | | 374,500 | | | |

| | 13,000 | | | North European Oil Royalty Trust | | | 299,000 | | | |

| | | | | | | | 2,499,881 | | | |

| Financials — 10.2% | | | | | | |

| | 17,000 | | | AllianceBernstein Holding LP (a) | | | 377,740 | | | |

| | 19,600 | | | Apollo Global Management LLC | | | 632,296 | | | |

| | 40,000 | | | Fifth Street Finance Corp. | | | 408,000 | | | |

| | 35,000 | | | KKR Financial Holdings LLC (a) | | | 346,850 | | | |

| | 20,500 | | | New Mountain Finance Corp. | | | 290,690 | | | |

| | 30,000 | | | New York Community Bancorp, Inc. (b) | | | 486,300 | | | |

| | 40,000 | | | Prospect Capital Corp. (a) | | | 453,600 | | | |

| | 14,800 | | | Solar Capital Ltd. | | | 339,660 | | | |

| | | | | | | | 3,335,136 | | | |

| Industrials — 3.0% | | | | | | |

| | 11,000 | | | Corrections Corp. of America (b) | | | 407,000 | | | |

| | 12,200 | | | TAL International Group, Inc. (a) | | | 589,382 | | | |

| | | | | | | | 996,382 | | | |

| Materials — 2.3% | | | | | | |

| | 12,000 | | | Southern Copper Corp. | | | 335,400 | | | |

| | 2,000 | | | Terra Nitrogen Co. LP (a) | | | 408,660 | | | |

| | | | | | | | 744,060 | | | |

| | | | | | | | | | |

| Shares | | | | | Value | | | |

| | | | | | | | | | |

| Common Stocks — (Continued) | | | | | | |

| Real Estate Investment Trusts — 9.9% | | | | | | |

| | 32,500 | | | Annaly Capital Management, Inc. | | $ | 383,175 | | | |

| | 6,900 | | | EPR Properties | | | 354,453 | | | |

| | 2,500 | | | Hatteras Financial Corp. | | | 45,500 | | | |

| | 16,000 | | | Hospitality Properties Trust | | | 470,080 | | | |

| | 36,000 | | | Inland Real Estate Corp. | | | 384,840 | | | |

| | 7,300 | | | Invesco Mortgage Capital, Inc. | | | 112,785 | | | |

| | 27,500 | | | Lexington Realty Trust | | | 321,750 | | | |

| | 20,000 | | | Medical Properties Trust, Inc. | | | 260,800 | | | |

| | 47,000 | | | NorthStar Realty Finance Corp. | | | 438,510 | | | |

| | 11,011 | | | Realty Income Corp. (a) | | | 458,608 | | | |

| | | | | | | | 3,230,501 | | | |

| Telecommunication Services — 4.1% | | | | | | |

| | 10,000 | | | AT&T, Inc. | | | 362,000 | | | |

| | 28,500 | | | NTELOS Holdings Corp. | | | 542,640 | | | |

| | 50,000 | | | Windstream Holdings, Inc. (a) | | | 427,500 | | | |

| | | | | | | | 1,332,140 | | | |

| Utilities — 1.0% | | | | | | |

| | 8,300 | | | Southern Co. | | | 339,553 | | | |

| | | | | | | | 12,794,108 | | | |

| Total Common Stocks (Cost $22,139,920) | | | 23,287,535 | | | |

| Preferred Stocks — 13.3% | | | | | | |

| Bermuda — 0.9% | | | | | | |

| Financials — 0.9% | | | | | | |

| | 11,500 | | | Axis Capital Holdings Ltd.,

Series C, 6.875% | | | 281,175 | | | |

| United States — 12.4% | | | | | | |

| Financials — 7.8% | | | | | | |

| | 13,000 | | | Ameriprise Financial, Inc., 7.750% | | | 337,740 | | | |

| | 16,000 | | | Deutsche Bank Contingent Capital Trust II, 6.550% | | | 400,960 | | | |

| | 14,000 | | | First Republic Bank, Series A, 6.700% | | | 342,300 | | | |

| | 15,000 | | | Merrill Lynch Preferred Capital Trust V,

Series F, 7.280% | | | 379,350 | | | |

| | 12,000 | | | PNC Financial Services Group, Inc.,

Series P, 6.125% | | | 304,560 | | | |

| | 15,000 | | | Raymond James Financial, Inc., 6.900% | | | 384,450 | | | |

| | 13,500 | | | Wells Fargo & Co., Series J, 8.000% | | | 383,940 | | | |

| | | | | | | | 2,533,300 | | | |

| Real Estate Investment Trusts — 3.3% | | | | | | |

| | 16,000 | | | PS Business Parks, Inc.,

Series S, 6.450% | | | 363,680 | | | |

| | 14,000 | | | Realty Income Corp., Series F, 6.625% | | | 342,580 | | | |

| | 14,500 | | | Vornado Realty LP, 7.875% | | | 383,525 | | | |

| | | | | | | | 1,089,785 | | | |

| Telecommunication Services — 1.3% | | | | | | |

| | 17,500 | | | Qwest Corp., 7.500% | | | 441,350 | | | |

| | | | | | | | 4,064,435 | | | |

| Total Preferred Stocks (Cost $4,497,910) | | | 4,345,610 | | | |

(See notes which are an integral part of the Financial Statements)

Annual Shareholder Report

6

| | |

| Huntington World Income Fund | | (Continued) |

| | | | | | | | | | |

Principal

Amount

or Shares | | | | | Value | | | |

| | | | | | | | | | |

| Corporate Bonds — 5.1% | | | | | | |

| Multi-Nationals — 1.2% | | | | | | |

| Financials — 1.2% | | | | | | |

| | 1,000,000 | | | Inter-American Development

Bank, 5.250%, 7/19/16 (c) | | $ | 402,441 | | | |

| United States — 3.9% | | | | | | |

| Financials — 1.6% | | | | | | |

| $ | 255,000 | | | General Electric Capital Corp.,

5.000%, 2/28/14 EMTN | | | 211,693 | | | |

| | 350,000 | | | General Electric Capital Corp.,

5.500%, 2/1/17 GMTN | | | 297,020 | | | |

| | | | | | | | 508,713 | | | |

| Materials — 1.6% | | | | | | |

| | 500,000 | | | Cliffs Natural Resources, Inc., 5.900%, 3/15/20 | | | 522,474 | | | |

| Real Estate Investment Trusts — 0.7% | | | | | | |

| | 200,000 | | | Developers Diversified Realty Corp., 7.500%, 4/1/17 | | | 234,296 | | | |

| | | | | | | | 1,265,483 | | | |

| Total Corporate Bonds (Cost $1,719,579) | | | 1,667,924 | | | |

| Foreign Government Bonds — 4.0% | | | | | | |

| Indonesia — 0.5% | | | | | | |

| | 1,700,000,000 | | | Indonesian Government,

Series FR55, 7.375%, 9/15/16 (d) | | | 152,955 | | | |

| Mexico — 1.3% | | | | | | |

| | 23,500 | | | Mexican Bonos,

Series M, 7.000%, 6/19/14 (d) | | | 183,798 | | | |

| | 30,000 | | | Mexican Bonos,

Series M, 5.000%, 6/15/17 (d) | | | 232,180 | | | |

| | | | | | | | 415,978 | | | |

| Poland — 1.4% | | | | | | |

| | 530,000 | | | Poland Government Bond,

Series 414, 5.750%, 4/25/14 (d) | | | 174,548 | | | |

| | 279,000 | | | Poland Government Bond,

Series 415, 5.500%, 4/25/15 (d) | | | 94,149 | | | |

| | 560,000 | | | Poland Government Bond,

Series 416, 5.000%, 4/25/16 (d) | | | 190,217 | | | |

| | | | | | | | 458,914 | | | |

| South Africa — 0.2% | | | | | | |

| | 620,000 | | | South Africa Government Bond,

Series R201, 8.750%,12/21/14 (d) | | | 64,344 | | | |

| Turkey — 0.6% | | | | | | |

| | 394,000 | | | Turkey Government Bond,

8.000%, 1/29/14 (d) | | | 197,957 | | | |

| Total Foreign Government Bonds (Cost $1,494,188) | | | 1,290,148 | | | |

| Options Purchased — 1.8% | | | | | | |

| | 200 | | | CBOE Volatility Index, Call @ $12,

Expiring December 2013 | | | 70,000 | | | |

| | 600 | | | CBOE Volatility Index, Call @ $12,

Expiring November 2013 | | | 148,800 | | | |

| | | | | | | | | | |

Contracts

or Shares | | | | | Value | | | |

| | | | | | | | | | |

| Options Purchased — (Continued) | | | | | | |

| | 200 | | | CBOE Volatility Index, Call @ $13,

Expiring November 2013 | | $ | 33,000 | | | |

| | 800 | | | SPDR S&P 500 Index ETF,

Call @ $185, Expiring

December 2013 (b) | | | 28,800 | | | |

| | 800 | | | SPDR S&P 500 Index ETF, Put @

$176, Expiring

December 2013 (e) | | | 310,400 | | | |

| Total Options Purchased (Cost $670,071) | | | 591,000 | | | |

| Cash Equivalents — 3.1% | | | | | | |

| | | | | | | | | | |

| | 1,007,686 | | | Huntington U.S. Treasury Money Market Fund, Trust Shares,

0.030% (f) (g) | | | 1,007,686 | | | |

| Total Cash Equivalents (Cost $1,007,686) | | | 1,007,686 | | | |

| Closed-End Funds — 1.0% | | | | | | |

| | 31,000 | | | GAMCO Global Gold, Natural Resources & Income Trust by

Gabelli | | | 329,840 | | | |

| Total Closed-End Funds (Cost $476,480) | | | 329,840 | | | |

| Short-Term Securities Held as Collateral for

Securities Lending — 19.5% | | | | | | |

| | 6,369,808 | | | Fidelity Institutional Money Market Portfolio, Institutional Class,

0.080% (g) | | | 6,369,808 | | | |

| Total Short-Term Securities Held as Collateral for

Securities Lending (Cost $6,369,808) | | | 6,369,808 | | | |

| Total Investments (Cost $38,375,642) — 119.2% | | | 38,889,551 | | | |

| Liabilities in Excess of Other Assets — (19.2)% | | | (6,262,052) | | | |

| Net Assets — 100.0% | | $ | 32,627,499 | | | |

| (a) | All or a portion of the security was on loan as of October 31, 2013. The total value of securities on loan as of October 31, 2013 was $6,228,028. |

| (b) | All or a portion of the security is held as collateral for written call options. |

| (c) | Foreign-denominated security. Principal amount is reported in Brazilian Real. |

| (d) | Foreign-denominated security. Principal amount is reported in applicable country’s currency. |

| (e) | All or a portion of the security is held as collateral for written put options. |

| (f) | Investment in affiliate. |

| (g) | Rate disclosed is the seven day yield as of October 31, 2013. |

| ADR | — American Depositary Receipt |

| EMTN | — Euro Medium Term Note |

| GMTN | — Global Medium Term Note |

(See notes which are an integral part of the Financial Statements)

Annual Shareholder Report

7

| | |

| | |

| Huntington Income Generation Fund | | October 31, 2013 |

| | |

| Portfolio of Investments Summary Table | | (unaudited) |

| | | | |

| Asset Allocation | | Percentage of

Market Value | |

Equity Mutual Funds1 | | | 100.0% | |

Total | | | 100.0% | |

| 1 | Investments in an affliated funds. |

Portfolio holdings are subject to change. As of October 31, 2013, percentages in the table above are based on total investments. Such total investments may differ from the percentage set forth below in the Portfolio of Investments which are computed using the Fund’s total nets assets.

Portfolio of Investments

| | | | | | | | | | |

| Shares | | | | | Value | | | |

| | | | | | | | | | |

| Mutual Funds — 99.7% (a) | | | | | | |

| | 15,495 | | | Huntington Disciplined Equity Fund, Trust Shares | | $ | 167,347 | | | |

| | 22,600 | | | Huntington Dividend Capture Fund, Trust Shares | | | 245,883 | | | |

| | 4,294 | | | Huntington Income Equity Fund, Trust Shares | | | 111,998 | | | |

| | 204,724 | | | Huntington World Income Fund, Trust Shares | | | 1,770,859 | | | |

| Total Mutual Funds (Cost $2,239,658) | | | 2,296,087 | | | |

| Total Investments

(Cost $2,239,658) — 99.7% | | | 2,296,087 | | | |

| Other Assets in Excess of Liabilities — 0.3% | | | 6,058 | | | |

| Net Assets — 100.0% | | $ | 2,302,145 | | | |

| (a) | Investment in affiliate. |

(See notes which are an integral part of the Financial Statements)

Annual Shareholder Report

8

Statements of Assets and Liabilities

October 31, 2013

| | | | | | | | |

| | | Huntington

World Income

Fund | | | Huntington

Income Generation

Fund | |

| Assets: | | | | | | | | |

Investments, at cost | | $ | 38,375,642 | | | $ | 2,239,658 | |

Investments, at value | | $ | 37,881,865 | | | $ | — | |

Investments in affiliated securities, at value | | | 1,007,686 | | | | 2,296,087 | |

Total investments | | | 38,889,551 | | | | 2,296,087 | |

Foreign currencies, at value (Cost $3,946 and $ -) | | | 3,947 | | | | — | |

Income receivable | | | 172,197 | | | | — | |

Receivable for investments sold | | | 1,009,296 | | | | — | |

Receivable for shares sold | | | 7,920 | | | | — | |

Receivable from Adviser | | | 44,427 | | | | 5,546 | |

Tax reclaims receivable | | | 17,014 | | | | — | |

Prepaid expenses and other assets | | | 16,566 | | | | 20,572 | |

Total assets | | | 40,160,918 | | | | 2,322,205 | |

| Liabilities: | | | | | | | | |

Payable for return of collateral on loaned securities | | | 6,369,808 | | | | — | |

Payable to custodian | | | — | | | | 4,453 | |

Options written, at value (premium received $203,701 and $ -) | | | 203,100 | | | | — | |

Payable for investments purchased | | | 895,936 | | | | — | |

Payable for shares redeemed | | | 13,383 | | | | 605 | |

Accrued expenses and other payables: | | | | | | | | |

Administration fees | | | 4,993 | | | | 349 | |

Custodian fees | | | 3,093 | | | | 279 | |

Distribution service fee | | | 1,591 | | | | 1,460 | |

Shareholder services fee | | | 6,943 | | | | 487 | |

Transfer and dividend disbursing agent fees and expenses | | | 2,781 | | | | 2,258 | |

Professional fees | | | 15,811 | | | | 8,898 | |

Printing and postage | | | 10,109 | | | | 943 | |

Compliance service fees | | | 269 | | | | 28 | |

Other | | | 5,602 | | | | 300 | |

Total Liabilities | | | 7,533,419 | | | | 20,060 | |

Net Assets | | $ | 32,627,499 | | | $ | 2,302,145 | |

| | | | | | | | | |

| Net Assets consist of: | | | | | | | | |

Paid in capital | | $ | 35,153,234 | | | $ | 2,235,678 | |

Net unrealized appreciation of investments, options and translations of assets and liabilities in foreign currency | | | 513,059 | | | | 56,429 | |

Accumulated net realized gain (loss) on investments, options and foreign currency transactions | | | (3,203,728 | ) | | | 10,038 | |

Accumulated net investment income | | | 164,934 | | | | — | |

Net Assets | | $ | 32,627,499 | | | $ | 2,302,145 | |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

Trust Shares | | $ | 24,780,464 | | | $ | 539 | |

Class A Shares | | $ | 7,847,035 | | | $ | — | |

Class C Shares | | $ | — | | | $ | 2,301,606 | |

| Shares Outstanding: (unlimited number of shares authorized, no par value): | | | | | | | | |

Trust Shares | | | 2,864,895 | | | | 52 | |

Class A Shares | | | 907,445 | | | | — | |

Class C Shares | | | — | | | | 223,606 | |

| Net Asset Value, Redemption Price and Offering Price Per Share: | | | | | | | | |

Trust Shares | | $ | 8.65 | | | $ | 10.30 | (b) |

Class A Shares | | $ | 8.65 | | | $ | — | |

Class C Shares (a) | | $ | — | | | $ | 10.29 | |

| Offering Price Per Share (100%/(100%-maximum sales charge) of net asset value adjusted to the nearest cent) per share: | | | | | | | | |

Class A Shares | | $ | 9.08 | | | $ | — | |

| Maximum Sales Charge: | | | | | | | | |

Class A Shares | | | 4.75 | % | | | — | |

| | | | | | | | | |

| (a) | A contingent deferred sales charge (“CDSC”) of 1.00% may be charged on shares held less than 12 months. |

| (b) | Per share amount does not recalculate due to rounding of net assets and/or shares outstanding. |

(See notes which are an integral part of the Financial Statements)

Annual Shareholder Report

9

Statements of Operations

Year Ended October 31, 2013

| | | | | | | | |

| | | Huntington

World Income

Fund | | | Huntington

Income Generation

Fund | |

| Investment Income: | | | | | | | | |

Dividend income | | $ | 2,681,798 | | | $ | — | |

Dividend income from affiliated securities | | | 439 | | | | 108,662 | |

Interest income | | | 271,329 | | | | — | |

Income from securities lending, net | | | 65,423 | | | | — | |

Foreign dividend taxes withheld | | | (102,718 | ) | | | — | |

Total investment income | | | 2,916,271 | | | | 108,662 | |

| Expenses: | | | | | | | | |

Investment adviser fees | | | 174,000 | | | | 2,278 | |

Administration fees | | | 62,933 | | | | 4,118 | |

Custodian fees | | | 16,956 | | | | 569 | |

Transfer and dividend disbursing agent fees and expenses | | | 31,828 | | | | 25,697 | |

Trustees’ fees | | | 3,002 | | | | 183 | |

Professional fees | | | 32,722 | | | | 10,071 | |

Class A Distribution services fee-Class A Shares | | | 16,867 | | | | — | |

Class C Distribution services fee-Class C Shares | | | — | | | | 16,398 | |

Trust Shareholder services fee-Trust Shares | | | 70,133 | | | | 230 | |

Class A Shareholder services fee-Class A Shares | | | 16,867 | | | | — | |

Class C Shareholder services fee-Class C Shares | | | — | | | | 5,466 | |

State registration costs | | | 35,198 | | | | 44,452 | |

Offering costs | | | — | | | | 6,969 | |

Printing and postage | | | 32,072 | | | | 8,074 | |

Insurance premiums | | | 3,612 | | | | 2,675 | |

Compliance service fees | | | 921 | | | | 13 | |

Line of credit fees | | | 614 | | | | 40 | |

Interest expense | | | — | | | | 35 | |

Other | | | 20,924 | | | | 1,914 | |

Total expenses | | | 518,649 | | | | 129,182 | |

Investment adviser fees contractually waived | | | (166,706 | ) | | | (2,278 | ) |

Investment adviser fees voluntarily waived | | | (7,294 | ) | | | — | |

Reimbursement from Adviser | | | (45,374 | ) | | | (105,366 | ) |

Net expenses | | | 299,275 | | | | 21,538 | |

Net investment income | | | 2,616,996 | | | | 87,124 | |

| Net Realized/Unrealized Gain (Loss) on Investments, Options and Foreign Currency Transactions: | | | | | | | | |

Net realized loss on investment transactions | | | (3,553,814 | ) | | | — | |

Net realized gain on investment transactions of affiliates | | | — | | | | 12,026 | |

Net realized gain on written option transactions | | | 681,300 | | | | — | |

Net realized gain on foreign currency transactions | | | 14,336 | | | | — | |

Net realized gain (loss) on investments, options and translation of assets and liabilities in foreign currency transactions | | | (2,858,178 | ) | | | 12,026 | |

Net change in unrealized appreciation of investments, options and translation of assets and liabilities in foreign currency | | | 1,883,593 | | | | 75,779 | |

Net realized and unrealized gain (loss) on investments, options and foreign currency transactions | | | (974,585 | ) | | | 87,805 | |

Change in net assets resulting from operations | | $ | 1,642,411 | | | $ | 174,929 | |

| | | | | | | | | |

(See notes which are an integral part of the Financial Statements)

Annual Shareholder Report

10

Statements of Changes in Net Assets

| | | | | | | | | | | | | | | | |

| | | Huntington World

Income Fund | | | Huntington Income

Generation Fund | |

| | | Year Ended

October 31,

2013 | | | Year Ended

October 31,

2012 | | | Year Ended

October 31,

2013 | | | Period Ended

October 31,

2012 (a) | |

| Increase (Decrease) in Net Assets: | | | | | | | | | | | | | | | | |

| Operations— | | | | | | | | | | | | | | | | |

Net investment income | | $ | 2,616,996 | | | $ | 2,242,114 | | | $ | 87,124 | | | $ | 6,430 | |

Net realized gain (loss) on investments, options and foreign currency transactions | | | (2,858,178 | ) | | | (777,432 | ) | | | 12,026 | | | | (113 | ) |

Net change in unrealized appreciation/depreciation of investments and foreign currency transactions | | | 1,883,593 | | | | (139,781 | ) | | | 75,779 | | | | (19,350 | ) |

Net increase (decrease) in net assets resulting from operations | | | 1,642,411 | | | | 1,324,901 | | | | 174,929 | | | | (13,033 | ) |

| Distributions to Shareholders— | | | | | | | | | | | | | | | | |

From and/or excess of net investment income: | | | | | | | | | | | | | | | | |

Trust Shares | | | (1,824,950 | ) | | | (1,911,632 | ) | | | (4,066 | ) | | | (331 | ) |

Class A Shares | | | (432,126 | ) | | | (345,108 | ) | | | — | | | | — | |

Class C Shares | | | — | | | | — | | | | (87,878 | ) | | | (3,407 | ) |

Change in net assets resulting from distributions to shareholders | | | (2,257,076 | ) | | | (2,256,740 | ) | | | (91,944 | ) | | | (3,738 | ) |

Change in net assets resulting from capital transactions | | | (5,248,382 | ) | | | 16,962,889 | | | | 554,626 | | | | 1,681,305 | |

Change in net assets | | | (5,863,047 | ) | | | 16,031,050 | | | | 637,611 | | | | 1,664,534 | |

| Net Assets | | | | | | | | | | | | | | | | |

Beginning of period | | | 38,490,546 | | | | 22,459,496 | | | | 1,664,534 | | | | — | |

End of period | | $ | 32,627,499 | | | $ | 38,490,546 | | | $ | 2,302,145 | | | $ | 1,664,534 | |

| | | | | | | | | | | | | | | | | |

Accumulated net investment income included in net assets at end of period | | $ | 164,934 | | | $ | 25,587 | | | $ | — | | | $ | 2,808 | |

| Capital Transactions: | | | | | | | | | | | | | | | | |

Trust Shares | | | | | | | | | | | | | | | | |

Shares sold | | | 6,593,362 | | | | 17,455,125 | | | | 3,111 | | | | 100,180 | |

Dividends reinvested | | | 889,869 | | | | 1,037,461 | | | | 4,057 | | | | 332 | |

Shares redeemed | | | (14,114,548 | ) | | | (4,548,333 | ) | | | (107,427 | ) | | | — | |

Total Trust Shares | | | (6,631,317 | ) | | | 13,944,253 | | | | (100,259 | ) | | | 100,512 | |

Class A Shares | | | | | | | | | | | | | | | | |

Shares sold | | | 5,079,956 | | | | 3,746,956 | | | | — | | | | — | |

Dividends reinvested | | | 234,913 | | | | 199,468 | | | | — | | | | — | |

Shares redeemed | | | (3,931,934 | ) | | | (927,788 | ) | | | — | | | | — | |

Total Class A Shares | | | 1,382,935 | | | | 3,018,636 | | | | — | | | | — | |

Class C Shares | | | | | | | | | | | | | | | | |

Shares sold | | | — | | | | — | | | | 1,053,717 | | | | 1,579,996 | |

Dividends reinvested | | | — | | | | — | | | | 55,356 | | | | 1,092 | |

Shares redeemed | | | — | | | | — | | | | (454,188 | ) | | | (295 | ) |

Total Class C Shares | | | — | | | | — | | | | 654,885 | | | | 1,580,793 | |

Net change resulting from capital transactions | | $ | (5,248,382 | ) | | $ | 16,962,889 | | | $ | 554,626 | | | $ | 1,681,305 | |

| Share Transactions: | | | | | | | | | | | | | | | | |

Trust Shares | | | | | | | | | | | | | | | | |

Shares sold | | | 767,418 | | | | 1,953,446 | | | | 306 | | | | 10,000 | |

Dividends reinvested | | | 104,142 | | | | 117,793 | | | | 407 | | | | 33 | |

Shares redeemed | | | (1,649,662 | ) | | | (509,367 | ) | | | (10,694 | ) | | | — | |

Total Trust Shares | | | (778,102 | ) | | | 1,561,872 | | | | (9,981 | ) | | | 10,033 | |

Class A Shares | | | | | | | | | | | | | | | | |

Shares sold | | | 592,161 | | | | 420,849 | | | | — | | | | — | |

Dividends reinvested | | | 27,517 | | | | 22,654 | | | | — | | | | — | |

Shares redeemed | | | (460,012 | ) | | | (106,163 | ) | | | — | | | | — | |

Total Class A Shares | | | 159,666 | | | | 337,340 | | | | — | | | | — | |

Class C Shares | | | | | | | | | | | | | | | | |

Shares sold | | | — | | | | — | | | | 105,955 | | | | 157,194 | |

Dividends reinvested | | | — | | | | — | | | | 5,529 | | | | 109 | |

Shares redeemed | | | — | | | | — | | | | (45,152 | ) | | | (29 | ) |

Total Class C Shares | | | — | | | | — | | | | 66,332 | | | | 157,274 | |

Net change resulting from share transactions | | | (618,436 | ) | | | 1,899,212 | | | | 56,351 | | | | 167,307 | |

| | | | | | | | | | | | | | | | | |

| (a) | Reflects operations from the period August 31, 2012 (commencement of operations) to October 31, 2012. |

(See notes which are an integral part of the Financial Statements)

Annual Shareholder Report

11

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Net Asset

Value,

beginning

of period | | | Net

investment

income (loss) | | | Net realized

and unrealized

gain (loss) on

investments | | | Total from

investment

operations | | |

Distributions

from net

investment

income | | | Total

distributions | |

| HUNTINGTON WORLD INCOME FUND | | | | | | | | | | | | | |

| Trust Shares | | | | | | | | | | | | | | | | | | | | | |

2011(4) | | $ | 10.00 | | | | 0.29 | | | | (1.00 | ) | | | (0.71 | ) | | | (0.28 | ) | | | (0.28 | ) |

2012 | | $ | 9.01 | | | | 0.61 | | | | (0.22 | ) | | | 0.39 | | | | (0.63 | ) | | | (0.63 | ) |

2013 | | $ | 8.77 | | | | 0.65 | (7) | | | (0.21 | ) | | | 0.44 | | | | (0.56 | ) | | | (0.56 | ) |

| Class A Shares | | | | | | | | | | | | | | | | | | | | | |

2011(4) | | $ | 10.00 | | | | 0.26 | | | | (0.98 | ) | | | (0.72 | ) | | | (0.27 | ) | | | (0.27 | ) |

2012 | | $ | 9.01 | | | | 0.58 | | | | (0.21 | ) | | | 0.37 | | | | (0.61 | ) | | | (0.61 | ) |

2013 | | $ | 8.77 | | | | 0.62 | (7) | | | (0.20 | ) | | | 0.42 | | | | (0.54 | ) | | | (0.54 | ) |

| HUNTINGTON INCOME GENERATION FUND | | | | | | | | | | | | | |

| Trust Shares | | | | | | | | | | | | | | | | | | | | | |

2012(8) | | $ | 10.00 | | | | 0.05 | | | | (0.06 | ) | | | (0.01 | ) | | | (0.03 | ) | | | (0.03 | ) |

2013 | | $ | 9.96 | | | | 0.41 | (7) | | | 0.42 | | | | 0.83 | | | | (0.49 | ) | | | (0.49 | ) |

| Class C Shares | | | | | | | | | | | | | | | | | | | | | |

2012(8) | | $ | 10.00 | | | | 0.04 | | | | (0.06 | ) | | | (0.02 | ) | | | (0.03 | ) | | | (0.03 | ) |

2013 | | $ | 9.95 | | | | 0.38 | (7) | | | 0.37 | | | | 0.75 | | | | (0.41 | ) | | | (0.41 | ) |

| (1) | Based on net asset value, which does not reflect a sales charge or contingent deferred sales charge, if applicable. |

| (2) | If applicable, certain fees were waived and/or reimbursed. If such waivers/reimbursements had not occurred, the ratios would have been as indicated. |

| (3) | Portfolio Turnover is calculated on the basis of the Fund as a whole without distinguishing among the classes of shares. |

| (4) | For the period May 2, 2011 (commencement of operations) to October 31, 2011. |

| (6) | Computed on an annualized basis. |

| (7) | Calculated using average shares for the period. |

| (8) | For the period August 31, 2012 (commencement of operations) to October 31, 2012. |

| (9) | Does not include the effect of expenses of underlying funds. |

(See notes which are an integral part of the Financial Statements)

Annual Shareholder Report

12

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Asset

Value, end

of period | | | Total

return(1) | | | Ratio of Net

Expenses to

Average Net

Assets | | | Ratio of Net

Investment

Income (Loss)

to Average

Net Assets | | | Ratio of Expenses

(Prior to

Reimbursements)

to Average Net Assets(2) | | | Net Assets,

end of

period (000 omitted) | | | Portfolio

turnover

rate(3) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| $ | 9.01 | | | | (7.17 | )%(5) | | | 1.79 | %(6) | | | 6.38 | %(6) | | | 1.79 | %(6) | | $ | 18,760 | | | | 60 | %(5) |

| $ | 8.77 | | | | 4.55 | % | | | 1.25 | % | | | 7.10 | % | | | 1.48 | % | | $ | 31,935 | | | | 76 | % |

| $ | 8.65 | | | | 5.35 | % | | | 0.81 | % | | | 7.59 | % | | | 1.44 | % | | $ | 24,780 | | | | 104 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| $ | 9.01 | | | | (7.27 | )%(5) | | | 2.04 | %(6) | | | 6.13 | %(6) | | | 2.04 | %(6) | | $ | 3,699 | | | | 60 | %(5) |

| $ | 8.77 | | | | 4.29 | % | | | 1.50 | % | | | 6.83 | % | | | 1.73 | % | | $ | 6,556 | | | | 76 | % |

| $ | 8.65 | | | | 5.10 | % | | | 1.06 | % | | | 7.23 | % | | | 1.69 | % | | $ | 7,847 | | | | 104 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| $ | 9.96 | | | | (0.07 | )%(5) | | | 0.04 | %(6)(9) | | | 2.83 | %(6) | | | 27.64 | %(6)(9) | | $ | 100 | | | | 2 | %(5) |

| $ | 10.30 | | | | 8.57 | % | | | 0.19 | %(9) | | | 4.15 | % | | | 5.18 | %(9) | | $ | 1 | | | | 62 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| $ | 9.95 | | | | (0.20 | )%(5) | | | 0.79 | %(6)(9) | | | 3.47 | %(6) | | | 26.85 | %(6)(9) | | $ | 1,565 | | | | 2 | %(5) |

| $ | 10.29 | | | | 7.72 | % | | | 0.98 | %(9) | | | 3.81 | % | | | 5.68 | %(9) | | $ | 2,302 | | | | 62 | % |

Annual Shareholder Report

13

Notes to Financial Statements

October 31, 2013

The Huntington Funds (the “Trust”) was organized as a single Delaware statutory trust on June 30, 2006. The Trust is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. As of October 31, 2013, the Trust operated 33 separate series, or mutual funds, each with its own investment objective and strategy. The prospectus provides a description of each fund’s investment objectives, policies and strategies along with information on the classes of shares currently being offered. This report contains financial statements and financial highlights of the Huntington World Income Fund (“World Income Fund”) and Huntington Income Generation Fund (“Income Generation Fund”) (individually referred to as a “Fund”, or collectively as the “Funds”). The World Income Fund commenced operations on May 2, 2011. The Income Generation Fund commenced operations on August 31, 2012. The World Income Fund offers Trust and Class A shares. The Income Generation Fund offers Trust and Class C shares. Each class of shares has identical rights and privileges except with respect to distribution (12b-1) and service fees, voting rights on matters affecting a single class of shares, exchange privileges of each class of shares and sales charges. The price at which the Fund will offer or redeem shares is the net asset value (“NAV”) per share next determined after the order is considered received, subject to any applicable front end or contingent deferred sales charges. Class A has a maximum sales charge on purchases of 4.75% as a percentage of the original purchase price. Class C has a contingent deferred sales charge of 1.00% on shares sold within one year of purchase.

Under the Trust’s organizational documents, its officers and Board of Trustees (“Trustees”) are indemnified against certain liabilities arising out of the performance of their duties to the Funds. In addition, in the normal course of business, the Trust may enter into contracts with vendors and others that provide for general indemnifications. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust. However, based on experience, the Trust expects that risk of loss to be remote.

| (2) | Significant Accounting Policies |

The following is a summary of significant accounting policies consistently followed by the Funds in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”). The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts of assets, liabilities, and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the period. Actual results could differ from those estimates.

The Trust calculates the NAV for each of the Funds by valuing securities held based on fair value. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

The valuation techniques described below maximize the use of observable inputs and minimize the use of unobservable inputs in determining fair value. The inputs used for valuing the Funds’ investments are summarized in the three broad levels listed below:

| • | | Level 1—quoted prices in active markets for identical assets. |

| • | | Level 2—other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). |

| • | | Level 3—significant unobservable inputs (including the Funds’ own assumptions in determining the fair value of investments). |

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The Trust recognizes transfers between fair value hierarchy levels at the reporting period end. The inputs or methodology used for valuing investments is not necessarily an indication of the risk associated with investing in those investments.

In computing the NAV of the Funds fair value is based on market valuations with respect to portfolio securities for which market quotations are readily available. Pursuant to Trustee-approved policies, the Trust relies on certain security pricing services to provide the current market value of securities. Those security pricing services value equity securities (including foreign equity securities, exchange-traded funds and closed-end funds) traded on a securities exchange at the last reported sales price on the principal exchange. Equity securities quoted by NASDAQ are valued at the NASDAQ official closing price. If there is no reported sale on the principal exchange, and in the case of over-the-counter securities, equity securities are valued at a bid price estimated by the security pricing service. In each of these situations, valuations are typically categorized as Level 1 in the fair value hierarchy. Investments in open-end investment companies are valued at their respective net asset value as reported by such companies and are typically categorized as Level 1 in the fair value hierarchy.

Option contracts are generally valued using the closing price based on quote data from the six major U.S. options exchanges on which such options are traded, and are typically categorized as Level 1 in the fair value hierarchy.

Debt securities traded on a national securities exchange or in the over-the-counter market are valued at the last reported sales price on the principal exchange. If there is no reported sale on the principal exchange, and for all other debt securities, debt securities are valued at a bid price estimated

Annual Shareholder Report

14

by the security pricing service. Foreign securities quoted in foreign currencies are translated in U.S. dollars at the foreign exchange rate in effect as of the close of the New York Stock Exchange (NYSE) (generally 4:00 p.m. Eastern Time), on the day the value of the foreign security is determined. Short-term investments with remaining maturities of 60 days or less at the time of purchase are valued at amortized cost. In each of these situations, valuations are typically categorized as Level 2 in the fair value hierarchy.

Under certain circumstances, a good faith determination of the fair value of a security may be used instead of its current market value, even if the security’s market price is readily available. In such circumstances, the Trust’s Administrator may request that the Trust’s Pricing Committee make its own fair value determination.

Securities for which market quotations are not readily available are valued at fair value under Trust procedures approved by the Trustees. In these cases, a Pricing Committee established and appointed by the Trustees determines in good faith, subject to Trust procedures, the fair value of portfolio securities held by a Fund (“good faith fair valuation”). When a good faith fair valuation of a security is required, consideration is generally given to a number of factors including, but not limited to the following: dealer quotes, published analyses by dealers or analysts regarding the security, transactions which provide implicit valuation of the security (such as a merger or tender offer transaction), the value of other securities or contracts which derive their value from the security at issue, and the implications of any other circumstances which have caused trading in the security to halt. With respect to certain narrow categories of securities, the procedures utilized by the Pricing Committee detail specific valuation methodologies to be applied in lieu of considering the aforementioned list of factors. Depending on the source and relative significance of valuation inputs, these instruments may be classified as Level 2 or Level 3 in the fair value hierarchy.

Fair valuation procedures are also used when a significant event affecting the value of a portfolio security is determined to have occurred between the time when the price of the portfolio security is determined and the close of trading on the NYSE, which is when each Fund’s NAV is computed. An event is considered significant if there is both an affirmative expectation that the security’s value will change in response to the event and a reasonable basis for quantifying the resulting change in value. Significant events include significant

securities market movements occurring between the time the price of the portfolio security is determined and the close of trading on the NYSE. For domestic fixed income securities, such events may occur where the cut-off time for the market information used by the independent pricing service is earlier than the end of regular trading on the NYSE. For securities normally priced at their last sale price in a foreign market, such events can occur between the close of trading in the foreign market and the close of trading on the NYSE.

In some cases, events affecting the issuer of a portfolio security may be considered significant events. Examples of potentially significant events include announcements concerning earnings, acquisitions, new products, management changes, litigation developments, a strike or natural disaster affecting the company’s operations or regulatory changes or market developments affecting the issuer’s industry occurring between the time when the price of the portfolio security is determined and the close of trading on the NYSE. For securities of foreign issuers, such events could also include political or other developments affecting the economy or markets in which the issuer conducts its operations or its securities are traded.

There can be no assurance that a Fund could purchase or sell a portfolio security at the price used to calculate the Fund’s NAV. In the case of good faith fair valued portfolio securities, lack of information and uncertainty as to the significance of information may lead to a conclusion that a prior valuation is the best indication of a portfolio security’s present value. Good faith fair valuations generally remain unchanged until new information becomes available. Consequently, changes in good faith fair valuation of portfolio securities may be less frequent and of greater magnitude than changes in the price of portfolio securities valued at their last sale price, by an independent pricing service, or based on market quotations.

The Funds’ Trustees have authorized the use of an independent fair valuation service to monitor changes in a designated U.S. market index after foreign markets close, and to implement a fair valuation methodology to adjust the closing prices of foreign securities if the movement in the index is significant. In the event of an increase or decrease greater than predetermined levels, the Funds may use a systematic valuation model provided by an independent third party to fair value its international equity securities, which are then typically categorized as Level 2 in the fair value hierarchy.

Annual Shareholder Report

15

Notes to Financial Statements (Continued)

The following is a summary of the inputs used to value the Funds’ investments as of October 31, 2013, based on the three levels defined previously:

| | | | | | | | | | | | | | | | |

| | | LEVEL 1 | | | LEVEL 2 | | | LEVEL 3 | | | Total | |

World Income Fund | | | | | | | | | | | | | | | | |

Investment Securities: | | | | | | | | | | | | | | | | |

Common Stocks | | $ | 23,287,535 | | | $ | — | | | $ | — | | | $ | 23,287,535 | |

Preferred Stocks | | | 4,345,610 | | | | — | | | | — | | | | 4,345,610 | |

Corporate Bonds | | | — | | | | 1,667,924 | | | | — | | | | 1,667,924 | |

Foreign Government Bonds | | | — | | | | 1,290,148 | | | | — | | | | 1,290,148 | |

Closed-End Funds | | | 329,840 | | | | — | | | | — | | | | 329,840 | |

Options Purchased | | | 591,000 | | | | — | | | | — | | | | 591,000 | |

Cash Equivalents | | | 1,007,686 | | | | — | | | | — | | | | 1,007,686 | |

Short-Term Securities Held as Collateral for Securities | | | 6,369,808 | | | | — | | | | — | | | | 6,369,808 | |

| | | | | | | | | | | | | | | | |

Total Investment Securities | | | 35,931,479 | | | | 2,958,072 | | | | — | | | | 38,889,551 | |

| | | | | | | | | | | | | | | | |

Other Financial Instruments:** | | | | | | | | | | | | | | | | |

Written Options | | | (203,100 | ) | | | — | | | | — | | | | (203,100 | ) |

| | | | | | | | | | | | | | | | |

Total Investments | | | 35,728,379 | | | | 2,958,072 | | | | — | | | | 38,686,451 | |

| | | | | | | | | | | | | | | | |

Income Generation Fund | | | | | | | | | | | | | | | | |

Investment Securities: | | | | | | | | | | | | | | | | |

Mutual Funds | | | 2,296,087 | | | | — | | | | — | | | | 2,296,087 | |

| | | | | | | | | | | | | | | | |

Total Investment Securities | | | 2,296,087 | | | | — | | | | — | | | | 2,296,087 | |

| | | | | | | | | | | | | | | | |

| ** | Other Financial Instruments are derivative instruments not reflected on the Porfolio of Investments, such as written option contracts. |

For the year ended October 31, 2013, there were no Level 3 investments for which significant unobservable inputs were used to determine fair value. The Trust recognizes significant transfers between fair value hierarchy levels at the reporting period end. There were no transfers between all levels as of October 31, 2013.

| B. | When-Issued and Delayed Transactions |

The World Income Fund may engage in when-issued or delayed delivery transactions. The World Income Fund records when-issued securities on the trade date and maintains security positions such that sufficient liquid assets will be available to make payment for the securities purchased. Securities purchased on a when-issued or delayed delivery basis are marked to market daily and begin earning interest on the settlement date. Losses may occur on these transactions due to changes in market conditions or the failure of counterparties to perform under the contract. The funds did not own any when-issued or delayed-delivery securities as of October 31, 2013.

| C. | Foreign Currency Translation |

The accounting records of the Funds are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars at the current rate of exchange each business day to determine the value of investments, and other assets and liabilities. Purchases and sales of foreign securities, and income and expenses, are translated at the prevailing rate of exchange on the respective date of these transactions. The Funds do not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from fluctuation arising from changes in market prices of securities held. These fluctuations are included with

the net realized and unrealized gain or loss from investments and foreign currency transactions.

The Funds may be subject to equity price risk and foreign currency exchange risk in the normal course of pursuing its investment objectives. The Funds may invest in various financial instruments including positions in foreign currency contracts and written option contracts to gain exposure to or hedge against changes in the value of equities or foreign currencies. The following is a description of the derivative instruments utilized by the Funds, including the primary underlying risk exposure related to each instrument type.

Foreign Exchange Contracts—The Funds may enter into forward foreign exchange contracts. A forward foreign exchange contract involves an obligation to purchase or sell a specific currency at a future date at a price set at the time of the contract. Such contracts are used to sell unwanted currency exposure that comes with holding securities in a market, or to buy currency exposure where the exposure from holding securities is insufficient to provide the desired currency exposure. The contracts are marked-to-market daily and the change in market value is recorded as unrealized appreciation or depreciation. When a forward foreign currency contract is closed, the Fund records a realized gain or loss equal to the difference between the value at the time it was opened and the value at the time it was closed. The Funds could be exposed to risks if the counterparties to the contracts are unable to meet the terms of their contracts and from unanticipated movements in exchange rates. At October 31, 2013 the Funds did not have any forward foreign exchange contracts outstanding.

Annual Shareholder Report

16

Written Options Contracts—The Funds may write options contracts for which premiums received are recorded as liabilities and are subsequently adjusted to the current value of the options written. Premiums received from writing options which expire are treated as realized gains. Premiums received

from writing options which are either exercised or closed are offset against the proceeds received or the amount paid on the transaction to determine realized gains or losses. Investing in written options contracts exposes the Funds to equity price risk.

The following is a summary of World Income Fund’s written option activity for the year ended October 31, 2013:

| | | | | | | | |

| Contracts | | Number of

Contracts | | | Premium | |

Outstanding at 10/31/2012 | | | 204 | | | $ | 17,755 | |

Options written | | | 33,256 | | | | 2,200,328 | |

Options closed | | | (21,304 | ) | | | (1,389,355 | ) |

Options expired | | | (4,909 | ) | | | (325,572 | ) |

Options exercised | | | (5,237 | ) | | | (299,455 | ) |

Outstanding at 10/31/2013 | | | 2,010 | | | $ | 203,701 | |

As of October 31, 2013, World Income Fund had the following outstanding written option contracts:

| | | | | | | | | | | | | | | | | | | | | | | | |

| Contract | | Type | | | Expiration

Date | | | Exercise

Price | | | Number

of Contracts | | | Fair

Value | | | Unrealized

Appreciation/

Depreciation | |

Corrections Corp. of America | | | Call | | | | November 2013 | | | $ | 37 | | | | 110 | | | $ | 8,800 | | | $ | 3,174 | |

New York Community Bancorp | | | Call | | | | November 2013 | | | | 16 | | | | 300 | | | | 7,500 | | | | (2,112 | ) |

SPDR S&P 500 Index ETF | | | Call | | | | December 2013 | | | | 182 | | | | 800 | | | | 68,400 | | | | 13,170 | |

SPDR S&P 500 Index ETF | | | Put | | | | December 2013 | | | | 168 | | | | 800 | | | | 118,400 | | | | (13,631 | ) |

Net unrealized appreciation on written

option contracts | | | | | | | | | | | | | | | | | | | | | | $ | 601 | |

The following tables provide a summary of the fair value of derivative instruments, not accounted for as hedging instruments as of October 31, 2013, and the effect of derivative instruments on the Statement of Operations for the year ended October 31, 2013.

The Fair Value of Derivative Instruments as of October 31, 2013:

| | | | | | | | | | |

| | | Asset Derivatives | | Liability Derivatives | | | | | |

| Primary Risk Exposure | | Statements of Assets

and Liabilities Location | | Statements of Assets and

Liabilities Location | | Fund | | Fair Value | |

Option Contracts | | | | Options Written, at value | | World Income Fund | | $ | 203,100 | |

| | | | |

| | Investments, at value | | | | World Income Fund | | | 591,000 | |

The effect of Derivative Instruments on the Statement of Operations for the fiscal year ended October 31, 2013:

| | | | | | | | | | | | |

| Primary Risk Exposure | | Location of Gain (Loss)

on Derivatives

Recognized in Income | | Fund | | Realized Loss on

Derivatives Recognized

in Income | | | Change in Unrealized

Appreciation/(Depreciation)

on Derivatives Recognized

in Income | |