UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05010

THE HUNTINGTON FUNDS

(Exact name of registrant as specified in charter)

2960 North Meridian Street, Suite 300

Attn: Huntington Funds Officer

Indianapolis, IN 46208

(Address of principal executive offices) (Zip code)

Martin R. Dean

The Huntington National Bank

37 West Broad Street, 6th Floor

Columbus, OH 43215

(Name and address of agent for service)

Copies to:

David C. Mahaffey, Esq.

Sullivan & Worcester

1666 K Street, N.W.

Washington, DC 20006

Registrant’s telephone number, including area code: 1-800-253-0412

Date of fiscal year end: December 31

Date of reporting period: December 31, 2014

Item 1. Reports to Stockholders.

Annual Shareholder Report

DECEMBER 31, 2014

CLASS A SHARES

CLASS C SHARES

INSTITUTIONAL SHARES

Message from the Chief Investment Officer

Dear Shareholder:

Much like last year, the final quarter of 2014 provided most of the performance for the entire year. This was particularly true for the Standard and Poor’s SmallCap 600 Index®(a) (“S&P 600”) which rose 9.85% during the quarter, pushing it into positive territory for the entire year. The larger cap issues, as highlighted by the Standard and Poor’s 500 Index®(b) (“S&P 500”), gained almost 5% for the quarter driving the index to exceed the other major indices with an annual return of 13.69%. Beset by currency and economic woes, the international equity markets as characterized by the Morgan Stanley Capital International Europe, Australasia and Far East Index(c) (“MSCI-EAFE”), fell in both the fourth quarter of 2014 and the entire year.

With this backdrop of mixed results, the managers of the Huntington Funds have characterized this past year as one that experienced a number of transitions. These transitions evoked both positive and negative perceptions within the investment community and, as a result, short-term volatility increased as investors tried to figure out the most attractive or prudent courses. The markets and economy have had to adjust to six very significant changes during the year.

First and probably foremost, is the decision by the Federal Reserve (“Fed”) to cease its six year quantitative easing monetary policy. This was of concern to some investors as liquidity provided by the Fed has served as a stimulus to the equity markets and to the economy, especially in certain sectors such as housing. The second impactful change was to the make-up of Congress, which shifted stronger control to the Republican Party as a result of the November elections. This could affect budgetary, regulatory and defense issues as the new majority deals with the Administration over the next two years. The third alteration of course was the assumption of a more bellicose attitude by Russia in its dealings with the West. Since 1989 and the fall of the Berlin Wall, the former components of the Soviet Union have moved more closely in alignment with the West in commerce and politics. This took a radical turn as conflict escalated within Ukraine and sanctions were imposed upon Russia.

The U.S. Dollar was also a highlight in 2014 as its surprising strength helped contain inflation and will probably make it more difficult to sell U.S. manufactured goods overseas. The year also marked the first time the U.S. has become energy independent, could export petroleum products and exceeded the actual production of Saudi Arabia. The resulting reduction of cost at the pump has become a boon to U.S. consumers. In our opinion, perhaps the most significant issue in 2014 was the most subtle. The perception of robotics in the workplace has been well established in manufacturing over the past few years. It is, however, remarkable that in this past year the use of drones and robots of various types became acceptable in the service and consumer sectors. This phenomenon may lay the ground work for a rapid expansion of robotics in daily life. While the long term implications of robotics in the work place and in the home may include the acceptance of a higher intrinsic level of unemployment, there will likely be an explosion of investor interest much like the halcyon days of the dot-com era with frequent Initial Public Offerings (IPOs) and significant technological breakthroughs.

It will be an interesting first quarter of 2015 for investors who will need to assess these transitions and how they will affect their investment strategies. Our experienced investment team of fund managers will strive to provide our own interpretations of these influences and chart a course that takes advantage of the forthcoming opportunities. As a business practice within Huntington Asset Advisors, we are continuously evaluating products and growth opportunities. In 2014, Huntington Funds made a strategic decision to close some of its funds with lower asset sizes in order to focus on a select group of core funds. We believe this

Message from the Chief Investment Officer

Message from the Chief Investment Officer (Continued)

action will strengthen our position and allow us to continue to generate growth and meet the investment needs of our shareholders. We are committed to the ongoing success of Huntington Funds and leveraging the expertise of our fund managers.

B. Randolph Bateman, CFA

Chief Investment Officer

Huntington Asset Advisors, Inc.

| (a) | The S&P 600 is a capitalization-weighted index representing all major industries in the small-cap range of the U.S. stock market. |

| (b) | The S&P 500 is a capitalization-weighted index comprised of 500 stocks and designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. |

| (c) | The MSCI-EAFE is a market-capitalization weighted equity index comprising 20 of the 48 countries in the MSCI universe and representing the developed world outside of North America. Each MSCI country index is created separately, and then aggregated, without change, into MSCI indices. |

The indices are unmanaged and, unlike the Fund, are not affected by cash flows. It is not possible to invest directly in an Index, although, you may invest in the underlying securities.

Message from the Chief Investment Officer

Annual Shareholder Report

MONEY MARKET FUNDS

Huntington Money Market Fund

Huntington U.S. Treasury Money Market Fund

EQUITY FUNDS

Huntington Dividend Capture Fund

Huntington Global Select Markets Fund

Huntington Real Strategies Fund

Huntington Situs Fund

ASSET ALLOCATION FUNDS

Huntington Balanced Allocation Fund

Huntington Conservative Allocation Fund

Huntington Growth Allocation Fund

| | |

| Dividend Capture Fund | | As of December 31, 2014 |

Management’s Discussion of Fund Performance

Portfolio Managers:

Kirk Mentzer, MBA

Director of Fund Research

Peter Sorrentino, CFA

Senior Vice President

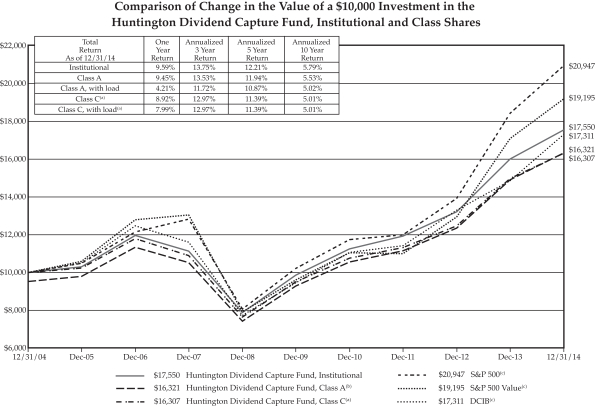

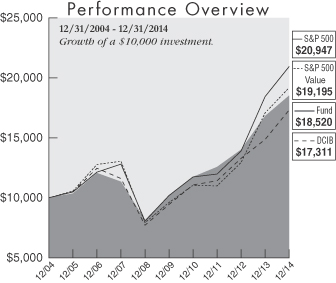

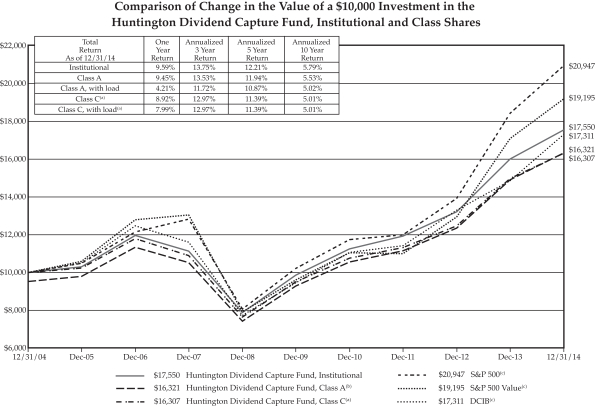

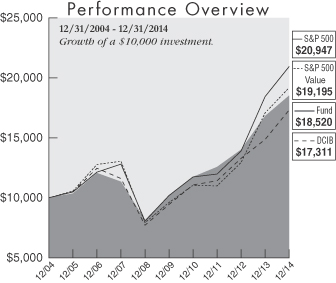

For the fiscal year ended December 31, 2014, the Huntington Dividend Capture Fund’s (“Fund”) Institutional Shares and Class A Shares produced total returns (not including the deduction of applicable sales charges) of 9.59% and 9.45%, respectively, based on net asset value. The Fund underperformed relative to the 12.36% total return of the Standard & Poor’s 500 Value Index® (“S&P 500 Value”)(a), its benchmark, and the 13.69% return of the Standard & Poor’s 500 Index® (“S&P 500” )(a), its previous benchmark for the same period. The Fund’s Class A Shares underperformed the benchmark by 2.91% for the same period. The Fund underperformed relative to the 16.74% total return of the Dividend Capture Indices Blend (“DCIB”)(b) for the same period.

The Fund is managed using our top-down style and portfolio construction techniques, which are aimed at producing a high level of stable income and low volatility by investing in three distinct asset classes highlighted below:

| | • | | Value-Style Common Stocks: Domestic equity market returns were nearly zero for the year in early October, but managed to rally during the fourth quarter to produce strong gains for all of 2014. Seasonal factors, improving economic growth (U.S.), low inflation, plentiful liquidity, and plummeting oil prices and bond yields all factored prominently into rising stock markets. Stocks as measured by the S&P 500 Value ended the year with a 12.36% total return. The Fund was overweight common stocks for the entire period versus the DCIB unmanaged custom index. Within this class, sector allocation subtracted 83 basis points and security selection detracted 388 basis points from performance. As a result, the common stocks in the Fund underperformed the overall market. The Fund’s common stock total return for 2014 was 7.07%, trailing the S&P 500 Value return for the year. The three largest positive contributors to performance were: Intel Corp. (+0.73%), Cisco Systems, Inc. (+0.72%) and CSX Corp. (+0.48%). The three largest detractors were: Noble Corp. PLC (-0.70%), Marathon Oil Corp. (-0.32%) and Peabody Energy Corp. (-0.31%). |

| | • | | Real Estate Investment Trusts (REITs)(c): Falling interest rates helped propel REIT markets in 2014, making them the best performing asset class. The Fund’s REIT holdings produced a total return of 26.13% for the fiscal year ended December 31, 2014, which slightly underperformed the benchmark NAREIT Index total return of 27.20% for the same period. The three largest positive contributors to performance were: HCP, Inc. (+2.83%), Kimco Realty Corp. (+2.79%) and Camden Property Trust (+2.06%). The three largest detractors were: Hospitality Properties Trust (-0.05%), Ramco-Gershenson Properties Trust (-0.02%) and Healthcare Realty Trust, Inc. (-0.01%). |

| | • | | Preferred Stocks(d): Declining yields, likewise, gave preferred stocks a tail wind for the year, making the class second best performing asset class of the Fund. The Fund’s preferred stocks holdings produced a total return of 17.33%, which outperformed the benchmark, BofA Merrill Lynch Fixed Rate Preferred Securities Index, total return of 15.44%. The three largest positive contributors to performance were: BB&T Corp., 5.85% (+0.38%), PS Business Parks, Inc., Series S, 6.45% (+0.33%) and Charles Schwab Corp., Series B, 6.00% (+0.32%). The three largest underperforming issues were: Ameriprise Financial, Inc., 7.75 % (+0.01%), Vornado Realty LP 7.875% (+0.01%) and NextEra Energy Capital Holdings, Inc., Series F, 8.75% (Called at 100) (0.00%), which were sold during the year. |

The composition of the Fund’s holdings is subject to change.

Annual Shareholder Report

1

Dividend Capture Fund (Continued)

| (a) | Effective 11/18/2014, the Dividend Capture Fund’s benchmark was updated from the S&P 500 Index® to the S&P 500 Value Index® as it was determined to more closely reflect the investment strategy of the Fund. The S&P 500 Index® is an unmanaged index generally representing the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The S&P 500 Value Index® is an unmanaged market-capitalization-weighted index consisting of those stocks within the S&P 500 Index® that exhibit strong value characteristics. It uses a numerical ranking system based on four value factors and three growth factors to determine the constituents and their weightings |

| | Indices are unmanaged and, unlike the Fund, are not affected by cash flows. It is not possible to invest directly in an Index. |

| (b) | The DCIB is a custom, blended index comprised of the following three indices with their noted respective weightings: S&P 500 Value Index (40%), Merrill Lynch Fixed Rate Preferred Index (40%) and NAREIT Index (20%). This custom, blended index and its respective weightings are reflective of the Fund’s sector diversification. Indices are unmanaged and, unlike the Fund, are not affected by cash flows. It is not possible to invest directly in an Index. |

| (c) | REIT returns represented by the NAREIT Index. The NAREIT Index represents returns for the National Association of Real Estate Investment Trust Equity Index. The index is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an Index. |

| (d) | Preferred returns represented by BofA Merrill Lynch Fixed Rate Preferred Securities Index. The BofA Merrill Lynch Fixed Rate Preferred Securities Index is a capitalization-weighted index that tracks the performance of fixed rate U.S. dollar denominated preferred securities issued in the U.S. domestic market. |

This commentary may include statements that constitute “forward looking statements” under the U.S. securities laws. Forward-looking statements include, among other things, projections, estimates, and information about possible or future results related to the Fund, market or regulatory developments. The views expressed above are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein. The views expressed above are those of the Advisor as of December 31, 2014 and are subject to change at any time based upon economic, market, or other conditions and the Advisor undertakes no obligation to update the views expressed herein. Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. The views expressed above (including any forward-looking statement) may not be relied upon as investment advice or as an indication of the Fund’s trading intent. Information about the Fund’s holdings, asset allocation or country diversification is historical and is not an indication of future Fund composition, which may vary.

The performance of any index mentioned in this commentary has not been adjusted for ongoing management, distribution and operating expenses, and sales charges applicable to mutual fund investments. If these additional fees were reflected, performance would have been lower.

There are no guarantees that dividend paying stocks will continue to pay dividends. In addition, dividend paying stocks may not experience the same capital appreciation potential as non-dividend paying stocks.

Annual Shareholder Report

2

Dividend Capture Fund (Continued)

The Fund’s past performance does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end or after-tax returns may be obtained by calling 1-800-253-0412. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. Total returns, with load, include the 4.75% maximum sales charge for the Class A shares or the 1.00% maximum deferred sales charge for the Class C shares.

| | | | |

| Class | | Expense Ratios | |

| Institutional Shares | | | 0.90% | |

| Class A Shares | | | 1.15% | |

| Class C Shares | | | 1.65% | |

The above expense ratios are from the Fund’s prospectus dated April 30, 2014, as amended September 2, 2014. Additional information pertaining to the Fund’s expense ratios as of December 31, 2014 can be found in the financial highlights.

The Fund’s performance assumes the reinvestment of all dividends and distributions on securities. The performance above reflects any fee reductions during the applicable periods. If such fee reductions had not occurred, the quoted performance would have been lower. The S&P 500 Value, S&P 500 and DCIB have been adjusted to reflect reinvestment of dividends on securities in the indices.

Investments in real estate investment trusts (“REITs”) and real-estate related securities involves special risks associated with an investment in real estate, such as limited liquidity and interest rate risks and may be more volatile than other securities. In addition, the value of REITs and other real estate-related investments is sensitive to changes in real estate values, extended vacancies of properties and other environmental and economic factors.

There are no guarantees that dividend paying stocks will continue to pay dividends. In addition, dividend paying stocks may not experience the same capital appreciation potential as non-dividend paying stocks.

The Fund is distributed by Unified Financial Securities, Inc. (Member FINRA), a wholly-owned subsidiary of Huntington Bancshares, Inc., and an affiliate of Huntington Asset Advisors, Inc., the advisor of the Huntington Funds.

| (a) | Class C Shares commenced operations on January 3, 2014. Prior to January 3, 2014, performance is based on the performance of Class A Shares adjusted for the Class C Shares 12b-1 fees and contingent deferred sales charge. |

| (b) | Represents a hypothetical investment of $10,000 in the Fund after deducting the maximum sales load of 4.75% ($10,000 investment minus $475 sales load = $9,525). |

| (c) | The S&P 500 Value, S&P 500 and DCIB are not adjusted to reflect sales charges, expenses, or other fees that are reflected in the Fund’s performance. The indices are unmanaged and, unlike the Fund, are not affected by cash flows. It is not possible to invest directly in an index. |

Annual Shareholder Report

3

| | |

| Global Select Markets Fund | | As of December 31, 2014 |

Management’s Discussion of Fund Performance

Portfolio Managers:

Paul W. Attwood, CFA

Senior Vice President

Martina Cheung, CFA, MBA

Vice President

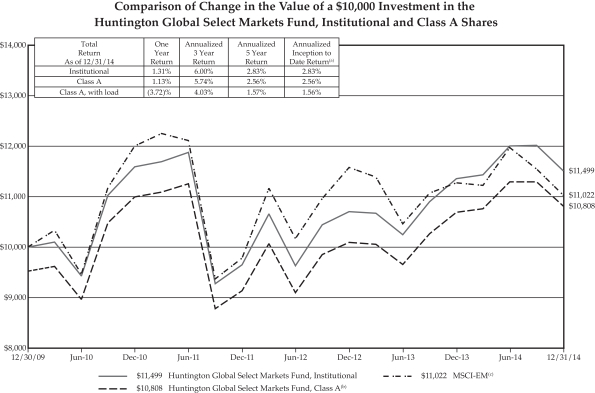

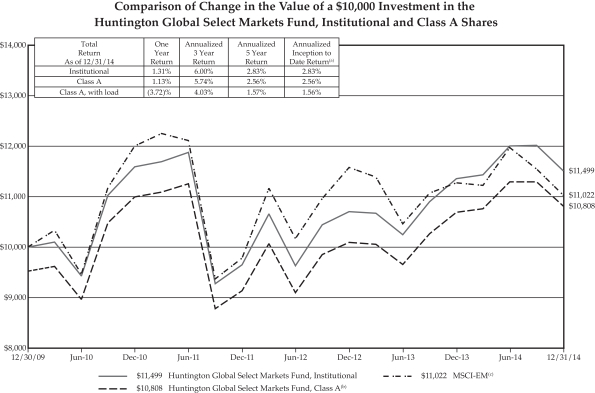

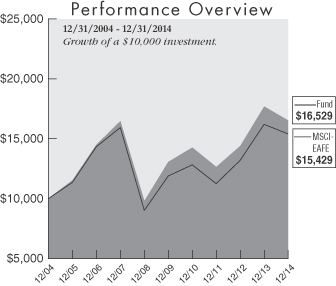

For the fiscal year ended December 31, 2014, the Huntington Global Select Markets Fund’s (“Fund”) Institutional Shares and Class A Shares reported total returns (not including the deduction of applicable sales charges) of 1.31% and 1.13%, respectively, based on net asset value. The Fund outperformed relative to the (2.19)% total return of the Morgan Stanley Capital International Emerging Markets Index (“MSCI-EM”)(a), its benchmark, for the same time period. The Fund’s Class A Shares outperformed the benchmark by 3.32% for the same period.

Although the MSCI-EM reported a negative total return in 2014, there were some very strong performances by individual countries. The Fund was able to outperform its benchmark by being overweight in some of these areas, such as India and Indonesia. In addition, the Fund had no exposure to Russia which experienced a collapse of both their equity market and currency. A substantial underweight in Brazil also contributed to the strong relative performance.

Energy and Material stocks were particularly weak. The Fund had very little exposure to these sectors. The Fund had a significant overweight in Healthcare, which was the best performing sector throughout 2014. Stock selection added to the relative outperformance of the Fund, relative to its benchmark. The three holdings that had the largest positive contribution to the Fund’s performance were KCE Electronics, Amara Raja Batteries and ICICI Bank Ltd. Collectively these holdings added 3.83% to the Fund’s return. The three holdings that had the largest negative contribution to the Fund’s return were LPP S.A., Kingsoft Corp. and Supermax Corp. These three holdings subtracted 2.12% from the Fund’s return and were all sold before the end of the year.

On December 19, 2014, Huntington International Equity Fund was merged into the Huntington Global Select Markets Fund. As we headed into year-end activities, the Fund retained some of the holdings from the International Equity Fund. The Fund’s December 31, 2014 Portfolio of Investments reflects these combined positions. The Fund’s portfolio is now being fully positioned to provide investors with exposure to what we consider to be the most attractive markets in the world, in a risk managed portfolio. As we begin 2015, we are targeting those countries that we believe display positive and improving fiscal and monetary policies and other key attributes that are essential to solid long-term performance.

| (a) | The MSCI-EM is a market-capitalization weighted equity index comprising 21 of the 48 countries in the MSCI universe. Each MSCI country index is created separately, then aggregated, without change, into MSCI indices. The index is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an Index. |

This commentary may include statements that constitute “forward looking statements” under the U.S. securities laws. Forward-looking statements include, among other things, projections, estimates, and information about possible or future results related to the Portfolio, market or regulatory developments. The views expressed above are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein. The views expressed above are those of the Advisor as of December 31, 2014 and are subject to change at any time based upon economic, market, or other conditions and the Advisor undertakes no obligation to update the views expressed herein. Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. The views expressed above (including any forward-looking statement) may not be relied upon as investment advice or as an indication of the Fund’s trading intent. Information about the Fund’s holdings, asset allocation or country diversification is historical and is not an indication of future Fund composition, which may vary.

The performance of any index mentioned in this commentary has not been adjusted for ongoing management, distribution and operating expenses, and sales charges applicable to mutual fund investments. If these additional fees were reflected, performance would have been lower.

Annual Shareholder Report

4

Global Select Markets Fund (Continued)

The Fund’s past performance does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end or after-tax returns may be obtained by calling 1-800-253-0412. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. Total returns, at load, include the 4.75% maximum sales charge for the Class A Shares.

| | | | |

| Class | | Expense Ratios | |

| Institutional Shares | | | 0.96% | |

| Class A Shares | | | 1.21% | |

The above expense ratios are from the Fund’s prospectus dated April 30, 2014, as amended September 2, 2014, and as supplemented October 1, 2014. Additional information pertaining to the Fund’s expense ratios as of December 31, 2014 can be found in the financial highlights.

The Fund’s performance assumes the reinvestment of all dividends and distributions on securities. The performance above reflects any fee reductions during the applicable periods. If such fee reductions had not occurred, the quoted performance would have been lower. The MSCI-EM has been adjusted to reflect reinvestment of dividends on securities in the index.

International investing involves special risks including currency risk, political risk, increased volatility of foreign securities, and differences in auditing and other financial standards. In addition, prices of emerging markets securities can be significantly more volatile than the prices of securities in developed countries.

The Fund is distributed by Unified Financial Securities, Inc. (Member FINRA), a wholly-owned subsidiary of Huntington Bancshares, Inc., and an affiliate of Huntington Asset Advisors, Inc., the advisor of the Huntington Funds.

| (a) | The Fund commenced operations for all share classes on December 30, 2009. |

| (b) | Represents a hypothetical investment of $10,000 in the Fund after deducting the maximum sales load of 4.75% ($10,000 investment minus $475 sales load = $9,525). |

| (c) | The MSCI-EM is not adjusted to reflect sales charges, expenses, or other fees that are reflected in the Fund’s performance. The index is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an index. |

Annual Shareholder Report

5

| | |

| Real Strategies Fund | | As of December 31, 2014 |

Management’s Discussion of Fund Performance

Portfolio Managers:

Peter Sorrentino, CFA

Senior Vice President

Paul Attwood, CFA

Senior Vice President

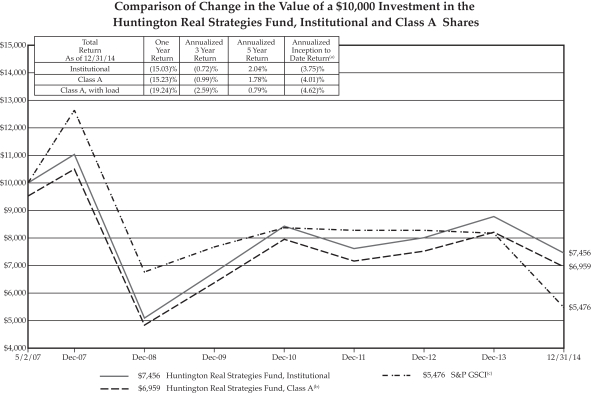

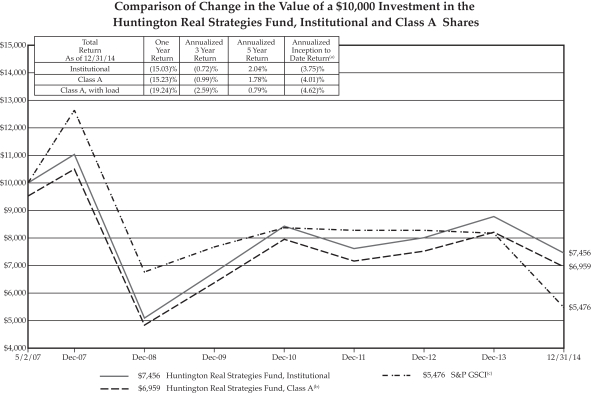

For the fiscal year ended December 31, 2014, the Huntington Real Strategies Fund’s (“Fund”) Institutional Shares and Class A Shares produced total returns (not including the deduction of applicable sales charges) of (15.03)% and (15.23)%, respectively, based upon net asset value. The Fund outperformed relative to the (33.05)% total return of the Standard & Poor’s Goldman Sachs Commodity Index® (“S&P GSCI”)(a), its benchmark, for the same period. The Fund’s Class A Shares outperformed its benchmark by 17.82%.

Thanks to the relatively stable pricing of natural gas during 2014, the Fund achieved returns that significantly outperformed its benchmark. With a number of natural gas liquefaction facilities nearing completion, the prospect of exporting low cost North American natural gas to the world market produced solid gains for companies such as Cheniere Energy (+63%) and Magellan Midstream Partners (+30%). Unfortunately, the confluence of a decade of over-investment along with slowing global growth and a rising U.S. Dollar drove virtually all other commodity prices down. At some point in 2014, every traded commodity, with the exception of gold, suffered at least a 25% price decline. Nowhere was this more evident than in the share prices of commodity driven economies, where the Fund’s investment in Canadian Oil Sands fell 52% and in Brazilian miner Vale S.A. lost 46%.

Efforts to insulate the Fund from these negative price actions contributed significantly to the outperformance relative to the benchmark. The covered call writing on the Fund’s holdings generated incremental return, as did the downside hedging through the purchase of put options on the Standard & Poor’s 500 Index® and the MSCI Emerging Markets Index. The Fund continued to employ the purchase of forward volatility through call options on the Chicago Board Options Exchange Volatility Index as another means of mitigating negative price action. The Fund disposed of two of its direct real estate holdings, the Scott’s Gahanna property and its interest in the BB&T office tower in Winston-Salem, North Carolina during the fourth quarter.

| (a) | The S&P GSCI® Index measures general price movements and inflation in the world economy. The Index is calculated primarily on a world production-weighted basis and is comprised of the principal physical commodities that are the subject of active, liquid futures markets. The index is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an Index. |

This commentary may include statements that constitute “forward looking statements” under the U.S. securities laws. Forward-looking statements include, among other things, projections, estimates, and information about possible or future results related to the Portfolio, market or regulatory developments. The views expressed above are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein. The views expressed above are those of the Advisor as of December 31, 2014 and are subject to change at any time based upon economic, market, or other conditions and the Advisor undertakes no obligation to update the views expressed herein. Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. The views expressed above (including any forward-looking statement) may not be relied upon as investment advice or as an indication of the Fund’s trading intent. Information about the Fund’s holdings, asset allocation or country diversification is historical and is not an indication of future Fund composition, which may vary.

The performance of any index mentioned in this commentary has not been adjusted for ongoing management, distribution and operating expenses, and sales charges applicable to mutual fund investments. If these additional fees were reflected, performance would have been lower.

Annual Shareholder Report

6

Real Strategies Fund (Continued)

The Fund’s past performance does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end or after-tax returns may be obtained by calling 1-800-253-0412. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. Total returns, at load, include the 4.75% maximum sales charge for the Class A Shares.

| | | | |

| Class | | Expense Ratios | |

| Institutional Shares | | | 1.10% | |

| Class A Shares | | | 1.35% | |

The above expense ratios are from the Fund’s prospectus dated April 30, 2014, as amended September 2, 2014. Additional information pertaining to the Fund’s expense ratios as of December 31, 2014 can be found in the financial highlights.

The Fund’s performance assumes the reinvestment of all dividends and distributions. The performance above reflects any fee reductions during the applicable periods. If such fee reductions had not occurred, the quoted performance would have been lower. The S&P GSCI has been adjusted to reflect reinvestment of dividends on securities in the indices.

Investments in real estate investment trusts (“REITs”) and real-estate related securities involve special risks associated with an investment in real estate, such as limited liquidity and interest rate risks and may be more volatile than other securities. In addition, the value of REITs and other real estate-related investments is sensitive to changes in real estate values, extended vacancies of properties and other environmental and economic factors.

Commodities-related investments are subject to the same risks as direct investments in commodities and prices may rise and fall in response to many factors such as economic, political and regulatory developments.

Funds whose investments are concentrated in a specific industry or sector may be subject to a higher degree of market risk than funds whose investments are diversified.

The Fund is distributed by Unified Financial Securities, Inc. (Member FINRA), a wholly-owned subsidiary of Huntington Bancshares, Inc., and an affiliate of Huntington Asset Advisors, Inc., the advisor of the Huntington Funds.

| (a) | The Fund commenced operations for all share classes on May 2, 2007. |

| (b) | Represents a hypothetical investment of $10,000 in the Fund after deducting the maximum sales load of 4.75% ($10,000 investment minus $475 sales load = $9,525). |

| (c) | The S&P GSCI is not adjusted to reflect sales charges, expenses, or other fees that are reflected in the Fund’s performance. The index is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an index. |

Annual Shareholder Report

7

| | |

| Situs Fund | | As of December 31, 2014 |

Management’s Discussion of Fund Performance

Portfolio Managers:

Randy Bateman, CFA

Chief Investment Officer

Kirk Mentzer, MBA

Director of Fund Research

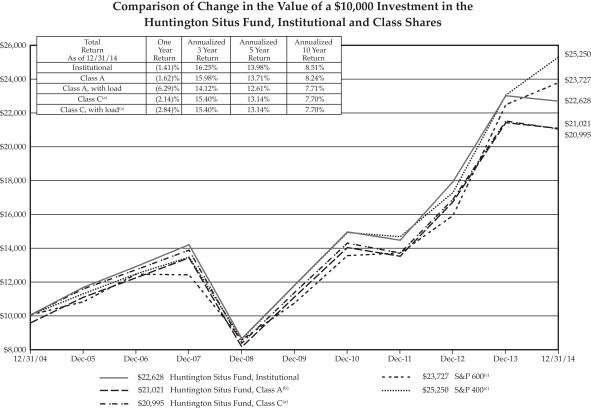

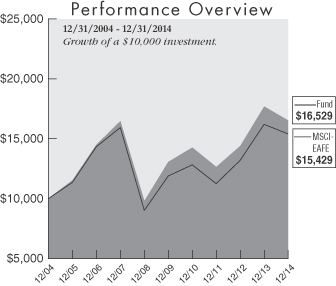

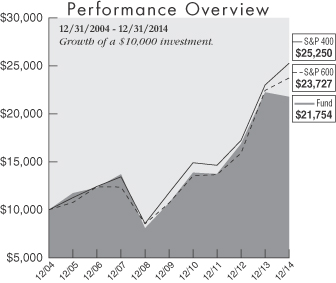

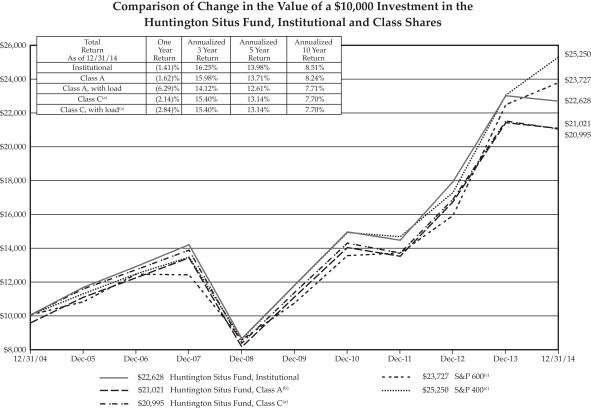

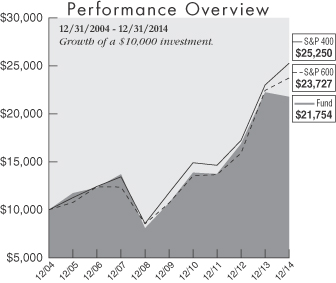

For the fiscal year ended December 31, 2014, the Huntington Situs Fund’s (“Fund”) Institutional Shares and Class A Shares produced total returns (not including the deduction of applicable sales charges) of (1.41)% and (1.62)%, respectively, based upon net asset value. The Fund underperformed relative to the 5.76% total return of the Standard and Poor’s SmallCap 600 Index® (“S&P 600”)(a), its benchmark, and the 9.77% total return of the Standard and Poor’s MidCap 400 Index® (“S&P 400”)(b) for the same period. The Fund’s Class A shares underperformed the benchmark by (7.38)%.

Prior to the beginning of the fiscal year, the Huntington Mid Corp America Fund was merged into the Fund adding close to $200 million to the size of the Fund and providing an opportunity to reduce the Fund’s expense ratio. Much of the portfolio structure underperformance was as a result of the integration of the Huntington Mid Corp America Fund as its capitalization had always been benchmarked to the Mid Cap marketplace. The Fund’s underperformance was primarily the result of certain stocks that fell along with the drop in the price of oil. With overproduction and a commitment by OPEC to maintain current production levels, oil prices fell precipitously during the final quarter of 2014, and GeoSpace Technologies and Carbo Ceramics were both heavily impacted by the energy price change.

One of the major drivers of performance from a stock selection perspective was TASER International, Inc. (“TASER”), which added 1.96% to the Fund’s performance for the 4th quarter and had been a minor holding until early autumn. The Fund made a major commitment to the holding following the events in Ferguson, Missouri. In the aftermath of the incident, a large number of police departments made commitments to TASER’s body cameras. This was duplicated internationally and the stock rose accordingly. Currently, the company is the largest single holding of the Fund. In addition to TASER, four other companies moved into the top ten holdings of the Fund. Watts Water, South State Bank, Sanderson Farms and Tyler Technologies were among the major structural changes in the Fund’s efforts to expand into earnings driven corporations for the coming quarters.

The markets in 2014 were primarily impacted by activities surrounding the monetary policies of the Federal Reserve System (“Fed”), international turmoil, the Ebola virus scare and the change in Congressional makeup as a result of the November 2014 elections. The Fed ended its quantitative easing monetary policy in October and the markets handled the news in stride. In fact, much of the performance of the markets for the entire year occurred following the Fed’s withdrawal from its bond purchase program. This was particularly evident in the S&P 600, which was down 3.74% for the first nine months of the year then recovered with a 9.83% rebound in the fourth quarter, allowing the index to increase 5.76% for the entire year.

Annual Shareholder Report

8

Situs Fund (Continued)

| (a) | The S&P 600 is a capitalization-weighted index representing all major industries in the small-cap range of the U.S. stock market. The index is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an Index. |

| (b) | The S&P 400 is a capitalization-weighted index comprised of common stocks representing all major industries in the mid-range of the U.S. stock market. The index is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an Index. |

This commentary may include statements that constitute “forward looking statements” under the U.S. securities laws. Forward-looking statements include, among other things, projections, estimates, and information about possible or future results related to the Fund, market or regulatory developments. The views expressed above are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein. The views expressed above are those of the Advisor as of December 31, 2014 and are subject to change at any time based upon economic, market, or other conditions and the Advisor undertakes no obligation to update the views expressed herein. Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. The views expressed above (including any forward-looking statement) may not be relied upon as investment advice or as an indication of the Fund’s trading intent. Information about the Fund’s holdings, asset allocation or country diversification is historical and is not an indication of future Fund composition, which may vary.

The performance of any index mentioned in this commentary has not been adjusted for ongoing management, distribution and operating expenses, and sales charges applicable to mutual fund investments. If these additional fees were reflected, performance would have been lower.

Annual Shareholder Report

9

Situs Fund (Continued)

The Fund’s past performance does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end or after-tax returns may be obtained by calling 1-800-253-0412. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. Total returns, with load, include the 4.75% maximum sales charge for the Class A shares or the 1.00% maximum deferred sales charge for the Class C shares.

| | | | |

| Class | | Expense Ratios | |

| Institutional Shares | | | 1.03% | |

| Class A Shares | | | 1.28% | |

| Class C Shares | | | 1.78% | |

The above expense ratios are from the Fund’s prospectus dated April 30, 2014, as amended September 2, 2014. Additional information pertaining to the Fund’s expense ratios as of December 31, 2014 can be found in the financial highlights.

The Fund’s performance assumes the reinvestment of all dividends and distributions. The performance above reflects any fee reductions during the applicable periods. If such fee reductions had not occurred, the quoted performance would have been lower. The S&P 600 and S&P 400 have been adjusted to reflect reinvestment of dividends on securities in the indices.

International investing involves special risks including currency risk, political risk, increased volatility of foreign securities, and differences in auditing and other financial standards. In addition, prices of emerging markets securities can be significantly more volatile than the prices of securities in developed countries.

Small company stocks may be less liquid and subject to greater price volatility than large capitalization stocks.

Funds whose investments are concentrated in a specific industry or sector may be subject to a higher degree of market risk than funds whose investments are diversified. In addition, the Fund may be subject to specific risks of the information technology sector, such as obsolescence.

The Fund is distributed by Unified Financial Securities, Inc. (Member FINRA), a wholly-owned subsidiary of Huntington Bancshares, Inc., and an affiliate of Huntington Asset Advisors, Inc., the advisor of the Huntington Funds.

Annual Shareholder Report

10

Situs Fund (Continued)

| (a) | Class C Shares commenced operations on January 3, 2014. Prior to January 3, 2014, performance is based on the performance of Class A Shares adjusted for the Class C Shares’ 12b-1 fees and contingent deferred sales charge. |

| (b) | Represents a hypothetical investment of $10,000 in the Fund after deducting the maximum sales load of 4.75% ($10,000 investment minus $475 sales load = $9,525). |

| (c) | The S&P 600 and S&P 400 are not adjusted to reflect sales charges, expenses, or other fees that are reflected in the Fund’s performance. The indices are unmanaged and, unlike the Fund, are not affected by cash flows. It is not possible to invest directly in an index. |

Annual Shareholder Report

11

| | |

| Balanced Allocation Fund | | As of December 31, 2014 |

Management’s Discussion of Fund Performance

Portfolio Manager:

Randy Bateman, CFA

Chief Investment Officer

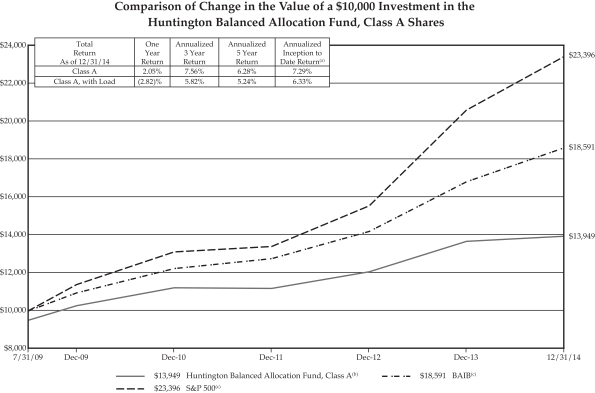

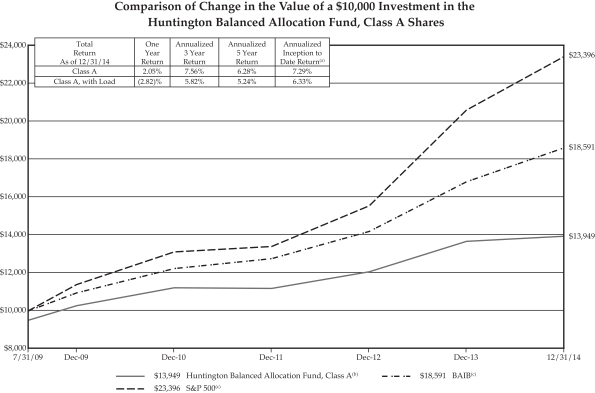

For the fiscal year ended December 31, 2014, the Huntington Balanced Allocation Fund’s (“Fund”) Class A Shares produced a total return (not including the deduction of applicable sales charges) of 2.05% based upon net asset value. The Fund underperformed relative to the 13.69% total return of the Standard & Poor’s 500 Index® (“S&P 500”)(a), its benchmark, and the 10.60% total return of the Balanced Allocation Indices Blend (“BAIB”)(b) for the same period.

Contributing to the performance was the Fund’s exposure of 57.3% in growth assets, 19.5% in income focused securities and 22.2% in stable assets. At year end, the Fund was balanced with exposure to the Federated Short-Intermediate Total Return Bond Fund at 7.2%(c) of net assets, the Huntington Global Select Markets Fund at 15.0%(c) of net assets and the Huntington Dividend Capture Fund, at 9.5%(c) of net assets. Other levels of exposure included the Huntington EcoLogical Strategy ETF at 12.7%(c) of net assets, the Huntington US Equity Rotation Strategy ETF at 11.6%(c) of net assets and the Huntington Situs Fund at 8.5%(c) of net assets. Other fixed income exposures included the Federated Total Return Government Bond Fund at 7.2%(c) of net assets and the Federated Mortgage Fund at 5.1%(c) of net assets. During the last days of 2014, the Fund was reallocated and the money market fund position was larger than traditionally maintained. Overall, the Fund was extremely diversified and reflected the market expectations of the Huntington Asset Advisors, Inc.

During much of the year, the Federal Reserve Bank (“Fed”) continued its strategy of maintaining an extremely easy monetary policy through quantitative easing (“QE”). In October, however, the Fed ceased the formal QE program and, despite fears of a market reversal, investors took the change in stride. In fact, most of the equity markets improved significantly in the fourth quarter. Stocks continued to build on their five year rally as Fed liquidity and the economic recovery led to higher corporate profits and continued optimism by investors. It was against this backdrop that the Fund maintained a moderate exposure to risk-based securities and rebalanced cash into equities. During the year, substantial changes were effected to adjust the asset allocation to match the opportunities that the markets presented.

| (a) | The S&P 500 is a capitalization-weighted index comprised of 500 stocks and designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The index is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an Index. |

| (b) | The Balanced Allocation Indices Blended Benchmark is a custom blended index comprised of the following two indices with their noted respective weightings: S&P 500 (60%) and the Barclays U.S. Aggregate Bond Index (40%). The Barclays U.S. Aggregate Bond Index is comprised of securities from the Barclays Government/Corporate Bond Index, Mortgage Securities Index and the Asset Based Index. Total return comprises price appreciation/depreciation and income as a percentage of the original investment. Indices are rebalanced monthly by market capitalization. The index is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an Index. |

| (c) | Percentage of holdings based on Fund’s net assets as of 12/31/2014. The composition of the Fund’s holdings is subject to change. |

This commentary may include statements that constitute “forward looking statements” under the U.S. securities laws. Forward-looking statements include, among other things, projections, estimates, and information about possible or future results related to the Fund, market or regulatory developments. The views expressed above are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein. The views expressed above are those of the Advisor as of December 31, 2014 and are subject to change at any time based upon economic, market, or other conditions and the Advisor undertakes no obligation to update the views expressed herein. Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. The views expressed above (including any forward-looking statement) may not be relied upon as investment advice or as an indication of the Fund’s trading intent. Information about the Fund’s holdings, asset allocation or country diversification is historical and is not an indication of future Fund composition, which may vary.

The performance of any index mentioned in this commentary has not been adjusted for ongoing management, distribution and operating expenses, and sales charges applicable to mutual fund investments. If these additional fees were reflected, performance would have been lower.

Annual Shareholder Report

12

Balanced Allocation Fund (Continued)

The Fund’s past performance does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end or after-tax returns may be obtained by calling 1-800-253-0412. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. Total returns, at load, include the 4.75% maximum sales charge for the Class A Shares.

| | | | |

| Class | | Expense Ratio | |

| Class A Shares | | | 1.90% | |

The above expense ratio is from the Fund’s prospectus dated April 30, 2014, as amended September 2, 2014. Additional information pertaining to the Fund’s expense ratio as of December 31, 2014 can be found in the financial highlights.

The Fund’s performance assumes the reinvestment of all dividends and distributions on securities. The performance above reflects any fee reductions during the applicable periods. If such fee reductions had not occurred, the quoted performance would have been lower. The S&P 500 and BAIB have been adjusted to reflect reinvestment of dividends on securities in the indices.

The Fund is distributed by Unified Financial Securities, Inc. (Member FINRA) a wholly-owned subsidiary of Huntington Bancshares, Inc. and an affiliate of Huntington Asset Advisors, Inc., the advisor to the Huntington Funds.

| (a) | The Fund commenced operations on July 31, 2009. |

| (b) | Represents a hypothetical investment of $10,000 in the Fund after deducting the maximum sales load of 4.75% ($10,000 investment minus $475 sales load = $9,525). |

| (c) | The S&P 500 and BAIB are not adjusted to reflect sales charges, expenses, or other fees that are reflected in the Fund’s performance. The indices are unmanaged and, unlike the Fund, are not affected by cash flows. It is not possible to invest directly in an index. |

Annual Shareholder Report

13

| | |

| Conservative Allocation Fund | | As of December 31, 2014 |

Management’s Discussion of Fund Performance

Portfolio Manager:

Randy Bateman, CFA

Chief Investment Officer

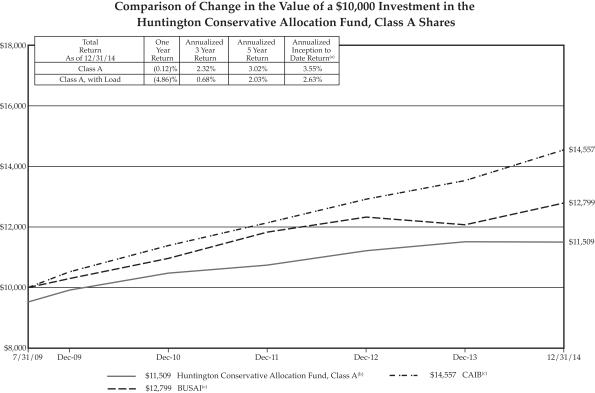

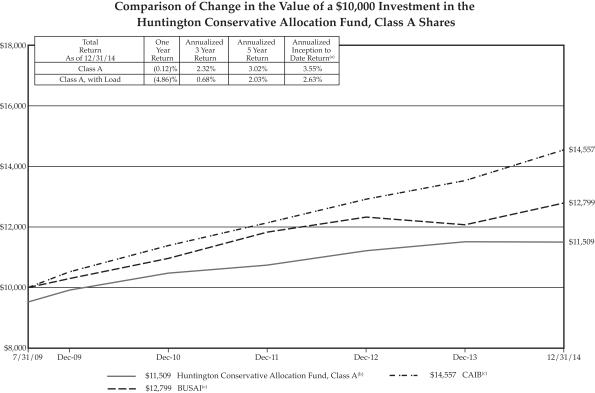

For the fiscal year ended December 31, 2014, the Huntington Conservative Allocation Fund’s (“Fund”) Class A Shares produced a total return (not including the deduction of applicable sales charges) of (0.12)% based upon net asset value. The Fund underperformed relative to the 5.97% total return of the Barclays U.S. Aggregate Bond Index (“BUSAI”)(a), its benchmark, and underperformed relative to the 7.51% total return for the Conservative Allocation Indices Blend (“CAIB”)(b) for the same period.

The Fund’s investment in the Huntington World Income Fund, sold in Q4, detracted from performance during the year. Despite the underperformance to the benchmark index, the Fund maintained relatively larger exposure to the equity markets, which enjoyed a strong fourth quarter, later in the year and could set the Fund up for better performance as we begin 2015. At year end, the Fund was balanced with exposure to the Federated Total Return Bond Fund at 14.1%(c) of net assets, the Federated Short-Intermediate Total Return Bond Fund with 14.1%(c) of net assets and the Federated Mortgage Fund, at 9.8%(c) of net assets. The largest growth components were a 10.8%(c) of net assets to the Huntington Global Select Markets Fund, 6.6%(c) of net assets to the Huntington Dividend Capture Fund and exposure to both the Huntington Ecological Strategy ETF and the Huntington U.S. Equity Rotation Strategy ETF for a combined 9.9%(c) of net assets. There was a rebalancing that occurred at year end that resulted in a heavier exposure to money markets funds. Those funds were allocated to the fixed income portion of the portfolio. For those reasons, the Fund maintained a beta(d) of only 0.6 at year-end.

During much of the year, the Federal Reserve Bank (“Fed”) continued its strategy of maintaining an extremely easy monetary policy through quantitative easing (“QE”). In October, however, the Fed ceased the formal QE program and, despite fears of a market reversal, investors took the change in stride. In fact, most of the equity markets improved significantly in the fourth quarter and bond portfolios fared better than expected. Extremely low international interest rates prevailed as worldwide economies were virtually inflation-free and central banks were willing to provide liquidity. Stocks continued to build on their five year rally as Fed liquidity and the economic recovery led to higher corporate profits and continued optimism by investors. It was against this backdrop that the manager of the Fund maintained its exposure to risk-based securities. During the year substantial changes were effected to adjust the asset allocation to match the opportunities that the markets presented.

Annual Shareholder Report

14

Conservative Allocation Fund (Continued)

| (a) | The Barclay’s U.S. Aggregate Bond Index is composed of securities from the Barclay’s Government/Corporate Bond Index, Mortgage Securities Index and the Asset Based Securities Index. Total return comprises price appreciation/depreciation and income as a percentage of the original investment. Indices are rebalanced monthly by market capitalization. The index is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an Index. |

| (b) | The Conservative Allocation Indices Blended Benchmark is a custom blended index comprised of the following two indices with their noted respective weightings: Standard & Poor’s 500 Index® (“S&P 500”) (20%) and the Barclays U.S. Aggregate Bond Index (80%). The S&P 500 is an unmanaged index generally representing the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Investments cannot be made in an index. |

| (c) | Percentage of holdings based on Fund’s net assets as of 12/31/2014. The composition of the Fund’s holdings is subject to change. |

| (d) | The beta of an investment is a measure of the risk arising from exposure to general market movements as opposed to idiosyncratic factors. A beta below 1 can indicate either an investment with lower volatility than the market, or a volatile investment whose price movements are not highly correlated with the market. |

This commentary may include statements that constitute “forward looking statements” under the U.S. securities laws. Forward-looking statements include, among other things, projections, estimates, and information about possible or future results related to the Portfolio, market or regulatory developments. The views expressed above are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein. The views expressed above are those of the Advisor as of December 31, 2014 and are subject to change at any time based upon economic, market, or other conditions and the Advisor undertakes no obligation to update the views expressed herein. Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. The views expressed above (including any forward-looking statement) may not be relied upon as investment advice or as an indication of the Fund’s trading intent. Information about the Fund’s holdings, asset allocation or country diversification is historical and is not an indication of future Fund composition, which may vary.

The performance of any index mentioned in this commentary has not been adjusted for ongoing management, distribution and operating expenses, and sales charges applicable to mutual fund investments. If these additional fees were reflected, performance would have been lower.

Annual Shareholder Report

15

Conservative Allocation Fund (Continued)

The Fund’s past performance does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end or after-tax returns may be obtained by calling 1-800-253-0412. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. Total returns, at load, include the 4.75% maximum sales charge for the Class A Shares.

| | | | |

| Class | | Expense Ratio | |

| Class A Shares | | | 1.90% | |

The above expense ratio is from the Fund’s prospectus dated April 30, 2014, as amended September 2, 2014. Additional information pertaining to the Fund’s expense ratio as of December 31, 2014 can be found in the financial highlights.

The Fund’s performance assumes the reinvestment of all dividends and distributions on securities. The performance above reflects any fee reductions during the applicable periods. If such fee reductions had not occurred, the quoted performance would have been lower. The BUSAI and CAIB have been adjusted to reflect reinvestment of dividends on securities in the indices.

The Fund is distributed by Unified Financial Securities, Inc. (Member FINRA) a wholly-owned subsidiary of Huntington Bancshares, Inc. and an affiliate of Huntington Asset Advisors, Inc., the advisor to the Huntington Funds.

| (a) | The Fund commenced operations on July 31, 2009. |

| (b) | Represents a hypothetical investment of $10,000 in the Fund after deducting the maximum sales load of 4.75% ($10,000 investment minus $475 sales load = $9,525). |

| (c) | The BUSAI and CAIB are not adjusted to reflect sales charges, expenses, or other fees that are reflected in the Fund’s performance. The indices are unmanaged and, unlike the Fund, are not affected by cash flows. It is not possible to invest directly in an index. |

Annual Shareholder Report

16

| | |

| Growth Allocation Fund | | As of December 31, 2014 |

Management’s Discussion of Fund Performance

Portfolio Manager:

Randy Bateman, CFA

Chief Investment Officer

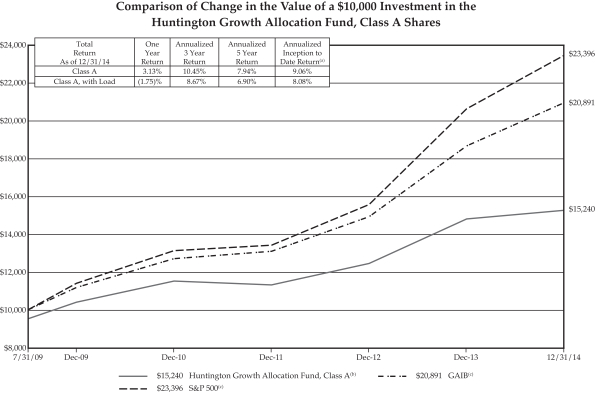

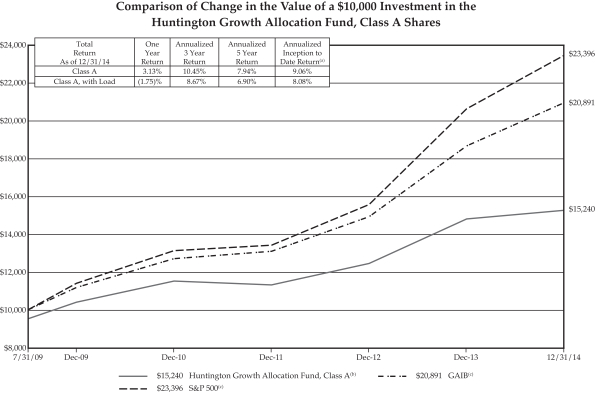

For the fiscal year ended December 31, 2014, the Huntington Growth Allocation Fund’s (“Fund”) Class A Shares produced a total return of (not including the deduction of applicable sales charges) 3.13% based upon net asset value. The Fund underperformed relative to the 13.69% total return of the Standard & Poor’s 500 Index®, (“S&P 500”)(a), its benchmark and the 12.14% total return for the Growth Allocation Indices Blend (“GAIB”)(b) for the same period.

Contributing to the Fund’s performance was its exposure of 77.7% to growth assets, 10.4% to income focused securities and 11.6% to stable assets. At year end, the Fund was balanced with exposure to the Huntington Global Select Markets Fund at 21.2%(c) of net assets, and the Huntington EcoLogical Strategy ETF which constituted 16.2%(c) of net assets. Other levels of exposure included the Huntington U.S. Equity Rotation Strategy ETF at 14.7%(c) of net assets, the Huntington Dividend Capture Fund at 13.9%(c) of net assets and the Huntington Situs Fund at 11.8%(c) of net assets. The largest exposure to fixed income funds was the 7.4%(c) of net assets commitment to the Federated Total Return Bond Fund. Overall, the Fund was extremely diversified and reflected the market expectations of Huntington Asset Advisors, Inc.

During much of the year, the Federal Reserve Bank (“Fed”) continued its strategy of maintaining an extremely easy monetary policy through quantitative easing (“QE”). In October, however, the Fed ceased the formal QE program and, despite fears of a market reversal, investors took the change in stride. In fact most of the equity markets improved significantly in the fourth quarter. Stocks continued to build on their five year rally as Fed liquidity and the economic recovery led to higher corporate profits and continued optimism by investors. It was against this backdrop that the manager of the Fund maintained its heavy exposure to risk-based securities. During the year substantial changes were effected to adjust the asset allocation to match the opportunities that the markets presented.

| (a) | The S&P 500 is a capitalization-weighted index comprised of 500 stocks and designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The index is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an Index. |

| (b) | The Growth Allocation Indices Blended Benchmark is a custom blended index comprised of the following two indices with their noted respective weightings: S&P 500 (80%) and the Barclays U.S. Aggregate Bond Index (20%). The Barclays U.S. Aggregate Bond Index is comprised of securities from the Barclays Government/Corporate Bond Index, Mortgage Securities Index and the Asset Based Index. Total return comprises price appreciation/depreciation and income as a percentage of the original investment. Indices are rebalanced monthly by market capitalization. The index is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an Index. Investments cannot be made in an index. |

| (c) | Percentage of holdings based on Fund’s net assets as of 12/31/2014. The composition of the Fund’s holdings is subject to change. |

This commentary may include statements that constitute “forward looking statements” under the U.S. securities laws. Forward-looking statements include, among other things, projections, estimates, and information about possible or future results related to the Portfolio, market or regulatory developments. The views expressed above are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein. The views expressed above are those of the Advisor as of December 31, 2014 and are subject to change at any time based upon economic, market, or other conditions and the Advisor undertakes no obligation to update the views expressed herein. Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. The views expressed above (including any forward-looking statement) may not be relied upon as investment advice or as an indication of the Fund’s trading intent. Information about the Fund’s holdings, asset allocation or country diversification is historical and is not an indication of future Fund composition, which may vary.

The performance of any index mentioned in this commentary has not been adjusted for ongoing management, distribution and operating expenses, and sales charges applicable to mutual fund investments. If these additional fees were reflected, performance would have been lower.

Annual Shareholder Report

17

Growth Allocation Fund (Continued)

The Fund’s past performance does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end or after-tax returns may be obtained by calling 1-800-253-0412. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. Total returns, at load, include the 4.75% maximum sales charge for the Class A Shares.

| | | | |

| Class | | Expense Ratio | |

| Class A Shares | | | 1.90% | |

The above expense ratio is from the Fund’s prospectus dated April 30, 2014, as amended September 2, 2014. Additional information pertaining to the Fund’s expense ratio as of December 31, 2014 can be found in the financial highlights.

The Fund’s performance assumes the reinvestment of all dividends and distributions on securities. The performance above reflects any fee reductions during the applicable periods. If such fee reductions had not occurred, the quoted performance would have been lower. The S&P 500 and GAIB have been adjusted to reflect reinvestment of dividends on securities in the indices.

The Fund is distributed by Unified Financial Securities, Inc. (Member FINRA) a wholly-owned subsidiary of Huntington Bancshares, Inc. and an affiliate of Huntington Asset Advisors, Inc., the advisor to the Huntington Funds.

| (a) | The Fund commenced operations on July 31, 2009. |

| (b) | Represents a hypothetical investment of $10,000 in the Fund after deducting the maximum sales load of 4.75% ($10,000 investment minus $475 sales load = $9,525). |

| (c) | The S&P 500 and GAIB are not adjusted to reflect sales charges, expenses, or other fees that are reflected in the Fund’s performance. The indices are unmanaged and, unlike the Fund, are not affected by cash flows. It is not possible to invest directly in an index. |

Annual Shareholder Report

18

| | |

| Huntington Money Market Fund | | December 31, 2014 |

| | |

| Portfolio of Investments Summary Table | | (unaudited) |

| | | | |

| Asset Allocation | | Percentage of

Market Value | |

U.S. Government Agencies | | | 29.1% | |

Corporate Bonds | | | 24.5% | |

Repurchase Agreements | | | 24.2% | |

Commercial Paper | | | 20.0% | |

Yankee Certificates of Deposit | | | 2.2% | |

Total | | | 100.0% | |

Portfolio holdings and allocations are subject to change. As of December 31, 2014, percentages in the table above are based on total investments. Such total investments may differ from the percentages set forth below in the Portfolio of Investments which are computed using the Fund’s net assets.

Portfolio of Investments

| | | | | | | | | | |

Principal

Amount | | | | | Fair Value | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Corporate Bonds — 23.9% | | | | | | |

| Consumer Staples — 1.9% | | | | | | |

| $ | 1,985,000 | | | PepsiCo, Inc.,

3.100%, 1/15/15 | | $ | 1,987,203 | | | |

| | 1,720,000 | | | PepsiCo, Inc., 0.433%, 7/30/15 (a) | | | 1,721,934 | | | |

| | 1,950,000 | | | Procter & Gamble Co./The, 3.500%, 2/15/15 | | | 1,957,678 | | | |

| | | | | | | | 5,666,815 | | | |

| Financials — 13.6% | | | | | | |

| | 10,000,000 | | | Bank of Montreal, MTN, 0.505%, 9/24/15 (a) | | | 10,017,404 | | | |

| | 7,500,000 | | | JPMorgan Chase & Co., MTN, 1.297%, 3/20/15 (a) | | | 7,515,455 | | | |

| | 7,500,000 | | | National Australia Bank Ltd., 0.436%, 5/28/15 (a) (b) | | | 7,506,067 | | | |

| | 6,540,000 | | | Royal Bank of Canada, 3.125%, 4/14/15 (b) | | | 6,593,557 | | | |

| | 7,573,000 | | | Wells Fargo & Co., 0.433%, 10/28/15 (a) | | | 7,580,714 | | | |

| | 1,000,000 | | | Westpac Banking Corp., 0.483%, 1/29/15 (a) (b) | | | 1,000,221 | | | |

| | | | | | | | 40,213,418 | | | |

| Health Care — 1.7% | | | | | | |

| | 5,000,000 | | | Medtronic, Inc., 3.000%, 3/15/15 | | | 5,027,401 | | | |

| Industrials — 4.1% | | | | | | |

| | 1,200,000 | | | Emerson Electric Co., 4.125%, 4/15/15 | | | 1,213,008 | | | |

| | 7,500,000 | | | Honeywell International, 0.210%, 6/24/15 (c) (d) | | | 7,492,388 | | | |

| | 3,600,000 | | | John Deere Capital Corp., MTN, 0.361%, 6/15/15 (a) | | | 3,602,795 | | | |

| | | | | | | | 12,308,191 | | | |

| Information Technology — 2.6% | | | | | | |

| | 2,650,000 | | | eBay, Inc., 1.625%, 10/15/15 | | | 2,672,230 | | | |

| | | | | | | | | | |

Principal

Amount | | | | | Fair Value | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Corporate Bonds — (Continued) | | | | | | |

| Information Technology — (Continued) | | | | | | |

| $ | 5,000,000 | | | International Business Machines Corp.,

0.550%, 2/6/15 | | $ | 5,001,657 | | | |

| | | | | | | | 7,673,887 | | | |

| Total Corporate Bonds (Cost $70,889,712) | | | 70,889,712 | | | |

| Commercial Paper — 19.6% (c) (d) | | | | | | |

| Consumer Discretionary — 2.5% | | | | | | |

| | 7,500,000 | | | Walt Disney Co./The, 0.110%, 3/18/15 | | | 7,498,258 | | | |

| Consumer Staples — 1.7% | | | | | | |

| | 5,000,000 | | | Coca-Cola Co.,

0.160%, 4/10/15 | | | 4,997,800 | | | |

| Financials — 12.7% | | | | | | |

| | 10,000,000 | | | Bank of Nova Scotia, 0.230%, 6/19/15 | | | 9,989,203 | | | |

| | 7,500,000 | | | Credit Suisse,

0.321%, 5/21/15 | | | 7,490,667 | | | |

| | 10,000,000 | | | Mizuho Funding LLC, 0.200%, 2/23/15 | | | 9,997,056 | | | |

| | 10,000,000 | | | Toronto-Dominion Holdings, Inc., 0.210%, 6/1/15 | | | 9,991,192 | | | |

| | | | | | | | 37,468,118 | | | |

| Industrials — 2.7% | | | | | | |

| | 8,000,000 | | | Emerson Electric Co., 0.170%, 4/6/15 | | | 7,996,411 | | | |

| Total Commercial Paper (Cost $57,960,587) | | | 57,960,587 | | | |

| Yankee Certificates of Deposit — 2.1% | | | | | | |

| Financials — 2.1% | | | | | | |

| | 634,000 | | | Bank of Montreal, 0.230%, 4/14/15 (a) | | | 633,964 | | | |

| | 4,850,000 | | | Credit Suisse,

0.553%, 8/24/15 (a) | | | 4,852,259 | | | |

(See notes which are an integral part of the Financial Statements)

Annual Shareholder Report

19

| | |

| Huntington Money Market Fund | | (Continued) |

| | | | | | | | | | |

Principal

Amount | | | | | Fair Value | | | |

| | | | | | | | | | |

| Yankee Certificates of Deposit — (Continued) | | | | | | |

| Financials — (Continued) | | | | | | |

| $ | 500,000 | | | Toronto-Dominion Bank, 0.231%, 4/15/15 (a) | | $ | 499,986 | | | |

| | 300,000 | | | Westpac Banking Corp., 0.247%, 3/20/15 (a) | | | 299,986 | | | |

| Total Yankee Certificates of Deposit

(Cost $6,286,195) | | | 6,286,195 | | | |

| U.S. Government Agencies — 28.5% | | | | | | |

| Federal Farm Credit Bank — 13.4% | | | | | | |

| | 10,000,000 | | | 0.230%, 3/16/15 (a) | | | 10,003,000 | | | |

| | 5,045,000 | | | 0.190%, 3/20/15 (a) | | | 5,046,163 | | | |

| | 4,500,000 | | | 0.184%, 4/23/15 (a) | | | 4,501,277 | | | |

| | 10,000,000 | | | 0.185%, 4/27/15 (a) | | | 10,002,434 | | | |

| | 10,000,000 | | | 0.130%, 8/7/15 (a) | | | 10,000,623 | | | |

| | | | | | | | 39,553,497 | | | |

| Federal Home Loan Bank — 3.4% | | | | | | |

| | 10,000,000 | | | 0.250%, 2/20/15 | | | 10,002,336 | | | |

| Federal Home Loan Bank Discount

Note — 7.8% | | | | | | |

| | 23,125,000 | | | 0.169%, 3/20/15 (c) (d) | | | 23,116,633 | | | |

| Federal National Mortgage

Association — 3.9% | | | | | | |

| | 11,650,000 | | | 0.140%, 2/27/15 (a) | | | 11,650,955 | | | |

| Total U.S. Government Agencies

(Cost $84,323,421) | | | 84,323,421 | | | |

| | | | | | | | | | |

Principal

Amount | | | | | Fair Value | | | |

| | | | | | | | | | |

| Repurchase Agreements — 23.6% | | | | | | |

| $ | 70,000,000 | | | TD Securities, 0.060%,

dated 12/30/14, due 1/2/15, repurchase price $70,000,467 (collateralized by U.S. Treasury Note, 3.750% 11/15/18, market value $71,701,398) | | $ | 70,000,000 | | | |

| Total Repurchase Agreements

(Cost $70,000,000) | | | 70,000,000 | | | |

| Total Investments

(Cost $289,459,915) — 97.7% | | | 289,459,915 | | | |

| Other Assets in Excess of Liabilities — 2.3% | | | 6,813,640 | | | |

| Net Assets — 100.0% | | $ | 296,273,555 | | | |

| (a) | Variable or Floating Rate Security. Rate disclosed is as of December 31, 2014. |

| (b) | Security exempt from registration under Rule 144A or Section 4(2) of the Securities Act of 1933. The security may be resold in transactions exempt from registration, normally to qualified institutional buyers. These securities have been deemed liquid by the Advisor in accordance with guidelines established by the Trustees. |

| (c) | Rate represents the effective yield at purchase. |

(See notes which are an integral part of the Financial Statements)

Annual Shareholder Report

20

| | |

| Huntington U.S. Treasury Money Market Fund | | December 31, 2014 |

| | |

| Portfolio of Investments Summary Table | | (unaudited) |

| | | | |

| Asset Allocation | | Percentage of

Market Value | |

U.S. Treasury Obligations | | | 73.8% | |

Repurchase Agreements | | | 26.2% | |

Total | | | 100.0% | |

Portfolio holdings and allocations are subject to change. As of December 31, 2014, percentages in the table above are based on total investments. Such total investments may differ from the percentages set forth below in the Portfolio of Investments which are computed using the Fund’s net assets.

Portfolio of Investments

| | | | | | | | | | |

Principal

Amount | | | | | Fair Value | | | |

| | | | | | | | | | |

| U.S. Treasury Obligations — 72.9% | | | | | | |

| U.S. Treasury Bills — 15.5% (a) | | | | | | |

| $ | 40,215,000 | | | 0.031%, 1/15/15 | | $ | 40,214,515 | | | |

| | 90,000,000 | | | 0.000%, 1/22/15 | | | 90,000,000 | | | |

| | 35,000,000 | | | 0.117%, 6/25/15 | | | 34,980,166 | | | |

| | | | | | | | 165,194,681 | | | |

| U.S. Treasury Notes — 57.4% | | | | | | |

| | 75,000,000 | | | 2.250%, 1/31/15 | | | 75,135,294 | | | |

| | 25,000,000 | | | 0.250%, 1/31/15 | | | 25,003,447 | | | |

| | 75,000,000 | | | 0.250%, 2/15/15 | | | 75,019,655 | | | |

| | 35,000,000 | | | 2.375%, 2/28/15 | | | 35,131,231 | | | |

| | 50,000,000 | | | 0.375%, 3/15/15 | | | 50,028,892 | | | |

| | 25,000,000 | | | 0.250%, 3/31/15 | | | 25,011,763 | | | |

| | 75,000,000 | | | 0.125%, 4/30/15 | | | 75,014,628 | | | |

| | 50,000,000 | | | 0.250%, 5/15/15 | | | 50,027,173 | | | |

| | 50,000,000 | | | 0.250%, 5/31/15 | | | 50,037,029 | | | |

| | 125,000,000 | | | 0.099%, 4/30/16 (b) | | | 125,006,394 | | | |

| | 25,000,000 | | | 0.083%, 10/31/16 (b) | | | 24,977,041 | | | |

| | | | | | | | 610,392,547 | | | |

| Total U.S. Treasury Obligations

(Cost $775,587,228) | | | 775,587,228 | | | |

| | | | | | | | | | |

Principal

Amount | | | | | Fair Value | | | |

| | | | | | | | | | |

| Repurchase Agreements — 25.8% | | | | | | |

| $ | 150,000,000 | | | TD Securities, 0.060%,

dated 12/30/14, due 1/2/15, repurchase price $150,000,750 (collateralized by U.S. Treasury Note, 3.750% 11/15/18, market value $153,645,852) | | $ | 150,000,000 | | | |

| | 125,000,000 | | | TD Securities, 0.080%,

dated 12/29/14, due 1/2/15, repurchase price $125,001,111 (collateralized by U.S. Treasury Note, 2.125% 6/30/21, market value $127,500,000) | | | 125,000,000 | | | |

| Total Repurchase Agreements

(Cost $275,000,000) | | | 275,000,000 | | | |

| Total Investments

(Cost $1,050,587,228) — 98.7% | | | 1,050,587,228 | | | |

| Other Assets in Excess of Liabilities — 1.3% | | | 14,156,573 | | | |

| Net Assets — 100.0% | | $ | 1,064,743,801 | | | |

| (a) | Rate represents the effective yield at purchase. |

| (b) | Variable or Floating Rate Security. Rate disclosed is as of December 31, 2014. |

(See notes which are an integral part of the Financial Statements)

Annual Shareholder Report

21

| | |

| Huntington Dividend Capture Fund | | December 31, 2014 |

| | |

| Portfolio of Investments Summary Table | | (unaudited) |

| | | | |

| Asset Allocation | | Percentage of

Market Value | |

Financials | | | 31.5% | |

Real Estate Investment Trusts | | | 13.9% | |

Energy | | | 8.7% | |

Information Technology | | | 7.4% | |

Health Care | | | 6.7% | |

Consumer Staples | | | 6.0% | |

Industrials | | | 5.9% | |

Cash(a) | | | 4.4% | |

Utilities | | | 3.8% | |

Short-Term Securities Held as Collateral for Securities Lending | | | 3.0% | |

Consumer Discretionary | | | 2.9% | |

Telecommunication Services | | | 2.5% | |

Exchange-Traded Funds | | | 1.7% | |

Materials | | | 1.6% | |

Total | | | 100.0% | |

| (a) | Investments in an affiliated money market fund. |

Portfolio holdings and allocations are subject to change. As of December 31, 2014, percentages in the table above are based on total investments. Such total investments may differ from the percentages set forth below in the Portfolio of Investments which are computed using the Fund’s net assets.

The Portfolio of Investments Summary Table and the Portfolio of Investments are broken down by sectors, and these sectors do not represent industry categories for purposes of identifying “industry concentration” as described in the Investment Company Act of 1940, as amended.

Portfolio of Investments

| | | | | | | | | | |

| Shares | | | | | Fair Value | | | |

| | | | | | | | | | |

| Common Stocks — 70.2% | | | | | | |

| Consumer Discretionary — 3.0% | | | | | | |

| | 16,500 | | | Comcast Corp., Class A | | $ | 957,165 | | | |

| | 72,000 | | | Ford Motor Co. | | | 1,116,000 | | | |

| | 53,250 | | | International Game Technology | | | 918,563 | | | |

| | 10,000 | | | McDonalds Corp. | | | 937,000 | | | |

| | 27,000 | | | Starwood Hotels & Resorts Worldwide, Inc. | | | 2,188,890 | | | |

| | | | | | | | 6,117,618 | | | |

| Consumer Staples — 6.2% | | | | | | |

| | 68,250 | | | Campbell Soup Co. | | | 3,003,000 | | | |

| | 21,750 | | | Colgate-Palmolive Co. | | | 1,504,882 | | | |

| | 50,000 | | | Flowers Foods, Inc. | | | 959,500 | | | |

| | 24,500 | | | Kellogg Co. | | | 1,603,280 | | | |

| | 26,000 | | | Kimberly-Clark Corp. | | | 3,004,040 | | | |

| | 22,500 | | | Philip Morris International, Inc. | | | 1,832,625 | | | |

| | 7,000 | | | Wal-Mart Stores, Inc. | | | 601,160 | | | |

| | | | | | | | 12,508,487 | | | |

| Energy — 8.9% | | | | | | |

| | 30,650 | | | ConocoPhillips | | | 2,116,689 | | | |

| | 7,500 | | | Enterprise Products Partners LP | | | 270,900 | | | |

| | 60,050 | | | Exxon Mobil Corp. | | | 5,551,622 | | | |

| | 101,000 | | | Marathon Oil Corp. | | | 2,857,290 | | | |

| | 15,250 | | | Murphy Oil Corp. | | | 770,430 | | | |

| | | | | | | | | | |

| Shares | | | | | Fair Value | | | |

| | | | | | | | | | |

| Common Stocks — (Continued) | | | | | | |

| Energy — (Continued) | | | | | | |

| | 105,000 | | | Noble Corp. PLC | | $ | 1,739,850 | | | |

| | 32,000 | | | Occidental Petroleum Corp. | | | 2,579,520 | | | |

| | 50,250 | | | Peabody Energy Corp. (a) | | | 388,935 | | | |

| | 56,150 | | | Suncor Energy, Inc. | | | 1,784,447 | | | |

| | | | | | | | 18,059,683 | | | |

| Financials — 15.9% | | | | | | |

| | 193,500 | | | Apollo Investment Corp. (a) (b) | | | 1,435,770 | | | |

| | 48,500 | | | Ares Capital Corp. (b) | | | 756,843 | | | |

| | 43,500 | | | Bank of Nova Scotia/The (a) | | | 2,482,980 | | | |

| | 17,250 | | | BB&T Corp. | | | 670,853 | | | |