UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05010

THE HUNTINGTON FUNDS

(Exact name of registrant as specified in charter)

2960 North Meridian Street, Suite 300

Attn: Huntington Funds Officer

Indianapolis, IN 46208

(Address of principal executive offices) (Zip code)

Dave Carson

The Huntington National Bank

41 South High Street

Columbus, OH 43287

(Name and address of agent for service)

Copies to:

David C. Mahaffey, Esq.

Sullivan & Worcester

1666 K Street, N.W.

Washington, DC 20006

Registrant’s telephone number, including area code: 1-800-253-0412

Date of fiscal year end: December 31

Date of reporting period: December 31, 2012

Item 1. Reports to Stockholders.

A Message from the

Chief Investment Officer and

Annual Shareholder Report

DECEMBER 31, 2012

CLASS A SHARES

TRUST SHARES

Letter from the Chief Investment Officer

Dear Shareholders:

Despite a raft of economic, political, earnings, international and market concerns during 2012, virtually all the equity markets produced attractive returns for the year. Buoyed by yet another announced Federal Reserve System bond buying program, investors were encouraged by the flood of liquidity provided to the economic system. Small and middle capitalized companies led the performance derby with returns of 16.33% and 17.88% as represented by the Standard & Poor’s Small Cap 600 Index (“S&P 600”)1 and the Standard & Poor’s Mid Cap 400 Index (“S&P 400”)2, respectively. The large caps, as represented by the Dow Jones Industrial Average3 and the Standard & Poor’s 500 Index (“S&P 500”)4, were also up 10.24% and 16.00%, respectively. Even the international markets provided investors with a strong rebound from the dismal double digit declines that occurred during 2011.

The most significant investment event during 2012 was certainly the Presidential election in November. Virtually all investment strategies were based upon who would win the White House. With diametrically opposed views on taxes and economic stimulus, the two candidates were closely deadlocked up until the day of the election. Huntington Asset Advisors, Inc. (“Huntington”) developed two separate strategies based upon the eventual outcome. We believed that certain sectors would perform differently under the policies of the two candidates. Upon confirmation of the election, we moved quickly in all of our Huntington Funds to implement our predetermined strategy. This included reducing betas and emphasizing investments in certain industries that would be favored under the Obama administration. Expectations regarding the tax policies associated with capital gains and dividends that had been espoused by President Obama ultimately were muted in the fiscal cliff negotiations. These tax policies will carry positive momentum for investors into 2013 and beyond.

One of the longer term strategies that Huntington employed during the year was to emphasize the agribusiness sector. With back to back strong years in farm income and dramatically growing international demand for food, our analysts looked into a variety of avenues to uncover opportunities. The traditional approach would be to invest in farm equipment, fertilizers and seed companies. We looked deeper into the periphery of agribusiness, which includes investments in rural retail establishments, irrigation and flow control devices, transportation equipment and catalogue companies that cater to outdoor life. We firmly believe that this strategy has longer term positive investment implications that can be implemented irrespective of Federal Reserve policy, economic issues and regulatory initiatives.

Looking into 2013 there are two major pieces of legislation that we believe will start to have significant impacts on the economy and the markets. With the drafting of Dodd-Frank regulations and the institution of the new healthcare laws, there will be new costs and regulations impacting critical aspects of the economy. Just as the passage of Sarbanes Oxley created ripples in the markets ten years ago, the impact of the banking and healthcare bills will need to be sorted out by investors.

One accompaniment of the Dodd-Frank legislation will most likely be an increase in merger and acquisition activities, as smaller financial firms seek to cover costs by adding economies of scale. This would be consistent with the experience of Sarbanes-Oxley as many firms merged, went private or sold out. In the year following the passage of Sarbanes-Oxley there were fewer publically traded companies than the year before, as many firms merged with significant premiums to previous valuations. This could be an interesting opportunity for 2013 strategies in our equity funds if past is prologue.

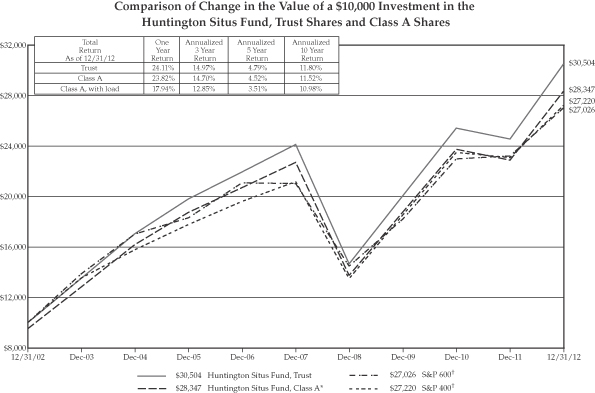

In 2102, we were especially proud of three of our equity fund that were recognized by Morningstar for their outstanding performance relative to their peers. The Huntington Situs Fund received a Five-Star Overall Morningstar RatingTM in the Mid-Cap Blend category. Both The Huntington International Equity Fund and the Huntington Dividend Capture Fund received a Four-Star Overall Morningstar RatingTM in the Foreign Large Blend and Large Value categories, respectively.

Letter from the Chief Investment Officer

Letter from the Chief Investment Officer (Continued)

As always, Huntington seeks to control risk while providing opportunities to add value for our Huntington Funds’ shareholders. We conduct our efforts with the highest level of attention to the disciplines that we have employed for several decades. We appreciate your confidence and your continued support. We look forward to helping you achieve your long-term financial goals, with a full range of Huntington Funds designed to meet both your individual needs and the economic challenges throughout the upcoming year.

Sincerely,

B. Randolph Bateman

Chief Investment Officer

Huntington Asset Advisors, Inc.

| (1) | The S&P 600 is a capitalization-weighted index which generally represents all major industries in the small cap range of the U.S. stock market. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an Index. |

| (2) | The S&P 400 is a capitalization-weighted index of common stocks representing the mid-range sector of the U.S. stock market. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an Index. |

| (3) | The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and Nasdaq. |

| (4) | The S&P 500 is a capitalization-weighted index comprised of 500 stocks and is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an Index. |

For each fund with at least a three-year history, Morningstar calculates a Morningstar Rating™ based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund’s monthly performance (including the effects of sales charges, loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. (Each share classis counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in the distribution percentages.) The Overall Morningstar Rating for a fund is derived from a weighted-average of the performance figures associated with its three-, five- and ten-year if applicable) Morningstar Rating metrics. Ratings are for the Trust class; other classes may have different performance characteristics. For the Overall, 3-, 5- and 10-year periods ended 12/31/2012, the Situs Fund received 5, 5, 4 and 5 stars and was rated among 352, 352, 309 and 195 funds, respectively. For the Overall, 3-, 5- and 10-year periods ended 12/31/2012, the International Equity Fund received 4, 3, 4 and 4 stars and was rated among 713, 713,589 and 325 funds, respectively. For the Overall, 3-, 5- and 10-year periods ended 12/31/2012,the Dividend Capture Fund received 4, 4, 4 and 3 stars and was rated among 1051,1051,930 and 591 funds, respectively. ©2012 Morningstar, Inc.

©2012 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

This commentary may include statements that constitute “forward looking statements” under the U.S. securities laws. Forward-looking statements include, among other things, projections, estimates, and information about possible or future results related to the Portfolio, market or regulatory developments. The views expressed above are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein. The views expressed above are those of the Advisor as of December 31, 2012 and are subject to change at any time based upon economic, market, or other conditions and the Advisor undertakes no obligation to update the views expressed herein. Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. The views expressed above (including any forward-looking statement) may not be relied upon as investment advice or as an indication of the Fund’s trading intent. Information about the Fund’s holdings, asset allocation or country diversification is historical and is not an indication of future Fund composition, which may vary.

The performance of any index mentioned in this commentary has not been adjusted for ongoing management, distribution and operating expenses, and sales charges applicable to mutual fund investments. In addition, the returns do not reflect additional fees charged by separate accounts or variable insurance contracts that an investor in the Fund may pay. If these additional fees were reflected, performance would have been lower.

Letter from the Chief Investment Officer

Annual Shareholder Report

MONEY MARKET FUNDS

Huntington Tax Free Money Market Fund

Huntington Money Market Fund

Huntington Ohio Municipal Money Market Fund

Huntington U.S. Treasury Money Market Fund

EQUITY FUNDS

Huntington Disciplined Equity Fund

Huntington Dividend Capture Fund

Huntington Global Select Markets Fund

Huntington Growth Fund

Huntington Income Equity Fund

Huntington International Equity Fund

Huntington Mid Corp America Fund

Huntington Real Strategies Fund

Huntington Rotating Markets Fund

Huntington Situs Fund

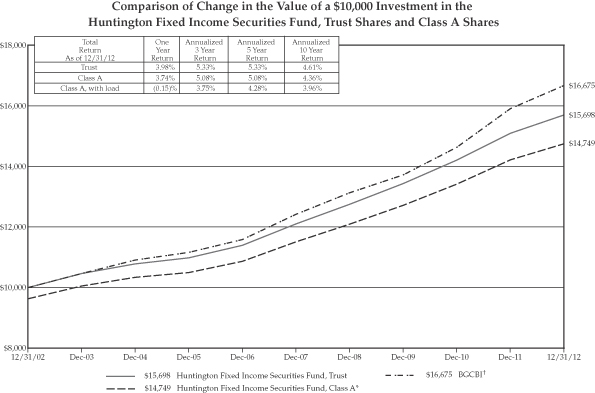

INCOME FUNDS

Huntington Fixed Income Securities Fund

Huntington Intermediate Government Income Fund

Huntington Mortgage Securities Fund

Huntington Ohio Tax-Free Fund

Huntington Short/Intermediate Fixed Income Securities Fund

ASSET ALLOCATION FUNDS

Huntington Balanced Allocation Fund

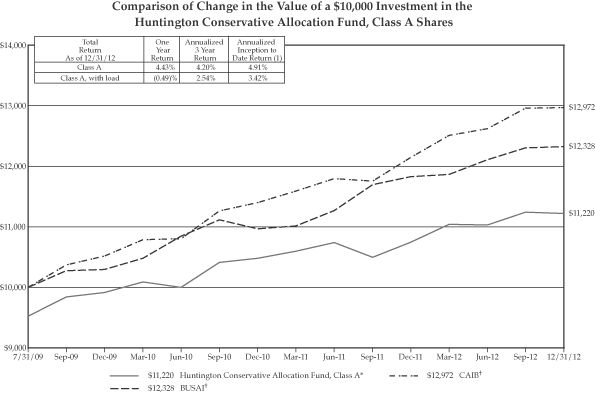

Huntington Conservative Allocation Fund

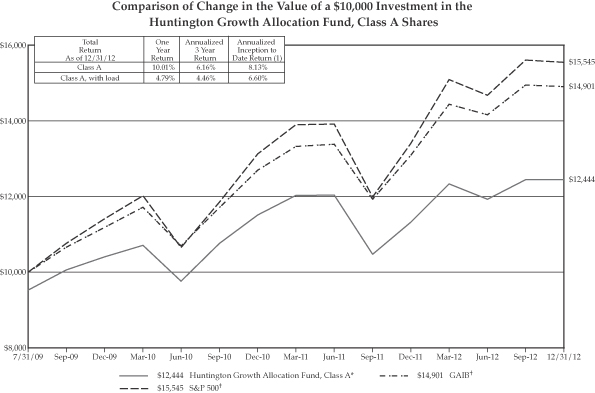

Huntington Growth Allocation Fund

| | |

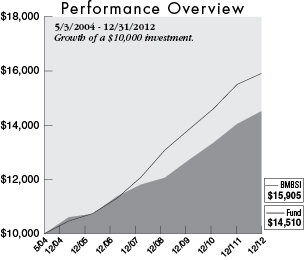

Disciplined Equity Fund | | As of 12/31/12 |

Management’s Discussion of Fund Performance

Portfolio Manager: Peter Sorrentino, CFA

Vice President

Huntington Asset Advisors, Inc.

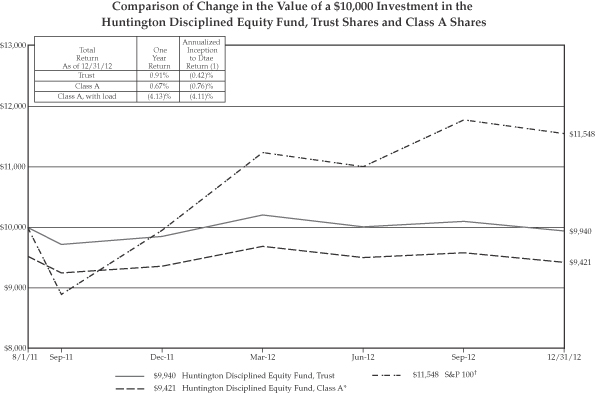

For the fiscal year ended December 31, 2012, the Huntington Disciplined Equity Fund’s Trust Shares and Class A Shares produced total returns (not including the deduction of applicable sales charges) of 0.91% and 0.67%, respectively, based upon net asset value. The Fund underperformed the Standard & Poor’s 100 Index (“S&P 100”)1, which returned 16.05% for the same period.

The Fund’s positive performance during the year was driven largely by strength in the financial sector. Two of the Fund’s top performing holdings were JPMorgan Chase & Co. (2.1%)* and Bank of America Corp. (1.2%)*, which delivered 36% and 110% returns for the year, respectively. Rounding out the Fund’s top contributors were Comcast Corp. (1.3%)* and Home Depot, Inc. (1.4%)* in the consumer sector. The overall top performer for the Fund was its holding of Apple, Inc. (5.8%)*. The price advance for shares of Apple, Inc., from $405 to a close of $533, generated 1.96% in incremental return for the Fund in 2012.

Despite positive equity returns for 2012, the Fund underperformed due to the cost of maintaining its protective risk hedges. In spite of the strong advance for the broad market, the options and futures markets in 2012 exhibited a pronounced negative skew. Investors displayed a strong distain for market volatility throughout the year, making the cost of mitigating downside price risk expensive. It was this expense that consumed the majority of the Fund’s income and price appreciation.

| * | Percentage of holdings based on Fund’s net assets as of 12/31/2012. The composition of the Fund’s holdings is subject to change. |

| (1) | The S&P 100 measures the performance of large cap companies in the United States, and is comprised of 100 major blue chip companies across multiple industry groups. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an Index. |

This commentary may include statements that constitute “forward looking statements” under the U.S. securities laws. Forward-looking statements include, among other things, projections, estimates, and information about possible or future results related to the Portfolio, market or regulatory developments. The views expressed above are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein. The views expressed above are those of the Advisor as of December 31, 2012 and are subject to change at any time based upon economic, market, or other conditions and the Advisor undertakes no obligation to update the views expressed herein. Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. The views expressed above (including any forward-looking statement) may not be relied upon as investment advice or as an indication of the Fund’s trading intent. Information about the Fund’s holdings, asset allocation or country diversification is historical and is not an indication of future Fund composition, which may vary.

The performance of any index mentioned in this commentary has not been adjusted for ongoing management, distribution and operating expenses, and sales charges applicable to mutual fund investments. In addition, the returns do not reflect additional fees charged by separate accounts or variable insurance contracts that an investor in the Fund may pay. If these additional fees were reflected, performance would have been lower.

Annual Shareholder Report

1

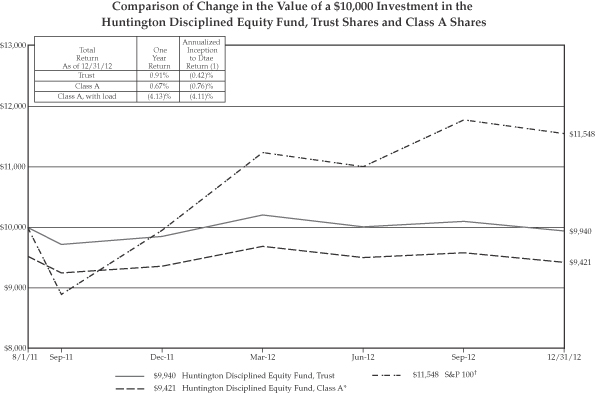

Disciplined Equity Fund (Continued)

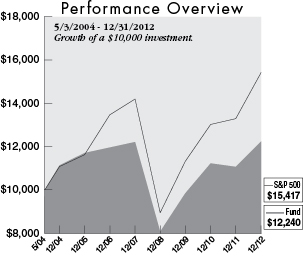

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month end performance, visit www.huntingtonfunds.com or call 1-800-253-0412. For after-tax returns call 1-800-253-0412. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund Shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. Total returns, at load, include the maximum 4.75% sales charge for the Class A Shares.

| | | | |

| Class | | Expense Ratios | |

A | | | 1.45% | |

Trust | | | 1.20% | |

The above expense ratios are from the Funds’ prospectus dated May 1, 2012. Additional information pertaining to the Fund’s expense ratio as of December 31, 2012 can be found in the financial highlights.

The Fund’s performance assumes the reinvestment of all dividends and distributions on securities. The S&P 100 has been adjusted to reflect reinvestment of dividends on securities in the index.

The Fund intends to write (sell) covered call options which may limit the Fund’s gain, if any, on the underlying securities, and the Fund continues to bear the risk of a decline in the value of the underlying stock until the option expires or is closed out. The Fund intends to write (sell) call options and purchase put options and/or enter into put option spreads. Option spreads present risk during periods of high market volatility. The Fund may also write (sell) put options on individual stocks deemed attractive for purchase at prices at or above the exercise price of the put options written. If a counterparty is unable to honor its commitments, the value of Fund shares may decline and/or the Fund could experience delays in the return of collateral or other assets held by the counterparty. No Fund is a complete investment program and you may lose money investing in the Fund.

Because the fund invests in a limited number of holdings, an increase or decrease in the value of a single security may have a greater impact on the fund’s net asset value and total return.

Funds whose investments are concentrated in a specific industry or sector may be subject to a higher degree of market risk than funds whose investments are diversified. In addition, the Fund may be subject to specific risks of the information technology sector, such as obsolescence.

The funds are distributed by Unified Financial Securities, Inc. (Member FINRA), a wholly owned subsidiary of Huntington Bancshares, Inc. and an affiliate of Huntington Asset Advisors, Inc., the advisor to the Huntington Funds.

| * | Represents a hypothetical investment of $10,000 in the Fund after deducting the maximum sales load of 4.75% ($10,000 investment minus $475 sales load = $9,525). |

| (1) | The Fund commenced operations for all share classes on August 1, 2011. |

| † | The S&P 100 is not adjusted to reflect sales charges, expenses, or other fees that the Securities and Exchange Commission requires to be reflected in the Fund’s performance. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an index. |

Annual Shareholder Report

2

| | |

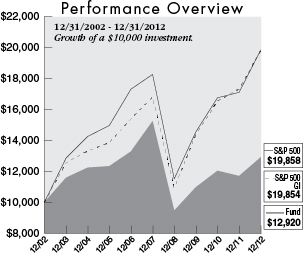

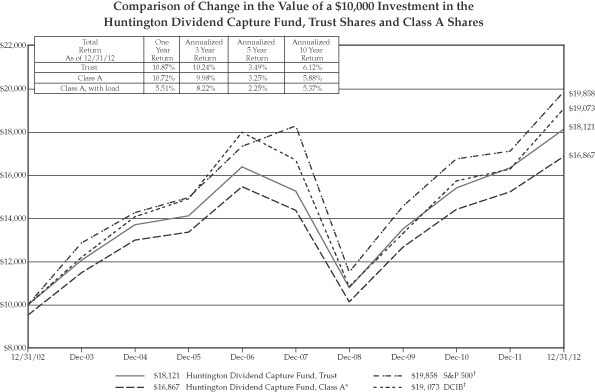

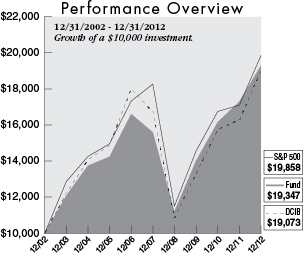

Dividend Capture Fund | | As of 12/31/12 |

Management’s Discussion of Fund Performance

Portfolio Manager:

Kirk Mentzer, MBA, Director of Research

Huntington Asset Advisors, Inc.

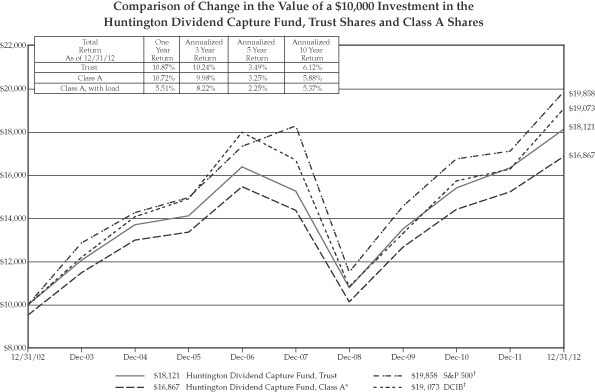

For the fiscal year ended December 31, 2012, the Huntington Dividend Capture Fund’s Trust Shares and Class A Shares produced total returns (not including the deduction of applicable sales charges) of 10.87% and 10.72%, respectively, based on net asset value. The Huntington Dividend Capture Fund’s Trust Shares’ performance fell below the total return of 16.00% for the Fund’s benchmark, the Standard & Poor’s 500 Index (“S&P 500”)1, and the total return of 16.45% for the Dividend Capture Indices Blend (“DCIB”)2 for the same period. The Huntington Dividend Capture Fund’s Class A class shares underperformed the benchmark for the same period.

The Fund is managed using our top-down style and portfolio construction techniques, which are aimed at producing a high level of stable income while managing volatility by investing in three distinct asset classes: common stocks, REITs, and preferred stocks.

| ¢ | | Value-style common stocks: Despite slowing economic and profit growth, U.S. equity markets produced a +16.00% total return for 2012. Sector performance favored financials, consumer discretion and healthcare sectors over utilities, energy and staples. Investors had less preference for the high quality, low volatility, dividend-paying stocks that the Fund was focused on for the period. As a result, the common stocks in the Fund underperformed the overall market. The Fund’s common stock total return for 2012 was +13.76% compared to the S&P 500 Value Index of +17.62%. |

| (1) | The S&P 500 is a capitalization-weighted index comprised of 500 stocks and is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an Index. |

| (2) | The DCIB is a custom, blended index comprised of the following three indices with their noted respective weightings: S&P 500 Value Index (40%), Merrill Lynch Fixed Rate Preferred Index (40%) and NAREIT Index (20%). This custom, blended index and its respective weightings are reflective of the Fund’s sector diversification. Indices are unmanaged and, unlike the Fund, are not affected by cashflows. It is not possible to invest directly in an Index. |

Annual Shareholder Report

3

Dividend Capture Fund (Continued)

| ¢ | | Real Estate Investment Trusts (REITs)**: REITs were the best performing asset class for the Fund in 2012. The Fund’s REIT holdings produced a total return of +21.96% which compared favorably to the benchmark NAREIT Index total return of +19.56%. |

| ¢ | | Preferred Stock***: Preferred stocks generally lagged the equity market, but outperformed corporate bonds with a +13.52% total return for 2012. Investors’ search for yield drove prices higher as credit spreads compressed. Performance for the preferred stocks landed between corporate bonds and common stock. |

Trading activity was responsible for -4.13% of the performance relative to the benchmark while portfolio structure had a impact of -5.30%. Portfolio structure can be explained by adding security characteristics: -8.02%, sector allocation: -1.84% and security selection: 4.57%.

The three holdings that had the largest positive contribution to the Fund’s performance were Waddell & Reed Financial, Inc. (0.7%)*, GAP, Inc. (sold) and Sunoco Logistic Partners LP (0.7%)*. These three holdings added 1.53% to the Fund’s return. The three holdings that had the largest negative contribution to the Fund’s performance were Freeport-McMoRan Copper & Gold, Inc. (0.7%)*, Total SA (sold) and Exelon Corp. (sold). These three holdings subtracted 0.65% from the Fund’s return.

| * | Percentage of holdings based on Fund’s net assets as of 12/31/2012. The composition of the Fund’s holdings is subject to change. |

| ** | REIT returns represented by the NAREIT Index. |

| *** | Preferred stock returns represented by BofA, Merrill Lynch US Fixed Rate Preferred Stock Index. |

This commentary may include statements that constitute “forward looking statements” under the U.S. securities laws. Forward-looking statements include, among other things, projections, estimates, and information about possible or future results related to the Portfolio, market or regulatory developments. The views expressed above are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein. The views expressed above are those of the Advisor as of December 31, 2012 and are subject to change at any time based upon economic, market, or other conditions and the Advisor undertakes no obligation to update the views expressed herein. Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. The views expressed above (including any forward-looking statement) may not be relied upon as investment advice or as an indication of the Fund’s trading intent. Information about the Fund’s holdings, asset allocation or country diversification is historical and is not an indication of future Fund composition, which may vary.

The performance of any index mentioned in this commentary has not been adjusted for ongoing management, distribution and operating expenses, and sales charges applicable to mutual fund investments. In addition, the returns do not reflect additional fees charged by separate accounts or variable insurance contracts that an investor in the Fund may pay. If these additional fees were reflected, performance would have been lower.

Annual Shareholder Report

4

Dividend Capture Fund (Continued)

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month end performance, visit www.huntingtonfunds.com or call 1-800-253-0412. For after-tax returns call 1-800-253-0412. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund Shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. Total returns, at load, include the maximum 4.75% sales charge for the Class A Shares.

| | | | |

| Class | | Expense Ratios | |

A | | | 1.15% | |

Trust | | | 0.90% | |

The above expense ratios are from the Funds’ prospectus dated September 27, 2012. Additional information pertaining to the Fund’s expense ratio as of December 31, 2012 can be found in the financial highlights.

The Fund’s performance assumes the reinvestment of all dividends and distributions on securities. The S&P 500 and DCIB have been adjusted to reflect reinvestment of dividends on securities in the indices.

Investments in real estate investment trusts (“REITs”) and real-estate related securities involves special risks associated with an investment in real estate, such as limited liquidity and interest rate risks and may be more volatile than other securities. In addition, the value of REITs and other real estate-related investments is sensitive to changes in real estate values, extended vacancies of properties and other environmental and economic factors.

There are no guarantees that dividend paying stocks will continue to pay dividends. In addition, dividend paying stocks may not experience the same capital appreciation potential as nondividend paying stocks.

The funds are distributed by Unified Financial Securities, Inc. (Member FINRA), a wholly owned subsidiary of Huntington Bancshares, Inc. and an affiliate of Huntington Asset Advisors, Inc., the advisor to the Huntington Funds.

| * | Represents a hypothetical investment of $10,000 in the Fund after deducting the maximum sales load of 4.75% ($10,000 investment minus $475 sales load = $9,525). |

| † | The S&P 500 and DCIB are not adjusted to reflect sales charges, expenses, or other fees that the Securities and Exchange Commission requires to be reflected in the Fund’s performance. The indices are unmanaged and, unlike the Fund, are not affected by cashflows. It is not possible to invest directly in an index. |

Annual Shareholder Report

5

| | |

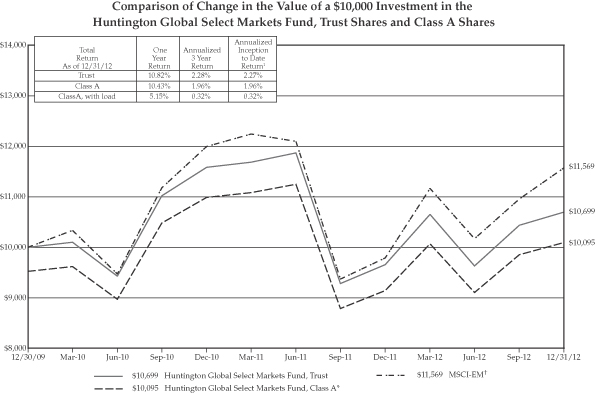

Global Select Markets Fund | | As of 12/31/12 |

Management’s Discussion of Fund Performance

Portfolio Manager:

Paul W. Attwood, CFA

Vice President

Huntington Asset Advisors, Inc.

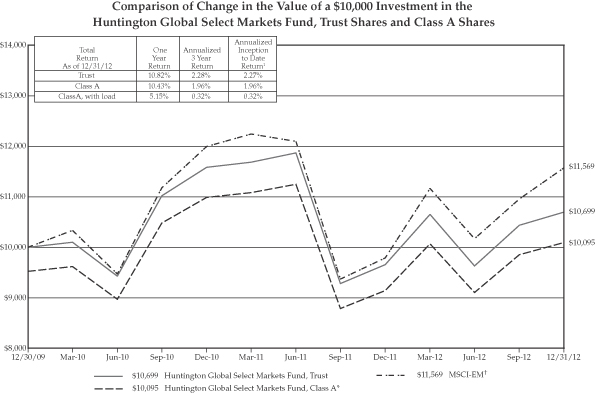

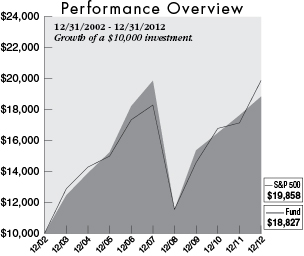

For the fiscal year ended December 31, 2012, the Huntington Global Select Markets Fund produced total returns (not including the deduction of applicable sales charges) of 10.82% and 10.43% for its Trust and Class A Shares respectively, based on net asset value. The Fund underperformed the total return of 18.22% for the Morgan Stanley Capital International (“MSCI”) Emerging Markets Index (“MSCI-EM”)1, the Fund’s benchmark index, for the same period.

Some of the best performers in the Index were countries that have in the recent past had significant challenges, both politically and economically. The top performing country was Turkey, up 61%, followed by Egypt, which rallied 44%. These are areas of the globe that the Fund has typically shied away from. We are searching for countries that provide long-term reward relative to the risk assumed. The countries that helped boost the Index in 2012 do not typically fit these parameters. One of the countries we believed would offer significant returns, on a secular basis, was Brazil. Brazil was one of the worst performers in the Index (-4%) and had a dramatic effect on overall relative performance. Concerns over global growth and more specifically, commodity demand from China, kept buyers away from Brazilian equities. Global trade, at this point, appears to be bottoming and we believe this should bode well for a rebound in the more industrialized sectors of their economy.

In addition to an underperforming equity market, the Brazilian Real was one of the weaker emerging markets currencies, falling by 9% against the U.S. Dollar. Indonesia’s Rupiah fell over 7% on concerns that the government was not progressing fast enough on domestic development in the country. Some of the stronger currencies were in the European region, specifically Eastern Europe, where an alternative to holding Euro in the form of Polish Zloty (+11%) appealed to investors. The South Korean Won was one of Asia’s star performers, up over 8%. This was largely due to a substantial interest rate differential between the Won and most of the developed world.

Annual Shareholder Report

6

Global Select Markets Fund (Continued)

With regards to sector performance, investors were “barbelling” strategies to reduce overall risk while still holding equities in sectors that would participate in growth driven rallies. This is evident in the top performing areas. Investments typically considered beneficiaries of an improving economy, technology (+26%) and financials (+22%) rallied along with areas considered to be defensive in nature, health care (+32%) and consumer staples (+23%). Energy (+2%) and utilities (+2%) were the weakest areas. This is symbolic of the constant barrage of headlines that were released throughout the year, first giving investors hope for sustained economic recovery followed by concerns over fiscal and political issues.

Our strategy of investing in the most attractive countries globally where there are enormous opportunities for substantial long-term returns cost us in terms of relative performance in 2012. As previously mentioned, the areas that we have concerns about over the long run managed to appreciate substantially. We believe that countries with superior monetary, fiscal and political discipline will reward patient investors. The Huntington Global Select Markets Fund will continue to focus on these core areas with the goal of providing superior risk-adjusted returns in the future.

| ¿ | | The composition of the Fund’s holdings is subject to change. |

| (1) | The MSCI-EM is a market-capitalization weighted equity index comprising 21 of the 48 countries in the MSCI universe. Each MSCI country index is created separately, then aggregated, without change, into MSCI indices. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an Index. |

This commentary may include statements that constitute “forward looking statements” under the U.S. securities laws. Forward-looking statements include, among other things, projections, estimates, and information about possible or future results related to the Portfolio, market or regulatory developments. The views expressed above are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein. The views expressed above are those of the Advisor as of December 31, 2012 and are subject to change at any time based upon economic, market, or other conditions and the Advisor undertakes no obligation to update the views expressed herein. Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. The views expressed above (including any forward-looking statement) may not be relied upon as investment advice or as an indication of the Fund’s trading intent. Information about the Fund’s holdings, asset allocation or country diversification is historical and is not an indication of future Fund composition, which may vary.

The performance of any index mentioned in this commentary has not been adjusted for ongoing management, distribution and operating expenses, and sales charges applicable to mutual fund investments. In addition, the returns do not reflect additional fees charged by separate accounts or variable insurance contracts that an investor in the Fund may pay. If these additional fees were reflected, performance would have been lower.

Annual Shareholder Report

7

Global Select Markets Fund (Continued)

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month end performance, visit www.huntingtonfunds.com or call 1-800-253-0412. For after-tax returns call 1-800-253-0412. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund Shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. Total returns, at load, include the maximum 4.75% sales charge for the Class A Shares.

| | | | |

| Class | | Expense Ratios | |

A | | | 2.17% | |

Trust | | | 1.92% | |

The above expense ratios are from the Funds’ prospectus dated May 1, 2012. Additional information pertaining to the Fund’s expense ratio as of December 31, 2012 can be found in the financial highlights.

The Fund’s performance assumes the reinvestment of all dividends and distributions on securities. The MSCI-EM has been adjusted to reflect reinvestment of dividends on securities in the index.

International investing involves special risks including currency risk, increased volatility of foreign securities, political risks, and differences in auditing and other financial standards. The Fund is subject to the risks associated with its investments in emerging market securities, which tend to be more volatile and less liquid than securities traded in developed countries.

The funds are distributed by Unified Financial Securities, Inc. (Member FINRA), a wholly owned subsidiary of Huntington Bancshares, Inc. and an affiliate of Huntington Asset Advisors, Inc., the advisor to the Huntington Funds.

| * | Represents a hypothetical investment of $10,000 in the Fund after deducting the maximum sales load of 4.75% ($10,000 investment minus $475 sales load = $9,525). |

| (1) | The Fund commenced operations for all share classes on December 30, 2009. |

| † | The MSCI-EM is not adjusted to reflect sales charges, expenses, or other fees that the Securities and Exchange Commission requires to be reflected in the Fund’s performance. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an index. |

Annual Shareholder Report

8

| | |

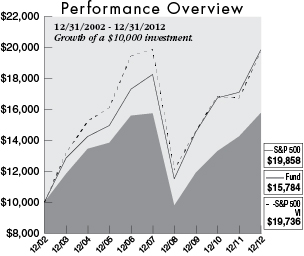

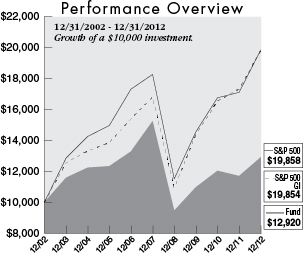

Growth Fund | | As of 12/31/12 |

Management’s Discussion of Fund Performance

Portfolio Manager:

Herb Chen, MBA

Senior Vice President

Huntington Asset Advisors, Inc.

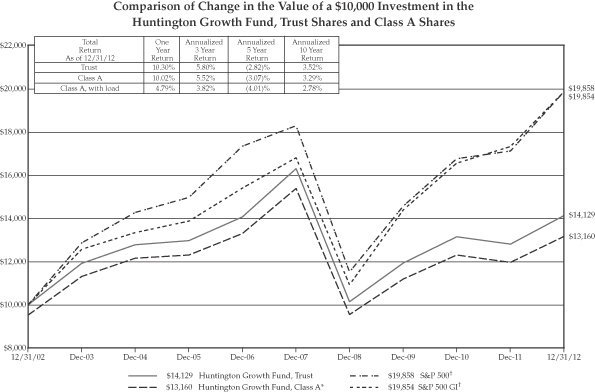

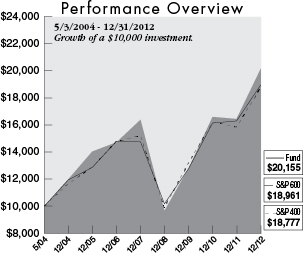

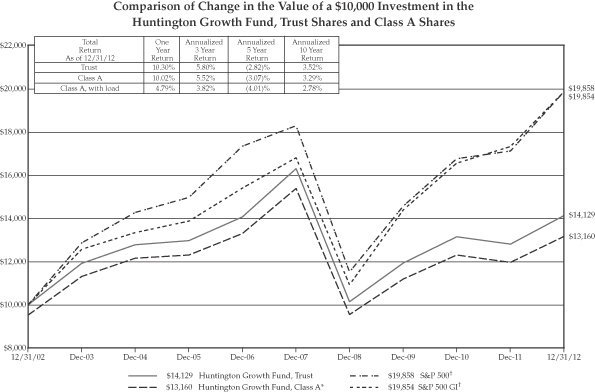

For the fiscal year ended December 31, 2012, the Huntington Growth Fund’s Trust Shares and Class A Shares produced total returns (not including the deduction of applicable sales charges) of 10.30% and 10.02%, respectively, based on net asset value. This performance was less than the total return of 14.60% for the Fund’s benchmark, the Standard & Poor’s 500 Growth Index (“S&P 500 GI”)1, for the same period. The Standard & Poor’s 500 Index (“S&P 500”)2 returned 16.00% for the same period.

The Fund is designed to provide investors with a portfolio of medium-to-large sized companies with potential for above-average growth potential. A top-down investment strategy is followed, using qualitative, quantitative, and technical analysis to evaluate the potential growth of companies in each industry. The stock selection process is also based on relative price to earnings growth methodology.

Portfolio structure had a negative 1.35% impact of the performance relative to the benchmark. Portfolio structure can be explained by a positive 0.52% impact from security selection, and a negative 1.03% and 0.83% impact from sector allocation and security characteristics, respectively. In addition, trading activity had a negative impact of 2.96%.

The three holdings that had the largest positive contribution to the Fund’s performance were Apple, Inc. (5.2%)*, Rackspace Hosting, Inc. (2.3%)* and Whole Foods Market, Inc. (3.0%)*. These three holdings added 3.91% to the Fund’s return. The three holdings that had the largest negative contribution to the Fund’s performance were Cirrus Logic, Inc. (sold), CARBO Ceramics, Inc. (sold) and Express Scripts Holding Co. (sold). These three holdings subtracted 1.56% from the Fund’s return.

| * | Percentage of holdings based on Fund’s net assets as of 12/31/2012. The composition of the Fund’s holdings is subject to change. |

| (1) | The S&P 500 GI is a capitalization-weighted index comprised of stocks in the S&P 500 having the highest price to book ratios. The index consists of approximately half of the S&P 500 on a market capitalization basis. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an Index. |

| (2) | The S&P 500 is a capitalization-weighted index comprised of 500 stocks and designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an Index. |

This commentary may include statements that constitute “forward looking statements” under the U.S. securities laws. Forward-looking statements include, among other things, projections, estimates, and information about possible or future results related to the Portfolio, market or regulatory developments. The views expressed above are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein. The views expressed above are those of the Advisor as of December 31, 2012 and are subject to change at any time based upon economic, market, or other conditions and the Advisor undertakes no obligation to update the views expressed herein. Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. The views expressed above (including any forward-looking statement) may not be relied upon as investment advice or as an indication of the Fund’s trading intent. Information about the Fund’s holdings, asset allocation or country diversification is historical and is not an indication of future Fund composition, which may vary.

The performance of any index mentioned in this commentary has not been adjusted for ongoing management, distribution and operating expenses, and sales charges applicable to mutual fund investments. In addition, the returns do not reflect additional fees charged by separate accounts or variable insurance contracts that an investor in the Fund may pay. If these additional fees were reflected, performance would have been lower.

Annual Shareholder Report

9

Growth Fund (Continued)

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month end performance, visit www.huntingtonfunds.com or call 1-800-253-0412. For after-tax returns call 1-800-253-0412. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund Shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. Total returns, at load, include the maximum 4.75% sales charge for the Class A Shares.

| | | | |

| Class | | Expense Ratios | |

A | | | 1.44% | |

Trust | | | 1.19% | |

The above expense ratios are from the Funds’ prospectus dated May 1, 2012. Additional information pertaining to the Fund’s expense ratio as of December 31, 2012 can be found in the financial highlights.

The Fund’s performance assumes the reinvestment of all dividends and distributions on securities. The S&P 500 and S&P 500 GI have been adjusted to reflect reinvestment of dividends on securities in the indices.

Funds whose investments are concentrated in a specific industry or sector may be subject to a higher degree of market risk than funds whose investments are diversified. In addition, the Fund may be subject to specific risks of the information technology sector, such as obsolescence.

The funds are distributed by Unified Financial Securities, Inc. (Member FINRA), a wholly owned subsidiary of Huntington Bancshares, Inc. and an affiliate of Huntington Asset Advisors, Inc., the advisor to the Huntington Funds.

| * | Represents a hypothetical investment of $10,000 in the Fund after deducting the maximum sales load of 4.75% ($10,000 investment minus $475 sales load = $9,525). |

| † | The S&P 500 and S&P 500 GI are not adjusted to reflect sales charges, expenses, or other fees that the Securities and Exchange Commission requires to be reflected in the Fund’s performance. The indices are unmanaged and, unlike the Fund, are not affected by cashflows. It is not possible to invest directly in an index. |

Annual Shareholder Report

10

| | |

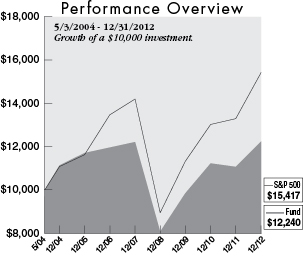

Income Equity Fund | | As of 12/31/12 |

Management’s Discussion of Fund Performance

Portfolio Manager:

Craig J. Hardy, CFA, MBA

Senior Vice President

Huntington Asset Advisors, Inc.

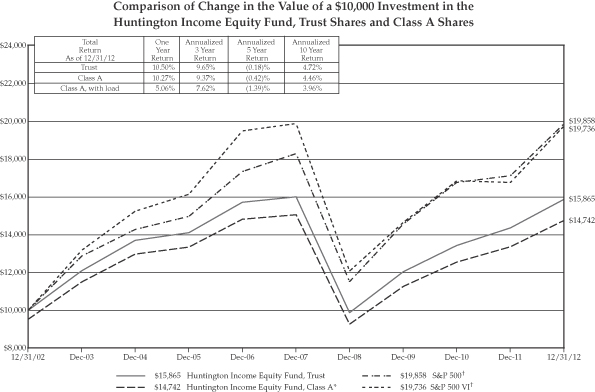

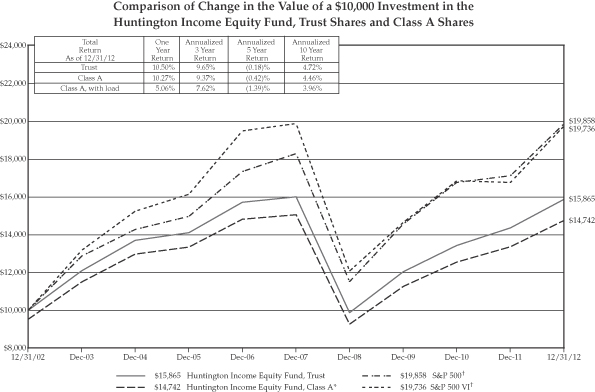

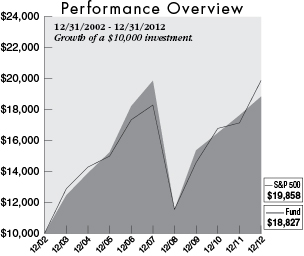

For the fiscal year ended December 31, 2012, the total returns (not including the deduction of applicable sales charges) for the Huntington Income Equity Fund were 10.50% and 10.27% for Trust Shares and Class A Shares, respectively, based on net asset value. These returns compare with a total return of 17.68% for the Standard & Poor’s 500 Value Index (“S&P 500 VI”)1, the Fund’s benchmark, for the same period. The Standard & Poor’s 500 Index (“S&P 500”)2 returned 16.00% for the same period.

During the fiscal year, the Fund was positioned relatively conservatively, with an emphasis on stocks with above average dividend yields, reasonable dividend growth prospects and value orientation. Constructing the Fund with those characteristics meant that the Fund’s largest sector exposure during the fiscal year was in the financials sector, followed by the energy sector. This combination of characteristics produced returns for the Fund that were lower than the return of the S&P 500 VI and the S&P 500 for the reporting period.

The sectors that contributed most positively to the performance of the Fund during the year were financials, health care and consumer staples. Although the financial sector provided the highest total return for the Fund, the performance of the Fund’s financial stocks trailed that of the benchmark’s financial stocks, thus contributing largely to the relative underperformance of the Fund. The sectors that most negatively impacted the Fund’s performance during the reporting period were telecommunications and utilities. During a year of rather strong stock market returns, these sectors did not enjoy the higher level of growth that characterized the broader market, although they did provide a healthy stream of income for the Fund. The stocks that contributed most positively to the performance of the Fund during the year were Seagate Technology (sold), Time Warner Cable, Inc. (1.2%)* and LyondellBasell Industries N.V. (1.3%)*. The stocks that most negatively impacted the Fund’s performance during the year were Best Buy Co., Inc. (sold), Windstream Corp. (1.2%)* and Banco Santander S.A. (sold). In general, the sale of covered calls as a hedging technique added to the performance of the Fund.

| * | Percentage of holdings based on Fund’s net assets as of 12/31/2012. The composition of the Fund’s holdings is subject to change. |

| (1) | The S&P 500 VI is a capitalization-weighted index comprised of the stocks in the S&P 500 having the lowest price to book ratios and consists of approximately half of the S&P 500 on a market capitalization basis. The S&P multifactor methodology is used to score constituents, which are weighted according to market cap and classified as value. The index has a relatively low turnover. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an Index. |

| (2) | The S&P 500 is a capitalization-weighted index comprised of 500 stocks and designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an Index. |

This commentary may include statements that constitute “forward looking statements” under the U.S. securities laws. Forward-looking statements include, among other things, projections, estimates, and information about possible or future results related to the Portfolio, market or regulatory developments. The views expressed above are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein. The views expressed above are those of the Advisor as of December 31, 2012 and are subject to change at any time based upon economic, market, or other conditions and the Advisor undertakes no obligation to update the views expressed herein. Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. The views expressed above (including any forward-looking statement) may not be relied upon as investment advice or as an indication of the Fund’s trading intent. Information about the Fund’s holdings, asset allocation or country diversification is historical and is not an indication of future Fund composition, which may vary.

The performance of any index mentioned in this commentary has not been adjusted for ongoing management, distribution and operating expenses, and sales charges applicable to mutual fund investments. In addition, the returns do not reflect additional fees charged by separate accounts or variable insurance contracts that an investor in the Fund may pay. If these additional fees were reflected, performance would have been lower.

Annual Shareholder Report

11

Income Equity Fund (Continued)

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month end performance, visit www.huntingtonfunds.com or call 1-800-253-0412. For after-tax returns call 1-800-253-0412. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund Shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. Total returns, at load, include the maximum 4.75% sales charge for the Class A Shares.

| | | | |

| Class | | Expense Ratios | |

A | | | 1.45% | |

Trust | | | 1.20% | |

The above expense ratios are from the Funds’ prospectus dated May 1, 2012. Additional information pertaining to the Fund’s expense ratio as of December 31, 2012 can be found in the financial highlights.

The Fund’s performance assumes the reinvestment of all dividends and distributions on securities. The S&P 500 and the S&P 500 VI have been adjusted to reflect reinvestment of dividends on securities in the indices.

There are no guarantees that dividend paying stocks will continue to pay dividends. In addition, dividend paying stocks may not experience the same capital appreciation potential as non-dividend paying stocks.

The funds are distributed by Unified Financial Securities, Inc. (Member FINRA), a wholly owned subsidiary of Huntington Bancshares, Inc. and an affiliate of Huntington Asset Advisors, Inc., the advisor to the Huntington Funds.

| * | Represents a hypothetical investment of $10,000 in the Fund after deducting the maximum sales load of 4.75% ($10,000 investment minus $475 sales load = $9,525). |

| † | The S&P 500 and the S&P 500 VI are not adjusted to reflect sales charges, expenses, or other fees that the Securities and Exchange Commission requires to be reflected in the Fund’s performance. The indices are unmanaged and, unlike the Fund, are not affected by cashflows. It is not possible to invest directly in an index. |

Annual Shareholder Report

12

| | |

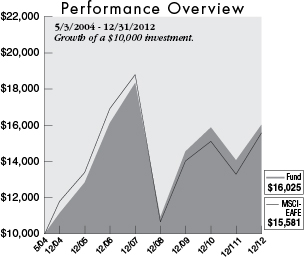

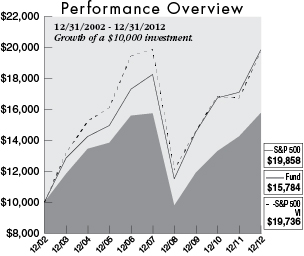

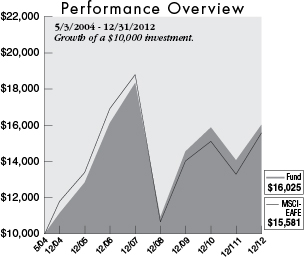

International Equity Fund | | As of 12/31/12 |

Management’s Discussion of Fund Performance

Portfolio Manager:

Paul W. Attwood, CFA

Vice President

Huntington Asset Advisors, Inc.

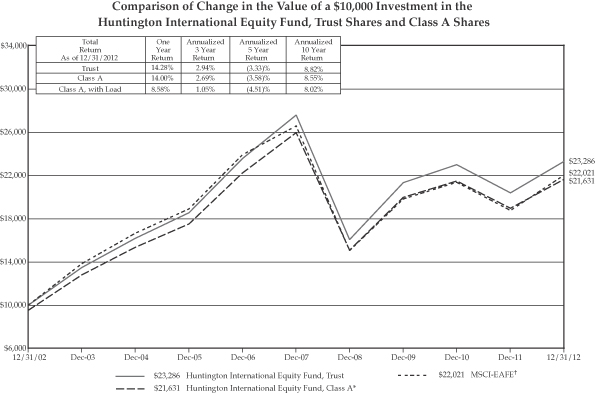

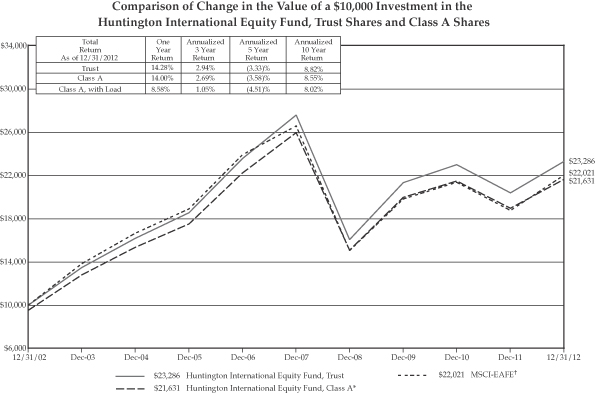

For the fiscal year ended December 31, 2012, the Huntington International Equity Fund produced total returns (not including the deduction of applicable sales charges) of 14.28% and 14.00% for Trust Shares and Class A Shares, respectively, based on net asset value. This underperformed the total return of 17.32% for the Morgan Stanley Capital International (“MSCI”) Europe, Australasia and Far East Index (“MSCI-EAFE”)1, the Fund’s benchmark index, for the same period.

Surprisingly, the top 3 performing countries in the Index were all European: Belgium (+36%), Denmark (+30%) and Germany (+27%). With the almost daily headlines coming out of Europe with regards to the collapse of sovereign debt prices, it is surprising that these markets were able to weather the storm and produce phenomenal returns for the year. On the flipside, as is to be expected, three of the bottom four performers were also European: Greece (-1%), Portugal (-1%) and Spain (-3%). Considering the potentially disastrous outcome from a collapse in both the Euro currency and the related Government debt, the equity markets were able to look through the morass to what appears to be a brighter future.

Concerns over foreign banks holding toxic debt whose quality could be considered questionable, did not prevent equity investors from buying financials and making them the number one performing sector in the MSCI-EAFE with a 28% gain. Consumer discretionary appreciated 22%. Names like Barclays, AXA and BNP Paribas were some of the highest contributors to performance. Michelin in the Consumer discretionary space added substantially to relative performance. Energy and telecommunications were the weakest areas, down 4% and 6% respectively. Vodaphone in the telecommunication space was disappointing after lower sales in troubled parts of Europe had a larger than expected impact on earnings.

European currencies across the board rallied against the dollar in 2012. The Euro managed a gain of 2%. One of the stronger regional currencies was the Norwegian Krone up over 7%. The major story at the end of last year in the currency market was the weakness in the Japanese Yen, which was down over 11% for the year. The newly elected government in Japan appears committed to boosting inflation and jump starting the economy. A devaluing of the Yen should help exporters specifically as we enter 2013.

| (1) | The MSCI-EAFE is a market-capitalization weighted equity index comprising 20 of the 48 countries in the MSCI universe and representing the developed world outside of North America. Each MSCI country index is created separately, then aggregated, without change, into MSCI indices. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an Index. |

Annual Shareholder Report

13

International Equity Fund (Continued)

The Fund’s return increment to the MSCI-EAFE was influenced by three main factors: its allocation to sectors and currency, along with exposure to economic factors such as global interest rates. The most beneficial impact to relative performance came from the selection of particular securities. Overall, sector weightings did not contribute to positive relative performance for the year. The portfolio had a positive impact from its weighting in stocks in the materials sector, which were strong contributors to index performance. This was partially offset by an above-index weighting in stocks in the industrial and information technology sectors, which did not add value.

The best contributors to overall return were stocks with less economic growth exposure and generous dividends, including BCE, Inc. (sold) based in Canada, Pearson PLC (1.6%)* and Vodafone Group PLC (1.6%)* based in the United Kingdom, ACE Ltd. (1.6%)*, a Swiss based insurance provider, and Sanofi-Aventis (2.1%)* based in France. Stocks that detracted from relative performance included two banks, Barclays (2.7%)* based in the United Kingdom and BNP Paribas (2.3%)* based in France. Komatsu Ltd. (sold), a Japanese heavy equipment maker, and the Swedish truck builder Volvo AB (1.6%) were also relatively negative. The currency exposure of the portfolio was additive to relative performance, mainly due to an underweight in the Euro, along with less than benchmark exposure to the UK pound and the Australian dollar.

Security selection had the most positive impact on relative performance. The stocks selected for the portfolio and their weightings were generally beneficial to the Fund.

| * | Percentage of holdings based on Fund’s net assets as of 12/31/2012. The composition of the Fund’s holdings is subject to change. |

This commentary may include statements that constitute “forward looking statements” under the U.S. securities laws. Forward-looking statements include, among other things, projections, estimates, and information about possible or future results related to the Portfolio, market or regulatory developments. The views expressed above are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein. The views expressed above are those of the Advisor as of December 31, 2012 and are subject to change at any time based upon economic, market, or other conditions and the Advisor undertakes no obligation to update the views expressed herein. Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. The views expressed above (including any forward-looking statement) may not be relied upon as investment advice or as an indication of the Fund’s trading intent. Information about the Fund’s holdings, asset allocation or country diversification is historical and is not an indication of future Fund composition, which may vary.

The performance of any index mentioned in this commentary has not been adjusted for ongoing management, distribution and operating expenses, and sales charges applicable to mutual fund investments. In addition, the returns do not reflect additional fees charged by separate accounts or variable insurance contracts that an investor in the Fund may pay. If these additional fees were reflected, performance would have been lower.

Annual Shareholder Report

14

International Equity Fund (Continued)

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month end performance, visit www.huntingtonfunds.com or call 1-800-253-0412. For after-tax returns call 1-800-253-0412. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund Shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. Total returns, at load, include the maximum 4.75% sales charge for the Class A Shares.

| | | | |

| Class | | Expense Ratios | |

A | | | 1.86% | |

Trust | | | 1.61% | |

The above expense ratios are from the Funds’ prospectus dated May 1, 2012. Additional information pertaining to the Fund’s expense ratio as of December 31, 2012 can be found in the financial highlights.

The Fund’s performance assumes the reinvestment of all dividends and distributions. The MSCI-EAFE has been adjusted to reflect reinvestment of dividends on securities in the index.

International investing involves special risks including currency risk, increased volatility of foreign securities, political risks, and differences in auditing and other financial standards. Prices of emerging markets securities can be significantly more volatile than the prices of securities in developed countries and currency risk and political risks are accentuated in emerging markets.

The funds are distributed by Unified Financial Securities, Inc. (Member FINRA), a wholly owned subsidiary of Huntington Bancshares, Inc. and an affiliate of Huntington Asset Advisors, Inc., the advisor to the Huntington Funds.

| * | Represents a hypothetical investment of $10,000 in the Fund after deducting the maximum sales load of 4.75% ($10,000 investment minus $475 sales load = $9,525). |

| † | The MSCI-EAFE is not adjusted to reflect sales charges, expenses, or other fees that the Securities and Exchange Commission requires to be reflected in the Fund’s performance. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an index. |

Annual Shareholder Report

15

| | |

Mid Corp America Fund | | As of 12/31/12 |

Management’s Discussion of Fund Performance

Portfolio Manager:

Christopher M. Rowane, CFA, MBA

Senior Vice President

Huntington Asset Advisors, Inc.

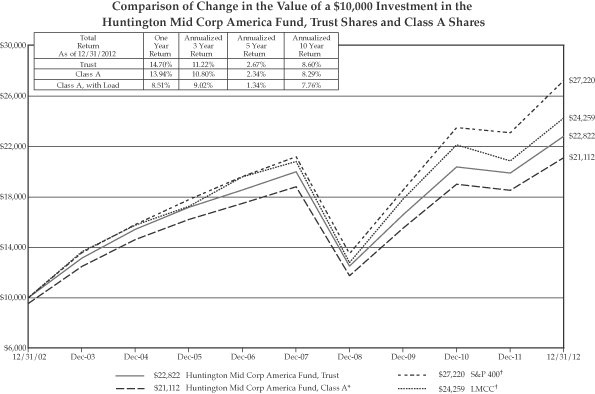

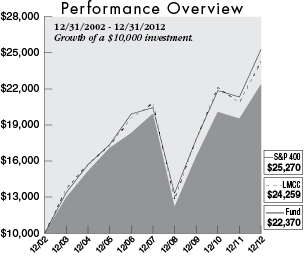

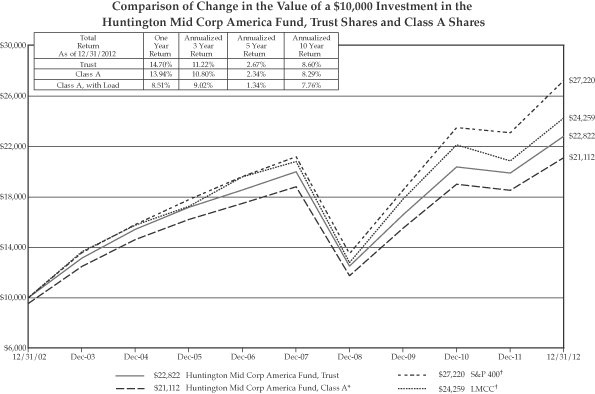

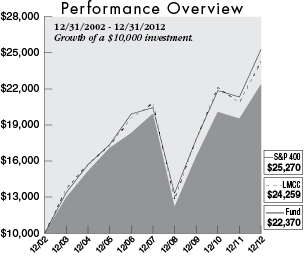

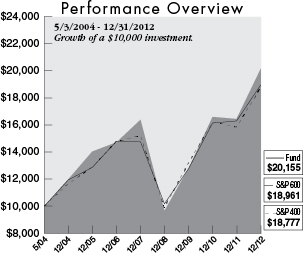

For the fiscal year ended December 31, 2012, the Huntington Mid Corp America Fund’s Trust Shares and Class A Shares produced total returns (not including the deduction of applicable sales charges) of 14.70% and 13.94%, respectively, based upon net asset value. In the same period, the Fund’s benchmark, the Standard & Poor’s MidCap 400 Index (“S&P 400”)1, produced a total return of 17.88%. The Lipper Mid Cap Core Average (“LMCC”)2 returned 15.59% for the same time period.

The three holdings that had the largest positive contribution to the Fund’s performance were Timken Co. (1.9%)*, Mylan, Inc. (2.5%)* and Albemarle Corp. (1.6%)*. These three holdings added 0.94% to the Fund’s return. The three holdings that had the largest negative contribution to the Fund’s performance were Teradata Corp. (2.3%)*, Citrix Systems, Inc. (2.0%)* and ITT Educational Services Inc. (0.2%)*. These three holdings subtracted 1.00% from the Fund’s return.

The Fund’s sector strategy benefited from allocations in healthcare, consumer staples and energy. The Fund’s underweight in the consumer discretionary sector, as well as the security selections in that sector, hampered the performance.

The equity market produced strong returns, especially in the mid-cap space, despite numerous levels of uncertainty from the U.S. Presidential election, European recession and Middle East conflicts. Mid-caps are primarily focused companies that operate and distribute on the domestic economy, which benefited from quantitative easing from the Federal Reserve.

| * | Percentage of holdings based on Fund’s net assets as of 12/31/2012. The composition of the Fund’s holdings is subject to change. |

| (1) | The S&P 400 is a capitalization weighted index comprised of common stocks representing all major industries in the mid-cap range of the U.S. stock market. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an Index. |

| (2) | LMCC figures represent the average of the total returns reported by all of the mutual funds designated by the Lipper, Inc. as falling in the category indicated. They do not reflect sales charges. |

This commentary may include statements that constitute “forward looking statements” under the U.S. securities laws. Forward-looking statements include, among other things, projections, estimates, and information about possible or future results related to the Portfolio, market or regulatory developments. The views expressed above are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein. The views expressed above are those of the Advisor as of December 31, 2012 and are subject to change at any time based upon economic, market, or other conditions and the Advisor undertakes no obligation to update the views expressed herein. Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. The views expressed above (including any forward-looking statement) may not be relied upon as investment advice or as an indication of the Fund’s trading intent. Information about the Fund’s holdings, asset allocation or country diversification is historical and is not an indication of future Fund composition, which may vary.

The performance of any index mentioned in this commentary has not been adjusted for ongoing management, distribution and operating expenses, and sales charges applicable to mutual fund investments. In addition, the returns do not reflect additional fees charged by separate accounts or variable insurance contracts that an investor in the Fund may pay. If these additional fees were reflected, performance would have been lower.

Annual Shareholder Report

16

Mid Corp America Fund (Continued)

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month end performance, visit www.huntingtonfunds.com or call 1-800-253-0412. For after-tax returns call 1-800-253-0412. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund Shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. Total returns, at load, include the maximum 4.75% sales charge for the Class A Shares.

| | | | |

| Class | | Expense Ratios | |

A | | | 1.58% | |

Trust | | | 1.33% | |

The above expense ratios are from the Funds’ prospectus dated May 1, 2012. Additional information pertaining to the Fund’s expense ratio as of December 31, 2012 can be found in the financial highlights.

The Fund’s performance assumes the reinvestment of all dividends and distributions. The S&P 400 and LMCC have been adjusted to reflect reinvestment of dividends on securities in the indices and average.

Mid-cap investing involves greater risk not associated with investing in more established companies, such as greater price volatility, business risk, less liquidity and increased competitive threat.

The funds are distributed by Unified Financial Securities, Inc. (Member FINRA), a wholly owned subsidiary of Huntington Bancshares, Inc. and an affiliate of Huntington Asset Advisors, Inc., the advisor to the Huntington Funds.

| * | Represents a hypothetical investment of $10,000 in the Fund after deducting the maximum sales load of 4.75% ($10,000 investment minus $475 sales load = $9,525). |

| † | The S&P 400 is not adjusted to reflect sales charges, expenses, or other fees that the Securities and Exchange Commission (SEC) requires to be reflected in the Fund’s performance. The index is unmanaged and, unlike the Fund, is not affected by cashflows. It is not possible to invest directly in an index. The LMCC represents the average of the total returns reported by all of the mutual funds designated by Lipper, Inc. as falling in the category indicated, and is not adjusted to reflect any sales charges. However, these total returns are reported net of expenses or other fees that the SEC requires to be reflected in a Fund’s performance. |

Annual Shareholder Report

17

| | |

Real Strategies Fund | | As of 12/31/12 |

Management’s Discussion of Fund Performance

Portfolio Manager:

Peter Sorrentino, CFA

Vice President

Huntington Asset Advisors, Inc.

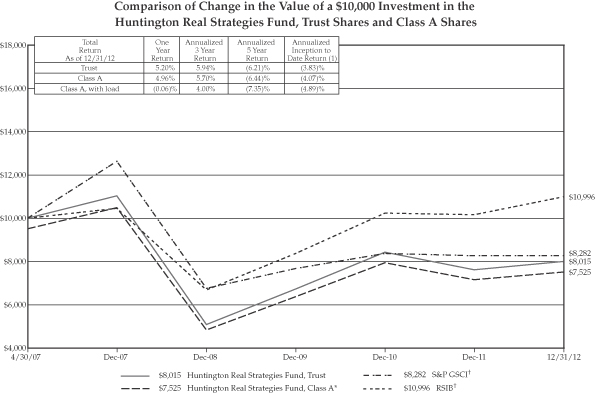

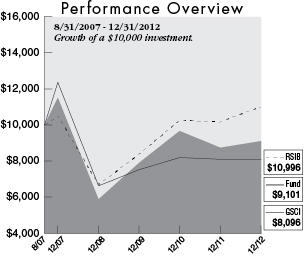

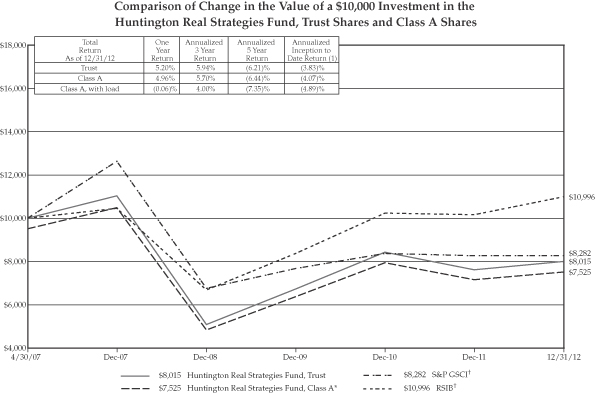

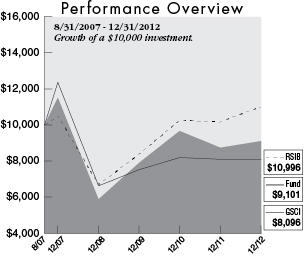

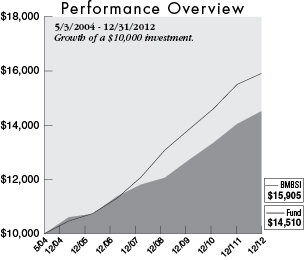

For the fiscal year ended December 31, 2012, the Huntington Real Strategies Fund produced total returns (not including the deduction of applicable sales charges) of 5.20% and 4.96% for Trust Shares and Class A Shares, respectively, based upon net asset value. The Fund outperformed its benchmark, the S&P GSCI® Index (“S&P CSCI”)1, which had a total return of 0.08% for the same period. The Fund underperformed the Real Strategies Indices Blend (“RSIB”)2, which returned 8.14% for the same period.

The Fund’s performance during the year was driven by a wide range of agricultural holdings. Three of the Fund’s top performing holdings were Agrium, Inc. (1.1%)* in the fertilizer arena, along with Valmont Industries, Inc. (1.4%)* and Lindsay Corp. (1.2%)* both manufacturers of irrigation systems. Rounding out the Fund’s top five contributors were Dean Foods Co. (sold) and Rayonier, Inc. (1.6%)*, both closely related to the agricultural industry. These investments represent the deliberate shift in emphasis of the portfolio from the areas of energy and industrial minerals to food related opportunities.

| * | Percentage of holdings based on Fund’s net assets as of 12/31/2012. The composition of the Fund’s holdings is subject to change. |

| (1) | The S&P GSCI® Index measures general price movements and inflation in the world economy. The Index is calculated primarily on a world production-weighted basis and is comprised of the principal physical commodities that are the subject of active, liquid futures markets. The Fund’s investment adviser elected to change the benchmark index from the S&P 500 to the S&P GSCI® Index because the S&P GSCI® Index is more reflective of the securities in which the Fund invests. The indices are unmanaged and, unlike the Fund, are not affected by cashflows. It is not |

| (2) | The Real Strategies Indices Blend is a custom blended index comprised of the following two indices with their noted respective weightings; Reuters/Jefferies CRB Total Return Index (50%) and NAREIT Index (50%). The Reuters/Jefferies CRB Total Return Index is a commodity index, a basket of exchange-traded futures contracts representing long-only positions in underlying commodities. Indices typically include a variety of commodity sectors to provide investors broader exposure to commodities as an asset class and free the investor from the mechanics of future trading (e.g., contract rolling and physical delivery). The index return does not reflect the deduction of expenses, which have been deducted from the Fund’s returns. The Index return assumes reinvestment of all distributions and does not reflect the deduction of taxes and fees. Individuals cannot invest directly in the Index, however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of benchmark Index. The NAREIT represents returns for the National Association of Real Estate Investment Trust Equity Index. The indices are unmanaged and, unlike the Fund, are not affected by cashflows. |

Annual Shareholder Report

18

Real Strategies Fund (Continued)

After an extended period of higher prices fueled global capacity additions, the Fund witnessed the price impact of those new volumes coming to market. This was particularly evident in 2012 for the prices in the energy and industrial metals markets. Coal producers were among those hit hard as evidenced by the performance of the Fund’s holdings in Natural Resource Partners, down 31.6% and Adaro Energy, down 9.7%. The decline in energy prices impacted many of the Fund’s foreign holdings as the U.S. Dollar was stronger relative to resource exporters such as Canada, Brazil and Indonesia. The negative currency impact hurt the Fund’s holding in Canadian Natural Resources Ltd. (0.9%)*, Canadian Oil Sands Ltd. (1.0%)*, Cameco Corp. (0.6%)*, Vale SA (0.6%)* and BHP Billiton Ltd. (0.6%)*.

Following over a decade of strong price advances, gold and silver turned in modest returns for 2012. The Fund’s silver holdings gained just 7.8% followed by the gold positions gain of 7.3%. These modest returns were still far better than the fate of the gold mining stocks as evidenced by the 22.6% decline for shares of Barrick Gold Corp.

These returns bear out the shift in asset emphasis towards food and away from energy and metals.

| * | Percentage of holdings based on Fund’s net assets as of 12/31/2012. The composition of the Fund’s holdings is subject to change. |

| (1) | The S&P GSCI® Index measures general price movements and inflation in the world economy. The Index is calculated primarily on a world production-weighted basis and is comprised of the principal physical commodities that are the subject of active, liquid futures markets. The Fund’s investment adviser elected to change the benchmark index from the S&P 500 to the S&P GSCI® Index because the S&P GSCI® Index is more reflective of the securities in which the Fund invests. The indices are unmanaged and, unlike the Fund, are not affected by cashflows. It is not |

| (2) | The Real Strategies Indices Blend is a custom blended index comprised of the following two indices with their noted respective weightings; Reuters/Jefferies CRB Total Return Index (50%) and NAREIT Index (50%). The Reuters/Jefferies CRB Total Return Index is a commodity index, a basket of exchange-traded futures contracts representing long-only positions in underlying commodities. Indices typically include a variety of commodity sectors to provide investors broader exposure to commodities as an asset class and free the investor from the mechanics of future trading (e.g., contract rolling and physical delivery). The index return does not reflect the deduction of expenses, which have been deducted from the Fund’s returns. The Index return assumes reinvestment of all distributions and does not reflect the deduction of taxes and fees. Individuals cannot invest directly in the Index, however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of benchmark Index. The NAREIT represents returns for the National Association of Real Estate Investment Trust Equity Index. The indices are unmanaged and, unlike the Fund, are not affected by cashflows. |

This commentary may include statements that constitute “forward looking statements” under the U.S. securities laws. Forward-looking statements include, among other things, projections, estimates, and information about possible or future results related to the Portfolio, market or regulatory developments. The views expressed above are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein. The views expressed above are those of the Advisor as of December 31, 2012 and are subject to change at any time based upon economic, market, or other conditions and the Advisor undertakes no obligation to update the views expressed herein. Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. The views expressed above (including any forward-looking statement) may not be relied upon as investment advice or as an indication of the Fund’s trading intent. Information about the Fund’s holdings, asset allocation or country diversification is historical and is not an indication of future Fund composition, which may vary.

The performance of any index mentioned in this commentary has not been adjusted for ongoing management, distribution and operating expenses, and sales charges applicable to mutual fund investments. In addition, the returns do not reflect additional fees charged by separate accounts or variable insurance contracts that an investor in the Fund may pay. If these additional fees were reflected, performance would have been lower.

Annual Shareholder Report

19

Real Strategies Fund (Continued)

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month end performance, visit www.huntingtonfunds.com or call 1-800-253-0412. For after-tax returns call 1-800-253-0412. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund Shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. Total returns, at load, include the maximum 4.75% sales charge for the Class A Shares.

| | | | |

| Class | | Expense Ratios | |

A | | | 1.68% | |

Trust | | | 1.43% | |

The above expense ratios are from the Funds’ prospectus dated May 1, 2012. Additional information pertaining to the Fund’s expense ratio as of December 31, 2012 can be found in the financial highlights.

The Fund’s performance assumes the reinvestment of all dividends and distributions. The S&P GSCI and RSIB have been adjusted to reflect reinvestment of dividends on securities in the indices.

Investments in real estate investment trusts (“REITs”) and real-estate related securities involve special risks associated with an investment in real estate, such as limited liquidity and interest rate risks and may be more volatile than other securities. In addition, the value of REITs and other real estate-related investments is sensitive to changes in real estate values, extended vacancies of properties and other environmental and economic factors.

Commodities-related investments are subject to the same risks as direct investments in commodities and prices may rise and fall in response to many factors such as economic, political and regulatory developments.

Funds whose investments are concentrated in a specific industry or sector may be subject to a higher degree of market risk than funds whose investments are diversified.

The funds are distributed by Unified Financial Securities, Inc. (Member FINRA), a wholly owned subsidiary of Huntington Bancshares, Inc. and an affiliate of Huntington Asset Advisors, Inc., the advisor to the Huntington Funds.

| * | Represents a hypothetical investment of $10,000 in the Fund after deducting the maximum sales load of 4.75% ($10,000 investment minus $475 sales load = $9,525). |

| (1) | The Fund commenced operations for all Share classes on May 2, 2007. |

| † | The S&P GSCI and RSIB are not adjusted to reflect sales charges, expenses, or other fees that the Securities and Exchange Commission requires to be reflected in the Fund’s performance. The indices are unmanaged and, unlike the Fund, are not affected by cashflows. It is not possible to invest directly in an index. |

Annual Shareholder Report

20

| | |

Rotating Markets Fund | | As of 12/31/12 |

Management’s Discussion of Fund Performance

Portfolio Manager:

Paul Koscik, JD

Vice President

Huntington Asset Advisors, Inc.

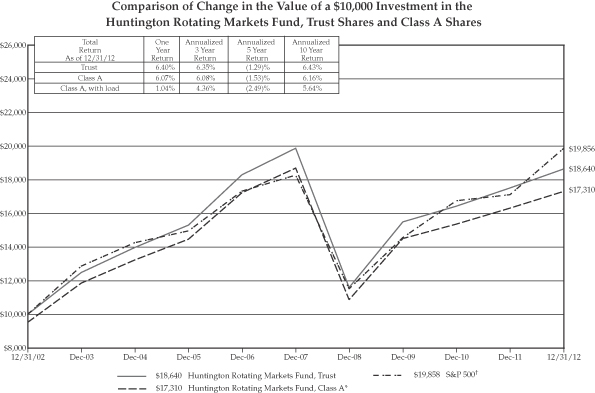

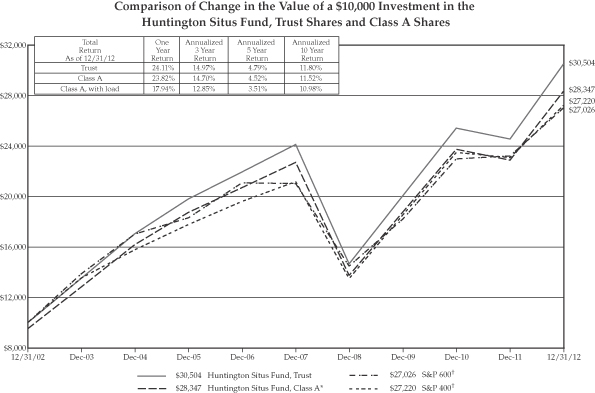

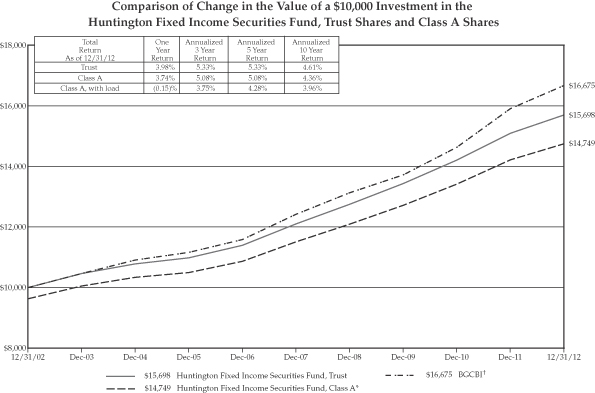

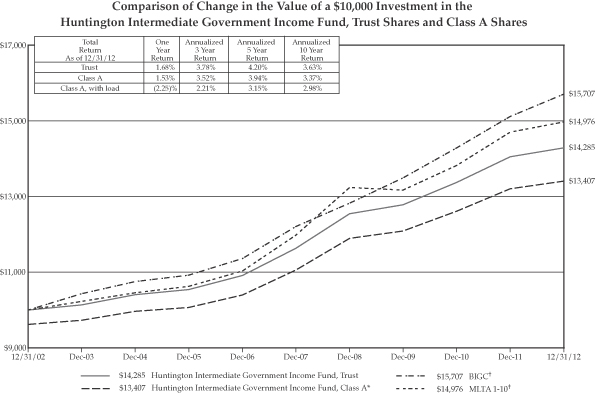

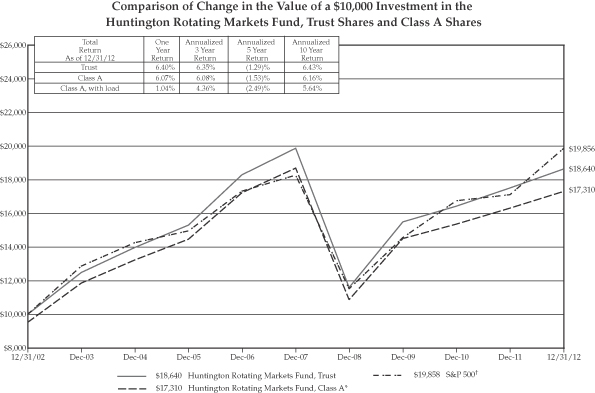

For the fiscal year ended December 31, 2012, the Huntington Rotating Markets Fund’s Trust Shares and Class A Shares produced total returns (not including the deduction of applicable sales charges) of 6.40% and 6.07%, respectively, based upon net asset value. In the same period, the Fund’s benchmark, the Standard & Poor’s 500 Index (“S&P 500”)1, produced a total return of 16.00%.